Second Quarter 2024 Shareholder Letter

“I am so excited to be joining the Shake Shack family at a time with so much great momentum in the business. I want to thank all our amazing team members for their hard work and the fantastic results in the second quarter and let everyone know that we are just getting started. There is so much more runway for Shake Shack, and we have the food, the teams, and the capabilities to continue to drive best-in-class top and bottom-line growth into the future,” said Chief Executive Officer, Rob Lynch. “We are proud of our strong performance in the second quarter, as we delivered record sales, Adjusted EBITDA, and free cash flow. Our results showed progress against our 2024 Strategic Priorities, including improving operations, increasing our brand awareness, and executing on our development pipeline with 23 system-wide Shack openings. We remain on track to meet our financial targets for FY2024, including growing Total revenue by 14% - 15% and Adjusted EBITDA by more than 25% year-over- year, as well as expanding Restaurant-level profit margins by 70 – 110 bps. With these drivers and lowering both pre-opening expense per Shack by at least 10% per Shack and our total cost to build by approximately 10% year-over-year, we expect to achieve positive free cash flow for FY2024– a first since 2017,” said Chief Financial Officer, Katie Fogertey. Q 2 2 0 2 4 H I G H L I G H T S System-wide Sales $483.7m 13.5% growth year-over-year. Same-Shack Sales (SSS) Growth +4.0% Sales-driving initiatives and operational focus on the guest experience drove strong performance and increasing awareness. Restaurant-level Profit Margin1 22.0% 100 bps higher versus last year and the highest quarterly result since 2019. 2 B U S I N E S S O V E R V I E W 1. Restaurant-level profit, Restaurant-level profit margin, Adjusted EBITDA and Adjusted pro forma net income (loss) are non-GAAP measures. Reconciliations to the most directly comparable financial measures presented in accordance with GAAP are set forth in the financial details section of this Shareholder Letter. SECOND QUARTER 2024 HIGHLIGHTS: • Total revenue grew 16.4% year-over-year to $316.5m. • Shack sales grew 16.7% year-over-year to $305.5m. • Licensing revenue grew 10.2% year-over-year to $11.0m. • System-wide sales grew 13.5% year-over-year to $483.7m. • Average weekly sales (AWS) was flat year-over-year at $77k. • Same-Shack sales (SSS) grew 4.0% year-over-year. • Operating income of $10.8m versus $4.7m last year. • Restaurant-level profit margin1 of 22.0% of Shack sales, 100 bps improvement year-over-year. • Net income of $10.4m versus $7.2m last year. • Adjusted EBITDA1 of $47.2m, up 27.4% year-over-year. • Net income attributable to Shake Shack Inc. of $9.7m, or earnings of $0.23 per diluted share. • Adjusted pro forma net income1 of $12.1m, or earnings of $0.27 per fully exchanged and diluted share. • Opened 12 new Company-operated Shacks, including three drive-thrus. Opened 11 new licensed Shacks.

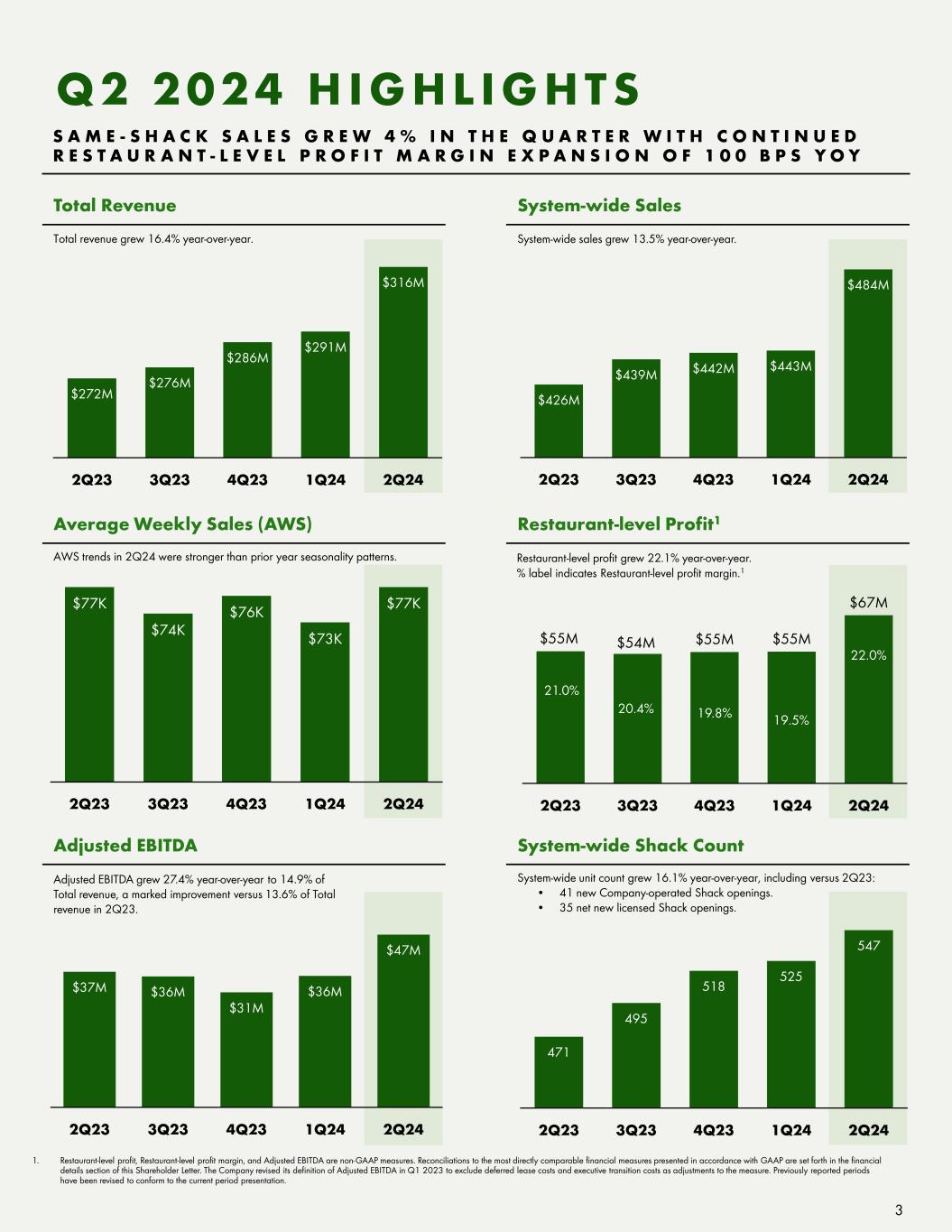

$77K $74K $76K $73K $77K 2Q23 3Q23 4Q23 1Q24 2Q24 $272M $276M $286M $291M $316M 2Q23 3Q23 4Q23 1Q24 2Q24 471 495 518 525 547 2Q23 3Q23 4Q23 1Q24 2Q24 $426M $439M $442M $443M $484M 2Q23 3Q23 4Q23 1Q24 2Q24 1. Restaurant-level profit, Restaurant-level profit margin, and Adjusted EBITDA are non-GAAP measures. Reconciliations to the most directly comparable financial measures presented in accordance with GAAP are set forth in the financial details section of this Shareholder Letter. The Company revised its definition of Adjusted EBITDA in Q1 2023 to exclude deferred lease costs and executive transition costs as adjustments to the measure. Previously reported periods have been revised to conform to the current period presentation. Total Revenue Adjusted EBITDA Average Weekly Sales (AWS) System-wide Shack Count System-wide Sales Q 2 2 0 2 4 H I G H L I G H T S S A M E - S H A C K S A L E S G R E W 4 % I N T H E Q U A R T E R W I T H C O N T I N U E D R E S T A U R A N T - L E V E L P R O F I T M A R G I N E X P A N S I O N O F 1 0 0 B P S Y O Y 3 Total revenue grew 16.4% year-over-year. System-wide sales grew 13.5% year-over-year. AWS trends in 2Q24 were stronger than prior year seasonality patterns. System-wide unit count grew 16.1% year-over-year, including versus 2Q23: • 41 new Company-operated Shack openings. • 35 net new licensed Shack openings. $37M $36M $31M $36M $47M 2Q23 3Q23 4Q23 1Q24 2Q24 Adjusted EBITDA grew 27.4% year-over-year to 14.9% of Total revenue, a marked improvement versus 13.6% of Total revenue in 2Q23. $55M $54M $55M $55M $67M 21.0% 20.4% 19.8% 19.5% 22.0% 18.0% 18.5% 19.0% 19.5% 20.0% 20.5% 21.0% 21.5% 22.0% 22.5% $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 2Q23 3Q23 4Q23 1Q24 2Q24 Restaurant-level Profit1 % label indicates Restaurant-level profit margin.1 Restaurant-level profit grew 22.1% year-over-year.

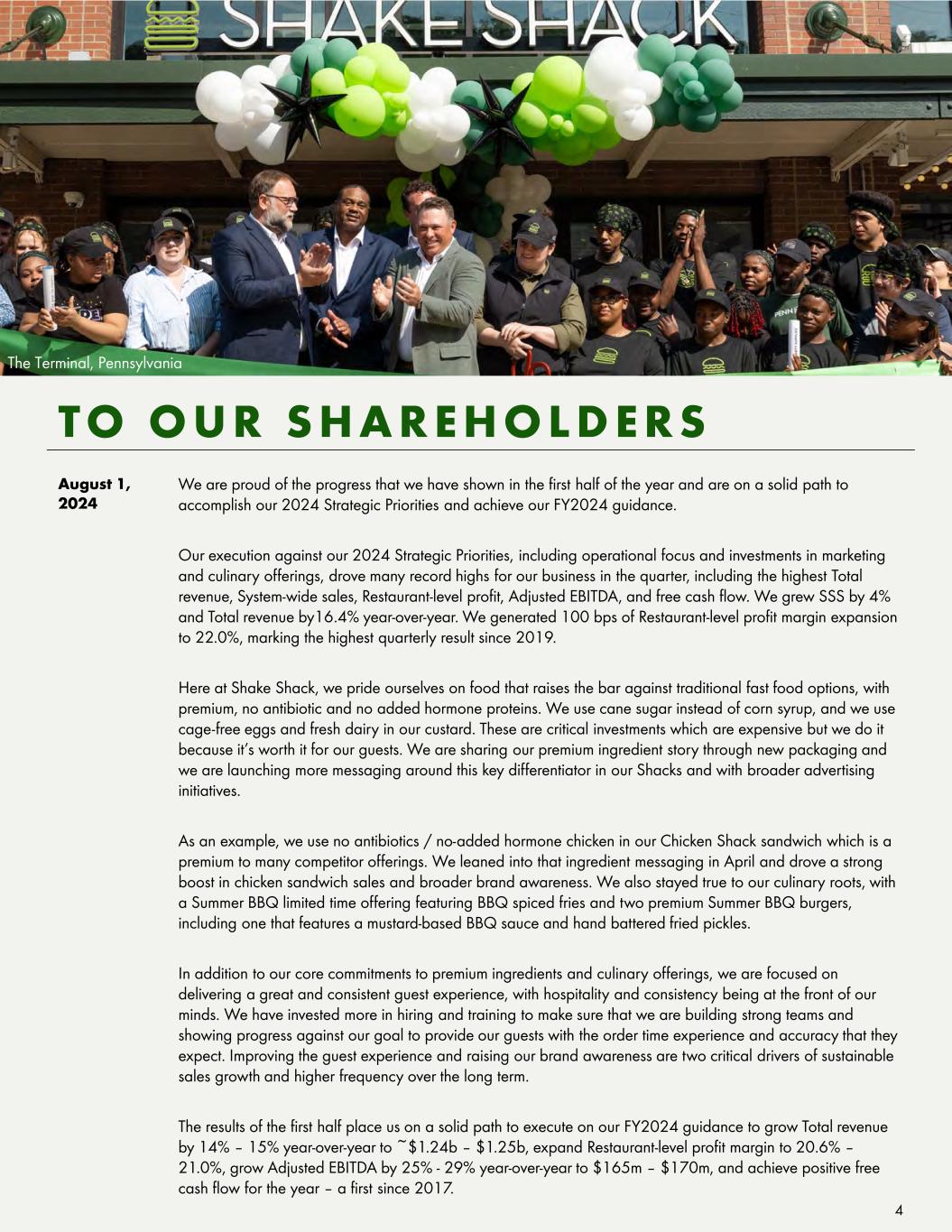

4 TO O U R S H A R E H O L D E R S We are proud of the progress that we have shown in the first half of the year and are on a solid path to accomplish our 2024 Strategic Priorities and achieve our FY2024 guidance. Our execution against our 2024 Strategic Priorities, including operational focus and investments in marketing and culinary offerings, drove many record highs for our business in the quarter, including the highest Total revenue, System-wide sales, Restaurant-level profit, Adjusted EBITDA, and free cash flow. We grew SSS by 4% and Total revenue by16.4% year-over-year. We generated 100 bps of Restaurant-level profit margin expansion to 22.0%, marking the highest quarterly result since 2019. Here at Shake Shack, we pride ourselves on food that raises the bar against traditional fast food options, with premium, no antibiotic and no added hormone proteins. We use cane sugar instead of corn syrup, and we use cage-free eggs and fresh dairy in our custard. These are critical investments which are expensive but we do it because it’s worth it for our guests. We are sharing our premium ingredient story through new packaging and we are launching more messaging around this key differentiator in our Shacks and with broader advertising initiatives. As an example, we use no antibiotics / no-added hormone chicken in our Chicken Shack sandwich which is a premium to many competitor offerings. We leaned into that ingredient messaging in April and drove a strong boost in chicken sandwich sales and broader brand awareness. We also stayed true to our culinary roots, with a Summer BBQ limited time offering featuring BBQ spiced fries and two premium Summer BBQ burgers, including one that features a mustard-based BBQ sauce and hand battered fried pickles. In addition to our core commitments to premium ingredients and culinary offerings, we are focused on delivering a great and consistent guest experience, with hospitality and consistency being at the front of our minds. We have invested more in hiring and training to make sure that we are building strong teams and showing progress against our goal to provide our guests with the order time experience and accuracy that they expect. Improving the guest experience and raising our brand awareness are two critical drivers of sustainable sales growth and higher frequency over the long term. The results of the first half place us on a solid path to execute on our FY2024 guidance to grow Total revenue by 14% – 15% year-over-year to ~$1.24b – $1.25b, expand Restaurant-level profit margin to 20.6% – 21.0%, grow Adjusted EBITDA by 25% - 29% year-over-year to $165m – $170m, and achieve positive free cash flow for the year – a first since 2017. August 1, 2024 The Terminal, Pennsylvania

5 Deliver a Consistent Guest Experience Grow Sales and Strengthen our Brand Awareness Make Shake Shack Even More Profitable in 2024 Improve How We Build and Open Shacks Develop and Reward High Performing Teams Consistency, speed of service, and standardization of the guest experience across all channels is paramount to hospitality in 2024. • Further reduced average wait times quarter-over- quarter, an important KPI to improve the overall guest experience. • Improved order accuracy metrics across all channels year-over-year. Driving traffic through increased marketing, culinary initiatives, and scaling our brand awareness. • Launched our Summer BBQ menu featuring two burger options and BBQ fries as the season commenced. • Increased aided brand awareness to best levels on record. We are working to improve Shack profitability by driving sales, optimizing labor, off-premise profitability, tactical menu pricing, and supply chain initiatives. We plan to target further leverage in G&A while still making targeted investments in advertising. • Expanded 2Q Restaurant-level profit margin by 100 bps. • Guide FY2024 Restaurant-level profit margin expansion of 70 bps – 110 bps. • Expect to turn free cash flow positive in FY2024, a first since 2017, while still investing for growth ahead. Focus on accelerating development pipelines and bringing down our elevated build and pre-opening costs. • Target approx. 10% reduction in FY2024 build costs. • Target at least a 10% reduction in FY2024 pre-opening expense per Shack. • Building FY2025 unit growth pipeline with lower build costs than FY2024 and strong AUVs. Our teams are at the center of all we do, and we will continue to invest in them. • Conducted Area Director Summits with over 50 operations leaders to provide tools and resources to develop leadership skills. • Launched our Enlightened Leadership program to enhance and upskill our current and incoming talent base. 2 0 2 4 S T R AT E G I C P R I O R I T I E S 2 Q P R O G R E S S

