WHERE THERE’S A WSFS, THERE’S A WAY. 1 WSFS Financial Corporation Investor Overview March 2024 Exhibit 99.1

Forward looking statements & non-GAAP Forward looking statements: This presentation contains estimates, predictions, opinions, projections and other "forward-looking statements" as that phrase is defined in the Private Securities Litigation Reform Act of 1995. Such statements include, without limitation, references to the Company's predictions or expectations of future business or financial performance as well as its goals and objectives for future operations, financial and business trends, business prospects, and management's outlook or expectations for earnings, revenues, expenses, capital levels, liquidity levels, asset quality or other future financial or business performance, strategies or expectations. The words “believe,” “expect,” “anticipate,” “plan,” “estimate,” “target,” “project” and similar expressions, among others, generally identify forward-looking statements. Such forward- looking statements are based on various assumptions (some of which may be beyond the Company's control) and are subject to significant risks and uncertainties (which change over time) and other factors, including the impacts related to or resulting from bank failures and other economic and industry volatility, including potential increased regulatory requirements and costs and potential impacts to macroeconomic conditions, the uncertain effects of geopolitical instability, armed conflicts, public health crises, inflation, interest rates and actions taken in response thereto on our business, results of operations, capital and liquidity, which could cause actual results to differ materially from those currently anticipated. Such risks and uncertainties are discussed in detail in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, and other documents filed by the Company with the Securities and Exchange Commission from time to time. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date on which they are made, and the Company disclaims any duty to revise or update any forward-looking statement, whether written or oral, that may be made from time to time by or on behalf of the Company for any reason, except as specifically required by law. As used in this presentation, the terms "WSFS", "the Company", "registrant", "we", "us", and "our" mean WSFS Financial Corporation and its subsidiaries, on a consolidated basis, unless the context indicates otherwise. Non-GAAP financial measures: This presentation contains financial measures determined by methods other than in accordance with accounting principles generally accepted in the United States (“GAAP”). These non-GAAP measures include core earnings per share (“EPS”), core efficiency ratio, pre-provision net revenue (“PPNR”), PPNR to average assets ratio, core PPNR to average assets ratio, core net revenue, core PPNR, core return on assets (“ROA”), core net interest income, core noninterest expense, tangible common book value (“TBV”), TBV excluding AOCI, tangible common equity (“TCE”), tangible assets, tangible equity, return on tangible common equity (“ROTCE”), core ROTCE, core fee revenue, core fee revenue ratio, effective AOCI, and coverage ratio including the estimated remaining credit marks and excluding HTM securities. The Company’s management believes that these non-GAAP measures provide a greater understanding of ongoing operations, enhance comparability of results of operations with prior periods and show the effects of significant gains and charges in the periods presented. The Company’s management believes that investors may use these non-GAAP measures to analyze the Company’s financial performance without the impact of unusual items or events that may obscure trends in the Company’s underlying performance. This non-GAAP data should be considered in addition to results prepared in accordance with GAAP, and is not a substitute for, or superior to, GAAP results. For a reconciliation of these non-GAAP measures to their comparable GAAP measures, see the Appendix. 2

Optimizing significant franchise investments: • Major investments gaining traction; building out Salesforce capabilities, implementing RPAs4, and evaluating artificial intelligence models • Increasing efficiencies, expanding controls, and improving overall Customer experience Diverse customer base: • Resilient relationship-based service model • 44% of deposits from Consumer, 24% from Commercial, 16% from Small Business, and 15% from Wealth and Trust Strong balance sheet: • Capital ratios significantly above “Well-Capitalized” • Well-reserved with 1.64% ACL coverage ratio5 and 22 concentration limits all within approved levels Commitment to long-term sustainable high performance: • Core ROA ranked 78th percentile in 2022 and 80th percentile in 2023 vs. KRX Peers1 • Returned 63% of earnings over the past five years through buybacks and dividends Differentiated fee revenue: • Wealth, Trust, and Cash Connect® fees generated 21% of total revenue in 2023 • Niche Mortgage and Capital Markets capabilities Highly attractive market position2,3: • Uniquely positioned between larger out-of-market banks and smaller community banks • Ranked 6th in deposits for the 5th largest MSA depository in the country Delivering Top-Quintile Financial Performance 3 Why invest in WSFS? 1 2 3 4 5 1 S&P Global; KBW Nasdaq Regional Banking Index (KRX) peer group used 2 U.S. Census Bureau (2022), American Community Survey 1-Year Estimates 3 FDIC and S&P Global. Data excludes brokered deposits, credit unions, and non-traditional banks; as of June 30, 2023. Also excludes TD Bank’s 2035 Limestone Rd Wilmington, DE location 4 Robotic process automation (RPA) 5 1.64% includes estimated remaining credit marks and excludes HTM securities. This is a non-GAAP financial measure and should be considered along with results prepared in accordance with GAAP, and not as a substitute for GAAP results. See Appendix for reconciliation to GAAP financial information. 6

We are uniquely positioned in our market 1 FDIC and S&P Global. Data excludes brokered deposits, credit unions, and non-traditional banks; as of June 30, 2023. Also excludes TD Bank’s 2035 Limestone Rd Wilmington, DE location 2 U.S. Census Bureau (2022), American Community Survey 1-Year Estimates 3 Bureau of Labor Statistics and ESRI (2022) 4 Greater Philadelphia is rich with businesses, talent and wealthy households holding investable assets; our position acts as a further catalyst for our relationship-banking and fee revenue success 7th Largest MSA population2 7th Largest MSA labor force3 5th Largest MSA depository2 • Centrally located in the MA-NY-PA-MD/DC corridor; #1 mega-region globally by economic output • MSA has over 6 million people and 2.5 million households • One of nation’s leading regions for academia and academic research; over 100 colleges and universities • Mix of stable and growing industries led by healthcare, biotech and logistics; #1 emerging U.S. startup ecosystem4 and lowest U.S. metro office rental rates5 • Exclusively positioned between larger out-of-market banks and smaller community banks • PA-NJ-DE has 8% of all U.S. households with over $1 million in investable assets6 Capitalizing on the opportunity as the only local bank with a full suite of products and national scale Philadelphia-Wilmington-Camden MSA1 Net Deposits (millions) Market Share % 1 Wells Fargo $34,134 15.6% 2 TD $33,941 15.5% 3 Citizens $25,765 11.8% 4 Bank of America $25,106 11.5% 5 PNC $21,962 10.1% 6 WSFS Bank $14,707 6.7% 7 M&T $10,681 4.9% 8 Santander $7,407 3.4% 9 Truist $5,405 2.5% 10 Univest $5,069 2.3% 85 Remaining $34,260 15.7% 2023 Rank 4 Startup Genome (2020) 5 Jones Lang LaSalle (2021) 6 Phoenix Marketing International

