Document

INTRODUCTION

CONSOLIDATED FINANCIAL STATEMENTS | FOR THE THIRTEEN MONTHS ENDED SEPTEMBER 30, 2023 AND YEAR ENDED AUGUST 31, 2022 41 This Management’s Discussion and Analysis dated December 19, 2023 (this “MD&A”), should be read in conjunction with the audited annual consolidated financial statements (the “Financial Statements”) of Organigram Holdings Inc. (the “Company” or “Organigram”) for the thirteen months ended September 30, 2023 and the twelve months ended August 31, 2022 (“Q4 Fiscal 2023” when referring to the four months ended September 30, 2023), including the accompanying notes thereto.

In May 2023, to better align the Company's financial statement reporting requirements with other public companies and calendar quarters, the Company's Board of Directors approved a change in the Company's fiscal year end from August 31 to September 30. Fiscal 2024 commenced on October 1, 2023 and continues through September 30, 2024. As a result of the change in year end, the financial information presented in this MD&A for the current period is for Q4 Fiscal 2023 and Fiscal 2023 whereas the comparative period is for Q4 Fiscal 2022 and Fiscal 2022, respectively.

References to "Fiscal 2023" are to the thirteen months from September 1, 2022 through September 30, 2023, references to "Fiscal 2022" are to the twelve months from September 1, 2021 through August 31, 2022 and references to "Fiscal 2021" are to the twelve months from September 1, 2020 through August 31, 2021. Except as otherwise stated, for each fiscal year, references to "Q1" are to the three months from September 1 through November 30, references to "Q2" are to the three months from December 1 through February 28, references to "Q3" are to the three months from March 1 through May 31, and references to Q4 are to the three months from June 1 through August 31, with the exception of Q4 Fiscal 2023, which is for the four month period from June 1, 2023 through September 30, 2023.

Financial data in this MD&A is based on the Financial Statements of the Company for the thirteen months ended September 30, 2023, and has been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”), unless otherwise stated. All financial information in this MD&A is expressed in thousands of Canadian dollars (“$”), except for share and per share calculations, references to $ millions and $ billions, per gram (“g”) or kilogram (“kg”) of dried flower and per milliliter (“mL”) or liter (“L”) of cannabis extracts calculations.

This MD&A contains forward-looking information within the meaning of applicable securities laws, and the use of Non-IFRS Measures (as defined herein). Refer to “Cautionary Statement Regarding Forward-Looking Information” and “Cautionary Statement Regarding Certain Non-IFRS Measures” included within this MD&A.

The financial information in this MD&A also contains certain financial and operational performance measures that are not defined by and do not have any standardized meaning under IFRS but are used by management to assess the financial and operational performance of the Company. These include, but are not limited to, the following:

•Gross margin before fair value adjustments;

•Adjusted gross margin;

•Adjusted earnings before interest, taxes, depreciation and amortization ("Adjusted EBITDA"); and

•Free cash flow ("FCF").

The Company believes that these Non-IFRS Measures, in addition to conventional measures prepared in accordance with IFRS, enable investors to evaluate the Company’s operating results, underlying performance and prospects in a similar manner to the Company’s management. The Non-IFRS Measures are defined in the sections in which they appear. Adjusted gross margin and Adjusted EBITDA are reconciled to IFRS in the “Financial Results and Review of Operations” section of this MD&A.

As there are no standardized methods of calculating these Non-IFRS Measures, the Company’s approaches may differ from those used by others, and the use of these measures may not be directly comparable. Accordingly, these Non-IFRS Measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. Refer to "Cautionary Statement Regarding Certain Non-IFRS Measures" included within this MD&A.

This MD&A contains information concerning our industry and the markets in which we operate, including our market position and market share, which is based on information from independent third-party sources. Although we believe these sources to be generally reliable, market and industry data is inherently imprecise, subject to interpretation and cannot be verified with complete certainty due to limits on the availability and reliability of raw data, the voluntary nature of the data gathering process, and other limitations and uncertainties inherent in any statistical survey or data collection process. We have not independently verified any third-party information contained herein.

The Company’s wholly-owned subsidiary, Organigram Inc. ("OGI"), is a licensed producer of cannabis and cannabis derived products (a “Licensed Producer” or “LP”) under the Cannabis Act (Canada) and the Cannabis Regulations (Canada) (together, the “Cannabis Act”) and regulated by Health Canada. The Company’s former wholly-owned subsidiaries, The Edibles and Infusions Corporation (“EIC”) and Laurentian Organic Inc. ("Laurentian"), were also licensed under the Cannabis Act until their amalgamation with Organigram Inc. effective October 1, 2023 to form a single entity as "OGI".

MANAGEMENT’S DISCUSSION AND ANALYSIS | FOR THE THIRTEEN MONTHS ENDED SEPTEMBER 30, 2023 AND YEAR ENDED AUGUST 31, 2022 1 The Company’s head office is located at 1400-145 King Street West, Toronto, Ontario, M5H 1J8.

The Company's registered office is located at 35 English Drive, Moncton, New Brunswick, E1E 3X3. The Company’s common shares (“Common Shares”) are listed under the ticker symbol “OGI” on both the Nasdaq Global Select Market (“NASDAQ”) and on the Toronto Stock Exchange (“TSX”). Any inquiries regarding the Company may be directed by email to investors@organigram.ca.

Additional information relating to the Company, including the Company’s most recent annual information form (the “AIF”), is available under the Company’s issuer profile on the Canadian Securities Administrators’ System for Electronic Document Analysis and Retrieval (“SEDAR+”) at www.sedarplus.com. The Company’s reports and other information filed with or furnished to the United States Securities and Exchange Commission (“SEC”) are available on the SEC’s Electronic Document Gathering and Retrieval System (“EDGAR”) at www.sec.gov.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Certain information herein contains or incorporates comments that constitute forward-looking information within the meaning of applicable securities legislation (“forward-looking information”). Forward-looking information, in general, can be identified by the use of forward-looking terminology such as “outlook”, “objective”, “may”, “will”, “could”, “would”, “might”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “plan”, “continue”, “budget”, “schedule” or “forecast” or similar expressions suggesting future outcomes or events. They include, but are not limited to, statements with respect to expectations, forecasts or other characterizations of future events or circumstances, and the Company’s objectives, goals, strategies, beliefs, intentions, plans, estimates, projections and outlook, including statements relating to the Company’s plans and objectives, or estimates or predictions of actions of customers, suppliers, partners, distributors, competitors or regulatory authorities; and statements regarding the Company’s future economic performance. These statements are not historical facts but instead represent management beliefs regarding future events, many of which by their nature are inherently uncertain and beyond management control. Forward-looking information in this MD&A is based on the Company’s current expectations about future events.

Certain forward-looking information in this MD&A includes, but is not limited to the following:

•Moncton Campus (as defined herein), Winnipeg Facility (as defined herein) and Lac-Supérieur Facility (as defined herein) licensing and production capacity and timing thereof;

•Expectations regarding production capacity, facility size, THC (as defined herein) content, costs and yields;

•Expectations regarding the prospects of the Company’s collaboration and proposed investment transaction with a wholly-owned subsidiary of British American Tobacco p.l.c. ("BAT");

•Expectations regarding the prospects for the Company’s subsidiary Organigram Inc. (formerly, Organigram, EIC and Laurentian);

•Expectations regarding the outcome and timing of the Health Canada redetermination following the Judicial Review decision in respect of the Company's Edison Jolts product ("Jolts");

•Expectations around demand for cannabis and related products, future opportunities and sales, including the relative mix of medical versus adult-use recreational cannabis products, the relative mix of products within the adult-use recreational category including wholesale and international, the Company’s financial position, future liquidity and other financial results;

•Changes in legislation related to permitted cannabis types, forms and potency and legislation of additional cannabis types and forms for adult-use recreational cannabis in Canada, including regulations relating thereto, the timing and the implementation thereof, and our future product forms;

•Expectations around branded products and derivative-based products with respect to timing, launch, product attributes, composition and consumer demand;

•Expectations about the Company's ability to develop current and future vapour hardware, and the Company's ability to enter and expand its share of the vapour market;

•The scope of protection the Company is able to establish and maintain, if any, for its intellectual property ("IP") rights;

•Strategic investments and capital expenditures, and expected related benefits;

•The expectation that the planned technical arrangement between Organigram and Phylos Bioscience Inc. ("Phylos") will permit Organigram to transition a portion of its garden to seed-based cultivation over time, and the anticipated benefits of seed-based production;

•The expectations regarding the Company's investment in Greentank (as defined herein);

