Alabama |

001-40727 | 26-2518085 |

||||||

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File Number) |

(IRS Employer

Identification No.)

|

||||||

| 615 Quintard Ave. | ||||||||

Anniston, AL |

36201 | |||||||

| (Address of Principal Executive Offices) | (Zip Code) |

|||||||

| Title of each class |

Trading

Symbols(s)

|

Name of exchange

on which registered

|

||||||

| Common Stock, $5.00 par value | SSBK | The NASDAQ Stock Market LLC |

||||||

| Exhibit No. |

Description | |||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |||||||

Dated: October 24, 2023 |

SOUTHERN STATES BANCSHARES, INC. | |||||||

| By: | /s/ Lynn Joyce | |||||||

| Name: | Lynn Joyce | |||||||

| Title: | Senior Executive Vice President and Chief Financial Officer |

|||||||

|

SOUTHERN STATES

BANCSHARES, INC.

|

615 Quintard Avenue / Anniston, AL 36201 / (256) 241-1092 | ||||

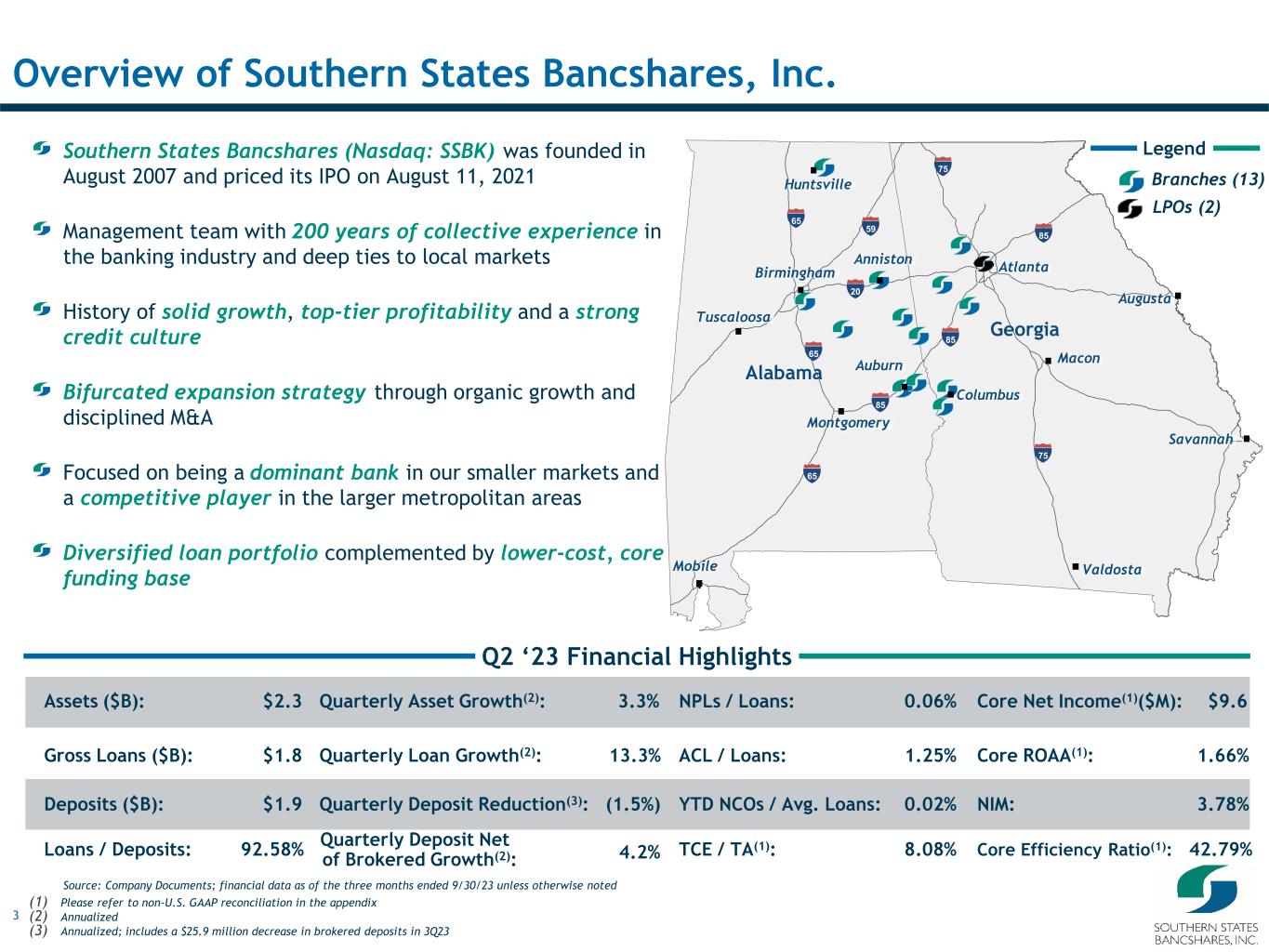

Southern States Bancshares, Inc. Announces Third Quarter 2023 Financial Results |

||||||||||||||

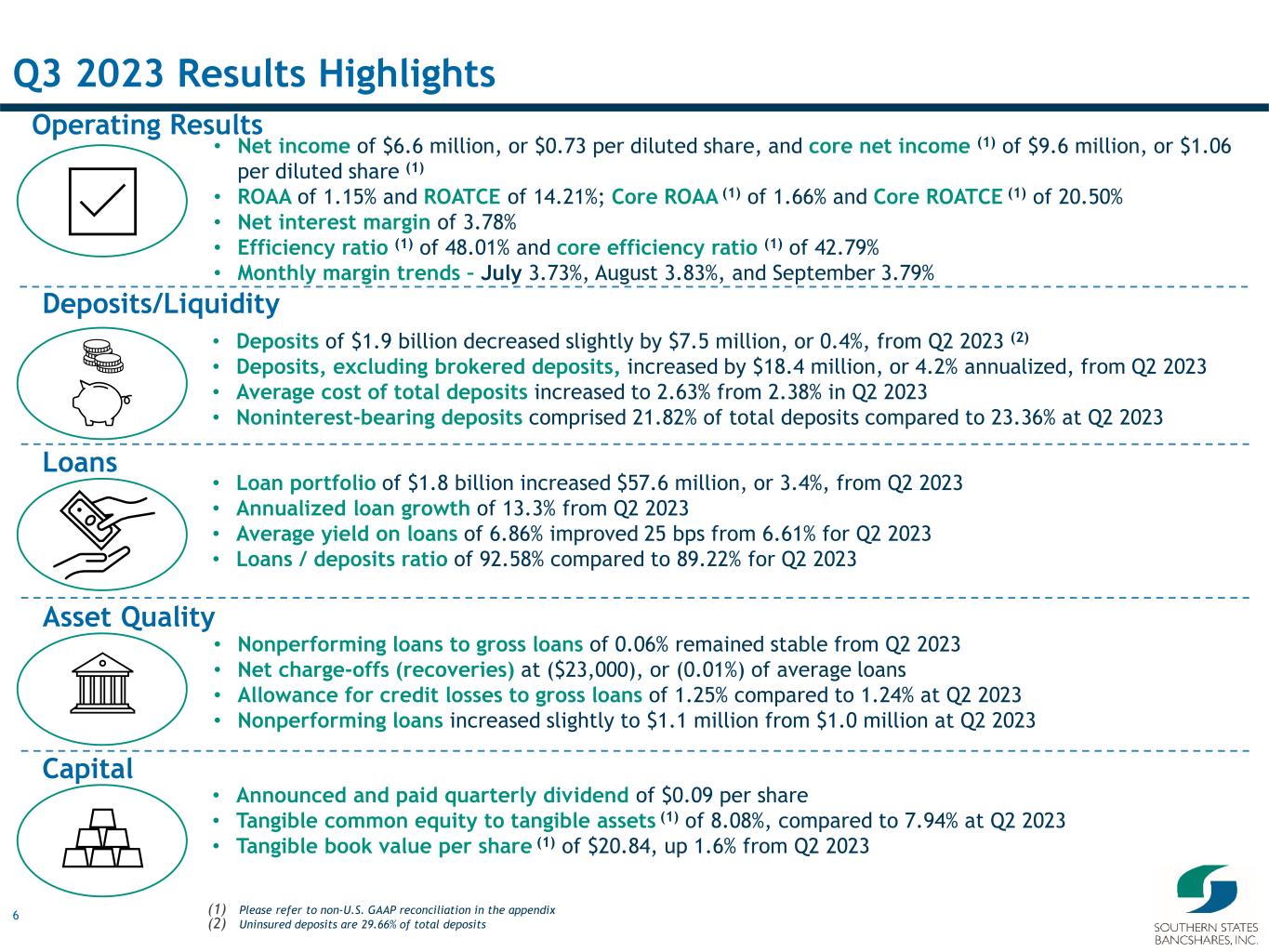

Third Quarter 2023 Performance and Operational Highlights | ||||||||||||||

•Core net income(1) of $9.6 million, or $1.06 per diluted share(1) | ||||||||||||||

•Net income of $6.6 million, or $0.73 per diluted share | ||||||||||||||

•Net interest income of $20.7 million, an increase of $1.3 million from the prior quarter | ||||||||||||||

•Net interest margin (“NIM”) of 3.78%, up 5 basis points from the prior quarter | ||||||||||||||

•NIM of 3.79% on a fully-taxable equivalent basis (“NIM - FTE”)(1) | ||||||||||||||

•Return on average assets (“ROAA”) of 1.15%; return on average stockholders’ equity (“ROAE”) of 12.96%; and return on average tangible common equity (“ROATCE”)(1) of 14.21% | ||||||||||||||

•Core ROAA(1) of 1.66%; and core ROATCE(1) of 20.50% | ||||||||||||||

•Efficiency ratio of 48.01%; and core efficiency ratio of 42.79% | ||||||||||||||

•Linked-quarter loan growth was 13.3% annualized | ||||||||||||||

•Linked-quarter total deposits declined 1.5% annualized, primarily due to a reduction in brokered deposits | ||||||||||||||

•Linked-quarter total deposits, excluding brokered deposits, increased 4.2% annualized from the prior quarter | ||||||||||||||

| (1) See "Reconciliation of Non-GAAP Financial Measures" below for reconciliation of non-GAAP financial measures to their most closely comparable GAAP financial measures. | ||||||||||||||

| CEO Commentary | ||||||||||||||

Mark Chambers, Chief Executive Officer and President of Southern States, said, “Our business development teams continued to identify compelling opportunities in the third quarter, driving annualized sequential loan growth of 13.3% and maintaining the strong momentum we’ve generated over the past two years as we meet steady loan demand across our economically dynamic footprint.” | ||||||||||||||

| “Our growth positioned the bank to capitalize on higher rates, with increased yields on earning assets driving a nearly 7% gain in net interest income from the second quarter and from a year earlier, bolstering our core earnings. As we pursue new business, we remain committed to diligent underwriting and robust credit quality. Our non-performing loans as a percentage of the overall loan portfolio totaled just 0.06%, consistent with the prior quarter.” | ||||||||||||||

| “Importantly, we continue to fund our loan growth with a healthy deposit franchise. Our funding costs did increase during the third quarter to remain competitive in terms of price amid higher rates to keep our total deposit levels relatively stable. However, this was more than offset by our loan growth and gains in yields, and our net interest margin expanded by 5 basis points in the quarter as a result.” | ||||||||||||||

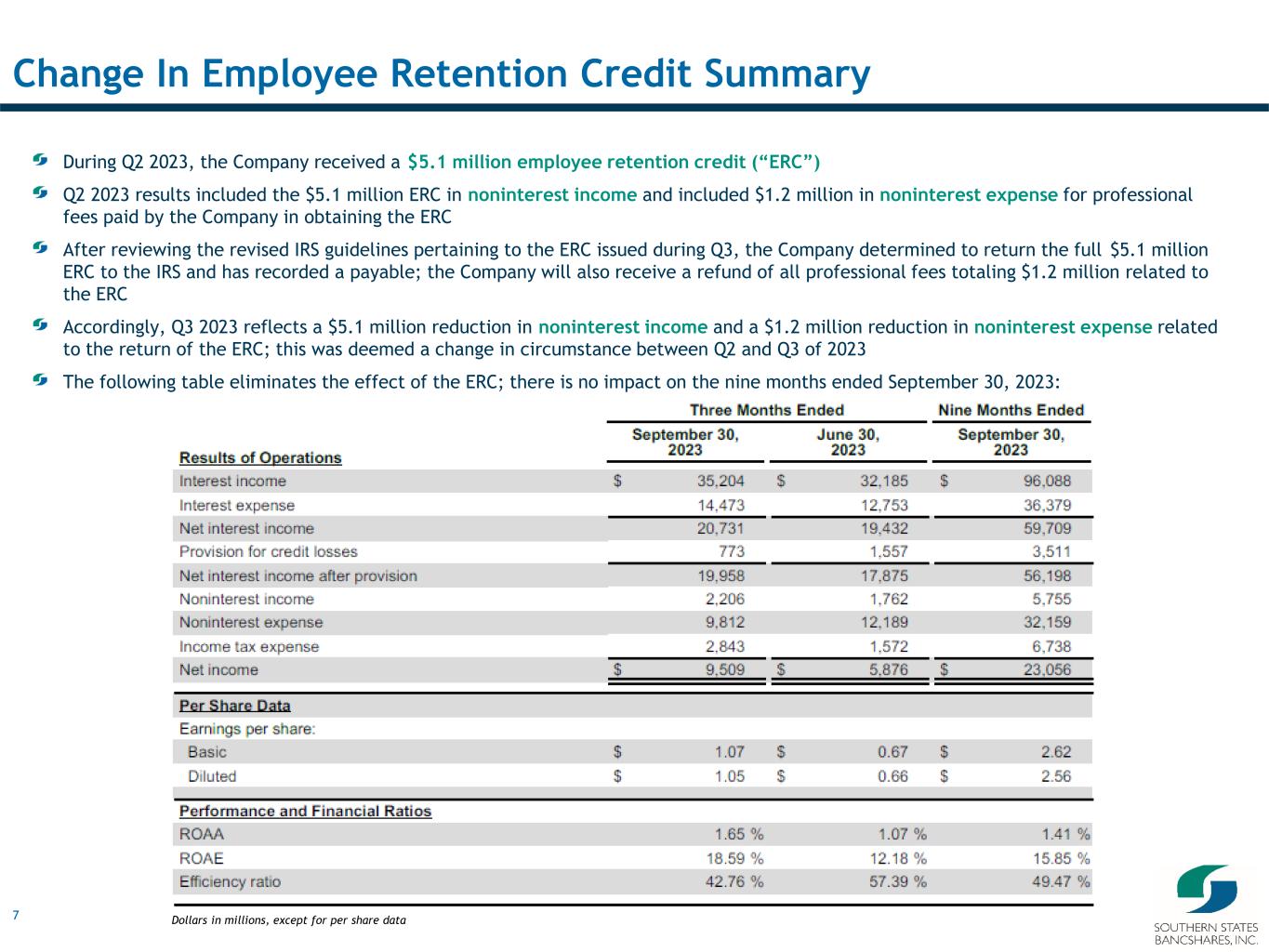

| Results excluding ERC | ||||||||||||||

|

Three Months Ended | Nine Months Ended | |||||||||||||||

| September 30, 2023 |

June 30, 2023 |

September 30, 2023 |

|||||||||||||||

| Results of Operations | |||||||||||||||||

| Interest income | $ | 35,204 | $ | 32,185 | $ | 96,088 | |||||||||||

| Interest expense | 14,473 | 12,753 | 36,379 | ||||||||||||||

| Net interest income | 20,731 | 19,432 | 59,709 | ||||||||||||||

| Provision for credit losses | 773 | 1,557 | 3,511 | ||||||||||||||

| Net interest income after provision | 19,958 | 17,875 | 56,198 | ||||||||||||||