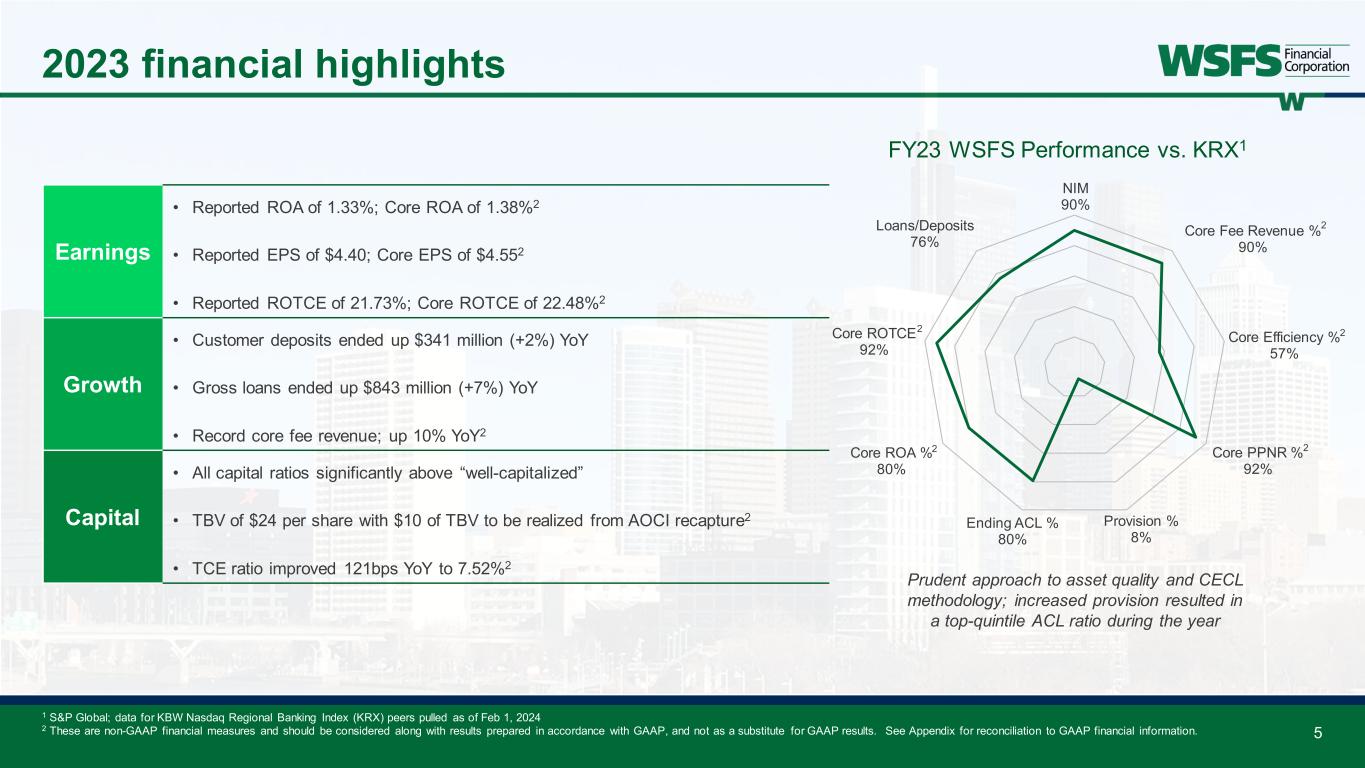

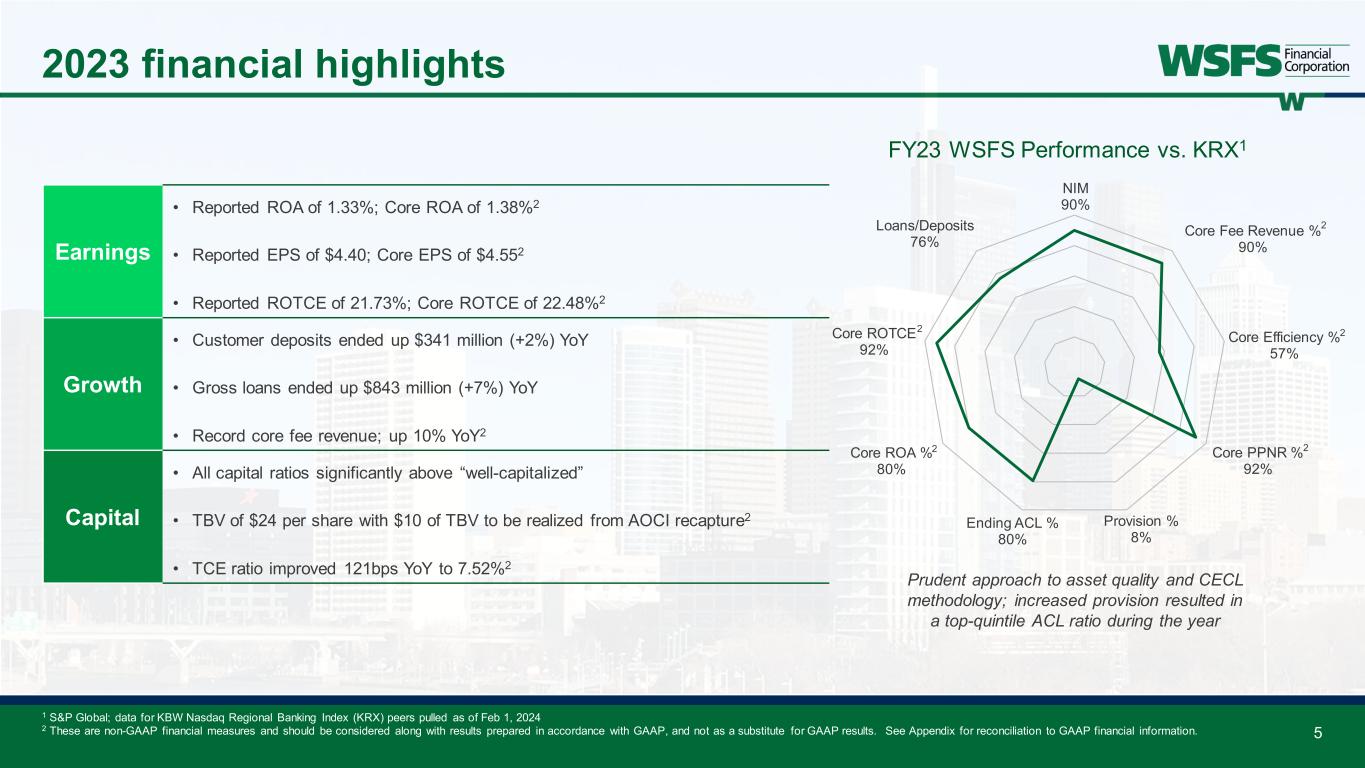

5 2023 financial highlights Earnings • Reported ROA of 1.33%; Core ROA of 1.38%2 • Reported EPS of $4.40; Core EPS of $4.552 • Reported ROTCE of 21.73%; Core ROTCE of 22.48%2 Growth • Customer deposits ended up $341 million (+2%) YoY • Gross loans ended up $843 million (+7%) YoY • Record core fee revenue; up 10% YoY2 Capital • All capital ratios significantly above “well-capitalized” • TBV of $24 per share with $10 of TBV to be realized from AOCI recapture2 • TCE ratio improved 121bps YoY to 7.52%2 NIM 90% Core Fee Revenue % 90% Core Efficiency % 57% Core PPNR % 92% Provision % 8% Ending ACL % 80% Core ROA % 80% Core ROTCE 92% Loans/Deposits 76% FY23 WSFS Performance vs. KRX1 Prudent approach to asset quality and CECL methodology; increased provision resulted in a top-quintile ACL ratio during the year 1 S&P Global; data for KBW Nasdaq Regional Banking Index (KRX) peers pulled as of Feb 1, 2024 2 These are non-GAAP financial measures and should be considered along with results prepared in accordance with GAAP, and not as a substitute for GAAP results. See Appendix for reconciliation to GAAP financial information. 2 22 2 2

6 2024 outlook as originally presented in 4Q 2023 Supplement 1 The Company is not able to reconcile the forward-looking non-GAAP estimates set forth above to their most directly comparable GAAP estimates without unreasonable efforts because it is unable to predict, forecast or determine the probable significance of the items impacting these estimates with a reasonable degree of accuracy2 Loan Growth Mid-single digit growth; Increase market share due to favorable market position Deposit Growth Low-single digit growth; Broad-based growth across our businesses Net Interest Margin Range of 3.80% - 3.90%; NIM expected to plateau mid-year; IB deposit beta of ~50% by year-end Fee Revenue Growth Double-digit growth; Cash Connect® and Wealth and Trust growth Net Charge-offs 0.50% - 0.60% of average loans; ~35bps when excluding Upstart and NewLane Efficiency Ratio +/-60%; Continued franchise investment Tax Rate Approximately 25% Full-Year Core ROA1 Outlook of +/-1.20% Delivering high-performing results and franchise growth Assumes a flat interest rate environment and a soft economic landing (FY GDP of ~1%) in 2024 2024 Core Outlook1

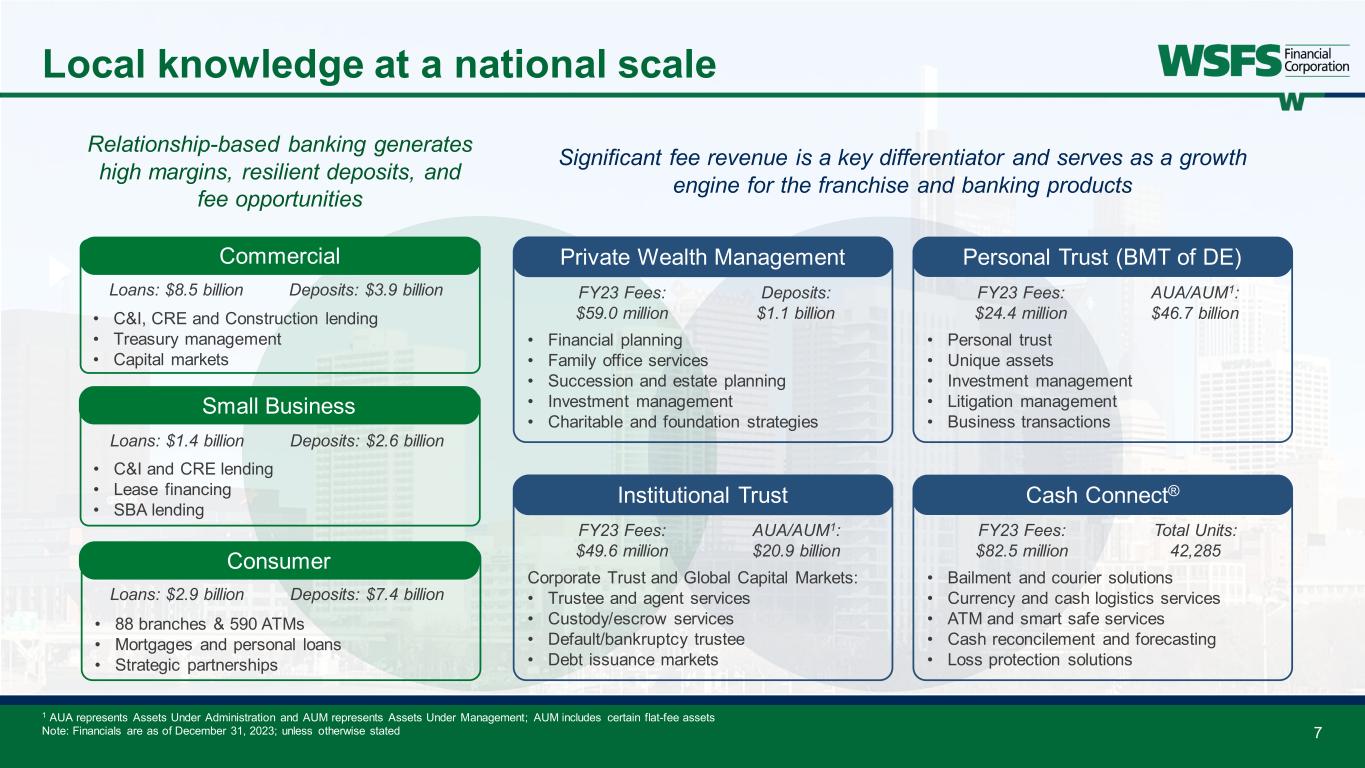

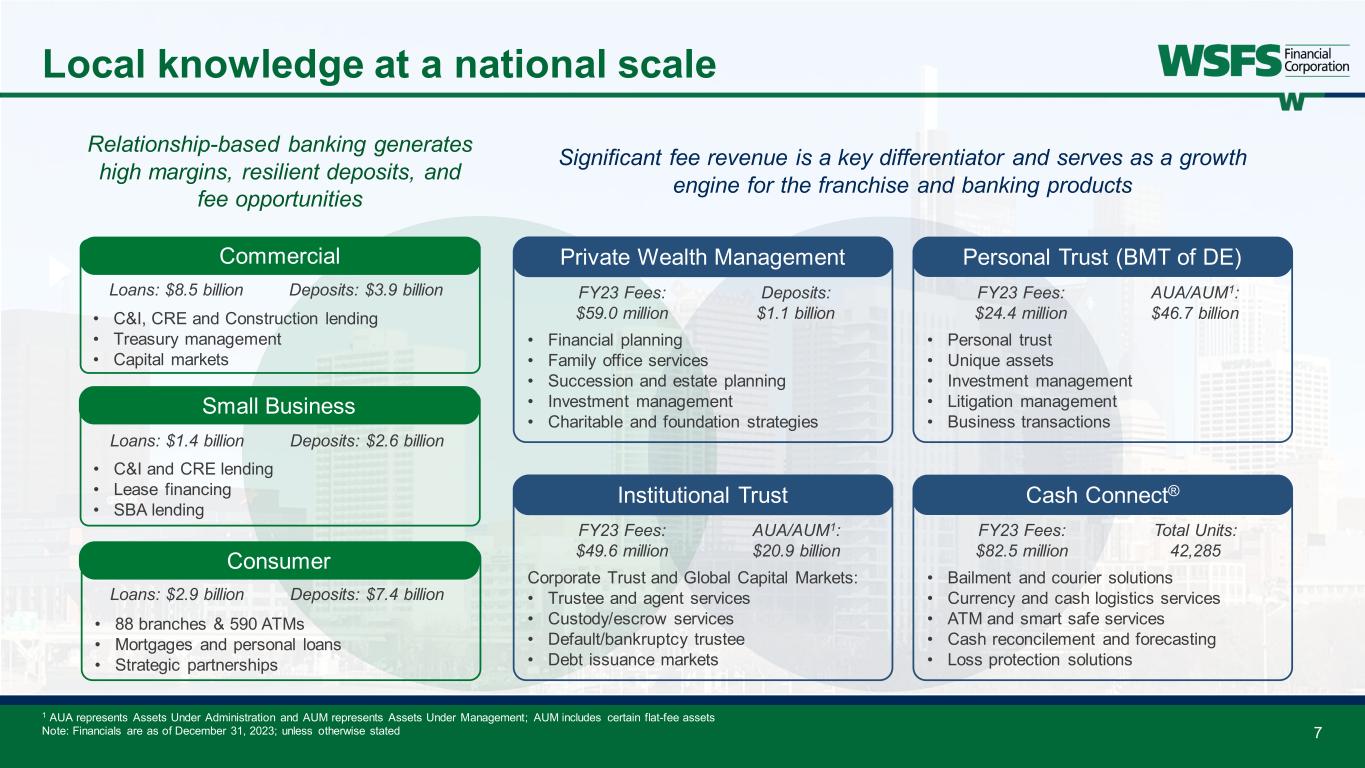

7 Local knowledge at a national scale • Financial planning • Family office services • Succession and estate planning • Investment management • Charitable and foundation strategies Private Wealth Management Corporate Trust and Global Capital Markets: • Trustee and agent services • Custody/escrow services • Default/bankruptcy trustee • Debt issuance markets Institutional Trust • Personal trust • Unique assets • Investment management • Litigation management • Business transactions Personal Trust (BMT of DE) • Bailment and courier solutions • Currency and cash logistics services • ATM and smart safe services • Cash reconcilement and forecasting • Loss protection solutions Cash Connect® FY23 Fees: $59.0 million Deposits: $1.1 billion FY23 Fees: $24.4 million AUA/AUM1: $46.7 billion FY23 Fees: $49.6 million AUA/AUM1: $20.9 billion FY23 Fees: $82.5 million Total Units: 42,285 Relationship-based banking generates high margins, resilient deposits, and fee opportunities 1 AUA represents Assets Under Administration and AUM represents Assets Under Management; AUM includes certain flat-fee assets Note: Financials are as of December 31, 2023; unless otherwise stated Significant fee revenue is a key differentiator and serves as a growth engine for the franchise and banking products • 88 branches & 590 ATMs • Mortgages and personal loans • Strategic partnerships Consumer Loans: $2.9 billion Deposits: $7.4 billion • C&I, CRE and Construction lending • Treasury management • Capital markets Commercial Loans: $8.5 billion Deposits: $3.9 billion • C&I and CRE lending • Lease financing • SBA lending Small Business Loans: $1.4 billion Deposits: $2.6 billion

