Document

CB Financial Services, Inc.

Announces Third Quarter 2025 Financial Results and

Declares Quarterly Cash Dividend

WASHINGTON, PA., October 23, 2025 -- CB Financial Services, Inc. (“CB” or the “Company”) (NASDAQGM: CBFV), the holding company of Community Bank (the “Bank”), today announced its third quarter and year-to-date 2025 financial results.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

9/30/25 |

6/30/25 |

3/31/25 |

12/31/24 |

9/30/24 |

|

9/30/25 |

9/30/24 |

| (Dollars in thousands, except per share data) (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (Loss) Income (GAAP) |

$ |

(5,696) |

|

$ |

3,949 |

|

$ |

1,909 |

|

$ |

2,529 |

|

$ |

3,219 |

|

|

$ |

164 |

|

$ |

10,065 |

|

Net Income Adjustments |

9,623 |

|

— |

|

808 |

|

(562) |

|

(293) |

|

|

10,431 |

|

(1,269) |

|

Adjusted Net Income (Non-GAAP) (1) |

$ |

3,927 |

|

$ |

3,949 |

|

$ |

2,717 |

|

$ |

1,967 |

|

$ |

2,926 |

|

|

$ |

10,595 |

|

$ |

8,796 |

|

|

|

|

|

|

|

|

|

|

| (Loss) Earnings per Common Share - Diluted (GAAP) |

$ |

(1.07) |

|

$ |

0.74 |

|

$ |

0.35 |

|

$ |

0.46 |

|

$ |

0.60 |

|

|

$ |

0.03 |

|

$ |

1.89 |

|

Adjusted Earnings per Common Share - Diluted (Non-GAAP) (1) |

$ |

0.74 |

|

$ |

0.74 |

|

$ |

0.50 |

|

$ |

0.35 |

|

$ |

0.55 |

|

|

$ |

1.98 |

|

$ |

1.65 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) Income Before Income Tax Expense (GAAP) |

$ |

(7,020) |

|

$ |

4,715 |

|

$ |

2,336 |

|

$ |

3,051 |

|

$ |

3,966 |

|

|

$ |

33 |

|

$ |

12,292 |

|

| Net Provision (Recovery) for Credit Losses |

259 |

|

8 |

|

(40) |

|

683 |

|

(41) |

|

|

227 |

|

(114) |

|

Pre-Provision Net Revenue (“PPNR”) |

$ |

(6,761) |

|

$ |

4,723 |

|

$ |

2,296 |

|

$ |

3,734 |

|

$ |

3,925 |

|

|

$ |

260 |

|

$ |

12,178 |

|

| Net Income Adjustments |

11,752 |

|

— |

|

1,023 |

|

(711) |

|

(383) |

|

|

11,772 |

|

(1,376) |

|

Adjusted PPNR (Non-GAAP) (1) |

$ |

4,991 |

|

$ |

4,723 |

|

$ |

3,319 |

|

$ |

3,023 |

|

$ |

3,542 |

|

|

$ |

12,032 |

|

$ |

10,802 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Refer to Explanation of Use of Non-GAAP Financial Measures and reconciliation of adjusted net income and adjusted earnings per common share - diluted as presented later in this Press Release.

