TABLE OF CONTENTS Legal Disclosures 3 Guiding Principles & Social Impact 4– 5 Business First Bancshares, Inc. Overview 6 – 11 Liquidity and Deposits 12 Securities Portfolio 13 Branches & Noninterest Revenue 14 – 15 Financial Results Q1 2025 Financial Results 17 – 18 Stable Credit Performance 19 Yield/Rate Analysis 20 – 22 Loan Portfolio Operating Loan Growth 24 Loan Composition 25 – 28 Appendix 30 – 37

Special Note Concerning Forward-Looking Statements This investor presentation contains “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact are forward-looking statements. You can identify these forward-looking statements in some cases through the Company’s use of words such as “believes,” “anticipates,” “expects,” “may,” “will,” “assumes,” “should,” “predicts,” “could,” “would,” “intends,” “targets,” “estimates,” “projects,” “plans,” “potential” and other similar words and expressions of the future or otherwise regarding the Company’s future business and financial performance and/or the performance of the banking and mortgage industry and economy in general. Forward-looking statements are based on the information known to, and current beliefs and expectations of, the Company’s management and are subject to significant risks and uncertainties. Actual results may differ materially from those contemplated by such forward-looking statements. A number of important factors could cause actual results to differ materially from those contemplated by the forward-looking statements in this presentation including, without limitation, the risks set forth in “Forward Looking Statements” and “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024, filed with the SEC on March 7, 2025 (as may be amended in the Company’s Quarterly Reports on Form 10-Q). Many of these factors are difficult to foresee and are beyond the Company’s ability to control or predict. The Company believes the forward-looking statements contained herein are reasonable; however, undue reliance should not be placed on any forward-looking statements, which are based on current expectations and speak only as of the date that they are made. The Company does not assume any obligation to update any forward-looking statements as a result of new information, future developments or otherwise, except as otherwise may be required by law. Non-GAAP Financial Measures This presentation includes certain financial measures that are not measures recognized under U.S. generally accepted accounting principles (“GAAP”) and therefore are considered non-GAAP financial measures. The Company’s management uses these non-GAAP financial measures in their analysis of the Company’s performance, financial condition and the efficiency of its operations. Management believes that these non-GAAP financial measures provide a greater understanding of the ongoing operations and enhance comparability of results with prior periods. The Company’s management also believes that investors find these non-GAAP financial measures useful as they assist investors in understanding the Company’s underlying operating performance and the analysis of ongoing operating trends. However, the non-GAAP financial measures discussed herein should not be considered in isolation or as a substitute for the most directly comparable or other financial measures calculated in accordance with GAAP. Moreover, the manner in which the Company calculates the non-GAAP financial measures discussed herein may differ from the reporting measures with similar names as used by other companies. You should understand how such other banking organizations calculate their non-GAAP financial measures with names similar to the non-GAAP financial measures discussed herein when comparing such information. Reconciliations of non-GAAP financial measures to GAAP financial measures are provided in the Appendix to this presentation.

b1BANK’s five guiding principles reflect our core beliefs and values, which drive all decisions irrespective of our goals, strategies, or external factors. These tenets are more than guides for making business decisions; they are the core of our culture, driving our day-to-day interactions between employees and with our clients to make a positive impact on the communities we serve.

2025 YTD Total Volunteerism: • 1,034 Hours • 96 hours of financial literacy education and non-profit service • Partnership through b1BANK Financial Institutions Group • Partner with Minority Deposit Institutions (MDI) by helping with correspondent banking services, specialized expertise, supplier network access and investment. Each partnership is unique based on the MDI’s needs. • Through YTD 2025: 16 bank partners 2021 Inception Through March 2025: • Mentored 816 businesses • Conducted training classes to help 3,380 entrepreneurs start or grow their business 1,034 Volunteer Hours 816 Businesses Mentored

Company Overview Ticker: BFST (Nasdaq) Market Capitalization: $720 million (as of March 31, 2025) Headquarters: Baton Rouge, Louisiana Franchise Highlights: • Diversified commercial-focused bank with $7.8 billion in assets and operations in Louisiana, Texas and Mississippi including: 39 legacy Louisiana full-service Banking Centers(5), two LPO/DPO offices, 15 metro-focused Texas Banking Centers and one registered investment advisory in Ridgeland, MS • #1 deposit market share in Louisiana for Louisiana-headquartered banks(1) • Texas markets represents 41% of credit exposure, as of 3/31/25 • Diversified deposit base with 129,161 accounts with an average balance of $50,001 and an organic deposit growth CAGR of ~16% since 4Q15(2) • Since 2018, completed three equity capital raises including IPO totaling $151.0 million of additional capital in addition to two subordinated debt issuances totaling $77.5 million • On October 1, 2024, Business First closed its previously announced acquisition of Oakwood Bancshares, Inc. (Oakwood) and its wholly-owned subsidiary, Oakwood Bank. Oakwood had approximately $862 million of total assets, $700 million of total loans, and $741 million of total deposits as of September 30, 2024 BFST operates 58 locations including 56 full-service Banking Centers(5) and 2 LPOs across Louisiana and Texas (1) Deposit market share is as of June 30, 2024, per FDIC data. (2) Jumbo deposits reflects total deposits of $250 thousand or greater. Deposit balances exclude Business First Bancshares Holding Company deposits with the Bank subsidiary and acquired deposits and includes brokered deposits. (3) Non-GAAP financial measure. See appendix for applicable reconciliation. (4) Preliminary consolidated capital ratios as of March 31, 2025. (5) Includes one closed full-service Banking Center in Rayville, LA that maintains an active ITM. *Dots above may not represent exact geographic location. Assets $7,785 Gross Loans Held for Investments $5,981 Deposits $6,458 Loan-to-Deposit Ratio 92.6% ROAA 1.00% ROACE 10.48% Core ROAA(3) 1.01% Core ROACE(3) 10.53% NPLs/Total Loans(HFI) 0.69% Tier 1 Risk-based Capital Ratio(4) 10.90% Tier 1 Leverage Ratio(4) 9.70% Total Risk-based Capital Ratio(4) 13.03% TCE/TA(3) 8.06% Financial Highlights of 1Q25 ($ millions)

Jude Melville Chairman, President and CEO Age: 50 Year Started at BFST: 2006 Philip Jordan EVP, Chief Banking Officer Age: 52 Year Started at BFST: 2008 Keith Mansfield EVP, Chief Operations Officer Age: 48 Year Started at BFST: 2016 Chad Carter EVP, Correspondent Banking Age: 42 Year Started at BFST: 2011 Gregory Robertson EVP, Chief Financial Officer Age: 53 Year Started at BFST: 2011 Heather Roemer SVP, Chief of Staff Age: 43 Year Started at BFST: 2009 Saundra Strong EVP, General Counsel Age: 47 Year Started at BFST: 2021 Kathryn Manning EVP, Chief Risk Officer Age: 37 Year Started at BFST: 2013 Warren McDonald EVP, Chief Credit Officer Age: 58 Year Started at BFST: 2006 Jerry Vascocu President, b1BANK Age: 51 Year Started at BFST: 2022

Note: Dollars in millions. Financial data as of March 31, 2025. Deposit balances do not tie to consolidated figures as a result of wholesale deposits, timing differences and other items recorded at the corporate level. Loan amounts based on outstanding loan balance before accounting adjustments. (1) Banking Center count includes one standalone ITM. (2) Excludes standalone ITM from Deposits / Banking Center calculation. Dallas Fort Worth Region # of Banking Centers: 12 # of LPOs: 1 Total Loans: $1,974.6 Total Deposits: $1,079.2 Deposits / Banking Center: $89.9 Houston Region # of Banking Centers: 5 Total Loans: $446.1 Total Deposits: $512.2 Deposits / Banking Center: $102.4 Southwest Louisiana Region # of Banking Centers: 22 Total Loans: $1,349.0 Total Deposits: $2,172.1 Deposits / Banking Center: $98.7 Greater New Orleans Region # of Banking Centers: 8 # of LPOs: 1 Total Loans: $1,161.2 Total Deposits: $999.4 Deposits / Banking Center: $124.9 North Louisiana Region # of Banking Centers(1): 9 Total Loans: $1,012.3 Total Deposits: $901.1 Deposits / Banking Center(2): $112.6

