First Quarter Interim Statement January – March 2024

Contents MorphoSys Group: First Quarter Interim Statement January – March 2024 3 Summary 6 Group Interim Statement 6 Operating Business Performance 14 Human Resources 15 Financial Analysis 24 Subsequent Events 24 Financial Guidance 27 Group Interim Statement 27 Consolidated Statement of Profit or Loss (IFRS) – (unaudited) 28 Consolidated Balance Sheet (IFRS) – (unaudited) 30 Consolidated Statement of Changes in Stockholders’ Equity (IFRS) – (unaudited) 32 Consolidated Statement of Cash Flows (IFRS) – (unaudited) 2 Group Interim Statement MorphoSys – I/2024

Summary of the First Quarter of 2024 Financial Results for the First Quarter of 2024 • The financial results presented for the first quarter of 2024 relate to continued business operations of MorphoSys. Due to the announcement on February 5, 2024, to sell and transfer tafasitamab to Incyte (please also refer to section "Corporate Development") the entire tafasitamab business has been classified as discontinued operations in accordance with IFRS 5. Consequently, the figures reported for the first quarter of 2023 were adapted due to this change in presentation. • Group revenues from continued operations amounted to € 27.5 million (3M 2023: € 24.3 million) and mainly included revenues from royalties and to a smaller extend licenses, milestones, and other sources. • Research and development expenses in the first quarter of 2024 amounted to € 85.2 million (3M 2023: € 65.4 million) and combined expenses for selling and general and administration totaled € 204.0 million (3M 2023: € 14.0 million). The increase in expenses for selling and general and administration mainly resulted from effects of both an accelerated vesting of certain share-based compensation programs and the recognition of remuneration-related provisions following the probable acquisition by Novartis. • Cash and other financial assets totaled € 631.9 million as of March 31, 2024 (December 31, 2023: € 680.5 million). • As a consequence of the sale and transfer of tafasitamab to Incyte on February 5, 2024, MorphoSys' 2024 financial guidance published on January 30, 2024, cannot be maintained and therefore was revoked. For the time being, MorphoSys will no longer make a forecast for revenues from product sales, as no such revenues are expected to be realized this year. For 2024, the Group expects R&D expenses of € 170 million to € 185 million on a standalone basis. R&D expenses mainly represent our investments in the development of pelabresib and tulmimetostat. Selling, administrative and general expenses are expected to be between € 90 million and € 105 million on a standalone basis. Potential effects from the implementation of the Novartis takeover offer, including potential Q1-related provisions and expenses associated with the change of control, are not included in this forecast. The overall forecast is subject to a number of uncertainties, including inflation and foreign currency effects. Corporate Developments • On February 5, 2024, MorphoSys announced that it entered into a Business Combination Agreement with Novartis BidCo AG (formerly known as Novartis data42 AG) and Novartis AG (hereinafter collectively referred to as “Novartis”) based on Novartis’ intention to submit a voluntary public takeover offer (the “Novartis Takeover Offer”) for all of MorphoSys’ outstanding common shares in exchange for payment of € 68.0 per share. Separately, MorphoSys entered into a purchase agreement (the "Purchase Agreement") with Incyte Corporation ("Incyte") to sell and transfer to Incyte all rights worldwide related to tafasitamab for a purchase price of US$ 25.0 million. MorphoSys and Incyte have been collaborating on the development and commercialization of tafasitamab since 2020. Prior to this agreement, tafasitamab was co-marketed in the U.S. by MorphoSys and Incyte as Monjuvi® (tafasitamab-cxix) and outside the U.S. by Incyte as Minjuvi®. • On March 22, 2024, MorphoSys announced the receipt of U.S. antitrust clearance under the Hart-Scott- Rodino Antitrust Improvements Act of 1976 (the “HSR Act”) in connection with the proposed acquisition of MorphoSys by Novartis AG, following the expiration of the HSR Act waiting period. MorphoSys previously also announced the receipt of antitrust clearance in Germany and Austria. As a result, the proposed acquisition of MorphoSys by Novartis has received all mandatory regulatory approvals. Group Interim Statement 3 MorphoSys – I/2024

Significant Events after the End of the First Quarter of 2024 • On April 11, 2024, Novartis published the offer document for the voluntary public takeover offer by its wholly owned subsidiary Novartis BidCo AG for all outstanding shares of MorphoSys AG. Following the publication of the offer document, the Management Board and Supervisory Board of MorphoSys AG issued a joint reasoned statement on the voluntary public takeover offer, recommending that shareholders accept the offer and tender their MorphoSys shares. Novartis offers MorphoSys shareholders € 68.00 per share in cash, representing a total equity value of € 2.7 billion. The offer price corresponds to a premium of 94% and 142% on the volume-weighted average price during the last month and three months, respectively, as of the unaffected January 25, 2024, closing price. The acceptance period has commenced with the publication of the offer document on April 11, 2024, and will end on May 13, 2024, at 24:00 hours CEST and 18:00 hours EDT (also on May 13, 2024). • On April 24, 2024, MorphoSys announced that new efficacy and safety data from the Phase 3 MANIFEST-2 trial of pelabresib, an investigational BET inhibitor, in combination with the JAK inhibitor ruxolitinib in JAK inhibitor-naïve patients with myelofibrosis will be highlighted during an oral presentation on Friday, May 31, at the 2024 American Society of Clinical Oncology (ASCO) Annual Meeting. Additionally, new data from the Phase 2 study of tulmimetostat, an investigational next-generation dual inhibitor of EZH2 and EZH1, in patients with advanced solid tumors or hematologic malignancies will be showcased in a poster presentation at ASCO 2024 on Saturday, June 1. 4 Group Interim Statement

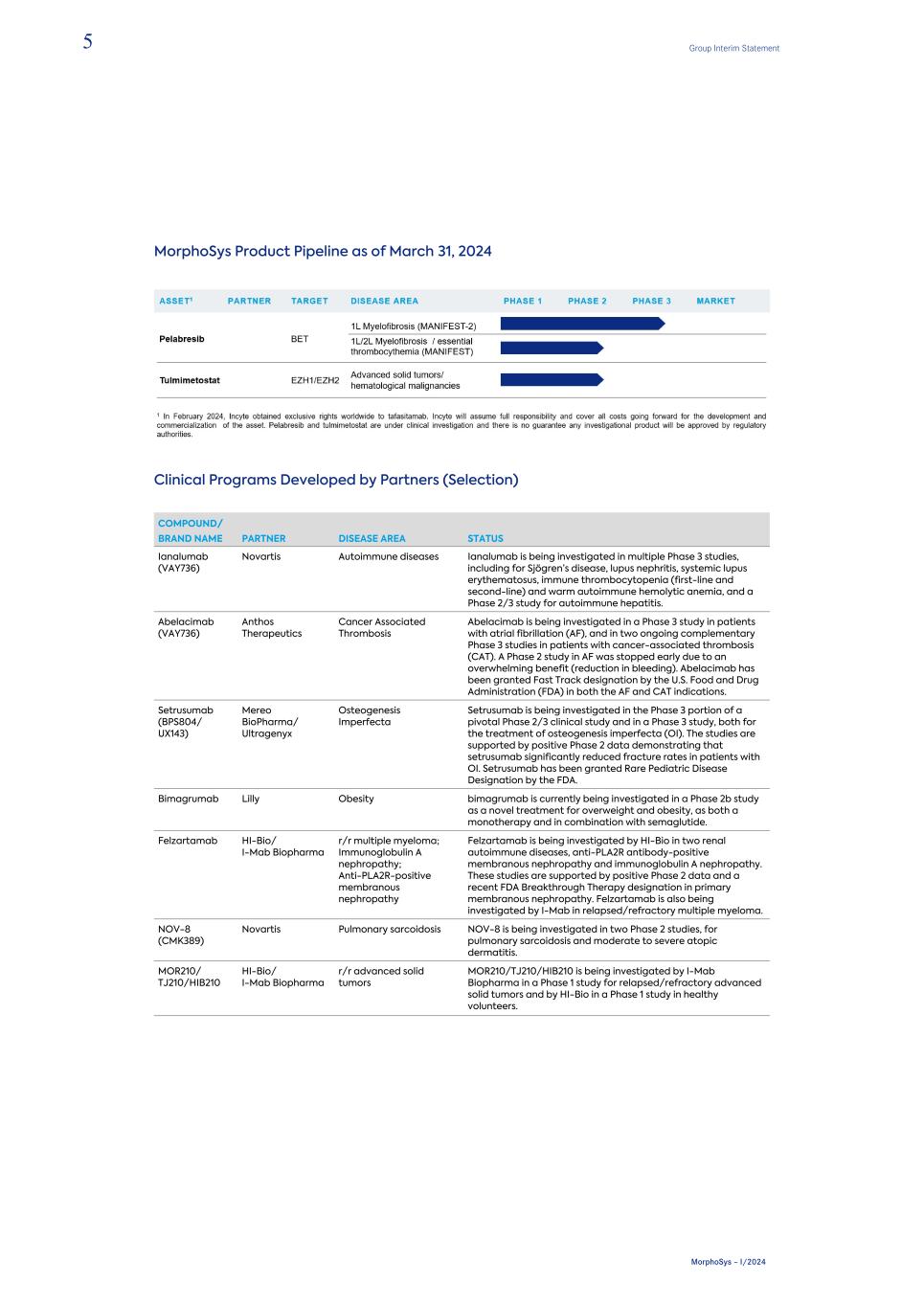

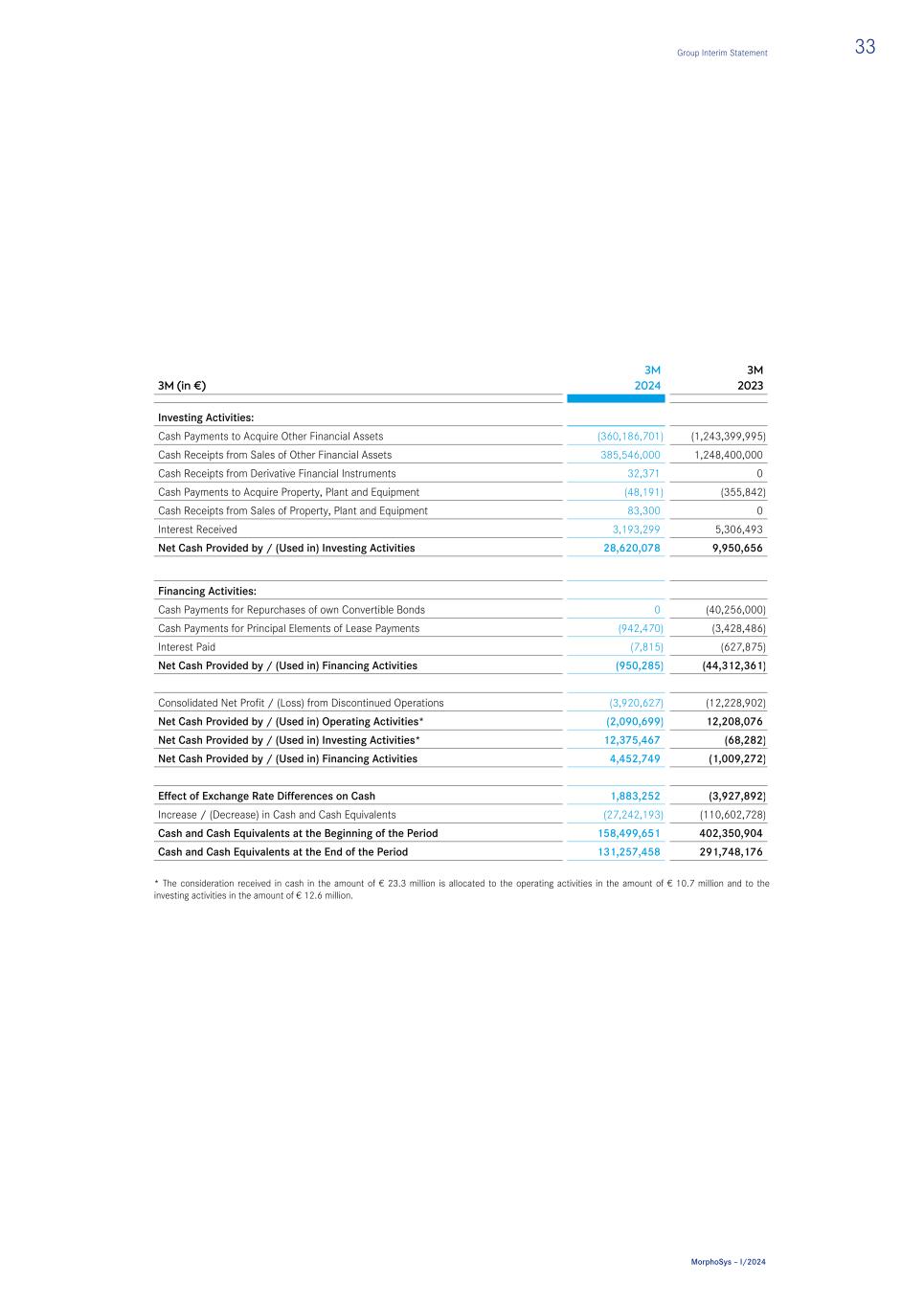

MorphoSys Product Pipeline as of March 31, 2024 Clinical Programs Developed by Partners (Selection) COMPOUND/ BRAND NAME PARTNER DISEASE AREA STATUS Ianalumab (VAY736) Novartis Autoimmune diseases Ianalumab is being investigated in multiple Phase 3 studies, including for Sjögren’s disease, lupus nephritis, systemic lupus erythematosus, immune thrombocytopenia (first-line and second-line) and warm autoimmune hemolytic anemia, and a Phase 2/3 study for autoimmune hepatitis. Abelacimab (VAY736) Anthos Therapeutics Cancer Associated Thrombosis Abelacimab is being investigated in a Phase 3 study in patients with atrial fibrillation (AF), and in two ongoing complementary Phase 3 studies in patients with cancer-associated thrombosis (CAT). A Phase 2 study in AF was stopped early due to an overwhelming benefit (reduction in bleeding). Abelacimab has been granted Fast Track designation by the U.S. Food and Drug Administration (FDA) in both the AF and CAT indications. Setrusumab (BPS804/ UX143) Mereo BioPharma/ Ultragenyx Osteogenesis Imperfecta Setrusumab is being investigated in the Phase 3 portion of a pivotal Phase 2/3 clinical study and in a Phase 3 study, both for the treatment of osteogenesis imperfecta (OI). The studies are supported by positive Phase 2 data demonstrating that setrusumab significantly reduced fracture rates in patients with OI. Setrusumab has been granted Rare Pediatric Disease Designation by the FDA. Bimagrumab Lilly Obesity bimagrumab is currently being investigated in a Phase 2b study as a novel treatment for overweight and obesity, as both a monotherapy and in combination with semaglutide. Felzartamab HI-Bio/ I-Mab Biopharma r/r multiple myeloma; Immunoglobulin A nephropathy; Anti-PLA2R-positive membranous nephropathy Felzartamab is being investigated by HI-Bio in two renal autoimmune diseases, anti-PLA2R antibody-positive membranous nephropathy and immunoglobulin A nephropathy. These studies are supported by positive Phase 2 data and a recent FDA Breakthrough Therapy designation in primary membranous nephropathy. Felzartamab is also being investigated by I-Mab in relapsed/refractory multiple myeloma. NOV-8 (CMK389) Novartis Pulmonary sarcoidosis NOV-8 is being investigated in two Phase 2 studies, for pulmonary sarcoidosis and moderate to severe atopic dermatitis. MOR210/ TJ210/HIB210 HI-Bio/ I-Mab Biopharma r/r advanced solid tumors MOR210/TJ210/HIB210 is being investigated by I-Mab Biopharma in a Phase 1 study for relapsed/refractory advanced solid tumors and by HI-Bio in a Phase 1 study in healthy volunteers. 5 Group Interim Statement MorphoSys – I/2024