•Expectations regarding the resolution of litigation and other legal proceedings;

•The general continuance of current, or where applicable, assumed industry conditions;

•Changes in laws, regulations and guidelines, including those relating to the recreational and/or medical cannabis markets domestically and internationally;

•Changes in laws, regulations, guidelines and policies, including those related to minor cannabinoids;

•The price of cannabis and derivative cannabis products;

•Expectations around the availability and introduction of new genetics including consistency and quality of seeds and plants and the characteristics thereof;

•The impact of the Company’s cash flow and financial performance on third parties, including its supply partners;

MANAGEMENT’S DISCUSSION AND ANALYSIS | FOR THE THIRTEEN MONTHS ENDED SEPTEMBER 30, 2023 AND YEAR ENDED AUGUST 31, 2022 2

•Fluctuations in the price of Common Shares and the market for Common Shares;

•The treatment of the Company’s business under governmental regulatory regimes and tax laws, including the Excise Act 2001 and the renewal of the Company’s licenses thereunder and the Company’s ability to obtain export licenses from time to time;

•The treatment of the Company's business under international regulatory regimes and impacts on changes thereto to the Company's international sales;

•Expectations related to the war between Israel and Hamas and its impact on the supply of product and collection of accounts receivable in the market and the demand of product in Israel;

•The Company’s growth strategy, targets for future growth and forecasts of the results of such growth;

•Expectations concerning access to capital and liquidity, the consummation of the Follow-on BAT Investment (as defined below) and the Company’s ability to access the public markets from time to time to fund operational activities and growth;

•The Company’s ability to remain listed on the TSX and NASDAQ and the impact of any actions it may be required to take to remain listed;

•The ability of the Company to generate cash flow from operations and from financing activities;

•The competitive conditions of the industry, including the Company’s ability to maintain or grow its market share;

•Expectations regarding the Company's ability to generate cost savings from new operational effectiveness and automation initiatives;

•Expectations regarding capital expenditures, current and targeted production capacity and timing thereof; and

•Expectations concerning the Company's performance during Q1 Fiscal 2024, including with respect to revenue, adjusted gross margin, selling, general and administrative expenses ("SG&A"), Adjusted EBITDA and Free cash flows ("FCF").

Forward-looking information is provided for the purposes of assisting the reader in understanding the Company and its business, operations, risks, financial performance, financial position and cash flows as at and for the periods ended on certain dates, and to present information about management’s current expectations and plans relating to the future, and the reader is cautioned that such statements may not be appropriate for other purposes. In addition, this MD&A may contain forward-looking information attributed to third party industry sources. Undue reliance should not be placed on forward-looking information, as there can be no assurance that the plans, intentions or expectations upon which they are based will occur. Forward-looking information does not guarantee future performance and involves known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in the forward-looking information. By its nature, forward-looking information involves numerous assumptions, known and unknown risks and uncertainties, both general and specific, that contribute to the possibility that the expectations, predictions, forecasts, projections and conclusions will not occur or prove accurate, that assumptions may not be correct, and that objectives, strategic goals and priorities will not be achieved. These and other factors may cause actual results or events to differ materially from those anticipated in the forward-looking information.

Factors that could cause actual results to differ materially from those set forth in forward-looking information include, but are not limited to: financial risks; cyber security risks; dependence on senior management and other key personnel, the board of directors of the Company (the “Board of Directors”), consultants and advisors; availability and sufficiency of insurance including continued availability and sufficiency of director and officer and other forms of insurance; the Company and its subsidiaries being able to, where applicable, cultivate cannabis pursuant to applicable law and on the currently anticipated timelines and in anticipated volumes; industry competition; global events, including heightened economic and industry uncertainty as a result of COVID-19 (as defined herein) and governmental action in respect thereto, including with respect to impacts on production, operations, disclosure controls and procedures or internal control over financial reporting, and supply chain and distribution disruptions; facility and technological risks; changes to government laws, regulations or policy, including environmental or tax, or the enforcement thereof; agricultural risks; ability to maintain any required licenses or certifications; supply risks; product risks; construction delays or postponements; packaging and shipping logistics; inflationary risk, expected number of medical and adult-use recreational cannabis users in Canada and internationally; potential time frame for the implementation of legislation to legalize cannabis internationally; the Company’s, its subsidiary's and its investees’ ability to, where applicable, obtain and/or maintain their status as Licensed Producers or other applicable licenses; risk factors affecting its investees; availability of any required financing on commercially attractive terms or at all; the potential size of the regulated adult-use recreational cannabis market in Canada; demand for and changes in the Company’s cannabis and related products, including the Company’s derivative products, and the sufficiency of the retail networks to supply such demand; ability of the Company to develop current and future vapour hardware and to expand into the vapour market; ability to enter and participate in international market opportunities; general economic, financial market, regulatory, industry and political conditions affecting the Company, expectations related to the war between Israel and Hamas and its impact on the supply of product in the market and the demand for product in Israel as well as the impact of the war on collection of accounts receivable; the ability of the Company to compete in the cannabis industry and changes in the competitive landscape; a material decline in cannabis prices; the Company’s ability to manage anticipated and unanticipated costs; the Company’s ability to implement and maintain effective internal control over financial reporting and disclosure controls and procedures; risk relating to potential failure of the Company's information technology (IT) system; the timing for the stabilization of the Company's enterprise resource planning ("ERP") system; continuing to meet listing standards for the TSX and the NASDAQ; risk relating to the Company's IP; liquidity risk; concentration risk; and, other risks and factors described from time to time in the documents filed by the Company with securities regulators in Canada and the United States. Material factors and assumptions used in establishing forward-looking information include that production activities will proceed as planned, and

MANAGEMENT’S DISCUSSION AND ANALYSIS | FOR THE THIRTEEN MONTHS ENDED SEPTEMBER 30, 2023 AND YEAR ENDED AUGUST 31, 2022 3 demand for cannabis and related products will change in the manner expected by management.

All forward-looking information is provided as of the date of this MD&A.

The Company does not undertake to update any such forward-looking information whether as a result of new information, future events or otherwise, except as required by law.

ADDITIONAL INFORMATION ABOUT THE ASSUMPTIONS, RISKS AND UNCERTAINTIES OF THE COMPANY’S BUSINESS AND MATERIAL FACTORS OR ASSUMPTIONS ON WHICH INFORMATION CONTAINED IN FORWARD-LOOKING INFORMATION IS BASED IS PROVIDED IN THE COMPANY’S DISCLOSURE MATERIALS, INCLUDING IN THIS MD&A UNDER “RISK FACTORS” AND THE COMPANY’S CURRENT AIF UNDER “RISK FACTORS”, FILED WITH THE SECURITIES REGULATORY AUTHORITIES IN CANADA AND AVAILABLE UNDER THE COMPANY’S ISSUER PROFILE ON SEDAR+ AT WWW.SEDARPLUS.COM, AND FILED WITH OR FURNISHED TO THE SEC AND AVAILABLE ON EDGAR AT WWW.SEC.GOV. ALL FORWARD-LOOKING INFORMATION IN THIS MD&A IS QUALIFIED BY THESE CAUTIONARY STATEMENTS.

CAUTIONARY STATEMENT REGARDING CERTAIN NON-IFRS MEASURES

This MD&A contains certain financial and operational performance measures that are not recognized or defined under IFRS (“Non-IFRS Measures”). As there are no standardized methods of calculating these Non-IFRS Measures, the Company's approaches may differ from those used by others, and, this data may not be comparable to similar data presented by other Licensed Producers of cannabis and cannabis companies. For an explanation of these measures to related comparable financial information presented in the Financial Statements prepared in accordance with IFRS, refer to the discussion below.

