| Maryland | 001-37399 | 30-0870244 | ||||||

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File Number) |

(IRS Employer

Identification No.)

|

||||||

120 Passaic Avenue Fairfield, New Jersey |

07004 |

|||||||

(Address of Principal Executive Offices) |

(Zip Code) | |||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

| Common Stock, $0.01 par value | KRNY | The NASDAQ Stock Market LLC | ||||||||||||

| Exhibit Number | Description | |||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). | |||||||

KEARNY FINANCIAL CORP. |

||||||||

Date: April 25, 2024 |

By: | /s/ Keith Suchodolski | ||||||

| Keith Suchodolski | ||||||||

| Senior Executive Vice President and Chief Financial Officer | ||||||||

| Linked-Quarter Comparative Financial Analysis | ||

| (Dollars and Shares in Thousands, Except Per Share Data) |

March 31, 2024 |

December 31, 2023 |

Variance or Change |

Variance or Change Pct. |

||||||||||

| Assets | ||||||||||||||

| Cash and cash equivalents | $ | 71,027 | $ | 73,860 | $ | (2,833) | -3.8 | % | ||||||

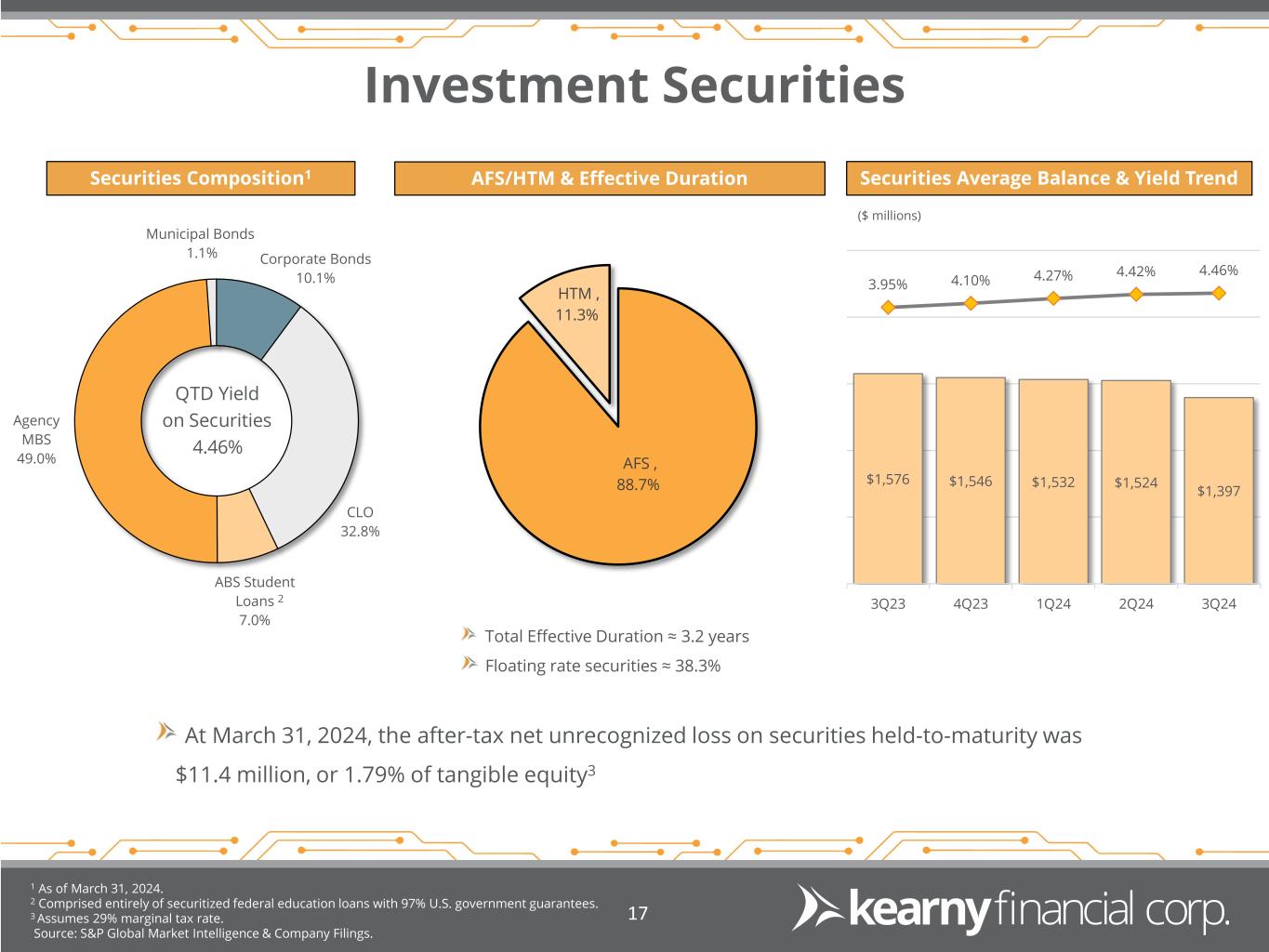

| Securities available for sale | 1,098,655 | 1,144,175 | (45,520) | -4.0 | % | |||||||||

| Securities held to maturity | 139,643 | 141,959 | (2,316) | -1.6 | % | |||||||||

| Loans held-for-sale | 4,117 | 14,030 | (9,913) | -70.7 | % | |||||||||

| Loans receivable | 5,758,336 | 5,745,629 | 12,707 | 0.2 | % | |||||||||

| Less: allowance for credit losses on loans | (44,930) | (44,867) | 63 | 0.1 | % | |||||||||

| Net loans receivable | 5,713,406 | 5,700,762 | 12,644 | 0.2 | % | |||||||||

| Premises and equipment | 45,053 | 45,928 | (875) | -1.9 | % | |||||||||

| Federal Home Loan Bank stock | 81,347 | 83,372 | (2,025) | -2.4 | % | |||||||||

| Accrued interest receivable | 31,065 | 30,258 | 807 | 2.7 | % | |||||||||

| Goodwill | 210,895 | 210,895 | — | — | % | |||||||||

| Core deposit intangible | 2,057 | 2,189 | (132) | -6.0 | % | |||||||||

| Bank owned life insurance | 296,493 | 256,064 | 40,429 | 15.8 | % | |||||||||

| Deferred income taxes, net | 47,225 | 46,116 | 1,109 | 2.4 | % | |||||||||

| Other real estate owned | — | 11,982 | (11,982) | -100.0 | % | |||||||||

| Other assets | 100,989 | 136,242 | (35,253) | -25.9 | % | |||||||||

| Total assets | $ | 7,841,972 | $ | 7,897,832 | $ | (55,860) | -0.7 | % | ||||||

| Liabilities | ||||||||||||||

| Deposits: | ||||||||||||||

| Non-interest-bearing | $ | 586,089 | $ | 584,130 | $ | 1,959 | 0.3 | % | ||||||

| Interest-bearing | 4,622,961 | 4,735,500 | (112,539) | -2.4 | % | |||||||||

| Total deposits | 5,209,050 | 5,319,630 | (110,580) | -2.1 | % | |||||||||

| Borrowings | 1,722,178 | 1,667,055 | 55,123 | 3.3 | % | |||||||||

| Advance payments by borrowers for taxes | 17,387 | 16,742 | 645 | 3.9 | % | |||||||||

| Other liabilities | 44,279 | 46,427 | (2,148) | -4.6 | % | |||||||||

| Total liabilities | 6,992,894 | 7,049,854 | (56,960) | -0.8 | % | |||||||||

| Stockholders' Equity | ||||||||||||||

| Common stock | 644 | 645 | (1) | -0.2 | % | |||||||||

| Paid-in capital | 493,187 | 493,297 | (110) | — | % | |||||||||

| Retained earnings | 440,308 | 439,755 | 553 | 0.1 | % | |||||||||

| Unearned ESOP shares | (21,402) | (21,889) | 487 | 2.2 | % | |||||||||

| Accumulated other comprehensive loss | (63,659) | (63,830) | 171 | 0.3 | % | |||||||||

| Total stockholders' equity | 849,078 | 847,978 | 1,100 | 0.1 | % | |||||||||

| Total liabilities and stockholders' equity | $ | 7,841,972 | $ | 7,897,832 | $ | (55,860) | -0.7 | % | ||||||

