Document

PEMBINA PIPELINE CORPORATION

ANNUAL INFORMATION FORM

For the Year Ended December 31, 2023

February 22, 2024

GLOSSARY OF TERMS

Terms used in this Annual Information Form and not otherwise defined have the meanings set forth below:

"2020 Base Shelf Prospectus" means the final short form base shelf prospectus filed with the securities commissions or similar regulatory authorities in each of the provinces of Canada on December 30, 2020 allowing Pembina to offer and issue, from time to time: (i) Class A Preferred Shares, (ii) bonds, debentures, notes or other evidence of indebtedness of any kind, nature or description of the Company, and (iii) any combination of the foregoing (together with the foregoing, collectively, the "2020 Securities") of up to an aggregate initial offering price of $2,000,000,000 (or the equivalent thereof in one or more foreign currencies or composite currencies, including U.S. dollars) during the 25 month period that the 2020 Base Shelf Prospectus is valid, which 2020 Securities may be offered separately or together, in amounts, at prices and on terms to be determined based on market conditions at the time of the sale and set forth in one or more shelf prospectus supplements;

"2020 Meeting" has the meaning ascribed thereto under "Corporate Structure – Amended By-laws";

"2021 Base Shelf Prospectus" means the final short form base shelf prospectus filed with the securities commissions or similar regulatory authorities in each of the provinces of Canada on November 29, 2021 allowing Pembina to offer and issue, from time to time: (i) Common Shares; (ii) Class A Preferred Shares; (iii) warrants to purchase Common Shares; (iv) bonds, debentures, notes or other evidence of indebtedness of any kind, nature or description of the Company; (v) subscription receipts of the Company; and (vi) units comprising any combination of the foregoing (together with the foregoing, collectively, the "2021 Securities") of up to $5,000,000,000 aggregate initial offering price of 2021 Securities (or the equivalent thereof in one or more foreign currencies or composite currencies, including U.S. dollars) during the 25 month period that the 2021 Base Shelf Prospectus is valid, which 2021 Securities may be offered separately or together, in amounts, at prices and on terms to be determined based on market conditions at the time of the sale and set forth in one or more shelf prospectus supplements;

"2021 MTN Prospectus" means the final short form base shelf prospectus filed with the securities commissions or similar regulatory authorities in each of the provinces of Canada on November 29, 2021 allowing Pembina to offer and issue, from time to time, Medium Term Notes of up to $5,000,000,000 aggregate principal amount or, if offered at an original issue discount, aggregate offering price, of Medium Term Notes (or the equivalent thereof in one or more foreign currencies or composite currencies, including U.S. dollars) during the 25 month period that the 2021 MTN Prospectus is valid, which Medium Term Notes may be offered at rates of interest, prices and on terms to be determined based on market conditions at the time of the sale and set forth in one or more shelf prospectus supplement or pricing supplements;

"2023 Base Shelf Prospectus" means the final short form base shelf prospectus filed with the securities commissions or similar regulatory authorities in each of the provinces of Canada on December 13, 2023 allowing Pembina to offer and issue, from time to time: (i) Common Shares; (ii) Class A Preferred Shares; (iii) warrants to purchase Common Shares; (iv) bonds, debentures, notes or other evidence of indebtedness of any kind, nature or description of the Company; (v) subscription receipts of the Company; and (vi) units comprising any combination of the foregoing (together with the foregoing, collectively, the "2023 Securities") during the 25 month period that the 2023 Base Shelf Prospectus is valid, which 2023 Securities may be offered separately or together, in amounts, at prices and on terms to be determined based on market conditions at the time of the sale and set forth in one or more shelf prospectus supplements;

"2023 MTN Prospectus" means the final short form base shelf prospectus filed with the securities commissions or similar regulatory authorities in each of the provinces of Canada on December 20, 2023 allowing Pembina to offer and issue, from time to time, Medium Term Notes during the 25 month period that the 2023 MTN Prospectus is valid, which Medium Term Notes may be offered at rates of interest, prices and on terms to be determined based on market conditions at the time of the sale and set forth in one or more shelf prospectus supplement or pricing supplements;

"ABCA" means the Business Corporations Act (Alberta), R.S.A. 2000, c. B-9, as amended from time to time, including the regulations promulgated thereunder;

"Advantage" has the meaning ascribed thereto under "Directors and Officers – Directors of Pembina";

"AEGS" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Pipelines Division – Assets";

"AEPA" means Alberta Environment and Protected Areas, a ministry of the Government of Alberta; "AER" means the Alberta Energy Regulator;

"Alberta Carbon Grid" has the meaning ascribed thereto under "General Developments of Pembina – Developments in 2021";

"Alliance Canada" means Alliance Pipeline Limited Partnership;

"Alliance Pipeline" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Pipelines Division – Assets";

"Alliance U.S." means Alliance Pipeline L.P.;

"Alliance/Aux Sable Acquisition" has the meaning ascribed thereto under "General Developments of Pembina – Developments in 2023";

"Alliance/Aux Sable Purchase and Sale Agreement" has the meaning ascribed thereto under "General Developments of Pembina – Developments in 2023";

"Amended Federal Methane Regulations" has the meaning ascribed thereto under "Risk Factors – Risks Inherent in Pembina's Business – Environmental Costs and Liabilities";

"Anti-Corruption Laws" means Canada's Criminal Code and Corruption of Foreign Public Officials Act, the United States Foreign Corrupt Practices Act, various state laws in the United States that criminalize bribery and corruption of United States Government Officials, the U.K. Bribery Act, 2010, the principles described in the Organisation for Economic Co-operation and Development's Convention on Combating Bribery of Foreign Public Officials in International Business Transactions and its Commentaries, and any local anti-bribery or anti-corruption laws applicable to Pembina;

"AUC" means the Alberta Utilities Commission;

"Aux Sable" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Marketing & New Ventures Division – Marketing Activities";

"Aux Sable Canada" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Marketing & New Ventures Division – Marketing Activities";

"Aux Sable U.S." has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Marketing & New Ventures Division – Marketing Activities";

"Aux Sable U.S. LP" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Marketing & New Ventures Division – Marketing Activities";

"Base Line Terminal" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Pipelines Division – Assets";

"BCEAO" means the British Columbia Environmental Assessment Office;

"BCER" means the British Columbia Energy Regulator;

"BCUC" means the British Columbia Utilities Commission;

"Board" or "Board of Directors" means the board of directors of Pembina from time to time;

"Brazeau Pipeline" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Pipelines Division – Assets";

"BRFN" has the meaning ascribed thereto under "Risk Factors – General Risk Factors – Indigenous Land Claims and Consultation Obligations"; "Burstall" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Facilities Division – Assets";

"Capstone" has the meaning ascribed thereto under "General Developments of Pembina – Developments in 2022";

"CDH" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Pipelines Division – Assets";

"CEAA" has the meaning ascribed thereto under "Risk Factors – Risks Inherent in Pembina's Business – Regulation and Legislation";

"Cedar LNG" means Pembina's partnership with the Haisla Nation to develop the Cedar LNG Project;

"Cedar LNG Project" has the meaning ascribed thereto under "General Developments of Pembina – Developments in 2021";

"CER" means the Canada Energy Regulator;

"CER Act" has the meaning ascribed thereto under "Other Information Relating to Pembina's Business – Industry Regulation – CER";

"Channahon Facility" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Marketing & New Ventures Division – Marketing Activities";

"Chinook Pathways" has the meaning ascribed thereto under "General Developments of Pembina – Developments in 2021";

"Class A Preferred Shares" means class A preferred shares of Pembina, issuable in series, and, where the context requires, includes the Series 1 Class A Preferred Shares, the Series 2 Class A Preferred Shares, the Series 3 Class A Preferred Shares, the Series 4 Class A Preferred Shares, the Series 5 Class A Preferred Shares, the Series 6 Class A Preferred Shares, the Series 7 Class A Preferred Shares, the Series 8 Class A Preferred Shares, the Series 9 Class A Preferred Shares, the Series 10 Class A Preferred Shares, the Series 15 Class A Preferred Shares, the Series 16 Class A Preferred Shares, the Series 17 Class A Preferred Shares, the Series 18 Class A Preferred Shares, the Series 19 Class A Preferred Shares, the Series 20 Class A Preferred Shares, the Series 21 Class A Preferred Shares, the Series 22 Class A Preferred Shares, the Series 25 Class A Preferred Shares, the Series 26 Class A Preferred Shares and the Series 2021-A Class A Preferred Shares;

"Class B Preferred Shares" means class B preferred shares of Pembina;

"CO2" means carbon dioxide;

"Cochin Pipeline" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Pipelines Division – Assets";

"Common Shares" means the common shares of Pembina;

"Company" or "Pembina" means Pembina Pipeline Corporation, an ABCA corporation, and, unless the context otherwise requires, includes its subsidiaries;

