Document

Table of Contents

2023 Annual Information Form

Introductory Notes

Unless otherwise noted, information contained in this annual information form (“AIF”) is provided as of March 27, 2024. Unless otherwise noted or the context otherwise indicates, references to the “Company”, “Sandstorm”, “Sandstorm Gold”, “us” and “our”, all refer to Sandstorm Gold Ltd.

Website and Third-Party Information

Sandstorm provides certain links to websites in this AIF, including www.sandstormgold.com. No such websites are incorporated by reference herein. Sandstorm also produces and references other materials that may be of assistance when reviewing (but which do not form part of, nor are incorporated by reference into) this AIF, including the 2022 Sustainability Report and the Asset Handbook (each as defined and discussed below).

Cautionary Note Regarding Forward-Looking Information

This AIF contains “forward-looking statements” or “forward-looking information” within the meaning of applicable securities legislation. Forward-looking information is provided as of the date of this AIF and Sandstorm does not intend, and does not assume any obligation, to update this forward-looking information, except as required by law.

Generally, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. Forward-looking information is based on reasonable assumptions that have been made by Sandstorm as at the date of such information and is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limited to: the impact of general business and economic conditions; each of the Mining Operations (as defined below); the absence of control over Mining Operations from which Sandstorm Gold will purchase gold or other commodities or from which it will receive royalty payments and risks related to those Mining Operations, including risks related to international operations, government and environmental regulation, delays in mine construction and operations, actual results of mining and current exploration activities, conclusions of economic evaluations and changes in project parameters as plans continue to be refined; problems inherent to the marketability of minerals; industry conditions, including fluctuations in the price of metals, fluctuations in foreign exchange rates and fluctuations in interest rates; government entities interpreting existing tax legislation or enacting new tax legislation in a way which adversely affects Sandstorm; the number or aggregate value of Common Shares (as defined below) which may be purchased under the NCIB (as defined below), audits being conducted by the CRA (as defined below) and available remedies; the expectation that the terms of the earn-in-milestone payments of SSR Mining’s (as defined below) agreement to acquire a 40% operating interest in the Hod Maden Project (as defined below) will be fulfilled, its intention to pursue project financing, including expectation of benefits to the overall development

2023 Annual Information Form

of the project as a result of the SSR Mining acquisition and its ability to fulfil its role as operator of the Hod Maden Project, including the social and regulatory license to operate; the expectations that the Company’s transactions with Horizon (as defined below) as described in this AIF will provide the potential benefits and synergies of the transactions and the ability of Sandstorm to successfully achieve business objectives, including integrating the companies or assets or the effects of unexpected costs, liabilities or delays; management’s expectations regarding the growth potential of Sandstorm, including in scale and production and the anticipated benefits of the transactions with Horizon; managements expectations regarding Sandstorm’s growth; stock market volatility; competition; the potential impact of natural disasters, terrorist acts, health crises and other disruptions and dislocations, as well as those factors discussed in the section entitled “Risk Factors” herein.

Forward-looking information in this AIF includes, among other things, disclosure regarding: audits being conducted by the CRA and available remedies, management’s expectations regarding the Company’s growth, Sandstorm Gold’s existing Streams (as defined below) and royalties and the payments to be made and received thereunder, the exploration, development and operation of the Mining Operations, Sandstorm’s future outlook, the operators of the mines ability to fulfil their roles as operators, including the social and regulatory licenses to operate, the Mineral Reserve (as defined below), Mineral Resource (as defined below) and production estimates for any of the Mining Operations, the number or value of Common Shares that may be sold pursuant to the 2023 ATM Program (as defined below), the use of, or amounts drawn under, the Credit Facility (as defined below) and the repayment of amounts outstanding under the Credit Facility and the Company’s climate change and sustainability goals, including its emissions reduction targets. Forward-looking information is based on assumptions management believes to be reasonable, including but not limited to the continued operation of the Mining Operations from which Sandstorm Gold will purchase gold and other commodities or from which it will receive royalty payments, no material adverse change in the market price of commodities, that the Mining Operations will operate in accordance with their public statements and achieve their stated production outcomes, and such other assumptions and factors as set out therein.

Although Sandstorm has attempted to identify important factors that could cause actual actions, events or results to differ materially from those contained in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as future actions and events and actual results could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information.

Non-IFRS and Other Financial Measures Disclosure

The Company has included certain performance measures and ratios in this AIF that do not have any standardized meaning prescribed by International Financial Reporting Standards Accounting Standards as issued by the International Accounting Standards Board (“IFRS Accounting Standards” or “IFRS”) including (i) total sales, royalties and income from other interests (“Total Sales, Royalties and Income from Other Interests”), (ii) attributable gold equivalent (“Attributable Gold Equivalent”) ounce, (iii) average cash cost per Attributable Gold Equivalent ounce, (iv) cash operating margin, and (v) cash flows from operating activities excluding changes in non-cash working capital.

2023 Annual Information Form

As Sandstorm’s operations are primarily focused on precious metals, the Company presents these measures as it believes that certain investors use this information to evaluate the Company’s performance in comparison to other mining companies in the precious metals mining industry who present results on a similar basis.

Other companies may calculate these measures differently as a result of differences in the underlying accounting principles, policies applied and in accounting frameworks, such as in IFRS, and as such these measures might not be comparable to the similar financial measures disclosed by other companies.

The presentation of these non-IFRS measures is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

iTotal Sales, Royalties and Income from Other Interests is a non-IFRS financial measure and is calculated by taking total revenue which includes Sales and Royalty Revenue, and adding contractual income relating to Streams, royalties and other interests excluding gains and losses on dispositions. The Company presents Total Sales, Royalties and Income from other interests as it believes that certain investors use this information to evaluate the Company’s performance and ability to generate cash flow in comparison to other streaming and royalty companies in the precious metals mining industry. See also “Principal Product” under “Description of the Business” below in this AIF. Figure 1.1 below provides a reconciliation of Total Sales, Royalties and Income from Other Interests.

|

|

|

|

|

|

|

|

|

| Figure 1.1 |

|

|

In $000s |

Year Ended

December 31, 2023 |

Year Ended

December 31, 2022 |

|

|

|

| Total Revenue |

$ |

179,636 |

|

$ |

148,732 |

|

| Add: |

|

|

Contractual income from Streams, Royalties and other interests 1 |

11,810 |

- |

| Equals: |

|

|

| Total Sales, Royalties, and Income from other interests |

$ |

191,446 |

|

$ |

148,732 |

|

1. During the three months ended March 31, 2023, the Company received a one-time contractual payment of $10.0 million relating to the Company’s Mt. Hamilton royalty included in other income. During the three months ended December 31, 2023, the Company received a one-time payment of $1.8 million related to the Company’s Ming gold Stream.

