| Washington | 001-36853 | 47-1645716 | ||||||||||||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

||||||||||||

1301 Second Avenue, Floor 36, Seattle, Washington |

98101 | |||||||||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

|||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Class A Common Stock, par value $0.0001 per share | ZG | The Nasdaq Global Select Market | ||||||

| Class C Capital Stock, par value $0.0001 per share | Z | The Nasdaq Global Select Market | ||||||

| Item 2.02 | Results of Operations and Financial Condition. | ||||

| Item 9.01 | Financial Statements and Exhibits. | ||||

| Exhibit Number |

Description | |||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

| 99.3 | ||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). | |||||||

Dated: October 30, 2025 |

ZILLOW GROUP, INC. | ||||||||||

| By: | /s/ JENNIFER ROCK |

||||||||||

| Name: | Jennifer Rock | ||||||||||

| Title: | Chief Accounting Officer | ||||||||||

| Contacts: | ||

| Investors | ||

| Brad Berning | ||

| ir@zillowgroup.com | ||

| Media | ||

| Chrissy Roebuck | ||

| press@zillow.com | ||

|

Three Months Ended

September 30,

|

2024 to 2025

% Change

|

Nine Months Ended

September 30,

|

2024 to 2025 % Change |

||||||||||||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||||||||||||||

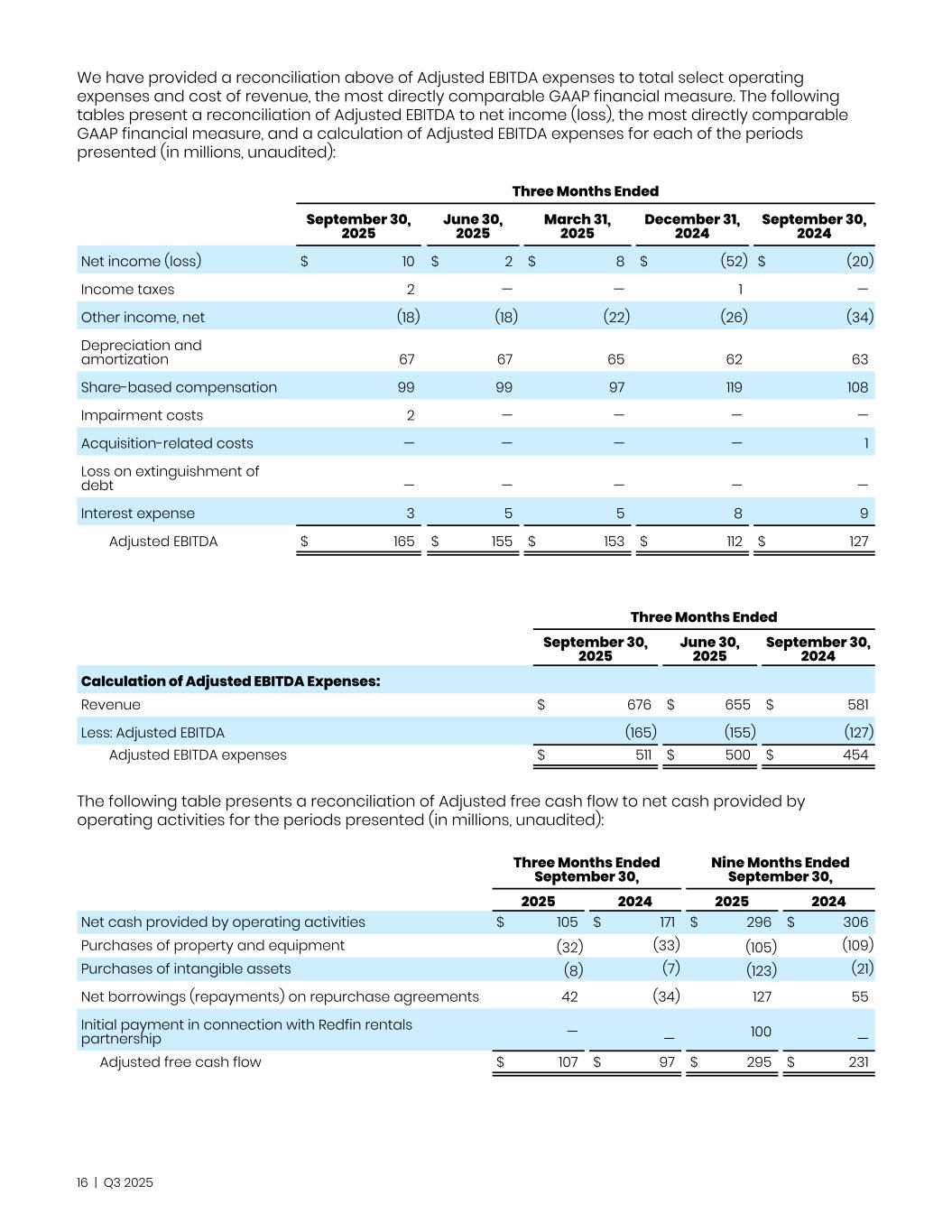

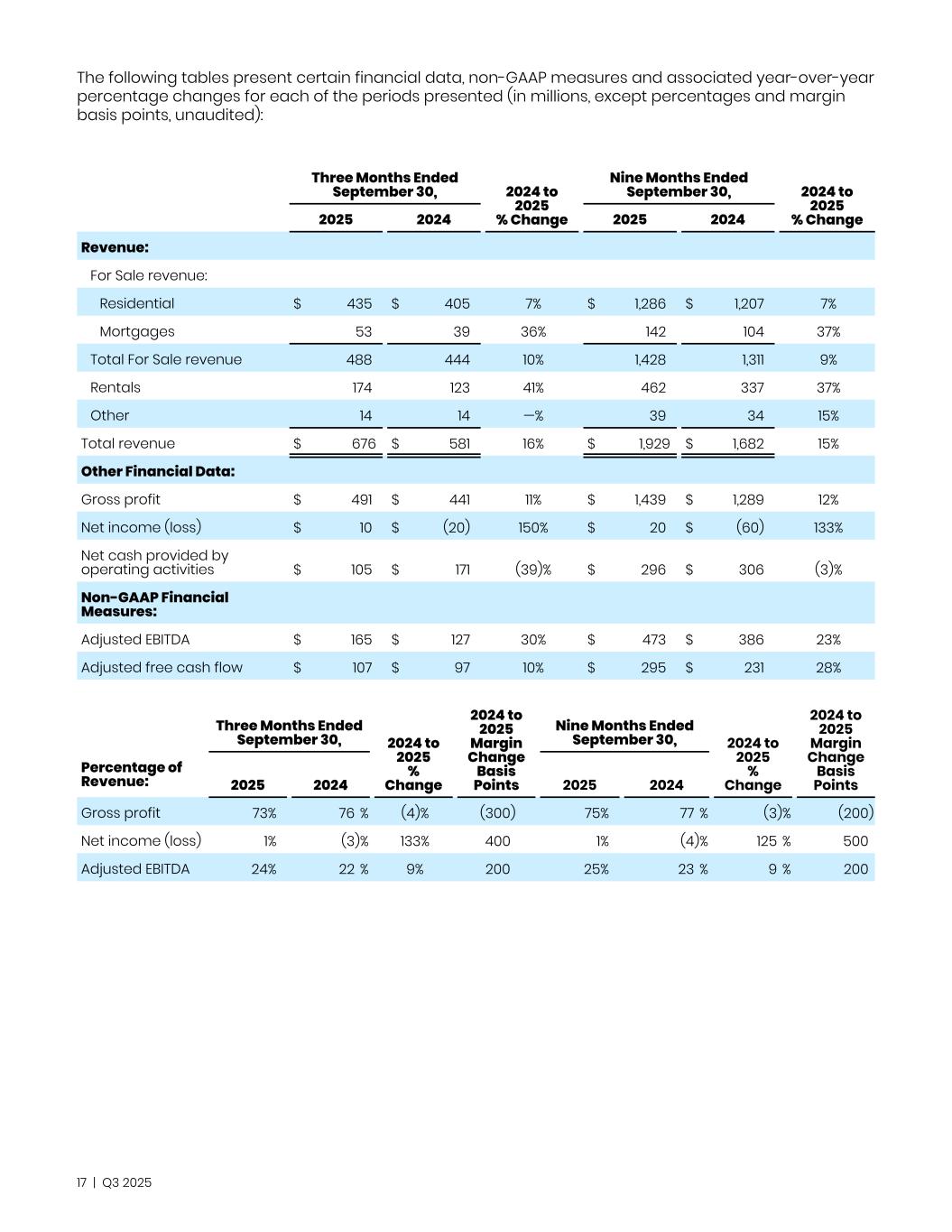

| Revenue: | |||||||||||||||||||||||||||||||||||

For Sale revenue: |

|||||||||||||||||||||||||||||||||||

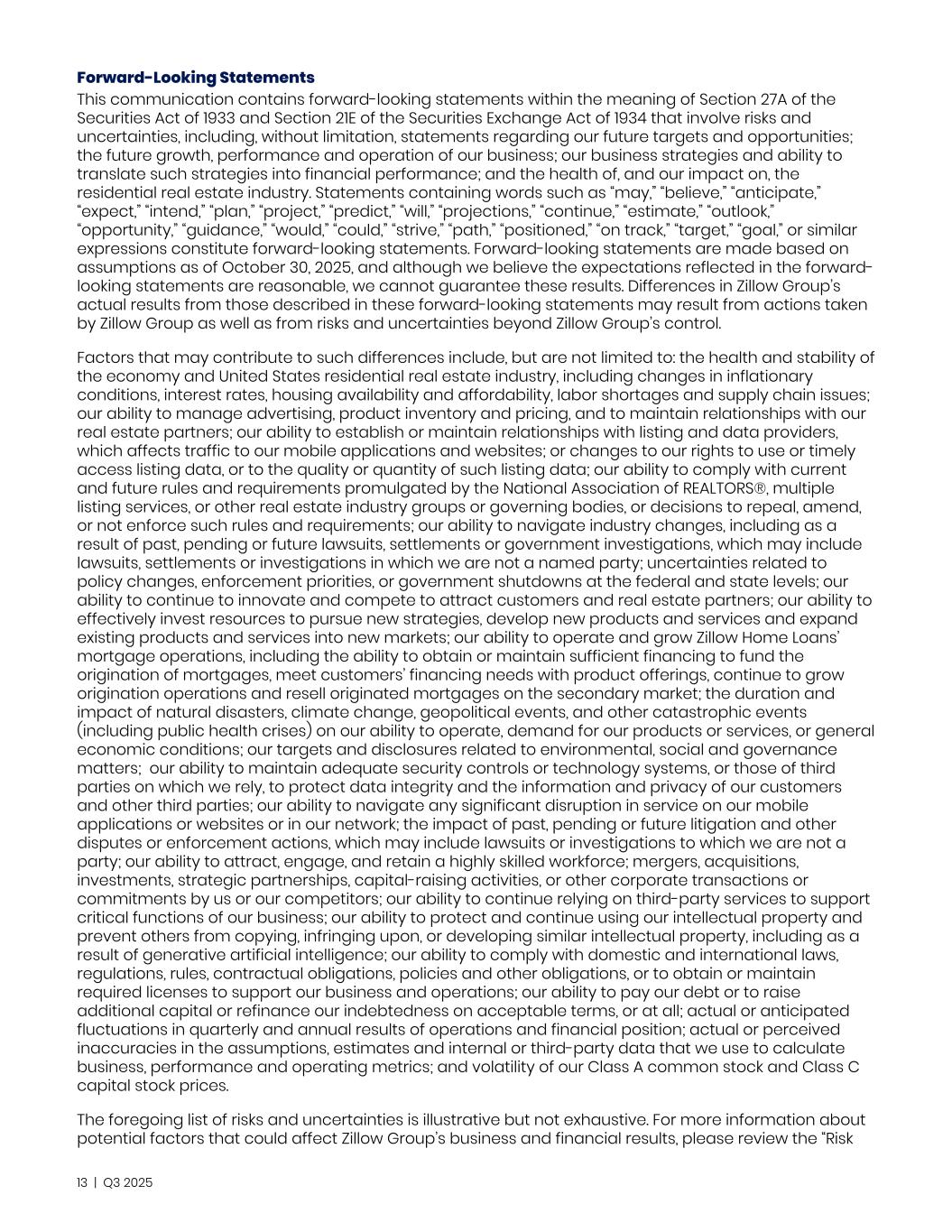

| Residential | $ | 435 | $ | 405 | 7% | $ | 1,286 | $ | 1,207 | 7% | |||||||||||||||||||||||||