Group Interim Statement: January 1 – March 31, 2024 Operating Business Performance MorphoSys AG (hereinafter also referred as "MorphoSys") focuses on advancing product candidates at various stages of development, positioning itself for long-term sustainable growth. The key measures of value for MorphoSys’ development activities include: • Advancement of development programs and product approvals • Clinical results • Regulatory interactions with (or feedback from) health authorities regarding the approval of new drug candidates • Collaborations, partnerships, and M&A activities with other companies to expand the drug pipeline and the technology base as well as to commercialize the therapeutic programs • Strong patent protection to secure MorphoSys’ market position Research and Development MorphoSys’ development activities were focused on the following clinical candidates: • Pelabresib – is an investigational small molecule designed to promote anti-tumor activity by selectively inhibiting the function of BET proteins to decrease the expression of abnormally expressed genes in cancer. • Tulmimetostat – is an investigational small molecule designed to promote anti-tumor activity by inhibiting EZH2 and EZH1, both enzymes involved in suppression of target gene expression. • Tafasitamab – is a humanized Fc-modified CD19-targeting immunotherapy. CD19 is a target for the treatment of B-cell malignancies, including DLBCL, r/r follicular lymphoma, or r/r FL, and r/r marginal zone lymphoma, or r/r MZL. In February 2024, Incyte obtained exclusive rights worldwide to tafasitamab. Incyte will assume full responsibility and cover all costs going forward for the development and commercialization of the asset. The following programs, among others, are being further developed by MorphoSys’ partners: • Ianalumab (VAY736) – a fully human IgG1/k antibody with a dual mode of action targeting B-cell lysis and BAFF-R blockade, developed by Novartis and being investigated in several Phase 3 studies for Sjögren’s disease, lupus nephritis, and other autoimmune diseases. • Abelacimab (MAA868) – an antibody directed against Factor XI, developed by Anthos Therapeutics and being investigated in three Phase 3 studies for venous thromboembolism prevention and cancer-associated thrombosis. • Setrusumab (BPS804/UX143) – an antibody directed against sclerostin, developed by Ultragenyx and Mereo BioPharma and being investigated in a pivotal Phase 2/3 study for osteogenesis imperfecta. • Bimagrumab - an antibody binding to activin type II receptors, developed by Lilly and being investigated in a Phase 2b study for adult obesity. • Felzartamab – a therapeutic human monoclonal antibody directed against CD38, developed by HI-Bio and I-Mab Biopharma and being investigated in clinical studies for renal autoimmune diseases and relapsed/ refractory multiple myeloma. 6 Group Interim Statement MorphoSys – I/2024

• MOR210/TJ210/HIB210 – a human antibody directed against C5aR1, the receptor of the complement factor C5a and, being investigated by I-Mab Biopharma in a Phase 1 study for relapsed or refractory advanced solid tumors and by HI-Bio in healthy volunteers. In addition to the partnered programs listed above, there are several additional partnered programs in early to mid-stage research and development, amongst others CMK389/NOV-8. Development of Tafasitamab MorphoSys’ commercial activities focused until February 5, 2024, on Monjuvi (tafasitamab-cxix) in the United States. On July 31, 2020, the Food and Drug Administration (FDA) granted Monjuvi in combination with lenalidomide an accelerated approval for the treatment of adult patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL) not otherwise specified, including DLBCL arising from low-grade lymphoma, and who are not eligible for autologous stem cell transplant (ASCT). In February 2024, Incyte obtained exclusive rights worldwide to tafasitamab. Incyte will assume full responsibility and cover all costs going forward for the development and commercialization of the asset. Commercial Performance of Tafasitamab Until the sale of tafasitamab to Incyte on February 5, 2024, Monjuvi sales reached € 5.9 million or US$ 6.4 million, respectively (3M 2023: € 19.4 million or US$ 20.8 million). Proprietary Clinical Development Studies of Pelabresib There are currently two ongoing trials evaluating pelabresib in Myelofibrosis, the Phase 3 MANIFEST-2 trial and the Phase 2 MANIFEST trial. MANIFEST‑2, a global, multicenter, double-blind, randomized Phase 3 clinical study, is evaluating pelabresib plus ruxolitinib versus placebo plus ruxolitinib in JAK-inhibitor-naïve patients with primary MF or post- essential thrombocythemia (post-ET) or post-polycythemia vera (post-PV) MF who have splenomegaly and symptoms requiring therapy. Since the acquisition of Constellation, MorphoSys has optimized the study’s design by increasing the number of trial participants. Measures were also taken to improve the speed of enrollment, including adding new contract research organizations (CROs), improving the interaction with investigators, and expanding the number of countries and sites. On April 4, 2023, MorphoSys announced that enrollment was completed for the MANIFEST-2 study. On November 20, 2023, MorphoSys announced topline results from the Phase 3 MANIFEST-2 study. MANIFEST-2 met its primary endpoint, as the combination therapy demonstrated a statistically significant and clinically meaningful improvement in the proportion of patients achieving at least a 35% reduction in spleen volume (SVR35) at week 24. The key secondary endpoints assessing symptom improvement – proportion of patients achieving at least a 50% reduction in total symptom score (TSS50) and absolute change in total symptom score (TSS) from baseline at week 24 – showed a strong positive trend favoring the pelabresib and ruxolitinib combination. In an analysis of patients classified as intermediate risk (Dynamic International Prognostic Scoring System [DIPSS] Int-1 and Int-2) – constituting more than 90% of patients in MANIFEST-2 – the combination therapy demonstrated significant improvements in both key secondary endpoints. DIPSS was a pre-defined stratification factor in the MANIFEST-2 study protocol. 430 JAK inhibitor- naïve adult patients with myelofibrosis were randomized for this study. On December 10, 2023, detailed findings of the MANIFEST-2 study were presented during an oral presentation at the 65th American Society for Hematology (ASH) Annual Meeting and Exposition: Group Interim Statement 7 MorphoSys – I/2024