$ 1 4 .1 $ 2 3 .8 $ 3 0 .0 $ 5 2 .1 $ 5 2 .9 $ 6 5 .6 $ 5 9 .7 $ 6 6 .7 $16.8 $24.6 $37.5 $53.9 $57.6 $66.3 $65.8 $72.2 2018 2019 2020 2021 2022 2023 2024 TTM Q1'25 Net Income Core Net Income Note: Dollars in millions, except for per share data. (1) Non-GAAP financial measure. See appendix for applicable reconciliation. (1) $ 1 .2 2 $ 1 .7 4 $ 1 .6 4 $ 2 .5 3 $ 2 .3 2 $ 2 .5 9 $ 2 .2 6 $ 2 .4 3 $1.45 $1.80 $2.05 $2.61 $2.52 $2.62 $2.49 $2.63 2018 2019 2020 2021 2022 2023 2024 TTM Q1'25 EPS Core EPS $ 1 9 .6 8 $ 2 1 .4 7 $ 1 9 .8 8 $ 2 1 .2 4 $ 2 0 .2 5 $ 2 2 .5 8 $ 2 4 .6 2 $ 2 5 .5 1 $ 1 5 .3 4 $ 1 7 .3 1 $ 1 6 .8 0 $ 1 7 .7 1 $ 1 6 .1 7 $ 1 8 .6 2 $ 1 9 .9 2 $ 2 0 .8 4 $15.60 $17.12 $16.28 $17.77 $19.12 $21.25 $22.05 $22.62 2018 2019 2020 2021 2022 2023 2024 Q1'25 BVPS TBVPS TBVPS (excl. AOCI) 7 1 .8 % 6 4 .4 % 6 7 .8 % 6 1 .8 % 6 5 .3 % 6 1 .6 % 6 5 .4 % 6 4 .1 % 66.9% 63.4% 61.1% 60.6% 62.8% 61.9% 64.5% 63.3% 2018 2019 2020 2021 2022 2023 2024 TTM Q1'25 Efficiency Ratio Core Efficiency Ratio (1) (1) (1) (1) Diluted EPS Available to Common Shareholders Tangible Book Value Per Share Net Income Available to Common Shareholders Efficiency Ratio

(amount s in act uals) Non-Jumbo Deposit Accounts 15,312 15,539 15,608 41,064 37,508 90,963 89,359 97,740 101,546 125,255 125,456 Jumbo Deposit Accounts (1) 448 502 612 987 1,001 1,902 2,300 2,714 3,009 3,564 3,705 Total Deposit Accounts (1) 15,760 16,041 16,220 42,051 38,509 92,865 91,659 100,454 104,555 128,819 129,161 Avg. Total Deposit Account Bal. 57,375$ 58,151$ 65,076$ 41,234$ 46,275$ 38,946$ 44,483$ 47,986$ 50,201$ 50,546$ 50,001$ $904 $933 $1,056 $1,180 $1,782 $2,442 $4,077 $4,343 $5,249 $5,798 $6,458 $554 $1,175 $477 $714 $904 $933 $1,056 $1,734 $1,782 $3,617 $4,077 $4,820 $5,249 $6,511 $6,458 Q4'15 Q4'16 Q4'17 Q4'18 Q4'19 Q4'20 Q4'21 Q4'22 Q4'23 Q4'24 Q1'25 Organic Deposits Acquired Deposits • Deposit strategy reflects consistent organic growth augmented with opportunistic M&A • Total deposit CAGR of ~24% since Q4’15 • Organic deposit CAGR of ~16% since Q4’15 (excluding acquired deposits)(2) • Acquired Texas Citizens and $477M in total deposits in 2022 • $266M organic growth in total deposits in 2022(2) 2022 • Acquired Pedestal and $1.2B in total deposits in 2020 • $660M organic growth in total deposits in 2020(2) 2020 • Acquired $554M deposits in 2018 (Minden & Richland) • $124M organic growth in total deposits in 2018(2) 2018 (3) 2024 • Acquired Oakwood and $714M in total deposits in 2024 • $549M organic growth in total deposits in 2024(2)

10.25-Year CAGR Total Assets 687$ 1,077$ 1,106$ 1,322$ 2,099$ 2,276$ 4,175$ 4,733$ 5,990$ 6,585$ 7,857$ 7,785$ 27% Core Net Income(1) 4.4$ 4.1$ 5.1$ 3.1$ 16.8$ 24.6$ 37.5$ 53.9$ 57.6$ 66.3$ 65.8$ 72.2$ 32% Core Diluted EPS(1) 0.72$ 0.73$ 0.70$ 0.39$ 1.45$ 1.80$ 2.05$ 2.61$ 2.52$ 2.62$ 2.49$ 2.63$ 13% Core ROAA(1) 0.58% 0.51% 0.45% 0.26% 1.00% 1.15% 1.09% 1.22% 1.05% 1.05% 0.94% 1.00% --- Core Efficiency Ratio(1) 76.5% 77.6% 81.1% 77.7% 66.9% 63.4% 61.1% 60.6% 62.8% 61.9% 64.5% 63.3% --- 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 Q1'25 TTM Texas Citizens Bancorp • Closed 3/1/22 • $546MM in assets(3) • 6 locations acquired • $54.8MM deal value(3) • 131 days to close transaction Note: Dollars in millions, except per share data. (1) Non-GAAP financial measure. See appendix for applicable reconciliation. Core earnings measures exclude merger charges, gain/loss on sale of securities, gain/loss on sale of former bank branches, among other non- core items. (2) Non-GAAP financial measure. See appendix for applicable reconciliation. Reflects TTM results as of March 31, 2025. (3) Reflects consolidated total assets and deal value at close. American Gateway • Closed 3/31/15 • $366MM in assets(3) • 10 locations acquired • $44.2MM deal value(3) • 250 days to close transaction Minden Bancorp • Closed 1/1/18 • $315MM in assets(3) • 2 locations acquired • $56.5MM deal value(3) • 87 days to close transaction Richland State Bancorp • Closed 11/30/18 • $307MM in assets(3) • 8 locations acquired • $44.7MM deal value(3) • 179 days to close transaction Pedestal Bancshares • Closed 5/1/20 • $1.26B in assets(3) • 22 locations acquired • $128.3MM deal value(3) • 100 days to close transaction • BFST has a proven M&A track record and has successfully closed and integrated six whole-bank acquisitions and one non-bank RIA acquisition since 2015 • Most recent ability to close was proven with Oakwood Bancshares transaction, which was announced on April 25, 2024, and closed on October 1, 2024 • 27% total asset CAGR, 32% core net income CAGR, and 13% core EPS CAGR since commencing BFST’s M&A strategy • Significant improvement in profitability over the last ~10 years, with core ROAA improving from 0.58% in 2014 to 1.00%(2) and core efficiency ratio improving from 76.5% to 63.3%(2) over the same timeframe Oakwood Bancshares • Closed 10/1/24 • $862MM in assets(3) • 6 locations acquired • $102.0MM deal value(3) • 159 days to close transaction

Deposit Composition Non-Interest Bearing NOW & Int. Bearing DDA MMDA & Savings Time Deposits • Continue to carry higher cash balances to support liquidity, with 5.53% of total assets at 3/31/2025. • Remain focused on core deposits, which represent over 87% of total deposits. • Continue to take advantage of wholesale funding alternatives to optimize interest costs and liquidity, utilizing FHLB and the brokered deposit market. • Ample contingent liquidity available of just under $4.0 billion (an increase for the quarter of $0.6 billion, or 17.0%) at 3/31/2025, to supplement core deposit growth as needed. $6.46B Note: Dollars in millions. Data as of March 31, 2025. Historical Deposit Composition Liquidity Sources FHLB Borrowings Capacity 1,627$ Unencumbered Securities 521$ Cash Reserves 312$ Fed Funds Sold 117$ Fed Funds Lines Available 160$ FRB Discount Window 1,255$ Total 3,992$