The Company believes that these Non-IFRS Measures are useful indicators of operating performance and are specifically used by management to assess the financial and operating performance of the Company. These Non-IFRS Measures include, but are not limited, to the following:

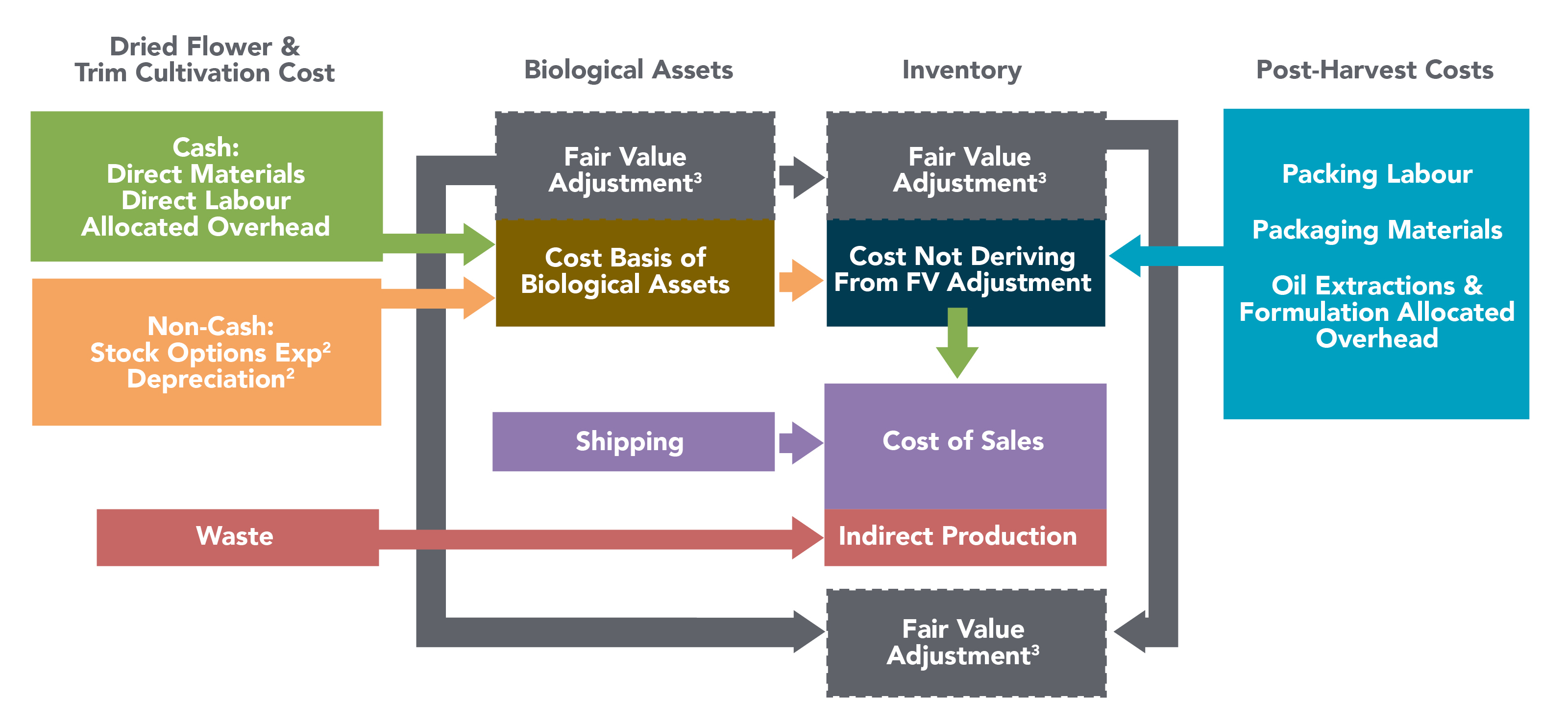

•Gross margin before fair value adjustments is calculated by subtracting cost of sales, before the effects of unrealized gain on changes in fair value of biological assets, realized fair value on inventories sold and other inventory charges from total net revenue. Gross margin before fair value adjustments percentage is calculated by dividing gross margin before fair value adjustments (defined above) by net revenue.

Management believes that these measures provide useful information to assess the profitability of our cannabis operations as they exclude the effects of non-cash fair value adjustments on inventory, biological assets and other charges, which are required by IFRS.

•Adjusted gross margin is calculated by subtracting cost of sales, before the effects of: (i) unrealized gain on changes in fair value of biological assets; (ii) realized fair value on inventories sold and other inventory charges; (iii) provisions (recoveries) of inventories and biological assets; (iv) provisions to net realizable value; and (v) unabsorbed overhead relating to underutilization of the production facility grow rooms and manufacturing equipment, most of which is related to non-cash depreciation expense, from net revenue. Adjusted gross margin percentage is calculated by dividing adjusted gross margin by net revenue. Adjusted gross margin is reconciled to the most directly comparable IFRS financial measure in the "Financial Results and Review of Operations" section of this MD&A.

Management believes that these measures provide useful information to assess the profitability of our operations as they represent the normalized gross margin generated from operations and exclude the effects of non-cash fair value adjustments on inventories and biological assets, which are required by IFRS. The most directly comparable measure to adjusted gross margin calculated in accordance with IFRS is gross margin before fair value adjustments.

•Adjusted EBITDA is calculated as net income (loss) excluding: financing costs, net of investment income; income tax expense (recovery); depreciation, amortization, reversal of/or impairment, normalization of depreciation add-back due to changes in depreciable assets resulting from impairment charges, (gain) loss on disposal of property, plant and equipment (per the consolidated statement of cash flows); share-based compensation (per the consolidated statement of cash flows); share of loss from investments in associates and impairment loss (recovery) from loans receivable; change in fair value of contingent consideration; change in fair value of derivative liabilities and other financial assets; expenditures incurred in connection with research and development activities (net of depreciation); unrealized gain on changes in fair value of biological assets; realized fair value on inventories sold and other inventory charges; provisions (recoveries) and net realizable value adjustments related to inventory and biological assets; Government subsidies and insurance recoveries; legal provisions (recoveries); incremental fair value component of inventories sold from acquisitions; ERP implementation costs; transaction costs; and share issuance costs. Adjusted EBITDA is reconciled to the most directly comparable IFRS financial measure in the "Financial Results and Review of Operations" section of this MD&A.

MANAGEMENT’S DISCUSSION AND ANALYSIS | FOR THE THIRTEEN MONTHS ENDED SEPTEMBER 30, 2023 AND YEAR ENDED AUGUST 31, 2022 4 Adjusted EBITDA is intended to provide a proxy for the Company’s operating cash flow and derives expectations of future financial performance for the Company, and excludes adjustments that are not reflective of current operating results.

The most directly comparable measure to Adjusted EBITDA calculated in accordance with IFRS is net income (loss).

•FCF is a non-IFRS financial measure that deducts capital expenditures from net cash provided by or used in operating activities. The Company believes this to be a useful indicator of its ability to operate without reliance on additional borrowing or usage of existing cash. FCF is intended to provide additional information only and does not have any standardized definition under IFRS and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. FCF is not necessarily indicative of operating profit or cash flow from operations as determined under IFRS. Other companies may calculate this measure differently.

Non-IFRS Measures should be considered together with other data prepared in accordance with IFRS to enable investors to evaluate the Company’s operating results, underlying performance and prospects in a manner similar to the Company’s management. Accordingly, these Non-IFRS Measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

BUSINESS OVERVIEW

NATURE AND HISTORY OF THE COMPANY’S BUSINESS

The Company’s wholly-owned subsidiary Organigram Inc. is a Licensed Producer of cannabis under the Cannabis Act.

The Company is authorized for wholesale shipping of cannabis plant cuttings, dried flower, blends, pre-rolls and cannabis derivative-based products to licensed retailers and wholesalers for adult-use recreational cannabis under the individual provincial and territorial regulations as per the Cannabis Act.

The Company is also authorized to distribute cannabis for medical use. In Fiscal 2022, Organigram made a strategic decision to shift its medical distribution fulfillment approach from direct shipment to patients from the Company to fulfillment via Medical Cannabis by Shoppers Drug Mart. On March 28, 2023, Shoppers Drug Mart announced that it would be transferring its medical cannabis business to Avicanna Inc. In July 2023, Organigram announced its products became available on Avicanna's MyMedi platform, providing Organigram products to medical patients across Canada.

The Company conducts its operations at its facilities located in Moncton, New Brunswick, Winnipeg, Manitoba and Lac-Supérieur, Québec. The Company has expanded its main facility in Moncton over time to create additional production capabilities by strategically acquiring land and buildings adjacent to the main facility (the “Moncton Campus”), including to add capacity for the manufacture of derivative product forms. In Fiscal 2022, the Phase 4C expansion at Moncton was completed which increased the grow rooms available for flowering to 115 and the approximate annual capacity to 85,000 kg of flower. The total capacity of the Moncton Campus will continue to fluctuate as the Company further refines its growing methods and room utilization.

