false2023FY00018288110.0251.3333.3333.33330.02510.0251100018288112023-01-012023-12-3100018288112023-12-29iso4217:USD00018288112024-02-29xbrli:shares0001828811licy:DeloitteMember2023-01-012023-12-310001828811us-gaap:ProductMember2023-01-012023-12-310001828811us-gaap:ProductMember2022-11-012022-12-310001828811us-gaap:ProductMember2021-11-012022-10-310001828811us-gaap:ProductMember2020-11-012021-10-310001828811us-gaap:ServiceMember2023-01-012023-12-310001828811us-gaap:ServiceMember2022-11-012022-12-310001828811us-gaap:ServiceMember2021-11-012022-10-310001828811us-gaap:ServiceMember2020-11-012021-10-3100018288112022-11-012022-12-3100018288112021-11-012022-10-3100018288112020-11-012021-10-31iso4217:USDxbrli:shares00018288112023-12-3100018288112022-12-3100018288112022-10-3100018288112021-10-310001828811us-gaap:CommonStockMember2020-10-310001828811us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2020-10-310001828811us-gaap:RetainedEarningsMember2020-10-310001828811us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-10-310001828811us-gaap:ParentMember2020-10-3100018288112020-10-310001828811us-gaap:CommonStockMember2020-11-012021-10-310001828811us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2020-11-012021-10-310001828811us-gaap:ParentMember2020-11-012021-10-310001828811us-gaap:RetainedEarningsMember2020-11-012021-10-310001828811us-gaap:CommonStockMember2021-10-310001828811us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2021-10-310001828811us-gaap:RetainedEarningsMember2021-10-310001828811us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-10-310001828811us-gaap:ParentMember2021-10-310001828811us-gaap:CommonStockMember2021-11-012022-10-310001828811us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2021-11-012022-10-310001828811us-gaap:ParentMember2021-11-012022-10-310001828811us-gaap:NoncontrollingInterestMember2021-11-012022-10-310001828811us-gaap:RetainedEarningsMember2021-11-012022-10-310001828811us-gaap:CommonStockMember2022-10-310001828811us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2022-10-310001828811us-gaap:RetainedEarningsMember2022-10-310001828811us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-10-310001828811us-gaap:ParentMember2022-10-310001828811us-gaap:NoncontrollingInterestMember2022-10-310001828811us-gaap:CommonStockMember2022-11-012022-12-310001828811us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2022-11-012022-12-310001828811us-gaap:ParentMember2022-11-012022-12-310001828811us-gaap:RetainedEarningsMember2022-11-012022-12-310001828811us-gaap:CommonStockMember2022-12-310001828811us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2022-12-310001828811us-gaap:RetainedEarningsMember2022-12-310001828811us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001828811us-gaap:ParentMember2022-12-310001828811us-gaap:NoncontrollingInterestMember2022-12-310001828811us-gaap:CommonStockMember2023-01-012023-12-310001828811us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2023-01-012023-12-310001828811us-gaap:ParentMember2023-01-012023-12-310001828811us-gaap:NoncontrollingInterestMember2023-01-012023-12-310001828811us-gaap:RetainedEarningsMember2023-01-012023-12-310001828811us-gaap:CommonStockMember2023-12-310001828811us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2023-12-310001828811us-gaap:RetainedEarningsMember2023-12-310001828811us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001828811us-gaap:ParentMember2023-12-310001828811us-gaap:NoncontrollingInterestMember2023-12-310001828811licy:PeridotAcquisitionCorp.Memberus-gaap:CommonClassAMemberlicy:CashElectionStockholdersMember2021-08-100001828811licy:PeridotShareholdersMember2021-08-102021-08-100001828811licy:PeridotAcquisitionCorp.Memberlicy:StockElectionShareholdersMemberus-gaap:CommonClassAMember2021-08-100001828811licy:PeridotAcquisitionCorp.Memberus-gaap:CommonClassBMember2021-08-100001828811licy:PeridotAcquisitionCorp.Member2021-08-100001828811licy:StockElectionShareholdersMemberlicy:LiCycleCorp.Member2021-08-100001828811licy:LiCycleCorp.ShareholdersMember2021-08-102021-08-1000018288112021-08-102021-08-1000018288112021-08-100001828811licy:LiCycleHoldingsCorp.Member2021-08-1000018288112021-08-1100018288112023-10-230001828811us-gaap:SubsequentEventMemberlicy:GlencoreConvertibleNotesMemberus-gaap:ConvertibleDebtMember2024-03-11xbrli:pure0001828811licy:LiCycleCorp.Member2023-12-310001828811licy:LiCycleAmericasCorp.Member2023-12-310001828811licy:LiCycleU.S.Inc.Member2023-12-310001828811licy:LiCycleInc.Member2023-12-310001828811licy:LiCycleNorthAmericaHubInc.Member2023-12-310001828811licy:LiCycleEuropeAGMember2023-12-310001828811licy:LiCycleAPACPTE.LTD.Member2023-12-310001828811licy:LiCycleGermanyGmbHMember2023-12-310001828811licy:LiCycleFranceSARLMember2023-12-310001828811licy:LiCycleUnitedKingdomLtd.Member2023-12-310001828811licy:LiCycleNorwayASMember2022-03-310001828811licy:LiCycleNorwayASMember2023-12-31licy:segment0001828811us-gaap:ComputerEquipmentMember2023-12-310001828811us-gaap:VehiclesMember2023-12-310001828811licy:PlantEquipmentMember2023-12-310001828811us-gaap:FurnitureAndFixturesMember2023-12-310001828811us-gaap:ContainersMember2023-12-310001828811licy:ProcessingEquipmentAndRotablePartsMembersrt:MinimumMember2023-12-310001828811licy:ProcessingEquipmentAndRotablePartsMembersrt:MaximumMember2023-12-310001828811us-gaap:BuildingMember2023-12-31licy:asset_grouplicy:model00018288112022-01-012022-12-310001828811us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberlicy:CustomerBMember2023-01-012023-12-310001828811us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberlicy:CustomerBMember2022-11-012022-12-310001828811us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberlicy:CustomerBMember2021-11-012022-10-310001828811us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberlicy:CustomerBMember2020-11-012021-10-310001828811us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberlicy:CustomerFMember2023-01-012023-12-310001828811us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberlicy:CustomerFMember2022-11-012022-12-310001828811us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberlicy:CustomerFMember2021-11-012022-10-310001828811us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberlicy:CustomerFMember2020-11-012021-10-310001828811us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberlicy:CustomerEMember2023-01-012023-12-310001828811us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberlicy:CustomerEMember2022-11-012022-12-310001828811us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberlicy:CustomerEMember2021-11-012022-10-310001828811us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberlicy:CustomerEMember2020-11-012021-10-310001828811us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberlicy:CustomerDMember2023-01-012023-12-310001828811us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberlicy:CustomerDMember2022-11-012022-12-310001828811us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberlicy:CustomerDMember2021-11-012022-10-310001828811us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberlicy:CustomerDMember2020-11-012021-10-310001828811us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberlicy:CustomerAMember2023-01-012023-12-310001828811us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberlicy:CustomerAMember2022-11-012022-12-310001828811us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberlicy:CustomerAMember2021-11-012022-10-310001828811us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberlicy:CustomerAMember2020-11-012021-10-310001828811us-gaap:AccountsReceivableMemberlicy:CustomerCMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-12-310001828811us-gaap:AccountsReceivableMemberlicy:CustomerCMemberus-gaap:CustomerConcentrationRiskMember2022-11-012022-12-310001828811us-gaap:AccountsReceivableMemberlicy:CustomerCMemberus-gaap:CustomerConcentrationRiskMember2021-11-012022-10-310001828811us-gaap:AccountsReceivableMemberlicy:CustomerCMemberus-gaap:CustomerConcentrationRiskMember2020-11-012021-10-310001828811licy:FinishedGoodsMember2023-01-012023-12-310001828811us-gaap:PublicUtilitiesInventoryRawMaterialsMember2023-01-012023-12-310001828811licy:FinishedGoodsMember2022-11-012022-12-310001828811us-gaap:PublicUtilitiesInventoryRawMaterialsMember2022-11-012022-12-310001828811licy:FinishedGoodsMember2021-11-012022-10-310001828811us-gaap:PublicUtilitiesInventoryRawMaterialsMember2021-11-012022-10-310001828811licy:FinishedGoodsMember2020-11-012021-10-310001828811us-gaap:PublicUtilitiesInventoryRawMaterialsMember2020-11-012021-10-310001828811licy:PlantEquipmentMember2022-12-310001828811licy:PlantEquipmentMember2022-10-310001828811licy:PlantEquipmentMember2021-10-310001828811us-gaap:ComputerEquipmentMember2022-12-310001828811us-gaap:ComputerEquipmentMember2022-10-310001828811us-gaap:ComputerEquipmentMember2021-10-310001828811us-gaap