AFS Securities Portfolio • Portfolio serves as a source of on-balance sheet liquidity and provides interest income stability during times of declining rates. • With the relatively high-rate environment, the Bank is reinvesting portfolio cash flows and taking opportunities to modestly grow the portfolio as liquidity allows. • Total portfolio as of 1Q25 was $987.6 million in AFS, of which agency mortgage-backed securities (MBS) and A-rated municipal securities were the largest components. - 1Q25 weighted average yield of 2.73% - Weighted average life of 4.81 years - Estimated effective duration of 3.76 years $987.6M Note: Dollars in millions. Data as of March 31, 2025. Book Market Net Unrealized Value Value Gain / (Loss) Municipal Securities 300.0$ 275.0$ (25.0)$ Mortgage-Backed Securities 610.2 571.8 (38.4)$ Corporate & Other Securities 49.6 47.3 (2.3)$ U.S. Government Agencies / Treasuries 27.8 26.5 (1.2)$ Total AFS Securities 987.6$ 920.6$ (67.0)$ Deferred Tax Impact 14.2$ Other Equities Unrealized Gain/Loss -$ Accumulated Other Comprehensive Income/Loss (52.8)$

✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ BFST Footprint(1) American Gateway (6 active / 4 closed) Pedestal (17 active / 1 Sold / 4 closed(4)) Minden (2 active / 0 closed) Texas Citizens (5 active / 1 closed) Richland (5 active (3) / 2 sold / 1 closed) Oakwood (6 active / 0 closed) Closed, Sold, or Consolidated (2 legacy / 13 acquired / 1 De Novo LPO) Loan Production Office (LPO) (2 active / 1 consolidated) Snyder, TX b1BANK (Organic / De Novo) (15 active(2) / 2 closed)

• • • • • • • • • • • • • • • • • •

(1) Non-GAAP financial measure. See appendix for applicable reconciliation. (2) Preliminary consolidated capital ratios as of 3/31/2025. (3) Past due and nonaccrual loan amounts exclude purchased impaired loans, even if contractually past due or if the Company does not expect to receive payment in full, as the Company is currently accreting interest income over the expected life of the loans. This was applicable to all periods 12/31/2022, and prior. The guidance and methodology were changed beginning 1/1/2023, due to CECL adoption. • Net interest margin excluding loan discount accretion increased 8 bps through continued pricing discipline with new and renewed loan originations while managing rate reductions on interest-bearing deposits. • Weighted average loan originations continued to hold strong in March at 7.87%, up from 7.58% in December. • The weighted average rate of new interest-bearing non-maturity deposits were 3.20% in March down from 3.86% in December. • Investments in non-interest income revenue initiatives continue to show early signs of success with loan sales, mostly SBA loans, producing income of $1.3 million coupled with swap revenue of $739,000 during Q1. 3/31/2024 6/30/2024 9/30/2024 12/31/2024 3/31/2025 Diluted Earnings per Common Share $0.48 $0.62 $0.65 $0.51 $0.65 ROAA 0.74 % 0.95 % 0.97 % 0.78 % 1.00 % ROACE 8.51 10.94 10.76 8.23 10.48 Net Interest Margin 3.32 3.45 3.51 3.61 3.68 Efficiency Ratio(1) 69.80 65.14 63.45 63.91 63.85 Net Income Available to Common Shareholders in thousands $12,220 $15,856 $16,492 $15,138 $19,193 Core Pre-Tax, Pre-Provision Income(1) in thousands $19,061 $23,494 $25,281 $33,450 $28,742 Core Diluted Earnings Per Common Share(1) $0.50 $0.64 $0.68 $0.66 $0.65 Core ROAA(1) 0.77 % 0.98 % 1.01 % 1.00 % 1.01 % Core ROACE(1) 8.92 11.22 11.23 10.58 10.53 Net Interest Margin excluding loan discount accretion(1) 3.27 3.34 3.46 3.56 3.64 Core Efficiency Ratio(1) 68.68 64.50 62.21 63.09 63.35 Tier 1 Leverage Ratio(2) 9.38 % 9.49 % 9.61 % 9.53 % 9.70 % Total Risk-Based Capital Ratio(2) 12.78 % 12.88 % 12.99 % 12.75 % 13.03 % Tangible Common Equity / Tangible Assets(1) 7.19 % 7.43 % 7.75 % 7.63 % 8.06 % Tangible Book Value Per Share(1) $18.61 $19.22 $20.60 $19.92 $20.84 NPLs / Loans (Excl. TDRs)(3) 0.43 % 0.43 % 0.50 % 0.42 % 0.69 % Allowance for Credit Losses / Loans (Excl. HFS) 0.88 0.86 0.86 0.98 1.01 ACL + FV Discount on Acquired Lns/ Loans (Excl. HFS) 1.10 1.05 1.04 1.18 1.20 NCOs / Average Loans 0.01 0.03 0.02 0.03 0.02 Asset Quality Profitability Capital For the Quarter Ended,

(1) Preliminary consolidated capital ratios as of December 31, 2024. (2) Non-GAAP financial measure. See appendix for applicable reconciliation. For the quarter ended, $ millions 3/31/2025 12/31/2024 3/31/2024 Gross Loans (Excl. HFS) $5,980.9 0% 18% ACL + Fair Value Discount on Acquired Loans $71.7 2% 30% Investment Securities $920.6 3% 5% Deposits $6,458.2 -1% 16% Borrowings $434.1 -10% 1% Total Equity $826.3 3% 27% Balance Sheet Ratios, $ actual 3/31/2025 12/31/2024 3/31/2024 Total Risk-Based Capital Ratio(1) 13.03 % 12.75 % 12.78 % Tangible Common Equity / Tangible Assets(2) 8.06 % 7.63 % 7.19 % Tangible Book Value Per Share(2) $20.84 $19.92 $18.61 Gross Loans (Excl. HFS) / Deposits 92.61 % 91.86 % 91.32 % Actual Change vs. Q1'25 Highlights Flat loan balances consisted of a 0.01% decrease for the quarter (0.03% Annualized) led by Real Estate-Construction loans decreasing ($36.8 million) and Residential Real Estate increasing ($49.8 million). Our Texas exposure remained stable at 41% of the overall loan portfolio. Deposits decreased $53.1 million (0.82%, or 3.31% Annualized) during Q1 mostly attributable to $48.7 million of noninterest bearing deposit decreases from customer withdrawals as opposed to account closures. $379.9 million of new account openings took place in the quarter led by Houston, Dallas, and SW Louisiana regions. ACL + Fair Value Discount on acquired loans as a percentage of total loans of 1.20%. Loan purchase discount decreased by approximately $799 thousand. The $27.0 million increase for the quarter stemmed from improvement in fair market value was due to positive fair value adjustments ($12.9 million) coupled with MBS purchases. Year-over-year shift was due to focus on organic deposit growth, measured loan growth, and acquisition of Oakwood Bank. Borrowings decreased $49.2 million for the quarter due to a reduction in short-term FHLB advances coupled with a $7.0 million redemption of subordinated debt. Increase in equity for the quarter of $26.8 million of which 69.9% was driven by positive quarterly earnings. Highlights Increase in equity for the quarter of $26.8 million of which 69.9% was driven by positive quarterly earnings. TBV increased from the linked quarter and is attributed to $19.2 million net income available to common shareholders coupled with a $10.1 million increase in AOCI. The improvement in the risk-based capital ratio was attributable to the retention of earnings coupled with reduction of risk-based assets in 1Q25.

ACL & FV Discount(3) Past Due Loans(1) Note: Dollars in millions. Peer average based on average of last five quarters ending 4Q24, Gulf South Peer Group defined as: FGBI, HBCP, ISTR, OBK, RRBI, GNTY, VBTX, TCBX, STEL. (1) Past due loans include balances past due 30 days or more and not on a nonaccrual status. (2) Nonperforming loans include loan balances past due 90 days or more as well as loans on a nonaccrual status. (3) Total Loans includes SBA PPP loan balances. Nonperforming Loans(2) Net Charge-offs

Note: Data is as of March 31, 2025. Chart based on GAAP data. (1) NIM excluding loan discount accretion is a non-GAAP financial measure and excludes the accretion of the loan discount on acquired loans. See appendix for applicable reconciliation.