| Noninterest income | 2,206 | 1,762 | 5,755 | ||||||||||||||

| Noninterest expense | 9,812 | 12,189 | 32,159 | ||||||||||||||

| Income tax expense | 2,843 | 1,572 | 6,738 | ||||||||||||||

| Net income | $ | 9,509 | $ | 5,876 | $ | 23,056 | |||||||||||

| Per Share Data | |||||||||||||||||

| Earnings per share: | |||||||||||||||||

| Basic | $ | 1.07 | $ | 0.67 | $ | 2.62 | |||||||||||

| Diluted | $ | 1.05 | $ | 0.66 | $ | 2.56 | |||||||||||

| Performance and Financial Ratios | |||||||||||||||||

| ROAA | 1.65 | % | 1.07 | % | 1.41 | % | |||||||||||

| ROAE | 18.59 | % | 12.18 | % | 15.85 | % | |||||||||||

| Efficiency ratio | 42.76 | % | 57.39 | % | 49.47 | % | |||||||||||

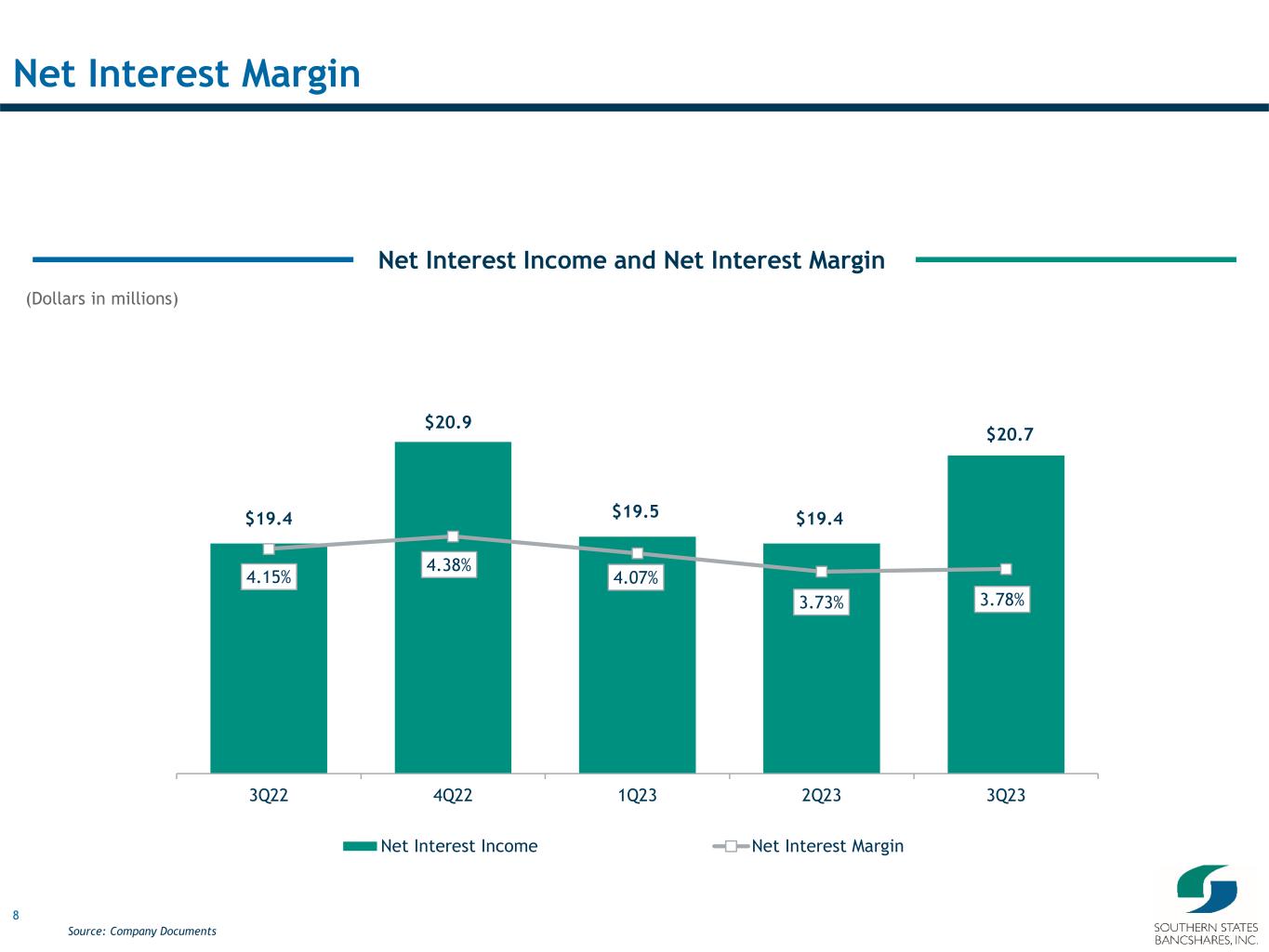

| Net Interest Income and Net Interest Margin | ||||||||||||||

|

Three Months Ended | % Change September 30, 2023 vs. |

|||||||||||||||||||||||||||

| September 30, 2023 |

June 30, 2023 |

September 30, 2022 |

June 30, 2023 |

September 30, 2022 |

|||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||

| Average interest-earning assets | $ | 2,175,103 | $ | 2,091,998 | $ | 1,859,104 | 4.0 | % | 17.0 | % | |||||||||||||||||||

| Net interest income | $ | 20,731 | $ | 19,432 | $ | 19,435 | 6.7 | % | 6.7 | % | |||||||||||||||||||

| Net interest margin | 3.78 | % | 3.73 | % | 4.15 | % | 5 | bps | (37) | bps | |||||||||||||||||||

| Noninterest Income | ||||||||||||||

|

Three Months Ended | % Change September 30, 2023 vs. |

|||||||||||||||||||||||||||

| September 30, 2023 |

June 30, 2023 |

September 30, 2022 |

June 30, 2023 |

September 30, 2022 |

|||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||

| Service charges on deposit accounts | $ | 442 | $ | 456 | $ | 508 | (3.1) | % | (13.0) | % | |||||||||||||||||||

| Swap fees | 453 | 173 | 11 | 161.8 | % | 4018.2 | % | ||||||||||||||||||||||

| SBA/USDA fees | 74 | 66 | 95 | 12.1 | % | (22.1) | % | ||||||||||||||||||||||

| Mortgage origination fees | 158 | 188 | 218 | (16.0) | % | (27.5) | % | ||||||||||||||||||||||

Net loss on securities |

(12) | (45) | (143) | (73.3) | % | (91.6) | % | ||||||||||||||||||||||

| Employee retention credit and related revenue | (5,100) | 5,100 | — | N/A | N/A | ||||||||||||||||||||||||

| Other operating income | 1,091 | 924 | 650 | 18.1 | % | 67.8 | % | ||||||||||||||||||||||

| Total noninterest income | $ | (2,894) | $ | 6,862 | $ | 1,339 | (142.2) | % | (316.1) | % | |||||||||||||||||||

| Noninterest Expense | ||||||||||||||

|

Three Months Ended | % Change September 30, 2023 vs. |

|||||||||||||||||||||||||||

| September 30, 2023 |

June 30, 2023 |

September 30, 2022 |

June 30, 2023 |

September 30, 2022 |

|||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||

| Salaries and employee benefits | $ | 5,752 | $ | 7,863 | $ | 6,152 | (26.8) | % | (6.5) | % | |||||||||||||||||||

| Equipment and occupancy expenses | 718 | 694 | 764 | 3.5 | % | (6.0) | % | ||||||||||||||||||||||

| Data processing fees | 650 | 646 | 599 | 0.6 | % | 8.5 | % | ||||||||||||||||||||||

| Regulatory assessments | 322 | 180 | 235 | 78.9 | % | 37.0 | % | ||||||||||||||||||||||

| Professional fees related to ERC | (1,243) | 1,243 | — | N/A | N/A | ||||||||||||||||||||||||

| Other operating expenses | 2,370 | 2,806 | 2,487 | (15.5) | % | (4.7) | % | ||||||||||||||||||||||

| Total noninterest expenses | $ | 8,569 | $ | 13,432 | $ | 10,237 | (36.2) | % | (16.3) | % | |||||||||||||||||||

| Loans and Credit Quality | ||||||||||||||

|

Three Months Ended | % Change September 30, 2023 vs. |

|||||||||||||||||||||||||||

| September 30, 2023 |

June 30, 2023 |

September 30, 2022 |

June 30, 2023 |

September 30, 2022 |

|||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||

| Gross loans | 1,779,846 | 1,722,278 | 1,530,129 | 3.3 | % | 16.3 | % | ||||||||||||||||||||||

| Unearned income | (5,698) | (5,766) | (5,139) | (1.2) | % | 10.9 | % | ||||||||||||||||||||||

| Loans, net of unearned income (“Loans”) | $ | 1,774,148 | $ | 1,716,512 | $ | 1,524,990 | 3.4 | % | 16.3 | % | |||||||||||||||||||

| Average loans, net of unearned (“Average loans”) | $ | 1,740,582 | $ | 1,676,816 | $ | 1,480,735 | 3.8 | % | 17.5 | % | |||||||||||||||||||

| Nonperforming loans (“NPL”) | $ | 1,082 | $ | 1,010 | $ | 3,950 | 7.1 | % | (72.6) | % | |||||||||||||||||||

| Provision for credit losses | $ | 773 | $ | 1,557 | $ | 1,663 | (50.4) | % | (53.5) | % | |||||||||||||||||||

| Allowance for credit losses (“ACL”) | $ | 22,181 | $ | 21,385 | $ | 18,423 | 3.7 | % | 20.4 | % | |||||||||||||||||||

| Net charge-offs (recoveries) | $ | (23) | $ | 27 | $ | 47 | (185.2) | % | (148.9) | % | |||||||||||||||||||

