Document

ANNUAL INFORMATION FORM

of

ERO COPPER CORP.

Suite 1050 – 625 Howe Street

Vancouver, British Columbia

V6C 2T6

Telephone: (604) 449-9244

Facsimile: (604) 398-3767

Website: www.erocopper.com

E-mail: info@erocopper.com

For the Year Ended December 31, 2023

Dated: March 7, 2024

TABLE OF CONTENTS

PRELIMINARY NOTES

Date of Information

In this Annual Information Form (“AIF”), Ero Copper Corp., together with its subsidiaries, as the context requires, is referred to as “Ero”, “Ero Copper” or the “Company”. All information contained herein is presented as at December 31, 2023, unless otherwise stated.

Currency

All dollar amounts in this AIF are expressed in Canadian dollars, except as otherwise indicated. References to “$” or “dollars” are to Canadian dollars, references to “US$” and “USD” are to US dollars and references to “R$” and “BRL” are to Brazilian Reais.

Cautionary Note Regarding Forward Looking Statements

This AIF contains “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of applicable Canadian securities legislation (collectively, “forward-looking statements”). Forward-looking statements include statements that use forward-looking terminology such as “may”, “could”, “would”, “will”, “should”, “intend”, “target”, “plan”, “guidance”, “strategy”, “model”, “expect”, “budget”, “estimate”, “forecast”, “schedule”, “anticipate”, “believe”, “continue”, “potential”, “view”, “assume” or the negative or grammatical variation thereof or other variations thereof or comparable terminology. Forward-looking statements may include, but are not limited to, statements with respect to Mineral Reserve and Mineral Resource (as defined below) estimates; targeting additional Mineral Resources and expansion of deposits; capital and operating cost estimates and economic analyses (including cash flow projections), including those from the Caraíba Operations Technical Report (as defined below), the Xavantina Operations Technical Report (as defined below) and the Tucumã Project Technical Report (as defined below); the Company’s expectations, strategies and plans for the Caraíba Operations (as defined below), the Xavantina Operations (as defined below) and the Tucumã Project (as defined below), including the Company’s planned exploration, development, construction and production activities; the results of future exploration and drilling; estimated completion dates for certain milestones; successfully adding or upgrading Mineral Resources and successfully developing new deposits; the costs and timing of current and future exploration, development and construction including but not limited to the Deepening Extension Project (as defined below) at the Caraíba Operations and the Tucumã Project; the timing and amount of future production at the Caraíba Operations, the Tucumã Project and the Xavantina Operations; the timing, receipt and maintenance of necessary approvals, licenses and permits from applicable governments, regulators or third parties; expectations regarding consumption, demand and future price of copper, gold and other metals; future financial or operating performance and condition of the Company and its business, operations and properties, including expectations regarding liquidity, capital structure, competitive position and payment of dividends; the possibility of entering judgments outside of Canada; expectations regarding future currency exchange rates; and any other statement that may predict, forecast, indicate or imply future plans, intentions, levels of activity, results, performance or achievements.

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual results, actions, events, conditions, performance or achievements to materially differ from those expressed or implied by the forward-looking statements, including, without limitation, risks related to:

•copper and gold prices are volatile and may be lower than expected;

•mining operations are risky;

•mining operations require geologic, metallurgic, engineering, title, environmental, economic and financial assessments that may be materially incorrect and thus the Company may not produce as expected;

•geotechnical, hydrological and climatic events could suspend mining operations or increase costs;

•actual production, capital and operating costs may be different than those anticipated;

•the Company’s financial performance and results of operations are currently dependent on the Caraíba Operations;

•infectious diseases may affect the Company’s business and operations;

•changes in climate conditions may affect the Company’s operations;

•currency fluctuations can result in unanticipated losses;

•the successful operation of the Caraíba Operations and the Xavantina Operations and the successful development, construction and operation of the Tucumã Project depend on the skills of the Company’s management and teams;

•operations during mining cycle peaks are higher cost;

•title to the Caraíba Operations, the Xavantina Operations and/or the Tucumã Project may be disputed;

•the Company may fail to comply with the law or may fail to obtain or renew necessary permits and licenses;

•the failure of a tailings dam could negatively impact the Company’s business, reputation and results of operations;

•compliance with environmental regulations can be costly;

•social and environmental activism can negatively impact exploration, development, construction and mining activities;

•the construction and start-up of new mines and projects at existing mines is subject to a number of factors and the Company may not be able to successfully complete new construction projects;

•land reclamation and mine closure requirements may be burdensome and costly;

•the mining industry is intensely competitive;

•inadequate infrastructure may constrain mining operations;

•operating cash flow may be insufficient for future needs;

•fluctuations in the market prices and availability of commodities and equipment affect the Company’s business;

•the Company is subject to restrictive covenants that limit its ability to operate its business;

•the Company’s indebtedness could adversely affect its financial condition and prevent the Company from fulfilling its obligations under debt instruments;

•the Company may not be able to generate sufficient cash to service all of its indebtedness and may be forced to take other actions to satisfy its obligations under such indebtedness, which may not be successful;

•counterparties may default on their contractual obligations to the Company;

•a failure to maintain satisfactory labour relations can adversely impact the Company;

•the Company’s insurance coverage may be inadequate to cover potential losses;

•it may be difficult to enforce judgments and effect service of process on directors, officers and experts named herein;

•the directors and officers may have conflicts of interest with the Company;

•future acquisitions may require significant expenditures and may result in inadequate returns;

•disclosure and internal control deficiencies may adversely affect the Company;

•failures of information systems or information security threats can be costly;

•the Company may be subject to costly legal proceedings;

•the Company may be subject to shareholder activism;

•product alternatives may reduce demand for the Company’s products;

•a lowering or withdrawal of the ratings assigned to the Company’s debt securities by rating agencies may increase the Company’s future borrowing costs and reduce its access to capital;

•the Company’s Brazilian operations are subject to political and other risks associated with operating in a foreign jurisdiction;

•the Company may be negatively impacted by changes to mining laws and regulations;

•a failure to maintain relationships with the communities in which the Company operates and other stakeholders may adversely affect the Company’s business;

•inaccuracies, corruption and fraud in Brazil relating to ownership of real property may adversely affect the Company’s business;

•the Company is exposed to the possibility that applicable taxing authorities could take actions that result in increased tax or other costs that might reduce the Company’s cash flow;

•inflation in Brazil, along with Brazilian governmental measures to combat inflation, may have a significant negative effect on the Brazilian economy and also on the Company's financial condition and results of operations;

•foreign exchange rate instability may have a material adverse effect on the Brazilian economy;

•the Company’s operations may be impaired as a result of restrictions to the acquisition or use of rural properties by foreign investors or Brazilian companies under foreign control;

•recent disruptions in international and domestic capital markets may lead to reduced liquidity and credit availability for the Company;

•the Company may be responsible for corruption and anti-bribery law violations;

•investors may lose their entire investment;

•dilution from equity financing could negatively impact holders of the common shares of the Company

(the “Common Shares”);

•equity securities are subject to trading and volatility risks;

•sales by existing shareholders can reduce share prices;

•the Company does not currently intend to pay dividends;

•public companies are subject to securities class action litigation risk;

•if securities or industry analysts do not publish research or publish inaccurate or unfavourable research about the Company’s business, the price and trading volume of the Common Shares could decline; and

•global financial conditions can reduce the price of the Common Shares.

This list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements. Although the Company has attempted to identify important factors that could cause actual results, actions, events, conditions, performance or achievements to differ materially from those contained in forward-looking statements, there may be other factors that cause results, actions, events, conditions, performance or achievements to differ from those anticipated, estimated or intended.

Forward-looking statements are not a guarantee of future performance. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements involves statements about the future and are inherently uncertain, and the Company’s actual results, achievements or other future events or conditions may differ materially from those reflected in the forward-looking statements due to a variety of risks, uncertainties and other factors, including, without limitation, those referred to in this AIF under the heading “Risk Factors”.

The Company’s forward-looking statements are based on the assumptions, beliefs, expectations and opinions of management on the date the statements are made, many of which may be difficult to predict and beyond the Company’s control.