Note: Dollars in millions; amounts may not total due to rounding. Betas are estimates that reflect the deposit portfolio composition as of March 31, 2025, based on analysis of BFST deposit pricing in prior cycles. (1) Core CDs exclude brokered deposits and CDARs. (2) Reflects weighted average rate as of month-end, March 31, 2025. • Internal modeling implies an estimated total deposit beta of 45% – 55%, in the near-term downward rate cycle • Opportunity to improve pre-tax earnings with a low single-digit expansion in the Core NIM under the 25 bps reduction scenario, assuming a static balance sheet over the next twelve months • Overall Core CD balance(1) retention rate was 83% during March • $114 million remaining Core CD balances(1) will mature in 2Q25, with $87 million maturing in 3Q25

• • • Outstanding Balance Weighted ($MM) (% of Total) Avg. Rate(1) Fixed Rate Loans (mature/reprice > 1 year) 2,707.1$ 45.4% 5.77% Fixed Rate Loans (mature/reprice < 1 year) 565.9 9.5% 6.06% Floating Rate with Floors 1,225.8 20.5% 7.62% Floating Rate without Floors 1,424.8 23.9% 7.71% Adjustable Rate Loans 45.1 0.8% 5.91% Total 5,968.7$ 100.0% 6.64% 45.4% 9.5% 20.5% 23.9% 0.8% Fixed Rate Loans Maturing Beyond 1-Year (dollars in millions) Q2'26 FY 2026 FY 2027 FY 2028 > FY 2028 C&D 5.8$ 15.0$ 88.5$ 9.7$ 39.6$ Owner-Occupied CRE 17.2 70.1 152.3 107.2 304.2 Income Producing CRE 40.6 132.6 313.6 102.2 220.9 C&I 16.0 41.2 87.5 76.2 243.9 Agricultural 14.1 14.8 0.9 0.7 3.9 Farmland 2.6 6.1 5.6 11.9 26.1 1-4 Family 31.4 63.3 81.0 50.7 223.6 Consumer & Other 3.5 34.3 84.6 57.2 37.7 Total 131.2$ 377.5$ 813.8$ 415.9$ 1,099.8$ Weighted Avg. Rate 5.96% 5.45% 5.20% 6.92% 5.87% Fixed Rate Loans Maturing within the next 12-Months NTM (dollars in millions) Q2'25 Q3'25 Q4'25 Q1'26 Total C&D 35.2$ 24.3$ 4.0$ 5.5$ 69.0$ Owner-Occupied CRE 27.1 21.7 6.7 23.1 78.5 Income Producing CRE 15.3 9.9 11.8 32.6 69.5 C&I 57.6 34.6 13.8 41.7 147.6 Agricultural 18.2 2.7 1.1 15.8 37.9 Farmland 5.9 1.4 0.1 0.2 7.5 1-4 Family 22.0 20.0 20.3 14.9 77.1 Consumer & Other 31.4 3.0 13.9 30.3 78.7 Total 212.7$ 117.5$ 71.6$ 164.1$ 565.9$ Weighted Avg. Rate 6.28% 6.47% 5.24% 5.85% 6.06% All Floating Rate Loans, Maturing, (dollars in millions) Q2'25 FY 2025 FY 2026 FY 2027 > FY 2027 C&D 89.9$ 173.6$ 97.0$ 56.0$ 82.1$ Owner-Occupied CRE 26.0 39.9 24.8 22.4 249.3 Income Producing CRE 53.0 86.0 96.4 56.9 227.3 C&I 210.6 402.3 282.2 59.5 283.6 Agricultural 11.1 14.8 11.7 0.7 2.2 Farmland 29.9 44.1 6.4 6.1 15.1 1-4 Family 14.6 25.5 17.7 10.7 98.4 Consumer & Other 32.5 58.5 33.6 28.9 36.6 Total 467.6$ 844.7$ 569.9$ 241.3$ 994.8$ Weighted Avg. Rate 7.84% 7.83% 7.84% 8.05% 7.33%

Note: Data is as of March 31, 2025. Dollars in millions. Loan balances are before accounting adjustments. (1) Net operating loans are defined as loans per the general ledger, excluding deferred costs/fees, corporate and other, overdrafts and loan premium/discount. Loan Composition by Region 13.0% 12.8% 17.0% 9.9% 5.2% 14.3% 33.2% 7.5% 0 1,000 2,000 3,000 4,000 5,000 6,000 12/31/16 12/31/17 12/31/18 12/31/19 12/31/20 12/31/21 12/31/22 12/31/23 12/31/24 03/31/25 Capital North Louisiana Southwest Louisiana Bayou Greater New Orleans Dallas Houston Q1’25 LTM Loan Growth Waterfall $1,740 $703 $(700) $(917) $53 $5,969 $5,089 Beginning Loans BFST Originations Oakwood Loans Paydowns Payoffs Net Refinance Ending Loans 3/31/24 3/31/25

Note: Loan composition as of March 31, 2025, based on preliminary FDIC call report data. $5.98 billion Total Loan Portfolio Composition Top 5 Exposure Categories Outstanding Unfunded Average NPLs % of Balance Commitment Loan Size Total Loans Commercial $1.78 billion $753 million $393 thousand 0.98% CRE - Owner-Occupied $1.05 billion $40 million $884 thousand 0.34% CRE - Non Owner-Occupied $1.3 billion $54 million $1.92 million 0.61% Construction & Land $634 million $243 million $586 thousand 0.78% 1-4 Family $582 million $9 million $208 thousand 1.11% Total $5.34 billion $1.1 billion $798 thousand 0.94%

Note: Data is as of March 31, 2025. Percentages based on loan balances before accounting adjustments. • Commercial loans represent 29.7% of the total loan portfolio • Total commercial loan growth year-over-year of 30.5% driven by regional growth in New Orleans, North Louisiana, and Southwest Louisiana as well as Dallas Fort Worth with the acquisition of Oakwood. • Weighted average maturity of the commercial portfolio is 2.59 years Commercial Loans by Collateral Commercial Loans by Region

