Document

|

|

|

|

|

|

| FOR IMMEDIATE RELEASE |

NASDAQ: NSIT |

INSIGHT ENTERPRISES, INC. REPORTS

FIRST QUARTER RESULTS AND CONFIRMS FULL YEAR GUIDANCE

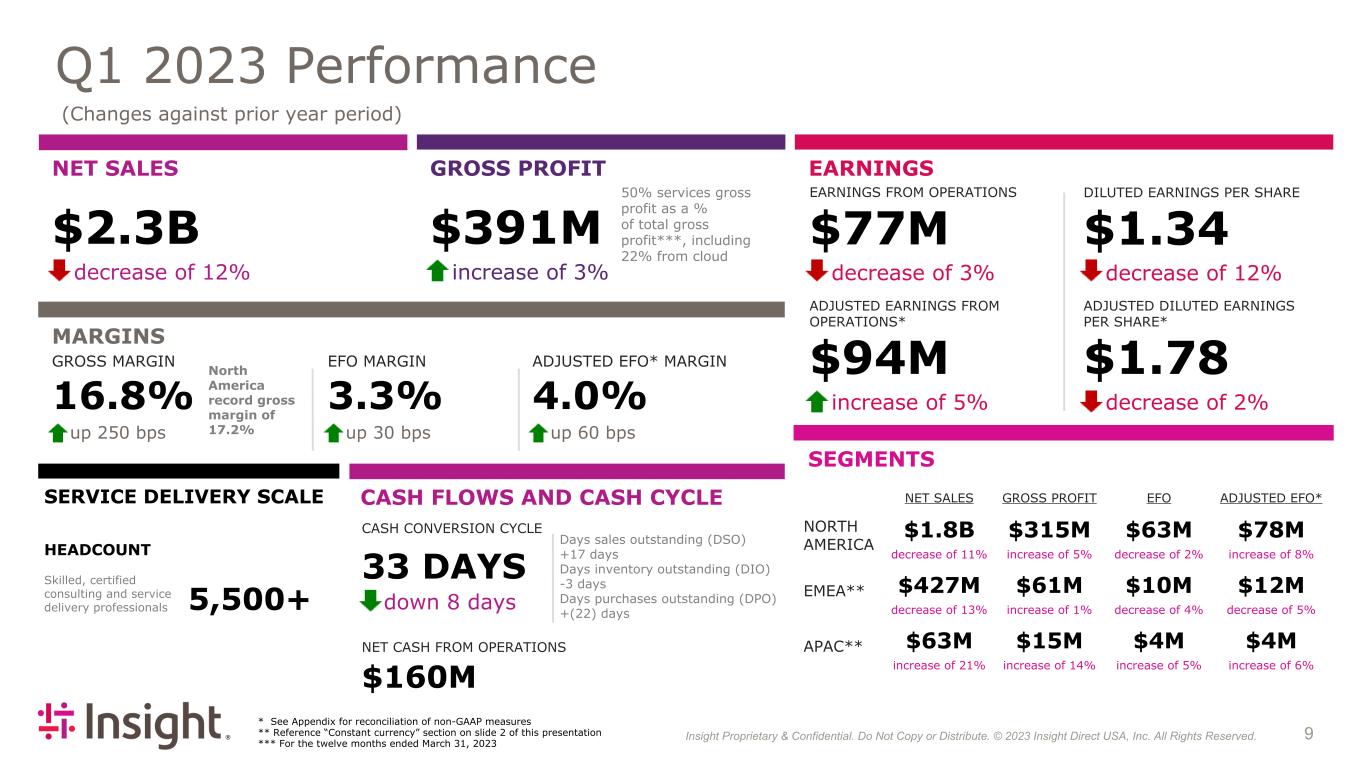

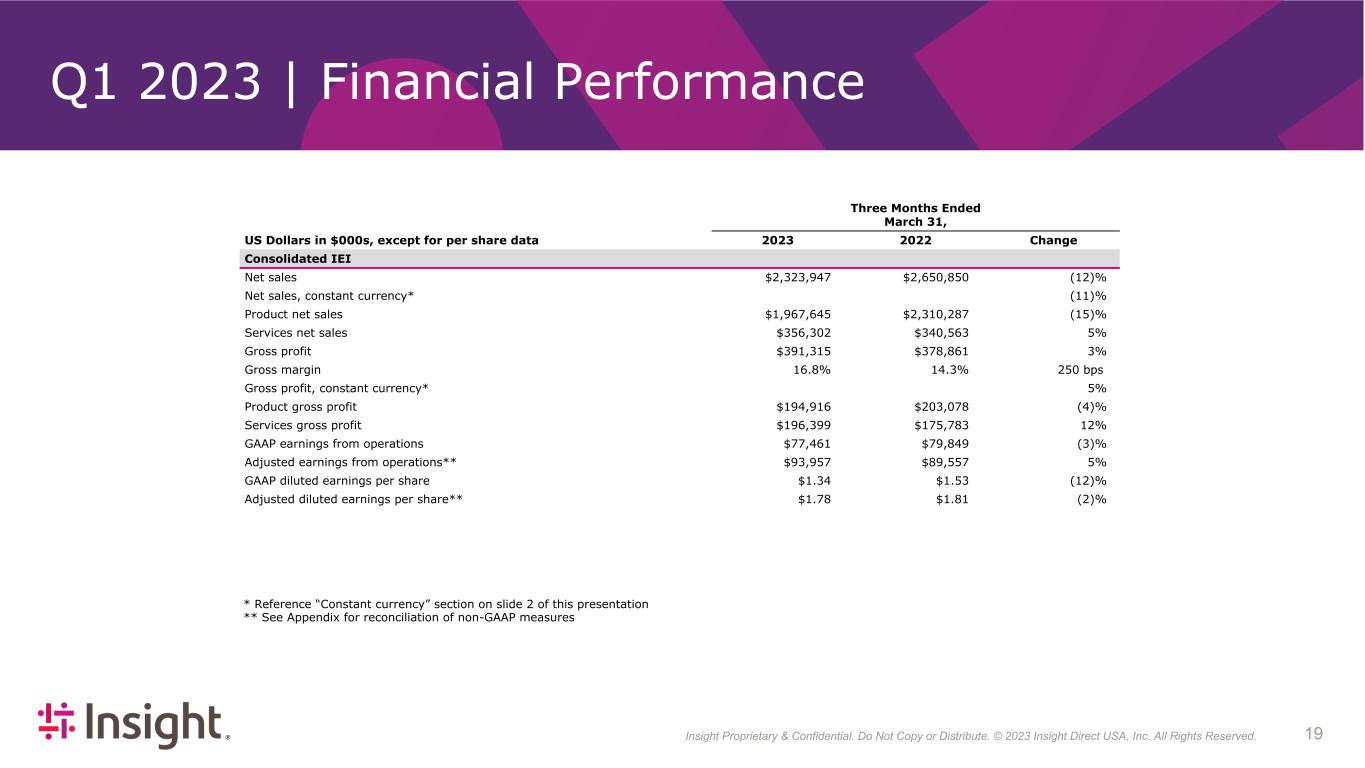

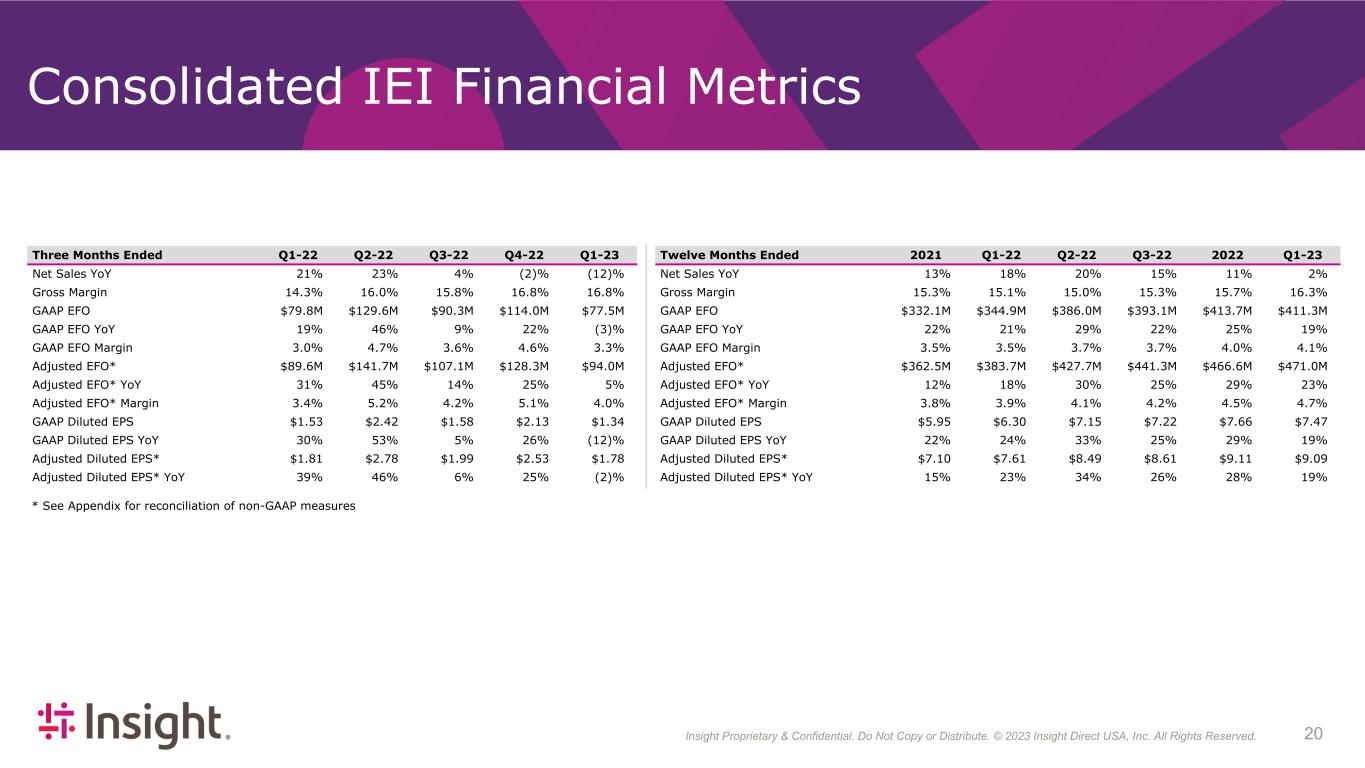

CHANDLER, AZ – May 2, 2023 – Insight Enterprises, Inc. (NASDAQ: NSIT) (the “Company”) today reported financial results for the quarter ended March 31, 2023. Highlights include:

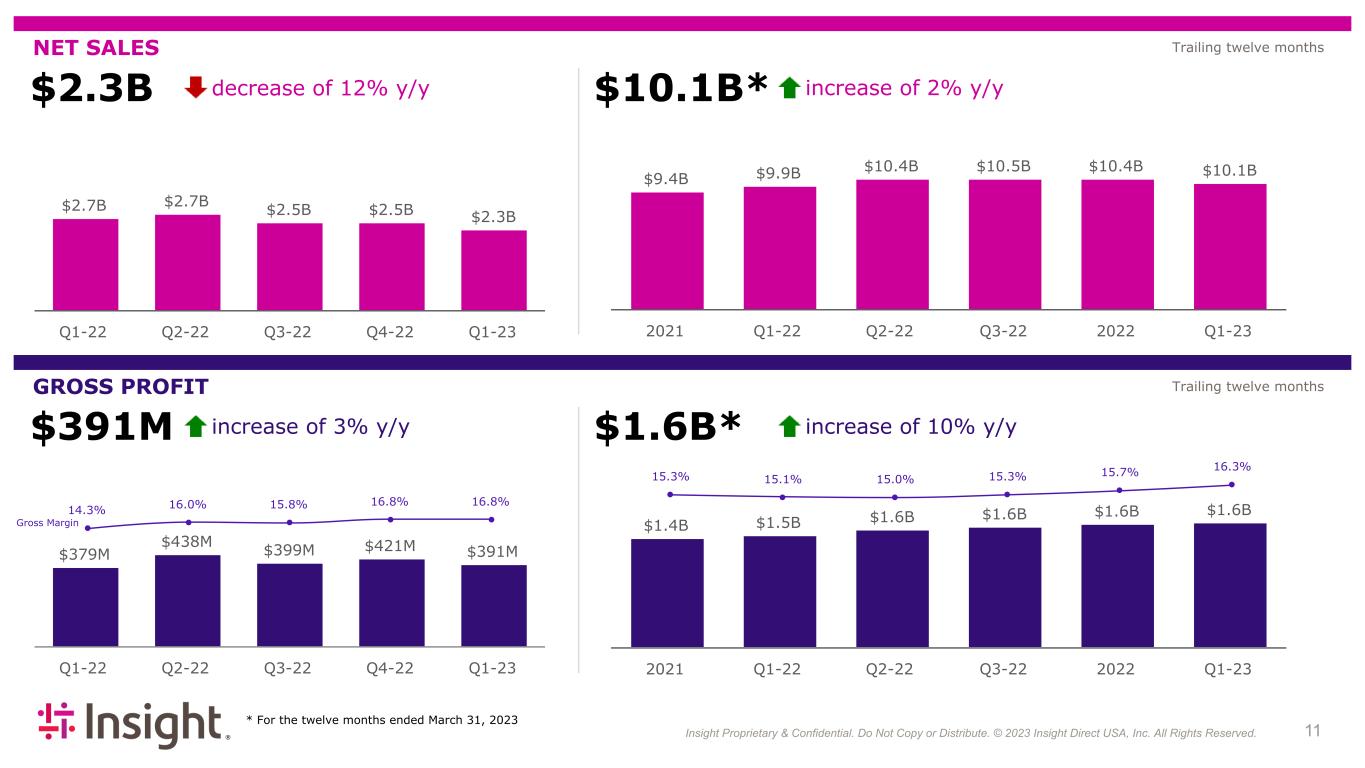

•Gross profit increased 3% year over year to $391.3 million with gross margin expanding 250 basis points to 16.8%