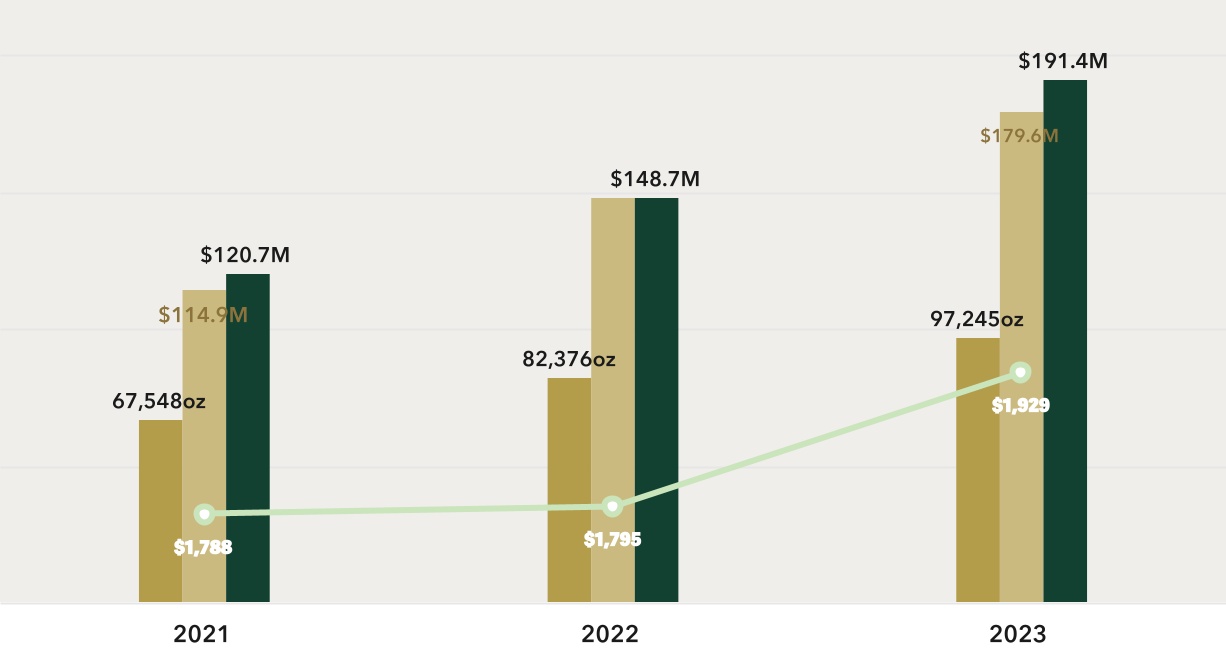

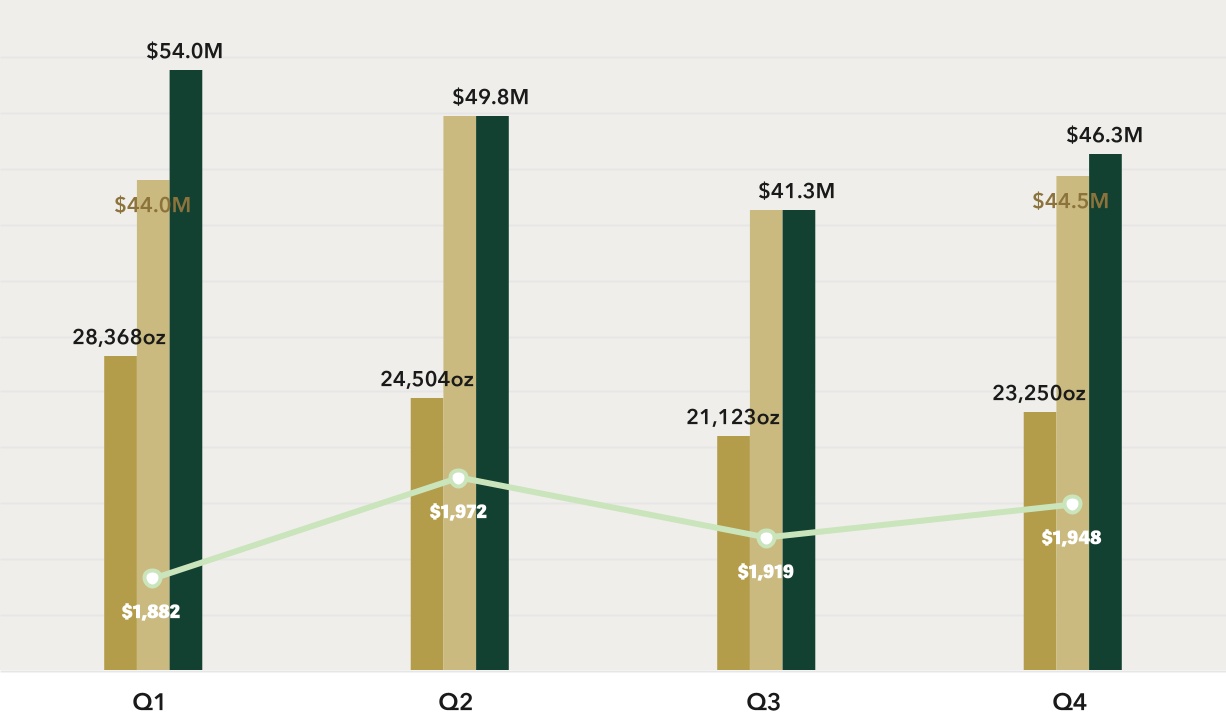

iiAttributable Gold Equivalent ounce is a non-IFRS financial ratio that uses Total Sales, Royalties, and Income from Other Interests as a component. Attributable Gold Equivalent ounce is calculated by dividing the Company’s Total Sales, Royalties, and Income from other interests (described further in item i above) less revenue attributable to non-controlling interests for the period, by the average realized gold price per ounce from the Company’s Streams for the same respective period. The Company presents Attributable Gold Equivalent ounces as it believes that certain investors use this information to evaluate the Company’s performance in comparison to other streaming and royalty companies in the precious metals mining industry that present results on a similar basis. See also “Principal Product” under “Description of the Business” below in this AIF. Figure 1.2 below provides a reconciliation of Attributable Gold Equivalent ounce.

2023 Annual Information Form

|

|

|

|

|

|

|

|

|

| Figure 1.2 |

|

|

In $000s (except for ounces and per ounce amounts) |

Year Ended

December 31, 2023 |

Year Ended

December 31, 2022 |

|

|

|

Total Sales, Royalties, and Income from other interests 1 |

$ |

191,446 |

|

$ |

148,732 |

|

| Less: |

|

|

| Revenue attributable to non-controlling interest |

3,907 |

|

850 |

|

Total Sales, Royalties, and Income from other interests

attributable to Sandstorm shareholders |

187,539 |

|

147,882 |

|

| Divided by: |

|

|

Average realized gold price per ounce from the Company's

Gold Streams |

1,929 |

1,795 |

| Equals: |

|

|

| Total Attributable Gold Equivalent ounces |

97,245 |

|

82,376 |

|

1. Prior to March 31, 2022, total Attributable Gold Equivalent ounces was calculated by dividing the royalty and other commodity stream revenue, including adjustments for contractual payments received relating to those interests, for that period by the average realized gold price per ounce from the Company's Gold Streams (as defined herein) for the same respective period. These Attributable Gold Equivalent ounces when combined with the gold ounces sold from the Company's Gold Streams equal total Attributable Gold Equivalent ounces sold. The change in the calculation of the measure did not result in a change to prior periods. Recalculated totals may differ due to rounding.

iiiAverage cash cost per Attributable Gold Equivalent ounce is a non-IFRS financial ratio that is calculated by dividing the Company’s cost of sales, excluding depletion by the number of Attributable Gold Equivalent ounces (described further in item ii above). The Company presents average cash cost per Attributable Gold Equivalent ounce as it believes that certain investors use this information to evaluate the Company’s performance and ability to generate cash flow in comparison to other streaming and royalty companies in the precious metals mining industry who present results on a similar basis. Figure 1.3 below provides a reconciliation of average cash cost of gold on a per ounce basis.

|

|

|

|

|

|

|

|

|

| Figure 1.3 |

|

|

|

In $000’s (except for ounces and per ounce amounts)

|

Year Ended

December 31, 2023 |

Year Ended

December 31, 2022 |

|

|

|

Cost of Sales, excluding depletion 1 |

$ |

21,677 |

|

$ |

23,366 |

|

| Divided by: |

|

|

| Total Attributable Gold Equivalent ounces sold |

97,245 |

82,376 |

| Equals: |

|

|

| Average cash cost (per Attributable Gold Equivalent ounce) |

$ |

223 |

|

$ |

284 |

|

1. Cost of Sales, excluding depletion, includes cash payments made for Gold Equivalent ounces associated with commodity streams.

ivCash operating margin is a non-IFRS financial measure that is calculated by subtracting the average cash cost per Attributable Gold Equivalent ounce from the average realized gold price per ounce from the Company’s Gold Streams. The Company presents cash operating margin as it believes that certain investors use this information to evaluate the Company’s performance and ability to generate cash flow in comparison to other streaming and royalty companies in the precious metals mining industry that present results on a similar basis.

2023 Annual Information Form

vCash flows from operating activities excluding changes in non-cash working capital is a non-IFRS financial measure and is calculated by adding back the decrease or subtracting the increase in changes in non-cash working capital to or from cash provided by (used in) operating activities. The Company presents cash flows from operating activities excluding changes in non-cash working capital as it believes that certain investors use this information to evaluate the Company’s performance in comparison to other streaming and royalty companies in the precious metals mining industry that present results on a similar basis. Figure 1.4 provides a reconciliation of cash flows from operating activities excluding changes in non-cash working capital.

|

|

|

|

|

|

|

|

|

| Figure 1.4 |

|

|

|

In $000’s

|

Year Ended

December 31, 2023 |

Year Ended

December 31, 2022 |

|

|

|

| Cash flows from operating activities |

$ |

152,754 |

|

$ |

106,916 |

|

| Less: |

|

|

| Changes in non-cash working capital |

1,697 |

(2,890) |

| Equals: |

|

|

Cash flows from operating activities excluding changes

in non-cash working capital |

$ |

151,057 |

|

$ |

109,806 |

|

Currency Presentation and Exchange Rate Information

All dollar amounts referenced, unless otherwise indicated, are expressed in United States dollars (“US Dollars”).

The high, low, average and closing exchange rates for Canadian dollars in terms of the United States dollar for each of the three years in the period ended December 31, 2023, as quoted by the Bank of Canada, were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended

December 31, 2023 |

Year Ended

December 31, 2022 |

Year Ended

December 31, 2021 |

|

|

|

|

| High |

C$1.3875 |

C$1.3856 |

C$1.2942 |

| Low |

C$1.3128 |

C$1.2451 |

C$1.2040 |

| Average |

C$1.3497 |

C$1.3013 |

C$1.2535 |

| Closing |

C$1.3226 |

C$1.3544 |

C$1.2678 |

Commodity Price Information

GOLD PRICES

The high, low, average and closing afternoon fixing gold prices in United States dollars per troy ounce for each of the three years in the period ended December 31, 2023, as quoted by the London Bullion Market Association, were as follows:

2023 Annual Information Form

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended

December 31, 2023 |

Year Ended

December 31, 2022 |

Year Ended

December 31, 2021 |

|

|

|

|

| High |

$2,078 |

$2,039 |

$1,943 |

| Low |

$1,811 |

$1,629 |

$1,684 |

| Average |

$1,941 |

$1,800 |

$1,800 |

| Closing |

$2,062 |

$1,813 |

$1,820 |

SILVER PRICES

The high, low, average and closing afternoon fixing silver prices in United States dollars per troy ounce for each of the three years in the period ended December 31, 2023, as quoted by the London Bullion Market Association, were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended

December 31, 2023 |

Year Ended

December 31, 2022 |

Year Ended

December 31, 2021 |

|

|

|

|

| High |

$26.03 |

$26.18 |

$29.59 |

| Low |

$20.09 |

$17.77 |

$21.53 |

| Average |

$23.35 |

$21.73 |

$25.17 |

| Closing |

$23.79 |

$23.95 |

$23.09 |

COPPER PRICES

The high, low, average and closing official cash settlement copper prices in United States dollars per pound for each of the three years in the period ended December 31, 2023, as quoted by the London Metal Exchange, were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended

December 31, 2023 |

Year Ended

December 31, 2022 |

Year Ended

December 31, 2021 |

|

|

|

|

| High |

$4.28 |

$4.87 |

$4.86 |

| Low |

$3.54 |

$3.18 |

$3.52 |

| Average |

$3.84 |

$4.00 |

$4.23 |

| Closing |

$3.84 |

$3.80 |

$4.40 |

Corporate Structure

The Company was incorporated under the Business Corporations Act (British Columbia) (“BCBCA”) on March 23, 2007. The Company changed its name from “Sandstorm Resources Ltd.” to “Sandstorm Gold Ltd.” on February 17, 2011. Effective June 19, 2015, Sandstorm Gold Ltd. amalgamated, by way of vertical short-form amalgamation under the BCBCA, with one of its wholly-owned subsidiaries, Premier Royalty Inc. Sandstorm Gold Ltd. was the continuing entity as a result of this amalgamation. Effective January 1, 2018, Sandstorm Gold Ltd. amalgamated, by way of vertical short-form amalgamation under the BCBCA, with one

2023 Annual Information Form

of its wholly-owned subsidiaries, Sandstorm Gold (Barbados) Limited. Sandstorm Gold Ltd. was the continuing entity as a result of this amalgamation.

