Document

Management’s Discussion & Analysis

For the three months ended January 31, 2024 and 2023

|

|

|

|

|

|

|

High Tide Inc. |

| Management's Discussion and Analysis |

| For the three months ended January 31, 2024 and 2023 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

Established consumer brands of High Tide Inc.

|

|

|

|

|

|

|

High Tide Inc. |

| Management's Discussion and Analysis |

| For the three months ended January 31, 2024 and 2023 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

About this MD&A:

This management’s discussion and analysis (this “MD&A”) of High Tide Inc. (“High Tide”, “we”, “our” or the “Company”) for the three months ended January 31, 2024 and 2023 is dated March 12, 2024. This MD&A should be read in conjunction with the unaudited condensed interim consolidated financial statements of the Company for the three months ended January 31, 2024 and 2023 together with the notes thereto and the audited consolidated financial statements of the Company for the years ended October 31, 2023 and 2022 (hereafter the “Financial Statements”). The financial information presented in this MD&A has been derived from the Financial Statements which prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). The Company’s continuous disclosure materials, including interim fillings, audited annual consolidated financial statements, annual information form and annual report on Form 40-F can be found on SEDAR+ at www.sedarplus.ca, with the company’s filings with the SEC at www.sec.gov.

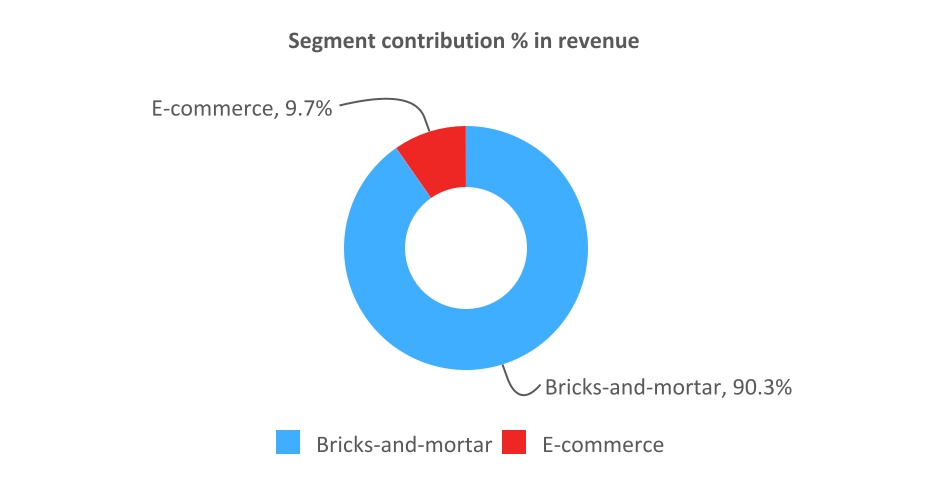

This MD&A also refers to the Company’s two reportable operating segments: (i) the “bricks-and-mortar” segment which includes the Company’s Canadian bricks-and-mortar locations, inclusive of the Canadian warehouse which supports the distribution of accessories and other items to the Canadian stores (ii) the “e-commerce” Segment which include the Company’s USA and international subsidiaries, inclusive of the USA warehouse which supports the distribution of accessories and other items to the USA and international subsidiaries (each as defined below under the heading – Segment Operations).

High Tide a high-impact, retail-forward enterprise built to deliver real-world value across every component of cannabis. The Company’s shares are listed on the Nasdaq Capital Market (“Nasdaq”) under the ticker symbol “HITI” as of June 2, 2021, the TSX Venture Exchange (“TSXV”) under the symbol “HITI”, and the Frankfurt Stock Exchange under the securities identification code ‘WKN: A2PBPS’ and the ticker symbol “2LYA”. The address of the Company’s headquarters is #112, 11127 15 Street NE, Calgary, Alberta, T3K 2M4.

|

|

|

|

|

|

|

High Tide Inc. |

| Management's Discussion and Analysis |

| For the three months ended January 31, 2024 and 2023 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

Corporate overview:

Founded in 2009, High Tide through its subsidiary Canna Cabana is the largest non-franchised cannabis retail chain in Canada. The Company operates 165 branded retail cannabis stores across Canada, of which 163 stores are corporately owned locations represented by 79 locations in Alberta, 54 locations in Ontario, 11 locations in Saskatchewan, 10 locations in British Columbia, and 11 locations in Manitoba. Further, the Company has a 50% interest in a partnership that operates a branded retail Canna Cabana location in Sudbury, Ontario and two joint venture operations with a 49% interest that operates two branded retail locations in Manitoba.

Leveraging the brand equity established through their consumer brands, High Tide sells cannabis, CBD products and consumption accessories through both traditional bricks-and-mortar as well as e-commerce platforms. Traditional bricks-and-mortar sales are conducted under the Company’s Canna Cabana brand, CBD product sales are conducted online under the Company’s FABCBD, Blessed CBD and NuLeaf brands, and online sales through e-commerce platforms are conducted under the Company’s Grasscity, Smoke Cartel, Daily High Club and Dankstop brands.

In addition to consumer sale, High Tide operates a wholesale division under their Valiant Distribution (“Valiant”) brand. Through Valiant, the Company supplies various Canadian shops and e-commerce platforms with consumption accessories that are designed and branded under the Valiant brand.

Under these established brands, High Tide has expanded their network to sell cannabis (only Canada), CBD products and consumption accessories throughout Canada, the UK, and the United States, becoming one of the most recognized cannabis retail groups globally.

Corporate update:

High Tide continues to lead the Canadian cannabis retail landscape as the largest non-franchised retailer across Canada, with 165 locations. The Company’s rapid progress can be attributed to the success of its innovative discount club model, which includes the ELITE paid membership program and the Cabana Club supported by its online global customer base. ELITE memberships are on the rise having grown at its fastest pace since inception over the past quarter. The Company’s Cabana Club loyalty program has also shown impressive increases, with membership now exceeding over 1.32 million. Given the Company’s goal to add 20-30 new Canna Cabana locations during this calendar year, the Company anticipates new Cabana Club members will continue to join its loyalty program throughout the year. Currently, ELITE offerings make up 12% of SKUs, which is up from 2% a year ago, and the Company continues to lay the groundwork to reach its communicated goal of 20-30% of in-store inventory cater towards ELITE. As we continue to scale up these exclusive ELITE product offerings, we expect membership numbers to continue rising.

The Company currently holds an average of over 10% market share in dollars across the provinces where it operates. The Company anticipates reaching 15% market share in Canada, driven by organic store openings, as well as strategic and accretive M&A to reach its target of 300 Canna Cabana locations in the long term.

The Company currently has 120 stores equipped with its Fastendr technology. The Company anticipates completing this rollout in the remainder of its store portfolio prior to the end of this fiscal year. With the recently announced acquisition of the Queen of Bud brand, the Company looks forward to developing and launching innovative cannabis and consumption accessory offerings to its ELITE and Cabana Club membership base.

