Q1 2024 INVESTOR PRESENTATION

NYSE: PFS Forward Looking Statements Certain statements contained herein are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements may be identified by reference to a future period or periods, or by the use of forward-looking terminology, such as “may,” “will,” “believe,” “expect,” “estimate,” “project,” “intend,” “anticipate,” “continue,” or similar terms or variations on those terms, or the negative of those terms. Forward-looking statements are subject to numerous risks and uncertainties, including, but not limited to, those set forth in Item 1A of the Company's Annual Report on Form 10-K, as supplemented by its Quarterly Reports on Form 10-Q, and those related to the economic environment, particularly in the market areas in which the Company operates, competitive products and pricing, fiscal and monetary policies of the U.S. Government, the effects of any turmoil or negative news in the banking industry, changes in accounting policies and practices that may be adopted by the regulatory agencies and the accounting standards setters, changes in government regulations affecting financial institutions, including regulatory fees and capital requirements, changes in prevailing interest rates, potential goodwill impairment, acquisitions and the integration of acquired businesses, credit risk management, asset-liability management, the financial and securities markets, the availability of and costs associated with sources of liquidity, the ability to complete, or any delays in completing, the pending merger between the Company and Lakeland Bancorp, Inc. (“Lakeland”); any failure to realize the anticipated benefits of the transaction when expected or at all; certain restrictions during the pendency of the transaction that may impact the Company’s ability to pursue certain business opportunities or strategic transactions; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of conditions imposed by regulators, unexpected factors or events, diversion of management’s attention from ongoing business operations and opportunities; potential adverse reactions or changes to business or employee relationships, including those resulting from the completion of the merger and integration of the companies; and the impact of a potential shutdown of the federal government. The Company cautions readers not to place undue reliance on any such forward-looking statements which speak only as of the date they are made. The Company advises readers that the factors listed above could affect the Company's financial performance and could cause the Company's actual results for future periods to differ materially from any opinions or statements expressed with respect to future periods in any current statements. The Company does not assume any duty, and does not undertake, to update any forward-looking statements to reflect events or circumstances after the date of this statement. 2

NYSE: PFS Corporate Profile (At or for the Quarter Ended 12/31/23) 3 Bank founded: 1839 Stock symbol: PFS (NYSE) Branches: 94 serving northern and central New Jersey, eastern Pennsylvania, Nassau and Queens Counties, NY Market capitalization: $1.14 Billion as of 2/12/24 Balance sheet: $14.21 Billion in Total Assets $10.77 Billion in Net Loans $10.29 Billion in Total Deposits Strong core funding: 195 bps cost of deposits Efficient operator: 1.98%: Annualized adjusted non- interest expenses / average assets(1) 61.32%: Efficiency Ratio(1) Wealth management business: Beacon Trust Company $3.86 Billion AUM Insurance business: Provident Protection Plus, Inc. YTD 2023 revenues ~ $14.2Million (1) See Appendix for a reconciliation of GAAP and non-GAAP financial measures.

