Document

Pangaea Logistics Solutions Ltd. Reports Financial Results for the

Three Months and Year Ended December 31, 2023

NEWPORT, RI - March 13, 2024 - Pangaea Logistics Solutions Ltd. (“Pangaea” or the “Company”) (NASDAQ: PANL), a global provider of comprehensive maritime logistics solutions, announced today its results for the three months and year ended December 31, 2023.

FOURTH QUARTER 2023 RESULTS

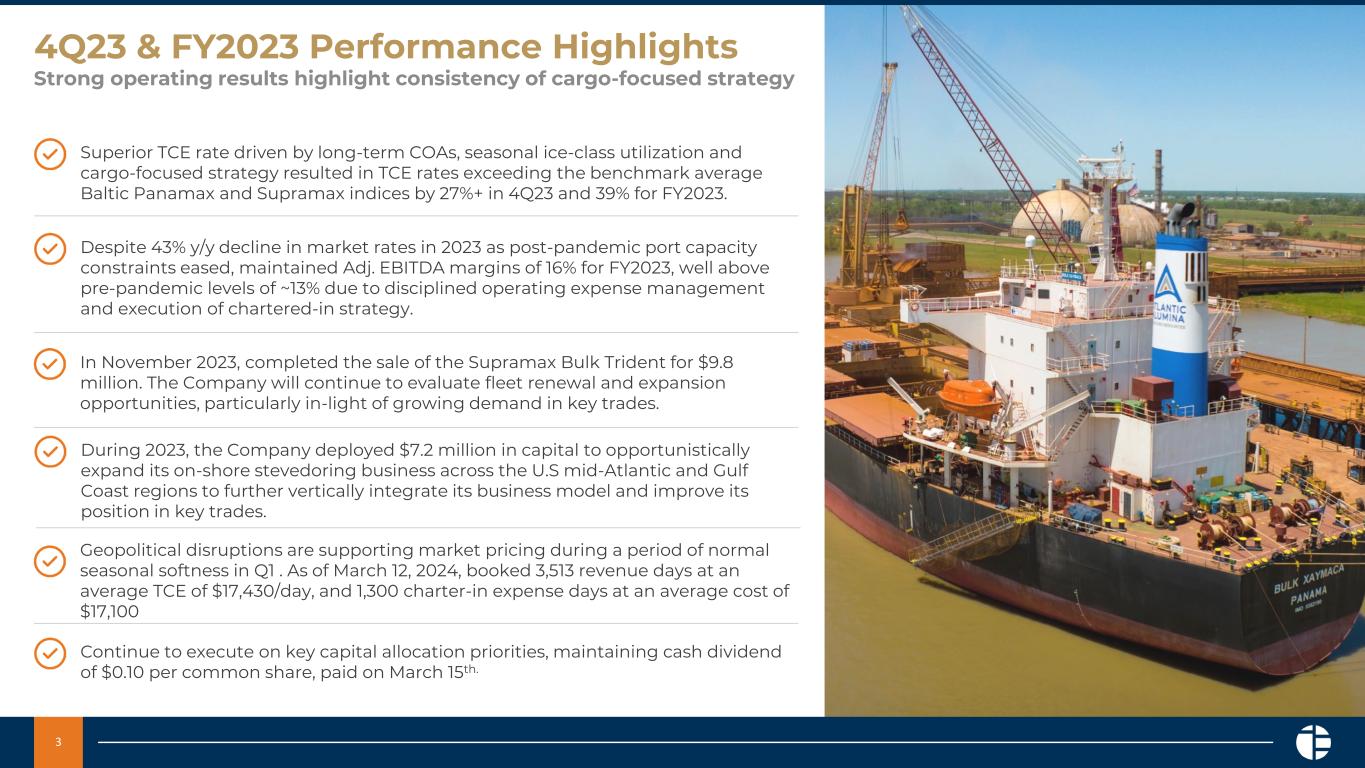

•Net income of $1.1 million, or $0.03 per diluted share

•Adjusted net income attributable to Pangaea Logistics Solutions Ltd. of $7.4 million, or $0.16 per diluted share

•Operating cash flow of $23.9 million

•Adjusted EBITDA of $19.7 million

•Time Charter Equivalent ("TCE") rates earned by Pangaea of $17,685 per day

•Pangaea’s TCE rates exceeded the average Baltic Panamax and Supramax indices by 27%

•Ratio of net debt to trailing twelve-month Adjusted EBITDA of 2.12x

•In November 2023, completed the sale of the Supramax Bulk Trident for $9.8 million

FULL YEAR 2023 RESULTS

•Net income attributable to Pangaea Logistics Solutions Ltd. of $26.3 million, or $0.58 per diluted share

•Adjusted Net Income attributable to Pangaea Logistics Solutions Ltd. of $31.4 million, or $0.69 per diluted share

•Operating cash flow of $53.8 million

•Adjusted EBITDA of $79.7 million

•Time Charter Equivalent ("TCE") rates earned by Pangaea of $15,849 per day

•Pangaea’s TCE rates exceeded the average Baltic Panamax and Supramax indices by 39%