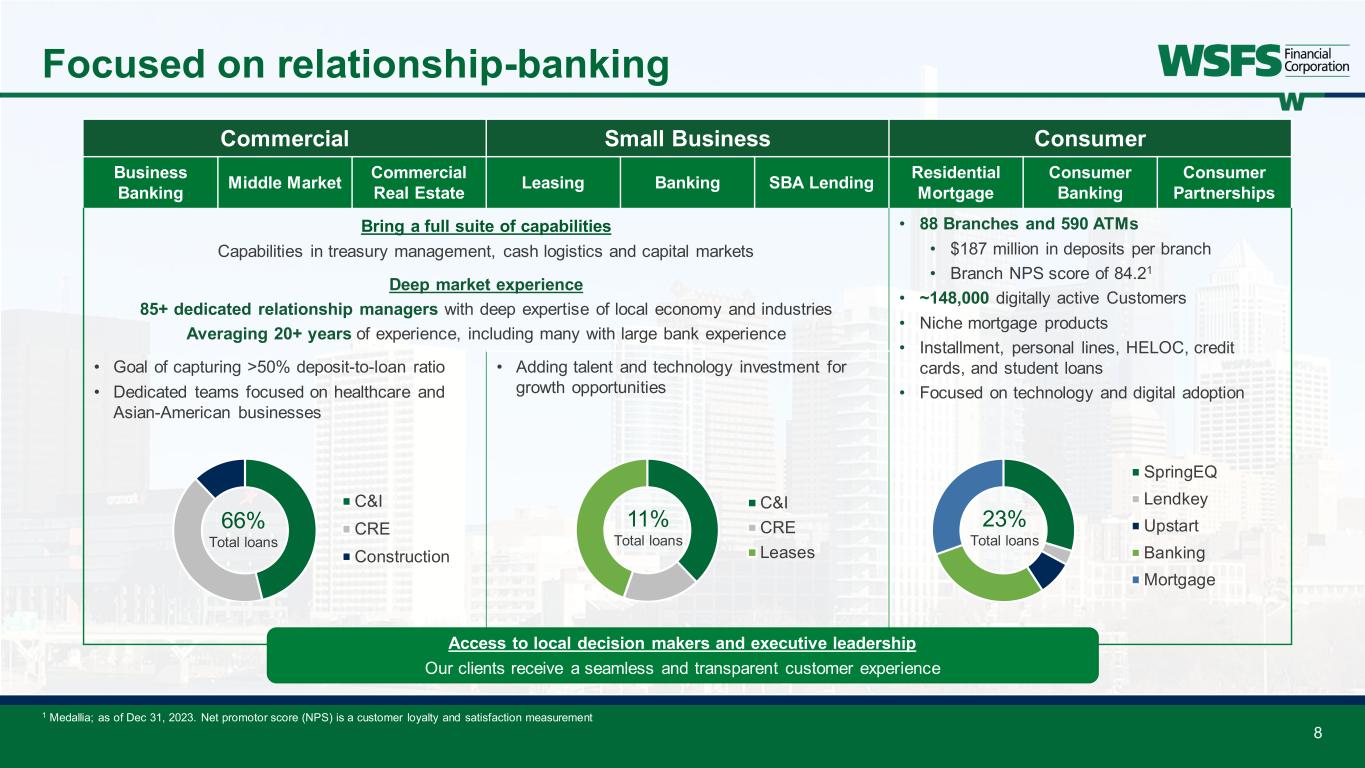

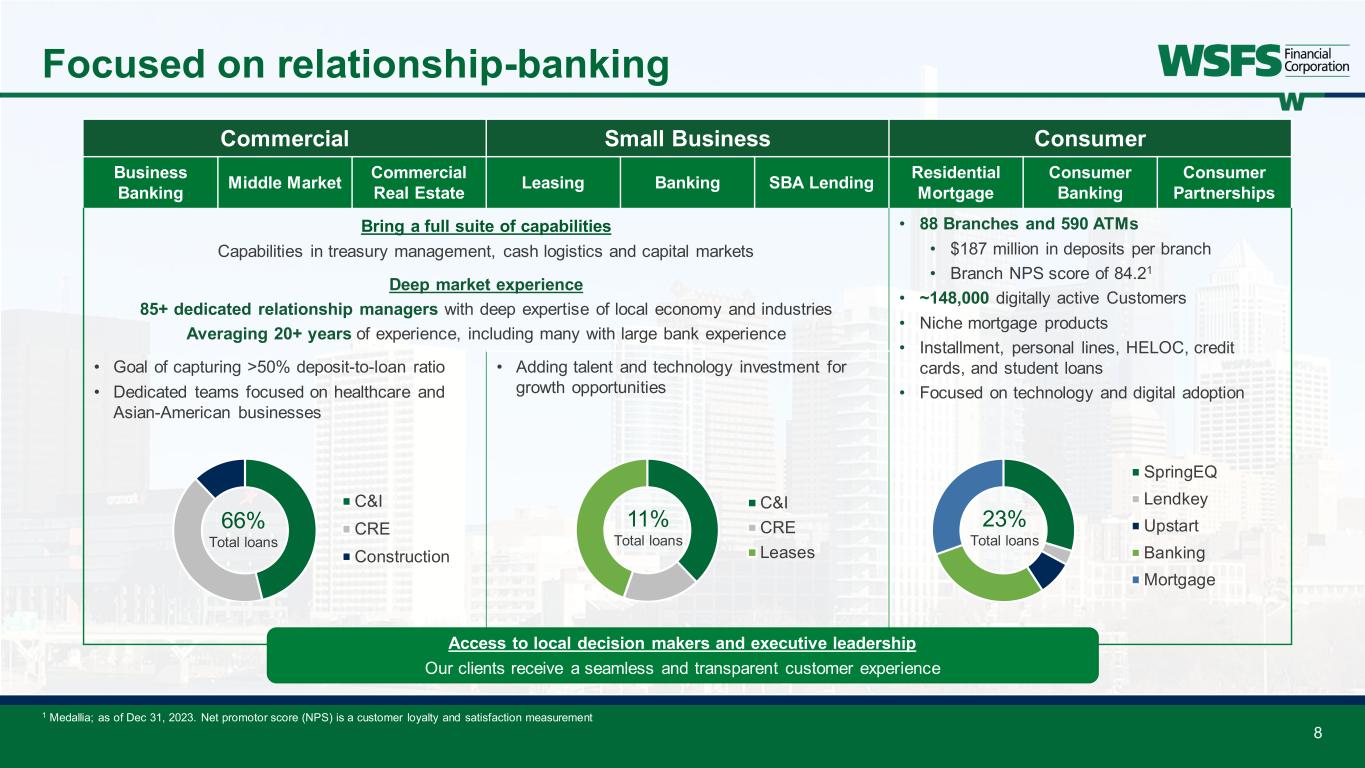

Commercial Small Business Consumer Business Banking Middle Market Commercial Real Estate Leasing Banking SBA Lending Residential Mortgage Consumer Banking Consumer Partnerships Bring a full suite of capabilities Capabilities in treasury management, cash logistics and capital markets Deep market experience 85+ dedicated relationship managers with deep expertise of local economy and industries Averaging 20+ years of experience, including many with large bank experience • 88 Branches and 590 ATMs • $187 million in deposits per branch • Branch NPS score of 84.21 • ~148,000 digitally active Customers • Niche mortgage products • Installment, personal lines, HELOC, credit cards, and student loans • Focused on technology and digital adoption • Goal of capturing >50% deposit-to-loan ratio • Dedicated teams focused on healthcare and Asian-American businesses • Adding talent and technology investment for growth opportunities C&I CRE Construction C&I CRE Leases Access to local decision makers and executive leadership Our clients receive a seamless and transparent customer experience 8 Focused on relationship-banking SpringEQ Lendkey Upstart Banking Mortgage 23% Total loans 66% Total loans 11% Total loans 1 Medallia; as of Dec 31, 2023. Net promotor score (NPS) is a customer loyalty and satisfaction measurement

9 Wealth and Trust: Overview 26% 40% 34% 0% 10% 20% 30% 40% 2021 2022 2023 Transaction-based Account-based AUM-based Fee Revenue Composition $20.7 $24.2 $34.6 $64.5 $78.1 $0 $20 $40 $60 $80 $100 2019 2020 2021 2022 2023 Bi llio ns AUA AUM AUA and AUM 5th largest wealth business amongst full-service banks under $100 billion in assets2 • Diversified Fee Revenue: • Up 8% YoY to $133.0 million • 66% of fees comes from non AUM-based services • Relationship and Client Growth: • ~12,000 Advisory Relationships • ~1,200 Institutional Clients • Exceptional Service: • Wealth NPS score of 70.53 • Leveraging the Bryn Mawr Trust brand • Strategic Goals: • Gain market share and expand markets/partnerships • Increase referral opportunities • Deliver best-in-class service and value 46% FY23 Fee Revenue Premier Full-Service National Wealth and Trust Franchise 1 AUM/AUA as of December 31, 2023 reflects a correction to the computation of AUA that reduces the previously reported AUM/AUA balance by $6.3 billion to $78.1 billion. 2 S&P Global; banks and thrifts with greater than $15 million annualized revenue generated from TTM (trailing twelve-month) fiduciary activities and between $5B to $100B in assets; data as of Feb 1, 2024 3 Medallia; as of Dec 31, 2023 1