In connection with the forward-looking statements contained in this AIF, the Company has made certain assumptions about, among other things: continued effectiveness of the measures taken by the Company to mitigate the possible impact of COVID-19 on its workforce and operations; favourable equity and debt capital markets; the ability to raise any necessary additional capital on reasonable terms to advance the production, development, construction and exploration of the Company’s properties and assets; future prices of copper, gold and other metal prices; the timing and results of exploration and drilling programs; the accuracy of any Mineral Reserve and Mineral Resource estimates; the geology of the Caraíba Operations, the Xavantina Operations and the Tucumã Project being as described in the Caraíba Operations Technical Report, the Xavantina Operations Technical Report and the Tucumã Project Technical Report, respectively; production costs; the accuracy of budgeted exploration, development and construction costs and expenditures; the price of other commodities such as fuel; future currency exchange rates and interest rates; operating conditions being favourable such that the Company is able to operate in a safe, efficient and effective manner; work force continuing to remain healthy in the face of prevailing epidemics, pandemics or other health risks (including COVID-19), political and regulatory stability; the receipt of governmental, regulatory and third party approvals, licenses and permits on favourable terms; obtaining required renewals for existing approvals, licenses and permits on favourable terms; requirements under applicable laws; sustained labour stability; stability in financial and capital goods markets; availability of equipment; positive relations with local groups and the Company’s ability to meet its obligations under its agreements with such groups; and satisfying the terms and conditions of the Company’s current loan arrangements. Although the Company believes that the assumptions inherent in forward-looking statements are reasonable as of the date of this AIF, these assumptions are subject to significant business, social, economic, political, regulatory, competitive and other risks and uncertainties, contingencies and other factors that could cause actual actions, events, conditions, results, performance or achievements to be materially different from those projected in the forward-looking statements. The Company cautions that the foregoing list of assumptions is not exhaustive. Other events or circumstances could cause actual results to differ materially from those estimated or projected and expressed in, or implied by, the forward-looking statements contained in this AIF.

Forward-looking statements contained herein are made as of the date of this AIF and the Company disclaims any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or results or otherwise, except as and to the extent required by applicable securities laws.

Scientific and Technical Information

Except as set out below, scientific and technical information contained in this AIF relating to the Company’s mining operations located within the Curaçá Valley, northeastern Bahia State, Brazil (the “Caraíba Operations” and formerly known as the MCSA Mining Complex), is derived from, and in some instances is a direct extract from, and based on the assumptions, qualifications and procedures set out in, the report prepared in accordance with National Instrument 43-101, Standards of Disclosure for Mineral Projects (“NI 43-101”) and entitled “2022 Mineral Resources and Mineral Reserves of the Caraíba Operations, Curaçá Valley, Bahia, Brazil”, dated December 22, 2022 with an effective date of September 30, 2022, prepared by Porfirio Cabaleiro Rodriguez, FAIG, Bernardo Horta de Cerqueira Viana, FAIG, Fábio Valério Câmara Xavier, MAIG and Ednie Rafael Moreira de Carvalho Fernandes, MAIG all of GE21 Consultoria Mineral Ltda. (“GE21”), Dr. Beck Nader, FAIG of BNA Mining Solutions (“BNA”) and Alejandro Sepulveda, Registered Member (#0293) (Chilean Mining Commission) of NCL Ingeniería y Construcción SpA (“NCL”) (the “Caraíba Operations Technical Report”). Each of Porfirio Cabaleiro Rodriguez, FAIG, Bernardo Horta de Cerqueira Viana, FAIG, Fábio Valério Câmara Xavier, MAIG, Ednie Rafael Moreira de Carvalho Fernandes, MAIG, Dr. Beck Nader, FAIG and Alejandro Sepulveda, Registered Member (#0293) (Chilean Mining Commission), reviewed and approved the scientific and technical information relating to the Caraíba Operations contained in this AIF, other than under the heading “Caraíba Operations – Updated Information with respect to the Caraíba Operations”, and is a “qualified person” (“QP” or “Qualified Person”) and “independent” of the Company within the meanings of NI 43-101. Information of a scientific and technical nature in respect of the Caraíba Operations set out in the AIF under the heading “Caraíba Operations – Updated Information with respect to the Caraíba Operations”, has been reviewed and approved by Cid Gonçalves Monteiro Filho, SME RM (04317974), MAIG (No. 8444), FAusIMM (No. 3219148) and Resource Manager of the Company. Mr. Gonçalves is a “qualified person” within the meanings of NI 43-101.

Except as set out below, scientific and technical information contained in this AIF relating to the Company’s mining operations located approximately 18 km west of the town of Nova Xavantina, southeastern Mato Grosso State, Brazil (the “Xavantina Operations” and formerly known as the “NX Gold Mine”), is derived from, and in some instances is a direct extract from, and based on the assumptions, qualifications and procedures set out in, the report prepared in accordance with NI 43-101 and entitled “Technical Report on the Xavantina Operations, Mato Grosso, Brazil”, dated May 12, 2023 with an effective date of October 31, 2022, prepared by Porfirio Cabaleiro Rodriguez, FAIG, Leonardo de Moraes Soares, MAIG and Guilherme Gomides Ferreira, MAIG, all of GE21 (the “Xavantina Operations Technical Report”). Each of Porfirio Cabaleiro Rodriguez, FAIG, Leonardo de Moraes Soares, MAIG and Guilherme Gomides Ferreira, MAIG, reviewed and approved the scientific and technical information relating to the Xavantina Operations contained in this AIF, other than under the heading “Xavantina Operations – Updated Information with respect to the Xavantina Operations”, and is a “qualified person” and “independent” of the Company within the meanings of NI 43-101. Information of a scientific and technical nature in respect of the Xavantina Operations set out in the AIF under the heading “Xavantina Operations – Updated Information with respect to the Xavantina Operations”, has been reviewed and approved by Cid Gonçalves Monteiro Filho, SME RM (04317974), MAIG (No.

8444), FAusIMM (No. 3219148) and Resource Manager of the Company, who is a “qualified person” within the meanings of NI 43-101.

Scientific and technical information contained in this AIF relating to the Tucumã Project, which is located within southeastern Pará State, Brazil (referred to herein as the “Tucumã Project” or by its former name, the “Boa Esperança Project”), is derived from, and in some instances is a direct extract from, and based on the assumptions, qualifications and procedures set out in, the report prepared in accordance with NI 43-101 and entitled “Boa Esperança Project NI 43-101 Technical Report on Feasibility Study Update”, dated November 12, 2021 with an effective date of August 31, 2021, prepared by Kevin Murray, P. Eng., Erin L. Patterson, P.E. and Scott C. Elfen, P.E. all of Ausenco Engineering Canada Inc. (or its affiliate Ausenco Engineering USA South Inc. in the case of Ms. Patterson) (collectively, “Ausenco”), Carlos Guzmán, FAusIMM RM CMC of NCL and Emerson Ricardo Re, MSc, MBA, MAusIMM (CP) (No. 305892), Registered Member (No. 0138) (Chilean Mining Commission) and Resource Manager of the Company on the date of the report (now of HCM Consultoria Geologica Eireli (“HCM”)) (the “Tucumã Project Technical Report”). Each of Kevin Murray, P. Eng., Erin L. Patterson, P.E. and Scott C. Elfen, P.E., Carlos Guzmán, FAusIMM RM CMC and Emerson Ricardo Re, MAusIMM (CP), reviewed and approved the scientific and technical information relating to the Tucumã Project contained in this AIF, and is a “qualified person” of the Company within the meanings of NI 43-101. Each of Kevin Murray, P. Eng., Erin L. Patterson, P.E., Scott C. Elfen, P.E., and Carlos Guzmán, FAusIMM RM CMC are “independent” of the Company within the meaning of NI 43-101. Emerson Ricardo Re, MAusIMM (CP), as Resource Manager of the Company (on the date of the report and now of HCM), was not “independent” of the Company on the date of the report, within the meaning of NI 43-101.

Reference should be made to the full text of the Caraíba Operations Technical Report, the Xavantina Operations Technical Report and the Tucumã Project Technical Report, each of which is available for review on the Company’s website at www.erocopper.com and under the Company’s profile on SEDAR+ at www.sedarplus.ca/landingpage/ and on EDGAR at www.sec.gov.

CIM Definition Standards

The Mineral Reserves and Mineral Resources for the Caraíba Operations (including as used in the Caraíba Operations Technical Report), the Xavantina Operations (including as used in the Xavantina Operations Technical Report) and the Tucumã Project (including as used in the Tucumã Project Technical Report) have been estimated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Definition Standards for Mineral Resources and Mineral Reserves adopted by the CIM Council on May 19, 2014 (the “CIM Standards” or “CIM Definition Standards”) and the CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines, adopted by CIM Council on November 29, 2019 (the “CIM Guidelines”), which are incorporated by reference in NI 43-101. The following definitions are reproduced from the CIM Definition Standards:

“Feasibility Study” means a comprehensive technical and economic study of the selected development option for a mineral project that includes appropriately detailed assessments of applicable Modifying Factors together with any other relevant operational factors and detailed financial analysis that are necessary to demonstrate, at the time of reporting, that extraction is reasonably justified (economically mineable). The results of the study may reasonably serve as the basis for a final decision by a proponent or financial institution to proceed with, or finance, the development of the project. The confidence level of the study will be higher than that of a Pre-Feasibility Study.

“Indicated Mineral Resource” means that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics are estimated with sufficient confidence to allow the application of Modifying Factors as described below in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Geological evidence is derived from adequately detailed and reliable exploration, sampling and testing and is sufficient to assume geological and grade or quality continuity between points of observation. An Indicated Mineral Resource has a lower level of confidence than that applying to a Measured Mineral Resource and may only be converted to a Probable Mineral Reserve.

