Document

The Joint Corp. Reports Third Quarter 2025 Financial Results

- Grew Revenue 6%, Compared to Third Quarter 2024 -

- Board authorizes an additional $12 million for share repurchases -

SCOTTSDALE, Ariz., November 6, 2025 – The Joint Corp. (NASDAQ: JYNT), a national operator, manager, and franchisor of chiropractic clinics, posted operating highlights and limited financial information for the quarter ended September 30, 2025. The following figures represent continuing operations unless otherwise stated.

Q3 2025 Financial Highlights summary

•Grew revenue to $13.4 million, up 6% compared to the third quarter of 2024.

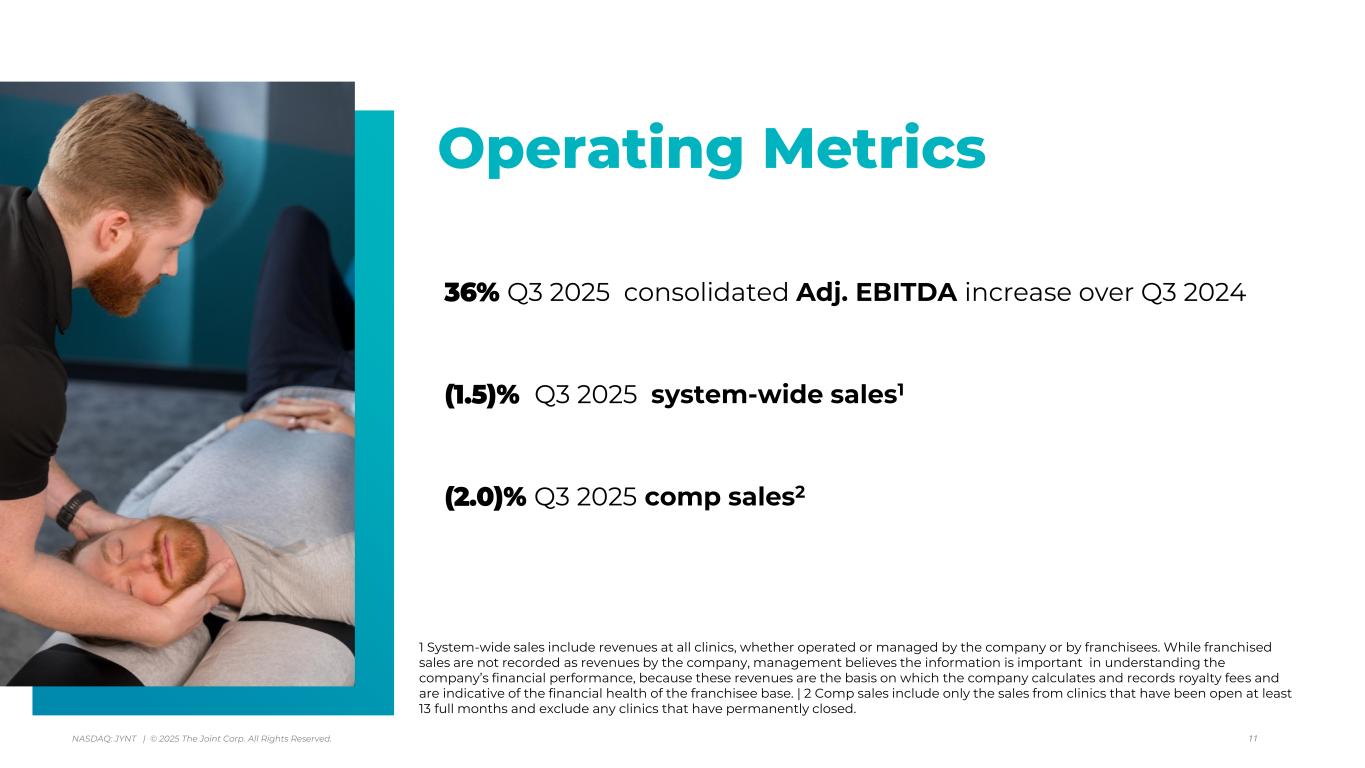

•Reported system-wide sales1 of $127.3 million, a decline of 1.5%.

•Reported comp sales2 of (2.0)%.

•Improved net income from consolidated operations to $855,000, compared to a net loss of $3.2 million in the third quarter of 2024. Reported net income from continuing operations of $290,000, compared to a net loss of $414,000 in the third quarter of 2024.

•Increased Adjusted EBITDA for consolidated operations 36% to $3.3 million from $2.4 million in the third quarter of 2024. Increased Adjusted EBITDA from continuing operations to $1.4 million from $262,000 in the third quarter of 2024.

Third Quarter 2025 Operating Highlights

•Sold eight franchise licenses compared to seven in the third quarter of 2024.

•Opened nine and closed 11 franchised clinics.

•Closed three company-owned or managed clinics.

•Refranchised one clinic.

•Total clinic count was 962, with 884 franchised and 78 company-owned or managed, as of September 30, 2025.

“Throughout 2025, we have strengthened our management team and executed on strategies to refranchise our corporate portfolio, drive new patient acquisition, grow system-wide sales, and improve comp sales as well as operating leverage,” said President and Chief Executive Officer of The Joint Corp., Sanjiv Razdan. “In the third quarter, we made strides on these initiatives, although their full financial benefit will take time to come to fruition. Our brand message has transitioned toward pain management, which will be amplified by shifting a portion of our advertising spend to national media. In addition, we are investing in search engine optimization to leverage AI-search, including more impactful clinic microsite content to drive website rankings. In August, we enhanced our mobile app with new features that are driving an improved patient experience. In November, we initiated a three-tiered pricing pilot for our wellness plan. We are actively negotiating asset purchase agreements for all remaining corporate clinics.

1 System-wide sales include revenues at all clinics, whether operated or managed by the company or by franchisees. While franchised sales are not recorded as revenues by the company, management believes the information is important in understanding the company’s financial performance, because these revenues are the basis on which the company calculates and records royalty fees and are indicative of the financial health of the franchisee base.

2 Comp sales include the revenues from both company-owned or managed clinics and franchised clinics that in each case have been open at least 13 full months and exclude any clinics that have closed.

In addition, throughout the year, we have implemented robust pre-opening protocols for new clinics to support strong early sales volumes and reduce time to breakeven.

“To increase shareholder value, we are investing in high-return initiatives and deploying capital to reduce our stock count. Since we initiated the stock repurchase program, we have repurchased 540,000 shares of our common stock for $5 million. The recent authorization of an additional $12 million to our stock repurchase program demonstrates our strong conviction in the progress we’re making toward reigniting growth, increasing profitability, and becoming a pure play franchisor.”

