Document

Inter & Co, Inc.

c/o Maples Corporate Services Limited

PO Box 309, Ugland House

Grand Cayman

KY1-1104

Cayman Islands

General

The board of directors (the “Board”) of Inter & Co, Inc. (the “Company” or “we”) is soliciting proxies for the annual general meeting of shareholders (the “AGM”) of the Company to be held on April 26, 2024 at 4:30 p.m. (São Paulo time). The AGM will be held at the offices of the Company located at Avenida Barbacena, No. 1.219, in the city of Belo Horizonte, state of Minas Gerais, CEP 30190-131, Brazil, and virtually by accessing the following link https://web.lumiagm.com/234117599 (Password: interco2024).

On or about March 26, 2024, we first mailed to our shareholders our proxy materials, including our proxy statement, the notice to shareholders of our AGM and the proxy card, along with instructions on how to vote using the proxy card provided therewith. This proxy statement can also be accessed, free of charge, on the Investor Relations section of the Company’s website at https://investors.inter.co/ and on the SEC’s website at https://www.sec.gov.

Record Date, Share Ownership and Quorum

Only the holders of record of Class A common shares (the “Class A Common Shares”) and Class B common shares (the “Class B Common Shares” and together with the Class A Common Shares, the “Common Shares”) of the Company as at the close of business on March 18, 2024, New York time (the “Record Date”) are entitled to receive notice of and attend the AGM and any adjournment thereof. No person shall be entitled to vote at the AGM unless it is registered as a shareholder of the Company on the Record Date for the AGM.

As of the close of business on the Record Date, 438,990,540 Common Shares were issued and outstanding, including 321,953,435 Class A Common Shares and 117,037,105 Class B Common Shares. One or more shareholders holding not less than 25% in aggregate of the voting power of all shares in issue and entitled to vote, present in person or by proxy or, if a corporation or other non-natural person, by its duly authorized representative, constitutes a quorum of the shareholders.

Voting and Solicitation

Each Class A Common Share issued and outstanding as of the close of business on the Record Date is entitled to one vote at the AGM. Each Class B Common Share issued and outstanding as of the close of business on the Record Date is entitled to ten votes at the AGM. Each ordinary resolution to be put to the vote at the AGM will be approved by a simple majority of the votes cast, by or on behalf of, the shareholders attending and voting at the AGM and each special resolution to be put to the vote at the AGM will be approved by a two-thirds majority of the votes cast, by or on behalf of, the shareholders attending and voting at the AGM.

|

|

|

Classificação da Informação: RESTRITA |

Voting by Holders of Common Shares

Common Shares that are properly voted, for which proxy cards are properly executed and returned within the deadline set forth below, will be voted at the AGM in accordance with the directions given. If no specific instructions are given in such proxy cards for all or any of the resolutions, and the proxy cards are executed and returned within the deadline, Common Shares represented by the proxies will be voted in favor of the resolution in question. The proxy holder will also vote in the discretion of such proxy holder on any other matters that may properly come before the AGM, or at any adjournment thereof. Where any holder of Common Shares affirmatively abstains from voting on any resolution, the votes attaching to such Common Shares will not be included or counted in the determination of the number of Common Shares present and voting for the purposes of determining whether such resolution has been passed (but they will be counted for the purposes of determining the quorum, as described above).

Proxies submitted by registered shareholders and street shareholders (by returning the proxy card) must be received by us no later than 11:59 p.m., Eastern time, on the day before the AGM to ensure your representation at our AGM.

The manner in which your shares may be voted depends on how your shares are held. If you own shares of record, meaning that your shares are represented by book entries in your name so that you appear as a shareholder on the records of Equiniti Trust Company, LLC (“Equiniti”) (i.e., you are a registered shareholder), our stock transfer agent, this proxy statement, the notice of AGM and the proxy card will be mailed to you by Equiniti. You may provide voting instructions by returning a proxy card. You also may attend the AGM and vote in person. If you own Common Shares of record and you do not vote by proxy or in person at the AGM, your shares will not be voted.

