Document

Annual

Report 2022

Summary Presentation 3 Corporate governance 31 People 46 Environment 71 Digital environment 80 Economic performance 90 Exhibits 97 Summary of indicators 101 Letter of assurance 108 Corporate information 111

Message from the CEO

[GRI 2-22]

The year 2022 was special for all of us who make Inter. We can say it was an intense journey full of challenges, in which we were able to grow in number of clients, increase our market share in all business verticals, and further expand the num-ber of features in our Super App, always seeking to meet the expectations of our stakeholders.

Among many achievements, a relevant milestone in 2022 was the corporate reorganization that resulted in the mi-gration of Banco Inter S.A.’s shareholder base from B3 S.A. - Brasil, Bolsa, Balcão (B3), in Brazil, to the holding com-pany Inter&Co, Inc., which is now listed on the Nasdaq, in the United States. The corporate reorganization expand-ed Inter’s access to international investors, through one of the world’s largest stock exchanges, which houses a large part of the global technology players. In addition, it was another step towards continuing our national expansion in the coming years, strengthening our position as a global technology company.

It is important to highlight that the corporate reorganization was an innovative operation in the market, and we share the credit for its accomplishment not only with our employees, but also with our investors, who gave the green light for Inter to take this important step towards a future even more full of possibilities and growth. Additionally, the corporate reorga-nization has put Inter on even more robust governance and compliance standards.

Last year, we added more than 8.3 million clients to our base and will reach 2023 with a volume of approximately 25 million clients - performance that requires discipline and focus from our entire team to achieve the goals defined in our strategic planning.

We also reached the mark of 1.5 million clients in the Indi-vidual Micro-Entrepreneur (MEI) and Corporate segments. Through the Inter Empresas Super App, our entrepreneurial clients have access to a 100% digital, free account with an investment section and marketplace.

Another milestone in 2022 was the completion of the acquisi-tion of Usend, now Inter&Co Payments, our first step towards offering financial services in US territory. Since April of 2022, Inter’s Super App offers a Global Account, focusing on two major audiences: Brazilians who want access to financial and non-financial solutions in U.S. dollars (tourists, self-employed people acting outside of Brazilian territory, companies im-porting/exporting goods and services) and U.S. residents, mainly for remittances. By 2022, we will increase the number of global service clients 23-fold, reaching almost 1 million clients.

In parallel, we created more functionalities for our clients, such as Doutor Inter, which allows our client access to a tele-medicine service with more than 20 medical specialties.

In addition, we started linking investment portfolios to envi-ronmental, social, and governance (ESG) criteria, maintaining a culture of sustainability. Our expectation is to have, in an increasingly cross-cutting manner, an ESG agenda in all of Inter’s spheres of action, in a manner integrated with our or-ganizational strategy.

Besides mitigating and offsetting our carbon emissions and making continuous improvements in corporate governance, we have financial education as a material topic and we act to strengthen it among our stakeholders and offer it in the social actions we promote through Inter Voluntariado (or, in English, Inter Volunteering).

We are in a continuous process of evolution, developing the awareness of our employees to enable ESG issues to be in-creasingly rooted in the company’s culture, whether in our investments or in the launching of new products.

Annual Report Inter&Co 2022 Corporate governance People Environment Digital environment Economic performance Exhibits Summary of indicators Letter of assurance Corporate information

Corporate Digital Economic Summary of Letter of Corporate

Presentation People Environment Exhibits

governance environment performance indicators assurance information

We want to be increasingly transversal in our ESG

agenda, adherent to our materiality and integrated into

all of Inter&Co’s spheres of activity.

In early 2023, we advanced even further in

this sustainability agenda, which is part of

our internal movement of maturing topics,

and we invested in the preparation of a product

that could represent our commitments

and thereby share it with our clients.

Once again, we use our high performance

and digital expertise to, through the Super

App, present ways for our client to exercise

more sustainable behavior, using a platform

of services called Sustainable Living

(Vida Sustentável).

The creation of this platform was a coordinated

action that involved the main business

areas to test and verify the sustainable cri-

teria that should be reflected in the application.

Sustainable Living, developed internally

by our team, offers our individual clients the

possibility to make donations, access financial

and social and environmental education

content, estimate and offset greenhouse

gas (GHG) emissions, make medical appointments,

access sustainable stores, and

participate in volunteer programs.

Inter is a signatory of the United Nations Organization

(UNO) Global Compact Network

Brazil, reaffirming our commitment to the

Ten Principles of the Global Compact and to

building a more balanced and sustainable

world. We are also a hub in Minas Gerais for

companies that develop and support projects

and initiatives to promote the 2030 Agenda,

Hub ODS Minas Gerais, and the 2030 Challenge

Network.

Corporate Digital Economic Summary of Letter of Corporate

Presentation People Environment Exhibits

governance environment performance indicators assurance information

In addition, we also reinforce our commitment to Agenda 2030

through the value generation provided by our business model.

With the Super App, we want to continue simplifying the lives

of more and more people around the world, while improving

our ESG performance and bringing sustainability into the

daily lives of our clients through education and sustainable

products and services.

For 2023 and beyond, we aim high to deliver an even better

Inter for our employees, clients, and investors. We are ready

to bring in more operational efficiency, win markets, and continue

producing solid results.

We will remain committed to fulfilling our mission of empowering

people to manage their finances and daily activities

through a simple and integrated digital experience, and we

are confident that our key focus areas will position us for

continued success in 2023 and beyond.

We are grateful for the trust our clients have placed in us so

far. We will continue to dedicate ourselves to providing excellent

service, creating value for all our stakeholders. I invite you

to learn more about Inter&Co’s strategy and journey through

our 2022 Annual Report.

Happy reading!

João Vitor Menin

CEO Inter&Co

Corporate

Presentation

governance

Growing while

making a

difference

Besides simplifying, Inter wants to contribute

to improving people's lives and be part of

the change that gives autonomy to those who

use the Super App. Accordingly, it innovates

every day through product and service diversification

and has a business model that

keeps growing while contributing to sustainable

development.

Inter has grown by betting on an eco-efficient

and scalable business model, reducing

operating costs and providing technology

that makes life easier for the customer while

opening up a range of possibilities for financial

and social movements through the Super

App, which was developed to have friendly

navigation, operated within high security

standards, and with cloud data, which allows

expansion of services and controls, with

increasingly precise and free interactions.

Digital Economic Summary of Letter of Corporate

People Environment Exhibits

environment performance indicators assurance information

Democratic

Through the Feemeter1 accounting, there were more

than BRL 25 billion in fee exemptions from 2017 to

December 2022. This differentiator of Inter allows it

to broaden banking access, through which customers

have a safe and reliable environment to expand their

financial horizons, thanks to the use of high technology

and the development of a multi-integrated platform,

supported by a robust cloud database system. A

pioneer in fully digital and free accounts in Brazil,

Inter installed, in 2016, in the city of Belo Horizonte

(MG), where its headquarters are located, a Feemeter

– a numerical panel that estimates how much its

customers who use this account have already saved

in bank fees, estimated. Inter manages the amounts

of fees that are no longer charged for each digital

transaction, taking into account the tables defined by

the Central Bank and accounting for these amounts as

a direct gain for the customer.

1 The Feemeter was launched by Inter at the end of 2016 and takes into account all bank transactions made by its

customers based on the fee table established by the Central Bank of Brazil. In 2022 alone, there were more than

R$11 billion in fee exemptions.

+R$25 billion

+R$11 billion

in fee exemptions

in 2022

in fee exemptions

since 2017

Corporate Digital Economic Summary of Letter of Corporate

Presentation People Environment Exhibits

governance environment performance indicators assurance information

Economic

+R$320 million

in cashback to heat up the

Brazilian economy

More than R$320 million in cashback returned in 2022, in a win win win

relationship. A return stimulus for the various sectors of the economy to gain,

with the customer having the option to invest this amount on Inter's investment

platform and may even choose to donate part of their cashback to social

and/or environmental actions, through the Sustainable Living section of the

Super App. Inter distributes up to 50% of the volume of its trading returns for

customers to use in new transactions, bringing a new dynamic to its customers'

buying and saving environment.

Eco-efficientOn average 95% more eco efficient2 per customer when compared to the

average environmental impact of operations of other traditional banking

players. The 100% digital environment avoids bureaucracy, the use of physical

branches and related negative impact externalities. It is strategic for Inter

to establish technological partnerships with providers aligned with the use

of sustainable digital platforms, that strengthen a low carbon economy,

increasingly seeking to develop eco efficiency in Inter's operations and

combat climate change.

2 The survey is based on benchmarking using GHG Protocol data and reporting of water and

energy consumption with the metric of number of clients per institution in the same segment.

95% 100%

more

eco-efficientdigital

Corporate Digital Economic Summary of Letter of Corporate

Presentation People Environment Exhibits

governance environment performance indicators assurance information

Our Report

[GRI 2-2, 2-3, 2-4, 2-5]

This is Inter’s third Annual Report and the first under the new

configuration as Inter&Co. Inc. (Inter&Co, holding company or

company). The 2022 edition marks the corporate reorganization

of the Inter Group, which from now on will begin to group

its environmental, social, and governance (ESG) indicators

in a common manner across all subsidiaries and the holding

company (which together are called the Inter Group).

This document reflects Inter&Co’s commitments to the ESG

agenda, demonstrating how they are intertwined with the

Group’s business model and purpose: creating what makes

people’s lives simpler.