The Company’s head, registered, and records office are located at Suite 3200, 733 Seymour Street, Vancouver, British Columbia, V6B 0S6.

The Company has one (1) principal wholly-owned subsidiary company, being Nomad Royalty Company Ltd. (as defined below in this AIF), organized under the laws of the Canada Business Corporations Act.

General Development of the Business

Public Offerings

On September 22, 2022, the Company filed a new short form base shelf prospectus (the “2022 Base Shelf Prospectus”) in Canada (in reliance on the well-known seasoned issuer exemption) and the United States which allows the Company to offer for sale and issue from time to time common shares of the Company (“Common Shares”), warrants to purchase Common Shares, debt securities, subscription receipts and units, or any combination thereof, in amounts, at prices and on terms to be determined based on market conditions at the time of the sale and as set forth in an accompanying prospectus supplement to the 2022 Base Shelf Prospectus. These sales may be made during the 25-month period that the 2022 Base Shelf Prospectus, including any amendments thereto, remains effective.

On October 4, 2022, the Company completed a bought deal financing with a syndicate of underwriters comprised of an offering of 15,700,000 Common Shares of the Company plus the exercise by the underwriters of an over-allotment option of 2,355,000 Common Shares, for an aggregate of 18,055,000 Common Shares all at a price of $5.10 per Common Share for gross proceeds of $92,080,500 (the “October 2022 Offering”). The Common Shares were sold pursuant to an underwriting agreement between the Company and a syndicate of investment dealers co-led by BMO Nesbitt Burns Inc. and Scotia Capital Inc. The Common Shares were offered by way of a prospectus supplement dated September 28, 2022, to the 2022 Base Shelf Prospectus in all of the provinces and territories of Canada, other than Québec, and in the United States under an effective shelf registration statement filed with the United States Securities and Exchange Commission (the “SEC”) under the Canada/U.S. multi-jurisdictional disclosure system. The net proceeds from the October 2022 Offering were primarily used to reduce amounts drawn under the Company’s revolving credit facility.

On June 9, 2023, the Company filed a prospectus supplement to the 2022 Base Shelf Prospectus in Canada and the United States and established an At-the-Market equity program (“2023 ATM Program”). The 2023 ATM Program allows the Company to issue up to $150 million worth of Common Shares from treasury to the public from time to time at prevailing market prices through the Toronto Stock Exchange (“TSX”), the New York Stock Exchange (“NYSE”) or any other marketplace on which the Common Shares are listed, quoted or otherwise trade. The volume and timing of distributions under the 2023 ATM Program, if any, are to be determined at the Company’s sole discretion, subject to applicable regulatory limitations. The 2023 ATM

2023 Annual Information Form

Program will be effective until the earliest of the date that all Common Shares available for issue under the 2023 ATM Program have been issued, October 22, 2024, or the 2023 ATM Program is terminated prior to such date by the Company or the agents. To date, the Company has not utilized, or sold any Common Shares under the 2023 ATM Program.

Credit Facility

On January 12, 2012, the Company entered into a revolving credit agreement with The Bank of Nova Scotia, which allowed the Company to borrow up to $50.0 million (the “Revolving Loan” or “Credit Facility”, as amended from time to time). The Revolving Loan had a term of three years, which was extendable by mutual consent of The Bank of Nova Scotia and the Company. On February 7, 2013, the Company amended the Credit Facility to increase the amount which the Company was permitted to borrow thereunder to up to $110.0 million. On December 20, 2017, the Credit Facility was amended to increase the amount which the Company was permitted to borrow thereunder to up to $150.0 million. On December 4, 2018, the Credit Facility was amended to increase the amount which the Company was permitted to borrow thereunder to up to $225.0 million. On September 4, 2019, the Credit Facility was amended to make housekeeping changes to the Credit Facility. On December 2, 2019, the Credit Facility was amended to upsizing the Credit Facility to $300 million by adding a $75 million accordion feature. On October 6, 2021, the Credit Facility was amended to increase the amount which the Company is permitted to borrow thereunder to up to $350 million, eliminate the accordion feature, and incorporate sustainability-linked performance targets to establish an “Environment, Social and Governance” linked credit facility. In 2021, the Company became the first royalty company with a credit facility linked to sustainability goals. This feature is described below.

On July 12, 2022, the Credit Facility was amended to increase the amount which the Company is permitted to borrow thereunder to up to $500 million (plus up to $125,000,000 under a related uncommitted accordion feature). This upsize to $500 million was contingent upon the closing of the BaseCore Transaction (as described below in this AIF) and the exercise of the accordion feature of up to $125 million was contingent upon the closing of the Nomad Acquisition (as described below in this AIF), both of which subsequently closed, thus allowing the Company to borrow up to $625 million under the Credit Facility. On each of August 15, 2022 and September 11, 2023, the Credit Facility was amended to make housekeeping and other related changes. The September 11, 2023 amendments included extending the Maturity Date of the Credit Facility to September 11, 2027.

With each of the aforementioned three amendments, the Credit Facility maintained its sustainability-linked performance targets as discussed below.

The Revolving Loan incorporates sustainability-linked incentive pricing terms that allow the Company to reduce the borrowing costs from the interest rates described herein as the Company’s Environment, Social and Governance performance targets are met. These targets focus on increasing the Company’s producing assets which report under sustainability and climate related standards as well as maintaining and improving the Company’s own external Environment, Social and Governance rating and ensuring diverse representation at the senior management and board levels.

2023 Annual Information Form

The Revolving Loan is for general corporate purposes and expires September 11, 2027, which is extendable based on mutual consent of the parties thereto. The amounts drawn on the Revolving Loan are subject to interest at SOFR (as defined below in this AIF) plus 1.875% to 3.50% per annum, and the undrawn portion of the Revolving Loan is subject to a standby fee of 0.4219% - 0.7875% per annum, both of which are dependent on the Company’s leverage ratio. The Company is required to maintain a leverage ratio of net debt divided by EBITDA (as defined in the Credit Facility) of less than or equal to 4.00:1.00 and an interest coverage ratio of greater than or equal to 3.00:1.00 for each fiscal quarter.

As at December 31, 2023, the Company was in compliance with its covenants and there was a balance drawn on or outstanding under the Credit Facility of $435 million. As of the date of this AIF, the balance drawn on or outstanding under the Credit Facility is $417 million, and the undrawn and available balance remaining is $208 million.

Normal Course Issuer Bid

On April 5, 2020, the Company commenced a new Normal Course Issuer Bid (the “2020 NCIB”) in accordance with TSX Rules and Canadian securities laws. Under the 2020 NCIB, the Company was entitled to purchase up to 17,170,237 Common Shares, representing approximately 10% of the Company’s issued and outstanding Common Shares as at March 31, 2020, after excluding those Common Shares held by the Company’s directors (“Directors”) and officers. Pursuant to the 2020 NCIB, the Company purchased no Common Shares in 2020, but, from December 31, 2020, to March 31, 2021, the Company purchased a total of 800,366 Common Shares for aggregate consideration of C$6,357,171 on the TSX and alternative Canadian trading platforms, and these 800,366 Common Shares were all returned to treasury for cancellation. No Common Shares were purchased during this period on the NYSE and alternative trading platforms in the United States of America. The 2020 NCIB terminated on April 5, 2021.

On April 7, 2021, the Company commenced a new Normal Course Issuer Bid (the “2021 NCIB”, together with the 2020 NCIB, the “NCIB”) pursuant to which the Company was entitled to purchase up to 19.1 million Common Shares, representing approximately 10% of the Company’s issued and outstanding Common Shares as at March 31, 2021, after excluding those Common Shares held by the Company’s Directors and officers. Pursuant to the 2021 NCIB, the Company purchased an aggregate of 4,651,049 Common Shares in 2021 (all of which were returned to treasury for cancellation) for aggregate consideration of (i) C$24,025,576.44 on the TSX and alternative Canadian trading platforms; and (ii) $10,071,658.51 on the NYSE and alternative trading platforms in the United States of America. From December 31, 2021, to the date that the 2021 NCIB terminated, the Company purchased no additional Common Shares and the 2021 NCIB terminated on April 6, 2022.

On April 7, 2022, the Company commenced a new Normal Course Issuer Bid (the “2022 NCIB”, together with the 2020 NCIB and 2021 NCIB, the “NCIB”) pursuant to which the Company was entitled to purchase up to 18.9 million Common Shares, representing approximately 10% of the Company’s issued and outstanding Common Shares as at March 31, 2022 after excluding those Common Shares held by the Company’s Directors and officers. Pursuant to the 2022 NCIB, the Company purchased an aggregate of 187,801 Common Shares in 2022 (all of which were returned to treasury for cancellation) for aggregate consideration of (i) C$454,625.38

2023 Annual Information Form

on the TSX and alternative Canadian trading platforms; and (ii) $600,968.22 on the NYSE and alternative trading platforms in the United States of America. From December 31, 2022, to March 31, 2023, the Company purchased a further 148,400 Common Shares for aggregate consideration of C$989,692.14 solely on the TSX and alternative Canadian trading platforms, and these 148,400 Common Shares were all returned to treasury for cancellation. The 2022 NCIB terminated on April 6, 2023.