| Mortgages | 53 | 39 | 36% | 142 | 104 | 37% | |||||||||||||||||||||||||||||

Total For Sale revenue |

488 | 444 | 10% | 1,428 | 1,311 | 9% | |||||||||||||||||||||||||||||

| Rentals | 174 | 123 | 41% | 462 | 337 | 37% | |||||||||||||||||||||||||||||

| Other | 14 | 14 | —% | 39 | 34 | 15% | |||||||||||||||||||||||||||||

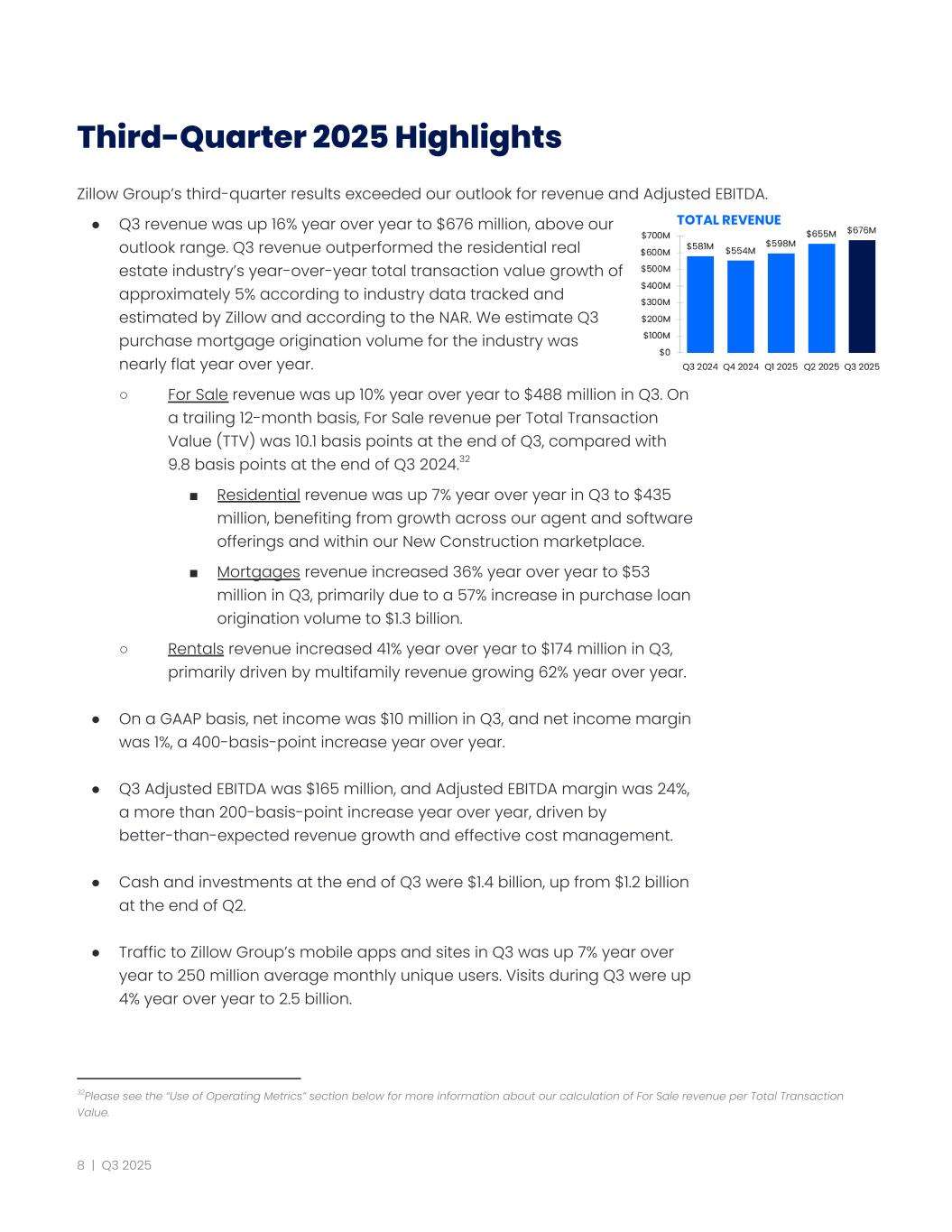

| Total revenue | $ | 676 | $ | 581 | 16% | $ | 1,929 | $ | 1,682 | 15% | |||||||||||||||||||||||||

| Other Financial Data: | |||||||||||||||||||||||||||||||||||

| Gross profit | $ | 491 | $ | 441 | $ | 1,439 | $ | 1,289 | |||||||||||||||||||||||||||

