Document

ANNUAL INFORMATION FORM

FOR THE YEAR ENDED DECEMBER 31, 2023

DATED: MARCH 6, 2024

TABLE OF CONTENTS

ITEM 1.GENERAL PROVISIONS

1.1Glossary of Terms

Except as otherwise defined herein, the following terms used but not otherwise defined in this Annual Information Form have the meanings set out below. Words importing the singular, where the context requires, include the plural and vice versa, and words importing any gender include all genders.

“2018 Note Offering” means the offering of units of the Company that closed on April 30, 2018 for aggregate gross proceeds of approximately US$98 million. Each unit consisted of US$1,000 principal amount of 2024 Gold-Linked Notes and 124 2024 Warrants.

“2020 Aris Gold Indenture” means the trust indenture among Aris Holdings, TSX Trust and the Collateral Agent dated November 5, 2020, as supplemented on February 8, 2022, pursuant to which the 2027 Aris Holdings Notes were issued.

“2020 Special Warrant Private Placement” means the bought deal private placement of 22,222,222 Special Warrants by Caldas Gold (now Aris Holdings) at a price of C$2.25 per Special Warrant for aggregate gross proceeds of approximately C$50,000,000 that closed on July 29, 2020.

“2021 Indenture” means the indenture dated as of August 9, 2021, as further amended, supplemented, amended and restated or otherwise modified and in effect from time to time, entered into between the Company, AM Segovia, ETK and Bank of New York Mellon in connection with the issuance of the 2026 Unsecured Notes.

“2021 Offering” means the offering of 2026 Unsecured Notes pursuant to Rule 144A and Regulation S under the U.S. Securities Act of 1933 that closed on August 9, 2021 for aggregate gross proceeds of US$300 million.

“2024 Debenture Indenture” means the indenture dated April 4, 2019, as amended on March 24, 2021 and as amended, supplemented, amended and restated or otherwise modified and in effect from time to time, entered into between the Company and TSX Trust in connection with the issuance of the 2024 Debentures.

“2024 Debenture Offering” means the underwritten offering of 2024 Debentures of the Company that closed on April 4, 2019 for aggregate gross proceeds of C$20,000,000.

“2024 Debentures” means the convertible unsecured subordinated debentures of the Company issued in connection with the 2024 Debenture Offering in denominations of C$1,000 and integral multiples thereof and that bear interest at a rate of 8.0% per annum. The 2024 Debentures may be converted into Common Shares at any time up to April 5, 2024, at a conversion rate of approximately 210.53 Common Shares per C$1,000 principal amount, subject to adjustment in certain circumstances, which equates to an initial conversion price of C$4.75 per Common Share. As of December 31, 2023, there was C$18,000,000 aggregate principal amount of 2024 Debentures outstanding.

“2024 Gold-Linked Notes” means the senior secured notes issued in connection with the 2018 Note Offering that traded on the TSX under the symbol “GCM.NT.U”. The 2024 Gold-Linked Notes have been fully redeemed by the Company.

“2024 Unlisted Warrants” means the common share purchase warrants issued by Caldas Gold (now Aris Holdings) pursuant to the RTO Warrant Indenture, each of which is exercisable into one-half of one Common Share at an exercise price of C$3.00 per 2024 Unlisted Warrant for an exercise price of C$6.00 per whole Common Share until December 19, 2024.

“2024 Warrants” means the warrants issued in connection with the 2018 Note Offering that trade on the TSX under the symbol “ARIS.WT.B”. Each 2024 Warrant entitles the holder thereof to purchase one Common Share at any time prior to April 30, 2024 at an exercise price of C$2.21 per Common Share.

“2025 Warrant Indenture” means the warrant indenture between Caldas Gold (now Aris Holdings) and Odyssey dated July 29, 2020, as modified and supplemented by the first supplemental warrant indenture between Caldas Gold (now Aris Holdings) and Odyssey dated August 26, 2020, by the second supplemental warrant indenture between Caldas Gold (now Aris Holdings) and Odyssey dated December 3, 2020 and by the third supplemental warrant indenture between the Company, Aris Mining and Odyssey dated September 26, 2022, pursuant to which the 2025 Warrants were issued.

“2025 Warrants” means the Common Share purchase warrants that trade on the TSX under the symbol “ARIS.WT.A”. The 2025 Warrants were issued pursuant to the 2025 Warrant Indenture, each of which is exercisable into one-half of one Common Share at an exercise price of C$2.75 per 2025 Warrant for an effective exercise price of C$5.50 per whole Common Share until July 29, 2025, subject to the terms and conditions contained in the 2025 Warrant Indenture.

“2026 Unsecured Notes” means the US$300 million aggregate principal amount of senior unsecured notes due on August 9, 2026 issued in connection with the 2021 Offering and issued in denominations of US$200,000 and integral multiples of US$1,000 in excess thereof; the 2026 Unsecured Notes trade on the SGX under the symbols “DCWB” and “GNDB” at a coupon rate of 6.875%.

“2027 Aris Holdings Notes” means the senior secured gold-linked notes of Aris Holdings (formerly, Aris Gold) which bear interest at a rate of 7.5% per annum and mature on August 26, 2027 and which were issued in denominations of US$1.00 and integral multiples of US$1.00 in excess thereof. As of December 31, 2023, there was an aggregate principal amount of US$58.6 million 2027 Aris Holdings Notes outstanding.

“AISC” means all-in sustaining costs.

“AM Segovia” means Aris Mining (Panama) Segovia S.A. (formerly Gran Colombia Gold Segovia S.A. and, before that, Zandor Capital S.A.), the Panamanian joint venture company used by GCM and Medoro as a vehicle for completing the acquisition whereby AM Segovia, through its Colombian branch, acquired all of the assets of Frontino Gold Mines Ltd.

“Annual Information Form” means this Annual Information Form dated March 6, 2024 in respect of the fiscal year ended December 31, 2023.

“Aris Debenture” has the meaning given to such term in “General Development of the Business – Year Ended December 31, 2022 – 2022 Investment in Aris Gold”.

“Aris Gold” means Aris Gold Corporation, now Aris Mining Holdings Corp.

“Aris Holdings” means Aris Mining Holdings Corp., an amalgamated corporation formed by the amalgamation of Aris Gold and 1373945 B.C. Ltd.

“Aris Mining Board and Management” has the meaning given to such term in “General Development of the Business – Year Ended December 31, 2022 – Aris Mining Transaction”.

“Aris Mining Marmato” means Aris Mining Marmato S.A.S., formerly Caldas Gold Marmato S.A.S., a wholly-owned subsidiary of the Company and existing under the laws of Colombia.

“Aris Mining Panama” means Aris Mining (Panama) Marmato Inc. (formerly Aris Gold Panama Inc.), a wholly-owned subsidiary of the Company existing under the laws of Panama.

“Aris Mining Transaction” has the meaning given to such term in “General Development of the Business – Year Ended December 31, 2022 – Aris Mining Transaction”.

“Aris Subscription Receipt Agreement” means the subscription receipt agreement providing for the issuance of the Aris Subscription Receipts among the Company, BC124 and Odyssey dated as of December 3, 2020, pursuant to which the Aris Subscription Receipts were issued.

“Aris Subscription Receipt Private Placement” means the non-brokered private placement of 37,777,778 Aris Subscription Receipts at a price of C$2.25 per Aris Subscription Receipt for aggregate gross proceeds of C$85,000,000 which was led by BC124 that closed on December 3, 2020.

“Aris Subscription Receipts” means the subscription receipts issued pursuant to the Aris Subscription Receipt Agreement in connection with the Aris Subscription Receipt Private Placement, each of which was converted, for no additional consideration or action on the part of the holder thereof, into one common share in the capital of Aris Gold (now Aris Holdings) and one 2025 Warrant on February 4, 2021.

“Audit Committee” means the audit committee of the Company.

“August 2024 Gold X Warrants” means the warrants issued by Gold X (now Aris Mining Guyana Holdings Corp.) on August 27, 2019 pursuant to the terms of their warrant certificates. Each August 2024 Gold X Warrant is exercisable into 0.6948 of one Common Share at an exercise price of C$2.80 per August 2024 Gold X Warrant until August 27, 2024.

“BC124” means 1247964 B.C. Ltd.

“BCBCA” means the Business Corporations Act (British Columbia).

“Board” means the board of directors of the Company.

“Caldas Gold” means Caldas Gold Corp., a corporation resulting from the Caldas RTO and existing under the BCBCA. On February 4, 2021, Caldas Gold was renamed Aris Gold, now Aris Holdings.