•Record gross margin in North America of 17.2%

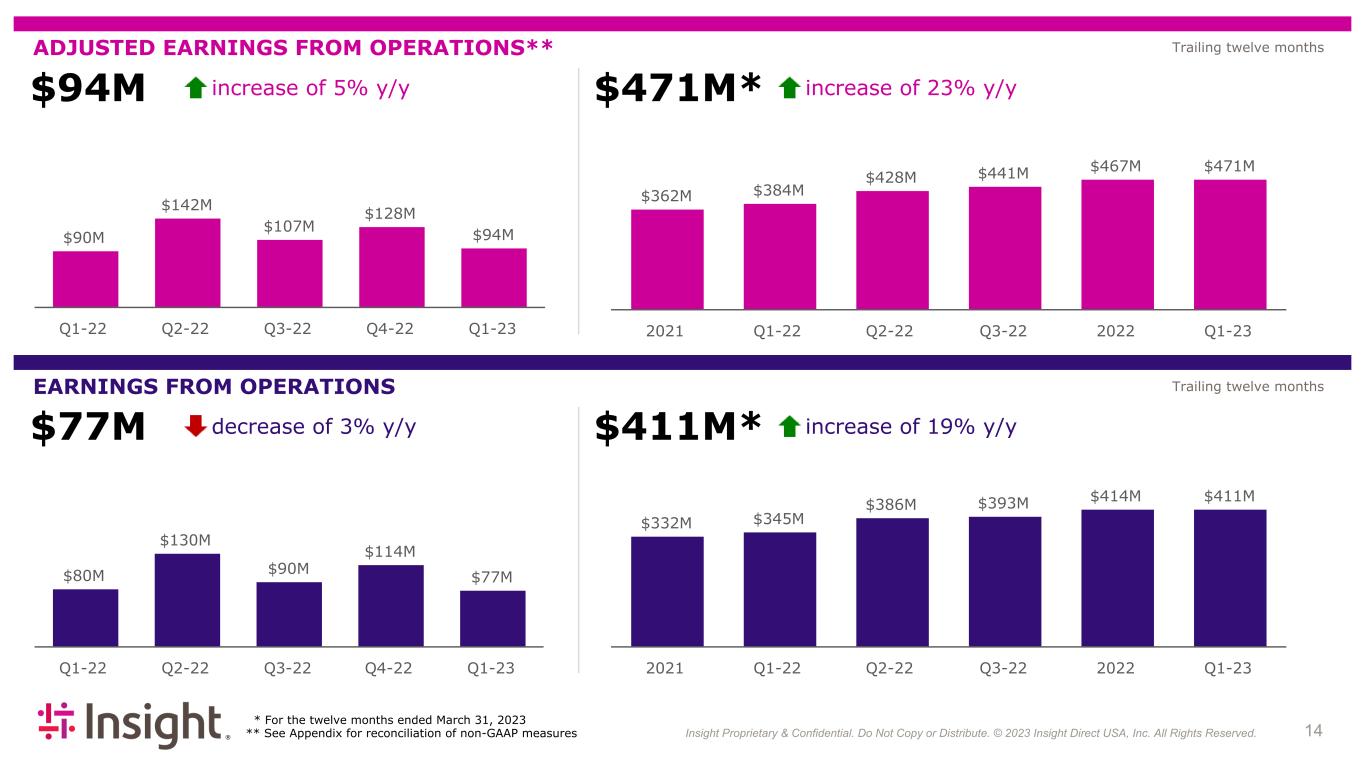

•Earnings from operations decreased 3% year to year to $77.5 million

•Adjusted earnings from operations increased 5% year over year to $94.0 million

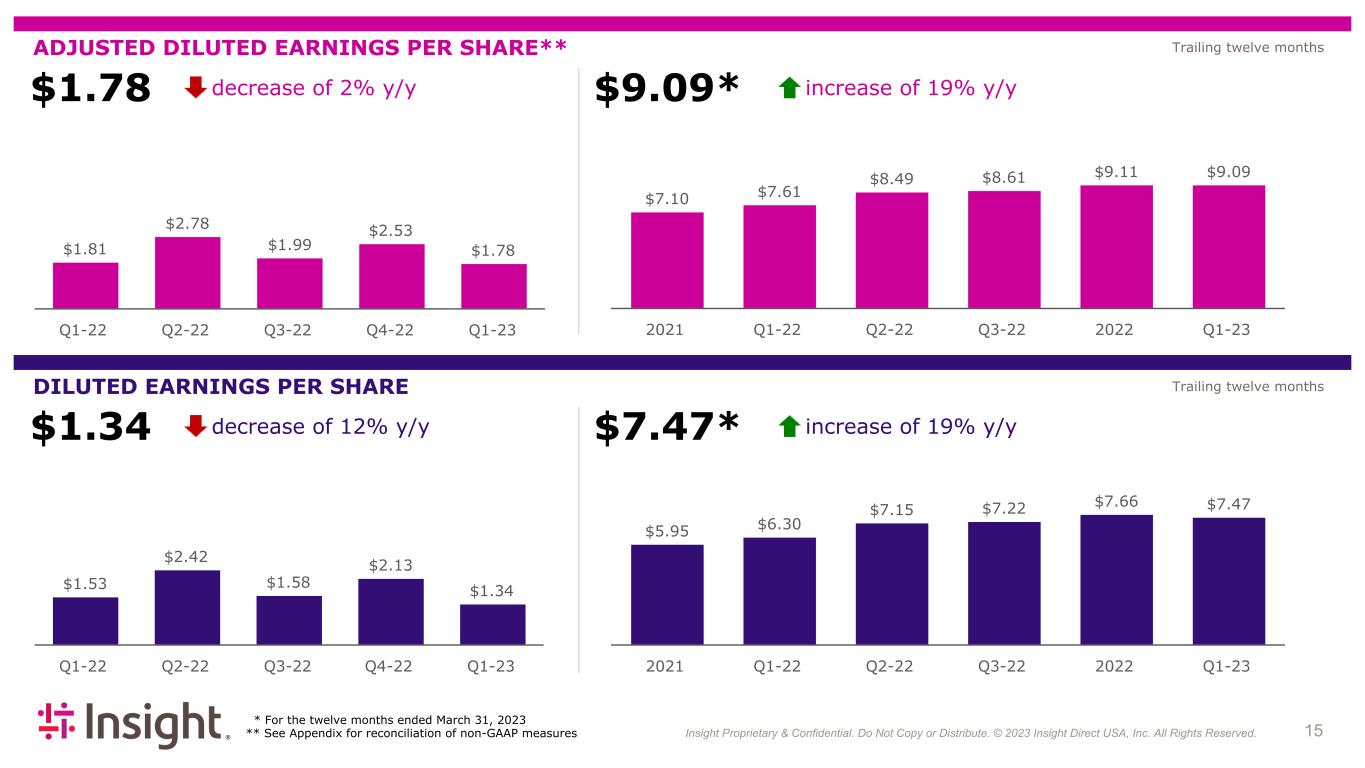

•Diluted earnings per share of $1.34 decreased 12% year to year

•Adjusted diluted earnings per share of $1.78 decreased 2% year to year

•Cash flows provided by operating activities were $160.2 million

In the first quarter of 2023, gross profit increased 3% and gross margin expanded 250 basis points to 16.8% compared to the first quarter of 2022, despite net sales being down 12%, year to year. Earnings from operations of $77.5 million decreased 3% compared to $79.8 million in the first quarter of 2022. Adjusted earnings from operations of $94.0 million increased 5% compared to $89.6 million in the first quarter of 2022. Diluted earnings per share for the quarter was $1.34, down 12%, year to year. Adjusted diluted earnings per share was $1.78, down 2%, year to year.

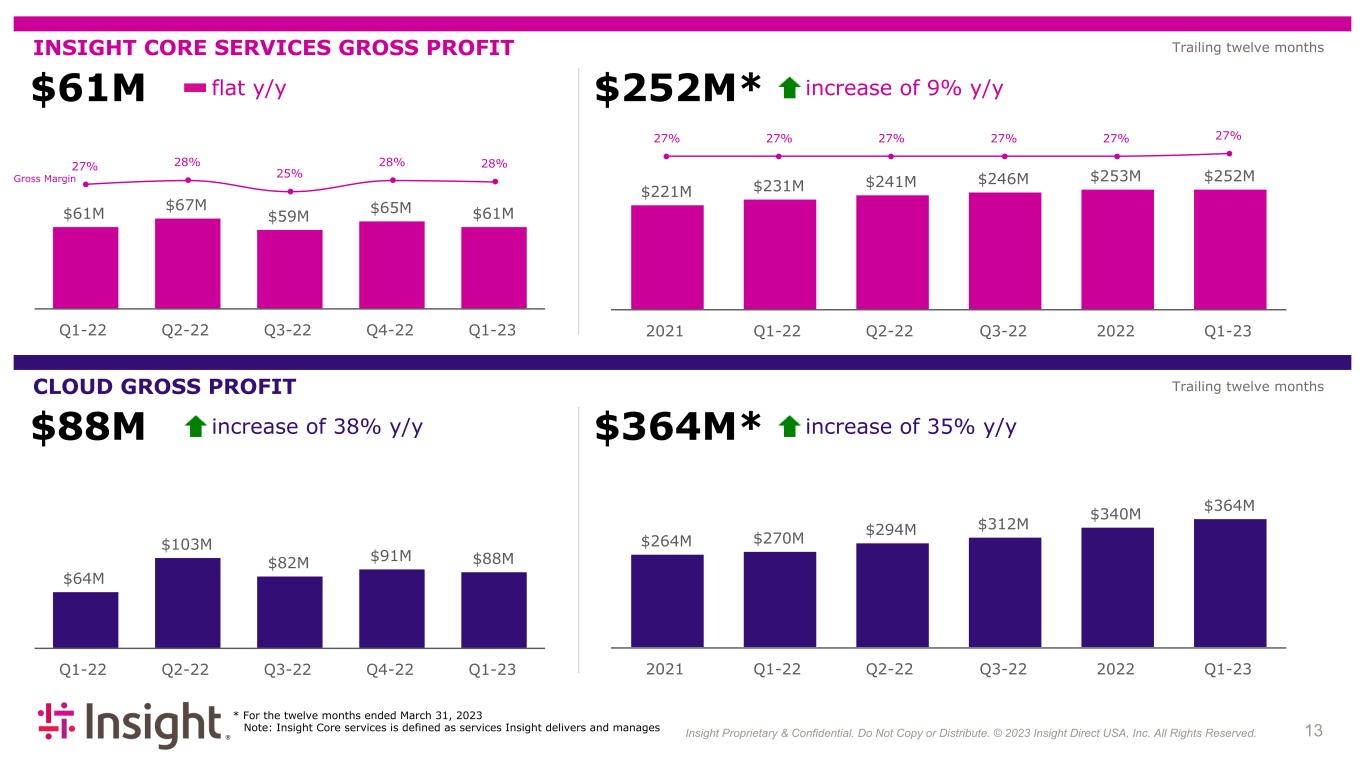

“Our first quarter results were in line with our expectations, in a market that was even more volatile than we had anticipated. We are pleased with our gross margin performance, which expanded by 250 basis points to 16.8%, led by 38% growth in cloud gross profit” stated Joyce Mullen, President and Chief Executive Officer. “This performance reflects our belief that, in a world of accelerated change, our clients need a partner with deep expertise they can trust to deliver innovative results fast,” Mullen stated.

