Document

Exhibit 99.1

Forge Global Holdings, Inc. Reports Third Quarter Fiscal Year 2023 Results

•Total Revenue Less Transaction Based Expenses Was $18.4 million in 3Q23

•Trading Volume Was $234.1 million in 3Q23

•Net Take Rate Was 3.0% in 3Q23

•Forge Trust Custodial Cash Was $518 million in 3Q23

SAN FRANCISCO – November 7, 2023 – Forge Global Holdings, Inc. (“Forge,” or the “Company”) (NYSE: FRGE), a leading provider of marketplace infrastructure, data services and technology solutions for private market participants, today announced its financial results for the third quarter ended September 30, 2023.

“In the third quarter, investors demonstrated a continued cautious return to the private market — which drove higher volumes and revenue in our markets business compared to both Q1 and Q2,” said Kelly Rodriques, CEO of Forge. “This improvement was observed for the third quarter even as continued concern over Fed actions and interest rates, as well as existing geopolitical conflicts served as a backdrop heading into the fourth quarter.”

Financial Highlights for the Third Quarter 2023

Forge believes that quarter-over-quarter comparisons are more indicative of the current state of the business. For year-ago-quarter comparisons, please reference the unaudited condensed consolidated financial statements in the Quarterly Report on Form 10-Q that will be filed on or around the date of this press release.

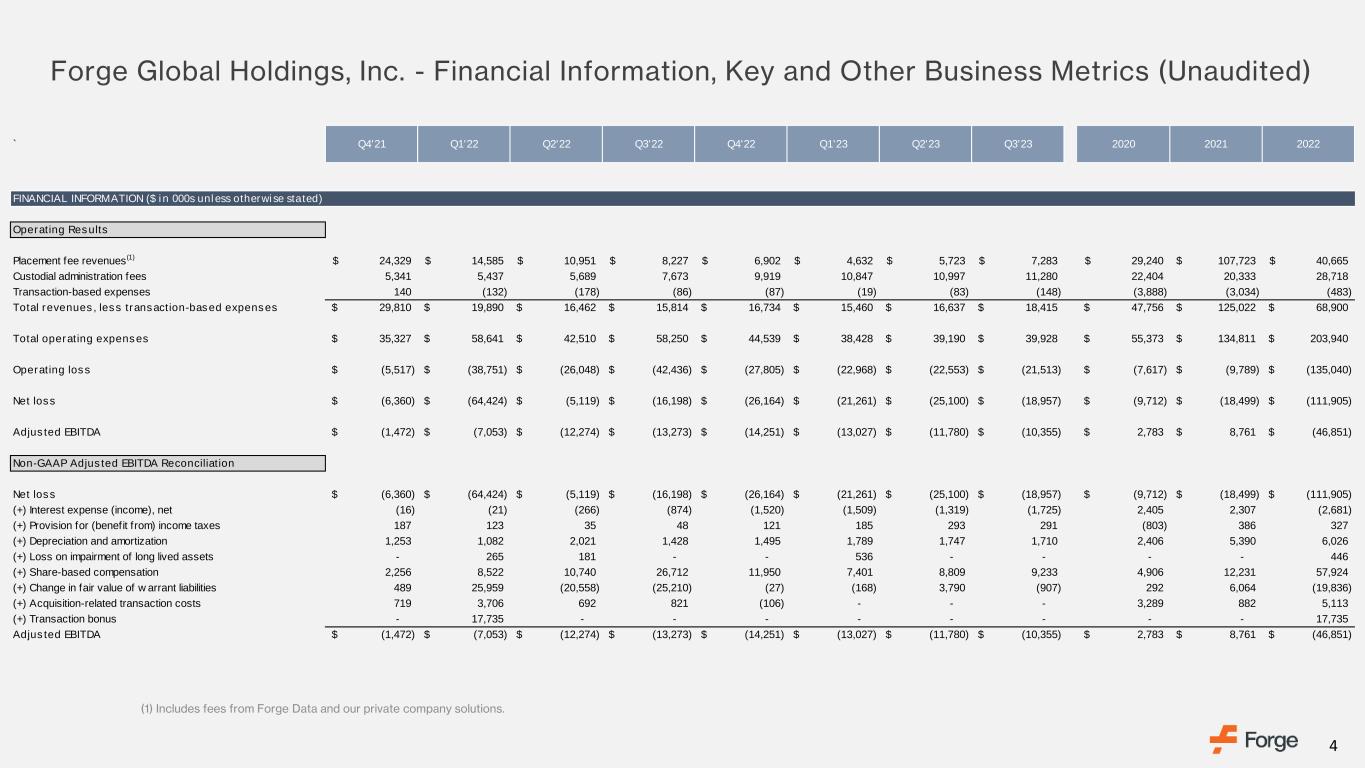

Revenue: Total revenue less transaction-based expenses was $18.4 million compared to $16.6 million in the quarter ended June 30, 2023.

