Document

Half-Year Report JANUARY – JUNE MorphoSys Group: Half-Year Report January – June 2023

2023

|

|

|

|

|

|

2 |

Group Interim Statement |

Contents

5 Interim Group Management Report

5 Operating Business Performance

13 Strategy and Group Management

13 Corporate Developments

13 General Business and Market Environment

21 Interim Consolidated Financial Statements

21 Consolidated Statement of Profit or Loss (IFRS)

22 Consolidated Statement of Comprehensive Income (IFRS)

23 Consolidated Balance Sheet (IFRS)

25 Consolidated Statement of Changes in Stockholder’s Equity (IFRS)

27 Consolidated Statement of Cash Flows (IFRS)

29 Notes to the Consolidated Financial Statements

|

|

|

|

|

|

|

Group Interim Statement

|

3 |

Summary of the Second Quarter of 2023

Highlights of the Second Quarter of 2023

•On April 4, 2023, MorphoSys announced the complete enrollment for MANIFEST-2, the ongoing Phase 3 study exploring the efficacy and safety of pelabresib, an investigational BET inhibitor, in combination with ruxolitinib versus ruxolitinib alone in patients with myelofibrosis who have not previously been treated with a JAK inhibitor (JAK inhibitor-naïve). 431 patients were enrolled in this study. The topline data from MANIFEST-2 are expected by the end of 2023.

•On June 21, 2023, MorphoSys hosted a virtual investor meeting on pelabresib with key opinion leaders. Jean-Paul Kress, M.D., MorphoSys' Chief Executive Officer, and Tim Demuth, M.D., Ph.D., MorphoSys' Chief Research and Development Officer, discussed the potential of pelabresib followed by presentations by two key opinion leaders on the disease burden for patients with myelofibrosis and a recap of encouraging findings in myelofibrosis from the Phase 2 MANIFEST study evaluating pelabresib alone and in combination with ruxolitinib and background on the Phase 3 MANIFEST-2 study.

Financial Results for the First Half-Year of 2023

•Monjuvi® (tafasitamab-cxix) U.S. net product sales in the first half-year of 2023 reached € 41.1 million (US$ 44.4 million) (H1 2022: € 38.3 million (US$ 41.9 million)) and gross margin of 82% (H1 2022: 80%).

•Research and development expenses in the first half-year of 2023 amounted to € 140.1 million (H1 2022: € 126.0 million). In the first half-year of 2023 the combined expenses for selling and general and administration totaled € 66.8 million (H1 2022: € 72.9 million).

•Cash and other financial assets totaled € 672.8 million as of June 30, 2023 (December 31, 2022: € 907.2 million).

Corporate Developments

•The MorphoSys AG Annual General Meeting on May 17, 2023 re-elected Mr. George Golumbeski, Ph.D. and Mr. Michael Brosnan to the Company’s Supervisory Board. The ordinary Annual General Meeting 2023 was conducted without the physical presence of shareholders or their proxies, as permitted by German law. The shareholders approved all resolutions proposed by the Company´s Management and Supervisory Boards.

Events After the End of the Second Quarter of 2023

•On August 1, 2023, Incyte announced the full enrollment of the Phase 3 study inMIND. The inMIND study evaluates whether tafasitamab and lenalidomide combined with rituximab provides improved clinical benefit compared with lenalidomide combined with rituximab in patients with r/r follicular lymphoma (FL) or r/r marginal zone lymphoma (MZL).

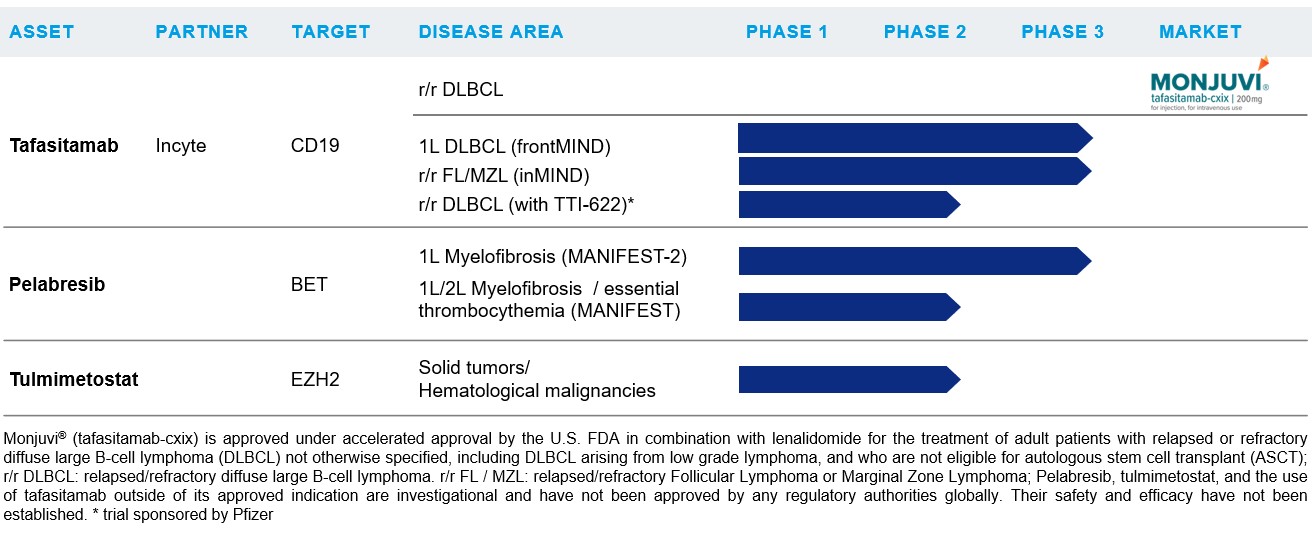

MorphoSys Development Pipeline as of June 30, 2023

Clinical Programs Developed by Partners (Selection)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| COMPOUND/BRAND NAME |

|

PARTNER |

|

DISEASE AREA |

|

STATUS |

| Ianalumab |

|

Novartis |

|

Sjögren’s, systemic lupus erythematosus (SLE), immune thrombocytopenia (1L and 2L ITP), warm autoimmune hemolytic anemia (wAIHA) and autoimmune hepatitis (AIH) |

|

Phase 3 clinical development for Sjögren’s, lupus nephritis (LN), systemic lupus erythematosus (SLE), immune thrombocytopenia (1L and 2L ITP), and warm autoimmune hemolytic anemia (wAIHA) ongoing. Phase 2 clinical development in autoimmune hepatitis (AIH) started. |

| Abelacimab |

|

Anthos Therapeutics |

|

Cancer Associated Thrombosis (CAT), Prevention of Stroke and Systemic Embolism in Patients with Atrial Fibrillation (SPAF) |

|

Phase 3 clinical development for CAT and started and Phase 3 in high-risk patients with atrial fibrillation (SPAF) started (both FDA Fast Track Designation). |

| Setrusumab |

|

Ultragenyx and Mereo BioPharma |

|

Osteogenesis Imperfecta |

|

Pivotal Phase 2/3 clinical study in Phase 3 part ongoing, additional Phase 3 study started. |

| Bimagrumab |

|

Versanis |

|

Adult Obesity |

|

Phase 2b study ongoing |

| Felzartamab |

|

HI-Bio

I-Mab Biopharma

|

|

HI-Bio: Membranous Nephropathy (MN),

IgA Nephropathy (IgAN)

I-Mab: Multiple Myeloma (MM)

|

|

MN & IgAN in Phase 2 studies

Phase 2 completed; pivotal Phase 3 ongoing (MM)

|

|

|

|

|

|

|

|

Group Interim Statement

|

5 |

Interim Group Management Report:

January 1 – June 30, 2023

Operating Business Performance

MorphoSys AG (hereinafter also referred as "MorphoSys") focuses on commercializing its marketed product and advancing product candidates at various stages of development, positioning itself for long-term sustainable growth.

The key measures of value for MorphoSys’ development activities include:

•Advancement of development programs and product approvals

•Clinical trial results

•Regulatory interactions with (or feedback from) health authorities regarding the approval of new drug candidates or of marketed drugs for additional indications

•Collaborations, partnerships, and M&A activities with other companies to develop the drug pipeline as well as to commercialize the therapeutic programs

•Strong patent protection to secure MorphoSys’ market position

Research and Development

MorphoSys’ research and development activities are currently focused on the following clinical candidates:

•Pelabresib (CPI-0610) is an investigational selective small-molecule BET inhibitor designed to promote anti-tumor activity by specifically inhibiting the function of BET proteins. The clinical development of pelabresib is currently focused on myelofibrosis (MF). MF is a form of bone marrow cancer that disrupts the body's normal production of blood cells.

