0001285785false2023FY12/31P3YP3Yhttp://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#LiabilitiesTotalMemberhttp://fasb.org/us-gaap/2023#LiabilitiesTotalMemberhttp://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentNethttp://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentNethttp://fasb.org/us-gaap/2023#LongTermDebtAndCapitalLeaseObligationsCurrenthttp://fasb.org/us-gaap/2023#LongTermDebtAndCapitalLeaseObligationsCurrenthttp://fasb.org/us-gaap/2023#LongTermDebtAndCapitalLeaseObligationshttp://fasb.org/us-gaap/2023#LongTermDebtAndCapitalLeaseObligationshttp://fasb.org/us-gaap/2023#LiabilitiesTotalMemberhttp://fasb.org/us-gaap/2023#LiabilitiesTotalMemberhttp://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#OtherAssetsNoncurrent3.80.150.0http://fasb.org/us-gaap/2023#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OperatingIncomeLoss00012857852023-01-012023-12-3100012857852023-12-31iso4217:USD00012857852024-02-16xbrli:shares00012857852023-10-012023-12-3100012857852022-01-012022-12-3100012857852021-01-012021-12-31iso4217:USDxbrli:shares00012857852022-12-3100012857852021-12-3100012857852020-12-310001285785us-gaap:CommonStockMember2020-12-310001285785us-gaap:AdditionalPaidInCapitalMember2020-12-310001285785us-gaap:RetainedEarningsMember2020-12-310001285785us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001285785us-gaap:NoncontrollingInterestMember2020-12-310001285785us-gaap:RetainedEarningsMember2021-01-012021-12-310001285785us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001285785us-gaap:NoncontrollingInterestMember2021-01-012021-12-310001285785us-gaap:CommonStockMember2021-01-012021-12-310001285785us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001285785us-gaap:CommonStockMember2021-12-310001285785us-gaap:AdditionalPaidInCapitalMember2021-12-310001285785us-gaap:RetainedEarningsMember2021-12-310001285785us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001285785us-gaap:NoncontrollingInterestMember2021-12-310001285785us-gaap:RetainedEarningsMember2022-01-012022-12-310001285785us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001285785us-gaap:NoncontrollingInterestMember2022-01-012022-12-310001285785us-gaap:CommonStockMember2022-01-012022-12-310001285785us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001285785us-gaap:CommonStockMember2022-12-310001285785us-gaap:AdditionalPaidInCapitalMember2022-12-310001285785us-gaap:RetainedEarningsMember2022-12-310001285785us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001285785us-gaap:NoncontrollingInterestMember2022-12-310001285785us-gaap:RetainedEarningsMember2023-01-012023-12-310001285785us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001285785us-gaap:NoncontrollingInterestMember2023-01-012023-12-310001285785us-gaap:CommonStockMember2023-01-012023-12-310001285785us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001285785us-gaap:CommonStockMember2023-12-310001285785us-gaap:AdditionalPaidInCapitalMember2023-12-310001285785us-gaap:RetainedEarningsMember2023-12-310001285785us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001285785us-gaap:NoncontrollingInterestMember2023-12-310001285785mos:MiskiMayoJointVentureMember2018-01-08xbrli:pure0001285785mos:MaadenWaadAlShamalPhosphateCompanyMembermos:MaadenWaadAlShamalPhosphateCompanyMember2023-12-310001285785mos:MaadenWaadAlShamalPhosphateCompanyMember2023-01-012023-12-310001285785srt:MaximumMember2023-01-012023-12-310001285785mos:CanpotexMember2023-12-310001285785mos:CanpotexMember2022-12-310001285785mos:CanpotexMember2023-01-012023-12-310001285785mos:CanpotexMember2022-01-012022-12-310001285785mos:CanpotexMember2021-01-012021-12-310001285785srt:MinimumMemberus-gaap:MachineryAndEquipmentMember2023-12-310001285785srt:MaximumMemberus-gaap:MachineryAndEquipmentMember2023-12-310001285785srt:MinimumMemberus-gaap:LandAndBuildingMember2023-12-310001285785srt:MaximumMemberus-gaap:LandAndBuildingMember2023-12-310001285785us-gaap:LandMember2023-12-310001285785us-gaap:LandMember2022-12-310001285785us-gaap:MiningPropertiesAndMineralRightsMember2023-12-310001285785us-gaap:MiningPropertiesAndMineralRightsMember2022-12-310001285785us-gaap:BuildingImprovementsMember2023-12-310001285785us-gaap:BuildingImprovementsMember2022-12-310001285785us-gaap:MachineryAndEquipmentMember2023-12-310001285785us-gaap:MachineryAndEquipmentMember2022-12-310001285785us-gaap:ConstructionInProgressMember2023-12-310001285785us-gaap:ConstructionInProgressMember2022-12-310001285785mos:EquityMethodInvesteeRiverBendAgMember2023-12-310001285785mos:EquityMethodInvesteeIFCMember2023-12-310001285785mos:MaadenWaadAlShamalPhosphateCompanyMemberus-gaap:EquityMethodInvesteeMember2023-12-310001285785mos:EquityMethodInvesteeCanpotexMember2023-12-310001285785us-gaap:EquityMethodInvestmentsMember2023-01-012023-12-310001285785us-gaap:EquityMethodInvestmentsMember2022-01-012022-12-310001285785us-gaap:EquityMethodInvestmentsMember2021-01-012021-12-310001285785us-gaap:EquityMethodInvestmentsMember2023-12-310001285785us-gaap:EquityMethodInvestmentsMember2022-12-310001285785us-gaap:EquityMethodInvestmentsMember2021-12-310001285785mos:MaadenWaadAlShamalPhosphateCompanyMemberus-gaap:EquityMethodInvesteeMember2023-01-012023-12-310001285785mos:MaadenWaadAlShamalPhosphateCompanyMemberus-gaap:EquityMethodInvesteeMember2022-01-012022-12-310001285785mos:MaadenWaadAlShamalPhosphateCompanyMemberus-gaap:EquityMethodInvesteeMember2021-01-012021-12-310001285785mos:MaadenWaadAlShamalPhosphateCompanyMemberus-gaap:EquityMethodInvesteeMember2016-07-012016-07-010001285785mos:PotashSegmentMember2021-12-310001285785mos:MosaicFertilizantesMember2021-12-310001285785mos:CorporateEliminationsAndOtherSegmentMember2021-12-310001285785mos:PotashSegmentMember2022-01-012022-12-310001285785mos:MosaicFertilizantesMember2022-01-012022-12-310001285785mos:CorporateEliminationsAndOtherSegmentMember2022-01-012022-12-310001285785mos:PotashSegmentMember2022-12-310001285785mos:MosaicFertilizantesMember2022-12-310001285785mos:CorporateEliminationsAndOtherSegmentMember2022-12-310001285785mos:PotashSegmentMember2023-01-012023-12-310001285785mos:MosaicFertilizantesMember2023-01-012023-12-310001285785mos:CorporateEliminationsAndOtherSegmentMember2023-01-012023-12-310001285785mos:PotashSegmentMember2023-12-310001285785mos:MosaicFertilizantesMember2023-12-310001285785mos:CorporateEliminationsAndOtherSegmentMember2023-12-310001285785srt:MinimumMember2023-01-012023-12-3100012857852021-08-190001285785us-gaap:RevolvingCreditFacilityMember2023-12-310001285785us-gaap:RevolvingCreditFacilityMember2022-12-310001285785us-gaap:RevolvingCreditFacilityMember2023-01-012023-12-3100012857852021-01-012021-08-1900012857852021-08-202021-12-310001285785us-gaap:RevolvingCreditFacilityMember2021-01-012021-12-310001285785mos:MosaicCreditFacilityMember2023-12-3100012857852020-01-070001285785mos:InventoryFinancingArrangementMember2023-01-012023-12-310001285785mos:ReceivablePurchasingAgreementDomain2023-01-012023-12-310001285785mos:ReceivablePurchasingAgreementMember2023-01-012023-12-310001285785mos:ReceivablePurchasingAgreementMember2022-01-012022-12-310001285785us-gaap:CommercialPaperMember2023-12-310001285785us-gaap:CommercialPaperMember2023-01-012023-12-310001285785us-gaap:CommercialPaperMember2022-12-310001285785us-gaap:CommercialPaperMember2022-01-012022-12-310001285785us-gaap:ShortTermDebtMember2023-12-310001285785us-gaap:SeniorNotesMembermos:SeniorNotesDue2022Member2023-12-310001285785mos:SeniorNotesDue2027Memberus-gaap:SeniorNotesMember2023-12-310001285785us-gaap:SeniorNotesMembermos:SeniorNotesDue2022Member2022-12-310001285785us-gaap:SeniorLoansMembermos:SeniorUnsecuredTermLoanFacilityMember2023-12-310001285785mos:SeniorNotesDue2028Memberus-gaap:SeniorNotesMember2023-12-310001285785mos:SeniorNotesDue2033Memberus-gaap:SeniorNotesMember2023-12-310001285785us-gaap:SeniorNotesMembermos:SeniorNotesDue2043Member2023-12-310001285785us-gaap:SeniorNotesMembermos:SeniorNotesDue2041Member2023-12-310001285785mos:SeniorNotesDue2023Memberus-gaap:SeniorNotesMember2023-01-012023-12-310001285785mos:SeniorNotesDue2023Memberus-gaap:SeniorNotesMember2023-12-310001285785mos:DebenturesDue2028Memberus-gaap:NotesPayableOtherPayablesMember2023-12-310001285785srt:MinimumMembermos:UnsecuredNotesMember2023-12-310001285785srt:MaximumMembermos:UnsecuredNotesMember2023-12-310001285785mos:UnsecuredNotesMember2023-12-310001285785mos:UnsecuredNotesMember2022-12-310001285785srt:MaximumMembermos:UnsecuredDebenturesMember2023-12-310001285785mos:UnsecuredDebenturesMember2023-12-310001285785mos:UnsecuredDebenturesMember2022-12-310001285785srt:MaximumMembermos:TermLoanMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-12-310001285785mos:TermLoanMember2023-12-310001285785mos:SeniorUnsecuredTermLoanFacilityMember2023-12-310001285785mos:SeniorUnsecuredTermLoanFacilityMember2022-12-310001285785srt:MinimumMemberus-gaap:CapitalLeaseObligationsMember2023-12-310001285785srt:MaximumMemberus-gaap:CapitalLeaseObligationsMember2023-12-310001285785us-gaap:CapitalLeaseObligationsMember2023-12-310001285785us-gaap:CapitalLeaseObligationsMember2022-12-310001285785mos:OtherTypesOfDebtMembersrt:MinimumMember2023-12-310001285785srt:MaximumMembermos:OtherTypesOfDebtMember2023-12-310001285785mos:OtherTypesOfDebtMember2023-12-310001285785mos:OtherTypesOfDebtMember2022-12-310001285785us-gaap:RevolvingCreditFacilityMember2022-01-012022-12-3100012857852016-08-310001285785us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel1Member2023-12-310001285785us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMember2023-12-310001285785us-gaap:FairValueInputsLevel2Memberus-gaap:MunicipalBondsMember2023-12-310001285785us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasuryAndGovernmentMember2023-12-310001285785us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel1Member2022-12-310001285785us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMember2022-12-310001285785us-gaap:FairValueInputsLevel2Memberus-gaap:MunicipalBondsMember2022-12-310001285785us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasuryAndGovernmentMember2022-12-310001285785us-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMember2022-12-310001285785us-gaap:CorporateDebtSecuritiesMember2023-12-310001285785us-gaap:CorporateDebtSecuritiesMember2022-12-310001285785us-gaap:MunicipalBondsMember2023-12-310001285785us-gaap:MunicipalBondsMember2022-12-310001285785us-gaap:USTreasuryAndGovernmentMember2023-12-310001285785us-gaap:USTreasuryAndGovernmentMember2022-12-310001285785us-gaap:DebtSecuritiesMember2023-12-310001285785us-gaap:DomesticCountryMember2023-01-012023-12-310001285785mos:ValeFertilizantesS.A.Member2023-01-012023-12-310001285785us-gaap:DomesticCountryMember2022-01-012022-12-310001285785mos:ValeFertilizantesS.A.Member2022-01-012022-12-310001285785us-gaap:DomesticCountryMember2021-01-012021-12-310001285785us-gaap:ForeignCountryMember2021-01-012021-12-310001285785mos:EsterhazyMineClosureMember2021-01-012021-12-310001285785mos:AnticipatoryForeignTaxCreditCarryforwardMember2023-12-310001285785mos:AnticipatoryForeignTaxCreditCarryforwardMember2022-12-310001285785mos:NetOperatingLossCarryforwardMember2023-12-310001285785us-gaap:CapitalLossCarryforwardMember2023-12-310001285785mos:ForeignTaxCreditCarryforwardMember2023-12-310001285785us-gaap:NonUsMember2023-12-310001285785us-gaap:ForeignCountryMembermos:NetOperatingLossCarryforwardMember2023-12-310001285785us-gaap:ForeignCountryMember2023-01-012023-12-310001285785mos:TaxYear2026OrEarlierMembermos:ForeignTaxCreditCarryforwardMember2023-12-310001285785mos:ForeignTaxCreditCarryforwardMembermos:TaxYear2029OrEarlierMember2023-12-310001285785mos:TaxYear2030OrEarlierMembermos:ForeignTaxCreditCarryforwardMember2023-12-310001285785mos:TaxYear2033OrEarlierMembermos:ForeignTaxCreditCarryforwardMember2023-12-310001285785us-gaap:ForeignCountryMember2023-01-012023-12-310001285785us-gaap:ForeignCountryMember2022-01-012022-12-310001285785country:US2022-12-310001285785mos:ValeFertilizantesS.A.Member2021-01-012021-12-310001285785country:US2021-12-310001285785us-gaap:NonUsMember2023-01-012023-12-310001285785mos:USandnonUSDomain2023-01-012023-12-310001285785us-gaap:UnfavorableRegulatoryActionMember2023-12-310001285785us-gaap:UnfavorableRegulatoryActionMember2022-12-310001285785mos:A2015ConsentDecreesWithEPAMemberus-gaap:UnfavorableRegulatoryActionMember2023-12-310001285785mos:PlantCityandBonnieFacilitiesMember2023-12-310001285785mos:BonnieFacilityTrustMember2018-07-270001285785mos:PlantCityandBonnieFacilitiesMember2022-12-310001285785us-gaap:InterestRateSwapMember2022-12-310001285785us-gaap:InterestRateSwapMember2023-12-310001285785us-gaap:ForeignExchangeContractMember2023-12-310001285785us-gaap:ForeignExchangeContractMember2022-12-310001285785us-gaap:CommodityContractMember2023-12-31utr:MMBTU0001285785us-gaap:CommodityContractMember2022-12-310001285785us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignExchangeContractMember2023-01-012023-12-310001285785us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignExchangeContractMember2023-12-310001285785us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignExchangeContractMember2022-12-310001285785us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommodityContractMember2023-12-310001285785us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommodityContractMember2022-12-310001285785us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310001285785us-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001285785us-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310001285785us-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310001285785us-gaap:PensionPlansDefinedBenefitMember2022-01-012022-12-310001285785us-gaap:PensionPlansDefinedBenefitMember2023-01-012023-12-310001285785srt:NorthAmericaMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310001285785srt:NorthAmericaMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001285785us-gaap:PensionPlansDefinedBenefitMember2022-12-310001285785us-gaap:PensionPlansDefinedBenefitMember2021-12-310001285785us-gaap:PensionPlansDefinedBenefitMember2023-12-310001285785us-gaap:FixedIncomeSecuritiesMember2023-12-310001285785us-gaap:EquitySecuritiesMember2023-12-310001285785us-gaap:CashMember2023-12-310001285785mos:NorthAmericanOtherPostretirementBenefitsPlanMember2023-12-310001285785mos:NorthAmericanOtherPostretirementBenefitsPlanMember2022-12-310001285785srt:MinimumMembermos:NorthAmericanOtherPostretirementBenefitsPlanMember2023-12-310001285785mos:BrazilOtherPostretirementBenefitsPlanMember2023-12-310001285785mos:BrazilOtherPostretirementBenefitsPlanMember2022-12-310001285785mos:BrazilOtherPostretirementBenefitsPlanMember2021-12-310001285785mos:BrazilOtherPostretirementBenefitsPlanMember2023-01-012023-12-310001285785mos:BrazilOtherPostretirementBenefitsPlanMember2022-01-012022-12-310001285785us-gaap:AccumulatedTranslationAdjustmentMember2020-12-310001285785us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-12-310001285785us-gaap:AociDerivativeQualifyingAsHedgeExcludedComponentParentMember2020-12-310001285785us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2020-12-310001285785us-gaap:AccumulatedTranslationAdjustmentMember2021-01-012021-12-310001285785us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-01-012021-12-310001285785us-gaap:AociDerivativeQualifyingAsHedgeExcludedComponentParentMember2021-01-012021-12-310001285785us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2021-01-012021-12-310001285785us-gaap:AccumulatedTranslationAdjustmentMember2021-12-310001285785us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-12-310001285785us-gaap:AociDerivativeQualifyingAsHedgeExcludedComponentParentMember2021-12-310001285785us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2021-12-310001285785us-gaap:AccumulatedTranslationAdjustmentMember2022-01-012022-12-310001285785us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-01-012022-12-310001285785us-gaap:AociDerivativeQualifyingAsHedgeExcludedComponentParentMember2022-01-012022-12-310001285785us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-01-012022-12-310001285785us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310001285785us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-12-310001285785us-gaap:AociDerivativeQualifyingAsHedgeExcludedComponentParentMember2022-12-310001285785us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-12-310001285785us-gaap:AccumulatedTranslationAdjustmentMember2023-01-012023-12-310001285785us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-01-012023-12-310001285785us-gaap:AociDerivativeQualifyingAsHedgeExcludedComponentParentMember2023-01-012023-12-310001285785us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-01-012023-12-310001285785us-gaap:AccumulatedTranslationAdjustmentMember2023-12-310001285785us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-12-310001285785us-gaap:AociDerivativeQualifyingAsHedgeExcludedComponentParentMember2023-12-310001285785us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-12-310001285785mos:ShareRepurchaseProgram2022Member2023-12-310001285785mos:AcceleratedShareRepurchaseAgreementMember2023-01-012023-12-310001285785mos:AcceleratedShareRepurchaseAgreementMember2023-12-3100012857852023-03-012023-03-310001285785mos:AcceleratedShareRepurchaseAgreement2023Member2023-01-012023-12-310001285785mos:ShareRepurchaseProgram2022Member2023-01-012023-12-310001285785mos:AcceleratedShareRepurchaseAgreement2023Member2022-12-310001285785mos:AcceleratedShareRepurchaseAgreementMember2022-01-012022-12-310001285785mos:ShareRepurchaseProgram2021Member2022-01-012022-12-310001285785mos:ValeFertilizantesS.A.Member2022-01-012022-12-310001285785mos:A2023StockAndIncentivePlanMember2023-12-310001285785mos:A2014StockandIncentivePlanMember2023-12-310001285785mos:OmnibusStockAndIncentivePlan2004Member2023-12-310001285785us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001285785us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001285785us-gaap:EmployeeStockOptionMember2022-12-310001285785us-gaap:EmployeeStockOptionMember2023-12-310001285785mos:A2014StockandIncentivePlanMemberus-gaap:EmployeeStockOptionMember2023-12-310001285785mos:OmnibusStockAndIncentivePlan2004Memberus-gaap:EmployeeStockOptionMember2023-12-310001285785us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001285785us-gaap:RestrictedStockUnitsRSUMember2022-12-310001285785us-gaap:RestrictedStockUnitsRSUMember2023-12-310001285785mos:TSRPerformanceUnitsMember2023-01-012023-12-310001285785mos:PerformanceUnitsCashSettledMember2023-01-012023-12-310001285785mos:PerformanceUnitsCashSettledMember2022-01-012022-12-310001285785mos:PerformanceUnitsCashSettledMember2021-01-012021-12-310001285785mos:TSRPerformanceUnitsMember2022-01-012022-12-310001285785mos:TSRPerformanceUnitsMember2021-01-012021-12-310001285785us-gaap:PerformanceSharesMember2022-12-310001285785us-gaap:PerformanceSharesMember2023-01-012023-12-310001285785us-gaap:PerformanceSharesMember2023-12-310001285785mos:PerformanceUnitsCashSettledMember2023-12-310001285785mos:PerformanceUnitsCashSettledMember2022-12-310001285785mos:InventoriesAtPriceTiedToNaturalGasMember2023-01-012023-12-31utr:t0001285785mos:NewWalesPhaseIIEastStackMember2023-12-310001285785mos:NewWalesPhaseIIWestStackMember2023-12-310001285785srt:MaximumMembermos:BraziliansubsidiaryjudicialandadministrativeproceedingsMember2023-12-310001285785mos:BraziliansubsidiaryjudicialandadministrativeproceedingsMember2023-12-310001285785srt:MaximumMembermos:BraziliansubsidiarylaborclaimsMember2023-12-310001285785mos:BraziliansubsidiarylaborclaimsMember2023-12-310001285785srt:MaximumMembermos:BrazilianNonIncomeTaxProceedingsMember2023-12-310001285785srt:MaximumMembermos:BrazilianNonIncomeTaxProceedingsMemberus-gaap:IndemnificationGuaranteeMember2023-12-310001285785srt:MaximumMembermos:PISAndCofinsCasesMembermos:BrazilianNonIncomeTaxProceedingsMember2023-12-310001285785us-gaap:RelatedPartyMember2023-12-310001285785us-gaap:RelatedPartyMember2022-12-310001285785us-gaap:RelatedPartyMember2023-01-012023-12-310001285785us-gaap:RelatedPartyMember2022-01-012022-12-310001285785us-gaap:RelatedPartyMember2021-01-012021-12-310001285785us-gaap:EquityMethodInvesteeMember2023-01-012023-12-310001285785us-gaap:EquityMethodInvesteeMember2022-01-012022-12-310001285785us-gaap:EquityMethodInvesteeMember2021-01-012021-12-310001285785mos:PhosphatesSegmentMember2023-01-012023-12-310001285785mos:PhosphatesSegmentMember2022-01-012022-12-310001285785mos:PhosphatesSegmentMember2021-01-012021-12-310001285785mos:PotashSegmentMember2021-01-012021-12-310001285785mos:MosaicFertilizantesMember2021-01-012021-12-310001285785mos:CorporateEliminationsAndOtherSegmentMember2021-01-012021-12-310001285785mos:PhosphatesSegmentMember2023-12-310001285785mos:PhosphatesSegmentMember2022-12-310001285785mos:PhosphatesSegmentMember2021-12-310001285785mos:ChinaandIndiadistributionoperationsMembermos:CorporateEliminationsAndOtherSegmentMember2023-01-012023-12-310001285785mos:ChinaandIndiadistributionoperationsMembermos:CorporateEliminationsAndOtherSegmentMember2022-01-012022-12-310001285785mos:ChinaandIndiadistributionoperationsMembermos:CorporateEliminationsAndOtherSegmentMember2021-01-012021-12-310001285785country:BRus-gaap:TransferredAtPointInTimeMember2023-01-012023-12-310001285785country:BRus-gaap:TransferredAtPointInTimeMember2022-01-012022-12-310001285785country:BRus-gaap:TransferredAtPointInTimeMember2021-01-012021-12-310001285785us-gaap:TransferredAtPointInTimeMembermos:CanpotexMember2023-01-012023-12-310001285785us-gaap:TransferredAtPointInTimeMembermos:CanpotexMember2022-01-012022-12-310001285785us-gaap:TransferredAtPointInTimeMembermos:CanpotexMember2021-01-012021-12-310001285785country:CNus-gaap:TransferredAtPointInTimeMember2023-01-012023-12-310001285785country:CNus-gaap:TransferredAtPointInTimeMember2022-01-012022-12-310001285785country:CNus-gaap:TransferredAtPointInTimeMember2021-01-012021-12-310001285785country:CAus-gaap:TransferredAtPointInTimeMember2023-01-012023-12-310001285785country:CAus-gaap:TransferredAtPointInTimeMember2022-01-012022-12-310001285785country:CAus-gaap:TransferredAtPointInTimeMember2021-01-012021-12-310001285785country:INus-gaap:TransferredAtPointInTimeMember2023-01-012023-12-310001285785country:INus-gaap:TransferredAtPointInTimeMember2022-01-012022-12-310001285785country:INus-gaap:TransferredAtPointInTimeMember2021-01-012021-12-310001285785country:PYus-gaap:TransferredAtPointInTimeMember2023-01-012023-12-310001285785country:PYus-gaap:TransferredAtPointInTimeMember2022-01-012022-12-310001285785country:PYus-gaap:TransferredAtPointInTimeMember2021-01-012021-12-310001285785country:JPus-gaap:TransferredAtPointInTimeMember2023-01-012023-12-310001285785country:JPus-gaap:TransferredAtPointInTimeMember2022-01-012022-12-310001285785country:JPus-gaap:TransferredAtPointInTimeMember2021-01-012021-12-310001285785country:MXus-gaap:TransferredAtPointInTimeMember2023-01-012023-12-310001285785country:MXus-gaap:TransferredAtPointInTimeMember2022-01-012022-12-310001285785country:MXus-gaap:TransferredAtPointInTimeMember2021-01-012021-12-310001285785us-gaap:TransferredAtPointInTimeMembercountry:CO2023-01-012023-12-310001285785us-gaap:TransferredAtPointInTimeMembercountry:CO2022-01-012022-12-310001285785us-gaap:TransferredAtPointInTimeMembercountry:CO2021-01-012021-12-310001285785country:PEus-gaap:TransferredAtPointInTimeMember2023-01-012023-12-310001285785country:PEus-gaap:TransferredAtPointInTimeMember2022-01-012022-12-310001285785country:PEus-gaap:TransferredAtPointInTimeMember2021-01-012021-12-310001285785country:ARus-gaap:TransferredAtPointInTimeMember2023-01-012023-12-310001285785country:ARus-gaap:TransferredAtPointInTimeMember2022-01-012022-12-310001285785country:ARus-gaap:TransferredAtPointInTimeMember2021-01-012021-12-310001285785us-gaap:TransferredAtPointInTimeMembercountry:AU2023-01-012023-12-310001285785us-gaap:TransferredAtPointInTimeMembercountry:AU2022-01-012022-12-310001285785us-gaap:TransferredAtPointInTimeMembercountry:AU2021-01-012021-12-310001285785country:HNus-gaap:TransferredAtPointInTimeMember2023-01-012023-12-310001285785country:HNus-gaap:TransferredAtPointInTimeMember2022-01-012022-12-310001285785country:HNus-gaap:TransferredAtPointInTimeMember2021-01-012021-12-310001285785country:DOus-gaap:TransferredAtPointInTimeMember2023-01-012023-12-310001285785country:DOus-gaap:TransferredAtPointInTimeMember2022-01-012022-12-310001285785country:DOus-gaap:TransferredAtPointInTimeMember2021-01-012021-12-310001285785country:THus-gaap:TransferredAtPointInTimeMember2023-01-012023-12-310001285785country:THus-gaap:TransferredAtPointInTimeMember2022-01-012022-12-310001285785country:THus-gaap:TransferredAtPointInTimeMember2021-01-012021-12-310001285785us-gaap:TransferredAtPointInTimeMembermos:OtherForeignMember2023-01-012023-12-310001285785us-gaap:TransferredAtPointInTimeMembermos:OtherForeignMember2022-01-012022-12-310001285785us-gaap:TransferredAtPointInTimeMembermos:OtherForeignMember2021-01-012021-12-310001285785mos:TotalForeignMemberus-gaap:TransferredAtPointInTimeMember2023-01-012023-12-310001285785mos:TotalForeignMemberus-gaap:TransferredAtPointInTimeMember2022-01-012022-12-310001285785mos:TotalForeignMemberus-gaap:TransferredAtPointInTimeMember2021-01-012021-12-310001285785country:USus-gaap:TransferredAtPointInTimeMember2023-01-012023-12-310001285785country:USus-gaap:TransferredAtPointInTimeMember2022-01-012022-12-310001285785country:USus-gaap:TransferredAtPointInTimeMember2021-01-012021-12-310001285785mos:TotalGeographyMember2023-01-012023-12-310001285785mos:TotalGeographyMember2022-01-012022-12-310001285785mos:TotalGeographyMember2021-01-012021-12-310001285785country:BR2023-01-012023-12-310001285785country:CN2023-01-012023-12-310001285785country:BD2023-01-012023-12-310001285785country:IN2023-01-012023-12-310001285785mos:OtherCountriesMember2023-01-012023-12-310001285785country:CA2023-12-310001285785country:CA2022-12-310001285785country:BR2023-12-310001285785country:BR2022-12-310001285785mos:OtherForeignMember2023-12-310001285785mos:OtherForeignMember2022-12-310001285785mos:TotalForeignMember2023-12-310001285785mos:TotalForeignMember2022-12-310001285785country:US2023-12-310001285785country:US2022-12-310001285785mos:ProductTypeOneMemberus-gaap:TransferredAtPointInTimeMember2023-01-012023-12-310001285785mos:ProductTypeOneMemberus-gaap:TransferredAtPointInTimeMember2022-01-012022-12-310001285785mos:ProductTypeOneMemberus-gaap:TransferredAtPointInTimeMember2021-01-012021-12-310001285785mos:ProductTypeTwoMemberus-gaap:TransferredAtPointInTimeMember2023-01-012023-12-310001285785mos:ProductTypeTwoMemberus-gaap:TransferredAtPointInTimeMember2022-01-012022-12-310001285785mos:ProductTypeTwoMemberus-gaap:TransferredAtPointInTimeMember2021-01-012021-12-310001285785mos:ProductTypeThreeMemberus-gaap:TransferredAtPointInTimeMember2023-01-012023-12-310001285785mos:ProductTypeThreeMemberus-gaap:TransferredAtPointInTimeMember2022-01-012022-12-310001285785mos:ProductTypeThreeMemberus-gaap:TransferredAtPointInTimeMember2021-01-012021-12-310001285785mos:ProductTypeFourMemberus-gaap:TransferredAtPointInTimeMember2023-01-012023-12-310001285785mos:ProductTypeFourMemberus-gaap:TransferredAtPointInTimeMember2022-01-012022-12-310001285785mos:ProductTypeFourMemberus-gaap:TransferredAtPointInTimeMember2021-01-012021-12-310001285785us-gaap:TransferredAtPointInTimeMembermos:ProductTypeFiveMember2023-01-012023-12-310001285785us-gaap:TransferredAtPointInTimeMembermos:ProductTypeFiveMember2022-01-012022-12-310001285785us-gaap:TransferredAtPointInTimeMembermos:ProductTypeFiveMember2021-01-012021-12-310001285785us-gaap:TransferredAtPointInTimeMembermos:OtherProductTypesMember2023-01-012023-12-310001285785us-gaap:TransferredAtPointInTimeMembermos:OtherProductTypesMember2022-01-012022-12-310001285785us-gaap:TransferredAtPointInTimeMembermos:OtherProductTypesMember2021-01-012021-12-310001285785us-gaap:FacilityClosingMemberus-gaap:PropertyPlantAndEquipmentMember2021-01-012021-12-310001285785us-gaap:AssetRetirementObligationCostsMemberus-gaap:FacilityClosingMember2021-01-012021-12-310001285785us-gaap:OtherCurrentAssetsMemberus-gaap:FacilityClosingMember2021-01-012021-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________