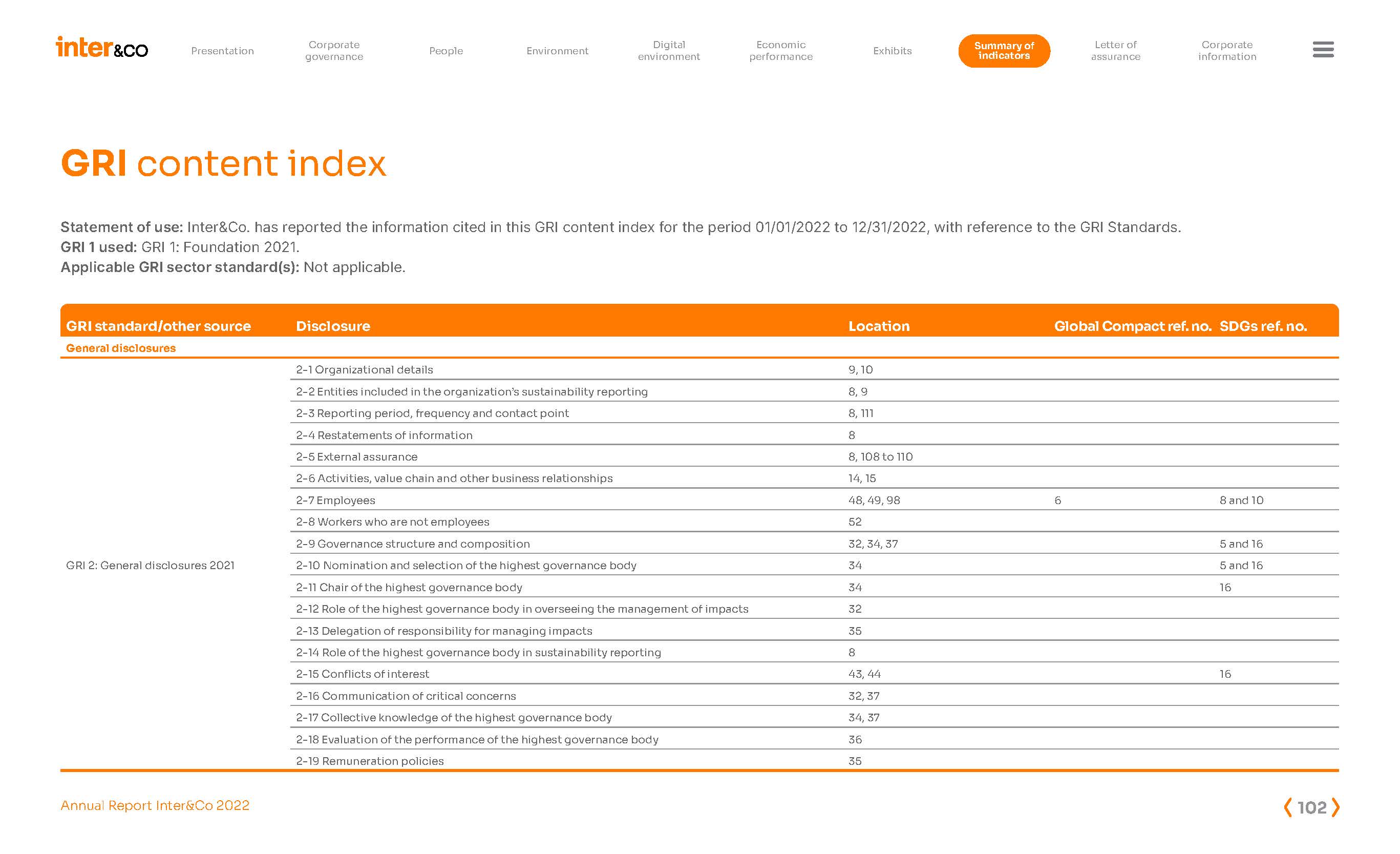

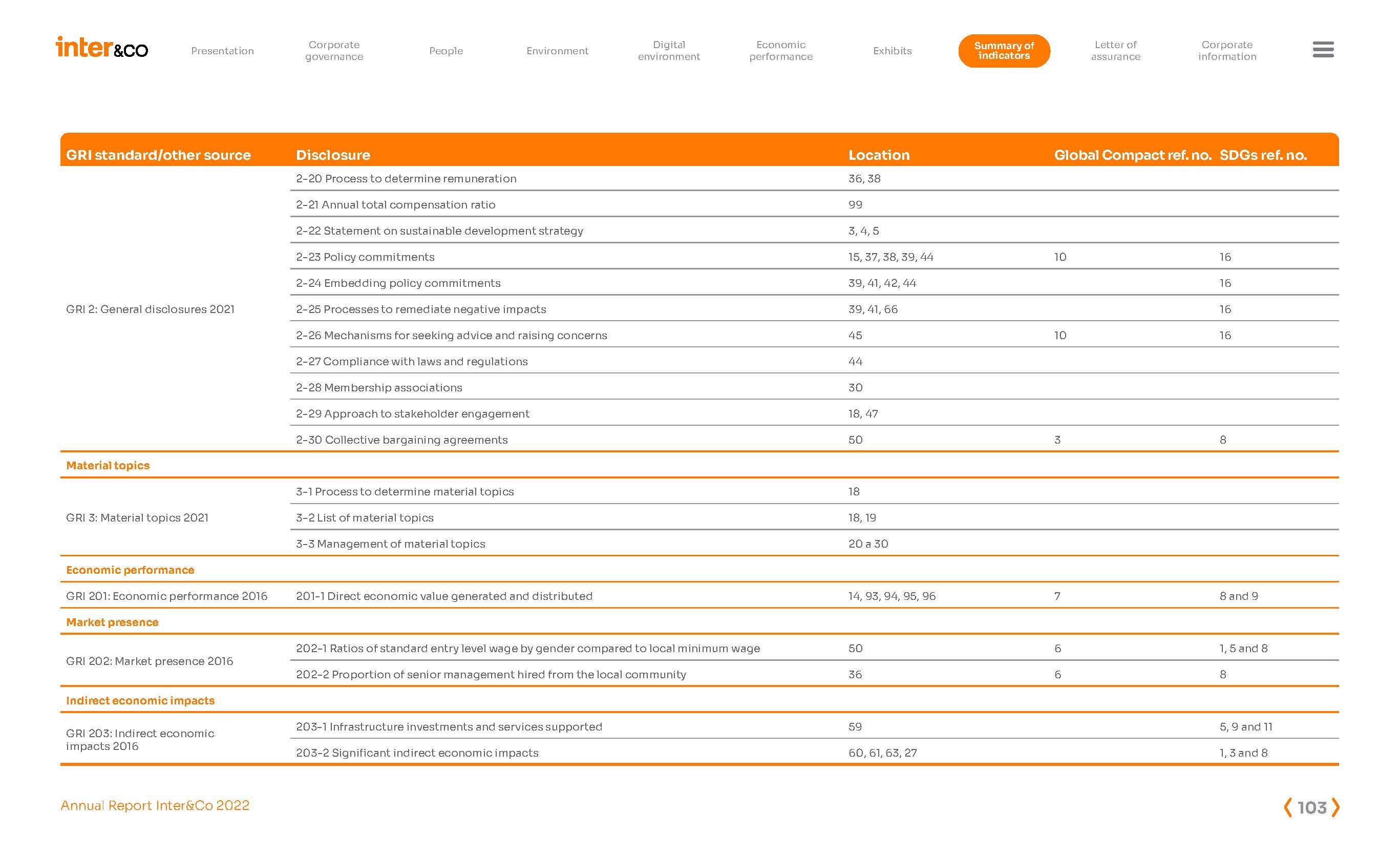

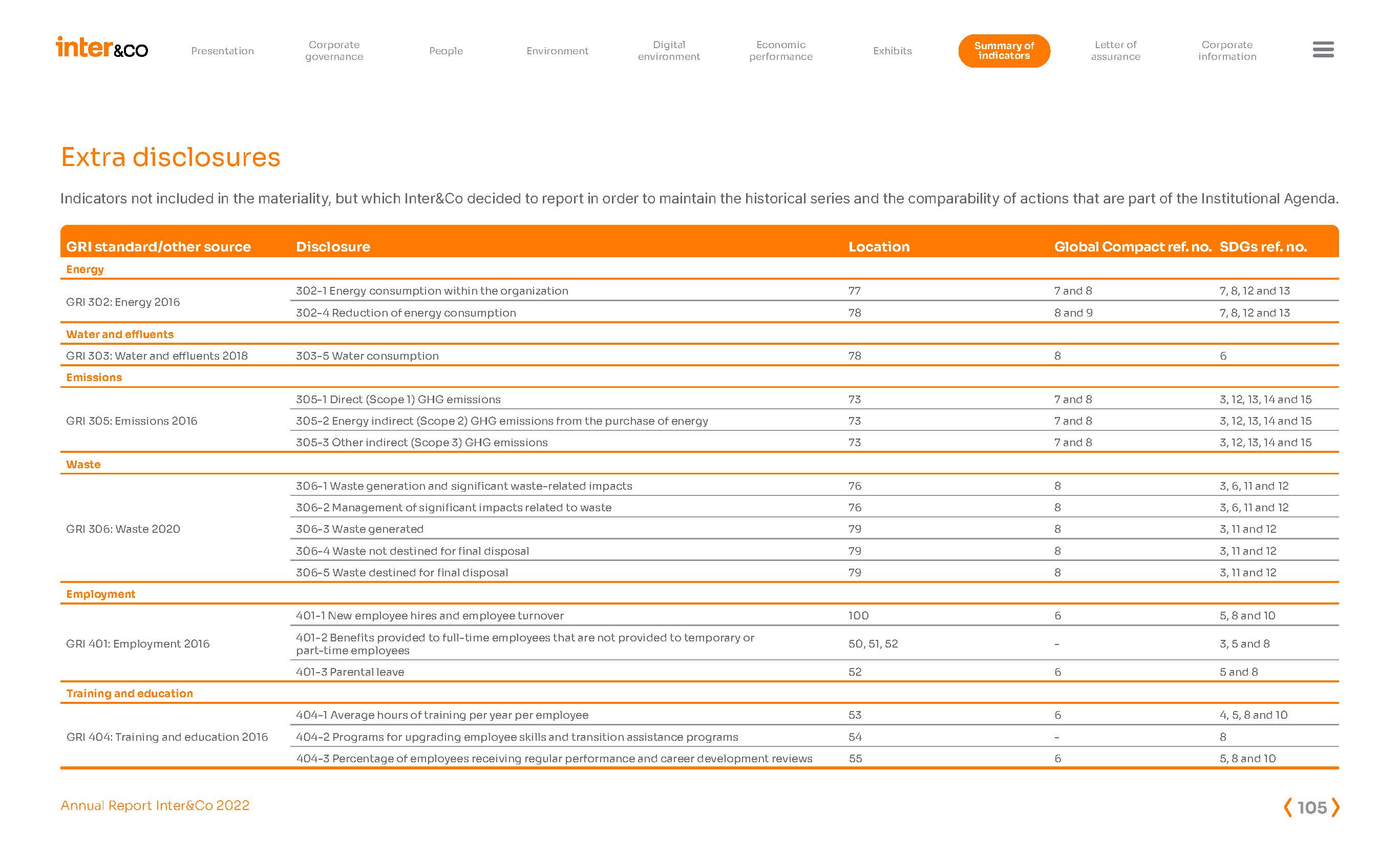

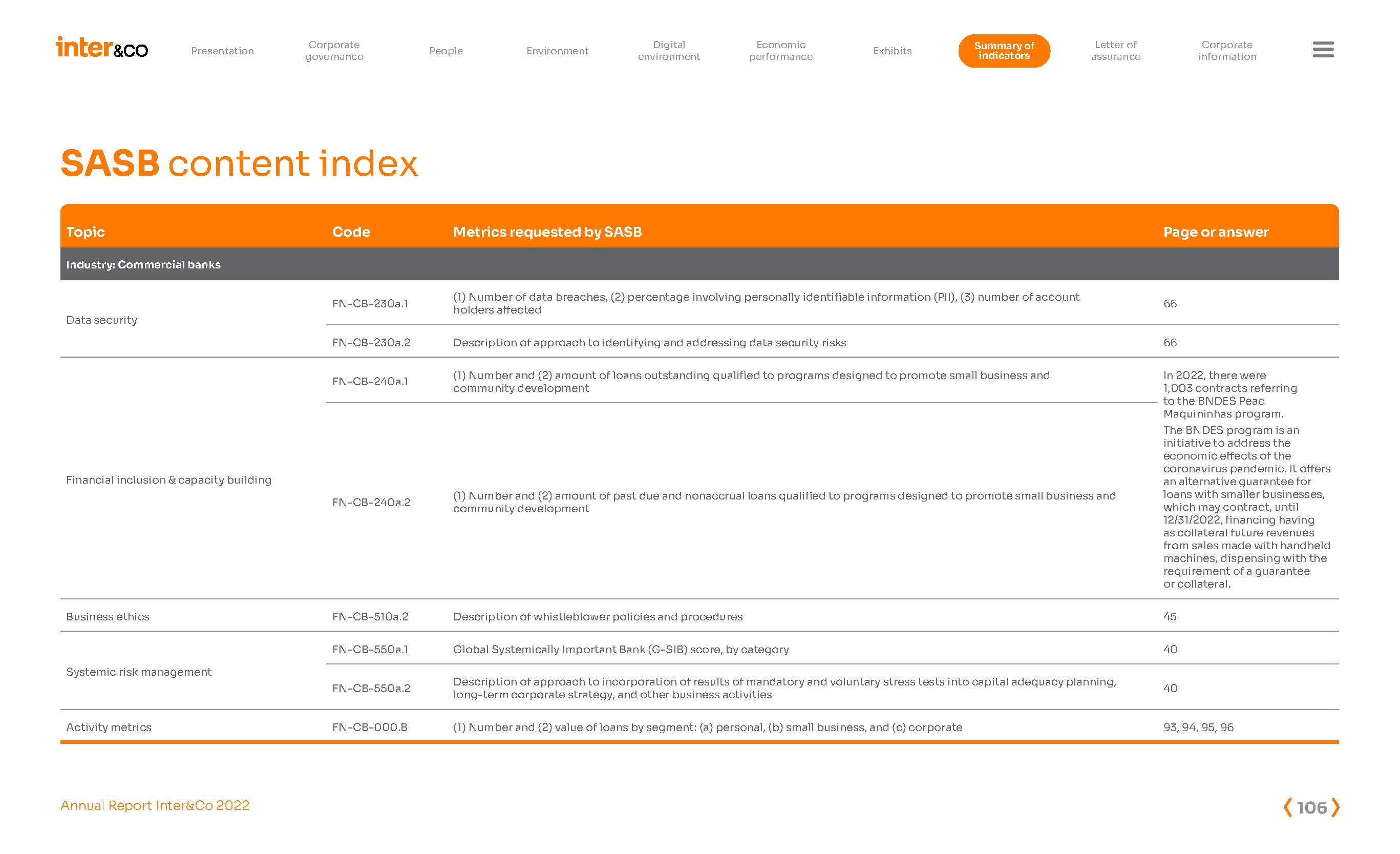

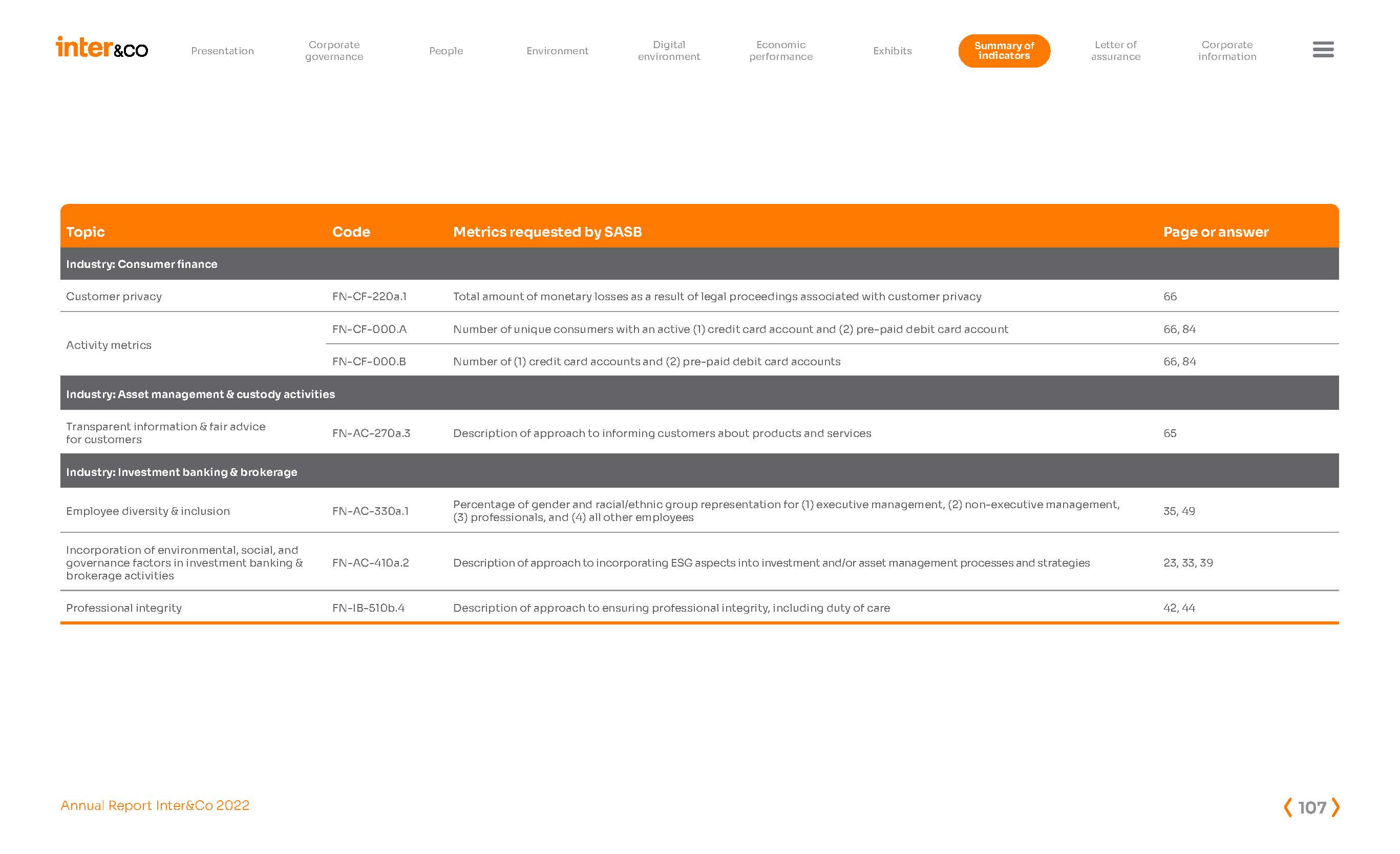

The Global Reporting Initiative (GRI) standards, the Sustainability

Accounting Standards Board (SASB) indicator

frameworks, and the Integrated Reporting proposed by the

International Integrated Reporting Council (IIRC), both currently

under the IFRS Foundation - international and benchmark

guidelines in corporate reporting, are part of this Report.

For the purposes of document evidence, the data from Inter’s

Progress Communiqué (COP), prepared for the United

Nations (UN) Global Compact, and the information on value

creation presented in this Report were considered, in accordance

with the international standard Interim Financial Reporting

(IAS) No. 34, issued by the International Accounting

Standards Board (IASB), and are part of the annual Financial

Statements audited by KPMG Auditores Independentes Ltda.

The Annual Report is designed to demonstrate how ESG is-

sues are intertwined with the business model and how they

are applied in day-to-day operational and strategic activities.

For the closing of this report and the financial information,

Inter provided a letter of assurance, through the independent

external audit firm Bureau Veritas (BVQI), which validated

the methodology employed in the construction of the Report

and the respective information. The external audit process is

coordinated and conducted by the Corporate Sustainability

and Investor Relations teams, and the content is validated by

members of the Board of Directors and the CEO. [GRI 2-5, 2-14]

To facilitate understanding, at the end of the Report, there

is a table with the GRI and SASB exhibits and the UN’s Sustainable

Development Goals (SDGs), present throughout the

chapters. In addition, it is possible to navigate through the

chapters by clicking on the buttons present in the menu at

the top of the pages.

The current issue is available on the institutional website,

with a link dedicated to Investor Relations. In addition, the

publications are directed to the U.S. Securities and Exchange

Commission (SEC) and the Securities and Exchange Commission

of Brazil (CVM). The period of the economic and

financial information coincides with the other information in

this Report.

[GRI 2-3]

For any questions, criticisms, or suggestions

about the content presented herein, there is an

open channel by e-mail at two addresses:

sustentabilidade@inter.co

ri@inter.co

Corporate Digital Economic Summary of Letter of Corporate

Presentation People Environment Exhibits

governance environment performance indicators assurance information

The Inter Group

[GRI 2-1, 2-2]

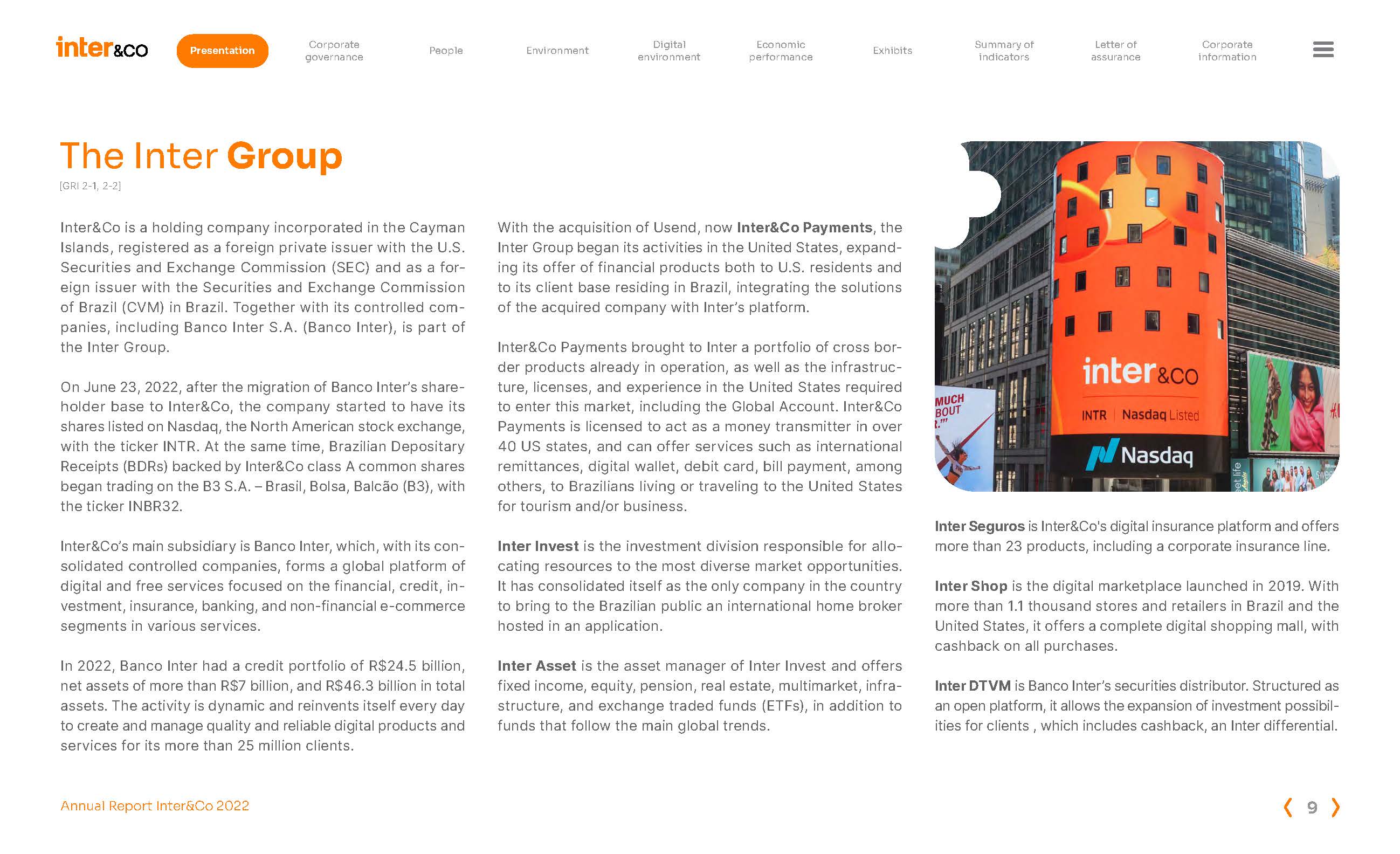

Inter&Co is a holding company incorporated in the Cayman

Islands, registered as a foreign private issuer with the U.S.

Securities and Exchange Commission (SEC) and as a foreign

issuer with the Securities and Exchange Commission

of Brazil (CVM) in Brazil. Together with its controlled companies,

including Banco Inter S.A. (Banco Inter), is part of

the Inter Group.

On June 23, 2022, after the migration of Banco Inter’s shareholder

base to Inter&Co, the company started to have its

shares listed on Nasdaq, the North American stock exchange,

with the ticker INTR. At the same time, Brazilian Depositary

Receipts (BDRs) backed by Inter&Co class A common shares

began trading on the B3 S.A. – Brasil, Bolsa, Balcão (B3), with

the ticker INBR32.

Inter&Co’s main subsidiary is Banco Inter, which, with its consolidated

controlled companies, forms a global platform of

digital and free services focused on the financial, credit, investment,

insurance, banking, and non-financial e-commerce

segments in various services.

In 2022, Banco Inter had a credit portfolio of R$24.5 billion,

net assets of more than R$7 billion, and R$46.3 billion in total

assets. The activity is dynamic and reinvents itself every day

to create and manage quality and reliable digital products and

services for its more than 25 million clients.

With the acquisition of Usend, now Inter&Co Payments, the

Inter Group began its activities in the United States, expanding

its offer of financial products both to U.S. residents and

to its client base residing in Brazil, integrating the solutions

of the acquired company with Inter’s platform.

Inter&Co Payments brought to Inter a portfolio of cross bor-

der products already in operation, as well as the infrastructure,

licenses, and experience in the United States required

to enter this market, including the Global Account. Inter&Co

Payments is licensed to act as a money transmitter in over

40 US states, and can offer services such as international

remittances, digital wallet, debit card, bill payment, among

others, to Brazilians living or traveling to the United States

for tourism and/or business.

Inter Invest is the investment division responsible for allocating

resources to the most diverse market opportunities.

It has consolidated itself as the only company in the country

to bring to the Brazilian public an international home broker

hosted in an application.

Inter Asset is the asset manager of Inter Invest and offers

fixed income, equity, pension, real estate, multimarket, infrastructure,

and exchange traded funds (ETFs), in addition to

funds that follow the main global trends.

Inter Seguros is Inter&Co's digital insurance platform and offers

more than 23 products, including a corporate insurance line.

Inter Shop is the digital marketplace launched in 2019. With

more than 1.1 thousand stores and retailers in Brazil and the

United States, it offers a complete digital shopping mall, with

cashback on all purchases.

Inter DTVM is Banco Inter’s securities distributor. Structured as

an open platform, it allows the expansion of investment possibilities

for clients , which includes cashback, an Inter differential.