•Tafasitamab (formerly known as MOR208, XmAb5574) is a humanized Fc-modified CD19 targeting immunotherapy. CD19 is selectively expressed on the surface of B-cells, which belong to a group of white blood cells. CD19 enhances B-cell receptor signaling, which is an important factor in B-cell survival and growth. CD19 is a target structure for the treatment of B-cell malignancies. MorphoSys is currently further investigating tafasitamab for the treatment of various B-cell malignancies, namely first-line DLBCL, r/r follicular lymphoma (r/r FL), and r/r marginal zone lymphoma (r/r MZL).

•Tulmimetostat (CPI‑0209) is an investigational small-molecule, second-generation dual EZH2 and EZH1 inhibitor with an epigenetic mechanism of action. Tulmimetostat was designed to improve on first generation EZH2 inhibitors through increased potency, longer residence time on target and a longer half-life, offering the potential for enhanced anti-tumor activity. Tulmimetostat is being investigated in a basket study of solid tumors and lymphomas.

In addition to MorphoSys’ own pipeline, the following programs, among others, are being further developed by MorphoSys’ partners:

•Ianalumab (VAY736) – a fully human IgG1/k mAb with a dual mode of action targeting B-cell lysis and BAFF-R blockade, developed by Novartis;

•Abelacimab (MAA868) – an antibody directed against Factor XI, developed by Anthos Therapeutics;

•Setrusumab (BPS804) – an antibody directed against sclerostin, developed by Ultragenyx and Mereo BioPharma;

•Bimagrumab - an antibody binding to activin type II receptors, developed by Versanis;

•Felzartamab – a therapeutic human monoclonal antibody directed against CD38, developed by HI-Bio and I-Mab Biopharma;

•MOR210/TJ210/HIB210 – a human antibody directed against C5aR1, the receptor of the complement factor C5a, developed by HI-Bio and I-Mab Biopharma.

In addition to the late-stage partnered programs listed above, there are several additional partnered programs in early to mid-stage research and development.

Development of Tafasitamab

MorphoSys’ commercial activities are currently focused on Monjuvi (tafasitamab-cxix) in the United States. On July 31, 2020, the Food and Drug Administration (FDA) granted Monjuvi in combination with lenalidomide accelerated approval for the treatment of adult patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL) not otherwise specified, including DLBCL arising from low-grade lymphoma, and who are not eligible for autologous stem cell transplant (ASCT). Tafasitamab is co-commercialized by Incyte Corporation (hereinafter also referred as "Incyte") and MorphoSys in the United States under the trade name Monjuvi and by Incyte in Europe and Canada under the trade name Minjuvi®.

Commercial Performance of Tafasitamab

During the first half-year of 2023, Monjuvi sales reached € 41.1 million (H1 2022: € 38.3 million). MorphoSys and Incyte continue to see a high penetration in the community setting driving approximately 70% of the sales with the balance coming from the academic setting. Since launch, the Company, along with its partner Incyte, has in aggregate received orders from 1,500 treatment sites. During the first half-year 2023, more than 750 accounts ordered with more than 85% of those accounts representing repeat orders. While MorphoSys continues to see a positive trend year-over-year, the Company recognizes that the competition has increased as additional second-line treatment options for relapsed or refractory diffuse large B-cell lymphoma have been recently approved.

Proprietary Clinical Development

Studies of Pelabresib

There are currently two ongoing trials evaluating pelabresib in myelofibrosis (MF), the Phase 2 MANIFEST trial and the Phase 3 MANIFEST-2 trial.

MANIFEST is a global, multicenter, open-label Phase 2 study that evaluates pelabresib as monotherapy or in combination with ruxolitinib (marketed as Jakafi/Jakavi), the current standard of care in MF.

|

|

|

|

|

|

|

Group Interim Statement

|

7 |

In Arm 3 of this study, pelabresib is being evaluated in combination with ruxolitinib in JAK-inhibitor-naïve MF patients, with a primary endpoint of the proportion of patients with a ≥35% spleen volume reduction from baseline (SVR35) after 24 weeks of treatment. Pelabresib is also being evaluated in a second-line setting (2L) either as a monotherapy in patients who are resistant to, intolerant of, or ineligible for ruxolitinib and no longer on the drug (Arm 1), or as add-on therapy to ruxolitinib in patients with a suboptimal response to ruxolitinib or MF progression (Arm 2). Patients in Arms 1 and 2 are being stratified based on transfusion-dependent (TD) status. The primary endpoint for the patients in cohorts 1A and 2A, who were TD at baseline, is conversion to transfusion independence for 12 consecutive weeks. The primary endpoint for patients in cohorts 1B and 2B, who were not TD at baseline, is the proportion of patients with an SVR35 after 24 weeks of treatment. In Arm 4 of this study, pelabresib is being evaluated as monotherapy in high-risk patients with essential thrombocythemia (ET) who are resistant or intolerant to hydroxyurea (HU).

In December 2022, MorphoSys presented new longer-term Phase 2 results on pelabresib in myelofibrosis from the ongoing MANIFEST study at ASH 2022. The latest analyses include longer-term data showing durable improvements in both spleen volume and symptom score beyond 24 weeks (data cutoff July 29, 2022), with pelabresib plus ruxolitinib in JAK inhibitor-naïve patients. Translational data from MANIFEST was also presented that indicated the association of biomarkers with potential disease-modifying activity of pelabresib.

At 24 weeks, 48, and 60, 68% (57/84), 61% (51/84), and 54% (45/84), respectively, of JAK inhibitor-naïve patients treated with pelabresib in combination with ruxolitinib achieved at least a 35% reduction in spleen volume (SVR35) from baseline. SVR35 was achieved by 80% of patients at any time on study. Also at 24 weeks, 56% (46/82) of patients had at least a 50% reduction in their total symptom score (TSS50) from baseline, suggesting a reduction in symptom burden. At 48 and 60 weeks, 44% (36/82) and 43% (35/82) of patients, respectively, achieved TSS50. An exploratory analysis demonstrated that bone marrow fibrosis improved by one grade or more in 27% (17/63) of evaluable patients at week 24, and 59% of those patients maintained that improvement at week 48 or beyond. An improvement of one grade or more at any time was achieved by 40% of patients. The most common hematologic treatment-emergent adverse event (AE) of any grade was thrombocytopenia, which was reported in 55% (grade ≥3: 18%) of patients. Anemia was reported in 43% (grade ≥3: 34%) of patients. The most common (≥25%) nonhematologic treatment-emergent AEs of any grade were diarrhea (43%), respiratory tract infection (41%), asthenic conditions (38%), musculoskeletal pain (32%), constipation (30%), nausea (29%), dizziness (27%), and abdominal pain (26%).

In the MANIFEST study, changes in biomarkers correlated with improvements in clinical measures of treatment success (SVR35, TSS50, and hemoglobin increases indicative of improved anemia), suggesting a potential disease-modifying effect of pelabresib. Examined biomarkers included bone marrow scarring, known as fibrosis, and the frequency of a Janus Kinase 2 allele (V617F) that is known to drive disease activity. Across the three MF arms of MANIFEST, 40% (33/82) of patients who achieved SVR35 at week 24 also had at least a one-grade improvement in bone marrow fibrosis and/or a 20% or greater reduction in the frequency of the variant allele. Of TSS50 responders at week 24, 28% (28/100) also showed at least a one-grade improvement in bone marrow fibrosis and/or a 20% or greater reduction in the frequency of the variant allele. And 29% (24/84) of patients who had hemoglobin improvements (any level of increase from baseline) also had at least a one-grade improvement in bone marrow fibrosis and/or a 20% or greater reduction in the frequency of the variant allele. All patients who had clinical responses (SVR35, TSS50 and hemoglobin improvement) plus reduced variant allele frequency and improvement in bone marrow fibrosis were naïve to JAK inhibitors.

During an oral presentation at the European Hematology Association (EHA) Hybrid Congress and a poster discussion at the American Society of Clinical Oncology (ASCO) Annual Meeting in June 2023, new preliminary results from the Phase 2 MANIFEST study Arm 4 exploring pelabresib as a monotherapy in patients with high-risk essential thrombocythemia who are refractory or intolerant to hydroxyurea were presented. These proof-of-concept results support the potential clinical benefit with pelabresib in other myeloid diseases.