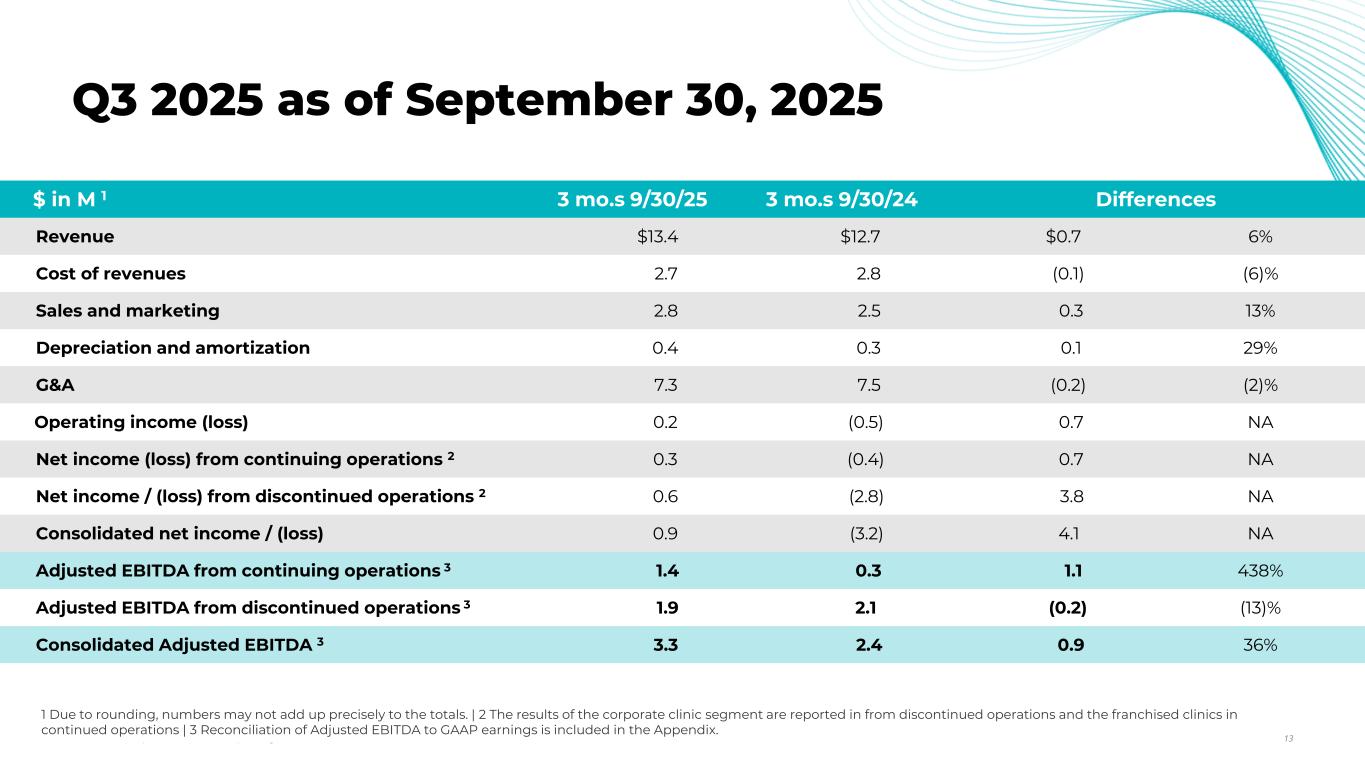

Financial Results for Third Quarter Ended September 30, 2025 Compared to September 30, 2024

Revenue increased 6% to $13.4 million, compared to $12.7 million in the third quarter of 2024. Cost of revenue was $2.7 million, down 6% compared to the prior year, reflecting lower regional developer royalties.

Selling and marketing expenses were $2.8 million, up 13% mainly driven by the digital marketing transformation efforts. Depreciation and amortization expenses increased $100,000, primarily related to the development of software, including the launch of the new mobile app. General and administrative expenses decreased 3% to $7.3 million.

Income tax expense was $10,000, compared to $5,000 in the third quarter of 2024. Consolidated net income was $855,000, compared to a net loss of $3.2 million in the third quarter of 2024. Net income from continuing operations was $290,000, compared to a net loss of $414,000 in the third quarter of 2024. Consolidated EPS was $0.06 per diluted share, compared to a net loss of $0.21 per basic share in the third quarter of 2024.