Corporate Digital Economic Summary of Letter of Corporate

Presentation People Environment Exhibits

governance environment performance indicators assurance information

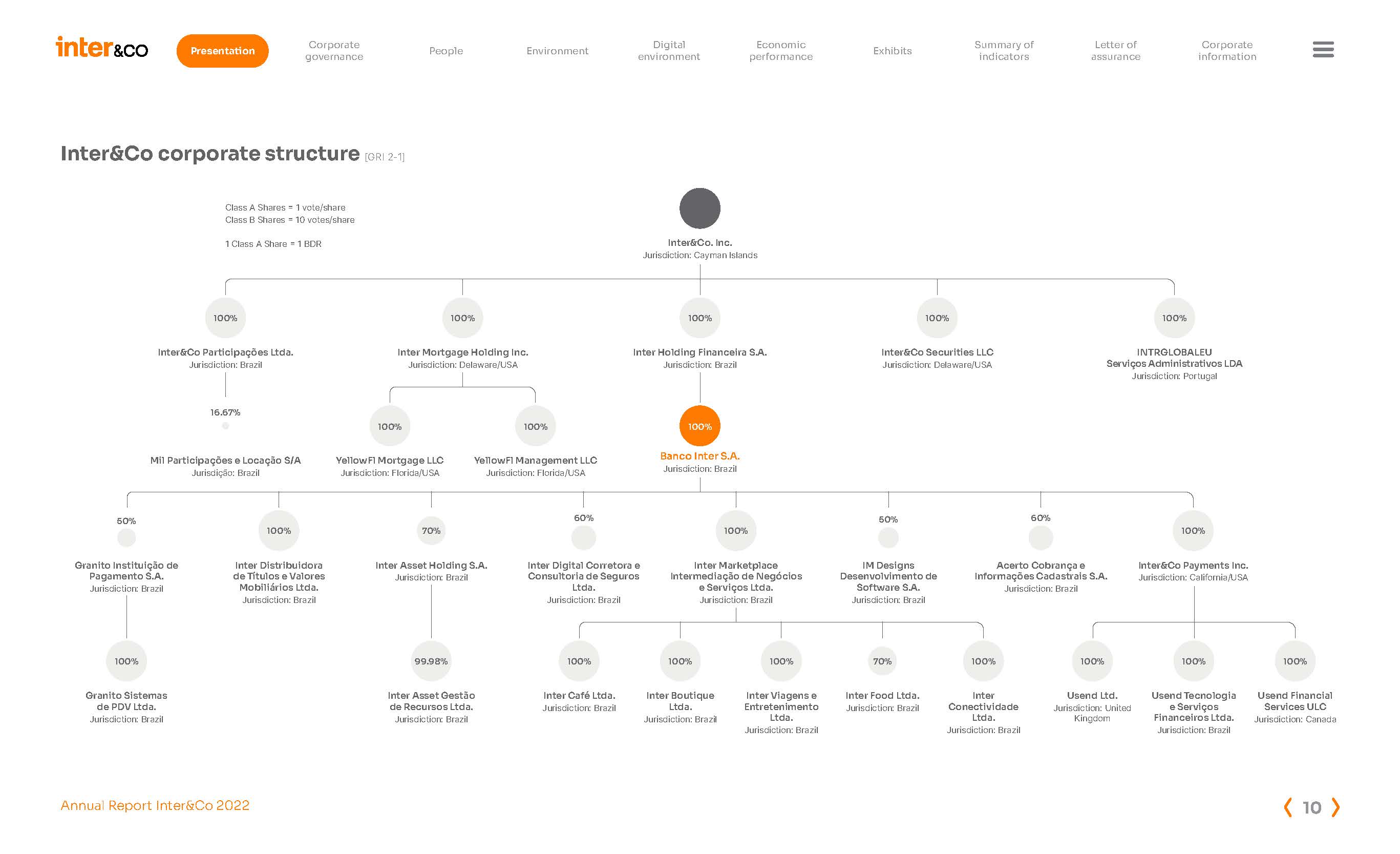

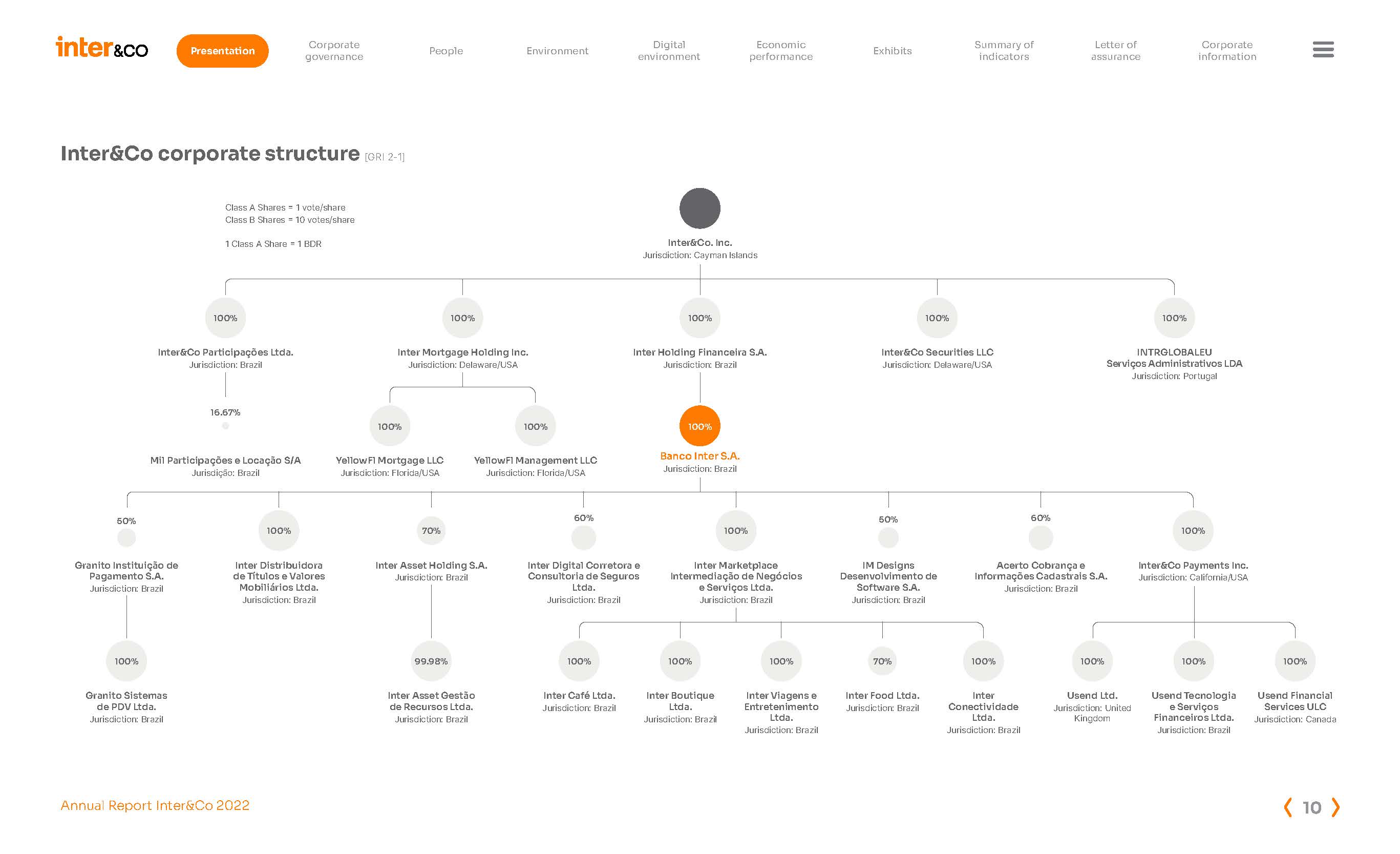

Inter&Co corporate structure [GRI 2-1]

Class A Shares = 1 vote/share

Class B Shares = 10 votes/share

1 Class A Share = 1 BDRInter&Co. Inc.

Jurisdiction: Cayman Islands

100% 100% 100% 100% 100%

Inter&Co Participações Ltda. Inter Mortgage Holding Inc. Inter Holding Financeira S.A. Inter&Co Securities LLC INTRGLOBALEU

Jurisdiction: Brazil Jurisdiction: Delaware/USA Jurisdiction: Brazil Jurisdiction: Delaware/USA Serviços Administrativos LDA

Jurisdiction: Portugal

16.67%

100% 100% 100%

Banco Inter S.A.

Mil Participações e Locação S/A YellowFl Mortgage LLC YellowFl Management LLC

Jurisdiction: Brazil

Jurisdição: Brazil Jurisdiction: Florida/USA Jurisdiction: Florida/USA

100% 70%

60%

100%

50% 60%

50%

100%

Granito Instituição de Inter Distribuidora Inter Asset Holding S.A. Inter Digital Corretora e Inter Marketplace IM Designs Acerto Cobrança e Inter&Co Payments Inc.

Pagamento S.A.

Jurisdiction: Brazil

de Títulos e Valores

Mobiliários Ltda.

Jurisdiction: Brazil Consultoria de Seguros

Ltda.

Intermediação de Negócios

e Serviços Ltda.

Desenvolvimento de

Software S.A.

Informações Cadastrais S.A.

Jurisdiction: Brazil

Jurisdiction: California/USA

Jurisdiction: Brazil Jurisdiction: Brazil Jurisdiction: Brazil Jurisdiction: Brazil

100%99.98%100% 100% 100% 70% 100% 100% 100% 100%

Granito Sistemas Inter Asset Gestão Inter Café Ltda. Inter Boutique Inter Viagens e Inter Food Ltda. Inter Usend Ltd. Usend Tecnologia Usend Financial

de PDV Ltda. de Recursos Ltda. Jurisdiction: Brazil Ltda. Entretenimento Jurisdiction: Brazil Conectividade Jurisdiction: United e Serviços Services ULC

Jurisdiction: Brazil Jurisdiction: Brazil Jurisdiction: Brazil Ltda. Ltda. Kingdom Financeiros Ltda. Jurisdiction: Canada

Jurisdiction: Brazil Jurisdiction: Brazil Jurisdiction: Brazil

Corporate Digital

Presentation People Environment

governance environment

Highlights & recognitions

Finance

Best Investment Bank − Forbes World’s Best

Estadão Banks Award

Inter took 1st place in the Best 2nd place in the ranking of the Best

Services 2022 ranking released by Banks in Brazil by Forbes. The ranking

the press outlet Estadão to recognize evaluates issues such as customer

consistent public relations work. satisfaction, reliability, digitalization,

service, and financial advisory services.

Las Disruptoras Most Admired Legal

2022 Award Executives − Análise

Editorial 2022

Helena Caldeira, Inter’s CFO,

was recognized by the American Ana Luiza Franco Forattini, general

publication Iupana News as one of counsel, chief governance and

the six most innovative women in Compliance officer, entered the list of

digital finance in Latin America. the most admired legal executives

in Brazil.

Economic Summary of

Exhibits

performance indicators

The Global

Economics Awards

Inter was voted the most customercentric

bank by The Global Economics

Awards, a London-based publication

that recognizes leading global market

players from different sectors.

Most Admired Executives −

Compliance On Top 2022

Thaiza Cançado, head of Compliance

and Regulatory Affairs at Inter, is among

the five most admired compliance

professionals in Brazil, in the Financial

Market/Insurance category.

Letter of Corporate

assurance information

500 Most Influential

People in Latin America −

Bloomberg (2022)

Helena Caldeira, Inter’s CFO,

entered Bloomberg Línea’s list, which

recognizes inspiring and resilient

leaders who set an example and

proudly carry the best of Latin America

to the world.

Corporate Digital Economic Summary of Letter of Corporate

Presentation People Environment Exhibits

governance environment performance indicators assurance information

Social

Best for Brazil

Award − Humanized

Inter was recognized with an A rating by the

Humanized index for being an organization open

to feedback, an agent of social and environmental

transformation that solves real problems,

generating value for all parts of the business and for

people in general.

Environmental

GHG Protocol Gold Seal

For the third consecutive time, Inter had its Greenhouse

Gas Emissions Inventory (GHG) recognized with

the Gold Seal of the GHG Protocol, reinforcing its

commitment to sustainable development.

CMVC Award − Connections

that Inspire 2022

The Employability Mentorship, carried out

by Inter in partnership with Vallourec to bring

knowledge and financial education to the

community, was elected by the Mineiro

Committee of Corporate Volunteering as the best

project of 2022.

Best Employer Brand in the

LinkedIn Talent Awards 2022

Inter received the Best Employer Brand award in

the LinkedIn Talent Awards 2022 evaluation. The

performance, results, and impact of more than 1,000

companies are considered using LinkedIn’s corporate

solutions in each of the participating countries.

Corporate Digital Economic Summary of Letter of Corporate

Presentation People Environment Exhibits

governance environment performance indicators assurance information

Technology

100 Best Companies

2022 Award − MESC

Institute

Chosen 2nd place in the Best

Customer Experience ranking in

the Digital Banking category.

IBest 2022 Award

Elected by public as Best Super App,

Best Investment Broker, and Best

Digital Bank in Brazil, in addition to

top 3 in Best Fintechs in the country.

Top 5 Award −

Excellence Program

Inter has won the Top 5 Award in the

Excellence Program 2022, awarded by

Mastercard. The feature was in the

following categories:

1st place

Send

2nd place

Card not present debit

5th place

Authentication and tokenization

Starburst Customer

Award Winners

Inter’s team received the title of top

Data Engineering − Data Lakehouse

team of the year. The award recognizes

Starburst clients, partners, and

company leaders who contribute and

innovate in the global data landscape.

Corporate Digital Economic Summary of Letter of Corporate

Presentation People Environment Exhibits

governance environment performance indicators assurance information

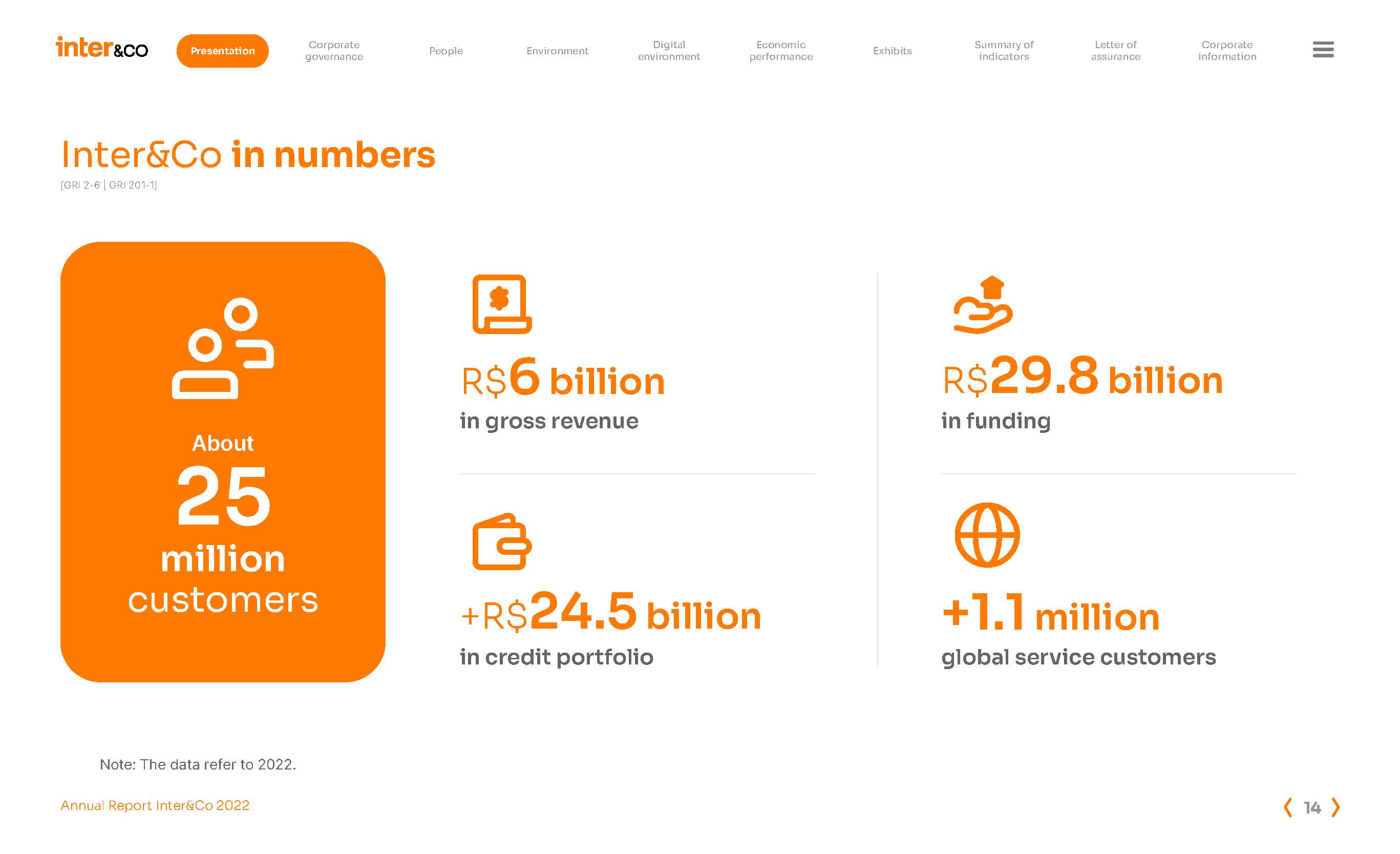

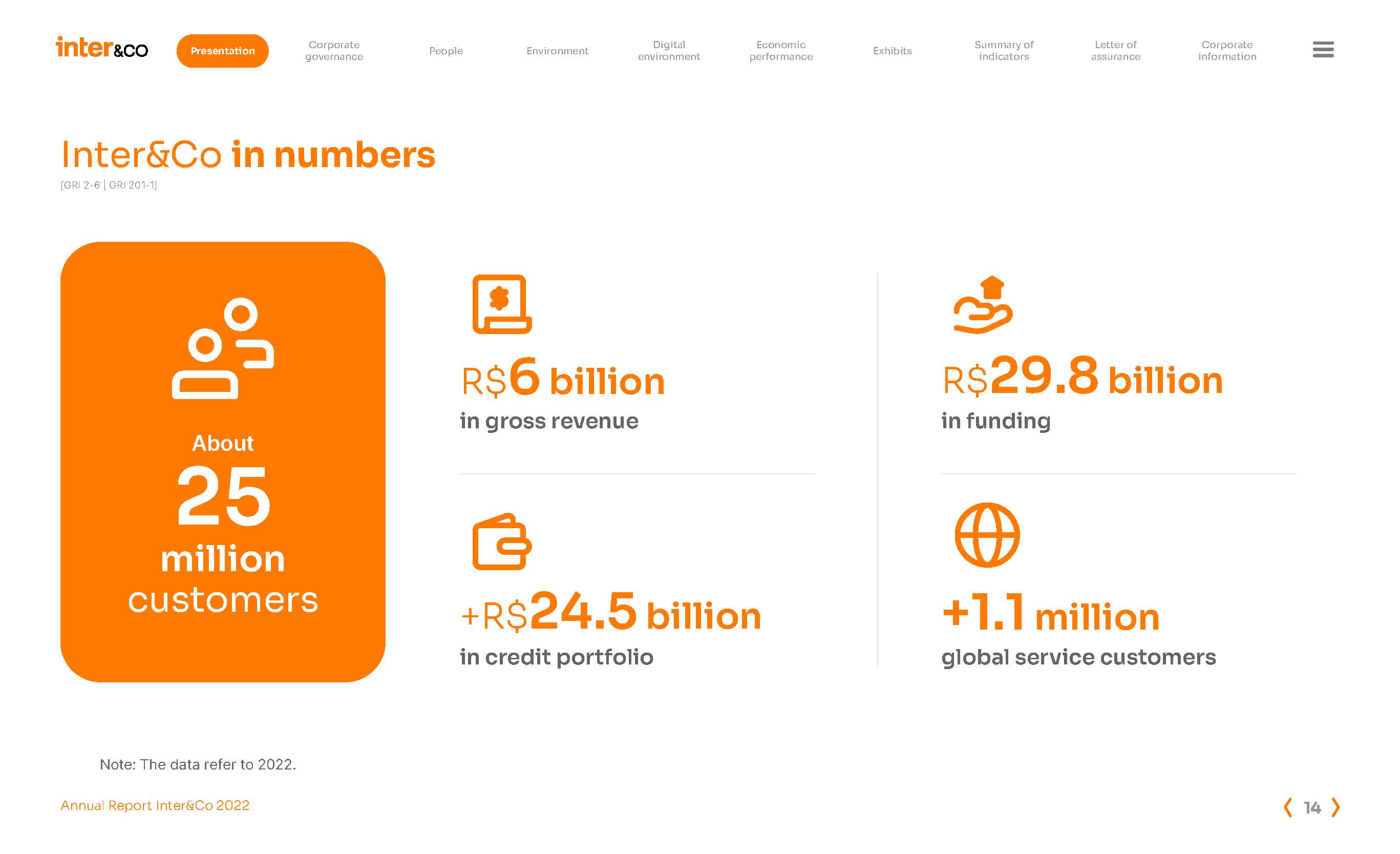

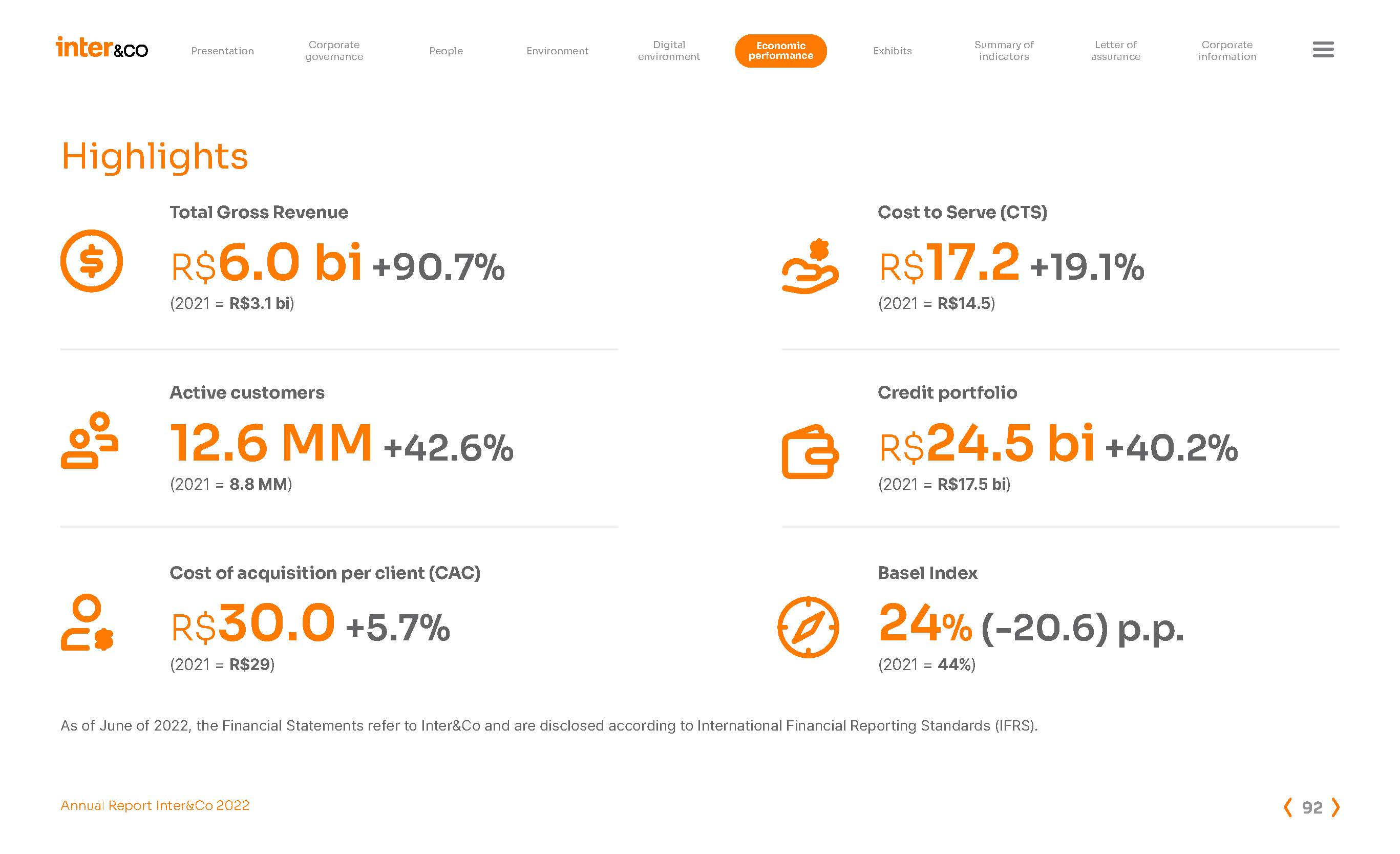

Inter&Co in numbers

[GRI 2-6 | GRI 201-1]

25

million

About

customers

R$29.8 billion

R$6 billion

in gross revenue

in funding

+R$24.5 billion

+1.1 million

in credit portfolio

global service customers

Note: The data refer to 2022.