Also at EHA, in a poster presentation on MANIFEST Arm 3, the combination of pelabresib and ruxolitinib in JAK-inhibitor-naïve patients with myelofibrosis resulted in durable and rather deep splenic and symptom responses at and beyond week 24. The findings demonstrated clinically meaningful improvements in anemia, including the need for fewer transfusions, which may positively impact patients’ quality of life. No new safety signals were observed with a longer follow-up of 11 additional months. A second poster on MANIFEST Arm 2 showed pelabresib in combination with ruxolitinib in patients with a suboptimal/lost response to ruxolitinib monotherapy resulted in durable and deepening splenic and symptom responses at and beyond week 24. The findings suggested improvements in anemia, including the need for fewer transfusions, which may positively impact patients’ quality of life. No new safety signals were observed with a longer follow-up of 11 additional months. The most common treatment-emergent adverse events (TEAE) were low grade.

MANIFEST‑2, a global, double-blinded, randomized Phase 3 clinical study, is evaluating pelabresib plus ruxolitinib versus placebo plus ruxolitinib in JAK-inhibitor-naïve patients with primary MF or post-essential thrombocythemia (post-ET) or post-polycythemia (post-PV) MF who have splenomegaly and symptoms requiring therapy. Since the acquisition of Constellation, MorphoSys has optimized the study’s design by increasing the number of trial participants. Measures were also taken to improve the speed of enrollment, including adding new contract research organizations (CROs), improving the interaction with investigators, and expanding the number of countries and sites. On April 4, 2023, MorphoSys announced that enrollment of 431 patients was completed for the MANIFEST-2 study. The topline data are expected by the end of 2023.

Studies of Tafasitamab

Tafasitamab is being clinically investigated as a therapeutic option in B-cell malignancies in several ongoing combination trials, with an emphasis on the treatment of adult patients with diffuse large B-cell lymphoma (DLBCL).

MorphoSys regards the treatment of first-line patients with DLBCL as a key future growth opportunity for tafasitamab and is conducting a clinical development program that may support the potential use of tafasitamab in the first-line treatment of patients with DLBCL. Tafasitamab is also being examined with inMIND, a Phase 3 study in patients with r/r follicular lymphoma (FL) and r/r nodal, splenic, or extranodal marginal zone lymphoma (MZL), which also represent growth opportunities for tafasitamab.

More details on each study are given below:

frontMIND: On May 11, 2021, MorphoSys announced that the first patient had been dosed in frontMIND, a pivotal Phase 3 trial of tafasitamab in first-line DLBCL: frontMIND is evaluating tafasitamab and lenalidomide in combination with R-CHOP compared to R-CHOP alone as first-line treatment for high-intermediate and high-risk patients with untreated DLBCL. On April 4, 2023, MorphoSys announced that the enrollment of the frontMIND study with more than 880 patients is complete.

|

|

|

|

|

|

|

Group Interim Statement

|

9 |

The topline data from this study are expected in the second half of 2025.

firstMIND: The Phase 1b study firstMIND is an open-label, randomized safety study combining tafasitamab or tafasitamab plus lenalidomide with standard R-CHOP for patients with newly diagnosed DLBCL that paved the way for the frontMIND study. On December 10, 2022, MorphoSys presented final analysis from this Phase 1b trial at ASH 2022. The final analysis showed no new safety signals and provided additional information on progression-free and overall survival at 24 months for patients with newly diagnosed diffuse large B-cell lymphoma treated with tafasitamab plus lenalidomide and R-CHOP. Additional analyses highlighted the prognostic potential of sensitive circulating tumor (ct) DNA minimal residual disease (MRD) assays in patients with DLBCL after first-line therapy.

The final analysis of firstMIND demonstrated an overall response rate at the end of treatment of 75.8% for patients treated with tafasitamab plus R-CHOP (n=33) and 81.8% for patients treated with tafasitamab, lenalidomide, and R-CHOP (n=33). In the tafasitamab, lenalidomide, and R-CHOP arm, 24-month progression-free survival (PFS) and overall survival (OS) rates were 76.8% and 93.8%, respectively. PFS and OS rates were 73.6% and 95.2%, respectively, for patients with high-intermediate to high-risk DLBCL (International Prognostic Index [IPI] 3–5) treated with tafasitamab, lenalidomide, and R-CHOP (n=22). Improved PFS was observed in MRD-negative patients compared with MRD-positive patients. The most common hematological treatment emergent adverse events in both patients treated with tafasitamab plus R-CHOP and patients treated with tafasitamab, lenalidomide, and R-CHOP were neutropenia (60.6% and 84.8%, respectively), anemia (51.5% and 60.6%), thrombocytopenia (21.2% and 42.4%), and leukopenia (30.3% and 27.3%), respectively. Rates of febrile neutropenia were equal (18.2%) in both arms. Non-hematological adverse events were well balanced between arms and were mostly grades 1 and 2. No unexpected toxicities or new safety signals were identified in the final analysis.

A second poster presentation and an oral presentation both demonstrated the potential of sensitive ctDNA MRD assays to predict PFS outcomes following first-line treatment in patients with DLBCL. In the poster presentation, negative MRD as detected by next-generation sequencing detection of ctDNA after treatment with tafasitamab in combination with lenalidomide and R-CHOP in the firstMIND study was associated with a significant improvement in PFS (p=0.008). One of 12 patients who were MRD-negative after treatment had developed disease progression by the time of data cutoff, when all patients had completed at least 18 months of post-treatment follow-up. The oral presentation highlighted the prognostic utility of sensitive ctDNA MRD assays in a meta-analysis of five prospective studies of first-line treatment regimens for large B-cell lymphomas. Achievement of MRD negativity after any of the first three cycles of treatment was strongly prognostic for PFS (p=0.0003), and failure to achieve MRD negativity by the end of treatment was associated with the highest risk for progression.

Additionally, Incyte is responsible for conducting inMIND, a Phase 3 study in patients with r/r follicular lymphoma (FL) and r/r nodal, splenic, or extranodal marginal zone lymphoma (MZL). On August 1, 2023, Incyte announced that the inMIND study is fully enrolled. The inMIND study evaluates whether tafasitamab and lenalidomide combined with rituximab provides improved clinical benefit compared with lenalidomide

combined with rituximab in patients with r/r follicular lymphoma (FL) or r/r marginal zone lymphoma (MZL). The study enrolled a total of over 600 patients. The primary endpoint of the study is PFS in the FL population, and the key secondary endpoints are PFS and OS in the overall population as well as PET-CR at the end of treatment in the FL population. Topline data from the inMIND study is expected in 2024.

L-MIND: On April 16, 2023, MorphoSys and Incyte presented at the American Association for Cancer Research (AACR) Annual Meeting 2023 final five-year follow-up data from the Phase 2 L-MIND study showing that Monjuvi (tafasitamab-cxix) plus lenalidomide followed by Monjuvi monotherapy provided prolonged, durable responses in adult patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL).

At the data cut-off (Nov. 14, 2022) for the full analysis set (80 patients), the best overall response rate (ORR) was 57.5% (95% CI = 45.9, 68.5; n = 46), and a complete response (CR) was observed in 41.2% of patients (95% CI = 30.4, 51.6; n = 33). A partial response (PR) was observed in 16.2% of patients (95% CI = 8.9, 26.2; n =13). Additional results included:

•Median duration of response was not reached after a median follow up of 44.0 months (95% CI = 29.9, 57.0).

•The median overall survival was 33.5 months (95% CI = 18.3, NR) and median progression-free survival was 11.6 months (95% CI = 5.7, 45.7).

•Of the 21 patients with >60 months of follow-up, 14 had received one prior line of therapy (pLoT), and seven patients had received ≥2 pLoT.

•Patients with one pLoT (n = 40) had a higher ORR of 67.5% (CR = 52.5% and PR = 15%) compared to 47.5% of patients with two or more pLoT (n = 40; CR = 30% and PR = 17.5%)

No new safety signals were identified. The majority of adverse events (AEs) were grade 1 or grade 2 during both combination and monotherapy treatment. Patients experienced a lower frequency of all-grade and grade 3 or higher adverse events during monotherapy. The most common adverse events with combination therapy were neutropenia (incidence per person per year, all-grade/grade ≥3: 3.79/2.09) and thrombocytopenia (1.52/0.52), which declined after patients switched to monotherapy (all-grade/grade ≥3: 1.09/0.70 and 0.17/0.06, respectively, in the first two years of monotherapy). Neutropenia and diarrhea were the most common adverse events in the first two years of monotherapy. Monjuvi, in combination with lenalidomide, was granted accelerated approval based on the one-year primary analysis of the L-MIND study. The data for the five-year analysis of the L-MIND study have not yet been submitted to, or reviewed by, the FDA.