“Inferred Mineral Resource” means that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

“Measured Mineral Resource” means that part of a Mineral Resource for which quantity, grade or quality, densities, shape, and physical characteristics are estimated with confidence sufficient to allow the application of Modifying Factors to support detailed mine planning and final evaluation of the economic viability of the deposit. Geological evidence is derived from detailed and reliable exploration, sampling and testing and is sufficient to confirm geological and grade or quality continuity between points of observation. A Measured Mineral Resource has a higher level of confidence than that applying to either an Indicated Mineral Resource or an Inferred Mineral Resource.

It may be converted to a Proven Mineral Reserve or to a Probable Mineral Reserve.

“Mineral Reserve” means the economically mineable part of a Measured and/or Indicated Mineral Resource. It includes diluting materials and allowances for losses, which may occur when the material is mined or extracted and is defined by studies at pre-feasibility or feasibility level as appropriate that include application of Modifying Factors. Such studies demonstrate that, at the time of reporting, extraction could reasonably be justified. The reference point at which Mineral Reserves are defined, usually the point where the ore is delivered to the processing plant, must be stated. It is important that, in all situations where the reference point is different, such as for a saleable product, a clarifying statement is included to ensure that the reader is fully informed as to what is being reported. The public disclosure of a Mineral Reserve must be demonstrated by a Pre-Feasibility Study or Feasibility Study.

“Mineral Resource” means a concentration or occurrence of solid material of economic interest in or on the Earth’s crust in such form, grade or quality and quantity that there are reasonable prospects for eventual economic extraction. The location, quantity, grade or quality, continuity and other geological characteristics of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge, including sampling.

“Pre-Feasibility Study” means a comprehensive study of a range of options for the technical and economic viability of a mineral project that has advanced to a stage where a preferred mining method, in the case of underground mining, or the pit configuration, in the case of an open pit, is established and an effective method of mineral processing is determined. It includes a financial analysis based on reasonable assumptions on the Modifying Factors and the evaluation of any other relevant factors which are sufficient for a qualified person, acting reasonably, to determine if all or part of the Mineral Resource may be converted to a Mineral Reserve at the time of reporting. A Pre-Feasibility Study is at a lower confidence level than a Feasibility Study.

“Probable Mineral Reserve” means the economically mineable part of an Indicated, and in some circumstances, a Measured Mineral Resource. The confidence in the Modifying Factors applying to a Probable Mineral Reserve is lower than that applying to a Proven Mineral Reserve.

“Proven Mineral Reserve” means the economically mineable part of a Measured Mineral Resource. A Proven Mineral Reserve implies a high degree of confidence in the Modifying Factors.

For the purposes of the CIM Definition Standards, “Modifying Factors” are considerations used to convert Mineral Resources to Mineral Reserves. These include, but are not restricted to, mining, processing, metallurgical, infrastructure, economic, marketing, legal, environmental, social and governmental factors.

Cautionary Notes Regarding Mineral Resource and Mineral Reserve Estimates

Unless otherwise indicated, all reserve and resource estimates included in this AIF and the documents incorporated by reference herein have been prepared in accordance with NI 43-101 and the CIM Standards. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Canadian standards, including NI 43-101, differ significantly from the requirements of the United States Securities and Exchange Commission (the “SEC”), and reserve and resource information included herein may not be comparable to similar information disclosed by U.S. companies. In particular, and without limiting the generality of the foregoing, this AIF and the documents incorporated by reference herein use the terms “measured resources,” “indicated resources” and “inferred resources” as defined in accordance with NI 43-101 and the CIM Standards.

Further to recent amendments, mineral property disclosure requirements in the United States (the “U.S. Rules”) are governed by subpart 1300 of Regulation S-K of the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”) which differ from the CIM Standards. As a foreign private issuer that is eligible to file reports with the SEC pursuant to the multi-jurisdictional disclosure system (the “MJDS”), Ero is not required to provide disclosure on its mineral properties under the U.S. Rules and will continue to provide disclosure under NI 43-101 and the CIM Standards. If Ero ceases to be a foreign private issuer or loses its eligibility to file its annual report on Form 40-F pursuant to the MJDS, then Ero will be subject to the U.S. Rules, which differ from the requirements of NI 43-101 and the CIM Standards.

Pursuant to the new U.S. Rules, the SEC recognizes estimates of “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources”. In addition, the definitions of “proven mineral reserves” and “probable mineral reserves” under the U.S. Rules are now “substantially similar” to the corresponding standards under NI 43-101. Mineralization described using these terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly, U.S. investors are cautioned not to assume that any measured mineral resources, indicated mineral resources, or inferred mineral resources that Ero reports are or will be economically or legally mineable. Further, “inferred mineral resources” have a greater amount of uncertainty as to their existence and as to whether they can be mined legally or economically.

Under Canadian securities laws, estimates of “inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies, except in rare cases. While the above terms under the U.S. Rules are “substantially similar” to the standards under NI 43-101 and CIM Standards, there are differences in the definitions under the U.S. Rules and CIM Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that Ero may report as “proven mineral reserves”, “probable mineral reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 would be the same had Ero prepared the reserve or resource estimates under the standards adopted under the U.S. Rules.

Alternative Performance (Non-IFRS) Measures

Financial results of the Company are prepared in accordance with the International Financial Reporting Standards (“IFRS”). The Company utilizes certain performance measures to monitor its performance, including copper C1 cash cost, copper C1 cash cost including foreign exchange hedges, realized copper price, gold C1 cash cost, gold all-in sustaining cost (“AISC”), realized gold price, earnings before interest, taxes, depreciation and amortization (“EBITDA”), adjusted EBITDA, adjusted net income attributable to owners of the Company, adjusted net income per share, net (cash) debt, working capital and available liquidity. These performance measures have no standardized meaning prescribed within generally accepted accounting principles under IFRS and, therefore, amounts presented may not be comparable to similar measures presented by other mining companies. These non-IFRS measures are intended to provide supplemental information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. The reader is directed to the Management’s Discussion and Analysis of the Company for the years ended December 31, 2023 (see “Alternative Performance (Non-IFRS) Measures” section) for a reconciliation of these non-IFRS measures to the most directly comparable IFRS measures as contained in the Company’s audited consolidated financial statements for the year ended December 31, 2023 and 2022. Unless otherwise noted, the non-IFRS measures presented herein have been calculated on a consistent basis for the periods presented.

Copper C1 Cash Cost and Copper C1 Cash Cost including Foreign Exchange Hedges

Copper C1 cash cost and copper C1 cash cost including foreign exchange hedges are non-IFRS performance measures used by the Company to manage and evaluate the performance of its copper mining operations.

Copper C1 cash cost is calculated as C1 cash costs divided by total pounds of copper produced during the period. C1 cash costs comprise the total cost of production, including expenses related to transportation, treatment and refining charges, as well as realized gains or losses on foreign exchange hedges. These costs are net of by-product credits, incentive payments and certain tax credits relating to sales invoiced to the Company's Brazilian customer. Copper C1 cash cost is widely reported in the mining industry as benchmarks for performance but does not have a standardized meaning and is disclosed in supplement to IFRS measures.

Copper C1 cash cost including foreign exchange hedges is calculated as C1 cash costs, adjusted for realized gains or losses from its operational foreign exchange hedges, divided by total pounds of copper produced during the period. Although the Company does not apply hedge accounting in its consolidated financial statements and recognizes these contracts at fair value through profit or loss, the Company believes it appropriate to present cash costs including the impact of realized gains and losses as these contracts were entered into to mitigate the impact of changes in exchange rates.

In light of changes to the Caraíba Operations' copper concentrate sales channels, effective in the fourth quarter of 2023, freight parity charged by its customers is presented as part of treatment, refining and other costs within the calculation of C1 cash costs. This charge was previously presented as a reduction of realized copper price.

Realized Copper Price

Realized copper price is a non-IFRS ratio that is calculated as gross copper revenue divided by pounds of copper sold during the period. Management believes measuring realized copper price enables investors to better understand performance based on the realized copper sales in each reporting period.

In light of changes to the Caraíba Operations' copper concentrate sales channels, effective in the fourth quarter of 2023, freight parity charged by its customers, previously presented as a reduction of realized copper price, will be reclassified as part of C1 cash costs of copper produced. In addition, royalty taxes are added back to reflect gross revenue to derive realized copper price.

Gold C1 Cash Cost

Gold C1 cash cost is a non-IFRS performance measure used by the Company to manage and evaluate the operating performance of its gold mining segment and is calculated as C1 cash costs divided by total ounces of gold produced during the period. C1 cash cost includes total cost of production, net of by-product credits and incentive payments. C1 cash cost of gold produced per ounce is widely reported in the mining industry as benchmarks for performance but does not have a standardized meaning and is disclosed in supplement to IFRS measures.