KEY HIGHLIGHTS

Results for the Quarter:

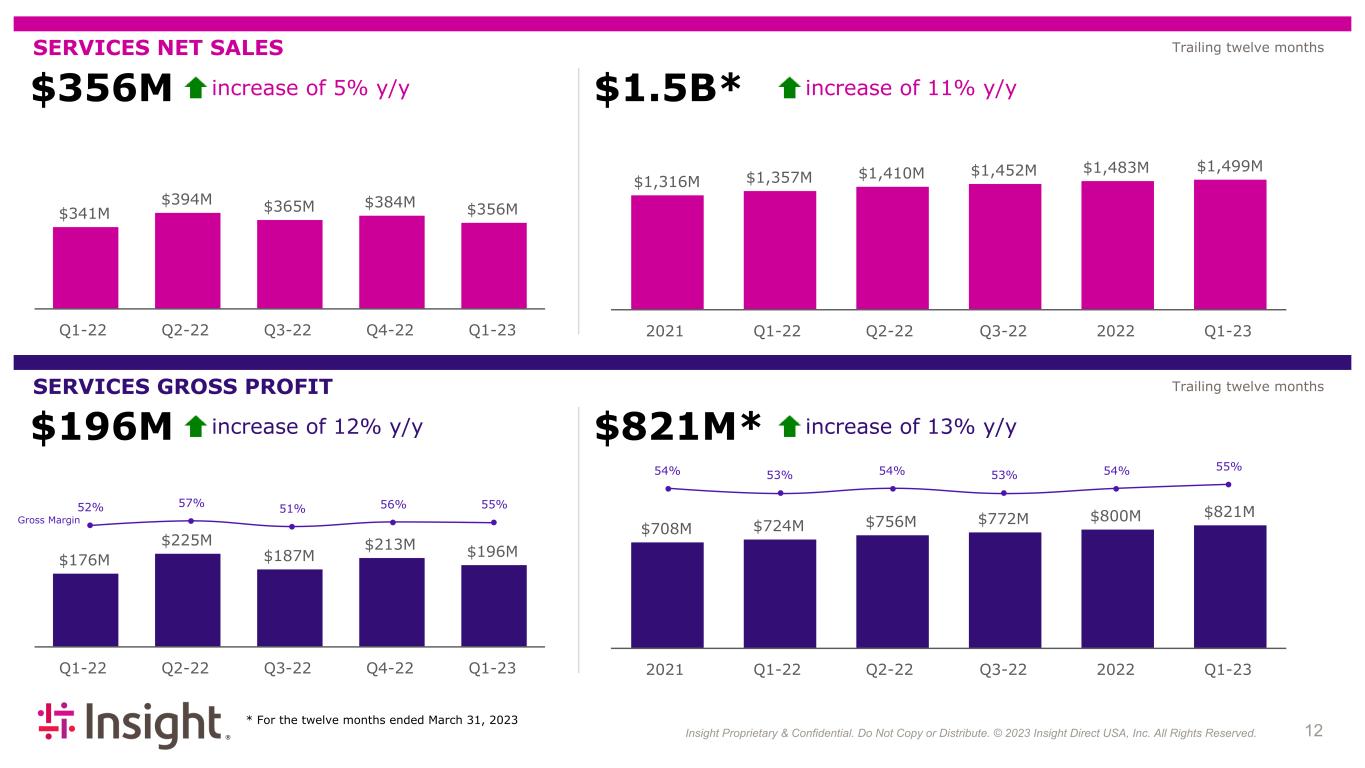

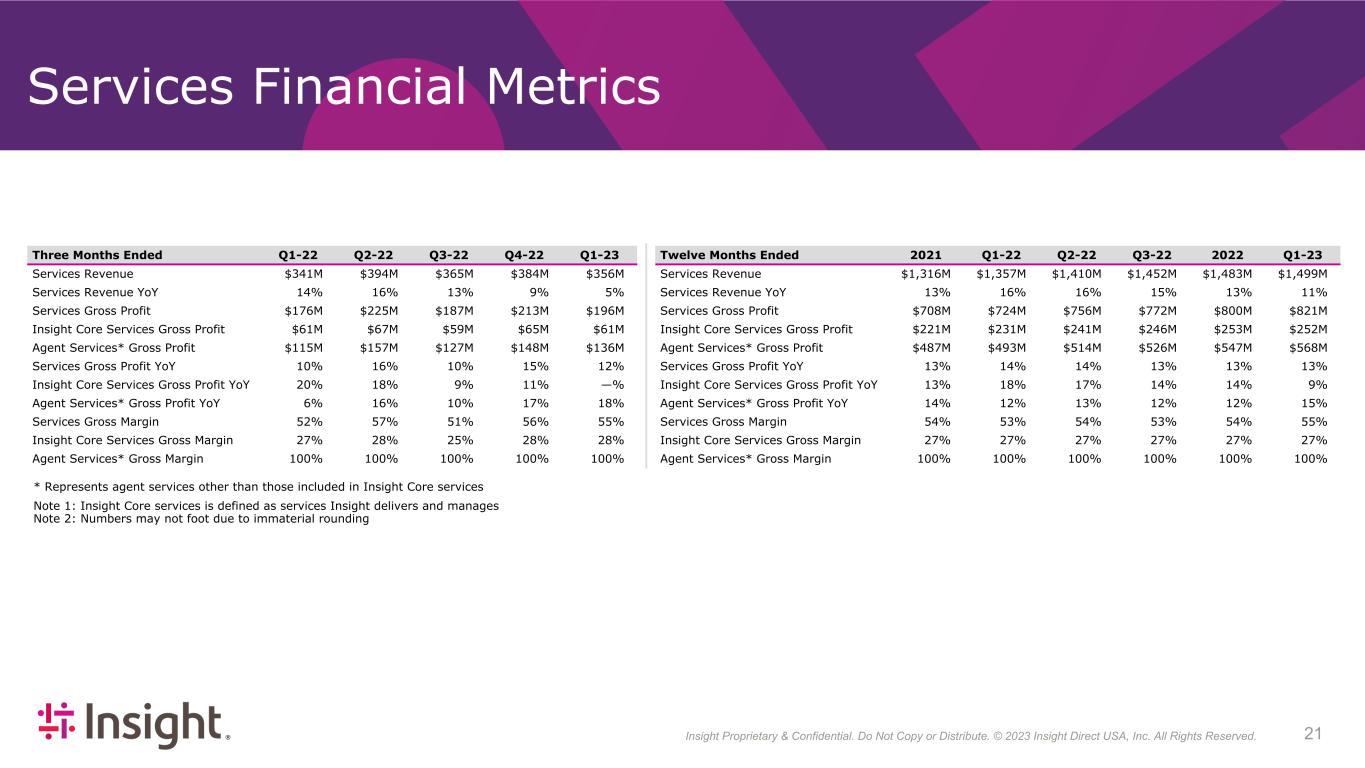

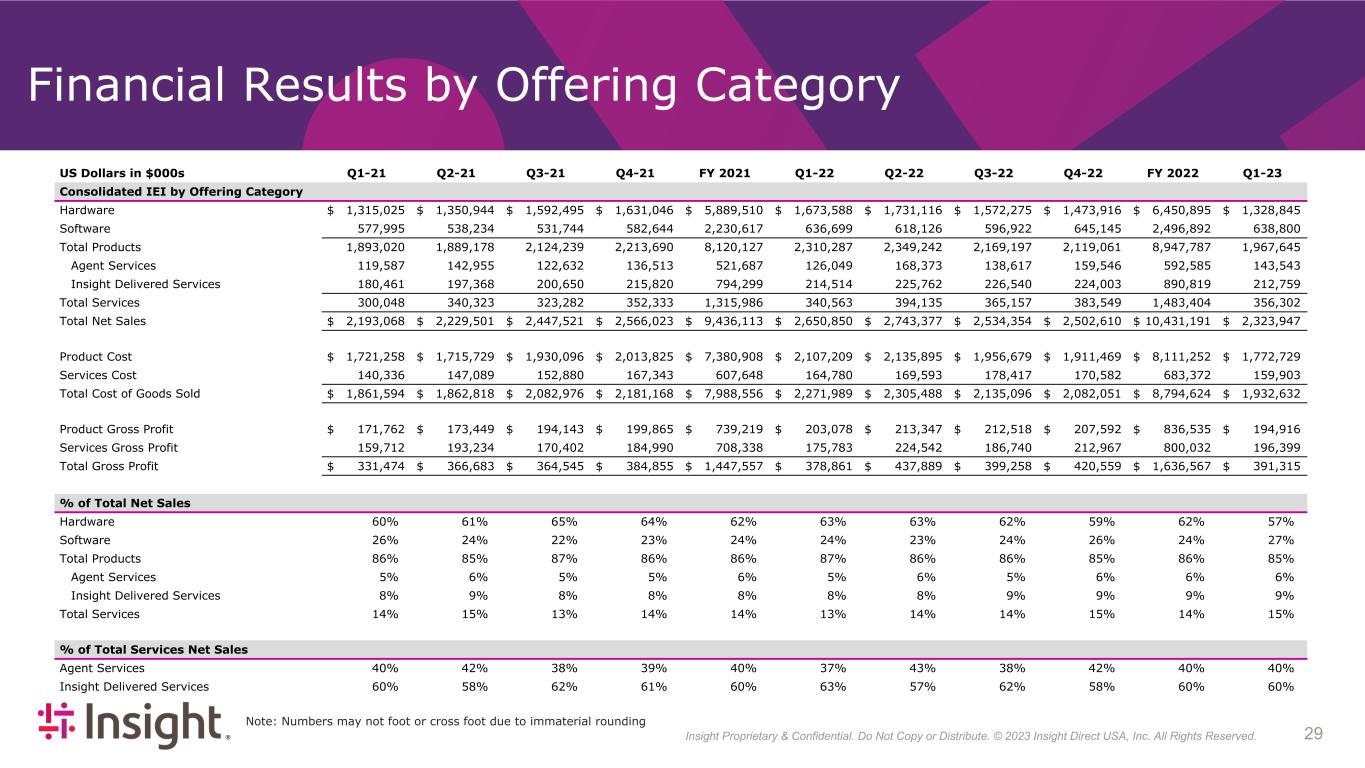

•Consolidated net sales for the first quarter of 2023 of $2.3 billion decreased 12%, year to year, when compared to the first quarter of 2022. Product net sales decreased 15%, year to year, and services net sales increased 5%, year over year.

•Net sales in North America decreased 11%, year to year, to $1.8 billion;

◦Product net sales decreased 14%, year to year, to $1.6 billion;

◦Services net sales increased 4%, year over year, to $283.5 million;

•Net sales in EMEA decreased 20%, year to year, to $427.0 million; and

•Net sales in APAC increased 15%, year over year, to $63.0 million.

•Excluding the effects of fluctuating foreign currency exchange rates, consolidated net sales decreased 11%, year to year, with declines in net sales in North America and EMEA of 11% and 13%, year to year, respectively, partially offset by growth in net sales in APAC of 21%, year over year.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- MORE - |

|

|

| Insight Enterprises, Inc. |

2701 E. Insight Way |

Chandler, Arizona 85286 |

800.467.4448 |

FAX 480.760.8958 |

•Consolidated gross profit increased to $391.3 million, an increase of 3% compared to the first quarter of 2022, with consolidated gross margin expanding 250 basis points to 16.8% of net sales. Product gross profit decreased 4%, year to year, and services gross profit increased 12%, year over year. Cloud gross profit increased 38% and Insight core services gross profit remained flat, year over year.

•Gross profit in North America increased 5%, year over year, to $315.1 million (17.2% record gross margin);

•Gross profit in EMEA decreased 6%, year to year, to $60.9 million (14.3% gross margin); and

•Gross profit in APAC increased 9%, year over year, to $15.3 million (24.3% gross margin).

•Excluding the effects of fluctuating foreign currency exchange rates, consolidated gross profit was up 5%, year over year, with gross profit growth in North America, EMEA and APAC of 5%, 1% and 14%, respectively, year over year.

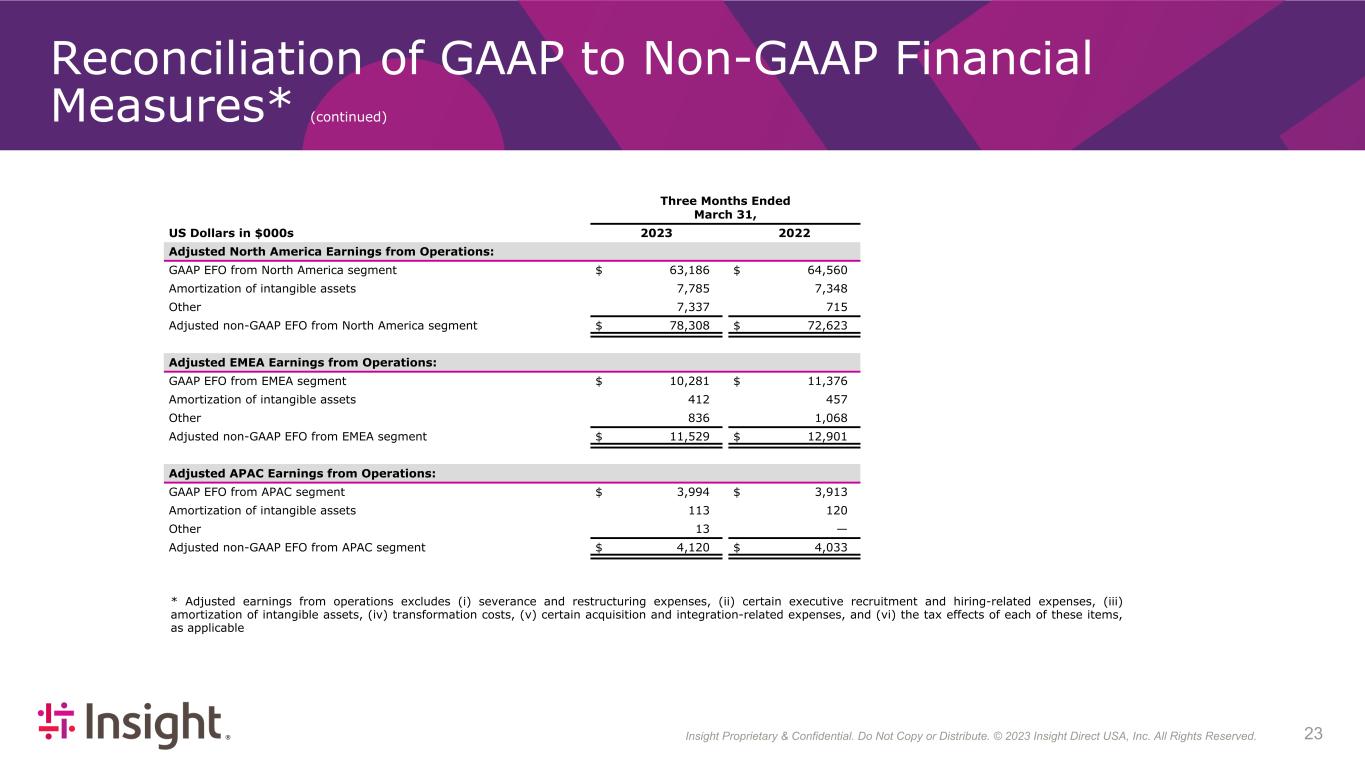

•Consolidated earnings from operations decreased 3% compared to the first quarter of 2022 to $77.5 million, or 3.3% of net sales.