During the American Society of Clinical Oncology (ASCO) Annual Meeting from June 2 to 6, 2023, the European Hematology Association (EHA) Hybrid Congress from June 8 to 11, 2023, and the International Conference on Malignant Lymphoma (ICML) from June 13 to 17, 2023, MorphoSys presented posters and e-publications of both the five-year L-MIND data overall and a new subgroup analysis. The new data showed that overall response rate was comparable across subgroups, numerically favoring patients with positive prognostic factors. Additionally, duration of response, progression-free survival and overall survival highlighted long-term clinical efficacy across all subgroups.

|

|

|

|

|

|

|

Group Interim Statement

|

11 |

B-MIND: The Phase 2/3 study B-MIND is evaluating the safety and efficacy of tafasitamab in combination with the chemotherapeutic agent bendamustine in comparison to rituximab plus bendamustine in patients with r/r DLBCL who are not candidates for high-dose chemotherapy and autologous stem cell transplantation. The study was fully recruited as of June 2021. The regulatory significance of the B-MIND study has decreased and long-term safety data for B-MIND are required by the EMA as an obligation for the conditional marketing authorization. The final analyses of primary and secondary endpoints will be performed in mid-2024.

In June 2022, Pfizer, Incyte, and MorphoSys announced a clinical trial collaboration and supply agreement to investigate the immunotherapeutic combination of Pfizer’s TTI-622, a novel SIRPα-Fc fusion protein, and Monjuvi (tafasitamab-cxix) plus lenalidomide in patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL) who are not eligible for autologous stem cell transplant (ASCT). Under the terms of the agreement, Pfizer initiated a multicenter, international Phase 1b/2 study of TTI-622 with Monjuvi and lenalidomide. MorphoSys and Incyte will provide Monjuvi for the study. The study will be sponsored and funded by Pfizer and is planned to be conducted in North America, Europe, and Asia-Pacific.

In mid-2022, a first patient was treated in the MINDway study, a Phase 1b/2 study evaluating the safety of a modified dosing of tafasitamab in combination with lenalidomide in the same population as L-MIND to enable less frequent dosing in patients with r/r DLBCL.

Study of Tulmimetostat

Patient enrollment in a Phase 1/2 clinical trial of the investigational small-molecule tulmimetostat is ongoing. The Phase 1 portion of the trial evaluated tulmimetostat as a monotherapy in patients with advanced solid tumors or lymphomas. Patients are currently being dosed in the Phase 2 expansion cohorts in selected tumor indications: urothelial or other advanced/metastatic solid tumors (ARID1A mutant), ovarian clear-cell carcinoma (ARID1A mutant), endometrial carcinoma (ARID1A mutant), lymphoma, mesothelioma (BAP1 loss), and metastatic castration-resistant prostate cancer.

In October 2022, MorphoSys announced preliminary results from the ongoing Phase 1/2 study with tulmimetostat. Heavily pretreated patients with advanced cancers showed partial responses or disease stabilization in five cohorts with evaluable patients. The data was presented during poster sessions at the 34th Symposium on Molecular Targets and Cancer Therapeutics hosted by the European Organization for Research and Treatment of Cancer (EORTC), the National Cancer Institute (NCI), and the American Association for Cancer Research (AACR) in Barcelona, Spain.

At data cutoff (July 16, 2022), 51 of 52 patients enrolled in the Phase 2 expansion phase of the trial had received at least one dose of tulmimetostat in the cohorts listed above. At trial entry, 51% of patients had been treated with at least three prior lines of therapy. Objective response was observed in patients with endometrial cancer as well as mesothelioma and peripheral T cell lymphoma (PTCL). Of the ten evaluable patients with ovarian clear-cell carcinoma, four had a partial response and three had stable disease. Of the eight evaluable patients with metastatic castration-resistant prostate cancer, five had stable disease. Of the four evaluable patients with endometrial carcinoma, two had partial responses and two had stable disease. Two of the three evaluable patients with peripheral T-cell lymphoma had complete responses. For the nine

evaluable patients with mesothelioma, there were two partial responses and four disease stabilizations. The safety profile of tulmimetostat was consistent with the mechanism of action of EZH2 inhibition. The most frequent treatment-emergent adverse events (TEAEs) determined to be possibly related to tulmimetostat included thrombocytopenia (47.1%), diarrhea (37.3%), nausea (29.4%), anemia (27.5%), fatigue (25.5%), neutropenia (17.6%), dysgeusia (17.6%), alopecia (15.7%), and vomiting (15.7%). Treatment-emergent AEs led to dose reductions in 16 patients (31.4%) and to dose interruptions in 33 patients (64.7%). Seven patients (13.7%) discontinued treatment due to AEs.

Also presented at this conference were final results from the Phase 1 dose-escalation portion of the trial, in which 41 patients were treated with oral tulmimetostat ranging from 50 mg to 375 mg daily. At study entry, 15 patients had ARID1A alterations across multiple tumor types, and all patients with mesothelioma had BAP1 alterations. One dose-limiting toxicity of grade 4 thrombocytopenia was observed, which occurred at the highest dose. The disease control rate (complete and partial responses + disease stabilizations) at 375 mg was 66.7%. Disease control was noted across doses except at 137.5 mg. Three of six patients in the 100 mg cohort had disease stabilization. Of the seven patients in the 225 mg cohort, four had disease stabilization and one with BAP1loss mutated mesothelioma had a partial response. Another partial response was noted in 375 mg cohort in ARID1A-mutated endometrial carcinoma. These initial results supported patient selection based on ARID1Amut and BAP1loss in the ongoing Phase 2 expansion study.

Updated safety and efficacy data from the ongoing Phase 2 study of tulmimetostat monotherapy in multiple advanced malignancies were presented during the American Society of Clinical Oncology (ASCO) Annual Meeting in June 2023. The data demonstrated disease stabilization or better across all solid tumor cohorts studied, including those with heavily pre-treated patients: ARID1A-mutated ovarian clear cell carcinoma and endometrial carcinoma, BAP1-mutated mesothelioma and metastatic castration resistant prostate cancer. In addition, complete and partial responses were observed in the lymphoma cohort. Safety findings from the trial were consistent with the mechanism of EZH2 inhibition.

Clinical Development Through Partners

Studies of Ianalumab

Ianalumab (VAY736) is a fully human IgG1/k mAb with a dual mode of action targeting B-cell lysis and BAFF-R blockade that is being investigated by Novartis in multiple indications within the immunology and hematology field. Ianalumab is currently in Phase 3 clinical development in lupus nephritis (LN), Sjögren’s, systemic lupus erythematosus (SLE), immune thrombocytopenia (1L and 2L ITP), and warm autoimmune hemolytic anemia (wAIHA). Ianalumab is also in Phase 2 clinical development in autoimmune hepatitis (AIH). MorphoSys is entitled to milestone payments and royalties upon approval and commercialization.

Study of Abelacimab

Abelacimab (MAA868) is an antibody directed against Factor XI that is being investigated by Anthos Therapeutics in two complementary Phase 3 clinical studies in cancer-associated thrombosis (CAT) for the prevention of venous thromboembolism (VTE) and in one Phase 3 study in high-risk patients with atrial fibrillation (AF). The FDA granted fast track designation to abelacimab for both indications under study. MorphoSys is entitled to milestone payments and royalties upon approval and commercialization.

|

|

|

|

|

|

|

Group Interim Statement

|

PAGE |

Study of Setrusumab

Setrusumab (BPS804/UX143) is a fully human monoclonal antibody inhibiting sclerostin that is currently being investigated by Ultragenyx and Mereo BioPharma in the Phase 3 portion of the pivotal Phase 2/3 clinical study and a Phase 3 study for the treatment of osteogenesis imperfecta. MorphoSys is entitled to milestone payments and royalties upon approval and commercialization.

Study of Bimagrumab

Bimagrumab is a fully human monoclonal antibody against activin type II receptors that is currently in clinical development. Versanis Bio is investigating bimagrumab in a global Phase 2b study in patients with obesity and has announced completion of enrollment in June 2023. MorphoSys is entitled to milestone payments and royalties upon approval and commercialization.