| Consolidated capital ratios | ||||||||||||||

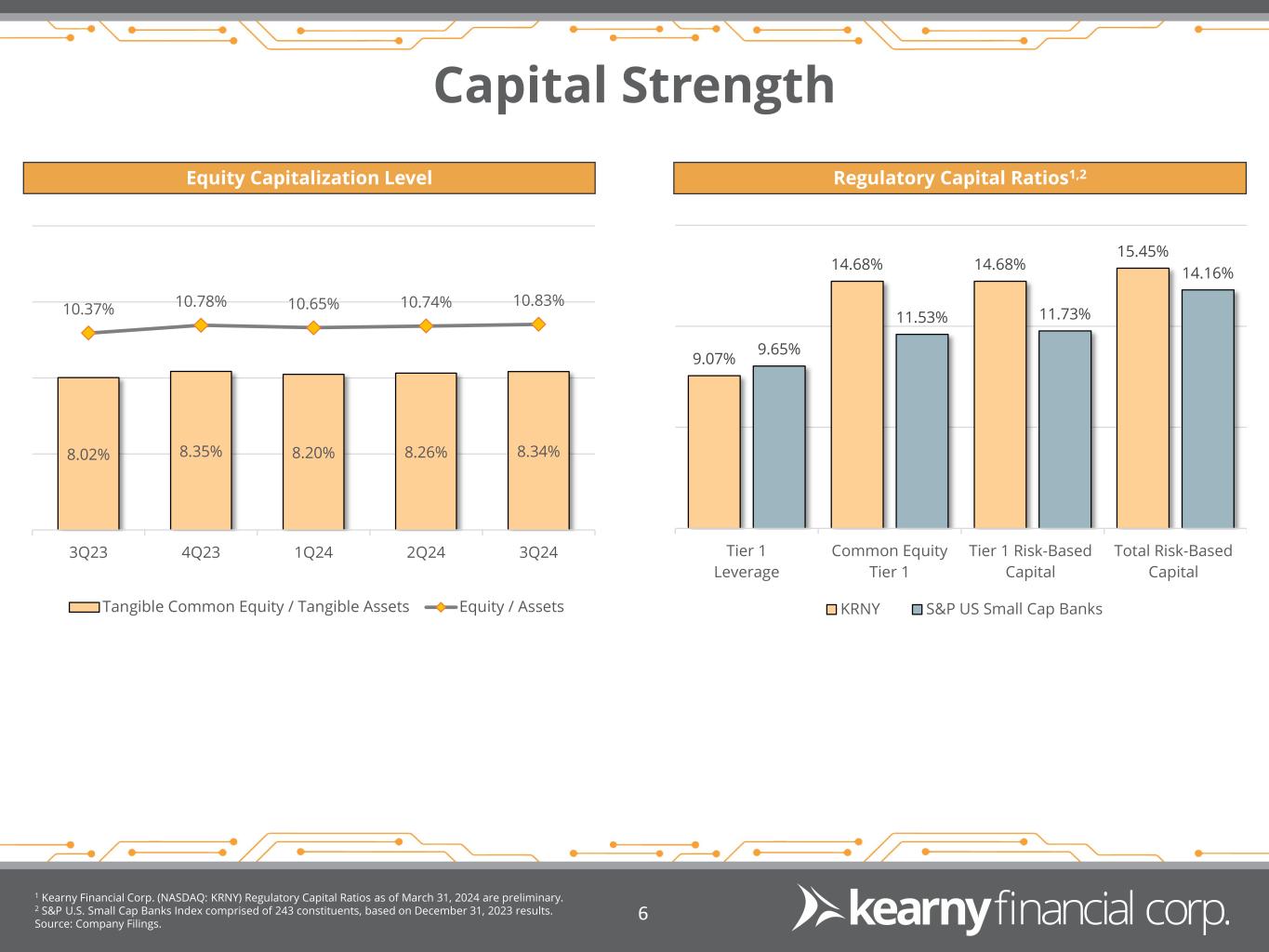

| Equity to assets | 10.83 | % | 10.74 | % | 0.09 | % | ||||||||

Tangible equity to tangible assets (1) |

8.34 | % | 8.26 | % | 0.08 | % | ||||||||

| Share data | ||||||||||||||

| Outstanding shares | 64,437 | 64,445 | (8) | — | % | |||||||||

| Book value per share | $ | 13.18 | $ | 13.16 | $ | 0.02 | 0.2 | % | ||||||

Tangible book value per share (2) |

$ | 9.87 | $ | 9.85 | $ | 0.02 | 0.2 | % | ||||||

| (Dollars and Shares in Thousands, Except Per Share Data) |

Three Months Ended | Variance or Change |

Variance or Change Pct. |

|||||||||||

| March 31, 2024 |

December 31, 2023 |

|||||||||||||

| Interest income | ||||||||||||||

| Loans | $ | 64,035 | $ | 63,384 | $ | 651 | 1.0 | % | ||||||

| Taxable investment securities | 15,490 | 16,756 | (1,266) | -7.6 | % | |||||||||

| Tax-exempt investment securities | 85 | 84 | 1 | 1.2 | % | |||||||||

| Other interest-earning assets | 2,475 | 2,401 | 74 | 3.1 | % | |||||||||

| Total interest income | 82,085 | 82,625 | (540) | -0.7 | % | |||||||||

| Interest expense | ||||||||||||||

| Deposits | 32,320 | 30,340 | 1,980 | 6.5 | % | |||||||||

| Borrowings | 15,446 | 16,446 | (1,000) | -6.1 | % | |||||||||

| Total interest expense | 47,766 | 46,786 | 980 | 2.1 | % | |||||||||

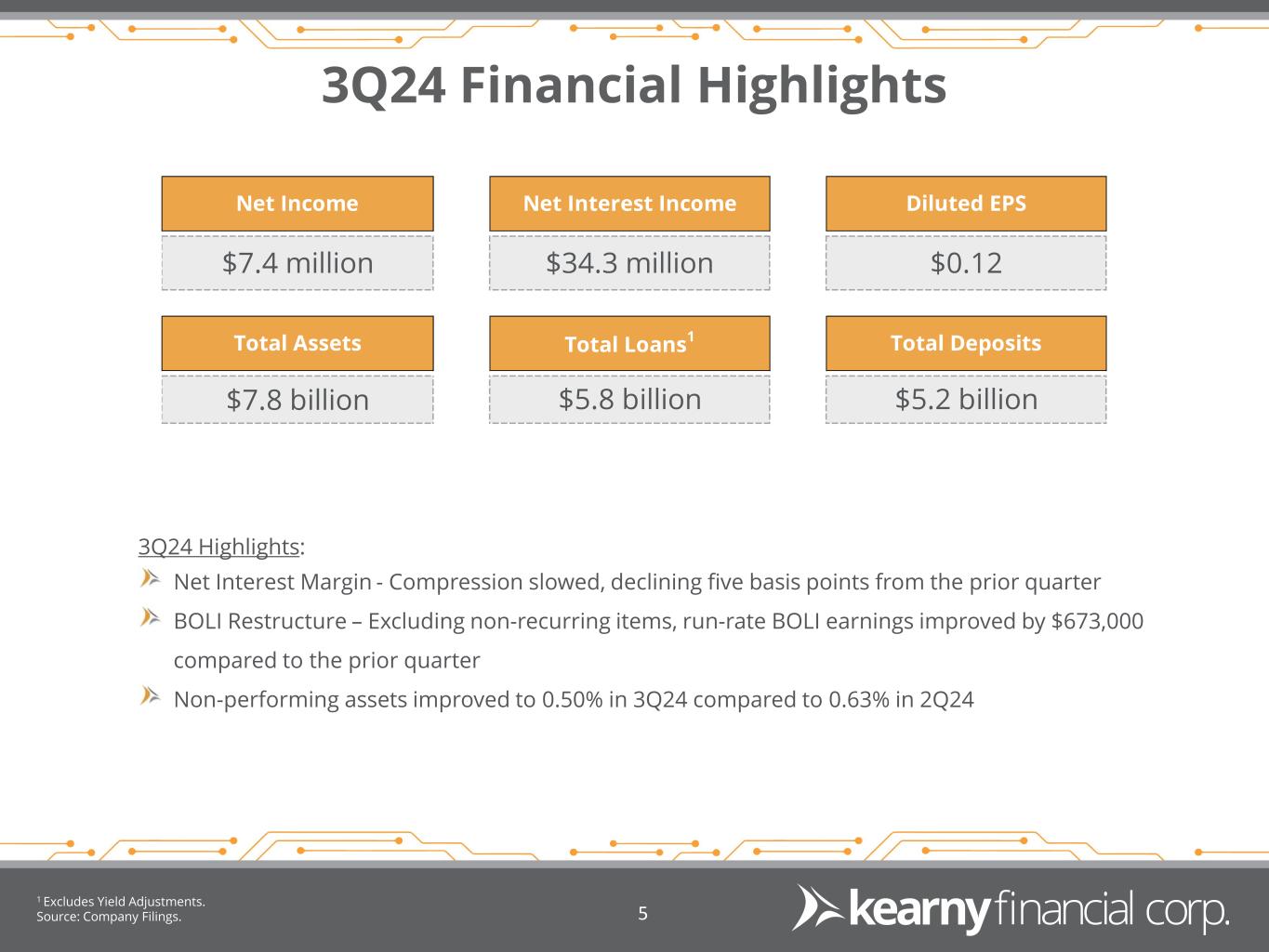

| Net interest income | 34,319 | 35,839 | (1,520) | -4.2 | % | |||||||||

| Provision for credit losses | 349 | 2,105 | (1,756) | -83.4 | % | |||||||||

| Net interest income after provision for credit losses | 33,970 | 33,734 | 236 | 0.7 | % | |||||||||

| Non-interest income | ||||||||||||||

| Fees and service charges | 657 | 624 | 33 | 5.3 | % | |||||||||

| Loss on sale and call of securities | — | (18,135) | 18,135 | 100.0 | % | |||||||||

| (Loss) gain on sale of loans | (712) | 104 | (816) | -784.6 | % | |||||||||

| Loss on other real estate owned | — | (974) | 974 | 100.0 | % | |||||||||

| Income from bank owned life insurance | 3,039 | 1,162 | 1,877 | 161.5 | % | |||||||||

| Electronic banking fees and charges | 464 | 396 | 68 | 17.2 | % | |||||||||

| Other income | 755 | 811 | (56) | -6.9 | % | |||||||||

| Total non-interest income | 4,203 | (16,012) | 20,215 | 126.2 | % | |||||||||

| Non-interest expense | ||||||||||||||

| Salaries and employee benefits | 16,911 | 17,282 | (371) | -2.1 | % | |||||||||

| Net occupancy expense of premises | 2,863 | 2,674 | 189 | 7.1 | % | |||||||||

| Equipment and systems | 3,823 | 3,814 | 9 | 0.2 | % | |||||||||

| Advertising and marketing | 387 | 301 | 86 | 28.6 | % | |||||||||

| Federal deposit insurance premium | 1,429 | 1,495 | (66) | -4.4 | % | |||||||||

| Directors' compensation | 360 | 393 | (33) | -8.4 | % | |||||||||

| Other expense | 3,286 | 3,808 | (522) | -13.7 | % | |||||||||

| Total non-interest expense | 29,059 | 29,767 | (708) | -2.4 | % | |||||||||

| Income (loss) before income taxes | 9,114 | (12,045) | 21,159 | 175.7 | % | |||||||||

| Income taxes | 1,717 | 1,782 | (65) | -3.6 | % | |||||||||

| Net income (loss) | $ | 7,397 | $ | (13,827) | $ | 21,224 | 153.5 | % | ||||||

| Net income (loss) per common share (EPS) | ||||||||||||||

| Basic | $ | 0.12 | $ | (0.22) | $ | 0.34 | ||||||||

| Diluted | $ | 0.12 | $ | (0.22) | $ | 0.34 | ||||||||

| Dividends declared | ||||||||||||||

| Cash dividends declared per common share | $ | 0.11 | $ | 0.11 | $ | — | ||||||||