"condensate" means a hydrocarbon mixture consisting primarily of pentanes and heavier hydrocarbon liquids;

"COVID-19" means the novel coronavirus, the global outbreak of which was declared a pandemic by the World Health Organization in March 2020;

"Crown" has the meaning ascribed thereto under "Risk Factors – General Risk Factors – Indigenous Land Claims and Consultation Obligations";

"CRP" means Cutbank Ridge Partnership, a partnership between Ovintiv and Cutbank Dawson Gas Resources Ltd., a subsidiary of Mitsubishi Corporation; "Cutbank Complex" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Facilities Division – Assets";

"Cutbank Gas Plant" means PGI's shallow cut sweet gas processing facility located near Grande Prairie, Alberta;

"Dawson Assets" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Facilities Division – Assets";

"DBRS" means DBRS Morningstar;

"deep cut" means ethane-plus extraction gas processing capabilities;

"Directive 088" has the meaning ascribed thereto under "Other Information Relating to Pembina's Business – Industry Regulation – AER and AUC";

"Dividend Equivalent Payment" has the meaning ascribed thereto under "Description of the Capital Structure of Pembina – Subscription Receipts";

"Drayton Valley Pipeline" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Pipelines Division – Assets";

"DRIPA" has the meaning ascribed thereto under "Risk Factors – General Risk Factors – Indigenous Land Claims and Consultation Obligations";

"Duvernay Complex" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Facilities Division – Assets";

"Duvernay Field Hub" means PGI's 30 MMcf/d gas, 10 mbpd condensate and 5 mbpd water handling and condensate stabilization facility located near Fox Creek, Alberta;

"Duvernay I" means PGI's 92 percent interest in the Duvernay I 100 MMcf/d shallow cut gas processing facility located near Fox Creek, Alberta;

"Duvernay II" means PGI's 92 percent interest in the Duvernay II 100 MMcf/d shallow cut gas processing facility located near Fox Creek, Alberta;

"Duvernay III" means PGI's 92 percent interest in the Duvernay III 100 MMcf/d shallow cut gas processing facility located near Fox Creek, Alberta;

"Duvernay Sour Gas Treating Facilities" means PGI's sour gas sweetening system, amine regeneration and acid incineration facility located near Fox Creek, Alberta;

"EA Act" has the meaning ascribed thereto under "Risk Factors – General Risk Factors – Indigenous Land Claims and Consultation Obligations";

"East NGL System" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Facilities Division – Assets";

"ECCC" means Environment and Climate Change Canada, a department of the Government of Canada;

"EDI" means equity, diversity and inclusion;

"EDGAR" means the Electronic Data Gathering, Analysis and Retrieval system;

"Edmonton South Terminal" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Pipelines Division – Assets"; "Edmonton Terminals" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Pipelines Division – Assets";

"EEA" has the meaning ascribed thereto under "Other Information Relating to Pembina's Business – Equity, Diversity and Inclusion";

"EMP" has the meaning ascribed thereto under "Other Information Relating to Pembina's Business – Emergency Management Program";

"Empress" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Facilities Division – Assets";

"Empress Co-generation Facility" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Facilities Division – Assets";

"Empress Pipeline" is an approximately 25 km pipeline of buried HVP ethane pipeline and associated riser facilities that connect the Alberta ethane market serviced by the AEGS to the Burstall ethane cavern storage facilities in Southern Saskatchewan;

"Enbridge" means Enbridge Inc.;

"ENT" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Pipelines Division – Assets";

"equity accounted investees" means Pembina's working interest in Alliance Pipeline, Aux Sable, NRGreen, Ruby Pipeline (prior to the completion of the Ruby Subsidiary Plan), PGI, Grand Valley I Limited Partnership, Fort Corp, the Alberta Carbon Grid and Cedar LNG;

"Escrow Release Condition" means the parties to the Alliance/Aux Sable Purchase and Sale Agreement are able to complete the Alliance/Aux Sable Acquisition in all material respects in accordance with the terms of the Alliance/Aux Sable Purchase and Sale Agreement, without amendment or waiver materially adverse to Pembina, unless the consent of the lead underwriters for the Subscription Receipt Offering is given to such amendment or waiver (such consent not to be unreasonably withheld, conditioned or delayed) but for the payment of the purchase price for the Alliance/Aux Sable Acquisition, and Pembina has available to it all other funds required to complete the Alliance/Aux Sable Acquisition; provided that the Escrow Release Condition may, if the foregoing conditions are met, at the election of Pembina, occur up to seven (7) business days prior to the scheduled closing date of the Alliance/Aux Sable Acquisition;

"Escrow Release Notice and Direction" means the notice to be provided to the Subscription Receipt Agent, executed by Pembina and the lead underwriters for the Subscription Receipt Offering, certifying that the Escrow Release Condition has been satisfied;

"Escrowed Funds" has the meaning ascribed thereto under "Description of the Capital Structure of Pembina – Subscription Receipts";

"ESG" means environmental, social and governance, the three central factors in measuring the sustainability and societal impact of a company;

"ESSC" has the meaning ascribed thereto under "Other Information Relating to Pembina's Business – Security Management Program";

"Federal Methane Regulations" has the meaning ascribed thereto under "Risk Factors – Risks Inherent in Pembina's Business – Environmental Costs and Liabilities";

"FERC" means the United States Federal Energy Regulatory Commission;

"Financial Statements" means Pembina's audited consolidated financial statements for the period ended December 31, 2023; "Five Year Government of Canada Yield" has the meaning ascribed thereto under "Description of the Capital Structure of Pembina – Subordinated Notes, Series 1 – Interest and Maturity";

"Form 40-F" means Pembina's annual report on Form 40-F for the fiscal year ended December 31, 2023 filed with the SEC;

"Fort Corp" means, collectively, Fort Saskatchewan Ethylene Storage Corporation and Fort Saskatchewan Ethylene Storage Limited Partnership;

"Fox Creek" refers to the Peace Pipeline pump station and terminal located near Fox Creek, Alberta;

"frac spread ratio" has the meaning ascribed thereto under "Risk Factors – Risks Inherent in Pembina's Business – Commodity Price Risk";

"Fund" has the meaning ascribed thereto under "Corporate Structure – Name, Address and Formation";

"GAAP" means Canadian generally accepted accounting principles, which are within the framework of IFRS;

"GGPPA" has the meaning ascribed thereto under "Other Information Relating to Pembina's Business – Industry Regulation – ECCC";

"GHG" means greenhouse gas;

"Gordondale" refers to the Peace Pipeline pump station and terminal located near Gordondale, Alberta;

"Government Officials" (foreign or domestic) include: Government ministers and their staff; members of legislative bodies or other elected officials; judges and ambassadors; officials or employees of government departments and agencies, regardless of rank or position; any employee of any branch of government at any level: federal, state, or local; customs, immigration, tax, and police personnel; an officer or employee of any state-owned or state-controlled company, including Crown corporations; persons employed by a board, commission, or other body or authority that is established to perform a duty or function on behalf of a foreign state; Indigenous government officials; political parties, party officials, and candidates for political office; and employees of public international organizations, such as the United Nations or World Bank;

"Grand Valley" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Pipelines Division – Assets";

"HOP" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Marketing & New Ventures Division – Marketing Activities";

"Horizon Pipeline" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Pipelines Division – Assets";

"Horizon Project" means the Horizon Oil Sands Project located approximately 70 km north of Fort McMurray, Alberta;

"HSE" has the meaning ascribed thereto under "Other Information Relating to Pembina's Business – Corporate Governance – Corporate Governance Policies";

"HVP" means high vapour pressure;

"Hythe Developments" has the meaning ascribed thereto under "General Developments of Pembina – Developments in 2021";

"Hythe Gas Plant" means PGI's sweet and sour gas processing facility located near Grande Prairie, Alberta;

"IAAC" means the Impact Assessment Agency of Canada;

"IAA" has the meaning ascribed thereto under "Risk Factors – Risks Inherent in Pembina's Business – Regulation and Legislation"; "ICA" means the Interstate Commerce Act of 1887 (United States);

"IFRS" means the International Financial Reporting Standards, as issued by the International Accounting Standards Board;

"Imperial" means Imperial Oil Limited;

"Inter Pipeline" means Inter Pipeline Ltd.;

"Jet Fuel Pipeline" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Pipelines Division – Assets";

"Jordan Cove" means the previously proposed development, construction and operation of an LNG production and export facility and related infrastructure on the west coast of the U.S. Pembina notified FERC of its decision to not proceed with the project on December 1, 2021;

"K3 Cogeneration Facility" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Facilities Division – Assets";

"K3 Plant" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Facilities Division – Assets";

"KA Plant" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Facilities Division – Assets";

"Kakwa" refers to the Peace Pipeline pump station and terminal located west of the Kakwa River Deep Cut Plant;