Gold AISC

Gold AISC is an extension of C1 cash cost of gold produced discussed above and is also a key performance measure used by management to evaluate operating performance of its gold mining segment. Gold AISC is calculated as AISC divided by total ounces of gold produced during the period. AISC includes C1 cash costs, site general and administrative costs, accretion of mine closure and rehabilitation provision, sustaining capital expenditures, sustaining leases, and royalties and production taxes. Gold AISC is widely reported in the mining industry as benchmarks for performance but does not have a standardized meaning and is disclosed in supplement to IFRS measures.

Realized Gold Price

Realized Gold Price is a non-IFRS ratio that is calculated as gross gold revenue divided by ounces of gold sold during the period. Management believes measuring Realized Gold Price enables investors to better understand performance based on the realized gold sales in each reporting period.

EBITDA and Adjusted EBITDA

EBITDA and adjusted EBITDA are non-IFRS performance measures used by management to evaluate its debt service capacity and performance of its operations. EBITDA represents earnings before finance expense, finance income, income taxes, depreciation and amortization. Adjusted EBITDA is EBITDA before the pre-tax effect of adjustments for non-cash and/or non-recurring items required in determination of EBITDA under its revolving credit facility for covenant calculation purposes.

Adjusted net income attributable to owners of the Company and Adjusted net income per share attributable to owners of the Company

“Adjusted net income attributable to owners of the Company” is net income attributed to shareholders as reported, adjusted for certain types of transactions that, in management's judgment, are not indicative of our normal operating activities or do not necessarily occur on a recurring basis. “Adjusted net income per share attributable to owners of the Company” (“Adjusted EPS”) is calculated as “adjusted net income attributable to owners of the Company” divided by weighted average number of outstanding Common Shares in the period. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, the Company and certain investor and analysts use these supplemental non-IFRS performance measures to evaluate the normalized performance of the Company. The presentation of Adjusted EPS is not meant to substitute the net income (loss) per share attributable to owners of the Company (“EPS”) presented in accordance with IFRS, but rather it should be evaluated in conjunction with such IFRS measures.

Net (Cash) Debt

Net (cash) debt is a performance measure used by the Company to assess its financial position and ability to pay down its debt. Net (cash) debt is determined based on cash and cash equivalents, short-term investments, net of loans and borrowings as reported in the Company’s consolidated financial statements.

Working Capital (Deficit) and Available Liquidity

Working capital is calculated as current assets less current liabilities as reported in the Company’s consolidated financial statements. The Company uses working capital as a measure of the Company’s short-term financial health and ability to meet its current obligations using its current assets. Available liquidity is calculated as the sum of cash and cash equivalents, short-term investments and the undrawn amount available on its revolving credit facilities. The Company uses this information to evaluate the liquid assets available.

For further details on Non-IFRS measures, please refer to the Company’s annual audited consolidated financial statements for the year ended December 31, 2023 and Management’s Discussion and Analysis relating thereto, a copy of which is available for review under the Company’s profile on SEDAR+ at www.sedarplus.ca/landingpage/ and EDGAR at www.sec.gov.

LIST OF ABBREVIATIONS

In this AIF, the following abbreviations have the meanings set forth below:

|

|

|

|

|

|

|

|

|

|

|

|

| Cu |

copper |

Mt |

megatonne |

| Ni |

nickel |

kt |

kilotonne |

| Co |

cobalt |

t |

metric tonne |

| Ag |

silver |

kg |

kilogram |

| Au |

gold |

g |

gram |

| Fe |

iron |

lb |

pound |

| Mn |

manganese |

ml |

millilitre |

| Zn |

zinc |

MW |

megawatt |

| Cr |

chromium |

kW |

kilowatt |

| Al |

aluminium |

MVA |

megavolt amperes |

| Ca |

calcium |

kV |

kilovolt |

| Mo |

molybdenum |

kWh |

kilowatt hour |

| W |

tungsten |

Hz |

hertz |

| Bi |

bismuth |

d |

day |

| S |

sulfur |

h |

hour |

| F |

fluorine |

s |

second |

| Cl |

chlorine |

Ga |

billion years |

| U |

uranium |

Ma |

million years |

| As |

arsenic |

masl |

metres above mean sea level |

| P |

phosphorus |

m3 |

cubic metre |

| Pb |

lead |

Mm3 |

cubic megametre |

| km |

kilometre |

mmWC |

millimeter of water column |

| m |

metre |

Pa |

pascal |

| cm |

centimetre |

mbar |

atmospheric air pressure (bar) |

| mm |

millimetre |

° |

degree |

| ft |

foot |

C |

Celsius |

| ha |

hectare |

µm |

micrometre |

| oz |

troy ounce |

tph |

Tonnes per hour

per hour

|

| gpt or g/t |

grams per tonne |

|

|

|

|

|

|

CORPORATE STRUCTURE

Ero Copper was incorporated under the Business Corporations Act (British Columbia) (“BCABC”) on May 16, 2016. Ero Copper’s head office is located at Suite 1050, 625 Howe Street, Vancouver, British Columbia, Canada, V6C 2T6 and its registered office is located at Suite 3500, 1133 Melville Street, Vancouver, British Columbia, Canada, V6E 4E5.

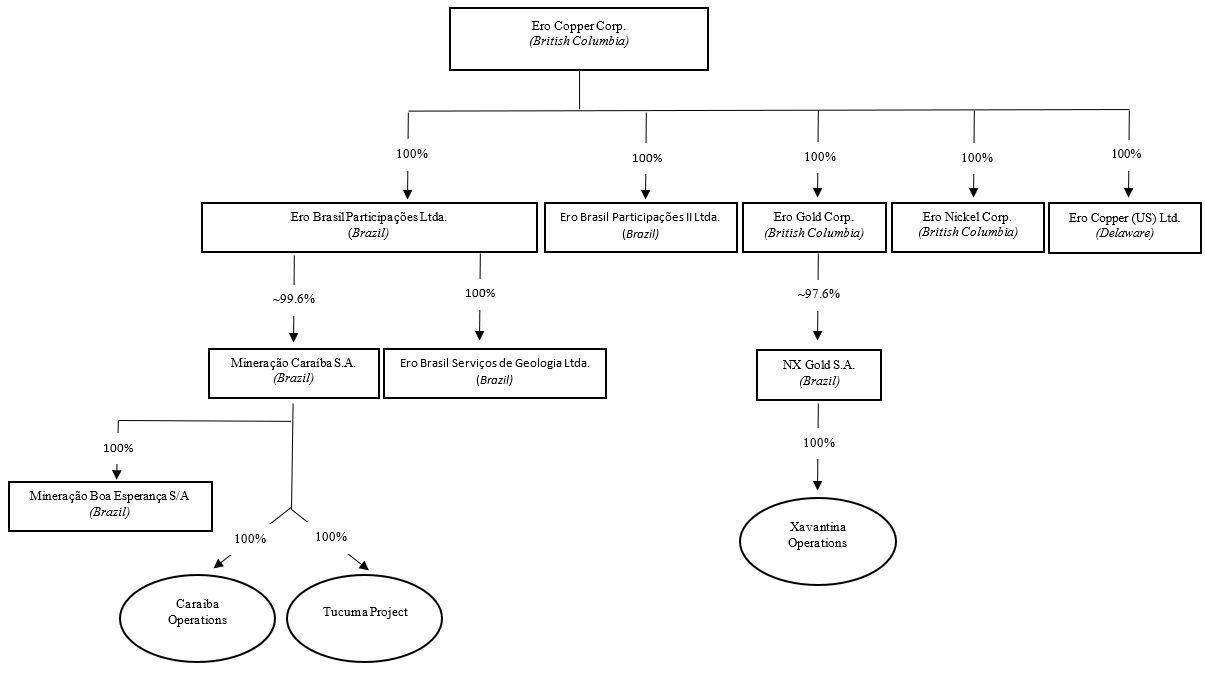

The Company indirectly holds approximately 99.6% of the voting shares of Mineração Caraíba S.A. (“MCSA” or “Mineração Caraíba”) through its wholly-owned subsidiary, Ero Brasil Participações Ltda. (“EBP”), and indirectly holds approximately 97.6% of the voting shares of NX Gold S.A. (“NX” or “NX Gold”) through its wholly-owned subsidiary, Ero Gold Corp. (“Ero Gold”), incorporated under the BCABC. MCSA holds a 100% interest in each of the Caraíba Operations and the Tucumã Project. NX Gold holds a 100% interest in the Xavantina Operations. EBP, MCSA and NX Gold were formed under the laws of Brazil. The remaining voting shares of MCSA are held by a minority group of shareholders, including former employees of MCSA. The remaining voting shares of NX Gold are held by a minority group of shareholders, including former employees of NX Gold. The following chart illustrates the Company’s principal subsidiaries, together with the governing law of each subsidiary and the percentage of voting securities beneficially owned or controlled or directed, directly or indirectly, by the Company, as well as the Company’s operating mines and development projects.