| Cash dividends declared | $ | 6,844 | $ | 6,882 | $ | (38) | ||||||||

| Dividend payout ratio | 92.5 | % | -49.8 | % | 142.3 | % | ||||||||

| Weighted average number of common shares outstanding | ||||||||||||||

| Basic | 62,205 | 62,299 | (94) | |||||||||||

| Diluted | 62,211 | 62,367 | (156) | |||||||||||

| (Dollars in Thousands) | Three Months Ended | Variance or Change |

Variance or Change Pct. |

|||||||||||

| March 31, 2024 |

December 31, 2023 |

|||||||||||||

| Assets | ||||||||||||||

| Interest-earning assets: | ||||||||||||||

| Loans receivable, including loans held for sale | $ | 5,752,477 | $ | 5,726,321 | $ | 26,156 | 0.5 | % | ||||||

| Taxable investment securities | 1,382,064 | 1,509,165 | (127,101) | -8.4 | % | |||||||||

| Tax-exempt investment securities | 14,614 | 15,025 | (411) | -2.7 | % | |||||||||

| Other interest-earning assets | 125,155 | 139,740 | (14,585) | -10.4 | % | |||||||||

| Total interest-earning assets | 7,274,310 | 7,390,251 | (115,941) | -1.6 | % | |||||||||

| Non-interest-earning assets | 577,411 | 554,335 | 23,076 | 4.2 | % | |||||||||

| Total assets | $ | 7,851,721 | $ | 7,944,586 | $ | (92,865) | -1.2 | % | ||||||

| Liabilities and Stockholders' Equity | ||||||||||||||

| Interest-bearing liabilities: | ||||||||||||||

| Deposits: | ||||||||||||||

| Interest-bearing demand | $ | 2,378,831 | $ | 2,301,169 | $ | 77,662 | 3.4 | % | ||||||

| Savings | 635,226 | 664,926 | (29,700) | -4.5 | % | |||||||||

| Certificates of deposit | 1,705,513 | 1,824,316 | (118,803) | -6.5 | % | |||||||||

| Total interest-bearing deposits | 4,719,570 | 4,790,411 | (70,841) | -1.5 | % | |||||||||

| Borrowings: | ||||||||||||||

| Federal Home Loan Bank advances | 1,428,801 | 1,513,497 | (84,696) | -5.6 | % | |||||||||

| Other borrowings | 210,989 | 142,283 | 68,706 | 48.3 | % | |||||||||

| Total borrowings | 1,639,790 | 1,655,780 | (15,990) | -1.0 | % | |||||||||

| Total interest-bearing liabilities | 6,359,360 | 6,446,191 | (86,831) | -1.3 | % | |||||||||

| Non-interest-bearing liabilities: | ||||||||||||||

| Non-interest-bearing deposits | 581,870 | 597,294 | (15,424) | -2.6 | % | |||||||||

| Other non-interest-bearing liabilities | 65,709 | 62,387 | 3,322 | 5.3 | % | |||||||||

| Total non-interest-bearing liabilities | 647,579 | 659,681 | (12,102) | -1.8 | % | |||||||||

| Total liabilities | 7,006,939 | 7,105,872 | (98,933) | -1.4 | % | |||||||||

| Stockholders' equity | 844,782 | 838,714 | 6,068 | 0.7 | % | |||||||||

| Total liabilities and stockholders' equity | $ | 7,851,721 | $ | 7,944,586 | $ | (92,865) | -1.2 | % | ||||||

| Average interest-earning assets to average interest-bearing liabilities | 114.39 | % | 114.65 | % | -0.26 | % | -0.2 | % | ||||||

| Three Months Ended | Variance or Change |

||||||||||

| March 31, 2024 |

December 31, 2023 |

||||||||||

| Average yield on interest-earning assets: | |||||||||||

| Loans receivable, including loans held for sale | 4.45 | % | 4.43 | % | 0.02 | % | |||||

| Taxable investment securities | 4.48 | % | 4.44 | % | 0.04 | % | |||||

Tax-exempt investment securities (1) |

2.32 | % | 2.25 | % | 0.07 | % | |||||

| Other interest-earning assets | 7.91 | % | 6.87 | % | 1.04 | % | |||||

| Total interest-earning assets | 4.51 | % | 4.47 | % | 0.04 | % | |||||

| Average cost of interest-bearing liabilities: | |||||||||||

| Deposits: | |||||||||||

| Interest-bearing demand | 3.08 | % | 2.91 | % | 0.17 | % | |||||

| Savings | 0.46 | % | 0.44 | % | 0.02 | % | |||||

| Certificates of deposit | 3.11 | % | 2.82 | % | 0.29 | % | |||||

| Total interest-bearing deposits | 2.74 | % | 2.53 | % | 0.21 | % | |||||

| Borrowings: | |||||||||||

| Federal Home Loan Bank advances | 3.55 | % | 3.82 | % | -0.27 | % | |||||

| Other borrowings | 5.22 | % | 5.65 | % | -0.43 | % | |||||

| Total borrowings | 3.77 | % | 3.97 | % | -0.20 | % | |||||

| Total interest-bearing liabilities | 3.00 | % | 2.90 | % | 0.10 | % | |||||

Interest rate spread (2) |

1.51 | % | 1.57 | % | -0.06 | % | |||||

Net interest margin (3) |

1.89 | % | 1.94 | % | -0.05 | % | |||||

| Non-interest income to average assets (annualized) | 0.21 | % | -0.81 | % | 1.02 | % | |||||

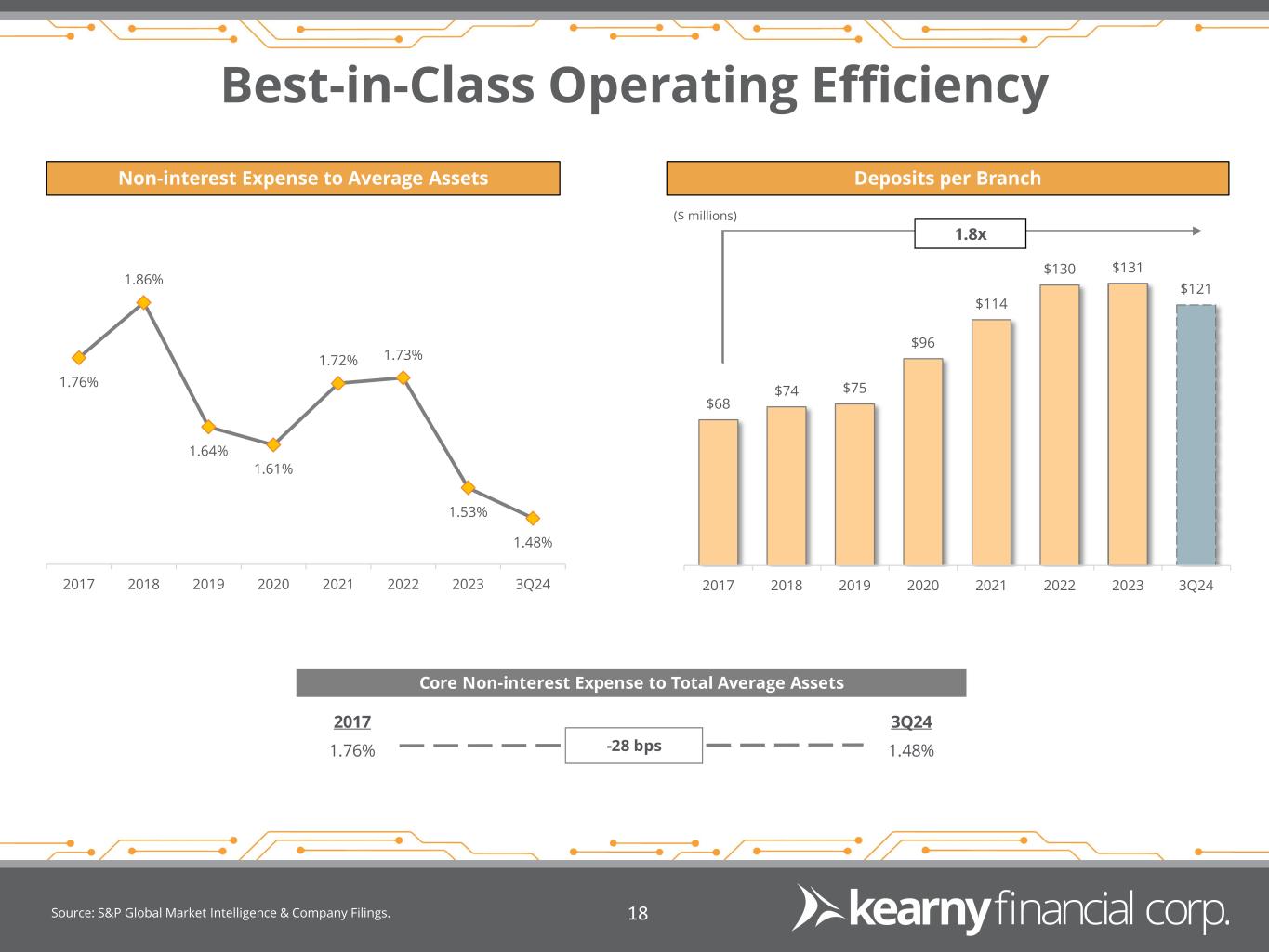

| Non-interest expense to average assets (annualized) | 1.48 | % | 1.50 | % | -0.02 | % | |||||

Efficiency ratio (4) |

75.43 | % | 150.13 | % | -74.70 | % | |||||

| Return on average assets (annualized) | 0.38 | % | -0.70 | % | 1.08 | % | |||||

| Return on average equity (annualized) | 3.50 | % | -6.59 | % | 10.09 | % | |||||