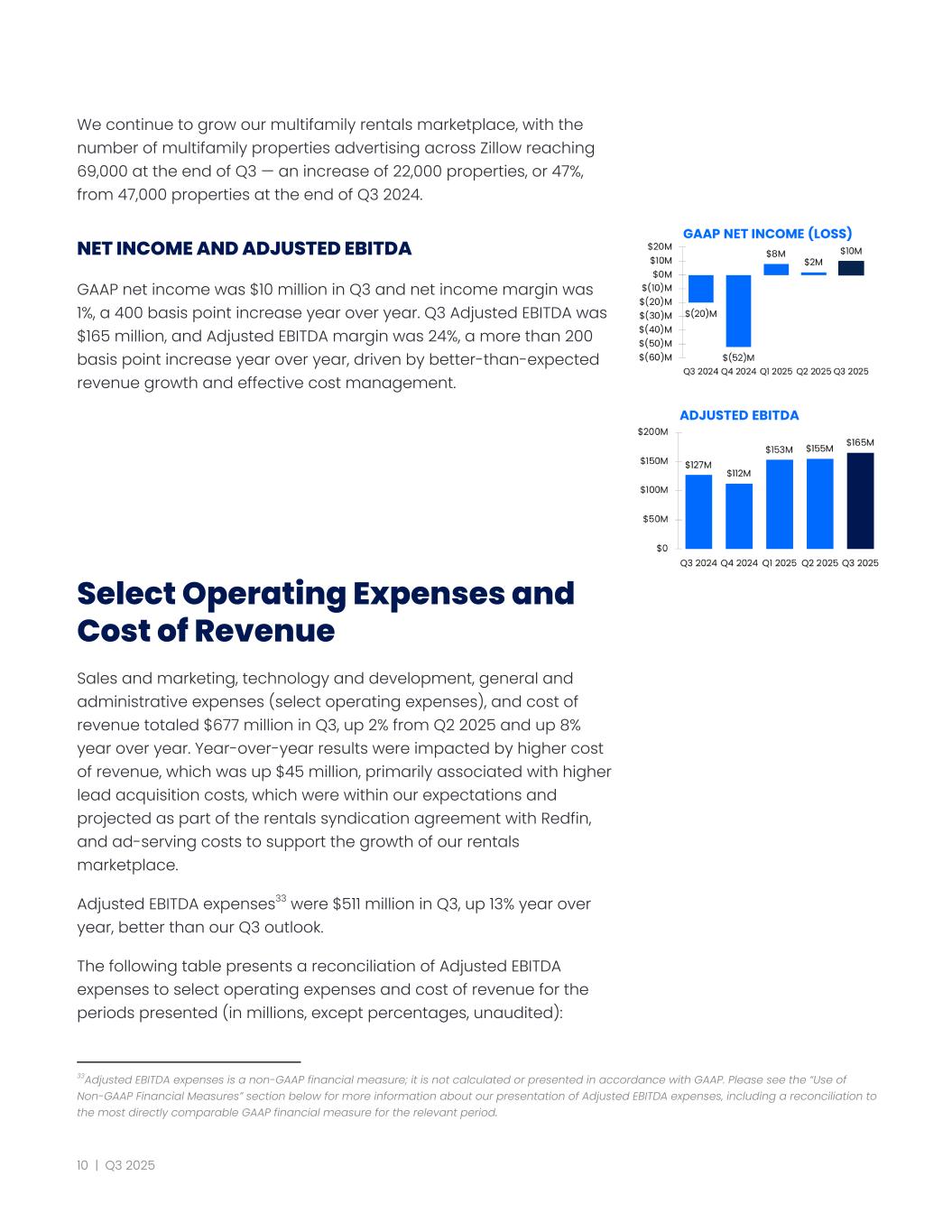

| Net income (loss) | $ | 10 | $ | (20) | $ | 20 | $ | (60) | |||||||||||||||||||||||||||

| Diluted net income (loss) per share | $ | 0.04 | $ | (0.08) | $ | 0.08 | $ | (0.26) | |||||||||||||||||||||||||||

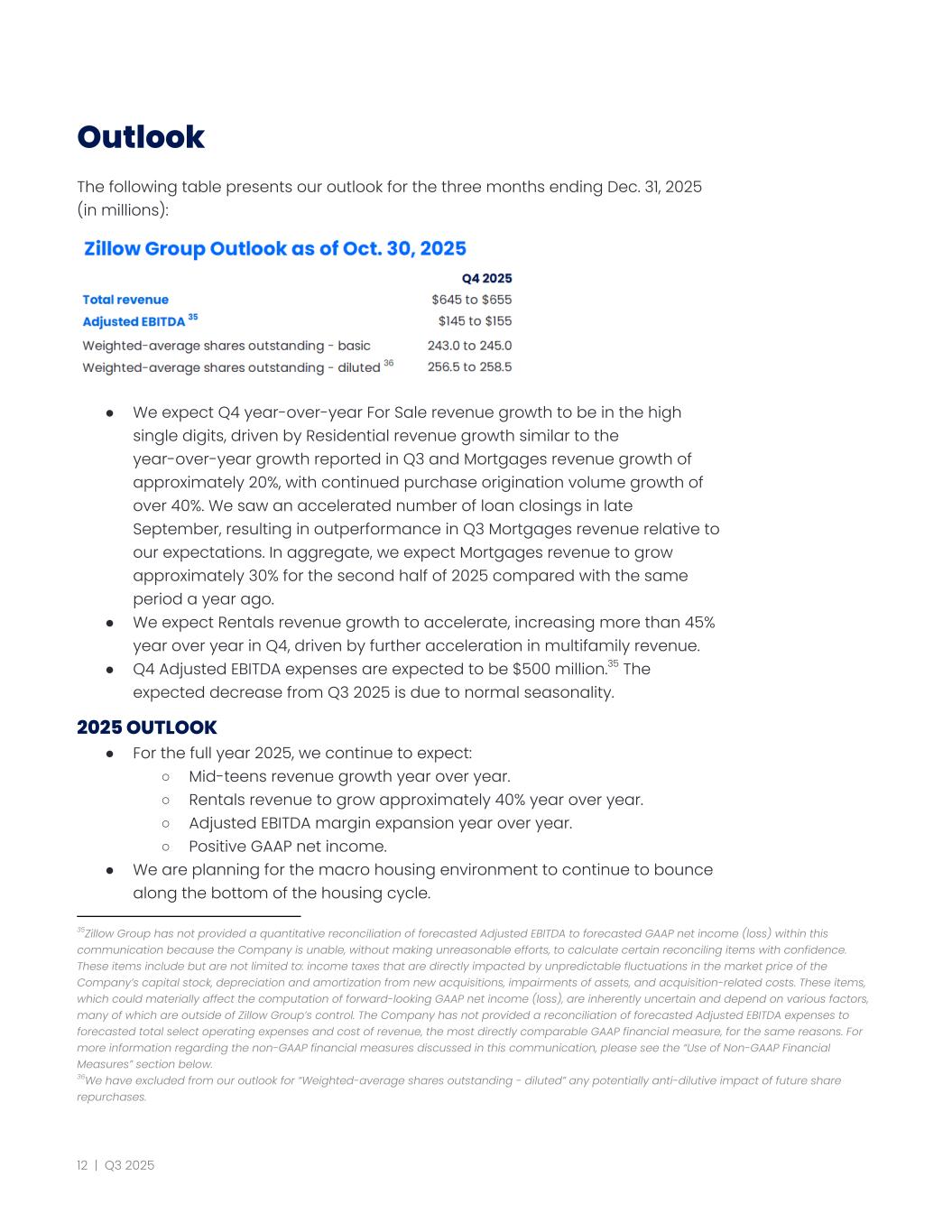

| Net cash provided by operating activities | $ | 105 | $ | 171 | $ | 296 | $ | 306 | |||||||||||||||||||||||||||

Non-GAAP Financial Measures:(1) |

|||||||||||||||||||||||||||||||||||

Adjusted EBITDA |

$ | 165 | $ | 127 | $ | 473 | $ | 386 | |||||||||||||||||||||||||||

Adjusted net income |

$ | 113 | $ | 89 | $ | 319 | $ | 281 | |||||||||||||||||||||||||||

Diluted adjusted net income per share |

$ | 0.44 | $ | 0.35 | $ | 1.25 | $ | 1.10 | |||||||||||||||||||||||||||

Adjusted free cash flow |

$ | 107 | $ | 97 | $ | 295 | $ | 231 | |||||||||||||||||||||||||||

| Percentage of Revenue: | |||||||||||||||||||||||||||||||||||

| Gross profit | 73% | 76 | % | 75% | 77 | % | |||||||||||||||||||||||||||||

Net income (loss) |

1% | (3) | % | 1% | (4) | % | |||||||||||||||||||||||||||||

Adjusted EBITDA(1) |

24% | 22 | % | 25% | 23 | % | |||||||||||||||||||||||||||||

Adjusted net income(1) |

17% | 15 | % | 17% | 17 | % | |||||||||||||||||||||||||||||

(1) These measures are non-GAAP financial measures. Please see the “Use of Non-GAAP Financial Measures” section below for more information about our presentation of these non-GAAP financial measures, including a reconciliation to the most directly comparable GAAP financial measures for the relevant period. | |||||||||||||||||||||||||||||||||||