The Company has generated over $13.3 million in free cash flow during the past three quarters and intends to remain free cash flow positive through fiscal 2024, although the quantum of free cash flow generation could vary in any given quarter, depending on the nature of working capital requirements needed to launch and ramp up new locations to maturity. A robust balance sheet, coupled with strong cost controls, should enable High Tide to take full advantage of opportunities to expand its network of Canna Cabana retail stores across Canada, focused on Ontario.

|

|

|

|

|

|

|

High Tide Inc. |

| Management's Discussion and Analysis |

| For the three months ended January 31, 2024 and 2023 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

Select financial highlights and operating performance:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended January 31 |

|

|

|

|

2024 |

|

2023 |

|

Change |

|

|

|

|

|

|

|

|

$ |

|

$ |

|

∆ |

|

|

|

|

|

|

| Revenue |

|

128,068 |

|

|

118,076 |

|

|

9 |

% |

|

|

|

|

|

|

| Gross profit |

|

35,994 |

|

|

32,181 |

|

|

12 |

% |

|

|

|

|

|

|

Gross profit margin(i) |

|

28 |

% |

|

27 |

% |

|

1 |

% |

|

|

|

|

|

|

| Total operating expenses |

|

(33,202) |

|

|

(36,103) |

|

|

(8) |

% |

|

|

|

|

|

|

| Income (loss) from operations |

|

2,792 |

|

|

(3,922) |

|

|

171 |

% |

|

|

|

|

|

|

| Free cash flow |

|

3,608 |

|

|

(847) |

|

|

526 |

% |

|

|

|

|

|

|

Adjusted EBITDA(ii) |

|

10,435 |

|

|

5,500 |

|

|

90 |

% |

|

|

|

|

|

|

| Net loss |

|

(5) |

|

|

(3,862) |

|

|

100 |

% |

|

|

|

|

|

|

| Basic and diluted loss per share |

|

- |

|

|

(0.05) |

|

|

99 |

% |

|

|

|

|

|

|

(i)Gross profit margin - a non-IFRS financial measure. Gross profit margin is calculated by dividing gross profit by revenue.

(ii)Adjusted EBITDA - a non-IFRS financial measure. A reconciliation of the Adjusted EBITDA to Net income (loss) is found under “Specified Financial Measures” section in this MD&A.

The key factors affecting the results of the three months ended January 31, 2024, were:

•Free cash flow positive – For the third consecutive quarter, the Company is free cash flow positive, ending the quarter with free cash flow of $3,608 which has been increased by 526% as compare to free cash flow of the same quarter of 2023. The increase was made possible through continued same-store sales growth, creating operating efficiencies, implementing strong cost controls, and diligent working capital management. Free cash flow is a non-IFRS measure prepared based on the calculation mentioned in “Specified Financial Measures" section of this document.

•Revenue – Revenue increased by 9% for the three months ended January 31, 2024, as compared to the three months ended January 31, 2023. The growth in revenue was largely driven by a shift in the retail pricing strategy, launch of the discount club model and organic growth. The growth in revenue has also been contributed by 10% increase in the number of stores from an average of 161 stores for the first quarter of 2024 versus 147 average stores in the same quarter of 2023.

•Gross profit margin – Gross profit margin remains consistent with 1% growth for the three months ended January 31, 2024, as compared to the three months ended January 31, 2023. As the Company continues to mature from the shift in its retail pricing strategy, gross profit margin is expected to remain consistent period over period.

•Operating expenses – Operating expenses, as a percentage of revenue, decreased by 5% to 26% during the three months ended January 31, 2024 as compared to 31% for the three months ended January 31, 2023. The decrease in operating expenses is driven by various initiatives of the Company to reduce expenditures where possible and implement more efficient cost-saving solutions without impacting revenue.

|

|

|

|

|

|

|

High Tide Inc. |

| Management's Discussion and Analysis |

| For the three months ended January 31, 2024 and 2023 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

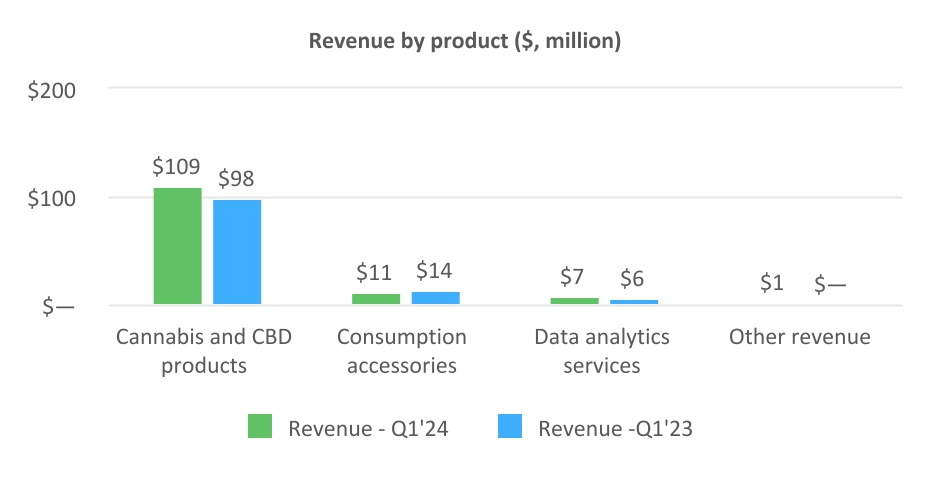

Revenue

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended January 31 |

|

|

|

|

2024 |

|

2023 |

|

Change |

|

|

|

|

|

|

|

|

$ |

|

$ |

|

∆ |

|

|

|

|

|

|

| Cannabis and CBD products |

|

108,908 |

|

97,542 |

|

12% |

|

|

|

|

|

|

| Consumption accessories |

|

11,378 |

|

13,828 |

|

(18)% |

|

|

|

|

|

|

| Data analytics services |

|

7,336 |

|

6,587 |

|

11% |

|

|

|

|

|

|

| Other revenue |

|

446 |

|

119 |

|

275% |

|

|

|

|

|

|

| Total revenue |

|

128,068 |

|

118,076 |

|

9% |

|

|

|

|

|

|

The revenue has increased by 9% to $128,068 in the first quarter of 2024 as compared to $118,076 for the same quarter of 2023.

The increase in revenue was primarily related to the combination of increase in number of stores in the bricks-and-mortar and overall organic growth in same-store sales. Total number of stores increased by 10% from an average of 147 branded retail stores in the first quarter of 2023 to 161 average stores in the first quarter of 2024. The new stores contributed $8,300 increase in revenue whereas organic growth of same-store revenue accounted for $6,600 which has been offset by reduction in revenue related to e-commerce sales ($5,900).

Canna Cabana provides a unique customer experience focused on retention and loyalty through the Cabana Club membership platform. Members of Cabana Club receive member-only pricing, through text messages, and email communications highlighting new and upcoming product arrivals, member-only events, and other special offers. The database communicates with highly relevant consumers who are segmented at the local level by delivering regular content that is specific to their local Canna Cabana. As of the date of this MD&A, over 1,310,000 members have joined Cabana Club, which is 34% more than the previous year members of Cabana Club (January 31, 2023: 975,000 members). The Company continued the rollout of ELITE, the first-of-its-kind cannabis paid loyalty program in Canada, with membership reaching approximately 32,000 as at the date of this MD&A, representing an increase of 237% year-over-year and 14% since January 29, 2024, which is the fastest pace of onboarding since ELITE was launched in late 2022.

Gross profit

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended January 31 |

|

|

|

|

2024 |

|

2023 |

|

Change |

|

|

|

|

|

|

|

|

$ |

|

$ |

|

∆ |

|

|

|

|

|

|

| Revenue |

|

128,068 |

|

|

118,076 |

|

|

9 |

% |

|

|

|

|

|

|

| Cost of sales |

|

92,074 |

|

|

85,895 |

|

|

7 |

% |

|

|

|

|

|

|

| Gross profit |

|

35,994 |

|

|

32,181 |

|

|

12 |

% |

|

|

|

|

|

|

For the three months ended January 31, 2024 gross profit increased by 12% to $35,994 from $32,181 in the same quarter of 2023.