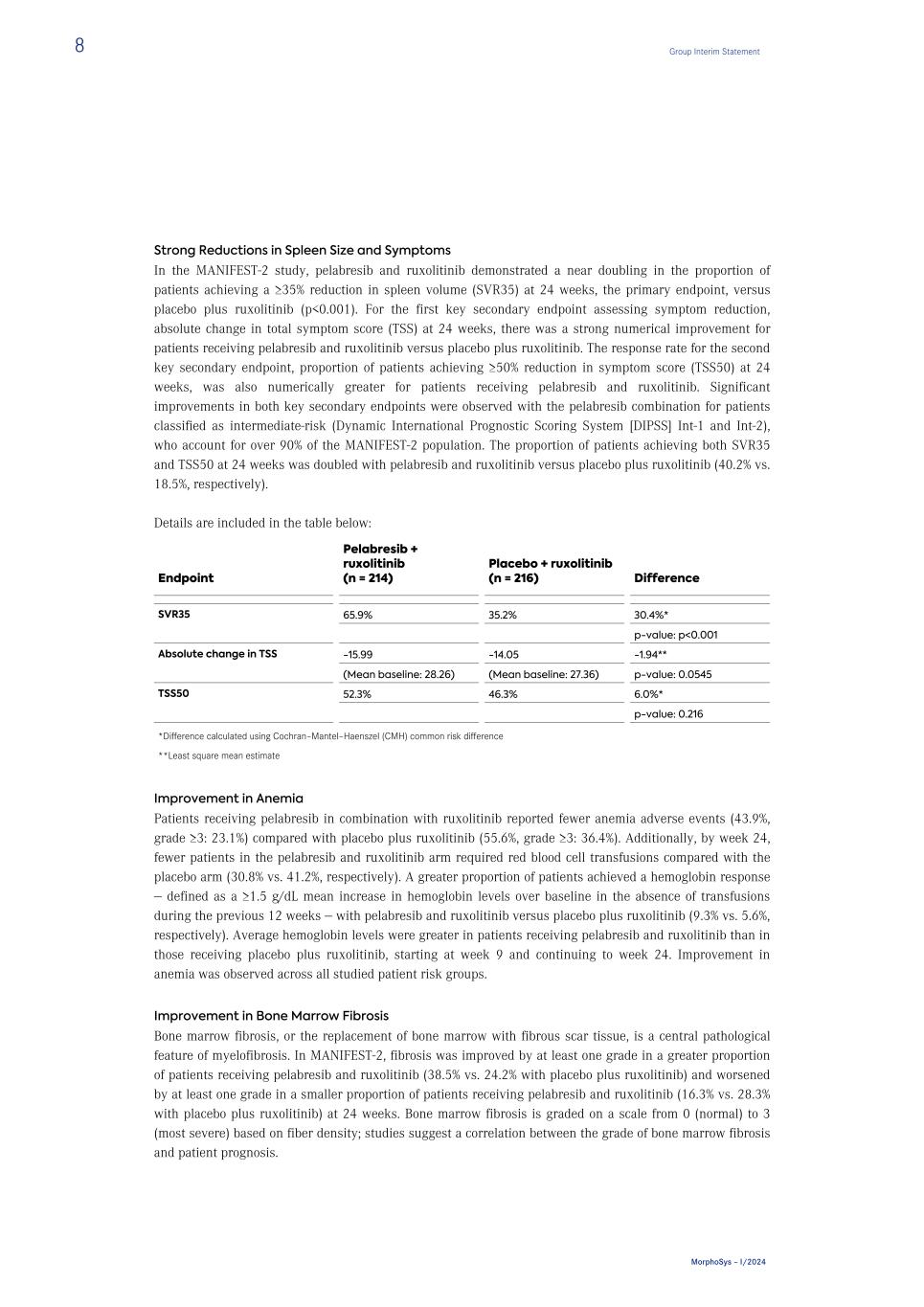

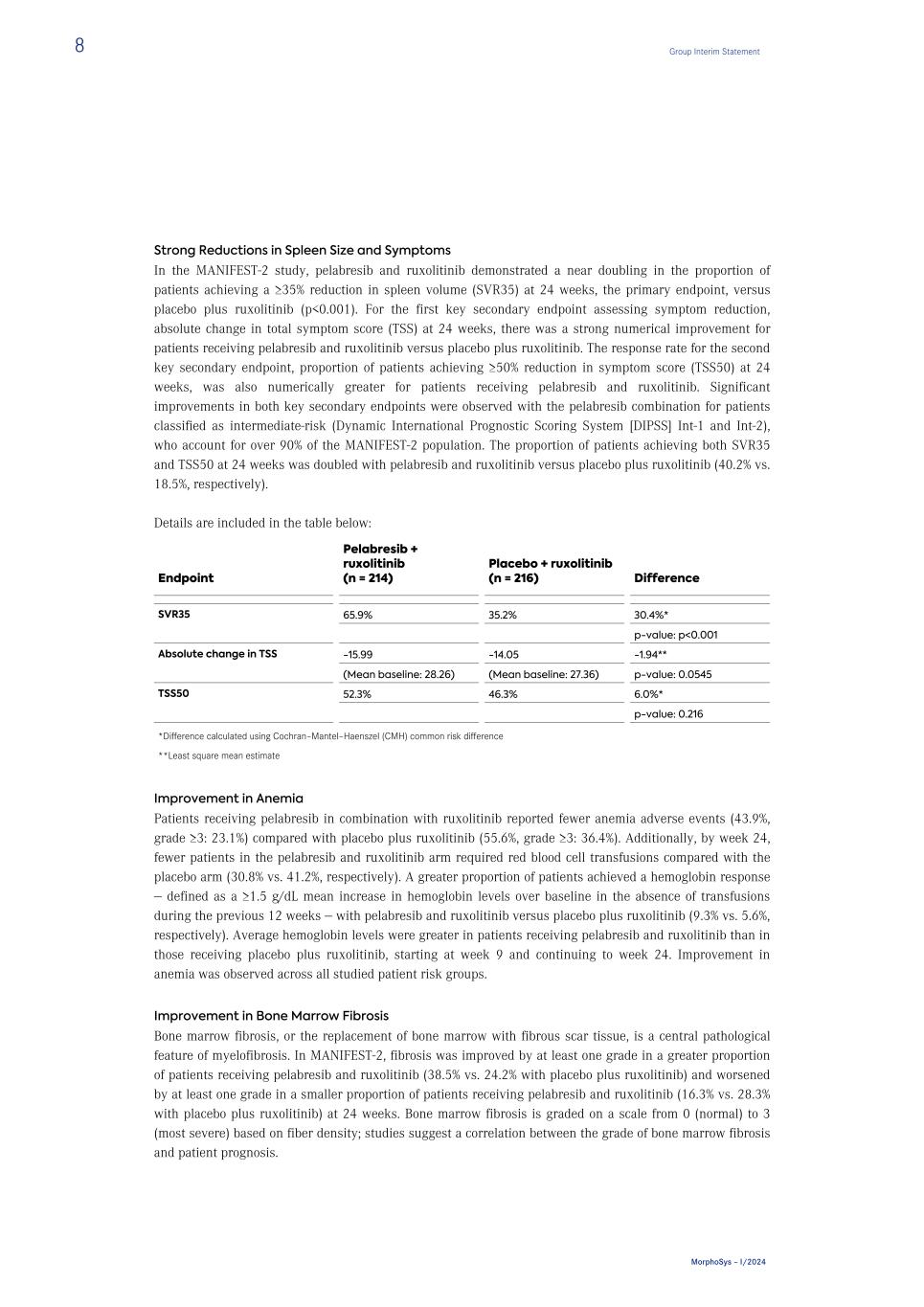

Strong Reductions in Spleen Size and Symptoms In the MANIFEST-2 study, pelabresib and ruxolitinib demonstrated a near doubling in the proportion of patients achieving a ≥35% reduction in spleen volume (SVR35) at 24 weeks, the primary endpoint, versus placebo plus ruxolitinib (p<0.001). For the first key secondary endpoint assessing symptom reduction, absolute change in total symptom score (TSS) at 24 weeks, there was a strong numerical improvement for patients receiving pelabresib and ruxolitinib versus placebo plus ruxolitinib. The response rate for the second key secondary endpoint, proportion of patients achieving ≥50% reduction in symptom score (TSS50) at 24 weeks, was also numerically greater for patients receiving pelabresib and ruxolitinib. Significant improvements in both key secondary endpoints were observed with the pelabresib combination for patients classified as intermediate-risk (Dynamic International Prognostic Scoring System [DIPSS] Int-1 and Int-2), who account for over 90% of the MANIFEST-2 population. The proportion of patients achieving both SVR35 and TSS50 at 24 weeks was doubled with pelabresib and ruxolitinib versus placebo plus ruxolitinib (40.2% vs. 18.5%, respectively). Details are included in the table below: Endpoint Pelabresib + ruxolitinib (n = 214) Placebo + ruxolitinib (n = 216) Difference SVR35 65.9% 35.2% 30.4%* p-value: p<0.001 Absolute change in TSS -15.99 -14.05 -1.94** (Mean baseline: 28.26) (Mean baseline: 27.36) p-value: 0.0545 TSS50 52.3% 46.3% 6.0%* p-value: 0.216 *Difference calculated using Cochran–Mantel–Haenszel (CMH) common risk difference **Least square mean estimate Improvement in Anemia Patients receiving pelabresib in combination with ruxolitinib reported fewer anemia adverse events (43.9%, grade ≥3: 23.1%) compared with placebo plus ruxolitinib (55.6%, grade ≥3: 36.4%). Additionally, by week 24, fewer patients in the pelabresib and ruxolitinib arm required red blood cell transfusions compared with the placebo arm (30.8% vs. 41.2%, respectively). A greater proportion of patients achieved a hemoglobin response — defined as a ≥1.5 g/dL mean increase in hemoglobin levels over baseline in the absence of transfusions during the previous 12 weeks — with pelabresib and ruxolitinib versus placebo plus ruxolitinib (9.3% vs. 5.6%, respectively). Average hemoglobin levels were greater in patients receiving pelabresib and ruxolitinib than in those receiving placebo plus ruxolitinib, starting at week 9 and continuing to week 24. Improvement in anemia was observed across all studied patient risk groups. Improvement in Bone Marrow Fibrosis Bone marrow fibrosis, or the replacement of bone marrow with fibrous scar tissue, is a central pathological feature of myelofibrosis. In MANIFEST-2, fibrosis was improved by at least one grade in a greater proportion of patients receiving pelabresib and ruxolitinib (38.5% vs. 24.2% with placebo plus ruxolitinib) and worsened by at least one grade in a smaller proportion of patients receiving pelabresib and ruxolitinib (16.3% vs. 28.3% with placebo plus ruxolitinib) at 24 weeks. Bone marrow fibrosis is graded on a scale from 0 (normal) to 3 (most severe) based on fiber density; studies suggest a correlation between the grade of bone marrow fibrosis and patient prognosis. 8 Group Interim Statement MorphoSys – I/2024

Biomarker Analysis Suggests Disease Modification In a biomarker analysis, average plasma levels of inflammatory cytokines (IL-8, IL-6, TNF-α, and other NF-κB- regulated cytokines) were reduced in patients receiving pelabresib and ruxolitinib compared with placebo plus ruxolitinib at 24 weeks. Increased cytokine levels are associated with all four disease hallmarks; increased IL-8 levels are also associated with worse survival outcomes. These biomolecular improvements suggest early evidence of a disease-modifying effect. Safety Profile Overall, grade ≥3 treatment-emergent adverse events (TEAEs) were reported less frequently with pelabresib and ruxolitinib than with placebo plus ruxolitinib (49.1% vs. 57.5%, respectively). In the pelabresib and ruxolitinib arm, the most common (≥10%) hematologic TEAEs were anemia (43.9%; grade ≥3: 23.1%), thrombocytopenia (32.1%; grade ≥3: 9.0%), and platelet count decrease (20.8%; grade ≥3: 4.2%). In the placebo plus ruxolitinib arm, the most common hematologic TEAEs were anemia (55.6%; grade ≥3: 36.4%), thrombocytopenia (23.4%; grade ≥3: 5.6%), and platelet count decrease (15.9%; grade ≥3: 0.9%). The most common (≥10%) non-hematologic TEAEs in the pelabresib and ruxolitinib arm were diarrhea (23.1%; grade ≥3: 0.5%), dysgeusia (18.4%; grade ≥3: 0.5%), constipation (18.4%; grade ≥3: 0%), nausea (14.2%; grade ≥3: 0.5%), cough (12.7%; grade ≥3: 0), asthenia (11.8%; grade ≥3: 0.5%), fatigue (11.8%; grade ≥3: 0.5%), dizziness (11.3%; grade ≥3: 0%), headache (11.3%; grade ≥3: 0.5%), and COVID-19 (11.3%; grade ≥3: 0%). The most common non- hematologic TEAEs in the placebo plus ruxolitinib arm were constipation (24.3%; grade ≥3: 0%), diarrhea (18.7%; grade ≥3: 1.4%), fatigue (16.8%; grade ≥3: 0.9%), COVID-19 (15.9%; grade ≥3: 1.9%), nausea (15.0%; grade ≥3: 0%), asthenia (13.6%; grade ≥3: 0%), dyspnea (13.1%; grade ≥3: 0.9%), cough (11.2%; grade ≥3: 0%), and headache (10.7%; grade ≥3: 0%). Discontinuation rates due to adverse events were 10.7% with pelabresib and ruxolitinib and 6.5% with placebo plus ruxolitinib. The safety profile of the pelabresib and ruxolitinib combination therapy was in line with assessments from previous clinical studies. Planned Regulatory Next Steps MorphoSys will continue conversations with regulatory agencies, with the intention to submit a New Drug Application (NDA) for pelabresib in combination with ruxolitinib in myelofibrosis to the FDA and a Marketing Authorization Application (MAA) to the European Medicines Agency in the second half of 2024. The combination therapy received Fast Track designation for this disease from the FDA in 2018. MANIFEST is a global, multicenter, open-label Phase 2 study that evaluates pelabresib as a monotherapy or in combination with ruxolitinib (marketed as Jakafi®/Jakavi®), the current standard of care. In Arm 3 of this study, pelabresib is being evaluated in combination with ruxolitinib in JAK-inhibitor-naïve MF patients, with a primary endpoint of the proportion of patients with a ≥35% spleen volume reduction from baseline (SVR35) at 24 weeks of treatment. Pelabresib is also being evaluated in a second-line setting (2L) either as a monotherapy in patients who are resistant to, intolerant of, or ineligible for ruxolitinib and no longer on the drug (Arm 1), or as an add-on therapy to ruxolitinib in patients with a suboptimal response to ruxolitinib or MF progression (Arm 2). Patients in Arms 1 and 2 are being stratified based on transfusion-dependent (TD) status. The primary endpoint for the patients in cohorts 1A and 2A, who were TD at baseline, is conversion to transfusion independence for 12 consecutive weeks. The primary endpoint for patients in cohorts 1B and 2B, who were not TD at baseline, is the proportion of patients with an SVR35 at 24 weeks of treatment. In Arm 4 of this study, pelabresib is being evaluated as a monotherapy in high-risk patients with essential thrombocythemia (ET) who are resistant or intolerant to hydroxyurea (HU). The primary endpoint for patients in Arm 4 is complete hematological response rate after one cycle, or 21 days, of treatment. In December 2022, MorphoSys presented longer-term Phase 2 results on pelabresib in myelofibrosis from the ongoing MANIFEST study at ASH 2022. This analyses include longer-term data showing durable Group Interim Statement 9 MorphoSys – I/2024

improvements in both spleen volume and symptom score beyond 24 weeks (data cutoff July 29, 2022), with pelabresib plus ruxolitinib in JAK inhibitor-naïve patients (Arm 3 of the study). Translational data from MANIFEST were also presented that suggest an association of biomarkers with potential disease-modifying activity of pelabresib. At 24, 48, and 60 weeks, 68% (57/84), 61% (51/84), and 54% (45/84), respectively, of JAK inhibitor-naïve patients treated with pelabresib in combination with ruxolitinib achieved at least a 35% reduction in spleen volume (SVR35) from baseline. SVR35 was achieved by 80% (67/84) of patients at any time on study. Also at 24 weeks, 56% (46/82) of patients had at least a 50% reduction in their total symptom score (TSS50) from baseline, suggesting a reduction in symptom burden. At 48 and 60 weeks, 44% (36/82) and 43% (35/82) of patients, respectively, achieved TSS50. An exploratory analysis demonstrated that bone marrow fibrosis improved by one grade or more in 27% (17/63) of evaluable patients at week 24, and 59% (10/17) of those patients maintained that improvement at week 48 or beyond. An improvement of one grade or more at any time was achieved by 40% (25/63) of patients. The most common hematologic treatment-emergent adverse event (AE) of any grade was thrombocytopenia, which was reported in 55% (grade ≥3: 18%) of patients. Anemia was reported in 43% (grade ≥3: 34%) of patients. The most common (≥25%) non-hematologic treatment-emergent AEs of any grade were diarrhea (43%), respiratory tract infection (41%), asthenic conditions (38%), musculoskeletal pain (32%), constipation (30%), nausea (29%), dizziness (27%), and abdominal pain (26%). In the MANIFEST study, changes in biomarkers correlated with improvements in clinical measures of treatment success (SVR35, TSS50, and hemoglobin increases indicative of improved anemia), suggesting a potential disease-modifying effect of pelabresib. Examined biomarkers included bone marrow scarring, known as fibrosis, and the frequency of a Janus Kinase 2 allele (V617F) that is known to drive disease activity. Across the three MF arms of MANIFEST, 40% (33/82) of patients who achieved SVR35 at week 24 also had at least a one-grade improvement in bone marrow fibrosis and/or a 20% or greater reduction in the frequency of the variant allele. Of TSS50 responders at week 24, 28% (28/100) also showed at least a one-grade improvement in bone marrow fibrosis and/or a 20% or greater reduction in the frequency of the variant allele. Furthermore, 29% (24/84) of patients who had hemoglobin improvements (any level of increase from baseline) also had at least a one-grade improvement in bone marrow fibrosis and/or a 20% or greater reduction in the frequency of the variant allele. All patients who had clinical responses (SVR35, TSS50, and hemoglobin improvement) plus reduced variant allele frequency and improvement in bone marrow fibrosis were naïve to JAK inhibitors. At the European Hematology Association (EHA) Hybrid Congress in June 2023, we presented a poster on Arm 3 of the MANIFEST study, which examines the combination of pelabresib and ruxolitinib in JAK-inhibitor- naïve patients with myelofibrosis. This treatment resulted in deep and durable spleen and symptom responses at and beyond week 24. The findings demonstrated clinically meaningful improvements in anemia, including the need for fewer transfusions, which may positively impact patients’ quality of life. No new safety signals were observed with a longer follow-up of 11 additional months. A second poster on MANIFEST Arm 2 showed pelabresib as an add-on to ongoing ruxolitinib therapy in patients with a suboptimal/lost response to ruxolitinib monotherapy resulted in durable and deepening splenic and symptom responses at and beyond week 24. The findings suggested improvements in anemia, including the need for fewer transfusions, which may positively impact patients’ quality of life. No new safety signals were observed with a longer follow-up of 11 additional months. The most common treatment-emergent adverse events (TEAEs) were low grade. During an oral presentation at the EHA and a poster discussion at the American Society of Clinical Oncology (ASCO) Annual Meeting in June 2023, MorphoSys presented positive results from Arm 4 of the Phase 2 10 Group Interim Statement MorphoSys – I/2024

MANIFEST study, which is investigating pelabresib as a monotherapy in patients with high-risk essential thrombocythemia (ET), whose disease is refractory or intolerant to hydroxyurea. These robust proof-of-concept results support pelabresib’s expansion into other myeloid diseases. As such, MorphoSys will continue its ongoing evaluation of pelabresib in ET in the MANIFEST study. We are also considering initiating a Phase 2 study in lower-risk myelodysplastic syndrome (MDS). Patients with MDS experience progressive anemia that can require regular blood transfusions or subcutaneous injections, often diminishing quality of life. Furthermore, patients have low long-term response rates to currently available treatments, reflecting a need for new therapeutic options. Study of Tulmimetostat Patient enrollment in a Phase 1/2 clinical trial of tulmimetostat is ongoing. This Phase 1/2, open-label, multi- center, first-in-human study is designed to evaluate the safety and tolerability and preliminary clinical activity in patients with advanced solid tumors or lymphomas. The Phase 1 evaluated the dose escalation period in patients with advanced tumors and aimed to determine maximum tolerated dose (MTD) and/or recommended Phase 2 dose (RP2D) as a monotherapy in patients with advanced tumors or lymphomas. Patients are currently enrolled in the Phase 2 expansion cohorts in selected tumor indications: urothelial or other advanced/metastatic solid tumors (ARID1A mutated), ovarian clear-cell carcinoma (ARID1A mutated), endometrial carcinoma (ARID1A mutated), lymphoma, mesothelioma (BAP1 loss mutation), and metastatic castration-resistant prostate cancer. Updated safety and efficacy data from the ongoing Phase 2 study of tulmimetostat monotherapy in multiple advanced malignancies were presented during the ASCO Annual Meeting in June 2023. The data demonstrated disease stabilization or better across all solid tumor cohorts studied, including those with heavily pre-treated patients: urothelial cancer or ARID1A-mutated advanced solid tumors, ARID1A-mutated ovarian clear-cell carcinoma and endometrial carcinoma, BAP1-mutated mesothelioma and, metastatic castration resistant prostate cancer. In addition, complete and partial responses were observed in the lymphoma cohort. Safety findings from the trial were consistent with the mechanism of EZH2 inhibition. At data cut-off (February 14, 2023), 81 patients enrolled in the Phase 2 expansion phase of the trial had received at least one dose of tulmimetostat in the cohorts listed above and 75 patients also had at least one post- baseline response assessment or discontinued the treatment prior to their first post-baseline assessment for any reason and hence included in the efficacy evaluable set. At trial entry, 86% of patients had been treated with at least two prior lines of therapy. Objective response was observed in patients with ovarian clear-cell carcinoma, endometrial cancer, mesothelioma, and peripheral T-cell lymphoma (PTCL). Of ten evaluable patients with urothelial cancer or ARID1A-mutated advanced solid tumors, one had a partial response as the best response and three had disease stabilization. Of the 14 evaluable patients with ovarian clear-cell carcinoma, four had a partial response as the best response and four had stable disease. Of the eight evaluable patients with endometrial carcinoma, three had partial responses as the best response and one had stable disease. Two of the eight evaluable patients with peripheral T-cell lymphoma had complete responses and one had a partial response. For the 21 evaluable patients with mesothelioma, there were three had partial responses as the best response and ten disease stabilizations. Of the ten evaluable patients with metastatic castration-resistant prostate cancer, six had stable disease. In the safety analysis set, 80 patients (98.8%) had at least one treatment-emergent AE (TEAE). The most frequent treatment-emergent adverse events (TEAEs) determined to be possibly related to tulmimetostat included thrombocytopenia (50.6%), diarrhea (45.7%), anemia (35.8%), nausea (33.3%), fatigue (32.1%), alopecia (27.2%), dysgeusia (24.7%), vomiting (22.2%), neutropenia (16.0%), decreased appetite (14.8%), and decreased weight (12.3%). TEAEs led to dose reductions in 31 patients (38.3%) and to dose interruptions in 57 patients (70.4%). Fourteen patients (17.3%) discontinued treatment due to AEs. Group Interim Statement 11 MorphoSys – I/2024