In March 2021, the Company formed a Product Development Collaboration ("PDC") with BAT, a leading, multi-category consumer goods business, and established a "Centre of Excellence" (the "CoE") to focus on the next generation of cannabis products across a range of cannabinoids and product formats. The CoE is located at the Moncton Campus, which holds the Health Canada licenses required to conduct research and development activities with cannabis products. Both companies contributed scientists, researchers, and product developers to the CoE which is governed and supervised by a steering committee consisting of an equal number of senior members from both companies. Under the terms of the Product Development Collaboration agreement between the parties dated March 10, 2021, (the "PDC Agreement"), both Organigram and BAT have access to certain of each other’s IP and, subject to certain limitations, have the right to independently, globally commercialize the products, technologies and IP created by the CoE pursuant to the PDC Agreement. In November 2023, the Company announced a $124.6 million follow-on strategic equity investment from BT DE Investments Inc., a wholly-owned subsidiary of BAT (the "Follow-on BAT Investment").

During April 2021, the Company expanded its manufacturing and production footprint with the acquisition of EIC, located in Winnipeg, Manitoba (the "Winnipeg Facility"). The Winnipeg Facility holds a research license and standard sale and processing license under the Cannabis Act. The acquisition enabled the Company to penetrate a new product category and gain expertise in the confectionary space. By leveraging its consumer product and marketing expertise, as of the end of Fiscal Q4 2023 Organigram held the #1 share of the gummy category1 after the integration of the Winnipeg Facility.

The Company has additional cannabis production capacity at its facility located in Lac-Supérieur, Québec (the "Lac-Supérieur Facility"), acquired on December 21, 2021 as part of the Company's acquisition of Laurentian Organic Inc. The Lac-Supérieur Facility has a cultivation focus on artisanal craft flower and on the production of hash, a cannabis derivative. The Lac-Supérieur Facility provides the Company with a foothold in the important Québec market, and also adds to the Company's premium product portfolio, providing further opportunities for margin expansion. The Lac-Supérieur Facility holds a standard processing and

1 As of September 30 2023 - Multiple sources (Hifyre, Weedcrawler, Provincial Board Data, Internal Modelling)

MANAGEMENT’S DISCUSSION AND ANALYSIS | FOR THE THIRTEEN MONTHS ENDED SEPTEMBER 30, 2023 AND YEAR ENDED AUGUST 31, 2022 5 cultivation license under the Cannabis Act.

As of the end of Fiscal Q4 2023, Organigram holds the #1 position in the Hash category nationally1. Site expansion at Lac-Supérieur was completed in Fiscal 2023, and the Company harvested its first craft cannabis from new grow rooms in December 2023.

STRATEGY

Organigram’s strategy is to leverage its broad brand and product portfolio and culture of innovation to increase market share, drive profitability and grow into an industry leader that delivers long-term shareholder value.

The pillars of the Company’s strategy are:

1.Innovation;

2.Consumer Focus;

3.Efficiency; and

4.Market Expansion.

1. Innovation

Meeting the demands of a fast-growing industry with changing consumer preferences requires the ability to innovate and create breakthrough products that are embraced by the market and establish a long-term competitive advantage.

The Company is committed to maintaining a culture of innovation and has established a track record of introducing differentiated products that are able to quickly capture market share, specifically:

•SHRED: the first milled flower product blended to create curated flavour profiles;

•Edison Jolts: Canada’s first flavoured high-potency lozenge with 100 mg of tetrahydrocannabinol ("THC") per package. See the "July 2023" update in the "Key Developments During the Quarter and Subsequent to September 30, 2023" section of this MD&A. The outcome and timing of the Health Canada redetermination as to proper categorization of the Company's Edison Jolts product as an "extract" or "edible" under the Cannabis Regulations, which has been ordered in response to the Company's application for Judicial Review (as defined herein), remains uncertain;

•Monjour Wellness gummies: The CBD-focused wellness brand available in a large format and providing multiple flavours in one package;

•SHRED X Rip-Strip hash: Botanical terpene-infused hash with 10 pre-cut strips available in a two gram format is the first of its kind in the Canadian cannabis industry;

•SHRED X Heavies: A line of ultra-high THC infused pre-rolls, infused with both diamonds and distillate. SHRED X Heavies is the first pre-roll offering from Organigram that has a potency of over 40% THC. The infusion of botanical terpenes further enhances the natural terpene profile of the cannabis blends;

•THCV gummies: Launched under Organigram's SHRED and Trailblazer brands, delivering the first whole-flower derived tetrahydrocannabivarin (THCV) products in the Canadian market. THCV offers consumers a differentiated experience compared to THC, with reports of appetite suppression and a more calm and focused experience; and

•SHRED Dartz and Holy Mountain Holy Smokes tube-style pre-rolls: These pre-rolls deliver a consumer friendly and familiar format in a sleek and low-profile package.

Consistent with its innovation culture, in Fiscal 2021, the Company announced the launch of its CoE as part of its PDC with BAT, a leading multi-category consumer goods business. The CoE focuses on research and development to develop the next generation of cannabis products, with an initial focus on cannabidiol (CBD) that has since broadened to include other cannabinoids and novel product formats.

2. Consumer Focus

The Company seeks to address the changing needs of the adult cannabis consumer through its broad product portfolio with offerings in the most popular categories and price points. Based on ongoing consumer research, the portfolio is refreshed frequently with different flower strains, new package formats and new product introductions. The Company’s alignment with consumers is evidenced by its #2 market position2 at the end of Fiscal Q4, 2023, and category leadership:

•SHRED products have been introduced in multiple categories with the brand producing ~$190 million in retail sales in the last 12 months3;

•Hash: after acquiring the Lac Superieur Facility in December 2021, the Company expanded Tremblant Hash distribution nationally and added new SKUs to its hash offering, including the innovative Rip-Strip Hash product. On September 30, 2023, the Company held the #1 market position3 in the hash category;

•HOLY MOUNTAIN: a new offering in the value sector consisting of unique flower strains, pressed hash, and tube-style pre-rolls;

2 As of September 30, 2023 - Multiple sources (Hifyre, Weedcrawler, OCS wholesale sales and e-commerce orders shipped data, provincial boards data and internal sales data)

3 Hifyre, September 30, 2023

MANAGEMENT’S DISCUSSION AND ANALYSIS | FOR THE THIRTEEN MONTHS ENDED SEPTEMBER 30, 2023 AND YEAR ENDED AUGUST 31, 2022 6

•Edison Jolts: #1 position for capsules4. See the "July 2023" update in the "Key Developments During the Quarter and Subsequent to September 30, 2023" section of this MD&A; and

•SHRED’ems gummies and Monjour soft chews: among the top-selling gummies in Canada. As of the end of Fiscal Q4, 2023, Organigram holds the #1 market position in the gummy category2 with Monjour being the best-selling CBD-only gummy.

In addition to third-party and direct consumer research, the Company maintains close contact with consumers through an active social media presence and has established the Cannabis Innovators Panel. This online panel engages with up to 2,500 cannabis consumers across Canada on a regular basis and helps to inform the Company on product development and brand initiatives.

3. Efficiency

From its inception, the Company has remained committed to being an efficient operator.

The Company’s growing facility in Moncton, New Brunswick utilizes three-tier cultivation technology to maximize square footage. The facility has proprietary information technology in place to track all aspects of the cannabis cultivation and harvest process. The Company maintains a continuous improvement program designed to maximize harvest yield while reducing operating costs. This is complemented by the introduction of automation in post-harvest production, including high-speed pouch packing, pre-roll machines and automated excise stamping.

The Winnipeg Facility is highly-automated and is able to efficiently handle both small-batch artisanal manufacture of edibles as well as large-scale nutraceutical-grade production. The Winnipeg Facility provides the Company with the ability to produce a wide range of high-quality edible products at attractive price points.

The Lac-Supérieur Facility houses a cultivation and derivatives processing facility. As at September 30, 2023, the cumulative post acquisition capital investment has been approximately $13 million. This investment has expanded the Lac-Supérieur Facility to increase capacity, processing and storage space, and deliver on automation.

Key efficiency milestones achieved in Fiscal 2023 include:

•Significant reduction in cultivation costs at the Moncton Campus, achieving a 32% reduction to the cost of cultivation from Fiscal 2022's average amount;

•Increasing the harvested volume by over 60% and increasing volume of flower exceeding 24% THC levels compared to Fiscal 2022 at the Moncton Campus. THC levels were up 14% on average compared to FY2022;

•Internal testing including cannabinoid testing and Radsource machine implementation in Moncton;

•Completion of conversion to 17,000 LED lights in Moncton, resulting in 37% energy consumption savings;

•Transitioned to fractional watering and staggered lighting in Moncton, reducing water consumption and lowering peak energy consumption rates;

•Completion of Cantos and CME machine installations resulting in pre-roll volume of up to 2.8 million pre-rolls per month; and

•$4.3 million in cost savings realized in Fiscal 2023 related to automating pouch lines, internalizing testing and remediation, rapid drying, fractional watering, and strategic sourcing initiatives.