If you own shares in street name (i.e., you are a street shareholder), meaning that your shares are held by a bank, brokerage firm, or other nominee, you are then considered the “beneficial owner” of shares held in “street name,” and as a result, this proxy statement, the notice of AGM and the proxy card will be provided to you by your bank, brokerage firm, or other nominee holding the shares. You may provide voting instructions to them directly by returning a voting instruction form received from that institution. If you own Common Shares in street name and attend the AGM, you must obtain a “legal proxy” from the bank, brokerage firm, or other nominee that holds your shares to be able to vote your shares at the meeting and present your voting information card.

Revocability of Proxies

Registered shareholders may revoke their proxy or change voting instructions before shares are voted at the AGM by submitting a written notice of revocation to our Investor Relations Department at ir@inter.co, or a duly executed proxy bearing a later date (which must be received by us no later than the date set forth below) or by attending the AGM and voting in person. A beneficial owner owning Common Shares in street name may revoke or change voting instructions by contacting the bank, brokerage firm, or other nominee holding the shares or by obtaining a legal proxy from such institution and voting in person at the AGM. If you are not planning to attend our AGM in person, to ensure your representation at our AGM, revocation of proxies submitted by registered shareholders and street shareholders (by returning a proxy card) must be received by us no later than 11:59 p.m., Eastern time, on the day before the AGM.

|

|

|

Classificação da Informação: RESTRITA |

2

PROPOSAL 1:

TO RESOLVE, AS AN ORDINARY RESOLUTION, THAT THE COMPANY'S FINANCIAL STATEMENTS AND THE AUDITOR'S REPORT FOR THE FISCAL YEAR ENDED 31 DECEMBER 2023 BE APPROVED, RATIFIED AND CONFIRMED IN ALL RESPECTS