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||

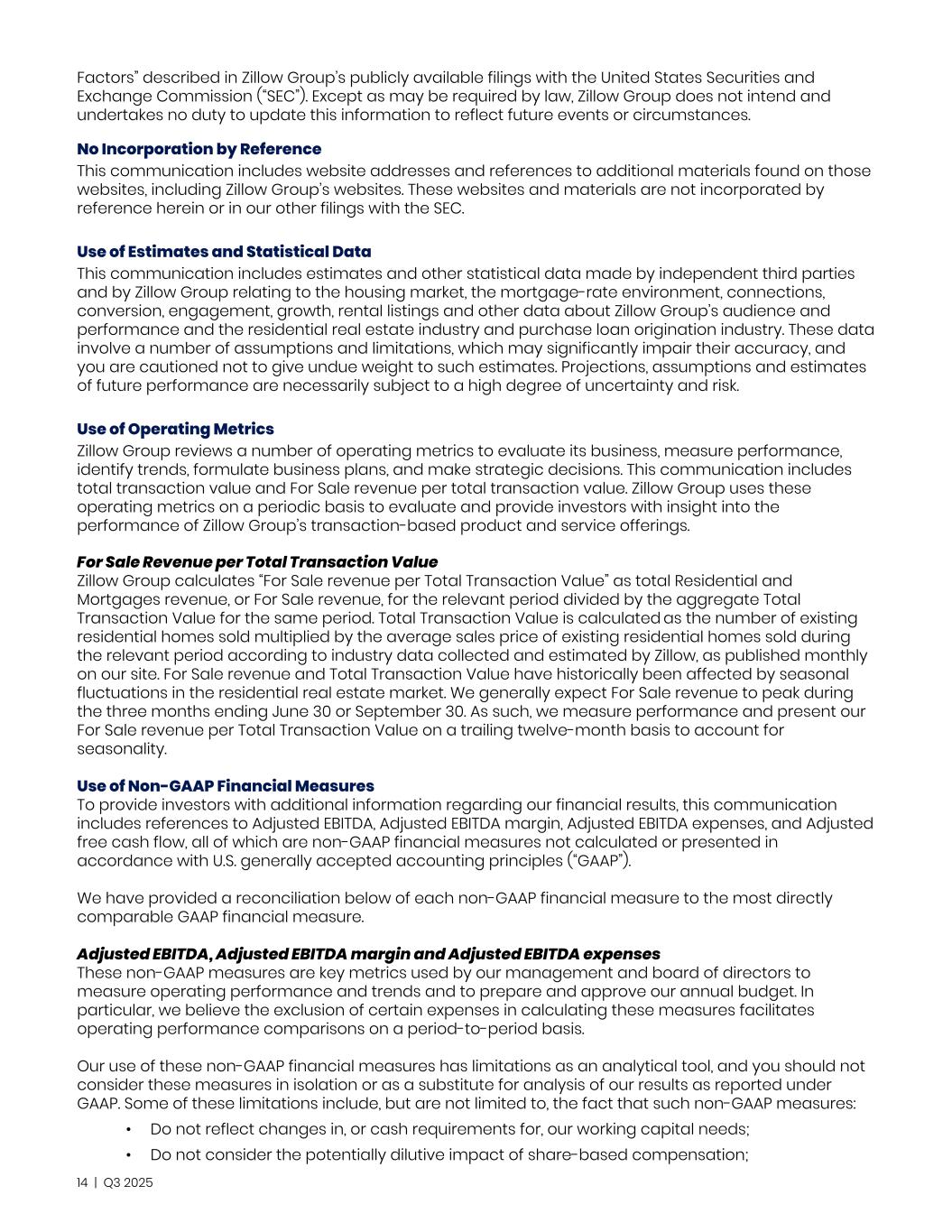

| Net income (loss) | $ | 10 | $ | (20) | $ | 20 | $ | (60) | |||||||||||||||

| Income taxes | 2 | — | 2 | 4 | |||||||||||||||||||

Other income, net |

(18) | (34) | (58) | (101) | |||||||||||||||||||

| Depreciation and amortization | 67 | 63 | 199 | 178 | |||||||||||||||||||

| Share-based compensation | 99 | 108 | 295 | 329 | |||||||||||||||||||

Impairment costs |

2 | — | 2 | 6 | |||||||||||||||||||

| Acquisition-related costs | — | 1 | — | 1 | |||||||||||||||||||

| Loss on extinguishment of debt | — | — | — | 1 | |||||||||||||||||||

| Interest expense | 3 | 9 | 13 | 28 | |||||||||||||||||||

| Adjusted EBITDA | $ | 165 | $ | 127 | $ | 473 | $ | 386 | |||||||||||||||

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||

| Net income (loss) | $ | 10 | $ | (20) | $ | 20 | $ | (60) | |||||||||||||||

| Share-based compensation | 99 | 108 | 295 | 329 | |||||||||||||||||||

Impairment costs |

2 | — | 2 | 6 | |||||||||||||||||||

| Acquisition-related costs | — | 1 | — | 1 | |||||||||||||||||||

| Loss on extinguishment of debt | — | — | — | 1 | |||||||||||||||||||

| Income taxes | 2 | — | 2 | 4 | |||||||||||||||||||

Adjusted net income |

$ | 113 | $ | 89 | $ | 319 | $ | 281 | |||||||||||||||

Diluted net income (loss) per share |

$ | 0.04 | $ | (0.08) | $ | 0.08 | $ | (0.26) | |||||||||||||||

Diluted adjusted net income per share |

