00017128072022FYFALSE00017128072023-01-012023-12-310001712807dei:BusinessContactMember2023-01-012023-12-310001712807pags:ClassACommonSharesMember2023-12-31xbrli:shares0001712807pags:ClassBCommonSharesMember2023-12-3100017128072023-12-31iso4217:BRL00017128072022-12-3100017128072022-01-012022-12-3100017128072021-01-012021-12-31iso4217:BRLxbrli:shares0001712807ifrs-full:IssuedCapitalMember2020-12-310001712807ifrs-full:TreasurySharesMember2020-12-310001712807ifrs-full:CapitalReserveMember2020-12-310001712807ifrs-full:ReserveOfSharebasedPaymentsMember2020-12-310001712807ifrs-full:RetainedEarningsMember2020-12-310001712807ifrs-full:RevaluationSurplusMember2020-12-310001712807ifrs-full:AccumulatedOtherComprehensiveIncomeMember2020-12-3100017128072020-12-310001712807ifrs-full:RetainedEarningsMember2021-01-012021-12-310001712807ifrs-full:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001712807ifrs-full:CapitalReserveMember2021-01-012021-12-310001712807ifrs-full:ReserveOfSharebasedPaymentsMember2021-01-012021-12-310001712807ifrs-full:TreasurySharesMember2021-01-012021-12-310001712807ifrs-full:IssuedCapitalMember2021-12-310001712807ifrs-full:TreasurySharesMember2021-12-310001712807ifrs-full:CapitalReserveMember2021-12-310001712807ifrs-full:ReserveOfSharebasedPaymentsMember2021-12-310001712807ifrs-full:RetainedEarningsMember2021-12-310001712807ifrs-full:RevaluationSurplusMember2021-12-310001712807ifrs-full:AccumulatedOtherComprehensiveIncomeMember2021-12-3100017128072021-12-310001712807ifrs-full:RetainedEarningsMember2022-01-012022-12-310001712807ifrs-full:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001712807ifrs-full:ReserveOfSharebasedPaymentsMember2022-01-012022-12-310001712807ifrs-full:TreasurySharesMember2022-01-012022-12-310001712807ifrs-full:IssuedCapitalMember2022-12-310001712807ifrs-full:TreasurySharesMember2022-12-310001712807ifrs-full:CapitalReserveMember2022-12-310001712807ifrs-full:ReserveOfSharebasedPaymentsMember2022-12-310001712807ifrs-full:RetainedEarningsMember2022-12-310001712807ifrs-full:RevaluationSurplusMember2022-12-310001712807ifrs-full:AccumulatedOtherComprehensiveIncomeMember2022-12-310001712807ifrs-full:RetainedEarningsMember2023-01-012023-12-310001712807ifrs-full:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001712807ifrs-full:ReserveOfSharebasedPaymentsMember2023-01-012023-12-310001712807ifrs-full:TreasurySharesMember2023-01-012023-12-310001712807ifrs-full:IssuedCapitalMember2023-12-310001712807ifrs-full:TreasurySharesMember2023-12-310001712807ifrs-full:CapitalReserveMember2023-12-310001712807ifrs-full:ReserveOfSharebasedPaymentsMember2023-12-310001712807ifrs-full:RetainedEarningsMember2023-12-310001712807ifrs-full:RevaluationSurplusMember2023-12-310001712807ifrs-full:AccumulatedOtherComprehensiveIncomeMember2023-12-3100017128072018-01-04xbrli:pure0001712807pags:NetposServicosDeInformaticaS.A.Member2023-07-182023-07-180001712807pags:NetposServicosDeInformaticaS.A.Member2022-12-310001712807pags:NetposServicosDeInformaticaS.A.Member2023-12-310001712807srt:MinimumMemberpags:PosDevicesMember2023-01-012023-12-310001712807pags:PosDevicesMembersrt:MaximumMember2023-01-012023-12-310001712807srt:MinimumMemberpags:BuildingLeasingsMember2023-01-012023-12-310001712807srt:MaximumMemberpags:BuildingLeasingsMember2023-01-012023-12-310001712807srt:MinimumMemberifrs-full:MachineryMember2023-01-012023-12-310001712807ifrs-full:MachineryMembersrt:MaximumMember2023-01-012023-12-310001712807ifrs-full:OtherAssetsMembersrt:MinimumMember2023-01-012023-12-310001712807ifrs-full:OtherAssetsMembersrt:MaximumMember2023-01-012023-12-310001712807ifrs-full:ComputerSoftwareMember2023-01-012023-12-310001712807pags:IncomeTaxMember2023-01-012023-12-310001712807pags:SocialContributionMember2023-01-012023-12-310001712807pags:BancoSeguroMemberpags:IncomeTaxMember2023-01-012023-12-310001712807pags:BancoSeguroMemberpags:SocialContributionMember2023-01-012023-12-310001712807pags:IncomeTaxMemberpags:PaginvestMember2023-01-012023-12-310001712807pags:SocialContributionMemberpags:PaginvestMember2023-01-012023-12-310001712807pags:PagSeguroBrazilMember2023-12-310001712807pags:PagSeguroBrazilMember2023-01-012023-12-310001712807pags:BSHoldingMember2023-12-310001712807pags:BSHoldingMember2023-01-012023-12-310001712807pags:PagsegParticipacoesMember2023-12-310001712807pags:PagsegParticipacoesMember2023-01-012023-12-310001712807pags:PagSeguroHoldingMember2023-12-310001712807pags:PagSeguroHoldingMember2023-01-012023-12-310001712807pags:PagbankParticipacoesMember2023-12-310001712807pags:PagbankParticipacoesMember2023-01-012023-12-310001712807pags:PaginvestMember2023-12-310001712807pags:PaginvestMember2023-01-012023-12-310001712807pags:NetPhoneMember2023-12-310001712807pags:NetPhoneMember2023-01-012023-12-310001712807pags:PagSeguroTecnologiaMember2023-12-310001712807pags:PagSeguroTecnologiaMember2023-01-012023-12-310001712807pags:BCPSMember2023-12-310001712807pags:BCPSMember2023-01-012023-12-310001712807pags:BivaSECMember2023-12-310001712807pags:BivaSECMember2023-01-012023-12-310001712807pags:BivaServiosMember2023-12-310001712807pags:BivaServiosMember2023-01-012023-12-310001712807pags:FIDCMember2023-12-310001712807pags:FIDCMember2023-01-012023-12-310001712807pags:TILIXMember2023-12-310001712807pags:TILIXMember2023-01-012023-12-310001712807pags:BancoSeguroMember2023-12-310001712807pags:BancoSeguroMember2023-01-012023-12-310001712807pags:YamMember2023-12-310001712807pags:YamMember2023-01-012023-12-310001712807pags:CDSMember2023-12-310001712807pags:CDSMember2023-01-012023-12-310001712807pags:ZygoMember2023-12-310001712807pags:ZygoMember2023-01-012023-12-310001712807pags:MoipMember2023-12-310001712807pags:MoipMember2023-01-012023-12-310001712807pags:ConcilMember2023-12-310001712807pags:ConcilMember2023-01-012023-12-310001712807pags:NetposServicosDeInformaticaS.A.Member2023-01-012023-12-310001712807pags:PagseguroChileMember2023-12-310001712807pags:PagseguroChileMember2023-01-012023-12-310001712807pags:PagseguroColombiaMember2023-12-310001712807pags:PagseguroColombiaMember2023-01-012023-12-310001712807pags:PSGPMxicoMember2023-12-310001712807pags:PSGPMxicoMember2023-01-012023-12-310001712807pags:PagseguroPeruMember2023-12-310001712807pags:PagseguroPeruMember2023-01-012023-12-310001712807pags:PagSeguroBrazilMember2022-12-310001712807pags:PagSeguroBrazilMember2022-01-012022-12-310001712807pags:BSHoldingMember2022-12-310001712807pags:BSHoldingMember2022-01-012022-12-310001712807pags:PagsegParticipacoesMember2022-12-310001712807pags:PagsegParticipacoesMember2022-01-012022-12-310001712807pags:PagSeguroHoldingMember2022-12-310001712807pags:PagSeguroHoldingMember2022-01-012022-12-310001712807pags:PagbankParticipacoesMember2022-12-310001712807pags:PagbankParticipacoesMember2022-01-012022-12-310001712807pags:PaginvestMember2022-12-310001712807pags:PaginvestMember2022-01-012022-12-310001712807pags:NetPhoneMember2022-12-310001712807pags:NetPhoneMember2022-01-012022-12-310001712807pags:PagSeguroTecnologiaMember2022-12-310001712807pags:PagSeguroTecnologiaMember2022-01-012022-12-310001712807pags:BCPSMember2022-12-310001712807pags:BCPSMember2022-01-012022-12-310001712807pags:BivaSECMember2022-12-310001712807pags:BivaSECMember2022-01-012022-12-310001712807pags:BivaServiosMember2022-12-310001712807pags:BivaServiosMember2022-01-012022-12-310001712807pags:BivaCorbanMember2022-12-310001712807pags:BivaCorbanMember2022-01-012022-12-310001712807pags:FIDCMember2022-12-310001712807pags:FIDCMember2022-01-012022-12-310001712807pags:TILIXMember2022-12-310001712807pags:TILIXMember2022-01-012022-12-310001712807pags:BancoSeguroMember2022-12-310001712807pags:BancoSeguroMember2022-01-012022-12-310001712807pags:YamMember2022-12-310001712807pags:YamMember2022-01-012022-12-310001712807pags:RegistraSeguroMember2022-12-310001712807pags:RegistraSeguroMember2022-01-012022-12-310001712807pags:CDSMember2022-12-310001712807pags:CDSMember2022-01-012022-12-310001712807pags:ZygoMember2022-12-310001712807pags:ZygoMember2022-01-012022-12-310001712807pags:MoipMember2022-12-310001712807pags:MoipMember2022-01-012022-12-310001712807pags:ConcilMember2022-12-310001712807pags:ConcilMember2022-01-012022-12-310001712807pags:PagseguroChileMember2022-12-310001712807pags:PagseguroChileMember2022-01-012022-12-310001712807pags:PagseguroColombiaMember2022-12-310001712807pags:PagseguroColombiaMember2022-01-012022-12-310001712807pags:PSGPMxicoMember2022-12-310001712807pags:PSGPMxicoMember2022-01-012022-12-310001712807pags:PagseguroPeruMember2022-12-310001712807pags:PagseguroPeruMember2022-01-012022-12-310001712807pags:FIDCMemberpags:ThirdPartyInvestorsMember2018-03-290001712807pags:FIDCMember2021-12-272021-12-270001712807pags:FIDCMemberpags:ThirdPartyInvestorsMember2022-10-310001712807pags:RegistraSeguroMember2019-10-020001712807pags:MoipMember2020-10-312020-10-310001712807pags:ConcilMember2021-08-122021-08-120001712807pags:CDSMember2020-08-312020-08-310001712807pags:TILIXMember2018-12-052018-12-050001712807pags:YamMember2019-08-092019-08-090001712807pags:ZygoMember2020-07-232020-07-230001712807pags:PaginvestMemberifrs-full:BottomOfRangeMember2022-05-130001712807pags:PaginvestMemberifrs-full:TopOfRangeMember2023-03-310001712807pags:PaginvestMember2023-03-3100017128072021-07-012021-09-30pags:subsidiary0001712807pags:BrazilianTreasuryBondsMember2023-12-310001