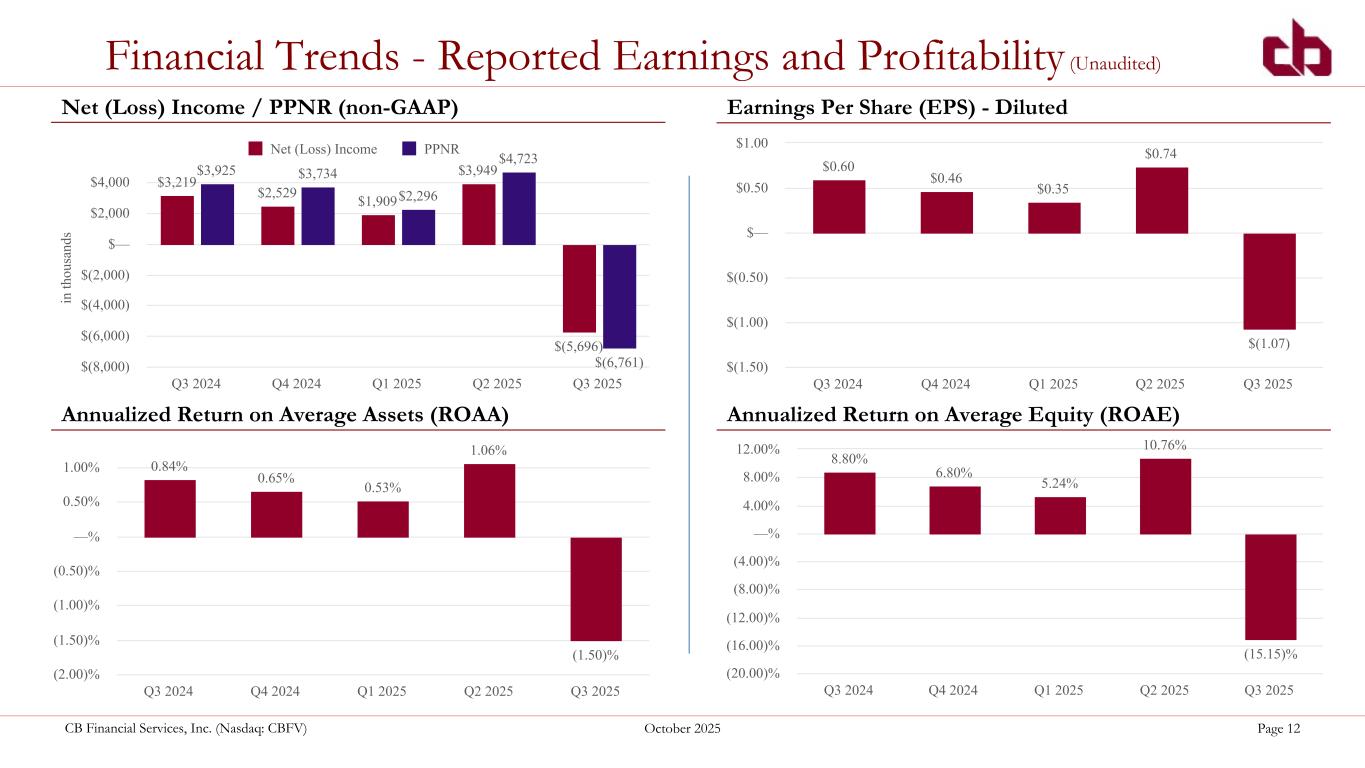

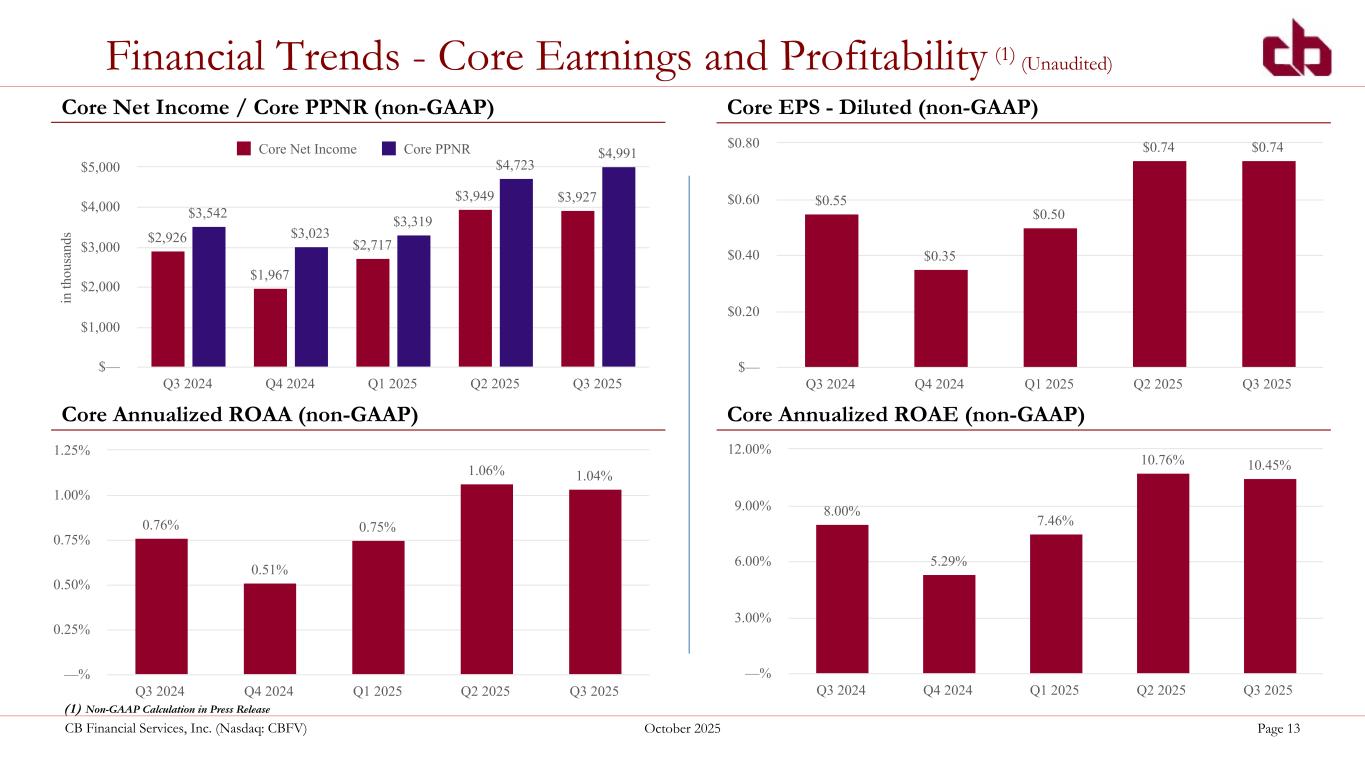

2025 Third Quarter Financial Highlights

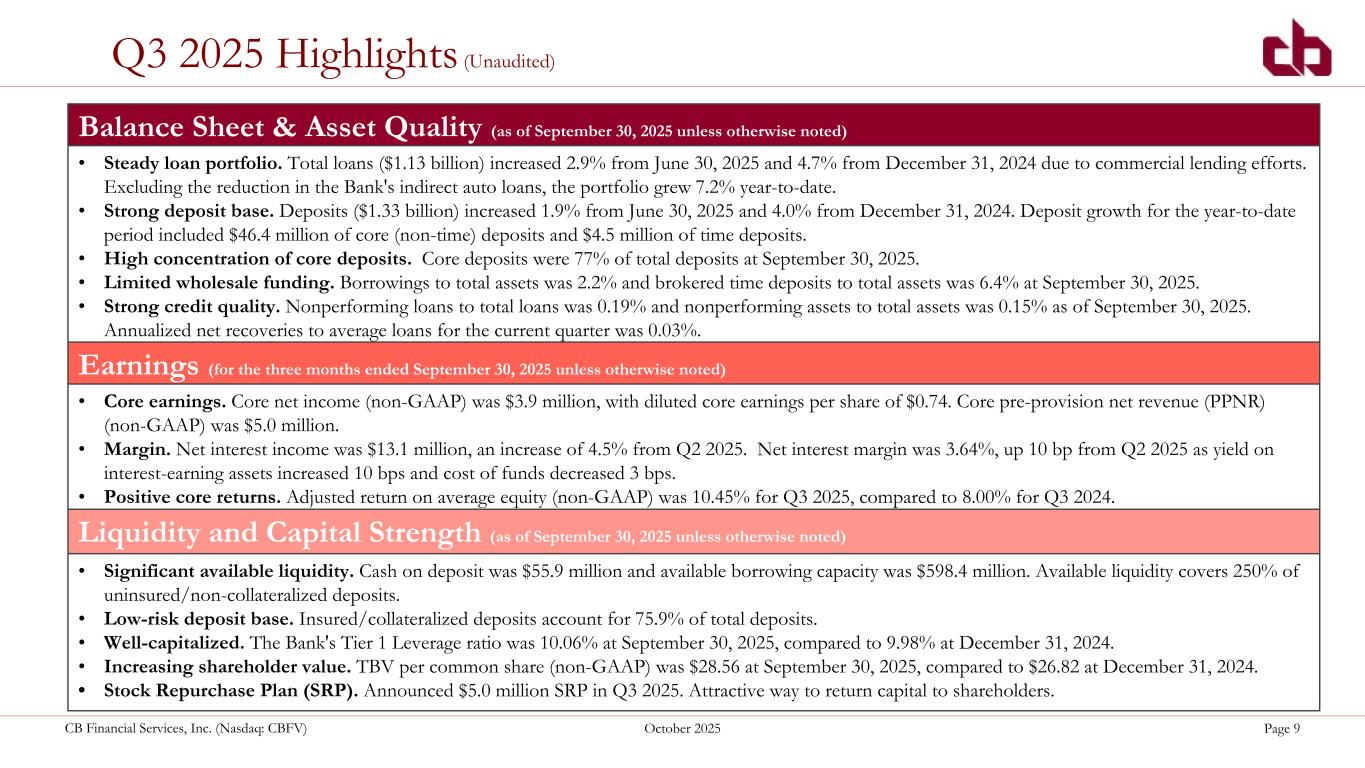

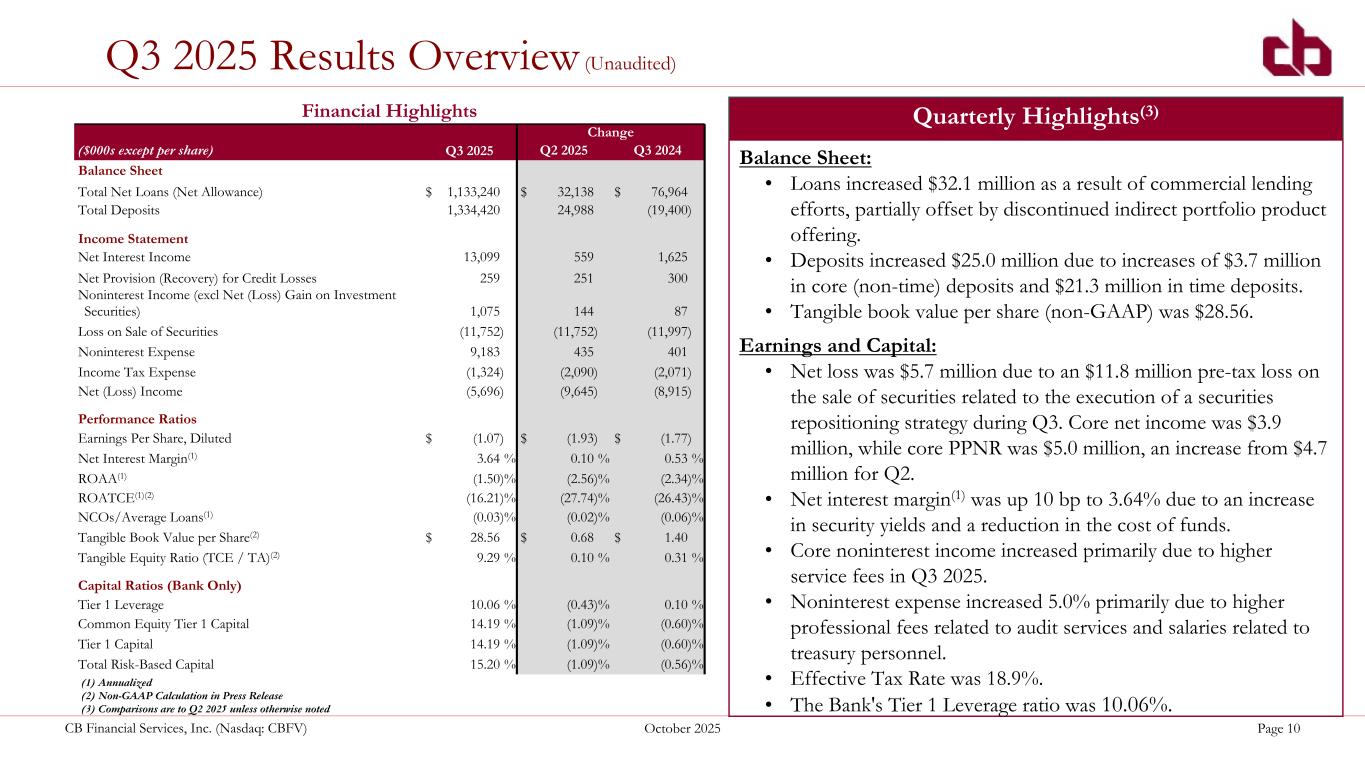

•During the quarter ended September 30, 2025, the Bank implemented a balance sheet repositioning strategy of its portfolio of available-for-sale investment securities in which $129.6 million in book value of lower-yielding investment securities with an average yield of 2.87% were sold for an after-tax realized loss of $9.3 million. Investment securities sold included $121.1 million of mortgage-backed securities/collateralized mortgage obligations issued by the U.S. government-sponsored agencies, $5.0 million of U.S. government agency securities and $3.5 million of municipal securities. The Bank then purchased $117.8 million of higher-yielding mortgage-backed securities/collateralized mortgage obligations issued by U.S government-sponsored agencies, municipal securities, subordinated debt investments and non-agency guaranteed securitizations with an expected tax-equivalent yield of approximately 5.43%. This strategy is expected to add nearly 19 basis points to net interest margin (“NIM”) and approximately $0.40 to annual earnings per share.

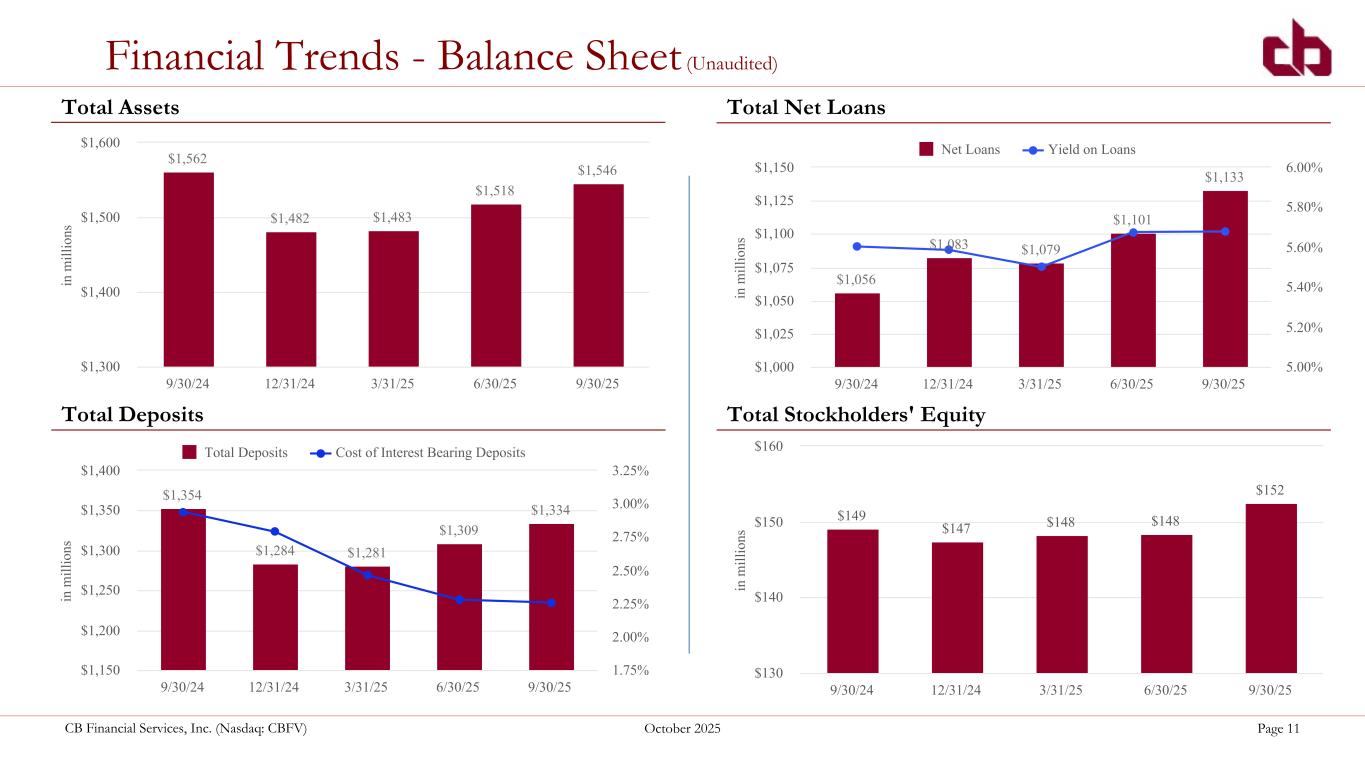

•Total assets were $1.55 billion at September 30, 2025, an increase of $27.5 million from June 30, 2025. Growth has been largely driven through strong commercial real estate and commercial and industrial loan production funded through a rise in core deposit accounts. The Bank also continues to focus efforts on repositioning the balance sheet to maximize earnings while maintaining its historic risk profile. These strategic movements include:

◦Effectively managing cash and liquidity.

◦Executing the aforementioned securites repositioning strategy.