Return on average tangible equity (annualized) (5) |

4.68 | % | -8.84 | % | 13.52 | % | |||||

| Five-Quarter Financial Trend Analysis | ||

| (Dollars and Shares in Thousands, Except Per Share Data) |

March 31, 2024 |

December 31, 2023 |

September 30, 2023 |

June 30, 2023 |

March 31, 2023 |

||||||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | (Audited) | (Unaudited) | |||||||||||||

| Assets | |||||||||||||||||

| Cash and cash equivalents | $ | 71,027 | $ | 73,860 | $ | 57,219 | $ | 70,515 | $ | 194,568 | |||||||

| Securities available for sale | 1,098,655 | 1,144,175 | 1,215,633 | 1,227,729 | 1,267,066 | ||||||||||||

| Securities held to maturity | 139,643 | 141,959 | 143,730 | 146,465 | 149,764 | ||||||||||||

| Loans held-for-sale | 4,117 | 14,030 | 3,934 | 9,591 | 5,401 | ||||||||||||

| Loans receivable | 5,758,336 | 5,745,629 | 5,736,049 | 5,829,421 | 5,966,325 | ||||||||||||

| Less: allowance for credit losses on loans | (44,930) | (44,867) | (46,872) | (48,734) | (49,122) | ||||||||||||

| Net loans receivable | 5,713,406 | 5,700,762 | 5,689,177 | 5,780,687 | 5,917,203 | ||||||||||||

| Premises and equipment | 45,053 | 45,928 | 46,868 | 48,309 | 49,589 | ||||||||||||

| Federal Home Loan Bank stock | 81,347 | 83,372 | 81,509 | 71,734 | 76,319 | ||||||||||||

| Accrued interest receivable | 31,065 | 30,258 | 29,766 | 28,133 | 28,794 | ||||||||||||

| Goodwill | 210,895 | 210,895 | 210,895 | 210,895 | 210,895 | ||||||||||||

| Core deposit intangible | 2,057 | 2,189 | 2,323 | 2,457 | 2,590 | ||||||||||||

| Bank owned life insurance | 296,493 | 256,064 | 294,491 | 292,825 | 291,220 | ||||||||||||

| Deferred income taxes, net | 47,225 | 46,116 | 56,500 | 51,973 | 53,151 | ||||||||||||

| Other real estate owned | — | 11,982 | 12,956 | 12,956 | 13,410 | ||||||||||||

| Other assets | 100,989 | 136,242 | 129,865 | 110,546 | 89,366 | ||||||||||||

| Total assets | $ | 7,841,972 | $ | 7,897,832 | $ | 7,974,866 | $ | 8,064,815 | $ | 8,349,336 | |||||||

| Liabilities | |||||||||||||||||

| Deposits: | |||||||||||||||||

| Non-interest-bearing | $ | 586,089 | $ | 584,130 | $ | 595,141 | $ | 609,999 | $ | 617,778 | |||||||

| Interest-bearing | 4,622,961 | 4,735,500 | 4,839,027 | 5,019,184 | 5,185,626 | ||||||||||||

| Total deposits | 5,209,050 | 5,319,630 | 5,434,168 | 5,629,183 | 5,803,404 | ||||||||||||

| Borrowings | 1,722,178 | 1,667,055 | 1,626,933 | 1,506,812 | 1,611,692 | ||||||||||||

| Advance payments by borrowers for taxes | 17,387 | 16,742 | 16,907 | 18,338 | 18,706 | ||||||||||||

| Other liabilities | 44,279 | 46,427 | 47,324 | 41,198 | 49,304 | ||||||||||||

| Total liabilities | 6,992,894 | 7,049,854 | 7,125,332 | 7,195,531 | 7,483,106 | ||||||||||||

| Stockholders' Equity | |||||||||||||||||

| Common stock | 644 | 645 | 652 | 659 | 667 | ||||||||||||

| Paid-in capital | 493,187 | 493,297 | 497,269 | 503,332 | 509,359 | ||||||||||||

| Retained earnings | 440,308 | 439,755 | 460,464 | 457,611 | 452,605 | ||||||||||||

| Unearned ESOP shares | (21,402) | (21,889) | (22,375) | (22,862) | (23,348) | ||||||||||||

| Accumulated other comprehensive loss | (63,659) | (63,830) | (86,476) | (69,456) | (73,053) | ||||||||||||

| Total stockholders' equity | 849,078 | 847,978 | 849,534 | 869,284 | 866,230 | ||||||||||||

| Total liabilities and stockholders' equity | $ | 7,841,972 | $ | 7,897,832 | $ | 7,974,866 | $ | 8,064,815 | $ | 8,349,336 | |||||||

| Consolidated capital ratios | |||||||||||||||||

| Equity to assets | 10.83 | % | 10.74 | % | 10.65 | % | 10.78 | % | 10.37 | % | |||||||

Tangible equity to tangible assets (1) |

8.34 | % | 8.26 | % | 8.20 | % | 8.35 | % | 8.02 | % | |||||||

| Share data | |||||||||||||||||

| Outstanding shares | 64,437 | 64,445 | 65,132 | 65,864 | 66,680 | ||||||||||||

| Book value per share | $ | 13.18 | $ | 13.16 | $ | 13.04 | $ | 13.20 | $ | 12.99 | |||||||

Tangible book value per share (2) |

$ | 9.87 | $ | 9.85 | $ | 9.77 | $ | 9.96 | $ | 9.79 | |||||||

| (Dollars in Thousands) | March 31, 2024 |

December 31, 2023 |

September 30, 2023 |

June 30, 2023 |

March 31, 2023 |

||||||||||||

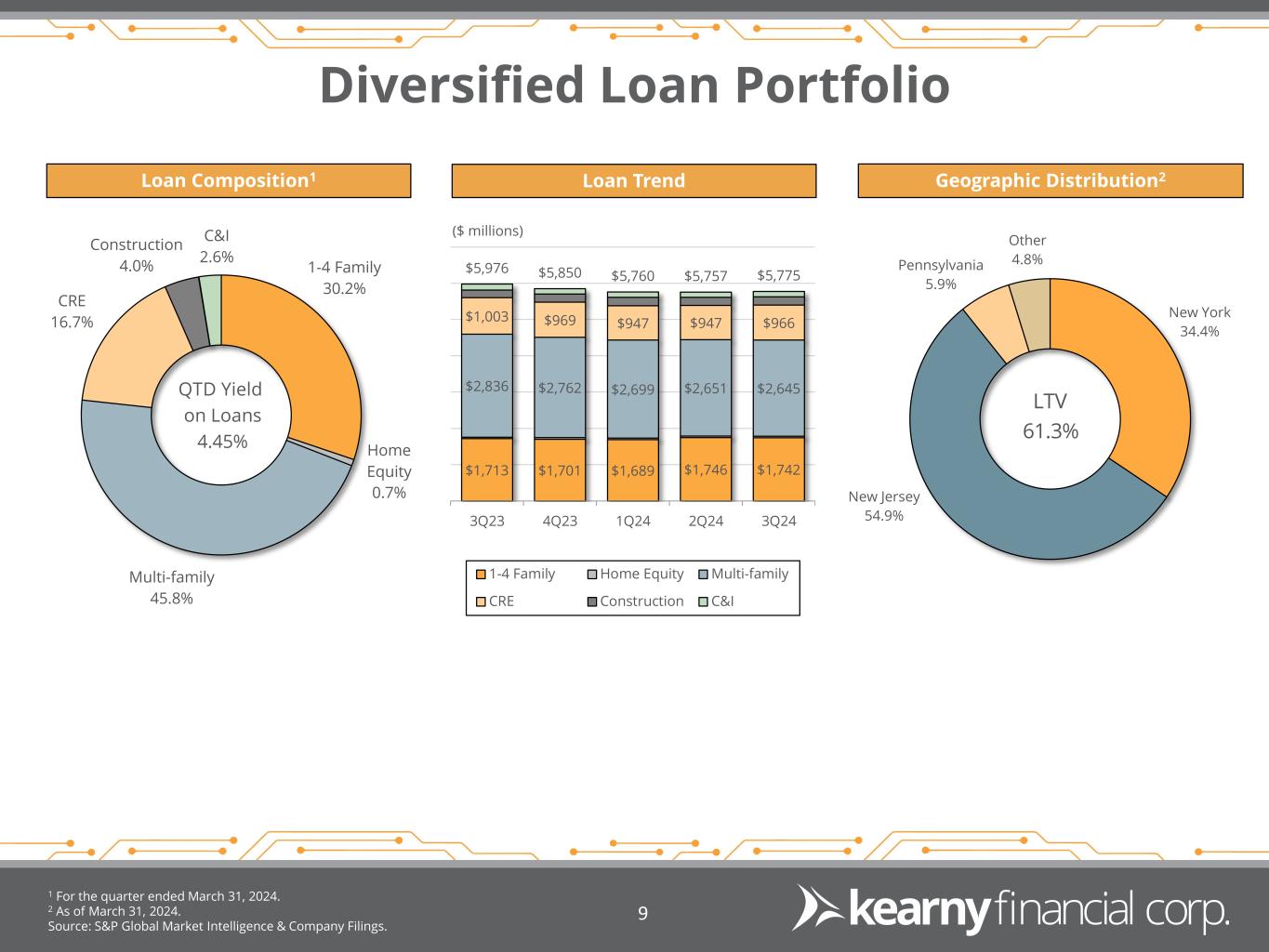

| Loan portfolio composition: | |||||||||||||||||

| Commercial loans: | |||||||||||||||||

| Multi-family mortgage | $ | 2,645,195 | $ | 2,651,274 | $ | 2,699,151 | $ | 2,761,775 | $ | 2,835,852 | |||||||

| Nonresidential mortgage | 965,539 | 947,287 | 946,801 | 968,574 | 1,002,643 | ||||||||||||

| Commercial business | 147,326 | 144,134 | 149,229 | 146,861 | 162,038 | ||||||||||||

| Construction | 229,457 | 221,933 | 230,703 | 226,609 | 215,524 | ||||||||||||

| Total commercial loans | 3,987,517 | 3,964,628 | 4,025,884 | 4,103,819 | 4,216,057 | ||||||||||||

| One- to four-family residential mortgage | 1,741,644 | 1,746,065 | 1,689,051 | 1,700,559 | 1,713,343 | ||||||||||||

| Consumer loans: | |||||||||||||||||

| Home equity loans | 42,731 | 43,517 | 42,896 | 43,549 | 44,376 | ||||||||||||

| Other consumer | 3,198 | 2,728 | 2,644 | 2,549 | 2,592 | ||||||||||||

| Total consumer loans | 45,929 | 46,245 | 45,540 | 46,098 | 46,968 | ||||||||||||

| Total loans, excluding yield adjustments | 5,775,090 | 5,756,938 | 5,760,475 | 5,850,476 | 5,976,368 | ||||||||||||

| Unaccreted yield adjustments | (16,754) | (11,309) | (24,426) | (21,055) | (10,043) | ||||||||||||

| Loans receivable, net of yield adjustments | 5,758,336 | 5,745,629 | 5,736,049 | 5,829,421 | 5,966,325 | ||||||||||||

| Less: allowance for credit losses on loans | (44,930) | (44,867) | (46,872) | (48,734) | (49,122) | ||||||||||||

| Net loans receivable | $ | 5,713,406 | $ | 5,700,762 | $ | 5,689,177 | $ | 5,780,687 | $ | 5,917,203 | |||||||