712807pags:SelicInterestRateMemberpags:BrazilianTreasuryBondsMember2022-12-310001712807pags:ItaMemberpags:VisaMember2023-12-310001712807pags:ItaMemberpags:MasterMember2023-12-310001712807pags:HipercardMemberpags:ItaMember2023-12-310001712807pags:ItaMember2023-12-310001712807pags:ItaMemberpags:VisaMember2022-12-310001712807pags:ItaMemberpags:MasterMember2022-12-310001712807pags:HipercardMemberpags:ItaMember2022-12-310001712807pags:ItaMember2022-12-310001712807pags:NubankMemberpags:VisaMember2023-12-310001712807pags:NubankMemberpags:MasterMember2023-12-310001712807pags:NubankMemberpags:EloMember2023-12-310001712807pags:NubankMemberpags:AmexMember2023-12-310001712807pags:NubankMember2023-12-310001712807pags:NubankMemberpags:VisaMember2022-12-310001712807pags:NubankMemberpags:MasterMember2022-12-310001712807pags:NubankMemberpags:EloMember2022-12-310001712807pags:NubankMemberpags:AmexMember2022-12-310001712807pags:NubankMember2022-12-310001712807pags:BradescoMemberpags:VisaMember2023-12-310001712807pags:BradescoMemberpags:MasterMember2023-12-310001712807pags:BradescoMemberpags:EloMember2023-12-310001712807pags:AmexMemberpags:BradescoMember2023-12-310001712807pags:BradescoMember2023-12-310001712807pags:BradescoMemberpags:VisaMember2022-12-310001712807pags:BradescoMemberpags:MasterMember2022-12-310001712807pags:BradescoMemberpags:EloMember2022-12-310001712807pags:AmexMemberpags:BradescoMember2022-12-310001712807pags:BradescoMember2022-12-310001712807pags:VisaMemberpags:SantanderMember2023-12-310001712807pags:MasterMemberpags:SantanderMember2023-12-310001712807pags:AmexMemberpags:SantanderMember2023-12-310001712807pags:SantanderMember2023-12-310001712807pags:VisaMemberpags:SantanderMember2022-12-310001712807pags:MasterMemberpags:SantanderMember2022-12-310001712807pags:AmexMemberpags:SantanderMember2022-12-310001712807pags:SantanderMember2022-12-310001712807pags:VisaMemberpags:BancoDoBrasilMember2023-12-310001712807pags:MasterMemberpags:BancoDoBrasilMember2023-12-310001712807pags:EloMemberpags:BancoDoBrasilMember2023-12-310001712807pags:BancoDoBrasilMember2023-12-310001712807pags:VisaMemberpags:BancoDoBrasilMember2022-12-310001712807pags:MasterMemberpags:BancoDoBrasilMember2022-12-310001712807pags:EloMemberpags:BancoDoBrasilMember2022-12-310001712807pags:BancoDoBrasilMember2022-12-310001712807pags:BancoCarrefourMemberpags:VisaMember2023-12-310001712807pags:BancoCarrefourMemberpags:MasterMember2023-12-310001712807pags:BancoCarrefourMember2023-12-310001712807pags:BancoCarrefourMemberpags:VisaMember2022-12-310001712807pags:BancoCarrefourMemberpags:MasterMember2022-12-310001712807pags:BancoCarrefourMember2022-12-310001712807pags:CEFMemberpags:VisaMember2023-12-310001712807pags:CEFMemberpags:MasterMember2023-12-310001712807pags:EloMemberpags:CEFMember2023-12-310001712807pags:CEFMember2023-12-310001712807pags:CEFMemberpags:VisaMember2022-12-310001712807pags:CEFMemberpags:MasterMember2022-12-310001712807pags:EloMemberpags:CEFMember2022-12-310001712807pags:CEFMember2022-12-310001712807pags:SicrediMemberpags:VisaMember2023-12-310001712807pags:SicrediMemberpags:MasterMember2023-12-310001712807pags:SicrediMember2023-12-310001712807pags:SicrediMemberpags:VisaMember2022-12-310001712807pags:SicrediMemberpags:MasterMember2022-12-310001712807pags:SicrediMember2022-12-310001712807pags:BancoC6Memberpags:MasterMember2023-12-310001712807pags:BancoC6Member2023-12-310001712807pags:BancoC6Memberpags:MasterMember2022-12-310001712807pags:BancoC6Member2022-12-310001712807pags:PortoSeguroMemberpags:VisaMember2023-12-310001712807pags:PortoSeguroMemberpags:MasterMember2023-12-310001712807pags:PortoSeguroMember2023-12-310001712807pags:PortoSeguroMemberpags:VisaMember2022-12-310001712807pags:PortoSeguroMemberpags:MasterMember2022-12-310001712807pags:PortoSeguroMember2022-12-310001712807pags:BancoCooperativoSicoobMemberpags:VisaMember2023-12-310001712807pags:BancoCooperativoSicoobMemberpags:MasterMember2023-12-310001712807pags:BancoCooperativoSicoobMember2023-12-310001712807pags:BancoCooperativoSicoobMemberpags:MasterMember2022-12-310001712807pags:BancoCooperativoSicoobMember2022-12-310001712807pags:BancoInterMemberpags:VisaMember2023-12-310001712807pags:BancoInterMemberpags:MasterMember2023-12-310001712807pags:BancoInterMemberpags:EloMember2023-12-310001712807pags:BancoInterMember2023-12-310001712807pags:BancoInterMemberpags:VisaMember2022-12-310001712807pags:BancoInterMemberpags:MasterMember2022-12-310001712807pags:BancoInterMemberpags:EloMember2022-12-310001712807pags:BancoInterMember2022-12-310001712807pags:WillFinanceiraMemberpags:MasterMember2023-12-310001712807pags:WillFinanceiraMember2023-12-310001712807pags:WillFinanceiraMemberpags:MasterMember2022-12-310001712807pags:WillFinanceiraMember2022-12-310001712807pags:BancoBradescardMemberpags:VisaMember2023-12-310001712807pags:BancoBradescardMemberpags:MasterMember2023-12-310001712807pags:BancoBradescardMemberpags:EloMember2023-12-310001712807pags:BancoBradescardMember2023-12-310001712807pags:BancoBradescardMemberpags:VisaMember2022-12-310001712807pags:BancoBradescardMemberpags:MasterMember2022-12-310001712807pags:BancoBradescardMemberpags:EloMember2022-12-310001712807pags:BancoBradescardMember2022-12-310001712807pags:BancoXPMemberpags:VisaMember2023-12-310001712807pags:BancoXPMemberpags:MasterMember2023-12-310001712807pags:BancoXPMember2023-12-310001712807pags:BancoXPMemberpags:VisaMember2022-12-310001712807pags:BancoXPMemberpags:MasterMember2022-12-310001712807pags:BancoXPMember2022-12-310001712807pags:MidwayMemberpags:VisaMember2023-12-310001712807pags:MidwayMemberpags:MasterMember2023-12-310001712807pags:MidwayMember2023-12-310001712807pags:MidwayMemberpags:VisaMember2022-12-310001712807pags:MidwayMemberpags:MasterMember2022-12-310001712807pags:MidwayMember2022-12-310001712807pags:VisaMemberpags:RealizeMember2023-12-310001712807pags:MasterMemberpags:RealizeMember2023-12-310001712807pags:RealizeMember2023-12-310001712807pags:VisaMemberpags:RealizeMember2022-12-310001712807pags:MasterMemberpags:RealizeMember2022-12-310001712807pags:RealizeMember2022-12-310001712807pags:MasterMemberpags:BancoVotorantimMember2023-12-310001712807pags:BancoVotorantimMember2023-12-310001712807pags:MasterMemberpags:BancoVotorantimMember2022-12-310001712807pags:BancoVotorantimMember2022-12-310001712807pags:PernambucanasMemberpags:VisaMember2023-12-310001712807pags:PernambucanasMemberpags:MasterMember2023-12-310001712807pags:PernambucanasMemberpags:EloMember2023-12-310001712807pags:PernambucanasMember2023-12-310001712807pags:PernambucanasMemberpags:VisaMember2022-12-310001712807pags:PernambucanasMemberpags:MasterMember2022-12-310001712807pags:PernambucanasMemberpags:EloMember2022-12-310001712807pags:PernambucanasMember2022-12-310001712807pags:MercadoPagoMemberpags:VisaMember2023-12-310001712807pags:MercadoPagoMemberpags:MasterMember2023-12-310001712807pags:MercadoPagoMember2023-12-310001712807pags:MercadoPagoMemberpags:VisaMember2022-12-310001712807pags:MercadoPagoMemberpags:MasterMember2022-12-310001712807pags:MercadoPagoMember2022-12-310001712807pags:BancoPanMemberpags:VisaMember2023-12-310001712807pags:BancoPanMemberpags:MasterMember2023-12-310001712807pags:BancoPanMemberpags:EloMember2023-12-310001712807pags:BancoPanMember2023-12-310001712807pags:BancoPanMemberpags:VisaMember2022-12-310001712807pags:BancoPanMemberpags:MasterMember2022-12-310001712807pags:BancoPanMemberpags:EloMember2022-12-310001712807pags:BancoPanMember2022-12-310001712807pags:CredSystemMemberpags:MasterMember2023-12-310001712807pags:CredSystemMemberpags:EloMember2023-12-310001712807pags:CredSystemMember2023-12-310001712807pags:CredSystemMemberpags:MasterMember2022-12-310001712807pags:CredSystemMemberpags:EloMember2022-12-310001712807pags:CredSystemMember2022-12-310001712807pags:BancoOriginalMemberpags:VisaMember2023-12-310001712807pags:BancoOriginalMemberpags:MasterMember2023-12-310001712807pags:BancoOriginalMember2023-12-310001712807pags:BancoOriginalMemberpags:MasterMember2022-12-310001712807pags:BancoOriginalMember2022-12-310001712807pags:CredzMemberpags:VisaMember2023-12-310001712807pags:CredzMemberpags:MasterMember2023-12-310001712807pags:CredzMember2023-12-310001712807pags:CredzMemberpags:VisaMember2022-12-310001712807pags:CredzMemberpags:MasterMember2022-12-310001712807pags:CredzMember2022-12-310001712807pags:BancoobMemberpags:VisaMember2023-12-310001712807pags:BancoobMemberpags:MasterMember2023-12-310001712807pags:BancoobMember2023-12-310001712807pags:BancoobMemberpags:VisaMember2022-12-310001712807pags:BancoobMemberpags:MasterMember2022-12-310001712807pags:BancoobMember2022-12-310001712807pags:DigioMemberpags:VisaMember2023-12-310001712807pags:DigioMemberpags:EloMember2023-12-310001712807pags:DigioMember2023-12-310001712807pags:DigioMemberpags:VisaMember2022-12-310001712807pags:DigioMemberpags:MasterMember2022-12-310001712807pags:DigioMemberpags:EloMember2022-12-310001712807pags:DigioMember2022-12-310001712807pags:VisaMemberpags:BanrisulMember2023-12-310001712807pags:MasterMemberpags:BanrisulMember2023-12-310001712807pags:BanrisulMember2023-12-310001712807pags:VisaMemberpags:BanrisulMember2022-12-310001712807pags:MasterMemberpags:BanrisulMember2022-12-310001712807pags:BanrisulMember2022-12-310001712807pags:OtherMemberpags:VisaMember2023-12-310001712807pags:OtherMemberpags:MasterMember2023-12-310001