The increase in gross profit was mainly driven by the increase in the number of stores from an average of 161 during the first quarter of 2024 as compared to the average of 147 stores in the first quarter of 2023, as well as 7% increase in same store sales.

|

|

|

|

|

|

|

High Tide Inc. |

| Management's Discussion and Analysis |

| For the three months ended January 31, 2024 and 2023 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

Operating expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended January 31 |

|

|

|

|

2024 |

|

2023 |

|

Change |

|

|

|

|

|

|

|

|

$ |

|

$ |

|

∆ |

|

|

|

|

|

|

| Salaries, wages and benefits |

|

15,903 |

|

|

14,302 |

|

|

11 |

% |

|

|

|

|

|

|

| Share-based compensation |

|

795 |

|

|

1,436 |

|

|

(45) |

% |

|

|

|

|

|

|

| General and administration |

|

5,606 |

|

|

7,497 |

|

|

(25) |

% |

|

|

|

|

|

|

| Professional fees |

|

2,071 |

|

|

2,428 |

|

|

(15) |

% |

|

|

|

|

|

|

| Advertising and promotion |

|

822 |

|

|

1,489 |

|

|

(45) |

% |

|

|

|

|

|

|

| Depreciation and amortization |

|

6,848 |

|

|

7,986 |

|

|

(14) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest and bank charges |

|

1,157 |

|

|

965 |

|

|

20 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

33,202 |

|

|

36,103 |

|

|

(8) |

% |

|

|

|

|

|

|

Total operating expenses decreased by 8% to $33,202 in the first quarter of 2024 (first quarter of 2023: $36,103). The total operating expenses, as a percentage of revenue, decreased to 26% compared to 31% for the three months ended January 31, 2023 due to the Company’s continued focus on implementing cost saving solutions that focus on efficiency without impacting quality.

Salaries, wages and benefits expenses increased by 11% to $15,903 in the first quarter of 2024 (2023: $14,302). The total salaries,wages and benefits expenses, as a percentage of revenue, consistent for the three months ended January 31, 2024. In terms of total headcount it has been increased by 4% from 1391 employees in the first quarter of 2023 to 1449 employees in the first quarter of 2024. The increase was mainly due to additional staffing related to corporate level personnel to facilitate the integration of previous acquisitions and to support the growth in the new store openings.

Share-based compensation decreased by 45% to $795 in the first quarter of 2024 (2023: $1,436). The total share-based compensation expenses, as a percentage of revenue, decreased to 0.6% compared to 1.2% for the three months ended January 31, 2023 The decrease in share-based compensation was mainly due to the inclusion of accounting for escrow shares which were recognized during the first quarter of 2023. The escrow shares were expired in the fiscal year of 2023 and has no impact during the three months ended January 31, 2024.

General and administration expenses decreased by 25% to $5,606 in the first quarter of 2024 (first quarter of 2023: $7,497). The total general and administration expenses, as a percentage of revenue, decreased by 2% for the three months ended January 31, 2024 as compared to the three months ended January 31, 2023. The decrease is primarily because of the effective cost controls established throughout the Company.

Professional fees expense decreased by 15% to $2,071 for the first quarter of 2024 (2023: $2,428). The total professional fees expenses, as a percentage of revenue, decreased to 1.6% compared to 2.1% three months ended January 31, 2023. The decrease is due to a reduction in the acquisition related activities during the current quarter of 2024 which is mainly offset by additional costs related to the professional services engaged to support the planning and implementing of various new initiatives across the Company.

Advertising and promotion expense decreased by 45% to $822 for the first quarter of 2024 (2023: $1,489). Management has performed detailed review of advertising and promotion expenses with the intent to remove any expenses that were redundant, added limited value in the e-commerce operations and as part of their changed strategy to move towards a centralized marketing approach for all segments. As a result, the total percentage of revenue, advertising and promotions expenses decreased to 0.6% in January 31, 2024 as compared to 1.3% in January 31, 2023.

Interest and bank charges increased by 20% to $1,157 for the first quarter of 2024 (2023: $965). The total interest and bank charges, as a percentage of revenue, remain consistent at 0.9% for the three months ended January 31, 2024. The increase in interest and bank charges is primarily due to increased merchant charges incurred through the normal course of business which is driven by sales volumes.

|

|

|

|

|

|

|

High Tide Inc. |

| Management's Discussion and Analysis |

| For the three months ended January 31, 2024 and 2023 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

ATM Program

Effective August 31, 2023, the Company has launched an offering of the 2023 ATM program to raise up to an additional $30,000 in capital to replace the previous ATM program. For the three months ended January 31, 2024, The Company issued 1,400 Common Shares for consideration of $3. Under the 2023 ATM program, the Company issued 1,057,261 Common Shares for consideration of $2,445 as at January 31, 2024.

The Company intends to use the net proceeds of the 2023 ATM Program, if any, and at the discretion of the Company, to fund strategic initiatives it is currently developing, to support the growth and development of the Company’s existing operations, funding future acquisitions as well as working capital and general corporate purposes.

Common Shares issued pursuant to the 2023 ATM Program will be issued pursuant to the 2023 ATM Prospectus Supplement to the Canadian Shelf Prospectus and U.S. Prospectus Supplement. The Canadian Prospectus Supplement and Canadian Shelf Prospectus are available for download from SEDAR+ at www.sedarplus.ca, and the U.S. Prospectus Supplement, U.S. Base Prospectus and Registration Statement are accessible via EDGAR on the SEC’s website at www.sec.gov.

The 2023 ATM Program is effective until the earlier of (i) the date that all Common Shares available for issue under the 2023 ATM Program have been sold, (ii) the date the Canadian Prospectus Supplement in respect of the 2023 ATM Program or Canadian Shelf Prospectus is withdrawn and (iii) the date that the 2023 ATM Program is terminated by the Company or Agents.

connectFirst Credit Facility

On August 15, 2022, the Company entered into a $19,000 demand term loan with connectFirst credit union (the "Credit Facility") with Tranche 1 - $12,100 available in a single advance, and Tranche 2 - $6,900 available in multiple draws subject to pre-disbursement conditions set. The demand loan bears interest at the Credit Union’s prime lending rate plus 2.50% per annum and is set to mature on September 5, 2027.

The first tranche, is repayable on demand, otherwise the connectFirst Credit Facility is repaid in monthly blended payments of principal and interest of $241. Blended payments may be adjusted from time to time, if necessary, based on connectFirst’s prime lending rate, the principal outstanding and amortization period remaining. On October 7, 2022, the Company received the inflow of funds for the first tranche. The purpose of the first tranche was to pay outstanding loans.

The second tranche is also repayable on demand, otherwise the connectFirst Credit Facility is repaid in monthly blended payments of principal and interest of $147. Blended payments may be adjusted from time to time, if necessary, on the basis of connectFirst prime lending rate, the principal outstanding and the amortization period remaining. On October 25, 2022, the Company received the inflow of funds for the second tranche Interest rate and terms (60 months) are the same as the first tranche. However, the purpose of the second tranche is to finance working capital and set up new organic stores.