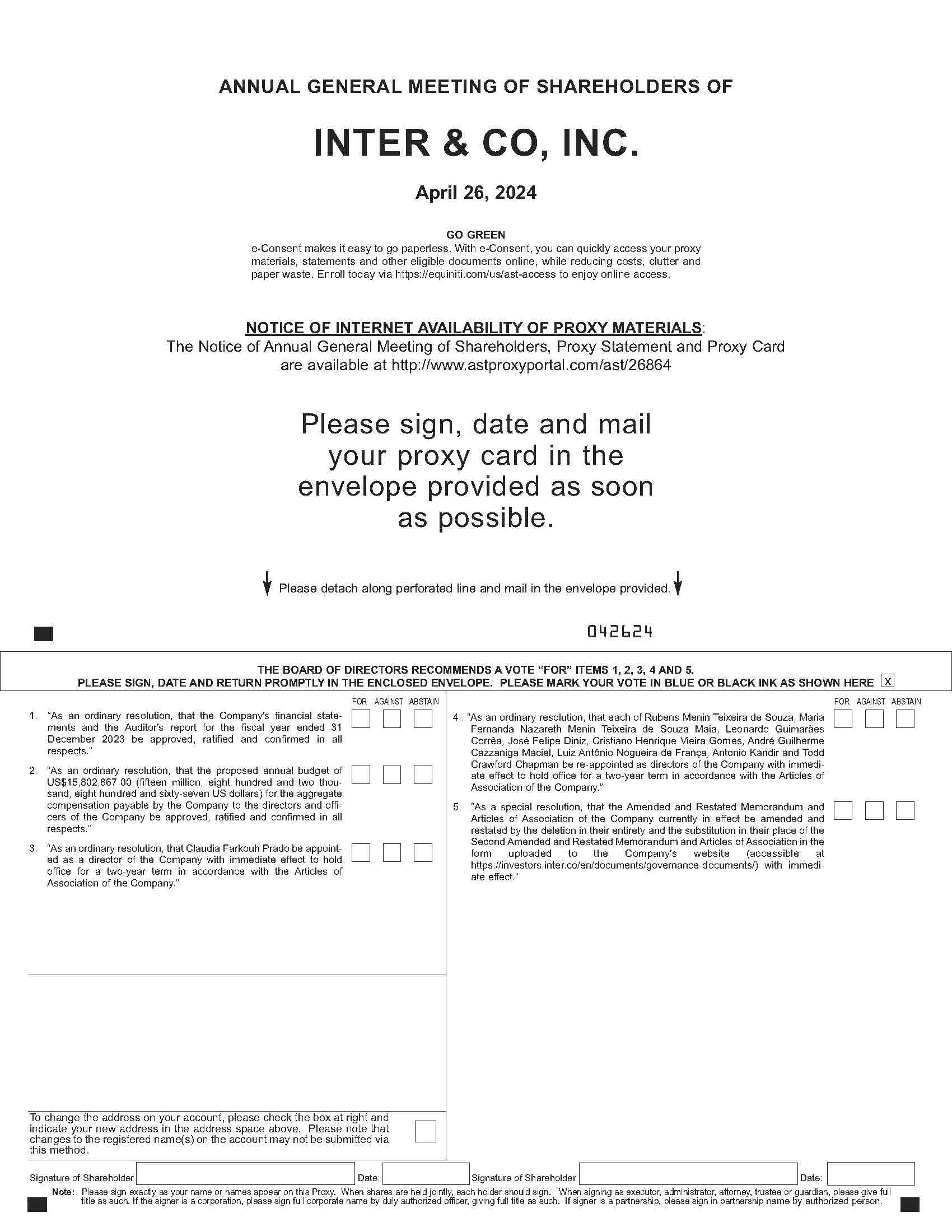

We are seeking shareholder approval, ratification and confirmation in all respects of the Company’s 2023 audited consolidated financial statements (the “Audited Accounts”) in the form presented at the AGM, which have been prepared in accordance with International Financial Reporting Standards, in respect of the fiscal year ended December 31, 2023. A copy of the Company’s Audited Accounts is available on the Company’s website at https://s3.amazonaws.com/sec.irpass.cc/2728/0001628280-24-003715.pdf.

The affirmative vote by the holders of a simple majority of the votes cast, by or on behalf of, the shareholders attending and voting at the AGM is required for this proposal. If proxies are properly submitted by signing, dating and returning a proxy card, Common Shares represented thereby will be voted in the manner specified therein. If not otherwise specified, and the proxy card is signed, Common Shares represented by the proxies will be voted in favor of this proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE APPROVAL, RATIFICATION AND CONFIRMATION IN ALL RESPECTS OF THE COMPANY’S FINANCIAL STATEMENTS AND THE AUDITOR'S REPORT FOR THE FISCAL YEAR ENDED DECEMBER 31, 2023.

PROPOSAL 2:

TO RESOLVE, AS AN ORDINARY RESOLUTION, THAT THE PROPOSED ANNUAL BUDGET OF US$15,802,867.00 (FIFTEEN MILLION, EIGHT HUNDRED AND TWO THOUSAND, EIGHT HUNDRED AND SIXTY-SEVEN US DOLLARS) FOR THE AGGREGATE COMPENSATION PAYABLE BY THE COMPANY TO THE DIRECTORS AND OFFICERS OF THE COMPANY BE APPROVED, RATIFIED AND CONFIRMED IN ALL RESPECTS

We are seeking shareholder approval, ratification and confirmation in all respects of the proposed annual budget of US$15,802,867.00 (fifteen million, eight hundred and two thousand, eight hundred and sixty-seven US dollars) for the aggregate compensation payable by the Company to the directors and officers of the Company.

The proposed annual budget comprises the compensation of directors which amounts to US$2,547,417.00 (two million, five hundred and forty-seven thousand, four hundred and seventeen US dollars) and the compensation of officers which amounts to US$13,255,450.00 (thirteen million, two hundred and fifty-five thousand, four hundred and fifty US dollars).

The proposed annual budget for the aggregate compensation has been calculated considering a Board of Directors composed of twelve (12) members, which is the maximum number of directors permitted by our Amended and Restated Memorandum and Articles of Association (the “Articles”). Our Board of Directors currently has ten (10) members, which means the proposed annual budget covers not only the compensation of the ten (10) current directors but also the compensation of two (2) additional directors who may eventually be appointed during the year.

The proposed annual budget has also been calculated considering the compensation paid to the officers of the Company, even though this compensation is fully paid by its subsidiaries.

