false2023FY0001830214P1YP1YP1YP1Yhttp://fasb.org/us-gaap/2023#AccruedLiabilitiesAndOtherLiabilitieshttp://fasb.org/us-gaap/2023#AccruedLiabilitiesAndOtherLiabilitieshttp://fasb.org/us-gaap/2023#OperatingLeaseLiabilityNoncurrenthttp://fasb.org/us-gaap/2023#OperatingLeaseLiabilityNoncurrenthttp://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#AccruedLiabilitiesAndOtherLiabilitieshttp://fasb.org/us-gaap/2023#AccruedLiabilitiesAndOtherLiabilities000018302142023-01-012023-12-310001830214us-gaap:CommonClassAMember2023-01-012023-12-310001830214us-gaap:WarrantMember2023-01-012023-12-3100018302142023-06-30iso4217:USD0001830214us-gaap:CommonClassAMember2024-02-22xbrli:shares0001830214us-gaap:CommonClassBMember2024-02-220001830214us-gaap:NonvotingCommonStockMember2024-02-2200018302142023-12-3100018302142022-12-310001830214us-gaap:RelatedPartyMember2023-12-310001830214us-gaap:RelatedPartyMember2022-12-31iso4217:USDxbrli:shares0001830214dna:CellEngineeringRevenueMember2023-01-012023-12-310001830214dna:CellEngineeringRevenueMember2022-01-012022-12-310001830214dna:CellEngineeringRevenueMember2021-01-012021-12-310001830214us-gaap:ProductMember2023-01-012023-12-310001830214us-gaap:ProductMember2022-01-012022-12-310001830214us-gaap:ProductMember2021-01-012021-12-310001830214us-gaap:ServiceMember2023-01-012023-12-310001830214us-gaap:ServiceMember2022-01-012022-12-310001830214us-gaap:ServiceMember2021-01-012021-12-3100018302142022-01-012022-12-3100018302142021-01-012021-12-310001830214us-gaap:RelatedPartyMember2023-01-012023-12-310001830214us-gaap:RelatedPartyMember2022-01-012022-12-310001830214us-gaap:RelatedPartyMember2021-01-012021-12-310001830214us-gaap:CommonStockMember2020-12-310001830214us-gaap:AdditionalPaidInCapitalMember2020-12-310001830214us-gaap:RetainedEarningsMember2020-12-310001830214us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001830214us-gaap:NoncontrollingInterestMember2020-12-3100018302142020-12-310001830214us-gaap:CommonStockMember2021-01-012021-12-310001830214us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001830214dna:SeriesBAndDPreferredStockMemberus-gaap:CommonStockMember2021-01-012021-12-310001830214us-gaap:SeriesEPreferredStockMemberus-gaap:CommonStockMember2021-01-012021-12-310001830214us-gaap:NoncontrollingInterestMember2021-01-012021-12-310001830214us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001830214us-gaap:RetainedEarningsMember2021-01-012021-12-310001830214us-gaap:CommonStockMember2021-12-310001830214us-gaap:AdditionalPaidInCapitalMember2021-12-310001830214us-gaap:RetainedEarningsMember2021-12-310001830214us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001830214us-gaap:NoncontrollingInterestMember2021-12-3100018302142021-12-310001830214us-gaap:CommonStockMember2022-01-012022-12-310001830214us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001830214us-gaap:NoncontrollingInterestMember2022-01-012022-12-310001830214us-gaap:RetainedEarningsMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2021-12-310001830214srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2021-12-310001830214us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001830214us-gaap:RetainedEarningsMember2022-01-012022-12-310001830214us-gaap:CommonStockMember2022-12-310001830214us-gaap:AdditionalPaidInCapitalMember2022-12-310001830214us-gaap:RetainedEarningsMember2022-12-310001830214us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001830214us-gaap:NoncontrollingInterestMember2022-12-310001830214us-gaap:CommonStockMember2023-01-012023-12-310001830214us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001830214us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001830214us-gaap:RetainedEarningsMember2023-01-012023-12-310001830214us-gaap:NoncontrollingInterestMember2023-01-012023-12-310001830214us-gaap:CommonStockMember2023-12-310001830214us-gaap:AdditionalPaidInCapitalMember2023-12-310001830214us-gaap:RetainedEarningsMember2023-12-310001830214us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001830214us-gaap:NoncontrollingInterestMember2023-12-310001830214srt:RevisionOfPriorPeriodReclassificationAdjustmentMember2022-12-310001830214srt:RevisionOfPriorPeriodReclassificationAdjustmentMember2022-01-012022-12-310001830214srt:RevisionOfPriorPeriodReclassificationAdjustmentMember2021-01-012021-12-310001830214dna:RevisionOfPriorPeriodReclassificationAdjustment1Member2022-01-012022-12-310001830214dna:RevisionOfPriorPeriodReclassificationAdjustment2Member2022-01-012022-12-310001830214dna:OneCustomerMemberdna:CellEngineeringSegmentMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2023-01-012023-12-31xbrli:pure0001830214dna:OneCustomerMemberdna:BiosecuritySegmentMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2023-01-012023-12-310001830214dna:TwoCustomersMemberdna:BiosecuritySegmentMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2022-01-012022-12-310001830214dna:OneCustomerMemberdna:CellEngineeringSegmentMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2021-01-012021-12-310001830214dna:OneCustomerMemberdna:BiosecuritySegmentMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2021-01-012021-12-310001830214srt:MinimumMemberdna:ComputerEquipmentAndSoftwareMember2023-12-310001830214dna:ComputerEquipmentAndSoftwareMembersrt:MaximumMember2023-12-310001830214us-gaap:FurnitureAndFixturesMember2023-12-310001830214srt:MinimumMemberdna:LabEquipmentMember2023-12-310001830214dna:LabEquipmentMembersrt:MaximumMember2023-12-310001830214srt:MinimumMemberus-gaap:ManufacturingFacilityMember2023-12-310001830214srt:MaximumMemberus-gaap:ManufacturingFacilityMember2023-12-310001830214us-gaap:VehiclesMember2023-12-310001830214dna:EquityMethodInvestmentFundingOfAdditionalLossesMember2022-12-310001830214dna:EquityMethodInvestmentFundingOfAdditionalLossesMember2021-12-310001830214dna:EquityMethodInvestmentFundingOfAdditionalLossesMember2023-12-310001830214dna:ZymergenMemberus-gaap:CommonClassAMember2022-10-190001830214dna:ZymergenMember2022-10-192022-10-190001830214dna:ZymergenMember2022-10-190001830214us-gaap:DevelopedTechnologyRightsMemberdna:ZymergenMember2022-10-192022-10-190001830214us-gaap:DevelopedTechnologyRightsMemberdna:ZymergenMember2022-10-190001830214us-gaap:DatabasesMemberdna:ZymergenMember2022-10-192022-10-190001830214us-gaap:DatabasesMemberdna:ZymergenMember2022-10-190001830214dna:ZymergenMember2022-01-012022-12-310001830214dna:NewGinkgoCommonStockMember2022-01-012022-12-310001830214dna:NewGinkgoCommonStockMember2022-12-310001830214dna:ZymergenMember2021-01-012021-12-310001830214dna:ZymergenMember2023-10-032023-10-030001830214dna:ZymergenMember2023-10-03dna:employee0001830214dna:ZymergenBankruptcyMember2023-10-032023-10-030001830214dna:ZymergenBankruptcyMember2023-12-310001830214us-gaap:DisposalGroupDisposedOfByMeansOtherThanSaleNotDiscontinuedOperationsMemberdna:ZymergenMember2023-10-020001830214us-gaap:DisposalGroupDisposedOfByMeansOtherThanSaleNotDiscontinuedOperationsMember2023-10-020001830214us-gaap:DisposalGroupDisposedOfByMeansOtherThanSaleNotDiscontinuedOperationsMemberdna:ZymergenMember2023-01-012023-10-020001830214us-gaap:DisposalGroupDisposedOfByMeansOtherThanSaleNotDiscontinuedOperationsMemberdna:ZymergenMember2022-10-192022-12-310001830214dna:BayerMember2022-10-17utr:sqft0001830214dna:BayerAcquisitionAndJointVentureMember2022-10-172022-10-17dna:lease0001830214dna:JoynBioMemberdna:BayerAcquisitionAndJointVentureMember2022-10-170001830214dna:BayerAcquisitionAndJointVentureMember2022-10-170001830214dna:BayerAcquisitionAndJointVentureMember2022-01-012022-12-310001830214dna:JoynBioMemberdna:BayerAcquisitionAndJointVentureMember2022-10-172022-10-170001830214dna:BayerAcquisitionAndJointVentureMember2022-10-162022-10-160001830214dna:BayerAcquisitionAndJointVentureMember2022-12-310001830214dna:JoynBioMemberdna:DevelopedTechnologyMember2023-12-310001830214dna:BayerAcquisitionAndJointVentureMember2023-01-012023-12-310001830214dna:AltarSasMember2022-10-032022-10-030001830214us-gaap:RestrictedStockMemberdna:AltarSasMember2022-10-030001830214us-gaap:CommonClassAMemberdna:AltarSasMember2022-10-030001830214dna:AltarSasMember2022-10-0300018302142022-10-030001830214dna:FgenMemberus-gaap:CommonClassAMember2022-04-012022-04-010001830214dna:FgenMemberdna:ContingentConsiderationRestrictedStockMember2022-04-012022-04-010001830214dna:FgenMemberdna:MilestonesMember2022-04-012022-04-010001830214dna:FgenMember2022-04-012022-04-010001830214dna:FgenMemberus-gaap:CommonClassAMember2022-04-010001830214dna:FgenMemberdna:UnrestrictedStockMember2022-04-010001830214dna:FgenMemberdna:UnrestrictedStockMember2022-04-012022-04-010001830214dna:FgenMemberus-gaap:RestrictedStockMember2022-04-012022-04-010001830214dna:FgenMemberus-gaap:RestrictedStockMember2022-04-01dna:tranche0001830214dna:FgenMemberus-gaap:RestrictedStockMember2022-04-042022-04-040001830214dna:FgenMemberus-gaap:RestrictedStockMember2022-12-310001830214dna:FgenMember2022-04-010001830214dna:FgenMember2022-01-012022-12-310001830214dna:CircularisBiotechnologiesIncMember2022-10-032022-10-030001830214dna:CircularisBiotechnologiesIncMemberus-gaap:CommonClassAMember2022-10-030001830214dna:CircularisBiotechnologiesIncMember2022-10-030001830214dna:DevelopedTechnologyMember2022-10-030001830214dna:BaktusIncMember2022-08-172022-08-170001830214dna:BaktusIncMemberus-gaap:CommonClassAMember2022-08-170001830214dna:BaktusIncMember2022-08-170001830214dna:SrngMember2021-09-162021-09-160001830214dna:SrngMember2021-09-1600018302142021-09-162021-09-1600018302142021-09-160001830214dna:NewGinkgoCommonStockMember2021-09-162021-09-160001830214srt:MinimumMember2021-09-162021-09-160001830214srt:MaximumMember2021-09-162021-09-160001830214us-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:CommonClassAMember2021-09-160001830214us-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:CommonClassAMember2021-09-162021-09-160001830214us-gaap:ShareBasedCompensationAwardTrancheTwoMemberus-gaap:CommonClassAMember2021-09-160001830214us-gaap:ShareBasedCompensationAwardTrancheTwoMemberus-gaap:CommonClassAMember2021-09-162021-09-160001830214us-gaap:ShareBasedCompensationAwardTrancheThreeMemberus-gaap:CommonClassAMember2021-09-160001830214us-gaap:ShareBasedCompensationAwardTrancheThreeMemberus-gaap:CommonClassAMember2021-09-162021-09-160001830214us-gaap:CommonClassAMemberdna:ShareBasedCompensationAwardTrancheFourMember2021-09-160001830214us-gaap:CommonClassAMemberdna:ShareBasedCompensationAwardTrancheFourMember2021-09-162021-09-1600018302142021-11-150001830214dna:NewGinkgoCommonStockMemberus-gaap:CommonClassAMember2021-09-162021-09-160001830214us-gaap:CommonClassAMember2021-09-162021-09-160001830214dna:PipeFinancingMemberus-gaap:CommonClassAMember2021-09-162021-09-160001830214dna:PipeFinancingMemberus-gaap:CommonClassAMember2021-09-160001830214dna:PipeFinancingMember2021-09-160001830214dna:SrngMemberus-gaap:CommonStockMember2021-09-160001830214dna:PipeFinancingMember2021-09-162021-09-160001830214us-gaap:SeriesBPreferredStockMember2021-09-160001830214us-gaap:SeriesCPreferredStockMember2021-09-160001830214us-gaap:SeriesDPreferredStockMember2021-09-160001830214us-gaap:SeriesEPreferredStockMember2021-09-160001830214dna:OldGinkgoCommonStockMember2021-09-162021-09-160001830214dna:NewGinkgoCommonStockMember2021-09-160001830214us-gaap:CommonClassBMemberus-gaap:RestrictedStockUnitsRSUMember2021-09-162021-09-160001830214us-gaap:CommonClassBMemberus-gaap:RestrictedStockMember2021-09-162021-09-160001830214us-gaap:MoneyMarketFundsMember2023-12-310001830214us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2023-12-310001830214us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMember2023-12-310001830214us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMember2023-12-310001830214dna:SynlogicIncWarrantsMember2023-12-310001830214us-gaap:FairValueInputsLevel1Memberdna:SynlogicIncWarrantsMember2023-12-310001830214us-gaap:FairValueInputsLevel2Memberdna:SynlogicIncWarrantsMember2023-12-310001830214us-gaap:FairValueInputsLevel3Memberdna:SynlogicIncWarrantsMember2023-12-310001830214dna:MarketableEquitySecuritiesMember2023-12-310001830214us-gaap:FairValueInputsLevel1Memberdna:MarketableEquitySecuritiesMember2023-12-310001830214us-gaap:FairValueInputsLevel2Memberdna:MarketableEquitySecuritiesMember