FORM 10-K

______________________________

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the year ended December 31, 2023

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission file number 001-32327

______________________________

The Mosaic Company

(Exact name of registrant as specified in its charter)

______________________________

|

|

|

|

|

|

|

|

|

| Delaware |

|

20-1026454 |

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

101 East Kennedy Blvd

Suite 2500

Tampa, Florida 33602

(800) 918-8270

(Address and zip code of principal executive offices and registrant’s telephone number, including area code)

______________________________

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading symbol |

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

MOS |

New York Stock Exchange |

______________________________

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one): Large accelerated filer ☒ Accelerated filer ☐ Non-accelerated filer ☐ Smaller reporting company ☐ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b) ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of June 30, 2023, the aggregate market value of the registrant’s voting common stock held by stockholders, other than directors, executive officers, subsidiaries of the Registrant and any other person known by the Registrant as of the date hereof to beneficially own ten percent or more of any class of Registrant’s outstanding voting common stock, and consisting of shares of Common Stock, was approximately $11.6 billion based upon the closing price of a share of Common Stock on the New York Stock Exchange on that date.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock: 321,688,938 shares of Common Stock as of February 16, 2024.

DOCUMENTS INCORPORATED BY REFERENCE

1.Portions of the registrant’s definitive proxy statement to be delivered in conjunction with the 2024 Annual Meeting of Stockholders (Part III)

2023 ANNUAL REPORT ON FORM 10-K CONTENTS

|

|

|

|

|

|

|

|

|

| Part I: |

|

Page |

| Item 1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Item 1A. |

|

|

| Item 1B. |

|

|

| Item 1C. |

|

|

| Item 2. |

|

|

| Item 3. |

|

|

| Item 4. |

|

|

| Part II: |

|

|

| Item 5. |

|

|

| Item 6. |

|

|

| Item 7. |

|

|

| Item 7A. |

|

|

| Item 8. |

|

|

| Item 9. |

|

|

| Item 9A. |

|

|

| Item 9B. |

|

|

| Part III: |

|

|

| Item 10. |

|

|

| Item 11. |

|

|

| Item 12. |

|

|

| Item 13. |

|

|

| Item 14. |

|

|

| Part IV. |

|

|

| Item 15. |

|

|

| Item 16. |

|

|

|

|

|

|

PART I.

Item 1. Business.

OVERVIEW

The Mosaic Company is the world’s leading producer and marketer of concentrated phosphate and potash crop nutrients. Through our broad product offering, we are a single source supplier of phosphate- and potash-based crop nutrients and animal feed ingredients. We serve customers in approximately 40 countries. We are the second largest integrated phosphate producer in the world and one of the largest producers and marketers of phosphate-based animal feed ingredients in North America and Brazil. We are the leading fertilizer production and distribution company in Brazil. We mine phosphate rock in Florida, Brazil and Peru. We process rock into finished phosphate products at facilities in Florida, Louisiana and Brazil. We are typically one of the top four global potash producers in the world. We mine potash in Saskatchewan, New Mexico and Brazil. We have other production, blending or distribution operations in Brazil, China, India and Paraguay, as well as an equity investment in a joint venture that operates a phosphate rock mine and chemical complexes in the Kingdom of Saudi Arabia. Our operations serve the top four nutrient-consuming countries in the world: China, India, U.S. and Brazil.

The Mosaic Company is a Delaware corporation that was incorporated in March 2004 and serves as the parent company of the business that was formed through the October 2004 combination of IMC Global Inc. (“IMC”) and the fertilizer businesses of Cargill, Incorporated. We are publicly traded on the New York Stock Exchange under the ticker symbol “MOS” and are headquartered in Tampa, Florida.

We conduct our business through wholly- and majority-owned subsidiaries as well as businesses in which we own less than a majority or a non-controlling interest. We are organized into three reportable business segments: Phosphates, Potash and Mosaic Fertilizantes. Intersegment eliminations, unrealized mark-to-market gains/losses on derivatives, debt expenses, and the results of the China and India distribution businesses are included within Corporate, Eliminations and Other.

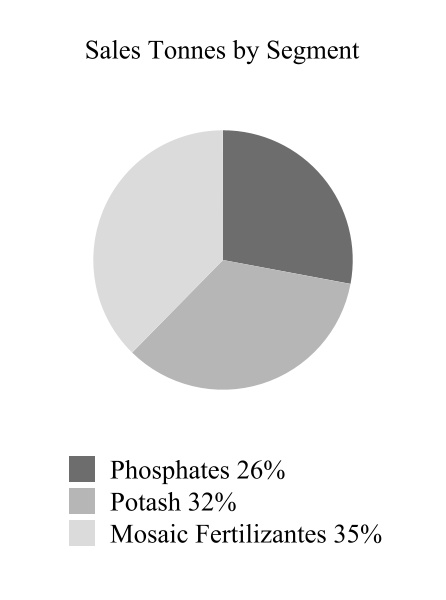

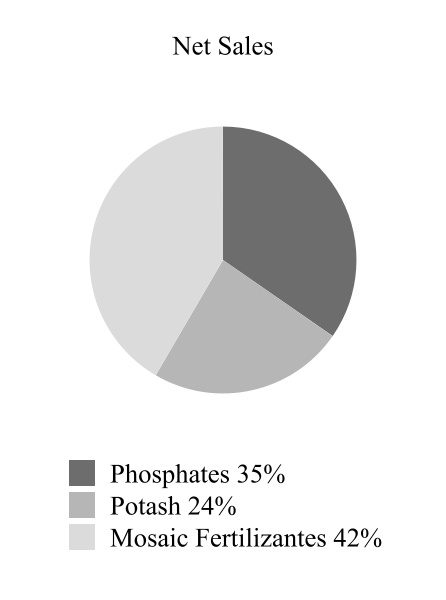

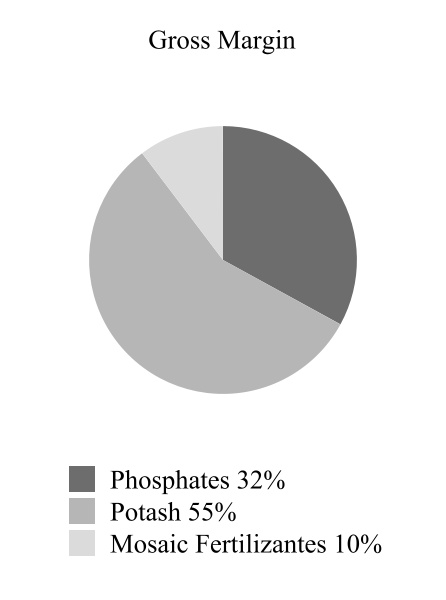

The following charts show the respective contributions to 2023 sales volumes, net sales and gross margin for each of our business segments in effect at December 31, 2023:

We account for approximately 12% of estimated global annual phosphate production. We also account for approximately 13% of estimated global annual potash production.

Phosphates Segment–We sell phosphate-based crop nutrients and animal feed ingredients throughout North America and internationally. We account for approximately 80% of estimated North American annual production of concentrated phosphate crop nutrients.

Potash Segment–We sell potash throughout North America and internationally, principally as fertilizer, but also for use in industrial applications and, to a lesser degree, as animal feed ingredients. We account for approximately 35% of estimated North American annual potash production.

Mosaic Fertilizantes Segment–We produce and sell phosphate- and potash-based crop nutrients, and animal feed ingredients, in Brazil. In addition to five phosphate rock mines, four chemical plants and a potash mine in Brazil, this segment consists of sales offices, crop nutrient blending and bagging facilities, port terminals and warehouses in Brazil and Paraguay. The Mosaic Fertilizantes segment also serves as a distribution outlet for our Phosphates and Potash segments. We account for approximately 72% of estimated annual production of concentrated phosphate crop nutrients in Brazil and 100% of estimated annual potash production in Brazil.

As used in this report:

•“Mosaic” or “Company” means The Mosaic Company;

•“we,” “us,” and “our” refer to Mosaic and its direct and indirect subsidiaries, individually or in any combination;

•“Cargill” means Cargill, Incorporated and its direct and indirect subsidiaries, individually or in any combination;

•“Cargill Crop Nutrition” means the crop nutrient business we acquired from Cargill in the Combination;

•“Combination” means the October 22, 2004 combination of IMC and Cargill Crop Nutrition; and

statements as to our industry position reflect information from the most recent period available.

Business Developments during 2023

•In January 2023, we completed the sale of the Streamsong Resort® (the “Resort”) and the approximately 7,000 acres on which it sits for net proceeds of $158 million. The Resort is a destination resort and conference center, which we developed in an area of previously mined land as part of our long-term business strategy to maximize the value and utility of our extensive land holdings in Florida. In addition to a hotel and conference center, the Resort includes multiple golf courses, a clubhouse and ancillary facilities. The sale resulted in a gain of $57 million.

•In the first quarter of 2023, we purchased the other 50% interest of equity of Gulf Sulphur Services (“GSS”), which gives us full ownership and secures control of our sulfur supply chain in the Gulf of Mexico.

•In the first quarter of 2023, our Board of Directors approved a special dividend of $0.25 per share to be distributed in March to our stockholders of record as of March 15, 2023. In the fourth quarter of 2023, our Board of Directors approved a regular dividend increase to $0.84 per share annually from $0.80, beginning with the dividend declared in December 2023.

•In February 2023, pursuant to existing stock repurchase authorizations, we entered into an accelerated share repurchase agreement (the “2023 ASR Agreement”) with a third-party financial institution to repurchase $300 million of our Common Stock. In 2023, we repurchased 16,879,059 shares of Common Stock in the open market for approximately $748 million. This includes 5,624,574 shares that we purchased under the 2023 ASR Agreement.

•In May 2023, we entered into a 10-year senior unsecured term loan facility pursuant to which we can draw up to $700 million. The term loan matures on May 18, 2033. We may voluntarily prepay the outstanding principal without premium or penalty. As of December 31, 2023, $500 million has been drawn under this facility.

•In 2023, we paid the outstanding balance of $900 million on our 4.25% senior notes, due November 15, 2023, without premium or penalty. On December 4, 2023, we issued new 5.375% senior notes consisting of $400 million aggregate principal, amount due 2028.

•In 2021, the U.S. Department of Commerce (“DOC”) issued countervailing duty (“CVD”) orders on imports of phosphate fertilizers from Morocco and Russia, in response to petitions filed by Mosaic. The orders were based on DOC's determination that the imports were unfairly subsidized and the U.S. International Trade Commission's (“ITC”) determination that the imports materially injure the U.S. fertilizer industry. The purpose of the CVD orders was to remedy the injury and thereby restore fair competition. CVD orders normally stay in place for at least five years, with possible extensions.

Moroccan and Russian producers have initiated actions at the U.S. Court of International Trade (“CIT”) seeking to overturn the orders. Mosaic has also made claims contesting certain aspects of DOC’s final determinations that, we believe, failed to capture the full extent of Moroccan and Russian subsidies.