"Kakwa 1-35 Gas Plant" means PGI's 100 percent interest in the shallow cut sweet gas processing facility located near Grande Prairie, Alberta;

"Kakwa River Deep Cut Plant" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Facilities Division – Assets";

"Kakwa River Shallow Cut Plant" means PGI's shallow cut sweet gas processing facility located near Grande Prairie, Alberta;

"KAPS" has the meaning ascribed thereto under "General Developments of Pembina – Developments in 2022";

"KAPS Divestiture" has the meaning ascribed thereto under "General Developments of Pembina – Developments in 2022";

"Keyera" means Keyera Corporation;

"Kinder Acquisition" means, collectively, the Kinder Morgan Canada Acquisition and Pembina's acquisition of the Cochin Pipeline system from Kinder Morgan, Inc. for a total purchase price of approximately $4.3 billion, which closed on December 16, 2019;

"Kinder Morgan Canada Acquisition" means Pembina's acquisition of KML, which closed on December 16, 2019;

"KKR" means KKR & Co, Inc.;

"KML" means PKM Canada Limited, formerly Kinder Morgan Canada Limited;

"KML Series 1 Preferred Shares" means the cumulative redeemable minimum rate reset preferred shares, series 1 in the capital of KML;

"KML Series 2 Preferred Shares" means the cumulative redeemable floating rate preferred shares, series 2 in the capital of KML, which were issuable on conversion of the KML Series 1 Preferred Shares;

"KML Series 3 Preferred Shares" means the cumulative redeemable minimum rate reset preferred shares, series 3 in the capital of KML; "KML Series 4 Preferred Shares" means the cumulative redeemable floating rate preferred shares, series 4 in the capital of KML, which were issuable on conversion of the KML Series 3 Preferred Shares;

"KUFPEC" means Kuwait Foreign Petroleum Exploration Company;

"La Glace" refers to the Peace Pipeline pump station and terminal located near La Glace, Alberta;

"LGS" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Pipelines Division – Assets";

"MD&A" means the management's discussion and analysis of the financial and operating results of Pembina dated February 22, 2024, for the year ended December 31, 2023, an electronic copy of which is available on Pembina's profile on the SEDAR+ website at www.sedarplus.ca, in Pembina's annual report on Form 40-F filed on the EDGAR website at www.sec.gov, or at www.pembina.com;

"Medium Term Notes" means, collectively, the Medium Term Notes, Series 3, the Medium Term Notes, Series 4, the Medium Term Notes, Series 5, the Medium Term Notes, Series 6, the Medium Term Notes, Series 7, the Medium Term Notes, Series 9, the Medium Term Notes, Series 10, the Medium Term Notes, Series 11, the Medium Term Notes, Series 12, the Medium Term Notes, Series 13, the Medium Term Notes, Series 15, the Medium Term Notes, Series 16, the Medium Term Notes, Series 17, the Medium Term Notes, Series 18, the Medium Term Notes, Series 19, the Medium Term Notes, Series 20, the Medium Term Notes, Series 21 and the Medium Term Notes, Series 22;

"Medium Term Notes, Series 3" means, collectively, the $200 million, $150 million and $100 million aggregate principal amount of medium term notes of Pembina issued April 30, 2013, February 2, 2015 and June 16, 2015, respectively. See "Description of the Capital Structure of Pembina – Medium Term Notes";

"Medium Term Notes, Series 4" means the $600 million aggregate principal amount of medium term notes of Pembina issued April 4, 2014. See "Description of the Capital Structure of Pembina – Medium Term Notes";

"Medium Term Notes, Series 5" means, collectively, the $450 million and $100 million aggregate principal amount of medium term notes of Pembina issued February 2, 2015 and June 22, 2023, respectively. See "Description of the Capital Structure of Pembina – Medium Term Notes";

"Medium Term Notes, Series 6" means, collectively, the $500 million and $100 million aggregate principal amount of medium term notes of Pembina issued June 16, 2015 and June 22, 2023, respectively. See "Description of the Capital Structure of Pembina – Medium Term Notes";

"Medium Term Notes, Series 7" means, collectively, the $500 million and $100 million aggregate principal amount of medium term notes of Pembina issued August 11, 2016 and May 28, 2020, respectively. See "Description of the Capital Structure of Pembina – Medium Term Notes";

"Medium Term Notes, Series 9" means, collectively, the $300 million and $250 million aggregate principal amount of medium term notes of Pembina issued January 20, 2017 and August 16, 2017, respectively. See "Description of the Capital Structure of Pembina – Medium Term Notes";

"Medium Term Notes, Series 10" means, collectively, the $400 million and $250 million aggregate principal amount of medium term notes of Pembina issued March 26, 2018 and January 10, 2020, respectively. See "Description of the Capital Structure of Pembina – Medium Term Notes";

"Medium Term Notes, Series 11" means, collectively, the $300 million and $500 million aggregate principal amount of medium term notes of Pembina issued March 26, 2018 and January 10, 2020, respectively. See "Description of the Capital Structure of Pembina – Medium Term Notes";

"Medium Term Notes, Series 12" means, collectively, the $400 million and $250 million aggregate principal amount of medium term notes of Pembina issued April 3, 2019 and January 10, 2020, respectively. See "Description of the Capital Structure of Pembina – Medium Term Notes"; "Medium Term Notes, Series 13" means, collectively, the $400 million and $300 million aggregate principal amount of medium term notes of Pembina issued April 3, 2019 and September 12, 2019, respectively.

See "Description of the Capital Structure of Pembina – Medium Term Notes";

"Medium Term Notes, Series 15" means the $600 million aggregate principal amount of medium term notes of Pembina issued September 12, 2019. See "Description of the Capital Structure of Pembina – Medium Term Notes";

"Medium Term Notes, Series 16" means the $400 million aggregate principal amount of medium term notes of Pembina issued May 28, 2020. See "Description of the Capital Structure of Pembina – Medium Term Notes";

"Medium Term Notes, Series 17" means the $500 million aggregate principal amount of medium term notes of Pembina issued on December 10, 2021. See "Description of the Capital Structure of Pembina – Medium Term Notes";

"Medium Term Notes, Series 18" means the $500 million aggregate principal amount of medium term notes of Pembina issued on December 10, 2021. See "Description of the Capital Structure of Pembina – Medium Term Notes";

"Medium Term Notes, Series 19" means the $300 million aggregate principal amount of medium term notes of Pembina issued on June 22, 2023. See "Description of the Capital Structure of Pembina – Medium Term Notes";

"Medium Term Notes, Series 20" means the $600 million aggregate principal amount of medium term notes of Pembina issued on January 12, 2024. See "Description of the Capital Structure of Pembina – Medium Term Notes";

"Medium Term Notes, Series 21" means the $600 million aggregate principal amount of medium term notes of Pembina issued on January 12, 2024. See "Description of the Capital Structure of Pembina – Medium Term Notes";

"Medium Term Notes, Series 22" means the $600 million aggregate principal amount of medium term notes of Pembina issued on January 12, 2024. See "Description of the Capital Structure of Pembina – Medium Term Notes";

"Musreau I" means the Musreau A, Musreau C and Musreau D trains, shallow cut sweet gas processing facility, owned 100 percent by PGI, and PGI's 50 percent interest in the Musreau B train, located near Grande Prairie, Alberta;

"Musreau II" means PGI's 100 MMcf/d shallow cut sweet gas processing plant and associated NGL and gas gathering pipelines near Musreau I;

"Musreau III" means PGI's 100 MMcf/d shallow cut sweet gas processing facility near Musreau I and II;

"Musreau Deep Cut" means the 205 MMcf/d NGL extraction facility and related approximately 10 km NGL sales pipeline connected to the Peace Pipeline and located at the Musreau I facility;

"Namao" refers to the Peace Pipeline interconnect junction located near Namao, Alberta;

"NCIB" has the meaning ascribed thereto under "General Developments of Pembina – Developments in 2021";

"NEBC Montney Infrastructure" includes an area production connection to Pembina's Birch terminal as well as upgrades to the terminal including additional storage and pump stations and minor site modifications to support additional volumes on the NEBC Pipeline and Pembina's downstream pipelines;

"NEBC MPS Expansion" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Pipelines Division – Assets";

"NEBC Pipeline" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Pipelines Division – Assets";

"Net-Zero Act" has the meaning ascribed thereto under "Risk Factors – Risks Inherent in Pembina's Business – Environmental Costs and Liabilities";

"NGA" means the Natural Gas Act of 1938 (United States); "NGL" means natural gas liquids, including ethane, propane, butane and condensate;

"Nipisi Pipeline" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Pipelines Division – Assets";

"North 40 Terminal" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Pipelines Division – Assets";

"Northern Pipeline" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Pipelines Division – Assets";