2023-12-310001830214us-gaap:FairValueInputsLevel3Memberdna:MarketableEquitySecuritiesMember2023-12-310001830214us-gaap:LoansReceivableMember2023-12-310001830214us-gaap:LoansReceivableMemberus-gaap:FairValueInputsLevel1Member2023-12-310001830214us-gaap:FairValueInputsLevel2Memberus-gaap:LoansReceivableMember2023-12-310001830214us-gaap:FairValueInputsLevel3Memberus-gaap:LoansReceivableMember2023-12-310001830214us-gaap:FairValueInputsLevel1Member2023-12-310001830214us-gaap:FairValueInputsLevel2Member2023-12-310001830214us-gaap:FairValueInputsLevel3Member2023-12-310001830214dna:PublicWarrantsMember2023-12-310001830214dna:PublicWarrantsMemberus-gaap:FairValueInputsLevel1Member2023-12-310001830214us-gaap:FairValueInputsLevel2Memberdna:PublicWarrantsMember2023-12-310001830214us-gaap:FairValueInputsLevel3Memberdna:PublicWarrantsMember2023-12-310001830214dna:PrivatePlacementWarrantsMember2023-12-310001830214us-gaap:FairValueInputsLevel1Memberdna:PrivatePlacementWarrantsMember2023-12-310001830214us-gaap:FairValueInputsLevel2Memberdna:PrivatePlacementWarrantsMember2023-12-310001830214us-gaap:FairValueInputsLevel3Memberdna:PrivatePlacementWarrantsMember2023-12-310001830214us-gaap:MoneyMarketFundsMember2022-12-310001830214us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2022-12-310001830214us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMember2022-12-310001830214us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMember2022-12-310001830214dna:SynlogicIncWarrantsMember2022-12-310001830214us-gaap:FairValueInputsLevel1Memberdna:SynlogicIncWarrantsMember2022-12-310001830214us-gaap:FairValueInputsLevel2Memberdna:SynlogicIncWarrantsMember2022-12-310001830214us-gaap:FairValueInputsLevel3Memberdna:SynlogicIncWarrantsMember2022-12-310001830214dna:MarketableEquitySecuritiesMember2022-12-310001830214us-gaap:FairValueInputsLevel1Memberdna:MarketableEquitySecuritiesMember2022-12-310001830214us-gaap:FairValueInputsLevel2Memberdna:MarketableEquitySecuritiesMember2022-12-310001830214us-gaap:FairValueInputsLevel3Memberdna:MarketableEquitySecuritiesMember2022-12-310001830214us-gaap:FairValueInputsLevel1Member2022-12-310001830214us-gaap:FairValueInputsLevel2Member2022-12-310001830214us-gaap:FairValueInputsLevel3Member2022-12-310001830214dna:PublicWarrantsMember2022-12-310001830214dna:PublicWarrantsMemberus-gaap:FairValueInputsLevel1Member2022-12-310001830214us-gaap:FairValueInputsLevel2Memberdna:PublicWarrantsMember2022-12-310001830214us-gaap:FairValueInputsLevel3Memberdna:PublicWarrantsMember2022-12-310001830214dna:PrivatePlacementWarrantsMember2022-12-310001830214us-gaap:FairValueInputsLevel1Memberdna:PrivatePlacementWarrantsMember2022-12-310001830214us-gaap:FairValueInputsLevel2Memberdna:PrivatePlacementWarrantsMember2022-12-310001830214us-gaap:FairValueInputsLevel3Memberdna:PrivatePlacementWarrantsMember2022-12-310001830214dna:SeniorSecuredNoteMember2023-12-012023-12-310001830214dna:SeniorSecuredNoteMember2023-12-310001830214dna:ConvertiblePromissoryNotesMember2023-12-012023-12-310001830214dna:ConvertiblePromissoryNotesMember2023-12-310001830214dna:BoltThreadsIncMember2023-12-012023-12-310001830214dna:MeasurementInputScenarioProbabilitiesMembersrt:MinimumMemberdna:CellEngineeringSegmentMember2023-12-310001830214dna:MeasurementInputScenarioProbabilitiesMemberdna:CellEngineeringSegmentMembersrt:MaximumMember2023-12-310001830214dna:CellEngineeringSegmentMemberus-gaap:MeasurementInputDiscountRateMember2023-12-310001830214srt:MinimumMemberdna:CellEngineeringSegmentMemberus-gaap:MeasurementInputExpectedTermMember2023-01-012023-12-310001830214dna:CellEngineeringSegmentMemberus-gaap:MeasurementInputExpectedTermMembersrt:MaximumMember2023-01-012023-12-310001830214dna:MeasurementInputScenarioProbabilitiesMembersrt:MinimumMemberdna:CellEngineeringSegmentMember2022-12-310001830214dna:MeasurementInputScenarioProbabilitiesMemberdna:CellEngineeringSegmentMembersrt:MaximumMember2022-12-310001830214dna:CellEngineeringSegmentMemberus-gaap:MeasurementInputDiscountRateMember2022-12-310001830214srt:MinimumMemberdna:CellEngineeringSegmentMemberus-gaap:MeasurementInputExpectedTermMember2022-01-012022-12-310001830214dna:CellEngineeringSegmentMemberus-gaap:MeasurementInputExpectedTermMembersrt:MaximumMember2022-01-012022-12-310001830214dna:CellEngineeringSegmentMember2023-12-310001830214dna:CellEngineeringSegmentMember2022-12-31dna:promissoryNote00018302142023-12-012023-12-310001830214dna:MeasurementInputScenarioProbabilitiesMembersrt:MinimumMember2023-12-310001830214dna:MeasurementInputScenarioProbabilitiesMembersrt:MaximumMember2023-12-310001830214us-gaap:MeasurementInputDiscountRateMember2023-12-310001830214us-gaap:MeasurementInputExpectedTermMembersrt:MaximumMember2023-12-012023-12-310001830214us-gaap:MeasurementInputExercisePriceMember2023-12-310001830214us-gaap:MeasurementInputExercisePriceMember2022-12-310001830214us-gaap:MeasurementInputSharePriceMember2023-12-310001830214us-gaap:MeasurementInputSharePriceMember2022-12-310001830214us-gaap:MeasurementInputPriceVolatilityMember2023-12-310001830214us-gaap:MeasurementInputPriceVolatilityMember2022-12-310001830214us-gaap:MeasurementInputExpectedTermMember2023-12-31utr:Y0001830214us-gaap:MeasurementInputExpectedTermMember2022-12-310001830214us-gaap:MeasurementInputRiskFreeInterestRateMember2023-12-310001830214us-gaap:MeasurementInputRiskFreeInterestRateMember2022-12-310001830214dna:PrivatePlacementWarrantsMember2022-12-310001830214dna:PrivatePlacementWarrantsMember2021-12-310001830214dna:PrivatePlacementWarrantsMember2023-01-012023-12-310001830214dna:PrivatePlacementWarrantsMember2022-01-012022-12-310001830214dna:PrivatePlacementWarrantsMember2023-12-310001830214us-gaap:RestrictedStockMemberdna:CircularisMember2023-12-310001830214us-gaap:RestrictedStockMemberdna:CircularisMember2023-01-012023-12-310001830214us-gaap:RestrictedStockMemberdna:CircularisMember2022-12-310001830214us-gaap:RestrictedStockMemberdna:CircularisMember2022-01-012022-12-310001830214dna:MeasurementInputProbabilityOfPaymentMemberdna:ProbabilityWeightedPresentValueMembersrt:MinimumMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001830214dna:MeasurementInputProbabilityOfPaymentMemberdna:ProbabilityWeightedPresentValueMemberus-gaap:FairValueMeasurementsRecurringMembersrt:MaximumMember2023-12-310001830214dna:MeasurementInputProbabilityOfPaymentMemberdna:ProbabilityWeightedPresentValueMembersrt:MinimumMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001830214dna:MeasurementInputProbabilityOfPaymentMemberdna:ProbabilityWeightedPresentValueMemberus-gaap:FairValueMeasurementsRecurringMembersrt:MaximumMember2022-12-310001830214dna:ProbabilityWeightedPresentValueMembersrt:MinimumMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MeasurementInputDiscountRateMember2023-12-310001830214dna:ProbabilityWeightedPresentValueMembersrt:MinimumMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MeasurementInputDiscountRateMember2022-12-310001830214dna:ProbabilityWeightedPresentValueMemberus-gaap:FairValueMeasurementsRecurringMembersrt:MaximumMemberus-gaap:MeasurementInputDiscountRateMember2022-12-310001830214us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:MeasurementInputDiscountRateMember2023-12-310001830214us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:MeasurementInputDiscountRateMember2022-12-310001830214dna:FGenAndAltarMember2021-07-310001830214dna:ContingentConsiderationMember2022-12-310001830214dna:ContingentConsiderationMember2021-12-310001830214dna:ContingentConsiderationMember2023-01-012023-12-310001830214dna:ContingentConsiderationMember2022-01-012022-12-310001830214dna:ContingentConsiderationMember2023-12-310001830214dna:GenomaticaIncPreferredStocksMember2023-01-012023-12-310001830214dna:GenomaticaIncPreferredStocksMember2022-01-012022-12-310001830214dna:NonMarketableEquitySecuritiesMember2023-01-012023-12-310001830214dna:SafeMember2023-01-012023-12-310001830214dna:MeasurementInputProbabilityWeightedMembersrt:MinimumMemberdna:SafeMember2023-12-310001830214dna:MeasurementInputProbabilityWeightedMemberdna:SafeMembersrt:MaximumMember2023-12-310001830214dna:SafeMemberus-gaap:MeasurementInputDiscountRateMember2023-12-310001830214dna:SafeMember2023-01-012023-12-310001830214dna:SafeMember2022-01-012022-12-310001830214srt:MinimumMemberus-gaap:MeasurementInputExpectedTermMember2023-01-012023-12-310001830214us-gaap:MeasurementInputExpectedTermMembersrt:MaximumMember2023-01-012023-12-310001830214dna:MeasurementInputScenarioProbabilitiesMembersrt:MinimumMember2022-12-310001830214dna:MeasurementInputScenarioProbabilitiesMembersrt:MaximumMember2022-12-310001830214us-gaap:MeasurementInputDiscountRateMember2022-12-310001830214srt:MinimumMemberus-gaap:MeasurementInputExpectedTermMember2022-01-012022-12-310001830214us-gaap:MeasurementInputExpectedTermMembersrt:MaximumMember2022-01-012022-12-310001830214dna:SafesMember2023-12-310001830214dna:SafesMember2022-12-310001830214dna:NonMarketableEquitySecuritiesMember2023-12-310001830214dna:NonMarketableEquitySecuritiesMember2022-12-310001830214dna:MarketableEquitySecuritiesMember2023-12-310001830214dna:MarketableEquitySecuritiesMember2022-12-310001830214dna:GenomaticaIncPreferredStockMember2023-12-310001830214dna:GenomaticaIncPreferredStockMember2022-12-310001830214dna:SynlogicIncCommonStockMember2023-12-310001830214dna:SynlogicIncCommonStockMember2022-12-310001830214dna:SynlogicIncWarrantMember2023-12-310001830214dna:SynlogicIncWarrantMember2022-12-310001830214dna:BiomeditLlcMember2023-12-310001830214dna:BiomeditLlcMember2022-12-310001830214dna:OtherEquityInvestessMember2023-12-310001830214dna:OtherEquityInvestessMember2022-12-310001830214dna:PlatformVenturesMember2023-12-310001830214dna:PlatformVenturesMember2022-12-310001830214dna:GenomaticaIncPreferredStockMember2023-01-012023-12-310001830214dna:GenomaticaIncPreferredStockMember2022-01-012022-12-310001830214dna:GenomaticaIncPreferredStockMember2021-01-012021-12-310001830214dna:NonMarketableEquitySecuritiesMember2022-01-012022-12-310001830214dna:NonMarketableEquitySecuritiesMember2021-01-012021-12-310001830214dna:MarketableEquitySecuritiesMember2023-01-012023-12-310001830214dna:MarketableEquitySecuritiesMember2022-01-012022-12-310001830214dna:MarketableEquitySecuritiesMember2021-01-012021-12-310001830214dna:SynlogicIncCommonStockMember2023-01-012023-12-310001830214dna:SynlogicIncCommonStockMember2022-01-012022-12-310001830214dna:SynlogicIncCommonStockMember2021-01-012021-12-310001830214dna:SafesMember2023-01-012023-12-310001830214dna:SafesMember2022-01-012022-12-310001830214dna:SafesMember2021-01-012021-12-310001830214dna:SynlogicIncWarrantMember2023-01-012023-12-310001830214dna:SynlogicIncWarrantMember2022-01-012022-12-310001830214dna:SynlogicIncWarrantMember2021-01-012021-12-310001830214dna:BiomeditLlcMember2023-01-012023-12-310001830214dna:BiomeditLlcMember2022-01-012022-12-310001830214dna:BiomeditLlcMember2021-01-012021-12-310001830214dna:JoynBioLlcMember2023-01-012023-12-310001830214dna:JoynBioLlcMember2022-01-012022-12-310001830214dna:JoynBioLlcMember2021-01-012021-12-310001830214dna:AllonniaLlcMember2023-01-012023-12-310001830214dna:AllonniaLlcMember2022-01-012022-12-310001830214dna:AllonniaLlcMember2021-01-012021-12-310001830214dna:ArcaeaLlcMember2023-01-012023-12-310001830214dna:ArcaeaLlcMember2022-01-012022-12-310001830214dna:ArcaeaLlcMember2021-01-012021-12-310001830214dna:VerbBioticsLlcMember2023-01-012023-12-310001830214dna:VerbBioticsLlcMember2022-01-012022-12-310001830214dna:VerbBioticsLlcMember2021-01-012021-12-310001830214dna:AyanaLlcMember2023-01-012023-12-310001830214dna:AyanaLlcMember2022-01-012022-12-310001830214dna:AyanaLlcMember2021-01-012021-12-310001830214dna:OtherEquityInvestessMember2023-01-012023-12-310001830214dna:OtherEquityInvestessMember2022-01-012022-12-310001830214dna:OtherEquityInvestessMember2021-01-012021-12-310001830214dna:JoynBioMember2022-01-012022-12-310001830214dna:JoynBioMember2022-12-310001830214us-gaap:ParentMember2023-01-012023-12-310001830214dna:AyanaBioLlcMemberus-gaap:LicenseMember2022-12-310001830214dna:VerbMemberus-gaap:LicenseMember2022-12-31dna:acquisition0001830214us-gaap:SeriesAPreferredStockMemberdna:VerbMember2021-09-012021-09-300001830214dna:AyanaBioLlcMemberus-gaap:SeriesAPreferredStockMember2021-09-012021-09-300001830214dna:VerbAndAyanaMember2022-01-012022-12-310001830214dna:VerbMember2022-12-310001830214dna:AyanaBioLlcMember2022-12-310001830214dna:VerbMembersrt:MaximumMember2022-12-310001830214us-gaap:MemberUnitsMemberdna:ConvertiblePromissoryNotesMember2022-01-012022-12-310001830214us-gaap:DevelopedTechnologyRightsMember2023-12-310001830214us-gaap:DevelopedTechnologyRightsMember2023-01-012023-12-310001830214us-gaap:CustomerRelationshipsMember2023-12-310001830214us-gaap:CustomerRelationshipsMember2023-01-012023-12-310001830214dna:AssembledWorkforceMember2023-12-310001830214dna:AssembledWorkforceMember2023-01-012023-12-310001830214us-gaap:DevelopedTechnologyRightsMember2022-12-310001830214us-gaap:DevelopedTechnologyRightsMember2022-01-012022-12-310001830214us-gaap:DatabasesMember2022-12-310001830214us-gaap:DatabasesMember2022-01-012022-12-310001830214us-gaap:CustomerRelationshipsMember2022-12-310001830214us-gaap:CustomerRelationshipsMember2022-01-012022-12-310001830214dna:AssembledWorkforceMember2022-12-310001830214dna:AssembledWorkforceMember2022-01-012022-12-310001830214us-gaap:DevelopedTechnologyRightsMemberdna:ZymergenMember2023-12-310001830214us-gaap:DatabasesMemberdna:ZymergenMember2022-12-310001830214srt:MinimumMember2023-12-310001830214srt:MaximumMember2023-12-310001830214srt:MinimumMemberdna:EquipmentLeasesMember2023-12-310001830214srt:MaximumMemberdna:EquipmentLeasesMember2023-12-3100018302142023-09-012023-09-300001830214us-gaap:BuildingMember2023-09-012023-09-300001830214us-gaap:LeaseholdImprovementsMember2023-09-012023-09-3000018302142023-09-300001830214dna:PublicWarrantsMember2021-02-260001830214dna:PrivatePlacementWarrantsMember2021-02-260001830214us-gaap:CommonClassAMember2021-02-2600018302142021-02-260001830214dna:PublicWarrantsMemberus-gaap:CommonClassAMember2021-02-260001830214dna:PublicWarrantsMember2021-02-262021-02-260001830214srt:MinimumMemberdna:WarrantsAndRightsSubjectToMandatoryRedemptionOneMemberus-gaap:CommonClassAMember2021-02-2600018302142021-02-262021-02-260001830214dna:PublicWarrantsMemberus-gaap:CommonClassAMember2023-12-310001830214dna:PrivatePlacementWarrantsMemberus-gaap:CommonClassAMember2023-12-310001830214dna:LabEquipmentMember2023-12-310001830214dna:LabEquipmentMember2022-12-310001830214us-gaap:LeaseholdImprovementsMember2023-12-310001830214us-gaap:LeaseholdImprovementsMember2022-12-310001830214us-gaap:ManufacturingFacilityMember2023-12-310001830214us-gaap:ManufacturingFacilityMember2022-12-310001830214us-gaap:ConstructionInProgressMember2023-12-310001830214us-gaap:ConstructionInProgressMember2022-12-310001830214dna:ComputerEquipmentAndSoftwareMember2023-12-310001830214dna:ComputerEquipmentAndSoftwareMember2022-12-310001830214us-gaap:FurnitureAndFixturesMember2022-12-310001830214us-gaap:LandMember2023-12-310001830214us-gaap:LandMember2022-12-31dna:facility0001830214dna:LabEquipmentMember2023-01-012023-12-310001830214us-gaap:AccountingStandardsUpdate201602Member2023-01-012023-12-310001830214us-gaap:AccountingStandardsUpdate201602Member2022-01-012022-12-3100018302142023-08-292023-08-290001830214dna:GoogleCloudMemberdna:CloudAndArtificialIntelligenceMember2023-12-310001830214dna:GoogleCloudMember2023-10-01dna:CloudAndArtificialIntelligenceMember2023-12-31dna:milestone00018302142022-03-312022-03-3100018302142023-03-310001830214dna:StridebioMemberus-gaap:CommonClassAMember2023-10-012023-10-310001830214dna:StridebioMemberus-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-10-012023-10-310001830214dna:StridebioMemberus-gaap:CommonStockMember2023-10-012023-10-310001830214dna:StridebioMember2023-12-310001830214dna:StridebioMember2023-01-012023-12-3100018302142021-09-012021-09-30dna:demand0001830214us-gaap:CommonClassAMember2023-12-310001830214us-gaap:CommonClassBMember2023-12-310001830214us-gaap:CommonClassCMember2023-12-310001830214us-gaap:CommonClassAMember2022-12-310001830214us-gaap:CommonClassBMember2022-12-310001830214us-gaap:CommonClassCMember2022-12-310001830214dna:ShelfRegistrationStatementMember2022-10-042022-10-040001830214dna:ShelfRegistrationStatementMember2023-01-012023-12-310001830214dna:UnderwritingAgreementMember2022-11-152022-11-150001830214dna:UnderwritingAgreementMember2022-11-150001830214dna:NewGinkgoPreferredStockMember2023-12-31dna:vote0001830214us-gaap:CommonClassBMember2023-01-012023-12-310001830214dna:TwoThousandAndTwentyOneIncentiveAwardPlanMember2023-12-310001830214dna:WarrantsToPurchaseClassACommonStockMember2023-12-310001830214dna:TwoThousandAndTwentyOneEmployeeStockPurchasePlanMember2023-12-310001830214dna:InducementPlanMember2023-12-310001830214us-gaap:EmployeeStockOptionMember2023-12-310001830214us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-12-310001830214us-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-12-310001830214us-gaap:ResearchAndDevelopmentExpenseMember2021-01-012021-12-310001830214us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-12-310001830214us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-12-310001830214us-gaap:GeneralAndAdministrativeExpenseMember2021-01-012021-12-310001830214dna:TwoThousandTwentyTwoInducementPlanMemberus-gaap:CommonStockMember2022-12-310001830214dna:TwoThousandTwentyTwoInducementPlanMember2023-12-310001830214dna:TwoThousandAndTwentyOneIncentiveAwardPlanMember2021-09-162021-09-160001830214dna:TwoThousandAndTwentyOneIncentiveAwardPlanMember2022-12-310001830214dna:TwoThousandAndTwentyOneIncentiveAwardPlanMember2021-09-160001830214dna:TwoThousandAndTwentyOneEmployeeStockPurchasePlanMember2021-09-162021-09-160001830214dna:TwoThousandAndTwentyOneEmployeeStockPurchasePlanMember2021-09-160001830214us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001830214us-gaap:RestrictedStockMember2023-01-012023-12-310001830214us-gaap:RestrictedStockUnitsRSUMember2021-11-162021-11-160001830214us-gaap:RestrictedStockUnitsRSUMember2021-11-192021-11-190001830214us-gaap:RestrictedStockUnitsRSUMember2021-12-310001830214us-gaap:RestrictedStockUnitsRSUMember2021-10-012021-12-310001830214us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001830214us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001830214us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-03-310001830214dna:NonEmployeeStockMember2022-01-012022-03-310001830214us-gaap:RestrictedStockUnitsRSUMember2022-12-310001830214us-gaap:RestrictedStockMember2022-12-310001830214us-gaap:RestrictedStockUnitsRSUMember2023-12-310001830214us-gaap:RestrictedStockMember2023-12-310001830214us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001830214us-gaap:RestrictedStockMember2021-01-012021-12-310001830214us-gaap:RestrictedStockMember2022-01-012022-12-310001830214dna:RestrictedStockAwardsMember2022-01-012022-12-310001830214dna:RestrictedStockAwardsMember2021-01-012021-12-310001830214dna:EarnOutSharesMember2021-09-162021-09-160001830214us-gaap:ShareBasedCompensationAwardTrancheOneMemberdna:EarnOutSharesMemberus-gaap:CommonStockMember2021-09-160001830214us-gaap:ShareBasedCompensationAwardTrancheTwoMemberdna:EarnOutSharesMemberus-gaap:CommonStockMember2021-09-160001830214us-gaap:ShareBasedCompensationAwardTrancheThreeMemberdna:EarnOutSharesMemberus-gaap:CommonStockMember2021-09-160001830214dna:EarnOutSharesMemberdna:ShareBasedCompensationAwardTrancheFourMemberus-gaap:CommonStockMember2021-09-160001830214srt:MinimumMemberdna:EarnOutSharesMember2021-09-162021-09-160001830214srt:MaximumMemberdna:EarnOutSharesMember2021-09-162021-09-160001830214dna:EarnoutRestrictedStockUnitsMember2021-10-012021-12-310001830214us-gaap:ShareBasedCompensationAwardTrancheOneMember2021-11-150001830214dna:EarnoutRestrictedStockUnitsMember2023-01-012023-12-310001830214dna:EarnoutRestrictedStockUnitsMember2022-01-012022-12-310001830214dna:EarnoutRestrictedStockUnitsMembersrt:MinimumMember2021-01-012021-12-310001830214dna:EarnoutRestrictedStockUnitsMembersrt:MaximumMember2021-01-012021-12-310001830214dna:EarnoutRestrictedStockUnitsMember2021-01-012021-12-310001830214dna:EarnoutRestrictedStockUnitsMember2022-12-310001830214dna:EarnoutRestrictedStockUnitsMember2023-12-310001830214dna:EarnOutSharesMember2023-12-310001830214dna:EarnOutSharesMember2023-01-012023-12-310001830214dna:RestrictedStockAwardsMember2023-01-012023-12-310001830214dna:PharmaAndBiotechMemberus-gaap:ProductConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2023-01-012023-12-310001830214dna:PharmaAndBiotechMemberus-gaap:ProductConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2022-01-012022-12-310001830214dna:PharmaAndBiotechMemberus-gaap:ProductConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2021-01-012021-12-310001830214dna:AgricultureMemberus-gaap:ProductConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2023-01-012023-12-310001830214dna:AgricultureMemberus-gaap:ProductConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2022-01-012022-12-310001830214dna:AgricultureMemberus-gaap:ProductConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2021-01-012021-12-310001830214dna:IndustrialAndEnvironmentMemberus-gaap:ProductConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2023-01-012023-12-310001830214dna:IndustrialAndEnvironmentMemberus-gaap:ProductConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2022-01-012022-12-310001830214dna:IndustrialAndEnvironmentMemberus-gaap:ProductConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2021-01-012021-12-310001830214dna:FoodAndNutritionMemberus-gaap:ProductConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2023-01-012023-12-310001830214dna:FoodAndNutritionMemberus-gaap:ProductConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2022-01-012022-12-310001830214dna:FoodAndNutritionMemberus-gaap:ProductConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2021-01-012021-12-310001830214us-gaap:ProductConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMemberdna:CustomerAndTechnologyMember2023-01-012023-12-310001830214us-gaap:ProductConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMemberdna:CustomerAndTechnologyMember2022-01-012022-12-310001830214us-gaap:ProductConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMemberdna:CustomerAndTechnologyMember2021-01-012021-12-310001830214dna:GovernmentAndDefenseMemberus-gaap:ProductConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2023-01-012023-12-310001830214dna:GovernmentAndDefenseMemberus-gaap:ProductConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2022-01-012022-12-310001830214dna:GovernmentAndDefenseMemberus-gaap:ProductConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2021-01-012021-12-310001830214dna:CellEngineeringRevenueMemberus-gaap:ProductConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2023-01-012023-12-310001830214dna:CellEngineeringRevenueMemberus-gaap:ProductConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2022-01-012022-12-310001830214dna:CellEngineeringRevenueMemberus-gaap:ProductConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2021-01-012021-12-310001830214country:USus-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2023-01-012023-12-310001830214country:USus-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2022-01-012022-12-310001830214country:USus-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2021-01-012021-12-3100018302142022-01-012022-03-31dna:segmentdna:asset0001830214dna:CellEngineeringSegmentMember2023-01-012023-12-310001830214dna:CellEngineeringSegmentMember2022-01-012022-12-310001830214dna:CellEngineeringSegmentMember2021-01-012021-12-310001830214dna:BiosecuritySegmentMember2023-01-012023-12-310001830214dna:BiosecuritySegmentMember2022-01-012022-12-310001830214dna:BiosecuritySegmentMember2021-01-012021-12-310001830214dna:CellEngineeringAndBiosecuritySegmentsMember2023-01-012023-12-310001830214dna:CellEngineeringAndBiosecuritySegmentsMember2022-01-012022-12-310001830214dna:CellEngineeringAndBiosecuritySegmentsMember2021-01-012021-12-310001830214us-gaap:OperatingSegmentsMember2023-01-012023-12-310001830214us-gaap:OperatingSegmentsMember2022-01-012022-12-310001830214us-gaap:OperatingSegmentsMember2021-01-012021-12-310001830214us-gaap:CorporateNonSegmentMember2023-01-012023-12-310001830214us-gaap:CorporateNonSegmentMember2022-01-012022-12-310001830214us-gaap:CorporateNonSegmentMember2021-01-012