Operating Loss: Total operating loss was $21.5 million compared to total operating loss of $22.6 million in the quarter ended June 30, 2023.

Net Loss: Net loss was $19.0 million compared to net loss of $25.1 million in the quarter ended June 30, 2023.

Adjusted EBITDA: Total adjusted EBITDA was a loss of $10.4 million compared to total adjusted EBITDA loss of $11.8 million in the quarter ended June 30, 2023.

Cash Flow from Operating Activities: Net cash used in operating activities was $3.5 million compared to $13.6 million in the quarter ended June 30, 2023.

Cash Flow from Investing Activities: Net cash used in investing activities was $0.5 million compared to net cash used in investing activities of $2.7 million in the quarter ended June 30, 2023.

Ending Cash Balance: Cash and cash equivalents as of September 30, 2023 was $155.1 million.

Share Count: Basic weighted-average number of shares used to compute net loss per share attributable to common stockholders for the quarter ended September 30, 2023, was 174 million shares and fully diluted outstanding share count as of September 30, 2023 was 198 million shares.

We estimate for the quarter ended December 31, 2023 that Forge will have 175.1 million weighted average basic shares outstanding, which will be used to calculate earnings per share in a loss position.

Fully diluted outstanding share count includes all common shares outstanding plus shares that would be issued in respect to outstanding options and warrants, net of shares to be withheld in respect to exercise price of the respective instruments. Instruments that are out of the money are excluded from the fully diluted outstanding share count.