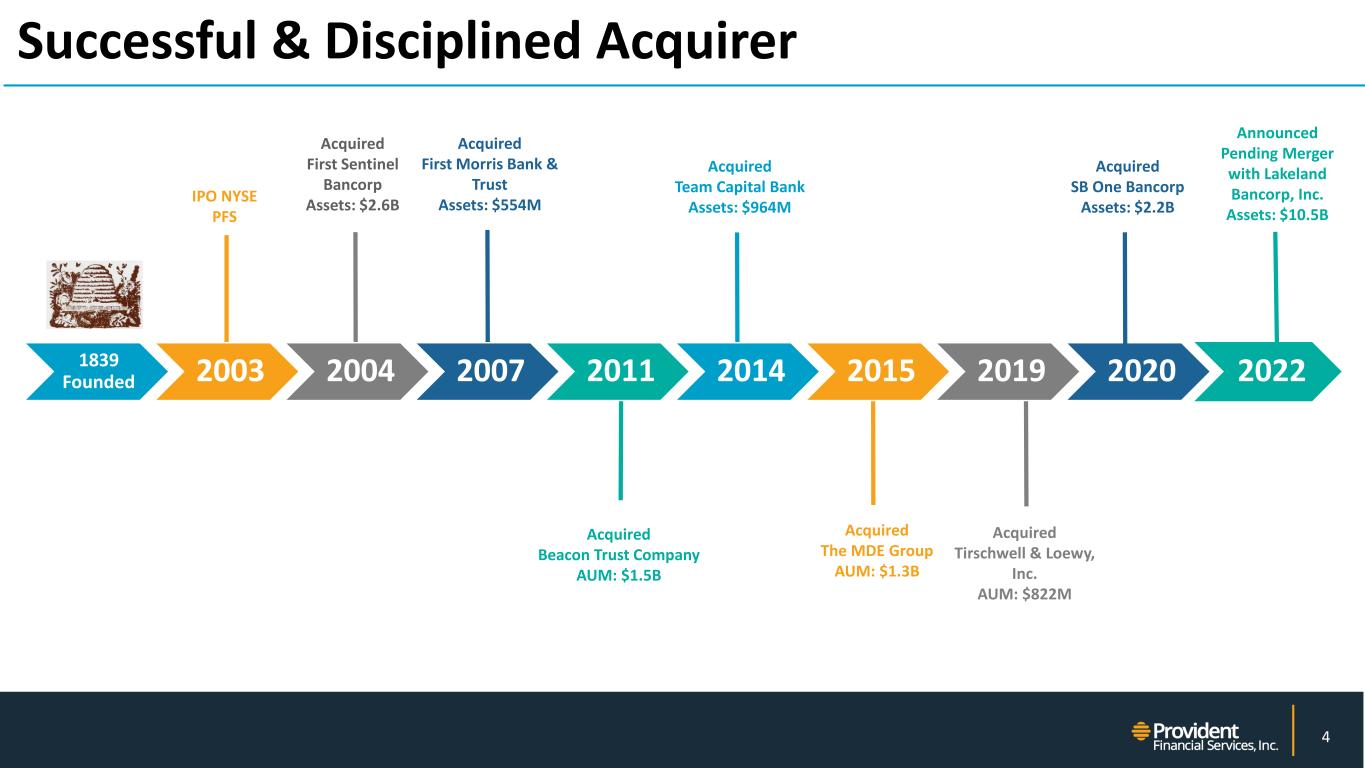

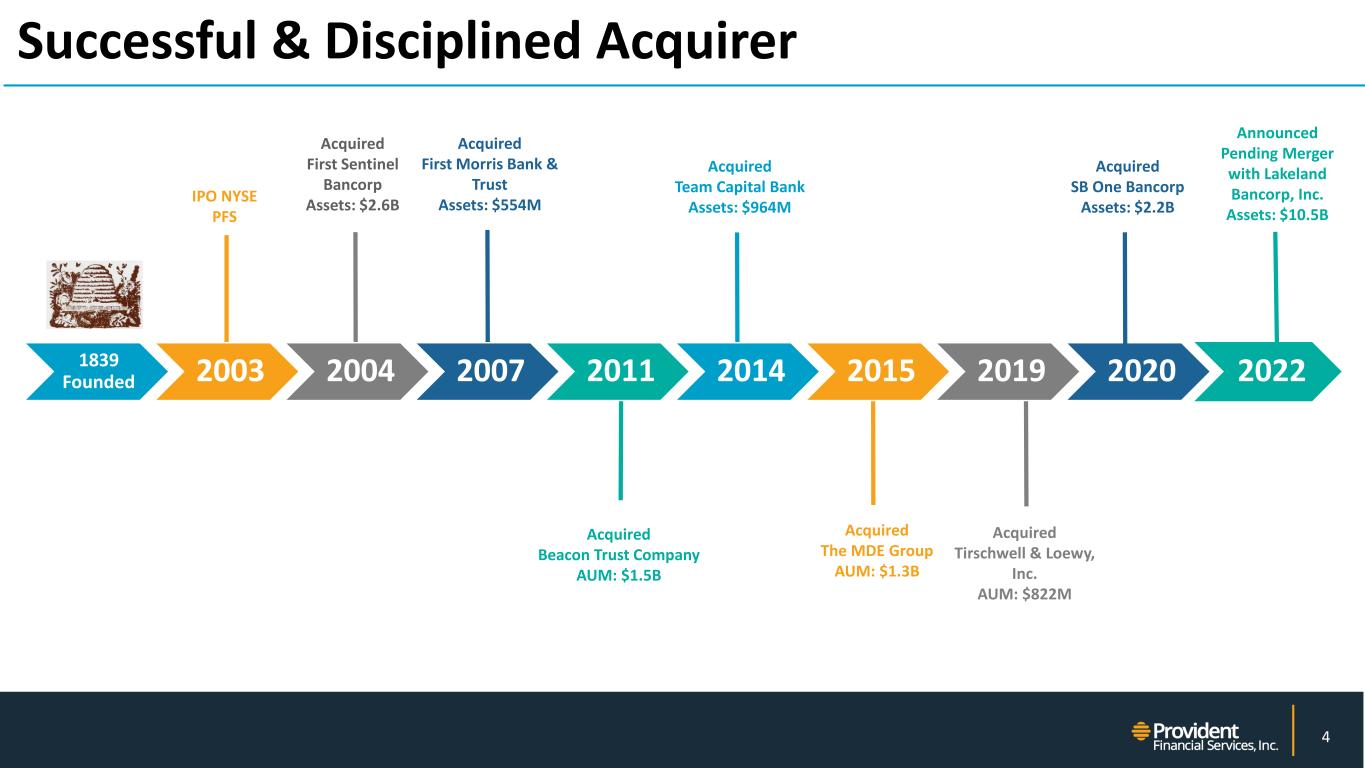

NYSE: PFS Acquired Tirschwell & Loewy, Inc. AUM: $822M Acquired The MDE Group AUM: $1.3B Acquired Team Capital Bank Assets: $964M Acquired First Sentinel Bancorp Assets: $2.6B Acquired First Morris Bank & Trust Assets: $554M Acquired Beacon Trust Company AUM: $1.5B IPO NYSE PFS 1839 Founded 2003 2004 2007 2011 2014 2015 2019 2020 2022 Successful & Disciplined Acquirer Acquired SB One Bancorp Assets: $2.2B 4 Announced Pending Merger with Lakeland Bancorp, Inc. Assets: $10.5B

NYSE: PFS POPULATION (as of February 2023 Estimates) NJ – 9,317,771 NY – 19,879,255 Queens – 2,340,201 Nassau – 1,393,596 PA – 12,979,881 Bucks – 647,873 Lehigh – 378,463 Northampton – 315,255 MEDIAN INCOME AND NATIONAL RANK NJ - $95,596 – 4th nationwide PA - $70,856 – 27th nationwide NY - $80,716 – 15th nationwide * Source: S&P Global MI (Median income and national rank as 01/2023; Population data as of 02/2023) Densely populated, lucrative markets Highly educated, wealthy population Diverse economy proximate to New York City and Philadelphia metro areas Strong Presence in Attractive Markets* 5