021-12-310001830214dna:BiomeditMemberus-gaap:SeriesAPreferredStockMember2022-04-012022-04-300001830214dna:BiomeditMember2022-04-012022-04-300001830214dna:BiomeditMember2023-03-310001830214dna:BiomeditMember2023-01-012023-03-310001830214dna:BiomeditMember2022-04-300001830214dna:BiomeditLlcMember2022-04-300001830214dna:BiomeditLlcMemberus-gaap:SeriesAPreferredStockMember2023-01-012023-12-310001830214dna:BiomeditLlcMember2023-12-31dna:materialRight0001830214dna:BiomeditLlcMember2023-01-012023-12-310001830214dna:BiomeditLlcMember2023-01-012023-03-310001830214dna:BiomeditLlcMember2023-03-31dna:obligation0001830214dna:BiomeditLlcMember2022-12-310001830214dna:BiomeditLlcMember2022-01-012022-12-310001830214us-gaap:SeriesAPreferredStockMember2021-03-012021-03-310001830214us-gaap:SeriesAPreferredStockMemberdna:ArcaeaMember2022-01-012022-12-310001830214us-gaap:SeriesAPreferredStockMember2022-01-012022-12-310001830214dna:ArcaeaMember2022-01-012022-12-310001830214dna:ArcaeaMember2021-03-012021-03-310001830214us-gaap:LicenseMemberdna:ArcaeaMember2022-03-310001830214dna:ArcaeaLlcMember2021-03-310001830214dna:ArcaeaLlcMemberus-gaap:LicenseMember2021-01-012021-12-310001830214dna:ArcaeaLlcMember2022-12-310001830214dna:ArcaeaLlcMember2022-12-310001830214dna:ArcaeaLlcMember2023-01-012023-12-310001830214dna:ArcaeaLlcMember2021-01-012021-12-310001830214dna:ArcaeaLlcMember2021-12-310001830214dna:ArcaeaLlcMember2023-12-310001830214dna:ArcaeaLlcMember2022-01-012022-12-310001830214us-gaap:SeriesAPreferredStockMemberdna:AllonniaMember2020-01-012020-12-310001830214us-gaap:SeriesAPreferredStockMember2020-01-012020-12-310001830214us-gaap:SeriesAPreferredStockMemberdna:AllonniaMember2021-12-310001830214us-gaap:SeriesAPreferredStockMemberdna:AllonniaMember2021-01-012021-12-310001830214dna:AllonniaMember2021-01-012021-12-310001830214us-gaap:SeriesAPreferredStockMemberdna:AllonniaMember2022-01-012022-12-310001830214us-gaap:SeriesAPreferredStockMemberdna:AllonniaMember2023-01-012023-12-310001830214dna:AllonniaMember2022-01-012022-12-310001830214dna:AllonniaMember2022-12-310001830214us-gaap:SeriesAPreferredStockMemberdna:AllonniaMember2022-12-310001830214dna:AllonniaMember2020-01-012020-12-310001830214dna:AllonniaMember2022-12-310001830214dna:AllonniaMember2023-01-012023-12-310001830214dna:AllonniaMember2022-01-012022-12-310001830214dna:AllonniaMember2023-12-310001830214dna:AllonniaMember2021-01-012021-12-310001830214dna:MotifFoodworksIncMemberdna:TechnicalDevelopmentAgreementMember2018-12-310001830214dna:MotifFoodworksIncMemberus-gaap:SeriesAPreferredStockMember2018-01-012018-12-310001830214dna:MotifFoodworksIncMember2018-01-012018-12-31dna:technicalDevelopmentPlan0001830214dna:MotifFoodworksIncMemberdna:TechnicalDevelopmentAgreementMember2018-12-010001830214dna:MotifFoodworksIncMemberdna:TechnicalDevelopmentAgreementMember2018-01-012018-12-310001830214dna:MotifFoodworksIncMemberdna:TechnicalDevelopmentAgreementMember2023-12-310001830214dna:MotifFoodworksIncMember2021-01-012021-12-310001830214dna:MotifFoodworksIncMember2022-01-012022-12-310001830214dna:MotifFoodworksIncMember2023-01-012023-12-310001830214dna:MotifFoodworksIncMember2018-12-310001830214dna:MaterialRightsTrancheOneMemberdna:MotifFoodworksIncMemberdna:TechnicalDevelopmentAgreementMember2018-12-310001830214dna:MotifFoodworksIncMember2023-12-310001830214dna:MotifFoodworksIncMember2022-12-310001830214dna:MotifFoodworksIncMember2023-01-012023-12-310001830214dna:MotifFoodworksIncMember2022-01-012022-12-310001830214dna:MotifFoodworksIncMember2021-01-012021-12-310001830214us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMemberdna:TwoThousandAndEighteenTechnicalDevelopmentAgreementMemberdna:GenomaticaMember2019-09-300001830214us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMemberdna:TwoThousandAndEighteenTechnicalDevelopmentAgreementMemberdna:GenomaticaMember2019-12-310001830214dna:GenomaticaMember2018-12-310001830214us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMemberdna:GenomaticaMemberdna:FoundryTermsOfServiceAgreementMember2022-12-310001830214us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMemberdna:GenomaticaMemberdna:FoundryTermsOfServiceAgreementMember2021-12-310001830214dna:GenomaticaMember2023-12-310001830214dna:GenomaticaMember2022-12-310001830214dna:GenomaticaMember2023-01-012023-12-310001830214dna:GenomaticaMember2022-01-012022-12-310001830214dna:GenomaticaMember2021-01-012021-12-310001830214dna:CooksoniaMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMemberus-gaap:CapitalUnitClassAMember2017-09-012017-09-300001830214dna:RelatedPartyInvestorMemberus-gaap:CapitalUnitClassBMemberdna:CooksoniaMember2017-09-012017-09-300001830214dna:RelatedPartyInvestorMemberus-gaap:CapitalUnitClassBMemberdna:JoynBioLlcMemberdna:CooksoniaMember2017-09-300001830214dna:RelatedPartyInvestorMemberdna:JoynBioLlcMemberdna:CooksoniaMemberdna:CapitalUnitsClassCMember2017-09-300001830214us-gaap:CapitalUnitClassBMemberdna:CooksoniaMember2017-09-012017-09-300001830214dna:JoynBioLlcMemberdna:CapitalUnitsClassCMember2017-09-012017-09-300001830214dna:JoynBioLlcMemberdna:CooksoniaMemberdna:CapitalUnitsClassCMember2017-09-300001830214dna:JoynBioLlcMemberdna:CapitalUnitsClassCMemberdna:BayerMember2017-09-012017-09-300001830214dna:JoynBioLlcMemberdna:CapitalUnitsClassCMemberdna:BayerMember2017-09-300001830214dna:FoundryServicesAgreementMemberdna:JoynBioLlcMember2017-09-300001830214dna:FoundryServicesAgreementMemberdna:JoynBioLlcMember2020-12-310001830214dna:JoynBioLlcMemberdna:CooksoniaMember2017-09-300001830214us-gaap:ParentMemberdna:CooksoniaMember2017-09-300001830214us-gaap:ParentMemberdna:CooksoniaMember2017-09-012017-09-300001830214dna:CooksoniaMember2017-09-300001830214dna:CooksoniaMemberus-gaap:NoncontrollingInterestMember2017-09-300001830214dna:JoynBioLlcMember2017-09-300001830214dna:AmyrisIncMemberdna:AmyrisCollaborationAgreementMember2023-01-012023-12-310001830214dna:AmyrisIncMemberdna:PromissoryNoteMemberdna:AmyrisCollaborationAgreementMember2023-01-012023-12-310001830214dna:AmyrisIncMemberdna:PromissoryNoteMember2021-12-310001830214srt:MinimumMemberdna:AmyrisIncMemberdna:PromissoryNoteMember2023-01-012023-12-310001830214dna:AmyrisIncMemberdna:PromissoryNoteMembersrt:MaximumMember2023-01-012023-12-310001830214dna:AmyrisIncMemberdna:PromissoryNoteMember2023-01-012023-12-310001830214dna:AmyrisIncMemberdna:PromissoryNoteMember2021-11-012021-11-150001830214dna:PartnershipAgreementMemberdna:AmyrisIncMemberdna:PromissoryNoteMember2021-11-150001830214dna:SynlogicIncMemberus-gaap:CommonStockMember2019-06-012019-06-300001830214dna:SynlogicIncMemberus-gaap:CommonStockMember2019-06-300001830214dna:WarrantAgreementMemberdna:SynlogicIncMember2019-06-300001830214dna:FoundryServicesAgreementMemberdna:SynlogicIncMember2019-06-300001830214dna:FoundryServicesAgreementMemberdna:SynlogicIncMember2019-06-012019-06-300001830214dna:SynlogicIncMember2019-06-300001830214dna:SynlogicIncMemberus-gaap:WarrantMember2019-06-300001830214dna:SynlogicIncMembersrt:MaximumMember2020-12-310001830214dna:SynlogicIncMember2023-12-310001830214dna:SynlogicIncMember2022-12-310001830214us-gaap:DomesticCountryMember2023-12-310001830214dna:BeginToExpireInTwoThousandAndTwentyNineMemberus-gaap:DomesticCountryMember2023-12-310001830214dna:CarriedForwardIndefinitelyMemberus-gaap:DomesticCountryMember2023-12-310001830214us-gaap:StateAndLocalJurisdictionMember2023-12-310001830214us-gaap:StateAndLocalJurisdictionMemberdna:BeginToExpireInTwoThousandAndThirtyMember2023-12-310001830214dna:CarriedForwardIndefinitelyMemberus-gaap:StateAndLocalJurisdictionMember2023-12-310001830214us-gaap:ForeignCountryMember2023-12-310001830214us-gaap:ResearchMemberus-gaap:DomesticCountryMember2023-12-310001830214us-gaap:ResearchMemberus-gaap:StateAndLocalJurisdictionMember2023-12-310001830214us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001830214us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001830214us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001830214dna:EarnOutSharesMember2023-01-012023-12-310001830214dna:EarnOutSharesMember2022-01-012022-12-310001830214dna:EarnOutSharesMember2021-01-012021-12-310001830214us-gaap:WarrantMember2023-01-012023-12-310001830214us-gaap:WarrantMember2022-01-012022-12-310001830214us-gaap:WarrantMember2021-01-012021-12-310001830214us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001830214us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001830214us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001830214us-gaap:RestrictedStockMember2023-01-012023-12-310001830214us-gaap:RestrictedStockMember2022-01-012022-12-310001830214us-gaap:RestrictedStockMember2021-01-012021-12-310001830214us-gaap:RelatedPartyMemberdna:AllonniaMember2023-12-310001830214us-gaap:RelatedPartyMemberdna:AllonniaMember2022-12-310001830214us-gaap:RelatedPartyMemberdna:AyanaMember2023-12-310001830214us-gaap:RelatedPartyMemberdna:AyanaMember2022-12-310001830214us-gaap:RelatedPartyMemberdna:ArcaeaMember2023-12-310001830214us-gaap:RelatedPartyMemberdna:ArcaeaMember2022-12-310001830214us-gaap:RelatedPartyMemberdna:VerbMember2023-12-310001830214us-gaap:RelatedPartyMemberdna:VerbMember2022-12-310001830214us-gaap:RelatedPartyMemberdna:BiomeditMember2023-12-310001830214us-gaap:RelatedPartyMemberdna:BiomeditMember2022-12-310001830214us-gaap:RelatedPartyMemberdna:OtherEquityInvesteesMember2023-12-310001830214us-gaap:RelatedPartyMemberdna:OtherEquityInvesteesMember2022-12-310001830214us-gaap:RelatedPartyMemberdna:MotifMember2023-12-310001830214us-gaap:RelatedPartyMemberdna:MotifMember2022-12-310001830214dna:GenomaticaMemberus-gaap:RelatedPartyMember2023-12-310001830214dna:GenomaticaMemberus-gaap:RelatedPartyMember2022-12-310001830214us-gaap:RelatedPartyMemberdna:MotifMember2023-01-012023-12-310001830214us-gaap:RelatedPartyMemberdna:MotifMember2022-01-012022-12-310001830214us-gaap:RelatedPartyMemberdna:MotifMember2021-01-012021-12-310001830214us-gaap:RelatedPartyMemberdna:ArcaeaMember2023-01-012023-12-310001830214us-gaap:RelatedPartyMemberdna:ArcaeaMember2022-01-012022-12-310001830214us-gaap:RelatedPartyMemberdna:ArcaeaMember2021-01-012021-12-310001830214dna:GenomaticaMemberus-gaap:RelatedPartyMember2023-01-012023-12-310001830214dna:GenomaticaMemberus-gaap:RelatedPartyMember2022-01-012022-12-310001830214dna:GenomaticaMemberus-gaap:RelatedPartyMember2021-01-012021-12-310001830214us-gaap:RelatedPartyMemberdna:BiomeditMember2023-01-012023-12-310001830214us-gaap:RelatedPartyMemberdna:BiomeditMember2022-01-012022-12-310001830214us-gaap:RelatedPartyMemberdna:BiomeditMember2021-01-012021-12-310001830214us-gaap:RelatedPartyMemberdna:AyanaMember2023-01-012023-12-310001830214us-gaap:RelatedPartyMemberdna:AyanaMember2022-01-012022-12-310001830214us-gaap:RelatedPartyMemberdna:AyanaMember2021-01-012021-12-310001830214us-gaap:RelatedPartyMemberdna:VerbMember2023-01-012023-12-310001830214us-gaap:RelatedPartyMemberdna:VerbMember2022-01-012022-12-310001830214us-gaap:RelatedPartyMemberdna:VerbMember2021-01-012021-12-310001830214us-gaap:RelatedPartyMemberdna:AllonniaMember2023-01-012023-12-310001830214us-gaap:RelatedPartyMemberdna:AllonniaMember2022-01-012022-12-310001830214us-gaap:RelatedPartyMemberdna:AllonniaMember2021-01-012021-12-310001830214us-gaap:RelatedPartyMemberdna:JoynBioMember2023-01-012023-12-310001830214us-gaap:RelatedPartyMemberdna:JoynBioMember2022-01-012022-12-310001830214us-gaap:RelatedPartyMemberdna:JoynBioMember2021-01-012021-12-310001830214us-gaap:RelatedPartyMemberdna:OtherEquityInvesteesMember2023-01-012023-12-310001830214us-gaap:RelatedPartyMemberdna:OtherEquityInvesteesMember2022-01-012022-12-310001830214us-gaap:RelatedPartyMemberdna:OtherEquityInvesteesMember2021-01-012021-12-310001830214us-gaap:RelatedPartyMember2022-04-300001830214dna:PromissoryNoteReceivableInterestRateMember2023-01-012023-12-310001830214dna:DiscountRateQualifyingEquityFinancingMember2023-01-012023-12-310001830214dna:DiscountRateNonQualifyingEquityFinancingMember2023-01-012023-12-310001830214us-gaap:LeaseAgreementsMemberus-gaap:SubsequentEventMember2024-02-270001830214us-gaap:LeaseAgreementsMemberus-gaap:SubsequentEventMember2024-02-272024-02-270001830214us-gaap:SubsequentEventMember2024-02-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________________