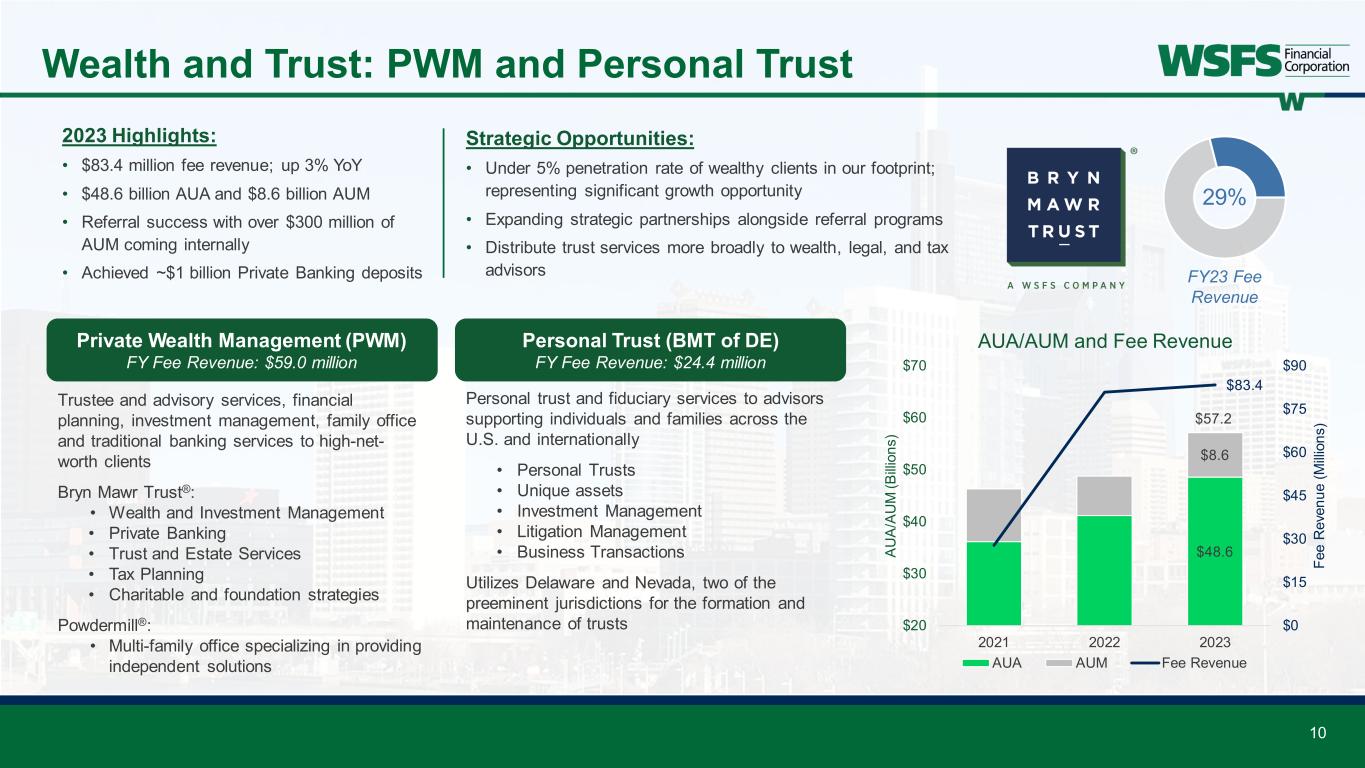

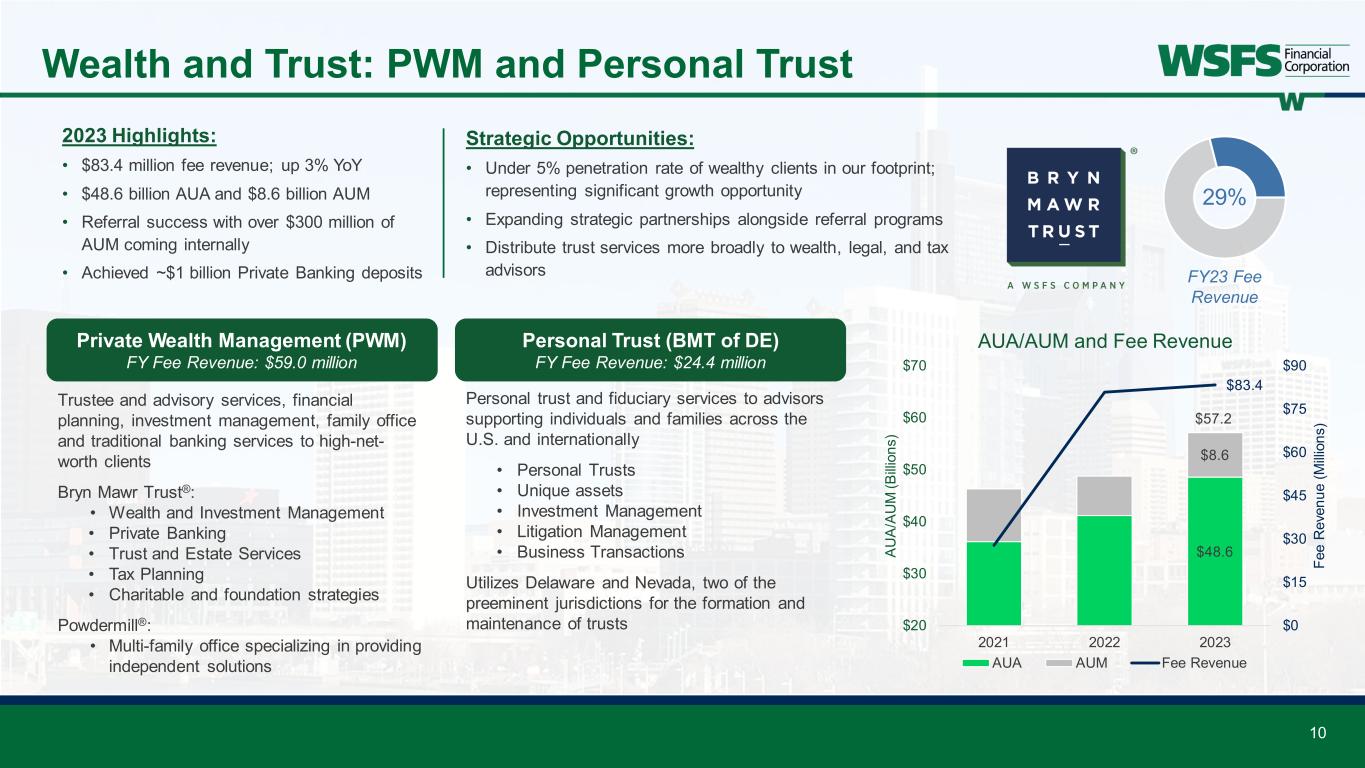

10 Wealth and Trust: PWM and Personal Trust 29% FY23 Fee Revenue Private Wealth Management (PWM) FY Fee Revenue: $59.0 million Personal Trust (BMT of DE) FY Fee Revenue: $24.4 million Trustee and advisory services, financial planning, investment management, family office and traditional banking services to high-net- worth clients Bryn Mawr Trust®: • Wealth and Investment Management • Private Banking • Trust and Estate Services • Tax Planning • Charitable and foundation strategies Powdermill®: • Multi-family office specializing in providing independent solutions Personal trust and fiduciary services to advisors supporting individuals and families across the U.S. and internationally • Personal Trusts • Unique assets • Investment Management • Litigation Management • Business Transactions Utilizes Delaware and Nevada, two of the preeminent jurisdictions for the formation and maintenance of trusts 2023 Highlights: • $83.4 million fee revenue; up 3% YoY • $48.6 billion AUA and $8.6 billion AUM • Referral success with over $300 million of AUM coming internally • Achieved ~$1 billion Private Banking deposits Strategic Opportunities: • Under 5% penetration rate of wealthy clients in our footprint; representing significant growth opportunity • Expanding strategic partnerships alongside referral programs • Distribute trust services more broadly to wealth, legal, and tax advisors $48.6 $8.6 $83.4 $0 $15 $30 $45 $60 $75 $90 $20 $30 $40 $50 $60 $70 2021 2022 2023 Fe e R ev en ue (M illi on s) AU A/ AU M (B illi on s) AUA/AUM and Fee Revenue AUA AUM Fee Revenue $57.2

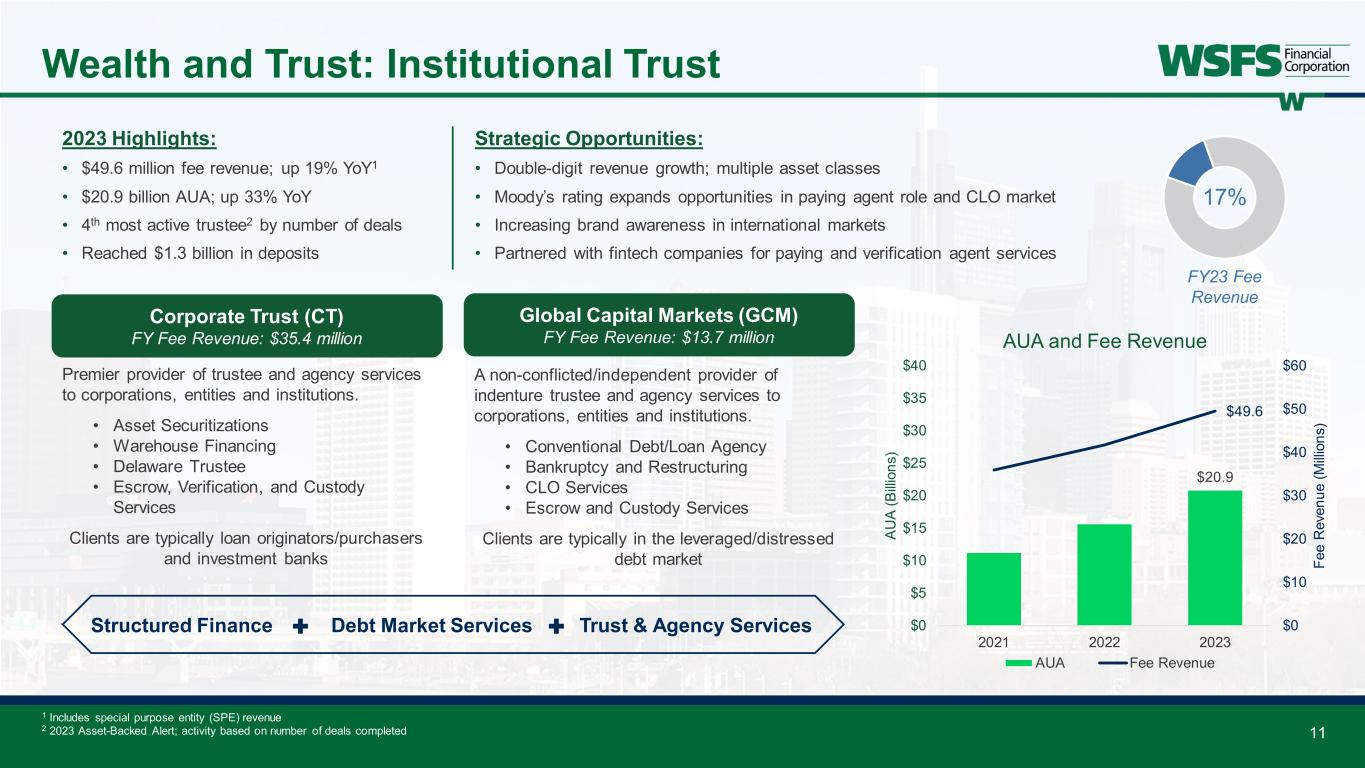

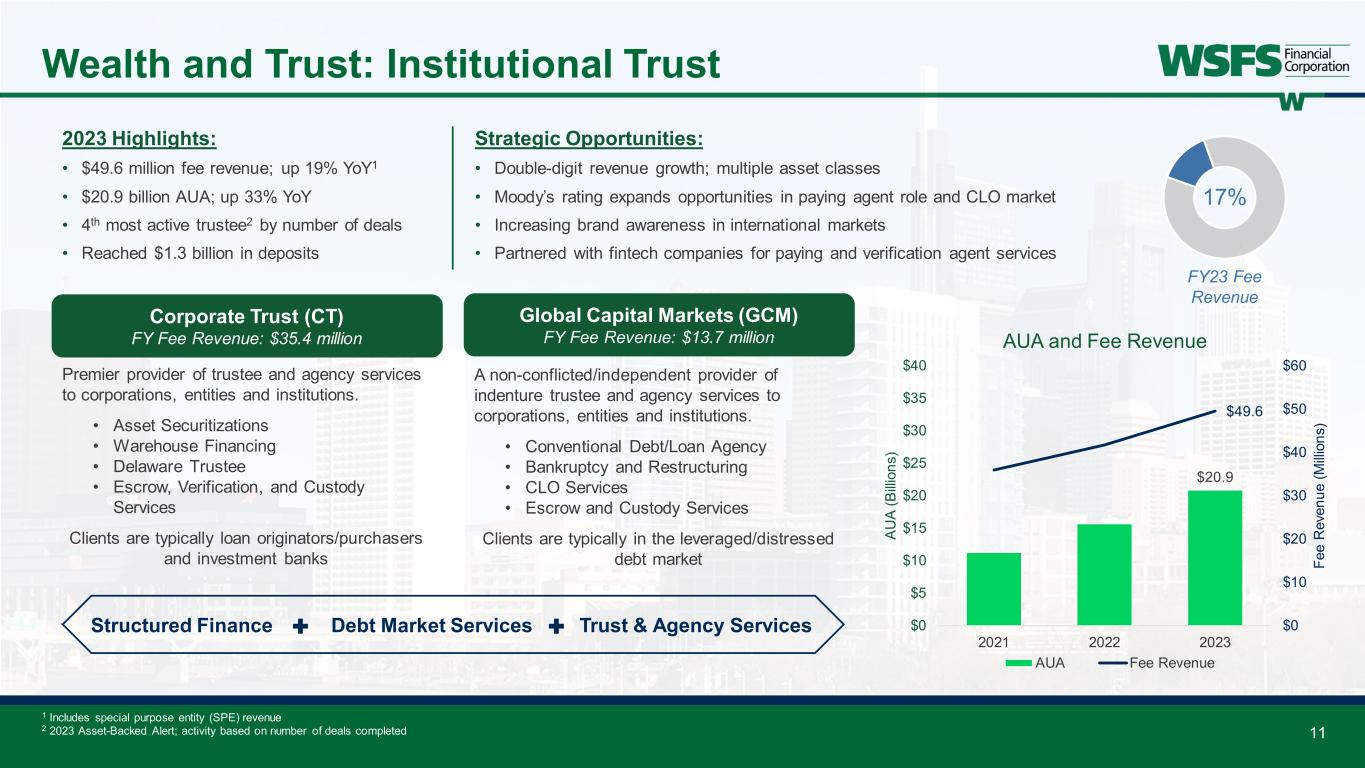

11 Wealth and Trust: Institutional Trust 2023 Highlights: • $49.6 million fee revenue; up 19% YoY1 • $20.9 billion AUA; up 33% YoY • 4th most active trustee2 by number of deals • Reached $1.3 billion in deposits 17% FY23 Fee Revenue Global Capital Markets (GCM) FY Fee Revenue: $13.7 million Corporate Trust (CT) FY Fee Revenue: $35.4 million A non-conflicted/independent provider of indenture trustee and agency services to corporations, entities and institutions. • Conventional Debt/Loan Agency • Bankruptcy and Restructuring • CLO Services • Escrow and Custody Services Clients are typically in the leveraged/distressed debt market Premier provider of trustee and agency services to corporations, entities and institutions. • Asset Securitizations • Warehouse Financing • Delaware Trustee • Escrow, Verification, and Custody Services Clients are typically loan originators/purchasers and investment banks Strategic Opportunities: • Double-digit revenue growth; multiple asset classes • Moody’s rating expands opportunities in paying agent role and CLO market • Increasing brand awareness in international markets • Partnered with fintech companies for paying and verification agent services $20.9 $49.6 $0 $10 $20 $30 $40 $50 $60 $0 $5 $10 $15 $20 $25 $30 $35 $40 2021 2022 2023 Fe e R ev en ue (M illi on s) AU A (B illi on s) AUA and Fee Revenue AUA Fee Revenue Trust & Agency ServicesStructured Finance Debt Market Services 1 Includes special purpose entity (SPE) revenue 2 2023 Asset-Backed Alert; activity based on number of deals completed