GENERAL DEVELOPMENT AND BUSINESS OF THE COMPANY

General

Ero is a high-margin, high-growth, low-carbon intensity copper producer with operations in Brazil and corporate headquarters in Vancouver, British Columbia, Canada. Ero is listed on the Toronto Stock Exchange (the “TSX”) and the New York Stock Exchange (“NYSE”), in each case under the symbol “ERO”.

Ero’s principal asset is its approximately 99.6% ownership interest in MCSA, held indirectly through its wholly-owned subsidiary, EBP. MCSA’s predominant activity is the production and sale of copper concentrate from the Caraíba Operations, located within the Curaçá Valley, northeastern Bahia State, Brazil, with gold and silver produced and sold as by-products. The Caraíba Operations have been in operation for over 40 years and consist of a fully integrated hub-and-spoke operating model, with current mining activities conducted at the Pilar underground mine, the Vermelhos underground mine, and the Surubim open pit mine feeding the central Caraíba Mill, a conventional crushing, grinding and flotation mill located adjacent to the Pilar underground mine. For further details concerning the Caraíba Operations, see below under the headings “Three Year History” and “Caraíba Operations”. In addition, MCSA holds a 100% interest in the Tucumã Project, a copper development project located within southeastern Pará State, Brazil. The Company commenced construction of the Tucumã Project in the second quarter of 2022 and is on schedule for first copper production in the second half of 2024. For further details concerning the Tucumã Project, see below under the headings “Three Year History” and “Tucumã Project”.

Ero also owns an approximately 97.6% ownership interest in NX Gold, held indirectly through its wholly-owned subsidiary, Ero Gold. NX Gold’s predominant activity is the production and sale of gold from the Xavantina Operations, located in Mato Grosso State, Brazil, with silver produced as a by-product. For further details concerning the Xavantina Operations, see below under the headings “Three Year History” and “Xavantina Operations”.

The Caraíba Operations, Xavantina Operations and the Tucumã Project are the mineral projects material to Ero for the purposes of NI 43-101.

Three Year History

NYSE Listing

•The Common Shares commenced trading on the NYSE on June 15, 2021 under the symbol “ERO”. The Common Shares continue trading on the TSX under the symbol “ERO”.

Senior Unsecured Notes

•In February 2022, the Company completed an offering of US$400 million aggregate principal amount of 6.50% senior notes due 2030 (the “Notes”). The Notes will mature on February 15, 2030. EBP and MCSA are currently the only guarantors of the Notes on a senior unsecured basis. The Notes are direct, senior obligations of the Company, EBP and MCSA, and are not secured by any mortgage, pledge or charge. The Company used a portion of the net proceeds of the offering to repay the outstanding borrowings under the 2018 Senior Credit Facility (as defined below) of approximately US$50 million and is using the balance for capital expenditures at the Tucumã Project and general corporate purposes. Additional information on the Notes is set out below under the heading “Description of Capital Structure”.

Senior Credit Facility

•On December 17, 2018, the Company replaced a US$50 million senior secured non-revolving credit facility entered into with The Bank of Nova Scotia (“Scotiabank”) on December 21, 2017 and approximately US$69 million in senior secured notes of MCSA held by Santander Bank, Banco ABC Brasil, Banco Fibra S.A. and Banco Pine S.A. with a new US$130 million debt financing with Scotiabank and Bank of Montreal, pursuant to an amended and restated credit agreement dated as of December 13, 2018 among the Company, as borrower, Scotiabank, as administrative agent, joint lead arranger and sole bookrunner, Bank of Montreal as joint lead arranger and syndication agent, and Scotiabank and Bank of Montreal, as lenders (the “2018 Senior Credit Facility Agreement”) and comprised of a US$80 million senior secured amortizing non-revolving credit facility (the “Term Facility”) and a US$50 million senior secured revolving term credit facility (the “Revolving Credit Facility”) (collectively the “2018 Senior Credit Facilities). The 2018 Senior Credit Facility Agreement was subsequently amended on (i) January 21, 2019; (ii) March 12, 2019; (iii) June 26, 2019, with the third amendment serving to, among other things, increase the Revolving Credit Facility from US$50 million to US$70 million; (iv) March 31, 2020, with the fourth amendment serving to, among other things, reduce the Term Facility to US$75 million at a 4-year term with principal payments beginning two years after closing (March 31, 2022) and with equal quarterly installments thereafter, and increase the Revolving Credit Facility to US$75 million payable in a lump sum at maturity, four years from closing (March 31, 2024); (v) May 29, 2020; (vi) March 16, 2021, with the sixth amendment serving to, among other things, amend the 2018 Senior Credit Facilities with a US$150 million Revolving Credit Facility payable in a lump sum at maturity on March 31, 2025; and (vii) January 21, 2022 to, among other things, permit the issuance of the Notes and, effective on February 2, 2022, reduce the Revolving Credit Facility from US$150 million to US$75 million, with an accordion option to increase to US$100 million at the election of the Company.

•On January 12, 2023, the Company replaced the 2018 Senior Credit Facility Agreement with a second amended and restated credit agreement (the “2023 Senior Credit Facility Agreement”) among the Company, as borrower, Bank of Montreal, as administrative agent, joint lead arranger and sole bookrunner, Scotiabank as joint lead arranger, Canadian Imperial Bank of Commerce as documentation agent, and the lenders party thereto from time to time, as lenders, pursuant to which, amongst other things, (i) the Revolving Credit Facility was increased to US$150 million (the “2023 Senior Credit Facility”) payable in a lump sum at maturity in December 2026.

Equity Financing

•On November 14, 2023, the Company completed an offering, on a bought deal basis, of 9,010,000 common shares, including, 500,000 common shares issued pursuant to the partial exercise of the underwriter’s over-allotment option, at a price of US$12.35 per common share for gross proceeds of approximately US$111 million or net proceeds of US$104 million after share issuance costs (the “Offering”). The Offering was conducted by a syndicate of underwriters led by BMO Capital Markets, as sole bookrunner and lead underwriter, and including Canaccord Genuity Corp., CIBC World Markets Inc., Scotia Capital Inc., TD Securities Inc., Cormark Securities Inc., National Bank Financial Inc., Paradigm Capital Inc., PI Financial Corp., Raymond James Ltd. and Stifel Canada. The net proceeds of the Offering are being used to advance growth initiatives at the Tucumã Project and Caraíba Operations, advance regional exploration in Brazil, and for working capital and other general corporate purposes.

Caraíba Operations

•On January 11, 2022, the Company announced that within the Caraíba Operations, it plans to create a two-mine system at the Pilar Mine (known as Pilar 3.0) whereby the upper levels of the mine, currently in operation, will be serviced by the existing shaft, while the Deepening Extension Zone will utilize a new, larger external shaft, expected to result in significant growth in total ore production from the mine, ramping from current levels of approximately 1.3 million tonnes per annum to approximately 3.0 million tonnes by 2026. Construction of the new external shaft began in the third quarter of 2021, with completion expected in late 2026. Following the completion of surface infrastructure, the main shaft sinking phase for the Pilar Mine’s new external shaft commenced as planned in December 2023.

•On September 29, 2022, the Company announced the discovery of a regional nickel sulphide system within the Curaçá Valley over an initial strike length of five kilometers, known as the “Umburana System”, located approximately 20 kilometers from the Company’s existing Caraíba processing facilities. The system remains open in all directions and is highlighted by multiple surface expressions of nickel mineralization. The system was discovered using new detailed field mapping and soil geochemistry collected during the Company's 2021 and 2022 exploration programs in conjunction with the Company's airborne electromagnetic survey.

•On November 7, 2022, the Company announced the addition of Project Honeypot into the Caraíba Operations’ 2022 Strategic Life of Mine (“LOM”) Plan, which, along with contributions from elsewhere within the operations, resulted in an increase of approximately 31% in the Caraíba Operations’ Proven and Probable Mineral Reserves. The inclusion of Project Honeypot into the Caraíba Operations' 2022 Strategic LOM Plan provides operational flexibility and improvements over prior production guidance, demonstrating steady growth in copper production from approximately 45.3kt (2023) to approximately 59.4kt of contained copper by 2036 and a mine life of approximately 20 years.

•On June 8, 2023, the Company announced an update on its ongoing regional nickel sulphide exploration program within the Curaçá Valley, with drilling focused on delineating the Umburana System, which has a current strike length of approximately five kilometers. Mineralization, which outcrops at surface, remains open to depth, to the north and between the VB and Lazaro zones.

•The Caraíba mill expansion, which is expected to increase mill throughput capacity from 3.2 to 4.2 million tonnes per annum, was completed in December 2023 with design capacity achieved by year-end.

Xavantina Operations

•On July 7, 2021, the Company announced the discovery of a new high-grade extension of the Matinha Vein, located approximately 550 meters east of development within the Brás Vein.