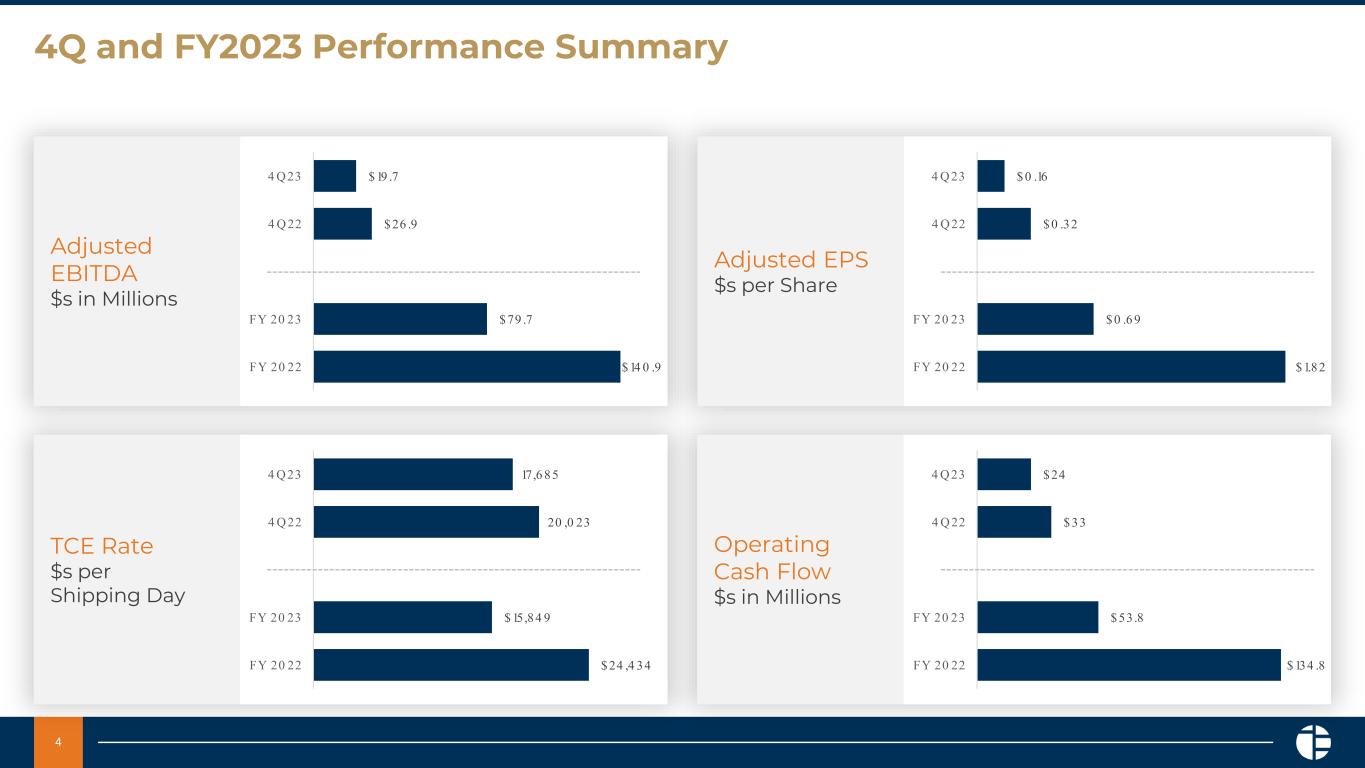

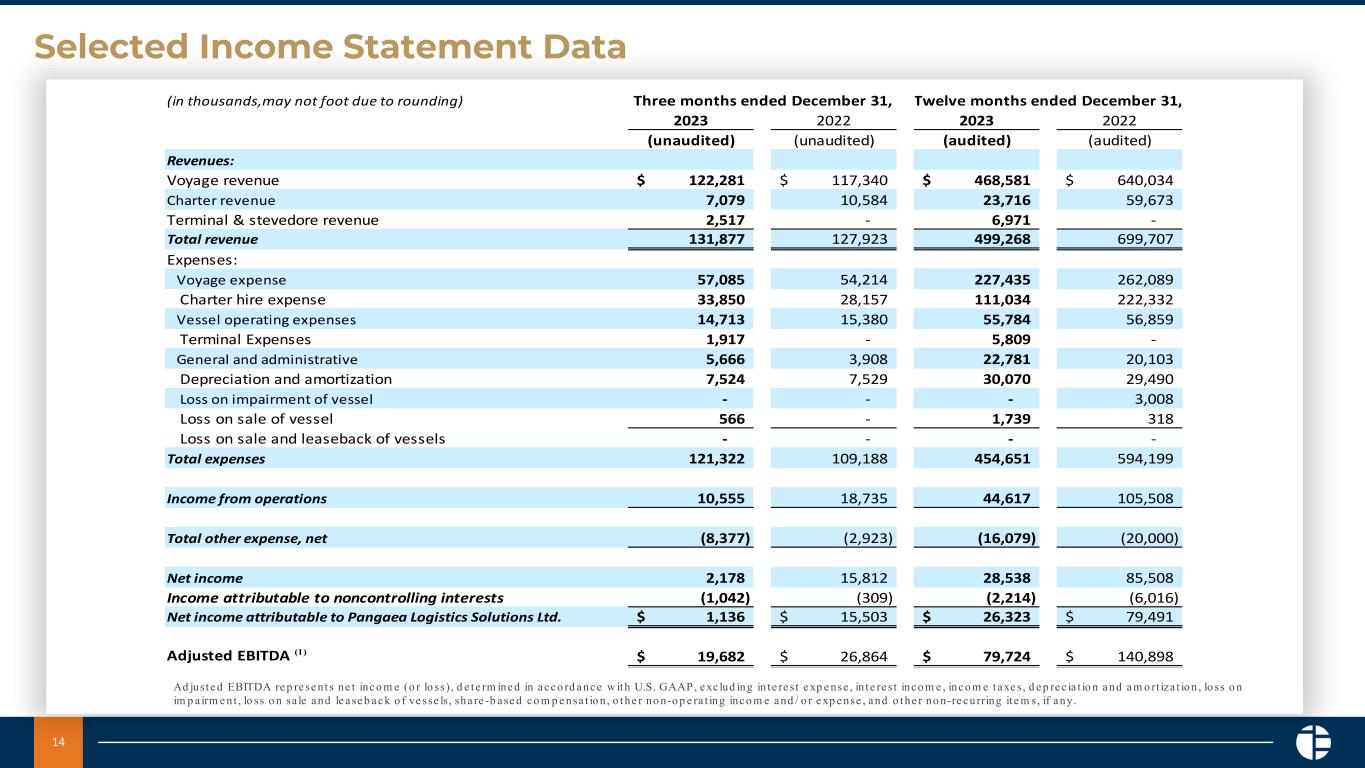

For the fourth quarter ended December 31, 2023, Pangaea reported non-GAAP adjusted net income of $7.4 million, or $0.16 per diluted share, on total revenue of $131.9 million. Fourth quarter TCE rates declined 11.7% on a year-over-year basis, while total shipping days, which include both voyage and time charter days, increased 11% to 4,087 days, when compared to the year-ago period.

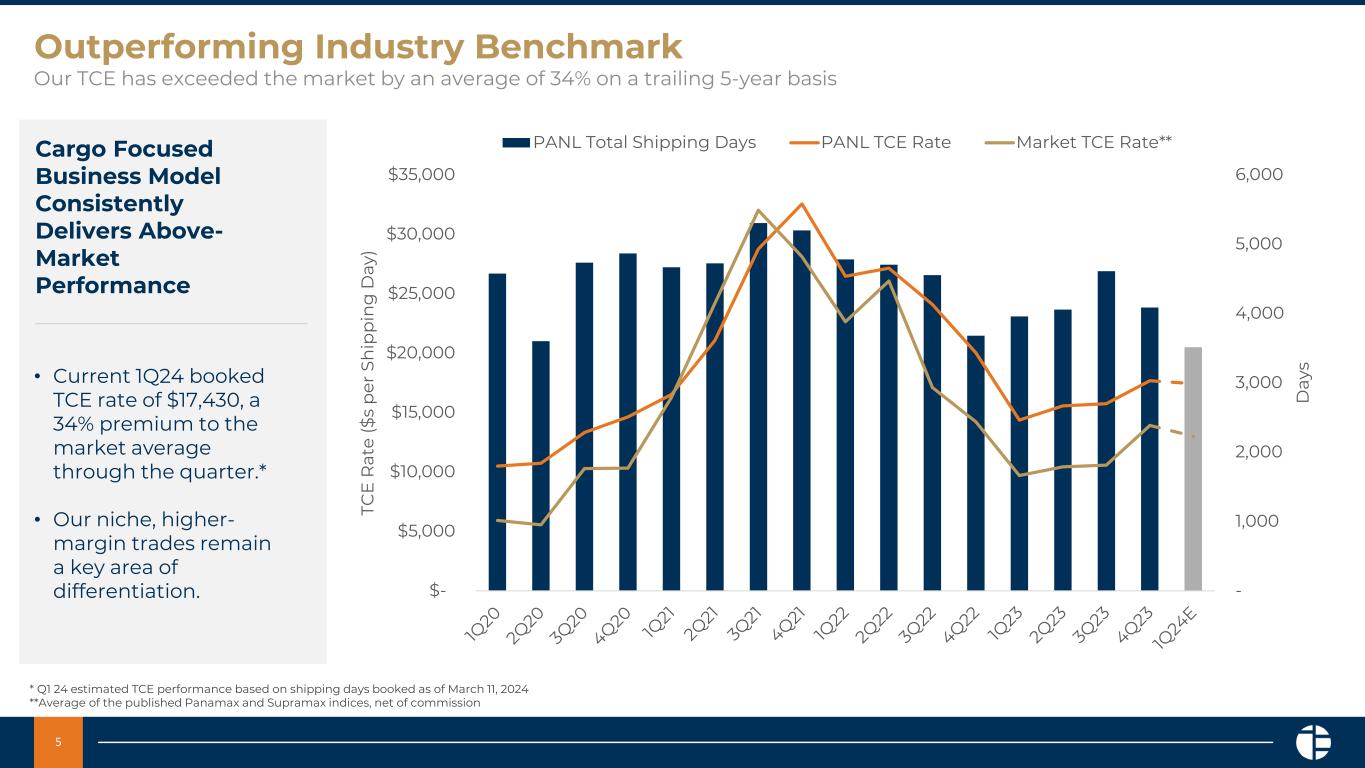

The TCE earned was $17,685 per day for the three months ended December 31, 2023, compared to an average of $20,023 per day for the same period in 2022. During the fourth quarter 2023, the Company’s average TCE rate exceeded the benchmark average Baltic Panamax and Supramax indices by approximately 27%, supported by Pangaea’s long-term contracts of affreightment ("COAs"), specialized fleet, and cargo-focused strategy.

Total Adjusted EBITDA decreased by 27% to $19.7 million in the fourth quarter due to fewer total shipping days and lower market rates, partially offset by the benefit of more owned ship days from a larger owned fleet and a decline in charter-hire expenses.

Total Adjusted EBITDA margin was 14.9% during the fourth quarter of 2023, compared to 21.0% during the prior year period. The decrease in Adjusted EBITDA margin reflects the 11% year-over-year increase in shipping days, coupled with the 12% year-over-year decrease in TCE rate, partially offset by a 4% year-over-year decline in vessel operating expenses per day, net of technical management fees. Fourth quarter 2024 expenses also reflect approximately $1.0 million impact from elevated Panama Canal transit fees caused by drought conditions in portions of Central and South America.

For the full year ended December 31, 2023, Pangaea reported non-GAAP adjusted net income of $31.4 million or $0.69 per diluted share, on total revenue of $499.3 million. Total Adjusted EBITDA was $79.7 million for the full year 2023 and total Adjusted EBITDA margin was 16.0%, compared to 20.1% for the full year 2022. Full year TCE rates declined 35.1% on a year-over-year basis in 2023 , while total shipping days decreased 5.7% to 16,711 when compared to 2022. The Company’s average TCE rate during 2023 exceeded the benchmark average Baltic Panamax and Supramax indices by approximately 39%, supported by Pangaea’s specialized fleet of ice-class vessels, long-term COAs, and cargo-focused strategies.