“Caldas RTO” means the spin-off of the Company’s assets in the Marmato Mine through a reverse takeover transaction completed with Bluenose Gold Corp. on February 25, 2020. The resulting issuer was renamed Caldas Gold Corp. (now Aris Holdings) and was listed on the TSX Venture Exchange at such time.

“Caldas RTO Financings” means, collectively, (a) the non-brokered private placement of units of Caldas Finance Corp. at a price of C$2.00 per unit for aggregate gross proceeds of C$15,000,000 that closed on February 7, 2020 and (b) the offering of subscription receipts of Caldas Finance Corp. for C$2.00 per subscription receipt for aggregate proceeds of C$6,585,000 that closed on December 19, 2019.

“Cboe Canada” means the Cboe Canada stock exchange, formerly the Neo Exchange Inc.

“CIM” means the Canadian Institute of Mining, Metallurgy and Petroleum.

“Collateral Agent” means TSX Trust in its capacity as collateral agent on behalf of the holders of 2027 Aris Holdings Notes and WPMI.

“Common Shares” means the common shares in the capital of the Company.

“Company”, “Aris Mining”, “our”, “we” or “us” means Aris Mining Corporation, formerly “GCM Mining Corp.” or “GCM”, a company existing under the laws of the Province of British Columbia

“COP” means Colombian pesos.

“Corpocaldas” has the meaning given to such term in “General Development of the Business – Year Ended December 31, 2023 – Receipt of Marmato Lower Mine License”.

“Delegated Authority” has the meaning given to such term in “Audit Committee Information – Pre-Approval Policies and Procedures”.

“Deposited Ounces” has the meaning given to such term in “Description of Capital Structure – Notes – 2027 Aris Holdings Notes”.

“DSU” means deferred share units.

“EBITDA” means earnings before interest, taxes, depreciation, and amortization.

“Echandia Mining Title” means the area of approximately 59.4 hectares covered by a contract awarded by the National Mining Agency of Colombia to Minera Croesus S.A.S., a wholly-owned subsidiary of the Company, under contract registration number RPP_357 in Marmato, Caldas Department, Colombia.

“ESG” means environmental, social and governance.

“ESTMA” has the meaning given to such term in “Risk Factors – Corruption”.

“ETK” means ETK, Inc., owner of the Toroparu Project.

“Exchange Ratio” has the meaning given to such term in “General Development of the Business – Year Ended December 31, 2022 – Aris Mining Transaction”.

“Floor Price” has the meaning given to such term in “Description of Capital Structure – Notes - 2027 Aris Holdings Notes”.

“GAAP” means generally accepted accounting principles.

“GCM Mining” or “GCM” mean GCM Mining Corp, presently Aris Mining Corporation, a company existing under the laws of the Province of British Columbia.

“Gold Trust Account” has the meaning given to such term in “Description of Capital Structure – Notes - 2027 Aris Holdings Notes”.

“Gold X” means Gold X Mining Corp., now named Aris Mining Guyana Holdings Corp.

“Gold X Arrangement” means the statutory plan of arrangement under the BCBCA whereby GCM acquired all of the issued and outstanding Gold X Shares not already owned by GCM in exchange for Common Shares on the basis of the Gold X Exchange Ratio.

“Gold X Exchange Ratio” has the meaning given to such term in “General Development of the Business – Year Ended December 31, 2021 – 2021 Gold X Arrangement”.

“Gold X Shares” means the common shares of Gold X (now named Aris Mining Guyana Holdings Corp.).

“Gold X Warrants” means, collectively, the June 2024 Gold X Warrants and the August 2024 Gold X Warrants.

“ICSID” has the meaning given to such term in “Legal Proceedings and Regulatory Actions – Legal Proceedings”.

“IFRS” means the International Financial Reporting Standards, accounting standards issued by the IFRS Foundation and the International Accounting Standards Board.

“Insolvency Proceedings” has the meaning given to such term in “Risk Factors – Bankruptcy and Insolvency Laws”.

“Intercreditor Agreement” means the intercreditor agreement among TSX Trust, WPMI, Aris Holdings, Aris Mining Panama, Aris Mining Marmato and SARC dated November 5, 2020.

“Juby Project” means the exploration-stage gold project located approximately 15 km west-southwest of the town of Gowganda and 100 km south-southeast of the Timmins gold camp within the Shining Tree area in the southern part of the Abitibi greenstone belt in Ontario, Canada.

“June 2024 Gold X Warrants” means the warrants issued by Gold X (now Aris Mining Guyana Holdings Corp.) on June 12, 2019 pursuant to the terms of their warrant certificates. Each June 2024 Gold X Warrant is exercisable into 0.6948 of one Common Share at an exercise price of C$1.32 per June 2024 Gold X Warrant until June 12, 2024.

“Lower Mine” means the mineral resources and reserves currently under construction located at the Zona Baja Mining Title at the Marmato Mine, consisting of porphyry style gold mineralization below 950 m elevation.

“Marmato Mine” means the gold-silver operation at Marmato, Caldas Department, Colombia, comprising three contiguous properties: Zona Alta Property, Zona Baja Property and Echandia Property, as more particularly described in the Marmato Technical Report, including the Marmato Mine, the existing 1,200 tpd processing plant and the area encompassing the Upper Mine and Lower Mine.

“Marmato PMPA” means the precious metals purchase agreement among WPMI, Aris Holdings, SARC, Aris Mining Marmato and Aris Mining Panama dated November 5, 2020, as amended on April 15, 2021 by the First Amending Agreement to the Precious Metals Purchase Agreement and as further amended on March 21, 2022 by the Second Amending Agreement to the Precious Metals Purchase Agreement.

“Marmato Technical Report” has the meaning given to such term in “General Provisions – Scientific and Technical Information”.

“MD&A” means Management’s Discussion & Analysis.

“Medoro” means Medoro Resources Ltd., the predecessor of Medoro Resources (B.C.) Inc. that existed under the Business Corporations Act of the Yukon Territory.

“Minesa” means Sociedad Minera de Santander S.A.S.

“NI 43-101” means National Instrument 43-101 – Standards of Disclosure for Mineral Projects issued by the Canadian Securities Administrators.

“NI 51-102” means National Instrument 51-102 – Continuous Disclosure Obligations issued by the Canadian Securities Administrators.

“NI 52-110” means National Instrument 52-110 – Audit Committees issued by the Canadian Securities Administrators.

“NYSE American” means the NYSE American LLC.

“Odyssey” means Odyssey Trust Company.

“Option” means a stock option granted by the Company to purchase Common Shares pursuant to the Company’s amended and restated incentive stock option plan adopted by the Board on March 14, 2023 and approved by the Shareholders on May 11, 2023.

“OTCQX” means the OTCQX® Best Market in the United States.

“PFS” means Prefeasibility Study.

“PMA” has the meaning given to such term in “General Development of the Business – Year Ended December 31, 2023 – Receipt of Marmato Lower Mine License”.

“Preferred Shares” means preferred shares, issuable in series, in the capital of the Company.

“Properties” means the Segovia Operations, the Toroparu Project, the Marmato Mine, the Soto Norte Project and the Juby Project.

“PSUs” means performance share units.

“Qualified Person” has the meaning given to such term under NI 43-101, section 1.1, “Definitions”.

“RTO Warrant Indenture” means the warrant indenture between Caldas Finance Corp. and Odyssey dated December 19, 2019, as supplemented by the supplemental warrant indenture among Aris Gold (now Aris Holdings) and Odyssey dated February 24, 2020, pursuant to which the 2024 Unlisted Warrants were issued.

“SARC” means South American Resources Corp., formerly a wholly-owned subsidiary of the Company, which ceased to be a standalone entity effective as of January 1, 2021 pursuant to a vertical short form amalgamation with Aris Holdings whereby all of the issued and outstanding shares of SARC were cancelled.

“SEC” means the U.S. Securities and Exchange Commission.

“SEDAR+” means the System for Electronic Document Analysis and Retrieval available at www.sedarplus.ca.

“Segovia Operations” means the Segovia operation consisting of four underground gold mines owned by Gran Colombia Gold Segovia Sucursal Colombia (now Aris Mining Segovia), a Colombian branch of AM Segovia, the Maria Dama processing plant, the polymetallic plant, and small-scale mining operations within the Company’s mining titles that are operated by miners under contract to deliver the ore mined to the Company’s Maria Dama plant for processing.

“Segovia Technical Report” has the meaning given to such term in “General Provisions – Scientific and Technical Information”.

“Series 1 Preferred Shares” means the series 1 preferred shares in the capital of the Company, being the first series of the Preferred Shares.

“Series 1 Redemption Price” has the meaning given to such term in “Description of Capital Structure –Preferred Shares – Series 1 Preferred Shares”.