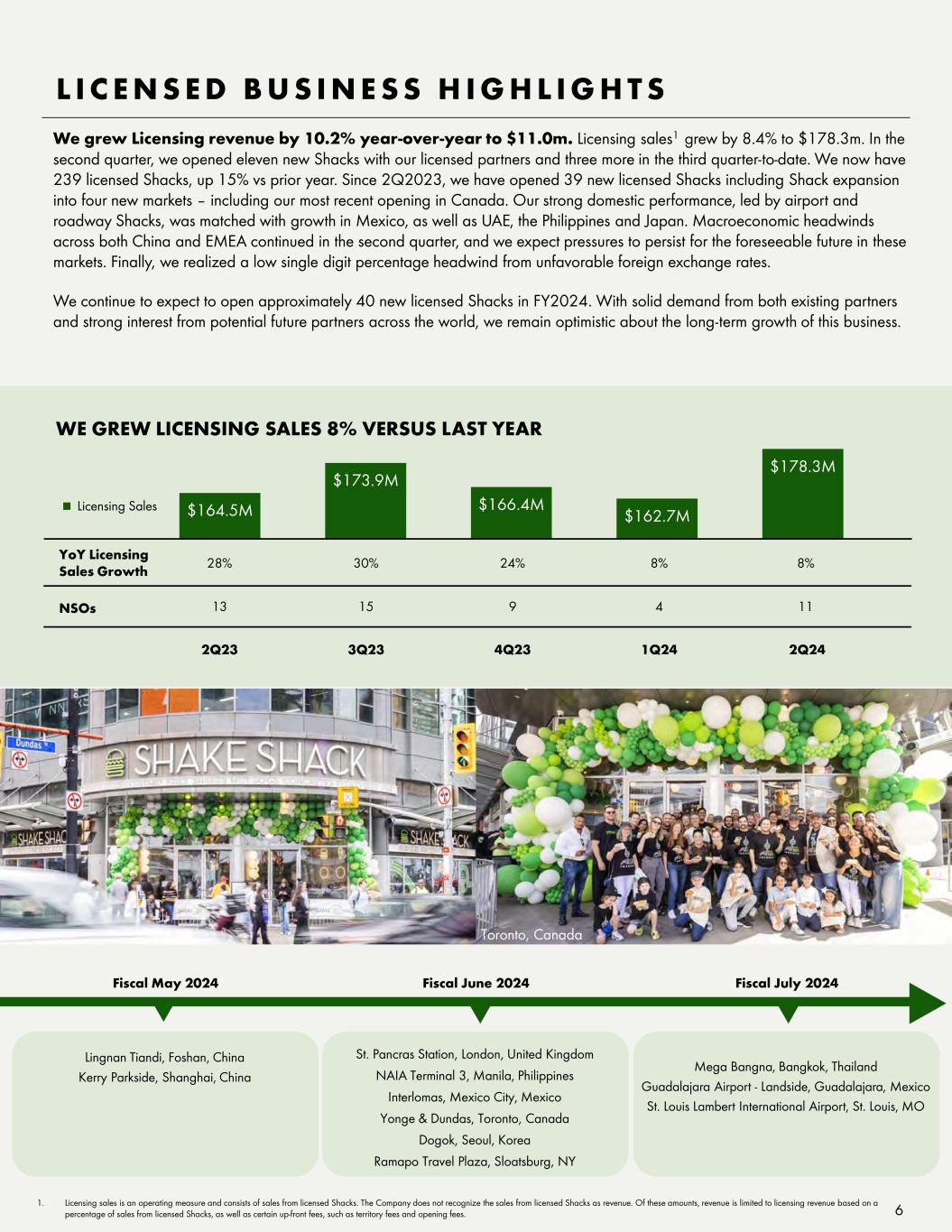

L I C E N S E D B U S I N E S S H I G H L I G H T S 1. Licensing sales is an operating measure and consists of sales from licensed Shacks. The Company does not recognize the sales from licensed Shacks as revenue. Of these amounts, revenue is limited to licensing revenue based on a percentage of sales from licensed Shacks, as well as certain up-front fees, such as territory fees and opening fees. 6 Fiscal May 2024 Fiscal June 2024 Fiscal July 2024 St. Pancras Station, London, United Kingdom NAIA Terminal 3, Manila, Philippines Interlomas, Mexico City, Mexico Yonge & Dundas, Toronto, Canada Dogok, Seoul, Korea Ramapo Travel Plaza, Sloatsburg, NY Mega Bangna, Bangkok, Thailand Guadalajara Airport - Landside, Guadalajara, Mexico St. Louis Lambert International Airport, St. Louis, MO $164.5M $173.9M $166.4M $162.7M $178.3M Licensing Sales WE GREW LICENSING SALES 8% VERSUS LAST YEAR 28% 30% 24% YoY Licensing Sales Growth 8% 8% 13 15 9 4 11NSOs We grew Licensing revenue by 10.2% year-over-year to $11.0m. Licensing sales1 grew by 8.4% to $178.3m. In the second quarter, we opened eleven new Shacks with our licensed partners and three more in the third quarter-to-date. We now have 239 licensed Shacks, up 15% vs prior year. Since 2Q2023, we have opened 39 new licensed Shacks including Shack expansion into four new markets – including our most recent opening in Canada. Our strong domestic performance, led by airport and roadway Shacks, was matched with growth in Mexico, as well as UAE, the Philippines and Japan. Macroeconomic headwinds across both China and EMEA continued in the second quarter, and we expect pressures to persist for the foreseeable future in these markets. Finally, we realized a low single digit percentage headwind from unfavorable foreign exchange rates. We continue to expect to open approximately 40 new licensed Shacks in FY2024. With solid demand from both existing partners and strong interest from potential future partners across the world, we remain optimistic about the long-term growth of this business. 2Q23 3Q23 4Q23 1Q24 2Q24 Toronto, Canada Lingnan Tiandi, Foshan, China Kerry Parkside, Shanghai, China

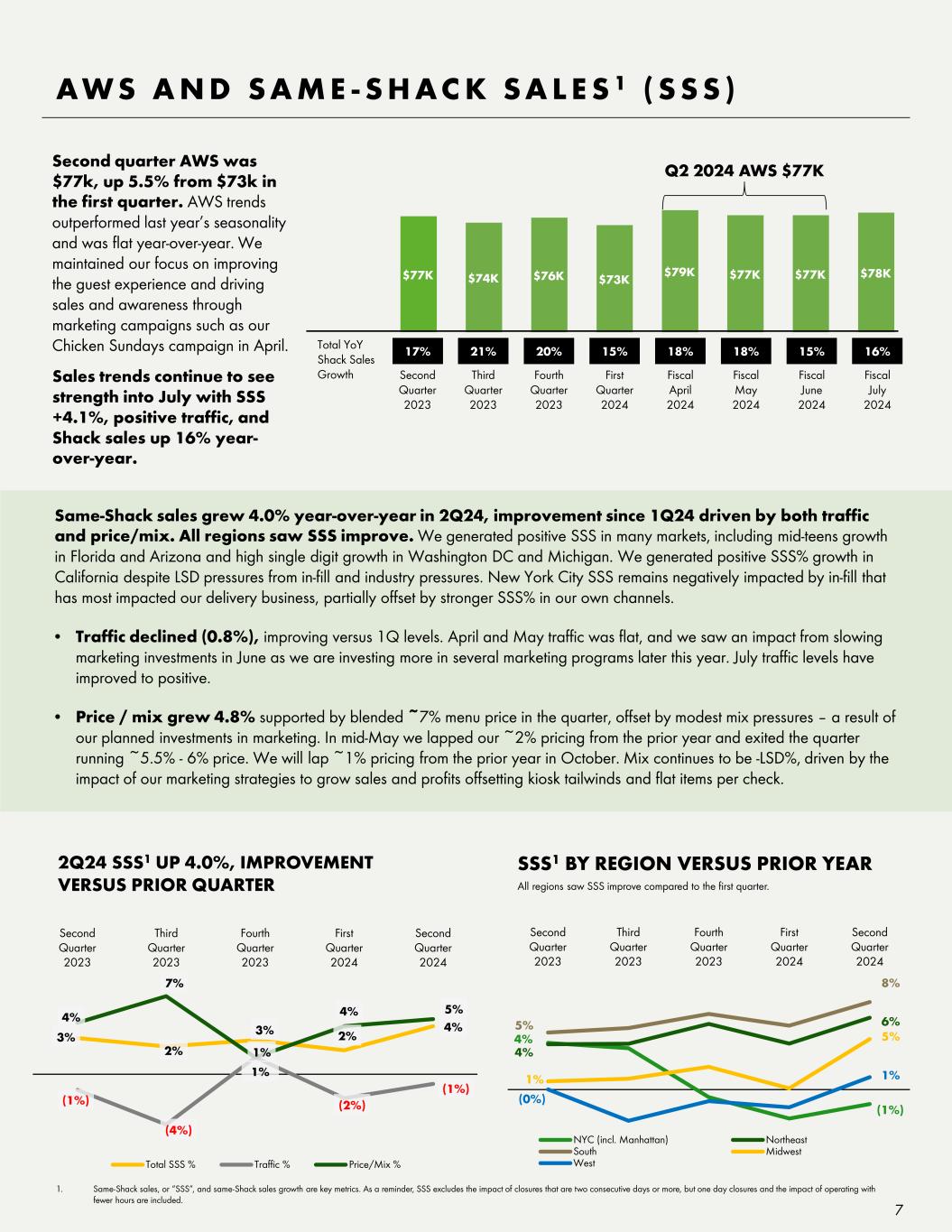

3% 2% 3% 2% 4% (1%) (4%) 1% (2%) (1%) 4% 7% 1% 4% 5% Second Quarter 2023 Third Quarter 2023 Fourth Quarter 2023 First Quarter 2024 Second Quarter 2024 Total SSS % Traffic % Price/Mix % Same-Shack sales grew 4.0% year-over-year in 2Q24, improvement since 1Q24 driven by both traffic and price/mix. All regions saw SSS improve. We generated positive SSS in many markets, including mid-teens growth in Florida and Arizona and high single digit growth in Washington DC and Michigan. We generated positive SSS% growth in California despite LSD pressures from in-fill and industry pressures. New York City SSS remains negatively impacted by in-fill that has most impacted our delivery business, partially offset by stronger SSS% in our own channels. • Traffic declined (0.8%), improving versus 1Q levels. April and May traffic was flat, and we saw an impact from slowing marketing investments in June as we are investing more in several marketing programs later this year. July traffic levels have improved to positive. • Price / mix grew 4.8% supported by blended ~7% menu price in the quarter, offset by modest mix pressures – a result of our planned investments in marketing. In mid-May we lapped our ~2% pricing from the prior year and exited the quarter running ~5.5% - 6% price. We will lap ~1% pricing from the prior year in October. Mix continues to be -LSD%, driven by the impact of our marketing strategies to grow sales and profits offsetting kiosk tailwinds and flat items per check. 2Q24 SSS1 UP 4.0%, IMPROVEMENT VERSUS PRIOR QUARTER AW S A N D S A M E - S H A C K S A L E S 1 ( S S S ) 7 1. Same-Shack sales, or “SSS”, and same-Shack sales growth are key metrics. As a reminder, SSS excludes the impact of closures that are two consecutive days or more, but one day closures and the impact of operating with fewer hours are included. SSS1 BY REGION VERSUS PRIOR YEAR 4% (1%) 4% 6% 5% 8% 1% 5% (0%) 1% Second Quarter 2023 Third Quarter 2023 Fourth Quarter 2023 First Quarter 2024 Second Quarter 2024 NYC (incl. Manhattan) Northeast South Midwest West Second quarter AWS was $77k, up 5.5% from $73k in the first quarter. AWS trends outperformed last year’s seasonality and was flat year-over-year. We maintained our focus on improving the guest experience and driving sales and awareness through marketing campaigns such as our Chicken Sundays campaign in April. $77K $74K $76K $73K $79K $77K $77K $78K Q2 2024 AWS $77K Total YoY Shack Sales Growth Fiscal June 2024 17% Fourth Quarter 2023 15% 18% First Quarter 2024 21% Second Quarter 2023 20% Third Quarter 2023 15% Fiscal May 2024 18% Fiscal April 2024 Fiscal July 2024 16% Sales trends continue to see strength into July with SSS +4.1%, positive traffic, and Shack sales up 16% year- over-year. All regions saw SSS improve compared to the first quarter.

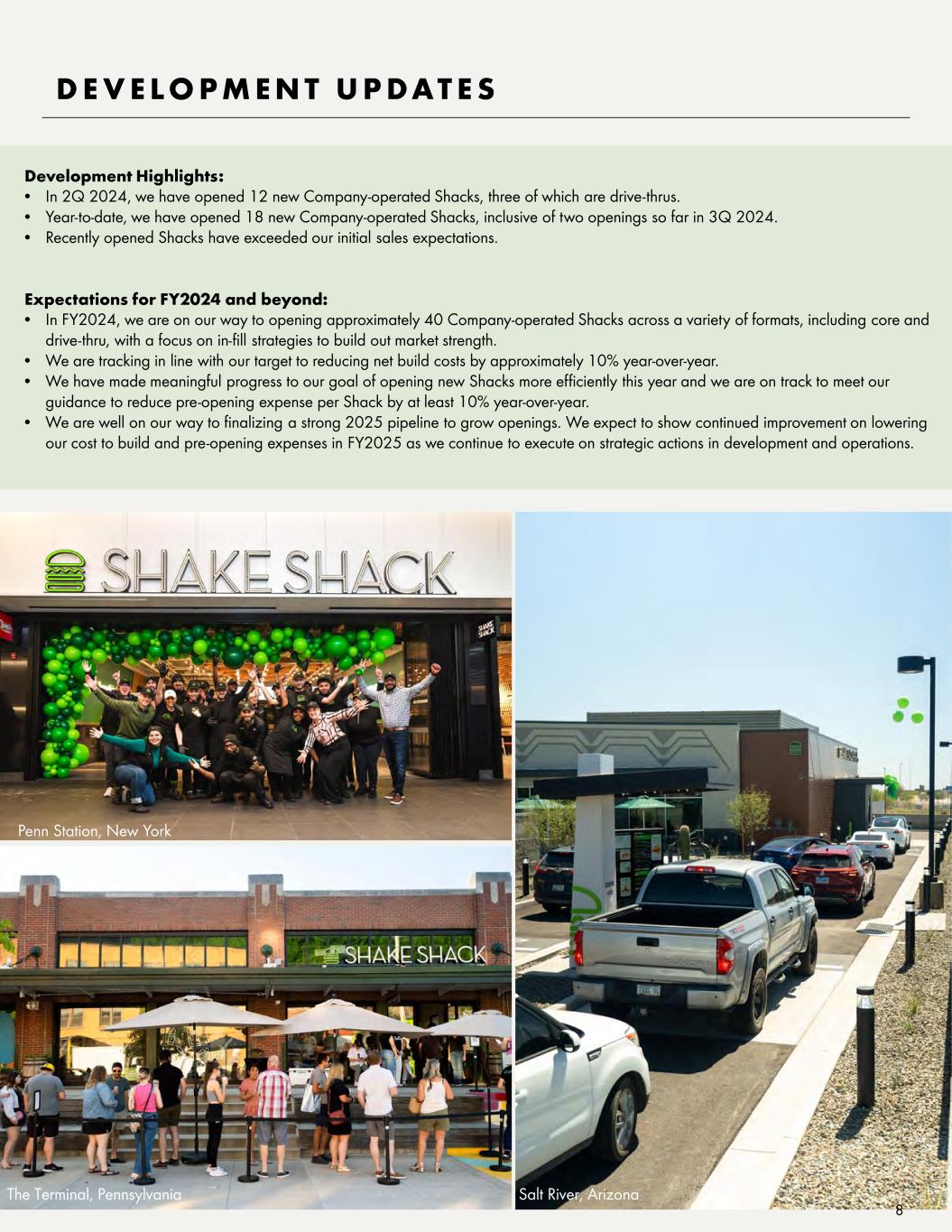

8 D E V E L O P M E N T U P DAT E S Development Highlights: • In 2Q 2024, we have opened 12 new Company-operated Shacks, three of which are drive-thrus. • Year-to-date, we have opened 18 new Company-operated Shacks, inclusive of two openings so far in 3Q 2024. • Recently opened Shacks have exceeded our initial sales expectations. Expectations for FY2024 and beyond: • In FY2024, we are on our way to opening approximately 40 Company-operated Shacks across a variety of formats, including core and drive-thru, with a focus on in-fill strategies to build out market strength. • We are tracking in line with our target to reducing net build costs by approximately 10% year-over-year. • We have made meaningful progress to our goal of opening new Shacks more efficiently this year and we are on track to meet our guidance to reduce pre-opening expense per Shack by at least 10% year-over-year. • We are well on our way to finalizing a strong 2025 pipeline to grow openings. We expect to show continued improvement on lowering our cost to build and pre-opening expenses in FY2025 as we continue to execute on strategic actions in development and operations. The Terminal, Pennsylvania Penn Station, New York Salt River, Arizona