Corporate Digital Economic

Presentation People Environment

governance environment performance

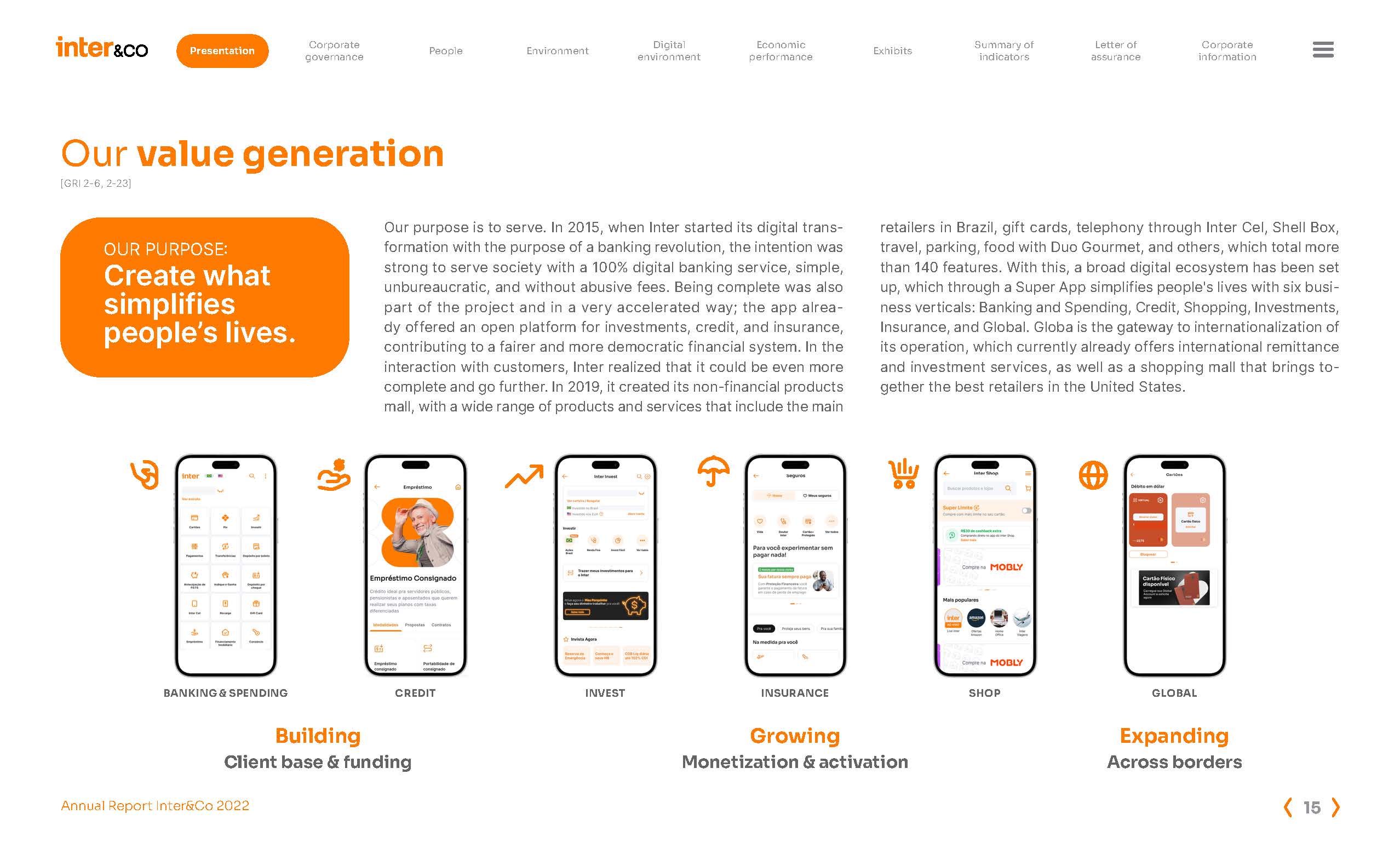

Our value generation

[GRI 2-6, 2-23]

OURPURPOSE:

Create what

simplifiespeople’s lives.

Our purpose is to serve. In 2015, when Inter started its digital transformation

with the purpose of a banking revolution, the intention was

strong to serve society with a 100% digital banking service, simple,

unbureaucratic, and without abusive fees. Being complete was also

part of the project and in a very accelerated way; the app already

offered an open platform for investments, credit, and insurance,

contributing to a fairer and more democratic financial system. In the

interaction with customers, Inter realized that it could be even more

complete and go further. In 2019, it created its non-financial products

mall, with a wide range of products and services that include the main

Summary of Letter of Corporate

Exhibits

indicators assurance information

retailers in Brazil, gift cards, telephony through Inter Cel, Shell Box,

travel, parking, food with Duo Gourmet, and others, which total more

than 140 features. With this, a broad digital ecosystem has been set

up, which through a Super App simplifies people's lives with six business

verticals: Banking and Spending, Credit, Shopping, Investments,

Insurance, and Global. Globa is the gateway to internationalization of

its operation, which currently already offers international remittance

and investment services, as well as a shopping mall that brings together

the best retailers in the United States.

BANKING & SPENDING CREDIT INVEST INSURANCE SHOP GLOBAL

Building Growing Expanding

Client base & funding Monetization & activation Across borders

Corporate Digital Economic Summary of Letter of Corporate

Presentation People Environment Exhibits

governance environment performance indicators assurance information

Inter’s product strategy is designed to increase client relationships

through a simple experience to consolidate its market

position by creating:

High Value

To generate more revenue per customer.

High volume

To generate more engagement per

active customer.

High variety

To capture more wallet-share

per customer.

All this has allowed Inter to deliver a client experience highly

differentiated from the market, and this is evidenced by

the score obtained in the survey by the Net Promoter Score

(NPS) system of 85 points, which places Inter in a rating area

of excellence, reinforced by more than 12 million active clients

by the end of 2022.

1

Banking & Spending

A digital account for financial and non-financial

transactions that allows the client to pay bills,

shop online and offline, transfer money, and

many other solutions.

Credit

2

Portfolio of credit products for individuals and

companies that helps clients realize projects

and dreams.

Investments

3

An open and maintenance-free platform

for investments with options that

empower clients to invest.

4

Insurance

Insurance broker that offers products

to protect its clients’ most important

assets and their lives.

Shopping & Commerce Plus

5

A marketplace that allows clients to shop more

efficiently from a growing list of products

and services for everyday life. The highlight

is the Sustainable Living platform, which

offers contents and social and environmental

possibilities for sustainable behavior.

Global

6

Solutions for clients traveling abroad and

for US residents, which brings many of

the Brazilian Super App experiences to a

global experience.

Corporate Digital Economic Summary of Letter of Corporate

Presentation People Environment Exhibits

governance environment performance indicators assurance information

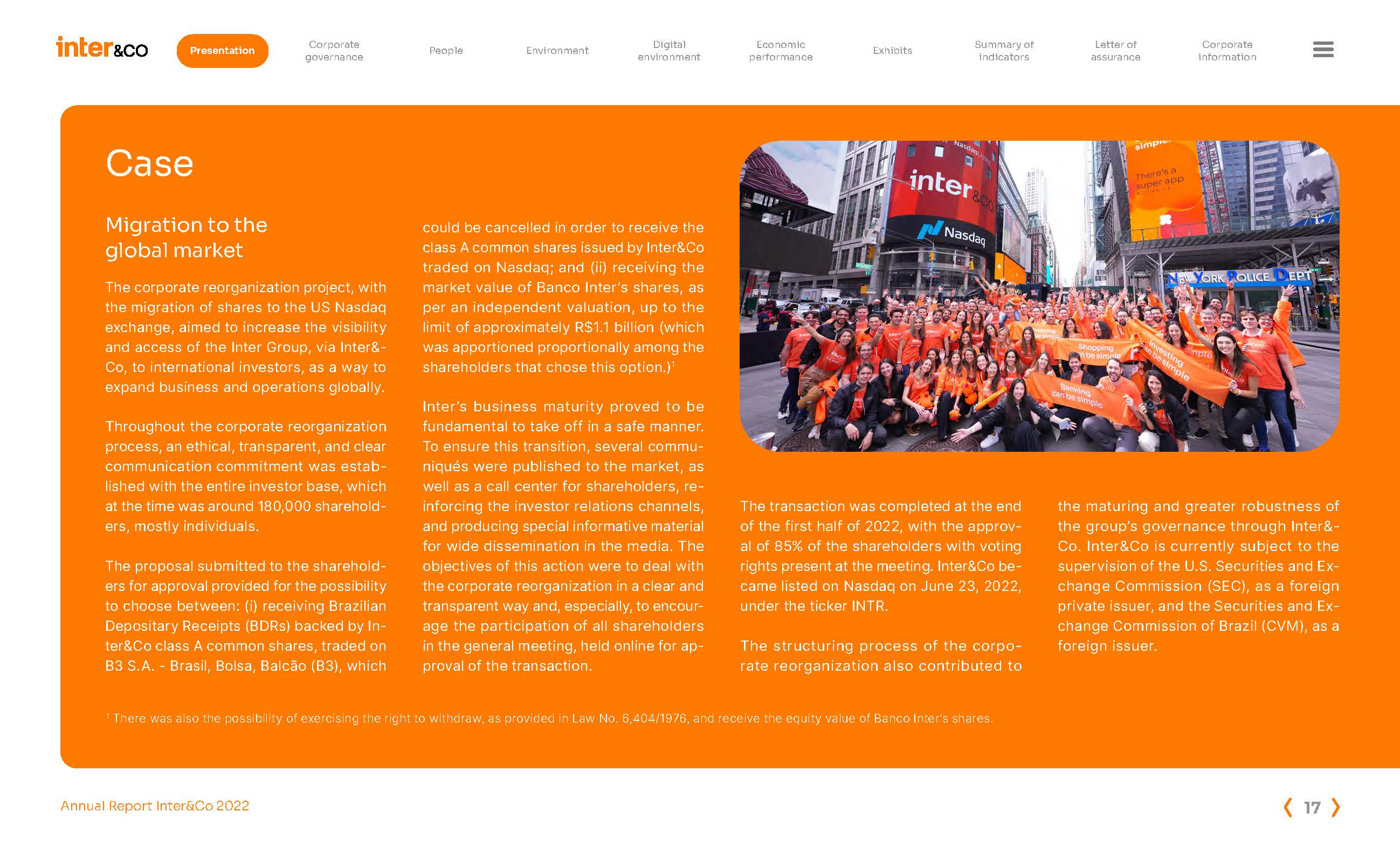

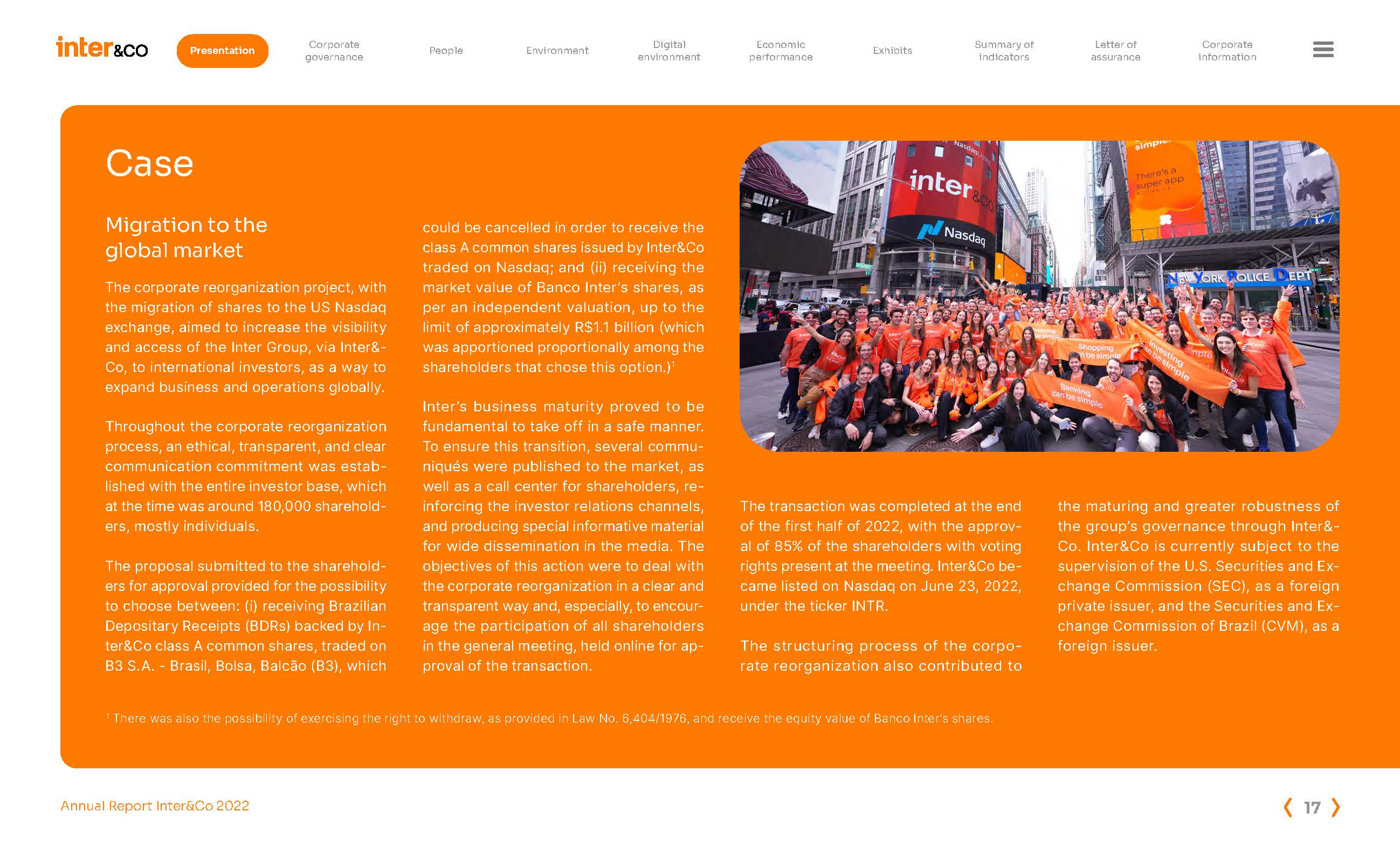

Migration to the

global market

The corporate reorganization project, with

the migration of shares to the US Nasdaq

exchange, aimed to increase the visibility

and access of the Inter Group, via Inter&

Co, to international investors, as a way to

expand business and operations globally.

Throughout the corporate reorganization

process, an ethical, transparent, and clear

communication commitment was estab

lished with the entire investor base, which

at the time was around 180,000 sharehold

ers, mostly individuals.

The proposal submitted to the sharehold

ers for approval provided for the possibility

to choose between: (i) receiving Brazilian

Depositary Receipts (BDRs) backed by In

ter&Co class A common shares, traded on

B3 S.A. - Brasil, Bolsa, Balcão (B3), which

could be cancelled in order to receive the

class A common shares issued by Inter&Co

traded on Nasdaq; and (ii) receiving the

market value of Banco Inter’s shares, as

per an independent valuation, up to the

limit of approximately R$1.1 billion (which

was apportioned proportionally among the

shareholders that chose this option.)1

Inter’s business maturity proved to be

fundamental to take off in a safe manner.

To ensure this transition, several commu

niqués were published to the market, as

well as a call center for shareholders, re

inforcing the investor relations channels,

and producing special informative material

for wide dissemination in the media. The

objectives of this action were to deal with

the corporate reorganization in a clear and

transparent way and, especially, to encour

age the participation of all shareholders

in the general meeting, held online for ap

proval of the transaction.

The transaction was completed at the end

of the first half of 2022, with the approv

al of 85% of the shareholders with voting

rights present at the meeting. Inter&Co be

came listed on Nasdaq on June 23, 2022,

under the ticker INTR.

The structuring process of the corpo

rate reorganization also contributed to

the maturing and greater robustness of

the group’s governance through Inter&

Co. Inter&Co is currently subject to the

supervision of the U.S. Securities and Ex

change Commission (SEC), as a foreign

private issuer, and the Securities and Ex

change Commission of Brazil (CVM), as a

foreign issuer.

Case

1 There was also the possibility of exercising the right to withdraw, as provided in Law No. 6,404/1976, and receive the equity value of Banco Inter’s shares.

Corporate Digital Economic Summary of Letter of Corporate

Presentation People Environment Exhibits

governance environment performance indicators assurance information

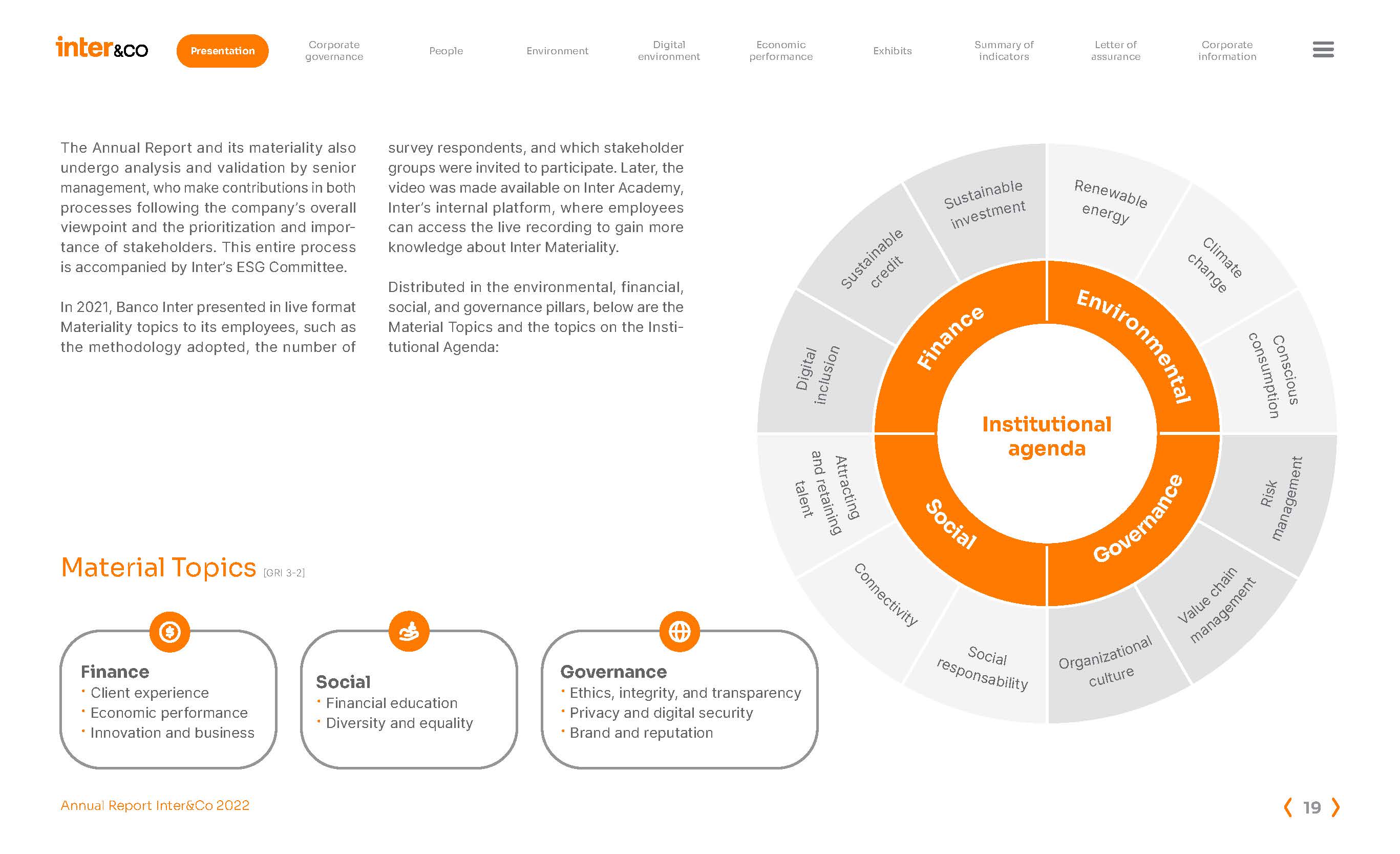

Materiality and SDGs

[GRI 2-29 | GRI 3-1, 3-2]

The Inter Materiality survey process was built

through a multi-sector materiality panel, considering

benchmarking with market players,

observing practices related to the Sustainability

Accounting Standards Board (SASB)

and Morgan Stanley Capital International

(MSCI), as well as global references on environmental,

social, and governance (ESG)

issues, in order to find out which issues are

most relevant among the sectors in which

the company operates. In addition, benchmarking

was developed with the ten largest

companies in sectors related to Inter's business

model.