These litigation challenges remain underway. Most recently, in January 2024, DOC and the ITC issued revised determinations on remand from the CIT, upholding their original determinations that Moroccan phosphate fertilizer is unfairly subsidized, and that Moroccan and Russian imports materially injure the U.S. industry, respectively. The CIT is now reviewing these remand determinations. Also in January 2024, the CIT issued a ruling affirming DOC's original determinations that Russian phosphate fertilizer is unfairly subsidized.

When a CVD order is in place, DOC normally conducts annual administrative reviews, which establish a final CVD assessment rate for past imports during a defined period, and a CVD cash deposit rate for future imports. In November 2023, DOC announced the final results of the first administrative reviews for the CVD orders on phosphate fertilizers for Russia and Morocco, covering the period November 30, 2020 to December 31, 2021. DOC calculated new subsidy rates of 2.12% for Moroccan producer OCP and 28.50% for Russian producer PhosAgro. Mosaic, foreign producers, and a U.S. importer have appealed these decisions to the CIT. DOC is also conducting administrative reviews covering the period January 1, 2022 to December 31, 2022. The applicable final CVD assessment rates and cash deposit rates for imports of phosphate fertilizer from Morocco and Russia could change as a result of these various proceedings and potential associated appeals, whether in federal courts or at the World Trade Organization.

We have included additional information about these and other developments in our business during 2023 in our Management’s Discussion and Analysis of Financial Condition and Results of Operations (“Management’s Analysis”) and in the Notes to Consolidated Financial Statements.

Throughout the discussion below, we measure units of production, sales and raw materials in metric tonnes, which are the equivalent of 2,205 pounds, or 1.102 tons (U.S. standard), unless we specifically state that we mean short or long ton(s), which are the equivalent of 2,000 pounds and 2,240 pounds, respectively. In addition, we measure natural gas, a raw material used in the production of our products, in MM BTU, which stands for one million British Thermal Units (“BTU”). One BTU is equivalent to 1.06 Joules.

Information concerning our mining properties in this Annual Report on Form 10-K has been prepared in accordance with Subpart 1300 of Regulation S-K (“S-K 1300”). S-K 1300 requires us to disclose our mineral resources, in addition to our mineral reserves, as of the end of our most recently completed fiscal year, both in the aggregate and for each of our individually material mining properties. We have four material properties: Belle Plaine, Esterhazy, Florida and Tapira. See Item 2. “Properties,” for further information regarding mineral reserves and resource and discussion of our material mining properties.

This report includes market share and industry data and forecasts that we obtained from publicly available information and industry publications, surveys, market research, internal company surveys and consultant surveys. We believe these sources to be reliable, but there can be no assurance as to the accuracy and completeness of such information. We have not independently verified the data from third-party sources, nor have we ascertained the underlying economic assumptions relied upon therein. Similarly, internal company surveys, industry forecasts and market research, which we believe to be reliable based upon management’s knowledge of the industry, have not been verified by any independent sources.

BUSINESS SEGMENT INFORMATION

The discussion below of our business segment operations should be read in conjunction with the following information that we have included in this report:

•The risk factors discussed in this report in Part I, Item 1A, “Risk Factors”.

•Our Management’s Analysis.

•The financial statements and supplementary financial information in our Consolidated Financial Statements (“Consolidated Financial Statements”).

This information is incorporated by reference into this section from Part II, Item 8, “Financial Statements and Supplementary Data”.

Phosphates Segment

Our Phosphates business segment owns and operates mines and production facilities in Florida which produce concentrated phosphate crop nutrients and phosphate-based animal feed ingredients, and processing plants in Louisiana which produce concentrated phosphate crop nutrients. We have a 75% economic interest in the Miski Mayo Phosphate Mine in Peru (“Miski Mayo Mine”), which is included in the results of our Phosphates segment.

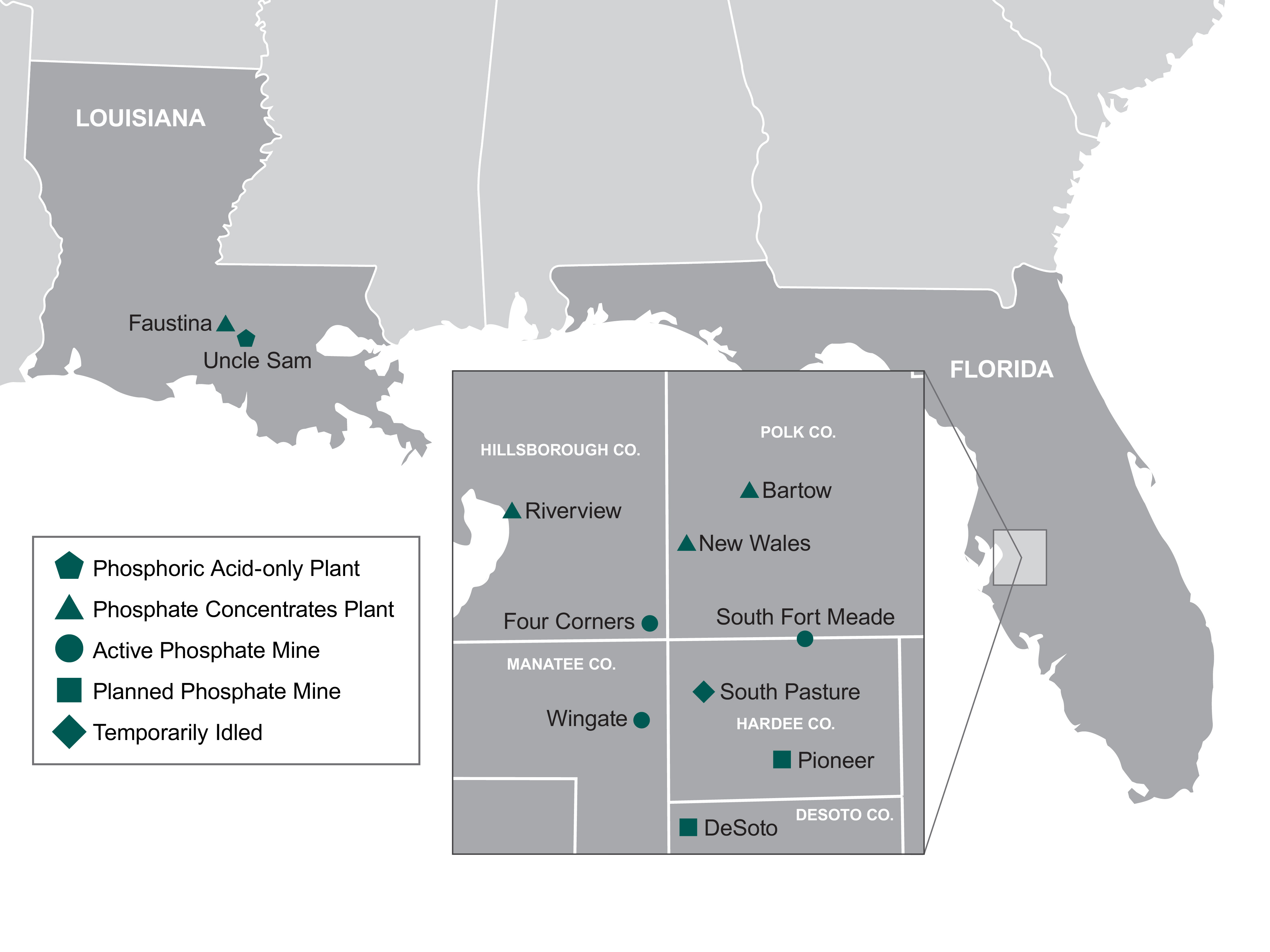

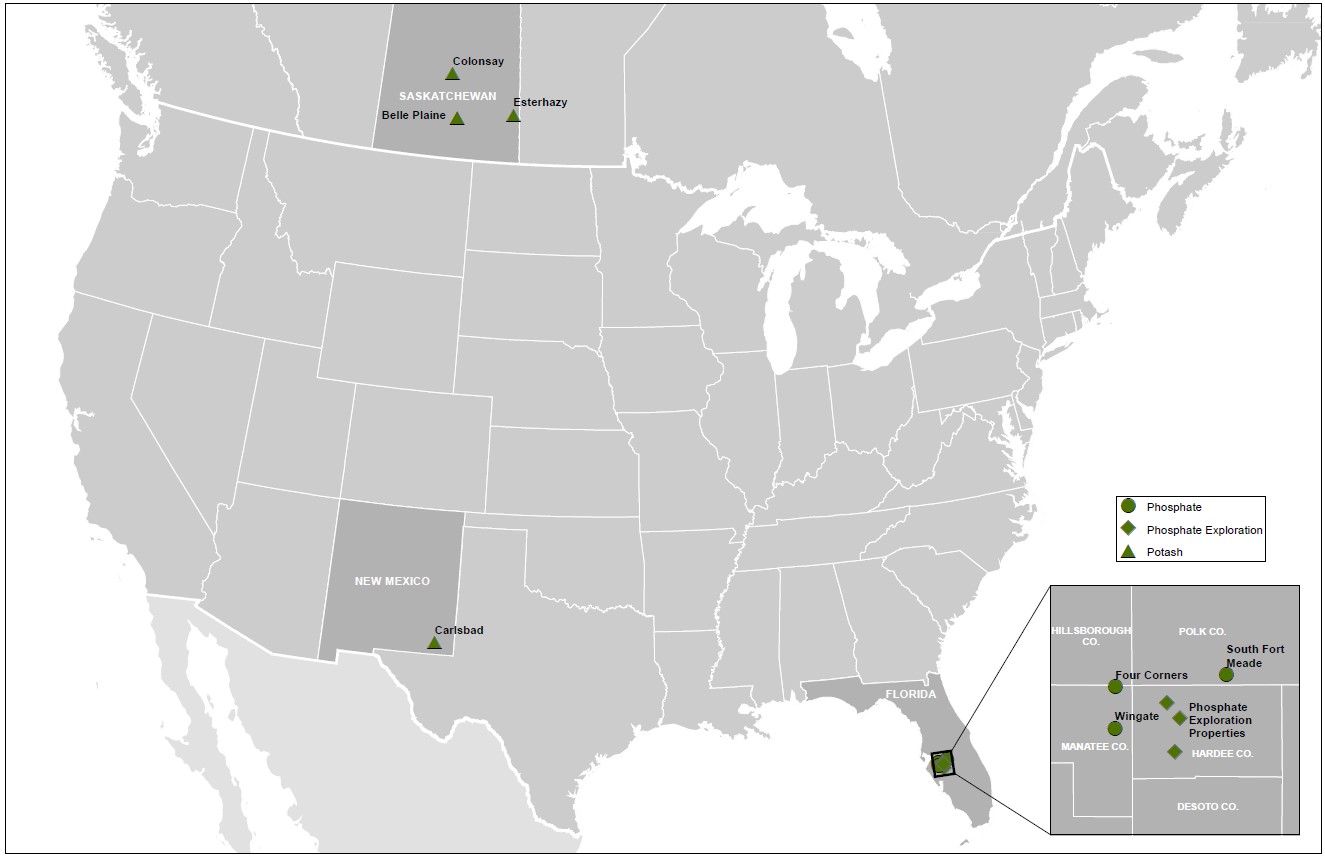

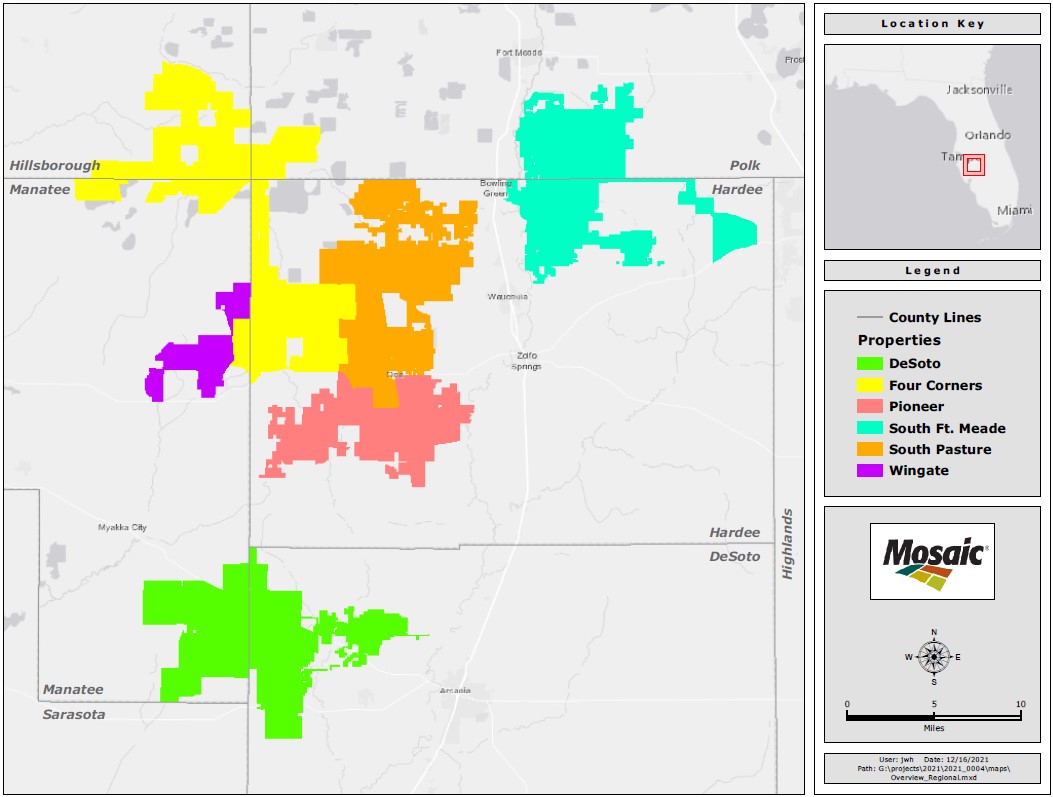

The following map shows the locations of each of our phosphate concentrates plants in the U.S. and each of our active, temporarily idled, and planned phosphate mine locations, including beneficiation plants, in Florida. The reserves associated with our Ona, Florida location have been allocated to other active mines based on our future mining plans:

U.S. Phosphate Crop Nutrients and Animal Feed Ingredients

Our U.S. Phosphate operations have capacity to produce approximately 4.5 million tonnes of phosphoric acid (“P2O5”) per year, or about 7% of world annual capacity and about 60% of North American annual capacity. P2O5 is produced by reacting finely ground phosphate rock with sulfuric acid. P2O5 is the key building block for the production of high analysis or concentrated phosphate crop nutrients and animal feed products and is the most comprehensive measure of phosphate capacity and production and a commonly used benchmark in our industry. Our U.S. P2O5 production totaled approximately 3.0 million tonnes during 2023. Our U.S. operations account for approximately 6% of estimated global annual production and 54% of estimated North American annual output.