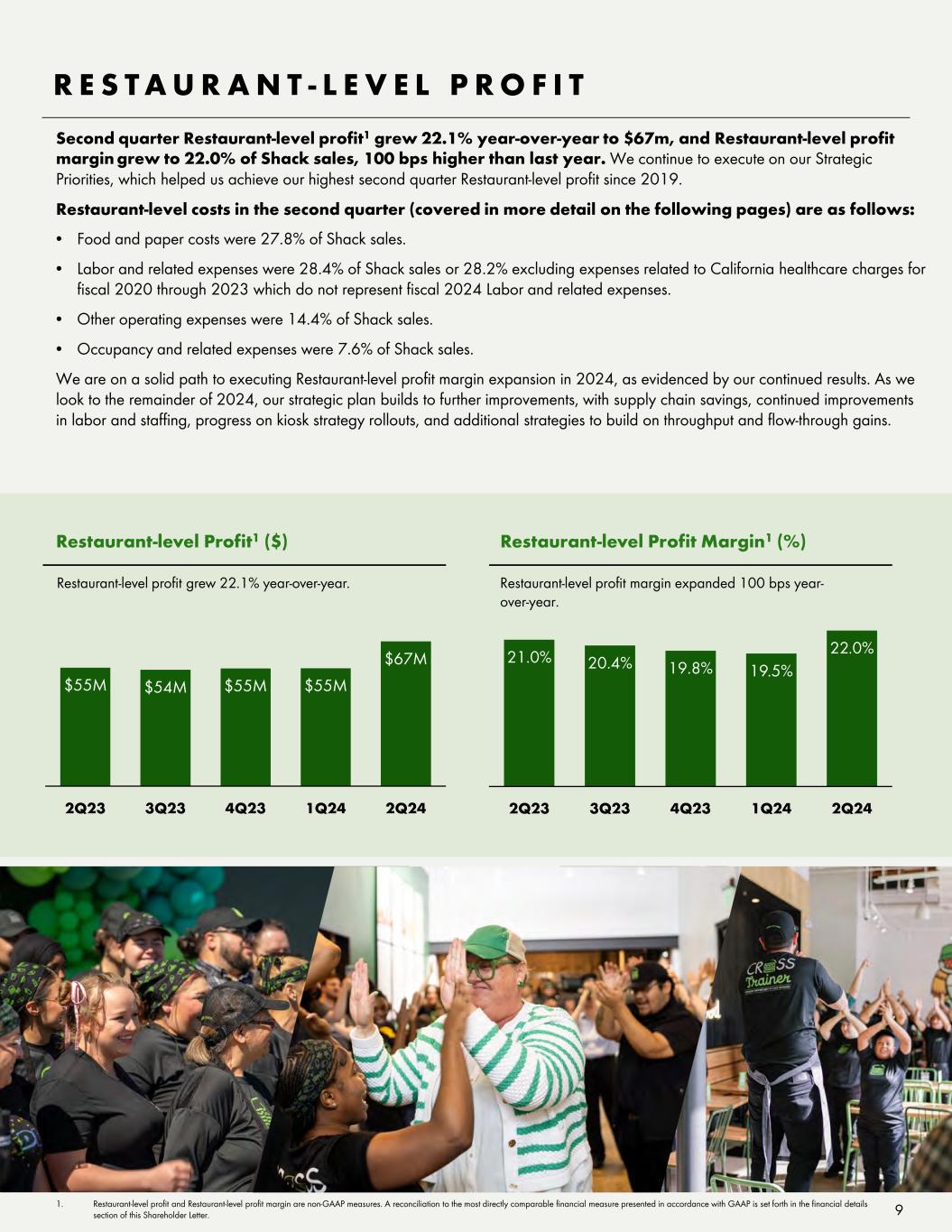

9 R E S T A U R A N T - L E V E L P R O F I T Second quarter Restaurant-level profit1 grew 22.1% year-over-year to $67m, and Restaurant-level profit margin grew to 22.0% of Shack sales, 100 bps higher than last year. We continue to execute on our Strategic Priorities, which helped us achieve our highest second quarter Restaurant-level profit since 2019. Restaurant-level costs in the second quarter (covered in more detail on the following pages) are as follows: • Food and paper costs were 27.8% of Shack sales. • Labor and related expenses were 28.4% of Shack sales or 28.2% excluding expenses related to California healthcare charges for fiscal 2020 through 2023 which do not represent fiscal 2024 Labor and related expenses. • Other operating expenses were 14.4% of Shack sales. • Occupancy and related expenses were 7.6% of Shack sales. We are on a solid path to executing Restaurant-level profit margin expansion in 2024, as evidenced by our continued results. As we look to the remainder of 2024, our strategic plan builds to further improvements, with supply chain savings, continued improvements in labor and staffing, progress on kiosk strategy rollouts, and additional strategies to build on throughput and flow-through gains. 1. Restaurant-level profit and Restaurant-level profit margin are non-GAAP measures. A reconciliation to the most directly comparable financial measure presented in accordance with GAAP is set forth in the financial details section of this Shareholder Letter. $55M $54M $55M $55M $67M 2Q23 3Q23 4Q23 1Q24 2Q24 Restaurant-level Profit1 ($) 21.0% 20.4% 19.8% 19.5% 22.0% 2Q23 3Q23 4Q23 1Q24 2Q24 Restaurant-level Profit Margin1 (%) Restaurant-level profit grew 22.1% year-over-year. Restaurant-level profit margin expanded 100 bps year- over-year.

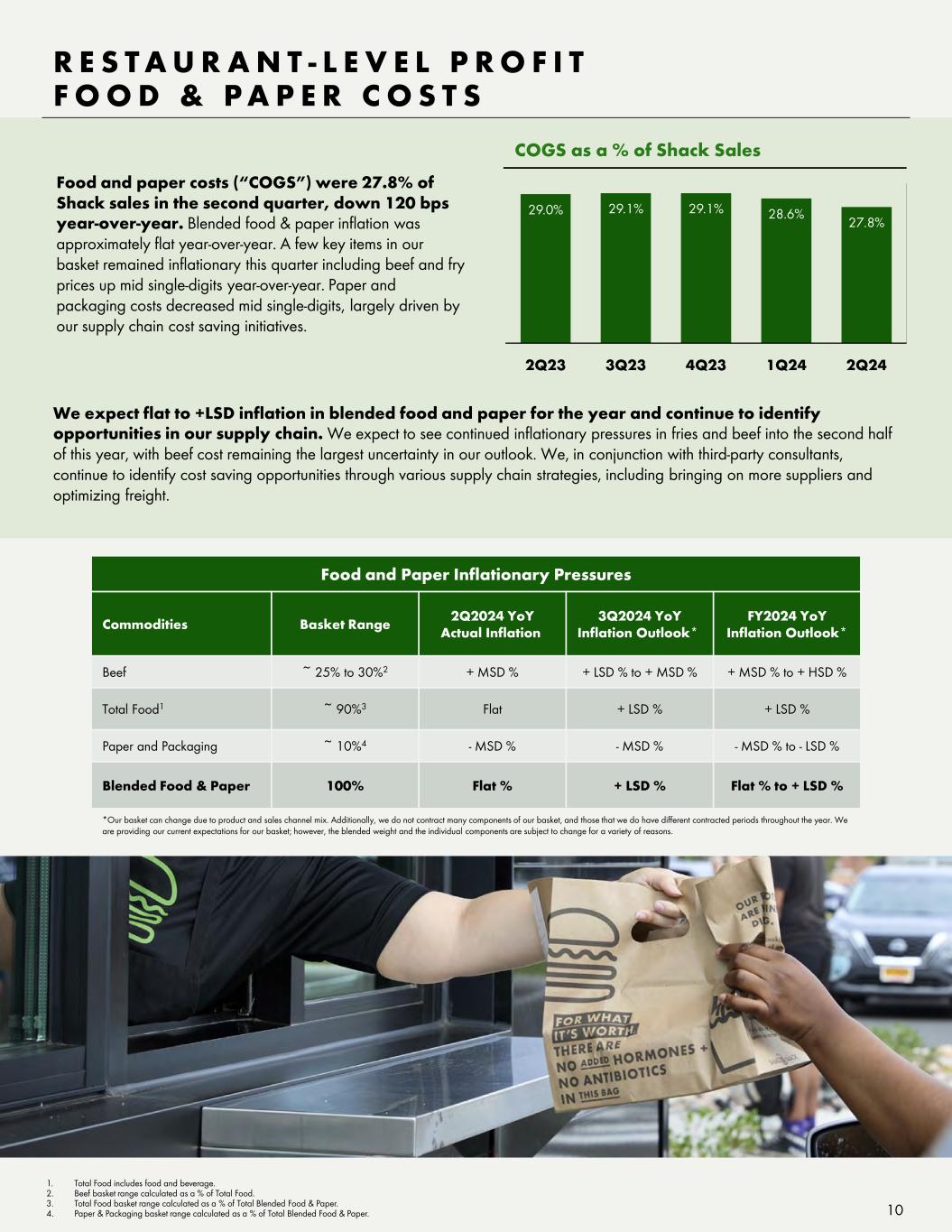

10 R E S T A U R A N T - L E V E L P R O F I T F O O D & P A P E R C O S T S Food and paper costs (“COGS”) were 27.8% of Shack sales in the second quarter, down 120 bps year-over-year. Blended food & paper inflation was approximately flat year-over-year. A few key items in our basket remained inflationary this quarter including beef and fry prices up mid single-digits year-over-year. Paper and packaging costs decreased mid single-digits, largely driven by our supply chain cost saving initiatives. 29.0% 29.1% 29.1% 28.6% 27.8% 2Q23 3Q23 4Q23 1Q24 2Q24 COGS as a % of Shack Sales Food and Paper Inflationary Pressures Commodities Basket Range 2Q2024 YoY Actual Inflation 3Q2024 YoY Inflation Outlook* FY2024 YoY Inflation Outlook* Beef ~ 25% to 30%2 + MSD % + LSD % to + MSD % + MSD % to + HSD % Total Food1 ~ 90%3 Flat + LSD % + LSD % Paper and Packaging ~ 10%4 - MSD % - MSD % - MSD % to - LSD % Blended Food & Paper 100% Flat % + LSD % Flat % to + LSD % We expect flat to +LSD inflation in blended food and paper for the year and continue to identify opportunities in our supply chain. We expect to see continued inflationary pressures in fries and beef into the second half of this year, with beef cost remaining the largest uncertainty in our outlook. We, in conjunction with third-party consultants, continue to identify cost saving opportunities through various supply chain strategies, including bringing on more suppliers and optimizing freight. *Our basket can change due to product and sales channel mix. Additionally, we do not contract many components of our basket, and those that we do have different contracted periods throughout the year. We are providing our current expectations for our basket; however, the blended weight and the individual components are subject to change for a variety of reasons. 1. Total Food includes food and beverage. 2. Beef basket range calculated as a % of Total Food. 3. Total Food basket range calculated as a % of Total Blended Food & Paper. 4. Paper & Packaging basket range calculated as a % of Total Blended Food & Paper.

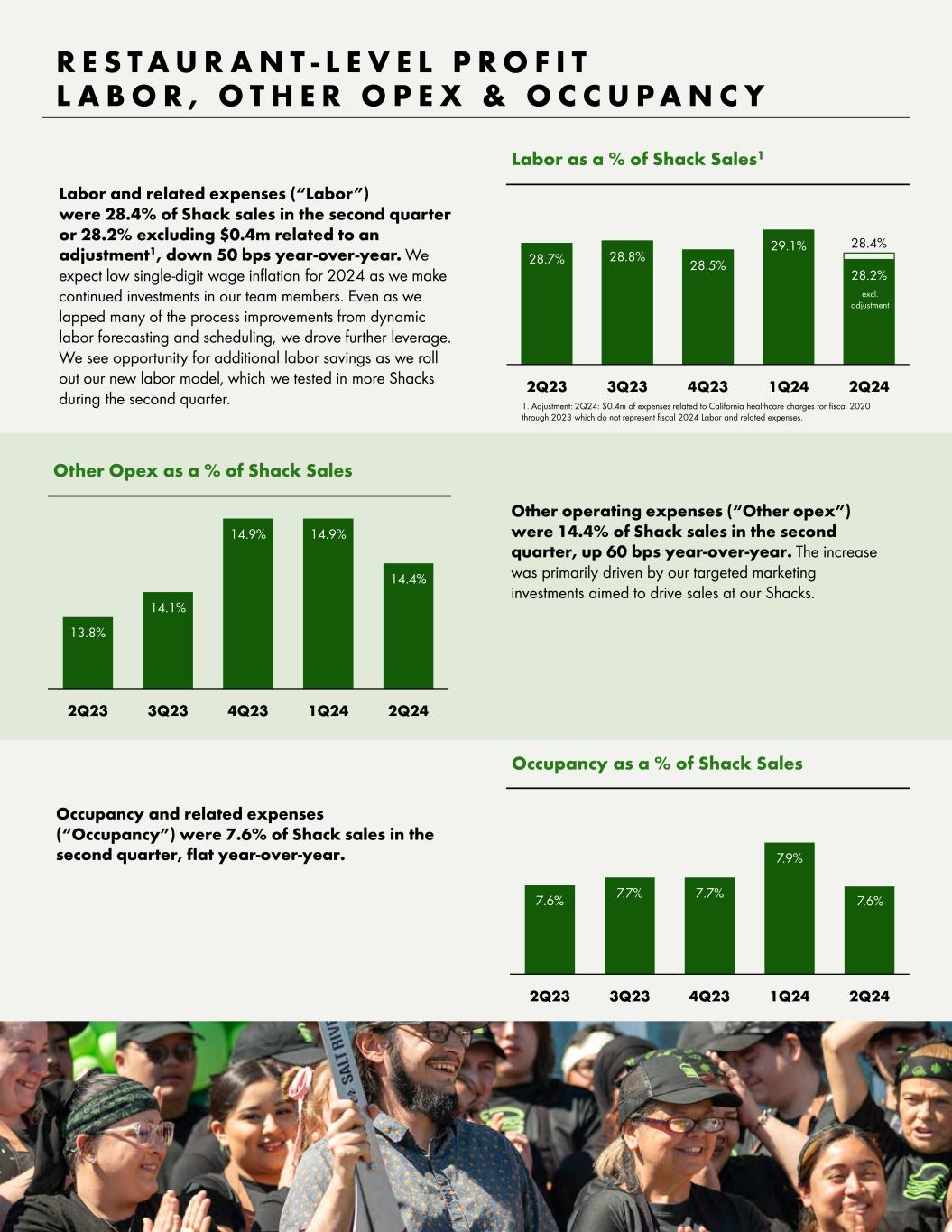

Occupancy and related expenses (“Occupancy”) were 7.6% of Shack sales in the second quarter, flat year-over-year. Other operating expenses (“Other opex”) were 14.4% of Shack sales in the second quarter, up 60 bps year-over-year. The increase was primarily driven by our targeted marketing investments aimed to drive sales at our Shacks. 7.6% 7.7% 7.7% 7.9% 7.6% 2Q23 3Q23 4Q23 1Q24 2Q24 13.8% 14.1% 14.9% 14.9% 14.4% 2Q23 3Q23 4Q23 1Q24 2Q24 R E S T A U R A N T - L E V E L P R O F I T L A B O R , O T H E R O P E X & O C C U P A N C Y 28.7% 28.8% 28.5% 29.1% 28.2% 2Q23 3Q23 4Q23 1Q24 2Q24 Labor as a % of Shack Sales1 Labor and related expenses (“Labor”) were 28.4% of Shack sales in the second quarter or 28.2% excluding $0.4m related to an adjustment1, down 50 bps year-over-year. We expect low single-digit wage inflation for 2024 as we make continued investments in our team members. Even as we lapped many of the process improvements from dynamic labor forecasting and scheduling, we drove further leverage. We see opportunity for additional labor savings as we roll out our new labor model, which we tested in more Shacks during the second quarter. Occupancy as a % of Shack Sales Other Opex as a % of Shack Sales 11 28.4% excl. adjustment 1. Adjustment: 2Q24: $0.4m of expenses related to California healthcare charges for fiscal 2020 through 2023 which do not represent fiscal 2024 Labor and related expenses.