:VehiclesMember2022-12-310001828811us-gaap:VehiclesMember2022-10-310001828811us-gaap:VehiclesMember2021-10-310001828811us-gaap:LeaseholdImprovementsMember2023-12-310001828811us-gaap:LeaseholdImprovementsMember2022-12-310001828811us-gaap:LeaseholdImprovementsMember2022-10-310001828811us-gaap:LeaseholdImprovementsMember2021-10-310001828811licy:RochesterHubMemberus-gaap:ConstructionInProgressMember2023-12-310001828811licy:RochesterHubMemberus-gaap:ConstructionInProgressMember2022-12-310001828811licy:RochesterHubMemberus-gaap:ConstructionInProgressMember2022-10-310001828811licy:RochesterHubMemberus-gaap:ConstructionInProgressMember2021-10-310001828811licy:SpokeNetworkMemberus-gaap:ConstructionInProgressMember2023-12-310001828811licy:SpokeNetworkMemberus-gaap:ConstructionInProgressMember2022-12-310001828811licy:SpokeNetworkMemberus-gaap:ConstructionInProgressMember2022-10-310001828811licy:SpokeNetworkMemberus-gaap:ConstructionInProgressMember2021-10-310001828811licy:BuildingsMemberus-gaap:ConstructionInProgressMember2023-12-310001828811licy:BuildingsMemberus-gaap:ConstructionInProgressMember2022-12-310001828811licy:BuildingsMemberus-gaap:ConstructionInProgressMember2022-10-310001828811licy:BuildingsMemberus-gaap:ConstructionInProgressMember2021-10-310001828811licy:InternalUseSoftwareMember2023-12-310001828811licy:InternalUseSoftwareMember2022-12-310001828811licy:InternalUseSoftwareMember2022-10-310001828811licy:InternalUseSoftwareMember2021-10-310001828811us-gaap:ComputerSoftwareIntangibleAssetMember2023-12-310001828811us-gaap:ComputerSoftwareIntangibleAssetMember2022-12-310001828811us-gaap:ComputerSoftwareIntangibleAssetMember2022-10-310001828811us-gaap:ComputerSoftwareIntangibleAssetMember2021-10-310001828811us-gaap:ComputerSoftwareIntangibleAssetMember2023-01-012023-12-310001828811us-gaap:ComputerSoftwareIntangibleAssetMember2020-11-012021-10-310001828811us-gaap:ComputerSoftwareIntangibleAssetMember2022-11-012022-12-310001828811us-gaap:ComputerSoftwareIntangibleAssetMember2021-11-012022-10-310001828811licy:AshlinBPGMember2023-01-012023-12-310001828811licy:AshlinBPGMember2022-11-012022-12-310001828811licy:AshlinBPGMember2021-11-012022-10-310001828811licy:AshlinBPGMember2020-11-012021-10-310001828811licy:FadeInProductionPty.Member2023-01-012023-12-310001828811licy:FadeInProductionPty.Member2022-11-012022-12-310001828811licy:FadeInProductionPty.Member2021-11-012022-10-310001828811licy:FadeInProductionPty.Member2020-11-012021-10-310001828811licy:ConsuleroInc.Member2023-01-012023-12-310001828811licy:ConsuleroInc.Member2022-11-012022-12-310001828811licy:ConsuleroInc.Member2021-11-012022-10-310001828811licy:ConsuleroInc.Member2020-11-012021-10-310001828811licy:GlencoreMember2023-01-012023-12-310001828811licy:GlencoreMember2022-11-012022-12-310001828811licy:GlencoreMember2021-11-012022-10-310001828811licy:GlencoreMember2020-11-012021-10-310001828811licy:AtriaLtdMember2023-01-012023-12-310001828811licy:AtriaLtdMember2022-11-012022-12-310001828811licy:AtriaLtdMember2021-11-012022-10-310001828811licy:AtriaLtdMember2020-11-012021-10-310001828811licy:AnthonyTseMember2023-01-012023-12-310001828811licy:AnthonyTseMember2022-11-012022-12-310001828811licy:AnthonyTseMember2021-11-012022-10-310001828811licy:AnthonyTseMember2020-11-012021-10-310001828811srt:PresidentMember2019-01-012021-12-31iso4217:CAD0001828811us-gaap:RelatedPartyMemberus-gaap:ProductMember2023-01-012023-12-310001828811us-gaap:RelatedPartyMemberus-gaap:ProductMember2022-11-012022-12-310001828811us-gaap:RelatedPartyMemberus-gaap:ProductMember2021-11-012022-10-310001828811us-gaap:RelatedPartyMemberus-gaap:ProductMember2020-11-012021-10-310001828811us-gaap:RelatedPartyMember2023-12-310001828811us-gaap:RelatedPartyMember2022-12-310001828811us-gaap:RelatedPartyMember2022-10-310001828811us-gaap:RelatedPartyMember2021-10-310001828811licy:LiCycleCorp.Memberlicy:AtriaLtdMember2020-05-010001828811us-gaap:RelatedPartyMember2020-05-012020-05-010001828811us-gaap:RelatedPartyMember2021-01-252021-01-250001828811licy:AtriaLtdMemberus-gaap:RelatedPartyMember2021-01-252021-01-250001828811us-gaap:RelatedPartyMemberlicy:PellaVenturesMember2021-01-252021-01-250001828811us-gaap:RelatedPartyMemberlicy:DirectorOfLiCycleCorp.Member2021-01-252021-01-250001828811licy:AnthonyTseMembersrt:DirectorMember2019-07-192019-07-190001828811licy:BDCCapitalLoanMember2020-10-310001828811licy:PromissoryNotesAndOtherMember2020-10-310001828811licy:BDCCapitalLoanMember2020-11-012021-10-310001828811licy:PromissoryNotesAndOtherMember2020-11-012021-10-310001828811licy:BDCCapitalLoanMember2021-10-310001828811licy:PromissoryNotesAndOtherMember2021-10-310001828811licy:BDCCapitalLoanMemberus-gaap:SecuredDebtMember2019-12-160001828811licy:BDCCapitalLoanMember2019-12-16licy:tranche0001828811srt:MinimumMemberlicy:BDCCapitalLoanMemberus-gaap:SecuredDebtMember2019-12-162019-12-160001828811srt:MaximumMemberlicy:BDCCapitalLoanMemberus-gaap:SecuredDebtMember2019-12-162019-12-160001828811licy:BDCCapitalLoanMemberus-gaap:SecuredDebtMember2020-12-162020-12-160001828811licy:FirstTrancheMemberlicy:BDCCapitalLoanMemberus-gaap:SecuredDebtMember2020-02-102020-02-100001828811licy:FirstTrancheMemberlicy:BDCCapitalLoanMemberus-gaap:SecuredDebtMember2020-02-100001828811licy:SecondTrancheMemberlicy:BDCCapitalLoanMemberus-gaap:SecuredDebtMember2020-11-022020-11-020001828811licy:ThirdTrancheMemberlicy:BDCCapitalLoanMemberus-gaap:SecuredDebtMember2021-04-072021-04-070001828811licy:BDCCapitalLoanMemberus-gaap:SecuredDebtMember2021-08-112021-08-110001828811licy:UnsecuredSubordinateDebtMemberlicy:PromissoryNotesMember2021-06-160001828811licy:UnsecuredSubordinateDebtMemberlicy:PromissoryNotesMember2021-08-172021-08-1700018288112023-03-282023-03-28iso4217:EUR0001828811licy:KSPConvertibleNotesMember2023-12-310001828811licy:KSPConvertibleNotesMember2022-12-310001828811licy:KSPConvertibleNotesMember2022-10-310001828811licy:KSPConvertibleNotesMember2021-10-310001828811licy:GlencoreConvertibleNotesMember2023-12-310001828811licy:GlencoreConvertibleNotesMember2022-12-310001828811licy:GlencoreConvertibleNotesMember2022-10-310001828811licy:GlencoreConvertibleNotesMember2021-10-310001828811us-gaap:ConvertibleDebtMemberlicy:KSPConvertibleNotesMember2022-12-310001828811us-gaap:ConvertibleDebtMemberlicy:KSPConvertibleNotesMember2022-10-310001828811us-gaap:ConvertibleDebtMemberlicy:KSPConvertibleNotesMember2021-10-310001828811us-gaap:ConvertibleDebtMemberlicy:KSPConvertibleNotesMember2020-10-310001828811us-gaap:ConvertibleDebtMemberlicy:KSPConvertibleNotesMember2023-01-012023-12-310001828811us-gaap:ConvertibleDebtMemberlicy:KSPConvertibleNotesMember2022-11-012022-12-310001828811us-gaap:ConvertibleDebtMemberlicy:KSPConvertibleNotesMember2021-11-012022-10-310001828811us-gaap:ConvertibleDebtMemberlicy:KSPConvertibleNotesMember2020-11-012021-10-310001828811us-gaap:ConvertibleDebtMemberlicy:KSPConvertibleNotesMember2023-12-310001828811licy:KSPConvertibleNotesMember2020-10-310001828811licy:KSPConvertibleNotesMember2023-01-012023-12-310001828811licy:KSPConvertibleNotesMember2022-11-012022-12-310001828811licy:KSPConvertibleNotesMember2021-11-012022-10-310001828811licy:KSPConvertibleNotesMember2020-11-012021-10-310001828811us-gaap:ConvertibleDebtMemberlicy:InitialKSPNoteMember2021-09-290001828811licy:VariableRateComponentOneMemberlicy:LondonInterbankOfferedRateMemberus-gaap:ConvertibleDebtMemberlicy:KSPConvertibleNotesMember2021-09-292021-09-290001828811licy:VariableRateComponentTwoMemberlicy:LondonInterbankOfferedRateMemberus-gaap:ConvertibleDebtMemberlicy:KSPConvertibleNotesMember2021-09-292021-09-290001828811licy:VariableRateComponentTwoMemberlicy:LondonInterbankOfferedRateMembersrt:MinimumMemberus-gaap:ConvertibleDebtMemberlicy:KSPConvertibleNotesMember2021-09-292021-09-290001828811srt:MaximumMemberlicy:VariableRateComponentTwoMemberlicy:LondonInterbankOfferedRateMemberus-gaap:ConvertibleDebtMemberlicy:KSPConvertibleNotesMember2021-09-292021-09-290001828811us-gaap:ConvertibleDebtMemberlicy:KSPConvertibleNotesMember2021-09-290001828811us-gaap:ConvertibleDebtMemberlicy:InitialKSPNoteMember2023-12-310001828811licy:KSPPIKNoteIssuedDecember312021Memberus-gaap:ConvertibleDebtMember2023-12-310001828811licy:KSPPIKNoteIssuedJune302022Memberus-gaap:ConvertibleDebtMember2023-12-310001828811licy:KSPPIKNoteIssuedDecember312022Memberus-gaap:ConvertibleDebtMember2023-12-310001828811licy:KSPPIKNoteIssuedJune302023Memberus-gaap:ConvertibleDebtMember2023-12-310001828811licy:KSPPIKNoteIssuedDecember312023Memberus-gaap:ConvertibleDebtMember2023-12-310001828811us-gaap:ConvertibleDebtMemberlicy:KSPConvertibleNotesMember2021-09-292021-09-29licy:day0001828811licy:KSPConvertibleNotesMember2021-09-290001828811us-gaap:MeasurementInputRiskFreeInterestRateMemberlicy:KSPConvertibleNotesMember2021-09-290001828811us-gaap:MeasurementInputRiskFreeInterestRateMemberlicy:KSPConvertibleNotesMember2021-10-310001828811us-gaap:MeasurementInputRiskFreeInterestRateMemberlicy:KSPConvertibleNotesMember2022-10-310001828811us-gaap:MeasurementInputRiskFreeInterestRateMemberlicy:KSPConvertibleNotesMember2022-12-310001828811us-gaap:MeasurementInputRiskFreeInterestRateMemberlicy:KSPConvertibleNotesMember2023-12-310001828811us-gaap:MeasurementInputExpectedTermMemberlicy:KSPConvertibleNotesMember2021-09-290001828811us-gaap:MeasurementInputExpectedTermMemberlicy:KSPConvertibleNotesMember2021-10-310001828811us-gaap:MeasurementInputExpectedTermMemberlicy:KSPConvertibleNotesMember2022-10-310001828811us-gaap:MeasurementInputExpectedTermMemberlicy:KSPConvertibleNotesMember2022-12-310001828811us-gaap:MeasurementInputExpectedTermMemberlicy:KSPConvertibleNotesMember2023-12-310001828811us-gaap:MeasurementInputExpectedDividendRateMemberlicy:KSPConvertibleNotesMember2021-09-290001828811us-gaap:MeasurementInputExpectedDividendRateMemberlicy:KSPConvertibleNotesMember2021-10-310001828811us-gaap:MeasurementInputExpectedDividendRateMemberlicy:KSPConvertibleNotesMember2022-10-310001828811us-gaap:MeasurementInputExpectedDividendRateMemberlicy:KSPConvertibleNotesMember2022-12-310001828811us-gaap:MeasurementInputExpectedDividendRateMemberlicy:KSPConvertibleNotesMember2023-12-310001828811us-gaap:MeasurementInputPriceVolatilityMemberlicy:KSPConvertibleNotesMember2021-09-290001828811us-gaap:MeasurementInputPriceVolatilityMemberlicy:KSPConvertibleNotesMember2021-10-310001828811us-gaap:MeasurementInputPriceVolatilityMemberlicy:KSPConvertibleNotesMember2022-10-310001828811us-gaap:MeasurementInputPriceVolatilityMemberlicy:KSPConvertibleNotesMember2022-12-310001828811us-gaap:MeasurementInputPriceVolatilityMemberlicy:KSPConvertibleNotesMember2023-12-310001828811us-gaap:MeasurementInputSharePriceMemberlicy:KSPConvertibleNotesMember2021-09-290001828811us-gaap:MeasurementInputSharePriceMemberlicy:KSPConvertibleNotesMember2021-10-310001828811us-gaap:MeasurementInputSharePriceMemberlicy:KSPConvertibleNotesMember2022-10-310001828811us-gaap:MeasurementInputSharePriceMemberlicy:KSPConvertibleNotesMember2022-12-310001828811us-gaap:MeasurementInputSharePriceMemberlicy:KSPConvertibleNotesMember2023-12-310001828811licy:GlencoreConvertibleNotesMemberus-gaap:ConvertibleDebtMember2022-12-310001828811licy:GlencoreConvertibleNotesMemberus-gaap:ConvertibleDebtMember2022-10-310001828811licy:GlencoreConvertibleNotesMemberus-gaap:ConvertibleDebtMember2021-10-310001828811licy:GlencoreConvertibleNotesMemberus-gaap:ConvertibleDebtMember2020-10-310001828811licy:GlencoreConvertibleNotesMemberus-gaap:ConvertibleDebtMember2023-01-012023-12-310001828811licy:GlencoreConvertibleNotesMemberus-gaap:ConvertibleDebtMember2022-11-012022-12-310001828811licy:GlencoreConvertibleNotesMemberus-gaap:ConvertibleDebtMember2021-11-012022-10-310001828811licy:GlencoreConvertibleNotesMemberus-gaap:ConvertibleDebtMember2020-11-012021-10-310001828811licy:GlencoreConvertibleNotesMemberus-gaap:ConvertibleDebtMember2023-12-310001828811licy:GlencoreConvertibleNotesMember2020-10-310001828811licy:GlencoreConvertibleNotesMember2023-01-012023-12-310001828811licy:GlencoreConvertibleNotesMember2022-11-012022-12-310001828811licy:GlencoreConvertibleNotesMember2021-11-012022-10-310001828811licy:GlencoreConvertibleNotesMember2020-11-012021-10-310001828811us-gaap:ConvertibleDebtMemberlicy:InitialGlencoreNoteMember2022-05-310001828811us-gaap:ConvertibleDebtMemberlicy:InitialGlencoreNoteMemberlicy:SecuredOvernightFinancingRateSOFRMember2022-05-312022-05-310001828811licy:VariableRateComponentOneMemberus-gaap:ConvertibleDebtMemberlicy:InitialGlencoreNoteMemberlicy:SecuredOvernightFinancingRateSOFRMember2022-05-312022-05-310001828811licy:VariableRateComponentTwoMemberus-gaap:ConvertibleDebtMemberlicy:InitialGlencoreNoteMemberlicy:SecuredOvernightFinancingRateSOFRMember2022-05-312022-05-310001828811srt:MinimumMemberus-gaap:ConvertibleDebtMemberlicy:InitialGlencoreNoteMemberlicy:SecuredOvernightFinancingRateSOFRMember2022-05-312022-05-310001828811srt:MaximumMemberus-gaap:ConvertibleDebtMemberlicy:InitialGlencoreNoteMemberlicy:SecuredOvernightFinancingRateSOFRMember2022-05-312022-05-310001828811us-gaap:ConvertibleDebtMemberlicy:InitialGlencoreNoteMember2023-12-310001828811licy:GlencorePIKNoteIssuedNovember302022Memberus-gaap:ConvertibleDebtMember2023-12-310001828811licy:GlencorePIKNoteIssuedMay312023Memberus-gaap:ConvertibleDebtMember2023-12-310001828811licy:GlencorePIKNoteIssuedNovember302023Memberus-gaap:ConvertibleDebtMember2023-12-310001828811licy:GlencoreConvertibleNotesMemberus-gaap:ConvertibleDebtMember2022-05-310001828811licy:GlencoreConvertibleNotesMember2022-05-310001828811us-gaap:MeasurementInputRiskFreeInterestRateMemberlicy:GlencoreConvertibleNotesMember2022-05-310001828811us-gaap:MeasurementInputRiskFreeInterestRateMemberlicy:GlencoreConvertibleNotesMember2022-10-310001828811us-gaap:MeasurementInputRiskFreeInterestRateMemberlicy:GlencoreConvertibleNotesMember2022-12-310001828811us-gaap:MeasurementInputRiskFreeInterestRateMemberlicy:GlencoreConvertibleNotesMember2023-12-310001828811licy:GlencoreConvertibleNotesMemberus-gaap:MeasurementInputExpectedTermMember2022-05-310001828811licy:GlencoreConvertibleNotesMemberus-gaap:MeasurementInputExpectedTermMember2022-10-310001828811licy:GlencoreConvertibleNotesMemberus-gaap:MeasurementInputExpectedTermMember2022-12-310001828811licy:GlencoreConvertibleNotesMemberus-gaap:MeasurementInputExpectedTermMember2023-12-310001828811licy:GlencoreConvertibleNotesMemberus-gaap:MeasurementInputExpectedDividendRateMember2022-05-310001828811licy:GlencoreConvertibleNotesMemberus-gaap:MeasurementInputExpectedDividendRateMember2022-10-310001828811licy:GlencoreConvertibleNotesMemberus-gaap:MeasurementInputExpectedDividendRateMember2022-12-310001828811licy:GlencoreConvertibleNotesMemberus-gaap:MeasurementInputExpectedDividendRateMember2023-12-310001828811licy:GlencoreConvertibleNotesMemberus-gaap:MeasurementInputPriceVolatilityMember2022-05-310001828811licy:GlencoreConvertibleNotesMemberus-gaap:MeasurementInputPriceVolatilityMember2022-10-310001828811licy:GlencoreConvertibleNotesMemberus-gaap:MeasurementInputPriceVolatilityMember2022-12-310001828811licy:GlencoreConvertibleNotesMemberus-gaap:MeasurementInputPriceVolatilityMember2023-12-310001828811licy:GlencoreConvertibleNotesMemberus-gaap:MeasurementInputSharePriceMember2022-05-310001828811licy:GlencoreConvertibleNotesMemberus-gaap:MeasurementInputSharePriceMember2022-10-310001828811licy:GlencoreConvertibleNotesMemberus-gaap:MeasurementInputSharePriceMember2022-12-310001828811licy:GlencoreConvertibleNotesMemberus-gaap:MeasurementInputSharePriceMember2023-12-310001828811licy:PublicWarrantsMember2021-08-100001828811licy:PrivateWarrantsMember2021-08-100001828811licy:WarrantRedemptionTermsOneMemberlicy:PublicWarrantsMember2021-08-100001828811licy:WarrantRedemptionTermsTwoMemberlicy:PublicWarrantsMember2021-08-100001828811licy:WarrantRedemptionTermsTwoMemberlicy:PublicWarrantsMember2021-08-102021-08-100001828811licy:PrivateWarrantsMembersrt:MinimumMember2021-08-100001828811srt:MaximumMemberlicy:PrivateWarrantsMember2021-08-100001828811licy:PrivateWarrantsMember2021-08-102021-08-1000018288112021-12-2700018288112022-01-1100018288112022-01-312022-01-3100018288112022-01-310001828811srt:MinimumMember2022-10-310001828811srt:MaximumMember2022-10-310001828811srt:MinimumMember2023-12-310001828811srt:MaximumMember2023-12-31licy:vote0001828811licy:SeriesCPrivatePlacementMember2020-11-13licy:entity0001828811licy:SeriesCPrivatePlacementMember2020-11-132020-11-1300018288112021-08-090001828811us-gaap:RestrictedStockUnitsRSUMember2021-08-100001828811us-gaap:RestrictedStockUnitsRSUMember2021-08-102021-08-100001828811us-gaap:EmployeeStockOptionMember2021-08-102021-08-100001828811licy:LGESAndLGCMember2022-05-122022-05-120001828811licy:LGESAndLGCMember2022-05-120001828811licy:LGEnergySolutionLtd.LGESMember2022-05-122022-05-120001828811licy:LGChemLtd.LGCMember2022-05-122022-05-120001828811licy:TrancheOneMemberlicy:LGESAndLGCMember2022-05-122022-05-120001828811licy:TrancheOneMemberlicy:LGESAndLGCMember2022-05-120001828811licy:TrancheTwoMemberlicy:LGESAndLGCMember2022-05-122022-05-120001828811licy:TrancheTwoMemberlicy:LGESAndLGCMember2022-05-1200018288112022-05-122022-05-120001828811licy:LTIPPlanMemberus-gaap:EmployeeStockOptionMember2023-12-310001828811licy:LTIPPlanMemberus-gaap:EmployeeStockOptionMember2023-01-012023-12-310001828811us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001828811us-gaap:EmployeeStockOptionMember2022-11-012022-12-310001828811us-gaap:EmployeeStockOptionMember2021-11-012022-10-310001828811us-gaap:EmployeeStockOptionMember2020-11-012021-10-310001828811srt:MinimumMemberlicy:LegacyPlansMember2023-12-310001828811srt:MaximumMemberlicy:LegacyPlansMember2023-12-310001828811licy:LegacyPlansMember2023-12-310001828811licy:LegacyPlansMember2023-01-012023-12-310001828811licy:LTIPPlanMembersrt:MinimumMember2023-12-310001828811licy:LTIPPlanMembersrt:MaximumMember2023-12-310001828811licy:LTIPPlanMember2023-12-310001828811licy:LTIPPlanMember2023-01-012023-12-310001828811us-gaap:EmployeeStockOptionMember2023-12-310001828811srt:MaximumMemberus-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001828811us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001828811us-gaap:RestrictedStockUnitsRSUMember2022-11-012022-12-310001828811us-gaap:RestrictedStockUnitsRSUMember2021-11-012022-10-310001828811us-gaap:RestrictedStockUnitsRSUMember2020-11-012021-10-310001828811us-gaap:RestrictedStockUnitsRSUMember2020-10-310001828811us-gaap:RestrictedStockUnitsRSUMember2021-10-310001828811us-gaap:RestrictedStockUnitsRSUMember2022-10-310001828811us-gaap:RestrictedStockUnitsRSUMember2022-12-310001828811us-gaap:RestrictedStockUnitsRSUMember2023-12-310001828811us-gaap:RestrictedStockUnitsRSUMembersrt:MinimumMember2023-01-012023-12-310001828811licy:LTIPPlanMemberus-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:EmployeeStockOptionMember2023-01-012023-12-310001828811licy:LTIPPlanMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMemberus-gaap:EmployeeStockOptionMember2023-01-012023-12-310001828811licy:LTIPPlanMemberus-gaap:EmployeeStockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2023-01-012023-12-310001828811licy:LiCycleNorwayASMember2022-01-260001828811licy:LiCycleNorwayASMemberlicy:ECOSTORMember2022-01-260001828811licy:MorrowMemberlicy:LiCycleNorwayASMember2022-01-260001828811licy:LiCycleNorwayASMember2023-06-292023-06-290001828811licy:LiCycleNorwayASMember2023-06-290001828811licy:LiCycleNorwayASMember2023-06-290001828811us-gaap:FairValueInputsLevel1Member2023-12-310001828811us-gaap:FairValueInputsLevel2Member2023-12-310001828811us-gaap:FairValueInputsLevel1Member2022-12-310001828811us-gaap:FairValueInputsLevel2Member2022-12-310001828811us-gaap:FairValueInputsLevel1Member2022-10-310001828811us-gaap:FairValueInputsLevel2Member2022-10-310001828811us-gaap:FairValueInputsLevel1Member2021-10-310001828811us-gaap:FairValueInputsLevel2Member2021-10-310001828811licy:CobaltMember2023-01-012023-12-31utr:T0001828811licy:NickelMember2023-01-012023-12-310001828811licy:CobaltMember2022-01-012022-12-310001828811licy:NickelMember2022-01-012022-12-310001828811licy:CobaltMember2021-11-012022-10-310001828811licy:NickelMember2021-11-012022-10-310001828811licy:CobaltMember2020-11-012021-10-310001828811licy:NickelMember2020-11-012021-10-31iso4217:USDutr:tlicy:lawsuit0001828811us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001828811us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001828811us-gaap:EmployeeStockOptionMember2021-11-012022-10-310001828811us-gaap:EmployeeStockOptionMember2020-11-012021-10-310001828811us-gaap:WarrantMember2023-01-012023-12-310001828811us-gaap:WarrantMember2022-01-012022-12-310001828811us-gaap:WarrantMember2021-11-012022-10-310001828811us-gaap:WarrantMember2020-11-012021-10-310001828811us-gaap:ConvertibleDebtSecuritiesMemberlicy:KSPConvertibleNotesMember2023-01-012023-12-310001828811us-gaap:ConvertibleDebtSecuritiesMemberlicy:KSPConvertibleNotesMember2022-01-012022-12-310001828811us-gaap:ConvertibleDebtSecuritiesMemberlicy:KSPConvertibleNotesMember2021-11-012022-10-310001828811us-gaap:ConvertibleDebtSecuritiesMemberlicy:KSPConvertibleNotesMember2020-11-012021-10-310001828811us-gaap:ConvertibleDebtSecuritiesMemberlicy:GlencoreConvertibleNotesMember2023-01-012023-12-310001828811us-gaap:ConvertibleDebtSecuritiesMemberlicy:GlencoreConvertibleNotesMember2022-01-012022-12-310001828811us-gaap:ConvertibleDebtSecuritiesMemberlicy:GlencoreConvertibleNotesMember2021-11-012022-10-310001828811us-gaap:ConvertibleDebtSecuritiesMemberlicy:GlencoreConvertibleNotesMember2020-11-012021-10-310001828811us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001828811us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001828811us-gaap:RestrictedStockUnitsRSUMember2021-11-012022-10-310001828811us-gaap:RestrictedStockUnitsRSUMember2020-11-012021-10-31licy:customer0001828811us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberlicy:CustomerAMember2023-01-012023-12-310001828811us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberlicy:CustomerAMember2022-11-012022-12-310001828811us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberlicy:CustomerAMember2021-11-012022-10-310001828811us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberlicy:CustomerAMember2020-11-012021-10-310001828811us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberlicy:CustomerBMember2023-01-012023-12-310001828811us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberlicy:CustomerBMember2022-11-012022-12-310001828811us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberlicy:CustomerBMember2021-11-012022-10-310001828811us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberlicy:CustomerBMember2020-11-012021-10-310001828811licy:CustomerCMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-12-310001828811licy:CustomerCMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2022-11-012022-12-310001828811licy:CustomerCMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2021-11-012022-10-310001828811licy:CustomerCMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2020-11-012021-10-310001828811us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberlicy:CustomerDMember2023-01-012023-12-310001828811us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberlicy:CustomerDMember2022-11-012022-12-310001828811us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberlicy:CustomerDMember2021-11-012022-10-310001828811us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberlicy:CustomerDMember2020-11-012021-10-310001828811us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberlicy:CustomerEMember2023-01-012023-12-310001828811us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberlicy:CustomerEMember2022-11-012022-12-310001828811us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberlicy:CustomerEMember2021-11-012022-10-310001828811us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberlicy:CustomerEMember2020-11-012021-10-310001828811us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberlicy:CustomerFMember2023-01-012023-12-310001828811us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberlicy:CustomerFMember2022-11-012022-12-310001828811us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberlicy:CustomerFMember2021-11-012022-10-310001828811us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberlicy:CustomerFMember2020-11-012021-10-310001828811country:CA2023-01-012023-12-310001828811country:US2023-01-012023-12-310001828811country:DE2023-01-012023-12-310001828811licy:OtherCountriesMember2023-01-012023-12-310001828811country:CA2022-11-012022-12-310001828811country:US2022-11-012022-12-310001828811country:DE2022-11-012022-12-310001828811licy:OtherCountriesMember2022-11-012022-12-310001828811country:CA2021-11-012022-10-310001828811country:US2021-11-012022-10-310001828811country:DE2021-11-012022-10-310001828811licy:OtherCountriesMember2021-11-012022-10-310001828811country:CA2020-11-012021-10-310001828811country:US2020-11-012021-10-310001828811country:DE2020-11-012021-10-310001828811licy:OtherCountriesMember2020-11-012021-10-310001828811country:CA2023-12-310001828811country:US2023-12-310001828811country:DE2023-12-310001828811licy:OtherCountriesMember2023-12-310001828811country:CA2022-12-310001828811country:US2022-12-310001828811country:DE2022-12-310001828811licy:OtherCountriesMember2022-12-310001828811country:CA2022-10-310001828811country:US2022-10-310001828811country:DE2022-10-310001828811licy:OtherCountriesMember2022-10-310001828811country:CA2021-10-310001828811country:US2021-10-310001828811country:DE2021-10-310001828811licy:OtherCountriesMember2021-10-310001828811us-gaap:DomesticCountryMember2023-12-310001828811us-gaap:DomesticCountryMember2022-12-310001828811us-gaap:DomesticCountryMember2022-10-310001828811us-gaap:DomesticCountryMember2021-10-310001828811us-gaap:ForeignCountryMember2023-12-310001828811us-gaap:ForeignCountryMember2022-12-310001828811us-gaap:ForeignCountryMember2022-10-310001828811us-gaap:ForeignCountryMember2021-10-310001828811licy:OtherTaxAuthoritiesMember2022-12-310001828811us-gaap:SubsequentEventMembersrt:MinimumMemberlicy:PikeMember2024-01-262024-01-260001828811us-gaap:SubsequentEventMembersrt:MaximumMemberlicy:PikeMember2024-01-262024-01-260001828811us-gaap:SubsequentEventMember2024-01-260001828811us-gaap:SubsequentEventMember2024-03-152024-03-150001828811us-gaap:SubsequentEventMemberlicy:SpokeNetworkMember2024-02-072024-02-070001828811us-gaap:SubsequentEventMemberlicy:SpokeNetworkMember2024-02-07licy:employee0001828811us-gaap:SubsequentEventMemberlicy:GlencoreConvertibleNotesMemberus-gaap:ConvertibleDebtMember2024-03-112024-03-1100018288112023-10-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________