In September 2023, the FDA granted Fast Track designation for tulmimetostat, for the treatment of patients with advanced, recurrent, or metastatic endometrial cancer harboring AT-rich interacting domain-containing protein 1A (ARID1A) mutations and who have progressed on at least one prior line of treatment. The FDA grants Fast Track designation to facilitate the development and expedite the review of medicines intended to treat serious conditions and potentially address an unmet medical need, with the goal of getting these important, new therapies to patients earlier. During the IGCS (International Gynecologic Cancer Society) 2023 Annual Global Meeting held in Seoul, South Korea, in November 2023, MorphoSys showcased in a featured poster abstract session, updated preliminary Phase 2 clinical data and first biomarker findings in a subset of patients with ARID1A-mutated ovarian clear- cell or endometrial carcinomas. At cutoff date (July 16, 2023), of the 89 patients enrolled in the Phase 2 study, efficacy data from 14 evaluable patients with ovarian clear-cell carcinoma and 11 evaluable patients with endometrial carcinoma were presented; >50% of each cohort have received ≥3 prior treatment lines. Of the 14 evaluable patients with ovarian clear-cell carcinoma, the best confirmed response was a partial response in one patient and stable disease in seven patients and of the 11 evaluable patients with endometrial carcinoma, four patients had a best confirmed response of PR and two patients had stable disease. The manageable safety profile across all 6 tumor cohorts (n = 89) was consistent with known class effects; Thrombocytopenia (in 50.6% patients) was the most frequent hematologic TEAE considered at least possibly related to tulmimetostat and diarrhea (in 51.7%) was the most frequent non-hematologic TEAE considered at least possibly related to tulmimetostat. Next generation sequencing did not reveal a specific hotspot for ARID1Amut locations impacting clinical outcome in patients with ovarian clear-cell or endometrial carcinoma. These efficacy, safety and biomarker data support further investigation of this dual inhibitor. Studies of Tafasitamab The clinical development of tafasitamab is focused on non-Hodgkin’s lymphoma (NHL). Treatment options for patients with r/r DLBCL who are not candidates for HDC and ASCT were limited prior to the U.S. approval of tafasitamab. The clinical studies frontMIND and firstMIND may support the potential use of tafasitamab in the first-line treatment of DLBCL. Tafasitamab is also being examined with inMIND, a Phase 3 study in patients with r/r follicular lymphoma (FL) Grade 1 to 3a or r/r nodal, splenic, or extranodal marginal zone lymphoma (MZL). In February 2024, Incyte obtained exclusive rights worldwide to tafasitamab. Incyte will assume full responsibility and cover all costs going forward for the development and commercialization of the asset. More details on each study are given below: frontMIND: In addition to clinical development in r/r DLBCL, on May 11, 2021, MorphoSys announced that the first patient had been dosed in frontMIND, a pivotal Phase 3 trial of tafasitamab in first-line DLBCL: frontMIND is evaluating tafasitamab and lenalidomide in combination with R-CHOP compared to R-CHOP alone as first-line treatment for high-intermediate and high-risk patients with untreated DLBCL. On April 4, 2023, MorphoSys announced that the enrollment of the frontMIND study with 899 patients was completed. The topline data from this study are expected in the second half of 2025. firstMIND: The study included patients with newly diagnosed DLBCL and paved the way for the frontMIND study. On December 10, 2022, MorphoSys presented updated results from the firstMIND trial at ASH 2022. The final analysis from this Phase 1b trial showed no new safety signals and provided additional information on progression-free and overall survival at 24 months for patients with newly diagnosed diffuse large B-cell lymphoma treated with tafasitamab plus lenalidomide and R-CHOP. The Phase 1b study firstMIND is an open- 12 Group Interim Statement MorphoSys – I/2024

label, randomized safety study combining tafasitamab or tafasitamab plus lenalidomide with standard R- CHOP for patients with newly diagnosed DLBCL. Additional analyses highlighted the prognostic potential of sensitive circulating tumor (ct) DNA minimal residual disease (MRD) assays in patients with DLBCL after first-line therapy. Additionally, Incyte is responsible for conducting inMIND, a Phase 3 study in patients with r/r follicular lymphoma (FL) Grade 1-3a or r/r nodal, splenic, or extranodal marginal zone lymphoma (MZL). On August 1, 2023, Incyte announced that the inMIND study is fully enrolled. The inMIND study evaluates whether tafasitamab and lenalidomide as an add-on to rituximab provides improved clinical benefit compared with lenalidomide alone as an add-on to rituximab in patients with r/r FL or r/r MZL. The primary endpoint of the study is PFS in the FL population, and the key secondary endpoints are PFS and OS in the overall population as well as PET-CR at the end of treatment in the FL population. Topline data are expected in the second half of 2024. Clinical Development Through Partners The most advanced programs being developed by partners are outlined below. Ianalumab Ianalumab (VAY736) is a fully human IgG1/k mAb with a dual mode of action targeting B-cell lysis and BAFF- R blockade that is being investigated by Novartis in multiple indications within the immunology and hematology field. Ianalumab is currently in Phase 3 clinical development in lupus nephritis (LN), Sjögren’s disease, systemic lupus erythematosus (SLE), immune thrombocytopenia (1L and 2L ITP), and warm autoimmune hemolytic anemia (wAIHA). Ianalumab is also in Phase 2 clinical development in autoimmune hepatitis (AIH). MorphoSys is entitled to milestone payments and royalties upon approval and commercialization. Abelacimab Abelacimab (MAA868) is an antibody directed against Factor XI that is being investigated by Anthos Therapeutics in two complementary Phase 3 clinical studies in cancer-associated thrombosis (CAT) for the prevention of venous thromboembolism (VTE) and in one Phase 3 study in high-risk patients with atrial fibrillation (AF). The FDA granted Fast Track designation to abelacimab for both indications under study. In September 2023, Anthos Therapeutics announced that the AZALEA-TIMI 71 Phase 2 study in atrial fibrillation at moderate-to-high risk of stroke has been stopped early due to an overwhelming benefit (reduction in bleeding compared to standard-of-care direct oral anticoagulant. MorphoSys is entitled to milestone payments and royalties upon approval and commercialization. Setrusumab Setrusumab (BPS804/UX143) is a fully human monoclonal antibody inhibiting sclerostin that is currently being investigated by Ultragenyx and Mereo BioPharma in the Phase 3 portion of the pivotal Phase 2/3 clinical study and a Phase 3 study for the treatment of osteogenesis imperfecta. MorphoSys is entitled to milestone payments and royalties upon approval and commercialization. Bimagrumab Bimagrumab is a fully human monoclonal antibody against activin type II receptors that is currently in clinical development. Lilly is investigating bimagrumab in a global Phase 2b study in patients with obesity and announced completion of enrollment in June 2023. MorphoSys is entitled to milestone payments and royalties upon approval and commercialization. Group Interim Statement 13 MorphoSys – I/2024

Felzartamab Felzartamab is a therapeutic human monoclonal antibody directed against CD38. Human Immunology Biosciences, Inc. (HI-Bio) obtained exclusive rights to develop and commercialize felzartamab across all indications worldwide, with the exception of Greater China. HI-Bio is evaluating felzartamab for patients with two renal autoimmune diseases, anti-PLA2R antibody-positive membranous nephropathy (M-PLACE and New- PLACE trials), and immunoglobulin A nephropathy (IGNAZ trial). On May 25, 2023, HI-Bio announced that the FDA has granted orphan drug designation (ODD) for felzartamab in development for the treatment of membranous nephropathy (MN). On October 31, 2023, HI-Bio announced that the FDA has granted Breakthrough Therapy designation for felzartamab in primary membranous nephropathy (PMN). The FDA selectively grants Breakthrough Therapy designation to expedite the development and review of drugs that are intended to treat a serious or life-threatening condition and preliminary clinical evidence indicates the drug may demonstrate substantial improvement over available therapy on a clinically significant endpoint(s). HI-Bio initiated an open label Phase 1b study in patients with lupus nephritis (LN) end of 2023. In addition, felzartamab is also under investigation in a randomized, controlled, double-blind pilot Phase 2 trial for chronic Antibody Mediated Transplant Rejection (AMR), this is an investigator initiated trial (IIT). I-Mab Biopharma holds the exclusive regional rights to develop and commercialize felzartamab in Greater China and is studying felzartamab in relapsed/refractory multiple myeloma. MorphoSys will be eligible to receive payments on achievement of development, regulatory, and commercial milestones in addition to royalties on net sales of felzartamab. MOR210/TJ210/HIB210 MOR210/TJ210/HIB210 is a human antibody directed against C5aR1, the receptor of the complement factor C5a. HI-Bio obtained exclusive worldwide rights to develop and commercialize MOR210 across all indications worldwide, with the exception of Greater China and South Korea. In July 2023, HI-Bio announced that the first participants have been dosed in a Phase 1 healthy volunteer study of HIB210. I-Mab Biopharma holds the exclusive rights for MOR210 in Greater China and South Korea and is currently investigating MOR210 for autoimmune diseases after Phase 1 trial in solid tumors completion. MorphoSys will be eligible to receive payments on achievement of development, regulatory, and commercial milestones in addition to royalties on net sales of MOR210/TJ210/HIB210. Other Programs (Selection) In addition to the partnered programs listed above, there are several additional partnered programs in early to mid-stage research and development, amongst others CMK389/NOV-8. Human Resources On March 31, 2024, the MorphoSys Group had 464 employees (December 31, 2023: 524). The decrease is mainly due to the reduction in the number of sales representatives following the decision to sell tafasitamab to Incyte on February 5, 2024 (section "Discontinued Operations"). During the first quarter of 2024, the MorphoSys Group employed an average of 497 people (3M 2023: 631). 14 Group Interim Statement MorphoSys – I/2024

Financial Analysis The effects from the various conflicts (e.g., the war in Ukraine or the crisis in the Middle East) on the business activities of the MorphoSys Group are monitored by the Management Board on an ongoing basis. Planned research and development activities have been adapted to minimize the potential impact the war could have. Currently, there are no material negative effects that have an impact on the Group's net assets, financial position and results of operations. The development of the equity of the parent company MorphoSys AG (including the assessment with regard to the provision of Section 92 German Stock Corporation Act) as well as of MorphoSys Group is closely monitored by the Management Board. In addition, the company is closely monitoring the liquidity situation of MorphoSys Group and of MorphoSys AG, and believes that MorphoSys has sufficient liquid funds to ensure business operations for the forecast period (at least twelve months from the issuance date of the consolidated and statutory financial statements), which is subject to the going-concern assessment, without requiring additional proceeds from external refinancing. Any potential cash flows resulting from the Novartis Business Combination Agreement as announced on February 5, 2024, were not considered in the recent corporate planning. At the time of this report, the Management Board is not aware of any imminent risks, neither individually nor collectively, that could affect the company as a going concern. As of March 31, 2024, MorphoSys had cash and investments of € 631.9 million (December 31, 2023: € 680.5 million). Liquid funds are predominantly used to advance the development of the proprietary portfolio to key clinical and regulatory milestones. The Management Board believes that the cash and other liquid financial assets, which also incorporates the additional cash impacts from the sale of tafasitamab to Incyte as announced on February 5, 2024, will be sufficient to fund the operating activities and other cash requirements until early 2026 including the repayment of the convertible bonds. Any potential cash flows resulting from the Novartis Business Combination Agreement as announced on February 5, 2024, were not considered in the recent corporate planning. Under the Business Combination Agreement, Novartis agreed to use all such efforts which are from the perspective of a prudent business person reasonable and appropriate to provide MorphoSys with the financial resources required following completion of the Novartis Takeover Offer to enable MorphoSys to pay any obligations of MorphoSys arising from the implementation of the Novartis Takeover Offer as and when due, for example, but not limited to the obligation from the convertible bonds and the obligations arising from the long-term incentive plans, each to the extent triggered by the completion of the Novartis Takeover Offer. For the unlikely case that Novartis would withdraw its takeover offer and MorphoSys consequently would remain a stand-alone company, management would need to assess different financing options to ensure the going-concern assumption beyond early 2026 according to regulatory requirements. Management would then consider both anti-dilutive financing options, such as out-licensing of (pre-)clinical assets or the sale of potential future royalties, but also considers accessing the capital markets by way of issuance of new shares or share instruments (ADSs) and/ or issuance or refinancing of convertible debt. MorphoSys reports the key financial figures – research and development expenses as well as combined expenses for selling and general and administration – relevant for internal management purposes in quarterly statements. Their presentation is supplemented accordingly if other areas of the statement of profit Group Interim Statement 15 MorphoSys – I/2024

or loss or balance sheet are affected by material business transactions during the quarter. With the sale and transfer of tafasitamab to Incyte as of February 5, 2024, MorphoSys will no longer forecast Monjuvi U.S. net sales and gross margin on Monjuvi U.S. net sales, as MorphoSys will no longer generate these revenues. For better transparency to the reader of the report, MorphoSys decided to present personal-related provisions in a separate balance sheet line item due to the effects from the probable takeover by Novartis. The prior year balance has been reclassified accordingly to provide better comparability. The figures discussed and presented below for the first quarter 2024 are related to continued operations, unless stated otherwise. Revenues Group revenues amounted to € 27.5 million (3M 2023: € 24.3 million). Group revenues mainly included revenues from royalties in the amount of € 27.0 million (3M 2023: € 20.9 million). Additional group revenues from continued operations were attributable to licenses, milestones, and other sources, amounting to € 0.5 million (3M 2023: € 3.5 million). Cost of Sales Cost of sales in the first quarter of 2024 amounted to € 2.8 million (3M 2023: € 1.0 million). The year-on-year increase was mainly attributable to higher personnel costs. Operating Expenses Research and Development Expenses Research and development expenses amounted to € 85.2 million in the first quarter of 2024 (3M 2023: € 65.4 million) and consisted primarily of personnel expenses of € 62.7 million (3M 2023: € 23.5 million) and costs for external research and development services of € 17.7 million (3M 2023: € 36.7 million). In the first quarter of 2024, the increase in personnel expenses mainly resulted from effects of both an accelerated vesting of certain share-based payment programs and the recognition of remuneration-related provisions following the probable acquisition by Novartis. In the first quarter of 2023, personnel expenses included a one-time effect resulting from severances in connection with the restructuring of the research area. Furthermore, the first quarter of 2023 comprised costs for external research and development services incurred due to the positive development of the patient recruitment in the major ongoing clinical studies of MorphoSys. Combined Expenses for Selling and General and Administration The combined expenses for selling and general and administration amounted to € 204.0 million in the first quarter of 2024 (3M 2023: € 14.0 million). This item mainly consisted of personnel expenses of € 108.6 million (3M 2023: € 9.0 million) and expenses for external services of € 92.8 million (3M 2023: € 1.3 million). 16 Group Interim Statement MorphoSys – I/2024