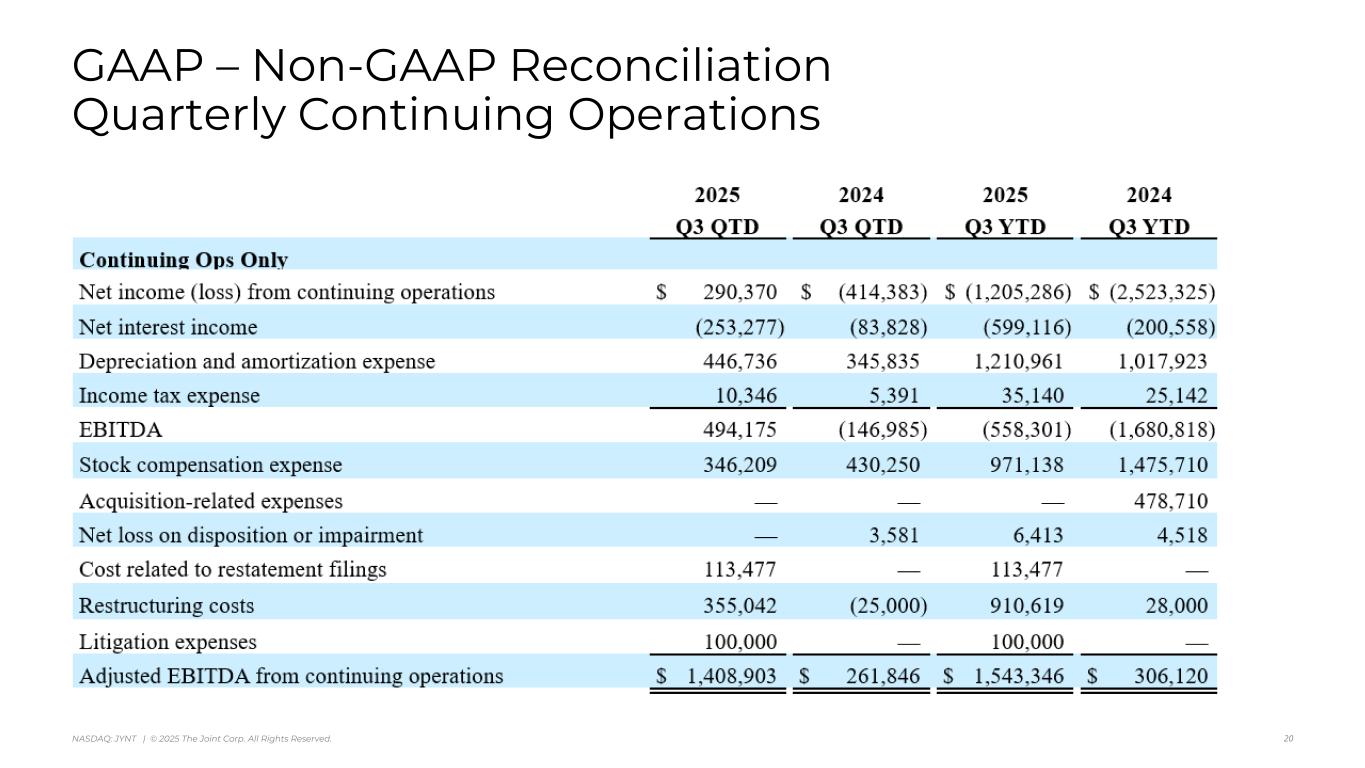

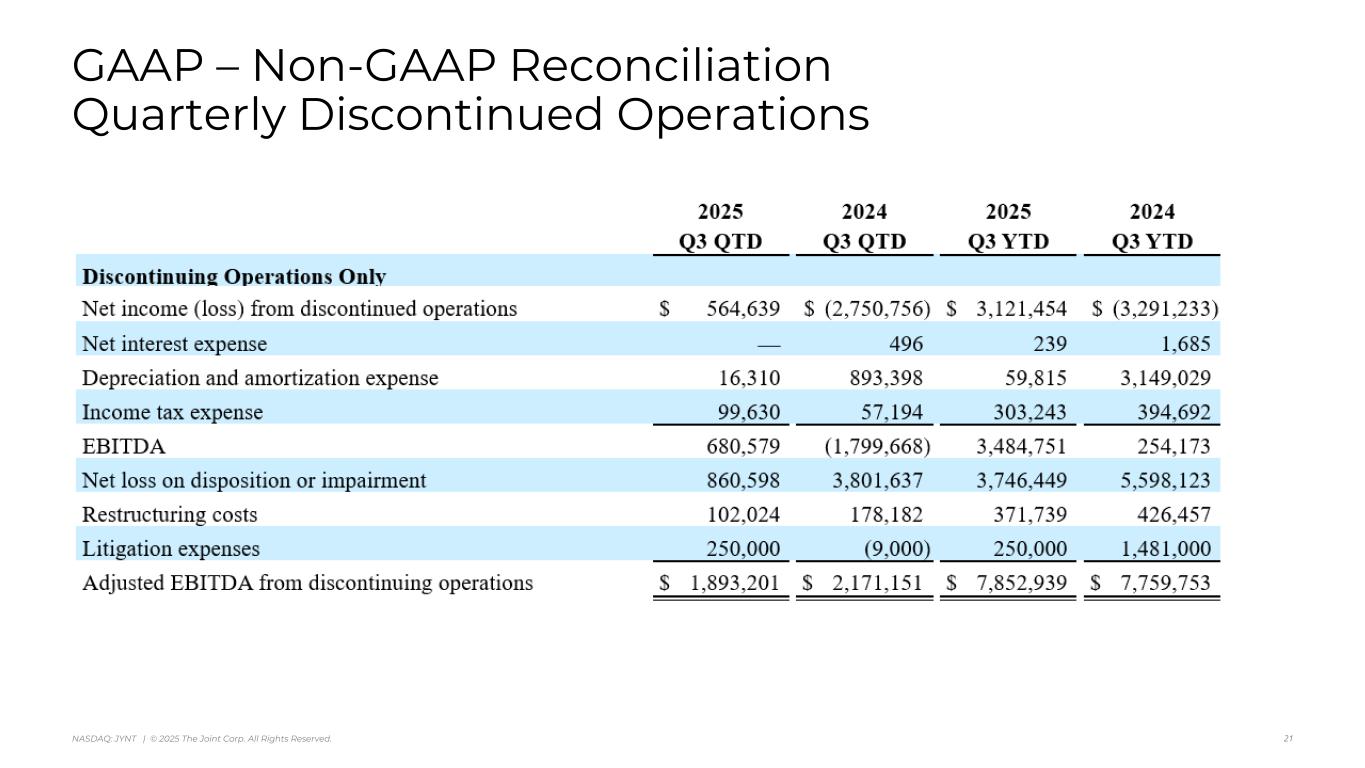

Adjusted EBITDA from consolidated operations increased 36% to $3.3 million, and Adjusted EBITDA from continuing operations improved to $1.4 million, compared to Adjusted EBITDA from consolidated operations of $2.4 million and Adjusted EBITDA from continuing operations of $262,000 in the third quarter of 2024.

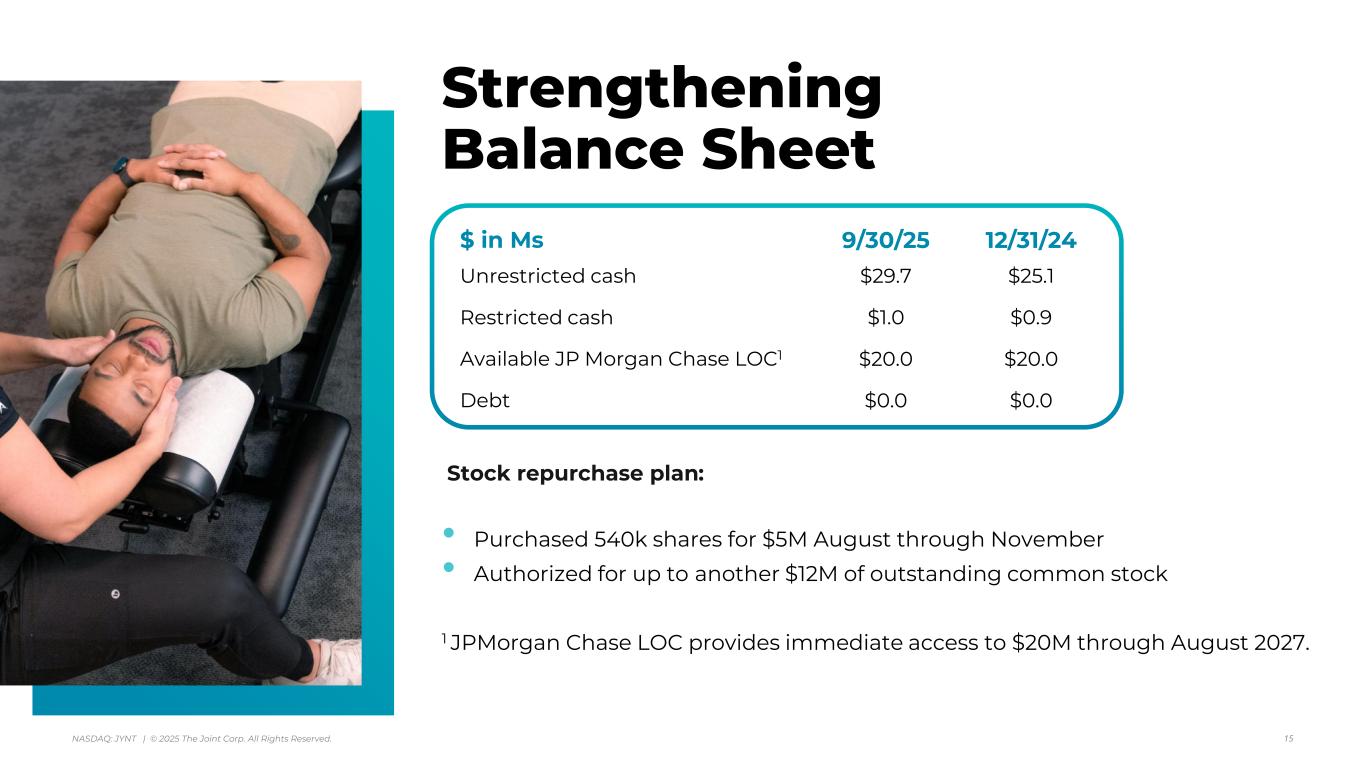

Balance Sheet and Cash Flow

Unrestricted cash was $29.7 million at September 30, 2025, compared to $25.1 million at December 31, 2024. The company maintains a currently undrawn line of credit with JP Morgan Chase, which grants immediate access to $20 million through August 2027.

During the third quarter of 2025, the company repurchased 228,000 shares for total consideration of $2.3 million. As announced on November 5th, 2025 between the third quarter end and the end of October, the company repurchased an additional 312,000 shares for total consideration of $2.7 million. In November, the company’s board of directors authorized an additional $12 million for its stock repurchase program.