“SGX” means the Singapore Exchange Limited.

“Shareholder” means a holder of Common Shares.

“Soto Norte Project” means the advanced exploration stage underground gold and copper project located in the department of Santander, Colombia operated by Sociedad Minera de Santander S.A.S. (“Minesa”) of which MDC Industry Holding Company LLC owns 80% of a joint venture interest and Aris Holdings holds 20% of a joint venture interest, with the option to acquire a further 30% interest.

“Soto Norte Technical Report” has the meaning given to such term in “General Provisions – Scientific and Technical Information”.

“Special Warrants” means the special warrants issued by Caldas Gold (now Aris Holdings) pursuant to a warrant indenture between the by Caldas Gold and Odyssey dated July 29, 2020, entered into in connection with the 2020 Special Warrant Private Placement, each of which was automatically exercised, for no additional consideration, into one unit on September 28, 2020. Each such unit was comprised of one common share in the capital of Caldas Gold and one 2025 Warrant.

“SRK (U.S.)” means SRK Consulting (U.S.), Inc.

“SRK (UK)” means SRK Consulting (UK), Limited.

“Sustainability Committee” means the sustainability committee of the Company.

“Technical Reports” has the meaning given to such term in “General Provisions – Scientific and Technical Information”.

“Toroparu Project” means the advanced exploration stage gold and copper project comprised of the Toroparu deposit and the Sona Hill deposit located in the Cuyuni-Mazaruni Region of Guyana.

“Toroparu Technical Report” has the meaning given to such term in “General Provisions – Scientific and Technical Information”.

“Toroparu PMPA” means the amended and restated precious metals purchase agreement among WPMI, Goldheart Investment Holdings Ltd. and Sandspring Resources Ltd. (now Aris Mining Guyana Holdings Corp.) dated April 22, 2015.

“TSX” means the Toronto Stock Exchange.

“TSX Trust” means TSX Trust Company.

“Upper Mine” means the Company’s current underground producing mine at the Marmato Mine operating from levels 16 through 21 using conventional cut and fill stoping and includes the transition zone operating on levels 20 and 21 using long hole stoping and drift and fill.

“Warrant” means any warrant of the Company, including the 2024 Warrants, 2025 Warrants, June 2024 Gold X Warrants and August 2024 Gold X Warrants.

“Wheaton” means Wheaton Precious Metals Corp., the parent corporation of WPMI.

“WPMI” means Wheaton Precious Metals International Ltd.

“Zona Baja Mining Title” means the area of approximately 952.6 ha covered by an exploration and mining contract for gold and silver (contrato en virtud de aporte) dated April 4, 1989, entered into between the Empresa Colombiana de Minas (later denominated Empresa Nacional Minera Ltda.) and Dominguez Saieh Compañia Ltda. and later assigned to Mineros Nacionales S.A. (now Aris Mining Marmato), under contract registration number 014-89M and mining title registration number GAFL-11 in the Municipality of Marmato, Caldas Department, Colombia.

1.2Forward-Looking Information

This Annual Information Form may contain or incorporate by reference information that constitutes “forward-looking information” or “forward-looking statements” (collectively, “forward-looking information”) within the meaning of the applicable securities legislation. All statements, other than statements of historical fact, contained or incorporated by reference in this Annual Information Form including, but not limited to, statements related to those items listed below, constitute forward-looking information. Forward-looking information involves known and unknown risks, uncertainties, and other factors that may cause the actual results, performance or achievements of the Company to be materially different from the forward-looking information contained herein. When used in this Annual Information Form, such information uses words such as “aims”, “anticipates”, “assumes”, “believes”, “budget”, “committed”, “continue”, “plans”, “project”, “endeavors”, “ensures”, “estimates”, “expects”, “focus”, “forecasts”, “forward”, “guidance”, “intends”, “likely”, “opportunity”, “outlook”, “pending”, “possible”, “potentially”, “predicts”, “proposed”, “scheduled”, “seeks”, “strives”, “targets” or variations of such words and phrases or statements that certain actions, events or results “can”, “could”, “generally”, “may”, “might”, “should”, “will” or “would” occur or be achieved and any other similar terminology.

The forward-looking information contained herein reflects current expectations regarding future events and operating performance and speaks only as of the date of this Annual Information Form. Generally, forward-looking information involves significant risks and uncertainties; therefore, it should not be read as a guarantee of future performance or results and will not necessarily be an accurate indication of whether or not such results will be achieved. Undue reliance should not be placed on such statements. A number of factors could cause the actual results to differ materially from the results discussed in the forward-looking information, including but not limited to, the factors discussed under “Risk Factors” herein. Although the forward-looking information is based on what management of the Company believes are reasonable assumptions, the Company cannot assure readers that actual results will be consistent with the forward-looking information.

This Annual Information Form includes forward-looking information pertaining to, among other factors, the following:

•the nature of the Company’s mineral reserves and resources;

•the realization of the Company’s mineral reserves and resources;

•the costs, plans and timing related to the development of the Properties;

•plans for increasing the capacity of the Maria Dama processing plant within the Segovia Operations;

•the results of future production, including the 2024 annual production and cost guidance and the Company’s future financial and operating performance generally;

•the expected increase to gold production to 500,000 ounces in 2026;

•supply and demand for gold, silver and copper;

•the ability of the Company to raise capital and limitations on access to sources of financing on competitive terms which are in compliance with existing debt covenants;

•expectations regarding ability to continually add to mineral reserves through acquisitions, exploration and development;

•treatment and legal proceedings under governmental regulatory regimes, labour, environment and tax laws;

•human rights and diversity and other social and environmental matters;

•the ability of the Company to obtain new permits, licenses and extensions of its existing licenses;

•stability of economic conditions and Colombian political conditions, generally;

•capital expenditure programs and the timing and method of financing thereof;

•risk factors affecting the Company’s business; and

•our strategy, plans and goals, including our proposed exploration, development, construction, permitting and operating plans and priorities, related timelines and schedules.

Forward-looking information is based upon a number of estimates and assumptions that, while considered reasonable by the Company as of the date of such statements, are inherently subject to significant business, economic and competitive uncertainties and contingencies. With respect to forward-looking information contained herein, the assumptions made by the Company include but are not limited to:

•that regulatory licenses, permits and authorizations will be maintained;

•future prices for gold, silver and copper;

•future currency exchange and interest rates;

•future prices for natural gas, fuel, oil, electricity and other key supplies or inputs;

•the Company’s ability to generate sufficient cash flow from operations and capital markets to meet its future obligations and continue as a going concern;

•there not being any significant disruption affecting operations, whether due to labour disruptions, supply disruptions, power disruptions, damage to equipment or otherwise;

•the Company’s ability to obtain the necessary permits, including but not limited to, environmental and mining permits to properly develop, operate and expand current and future projects;

•political developments in any jurisdiction in which the Company operates being consistent with the Company’s current expectations;

•the validity of its existing title to property and mineral claims;

•experts retained by the Company, technical and otherwise, being appropriately reputable and qualified;

•the viability, economically and otherwise, of maintaining and developing the Segovia Operations;

•the viability, economically and otherwise, of maintaining current operations at the Marmato Upper Mine and constructing the Marmato Lower Mine;

•the viability, economically and otherwise, of developing the Soto Norte Project;

•the viability, economically and otherwise, of developing the Toroparu Project;

•the viability, economically and otherwise, of exploring and developing the Juby Project;

•the Company’s ability to obtain qualified staff and equipment in a timely and cost-efficient manner to meet the Company’s demand; and

•the impact of acquisitions, dispositions, suspensions or delays on the Company’s business.