Our phosphate crop nutrient products are marketed worldwide to crop nutrient manufacturers, distributors, retailers and farmers. Our principal phosphate crop nutrient products are:

•Diammonium Phosphate (18-46-0): Diammonium Phosphate (“DAP”) is the most widely used high-analysis phosphate crop nutrient worldwide. DAP is produced by first combining phosphoric acid with anhydrous ammonia in a reaction vessel. This initial reaction creates a slurry that is then pumped into a granulation plant where it is reacted with additional ammonia to produce DAP. DAP is a solid granular product that is applied directly or blended with other solid plant nutrient products, such as urea and potash.

•Monoammonium Phosphate (11-52-0): Monoammonium Phosphate (“MAP”) is the second most widely used high-analysis phosphate crop nutrient. MAP is also produced by first combining phosphoric acid with anhydrous ammonia in a reaction vessel. The resulting slurry is then pumped into the granulation plant where it is reacted with additional P2O5 to produce MAP. MAP is a solid granular product that is applied directly or blended with other solid plant nutrient products.

•MicroEssentials® is a value-added ammoniated phosphate product that is enhanced through a patented process that creates very thin platelets of sulfur and other micronutrients, such as zinc, on the granulated product. The patented process incorporates both the sulfate and elemental forms of sulfur, providing season-long availability to crops.

Production of our animal feed ingredients products is located at our New Wales, Florida facility. We market our feed phosphate primarily under the leading brand names of Biofos® and Nexfos®.

Annual capacity by plant as of December 31, 2023 and production volumes by plant for 2023 are listed below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (tonnes in millions) |

|

Phosphoric Acid |

|

Processed Phosphate(a)/DAP/MAP/ MicroEssentials®/Feed Phosphate |

| |

|

Operational Capacity(b) |

|

|

|

Operational Capacity(b) |

|

|

| Facility |

|

Production(c) |

|

Production(c) |

| Florida: |

|

|

|

|

|

|

|

|

| Bartow |

|

1.1 |

|

|

0.8 |

|

|

2.5 |

|

|

1.9 |

|

| New Wales |

|

1.7 |

|

|

1.1 |

|

|

4.0 |

|

|

2.4 |

|

| Riverview |

|

0.9 |

|

|

0.7 |

|

|

1.8 |

|

|

1.4 |

|

|

|

3.7 |

|

|

2.6 |

|

|

8.3 |

|

|

5.7 |

|

| Louisiana: |

|

|

|

|

|

|

|

|

| Faustina |

|

— |

|

|

— |

|

|

1.6 |

|

|

0.9 |

|

| Uncle Sam |

|

0.8 |

|

|

0.4 |

|

|

— |

|

|

— |

|

|

|

0.8 |

|

|

0.4 |

|

|

1.6 |

|

|

0.9 |

|

| Total |

|

4.5 |

|

|

3.0 |

|

|

9.9 |

|

|

6.6 |

|

______________________________

(a)Our ability to produce processed phosphates has been less than our annual operational capacity stated in the table above, except to the extent we purchase P2O5. Factors affecting actual production are described in note (c) below.

(b)Operational capacity is our estimated long-term capacity based on an average amount of scheduled down time, including maintenance and scheduled turnaround time, and product mix, and no significant modifications to operating conditions, equipment or facilities.

(c)Actual production varies from annual operational capacity shown in the above table due to factors that include, among others, the level of demand for our products, maintenance and turnaround time, accidents, mechanical failure, product mix, and other operating conditions.

The P2O5 produced at Uncle Sam is shipped to Faustina, where it is used to produce DAP, MAP and MicroEssentials®. Our Faustina plant also manufactures ammonia that is mostly consumed in our concentrate plants.

We produced approximately 6.2 million tonnes of concentrated phosphate crop nutrients during 2023 and accounted for approximately 80% of estimated North American annual production.

Phosphate Rock

Phosphate rock is the key mineral used to produce phosphate crop nutrients and feed phosphate. Our Florida phosphate rock mines produced approximately 10.0 million tonnes in 2023 and accounted for approximately 47% of estimated North American annual production. We are the world’s second largest miner of phosphate rock (excluding China) and currently operate four mines in North America with a combined annual capacity of approximately 18.0 million tonnes.

Additionally, we own 75% of the Miski Mayo Mine, which has an annual capacity of 4.8 million tonnes. Production of one tonne of DAP requires between 1.6 and 1.7 tonnes of phosphate rock.

All of our wholly-owned phosphate mines and related mining operations in North America are located in central Florida. During 2023, we operated three active mines in Florida: Four Corners, South Fort Meade and Wingate. We plan to explore and develop the DeSoto property and the South Pasture property, which was previously idled, to offset future depletion at our Florida properties. We have a 75% economic interest in the Miski Mayo Mine, which allows us to supplement our other produced rock to meet our overall fertilizer production needs and is the primary source of rock for our Louisiana operations. We have the right to use or sell to third parties 75% of the Miski Mayo Mine’s annual production.

See “Item 2. Properties” for a discussion of our phosphate mining properties, including processing methods, facilities, production and summaries of our mineral resources and reserves, both in the aggregate and for our individual material phosphate mining properties.

Investment in Ma’aden Wa’ad Al Shamal Phosphate Company (“MWSPC”)

We own a 25% interest in MWSPC and, in connection with our equity share, we are entitled to market approximately 25% of MWSPC’s production. MWSPC consists of a mine and two chemical complexes (the “Project”) that produce phosphate fertilizers and other downstream phosphates products in the Kingdom of Saudi Arabia. The greenfield project was built in the northern region of Saudi Arabia at Wa’ad Al Shamal Minerals Industrial City and included further expansion of processing plants in Ras Al Khair Minerals Industrial City, which is located on the east coast of Saudi Arabia. Ammonia operations commenced in late 2016 and on December 1, 2018, MWSPC commenced commercial operations of the phosphate plant, thereby bringing the entire project to the commercial production phase and an annual production capacity of 3.0 million tonnes. Actual phosphate production was 3.1 million tonnes in 2023. The Project benefits from the availability of key raw nutrients from sources within Saudi Arabia.

Sulfur

We use molten sulfur at our phosphates concentrates plants to produce sulfuric acid, primarily for use in our production of P2O5. We purchased approximately 3.3 million long tons of sulfur during 2023. We purchase the majority of this sulfur from North American oil and natural gas refiners who are required to remove or recover sulfur during the refining process. Production of one tonne of DAP requires approximately 0.40 long tons of sulfur. We procure our sulfur from multiple sources and receive it by truck, rail, barge and vessel, either directly at our phosphate plants or have it sent for gathering to terminals that are located on the U.S. gulf coast. In addition, we use formed sulfur received through Tampa, Florida ports, which are delivered by truck to our New Wales facility and melted through our sulfur melter.

We own and operate sulfur terminals in Riverview and Tampa, Florida, along with Galveston, Texas and Faustina, Louisiana. We also lease terminal space in Beaumont, Texas. We have long-term time charters on two ocean-going tugs/barges and one ocean-going vessel that transports molten sulfur from the Texas terminals to Tampa. We then further transport by truck to our Florida phosphate plants. Our sulfur logistic assets also include a large fleet of leased railcars that supplement our marine sulfur logistic system. Our Louisiana operations are served by truck from nearby refineries.

Although sulfur is readily available from many different suppliers and can be transported to our phosphate facilities by a variety of means, sulfur is an important raw material used in our business that has in the past been, and may in the future, be the subject of volatile pricing and availability. Alternative transportation and terminaling facilities might not have sufficient capacity to fully serve all of our facilities in the event of a disruption to current transportation or terminaling facilities. Changes in the price of sulfur or disruptions to sulfur transportation or terminaling facilities could have a material impact on our business. We have included a discussion of sulfur prices in our Management’s Analysis.

Ammonia

We use ammonia together with P2O5 to produce DAP, MAP and MicroEssentials®. We consumed approximately 1.0 million tonnes of ammonia during 2023. Production of one tonne of DAP requires approximately 0.23 tonnes of ammonia. We purchase approximately one-third of our ammonia from various suppliers in the spot market with the remaining two-thirds either purchased through our ammonia supply agreement (the “CF Ammonia Supply Agreement”) with an affiliate of CF Industries Inc. (“CF”) or produced internally at our Faustina, Louisiana location.

Our Florida ammonia needs are currently supplied under multi-year contracts with both domestic and offshore producers. Ammonia for our Florida plants is terminaled through owned ammonia facilities at the Port of Tampa and Port Sutton, Florida. Ammonia is transported by pipeline from the terminals to our production facilities. We have service agreements with the operators of the pipelines for Bartow, New Wales and Riverview, which provide service through June 30, 2025 with two year auto-renewal provisions unless either party objects.

Under the CF Ammonia Supply Agreement, we purchased 562,000 metric tonnes in 2023. On October 14, 2022, we received notice from CF to exercise the bilateral, contractual right to end the ammonia supply agreement in its current form, effective January 1, 2025. We are confident that we will continue to have adequate sources of supply for ammonia at competitive pricing.

We produce ammonia at Faustina, Louisiana primarily for our own consumption. Our annual capacity is approximately 530,000 tonnes. From time to time, we sell surplus ammonia to unrelated parties and/or may transport surplus ammonia to the Port of Tampa. In certain circumstances, we source ammonia from alternative sources to receive at Faustina.

Although ammonia is readily available from many different suppliers and can be transported to our Phosphate facilities by a variety of means, ammonia is an important raw material used in our business that has in the past been, and may in the future be, the subject of volatile pricing. In addition, alternative transportation and terminaling facilities might not have sufficient capacity to fully serve all of our facilities in the event of a disruption to existing transportation or terminaling facilities. Changes in the price of ammonia or disruptions to ammonia transportation or terminaling could have a material impact on our business. We have included a discussion of ammonia prices in our Management’s Analysis.

Natural Gas for Phosphates

Natural gas is the primary raw material used to manufacture ammonia. At our Faustina facility, ammonia is manufactured on site. The majority of natural gas is purchased through firm delivery contracts based on published index-based prices and is sourced from Texas and Louisiana via pipelines interconnected to the Henry Hub. We use over-the-counter swap and/or option contracts to forward price portions of future natural gas purchases. We typically purchase approximately 15.5 million MM BTU of natural gas per year for use in ammonia production at Faustina.

Our ammonia requirements for our Florida operations are purchased rather than manufactured on site. Therefore, while we typically purchase approximately 2.7 million MM BTU of natural gas per year in Florida, it is only used as a thermal fuel for various phosphate production processes.

Florida Land Holdings

We are a significant landowner in the State of Florida, which has in the past been considered one of the fastest areas of population growth in the U.S. We have land holdings totaling over 368,000 acres. These landholdings give Mosaic access to phosphate rock reserves and exist as fee simple, mining agreements or mineral rights. Some of our land holdings are needed to operate our Phosphates business, while a portion of our land assets, such as certain reclaimed properties, are no longer required for our ongoing operations. As a general matter, more of our reclaimed property becomes available for uses other than for phosphate operations each year. Our real property assets are generally comprised of concentrates plants, port facilities, phosphate mines and other property which we have acquired through our presence in Florida. Our long-term future land use strategy is to optimize the value of our land assets.

Potash Segment

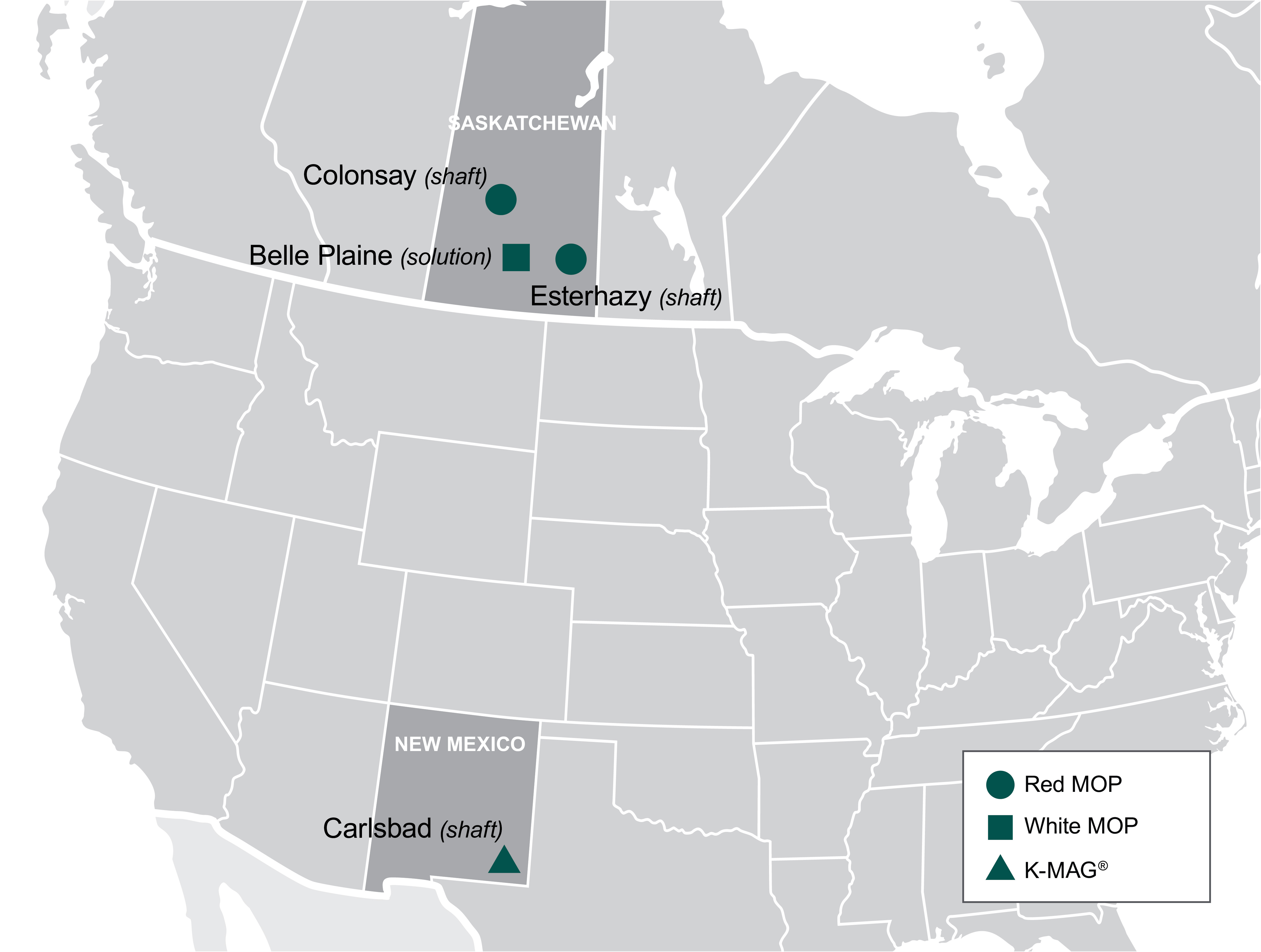

We are one of the leading potash producers in the world. We mine and process potash in Canada and the U.S. and sell potash in North America and internationally. The term “potash” applies generally to the common salts of potassium. Muriate of potash (“MOP”) is the primary source of potassium for the crop nutrient industry. Red MOP has traces of iron oxide. The granular and standard grade red MOP products are well suited for direct fertilizer application and bulk blending. White MOP has a higher percent potassium oxide (“K2O”). White MOP, besides being well suited for the agricultural market, is used in many industrial applications. We also produce a double sulfate of potash magnesia product, which we market under our brand name K-Mag®, at our Carlsbad, New Mexico facility.