FORM 10-K

______________________________________________

(Mark One)

|

|

|

|

|

|

| x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

OR

|

|

|

|

|

|

| o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number 001-40097

______________________________________________

GINKGO BIOWORKS HOLDINGS, INC.

(Exact name of Registrant as specified in its Charter)

______________________________________________

|

|

|

|

|

|

Delaware |

87-2652913 |

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|

|

|

27 Drydock Avenue

8th Floor

Boston, MA

|

02210 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (877) 422-5362

______________________________________________

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered |

Class A common stock, par value $0.0001 per share |

|

DNA |

|

NYSE |

Warrants to purchase one share of Class A common stock, each at an exercise price of $11.50 per share |

|

DNA.WS |

|

NYSE |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No x

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Large accelerated filer |

x |

|

Accelerated filer |

o |

| Non-accelerated filer |

o |

|

Smaller reporting company |

o |

|

|

|

Emerging growth company |

o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). o

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of June 30, 2023, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the voting and non-voting common equity held by our non-affiliates was approximately $2,433 million based upon the closing price reported for such date on the New York Stock Exchange.

As of February 22, 2024, there were 1,650,909,109 shares of Class A common stock, 381,486,677 shares of Class B common stock, and 120,000,000 shares of non-voting Class C common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of this report is incorporated by reference from the registrant’s definitive proxy statement relating to its annual meeting of stockholders to be held in 2024, which definitive proxy statement will be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates.

Table of Contents

Cautionary Note Regarding Forward Looking Statements

This annual report on Form 10-K and our annual report to shareholders (the “Annual Report”) include forward-looking statements regarding, among other things, the plans, strategies and prospects, both business and financial, of Ginkgo Bioworks Holdings, Inc. (“Ginkgo”). These statements are based on the beliefs and assumptions of the management of Ginkgo. Although Ginkgo believes that its plans, intentions and expectations reflected in or suggested by these forward-looking statements are reasonable, Ginkgo cannot assure you that it will achieve or realize these plans, intentions or expectations. Forward-looking statements are inherently subject to risks, uncertainties and assumptions. Generally, statements that are not historical facts, including statements concerning possible or assumed future actions, business strategies, events or results of operations, are forward-looking statements. These statements may be preceded by, followed by or include the words “believes”, “estimates”, “expects”, “projects”, “forecasts”, “may”, “will”, “should”, “seeks”, “plans”, “scheduled”, “anticipates” or “intends” or similar expressions. Forward-looking statements contained in the Annual Report include, but are not limited to, statements about:

•Ginkgo’s ability to raise financing in the future and to comply with restrictive covenants related to long-term indebtedness;

•Ginkgo’s ability to retain or recruit, or adapt to changes required in, its founders, senior executives, key personnel or directors;

•factors relating to the business, operations and financial performance of Ginkgo, including:

◦the performance and output of Ginkgo’s cell engineering and biosecurity platforms;

◦Ginkgo’s ability to effectively manage its growth, including its anticipated approach to inorganic growth and related impacts on Ginkgo’s financial performance;

◦Ginkgo’s exposure to the volatility and liquidity risks inherent in holding equity interests in certain of its customers;

◦rapidly changing technology and extensive competition in the synthetic biology industry that could make the products and processes Ginkgo is developing obsolete or non-competitive unless it continues to collaborate on the development of new and improved products and processes and pursue new market opportunities;

◦Ginkgo’s ability to convert potential customers from “on prem” research and development (“R&D”) to outsourced services, Ginkgo’s reliance on its customers to develop, produce and manufacture products using the engineered cells and/or biomanufacturing processes that Ginkgo develops and Ginkgo’s ability to accurately predict customer demand, including with respect to the data we access and hold;

◦the anticipated growth of Ginkgo’s biomonitoring and bioinformatic support services, including its bioradar and biological intelligence offerings, its expanding epidemiology capabilities and potential impact on the ability to predict pathogen emergence and evolution, its international expansion and the relative value of the services on Ginkgo’s future Biosecurity revenue;

◦Ginkgo’s development of and investment in artificial intelligence (“AI”) tools and achievement of certain milestones under its agreement with Google LLC (“Google Cloud”);

◦Ginkgo’s ability to comply with laws and regulations applicable to its business; and

◦market conditions and global and economic factors beyond Ginkgo’s control, including initiatives undertaken by the U.S. government in the biotechnology sector, the frequency and scale of biological risks and threats, and the future potential and commercial applications of AI and the biotechnology sector.

Each forward-looking statement is subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. Applicable risks and uncertainties include, among others:

•intense competition and competitive pressures from other companies worldwide in the industries in which Ginkgo operates;

•litigation, including securities or shareholder litigation, and the ability to adequately protect Ginkgo’s intellectual property rights;

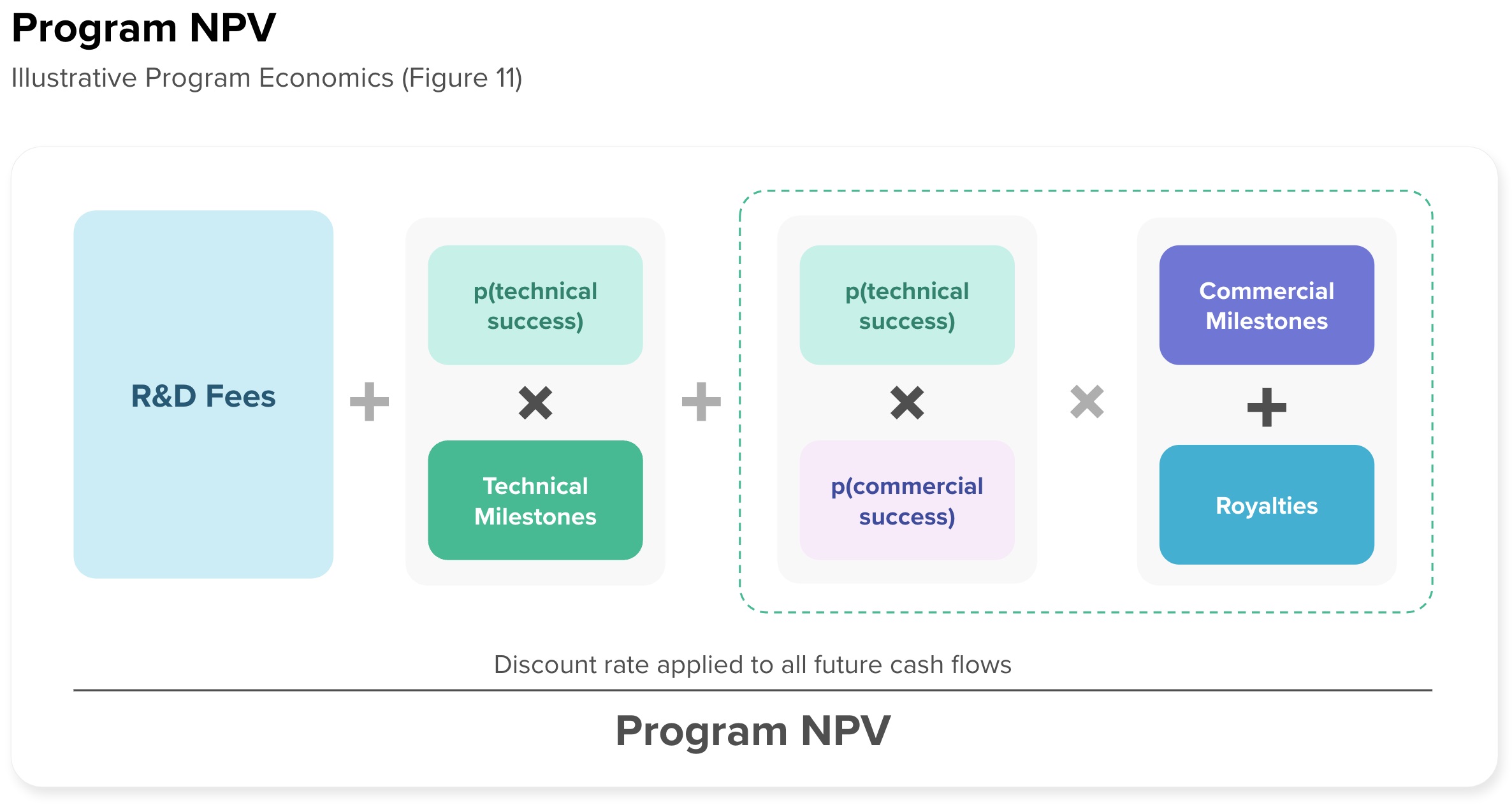

•the success of Ginkgo’s programs, including the growing efficiency and cost-advantage of Foundry cell engineering services, and their potential to contribute revenue, and the relative contribution of Ginkgo’s programs to its future revenue, including the potential for future revenue related to downstream value to be in the form of potential future milestone payments, royalties, and/or equity consideration; and

•other factors detailed under the section entitled “Risk Factors.”

These and other factors that could cause actual results to differ from those implied by the forward-looking statements in this Annual Report are more fully described under the heading “Risk Factors” and elsewhere in this report. The risks described under the heading “Risk Factors” are not exhaustive. Other sections of this Annual Report describe additional factors that could adversely affect the business, financial condition or results of Ginkgo. New risk factors emerge from time to time and it is not possible to predict all such risk factors, nor can Ginkgo assess the impact of all such risk factors on the business of Ginkgo, or the extent to which any factor or combination of factors may cause actual results to differ materially from those contained in any forward-looking statements. Forward-looking statements are not guarantees of performance. You should not put undue reliance on these statements, which speak only as of the date hereof. All forward-looking statements attributable to Ginkgo or persons acting on its behalf are expressly qualified in their entirety by the foregoing cautionary statements. Ginkgo undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Risk Factors Summary

Investing in our securities involves risks. You should carefully consider the risks described in “Risk Factors” beginning on page

37 before making a decision to invest in our Class A common stock. If any of these risks actually occur, our business, financial condition and results of operations would likely be materially adversely affected. Some of the risks related to Ginkgo’s business and industry are summarized below. References in the summary below to “we,” “us,” “our” and “the Company” generally refer to Ginkgo.

•We have a history of net losses. We expect to continue to incur losses for the foreseeable future, and we may never achieve or maintain profitability.