Forward-looking information is based on current expectations, estimates and projections that involve a number of risks which could cause the actual results to vary and, in some instances, to differ materially from those described in the forward-looking information contained in this Annual Information Form. These material risks include, but are not limited to:

•local environmental and regulatory requirements and delays in obtaining required environmental and other licenses, including delays associated with local communities and indigenous peoples;

•changes in national and local government legislation, taxation, controls, regulations and political or economic developments in Canada, Colombia, or Guyana, or other countries in which the Company does business or may carry on business in the future;

•uncertainties and hazards associated with gold exploration, development and mining, including but not limited to, environmental hazards, industrial accidents, unusual or unexpected formations, pressures, cave-ins, flooding and gold doré losses and blockades and operational stoppages;

•risks associated with tailings management, including at the Segovia Operations and the Marmato Mine;

•economic and political risks associated with operating in foreign jurisdictions, including emerging country risks, exchange controls, expropriation risks, political instability and corruption;

•risks associated with capital and operating cost estimates;

•dependence of operations on construction and maintenance of adequate infrastructure;

•fluctuations in foreign exchange or interest rates and stock market volatility;

•operational and technical problems;

•the Company’s ability to maintain good relations with employees and labour unions;

•reliance on key personnel;

•litigation risks;

•competition for, among other things, capital, and the acquisition of mining properties, undeveloped lands and skilled personnel;

•uncertainties relating to title to property and mineral resource and mineral reserve estimates;

•risks associated with acquisitions and integration;

•risks associated with the Company’s ability to meet its financial obligations as they fall due;

•volatility in the price of gold, silver, copper or certain other commodities relevant to the Company’s operations, such as diesel fuel and electricity;

•risks that the Company’s actual production may be less than is currently estimated;

•risks associated with servicing the Company’s indebtedness and additional funding requirements for exploration, operational programs or expansion properties, as well as to complete any large scale development projects;

•risks associated with general economic factors, including ongoing economic conditions, investor sentiment, market accessibility and market perception;

•risks associated with secured debt, including the ability of secured creditors to enforce any judgments in an Insolvency Proceeding, any fluctuations in the value of collateral securing debt and interpretation and enforcement of bankruptcy and insolvency laws of Canada and Colombia;

•changes in the accessibility and availability of insurance for mining operations and property;

•environmental, sustainability and governance practices and performance;

•risks associated with climate change;

•risks associated with the reliance on experts outside of Canada;

•costs associated with the decommissioning of the Company’s mines and exploration properties;

•pandemics, epidemics and public health crises;

•potential conflicts of interest among the directors of the Company;

•uncertainties relating to the enforcement of civil labilities and service of process outside of Canada;

•risks associated with keeping adequate cyber-security measures;

•risks associated with operating a joint venture;

•volatility of the Company’s stock price;

•the Company’s obligations as a public company;

•the Company’s ability to pay dividends in the future; and

•other factors further discussed under “Risk Factors”.

Readers are cautioned that the foregoing lists of factors are not exhaustive. There can be no assurance that forward-looking information will prove to be accurate. Forward-looking information is provided for the purpose of providing information about management’s expectations and plans relating to the future. The forward-looking information included in this Annual Information Form is qualified by these cautionary statements and those made in the Company’s other filings with the securities regulators of Canada including, but not limited to, the cautionary statements made in the “Risks and Uncertainties” section of the Company’s most recently filed MD&A.

The forward-looking information contained herein is made as of the date of this Annual Information Form and the Company assumes no obligations to update or revise it to reflect new events or circumstances, other than as required by applicable securities laws.

This Annual Information Form contains information that may constitute future-orientated financial information or financial outlook information (collectively, “FOFI”) about the Company’s prospective financial performance, financial position or cash flows, all of which is subject to the same assumptions, risk factors, limitations and qualifications as set forth above. Readers are cautioned that the assumptions used in the preparation of such information, although considered reasonable at the time of preparation, may prove to be imprecise or inaccurate and, as such, undue reliance should not be placed on FOFI. The Company’s actual results, performance and achievements could differ materially from those expressed in, or implied by, FOFI. The Company has included FOFI in order to provide readers with a more complete perspective on the Company’s future operations and management’s current expectations relating to the Company’s future performance. Readers are cautioned that such information may not be appropriate for other purposes. FOFI contained herein was made as of the date of this Annual Information Form. Unless required by applicable laws, the Company does not undertake any obligation to publicly update or revise any FOFI statements, whether as a result of new information, future events or otherwise.

1.3General Matters

Unless otherwise indicated, all information in this Annual Information Form is as of December 31, 2023 and relates, in part, to a period of time prior to the change of the Company’s management and the Company’s Board on September 26, 2022 (as described below under “General Development of the Business – Year Ended December 31, 2022 – Aris Mining Transaction”).

In this Annual Information Form, unless otherwise indicated, all dollar amounts are expressed in U.S. dollars and references to “$” or “US$” are to U.S. dollars. References to “C$” are to Canadian dollars. All financial information in this Annual Information Form has been prepared in accordance with IFRS unless otherwise expressly indicated.

1.3.1Exchange Rate Information

1.3.1.1United States Exchange Rate Information

The following table sets out the rate of exchange in effect at the end of each of the periods set out immediately below for one Canadian dollar in U.S. dollars; the high and low rate of exchange during those periods; and the average rate of exchange for those periods, each based on the daily rate of exchange as published on the Bank of Canada’s website. On March 5, 2024, the last business day preceding the date of this Annual Information Form, the exchange rate for one Canadian dollar in U.S. dollars, as published by the Bank of Canada, was C$1.00 = US$0.7363.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

High |

Low |

Average |

End of Period |

| Year ended December 31 |

|

|

|

|

| 2023 |

0.7617 |

0.7207 |

0.7410 |

0.7561 |

| 2022 |

0.8031 |

0.7217 |

0.7692 |

0.7383 |

| 2021 |

0.8306 |

0.7727 |

0.7980 |

0.7888 |

1.3.1.2Colombia Exchange Rate Information

The following table sets out the rate of exchange in effect at the end of each of the periods set out immediately below for one U.S. dollar in COP; the high and low rate of exchange during those periods; and the average rate of exchange for those periods, each based on the rates as published on the Bank of the Republic of Colombia’s website. On March 5, 2024, the last business day preceding the date of this Annual Information Form, the exchange rate for one US dollar in COP, as published by the Bank of the Republic of Colombia, was US$1.00 = 3,945.32COP.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

High |

Low |

Average |

End of Period |

| Year ended December 31 |

|

|

|

|

| 2023 |

4,989.58 |

3,822.05 |

4,330.14 |

3,822.05 |

| 2022 |

5,061.21 |

3,706.95 |

4,257.12 |

4,810.20 |

| 2021 |

4,023.68 |

3,420.78 |

3,743.09 |

3,981.16 |

1.3.2Special Note to Reader

References in this Annual Information Form to “GCM” refer to the Company prior to the completion of the Aris Mining Transaction and references to “Aris Mining” refer to the Company following the completion of the Aris Mining Transaction.

1.4Non-IFRS and Other Financial Measures

This Annual Information Form includes certain non-IFRS measures, namely: cash costs; cash costs per ounce (oz) sold; AISC; AISC per oz sold; EBITDA and sustaining and non-sustaining capital expenditures. Such measures are “non-GAAP financial measures”, “non-GAAP ratios”, “supplementary financial measures” or “capital management measures” (as such terms are defined in National Instrument 52-112 – Non-GAAP and Other Financial Measures Disclosure).

Aris Mining believes these measures, while not a substitute for measures of performance prepared in accordance with IFRS, provide investors an improved ability to evaluate the underlying performance of the Company. These measures do not have any standardized meaning prescribed under IFRS, and therefore may not be comparable to the information provided by other issuers.

Please see the information under the heading “Non-IFRS Measures” in the Company’s MD&A for the year ended December 31, 2023, which section is incorporated by reference in this Annual Information Form, for a description of the non-IFRS financial measures noted above. The MD&A may be found on the Company’s SEDAR+ profile at www.sedarplus.ca and in its filings with the SEC at www.sec.gov.

1.5Scientific and Technical Information

Unless otherwise stated, the technical disclosure in this Annual Information Form is derived from and in some instances is an extract from, the technical reports (collectively, the “Technical Reports”) prepared for those properties in accordance with NI 43-101. The summaries of the Technical Reports contained in this Annual Information Form do not purport to be complete summaries of the Technical Reports, are subject to all the assumptions, qualifications and procedures set out in the Technical Reports and are qualified in their entirety with reference to the full text of the Technical Reports. Each of the authors of the Technical Reports is a “Qualified Person”, as such term is defined in NI 43-101 and each of the authors of the Technical Reports is independent of the Company within the meaning of NI 43-101 other than Robert Anderson P.Eng., the Process Manager of Minesa, Pamela De Mark, P.Geo., the SVP, Geology and Exploration for the Company and Inivaldo Diaz, CP, the VP, Technical Services of the Company’s Colombian operations.

The Technical Reports are as follows:

1.The technical report relating to the Segovia Operations having an effective date of September 30, 2023 entitled “NI 43-101 Technical Report for the Segovia Operations, Antioquia, Colombia” (the “Segovia Technical Report”) prepared by Pamela De Mark, P.Geo., Inivaldo Diaz, CP and Cornelius Lourens, FAusIMM, and dated and filed December 6, 2023.