The Company’s directors receive a fixed amount for their services as members of the Board of Directors. An additional fixed amount is paid to those directors who also serve as members of committee(s), such as the Audit Committee. Such additional amount is included in the annual budget proposed above.

|

|

|

Classificação da Informação: RESTRITA |

3

Three (3) directors of the Company, whose compensation was included in the proposed annual budget above, receive their compensation directly from its subsidiaries.

The Company’s officers receive a fixed and a variable amount, and may also receive stock-based compensation under the Company’s incentive plans, which are all included in the annual budget proposed above.

The affirmative vote by the holders of a simple majority of the votes cast, by or on behalf of, the shareholders attending and voting at the AGM is required for this proposal. If proxies are properly submitted by signing, dating and returning a proxy card, Common Shares represented thereby will be voted in the manner specified therein. If not otherwise specified, and the proxy card is signed, Common Shares represented by the proxies will be voted in favor of this proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE APPROVAL, RATIFICATION AND CONFIRMATION IN ALL RESPECTS OF THE PROPOSED ANNUAL BUDGET OF US$15,802,867.00 (FIFTEEN MILLION, EIGHT HUNDRED AND TWO THOUSAND, EIGHT HUNDRED AND SIXTY-SEVEN US DOLLARS) FOR THE AGGREGATE COMPENSATION PAYABLE BY THE COMPANY TO THE DIRECTORS AND OFFICERS OF THE COMPANY.

PROPOSAL 3:

TO RESOLVE, AS AN ORDINARY RESOLUTION, THAT CLAUDIA FARKOUH PRADO BE APPOINTED AS A DIRECTOR OF THE COMPANY WITH IMMEDIATE EFFECT TO HOLD OFFICE FOR A TWO-YEAR TERM IN ACCORDANCE WITH THE ARTICLES OF ASSOCIATION OF THE COMPANY

The Board unanimously resolved to appoint Claudia Farkouh Prado to fill a vacancy in the Board as interim Director, to hold office in accordance with the Amended and Restated Articles of Association of the Company (the "Articles") until the AGM.

We are seeking shareholder approval for the appointment of Claudia Farkouh Prado as a director of the Company with immediate effect to hold office in accordance with the Articles.

Claudia Prado is currently an independent director at B3 S.A. – Brasil, Bolsa, Balcão, where she is also the coordinator of the Governance and Nomination Committee, a member of the People and Remuneration Committee and the Sustainability Committee. She is also an independent member of the Board of Directors of the Social Responsibility Institute of the Hospital Sírio Libanês. Previously, Cláudia was a member of the Board of Directors, President of Latin America and coordinator of the Global Finance Committee and the Global Diversity Committee of Baker McKenzie Global Law Firm, as well as a member of the Advisory Board of TrustWomen (Thompson Reuters Foundation). She was a managing associate at Trench Rossi Watanabe Advogados, where she acted as the Latin American coordinator of M&A and private equity practice groups and as a specialized M&A lawyer in Brazil and the United States. In the third sector, she was a member of the Fiscal Council of the Sírio-Libanês Social Responsibility Institute and is currently a member of the Governance Council of B3 Social.

The affirmative vote by the holders of a simple majority of the votes cast, by or on behalf of, the shareholders attending and voting at the AGM is required for this proposal. If proxies are properly submitted by signing, dating and returning a proxy card, Common Shares represented thereby will be voted in the manner specified therein. If not otherwise specified, and the proxy card is signed, Common Shares represented by the proxies will be voted in favor of this proposal.

|

|

|

Classificação da Informação: RESTRITA |

4

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE APPOINTMENT OF CLAUDIA FARKOUH PRADO AS DIRECTOR OF THE COMPANY WITH IMMEDIATE EFFECT TO HOLD OFFICE FOR A TWO-YEAR TERM IN ACCORDANCE WITH THE ARTICLES.