| NPL to gross loans | 0.06 | % | 0.06 | % | 0.26 | % | |||||||||||||||||||||||

Net charge-offs (recoveries) to average loans(1) |

(0.01) | % | 0.01 | % | 0.01 | % | |||||||||||||||||||||||

| ACL to loans | 1.25 | % | 1.25 | % | 1.21 | % | |||||||||||||||||||||||

| (1) Ratio is annualized. | |||||||||||||||||||||||||||||

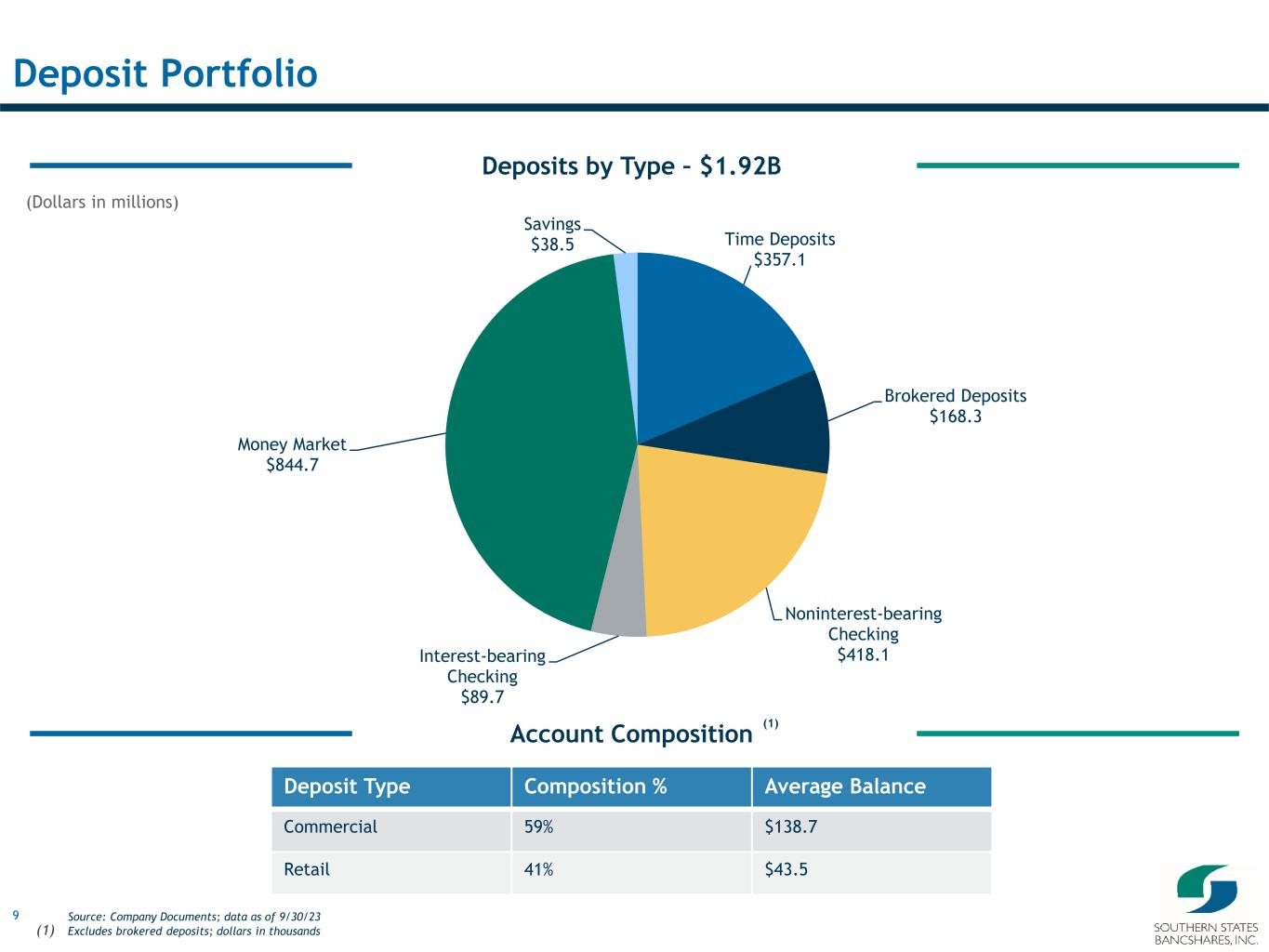

| Deposits | ||||||||||||||

|

Three Months Ended | % Change September 30, 2023 vs. |

|||||||||||||||||||||||||||

| September 30, 2023 |

June 30, 2023 |

September 30, 2022 |

June 30, 2023 |

September 30, 2022 |

|||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||

| Noninterest-bearing deposits | $ | 418,125 | $ | 449,433 | $ | 499,613 | (7.0) | % | (16.3) | % | |||||||||||||||||||

| Interest-bearing deposits | 1,498,276 | 1,474,478 | 1,267,479 | 1.6 | % | 18.2 | % | ||||||||||||||||||||||

| Total deposits | $ | 1,916,401 | $ | 1,923,911 | $ | 1,767,092 | (0.4) | % | 8.4 | % | |||||||||||||||||||

| Uninsured deposits | $ | 568,323 | $ | 553,084 | $ | 707,371 | 2.8 | % | (19.7) | % | |||||||||||||||||||

| Uninsured deposits to total deposits | 29.66 | % | 28.75 | % | 40.03 | % | |||||||||||||||||||||||

| Noninterest deposits to total deposits | 21.82 | % | 23.36 | % | 28.27 | % | |||||||||||||||||||||||

| Capital | ||||||||||||||

|

September 30, 2023 |

June 30, 2023 |

September 30, 2022 |

||||||||||||||||||||||||||||||||

| Company | Bank | Company | Bank | Company | Bank | ||||||||||||||||||||||||||||||

| Tier 1 capital ratio to average assets | 8.70 | % | 11.71 | % | 8.70 | % | 11.82 | % | 8.44 | % | 11.49 | % | |||||||||||||||||||||||

| Risk-based capital ratios: | |||||||||||||||||||||||||||||||||||

| Common equity tier 1 (“CET1”) capital ratio | 9.32 | % | 12.55 | % | 9.11 | % | 12.37 | % | 8.73 | % | 11.89 | % | |||||||||||||||||||||||

| Tier 1 capital ratio | 9.32 | % | 12.55 | % | 9.11 | % | 12.37 | % | 8.73 | % | 11.89 | % | |||||||||||||||||||||||

| Total capital ratio | 14.60 | % | 13.67 | % | 14.42 | % | 13.47 | % | 12.26 | % | 12.87 | % | |||||||||||||||||||||||

| About Southern States Bancshares, Inc. | ||||||||||||||

| Forward-Looking Statements | ||||||||||||||

| Contact Information | ||||||||||||||

| Lynn Joyce | Kevin Dobbs | |||||||||||||

| (205) 820-8065 | (310) 622-8245 | |||||||||||||

| ljoyce@ssbank.bank | ssbankir@finprofiles.com | |||||||||||||

| SELECT FINANCIAL DATA | |||||||||||||||||||||||||||||

| (Dollars in thousands, except share and per share amounts) | |||||||||||||||||||||||||||||

|

Three Months Ended | Nine Months Ended | |||||||||||||||||||||||||||

| September 30, 2023 |

June 30, 2023 |

September 30, 2022 |

September 30, 2023 |

September 30, 2022 |

|||||||||||||||||||||||||

| Results of Operations | |||||||||||||||||||||||||||||

| Interest income | $ | 35,204 | $ | 32,185 | $ | 22,520 | $ | 96,088 | $ | 56,144 | |||||||||||||||||||

| Interest expense | 14,473 | 12,753 | 3,085 | 36,379 | 5,690 | ||||||||||||||||||||||||

| Net interest income | 20,731 | 19,432 | 19,435 | 59,709 | 50,454 | ||||||||||||||||||||||||

| Provision for credit losses | 773 | 1,557 | 1,663 | 3,511 | 3,667 | ||||||||||||||||||||||||

| Net interest income after provision | 19,958 | 17,875 | 17,772 | 56,198 | 46,787 | ||||||||||||||||||||||||

| Noninterest income | (2,894) | 6,862 | 1,339 | 5,755 | 4,074 | ||||||||||||||||||||||||

| Noninterest expense | 8,569 | 13,432 | 10,237 | 32,159 | 29,178 | ||||||||||||||||||||||||

| Income tax expense | 1,866 | 2,549 | 2,174 | 6,738 | 5,204 | ||||||||||||||||||||||||

| Net income | $ | 6,629 | $ | 8,756 | $ | 6,700 | $ | 23,056 | $ | 16,479 | |||||||||||||||||||

Core net income(1) |

$ | 9,563 | $ | 7,058 | $ | 6,806 | $ | 23,901 | $ | 16,883 | |||||||||||||||||||

| Share and Per Share Data | |||||||||||||||||||||||||||||

| Shares issued and outstanding | 8,834,168 | 8,738,814 | 8,705,920 | 8,834,168 | 8,705,920 | ||||||||||||||||||||||||

| Weighted average shares outstanding: | |||||||||||||||||||||||||||||

| Basic | 8,846,018 | 8,763,635 | 8,693,745 | 8,791,007 | 8,797,720 | ||||||||||||||||||||||||

| Diluted | 9,040,687 | 8,950,847 | 8,871,116 | 9,016,603 | 8,952,600 | ||||||||||||||||||||||||

| Earnings per share: | |||||||||||||||||||||||||||||

| Basic | $ | 0.75 | $ | 1.00 | $ | 0.77 | $ | 2.62 | $ | 1.87 | |||||||||||||||||||

| Diluted | $ | 0.73 | $ | 0.98 | $ | 0.75 | $ | 2.56 | $ | 1.84 | |||||||||||||||||||

Core - diluted(1) |

$ | 1.06 | $ | 0.79 | $ | 0.77 | $ | 2.65 | $ | 1.89 | |||||||||||||||||||

| Book value per share | $ | 22.86 | $ | 22.57 | $ | 19.56 | $ | 22.86 | $ | 19.56 | |||||||||||||||||||

Tangible book value per share(1) |

$ | 20.84 | $ | 20.52 | $ | 17.48 | $ | 20.84 | $ | 17.48 | |||||||||||||||||||

| Cash dividends per common share | $ | 0.09 | $ | 0.09 | $ | 0.09 | $ | 0.27 | $ | 0.27 | |||||||||||||||||||

| Performance and Financial Ratios | |||||||||||||||||||||||||||||

| ROAA | 1.15 | % | 1.60 | % | 1.35 | % | 1.41 | % | 1.19 | % | |||||||||||||||||||

| ROAE | 12.96 | % | 18.15 | % | 15.42 | % | 15.85 | % | 12.72 | % | |||||||||||||||||||

Core ROAA(1) |

1.66 | % | 1.29 | % | 1.37 | % | 1.47 | % | 1.21 | % | |||||||||||||||||||

ROATCE(1) |

14.21 | % | 20.01 | % | 17.24 | % | 17.47 | % | 14.22 | % | |||||||||||||||||||

Core ROATCE(1) |

20.50 | % | 16.13 | % | 17.51 | % | 18.11 | % | 14.57 | % | |||||||||||||||||||

| NIM | 3.78 | % | 3.73 | % | 4.15 | % | 3.85 | % | 3.85 | % | |||||||||||||||||||

NIM - FTE(2) |

3.79 | % | 3.74 | % | 4.17 | % | 3.87 | % | 3.87 | % | |||||||||||||||||||

| Net interest spread | 2.84 | % | 2.86 | % | 3.86 | % | 3.00 | % | 3.64 | % | |||||||||||||||||||

| Yield on loans | 6.86 | % | 6.61 | % | 5.37 | % | 6.62 | % | 4.97 | % | |||||||||||||||||||

| Yield on interest-earning assets | 6.42 | % | 6.17 | % | 4.81 | % | 6.20 | % | 4.29 | % | |||||||||||||||||||

| Cost of interest-bearing liabilities | 3.58 | % | 3.31 | % | 0.95 | % | 3.20 | % | 0.65 | % | |||||||||||||||||||

Cost of funds(2) |

2.80 | % | 2.58 | % | 0.69 | % | 2.48 | % | 0.46 | % | |||||||||||||||||||

| Cost of interest-bearing deposits | 3.43 | % | 3.12 | % | 0.82 | % | 3.02 | % | 0.52 | % | |||||||||||||||||||

| Cost of total deposits | 2.63 | % | 2.38 | % | 0.58 | % | 2.29 | % | 0.36 | % | |||||||||||||||||||

| Noninterest deposits to total deposits | 21.82 | % | 23.36 | % | 28.27 | % | 21.82 | % | 28.27 | % | |||||||||||||||||||

| Core deposits to total deposits | 86.58 | % | 86.18 | % | 92.17 | % | 86.58 | % | 92.17 | % | |||||||||||||||||||

| Uninsured deposits to total deposits | 29.66 | % | 28.75 | % | 40.03 | % | 29.66 | % | 40.03 | % | |||||||||||||||||||

| Total loans to total deposits | 92.58 | % | 89.22 | % | 86.30 | % | 92.58 | % | 86.30 | % | |||||||||||||||||||

| Efficiency ratio | 48.01 | % | 51.00 | % | 48.94 | % | 49.47 | % | 52.98 | % | |||||||||||||||||||

Core efficiency ratio(1) |

42.79 | % | 49.96 | % | 48.94 | % | 47.06 | % | 52.98 | % | |||||||||||||||||||

| SELECT FINANCIAL DATA | |||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||

|

Three Months Ended | Nine Months Ended | |||||||||||||||||||||||||||

| September 30, 2023 |

June 30, 2023 |

September 30, 2022 |

September 30, 2023 |

September 30, 2022 |

|||||||||||||||||||||||||

| Financial Condition (ending) | |||||||||||||||||||||||||||||

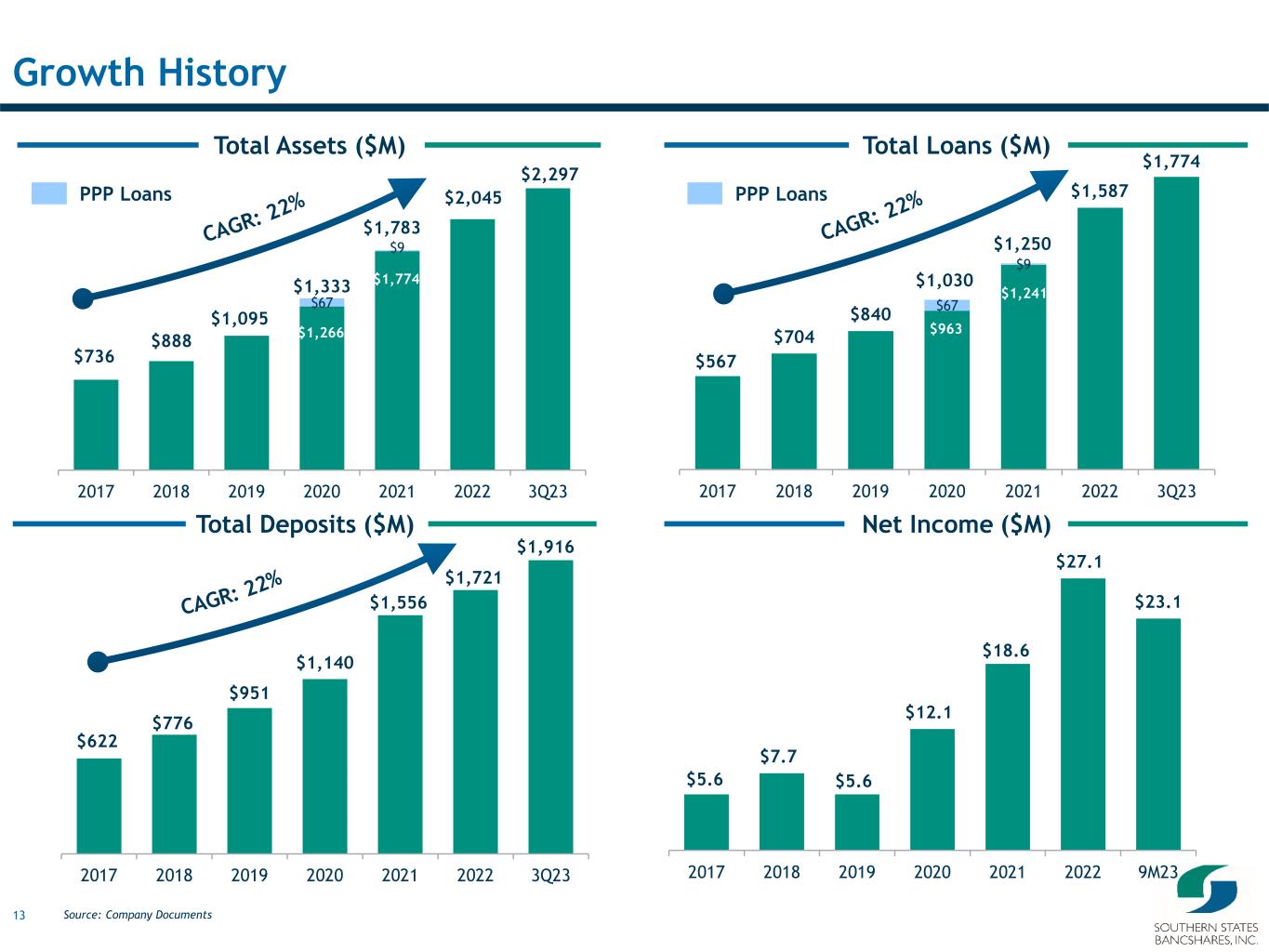

| Total loans | $ | 1,774,148 | $ | 1,716,512 | $ | 1,524,990 | $ | 1,774,148 | $ | 1,524,990 | |||||||||||||||||||

| Total securities | 189,496 | 182,717 | 170,375 | 189,496 | 170,375 | ||||||||||||||||||||||||

| Total assets | 2,296,527 | 2,277,803 | 2,052,725 | 2,296,527 | 2,052,725 | ||||||||||||||||||||||||

| Total noninterest bearing deposits | 418,125 | 449,433 | 499,613 | 418,125 | 499,613 | ||||||||||||||||||||||||