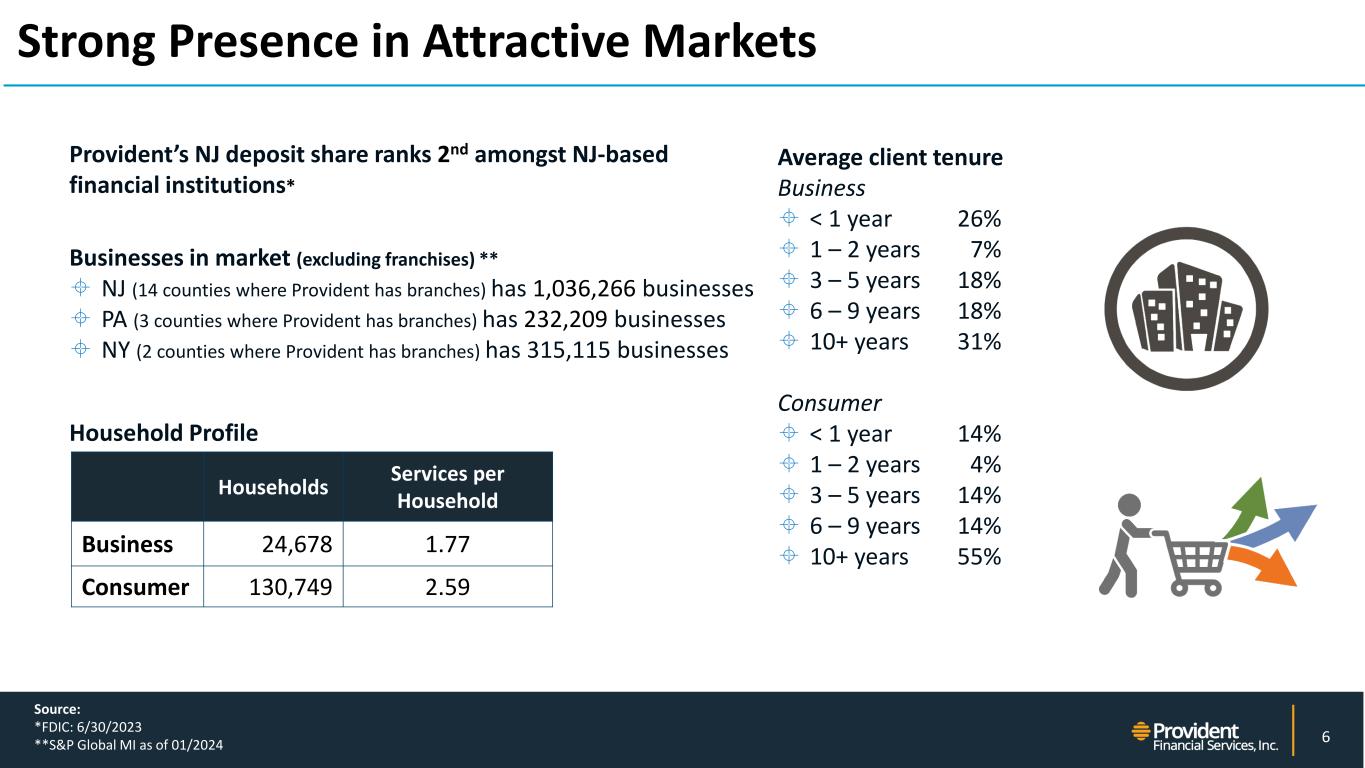

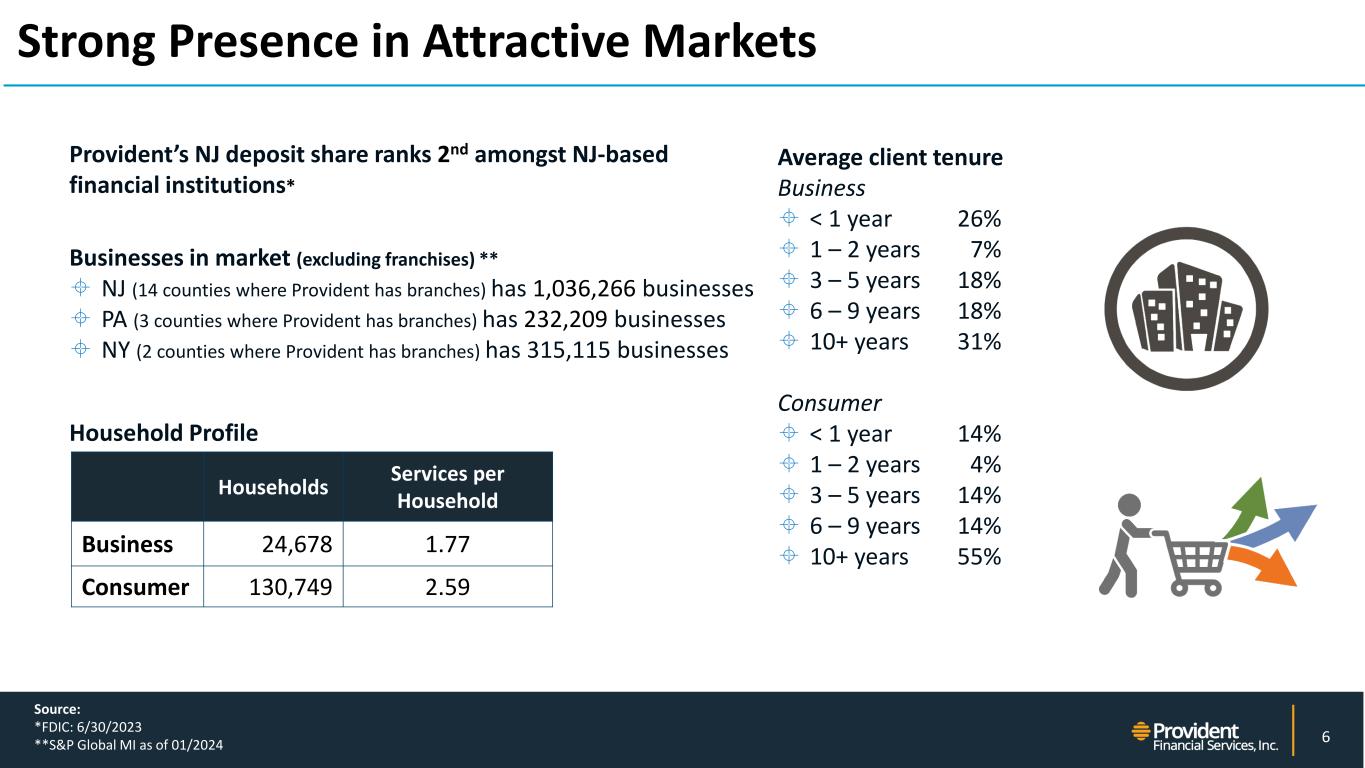

NYSE: PFS Average client tenure Business < 1 year 26% 1 – 2 years 7% 3 – 5 years 18% 6 – 9 years 18% 10+ years 31% Consumer < 1 year 14% 1 – 2 years 4% 3 – 5 years 14% 6 – 9 years 14% 10+ years 55% Provident’s NJ deposit share ranks 2nd amongst NJ-based financial institutions* Businesses in market (excluding franchises) ** NJ (14 counties where Provident has branches) has 1,036,266 businesses PA (3 counties where Provident has branches) has 232,209 businesses NY (2 counties where Provident has branches) has 315,115 businesses Households Services per Household Business 24,678 1.77 Consumer 130,749 2.59 Source: *FDIC: 6/30/2023 **S&P Global MI as of 01/2024 Household Profile Strong Presence in Attractive Markets 6