2.The technical report, relating to the Marmato Mine having an effective date of June 30, 2022 entitled “Technical Report for the Marmato Gold Mine, Caldas Department, Colombia, Pre-Feasibility Study of the Lower Mine Expansion Project” (the “Marmato Technical Report”) prepared by Ben Parsons, MAusIMM (CP), Anton Chan, P.Eng., Brian Prosser, PE, SME-RM, Joanna Poeck, SME-RM, MMSAQP, Eric J. Olin, SME-RM, MAusIMM, Fredy Henriquez, SME-RM, ISRM, David Hoekstra, PE, NCEES, SME-RM, Mark Allan Willow, CEM, SME-RM, Vladimir Ugorets, MMSA, Colleen Crystal, PE, GE, Kevin Gunesch, B.Eng., PE, Tommaso Roberto Raponi, P.Eng., David Bird, PG, SME-RM and Pamela De Mark, P.Geo., and dated and filed on November 23, 2022.

3.The technical report relating to the Soto Norte Project having an effective date of January 1, 2021 entitled “NI 43-101 Technical Report Feasibility Study of the Soto Norte Project, Santander, Colombia” (the “Soto Norte Technical Report”) prepared by Ben Parsons, MSc, MAusIMM (CP), Chris Bray, BEng, MAusIMM (CP), Robert Anderson P.Eng., Dr John Willis PhD, BE (MET), MAusIMM (CP), and Dr Henri Sangam, Ph.D., P.Eng., and dated and filed on March 21, 2022.

4.The technical report relating to the Toroparu Project having an effective date of February 10, 2023, entitled “Updated Mineral Resource Estimate, NI 43-101 Technical Report for the Toroparu Project, Cuyuni-Mazaruni, Guyana” (the “Toroparu Technical Report”) prepared by Ekow Taylor, FAusIMM(CP), Maria Muñoz, MAIG and Karl Haase, P.Eng. and dated and filed on March 31, 2023.

All of the Technical Reports are available for download on the Company’s website at www.aris-mining.com and in its filings with the SEC at www.sec.gov. All Technical Reports other than the Soto Norte Technical Report are available for download on the Company’s profile on SEDAR+ at www.sedarplus.ca. The Soto Norte Technical Report is available for download on the SEDAR+ profile of Aris Holdings, a subsidiary of the Company, at www.sedarplus.ca.

1.6Cautionary Note to U.S. Investors Concerning Estimates of Mineral Reserves and Mineral Resources

This Annual Information Form has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ in certain material respects from the disclosure requirements promulgated by the SEC. For example, the terms “mineral reserve”, “proven mineral reserve”, “probable mineral reserve”, “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are Canadian mining terms as defined in accordance with Canadian National Instrument 43-101 Standards of Disclosure for Mineral Projects and the CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. These definitions differ from the definitions in the disclosure requirements promulgated by the SEC. Accordingly, information contained in this Annual Information Form may not be comparable to similar information made public by U.S. companies reporting pursuant to SEC disclosure requirements.

ITEM 2.CORPORATE STRUCTURE

2.1Name, Address and Incorporation

The full corporate name of the Company is Aris Mining Corporation (formerly, GCM Mining Corp.). The head office of the Company is located at 425 Hornby Street, Vancouver, British Columbia V6C 2Y2 and its registered office is located at Suite 2900, 550 Burrard Street, Vancouver, British Columbia V6C 0A3.

The Company was incorporated under the British Columbia Company Act on May 27, 1982 under the name “Impala Resources Ltd.” On August 26, 1987, Impala Resources Ltd. changed its name to “International Impala Resources Ltd.” On November 13, 1992, International Impala Resources Ltd. changed its name to “Tapestry Ventures Ltd.” On December 22, 2004, Tapestry Ventures Ltd. changed its name to “Tapestry Resource Corp.” On August 13, 2010, in connection with an arm’s length reverse takeover, Tapestry Resource Corp. acquired all of the issued and outstanding securities of Gran Colombia Gold, S.A. and the Company changed its name from “Tapestry Resource Corp.” to “Gran Colombia Gold Corp.”

Effective June 10, 2011, Gran Colombia Gold Corp. completed a merger with Medoro, a TSX listed company. The combined company was continued under the BCBA under the name “Gran Colombia Gold Corp.” As part of the Company’s efforts to streamline its corporate structure, effective January 1, 2017, the Company completed a vertical short form amalgamation with its wholly-owned subsidiary, Medoro Resources (B.C.) Ltd. On November 29, 2021, the Company changed its name from “Gran Colombia Gold Corp.” to “GCM Mining Corp.”

On September 26, 2022, GCM completed the Aris Mining Transaction whereby, among other transactions, the Company acquired all of the issued and outstanding common shares of Aris Gold not already owned by GCM, resulting in Aris Gold becoming a wholly-owned subsidiary of the Company, and amended its articles to change its name to “Aris Mining Corporation and add a new series of Preferred Shares, being the Series 1 Preferred Shares. See “General Development of the Business – Year Ended December 31, 2022 – Aris Mining Transaction” for further information.

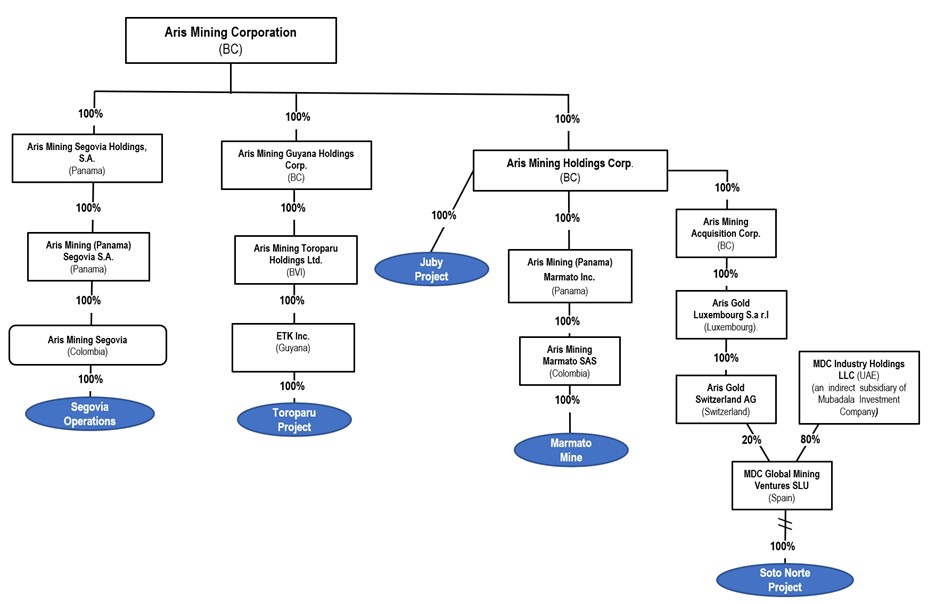

2.2Intercorporate Relationships

The following chart illustrates the Company’s material subsidiaries, together with the jurisdiction of incorporation of each company and the percentage of voting securities beneficially owned or over which control or direction is exercised, directly or indirectly, by the Company as at the date hereof.

ITEM 3.GENERAL DEVELOPMENT OF THE BUSINESS

3.1Year Ended December 31, 2021

Aris Gold Transaction

On February 4, 2021, upon satisfaction of certain escrow release conditions, the 7,555,556 Caldas Gold subscription receipts which were acquired by the Company on December 3, 2020 were converted into 7,555,556 subscription receipt units of Aris Gold, resulting in the issuance of 7,555,556 common shares of Caldas Gold (now Aris Holdings) and 7,555,556 2025 Warrants to the Company (the “Aris Gold Transaction”).

In connection with the closing of the Aris Gold Transaction, Caldas Gold changed its name to Aris Gold Corporation.

Also, in connection with the closing of the Aris Gold Transaction, six out of the eight members of the former board of directors of Caldas Gold resigned. Messrs. Serafino Iacono and the late Hernan Martinez remained on the new board of directors of Aris Gold, as nominees of the Company. As a result of the completion of the Aris Gold Transaction, Serafino Iacono, the former Chief Executive Officer of Caldas Gold; Lombardo Paredes, the former President of Caldas Gold; Michael Davies, the former Chief Financial Officer of Caldas Gold; and Amanda Fullerton, the former VP Legal and Corporate Secretary of Caldas Gold, were replaced by a new management team and the Company no longer controlled a majority of Aris Gold’s undiluted share capital.

2021 Gold X Arrangement

On June 4 2021, the Company announced that it had closed the Gold X Arrangement following shareholder approval for both Gold X (now named Aris Mining Guyana Holdings Corp.) and the Company.

Under the terms of the Gold X Arrangement, all of the issued and outstanding Gold X Shares were acquired by GCM Mining in exchange for Common Shares on the basis of 0.6948 of a Common Share for each Gold X Share (the “Gold X Exchange Ratio”) and Gold X became a direct, wholly-owned subsidiary of the Company.