PROPOSAL 4:

TO RESOLVE, AS AN ORDINARY RESOLUTION, THAT EACH OF RUBENS MENIN TEIXEIRA DE SOUZA, MARIA FERNANDA NAZARETH MENIN TEIXEIRA DE SOUZA MAIA, LEONARDO GUIMARAES CORREA, JOSE FELIPE DINIZ, CRISTIANO HENRIQUE VIERA GOMES, ANDRE GUILHERME CAZZANIGA MACIEL, LUIZ ANTONIO NOGUEIRA DE FRANCA, ANTONIO KANDIR AND TODD CRAWFORD CHAPMAN BE RE-APPOINTED FOR A TWO-YEAR TERM IN ACCORDANCE WITH THE ARTICLES OF ASSOCIATION OF THE COMPANY

We are seeking shareholder approval for the re-appointment of each of Rubens Menin Teixeira de Souza, Maria Fernanda Nazareth Menin Teixeira de Souza Maia, Leonardo Guimarães Corrêa, José Felipe Diniz, Cristiano Henrique Vieira Gomes, André Guilherme Cazzaniga Maciel, Luiz Antônio Nogueira de França, Antonio Kandir and Todd Crawford Chapman with immediate effect to hold office for a two-year term in accordance with the Articles.

Rubens Menin is Chairman of the Board of Directors of Inter&Co, as well as founder and Chairman of the Board of Directors of Banco Inter since its incorporation. Rubens also founded MRV Engenharia in 1979, where he served as Chief Executive Officer until March 2014, and is currently Chairman of its Board of Directors. He is also Chairman of the Board of Directors of LOG Commercial Properties S.A. and Urbamais Properties e Participações S.A., companies from the MRV Group. Rubens holds a degree in Civil Engineering from the Federal University of Minas Gerais – UFMG (1979).

Maria Fernanda Menin is a member of the Board of Directors of Inter&Co and Banco Inter. Maria Fernanda joined MRV Engenharia Ltda in 1997, as an intern in the Billing Department. At MRV, she held the positions of intern in the Legal Department, Legal Assistant, Coordinator of the Legal Department, Legal Superintendent and Legal Executive Manager. She was elected Chief Legal Officer of MRV in 2010, a position she held until 2019, when she was elected member of the Board of Directors. On December 23, 2019 she was elected member of the Board of Directors of Banco Inter. She holds a law degree from Milton Campos Law School (2001) and a post-graduate degree in Economic and Business Law from FGV (2003).

Leonardo Guimarães Corrêa is a member of the Board of Directors of Inter&Co. Leonardo served at MRV Engenharia as Chief Financial and Investor Relations Officer from 2006 to 2019. He is currently Vice Chairman of MRV’s Board of Directors and is also a member of the Board of Directors of LOG C. P. S.A., of RESIA/AHS DEVELOPMENT LLC and of NOVUS MIDIA S.A. Throughout his career, Leonardo was also a founding partner at Perfin Administração de Recursos, between 2003 and 2006, and a partner at then Banco Pactual, from 2000 to 2003. Previously, he worked for JP Morgan for 10 years, his last position being Treasurer for Brazil, and for 8 years at Lloyds Bank as Treasury Manager. He holds a degree in Economics from the Federal University of Minas Gerais – UFMG (1980) and a postgraduate degree in Finance from FGV (1986).

José Felipe Diniz is a member of the Board of Directors of Inter&Co and Banco Inter. José Felipe is a managing partner of Santa Rosa Urbanismo and was Vice President of Communication at Sinduscon/MG from 2003 to 2005. He holds a degree in Economics from the Pontifical Catholic University of Minas Gerais (PUC/MG) (1989).

|

|

|

Classificação da Informação: RESTRITA |

5

Cristiano Gomes is a member of the Board of Directors of Inter&Co. Cristiano joined Banco Inter in 2011 as Commercial Officer, a position he held until 2015, when he was elected a member of its Board of Directors. Before joining Banco Inter, he was Chief Financial Officer of Banco Mercantil do Brasil between 2007 and 2011, Executive Officer of Banco Interatlântico between 1994 and 1999 and Senior Foreign Trade Manager at Lloyds Bank PLC until 1990. He holds a degree in Economics from the Pontifical Catholic University of Minas Gerais (PUC-MG) (1979), with a postgraduate degree in International Relations from Mary Ward University in London (1980), and a training in Advanced Management Program from INSEAD in Fontainebleau, France (1997).