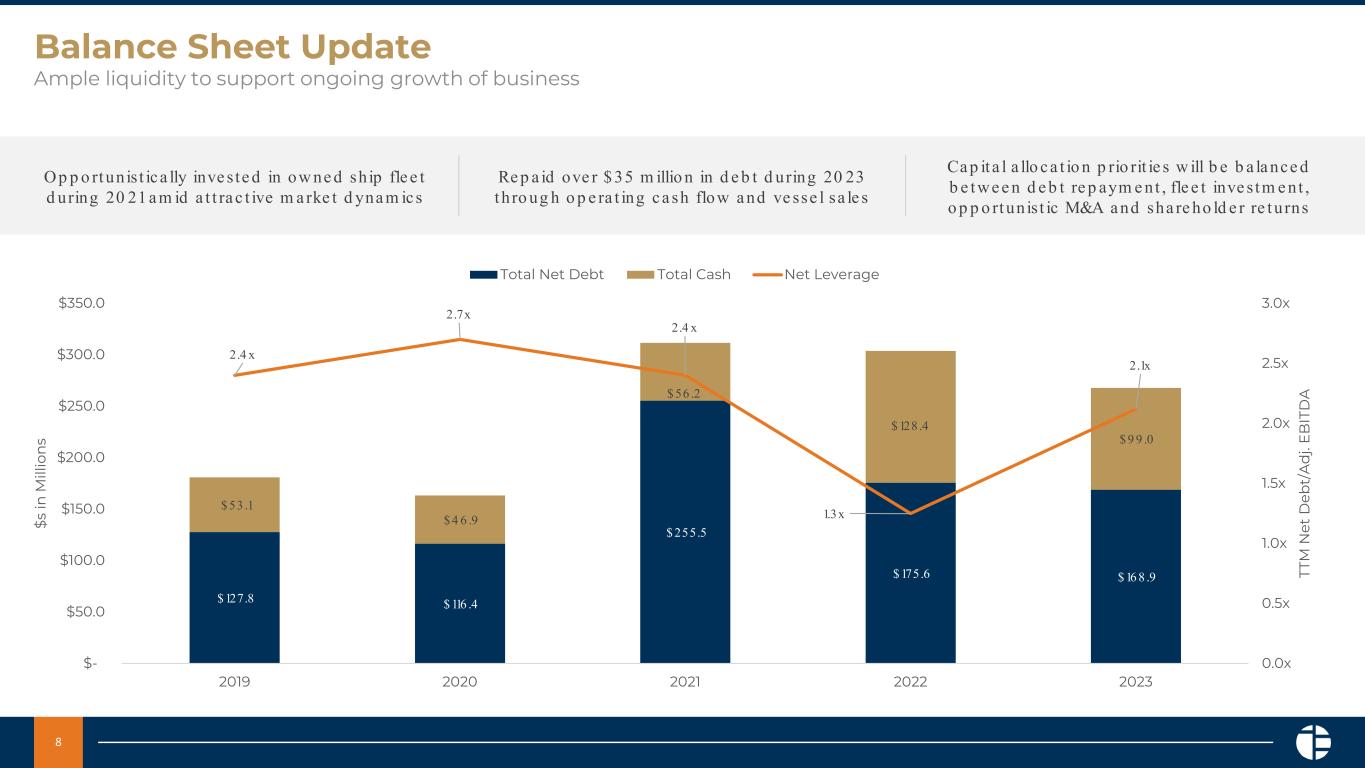

As of December 31, 2023, the Company had $99.0 million in cash and equivalents. Total debt, including lease finance obligations was $264 million at year-end 2023. At the end of the fourth quarter 2023, the ratio of net debt to trailing twelve-month adjusted EBITDA was 2.12x, versus 1.25x in the prior-year period. During the three months ended December 31, 2023, the Company repaid $3.3 million of long-term debt, $8.0 million of finance leases, and paid $4.5 million of cash dividends.

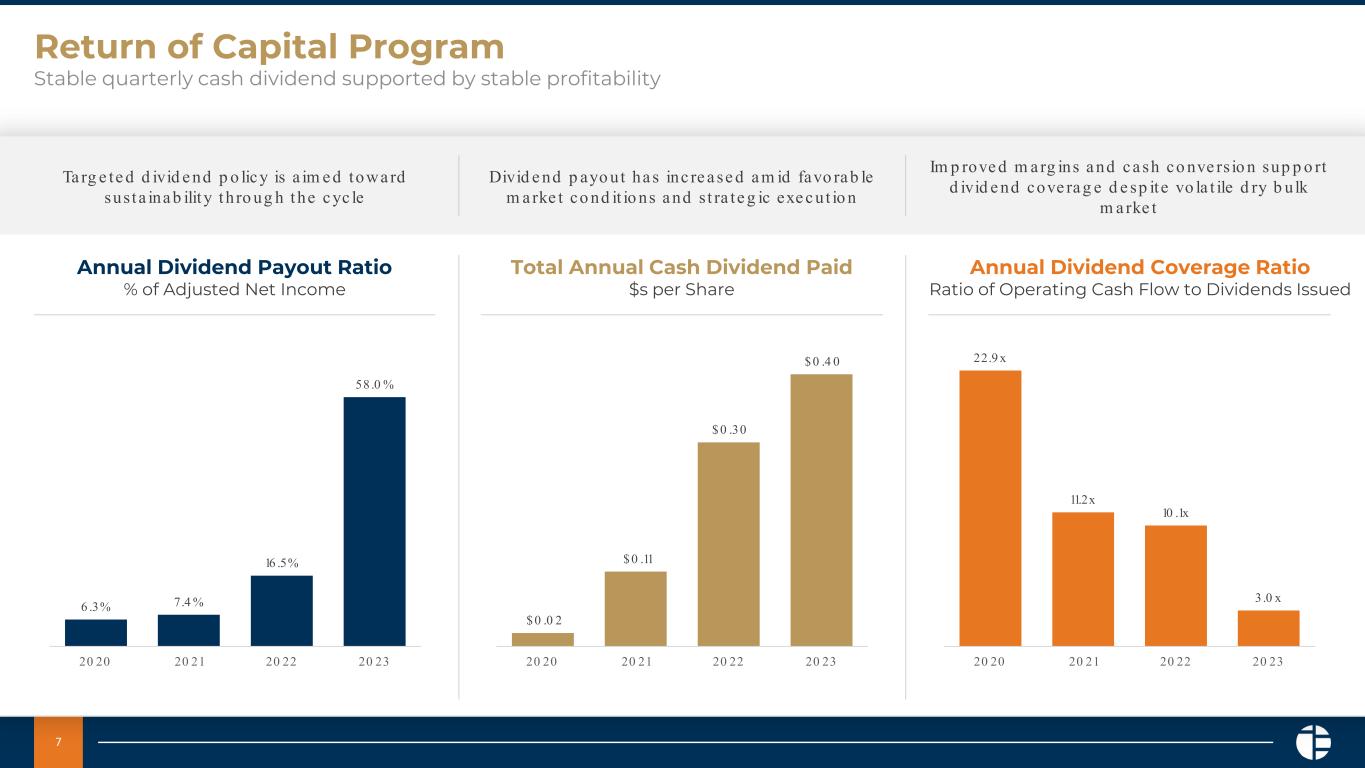

As previously announced on Feb 15, 2024, the Company's Board of Directors declared a quarterly cash dividend of $0.10 per common share, to be paid on March 15, 2024, to all shareholders of record as of March 1, 2024.