Total core deposits(1) |

1,659,291 | 1,657,961 | 1,628,660 | 1,659,291 | 1,628,660 | ||||||||||||||||||||||||

| Total deposits | 1,916,401 | 1,923,911 | 1,767,092 | 1,916,401 | 1,767,092 | ||||||||||||||||||||||||

| Total borrowings | 146,573 | 131,472 | 93,020 | 146,573 | 93,020 | ||||||||||||||||||||||||

| Total liabilities | 2,094,603 | 2,080,553 | 1,882,400 | 2,094,603 | 1,882,400 | ||||||||||||||||||||||||

| Total shareholders’ equity | 201,924 | 197,250 | 170,325 | 201,924 | 170,325 | ||||||||||||||||||||||||

| Financial Condition (average) | |||||||||||||||||||||||||||||

| Total loans | $ | 1,740,582 | $ | 1,676,816 | $ | 1,480,735 | $ | 1,676,134 | $ | 1,373,564 | |||||||||||||||||||

| Total securities | 201,830 | 196,731 | 185,670 | 197,005 | 175,381 | ||||||||||||||||||||||||

| Total other interest-earning assets | 232,691 | 218,451 | 192,699 | 199,379 | 202,837 | ||||||||||||||||||||||||

| Total interest-bearing assets | 2,175,103 | 2,091,998 | 1,859,104 | 2,072,518 | 1,751,782 | ||||||||||||||||||||||||

| Total assets | 2,282,217 | 2,200,843 | 1,966,556 | 2,180,851 | 1,858,993 | ||||||||||||||||||||||||

| Total noninterest-bearing deposits | 448,616 | 438,987 | 491,917 | 442,149 | 502,951 | ||||||||||||||||||||||||

| Total interest-bearing deposits | 1,472,024 | 1,412,047 | 1,207,797 | 1,395,529 | 1,097,693 | ||||||||||||||||||||||||

| Total deposits | 1,920,640 | 1,851,034 | 1,699,714 | 1,837,678 | 1,600,644 | ||||||||||||||||||||||||

| Total borrowings | 129,882 | 131,411 | 75,039 | 122,156 | 68,719 | ||||||||||||||||||||||||

| Total interest-bearing liabilities | 1,601,906 | 1,543,458 | 1,282,836 | 1,517,685 | 1,166,412 | ||||||||||||||||||||||||

| Total shareholders’ equity | 202,955 | 193,516 | 172,402 | 194,430 | 173,210 | ||||||||||||||||||||||||

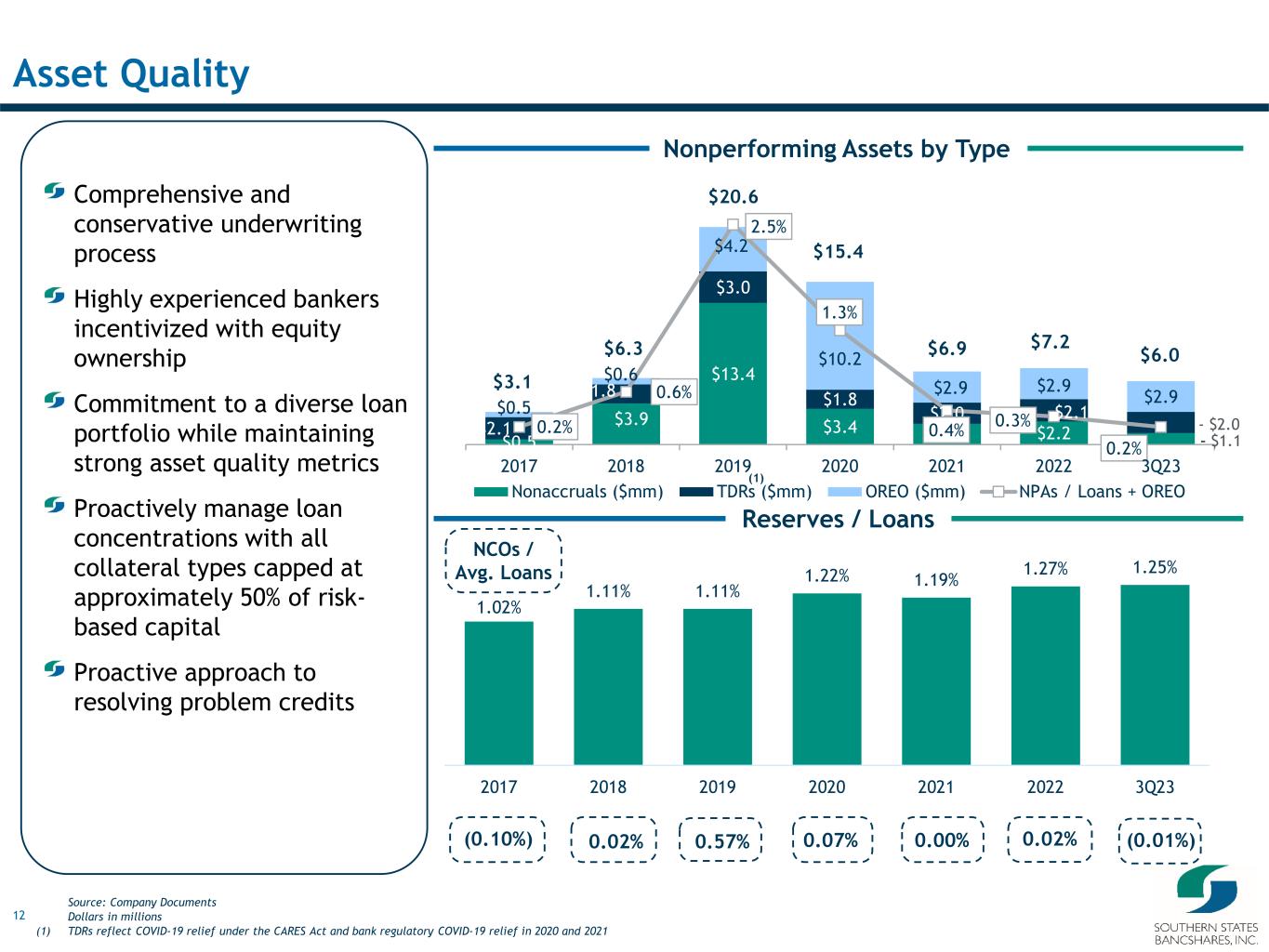

| Asset Quality | |||||||||||||||||||||||||||||

| Nonperforming loans | $ | 1,082 | $ | 1,010 | $ | 3,950 | $ | 1,082 | $ | 3,950 | |||||||||||||||||||

| Other real estate owned (“OREO”) | $ | 2,903 | $ | 2,870 | $ | 2,930 | $ | 2,903 | $ | 2,930 | |||||||||||||||||||

| Nonperforming assets (“NPA”) | $ | 3,985 | $ | 3,880 | $ | 6,880 | $ | 3,985 | $ | 6,880 | |||||||||||||||||||

Net charge-offs (recovery) to average loans(2) |

(0.01) | % | 0.01 | % | 0.01 | % | 0.02 | % | 0.01 | % | |||||||||||||||||||

Provision for credit losses to average loans(2) |

0.18 | % | 0.37 | % | 0.45 | % | 0.28 | % | 0.36 | % | |||||||||||||||||||

| ACL to loans | 1.25 | % | 1.25 | % | 1.21 | % | 1.25 | % | 1.21 | % | |||||||||||||||||||

| ACL to gross loans | 1.25 | % | 1.24 | % | 1.20 | % | 1.25 | % | 1.20 | % | |||||||||||||||||||

| ACL to NPL | 2050.00 | % | 2117.33 | % | 466.41 | % | 2050.00 | % | 466.41 | % | |||||||||||||||||||

| NPL to loans | 0.06 | % | 0.06 | % | 0.26 | % | 0.06 | % | 0.26 | % | |||||||||||||||||||

| NPL to gross loans | 0.06 | % | 0.06 | % | 0.26 | % | 0.06 | % | 0.26 | % | |||||||||||||||||||

| NPA to gross loans and OREO | 0.22 | % | 0.22 | % | 0.45 | % | 0.22 | % | 0.45 | % | |||||||||||||||||||

| NPA to total assets | 0.17 | % | 0.17 | % | 0.34 | % | 0.17 | % | 0.34 | % | |||||||||||||||||||

| Regulatory and Other Capital Ratios | |||||||||||||||||||||||||||||

| Total shareholders’ equity to total assets | 8.79 | % | 8.66 | % | 8.30 | % | 8.79 | % | 8.30 | % | |||||||||||||||||||

Tangible common equity to tangible assets(3) |

8.08 | % | 7.94 | % | 7.48 | % | 8.08 | % | 7.48 | % | |||||||||||||||||||

| Tier 1 capital ratio to average assets | 8.70 | % | 8.70 | % | 8.44 | % | 8.70 | % | 8.44 | % | |||||||||||||||||||

Risk-based capital ratios: |

|||||||||||||||||||||||||||||

| CET1 capital ratio | 9.32 | % | 9.11 | % | 8.73 | % | 9.32 | % | 8.73 | % | |||||||||||||||||||

| Tier 1 capital ratio | 9.32 | % | 9.11 | % | 8.73 | % | 9.32 | % | 8.73 | % | |||||||||||||||||||

| Total capital ratio | 14.60 | % | 14.42 | % | 12.26 | % | 14.60 | % | 12.26 | % | |||||||||||||||||||

CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION | |||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||

|

September 30, 2023 |

June 30, 2023 |

December 31, 2022 |

September 30, 2022 |

|||||||||||||||||||

| (Unaudited) | (Unaudited) | (Audited) | (Unaudited) | ||||||||||||||||||||

| Assets | |||||||||||||||||||||||

| Cash and due from banks | $ | 31,047 | $ | 21,299 | $ | 15,260 | $ | 17,394 | |||||||||||||||

| Interest-bearing deposits in banks | 103,646 | 159,818 | 90,198 | 165,637 | |||||||||||||||||||

| Federal funds sold | 81,487 | 84,812 | 63,041 | 63,031 | |||||||||||||||||||

| Total cash and cash equivalents | 216,180 | 265,929 | 168,499 | 246,062 | |||||||||||||||||||

| Securities available for sale, at fair value | 169,859 | 163,075 | 155,544 | 150,718 | |||||||||||||||||||

| Securities held to maturity, at amortized cost | 19,637 | 19,642 | 19,652 | 19,657 | |||||||||||||||||||

| Other equity securities, at fair value | 3,654 | 3,762 | 4,444 | 5,694 | |||||||||||||||||||

| Restricted equity securities, at cost | 4,971 | 3,862 | 3,134 | 2,791 | |||||||||||||||||||

| Loans held for sale | 1,799 | 1,589 | 1,047 | 1,643 | |||||||||||||||||||

| Loans, net of unearned income | 1,774,148 | 1,716,512 | 1,587,164 | 1,524,990 | |||||||||||||||||||

| Less allowance for credit losses | 22,181 | 21,385 | 20,156 | 18,423 | |||||||||||||||||||

| Loans, net | 1,751,967 | 1,695,127 | 1,567,008 | 1,506,567 | |||||||||||||||||||

| Premises and equipment, net | 26,694 | 26,957 | 27,345 | 28,585 | |||||||||||||||||||

| Accrued interest receivable | 8,321 | 7,372 | 6,963 | 5,699 | |||||||||||||||||||

| Bank owned life insurance | 29,697 | 29,521 | 29,186 | 29,677 | |||||||||||||||||||

| Annuities | 15,266 | 15,359 | 15,478 | 15,564 | |||||||||||||||||||

| Foreclosed assets | 2,903 | 2,870 | 2,930 | 2,930 | |||||||||||||||||||

| Goodwill | 16,862 | 16,862 | 16,862 | 16,862 | |||||||||||||||||||

| Core deposit intangible | 981 | 1,062 | 1,226 | 1,302 | |||||||||||||||||||

| Other assets | 27,736 | 24,814 | 25,886 | 18,974 | |||||||||||||||||||

| Total assets | $ | 2,296,527 | $ | 2,277,803 | $ | 2,045,204 | $ | 2,052,725 | |||||||||||||||