KPIs for the Third Quarter 2023

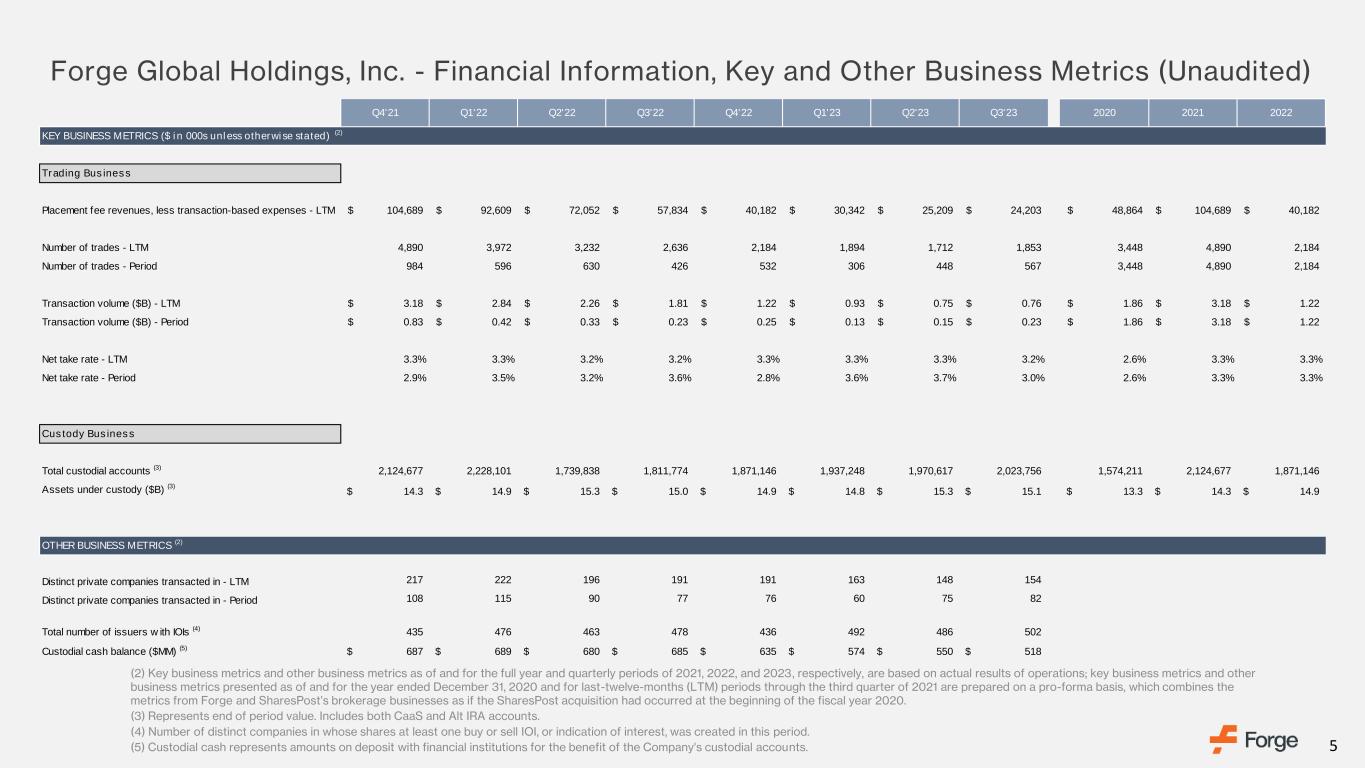

•Trading Volume was $234.1 million, up 53% quarter-over-quarter.

•Net Take Rate was 3.0%, down 19% quarter-over-quarter.

•Total Placement Fee revenues, less transaction-based expenses, totaled $7.1 million, up 27% quarter-over-quarter.

•Total Custodial Administration Fee revenues totaled $11.3 million, up 3% quarter-over-quarter.

•Total Custodial Accounts increased from 1.97 million to 2.02 million, up 3% quarter-over-quarter.

•Total Assets Under Custody decreased from $15.3 billion to $15.1 billion, down 1% quarter-over-quarter.

Additional Business Metrics for the Third Quarter 2023

•Forge Trust Custodial Cash: Forge Trust Custodial Cash totaled $518 million, down 6% quarter-over-quarter.

•Total Number of Companies with Indications of Interest (IOIs): The total number of companies with IOIs were 502, up 3% quarter-over-quarter.

•Headcount: Forge finished out the quarter ended September 30, 2023 with a total headcount of 344, a decrease of 4% quarter-over-quarter.

Please refer to the section titled “Use of Non-GAAP Financial Information” and the tables within this press release which contain explanations and reconciliations of the Company’s non-GAAP financial measures.

Webcast/Conference Call Details

Forge will host a webcast conference call today, November 7th, 2023, at 4:30 p.m. Eastern Time / 1:30 p.m Pacific Time to discuss these financial results and business highlights. The listen-only webcast is available at https://ir.forgeglobal.com. Investors and participants can access the conference call over the phone by dialing 1 (888) 440-4165 from the United States, or +1 (646) 960-0858 internationally. The conference ID is 5410143. The Supplemental Investor Information for this quarter is also posted on https://ir.forgeglobal.com.

Use of Non-GAAP Financial Information

In addition to our financial results determined in accordance with generally accepted accounting principles in the United States of America ("GAAP"), we present Adjusted EBITDA, a non-GAAP financial measure. We use Adjusted EBITDA to evaluate our ongoing operations and for internal planning and forecasting purposes. We believe that Adjusted EBITDA, when taken together with the corresponding GAAP financial measure, provides meaningful supplemental information regarding our performance by excluding specific financial items that have less bearing on our core operating performance. We consider Adjusted EBITDA to be an important measure because it helps illustrate underlying trends in our business and our historical operating performance on a more consistent basis.

However, non-GAAP financial information is presented for supplemental informational purposes only, has limitations as an analytical tool and should not be considered in isolation or as a substitute for financial information presented in accordance with GAAP. In addition, other companies, including companies in our industry, may calculate similarly titled non-GAAP financial measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of Adjusted EBITDA as a tool for comparison.

A reconciliation is provided below for Adjusted EBITDA to net loss, the most directly comparable financial measure stated in accordance with GAAP. Investors are encouraged to review Adjusted EBITDA and the reconciliation of Adjusted EBITDA to net loss, and not to rely on any single financial measure to evaluate our business.

We defined Adjusted EBITDA as net loss, adjusted to exclude: (i) interest expense, net, (ii) provision for or benefit from income taxes, (iii) depreciation and amortization, (iv) share-based compensation expense, (v) change in fair value of warrant liabilities, (vi) acquisition-related transaction costs, and (vii) other significant gains, losses, and expenses (such as impairments, transaction bonus) that we believe are not indicative of our ongoing results.