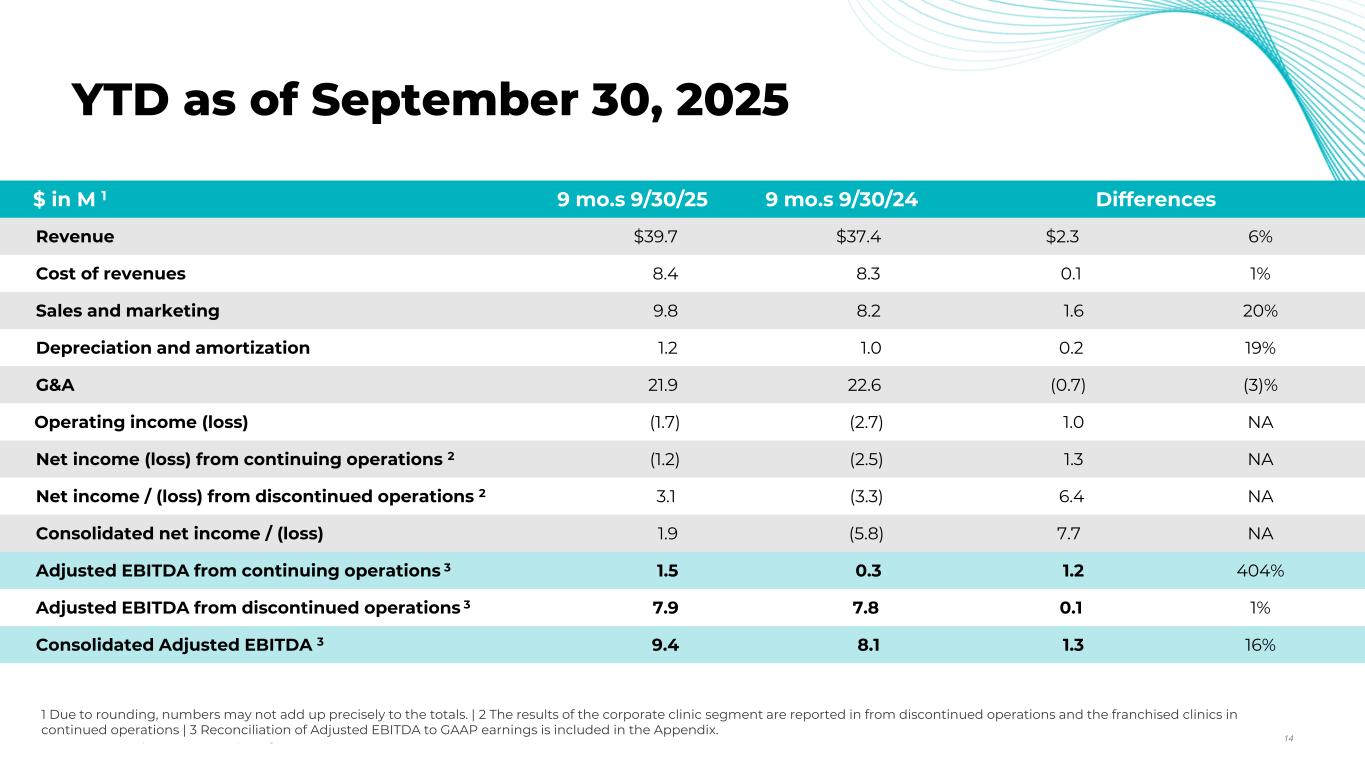

Financial Results for Nine Months Ended September 30, 2025 Compared to September 30, 2024

Revenue was $39.7 million in the first nine months of 2025, up 6% compared to $37.4 million in same period in 2024. Consolidated net income was $1.9 million, compared to a net loss of $5.8 million in the nine months ended September 30, 2024. Net loss from continuing operations was $1.2 million, compared to a net loss of $2.5 million in the nine months ended September 30, 2024. Consolidated EPS was $0.12 per diluted share, compared to a net loss of $0.39 per basic share in the nine months ended September 30,2024.

Adjusted EBITDA from consolidated operations expanded to $9.4 million and Adjusted EBITDA from continuing operations improved to $1.5 million, compared to Adjusted EBITDA from consolidated operations of $8.1 million and Adjusted EBITDA from continuing operations of $306,000 in the nine months ended September 30,2024.

Subsequent to September 30, 2025

The company reached an initial agreement to sell 45 corporate clinics in Southern California for $4.5 million via an asset purchase agreement. Management continues to negotiate certain terms and will provide an update, if and when, the parties align on final terms.

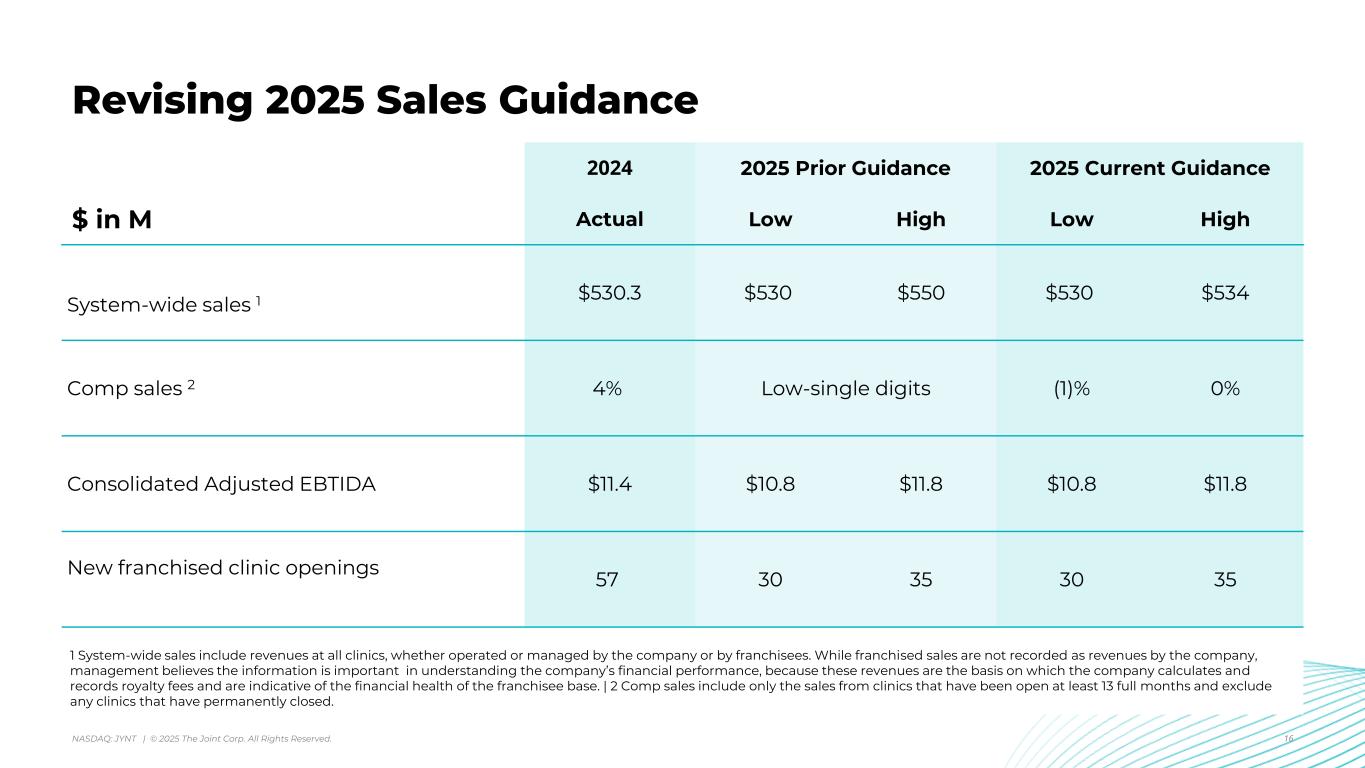

2025 Guidance

The company has updated its system-wide sales and comp sales guidance for the full year of 2025:

•System-wide sales1 are now expected to range from $530 million to $534 million, which compares to prior guidance of $530 million to $550 million.