4. Market Expansion

The Company is committed to expanding its market presence by adding to its product offerings and enhancing its geographical presence. This strategy is enabled by strategic merger and acquisition opportunities and assessing expansion into international markets.

Examples of market expansion include:

•The strategic acquisitions of (i) EIC which added a purpose-built, highly-automated, 51,000-square-foot cannabis edibles manufacturing facility, and (ii) Laurentian, whose Lac-Supérieur Facility added craft cultivation and hash to Organigram's product portfolio and increased the Company's presence in Québec; and

•Shipments to Canndoc Ltd. ("Canndoc") in Israel and Cannatrek Medical Pty Ltd. ("Cannatrek") and MedCan Australia Pty Ltd. ("MedCan") in Australia to supply bulk cannabis into these markets. In fiscal Q3, 2023, the Company signed additional supply agreements with Sanity Group GmbH ("Sanity Group") to supply medical cannabis to the German market, and 4C Labs Ltd. ("4C LABS") to supply medical cannabis to the UK market.

4 Hifyre, February 28, 2023, data extracted from March 28, 2023

MANAGEMENT’S DISCUSSION AND ANALYSIS | FOR THE THIRTEEN MONTHS ENDED SEPTEMBER 30, 2023 AND YEAR ENDED AUGUST 31, 2022 7 Note 1: Equals gross margin before fair value adjustments (as reflected in the Financial Statements) divided by net revenue.

KEY QUARTERLY FINANCIAL AND OPERATING RESULTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q4-2023 |

|

Q4-2022 |

|

CHANGE |

|

% CHANGE |

| Financial Results |

|

|

|

|

|

|

|

| Gross revenue |

$ |

71,458 |

|

|

$ |

65,657 |

|

|

$ |

5,801 |

|

|

9 |

% |

| Net revenue |

$ |

46,040 |

|

|

$ |

45,480 |

|

|

$ |

560 |

|

|

1 |

% |

| Cost of sales |

$ |

42,885 |

|

|

$ |

36,718 |

|

|

$ |

6,167 |

|

|

17 |

% |

Gross margin before fair value adjustments(2) |

$ |

3,155 |

|

|

$ |

8,762 |

|

|

$ |

(5,607) |

|

|

(64) |

% |

Gross margin % before fair value adjustments(1) |

7 |

% |

|

19 |

% |

|

(12) |

% |

|

(63) |

% |

Operating expenses |

$ |

45,550 |

|

|

$ |

22,788 |

|

|

$ |

22,762 |

|

|

100 |

% |

Other income |

$ |

(1,275) |

|

|

$ |

(2,097) |

|

|

$ |

822 |

|

|

39 |

% |

Adjusted EBITDA(2) |

$ |

(2,360) |

|

|

$ |

3,232 |

|

|

$ |

(5,592) |

|

|

(173) |

% |

Net loss |

$ |

(32,991) |

|

|

$ |

(6,144) |

|

|

$ |

(26,847) |

|

|

(437) |

% |

|

|

|

|

|

|

|

|

Net cash used in operating activities |

$ |

17,017 |

|

|

$ |

19,695 |

|

|

$ |

(2,678) |

|

|

(14) |

% |

|

|

|

|

|

|

|

|

Adjusted Gross Margin(2) |

$ |

7,939 |

|

|

$ |

10,362 |

|

|

$ |

(2,423) |

|

|

(23) |

% |

Adjusted Gross Margin %(2) |

17 |

% |

|

23 |

% |

|

(6) |

% |

|

(26) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Results |

|

|

|

|

|

|

|

Kilograms harvested - dried flower |

28,071 |

|

|

16,101 |

|

|

11,970 |

|

|

74 |

% |

| Kilograms sold - dried flower |

19,429 |

|

|

18,102 |

|

|

1,327 |

|

|

7 |

% |

Note 2: Gross Margin Before Fair Value Adjustments, Adjusted EBITDA, Adjusted Gross Margin and Adjusted Gross Margin % are non-IFRS measures. See "Cautionary Statement Regarding Certain Non-IFRS Measures" and "Financial Results and Review of Operations" in this MD&A.

REVENUE

For Q4 Fiscal 2023, the Company reported $46,040 in net revenue. Of this amount $44,596 (97%) was attributable to sales to the adult-use recreational cannabis market, $469 (1%) to the international market, $707 (2%) to the medical market and $268 (1%) to other revenues. Q4 Fiscal 2023 net revenue increased 1%, or $560, from Q4 Fiscal 2022 net revenue of $45,480, primarily due to an increase of $7,075 in adult-use recreational cannabis revenue, which was mostly offset by a decrease in international revenue of $5,427, and a decrease in medical revenue by $981.

Sale of flower from all product categories in the recreational market comprised 66% of total net revenue in the quarter. The average net selling price ("ASP") of recreational flower decreased to $1.59 per gram in Q4 Fiscal 2023 as compared to $1.75 per gram in Q4 Fiscal 2022, as both the Company and the Canadian cannabis industry continued to experience general price compression in the adult-use recreational markets as the customer and product mix evolved to focus more on value offerings. Selling prices are prone to fluctuation and there may be further price compression if the market remains oversupplied. The Company is committed to refining its product mix as customer preferences evolve and it is revitalizing its Trailblazer brand and adding craft flower to its Laurentian brand, supplied by its Lac-Supérieur facility.

The volume of flower sales in grams increased 7% to 19,429 kg in Q4 Fiscal 2023 compared to 18,102 kg in the prior year comparative quarter, primarily as a result of the four months period compared to the three months period in the comparative year. This increase was partially offset by a reduction in recreational flower sales during the current period.

COST OF SALES

Cost of sales for the four months ended September 30, 2023 increased to $42,885 compared to $36,718 in Q4 Fiscal 2022, primarily as a result of an increase in inventory provisions and sales volume in the adult-use recreational cannabis market. Included in Q4 Fiscal 2023 cost of sales are $4,784 of inventory provisions for unsaleable inventories. The prior fiscal year’s comparative quarter had inventory provisions adjustments of $1,600.

GROSS MARGIN BEFORE FAIR VALUE ADJUSTMENTS AND ADJUSTED GROSS MARGIN

The Company realized gross margin before fair value adjustments5 for the four months ended September 30, 2023 of $3,155, or 7% as a percentage of net revenue, compared to $8,762, or 19%, in the prior year comparative period. The decrease in gross margin before fair value adjustments as a percentage of net revenue is primarily due to lower international revenue and higher cost of s

5 Gross margin before fair value adjustments is a non-IFRS financial measure. See the cautionary statement regarding non-IFRS financial measures in the “Introduction” section of this MD&A, and the discussion under the heading “Gross margin before fair value adjustments” and the reconciliation to IFRS measures in the “Financial Results and Review of Operations” section of this MD&A.

MANAGEMENT’S DISCUSSION AND ANALYSIS | FOR THE THIRTEEN MONTHS ENDED SEPTEMBER 30, 2023 AND YEAR ENDED AUGUST 31, 2022 8 ales per unit.

The cost of sales per unit was higher primarily due to higher inventory provisions for unsaleable inventories and net realizable value adjustments.

Adjusted gross margin6 for the four months ended September 30, 2023 was $7,939, or 17% as a percentage of net revenue, compared to $10,362, or 23%, in the prior year comparable quarter. The decline is attributable to lower international revenue, higher cost of sales per unit and the restriction of sale imposed by Health Canada on Edison Jolts described in the "Key Developments During the Quarter and Subsequent to September 30, 2023" section of this MD&A. Please refer to the “Financial Results and Review of Operations” section of this MD&A for a reconciliation of adjusted gross margin to net revenue.

OPERATING EXPENSES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q4-2023 |

|

Q4-2022 |

|

CHANGE |

|

% CHANGE |

|

|

|

|

|

|

|

|

| General and administrative |

$ |

15,599 |

|

|

$ |

11,546 |

|

|

$ |

4,053 |

|

|

35 |

% |

| Sales and marketing |

5,973 |

|

|

4,111 |

|

|

1,862 |

|

|

45 |

% |

| Research & development |

4,007 |

|

|

2,390 |

|

|

1,617 |

|

|

68 |

% |

| Share-based compensation |

1,102 |

|

|

2,496 |

|

|

(1,394) |

|

|

(56) |

% |

| Impairment of intangible assets and goodwill |

6,951 |

|

|

— |

|

|

6,951 |

|

|

N/A |

| Impairment of property, plant and equipment |

11,918 |

|

|

2,245 |

|

|

9,673 |

|

|

431 |

% |

| Total operating expenses |

$ |

45,550 |

|

|

$ |

22,788 |

|

|

$ |

22,762 |

|

|

100 |

% |

GENERAL AND ADMINISTRATIVE

General and administrative expenses of $15,599 increased from the prior year's comparison quarter of $11,546, primarily due to the current year period being four months compared to three months period of the comparative prior year. The increase in current period expenses is also marginally attributable to increased audit and legal fees.