Forward-Looking Statements

This press release contains “forward-looking statements,” which generally are accompanied by words such as “believe,” “may,” “could,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “target,” “goal,” “expect,” “should,” “would,” “plan,” “predict,” “project,” “forecast,” “potential,” “seem,” “seek,” “future,” “outlook,” and similar expressions that predict, indicate or relate to future events or trends or Forge’s future financial or operating performance, or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding Forge’s beliefs regarding its financial position and operating performance, as well as future opportunities for Forge to expand its business. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, while considered reasonable by Forge and its management, are subject to risks and uncertainties that may cause actual results to differ materially from current expectations. You should carefully consider the risks and uncertainties described in Forge’s documents filed, or to be filed, with the SEC, including in its Quarterly Report on Form 10-Q that will be filed on or around the date of this press release. There may be additional risks that Forge presently does not know of or that it currently believes are immaterial that could also cause actual results to differ materially from those contained in the forward-looking statements. In addition, forward-looking statements reflect Forge’s expectations, plans or forecasts of future events and views as of the date of this press release. Forge anticipates that subsequent events and developments will cause its assessments to change. However, while Forge may elect to update these forward-looking statements at some point in the future, Forge specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing Forge’s assessments as of any date subsequent to the date of this press release. Accordingly, undue reliance should not be placed upon the forward-looking statements.

About Forge

Forge is a leading provider of marketplace infrastructure, data services and technology solutions for private market participants. Forge Securities LLC is a registered broker-dealer and a Member of FINRA that operates an alternative trading system.

Contacts

Investor Relations Contact:

Dominic Paschel

ir@forgeglobal.com

Media Contact:

Lindsay Riddell

press@forgeglobal.com

FORGE GLOBAL HOLDINGS, INC.

Unaudited Condensed Consolidated Balance Sheets

(In thousands of U.S. dollars, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30,

2023 |

|

December 31,

2022 |

| Assets |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

155,127 |

|

|

$ |

193,136 |

|

| Restricted cash |

1,299 |

|

|

1,829 |

|

| Accounts receivable, net |

3,871 |

|

|

3,544 |

|

|

|

|

|

| Prepaid expenses and other current assets |

10,148 |

|

|

8,379 |

|

| Total current assets |

$ |

170,445 |

|

|

$ |

206,888 |

|

| Property and equipment, net |

317 |

|

|

359 |

|

| Internal-use software, net |

5,023 |

|

|

7,640 |

|

| Goodwill and other intangible assets, net |

130,897 |

|

|

133,887 |

|

| Operating lease right-of-use assets |

3,379 |

|

|

5,706 |

|

| Payment-dependent notes receivable, noncurrent |

5,763 |

|

|

7,371 |

|

| Other assets, noncurrent |

1,696 |

|

|

1,878 |

|

| Total assets |

$ |

317,520 |

|

|

$ |

363,729 |

|

| Liabilities, convertible preferred stock and stockholders’ equity |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable |

$ |

1,480 |

|

|

$ |

2,797 |

|

| Accrued compensation and benefits |

8,798 |

|

|

13,271 |

|

| Accrued expenses and other current liabilities |

8,121 |

|

|

6,421 |

|

| Operating lease liabilities, current |

2,300 |

|

|

3,896 |

|

|

|

|

|

| Total current liabilities |

$ |

20,699 |

|

|

$ |

26,385 |

|

| Operating lease liabilities, noncurrent |

2,002 |

|

|

3,541 |

|

| Payment-dependent notes payable, noncurrent |

5,763 |

|

|

7,371 |

|

| Warrant liabilities |

3,321 |

|

|

606 |

|

| Other liabilities, noncurrent |

185 |

|

|

365 |

|

| Total liabilities |

$ |

31,970 |

|

|

$ |

38,268 |

|

| Commitments and contingencies |

|

|

|

| Stockholders’ equity: |

|

|

|

Common stock, $0.0001 par value; 175,173,113 and 172,560,916 shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively |

18 |

|

|

18 |

|

| Additional paid-in capital |

534,659 |

|

|

509,094 |

|

| Accumulated other comprehensive loss |

601 |

|

|

693 |

|

| Accumulated deficit |

(254,843) |

|

|

(190,418) |

|

| Total Forge Global Holdings, Inc. stockholders’ equity |

$ |

280,435 |

|

|

$ |

319,387 |

|

| Noncontrolling Interest |

5,115 |

|

|

6,074 |

|

| Total stockholders’ equity |

$ |

285,550 |

|

|

$ |

325,461 |

|

| Total liabilities, convertible preferred stock and stockholders’ equity |

$ |

317,520 |

|

|

$ |

363,729 |

|

FORGE GLOBAL HOLDINGS, INC.