•Only our employees and directors are entitled to hold shares of Class B common stock (including shares of Class B common stock issued in the future), which have ten votes per share. This limits or precludes other stockholders’ ability to influence the outcome of matters submitted to stockholders for approval, including the election of directors, the approval of certain employee compensation plans, the adoption of certain amendments to our organizational documents and the approval of any merger, consolidation, sale of all or substantially all of our assets, or other major corporate transactions requiring stockholder approval.

•We may need substantial additional capital in the future in order to fund our business.

•We have experienced rapid growth and expect our growth to continue, and if we fail to effectively manage our growth, then our business, results of operations, and financial condition could be adversely affected.

•Our limited operating history makes it difficult to evaluate our current business and future prospects.

•We currently own and may in the future own equity interests in other operating companies, including certain of our customers and we may receive non-cash consideration which involves estimations of fair market value. The initial fair market value of the non-cash consideration may decrease after contract inception and the amount of cash proceeds eventually realized may be less than the revenue recognized. Consequently, we have exposure to the volatility and liquidity risks inherent in holding their equity and overall operational and financial performance of these businesses.

•We have in the past, and in the future may continue to pursue strategic acquisitions and investments that are dilutive to our stockholders and that could have an adverse impact on our business if they are unsuccessful.

•We must continue to secure and maintain sufficient and stable supplies of laboratory reagents, consumables, equipment, and laboratory services. We depend on a limited number of suppliers, some of which are single-source suppliers, and contract manufacturers for critical supplies, equipment, and services for research, development, and manufacturing of our products and processes. Our reliance on these third parties exposes us to risks relating to costs, contractual terms, supply, and logistics, and the loss of any one or more of these suppliers or contract manufacturers or their failure to supply us with the necessary supplies, equipment, or services on a timely basis, could cause delays in our research, development, or production capacity and adversely affect our business.

•We use biological, hazardous, flammable and/or regulated materials that require considerable training, expertise and expense for handling, storage and disposal and may result in claims against us.

•Third parties may use our engineered cells, materials, and organisms and accompanying production processes in ways that could damage our reputation.

•If our customers discontinue their development, production and manufacturing efforts using our engineered cells and/or biomanufacturing processes, our future financial position may be adversely impacted.

•Further, because our revenue is concentrated in a limited number of customers, some of which are related parties, our revenue, results of operations, cash flows and reputation in the marketplace may suffer upon the loss of a significant customer.

•We are or could become involved in securities or shareholder litigation and other related matters, which could be expensive and time-consuming. Such litigation and related matters could harm our business.

•In certain cases, our business partners may have discretion in determining when and whether to make announcements about the status of our collaborations, including about developments and timelines for advancing programs, and the price of our common stock may decline as a result of announcements of unexpected results or developments.

•Uncertainty regarding the demand for passive monitoring programs and biosecurity services could materially adversely affect our business.

•Rapidly changing technology and emerging competition in the synthetic biology industry could make the platform, programs, and products we and our customers are developing obsolete or non-competitive unless we continue to develop our platform and pursue new market opportunities.

•Our investments in and use of AI may result in reputational harm, liability, or other adverse consequences to our business operations.

•Ethical, legal and social concerns about genetically modified organisms (“GMOs”) and genetically modified plant or animal cells and genetically modified proteins and biomaterials (collectively, “Genetically Modified Materials”) and their resulting products could limit or prevent the use of products or processes using our technologies, limit public acceptance of such products or processes and limit our revenues.

•If we are unable to obtain, maintain and defend patents protecting our intellectual property, our competitive position will be harmed. If we are unable to protect the confidentiality of our trade secrets, our business and competitive position will be harmed. We may become involved in lawsuits or other enforcement proceedings to protect or enforce our patents or other intellectual property, which could be expensive, time consuming and potentially unsuccessful.

•We rely on our customers, joint venturers, equity investees and other third parties to deliver timely and accurate information in order to accurately report our financial results in the time frame and manner required by law.

•We identified a material weakness in our internal controls over financial reporting and may identify additional material weaknesses in the future. A failure to maintain an effective system of internal control over financial reporting may result in a failure to accurately report our financial results or prevent fraud, which could harm our business and the trading price of our common stock.

•Failure to comply with federal, state, local and international laws and regulations could expose us to significant liabilities or penalties and adversely affect our business, our financial condition and results of operations and we may incur significant costs complying with such laws and regulations

•We and our laboratory partners are subject to a variety of laboratory testing standards, compliance with which is an expensive and time-consuming process, and any failure to comply could result in substantial penalties and disruptions to our business.

•Significant disruptions to our and our service providers’ information technology systems or data security incidents could result in significant financial, legal, regulatory, business and reputational harm to us.

PART I

Item 1. Business.

Unless the context otherwise requires, all references in this section to the “Company,” “Ginkgo,” “we,” “us,” or “our” refer to the business of Ginkgo Bioworks Holdings, Inc. and our subsidiaries.

Overview: Our Mission is to Make Biology Easier to Engineer

Our mission is to make biology easier to engineer. That has never changed. Every choice we’ve made with respect to our business model, our platform, our people, and our culture is grounded in whether it will advance our mission.

Why? Because:

1.Biology is programmable. All living things run on the same DNA code.

2.Biology matters. The ability to engineer biology has had and will have a profound impact on how we develop new medicines and vaccines, grow our food, and manufacture many of the things we use every day.

3.Biology is hard. Today, it is still too difficult and too costly to engineer biology, preventing critical innovations from reaching the market.

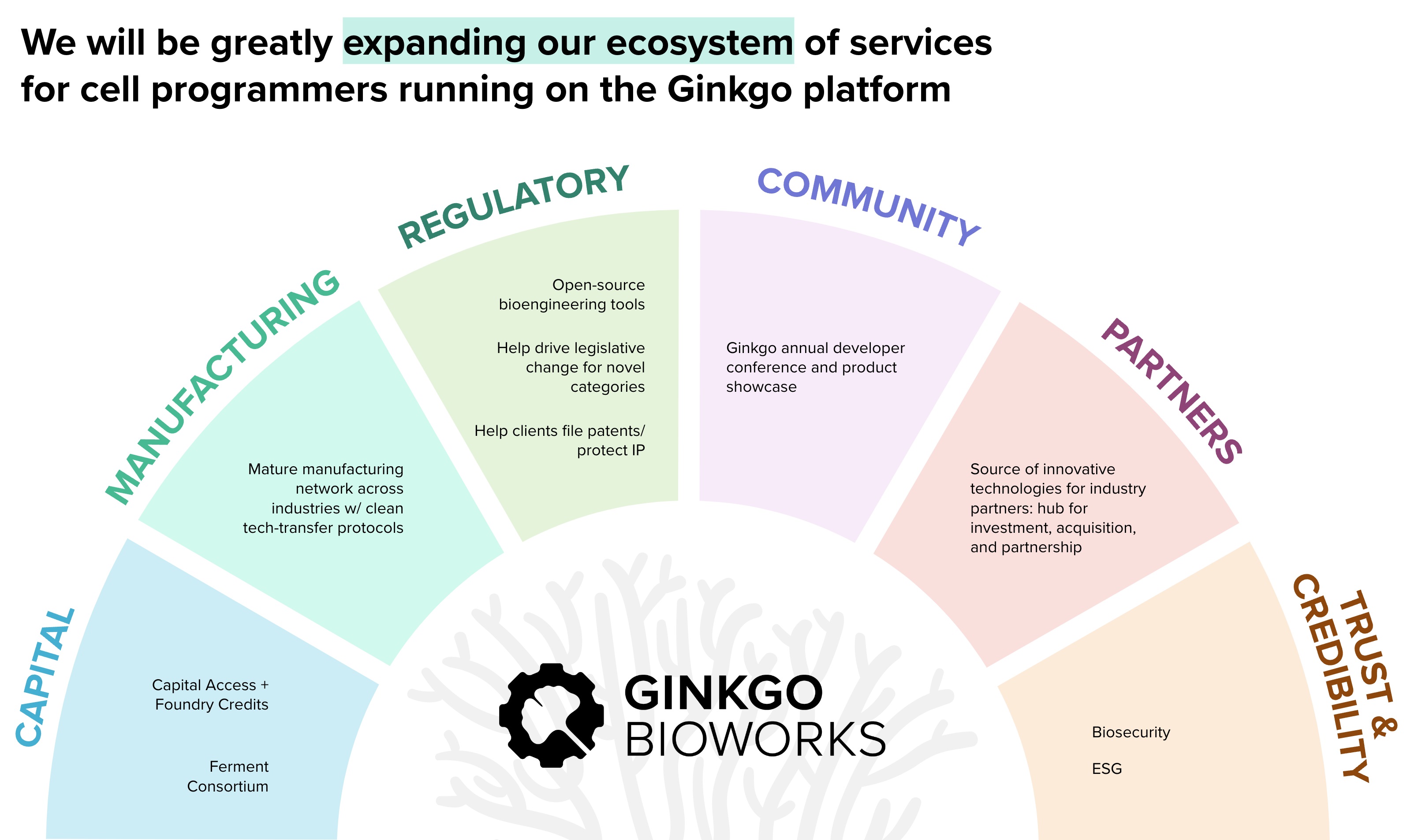

Making biology easier to engineer is a systems challenge. No single technology offers a solution. In a way, Ginkgo acts as a systems integrator, bringing together many different technologies–whether built internally, acquired, or through partners–to offer our customers a more integrated and complete solution to a multi-dimensional challenge. We offer these integrated solutions in two domains: cell engineering, where we work to solve biological R&D challenges for our customers across a range of industries, and biosecurity, where we seek to build solutions to identify, respond to, and ultimately prevent, biological threats. An overview of these two business lines is provided below.

Cell engineering

Our cell engineering customers work with biology to do incredible things, with transformative potential across industries:

•in medicine, developing innovative new therapeutics and vaccines;

•in agriculture, advancing the sustainability and security of our food systems; and

•in industrial biotechnology, advancing the way we manufacture a wide range of products for better performance and lower environmental impact.

We are inspired by the incredible diversity of innovations our customers are enabling. Our mission is to make it easier for them to do their critical work.

Because engineering biology is incredibly hard, biotech R&D is traditionally performed by in-house labs filled with highly trained scientists running lab experiments by hand over several years in the hope of ultimately developing a working product. Many attempted cell engineering projects fail in development due to scientific challenges, and many are terminated because they are taking too long or are over budget. How many innovative new medicines or climate solutions are stuck for lack of the right tool?

Ginkgo does not make products; we build enabling platform services so that our customers can bring products to market. Ginkgo provides flexible, end-to-end biotech R&D services that can offer customers better results on the dimension of cost, speed, or probability of success – and ideally on all three. In exchange for these services, Ginkgo’s customers generally pay us through a blend of fees during the development of their product and downstream value share in the form of milestones, royalties, or equity, which allows us to align our economics with the success of the products enabled by our platform.