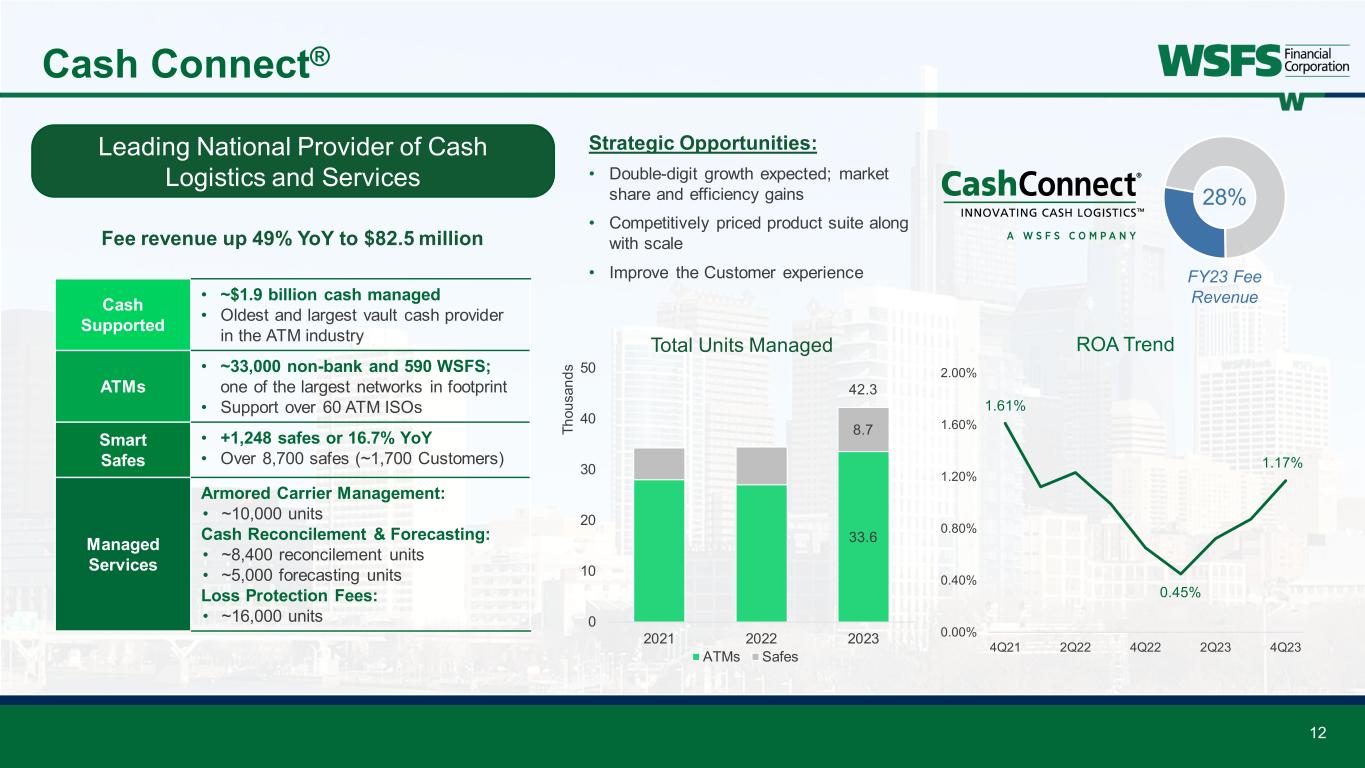

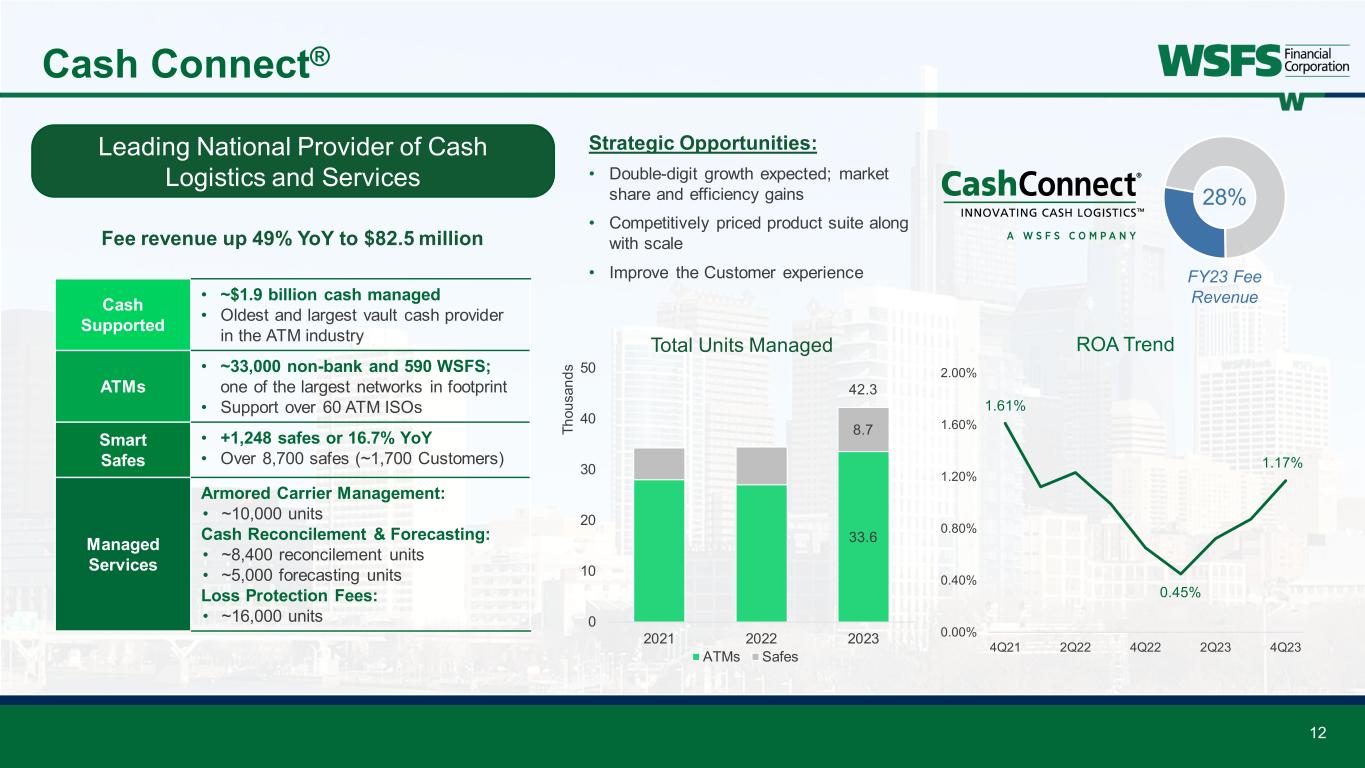

12 Cash Connect® 28% FY23 Fee RevenueCash Supported • ~$1.9 billion cash managed • Oldest and largest vault cash provider in the ATM industry ATMs • ~33,000 non-bank and 590 WSFS; one of the largest networks in footprint • Support over 60 ATM ISOs Smart Safes • +1,248 safes or 16.7% YoY • Over 8,700 safes (~1,700 Customers) Managed Services Armored Carrier Management: • ~10,000 units Cash Reconcilement & Forecasting: • ~8,400 reconcilement units • ~5,000 forecasting units Loss Protection Fees: • ~16,000 units Leading National Provider of Cash Logistics and Services 33.6 8.7 42.3 0 10 20 30 40 50 2021 2022 2023 Th ou sa nd s Total Units Managed ATMs Safes Strategic Opportunities: • Double-digit growth expected; market share and efficiency gains • Competitively priced product suite along with scale • Improve the Customer experience 1.61% 0.45% 1.17% 0.00% 0.40% 0.80% 1.20% 1.60% 2.00% 4Q21 2Q22 4Q22 2Q23 4Q23 ROA Trend Fee revenue up 49% YoY to $82.5 million

~27,000 small business customers; <1% market penetration in this segment • Market Opportunity: • $100+ billion segment with over 100,000 equipment dealer • Over 30 million small businesses nationwide • Customer Growth: • Eligible customer 3-year CAGR of +60% • Granular with High-Yields and Collateral: • 9.5% 4Q23 origination yield • ~$32,000 average deal size • Asset Quality: • 4Q23 NCO: 0.66% of portfolio • 4Q23 Reserve: 2.43% of portfolio • 4Q23 DLQ: 1.06% of portfolio 13 NewLane Finance $280 $0 $50 $100 $150 $200 $250 $300 $350 2021 2022 2023 M ill io ns Leasing Originations $574 $0 $100 $200 $300 $400 $500 $600 $700 4Q 2021 4Q 2022 4Q 2023 M ill io ns NewLane Lease Balances1 Small Ticket Commercial Equipment Financing (Leasing) 5% EOP Gross Loans Strategic Goals: • Growth aligned with credit risk environment • Focused on industries with essential equipment 1 NewLane lease balances exclude acquired portfolios

