Sustainability Report 2024

| Managing sustainability and climate risks

95

Risk management and control

In 2024,

we continued

to develop

solutions to

integrate sustainability

and climate

risks into

traditional risk

categories,

such as our credit, market,

liquidity, non-financial and reputational risk frameworks. We

progressively enhanced our four-

stage approach (defined above in

the sustainability and climate risk

management framework) by leveraging

research on

how sustainability and climate

risk drivers may be

transmitted to our clients

(and their assets)

and ultimately to

the firm

in the form

of financial

and non-financial

risks. Our

approach supports

the ongoing

management of

sustainability and

climate risks as

they manifest

across traditional risk

categories and has

been built in

line with principles

outlined by the

Basel

Committee

on

Banking

Supervision

(the

BCBS)

and

the

Task

Force

on

Climate-related

Financial

Disclosures

(the

TCFD,

now

organized

under

the

ISSB).

As

Swiss

financial

regulator

FINMA

has

mandated

financial

institutions

to

implement

nature-related

financial

risks

in

their

due

diligence

processes

by

2028

(FINMA

Circular

2026/1

on

nature-

related

financial

risk),

UBS

is

building

its

capabilities

to

embed

the

management

of

these

risks

in

its

due

diligence

processes.

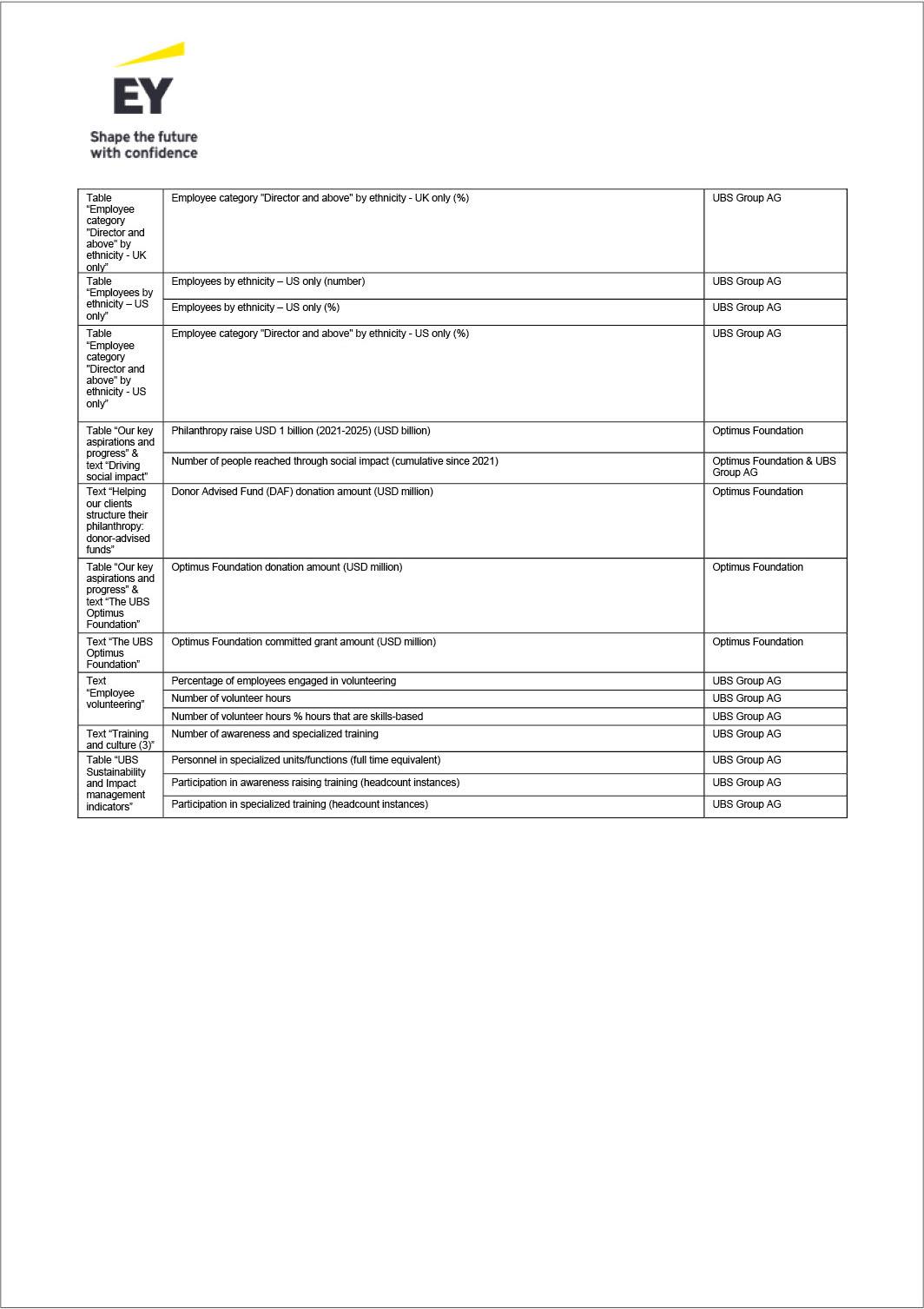

Our progress is summarized in the following table.