Pursuant to the Gold X Arrangement, all stock options of Gold X were accelerated and exercised prior to June 4, 2021, or, if not exercised, were terminated on June 4, 2021 without payment of any consideration to the holders of such terminated options. All Gold X Warrants outstanding immediately prior to June 4, 2021 remained outstanding, subject to the applicable expiry date of each such warrant outstanding and each Gold X Warrant entitles the holder thereof to receive, upon exercise, Common Shares in accordance with the Gold X Exchange Ratio, on and subject to the terms and conditions of such securities.

Following completion of the Gold X Arrangement, the Gold X Shares were delisted from the TSX Venture Exchange and Gold X ceased to be a reporting issuer.

2026 Unsecured Notes

On August 9, 2021, the Company closed an offering of US$300 million in 2026 Unsecured Notes with proceeds from the offering to be used (i) to fund the development of the Toroparu Project, (ii) to prepay the remaining 2024 Gold-Linked Notes and (iii) for general corporate purposes. See “Description of Capital Structure – Notes – 2026 Unsecured Notes” for further information.

Name Change

On November 29, 2021, the Company changed its name from Gran Colombia Gold Corp. to GCM Mining Corp. There was no change to the Company’s trading symbols for its Common Shares and Warrants.

3.2Year Ended December 31, 2022

2022 Investment in Aris Gold

On April 12, 2022, the Company subscribed for a US$35 million convertible senior unsecured debenture (the “Aris Debenture”) which was issued by a wholly-owned subsidiary of Aris Gold. The proceeds of the Aris Debenture were used by Aris Gold to pay a portion of the purchase price for the acquisition of a 20% joint venture interest in the Soto Norte Project. In connection with the terms of the Aris Mining Transaction, the Aris Debenture was repaid in full by Aris Gold on September 26, 2022.

Aris Mining Transaction

On September 26, 2022, the Company (i) acquired all of the issued and outstanding common shares of Aris Gold not already owned by the Company, resulting in Aris Gold becoming a wholly-owned subsidiary of the Company (the “Aris Mining Transaction”), with the former shareholders of Aris Gold (other than Caldas Holding Corp., a wholly-owned subsidiary of the Company), receiving 0.5 of a Common Share for every one Aris Gold share held (the “Exchange Ratio”) and (ii) issued a new series of Preferred Shares, being the Series 1 Preferred Shares. Accordingly, the Company issued (i) 38,420,690 Common Shares to the former shareholders of Aris Gold (other than Caldas Holding Corp.) in exchange for all of the Aris Gold common shares then held by such shareholders and (ii) issued 1,000 Series 1 Preferred Shares to Caldas Holding Corp. (now Aris Mining (British Columbia) Corp.), in consideration for all of the Aris Gold common shares then held by such shareholder. Additionally, each Aris Gold option, warrant, PSU and DSU outstanding immediately prior to the closing of the Aris Mining Transaction was adjusted in accordance with their terms. All outstanding Aris Gold options and warrants became exercisable for Common Shares based on the Exchange Ratio in lieu of any Aris Gold shares such securities would otherwise be exercisable for. Immediately following the completion of the Aris Mining Transaction, the Company changed its name to “Aris Mining Corporation”.

On September 28, 2022, the Common Shares listed on the TSX under the symbol “GCM” commenced trading on the TSX under the symbol “ARIS”. Concurrently, the 2024 Warrants listed on the TSX under the symbol GCM.WT.B commenced trading on the TSX under the symbol “ARIS.WT.B” and the 2025 Warrants listed on the TSX under the symbol “ARIS.WT” commenced trading on the TSX under the symbol “ARIS.WT.A”.

In connection with the Aris Mining Transaction, the majority of the GCM board of directors and the entire GCM management team resigned and the Aris Gold management team and board were appointed. As of the date hereof, the Aris Mining Board and management of the Company consists of the following individuals (collectively, the “Aris Mining Board and Management”):

|

|

|

|

|

|

|

|

|

|

|

|

| Board of Directors |

|

Executive Team |

|

| Ian Telfer |

Chair |

Neil Woodyer |

CEO |

| Daniela Cambone |

Director |

Doug Bowlby |

EVP and CFO |

| David Garofalo |

Director |

Richard Thomas |

COO |

| Serafino Iacono |

Director |

Alejandro Jimenez |

Country Manager, Colombia |

| Peter Marrone |

Director |

Ashley Baker |

General Counsel and Corp. Secretary |

| Attie Roux |

Director |

Pamela De Mark |

SVP, Geology and Exploration |

| Mónica de Greiff |

Director |

Giovanna Romero |

SVP, Corporate Affairs and Sustainability |

| Gonzalo Hernández Jiménez |

Director |

Robert Eckford |

Head of Finance |

| Germán Arce Zapata |

Director |

|

|

| Neil Woodyer |

Director |

|

|

See “Directors and Officers” for information about the Aris Mining Board and Management.

3.3Year Ended December 31, 2023

Receipt of Marmato Lower Mine License

On July 12, 2023, the Company announced it received approval from the Corporación Autónoma Regional del Caldas (“Corpocaldas”), a regional environmental authority in Colombia, of the Environmental Management Plan (“PMA”) which permits the development of the Marmato Lower Mine. The new underground mine will provide access to the wider porphyry mineralization below the current Upper Mine, which allows for bulk mining methods in the Lower Mine.

NYSE American Listing

Trading of the Common Shares on the NYSE American commenced on September 14, 2023 under the symbol “ARMN”, with trading on the OTCQX ceasing concurrent with the NYSE American listing.

Updates to the Segovia Operation’s Mineral Resource and Mineral Reserve Estimates

On November 2, 2023, the Company announced updated mineral resource estimates for its Segovia Operations effective September 30, 2023. On November 27, 2023, the Company further announced updated mineral reserve estimates for its Segovia Operations effective September 30, 2023, and that it is increasing the capacity of the Maria Dama processing plant within the Segovia Operations from 2,000 to 3,000 tonnes per day (tpd). See “Material Mineral Properties – Segovia Operations” for further information.

3.4Subsequent Developments

Appointment of Two Independent Directors

On February 14, 2024, the Company announced the appointment of Mr. Gonzalo Hernández Jiménez and Mr. Germán Arce Zapata as independent directors of the Company. Mr. Hernández was appointed to the Sustainability Committee, and the Audit Committee effective March 6, 2024, and Mr. Arce was appointed to the Compensation Committee. The two appointments follow the unexpected passing of Mr. Hernan Martinez in late 2023, a director of the Company and its predecessors since 2011.

ITEM 4.DESCRIPTION OF THE BUSINESS

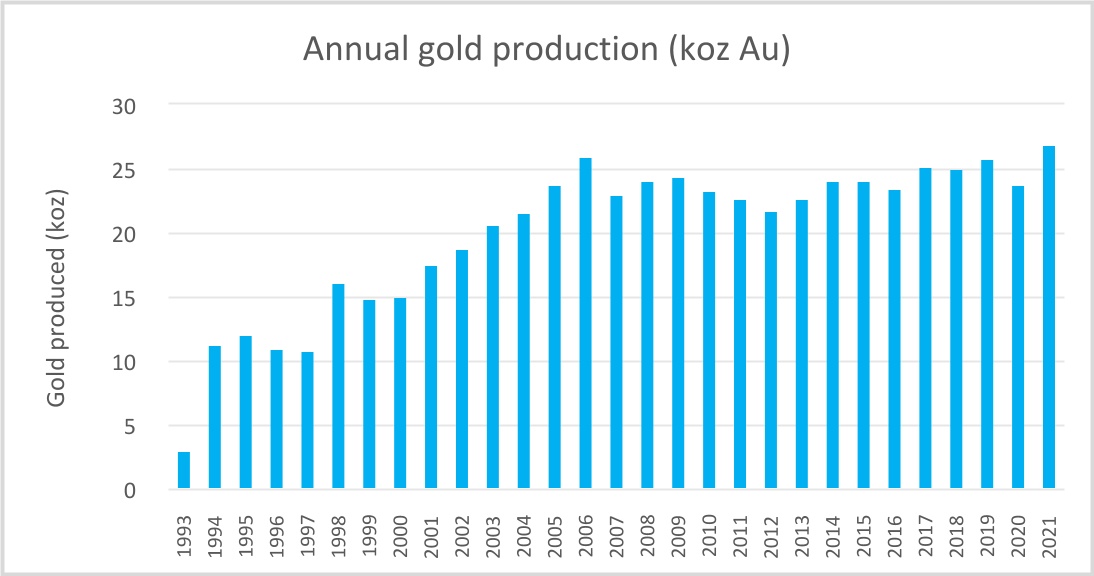

Aris Mining is a gold producer in the Americas with an attractive blend of current production, exploration, and growth projects. The Company operates two mines in Colombia, the Segovia Operations and the Upper Mine, known for their high-grade deposits, which produced 226,000 ounces of gold in 2023. With expansion projects in progress, the Segovia Operations and the Marmato Mine aim to produce a combined 500,000 ounces of gold in 2026. Aris Mining also operates and is 20% owner of the

Soto Note Project joint venture, where environmental licensing is advancing to develop a new underground gold, silver and copper mine. In Guyana, Aris Mining is advancing the Toroparu Project, a gold/copper project. Aris Mining is committed to pursuing acquisitions and other growth opportunities to unlock value through scale and diversification.