Luiz França is an independent member of the Board of Directors of Inter&Co and was an independent member of the Board of Directors of Banco Inter from 2018 to 2023. Luiz served as Head of the Investment Bank at Banco Itaú, being responsible for the areas of Capital Markets, M&A and Project Finance. He structured Banco Itaú’s Real Estate Credit area, focused on financing developers and individuals, responsible for the backoffice, products, treasury and wholesale and retail distribution. He is currently CEO of Abrainc (Brazilian Association of Real Estate Developers), and CEO of França Participações. He holds a degree in Civil Engineering from Mackenzie University (1985).

André Maciel is an independent member of the Board of Directors of Inter&Co and was an independent member of the Board of Directors of Banco Inter from 2019 to 2023. André served as Managing Partner and Head of Brazil at Softbank Group International between 2019 and 2020. He is the founder of Volpe Capital and co-founded 30Knots, an investment fund dedicated to Venture Capital in Latin America. He served as Managing Director of J.P. Morgan, Head of Investment Banking Advisory in Brazil, responsible for covering the technology, telecommunications and media sectors in Latin America. With almost 17 years at J.P. Morgan, 7 of them in New York, André has been involved in over 200 M&A and Capital Markets transactions. He holds a degree in business administration from EAESP-FGV (2003) and is fluent in English, Portuguese and Spanish.

Antonio Kandir is an independent member of the Board of Directors of Inter&Co. Antonio has served as Minister of State for Planning and Budget, Special Secretary for Economic Policy, President of the National Privatization Council, Brazilian Governor at the Inter-American Development Bank, President of the Institute of Applied Economic Research – IPEA, Congressman, Fund Advisor of Private Equity and Hedge Funds and Research Coordinator at Itaú Plano e Engenharia S.A. Kandir has also worked as Professor at the University of Campinas (UNICAMP) and at the Pontifical Catholic University of São Paulo (PUC-SP), as well as an Assistant at the University of Notre Dame in the United States. He holds a PhD and Master’s degree in Economics from the University of Campinas (UNICAMP) and a degree in Mechanical Production Engineering from the Polytechnic School of the University of São Paulo (USP). Antonio was already serving as a member of the Audit Committee of Banco Inter S.A. (a committee regulated by the Brazilian Central Bank) and will maintain this position.

|

|

|

Classificação da Informação: RESTRITA |

6

Todd Chapman is an independent member of the Board of Directors of Inter&Co. Todd recently retired from the US Government after 30 years as a career diplomat in the US Foreign Service. As US Ambassador to Brazil from 2020 to 2021, he advanced a broad economic, environmental and security agenda at the sixth largest US embassy in the world, coordinating assistance to more than 275,000 Americans residing in Brazil. Previously, he served as US Ambassador to Ecuador from 2016 to 2019, revitalizing bilateral relations and attracting new US investment to Ecuador. His international experience throughout the foreign service and private sector career includes positions in Afghanistan, Bolivia, Costa Rica, Mozambique, Nigeria, Saudi Arabia and Taiwan. Todd was recently admitted to the American Academy of Diplomacy in Washington D.C. He has also served as Senior Adviser to Assistant Secretary of State for Economic Affairs Keith Krach and Senior Assistant Secretary of State for the Bureau of Military-Political Affairs at the US Department of State. He is currently a Non-Resident Fellow at the Payne Institute for Public Policy and a Senior Consultant (Non-Resident) at the Center for Strategic and International Studies (CSIS). He holds a Master’s degree from the National Intelligence University and a Bachelor’s from Duke University. Fluent in both Spanish and Portuguese, Todd was serving the Company as a member of its Advisory Committee.

The affirmative vote by the holders of a simple majority of the votes cast, by or on behalf of, the shareholders attending and voting at the AGM is required for this proposal. If proxies are properly submitted by signing, dating and returning a proxy card, Common Shares represented thereby will be voted in the manner specified therein. If not otherwise specified, and the proxy card is signed, Common Shares represented by the proxies will be voted in favor of this proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RE-APPOINTMENT OF THE CURRENT DIRECTORS OF THE COMPANY WITH IMMEDIATE EFFECT TO HOLD OFFICE FOR A TWO-YEAR TERM IN ACCORDANCE WITH THE ARTICLES.