Our potash products are marketed worldwide to crop nutrient manufacturers, distributors and retailers and are also used in the manufacturing of mixed crop nutrients and, to a lesser extent, in animal feed ingredients. We also sell potash to customers for industrial use. In addition, our potash products are used for de-icing and as a water softener regenerant.

In 2023, we operated three potash mines in Canada, including two shaft mines and one solution mine, as well as one potash shaft mine in the U.S. Esterhazy, the largest Potash mine in the world, is expected to complete full ramp up of capacity and production during 2024 or early 2025. The K3 expansion has been supplying the capacity and production needed since the closure of the K1 and K2 mines in the second quarter of 2021. Decommissioning of the K1 and K2 shafts at our Esterhazy, Saskatchewan mine was completed in 2022. The Colonsay mine was idled through the first half of 2023 and returned to production in July 2023. We utilize the Colonsay mine as needed to help meet market demand.

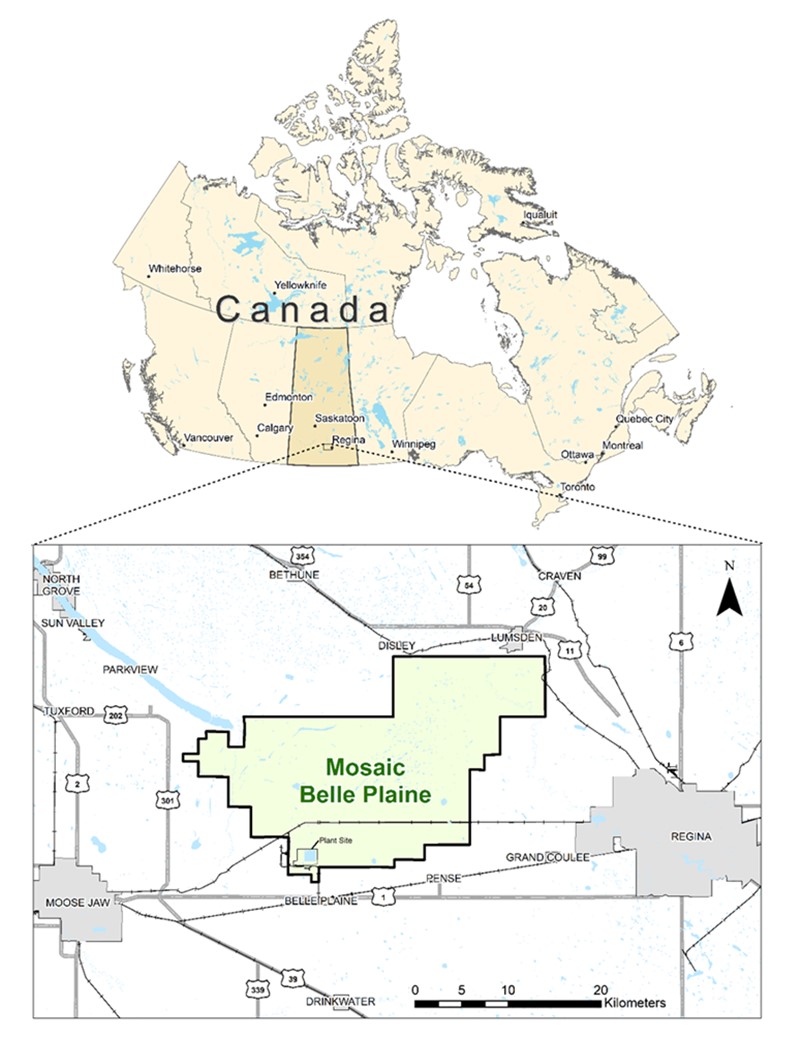

Mosaic leases approximately 291,500 acres of mineral rights from the government of Saskatchewan, and approximately 99,700 acres of freehold mineral rights in the Kronau/Regina area, which have not been developed.

We pay Canadian resource taxes consisting of the Potash Production Tax and resource surcharge. The Potash Production Tax is a Saskatchewan provincial tax on potash production and consists of a base payment and a profits tax. We also pay a percentage of the value of resource sales from our Saskatchewan mines. In addition to the Canadian resource taxes, royalties are payable to the mineral owners in respect of potash reserves or production of potash. We have included a further discussion of the Canadian resource taxes and royalties in our Management’s Analysis.

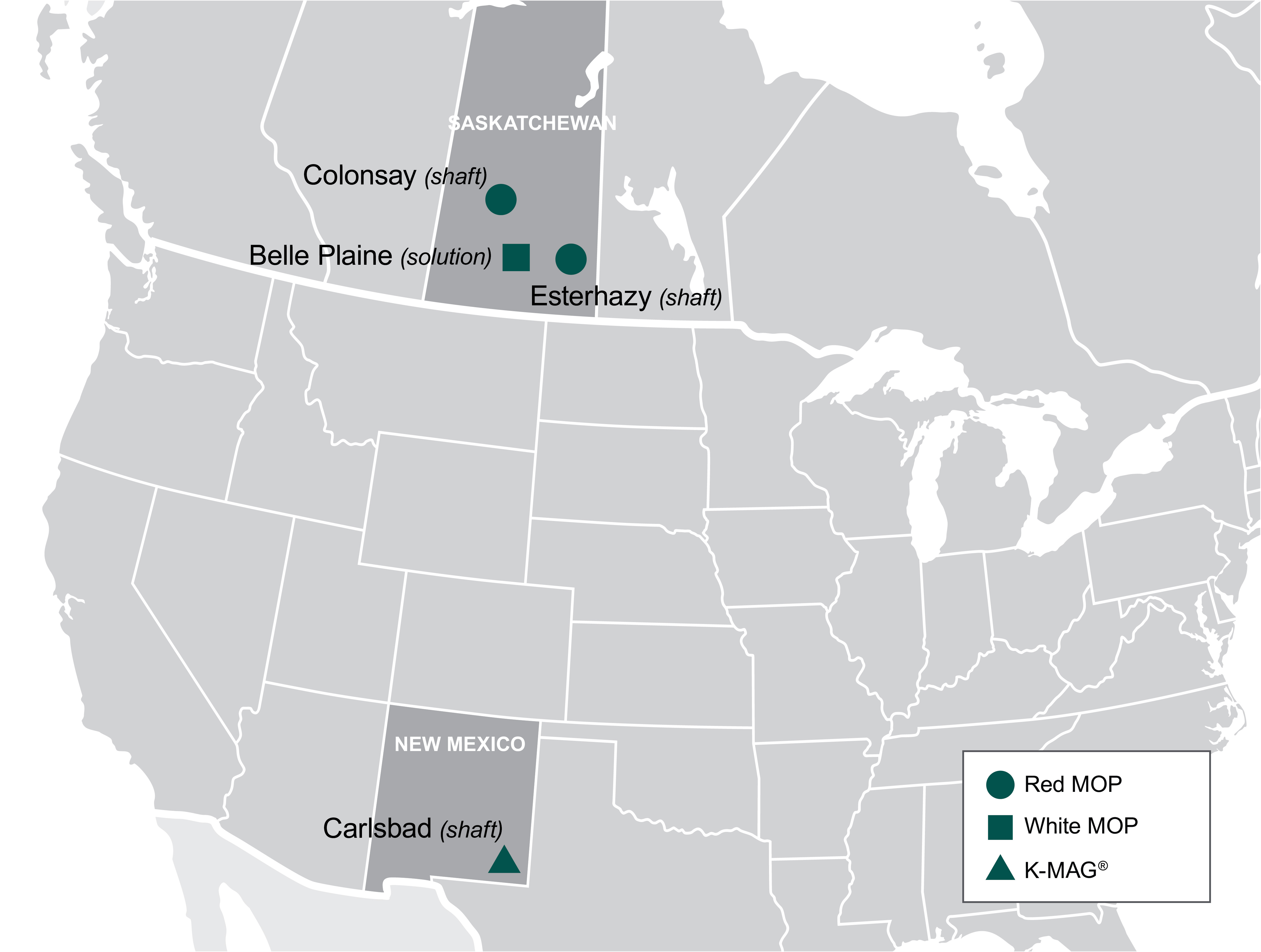

The map below shows the location of each of our potash properties:

Our North American potash annualized operational capacity totals 11.5 million tonnes of product per year and accounts for approximately 14% of world annual capacity and 41% of North American annual operational capacity. Production during 2023 totaled 8.3 million tonnes. We account for approximately 13% of estimated world annual production and 35% of estimated North American annual production.

The following table shows, for each of our potash mines, annual capacity as of December 31, 2023 and finished product output for 2023:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (tonnes in millions) |

|

|

|

|

|

|

|

|

|

|

|

|

| Facility |

Annualized

Proven

Peaking

Capacity

(a)(c)

|

|

Annual

Operational

Capacity

(a)(b)(e)

|

|

|

|

|

Finished

Product(b)

|

|

|

|

|

|

|

|

|

|

|

|

|

| Canada |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Belle Plaine—MOP(d) |

3.9 |

|

|

3.0 |

|

|

|

|

|

2.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Colonsay—MOP (d)(f) |

2.6 |

|

|

1.5 |

|

|

|

|

|

0.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Esterhazy—MOP(d)(g) |

6.3 |

|

|

6.3 |

|

|

|

|

|

4.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Canadian Total |

12.8 |

|

|

10.8 |

|

|

|

|

|

7.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| United States |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Carlsbad—K-Mag®(h) |

0.9 |

|

|

0.7 |

|

|

|

|

|

0.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| United States Total |

0.9 |

|

|

0.7 |

|

|

|

|

|

0.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Totals |

13.7 |

|

|

11.5 |

|

|

|

|

|

8.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

______________________________

(a)Finished product.

(b)Actual production varies from annual operational capacity shown in the above table due to factors that include, among others, the level of demand for our products, maintenance and turnaround time, the quality of the reserves and the nature of the geologic formations we are mining at any particular time, accidents, mechanical failure, product mix, and other operating conditions.

(c)Represents full capacity assuming no turnaround or maintenance time.

(d)The annualized proven peaking capacity shown above is the capacity currently used to determine our share of Canpotex, Limited (“Canpotex”) sales. Canpotex members’ respective shares of Canpotex sales are based upon the members’ respective proven peaking capacities for producing potash. When a Canpotex member expands an existing mine, the new capacity is added to that member’s proven peaking capacity based on either a 90-day production run at the maximum production levels or an engineering audit of the expansion performed by an independent engineering firm in accordance with approved protocols. The annual operational capacity of a mine reported in the table above can exceed the annualized proven peaking capacity until the proving run or engineering audit has been completed. Subject to Note (g), our current entitlement percentage of Canpotex is 36.2%.

(e)Annual operational capacity is our estimated potash production capacity based on the quality of reserves and the nature of the geologic formations expected to be mined, milled and/or processed over the long term, average amount of scheduled down time, including maintenance and scheduled turnaround time, and product mix, and no significant modifications to operating conditions, equipment or facilities. Operational capacities will continue to be updated to the extent new production results impact ore grades assumptions.

(f)Our Colonsay mine operates as a swing mine to meet market demands. We have the ability to reach an annual operating capacity of 2.1 million tonnes over time by increasing our staffing levels and investment in mine development activities.

(g)Following completion of our Esterhazy K3 expansion project, a third-party audit assessed our Esterhazy Facility's nameplate capacity at 7.8 million tonnes. We are currently working with Canpotex through established procedures to determine our adjusted Canpotex entitlement percentage based on our Esterhazy Facility's audited productive capacity.

(h)K-Mag® is a specialty product that we produce at our Carlsbad facility.

See Item 2. “Properties” for a discussion of our potash mining properties, including processing methods, facilities, production and summaries of our mineral resources and reserves, both in the aggregate and for our individual material potash mining properties.

Natural Gas

Natural gas is used at our Belle Plaine solution mine as a fuel to produce steam and to dry potash products. The steam is used to generate electricity and provide thermal energy to the evaporation, crystallization and solution mining processes. The Belle Plaine solution mine typically accounts for approximately 80% of our Potash segment’s total natural gas requirements for potash production. At our shaft mines, natural gas is used as a fuel to heat fresh air supplied to the shaft mines and for drying potash products. Combined natural gas usage for both the solution and shaft mines totaled 16.6 million MM BTU during 2023. We purchase our natural gas requirements on firm delivery index price-based physical contracts and on short-term spot-priced physical contracts. Our Canadian operations purchase physical natural gas from companies in Alberta and Saskatchewan using AECO price indices references and transport the gas to our plants via the TransGas pipeline system. The U.S. potash operation in New Mexico purchases physical gas in the southwest respective regional market using the El Paso San Juan Basin market pricing reference.