"Northwest Pipeline" means the pipeline system and related facilities delivering crude oil from northeastern British Columbia to Boundary Lake, Alberta;

"NRGreen" means NRGreen Power Limited Partnership;

"NYSE" means the New York Stock Exchange;

"OMS" has the meaning ascribed thereto under "Other Information Relating to Pembina's Business – Operating Management System";

"OPEC" means the Organization of the Petroleum Exporting Countries;

"Option Plan" means the stock option plan of Pembina approved by the Shareholders on May 26, 2011, as amended effective November 30, 2016, February 26, 2020 and August 4, 2022;

"Outside Date" means October 1, 2024;

"Over-Allotment Option" has the meaning ascribed thereto under "General Developments of Pembina – Developments in 2023";

"Ovintiv" means Ovintiv Inc.;

"Palermo Conditioning Plant" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Marketing & New Ventures Division – Marketing Activities";

"Parallel" has the meaning ascribed thereto under "Directors and Officers – Directors of Pembina";

"Patterson Creek" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Facilities Division – Assets";

"Peace Pipeline" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Pipelines Division – Assets";

"PG&E" has the meaning ascribed thereto under "Directors and Officers – Executive Officers of Pembina";

"PGI" means Pembina Gas Infrastructure Inc.;

"PGI Transaction" has the meaning ascribed thereto under "General Developments of Pembina – Developments in 2022";

"Phase VII Expansion" has the meaning ascribed thereto under "General Developments of Pembina – Developments in 2021";

"Phase VIII Expansion" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Pipelines Division – Assets";

"Phase IX Expansion" has the meaning ascribed thereto under "General Developments of Pembina – Developments in 2021";

"PHMSA" means the U.S. Pipeline and Hazardous Materials Safety Administration; "PIC" means Petrochemical Industries Company K.S.C., a subsidiary of the Kuwait Petroleum Corporation, a company owned by the State of Kuwait;

"Plains" has the meaning ascribed thereto under "General Developments of Pembina – Developments in 2022";

"Plan" has the meaning ascribed thereto under "Description of the Capital Structure of Pembina – Common Shares";

"PMM" has the meaning ascribed thereto under "Other Information Relating to Pembina's Business – Operating Management System – Operations and Maintenance Program";

"Pouce Coupé Pipeline" means the pipeline system and related facilities delivering sweet crude oil and HVP hydrocarbon products from Dawson Creek, British Columbia to Pouce Coupé, Alberta;

"Prairie Rose Pipeline" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Marketing & New Ventures Division – Marketing Activities";

"Previous Revolving Credit Facility" has the meaning ascribed thereto under "General Developments of Pembina – Developments in 2022";

"Prince Rupert Terminal" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Facilities Division – Assets";

"rate base" means the amount of investment on which a return is authorized to be earned, which typically includes net plant in service plus an allowance for working capital;

"Redemption Amount" has the meaning ascribed thereto under "Description of the Capital Structure of Pembina – Class B Preferred Shares";

"Redwater Complex" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Facilities Division – Assets";

"Resthaven Facility" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Facilities Division – Assets";

"Revolving Credit Facility" has the meaning ascribed thereto under "Description of the Capital Structure of Pembina – Credit Facilities";

"RFS I" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Facilities Division – Assets";

"RFS II" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Facilities Division – Assets";

"RFS III" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Facilities Division – Assets";

"RFS IV" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Facilities Division – Assets";

"rich gas" means natural gas with relatively high NGL content including ethane, propane, butane and condensate;

"Ruby Pipeline" means the natural gas transmission system delivering natural gas production from the Rockies basin owned by the Ruby Subsidiary, which was previously owned equally by each of Pembina and Kinder Morgan, Inc.;

"Ruby Settlement Agreement" has the meaning ascribed thereto under "General Developments of Pembina – Developments in 2022";

"Ruby Subsidiary" has the meaning ascribed thereto under "General Developments of Pembina – Developments in 2022"; "Ruby Subsidiary Bankruptcy" means the voluntary petition for relief filed by the Ruby Subsidiary on March 31, 2022 under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court for the District of Delaware;

"Ruby Subsidiary Plan" means the Ruby Subsidiary's Chapter 11 plan of reorganization, which was approved by the United States Bankruptcy Court for the District of Delaware in January 2023;

"SACC" has the meaning ascribed thereto under "Risk Factors – Risk Inherent to Pembina's Business – Regulation and Legislation";

"S&P" means S&P Global Ratings, a division of The McGraw-Hill Companies;

"Saturn I" means PGI's deep cut NGL extraction facility located in the Berland area of Alberta with 220 MMcf/d of extraction capacity;

"Saturn II" means PGI's second deep cut NGL extraction facility in the Berland area, a twin of Saturn I;

"Saturn Complex" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Facilities Division – Assets";

"Saturn Gas Plant" means PGI's sweet gas processing facility located near Dawson Creek, British Columbia;

"SCADA" has the meaning ascribed thereto under "Other Information Relating to Pembina's Business – Operating Management System – Operations and Maintenance Program";

"SEC" means the United States Securities and Exchange Commission;

"SEDAR+" means the System for Electronic Document Analysis and Retrieval+;

"Senior Note Indenture" means the indenture dated March 29, 2011 between Pembina and Computershare Trust Company of Canada, as further supplemented by the second supplemental note indenture dated October 24, 2014, and as further supplemented by the third supplemental indenture dated April 4, 2018 providing for the issuance of the Medium Term Notes. Certain subsidiaries of Pembina are also party to the Senior Note Indenture as former guarantors thereunder;

"Septimus Pipeline" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Marketing & New Ventures Division – Marketing Activities";

"Series 1 Class A Preferred Shares" means the cumulative redeemable rate reset Class A Preferred Shares, series 1 of Pembina, issued July 26, 2013. See "Description of the Capital Structure of Pembina – Class A Preferred Shares";

"Series 2 Class A Preferred Shares" means the cumulative redeemable floating rate Class A Preferred Shares, series 2 of Pembina, issuable on conversion of the Series 1 Class A Preferred Shares. See "Description of the Capital Structure of Pembina – Class A Preferred Shares";

"Series 3 Class A Preferred Shares" means the cumulative redeemable rate reset Class A Preferred Shares, series 3 of Pembina, issued October 2, 2013. See "Description of the Capital Structure of Pembina – Class A Preferred Shares";

"Series 4 Class A Preferred Shares" means the cumulative redeemable floating rate Class A Preferred Shares, series 4 of Pembina, issuable on conversion of the Series 3 Class A Preferred Shares. See "Description of the Capital Structure of Pembina – Class A Preferred Shares";

"Series 5 Class A Preferred Shares" means the cumulative redeemable rate reset Class A Preferred Shares, series 5 of Pembina, issued January 16, 2014. See "Description of the Capital Structure of Pembina – Class A Preferred Shares";

"Series 6 Class A Preferred Shares" means the cumulative redeemable floating rate Class A Preferred Shares, series 6 of Pembina, issuable on conversion of the Series 5 Class A Preferred Shares. See "Description of the Capital Structure of Pembina – Class A Preferred Shares"; "Series 7 Class A Preferred Shares" means the cumulative redeemable rate reset Class A Preferred Shares, series 7 of Pembina, issued September 11, 2014.

See "Description of the Capital Structure of Pembina – Class A Preferred Shares";

"Series 8 Class A Preferred Shares" means the cumulative redeemable floating rate Class A Preferred Shares, series 8 of Pembina, issuable on conversion of the Series 7 Class A Preferred Shares. See "Description of the Capital Structure of Pembina – Class A Preferred Shares";

"Series 9 Class A Preferred Shares" means the cumulative redeemable rate reset Class A Preferred Shares, series 9 of Pembina, issued April 10, 2015. See "Description of the Capital Structure of Pembina – Class A Preferred Shares";

"Series 10 Class A Preferred Shares" means the cumulative redeemable floating rate Class A Preferred Shares, series 10 of Pembina, issuable on conversion of the Series 9 Class A Preferred Shares. See "Description of the Capital Structure of Pembina – Class A Preferred Shares";

"Series 11 Class A Preferred Shares" means the cumulative redeemable minimum rate reset Class A Preferred Shares, series 11 of Pembina, issued January 15, 2016 and redeemed on March 1, 2021. See "Description of the Capital Structure of Pembina – Class A Preferred Shares";

"Series 13 Class A Preferred Shares" means the cumulative redeemable minimum rate reset Class A Preferred Shares, series 13 of Pembina, issued April 27, 2016 and redeemed on June 1, 2021. See "Description of the Capital Structure of Pembina – Class A Preferred Shares";

"Series 15 Class A Preferred Shares" means the cumulative redeemable rate reset Class A Preferred Shares, series 15 of Pembina, issued in exchange for the Veresen Series A Preferred Shares on October 2, 2017. See "Description of the Capital Structure of Pembina – Class A Preferred Shares";