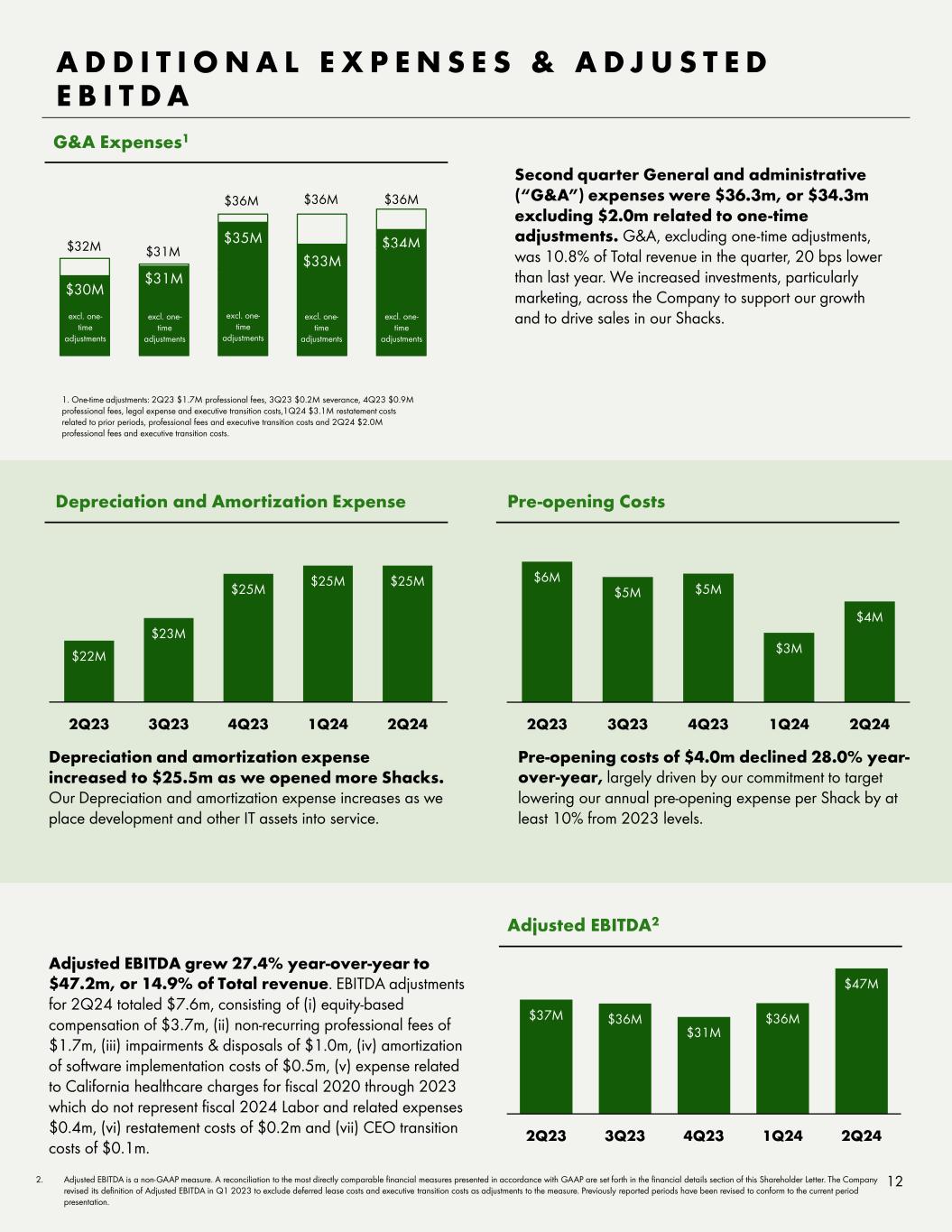

$30M $31M $35M $33M $34M G&A Expenses1 Second quarter General and administrative (“G&A”) expenses were $36.3m, or $34.3m excluding $2.0m related to one-time adjustments. G&A, excluding one-time adjustments, was 10.8% of Total revenue in the quarter, 20 bps lower than last year. We increased investments, particularly marketing, across the Company to support our growth and to drive sales in our Shacks. $22M $23M $25M $25M $25M 2Q23 3Q23 4Q23 1Q24 2Q24 Depreciation and Amortization Expense $6M $5M $5M $3M $4M 2Q23 3Q23 4Q23 1Q24 2Q24 Pre-opening Costs A D D I T I O N A L E X P E N S E S & A D J U S T E D E B I T D A 2. Adjusted EBITDA is a non-GAAP measure. A reconciliation to the most directly comparable financial measures presented in accordance with GAAP are set forth in the financial details section of this Shareholder Letter. The Company revised its definition of Adjusted EBITDA in Q1 2023 to exclude deferred lease costs and executive transition costs as adjustments to the measure. Previously reported periods have been revised to conform to the current period presentation. Adjusted EBITDA grew 27.4% year-over-year to $47.2m, or 14.9% of Total revenue. EBITDA adjustments for 2Q24 totaled $7.6m, consisting of (i) equity-based compensation of $3.7m, (ii) non-recurring professional fees of $1.7m, (iii) impairments & disposals of $1.0m, (iv) amortization of software implementation costs of $0.5m, (v) expense related to California healthcare charges for fiscal 2020 through 2023 which do not represent fiscal 2024 Labor and related expenses $0.4m, (vi) restatement costs of $0.2m and (vii) CEO transition costs of $0.1m. $37M $36M $31M $36M $47M 2Q23 3Q23 4Q23 1Q24 2Q24 Adjusted EBITDA2 12 1. One-time adjustments: 2Q23 $1.7M professional fees, 3Q23 $0.2M severance, 4Q23 $0.9M professional fees, legal expense and executive transition costs,1Q24 $3.1M restatement costs related to prior periods, professional fees and executive transition costs and 2Q24 $2.0M professional fees and executive transition costs. excl. one- time adjustments $31M $36M Depreciation and amortization expense increased to $25.5m as we opened more Shacks. Our Depreciation and amortization expense increases as we place development and other IT assets into service. Pre-opening costs of $4.0m declined 28.0% year- over-year, largely driven by our commitment to target lowering our annual pre-opening expense per Shack by at least 10% from 2023 levels. $36M $32M $36M excl. one- time adjustments excl. one- time adjustments excl. one- time adjustments excl. one- time adjustments

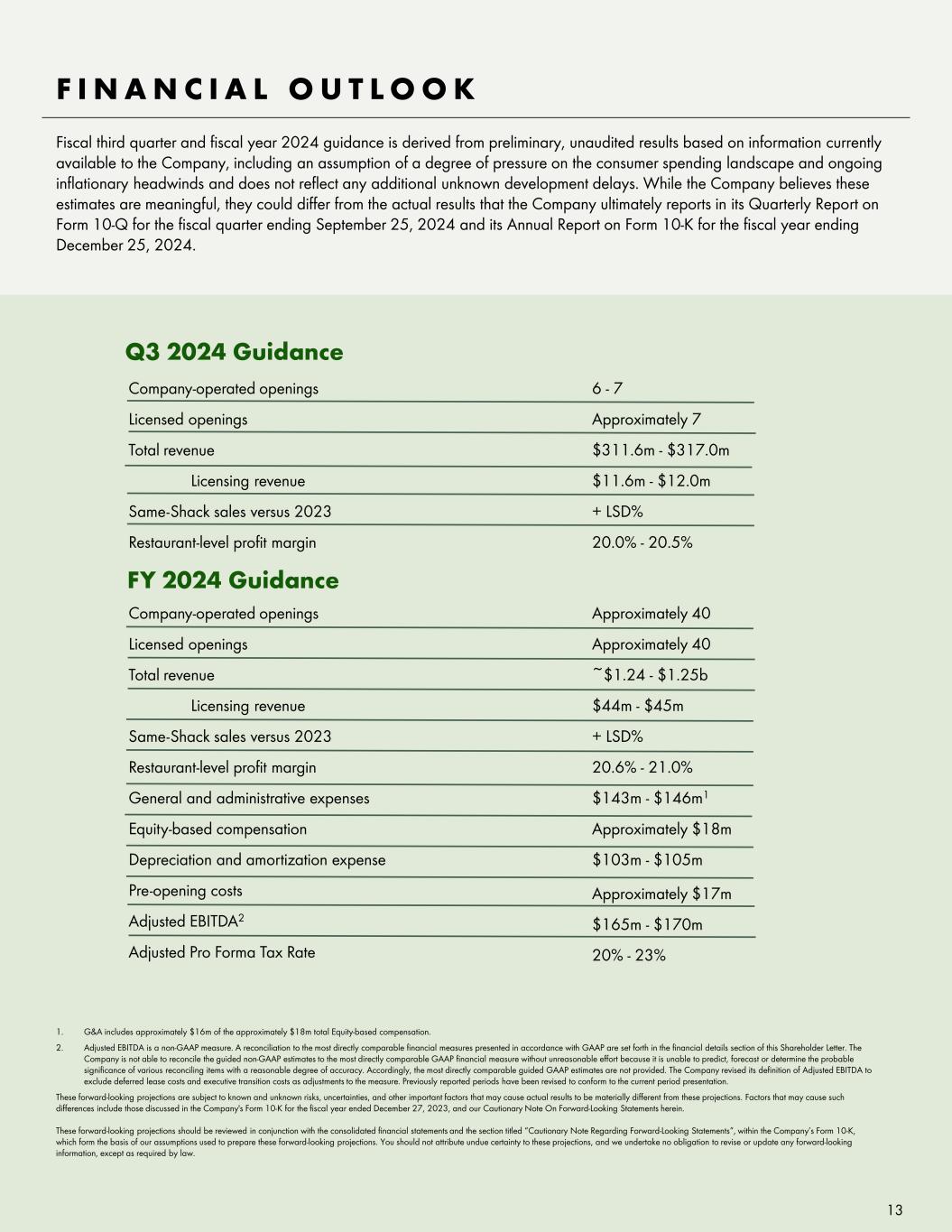

Fiscal third quarter and fiscal year 2024 guidance is derived from preliminary, unaudited results based on information currently available to the Company, including an assumption of a degree of pressure on the consumer spending landscape and ongoing inflationary headwinds and does not reflect any additional unknown development delays. While the Company believes these estimates are meaningful, they could differ from the actual results that the Company ultimately reports in its Quarterly Report on Form 10-Q for the fiscal quarter ending September 25, 2024 and its Annual Report on Form 10-K for the fiscal year ending December 25, 2024. F I N A N C I A L O U T L O O K 13 1. G&A includes approximately $16m of the approximately $18m total Equity-based compensation. 2. Adjusted EBITDA is a non-GAAP measure. A reconciliation to the most directly comparable financial measures presented in accordance with GAAP are set forth in the financial details section of this Shareholder Letter. The Company is not able to reconcile the guided non-GAAP estimates to the most directly comparable GAAP financial measure without unreasonable effort because it is unable to predict, forecast or determine the probable significance of various reconciling items with a reasonable degree of accuracy. Accordingly, the most directly comparable guided GAAP estimates are not provided. The Company revised its definition of Adjusted EBITDA to exclude deferred lease costs and executive transition costs as adjustments to the measure. Previously reported periods have been revised to conform to the current period presentation. These forward-looking projections are subject to known and unknown risks, uncertainties, and other important factors that may cause actual results to be materially different from these projections. Factors that may cause such differences include those discussed in the Company's Form 10-K for the fiscal year ended December 27, 2023, and our Cautionary Note On Forward-Looking Statements herein. These forward-looking projections should be reviewed in conjunction with the consolidated financial statements and the section titled “Cautionary Note Regarding Forward-Looking Statements”, within the Company’s Form 10-K, which form the basis of our assumptions used to prepare these forward-looking projections. You should not attribute undue certainty to these projections, and we undertake no obligation to revise or update any forward-looking information, except as required by law. Company-operated openings Licensed openings Total revenue Licensing revenue Same-Shack sales versus 2023 Restaurant-level profit margin Company-operated openings Licensed openings Total revenue Licensing revenue Same-Shack sales versus 2023 Restaurant-level profit margin General and administrative expenses Equity-based compensation Depreciation and amortization expense Pre-opening costs Adjusted EBITDA2 Adjusted Pro Forma Tax Rate 6 - 7 Approximately 7 $311.6m - $317.0m $11.6m - $12.0m + LSD% 20.0% - 20.5% Approximately 40 Approximately 40 ~$1.24 - $1.25b $44m - $45m + LSD% 20.6% - 21.0% $143m - $146m1 Approximately $18m $103m - $105m Approximately $17m $165m - $170m 20% - 23% Q3 2024 Guidance FY 2024 Guidance

“Going to shake shack this weekend and taking the family! ” “The nearest Shake Shack to me is 30 mins away, but I have it on my ‘To Do’ list for next Sunday!!!” “I have never had Shake Shack but will be going now!!! Looks so good” “I never heard of this place will definitely be trying this! New follower ! Love your videos” “@SHAKE SHACK you did a solid move with this – I think I’m going to get one of these for dinner tonight!” “Yasss we love a supportive company!!! Gonna order some shake shack today! @SHAKE SHACK ” “We love to see it!! I’m going to @SHAKESHACK this week!” “I haven’t been to @SHAKESHACK in forever! Time to make a visit ” “All of a sudden I’m stoked for the shake shack opening by my house! ”