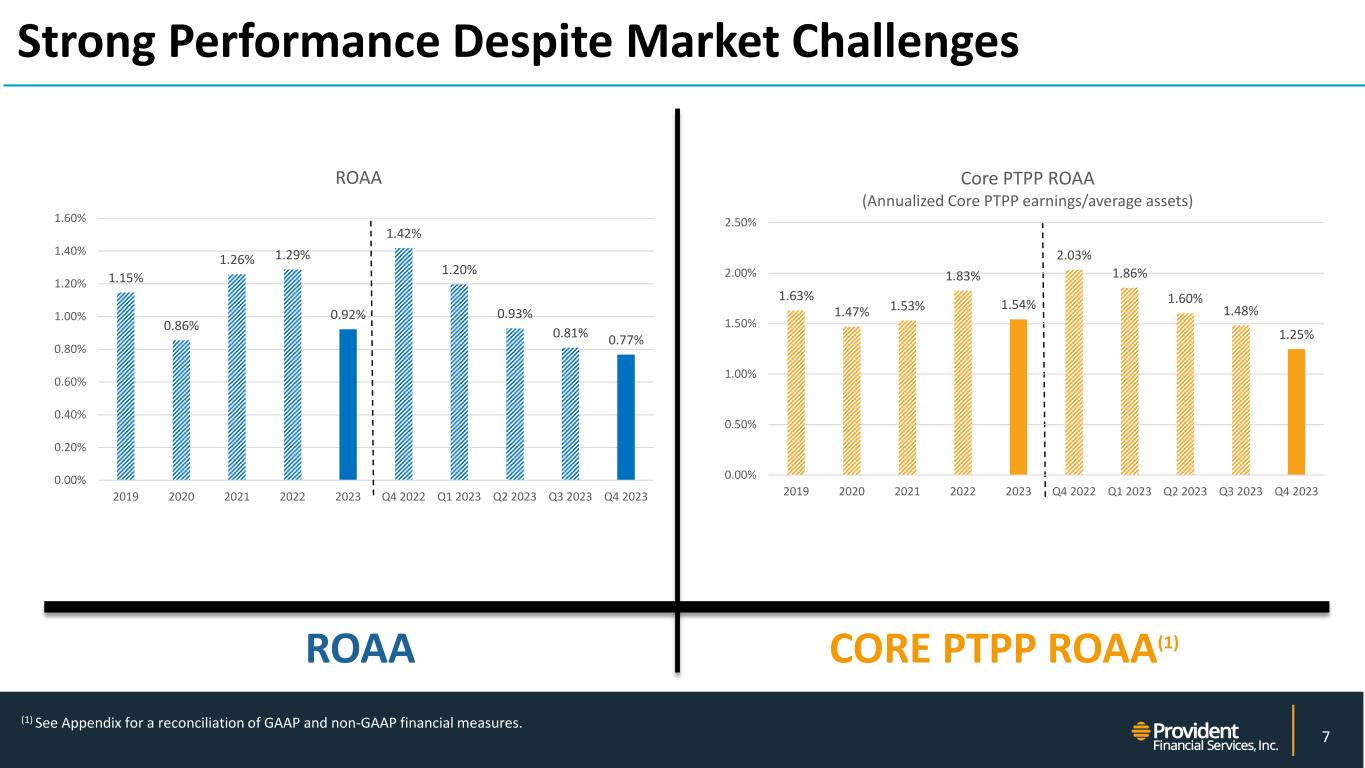

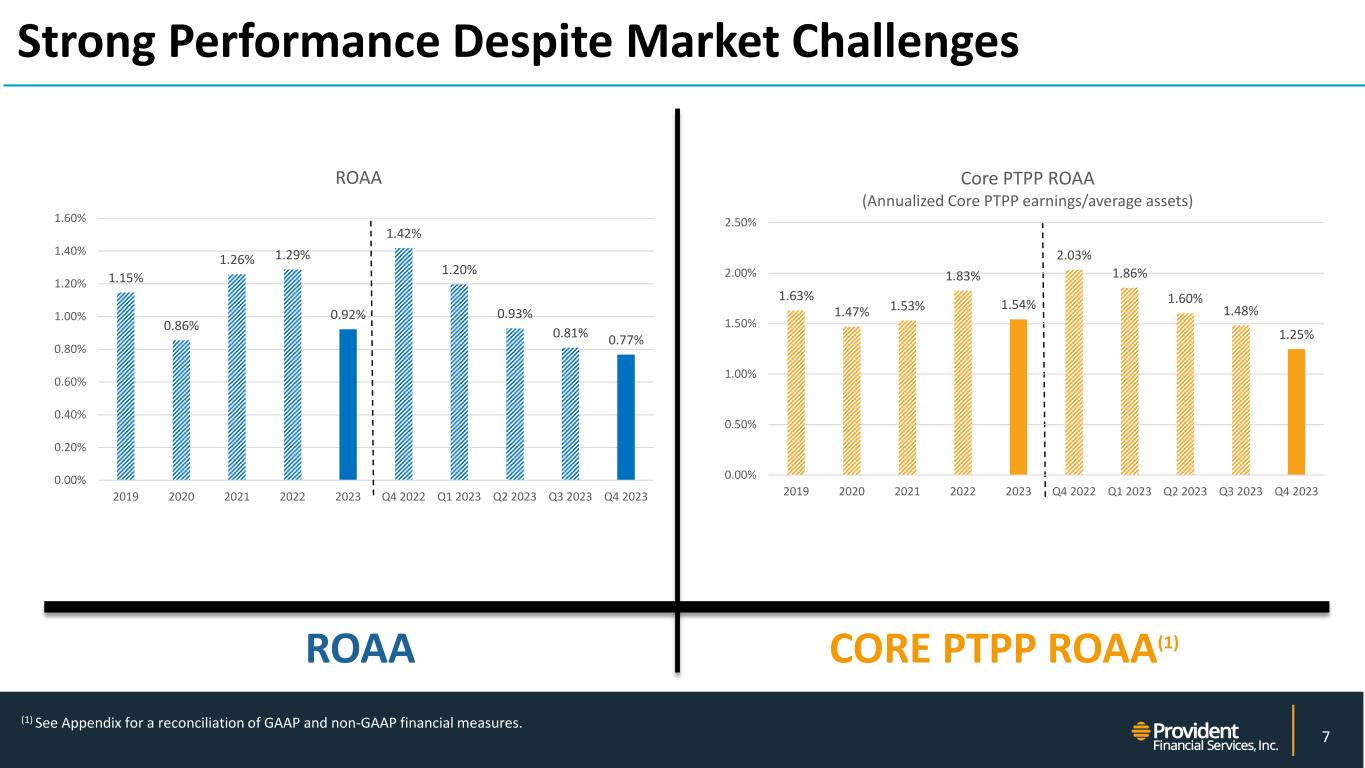

NYSE: PFS 1.15% 0.86% 1.26% 1.29% 0.92% 1.42% 1.20% 0.93% 0.81% 0.77% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 1.60% 2019 2020 2021 2022 2023 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 ROAA ROAA CORE PTPP ROAA(1) (1) See Appendix for a reconciliation of GAAP and non-GAAP financial measures. Strong Performance Despite Market Challenges 7 1.63% 1.47% 1.53% 1.83% 1.54% 2.03% 1.86% 1.60% 1.48% 1.25% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 2019 2020 2021 2022 2023 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Core PTPP ROAA (Annualized Core PTPP earnings/average assets)

NYSE: PFS 11.71% 9.28% 13.89% 15.20% 10.84% 17.51% 14.10% 10.75% 9.47% 9.15% 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% 18.00% 20.00% 2019 2020 2021 2022 2023 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 ROATE (Annualized net income/average tangible stockholders' equity) ROAE ROATE(1) (1) See Appendix for a reconciliation of GAAP and non-GAAP financial measures. Strong Performance Despite Market Challenges 8 8.07% 6.49% 10.03% 10.86% 7.81% 12.37% 10.11% 7.76% 6.84% 6.60% 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 2019 2020 2021 2022 2023 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 ROAE (Annualized net income/average stockholders' equity)

3.5% 3.7% 5.1% 4.0% 4.5% 5.3% Dividend yield $0.23 $0.23 $0.23 $0.24 $0.24 $0.24 Regular quarterly cash dividend per share (1) 2.19% CAGR 2.84% CAGR +0.85% 5-year TSR 6.02% (As of 2/12/24) 9 Historically Strong Track Record of Returns Note: See Appendix for a reconciliation of GAAP and non-GAAP financial measures. DECEMBER : $2.57 $2.47 $2.40 $2.67 $3.33 $2.87 2018 2019 2020 2021 2022 2023 Core Diluted Earnings per share $14.18 $14.85 $14.86 $16.02 $15.12 $16.32 Tangible book value per share (Tangible stockholders' equity/shares outstanding)