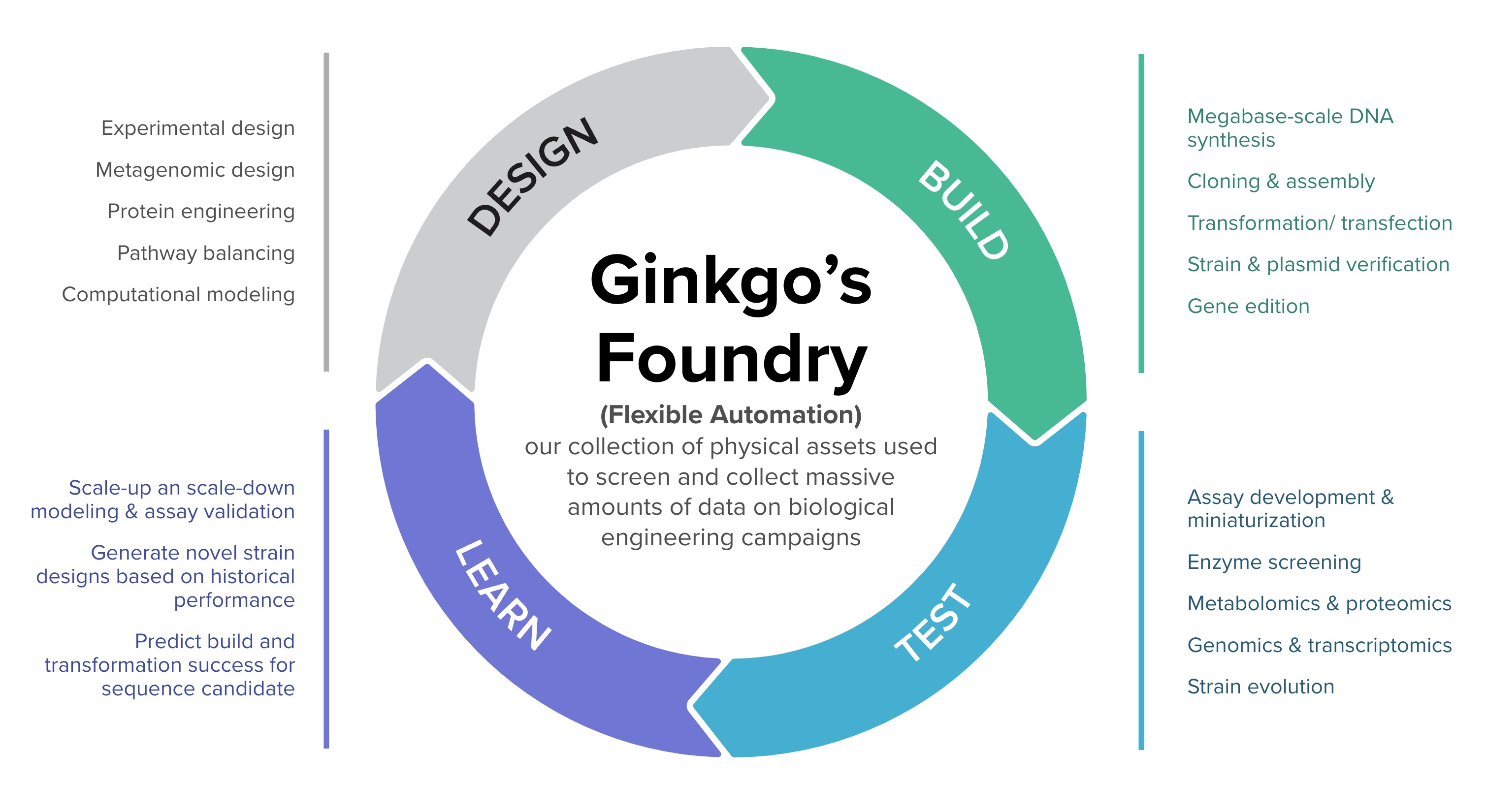

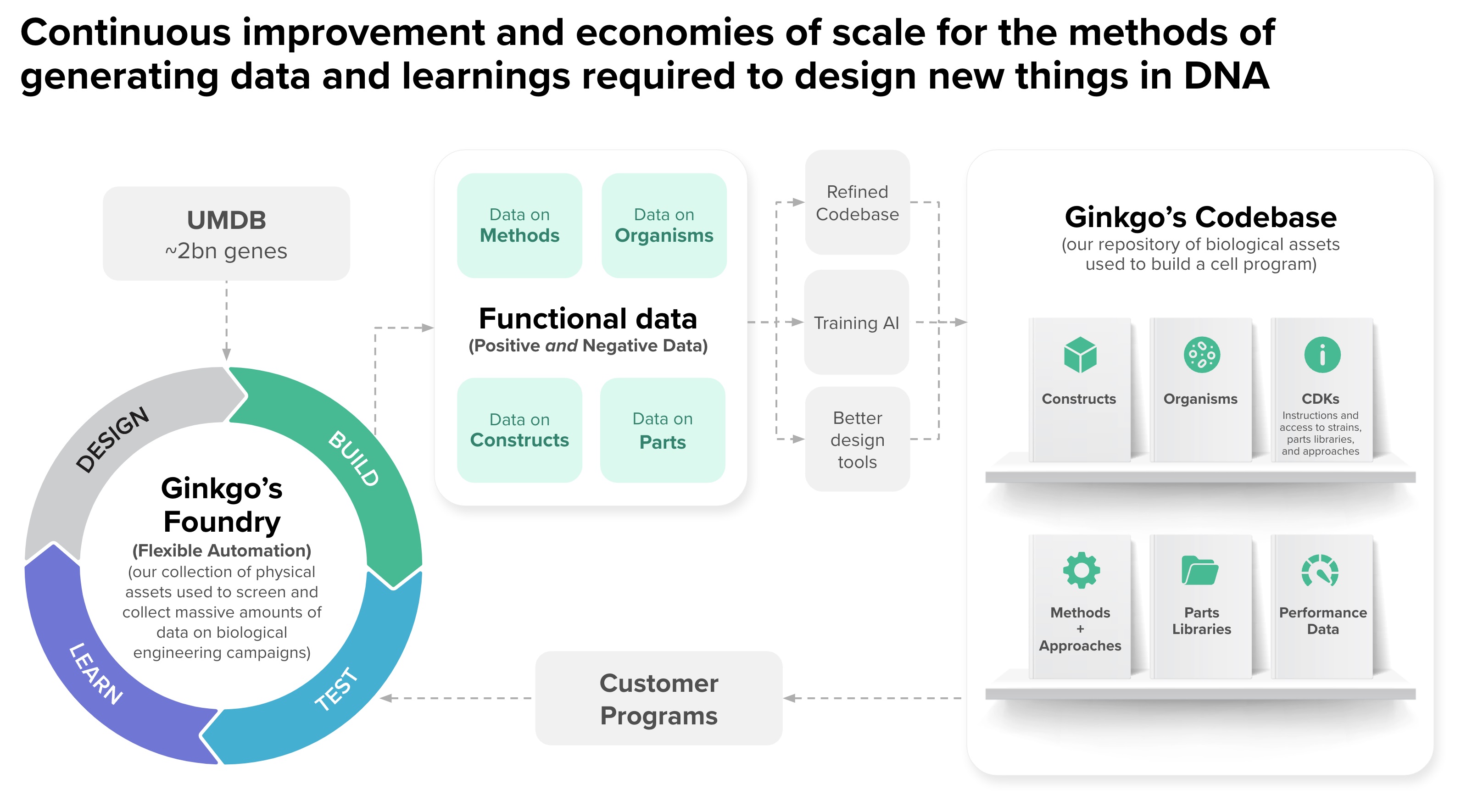

The fundamental advantage of our platform over traditional cell engineering done by hand at our customers’ labs is that our platform improves with scale while in-house cell engineering in our customers' labs largely does not. Compounding and mutually reinforcing improvements of our laboratory automation and software infrastructure—our Foundry—and our reusable data assets—our Codebase—enable us to improve our services while also enabling the flexibility to apply high throughput automation to the diversity of challenges across biological systems encountered by our customers.

•Our Foundry is a highly automated, yet flexible, lab powered by proprietary automation and software to enable flexibility and scale. The Foundry automates lab workflows at high levels of abstraction, enabling users to generate potentially valuable datasets labeling broad genetic sequence design space with a wide range of functional data through modular design-build-test-learn cycles or campaigns. Our scale economic means that the Foundry’s capacity to perform more and more diverse campaigns grows while the cost per campaign decreases. We call this scaling factor Knight’s Law.

•Our Codebase is a data asset which accumulates as we operate our Foundry in service of customer projects. Our Codebase includes vast amounts of data at different levels of characterization and usability in engineering projects, including: proprietary libraries of genetic sequence data that can be used for pretraining large language models via unsupervised learning, experimental data for fine tuning task-specific generative AI models, as well as best practices for cell engineering, sequences and host cells that have been honed through dozens of programs and can be directly reusable for different applications of cell engineering.

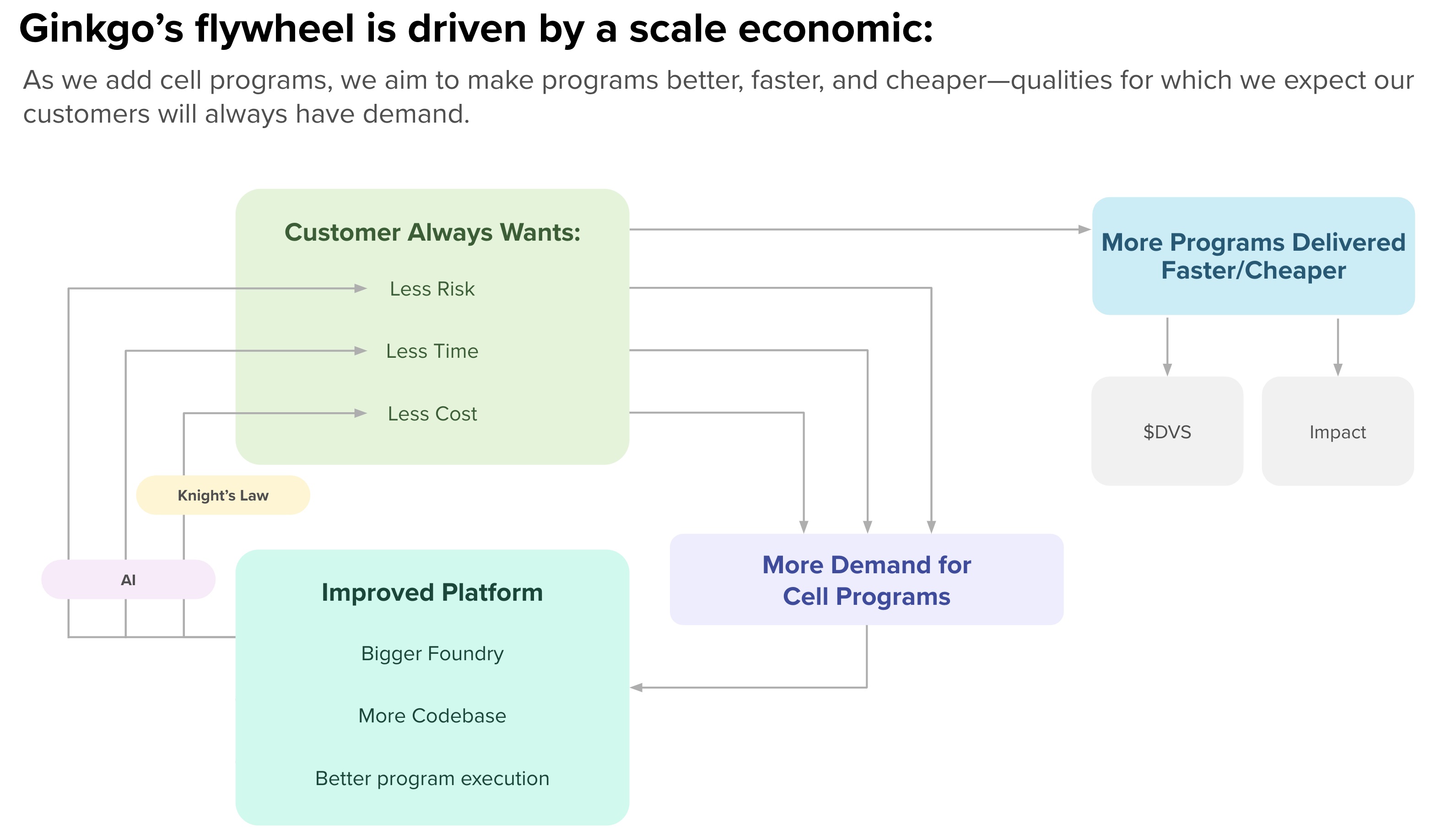

This flexible capability for large scale data generation and broad, growing data asset empowers generative AI and machine learning (“ML”) tools that enable more predictive design of cell programs and higher probability of success for our customers. As the platform scales, we have observed a virtuous cycle between our Foundry, our Codebase, and the value we deliver to customers. We believe this creates a powerful “flywheel,” where new cell programs drive improvements in our platform which in turn drives customers to outsource even more new cell programs.

Figure 1: Ginkgo’s flywheel is driven by a scale economic: as we add cell programs, we aim to make programs better, faster, and cheaper – qualities of which we expect our customers will always have demand.

We believe that cell programming has the potential to be as ubiquitous in the physical world as computer programming has become in the digital world and that products in the future will be grown rather than made. To enable that vision, we are building a horizontal platform to make biology easier to engineer. Our business model is aligned with this strategy and with the success of our customers, setting us on what we believe is a path towards sustainable innovation for years to come.

Biosecurity

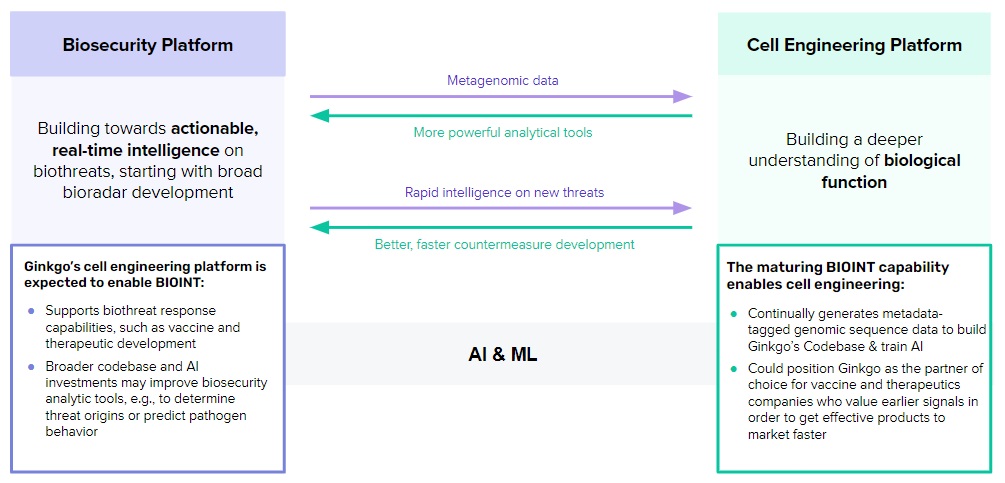

As with every technological revolution, reaping its benefits to the economy and society also requires us to grapple with its risks. A critical part of making biology easier to engineer is creating biosecurity infrastructure with the goal of managing the many accelerating and diversifying sources of biological risk, whether natural or engineered, accidental or malicious. And many of the same biotechnological capabilities that we’re applying to industry can also be applied to safeguarding lives and livelihoods.

In the digital world, we’ve learned that we need to build comprehensive infrastructure to protect our personal computers and digital systems of all kinds—from financial markets to power grids—from harmful code. The modern cybersecurity industry offers tools to constantly monitor for cyberthreats, assess the damage and ongoing risk of cyber incidents in near-real-time, recover system integrity, track the sources of threats, and rapidly deploy pieces of software that reduce vulnerabilities in our systems. This is happening constantly, all around us. A physical world grown with cell programming demands the same type of widespread biosecurity infrastructure to detect, characterize, respond to, attribute, and prevent biological threats.