•On August 6, 2021, the Company announced the closing of a Precious Metals Purchase Agreement (the “NX Gold Stream Agreement”) with RGLD Gold AG (“RG AG”), a wholly owned subsidiary of Royal Gold, Inc., unlocking significant value from the NX Gold Mine and further highlighting the exploration potential of the broader NX Gold land package. The Company received total upfront cash consideration of US$100 million from RG AG in exchange for an amount equivalent to 25% of gold produced from the NX Gold Mine until 93,000 ounces of gold have been delivered, decreasing to 10% of gold produced over the remaining life of mine. RG AG will make ongoing payments equal to 20% of the prevailing spot gold price for each ounce of gold delivered until 49,000 ounces of gold have been received, after which it will pay 40% of the prevailing spot gold price for each ounce of gold delivered. An additional amount of up to US$10 million will be payable to the Company subject to certain performance conditions related to planned exploration drilling and increases to the Measured and Indicated Mineral Resources of the NX Gold Mine. RG AG shall also commit US$5 per ounce of gold delivered under the NX Gold Stream Agreement to support the Company’s environmental, social and governance commitments for the NX Gold Mine and surrounding communities.

•On January 11, 2022, the Company announced its plans to target higher sustained gold production levels of approximately 60,000 ounces per year at the NX Gold Mine, in an initiative known as “NX 60”. The initiative is supported by the January 6, 2022 announcement of a maiden Mineral Reserve for the Matinha Vein.

•On March 28, 2023, the Company announced an updated mineral resource and mineral reserve estimate for the Xavantina Operations, which includes an 18% increase in proven and probable mineral reserves as compared to the 2021 estimate, including a 15% increase at the Santo Antônio vein and a 45% increase at the Matinha vein, a 22% increase in measured and indicated mineral resources, inclusive of mineral reserves, as compared to the 2021 estimate, and an extension of mine life to six years.

Tucumã Project

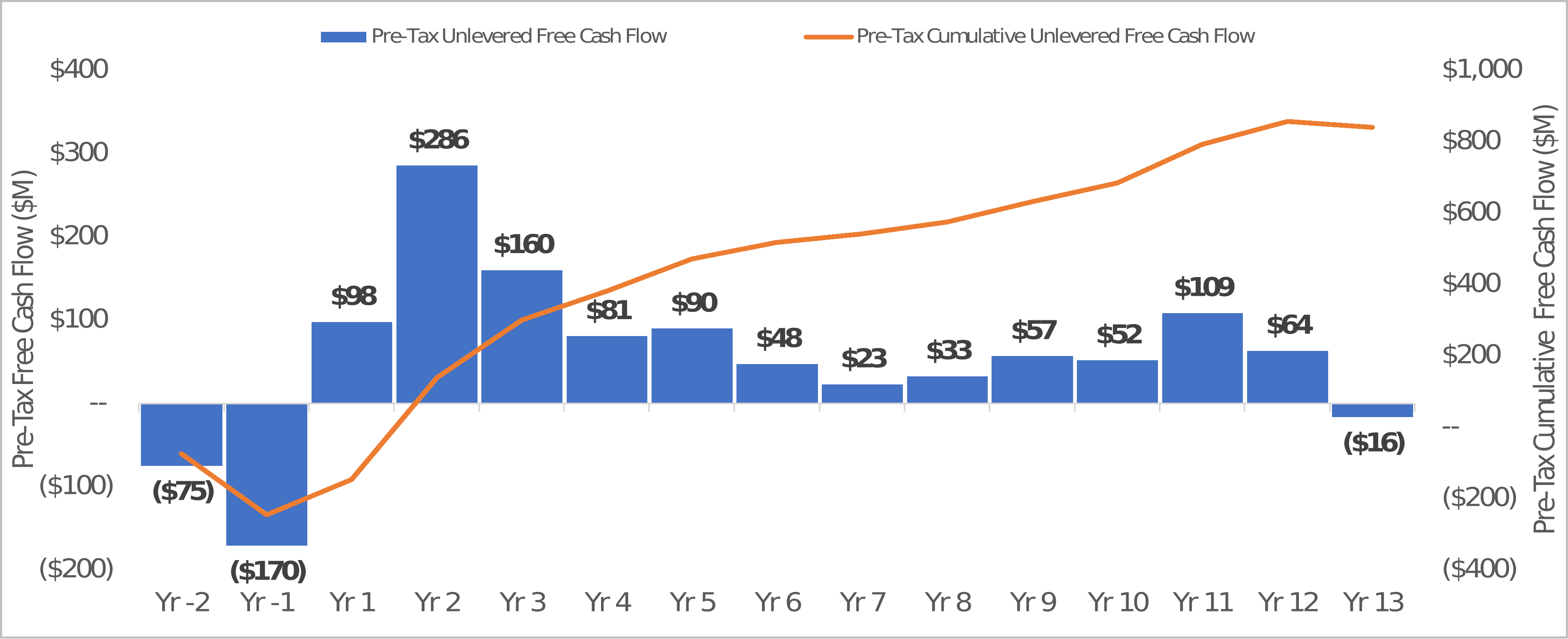

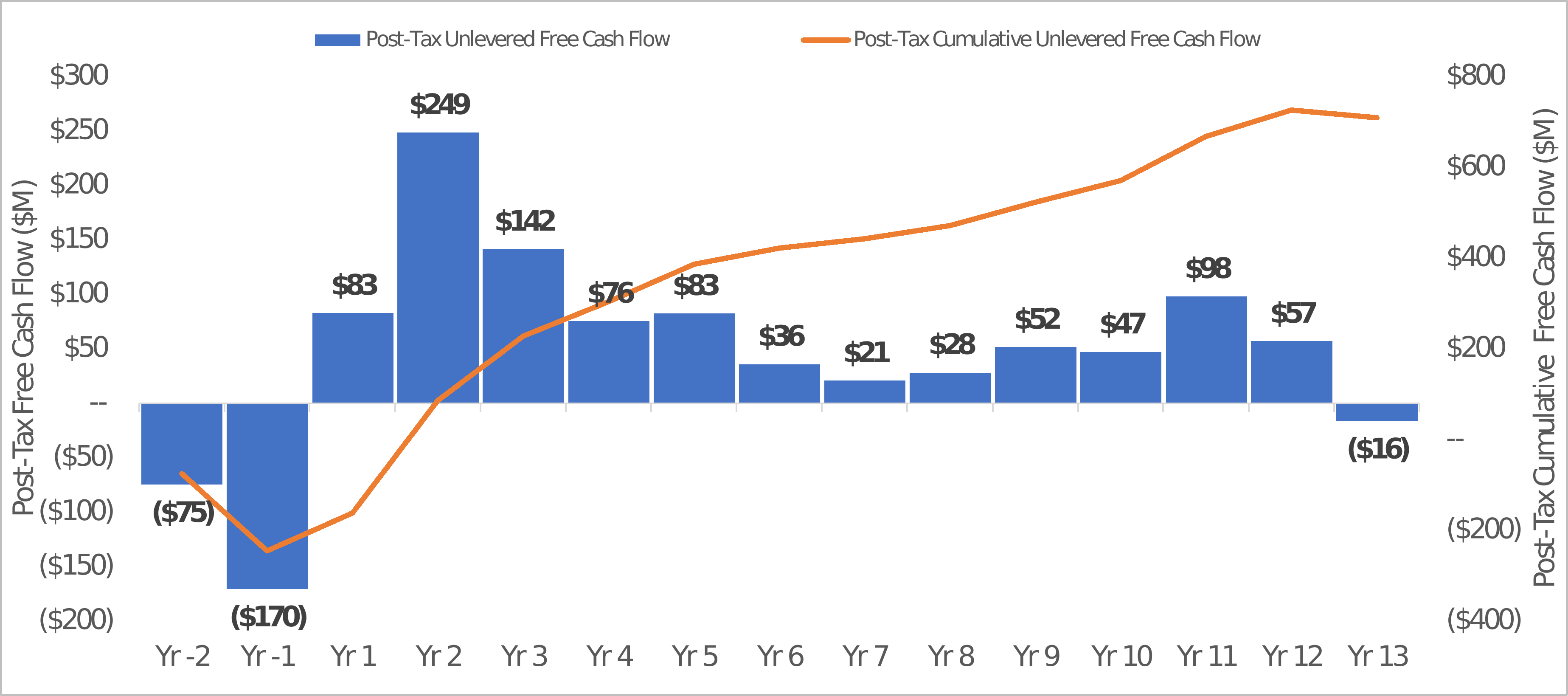

•On September 28, 2021, the Company announced the results of its optimized feasibility study on the Tucumã Project, including (i) doubled LOM copper production to approximately 326,000 tonnes with increased mine life of 12 years; (ii) increased annual average LOM copper production from approximately 18,000 tonnes to over 27,000 tonnes, with the first five years of production averaging approximately 35,000 tonnes per annum; and (iii) mine life of twelve years supported by updated Proven Mineral Reserves of 30.7 million tonnes at 0.89% copper and Probable Mineral Reserves of 12.4 million tonnes at 0.67% copper, as well as significant exploration upside identified within an under-explored area within the final pit limits, known as the "Gap Zone".