MANAGEMENT COMMENTARY

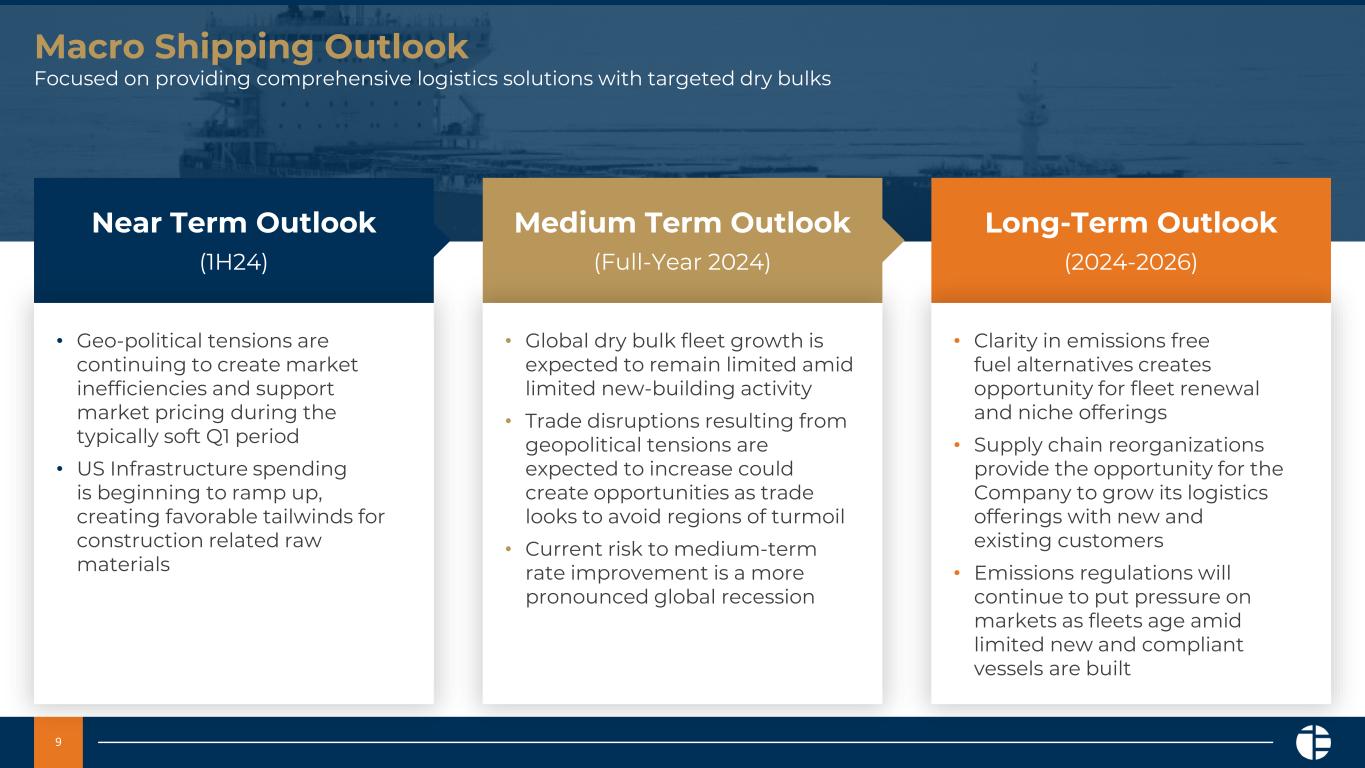

“We continued to execute on our premium-rate, cargo-centric strategy throughout the year, culminating in a strong fourth quarter operating performance,” stated Mark Filanowski, Chief Executive Officer of Pangaea Logistics Solutions. “While the fourth quarter is generally a slower period for Pangaea as we complete the peak Arctic trade season, ongoing geopolitical trade disruptions have led to increased demand for our solutions outside of our traditional trade routes, contributing to increased shipping days in the period compared to the prior year.”

“During the fourth quarter and full-year 2023, our TCE rate exceeded the benchmark BSI Index by nearly 27% and 39%, respectively,” continued Filanowski. “This performance is demonstrates our ability to drive relative out performance versus the broader industry even in periods of pronounced rate volatility. We believe we are the industry leader in this regard. During 2023, we also celebrated our 27th year of service to our loyal customer base and we rebranded our operating companies, Phoenix Bulk and Nordic Bulk, with proud Pangaea Logistics names.”

“Entering 2024, trade disruptions are causing persistent market inefficiencies driving a higher seasonal freight rate environment,” continued Filanowski. “Through today, we have performed 3,513 shipping days generating a TCE of $17,430/day, representing a strong seasonal start to the new year.”

“While dry bulk demand conditions remain robust, the global supply of newer, compliant fleet tonnage remains constrained, with the order book for new dry bulk vessels continuing to sit well below historical levels,” continued Filanowski. “With a limited volume of newbuild vessels scheduled to enter service over the next several years, the existing fleet of vessels in operation are expected to stay in high demand, a dynamic supportive of a strengthening rate environment.”

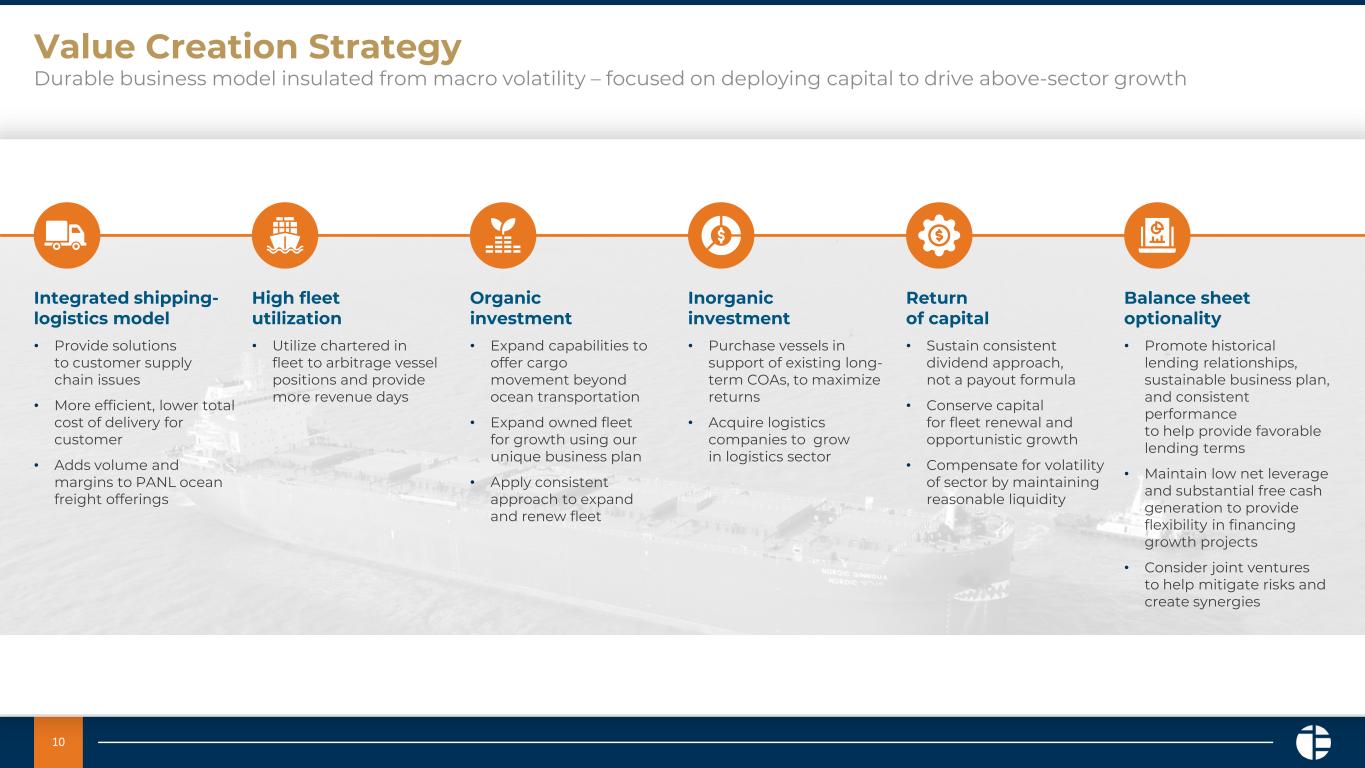

“In a strengthening dry-bulk market, Pangaea will continue to focus on driving superior returns on capital deployed,” continued Filanowski. “In 2023, we invested in the strategic expansion of our logistics capabilities through the acquisition of new port and terminal operations, deployed more than $34 million in our fleet renewal strategy, reduced our long-term debt by $36 million, and returned more than $18 million of capital to shareholders through our quarterly cash dividend. In 2024, we intend to prioritize growth in our fleet and logistics capabilities, while we continue to maintain a stable return of capital program, consistent with our long-term focus on shareholder value creation.”

STRATEGIC UPDATE

Pangaea remains committed to developing a leading dry bulk logistics and transportation services company of scale, providing its customers with specialized shipping and supply chain and logistics offerings in commodity and niche markets, which drive premium returns measured in time charter equivalent per day.

Leverage integrated shipping and logistics model. In addition to operating one of the largest high ice class dry bulk fleet of Panamax and post-Panamax vessels globally, Pangaea also performs stevedoring services, together with port and terminal operations capabilities. Following the acquisition of marine port terminal operations in Port Everglades/Ft. Lauderdale, Port of Palm Beach, Florida, and Port of Baltimore, Maryland in June 2023, the company has been actively working to expand its onshore relationships with new and existing customers. During 2024, the Company intends to opportunistically expand its marine port terminal operations footprint across the U.S Gulf Coast through strategic joint operations partnerships.