In connection with the connectFirst Credit Facility, the Company provided:

a)A general security agreement comprising a first charge security interest over all present and after acquired personal property, registered at Personal Property Registry and provided an unlimited guarantee and postponement of claim granted by Canna Cabana (including supporting corporate documents);

b)A general security agreement comprising a first charge security interest over all present and after-acquired personal property, registered at Personal Property Registry and provided an unlimited guarantee and postponement of claim granted by Meta Growth (including supporting corporate documents);

c)A general security agreement comprising a first charge security interest over all present and after-acquired personal property, registered at Personal Property Registry and provided an unlimited guarantee and postponement of claim granted by 2680495 Ontario Inc. (including supporting corporate documents);

d)A general security agreement comprising a first charge security interest over all present and after-acquired personal property, registered at Personal Property Registry and provided an unlimited guarantee and postponement of claim granted by Valiant Distributions (including supporting corporate documents); and

e)A general security agreement comprising a first charge security interest over all present and after-acquired personal property, registered at the Personal Property Registry.

|

|

|

|

|

|

|

High Tide Inc. |

| Management's Discussion and Analysis |

| For the three months ended January 31, 2024 and 2023 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

Covenants attached to the loan:

a)The Company’s debt service coverage ratio shall be not less than 1.40:1, to be tested at the end of each fiscal quarter of the Company based on a trailing four-quarters basis using consolidated financial statements. As at January 31, 2024, the Company was in compliance with the debt service coverage ratio.

b)The Company shall at all times maintain in the Company’s account with connectFirst the greater of $7,500 and 50% of the aggregate debt of the Company to connectFirst. A five-business day cure period is permitted. Included in the Cash and cash equivalents is $7,900 held in the Company’s account with connectFirst.

c)The Company shall at all times maintain a current ratio of not less than 1.25:1, to be tested monthly using consolidated financial statements. As at January 31, 2024, the Company was in compliance with the current ratio.

d)The Company shall at all times maintain a funded debt to EBITDA ratio of not more than 3:1, to be tested quarterly on a consolidated basis beginning January 31, 2023. As at January 31, 2024, the Company was in compliance with the funded debt to EBITDA ratio.

As of January 31, 2024, the Company has met all the covenants attached to the loan.

Segment operations:

In the first quarter of 2024, the Company has changed its reporting segments to reflect its current operating structure. The reporting segments are now being reported in the following two operating segments:

1.Bricks-and-mortar operations which includes the Company’s Canadian bricks-and-mortar locations, inclusive of the Canadian warehouse which supports the distribution of accessories and other items to the Canadian stores. In addition, corporate overhead has been allocated to the reporting segment.

2.E-commerce operations which include the Company’s US and international subsidiaries, inclusive of the US warehouse which supports the distribution of accessories and other items to the US and international subsidiaries. In addition, corporate overhead has been allocated to the reporting segment

Corporate costs are allocated to each segment based on percentage of revenue.

These reporting segments of the Company have been identified because they are segments: (a) that engage in business activities from which revenues are earned and expenses are incurred; (b) whose operating results are regularly reviewed by the Company’s chief operating decision maker, identified as the Chief Executive Officer, to make decisions about the resources to be allocated to each segment and assess its performance; and (c) for which discrete financial information is available. In accordance with IFRS 8, the Company has reporting segments which are based on the similarity of goods and services provided and economic characteristics exhibited by the operating segments.

The audited consolidated financial statements of the Company for the year ended October 31, 2023, included three reporting segments as follows:

1.Retail operations which included both bricks-and-mortar and e-commerce operations, without the allocation of corporate overhead.

2.Wholesale operations which included both the Canadian and US warehouse.

3.Corporate operations which included all costs associated with the Company’s head office.

The accounting policies used for segment reporting are consistent with the accounting policies used for the preparation of the Company’s annual audited financial statements. The comparative information has been prepared in accordance with the current reporting segments noted above. There have been no changes to the underlying data used to prepare the comparative reporting segments for the prior year.

|

|

|

|

|

|

|

High Tide Inc. |

| Management's Discussion and Analysis |

| For the three months ended January 31, 2024 and 2023 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

The following is a representation of these operational segments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bricks-and-Mortar |

|

Bricks-and-Mortar |

|

E-commerce |

|

E-commerce |

|

Total |

|

Total |

| For the three months ended January 31, |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

| Total revenue |

|

115,701 |

|

|

99,764 |

|

|

12,367 |

|

|

18,312 |

|

|

128,068 |

|

|

118,076 |

|

| Gross profit |

|

30,911 |

|

|

23,408 |

|

|

5,083 |

|

|

8,773 |

|

|

35,994 |

|

|

32,181 |

|

| Income (loss) from operations |

|

2,955 |

|

|

(3,867) |

|

|

(163) |

|

|

(55) |

|

|

2,792 |

|

|

(3,922) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bricks-and-Mortar |

|

Bricks-and-Mortar |

|

E-commerce |

|

E-commerce |

|

Total |

|

Total |

| As at January 31, 2024 and October 31, 2023 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

| Current assets |

|

56,866 |

|

|

37,946 |

|

|

8,416 |

|

|

30,699 |

|

|

65,282 |

|

|

68,645 |

|

| Non-current assets |

|

125,195 |

|

|

125,951 |

|

|

36,831 |

|

|

38,805 |

|

|

162,026 |

|

|

164,756 |

|

| Current liabilities |

|

47,493 |

|

|

45,672 |

|

|

10,293 |

|

|

12,465 |

|

|

57,786 |

|

|

58,137 |

|

| Non-current liabilities |

|

27,616 |

|

|

36,834 |

|

|

1,811 |

|

|

4,764 |

|

|

29,427 |

|

|

41,598 |

|

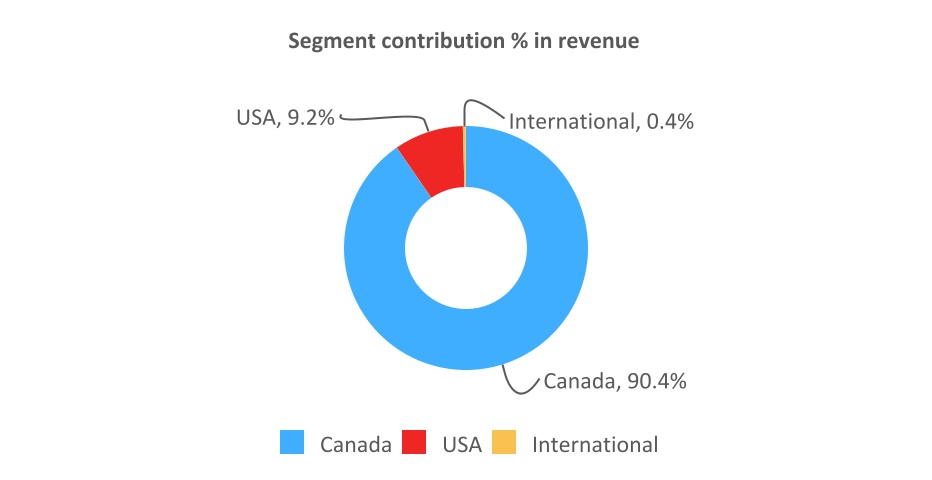

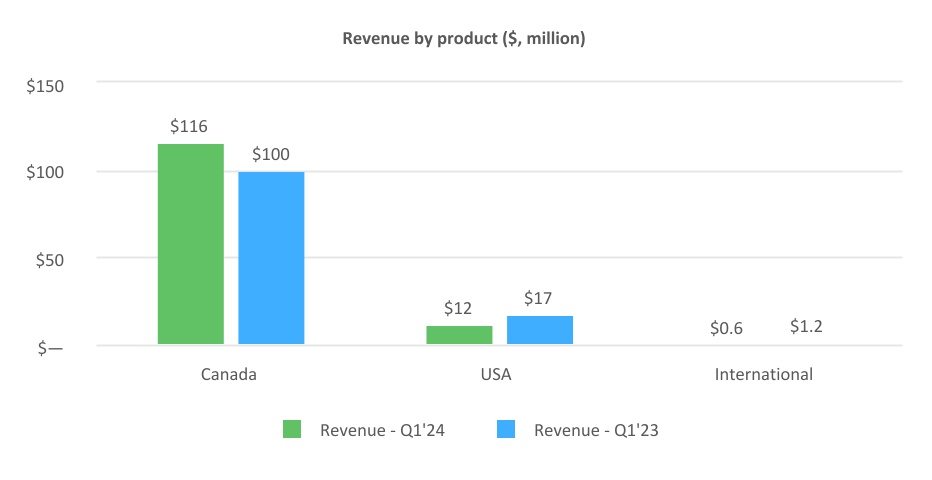

The geographical markets represent the performance based on the geographical locations of the customers who have contributed to the revenue.

