FALSE000161724200016172422024-02-092024-02-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_____________________________

FORM 8-K

_____________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 9, 2024

_____________________________

KEARNY FINANCIAL CORP.

(Exact name of Registrant as Specified in Its Charter)

_____________________________

|

|

|

|

|

|

|

|

|

| Maryland |

001-37399 |

30-0870244 |

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File Number) |

(IRS Employer

Identification No.)

|

|

|

|

120 Passaic Avenue Fairfield, New Jersey |

|

07004 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (973) 244-4500

(Former Name or Former Address, if Changed Since Last Report)

_____________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.01 par value |

|

KRNY |

|

The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure

On February 9, 2024, Kearny Financial Corp. (the “Company”) released a slide presentation to investors to supplement and be read in conjunction with the Company’s investor presentation dated January 31, 2024.

In accordance with General Instruction B.2 of Form 8-K, the information furnished pursuant to Item 7.01, including Exhibits 99.1 furnished herewith, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

(a)Financial Statements of Business Acquired. Not applicable.

(b)Pro Forma Financial Information. Not applicable.

(c)Shell Company Transaction. Not applicable.

(d)Exhibits.

|

|

|

|

|

|

|

|

|

| Exhibit Number |

|

Description |

| 99.1 |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

KEARNY FINANCIAL CORP. |

|

|

|

| Date: February 9, 2024 |

By: |

/s/ Keith Suchodolski |

|

|

Keith Suchodolski |

|

|

Senior Executive Vice President and Chief Financial Officer |

EX-99.1

2

ex-991xkrnyinvestorprese.htm

EX-99.1

ex-991xkrnyinvestorprese

FEBRUARY 9, 2024 S U P P L E M E N T T O I N V E S T O R P R E S E N TAT I O N D A T E D J A N U A R Y 3 1 , 2 0 2 4 EXHIBIT 99.1

Forward Looking Statements & Financial Measures 2 This presentation may include certain “forward-looking statements,” which are made in good faith by Kearny Financial Corp. (the “Company”) pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to risks and uncertainties, such as statements of the Company’s plans, objectives, expectations, estimates and intentions that are subject to change based on various important factors (some of which are beyond the Company’s control). In addition to the factors described under Item 1A. Risk Factors in the Company’s Annual Report on Form 10-K, and subsequent filings with the Securities and Exchange Commission, the following factors, among others, could cause the Company’s financial performance to differ materially from the plans, objectives, expectations, estimates and intentions expressed in such forward-looking statements: • the strength of the United States economy in general and the strength of the local economy in which the Company conducts operations, • the effects of, and changes in, trade, monetary and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System, inflation, interest rates, market and monetary fluctuations, • the impact of changes in laws, regulations and government policies regarding financial institutions (including laws concerning taxation, banking, securities and insurance), • changes in accounting policies and practices, as may be adopted by regulatory agencies, the Financial Accounting Standards Board (“FASB”) or the Public Company Accounting Oversight Board, • technological changes, • competition among financial services providers, and • the success of the Company at managing the risks involved in the foregoing and managing its business. The Company cautions that the foregoing list of important factors is not exhaustive. Readers should not place any undue reliance on any forward looking statements, which speak only as of the date made. The Company does not undertake any obligation to update any forward-looking statement, whether written or oral, that may be made from time to time by or on behalf of the Company.

Diversified Multifamily Portfolio Multifamily Loan Portfolio Composition1 New York City (“NYC”) Multifamily1 Source: Company Filings 1 As of December 31, 2023. 3 Less than half of our Multifamily portfolio is collateralized by properties in NYC Only 8% of our Multifamily portfolio is collateralized by majority or fully rent-regulated NYC properties There are limited levels of maturing or repricing NYC Multifamily loans in calendar 2024 and 2025 Outstanding asset quality over multiple credit cycles NYC Multifamily Portfolio: $ 1.3 billion Average Loan Balance: $ 3.50 million Weighted Average LTV: 62.7% Nonperforming Loans / Total MF Loans: 0.5% Calendar year 2024 Maturity & Repricing: $ 47.9 million Calendar year 2025 Maturity & Repricing: $ 121.4 million Majority NYC Free Market 40.1% Outside NYC 52.2% 100% NYC Rent Regulated 3.7% Majority NYC Rent Regulated 4.1% Total MF $2.7 B