Selling expenses amounted to € 18.5 million in the first quarter of 2024 (3M 2023: € 3.4 million). This item mainly consisted of personnel expenses of € 17.0 million (3M 2023: € 0.8 million) and expenses for external services of € 0.5 million (3M 2023: € 0.7 million). The increase in selling expenses was mainly due to the effects of accelerated vesting of certain share-based payment programs and the recognition of remuneration-related provisions following the probable acquisition by Novartis. In comparison to the same period of the previous year, general and administrative expenses increased to € 185.5 million (3M 2023: € 10.6 million). This line item mainly comprised personnel expenses amounting to € 91.6 million (3M 2023: € 8.1 million) and expenses for external services of € 92.3 million (3M 2023: € 0.5 million). The increase in general and administrative expenses was mainly due to the effects of accelerated vesting of certain share-based payment programs and the recognition of remuneration-related provisions following the probable acquisition by Novartis. Expenses resulting from external services mainly increased due to the transaction costs in connection with the probable acquisition by Novartis. Finance Income / Finance Expenses Finance income totaled € 9.6 million in the first quarter of 2024 (3M 2023: € 50.8 million) and included gains from investment of cash and cash equivalents as well as foreign currency translation gains from investment of financial assets amounting to € 9.5 million (3M 2023: € 6.0 million). In the first quarter of 2023 finance income included measurement effects from deviations between planning assumptions and actual numbers of financial liabilities from future payments to Royalty Pharma of € 28.2 million as well as income from the repurchase of own convertible bonds in the amount of € 16.4 million. Finance expenses totaled € 56.8 million in the first quarter of 2024 (3M 2023: € 25.2 million). This increase compared to the previous year was mainly due to the higher measurement effects from financial liabilities from future payments to Royalty Pharma of € 52.3 million (3M 2023: € 20.5 million) resulting from deviations between planning assumptions and actual numbers, foreign currency effects and the application of the effective interest method. Also included were finance expenses from the investment of liquid funds and foreign currency translation losses from financing activities in the amount of € 1.7 million (3M 2023: € 1.2 million). Furthermore, interest expenses on the convertible bond issued in 2020 were included in the amount of € 2.7 million (3M 2023: € 3.1 million). Income Taxes In the first quarter of 2024, the Group recorded an income tax benefit in the amount of € 1.6 million (3M 2023: tax benefit or tax expenses of € 0.0 million). In the current period, no additional deferred taxes on current tax losses and temporary differences were capitalized. Group Interim Statement 17 MorphoSys – I/2024

Cash and Investments On March 31, 2024, the Group held cash and investments of € 631.9 million, compared to € 680.5 million on December 31, 2023. Cash and investments are presented in the balance sheet items "Cash and Cash Equivalents" and "Other Financial Assets". The decrease in cash and cash equivalents and financial assets resulted mainly from the consumption of cash for operating activities in the first quarter of 2024. Discontinued Operations On February 5, 2024, the sale and transfer of tafasitamab to Incyte was announced. Effective with this date, Incyte received exclusive worldwide rights, assumed full responsibility and bears all costs for the development and commercialization of tafasitamab. In return, MorphoSys received a total amount of US$ 25.0 million (€ 23.3 million) in cash (purchase price). The sale and transfer of tafasitamab to Incyte is considered a discontinued operation in accordance with IFRS 5, and the consolidated income statement for the comparative period has therefore been adjusted to present discontinued operation separately from continued operations. The loss of the discontinued operations as of March 31, 2024 in the amount of € 3.9 million is fully attributable to the owners of MorphoSys. Monjuvi® U.S. net product sales reached € 5.9 million (US$ 6.4 million) until February 5, 2024 (3M 2023: € 19.4 million; US$ 20.8 million). In the first three months of 2024 other revenue amounted to € 31.2 million (3M 2023:€ 18.6 million), predominantly comprising additional sales of tafasitamab and transitional services provided to Incyte during the agreed transition period of 180 days. As of February 5, 2024, MorphoSys transferred all intellectual property rights related to tafasitamab in the amount of € 74.8 million (Balance Sheet item: Intangible Assets) to Incyte. Furthermore, due to the sale of tafasitamab, all balances for commercial and clinical inventories associated with the production of tafasitamab in the amount of € 61.6 million, advance payments made in the amount of € 17.8 million and rights of use for technical equipment in the amount of € 3.7 million were derecognized through profit or loss. As of February 5, 2024, MorphoSys had recognized current and non-current provisions related to tafasitamab, which ceased to exist due to the assumption of full responsibility by Incyte for the manufacturing and commercialization of tafasitamab going forward. As a result, current and non-current provisions in the amount of € 3.6 million and € 3.6 million, respectively, were derecognized through profit or loss. With the sale and transfer of tafasitamab, the collaboration and license agreement concluded between MorphoSys and Incyte in 2020 was terminated. As a result, the related balance sheet item "Financial Liabilities from Collaborations" was derecognized through profit or loss (see section 4.19 of the notes to MorphoSys' Annual Report 2023 "Financial Liabilities from Collaborations"). This resulted in income from Discontinued Operations in the amount of € 117.6 million. 18 Group Interim Statement MorphoSys – I/2024

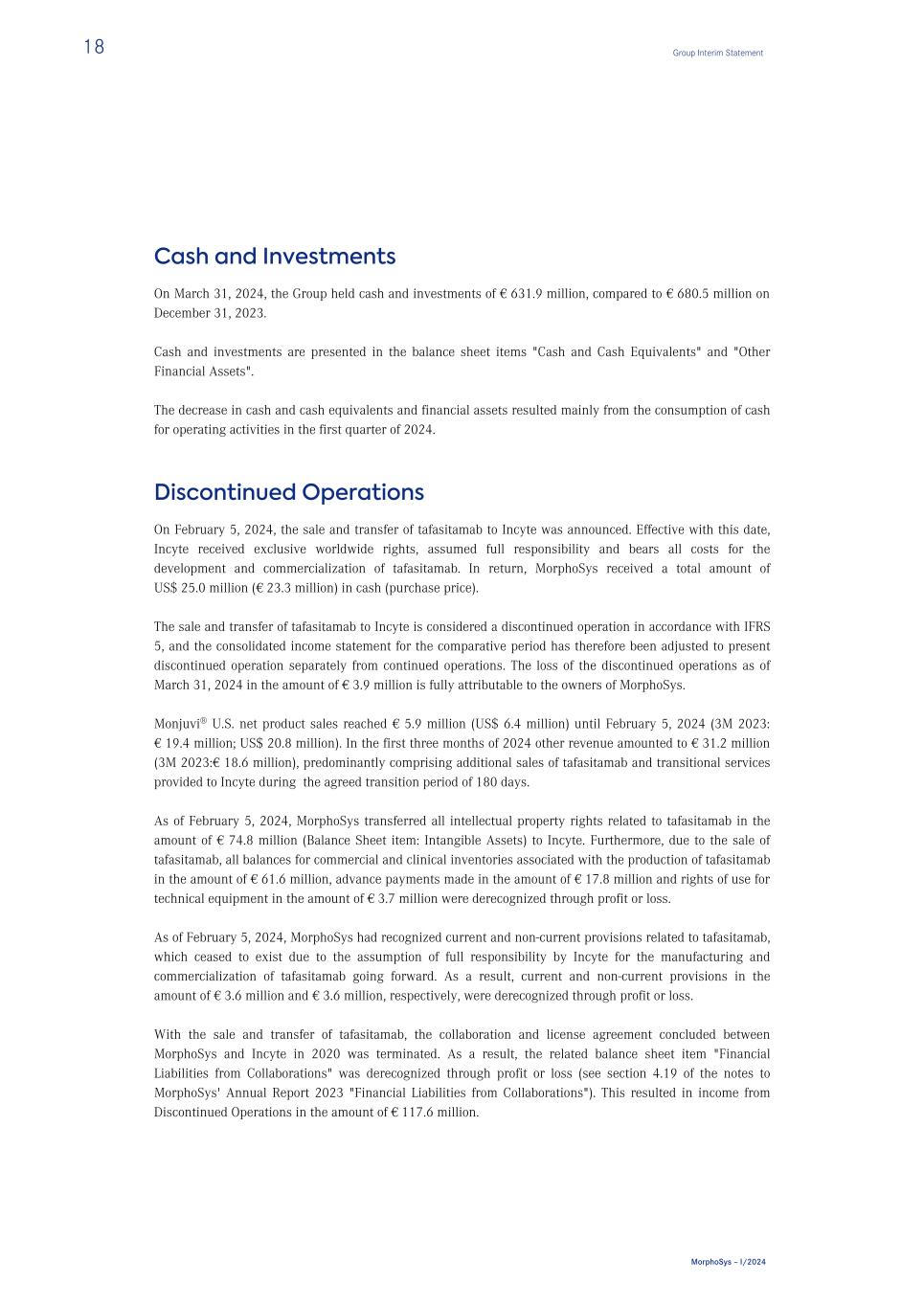

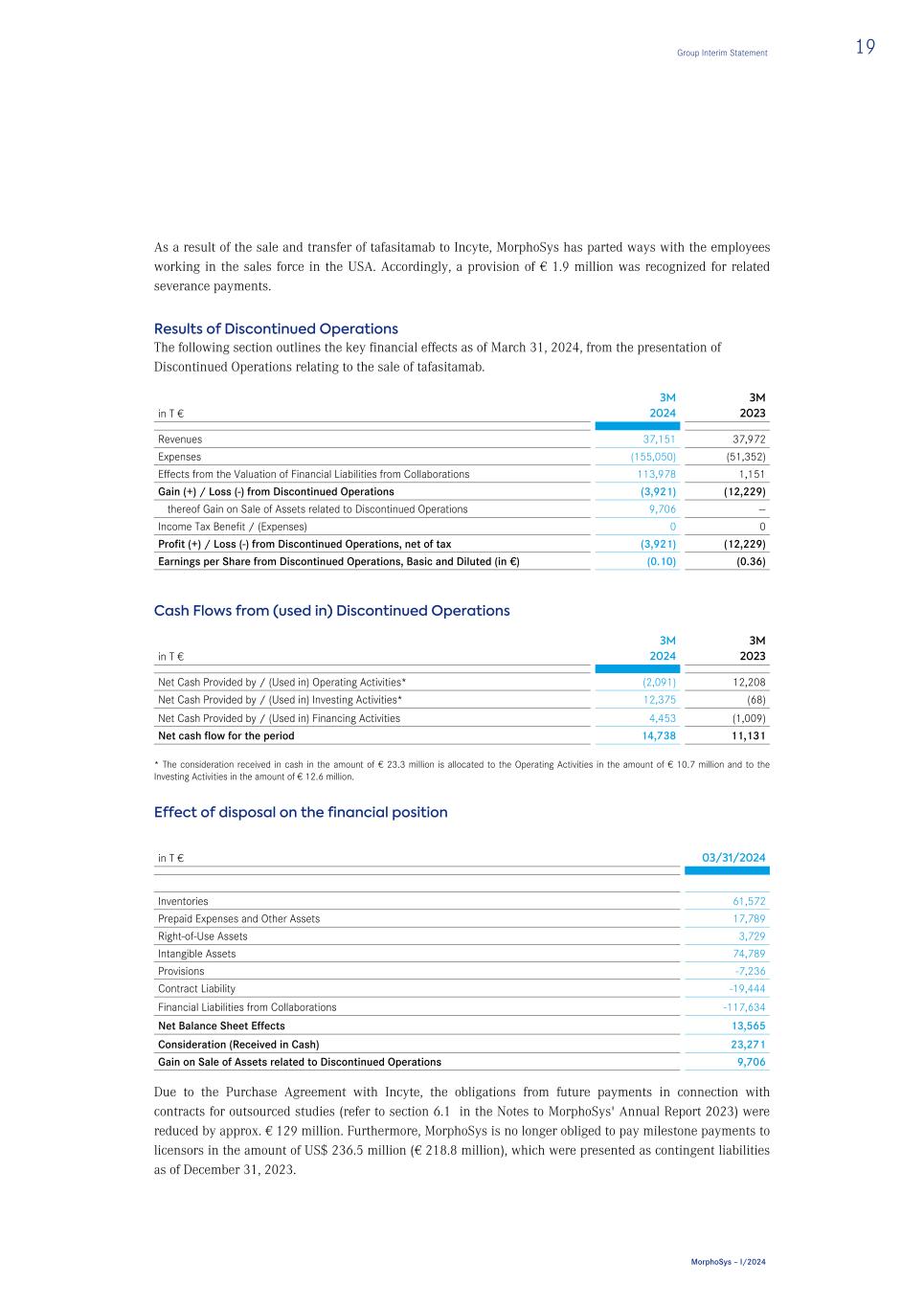

As a result of the sale and transfer of tafasitamab to Incyte, MorphoSys has parted ways with the employees working in the sales force in the USA. Accordingly, a provision of € 1.9 million was recognized for related severance payments. Results of Discontinued Operations The following section outlines the key financial effects as of March 31, 2024, from the presentation of Discontinued Operations relating to the sale of tafasitamab. in T € 3M 2024 3M 2023 Revenues 37,151 37,972 Expenses (155,050) (51,352) Effects from the Valuation of Financial Liabilities from Collaborations 113,978 1,151 Gain (+) / Loss (-) from Discontinued Operations (3,921) (12,229) thereof Gain on Sale of Assets related to Discontinued Operations 9,706 — Income Tax Benefit / (Expenses) 0 0 Profit (+) / Loss (-) from Discontinued Operations, net of tax (3,921) (12,229) Earnings per Share from Discontinued Operations, Basic and Diluted (in €) (0.10) (0.36) Cash Flows from (used in) Discontinued Operations in T € 3M 2024 3M 2023 Net Cash Provided by / (Used in) Operating Activities* (2,091) 12,208 Net Cash Provided by / (Used in) Investing Activities* 12,375 (68) Net Cash Provided by / (Used in) Financing Activities 4,453 (1,009) Net cash flow for the period 14,738 11,131 * The consideration received in cash in the amount of € 23.3 million is allocated to the Operating Activities in the amount of € 10.7 million and to the Investing Activities in the amount of € 12.6 million. Effect of disposal on the financial position in T € 03/31/2024 Inventories 61,572 Prepaid Expenses and Other Assets 17,789 Right-of-Use Assets 3,729 Intangible Assets 74,789 Provisions -7,236 Contract Liability -19,444 Financial Liabilities from Collaborations -117,634 Net Balance Sheet Effects 13,565 Consideration (Received in Cash) 23,271 Gain on Sale of Assets related to Discontinued Operations 9,706 Due to the Purchase Agreement with Incyte, the obligations from future payments in connection with contracts for outsourced studies (refer to section 6.1 in the Notes to MorphoSys' Annual Report 2023) were reduced by approx. € 129 million. Furthermore, MorphoSys is no longer obliged to pay milestone payments to licensors in the amount of US$ 236.5 million (€ 218.8 million), which were presented as contingent liabilities as of December 31, 2023. Group Interim Statement 19 MorphoSys – I/2024