Unaudited Condensed Consolidated Statements of Operations

(In thousands of U.S. dollars, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

September 30, 2023 |

|

June 30, 2023 |

|

September 30, 2022 |

|

September 30, 2023 |

|

September 30, 2022 |

| Revenues: |

|

|

|

|

|

|

|

|

|

| Placement fees |

$ |

7,283 |

|

|

$ |

5,723 |

|

|

$ |

8,227 |

|

|

$ |

17,638 |

|

|

$ |

33,763 |

|

| Custodial administration fees |

11,280 |

|

|

10,997 |

|

|

7,673 |

|

|

33,124 |

|

|

18,799 |

|

| Total revenues |

$ |

18,563 |

|

|

$ |

16,720 |

|

|

$ |

15,900 |

|

|

$ |

50,762 |

|

|

$ |

52,562 |

|

| Transaction-based expenses: |

|

|

|

|

|

|

|

|

|

| Transaction-based expenses |

(148) |

|

|

(83) |

|

|

(86) |

|

|

(250) |

|

|

(397) |

|

| Total revenues, less transaction-based expenses |

$ |

18,415 |

|

|

$ |

16,637 |

|

|

$ |

15,814 |

|

|

$ |

50,512 |

|

|

$ |

52,165 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

| Compensation and benefits |

27,650 |

|

|

25,154 |

|

|

44,040 |

|

|

78,566 |

|

|

115,064 |

|

| Professional services |

2,883 |

|

|

3,265 |

|

|

3,799 |

|

|

8,884 |

|

|

11,169 |

|

| Acquisition-related transaction costs |

— |

|

|

— |

|

|

821 |

|

|

— |

|

|

5,219 |

|

| Advertising and market development |

910 |

|

|

876 |

|

|

928 |

|

|

2,463 |

|

|

3,873 |

|

| Rent and occupancy |

1,142 |

|

|

1,148 |

|

|

1,097 |

|

|

3,616 |

|

|

3,803 |

|

| Technology and communications |

3,763 |

|

|

3,475 |

|

|

3,536 |

|

|

10,628 |

|

|

8,368 |

|

| General and administrative |

1,870 |

|

|

3,525 |

|

|

2,601 |

|

|

8,143 |

|

|

7,373 |

|

| Depreciation and amortization |

1,710 |

|

|

1,747 |

|

|

1,428 |

|

|

5,246 |

|

|

4,531 |

|

| Total operating expenses |

$ |

39,928 |

|

|

$ |

39,190 |

|

|

$ |

58,250 |

|

|

$ |

117,546 |

|

|

$ |

159,400 |

|

| Operating loss |

$ |

(21,513) |

|

|

$ |

(22,553) |

|

|

$ |

(42,436) |

|

|

$ |

(67,034) |

|

|

$ |

(107,235) |

|

| Interest and other income (expenses): |

|

|

|

|

|

|

|

|

|

| Interest income |

1,725 |

|

|

1,319 |

|

|

874 |

|

|

4,553 |

|

|

1,161 |

|

| Change in fair value of warrant liabilities |

907 |

|

|

(3,790) |

|

|

25,210 |

|

|

(2,715) |

|

|

19,808 |

|

| Other income (expenses), net |

215 |

|

|

217 |

|

|

202 |

|

|

647 |

|

|

731 |

|

| Total interest income and other income (expenses) |

$ |

2,847 |

|

|

$ |

(2,254) |

|

|

$ |

26,286 |

|

|

$ |

2,485 |

|

|

$ |

21,700 |

|

| Loss before provision for income taxes |

$ |

(18,666) |

|

|

$ |

(24,807) |

|

|

$ |

(16,150) |

|

|

$ |

(64,549) |

|

|

$ |

(85,535) |

|

| Provision for income taxes |

291 |

|

|

293 |

|

|

48 |

|

|

769 |

|

|

206 |

|

| Net loss |

$ |

(18,957) |

|

|

$ |

(25,100) |

|

|

$ |

(16,198) |

|

|

$ |

(65,318) |

|

|

$ |

(85,741) |

|

| Net loss attributable to noncontrolling interest |

$ |

(609) |

|

|

$ |

(211) |

|

|

$ |

— |

|

|

$ |

(893) |

|

|

$ |

— |

|

| Net loss attributable to Forge Global Holdings, Inc. |

$ |

(18,348) |

|

|

$ |

(24,889) |

|

|

$ |

(16,198) |

|

|

$ |

(64,425) |

|

|

$ |

(85,741) |

|

| Net loss per share attributable to Forge Global Holdings, Inc. common stockholders: |