SALES AND MARKETING

Sales and marketing expenses of $5,973 increased from the prior year's comparative quarter of $4,111, primarily due to the fact that the current year period is for a four month period compared to a three month period in the comparative year.

RESEARCH AND DEVELOPMENT

Research and development costs of $4,007 increased from the prior year's comparative quarter of $2,390, as the Company increased activity under the PDC Agreement and other internal product innovation projects.

SHARE-BASED COMPENSATION

Share-based compensation expense of $1,102 decreased from the prior year's comparative quarter of $2,496, primarily due to employee equity awards issued during the early months of Q4 Fiscal 2022. These equity awards were partially vested in the current period and the Company issued less awards in Q4 Fiscal 2023 when compared to Q4 Fiscal 2022.

IMPAIRMENT

Impairment on property, plant, equipment of $11,918 increased from the prior year's comparative quarter of $2,245. During Q4 Fiscal 2023, management identified impairment indicators for its Moncton Campus CGU and as a result performed an impairment test as at September 30, 2023. The impairment test considered several factors including forecasted operational cash flows (net of tax impact), on-going investments in working capital and sustaining capital expenditures, post-tax discount rates, terminal value growth rate and this analysis resulted in the recognition of an impairment loss of $11,918. A meaningful contributing factor to the quantum of the impairment charge was related to the impact to flower sales and margins due to continued THC inflation. The prior year's comparative quarter had an impairment loss of $2,245 in relation to a chocolate manufacturing line at Moncton Campus.

The Company also performed its annual goodwill impairment test as at September 30, 2023 and recognized impairment loss of $6,951 against goodwill.

6 Adjusted gross margin is a non-IFRS financial measure. See the cautionary statement regarding non-IFRS financial measures in the “Introduction” section of this MD&A, and the discussion under the heading “Adjusted EBITDA” and the reconciliation to IFRS measures in the "Financial Results and Review of Operations" section of this MD&A.

MANAGEMENT’S DISCUSSION AND ANALYSIS | FOR THE THIRTEEN MONTHS ENDED SEPTEMBER 30, 2023 AND YEAR ENDED AUGUST 31, 2022 9 Investment income of $1,056 was earned during the four months ended September 30, 2023, compared to $532 for the three months ended August 31, 2022.

OTHER (INCOME) / EXPENSES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q4-2023 |

|

Q4-2022 |

|

CHANGE |

|

% CHANGE |

|

|

|

|

|

|

|

|

| Financing costs |

$ |

133 |

|

|

$ |

168 |

|

|

$ |

(35) |

|

|

(21) |

% |

Investment income |

(1,056) |

|

|

(532) |

|

|

(524) |

|

|

(98) |

% |

| Insurance recoveries |

(213) |

|

|

— |

|

|

(213) |

|

|

— |

% |

| Government subsidies |

(194) |

|

|

— |

|

|

(194) |

|

|

100 |

% |

Share of loss from investments in associates |

15 |

|

|

528 |

|

|

(513) |

|

|

(97) |

% |

| Impairment (recovery) of loan receivable |

(66) |

|

|

— |

|

|

(66) |

|

|

100 |

% |

| Loss on disposal of property, plant and equipment |

159 |

|

|

837 |

|

|

(678) |

|

|

(81) |

% |

| Change in fair value of contingent consideration |

(466) |

|

|

317 |

|

|

(783) |

|

|

(247) |

% |

|

|

|

|

|

|

|

|

| Change in fair value of derivative liabilities |

413 |

|

|

(3,415) |

|

|

3,828 |

|

|

112 |

% |

| Legal provision (recovery) |

— |

|

|

— |

|

|

— |

|

|

— |

% |

| Total other (income)/expenses |

$ |

(1,275) |

|

|

$ |

(2,097) |

|

|

$ |

822 |

|

|

(39) |

% |

INVESTMENT INCOME

The change in investment income was due to higher interest rates and one additional month in the current period as compared to the prior year comparative period.

CHANGE IN FAIR VALUE OF CONTINGENT CONSIDERATION

Change in fair value of contingent consideration was a gain of $466 during Q4 Fiscal 2023 compared to a loss of $317 in Q4 Fiscal 2022. The current period gain was primarily on account of $500 being waived as part of a negotiated settlement with the former shareholders of EIC.

CHANGE IN FAIR VALUE OF DERIVATIVE LIABILITIES

Change in fair value of derivative warrant liabilities was a loss of $413 during Q4 Fiscal 2023 compared to a gain of $3,415 in Q4 Fiscal 2022. The decrease in gain is primarily due to the shorter remaining life of the warrants in the current period.

ADJUSTED EBITDA

Negative Adjusted EBITDA7 was $2,360 in Q4 Fiscal 2023 compared to positive Adjusted EBITDA of $3,232 in Q4 Fiscal 2022. The $5,592 decrease in Adjusted EBITDA from the comparative period is primarily attributable to lower net flower revenue, the decrease in adjusted gross margins8 and higher SG&A expenses. Please refer to the “Financial Results and Review of Operations” section of this MD&A for a reconciliation of Adjusted EBITDA to net loss.

NET LOSS

The net loss was $32,991 in Q4 Fiscal 2023 compared to a net loss of $6,144 in Q4 Fiscal 2022. The increase in net loss from the comparative period is primarily due to lower international revenue and impairment losses of $11,918 on the Company's property, plant, and equipment and $6,951 on intangibles and goodwill.

KEY DEVELOPMENTS DURING THE QUARTER AND SUBSEQUENT TO SEPTEMBER 30, 2023

In June 2023, the Company introduced SHRED X Heavies ("Heavies"), its first infused pre-roll offering with THC content surpassing 40% THC, to address the growing consumer demand for flavourful, higher THC and ready-to-consume products. Each Heavies package contains three 0.5g infused pre-rolls and is available in Tropic Thunder and Gnarberry, two of SHRED's best-selling pre-milled blends, as well as the popular Blueberry Blaster flavour.

In June 2023, the Company announced a one-for-four share consolidation (the "Share Consolidation") to facilitate compliance with NASDAQ's listing requirements with respect to the minimum bid price for listed securities, reducing volatility, and to enhance the marketability of the Company's Common Shares to institutional investors. The Share Consolidation took legal effect on July 5, 2023.

In July 2023, the Company commenced a judicial review in the Federal Court of Canada (the "Court") pertaining to the Company's March 2023 announcement that it had received notification from Health Canada that Health Canada had determined

7 Adjusted EBITDA is a non-IFRS financial measure. See "Cautionary Statement Regarding Certain Non-IFRS Measures" in the “Introduction” section of this MD&A, and the discussion under the heading “Adjusted EBITDA” and the reconciliation to IFRS measures in the "Financial Results and Review of Operations" section of this MD&A.

8 Adjusted gross margin is a non-IFRS financial measure. See "Cautionary Statement Regarding Certain Non-IFRS Measures".

MANAGEMENT’S DISCUSSION AND ANALYSIS | FOR THE THIRTEEN MONTHS ENDED SEPTEMBER 30, 2023 AND YEAR ENDED AUGUST 31, 2022 10 that certain Jolts lozenge products in their 100 mg THC per package format (the “Products”) had been improperly classified as an “extract” rather than an “edible” under the Cannabis Regulations.

On March 31, 2023, the Company filed a notice of application for Judicial Review (the "Judicial Review") of Health Canada's decision with the Federal Court of Canada. The Judicial Review hearing occurred on July 25, 2023. On August 8, 2023, the Court granted Organigram’s application for judicial review of a decision of Health Canada determining that the Edison Jolts lozenges are to be classified as edible cannabis. The Court found there was a breach of procedural fairness by Health Canada. The matter was remitted back to Health Canada for redetermination taking the Court’s reasons into consideration. Organigram has restarted Jolts production and intends to continue selling Jolts pending a final redetermination from Health Canada. There can be no assurance as to the outcome and timing of Health Canada's final redetermination of the matter, or that the Company will be able to continue production and commercialization of this product in the future.