Studies of Felzartamab

Felzartamab is an investigational therapeutic human monoclonal antibody directed against CD38. Human Immunology Biosciences, Inc. (HI-Bio) obtained exclusive rights to develop and commercialize felzartamab across all indications worldwide, with the exception of Greater China. During a transition phase MorphoSys evaluated felzartamab for patients with two renal autoimmune diseases, anti-PLA2R antibody-positive membranous nephropathy (M-PLACE and New-PLACE trial) and immunoglobulin A nephropathy (IGNAZ trial) together with HI-Bio. On May 25, 2023, HI-Bio announced that the FDA has granted orphan drug designation (ODD) for felzartamab in development for the treatment of membranous nephropathy (MN). I-Mab Biopharma holds the exclusive regional rights to develop and commercialize felzartamab in Greater China and is studying felzartamab in relapsed/refractory multiple myeloma. MorphoSys will be eligible to receive payments on achievement of development, regulatory, and commercial milestones in addition to royalties on net sales of felzartamab.

Studies of MOR210/TJ210/HIB210

MOR210/TJ210/HIB210 is an investigational human antibody directed against C5aR1, the receptor of the complement factor C5a. HI-Bio obtained exclusive worldwide rights to develop and commercialize MOR210 across all indications worldwide, with the exception of Greater China and South Korea. On July 11, 2023, HI-Bio announced that the first participants have been dosed in a Phase 1 healthy volunteer study of HIB210. I-Mab Biopharma holds the exclusive rights for MOR210 in Greater China and South Korea and is currently investigating MOR210 for the treatment of relapsed or refractory advanced solid tumors (Phase 1). MorphoSys will be eligible to receive payments on achievement of development, regulatory, and commercial milestones in addition to royalties on net sales of MOR210/TJ210/HIB210.

Other Programs (Selection)

In addition to the late-stage partnered programs listed above, there are several additional partnered programs in early to mid-stage research and development.

Strategy and Group Management

The Company aims to realize intermediate- and long-term growth through its focus on proprietary drug development and commercialization. Through the acquisition of Constellation in July 2021, the Company has expanded its pipeline in the hematology/oncology area. The Company prioritizes the lead development candidates pelabresib and tafasitamab. Provided MorphoSys receives positive pivotal study results and subsequent approval from regulatory authorities, pelabresib is expected to be launched in first-line myelofibrosis, with the potential to expand to other myeloid diseases. Monjuvi continues to be prescribed in its approved indication in relapsed or refractory diffuse large B-cell lymphoma, and MorphoSys is exploring it’s use in two phase 3 studies in different types or treatment lines for lymphoma. MorphoSys is also pursuing the development of further clinical candidates as described in the Annual Report 2022 starting on page 33. The group management has been adjusted to reflect these operations.

Corporate Developments

The MorphoSys AG Annual General Meeting on May 17, 2023 re-elected Mr. George Golumbeski, Ph.D. and Mr Michael Brosnan to the Company’s Supervisory Board. The ordinary Annual General Meeting 2023 was conducted without the physical presence of shareholders or their proxies, as permitted by German law. Via a password-protected web service, registered shareholders could, among other things, submit questions, visually and audibly follow the entire Annual General Meeting and exercise their voting rights. Shareholders or their proxies who were connected electronically to the General Meeting had the possibility to speak at the General Meeting by way of video communication and ask follow-up questions about all answers given by the Management Board beforehand. The shareholders approved all resolutions proposed by the Company's Management and Supervisory Boards.

Subsequent Events

On August 1, 2023, Incyte announced the full enrollment of the Phase 3 study inMIND. The inMIND study evaluates whether tafasitamab and lenalidomide combined with rituximab provides improved clinical benefit compared with lenalidomide combined with rituximab in patients with r/r follicular lymphoma (FL) or r/r marginal zone lymphoma (MZL).

General Business and Market Environment

Economic Trends

In early 2023, the International Monetary Fund (IMF) expected a soft landing for the world economy — with inflation coming down and growth steady. But with inflation above target levels, the resultant raised interest rates have led to vulnerability within the banking sector. Commodity prices that rose sharply following Russia’s invasion of Ukraine in 2022 have moderated, but the war continues, and geopolitical tensions are high. In its updated World Economic Outlook from July 25, 2023, the International Monetary Fund (IMF) projects a slower global growth from an estimated 3.5% in 2022 to 3.0% in 2023 and 2024. The forecast for 2023 and 2024 remains well below the historical (2000–19) annual average of 3.8%.

|

|

|

|

|

|

|

Group Interim Statement

|

PAGE |

The Global headline inflation is expected to fall from 8.7% in 2022 to 6.8%t in 2023 and 5.2% in 2024. Advanced economies are expected to see an especially pronounced growth slowdown, from 2.7% in 2022 to 1.5% in 2023.

Stock markets around the world have risen by around 12% since the beginning of 2023 despite the ongoing war in Ukraine, turbulence on the commodity markets and a banking crisis. At the end of the first half of the year, the German DAX index closed almost 16% higher, the SDAX index for smaller companies gained more than 12% and the TecDAX technology index ended the first half of the year more than 9% up. Biotechnology stocks in general did not follow this global trend, as evidenced by the performance of the Nasdaq Biotech Index, which closed the first half of the year 2023 with a loss of more than 3%. The MorphoSys share started 2023 at 13.56 euros and reached a high of 28.00 euros in on June 12, 2023. The paper closed the first half of 2023 at 27.23 euros on June 30, 2023.

Sector Developments

In the first half of 2023, numerous medical conferences were held where companies in the sector presented their research results. Among other events, MorphoSys and Incyte announced in April 2023 final results from the five-year follow-up period of the Phase 2 L-MIND trial at the annual meeting of the American Association for Cancer Research (AACR). The world’s largest oncology conference, the American Society of Clinical Oncology (ASCO) Annual Meeting, was held on June 2 — 6, 2023 as a hybrid conference (live and virtual), as was the leading European conference in the field of hematology, the Annual Meeting of the European Hematology Association (EHA), which was held on June 8 — 11, 2023. MorphoSys presented clinical results of pelabresib, tafasitamab and tulmimetostat in oral presentations, posters and publications at these medical conferences.

In the second quarter of 2023, MorphoSys participated in six investor conferences and events, the majority of which took place as face-to-face meetings between the Management and institutional investors.

On June 21, 2023, MorphoSys hosted a virtual investor meeting on pelabresib with key opinion leaders (KOLs). Jean-Paul Kress, M.D., MorphoSys' Chief Executive Officer, and Tim Demuth, M.D., Ph.D., MorphoSys' Chief Research and Development Officer, discussed the potential of pelabresib together with two key opinion leaders, John Mascarenhas, M.D., Professor of Medicine and Director of the Adult Leukemia Program at The Tisch Cancer Institute at Mount Sinai, New York, and Gabriela Hobbs, M.D., Assistant Professor of Medicine at Harvard Medical School, and Clinical Director of Leukemia Service at Massachusetts General Hospital. The KOLs presented an overview of the disease burden for patients with myelofibrosis and a recap of encouraging findings in myelofibrosis from the pelabresib Phase 2 MANIFEST study in combination with ruxolitinib and background on the Phase 3 MANIFEST-2 study. After that, MorphoSys management and the key opinion leaders answered questions from the participants. A replay of the webcast and presentation will be accessible via the event entry on the company’s website until the end of 2023 at https://www.morphosys.com/en/all-events-conferences.

Intellectual Property

In the first six months of 2023, we continued to reinforce the patent protection of our development programs and technology portfolio, which represent the core value drivers of our Company.

Currently, the Company has more than 110 different proprietary patent families worldwide, in addition to the numerous patent families we are pursuing in collaboration with our partners.

Human Resources

On June 30, 2023, the MorphoSys Group had 544 employees (December 31, 2022: 629). During the first half-year of 2023, the MorphoSys Group employed an average of 591 people (H1 2022: 661). The decrease is caused by the decision to terminate all preclinical research programs and discontinue all related activities, as announced on March 2, 2023.

|

|

|

|

|

|

|

Group Interim Statement

|

17 |

Financial Analysis

MorphoSys reports the key financial figures – Monjuvi U.S. net product sales, gross margin of Monjuvi U.S. net product sales, research and development expenses as well as combined expenses for selling and general and administration – relevant for internal management purposes in quarterly statements. Their presentation is supplemented accordingly if other areas of the statement of profit or loss or balance sheet are affected by material business transactions during the quarter.

Revenues

Group revenues amounted in the first half-year of 2023 to € 115.5 million (H1 2022: € 100.9 million). This increase resulted from higher revenues from product sales and royalties. Group revenues included revenues of € 41.1 million (H1 2022: € 38.3 million) from the recognition of Monjuvi U.S. net product sales.