| Liabilities and Stockholders' Equity | |||||||||||||||||||||||

| Liabilities: | |||||||||||||||||||||||

| Deposits: | |||||||||||||||||||||||

| Noninterest-bearing | $ | 418,125 | $ | 449,433 | $ | 460,977 | $ | 499,613 | |||||||||||||||

| Interest-bearing | 1,498,276 | 1,474,478 | 1,259,766 | 1,267,479 | |||||||||||||||||||

| Total deposits | 1,916,401 | 1,923,911 | 1,720,743 | 1,767,092 | |||||||||||||||||||

| Other borrowings | 4,991 | (13) | (19) | 19,978 | |||||||||||||||||||

| FHLB advances | 55,000 | 45,000 | 31,000 | 26,000 | |||||||||||||||||||

| Subordinated notes | 86,582 | 86,485 | 86,314 | 47,042 | |||||||||||||||||||

| Accrued interest payable | 1,280 | 1,063 | 584 | 359 | |||||||||||||||||||

| Other liabilities | 30,349 | 24,107 | 24,863 | 21,929 | |||||||||||||||||||

| Total liabilities | 2,094,603 | 2,080,553 | 1,863,485 | 1,882,400 | |||||||||||||||||||

| Stockholders' equity: | |||||||||||||||||||||||

| Common stock | 44,307 | 43,831 | 43,714 | 43,529 | |||||||||||||||||||

| Capital surplus | 77,671 | 77,101 | 76,785 | 75,835 | |||||||||||||||||||

| Retained earnings | 94,429 | 88,603 | 73,764 | 63,956 | |||||||||||||||||||

| Accumulated other comprehensive loss | (13,126) | (10,799) | (11,048) | (12,403) | |||||||||||||||||||

| Unvested restricted stock | (580) | (709) | (477) | (592) | |||||||||||||||||||

| Vested restricted stock units | (777) | (777) | (1,019) | — | |||||||||||||||||||

| Total stockholders' equity | 201,924 | 197,250 | 181,719 | 170,325 | |||||||||||||||||||

| Total liabilities and stockholders' equity | $ | 2,296,527 | $ | 2,277,803 | $ | 2,045,204 | $ | 2,052,725 | |||||||||||||||

| CONSOLIDATED STATEMENTS OF INCOME | |||||||||||||||||||||||||||||

| (Dollars in thousands, except per share amounts) | |||||||||||||||||||||||||||||

|

Three Months Ended | Nine Months Ended | |||||||||||||||||||||||||||

| September 30, 2023 |

June 30, 2023 |

September 30, 2022 |

September 30, 2023 |

September 30, 2022 |

|||||||||||||||||||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | |||||||||||||||||||||||||

| Interest income: | |||||||||||||||||||||||||||||

| Loans, including fees | $ | 30,084 | $ | 27,630 | $ | 20,052 | $ | 83,049 | $ | 51,083 | |||||||||||||||||||

| Taxable securities | 1,796 | 1,641 | 1,010 | 4,819 | 2,417 | ||||||||||||||||||||||||

| Nontaxable securities | 227 | 228 | 323 | 747 | 931 | ||||||||||||||||||||||||

| Other interest and dividends | 3,097 | 2,686 | 1,135 | 7,473 | 1,713 | ||||||||||||||||||||||||

| Total interest income | 35,204 | 32,185 | 22,520 | 96,088 | 56,144 | ||||||||||||||||||||||||

| Interest expense: | |||||||||||||||||||||||||||||

| Deposits | 12,732 | 10,998 | 2,489 | 31,498 | 4,251 | ||||||||||||||||||||||||

| Other borrowings | 1,741 | 1,755 | 596 | 4,881 | 1,439 | ||||||||||||||||||||||||

| Total interest expense | 14,473 | 12,753 | 3,085 | 36,379 | 5,690 | ||||||||||||||||||||||||

| Net interest income | 20,731 | 19,432 | 19,435 | 59,709 | 50,454 | ||||||||||||||||||||||||

| Provision for credit losses | 773 | 1,557 | 1,663 | 3,511 | 3,667 | ||||||||||||||||||||||||

| Net interest income after provision for credit losses | 19,958 | 17,875 | 17,772 | 56,198 | 46,787 | ||||||||||||||||||||||||

| Noninterest income: | |||||||||||||||||||||||||||||

| Service charges on deposit accounts | 442 | 456 | 508 | 1,348 | 1,433 | ||||||||||||||||||||||||

| Swap fees | 453 | 173 | 11 | 622 | 48 | ||||||||||||||||||||||||

| SBA/USDA fees | 74 | 66 | 95 | 274 | 575 | ||||||||||||||||||||||||

| Mortgage origination fees | 158 | 188 | 218 | 446 | 717 | ||||||||||||||||||||||||

Net (loss) gain on securities |

(12) | (45) | (143) | 457 | (546) | ||||||||||||||||||||||||

| Employee retention credit and related revenue | (5,100) | 5,100 | — | — | — | ||||||||||||||||||||||||

| Other operating income | 1,091 | 924 | 650 | 2,608 | 1,847 | ||||||||||||||||||||||||

| Total noninterest income | (2,894) | 6,862 | 1,339 | 5,755 | 4,074 | ||||||||||||||||||||||||

| Noninterest expenses: | |||||||||||||||||||||||||||||

| Salaries and employee benefits | 5,752 | 7,863 | 6,152 | 19,926 | 17,859 | ||||||||||||||||||||||||

| Equipment and occupancy expenses | 718 | 694 | 764 | 2,095 | 2,188 | ||||||||||||||||||||||||

| Data processing fees | 650 | 646 | 599 | 1,889 | 1,733 | ||||||||||||||||||||||||

| Regulatory assessments | 322 | 180 | 235 | 844 | 760 | ||||||||||||||||||||||||

| Professional fees related to ERC | (1,243) | 1,243 | — | — | — | ||||||||||||||||||||||||

| Other operating expenses | 2,370 | 2,806 | 2,487 | 7,405 | 6,638 | ||||||||||||||||||||||||

| Total noninterest expenses | 8,569 | 13,432 | 10,237 | 32,159 | 29,178 | ||||||||||||||||||||||||

| Income before income taxes | 8,495 | 11,305 | 8,874 | 29,794 | 21,683 | ||||||||||||||||||||||||

| Income tax expense | 1,866 | 2,549 | 2,174 | 6,738 | 5,204 | ||||||||||||||||||||||||

| Net income | $ | 6,629 | $ | 8,756 | $ | 6,700 | $ | 23,056 | $ | 16,479 | |||||||||||||||||||

| Basic earnings per share | $ | 0.75 | $ | 1.00 | $ | 0.77 | $ | 2.62 | $ | 1.87 | |||||||||||||||||||

| Diluted earnings per share | $ | 0.73 | $ | 0.98 | $ | 0.75 | $ | 2.56 | $ | 1.84 | |||||||||||||||||||

| AVERAGE BALANCE SHEET AND NET INTEREST MARGIN | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Three Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| September 30, 2023 |

June 30, 2023 |

September 30, 2022 |

|||||||||||||||||||||||||||||||||||||||||||||||||||

| Average Balance |

Interest | Yield/Rate | Average Balance |

Interest | Yield/Rate | Average Balance |

Interest | Yield/Rate | |||||||||||||||||||||||||||||||||||||||||||||

| Assets: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-earning assets: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Loans, net of unearned income(1) |

$ | 1,740,582 | $ | 30,084 | 6.86 | % | $ | 1,676,816 | $ | 27,630 | 6.61 | % | $ | 1,480,735 | $ | 20,052 | 5.37 | % | |||||||||||||||||||||||||||||||||||

| Taxable securities | 156,364 | 1,796 | 4.56 | % | 151,107 | 1,641 | 4.36 | % | 128,932 | 1,010 | 3.11 | % | |||||||||||||||||||||||||||||||||||||||||

| Nontaxable securities | 45,466 | 227 | 1.98 | % | 45,624 | 228 | 2.00 | % | 56,738 | 323 | 2.26 | % | |||||||||||||||||||||||||||||||||||||||||

| Other interest-earnings assets | 232,691 | 3,097 | 5.28 | % | 218,451 | 2,686 | 4.93 | % | 192,699 | 1,135 | 2.34 | % | |||||||||||||||||||||||||||||||||||||||||

| Total interest-earning assets | $ | 2,175,103 | $ | 35,204 | 6.42 | % | $ | 2,091,998 | $ | 32,185 | 6.17 | % | $ | 1,859,104 | $ | 22,520 | 4.81 | % | |||||||||||||||||||||||||||||||||||

| Allowance for credit losses | (21,606) | (20,154) | (17,250) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest-earning assets | 128,720 | 128,999 | 124,702 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Assets | $ | 2,282,217 | $ | 2,200,843 | $ | 1,966,556 | |||||||||||||||||||||||||||||||||||||||||||||||

| Liabilities and Stockholders’ Equity: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing transaction accounts | 88,668 | 20 | 0.09 | % | 92,245 | 20 | 0.09 | % | 114,517 | 26 | 0.09 | % | |||||||||||||||||||||||||||||||||||||||||

| Savings and money market accounts | 867,066 | 7,767 | 3.55 | % | 845,742 | 6,872 | 3.26 | % | 811,349 | 1,644 | 0.80 | % | |||||||||||||||||||||||||||||||||||||||||

| Time deposits | 516,290 | 4,945 | 3.80 | % | 474,060 | 4,106 | 3.47 | % | 281,931 | 819 | 1.15 | % | |||||||||||||||||||||||||||||||||||||||||

| FHLB advances | 43,261 | 514 | 4.72 | % | 45,000 | 529 | 4.72 | % | 27,380 | 102 | 1.47 | % | |||||||||||||||||||||||||||||||||||||||||

| Other borrowings | 86,621 | 1,227 | 5.62 | % | 86,411 | 1,226 | 5.69 | % | 47,659 | 494 | 4.12 | % | |||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | $ | 1,601,906 | $ | 14,473 | 3.58 | % | $ | 1,543,458 | $ | 12,753 | 3.31 | % | $ | 1,282,836 | $ | 3,085 | 0.95 | % | |||||||||||||||||||||||||||||||||||

| Noninterest-bearing liabilities: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest-bearing deposits | $ | 448,616 | $ | 438,987 | $ | 491,917 | |||||||||||||||||||||||||||||||||||||||||||||||

| Other liabilities | 28,740 | 24,882 | 19,401 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total noninterest-bearing liabilities | 477,356 | 463,869 | 511,318 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Stockholders’ Equity | 202,955 | 193,516 | 172,402 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Liabilities and Stockholders’ Equity | $ | 2,282,217 | $ | 2,200,843 | $ | 1,966,556 | |||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 20,731 | $ | 19,432 | $ | 19,435 | |||||||||||||||||||||||||||||||||||||||||||||||

Net interest spread(2) |

2.84 | % | 2.86 | % | 3.86 | % | |||||||||||||||||||||||||||||||||||||||||||||||

Net interest margin(3) |

3.78 | % | 3.73 | % | 4.15 | % | |||||||||||||||||||||||||||||||||||||||||||||||

Net interest margin - FTE(4)(5) |

3.79 | % | 3.74 | % | 4.17 | % | |||||||||||||||||||||||||||||||||||||||||||||||

Cost of funds(6) |

2.80 | % | 2.58 | % | 0.69 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Cost of interest-bearing deposits | 3.43 | % | 3.12 | % | 0.82 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Cost of total deposits | 2.63 | % | 2.38 | % | 0.58 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| AVERAGE BALANCE SHEET AND NET INTEREST MARGIN | |||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||

|

Nine Months Ended | ||||||||||||||||||||||||||||||||||

| September 30, 2023 |

September 30, 2022 |

||||||||||||||||||||||||||||||||||

| Average Balance |

Interest | Yield/Rate | Average Balance |

Interest | Yield/Rate | ||||||||||||||||||||||||||||||

| Assets: | |||||||||||||||||||||||||||||||||||

| Interest-earning assets: | |||||||||||||||||||||||||||||||||||

Loans, net of unearned income(1) |

$ | 1,676,134 | $ | 83,049 | 6.62 | % | $ | 1,373,564 | $ | 51,083 | 4.97 | % | |||||||||||||||||||||||

| Taxable securities | 149,058 | 4,819 | 4.32 | % | 119,224 | 2,417 | 2.71 | % | |||||||||||||||||||||||||||

| Nontaxable securities | 47,947 | 747 | 2.08 | % | 56,157 | 931 | 2.22 | % | |||||||||||||||||||||||||||

| Other interest-earnings assets | 199,379 | 7,473 | 5.01 | % | 202,837 | 1,713 | 1.13 | % | |||||||||||||||||||||||||||

| Total interest-earning assets | $ | 2,072,518 | $ | 96,088 | 6.20 | % | $ | 1,751,782 | $ | 56,144 | 4.29 | % | |||||||||||||||||||||||

| Allowance for credit losses | (20,750) | (16,044) | |||||||||||||||||||||||||||||||||

| Noninterest-earning assets | 129,083 | 123,255 | |||||||||||||||||||||||||||||||||

| Total Assets | $ | 2,180,851 | $ | 1,858,993 | |||||||||||||||||||||||||||||||

| Liabilities and Stockholders’ Equity: | |||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities: | |||||||||||||||||||||||||||||||||||

| Interest-bearing transaction accounts | 91,602 | 59 | 0.09 | % | 113,427 | 78 | 0.09 | % | |||||||||||||||||||||||||||

| Savings and money market accounts | 839,827 | 19,679 | 3.13 | % | 741,397 | 2,862 | 0.52 | % | |||||||||||||||||||||||||||

| Time deposits | 464,100 | 11,760 | 3.39 | % | 242,869 | 1,311 | 0.72 | % | |||||||||||||||||||||||||||

| FHLB advances | 35,703 | 1,202 | 4.50 | % | 26,115 | 144 | 0.74 | % | |||||||||||||||||||||||||||

| Other borrowings | 86,453 | 3,679 | 5.69 | % | 42,604 | 1,295 | 4.06 | % | |||||||||||||||||||||||||||

| Total interest-bearing liabilities | $ | 1,517,685 | $ | 36,379 | 3.20 | % | $ | 1,166,412 | $ | 5,690 | 0.65 | % | |||||||||||||||||||||||

| Noninterest-bearing liabilities: | |||||||||||||||||||||||||||||||||||

| Noninterest-bearing deposits | $ | 442,149 | $ | 502,951 | |||||||||||||||||||||||||||||||

| Other liabilities | 26,587 | 16,420 | |||||||||||||||||||||||||||||||||

| Total noninterest-bearing liabilities | $ | 468,736 | $ | 519,371 | |||||||||||||||||||||||||||||||

| Stockholders’ Equity | 194,430 | 173,210 | |||||||||||||||||||||||||||||||||

| Total Liabilities and Stockholders’ Equity | $ | 2,180,851 | $ | 1,858,993 | |||||||||||||||||||||||||||||||

| Net interest income | $ | 59,709 | $ | 50,454 | |||||||||||||||||||||||||||||||