We use financial derivative contracts to manage the pricing on portions of our natural gas requirements.

Mosaic Fertilizantes Segment

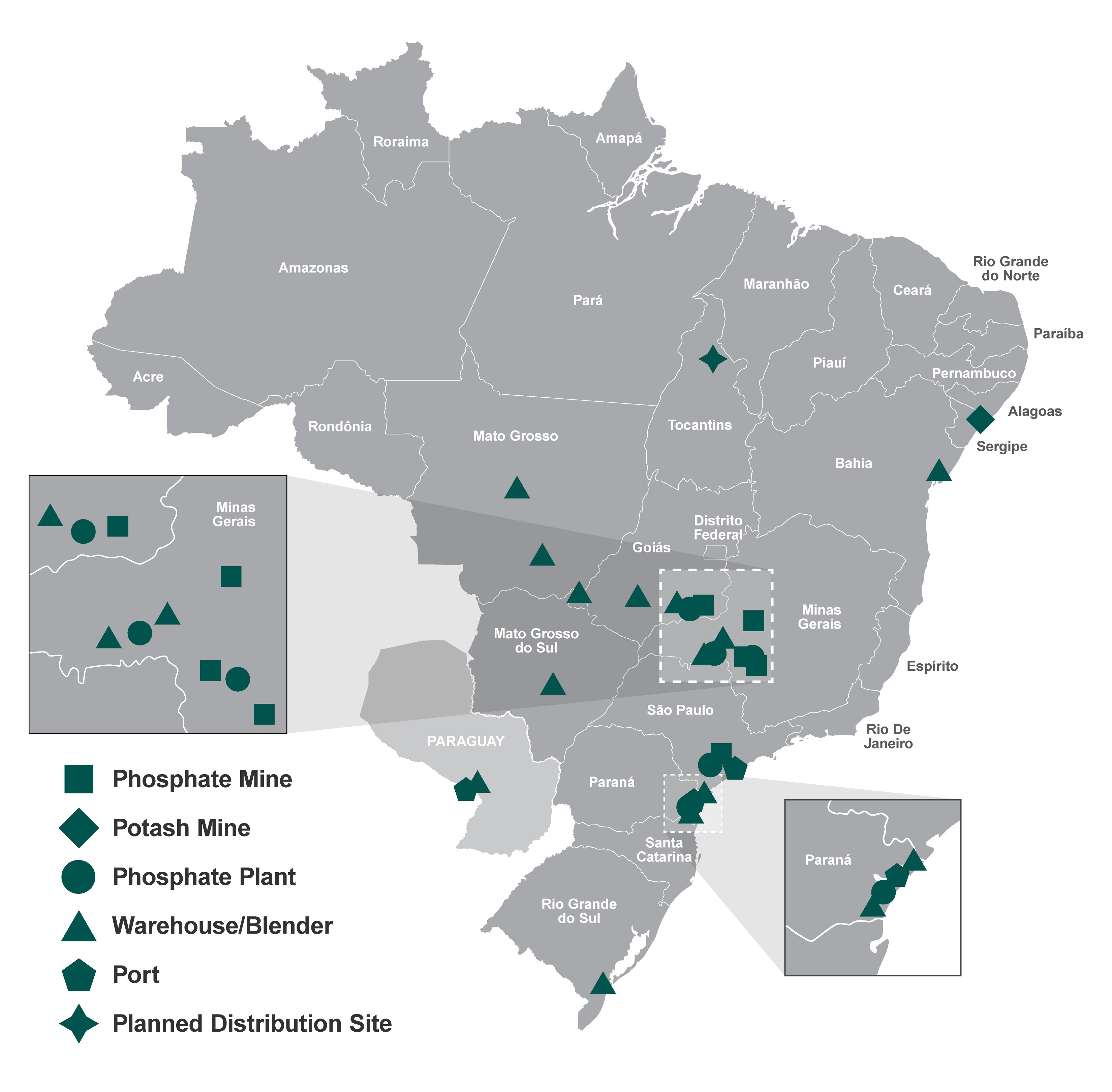

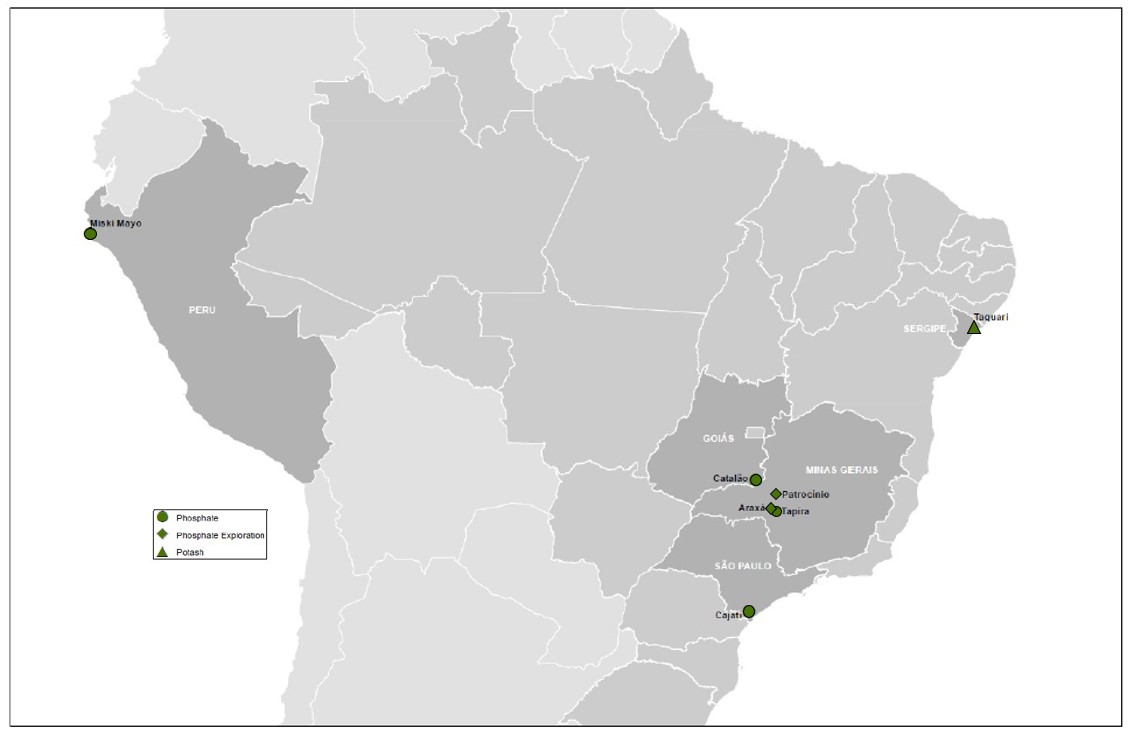

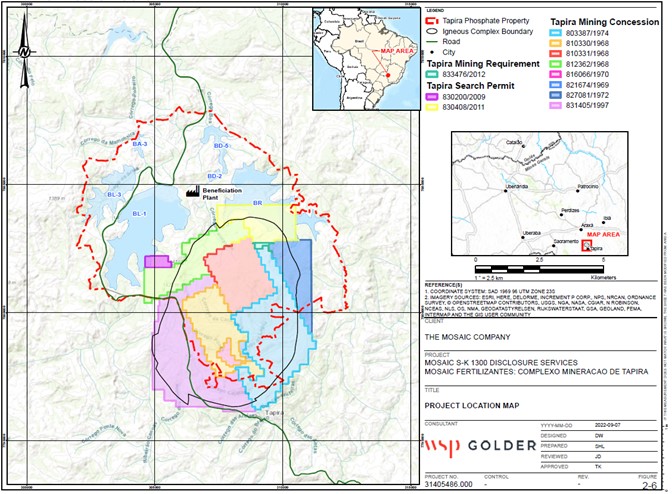

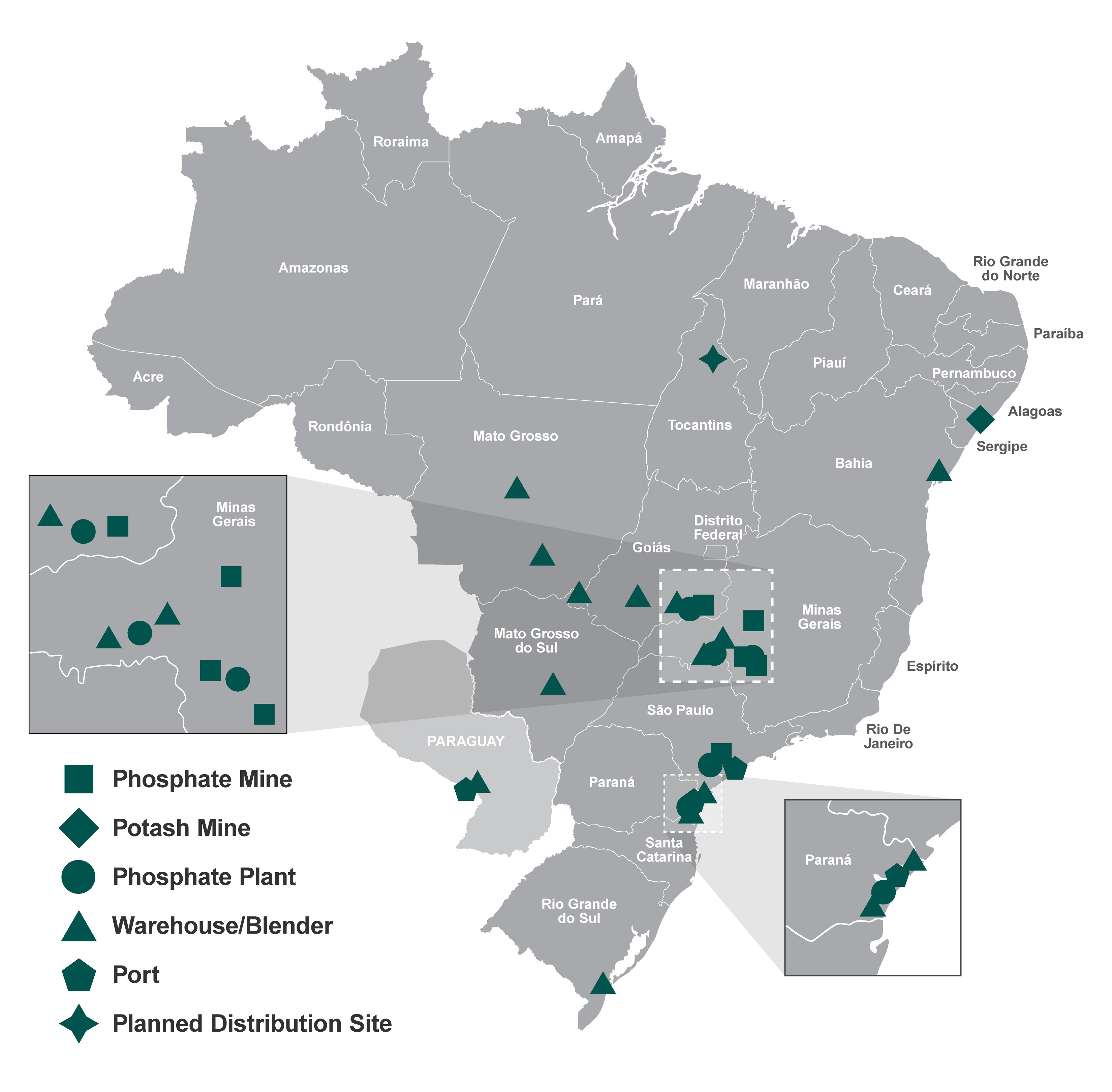

Our Mosaic Fertilizantes segment owns and operates mines, chemical plants, crop nutrient blending and bagging facilities, port terminals and warehouses in Brazil and Paraguay, which produce and sell concentrated phosphates crop nutrients, phosphate-based animal feed ingredients and potash fertilizer. The following map shows the locations of our operations in Brazil and Paraguay:

We are the largest producer and one of the largest distributors of blended crop nutrients for agricultural use in Brazil. We produce and sell phosphate- and potash-based crop nutrients, and animal feed ingredients through our operations. Our operations in Brazil include five phosphate mines, four chemical plants and a potash mine. We own and operate ten blending plants in Brazil and one blending plant and port in Paraguay. We are currently constructing a one million tonne distribution facility in northern Brazil in Palmeirante. In addition, we lease several other warehouses and blending units depending on sales and production levels. We also have a 62% ownership interest in Fospar, S.A. (“Fospar”). Fospar owns and operates an SSP (defined below) granulation plant, which produces approximately 0.5 million tonnes of SSP per year, and a deep-water port and throughput warehouse terminal facility in Paranagua, Brazil. The port facility at Paranagua handles approximately 3.6 million tonnes of imported crop nutrients.

In 2023, Mosaic Fertilizantes sold approximately 9.7 million tonnes of crop nutrient products and accounted for approximately 20% of fertilizer shipments in Brazil.

We have the capability to annually produce approximately 4.5 million tonnes of phosphate- and potash-based crop nutrients and animal feed ingredients. Crop nutrient products produced are marketed to crop nutrient manufacturers, distributors, retailers and farmers.

In addition to producing crop nutrients, Mosaic Fertilizantes purchases phosphates, potash and nitrogen products which are either used to produce blended crop nutrients (“Blends”) or for resale. In 2023, Mosaic Fertilizantes purchased 1.4 million tonnes of phosphate-based products, primarily MicroEssentials®, from our Phosphates segment, and 2.1 million tonnes of potash products from our Potash segment and Canpotex.

Phosphate Crop Nutrients and Animal Feed Ingredients

Our Brazilian phosphates operations have capacity to produce approximately 1.1 million tonnes of P2O5 per year, or about 70% of Brazilian annual capacity. Phosphoric acid is produced by reacting ground phosphate rock with sulfuric acid. P2O5 is the key building block for the production of high analysis or concentrated phosphate crop nutrients and animal feed products and is the most comprehensive measure of phosphate capacity and production and a commonly used benchmark in our industry. Our Brazilian phosphoric acid production totaled approximately 1.0 million tonnes in 2023 and accounted for approximately 84% of Brazilian annual output.