•Earnings from operations in North America decreased 2%, year to year, to $63.2 million, or 3.4% of net sales;

•Earnings from operations in EMEA decreased 10%, year to year, to $10.3 million, or 2.4% of net sales; and

•Earnings from operations in APAC increased 2%, year over year, to $4.0 million, or 6.3% of net sales.

•Excluding the effects of fluctuating foreign currency exchange rates, consolidated earnings from operations were down 1%, year to year, with decreased earnings from operations in North America and EMEA of 1% and 4%, year to year, respectively, partially offset by increased earnings from operations in APAC of 5%, year over year.

•Adjusted earnings from operations increased 5% compared to the first quarter of 2022 to $94.0 million, or 4.0% of net sales.

•Adjusted earnings from operations in North America increased 8%, year over year, to $78.3 million, or 4.3% of net sales;

•Adjusted earnings from operations in EMEA decreased 11%, year to year, to $11.5 million, or 2.7% of net sales; and

•Adjusted earnings from operations in APAC increased 2%, year over year, to $4.1 million, or 6.5% of net sales.

•Excluding the effects of fluctuating foreign currency exchange rates, Adjusted consolidated earnings from operations were up 7%, year over year, with increased Adjusted earnings from operations in North America and APAC of 9% and 6%, respectively, year over year, partially offset by a decrease in Adjusted earnings from operations in EMEA of 5%, year to year.

•Consolidated net earnings and diluted earnings per share for the first quarter of 2023 were $50.0 million and $1.34, respectively, at an effective tax rate of 24.7%.

•Adjusted consolidated net earnings and Adjusted diluted earnings per share for the first quarter of 2023 were $62.3 million and $1.78, respectively. Excluding the effects of fluctuating foreign currency exchange rates, Adjusted diluted earnings per share was flat.

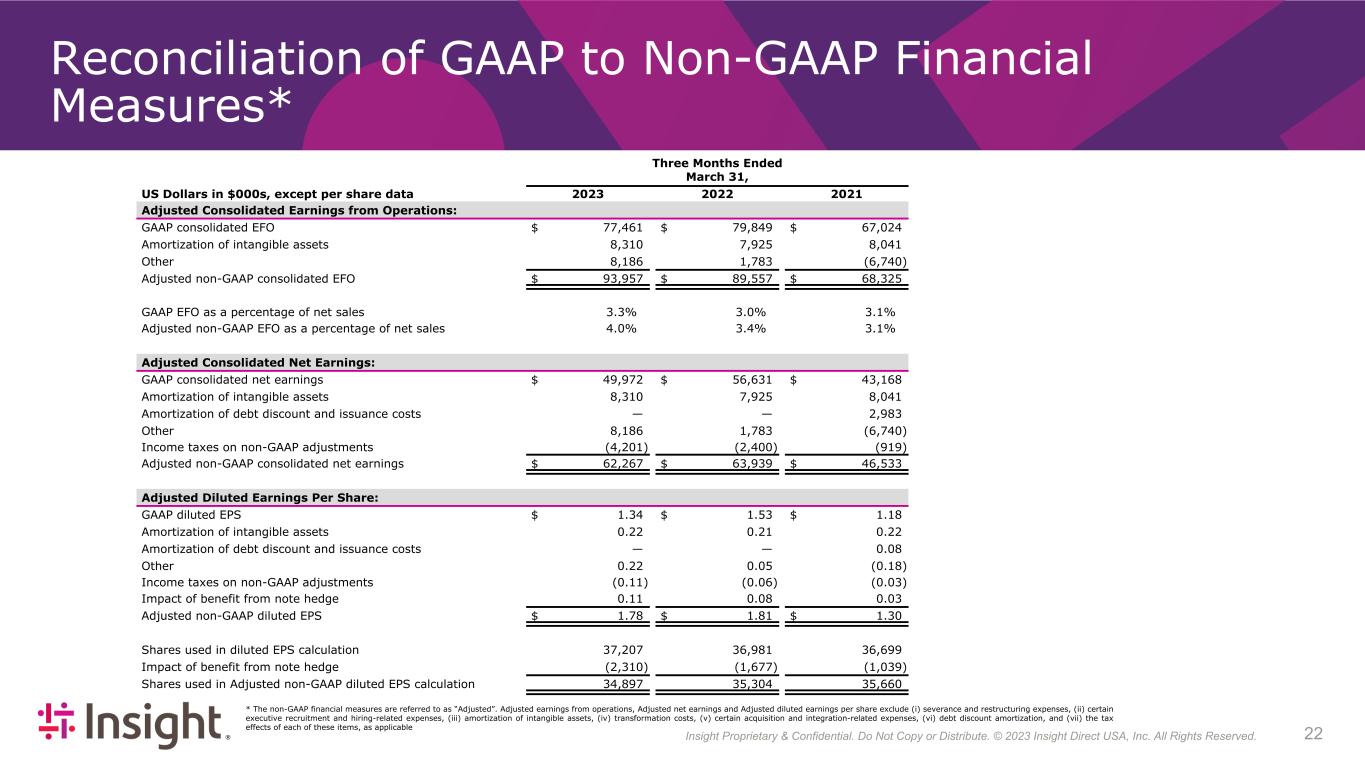

In discussing financial results for the three months ended March 31, 2023 and 2022 in this press release, the Company refers to certain financial measures that are adjusted from the financial results prepared in accordance with United States generally accepted accounting principles (“GAAP”). When referring to non-GAAP measures, the Company refers to them as “Adjusted.” See “Use of Non-GAAP Financial Measures” for additional information. A tabular reconciliation of financial measures prepared in accordance with GAAP to the non-GAAP financial measures is included at the end of this press release.

In some instances, the Company refers to changes in net sales, gross profit, earnings from operations and Adjusted earnings from operations on a consolidated basis and in North America, EMEA and APAC excluding the effects of fluctuating foreign currency exchange rates. In addition, the Company refers to changes in Adjusted diluted earnings per share on a consolidated basis excluding the effects of fluctuating foreign currency exchange rates. In computing these changes and percentages, the Company compares the current year amount as translated into U.S. dollars under the applicable accounting standards to the prior year amount in local currency translated into U.S. dollars utilizing the weighted average translation rate for the current period.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- MORE - |

|

|

| Insight Enterprises, Inc. |

2701 E. Insight Way |

Chandler, Arizona 85286 |

800.467.4448 |

FAX 480.760.8958 |

The tax effect of Adjusted amounts referenced herein were computed using the statutory tax rate for the taxing jurisdictions in the operating segment in which the related expenses were recorded, adjusted for the effects of valuation allowances on net operating losses in certain jurisdictions.

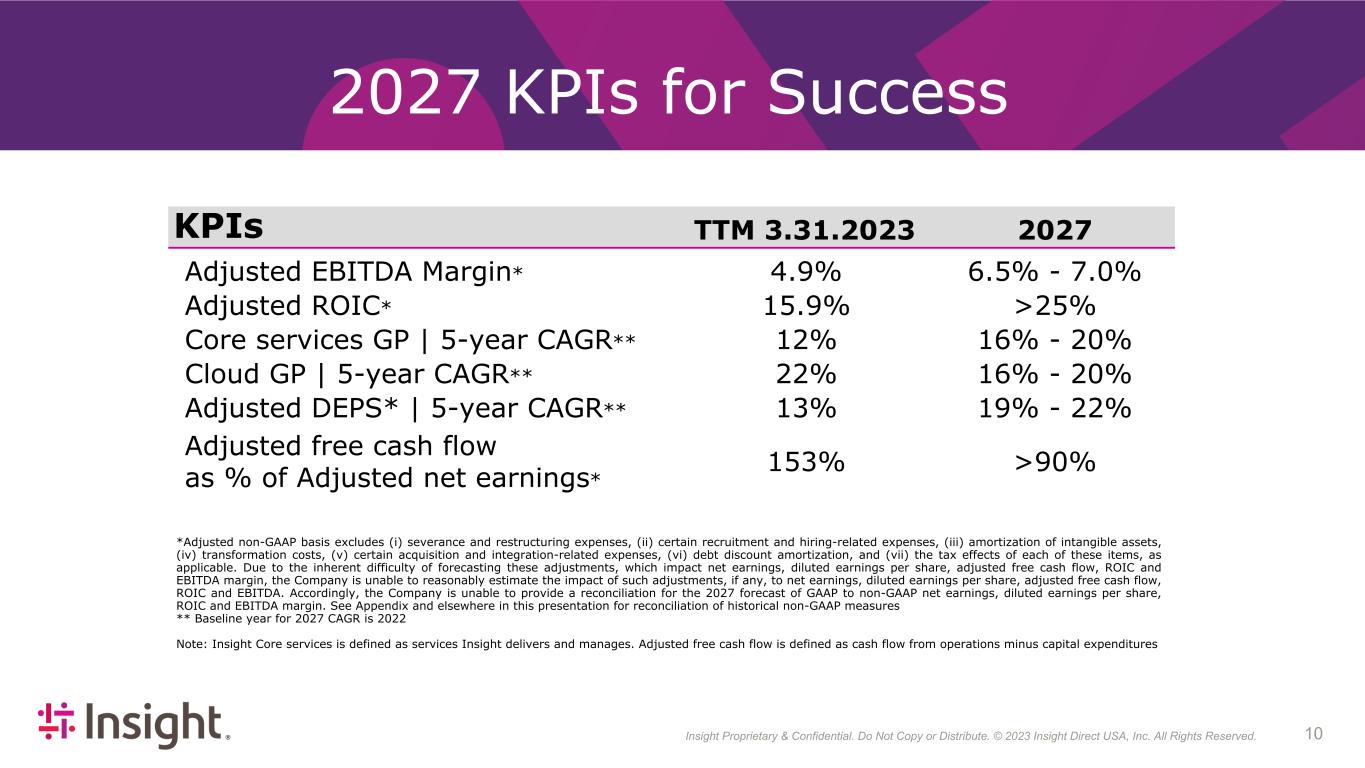

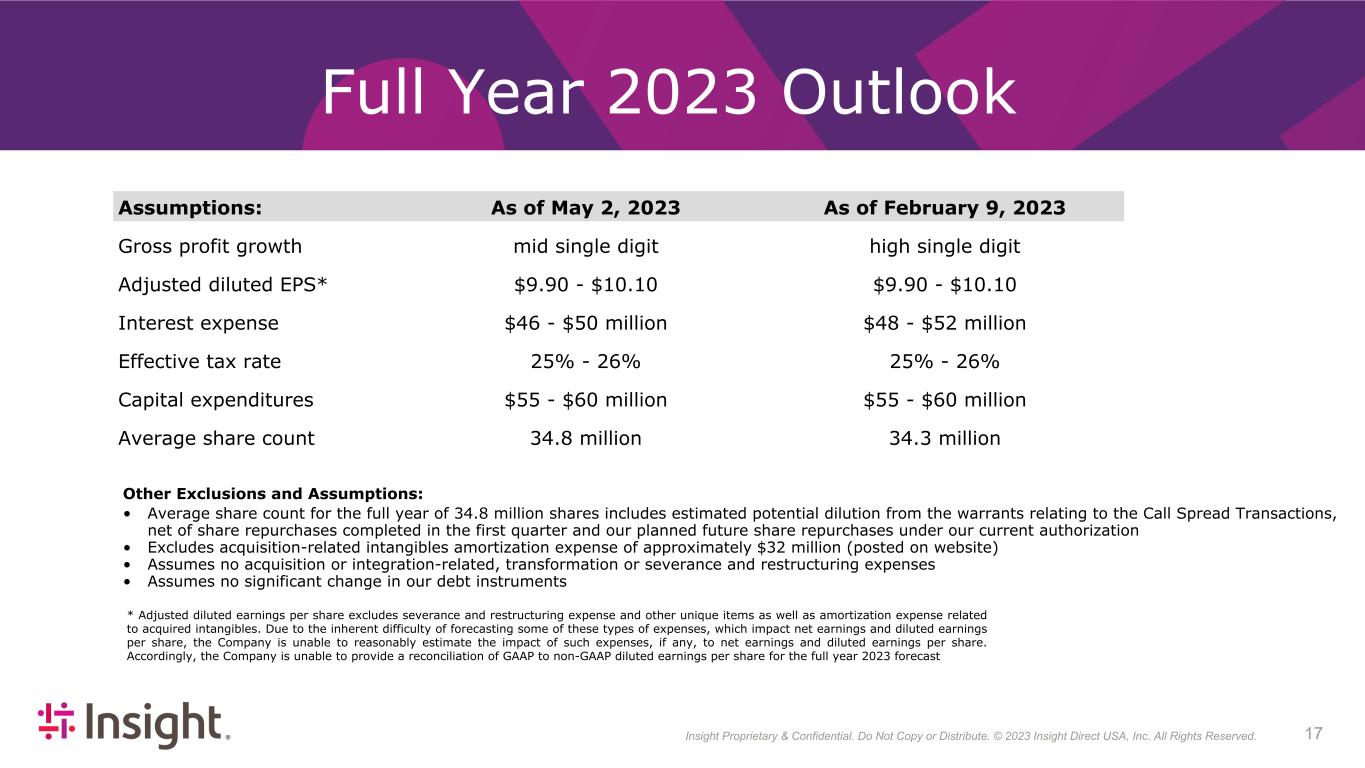

GUIDANCE

For the full year 2023, and consistent with our guidance given in February 2023, the Company expects Adjusted diluted earnings per share to be between $9.90 and $10.10. We now expect to deliver gross profit growth in the mid single digit range.