Financial Details & Definitions DRAFT

C A U T I O N A RY N O T E O N F O R WA R D - L O O K I N G S TAT E M E N T S 16 This presentation contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995 ("PSLRA"), which are subject to known and unknown risks, uncertainties and other important factors that may cause actual results to be materially different from the statements made herein. All statements other than statements of historical fact included in this presentation are forward-looking statements, including, but not limited to, the Company's strategic initiatives, expected financial results and operating performance for fiscal 2024, expected development targets, including expected Shack construction and openings, expected same-Shack sales growth, average weekly sales and trends in the Company’s operations, the expansion of the Company’s delivery services, the Company's kiosk, digital, drive-thru and multiple format investments and strategies, 2024 guidance, and statements relating to the impact of COVID-19. Forward-looking statements discuss the Company’s current expectations and projections relating to its financial position, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as "aim," "anticipate," "believe," "estimate," "expect," "forecast," "future," "intend," "outlook," "potential," "preliminary," "project," "projection," "plan," "seek," "may," "could," "would," "will," "should," "can," "can have," "likely," the negatives thereof and other similar expressions. All forward- looking statements are expressly qualified in their entirety by these cautionary statements. Some of the factors which could cause results to differ materially from the Company’s expectations include the continuing impact of the COVID-19 pandemic, including the potential impact of any COVID-19 variants, the Company's ability to develop and open new Shacks on a timely basis, increased costs or shortages or interruptions in the supply and delivery of the Company's products, increased labor costs or shortages, inflationary pressures, the Company's management of its digital capabilities and expansion into new channels including drive-thru and multiple format investments, the Company's ability to maintain and grow sales at its existing Shacks, risks relating to the restaurant industry generally, and the impact of any material weakness in the Company's internal controls over financial reporting identified in connection with the restatement described in the Company's Annual Report on Form 10-K filed with the SEC on February 29, 2024 or otherwise. You should evaluate all forward-looking statements made in this presentation in the context of the risks and uncertainties disclosed in the Company’s Annual Report on Form 10-K for the fiscal year ended December 27, 2023 as filed with the Securities and Exchange Commission ("SEC"). All of the Company's SEC filings are available online at www.sec.gov, www.shakeshack.com or upon request from Shake Shack Inc. The forward-looking statements included in this presentation are made only as of the date hereof. The Company undertakes no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

D E F I N I T I O N S 17 The following definitions, and definitions on the subsequent pages, apply to terms as used in this shareholder letter: "Shack sales" is defined as the aggregate sales of food, beverages, gift card breakage income, and Shake Shack branded merchandise at Company-operated Shacks and excludes sales from licensed Shacks. “System-wide sales” is an operating measure and consists of sales from Company-operated Shacks and licensed Shacks. The Company does not recognize the sales from licensed Shacks as revenue. Of these amounts, revenue is limited to licensing revenue based on a percentage of sales from licensed Shacks, as well as certain up-front fees, such as territory fees and opening fees. "Same-Shack sales" or “SSS” represents Shack sales for the comparable Shack base, which is defined as the number of Company- operated Shacks open for 24 full fiscal months or longer. For consecutive days that Shacks were temporarily closed, the comparative period was also adjusted. "Average weekly sales" or “AWS” is calculated by dividing total Shack sales by the number of operating weeks for all Shacks in operation during the period. For Shacks that are not open for the entire period, fractional adjustments are made to the number of operating weeks open such that it corresponds to the period of associated sales. “Adjusted pro forma net income," a non-GAAP measure, represents Net income (loss) attributable to Shake Shack Inc. assuming the full exchange of all outstanding SSE Holdings, LLC membership interests ("LLC Interests") for shares of Class A common stock, adjusted for certain non-recurring and other items that the Company does not believe directly reflect its core operations and may not be indicative of the Company’s recurring business operations. “EBITDA,” a non-GAAP measure, is defined as Net income (loss) before interest expense (net of interest income), Income tax expense (benefit), and Depreciation and amortization expense. “Adjusted EBITDA,” a non-GAAP measure, is defined as EBITDA (as defined above), excluding equity-based compensation expense, Impairment and loss on disposal of assets, amortization of cloud-based software implementation costs, as well as certain non-recurring items that the Company does not believe directly reflect its core operations and may not be indicative of the Company's recurring business operations. “Adjusted EBITDA margin,” a non-GAAP measure, is defined as Net income (loss) before interest expense (net of interest income), Income tax expense (benefit) and Depreciation and amortization expense, which also excludes equity-based compensation expense, Impairment and loss on disposal of assets, amortization of cloud-based software implementation costs, as well as certain non-recurring items that the Company does not believe directly reflect its core operations and may not be indicative of the Company's recurring business operations, as a percentage of Total revenue. “Restaurant-level profit,” a non-GAAP measure, formerly referred to as Shack-level operating profit, is defined as Shack sales less Shack-level operating expenses, including Food and paper costs, Labor and related expenses, Other operating expenses, and Occupancy and related expenses. "Restaurant-level profit margin," a non-GAAP measure, formerly referred to as Shack-level operating profit margin, is defined as Shack sales less Shack-level operating expenses, including Food and paper costs, Labor and related expenses, Other operating expenses and Occupancy and related expenses as a percentage of Shack sales.

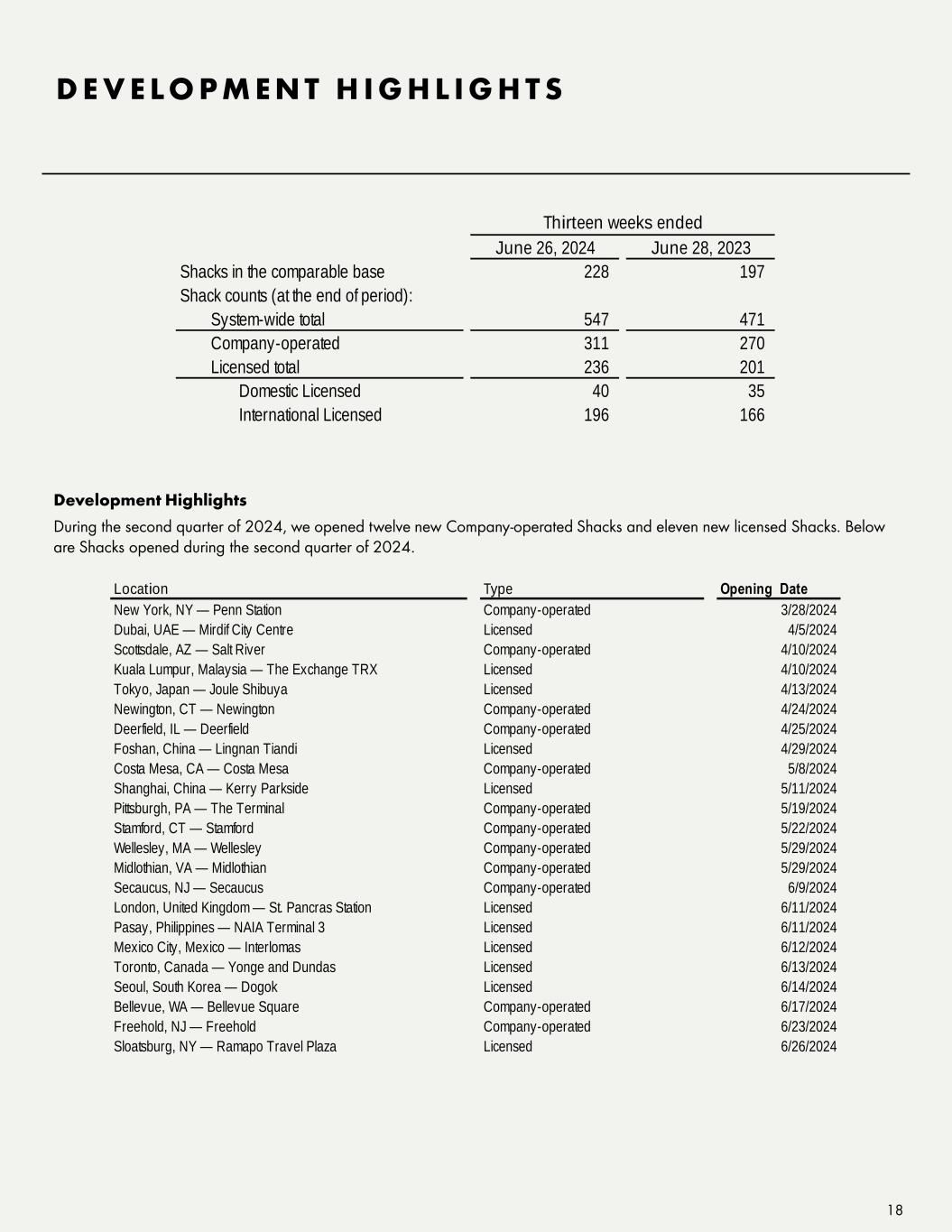

June 26, 2024 June 28, 2023 Shacks in the comparable base 228 197 Shack counts (at the end of period): System-wide total 547 471 Company-operated 311 270 Licensed total 236 201 Domestic Licensed 40 35 International Licensed 196 166 Thirteen weeks ended D E V E L O P M E N T H I G H L I G H T S 18 Development Highlights During the second quarter of 2024, we opened twelve new Company-operated Shacks and eleven new licensed Shacks. Below are Shacks opened during the second quarter of 2024. Location Type Opening Date New York, NY — Penn Station Company-operated 3/28/2024 Dubai, UAE — Mirdif City Centre Licensed 4/5/2024 Scottsdale, AZ — Salt River Company-operated 4/10/2024 Kuala Lumpur, Malaysia — The Exchange TRX Licensed 4/10/2024 Tokyo, Japan — Joule Shibuya Licensed 4/13/2024 Newington, CT — Newington Company-operated 4/24/2024 Deerfield, IL — Deerfield Company-operated 4/25/2024 Foshan, China — Lingnan Tiandi Licensed 4/29/2024 Costa Mesa, CA — Costa Mesa Company-operated 5/8/2024 Shanghai, China — Kerry Parkside Licensed 5/11/2024 Pittsburgh, PA — The Terminal Company-operated 5/19/2024 Stamford, CT — Stamford Company-operated 5/22/2024 Wellesley, MA — Wellesley Company-operated 5/29/2024 Midlothian, VA — Midlothian Company-operated 5/29/2024 Secaucus, NJ — Secaucus Company-operated 6/9/2024 London, United Kingdom — St. Pancras Station Licensed 6/11/2024 Pasay, Philippines — NAIA Terminal 3 Licensed 6/11/2024 Mexico City, Mexico — Interlomas Licensed 6/12/2024 Toronto, Canada — Yonge and Dundas Licensed 6/13/2024 Seoul, South Korea — Dogok Licensed 6/14/2024 Bellevue, WA — Bellevue Square Company-operated 6/17/2024 Freehold, NJ — Freehold Company-operated 6/23/2024 Sloatsburg, NY — Ramapo Travel Plaza Licensed 6/26/2024

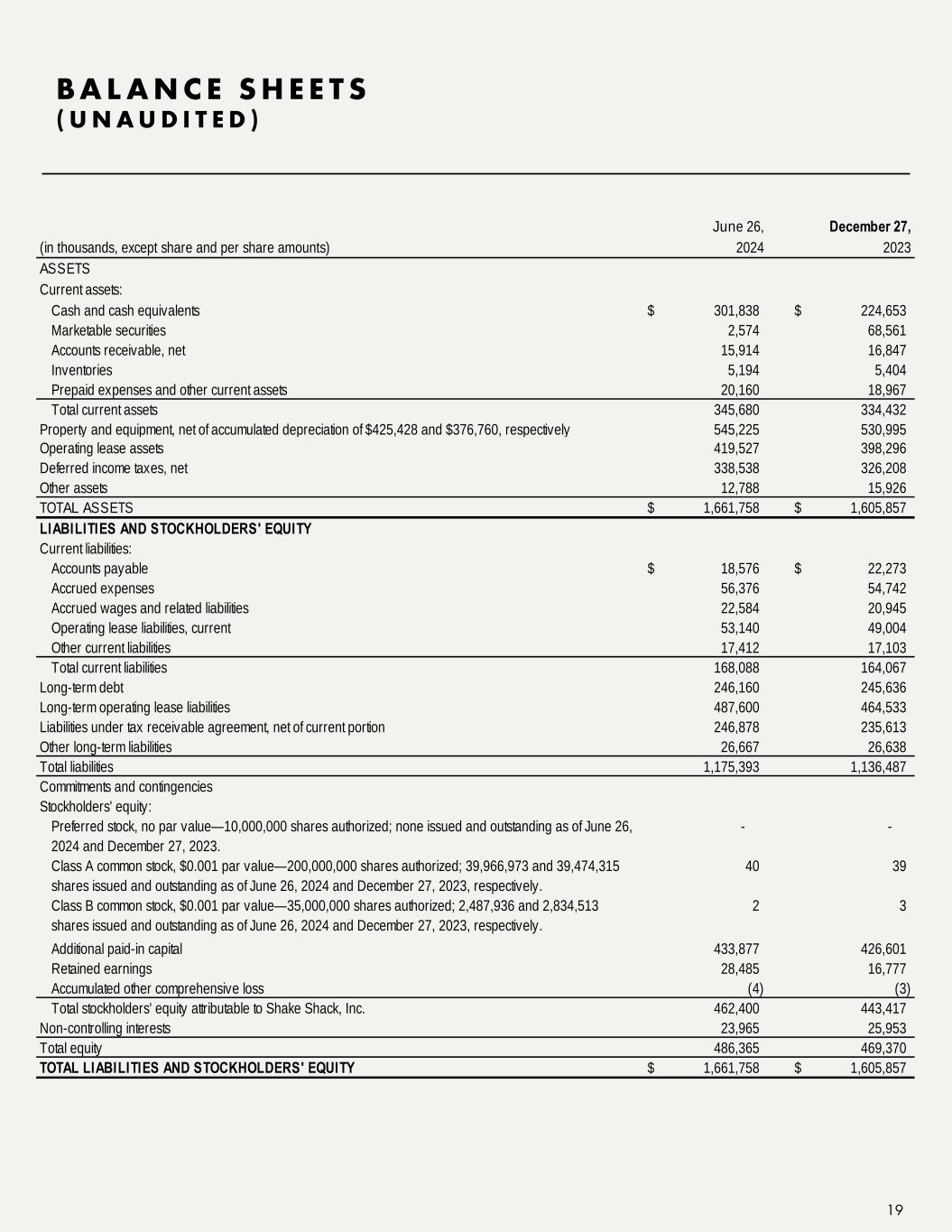

B A L A N C E S H E E T S ( U N A U D I T E D ) 19 June 26, December 27, 2024 2023 ASSETS Current assets: Cash and cash equivalents 301,838$ 224,653$ Marketable securities 2,574 68,561 Accounts receivable, net 15,914 16,847 Inventories 5,194 5,404 Prepaid expenses and other current assets 20,160 18,967 Total current assets 345,680 334,432 Property and equipment, net of accumulated depreciation of $425,428 and $376,760, respectively 545,225 530,995 Operating lease assets 419,527 398,296 Deferred income taxes, net 338,538 326,208 Other assets 12,788 15,926 TOTAL ASSETS 1,661,758$ 1,605,857$ LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable 18,576$ 22,273$ Accrued expenses 56,376 54,742 Accrued wages and related liabilities 22,584 20,945 Operating lease liabilities, current 53,140 49,004 Other current liabilities 17,412 17,103 Total current liabilities 168,088 164,067 Long-term debt 246,160 245,636 Long-term operating lease liabilities 487,600 464,533 Liabilities under tax receivable agreement, net of current portion 246,878 235,613 Other long-term liabilities 26,667 26,638 Total liabilities 1,175,393 1,136,487 Commitments and contingencies Stockholders' equity: Preferred stock, no par value—10,000,000 shares authorized; none issued and outstanding as of June 26, 2024 and December 27, 2023. - - Class A common stock, $0.001 par value—200,000,000 shares authorized; 39,966,973 and 39,474,315 shares issued and outstanding as of June 26, 2024 and December 27, 2023, respectively. 40 39 Class B common stock, $0.001 par value—35,000,000 shares authorized; 2,487,936 and 2,834,513 shares issued and outstanding as of June 26, 2024 and December 27, 2023, respectively. 2 3 Additional paid-in capital 433,877 426,601 Retained earnings 28,485 16,777 Accumulated other comprehensive loss (4) (3) Total stockholders' equity attributable to Shake Shack, Inc. 462,400 443,417 Non-controlling interests 23,965 25,953 Total equity 486,365 469,370 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY 1,661,758$ 1,605,857$ (in thousands, except share and per share amounts)