"Series 16 Class A Preferred Shares" means the cumulative redeemable floating rate Class A Preferred Shares, series 16 of Pembina, issuable on conversion of the Series 15 Class A Preferred Shares. See "Description of the Capital Structure of Pembina – Class A Preferred Shares";

"Series 17 Class A Preferred Shares" means the cumulative redeemable rate reset Class A Preferred Shares, series 17 of Pembina, issued in exchange for the Veresen Series C Preferred Shares on October 2, 2017. See "Description of the Capital Structure of Pembina – Class A Preferred Shares";

"Series 18 Class A Preferred Shares" means the cumulative redeemable floating rate Class A Preferred Shares, series 18 of Pembina, issuable on conversion of the Series 17 Class A Preferred Shares. See "Description of the Capital Structure of Pembina – Class A Preferred Shares";

"Series 19 Class A Preferred Shares" means the cumulative redeemable rate reset Class A Preferred Shares, series 19 of Pembina, issued in exchange for the Veresen Series E Preferred Shares on October 2, 2017. See "Description of the Capital Structure of Pembina – Class A Preferred Shares";

"Series 20 Class A Preferred Shares" means the cumulative redeemable floating rate Class A Preferred Shares, series 20 of Pembina, issuable on conversion of the Series 19 Class A Preferred Shares. See "Description of the Capital Structure of Pembina – Class A Preferred Shares";

"Series 21 Class A Preferred Shares" means the cumulative redeemable minimum rate reset Class A Preferred Shares, series 21 of Pembina, issued December 7, 2017 and issuable on conversion of the Series 22 Class A Preferred Shares. See "Description of the Capital Structure of Pembina – Class A Preferred Shares";

"Series 22 Class A Preferred Shares" means the cumulative redeemable floating rate Class A Preferred Shares, series 22 of Pembina, issued March 1, 2023 and issuable on conversion of the Series 21 Class A Preferred Shares. See "Description of the Capital Structure of Pembina – Class A Preferred Shares";

"Series 23 Class A Preferred Shares" means the cumulative redeemable minimum rate reset Class A Preferred Shares, series 23 of Pembina, issued in exchange for the KML Series 1 Preferred Shares on December 16, 2019 and redeemed on November 15, 2022. See "Description of the Capital Structure of Pembina – Class A Preferred Shares"; "Series 24 Class A Preferred Shares" means the cumulative redeemable floating rate Class A Preferred Shares, series 24 of Pembina, which were issuable on conversion of the Series 23 Class A Preferred Shares prior to their redemption on November 15, 2022.

See "Description of the Capital Structure of Pembina – Class A Preferred Shares";

"Series 25 Class A Preferred Shares" means the cumulative redeemable minimum rate reset Class A Preferred Shares, series 25 of Pembina, issued in exchange for the KML Series 3 Preferred Shares on December 16, 2019. See "Description of the Capital Structure of Pembina – Class A Preferred Shares";

"Series 26 Class A Preferred Shares" means the cumulative redeemable floating rate Class A Preferred Shares, series 26 of Pembina, issuable on conversion of the Series 25 Class A Preferred Shares. See "Description of the Capital Structure of Pembina – Class A Preferred Shares";

"Series 2021-A Class A Preferred Shares" means the cumulative redeemable fixed-to-fixed rate Class A Preferred Shares, Series 2021-A. See "Description of the Capital Structure of Pembina – Class A Preferred Shares";

"shallow cut" means sweet gas processing with propane and/or condensate-plus extraction capabilities;

"Shareholders" means the holders of Common Shares;

"SLL Credit Facility" has the meaning ascribed thereto under "Description of the Capital Structure of Pembina – Credit Facilities";

"SMP" has the meaning ascribed thereto under "Other Information Relating to Pembina's Business – Security Management Program";

"Steeprock Gas Plant" means PGI's sour gas processing facility located near Grande Prairie, Alberta;

"Sturgeon Refinery" means the crude oil upgrader, built and operated by North West Redwater Partnership in Sturgeon County, Alberta;

"Subordinated Note Indenture" means the indenture dated January 25, 2021 between Pembina and Computershare Trust Company of Canada;

"Subordinated Notes, Series 1" has the meaning ascribed thereto under "General Developments of Pembina – Developments in 2021";

"Subscription Receipts" has the meaning ascribed thereto under "Description of the Capital Structure of Pembina – Subscription Receipts";

"Subscription Receipt Agent" has the meaning ascribed thereto under "Description of the Capital Structure of Pembina – Subscription Receipts";

"Subscription Receipt Agreement" means the subscription receipt agreement dated December 19, 2023 among Pembina, TD Securities Inc., RBC Dominion Securities Inc., Scotia Capital Inc., on their own behalf and on behalf of the other underwriters for the Subscription Receipt Offering, and the Subscription Receipt Agent;

"Subscription Receipt Offering" has the meaning ascribed thereto under "General Developments of Pembina – Developments in 2023";

"Sunrise Gas Plant" means PGI's sweet gas processing facility located near Dawson Creek, British Columbia;

"Swan Hills Pipeline" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Pipelines Division – Assets";

"Syncrude Pipeline" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Pipelines Division – Assets";

"Syncrude Project" means the joint venture that was formed for the recovery of oil sands, crude bitumen or products derived from the Athabasca oil sands, located near Fort McMurray, Alberta; "take-or-pay" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Pipelines Division – Customers and Commercial Structure";

"Taylor to Belloy Pipeline" means the pipeline and related facilities delivering NGL from Taylor, British Columbia to Belloy, Alberta;

"Taylor to Boundary Lake Pipeline" means the pipeline and related facilities delivering HVP hydrocarbon products from Taylor, British Columbia to Boundary Lake, Alberta;

"TC Energy" means TC Energy Corporation;

"Termination Date" means the date on which the Termination Time occurs;

"Termination Event" means the occurrence of (i) 5:00 p.m. (Calgary time) on the Outside Date, if (a) the Escrow Release Notice and Direction is not delivered to the Subscription Receipt Agent prior to such time, or (b) an Escrow Release Notice and Direction has been delivered to the Subscription Receipt Agent prior to such time, but the Escrowed Funds are subsequently returned to the Subscription Receipt Agent and no further Escrow Release Notice and Direction is delivered to the Subscription Receipt Agent prior to such time; (ii) the Alliance/Aux Sable Purchase and Sale Agreement is terminated; (iii) Pembina gives notice to the lead underwriters for the Subscription Receipt Offering that it does not intend to proceed with the Alliance/Aux Sable Acquisition; or (iv) Pembina announces to the public that it does not intend to proceed with the Alliance/Aux Sable Acquisition;

"Termination Payment" means an amount per Subscription Receipt equal to the offering price in respect of such Subscription Receipt, being $42.85, plus (a) if a Dividend Equivalent Payment has been paid or is payable in respect of the Subscription Receipts at any time following December 19, 2023, any unpaid Dividend Equivalent Payment owing to such holder, or (b) if no Dividend Equivalent Payment has been paid or is payable in respect of the Subscription Receipts at any time following December 19, 2023, such holder's proportionate share of any interest and other income received or credited on the investment of the Escrowed Funds between December 19, 2023 and the Termination Date, in each case net of any applicable withholding taxes;

"Termination Time" means the time of the earliest Termination Event to occur;

"throughput" means volume of product delivered through a pipeline or terminal;

"TIER" has the meaning ascribed thereto under "Risk Factors – Risks Inherent in Pembina's Business – Environmental Costs and Liabilities";

"TMQ" has the meaning ascribed thereto under "Other Information Relating to Pembina's Business – Operating Management System – Operations and Maintenance Program";

"Tower Gas Plant" means PGI's sweet gas processing facility located near Dawson Creek, British Columbia;

"TSX" means the Toronto Stock Exchange;

"UNDRIP" has the meaning ascribed thereto under "Risk Factors – General Risk Factors – Indigenous Land Claims and Consultation Obligations";

"Valleyview" refers to the Peace Pipeline pump station and terminal located near Valleyview, Alberta;

"Vancouver Wharves" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Facilities Division – Assets";

"Veresen" means Veresen Inc.;

"Vantage Pipeline" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Pipelines Division – Assets"; "Veresen Acquisition" means the acquisition of Veresen, pursuant to which Pembina acquired all of the issued and outstanding common shares of Veresen and Veresen Preferred Shares, by way of a plan of arrangement under the ABCA, in accordance with the terms and conditions of an arrangement agreement dated May 1, 2017 between Pembina and Veresen;

"Veresen Midstream" means, collectively, Veresen Midstream Limited Partnership and Veresen Midstream General Partner Inc. and their subsidiaries;