712807pags:OtherMemberpags:EloMember2023-12-310001712807pags:AmexMemberpags:OtherMember2023-12-310001712807pags:OtherMember2023-12-310001712807pags:OtherMemberpags:VisaMember2022-12-310001712807pags:OtherMemberpags:MasterMember2022-12-310001712807pags:OtherMemberpags:EloMember2022-12-310001712807pags:AmexMemberpags:OtherMember2022-12-310001712807pags:OtherMember2022-12-310001712807pags:TotalCardIssuersMemberpags:VisaMember2023-12-310001712807pags:TotalCardIssuersMemberpags:MasterMember2023-12-310001712807pags:HipercardMemberpags:TotalCardIssuersMember2023-12-310001712807pags:TotalCardIssuersMemberpags:EloMember2023-12-310001712807pags:AmexMemberpags:TotalCardIssuersMember2023-12-310001712807pags:TotalCardIssuersMember2023-12-310001712807pags:TotalCardIssuersMemberpags:VisaMember2022-12-310001712807pags:TotalCardIssuersMemberpags:MasterMember2022-12-310001712807pags:HipercardMemberpags:TotalCardIssuersMember2022-12-310001712807pags:TotalCardIssuersMemberpags:EloMember2022-12-310001712807pags:AmexMemberpags:TotalCardIssuersMember2022-12-310001712807pags:TotalCardIssuersMember2022-12-310001712807pags:CurrentCardIssuersMember2023-12-310001712807pags:CurrentCardIssuersMember2022-12-310001712807pags:NonCurrentCardIssuersMember2023-12-310001712807pags:NonCurrentCardIssuersMember2022-12-310001712807pags:GetnetMember2023-12-310001712807pags:GetnetMember2022-12-310001712807pags:OtherIIMember2023-12-310001712807pags:OtherIIMember2022-12-310001712807pags:TotalAcquirersIiMember2023-12-310001712807pags:TotalAcquirersIiMember2022-12-310001712807pags:WorkingCapitalLoansMember2023-12-310001712807pags:WorkingCapitalLoansMember2022-12-310001712807pags:CreditCardReceivablesMemberMember2023-12-310001712807pags:CreditCardReceivablesMemberMember2022-12-310001712807pags:OtherCreditInitiativesMember2023-12-310001712807pags:OtherCreditInitiativesMember2022-12-310001712807pags:TotalCreditReceivablesIiiMember2023-12-310001712807pags:TotalCreditReceivablesIiiMember2022-12-310001712807pags:CurrentCreditReceivablesMember2023-12-310001712807pags:CurrentCreditReceivablesMember2022-12-310001712807pags:NonCurrentCreditReceivablesMember2023-12-310001712807pags:NonCurrentCreditReceivablesMember2022-12-310001712807pags:OtherAccountsReceivableMember2023-12-310001712807pags:OtherAccountsReceivableMember2022-12-310001712807pags:VisaMember2023-12-310001712807pags:MasterMember2023-12-310001712807pags:HipercardMember2023-12-310001712807pags:EloMember2023-12-310001712807pags:AmexMember2023-12-310001712807pags:VisaMember2022-12-310001712807pags:MasterMember2022-12-310001712807pags:HipercardMember2022-12-310001712807pags:EloMember2022-12-310001712807pags:AmexMember2022-12-310001712807ifrs-full:CurrentMember2023-12-310001712807ifrs-full:CurrentMember2022-12-310001712807ifrs-full:NotLaterThanOneMonthMember2023-12-310001712807ifrs-full:NotLaterThanOneMonthMember2022-12-310001712807pags:DueWithin31To120DaysMember2023-12-310001712807pags:DueWithin31To120DaysMember2022-12-310001712807pags:DueWithin121To180DaysMember2023-12-310001712807pags:DueWithin121To180DaysMember2022-12-310001712807ifrs-full:LaterThanSixMonthsAndNotLaterThanOneYearMember2023-12-310001712807ifrs-full:LaterThanSixMonthsAndNotLaterThanOneYearMember2022-12-310001712807ifrs-full:LaterThanOneYearMember2023-12-310001712807ifrs-full:LaterThanOneYearMember2022-12-310001712807pags:CreditReceivablesMemberifrs-full:CurrentMemberpags:LoansMemberMember2023-12-310001712807pags:CreditReceivablesMemberpags:CreditCardReceivablesMemberMemberifrs-full:CurrentMember2023-12-310001712807pags:CreditReceivablesMemberpags:PayrollLoansAndOtherMemberifrs-full:CurrentMember2023-12-310001712807pags:CreditReceivablesMemberifrs-full:CurrentMember2023-12-310001712807ifrs-full:NotLaterThanOneMonthMemberpags:CreditReceivablesMemberpags:LoansMemberMember2023-12-310001712807ifrs-full:NotLaterThanOneMonthMemberpags:CreditReceivablesMemberpags:CreditCardReceivablesMemberMember2023-12-310001712807ifrs-full:NotLaterThanOneMonthMemberpags:CreditReceivablesMemberpags:PayrollLoansAndOtherMember2023-12-310001712807ifrs-full:NotLaterThanOneMonthMemberpags:CreditReceivablesMember2023-12-310001712807pags:DueWithin31To120DaysMemberpags:CreditReceivablesMemberpags:LoansMemberMember2023-12-310001712807pags:DueWithin31To120DaysMemberpags:CreditReceivablesMemberpags:CreditCardReceivablesMemberMember2023-12-310001712807pags:DueWithin31To120DaysMemberpags:CreditReceivablesMemberpags:PayrollLoansAndOtherMember2023-12-310001712807pags:DueWithin31To120DaysMemberpags:CreditReceivablesMember2023-12-310001712807pags:CreditReceivablesMemberpags:LoansMemberMemberpags:DueWithin121To180DaysMember2023-12-310001712807pags:CreditReceivablesMemberpags:CreditCardReceivablesMemberMemberpags:DueWithin121To180DaysMember2023-12-310001712807pags:CreditReceivablesMemberpags:PayrollLoansAndOtherMemberpags:DueWithin121To180DaysMember2023-12-310001712807pags:CreditReceivablesMemberpags:DueWithin121To180DaysMember2023-12-310001712807pags:CreditReceivablesMemberifrs-full:LaterThanSixMonthsAndNotLaterThanOneYearMemberpags:LoansMemberMember2023-12-310001712807pags:CreditReceivablesMemberifrs-full:LaterThanSixMonthsAndNotLaterThanOneYearMemberpags:CreditCardReceivablesMemberMember2023-12-310001712807pags:CreditReceivablesMemberpags:PayrollLoansAndOtherMemberifrs-full:LaterThanSixMonthsAndNotLaterThanOneYearMember2023-12-310001712807pags:CreditReceivablesMemberifrs-full:LaterThanSixMonthsAndNotLaterThanOneYearMember2023-12-310001712807pags:CreditReceivablesMemberifrs-full:LaterThanOneYearMemberpags:LoansMemberMember2023-12-310001712807pags:CreditReceivablesMemberpags:CreditCardReceivablesMemberMemberifrs-full:LaterThanOneYearMember2023-12-310001712807pags:CreditReceivablesMemberpags:PayrollLoansAndOtherMemberifrs-full:LaterThanOneYearMember2023-12-310001712807pags:CreditReceivablesMemberifrs-full:LaterThanOneYearMember2023-12-310001712807pags:CreditReceivablesMemberpags:MaturityMemberpags:LoansMemberMember2023-12-310001712807pags:CreditReceivablesMemberpags:MaturityMemberpags:CreditCardReceivablesMemberMember2023-12-310001712807pags:CreditReceivablesMemberpags:PayrollLoansAndOtherMemberpags:MaturityMember2023-12-310001712807pags:CreditReceivablesMemberpags:MaturityMember2023-12-310001712807pags:CreditReceivablesMemberpags:LoansMemberMember2023-12-310001712807pags:CreditReceivablesMemberpags:CreditCardReceivablesMemberMember2023-12-310001712807pags:CreditReceivablesMemberpags:PayrollLoansAndOtherMember2023-12-310001712807pags:CreditReceivablesMember2023-12-310001712807pags:CreditReceivablesMemberifrs-full:CurrentMemberpags:LoansMemberMember2022-12-310001712807pags:CreditReceivablesMemberpags:CreditCardReceivablesMemberMemberifrs-full:CurrentMember2022-12-310001712807pags:CreditReceivablesMemberpags:PayrollLoansAndOtherMemberifrs-full:CurrentMember2022-12-310001712807pags:CreditReceivablesMemberifrs-full:CurrentMember2022-12-310001712807ifrs-full:NotLaterThanOneMonthMemberpags:CreditReceivablesMemberpags:LoansMemberMember2022-12-310001712807ifrs-full:NotLaterThanOneMonthMemberpags:CreditReceivablesMemberpags:CreditCardReceivablesMemberMember2022-12-310001712807ifrs-full:NotLaterThanOneMonthMemberpags:CreditReceivablesMemberpags:PayrollLoansAndOtherMember2022-12-310001712807ifrs-full:NotLaterThanOneMonthMemberpags:CreditReceivablesMember2022-12-310001712807pags:DueWithin31To120DaysMemberpags:CreditReceivablesMemberpags:LoansMemberMember2022-12-310001712807pags:DueWithin31To120DaysMemberpags:CreditReceivablesMemberpags:CreditCardReceivablesMemberMember2022-12-310001712807pags:DueWithin31To120DaysMemberpags:CreditReceivablesMemberpags:PayrollLoansAndOtherMember2022-12-310001712807pags:DueWithin31To120DaysMemberpags:CreditReceivablesMember2022-12-310001712807pags:CreditReceivablesMemberpags:LoansMemberMemberpags:DueWithin121To180DaysMember2022-12-310001712807pags:CreditReceivablesMemberpags:CreditCardReceivablesMemberMemberpags:DueWithin121To180DaysMember2022-12-310001712807pags:CreditReceivablesMemberpags:PayrollLoansAndOtherMemberpags:DueWithin121To180DaysMember2022-12-310001712807pags:CreditReceivablesMemberpags:DueWithin121To180DaysMember2022-12-310001712807pags:CreditReceivablesMemberifrs-full:LaterThanSixMonthsAndNotLaterThanOneYearMemberpags:LoansMemberMember2022-12-310001712807pags:CreditReceivablesMemberifrs-full:LaterThanSixMonthsAndNotLaterThanOneYearMemberpags:CreditCardReceivablesMemberMember2022-12-310001712807pags:CreditReceivablesMemberpags:PayrollLoansAndOtherMemberifrs-full:LaterThanSixMonthsAndNotLaterThanOneYearMember2022-12-310001712807pags:CreditReceivablesMemberifrs-full:LaterThanSixMonthsAndNotLaterThanOneYearMember2022-12-310001712807pags:CreditReceivablesMemberifrs-full:LaterThanOneYearMemberpags:LoansMemberMember2022-12-310001712807pags:CreditReceivablesMemberpags:CreditCardReceivablesMemberMemberifrs-full:LaterThanOneYearMember2022-12-310001712807pags:CreditReceivablesMemberpags:PayrollLoansAndOtherMemberifrs-full:LaterThanOneYearMember2022-12-310001712807pags:CreditReceivablesMemberifrs-full:LaterThanOneYearMember2022-12-310001712807pags:CreditReceivablesMemberpags:MaturityMemberpags:LoansMemberMember2022-12-310001712807pags:CreditReceivablesMemberpags:MaturityMemberpags:CreditCardReceivablesMemberMember2022-12-310001712807pags:CreditReceivablesMemberpags:PayrollLoansAndOtherMemberpags:MaturityMember2022-12-