Net interest spread(2) |

3.00 | % | 3.64 | % | |||||||||||||||||||||||||||||||

Net interest margin(3) |

3.85 | % | 3.85 | % | |||||||||||||||||||||||||||||||

Net interest margin - FTE(4)(5) |

3.87 | % | 3.87 | % | |||||||||||||||||||||||||||||||

Cost of funds(6) |

2.48 | % | 0.46 | % | |||||||||||||||||||||||||||||||

| Cost of interest-bearing deposits | 3.02 | % | 0.52 | % | |||||||||||||||||||||||||||||||

| Cost of total deposits | 2.29 | % | 0.36 | % | |||||||||||||||||||||||||||||||

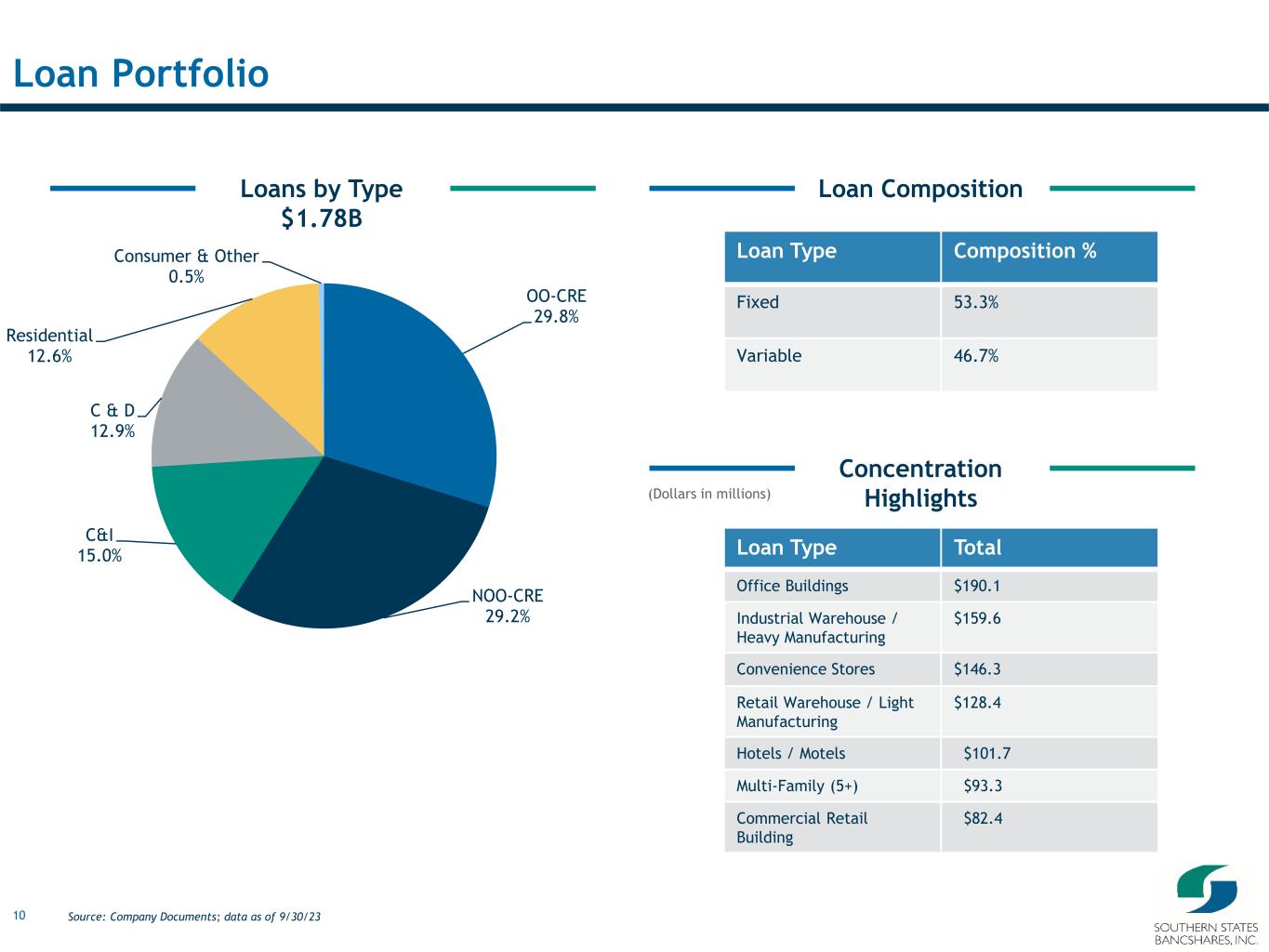

| LOAN COMPOSITION | |||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||

|

September 30, 2023 |

June 30, 2023 |

December 31, 2022 |

September 30, 2022 |

|||||||||||||||||||||||||||||||||||||||||||

| Amount | % of gross | Amount | % of gross | Amount | % of gross | Amount | % of gross | ||||||||||||||||||||||||||||||||||||||||

| Real estate mortgages: | |||||||||||||||||||||||||||||||||||||||||||||||

| Construction and development | $ | 229,188 | 12.9 | % | $ | 228,236 | 13.3 | % | $ | 255,736 | 16.1 | % | $ | 222,159 | 14.5 | % | |||||||||||||||||||||||||||||||

| Residential | 224,499 | 12.6 | % | 214,897 | 12.5 | % | 167,891 | 10.5 | % | 164,296 | 10.7 | % | |||||||||||||||||||||||||||||||||||

| Commercial | 1,049,545 | 59.0 | % | 1,011,815 | 58.7 | % | 904,872 | 56.8 | % | 889,942 | 58.2 | % | |||||||||||||||||||||||||||||||||||

| Commercial and industrial | 268,283 | 15.0 | % | 259,195 | 15.0 | % | 256,553 | 16.1 | % | 243,577 | 15.9 | % | |||||||||||||||||||||||||||||||||||

| Consumer and other | 8,331 | 0.5 | % | 8,135 | 0.5 | % | 7,655 | 0.5 | % | 10,155 | 0.7 | % | |||||||||||||||||||||||||||||||||||

| Gross loans | 1,779,846 | 100.0 | % | 1,722,278 | 100.0 | % | 1,592,707 | 100.0 | % | 1,530,129 | 100.0 | % | |||||||||||||||||||||||||||||||||||

| Unearned income | (5,698) | (5,766) | (5,543) | (5,139) | |||||||||||||||||||||||||||||||||||||||||||

| Loans, net of unearned income | 1,774,148 | 1,716,512 | 1,587,164 | 1,524,990 | |||||||||||||||||||||||||||||||||||||||||||

| Allowance for credit losses | (22,181) | (21,385) | (20,156) | (18,423) | |||||||||||||||||||||||||||||||||||||||||||

| Loans, net | $ | 1,751,967 | $ | 1,695,127 | $ | 1,567,008 | $ | 1,506,567 | |||||||||||||||||||||||||||||||||||||||

| DEPOSIT COMPOSITION | |||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||

|

September 30, 2023 |

June 30, 2023 |

December 31, 2022 |

September 30, 2022 |

|||||||||||||||||||||||||||||||||||||||||||

| Amount | % of total | Amount | % of total | Amount | % of total | Amount | % of total | ||||||||||||||||||||||||||||||||||||||||

| Noninterest-bearing transaction | $ | 418,125 | 21.8 | % | $ | 449,433 | 23.3 | % | $ | 460,977 | 26.8 | % | $ | 499,613 | 28.3 | % | |||||||||||||||||||||||||||||||

| Interest-bearing transaction | 934,383 | 48.8 | % | 922,835 | 48.0 | % | 837,127 | 48.6 | % | 855,350 | 48.4 | % | |||||||||||||||||||||||||||||||||||

| Savings | 38,518 | 2.0 | % | 41,574 | 2.2 | % | 49,235 | 2.9 | % | 78,687 | 4.5 | % | |||||||||||||||||||||||||||||||||||

| Time deposits, $250,000 and under | 436,613 | 22.8 | % | 438,228 | 22.8 | % | 307,145 | 17.8 | % | 266,491 | 15.0 | % | |||||||||||||||||||||||||||||||||||

| Time deposits, over $250,000 | 88,762 | 4.6 | % | 71,841 | 3.7 | % | 66,259 | 3.9 | % | 66,951 | 3.8 | % | |||||||||||||||||||||||||||||||||||

| Total deposits | $ | 1,916,401 | 100.0 | % | $ | 1,923,911 | 100.0 | % | $ | 1,720,743 | 100.0 | % | $ | 1,767,092 | 100.0 | % | |||||||||||||||||||||||||||||||

| Nonperfoming Assets | |||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||

|

September 30, 2023 |

June 30, 2023 |

December 31, 2022 |

September 30, 2022 |

|||||||||||||||||||

| Nonaccrual loans | $ | 1,082 | $ | 1,010 | $ | 2,245 | $ | 3,950 | |||||||||||||||

| Past due loans 90 days or more and still accruing interest | — | — | — | — | |||||||||||||||||||

| Total nonperforming loans | 1,082 | 1,010 | 2,245 | 3,950 | |||||||||||||||||||

| OREO | 2,903 | 2,870 | 2,930 | 2,930 | |||||||||||||||||||

| Total nonperforming assets | $ | 3,985 | $ | 3,880 | $ | 5,175 | $ | 6,880 | |||||||||||||||

Troubled debt restructured loans – nonaccrual(1) |

970 | 724 | 832 | 1,011 | |||||||||||||||||||

| Troubled debt restructured loans – accruing | 1,052 | 1,328 | 1,292 | 1,307 | |||||||||||||||||||

| Total troubled debt restructured loans | $ | 2,022 | $ | 2,052 | $ | 2,124 | $ | 2,318 | |||||||||||||||

| Allowance for credit losses | $ | 22,181 | $ | 21,385 | $ | 20,156 | $ | 18,423 | |||||||||||||||

| Loans, net of unearned income at the end of the period | $ | 1,774,148 | $ | 1,716,512 | $ | 1,587,164 | $ | 1,524,990 | |||||||||||||||

| Gross loans outstanding at the end of period | $ | 1,779,846 | $ | 1,722,278 | $ | 1,592,707 | $ | 1,530,129 | |||||||||||||||

| Total assets | $ | 2,296,527 | $ | 2,277,803 | $ | 2,045,204 | $ | 2,052,725 | |||||||||||||||

| Allowance for credit losses to nonperforming loans | 2050.00 | % | 2117.33 | % | 897.82 | % | 466.41 | % | |||||||||||||||

| Nonperforming loans to loans, net of unearned income | 0.06 | % | 0.06 | % | 0.14 | % | 0.26 | % | |||||||||||||||

| Nonperforming loans to gross loans | 0.06 | % | 0.06 | % | 0.14 | % | 0.26 | % | |||||||||||||||

| Nonperforming assets to gross loans and OREO | 0.22 | % | 0.22 | % | 0.32 | % | 0.45 | % | |||||||||||||||

| Nonperforming assets to total assets | 0.17 | % | 0.17 | % | 0.25 | % | 0.34 | % | |||||||||||||||

| Nonaccrual loans by category: | |||||||||||||||||||||||

| Real estate mortgages: | |||||||||||||||||||||||

| Construction & Development | $ | — | $ | 33 | $ | 67 | $ | 70 | |||||||||||||||

| Residential Mortgages | 289 | 297 | 565 | 550 | |||||||||||||||||||

| Commercial Real Estate Mortgages | 785 | 671 | 1,278 | 2,888 | |||||||||||||||||||

| Commercial & Industrial | 8 | 9 | 312 | 434 | |||||||||||||||||||

| Consumer and other | — | — | 23 | 8 | |||||||||||||||||||

| Total | $ | 1,082 | $ | 1,010 | $ | 2,245 | $ | 3,950 | |||||||||||||||

| Allowance for Credit Losses | |||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||

|

Three Months Ended | Nine Months Ended | |||||||||||||||||||||||||||

| September 30, 2023 |

June 30, 2023 |

September 30, 2022 |

September 30, 2023 |

September 30, 2022 | |||||||||||||||||||||||||

| Average loans, net of unearned income | $ | 1,740,582 | $ | 1,676,816 | $ | 1,480,735 | $ | 1,676,134 | $ | 1,373,564 | |||||||||||||||||||

| Loans, net of unearned income | $ | 1,774,148 | $ | 1,716,512 | $ | 1,524,990 | $ | 1,774,148 | $ | 1,524,990 | |||||||||||||||||||

| Gross loans | $ | 1,779,846 | $ | 1,722,278 | $ | 1,530,129 | $ | 1,779,846 | $ | 1,530,129 | |||||||||||||||||||

| Allowance for credit losses at beginning of the period | $ | 21,385 | $ | 19,855 | $ | 16,807 | $ | 20,156 | $ | 14,844 | |||||||||||||||||||