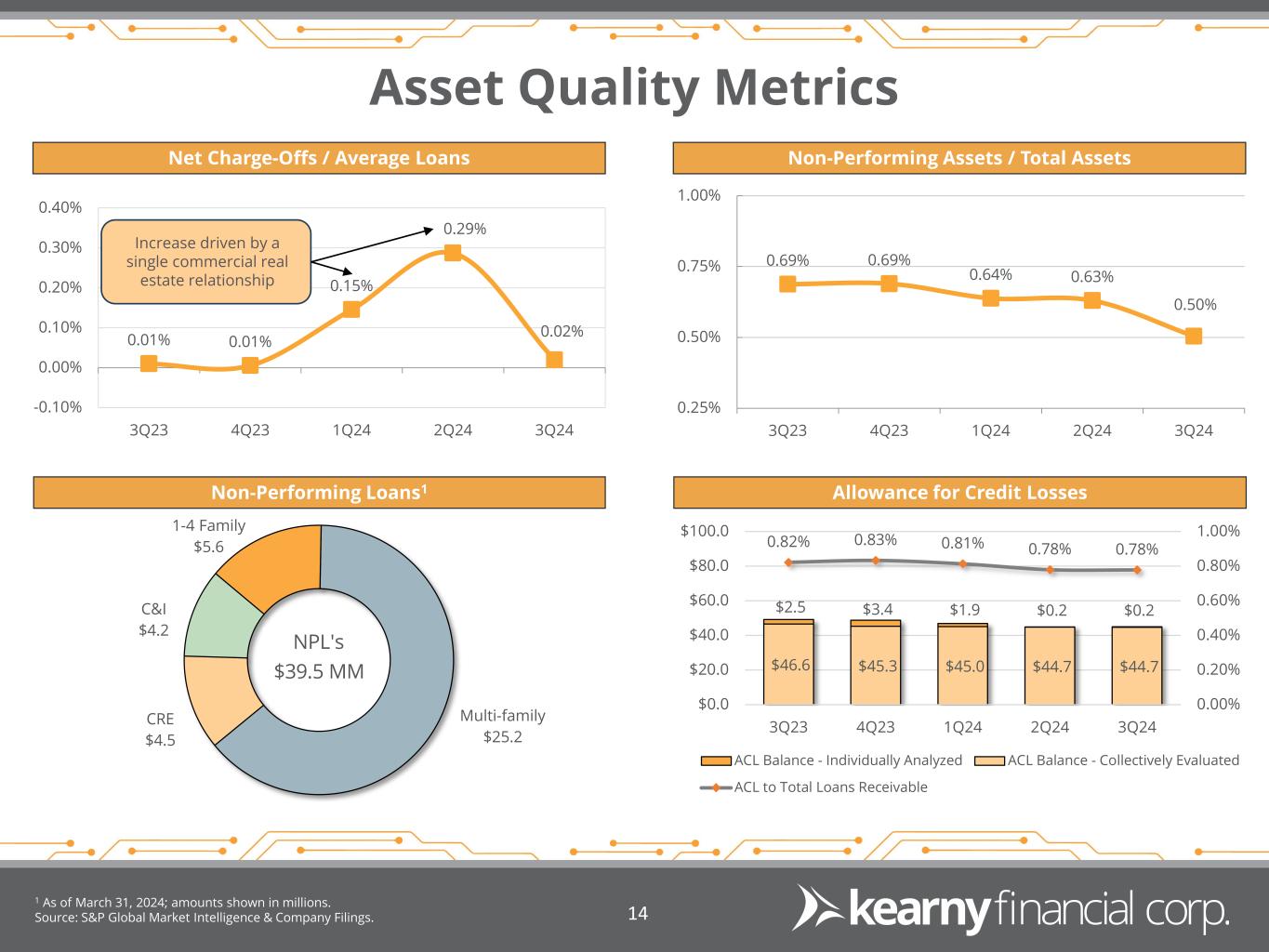

| Asset quality: | |||||||||||||||||

| Nonperforming assets: | |||||||||||||||||

| Accruing loans - 90 days and over past due | $ | — | $ | — | $ | — | $ | — | $ | — | |||||||

| Nonaccrual loans | 39,546 | 28,089 | 37,912 | 42,627 | 44,026 | ||||||||||||

| Total nonperforming loans | 39,546 | 28,089 | 37,912 | 42,627 | 44,026 | ||||||||||||

| Nonaccrual loans held-for-sale | — | 9,700 | — | — | — | ||||||||||||

| Other real estate owned | — | 11,982 | 12,956 | 12,956 | 13,410 | ||||||||||||

| Total nonperforming assets | $ | 39,546 | $ | 49,771 | $ | 50,868 | $ | 55,583 | $ | 57,436 | |||||||

| Nonperforming loans (% total loans) | 0.69 | % | 0.49 | % | 0.66 | % | 0.73 | % | 0.74 | % | |||||||

| Nonperforming assets (% total assets) | 0.50 | % | 0.63 | % | 0.64 | % | 0.69 | % | 0.69 | % | |||||||

| Classified loans | $ | 115,772 | $ | 94,676 | $ | 98,616 | $ | 93,526 | $ | 103,461 | |||||||

| Allowance for credit losses on loans (ACL): | |||||||||||||||||

| ACL to total loans | 0.78 | % | 0.78 | % | 0.81 | % | 0.83 | % | 0.82 | % | |||||||

| ACL to nonperforming loans | 113.61 | % | 159.73 | % | 123.63 | % | 114.33 | % | 111.57 | % | |||||||

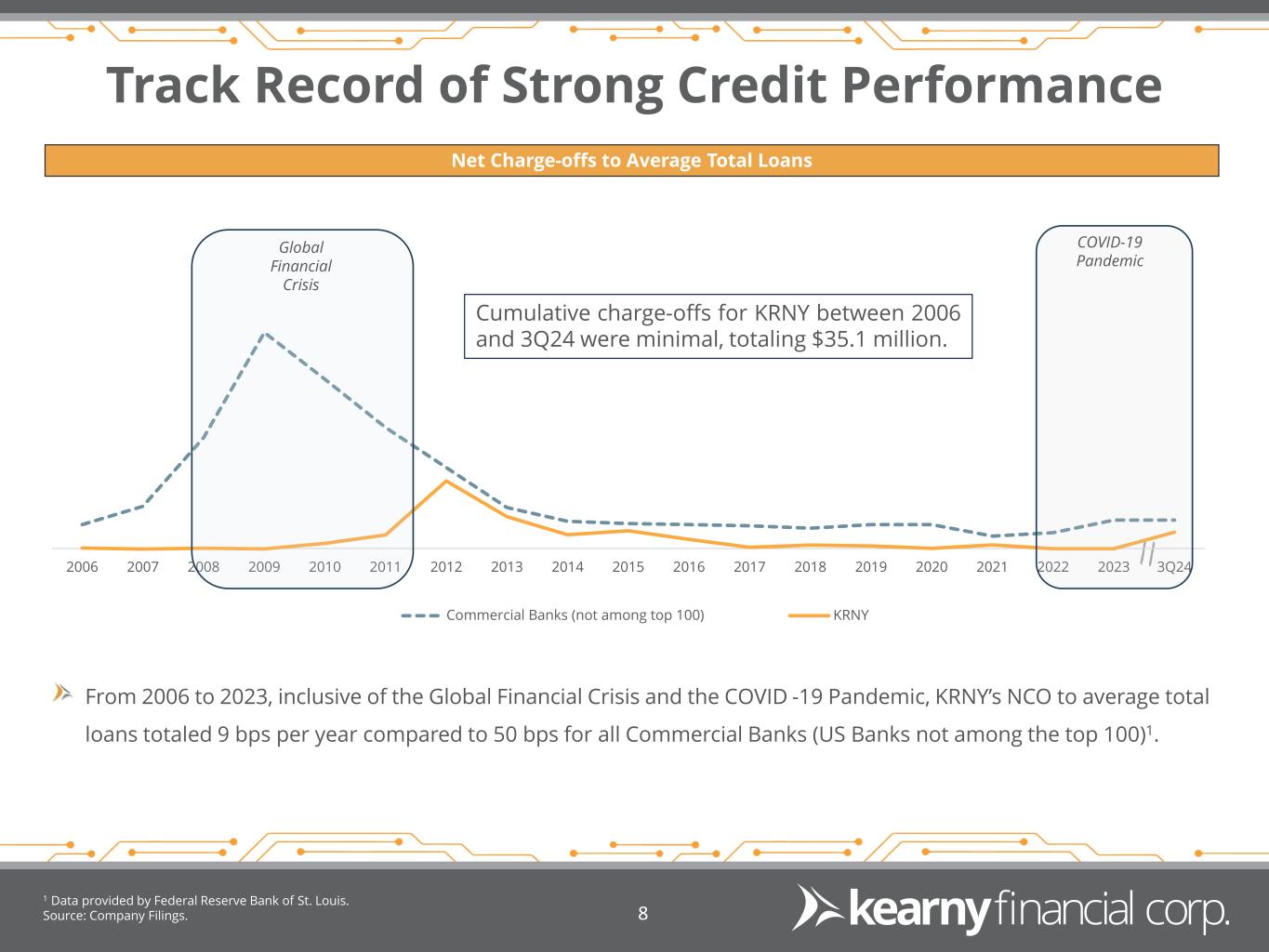

| Net charge-offs | $ | 286 | $ | 4,110 | $ | 2,107 | $ | 82 | $ | 206 | |||||||

| Average net charge-off rate (annualized) | 0.02 | % | 0.29 | % | 0.15 | % | 0.01 | % | 0.01 | % | |||||||

