0001664703FALSEApril 15, 2024April 17, 202400016647032024-04-172024-04-1700016647032023-12-222023-12-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________________

FORM 8-K

______________________

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): April 15, 2024

___________________________________________

BLOOM ENERGY CORPORATION

(Exact name of registrant as specified in its charter)

001-38598

(Commission File Number)

___________________________________________

|

|

|

|

|

|

|

|

|

|

|

|

| Delaware |

77-0565408 |

| (State or other jurisdiction of incorporation) |

(I.R.S. Employer Identification No.) |

| |

|

| 4353 North First Street, |

San Jose, |

California |

95134 |

| (Address of principal executive offices) |

(Zip Code) |

| |

|

| (408) |

543-1500 |

| (Registrant’s telephone number, including area code) |

| |

| Not Applicable |

| (Former name or former address, if changed since last report) |

___________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class |

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

| Class A Common Stock, $0.0001 par value |

|

BE |

|

New York Stock Exchange |

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On April 17, 2024, Bloom Energy Corporation (the "Company" or "Bloom") issued a press release announcing that Daniel Berenbaum has been appointed to serve as the Company’s Chief Financial Officer effective as of April 29, 2024. Mr. Berenbaum succeeds Greg Cameron whose departure was previously announced and who will leave the Company in mid-May 2024. The Company’s press release announcing Mr. Berenbaum’s appointment is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

Mr. Berenbaum, 54, joins Bloom from National Instruments Corporation, a provider of software-connected automated test and measurement systems, where he served as Executive Vice President and Chief Financial Officer from January 2023 until the sale of the company in October 2023.

Mr. Berenbaum has no direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

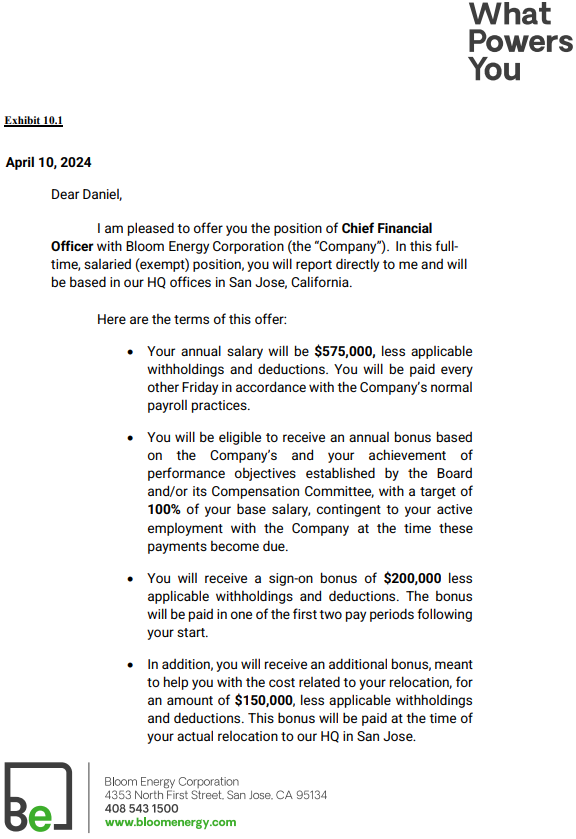

In connection with Mr. Berenbaum’s appointment, the Company entered into a letter agreement with Mr. Berenbaum (the “Offer Letter”) which established his compensation, as summarized below.

Salary; Annual Incentive Bonus. Mr. Berenbaum’s annual base salary will be $575,000. Mr. Berenbaum will be eligible to participate in the Company’s Incentive (Bonus) Plan with a target annual incentive bonus of 100% of his annual base salary.

Sign-On Bonus; Relocation Payment. Mr. Berenbaum will receive a sign-on bonus of $200,000. In addition, he will receive a relocation payment of $150,000 to assist in his relocation to the San Francisco Bay Area, the payment of which will be made upon his relocation to the San Francisco Bay Area.

Equity Awards. Mr. Berenbaum will receive equity grants for the number of shares of Bloom Class A common stock, as follows:

|

|

|

|

|

|

| 1 |

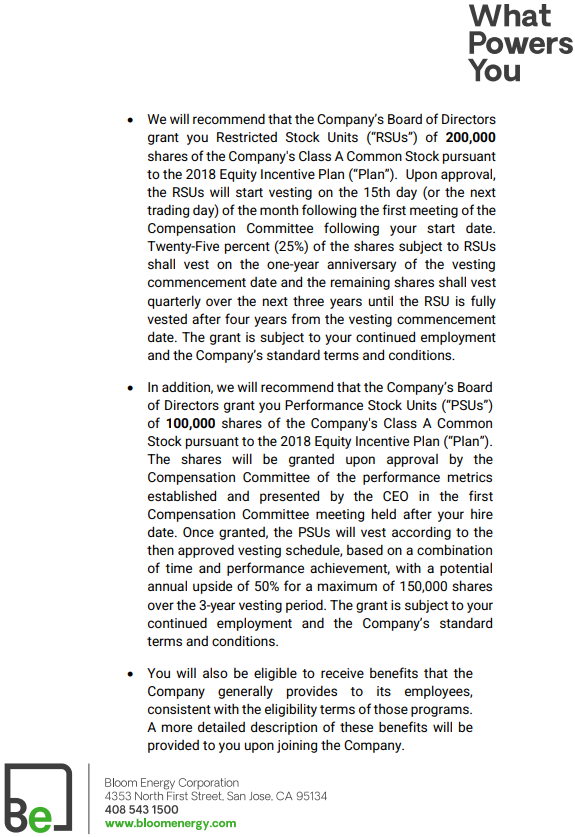

Restricted stock units (“RSUs”) for 200,000 shares of Class A common stock. Twenty-five percent (25%) of the RSUs granted will vest on the first year anniversary of the grant date. The remaining will vest quarterly until the RSUs fully vest over four years, subject to Mr. Berenbaum’s continued employment and the Company’s standard terms and conditions. |