On April 11, 2023, the Company commenced a new Normal Course Issuer Bid (the “2023 NCIB”, together with the 2020 NCIB, 2021 NCIB and 2022 NCIB, the “NCIB”) pursuant to which the Company is entitled to purchase up to 24.0 million Common Shares, representing approximately 9.7% of the Company’s issued and outstanding Common Shares as at March 31, 2023 after excluding those Common Shares held by the Company’s Directors and officers. Pursuant to the 2023 NCIB, the Company purchased an aggregate of 2,639,595 Common Shares in 2023 (all of which were returned to treasury for cancellation) for aggregate consideration of (i) C$14,668,366.70 on the TSX and alternative Canadian trading platforms; and (ii) $2,700,730.50 on the NYSE and alternative trading platforms in the United States of America. From December 31, 2023, to the date of this AIF, the Company made no further purchases under the 2023 NCIB. The 2023 NCIB will terminate on April 10, 2024.

The NCIB provides the Company with the option to purchase its Common Shares from time to time. Purchases under the NCIB were executed on the open market through the facilities of the TSX or alternative Canadian trading platforms and through the facilities of the NYSE or alternative trading platforms in the United States of America. Purchases made by the Company over the NYSE or such alternative trading platforms were made in compliance with applicable United States securities laws. All purchases under the NCIB are made at the market price of the Common Shares at the time of acquisition and are funded by the Company’s working capital. Decisions regarding purchases are based on market conditions, share price, best use of available cash, and other factors. All Common Shares acquired by the Company are cancelled.

The Company is prohibited from making purchases of Common Shares under the NCIB while sales of Common Shares are being made under any ATM Program which the Company may have in effect.

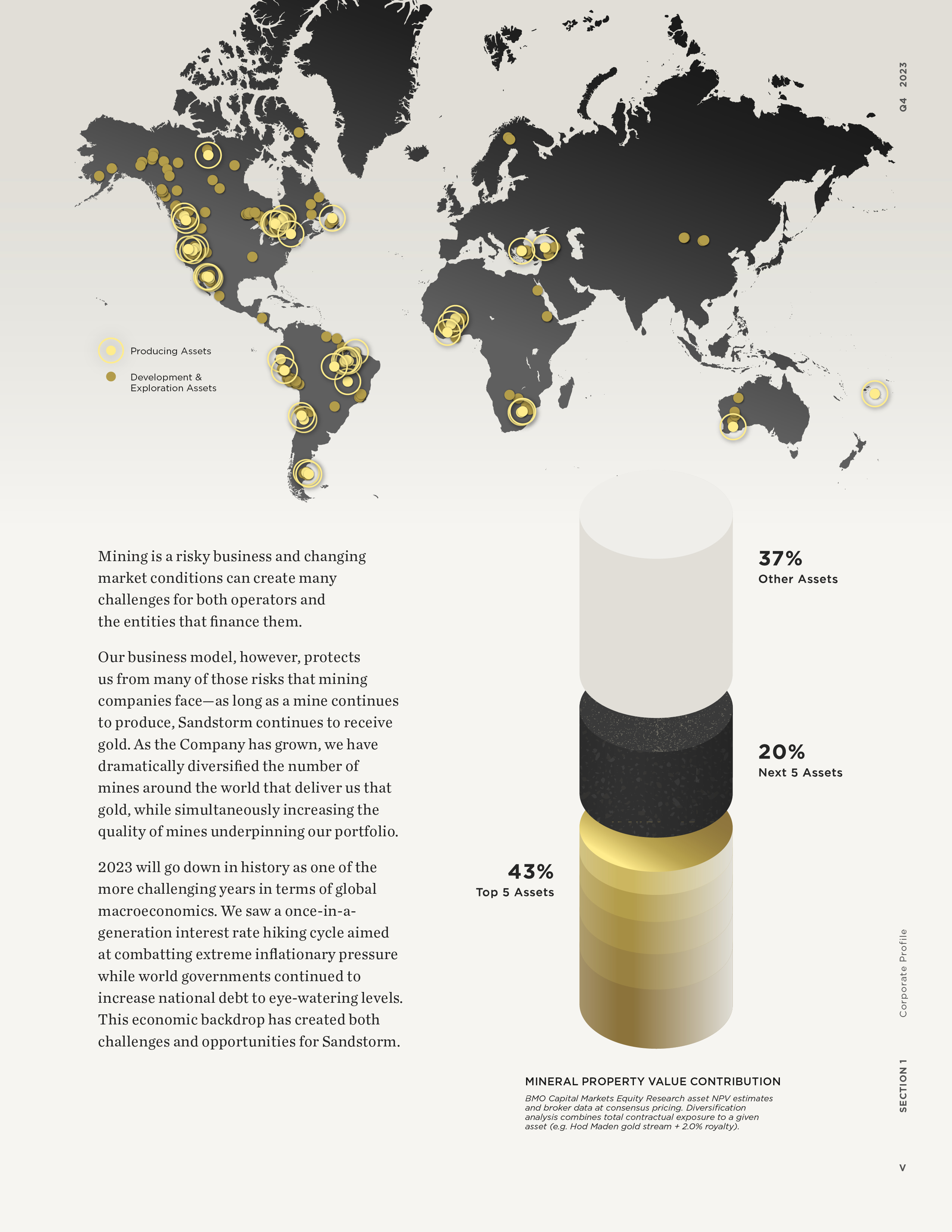

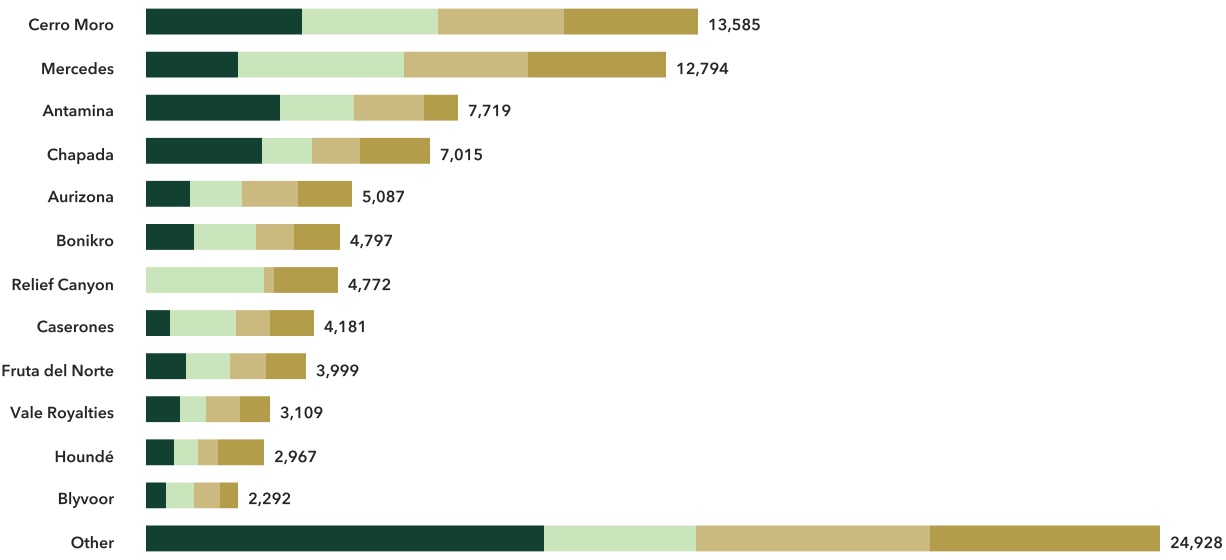

Mineral Interests

The Company currently has 242 Streams and royalties, of which 40 of the underlying mines are producing. The Company has published its 2024 Asset Handbook (“Asset Handbook”), a copy of which is available on the Company’s website at www.sandstormgold.com. To the best of the Company’s knowledge, the information pertaining to the assets in the Asset Handbook are believed to be accurate as of February 7, 2024. The Asset Handbook does not form part of, nor is it incorporated by reference into this AIF.

Below is a description of certain of the Company’s key producing and other assets, as well as a discussion of significant transactions closed by the Company in 2023.

2023 Annual Information Form

Aurizona Mine Royalties

Through a series of restructurings with respect to the Company’s former gold stream (“Aurizona Gold Stream”) on the Aurizona mine, located in Brazil (the “Aurizona Mine”), the Aurizona Gold Stream was terminated and replaced by two net smelter return (“NSR”) royalties (the “Aurizona Project NSR” and the “Greenfields NSR”) with the now current owner of the project, Equinox Gold Corp. (“Equinox”). The Aurizona Project NSR is a sliding scale royalty based on the price of gold as follows: 3% if the price of gold is less than or equal to $1,500 per ounce; 4% if the price of gold is between $1,500 per ounce and $2,000 per ounce; and 5% if the price of gold is greater than $2,000 per ounce. This royalty is calculated based on sales for the month and the average monthly gold price. The Greenfields NSR royalty covers approximately 190,000 – 220,000 hectares of greenfields exploration ground (“Aurizona Greenfields”) held by Equinox and is a 2% NSR royalty. Equinox has the right to purchase one-half of the Greenfields NSR royalty for $10.0 million at any time prior to commercial production. The Company holds a right of first refusal on any future streams or royalties on the Aurizona Mine and Aurizona Greenfields.

The Aurizona Mine is located in Maranhão State in northern Brazil and is an orogenic gold deposit hosted in a greenstone belt of the São Luis Craton. There are many mineralized bodies on the Aurizona property but work to date has focused on the Piaba and Tatajuba deposits.

On July 2, 2019, Equinox announced that it had achieved commercial production at the Aurizona Mine effective July 1, 2019. On September 20, 2021, Equinox announced a positive NI 43-101 (as defined below in this AIF) Pre-Feasibility Study for an expansion to the Aurizona Mine through the development of an underground mine which could be operated concurrently with the existing open-pit mine and is subject to the Company’s Aurizona Project NSR. This technical report, which is available on SEDAR+, was filed by Equinox on November 4, 2021. The assessment outlines total production of 1.5 million ounces of gold over an eleven-year mine life.