FORM 10-K

________________________

|

|

|

|

|

|

| x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

OR

|

|

|

|

|

|

| o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from to .

Commission file number 001-40733

________________________

Li-Cycle Holdings Corp.

(Exact Name of Registrant as Specified in Its Charter)

________________________

|

|

|

|

|

|

|

|

|

Province of Ontario, Canada |

|

Not Applicable |

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

207 Queens Quay West, Suite 590, Toronto, ON, M5J 1A7, Canada

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (877) 542-9253

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common shares, without par value |

LICY |

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

x |

|

Accelerated filer |

o |

| Non-accelerated filer |

o |

|

Smaller reporting company |

o |

|

|

|

Emerging growth company |

o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).Yes o No x

The aggregate market value of the registrant's common shares held by non-affiliates, based on the closing sale price as reported by the New York Stock Exchange on December 29, 2023, the last business day of the registrant’s most recently completed fiscal quarter, was approximately $104.3 million.

Common shares beneficially owned by each executive officer, director and holder of more than 10% of common stock have been excluded in that such persons may be deemed to be affiliates.

As of February 29, 2024, the registrant had 179,047,118 common shares outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

None.

LI-CYCLE HOLDINGS CORP.

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this Annual Report on Form 10-K may be considered “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the U.S. Securities Act of 1933, as amended, Section 21 of the U.S. Securities Exchange Act of 1934, as amended, and applicable Canadian securities laws.

Forward-looking statements may generally be identified by the use of words such as “believe”, “may”, “will”, “continue”, “anticipate”, “intend”, “expect”, “should”, “would”, “could”, “plan”, “potential”, “future”, “target” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters, although not all forward-looking statements contain such identifying words. Forward-looking statements in this Annual Report on Form 10‑K include but are not limited to statements about: the expectation that Li-Cycle will recover critical battery-grade materials to create a domestic closed-loop battery supply chain for a clean energy future; the expectation that the steps taken under the Cash Preservation Plan will result in cash savings; Li-Cycle’s expectations regarding cash outflows; Li-Cycle’s expectations regarding the DOE Loan; Li-Cycle’s expectations that it will require significant funding before restarting the Rochester Hub project or that it will be able to restart the Rochester Hub project; Li-Cycle’s expectation that the phased approach may include the ability to produce intermediate battery metal products such as MHP; Li-Cycle’s expectations that it will be stopping or slowing operations at its operational Spokes in North America and re-evaluating its strategy for bringing on additional Spoke and Hub capacity in the near-term; Li-Cycle’s expectation to recognize revenue from the sale of critical battery materials; Li-Cycle’s expectation regarding other capital expenditures in 2024; Li-Cycle’s expectation that it will need to secure an alternative short or long-term financing in the near term or else it will not have sufficient cash and cash equivalents on hand or other resources to support current operations for the twelve months following the filing of this Annual Report; and expectations related to potential financing and other strategic alternatives. These statements are based on various assumptions, whether or not identified in this Annual Report on Form 10-K, made by Li-Cycle’s management, including but not limited to assumptions regarding the timing, scope and cost of Li-Cycle’s projects, including paused projects; the processing capacity and production of Li-Cycle’s facilities; Li-Cycle’s expectations regarding near-term significant workforce reductions; Li-Cycle's ability to source feedstock and manage supply chain risk; Li-Cycle’s ability to increase recycling capacity and efficiency; Li-Cycle’s ability to obtain financing on acceptable terms or execute any strategic transactions; the expected closing of the Glencore Senior Secured Convertible Note investment; Li-Cycle’s ability to retain and hire key personnel and maintain relationships with customers, suppliers and other business partners; the success of the Cash Preservation Plan, the outcome of the review of the go-forward strategy of the Rochester Hub, Li-Cycle’s ability to attract new suppliers or expand its supply pipeline from existing suppliers; general economic conditions; currency exchange and interest rates; compensation costs; and inflation. There can be no assurance that such assumptions will prove to be correct and, as a result, actual results or events may differ materially from expectations expressed in or implied by the forward-looking statements.

Forward-looking statements involve inherent risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of Li-Cycle, and which may cause actual results to differ materially from the forward-looking information. The risk factors and cautionary language discussed in this Annual Report on Form 10-K provide examples of risks, uncertainties and events that may cause actual results to differ materially from the expectations described by us in such forward-looking statements, including among other things:

•Li-Cycle’s inability to economically and efficiently source, recover and recycle lithium-ion batteries and lithium-ion battery manufacturing scrap, as well as third party black mass, and to meet the market demand for an environmentally sound, closed-loop solution for manufacturing waste and end-of-life lithium-ion batteries;

•Li-Cycle’s inability to successfully implement its global growth strategy, on a timely basis or at all;

•Li-Cycle’s inability to manage future global growth effectively;

•Li-Cycle’s inability to develop the Rochester Hub as anticipated or at all, and other future projects including its Spoke network expansion projects in a timely manner or on budget or that those projects will not meet expectations with respect to their productivity or the specifications of their end products;

•Li-Cycle's history of losses and expected significant expenses for the foreseeable future as well as additional funds required to meet Li-Cycle’s liquidity needs and capital requirements in the future not being available to Li-Cycle on acceptable terms or at all when it needs them;

•risk and uncertainties related to Li-Cycle’s ability to continue as a going concern;

•uncertainty related to the success of Li-Cycle’s Cash Preservation Plan and related past and expected near-term further significant workforce reductions;

•Li-Cycle's inability to attract, train and retain top talent who possess specialized knowledge and technical skills;

•Li-Cycle’s failure to oversee and supervise strategic review of all or any of Li-Cycle’s operations and capital project and obtain financing and other strategic alternatives;

•Li-Cycle’s ability to service its debt and the restrictive nature of the terms of its debt;

•Li-Cycle's potential engagement in strategic transactions, including acquisitions, that could disrupt its business, cause dilution to its shareholders, reduce its financial resources, result in incurrence of debt, or prove not to be successful;

•one or more of Li-Cycle's current or future facilities becoming inoperative, capacity constrained or disrupted, or lacking sufficient feed streams to remain in operation;

•the potential impact of the pause in construction of the Rochester Hub on the authorizations and permits granted to Li-Cycle for the operation of the Rochester Hub and the Spokes on pause;

•the risk that the New York state and municipal authorities determine that the permits granted to Li-Cycle for the production of metal sulphates at the Rochester Hub will be impacted by the change to MHP and the reduction in scope for the project;

•Li-Cycle's failure to materially increase recycling capacity and efficiency;

•Li-Cycle expects to continue to incur significant expenses and may not achieve or sustain profitability;

•problems with the handling of lithium-ion battery cells that result in less usage of lithium-ion batteries or affect Li-Cycle’s operations;

•Li-Cycle’s inability to maintain and increase feedstock supply commitments as well as secure new customers and off-take agreements;

•a decline in the adoption rate of EVs, or a decline in the support by governments for “green” energy technologies;

•decreases in benchmark prices for the metals contained in Li-Cycle’s products;

•changes in the volume or composition of feedstock materials processed at Li-Cycle’s facilities;

•the development of an alternative chemical make-up of lithium-ion batteries or battery alternatives;

•Li-Cycle’s expected revenues for the Rochester Hub are expected to be derived significantly from a limited number of customers;

•uncertainty regarding the sublease agreement with Pike Conductor Dev 1, LLC related to the construction, financing and leasing of a warehouse and administrative building for the Rochester Hub;

•Li-Cycle’s insurance may not cover all liabilities and damages;

•Li-Cycle’s heavy reliance on the experience and expertise of its management;

•Li-Cycle’s reliance on third-party consultants for its regulatory compliance;

•Li-Cycle’s inability to complete its recycling processes as quickly as customers may require;

•Li-Cycle’s inability to compete successfully;

•increases in income tax rates, changes in income tax laws or disagreements with tax authorities;

•significant variance in Li-Cycle’s operating and financial results from period to period due to fluctuations in its operating costs and other factors;

•fluctuations in foreign currency exchange rates which could result in declines in reported sales and net earnings;

•unfavorable economic conditions, such as consequences of the global COVID-19 pandemic;

•natural disasters, unusually adverse weather, epidemic or pandemic outbreaks, cyber incidents, boycotts and geo-political events;

•failure to protect or enforce Li-Cycle’s intellectual property;

•Li-Cycle may be subject to intellectual property rights claims by third parties;

•Li-Cycle may be subject to cybersecurity attacks, including, but not limited to, ransomware;

•Li-Cycle’s failure to effectively remediate the material weaknesses in its internal control over financial reporting that it has identified or its failure to develop and maintain a proper and effective internal control over financial reporting;

•the potential for Li-Cycle’s directors and officers who hold Company common shares to have interests that may differ from, or be in conflict with, the interests of other shareholders; and

•risks related to adoption of Li-Cycle’s shareholder rights plan and amendment to the shareholder rights plan and the volatility of the price of Li-Cycle’s common shares.