PROPOSAL 5:

TO RESOLVE, AS A SPECIAL RESOLUTION, THAT THE AMENDED AND RESTATED MEMORANDUM AND ARTICLES OF ASSOCIATION OF THE COMPANY CURRENTLY IN EFFECT BE AMENDED AND RESTATED BY THE DELETION IN THEIR ENTIRETY AND THE SUBSTITUTION IN THEIR PLACE OF THE SECOND AMENDED AND RESTATED MEMORANDUM AND ARTICLES OF ASSOCIATION IN THE FORM UPLOADED TO THE COMPANY'S WEBSITE (ACCESSIBLE AT https://investors.inter.co/en/documents/governance-documents/) WITH IMMEDIATE EFFECT.

We are seeking shareholder approval to amend and restate the Articles, by substituting the Articles by the Second Amended and Restated Memorandum and Articles of Association in the form uploaded to the Company’s website, which can be accessed at https://investors.inter.co/en/documents/governance-documents/.

|

|

|

Classificação da Informação: RESTRITA |

7

Since first amending our Articles, at the time of the Company’s listing on Nasdaq, we have noted that a few changes were needed. The proposed amendments are the following:

|

|

|

|

|

|

|

|

|

| Current Provision (First Amended and Restated Memorandum and Articles of Association) |

Amended Provision (Second Amended and Restated Memorandum and Articles of Association) |

Basis of the Proposal |

| 6. The Company shall not trade in the Cayman Islands with any person, firm or corporation except in furtherance of the business of the Company carried on outside the Cayman Islands; provided that nothing in this clause shall be construed as to prevent the Company effecting and concluding contracts in the Cayman Islands, and exercising in the Cayman Islands all of its powers necessary for the carrying on of its business outside the Cayman Islands. |

6. The Company shall not trade in the Cayman Islands with any person, firm or corporation except in furtherance of the business of the Company carried on outside the Cayman Islands; provided that nothing in this clause shall be construed as to prevent the Company from effecting and concluding contracts in the Cayman Islands, and exercising in the Cayman Islands all of its powers necessary for the carrying on of its business outside the Cayman Islands. |

The amendment simply corrects the language of the provision to add a missing word (“from”). |

|

1.2. In these Articles: (a) the following terms shall have the meanings set opposite if not inconsistent with the subject or context:

(…)

“Nominating Committee” the nominating committee of the Company formed by the Board pursuant to Article 23.3(a) hereof, or any successor of the nominating governance committee;

|

1.2. In these Articles: (a) the following terms shall have the meanings set opposite if not inconsistent with the subject or context:

(…)

“Nominating Committee” the nominating committee of the Company formed by the Board pursuant to Article 23.3(a) hereof, or any successor of the nominating committee;

|

The amendment simply corrects the language of the provision to exclude the word “governance” which is out of context. |

15.2. In lieu of, or apart from, closing the Register of Members, the Directors may fix, in advance or in arrears, a date as the record date for any such determination of Members entitled to notice of, or to vote at any meeting of the Members or any adjournment thereof, or for the purpose of determining the Members entitled to receive payment of any dividend or other distribution, or in order to make a determination of Members for any other purpose, provided that such a record date shall not exceed forty (40) clear days prior to the date where the determination will be made. |

15.2. In lieu of, or apart from, closing the Register of Members, the Directors may fix, in advance or in arrears, a date as the record date for any such determination of Members entitled to notice of, or to vote at any meeting of the Members or any adjournment thereof, or for the purpose of determining the Members entitled to receive payment of any dividend or other distribution, or in order to make a determination of Members for any other purpose, provided that such a record date shall not exceed sixty (60) clear days prior to the date where the determination will be made. |