| (Dollars in Thousands) | March 31, 2024 |

December 31, 2023 |

September 30, 2023 |

June 30, 2023 |

March 31, 2023 |

||||||||||||

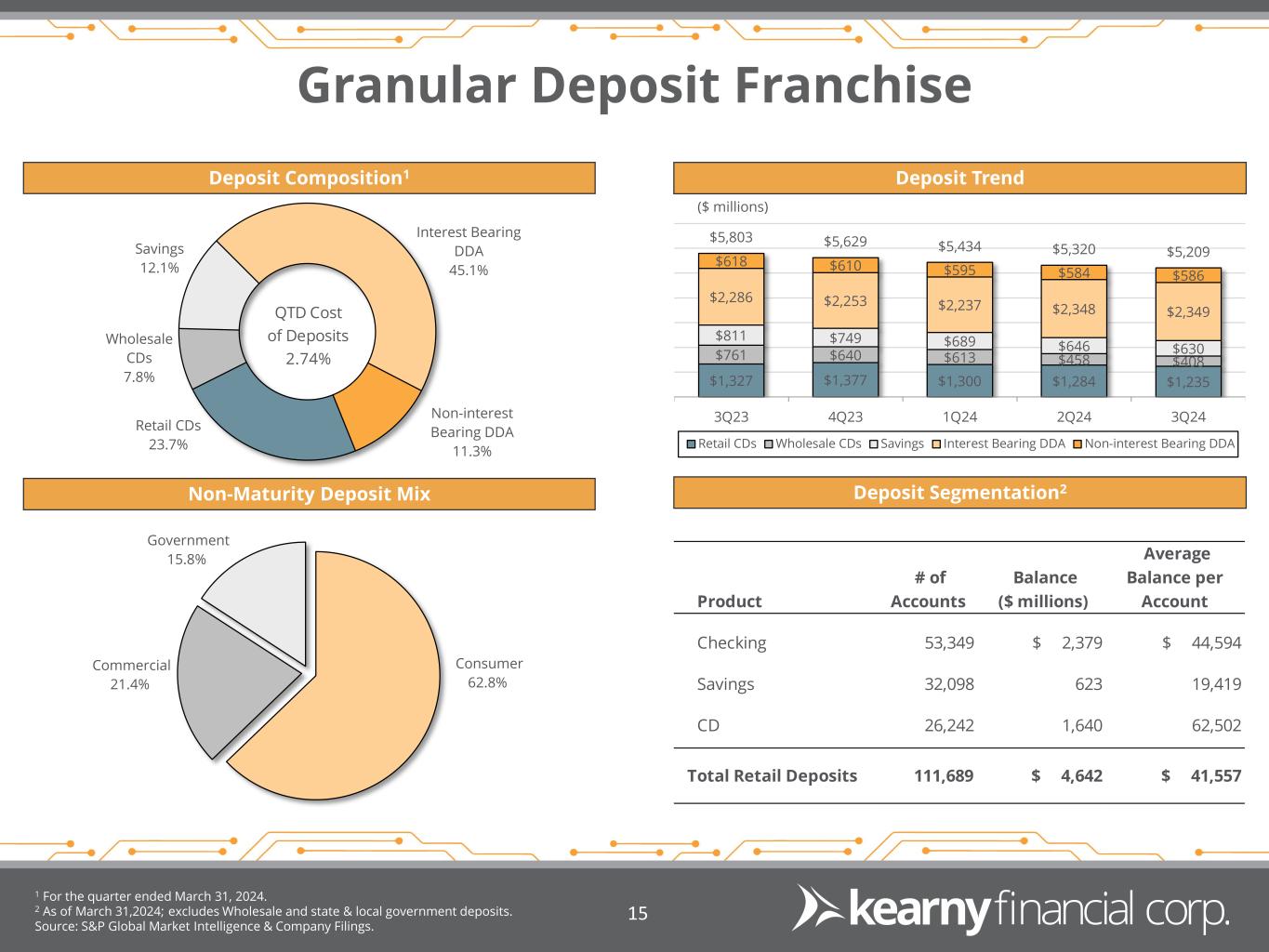

| Funding composition: | |||||||||||||||||

| Deposits: | |||||||||||||||||

| Non-interest-bearing deposits | $ | 586,089 | $ | 584,130 | $ | 595,141 | $ | 609,999 | $ | 617,778 | |||||||

| Interest-bearing demand | 2,349,032 | 2,347,262 | 2,236,573 | 2,252,912 | 2,285,799 | ||||||||||||

| Savings | 630,456 | 646,182 | 689,163 | 748,721 | 811,483 | ||||||||||||

| Certificates of deposit (retail) | 1,235,261 | 1,283,676 | 1,300,382 | 1,377,028 | 1,327,343 | ||||||||||||

| Certificates of deposit (brokered and listing service) | 408,212 | 458,380 | 612,909 | 640,523 | 761,001 | ||||||||||||

| Interest-bearing deposits | 4,622,961 | 4,735,500 | 4,839,027 | 5,019,184 | 5,185,626 | ||||||||||||

| Total deposits | 5,209,050 | 5,319,630 | 5,434,168 | 5,629,183 | 5,803,404 | ||||||||||||

| Borrowings: | |||||||||||||||||

| Federal Home Loan Bank advances | 1,357,178 | 1,432,055 | 1,456,933 | 1,281,812 | 1,156,692 | ||||||||||||

| Other borrowings | 365,000 | 235,000 | 170,000 | 225,000 | 455,000 | ||||||||||||

| Total borrowings | 1,722,178 | 1,667,055 | 1,626,933 | 1,506,812 | 1,611,692 | ||||||||||||

| Total funding | $ | 6,931,228 | $ | 6,986,685 | $ | 7,061,101 | $ | 7,135,995 | $ | 7,415,096 | |||||||

| Loans as a % of deposits | 109.8 | % | 107.4 | % | 104.8 | % | 102.9 | % | 102.1 | % | |||||||

| Deposits as a % of total funding | 75.2 | % | 76.1 | % | 77.0 | % | 78.9 | % | 78.3 | % | |||||||

| Borrowings as a % of total funding | 24.8 | % | 23.9 | % | 23.0 | % | 21.1 | % | 21.7 | % | |||||||

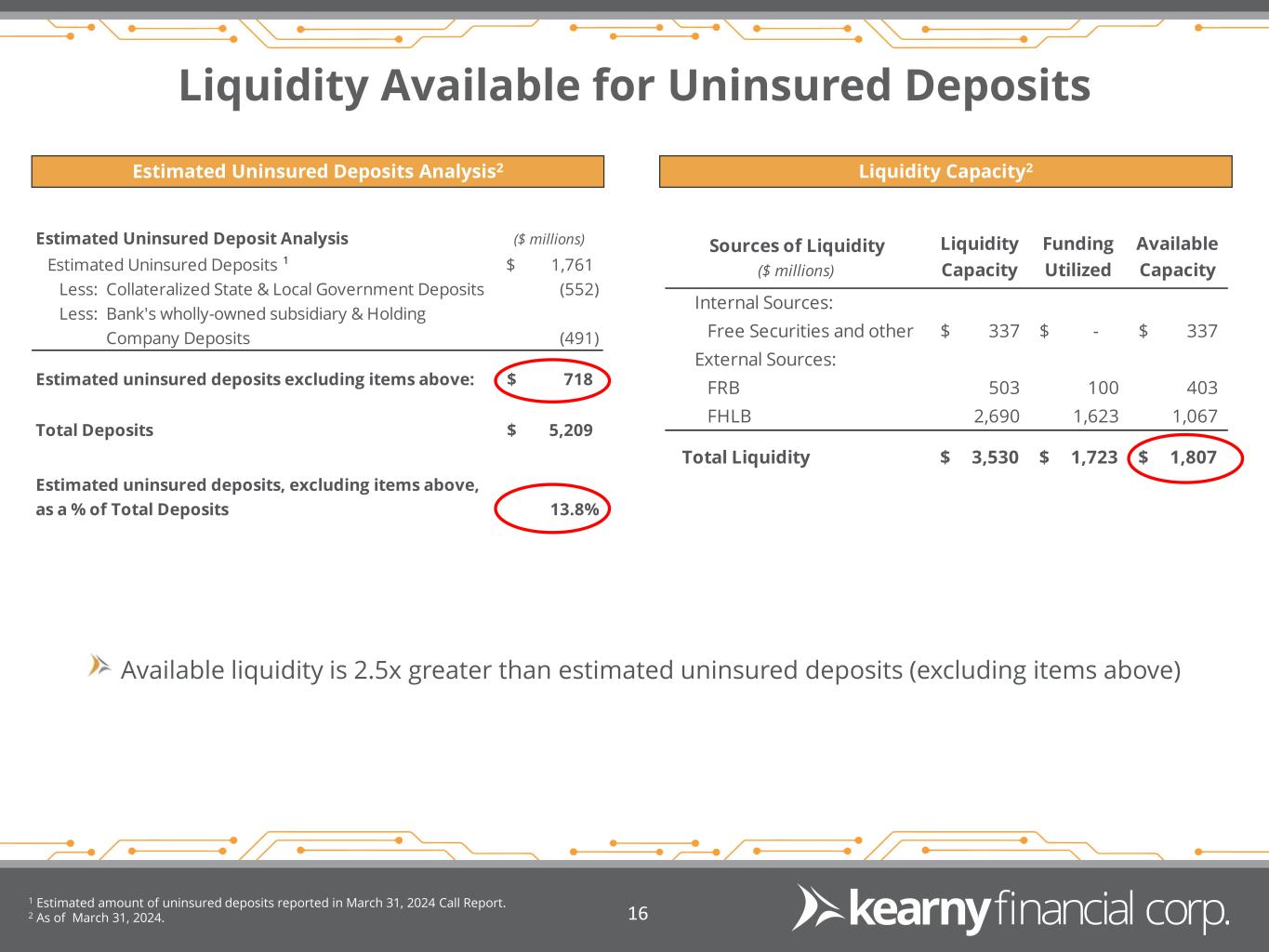

| Uninsured deposits: | |||||||||||||||||

Uninsured deposits (reported) (1) |

$ | 1,760,740 | $ | 1,813,122 | $ | 1,734,288 | $ | 1,771,416 | $ | 1,678,051 | |||||||