This outlook assumes:

•interest expense of $46 to $50 million;

•an effective tax rate of 25% to 26% for the full year;

•capital expenditures of $55 to $60 million; and

•an average share count for the full year of 34.8 million shares including estimated potential dilution from the warrants relating to the Call Spread Transactions (as defined below), net of share repurchases completed in the first quarter and our planned future share repurchases under our current authorization.

This outlook excludes acquisition-related intangibles amortization expense of approximately $32 million, assumes no acquisition or integration related expenses, transformation or severance and restructuring expenses, and no significant change in our debt instruments. Due to the inherent difficulty of forecasting some of these types of expenses, which impact net earnings, diluted earnings per share and selling and administrative expenses, the Company is unable to reasonably estimate the impact of such expenses, if any, to net earnings, diluted earnings per share and selling and administrative expenses. Accordingly, the Company is unable to provide a reconciliation of GAAP to non-GAAP diluted earnings per share for the full year 2023 forecast.

CONFERENCE CALL AND WEBCAST

The Company will host a conference call and live web cast today at 9:00 a.m. ET to discuss first quarter 2023 results of operations. A live web cast of the conference call (in listen-only mode) will be available on the Company’s web site at http://investor.insight.com/, and a replay of the web cast will be available on the Company’s web site for a limited time following the call. To access the live conference call, please register in advance using this event link. Upon registering, participants will receive dial-in information via email, as well as a unique registrant ID, event passcode, and detailed instructions regarding how to join the call.

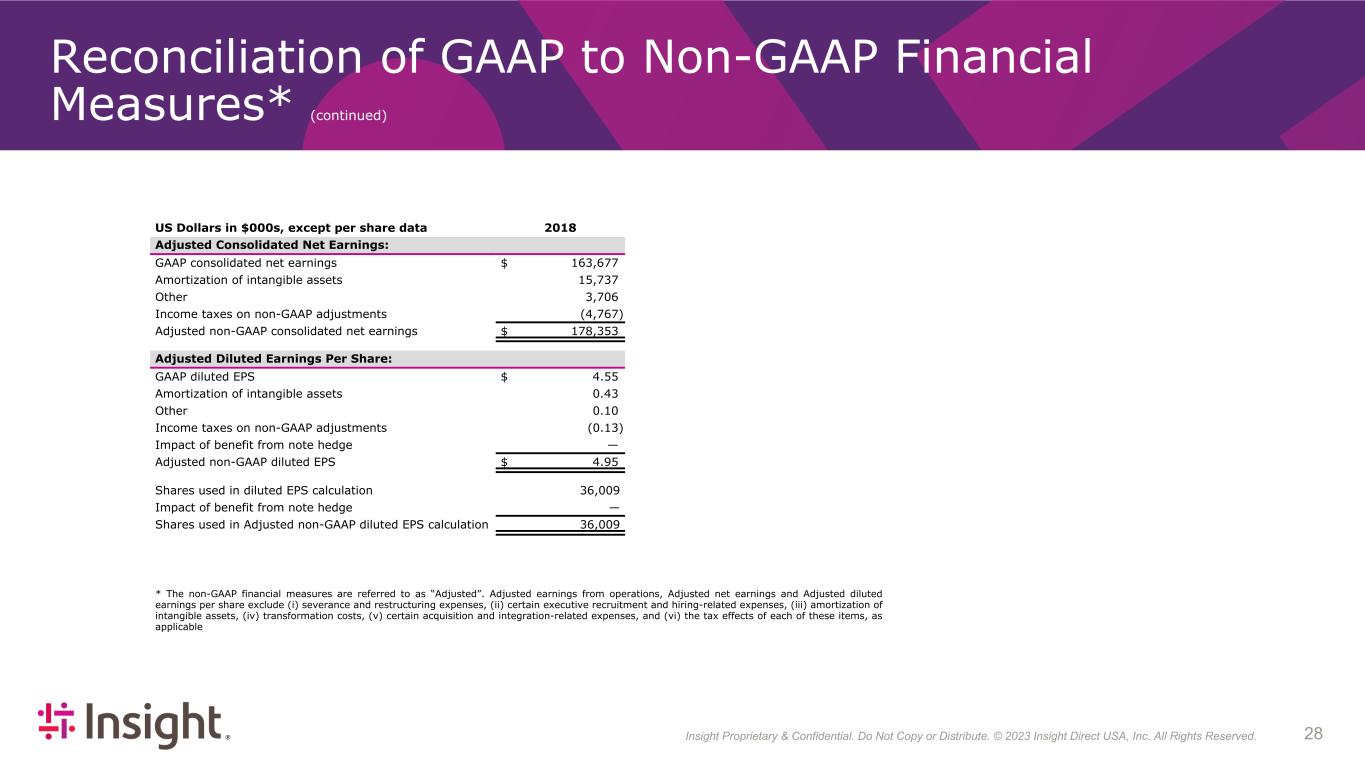

USE OF NON-GAAP FINANCIAL MEASURES

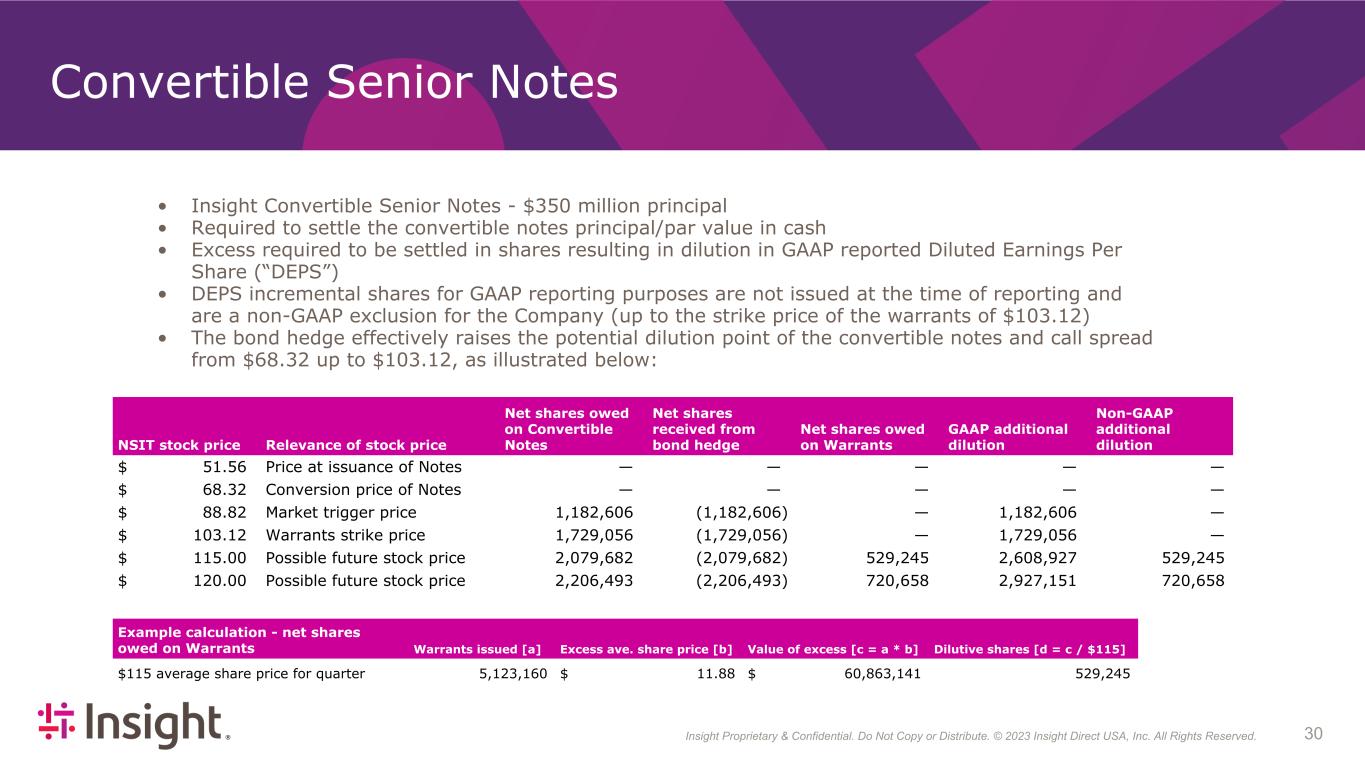

The non-GAAP financial measures are referred to as “Adjusted”. Adjusted earnings from operations, Adjusted net earnings and Adjusted diluted earnings per share exclude (i) severance and restructuring expenses, (ii) certain executive recruitment and hiring related expenses, (iii) amortization of intangible assets, (iv) transformation costs, (v) certain acquisition and integration related expenses, and (vi) the tax effects of each of these items, as applicable. Transformation costs represent costs we are incurring to transform our business, to help us achieve our strategic objectives, including becoming a leading solutions integrator. The Company excludes these items when internally evaluating earnings from operations, tax expense, net earnings and diluted earnings per share for the Company and earnings from operations for each of the Company’s operating segments. Adjusted diluted earnings per share also includes the impact of the benefit from the note hedge where the Company’s average stock price for the first quarter of 2023 was in excess of $68.32, which is the initial conversion price of the convertible senior notes. Adjusted EBITDA excludes (i) interest expense, (ii) income tax expense, (iii) depreciation and amortization of property and equipment, (iv) amortization of intangible assets, (v) severance and restructuring expenses (vi) certain executive recruitment and hiring related expenses, (vii) transformation costs and (viii) certain acquisition and integration related expenses. Adjusted return on invested capital (“ROIC”) excludes (i) severance and restructuring expenses, (ii) certain executive recruitment and hiring related expenses, (iii) amortization of intangible assets, (iv) transformation costs, (v) certain acquisition and integration related expenses and (vi) the tax effects of each of these items, as applicable.

These non-GAAP measures are used by the Company and its management to evaluate financial performance against budgeted amounts, to calculate incentive compensation, to assist in forecasting future performance and to compare the Company’s results to those of the Company’s competitors. The Company believes that these non-GAAP financial measures are useful to investors because they allow for greater transparency,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- MORE - |

|

|

| Insight Enterprises, Inc. |

2701 E. Insight Way |

Chandler, Arizona 85286 |

800.467.4448 |

FAX 480.760.8958 |

facilitate comparisons to prior periods and the Company’s competitors’ results and assist in forecasting performance for future periods. These non-GAAP financial measures are not prepared in accordance with GAAP and may be different from non-GAAP financial measures presented by other companies. Non-GAAP financial measures should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- MORE - |

|

|

| Insight Enterprises, Inc. |

2701 E. Insight Way |

Chandler, Arizona 85286 |

800.467.4448 |

FAX 480.760.8958 |

FINANCIAL SUMMARY TABLE

(DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA)