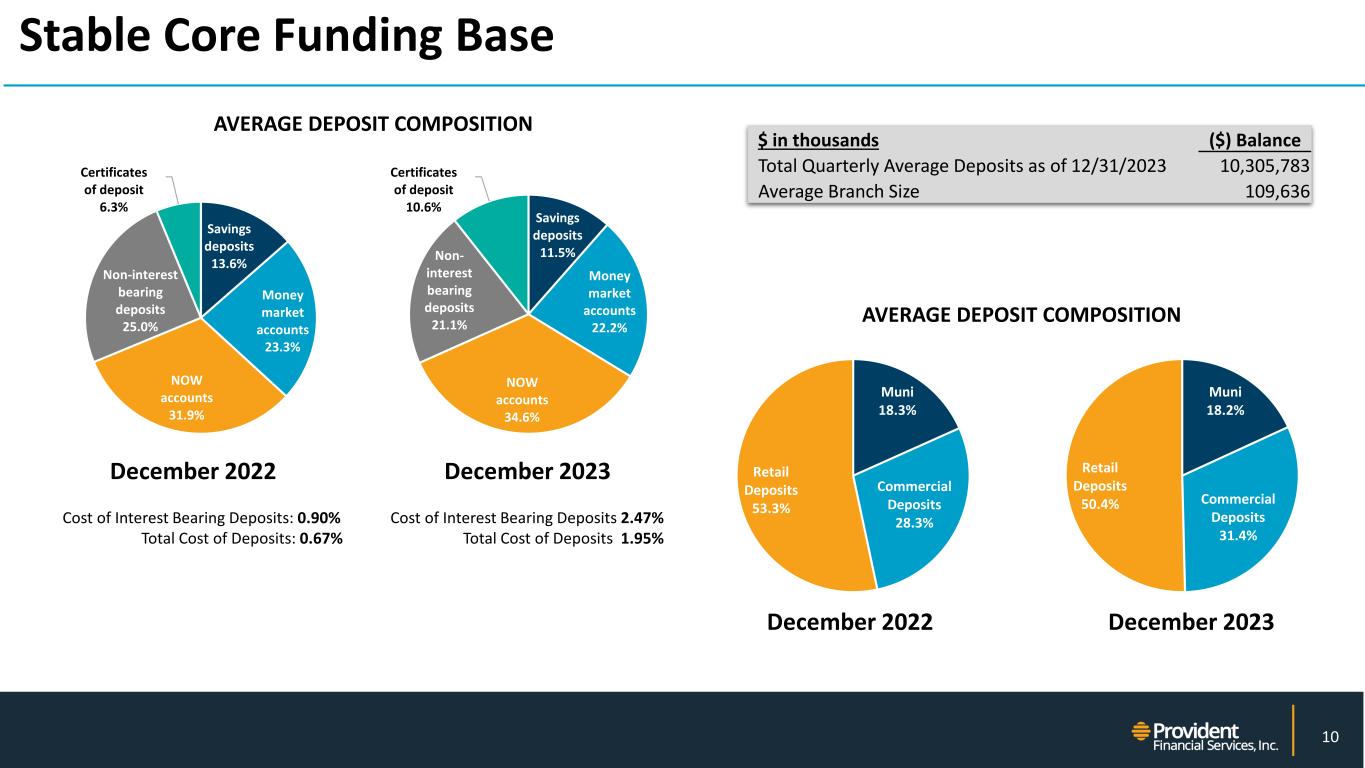

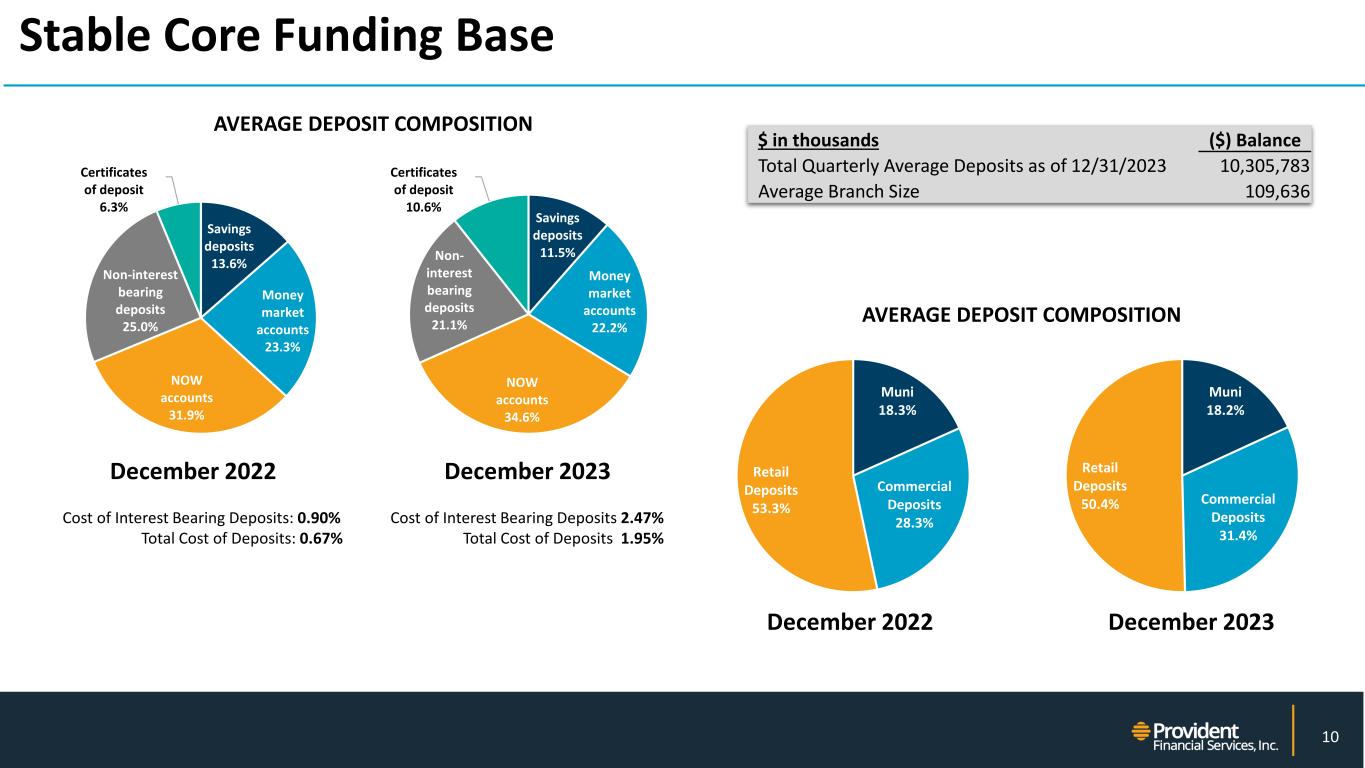

NYSE: PFS Stable Core Funding Base $ in thousands ($) Balance Total Quarterly Average Deposits as of 12/31/2023 10,305,783 Average Branch Size 109,636 Cost of Interest Bearing Deposits: 0.90% Total Cost of Deposits: 0.67% AVERAGE DEPOSIT COMPOSITION AVERAGE DEPOSIT COMPOSITION 10 Savings deposits 13.6% Money market accounts 23.3% NOW accounts 31.9% Non-interest bearing deposits 25.0% Certificates of deposit 6.3% Muni 18.3% Commercial Deposits 28.3% Retail Deposits 53.3% Savings deposits 11.5% Money market accounts 22.2% NOW accounts 34.6% Non- interest bearing deposits 21.1% Certificates of deposit 10.6% December 2022 December 2023 Muni 18.2% Commercial Deposits 31.4% Retail Deposits 50.4% December 2022 December 2023 Cost of Interest Bearing Deposits 2.47% Total Cost of Deposits 1.95%

NYSE: PFS Diversified Loan Portfolio As of 12/31/22 11 Residential Mortgage Loans 11% Commercial Mortgage 42% Multi-family Loans 15% Commercial Construction Loans 7% Commercial Loans 22% Consumer Loans 3% As of 12/31/23 Residential Mortgage Loans 11% Commercial Mortgage 41%Multi-family Loans 17% Commercial Construction Loans 6% Commercial Loans 22% Consumer Loans 3% Total Gross Loans $10.87 Billion Q4 2023 Avg Net Loan Yield 5.50% Total Gross Loans $10.26 Billion Q4 2022 Avg Net Loan Yield 4.82%