In August 2023, the Company introduced its new tube-style pre-rolls, SHRED Dartz and Holy Smokes. These tube-style pre-rolls marked the inception of 0.4g pre-rolls for Organigram, crafted using the state-of-the-art, high-speed Cantos tube-style rolling machine, complemented by cutting-edge packaging capabilities. Organigram today, is one of a small number of licensed producers in Canada that possess the equipment and expertise to manufacture this sophisticated tube-style pre-roll format.

In August 2023, the Company announced that it expanded its global footprint by entering into a supply agreement (“the Agreement”) to provide dried medical cannabis flower to 4C LABS, a rapidly scaling healthcare, technology, and pharmaceutical company focused on virtual prescribing, pharmaceutical distribution, and clinical development of cannabis-based products for human health in the United Kingdom. Under the terms of the Agreement, the Company expects to supply approximately 600 kilograms of high-quality, indoor-grown dried flower product to 4C LABS within the first year of the Agreement, and granted 4C LABS strain exclusivity within the geographical boundaries of the United Kingdom and Channel Islands for as long as minimum purchase commitments are satisfied.

In August 2023, the Company relaunched one of Canada’s best known cannabis brands, Trailblazer, exemplifying the Company’s commitment to keeping consumer insights at the heart of its brand and product development strategy. Featuring THCV gummies, CBG infused pre-rolls and a high-potency 1x0.5g pre-roll, Trailblazer is re-entering the market with a range of differentiated offerings.

In August 2023, the Company launched its first range of whole-flower derived THCV products through the Company’s popular SHRED and Trailblazer brands.

In September 2023, the Company announced that Ms. Caroline Ferland resigned from the Board of Directors. Ms. Ferland was a board member nominee appointed by BAT. Ms. Ferland left the Board of Directors as a result of her appointment to Group Company Secretary & Assistant General Counsel for BAT, based in the UK.

In October 2023, the Company obtained a receipt for a final short form base shelf prospectus (the “Base Shelf Prospectus”) filed with the securities commissions in each of the provinces and territories of Canada. A corresponding shelf registration statement on Form F-10 (the “Registration Statement”) was filed with the United States Securities and Exchange Commission (the "SEC") (SEC File No. 333-274686) and was subsequently declared effective by the SEC on November 29, 2023. The Base Shelf Prospectus and corresponding Registration Statement enable Organigram to qualify the distribution of up to $500,000,000 of common shares, debt securities, subscription receipts, warrants, and units during the 25-month period that the Base Shelf Prospectus remains effective. The specific terms of any future offering of securities will be disclosed in a prospectus supplement filed with the applicable Canadian regulatory authorities and the SEC. The Base Shelf Prospectus will provide flexibility for financing options to pursue the Company’s objectives.

In October 2023, the Company provided a corporate update highlighting updates in national market share, category leadership, facility improvements, product launches, the strategic investment in Phylos, the PDC with BAT, and its change in fiscal year end.

Market share: the Company announced that it achieved the #2 market share position2 in the prior two months, August and September, driven in large part by the success of its growing pre-roll business. Market share strength was also buoyed with strength in gummies, hash, and flower.

Category leadership: the Company announced that it achieved a category leadership position in two growing categories: hash and gummies. The Company achieved the #1 market share position in hash as of November 2022 driven by innovative product launches on Tremblant, Holy Mountain and SHRED, including yet another first to market innovation, the ultra-convenient and flavourful Rip-Strips. Organigram has also secured the #1 market share position in gummies in, August and September.2

Facility improvements:

•Moncton: The Company was designated an Energy Champion by New Brunswick Power ("NB Power") as a result of the reduction in its environmental footprint through the conversion of 17,000 LED fixtures. With this change, Organigram’s energy footprint per room was reduced by 30%. The Company also continues to identify initiatives to reduce its energy

MANAGEMENT’S DISCUSSION AND ANALYSIS | FOR THE THIRTEEN MONTHS ENDED SEPTEMBER 30, 2023 AND YEAR ENDED AUGUST 31, 2022 11 usage through a partnership with NB Power in the New Brunswick Strategic Energy Management Program.

Further, Organigram commissioned its high-speed pre-roll tube-style machine in June, enabling the Company to enter the growing tube-style pre-roll joint segment with its popular SHRED and Holy Mountain brands. This investment in automated pre-roll technology has helped Organigram secure the #2 position in the category.

•Lac Supérieur: Construction at Organigram’s Lac Supérieur craft cultivation facility is now complete with the addition of four new grow rooms and an expanded packaging area. With power at the facility, equipment commissioned, and all growing, harvesting, and drying rooms being completed, Organigram is now in a position to begin growing top shelf craft quality, small batch flower out of its signature craft facility. Clones are now onsite, and Organigram expects to see the first harvest out of that facility by early December. Organigram has also finished the implementation of its new ERP system at the Lac Supérieur Facility, which is expected to provide the most up to date, accurate and timely data needed to deliver actionable business insights.

Product launches: Organigram continued its commitment to bringing high-quality cannabis products to the market that meet the evolving needs of our various consumer segments, from the price-conscious, experienced user, to the more wellness-oriented individual looking to fulfill targeted needs through cannabis. The Company outlined the launch of 11 new products designed to meet these consumer needs.

Phylos: Realizing the benefits from the investment in Phylos continues to be a key focus as Organigram moves towards seed-based production in its Moncton facility. Three seed trials have already been harvested with two more nearing completion. Overall, eight F1 Hybrid cultivars are being tested with the first production scale trial room load scheduled in December 2023 and first full-scale commercial harvest planned for March 2024. Organigram is on track to convert up to 30% of harvests to seed based production by end of 2024 with Phylos investment milestones tracking towards early completion.

Product Development Collaboration with BAT: Organigram and BAT continue to work together through their PDC on new workstreams to develop innovative technologies in the edible, vape and beverage categories in addition to new disruptive inhalation formats aimed at addressing the biggest consumer pain points that exist in the category today. Organigram is preparing to deliver new products in these spaces and the immediate launch priority includes gummies which will feature a new nano-emulsion technology, scheduled to begin commercialization in the first half of 2024.

Change in fiscal year end: As previously disclosed, Organigram recently changed its fiscal year end to better reflect its operating and financial cycles. Organigram’s new fiscal year began on October 1, 2023, and will end on September 30, 2024. As a result, fiscal year 2023 had 13 months and reflected the period starting September 1, 2022, and ending September 30, 2023.

In November 2023, the Company announced the Follow-on BAT Investment. The majority of the $124.6 million investment will be used by Organigram to create a strategic investment pool, named Jupiter. Jupiter will target investments in emerging cannabis opportunities that will enable Organigram to apply its industry-leading capabilities to new markets. Management has identified that geographic expansion is a strategic priority and this opportunity presents the Company with the capital to lay global foundations as the legal recreational cannabis market continues to see significant growth. Organigram maintains the highest level of regulatory and product stewardship and will continue to monitor the cannabis regulatory environment carefully. As a result, all potential investments will undertake rigorous legal compliance and due diligence processes. Subject to the receipt of certain regulatory approvals, approval from Organigram’s shareholders and other conditions, BAT will subscribe for 38,679,525 shares at a price of $3.2203 per share, for gross proceeds of $124.6 million across three tranches. BAT will subscribe for 12,893,175 million shares on the closing of the first tranche (currently expected to be on or around January 16, 2024) for gross proceeds of $41.5 million with the remaining 25,786,350 shares to be subscribed for in two further equal tranches on or around August 30, 2024 and February 28, 2025. To the extent BAT exceeds 30.0% holding of outstanding Common Shares, it will be issued non-voting Class A convertible preferred shares (“Preferred Shares”). Accordingly, in aggregate, based on Organigram’s current 81,161,630 Common Shares outstanding, 12,999,231 Common Shares will be issued, and the remaining 25,680,294 shares will be initially issued as Preferred Shares. The Preferred Shares will be eligible for conversion into voting Common Shares at BAT’s option, provided that such conversion would not result in BAT’s voting interest in the Company exceeding 30%. Each Preferred Share shall be economically equivalent to a Common Share and will be convertible into Common Shares at the option of BAT without payment of any additional consideration. The conversion ratio shall initially be one-for-one, and post-issuance shall increase at a rate of 7.5% per annum, compounded annually, until such time as the Preferred Shares are converted into Common Shares or the aggregate equity interest of BAT in Organigram (inclusive of both the Common Shares and Preferred Shares as if converted into Common Shares) reaches 49%. BAT shall be periodically required to convert Preferred Shares to the extent that it holds less than 30% of the Common Shares outstanding. In connection with the closing of the first tranche, Organigram and BAT will enter into an amended and restated investor rights agreement, pursuant to which BAT will be eligible to appoint up to 30% of the Board of Directors.