Entrée Gold Stream

In February 2013 (as amended February 2016), the Company entered into a funding agreement (the “Entrée Metal Credits Agreement”) with Entrée Gold Inc. (now known as Entrée Resources Ltd., “Entrée”) to purchase, for a period of 50 years (which may be extended), metal credits equal to:

•5.619% of the gold, 5.619% of the silver and 0.415% of the copper produced from the Hugo North Extension deposit (Lower Level);

•8.425% of the gold, 8.425% of the silver and 0.623% of the copper produced from the Hugo North Extension deposit (Upper Level);

•4.258% of the gold, 4.258% of the silver and 0.415% of the copper produced from the Heruga Deposit (Lower Level); and

•6.391% of the gold, 6.391% of the silver and 0.623% of the copper produced from the Heruga Deposit (Upper Level);

(all of which are subject to adjustment upon the occurrence of certain stated events and reflect reduced percentages, as further discussed below). The above-mentioned deposits are all located in the South Gobi

2023 Annual Information Form

Desert of Mongolia and form part of the Oyu Tolgoi mining complex (the lower and upper levels of the Hugo North Extension and the lower and upper levels of the Heruga Deposit collectively referred to herein as the “Entrée JV Project”).

The amendment entered into in February 2016, reduced the Company’s metal credits interests by 17% from the original numbers, for which the Company initially paid $40.0 million in 2013. Please note that the metal credits figures set out above are the reduced figures. In exchange for the 17% reduction, Entrée paid the Company $5.5 million in cash and issued 5,128,604 common shares of Entrée (“Entrée Shares”) to the Company (having an aggregate value of $1.3 million)

The Company will make ongoing payments equal to the lesser of the prevailing market price and $220 per ounce for the gold, $5 per ounce for the silver and $0.50 per pound for the copper, until approximately 8.6 million ounces of gold, 40.3 million ounces of silver and 9.1 billion pounds of copper have been produced from the Entrée JV Project (the “Initial Fixed Prices”). Thereafter, the ongoing payments will increase to the lesser of the prevailing market price and $500 per ounce for the gold, $10 per ounce for the silver and $1.10 per pound for the copper (the “Subsequent Fixed Prices”). The Initial Fixed Prices are all subject to a 1% annual inflationary adjustment beginning on the fourth anniversary of the date upon which the Company commences receiving payable gold, silver and copper.

The Company is not required to contribute any further capital, exploration, or operating expenditures to Entrée.

The Hugo North Extension is a copper-gold-porphyry deposit, and the Heruga Deposit is a copper-gold-molybdenum deposit, which are both part of the Oyu Tolgoi mining complex and are being developed by the Government of Mongolia (which owns 34% of the project) and its 66% owner and project manager Rio Tinto plc (“Rio Tinto”). Entrée retains a 20% interest in the resources of the Hugo North Extension and Heruga deposits.

On October 21, 2021, Entrée announced the completion of an updated NI 43-101 Technical Report on its interest in the Entrée/Oyu Tolgoi joint venture property, which report was filed by Entrée on October 21, 2021, and is available on SEDAR+. The updated report discusses a Feasibility Study based on Mineral Reserves attributable to the joint venture from the first lift of the Hugo North Extension copper-gold deposit and aligns Entrée’s disclosure with that of other Oyu Tolgoi project stakeholders on development of the first lift of the underground mine. Entrée further announced that optimization studies on Panel 1 are currently underway which have the potential to further improve Lift 1 economics for the Entrée/Oyu Tolgoi joint venture.

Multi-Asset Stream with Yamana Gold Inc.

In October 2015, the Company entered into a series of agreements with Yamana Gold Inc. (“Yamana”) (the “Yamana Transaction”) on certain of its mining assets. For upfront consideration of $152.0 million in cash plus 15.0 million warrants of the Company (fully exercised by Yamana in April 2020 at a price of $3.50 per Common Share), the Company has a silver stream (the “Silver Stream”) on the operating Cerro Moro gold-silver mine in Argentina (the “Cerro Moro Mine”), a copper stream (the “Copper Stream”) on the operating open pit copper-gold Chapada mine in Brazil (the “Chapada Mine”) and a potential gold stream

2023 Annual Information Form

on the project formerly known as the Agua Rica project in Argentina (now known as the “MARA Project”) at the Company’s sole option (the “Early Deposit Gold Stream”).

The Yamana Transaction provided the Company with asset diversification on projects which are low cost and economically robust with significant exploration upside.

NOTE: On March 31, 2023, Pan American Silver Corp. (“Pan American Silver”) announced that it had acquired Yamana, following the sale by Yamana of its Canadian assets to Agnico Eagle Mines Limited, all by way of plan of arrangement under the Canada Business Corporations Act. The Company’s rights under its various agreements with Yamana remain intact.

THE SILVER STREAM — Cerro Moro Mine

In exchange for $70.0 million, pursuant to the Silver Stream, the Company agreed to purchase an amount of silver from the Cerro Moro Mine equal to 20% of the silver produced (up to an annual maximum of 1.2 million ounces), until 7.0 million ounces of silver have been delivered to the Company; then 9% of the silver produced thereafter, for the life of the mine. Based on the cumulative ounces of silver purchased to date, the Company’s current silver entitlement is 20%.

The Company agreed to make ongoing payments for each ounce of silver received under the Silver Stream equal to 30% of the spot price per ounce of silver.

The Cerro Moro Mine, which commenced commercial production in 2018, is located approximately 70 kilometres southwest of the coastal port city of Puerto Deseado in the Santa Cruz province of Argentina. The Cerro Moro Mine contains several high-grade epithermal gold and silver deposits, some of which will be mined via open pit and some via underground mining methods.

THE COPPER STREAM — Chapada Mine

In exchange for $70.0 million, pursuant to the Copper Stream, the Company agreed to purchase an amount of copper from the Chapada Mine equal to: 4.2% of the copper produced (up to an annual maximum of 3.9 million pounds), until the Chapada Mine has delivered 39.0 million pounds of copper to the Company (the “First Chapada Delivery Threshold”); then 3.0% of the copper produced until, on a cumulative basis, the Chapada Mine has delivered 50.0 million pounds of copper to the Company (the “Second Chapada Delivery Threshold”); then 1.5% of the copper produced thereafter, for the life of the Chapada Mine. Based on the cumulative pounds of copper purchased to date, the Company’s current copper entitlement is 4.2%.

The Company agreed to make ongoing payments for each pound of copper received under the Copper Stream equal to 30% of the spot price per pound of copper.

NOTE: On July 5, 2019, Yamana announced that it had sold the Chapada Mine to Lundin Mining Corporation (TSX:LUN) (“Lundin Mining”). The Company’s rights under the Copper Stream remain intact.

The Chapada Mine has been in production since 2007 and is a relatively low-cost South American open-pit copper-gold operation. It is located 270 kilometres northwest of Brasília in Goiás State, Brazil. The ore is treated through a flotation plant with processing capacity of 24 million tonnes of ore per annum. On October

2023 Annual Information Form

10, 2019, Lundin Mining filed an updated NI 43-101 Technical Report on the Chapada Mine, which is available on SEDAR+, which outlines production through 2050. This excludes any production from Lundin Mining’s recent Saúva discovery.

THE EARLY DEPOSIT GOLD STREAM

In exchange for $12.0 million, $4.0 million of which was paid in April 2016 (the “Advance Payment”), the Company entered into an Early Deposit Gold Stream agreement (which was subsequently amended on December 17, 2020) on the Agua Rica Project, a copper-molybdenum-gold porphyry deposit. At the time of a construction decision for the Agua Rica Project, the Company may elect to make an additional advance payment equal to between $135.0 million and $225.0 million based on the following formula: $150,000 multiplied by the Average Quarterly Gold Price (as defined in the Early Deposit Gold Stream agreement, as amended) plus $7.5 million (the “Additional Advance Payment”). The payment of the Additional Advance Payment will occur proportionately throughout the construction period. If the Company elects to pay the Additional Advance Payment, the Company will have the right to purchase an amount of gold equal to 20% of the life of mine gold produced from the Agua Rica Project. The Company would make ongoing payments for each ounce of gold received, equal to 30% of the spot price per ounce of gold. If the Company elects not to pay the Additional Advance Payment, the Advance Payment will convert into a 0.25% NSR royalty on the Agua Rica Project and all other rights under the Early Deposit Gold Stream agreement will terminate. In addition, in the event that the Company wishes to syndicate the Early Deposit Gold Stream to a third party, it has the right to transfer any and all of its rights and obligations, under certain conditions.

The Agua Rica Project is a large-scale porphyry copper, molybdenum, gold and silver deposit located in the province of Catamarca, Argentina. In March 2015, Yamana signed a definitive agreement (the “Definitive Agreement”) with the provincial Government of Catamarca, Argentina, represented by the provincial mining company Catamarca Mineria y Energetica Sociedad del Estado (“CAMYEN”). The Definitive Agreement advances the memorandum of understanding between CAMYEN and Yamana, which set the groundwork for cooperation to consolidate important mining projects and prospective properties in the province, creating the Catamarca mining district. On March 7, 2019, Yamana (which was acquired by Pan American Silver in March 2023), Glencore International AG and Goldcorp Inc. (which was acquired by Newmont Corporation (“Newmont”) in April 2019) announced the signing of an integration agreement pursuant to which the Agua Rica Project would be developed and operated using the existing infrastructure and facilities of Minera Alumbrera Limited in the province of Catamarca, Argentina. On December 18, 2020, Yamana announced the completion of the integration of the Agua Rica Project with the Minera Alumbrera Limited plant and infrastructure and stated that, going forward the integrated project will be known as the MARA project and that Yamana, Glencore International AG and Newmont had created a new joint venture for the purpose of developing the project. On September 23, 2022, Glencore International AG and Newmont announced that they had reached an agreement pursuant to which Glencore International AG would acquire Newmont’s 18.75% shareholding in the MARA project, following which Glencore International AG owned 43.75% of the project. Yamana remained as the operator, owning 56.25% of the project at that time. On July 31, 2023, Glencore International AG announced that they had reached an agreement with Pan American Silver, to acquire Pan American Silver’s 56.25% stake in the project. This transaction closed in September 2023, and Glencore International AG became the sole owner and operator of the MARA project.