Other Business Transactions Relevant for Financial Reporting On February 5, 2024, MorphoSys announced that it entered into a Business Combination Agreement with Novartis BidCo AG (formerly known as Novartis data42 AG) and Novartis AG (hereinafter collectively referred to as “Novartis”). On April 11, 2024, Novartis published the voluntary public takeover offer (the “Novartis Takeover Offer”) for all of MorphoSys’ outstanding common shares in exchange for payment of € 68.00 per share. Separately, MorphoSys entered into a purchase agreement (the "Purchase Agreement") with Incyte Corporation ("Incyte") to sell and transfer to Incyte all rights worldwide related to tafasitamab for a purchase price of US$ 25.0 million. MorphoSys and Incyte have been collaborating on the development and commercialization of tafasitamab since 2020. Prior to this agreement, tafasitamab was co-marketed in the U.S. by MorphoSys and Incyte as Monjuvi® (tafasitamab-cxix) and outside the U.S. by Incyte as Minjuvi®. MorphoSys’ Management Board and Supervisory Board unanimously approved both agreements. Novartis offers MorphoSys’ shareholders € 68.00 per share in cash, for a total equity value of € 2.7 billion. The offer price corresponds to a premium of 94% and 142% on the volume-weighted average price during the last month and three months as of the unaffected January 25, 2024 close, respectively – the day before rumors about a transaction first surfaced. It also represents a premium of 89% to the closing share price of January 25, 2024. Subject to a careful review of the offer document published by Novartis BidCo AG, MorphoSys’ Management Board and Supervisory Board recommend the acceptance of the Novartis Takeover Offer. The Novartis Takeover Offer contains customary closing conditions, in particular a minimum acceptance threshold of 65% of MorphoSys’ share capital and regulatory clearances. The closing is currently expected to take place in the first half of 2024. MorphoSys and Novartis agreed to take MorphoSys private promptly after the Novartis Takeover Offer has been settled. There is no assurance that the business combination will be consummated on the proposed terms, timing or at all. The offer document of the Novartis Takeover Offer was published by Novartis BidCo AG on April 11, 2024 in accordance with the provisions of the German Securities Acquisition and Takeover Act. Promptly after the offer document was published, MorphoSys’ Management Board and Supervisory Board issued a joint reasoned statement in accordance with sec. 27 of the German Securities Acquisition and Takeover Act. In accordance with U.S. securities laws, Novartis BidCo AG and Novartis AG filed a Tender Offer Statement, which included the offer document on Schedule TO, and MorphoSys filed a Solicitation/Recommendation Statement on Schedule with the U.S. Securities and Exchange Commission. The transaction would result in MorphoSys' common shares being acquired by Novartis in exchange for payment. Novartis offers a price per MorphoSys share which is significantly higher than the trading price of the MorphoSys shares prior to the announcement of the transaction. Management Board believes that the minimum acceptance threshold of 65% will be obtained and the change of control by Novartis will take place. Based on the Business Combination Agreement, Novartis undertakes to MorphoSys to use all such efforts which are from the perspective of a prudent business person reasonable and appropriate to provide the MorphoSys Group with the financial resources required following completion of the Novartis Takeover Offer to enable the relevant MorphoSys Group companies pay any obligations arising from the implementation of the Novartis Takeover Offer as and when due, including any obligations for example, but not limited to, from 20 Group Interim Statement MorphoSys – I/2024

the convertible bond and the obligations arising from the long-term incentive plans, each to the extent triggered by completion of the Novartis Takeover Offer. The major effects on MorphoSys Group's financial statements as of March 31, 2024, are described in the following sections. The sale of tafasitamab to Incyte is presented as discontinued operations and described in the chapter "Discontinued Operations". Effects resulting from the assumed acceptance of the takeover offer As management assumes that it is probable that the voluntary takeover offer from Novartis will reach the minimum acceptance threshold and thus a change of control will take place, MorphoSys has recognized the following effects as of March 31, 2024. In the past, MorphoSys granted various share-based payment programs ("Long-Term Incentive Plans") (as refer to sections 5.1 and 5.2 of the notes to the consolidated financial statements 2023) to selected beneficiaries. As outlined in the Business Combination Agreement, MorphoSys and Novartis commit to use all such efforts which are from the perspective of a prudent business person reasonable and appropriate to ensure uncapped payouts of any long-term incentive plans active prior to signing of the Business Combination Agreement (the “Pre-2024 Long-Term Incentive Plans”) to Management Board members and all employees affected by any caps under German law. It will be offered to all beneficiaries to fully close out their still active Pre-2024 Long-Term Incentive Plans against payment of the offer price after the Novartis Takeover Offer. For certain Long-Term Incentive Plans for which MorphoSys assumed an equity settlement after the vesting period, this assumption will now need to be revised to a full cash-settlement, and the respective provisions for subsequent valuation are to be applied to these programs accordingly. The amounts previously recognized in equity in the amount of € 13.7 million were reclassified to liabilities with no effect on income. A total of € 108.9 million was recognized in profit or loss in the first quarter for the aforementioned matters, resulting in a personnel-related provision totaling € 141.3 million as of March 31, 2024, presented as a separate balance sheet line item. A payment is expected in calendar year 2024 after a successful change-of- control has taken place and MorphoSys has been delisted from both stock exchanges. In addition, as of March 31, 2024, MorphoSys recognized expected transaction costs in the event of a successful change of control in the amount of € 89.4 million and provisions for probable personnel-related compensation claims in the amount of € 36.0 million. Under the Business Combination Agreement, Novartis agreed to use all such efforts which are from the perspective of a prudent business person reasonable and appropriate to provide MorphoSys with the financial resources required following completion of the Novartis Takeover Offer to enable MorphoSys to pay any obligations of MorphoSys arising from the implementation of the Novartis Takeover Offer as and when due, for example, but not limited to the obligation from the convertible bonds and the obligations arising from the long-term incentive plans, each to the extent triggered by the completion of the Novartis Takeover Offer. Performance Share Unit Program 2024 On January 22, 2024, MorphoSys established a performance share unit program (PSU program) for the Management Board and certain employees of the Company (beneficiaries). The program is considered a cash- settled, share-based payment and is accounted for accordingly. The PSU program is a performance-based program and is paid out in cash subject to the fulfillment of predefined performance criteria. The grant date Group Interim Statement 21 MorphoSys – I/2024

was January 22, 2024; the vesting period/performance period is four years. If the predefined performance criteria for the four-year period are fully met, 100% of the performance share units become vested in the four- year vesting period. The number of performance share units to be vested is calculated on the basis of the performance criteria of the relative development of the MorphoSys share price compared to the EURO STOXX Total Market Pharmaceuticals & Biotechnology Index, the achievement of Development Milestones and an assessment of the employee engagement. The performance criteria can be met up to a maximum of 200%. If the defined performance criteria are met by less than 0%, no performance share units will be earned for the four-year assessment period. The right to receive a certain cash settlement from the PSU program does not arise until the end of the four-year vesting period/performance period. After the end of the four-year vesting period, there is a three-month period during which the earned performance shares are transferred from the Company to the beneficiaries by means of a cash settlement. MorphoSys reserves the right to settle the PSU program at the end of the vesting period in MorphoSys AG’s ordinary shares equal to the amount of the performance share units earned. The currently available treasury stocks are likely not sufficient to settle the vested awards. MorphoSys therefore accounts for the plan as a cash-settled share-based payment in accordance with IFRS 2. In the event of a departure from the Company, beneficiaries generally retain the performance share units that have vested by the time of their departure. In the event of a termination of a beneficiary for reasons of conduct or a revocation of the appointment of a member of the Management Board for reasons constituting good cause within the meaning of Section 626 (2) of the German Civil Code (BGB), all unexercised stock options forfeit without entitlement to compensation. As of January 22, 2024 a total of 500,188 performance share units were granted to beneficiaries, of which 124,746 performance share units to the Management Board, 90,906 performance share units to other members of the Executive Committee and 284,536 performance share units to certain employees of the Company who are not members of the Management Board or Executive Committee. For the PSU program 2024, the calculation of personnel expenses from share-based compensation was based on the assumption that beneficiaries would leave the Company during the four-year period, for which 25% of the shares granted are designated. MorphoSys US – 2024 Long-Term Incentive Plan On January 22, 2024, MorphoSys established a Long-Term Incentive Plan (LTI Plan) for certain employees of MorphoSys US Inc. and the Constellation Pharmaceuticals. Inc. (beneficiaries). According to IFRS 2, this program is considered a share-based payment program with settlement in cash and is accounted for accordingly. The LTI Plan is a performance-related share plan (Restricted Stock Unit Plan – RSUP) and is paid out in cash when predefined key performance criteria are achieved. The plan has a term of three years and comprises three performance periods with a term of one year each. If the predefined performance criteria for the respective period are fully met, 33.3% of the performance shares become vested in each year. The number of shares vested per year is calculated based on key performance criteria of MorphoSys US entities during the annual performance period. The performance criteria can be met annually up to a maximum of 175%. If the specified performance criteria are met by less than 50% in one year, no shares will be earned for that year. After the end of the total three-year performance period, the final cash payment amount is calculated. If a beneficiary ceases to hold office or is no longer employed at MorphoSys US Inc. or Constellation Pharmaceuticals. Inc. before the end of a performance period, the beneficiary is generally entitled to all 22 Group Interim Statement MorphoSys – I/2024

restricted stock units that have vested for previously completed one-year performance periods. All other restricted stock units will be forfeited without compensation. As of January 22, 2024, U.S. beneficiaries had been granted 233,497 restricted shares. In the period from January 22, 2024 to March 31, 2024, U.S. beneficiaries have left MorphoSys US Inc. and Constellation Pharmaceuticals, Inc., and therefore 36,325 restricted shares have expired. For the 2024 LTI Plan, the calculation of personnel expenses from share-based compensation was based on the assumption that beneficiaries would leave the Company during the three-year period, for which 40% of the shares granted are designated. Group Interim Statement 23 MorphoSys – I/2024

Subsequent Events On April 11, 2024, Novartis published the offer document for the voluntary public takeover offer by its wholly owned subsidiary Novartis BidCo AG for all outstanding shares of MorphoSys AG. The acceptance period has commenced with the publication of the offer document on April 11, 2024, and will end on May 13, 2024, at 24:00 hours CEST and 18:00 hours EDT (also on May 13, 2024). 24 Group Interim Statement MorphoSys – I/2024

Financial Guidance As a consequence of the sale and transfer of tafasitamab to Incyte on February 5, 2024, MorphoSys' 2024 financial guidance published on January 30, 2024, cannot be maintained and therefore was revoked. For the time being, MorphoSys will no longer make a forecast for revenues from product sales, as no such revenues will be realized. For 2024, the Group expects R&D expenses of € 170 million to € 185 million on a standalone basis. R&D expenses mainly represent our investments in the development of pelabresib and tulmimetostat. Selling, administrative and general expenses are expected to be between € 90 million and € 105 million on a standalone basis. Potential effects from the implementation of the Novartis takeover offer, including potential 1. Quarter 2024 related provisions and expenses associated with the change of control, are not included in this forecast. The overall forecast is subject to a number of uncertainties, including inflation and foreign currency effects. The development of the equity of the parent company MorphoSys AG (including the assessment with regard to the provision of Section 92 German Stock Corporation Act) as well as of MorphoSys Group is closely monitored by the Management Board. In addition, the company is closely monitoring the liquidity situation of MorphoSys Group and of MorphoSys AG, and believes that MorphoSys has sufficient liquid funds to ensure business operations for the forecast period (at least twelve months from the issuance date of the consolidated and statutory financial statements), which is subject to the going-concern assessment, without requiring additional proceeds from external refinancing. Any potential cash flows resulting from the Novartis Business Combination Agreement as announced on February 5, 2024, were not considered in the recent corporate planning. At the time of this report, the Management Board is not aware of any imminent risks, neither individually nor collectively, that could affect the company as a going concern. As of March 31, 2024, MorphoSys had cash and investments of € 631.9 million (December 31, 2023: € 680.5 million). Liquid funds are predominantly used to advance the development of the proprietary portfolio to key clinical and regulatory milestones. The Management Board believes that the cash and other liquid financial assets, which also incorporates the additional cash impacts from the sale of tafasitamab to Incyte as announced on February 5, 2024, will be sufficient to fund the operating activities and other cash requirements until early 2026 including the repayment of the convertible bonds. Any potential cash flows resulting from the Novartis Business Combination Agreement as announced on February 5, 2024, were not considered in the recent corporate planning. Under the Business Combination Agreement, Novartis agreed to use all such efforts which are from the perspective of a prudent business person reasonable and appropriate to provide MorphoSys with the financial resources required following completion of the Novartis Takeover Offer to enable MorphoSys to pay any obligations of MorphoSys arising from the implementation of the Novartis Takeover Offer as and when due, for example, but not limited to the obligation from the convertible bonds and the obligations arising from the long-term incentive plans, each to the extent triggered by the completion of the Novartis Takeover Offer. Group Interim Statement 25 MorphoSys – I/2024

For the unlikely case that Novartis would withdraw its takeover offer and MorphoSys consequently would remain a stand-alone company, management would need to assess different financing options to ensure the going-concern assumption beyond early 2026 according to regulatory requirements. Management would then consider both anti-dilutive financing options, such as out-licensing of (pre-)clinical assets or the sale of potential future royalties, but also considers accessing the capital markets by way of issuance of new shares or share instruments (ADSs) and/ or issuance or refinancing of convertible debt. 26 Group Interim Statement MorphoSys – I/2024