310001712807pags:CreditReceivablesMemberpags:MaturityMember2022-12-310001712807pags:CreditReceivablesMemberpags:LoansMemberMember2022-12-310001712807pags:CreditReceivablesMemberpags:CreditCardReceivablesMemberMember2022-12-310001712807pags:CreditReceivablesMemberpags:PayrollLoansAndOtherMember2022-12-310001712807pags:CreditReceivablesMember2022-12-310001712807pags:Stage1Memberpags:CreditAmountMemberpags:LoansMemberMember2023-12-310001712807pags:ExposureOffBalanceCreditLimitsNotUsedMemberpags:Stage1Memberpags:LoansMemberMember2023-12-310001712807pags:Stage1Memberpags:ExpectedCreditLossesMemberpags:LoansMemberMember2023-12-310001712807pags:Stage2Memberpags:CreditAmountMemberpags:LoansMemberMember2023-12-310001712807pags:ExposureOffBalanceCreditLimitsNotUsedMemberpags:Stage2Memberpags:LoansMemberMember2023-12-310001712807pags:Stage2Memberpags:ExpectedCreditLossesMemberpags:LoansMemberMember2023-12-310001712807pags:Stage3Memberpags:CreditAmountMemberpags:LoansMemberMember2023-12-310001712807pags:ExposureOffBalanceCreditLimitsNotUsedMemberpags:Stage3Memberpags:LoansMemberMember2023-12-310001712807pags:Stage3Memberpags:ExpectedCreditLossesMemberpags:LoansMemberMember2023-12-310001712807pags:Stage1Memberpags:CreditCardReceivablesMemberMemberpags:CreditAmountMember2023-12-310001712807pags:ExposureOffBalanceCreditLimitsNotUsedMemberpags:Stage1Memberpags:CreditCardReceivablesMemberMember2023-12-310001712807pags:Stage1Memberpags:ExpectedCreditLossesMemberpags:CreditCardReceivablesMemberMember2023-12-310001712807pags:Stage2Memberpags:CreditCardReceivablesMemberMemberpags:CreditAmountMember2023-12-310001712807pags:ExposureOffBalanceCreditLimitsNotUsedMemberpags:Stage2Memberpags:CreditCardReceivablesMemberMember2023-12-310001712807pags:Stage2Memberpags:ExpectedCreditLossesMemberpags:CreditCardReceivablesMemberMember2023-12-310001712807pags:Stage3Memberpags:CreditCardReceivablesMemberMemberpags:CreditAmountMember2023-12-310001712807pags:ExposureOffBalanceCreditLimitsNotUsedMemberpags:Stage3Memberpags:CreditCardReceivablesMemberMember2023-12-310001712807pags:Stage3Memberpags:ExpectedCreditLossesMemberpags:CreditCardReceivablesMemberMember2023-12-310001712807pags:Stage1Memberpags:PayrollLoansAndOtherMemberpags:CreditAmountMember2023-12-310001712807pags:ExposureOffBalanceCreditLimitsNotUsedMemberpags:Stage1Memberpags:PayrollLoansAndOtherMember2023-12-310001712807pags:Stage1Memberpags:PayrollLoansAndOtherMemberpags:ExpectedCreditLossesMember2023-12-310001712807pags:PayrollLoansAndOtherMemberpags:Stage2Memberpags:CreditAmountMember2023-12-310001712807pags:ExposureOffBalanceCreditLimitsNotUsedMemberpags:PayrollLoansAndOtherMemberpags:Stage2Member2023-12-310001712807pags:PayrollLoansAndOtherMemberpags:Stage2Memberpags:ExpectedCreditLossesMember2023-12-310001712807pags:PayrollLoansAndOtherMemberpags:Stage3Memberpags:CreditAmountMember2023-12-310001712807pags:ExposureOffBalanceCreditLimitsNotUsedMemberpags:PayrollLoansAndOtherMemberpags:Stage3Member2023-12-310001712807pags:PayrollLoansAndOtherMemberpags:Stage3Memberpags:ExpectedCreditLossesMember2023-12-310001712807pags:CreditAmountMember2023-12-310001712807pags:ExposureOffBalanceCreditLimitsNotUsedMember2023-12-310001712807pags:ExpectedCreditLossesMember2023-12-310001712807pags:Stage1Memberpags:CreditAmountMemberpags:LoansMemberMember2022-12-310001712807pags:ExposureOffBalanceCreditLimitsNotUsedMemberpags:Stage1Memberpags:LoansMemberMember2022-12-310001712807pags:Stage1Memberpags:ExpectedCreditLossesMemberpags:LoansMemberMember2022-12-310001712807pags:Stage2Memberpags:CreditAmountMemberpags:LoansMemberMember2022-12-310001712807pags:ExposureOffBalanceCreditLimitsNotUsedMemberpags:Stage2Memberpags:LoansMemberMember2022-12-310001712807pags:Stage2Memberpags:ExpectedCreditLossesMemberpags:LoansMemberMember2022-12-310001712807pags:Stage3Memberpags:CreditAmountMemberpags:LoansMemberMember2022-12-310001712807pags:ExposureOffBalanceCreditLimitsNotUsedMemberpags:Stage3Memberpags:LoansMemberMember2022-12-310001712807pags:Stage3Memberpags:ExpectedCreditLossesMemberpags:LoansMemberMember2022-12-310001712807pags:Stage1Memberpags:CreditCardReceivablesMemberMemberpags:CreditAmountMember2022-12-310001712807pags:ExposureOffBalanceCreditLimitsNotUsedMemberpags:Stage1Memberpags:CreditCardReceivablesMemberMember2022-12-310001712807pags:Stage1Memberpags:ExpectedCreditLossesMemberpags:CreditCardReceivablesMemberMember2022-12-310001712807pags:Stage2Memberpags:CreditCardReceivablesMemberMemberpags:CreditAmountMember2022-12-310001712807pags:ExposureOffBalanceCreditLimitsNotUsedMemberpags:Stage2Memberpags:CreditCardReceivablesMemberMember2022-12-310001712807pags:Stage2Memberpags:ExpectedCreditLossesMemberpags:CreditCardReceivablesMemberMember2022-12-310001712807pags:Stage3Memberpags:CreditCardReceivablesMemberMemberpags:CreditAmountMember2022-12-310001712807pags:ExposureOffBalanceCreditLimitsNotUsedMemberpags:Stage3Memberpags:CreditCardReceivablesMemberMember2022-12-310001712807pags:Stage3Memberpags:ExpectedCreditLossesMemberpags:CreditCardReceivablesMemberMember2022-12-310001712807pags:Stage1Memberpags:PayrollLoansAndOtherMemberpags:CreditAmountMember2022-12-310001712807pags:ExposureOffBalanceCreditLimitsNotUsedMemberpags:Stage1Memberpags:PayrollLoansAndOtherMember2022-12-310001712807pags:Stage1Memberpags:PayrollLoansAndOtherMemberpags:ExpectedCreditLossesMember2022-12-310001712807pags:PayrollLoansAndOtherMemberpags:Stage2Memberpags:CreditAmountMember2022-12-310001712807pags:ExposureOffBalanceCreditLimitsNotUsedMemberpags:PayrollLoansAndOtherMemberpags:Stage2Member2022-12-310001712807pags:PayrollLoansAndOtherMemberpags:Stage2Memberpags:ExpectedCreditLossesMember2022-12-310001712807pags:PayrollLoansAndOtherMemberpags:Stage3Memberpags:CreditAmountMember2022-12-310001712807pags:ExposureOffBalanceCreditLimitsNotUsedMemberpags:PayrollLoansAndOtherMemberpags:Stage3Member2022-12-310001712807pags:PayrollLoansAndOtherMemberpags:Stage3Memberpags:ExpectedCreditLossesMember2022-12-310001712807pags:CreditAmountMember2022-12-310001712807pags:ExposureOffBalanceCreditLimitsNotUsedMember2022-12-310001712807pags:ExpectedCreditLossesMember2022-12-310001712807pags:LoansMemberMember2021-12-310001712807pags:CreditCardReceivablesMemberMember2021-12-310001712807pags:PayrollLoansAndOtherMember2021-12-310001712807pags:LoansMemberMember2022-01-012022-12-310001712807pags:CreditCardReceivablesMemberMember2022-01-012022-12-310001712807pags:PayrollLoansAndOtherMember2022-01-012022-12-310001712807pags:LoansMemberMember2022-12-310001712807pags:CreditCardReceivablesMemberMember2022-12-310001712807pags:PayrollLoansAndOtherMember2022-12-310001712807pags:LoansMemberMember2023-01-012023-12-310001712807pags:CreditCardReceivablesMemberMember2023-01-012023-12-310001712807pags:PayrollLoansAndOtherMember2023-01-012023-12-310001712807pags:LoansMemberMember2023-12-310001712807pags:CreditCardReceivablesMemberMember2023-12-310001712807pags:PayrollLoansAndOtherMember2023-12-310001712807pags:CreditCardReceivablesMemberMember2023-01-012023-12-310001712807pags:LoansMemberMember2023-01-012023-12-310001712807pags:PayrollLoansAndOtherMember2023-01-012023-12-310001712807pags:UOL_DepositsMember2023-12-310001712807pags:UOL_DepositsMember2022-12-310001712807pags:UOLEdtechTecnologiaDepositsMember2023-12-310001712807pags:UOLEdtechTecnologiaDepositsMember2022-12-310001712807pags:WebJumpDesingEmInformaticaLtdaDepositsMember2023-12-310001712807pags:WebJumpDesingEmInformaticaLtdaDepositsMember2022-12-310001712807pags:Ingresso.comLtdaDepositsMember2023-12-310001712807pags:Ingresso.comLtdaDepositsMember2022-12-310001712807pags:InvilliaDesenvolvimentoDeProdutosDigitaisLtdaDepositsMember2023-12-310001712807pags:InvilliaDesenvolvimentoDeProdutosDigitaisLtdaDepositsMember2022-12-310001712807pags:InvilliaHoldingLtdaDepositsMember2023-12-310001712807pags:InvilliaHoldingLtdaDepositsMember2022-12-310001712807pags:OthersDepositsMember2023-12-310001712807pags:OthersDepositsMember2022-12-310001712807us-gaap:DepositsMember2023-12-310001712807us-gaap:DepositsMember2022-12-310001712807pags:UOL_salesOfServiceMember2023-12-310001712807pags:UOL_salesOfServiceMember2022-12-310001712807pags:CompassoTecnologiaLtda.SalesOfServicesMember2023-12-310001712807pags:CompassoTecnologiaLtda.SalesOfServicesMember2022-12-310001712807pags:CompassUOLSASalesOfServicesMember2023-12-310001712807pags:CompassUOLSASalesOfServicesMember2022-12-310001712807pags:UOLDiveoSalesofServiceMember2023-12-310001712807pags:UOLDiveoSalesofServiceMember2022-12-310001712807pags:InvilliaDesenvolvimentoDeProdutosDigitaisLtdaSalesOfServicesMember2023-12-310001712807pags:InvilliaDesenvolvimentoDeProdutosDigitaisLtdaSalesOfServicesMember2022-12-310001712807pags:EdgeUOLTecnologiaLtdaSalesOfServicesMember2023-12-310001712807pags:EdgeUOLTecnologiaLtdaSalesOfServicesMember2022-12-310001712807pags:UOL_sharedservicecostsMember2023-12-310001712807pags:UOL_sharedservicecostsMember2022-12-310001712807pags:DigitalServicesUOLS.ABorrowingMember2023-12-310001712807pags:DigitalServicesUOLS.ABorrowingMember2022-12-310001712807pags:OthersTransactionsAndServicesMember2023-12-310001712807pags:OthersTransactionsAndServicesMember2022-12-310001712807pags:AffiliatedCompaniesMember2023-12-310001712807pags:AffiliatedCompaniesMember2022-12-310001712807pags:BancoSeguroMemberifrs-full:BottomOfRangeMember2023-01-012