These and other risks and uncertainties related to Li-Cycle’s business and the assumptions on which the forward-looking information is based are described in greater detail in the sections titled “Item 1A. Risk Factors”, “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Factors Affecting Li-Cycle’s Performance” and elsewhere in this Annual Report on Form 10-K. Because of these risks, uncertainties and assumptions, readers should not place undue reliance on these forward-looking statements. Actual results could differ materially from those contained in any forward-looking statements.

Li-Cycle assumes no obligation to update or revise any forward-looking statements, except as required by applicable laws. These forward-looking statements should not be relied upon as representing Li-Cycle’s assessments as of any date subsequent to the date of this Annual Report on Form 10-K.

FREQUENTLY USED TERMS

As used in this Annual Report on Form 10-K, unless the context otherwise requires or indicates otherwise, references to “we,” “us,” “our,” “Li-Cycle” or the “Company” refer to Li-Cycle Holdings Corp., an Ontario corporation, and its consolidated subsidiaries.

In this document:

“A&R Glencore Convertible Notes” means amended and restated Glencore Convertible Notes, to be issued upon closing of the issuance of the Glencore Senior Secured Convertible Note.

“Alabama Spoke” means Li-Cycle’s Spoke near Tuscaloosa, Alabama, which commenced operations on October 13, 2022.

“Amalgamation” means the amalgamation of Peridot Ontario and NewCo in accordance with the terms of the Arrangement.

“ancillary processing capacity” means, in relation to Li-Cycle’s Spokes, the capacity to process LIB through dry shredding, powder processing and baling.

“Arizona Spoke” means Li-Cycle’s Spoke in Gilbert, Arizona, which commenced operations on May 17, 2022.

“Arrangement” means the plan of arrangement (including the Business Combination) in substantially the form attached as Annex C to the proxy statement/prospectus forming a part of the registration statement on Form F-4, filed by the Company with the SEC on July 6, 2021.

“black mass” means a powder-like substance which contains a number of valuable metals, including nickel, cobalt and lithium.

“Black Mass & Equivalents” or “BM&E” means black mass and products analogous to black mass that have a similar metal content.

“Business Combination” means the transactions contemplated by the Business Combination Agreement.

“Business Combination Agreement” means the Business Combination Agreement, dated as of February 15, 2021, as amended, by and among Peridot, Li-Cycle Corp. and NewCo.

“Cash Preservation Plan” means the cash preservation plan initiated on November 1, 2023, which included reducing staffing in its corporate support functions, pausing production at its Ontario Spoke and implementing a plan to manage lower levels of Black Mass & Equivalents production and otherwise slow down operations at its remaining operating Spoke locations in order to reduce expenses and slow cash outflows as well as reviewing existing plans for bringing on additional Spoke capacity and taking other steps to preserve the Company’s available cash while pursuing funding alternatives for the Company and continuing to review the go-forward strategy for the Rochester Hub project.

“Closing Date” means the closing date of the Business Combination.

“common shares” means the common shares of the Company, without par value.

“Consolidated Financial Statements” means the annual consolidated financial statements included in Item 8 of this Annual Report on Form 10-K.

“Continuance” means the continuance of Peridot from the Cayman Islands under the Companies Act to the Province of Ontario, Canada as a corporation existing under the OBCA.

“DFS” means definitive feasibility study.

“EV” means electric vehicles.

“Germany Spoke” means Li-Cycle’s Spoke in Magdeburg, Germany, which commenced operations on August 1, 2023.

“Glencore” means Glencore plc and its subsidiaries.

“Glencore Convertible Note” means the unsecured convertible note in the principal amount of $200.0 million due May 31, 2027 issued to Glencore Ltd. pursuant to the Glencore Note Purchase Agreement on May 31, 2022, as such note may be amended from time to time.

“Glencore Convertible Notes” means the Glencore Convertible Note together with any PIK Notes issued in satisfaction of interest due and payable thereon.

“Glencore Note Purchase Agreement” means the note purchase agreement, dated as of May 5, 2022, between the Company and Glencore Ltd.

“Glencore Senior Secured Convertible Note” means a senior secured convertible note in an aggregate principal amount of $75.0 million to be issued to an affiliate of Glencore plc pursuant to the Glencore Senior Secured Convertible Note Purchase Agreement, as such note may be amended from time to time.

“Glencore Senior Secured Convertible Note Purchase Agreement” means the agreement dated March 11, 2024 by and between the Company, an affiliate of Glencore plc and the other parties named therein for the issuance of the Glencore Senior Secured Convertible Note.

“Glencore Warrants” means warrants to be issued by Li-Cycle to the holder of the Glencore Convertible Note in connection with an optional redemption of the Glencore Convertible Note that entitle the holder to acquire, until the maturity date of the Glencore Convertible Note, a number of common shares equal to the principal amount of the Glencore Convertible Note being redeemed divided by the then applicable conversion price.

“Hub” means a centralized facility for large-scale production of specialty materials that achieves economies of scale in recycling.

“IP” means intellectual property.

“Investor Agreement” means the Investor and Registration Rights Agreement, dated as of August 10, 2021, by and among the Company, the Peridot Class B Holders and the Li-Cycle Holders.

“KSP Convertible Note” means the unsecured convertible note in the principal amount of $100.0 million due September 29, 2026 originally issued to Spring Creek Capital, LLC (an affiliate of Koch Strategic Platforms, LLC, being a company within the Koch Investments Group) pursuant to the KSP Note Purchase Agreement on September 29, 2021 and subsequently assigned on May 1, 2022, to one of its affiliates, Wood River Capital, LLC, as such note may be amended from time to time.

“KSP Convertible Notes” means the KSP Convertible Note together with any PIK Notes issued in satisfaction of interest due and payable thereon.

“KSP Note Purchase Agreement” means the Note Purchase Agreement, dated as of September 29, 2021, between the Company and Spring Creek Capital, LLC, and assigned on May 1, 2022, to Wood River Capital, LLC.

“LGC” means LG Chem, Ltd.

“LGES” means LG Energy Solution, Ltd.

“LIB” means lithium-ion batteries, including lithium-ion battery manufacturing scrap and end-of-life lithium-ion batteries.

“LIBOR” means the London Inter-Bank Offered Rate.

“Li-Cycle Holders” means the prior shareholders of Li-Cycle Corp. that entered into the Li-Cycle Transaction Support Agreements in connection with the Business Combination.

“Li-Cycle Shares” means the issued and outstanding common shares of Li-Cycle Corp. prior to the Business Combination.

“Li-Cycle Transaction Support Agreements” means the Transaction Support Agreements, each dated as of February 15, 2021, among Peridot and the Li-Cycle Holders, entered into in connection with the Business Combination Agreement.

“Long-Term Incentive Plan” means the Company’s 2021 Incentive Award Plan.

“main line processing capacity” means, in relation to Li-Cycle’s Spokes, the capacity to process materials using Li-Cycle’s patented submerged shredding process or “wet shredding” designed specifically for battery materials that contain electrolyte and have risk of thermal runaway.

“MHP” means mixed hydroxide precipitate, containing nickel, cobalt and manganese.

“MHP scope” means a scope for the Rochester Hub project that focuses only on those process areas needed to produce lithium carbonate and MHP.

“Moelis” means Moelis & Company LLC.

“NewCo” means Li-Cycle Holdings Corp. prior to the Amalgamation.

“New Ontario Spoke” means the planned, expanded Spoke and warehouse facility, the development of which has been postponed indefinitely.

“New York Spoke” means Li-Cycle’s operational Spoke in Rochester, New York, which commenced operations in late 2020.

“Norway Spoke” means Li-Cycle’s planned Spoke in Moss, Norway, the development of which is currently paused.

“NYSE” means the New York Stock Exchange.

“OBCA” means the Ontario Business Corporations Act.

“OEM” means an original equipment manufacturer.

“Ontario Spoke” means Li-Cycle’s Spoke in Kingston, Ontario, the operations of which are currently paused.

“Peridot Class B Holders” means the holders of Peridot Class B Shares immediately prior to the Business Combination.

“Peridot Class B Shares” means the Class B common shares of Peridot.

“Peridot” means, before the Continuance, Peridot Acquisition Corp., a Cayman Islands exempt company and, after the Continuance, Peridot Ontario.

“Peridot Ontario” means Peridot as continued under the OBCA following the Continuance.

“PIK Notes” means the additional unsecured convertible notes that may be issued by Li-Cycle from time to time in satisfaction of the interest due and payable on the KSP Convertible Notes or the Glencore Convertible Notes, as the case may be, as such notes may be amended from time to time.

“PIPE Financing” means the issuance and sale to the PIPE Investors, following the Amalgamation and prior to the closing date of the Business Combination, of an aggregate of 31,549,000 common shares for a purchase price of $10.00 per share, for aggregate gross proceeds of $315,490,000.

“PIPE Investors” means those certain investors, including an affiliate of Peridot’s Sponsor, who entered into Subscription Agreements to purchase common shares in the PIPE Financing.

“Planned Portovesme Hub” means the planned joint development project with Glencore to produce critical battery materials at a Hub facility in Portovesme, Italy, the definitive feasibility study for which is currently paused.

“private placement warrants” means 8,000,000 warrants to purchase common shares that were issued to the Sponsor in exchange for outstanding warrants of Peridot in connection with the Business Combination, which were exercised or surrendered for common shares or redeemed on January 26, 2022 pursuant to the notice of redemption dated December 27, 2021.

“public warrants” means 15,000,000 warrants to purchase common shares that were issued in exchange for outstanding warrants of Peridot that were issued in Peridot’s initial public offering, which were exercised or surrendered for common shares or redeemed on January 26, 2022 pursuant to the notice of redemption dated December 27, 2021.

“Rochester Hub” means Li-Cycle’s planned, first commercial-scale Hub, under development in Rochester, New York, the construction of which is currently paused.

“SEC” means the U.S. Securities and Exchange Commission.

“Securities Act” means the U.S. Securities Act of 1933, as amended.

“SOFR” means the Secured Overnight Financing Rate.

“Special Committee” means the Special Committee comprised of independent directors that was established in connection with the comprehensive review of the go-forward strategy of the Rochester Hub project. See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Recent Liquidity Developments.”