•Comp sales2 are now expected to be in the range of (1)% to 0%, which compares to prior guidance of an increase in the low-single digit range.

•Consolidated Adjusted EBITDA guidance continues to be in the range of $10.8 million to $11.8 million.

•New clinic openings guidance continues to be in the range of 30 to 35.

Conference Call The Joint Corp. management will host a conference call at 5:00 p.m. ET on Thursday, November 6, 2025, after the market close. Stockholders and interested participants may listen to a live broadcast of the conference call by dialing 1-(833) 630-0823 or (412) 317-1831 and ask to be joined into the ‘The Joint’ call approximately 15 minutes prior to the start time.

The live webcast of the call with accompanying slide presentation can be accessed in the IR events section https://ir.thejoint.com/events and available for approximately one year. An audio archive can be accessed for one week by dialing (877) 344-7529 or (412) 317-0088 and entering conference ID 3346890.

Commonly Discussed Performance Metrics

This release includes a presentation of commonly discussed performance metrics. System-wide sales include revenues at all clinics, whether operated by the company or by franchisees. While franchised sales are not recorded as revenues by the company, management believes the information is important in understanding the company’s financial performance because these sales are the basis on which the company calculates and records royalty fees and are indicative of the financial health of the franchisee base. Comp sales include the revenues from both company-owned or managed clinics and franchised clinics that in each case have been open at least 13 full months and exclude any clinics that have closed.

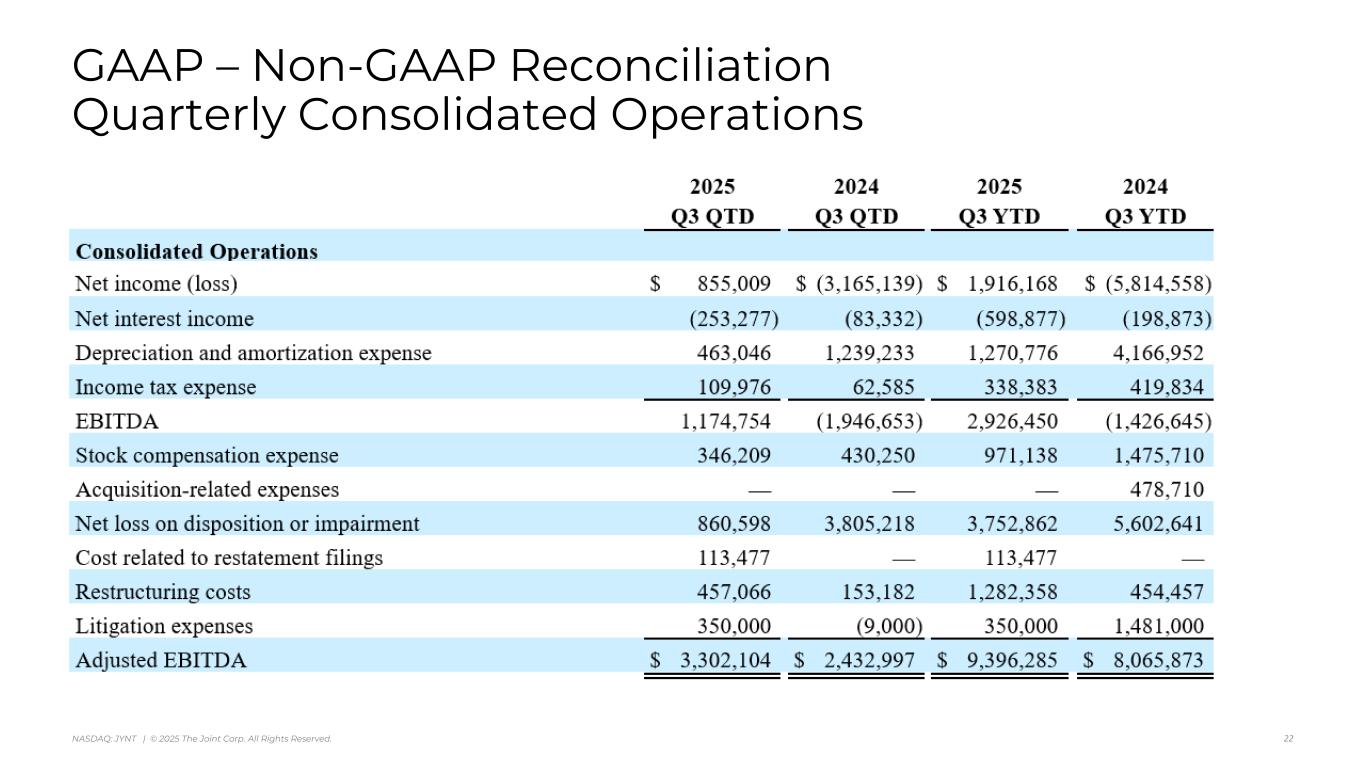

Non-GAAP Financial Information

This release also includes a presentation of non-GAAP financial measures. EBITDA and Adjusted EBITDA are presented because they are important measures used by management to assess financial performance, as management believes they provide a more transparent view of the company’s underlying operating performance and operating trends. Reconciliation of historical net income/(loss) to EBITDA and Adjusted EBITDA is presented in the table below. The company defines EBITDA as net income/(loss) before net interest, tax expense, depreciation, and amortization expenses. The company defines Adjusted EBITDA as EBITDA before acquisition-related expenses (which includes contract termination costs associated with reacquired regional developer rights), net (gain)/loss on disposition or impairment, stock-based compensation expenses, costs related to restatement filings, restructuring costs, and litigation expenses (consisting of legal and related fees for specific proceedings that arise outside of the ordinary course of our business). EBITDA and Adjusted EBITDA do not represent and should not be considered alternatives to net income or cash flows from operations, as determined by accounting principles generally accepted in the United States, or GAAP. While EBITDA and Adjusted EBITDA are used as measures of financial performance and the ability to meet debt service requirements, they are not necessarily comparable to other similarly titled captions of other companies due to potential inconsistencies in the methods of calculation. EBITDA and Adjusted EBITDA should be reviewed in conjunction with the company’s financial statements filed with the SEC. Please refer to the reconciliations of non-GAAP financial measures to their GAAP equivalents located at the end of this release. This release includes forward-looking guidance for certain non-GAAP financial measures, including Adjusted EBITDA.

These measures will differ from net income (loss), determined in accordance with GAAP, in ways similar to those described in the reconciliations at the end of this release. We are not able to provide, without unreasonable effort, guidance for net income (loss), determined in accordance with GAAP, or a reconciliation of guidance for Adjusted EBITDA to the most directly comparable GAAP measure because the company is not able to predict with reasonable certainty the amount or nature of all items that will be included in net income (loss).