Aris Mining promotes the formalization of small-scall mining as this process enables all miners to operate in a legal, safe and responsible manner that protects both the small-scale miners and the environment.

The Company’s corporate offices are located in Vancouver, Canada and in Bogotá, Colombia with additional offices in Medellín, Colombia and in Georgetown, Guyana.

4.1Principal Products

The Company’s principal product is gold doré. The Company’s revenue is primarily generated from the sale of gold, in doré form.

The gold market is relatively deep and liquid and is traded on a worldwide basis. As a result, the Company is not dependent on a particular purchaser with regard to the sale of gold. The demand for gold is primarily for jewellery fabrication purposes and bullion investment, and the price of gold is generally quoted in US dollars.

The use of gold as a store of value (principally due to the historical tendency of gold to retain its value in relative terms against basic goods and in times of inflation and monetary crisis) and the large quantities of gold held for this purpose in relation to annual mine production, has meant that historically, the potential total supply of gold has been far greater than demand. Thus, while current supply and demand plays some part in determining the price of gold, this does not occur to the same extent as with other commodities. Gold prices are significantly affected by macro-economic factors such as expectations of U.S. inflation, U.S. interest rates, exchange rates, changes in reserve policy by central banks and global or regional political and economic crises. Due to these factors, the gold price fluctuates continually, and such fluctuations are beyond the Company’s control.

4.2Employees

As at the date of this Annual Information Form, the Company and its subsidiaries had 16 employees at its corporate offices, approximately 3,405 employees in Colombia and approximately 64 employees in Guyana who are employed indirectly by ETK.

4.3Local Communities and Artisanal and Small Scale Miners

The Company understands the importance of local community engagement and collaboration with artisanal and small-scale miners. With local communities, we have implemented a constant and regular stakeholder engagement process to ensure our social investment programs are structured in a way that benefits all stakeholders and that are aligned with the local, regional, and national Colombian development plans.

The Company is also committed to the local procurement of labor, goods and services, and provides training programs in a variety of skilled areas to improve the quality of life of local community members. The Company implements a materiality analysis every two years with its stakeholders. Materiality analyses serve as an opportunity for stakeholders and management to discuss the economic, social, and environmental impacts of the Company’s operations and identify and address those issues most impacted by Aris Mining and its operations.

The Company is also committed to developing artisanal and small-scale miner programs in Segovia, Marmato and Soto Norte. In 2023, the Company entered into an agreement to form a new partnership with approximately 260 artisanal and small-scale miners to deliver high-grade material from Level 16 of the currently operating Marmato Upper Mine. To date, there are more than 3,000 miners formalized in Segovia through 66 operating contracts. With these agreements, the Company recognizes that local artisanal, ancestral and traditional mining are an integral part of the mining process and promotes the coexistence of these processes with industry best practices in order to achieve the appropriate technical, legal and environmental conditions required to reach the environmental and social sustainability goals of formalization.

The Company has developed and conducts training programs for artisanal and small-scale miners at the Segovia Operations and the Marmato Mine to help foster a culture that prioritizes health and safety and environmental stewardship. The Company also provides artisanal and small-scale miners training in accounting, compliance and business management.

4.4Specialized Skill and Knowledge

Operations in the gold exploration and development industry mean that the Company requires professionals with skills and knowledge in diverse fields of expertise. In the course of its exploration, development and operations, the Company requires the expertise of geologists, engineers and metallurgists and employs such persons directly and indirectly. To date, the Company has not experienced any difficulties in hiring and retaining the professionals and experts it requires for its operations and has found that it can locate and retain such employees and consultants and believes it will continue to be able to do so. See “Risk Factors – Shortage of Experienced Personnel.”

4.5Competitive Conditions

The precious metal mineral exploration and mining business is a competitive business. The Company competes with numerous other companies and individuals in the search for and the acquisition of attractive precious metal mineral assets. The Company’s ability to acquire precious metal mineral assets in the future will depend not only on its ability to develop its present properties, but also on its ability to select and acquire suitable producing properties or prospects for precious metal development or mineral exploration. See “Risk Factors – Competition”.

4.6Foreign Operations

The Company’s material property interests are located in Colombia and Guyana and the Company also has property interests in Canada and legacy interests and claims in Venezuela. The Company’s activities in foreign jurisdictions may be affected by possible political or economic instability and government regulations relating to the mining industry and foreign investors therein. The risks created by this potential political and economic instability include, but are not limited to, extreme fluctuations in currency exchange rates and high rates of inflation. Changes in exploration or investment policies or shifts in political attitude in such jurisdictions may adversely affect the Company’s business. Mineral exploration and mining activities may be affected in varying degrees by government regulations with respect to restrictions on production, price controls, export controls, income taxes, expropriation of property, maintenance of property, environmental legislation, land use, land claims of local people, water use and property safety. The effect of these factors on the Company cannot be accurately predicted. Further information is provided under the heading entitled “Risk Factors”.

4.7Business Cycles

The mining business is subject to mineral price cycles. The marketability of minerals and mineral concentrates is also affected by worldwide economic cycles. The Company’s operations are related and sensitive to the market price of gold and, to a lesser degree, to other metal prices such as silver. Metal prices fluctuate widely and are affected by numerous factors such as global supply, demand, inflation, exchange rates, interest rates, forward selling by producers, central bank sales and purchases, production, global or regional political, economic or financial situations and other factors beyond the control of the Company.

4.8Environmental Protection

The mining industry in Colombia, Guyana and Canada is subject to environmental laws and regulations under various governmental legislation relating to the protection of the environment, including requirements for closure and reclamation of mining properties. Compliance with such obligations and requirements can mean significant expenditures and may constrain the Company’s operations in the country. Breach of environmental obligations could lead to suspension or revocation of requisite environmental licenses and permits, civil liability for damages caused, and possible fines and penalties, all of which may significantly and negatively impact the Company’s position and competitiveness. See “Risk Factors – Environmental Laws”.

In prior years, the Company was subject to certain environmental charges assessed by the regional environmental authority in Segovia, known as Corantioquia, in connection with the discharges of effluents from the Maria Dama plant into the nearby river basin. As a result of continuing efforts to minimize these discharges, as of July 2017 the Company had virtually eliminated all discharges from the Maria Dama plant. Through continued strategic investments, including construction of the tailings storage facility and a STARI water treatment plant, the Company strives to continue to operate with zero discharges for the rest of the mine’s life.

The Company holds a formally accepted amended PMA for the El Silencio, Providencia, and Sandra K mines at the Segovia Operations which was approved on February 22, 2019, with a renewal period of five years, as well as an approval granted on November 25, 2019, both of which jointly approve the PMA for the Segovia Operations, with an expiry in December 2024. Aris Mining is currently updating the environmental plan for renewal. The Company expects the renewal to be received in the

normal course. The PMA relating to the Carla mine is authorized an in force for the useful life of the Property. The environmental assessments included the measures and activities proposed by the Company for the control and mitigation of environmental risks and impacts based on technical studies, thus providing a reliable estimate of the environmental costs for the operation of the mining projects.

Other environmental permits related to water concessions, discharge permits, forest exploitation and water channel occupancy have also been updated and filed before Corantioquia, with such minor permits requested and granted on a rolling basis. The filing of such permits does not affect the PMA.

Mining at Marmato predates the regulatory requirements to prepare an environmental impact assessment as part of the permitting process. The Upper Mine operations are authorized through the approval of the PMA on October 29, 2001, covering environmental studies and management procedures for the Upper Mine. The construction of the Lower Mine expansion Project is authorized through the approval of the Lower Mine PMA on July 12, 2023.