Uninsured deposits (adjusted) (2) |

$ | 718,026 | $ | 694,510 | $ | 683,265 | $ | 710,377 | $ | 705,727 | |||||||

| Three Months Ended | |||||||||||||||||

| (Dollars and Shares in Thousands, Except Per Share Data) |

March 31, 2024 |

December 31, 2023 |

September 30, 2023 |

June 30, 2023 |

March 31, 2023 |

||||||||||||

| Interest income | |||||||||||||||||

| Loans | $ | 64,035 | $ | 63,384 | $ | 62,769 | $ | 62,044 | $ | 60,172 | |||||||

| Taxable investment securities | 15,490 | 16,756 | 16,265 | 15,736 | 15,459 | ||||||||||||

| Tax-exempt investment securities | 85 | 84 | 87 | 91 | 99 | ||||||||||||

| Other interest-earning assets | 2,475 | 2,401 | 2,047 | 1,821 | 1,441 | ||||||||||||

| Total interest income | 82,085 | 82,625 | 81,168 | 79,692 | 77,171 | ||||||||||||

| Interest expense | |||||||||||||||||

| Deposits | 32,320 | 30,340 | 27,567 | 26,226 | 22,246 | ||||||||||||

| Borrowings | 15,446 | 16,446 | 14,441 | 13,286 | 12,554 | ||||||||||||

| Total interest expense | 47,766 | 46,786 | 42,008 | 39,512 | 34,800 | ||||||||||||

| Net interest income | 34,319 | 35,839 | 39,160 | 40,180 | 42,371 | ||||||||||||

| Provision for (reversal of) credit losses | 349 | 2,105 | 245 | (306) | 451 | ||||||||||||

| Net interest income after provision for (reversal of) credit losses | 33,970 | 33,734 | 38,915 | 40,486 | 41,920 | ||||||||||||

| Non-interest income | |||||||||||||||||

| Fees and service charges | 657 | 624 | 748 | 699 | 910 | ||||||||||||

| Loss on sale and call of securities | — | (18,135) | — | — | — | ||||||||||||

| Gain (loss) on sale of loans | (712) | 104 | 215 | 199 | (2,373) | ||||||||||||

| Loss on sale of other real estate owned | — | (974) | — | (139) | — | ||||||||||||

| Income from bank owned life insurance | 3,039 | 1,162 | 1,666 | 1,605 | 1,581 | ||||||||||||

| Electronic banking fees and charges | 464 | 396 | 367 | 399 | 457 | ||||||||||||

| Other income | 755 | 811 | 1,014 | 903 | 1,071 | ||||||||||||

| Total non-interest income | 4,203 | (16,012) | 4,010 | 3,666 | 1,646 | ||||||||||||

| Non-interest expense | |||||||||||||||||

| Salaries and employee benefits | 16,911 | 17,282 | 17,761 | 17,315 | 18,005 | ||||||||||||

| Net occupancy expense of premises | 2,863 | 2,674 | 2,758 | 2,862 | 3,097 | ||||||||||||

| Equipment and systems | 3,823 | 3,814 | 3,801 | 3,511 | 3,537 | ||||||||||||

| Advertising and marketing | 387 | 301 | 228 | 231 | 413 | ||||||||||||

| Federal deposit insurance premium | 1,429 | 1,495 | 1,524 | 1,455 | 1,546 | ||||||||||||

| Directors' compensation | 360 | 393 | 393 | 345 | 340 | ||||||||||||

| Other expense | 3,286 | 3,808 | 3,309 | 3,042 | 3,414 | ||||||||||||

| Total non-interest expense | 29,059 | 29,767 | 29,774 | 28,761 | 30,352 | ||||||||||||

| Income (loss) before income taxes | 9,114 | (12,045) | 13,151 | 15,391 | 13,214 | ||||||||||||

| Income taxes | 1,717 | 1,782 | 3,309 | 3,378 | 2,902 | ||||||||||||

| Net income (loss) | $ | 7,397 | $ | (13,827) | $ | 9,842 | $ | 12,013 | $ | 10,312 | |||||||

| Net income (loss) per common share (EPS) | |||||||||||||||||

| Basic | $ | 0.12 | $ | (0.22) | $ | 0.16 | $ | 0.19 | $ | 0.16 | |||||||

| Diluted | $ | 0.12 | $ | (0.22) | $ | 0.16 | $ | 0.19 | $ | 0.16 | |||||||

| Dividends declared | |||||||||||||||||

| Cash dividends declared per common share | $ | 0.11 | $ | 0.11 | $ | 0.11 | $ | 0.11 | $ | 0.11 | |||||||

| Cash dividends declared | $ | 6,844 | $ | 6,882 | $ | 6,989 | $ | 7,007 | $ | 7,196 | |||||||

| Dividend payout ratio | 92.5 | % | -49.8 | % | 71.0 | % | 58.3 | % | 69.8 | % | |||||||

| Weighted average number of common shares outstanding | |||||||||||||||||

| Basic | 62,205 | 62,299 | 63,014 | 63,667 | 64,769 | ||||||||||||

| Diluted | 62,211 | 62,367 | 63,061 | 63,667 | 64,783 | ||||||||||||

| Three Months Ended | |||||||||||||||||

| (Dollars in Thousands) | March 31, 2024 |

December 31, 2023 |

September 30, 2023 |

June 30, 2023 |

March 31, 2023 |

||||||||||||

| Assets | |||||||||||||||||

| Interest-earning assets: | |||||||||||||||||

| Loans receivable, including loans held-for-sale | $ | 5,752,477 | $ | 5,726,321 | $ | 5,788,074 | $ | 5,932,541 | $ | 5,986,669 | |||||||

| Taxable investment securities | 1,382,064 | 1,509,165 | 1,516,393 | 1,529,582 | 1,558,222 | ||||||||||||

| Tax-exempt investment securities | 14,614 | 15,025 | 15,483 | 16,346 | 17,663 | ||||||||||||

| Other interest-earning assets | 125,155 | 139,740 | 130,829 | 128,158 | 131,682 | ||||||||||||

| Total interest-earning assets | 7,274,310 | 7,390,251 | 7,450,779 | 7,606,627 | 7,694,236 | ||||||||||||

| Non-interest-earning assets | 577,411 | 554,335 | 568,723 | 556,962 | 575,009 | ||||||||||||

| Total assets | $ | 7,851,721 | $ | 7,944,586 | $ | 8,019,502 | $ | 8,163,589 | $ | 8,269,245 | |||||||

| Liabilities and Stockholders' Equity | |||||||||||||||||

| Interest-bearing liabilities: | |||||||||||||||||

| Deposits: | |||||||||||||||||

| Interest-bearing demand | $ | 2,378,831 | $ | 2,301,169 | $ | 2,245,831 | $ | 2,321,120 | $ | 2,363,762 | |||||||

| Savings | 635,226 | 664,926 | 719,508 | 774,854 | 858,673 | ||||||||||||

| Certificates of deposit | 1,705,513 | 1,824,316 | 1,968,512 | 2,057,818 | 2,069,396 | ||||||||||||

| Total interest-bearing deposits | 4,719,570 | 4,790,411 | 4,933,851 | 5,153,792 | 5,291,831 | ||||||||||||

| Borrowings: | |||||||||||||||||

| Federal Home Loan Bank advances | 1,428,801 | 1,513,497 | 1,386,473 | 1,374,316 | 1,402,269 | ||||||||||||

| Other borrowings | 210,989 | 142,283 | 158,098 | 100,055 | 1,611 | ||||||||||||

| Total borrowings | 1,639,790 | 1,655,780 | 1,544,571 | 1,474,371 | 1,403,880 | ||||||||||||

| Total interest-bearing liabilities | 6,359,360 | 6,446,191 | 6,478,422 | 6,628,163 | 6,695,711 | ||||||||||||

| Non-interest-bearing liabilities: | |||||||||||||||||

| Non-interest-bearing deposits | 581,870 | 597,294 | 612,251 | 608,765 | 634,324 | ||||||||||||

| Other non-interest-bearing liabilities | 65,709 | 62,387 | 66,701 | 64,970 | 60,327 | ||||||||||||

| Total non-interest-bearing liabilities | 647,579 | 659,681 | 678,952 | 673,735 | 694,651 | ||||||||||||

| Total liabilities | 7,006,939 | 7,105,872 | 7,157,374 | 7,301,898 | 7,390,362 | ||||||||||||

| Stockholders' equity | 844,782 | 838,714 | 862,128 | 861,691 | 878,883 | ||||||||||||

| Total liabilities and stockholders' equity | $ | 7,851,721 | $ | 7,944,586 | $ | 8,019,502 | $ | 8,163,589 | $ | 8,269,245 | |||||||

| Average interest-earning assets to average interest-bearing liabilities

|

114.39 | % | 114.65 | % | 115.01 | % | 114.76 | % | 114.91 | % | |||||||

| Three Months Ended | |||||||||||||||||

| March 31, 2024 |

December 31, 2023 |

September 30, 2023 |

June 30, 2023 |

March 31, 2023 |

|||||||||||||

| Average yield on interest-earning assets: | |||||||||||||||||

| Loans receivable, including loans held-for-sale | 4.45 | % | 4.43 | % | 4.34 | % | 4.18 | % | 4.02 | % | |||||||

| Taxable investment securities | 4.48 | % | 4.44 | % | 4.29 | % | 4.12 | % | 3.97 | % | |||||||