Forward-Looking Statements

This press release contains statements about future events and expectations that constitute forward-looking statements. Forward-looking statements are based on our beliefs, assumptions and expectations of industry trends, our future financial and operating performance and our growth plans, taking into account the information currently available to us. These statements are not statements of historical fact. Words such as, "anticipates," "believes," "continues," "estimates," "expects," "goal," "objectives," "intends," "may," "opportunity," "plans," "potential," "near-term," "long-term," "projections," "assumptions," "projects," "guidance," "forecasts," "outlook," "target," "trends," "should," "could," "would," "will," and similar expressions are intended to identify such forward-looking statements. Specific forward-looking statements made in this press release include, among others, our belief that the full financial benefit of certain initiatives, including strengthening our management team and executing on strategies to refranchise our corporate portfolio, drive new patient acquisition, grow system-wide sales, and improve comp sales as well as operating leverage, will take time to come to fruition; our plan to finalize corporate clinic purchase agreements; our belief that we remain on track to be a pure-play franchisor by year end; our belief that we will be able to amplify the transition of our brand message toward pain management even further by shifting a portion of our advertising spend to national media; our plan to augment our digital efforts with improved search engine optimization and AI-search, including more impactful microsite content to drive website rankings; our belief that to increase value, we are investing in high-return initiatives and returning capital to our stockholders; our belief that the recent addition of an extra $12 million to our stock repurchase program demonstrates our strong conviction in the progress we’re making toward our goals of reigniting growth and increasing profitability; and our reiterated 2025 guidance for system-wide sales, comp sales, consolidated Adjusted EBITDA, and new clinic openings. Forward-looking statements involve risks and uncertainties that may cause our actual results to differ materially from the expectations of future results we express or imply in any forward-looking statements, and you should not place undue reliance on such statements. Factors that could contribute to these differences include, but are not limited to, our inability to identify and recruit enough qualified chiropractors and other personnel to staff our clinics, due in part to the nationwide labor shortage and an increase in operating expenses due to measures we may need to take to address such shortage; inflation, leading to increased labor costs and interest rates, as well as changes to import tariffs, may lead to reduced discretionary spending, all of which may negatively impact our business; our failure to profitably operate company-owned or managed clinics; our failure to refranchise as planned; short-selling strategies and negative opinions posted on the internet, which could drive down the market price of our common stock and result in class action lawsuits; our failure to remediate future material weaknesses in our internal control over financial reporting, which could negatively impact our ability to accurately report our financial results, prevent fraud, or maintain investor confidence; and other factors described in our filings with the SEC, including in the section entitled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2024 filed with the SEC on March 14, 2025 and subsequent filings with the SEC. We qualify any forward-looking statements entirely by these cautionary factors. We assume no obligation to update or revise any forward-looking statements for any reason or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should only be viewed as historical data.

About The Joint Corp. (NASDAQ: JYNT)

The Joint Corp. (NASDAQ: JYNT) revolutionized access to chiropractic care when it introduced its retail healthcare business model in 2010. Today, it is the nation’s largest operator, manager and franchisor of chiropractic clinics through The Joint Chiropractic network. The company is making quality care convenient and affordable, while eliminating the need for insurance, for millions of patients seeking pain relief and ongoing wellness. Headquartered in Scottsdale and with over 950 locations nationwide and more than 14 million patient visits annually, The Joint Chiropractic is a key leader in the chiropractic industry. The brand is consistently named to Franchise Times’ annual “Top 400” and “Fast & Serious” list of 40 smartest growing brands. Entrepreneur named The Joint “No. 1 in Chiropractic Services,” and it is regularly ranked on the publication’s “Franchise 500,” the “Fastest-Growing Franchises,” and the “Best of the Best” lists, as well as its “Top Franchise for Veterans” and “Top Brands for Multi-Unit Owners” lists. SUCCESS named the company as one of the “Top 50 Franchises” in 2024. The Joint Chiropractic is an innovative force, where healthcare meets retail. For more information, visit www.joint.com. To learn about franchise opportunities, visit www.thejointfranchise.com.

Business Structure

The Joint Corp. is a franchisor of clinics and an operator of clinics in certain states. In Arkansas, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Illinois, Kansas, Kentucky, Maryland, Michigan, Minnesota, New Jersey, New York, North Carolina, Oregon, Pennsylvania, Tennessee, Washington, and West Virginia, The Joint Corp. and its franchisees provide management services to affiliated professional chiropractic practices.

Media Contact:

Margie Wojciechowski, The Joint Corp., margie.wojciechowski@thejoint.com

Investor Contact:

Richard Land, Alliance Advisors IR, thejointinvestor@allianceadvisors.com 212-838-3777

– Financial Tables Follow –

THE JOINT CORP.

CONSOLIDATED BALANCE SHEETS

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30,

2025 |

|

December 31,

2024 |

| ASSETS |

(unaudited) |

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

29,699,953 |

|

|

$ |

25,051,355 |

|

| Restricted cash |

1,013,182 |

|

|

945,081 |

|

| Accounts receivable, net |

2,901,028 |

|

|

2,586,381 |

|

| Deferred franchise and regional development costs, current portion |

1,111,248 |

|

|

1,055,582 |

|

| Prepaid expenses and other current assets |

2,057,868 |

|

|

1,787,994 |

|

Discontinued operations current assets ($1.1 million and $1.1 million attributable to VIEs, respectively) |

23,719,082 |

|

|

43,151,055 |

|

| Total current assets |

60,502,361 |

|

|

74,577,448 |

|

| Property and equipment, net |

3,035,659 |

|

|

3,206,754 |

|

| Operating lease right-of-use asset |

1,630,228 |

|

|

555,536 |

|

| Deferred franchise and regional development costs, net of current portion |

3,878,857 |

|

|

4,513,891 |

|

| Deposits and other assets |

338,376 |

|

|

300,779 |

|

| Total assets |

$ |

69,385,481 |

|

|

$ |

83,154,408 |

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable |

$ |

1,204,976 |

|

|

$ |

1,750,938 |

|

| Accrued expenses |

761,203 |

|

|

1,505,827 |

|

| Co-op funds liability |

1,013,182 |

|

|

945,082 |

|

| Payroll liabilities |

3,423,061 |

|

|

3,551,173 |

|

| Operating lease liability, current portion |

191,641 |

|

|

483,337 |

|

| Deferred franchise fee revenue, current portion |

2,520,824 |

|

|

2,546,926 |

|

| Upfront regional developer fees, current portion |

277,394 |

|

|

288,095 |

|

| Other current liabilities |

777,589 |

|

|

603,250 |

|

Discontinued operations current liabilities ($5.9 million and $7.1 million attributable to VIEs, respectively) |

22,878,807 |

|

|

37,367,459 |

|

| Total current liabilities |

33,048,677 |

|

|

49,042,087 |

|

| Operating lease liability, net of current portion |

1,899,557 |

|

|

311,689 |

|

| Deferred franchise fee revenue, net of current portion |

11,290,223 |

|

|

12,450,179 |

|

| Upfront regional developer fees, net of current portion |

425,475 |

|

|

672,334 |

|

| Total liabilities |

46,663,932 |

|

|

62,476,289 |

|

| Commitments and contingencies |

|

|

|

| Stockholders' equity: |

|

|

|

| Series A preferred stock, $0.001 par value; 50,000 shares authorized, zero issued and outstanding, respectively |

— |

|

|

— |

|

Common stock, $0.001 par value; 20,000,000 shares authorized, 15,433,861 shares issued and 15,172,257 shares outstanding and 15,192,893 shares issued and 15,159,878 outstanding, respectively |

15,433 |

|

|

15,192 |

|

| Additional paid-in capital |

51,634,910 |

|

|

49,210,455 |

|

Treasury stock 261,604 shares and 33,015 shares, at cost, respectively |

(3,167,492) |

|

|

(870,058) |

|

| Accumulated deficit |

(25,786,302) |

|

|

(27,702,470) |

|

| Total The Joint Corp. stockholders' equity |

22,696,549 |

|

|

20,653,119 |

|

| Non-controlling Interest |

25,000 |

|

|

25,000 |

|

| Total equity |

22,721,549 |

|

|

20,678,119 |

|

| Total liabilities and stockholders' equity |

$ |

69,385,481 |

|

|

$ |

83,154,408 |

|

THE JOINT CORP.