$ | 0.44 | $ | 0.35 | $ | 1.25 | $ | 1.10 | |||||||||||||||

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||

Diluted weighted-average shares outstanding |

256,243 | 232,521 | 254,700 | 233,553 | |||||||||||||||||||

| Effect of dilutive securities: | |||||||||||||||||||||||

| Option awards | — | 3,303 | — | 2,619 | |||||||||||||||||||

| Unvested restricted stock units | — | 2,131 | — | 2,093 | |||||||||||||||||||

| Convertible senior notes | — | 21,039 | — | 23,915 | |||||||||||||||||||

Adjusted diluted weighted-average shares outstanding |

256,243 | 258,994 | 254,700 | 262,180 | |||||||||||||||||||

|

Three Months Ended

September 30,

|

Nine Months Ended September 30, |

||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||

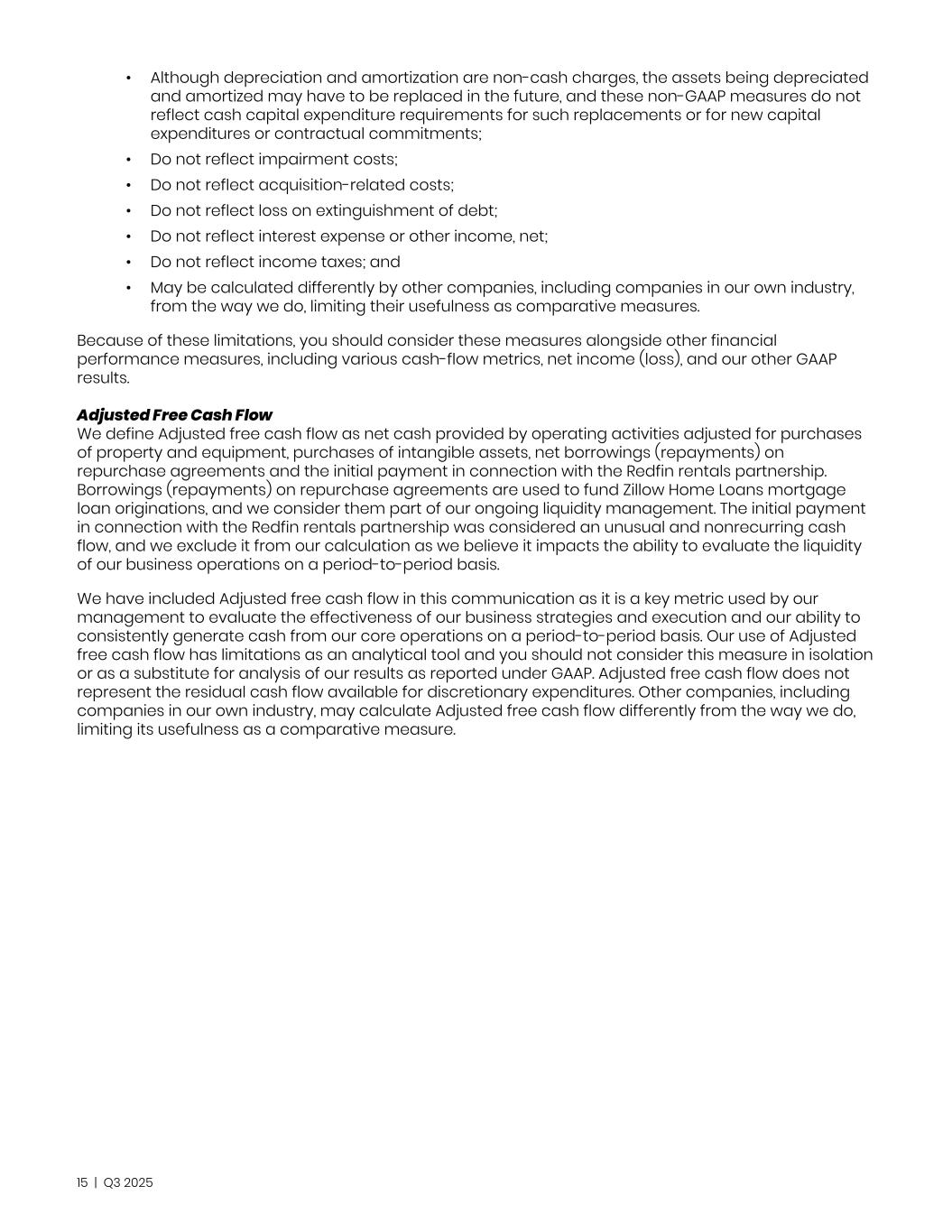

Net cash provided by operating activities |

$ | 105 | $ | 171 | $ | 296 | $ | 306 | |||||||||||||||

Purchases of property and equipment |

(32) | (33) | (105) | (109) | |||||||||||||||||||

Purchases of intangible assets |

(8) | (7) | (123) | (21) | |||||||||||||||||||

Net borrowings (repayments) on repurchase agreements |

42 | (34) | 127 | 55 | |||||||||||||||||||

Initial payment in connection with Redfin rentals partnership |

— | — | 100 | — | |||||||||||||||||||

Adjusted free cash flow |

$ | 107 | $ | 97 | $ | 295 | $ | 231 | |||||||||||||||

| September 30, 2025 | December 31, 2024 | ||||||||||

| Assets | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | 874 | $ | 1,082 | |||||||

Short-term investments |

515 | 776 | |||||||||

Accounts receivable, net |

157 | 104 | |||||||||

| Mortgage loans held for sale | 291 | 159 | |||||||||

| Prepaid expenses and other current assets | 277 | 210 | |||||||||

| Restricted cash | 5 | 3 | |||||||||

| Total current assets | 2,119 | 2,334 | |||||||||

| Contract cost assets | 27 | 25 | |||||||||

| Property and equipment, net | 371 | 360 | |||||||||

| Right of use assets | 58 | 59 | |||||||||

| Goodwill | 2,823 | 2,823 | |||||||||

| Intangible assets, net | 273 | 207 | |||||||||

| Other assets | 27 | 21 | |||||||||

| Total assets | $ | 5,698 | $ | 5,829 | |||||||

| Liabilities and shareholders’ equity | |||||||||||

| Current liabilities: | |||||||||||

| Accounts payable | $ | 38 | $ | 30 | |||||||

| Accrued expenses and other current liabilities | 133 | 105 | |||||||||

| Accrued compensation and benefits | 59 | 57 | |||||||||

| Borrowings under credit facilities | 272 | 145 | |||||||||

| Deferred revenue | 69 | 62 | |||||||||

| Lease liabilities, current portion | 13 | 14 | |||||||||

Convertible senior notes |

— | 418 | |||||||||

| Total current liabilities | 584 | 831 | |||||||||

| Lease liabilities, net of current portion | 82 | 83 | |||||||||

| Other long-term liabilities | 40 | 67 | |||||||||

| Total liabilities | 706 | 981 | |||||||||

| Shareholders’ equity: | |||||||||||

Class A common stock |

— | — | |||||||||

Class B common stock |

— | — | |||||||||

Class C capital stock |

— | — | |||||||||

| Additional paid-in capital | 6,852 | 6,733 | |||||||||

Accumulated other comprehensive income (loss) |

2 | (3) | |||||||||

| Accumulated deficit | (1,862) | (1,882) | |||||||||

| Total shareholders’ equity | 4,992 | 4,848 | |||||||||

| Total liabilities and shareholders’ equity | $ | 5,698 | $ | 5,829 | |||||||

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||

| Revenue | $ | 676 | $ | 581 | $ | 1,929 | $ | 1,682 | |||||||||||||||

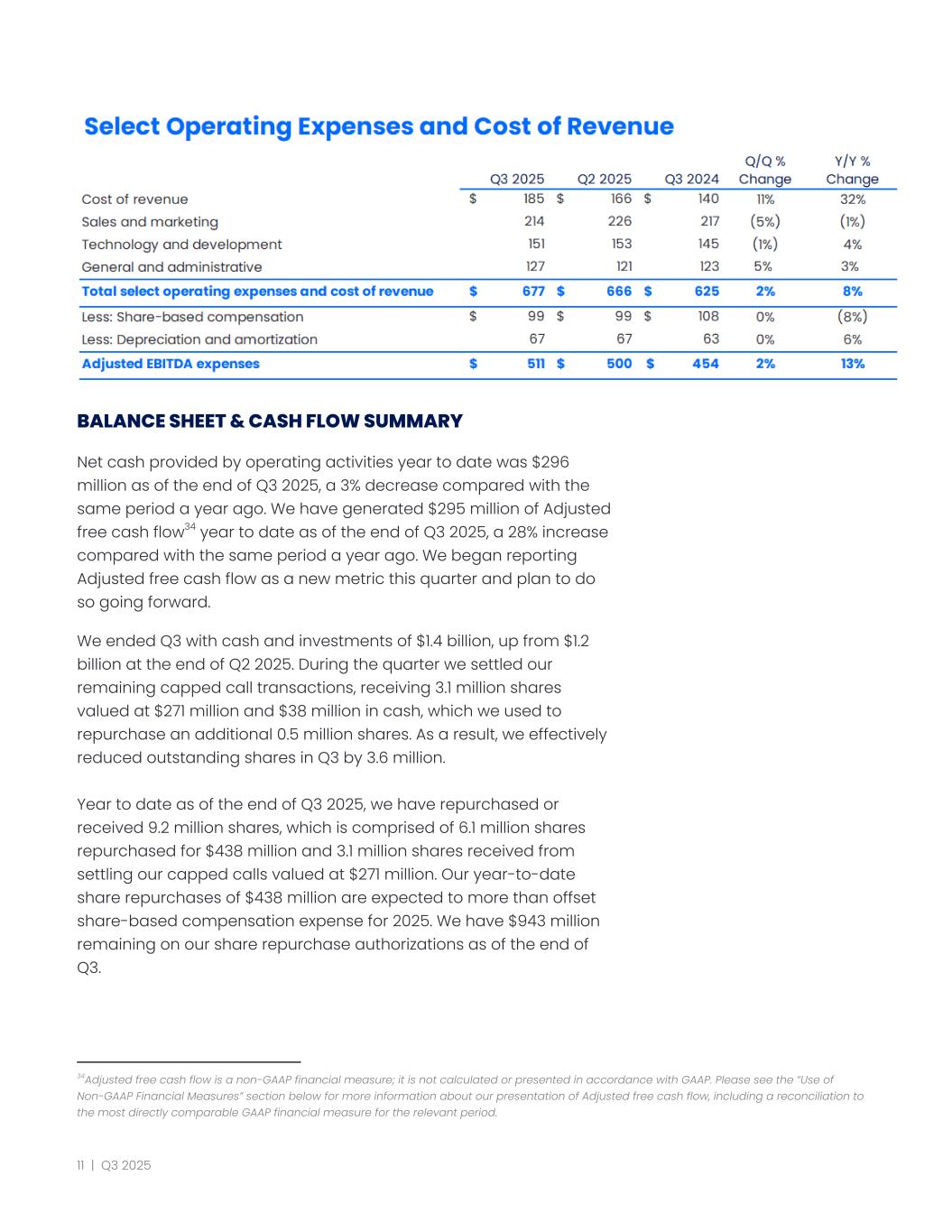

Cost of revenue (1) |

185 | 140 | 490 | 393 | |||||||||||||||||||

| Gross profit | 491 | 441 | 1,439 | 1,289 | |||||||||||||||||||

| Operating expenses: | |||||||||||||||||||||||

Sales and marketing (1) |

214 | 217 | 638 | 588 | |||||||||||||||||||

Technology and development (1) |

151 | 145 | 453 | 436 | |||||||||||||||||||

General and administrative (1) |

127 | 123 | 369 | 386 | |||||||||||||||||||

| Impairment costs | 2 | — | 2 | 6 | |||||||||||||||||||

| Acquisition-related costs | — | 1 | — | 1 | |||||||||||||||||||

| Total operating expenses | 494 | 486 | 1,462 | 1,417 | |||||||||||||||||||

| Loss from operations | (3) | (45) | (23) | (128) | |||||||||||||||||||

| Loss on extinguishment of debt | — | — | — | (1) | |||||||||||||||||||

Other income, net |

18 | 34 | 58 | 101 | |||||||||||||||||||

| Interest expense | (3) | (9) | (13) | (28) | |||||||||||||||||||

| Income (loss) before income taxes | 12 | (20) | 22 | (56) | |||||||||||||||||||

| Income tax expense | (2) | — | (2) | (4) | |||||||||||||||||||

| Net income (loss) | $ | 10 | $ | (20) | $ | 20 | $ | (60) | |||||||||||||||

Net income (loss) per share: |

|||||||||||||||||||||||

Basic |

$ | 0.04 | $ | (0.08) | $ | 0.08 | $ | (0.26) | |||||||||||||||

| Diluted | $ | 0.04 | $ | (0.08) | $ | 0.08 | $ | (0.26) | |||||||||||||||

| Weighted-average shares outstanding: | |||||||||||||||||||||||

Basic |

242,326 | 232,521 | 241,889 | 233,553 | |||||||||||||||||||

| Diluted | 256,243 | 232,521 | 254,700 | 233,553 | |||||||||||||||||||

| (1) Includes share-based compensation expense as follows: | |||||||||||||||||||||||