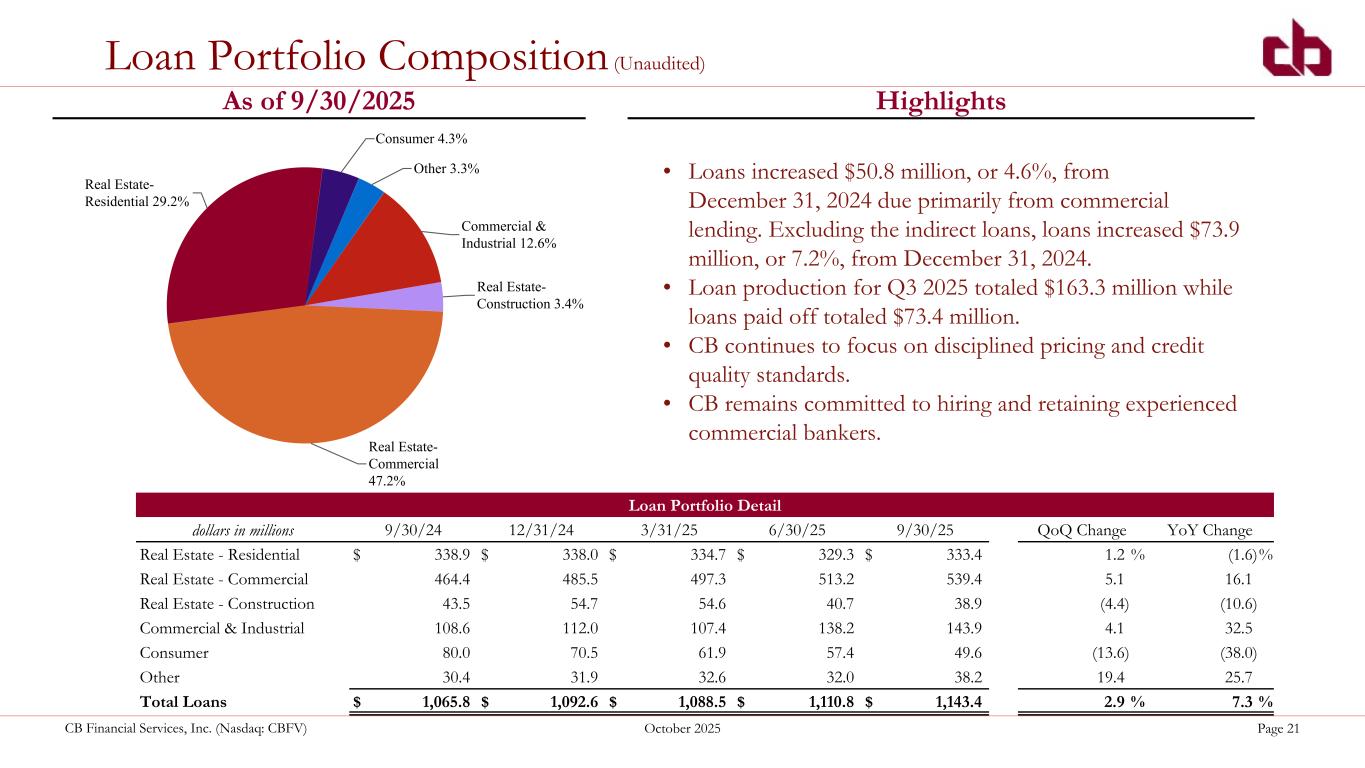

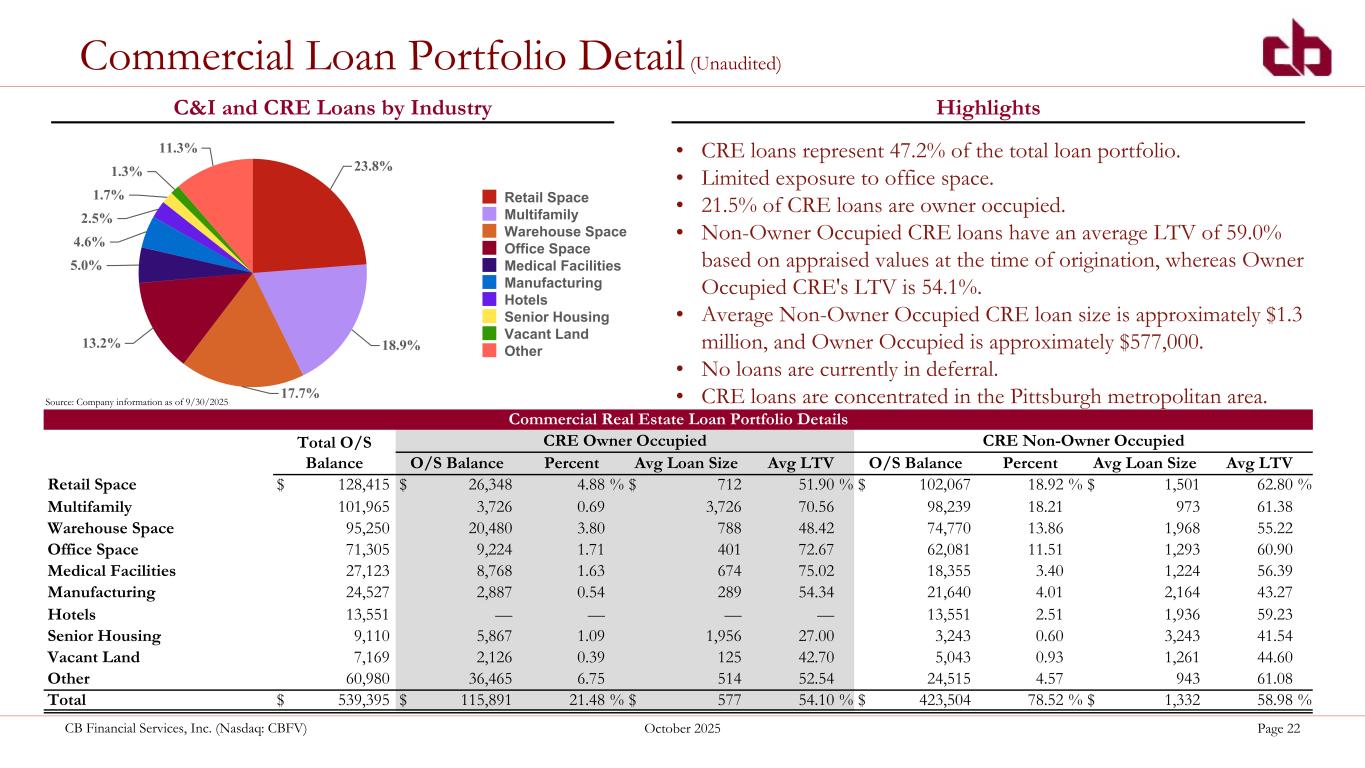

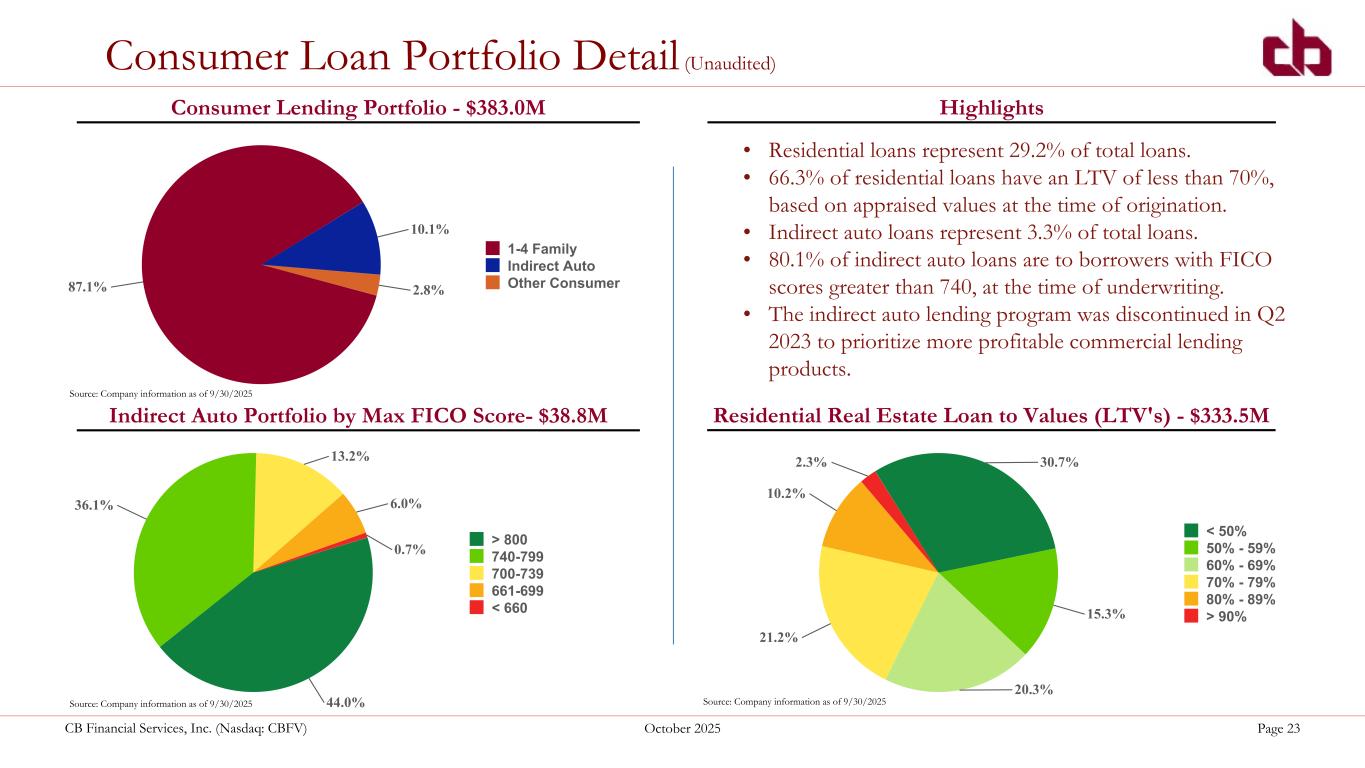

◦Redeploying repayments of indirect automobile and residential mortgage loans into higher-yielding commercial loan products. Commercial loans totaled 59.8% of the Bank’s loan portfolio at September 30, 2025 compared to 53.8% at September 30, 2024.

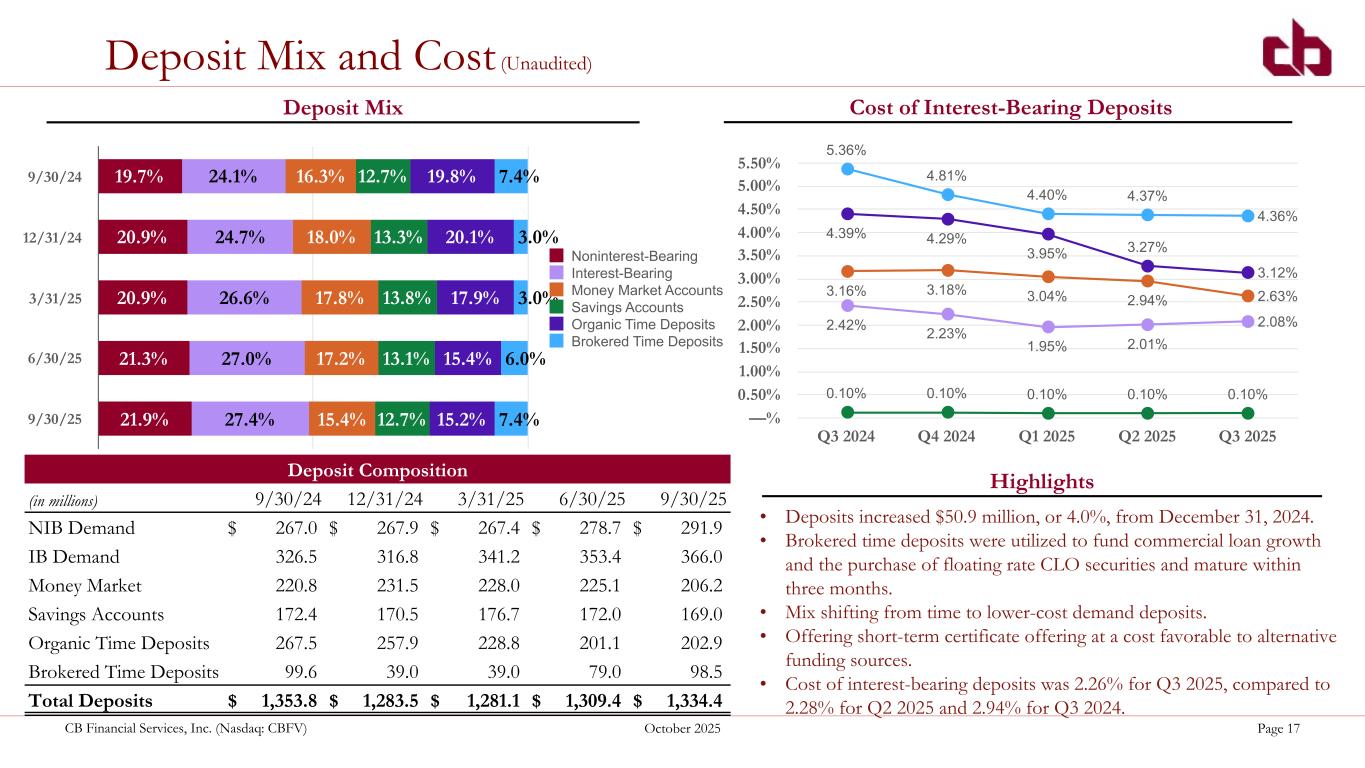

◦Effecting changes in the Bank’s deposit mix by focusing on growth in lower cost core deposit relationships and reducing reliance on higher priced funding.