•In December 2021, the Tucumã Project was added to the Investment Partnership Program under Brazil’s Strategic Pro-Mineral Policy, which seeks to facilitate permitting, licensing and other regulatory requirements related to mining strategic minerals, including copper. As a result, the Tucumã Project is treated as a “national priority” as the Brazilian government aims to increase the country’s copper production to support its domestic and economic development.

•On February 15, 2022, the Company announced that its Board of Directors (the “Board”) approved the construction of the Tucumã Project. The Company commenced construction in the second quarter of 2022.

•On January 16, 2024, the Company announced that the Tucumã Project achieved a major milestone, with physical completion reaching over 85% and the commencement of the commissioning phase with first copper production anticipated during the second half of 2024.

Corporate

•On August 1, 2022, the Company announced the appointment of Jill Angevine to the Board effective August 1, 2022.

•On January 11, 2023, the Company announced the retirement of Christopher Noel Dunn from his executive position of Executive Chairman as part of the Company's overall succession planning. Mr. Dunn remains the Chairman of the Company’s Board.

•On May 8, 2023, the Company announced the appointment of Makko DeFilippo as President and Chief Operating Officer of the Company. Mr. DeFilippo, who has been with the Company since 2017, has served as President of the Company since January 2021 and prior to that as Vice President, Corporate Development.

•On October 30, 2023, the Company announced it entered into a binding term sheet (the “Term Sheet”) with Salobo Metais S.A., part of the Vale Base Metals business (“VBM”) to advance its Furnas copper project (the “Furnas Project”) located in the Carajás Mineral Province in Pará State, Brazil. The Term Sheet contemplates the Company earning a 60% interest in the Furnas Project upon completion of several exploration, engineering and development milestones over a period of five years from the execution of a definitive earn-in agreement. In exchange for its 60% interest, the Company will solely fund a phased exploration and engineering work program during the earn-in period and grant VBM up to an 11.0% free carry on future Furnas Project construction capital expenditures.

•On November 1, 2023, the Company announced the appointment of Faheem Tejani to the Board effective November 1, 2023 and Matthew Wubs’ intention not to stand for re-election at the 2024 annual meeting of shareholders.

2024 Production Guidance and Three-Year Production Outlook

The Company's 2024 production guidance and three-year production outlook reflect the ongoing execution of its organic growth strategy, including the successful completion of the Xavantina Operations' NX 60 initiative as well as the anticipated completion of the Tucumã Project, which remains on track to commence production in the second half of this year. As a result, the Company expects to deliver sustained annual gold production of 55,000 to 60,000 ounces through 2026 and more than double copper production to 95,000 to 105,000 tonnes in concentrate in 2025.

At the Caraíba Operations, copper production is projected to range from 42,000 to 47,000 tonnes through 2026, with higher mill throughput volumes expected to offset lower forecast mined and processed copper grades. Following the anticipated completion of the Pilar Mine's new external shaft in late 2026, the Company expects mined and processed copper grades to increase as mining from the high-grade Deepening Extension Zone ramps up.

Copper production from the Tucumã Operations is expected to increase from 17,000 to 25,000 tonnes in the second half of 2024 to 53,000 to 58,000 tonnes in 2025, when the mine achieves its first full year of production. The Tucumã mill is expected to sustain nameplate throughput levels of approximately 4.0 million tonnes per annum beginning in 2025 with strong mined and processed copper grades projected through 2026.

At the Xavantina Operations, higher mill throughput levels are expected to offset lower mined and processed gold grades over the next three years. In 2024, gold production is expected to be slightly weighted towards the first half of the year due to higher anticipated gold grades compared to the second half of the year.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Three-year Outlook |

|

2024 |

|

2025 |

|

2026 |

| Copper (tonnes) |

|

|

|

|

|

|

| Caraíba Operations |

|

42,000 - 47,000 |

|

42,000 - 47,000 |

|

42,000 - 47,000 |

| Tucumã Operations |

|

17,000 - 25,000 |

|

53,000 - 58,000 |

|

48,000 - 53,000 |

| Total Copper |

|

59,000 - 72,000 |

|

95,000 - 105,000 |

|

90,000 - 100,000 |

|

|

|

|

|

|

|

| Gold (ounces) |

|

|

|

|

|

|

| Xavantina Operations |

|

55,000 - 60,000 |

|

55,000 - 60,000 |

|

55,000 - 60,000 |

2024 capital expenditures are expected to decrease to a range of $299 to $349 million due to the anticipated completion of the Tucumã Project, which is on track to commence production in the second half of the year. As a result, capital spend is expected to be weighted towards the first half of 2024. The table below includes an estimated $30 to $40 million of consolidated exploration expenditures. This estimate includes approximately $20 million designated for drilling activities at the Caraíba Operations, including expenditures related to the Curaçá Valley nickel exploration program. Additionally, the Company has budgeted approximately $6 million for the first phase of work at the Furnas Project.

The 2024 capital expenditure guidance assumes an exchange rate of 5.10 USD:BRL for the Tucumã Project based on designated foreign exchange hedges with a weighted average ceiling and floor of 5.10 and 5.23 USD:BRL, respectively. All other capital expenditures assume an exchange rate of 5.00 USD:BRL. Figures presented below are in USD millions.

|

|

|

|

|

|

|

|

|

|

|

2024 Guidance |

| Caraíba Operations |

|

|

| Growth |

|

$80 - $90 |

| Sustaining |

|

$100 - $110 |

| Total |

|

$180 - $200 |

|

|

|

| Tucumã Project |

|

|

| Growth |

|

$65 - $75 |

| Capitalized Ramp-Up Costs |

|

$4 - $6 |

| Sustaining |

|

$2 - $5 |

| Total |

|

$71 - $86 |

|

|

|

| Xavantina Operations |

|

|

| Growth |

|

$3 - $5 |

| Sustaining |

|

$15 - $18 |

| Total |

|

$18 - $23 |

|

|

|

| Consolidated Exploration Programs |

|

$30 - $40 |

|

|

|

| Consolidated Capital Expenditures |

|

|

| Growth |

|

$148 - $170 |

| Capitalized Ramp-Up Costs |

|

$4 - $6 |

| Sustaining |

|

$117 - $133 |

| Exploration |

|

$30 - $40 |

| Total |

|

$299 - $349 |

Business of the Company

Principal Products and Operations

The Company’s principal product is copper produced and sold from the Caraíba Operations, with gold and silver produced and sold as by-products from the Caraíba Operations. Gold and, as a by-product, silver is also produced and sold from the Xavantina Operations. During the year ended December 31, 2023, the operations of the Caraíba Operations processed 3,231,667 tonnes of material, producing 43,857 tonnes of copper and the operations of the Xavantina Operations processed 136,002 tonnes of material, producing 59,222 ounces of gold. The following tables summarize the Company’s production for the financial years ended December 31, 2023 and 2022 from the Caraíba Operations and the Xavantina Operations:

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended

December 31, 2023

|

|

Year Ended

December 31, 2022

|

| Operating Information |

|

|

|

Copper (Caraíba Operations) |

|

|

|

| Ore Processed (tonnes) |

3,231,667 |

|

2,864,230 |

| Grade (% Cu) |

1.49% |

|

1.76% |

| Cu Production (tonnes) |

43,857 |

|

46,371 |

| Cu Production (lbs) |

96,687,638 |

|

102,229,718 |

| Concentrate Grade (% Cu) |

33.7% |

|

33.4% |

| Recovery (%) |

91.4% |

|

91.9% |

| Concentrate Sales (tonnes) |

131,002 |

|

137,430 |

| Cu Sold in Concentrate (tonnes) |

42,595 |

|

45,911 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended

December 31, 2023

|

|

Year Ended

December 31, 2022

|

| Operating Information |

|

|

|

| Gold (Xavantina Operations) |

|

|

|

| Ore milled (tonnes) |

136,002 |

|

189,783 |

| Head grade (grams per tonne Au) |

15.13 |

|

7.61 |

| Recovery (%) |

89.5% |

|

92.0% |

| Gold ounces produced (oz) |

59,222 |

|

42,669 |

| Gold Sales (oz) |

57,949 |

|

41,951 |

During the year ended December 31, 2023, the Company generated net operating revenue of US$427.5 million. The following table summarizes the net revenue of the Company for the financial years ended December 31, 2023 and 2022. Tabular amounts are in thousands of US dollars:

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, 2023

(US$000s)

|

Year Ended

December 31, 2022

(US$000s)

|

| Copper concentrate |

320,603 |

351,404 |

| Gold |

106,877 |

74,988 |

| Net Operating Revenues: |

427,480 |

426,392 |

There are global copper and gold markets into which the Company can sell its copper concentrate and gold and, as a result, the Company is not dependent on a particular purchaser with regard to the sale of the copper concentrate and gold that it produces.