023-12-310001712807ifrs-full:TopOfRangeMemberpags:BancoSeguroMember2023-01-012023-12-310001712807pags:BancoSeguroMemberifrs-full:BottomOfRangeMember2022-01-012022-12-310001712807ifrs-full:TopOfRangeMemberpags:BancoSeguroMember2022-01-012022-12-310001712807pags:DueWithin31To120DaysMemberus-gaap:DepositsMember2023-12-310001712807pags:DueWithin31To120DaysMemberus-gaap:DepositsMember2022-12-310001712807us-gaap:DepositsMemberpags:DueWithin121To180DaysMember2023-12-310001712807us-gaap:DepositsMemberpags:DueWithin121To180DaysMember2022-12-310001712807us-gaap:DepositsMemberifrs-full:LaterThanSixMonthsAndNotLaterThanOneYearMember2023-12-310001712807us-gaap:DepositsMemberifrs-full:LaterThanSixMonthsAndNotLaterThanOneYearMember2022-12-310001712807us-gaap:DepositsMemberifrs-full:LaterThanOneYearMember2023-12-310001712807us-gaap:DepositsMemberifrs-full:LaterThanOneYearMember2022-12-310001712807pags:UOL_DepositsMember2023-01-012023-12-310001712807pags:UOL_DepositsMember2022-01-012022-12-310001712807pags:UOL_DepositsMember2021-01-012021-12-310001712807pags:UOLEdtechTecnologiaEducacionalS.ADepositsMember2023-01-012023-12-310001712807pags:UOLEdtechTecnologiaEducacionalS.ADepositsMember2022-01-012022-12-310001712807pags:UOLEdtechTecnologiaEducacionalS.ADepositsMember2021-01-012021-12-310001712807pags:WebJumpDesignEmInformaticaLtdaDepositsMember2023-01-012023-12-310001712807pags:WebJumpDesignEmInformaticaLtdaDepositsMember2022-01-012022-12-310001712807pags:WebJumpDesignEmInformaticaLtdaDepositsMember2021-01-012021-12-310001712807pags:Ingresso.comLtdaDepositsMember2023-01-012023-12-310001712807pags:Ingresso.comLtdaDepositsMember2022-01-012022-12-310001712807pags:Ingresso.comLtdaDepositsMember2021-01-012021-12-310001712807pags:UOLCursosTec.Ed.Ltda.DepositsMember2023-01-012023-12-310001712807pags:UOLCursosTec.Ed.Ltda.DepositsMember2022-01-012022-12-310001712807pags:UOLCursosTec.Ed.Ltda.DepositsMember2021-01-012021-12-310001712807pags:InvilliaDesenvolvimentoDeProdutosDigitaisLtdaDepositsMember2023-01-012023-12-310001712807pags:InvilliaDesenvolvimentoDeProdutosDigitaisLtdaDepositsMember2022-01-012022-12-310001712807pags:InvilliaDesenvolvimentoDeProdutosDigitaisLtdaDepositsMember2021-01-012021-12-310001712807us-gaap:DepositsMember2023-01-012023-12-310001712807us-gaap:DepositsMember2022-01-012022-12-310001712807us-gaap:DepositsMember2021-01-012021-12-310001712807pags:UOL_salesOfServiceMember2023-01-012023-12-310001712807pags:UOL_salesOfServiceMember2022-01-012022-12-310001712807pags:UOL_salesOfServiceMember2021-01-012021-12-310001712807pags:DigitalServicesUOLSASalesOfServicesMember2023-01-012023-12-310001712807pags:DigitalServicesUOLSASalesOfServicesMember2022-01-012022-12-310001712807pags:DigitalServicesUOLSASalesOfServicesMember2021-01-012021-12-310001712807pags:CompassoTecnologiaLtda.SalesOfServicesMember2023-01-012023-12-310001712807pags:CompassoTecnologiaLtda.SalesOfServicesMember2022-01-012022-12-310001712807pags:CompassoTecnologiaLtda.SalesOfServicesMember2021-01-012021-12-310001712807pags:CompassoUOLS.A.SalesOfServicesMember2023-01-012023-12-310001712807pags:CompassoUOLS.A.SalesOfServicesMember2022-01-012022-12-310001712807pags:CompassoUOLS.A.SalesOfServicesMember2021-01-012021-12-310001712807pags:InvilliaDesenvolvimentoDeProdutosDigitaisLtdaSalesOfServicesMember2023-01-012023-12-310001712807pags:InvilliaDesenvolvimentoDeProdutosDigitaisLtdaSalesOfServicesMember2022-01-012022-12-310001712807pags:InvilliaDesenvolvimentoDeProdutosDigitaisLtdaSalesOfServicesMember2021-01-012021-12-310001712807pags:EdgeUOLTecnologiaLtdaSalesOfServicesMember2023-01-012023-12-310001712807pags:EdgeUOLTecnologiaLtdaSalesOfServicesMember2022-01-012022-12-310001712807pags:EdgeUOLTecnologiaLtdaSalesOfServicesMember2021-01-012021-12-310001712807pags:UOL_sharedservicecostsMember2023-01-012023-12-310001712807pags:UOL_sharedservicecostsMember2022-01-012022-12-310001712807pags:UOL_sharedservicecostsMember2021-01-012021-12-310001712807pags:DigitalServicesUOLS.ABorrowingMember2023-01-012023-12-310001712807pags:DigitalServicesUOLS.ABorrowingMember2022-01-012022-12-310001712807pags:DigitalServicesUOLS.ABorrowingMember2021-01-012021-12-310001712807pags:OthersTransactionsAndServicesMember2023-01-012023-12-310001712807pags:OthersTransactionsAndServicesMember2022-01-012022-12-310001712807pags:OthersTransactionsAndServicesMember2021-01-012021-12-310001712807pags:AffiliatedCompaniesMember2023-01-012023-12-310001712807pags:AffiliatedCompaniesMember2022-01-012022-12-310001712807pags:AffiliatedCompaniesMember2021-01-012021-12-310001712807pags:InterestRateCDIMemberpags:BivaSECMember2023-01-012023-12-310001712807pags:InterestRatePerYearMemberpags:BivaSECMember2023-01-012023-12-310001712807pags:NetposServicosDeInformaticaS.A.Member2023-07-180001712807pags:NetposServicosDeInformaticaS.A.Memberifrs-full:CustomerrelatedIntangibleAssetsMember2023-07-180001712807pags:NonCompeteAgreementsMemberpags:NetposServicosDeInformaticaS.A.Member2023-07-180001712807ifrs-full:ComputerSoftwareMemberpags:NetposServicosDeInformaticaS.A.Member2023-07-180001712807ifrs-full:BottomOfRangeMemberpags:NetposServicosDeInformaticaS.A.Member2023-01-012023-12-310001712807ifrs-full:TopOfRangeMemberpags:NetposServicosDeInformaticaS.A.Member2023-01-012023-12-310001712807pags:NetposServicosDeInformaticaS.A.Member2023-12-310001712807pags:NetposServicosDeInformaticaS.A.Member2023-01-012023-12-310001712807ifrs-full:GrossCarryingAmountMemberifrs-full:ComputerEquipmentMember2023-12-310001712807ifrs-full:ComputerEquipmentMemberifrs-full:AccumulatedDepreciationAndAmortisationMember2023-12-310001712807ifrs-full:ComputerEquipmentMember2023-12-310001712807ifrs-full:GrossCarryingAmountMemberifrs-full:MachineryMember2023-12-310001712807ifrs-full:MachineryMemberifrs-full:AccumulatedDepreciationAndAmortisationMember2023-12-310001712807ifrs-full:MachineryMember2023-12-310001712807ifrs-full:GrossCarryingAmountMemberifrs-full:LeaseholdImprovementsMember2023-12-310001712807ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:LeaseholdImprovementsMember2023-12-310001712807ifrs-full:LeaseholdImprovementsMember2023-12-310001712807ifrs-full:GrossCarryingAmountMemberifrs-full:OtherPropertyPlantAndEquipmentMember2023-12-310001712807ifrs-full:OtherPropertyPlantAndEquipmentMemberifrs-full:AccumulatedDepreciationAndAmortisationMember2023-12-310001712807ifrs-full:OtherPropertyPlantAndEquipmentMember2023-12-310001712807ifrs-full:GrossCarryingAmountMember2023-12-310001712807ifrs-full:AccumulatedDepreciationAndAmortisationMember2023-12-310001712807ifrs-full:GrossCarryingAmountMemberifrs-full:ComputerEquipmentMember2022-12-310001712807ifrs-full:ComputerEquipmentMemberifrs-full:AccumulatedDepreciationAndAmortisationMember2022-12-310001712807ifrs-full:ComputerEquipmentMember2022-12-310001712807ifrs-full:GrossCarryingAmountMemberifrs-full:MachineryMember2022-12-310001712807ifrs-full:MachineryMemberifrs-full:AccumulatedDepreciationAndAmortisationMember2022-12-310001712807ifrs-full:MachineryMember2022-12-310001712807ifrs-full:GrossCarryingAmountMemberifrs-full:LeaseholdImprovementsMember2022-12-310001712807ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:LeaseholdImprovementsMember2022-12-310001712807ifrs-full:LeaseholdImprovementsMember2022-12-310001712807ifrs-full:GrossCarryingAmountMemberifrs-full:OtherPropertyPlantAndEquipmentMember2022-12-310001712807ifrs-full:OtherPropertyPlantAndEquipmentMemberifrs-full:AccumulatedDepreciationAndAmortisationMember2022-12-310001712807ifrs-full:OtherPropertyPlantAndEquipmentMember2022-12-310001712807ifrs-full:GrossCarryingAmountMember2022-12-310001712807ifrs-full:AccumulatedDepreciationAndAmortisationMember2022-12-310001712807ifrs-full:GrossCarryingAmountMemberifrs-full:ComputerEquipmentMember2021-12-310001712807ifrs-full:GrossCarryingAmountMemberifrs-full:MachineryMember2021-12-310001712807ifrs-full:GrossCarryingAmountMemberifrs-full:LeaseholdImprovementsMember2021-12-310001712807ifrs-full:GrossCarryingAmountMemberifrs-full:OtherPropertyPlantAndEquipmentMember2021-12-310001712807ifrs-full:GrossCarryingAmountMember2021-12-310001712807ifrs-full:ComputerEquipmentMemberifrs-full:AccumulatedDepreciationAndAmortisationMember2021-12-310001712807ifrs-full:MachineryMemberifrs-full:AccumulatedDepreciationAndAmortisationMember2021-12-310001712807ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:LeaseholdImprovementsMember2021-12-310001712807ifrs-full:OtherPropertyPlantAndEquipmentMemberifrs-full:AccumulatedDepreciationAndAmortisationMember2021-12-310001712807ifrs-full:AccumulatedDepreciationAndAmortisationMember2021-12-310001712807ifrs-full:ComputerEquipmentMember2021-12-310001712807ifrs-full:MachineryMember2021-12-310001712807ifrs-full:LeaseholdImprovementsMember2021-12-310001712807ifrs-full:OtherPropertyPlantAndEquipmentMember2021-12-310001712807ifrs-full:GrossCarryingAmountMemberifrs-full:ComputerEquipmentMember2022-01-012022-12-310001712807ifrs-full:GrossCarryingAmountMemberifrs-full:MachineryMember2022-01-012022-12-310001712807ifrs-full:GrossCarryingAmountMemberifrs-full:LeaseholdImprovementsMember2022-01-012022-12-310001712807ifrs-full:GrossCarryingAmountMemberifrs-full:OtherPropertyPlantAndEquipmentMember2022-01-012022-12-310001712807ifrs-full:GrossCarryingAmountMember2022-01-012022-12-310001712807ifrs-full:ComputerEquipmentMemberifrs-full:AccumulatedDepreciationAndAmortisationMember2022-01-012022-12-310001712807ifrs-full:MachineryMemberifrs-full:AccumulatedDepreciationAndAmortisationMember2022-01-012022-12-310001712807ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:LeaseholdImprovementsMember2022-01-012022-12-310001712807ifrs-full:OtherPropertyPlantAndEquipmentMemberifrs-full:AccumulatedDepreciationAndAmortisationMember2022-01-012022-12-310001712807ifrs-full:AccumulatedDepreciationAndAmortisationMember2022-01-012022-12-310001712807ifrs-full:GrossCarryingAmountMemberifrs-full:ComputerEquipmentMember2023-01-012023-12-310001712807ifrs-full:GrossCarryingAmountMemberifrs-full:MachineryMember2023-01-012023-12-310001712807ifrs-full:GrossCarryingAmountMemberifrs-full:LeaseholdImprovementsMember2023-01-012023-12-310001712807ifrs-full:GrossCarryingAmountMemberifrs-full:OtherPropertyPlantAndEquipmentMember2023-01-012023-12-310001712807ifrs-full:GrossCarryingAmountMember2023-01-012023-12-310001712807ifrs-full:ComputerEquipmentMemberifrs-full:AccumulatedDepreciationAndAmortisationMember2023-01-012023-12-310001712807ifrs-full:MachineryMemberifrs-full:AccumulatedDepreciationAndAmortisationMember2023-01-012023-12-310001712807ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:LeaseholdImprovementsMember2023-01-012023-12-310001712807ifrs-full:OtherPropertyPlantAndEquipmentMemberifrs-full:AccumulatedDepreciationAndAmortisationMember2023-01-012023-12-310001712807ifrs-full:AccumulatedDepreciationAndAmortisationMember2023-01-012023-12-310001712807ifrs-full:MachineryMember2023-01-012023-12-310001712807ifrs-full:MachineryMember2022-01-012022-12-310001712807ifrs-full:MachineryMemberifrs-full:AccumulatedDepreciationAndAmortisationMember2021-01-012021-12-310001712807srt:ScenarioForecastMemberpags:OtherAcquisitionsMember2027-01-012027-12-310001712807ifrs-full:GrossCarryingAmountMemberpags:ExpendituresRelatedtoSoftwareandTechnologyMember2023-12-310001712807pags:ExpendituresRelatedtoSoftwareandTechnologyMemberifrs-full:AccumulatedImpairmentMember2023-12-310001712807pags:ExpendituresRelatedtoSoftwareandTechnologyMember2023-12-310001712807ifrs-full:ComputerSoftwareMemberifrs-full:GrossCarryingAmountMember2023-12-310001712807ifrs-full:ComputerSoftwareMemberifrs-full:AccumulatedImpairmentMember2023-12-310001712807ifrs-full:ComputerSoftwareMember2023-12-310001712807ifrs-full:GrossCarryingAmountMemberifrs-full:GoodwillMember2023-12-310001712807ifrs-full:GoodwillMemberifrs-full:AccumulatedImpairmentMember2023-12-310001712807ifrs-full:GoodwillMember2023-12-310001712807ifrs-full:GrossCarryingAmountMemberifrs-full:OtherIntangibleAssetsMember2023-12-310001712807ifrs-full:OtherIntangibleAssetsMemberifrs-full:AccumulatedImpairmentMember2023-12-310001712807ifrs-full:OtherIntangibleAssetsMember2023-12-310001712807ifrs-full:AccumulatedImpairmentMember2023-12-310001712807ifrs-full:GrossCarryingAmountMemberpags:ExpendituresRelatedtoSoftwareandTechnologyMember2022-12-310001712807pags:ExpendituresRelatedtoSoftwareandTechnologyMemberifrs-full:AccumulatedImpairmentMember2022-12-310001712807pags:ExpendituresRelatedtoSoftwareandTechnologyMember2022-12-310001712807ifrs-full:ComputerSoftwareMemberifrs-full:GrossCarryingAmountMember2022-12-310001712807ifrs-full:ComputerSoftwareMemberifrs-full:AccumulatedImpairmentMember2022-12-310001712807ifrs-full:ComputerSoftwareMember2022-12-310001712807ifrs-full:GrossCarryingAmountMemberifrs-full:GoodwillMember2022-12-310001712807ifrs-full:GoodwillMemberifrs-full:AccumulatedImpairmentMember2022-12-310001712807ifrs-full:GoodwillMember2022-12-310001712807ifrs-full:GrossCarryingAmountMemberifrs-full:OtherIntangibleAssetsMember2022-12-310001712807ifrs-full:OtherIntangibleAssetsMemberifrs-full:AccumulatedImpairmentMember2022-12-310001712807ifrs-full:OtherIntangibleAssetsMember2022-12-310001712807ifrs-full:AccumulatedImpairmentMember2022-12-310001712807pags:ExpendituresRelatedtoSoftwareandTechnologyMember2023-01-012023-12-310001712807ifrs-full:GrossCarryingAmountMemberpags:ExpendituresRelatedtoSoftwareandTechnologyMember2021-12-310001712807ifrs-full:ComputerSoftwareMemberifrs-full:GrossCarryingAmountMember2021-12-310001712807ifrs-full:GrossCarryingAmountMemberifrs-full:GoodwillMember2021-12-310001712807ifrs-full:GrossCarryingAmountMemberifrs-full:OtherIntangibleAssetsMember2021-12-310001712807pags:ExpendituresRelatedtoSoftwareandTechnologyMemberifrs-full:AccumulatedImpairmentMember2021-12-310001712807ifrs-full:ComputerSoftwareMemberifrs-full:AccumulatedImpairmentMember2021-12-310001712807ifrs-full:GoodwillMemberifrs-full:AccumulatedImpairmentMember2021-12-310001712807ifrs-full:OtherIntangibleAssetsMemberifrs-full:AccumulatedImpairmentMember2021-12-310001712807ifrs-full:AccumulatedImpairmentMember2021-12-310001712807pags:ExpendituresRelatedtoSoftwareandTechnologyMember2021-12-310001712807ifrs-full:ComputerSoftwareMember2021-12-310001712807ifrs-full:GoodwillMember2021-12-310001712807ifrs-full:OtherIntangibleAssetsMember2021-12-310001712807ifrs-full:GrossCarryingAmountMemberpags:ExpendituresRelatedtoSoftwareandTechnologyMember2022-01-012022-12-310001712807ifrs-full:ComputerSoftwareMemberifrs-full:GrossCarryingAmountMember2022-01-012022-12-310001712807ifrs-full:GrossCarryingAmountMemberifrs-full:GoodwillMember2022-01-012022-12-310001712807ifrs-full:GrossCarryingAmountMemberifrs-full:OtherIntangibleAssetsMember2022-01-012022-12-310001712807pags:ExpendituresRelatedtoSoftwareandTechnologyMember2022-01-012022-12-310001712807ifrs-full:ComputerSoftwareMember2022-01-012022-12-310001712807ifrs-full:GoodwillMember2022-01-012022-12-310001712807ifrs-full:OtherIntangibleAssetsMember2022-01-012022-12-310001712807pags:ExpendituresRelatedtoSoftwareandTechnologyMemberifrs-full:AccumulatedImpairmentMember2022-01-012022-12-310001712807ifrs-full:ComputerSoftwareMemberifrs-full:AccumulatedImpairmentMember2022-01-012022-12-310001712807ifrs-full:GoodwillMemberifrs-full:AccumulatedImpairmentMember2022-01-012022-12-310001712807ifrs-full:OtherIntangibleAssetsMemberifrs-full:AccumulatedImpairmentMember2022-01-012022-12-310001712807ifrs-full:AccumulatedImpairmentMember2022-01-012022-12-310001712807ifrs-full:GrossCarryingAmountMemberpags:ExpendituresRelatedtoSoftwareandTechnologyMember2023-01-012023-12-310001712807ifrs-full:ComputerSoftwareMemberifrs-full:GrossCarryingAmountMember2023-01-012023-12-310001712807ifrs-full:GrossCarryingAmountMemberifrs-full:GoodwillMember2023-01-012023-12-310001712807ifrs-full:GrossCarryingAmountMemberifrs-full:OtherIntangibleAssetsMember2023-01-012023-12-310001712807ifrs-full:ComputerSoftwareMember2023-01-012023-12-310001712807ifrs-full:GoodwillMember2023-01-012023-12-310001712807ifrs-full:OtherIntangibleAssetsMember2023-01-012023-12-310001712807pags:ExpendituresRelatedtoSoftwareandTechnologyMemberifrs-full:AccumulatedImpairmentMember2023-01-012023-12-310001712807ifrs-full:ComputerSoftwareMemberifrs-full:AccumulatedImpairmentMember2023-01-012023-12-310001712807ifrs-full:GoodwillMemberifrs-full:AccumulatedImpairmentMember2023-01-012023-12-310001712807ifrs-full:OtherIntangibleAssetsMemberifrs-full:AccumulatedImpairmentMember2023-01-012023-12-310001712807ifrs-full:AccumulatedImpairmentMember2023-01-012023-12-310001712807pags:MoipMember2023-12-310001712807pags:MoipMember2022-12-310001712807pags:ConcilMember2023-12-310001712807pags:ConcilMember2022-12-310001712807pags:NetposServicosDeInformaticaS.A.Member2023-12-310001712807pags:NetposServicosDeInformaticaS.A.Member2022-12-310001712807pags:BivaServiosMember2023-12-310001712807pags:BivaServiosMember2022-12-310001712807pags:BancoSeguroMember2023-12-310001712807pags:BancoSeguroMember2022-12-310001712807pags:PagSeguroTecnologiaMember2023-12-310001712807pags:PagSeguroTecnologiaMember2022-12-310001712807pags:ZygoMember2023-12-310001712807pags:ZygoMember2022-12-310001712807pags:YamiMember2023-12-310001712807pags:YamiMember2022-12-310001712807srt:ScenarioForecastMemberpags:OtherAcquisitionsMember2028-01-012028-12-310001712807ifrs-full:BottomOfRangeMemberpags:OtherAcquisitionsMember2023-01-012023-12-310001712807ifrs-full:TopOfRangeMemberpags:OtherAcquisitionsMember2023-01-012023-12-310001712807pags:CertificateOfDepositsMember2023-12-310001712807pags:CertificateOfDepositsMember2022-12-310001712807pags:InterbankDepositMember2023-12-310001712807pags:InterbankDepositMember2022-12-310001712807pags:CorporateSecuritiesMember2023-12-310001712807pags:CorporateSecuritiesMember2022-12-310001712807pags:IPCAMemberpags:CertificateOfDepositsMember2023-12-310001712807pags:IPCAMemberpags:CertificateOfDepositsMember2022-12-310001712807ifrs-full:NotLaterThanOneMonthMember2023-12-310001712807ifrs-full:NotLaterThanOneMonthMember2022-12-310001712807pags:LaterThanOneMonthAndNotLaterThanFourMonthsMember2023-12-310001712807pags:LaterThanOneMonthAndNotLaterThanFourMonthsMember2022-12-310001712807pags:LaterThanFourMonthsAndNotLaterThanSixMonthsMember2023-12-310001712807pags:LaterThanFourMonthsAndNotLaterThanSixMonthsMember2022-12-310001712807ifrs-full:LaterThanSixMonthsAndNotLaterThanOneYearMember2023-12-310001712807ifrs-full:LaterThanSixMonthsAndNotLaterThanOneYearMember2022-12-310001712807ifrs-full:LaterThanOneYearMember2023-12-310001712807ifrs-full:LaterThanOneYearMember2022-12-310001712807ifrs-full:TaxContingentLiabilityMember2023-12-310001712807ifrs-full:TaxContingentLiabilityMember2022-12-310001712807pags:LaborRelatedContingentLiabilityMember2023-12-310001712807pags:LaborRelatedContingentLiabilityMember2022-12-310001712807currency:USD2023-01-012023-12-3100017128072021-11-30iso4217:USD00017128072021-11-012021-11-30pags:perDollar0001712807currency:BRLifrs-full:NotLaterThanOneYearMemberpags:SwapMemberMember2021-11-3000017128072022-11-012022-11-3000017128072022-02-2800017128072022-02-012022-02-280001712807pags:BrazilianInterbankOfferingRateMember2023-12-3100017128072022-05-012022-05-3100017128072022-08-3100017128072022-05-310001712807ifrs-full:NotLaterThanOneYearMemberpags:SwapMemberMembercurrency:USD2023-03-3100017128072023-03-310001712807currency:BRLifrs-full:NotLaterThanOneYearMemberpags:SwapMemberMember2023-03-310001712807pags:BrazilianInterbankOfferingRateMember2023-03-3100017128072023-09-300001712807currency:BRLifrs-full:NotLaterThanThreeMonthsMemberpags:SwapMemberMember2023-04-300001712807pags:BrazilianInterbankOfferingRateMember2023-04-3000017128072023-04-302024-07-310001712807ifrs-full:UnusedTaxLossesMember2021-12-310001712807ifrs-full:UnusedTaxCreditsMember2021-12-310001712807pags:TechnologicalInnovationMember2021-12-310001712807ifrs-full:OtherTemporaryDifferencesMember2021-12-310001712807pags:OtherTemporaryDifferencesLiabilityMember2021-12-310001712807pags:DeferredTaxLiabilityAssetMember2021-12-310001712807ifrs-full:UnusedTaxLossesMember2022-01-012022-12-310001712807ifrs-full:UnusedTaxCreditsMember2022-01-012022-12-310001712807pags:TechnologicalInnovationMember2022-01-012022-12-310001712807ifrs-full:OtherTemporaryDifferencesMember2022-01-012022-12-310001712807pags:OtherTemporaryDifferencesLiabilityMember2022-01-012022-12-310001712807pags:DeferredTaxLiabilityAssetMember2022-01-012022-12-310001712807ifrs-full:UnusedTaxLossesMember2022-12-310001712807ifrs-full:UnusedTaxCreditsMember2022-12-310001712807pags:TechnologicalInnovationMember2022-12-310001712807ifrs-full:OtherTemporaryDifferencesMember2022-12-310001712807pags:OtherTemporaryDifferencesLiabilityMember2022-12-310001712807pags:DeferredTaxLiabilityAssetMember2022-12-310001712807ifrs-full:UnusedTaxLossesMember2023-01-012023-12-310001712807ifrs-full:UnusedTaxCreditsMember2023-01-012023-12-310001712807pags:TechnologicalInnovationMember2023-01-012023-12-310001712807ifrs-full:OtherTemporaryDifferencesMember2023-01-012023-12-310001712807pags:OtherTemporaryDifferencesLiabilityMember2023-01-012023-12-310001712807pags:DeferredTaxLiabilityAssetMember2023-01-012023-12-310001712807ifrs-full:UnusedTaxLossesMember2023-12-310001712807ifrs-full:UnusedTaxCreditsMember2023-12-310001712807pags:TechnologicalInnovationMember2023-12-310001712807ifrs-full:OtherTemporaryDifferencesMember2023-12-310001712807pags:OtherTemporaryDifferencesLiabilityMember2023-12-310001712807pags:DeferredTaxLiabilityAssetMember2023-12-310001712807ifrs-full:OrdinarySharesMember2023-12-31iso4217:USDxbrli:shares0001712807pags:ClassCommonSharesMemberpags:ShareBasedLongTermIncentivePlanLTIPMember2018-01-262018-01-26pags:share0001712807ifrs-full:TopOfRangeMemberpags:ShareBasedLongTermIncentivePlanLTIPMember2023-12-310001712807ifrs-full:BottomOfRangeMemberpags:ShareBasedLongTermIncentivePlanLTIPMember2023-12-310001712807pags:ShareBasedLongTermIncentivePlanLTIPMember2023-01-012023-12-310001712807pags:ShareBasedLongTermIncentivePlanLTIPMember2022-01-012022-12-310001712807pags:ShareBasedLongTermIncentivePlanLTIPMember2021-01-012021-12-310001712807pags:ShareBasedLongTermIncentivePlanLTIPMember2023-12-3100017128072018-10-3000017128072024-01-012024-12-310001712807pags:ShortTermInvestmentsMemberMemberifrs-full:InterestRateRiskMember2023-12-310001712807pags:SensitivityScenarioMaintainingCDIMemberpags:ShortTermInvestmentsMemberMemberifrs-full:InterestRateRiskMember2023-12-310001712807pags:SensitivityScenarioProbableIncreaseInCDIMemberpags:ShortTermInvestmentsMemberMemberifrs-full:InterestRateRiskMember2023-12-310001712807ifrs-full:InterestRateRiskMemberpags:FinancialInvestmentsMember2023-12-310001712807pags:SensitivityScenarioMaintainingCDIMemberifrs-full:InterestRateRiskMemberpags:FinancialInvestmentsMember2023-12-310001712807pags:SensitivityScenarioProbableIncreaseInCDIMemberifrs-full:InterestRateRiskMemberpags:FinancialInvestmentsMember2023-12-310001712807us-gaap:DepositsMemberifrs-full:InterestRateRiskMember2023-12-310001712807us-gaap:DepositsMember2023-12-310001712807pags:SensitivityScenarioMaintainingCDIMemberus-gaap:DepositsMemberifrs-full:InterestRateRiskMember2023-12-310001712807us-gaap:DepositsMemberpags:SensitivityScenarioProbableIncreaseInCDIMemberifrs-full:InterestRateRiskMember2023-12-310001712807ifrs-full:InterestRateRiskMemberpags:CertificateOfDepositRelatedPartyMember2023-12-310001712807pags:SensitivityScenarioMaintainingCDIMemberifrs-full:InterestRateRiskMemberpags:CertificateOfDepositRelatedPartyMember2023-12-310001712807pags:SensitivityScenarioProbableIncreaseInCDIMemberifrs-full:InterestRateRiskMemberpags:CertificateOfDepositRelatedPartyMember2023-12-310001712807ifrs-full:InterestRateRiskMemberpags:InterbankDepositMember2023-12-310001712807pags:SensitivityScenarioMaintainingCDIMemberifrs-full:InterestRateRiskMemberpags:InterbankDepositMember2023-12-310001712807pags:SensitivityScenarioProbableIncreaseInCDIMemberifrs-full:InterestRateRiskMemberpags:InterbankDepositMember2023-12-310001712807pags:CorporateSecuritiesMemberifrs-full:InterestRateRiskMember2023-12-310001712807pags:SensitivityScenarioMaintainingCDIMemberpags:CorporateSecuritiesMemberifrs-full:InterestRateRiskMember2023-12-310001712807pags:SensitivityScenarioProbableIncreaseInCDIMemberpags:CorporateSecuritiesMemberifrs-full:InterestRateRiskMember2023-12-310001712807ifrs-full:InterestRateRiskMemberpags:BankAccountsMember2023-12-310001712807pags:SensitivityScenarioMaintainingCDIMemberifrs-full:InterestRateRiskMemberpags:BankAccountsMember2023-12-310001712807pags:SensitivityScenarioProbableIncreaseInCDIMemberifrs-full:InterestRateRiskMemberpags:BankAccountsMember2023-12-310001712807pags:SensitivityScenarioMaintainingCDIMemberifrs-full:InterestRateRiskMember2023-12-310001712807pags:SensitivityScenarioProbableIncreaseInCDIMemberifrs-full:InterestRateRiskMember2023-12-31pags:processpags:numeral0001712807ifrs-full:NotLaterThanOneYearMemberpags:SwapMemberMember2023-03-310001712807pags:FinancialInstrumentsNotionalValueMember2023-12-310001712807pags:FinancialLiabilitiesMemberMember2023-12-310001712807pags:FinancialInstrumentMember2023-12-310001712807pags:FairValueMember2023-12-310001712807pags:MTMMember2023-12-310001712807pags:NotionalLiabilityMemberpags:IPCACDBMember2023-12-310001712807ifrs-full:FinancialLiabilitiesAtFairValueMemberpags:IPCACDBMember2023-12-310001712807pags:MtmOneMemberpags:IPCACDBMember2023-12-310001712807pags:NotionalLiabilityMemberpags:FixedRatedCDBMember2023-12-310001712807ifrs-full:FinancialLiabilitiesAtFairValueMemberpags:FixedRatedCDBMember2023-12-310001712807pags:MtmOneMemberpags:FixedRatedCDBMember2023-12-310001712807pags:NotionalLiabilityMember2023-12-310001712807ifrs-full:FinancialLiabilitiesAtFairValueMember2023-12-310001712807pags:MtmOneMember2023-12-310001712807pags:NotionalSWAPMemberpags:IPCACDBMember2023-12-310001712807pags:SwapMemberMemberpags:IPCACDBMember2023-12-310001712807pags:MtmTwoMemberpags:IPCACDBMember2023-12-310001712807pags:ProfitAndLossMemberpags:IPCACDBMember2023-12-310001712807pags:NotionalSWAPMemberpags:FixedRatedCDBMember2023-12-310001712807pags:SwapMemberMemberpags:FixedRatedCDBMember2023-12-310001712807pags:MtmTwoMemberpags:FixedRatedCDBMember2023-12-310001712807pags:ProfitAndLossMemberpags:FixedRatedCDBMember2023-12-310001712807pags:NotionalSWAPMember2023-12-310001712807pags:SwapMemberMember2023-12-310001712807pags:MtmTwoMember2023-12-310001712807pags:ProfitAndLossMember2023-12-310001712807pags:NotionalLiabilityMemberpags:IPCACDBMember2022-12-310001712807ifrs-full:FinancialLiabilitiesAtFairValueMemberpags:IPCACDBMember2022-12-310001712807pags:MtmOneMemberpags:IPCACDBMember2022-12-310001712807pags:NotionalLiabilityMemberpags:FixedRatedCDBMember2022-12-310001712807ifrs-full:FinancialLiabilitiesAtFairValueMemberpags:FixedRatedCDBMember2022-12-310001712807pags:MtmOneMemberpags:FixedRatedCDBMember2022-12-310001712807pags:NotionalLiabilityMember2022-12-310001712807ifrs-full:FinancialLiabilitiesAtFairValueMember2022-12-310001712807pags:MtmOneMember2022-12-310001712807pags:NotionalSWAPMemberpags:IPCACDBMember2022-12-310001712807pags:SwapMemberMemberpags:IPCACDBMember2022-12-310001712807pags:MtmTwoMemberpags:IPCACDBMember2022-12-310001712807pags:ProfitAndLossMemberpags:IPCACDBMember2022-12-310001712807pags:NotionalSWAPMemberpags:FixedRatedCDBMember2022-12-310001712807pags:SwapMemberMemberpags:FixedRatedCDBMember2022-12-310001712807pags:MtmTwoMemberpags:FixedRatedCDBMember2022-12-310001712807pags:ProfitAndLossMemberpags:FixedRatedCDBMember2022-12-310001712807pags:NotionalSWAPMember2022-12-310001712807pags:SwapMemberMember2022-12-310001712807pags:MtmTwoMember2022-12-310001712807pags:ProfitAndLossMember2022-12-310001712807ifrs-full:Level1OfFairValueHierarchyMember2023-12-310001712807ifrs-full:Level2OfFairValueHierarchyMember2023-12-310001712807ifrs-full:Level3OfFairValueHierarchyMember2023-12-310001712807ifrs-full:Level1OfFairValueHierarchyMember2022-12-310001712807ifrs-full:Level2OfFairValueHierarchyMember2022-12-310001712807ifrs-full:Level3OfFairValueHierarchyMember2022-12-31