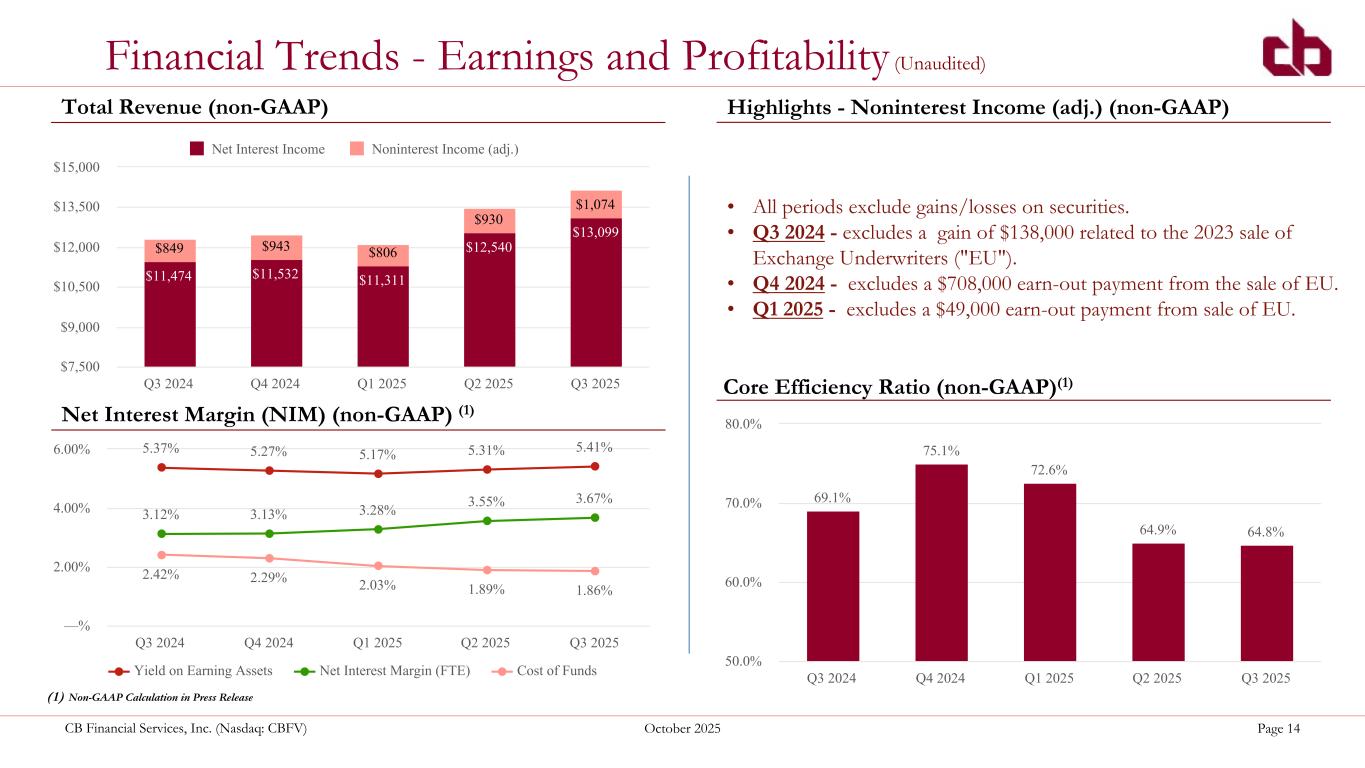

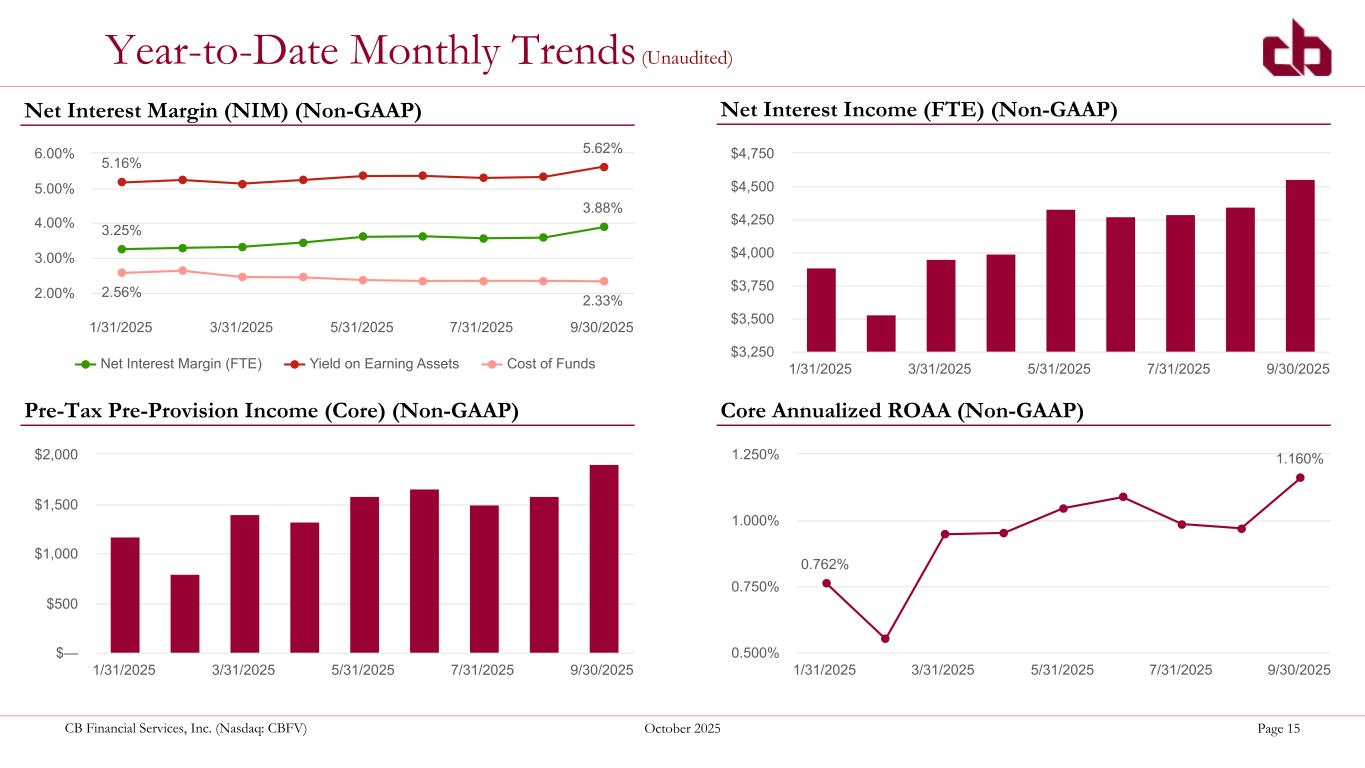

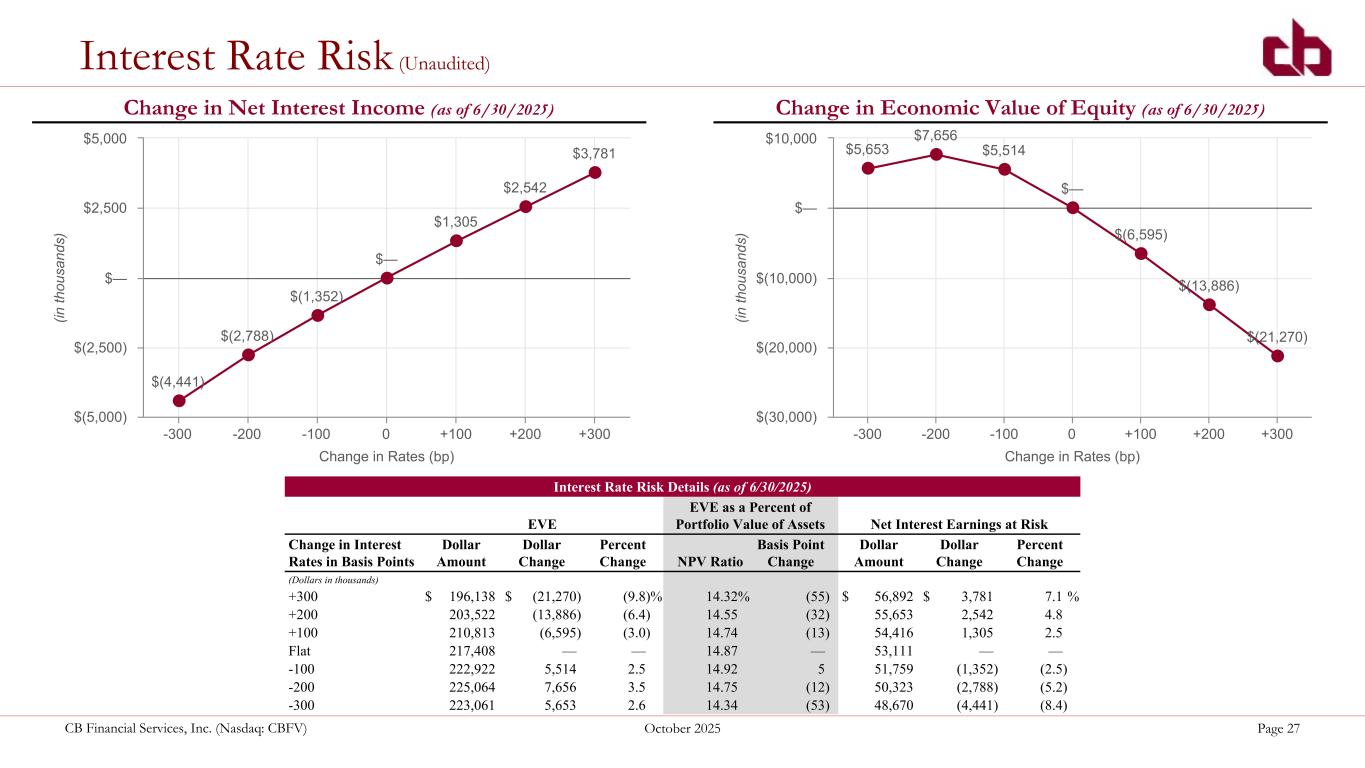

•NIM improved to 3.64% for the three months ended September 30, 2025 compared to 3.54% for the three months ended June 30, 2025. Main factors impacting the improved NIM included:

◦An increase in the yield on earning assets to 5.41% from 5.31% as the positive impact of the balance sheet repositioning strategies offset the effect of recent federal funds rate cuts on asset repricing.

◦A reduction in the cost of funds to 1.86% from 1.89% resulting from the favorable change in the Bank’s deposit mix coupled with disciplined deposit pricing and the recent reduction in the federal funds rate.

•Noninterest expenses increased $435,000 to $9.2 million for the three months ended September 30, 2025 compared to $8.7 million for the three months ended June 30, 2025. This increase was driven by increases in professional fees due to the timing of internal and external audit services, Pennsylvania shares tax expense due to refunds received during the three months ended June 30, 2025 and salaries and employee benefits resulting primarily from additions to the Bank’s Treasury personnel.