“Spoke” means a decentralized facility that mechanically processes batteries close to sources of supply and handles the preliminary processing of end-of-life batteries and battery manufacturing scrap.

“Sponsor” means Peridot Acquisition Sponsor, LLC, a Delaware limited liability company.

“Subscription Agreements” means the subscription agreements entered into with the PIPE Investors, in connection with the PIPE Financing.

“Traxys” means Traxys North America LLC.

“warrants” means the public warrants and the private placement warrants.

References to “dollar,” “USD,” “US$” and “$” are to U.S. dollars and references to “CA$” and “Cdn. $” are to Canadian dollars.

This annual report includes certain trademarks, service marks and trade names that we own or otherwise have the right to use, such as “Li-Cycle” and “Spoke & Hub Technologies” which are protected under applicable intellectual property laws and are our property. We have, or are in the process of obtaining, the exclusive right to use such trademarks, service marks and trade names in the countries in which we operate or may operate in the future. This annual report also contains additional trademarks, tradenames, and service marks belonging to other parties, which are the property of their respective owners. Solely for convenience, our trademarks, service marks and trade names referred to in this annual report may appear without the ® or ™ symbol, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights to these trademarks, service marks and trade names. We do not intend our use or display of other parties’ trademarks, tradenames, or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

PART I

ITEM 1. BUSINESS

Our Company Overview

Li-Cycle (NYSE: LICY) is a leading global lithium-ion battery (“LIB”) resource recovery company. Established in 2016, and with customers and partners around the world, Li-Cycle's mission is to recover critical battery-grade materials to create a domestic closed-loop battery supply chain for a clean energy future. The Company’s proprietary “Spoke & Hub” recycling and resource recovery process is designed (a) at its Spokes, or pre-processing facilities, to process battery manufacturing scrap and end-of-life batteries to produce “black mass”, a powder-like substance which contains a number of valuable metals, and other intermediate products, and (b) at its future Hubs, or post-processing facilities, to process black mass to produce critical materials for the lithium-ion battery supply chain, including lithium carbonate.

At its Spokes, in addition to producing black mass, the Company produces certain other intermediate products analogous to black mass that have a similar metal content, and, as a result, the Company tracks its production using a unit of measure called black mass and black mass equivalents (“Black Mass & Equivalents” or “BM&E”).

Li-Cycle pioneered what it believes to be an innovative and scalable metallurgical processing method with its Spoke & Hub network, with the goal of making a valuable contribution to the EV industry and the world’s transition to a circular economy by offering an environmentally-friendly recycling solution alternative to energy-intensive pyrometallurgical processing methods. By re-inserting critical materials back into the lithium-ion battery supply chain, we believe we will be able to effectively close the loop between the beginning and end-of-life manufacturing phases in both an environmentally and what we believe to be an economically sustainable manner.

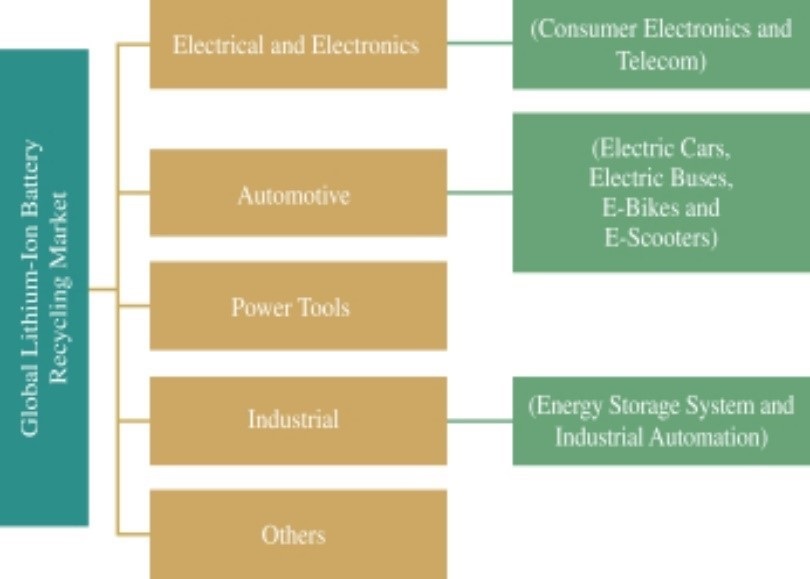

Lithium-ion batteries are increasingly powering products and solutions in a range of industries, including consumer electronics, EVs and energy storage. An overview of the industries in which lithium-ion batteries are utilized is set forth below:

Source: Expert Interviews, Secondary Research, and BIS Research Analysis

Our Industry, Market Trends and Supply Chain

Li-Cycle is at the intersection of three broad and accelerating trends that it believes are key drivers for successful movement toward a zero-carbon economy: the EV revolution; sustainability with emphasis on a circular economy; and localized investments in battery production to establish and grow sustainable domestic supplies of strategic battery materials.

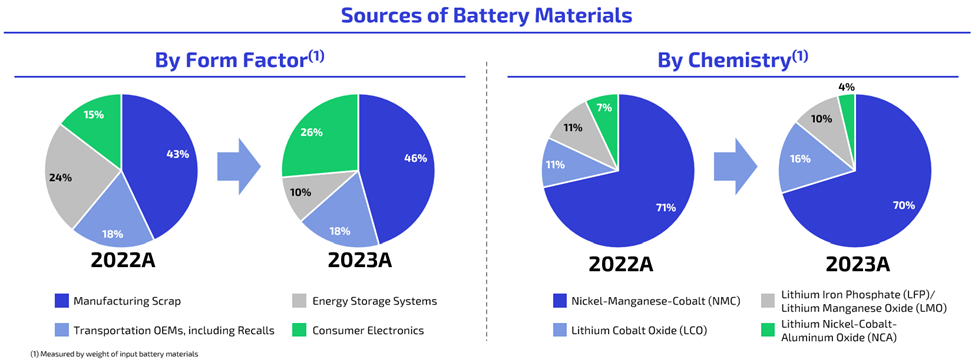

As battery manufacturers and automotive OEMs in the lithium-ion battery supply chain increasingly establish localized manufacturing operations in North America and Europe, the lithium-ion battery market continues to develop in terms of the growth and need for recycling various "form factors" (see bottom left chart) and "chemistries" (see bottom right chart).

•Form factor refers to a battery’s physical shape, size, configuration, and arrangement. Market forecasts call for increased quantities of EV battery manufacturing scrap and end-of-life batteries to become available for recycling in our key focus regions.

•Battery chemistries are diverse and include: (i) lithium nickel manganese cobalt (“NMC”), which is one of the most widely used cathode chemistries in lithium-ion batteries, known to have a high capacity, high operating voltage, and relatively slow reaction time with electrolytes; (ii) lithium nickel cobalt aluminum oxide (“NCA”), which is similar to NMC and offers high specific energy and high durability; (iii) lithium-iron phosphate (“LFP”), which has a moderate specific energy and is widely used for residential storage systems; and (iv) lithium manganese oxide (“LMO”), which has a specific energy that makes it an attractive cathode material for lithium-ion batteries that are used mostly in power tools and electric powertrains.

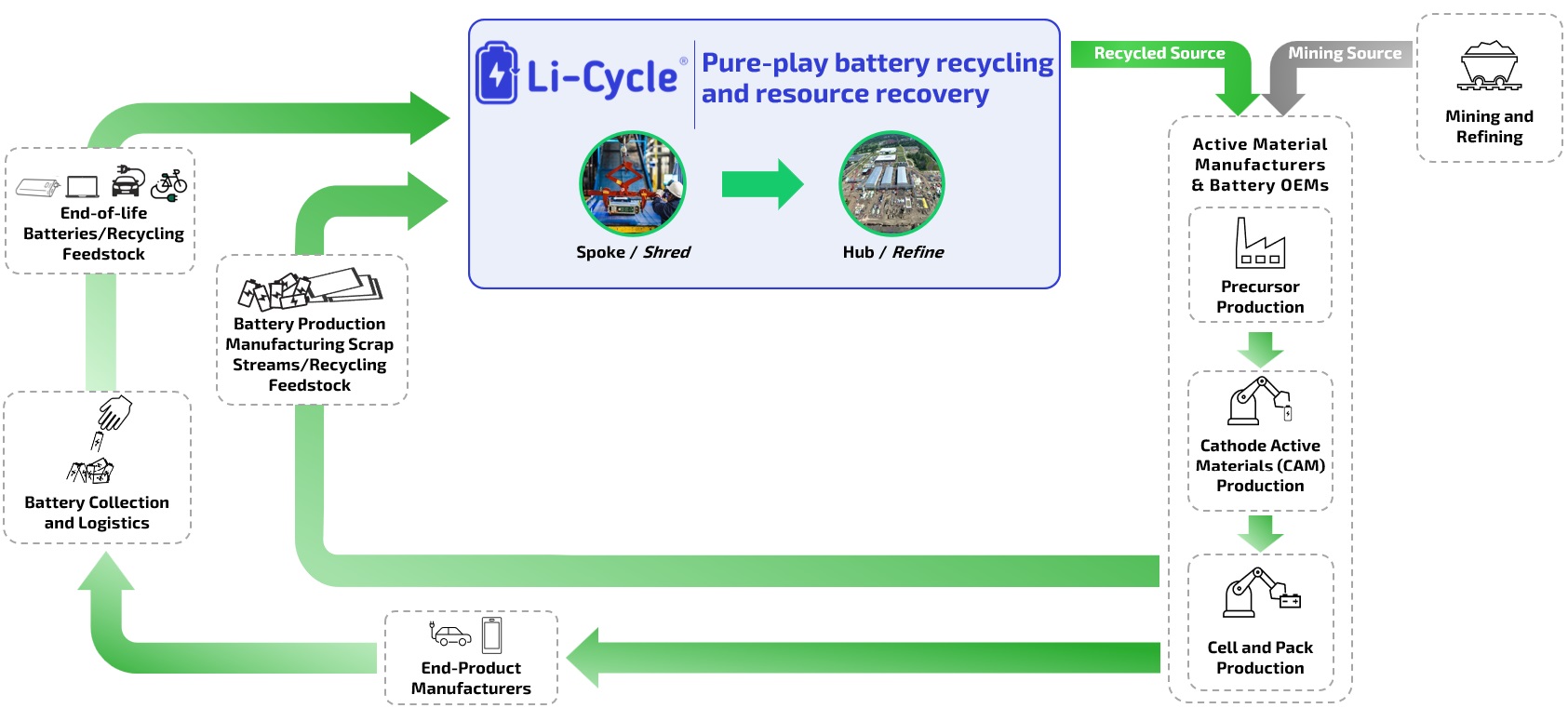

We believe that a secure supply of critical materials is core to the success of the battery supply chain. As shown in the chart below, Li-Cycle’s expected operating model enables a circular loop in the EV battery value chain which we believe will make Li-Cycle well-placed to be a preferred supplier of domestic and recycled critical materials to key global battery supply chain participants. Many of Li-Cycle’s key commercial partners are cathode producers and battery OEMs.