After this benchmarking process, Inter raised

20 topics of relevance, which were submitted

to our stakeholders in an active listening

process, focused on the perception of the

main risks and opportunities of the business

model. In all, 17 stakeholder groups were

selected and participated in commenting.

They are: employees, upper management,

clients, shareholders, sustainability specialists,

institutional partners, media, auditors,

competitors, rating agencies, representative

entities, regulators, government, suppliers,

labor unions, neighborhood, and society.

In the stakeholder survey, we had 6,407 responses

in total, 5,550 from external stakeholders

and 857 from internal stakeholders.

By listening to the stakeholders, eight Material

Topics were mapped out, which are

adjusted to the Inter Group’s performance

pillars. These topics are a priority in relation

to the ESG strategy, ensuring its reach in the

company’s operations.

In addition, at the meetings of Banco Inter’s

ESG Committee held throughout 2022 and in

early 2023, they analyzed (i) the ESG issues

assessed by various market indices, (ii) the

ESG actions already implemented at Inter,

and (iii) the challenges and opportunities

of this agenda that are most related to Inter’s

culture.

The work of the ESG Committee was supported

by professionals from various areas

of Inter and resulted in the establishment of

an ESG Institutional Agenda with 12 action

fronts: (i) risk management, (ii) ESG product

development, (iii) consumer protection,

(iv) internal human capital development, (v)

promoting access to finance, (vi) privacy

and digital security, (vii) diversity, (viii) independence,

(ix) competence, (x) transparency,

(xi) ethics, and (xii) corporate behavior

(acting to prevent fraud, corruption, and

money laundering).

A new materiality consultation will be held

later in 2023, as an update, given the expansion

of the Inter Group’s business model, the

entry of new customers, shareholders, and

new consumer service platforms. The ESG

Committee is working on the materiality and

strategy agenda with senior management to

align the topics that make up the agenda.

Corporate Digital Economic Summary of Letter of Corporate

Presentation People Environment Exhibits

governance environment performance indicators assurance information

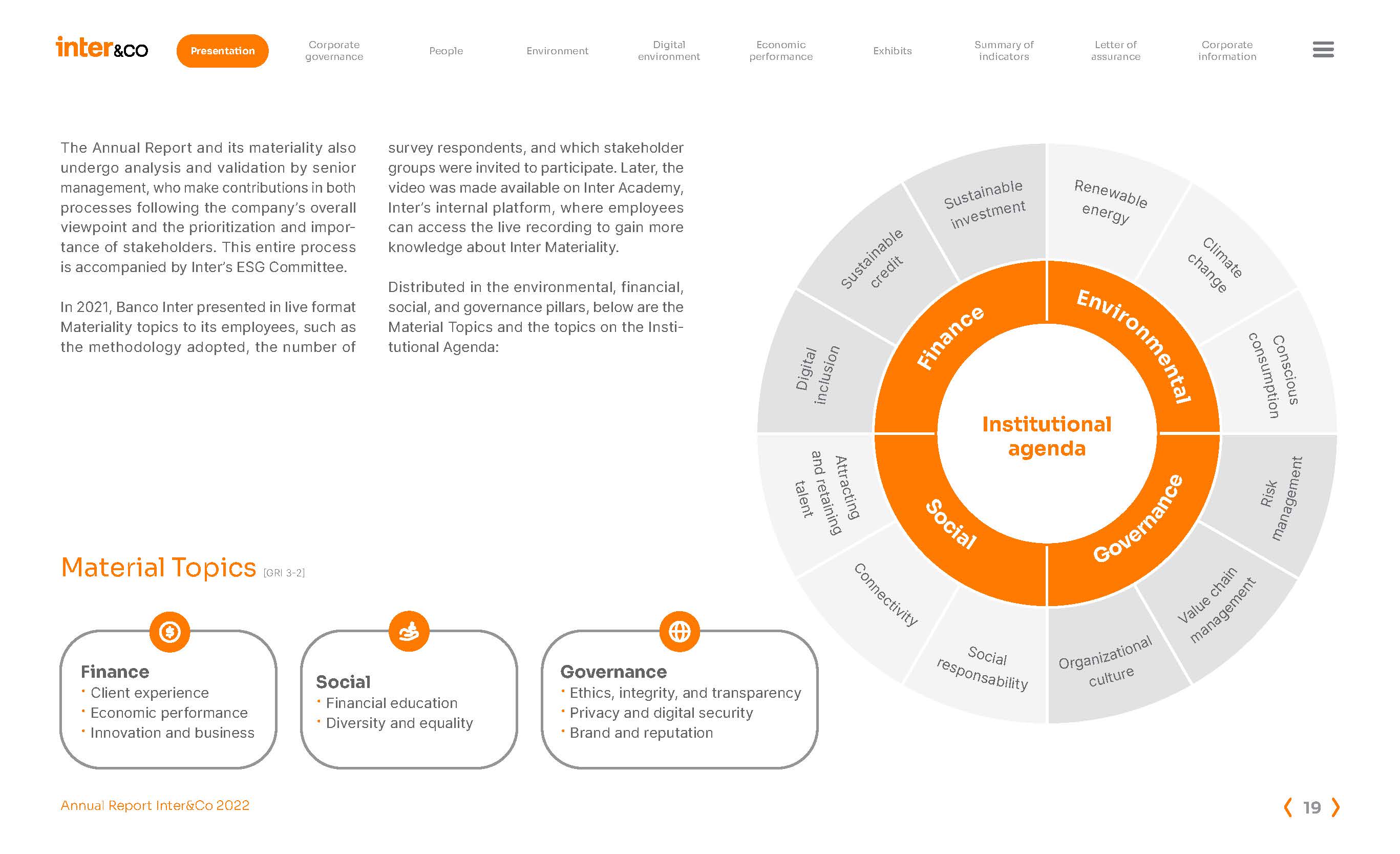

The Annual Report and its materiality also

undergo analysis and validation by senior

management, who make contributions in both

processes following the company’s overall Inter’

viewpoint and the prioritization and importance

of stakeholders. This entire process

is accompanied by Inter’s ESG Committee.

In 2021, Banco Inter presented in live format

Materiality topics to its employees, such as

the methodology adopted, the number of tutional Agenda:

Material Topics [GRI 3-2]

Finance

· Client experience

· Economic performance

· Innovation and business

Social

· Financial education

· Diversity and equality

survey respondents, and which stakeholder

groups were invited to participate. Later, the

video was made available on Inter Academy,

s internal platform, where employees

can access the live recording to gain more

knowledge about Inter Materiality.

Distributed in the environmental, financial,

social, and governance pillars, below are the

Material Topics and the topics on the Insti-

Environmental

Governance

Social

Finance

Institutional

agenda

responsability

Social

talent

andretaining

Attracting

Connectivity

management

Risk

cultureOrganizational

management

Valuechain

inclusion

Digital

credit

Sustainable

investmentSustainable

energy

Renewable

change

Climate

consumptionConscious

Governance

· Ethics, integrity, and transparency

· Privacy and digital security

· Brand and reputation

Corporate

Presentation People

governance

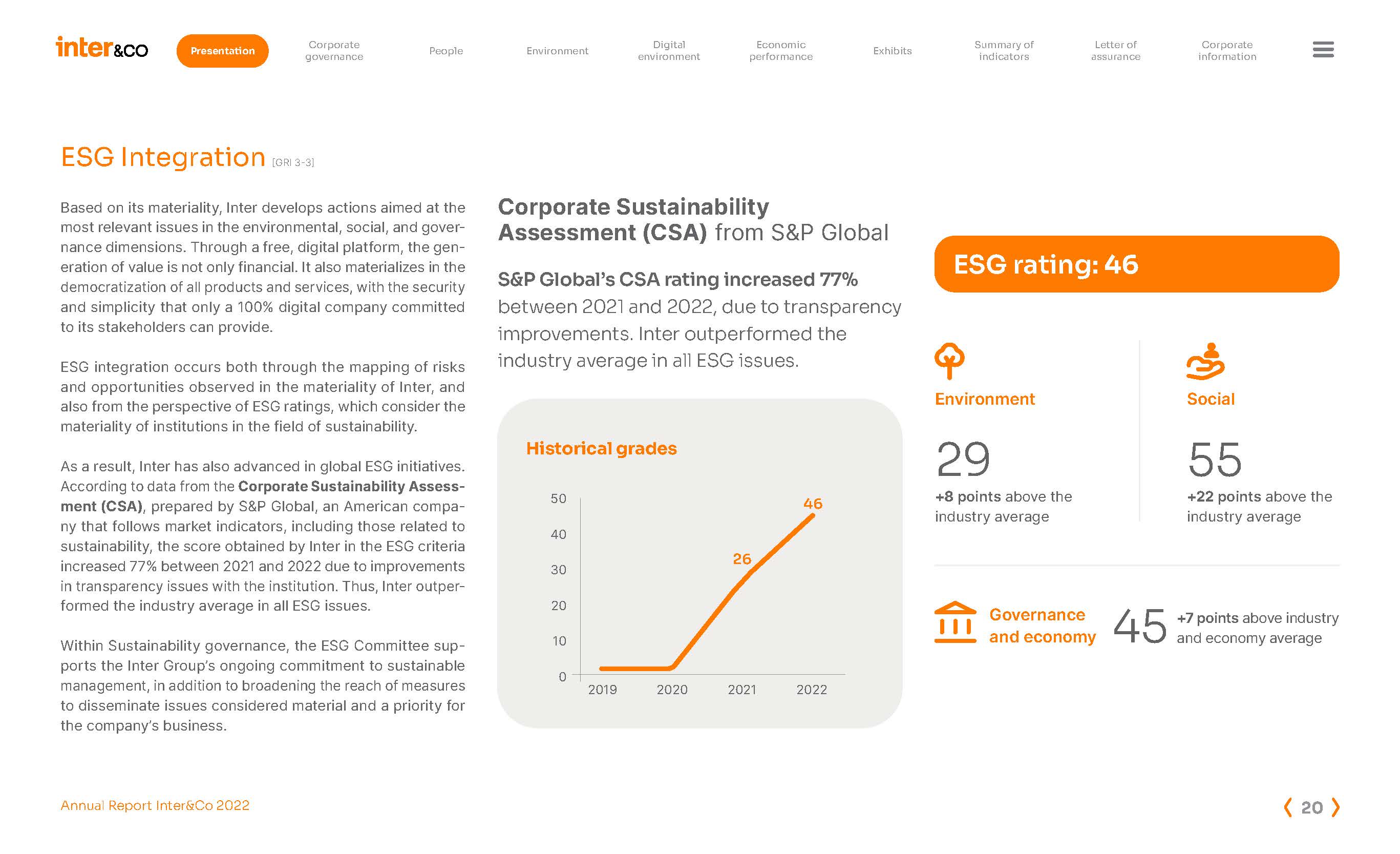

ESG Integration [GRI 3-3]

Based on its materiality, Inter develops actions aimed at the

most relevant issues in the environmental, social, and governance

dimensions. Through a free, digital platform, the generation

of value is not only financial. It also materializes in the

democratization of all products and services, with the security

and simplicity that only a 100% digital company committed

to its stakeholders can provide.

ESG integration occurs both through the mapping of risks

and opportunities observed in the materiality of Inter, and

also from the perspective of ESG ratings, which consider the

materiality of institutions in the field of sustainability.

As a result, Inter has also advanced in global ESG initiatives.

According to data from the Corporate Sustainability Assessment

(CSA), prepared by S&P Global, an American company

that follows market indicators, including those related to

sustainability, the score obtained by Inter in the ESG criteria

increased 77% between 2021 and 2022 due to improvements

in transparency issues with the institution. Thus, Inter outperformed

the industry average in all ESG issues.

Within Sustainability governance, the ESG Committee supports

the Inter Group’s ongoing commitment to sustainable

management, in addition to broadening the reach of measures

to disseminate issues considered material and a priority for

the company’s business.

Digital Economic

Environment Exhibits

environment performance

Corporate Sustainability

Assessment (CSA) from S&P Global

S&P Global’s CSA rating increased 77%

between 2021 and 2022, due to transparency

improvements. Inter outperformed the

industry average in all ESG issues.

2019 2020 2021 2022

50

40

30

20

10

0

46

26

Historical grades

Summary of Letter of

indicators assurance

Environment

29

+8 points above the

industry average

Corporate

information

ESG rating: 46

Social

55

+22 points above the

industry average

Governance +7 points above industry

and economy and economy average

45

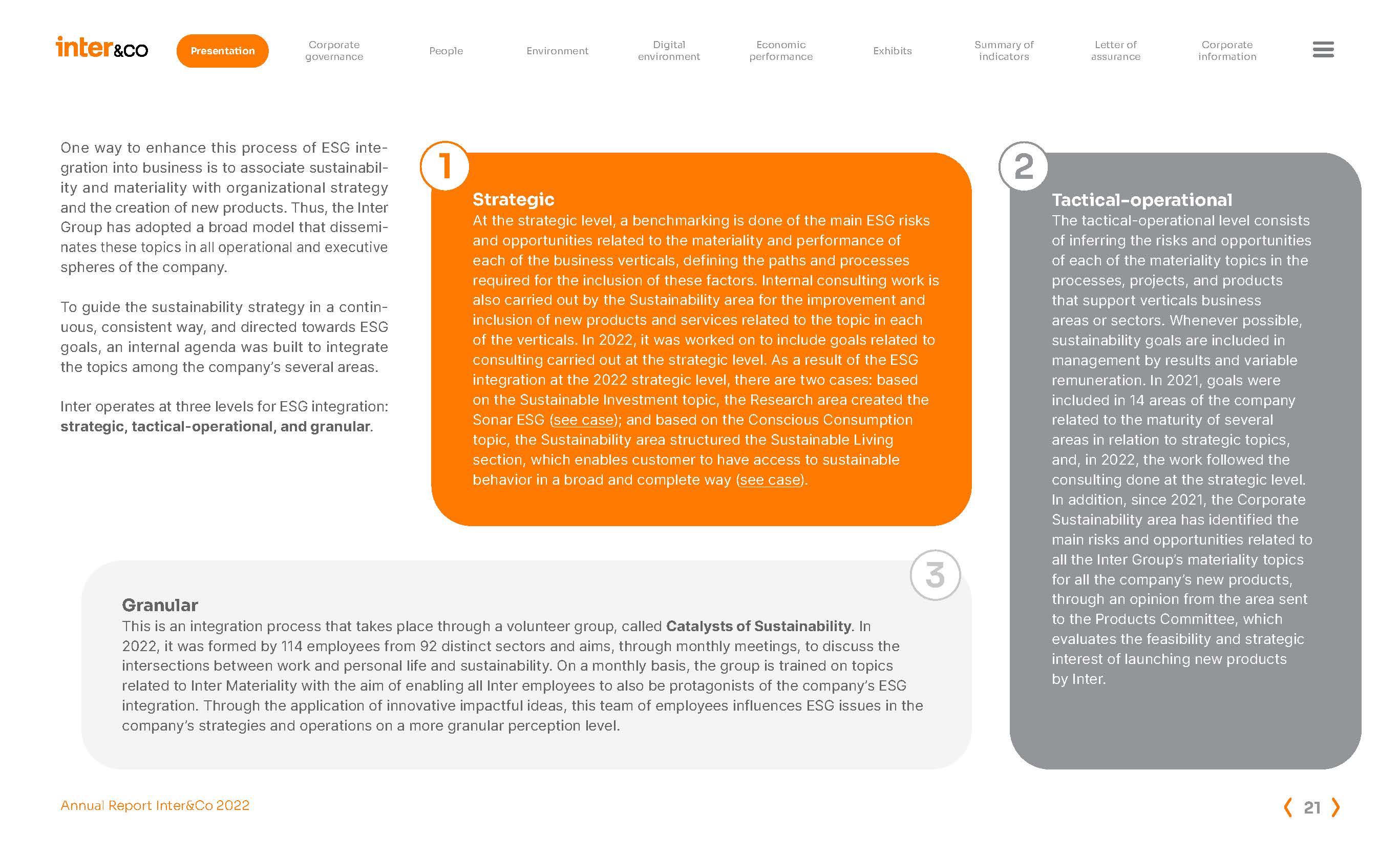

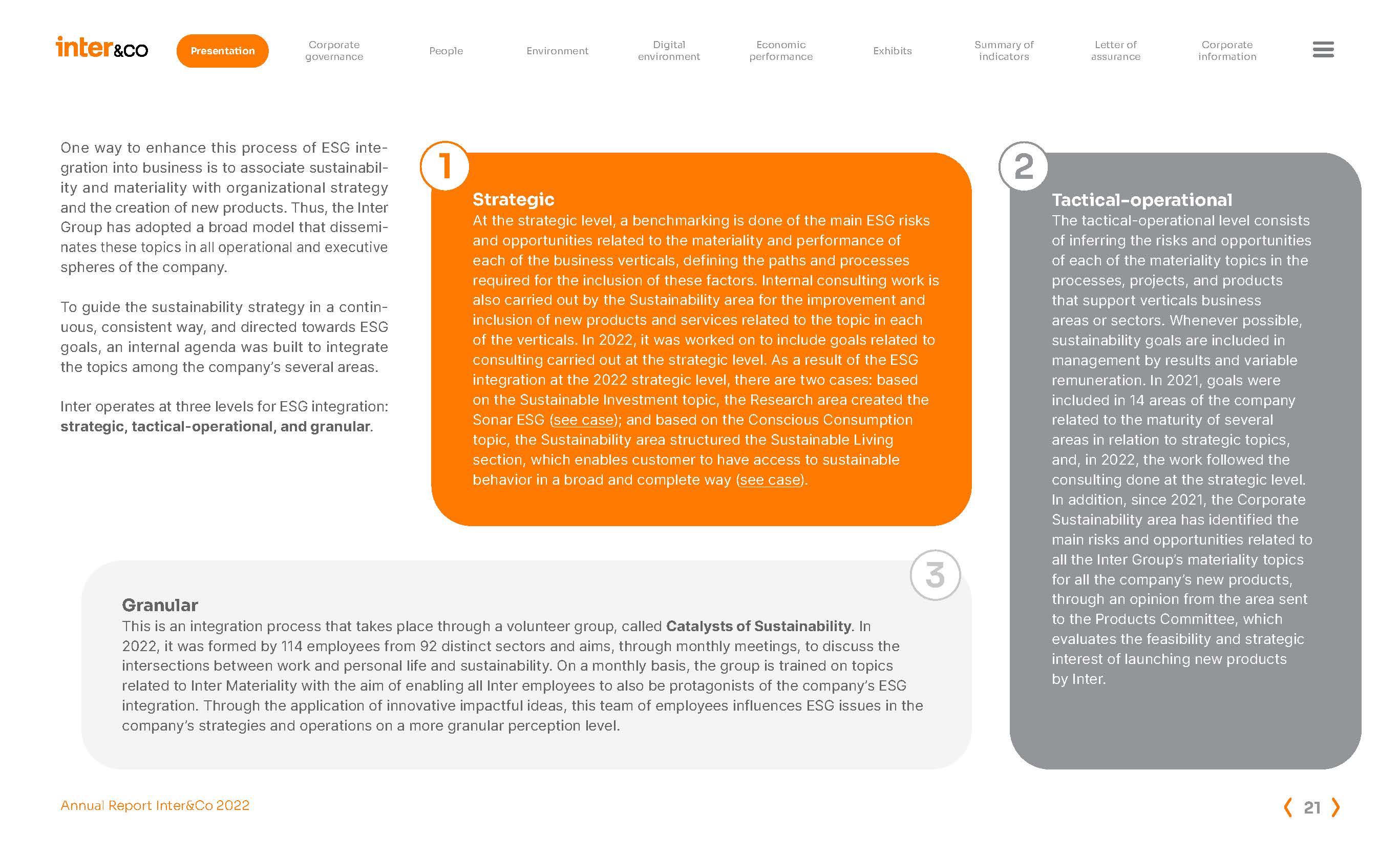

Granular

This is an integration process that takes place through a volunteer group, called Catalysts of Sustainability. In

2022, it was formed by 114 employees from 92 distinct sectors and aims, through monthly meetings, to discuss the

intersections between work and personal life and sustainability. On a monthly basis, the group is trained on topics

related to Inter Materiality with the aim of enabling all Inter employees to also be protagonists of the company’s ESG

integration. Through the application of innovative impactful ideas, this team of employees influences ESG issues in the

company’s strategies and operations on a more granular perception level.