C&D Composition CRE Composition - Owner Occupied C&D Portfolio Raw Land 5.4% Vacant Residential Lots 9.7% Vacant Commercial Lots 15.6% Land Development - Residential 16.4% Residential Construction - OORE 4.8% Residential Construction - Non OORE 11.6% Commercial Construction - Retail 6.6% Commercial Construction - Office 8.0% Commercial Construction - Apartment/Multi-Family 11.2% Commercial Construction - Other 10.7% Total C&D 100.0% 5.4% 9.7% 15.6% 16.4% 4.8% 11.6% 6.6% 8.0% 11.2% 10.7% Income Producing CRE Geography(1) Income Producing CRE Portfolio Dallas, TX 19.9% Baton Rouge, LA 9.5% Covington, LA 7.8% Monroe, LA 7.4% Houston, TX 6.4% Lafayette, LA 3.4% New Orleans, LA 3.3% Lake Charles, LA 3.2% Metairie, LA 2.9% Austin, TX 2.2% All Other Geographies 34.1% Total CRE - Income Producing 100.0% 19.9% 9.5% 7.8% 7.4% 6.4% 3.4% 3.3% 3.2% 2.9% 2.2% 34.1% Owner Occupied CRE Geography(1) Income Producing CRE Geography(1) Owner Occupied CRE Portfolio Dallas, TX 10.2% Baton Rouge, LA 10.0% Houston, TX 6.8% New Orleans, LA 6.6% Monroe, LA 3.8% Lake Charles, LA 3.3% Lafayette, LA 2.7% Houma, LA 2.7% Bossier City, LA 2.6% Metairie, LA 2.5% All Other Geographies 49.0% Total CRE - Owner Occupied 100.0% 10.2% 10.0% 6.8% 6.6% 3.8% 3.3% 2.7% 2.7% 2.6% 2.5% 49.0% C&D by Geography(1) Own r Occupied CRE Geography(1) C&D Portfolio Dallas, TX 24.6% Baton Rouge, LA 15.6% Covington, LA 8.1% Hammond, LA 3.4% Houston, TX 3.2% Plain Dealing, LA 3.0% New Orleans, LA 3.0% Celina, TX 2.9% Friendswood, TX 2.5% Allen, TX 2.0% All Other Geographies 31.8% Total C&D 100.0% 24.6% 15.6% 8.1% 3.4% 3.2% 3.0% 3.0% 2.9% 2.5% 2.0% 31.8% Note: Dollars in millions. Data is as of March 31, 2025. Percentages based on loan balances before accounting adjustments. (1) Geographic composition detail reflects borrower zip code on file in loan source files. Does not necessarily reflect zip code or location of loan collateral. Loan balances include Oakwood totals within Dallas geography. (2) Represents the largest loan in each portfolio net of balances sold to other institutions. (3) Represents the outstanding principal balance of all loans maturing between April 1, 2025, through March 31, 2026. C&D Highlights • $633.7 million total portfolio • $22.6 million largest relationship(2) • $588 thousand average loan size • $255.1 million maturing over the next 12-months(3) • Dallas, Baton Rouge and Covington represent top 3 geographies within C&D and comprise 48.3% of all C&D loans or $305.9 million Owner-Occupied Highlights • $1.05 billion total portfolio • $14.8 million largest relationship(2) • $887 thousand average loan size • $118.8 million maturing over the next 12-months(3) • Dallas, Baton Rouge and Houston represent top 3 geographies within owner-occupied and comprise 26.9% of all owner-occupied loans or $281.2 million Income Producing Highlights • $1.30 billion total portfolio • $27.9 million largest relationship(2) • $1.93 million average loan size • $169.8 million balance maturing over the next 12-months(3) • Dallas, Baton Rouge and Covington represent top 3 geographies within income producing and comprise 37.1% of all income producing loans or $481.8 million $633.7 million $1.05 billion $1.30 billion $633.7 million $1.05 billion $1.30 billion CRE Composition - Income Producing Owner Occupied CRE Portfolio Hotel/Motel 0.6% Office Building 30.7% Office/Warehouse 23.0% Retail 16.4% Commercial Building 11.8% Other 17.4% Total CRE - Owner Occupied 100.0% 0.6% 30.7% 23.0% 16.4% 11.8% 17.4% Income Producing CRE Portfolio Hotel/Motel 15.4% Office Building 23.2% Office/Warehouse 3.6% Warehouse 8.7% Retail - Single-Tenant 8.7% Retail - Multi-Tenant 25.6% Commercial Building 6.2% Other 8.7% Total CRE - Income Producing 100.0% 15.4% 23.2% 3.6% 8.7% 8.7% 25.6% 6.2% 8.7%

Office CRE – Income-Producing by Geography(1)(2) Office CRE – Owner-Occupied by Geography(1)(2) Office C&D by Geography(1)(2) 59.7% 25.0% 7.6% 6.3% 1.4% Office C&D Dallas, TX 59.7% Baton Rouge, LA 25.0% Houma, LA 7.6% Plano, TX 6.3% Frisco, TX 1.4% Other Geographies 0.0% Total Office C&D 100.0% $563.8MM Total C&D $22.1MM Office C&D 10.9% 9.6% 6.3% 5.6% 4.8% 62.8% Owner Occupied Office CRE Baton Rouge, LA 10.9% Covington, LA 9.6% Houston, TX 6.3% Grapevine, TX (DFW) 5.6% Houma, LA 4.8% Other Geographies 62.8% Total OO Office CRE 100.0% $303.8MM Owner Occupied Office CRE $974.6MM Owner Occupied CRE 28.5% 17.8% 15.4% 6.5% 4.6% 27.2% $1.17B Income Producing CRE $264.2MM Income Producing Office CRE Income Producing Office CRE Dallas, TX 28.5% Houston, TX 17.8% Baton Rouge, LA 15.4% Metairie, LA 6.5% Shreveport, LA 4.6% Other Geographies 27.2% Total Inc. Prod. Office CRE 100.0% 22.6% Income Producing Office CRE 77.4% All Other Income Producing CRE 68.8% All Other Owner Occupied CRE 31.2% Owner Occupied Office CRE 96.1% All Other C&D 3.9% Office C&D Office C&D Highlights • $22.1 million total office C&D portfolio comprised of 10 loans in 5 distinct geographies throughout Texas and Louisiana • Largest C&D office loan is a $11.2 million credit in Dallas, TX • 100.0% of the office C&D portfolio is risk rated as pass watch or better Office CRE Owner-Occupied Highlights • $303.8 million total office CRE owner- occupied portfolio comprised of 352 loans in 101 distinct geographies throughout Texas and Louisiana • Largest office CRE owner-occupied loan is a $14.6 million credit in Grapevine (DFW), TX • 99.0% of the office CRE – owner-occupied portfolio is risk rated as pass watch or better Office CRE Income Producing Highlights • $264.2 million total office CRE income- producing portfolio comprised of 155 loans in 50 distinct geographies throughout Texas and Louisiana • Largest office CRE income producing loan is a $27.9 million credit in Houston, TX • 99.9% of the office CRE – income- producing portfolio is risk rated as pass watch or better (1)(2) (1)(2) (1)(2)

Note: Dollars in thousands. As of December 31. (1) Non-GAAP Financial measure. See appendix for applicable reconciliation. (2) Preliminary consolidated capital ratios as of 3/31/2025. Total Capital Ratio not available for FY 2020 due to the bank’s use of the Community Bank Leverage Ratio. (3) Excludes SBA PPP loans. (4) Calculated at the bank level based on preliminary FDIC call report data. (5) Past due and nonaccrual loan amounts exclude purchased impaired loans, even if contractually past due or if the Company does not expect to receive payment in full, as the Company is currently accreting interest income over the expected life of the loans. This was applicable to all periods 12/31/2022, and prior. The guidance and methodology were changed beginning 1/1/2023, due to CECL adoption. YTD 2020 2021 2022 2023 2024 2025 Balance Sheet & Capital Total Assets $4,160,360 $4,726,378 $5,990,460 $6,584,550 $7,857,090 $7,784,728 Gross Loans (Excl. HFS) 2,991,355 3,189,608 4,606,176 4,992,785 5,981,399 5,980,919 Deposits 3,616,679 4,077,283 4,820,345 5,248,790 6,511,331 6,458,181 Total Equity 409,963 433,368 580,481 644,259 799,466 826,312 Tangible Common Equity / Tangible Assets(1) 8.45 % 7.76 % 6.89 % 7.28 % 7.63 % 8.06 % Tier 1 Leverage Ratio(2) 8.79 8.14 9.49 9.52 9.53 9.70 Total Risk-based Capital Ratio(2) -- 11.94 12.75 12.85 12.75 13.03 Net Loans (Excl. HFS) / Assets 71.37 % 66.87 % 76.25 % 75.21 % 75.43 % 76.10 % Gross Loans (Excl. HFS) / Deposits 82.71 78.23 95.56 95.12 91.86 92.61 NIB Deposits / Deposits 32.19 31.66 32.14 24.75 20.84 20.26 Commercial Loans / Loans (Excl. HFS)(3) 21.60 22.62 25.05 27.22 31.24 31.14 C&D / Total Risk-Based Capital(4) 106.0 % 117.0 % 109.8 % 91.7 % 78.2 % 71.8 % CRE / Total Risk-Based Capital(4) 262.0 250.1 272.1 253.5 253.6 247.8 Asset Quality NPLs / Loans (Excl. TDRs)(5) 0.35 % 0.41 % 0.25 % 0.34 % 0.42 % 0.69 % NPAs / Assets (Excl. TDRs)(5) 0.48 0.31 0.21 0.28 0.39 0.55 Reserves / Loans (Excl. HFS) 0.74 0.91 0.83 0.81 0.92 0.95 NCOs / Average Loans 0.06 0.03 0.04 0.11 0.08 0.02 Profitability Ratios Net Income Available to Common Shareholders $29,994 $52,136 $52,905 $65,642 $59,706 $19,193 ROAA 0.88 % 1.18 % 0.97 % 1.04 % 0.86 % 1.00 % ROACE 8.42 12.25 11.59 12.36 9.54 10.48 Net Interest Margin 4.06 % 3.84 % 3.92 % 3.62 % 3.48 % 3.68 % Efficiency Ratio 67.75 61.84 65.26 61.61 65.42 63.85 Non-Interest Income / Avg. Assets 0.63 0.80 0.54 0.62 0.63 0.68 Non-Interest Expense / Avg. Assets 2.95 2.66 2.73 2.47 2.55 2.61 For the Fiscal Year Ended December 31,