Our principal phosphate crop nutrient products are:

•Monoammonium Phosphate (11-52-0) (“MAP”): MAP is a crop nutrient composed of two macronutrients, nitrogen and phosphoric acid. This slurry is added inside a rotary drum type granulator with ammonia to complete the neutralization reaction and produce MAP.

•Triple superphosphate (“TSP”): TSP is a highly concentrated phosphate crop nutrient. TSP is produced from the phosphate rock reaction with phosphoric acid in a kuhlmann type reactor. The process for the production of TSP in Brazil is run of pile where the product undergoes a curing process of approximately seven days for later granulation.

•Single superphosphate (“SSP”): SSP is a crop nutrient with a low concentration of phosphorus that is used in agriculture because of the sulfur content in its formulation. SSP is produced from mixing phosphate rock with sulfuric acid in a kuhlmann or malaxador type reactor. After the reaction, the product goes to the curing process and then feeds the granulation units.

•Dicalcium phosphate (“DCP”): Dicalcium phosphate is produced by the reaction of desulphurized phosphoric acid with limestone. At Uberaba, it is produced from the reaction of concentrated phosphoric acid with limestone slurry. At Cajati, the phosphoric acid is diluted with dry limestone. The reaction of the DCP occurs in a kuhlmann or spinden type reactor.

Our primary mines and chemical plants are located in the states of Minas Gerais, São Paulo, and Goias. Production of our animal feed ingredients products is located at our Uberaba, Minas Gerais and Cajati, São Paulo facilities. We market our feed phosphate primarily under the brand name Foscálcio.

Annual capacity and production volume by plant as of December 31, 2023 are listed below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (tonnes of ore in millions) |

|

Phosphoric Acid |

|

Processed Phosphate(a) (MAP/TSP/SSP/DCP/Feed) |

| Facility |

|

Capacity(b) |

|

Production(c) |

|

Capacity(b) |

Production(c) |

| Phosphate |

|

|

|

|

|

|

|

| Uberaba |

|

0.9 |

|

|

0.8 |

|

|

2.0 |

|

1.6 |

|

| Cajati |

|

0.2 |

|

|

0.2 |

|

|

0.5 |

|

0.4 |

|

| Araxá |

|

— |

|

|

— |

|

|

1.1 |

|

0.8 |

|

| Catalão |

|

— |

|

|

— |

|

|

0.4 |

|

0.3 |

|

| Total |

|

1.1 |

|

|

1.0 |

|

|

4.0 |

|

3.1 |

|

______________________________

(a)Our ability to produce processed phosphates has been less than our annual operational capacity as stated in the table above, except to the extent we purchase phosphoric acid. Factors affecting actual production are described in note (c) below.

(b)The annual production capacity was calculated using the hourly capacity, days stopped for annual maintenance and OEE (historical utilization factor and capacity factor).

(c)Actual production varies from annual operational capacity shown in the table above due to factors that include, among others, the level of demand for our products, maintenance and turnaround time, accidents and mechanical failure.

The phosphoric acid produced at Cajati is used to produce DCP. The phosphoric acid produced at Uberaba is used to produce MAP, TSP and DCP.

We produced approximately 2.6 million tonnes of concentrated phosphate crop nutrients during 2023 which accounted for approximately 48% of estimated Brazilian annual production.

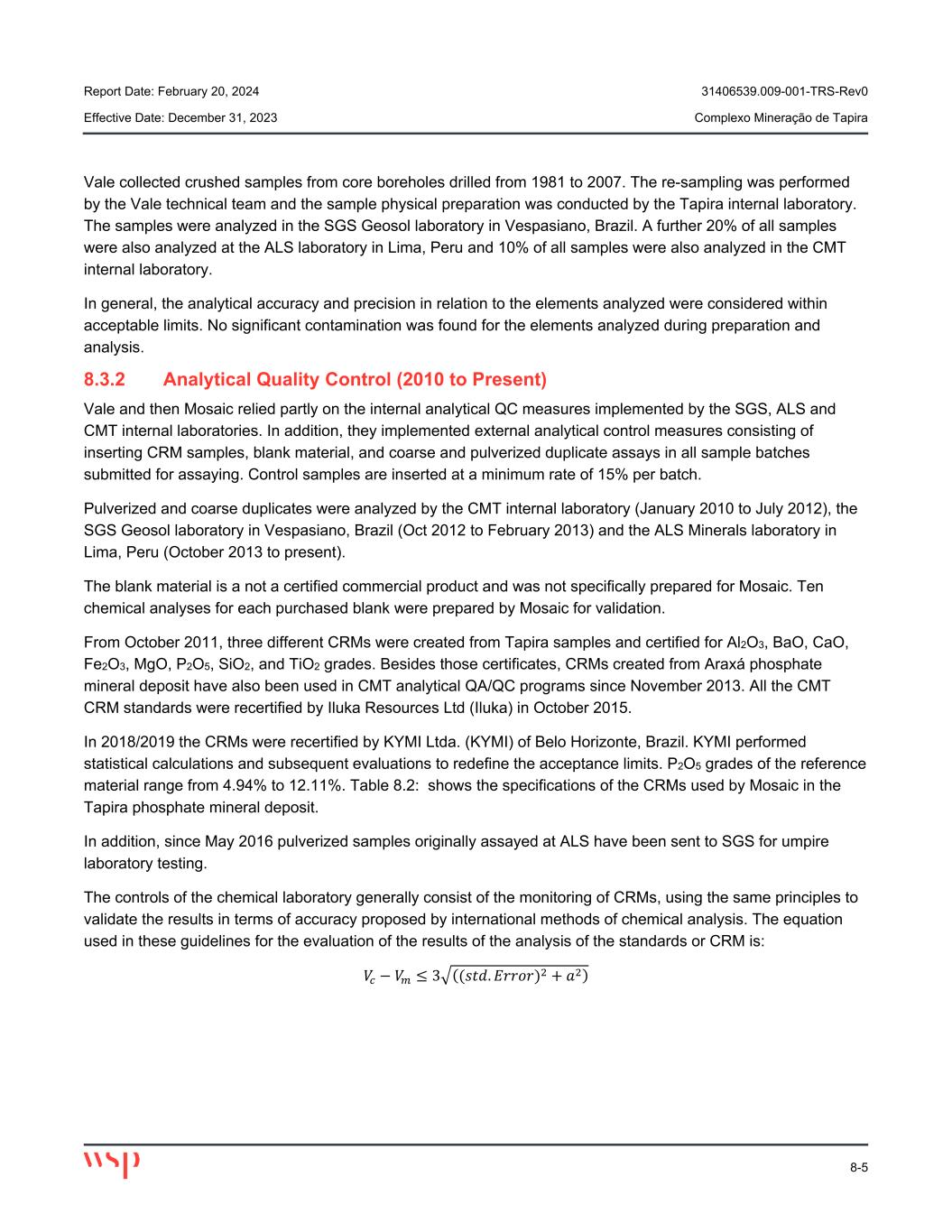

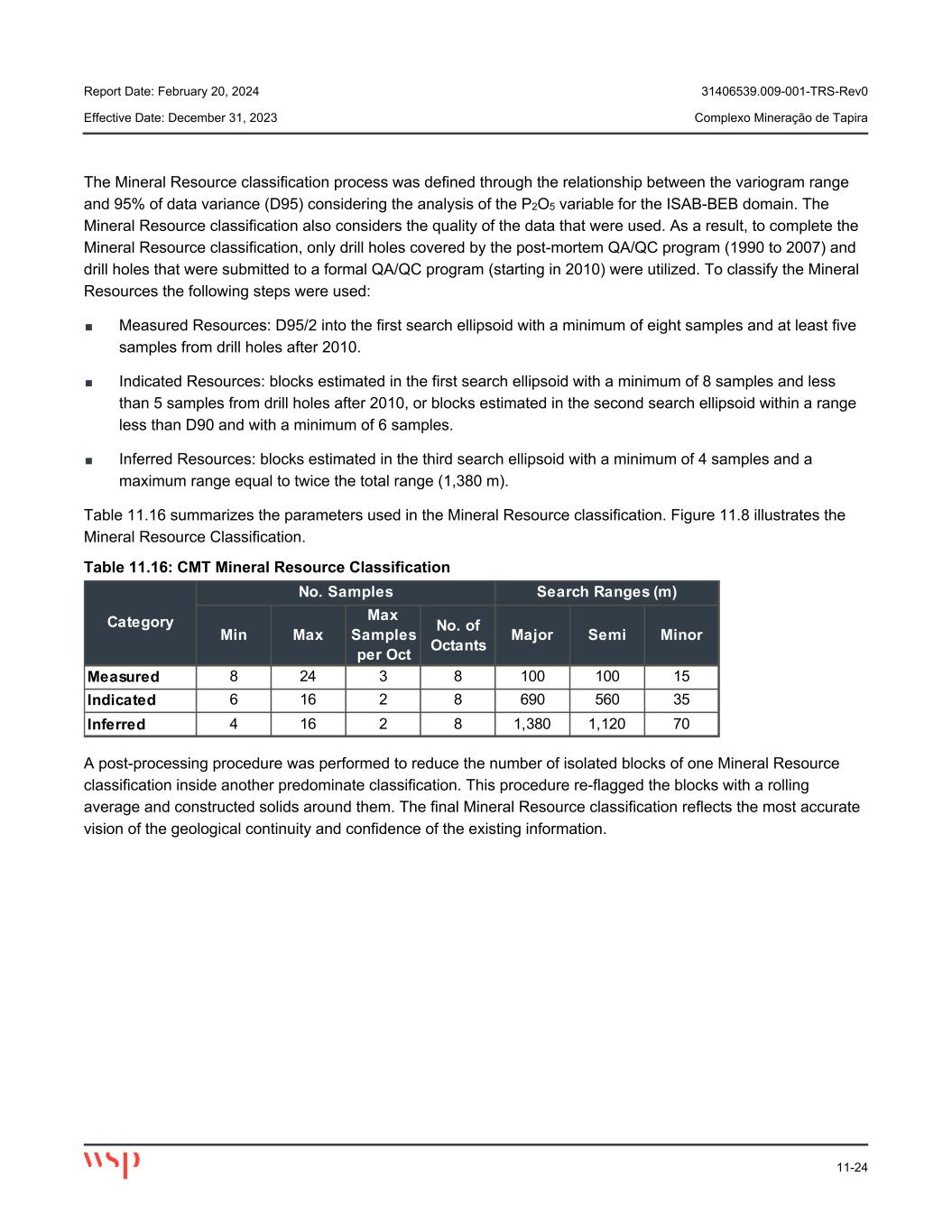

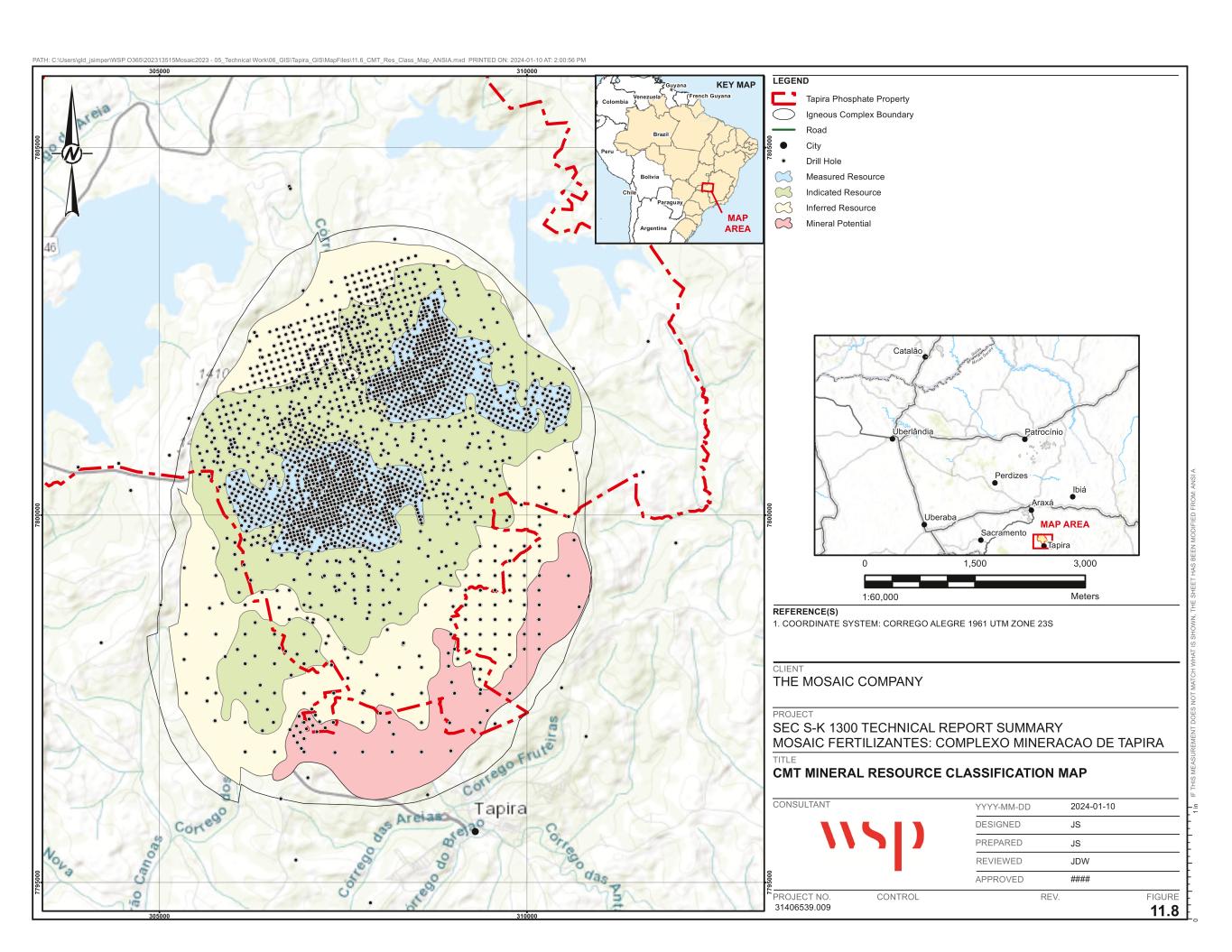

Phosphate Rock