Corporate Digital Economic Summary of Letter of Corporate

Presentation People Environment Exhibits

governance environment performance indicators assurance information

One way to enhance this process of ESG integration

into business is to associate sustainability

and materiality with organizational strategy

and the creation of new products. Thus, the Inter

Group has adopted a broad model that disseminates

these topics in all operational and executive

spheres of the company.

To guide the sustainability strategy in a continuous,

consistent way, and directed towards ESG

goals, an internal agenda was built to integrate

the topics among the company’s several areas.

Inter operates at three levels for ESG integration:

strategic, tactical-operational, and granular.

Strategic

At the strategic level, a benchmarking is done of the main ESG risks

and opportunities related to the materiality and performance of

each of the business verticals, defining the paths and processes

required for the inclusion of these factors. Internal consulting work is

also carried out by the Sustainability area for the improvement and

inclusion of new products and services related to the topic in each

of the verticals. In 2022, it was worked on to include goals related to

consulting carried out at the strategic level. As a result of the ESG

integration at the 2022 strategic level, there are two cases: based

on the Sustainable Investment topic, the Research area created the

Sonar ESG (see case); and based on the Conscious Consumption

topic, the Sustainability area structured the Sustainable Living

section, which enables customer to have access to sustainable

behavior in a broad and complete way (see case).

1

3

Tactical operational

The tactical operational level consists

of inferring the risks and opportunities

of each of the materiality topics in the

processes, projects, and products

that support verticals business

areas or sectors. Whenever possible,

sustainability goals are included in

management by results and variable

remuneration. In 2021, goals were

included in 14 areas of the company

related to the maturity of several

areas in relation to strategic topics,

and, in 2022, the work followed the

consulting done at the strategic level.

In addition, since 2021, the Corporate

Sustainability area has identified the

main risks and opportunities related to

all the Inter Group’s materiality topics

for all the company’s new products,

through an opinion from the area sent

to the Products Committee, which

evaluates the feasibility and strategic

interest of launching new products

by Inter.

2

Corporate Digital Economic Summary of Letter of Corporate

Presentation People Environment Exhibits

governance environment performance indicators assurance information

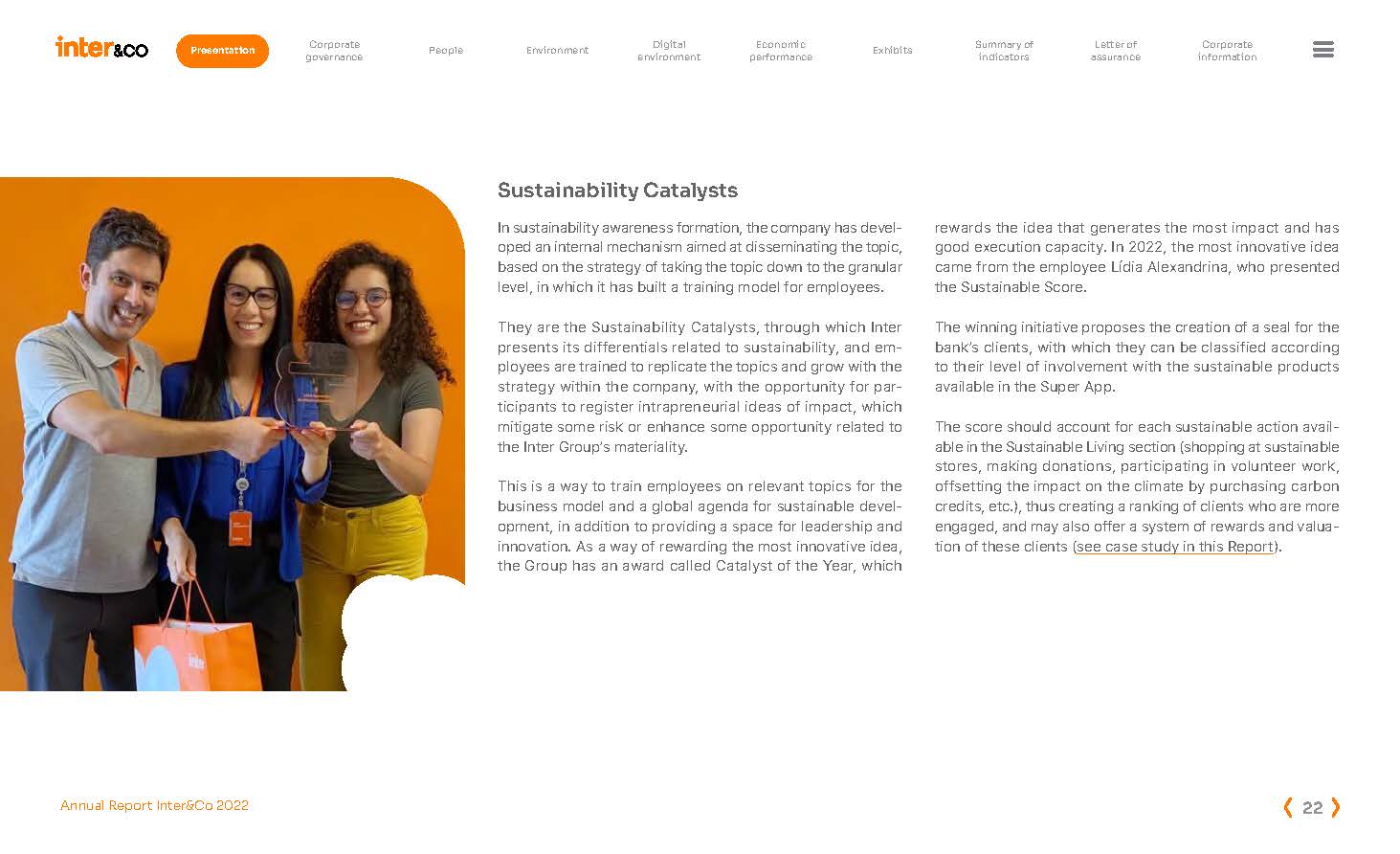

Sustainability Catalysts

In sustainability awareness formation, the company has developed

an internal mechanism aimed at disseminating the topic,

based on the strategy of taking the topic down to the granular

level, in which it has built a training model for employees.

They are the Sustainability Catalysts, through which Inter

presents its differentials related to sustainability, and employees

are trained to replicate the topics and grow with the

strategy within the company, with the opportunity for participants

to register intrapreneurial ideas of impact, which

mitigate some risk or enhance some opportunity related to

the Inter Group’s materiality.

This is a way to train employees on relevant topics for the

business model and a global agenda for sustainable development,

in addition to providing a space for leadership and

innovation. As a way of rewarding the most innovative idea,

the Group has an award called Catalyst of the Year, which

rewards the idea that generates the most impact and has

good execution capacity. In 2022, the most innovative idea

came from the employee Lídia Alexandrina, who presented

the Sustainable Score.

The winning initiative proposes the creation of a seal for the

bank’s clients, with which they can be classified according

to their level of involvement with the sustainable products

available in the Super App.

The score should account for each sustainable action available

in the Sustainable Living section (shopping at sustainable

stores, making donations, participating in volunteer work,

offsetting the impact on the climate by purchasing carbon

credits, etc.), thus creating a ranking of clients who are more

engaged, and may also offer a system of rewards and valuation

of these clients (see case study in this Report).

Corporate

Presentation People

governance

ESG Highlights – Products

ESG Advances – Inter Invest

As a result of the ESG integration in the Inter Invest business

vertical, the Sustainability team has been supporting the Inter

Asset and Inter DTVM teams in improving the governance,

evaluation, and offer of products and reports with ESG content,

on the Super App investment platform. The materiality

topic, Sustainable Investment, drives this movement and

sheds light on various possibilities for mitigating risks and

enhancing opportunities. The following progress was made

in this regard by Inter in 2022. [SASB FN-AC-410a.2]

The year 2022 was particularly rich for the investment funds

segment managed by Inter Asset, which included an assessment

of the existing portfolio against ESG criteria. Materiality

requirements and commitments that reflect the degree of

maturity in relation to sustainability were listed in a questionnaire

in order to be able to assess companies’ ESG maturity.

This process was applied to 100% of equity portfolios and

53% of fixed income portfolios.

Furthermore, Inter has joined two extremely relevant initia

tivesin the environmental area,Investorsfor the Climate −

which promotes engagement and training of professional

investors to advance the agenda of portfolio decarbonization

and climate risk mitigation − and the Principles for Sustainable

Investment − an initiative created by the United Nations

(UN) for financial market agents.

Digital Economic

Environment Exhibits

environment performance

By signing it, Inter Asset committed to incorporate ESG topics

into its investment analysis, decision-making, and policies.

In addition, the offer of Funds with ESG criteria available on

Inter DTVM's Open Fund Platform was expanded:

• SulAmérica Crédito ESG FIRF

• Compassion ESG Credit Selection FIC FIRF CP LP

• JGP Crédito ESG FIC FIM CP

• JGP ESG FIC FIA

• BB Asset Ações Nordea Clima Global And

• MAG Global Sustainable FIC FMIE

• Schroeder Sustentabilidade Ações Globais USD FIC FIA IS

• Vox Desenvolvimento Sustentável FIRF CP LP

• Fama FIC FIA

When it comes to ESG aspects, one of the products that

deserves to be highlighted is the Fama FIC FIA fund. Fama

Investimentos has more than BRL 1.4 billion in assets under

management. Its great differentiator is the long track record

of management, with more than 29 years of history committed

to responsible investment.

The fund invests in solid, well-managed Brazilian companies

with excellent operating prospects, selected on the basis

of purely fundamentalist criteria, always using conservative

assumptions. Its aim is to achieve consistent returns through

a portfolio of high-quality companies that meet ethical and

Summary of Letter of Corporate

indicators assurance information

ESG criteria, have clear competitive advantages, and are led

by experienced managers. Alignment of interest between

controlling and minority shareholders, companies with strong

balance sheets, and cash generators with potential for value

creation initiatives are valued.

Corporate Digital Economic Summary of Letter of Corporate

Presentation People Environment Exhibits

governance environment performance indicators assurance information

Research Reports

Among the various materials that Inter makes available to

its clients are the Inter Research newsletters, which support

investment decision-making. Inter’s Strategy and Economic

Research team is accessible through a newsletter and the

reports available to the client/investor.

In this list of materials produced by the team of experts are

the following contents:

Going beyond these

items, Inter makes

available special

reports in which

one can monitor

the performance of

various market and

macroeconomic

conjunctures.

Macro Research

Analysis of the

economic conjuncture

and projections for

the Brazilian economy.

Real Estate Funds

Overview of the real

estate market and

recommended portfolio.

Equity Research

Recommendations

and analysis

of the main

listed companies.

Inter Strategy

Stay up to date with

what is happening in

the financial market.

Corporate Digital Economic Summary of Letter of Corporate

Presentation People Environment Exhibits

governance environment performance indicators assurance information

Sonar ESG

As a result of the ESG integration at the strategic level of

the Inter Invest vertical, the Inter ESG Seal is a analysis

that the Research team assigns to market companies,

proving their standards regarding environmental, social,

and governance issues. In addition, legitimizing the fidu-

ciary duty to investors, companies need to demonstrate

good financial fundamentals and attractive valuation with

a buy or neutral recommendation.

The targeting of ESG topics has been a guideline for all

investment areas that are related to Inter. It is from this

commitment that Sonar ESG was born, an internal analy-

sis structure of sustainability requirements, connected

to environmental, social, and governance standards, to

look at the performance of listed companies in the market

and indicate them within future investment portfolios.

After adopting these analysis criteria, using a basis of

parameters that are part of the Refinitiv system, a partner

that provides information for global financial markets and

supports, through its indicators, the construction of the

first report focused on the ESG topic, in which 15 com-

panies were checked at first, the balance requirements

in the three spheres (environmental, social, governance)

were looked at and what was highlighted in their profile,

with the awarding of an Inter ESG Seal.

These evaluations, which are now presented to Inter’s

investors, take into account more than 400 parameters

and are done systematically, and are updated contem-

plating all the companies evaluated.

With this report, Inter advances the ESG scope in its mar-

ket performance analysis. Every quarter, listed compa-

nies that are on the radar of the investment portfolio

are analyzed.

The analysis was divided into a summary of what the

company’s operating result was for the quarter, as well

as investment thesis as seen by the analyst responsible

for the coverage, and, of course, the main ESG advances,

divided among these four points:

Case

In addition, the main issues that the market has been discuss-

ing, such as the COP27 climate conference, which was the

subject of intense debates, are covered. The points discussed

throughout the conference lead to many expectations of how

economies will behave with regard to the climate emergency,

interfering with investments by various companies.

Based on this report, several companies started to establish

closer contact with Inter in order to be always up to date

with the information on their ESG initiatives and offer the

market, through the Inter reports, a panel that is as up to

date as possible in the classification of the sustainability

aspects of their companies.

Highlighted if the company has obtained an

ESG index of relevance;

Environmental advances;

Social advances;

Advances in corporate governance.

Corporate Digital Economic Summary of Letter of Corporate

Presentation People Environment Exhibits

governance environment performance indicators assurance information

One of the highlights of the Super App Inter can be evidenced

in the strong adherence of customers to the Doctor Inter tele-

medicine service, an online medical consultation service that

enables the first remote care and continued patient follow-up.

With this service, the patient has teleconsultations and can

opt for scheduled care with a medical team of various special-

ties, including highly qualified nutritionists and psychologists.

Easy to search and schedule

Choice of specialist and appointment

scheduling with the Super App.

Discounts on laboratories and medicines

Up to 30% discount on medicines and up to 15%

discount on laboratory exams.

All without leaving home

100% digital consultations, prescriptions, exam

requests, and certificates.

Telemedicine within everyone’s reach

It is a democratic

and eco-efficient

service, as it

avoids travel and

is low cost.

Corporate

Presentation People

governance

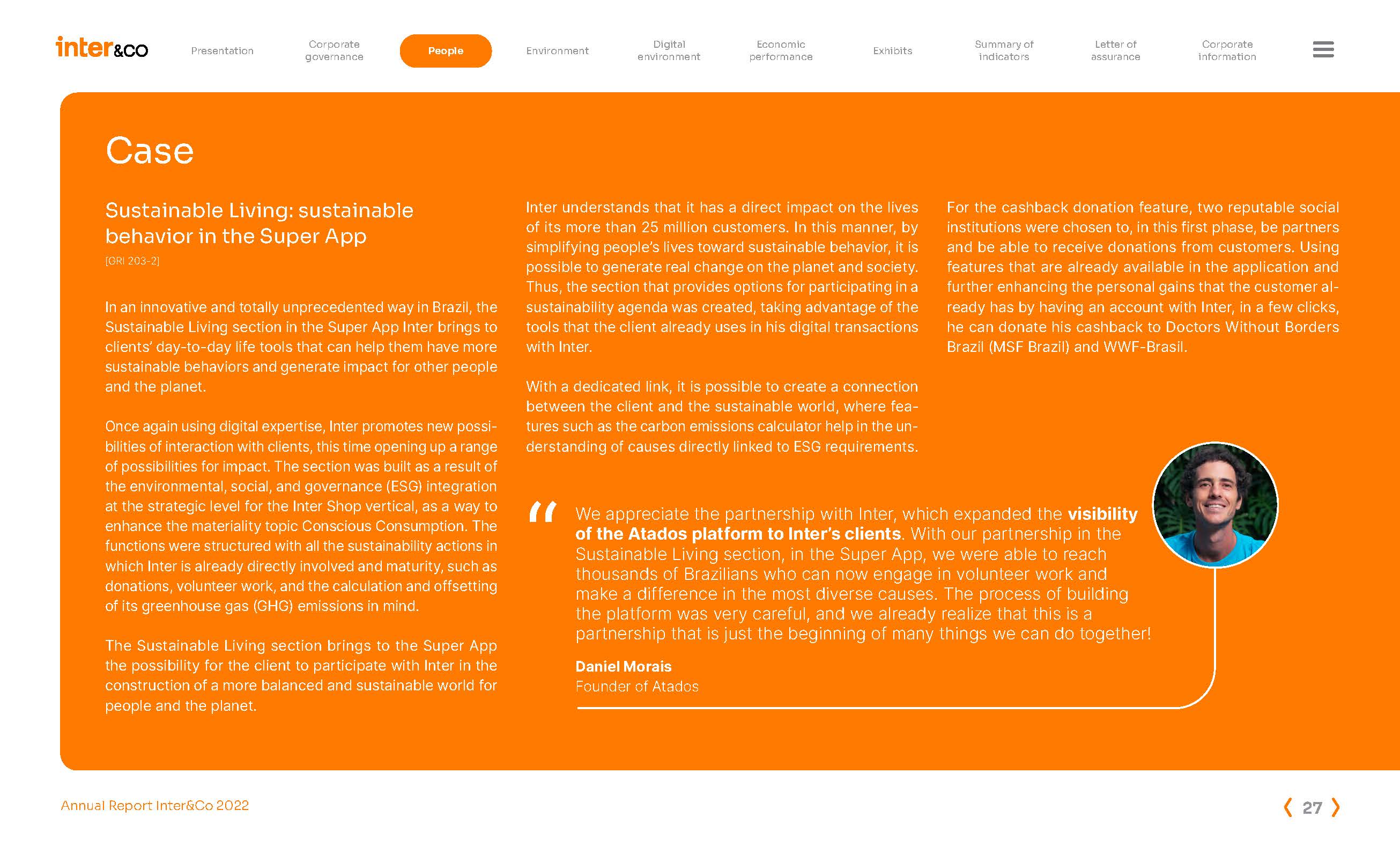

Case

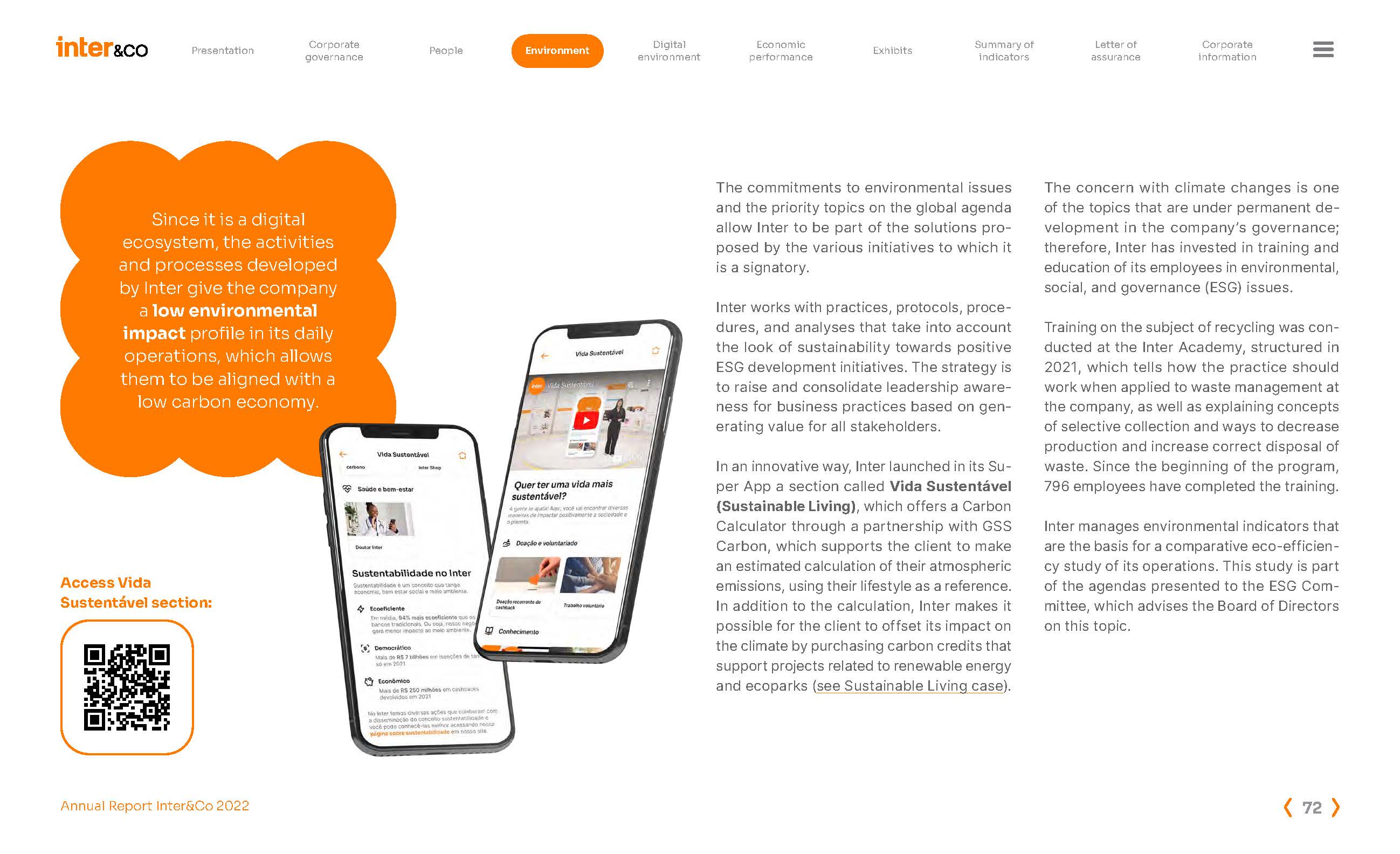

Sustainable Living: sustainable

behavior in the Super App

[GRI 203-2]

In an innovative and totally unprecedented way in Brazil, the

Sustainable Living section in the Super App Inter brings to

clients’ day to day life tools that can help them have more

sustainable behaviors and generate impact for other people

and the planet.