"Veresen Preferred Shares" means the Veresen Series A Preferred Shares, the Veresen Series B Preferred Shares, the Veresen Series C Preferred Shares, the Veresen Series D Preferred Shares, the Veresen Series E Preferred Shares and the Veresen Series F Preferred Shares;

"Veresen Series A Preferred Shares" means the cumulative redeemable preferred shares, series A of Veresen, issued February 14, 2012;

"Veresen Series B Preferred Shares" means the cumulative redeemable preferred shares, series B of Veresen, which were issuable on conversion of the Veresen Series A Preferred Shares;

"Veresen Series C Preferred Shares" means the cumulative redeemable preferred shares, series C of Veresen, issued October 21, 2013;

"Veresen Series D Preferred Shares" means the cumulative redeemable preferred shares, series D of Veresen, which were issuable on conversion of the Veresen Series C Preferred Shares;

"Veresen Series E Preferred Shares" means the cumulative redeemable preferred shares, series E of Veresen, issued April 1, 2015;

"Veresen Series F Preferred Shares" means the cumulative redeemable preferred shares, series F of Veresen, which were issuable on conversion of the Veresen Series E Preferred Shares;

"Wapiti" refers to the Peace Pipeline pump station and terminal located south of Wembley, Alberta;

"Wapiti Condensate Lateral" means a 12-inch, approximately 30 km pipeline which connects condensate volumes from a third-party owned facility in the Pipestone Montney region into the Peace Pipeline;

"Wapiti Expansion" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Facilities Division – Assets";

"Wapiti Plant" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Facilities Division – Assets";

"WCSB" means the Western Canadian Sedimentary Basin;

"Western Pipeline" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Pipelines Division – Assets"; and

"Younger" has the meaning ascribed thereto under "Description of Pembina's Business and Operations – Facilities Division – Assets".

All dollar amounts set forth in this Annual Information Form are in Canadian dollars unless otherwise indicated. References to "$" or "C$" are to Canadian dollars and references to "US$" are to U.S. dollars. On February 21, 2024, the daily exchange rate reported by the Bank of Canada, was C$1.00 equals US$0.7401.

Except where otherwise indicated, all information in this Annual Information Form is presented as at the end of Pembina's most recently completed financial year, being December 31, 2023.

A reference made in this Annual Information Form to other documents or to information or documents available on a website does not constitute the incorporation by reference into this Annual Information Form of such other documents or such other information or documents available on such website, unless otherwise stated.

ABBREVIATIONS AND CONVERSIONS

In this Annual Information Form, the following abbreviations have the indicated meanings:

|

|

|

|

|

|

| mbbls |

thousands of barrels, each barrel representing 34.972 Imperial gallons or 42 U.S. gallons |

| mmbbls |

millions of barrels |

| mbpd |

thousands of barrels per day |

| mmbpd |

millions of barrels per day |

| MMcf/d |

million cubic feet per day |

| mboe/d |

thousands of barrels of oil equivalent per day |

| mmboe/d |

millions of barrels of oil equivalent per day |

| bcf/d |

billion cubic feet per day |

| km |

kilometres |

CO2e |

carbon dioxide equivalent |

| MW |

megawatt |

Barrels of oil equivalent ("boe") may be misleading, particularly if used in isolation. A boe conversion ratio of 6 mcf of natural gas: 1 bbl of crude oil is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead.

The following table sets forth certain standard conversions between Standard Imperial Units and the International System of Units (or metric units).

|

|

|

|

|

|

|

|

|

| To convert from |

To |

Multiply by |

| bbls |

cubic metres |

0.159 |

| cubic metres |

bbls |

6.293 |

| miles |

kilometres |

1.609 |

| kilometres |

miles |

0.621 |

NON–GAAP FINANCIAL MEASURES

Throughout this Annual Information Form, Pembina has disclosed certain financial measures and ratios that are not specified, defined or determined in accordance with GAAP and which are not disclosed in the Financial Statements. Non-GAAP financial measures either exclude an amount that is included in, or include an amount that is excluded from, the composition of the most directly comparable financial measure specified, defined and determined in accordance with GAAP. These non-GAAP financial measures and non-GAAP ratios, together with financial measures and ratios specified, defined and determined in accordance with GAAP, are used by management to evaluate the performance and cash flows of Pembina and its businesses and to provide additional useful information respecting Pembina's financial performance and cash flows to investors and analysts.

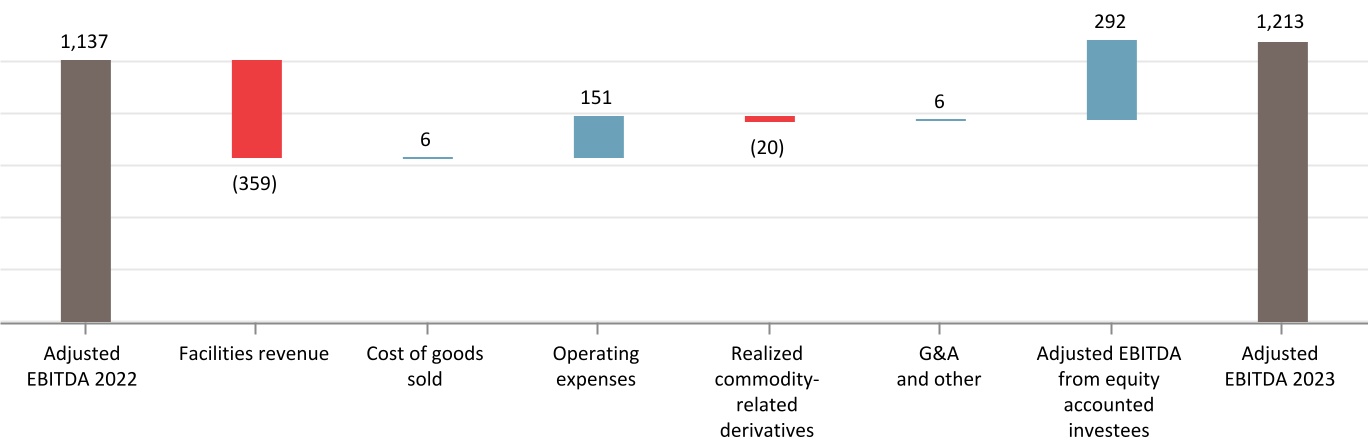

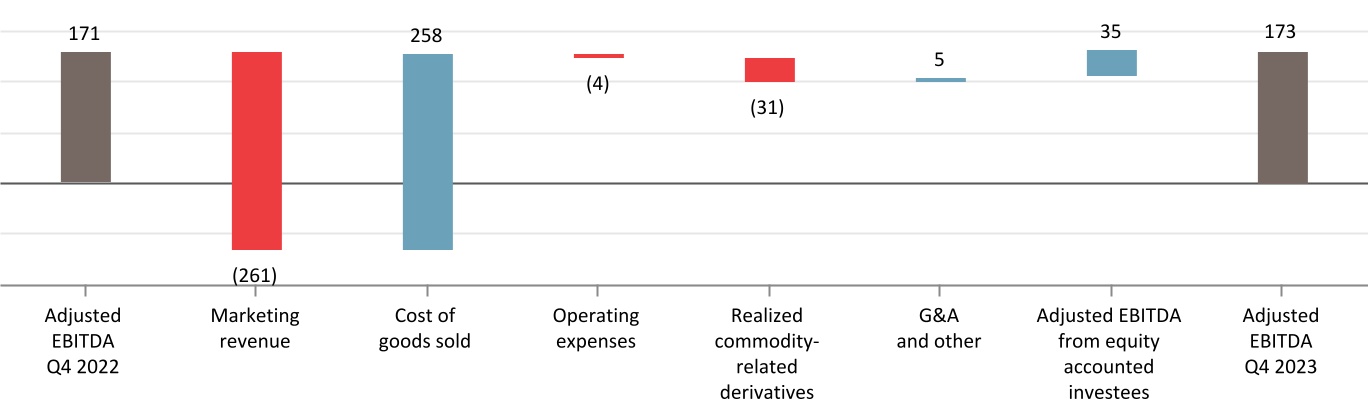

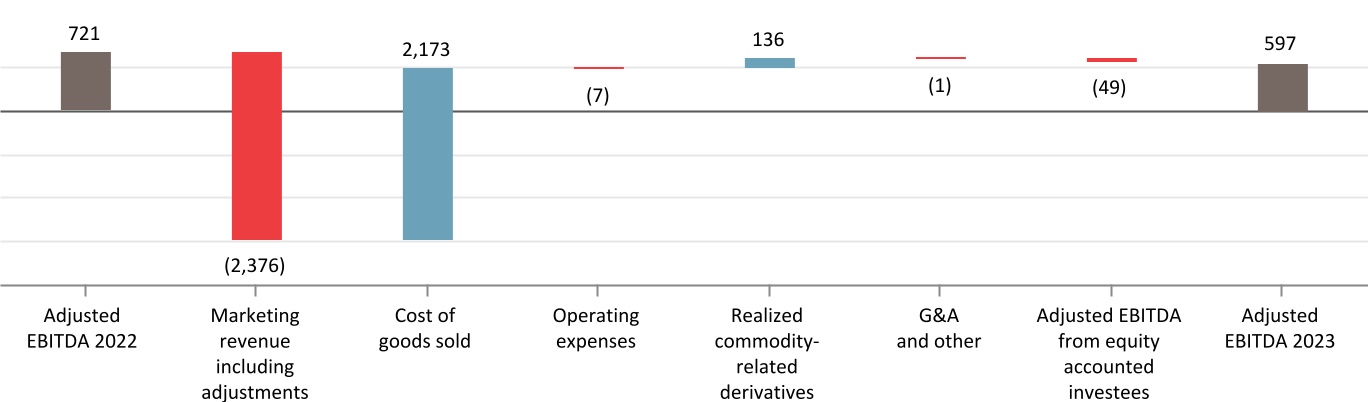

In this Annual Information Form, Pembina has disclosed the following non-GAAP financial measures and non-GAAP ratios: net revenue, adjusted earnings before interest, taxes, depreciation and amortization ("adjusted EBITDA"), and adjusted EBITDA per common share.