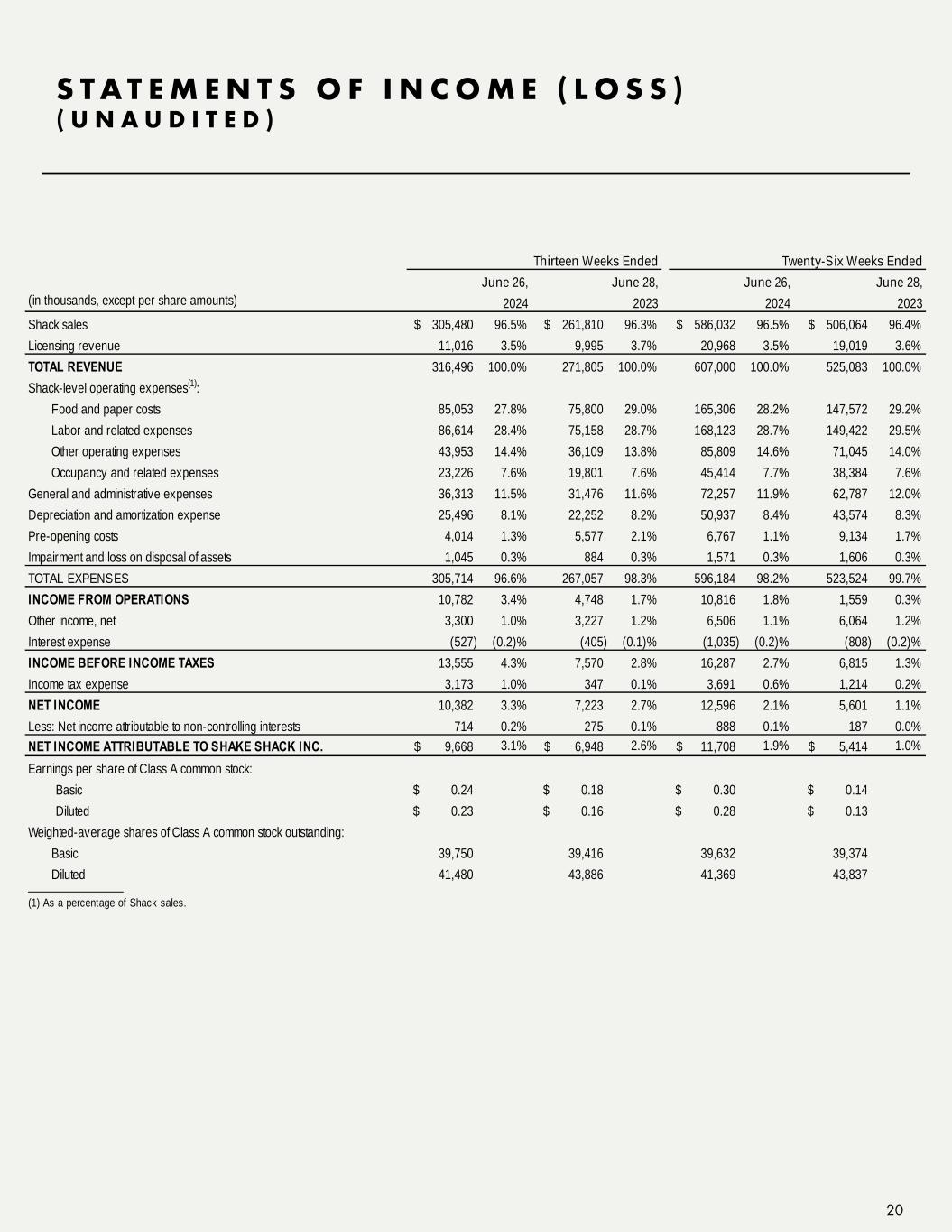

S T A T E M E N T S O F I N C O M E ( L O S S ) ( U N A U D I T E D ) 20 Shack sales 305,480$ 96.5% 261,810$ 96.3% 586,032$ 96.5% 506,064$ 96.4% Licensing revenue 11,016 3.5% 9,995 3.7% 20,968 3.5% 19,019 3.6% TOTAL REVENUE 316,496 100.0% 271,805 100.0% 607,000 100.0% 525,083 100.0% Shack-level operating expenses(1): Food and paper costs 85,053 27.8% 75,800 29.0% 165,306 28.2% 147,572 29.2% Labor and related expenses 86,614 28.4% 75,158 28.7% 168,123 28.7% 149,422 29.5% Other operating expenses 43,953 14.4% 36,109 13.8% 85,809 14.6% 71,045 14.0% Occupancy and related expenses 23,226 7.6% 19,801 7.6% 45,414 7.7% 38,384 7.6% General and administrative expenses 36,313 11.5% 31,476 11.6% 72,257 11.9% 62,787 12.0% Depreciation and amortization expense 25,496 8.1% 22,252 8.2% 50,937 8.4% 43,574 8.3% Pre-opening costs 4,014 1.3% 5,577 2.1% 6,767 1.1% 9,134 1.7% Impairment and loss on disposal of assets 1,045 0.3% 884 0.3% 1,571 0.3% 1,606 0.3% TOTAL EXPENSES 305,714 96.6% 267,057 98.3% 596,184 98.2% 523,524 99.7% INCOME FROM OPERATIONS 10,782 3.4% 4,748 1.7% 10,816 1.8% 1,559 0.3% Other income, net 3,300 1.0% 3,227 1.2% 6,506 1.1% 6,064 1.2% Interest expense (527) (0.2)% (405) (0.1)% (1,035) (0.2)% (808) (0.2)% INCOME BEFORE INCOME TAXES 13,555 4.3% 7,570 2.8% 16,287 2.7% 6,815 1.3% Income tax expense 3,173 1.0% 347 0.1% 3,691 0.6% 1,214 0.2% NET INCOME 10,382 3.3% 7,223 2.7% 12,596 2.1% 5,601 1.1% Less: Net income attributable to non-controlling interests 714 0.2% 275 0.1% 888 0.1% 187 0.0% NET INCOME ATTRIBUTABLE TO SHAKE SHACK INC. 9,668$ 3.1% 6,948$ 2.6% 11,708$ 1.9% 5,414$ 1.0% Earnings per share of Class A common stock: Basic $ 0.24 $ 0.18 $ 0.30 $ 0.14 Diluted $ 0.23 $ 0.16 $ 0.28 $ 0.13 Weighted-average shares of Class A common stock outstanding: Basic 39,750 39,416 39,632 39,374 Diluted 41,480 43,886 41,369 43,837 _______________ June 28, June 28, Thirteen Weeks Ended Twenty-Six Weeks Ended (in thousands, except per share amounts) 2024 2023 2024 2023 (1) As a percentage of Shack sales. June 26, June 26,

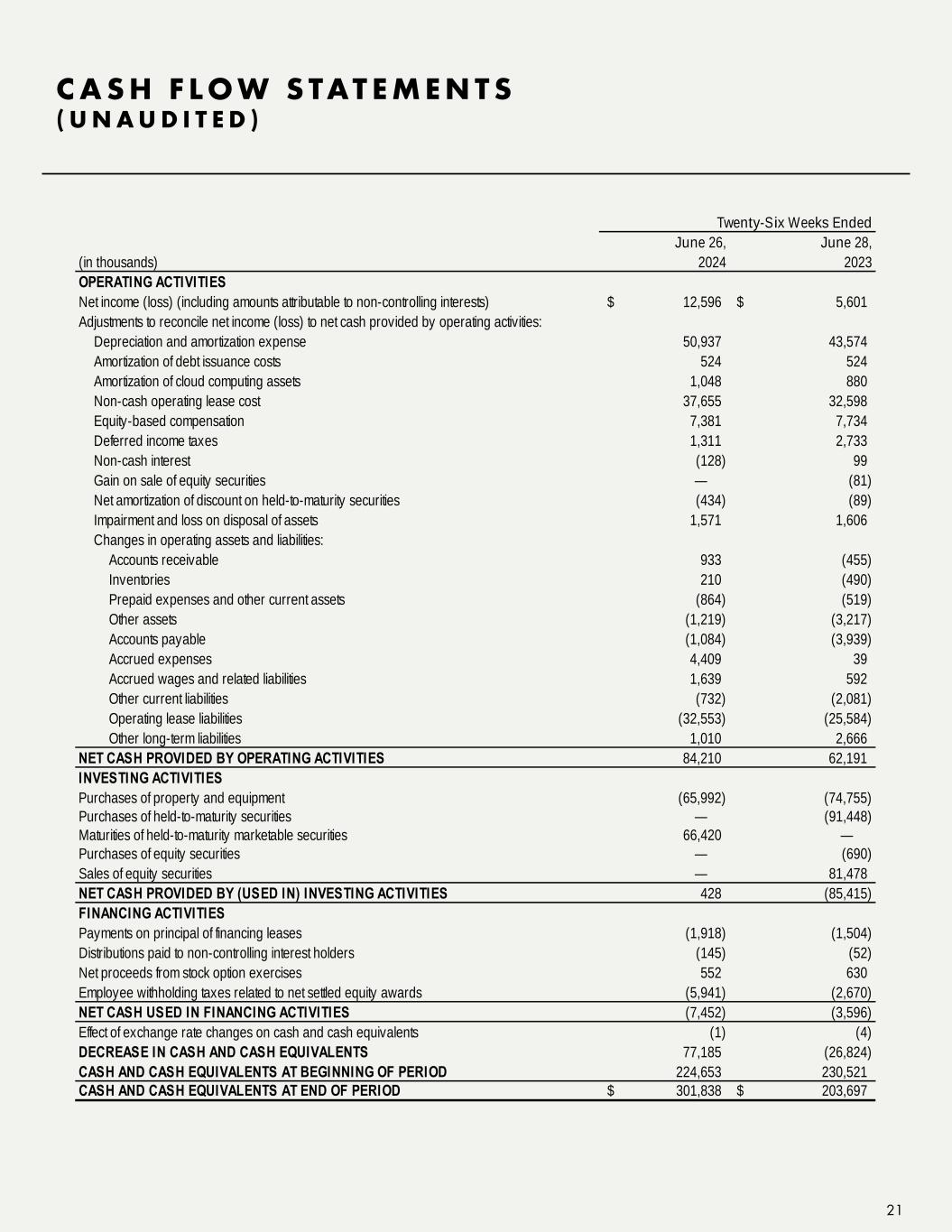

C A S H F L O W S TAT E M E N T S ( U N A U D I T E D ) 21 June 26, June 28, (in thousands) 2024 2023 OPERATING ACTIVITIES Net income (loss) (including amounts attributable to non-controlling interests) 12,596$ 5,601$ Adjustments to reconcile net income (loss) to net cash provided by operating activities: Depreciation and amortization expense 50,937 43,574 Amortization of debt issuance costs 524 524 Amortization of cloud computing assets 1,048 880 Non-cash operating lease cost 37,655 32,598 Equity-based compensation 7,381 7,734 Deferred income taxes 1,311 2,733 Non-cash interest (128) 99 Gain on sale of equity securities — (81) Net amortization of discount on held-to-maturity securities (434) (89) Impairment and loss on disposal of assets 1,571 1,606 Changes in operating assets and liabilities: Accounts receivable 933 (455) Inventories 210 (490) Prepaid expenses and other current assets (864) (519) Other assets (1,219) (3,217) Accounts payable (1,084) (3,939) Accrued expenses 4,409 39 Accrued wages and related liabilities 1,639 592 Other current liabilities (732) (2,081) Operating lease liabilities (32,553) (25,584) Other long-term liabilities 1,010 2,666 NET CASH PROVIDED BY OPERATING ACTIVITIES 84,210 62,191 INVESTING ACTIVITIES Purchases of property and equipment (65,992) (74,755) Purchases of held-to-maturity securities — (91,448) Maturities of held-to-maturity marketable securities 66,420 — Purchases of equity securities — (690) Sales of equity securities — 81,478 NET CASH PROVIDED BY (USED IN) INVESTING ACTIVITIES 428 (85,415) FINANCING ACTIVITIES Payments on principal of financing leases (1,918) (1,504) Distributions paid to non-controlling interest holders (145) (52) Net proceeds from stock option exercises 552 630 Employee withholding taxes related to net settled equity awards (5,941) (2,670) NET CASH USED IN FINANCING ACTIVITIES (7,452) (3,596) Effect of exchange rate changes on cash and cash equivalents (1) (4) DECREASE IN CASH AND CASH EQUIVALENTS 77,185 (26,824) CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD 224,653 230,521 CASH AND CASH EQUIVALENTS AT END OF PERIOD 301,838$ 203,697$ Twenty-Six Weeks Ended