4.9Social and Environmental Policies

The Company recognizes the importance of achieving its ESG objectives and the impact of successful sustainability and corporate responsibility programs on creating shared value for its stakeholders. The Company has established guidelines and management systems to comply with the laws and regulations of Colombia, Guyana and Canada and other countries in which it may operate. The Company is committed to upholding best practices and international standards in its approach to sustainability and has established management systems and policies to govern the way in which it operates as a responsible mining company. The Company’s approach and commitments are reflected across the Company and manifested in the formation of the Sustainability Committee, a Technical Committee which is comprised of members of the Board, management and the in-country teams, together with certain of the Company’s policies including the Environmental and Corporate Social Responsibility Policy, the Sustainability Policy, the Business Conduct and Ethics Policy, the Anti-Bribery and Anti-Corruption Policy, the Diversity Policy, the Anti-Discrimination Policy and the Supplier Code of Conduct and the Human Rights Declaration of the Company, each of which was adopted by the Board and is available on the Company’s website at www.aris-mining.com.

4.9.1The Environment

The Company protects the environment by managing the environmental risks associated with its operations. Further, the Company endeavours to improve the environment of our host communities by investing in programs that will reduce emissions, improve water and air quality and enhance biodiversity. The Company has designed management systems to manage risks and, wherever feasible, contribute positively to environmental stewardship and to sustainable community development.

The Company has instituted social awareness and responsibility programs, specific to the areas in which it operates, which are carried out by sustainability teams in Colombia. The Company’s corporate affairs and sustainability department visits the various municipalities in which it operates to identify the specific needs and formulate programs specific to those municipalities.

In August of 2012, the Company joined the UNIDO (United Nations for Industrial Development Organization) Global Mercury Project, which began in 2002 to address the environmental issue of mercury contamination from artisanal and small-scale gold mining introduced to the environment through the use of traditional mining methods. The objectives of the project were to introduce cleaner technologies, train miners, develop regulatory capacities within national and regional governments, conduct environmental and health assessments and build capacity within participating countries to continue monitoring mercury pollution after projects finish.

The Company is also a member of the Colombian Mining Association (Asociación Colombiana de Minería, or the “ACM”) whose fundamental objective is the promotion of responsible mining that contributes to Colombia’s sustainable and equitable development. Companies linked with the ACM are committed to Colombia’s economic and social development and in particular, that of the communities where mining operations take place. In this respect, the Company seeks to incorporate internationally recognized best practices within the framework of responsible and sustainable mining. The Company also entered into an agreement in February 2013 with several other mining companies with operations in Colombia in an effort to improve the living conditions of those who are in a state of extreme poverty in Colombia.

The Company partakes in several flagship environmental initiatives. Waste from the mining activity at the Segovia Operations, prior to disposal at the tailings facility, is reprocessed at a polymetallic plant to remove additional contaminants before final disposal at the tailings facilities. This has resulted in zinc and lead being extracted for sale, which ultimately benefits the

environment as it is not included in the materials deposited at the tailings facilities, while generating additional income for the Company.

The environmental initiatives have also focused on biodiversity and water for the future and in partnership with local organizations, the Company developed an extensive reforestation program to recover areas affected by illegal miners.

The Company has also instated a program to recover closed tailings facilities at the Segovia Operation. By the end of 2023, the Company launched a cultural and sports park, the “Colibrí Ecopark”, in former tailings facilities areas. This park stands as one of Aris Mining's environmental and social projects, serving as a model for the management and use of tailings storage facilities. It is a part of the initial phase of the Segovia Tailings Deposit Master Plan, recognized as a success story in Colombia and Latin America for its proper solid waste management. Covering an area of 9,200 m2, this Ecopark features a sandy soccer field, a cycling route, a jogging track, a playground, an outdoor gym, a stage with seating for 300 people, and parking facilities.

4.9.2The Community

During 2023, the Company continued to promote initiatives that help develop human, social and economic growth in a way that benefits people, communities and businesses, making positive, mutually beneficial and lasting contributions to artisanal and small-scale miners, infrastructure, education, social and economic development, biodiversity and water for the future, health and wellness, and diversity and inclusion programs. Additionally, through the Company’s small-scale miners supply chain initiative, the Company has executed numerous operations contracts with small-scale miners over the last ten years, resulting in the formalization of small-scale miners and a reduction in the use of mercury by small-scale miners.

The education and leadership initiatives benefited approximately 900 students through education and training in fully bilingual and sponsored education at the la Salada School located at Segovia.

The Company has also invested in infrastructure initiatives by improving local roads, providing hospital endowment, and improving education facilities, among others, which ultimately benefits more than 30,000 people in Segovia and Marmato.

Aris Mining has also sponsored artisanal and small-scale miner training programs, where more than 2,500 miners have benefited from environmental, health and safety, and accounting courses to improve their competitiveness in the marketplace.

The Company fostered health and wellness of the communities of Segovia and Remedios in partnership with CONFAMA (Caja de Compensación Familiar de Antioquia) through health and entrepreneurial campaigns aimed at preventing diseases and providing business training for the community and small-scale miners. In addition, the Company has provided a local family welfare fund access to the Marceleth Club to assist the communities of Segovia and Remedios.

In Marmato, the Company has partnered with a local charitable organization, Angelitos de Luz, to carry out health, wellness, and education programs in local communities, including:

•Caldas Community Centre – The Company provided funding for the development and construction of a state-of-the-art community centre in the community of Marmato to promote community spirit and provide a central location for extracurricular education and training in areas such as English language, coding, robotics and textile design.

•Marmato Municipal Park – To encourage healthy and active lifestyles, the Company funded the construction of a major new municipal park in the community of Marmato. The modern 850 square meter park is an important centerpiece of the community.

During 2023, the Company paid social contributions of US$10.2 million to local communities and royalty and income tax payments of US$52.9 million.

4.9.3People

The Company is committed to promoting local employment, equality, diversity, inclusion and respect for human rights. Further, the health and safety of the Company’s employees, contractors and visitors take priority above all else. The Company strives to provide a safe work environment and to create a culture with safety at its core.

Health and Safety

The Company is committed to achieving excellence in the management of health and safety at its operations. The Company understands its responsibility to provide a safe and healthy working environment to its workforce and is committed to preventing incidents and accidents and to mitigating health and safety risks and hazards. The Company believes that health and safety must be everyone’s responsibility and priority to achieve a culture of zero harm. Further, the Company promotes a culture of personal responsibility among its workforce together with health and safety leadership for supervisors and managers. The Company is committed to implementing health and safety management systems that meet international standards and applicable best practices including setting objectives and targets and measuring the Company’s performance against them.

Human Rights and Diversity

The Company is committed to providing an environment that is free from unlawful discrimination and harassment. All employees, volunteers and members are entitled to an environment where they are treated with respect and dignity and have equal opportunity to fully contribute. All individuals within the organization are required to conduct themselves in a professional and appropriate manner, and to refrain from engaging in discrimination or harassment. Although the Company recognizes governments have the primary duty to ensure the respect, promotion and protection of human rights, the Company believes businesses play an important positive role in the respect of human rights in local communities, not only as catalysts, but also as safeguards in the Company’s areas of operation.

The Company strives to create an inclusive organizational culture that promotes equality of opportunity. The Company looks to attract, develop and retain the best talent and create a working environment that is inclusive and diverse, where everyone is treated without discrimination. The Company values talent regardless of age, race, gender, background, sexuality, religion or physical impairment and believes that diversity strengthens the team by promoting unique viewpoints and challenging us to think beyond our traditional frames of reference.

ITEM 5.RISK FACTORS

The business and operations of the Company are subject to a number of risks. The Company considers the risks set out below to be the most significant to existing and potential investors in the Company, but they do not purport to be all of the risks associated with an investment in securities of the Company. If any of these risks materialize into actual events or circumstances, or other possible risks and uncertainties of which the Company is currently unaware or which it considers to be immaterial actually occur, the Company’s assets, liabilities, financial condition, results of operations (including future results of operations), business and business prospects are likely to be materially and adversely affected. In such circumstances, the price of the Company’s securities could decline and investors may lose all or part of their investment.

Regulatory Approvals

The operations of the Company and the exploration agreements into which it has entered require approvals, licenses and permits from various regulatory authorities, governmental and otherwise (including project specific governmental decrees) that are by no means guaranteed. The Company believes that it holds or will obtain all necessary approvals, licenses and permits under applicable laws and regulations in respect of its main projects and, to the extent that they have already been granted, believes it is presently complying in all material respects with the terms of such approvals, licenses and permits. However, such approvals, licenses and permits are subject to change in various circumstances and further project-specific governmental decrees and/or legislative enactments may be required. There can be no guarantee that the Company will be able to obtain or maintain all necessary approvals, licenses and permits that may be required and/or that all project-specific governmental decrees and/or required legislative enactments will be forthcoming to explore and develop the properties on which it has exploration rights, commence construction or operation of mining facilities or to maintain continued operations that economically justify the costs involved.

Environmental Laws