The following is a representation of these geographical markets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Canada |

|

Canada |

|

USA |

|

USA |

|

International |

|

International |

|

Total |

|

Total |

| For the three months ended January 31, |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

| Total revenue |

|

115,701 |

|

|

99,764 |

|

|

11,815 |

|

|

17,071 |

|

|

552 |

|

|

1,241 |

|

|

128,068 |

|

|

118,076 |

|

| Gross profit |

|

30,916 |

|

|

23,407 |

|

|

4,751 |

|

|

8,210 |

|

|

327 |

|

|

564 |

|

|

35,994 |

|

|

32,181 |

|

| Income (loss) from operations |

|

2,485 |

|

|

(4,931) |

|

|

146 |

|

|

644 |

|

|

161 |

|

|

365 |

|

|

2,792 |

|

|

(3,922) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Canada |

|

Canada |

|

USA |

|

USA |

|

International |

|

International |

|

Total |

|

Total |

| As at January 31, 2024 and October 31, 2023 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

| Current assets |

|

59,859 |

|

|

55,787 |

|

|

5,323 |

|

|

11,386 |

|

|

100 |

|

|

1,472 |

|

|

65,282 |

|

|

68,645 |

|

| Non-current assets |

|

125,750 |

|

|

126,579 |

|

|

32,021 |

|

|

34,006 |

|

|

4,255 |

|

|

4,171 |

|

|

162,026 |

|

|

164,756 |

|

| Current liabilities |

|

51,758 |

|

|

50,968 |

|

|

5,817 |

|

|

5,958 |

|

|

211 |

|

|

1,211 |

|

|

57,786 |

|

|

58,137 |

|

| Non-current liabilities |

|

25,959 |

|

|

37,308 |

|

|

3,149 |

|

|

3,814 |

|

|

319 |

|

|

476 |

|

|

29,427 |

|

|

41,598 |

|

(i) Corporate overhead is allocated to bricks-and-mortar and e-commerce based on a percentage of revenue for the three months ended January 31, 2024 as 90% bricks-and-mortar and 10% e-commerce (2023 - 84% bricks-and-mortar and 16% e-commerce).

|

|

|

|

|

|

|

High Tide Inc. |

| Management's Discussion and Analysis |

| For the three months ended January 31, 2024 and 2023 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

Performance by segment:

Bricks-and-mortar performance

|

|

|

|

|

|

|

High Tide Inc. |

| Management's Discussion and Analysis |

| For the three months ended January 31, 2024 and 2023 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended January 31 |

|

|

|

2024 |

|

2023 |

|

Change |

|

|

|

|

|

|

|

$ |

|

$ |

|

∆ |

|

|

|

|

|

| Revenue |

|

115,701 |

|

|

99,764 |

|

|

16 |

% |

|

|

|

|

|

| Cost of goods sold |

|

84,790 |

|

|

76,356 |

|

|

11 |

% |

|

|

|

|

|

| Gross profit |

|

30,911 |

|

|

23,408 |

|

|

32 |

% |

|

|

|

|

|

| Gross profit margin |

|

27 |

% |

|

23 |

% |

|

4 |

% |

|

|

|

|

|

| Operating expenses |

|

27,956 |

|

|

27,275 |

|

|

3 |

% |

|

|

|

|

|

| Income (loss) from operations |

|

2,955 |

|

|

(3,867) |

|

|

176 |

% |

|

|

|

|

|

The Company’s bricks-and-mortar segment demonstrated significant sales growth with an increased revenue by 16% to $115,701 for the three months ended January 31, 2024 compared to the prior three months ended January 31, 2023 ($99,764). Revenue growth is primarily attributable to continued same-store sales growth, the Company’s shift in the retail pricing strategy, new stores build outs, from an average of 147 in the first quarter of 2023 to an average of 161 in the first quarter of 2024. During the three months ended January 31, 2024, and the corresponding quarter of the previous year, 141 stores were operational, and same store sales increased by 7%. This increase was partially offset by a drop in e-commerce sales ($6,000).

For the three months ended January 31, 2024 the Company recognized $7,336 in revenue generated from its proprietary data analytics service named 'Cabanalytics Business Data and Insights Platform' which is 11% higher than the same quarter results of 2023 $6,587. The Cabanalytics Business Data and Insights Platform provides subscribers with a monthly report of anonymized consumer purchase data, in order to assist them with forecasting and planning their future product decisions and implementing appropriate marketing initiatives.

Gross profit for the three months ended January 31, 2024, increased by 32% and the gross profit margin increased by 4% to 27%

whereas 23% was realized in the three months ended January 31, 2024. The slight increase in the gross profit margin was driven primarily by the increase in proprietary data analytics service revenues during fiscal 2024 compared to fiscal 2023, in addition management of the Company continued to focus on region specific pricing which allowed for increased margins at various stores which has supported the overall increase in margins for the quarter ended January 31, 2024.

E-commerce segment performance

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended January 31 |

|

|

|

|

2024 |

|

2023 |

|

Change |

|

|

|

|

|

|

|

|

$ |

|

$ |

|

∆ |

|

|

|

|

|

|

| Revenue |

|

12,367 |

|

|

18,312 |

|

|

(33) |

% |

|

|

|

|

|

|

| Cost of goods sold |

|

7,284 |

|

|

9,539 |

|

|

(24) |

% |

|

|

|

|

|

|

| Gross profit |

|

5,083 |

|

|

8,773 |

|

|

(42) |

% |

|

|

|

|

|

|

| Gross profit margin |

|

41 |

% |

|

48 |

% |

|

(7) |

% |

|

|

|

|

|

|

| Operating expenses |

|

5,246 |

|

|

8,828 |

|

|

(41) |

% |

|

|

|

|

|

|

| Loss from operations |

|

(163) |

|

|

(55) |

|

|

(196) |

% |

|

|

|

|

|

|

Revenues in the Company’s E-commerce segment decreased by 33% to $12,367 for the three months ended January 31, 2024 (three months ended January 31, 2023: $18,312). The decrease in revenue is a change in consumers preferences to purchase products in store rather than online which the Company has experienced since the release of COVID-19 restrictions.