Non-GAAP financial measures and non-GAAP ratios disclosed in this Annual Information Form do not have any standardized meaning under IFRS and may not be comparable to similar financial measures disclosed by other issuers. The financial measures and ratios should not, therefore, be considered in isolation or as a substitute for, or superior to, measures and ratios of Pembina's financial performance, or cash flows specified, defined or determined in accordance with GAAP, including revenue, earnings before income tax, and earnings per common share.

Except as otherwise described herein, these non-GAAP financial measures and non-GAAP ratios are calculated on a consistent basis from period to period. Specific reconciling items may only be relevant in certain periods.

Additional information relating to each non-GAAP financial measure and non-GAAP ratio disclosed in this Annual Information Form, including: (i) an explanation of the composition of each non-GAAP financial measure and non-GAAP ratio; (ii) an explanation of how each non-GAAP financial measure and non-GAAP ratio provides useful information to investors and the additional purposes, if any, for which management uses each non-GAAP financial measure and non-GAAP ratio; (iii) a quantitative reconciliation of each non-GAAP financial measure to the most directly comparable financial measure that is specified, defined and determined in accordance with GAAP; and (iv) an explanation of the reason for any change in the label or composition of each non-GAAP financial measure and non-GAAP ratio from what was previously disclosed, is contained in the "Non-GAAP & Other Financial Measures" section of the MD&A, which section is incorporated by reference in this Annual Information Form. The MD&A is available on SEDAR+ at www.sedarplus.ca, EDGAR at www.sec.gov and Pembina's website at www.pembina.com.

FORWARD-LOOKING STATEMENTS AND INFORMATION

Certain statements contained in this Annual Information Form constitute "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation (collectively, "forward-looking statements"). All forward-looking statements are based on Pembina's current expectations, estimates, projections, beliefs, judgments and assumptions based on information available at the time the applicable forward-looking statement was made and in light of Pembina's experience and its perception of historical trends. Forward-looking statements are typically identified by words such as "anticipate", "continue", "estimate", "expect", "may", "will", "project", "should", "could", "would", "believe", "plan", "intend", "design", "target", "undertake", "view", "indicate", "maintain", "explore", "entail", "schedule", "objective", "strategy", "likely", "potential", "outlook", "aim", "propose", "goal", and similar expressions suggesting future events or future performance.

By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Pembina believes the expectations reflected in those forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this Annual Information Form should not be unduly relied upon. The forward-looking statements included herein speak only as of the date of the Annual Information Form.

In particular, this Annual Information Form contains forward-looking statements pertaining to, among other things, the following:

•the future levels and sustainability of cash dividends that Pembina intends to pay to its Shareholders, including expected dividend payment dates;

•planning, construction, capital expenditure estimates, schedules, regulatory and environmental applications and anticipated approvals, expected capacity, incremental volumes, in-service dates, rights, activities, benefits and operations with respect to new construction of, or expansions on existing pipelines, gas services facilities, fractionation facilities, terminalling, storage and hub facilities and other facilities or energy infrastructure, as well as the impact of Pembina's new projects on its future financial performance;

•pipeline, processing, fractionation and storage facility and system operations and throughput levels;

•treatment under existing and proposed governmental regulatory regimes, including taxes, environmental, project assessment and GHG regulations and related abandonment and reclamation obligations, and Indigenous, landowner and other stakeholder consultation requirements;

•Pembina's estimates of and strategy for payment of future abandonment costs and decommissioning obligations;

•Pembina's strategy and the development and expected timing of new business initiatives, growth opportunities and the impact thereof;

•increased throughput potential, processing capacity and fractionation capacity due to increased oil and gas industry activity and new connections and other initiatives on Pembina's pipelines and at Pembina's facilities;

•expected future cash flows and the sufficiency thereof, financial strength, sources of and access to funds at acceptable rates, future contractual obligations, future financing options, future renewal of its credit facilities, availability of capital to fund growth plans, investments operating obligations and dividends and the use of proceeds from financings;

•future demand for Pembina's infrastructure and services;

•statement regarding Pembina's investment relating to managing its environmental liability and the benefits thereof;

•tolls and tariffs, and processing, transportation, fractionation, storage and services commitments and contracts;

•operating risks (including the amount of future liabilities related to pipeline spills and other environmental incidents) and related insurance coverage and inspection and integrity programs;

•inventory and pricing of commodities;

•the future success, growth, expansions, contributions, capacity expectations, results of operations, financial strength of certain of Pembina's equity accounted investees;

•the Alliance/Aux Sable Acquisition, including the expected timing of closing thereof;

•the development and anticipated benefits of Pembina's new projects and developments, including RFS IV, the Phase VIII Expansion, the NEBC MPS Expansion, the K3 Cogeneration Facility, the Wapiti Expansion, the Cedar LNG Project and the Alberta Carbon Grid, as well as the timing thereof;

•compliance by the Company with integrity regulatory compliance requirements, including the effectiveness of related programs and systems;

•Pembina's commitment to, and the effectiveness and impact of its OMS and other operations and governance policies and ESG-related practices and targets;

•the impact of the current commodity price environment on Pembina; and

•competitive conditions and Pembina's ability to position itself competitively in the industry.

Various factors or assumptions are typically applied by Pembina in drawing conclusions or making the forecasts, projections, predictions or estimations set out in forward-looking statements based on information currently available to Pembina. These factors and assumptions include, but are not limited to:

•oil and gas industry exploration and development activity levels and the geographic region of such activity;

•the success of Pembina's operations;

•prevailing commodity prices, interest rates, carbon prices, tax rates, exchange rates and inflation rates;

•the ability of Pembina to maintain current credit ratings;

•the availability and cost of capital to fund future capital requirements relating to existing assets, projects and the repayment or refinancing of existing debt as it becomes due;

•future operating costs, including geotechnical and integrity costs, being consistent with historical costs;

•oil and gas industry compensation levels remaining consistent with historical levels;

•in respect of current developments, expansions, planned capital expenditures, completion dates and capacity expectations: that third parties will provide any necessary support; that any third-party projects relating to Pembina's growth projects will be sanctioned and completed as expected; that any required commercial agreements can be reached; that all required regulatory and environmental approvals can be obtained on the necessary terms in a timely manner; that counterparties will comply with contracts in a timely manner; that there are no supply chain disruptions impacting Pembina's ability to obtain required equipment, materials or labour; that there are no unforeseen events preventing the performance of contracts or the completion of the relevant facilities; and that there are no unforeseen material costs relating to the facilities which are not recoverable from customers;

•in respect of the stability of Pembina's dividends: prevailing commodity prices, margins and exchange rates; that Pembina's future results of operations will be consistent with past performance and management expectations in relation thereto; the continued availability of capital at attractive prices to fund future capital requirements relating to existing assets and projects, including, but not limited to, future capital expenditures relating to expansion, upgrades and maintenance shutdowns; the success of growth projects; future operating costs; that counterparties to agreements will continue to perform their obligations in a timely manner; that there are no unforeseen events preventing the performance of contracts; and that there are no unforeseen material construction or other costs related to current growth projects, current operations or the repayment or refinancing of existing debt as it becomes due;

•prevailing regulatory, tax and environmental laws and regulations and tax pool utilization; and

•the amount of future liabilities relating to lawsuits and environmental incidents and the availability of coverage under Pembina's insurance policies (including in respect of Pembina's business interruption insurance policy).