Note: Dollars in thousands. (1) Calculated at the bank level based on preliminary FDIC call report data. (2) Based on outstanding loan balances prior to accounting adjustments. Percentage based on CRE loans outstanding. (3) Past due and nonaccrual loan amounts exclude purchased impaired loans, even if contractually past due or if the Company does not expect to receive payment in full, as the Company is currently accreting interest income over the expected life of the loans. This was applicable to all periods 12/31/2022, and prior. The guidance and methodology were changed beginning 1/1/2023, due to CECL adoption. (4) All charge-offs are YTD through period noted. Q4'19 Q4'20 Q4'21 Q4'22 Q4'23 Q4'24 Q1'25 Construction - 1-4 Family Residential 60,780$ 68,503$ 90,861$ 109,629$ 117,128$ 105,098$ 106,957$ Other Const, Development, Vacant Land & Lots 183,401 334,562 457,667 612,445 552,670 565,404 526,741 Total Construction 244,181 403,065 548,528 722,074 669,798 670,502 633,698 % of Total Loans (1) 14.3% 13.5% 17.2% 15.7% 13.4% 11.2% 10.6% % of Total Bank Capital 95.9% 106.0% 117.0% 116.7% 97.6% 83.9% 77.1% Multi-Family Properties 36,454 95,707 97,508 98,637 108,432 200,454 253,616 Commercial Rental 284,795 496,198 525,977 967,915 1,072,280 1,299,469 1,298,434 Other Loans for Real Estate Purposes 708 736 500 409 481 4,112 1,284 Total Outstanding CRE Exposure 566,138$ 995,706$ 1,172,513$ 1,789,035$ 1,850,991$ 2,174,537$ 2,187,032$ % of Total Loans (1) 33.1% 33.3% 36.7% 38.8% 37.1% 36.4% 36.6% % of Total Bank Capital 222.4% 262.0% 250.1% 289.1% 269.7% 272.1% 266.0% Credit Ratings (2) Pass-Watch / Special Mention % 0.5% 1.7% 2.7% 3.0% 2.4% 7.1% 10.8% Classified % 0.9% 0.7% 1.2% 0.7% 0.6% 0.4% 0.4% Total Watch List % 1.4% 2.4% 3.9% 3.6% 3.0% 7.6% 11.2% Past Dues(3) Nonaccrual Loans 1,449$ 1,578$ 1,701$ 1,250$ 4,569$ 6,130$ 8,049$ Past Due 90 days or more - 77 - 4 - - 4,835 Total Past Due 1,449$ 1,654$ 1,701$ 1,254$ 4,569$ 6,130$ 12,883$ Total Past Due / Total CRE Loans 0.3% 0.2% 0.1% 0.1% 0.2% 0.3% 0.6% Net Charge Offs YTD(4) (2)$ 14$ 147$ (9)$ 1,982$ 1,683$ (95)$ Net Charge Offs YTD / CRE Loans (0.00%) 0.00% 0.01% (0.00%) 0.11% 0.08% (0.00%)