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

|

|

|

|

|

|

|

|

|

|

|

2023 |

|

2022 |

|

change |

|

|

|

|

|

|

|

|

| Insight Enterprises, Inc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net sales: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Products |

|

|

|

|

|

|

|

$ |

1,967,645 |

|

$ |

2,310,287 |

|

(15%) |

|

|

|

|

|

|

|

|

| Services |

|

|

|

|

|

|

|

$ |

356,302 |

|

$ |

340,563 |

|

5% |

|

|

|

|

|

|

|

|

| Total net sales |

|

|

|

|

|

|

|

$ |

2,323,947 |

|

$ |

2,650,850 |

|

(12%) |

|

|

|

|

|

|

|

|

| Gross profit |

|

|

|

|

|

|

|

$ |

391,315 |

|

$ |

378,861 |

|

3% |

|

|

|

|

|

|

|

|

| Gross margin |

|

|

|

|

|

|

|

16.8% |

|

14.3% |

|

250 bps |

|

|

|

|

|

|

|

|

| Selling and administrative expenses |

|

|

|

|

|

|

|

$ |

310,001 |

|

$ |

297,640 |

|

4% |

|

|

|

|

|

|

|

|

| Severance and restructuring expenses |

|

|

|

|

|

|

|

$ |

3,802 |

|

$ |

1,372 |

|

> 100% |

|

|

|

|

|

|

|

|

| Acquisition and integration related expenses |

|

|

|

|

|

|

|

$ |

51 |

|

$ |

— |

|

* |

|

|

|

|

|

|

|

|

| Earnings from operations |

|

|

|

|

|

|

|

$ |

77,461 |

|

$ |

79,849 |

|

(3%) |

|

|

|

|

|

|

|

|

| Net earnings |

|

|

|

|

|

|

|

$ |

49,972 |

|

$ |

56,631 |

|

(12%) |

|

|

|

|

|

|

|

|

| Diluted earnings per share |

|

|

|

|

|

|

|

$ |

1.34 |

|

$ |

1.53 |

|

(12%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| North America |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net sales: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Products |

|

|

|

|

|

|

|

$ |

1,550,436 |

|

$ |

1,792,866 |

|

(14%) |

|

|

|

|

|

|

|

|

| Services |

|

|

|

|

|

|

|

$ |

283,528 |

|

$ |

271,639 |

|

4% |

|

|

|

|

|

|

|

|

| Total net sales |

|

|

|

|

|

|

|

$ |

1,833,964 |

|

$ |

2,064,505 |

|

(11%) |

|

|

|

|

|

|

|

|

| Gross profit |

|

|

|

|

|

|

|

$ |

315,144 |

|

$ |

300,084 |

|

5% |

|

|

|

|

|

|

|

|

| Gross margin |

|

|

|

|

|

|

|

17.2% |

|

14.5% |

|

270 bps |

|

|

|

|

|

|

|

|

| Selling and administrative expenses |

|

|

|

|

|

|

|

$ |

248,820 |

|

$ |

235,220 |

|

6% |

|

|

|

|

|

|

|

|

| Severance and restructuring expenses |

|

|

|

|

|

|

|

$ |

3,087 |

|

$ |

304 |

|

> 100% |

|

|

|

|

|

|

|

|

| Acquisition and integration related expenses |

|

|

|

|

|

|

|

$ |

51 |

|

$ |

— |

|

* |

|

|

|

|

|

|

|

|

| Earnings from operations |

|

|

|

|

|

|

|

$ |

63,186 |

|

$ |

64,560 |

|

(2%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sales Mix |

|

|

|

|

|

|

|

|

|

|

|

** |

|

|

|

|

|

|

|

|

| Hardware |

|

|

|

|

|

|

|

63 |

% |

|

70 |

% |

|

(20%) |

|

|

|

|

|

|

|

|

| Software |

|

|

|

|

|

|

|

22 |

% |

|

17 |

% |

|

16% |

|

|

|

|

|

|

|

|

| Services |

|

|

|

|

|

|

|

15 |

% |

|

13 |

% |

|

4% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100 |

% |

|

100 |

% |

|

(11%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EMEA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net sales: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Products |

|

|

|

|

|

|

|

$ |

377,451 |

|

$ |

483,025 |

|

(22%) |

|

|

|

|

|

|

|

|

| Services |

|

|

|

|

|

|

|

$ |

49,553 |

|

$ |

48,408 |

|

2% |

|

|

|

|

|

|

|

|

| Total net sales |

|

|

|

|

|

|

|

$ |

427,004 |

|

$ |

531,433 |

|

(20%) |

|

|

|

|

|

|

|

|

| Gross profit |

|

|

|

|

|

|

|

$ |

60,888 |

|

$ |

64,770 |

|

(6%) |

|

|

|

|

|

|

|

|

| Gross margin |

|

|

|

|

|

|

|

14.3% |

|

12.2% |

|

210 bps |

|

|

|

|

|

|

|

|

| Selling and administrative expenses |

|

|

|

|

|

|

|

$ |

49,905 |

|

$ |

52,326 |

|

(5%) |

|

|

|

|

|

|

|

|

| Severance and restructuring expenses |

|

|

|

|

|

|

|

$ |

702 |

|

$ |

1,068 |

|

(34%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings from operations |

|

|

|

|

|

|

|

$ |

10,281 |

|

$ |

11,376 |

|

(10%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sales Mix |

|

|

|

|

|

|

|

|

|

|

|

** |

|

|

|

|

|

|

|

|

| Hardware |

|

|

|

|

|

|

|

38 |

% |

|

40 |

% |

|

(23%) |

|

|

|

|

|

|

|

|

| Software |

|

|

|

|

|

|

|

50 |

% |

|

51 |

% |

|

(21%) |

|

|

|

|

|

|

|

|

| Services |

|

|

|

|

|

|

|

12 |

% |

|

9 |

% |

|

2% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100 |

% |

|

100 |

% |

|

(20%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- MORE - |

|

|

| Insight Enterprises, Inc. |

2701 E. Insight Way |

Chandler, Arizona 85286 |

800.467.4448 |

FAX 480.760.8958 |

FINANCIAL SUMMARY TABLE (CONTINUED)

(DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA)

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

|

|

|

|

|

|

|

|

|

|

|

2023 |

|

2022 |

|

change |

|

|

|

|

|

|

|

|

| APAC |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net sales: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Products |

|

|

|

|

|

|

|

$ |

39,758 |

|

$ |

34,396 |

|

16% |

|

|

|

|

|

|

|

|

| Services |

|

|

|

|

|

|

|

$ |

23,221 |

|

$ |

20,516 |

|

13% |

|

|

|

|

|

|

|

|

| Total net sales |

|

|

|

|

|

|

|

$ |

62,979 |

|

$ |

54,912 |

|

15% |

|

|

|

|

|

|

|

|

| Gross profit |

|

|

|

|

|

|

|

$ |

15,283 |

|

$ |

14,007 |

|

9% |

|

|

|

|

|

|

|

|

| Gross margin |

|

|

|

|

|

|

|

24.3% |

|

25.5% |

|

(120 bps) |

|

|

|

|

|

|

|

|

| Selling and administrative expenses |

|

|

|

|

|

|

|

$ |

11,276 |

|

$ |

10,094 |

|

12% |

|

|

|

|

|

|

|

|

| Severance and restructuring expenses |

|

|

|

|

|

|

|

$ |

13 |

|

$ |

— |

|

* |

|

|

|

|

|

|

|

|

| Earnings from operations |

|

|

|

|

|

|

|

$ |

3,994 |

|

$ |

3,913 |

|

2% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sales Mix |

|

|

|

|

|

|

|

|

|

|

|

** |

|

|

|

|

|

|

|

|

| Hardware |

|

|

|

|

|

|

|

16 |

% |

|

21 |

% |

|

(11%) |

|

|

|

|

|

|

|

|

| Software |

|

|

|

|

|

|

|

47 |

% |

|

42 |

% |

|

29% |

|

|

|

|

|

|

|

|

| Services |

|

|

|

|

|

|

|

37 |

% |

|

37 |

% |

|

13% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100 |

% |

|

100 |

% |

|

15% |

|

|

|

|

|

|

|

|

* Percentage change not considered meaningful

** Change in sales mix represents growth/decline in category net sales on a U.S. dollar basis and does not exclude the effects of fluctuating foreign currency exchange rates

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- MORE - |

|

|

| Insight Enterprises, Inc. |

2701 E. Insight Way |

Chandler, Arizona 85286 |

800.467.4448 |

FAX 480.760.8958 |

FORWARD-LOOKING INFORMATION

Certain statements in this release and the related conference call, web cast and presentation are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements, including those related to the Company’s future responses to and the potential impact of coronavirus strain COVID-19 (“COVID-19”) on the Company, the impact of inflation and higher interest rates, the Company’s future financial performance and results of operations, including gross profit growth, Adjusted diluted earnings per share, and Adjusted selling and administrative expenses, the Company’s anticipated effective tax rate, capital expenditures, and expected average share count including our expectations for future planned share repurchases in 2023, the Company’s expectations that note holders will not convert the Company’s convertible senior notes in the near term, the Company’s expectations regarding cash flow, the Company’s expectations regarding current supply constraints and shipment of backlog, future trends in the IT market, the Company’s business strategy and strategic initiatives, which are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified. Future events and actual results could differ materially from those set forth in, contemplated by, or underlying the forward-looking statements. There can be no assurances that the results discussed by the forward-looking statements will be achieved, and actual results may differ materially from those set forth in the forward-looking statements. Some of the important factors that could cause the Company’s actual results to differ materially from those projected in any forward-looking statements include, but are not limited to, the following, which are discussed in the Company’s filings with the Securities and Exchange Commission (the “SEC”), including in the “Risk Factors” sections of the Company’s most recently filed periodic reports on Form 10-K and subsequent filings with the SEC:

•actions of our competitors, including manufacturers and publishers of products we sell;

•our reliance on our partners for product availability, competitive products to sell and marketing funds and purchasing incentives, which can change significantly in the amounts made available and in the requirements year over year;

•our ability to keep pace with rapidly evolving technological advances and the evolving competitive marketplace;

•general economic conditions, economic uncertainties and changes in geopolitical conditions, including the possibility of a recession or as a result of the ongoing war between Russia and Ukraine;

•changes in the IT industry and/or rapid changes in technology;

•our ability to provide high quality services to our clients;

•accounts receivable risks, including increased credit loss experience or extended payment terms with our clients;

•our reliance on independent shipping companies;

•the risks associated with our international operations;

•supply constraints for products;

•the duration and severity of the COVID-19 pandemic and its effects on our business, results of operations and financial condition, as well as the widespread outbreak of any other illnesses or communicable diseases;

•natural disasters or other adverse occurrences;

•disruptions in our IT systems and voice and data networks;

•cyberattacks or breaches of data privacy and security regulations;

•intellectual property infringement claims and challenges to our registered trademarks and trade names;

•legal proceedings, client audits and failure to comply with laws and regulations;

•failure to comply with the terms and conditions of our commercial and public sector contracts;

•exposure to changes in, interpretations of, or enforcement trends related to tax rules and regulations;

•our potential to draw down a substantial amount of indebtedness;

•the conditional conversion feature of our convertible senior notes (the “Notes”), which has been triggered, may adversely affect the Company’s financial condition and operating results;

•the Company is subject to counterparty risk with respect to certain hedge and warrant transactions entered into in connection with the issuance of the notes (the "Call Spread Transactions");

•increased debt and interest expense and the possibility of decreased availability of funds under our financing facilities;

•risks associated with the discontinuation of LIBOR as a benchmark rate;

•possible significant fluctuations in our future operating results as well as seasonality and variability in client demands;

•our dependence on certain key personnel and our ability to attract, train and retain skilled teammates;

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- MORE - |

|

|

| Insight Enterprises, Inc. |

2701 E. Insight Way |

Chandler, Arizona 85286 |

800.467.4448 |

FAX 480.760.8958 |

•risks associated with the integration and operation of acquired businesses, including achievement of expected synergies and benefits; and

•future sales of the Company’s common stock or equity-linked securities in the public market could lower the market price for our common stock.

Additionally, there may be other risks that are otherwise described from time to time in the reports that the Company files with the SEC. Any forward-looking statements in this release, the related conference call, webcast and presentation speak only as of the date on which they are made and should be considered in light of various important factors, including the risks and uncertainties listed above, as well as others. The Company assumes no obligation to update, and, except as may be required by law, does not intend to update, any forward-looking statements. The Company does not endorse any projections regarding future performance that may be made by third parties.

|

|

|

|

|

|

|

|

|

CONTACT: |

GLYNIS BRYAN |

|

|

CHIEF FINANCIAL OFFICER |

|

|

TEL. 480.333.3390 |

|

|

EMAIL glynis.bryan@insight.com |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- MORE - |

|

|

| Insight Enterprises, Inc. |

2701 E. Insight Way |

Chandler, Arizona 85286 |

800.467.4448 |

FAX 480.760.8958 |

INSIGHT ENTERPRISES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(IN THOUSANDS, EXCEPT PER SHARE DATA)

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

|

|

|

|

2023 |

|

2022 |

|

|

|

|

|

|

|

|

| Net sales: |

|

|

|

|

|

|

|

|

|

|

|

| Products |

$ |

1,967,645 |

|

|

$ |

2,310,287 |

|

|

|

|

|

|

|

|

|

| Services |

356,302 |

|

|

340,563 |

|

|

|

|

|

|

|

|

|

| Total net sales |

2,323,947 |

|

|

2,650,850 |

|

|

|

|

|

|

|

|

|

| Costs of goods sold: |

|

|

|

|

|

|

|

|

|

|

|

| Products |

1,772,729 |

|

|

2,107,209 |

|

|

|

|

|

|

|

|

|

| Services |

159,903 |

|

|

164,780 |

|

|

|

|

|

|

|

|

|

| Total costs of goods sold |

1,932,632 |

|

|

2,271,989 |

|

|

|

|

|

|

|

|

|

| Gross profit |

391,315 |

|

|

378,861 |

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

| Selling and administrative expenses |

310,001 |

|

|

297,640 |

|

|

|

|

|

|

|

|

|

| Severance and restructuring expenses |

3,802 |

|

|

1,372 |

|

|

|

|

|

|

|

|

|

| Acquisition and integration related expenses |

51 |

|

|

— |

|

|

|

|

|

|

|

|

|

| Earnings from operations |

77,461 |

|

|

79,849 |

|

|

|

|

|

|

|

|

|

| Non-operating (income) expense: |

|

|

|

|

|

|

|

|

|

|

|

| Interest expense, net |

10,348 |

|

|

8,068 |

|

|

|

|

|

|

|

|

|

| Other expense (income), net |

752 |

|

|

(2,843) |

|

|

|

|

|

|

|

|

|

| Earnings before income taxes |

66,361 |

|

|

74,624 |

|

|

|

|

|

|

|

|

|

| Income tax expense |

16,389 |

|

|

17,993 |

|

|

|

|

|

|

|

|

|

| Net earnings |

$ |

49,972 |

|

|

$ |

56,631 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

| Basic |

$ |

1.48 |

|

|

$ |

1.62 |

|

|

|

|

|

|

|

|

|

| Diluted |

$ |

1.34 |

|

|

$ |

1.53 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shares used in per share calculations: |

|

|

|

|

|

|

|

|

|

|

|

| Basic |

33,706 |

|

|

34,974 |

|

|

|

|

|

|

|

|

|

| Diluted |

37,207 |

|

|

36,981 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- MORE - |

|

|

| Insight Enterprises, Inc. |

2701 E. Insight Way |

Chandler, Arizona 85286 |

800.467.4448 |

FAX 480.760.8958 |

INSIGHT ENTERPRISES, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(In THOUSANDS)