Success-based payments including royalties accounted for 43% or € 49.9 million (H1 2022: 42% or € 42.8 million) of total revenues. On a regional basis, MorphoSys generated 96% or € 111.4 million of its commercial revenues from product sales and with biopharmaceutical companies in North America and 4% or € 4.1 million from customers primarily located in Europe and Asia. In the same period last year, these percentages were 96% (€ 97.4 million) and 4% (€ 3.6 million), respectively. 75% of the Group's revenues were generated with customers Janssen, Incyte and McKesson (H1 2022: 73% with Janssen, Incyte and McKesson).

Cost of Sales

Cost of sales in the first half-year of 2023 amounted to € 28.7 million (H1 2022: € 25.1 million). The year-on-year increase resulted primarily from expenses related to vial sales to Incyte. Cost of sales related to Monjuvi U.S. product sales amounted to € 7.2 million in the first half-year of 2023. The gross margin of Monjuvi U.S. net product sales amounted to 82% (H1 2022: 80%).

Operating Expenses

Research and Development Expenses

Research and development expenses amounted to € 140.1 million in the first half-year of 2023 (H1 2022: € 126.0 million). The increase mainly resulted from additional costs incurred due to the positive development of the patient recruitment in the major ongoing clinical studies of MorphoSys. Specifically, the MANIFEST-2 study is fully recruited and therefore lead to higher costs when compared to the previous year. Additionally, a one-time effect resulting from severances in connection with the restructuring of the research area was included in the first quarter 2023. Expenses in this area consisted primarily of expenses for external services

of € 87.7 million (H1 2022: € 80.1 million) and personnel expenses of € 41.8 million (H1 2022: € 33.0 million).

Combined Expenses for Selling and General and Administration

The combined expenses for selling and general and administration amounted to € 66.8 million in the first half-year of 2023 (H1 2022: € 72.9 million). This sum consisted mainly of personnel expenses of € 40.8 million (H1 2022: € 39.4 million) and expenses for external services of € 18.1 million (H1 2022: € 25.3 million).

Selling expenses amounted to € 38.9 million in the first half-year of 2023 (H1 2022: € 45.9 million). This item consisted mainly of personnel expenses of € 20.7 million (H1 2022: € 23.3 million) and expenses for external services of € 13.8 million (H1 2022: € 18.5 million) and decreased due to streamlining and focusing of selling efforts. Selling expenses also included all of the expenses for services provided by Incyte as part of the joint U.S. marketing activities for Monjuvi.

In comparison to the same period of the previous year, general and administrative expenses increased to € 27.9 million (H1 2022: € 27.0 million). This line item mainly comprised personnel expenses amounting to € 20.1 million (H1 2022: € 16.1 million) and expenses for external services of € 4.3 million (H1 2022: € 6.8 million).

Finance Income / Finance Expenses

Finance income totaled € 61.6 million in the first half-year of 2023 (H1 2022: € 16.7 million) and mainly resulted from measurement effects from deviations between underlying planning assumptions and actual numbers of financial liabilities from future payments to Royalty Pharma of € 28.8 million (H1 2022: € 0.0 million). Additional finance income was derived from the repurchase of own convertible bonds in the amount of € 16.4 million (H1 2022: € 0.0 million). Finance income also includes income from the investment of cash and cash equivalents and corresponding currency translation gains from investing of funds amounting to € 12.1 million (H1 2022: € 11.3 million). Additionally, the amount included effects from the measurement of financial liabilities from collaborations in the amount of € 4.0 million (H1 2022: € 5.2 million).

Finance expenses totaled € 56.6 million in the first half-year of 2023 (H1 2022: € 248.0 million). This decrease was mainly due to the measurement effects from financial liabilities from future payments to Royalty Pharma of € 43.8 million (H1 2022: € 150.1 million) resulting from differences between underlying planning assumptions and actual figures, foreign currency effects and the application of the effective interest method. Furthermore, finance expense from financial liabilities from collaborations decreased to € 5.0 million (H1 2022: € 89.7 million), and in particular reduced effects from the foreign currency valuation as well as the application of the effective interest method contributed to the decrease. Also included are finance expenses from the investment of liquid funds and foreign currency translation losses from financing activities in the amount of € 1.4 million (H1 2022: € 0.3 million).

|

|

|

|

|

|

|

Group Interim Statement

|

19 |

Furthermore, interest expenses on the convertible bond issued in 2020 were included in the amount of € 5.7 million (H1 2022: € 6.1 million).

Financial Position

Cash and Investments

On June 30, 2023, the Group had cash and investments of € 672.8 million, compared to € 907.2 million on December 31, 2022.

Cash and investments are presented in the balance sheet items "Cash and Cash Equivalents" and current and non-current "Other Financial Assets".

The decrease in cash and investments resulted mainly from financing the operating activities in the first half-year of 2023. In addition, the partial redemption of the convertible bond as of March 30, 2023 resulted in a cash-outlfow of € 40.2 million.

Balance Sheet

Assets

Total assets on June 30, 2023, amounted to € 2,142.5 million, a decrease of € 254.4 million compared to December 31, 2022 (€ 2,396.9 million).

The decrease in Current Assets resulted mainly from the decrease in the balance sheet item “Cash and Cash Equivalents” by € 218.0 million and from the decrease in the item “Other Financial Assets” by € 17.4 million, mainly due to the financing of operating activities in the first half-year of 2023. Furthermore, the balance sheet item “Accounts Receivable” decreased by € 20.0 million and “Prepaid Expenses and Other Assets” decreased by € 17.7 million. This decrease was partially offset by an increase in the item “Inventories” by € 47.5 million, mainly driven by higher stock of Monjuvi drug substance.

In comparison to December 31, 2022, Non-Current Assets decreased by € 28.3 million to € 1,279.6 million, mainly due to the decrease in the balance sheet items “Intangible Assets” by € 16.3 million as well as “Goodwill” by € 6.5 million. The decrease in intangible assets and goodwill mainly resulted from the strengthening of the Euro against the US dollar exchange rate compared to December 31, 2022. Furthermore, the item "Investment in Associates" decreased by € 2.3 million to € 3.1 million due to subsequent measurement of the investment in HI-Bio using the equity method.

Liabilities

Current Liabilities decreased from € 278.3 million as of December 31, 2022, to € 241.7 million as of June 30, 2023, mainly as a result of a decrease of € 37.5 million in the item “Accounts Payable and Accruals”, this mainly resulted from the decrease of accrued expenses in the amount € 24.5 million and the reduction of accounts payable by € 12.9 million.

Non-Current Liabilities decreased by € 92.0 million to € 1,869.1 million, compared to December 31, 2022, mainly due to the decrease of the items “Financial Liabilities from Future Payments to Royalty Pharma” by € 44.7 million and “Financial Liabilities from Collaborations” by € 3.7 million due to adjustments in planning assumptions. Furthermore, the item "Bonds" decreased by € 52.1 million due to the repurchase of own convertible bonds. This decrease was partially offset by an increase of the item "Provisions" by € 10.5 million.

Stockholder’s Equity

As of June 30, 2023, the Company’s common stock including treasury shares amounted to € 34,231,943 (December 31, 2022: € 34,231,943).

As of June 30, 2023, the value of treasury shares decreased from € 2,450,303 on December 31, 2022, to € 2,296,956. The reason for this decrease was the transfer of 4,149 treasury shares from the 2019 performance-based Long-Term Incentive Plan (LTI Plan) in the amount of € 153,347 to the Management Board and certain employees of the Company (beneficiaries). The vesting period for this LTI Plan expired on April 1, 2023, and offers beneficiaries a six-month period until November 3, 2023, to receive a total of 12,295 shares. As a result, the number of MorphoSys shares held by the Company as of June 30, 2023, amounted to 61,831 shares (December 31, 2022: 65,980 shares).

As of June 30, 2023, additional paid-in capital amounted to € 842,165,941 (December 31, 2022: € 833,708,724). The increase totaling € 8,457,217 was largely a result of the sale of the investment in adivo GmbH on June 7, 2023. The gain on the disposal amounted to € 6,271,775 and was recognized in equity, due to the recycling from other comprehensive income. Furthermore, the increase is attributable to the allocation of personnel expenses from share-based payments in the amount of € 2,338,789.

On June 30, 2023, the other comprehensive income reserve mainly contained foreign currency translation differences from the consolidation of € 99,042,501 (December 31, 2022: € 115,354,088). The currency translation differences from the consolidation included exchange rate differences from the translation of the financial statements of Group companies prepared in foreign currencies and differences between the exchange rates used in the balance sheet and income statement.

The consolidated net loss for the first six months of 2023 of € 118,398,799 is reported under “accumulated deficit.” As a result, the accumulated deficit increased from € 823,407,416 on December 31, 2022 to € 941,806,215 on June 30, 2023.