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

for the fiscal year ended December 31, 2023

Commission File Number 1-38353

PAGSEGURO DIGITAL LTD.

(Exact name of registrant as specified in its charter)

The Cayman Islands

(Jurisdiction of incorporation or organization)

Conyers Trust Company (Cayman) Limited,

Cricket Square, Hutchins Drive, P.O. Box 2681,

Grand Cayman, KY1-1111, Cayman Islands

(Registered office address)

Artur Gaulke Schunck

+55-11-3914-9524– ir@pagbank.com

Av. Brigadeiro Faria Lima, 1384, 1º ao 10º andares, Salão e Mezanino

São Paulo, SP, 01451-001, Brazil

(Name, telephone, e-mail and/or facsimile

number and address of company contact person)

Copies to:

David Flechner

Allen & Overy LLP

1221 Avenue of the Americas

New York | NY 10020

Phone: (212) 610 6300 | Fax: (212) 610 6399

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of each class: |

|

Trading Symbol(s): |

|

Name of each exchange on which registered: |

| Class A common shares, par value US$0.000025 |

|

PAGS |

|

New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

As of December 31, 2023 there were 209,148,916 Class A common shares (including treasury shares), par value of US$0.000025 per share, and 120,459,508 Class B common shares, par value of US$0.000025 per share, outstanding.

Yes ☑ No ☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15 (d) of the Securities Exchange Act of 1934.

Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

Large Accelerated Filer ☑ Accelerated Filer ☐ Non-accelerated Filer ☐ Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ☐ International Financial Reporting Standards as issued by the International Accounting Standards Board ☑ Other ☐

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☑

Table of Contents

|

|

|

|

|

|

|

Page |

|

|

|

|

|

|

|

|

|

|

|

|

Item 4. INFORMATION ON THE COMPANY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORWARD-LOOKING STATEMENTS

This annual report contains information that constitutes forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. In addition, from time to time we or our representatives have made or may make forward-looking statements orally or in writing. Furthermore, such forward-looking statements may be included in various filings that we make with the U.S. Securities and Exchange Commission, or the SEC, or press releases or oral statements made by or with the approval of one of our authorized executive officers. These forward-looking statements are subject to certain known and unknown risks and uncertainties, as well as assumptions that could cause actual results to differ materially from those reflected in these forward-looking statements.

This annual report includes estimates and forward-looking statements, principally under the captions “Item 3. Key Information—Risk Factors”, “Item 4. Information on the Company,” and “Item 5. Operating and Financial Review and Prospects.”

These estimates and forward-looking statements are based mainly on our current expectations and estimates of future events and trends that affect or may affect our business, financial condition, results of operations, cash flow, liquidity, prospects and the trading price of our Class A common shares. Although we believe that these estimates and forward-looking statements are based upon reasonable assumptions, they are subject to many significant risks, uncertainties and assumptions and are made in light of information currently available to us.

These statements appear throughout this annual report and include statements regarding our intent, belief or current expectations in connection with:

•the inherent risks related to the digital payments market, such as the interruption, failure or cybersecurity related incident involving our computer or information technology systems;

•our ability to innovate and respond to technological advances and changing customer demands;

•the maintenance of tax incentives;

•our ability to attract and retain qualified personnel;

•general economic, political and business conditions in Brazil, particularly in the geographic markets we serve as well as any other countries we may serve in the future and their impact on our business, notably with respect to inflation;

•labor disputes, employee strikes and other labor-related disruptions, including in connection with negotiations with unions;

•management’s expectations and estimates concerning our future financial performance and financing plans and programs;

•our interest rates and our level of debt and other fixed obligations;

•inflation, appreciation, depreciation and devaluation of the real;

•expenses, ability to generate cash flow, and ability to achieve, and maintain, future profitability;

•our ability to anticipate market needs and develop and introduce new and enhanced products and service functionality to adapt to changes in our industry;

•our anticipated growth and growth strategies and our ability to effectively manage that growth;

•the impact of increased competition in our market, innovation by our competitors, and our ability to compete effectively;

•our ability to successfully enter new markets and manage our expansion;

•our ability to further penetrate our existing client base to grow our ecosystem;

•our expectations concerning relationships with third parties and key suppliers;

•our ability to maintain, protect and enhance our brand and intellectual property;

•the sufficiency of our cash and cash equivalents and cash generated from operations to meet our working capital and capital expenditure requirements;

•our compliance with applicable regulatory and legislative developments and regulations and legislation that currently apply or become applicable to our business;

•the economic, financial, political and social effects of the COVID-19 pandemic or other pandemics, epidemics and similar crises, particularly in Brazil, and the extent to which they continue to cause serious negative macroeconomic effects, thus enhancing the risks described under “Item 3. Key Information—D. Risk Factors;”

•developments and the perception of risks in Brazil in connection with ongoing corruption and other investigations and uncertainties related to the ability of the newly elected government to continue promoting economic and financial reforms in the country, including protests and riots as a result of the general election held in October 2022 in which the current president Mr. Luiz Inácio Lula da Silva, or Mr. Lula da Silva, narrowly won over the former president Jair Bolsonaro, as well as policies and potential changes to address these matters or otherwise, including economic and fiscal reforms, any of which may negatively affect growth prospects in the Brazilian economy as a whole;

•the impact of the armed conflict in Israel/Gaza, recent escalations between Israel and Iran, the ongoing war in Ukraine and the economic sanctions imposed on Russia, and the resulting volatility and consequences for the global economy, which remain highly uncertain and difficult to predict;

•other factors that may affect our financial condition, liquidity and results of operations; and

•other risk factors discussed under “Item 3. Key Information—Risk Factors.”

The words “believe,” “understand,” “may,” “will,” “aim,” “estimate,” “continue,” “anticipate,” “seek,” “intend,” “expect,” “should,” “could,” “forecast” and similar words are intended to identify forward-looking statements. You should not place undue reliance on such statements, which speak only as of the date they were made. We do not undertake any obligation to update publicly or to revise any forward-looking statements after we file this annual report because of new information, future events or other factors. Our independent public auditors have neither examined nor compiled the forward-looking statements and, accordingly, do not provide any assurance with respect to such statements. In light of the risks and uncertainties described above, the future events and circumstances discussed in this annual report might not occur and are not guarantees of future performance. Because of these uncertainties, you should not make any investment decision based upon these estimates and forward-looking statements.

CERTAIN TERMS AND CONVENTIONS

For a glossary of industry and other defined terms included in this annual report, see “Glossary of Terms” included elsewhere in this annual report.

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

The following references in this annual report have the meanings shown below:

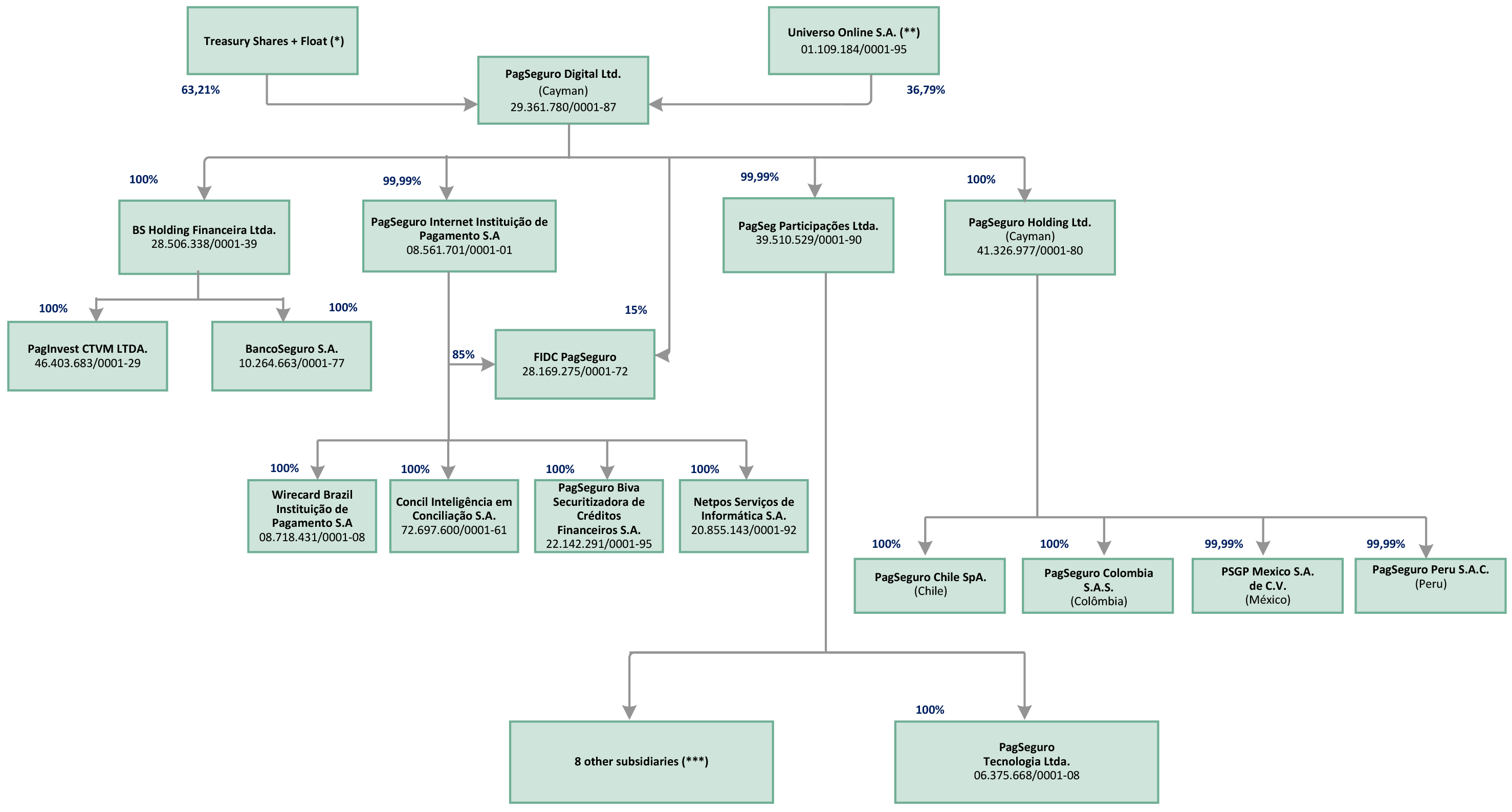

•“PagSeguro Digital” or the “Company” mean PagSeguro Digital Ltd., an exempted company with limited liability incorporated under the laws of the Cayman Islands.

•“PagSeguro Brazil” means PagSeguro Internet Instituição de Pagamento S.A., our primary operating company, a sociedade por ações incorporated in Brazil. PagSeguro Brazil is substantially wholly-owned by PagSeguro Digital Ltd.

•“Pag Participações” means Pag Participações Ltda., a holding company incorporated in Brazil, which is wholly owned by PagSeg Participações Ltda., or PagSeg, which in turn is wholly owned by PagSeguro Digital.

•“We,” “us” or “our” means PagSeguro Digital, PagSeguro Brazil and their respective subsidiaries on a consolidated basis.

•“PagSeguro” means our digital payments business, which is operated by PagSeguro Brazil.

•“UOL” means Universo Online S.A., the controlling shareholder of PagSeguro Digital. For more information regarding UOL, see “Item 7. Major Shareholders and Related Party Transactions.”

•“PagBank Group” means PagSeguro Digital, together with its subsidiaries;

•“Group” means PagBank Group and UOL, together with its subsidiaries.

•“Brazilian government” means the federal government of Brazil.

•All references to the “Companies Act” are to the Cayman Islands Companies Act (As Revised) as the same may be amended from time to time, unless the context otherwise requires.