For the period ended January 31, 2024, management of the company has engaged in an internal project to refine the E-commerce operations of the Company with a focus on top line growth while maintaining strong profit margins.

|

|

|

|

|

|

|

High Tide Inc. |

| Management's Discussion and Analysis |

| For the three months ended January 31, 2024 and 2023 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

Performance by geographical market

Geographical markets

Geographical markets represent revenue based on the geographical locations of the customers who have contributed to the revenue. The following is a representation of these geographical markets.

|

|

|

|

|

|

|

High Tide Inc. |

| Management's Discussion and Analysis |

| For the three months ended January 31, 2024 and 2023 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

The following presents information related to the Company’s geographical market.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Canada |

|

Canada |

|

USA |

|

USA |

|

International |

|

International |

|

Total |

|

Total |

| For the three months ended January 31 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

115,701 |

|

|

99,764 |

|

|

11,815 |

|

|

17,071 |

|

|

552 |

|

|

1,241 |

|

|

128,068 |

|

|

118,076 |

|

| Cost of goods sold |

|

84,785 |

|

|

76,357 |

|

|

7,064 |

|

|

8,861 |

|

|

225 |

|

|

677 |

|

|

92,074 |

|

|

85,895 |

|

| Gross profit |

|

30,916 |

|

|

23,407 |

|

|

4,751 |

|

|

8,210 |

|

|

327 |

|

|

564 |

|

|

35,994 |

|

|

32,181 |

|

| Gross profit margin |

|

27% |

|

23% |

|

40% |

|

48% |

|

59% |

|

45% |

|

27% |

|

23% |

| Operating expenses |

|

28,431 |

|

|

28,338 |

|

|

4,605 |

|

|

7,566 |

|

|

166 |

|

|

199 |

|

|

33,202 |

|

|

36,103 |

|

| Income (loss) from operations |

|

2,485 |

|

|

(4,931) |

|

|

146 |

|

|

644 |

|

|

161 |

|

|

365 |

|

|

2,792 |

|

|

(3,922) |

|

The Company continues to operate primarily in Canada with a focus on increasing the footprint across the Canadian provinces. During the three months ended January 31, 2024, the Company expanded the footprint in Canada by opening of 7 stores. As a result of the expansion and growth of same-store sales, revenues for the Canadian operations increased by 16% for the three months ended January 31, 2024.

Operations within the USA are made up of Company’s e-commerce platforms including Smoke Cartel, Grasscity, Daily High Club, DankStop, NuLeaf Naturals and FABCBD. During the first quarter of 2024, the Company has seen a decrease in revenue from these operations by 31% which has been attributed to consumer preferences to shop in store rather than online after the lifting of COVID-19 restrictions. The company continues to monitor the performance of their e-commerce platforms and are working on various initiatives to strengthen their performance during the year 2024.

Operations within the International space are made up of the Company’s e-commerce platform Blessed, as well as international sales on the aforementioned e-commerce platforms. Within the internal CBD and accessories space, the Company has seen the entrance of many new competitors which has impacted revenue growth leading to the decline in revenue by 56% since January 31, 2023.

Please note that under the revised segments, Canadian operations closely aligns with the bricks-and-mortar segment and US and international operations closely aligns with the e-commerce segments. Differences between the geographic regions and the segments is related to corporate overhead allocation which is incurred in Canada and allocated to each segment proportionally based on a percentage of revenues generated by each segment.

|

|

|

|

|

|

|

High Tide Inc. |

| Management's Discussion and Analysis |

| For the three months ended January 31, 2024 and 2023 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

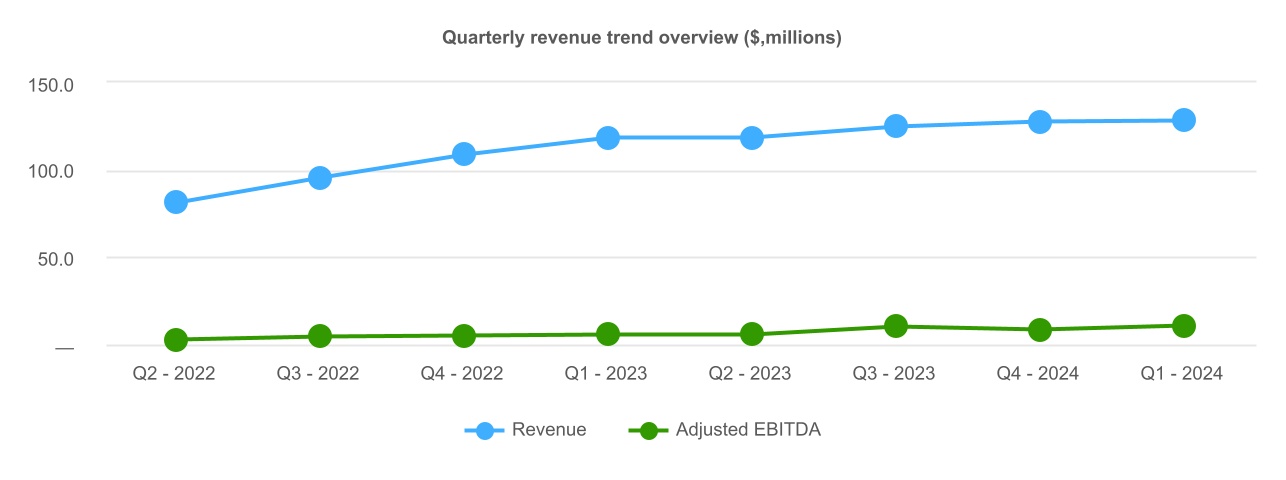

Summary of quarterly results:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2024 |

2023 |

2022 |

|

Q1 |

Q4 |

Q3 |

Q2 |

Q1 |

Q4 |

Q3 |

Q2 |

| Revenue |

128,068 |

|

127,105 |

|

124,352 |

|

118,136 |

|

118,076 |

|

108,249 |

|

95,354 |

|

81,031 |

|

Adjusted EBITDA (i) |

10,435 |

|

8,362 |

|

10,184 |

|

6,590 |

|

5,500 |

|

5,017 |

|

4,246 |

|

2,402 |

|

| Income (loss) from operations |

2,792 |

|

(34,204) |

|

(657) |

|

(2,642) |

|

(3,922) |

|

(53,916) |

|

(4,670) |

|

(7,585) |

|

| Net loss |

(5) |

|

(31,805) |

|

(3,717) |

|

(1,568) |

|

(3,862) |

|

(52,503) |

|

(2,717) |

|

(8,277) |

|

Basic and diluted loss per share (ii) |

— |

|

(0.39) |

|

(0.04) |

|

(0.02) |

|

(0.06) |

|

(0.85) |

|

(0.04) |

|

(0.14) |

|

(i) Adjusted EBITDA is a not a recognized measure under IFRS, and accordingly, the Company’s use of such term may not be comparable to similarly defined measures presented by other entities. A reconciliation of the Adjusted EBITDA to Net (Loss) income is found under “EBITDA and Adjusted EBITDA of “special Financial Measures” section in this MD&A.

The Company has continued its trend of quarter over quarter increases in revenues, experiencing 1% growth over Q4 2023 and 8% growth over the same period ended January 31, 2023. The Company continues to see strong Adjusted EBITDA results reaching $10,435 during the quarter ended January 31, 2024. This represents 16 consecutive quarters of positive EBITDA, and an 90% increase over the same period ended January 31, 2023.

Adjusted EBITDA increased by $4,935 for the three months ended January 31, 2024 compared to the same quarter of the prior year as a result of an increase in revenue due to opening of new stores and organic growth with same store sales increase of 7%, which is slightly offset by a decrease in revenue of the e-commerce business.