In November 2023, the Company announced that Derrick West informed Organigram that he would transition away from his role as Chief Financial Officer (“CFO”) in order to take time to focus on his health and recovery following surgery. Paolo De Luca,

MANAGEMENT’S DISCUSSION AND ANALYSIS | FOR THE THIRTEEN MONTHS ENDED SEPTEMBER 30, 2023 AND YEAR ENDED AUGUST 31, 2022 12 current Chief Strategy Officer, was appointed interim CFO effective November 13, 2023, while the Company completes a search for a new permanent CFO. Paolo previously served as the Company’s CFO between 2017 and 2020.

In November 2023, the Company announced that Phylos achieved the first milestone under the loan agreement entered into in May 2023 (the “Loan Agreement”) and closed the second tranche under the Loan Agreement with Organigram advancing US$2.75 million to Phylos. This second tranche followed the initial tranche of US$3.25 million advanced in May 2023 for a total of US$6 million in senior secured convertible loans (“Secured Convertible Loan”) currently outstanding. Organigram’s ongoing trials using Phylos technology have resulted in highly-uniform, predictable, and fast-growing seedlings.

Organigram will now advance the conversion of its grow rooms with custom designed, F1 Hybrid seeds and expects to soon be able to begin low-cost production of high-potency, terpene-rich cultivars destined for various products and blends across its brand portfolio. Organigram is also on track to convert more than 30% of its cultivation space in the Moncton facility to F1 Hybrid seed grow by end of Fiscal 2024.

In December 2023, the Company announced that Greg Guyatt is appointed as new CFO and will join the Company effective January 8, 2023. Greg is a seasoned financial executive with over 25 years of public and private equity backed company experience.

OPERATIONS AND PRODUCTION

Moncton Cultivation Campus

At the Moncton Campus, the Company continues to make progress on its ongoing improvement program. This includes implementation of various new initiatives which have resulted in an increase in an average THC. The Phase 4C expansion at Moncton was completed in Fiscal 2022 which increased the approximate annual capacity to 85,000 kg of flower. The Company has also identified additional changes to its growing and harvesting methodologies, that should assist the operating conditions of the Moncton Campus, resulting in higher quality flower and a reduction in production costs. The total capacity of the Moncton Campus will continue to fluctuate as the Company further refines its growing methods and room utilization.

In Q3 Fiscal 2023, the Company continued to invest in driving operational efficiencies through automation and internalizing certain post-harvest processes including commissioning a new automated packaging line for SHRED milled products, internalizing THC testing, internalizing remediation, and commissioning new drying machines. These initiatives reduced headcount and significantly reduced costs while increasing time savings. The Company had realized a portion of these savings beginning in Q2 Fiscal 2023. Further, Organigram anticipates realizing approximately $10 million in annual savings from these initiatives in Fiscal 2024.

The Company harvested 28,071 kg of dried flower during Q4 Fiscal 2023 compared to 16,031 kg of dried flower in Q4 Fiscal 2022. The increase of 12,040 kg (75%) from the comparative period was primarily related to one additional month in the current period and increased cultivation, planting and environmental upgrades along with additional rooms being available in the current period.

Moncton Derivatives Facility

Contained in the 56,000 square foot expansion referred to as Phase 5 of the Moncton Campus is the Company's derivatives facility ("Phase 5"). Phase 5 includes Supercritical CO2, dry sift and cold water extraction laboratories, as well as in-house formulation and finishing of ingestibles, extracts, vape oils and concentrates, in addition to high speed cart filling, bottling and automated packaging.

Winnipeg Facility

The Company has a purpose-built, highly-automated, 51,000 square-foot manufacturing facility in Winnipeg, Manitoba. The Winnipeg Facility has been designed to handle both smaller-batch artisanal manufacturing as well as large-scale nutraceutical-grade high-efficiency manufacturing, and to produce highly customizable, precise, and scalable cannabis-infused products in various formats and dosages including pectin, gelatin, sugar-free soft chews (gummies) and lozenges with novel capabilities such as infusions, striping and the possibility of using fruit purees. Automation and efficiency investments in the Winnipeg Facility have resulted in an increase in production. As of September 30, 2023, the Winnipeg Facility has produced up to 3.2 million gummies monthly. In Fiscal Q4 2023, the Company began recalibrating its gummy manufacturing equipment, resulting in temporary fluctuations in production output.

The Winnipeg Facility currently holds a research license and a standard sale and processing license issued under the Cannabis Act, and commenced commercial operations during Fiscal 2021.

Lac-Supérieur Concentrates and Craft Flower Facility

The Company acquired the Lac-Supérieur Facility in December 2021. The Lac-Supérieur Facility had 6,800 square feet of cultivation area, which was expanded to 33,000 square feet in Q4 Fiscal 2023. The Lac-Supérieur Facility was initially equipped to produce approximately 600 kilograms of flower and 1 million packaged units of hash annually. The now completed expansion

MANAGEMENT’S DISCUSSION AND ANALYSIS | FOR THE THIRTEEN MONTHS ENDED SEPTEMBER 30, 2023 AND YEAR ENDED AUGUST 31, 2022 13 program increases annual capacity to 2,400 kilograms of flower and over 2 million packaged units of hash annually.

The production of SHRED X Rip Strip Hash started in February 2023 using ultrasonic knife technology with a capacity of 150 units per minute. A second ultrasonic knife was installed in Q4 Fiscal 2023 to keep up with demand. Management believes that there may be future opportunities for cost savings from further investments in automation and increased capacity. The first craft grow rooms resulting from the expansion plans came online in October, 2023. Organigram has begun growing craft quality, small batch flower out of its signature craft facility. Organigram completed its first Lac-Supérieur harvest in December 2023.

CANADIAN ADULT-USE RECREATIONAL CANNABIS MARKET

Organigram continues to increase its focus on generating meaningful consumer insights and applying these insights to the ongoing optimization of its brand and product portfolio with the goal of ensuring that they are geared towards meeting consumer preferences. The Company has aggressively and successfully revitalized its product portfolio to meet rapidly evolving consumer preferences and through its increased focus on insights, has continued its expansion of brands and products aimed at driving continued momentum in the marketplace.

DRIED FLOWER AND PRE-ROLLS

Dried flower and pre-rolls remain the first and second largest product categories, respectively, in the Canadian adult-use recreational cannabis market9 and the Company believes that these categories will continue to dominate based on the market data from mature legal markets in certain U.S. states as well as regulatory restrictions on other form factors (e.g. the 10 mg per package THC limit in the edibles category). While the Company expects consumer preferences will slowly evolve away from THC content and price being the key purchase drivers, today they appear to be the most important attributes to consumers for flower products. Over time, the Company expects that genetic diversity and other quality related attributes such as terpene profile, bud density, the presence of minor cannabinoids, and aroma, will become increasingly important to consumers. While the Company’s efforts are focused on delivering on consumer expectations today, it is concurrently planning for the eventual evolution towards a more nuanced approach to cannabis appreciation through its ongoing work in genetic breeding, pheno-hunting, and transitioning a portion of production to seed-based cultivation, with the goal of offering a unique, consistent, and relevant assortment to consumers. Additionally, the strategic acquisition of Laurentian in December 2021 allows the Company the opportunity to participate in the growing craft cannabis segment, through its craft facility located in the province of Québec.

The Company's portfolio of brands continues to show strong momentum within the flower segment in Canada and as of September 30, 2023, Organigram holds the #3 share in the flower category3. The growth and significant contribution of dried flower value segment brands, however, have contributed to overall margin pressure for Organigram and many of its peers over the last number of quarters. To counteract this phenomenon, Organigram is revitalizing its Trailblazer brand and adding craft flower to its Laurentian brand, supplied by its Lac-Supérieur facility. If any of these initiatives are completed, it is expected to increase premium flower sales, which have a higher average sales price than value brands and therefore attract higher margins. To address the growing demand for strain differentiation in the value segment, the Company expanded the strains available in its Big Bag O' Buds product line and also introduced Holy Mountain, a value-sector brand offering hash and dry flower strains in the 3.5 and 28 gram formats.

CANNABIS DERIVATIVES

While dried flower and pre-rolls are currently the largest categories in Canada, derivative cannabis products, including vapes, concentrates and edibles, are projected to continue to increase in market share over the next several years at the expense of dried flower.