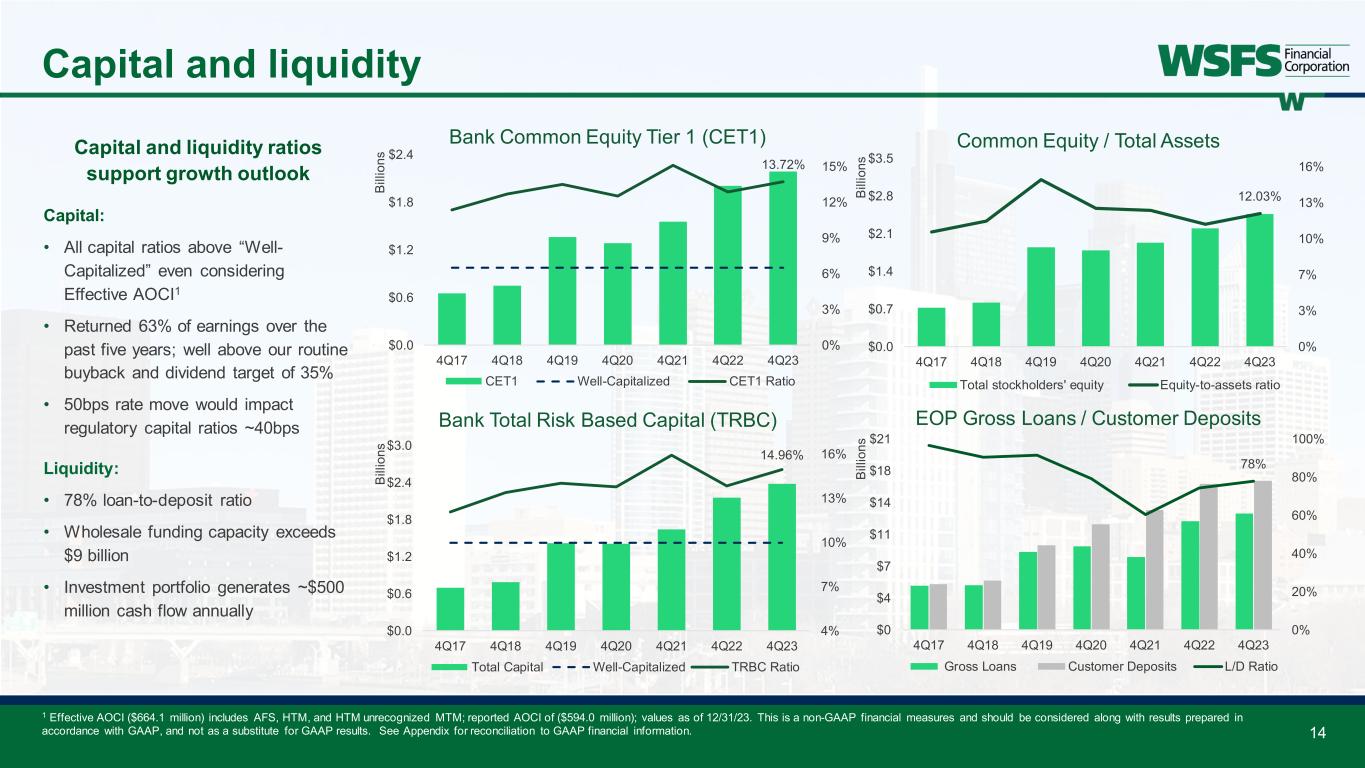

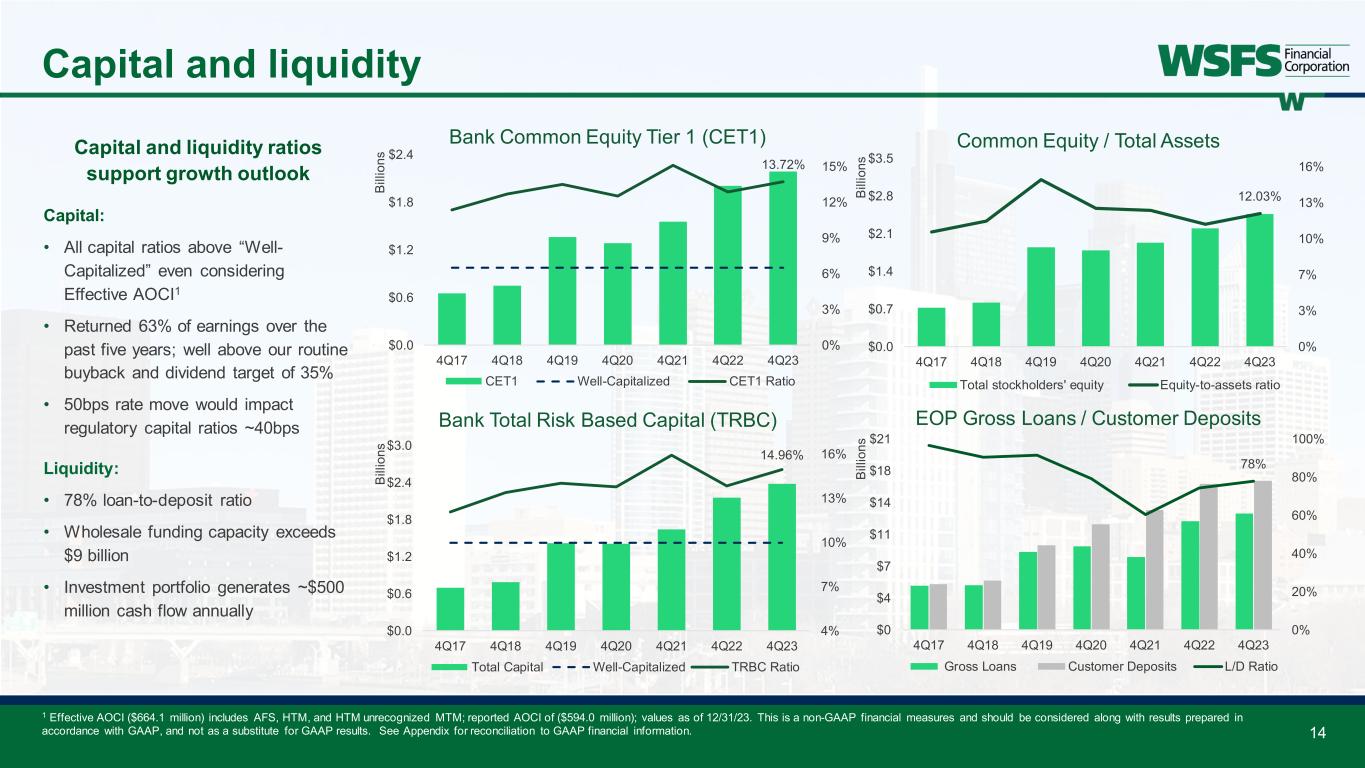

13.72% 0% 3% 6% 9% 12% 15% $0.0 $0.6 $1.2 $1.8 $2.4 4Q17 4Q18 4Q19 4Q20 4Q21 4Q22 4Q23 Bi lli on s CET1 Well-Capitalized CET1 Ratio 14 Capital and liquidity 78% 0% 20% 40% 60% 80% 100% $0 $4 $7 $11 $14 $18 $21 4Q17 4Q18 4Q19 4Q20 4Q21 4Q22 4Q23 Bi lli on s Gross Loans Customer Deposits L/D Ratio 14.96% 4% 7% 10% 13% 16% $0.0 $0.6 $1.2 $1.8 $2.4 $3.0 4Q17 4Q18 4Q19 4Q20 4Q21 4Q22 4Q23 Bi lli on s Total Capital Well-Capitalized TRBC Ratio 12.03% 0% 3% 7% 10% 13% 16% $0.0 $0.7 $1.4 $2.1 $2.8 $3.5 4Q17 4Q18 4Q19 4Q20 4Q21 4Q22 4Q23 Bi lli on s Total stockholders' equity Equity-to-assets ratio EOP Gross Loans / Customer Deposits Bank Common Equity Tier 1 (CET1) Common Equity / Total Assets Bank Total Risk Based Capital (TRBC) Capital and liquidity ratios support growth outlook Capital: • All capital ratios above “Well- Capitalized” even considering Effective AOCI1 • Returned 63% of earnings over the past five years; well above our routine buyback and dividend target of 35% • 50bps rate move would impact regulatory capital ratios ~40bps Liquidity: • 78% loan-to-deposit ratio • Wholesale funding capacity exceeds $9 billion • Investment portfolio generates ~$500 million cash flow annually 1 Effective AOCI ($664.1 million) includes AFS, HTM, and HTM unrecognized MTM; reported AOCI of ($594.0 million); values as of 12/31/23. This is a non-GAAP financial measures and should be considered along with results prepared in accordance with GAAP, and not as a substitute for GAAP results. See Appendix for reconciliation to GAAP financial information.

15 Asset quality 1 Excludes the impact of PPP loans since March 2020 2 Includes non-accruing loans 3 This is a non-GAAP financial measure and should be considered along with results prepared in accordance with GAAP, and not as a substitute for GAAP results. See Appendix for reconciliation to GAAP financial information. 4 Ratio of quarterly net charge-offs to average gross loans 0.80% 0.0% 0.2% 0.4% 0.6% 0.8% 1.0% 1.2% 4Q 18 4Q 19 4Q 20 4Q 21 4Q 22 4Q 23 Delinquencies Govt. Guaranteed Student Loans 0.37% 0.0% 0.2% 0.4% 0.6% 0.8% 1.0% 4Q 18 4Q 19 4Q 20 4Q 21 4Q 22 4Q 23 0.46% 0.0% 0.2% 0.4% 0.6% 0.8% 4Q 18 4Q 19 4Q 20 4Q 21 4Q 22 4Q 23 17.29% 23.44% 10% 20% 30% 40% 50% 4Q 18 4Q 19 4Q 20 4Q 21 4Q 22 4Q 23 Classified Loans Problem Loans Delinquencies2 / Gross Loans1 Net Charge-Offs4 / Gross Loans1 Problem & Classified Loans / Tier-1 + ACL1 NPAs / Total Assets1 Proactive and systematic approach to asset quality • Well-reserved with a 1.64% ACL coverage ratio when including estimated remaining credit marks and excluding HTM securities3 • Credit ratios within historical experience • Diversified loan portfolios with 22 distinct concentration limits • CRE: 220% vs. 300% limit • CRE Multifamily: 73% vs. 90% limit • CRE Office: 36% vs. 40% limit • CRE portfolio with long-standing sponsors, low LTVs and recourse options • Nearly all Commercial Customers have deposit and/or Wealth and Trust relationships