2023 Annual Information Form

MARA has Proven and Probable Mineral Reserves of 5.4 million tonnes of copper and 7.4 million ounces of gold contained in 1.105 billion tonnes of ore with an initial mine life of 28 years. For more information, visit Glencore plc’s website at www.glencore.com.

Royalty Package from Teck Resources Limited

In January 2016, the Company agreed to acquire (the “Teck Transaction”) 56 royalties from Teck Resources Limited and its affiliates (collectively, “Teck”). Teck was subsequently unable to complete the transfer of four of the 56 royalties to the Company because underlying rights of first offer and refusal (“ROFRs”) were exercised. As partial consideration for the 56 royalties, on closing, the Company issued a total of 8,762,222 Common Shares (the “Acquisition Shares”) to Teck. Due to the exercise of the four ROFRs, Teck returned 1,273,065 of the 8,762,222 Common Shares to the Company in May 2016, which were then returned to treasury by the Company for cancellation. Accordingly, the total net consideration paid by the Company to Teck for the 52 royalties (the “Teck Royalty Package”) was $16.8 million, paid as to $1.4 million in cash and $15.4 million in Common Shares of the Company.

Royalty counterparties included Barrick Gold Corporation, Glencore plc, KGHM Polska Miedz SA, Newmont, Kinross Gold Corporation (“Kinross”), New Gold Inc. and Imperial Metals Corporation. The Teck Royalty Package included the following key assets:

•2.0% NSR royalty (“Hod Maden NSR Royalty”) on the high-grade, exploration-stage Hod Maden project (“Hod Maden Project”) located in Türkiye, owned by the Company’s former subsidiary Mariana Resources Limited (as to 30%) and its Turkish partner Lidya Madencilik Sanayi ve Ticaret A.S. (“Lidya”) (as to 70%) through their Turkish subsidiary company. When the Company sold its equity interest in the Hod Maden Project in August 2022 to Horizon Copper Corp. in exchange for, inter alia, the Hod Maden Gold Stream (as defined in this AIF), the Company maintained its Hod Maden NSR Royalty. Please see “GENERAL DEVELOPMENT OF THE BUSINESS – Creation of Strategic Mining Partner – Spin-Out Transaction” for further details;

•1.75% NSR royalty on 60% of production (i.e. 1.05%) subject to a $40.0 million cap, on the development-stage Lobo-Marte project (“Lobo-Marte”) located in the Maricunga gold district (Atacama region) of Chile owned by Kinross. In November 2021, Kinross announced the results of a feasibility study at Lobo-Marte, which included a total life of mine production estimate of approximately 4.7 million gold ounces during a 16-year mine life. A positive development decision by Kinross would depend on a range of factors, including permitting and other potential opportunities in the region. For more information, visit Kinross’ website at www.kinross.com;

•2.0% NSR royalty on the development-stage Ivrindi project in Türkiye owned by Tümad Madencilik Sanayi ve Ticaret A.Ș. The Ivrindi royalty began paying after 300,000 ounces were produced; and

•$10/ounce production royalty bonus, subject to a maximum ounce cap (600,000 ounces from Ağı Dağı and 250,000 from Kirazli), on the Ağı Dağı/Kirazli projects in Türkiye owned by Alamos Gold Inc. and payable by Newmont upon commencement of commercial production.

2023 Annual Information Form

Houndé Royalty

In January 2018, the Company acquired a 2% NSR royalty (“Houndé Royalty”) on the producing Houndé gold mine located in Burkina Faso in West Africa (“Houndé Mine”). Sandstorm acquired the Houndé Royalty from Acacia Mining PLC (the previous owner of the Houndé Royalty) for $45.0 million in cash. The Houndé Royalty covers the Kari North and Kari South tenements, representing approximately 500 square kilometres of the Houndé property package. The Houndé Mine is 90% owned by Endeavour Mining Corporation (“Endeavour”) and 10% by the Government of Burkina Faso.

The Houndé Tenements include the Vindaloo deposit, Kari West, stockpiles and the Bouéré deposit. Houndé is an open pit gold mine with a 3.0 million tonne per year nameplate capacity CIL processing plant using a gravity circuit and a carbon-in-leach plant.

Endeavour reports on their website that, on a 100% basis, the Houndé Mine hosts a Proven and Probable Mineral Reserve containing 2,733,000 ounces (rounded to the nearest 1,000 ounces) of gold within 54.0 million tonnes (rounded to the nearest 100,000 tonnes) of ore with an average grade of 1.57 grams per tonne gold. The Measured and Indicated Resources contain 4,678,000 ounces (rounded to the nearest 1,000 ounces) of gold contained in 93.4 million tonnes (rounded to the nearest 100,000 tonnes) of ore with an average grade of 1.56 grams per tonne gold. This Reserve and Resource estimate, a portion of which is not subject to the Houndé Royalty, is based on an economic cut-off grade of 0.5 grams per tonne gold, inclusive of reserves, and is effective as of December 31, 2022. For more information, visit Endeavour’s website at www.endeavourmining.com.

Fruta del Norte Royalty

In January 2019, the Company acquired a 0.9% NSR royalty (“Fruta del Norte Royalty”) on the precious metals produced from the Fruta del Norte gold project located in Ecuador (“Fruta del Norte Mine”) owned by Lundin Gold Inc. (“Lundin Gold”). Sandstorm acquired the Fruta del Norte Royalty from a private third party for $32.8 million in cash. The Fruta del Norte Royalty covers 644 square kilometres, including all 29 mining concessions held by Lundin Gold, and includes an additional one-kilometre area of interest around the property.

On February 20, 2020, Lundin Gold announced that it had achieved commercial production at the Fruta del Norte Mine. In their news release dated March 31, 2023, Lundin Gold announced the completion of an updated NI 43-101 Technical Report having an effective date of December 31, 2022, on its Fruta del Norte Mine, which report was filed by Lundin Gold on March 31, 2023, and is available on SEDAR+. Lundin Gold’s Annual Information Form dated March 31, 2023, contains details based upon this new NI 43-101 Technical Report and discloses that the Fruta del Norte Mine Probable Mineral Reserve contains an estimated 5.02 million ounces of gold in 17.98 million tonnes of ore with an average grade of 8.68 grams per tonne, as of December 31, 2022, based on cut-off grades of 4.19 grams per tonne and 5.00 grams per tonne depending on mining method.

On December 4, 2023, Lundin Gold announced that 2024 production at the Fruta del Norte Mine is estimated to be between 450,000 and 500,000 ounces. 56,000 metres are planned to be drilled under their 2024 near-mine and regional exploration programs utilizing a minimum of nine rigs as compared to approximately

2023 Annual Information Form

42,000 metres in 2023. They are also planning on increasing plant throughput to 5,000 tonnes per day and installing new flotation technologies to improve recoveries, which is expected to be operational by Q4 2024.

On January 11, 2024, Lundin Gold announced that gold production at the Fruta del Norte Mine for 2023 was 481,274 ounces (of which 310,831 was produced as concentrate and 170,443 as doré) based on an average throughput rate of 4,533 tonnes per day. The average head grade was 10.2 grams per tonne. Average mill recovery for the year was 88.4%. For more information, visit Lundin Gold’s website at www.lundingold.com.

Relief Canyon Gold Stream

On April 3, 2019, the Company entered into a $42.5 million financing package with Americas Gold and Silver Corporation (“Americas Gold”) which included a $25 million precious metal stream and an NSR on the Relief Canyon gold project in Nevada, USA. (“Relief Canyon” or the “Relief Canyon Mine”), a $10 million convertible debenture and a $7.5 million private placement. Under the terms of the precious metals stream, including additional stream funding advanced in 2023 pursuant to the terms of an amending agreement entered into between Sandstorm and Americas Gold in February 2023, Sandstorm is entitled to receive 39,174 ounces of gold over a 6.5-year period which began in April 2020 (the “Fixed Deliveries”). After receipt of 32,022 gold ounces under the Fixed Deliveries, the Company is entitled to purchase 4.0% of the gold and silver produced from the Relief Canyon Mine for ongoing per ounce cash payments equal to 30%–65% of the spot price of gold or silver, with the range dependent on the concession’s existing royalty obligations. In addition, Sandstorm will also receive a 1.4%–2.8% NSR royalty on the area surrounding the Relief Canyon Mine.

The Relief Canyon Mine is a past producing open pit mine located in Nevada at the southern end of the Pershing Gold and Silver Trend. On January 11, 2021, Americas Gold announced that it had achieved commercial production at the Relief Canyon Mine. Since then, the ramp up of operations has been challenging and Americas Gold have suspended mining operations while efforts are under way to resolve metallurgical challenges. Americas Gold discontinued leaching and heap rinsing operations in the fourth quarter of 2023 and will reassess the status of the operation as the results of these efforts become available and are evaluated.

Vale Participating Royalties

On June 29, 2021, the Company announced that it had acquired a diverse package of participating royalties (“Vale Participating Royalties”) on several of Vale S.A.’s (“Vale”) assets located in Brazil for consideration of $109.1 million. During the third quarter of 2021, the Company made an additional $8.7 million investment in the Vale Participating Royalties on similar pro-rata terms. The Vale Participating Royalties are publicly traded on Brazil’s National Debenture System and are economically equivalent to royalty interests with no maturity until the underlying mining rights are extinguished.