The development of the equity of the parent company MorphoSys AG (including the assessment with regard to the provision of section 92 German Stock Corporation Act) as well as of MorphoSys Group is closely monitored by the Management Board. In addition, the company is thoroughly monitoring the liquidity situation of MorphoSys Group, and believes that MorphoSys has sufficient liquid funds to ensure business operations for the forecast period which is subject to the going-concern assessment (at least twelve months from the issuance date of the interim consolidated financial statements) without requiring additional proceeds from external refinancing. At the time of this report, the Management Board is not aware of any imminent risks that could affect the company as a going concern.

|

|

|

|

|

|

|

Group Interim Statement

|

PAGE |

Risks and Opportunities

Taking into account current developments on the relevant markets, the risk and opportunities and their assessment remain unchanged in all material respects compared with the situation described on pages 64 to 74 in the 2022 Annual Report.

Consolidated Statement of Profit or Loss (IFRS) – (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| in € |

|

Note |

|

H1

2023

|

|

H1

2022

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Product Sales |

|

2 |

|

41,124,021 |

|

38,328,433 |

| Royalties |

|

2 |

|

48,428,938 |

|

41,042,372 |

| Licenses, Milestones and Other |

|

2 |

|

25,930,515 |

|

21,537,274 |

| Revenues |

|

2 |

|

115,483,474 |

|

100,908,079 |

| Cost of Sales |

|

|

|

(28,686,762) |

|

(25,134,424) |

| Gross Profit |

|

|

|

86,796,712 |

|

75,773,655 |

| Operating Expenses |

|

|

|

|

|

|

| Research and Development |

|

|

|

(140,078,391) |

|

(125,964,896) |

| Selling |

|

|

|

(38,901,747) |

|

(45,893,251) |

| General and Administrative |

|

|

|

(27,861,642) |

|

(26,978,239) |

| Total Operating Expenses |

|

|

|

(206,841,780) |

|

(198,836,386) |

| Operating Profit / (Loss) |

|

|

|

(120,045,068) |

|

(123,062,731) |

| Other Income |

|

|

|

2,711,622 |

|

9,165,669 |

| Other Expenses |

|

|

|

(2,366,521) |

|

(15,491,288) |

| Finance Income |

|

|

|

61,597,091 |

|

16,727,818 |

| Finance Expenses |

|

|

|

(56,582,555) |

|

(247,963,035) |

| Income from Reversals of Impairment Losses / (Impairment Losses) on Financial Assets |

|

|

|

590,967 |

|

(1,040,000) |

| Income Tax Benefit / (Expenses) |

|

3 |

|

0 |

|

4,021,790 |

| Share of Loss of Associates accounted for using the Equity Method |

|

|

|

(4,304,335) |

|

0 |

| Consolidated Net Profit / (Loss) |

|

|

|

(118,398,799) |

|

-357,641,777 |

| Earnings per Share, Basic and Diluted (in €) |

|

|

|

(3.47) |

|

(10.47) |

| Shares Used in Computing Earnings per Share, Basic and Diluted |

|

|

|

34,166,401 |

|

34,150,505 |

| Shares Used in Computing Earnings per Share, Basic |

|

|

|

— |

|

— |

| Shares Used in Computing Earnings per Share, Diluted |

|

|

|

— |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Group Interim Statement

|

23 |

Consolidated Statement of Comprehensive Income (IFRS) – (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| in € |

|

H1

2023

|

|

H1

2022

|

|

|

|

|

|

|

|

|

|

|

| Consolidated Net Profit / (Loss) |

|

(118,398,799) |

|

(357,641,777) |

| Items that will not be reclassified to Profit or Loss |

|

|

|

|

| Change in Fair Value of Shares through Other Comprehensive Income |

|

359,458 |

|

0 |

| Items that may be reclassified to Profit or Loss |

|

|

|

|

| Foreign Currency Translation Differences from Consolidation |

|

(16,311,587) |

|

84,638,199 |

| Other Comprehensive Income |

|

(15,952,129) |

|

84,638,199 |

| Total Comprehensive Income |

|

(134,350,928) |

|

(273,003,578) |

|

|

|

|

|

Consolidated Balance Sheet

(IFRS) – (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| in € |

|

Note |

|

06/30/2023 |

|

12/31/2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ASSETS |

|

|

|

|

|

|

| Current Assets |

|

|

|

|

|

|

| Cash and Cash Equivalents |

|

5 |

|

184,327,910 |

|

402,350,904 |

| Other Financial Assets |

|

5 |

|

487,444,578 |

|

504,822,678 |

| Accounts Receivable |

|

5 |

|

71,267,032 |

|

91,231,143 |

| Income Tax Receivables |

|

|

|

3,263,299 |

|

2,601,052 |

| Other Receivables |

|

5 |

|

11,654,110 |

|

12,852,390 |

| Inventories |

|

|

|

71,729,294 |

|

24,252,987 |

| Prepaid Expenses and Other Assets |

|

|

|

33,188,090 |

|

50,929,633 |

| Total Current Assets |

|

|

|

862,874,313 |

|

1,089,040,787 |

| Non-Current Assets |

|

|

|

|

|

|

| Property, Plant and Equipment |

|

|

|

4,976,176 |

|

5,926,942 |

| Right-of-Use Assets |

|

|

|

42,575,689 |

|

45,060,360 |

| Intangible Assets |

|

|

|

870,318,215 |

|

886,582,956 |

| Goodwill |

|

|

|

349,712,311 |

|

356,239,773 |

| Other Financial Assets |

|

5 |

|

1,013,775 |

|

0 |

| Investment in Associates |

|

13 |

|

3,060,336 |

|

5,352,451 |

| Prepaid Expenses and Other Assets |

|

5 |

|

7,971,592 |

|

8,728,994 |

| Total Non-Current Assets |

|

|

|

1,279,628,094 |

|

1,307,891,476 |

| TOTAL ASSETS |

|

|

|

2,142,502,407 |

|

2,396,932,263 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Group Interim Statement

|

25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| in € |

|

Note |

|

06/30/2023 |

|

12/31/2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

| Current Liabilities |

|

|

|

|

|

|

| Accounts Payable and Accruals |

|

5 |

|

119,819,110 |

|

157,270,380 |

| Lease Liabilities |

|

5 |

|

3,537,099 |

|

7,561,126 |

| Tax Liabilities |

|

3 |

|

783,877 |

|

792,675 |

| Provisions |

|

|

|

3,929,944 |

|

6,006,229 |

| Bonds |

|

|

|

1,640,369 |

|

2,031,250 |

| Financial Liabilities from Collaborations |

|

4, 5 |

|

4,972,388 |

|

2,513,718 |

| Financial Liabilities from Future Payments to Royalty Pharma |

|

4, 5 |

|

107,018,187 |

|

102,171,167 |

| Total Current Liabilities |

|

|

|

241,700,974 |

|

278,346,545 |

| Non-Current Liabilities |

|

|

|

|

|

|

| Lease Liabilities |

|

|

|

36,420,757 |

|

38,219,225 |

| Provisions |

|

|

|

19,141,908 |

|

8,674,110 |

| Deferred Tax Liability |

|

3 |

|

6,386,648 |

|

6,506,420 |

| Bonds |

|

13 |

|

239,522,165 |

|

291,647,407 |

| Financial Liabilities from Collaborations |

|

4, 5 |

|

214,104,753 |

|

217,825,779 |

| Financial Liabilities from Future Payments to Royalty Pharma |

|

4, 5 |

|

1,353,556,017 |

|

1,398,303,228 |

| Total Non-Current Liabilities |

|

|

|

1,869,132,248 |

|

1,961,176,169 |

| Total Liabilities |

|

|

|

2,110,833,222 |

|

2,239,522,714 |

|

|

|

|

|

|

|

| Stockholders’ Equity |

|

|

|

|

|

|

| Common Stock |

|

6 |

|

34,231,943 |

|

34,231,943 |

Treasury Stock (61,831 and 65,980 shares for 2023 and 2022, respectively), at Cost |

|

|

|

(2,296,956) |

|

(2,450,303) |

| Additional Paid-in Capital |

|

6 |

|

842,165,941 |

|

833,708,724 |

| Other Comprehensive Income Reserve |

|

6 |

|

99,374,472 |

|

115,326,601 |

| Accumulated Deficit |

|

6 |

|

(941,806,215) |

|

(823,407,416) |

| Total Stockholders’ Equity |

|

|

|

31,669,185 |

|

157,409,549 |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

2,142,502,407 |

|

2,396,932,263 |

|

|

|

|

|

|

|

Consolidated Statement of Changes in Stockholders’ Equity (IFRS) – (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