Continue to drive strong fleet utilization. In the fourth quarter, Pangaea's 24 owned vessels were fully utilized and supplemented with an average of 20 chartered-in vessels to support cargo and COA commitments. While the Company benefited from continued artic trade activity demand early in the quarter, global trade disruptions bolstered demand, resulting in an 11% increase in shipping days. Going forward, the Company will continue to opportunistically evaluate the composition of its fleet in order to meet the growing needs of new and existing customers.

Continue to upgrade fleet, while divesting older, non-core assets. In November 2023, the Company completed the sale of the 2006-built Supramax Bulk Trident for $9.8 million. Looking ahead, the Company intends to opportunistically manage its fleet with the purpose of maximizing TCE rates, while continuing to support client requirements on an on-demand basis.

FOURTH QUARTER 2023 CONFERENCE CALL

The Company’s management team will host a conference call to discuss the Company’s financial results on Thursday, March 14, 2024 at 8:00 a.m., Eastern Time (ET). Accompanying presentation materials will be available in the Investor Relations section of the Company’s website at https://www.pangaeals.com/investors/.

To participate in the live teleconference:

Domestic Live: 1-800-245-3047

International Live: 1-203-518-9765

Conference ID: PANLQ423

To listen to a replay of the teleconference, which will be available through March 21, 2024:

Domestic Replay: 1-800-839-5630

International Replay: 1-402-220-2557

Pangaea Logistics Solutions Ltd.

Consolidated Statements of Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three months ended December 31, |

|

Twelve months ended December 31, |

| |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

(unaudited) |

|

(unaudited) |

|

|

|

|

| Revenues: |

|

|

|

|

|

|

|

| Voyage revenue |

$ |

122,280,728 |

|

|

$ |

117,339,854 |

|

|

$ |

468,580,914 |

|

|

$ |

640,033,668 |

|

| Charter revenue |

7,078,975 |

|

|

10,583,556 |

|

|

23,715,895 |

|

|

59,673,238 |

|

| Terminal & stevedore revenue |

2,517,214 |

|

|

— |

|

|

6,971,025 |

|

|

— |

|

| Total revenue |

131,876,917 |

|

|

127,923,410 |

|

|

499,267,834 |

|

|

699,706,906 |

|

|

|

|

|

|

|

|

|

| Expenses: |

|

|

|

|

|

|

|

| Voyage expense |

57,085,198 |

|

|

54,214,070 |

|

|

227,434,670 |

|

|

262,088,555 |

|

| Charter hire expense |

33,850,149 |

|

|

28,156,765 |

|

|

111,033,537 |

|

|

222,332,197 |

|

| Vessel operating expenses |

14,713,363 |

|

|

15,380,167 |

|

|

55,783,562 |

|

|

56,859,340 |

|

| Terminal & stevedore expenses |

1,916,707 |

|

|

— |

|

|

5,809,025 |

|

|

— |

|

| General and administrative |

5,665,924 |

|

|

3,907,905 |

|

|

22,780,937 |

|

|

20,103,346 |

|

| Depreciation and amortization |

7,524,045 |

|

|

7,529,397 |

|

|

30,070,395 |

|

|

29,489,810 |

|

| Loss on impairment of vessels |

— |

|

|

— |

|

|

— |

|

|

3,007,809 |

|

| Loss on sale of vessels |

566,315 |

|

|

— |

|

|

1,738,511 |

|

|

318,032 |

|

| Total expenses |

121,321,701 |

|

|

109,188,304 |

|

|

454,650,637 |

|

|

594,199,089 |

|

|

|

|

|

|

|

|

|

| Income from operations |

10,555,216 |

|

|

18,735,106 |

|

|

44,617,197 |

|

|

105,507,817 |

|

|

|

|

|

|

|

|

|

| Other (expense) income: |

|

|

|

|

|

|

|

| Interest expense |

(4,300,627) |

|

|

(4,264,918) |

|

|

(17,025,547) |

|

|

(15,704,233) |

|

| Interest income |

704,220 |

|

|

614,978 |

|

|

3,572,134 |

|

|

932,069 |

|

| Loss (income) attributable to Non-controlling interest recorded as long-term liability interest expense |

565,648 |

|

|

(755,563) |

|

|

(462,150) |

|

|

(6,717,414) |

|

| Unrealized (loss) gain on derivative instruments |

(5,685,406) |

|

|

1,192,416 |

|

|

(2,925,347) |

|

|

682,323 |

|

| Other income |

338,849 |

|

|

290,025 |

|

|

761,485 |

|

|

807,142 |

|

| Total other expense, net |

(8,377,316) |

|

|

(2,923,062) |

|

|

(16,079,425) |

|

|

(20,000,113) |

|

|

|

|

|

|

|

|

|

| Net income |

2,177,900 |

|

|

15,812,044 |

|

|

28,537,772 |

|

|

85,507,704 |

|

| Income attributable to noncontrolling interests |

(1,041,698) |

|

|

(309,443) |

|

|

(2,214,472) |

|

|

(6,016,291) |

|

| Net income attributable to Pangaea Logistics Solutions Ltd. |

$ |

1,136,202 |

|

|

$ |

15,502,601 |

|

|

$ |

26,323,300 |

|

|

$ |

79,491,413 |

|

|

|

|

|

|

|

|

|

| Earnings per common share: |

|

|

|

|

|

|

|

| Basic |

$ |

0.03 |

|

|

$ |

0.35 |

|

|

$ |

0.59 |

|

|

$ |

1.79 |

|

| Diluted |

$ |

0.03 |

|

|

$ |

0.34 |

|

|

$ |

0.58 |

|

|

$ |

1.76 |

|

|

|

|

|

|

|

|

|

| Weighted average shares used to compute earnings per common share |

|

|

|

|

|

|

|

| Basic |

44,815,282 |

|

|

44,435,664 |

|

|

44,773,899 |

|

|

44,398,987 |

|

| Diluted |

45,392,225 |

|

|

44,985,969 |

|

|

45,475,453 |

|

|

45,059,587 |

|

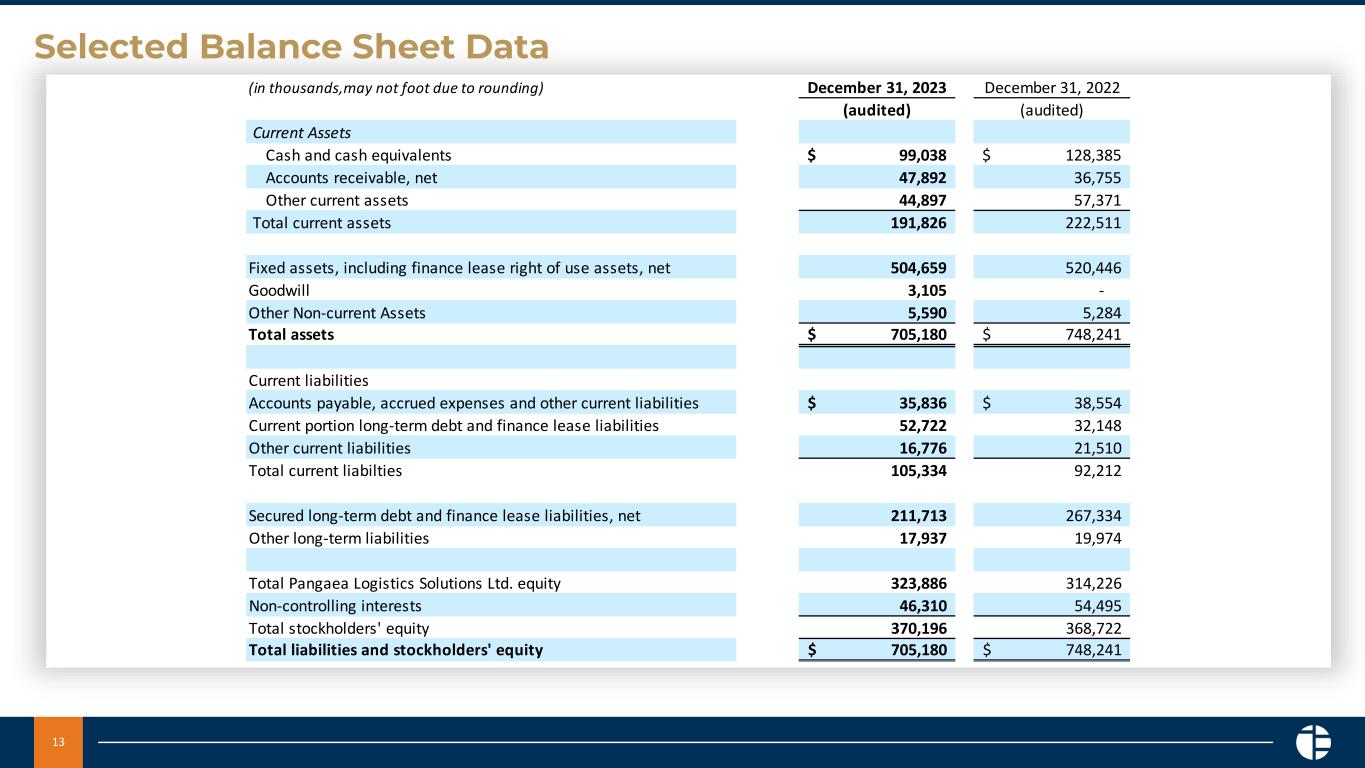

Pangaea Logistics Solutions Ltd.