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31,

2023 |

|

December 31,

2022 |

| ASSETS |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

175,726 |

|

|

$ |

163,637 |

|

| Accounts receivable, net |

3,087,105 |

|

|

3,272,371 |

|

| Inventories |

265,570 |

|

|

265,154 |

|

| Other current assets |

217,415 |

|

|

199,506 |

|

| Total current assets |

3,745,816 |

|

|

3,900,668 |

|

|

|

|

|

| Property and equipment, net |

200,969 |

|

|

204,260 |

|

| Goodwill |

493,724 |

|

|

493,033 |

|

| Intangible assets, net |

196,879 |

|

|

204,998 |

|

| Other assets |

323,140 |

|

|

309,622 |

|

|

$ |

4,960,528 |

|

|

$ |

5,112,581 |

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable – trade |

$ |

1,711,878 |

|

|

$ |

1,785,076 |

|

| Accounts payable – inventory financing facilities |

410,126 |

|

|

301,314 |

|

| Accrued expenses and other current liabilities |

415,519 |

|

|

433,789 |

|

| Current portion of long-term debt |

346,672 |

|

|

346,228 |

|

| Total current liabilities |

2,884,195 |

|

|

2,866,407 |

|

|

|

|

|

| Long-term debt |

168,875 |

|

|

291,672 |

|

| Deferred income taxes |

28,728 |

|

|

32,844 |

|

| Other liabilities |

305,132 |

|

|

283,590 |

|

|

3,386,930 |

|

|

3,474,513 |

|

| Stockholders’ equity: |

|

|

|

| Preferred stock |

— |

|

|

— |

|

| Common stock |

333 |

|

|

340 |

|

| Additional paid-in capital |

317,283 |

|

|

327,872 |

|

| Retained earnings |

1,310,178 |

|

|

1,368,658 |

|

Accumulated other comprehensive loss – foreign currency translation adjustments |

(54,196) |

|

|

(58,802) |

|

| Total stockholders’ equity |

1,573,598 |

|

|

1,638,068 |

|

|

$ |

4,960,528 |

|

|

$ |

5,112,581 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- MORE - |

|

|

| Insight Enterprises, Inc. |

2701 E. Insight Way |

Chandler, Arizona 85286 |

800.467.4448 |

FAX 480.760.8958 |

INSIGHT ENTERPRISES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(IN THOUSANDS)

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

2023 |

|

2022 |

| Cash flows from operating activities: |

|

|

|

| Net earnings |

$ |

49,972 |

|

|

$ |

56,631 |

|

| Adjustments to reconcile net earnings to net cash provided by (used in) operating activities: |

|

|

|

| Depreciation and amortization |

14,663 |

|

|

13,314 |

|

| Provision for losses on accounts receivable |

1,484 |

|

|

1,031 |

|

| Non-cash stock-based compensation |

6,896 |

|

|

5,007 |

|

| Deferred income taxes |

(4,284) |

|

|

(1,715) |

|

| Amortization of debt issuance costs |

1,213 |

|

|

1,623 |

|

| Other adjustments |

2,122 |

|

|

(106) |

|

| Changes in assets and liabilities: |

|

|

|

| Decrease (increase) in accounts receivable |

197,918 |

|

|

(103,326) |

|

| Increase in inventories |

(1,146) |

|

|

(57,876) |

|

| (Increase) decrease in other assets |

(22,794) |

|

|

4,111 |

|

| Decrease in accounts payable |

(76,783) |

|

|

(137,144) |

|

| Decrease in accrued expenses and other liabilities |

(9,101) |

|

|

(65,789) |

|

| Net cash provided by (used in) operating activities: |

160,160 |

|

|

(284,239) |

|

| Cash flows from investing activities: |

|

|

|

|

|

|

|

| Purchases of property and equipment |

(9,106) |

|

|

(25,745) |

|

|

|

|

|

| Net cash used in investing activities: |

(9,106) |

|

|

(25,745) |

|

| Cash flows from financing activities: |

|

|

|

| Borrowings on ABL revolving credit facility |

1,016,980 |

|

|

1,151,440 |

|

| Repayments on ABL revolving credit facility |

(1,140,774) |

|

|

(831,440) |

|

| Net borrowings under inventory financing facilities |

108,257 |

|

|

6,692 |

|

| Repurchases of common stock |

(117,129) |

|

|

— |

|

| Other payments |

(7,988) |

|

|

(6,738) |

|

| Net cash (used in) provided by financing activities: |

(140,654) |

|

|

319,954 |

|

| Foreign currency exchange effect on cash, cash equivalents and restricted cash balances |