These royalties provide holders with life of mine net sales royalties on seven producing mines and several exploration properties covering a total area of interest of 15,097 square kilometres (the “Vale Royalties” or the “Vale Royalty Package”). Sandstorm’s attributable portion of the Vale Royalty Package is as follows:

2023 Annual Information Form

Copper and Gold

•0.03% net sales royalty on the Sossego copper-gold mine; and

•0.06% net sales royalty on copper and gold and a 0.03% net sales royalty on all other minerals from certain assets.

Iron Ore

•0.05% net sales royalty on iron ore sales from the Northern System; and

•0.05% net sales royalty on iron ore sales from a portion of the Southeastern System (subject to the thresholds described below).

Other

•0.03% of net sales proceeds in the event of an underlying asset sale on certain assets.

Royalty payments are made on a semi-annual basis on March 31 and September 30 of each year reflecting sales in the preceding half calendar year period.

NORTHERN SYSTEM

The Northern System is comprised of three mining complexes: Serra Sul, Serra Norte, and Serra Leste located in the Carajas District. Vale is currently executing plans to increase the Northern System’s production capacity to a long-term target of 240Mt per annum, which would be achieved via the approved expansion at Serra Sul and other growth projects. In addition, Vale continues to study a number of additional growth projects at the pre-feasibility or definitive feasibility study level which could enhance production from Sandstorm’s royalty grounds.

Mining commenced in 1984 at Serra Norte and, based on current Mineral Reserves, is currently expected to run through the late-2030s. Mining at Serra Leste and Serra Sul began production in 2014 and 2016 respectively and both systems are expected to produce beyond the mid-2050s.

SOUTHEASTERN SYSTEM

The Southeastern System, a portion of which is not covered by the Vale Royalties, is comprised of three mining complexes: Itabira, Minas Centrais, and Mariana located in Minas Gerais. These complexes will start contributing to the Vale Royalties once a cumulative sales threshold of 1.7 billion tonnes of iron ore has been reached, which Vale most recently estimated would occur in 2025.

Vale is one of the world’s largest low-cost iron mining companies, contributing approximately 15% of global iron ore supply. Vale’s iron ore production is in the first quartile of the cost curve and the Northern and Southeastern Systems have reserve weighted mine lives of 30 years.

2023 Annual Information Form

Vatukoula Gold Stream

On June 28, 2021, the Company entered into an agreement (the “Vatukoula Gold Stream”) to acquire a gold stream from Vatukoula Gold Mines PTE Limited (“VGML”) on the operating underground Vatukoula gold mine located in Fiji (“Vatukoula” or the “Vatukoula Mine”) in exchange for a $30 million upfront deposit. In December 2021, the Company closed this gold purchase agreement which entitles it to purchase 25,920 ounces of gold over an approximate 5.5-year period and thereafter 2.55%-2.90% of the gold produced from the Vatukoula Mine for ongoing per ounce cash payments equal to 20% of the spot price of the gold. In addition to the Vatukoula Gold Stream, Sandstorm received an effective 0.45% NSR royalty on certain prospecting licenses, plus a five-kilometre area of interest.

In November 2022 and in consideration for $15.9 million, Sandstorm agreed to decrease the deliveries owed under the Vatukoula Gold Stream by approximately 45%. Accordingly, under the amended Vatukoula Gold Stream, the Company has agreed to purchase 11,022 ounces of gold over a 4.5-year period which began in January 2023 (the “Fixed Delivery Period”) and thereafter 1.2%–1.4% of the gold produced from VGML’s underground gold mine for ongoing per ounce cash payments equal to 20% of the spot price of gold. In addition, to the Vatukoula Gold Stream, as amended, the Company holds an effective 0.21% NSR royalty on certain prospecting licenses plus a five-kilometre area of interest.

Beginning in January 2023, during the first year of the Fixed Delivery Period, Sandstorm is expected to receive approximately 1,320 ounces of gold, which will increase to 2,772 ounces of gold per year during the final 3.5 years of the Fixed Delivery Period, following which Sandstorm will receive a variable proportion of gold produced from the Vatukoula Mine for the life of the mine.

Mercedes Gold Stream

On December 16, 2021, the Company entered into a $60 million financing package with Bear Creek Mining Corporation (“Bear Creek”) to facilitate Bear Creek’s acquisition of the producing Mercedes gold-silver mine in Sonora, Mexico (“Mercedes” or the “Mercedes Mine”) from Equinox. The financing package included a $37.5 million gold stream on the Mercedes Mine (the “Mercedes Gold Stream”) and a $22.5 million convertible debenture bearing interest at 6% per annum for a term of three years (the “Bear Creek Debenture”), both of which were payable on closing which occurred in April 2022. Sandstorm had the right to convert the principal amount of the Bear Creek Debenture into common shares of Bear Creek, at any time prior to the maturity date, at a 35% premium, or as approved by the TSX Venture Exchange, to Bear Creek’s share price on closing of the transaction.

Under the original terms of the Mercedes Gold Stream, beginning in April 2022, Sandstorm agreed to purchase 25,200 ounces of gold over a 3.5-year period (the “Fixed Delivery Term”) and thereafter 4.4% of the gold produced from Mercedes Mine for the remainder of the life-of-mine. During the Fixed Delivery Term, Sandstorm was to make ongoing per ounce cash payments to Bear Creek equal to 7.5% of the spot price of gold. After the receipt of the fixed deliveries, the ongoing per ounce cash payment was to increase to 25% of the spot price of the gold.

2023 Annual Information Form

In January 2024, the Company closed a re-structuring of its existing debt investments in Bear Creek as well as the terms of its gold and silver streams on Bear Creek’s Mercedes Mine, which re-structuring terms are discussed below.

AMENDED GOLD STREAM ON MERCEDES

Effective January 1, 2024, the Company now has the right to purchase 275 gold ounces per month through April 2028 and has a 4.4% gold stream thereafter, for an ongoing cash payment equal to 25% of the spot price of gold for each gold ounce delivered.

AMENDED SILVER STREAM ON MERCEDES

As part of the Nomad Acquisition described below, the Company also acquired a silver stream on Mercedes, which entitled it to receive 75,000 silver ounces per quarter until 1.2 million silver ounces had been delivered, after which, the Company was entitled to receive 100% of the silver production from Mercedes until an additional 1.2 million silver ounces had been delivered, following which the Company’s entitlement was to decrease to 30%. The deliverables under this silver stream were subject to the Company making ongoing per ounce cash payments equal to 20% of the spot price of silver.

Effective January 1, 2024 (as a result of the discussed re-structuring), this silver stream was suspended through the fixed gold delivery period described above (i.e. through April 2028). Thereafter, the Company will now receive 100% of the silver production from Mercedes for the life of mine for an ongoing cash payment equal to 25% of the spot price of silver for each silver ounce delivered.

REVISED BEAR CREEK DEBT

The Company and Bear Creek refinanced the terms of the Bear Creek Debenture (as well as a $14.4 million secured loan issued by the Company in 2023), into five-year convertible notes bearing interest at 7% per annum and convertible into common shares of Bear Creek at a price of C$0.73 per Bear Creek share (the “Refinanced Debentures”).

In consideration for the foregoing stream and debt amendments, the Company also received:

•a 1.0% NSR royalty on Bear Creek’s wholly owned Corani silver deposit project in Peru; and

•$10.0 million in non-royalty consideration - i.e. additional consideration comprised of 28,706,687 common shares of Bear Creek and $4.3 million in principal to be added to the Refinanced Debentures described above.

The Mercedes Gold Stream covers all 69,285 hectares of mineral concessions at Mercedes, plus a five-kilometre area of interest.

The Mercedes district has been the focus of mining activities dating back to the 1880s. Commercial production commenced at the Mercedes Mine in 2011 and the mine has produced over 800,000 ounces of gold. The Mercedes mill has a current capacity of 2,000 tonnes per day.

2023 Annual Information Form

Non-Core Royalty Asset Sales to Sandbox Royalties Corp.

On June 28, 2022, each of the Company and Equinox closed their previously announced purchase and sale agreements with Sandbox Royalties Corp. (formerly known as Rosedale Resources Ltd.) (“Sandbox”) pursuant to which Sandbox acquired a portfolio of royalties from Equinox (for aggregate consideration of $28.4 million) and the Company (for aggregate consideration of $65 million). Under the terms of the purchase and sale agreement between the Company and Sandbox, the Company received total consideration of $65 million comprised of 34 million shares of Sandbox at a deemed price of C$0.70 per Sandbox share, a $15 million cash payment and a $31,436,000 10-year secured convertible promissory note (“Sandbox Promissory Note”). Non-core royalty assets sold by the Company to Sandbox included, inter alia, Hackett River, Prairie Creek, Vittangi, Mason and Converse.

On closing of the aforementioned Sandbox transaction, Sandbox held a portfolio of 23 metals royalties across a range of assets and jurisdictions, including the existing royalties held by Sandbox.

Subsequently, in the late Fall of 2023, the Company sold its El Pilar and Blackwater non-core royalties to Sandbox for aggregate consideration of $25 million, as to $10 million in cash and as to $15 million in common shares of Sandbox (i.e. 29,557,436 Sandbox shares) at a deemed price of C$0.70 per Sandbox share.

Also, during the year ended December 31, 2023, Sandbox issued 33,837,247 shares to the Company having a total value of $17,249,454 as repayment for a portion of the above-mentioned Sandbox Promissory Note.

As a result of this transaction, the Company’s position in Sandbox, on a fully diluted basis, is greater than 20%. As at December 31, 2023, this position represents 34.0% of the Sandbox common shares on a non-diluted basis. Each of Equinox and the Company have entered into an investor rights agreement with Sandbox providing for, among other things, customary anti-dilution provisions and board representation rights.