CRE Lending Source: Company Filings. 1 As of December 31, 2023. 4 CRE Portfolio by Collateral Type1 CRE Loan Geographic Distribution1 Total CRE $0.9 B New Jersey 56.1% Brooklyn 9.9% New York (Ex. Brooklyn) 27.6% Pennsylvania 3.8% Other 2.6%Retail 36.6% Mixed Use 27.1% Office 15.8% Industrial 14.8% Specialty & Other 2.1% Medical 3.6%

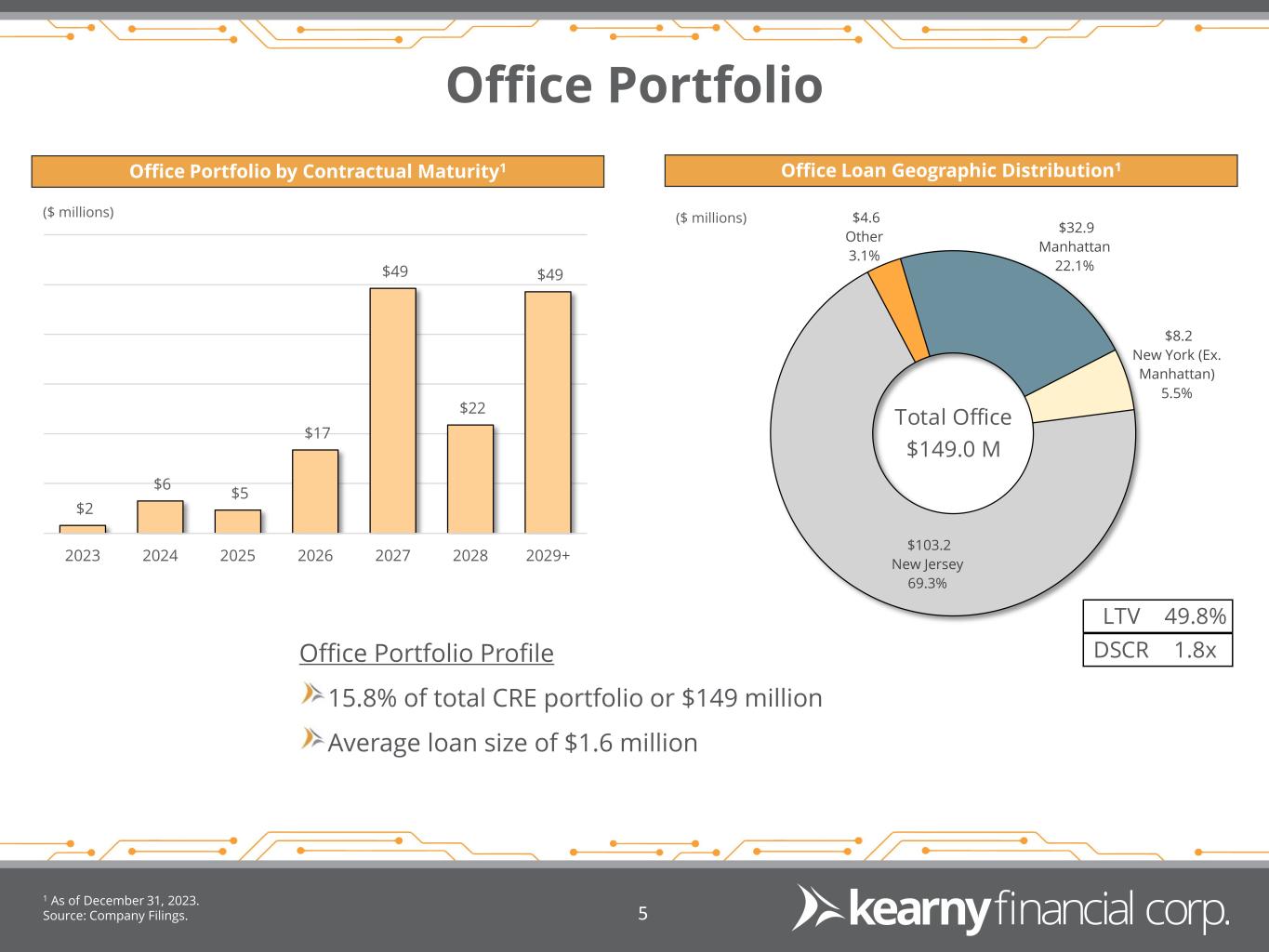

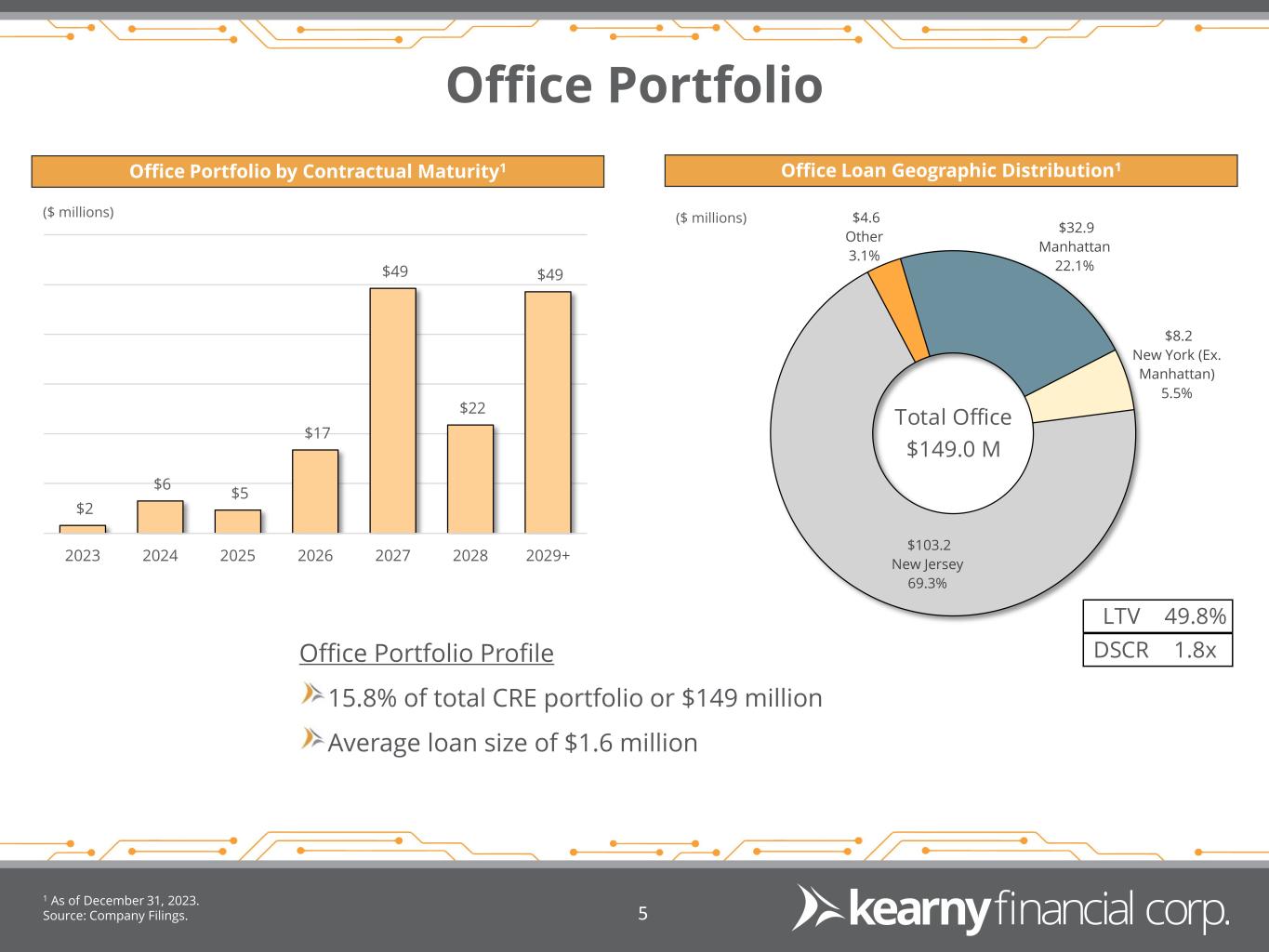

Office Portfolio 1 As of December 31, 2023. Source: Company Filings. 5 Office Portfolio by Contractual Maturity1 Office Loan Geographic Distribution1 Office Portfolio Profile 15.8% of total CRE portfolio or $149 million Average loan size of $1.6 million ($ millions) ($ millions) $2 $6 $5 $17 $49 $22 $49 2023 2024 2025 2026 2027 2028 2029+ Total Office $149.0 M $4.6 Other 3.1% $32.9 Manhattan 22.1% $8.2 New York (Ex. Manhattan) 5.5% $103.2 New Jersey 69.3% LTV 49.8% DSCR 1.8x