|

|

|

|

|

|

|

|

|

| Basic |

$ |

(0.11) |

|

|

$ |

(0.14) |

|

|

$ |

(0.10) |

|

|

$ |

(0.37) |

|

|

$ |

(0.64) |

|

| Diluted |

$ |

(0.11) |

|

|

$ |

(0.14) |

|

|

$ |

(0.12) |

|

|

$ |

(0.37) |

|

|

$ |

(0.66) |

|

| Weighted-average shares used in computing net loss per share attributable to Forge Global Holdings, Inc. common stockholders: |

|

|

|

|

|

|

|

|

|

| Basic |

173,957,880 |

|

|

173,289,549 |

|

|

169,838,778 |

|

|

173,045,721 |

|

|

134,683,950 |

|

| Diluted |

173,957,880 |

|

|

173,289,549 |

|

|

170,209,256 |

|

|

173,045,721 |

|

|

135,960,612 |

|

FORGE GLOBAL HOLDINGS, INC.

Unaudited Condensed Consolidated Statements of Cash Flows

(In thousands of U.S. dollars)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

September 30, 2023 |

|

June 30, 2023 |

|

September 30, 2022 |

|

September 30, 2023 |

|

September 30, 2022 |

| Cash flows from operating activities: |

|

|

|

|

|

|

|

|

|

| Net loss |

$ |

(18,957) |

|

|

$ |

(25,100) |

|

|

$ |

(16,198) |

|

|

$ |

(65,318) |

|

|

$ |

(85,741) |

|

| Adjustments to reconcile net loss including noncontrolling interest to net cash (used in) provided by operations: |

|

|

|

|

|

|

|

|

|

| Share-based compensation |

9,233 |

|

|

8,809 |

|

|

26,712 |

|

|

25,443 |

|

|

45,974 |

|

| Depreciation and amortization |

1,711 |

|

|

1,747 |

|

|

1,428 |

|

|

5,247 |

|

|

4,531 |

|

| Transaction expenses related to the Merger |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

3,132 |

|

| Amortization of right-of-use assets |

748 |

|

|

734 |

|

|

858 |

|

|

2,327 |

|

|

2,819 |

|

| Loss on impairment of long lived assets |

— |

|

|

— |

|

|

— |

|

|

536 |

|

|

446 |

|

| Allowance for doubtful accounts |

358 |

|

|

49 |

|

|

25 |

|

|

529 |

|

|

294 |

|

| Change in fair value of warrant liabilities |

(907) |

|

|

3,790 |

|

|

(25,210) |

|

|

2,715 |

|

|

(19,808) |

|

| Settlement of related party promissory notes |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

5,517 |

|

|

|

|

|

|

|

|

|

|

|

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

| Accounts receivable |

456 |

|

|

(1,448) |

|

|

(1,586) |

|

|

(857) |

|

|

2,042 |

|

| Prepaid expenses and other assets |

1,371 |

|

|

(2,227) |

|

|

2,678 |

|

|

1,590 |

|

|

(4,265) |

|

| Accounts payable |

(89) |

|

|

148 |

|

|

(1,886) |

|

|

(1,318) |

|

|

(43) |

|

| Accrued expenses and other liabilities |

723 |

|

|

1,691 |

|

|

1,584 |

|

|

2,011 |

|

|

402 |

|

| Accrued compensation and benefits |

3,042 |

|

|

(783) |

|

|

1,558 |

|

|

(4,472) |

|

|

(11,118) |

|

| Operating lease liabilities |

(1,236) |

|

|

(1,032) |

|

|

(1,361) |

|

|

(3,317) |

|

|

(3,942) |

|

| Net cash used in operating activities |

$ |

(3,547) |

|

|

$ |

(13,622) |

|

|

$ |

(11,398) |

|

|

$ |

(34,884) |

|

|

$ |

(59,760) |

|

| Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

| Purchases of property and equipment |

(14) |

|

|

(28) |

|

|

(10) |

|

|

(113) |

|

|

(116) |

|

|

|

|

|

|

|

|

|

|

|

| Purchases of intangible assets |

— |

|

|

— |

|

|

(29) |

|

|

— |

|

|

(126) |

|

| Capitalized internal-use software development costs |

— |

|

|

— |

|

|

(1,358) |

|

|

— |

|

|

(4,590) |

|

| Purchases of certificates of deposit |

(515) |

|

|

(2,665) |

|

|

— |

|

|

(3,180) |

|

|

— |

|

| Net cash used in investing activities |

$ |

(529) |

|

|

$ |

(2,693) |

|

|

$ |

(1,397) |

|

|

$ |

(3,293) |

|

|

$ |

(4,832) |

|

| Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

| Proceeds from the Merger |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