MCSA sells its final copper concentrate, containing gold and silver as by-product metals, to various international trading companies that ship the copper concentrate purchased from MCSA to smelters globally via the Barra dos Coqueiros port located in Barra dos Coqueiros, Sergipé State, Brazil. All copper concentrate is transported from site to the port by road using standard highway trucks, which are weighed and sampled for final assay prior to shipment.

NX Gold produces and sells doré bars containing gold and silver to COIMPA Industrial Ltda. (“COIMPA”). The doré bars are transported to COIMPA’s facility in Manaus, State of Amazonas, Brazil by airplane using a secure gravel airstrip located on the Xavantina Operations.

Competitive Conditions

The Company’s primary business is to produce and sell copper. The Company also produces and sells gold. Prices are determined by world markets over which the Company has no influence or control. Ero’s competitive position is primarily determined by its costs compared to other producers throughout the world and its ability to maintain its financial integrity through metal price cycles. Costs are governed to a large extent by the grade, nature and location of the Company’s Mineral Reserves and Mineral Resources as well as by input costs and the level of operating and management skill employed in the production process.

The mining industry is competitive, particularly in the acquisition of additional Mineral Reserves and Mineral Resources in all phases of operation, and the Company competes with many companies possessing similar or greater financial and technical resources. The Company also competes with other mining companies and other third parties over sourcing raw materials, equipment and supplies in connection with its production, development and exploration operations, as well as for skilled and experienced personnel and transportation capacity.

Specialized Skills and Knowledge

The nature of the Company’s business requires specialized skills, knowledge and technical expertise in the areas of geology, engineering, mine planning, mine operations, metallurgical processing, and environmental compliance. In addition to the specialized skills listed above, the Company also relies on staff members, contractors and consultants with specialized knowledge of logistics and operations in Brazil and local community relations. In order to attract and retain personnel with the specialized skills and knowledge required for the Company’s operations, the Company maintains competitive remuneration and compensation packages. To date, the Company has been able to meet its staffing requirements.

Business Cycles

The mining business is subject to global economic cycles which affect the marketability of products derived from mining.

Employees

As at December 31, 2023, Ero and its subsidiaries employed a total of 3,374 employees (consisting of 23 employees of Ero, 4 employees of Ero Copper (US) Ltd., 82 employees of EBP, 21 employees of Ero Brasil Serviços Geologia Ltda., 2,582 employees of MCSA, 128 employees of Mineração Boa Esperança S/A and 534 employees of NX Gold) and 3,320 contractors (consisting of 19 contractors of Ero, 64 contractors of Ero Brasil Serviços Geologia Ltda., 2,086 contractors of MCSA, 883 contractors of Mineração Boa Esperança S/A and 268 contractors of NX Gold).

Foreign Operations

Ero’s material properties are the Caraíba Operations, the Xavantina Operations and the Tucumã Project, each located in Brazil. Foreign operations accounted for 100% of the Company’s revenue and represented approximately 93% of its assets as at December 31, 2023. Accordingly, the Company is entirely dependent on its foreign operations for the exploration and development of its properties and for the production of copper and gold. Any changes in regulations or shifts in political attitudes in any of these jurisdictions, or other jurisdictions in which Ero has projects from time to time, are beyond the control of the Company and may adversely affect its business. Future development and operations may be affected in varying degrees by such factors as government regulations (or changes thereto) with respect to the restrictions on production, export controls, income taxes, expropriation of property, repatriation of profits, environmental legislation, land use, water use, land claims of local people, mine safety, work force health and safety in the face of prevailing epidemics, pandemics or other health risks, and receipt of necessary permits. The effect of these factors cannot be accurately predicted. See below under the heading “Risks Factors”.

The risks of the corporate structure of the Company and its subsidiaries are risks that are typical and inherent for companies that have material assets and property interests held indirectly through foreign subsidiaries and located in foreign jurisdictions. The Company’s business and operations in Brazil are exposed to various levels of political, economic and other risks and uncertainties associated with operating in a foreign jurisdiction such as a difference in laws, business cultures and practices, banking systems and internal control over financial reporting. See below under the heading “Risk Factors”.

The Company has implemented a system of corporate governance, internal controls over financial reporting and disclosure controls and procedures that apply at all levels of the Company and its subsidiaries. These systems are overseen by the Board and implemented by the Company’s senior management. The relevant features of these systems are set out below.

Control over and Communication with Foreign Subsidiaries

The Company controls its foreign subsidiaries by virtue of corporate oversight and by its ownership interest in such entities (see above under the heading “Corporate Structure”). The Company’s management has the (i) power to appoint and dismiss, at any time, any and all of the foreign subsidiaries’ officers and directors, (ii) power to instruct the foreign subsidiaries’ officers to pursue business activities in accordance with the Company’s wishes, and (iii) legal right, as a shareholder, to require the officers of each such foreign subsidiary to comply with their fiduciary obligations. As a result, management of the Company can effectively align its business objectives with those of the foreign subsidiaries and implement such objectives at the subsidiary level.

The Company maintains open communication with each of its operations in Brazil through several senior officers who are proficient in Brazilian Portuguese. In addition, all management team members in Brazil are fluent in Brazilian Portuguese and fluent (or proficient) in English. The primary language used in management and Board meetings is English and material documents relating to the Company and its operations that are provided to the Board are in English. If necessary, management of the Company and the Board have access to independent translators to overcome any language differences. The Company does not currently have a formal communication plan or policy in place and has not, to date, experienced any communication-related issues.

Board and Management Expertise

Each of the Company’s non-executive directors (other than Faheem Tejani who joined the Board on November 1, 2023) and senior officers have experience in Brazil, being the jurisdiction in which the Company operates. In addition, the Board, through its corporate governance practices, receives monthly management and technical updates and progress reports in connection with the foreign subsidiaries, and at each quarterly Board meeting, the directors meet with management on topics including short, medium and long-term corporate objectives, strategic risk and mitigation strategies and strategic planning, and in so doing, maintains effective oversight of the Company’s business and operations. Moreover, Board members and senior officers have access to corporate director education programs which offer courses on topics such as strategic direction and risks, financial essentials, audit committee effectiveness, risks and disclosure, human resource and compensation committee performance and enterprise risk oversight.

In 2023, most senior officers visited the Company’s operations in Brazil quarterly, or more frequently if circumstances required, on a rotating basis, to ensure effective control and management of the Company’s foreign operations. Each of the Company’s non-executive directors, other than Matthew Wubs (who visited each of the Company’s operations on multiple occasions prior to 2023) visited the Caraíba Operations and Tucumã Project in 2023. Dr. Sally Eyre, Chantal Gosselin and John Wright also visited the Xavantina Operations in 2023. During these visits and/or past visits, they have met with local employees and community members, with such interactions enhancing the visiting directors’ and officers’ knowledge of local culture and key stakeholders.

Further, to ensure effective control and management of the Company’s foreign operations, all directors are provided with monthly reports regarding the Company’s business and operations, and virtual or in-person meetings are held amongst the Board and management quarterly, or more frequently if circumstances required, and virtual meetings are held amongst management and the operations team in Brazil weekly, or more frequently if circumstances required.

Internal Control Over Financial Reporting and Funds

The Company maintains internal control over financial reporting with respect to its operations in Brazil by taking various measures. Several of the Company’s senior officers have the relevant language proficiency (Brazilian Portuguese) and each senior officer has local cultural understanding and relevant work experience in Brazil which facilitates better understanding and oversight of the Company’s operations in the context of internal controls over financial reporting.

Pursuant to the requirements of National Instrument 52-109, Certification of Disclosure in Issuers’ Annual and Interim Filings, the Company assesses the design and effectiveness of its internal controls over financial reporting on an annual basis. Furthermore, key controls for the accounts in scope are tested across the Company on an annual basis and the working papers of these tests performed at all the locations are reviewed at the head office level.

Differences in banking systems and controls between Canada and Brazil are addressed by having internal controls over cash; especially over access to cash, cash disbursements, appropriate authorization levels, performing and reviewing bank reconciliations and the segregation of duties.

The Company ensures the flow of funds between Canada and Brazil functions as intended by:

•appointing common officers of the Company and Ero Brasil/MCSA/NX Gold;

•involving the Company’s Chief Financial Officer, located in Vancouver, in hiring key finance personnel in Brazil; and

•monitoring the finance departments in Brazil by regular personal visits by the Chief Financial Officer, the Vice President, Finance and other key executives to Brazil.

Records

All of the minute books and corporate records and documents of the foreign subsidiaries are filed at the relevant entity’s headquarters, and with the relevant governmental or regulatory body in Brazil. The custodians of such documents report directly to the Company’s head office and senior management team to ensure continued oversight.

Environmental Protection