The amendment provides the Directors with the ability to fix a date as the record date so long as that such a record date does not exceed sixty (60) clear days prior to any meeting of the Members. Therefore, the amendment extends in twenty (20) clear days the limit the Directors have to set the record date, from forty (40) to sixty (60) clear days prior to any meeting of the Members, allowing the Board to have more flexibility and making it possible to call the general meetings a bit more in advance than it is currently feasible. |

|

|

|

Classificação da Informação: RESTRITA |

8

|

|

|

|

|

|

|

|

|

| 21.3. Any vacancies on the Board arising other than upon the removal of a Director by resolution passed at a general meeting can be filled by the remaining Director(s) (notwithstanding that the remaining Director(s) may constitute fewer than the number of Directors required by Article 20.1 or fewer than is required for a quorum pursuant to Article 28.1). (…) |

21.3 The Directors may appoint any person to be a Director, either to fill a vacancy on the Board (other than upon the removal of a Director by resolution passed at a general meeting) or as an additional Director provided that the appointment does not cause the number of Directors to exceed any number fixed by or in accordance with the Articles as the maximum number of Directors (notwithstanding that the remaining Director(s) may constitute fewer than the number of Directors required by Article 20.1 or fewer than is required for a quorum pursuant to Article 28.1). (…) |

The amendment clarifies the position that the Directors are able to appoint interim Directors up to the maximum number of Directors set out in the Articles. |

| 21.5. Additions to the existing Board may be made by Ordinary Resolution. |

21.5. Additions to the existing Board, separate to those made pursuant to Article 21.3, may be made by Ordinary Resolution. |

The amendment streamlines the reading of the Articles by including a cross reference to another provision that addresses the same matter. |

| 24.5. Without limiting the generality of Article 24.4, the Board shall establish a permanent Audit Committee, which shall comprise at least three (3) Persons and up to five (5) Persons, and may establish a Compensation Committee, which shall comprise at least three (3) Persons and up to six (6) Persons, a Nominating Committee, which shall comprise at least three (3) Persons and up to six (6) Persons, and an ESG Committee, which shall comprise at least three (3) Persons and up to seven (7) Persons, and, where such committees are established, the Board may adopt formal written charters for such committees and, if so, shall review and assess the adequacy of such formal written charters on an annual basis. (…) |

24.5. Without limiting the generality of Article 24.4, the Board shall establish a permanent Audit Committee, which shall comprise at least three (3) Persons and up to five (5) Persons, and may establish a Compensation Committee, which shall comprise at least two (2) Persons, a Nominating Committee, which shall comprise at least two (2) Persons, and an ESG Committee, which shall comprise at least two (2) Persons, and, where such committees are established, the Board may adopt formal written charters for such committees and, if so, shall review and assess the adequacy of such formal written charters on an annual basis. (…) |

The Board considers that flexibility when establishing and appointing members to the committees other than the Audit Committee, listed in Article 24.5, is of utmost importance. This amendment aims to guarantee this flexibility to the Board when appointing members to those committees other than the Audit Committee. |

The affirmative vote by the holders of a two-thirds majority of the votes cast, by or on behalf of, the shareholders attending and voting at the AGM is required for this proposal. If proxies are properly submitted by signing, dating and returning a proxy card, Common Shares represented thereby will be voted in the manner specified therein. If not otherwise specified, and the proxy card is signed, Common Shares represented by the proxies will be voted in favor of this proposal.

|

|

|

Classificação da Informação: RESTRITA |

9

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE AMENDMENT AND RESTATEMENT OF THE AMENDED AND RESTATED MEMORANDUM AND ARTICLES OF ASSOCIATION OF THE COMPANY IN EFFECT BY THE DELETION IN THEIR ENTIRETY AND THE SUBSTITUTION IN THEIR PLACE OF THE SECOND AMENDED AND RESTATED MEMORANDUM AND ARTICLES OF ASSOCIATION IN THE FORM UPLOADED TO THE COMPANY'S WEBSITE (ACCESSIBLE AT https://investors.inter.co/en/documents/governance-documents/) WITH IMMEDIATE EFFECT.

COMPANY INFORMATION

A copy of this proxy statement may be accessed on the Company’s Investor Relations website at https://investors.inter.co/en/documents/governance-documents/.

By Order of the Board of Directors

Dated:

|

|

|

Classificação da Informação: RESTRITA |

10