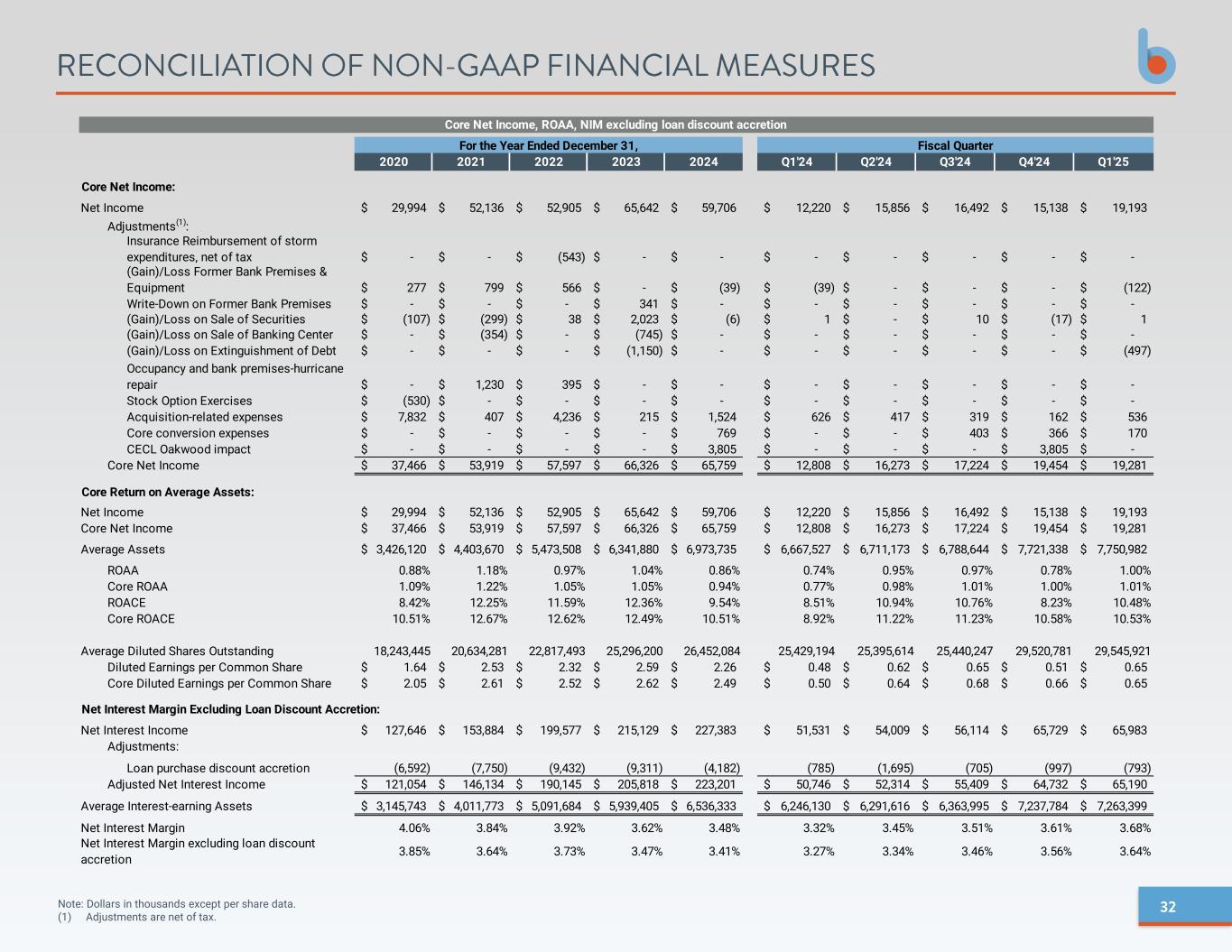

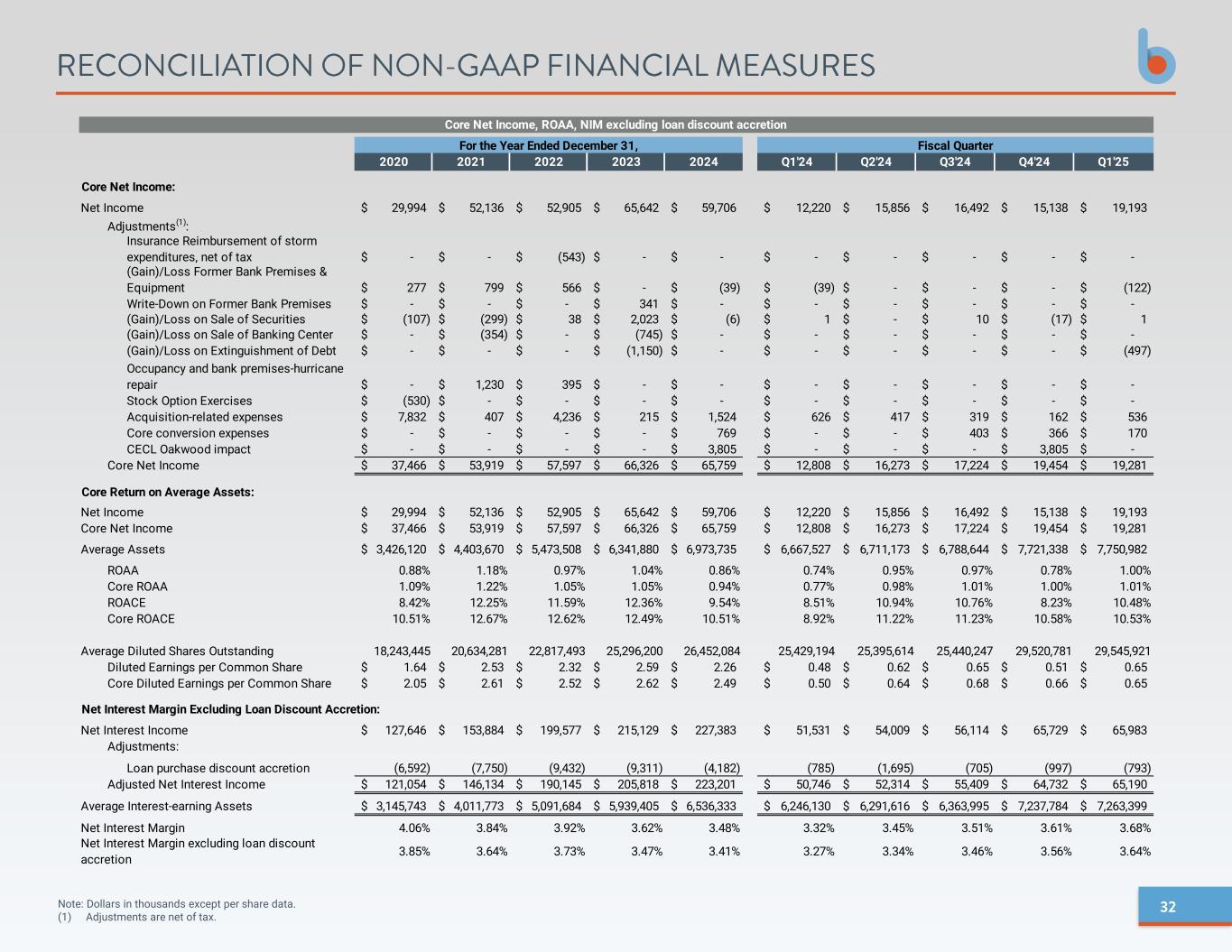

Note: Dollars in thousands except per share data. (1) Adjustments are net of tax. 2020 2021 2022 2023 2024 Q1'24 Q2'24 Q3'24 Q4'24 Q1'25 Core Net Income: Net Income 29,994$ 52,136$ 52,905$ 65,642$ 59,706$ 12,220$ 15,856$ 16,492$ 15,138$ 19,193$ Adjustments(1): -$ -$ (543)$ -$ -$ -$ -$ -$ -$ -$ 277$ 799$ 566$ -$ (39)$ (39)$ -$ -$ -$ (122)$ -$ -$ -$ 341$ -$ -$ -$ -$ -$ -$ (107)$ (299)$ 38$ 2,023$ (6)$ 1$ -$ 10$ (17)$ 1$ -$ (354)$ -$ (745)$ -$ -$ -$ -$ -$ -$ -$ -$ -$ (1,150)$ -$ -$ -$ -$ -$ (497)$ -$ 1,230$ 395$ -$ -$ -$ -$ -$ -$ -$ (530)$ -$ -$ -$ -$ -$ -$ -$ -$ -$ 7,832$ 407$ 4,236$ 215$ 1,524$ 626$ 417$ 319$ 162$ 536$ -$ -$ -$ -$ 769$ -$ -$ 403$ 366$ 170$ -$ -$ -$ -$ 3,805$ -$ -$ -$ 3,805$ -$ Core Net Income 37,466$ 53,919$ 57,597$ 66,326$ 65,759$ 12,808$ 16,273$ 17,224$ 19,454$ 19,281$ Core Return on Average Assets: Net Income 29,994$ 52,136$ 52,905$ 65,642$ 59,706$ 12,220$ 15,856$ 16,492$ 15,138$ 19,193$ Core Net Income 37,466$ 53,919$ 57,597$ 66,326$ 65,759$ 12,808$ 16,273$ 17,224$ 19,454$ 19,281$ Average Assets 3,426,120$ 4,403,670$ 5,473,508$ 6,341,880$ 6,973,735$ 6,667,527$ 6,711,173$ 6,788,644$ 7,721,338$ 7,750,982$ ROAA 0.88% 1.18% 0.97% 1.04% 0.86% 0.74% 0.95% 0.97% 0.78% 1.00% Core ROAA 1.09% 1.22% 1.05% 1.05% 0.94% 0.77% 0.98% 1.01% 1.00% 1.01% ROACE 8.42% 12.25% 11.59% 12.36% 9.54% 8.51% 10.94% 10.76% 8.23% 10.48% Core ROACE 10.51% 12.67% 12.62% 12.49% 10.51% 8.92% 11.22% 11.23% 10.58% 10.53% Average Diluted Shares Outstanding 18,243,445 20,634,281 22,817,493 25,296,200 26,452,084 25,429,194 25,395,614 25,440,247 29,520,781 29,545,921 Diluted Earnings per Common Share 1.64$ 2.53$ 2.32$ 2.59$ 2.26$ 0.48$ 0.62$ 0.65$ 0.51$ 0.65$ Core Diluted Earnings per Common Share 2.05$ 2.61$ 2.52$ 2.62$ 2.49$ 0.50$ 0.64$ 0.68$ 0.66$ 0.65$ Net Interest Margin Excluding Loan Discount Accretion: Net Interest Income 127,646$ 153,884$ 199,577$ 215,129$ 227,383$ 51,531$ 54,009$ 56,114$ 65,729$ 65,983$ Adjustments: (6,592) (7,750) (9,432) (9,311) (4,182) (785) (1,695) (705) (997) (793) Adjusted Net Interest Income 121,054$ 146,134$ 190,145$ 205,818$ 223,201$ 50,746$ 52,314$ 55,409$ 64,732$ 65,190$ Average Interest-earning Assets 3,145,743$ 4,011,773$ 5,091,684$ 5,939,405$ 6,536,333$ 6,246,130$ 6,291,616$ 6,363,995$ 7,237,784$ 7,263,399$ Net Interest Margin 4.06% 3.84% 3.92% 3.62% 3.48% 3.32% 3.45% 3.51% 3.61% 3.68% 3.85% 3.64% 3.73% 3.47% 3.41% 3.27% 3.34% 3.46% 3.56% 3.64% Core conversion expenses CECL Oakwood impact Loan purchase discount accretion Net Interest Margin excluding loan discount accretion (Gain)/Loss on Sale of Securities (Gain)/Loss on Sale of Banking Center (Gain)/Loss on Extinguishment of Debt Occupancy and bank premises-hurricane repair Stock Option Exercises Acquisition-related expenses Core Net Income, ROAA, NIM excluding loan discount accretion For the Year Ended December 31, Fiscal Quarter Insurance Reimbursement of storm expenditures, net of tax (Gain)/Loss Former Bank Premises & Equipment Write-Down on Former Bank Premises

Note: Dollars in thousands except per share data. (1) Adjustments are net of tax. TTM Q2'24 Q3'24 Q4'24 Q1'25 Q1'25 Core Net Income: Net Income 15,856$ 16,492$ 15,138$ 19,193$ 66,679$ Adjustments(1): -$ -$ -$ (122)$ (122)$ -$ 10$ (17)$ 1$ (6)$ -$ -$ -$ (497)$ (497)$ 417$ 319$ 162$ 536$ 1,434$ -$ 403$ 366$ 170$ 940$ -$ -$ 3,805$ -$ 3,805$ Core Net Income 16,273$ 17,224$ 19,454$ 19,281$ 72,231$ Core Return on Average Assets: Net Income 15,856$ 16,492$ 15,138$ 19,193$ 66,679$ Core Net Income 16,273$ 17,224$ 19,454$ 19,281$ 72,231$ Average Assets 6,711,173$ 6,788,644$ 7,721,338$ 7,750,982$ 7,243,034$ ROAA 0.95% 0.97% 0.78% 1.00% 0.92% Core ROAA 0.98% 1.01% 1.00% 1.01% 1.00% Average Diluted Shares Outstanding 25,395,614 25,440,247 29,520,781 29,545,921 27,475,641 Diluted Earnings per Common Share 0.62$ 0.65$ 0.51$ 0.65$ 2.43$ Core Diluted Earnings per Common Share 0.64$ 0.68$ 0.66$ 0.65$ 2.63$ Core conversion expenses CECL Oakwood impact Core Net Income and ROAA - Trailing Twelve Months Fiscal Quarter (Gain)/Loss Former Bank Premises & Equipment (Gain)/Loss on Sale of Securities (Gain)/Loss on Extinguishment of Debt Acquisition-related expenses