Appendix: Non-GAAP Information 16

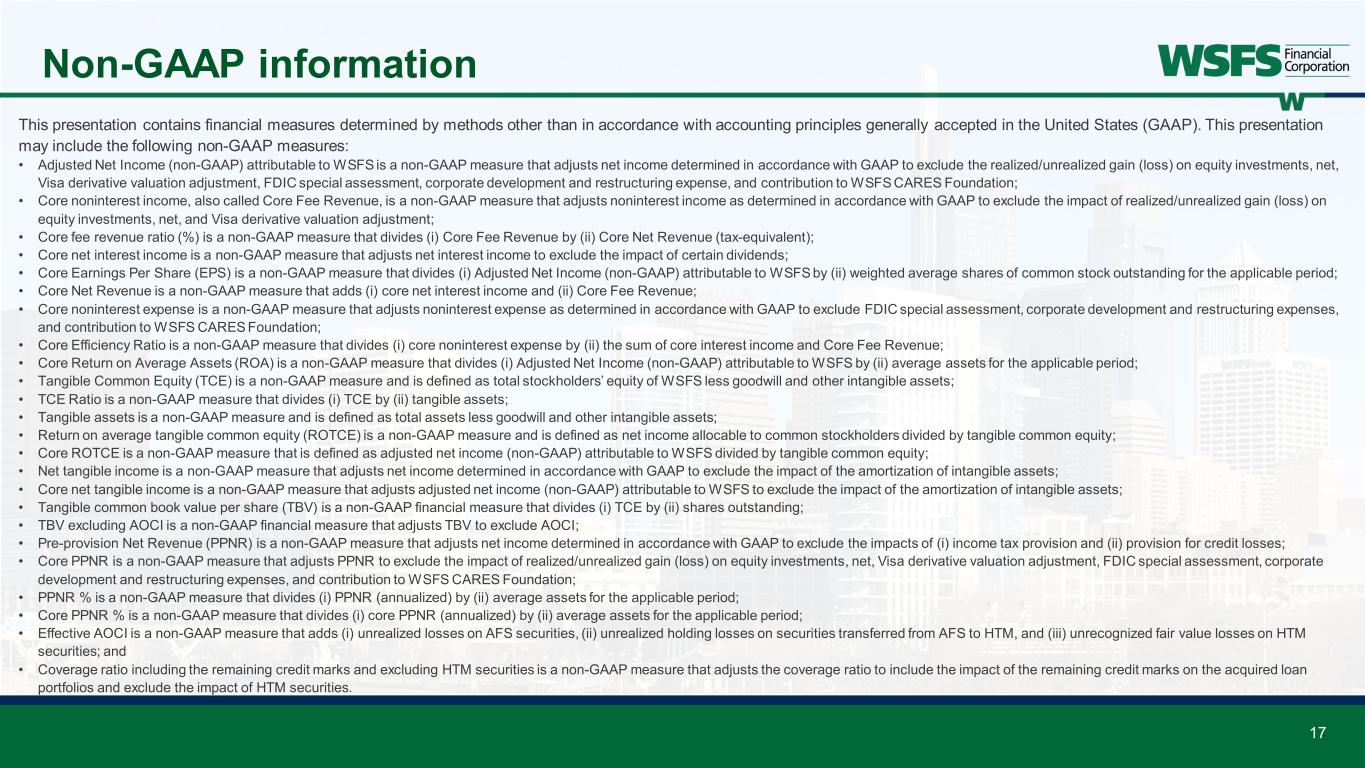

17 Non-GAAP information This presentation contains financial measures determined by methods other than in accordance with accounting principles generally accepted in the United States (GAAP). This presentation may include the following non-GAAP measures: • Adjusted Net Income (non-GAAP) attributable to WSFS is a non-GAAP measure that adjusts net income determined in accordance with GAAP to exclude the realized/unrealized gain (loss) on equity investments, net, Visa derivative valuation adjustment, FDIC special assessment, corporate development and restructuring expense, and contribution to WSFS CARES Foundation; • Core noninterest income, also called Core Fee Revenue, is a non-GAAP measure that adjusts noninterest income as determined in accordance with GAAP to exclude the impact of realized/unrealized gain (loss) on equity investments, net, and Visa derivative valuation adjustment; • Core fee revenue ratio (%) is a non-GAAP measure that divides (i) Core Fee Revenue by (ii) Core Net Revenue (tax-equivalent); • Core net interest income is a non-GAAP measure that adjusts net interest income to exclude the impact of certain dividends; • Core Earnings Per Share (EPS) is a non-GAAP measure that divides (i) Adjusted Net Income (non-GAAP) attributable to WSFS by (ii) weighted average shares of common stock outstanding for the applicable period; • Core Net Revenue is a non-GAAP measure that adds (i) core net interest income and (ii) Core Fee Revenue; • Core noninterest expense is a non-GAAP measure that adjusts noninterest expense as determined in accordance with GAAP to exclude FDIC special assessment, corporate development and restructuring expenses, and contribution to WSFS CARES Foundation; • Core Efficiency Ratio is a non-GAAP measure that divides (i) core noninterest expense by (ii) the sum of core interest income and Core Fee Revenue; • Core Return on Average Assets (ROA) is a non-GAAP measure that divides (i) Adjusted Net Income (non-GAAP) attributable to WSFS by (ii) average assets for the applicable period; • Tangible Common Equity (TCE) is a non-GAAP measure and is defined as total stockholders’ equity of WSFS less goodwill and other intangible assets; • TCE Ratio is a non-GAAP measure that divides (i) TCE by (ii) tangible assets; • Tangible assets is a non-GAAP measure and is defined as total assets less goodwill and other intangible assets; • Return on average tangible common equity (ROTCE) is a non-GAAP measure and is defined as net income allocable to common stockholders divided by tangible common equity; • Core ROTCE is a non-GAAP measure that is defined as adjusted net income (non-GAAP) attributable to WSFS divided by tangible common equity; • Net tangible income is a non-GAAP measure that adjusts net income determined in accordance with GAAP to exclude the impact of the amortization of intangible assets; • Core net tangible income is a non-GAAP measure that adjusts adjusted net income (non-GAAP) attributable to WSFS to exclude the impact of the amortization of intangible assets; • Tangible common book value per share (TBV) is a non-GAAP financial measure that divides (i) TCE by (ii) shares outstanding; • TBV excluding AOCI is a non-GAAP financial measure that adjusts TBV to exclude AOCI; • Pre-provision Net Revenue (PPNR) is a non-GAAP measure that adjusts net income determined in accordance with GAAP to exclude the impacts of (i) income tax provision and (ii) provision for credit losses; • Core PPNR is a non-GAAP measure that adjusts PPNR to exclude the impact of realized/unrealized gain (loss) on equity investments, net, Visa derivative valuation adjustment, FDIC special assessment, corporate development and restructuring expenses, and contribution to WSFS CARES Foundation; • PPNR % is a non-GAAP measure that divides (i) PPNR (annualized) by (ii) average assets for the applicable period; • Core PPNR % is a non-GAAP measure that divides (i) core PPNR (annualized) by (ii) average assets for the applicable period; • Effective AOCI is a non-GAAP measure that adds (i) unrealized losses on AFS securities, (ii) unrealized holding losses on securities transferred from AFS to HTM, and (iii) unrecognized fair value losses on HTM securities; and • Coverage ratio including the remaining credit marks and excluding HTM securities is a non-GAAP measure that adjusts the coverage ratio to include the impact of the remaining credit marks on the acquired loan portfolios and exclude the impact of HTM securities.

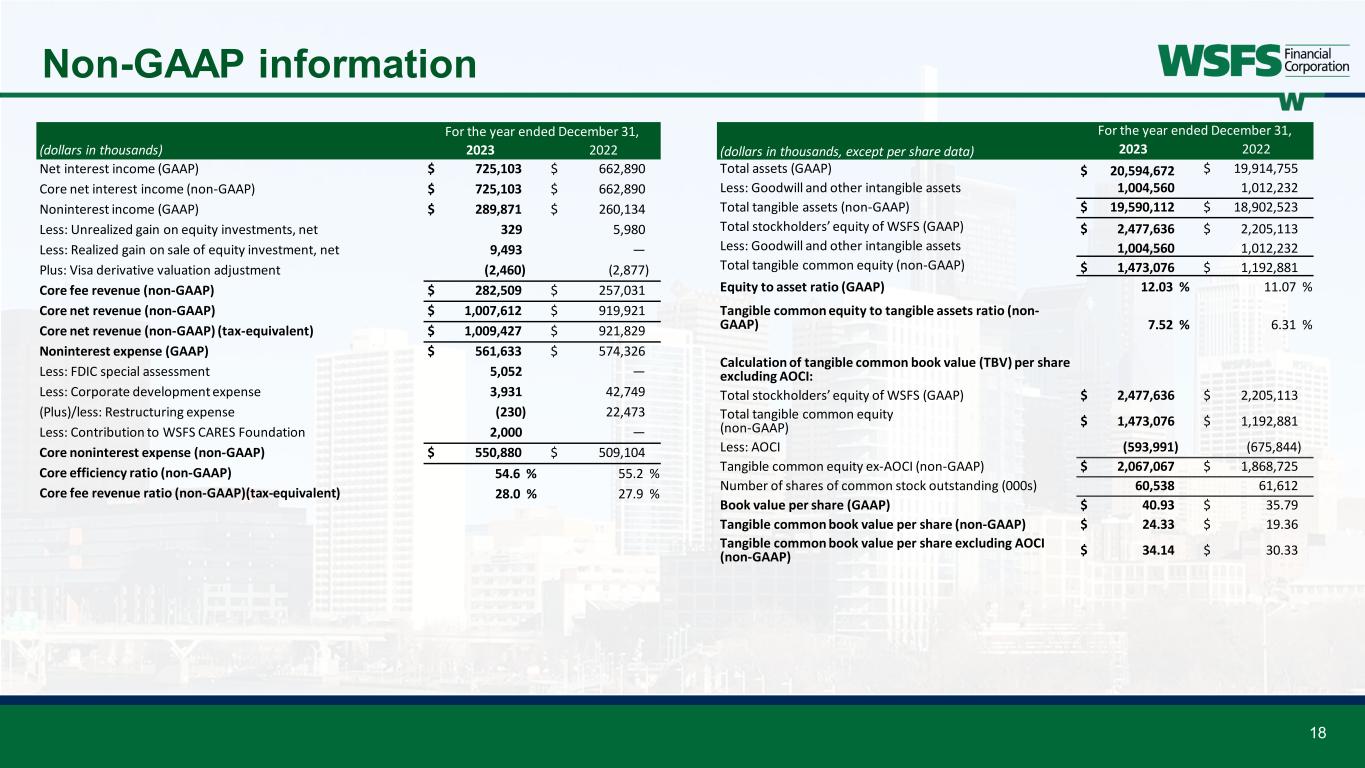

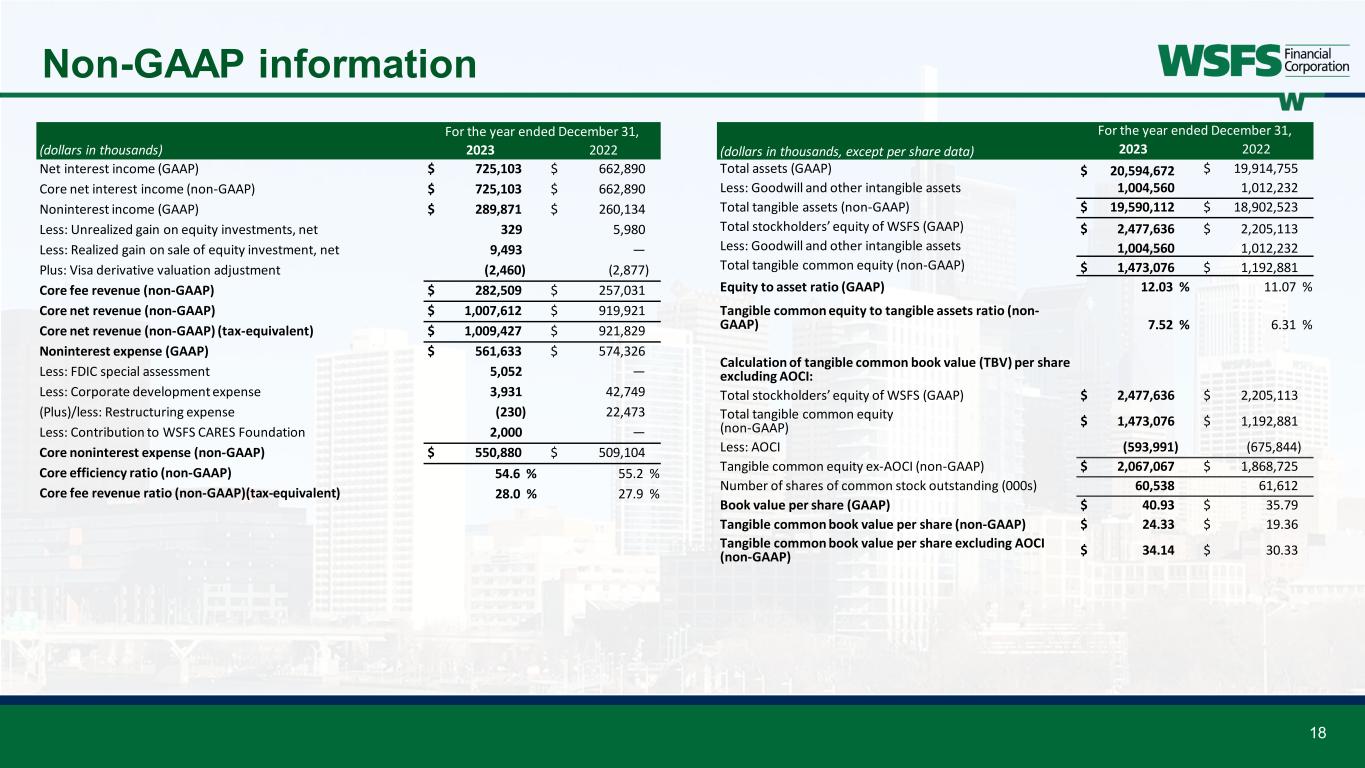

18 Non-GAAP information For the year ended December 31, (dollars in thousands) 2023 2022 Net interest income (GAAP) $ 725,103 $ 662,890 Core net interest income (non-GAAP) $ 725,103 $ 662,890 Noninterest income (GAAP) $ 289,871 $ 260,134 Less: Unrealized gain on equity investments, net 329 5,980 Less: Realized gain on sale of equity investment, net 9,493 — Plus: Visa derivative valuation adjustment (2,460) (2,877) Core fee revenue (non-GAAP) $ 282,509 $ 257,031 Core net revenue (non-GAAP) $ 1,007,612 $ 919,921 Core net revenue (non-GAAP) (tax-equivalent) $ 1,009,427 $ 921,829 Noninterest expense (GAAP) $ 561,633 $ 574,326 Less: FDIC special assessment 5,052 — Less: Corporate development expense 3,931 42,749 (Plus)/less: Restructuring expense (230) 22,473 Less: Contribution to WSFS CARES Foundation 2,000 — Core noninterest expense (non-GAAP) $ 550,880 $ 509,104 Core efficiency ratio (non-GAAP) 54.6 % 55.2 % Core fee revenue ratio (non-GAAP)(tax-equivalent) 28.0 % 27.9 % For the year ended December 31, (dollars in thousands, except per share data) 2023 2022 Total assets (GAAP) $ 20,594,672 $ 19,914,755 Less: Goodwill and other intangible assets 1,004,560 1,012,232 Total tangible assets (non-GAAP) $ 19,590,112 $ 18,902,523 Total stockholders’ equity of WSFS (GAAP) $ 2,477,636 $ 2,205,113 Less: Goodwill and other intangible assets 1,004,560 1,012,232 Total tangible common equity (non-GAAP) $ 1,473,076 $ 1,192,881 Equity to asset ratio (GAAP) 12.03 % 11.07 % Tangible common equity to tangible assets ratio (non- GAAP) 7.52 % 6.31 % Calculation of tangible common book value (TBV) per share excluding AOCI: Total stockholders’ equity of WSFS (GAAP) $ 2,477,636 $ 2,205,113 Total tangible common equity (non-GAAP) $ 1,473,076 $ 1,192,881 Less: AOCI (593,991) (675,844) Tangible common equity ex-AOCI (non-GAAP) $ 2,067,067 $ 1,868,725 Number of shares of common stock outstanding (000s) 60,538 61,612 Book value per share (GAAP) $ 40.93 $ 35.79 Tangible common book value per share (non-GAAP) $ 24.33 $ 19.36 Tangible common book value per share excluding AOCI (non-GAAP) $ 34.14 $ 30.33