Consolidated Balance Sheets

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2023 |

|

December 31, 2022 |

| Assets |

|

|

|

| Current Assets |

|

|

|

| Cash and cash equivalents |

$ |

99,037,866 |

|

|

$ |

128,384,606 |

|

|

|

|

|

| Accounts receivable (net of allowance of $5,657,837 and $4,367,848 at December 31, 2023 and 2022, respectively) |

47,891,501 |

|

|

36,755,149 |

|

| Bunker inventory |

16,556,266 |

|

|

29,104,436 |

|

| Advance hire, prepaid expenses and other current assets |

28,340,246 |

|

|

28,266,831 |

|

|

|

|

|

| Total current assets |

191,825,879 |

|

|

222,511,022 |

|

|

|

|

|

|

|

|

|

| Fixed assets, at cost, net of accumulated depreciation of $127,015,253 and $108,844,668, at December 31, 2023 and 2022, respectively |

474,265,171 |

|

|

476,524,752 |

|

|

|

|

|

|

|

|

|

| Finance lease right of use assets, at cost, net of accumulated depreciation of $10,393,823 and $12,139,654 at December 31, 2023 and 2022, respectively |

30,393,823 |

|

|

43,921,569 |

|

| Goodwill |

3,104,800 |

|

|

— |

|

| Other Non-current Assets |

5,590,295 |

|

|

5,284,127 |

|

| Total assets |

$ |

705,179,968 |

|

|

$ |

748,241,470 |

|

|

|

|

|

| Liabilities and stockholders' equity |

|

|

|

| Current liabilities |

|

|

|

| Accounts payable, accrued expenses and other current liabilities |

$ |

35,836,262 |

|

|

$ |

38,554,131 |

|

|

|

|

|

| Deferred revenue |

15,629,886 |

|

|

20,883,958 |

|

| Current portion of long-term debt |

30,751,726 |

|

|

15,782,530 |

|

| Current portion of finance lease liabilities |

21,970,124 |

|

|

16,365,075 |

|

| Dividends payable |

1,146,321 |

|

|

626,178 |

|

| Total current liabilities |

105,334,319 |

|

|

92,211,872 |

|

|

|

|

|

| Secured long-term debt, net |

68,446,309 |

|

|

98,819,739 |

|

| Finance lease liabilities |

143,266,867 |

|

|

168,513,939 |

|

| Long-term liabilities - other |

17,936,540 |

|

|

19,974,390 |

|

|

|

|

|

| Stockholders' equity: |

|

|

|

| Preferred stock, $0.0001 par value, 1,000,000 shares authorized and no shares issued or outstanding |

— |

|

|

— |

|

| Common stock, $0.0001 par value, 100,000,000 shares authorized, 46,466,622 and 45,898,395 shares issued and outstanding at December 31, 2023 and 2022, respectively |

4,648 |

|

|

4,590 |

|

| Additional paid-in capital |

164,854,546 |

|

|

162,894,080 |

|

| Retained Earnings |

159,026,799 |

|

|

151,327,392 |

|

| Total Pangaea Logistics Solutions Ltd. equity |

323,885,993 |

|

|

314,226,062 |

|

| Non-controlling interests |

46,309,940 |

|

|

54,495,468 |

|

| Total stockholders' equity |

370,195,933 |

|

|

368,721,530 |

|

| Total liabilities and stockholders' equity |

$ |

705,179,968 |

|

|

$ |

748,241,470 |

|

Pangaea Logistics Solutions Ltd.

Consolidated Statements of Cash Flows

|

|

|

|

|

|

|

|

|

|

|

|

| |

Years ended December 31, |

| |

2023 |

|

2022 |

| Operating activities |

|

|

|

| Net income |

$ |

28,537,772 |

|

|

$ |

85,507,704 |

|

| Adjustments to reconcile net income to net cash provided by operations: |

|

|

|

| Depreciation and amortization expense |

30,070,395 |

|

|

29,489,810 |

|

| Amortization of deferred financing costs |

946,593 |

|

|

1,005,487 |

|

| Amortization of prepaid rent |

121,532 |

|

|

122,343 |

|

| Unrealized loss (gain) on derivative instruments |

2,925,347 |

|

|

(682,323) |

|

| Income from equity method investee |

(684,470) |

|

|

(807,142) |

|

| Earnings attributable to non-controlling interest recorded as interest expense |

462,150 |

|

|

6,717,414 |

|

| Provision for doubtful accounts |

2,938,879 |

|

|

2,377,389 |

|

| Loss on impairment of vessels |

— |

|

|

3,007,809 |

|

| Loss on sales of vessels |

1,738,511 |

|

|

— |

|

| Drydocking costs |

(4,154,283) |

|

|

(6,019,126) |

|

| Share-based compensation |

2,087,807 |

|

|

1,767,726 |

|

| Change in operating assets and liabilities: |

|

|

|

| Accounts receivable |

(14,075,231) |

|

|

15,126,727 |

|

| Bunker inventory |

12,548,170 |

|

|

(1,956,676) |

|

| Advance hire, prepaid expenses and other current assets |

(342,776) |

|

|

19,086,893 |

|

| Accounts payable, accrued expenses and other current liabilities |

(4,079,047) |

|

|

(8,939,313) |

|

| Deferred revenue |

(5,254,072) |

|

|

(11,321,354) |

|

| Net cash provided by operating activities |

53,787,277 |

|

|

134,801,400 |

|

|

|

|

|

| Investing activities |

|

|

|

| Purchase of vessels and vessel improvements |

(27,264,044) |

|

|

(35,740,482) |

|

| Proceeds from sale of vessels |

17,271,489 |

|

|

8,400,000 |

|

|

|

|

|

| Acquisitions, net of cash acquired |

(7,200,000) |

|

|

— |

|

| Purchase of equipment and internal use software |

— |

|

|

(653,452) |

|

| Contributions to non-consolidated subsidiaries |

(427,270) |

|

|

(515,162) |

|

|

|

|

|

| Dividends received from equity method investments |

1,637,500 |

|

|

— |

|

| Net cash used in investing activities |

(15,982,325) |

|

|

(28,509,096) |

|

|

|

|

|

| Financing activities |

|

|

|

|

|

|

|

|

|

|

|

| Proceeds from long-term debt |

— |

|

|

8,500,000 |

|

| Payments of financing and issuance costs |

— |

|

|

(466,544) |

|

| Payments of long-term debt |

(15,782,528) |

|

|

(15,443,115) |

|

| Proceeds from finance leases |

— |

|

|

15,000,000 |

|

| Payments on finance lease obligation |

(20,238,131) |

|

|

(15,834,059) |

|

| Payments on other long-term liability |

— |

|

|

(5,000,000) |

|

| Dividends paid to non-controlling interests |

(10,400,000) |

|

|

(5,000,000) |

|

| Common stock accrued dividends paid |

(18,103,750) |

|

|

(13,414,984) |

|

| Cash paid for incentive compensation shares relinquished |

(127,283) |

|

|

(407,898) |

|

|

|

|

|

|

|

|

|

| Payments to non-controlling interest recorded as long-term liability |

(2,500,000) |

|

|

(2,050,000) |

|

| Net cash used in financing activities |

(67,151,692) |

|

|

(34,116,600) |

|

|

|

|

|

| Net (decrease) increase in cash and cash equivalents |

(29,346,740) |

|

|

72,175,704 |

|

| Cash and cash equivalents at beginning of period |

128,384,606 |

|

|

56,208,902 |

|

| Cash and cash equivalents at end of period |

$ |

99,037,866 |

|

|

$ |

128,384,606 |

|

|

|

|

|

| Supplemental cash flow items: |

|

|

|

| Cash paid for interest |

$ |

18,850,078 |

|

|

$ |

14,906,972 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Pangaea Logistics Solutions Ltd.