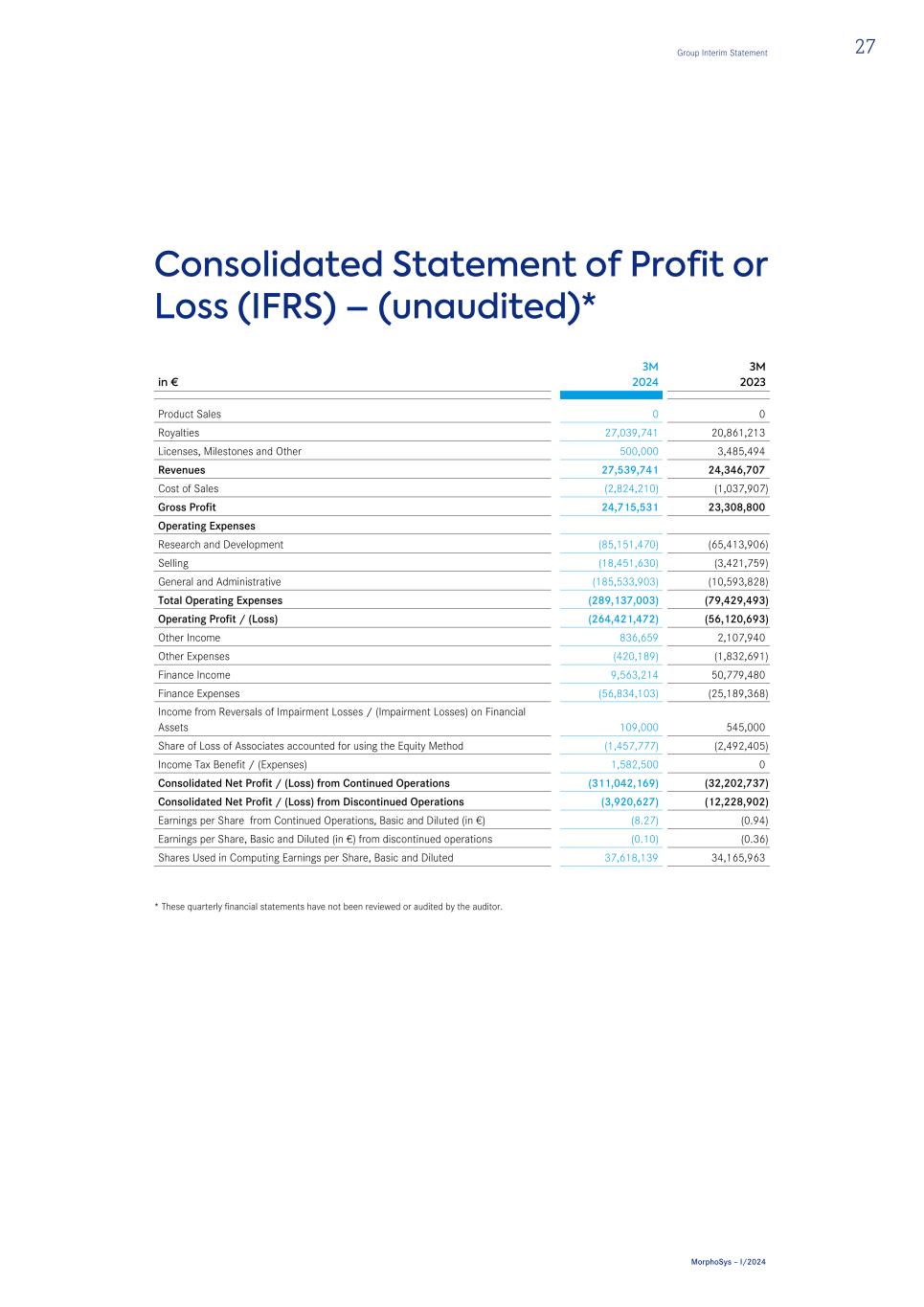

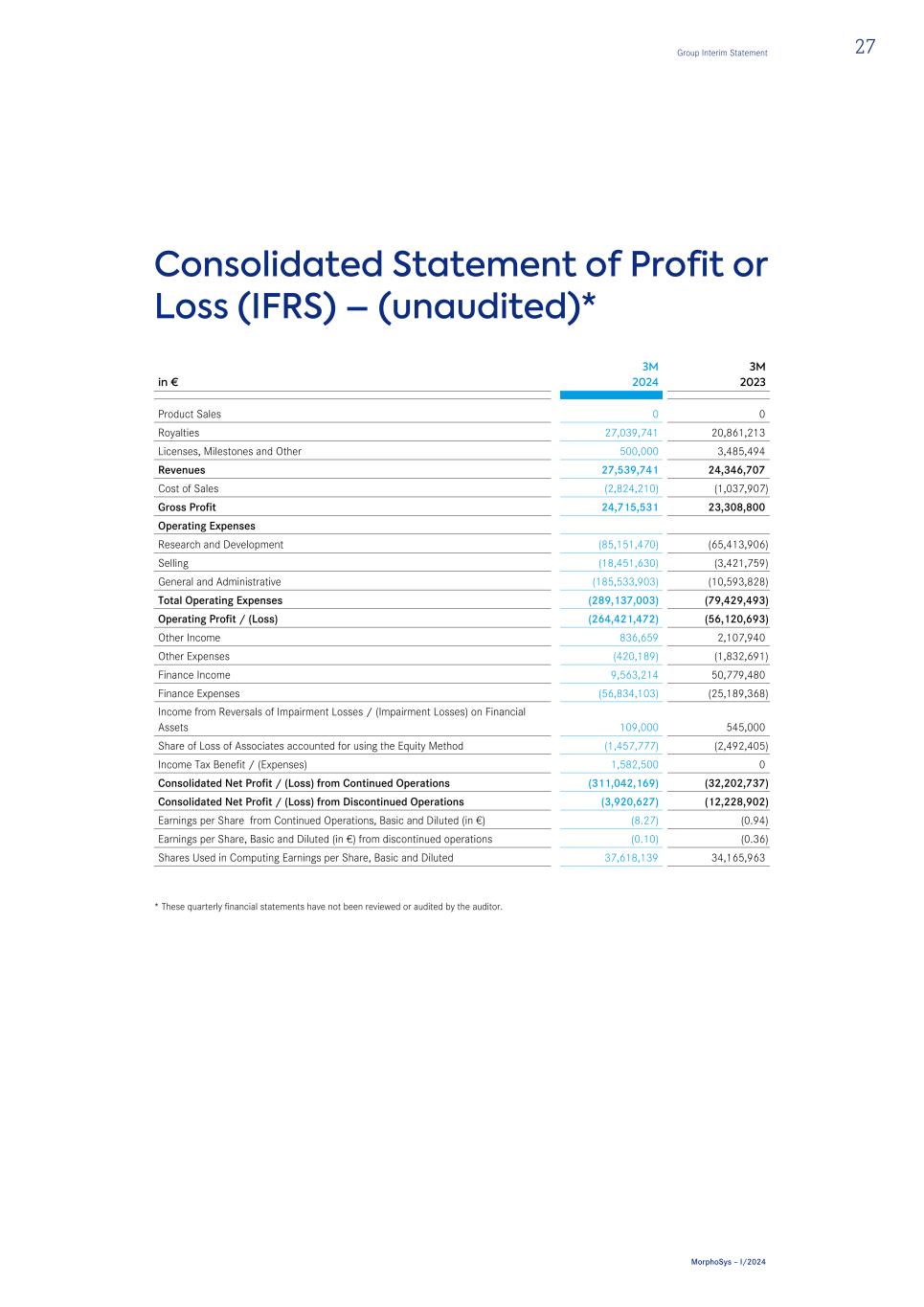

Consolidated Statement of Profit or Loss (IFRS) – (unaudited)* in € 3M 2024 3M 2023 Product Sales 0 0 Royalties 27,039,741 20,861,213 Licenses, Milestones and Other 500,000 3,485,494 Revenues 27,539,741 24,346,707 Cost of Sales (2,824,210) (1,037,907) Gross Profit 24,715,531 23,308,800 Operating Expenses Research and Development (85,151,470) (65,413,906) Selling (18,451,630) (3,421,759) General and Administrative (185,533,903) (10,593,828) Total Operating Expenses (289,137,003) (79,429,493) Operating Profit / (Loss) (264,421,472) (56,120,693) Other Income 836,659 2,107,940 Other Expenses (420,189) (1,832,691) Finance Income 9,563,214 50,779,480 Finance Expenses (56,834,103) (25,189,368) Income from Reversals of Impairment Losses / (Impairment Losses) on Financial Assets 109,000 545,000 Share of Loss of Associates accounted for using the Equity Method (1,457,777) (2,492,405) Income Tax Benefit / (Expenses) 1,582,500 0 Consolidated Net Profit / (Loss) from Continued Operations (311,042,169) (32,202,737) Consolidated Net Profit / (Loss) from Discontinued Operations (3,920,627) (12,228,902) Earnings per Share from Continued Operations, Basic and Diluted (in €) (8.27) (0.94) Earnings per Share, Basic and Diluted (in €) from discontinued operations (0.10) (0.36) Shares Used in Computing Earnings per Share, Basic and Diluted 37,618,139 34,165,963 * These quarterly financial statements have not been reviewed or audited by the auditor. Group Interim Statement 27 MorphoSys – I/2024

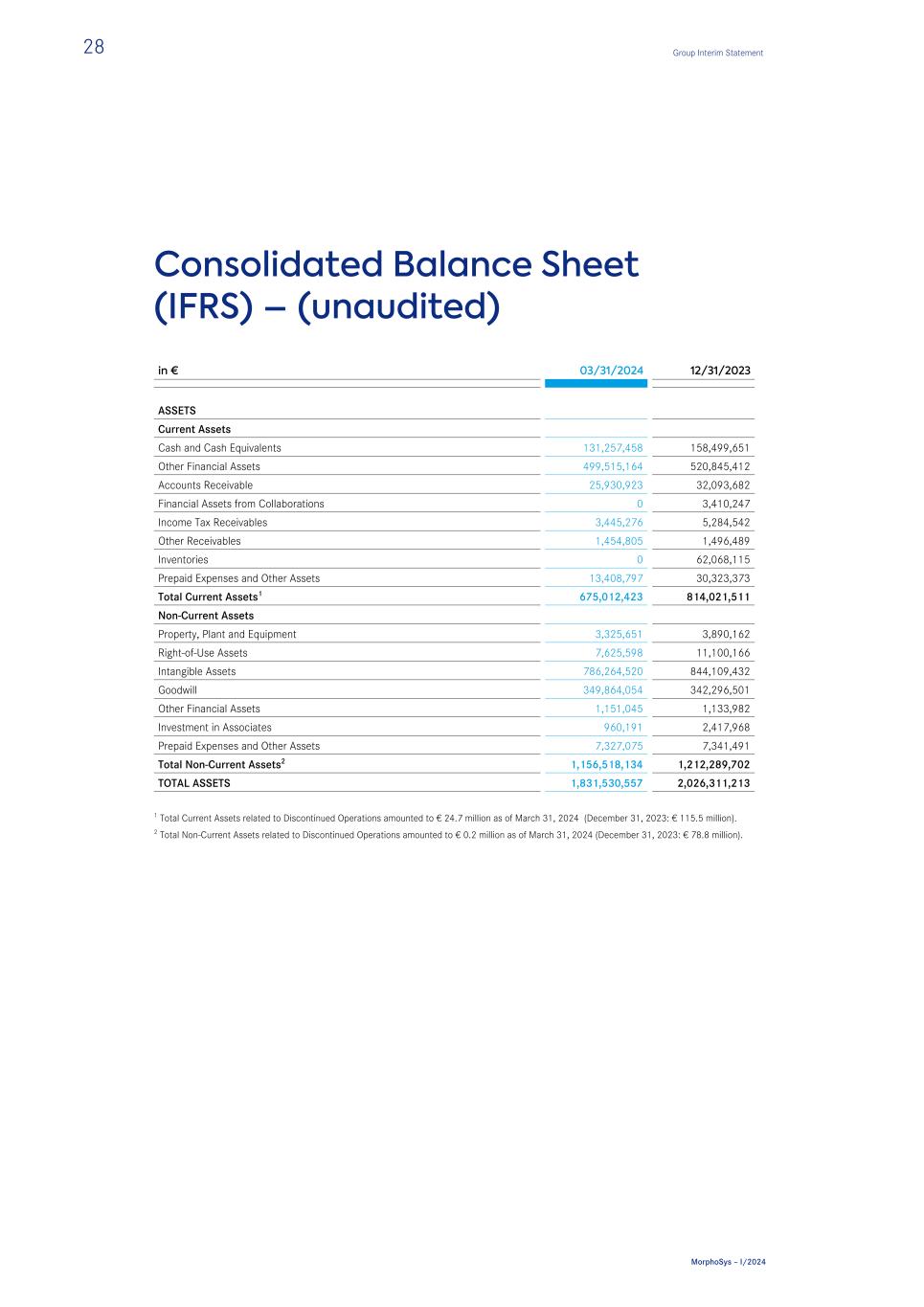

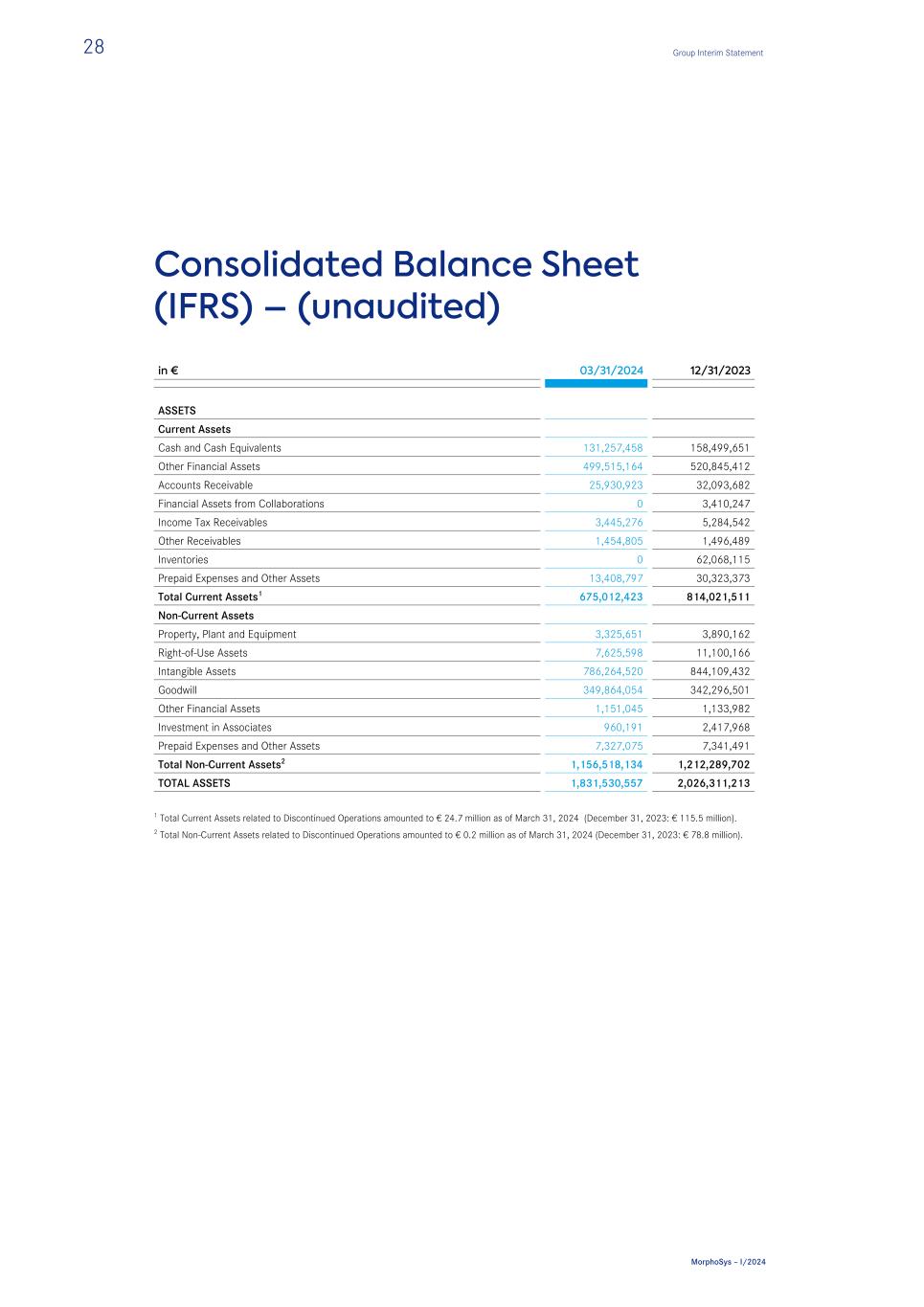

Consolidated Balance Sheet (IFRS) – (unaudited) in € 03/31/2024 12/31/2023 ASSETS Current Assets Cash and Cash Equivalents 131,257,458 158,499,651 Other Financial Assets 499,515,164 520,845,412 Accounts Receivable 25,930,923 32,093,682 Financial Assets from Collaborations 0 3,410,247 Income Tax Receivables 3,445,276 5,284,542 Other Receivables 1,454,805 1,496,489 Inventories 0 62,068,115 Prepaid Expenses and Other Assets 13,408,797 30,323,373 Total Current Assets1 675,012,423 814,021,511 Non-Current Assets Property, Plant and Equipment 3,325,651 3,890,162 Right-of-Use Assets 7,625,598 11,100,166 Intangible Assets 786,264,520 844,109,432 Goodwill 349,864,054 342,296,501 Other Financial Assets 1,151,045 1,133,982 Investment in Associates 960,191 2,417,968 Prepaid Expenses and Other Assets 7,327,075 7,341,491 Total Non-Current Assets2 1,156,518,134 1,212,289,702 TOTAL ASSETS 1,831,530,557 2,026,311,213 1 Total Current Assets related to Discontinued Operations amounted to € 24.7 million as of March 31, 2024 (December 31, 2023: € 115.5 million). 2 Total Non-Current Assets related to Discontinued Operations amounted to € 0.2 million as of March 31, 2024 (December 31, 2023: € 78.8 million). 28 Group Interim Statement MorphoSys – I/2024