| Cost of revenue | $ | 3 | $ | 3 | $ | 9 | $ | 11 | |||||||||||||||

| Sales and marketing | 18 | 19 | 55 | 57 | |||||||||||||||||||

| Technology and development | 41 | 40 | 119 | 124 | |||||||||||||||||||

| General and administrative | 37 | 46 | 112 | 137 | |||||||||||||||||||

| Total share-based compensation | $ | 99 | $ | 108 | $ | 295 | $ | 329 | |||||||||||||||

| Adjusted EBITDA (2) | $ | 165 | $ | 127 | $ | 473 | $ | 386 | |||||||||||||||

(2) Adjusted EBITDA is a non-GAAP financial measure; it is not calculated or presented in accordance with U.S. generally accepted accounting principles, or GAAP. See Exhibit 99.1 for more information regarding our presentation of Adjusted EBITDA and for a reconciliation of Adjusted EBITDA to net income (loss), the most directly comparable GAAP financial measure, for each of the periods presented. | |||||||||||||||||||||||

| Nine Months Ended September 30, |

|||||||||||

| 2025 | 2024 | ||||||||||

| Operating activities | |||||||||||

| Net income (loss) | $ | 20 | $ | (60) | |||||||

Adjustments to reconcile net income (loss) to net cash provided by operating activities: |

|||||||||||

| Depreciation and amortization | 199 | 178 | |||||||||

| Share-based compensation | 295 | 329 | |||||||||

| Amortization of right of use assets | 6 | 8 | |||||||||

| Amortization of contract cost assets | 16 | 14 | |||||||||

| Amortization of debt issuance costs | 1 | 4 | |||||||||

Impairment costs |

2 | 6 | |||||||||

| Accretion of bond discount | (7) | (23) | |||||||||

Other adjustments to reconcile net income (loss) to net cash provided by operating activities |

(6) | 14 | |||||||||

| Changes in operating assets and liabilities: | |||||||||||

| Accounts receivable | (53) | (21) | |||||||||

| Mortgage loans held for sale | (132) | (64) | |||||||||

| Prepaid expenses and other assets | (67) | (73) | |||||||||

| Contract cost assets | (18) | (15) | |||||||||

| Lease liabilities | (9) | (31) | |||||||||

| Accounts payable | 8 | 25 | |||||||||

| Accrued expenses and other current liabilities | 32 | 8 | |||||||||

| Accrued compensation and benefits | 2 | 2 | |||||||||

| Deferred revenue | 7 | 5 | |||||||||

Net cash provided by operating activities |

296 | 306 | |||||||||

| Investing activities | |||||||||||

| Proceeds from maturities of investments | 338 | 906 | |||||||||

| Proceeds from sales of investments | 61 | 13 | |||||||||

| Purchases of investments | (127) | (668) | |||||||||

| Purchases of property and equipment | (105) | (109) | |||||||||

| Purchases of intangible assets | (123) | (21) | |||||||||

Net cash provided by investing activities |

44 | 121 | |||||||||

| Financing activities | |||||||||||

| Net borrowings on repurchase agreements | 127 | 55 | |||||||||

| Repurchases of Class A common stock and Class C capital stock | (438) | (301) | |||||||||

Settlement of convertible senior notes |

(419) | (697) | |||||||||

| Proceeds from settlement of capped call transactions | 38 | — | |||||||||

| Proceeds from exercise of stock options | 176 | 96 | |||||||||

| Payment of contingent consideration for acquisition | (30) | — | |||||||||

| Net cash used in financing activities | (546) | (847) | |||||||||

| Net decrease in cash, cash equivalents and restricted cash during period | (206) | (420) | |||||||||

| Cash, cash equivalents and restricted cash at beginning of period | 1,085 | 1,495 | |||||||||

| Cash, cash equivalents and restricted cash at end of period | $ | 879 | $ | 1,075 | |||||||

| Supplemental disclosures of cash flow information | |||||||||||

| Noncash transactions: | |||||||||||

| Write-off of fully depreciated property and equipment | $ | 116 | $ | 63 | |||||||

Write-off of fully amortized intangible assets |

58 | 21 | |||||||||

| Capitalized share-based compensation | 48 | 56 | |||||||||

| Three Months Ended September 30, |

2024 to 2025

% Change

|

Nine Months Ended September 30, |

2024 to 2025

% Change

|

||||||||||||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||||||||||||||

Visits (1) |

2,546 | 2,440 | 4% | 7,490 | 7,251 | 3% | |||||||||||||||||||||||||||||

Average monthly unique users (2) |

250 | 233 | 7% | 240 | 227 | 6% | |||||||||||||||||||||||||||||

| (1) Visits includes groups of interactions by users with the Zillow, Trulia and StreetEasy mobile apps and websites. Zillow and StreetEasy measure visits with an internal measurement tool and Trulia measures visits with Adobe Analytics. | |||||||||||||||||||||||||||||||||||

| (2) Zillow, StreetEasy and HotPads measure unique users with an internal measurement tool and Trulia measures unique users with Adobe Analytics. | |||||||||||||||||||||||||||||||||||

|

Twelve Months Ended

September 30,

|

2024 to 2025

% Change

|

||||||||||||||||

| 2025 | 2024 | ||||||||||||||||

| For Sale revenue (in millions) | $ | 1,856 | $ | 1,682 | 10% | ||||||||||||

Total Transaction Value (in trillions) (1) |

$ | 1.8 | $ | 1.7 | 7% | ||||||||||||

For Sale revenue per Total Transaction Value (in basis points) |

10.1 | 9.8 | 3% | ||||||||||||||

| (1) TTV is calculated as the number of existing residential homes sold during the relevant period multiplied by the average sales price of existing residential homes sold during the same period according to residential real estate data collected and estimated by Zillow Group, as published monthly on our site. | |||||||||||||||||

| Three Months Ended September 30, |

2024 to 2025

% Change

|

Nine Months Ended September 30, |

2024 to 2025

% Change

|

||||||||||||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||||||||||||||

| Purchase loan origination volume | $ | 1,276 | $ | 812 | 57% | $ | 3,183 | $ | 2,169 | 47% | |||||||||||||||||||||||||

| Refinance loan origination volume | 5 | 7 | (29)% | 20 | 14 | 43% | |||||||||||||||||||||||||||||

| Total loan origination volume | $ | 1,281 | $ | 819 | 56% | $ | 3,203 | $ | 2,183 | 47% | |||||||||||||||||||||||||