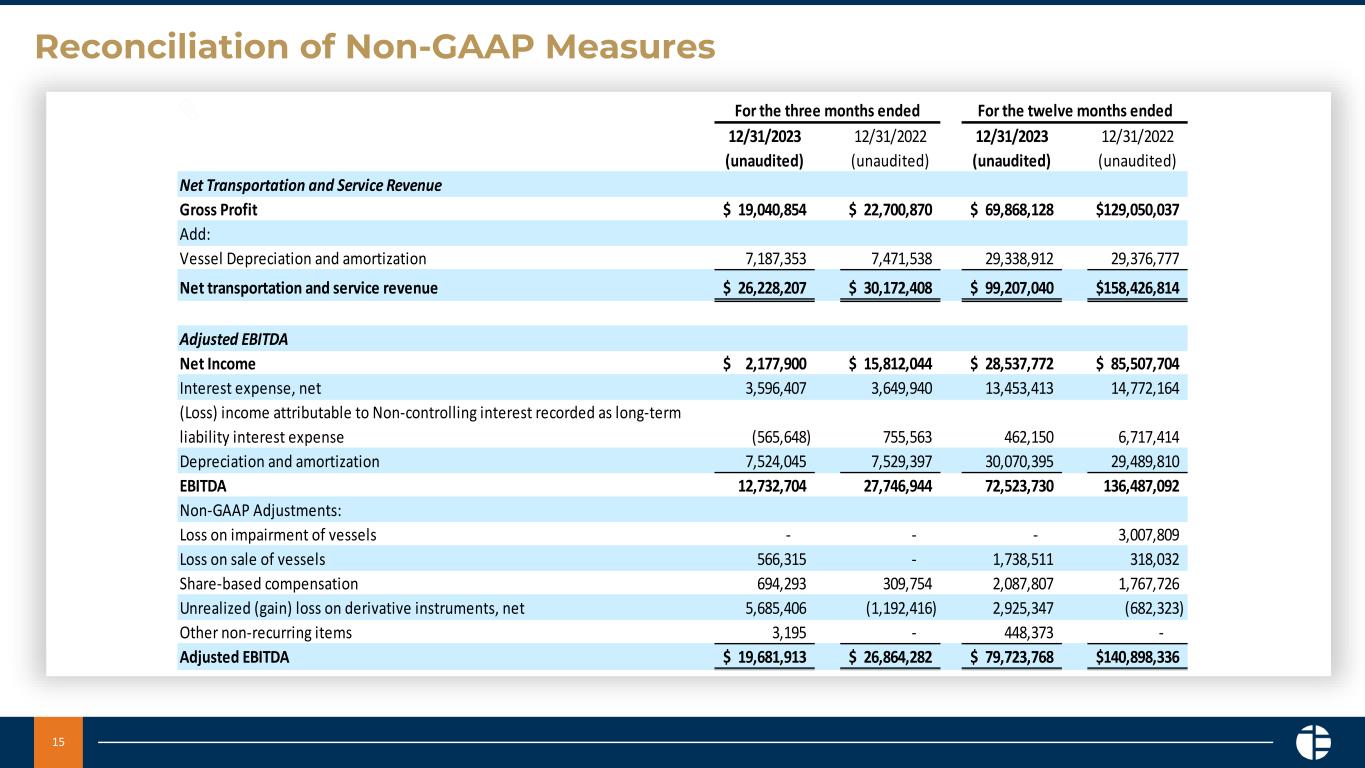

Reconciliation of Non-GAAP Measures

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended |

|

For the twelve months ended |

|

December 31, 2023 |

|

December 31, 2022 |

|

December 31, 2023 |

|

December 31, 2022 |

| Net Transportation and Service Revenue |

|

|

|

|

|

|

|

| Gross Profit |

$ |

19,040,854 |

|

|

$ |

22,700,870 |

|

|

$ |

69,868,128 |

|

|

$ |

129,050,037 |

|

| Add: |

|

|

|

|

|

|

|

| Vessel Depreciation and amortization |

7,187,353 |

|

|

7,471,538 |

|

|

29,338,912 |

|

|

29,376,777 |

|

| Net transportation and service revenue |

$ |

26,228,207 |

|

|

$ |

30,172,408 |

|

|

$ |

99,207,040 |

|

|

$ |

158,426,814 |

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

|

|

|

|

|

|

| Net Income |

$ |

2,177,900 |

|

|

$ |

15,812,044 |

|

|

$ |

28,537,772 |

|

|

$ |

85,507,704 |

|

| Interest expense, net |

3,596,407 |

|

|

3,649,940 |

|

|

13,453,413 |

|

|

14,772,164 |

|

| (Loss) income attributable to Non-controlling interest recorded as long-term liability interest expense |