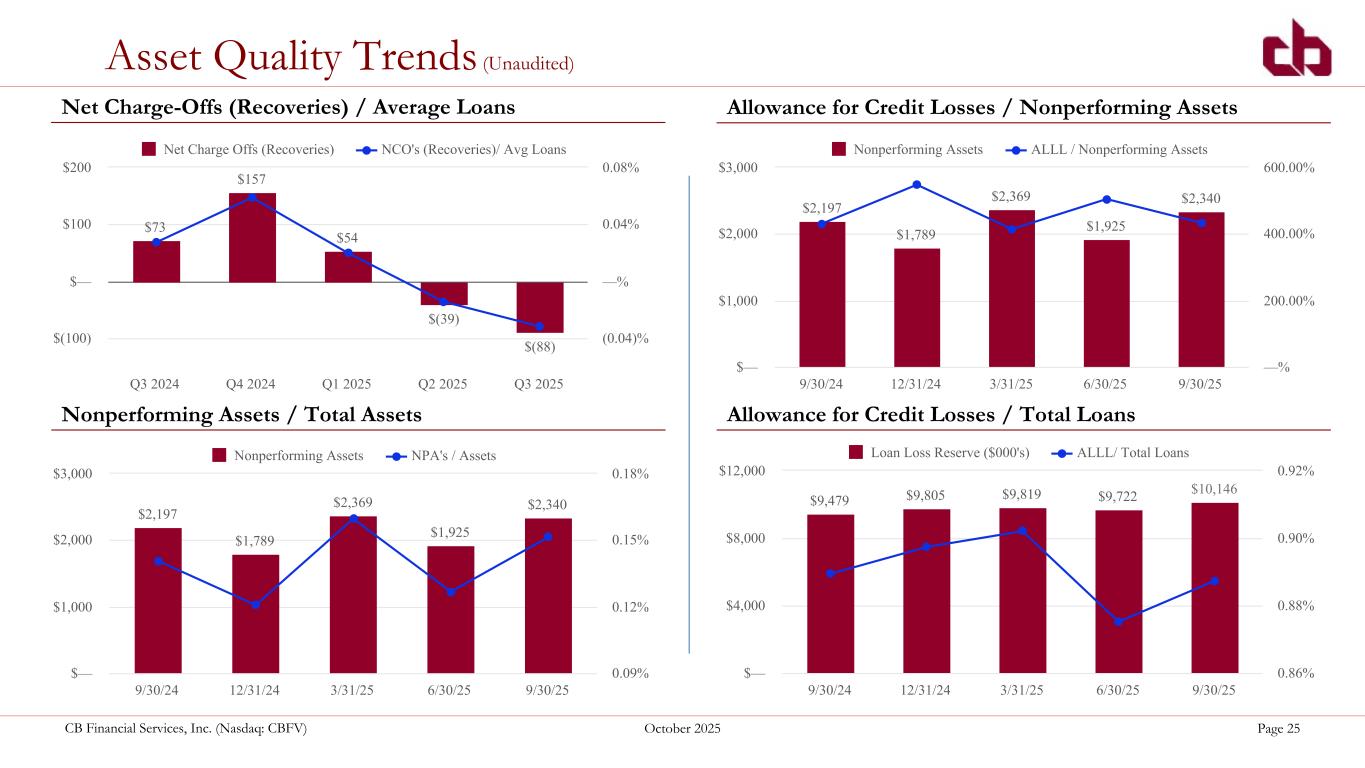

•Asset quality remains strong as nonperforming loans to total loans was 0.19% at September 30, 2025.

•Book value per share and tangible book value per share (Non-GAAP) was $30.50 and $28.56, respectively at September 30, 2025. The improvements since year-end resulted from increased equity due to the decrease in accumulated other comprehensive losses resulting from the securities repositioning strategy and current period net income, partially offset by treasury shares repurchased under the Company’s stock repurchase program and the payment of dividends.

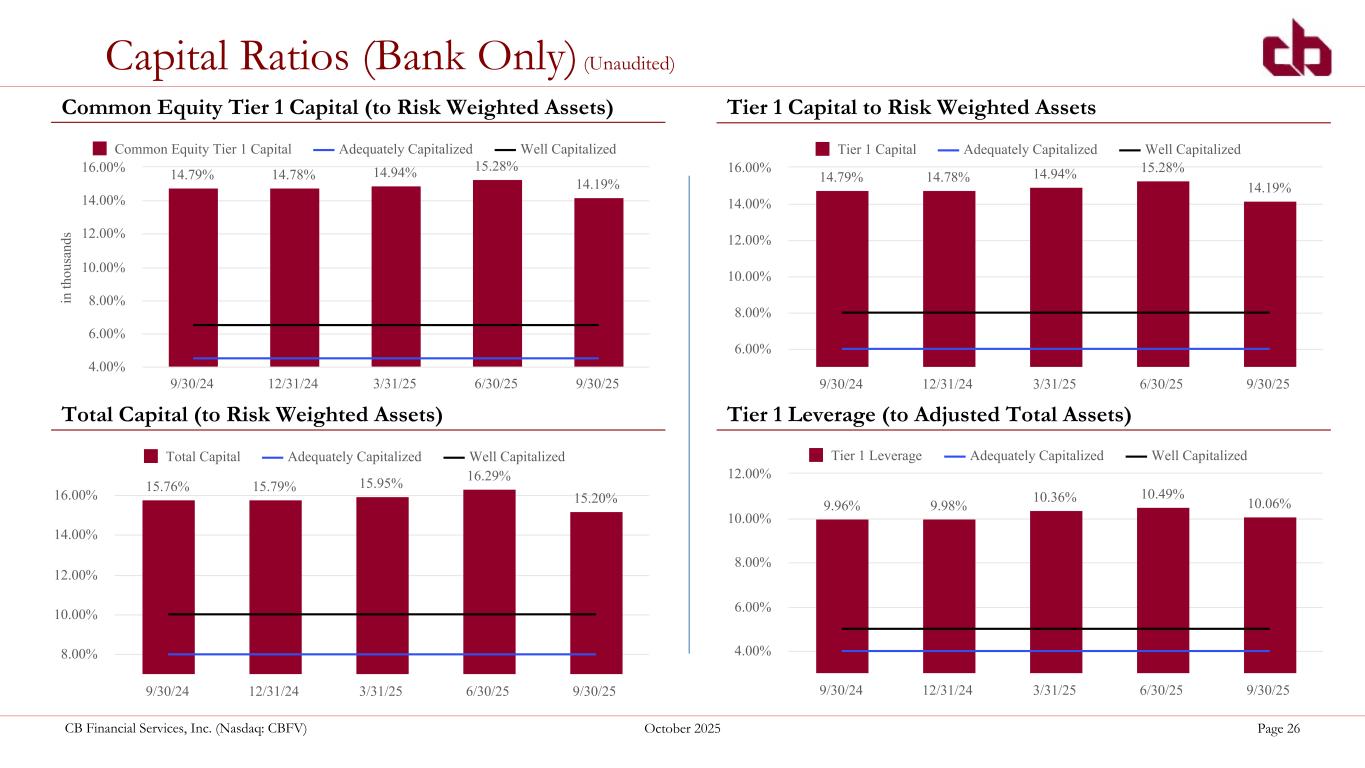

•The Bank remains well-capitalized and is positioned for future growth.

Management Commentary

President and CEO John H. Montgomery commented, “ We are pleased with our third quarter results as continued balance sheet repositioning, including the realignment of our securities portfolio, drove strong core earnings. During the third quarter, we replaced low yielding indirect auto and residential mortgage loans with higher yielding, relationship driven, commercial loans. In addition, we saw a favorable shift in our deposit mix resulting from a targeted effort to build core banking relationships while strategically reducing higher priced deposits.

During the quarter, we made the strategic decision to realign our securities portfolio. This repositioning is expected to deliver meaningful long-term benefits to both our earnings profile and overall balance sheet performance. Specifically, we anticipate an approximate 19 basis point increase to our net interest margin and an estimated $0.40 increase in annual earnings per share. We view this initiative as a disciplined and forward-looking deployment of capital that reflects our commitment to enhancing long-term shareholder value while supporting sustainable earnings growth.

The balance sheet and securities portfolio repositioning resulted in the yield on earning assets to increase which helped offset the effects of declining interest rates on asset yields. Collectively, these outcomes highlight the strength of our active balance sheet management and support our ability to maintain solid margin performance going forward.

With economic headwinds still present, we continue to take a disciplined approach by maintaining a conservative balance sheet and closely managing risk across our loan portfolio. Since year-end, total loans have increased by $50.8 million, or 4.6%, primarily driven by strong activity in commercial real estate and commercial and industrial loans, while declines in indirect auto, construction and residential real estate lending partially offset that growth. We were encouraged by the momentum in loan demand this quarter. Credit quality remains solid, with nonperforming loans representing just 0.19% of total loans and allowance for credit losses covering 433.6% of nonperforming assets at quarter-end. These results reflect our continued focus on sound credit management and disciplined lending practices.

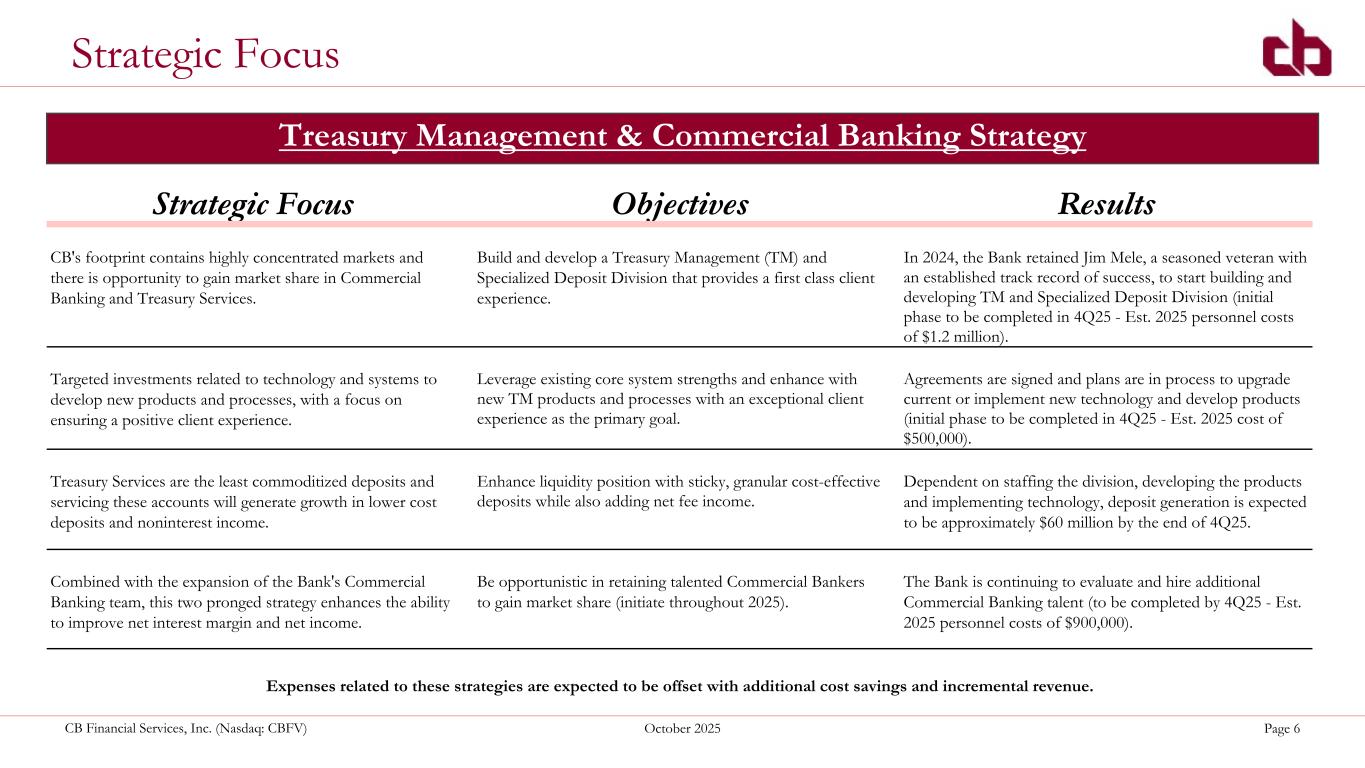

During the third quarter we continued forward with meaningful progress on the implementation of our Specialty Treasury Payments & Services program, a key pillar of our long-term strategy to drive sustainable revenue growth and expand our core deposit base. We have nearly completed building out the necessary treasury products, talent, and technology infrastructure for the program, with full deployment expected by the end of the year. While we anticipate a modest near-term impact on operating expenses, we view this as a high-value investment that will enhance the strength, efficiency, and long-term scalability of our franchise and is expected to generate meaningful revenue growth over time.

We remain focused on deepening core banking relationships. Looking ahead, as our treasury deposit initiatives begin to scale, we see meaningful potential to reduce or fully replace brokered funding, further aligning our deposit mix with the long-term goals of our funding strategy.”

Dividend Declaration

The Company’s Board of Directors declared a $0.26 quarterly cash dividend per outstanding share of common stock, payable on or about November 28, 2025, to stockholders of record as of the close of business on November 14, 2025.