In addition to Li-Cycle, other key players in the North American lithium-ion battery recycling market include Ascend Elements, Inc., Cirba Solutions, and Redwood Materials Inc.

Our Integrated Spoke & Hub Strategy and Network

Li-Cycle’s strategic goal is to be a preferred global recycler of lithium-ion batteries and battery manufacturing scrap to produce critical materials for the battery supply chain. Prior to the pause in construction of the Rochester Hub, the slowdown of operations at the North American Spokes, and the re-evaluation of the Company’s strategy for its current North American Spokes and bringing on additional Spoke and Hub capacity, the Company worked to position its network in multiple regions within the battery supply chain where there was growth of manufacturing of lithium-ion batteries in order to capture and process manufacturing scrap (“yield loss”) and end-of-life lithium-ion batteries available for recycling. The Company sought to develop a network of Spokes strategically located near customers and feedstock to reduce handling costs and operational risk. Additionally, the Spoke network was intended to produce a sustainable supply of black mass for processing at future centralized large-scale battery material refining facilities, or Hubs. These investments were supported in the near term with multi-year in-take and off-take commercial contracts, with a mid- to long-term objective of closing the supply chain loop – meaning matching up customer off-take with in-take arrangements.

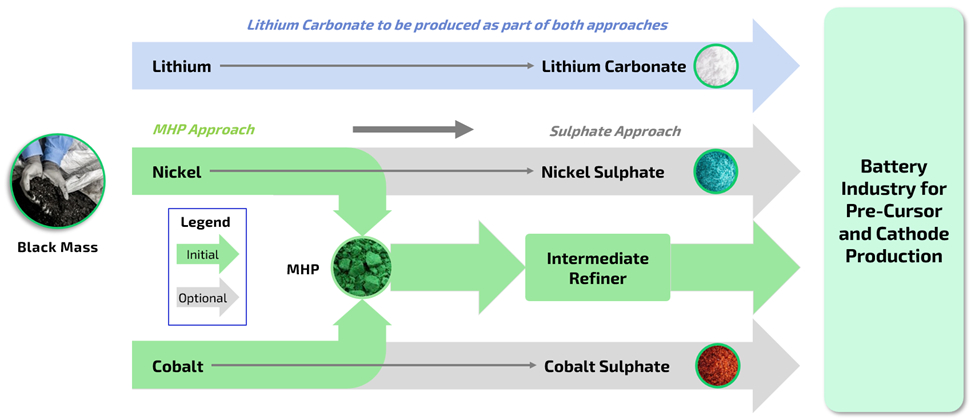

On October 23, 2023, the Company announced that it was pausing construction work on its Rochester Hub project, pending completion of a comprehensive review of the go-forward strategy for the project. The pause in construction was due to escalating costs and the expectation that aggregate costs to complete the existing scope of the project would exceed the previously disclosed budget of $560.0 million. Prior to the construction pause, commissioning of the Rochester Hub project had been expected to commence in late 2023. As part of the comprehensive review, the Company is examining the scope, expected capital cost, financing, timing of completion and go-forward construction strategy options for the Rochester Hub project. The Company has been conducting an internal technical and economic review of the Rochester Hub project to assess a possible change in the project development strategy. The Company has since focused its technical review on constructing, commissioning, and operating only those process areas needed to produce two key products: lithium carbonate and MHP (the “MHP scope”). The construction, commissioning and operating costs for process areas associated with production of nickel sulphate and cobalt sulphate, as originally planned for the Rochester Hub, have not been included in the internal technical review. and there are no current plans that include production of nickel sulphate and cobalt sulphate. However, the areas dedicated to the production of nickel sulphate and cobalt sulphate would be left intact under the MHP scope, to allow for the potential construction, completion, and integration of these areas in the future, although no such plans are contemplated at this time. Taking into account total cash spend of $452.2 million as of December 31, 2023, the revised estimated project cost of the Rochester Hub project is approximately $960.2 million for the MHP scope. For more information, see “Item 7. Management’s Discussion and Analysis of Financial Conditions and Results of Operations – Update on Business Outlook and Strategy.”

The Company will require significant funding before restarting the Rochester Hub project. Following the pause in construction of the Rochester Hub project, the Company has slowed operations at its North American Spokes by pausing operations at the Ontario Spoke and slowing down production at its New York, Arizona and Alabama Spokes as it reviews the timing and BM&E needs of the Rochester Hub and may continue to pause or slow down operations at its operational Spokes in North America in the near term.

The Company is also re-evaluating its strategy for bringing on additional Spoke and Hub capacity in the near-term. For additional details, see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Update on Business Outlook and Strategy.”

An overview of Li-Cycle’s current and planned Spoke and Hub operations, relative to centers of demand for recycling of lithium-ion battery manufacturing scrap, is set forth in the chart below.

Under the Company’s two-part Spoke & Hub process, end-of-life batteries and battery-related scrap are first shipped to Spoke locations, where the materials are mechanically processed into several intermediate products, including black mass. When one or more Hub locations become operational, we expect that black mass from several Spoke locations will be received at a Hub location and processed through a hydrometallurgical (or “wet chemistry”) process to produce critical battery materials which can be sold back into the battery supply chain and used in the manufacturing of new lithium-ion batteries.

As at December 31, 2023, Li-Cycle had four operational Spokes in North America and Europe, which were located in Rochester, New York (the “New York Spoke”), Gilbert, Arizona (the “Arizona Spoke”), Tuscaloosa, Alabama (the “Alabama Spoke”), and Magdeburg, Germany (the “Germany Spoke”). Production at the Spoke in Ontario, Canada (the “Ontario Spoke”) and the construction of the Rochester Hub project continue to be paused and operations have been slowed down at the New York, Arizona and Alabama Spokes, pending completion of a comprehensive review of the go-forward strategy for the Rochester Hub project, and subject to the availability of required funding. Further pauses or slowdowns of North American Spokes are expected in the near-term. In May 2023, the Company announced it had signed a letter of intent with Glencore International AG, a wholly owned subsidiary of Glencore plc (“Glencore”), to jointly study the feasibility of, and later, develop a Hub facility in Portovesme, Italy (the “Planned Portovesme Hub”) to produce critical battery materials. The Planned Portovesme Hub would repurpose part of the existing Glencore metallurgical complex, which would enable what we expect would be an expedited and cost-efficient development plan. Work on the definitive feasibility study (“DFS”) for the Planned Portovesme Hub project has been paused and the project is currently under review by the Company and Glencore.

Spokes

Batteries for recycling are broken down at our Spokes through a mechanical size reduction process known as shredding and separated into black mass, shredded metals and mixed plastics. Black mass is a powder-like substance, which contains a number of valuable metals, including nickel, cobalt and lithium. Black mass is an intermediate product which is significantly easier and safer to transport than lithium-ion batteries and we intend to further process black mass produced at our Spokes at our future Hub facilities. At our Spokes, we also produce certain products analogous to black mass that have a similar metal content, and, as a result, we track our production using a unit of measure called Black Mass & Equivalents or BM&E.

Li-Cycle has developed its Spoke processing technology over three generations of design. The Company’s first Spoke (the “Generation 1” Ontario Spoke in 2020, now paused) was a stick build format with a single shredder design. The Company’s next Spoke facility (the “Generation 2” New York Spoke) was a modular build with multiple shredder design and increased recovery rates. The latest Spoke design (the “Generation 3” Arizona Spoke, Alabama Spoke and Germany Spoke design) is based on a modular build, multi-stage shredding design with capabilities to shred full-pack EV batteries without dismantling, and further, increased recovery rates.

With each subsequent Spoke generation rollout, the Company has also incorporated capacity and processing upgrades to flex with our current and potential customers’ growing volumes and mix of battery material form factors. Total processing capacity of the Spokes is composed of “main line processing capacity” and “ancillary processing capacity”. Main line processing capacity refers to the capacity to process materials using its patented submerged shredding process, or “wet shredding”, designed specifically for battery materials that contain electrolyte and have risk of thermal runaway. Ancillary processing capacity refers to the capacity to process LIB through: (1) Dry Shredding, which processes materials that do not contain electrolyte and therefore are at less risk of thermal runaway; (2) Powder Processing, which processes electrode powders to minimize dusting in downstream processes; and (3) Baling, which processes electrode foils into formed cubes for optimizing logistics and downstream processing.

Li-Cycle’s Spokes, are battery and form factor agnostic, with the capability to process entire EV and energy storage battery packs with no disassembly. This has become increasingly important as EV battery packs have continued to become larger and automakers are implementing cell-to-pack architecture with minimal ability to dismantle.

Our sources of recycling feed are derived primarily from three key sources: 1) battery manufacturing scrap; 2) end-of-life lithium-ion batteries; and 3) damaged, defective, or recalled lithium-ion batteries. The below charts show the Company’s battery supply in-take by form factor and by chemistry.

Hubs