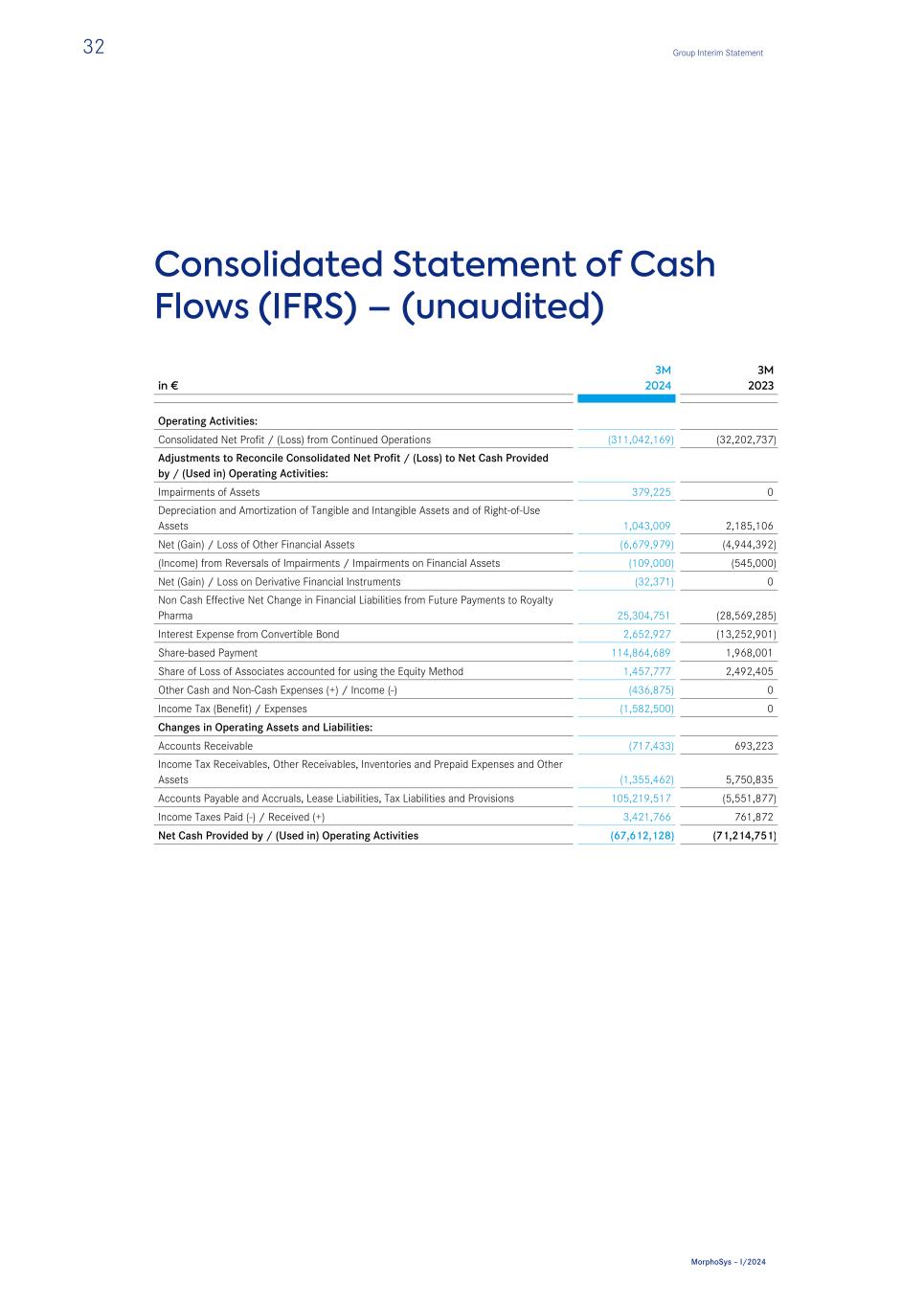

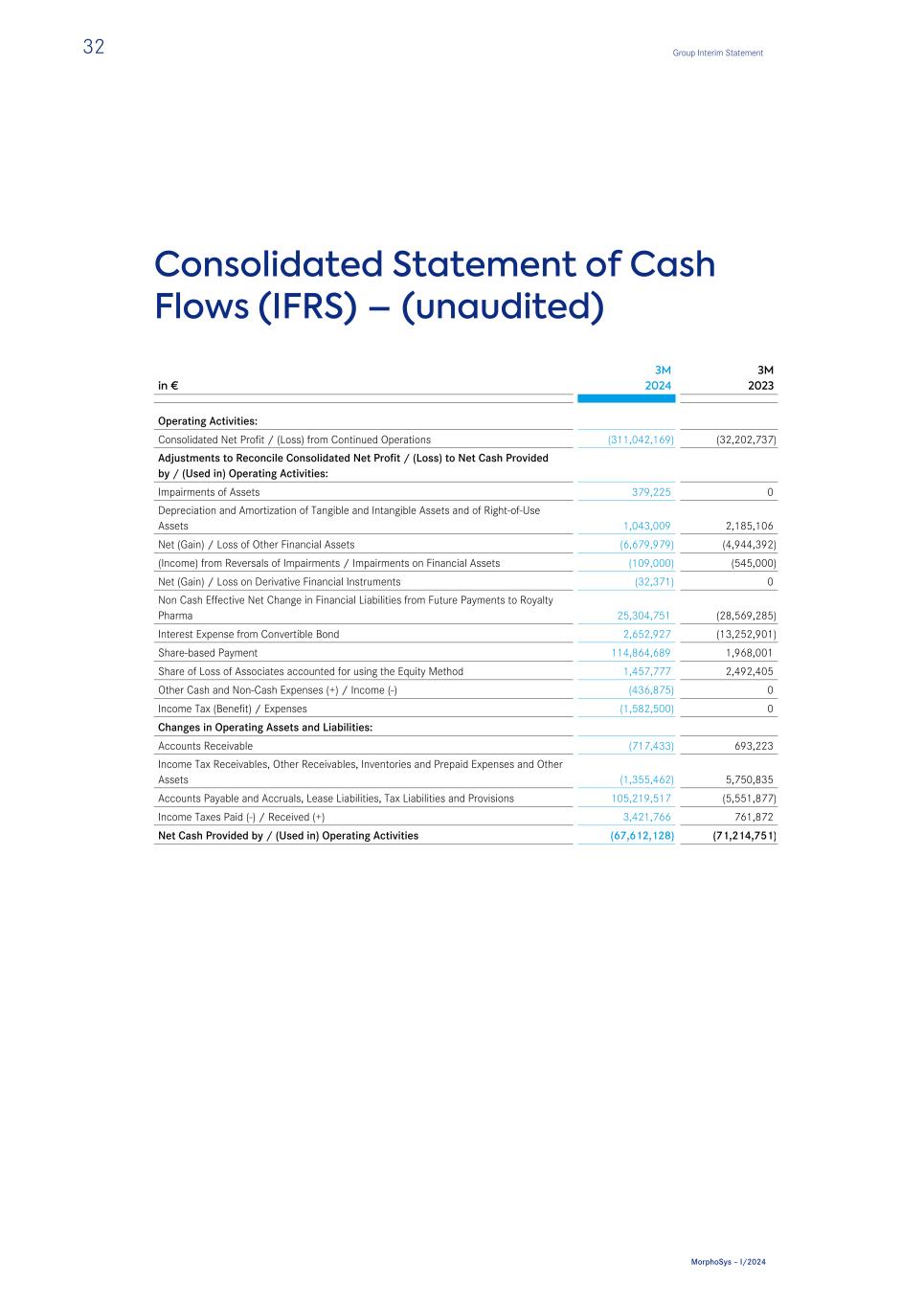

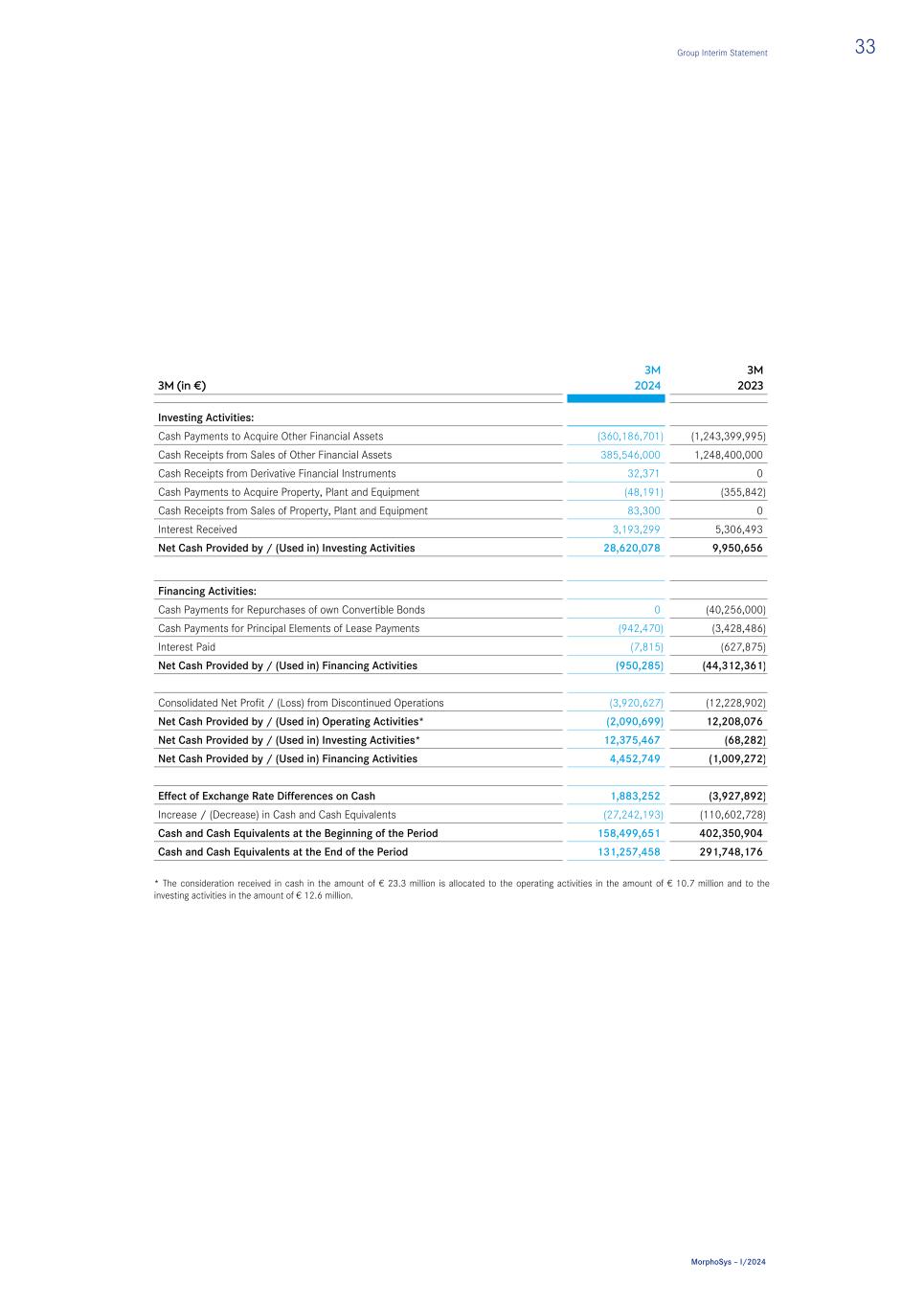

in € 03/31/2024 12/31/2023 LIABILITIES AND STOCKHOLDERS’ EQUITY Current Liabilities Accounts Payable and Accruals 72,586,069 109,804,500 Lease Liabilities 4,165,694 3,628,433 Tax Liabilities 329,723 329,723 Provisions 89,428,592 4,127,121 Personnel-Related Provisions 183,262,865 0 Contract Liability 0 19,443,663 Bonds 1,638,125 1,638,125 Financial Liabilities from Collaborations 417,025 5,526,679 Financial Liabilities from Future Payments to Royalty Pharma 136,011,423 119,811,363 Total Current Liabilities3 487,839,516 264,309,607 Non-Current Liabilities Lease Liabilities 8,559,685 8,796,915 Provisions 121,072 3,794,171 Personnel-Related Provisions 5,860,062 24,568,963 Deferred Tax Liability 6,694,467 6,549,655 Bonds 246,673,882 244,020,955 Financial Liabilities from Collaborations 0 108,868,561 Financial Liabilities from Future Payments to Royalty Pharma 1,337,448,762 1,316,353,147 Total Non-Current Liabilities4 1,605,357,930 1,712,952,367 Total Liabilities 2,093,197,446 1,977,261,974 Stockholders’ Equity Common Stock 37,716,423 37,655,137 Treasury Stock (53,685 and 53,685 shares for 2024 and 2023, respectively), at Cost (1,995,880) (1,995,880) Additional Paid-in Capital 927,779,776 938,088,474 Other Comprehensive Income Reserve 102,929,531 88,435,451 Accumulated Deficit5 (1,328,096,739) (1,013,133,943) Total Stockholders’ Equity (261,666,889) 49,049,239 TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY 1,831,530,557 2,026,311,213 3 Total Current Liabilities related to Discontinued Operations amounted to € 22.9 million as of March 31, 2024 (December 31, 2023: € 70.6 million). 4 Total Non-Current Liabilities related to Discontinued Operations amounted to € 0 million as of March 31, 2024 (December 31, 2023: € 112.5 million). 5 The change in Accumulated Deficit is allocated to Continued Operations in the amount of € 311.0 million and Discontinued Operations in the amount of € 3.9 million. Group Interim Statement 29 MorphoSys – I/2024