NYSE: PFS CRE Investment Portfolio by Property type 12 As of 12/31/23 RETAIL 29% MULTI- FAMILY 27% INDUSTRIAL 20% OFFICE 8% MIXED USE 7% SPECIAL USE 4% RESIDENTIAL 3% HOTEL 2% LAND 1% Portfolio Characteristics 10 Largest CRE Loans 15% of CRE Investment Portfolio 10 Largest CRE Loans 8% of Total Loan Portfolio Average Loan Size Outstanding $2,589,582 Weighted Average Risk Rating 3.40 Portfolio Concentration Limit 65% of Total Loan Portfolio Portfolio Concentration Limit 500% of Total Regulatory Capital Total CRE Investment Portfolio = $6.33 Billion

NYSE: PFS Multi-family Composition (NY and Rent Stabilized sectors) 13 Total multi-family loan portfolio: $1.81 Billion • Of the total, 69 Loans on multi-family properties in the five boroughs of NYC, aggregate outstanding $186.8M Rent stabilized loan portfolio: $117.4 Million, (6.49% of multi-family loan portfolio) • Average balance: $3.0M • WALTV: 53.49% • DSCR of ~1.30x • All performing • Largest loan: $42.2 million with 67% LTV and 1.26x DSCR • 38 loans secured by 754 apartment units, of which 609 are rent stabilized • Maturities/Repricing: - 2024: $953K - 2029 & Beyond: $49.7M Multi-family balances by origination Year: • NY 2022 loans: $12.8 MM • NY 2021 loans: $8.3 MM • NY 2020 loans: $0.2 MM • All Multi-family 2022 loans: $172.2 MM • All Multi-family 2021 loans: $219.4 MM • All Multi-family 2020 loans: $292.2 MM MANHATTAN 13% OTHER NY BOROUGHS 70% OTHER NY 17% Total NY Multi-family Loans = $216.1 Million

NYSE: PFS CRE Office Composition 14 • Medical Office: approx. 39%, with LTV of 58% and DSCR 1.61x • Single Tenant: approx. 27%,with LTV of 59% and DSCR of 1.62x • LTVs> 60%: approx. 41% and weighted avg DSCR of 1.26x • Occupancy less than 80%: approx. 19%, with DSCR of 1.63x Maturity or Reprice by Year 2024 $60.7 M 2025 17.1 M 2026 110.1 M 2027 51.8 M 2028 66.9 M 2029 & BEYOND 176.5 M Total $483.1 M NEW JERSEY 60% MANHATTAN 2% OTHER NY BOROUGHS 12% OTHER NY 2% PENNSYLVANIA 17% OUT OF MARKET 7% No significant central business district exposure Total CRE Office Portfolio = $483.1 Million

Strong Credit Metrics 15 1.03% 0.84% 0.86% 0.99% 0.86% 0.91% 0.97% 1.01% 0.99% Total allowance to total loans 0.93% 0.59% 0.59% 0.56% 0.59% 0.48% 0.57% 0.52% 0.56% Non performing assets to Loans +REO 0.89% 0.50% 0.57% 0.46% 0.57% 0.35% 0.44% 0.37% 0.46%Total non-performing loans to total loans 0.71% 0.41% 0.44% 0.43% 0.44% 0.36% 0.42% 0.40% 0.43% Total non-performing assets as a percentage of total assets 0.06% (0.04%) 0.01% 0.08% 0.16% 0.03% 0.04% 0.21% 0.03% Net charge-off ratio Q2 2320212020 2022 Q4 22 Q1 232023 Q3 23 Q4 23

NYSE: PFS Non-Performing Assets $ in thousands Strong Credit Metrics 16 At December 12/31/2020 12/31/2021 12/31/2022 12/31/2023 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Mortgage loans: Residential $9,315 $6,072 $1,928 $853 $1,928 $1,744 $1,698 $1,329 $853 Commercial 31,982 16,887 28,212 5,151 28,212 6,815 7,279 11,667 5,151 Multi-family 0 439 1,565 744 1,565 1,548 2,314 2,258 744 Construction 1,392 2,365 1,878 771 1,878 1,874 1,874 1,868 771 Total mortgage loans 42,689 25,763 33,583 7,519 33,583 11,981 13,165 17,122 7,519 Commercial loans 42,118 20,582 24,188 41,487 24,188 23,129 31,885 21,912 41,487 Consumer loans 2,283 1,682 738 633 738 346 878 495 633 Total non-accruing loans 87,090 48,027 58,509 49,639 58,509 35,456 45,928 39,529 49,639 Accruing loans - 90 days or more delinquent - - - - - - - - - Total non-performing loans $87,090 $48,027 $58,509 $49,639 $58,509 $35,456 $45,928 $39,529 $49,639 Foreclosed assets 4,475 8,731 2,124 11,651 2,124 13,743 13,697 16,487 11,651 Total non-performing assets $91,565 $56,758 $60,633 $61,290 $60,633 $49,199 $59,625 $56,016 $61,290

NYSE: PFS $0 $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 $80,000 $90,000 2020 2021 2022 2023 Q4 22 Q1 23 Q2 23 Q3 23 Q4 23 Other income Net gain on securities transactions Bank-owned life insurance Insurance agency income Wealth management income Fees Emphasis on Fee Income Non-Interest Income $ in thousands 17 (1) Durbin Act negative impact starting July 1, 2021 of approximately $1.2 million per quarter and includes incremental revenue as a result of acquisition of SB One. (2) Other income for the quarter ended September 30, 2022 included an $8.6 million gain realized on the sale of a foreclosed commercial office property. 020 021 2 2 20 Q4 Q1 2 Q2 2 Q3 23 Q 23 Fees $23,847 $29,967 $28,128 $24,396 $6,612 $6,387 $5,775 $6,132 $6,102 Wealth management income 25,733 30,756 27,870 27,669 6,596 6,915 6,919 6,992 6,843 Insurance agency income 3,513 10,216 11,440 13,934 2,305 4,102 3,847 3,224 2,759 Bank-owned life insurance 6,491 7,930 5,988 6,482 2,010 1,484 1,534 1,820 1,644 Net gain on securities transactions 81 255 181 30 27 (5) 29 13 (7) Other income 12,766 7,685 14,182 7,318 716 3,269 1,283 1,139 1,627 Total non-interest income $72,431 $86,809 $87,789 $79,829 $18,266 $22,152 $19,387 $19,320 $18,968 (2) (1)

NYSE: PFS * Represents interest on lines of credit to Beacon clients, whose investment accounts are pledged as collateral. ** Does not include miscellaneous recovery of $303,291. Advisory 86% Trust & Estate 7% Tax 3% Private Banking 4% Focus on Wealth Management Business 2023 YTD Revenue Advisory $ 24,826,836 Trust & Estate $ 2,031,100 Tax $ 811,423 Private Banking $ 1,154,903 * Total $ 28,824,262 ** 18 $3.9 Billion AUM For 1,019 family relationships

NYSE: PFS AVERAGE CLIENT SIZE $3,789,000 As of December 31, 2023, based on AUM of $3.86B for 1,019 family relationships AVERAGE FEE 74 bps EBITDA & NET INCOME EBITDA (YTD December 31, 2023) $ 12,269,418 Net Income (YTD December 31, 2023) $ 8,513,750 CROSSOVER PROVIDENT/BEACON (HOW MANY PROVIDENT CUSTOMERS ARE BEACON CLIENTS) 112 Provident Bank households are also Beacon clients Focus on Wealth Management Business 19