2025 Third Quarter Financial Review

Net Interest and Dividend Income

Net interest and dividend income increased $1.6 million, or 14.2%, to $13.1 million for the three months ended September 30, 2025 compared to $11.5 million for the three months ended September 30, 2024.

•Net Interest Margin (NIM) (GAAP) increased to 3.64% for the three months ended September 30, 2025 compared to 3.11% for the three months ended September 30, 2024. Fully tax equivalent (FTE) NIM (Non-GAAP) increased 55 basis points (“bps”) to 3.67% for the three months ended September 30, 2025 compared to 3.12% for the three months ended September 30, 2024.

•Interest and dividend income decreased $432,000, or 2.2%, to $19.3 million for the three months ended September 30, 2025 compared to $19.8 million for the three months ended September 30, 2024.

◦Interest income on loans increased $1.0 million, or 6.9%, to $16.0 million for the three months ended September 30, 2025 compared to $14.9 million for the three months ended September 30, 2024. The average balance of loans increased $56.1 million to $1.12 billion from $1.06 billion, causing an $830,000 increase in interest income on loans. Additionally, the average yield on loans increased 8 bps to 5.68% from 5.60% despite a 125bp reduction in the federal funds rate since September 2024. While this led to the downward repricing of variable and adjustable rate loans, the impact was negated by a reduction in lower yielding consumer loans due to the discontinuation of the indirect automobile loan product with the redeployment of those funds into higher yielding commercial loan products. The increase in the average yield caused a $217,000 increase in interest income on loans.

◦Interest income on investment securities decreased $295,000, or 9.0%, to $3.0 million for the three months ended September 30, 2025 compared to $3.3 million for the three months ended September 30, 2024 driven by a $16.6 million decrease in average balances and a 9 bp decrease in average yield. The decrease in volume was due to the timing of sales and subsequent repurchases in the securites repositioning strategy. The decrease in yield resulted from the reductions in the federal funds rate since September 2024.

◦Interest income on interest-earning deposits at other banks decreased $1.2 million to $293,000 for the three months ended September 30, 2025 compared to $1.4 million for the three months ended September 30, 2024 driven by a 126 bp decrease in the average yield and a $81.4 million decrease in average balances. The decrease in the yield was directly related to the Federal Reserve’s reductions in the federal funds rate while the decrease in the volume was due to the funding of loans and decrease in average deposits.

•Interest expense decreased $2.1 million, or 24.8%, to $6.2 million for the three months ended September 30, 2025 compared to $8.3 million for the three months ended September 30, 2024.

◦Interest expense on deposits decreased $2.1 million, or 26.4%, to $5.8 million for the three months ended September 30, 2025 compared to $7.9 million for the three months ended September 30, 2024. The cost of interest-bearing deposits declined 68 bps to 2.26% for the three months ended September 30, 2025 from 2.94% for the three months ended September 30, 2024 due to the change in the deposit mix and the recent Federal Reserve federal funds rate decreases. The decrease in the cost of interest-bearing deposits accounted for a $1.8 million decrease in interest expense. Average interest-bearing deposit balances decreased $47.0 million, or 4.4%, to $1.02 billion as of September 30, 2025 compared to $1.07 billion as of September 30, 2024, primarily as the Bank strategically reduced time deposit only relationships. The decrease in average balances accounted for a $320,000 decrease in interest expense.

Provision for Credit Losses

A provision for credit losses of $259,000 was recorded for the three months ended September 30, 2025. The provision for credit losses on loans was $336,000 and was primarily due to additional reserves required for overall loan growth, changes in qualitative factors and an addition to individually assessed loans requiring specific reserves, partially offset by favorable changes in portfolio concentrations and the calculated loss rate. This was partially offset by a $77,000 recovery for credit losses on unfunded commitments due to a decrease in unfunded commitments. This compared to a net recovery of $41,000 recorded for the three months ended September 30, 2024 as the recovery for credit losses on unfunded commitments was $66,000 due to a decreases in unfunded commitments and the loss rate on construction loans and the provision for credit losses on loans was $25,000 due to changes in qualitative factors partially offset by changes in loan portfolio concentrations and an improvement in loss rates.

Noninterest Income

Noninterest income decreased $11.9 million, or 965.9%, to a loss of $10.7 million for the three months ended September 30, 2025, compared to income of $1.2 million for the three months ended September 30, 2024 as a result of $11.8 million in losses on the sale of securities from the securities repositioning strategy. Excluding security gains and losses from both periods and a gain on the sale of a subsidiary recognized during the three months ended September 30, 2025, noninterest income increased $225,000, or 26.5%, to $1.1 million for the three months ended September 30, 2025, compared to $850,000 for the three months ended September 30, 2024.

This resulted primarily from a $123,000 increase in service fees primarily related to corporate deposit and Individual Covered Health Reimbursement Arrangement accounts and a $112,000 increase in other income related to hedge fees.

Noninterest Expense

Noninterest expense increased $401,000, or 4.6%, to $9.2 million for the three months ended September 30, 2025 compared to $8.8 million for the three months ended September 30, 2024. Salaries and benefits increased $686,000, or 15.0%, to $5.2 million primarily due to merit increases, revenue producing staff additions and higher insurance benefit costs, partially offset by savings realized due to the reduction in force implemented earlier this year. Legal and professional fees increased $114,000 due to timing of internal and external audit services. Equipment expense increased $87,000 due to higher depreciation expense associated with interactive teller machines, security system upgrades and other equipment placed into service in 2024. These increases were partially offset as intangible amortization decreased $264,000 as the Bank’s core deposit intangibles were fully amortized in 2024. Occupancy expense decreased $181,000 due to environmental remediation costs related to a construction project on one of the Bank’s office locations recognized only in 2024 and certain property management cost savings initiatives implemented in 2025. Data processing expense decreased $64,000 due to costs associated with the implementation of a new loan origination system and financial dashboard platform during mid-2024.

Statement of Financial Condition Review

Assets

Total assets increased $64.0 million, or 4.3%, to $1.55 billion at September 30, 2025, compared to $1.48 billion at December 31, 2024.

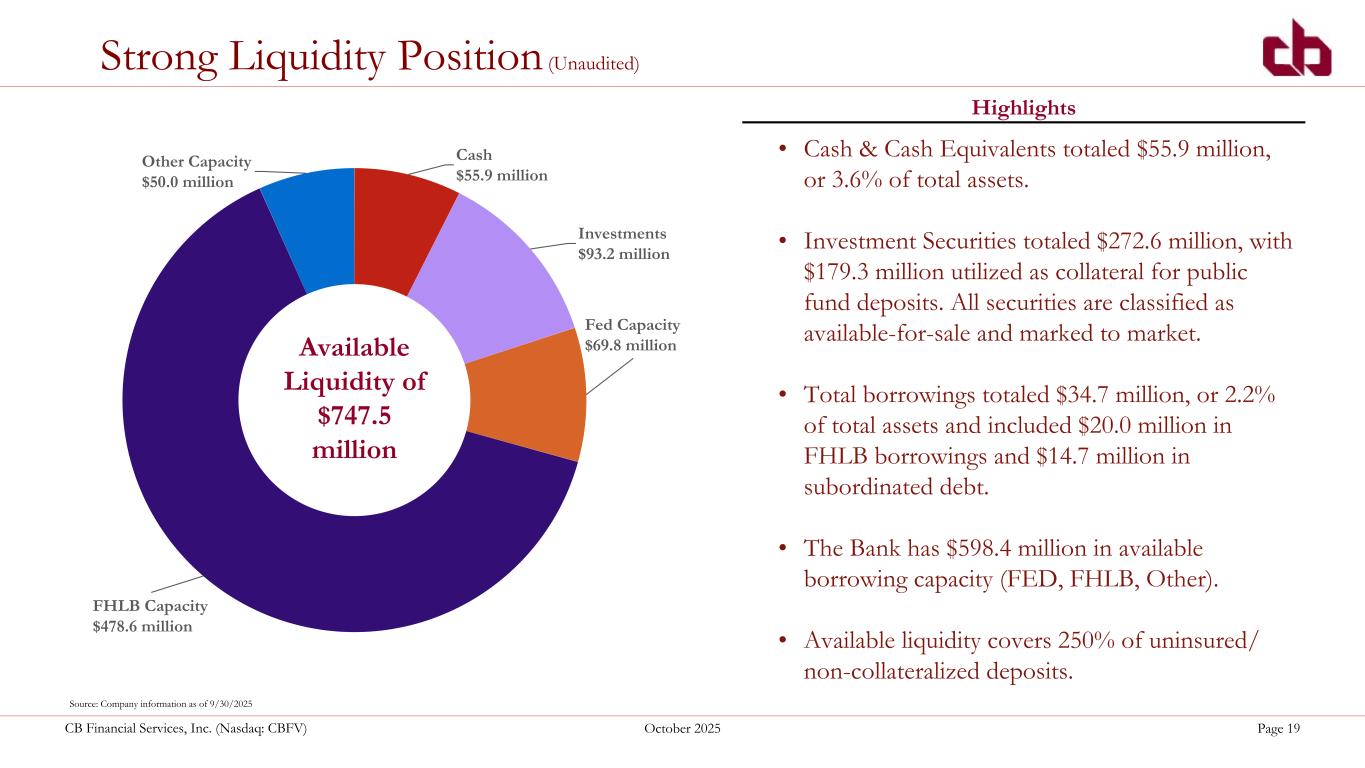

•Cash and due from banks increased $6.3 million, or 12.7%, to $55.9 million at September 30, 2025, compared to $49.6 million at December 31, 2024.

•Securities increased $10.4 million, or 4.0%, to $272.6 million at September 30, 2025, compared to $262.2 million at December 31, 2024.

Loans and Credit Quality

•Total loans increased $50.8 million, or 4.6%, to $1.14 billion compared to $1.09 billion, and included increases in commercial real estate, commercial and industrial and other loans of $53.9 million, $31.9 million and $6.3 million, respectively, partially offset by decreases in consumer, construction and residential real estate loans of $20.9 million, $15.8 million and $4.6 million, respectively. The decrease in consumer loans resulted from a reduction in indirect automobile loan production due to the discontinuation of this product offering as of June 30, 2023. This portfolio is expected to continue to decline as resources are allocated and production efforts are focused on more profitable commercial products. Excluding the $23.1 million decrease in indirect automobile loans, total loans increased $73.9 million, or 7.2%. Loan production totaled $163.3 million while $73.4 million of loans were paid off since December 31, 2024.

•The allowance for credit losses (ACL) was $10.1 million at September 30, 2025 and $9.8 million at December 31, 2024. As a result, the ACL to total loans was 0.89% at September 30, 2025 and 0.90% at December 31, 2024. During the current year, the Company recorded a net provision for credit losses of $227,000. The allowance for credit losses to nonperforming assets was 433.6% at September 30, 2025 and 548.1% at December 31, 2024.

•Net recoveries for the three months ended September 30, 2025 were $88,000, or 0.03% of average loans on an annualized basis. Net charge-offs for the three months ended September 30, 2024 were $73,000, or 0.03% of average loans on an annualized basis. Net recoveries for the nine months ended September 30, 2025 were $72,000. Net charge-offs for the nine months ended September 30, 2024 were $123,000.

•Nonperforming loans, which include nonaccrual loans and accruing loans past due 90 days or more, were $2.2 million at September 30, 2025 and $1.8 million at December 31, 2024. Nonperforming loans to total loans ratio was 0.19% at September 30, 2025 and 0.16% at December 31, 2024.

Liabilities

Total liabilities increased $58.9 million, or 4.4%, to $1.39 billion at September 30, 2025 compared to $1.33 billion at December 31, 2024.