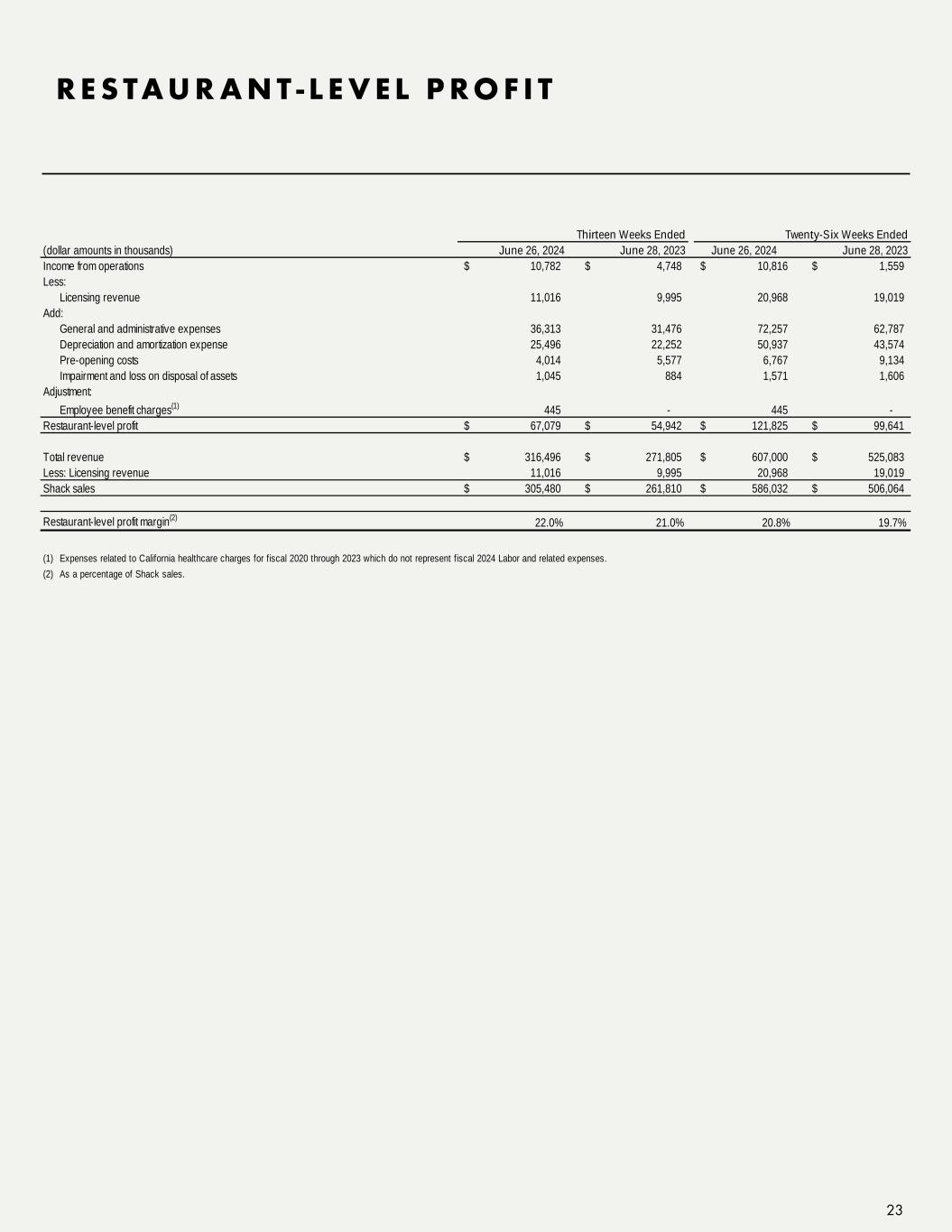

R E S TA U R A N T - L E V E L P R O F I T D E F I N I T I O N S 22 Restaurant-Level Profit “Restaurant-level profit,” a non-GAAP measure, formerly referred to as Shack-level operating profit, is defined as Shack sales less Shack-level operating expenses, including Food and paper costs, Labor and related expenses, Other operating expenses, and Occupancy and related expenses. Restaurant-level Profit Margin "Restaurant-level profit margin," a non-GAAP measure, formerly referred to as Shack-level operating profit margin, is defined as Shack sales less Shack-level operating expenses, including Food and paper costs, Labor and related expenses, Other operating expenses and Occupancy and related expenses as a percentage of Shack sales. How This Measure Is Useful When used in conjunction with GAAP financial measures, Restaurant-level profit and Restaurant-level profit margin are supplemental measures of operating performance that the Company believes are useful measures to evaluate the performance and profitability of its Shacks. Additionally, Restaurant-level profit and Restaurant-level profit margin are key metrics used internally by management to develop internal budgets and forecasts, as well as assess the performance of its Shacks relative to budget and against prior periods. It is also used to evaluate employee compensation as it serves as a metric in certain performance-based employee bonus arrangements. The Company believes presentation of Restaurant-level profit and Restaurant-level profit margin provides investors with a supplemental view of its operating performance that can provide meaningful insights to the underlying operating performance of the Shacks, as these measures depict the operating results that are directly impacted by the Shacks and exclude items that may not be indicative of, or are unrelated to, the ongoing operations of the Shacks. It may also assist investors to evaluate the Company's performance relative to peers of various sizes and maturities and provides greater transparency with respect to how management evaluates the business, as well as the financial and operational decision-making. Limitations of the Usefulness of this Measure Restaurant-level profit and Restaurant-level profit margin may differ from similarly titled measures used by other companies due to different methods of calculation. Presentation of Restaurant-level profit and Restaurant-level profit margin is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. Restaurant-level profit excludes certain costs, such as General and administrative expenses and Pre-opening costs, which are considered normal, recurring cash operating expenses and are essential to support the operation and development of the Company's Shacks. Therefore, this measure may not provide a complete understanding of the Company's operating results as a whole and Restaurant-level profit and Restaurant-level profit margin should be reviewed in conjunction with the Company’s GAAP financial results. A reconciliation of Restaurant-level profit to operating income (loss), the most directly comparable GAAP financial measure, is set forth on next slide.

R E S TA U R A N T - L E V E L P R O F I T 23 (dollar amounts in thousands) June 26, 2024 June 28, 2023 June 26, 2024 June 28, 2023 Income from operations 10,782$ 4,748$ 10,816$ 1,559$ Less: Licensing revenue 11,016 9,995 20,968 19,019 Add: General and administrative expenses 36,313 31,476 72,257 62,787 Depreciation and amortization expense 25,496 22,252 50,937 43,574 Pre-opening costs 4,014 5,577 6,767 9,134 Impairment and loss on disposal of assets 1,045 884 1,571 1,606 Adjustment: Employee benefit charges(1) 445 - 445 - Restaurant-level profit 67,079$ 54,942$ 121,825$ 99,641$ Total revenue 316,496$ 271,805$ 607,000$ 525,083$ Less: Licensing revenue 11,016 9,995 20,968 19,019 Shack sales 305,480$ 261,810$ 586,032$ 506,064$ Restaurant-level profit margin(2) 22.0% 21.0% 20.8% 19.7% (1) (2) As a percentage of Shack sales. Thirteen Weeks Ended Twenty-Six Weeks Ended Expenses related to California healthcare charges for fiscal 2020 through 2023 which do not represent fiscal 2024 Labor and related expenses.

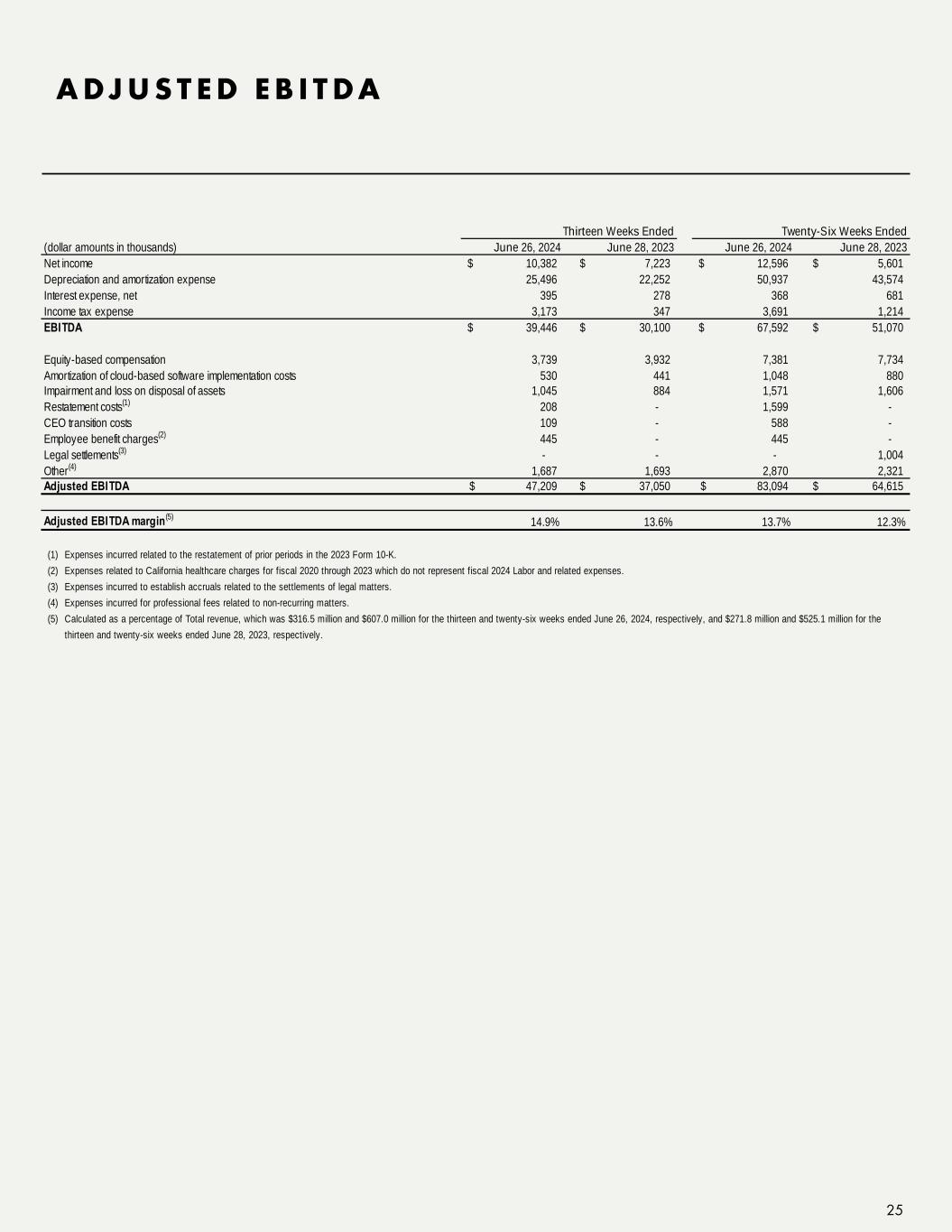

EBITDA and Adjusted EBITDA EBITDA, a non-GAAP measure, is defined as Net income (loss) before interest expense (net of interest income), Income tax expense (benefit) and Depreciation and amortization expense. Adjusted EBITDA, a non-GAAP measure, is defined as EBITDA (as defined above) excluding equity-based compensation expense, Impairment and loss on the disposal of assets, amortization of cloud-based software implementation costs, as well as certain non-recurring items that the Company does not believe directly reflect its core operations and may not be indicative of the Company's recurring business operations. How These Measures Are Useful When used in conjunction with GAAP financial measures, EBITDA and adjusted EBITDA are supplemental measures of operating performance that the Company believes are useful measures to facilitate comparisons to historical performance and competitors' operating results. Adjusted EBITDA is a key metric used internally by management to develop internal budgets and forecasts and also serves as a metric in its performance-based equity incentive programs and certain bonus arrangements. The Company believes presentation of EBITDA and adjusted EBITDA provides investors with a supplemental view of the Company's operating performance that facilitates analysis and comparisons of its ongoing business operations because they exclude items that may not be indicative of the Company's ongoing operating performance. Limitations of the Usefulness of These Measures EBITDA and adjusted EBITDA may differ from similarly titled measures used by other companies due to different methods of calculation. Presentation of EBITDA and adjusted EBITDA is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. EBITDA and adjusted EBITDA exclude certain normal recurring expenses. Therefore, these measures may not provide a complete understanding of the Company's performance and should be reviewed in conjunction with the GAAP financial measures. A reconciliation of EBITDA and adjusted EBITDA to Net income (loss), the most directly comparable GAAP measure, is set forth on next slide. A DJ U S T E D E B I T D A D E F I N I T I O N S 24

A DJ U S T E D E B I T D A 25 (dollar amounts in thousands) June 26, 2024 June 28, 2023 June 26, 2024 June 28, 2023 Net income 10,382$ 7,223$ 12,596$ 5,601$ Depreciation and amortization expense 25,496 22,252 50,937 43,574 Interest expense, net 395 278 368 681 Income tax expense 3,173 347 3,691 1,214 EBITDA 39,446$ 30,100$ 67,592$ 51,070$ Equity-based compensation 3,739 3,932 7,381 7,734 Amortization of cloud-based software implementation costs 530 441 1,048 880 Impairment and loss on disposal of assets 1,045 884 1,571 1,606 Restatement costs(1) 208 - 1,599 - CEO transition costs 109 - 588 - Employee benefit charges(2) 445 - 445 - Legal settlements(3) - - - 1,004 Other(4) 1,687 1,693 2,870 2,321 Adjusted EBITDA 47,209$ 37,050$ 83,094$ 64,615$ Adjusted EBITDA margin(5) 14.9% 13.6% 13.7% 12.3% (1) (2) (3) (4) (5) Expenses incurred to establish accruals related to the settlements of legal matters. Expenses incurred for professional fees related to non-recurring matters. Calculated as a percentage of Total revenue, which was $316.5 million and $607.0 million for the thirteen and twenty-six weeks ended June 26, 2024, respectively, and $271.8 million and $525.1 million for the thirteen and twenty-six weeks ended June 28, 2023, respectively. Expenses related to California healthcare charges for fiscal 2020 through 2023 which do not represent fiscal 2024 Labor and related expenses. Thirteen Weeks Ended Twenty-Six Weeks Ended Expenses incurred related to the restatement of prior periods in the 2023 Form 10-K.

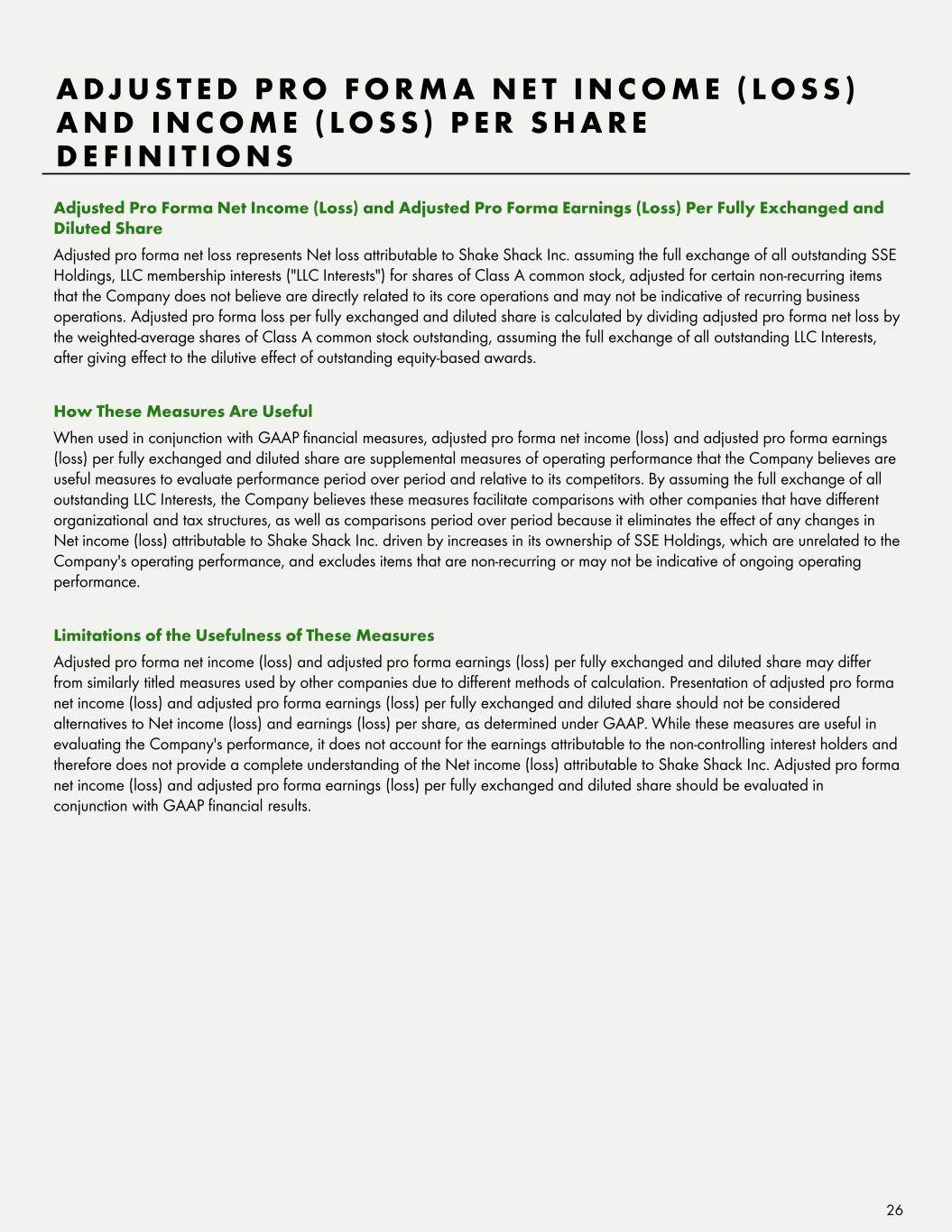

Adjusted Pro Forma Net Income (Loss) and Adjusted Pro Forma Earnings (Loss) Per Fully Exchanged and Diluted Share Adjusted pro forma net loss represents Net loss attributable to Shake Shack Inc. assuming the full exchange of all outstanding SSE Holdings, LLC membership interests ("LLC Interests") for shares of Class A common stock, adjusted for certain non-recurring items that the Company does not believe are directly related to its core operations and may not be indicative of recurring business operations. Adjusted pro forma loss per fully exchanged and diluted share is calculated by dividing adjusted pro forma net loss by the weighted-average shares of Class A common stock outstanding, assuming the full exchange of all outstanding LLC Interests, after giving effect to the dilutive effect of outstanding equity-based awards. How These Measures Are Useful When used in conjunction with GAAP financial measures, adjusted pro forma net income (loss) and adjusted pro forma earnings (loss) per fully exchanged and diluted share are supplemental measures of operating performance that the Company believes are useful measures to evaluate performance period over period and relative to its competitors. By assuming the full exchange of all outstanding LLC Interests, the Company believes these measures facilitate comparisons with other companies that have different organizational and tax structures, as well as comparisons period over period because it eliminates the effect of any changes in Net income (loss) attributable to Shake Shack Inc. driven by increases in its ownership of SSE Holdings, which are unrelated to the Company's operating performance, and excludes items that are non-recurring or may not be indicative of ongoing operating performance. Limitations of the Usefulness of These Measures Adjusted pro forma net income (loss) and adjusted pro forma earnings (loss) per fully exchanged and diluted share may differ from similarly titled measures used by other companies due to different methods of calculation. Presentation of adjusted pro forma net income (loss) and adjusted pro forma earnings (loss) per fully exchanged and diluted share should not be considered alternatives to Net income (loss) and earnings (loss) per share, as determined under GAAP. While these measures are useful in evaluating the Company's performance, it does not account for the earnings attributable to the non-controlling interest holders and therefore does not provide a complete understanding of the Net income (loss) attributable to Shake Shack Inc. Adjusted pro forma net income (loss) and adjusted pro forma earnings (loss) per fully exchanged and diluted share should be evaluated in conjunction with GAAP financial results. A DJ U S T E D P R O F O R M A N E T I N C O M E ( L O S S ) A N D I N C O M E ( L O S S ) P E R S H A R E D E F I N I T I O N S 26