|

|

|

|

|

|

Shares |

|

€ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance as of January 1, 2022 |

|

|

|

34,231,943 |

|

34,231,943 |

|

|

| Expenses through Share-based Payment Transactions and Issue of Convertible Instruments |

|

|

|

0 |

|

0 |

|

|

| Transfer of Treasury Stock for Long-Term Incentive Programs |

|

|

|

0 |

|

0 |

|

|

| Balance as of Reserves: |

|

|

|

|

|

|

|

|

| Foreign Currency Translation Differences from Consolidation |

|

|

|

0 |

|

0 |

|

|

| Consolidated Net Loss |

|

|

|

0 |

|

0 |

|

|

| Total Comprehensive Income |

|

|

|

0 |

|

0 |

|

|

| Balance as of June 30, 2022 |

|

|

|

34,231,943 |

|

34,231,943 |

|

|

| Balance as of January 1, 2023 |

|

|

|

34,231,943 |

|

34,231,943 |

|

|

| Expenses through Share-based Payment Transactions and Issue of Convertible Instruments |

|

6, 7, 11 |

|

0 |

|

0 |

|

|

| Transfer of Treasury Stock for Long-Term Incentive Programs |

|

6, 7, 11 |

|

0 |

|

0 |

|

|

| Balance as of Reserves: |

|

|

|

|

|

|

|

|

| Change in Fair Value of Shares through Other Comprehensive Income |

|

|

|

0 |

|

0 |

|

|

| Foreign Currency Translation Differences from Consolidation |

|

6 |

|

0 |

|

0 |

|

|

| Consolidated Net Loss |

|

6 |

|

0 |

|

0 |

|

|

| Total Comprehensive Income |

|

|

|

0 |

|

0 |

|

|

| Balance as of June 30, 2023 |

|

|

|

34,231,943 |

|

34,231,943 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Group Interim Statement

|

27 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Treasury Stock |

|

Additional Paid-in Capital |

|

Other Comprehensive Income Reserve |

|

Accumulated Deficit |

|

Total

Stockholders’

Equity

|

|

|

Shares |

|

€ |

€ |

€ |

€ |

€ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

83,154 |

|

(3,085,054) |

|

833,320,689 |

|

52,757,591 |

|

(672,349,226) |

|

244,875,943 |

|

|

0 |

|

0 |

|

668,884 |

|

0 |

|

0 |

|

668,884 |

|

|

(4,587) |

|

169,536 |

|

(169,536) |

|

0 |

|

0 |

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

0 |

|

0 |

|

84,638,199 |

|

0 |

|

84,638,199 |

|

|

0 |

|

0 |

|

0 |

|

0 |

|

(357,641,777) |

|

(357,641,777) |

|

|

0 |

|

0 |

|

0 |

|

84,638,199 |

|

(357,641,777) |

|

(273,003,578) |

|

|

78,567 |

|

(2,915,518) |

|

833,820,037 |

|

137,395,790 |

|

(1,029,991,003) |

|

(27,458,751) |

|

|

65,980 |

|

(2,450,303) |

|

833,708,724 |

|

115,326,601 |

|

(823,407,416) |

|

157,409,549 |

|

|

0 |

|

0 |

|

2,338,789 |

|

0 |

|

0 |

|

2,338,789 |

|

|

(4,149) |

|

153,347 |

|

(153,347) |

|

0 |

|

0 |

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

0 |

|

6,271,775 |

|

359,458 |

|

0 |

|

6,631,233 |

|

|

0 |

|

0 |

|

0 |

|

(16,311,587) |

|

0 |

|

(16,311,587) |

|

|

0 |

|

0 |

|

0 |

|

0 |

|

(118,398,799) |

|

(118,398,799) |

|

|

0 |

|

0 |

|

6,271,775 |

|

(15,952,129) |

|

(118,398,799) |

|

(128,079,153) |

|

|

61,831 |

|

(2,296,956) |

|

842,165,941 |

|

99,374,472 |

|

(941,806,215) |

|

31,669,185 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Statement of Cash Flows (IFRS) – (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

H1 (in €) |

|

Note |

|

2023 |

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Activities: |

|

|

|

|

|

|

| Consolidated Net Profit / (Loss) |

|

|

|

(118,398,799) |

|

(357,641,777) |

| Adjustments to Reconcile Consolidated Net Profit / (Loss) to Net Cash Provided by / (Used in) Operating Activities: |

|

|

|

|

|

|

| Impairments of Assets |

|

|

|

0 |

|

797,944 |

| Depreciation and Amortization of Tangible and Intangible Assets and of Right-of-Use Assets |

|

|

|

5,742,395 |

|

5,142,636 |

| Net (Gain) / Loss of Other Financial Assets |

|

|

|

(10,461,167) |

|

(335,244) |

| (Income) from Reversals of Impairments / Impairments on Financial Assets |

|

|

|

(590,967) |

|

1,040,000 |

| Net (Gain) / Loss on Derivative Financial Instruments |

|

|

|

0 |

|

(212,445) |

| Non Cash Effective Net Change in Financial Assets / Liabilities from Collaborations |

|

|

|

1,002,264 |

|

84,481,103 |

| Non Cash Effective Net Change in Financial Liabilities from Future Payments to Royalty Pharma |

|

|

|

(30,584,264) |

|

110,432,607 |

| Gain on Repurchase and interest expense from Convertible Bond |

|

|

|

(10,656,108) |

|

6,144,606 |

| Share-based Payment |

|

10 |

|

12,807,771 |

|

924,380 |

| Share of Loss of Associates accounted for using the Equity Method |

|

|

|

4,304,335 |

|

0 |

| Other Cash and Non-Cash Expenses (+) / Income (-) |

|

|

|

(183,783) |

|

0 |

| Income Tax (Benefit) / Expenses |

|

3 |

|

0 |

|

(4,021,790) |

| Changes in Operating Assets and Liabilities: |

|

|

|

|

|

|

| Accounts Receivable |

|

|

|

19,632,154 |

|

(41,960,183) |

| Income Tax Receivables, Other Receivables, Inventories and Prepaid Expenses and Other Assets |

|

|

|

(31,140,851) |

|

(23,600,414) |

| Accounts Payable and Accruals, Lease Liabilities, Tax Liabilities and Provisions |

|

|

|

(38,541,663) |

|

(34,505,608) |

| Contract Liability |

|

13 |

|

0 |

|

15,441,847 |

| Income Taxes Paid (-) / Received (+) |

|

|

|

(132,740) |

|

(136,365) |

| Net Cash Provided by / (Used in) Operating Activities |

|

|

|

(197,201,423) |

|

(238,008,703) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Group Interim Statement

|

29 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

H1 (in €) |

|

Note |

|

2023 |

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Investing Activities: |

|

|

|

|

|

|

| Cash Payments to Acquire Other Financial Assets |

|

|

|

(2,022,299,995) |

|

(566,000,000) |

| Cash Receipts from Sales of Other Financial Assets |

|

|

|

2,042,300,000 |

|

784,180,445 |

| Cash Payments for Derivative Financial Instruments |

|

|

|

0 |

|

212,445 |

| Cash Payments to Acquire Property, Plant and Equipment |

|

|

|

(319,107) |

|

(1,026,202) |

| Cash Payments to Acquire Intangible Assets |

|

|

|

(207,114) |

|

(3,691,434) |

| Cash Receipts from Sales of Shares at Fair Value through Other Comprehensive Income |

|

13 |

|

4,360,421 |

|

0 |

| Interest Received |

|

|

|

9,295,190 |

|

329,705 |

| Net Cash Provided by / (Used in) Investing Activities |

|

|

|

33,129,395 |

|

214,004,959 |

|

|

|

|

|

|

|

| Financing Activities: |

|

|

|

|

|

|

| Cash Payments for Repurchases of own Convertible Bonds |

|

13 |

|

(40,256,000) |

|

0 |

| Payment for transaction costs for repurchases of own convertible bonds |

|

|

|

(507,708) |

|

0 |

| Cash Receipts (+) / Cash Payments (-) from Financing from Collaborations |

|

|

|

(2,264,622) |

|

19,502,950 |

| Cash Payments for Principal Elements of Lease Payments |

|

|

|

(5,457,411) |

|

(1,773,150) |

| Interest Paid |

|

|

|

(1,510,415) |

|

(2,012,263) |

| Net Cash Provided by / (Used in) Financing Activities |

|

|

|

(49,996,156) |

|

15,717,537 |

| Effect of Exchange Rate Differences on Cash |

|

|

|

(3,954,810) |

|

4,092,251 |