19 Non-GAAP information 1 Pre-tax adjustments include realized/unrealized gain on equity investments, net, Visa derivative valuation adjustment, FDIC special assessment, corporate development and restructuring expense, and contribution to WSFS Cares Foundation For the year ended December 31, (dollars in thousands, except per share data) 2023 2022 GAAP net income attributable to WSFS $ 269,156 $ 222,375 Plus/(less): Pre-tax adjustments1 3,391 62,119 Plus: Tax adjustments: BOLI surrender 7,056 — (Plus)/less: Tax impact of pre-tax adjustments (764) (13,809) Adjusted net income (non-GAAP) attributable to WSFS $ 278,839 $ 270,685 Net income (GAAP) $ 269,025 $ 222,648 Plus: Income tax provision 96,245 77,961 Plus: Provision for credit losses 88,071 48,089 PPNR (Non-GAAP) $ 453,341 $ 348,698 Plus/(less): Pre-tax adjustments1 3,391 62,119 Core PPNR (Non-GAAP) $ 456,732 $ 410,817 Average Assets $ 20,203,037 $ 20,463,695 PPNR % (Non-GAAP) 2.24 % 1.70 % Core PPNR % (Non-GAAP) 2.26 % 2.01 % GAAP return on average assets (ROA) 1.33 % 1.09 % Plus/(less): Pre-tax adjustments1 0.02 0.30 Plus: Tax adjustments: BOLI surrender 0.03 — (Plus)/less: Tax impact of pre-tax adjustments — (0.07) Core ROA (non-GAAP) 1.38 % 1.32 % Earnings per share (diluted)(GAAP) $ 4.40 $ 3.49 Plus/(less): Pre-tax adjustments1 0.05 0.98 Plus: Tax adjustments: BOLI surrender 0.12 — (Plus)/less: Tax impact of pre-tax adjustments (0.02) (0.22) Core earnings per share (non-GAAP) $ 4.55 $ 4.25

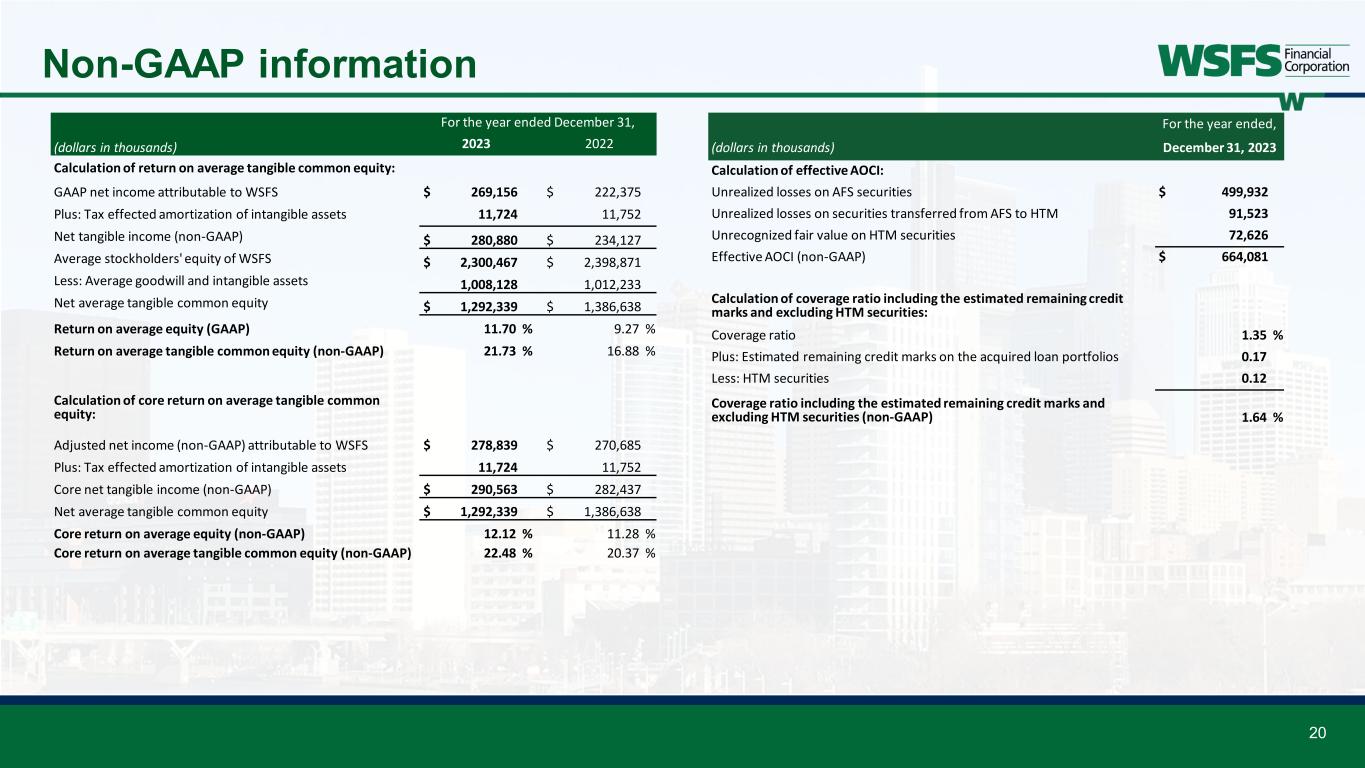

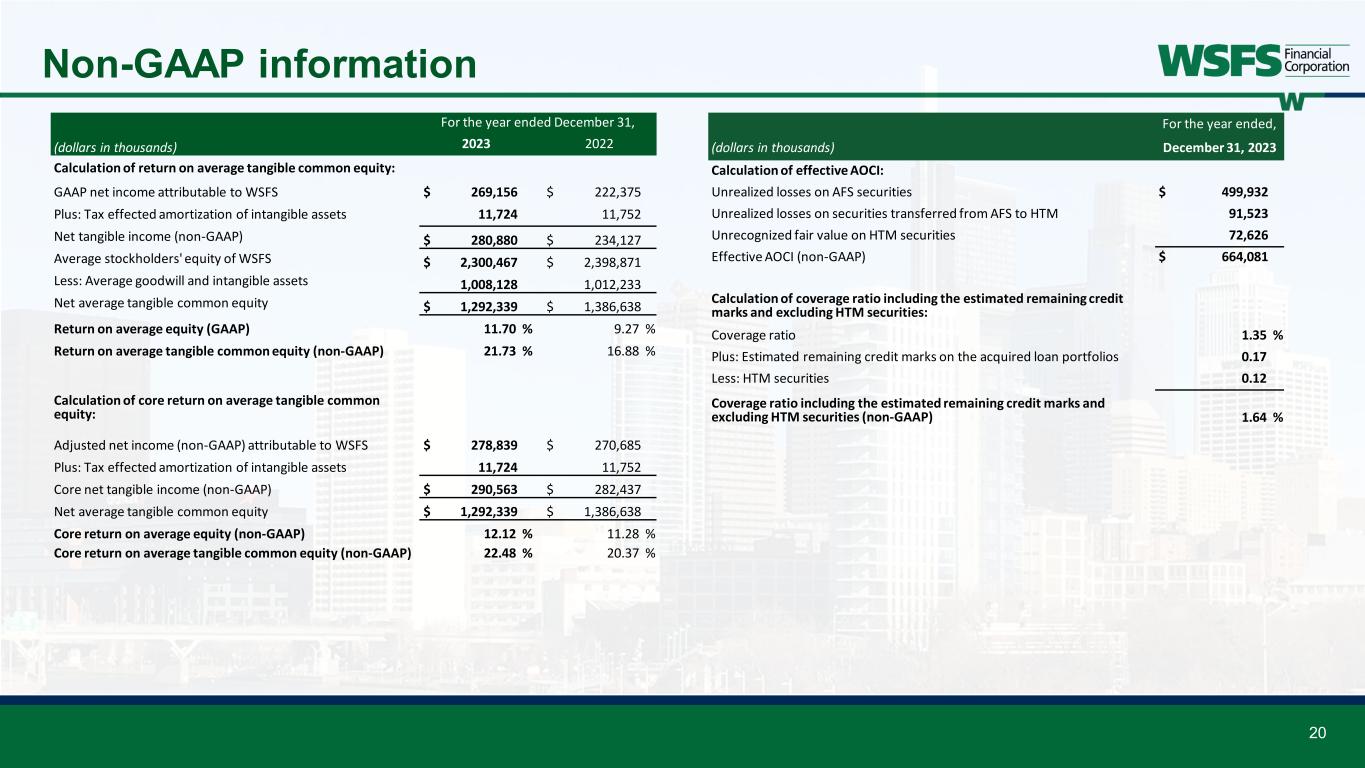

20 Non-GAAP information For the year ended December 31, (dollars in thousands) 2023 2022 Calculation of return on average tangible common equity: GAAP net income attributable to WSFS $ 269,156 $ 222,375 Plus: Tax effected amortization of intangible assets 11,724 11,752 Net tangible income (non-GAAP) $ 280,880 $ 234,127 Average stockholders' equity of WSFS $ 2,300,467 $ 2,398,871 Less: Average goodwill and intangible assets 1,008,128 1,012,233 Net average tangible common equity $ 1,292,339 $ 1,386,638 Return on average equity (GAAP) 11.70 % 9.27 % Return on average tangible common equity (non-GAAP) 21.73 % 16.88 % Calculation of core return on average tangible common equity: Adjusted net income (non-GAAP) attributable to WSFS $ 278,839 $ 270,685 Plus: Tax effected amortization of intangible assets 11,724 11,752 Core net tangible income (non-GAAP) $ 290,563 $ 282,437 Net average tangible common equity $ 1,292,339 $ 1,386,638 Core return on average equity (non-GAAP) 12.12 % 11.28 % Core return on average tangible common equity (non-GAAP) 22.48 % 20.37 % For the year ended, (dollars in thousands) December 31, 2023 Calculation of effective AOCI: Unrealized losses on AFS securities $ 499,932 Unrealized losses on securities transferred from AFS to HTM 91,523 Unrecognized fair value on HTM securities 72,626 Effective AOCI (non-GAAP) $ 664,081 Calculation of coverage ratio including the estimated remaining credit marks and excluding HTM securities: Coverage ratio 1.35 % Plus: Estimated remaining credit marks on the acquired loan portfolios 0.17 Less: HTM securities 0.12 Coverage ratio including the estimated remaining credit marks and excluding HTM securities (non-GAAP) 1.64 %

21 Stockholders or others seeking information regarding the Company may call or write: WSFS Financial Corporation Investor Relations WSFS Bank Center 500 Delaware Avenue Wilmington, DE 19801 302-504-9857 stockholderrelations@wsfsbank.com www.wsfsbank.com Rodger Levenson Chairman, President and CEO 302-571-7296 rlevenson@wsfsbank.com Arthur J. Bacci Chief Wealth Officer and Interim CFO 302-504-1407 abacci@wsfsbank.com Andrew Basile Head of Investor Relations 215-864-3547 abasile@wsfsbank.com