Once again using digital expertise, Inter promotes new possi

bilities of interaction with clients, this time opening up a range

of possibilities for impact. The section was built as a result of

the environmental, social, and governance (ESG) integration

at the strategic level for the Inter Shop vertical, as a way to

enhance the materiality topic Conscious Consumption. The

functions were structured with all the sustainability actions in

which Inter is already directly involved and maturity, such as

donations, volunteer work, and the calculation and offsetting

of its greenhouse gas (GHG) emissions in mind.

The Sustainable Living section brings to the Super App

the possibility for the client to participate with Inter in the

construction of a more balanced and sustainable world for

people and the planet.

Digital Economic Summary of Letter of Corporate

Environment Exhibits

environment performance indicators assurance information

Inter understands that it has a direct impact on the lives

of its more than 25 million customers. In this manner, by

simplifying people’s lives toward sustainable behavior, it is

possible to generate real change on the planet and society.

Thus, the section that provides options for participating in a

sustainability agenda was created, taking advantage of the

tools that the client already uses in his digital transactions

with Inter.

With a dedicated link, it is possible to create a connection

between the client and the sustainable world, where fea

tures such as the carbon emissions calculator help in the un

derstanding of causes directly linked to ESG requirements.

For the cashback donation feature, two reputable social

institutions were chosen to, in this first phase, be partners

and be able to receive donations from customers. Using

features that are already available in the application and

further enhancing the personal gains that the customer al

ready has by having an account with Inter, in a few clicks,

he can donate his cashback to Doctors Without Borders

Brazil (MSF Brazil) and WWF-Brasil.

We appreciate the partnership with Inter, which expanded the visibility

of the Atados platform to Inter’s clients. With our partnership in the

“ Sustainable Living section, in the Super App, we were able to reach

thousands of Brazilians who can now engage in volunteer work and

make a difference in the most diverse causes. The process of building

the platform was very careful, and we already realize that this is a

partnership that is just the beginning of many things we can do together!

Daniel Morais

Founder of Atados

Corporate Digital Economic Summary of Letter of Corporate

Presentation People Environment Exhibits

governance environment performance indicators assurance information

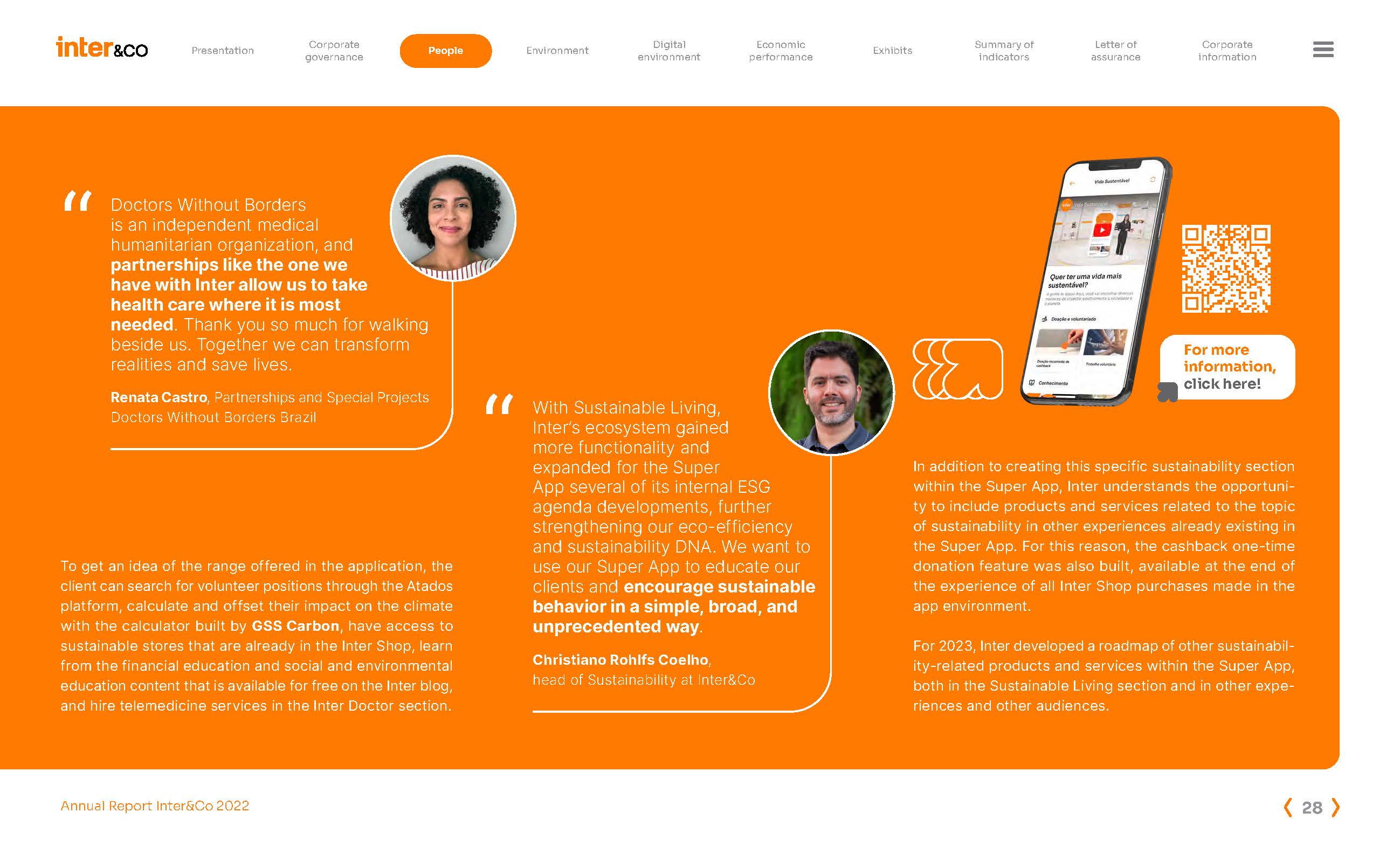

Doctors Without Borders

is an independent medical “ humanitarian organization, and

partnerships like the one we

have with Inter allow us to take

health care where it is most

needed. Thank you so much for walking

beside us. Together we can transform

realities and save lives.

Renata Castro, Partnerships and Special Projects

Doctors Without Borders Brazil

To get an idea of the range offered in the application, the

client can search for volunteer positions through the Atados

platform, calculate and offset their impact on the climate

with the calculator built by GSS Carbon, have access to

sustainable stores that are already in the Inter Shop, learn

from the financial education and social and environmental

education content that is available for free on the Inter blog,

and hire telemedicine services in the Inter Doctor section.

With Sustainable Living,

Inter’s ecosystem gained

“ more functionality and

expanded for the Super

App several of its internal ESG

agenda developments, further

strengthening our eco efficiency

and sustainability DNA. We want to

use our Super App to educate our

clients and encourage sustainable

behavior in a simple, broad, and

unprecedented way.

Christiano Rohlfs Coelho,

head of Sustainability at Inter&Co

For more

information,

click here!

In addition to creating this specific sustainability section

within the Super App, Inter understands the opportuni

ty to include products and services related to the topic

of sustainability in other experiences already existing in

the Super App. For this reason, the cashback one time

donation feature was also built, available at the end of

the experience of all Inter Shop purchases made in the

app environment.

For 2023, Inter developed a roadmap of other sustainabil

ity related products and services within the Super App,

both in the Sustainable Living section and in other expe

riences and other audiences.

Corporate

Presentation People

governance

Global Compact and SDGs

Listening to the stakeholders’ perspective and aligned with

the Ten Principles of the Global Compact are examples

of how the Inter Group seeks to be broader and more assertive

in its sustainability strategy, aiming to build an offer

of products and services that promote conscientious

transformation, becoming an important agent in achieving

a regenerative economy.

Inter has been a signatory of the UN Global Compact Network

Brazil since 2020, and the Sustainable Development

Goals (SDGs) permeate its sustainability guidelines.

The 17 SDGs and their 169 targets were evaluated through

the expertise of the Sustainability team, with analysis of actions

that are currently developed by the company and converge

with some of the SDGs.

As the business evolves, the Inter SDG Map is updated to reflect

which SDGs are most correlated to the activities and the

impact generated, in line with the related 2030 Agenda Goals.

In building the presentation of the SDG framework, the priority

and secondary SDGs were placed in the context of materiality

and the actions developed by the Inter ecosystem. The SDGs

are aligned with the dynamics of the strategies and practices

already implemented by the Inter ecosystem and that are

Digital Economic Summary of Letter of Corporate

Environment Exhibits

environment performance indicators assurance information

naturally contributing to the achievement of these goals. In

the next steps of ESG integration, the Group will define the

strategies for action based on the update of their materiality.

Inter has intensified an internal agenda of training and dissemination

of Agenda 2030 and the SDGs to be developed

and achieved within the company’s business strategies. Since

2020, more than 332 employees from 165 sectors have completed

the Agenda 2030 course within the Inter Academy

education platform.

In addition, upon joining Inter, all employees undergo onboarding

training, in which topics such as Agenda 2030,

stakeholder capitalism, conscious capitalism, SDGs, sustainability,

ESG, climate change, social responsibility, recycling,

and materiality are covered. Thus, since 2020, 100% of the

employees have been trained in these topics.

Inter is also part of the Challenge 2030 Network (D2030) and

the MG SDG Hub, initiatives formed by organizations from

Minas Gerais that seek to be more sustainable each day, united

to expand the contribution of the business community of

Minas Gerais to meet the 2030 Agenda. The SDG Hub is linked

to the Global Compact Network Brazil, supporting projects,

education initiatives, and actions to promote sustainability

in the state.

When employees finish the Agenda 2030 training,

they receive a button to identify them as fostering

the SDGs.

Inter SDG Map

Corporate Digital Economic

Presentation People Environment Exhibits

governance environment performance

Inter is also part of a network of associations and actively participates in representative

entities related to capital markets, advocacy of environmental topics, ESG, climate change,

and social development: [GRI 2-28]

SOCIAL

• Ethos Institute of Social Responsibility;

• Global Compact Network Brazil, a UN initiative with

the business sector;

• 2030 Challenge Network - Minas Gerais;

• SDG MG Hub, linked to the Global Compact

Network Brazil;

• Minas Gerais Corporate Volunteering

Committee (CMVC);

• Committee S (Social Responsibility) of the Brazilian

Association of Banks (ABBC);

• Cooperation for Development and Human

Housing (CDM).

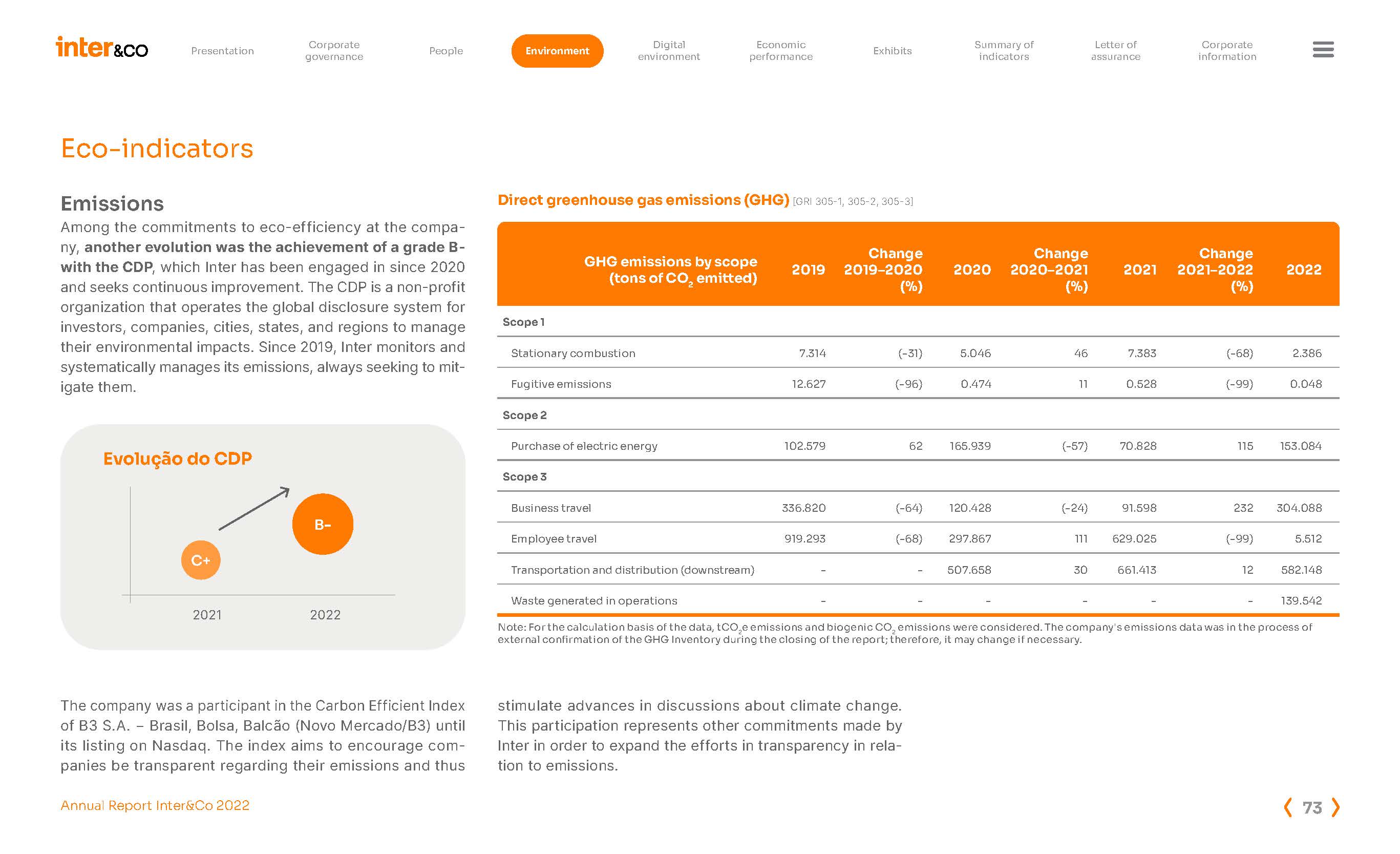

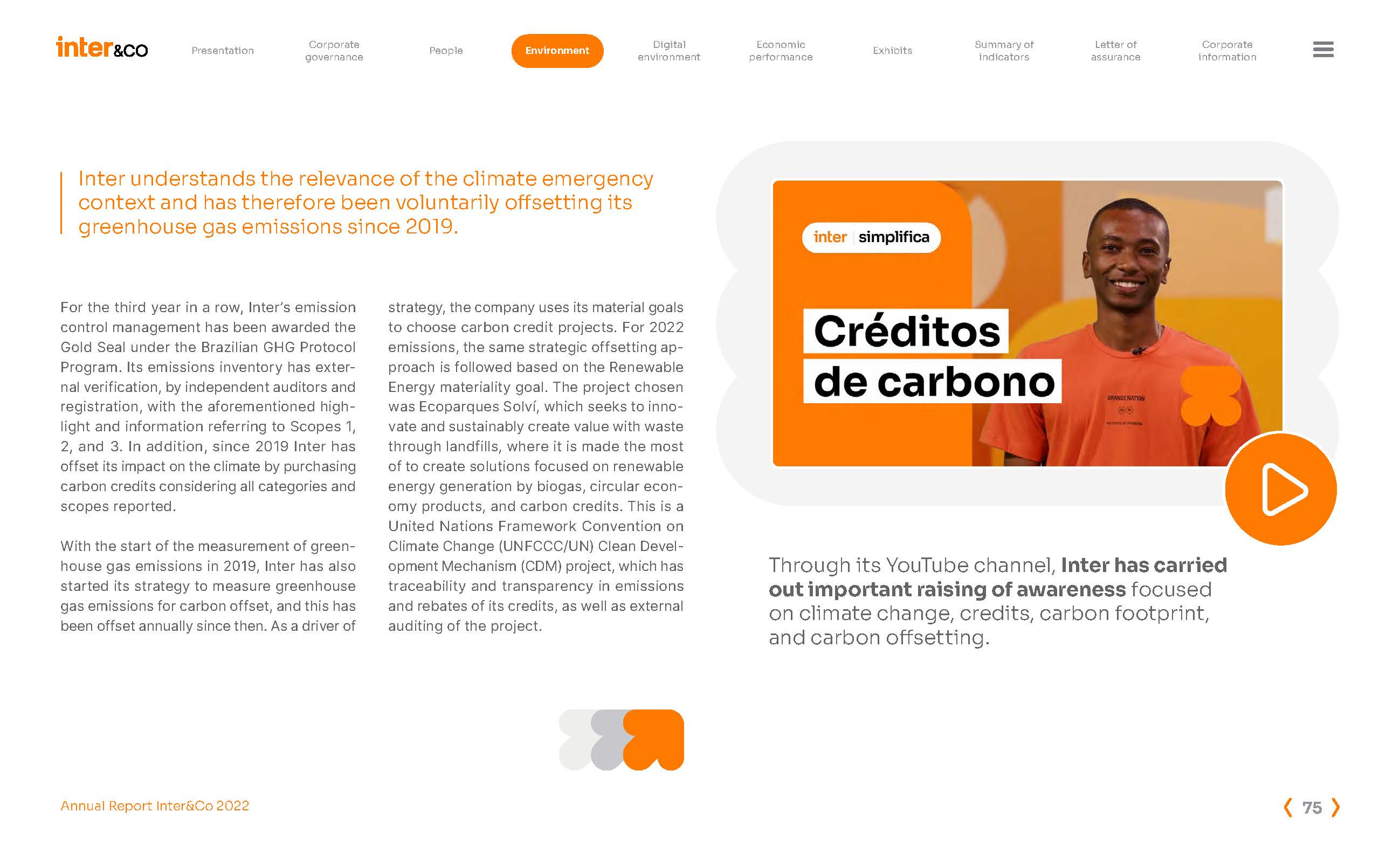

CLIMATE

• Investors for the Climate (IPC);

• GHG Protocol Brazil ‒ Public Emissions Registry.

FINANCIAL MARKET

• ABBC, acting as a member of the Compliance

Committee, with direct action on anti-corruption and

compliance issues, and of Committee S, which deals with

issues of social responsibility;

• Brazilian Federation of Banks (Febraban), acting as

member of the Board of Directors, ESG Committee, and

Executive Board;

• Nasdaq ESG and other initiatives in which Inter is engaged.

GOVERNANCE

• Principles for Responsible Investment (PRI)/UN;

• Brazilian Institute of Corporate Governance (IBGC);

• Amcham.

Summary of Letter of Corporate

indicators assurance information

Inter also stands out in other market indicators. The evolution

in the Morgan Stanley Capital International (MSCI) ranking

since 2019, when Banco Inter was a listed company on B3,

has been relevant. In 2022, the year of the corporate reorganization,

Inter’s rating increased from BB to BBB, reflecting

the evolution of its ESG practices.

Evolution in MSCI Ratings

October

2019

September

2020

June

2022

B

BB

BBB

MSCI is one of the world’s leading global providers of data

and indices for investors, accumulating over 50 years of experience

in data and research for building portfolios focused

on risk, return, and confidence.