Note: Dollars in thousands except per share data. Q1'24 Q2'24 Q3'24 Q4'24 Q1'25 Tangible Common Equity / Tangible Assets: Tangible Common Equity Total Shareholders' Equity 649,034$ 664,530$ 699,524$ 799,466$ 826,312$ Preferred Stock (71,930) (71,930) (71,930) (71,930) (71,930) Total Common Shareholders' Equity 577,104$ 592,600$ 627,594$ 727,536$ 754,382$ Adjustments: Goodwill (91,527) (91,527) (91,527) (121,572) (121,691) Core deposit and other intangibles (11,372) (10,849) (10,326) (17,252) (16,538) Total Tangible Common Equity 474,205$ 490,224$ 525,741$ 588,712$ 616,153$ Tangible Assets Total Assets 6,695,558$ 6,703,889$ 6,888,649$ 7,857,090$ 7,784,728$ Adjustments: Goodwill (91,527) (91,527) (91,527) (121,572) (121,691) Core deposit and other intangibles (11,372) (10,849) (10,326) (17,252) (16,538) Total Tangible Assets 6,592,659$ 6,601,513$ 6,786,796$ 7,718,266$ 7,646,499$ Common Equity to Total Assets 8.62% 8.84% 9.11% 9.26% 9.69% Tangible Common Equity to Tangible Assets 7.19% 7.43% 7.75% 7.63% 8.06% Tangible Book Value per Share: Tangible Common Equity Total Shareholders' Equity 649,034$ 664,530$ 699,524$ 799,466$ 826,312$ Preferred Stock (71,930) (71,930) (71,930) (71,930) (71,930) Total Common Shareholders' Equity 577,104$ 592,600$ 627,594$ 727,536$ 754,382$ Adjustments: Goodwill (91,527) (91,527) (91,527) (121,572) (121,691) Core deposit and other intangibles (11,372) (10,849) (10,326) (17,252) (16,538) Total Tangible Common Equity 474,205$ 490,224$ 525,741$ 588,712$ 616,153$ Adjustments: Exclude AOCI (71,634) (67,784) (46,144) (62,998) (52,844) Total Tangible Common Equity (excl. AOCI) 545,839$ 558,008$ 571,885$ 651,710$ 668,997$ Common shares outstanding 25,485,383 25,502,175 25,519,501 29,552,358 29,572,297 Book Value per Common Share 22.64$ 23.24$ 24.59$ 24.62$ 25.51$ Tangible Book Value per Common Share 18.61$ 19.22$ 20.60$ 19.92$ 20.84$ Tangible Book Value per Common Share (excl. AOCI) 21.42$ 21.88$ 22.41$ 22.05$ 22.62$ TCE/TA, TBVPS Fiscal Quarter

Note: Dollars in thousands except per share data. 2020 2021 2022 2023 2024 Tangible Common Equity / Tangible Assets: Tangible Common Equity Total Shareholders' Equity 409,963$ 433,368$ 580,481$ 644,259$ 799,466$ Preferred Stock - - (71,930) (71,930) (71,930) Total Common Shareholders' Equity 409,963$ 433,368$ 508,551$ 572,329$ 727,536$ Adjustments: Goodwill (53,862) (59,894) (88,543) (88,391) (121,572) Core deposit and other intangibles (9,734) (12,203) (14,042) (11,895) (17,252) Total Tangible Common Equity 346,367$ 361,271$ 405,966$ 472,043$ 588,712$ Tangible Assets Total Assets 4,160,360$ 4,726,378$ 5,990,460$ 6,584,550$ 7,857,090$ Adjustments: Goodwill (53,862) (59,894) (88,543) (88,391) (121,572) Core deposit and other intangibles (9,734) (12,203) (14,042) (11,895) (17,252) Total Tangible Assets 4,096,764$ 4,654,281$ 5,887,875$ 6,484,264$ 7,718,266$ Common Equity to Total Assets 9.85% 9.17% 8.49% 8.69% 9.26% Tangible Common Equity to Tangible Assets 8.45% 7.76% 6.89% 7.28% 7.63% Tangible Book Value per Share: Tangible Common Equity Total Shareholders' Equity 409,963$ 433,368$ 580,481$ 644,259$ 799,466$ Preferred Stock - - (71,930) (71,930) (71,930) Total Common Shareholders' Equity 409,963$ 433,368$ 508,551$ 572,329$ 727,536$ Adjustments: Goodwill (53,862) (59,894) (88,543) (88,391) (121,572) Core deposit and other intangibles (9,734) (12,203) (14,042) (11,895) (17,252) Total Tangible Common Equity 346,367$ 361,271$ 405,966$ 472,043$ 588,712$ Adjustments: Exclude AOCI 10,628 (1,177) (74,204) (66,585) (62,998) Total Tangible Common Equity 335,739$ 362,448$ 480,170$ 538,628$ 651,710$ Common shares outstanding 20,621,437 20,400,349 25,110,313 25,351,809 29,552,358 Book Value per Common Share 19.88$ 21.24$ 20.25$ 22.58$ 24.62$ Tangible Book Value per Common Share 16.80$ 17.71$ 16.17$ 18.62$ 19.92$ Tangible Book Value per Common Share (excl. AOCI) 16.28$ 17.77$ 19.12$ 21.25$ 22.05$ TCE/TA, TBVPS For the Year Ended December 31,

Note: Dollars in thousands. (1) Excludes gains/losses on sales of securities. TTM Q1'24 Q2'24 Q3'24 Q4'24 Q1'25 12/31/2023 12/31/2024 Q1'25 Core Efficiency Ratio: Noninterest Expense 42,522$ 43,110$ 42,450$ 49,570$ 50,578$ 156,702$ 177,652$ 185,708$ Core Adjustments (715)$ (419)$ (830)$ (631)$ (895)$ (668)$ (2,595)$ (2,775)$ Net Interest and Noninterest Income 60,918$ 66,185$ 66,901$ 77,565$ 79,210$ 254,336$ 271,569$ 289,861$ Core Adjustments (50)$ -$ -$ -$ (785)$ (2,403)$ (50)$ (785)$ Efficiency Ratio(1) 69.80% 65.14% 63.45% 63.91% 63.85% 61.61% 65.42% 64.07% Core Efficiency Ratio 68.68% 64.50% 62.21% 63.09% 63.35% 61.93% 64.47% 63.28% Core Efficiency Ratio Fiscal Quarter Fiscal Year Ended

Note: Dollars in thousands. Q1'24 Q2'24 Q3'24 Q4'24 Q1'25 Core pre-tax, pre-provision earnings: Pre-tax, pre-provision earnings 18,395$ 23,075$ 24,438$ 28,016$ 28,631$ Adjustments: (50)$ -$ -$ -$ (155)$ -$ -$ -$ -$ -$ 1$ -$ 13$ (21)$ 1$ -$ -$ -$ -$ (630)$ 715$ 419$ 319$ 168$ 679$ -$ -$ 511$ 463$ 216$ -$ -$ -$ 4,824$ -$ Core pre-tax, pre-provision earnings 19,061$ 23,494$ 25,281$ 33,450$ 28,742$ Acquisition-related expenses Core conversion expenses CECL Oakwood impact Core Pre-tax, Pre-provision Earnings Fiscal Quarter (Gain)/Loss Former Bank Premises & Equipment Write-Down on Former Bank Premises (Gain)/Loss on Sale of Securities (Gain)/Loss on Extinguishment of Debt