CONSOLIDATED INCOME STATEMENTS

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Revenues: |

|

|

|

|

|

|

|

|

| Royalty fees |

|

$ |

8,106,915 |

|

|

$ |

7,870,033 |

|

|

$ |

24,311,022 |

|

|

$ |

23,303,907 |

|

| Franchise fees |

|

964,796 |

|

|

697,688 |

|

|

2,561,415 |

|

|

2,072,665 |

|

| Advertising fund revenue |

|

2,344,833 |

|

|

2,247,663 |

|

|

6,985,030 |

|

|

6,654,974 |

|

| Software fees |

|

1,545,331 |

|

|

1,431,321 |

|

|

4,488,959 |

|

|

4,233,133 |

|

| Other revenues |

|

418,810 |

|

|

407,691 |

|

|

1,382,119 |

|

|

1,184,469 |

|

| Total revenues |

|

13,380,685 |

|

|

12,654,396 |

|

|

39,728,545 |

|

|

37,449,148 |

|

| Cost of revenues: |

|

|

|

|

|

|

|

|

| Franchise and regional development cost of revenues |

|

2,232,419 |

|

|

2,450,400 |

|

|

7,134,267 |

|

|

7,250,351 |

|

| IT cost of revenues |

|

428,815 |

|

|

364,563 |

|

|

1,271,700 |

|

|

1,081,513 |

|

| Total cost of revenues |

|

2,661,234 |

|

|

2,814,963 |

|

|

8,405,967 |

|

|

8,331,864 |

|

| Selling and marketing expenses |

|

2,816,081 |

|

|

2,504,168 |

|

|

9,805,075 |

|

|

8,182,142 |

|

| Depreciation and amortization |

|

446,736 |

|

|

345,835 |

|

|

1,210,961 |

|

|

1,017,923 |

|

| General and administrative expenses |

|

7,295,719 |

|

|

7,478,669 |

|

|

21,955,915 |

|

|

22,611,442 |

|

Total selling, general and administrative expenses |

|

10,558,536 |

|

|

10,328,672 |

|

|

32,971,951 |

|

|

31,811,507 |

|

| Net loss on disposition or impairment |

|

— |

|

|

3,581 |

|

|

6,413 |

|

|

4,518 |

|

| Income (loss) from operations |

|

160,915 |

|

|

(492,820) |

|

|

(1,655,786) |

|

|

(2,698,741) |

|

| Other income, net |

|

139,801 |

|

|

83,828 |

|

|

485,640 |

|

|

200,558 |

|

| Income (loss) before income tax expense |

|

300,716 |

|

|

(408,992) |

|

|

(1,170,146) |

|

|

(2,498,183) |

|

| Income tax expense |

|

10,346 |

|

|

5,391 |

|

|

35,140 |

|

|

25,142 |

|

| Net income (loss) from continuing operations |

|

290,370 |

|

|

(414,383) |

|

|

(1,205,286) |

|

|

(2,523,325) |

|

| Discontinued operations: |

|

|

|

|

|

|

|

|

| Income (loss) from discontinued operations before income tax expense |

|

664,269 |

|

|

(2,693,562) |

|

|

3,424,697 |

|

|

(2,896,541) |

|

| Income tax expense from discontinued operations |

|

99,630 |

|

|

57,194 |

|

|

303,243 |

|

|

394,692 |

|

| Net income (loss) from discontinued operations |

|

564,639 |

|

|

(2,750,756) |

|

|

3,121,454 |

|

|

(3,291,233) |

|

| Net income (loss) |

|

$ |

855,009 |

|

|

$ |

(3,165,139) |

|

|

$ |

1,916,168 |

|

|

$ |

(5,814,558) |

|

|

|

|

|

|

|

|

|

|

| Net income (loss) from continuing operations per common share: |

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.02 |

|

|

$ |

(0.03) |

|

|

$ |

(0.08) |

|

|

$ |

(0.17) |

|

| Diluted |

|

$ |

0.02 |

|

|

$ |

(0.03) |

|

|

$ |

(0.08) |

|

|

$ |

(0.17) |

|

| Net income (loss) from discontinued operations per common share: |

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.04 |

|

|

$ |

(0.18) |

|

|

$ |

0.20 |

|

|

$ |

(0.22) |

|

| Diluted |

|

$ |

0.04 |

|

|

$ |

(0.18) |

|

|

$ |

0.20 |

|

|

$ |

(0.22) |

|

| Net income (loss) per common share: |

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.06 |

|

|

$ |

(0.21) |

|

|

$ |

0.12 |

|

|

$ |

(0.39) |

|

| Diluted |

|

$ |

0.06 |

|

|

$ |

(0.21) |

|

|

$ |

0.12 |

|

|

$ |

(0.39) |

|

|

|

|

|

|

|

|

|

|

| Basic weighted average shares |

|

15,344,844 |

|

|

14,959,132 |

|

|

15,281,775 |

|

|

14,903,726 |

|

| Diluted weighted average shares |

|

15,398,594 |

|

|

15,192,379 |

|

|

15,348,944 |

|

|

15,138,148 |

|

THE JOINT CORP.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

|

2025 |

|

2024 |

| Cash flows from operating activities: |

|

|

|

|

| Net income (loss) |

|

$ |

1,916,168 |

|

|

$ |

(5,814,558) |

|

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: |

|

|

|

|

| Depreciation and amortization |

|

1,270,776 |

|

|

4,166,952 |

|

| Net loss on disposition or impairment (non-cash portion) |

|

3,752,862 |

|

|

5,602,641 |

|

| Net franchise fees recognized upon termination of franchise agreements |

|

(257,797) |

|

|

(99,966) |

|

| Deferred income taxes |

|

— |

|

|

67,990 |

|

| Stock-based compensation expense |

|

971,138 |

|

|

1,475,710 |

|

| Changes in operating assets and liabilities, net of acquisitions: |

|

|

|

|

| Accounts receivable |

|

1,464,026 |

|

|

240,981 |

|

| Prepaid expenses and other current assets |

|

(424,897) |

|

|

(53,888) |

|

| Deferred franchise costs |

|

382,986 |

|

|

456,894 |

|

| Deposits and other assets |

|

(19,280) |

|

|

15,710 |

|

| Assets and liabilities held for sale, net |

|

— |

|

|

(2,147,354) |

|

| Accounts payable |

|

(649,903) |

|

|

276,296 |

|

| Accrued expenses |

|

(3,475,804) |

|

|

1,255,713 |

|

| Payroll liabilities |

|

(925,440) |

|

|

2,621,327 |

|

| Operating leases |

|

(3,843,956) |

|

|

— |

|

| Deferred revenue |

|

(1,643,696) |

|

|

(1,504,305) |

|

| Upfront regional developer fees |

|

(215,524) |

|

|

(346,357) |

|

| Other liabilities |

|

489,649 |

|

|

(928,850) |

|

| Net cash (used in) provided by operating activities |