NYSE: PFS • Provident acquired SB One Insurance Agency as part of the July 31, 2020 merger with SB One Bancorp. • In July of 2022 SB One Insurance Agency was rebranded as Provident Protection Plus, Inc. • Provident Protection Plus, Inc. provides insurance agency services including business, personal and employee benefits insurance products. • The insurance agency’s primary source of revenue is commission income earned from the sale of business and personal property and casualty insurance coverage for its customers with various insurance underwriters. • The insurance agency places property and casualty, life and health, and other coverage with about 25 different insurance carriers licensed in 37 states. Provident Protection Plus, Inc. 20 $1,995 $2,281 $2,402 $2,903 $3,595 $4,765 $778 $473 $1,953 $1,446 $874 $492 2018 2019 2020 2021 2022 2023 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Insurance Services Income Before Tax ($ in thousands) 5-year CAGR 19.02%

APPENDIX

NYSE: PFS Note: The Company has presented the following non-GAAP (Generally Accepted Accounting Principles) financial measures because it believes that these measures provide useful and comparative information to assess trends in the Company’s results of operations and financial condition. Presentation of these non-GAAP financial measures is consistent with how the Company evaluates its performance internally and these non-GAAP financial measures are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in the Company’s industry. Investors should recognize that the Company’s presentation of these non-GAAP financial measures might not be comparable to similarly-titled measures of other companies. These non-GAAP financial measures should not be considered a substitute for GAAP basis measures and the Company strongly encourages a review of its consolidated financial statements in their entirety. Reconciliation of GAAP to Non-GAAP Financial Measures 22 $ in thousands, except per share data) 2020 2021 2022 2023 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Core PTPP ROAA: Net Income 96,951$ 167,921$ 175,648$ 128,398$ 43,962$ 39,228$ 43,421$ 49,034$ 40,536$ 32,003$ 28,547$ 27,312$ Add: provision for credit losses 29,719 (24,339) 8,388 27,904 (6,405) 2,996 8,413 3,384 6,001 10,397 11,009 497 Add: provision for credit losses for off-balance sheet credit exposure 1,814 1,515 (3,384) 264 (2,390) (973) 1,575 (1,596) 739 (647) 1,532 (1,360) Add: income tax expense 30,603 59,197 64,458 47,381 15,231 14,337 16,657 18,234 14,454 11,630 8,843 12,456 Add: merger related charges 6,310 - 4,128 7,826 - - 2,886 1,242 1,100 1,960 2,289 2,477 Add: Contingent litigation reserves 3,000 3,000 Add: COVID-19 related costs 1,387 - - - - - - - - - - - Core PTPP earnings 166,784$ 204,294$ 249,238$ 214,773$ 50,398$ 55,588$ 72,952$ 70,298$ 62,830$ 55,343$ 52,220$ 44,382$ Avg Diluted Shares outstanding 69,625,958$ 76,560,840$ 74,782,370$ 74,873,256$ 75,914,079$ 74,400,788$ 74,393,380$ 74,443,511$ 74,702,527$ 74,830,187$ 74,914,205$ 75,041,545$ Core PTPP Earnings per Share 2.40$ 2.67$ 3.33$ 2.87$ 0.66$ 0.75$ 0.98$ 0.94$ 0.84$ 0.74$ 0.70$ 0.59$ Annualized Core PTPP earnings 166,784$ 204,294$ 249,238$ 214,773$ 204,392$ 222,963$ 289,429$ 278,900$ 254,811$ 221,980$ 207,177$ 176,081$ Average assets 11,337,140$ 13,338,911$ 13,642,849$ 13,915,467$ 13,693,429$ 13,541,209$ 13,622,564$ 13,714,201$ 13,732,708$ 13,833,055$ 13,976,610$ 14,114,626$ Core PTPP ROAA (Annualized Core PTPP earnings/average assets) 1.47% 1.53% 1.83% 1.54% 1.49% 1.65% 2.12% 2.03% 1.86% 1.60% 1.48% 1.25% 2020 2021 2022 2023 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 ROATE: Net income 96,951$ 167,921$ 175,648$ 128,398$ 43,962$ 39,228$ 43,421$ 49,034$ 40,536$ 32,003$ 28,547$ 27,312$ Annualized net income 96,951$ 167,921$ 175,648$ 128,398$ 178,290$ 157,343$ 172,268$ 194,537$ 164,396$ 128,364$ 113,257$ 108,357$ Average stockholders' equity 1,494,563$ 1,673,715$ 1,618,090$ 1,644,529$ 1,686,324$ 1,601,245$ 1,613,522$ 1,572,572$ 1,626,370$ 1,653,677$ 1,654,920$ 1,642,854$ Less: average intangible assets 449,711 465,214 462,620 459,503 463,890 463,039 462,180 461,402 460,631 459,865 459,133 458,410 Average tangible stockholders' equity 1,044,852$ 1,208,501$ 1,155,470$ 1,185,026$ 1,222,434$ 1,138,206$ 1,151,342$ 1,111,170$ 1,165,739$ 1,193,812$ 1,195,787$ 1,184,444$ ROATE (Annualized net income/average tangible stockholders' equity) 9.28% 13.89% 15.20% 10.84% 14.58% 13.82% 14.96% 17.51% 14.10% 10.75% 9.47% 9.15% Tangible book value per share: Stockholders' equity 1,619,797$ 1,697,096$ 1,597,703$ 1,690,596$ 1,621,131$ 1,585,265$ 1,550,985$ 1,597,703$ 1,640,080$ 1,642,471$ 1,622,970$ 1,690,596$ Less: intangible assets 466,212 464,183 460,892 457,942 463,325 462,451 461,673 460,892 460,132 459,383 458,663 457,942 Tangible stockholders' equity 1,153,585$ 1,232,913$ 1,136,811$ 1,232,654$ 1,157,806$ 1,122,814$ 1,089,312$ 1,136,811$ 1,179,948$ 1,183,088$ 1,164,307$ 1,232,654$ Shares outstanding 77,611,107 76,969,999 75,169,196 75,537,186 75,881,889 75,163,718 75,162,357 75,169,196 75,467,890 75,530,425 75,531,884 75,537,186 Tangible book value per share (Tangible stockholders' equity/shares outstanding) 14.86$ 16.02$ 15.12$ 16.32$ 15.26$ 14.94$ 14.49$ 15.12$ 15.64$ 15.66$ 15.41$ 16.32$

NYSE: PFS Note: The Company has presented the following non-GAAP (Generally Accepted Accounting Principles) financial measures because it believes that these measures provide useful and comparative information to assess trends in the Company’s results of operations and financial condition. Presentation of these non-GAAP financial measures is consistent with how the Company evaluates its performance internally and these non-GAAP financial measures are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in the Company’s industry. Investors should recognize that the Company’s presentation of these non-GAAP financial measures might not be comparable to similarly-titled measures of other companies. These non-GAAP financial measures should not be considered a substitute for GAAP basis measures and the Company strongly encourages a review of its consolidated financial statements in their entirety. ($ in thousands, except per share data) Reconciliation of GAAP to Non-GAAP Financial Measures 23 Annualized Adjusted Non-Interest Expense to Average Assets Three Months Ended Dec-23 Reported non-interest expense 74,491$ Adjustments to non-interest expense: Contingent litigation reserves 3,000 Credit loss expense for off-balance sheet credit exposures (1,360) Merger-related transaction costs and COVID-19 expenses 2,477 Adjusted non-interest expense 70,374$ Annualized adjusted non-interest expense 279,201$ Average assets 14,114,626 Annualized adjusted non-interest expense/average assets 1.98% Efficiency Ratio Calculation Three Months Ended Dec-23 Net Interest income 95,788$ Non-interest income 18,968 Total income 114,756$ Adjusted non-interest expense 70,374$ Efficiency ratio (adjusted non-interest expense/income) 61.32%