1,652 |

|

|

969 |

|

| Increase in cash, cash equivalents and restricted cash |

12,052 |

|

|

10,939 |

|

| Cash, cash equivalents and restricted cash at beginning of period |

165,718 |

|

|

105,977 |

|

| Cash, cash equivalents and restricted cash at end of period |

$ |

177,770 |

|

|

$ |

116,916 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- MORE - |

|

|

| Insight Enterprises, Inc. |

2701 E. Insight Way |

Chandler, Arizona 85286 |

800.467.4448 |

FAX 480.760.8958 |

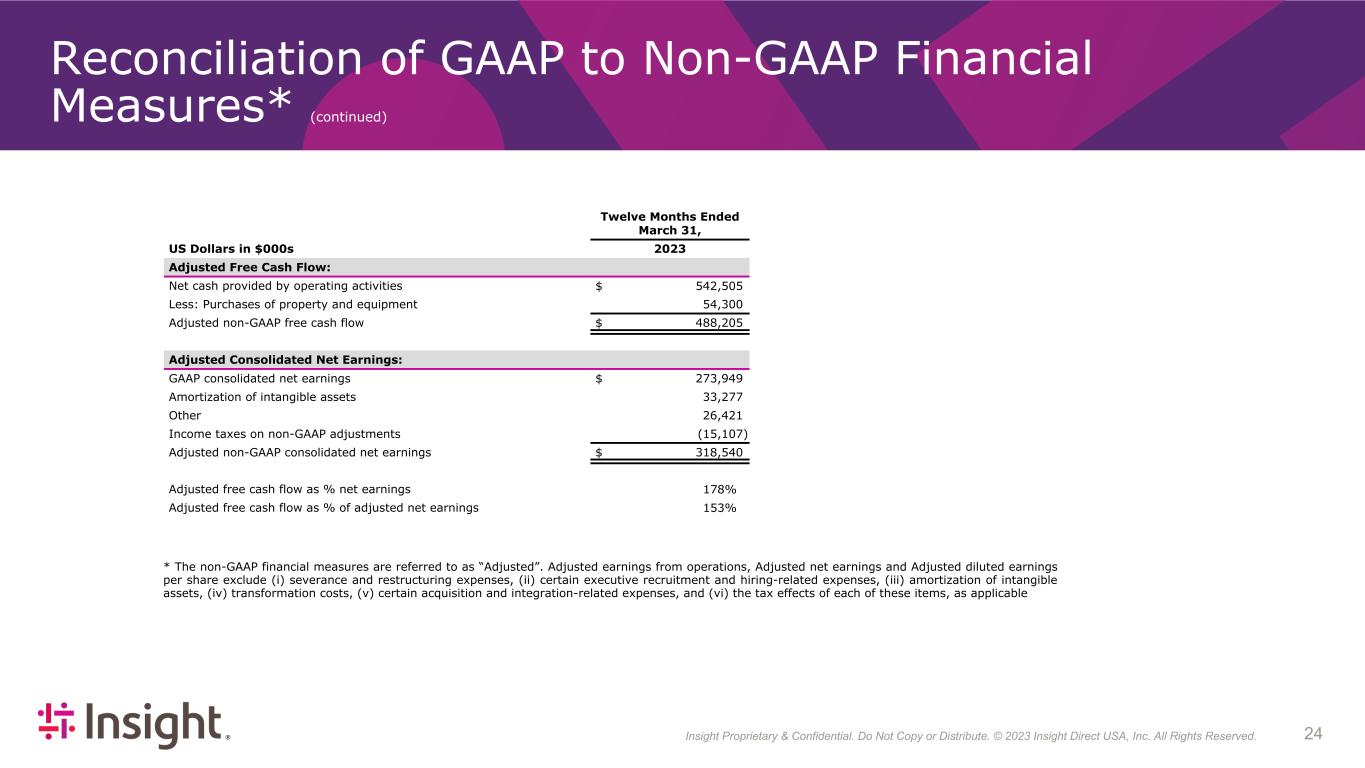

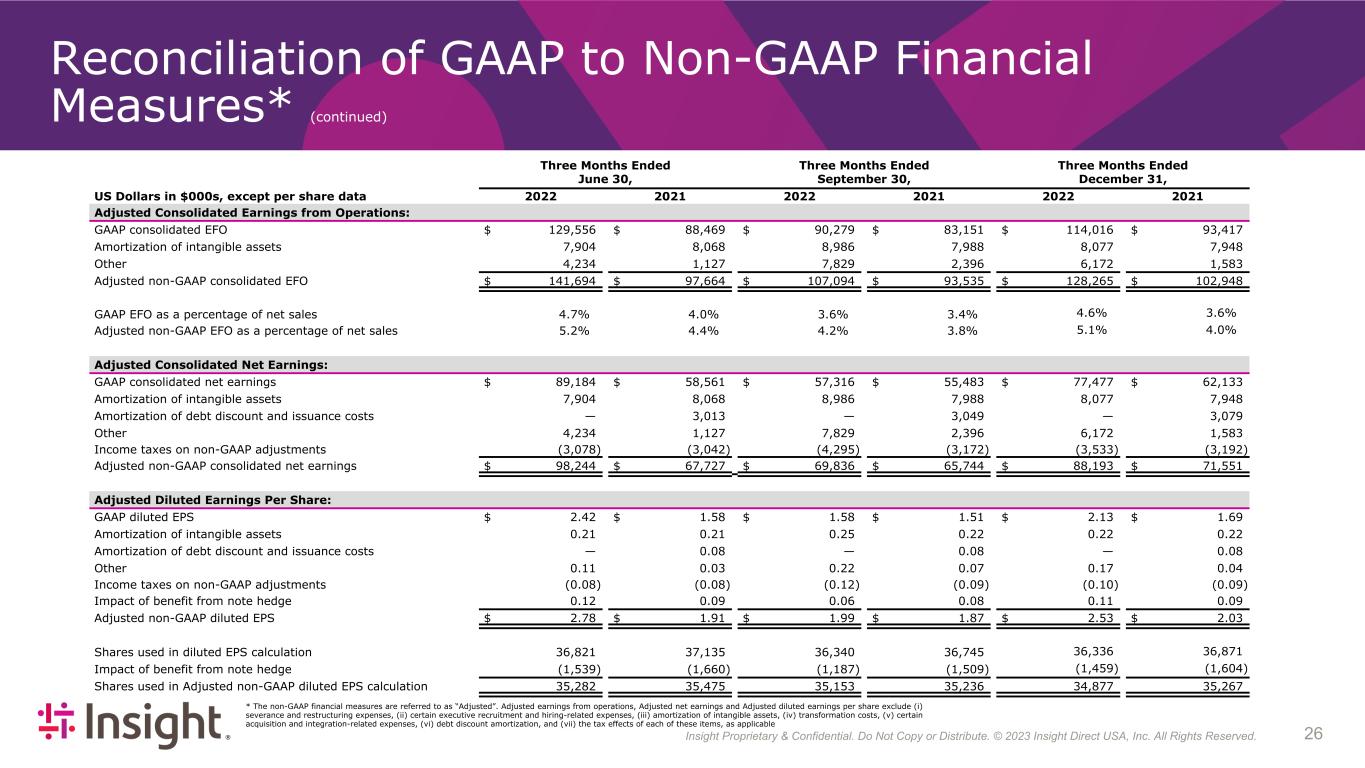

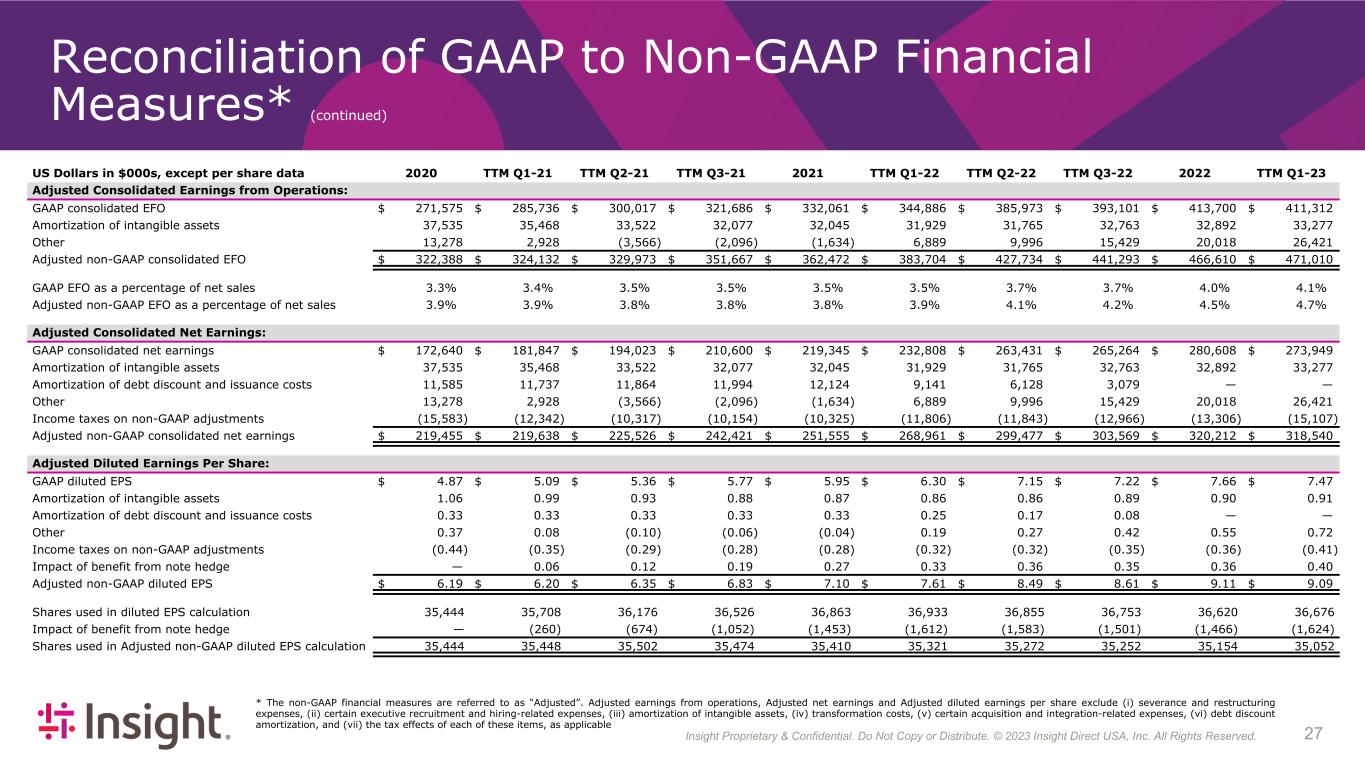

INSIGHT ENTERPRISES, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(IN THOUSANDS, EXCEPT PER SHARE DATA)

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

|

|

|

|

|

2023 |

|

2022 |

|

|

|

|

|

|

|

|

| Adjusted Consolidated Earnings from Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP consolidated EFO |

|

$ |

77,461 |

|

$ |

79,849 |

|

|

|

|

|

|

|

|

| Amortization of intangible assets |

|

8,310 |

|

7,925 |

|

|

|

|

|

|

|

|

| Other |

|

8,186 |

|

1,783 |

|

|

|

|

|

|

|

|

| Adjusted non-GAAP consolidated EFO |

|

$ |

93,957 |

|

$ |

89,557 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP EFO as a percentage of net sales |

|

3.3% |

|

3.0% |

|

|

|

|

|

|

|

|

| Adjusted non-GAAP EFO as a percentage of net sales |

|

4.0% |

|

3.4% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Consolidated Net Earnings: |

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP consolidated net earnings |

|

$ |

49,972 |

|

$ |

56,631 |

|

|

|

|

|

|

|

|

| Amortization of intangible assets |

|

8,310 |

|

7,925 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other |

|

8,186 |

|

1,783 |

|

|

|

|

|

|

|

|

| Income taxes on non-GAAP adjustments |

|

(4,201) |

|

(2,400) |

|

|

|

|

|

|

|

|

| Adjusted non-GAAP consolidated net earnings |

|

$ |

62,267 |

|

$ |

63,939 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Diluted Earnings Per Share: |

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP diluted EPS |

|

$ |

1.34 |

|

|

$ |

1.53 |

|

|

|

|

|

|

|

|

|

| Amortization of intangible assets |

|

0.22 |

|

|

0.21 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other |

|

0.22 |

|

|

0.05 |

|

|

|

|

|

|

|

|

|

| Income taxes on non-GAAP adjustments |

|

(0.11) |

|

|

(0.06) |

|

|

|

|

|

|

|

|

|

| Impact of benefit from note hedge |

|

0.11 |

|

|

0.08 |

|

|

|

|

|

|

|

|

|

| Adjusted non-GAAP diluted EPS |

|

$ |

1.78 |

|

|

$ |

1.81 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shares used in diluted EPS calculation |

|

37,207 |

|

36,981 |

|

|

|

|

|

|

|

|

| Impact of benefit from note hedge |

|

(2,310) |

|

(1,677) |

|

|

|

|

|

|

|

|

| Shares used in Adjusted non-GAAP diluted EPS calculation |

|

34,897 |

|

35,304 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted North America Earnings from Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP EFO from North America segment |

|

$ |

63,186 |

|

|

$ |

64,560 |

|

|

|

|

|

|

|

|

|

| Amortization of intangible assets |

|

7,785 |

|

|

7,348 |

|

|

|

|

|

|

|

|

|

| Other |

|

7,337 |

|

|

715 |

|

|

|

|

|

|

|

|

|

| Adjusted non-GAAP EFO from North America segment |

|

$ |

78,308 |

|

|

$ |

72,623 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP EFO as a percentage of net sales |

|

3.4 |

% |

|

3.1 |

% |

|

|

|

|

|

|

|

|

| Adjusted non-GAAP EFO as a percentage of net sales |

|

4.3 |

% |

|

3.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- MORE - |

|

|

| Insight Enterprises, Inc. |

2701 E. Insight Way |

Chandler, Arizona 85286 |

800.467.4448 |

FAX 480.760.8958 |

INSIGHT ENTERPRISES, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES (CONTINUED)

(IN THOUSANDS, EXCEPT PER SHARE DATA)

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

|

|

|

|

|

2023 |

|

2022 |

|

|

|

|

|

|

|

|

| Adjusted EMEA Earnings from Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP EFO from EMEA segment |

|

$ |

10,281 |

|

|

$ |

11,376 |

|

|

|

|

|

|

|

|

|

| Amortization of intangible assets |

|

412 |

|

|

457 |

|

|

|

|

|

|

|

|

|

| Other |

|

836 |

|

|

1,068 |

|

|

|

|

|

|

|

|

|

| Adjusted non-GAAP EFO from EMEA segment |

|

$ |

11,529 |

|

|

$ |

12,901 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP EFO as a percentage of net sales |

|

2.4 |

% |

|

2.1 |

% |

|

|

|

|

|

|

|

|

| Adjusted non-GAAP EFO as a percentage of net sales |

|

2.7 |

% |

|

2.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted APAC Earnings from Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP EFO from APAC segment |

|

$ |

3,994 |

|

|

$ |

3,913 |

|

|

|

|

|

|

|

|

|

| Amortization of intangible assets |

|

113 |

|

|

120 |

|

|

|

|

|

|

|

|

|

| Other |

|

13 |

|

|

— |

|

|

|

|

|

|

|

|

|

| Adjusted non-GAAP EFO from APAC segment |

|

$ |

4,120 |

|

|

$ |

4,033 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP EFO as a percentage of net sales |

|

6.3 |

% |

|

7.1 |

% |

|

|

|

|

|

|

|

|

| Adjusted non-GAAP EFO as a percentage of net sales |

|

6.5 |

% |

|

7.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP consolidated net earnings |

|

$ |

49,972 |

|

$ |

56,631 |

|

|

|

|

|

|

|

|

| Interest expense |

|

11,688 |

|

8,348 |

|

|

|

|

|

|

|

|

| Income tax expense |

|

16,389 |

|

17,993 |

|

|

|

|

|

|

|

|

| Depreciation and amortization of property and equipment |

|

6,353 |

|

5,389 |

|

|

|

|

|

|

|

|

| Amortization of intangible assets |

|

8,310 |

|

7,925 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other |

|

8,186 |

|

1,783 |

|

|

|

|

|

|

|

|

| Adjusted non-GAAP EBITDA |

|

$ |

100,898 |

|

$ |

98,069 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP consolidated net earnings as a percentage of net sales |

|

2.2% |

|

2.1% |

|

|

|

|

|

|

|

|

| Adjusted non-GAAP EBITDA as a percentage of net sales |

|

4.3% |

|

3.7% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- MORE - |

|

|

| Insight Enterprises, Inc. |

2701 E. Insight Way |

Chandler, Arizona 85286 |

800.467.4448 |

FAX 480.760.8958 |

INSIGHT ENTERPRISES, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES (CONTINUED)

(IN THOUSANDS, EXCEPT PER SHARE DATA)

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Twelve Months Ended

March 31,

|

|

|

2023 |

|

2022 |

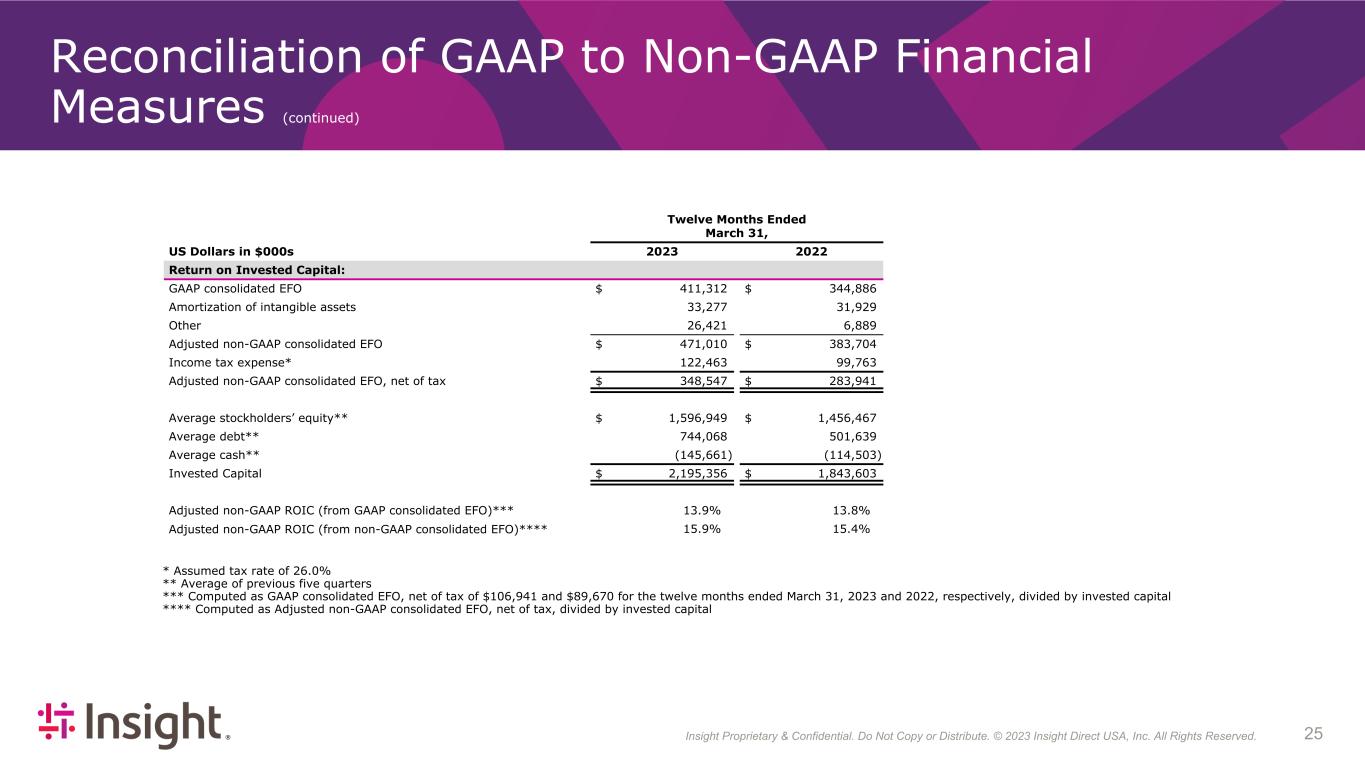

| Adjusted return on invested capital: |

|

|

|

|

| GAAP consolidated EFO |

|

$ |

411,312 |

|

$ |

344,886 |

| Amortization of intangible assets |

|

33,277 |

|

31,929 |

| Other |

|

26,421 |

|

6,889 |

| Adjusted non-GAAP consolidated EFO |

|

471,010 |

|

383,704 |

| Income tax expense* |

|

122,463 |

|

99,763 |

| Adjusted non-GAAP consolidated EFO, net of tax |

|

$ |

348,547 |

|

$ |

283,941 |

| Average stockholders’ equity** |

|

$ |

1,596,949 |

|

$ |

1,456,467 |

| Average debt** |

|

744,068 |

|

501,639 |

| Average cash** |

|

(145,661) |

|

(114,503) |

| Invested Capital |

|

$ |

2,195,356 |

|

$ |

1,843,603 |

|

|

|

|

|

| Adjusted non-GAAP ROIC (from GAAP consolidated EFO) *** |

|

13.86 |

% |

|

13.84 |

% |

Adjusted non-GAAP ROIC (from non-GAAP consolidated EFO) **** |

|

15.88 |

% |

|

15.40 |

% |

* Assumed tax rate of 26.0%.

** Average of previous five quarters.

*** Computed as GAAP consolidated EFO, net of tax of $106,941 and $89,670 for the twelve months ended March 31, 2023 and 2022, respectively, divided by invested capital.

**** Computed as Adjusted non-GAAP consolidated EFO, net of tax, divided by invested capital.