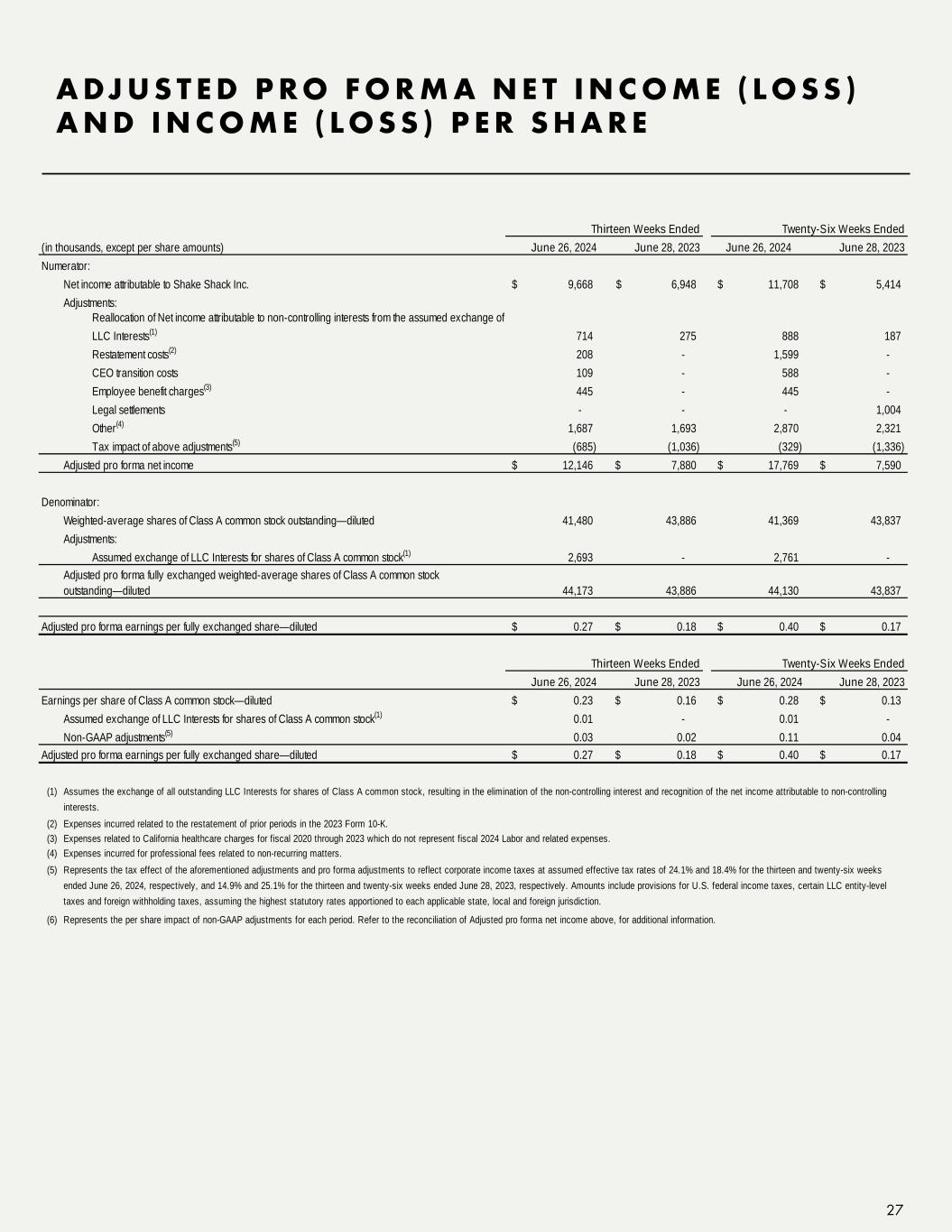

A DJ U S T E D P R O F O R M A N E T I N C O M E ( L O S S ) A N D I N C O M E ( L O S S ) P E R S H A R E 27 (in thousands, except per share amounts) June 26, 2024 June 28, 2023 June 26, 2024 June 28, 2023 Numerator: Net income attributable to Shake Shack Inc. 9,668$ 6,948$ 11,708$ 5,414$ Adjustments: Reallocation of Net income attributable to non-controlling interests from the assumed exchange of LLC Interests(1) 714 275 888 187 Restatement costs(2) 208 - 1,599 - CEO transition costs 109 - 588 - Employee benefit charges(3) 445 - 445 - Legal settlements - - - 1,004 Other(4) 1,687 1,693 2,870 2,321 Tax impact of above adjustments(5) (685) (1,036) (329) (1,336) Adjusted pro forma net income 12,146$ 7,880$ 17,769$ 7,590$ Denominator: Weighted-average shares of Class A common stock outstanding—diluted 41,480 43,886 41,369 43,837 Adjustments: Assumed exchange of LLC Interests for shares of Class A common stock(1) 2,693 - 2,761 - 44,173 43,886 44,130 43,837 Adjusted pro forma earnings per fully exchanged share—diluted 0.27$ 0.18$ 0.40$ 0.17$ June 26, 2024 June 28, 2023 June 26, 2024 June 28, 2023 Earnings per share of Class A common stock—diluted 0.23$ 0.16$ 0.28$ 0.13$ Assumed exchange of LLC Interests for shares of Class A common stock(1) 0.01 - 0.01 - Non-GAAP adjustments(5) 0.03 0.02 0.11 0.04 Adjusted pro forma earnings per fully exchanged share—diluted 0.27$ 0.18$ 0.40$ 0.17$ (1) (2) (3) (4) (5) (6) Represents the per share impact of non-GAAP adjustments for each period. Refer to the reconciliation of Adjusted pro forma net income above, for additional information. Thirteen Weeks Ended Twenty-Six Weeks Ended Adjusted pro forma fully exchanged weighted-average shares of Class A common stock outstanding—diluted Thirteen Weeks Ended Twenty-Six Weeks Ended Assumes the exchange of all outstanding LLC Interests for shares of Class A common stock, resulting in the elimination of the non-controlling interest and recognition of the net income attributable to non-controlling interests. Expenses incurred related to the restatement of prior periods in the 2023 Form 10-K. Expenses related to California healthcare charges for fiscal 2020 through 2023 which do not represent fiscal 2024 Labor and related expenses. Expenses incurred for professional fees related to non-recurring matters. Represents the tax effect of the aforementioned adjustments and pro forma adjustments to reflect corporate income taxes at assumed effective tax rates of 24.1% and 18.4% for the thirteen and twenty-six weeks ended June 26, 2024, respectively, and 14.9% and 25.1% for the thirteen and twenty-six weeks ended June 28, 2023, respectively. Amounts include provisions for U.S. federal income taxes, certain LLC entity-level taxes and foreign withholding taxes, assuming the highest statutory rates apportioned to each applicable state, local and foreign jurisdiction.

Adjusted Pro Forma Effective Tax Rate Adjusted pro forma effective tax rate represents the effective tax rate assuming the full exchange of all outstanding SSE Holdings, LLC membership interests ("LLC Interests") for shares of Class A common stock, adjusted for certain non-recurring items that the Company does not believe are directly related to its core operations and may not be indicative of its recurring business operations. How This Measure Is Useful When used in conjunction with GAAP financial measures, adjusted pro forma effective tax rate is a supplemental measure of operating performance that the Company believes is useful to evaluate its performance period over period and relative to its competitors. By assuming the full exchange of all outstanding LLC Interests, the Company believes this measure facilitates comparisons with other companies that have different organizational and tax structures, as well as comparisons period over period because it eliminates the effect of any changes in effective tax rate driven by increases in its ownership of SSE Holdings, which are unrelated to the Company's operating performance, and excludes items that are non-recurring or may not be indicative of ongoing operating performance. Limitations of the Usefulness of this Measure Adjusted pro forma effective tax rate may differ from similarly titled measures used by other companies due to different methods of calculation. Presentation of adjusted pro forma effective tax rate should not be considered an alternative to effective tax rate, as determined under GAAP. While this measure is useful in evaluating the Company's performance, it does not account for the effective tax rate attributable to the non-controlling interest holders and therefore does not provide a complete understanding of effective tax rate. Adjusted pro forma effective tax rate should be evaluated in conjunction with GAAP financial results. A reconciliation of adjusted pro forma effective tax rate, the most directly comparable GAAP measure, is set forth on next slide. A DJ U S T E D P R O F O R M A E F F E C T I V E TA X R AT E D E F I N I T I O N S 28

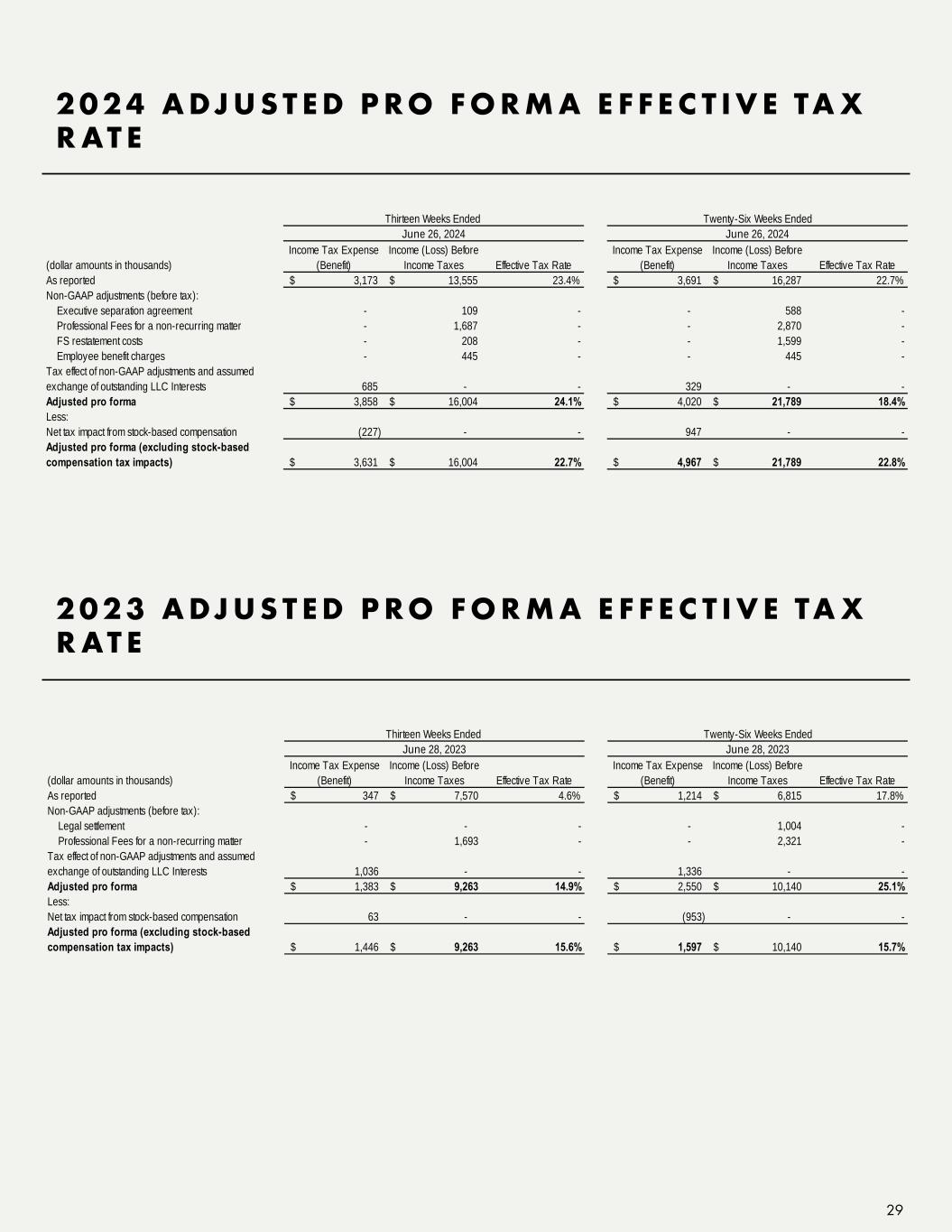

2 0 2 4 A DJ U S T E D P R O F O R M A E F F E C T I V E TA X R AT E 29 2 0 2 3 A DJ U S T E D P R O F O R M A E F F E C T I V E TA X R AT E (dollar amounts in thousands) Income Tax Expense (Benefit) Income (Loss) Before Income Taxes Effective Tax Rate Income Tax Expense (Benefit) Income (Loss) Before Income Taxes Effective Tax Rate As reported 3,173$ 13,555$ 23.4% 3,691$ 16,287$ 22.7% Non-GAAP adjustments (before tax): Executive separation agreement - 109 - - 588 - Professional Fees for a non-recurring matter - 1,687 - - 2,870 - FS restatement costs - 208 - - 1,599 - Employee benefit charges - 445 - - 445 - Tax effect of non-GAAP adjustments and assumed exchange of outstanding LLC Interests 685 - - 329 - - Adjusted pro forma 3,858$ 16,004$ 24.1% 4,020$ 21,789$ 18.4% Less: Net tax impact from stock-based compensation (227) - - 947 - - Adjusted pro forma (excluding stock-based compensation tax impacts) 3,631$ 16,004$ 22.7% 4,967$ 21,789$ 22.8% Thirteen Weeks Ended Twenty-Six Weeks Ended June 26, 2024 June 26, 2024 (dollar amounts in thousands) Income Tax Expense (Benefit) Income (Loss) Before Income Taxes Effective Tax Rate Income Tax Expense (Benefit) Income (Loss) Before Income Taxes Effective Tax Rate As reported 347$ 7,570$ 4.6% 1,214$ 6,815$ 17.8% Non-GAAP adjustments (before tax): Legal settlement - - - - 1,004 - Professional Fees for a non-recurring matter - 1,693 - - 2,321 - Tax effect of non-GAAP adjustments and assumed exchange of outstanding LLC Interests 1,036 - - 1,336 - - Adjusted pro forma 1,383$ 9,263$ 14.9% 2,550$ 10,140$ 25.1% Less: Net tax impact from stock-based compensation 63 - - (953) - - Adjusted pro forma (excluding stock-based compensation tax impacts) 1,446$ 9,263$ 15.6% 1,597$ 10,140$ 15.7% June 28, 2023 June 28, 2023 Thirteen Weeks Ended Twenty-Six Weeks Ended

INVESTOR CONTACT Melissa Calandruccio, ICR Michelle Michalski, ICR (844) Shack-04 (844-742-2504) investor@shakeshack.com MEDIA CONTACT Meg Davis, Shake Shack mcastranova@shakeshack.com CONTACT INFORMATION