Tax-exempt investment securities (1) |

2.32 | % | 2.25 | % | 2.25 | % | 2.23 | % | 2.23 | % | |||||||

| Other interest-earning assets | 7.91 | % | 6.87 | % | 6.26 | % | 5.68 | % | 4.38 | % | |||||||

| Total interest-earning assets | 4.51 | % | 4.47 | % | 4.36 | % | 4.19 | % | 4.01 | % | |||||||

| Average cost of interest-bearing liabilities: | |||||||||||||||||

| Deposits: | |||||||||||||||||

| Interest-bearing demand | 3.08 | % | 2.91 | % | 2.58 | % | 2.38 | % | 2.01 | % | |||||||

| Savings | 0.46 | % | 0.44 | % | 0.47 | % | 0.48 | % | 0.41 | % | |||||||

| Certificates of deposit | 3.11 | % | 2.82 | % | 2.49 | % | 2.24 | % | 1.84 | % | |||||||

| Total interest-bearing deposits | 2.74 | % | 2.53 | % | 2.23 | % | 2.04 | % | 1.68 | % | |||||||

| Borrowings: | |||||||||||||||||

| Federal Home Loan Bank advances | 3.55 | % | 3.82 | % | 3.54 | % | 3.51 | % | 3.58 | % | |||||||

| Other borrowings | 5.22 | % | 5.65 | % | 5.46 | % | 4.89 | % | 5.15 | % | |||||||

| Total borrowings | 3.77 | % | 3.97 | % | 3.74 | % | 3.60 | % | 3.58 | % | |||||||

| Total interest-bearing liabilities | 3.00 | % | 2.90 | % | 2.59 | % | 2.38 | % | 2.08 | % | |||||||

Interest rate spread (2) |

1.51 | % | 1.57 | % | 1.77 | % | 1.81 | % | 1.93 | % | |||||||

Net interest margin (3) |

1.89 | % | 1.94 | % | 2.10 | % | 2.11 | % | 2.20 | % | |||||||

| Non-interest income to average assets (annualized) | 0.21 | % | -0.81 | % | 0.20 | % | 0.18 | % | 0.08 | % | |||||||

| Non-interest expense to average assets (annualized) | 1.48 | % | 1.50 | % | 1.49 | % | 1.41 | % | 1.47 | % | |||||||

Efficiency ratio (4) |

75.43 | % | 150.13 | % | 68.97 | % | 65.60 | % | 68.96 | % | |||||||

| Return on average assets (annualized) | 0.38 | % | -0.70 | % | 0.49 | % | 0.59 | % | 0.50 | % | |||||||

| Return on average equity (annualized) | 3.50 | % | -6.59 | % | 4.57 | % | 5.58 | % | 4.69 | % | |||||||

Return on average tangible equity (annualized) (5) |

4.68 | % | -8.84 | % | 6.07 | % | 7.41 | % | 6.20 | % | |||||||

| Three Months Ended | |||||||||||||||||

| (Dollars and Shares in Thousands, Except Per Share Data) |

March 31, 2024 |

December 31, 2023 |

September 30, 2023 |

June 30, 2023 |

March 31, 2023 |

||||||||||||

| Adjusted net income: | |||||||||||||||||

| Net income (loss) (GAAP) | $ | 7,397 | $ | (13,827) | $ | 9,842 | $ | 12,013 | $ | 10,312 | |||||||

| Non-recurring transactions - net of tax: | |||||||||||||||||

| Branch consolidation expenses | — | — | — | — | 568 | ||||||||||||

| Net effect of sale and call of securities | — | 12,876 | — | — | — | ||||||||||||

| Net effect of bank-owned life insurance restructure | — | 6,286 | — | — | — | ||||||||||||

| Adjusted net income | $ | 7,397 | $ | 5,335 | $ | 9,842 | $ | 12,013 | $ | 10,880 | |||||||

| Calculation of pre-tax, pre-provision net revenue: | |||||||||||||||||

| Net income (loss) (GAAP) | $ | 7,397 | $ | (13,827) | $ | 9,842 | $ | 12,013 | $ | 10,312 | |||||||

| Adjustments to net income (GAAP): | |||||||||||||||||

| Provision for income taxes | 1,717 | 1,782 | 3,309 | 3,378 | 2,902 | ||||||||||||

| Provision for (reversal of) credit losses | 349 | 2,105 | 245 | (306) | 451 | ||||||||||||

| Pre-tax, pre-provision net revenue (non-GAAP) | $ | 9,463 | $ | (9,940) | $ | 13,396 | $ | 15,085 | $ | 13,665 | |||||||

| Adjusted earnings per share: | |||||||||||||||||

| Weighted average common shares - basic | 62,205 | 62,299 | 63,014 | 63,667 | 64,769 | ||||||||||||

| Weighted average common shares - diluted | 62,211 | 62,367 | 63,061 | 63,667 | 64,783 | ||||||||||||

| Earnings per share - basic (GAAP) | $ | 0.12 | $ | (0.22) | $ | 0.16 | $ | 0.19 | $ | 0.16 | |||||||

| Earnings per share - diluted (GAAP) | $ | 0.12 | $ | (0.22) | $ | 0.16 | $ | 0.19 | $ | 0.16 | |||||||

| Adjusted earnings per share - basic (non-GAAP) | $ | 0.12 | $ | 0.09 | $ | 0.16 | $ | 0.19 | $ | 0.17 | |||||||

| Adjusted earnings per share - diluted (non-GAAP) | $ | 0.12 | $ | 0.09 | $ | 0.16 | $ | 0.19 | $ | 0.17 | |||||||

| Pre-tax, pre-provision net revenue per share: | |||||||||||||||||

| Pre-tax, pre-provision net revenue per share - basic (non-GAAP)

|

$ | 0.15 | $ | (0.16) | $ | 0.21 | $ | 0.24 | $ | 0.21 | |||||||

| Pre-tax, pre-provision net revenue per share - diluted (non-GAAP)

|

$ | 0.15 | $ | (0.16) | $ | 0.21 | $ | 0.24 | $ | 0.21 | |||||||

| Adjusted return on average assets: | |||||||||||||||||

| Total average assets | $ | 7,851,721 | $ | 7,944,586 | $ | 8,019,502 | $ | 8,163,589 | $ | 8,269,245 | |||||||

| Return on average assets (GAAP) | 0.38 | % | -0.70 | % | 0.49 | % | 0.59 | % | 0.50 | % | |||||||

| Adjusted return on average assets (non-GAAP) | 0.38 | % | 0.27 | % | 0.49 | % | 0.59 | % | 0.53 | % | |||||||

| Adjusted return on average equity: | |||||||||||||||||

| Total average equity | $ | 844,782 | $ | 838,714 | $ | 862,128 | $ | 861,691 | $ | 878,883 | |||||||

| Return on average equity (GAAP) | 3.50 | % | -6.59 | % | 4.57 | % | 5.58 | % | 4.69 | % | |||||||

| Adjusted return on average equity (non-GAAP) | 3.50 | % | 2.54 | % | 4.57 | % | 5.58 | % | 4.95 | % | |||||||

| Three Months Ended | |||||||||||||||||

| (Dollars and Shares in Thousands, Except Per Share Data) |

March 31, 2024 |

December 31, 2023 |

September 30, 2023 |

June 30, 2023 |

March 31, 2023 |

||||||||||||

| Adjusted return on average tangible equity: | |||||||||||||||||

| Total average equity | $ | 844,782 | $ | 838,714 | $ | 862,128 | $ | 861,691 | $ | 878,883 | |||||||

| Less: average goodwill | (210,895) | (210,895) | (210,895) | (210,895) | (210,895) | ||||||||||||

| Less: average other intangible assets | (2,138) | (2,277) | (2,411) | (2,544) | (2,683) | ||||||||||||

| Total average tangible equity | $ | 631,749 | $ | 625,542 | $ | 648,822 | $ | 648,252 | $ | 665,305 | |||||||

| Return on average tangible equity (non-GAAP) | 4.68 | % | -8.84 | % | 6.07 | % | 7.41 | % | 6.20 | % | |||||||

| Adjusted return on average tangible equity (non-GAAP) | 4.68 | % | 3.41 | % | 6.07 | % | 7.41 | % | 6.54 | % | |||||||

| Adjusted non-interest expense ratio: | |||||||||||||||||

| Non-interest expense (GAAP) | $ | 29,059 | $ | 29,767 | $ | 29,774 | $ | 28,761 | $ | 30,352 | |||||||

| Non-recurring transactions: | |||||||||||||||||

| Branch consolidation expenses | — | — | — | — | (800) | ||||||||||||

| Non-interest expense (non-GAAP) | $ | 29,059 | $ | 29,767 | $ | 29,774 | $ | 28,761 | $ | 29,552 | |||||||

| Non-interest expense ratio (GAAP) | 1.48 | % | 1.50 | % | 1.49 | % | 1.41 | % | 1.47 | % | |||||||

| Adjusted non-interest expense ratio (non-GAAP) | 1.48 | % | 1.50 | % | 1.49 | % | 1.41 | % | 1.43 | % | |||||||

| Adjusted efficiency ratio: | |||||||||||||||||

| Non-interest expense (non-GAAP) | $ | 29,059 | $ | 29,767 | $ | 29,774 | $ | 28,761 | $ | 29,552 | |||||||

| Net interest income (GAAP) | $ | 34,319 | $ | 35,839 | $ | 39,160 | $ | 40,180 | $ | 42,371 | |||||||

| Total non-interest income (GAAP) | 4,203 | (16,012) | 4,010 | 3,666 | 1,646 | ||||||||||||

| Non-recurring transactions: | |||||||||||||||||

| Net effect of sale and call of securities | — | 18,135 | — | — | — | ||||||||||||

| Net effect of bank-owned life insurance restructure | — | 573 | — | — | — | ||||||||||||

| Total revenue (non-GAAP) | $ | 38,522 | $ | 38,535 | $ | 43,170 | $ | 43,846 | $ | 44,017 | |||||||

| Efficiency ratio (GAAP) | 75.43 | % | 150.13 | % | 68.97 | % | 65.60 | % | 68.96 | % | |||||||

| Adjusted efficiency ratio (non-GAAP) | 75.43 | % | 77.25 | % | 68.97 | % | 65.60 | % | 67.14 | % | |||||||