The Company and Equinox both hold significant equity positions in Sandbox, providing the opportunity to participate in and facilitate the future growth of Sandbox.

BaseCore Transaction

Pursuant to the terms of an Asset Purchase and Sale Agreement dated May 1, 2022 (the “BaseCore Asset Purchase Agreement”), on July 12, 2022, the Company closed its acquisition of nine royalties and one stream (the “BaseCore Royalty Package”) from BaseCore Metals LP for total consideration payable as to $425 million in cash and the issuance of an aggregate of 13,495,276 Common Shares to Glencore Plc and Ontario Teachers’ Pension Plan Board (each as to 6,747,638 Common Shares) (the “BaseCore Transaction”).

Concurrent with the BaseCore Transaction, Sandstorm partnered with Horizon Copper Corp. to sell a portion of a copper royalty acquired in the BaseCore Transaction and retain a silver stream on the asset. Please see below under the title “Creation of Strategic Mining Partner - Spin-off of Antamina NPI”, for details concerning this arrangement.

BaseCore is an entity that was equally owned by affiliates of Glencore Plc and Ontario Teachers’ Pension Plan Board which held a high quality, long-life portfolio that included ten royalty and stream assets, of which three are on currently producing assets.

2023 Annual Information Form

The BaseCore Royalty Package includes, among other things, a 1.66% net profits interest on the Antamina copper/zinc mine (producing and located in Peru) (the “Antamina Mine”), a 1.0% stream on production from the CEZinc project (producing and located in Canada), a 2.0% NSR royalty on the Horne 5 gold project (a development stage project located in Canada), and a 0.5% NPI on the Highland Valley copper mine (producing and located in Canada). Royalty revenues from the BaseCore Royalty Package accrued to Sandstorm as of April 1, 2022.

The BaseCore Transaction was subject to regulatory approvals including the approval of the TSX for the listing of the Common Shares issuable thereunder, the Canadian Competition Bureau, waiver of rights of first offer or refusal on certain exploration stage royalties, and other customary conditions for a transaction of this nature.

The BaseCore Transaction constituted a “significant acquisition” within the meaning of National Instrument 51-102 - Continuous Disclosure Obligations (“NI 51-102”). The Company does not consider the BaseCore Transaction to meet the definition of an acquisition of a “business” under Canadian securities laws; however, for full and transparent disclosures and consistent with the information provided to the Company’s shareholders (the “Shareholders”), the Company filed a Form 51-102F4, Business Acquisition Report, in accordance with NI 51-102 in respect of the BaseCore Transaction, which is available under the Company’s profile on SEDAR+ at www.sedarplus.ca. The Business Acquisition Report is not incorporated by reference herein.

The following is additional information with respect to three of the assets acquired from BaseCore:

•CEZinc Stream — a zinc stream to purchase 1.0% of the zinc processed at the Canadian Electrolytic Zinc Limited (“CEZinc”) smelter which is located on the St. Lawrence Seaway along major transportation networks in Quebec, Canada, that connect the facility to its end markets in the United States and Canada. This stream permits the Company to purchase 1.0% of the zinc until the later of June 30, 2030, or delivery of 68 million pounds zinc, for ongoing per pound cash payments of 20% of the average quarterly spot price of zinc. Noranda Income Fund owns the processing facility and ancillary assets and CEZinc operates and manages it. Both entities are now wholly-owned subsidiaries of Glencore Canada Corporation.

•Horne 5 Royalty — a 2.0% NSR royalty on the Horne 5 deposit (“Horne 5 Project”) located in Quebec, Canada, owned by Falco Resources Ltd. (“Falco”). An updated Feasibility Study, released in April 2021, envisions an underground operation producing approximately 320,000 gold equivalent ounces annually over a 15-year mine life. Proven and Probable Mineral Reserves are 80.9 million tonnes at an average grade of 1.44 grams per tonne gold, 14.14 grams per tonne silver, 0.17% copper, and 0.77% zinc with an effective date of August 26, 2017 (NSR cut-off grade of CAD$55 per tonne). In their news release dated January 24, 2024, Falco announced that they have entered into an operating license and indemnity agreement with Glencore Canada Corporation pursuant to which Glencore Canada Corporation granted to Falco, subject to certain conditions, a license to utilize a portion of its lands, which Falco will use to develop and operate the Horne 5 Project. This arrangement with Glencore Canada Corporation allows Falco to move forward with the next steps of the development of the Horne 5 Project, mainly the advancement of permitting with the government of Québec and financing for the development of the project. For more information, visit Falco’s website at www.falcores.com/en.

•Highland Valley NPI — a 0.5% NPI on the Highland Valley copper operations (“Highland Valley”) located in British Columbia, Canada and owned and operated by Teck. Highland Valley has been in production since 1962 and produces both copper and molybdenum concentrates. In their news release dated January 15, 2024, Teck announced that copper production at Highland Valley was 98.8 tonnes in 2023. They guided for 2024 to 2027

2023 Annual Information Form

copper production from Highland Valley of 112,000 - 160,000 tonnes per year, with 2024 expected to be at the lower end of the range followed by increased production in 2025 and 2026. Teck continues to evaluate the Highland Valley copper project, and they expect that copper production will increase in 2024 as they move into the Lornex pit, which is higher grade, and as a result of improved mill availability. They are also progressing permitting at their Highland Valley life extension project. For more information, visit Teck’s website at www.teck.com.

Blyvoor Gold Stream

As discussed below, pursuant to the Nomad Acquisition, the Company acquired certain producing assets, one of which is a Gold Stream (the “Blyvoor Gold Stream”) on Blyvoor Gold (Pty) Ltd.’s (“Blyvoor”) underground gold mine located on the Witwatersrand gold belt, South Africa (the “Blyvoor Mine”). Under the terms of the Blyvoor Gold Stream, until 300,000 ounces have been delivered (“Initial Blyvoor Delivery Threshold”), Blyvoor will deliver 10% of gold production until 16,000 ounces have been delivered in the calendar year, then 5% of the remaining production for that calendar year. Following the Initial Blyvoor Delivery Threshold, Sandstorm will receive 0.5% of gold production on the first 100,000 ounces in a calendar year until a cumulative 10.32 million ounces of gold have been produced. Under the Blyvoor Gold Stream, Sandstorm will make ongoing cash payments of $572 per ounce of gold delivered.

The Blyvoor Mine, which commenced production in 1942, is situated in a prolific gold mining area within the Carletonville Goldfield. The region hosts a number of well-established gold mines and is well serviced by all amenities. The mine is located approximately 14 kilometres from the town of Carletonville, Gauteng Province, and about 80 kilometres from Johannesburg, a major metropolitan centre. In June 2021, an updated NI 43-101 Technical Report was filed on the Blyvoor Mine outlining a 22-year mine life. The current processing plant has a capacity of 1,300 tonnes per day. For more information, refer to the Blyvoor technical report dated June 25, 2021, under Nomad Royalty Company Ltd.’s profile on www.sedarplus.ca.

Caserones Royalty

As discussed below, pursuant to the Nomad Acquisition, the Company acquired certain producing assets, one of which is an effective 0.63% NSR royalty (at copper prices above $1.25 per pound) on the production from the Caserones open-pit mine located in the Atacama region of Chile (the “Caserones Mine”), operated by Lundin Mining and owned by Lundin Mining through a wholly-owned subsidiary (as to 51%) and JX Nippon Mining & Metals Corporation (as to 49%).

The Caserones Mine has over ten years of operational history. On July 13, 2023, Lundin Mining filed a NI 43-101 Technical Report on the Caserones Mine, which is available on SEDAR+, which outlines a mine life through 2037 and average annual production of approximately 110,000 tonnes of copper. In their news release dated July 13, 2023, Lundin Mining stated that annual production guidance for Caserones on a 100% basis for both 2024 and 2025 is 110,000 – 120,000 tonnes of copper and 1,500 – 2,500 tonnes of molybdenum. This mine benefits from a significant historical investment of $4.2 billion, well-established infrastructure and is expected to produce significant volumes of copper and molybdenum over the long-term. Lundin Mining has identified several priority exploration targets at the property, the majority of which are situated on the Company’s royalty ground.

2023 Annual Information Form

On February 21, 2024, Lundin Mining announced that the Caserones Mine produced 65,210 tonnes of copper and 2,024 tonnes of molybdenum (on a 100% basis) during the year, from their acquisition closing date (July 13, 2023) to the end of the year. Their guidance for this mine for 2024 (on a 100% basis) is 120,000 – 130,000 tonnes of copper and 2,500 – 3,000 tonnes of molybdenum. Exploration drilling campaigns for 2024 are underway at the mine and drilling is targeting the Angelica target and Caserones sulphide deep target with three rigs. For more information, visit Lundin Mining’s website at www.lundinmining.com.

Bonikro Gold Stream

Pursuant to the Nomad Acquisition, the Company acquired certain producing assets, one of which is a Gold Stream (the “Bonikro Gold Stream”) on Allied Gold Corporation’s (previously Allied Gold Corp.) (“Allied”) Bonikro gold mine located mine located in Cotê d’Ivoire (the “Bonikro Mine”). Under the terms of the Bonikro Gold Stream, Allied will deliver 6% of gold produced at the mine until 39,000 ounces of gold are delivered, then 3.5% of gold produced until a cumulative 61,750 ounces of gold have been delivered, then 2% thereafter. Under the Bonikro Gold Stream, Sandstorm will make ongoing cash payments of $400 per ounce of gold delivered.

The Bonikro Mine is a producing gold-silver mine located approximately 100 kilometres south of Yamassoukro, the political capital of Côte d'Ivoire, and approximately 214 kilometres northwest from Abidjan, the commercial capital of the country. The operation consists of two primary areas: the Bonikro mining license and the Hiré mining license. Gold has been produced from the Bonikro open-pit and through the Bonikro carbon-in-leach plant since 2008 with over 1.0 million ounces having been produced.