Deposits

•Total deposits increased $50.9 million, or 4.0%, to $1.33 billion as of September 30, 2025 compared to $1.28 billion at December 31, 2024. Interest-bearing demand, non interest-bearing demand and time deposits increased $49.2 million, $24.0 million and $4.5 million, respectively while money market and savings deposits decreased $25.3 million and

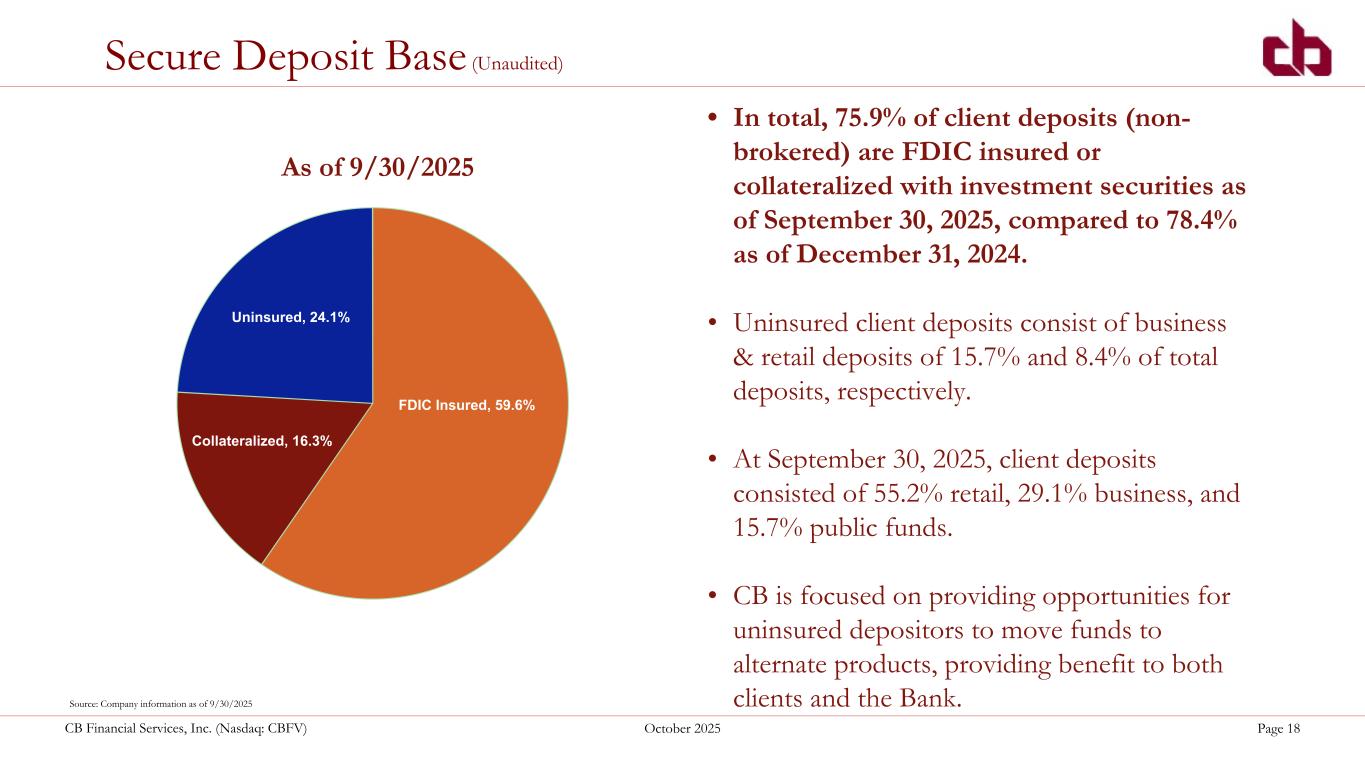

$1.5 million, respectively. This favorable change in the deposit mix was the result of an increased focus on building core banking relationships while strategically reducing higher priced relationships. Brokered time deposits totaled $98.5 million as of September 30, 2025 and $39.0 million as of December 31, 2024, all of which mature within three months and were utilized to fund the purchase of floating rate CLO securities. At September 30, 2025, FDIC insured deposits totaled approximately 59.6% of total deposits while an additional 16.3% of total deposits were collateralized with investment securities.

Accrued Interest Payable and Other Liabilities

•Accrued interest payable and other liabilities increased $7.9 million, or 49.5%, to $23.9 million at September 30, 2025, compared to $16.0 million at December 31, 2024 primarily due to $4.0 million of syndicated national credits purchased and not yet settled and $4.0 million of securities purchased and not yet settled.

Stockholders’ Equity

Stockholders’ equity increased $5.1 million, or 3.5%, to $152.5 million at September 30, 2025, compared to $147.4 million at December 31, 2024. The key factors positively impacting stockholders’ equity was a $13.2 million decrease in accumulated other comprehensive loss resulting primarily from the securities repositioning strategy, $1.7 million of shares issued as a result of stock option exercises and $164,000 of net income for the current year, partially offset by $6.8 million of treasury shares purchased under the stock repurchase program and the payment of $3.8 million in dividends since December 31, 2024.

Book value per share

Book value per common share was $30.50 at September 30, 2025 compared to $28.71 at December 31, 2024, an increase of $1.79.

Tangible book value per common share (Non-GAAP) was $28.56 at September 30, 2025, compared to $26.82 at December 31, 2024, an increase of $1.74.

Refer to “Explanation of Use of Non-GAAP Financial Measures” at the end of this Press Release.

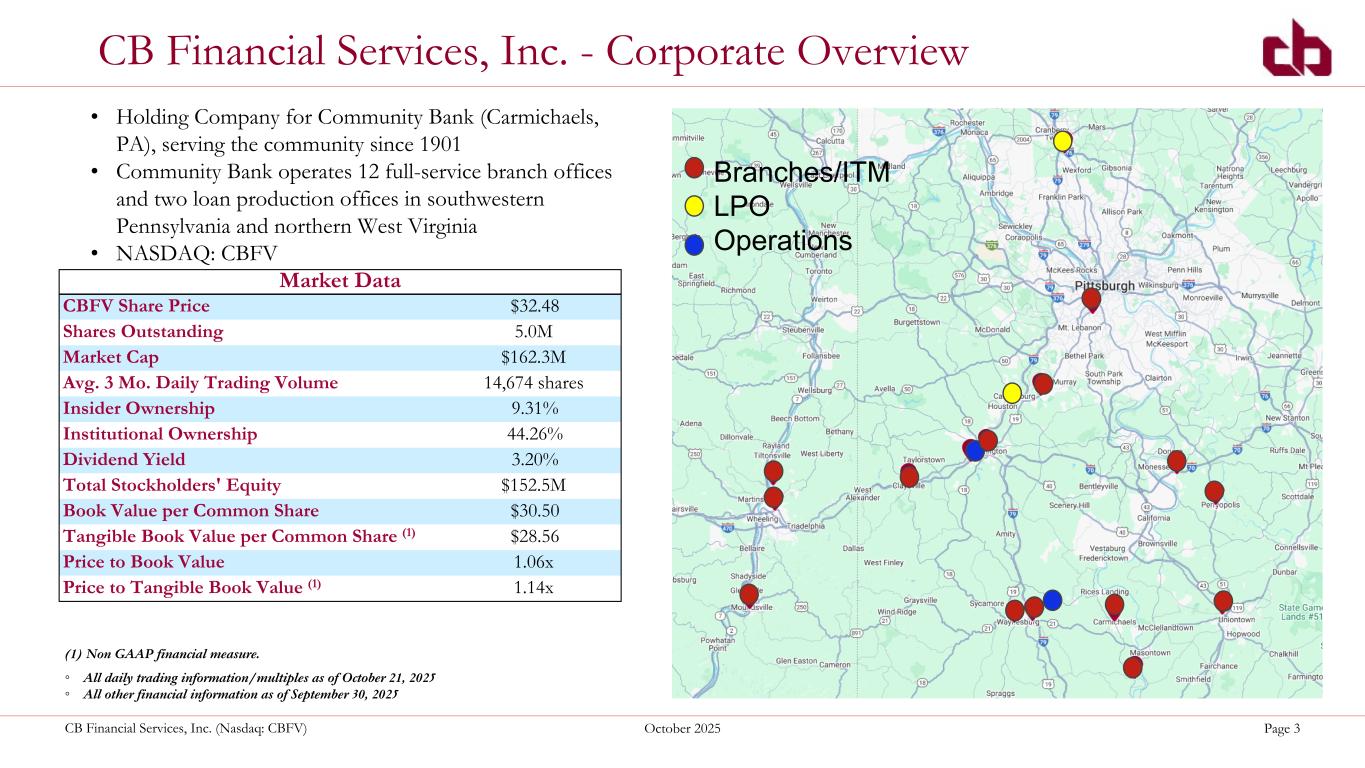

About CB Financial Services, Inc.

CB Financial Services, Inc. is the bank holding company for Community Bank, a Pennsylvania-chartered commercial bank. Community Bank operates its branch network in southwestern Pennsylvania and West Virginia. Community Bank offers a broad array of retail and commercial lending and deposit services.

For more information about CB Financial Services, Inc. and Community Bank, visit our website at www.cb.bank.

Statement About Forward-Looking Statements

Statements contained in this press release that are not historical facts may constitute forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995 and such forward-looking statements are subject to significant risks and uncertainties. The Company intends such forward-looking statements to be covered by the safe harbor provisions contained in the Act. The Company’s ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse effect on the operations and future prospects of the Company and its subsidiaries include, but are not limited to, general and local economic conditions, changes in market interest rates, deposit flows, demand for loans, real estate values and competition, competitive products and pricing, the ability of our customers to make scheduled loan payments, loan delinquency rates and trends, our ability to manage the risks involved in our business, our ability to control costs and expenses, inflation, market and monetary fluctuations, changes in federal and state legislation and regulation applicable to our business, actions by our competitors, and other factors that may be disclosed in the Company’s periodic reports as filed with the Securities and Exchange Commission. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. The Company assumes no obligation to update any forward-looking statements except as may be required by applicable law or regulation.

Company Contact:

John H. Montgomery

President and Chief Executive Officer

Phone: (724) 223-8317

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CB FINANCIAL SERVICES, INC.

SELECTED CONSOLIDATED FINANCIAL INFORMATION

|

| (Dollars in thousands, except share and per share data) (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selected Financial Condition Data |