|

(1,058,973) |

|

|

5,284,936 |

|

|

|

|

|

|

| Cash flows from investing activities: |

|

|

|

|

| Proceeds from sale of clinics |

|

7,778,287 |

|

|

374,100 |

|

|

|

|

|

|

| Purchase of property and equipment |

|

(1,154,385) |

|

|

(901,394) |

|

| Net cash provided by (used in) investing activities |

|

6,623,902 |

|

|

(527,294) |

|

|

|

|

|

|

| Cash flows from financing activities: |

|

|

|

|

| Payments of finance lease obligation |

|

(4,354) |

|

|

(19,013) |

|

| Purchases of treasury stock under employee stock plans |

|

(8,440) |

|

|

(9,583) |

|

| Purchases of common stock under share repurchase programs |

|

(2,288,994) |

|

|

— |

|

| Proceeds from exercise of stock options |

|

1,453,558 |

|

|

52,098 |

|

| Repayment of debt under the Credit Agreement |

|

— |

|

|

(2,000,000) |

|

| Net cash used in financing activities |

|

(848,230) |

|

|

(1,976,498) |

|

|

|

|

|

|

| Increase in cash, cash equivalents and restricted cash |

|

4,716,699 |

|

|

2,781,144 |

|

| Cash, cash equivalents and restricted cash, beginning of period |

|

25,996,436 |

|

|

19,214,292 |

|

| Cash, cash equivalents and restricted cash, end of period |

|

$ |

30,713,135 |

|

|

$ |

21,995,436 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of cash, cash equivalents and restricted cash: |

|

September 30, 2025 |

|

September 30, 2024 |

| Cash and cash equivalents |

|

$ |

29,699,953 |

|

|

$ |

20,737,769 |

|

| Restricted cash |

|

1,013,182 |

|

|

1,257,667 |

|

| Cash, cash equivalents and restricted cash, end of period |

|

$ |

30,713,135 |

|

|

$ |

21,995,436 |

|

THE JOINT CORP.

CONSOLIDATED RECONCILIATION FROM GAAP TO NON-GAAP

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

2025 |

|

2024 |

|

from Continuing Operations |

|

from Discontinued Operations |

|

Net Operations |

|

from Continuing Operations |

|

from Discontinued Operations |

|

Net Operations |

| Non-GAAP Financial Data: |

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

$ |

290,370 |

|

|

$ |

564,639 |

|

|

$ |

855,009 |

|

|

$ |

(414,383) |

|

|

$ |

(2,750,756) |

|

|

$ |

(3,165,139) |

|

| Net interest (income) expense |

(253,277) |

|

|

— |

|

|

(253,277) |

|

|

(83,828) |

|

|

496 |

|

|

(83,332) |

|

| Depreciation and amortization expense |

446,736 |

|

|

16,310 |

|

|

463,046 |

|

|

345,835 |

|

|

893,398 |

|

|

1,239,233 |

|

| Income tax expense |

10,346 |

|

|

99,630 |

|

|

109,976 |

|

|

5,391 |

|

|

57,194 |

|

|

62,585 |

|

| EBITDA |

494,175 |

|

|

680,579 |

|

|

1,174,754 |

|

|

(146,985) |

|

|

(1,799,668) |

|

|

(1,946,653) |

|

| Stock compensation expense |

346,209 |

|

|

— |

|

|

346,209 |

|

|

430,250 |

|

|

— |

|

|

430,250 |

|

| Acquisition-related expenses |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Net loss on disposition or impairment |

— |

|

|

860,598 |

|

|

860,598 |

|

|

3,581 |

|

|

3,801,637 |

|

|

3,805,218 |

|

| Costs related to restatement filings |

113,477 |

|

|

— |

|

|

113,477 |

|

|

— |

|

|

— |

|

|

— |

|

| Restructuring costs |

355,042 |

|

|

102,024 |

|

|

457,066 |

|

|

(25,000) |

|

|

178,182 |

|

|

153,182 |

|

| Litigation expenses |

100,000 |

|

250,000 |

|

350,000 |

|

|

— |

|

(9,000) |

|

|

(9,000) |

|

| Adjusted EBITDA |

$ |

1,408,903 |

|

|

$ |

1,893,201 |

|

|

$ |

3,302,104 |

|

|

$ |

261,846 |

|

|

$ |

2,171,151 |

|

|

$ |

2,432,997 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

2025 |

|

2024 |

|

from Continuing Operations |

|

from Discontinued Operations |

|

Net Operations |

|

from Continuing Operations |

|

from Discontinued Operations |

|

Net Operations |

| Non-GAAP Financial Data: |

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) income |

$ |

(1,205,286) |

|

|

$ |

3,121,454 |

|

|

$ |

1,916,168 |

|

|

$ |

(2,523,325) |

|

|

$ |

(3,291,233) |

|

|

$ |

(5,814,558) |

|

| Net interest (income) expense |

(599,116) |

|

|

239 |

|

|

(598,877) |

|

|

(200,558) |

|

|

1,685 |

|

|

(198,873) |

|

| Depreciation and amortization expense |

1,210,961 |

|

|

59,815 |

|

|

1,270,776 |

|

|

1,017,923 |

|

|

3,149,029 |

|

|

4,166,952 |

|

| Income tax expense |

35,140 |

|

|

303,243 |

|

|

338,383 |

|

|

25,142 |

|

|

394,692 |

|

|

419,834 |

|

| EBITDA |

(558,301) |

|

|

3,484,751 |

|

|

2,926,450 |

|

|

(1,680,818) |

|

|

254,173 |

|

|

(1,426,645) |

|

| Stock compensation expense |

971,138 |

|

|

— |

|

|

971,138 |

|

|

1,475,710 |

|

|

— |

|

|

1,475,710 |

|

| Acquisition-related expenses |

— |

|

|

— |

|

|

— |

|

|

478,710 |

|

|

— |

|

|

478,710 |

|

| Net loss on disposition or impairment |

6,413 |

|

|

3,746,449 |

|

|

3,752,862 |

|

|

4,518 |

|

|

5,598,123 |

|

|

5,602,641 |

|

| Costs related to restatement filings |

113,477 |

|

|

— |

|

|

113,477 |

|

|

— |

|

|

— |

|

|

— |

|

| Restructuring costs |

910,619 |

|

|

371,739 |

|

|

1,282,358 |

|

|

28,000 |

|

|

426,457 |

|

|

454,457 |

|

| Litigation expenses |

100,000 |

|

250,000 |

|

350,000 |

|

|

— |

|

1,481,000 |

|

|

1,481,000 |

|

| Adjusted EBITDA |

$ |

1,543,346 |

|

|

$ |

7,852,939 |

|

|

$ |

9,396,285 |

|

|

$ |

306,120 |

|

|

$ |

7,759,753 |

|

|

$ |

8,065,873 |

|