The actual results of Pembina could differ materially from those anticipated in the forward-looking statements included in this Annual Information Form as a result of the material risk factors set forth below:

•the regulatory environment and decisions, and Indigenous and landowner consultation requirements;

•the impact of competitive entities and pricing;

•reliance on third parties to successfully operate and maintain certain assets;

•labour and material shortages;

•reliance on key relationships and agreements and the outcome of stakeholder engagement;

•the strength and operations of the oil and natural gas production industry and related commodity prices;

•non-performance or default by counterparties to agreements which Pembina or one or more of its subsidiaries has entered into in respect of its business;

•actions by joint venture partners or other partners which hold interests in certain of Pembina's assets;

•actions by governmental or regulatory authorities, including changes in tax laws and treatment, changes in royalty rates, changes in regulatory processes or increased environmental regulation;

•fluctuations in operating results;

•adverse general economic and market conditions, including potential recessions, in Canada, North America and worldwide, resulting in changes, or prolonged weaknesses, as applicable, in interest rates, foreign currency exchange rates, inflation rates, commodity prices, supply/demand trends and overall industry activity levels;

•constraints on, or the unavailability of, adequate infrastructure;

•the political environment and public opinion in North America and elsewhere;

•ability to access various sources of debt and equity capital;

•changes in credit ratings;

•counterparty credit risk;

•technology and security risks including cyber-security risks;

•natural catastrophes; and

•other risk factors as set out in this Annual Information Form under "Risk Factors".

These factors should not be construed as exhaustive. Unless required by law, Pembina does not undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Any forward-looking statements contained herein are expressly qualified by this cautionary statement.

CORPORATE STRUCTURE

Name, Address and Formation

Pembina Pipeline Corporation is a corporation amalgamated under the ABCA. It is the successor to Pembina Pipeline Income Fund (the "Fund") following the completion of the reorganization of the Fund from an income trust structure to a corporate structure by way of plan of arrangement involving the Fund, Pembina and the holders of the Fund's trust units, pursuant to which the trust was reorganized into Pembina on October 1, 2010. Pembina is also the successor to Veresen following the completion of the Veresen Acquisition on October 2, 2017, whereby, among other things, Pembina amalgamated with Veresen and the resulting entity continued as "Pembina Pipeline Corporation". Pembina's principal and registered office is located at Suite 4000, 585 - 8th Avenue S.W., Calgary, Alberta, T2P 1G1.

Pembina's Subsidiaries

The following chart indicates Pembina's material subsidiaries, including their jurisdictions of incorporation, formation or organization and the percentage of voting securities owned, or controlled or directed, directly or indirectly, by Pembina or its subsidiaries.

|

|

|

|

|

|

|

|

|

Principal Subsidiaries(1) |

Jurisdiction of Incorporation/Formation/ Organization |

Ownership |

| Pembina Empress NGL Partnership |

Alberta |

100% |

| Pembina Holding Canada L.P. |

Alberta |

100% |

| Pembina Infrastructure and Logistics L.P. |

Alberta |

100% |

| Pembina Midstream Limited Partnership |

Alberta |

100% |

| Pembina Oil Sands Pipeline L.P. |

Alberta |

100% |

| Pembina Pipeline |

Alberta |

100% |

| Pembina Cochin LLC |

Delaware U.S. |

100% |

(1) Subsidiaries are omitted where, at Pembina's most recent financial year-end: (i) the total assets of the subsidiary do not exceed 10 percent of Pembina's consolidated assets; (ii) the revenue of the subsidiary does not exceed 10 percent of Pembina's consolidated revenue; and (iii) the conditions in (i) and (ii) would be satisfied if the omitted subsidiaries were aggregated, and the reference in (i) and (ii) changed from 10 percent to 20 percent.

Amended Articles

On May 13, 2013, Pembina filed articles of amendment under the ABCA to create a new class of shares, the Class A Preferred Shares, to change the designation and terms of the Class B Preferred Shares, and to increase the maximum number of directors of Pembina from eleven to thirteen, after receiving Shareholder approval for such amendments.

On October 2, 2017, Pembina filed articles of amendment under the ABCA to create the Series 15, Series 16, Series 17, Series 18, Series 19 and Series 20 Class A Preferred Shares.

On October 2, 2017, Pembina filed articles of amalgamation under the ABCA to effect the amalgamation of Pembina and Veresen pursuant to the Veresen Acquisition. Pursuant to the Veresen Acquisition, all of the outstanding Veresen Series A, C and E Preferred Shares were exchanged for Series 15, 17 and 19 Class A Preferred Shares, respectively. The Series 15, 17 and 19 Class A Preferred Shares have substantially the same terms and conditions as the previously outstanding Veresen Series A, C and E Preferred Shares. The Series 16, 18 and 20 Class A Preferred Shares have substantially the same terms and conditions as the Veresen Series B, D and F Preferred Shares.

On December 1, 2017, Pembina filed articles of amendment under the ABCA to create the Series 21 and Series 22 Class A Preferred Shares.

On June 25, 2019, Pembina filed articles of amendment under the ABCA to increase the limit on the number of Class A Preferred Shares Pembina is authorized to issue from 20 percent of the number of Common Shares issued and outstanding at the time of issuance to a maximum of 254,850,850 Class A Preferred Shares, after receiving approval from the Shareholders and the holders of the Class A Preferred Shares for such amendment.

On December 16, 2019, Pembina filed articles of amendment under the ABCA to create the Series 23, Series 24, Series 25 and Series 26 Class A Preferred Shares. Pursuant to the Kinder Morgan Canada Acquisition, all of the outstanding KML Series 1 and 3 Preferred Shares were exchanged for Series 23 and 25 Class A Preferred Shares, respectively.

The Series 23 and 25 Class A Preferred Shares have substantially the same terms and conditions as the previously outstanding KML Series 1 and 3 Preferred Shares. The Series 24 and 26 Class A Preferred Shares have substantially the same terms and conditions as the KML Series 2 and 4 Preferred Shares. The issued and outstanding Series 23 Preferred Shares were redeemed and subsequently cancelled by Pembina on November 15, 2022.

On January 22, 2021, Pembina filed articles of amendment under the ABCA to create the Series 2021-A Class A Preferred Shares in connection with the issuance of the Subordinated Notes, Series 1. On January 25, 2021, prior to the issuance of such Series 2021-A Preferred Shares, Pembina filed articles of amendment amending and restating the terms of the Series 2021-A Class A Preferred Shares.

See "Description of the Capital Structure of Pembina".

Amended By-laws

On May 8, 2020, at the annual and special meeting of Shareholders (the "2020 Meeting"), Shareholders confirmed Pembina's amended and restated By-law No. 1 to, among other things: (i) permit only one officer or director, rather than two officers or directors, to execute certain documents on behalf of the Company, and (ii) provide that the Chair of the Board of Directors does not receive a second or casting vote when there is a voting deadlock at a meeting of the Board of Directors, bringing Pembina's by-laws in line with its peers and best corporate governance practices. At the 2020 Meeting, Shareholders also confirmed By-law No. 2, a by-law relating to the advance notice for the nomination of directors, which provides a framework for nominating directors for election to the Board of Directors.

GENERAL DEVELOPMENTS OF PEMBINA

During the three-year period ending on December 31, 2023 and 2024 year-to-date, Pembina continued to execute its business plan and advance its growth strategy as discussed below.

Developments in 2021

|

|

|

|

|

|

| Jan 19 |

The FERC denied a petition on Jordan Cove for a declaratory order that the Oregon Department of Environmental Quality waived its authority to issue a water quality certification pursuant to Section 401 of the Clean Water Act for failure to act within the statutorily-mandated period. |

| Jan 25 |

Pembina issued and sold $600 million aggregate principal amount of 4.80 percent Fixed-to-Fixed Rate Subordinated Notes, Series 1 due January 25, 2081 (the "Subordinated Notes, Series 1") pursuant to its 2020 Base Shelf Prospectus, as supplemented by a prospectus supplement dated January 12, 2021. In connection with the issuance of the Subordinated Notes, Series 1, Pembina also issued 600,000 Series 2021-A Class A Preferred Shares to be held in trust by Computershare Trust Company of Canada to satisfy Pembina's obligations under the Subordinated Note Indenture for the Subordinated Notes, Series 1. Pembina expects to use the net proceeds from the sale of the Subordinated Notes, Series 1 to redeem or repurchase Pembina's Series 11 Class A Preferred Shares and its Series 13 Class A Preferred Shares, to repay outstanding indebtedness, as well as for general corporate purposes. See "Description of the Capital Structure of Pembina – Subordinated Notes" and "Description of the Capital Structure of Pembina – Class A Preferred Shares". |

| Feb 8 |

The United States Secretary of Commerce for Oceans and Atmosphere upheld the Oregon Department of Land Conservation and Development's objection to the Jordan Cove certification of consistency under the Coastal Zone Management Act, denying Pembina's appeal on the matter. |

| Feb 25 |