7,865 |

|

| Proceeds from PIPE investment and A&R FPA investors |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

208,500 |

|

| Payments for offering costs |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(56,852) |

|

| Proceeds from exercise of Public Warrants |

— |

|

|

— |

|

|

804 |

|

|

— |

|

|

22,940 |

|

| Proceeds from exercise of options, including proceeds from repayment of promissory notes |

23 |

|

|

269 |

|

|

492 |

|

|

353 |

|

|

997 |

|

| Taxes withheld and paid related to net share settlement of equity awards |

— |

|

|

— |

|

|

— |

|

|

(557) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Formation of Forge Europe |

— |

|

|

— |

|

|

9,488 |

|

|

— |

|

|

9,488 |

|

| Payments for redemption of Public Warrants |

— |

|

|

— |

|

|

(165) |

|

|

— |

|

|

(165) |

|

| Net cash (used in) provided by financing activities |

$ |

23 |

|

|

$ |

269 |

|

|

$ |

10,619 |

|

|

$ |

(204) |

|

|

$ |

192,773 |

|

| Effect of changes in currency exchange rates on cash and cash equivalents |

(333) |

|

|

(53) |

|

|

(159) |

|

|

(158) |

|

|

(159) |

|

| Net (decrease) increase in cash and cash equivalents |

(4,386) |

|

|

(16,099) |

|

|

(2,335) |

|

|

(38,539) |

|

|

128,022 |

|

| Cash, cash equivalents and restricted cash, beginning of the period |

160,812 |

|

|

176,911 |

|

|

206,761 |

|

|

194,965 |

|

|

76,404 |

|

| Cash, cash equivalents and restricted cash, end of the period |

$ |

156,426 |

|

|

$ |

160,812 |

|

|

$ |

204,426 |

|

|

$ |

156,426 |

|

|

$ |

204,426 |

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of cash, cash equivalents and restricted cash to the amounts reported within the consolidated balance sheets |

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

$ |

155,127 |

|

|

$ |

159,526 |

|

|

$ |

202,603 |

|

|

$ |

155,127 |

|

|

$ |

202,603 |

|

| Restricted cash |

1,299 |

|

|

1,286 |

|

|

1,823 |

|

|

1,299 |

|

|

1,823 |

|

| Total cash, cash equivalents and restricted cash, end of the period |

$ |

156,426 |

|

|

$ |

160,812 |

|

|

$ |

204,426 |

|

|

$ |

156,426 |

|

|

$ |

204,426 |

|

FORGE GLOBAL HOLDINGS, INC.

Reconciliation of GAAP to Non-GAAP Results

(In thousands of U.S. dollars)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

September 30, 2023 |

|

June 30, 2023 |

|

September 30, 2022 |

|

September 30, 2023 |

|

September 30, 2022 |

| Net loss |

$ |

(18,957) |

|

|

$ |

(25,100) |

|

|

$ |

(16,198) |

|

|

$ |

(65,318) |

|

|

$ |

(85,741) |

|

| Add: |

|

|

|

|

|

|

|

|

|

| Interest income (expense), net |

(1,725) |

|

|

(1,319) |

|

|

(874) |

|

|

(4,553) |

|

|

(1,161) |

|

| Provision for (benefit from) income taxes |

291 |

|

|

293 |

|

|

48 |

|

|

769 |

|

|

206 |

|

| Depreciation and amortization |

1,710 |

|

|

1,747 |

|

|

1,428 |

|

|

5,246 |

|

|

4,531 |

|

| Loss or impairment on long lived assets |

— |

|

|

— |

|

|

— |

|

|

536 |

|

|

446 |

|

| Share-based compensation expense |

9,233 |

|

|

8,809 |

|

|

26,712 |

|

|

25,443 |

|

|

45,974 |

|

| Change in fair value of warrant liabilities |

(907) |

|

|

3,790 |

|

|

(25,210) |

|

|

2,715 |

|

|

(19,808) |

|

Acquisition-related transaction costs (1) |

— |

|

|

— |

|

|

821 |

|

|

— |

|

|

5,219 |

|

Transaction bonus (2) |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

17,735 |

|

| Adjusted EBITDA |

$ |

(10,355) |

|

|

$ |

(11,780) |

|

|

$ |

(13,273) |

|

|

$ |

(35,162) |

|

|

$ |

(32,599) |

|

(1)Acquisition-related transaction costs represent charges involved in the merger between Forge Global, Inc. and Motive Capital Corp as further described in our Annual Report on Form 10-K for the year ended December 31, 2022 (the “Merger”), other business combinations, and strategic opportunities. These expenses include legal, accounting, and investment banking advisory services.