This is a hard problem, and one we’ve been working towards for a long time. But the COVID-19 pandemic showed us—and the world—just how urgent it is to address. Our healthcare infrastructure, biomedical technology industry, and communities across the world mobilized in valiant and unprecedented ways, but still left us with losses of millions of lives and trillions of dollars. Our current systems are reactive: designed to pick up on patterns of illness, then figure out the nature of the threat, then try to quickly mobilize diagnostics, therapeutics, and vaccines.

We need a fundamentally different approach to securing biology—one that starts with data. The DNA and RNA code that underlies the biological world is what allows us to program it like computers, but it’s also what allows us to understand it at a molecular level and learn to predict how it’s going to behave in the world. Ginkgo’s Biosecurity platform is built on the premise that genetic code is a high-fidelity data asset that will form the foundation for next-generation biosecurity—making step changes in our ability to rapidly and reliably respond to, prevent, and attribute biological threats.

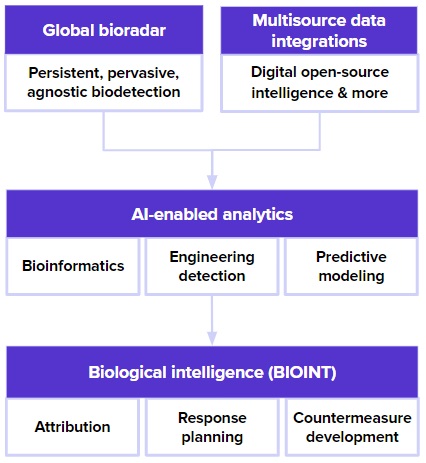

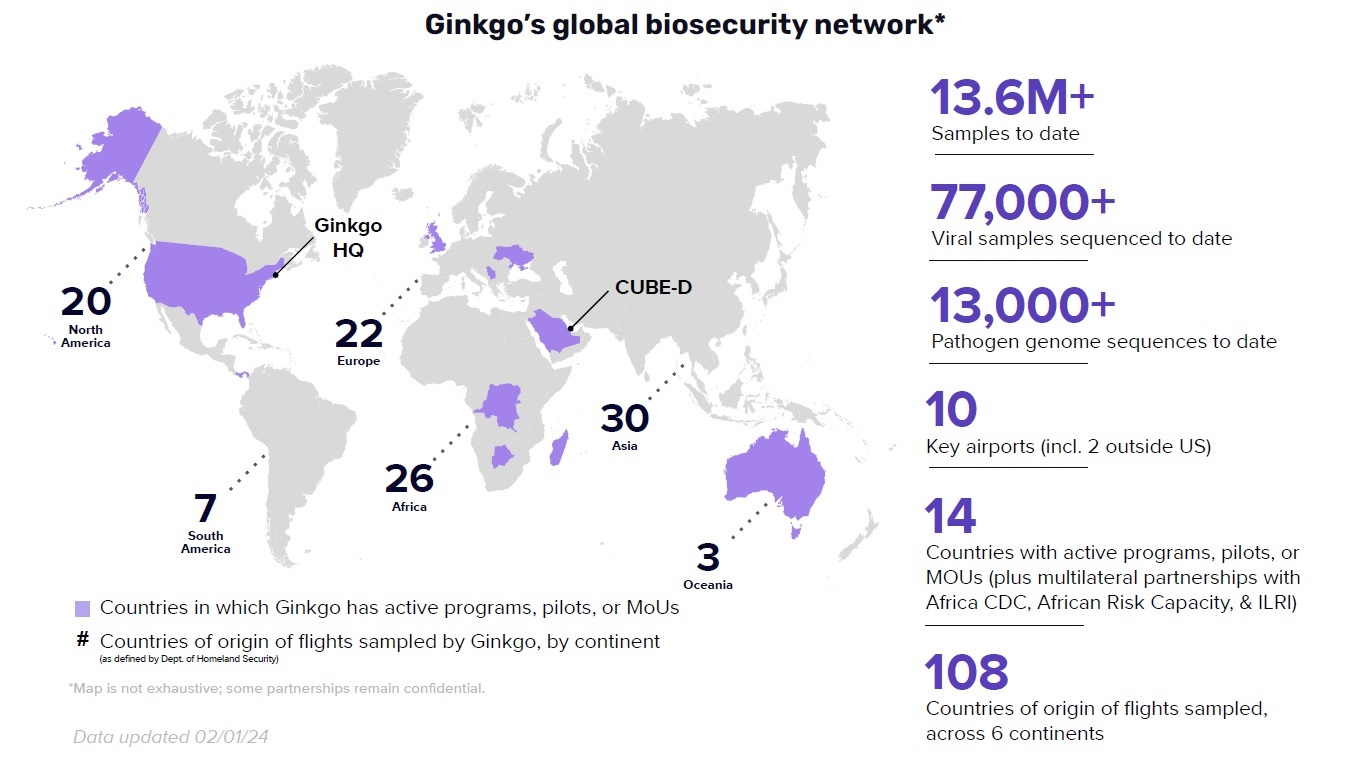

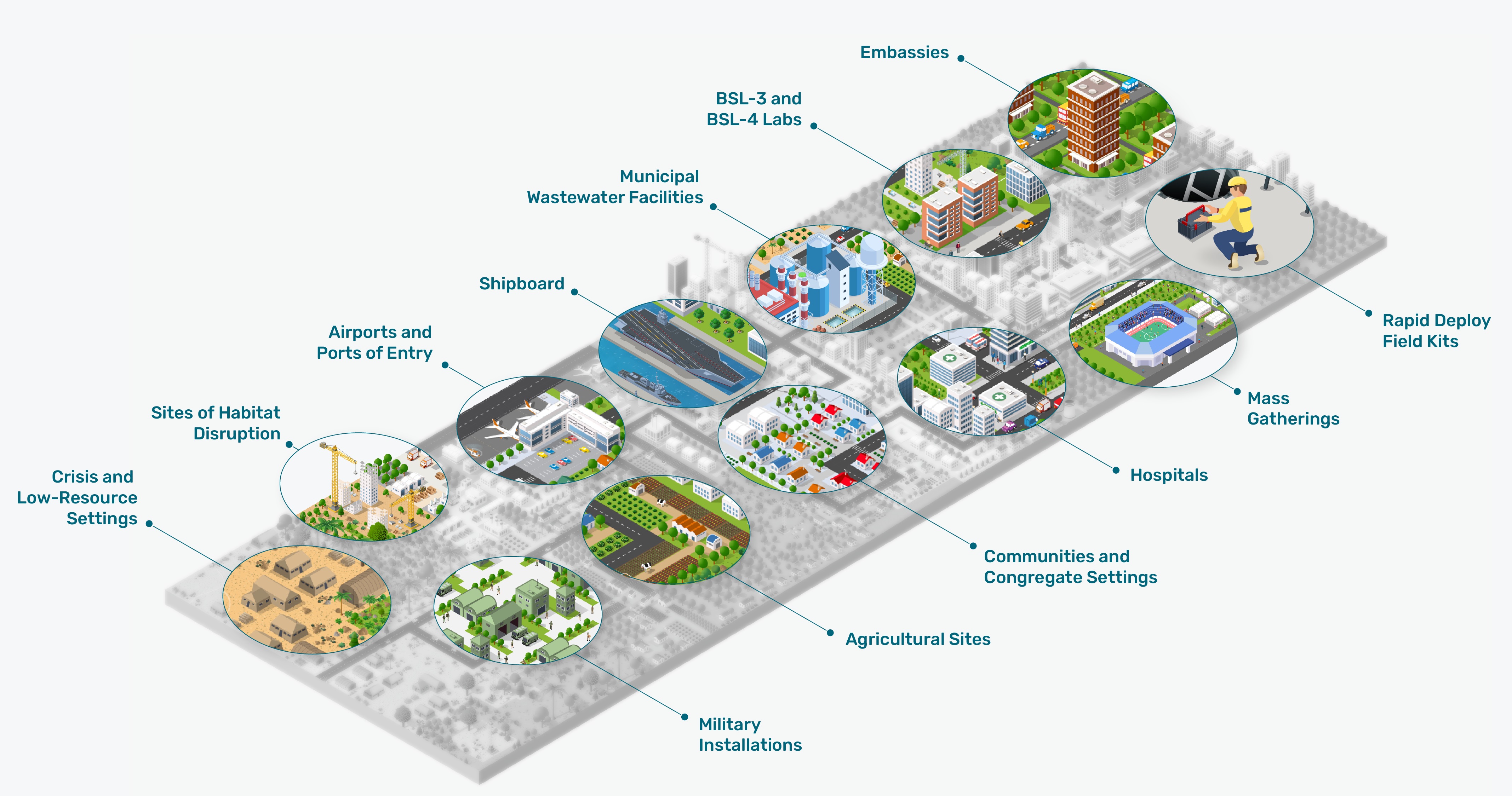

Because biosecurity is a matter of national and global security, our primary biosecurity customers are national governments. We offer them end-to-end tools and services for:

•persistent and pervasive collecting of environmental samples at critical nodes—like airports and borders, agricultural settings, cities and communities;

•testing and sequencing the samples’ non-human DNA and RNA and analyzing the genetic code for signatures of natural or engineered biological threats; and

•putting that information in global context with insights from our network and other data sources to provide critical, early information on what’s coming and what to do about it.

Like our cell engineering platform, our biosecurity platform gets better with scale. We are observing a network effect: as we partner with more countries to stand up detection nodes and build underlying local biosurveillance capacity, we have been able to achieve earlier detection and deeper insights on a global scale. We also prioritize reinvestment in our platform with the goal of serving new types of nodes and samples, detecting new targets, integrating additional sources of data, building better predictive capabilities, and eventually plugging directly back into countermeasure development, in near-real-time. We believe that with scale we can substantially strengthen the value of our platform, with global data providing insights far beyond what any one country’s data could yield alone.

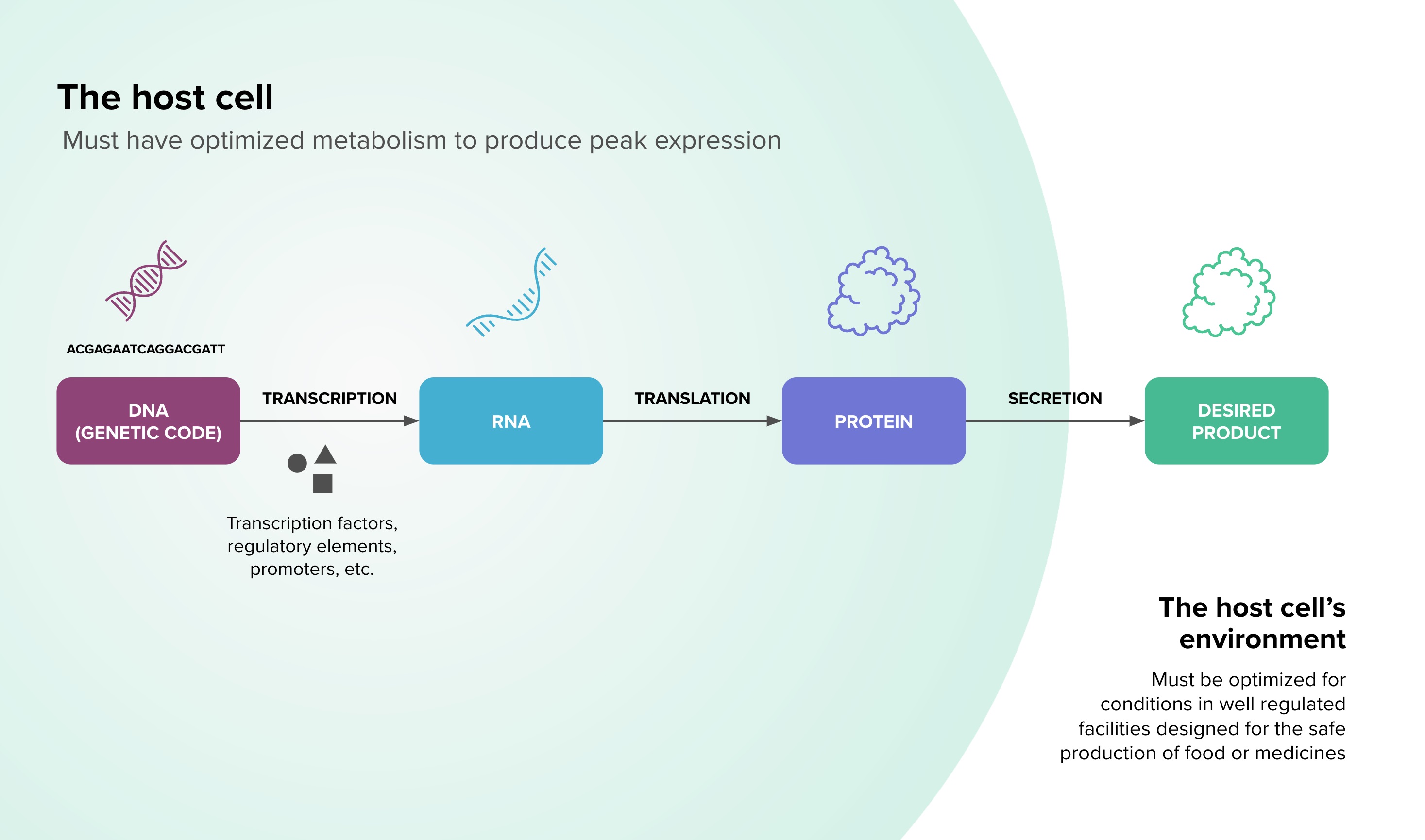

An introduction to synthetic biology: designing biological sequences