(565,648) |

|

|

755,563 |

|

|

462,150 |

|

|

6,717,414 |

|

| Depreciation and amortization |

7,524,045 |

|

|

7,529,397 |

|

|

30,070,395 |

|

|

29,489,810 |

|

| EBITDA |

12,732,704 |

|

|

27,746,944 |

|

|

72,523,730 |

|

|

136,487,092 |

|

| Non-GAAP Adjustments: |

|

|

|

|

|

|

|

| Loss on impairment of vessels |

— |

|

|

— |

|

|

— |

|

|

3,007,809 |

|

| Loss on sale of vessels |

566,315 |

|

|

— |

|

|

1,738,511 |

|

|

318,032 |

|

| Share-based compensation |

694,293 |

|

|

309,754 |

|

|

2,087,807 |

|

|

1,767,726 |

|

| Unrealized loss (gain) on derivative instruments, net |

5,685,406 |

|

|

(1,192,416) |

|

|

2,925,347 |

|

|

(682,323) |

|

| Other non-recurring items |

$ |

3,195 |

|

|

$ |

— |

|

|

$ |

448,373 |

|

|

$ |

— |

|

| Adjusted EBITDA |

$ |

19,681,913 |

|

|

$ |

26,864,282 |

|

|

$ |

79,723,768 |

|

|

$ |

140,898,336 |

|

|

|

|

|

|

|

|

|

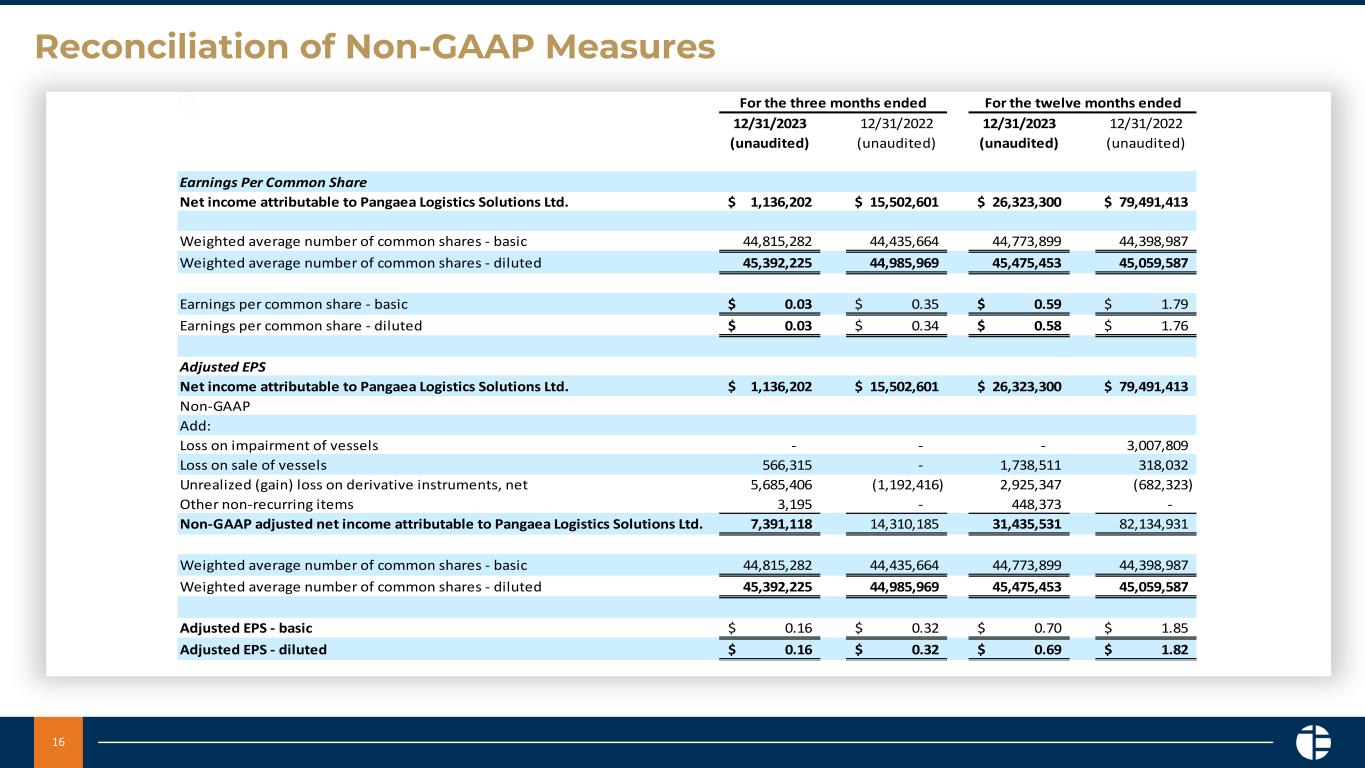

| Earnings Per Common Share |

|

|

|

|

|

|

|

| Net income attributable to Pangaea Logistics Solutions Ltd. |

$ |

1,136,202 |

|

|

$ |

15,502,601 |

|

|

$ |

26,323,300 |

|

|

$ |

79,491,413 |

|

|

|

|

|

|

|

|

|

| Weighted average number of common shares - basic |

44,815,282 |

|

|

44,435,664 |

|

|

44,773,899 |

|

|

44,398,987 |

|

| Weighted average number of common shares - diluted |

45,392,225 |

|

|

44,985,969 |

|

|

45,475,453 |

|

|

45,059,587 |

|

|

|

|

|

|

|

|

|

| Earnings per common share - basic |

$ |

0.03 |

|

|

$ |

0.35 |

|

|

$ |

0.59 |

|

|

$ |

1.79 |

|

| Earnings per common share - diluted |

$ |

0.03 |

|

|

$ |

0.34 |

|

|

$ |

0.58 |

|

|

$ |

1.76 |

|

|

|

|

|

|

|

|

|

| Adjusted EPS |

|

|

|

|

|

|

|

| Net income attributable to Pangaea Logistics Solutions Ltd. |

$ |

1,136,202 |

|

|

$ |

15,502,601 |

|

|

$ |

26,323,300 |

|

|

$ |

79,491,413 |

|

| Non-GAAP |

|

|

|

|

|

|

|

| Add: |

|

|

|

|

|

|

|

| Loss on impairment of vessels |

— |

|

|

— |

|

|

— |

|

|

3,007,809 |

|

| Loss on sale of vessels |

566,315 |

|

|

— |

|

|

1,738,511 |

|

|

318,032 |

|

| Unrealized loss (gain) on derivative instruments, net |

5,685,406 |

|

|

(1,192,416) |

|

|

2,925,347 |

|

|

(682,323) |

|

| Other non-recurring items |

3,195 |

|

|

— |

|

|

448,373 |

|

|

— |

|

| Non-GAAP adjusted net income attributable to Pangaea Logistics Solutions Ltd. |

$ |

7,391,118 |

|

|

$ |

14,310,185 |

|

|

$ |

31,435,531 |

|

|

$ |

82,134,931 |

|

|

|

|

|

|

|

|

|

| Weighted average number of common shares - basic |

44,815,282 |

|

|

44,435,664 |

|

|

44,773,899 |

|

|

44,398,987 |

|

| Weighted average number of common shares - diluted |

45,392,225 |

|

|

44,985,969 |

|

|

45,475,453 |

|

|

45,059,587 |

|

|

|

|

|

|

|

|

|

| Adjusted EPS - basic |

$ |

0.16 |

|

|

$ |

0.32 |

|

|

$ |

0.70 |

|

|

$ |

1.85 |

|

| Adjusted EPS - diluted |

$ |

0.16 |

|

|

$ |

0.32 |

|

|

$ |

0.69 |

|

|

$ |

1.82 |

|

INFORMATION ABOUT NON-GAAP FINANCIAL MEASURES. As used herein, “GAAP” refers to accounting principles generally accepted in the United States of America. To supplement our consolidated financial statements prepared and presented in accordance with GAAP, this earnings release discusses non-GAAP financial measures, including non-GAAP net revenue, non-GAAP adjusted EBITDA and non-GAAP Adjusted EPS. These are considered non-GAAP financial measures as defined in Rule 101 of Regulation G promulgated by the Securities and Exchange Commission. Generally, a non-GAAP financial measure is a numerical measure of a company’s historical or future performance, financial position, or cash flows that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with GAAP. The presentation of this non-GAAP financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP.

We use non-GAAP financial measures for internal financial and operational decision making purposes and as a means to evaluate period-to-period comparisons of the performance and results of operations of our core business. Our management believes that non-GAAP financial measures provide meaningful supplemental information regarding the performance of our core business by excluding charges that are not incurred in the normal course of business. Non-GAAP financial measures also facilitate management's internal planning and comparisons to our historical performance and liquidity. We believe certain non-GAAP financial measures are useful to investors as they allow for greater transparency with respect to key metrics used by management in its financial and operational decision making and are used by our institutional investors and the analyst community to help them analyze the performance and operational results of our core business.

Gross Profit. Gross profit represents total revenue less net transportation and service revenue and less vessel depreciation and amortization.

Net transportation and service revenue. Net transportation and service revenue represents total revenue less the total direct costs of transportation and services, which includes charter hire, voyage and vessel operating expenses. Net transportation and service revenue is included because it is used by management and certain investors to measure performance by comparison to other logistic service providers. Net transportation and service revenue is not an item recognized by the generally accepted accounting principles in the United States of America, or U.S. GAAP, and should not be considered as an alternative to net income, operating income, or any other indicator of a company's operating performance required by U.S. GAAP. Pangaea’s definition of net transportation and service revenue used here may not be comparable to an operating measure used by other companies.

Adjusted EBITDA and adjusted EPS. Adjusted EBITDA represents net income (or loss), determined in accordance with U.S. GAAP, excluding interest expense, income taxes, depreciation and amortization, loss on sale and leaseback of vessels, share-based compensation and other non-operating income and/or expense, if any. Earnings per share represents net income divided by the weighted average number of common shares outstanding. Adjusted earnings per share represents net income attributable to Pangaea Logistics Solutions Ltd. plus, when applicable, loss on sale of vessel, loss on sale and leaseback of vessel, loss on impairment of vessel, unrealized gains and losses on derivative instruments, and certain non-recurring charges, divided by the weighted average number of shares of common stock.

There are limitations related to the use of net revenue versus income from operations, adjusted EBITDA versus income from operations, and adjusted EPS versus EPS calculated in accordance with GAAP. In particular, Pangaea’s definition of adjusted EBITDA used here are not comparable to EBITDA.

The table set forth above provides a reconciliation of the non-GAAP financial measures presented to the most directly comparable financial measures prepared in accordance with GAAP.

About Pangaea Logistics Solutions Ltd.

Pangaea Logistics Solutions Ltd. (NASDAQ: PANL) and its subsidiaries (collectively, “Pangaea” or the “Company”) provides seaborne drybulk logistics and transportation services as well as terminal and stevedoring services. Pangaea utilizes its logistics expertise to service a broad base of industrial customers who require the transportation of a wide variety of drybulk cargoes, including grains, coal, iron ore, pig iron, hot briquetted iron, bauxite, alumina, cement clinker, dolomite and limestone. The Company addresses the logistics needs of its customers by undertaking a comprehensive set of services and activities, including cargo loading, cargo discharge, port and terminal operations, vessel chartering, voyage planning, and vessel technical management. Learn more at www.pangaeals.com.

Investor Relations Contacts

|

|

|

|

|

|

|

|

|

| Gianni Del Signore |

|

Noel Ryan or Stefan Neely |

| Chief Financial Officer |

|

|

| 401-846-7790 |

|

|

| Investors@pangaeals.com |

|

PANL@val-adv.com |

Forward-Looking Statements

Certain statements in this press release are “forward-looking statements” within the meaning of the Private Securities Litigation Act of 1995. These forward-looking statements are based on our current expectations and beliefs and are subject to a number of risk factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. The Company disclaims any obligation to publicly update or revise these statements whether as a result of new information, future events or otherwise, except as required by law. Such risks and uncertainties include, without limitation, the strength of world economies and currencies, general market conditions, including fluctuations in charter rates and vessel values, changes in demand for dry bulk shipping capacity, changes in our operating expenses, including bunker prices, dry-docking and insurance costs, the market for our vessels, availability of financing and refinancing, charter counterparty performance, ability to obtain financing and comply with covenants in such financing arrangements, changes in governmental rules and regulations or actions taken by regulatory authorities, potential liability from pending or future litigation, general domestic and international political conditions, potential disruption of shipping routes due to accidents or political events, vessels breakdowns and instances of off-hires and other factors, as well as other risks that have been included in filings with the Securities and Exchange Commission, all of which are available at www.sec.gov.