| 2 |

Performance stock units (“PSUs”) for 100,000 shares of the Company's Class A common stock. The shares will be granted upon approval by the Compensation Committee of the performance metrics established and presented by the CEO in the first Compensation Committee meeting held after Mr. Berenbaum’s hire date. Once granted, the PSUs will vest according to the then approved vesting schedule, based on a combination of time and performance achievement, with a potential annual upside of 50% for a maximum of 150,000 shares over the 3-year vesting period. The grant is subject to Mr. Berenbaum’s continued employment and the Company’s standard terms and conditions. |

Change in Control and Severance Agreement. The Company has entered into a Change of Control and Severance Agreement with Mr. Berenbaum, the terms and conditions of which are set forth in Attachment A to the Offer Letter attached hereto as Exhibit 10.1 and which are incorporated by reference herein.

The foregoing description of the Offer Letter is qualified in its entirety by reference to the full text of the Offer Letter attached hereto as Exhibit 10.1.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

|

|

|

|

|

|

|

|

| Exhibit No. |

|

Description |

|

|

Offer Letter between the Company and Daniel Berenbaum, dated April 15, 2024 |

|

|

Press Release dated April 17, 2024 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| BLOOM ENERGY CORPORATION |

| |

|

|

|

|

| Date: |

April 17, 2024 |

By: |

|

|

/s/ Shawn Soderberg |

|

| |

|

|

|

|

Shawn Soderberg |

|

| |

|

|

|

|

Chief Legal Officer and Corporate Secretary |

|

| |

|

|

|

|

EX-10.1

2

a8-kexhibit101.htm

EX-10.1

Document

EX-99.1

3

a8-kexhibit991.htm

EX-99.1

Document

Bloom Energy Appoints Daniel Berenbaum as Chief Financial Officer

Seasoned financial leader brings deep experience delivering operational efficiency and profitable growth

SAN JOSE, Calif., April 17, 2024 – Bloom Energy Inc. (NYSE: BE), a leading provider of clean energy solutions, announced today the appointment of Daniel Berenbaum as Chief Financial Officer, effective April 29. 2024. Berenbaum will succeed Greg Cameron who will remain with the company until mid-May 2024 to ensure a smooth transition.

“We’re thrilled to have Dan join our leadership team,” said KR Sridhar, Founder, Chairman and Chief Executive Officer. “He stood out among an exceptional group of finalists by showing a strong record of success across the board – on scaling and strategy, on financial discipline and cost reduction, on internal leadership, team building, and external communications, and on profitability. He’s intellectually curious and passionate about achieving our mission. He’s a great fit for Bloom.”

Berenbaum’s financial and operational career spans more than three decades. A Naval Academy graduate, he most recently served as Executive Vice President and Chief Financial Officer at National Instruments (NASDAQ: NATI). Prior to National Instruments, Berenbaum held executive finance positions in several other high-tech companies, including Vice President, Finance, Global Operations Controller for Micron Technology (NASDAQ: MU); Chief Financial Officer at Everspin Technologies (NASDAQ: MRAM); and APAC CFO at GlobalFoundries. Prior to these roles, he spent ten years on Wall Street as an analyst covering technology stocks. Earlier in his career, Berenbaum spent seven years in various technical and management roles at Applied Materials (NASDAQ: AMAT), and five years as a nuclear-power-trained surface line officer in the United States Navy.

“I am excited to join the market leader in onsite clean energy as it scales to transform the global energy marketplace,” said Berenbaum. “Bloom is well-positioned to drive sustainable growth in the coming years as we provide solutions to some of the world’s most pressing challenges.”

About Bloom Energy

Bloom Energy’s mission is to make clean, reliable energy affordable for everyone in the world. Bloom Energy’s product, the Bloom Energy Server, delivers highly reliable and resilient, always-on electric power that is clean, cost-effective, and ideal for microgrid applications. Bloom Energy’s customers include many Fortune 100 companies and leaders in manufacturing, data centers, healthcare, retail, higher education, utilities, and other industries. For more information, visit www.bloomenergy.com.

Forward-Looking Statements

This press release contains certain forward-looking statements, which are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intent,” “may,” “should,” “will” and “would” or the negative of these words or similar terms or expressions that concern Bloom’s expectations, strategy, priorities, plans or intentions. These forward-looking statements include, but are not limited, to, expectations for achieving sustainable growth. Readers are cautioned that these forward-looking statements are only predictions and may differ materially from actual future events or results due to a variety of factors including, but not limited to, risks and uncertainties detailed in Bloom’s SEC filings. More information on potential risks and uncertainties that may impact Bloom’s business are set forth in Bloom’s periodic reports filed with the SEC, including its Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC

on February 15, 2024, as well as subsequent reports filed with or furnished to the SEC. Bloom assumes no obligation to, and does not intend to, update any such forward-looking statements.

Bloom Media Contact:

Amanada Song

press@bloomenergy.com

Bloom Investor Contact:

Ed Vallejo

investor@bloomenergy.com