Managing sustainability and climate risks

within traditional risk categories

Traditional risk

Sustainability and climate risk

transmission channels.

Key developments

Our potential credit losses driven by

risks from a changing physical climate,

the transition to a low-carbon

economy.

Climate-related risk drivers can impact

household, corporate or sovereign

income and / or wealth. Physical and

transition risk drivers increase our

potential losses as soon as they have a

negative effect on a borrower’s ability

to repay and / or fully recover the value

of a loan in the event of default.

In 2024, we further embedded climate-related

risks into our credit risk management framework.

By collaborating

across business divisions and between both the first and second

lines of defense, we developed innovative

solutions tailored to the risk profiles and material drivers of

risk within our businesses:

Investment Bank:

The current credit-granting process has been amended to identify and

measure the potential for

credit losses driven by climate-related risks for corporate lending and

leveraged finance. At the transaction level,

this is achieved by integrating tools such as sector-level climate-related

risk heatmaps and company-level due

diligence scorecards into the credit approval analysis and decision-making

process. In addition, where mandated,

concentration triggers have been set up and are monitored and reported

on a quarterly basis for all relevant

counterparties. Furthermore, at the divisional level, progress has been made to enhance

and automate reporting of

the full Investment Bank lending portfolio, on a quarterly basis.

Global Wealth Management:

The current credit-granting process identifies and assess potential

credit losses driven

by climate-related risks for Lombard lending in Switzerland

and international locations by integrating climate-

related due diligence questions and leveraging the climate risk heatmaps

in the credit assessment at a transaction

level. The approach encompasses Lombard loans to operating companies

and those backed by concentrated equity

posted as collateral and we aim to further enhance the scope across

regions and products in future. Furthermore,

progress was made to enhance and automate reporting of

the combined Global Wealth Management Lombard

lending portfolio, on a quarterly basis.

Personal & Corporate Banking:

The current credit-granting process identifies and assesses potential

credit losses

driven by climate-related risks by integrating climate-related due diligence

questions and leveraging the climate

risk heatmaps in the credit assessment at a transaction level. This approach was rolled

out in 2023 to the P&C

Multinationals business and expanded in 2024 to include

a wider coverage of the corporate client portfolio as well

as the commodity trade finance business. Furthermore, at the divisional level progress was made to

enhance and

automate reporting of the combined Personal and Corporate lending portfolio, on a quarterly basis.

Market risk

(traded and

Potential financial impacts on the firm

from price shifts and / or market

volatility. A changing physical

environment (including climate

change) may affect the value of

companies reliant on the natural

environment and / or how the market

perceives such companies. The

transition to a low-carbon economy

through climate policies, low-carbon

technologies, demand shifts and / or

market perception may also impact the

value of our positions and / or lead to

a breakdown in correlations between

risk factors (e.g. prompting a change

in market liquidity and / or challenging

assumptions in our model).

In 2024, we assessed the risk from planned portfolios, in line with our multi-year

sustainability and climate risk

initiative, and established solutions for integrating climate-related risks into our market risk management

framework. Progress on integrating climate-related risks into our market risk management

was incrementally

driven by enhancing analytical capacity, applying the climate risk rating model

in our market-risk monitoring

systems and developing stress testing capabilities. We have adapted our in-house

long-term scenarios to the

specifics of short-term market risk analytical requirements.

Enhancing analytical capacity:

Leveraging existing sector-level heatmap methodologies

and our in-house scenario

development capacity, we sought to perform a loss-driven materiality assessment.

By linking the risk ratings with

adverse-scenario-driven shocks, we were able to further examine the correlations

between risk factors and

understand the short-term loss potentials for climate. In 2024, we were

able to introduce a climate risk rating

model for the first time.

Automation:

Market risks systems facilitate for daily monitoring, reporting and control.

By integrating these with

our centralized climate sector-level heatmap together with climate

risk rating model, we are able to understand

and react to drivers of climate impacts on our portfolios

through regular assessments and monitoring.

Quantitative risk appetite:

For selected legal entities, climate risk concentration triggers were introduced in 2023

based on the sector-level climate risk heatmaps.

The solution facilitates daily monitoring of positions that are

considered inherently sensitive to climate risks, including an automated

breach escalation process along with the

market risk escalation path for concentration limits, providing an opportunity for remediation

actions. The triggers

cover credit delta and equity delta aggregated in accordance with the “sensitivity,” as defined through our | Managing sustainability and climate risks 96