(2)Represents a one-time transaction bonus to certain executives as a result of the consummation of the Merger.

FORGE GLOBAL HOLDINGS, INC.

SUPPLEMENTAL FINANCIAL INFORMATION

KEY OPERATING METRICS

(In thousands of U.S. dollars)

Key Business Metrics

We monitor the following key business metrics to help us evaluate our business, identify trends affecting our business, formulate business plans and make strategic decisions. The tables below reflect period-over-period changes in our key business metrics, along with the percentage change between such periods. We believe the following business metrics are useful in evaluating our business:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

| Dollars in thousands |

September 30,

2023 |

|

June 30,

2023 |

|

September 30,

2022 |

|

September 30,

2023 |

|

September 30,

2022 |

| TRADING BUSINESS |

|

|

|

|

|

|

|

|

|

| Trades |

567 |

|

448 |

|

426 |

|

1,321 |

|

1,652 |

| Volume |

234,141 |

|

153,182 |

|

226,229 |

|

515,486 |

|

975,984 |

| Net Take Rate |

3.0 |

% |

|

3.7 |

% |

|

3.6 |

% |

|

3.4 |

% |

|

3.4 |

% |

| Placement fee revenues, less transaction-based expenses |

7,135 |

|

5,640 |

|

8,141 |

|

17,388 |

|

33,366 |

•Trades are defined as the total number of orders executed by us and acquired entities buying and selling private stocks on behalf of private investors and shareholders. Increasing the number of orders is critical to increasing our revenue and, in turn, to achieving profitability.

•Volume is defined as the total sales value for all securities traded through our Forge Markets platform. Volume is defined as the aggregate value of the issuer company’s equity attributed to both the buyer and seller in a trade and as such a $100 trade of equity between buyer and seller would be captured as $200 volume for us. Although we typically capture a commission on each side of a trade, we may not in certain cases due to factors such as the use of an external broker by one of the parties or supply factors that would not allow us to attract sellers of shares of certain issuers. Volume is influenced by, among other things, the pricing and quality of our services as well as market conditions that affect private company valuations, such as increases in valuations of comparable companies at IPO.

•Net Take Rates are defined as our placement fee revenues, less transaction-based expenses (as defined below), divided by Volume. These represent the percentage of fees earned by our marketplace on any transactions executed from the commission we charged on such transactions (less transaction-based expenses), which is a determining factor in our revenue. The Net Take Rate can vary based upon the service or product offering and is also affected by the average order size and transaction frequency. Transaction-based expenses represent fees incurred to support placement activities. These include, but are not limited to, those for fund management, fund and trade settlement, external broker fees and transfer fees.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of |

|

QoQ |

|

YoY |

| Dollars in thousands |

|

September 30, 2023 |

|

June 30, 2023 |

|

September 30, 2022 |

|

Change |

|

% Change |

|

Change |

|

% Change |

| CUSTODY BUSINESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Custodial Accounts |

|

2,023,756 |

|

|

1,970,617 |

|

|

1,811,774 |

|

|

53,139 |

|

|

3 |

% |

|

211,982 |

|

|

12 |

% |

| Assets Under Custody |

|

$ |

15,148,480 |

|

|

$ |

15,299,816 |

|

|

$ |

14,967,314 |

|

|

$ |

(151,336) |

|

|

(1) |

% |

|

$ |

181,166 |

|

|

1 |

% |

•Total Custodial Accounts are defined as our direct customers’ existing or new custodial accounts that are funded, or unfunded accounts that are in the process of funding with active transfer activity on the account. These relate to our Custodial Administration fees revenue stream and are an important measure of our business as the number of Total Custodial Accounts is an indicator of our future revenues from certain account maintenance, transaction and sub-account fees.

•Assets Under Custody is the reported value of all client holdings held under our agreements, including cash submitted to us by the responsible party. These assets can be held at various financial institutions, issuers and in our vault. As the custodian of the accounts, we collect all interest and dividends, handle all fees and transactions, and any other considerations for the assets concerned. Our fees are earned from the overall maintenance activities of all assets and are not charged on the basis of the dollar value of Assets Under Custody, but we believe that Assets Under Custody is a useful metric for assessing the relative size and scope of our business.