Specified financial measurements:

EBITDA and Adjusted EBITDA

The Company defines EBITDA and Adjusted EBITDA as per the table below. It should be noted that these performance measures are not defined under IFRS and may not be comparable to similar measures used by other entities. The Company believes that these measures are useful financial metrics as they assist in determining the ability to generate cash from operations. Investors should be cautioned that EBITDA and Adjusted EBITDA should not be construed as an alternative to net earnings or cash flows as determined under IFRS. Management defines “Adjusted EBITDA” as the net (loss) income for the period, before income tax (recovery) expense, accretion and interest expense, depreciation and amortization, and adjusted for foreign exchange (gain) losses, transaction and acquisition costs, (gain) loss on revaluation of put option liability, (gain) loss on extinguishment of debenture, impairment loss, share-based compensation, (gain) loss on revaluation of marketable securities and (gain) loss on extinguishment of financial liability.

|

|

|

|

|

|

|

High Tide Inc. |

| Management's Discussion and Analysis |

| For the three months ended January 31, 2024 and 2023 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

The reconciling items between net earnings, EBITDA, and Adjusted EBITDA are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2024 |

2023 |

2022 |

|

Q1 |

Q4 |

Q3 |

Q2 |

Q1 |

Q4 |

Q3 |

Q2 |

| Net loss |

(5) |

|

(31,805) |

|

(3,717) |

|

(1,568) |

|

(3,862) |

|

(52,503) |

|

(2,717) |

|

(8,277) |

|

| Income/deferred tax (recovery) expense |

(233) |

|

(4,571) |

|

204 |

|

(2,041) |

|

(1,236) |

|

- |

|

- |

|

- |

|

| Accretion and interest |

1,743 |

|

1,632 |

|

1,931 |

|

1,759 |

|

1,814 |

|

782 |

|

1,470 |

|

1,541 |

|

| Depreciation and amortization |

6,848 |

|

8,583 |

|

8,493 |

|

7,699 |

|

7,986 |

|

8,249 |

|

7,182 |

|

7,627 |

|

| EBITDA |

8,353 |

|

(26,161) |

|

6,911 |

|

5,849 |

|

4,702 |

|

(45,254) |

|

6,666 |

|

91 |

|

| Foreign exchange loss (gain) |

5 |

|

(152) |

|

31 |

|

2 |

|

(15) |

|

(14) |

|

120 |

|

107 |

|

| Transaction and acquisition costs |

515 |

|

691 |

|

801 |

|

435 |

|

664 |

|

2,444 |

|

1,014 |

|

669 |

|

| (Gain) loss revaluation of put option liability |

(300) |

|

544 |

|

73 |

|

(1,288) |

|

(1,261) |

|

(3,166) |

|

(6,078) |

|

(728) |

|

| Other loss |

755 |

|

37 |

|

18 |

|

- |

|

- |

|

- |

|

- |

|

- |

|

| Loss (gain) on extinguishment of debenture |

- |

|

- |

|

- |

|

- |

|

- |

|

609 |

|

(140) |

|

(133) |

|

| Impairment loss |

- |

|

34,265 |

|

- |

|

- |

|

- |

|

48,592 |

|

- |

|

- |

|

| Share-based compensation |

795 |

|

(284) |

|

2,350 |

|

1,532 |

|

1,436 |

|

2,091 |

|

1,734 |

|

2,353 |

|

| Loss (gain) on revaluation of marketable securities |

77 |

|

(13) |

|

- |

|

(19) |

|

(8) |

|

- |

|

- |

|

- |

|

| (Gain) loss on revaluation of debenture |

- |

|

(505) |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

| Loss (gain) on extinguishment of financial liability |

235 |

|

(60) |

|

- |

|

78 |

|

(18) |

|

- |

|

- |

|

- |

|

| Adjusted EBITDA |

10,435 |

|

8,362 |

|

10,184 |

|

6,590 |

|

5,500 |

|

5,302 |

|

3,316 |

|

2,359 |

|

Free Cash Flow

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q1 2024 |

|

Q4 2023 |

|

Q3 2023 |

|

Q2 2023 |

|

Q1 2023 |

| Operating cash flows |

|

6,873 |

|

|

9,637 |

|

|

7,545 |

|

|

1,365 |

|

|

2,114 |

|

| Sustaining capex |

|

(511) |

|

|

(1,080) |

|

|

(705) |

|

|

(625) |

|

|

(246) |

|

| Lease liability payments |

|

(2,754) |

|

|

(2,870) |

|

|

(2,789) |

|

|

(2,691) |

|

|

(2,715) |

|

| Free cash flows |

|

3,608 |

|

|

5,687 |

|

|

4,051 |

|

|

(1,951) |

|

|

(847) |

|

The Company defines free cash flows as net cash provided by operating activities, minus sustaining capex, minus lease liability payments. Sustaining Capex is defined as leasehold improvements and maintenance spend required in the existing business. The most directly comparable financial measure is net cash provided by operating activities, as disclosed in the consolidated statement of cash flows. It should not be viewed as a measure of liquidity or a substitute for comparable metrics prepared in accordance with IFRS.

Financial position, liquidity and capital resources:

Assets

As of January 31, 2024, the Company had a cash balance of $28,685 (October 31, 2023: $30,121).

Working capital including cash as of January 31, 2024, was a surplus of $7,496 (October 31, 2023: surplus $10,508). Working capital is a non-IFRS measure and is calculated as the difference between total current assets and total current liabilities. The change is mainly due to decrease in accounts payables, the settlement of convertible debentures and moving the Notes payable, with a maturity of December 31, 2024, from non-current liabilities to current liabilities. These transactions provide the Company enough liquidity for its working capital needs.

Total assets of the Company were $227,308 on January 31, 2024, compared to $233,401 on October 31, 2023.

|

|

|

|

|

|

|

High Tide Inc. |

| Management's Discussion and Analysis |

| For the three months ended January 31, 2024 and 2023 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

Liabilities

Total liabilities decreased to $87,213 as at January 31, 2024, compared to $99,735 as of October 31, 2023, primarily due to a decrease in long-term debt, accounts payable and accrued liabilities.

Summary of Outstanding Share Data

The Company had the following securities issued and outstanding as at the date of this MD&A:

|

|

|

|

|

|

|

|

|

Securities (i) |

|

Units Outstanding (ii) |

| Common shares |

|

78,557,281 |

|

| Warrants |

|

51,266,522 |

|

| Stock options |

|

3,600,135 |

|

| RSUs |

|

379,700 |

|

(i)Refer to the Financial Statements for a detailed description of these securities.

(ii)Securities outstanding are shown on post-consolidation basis. In connection with listing on the Nasdaq, on May 14, 2021, the Company underwent a 15:1 consolidation. As of January 31, 2024, 46,309,562 warrants with a 15:1 exercise right were outstanding.

Cash Flows

During the three months ended January 31, 2024, the Company's cash and cash equivalents decreased to $28,685 (2023: $30,121).

Total cash provided by operating activities was $6,873 for the three months ended January 31, 2024 (2023: $2,115 cash provided by operating activities). The increase in operating cash inflows is primarily driven by the continued increase in same-store sales, increase in revenue due to the Company’s bricks-and-mortar segment’s shift in the retail pricing strategy, the building of new stores in the period, and gross margin improvements within the bricks-and-mortar locations.

Cash used in investing activities for the three months ended January 31, 2024 was $2,076 (2023: cash used ($1,069) due to the opening of new stores. Cash used in financing activities for the three months ended January 31, 2024 was $6,196 (2023: $2,434) which is mainly related to the settlement of convertible debentures and payments of leases.

Liquidity

On August 15, 2022, the Company entered into a $19,000 demand term loan with connectFirst Credit Union (the “Credit Facility”) with the first tranche, $12,100, available in a single advance, and the second tranche, $6,900, available in multiple draws subject to certain pre-disbursement conditions. The demand loan bears interest at connectFirst’s prime lending rate plus 2.50% per annum and matures on September 5, 2027.

The first tranche is repaid in monthly blended payments of principal and interest of $241. Blended payments may be adjusted from time to time, if necessary, based on connectFirst’s prime lending rate, the principal outstanding, and amortization period remaining. On October 7, 2022, the Company received the inflow of funds for the first tranche.

The second tranche is repaid in monthly blended payments of principal and interest of $147. Blended payments may be adjusted from time to time, if necessary, based on connectFirst’s prime lending rate, the principal outstanding and amortization period remaining. On October 25, 2022, the Company received the inflow of funds for the second tranche.

|

|

|

|

|

|

|

High Tide Inc. |

| Management's Discussion and Analysis |

| For the three months ended January 31, 2024 and 2023 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

Capital Management

The Company’s objectives when managing capital resources are to:

(i)Explore profitable growth opportunities;

(ii)Deploy capital to provide an appropriate return on investment for shareholders;

(iii)Maintain financial flexibility to preserve the ability to meet financial obligations; and

(iv)Maintain a capital structure that provides financial flexibility to executed on strategic opportunities.