CORPORATE

GOVERNANCE

[GRI 2-9, 2-10, 2-11, 2-12, 2-13, 2-15, 2-16, 2-17, 2-18, 2-19, 2-20, 2-23, 2-24,

2-25, 2-26, 2-27 | GRI 202-2 | GRI 205-1, 205-2, 205-3 | GRI 405-1 | GRI 415-1

| SASB FN-AC-410a.2, FN-IB-510b.4, FN-AC-330a.1, FN-CB-510a.2, FN-CB550a.

1, FN-CB-550a.2]

Corporate Digital Economic

Presentation People Environment Exhibits

governance environment performance

Inter&Co has an ongoing commitment to best governance

practices, whether they are associated with compliance standards

or the adoption of market best practices.

The Inter Group’s governance bodies, through the strategic

vision of the Boards of Directors of Inter&Co and the Group’s

other companies, as well as their advisory committees, integrate

the performance of environmental, social, and governance

(ESG) issues with the perception of business risks and

opportunities, safeguarding the interests of its shareholders,

clients, and other stakeholders. Leadership plays its role

through a culture of governance, transparency, accountability,

integrity, social responsibility, and sustainability. [GRI 2-12]

The governance practices adopted by Inter&Co are aligned

with the regulatory parameters of the markets where it operates

and in line with Nasdaq rules, U.S. Securities and Exchange

Commission (SEC) regulations, U.S. capital markets

legislation applicable to foreign private issuers, and the regulations

of the Securities and Exchange Commission of Brazil

(CVM) applicable to foreign issuers registered in Category A

with a Level 2 Brazilian Depositary Receipts (BDRs) program.

Summary of Letter of Corporate

indicators assurance information

Since the migration of the shareholder base to Nasdaq, the

publicly traded company of the Inter Group has become Inter&

Co. As a result, the quarterly and annual financial statements

for Inter&Co are now published in accordance with

International Financial Reporting Standards (IFRS). With this,

all quarterly reports with financial and managerial analyses

made available by the Investor Relations area are now based

on this standard. [GRI 2-16]

Inter&Co governance [GRI 2-9]

After the corporate reorganization, Inter&Co’s Board of Directors

became the group’s main governance body, with a

strategic vision for all its businesses. Inter&Co’s Board of

Directors is assisted by an Audit Committee, established in

accordance with SEC and Nasdaq rules, composed of independent

members only.

In addition, Banco Inter continues to have (i) its own Board

of Directors, (ii) its own Audit Committee, composed in accordance

with the rules of the Central Bank of Brazil, (iii) and

other corporate advisory committees for technical matters,

which also include the participation of independent members

of Inter&Co’s Board of Directors, which, as stated, strategically

oversees the group’s business.

Corporate Digital Economic

Presentation People Environment Exhibits

governance environment performance

Inter&Co has an ongoing commitment to best governance

practices, whether they are associated with compliance standards

or the adoption of market best practices.

The Inter Group’s governance bodies, through the strategic

vision of the Boards of Directors of Inter&Co and the Group’s

other companies, as well as their advisory committees, integrate

the performance of environmental, social, and governance

(ESG) issues with the perception of business risks and

opportunities, safeguarding the interests of its shareholders,

clients, and other stakeholders. Leadership plays its role

through a culture of governance, transparency, accountability,

integrity, social responsibility, and sustainability. [GRI 2-12]

The governance practices adopted by Inter&Co are aligned

with the regulatory parameters of the markets where it operates

and in line with Nasdaq rules, U.S. Securities and Exchange

Commission (SEC) regulations, U.S. capital markets

legislation applicable to foreign private issuers, and the regulations

of the Securities and Exchange Commission of Brazil

(CVM) applicable to foreign issuers registered in Category A

with a Level 2 Brazilian Depositary Receipts (BDRs) program.

Summary of Letter of Corporate

indicators assurance information

Since the migration of the shareholder base to Nasdaq, the

publicly traded company of the Inter Group has become Inter&

Co. As a result, the quarterly and annual financial statements

for Inter&Co are now published in accordance with

International Financial Reporting Standards (IFRS). With this,

all quarterly reports with financial and managerial analyses

made available by the Investor Relations area are now based

on this standard. [GRI 2-16]

Inter&Co governance [GRI 2-9]

After the corporate reorganization, Inter&Co’s Board of Directors

became the group’s main governance body, with a

strategic vision for all its businesses. Inter&Co’s Board of

Directors is assisted by an Audit Committee, established in

accordance with SEC and Nasdaq rules, composed of independent

members only.

In addition, Banco Inter continues to have (i) its own Board

of Directors, (ii) its own Audit Committee, composed in accordance

with the rules of the Central Bank of Brazil, (iii) and

other corporate advisory committees for technical matters,

which also include the participation of independent members

of Inter&Co’s Board of Directors, which, as stated, strategically

oversees the group’s business.

Corporate Digital Economic

Presentation People Environment Exhibits

governance environment performance

Inter&Co has an ongoing commitment to best governance

practices, whether they are associated with compliance standards

or the adoption of market best practices.

The Inter Group’s governance bodies, through the strategic

vision of the Boards of Directors of Inter&Co and the Group’s

other companies, as well as their advisory committees, integrate

the performance of environmental, social, and governance

(ESG) issues with the perception of business risks and

opportunities, safeguarding the interests of its shareholders,

clients, and other stakeholders. Leadership plays its role

through a culture of governance, transparency, accountability,

integrity, social responsibility, and sustainability. [GRI 2-12]

The governance practices adopted by Inter&Co are aligned

with the regulatory parameters of the markets where it operates

and in line with Nasdaq rules, U.S. Securities and Exchange

Commission (SEC) regulations, U.S. capital markets

legislation applicable to foreign private issuers, and the regulations

of the Securities and Exchange Commission of Brazil

(CVM) applicable to foreign issuers registered in Category A

with a Level 2 Brazilian Depositary Receipts (BDRs) program.

Summary of Letter of Corporate

indicators assurance information

Since the migration of the shareholder base to Nasdaq, the

publicly traded company of the Inter Group has become Inter&

Co. As a result, the quarterly and annual financial statements

for Inter&Co are now published in accordance with

International Financial Reporting Standards (IFRS). With this,

all quarterly reports with financial and managerial analyses

made available by the Investor Relations area are now based

on this standard. [GRI 2-16]

Inter&Co governance [GRI 2-9]

After the corporate reorganization, Inter&Co’s Board of Directors

became the group’s main governance body, with a

strategic vision for all its businesses. Inter&Co’s Board of

Directors is assisted by an Audit Committee, established in

accordance with SEC and Nasdaq rules, composed of independent

members only.

In addition, Banco Inter continues to have (i) its own Board

of Directors, (ii) its own Audit Committee, composed in accordance

with the rules of the Central Bank of Brazil, (iii) and

other corporate advisory committees for technical matters,

which also include the participation of independent members

of Inter&Co’s Board of Directors, which, as stated, strategically

oversees the group’s business.

Corporate Digital Economic Summary of Letter of Corporate

Presentation People Environment Exhibits

governance environment performance indicators assurance information

deliveries achieved by Inter and individual

The Board of Directors meets ordinarily at performance, thus enabling a more attractive

30<>

>50yearsold

<30yea

BrYellow

1.24%

1.9%

17.39%

least eight times per year or whenever nec-and competitive total compensation poten

10.6%

essary. All meetings of the Inter Group’s gov-tial, in line with the practices adopted by the

ernance bodies have been held, since 2019, market. [GRI 2-19]

Notdeclared

White

81.37%

13%

74.5%

The agenda for Board of Directors meetings

is defined jointly by the Board members,

and all Board members are encouraged to

request inclusion of topics they consider relevant

for the meetings. The chairman of the

Board is responsible for organizing the agenda,

with the support of the Executive Board

and the Secretary of Governance, and for

ensuring that the topics requested by board

members are present at the meetings.

The Internal Rules of the Board regulate its

operation, its convening and call to order, the

quorum for resolutions, the procedures for

formalizing decisions, the support functions

performed by the Governance Board, and the

duties and responsibilities of Board members.

with the support of a governance portal,

which allows secure and traceable access to

the support materials prepared for the discussion

of the agenda topics. This same platform

is used for signing and archiving minutes and

other governance documents. [GRI 2-13]

Governance technology innovations have

also been in use since 2021 by Banco Inter

and now by Inter&Co for shareholder meetings

online, in order to facilitate and encourage

everyone’s participation.

Inter adopts variable remuneration programs

that cover all employees covered by the Consolidated

Labor Laws and members of senior

management, in order to recognize the

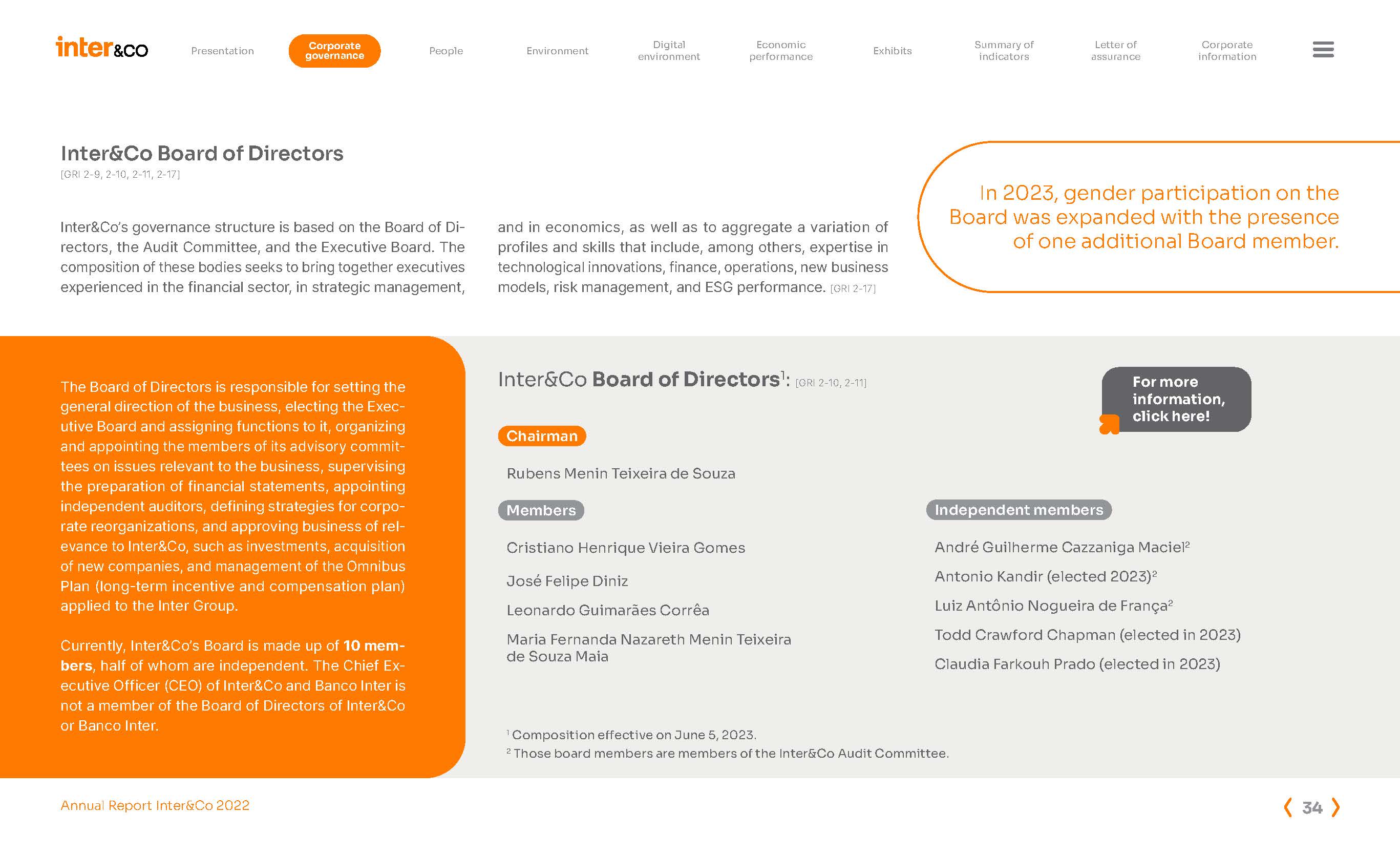

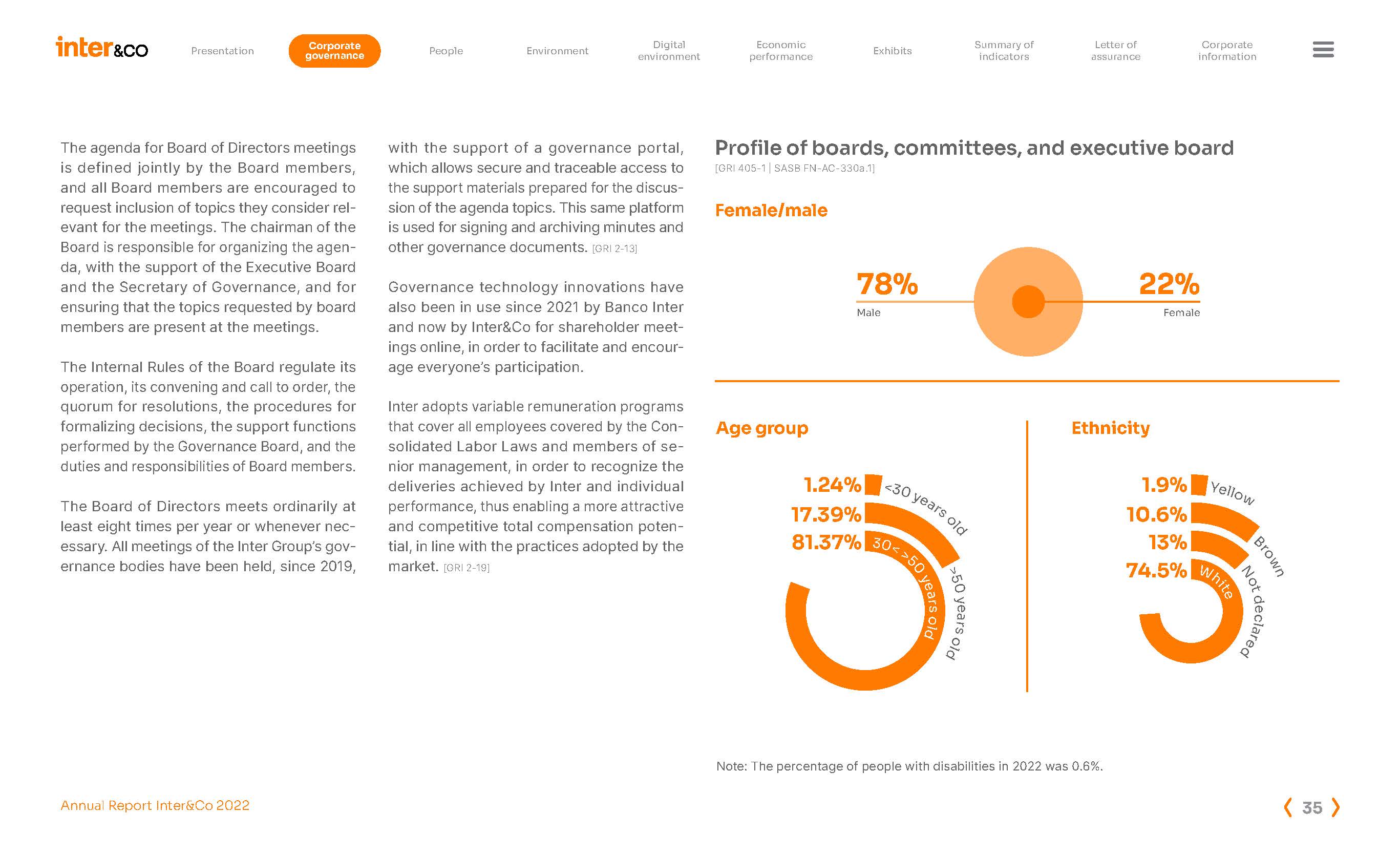

Profile of boards, committees, and executive board

[GRI 405-1 | SASB FN-AC-330a.1]

Female/male

78% 22%

Male Female

Age group

Ethnicity

Note: The percentage of people with disabilities in 2022 was 0.6%.

Corporate Digital Economic Summary of Letter of Corporate

Presentation People Environment Exhibits

governance environment performance indicators assurance information

Since 2021, an annual evaluation is conducted

by the Board of Directors regarding

its performance and functioning, the work

done by its committees, and the Governance

Secretary. The evaluation is done individually

by Board members, using an online form focused

on the individual performance of the

board members and the joint body. Based

on the results, the Governance Secretary

prepares, together with the chairman of the

Board, reports and action plans for each of

the points for improvement identified in the

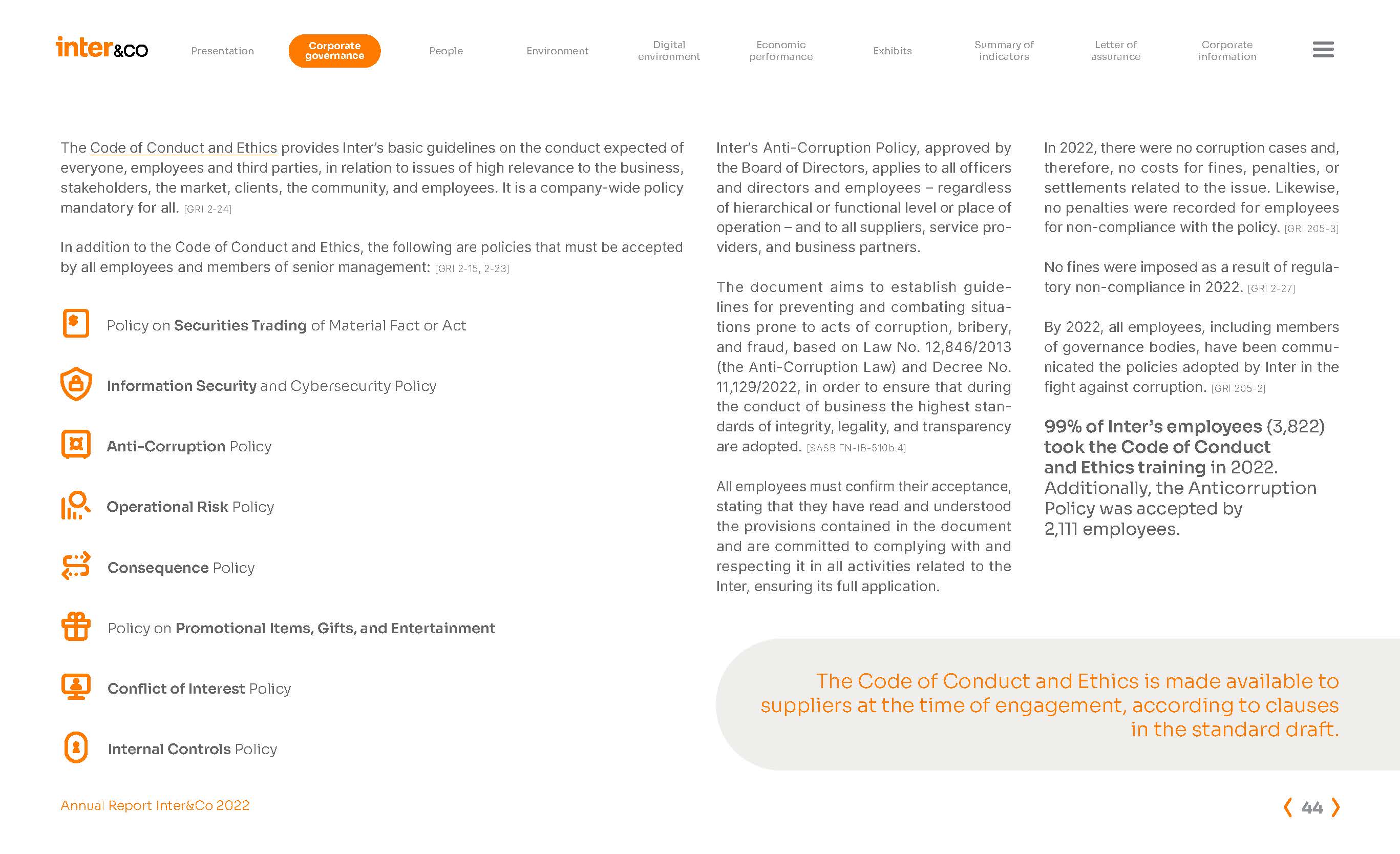

assessment. [GRI 2-18]