| Impact of adoption of ASC 326 | $ | — | $ | — | $ | — | $ | (1,285) | $ | — | |||||||||||||||||||

| Charge-offs: | |||||||||||||||||||||||||||||

| Construction and development | 3 | — | — | 3 | 66 | ||||||||||||||||||||||||

| Residential | — | — | — | — | 7 | ||||||||||||||||||||||||

| Commercial | — | — | — | — | — | ||||||||||||||||||||||||

| Commercial and industrial | — | 44 | 269 | 262 | 269 | ||||||||||||||||||||||||

| Consumer and other | — | — | 1 | 6 | 8 | ||||||||||||||||||||||||

| Total charge-offs | 3 | 44 | 270 | 271 | 350 | ||||||||||||||||||||||||

| Recoveries: | |||||||||||||||||||||||||||||

| Construction and development | — | — | — | — | — | ||||||||||||||||||||||||

| Residential | 10 | 17 | 11 | 38 | 46 | ||||||||||||||||||||||||

| Commercial | — | — | — | — | — | ||||||||||||||||||||||||

| Commercial and industrial | — | — | 204 | 14 | 204 | ||||||||||||||||||||||||

| Consumer and other | 16 | — | 8 | 18 | 12 | ||||||||||||||||||||||||

| Total recoveries | 26 | 17 | 223 | 70 | 262 | ||||||||||||||||||||||||

| Net charge-offs (recoveries) | $ | (23) | $ | 27 | $ | 47 | $ | 201 | $ | 88 | |||||||||||||||||||

| Provision for credit losses | $ | 773 | $ | 1,557 | $ | 1,663 | $ | 3,511 | $ | 3,667 | |||||||||||||||||||

| Balance at end of the period | $ | 22,181 | $ | 21,385 | $ | 18,423 | $ | 22,181 | $ | 18,423 | |||||||||||||||||||

| Allowance for credit losses on unfunded commitments at beginning of the period | $ | 1,495 | $ | 1,285 | $ | — | $ | — | $ | — | |||||||||||||||||||

| Impact of adoption of ASC 326 | — | — | — | 1,285 | — | ||||||||||||||||||||||||

| Provision for credit losses on unfunded commitments | 29 | 210 | — | 239 | — | ||||||||||||||||||||||||

| Balance at the end of the period | $ | 1,524 | $ | 1,495 | $ | — | $ | 1,524 | $ | — | |||||||||||||||||||

| Allowance to loans, net of unearned income | 1.25 | % | 1.25 | % | 1.21 | % | 1.25 | % | 1.21 | % | |||||||||||||||||||

| Allowance to gross loans | 1.25 | % | 1.24 | % | 1.20 | % | 1.25 | % | 1.20 | % | |||||||||||||||||||

Net charge-offs (recoveries) to average loans, net of unearned income(1) |

(0.01) | % | 0.01 | % | 0.01 | % | 0.02 | % | 0.01 | % | |||||||||||||||||||

Provision for credit losses to average loans, net of unearned income(1) |

0.18 | % | 0.37 | % | 0.45 | % | 0.28 | % | 0.36 | % | |||||||||||||||||||

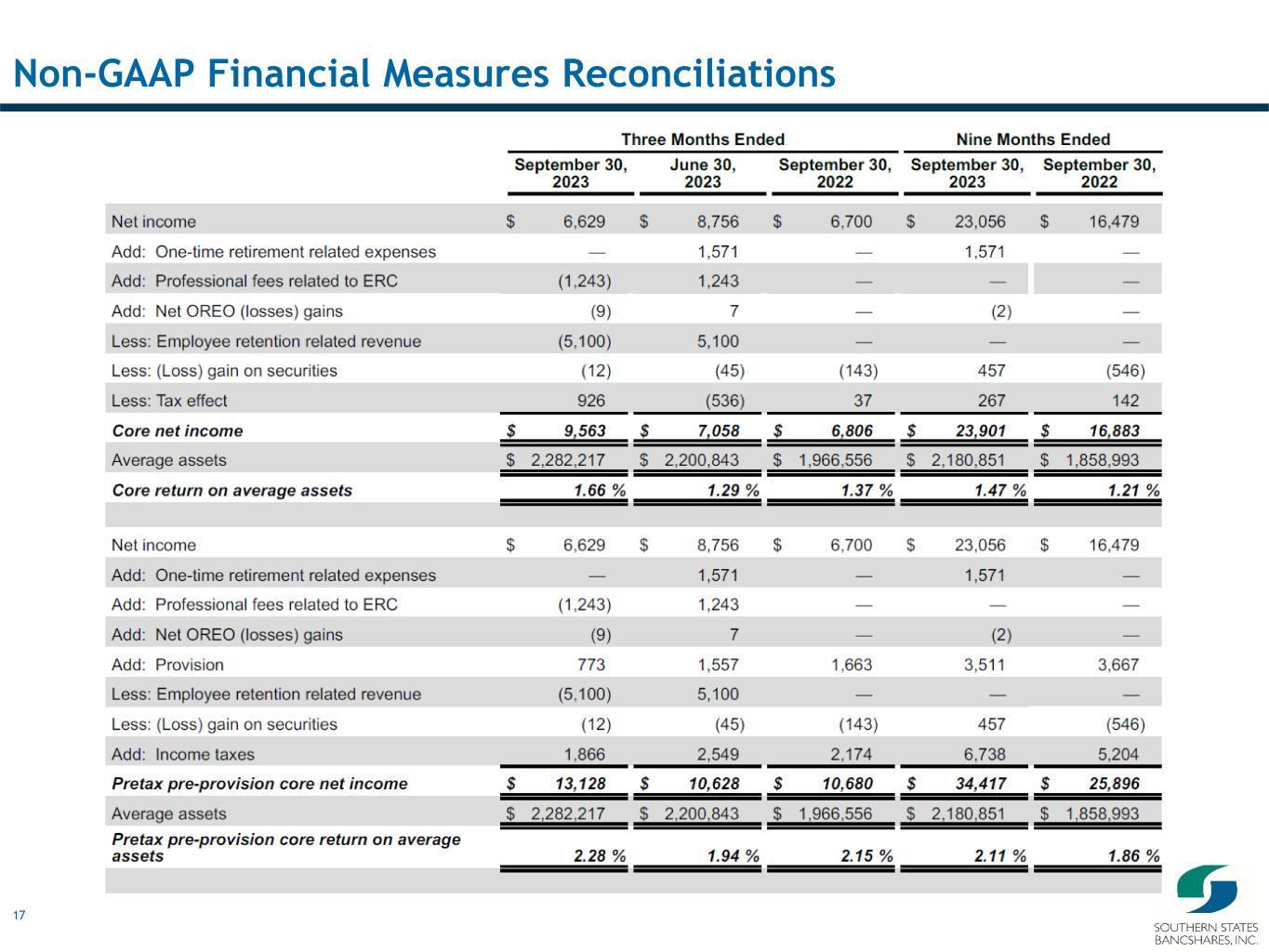

| Reconciliation of Non-GAAP Financial Measures | ||||||||||||||

| Reconciliation of Non-GAAP Financial Measures | |||||||||||||||||||||||||||||

| (Dollars in thousands, except share and per share amounts) | |||||||||||||||||||||||||||||

|

Three Months Ended | Nine Months Ended | |||||||||||||||||||||||||||

| September 30, 2023 |

June 30, 2023 |

September 30, 2022 |

September 30, 2023 |

September 30, 2022 |

|||||||||||||||||||||||||

| Net income | $ | 6,629 | $ | 8,756 | $ | 6,700 | $ | 23,056 | $ | 16,479 | |||||||||||||||||||

| Add: One-time retirement related expenses | — | 1,571 | — | 1,571 | — | ||||||||||||||||||||||||

| Add: Professional fees related to ERC | (1,243) | 1,243 | — | — | — | ||||||||||||||||||||||||

| Add: Net OREO (losses) gains | (9) | 7 | — | (2) | — | ||||||||||||||||||||||||

| Less: Employee retention related revenue | (5,100) | 5,100 | — | — | — | ||||||||||||||||||||||||

| Less: (Loss) gain on securities | (12) | (45) | (143) | 457 | (546) | ||||||||||||||||||||||||

| Less: Tax effect | 926 | (536) | 37 | 267 | 142 | ||||||||||||||||||||||||

| Core net income | $ | 9,563 | $ | 7,058 | $ | 6,806 | $ | 23,901 | $ | 16,883 | |||||||||||||||||||

| Average assets | $ | 2,282,217 | $ | 2,200,843 | $ | 1,966,556 | $ | 2,180,851 | $ | 1,858,993 | |||||||||||||||||||

| Core return on average assets | 1.66 | % | 1.29 | % | 1.37 | % | 1.47 | % | 1.21 | % | |||||||||||||||||||

| Net income | $ | 6,629 | $ | 8,756 | $ | 6,700 | $ | 23,056 | $ | 16,479 | |||||||||||||||||||

| Add: One-time retirement related expenses | — | 1,571 | — | 1,571 | — | ||||||||||||||||||||||||

| Add: Professional fees related to ERC | (1,243) | 1,243 | — | — | — | ||||||||||||||||||||||||

| Add: Net OREO (losses) gains | (9) | 7 | — | (2) | — | ||||||||||||||||||||||||

| Add: Provision | 773 | 1,557 | 1,663 | 3,511 | 3,667 | ||||||||||||||||||||||||

| Less: Employee retention related revenue | (5,100) | 5,100 | — | — | — | ||||||||||||||||||||||||

| Less: (Loss) gain on securities | (12) | (45) | (143) | 457 | (546) | ||||||||||||||||||||||||

| Add: Income taxes | 1,866 | 2,549 | 2,174 | 6,738 | 5,204 | ||||||||||||||||||||||||

| Pretax pre-provision core net income | $ | 13,128 | $ | 10,628 | $ | 10,680 | $ | 34,417 | $ | 25,896 | |||||||||||||||||||

| Average assets | $ | 2,282,217 | $ | 2,200,843 | $ | 1,966,556 | $ | 2,180,851 | $ | 1,858,993 | |||||||||||||||||||

| Pretax pre-provision core return on average assets | 2.28 | % | 1.94 | % | 2.15 | % | 2.11 | % | 1.86 | % | |||||||||||||||||||

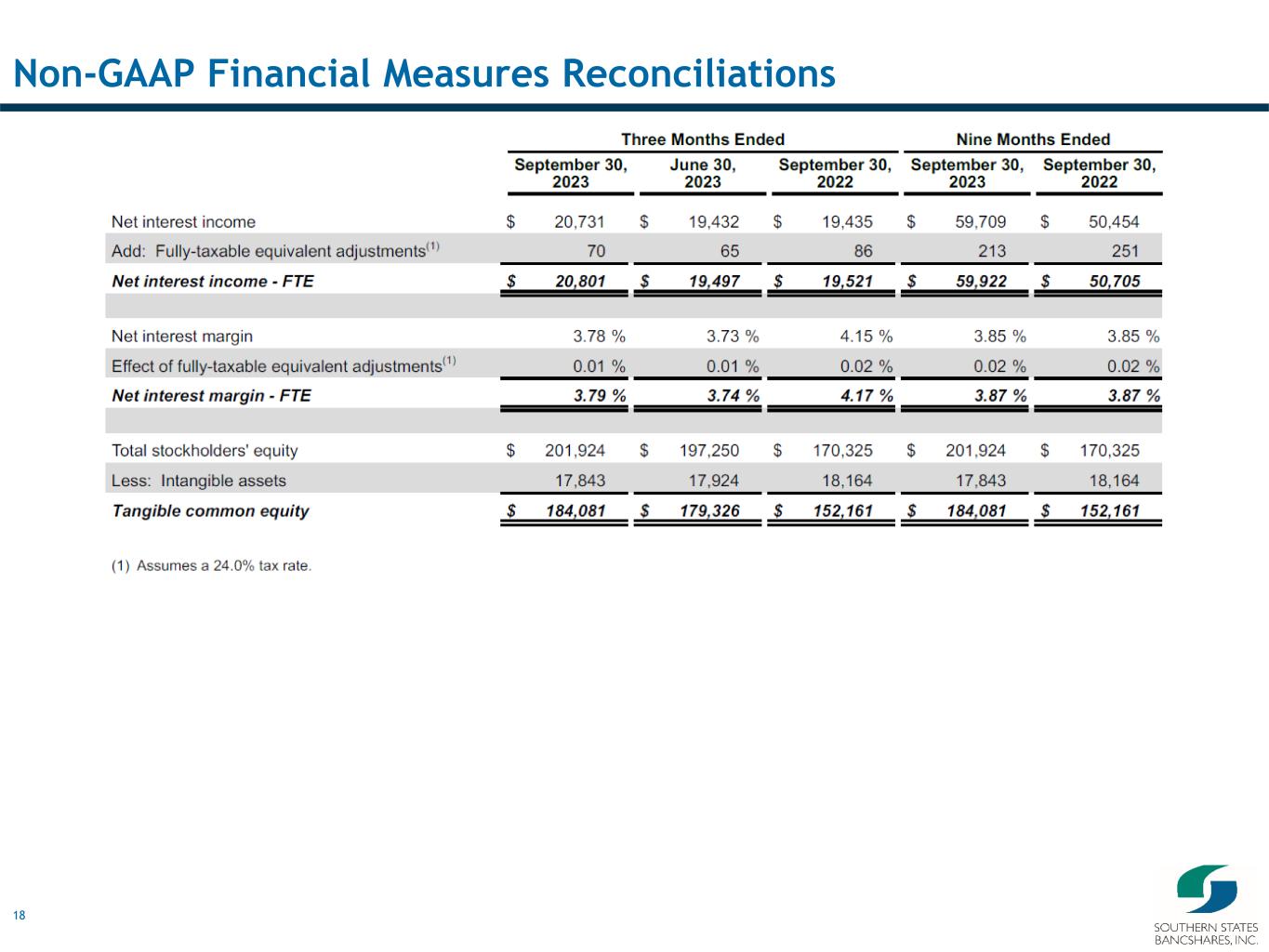

| Net interest income | $ | 20,731 | $ | 19,432 | $ | 19,435 | $ | 59,709 | $ | 50,454 | |||||||||||||||||||