The Company’s strategy is formulated to maintain a flexible capital structure consistent with the objectives stated above as well to respond to changes in economic conditions and to the risks inherent in its underlying assets. The Board of Directors does not establish quantitative return on capital criteria for management, but rather promotes year‐over‐year sustainable profitable growth. The Company’s capital structure consists of equity and working capital. To maintain or alter the capital structure, the Company may adjust capital spending, take on new debt and issue share capital. The Company anticipates that it will have adequate liquidity to fund future working capital, commitments, and forecasted capital expenditures through a combination of cash flow, cash‐on‐hand and financings as required.

Off Balance Sheet Transactions

The Company does not have any financial arrangements that are excluded from the Financial Statements as of January 31, 2024, nor are any such arrangements outstanding as of the date of this MD&A.

Transactions between related parties:

As at January 31, 2024, the Company had the following transactions with related parties as defined in IAS 24 – Related Party Disclosures, except those pertaining to transactions with key management personnel in the ordinary course of their employment and/or directorship arrangements and transactions with the Company’s shareholders in the form of various financing.

Operational transactions

An office and warehouse unit has been developed by Grover Properties Inc., a company that is related through a common controlling shareholder and the President & CEO of the Company. The office and warehouse space were leased to High Tide to accommodate the Company’s operational expansion. The lease was established by an independent real estate valuations services company at prevailing market rates and has annual lease payments totaling $386 per annum. The primary lease term is 5 years with two additional 5-year term extensions exercisable at the option of the Company.

Financing transactions

On August 15, 2022, the Company entered into a $19,000 demand term loan with Connect First credit union (the "Credit Facility") with Tranche 1 - $12,100 available in a single advance, and Tranche 2 - $6,900 available in multiple draws subject to pre-disbursement conditions set. To facilitate the credit facility, the president and CEO of the Company provided limited Recourse Guarantee against $5,000 worth of High Tide Inc. shares held by the CEO, and affiliates, to be pledged in favor of the Credit Union until the earlier of:

(i) 12 months following initial funding, provided all covenants of High Tide Inc. are in good standing; and

(ii) The CEO no longer being an officer of High Tide Inc.

The parties agree that this personal guarantee will only be available after all collection efforts against High Tide Inc. have been exhausted, including the sale of High Tide Inc.

|

|

|

|

|

|

|

High Tide Inc. |

| Management's Discussion and Analysis |

| For the three months ended January 31, 2024 and 2023 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

Financial instruments:

The Company’s activities expose it to a variety of financial risks. The Company is exposed to credit, liquidity, interest and market risk due to holding certain financial instruments. This note presents information about changes to the Company’s exposure to each of these risks, its objectives, policies, and processes for measuring and managing risk, and its management of capital during the year. Further quantitative disclosure is included throughout these condensed interim consolidated financial statements. The Company’s overall risk management program focuses on the unpredictability of financial markets and seeks to minimize potential adverse effects on the Company’s financial performance.

Fair value

The Company classifies fair value measurements using a fair value hierarchy that reflects the significance of the inputs used in making the measurements. The fair value hierarchy has the following levels:

•Level 1 – Quoted prices (unadjusted) in active markets for identical assets and liabilities

•Level 2 – Inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly (i.e. as prices) or indirectly (i.e. derived from prices); and

•Level 3 – Inputs for the asset or liability that are not based on observable market data (unobservable inputs)

The Company assessed that the fair values of cash and cash equivalents, trade and other receivable, accounts payable and accrued liabilities, and current liabilities approximate their carrying amounts largely due to the short-term nature of these instruments.

The following methods and assumptions were used to estimate the fair value:

•Marketable securities are determined based on level 1 inputs, as the prices for the marketable securities are quoted in public exchanges.

•The Convertible debentures are evaluated by the Company based on level 2 inputs such as the effective interest rate and the market rates of comparable securities. The convertible debentures are initially measured at amortized cost and at each reporting period accretion incurred in the period is recorded to transaction costs in the consolidated statement of loss and comprehensive loss.

Credit risk

Credit risk arises when a party to a financial instrument will cause a financial loss for the counter party by failing to fulfill its obligation. The maximum exposure to credit risk is equal to the carrying value (net of allowances) of the financial assets. The objective of managing credit risk is to prevent losses on financial assets. The Company assesses the credit quality of counterparties, considering their financial position, past experience, and other factors. Cash and cash equivalents consist of bank balances. Credit risk associated with cash is minimized substantially by ensuring that these financial assets are held in highly rated financial institutions. The Company holds all cash and cash equivalents with large commercial banks or credit unions, which minimizes credit risk. The following table sets forth details of the aging profile of accounts receivable and the allowance for expected credit loss.

The following table sets forth details of the aging profile of accounts receivable and the allowance for expected credit loss:

|

|

|

|

|

|

|

High Tide Inc. |

| Management's Discussion and Analysis |

| For the three months ended January 31, 2024 and 2023 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| As at |

|

January 31, 2024 |

|

October 31, 2023 |

|

|

$ |

|

$ |

| Current (for less than 30 days) |

|

2,686 |

|

2,449 |

| 31 – 60 days |

|

172 |

|

1,234 |

| 61 – 90 days |

|

78 |

|

934 |

| Greater than 90 days |

|

1,365 |

|

3,390 |

| Less allowance |

|

(219) |

|

(536) |

|

|

4,082 |

|

7,471 |

Accounts receivable consist primarily of accounts receivable from invoicing for products and services rendered. The Company’s credit risk arises from the possibility that a customer which owes the Company money is unable or unwilling to meet its obligations in accordance with the terms and conditions in the contracts with the Company, which would result in a financial loss for the Company. This risk is mitigated through established credit management techniques, including monitoring customer’s creditworthiness, setting exposure limits and monitoring exposure against these customer credit limits.

For the three months ended January 31, 2024, $2 (three months ended January 31, 2023: $380) in trade receivables were written off against the loss allowance due to bad debts and $773 (2023 - nil) was written off directly to bad debts. Individual receivables which are known to be uncollectible are written off by reducing the carrying amount directly. The remaining accounts receivable are evaluated by the Company based on parameters such as interest rates, specific country risk factors, and individual creditworthiness of the customer. Based on this evaluation, allowances are taken into account for the estimated losses of these receivables.

The Company performs a regular assessment of collectability of accounts receivables. In determining the expected credit loss amount, the Company considers the customer’s financial position, payment history and economic conditions.

Liquidity risk

Liquidity risk is the risk that the Company will not be able to meet its financial obligations as they fall due. The Company’s objective in managing liquidity risk is to maintain sufficient readily available reserves in order to meet its liquidity requirements at any point in time. The Company generally relies on funds generated from operations, equity and debt financing to provide sufficient liquidity to meet budgeted operating requirements and to supply capital to expand its operations. The Company continues to seek capital to meet current and future obligations as they come due. The Company’s ability to manage its liquidity risk going forward will require some or all of the following: the ability to generate positive cash flows from operations and to secure capital or credit facilities on reasonable terms.

Maturities of the Company’s financial liabilities are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contractual Cash Flows |

|

Less than one year |

|

1-3 years |

|

4-5 years |

|

Greater than 5 years |

|

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

| October 31, 2023 |

|

|

|

|

|

|

|

|

|

|

| Accounts payable and accrued liabilities |

|

20,902 |

|

20,902 |

|

- |

|