NYSE: PFS C & I – (Includes owner occupied) Loans by NAICS Sector – 12/31/23 24 NAIC Sector2 Loan Count Exposure ($) Balances ($) Real Estate and Rental and Leasing 720 720,117,509 503,275,119 Construction 451 516,129,329 227,035,253 Manufacturing 212 397,294,939 284,843,618 Health Care and Social Assistance 398 382,771,180 301,403,309 Wholesale Trade 192 305,828,715 214,522,807 Finance and Insurance 34 165,711,943 80,438,979 Retail Trade 158 159,315,335 130,046,047 Other Services (except Public Administration) 203 153,992,797 104,898,808 Educational Services 76 146,537,499 116,835,519 Professional, Scientific, and Technical Services 197 140,481,176 59,032,830 Arts, Entertainment, and Recreation 89 119,001,581 104,730,660 Administrative and Support and Waste Management and Remediation Services 176 114,170,147 86,259,018 Transportation and Warehousing 141 86,368,738 63,398,375 Accommodation and Food Services 110 84,028,999 70,232,485 Management of Companies and Enterprises 14 47,191,304 42,819,698 Agriculture, Forestry, Fishing and Hunting 10 25,587,685 23,218,268 Information 12 15,786,671 10,837,073 Public Administration 17 10,569,284 9,604,284 Utilities 15 8,276,949 5,451,949 Mining, Quarrying, and Oil and Gas Extraction 3 911,700 470,000 Grand Total 3,228 3,600,073,482 2,439,354,099

NYSE: PFS CRE Investment Portfolio Loans by NAICS Sector – 12/31/23 25 NAIC Sector2 Loan Count Exposure ($) Balances ($) Real Estate and Rental and Leasing 2,234 6,055,442,691 5,949,801,232 Accommodation and Food Services 42 160,497,786 160,313,114 Construction 32 55,691,367 53,294,320 Health Care and Social Assistance 22 48,379,575 48,060,330 Other Services (except Public Administration) 40 38,854,308 34,155,344 Retail Trade 16 22,172,495 22,172,495 Arts, Entertainment, and Recreation 4 19,799,376 19,799,376 Transportation and Warehousing 5 19,745,281 19,743,033 Educational Services 2 6,957,817 6,957,817 Manufacturing 6 5,260,307 5,260,307 Finance and Insurance 7 4,387,218 4,387,218 Professional, Scientific, and Technical Services 5 2,396,415 2,396,415 Management of Companies and Enterprises 2 2,065,009 2,065,009 Public Administration 21 1,821,976 821,976 Information 1 1,727,392 1,727,392 Administrative and Support and Waste Management and Remediation Services 1 571,426 571,426 Grand Total 2,440 6,445,770,439 6,331,526,804

NYSE: PFS Construction Loans by NAICS Sector – 12/31/23 26 NAIC Sector2 Loan Count Exposure ($) Balances ($) Real Estate and Rental and Leasing 74 949,451,110 587,534,554 Construction 8 81,640,000 25,396,334 Health Care and Social Assistance 2 21,359,500 21,359,500 Manufacturing 1 11,250,000 7,972,528 Arts, Entertainment, and Recreation 1 6,175,000 3,109,510 Other Services (except Public Administration) 1 5,800,000 4,298,307 Accommodation and Food Services 1 3,567,500 3,567,500 Grand Total 88 1,079,243,110 653,238,233

NYSE: PFS As of 12/31/23 ($ in thousands) CRE Investment Portfolio by Property Type 27 PROPERTY TYPE COUNT $ OUTSTANDING % OUTSTANDING WARR Multi-Family 542 1,817,510 28.71% 3.25 Retail 521 1,736,435 27.43% 3.36 Industrial 311 1,269,999 20.06% 3.35 Office 264 483,084 7.63% 3.56 Mixed 362 456,160 7.20% 3.57 Special Use Property 67 222,065 3.51% 3.59 Residential 335 161,945 2.56% 3.57 Hotel 31 151,156 2.39% 4.40 Land 12 33,174 0.52% 4.00 TOTAL PORTFOLIO 2,445 6,331,527 100.00% 3.40

NYSE: PFS Guideline is 300% of Regulatory Capital CRE to Total Risk-Based Capital 28 422.0% 440.8% 457.3% 471.6% 485.3% 499.6% 491.3% 490.9% 473.3% 477.8% 484.8% 485.9% 0.00% 100.00% 200.00% 300.00% 400.00% 500.00% 600.00% 12/31/18 12/31/19 12/31/20 12/31/21 03/31/22 06/30/22 09/30/22 12/31/22 03/31/23 06/30/23 09/30/23 12/31/23

NYSE: PFS Performance Ratios – PFS (HoldCo.) Capital 29 9. 30 9. 45 10 .0 0 10 .2 2 9. 41 9. 43 9. 62 9. 78 10 .0 0 10 .1 7 10 .2 2 10 .2 2 10 .2 2 10 .4 6 11 .4 7 11 .3 6 11 .4 5 10 .9 2 11 .5 6 11 .0 5 10 .9 1 11 .3 6 11 .6 6 11 .5 3 11 .4 4 11 .4 5 10 .5 8 11 .5 9 11 .4 7 11 .5 6 11 .0 4 11 .6 8 11 .1 6 11 .0 2 11 .4 7 11 .7 8 11 .6 3 11 .5 5 11 .5 6 11 .9 4 12 .2 5 12 .1 5 12 .3 9 11 .9 9 12 .3 2 11 .7 7 11 .7 1 12 .1 5 12 .5 3 12 .4 4 12 .4 0 12 .3 9 2020 2021 2022 2023 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Tier 1 leverage capital Common equity Tier 1 risk-based capital Tier 1 risk-based capital Total risk-based capital

NYSE: PFS Performance Ratios – Bank Capital 30 8. 75 8. 86 9. 51 9. 84 8. 86 8. 86 9. 13 9. 28 9. 51 9. 76 9. 84 9. 84 9. 849. 96 10 .8 7 10 .9 1 11 .1 2 10 .8 7 10 .9 8 10 .6 0 10 .4 6 10 .9 1 11 .3 0 11 .2 0 11 .1 3 11 .1 2 9. 96 10 .8 7 10 .9 1 11 .1 2 10 .8 7 10 .9 8 10 .6 0 10 .4 6 10 .9 1 11 .3 0 11 .2 0 11 .1 3 11 .1 2 11 .2 1 11 .5 3 11 .5 8 11 .9 5 11 .5 3 11 .6 1 11 .2 1 11 .1 4 11 .5 8 12 .0 6 12 .0 0 11 .9 8 11 .9 5 2020 2021 2022 2023 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Tier 1 leverage capital Common equity Tier 1 risk-based capital Tier 1 risk-based capital Total risk-based capital

Q1 2024 INVESTOR PRESENTATION