Add: Fully-taxable equivalent adjustments(1) |

70 | 65 | 86 | 213 | 251 | ||||||||||||||||||||||||

| Net interest income - FTE | $ | 20,801 | $ | 19,497 | $ | 19,521 | $ | 59,922 | $ | 50,705 | |||||||||||||||||||

| Net interest margin | 3.78 | % | 3.73 | % | 4.15 | % | 3.85 | % | 3.85 | % | |||||||||||||||||||

Effect of fully-taxable equivalent adjustments(1) |

0.01 | % | 0.01 | % | 0.02 | % | 0.02 | % | 0.02 | % | |||||||||||||||||||

| Net interest margin - FTE | 3.79 | % | 3.74 | % | 4.17 | % | 3.87 | % | 3.87 | % | |||||||||||||||||||

| Total stockholders' equity | $ | 201,924 | $ | 197,250 | $ | 170,325 | $ | 201,924 | $ | 170,325 | |||||||||||||||||||

| Less: Intangible assets | 17,843 | 17,924 | 18,164 | 17,843 | 18,164 | ||||||||||||||||||||||||

| Tangible common equity | $ | 184,081 | $ | 179,326 | $ | 152,161 | $ | 184,081 | $ | 152,161 | |||||||||||||||||||

| (1) Assumes a 24.0% tax rate. | |||||||||||||||||||||||||||||

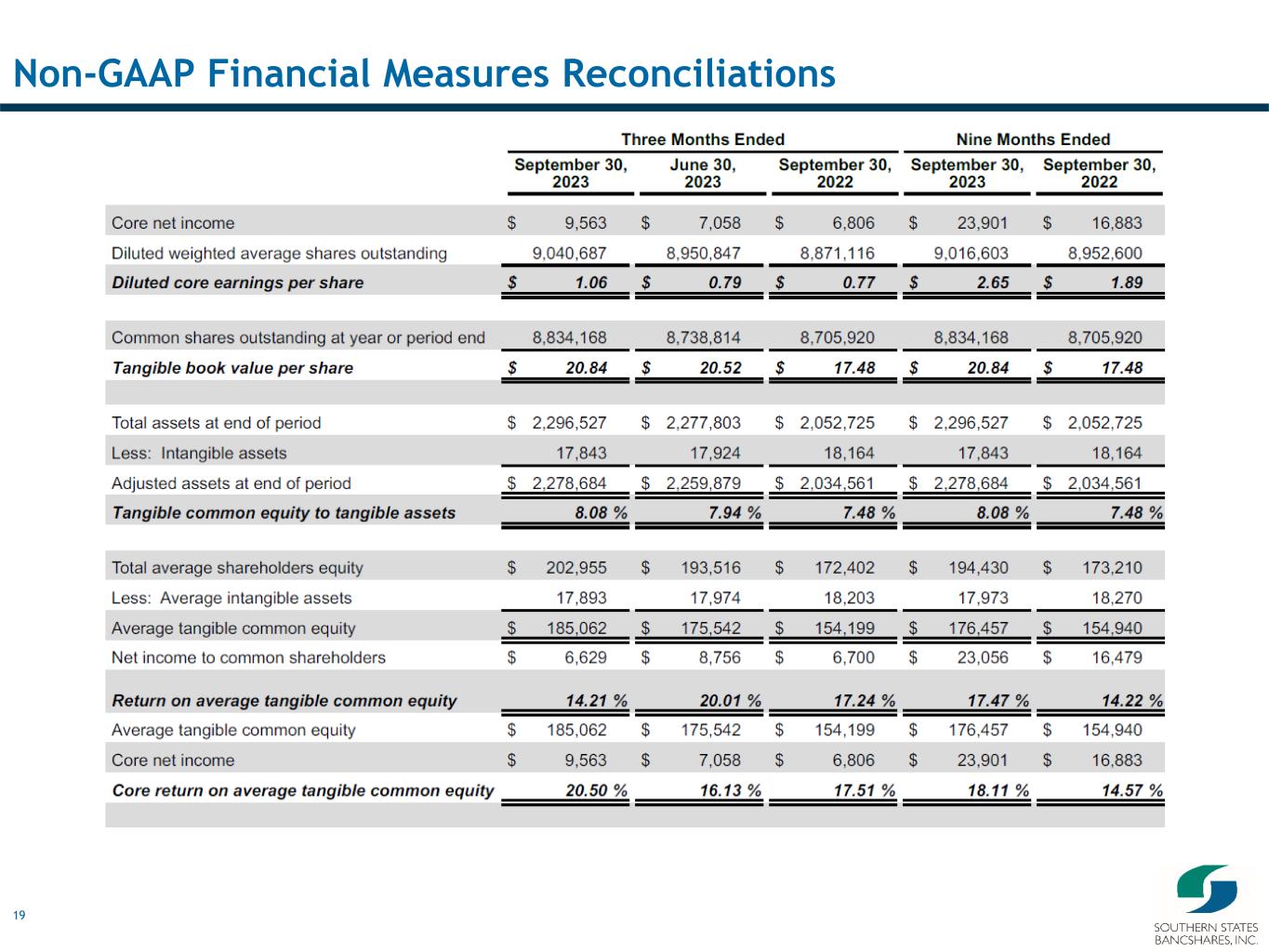

| Reconciliation of Non-GAAP Financial Measures | |||||||||||||||||||||||||||||

| (Dollars in thousands, except share and per share amounts) | |||||||||||||||||||||||||||||

|

Three Months Ended | Nine Months Ended | |||||||||||||||||||||||||||

| September 30, 2023 |

June 30, 2023 |

September 30, 2022 |

September 30, 2023 |

September 30, 2022 |

|||||||||||||||||||||||||

| Core net income | $ | 9,563 | $ | 7,058 | $ | 6,806 | $ | 23,901 | $ | 16,883 | |||||||||||||||||||

| Diluted weighted average shares outstanding | 9,040,687 | 8,950,847 | 8,871,116 | 9,016,603 | 8,952,600 | ||||||||||||||||||||||||

| Diluted core earnings per share | $ | 1.06 | $ | 0.79 | $ | 0.77 | $ | 2.65 | $ | 1.89 | |||||||||||||||||||

| Common shares outstanding at year or period end | 8,834,168 | 8,738,814 | 8,705,920 | 8,834,168 | 8,705,920 | ||||||||||||||||||||||||

| Tangible book value per share | $ | 20.84 | $ | 20.52 | $ | 17.48 | $ | 20.84 | $ | 17.48 | |||||||||||||||||||

| Total assets at end of period | $ | 2,296,527 | $ | 2,277,803 | $ | 2,052,725 | $ | 2,296,527 | $ | 2,052,725 | |||||||||||||||||||

| Less: Intangible assets | 17,843 | 17,924 | 18,164 | 17,843 | 18,164 | ||||||||||||||||||||||||

| Adjusted assets at end of period | $ | 2,278,684 | $ | 2,259,879 | $ | 2,034,561 | $ | 2,278,684 | $ | 2,034,561 | |||||||||||||||||||

| Tangible common equity to tangible assets | 8.08 | % | 7.94 | % | 7.48 | % | 8.08 | % | 7.48 | % | |||||||||||||||||||

| Total average shareholders equity | $ | 202,955 | $ | 193,516 | $ | 172,402 | $ | 194,430 | $ | 173,210 | |||||||||||||||||||

| Less: Average intangible assets | 17,893 | 17,974 | 18,203 | 17,973 | 18,270 | ||||||||||||||||||||||||

| Average tangible common equity | $ | 185,062 | $ | 175,542 | $ | 154,199 | $ | 176,457 | $ | 154,940 | |||||||||||||||||||

| Net income to common shareholders | $ | 6,629 | $ | 8,756 | $ | 6,700 | $ | 23,056 | $ | 16,479 | |||||||||||||||||||

| Return on average tangible common equity | 14.21 | % | 20.01 | % | 17.24 | % | 17.47 | % | 14.22 | % | |||||||||||||||||||

| Average tangible common equity | $ | 185,062 | $ | 175,542 | $ | 154,199 | $ | 176,457 | $ | 154,940 | |||||||||||||||||||

| Core net income | $ | 9,563 | $ | 7,058 | $ | 6,806 | $ | 23,901 | $ | 16,883 | |||||||||||||||||||

| Core return on average tangible common equity | 20.50 | % | 16.13 | % | 17.51 | % | 18.11 | % | 14.57 | % | |||||||||||||||||||

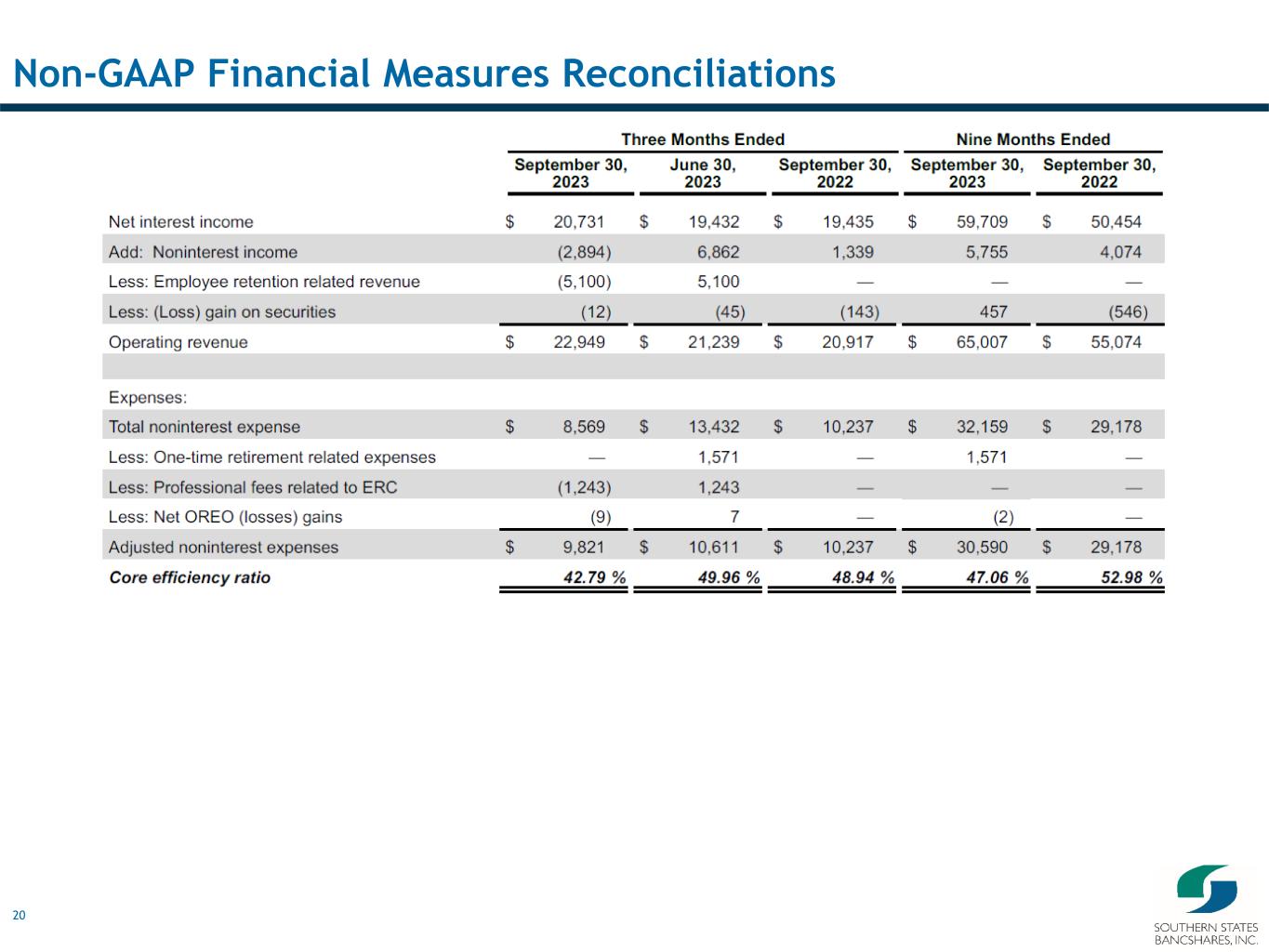

| Net interest income | $ | 20,731 | $ | 19,432 | $ | 19,435 | $ | 59,709 | $ | 50,454 | |||||||||||||||||||

| Add: Noninterest income | (2,894) | 6,862 | 1,339 | 5,755 | 4,074 | ||||||||||||||||||||||||

| Less: Employee retention related revenue | (5,100) | 5,100 | — | — | — | ||||||||||||||||||||||||

| Less: (Loss) gain on securities | (12) | (45) | (143) | 457 | (546) | ||||||||||||||||||||||||

| Operating revenue | $ | 22,949 | $ | 21,239 | $ | 20,917 | $ | 65,007 | $ | 55,074 | |||||||||||||||||||

| Expenses: | |||||||||||||||||||||||||||||

| Total noninterest expense | $ | 8,569 | $ | 13,432 | $ | 10,237 | $ | 32,159 | $ | 29,178 | |||||||||||||||||||

| Less: One-time retirement related expenses | — | 1,571 | — | 1,571 | — | ||||||||||||||||||||||||

| Less: Professional fees related to ERC | (1,243) | 1,243 | — | — | — | ||||||||||||||||||||||||

| Less: Net OREO (losses) gains | (9) | 7 | — | (2) | — | ||||||||||||||||||||||||

| Adjusted noninterest expenses | $ | 9,821 | $ | 10,611 | $ | 10,237 | $ | 30,590 | $ | 29,178 | |||||||||||||||||||

| Core efficiency ratio | 42.79 | % | 49.96 | % | 48.94 | % | 47.06 | % | 52.98 | % | |||||||||||||||||||