9/30/25 |

|

6/30/25 |

|

3/31/25 |

|

12/31/24 |

|

9/30/24 |

| Assets |

|

|

|

|

|

|

|

|

|

| Cash and Due From Banks |

$ |

55,890 |

|

|

$ |

64,506 |

|

|

$ |

61,274 |

|

|

$ |

49,572 |

|

|

$ |

147,325 |

|

| Securities |

272,559 |

|

|

267,171 |

|

|

258,699 |

|

|

262,153 |

|

|

270,881 |

|

| Loans Held for Sale |

107 |

|

|

512 |

|

|

230 |

|

|

900 |

|

|

428 |

|

| Loans |

|

|

|

|

|

|

|

|

|

| Real Estate: |

|

|

|

|

|

|

|

|

|

| Residential |

333,430 |

|

|

329,324 |

|

|

334,744 |

|

|

337,990 |

|

|

338,926 |

|

| Commercial |

539,395 |

|

|

513,197 |

|

|

497,316 |

|

|

485,513 |

|

|

464,354 |

|

| Construction |

38,905 |

|

|

40,680 |

|

|

54,597 |

|

|

54,705 |

|

|

43,515 |

|

| Commercial and Industrial |

143,919 |

|

|

138,221 |

|

|

107,419 |

|

|

112,047 |

|

|

108,554 |

|

| Consumer |

49,581 |

|

|

57,376 |

|

|

61,854 |

|

|

70,508 |

|

|

80,004 |

|

| Other |

38,156 |

|

|

32,026 |

|

|

32,564 |

|

|

31,863 |

|

|

30,402 |

|

| Total Loans |

1,143,386 |

|

|

1,110,824 |

|

|

1,088,494 |

|

|

1,092,626 |

|

|

1,065,755 |

|

| Allowance for Credit Losses |

(10,146) |

|

|

(9,722) |

|

|

(9,819) |

|

|

(9,805) |

|

|

(9,479) |

|

| Loans, Net |

1,133,240 |

|

|

1,101,102 |

|

|

1,078,675 |

|

|

1,082,821 |

|

|

1,056,276 |

|

|

|

|

|

|

|

|

|

|

|

| Premises and Equipment, Net |

19,896 |

|

|

20,223 |

|

|

20,392 |

|

|

20,708 |

|

|

20,838 |

|

| Bank-Owned Life Insurance |

24,660 |

|

|

24,506 |

|

|

24,358 |

|

|

24,209 |

|

|

24,057 |

|

| Goodwill |

9,732 |

|

|

9,732 |

|

|

9,732 |

|

|

9,732 |

|

|

9,732 |

|

| Intangible Assets, Net |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

88 |

|

| Accrued Interest Receivable and Other Assets |

29,430 |

|

|

30,232 |

|

|

30,096 |

|

|

31,469 |

|

|

32,116 |

|

| Total Assets |

$ |

1,545,514 |

|

|

$ |

1,517,984 |

|

|

$ |

1,483,456 |

|

|

$ |

1,481,564 |

|

|

$ |

1,561,741 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deposits |

|

|

|

|

|

|

|

|

|

| Noninterest-Bearing Demand Accounts |

$ |

291,882 |

|

|

$ |

278,685 |

|

|

$ |

267,392 |

|

|

$ |

267,896 |

|

|

$ |

267,022 |

|

| Interest-Bearing Demand Accounts |

365,976 |

|

|

353,448 |

|

|

341,212 |

|

|

316,764 |

|

|

326,505 |

|

| Money Market Accounts |

206,166 |

|

|

225,141 |

|

|

228,005 |

|

|

231,458 |

|

|

220,789 |

|

| Savings Accounts |

169,005 |

|

|

172,021 |

|

|

176,722 |

|

|

170,530 |

|

|

172,354 |

|

| Time Deposits |

301,391 |

|

|

280,137 |

|

|

267,766 |

|

|

296,869 |

|

|

367,150 |

|

| Total Deposits |

1,334,420 |

|

|

1,309,432 |

|

|

1,281,097 |

|

|

1,283,517 |

|

|

1,353,820 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other Borrowings |

34,748 |

|

|

34,738 |

|

|

34,728 |

|

|

34,718 |

|

|

34,708 |

|

| Accrued Interest Payable and Other Liabilities |

23,881 |

|

|

25,452 |

|

|

19,342 |

|

|

15,951 |

|

|

24,073 |

|

| Total Liabilities |

1,393,049 |

|

|

1,369,622 |

|

|

1,335,167 |

|

|

1,334,186 |

|

|

1,412,601 |

|

|

|

|

|

|

|

|

|

|

|

| Stockholders’ Equity |

152,465 |

|

|

148,362 |

|

|

148,289 |

|

|

147,378 |

|

|

149,140 |

|

| Total Liabilities and Stockholders’ Equity |

$ |

1,545,514 |

|

|

$ |

1,517,984 |

|

|

$ |

1,483,456 |

|

|

$ |

1,481,564 |

|

|

$ |

1,561,741 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Dollars in thousands, except share and per share data) (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

Nine Months Ended |

| Selected Operating Data |

9/30/25 |

6/30/25 |

3/31/25 |

12/31/24 |

9/30/24 |

9/30/25 |

9/30/24 |

| Interest and Dividend Income: |

|

|

|

|

|

|

|

| Loans, Including Fees |

$ |

15,973 |

|

$ |

15,492 |

|

$ |

14,528 |

|

$ |

14,930 |

|

$ |

14,945 |

|

$ |

45,993 |

|

$ |

44,453 |

|

| Securities: |

|

|

|

|

|

|

|

| Taxable |

2,848 |

|

2,860 |

|

2,777 |

|

3,096 |

|

3,289 |

|

8,485 |

|

8,437 |

|

| Tax-Exempt |

146 |

|

— |

|

— |

|

— |

|

— |

|

146 |

|

— |

|

| Dividends |

7 |

|

9 |

|

28 |

|

27 |

|

28 |

|

44 |

|

82 |

|

| Other Interest and Dividend Income |

367 |

|

399 |

|

514 |

|

1,378 |

|

1,511 |

|

1,279 |

|

3,727 |

|

| Total Interest and Dividend Income |

19,341 |

|

18,760 |

|

17,847 |

|

19,431 |

|

19,773 |

|

55,947 |

|

56,699 |

|

| Interest Expense: |

|

|

|

|

|

|

|

| Deposits |

5,810 |

|

5,721 |

|

6,111 |

|

7,492 |

|

7,892 |

|

17,643 |

|

20,948 |

|

| Short-Term Borrowings |

68 |

|

108 |

|

23 |

|

— |

|

— |

|

199 |

|

— |

|

| Other Borrowings |

364 |

|

391 |

|

402 |

|

407 |

|

407 |

|

1,156 |

|

1,215 |

|

| Total Interest Expense |

6,242 |

|

6,220 |

|

6,536 |

|

7,899 |

|

8,299 |

|

18,998 |

|

22,163 |

|

| Net Interest and Dividend Income |

13,099 |

|

12,540 |

|

11,311 |

|

11,532 |

|

11,474 |

|

36,949 |

|

34,536 |

|

| Provision (Recovery) for Credit Losses - Loans |

336 |

|

(136) |

|

68 |

|

483 |

|

25 |

|

269 |

|

(105) |

|

| (Recovery) Provision for Credit Losses - Unfunded Commitments |

(77) |

|

144 |

|

(108) |

|

200 |

|

(66) |

|

(42) |

|

(9) |

|

| Net Interest and Dividend Income After Net Provision (Recovery) for Credit Losses |

12,840 |

|

12,532 |

|

11,351 |

|

10,849 |

|

11,515 |

|

36,722 |

|

34,650 |

|

| Noninterest Income: |

|

|

|

|

|

|

|

| Service Fees |

574 |

|

559 |

|

462 |

|

460 |

|

451 |

|

1,595 |

|

1,220 |

|

| Insurance Commissions |

1 |

|

1 |

|

1 |

|

1 |

|

1 |

|

3 |

|

4 |

|

| Other Commissions |

63 |

|

66 |

|

63 |

|

63 |

|

104 |

|

192 |

|

188 |

|

| Net Gain on Sale of Loans |

50 |

|

26 |

|

22 |

|

3 |

|

18 |

|

99 |

|

49 |

|

| Net (Loss) Gain on Securities |

(11,752) |

|

— |

|

(69) |

|

3 |

|

245 |

|

(11,821) |

|

49 |

|

| Net Gain on Purchased Tax Credits |

4 |

|

4 |

|

4 |

|

12 |

|

12 |

|

11 |

|

37 |

|

| Gain on Sale of Subsidiary |

— |

|

— |

|

— |

|

— |

|

138 |

|

— |

|

138 |

|

| Net Gain on Disposal of Premises and Equipment |

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

274 |

|

| Income from Bank-Owned Life Insurance |

154 |

|

148 |

|

149 |

|

152 |

|

147 |

|

451 |

|

442 |

|

| Net Gain on Bank-Owned Life Insurance Claims |

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

915 |

|

| Other Income |

229 |

|

127 |

|

155 |

|

961 |

|

117 |

|

512 |

|

523 |

|

| Total Noninterest (Loss) Income |

(10,677) |

|

931 |

|

787 |

|

1,655 |

|

1,233 |

|

(8,958) |

|

3,839 |

|

| Noninterest Expense: |

|

|

|

|

|

|

|

| Salaries and Employee Benefits |

5,247 |

|

5,088 |

|

6,036 |

|

5,258 |

|

4,561 |

|

16,371 |

|

13,563 |

|

| Occupancy |

574 |

|

616 |

|

750 |

|

652 |

|

755 |

|

1,939 |

|

2,444 |

|

| Equipment |

367 |

|

372 |

|

330 |

|

313 |

|

280 |

|

1,070 |

|

842 |

|

| Data Processing |

708 |

|

761 |

|

797 |

|

832 |

|

772 |

|

2,266 |

|

2,476 |

|

| Federal Deposit Insurance Corporation Assessment |

173 |

|

203 |

|

176 |

|

172 |

|

177 |

|

552 |

|

467 |

|

| Pennsylvania Shares Tax |

306 |

|

143 |

|

257 |

|

301 |

|

265 |

|

706 |

|

860 |

|

| Contracted Services |

371 |

|

382 |

|

310 |

|

522 |

|

431 |

|

1,063 |

|

1,102 |

|

| Legal and Professional Fees |

411 |

|

117 |

|

262 |

|

268 |

|

297 |

|

789 |

|

717 |

|

| Advertising |

132 |

|

124 |

|

119 |

|

137 |

|

141 |

|

374 |

|

348 |

|

Other Real Estate Owned |

8 |

|

1 |

|

— |

|

34 |

|

2 |

|

9 |

|

16 |

|

| Amortization of Intangible Assets |

— |

|

— |

|

— |

|

88 |

|

264 |

|

— |

|

870 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other Expense |

886 |

|

941 |

|

765 |

|

876 |

|

837 |

|

2,592 |

|

2,492 |

|

| Total Noninterest Expense |

9,183 |

|

8,748 |

|

9,802 |

|

9,453 |

|

8,782 |

|

27,731 |

|

26,197 |

|

| (Loss) Income Before Income Tax Expense |

(7,020) |

|

4,715 |

|

2,336 |

|

3,051 |

|

3,966 |

|

33 |

|

12,292 |

|

| Income Tax (Benefit) Expense |

(1,324) |

|

766 |

|

427 |

|

522 |

|

747 |

|

(131) |

|

2,227 |

|

| Net (Loss) Income |

$ |

(5,696) |

|

$ |

3,949 |

|

$ |

1,909 |

|

$ |

2,529 |

|

$ |

3,219 |

|

$ |

164 |

|

$ |

10,065 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

Nine Months Ended |

| Per Common Share Data |

9/30/25 |

6/30/25 |

3/31/25 |

12/31/24 |

9/30/24 |

9/30/25 |

9/30/24 |

| Dividends Per Common Share |

$ |

0.26 |

|

$ |

0.25 |

|

$ |

0.25 |

|

$ |

0.25 |

|

$ |

0.25 |

|

$ |

0.76 |

|

$ |

0.75 |

|

| (Loss) Earnings Per Common Share - Basic |

(1.14) |

|

0.79 |

|

0.37 |

|

0.49 |

|

0.63 |

|

0.03 |

|

1.96 |

|

| (Loss) Earnings Per Common Share - Diluted |

(1.07) |

|

0.74 |

|

0.35 |

|

0.46 |

|

0.60 |

|

0.03 |

|

1.89 |

|

|

|

|

|

|

|

|

|

| Weighted Average Common Shares Outstanding - Basic |

4,985,188 |

|

5,022,813 |

|

5,125,577 |

|

5,126,782 |

|

5,137,586 |

|

5,044,012 |

|

5,136,546 |

|

| Weighted Average Common Shares Outstanding - Diluted |

5,319,594 |

|

5,332,026 |

|

5,471,006 |

|

5,544,829 |

|

5,346,750 |

|

5,357,173 |

|

5,328,610 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9/30/25 |

6/30/25 |

3/31/25 |

12/31/24 |

9/30/24 |

| Common Shares Outstanding |

4,998,383 |

|

4,972,300 |

|

5,099,069 |

|

5,132,654 |

|

5,129,921 |

|

| Book Value Per Common Share |

$ |

30.50 |

|

$ |

29.84 |

|

$ |

29.08 |

|

$ |

28.71 |

|

$ |

29.07 |

|

Tangible Book Value per Common Share (1) |

28.56 |

|

27.88 |

|

27.17 |

|

26.82 |

|

27.16 |

|

| Stockholders’ Equity to Assets |

9.9 |

% |

9.8 |

% |

10.0 |

% |

9.9 |

% |

9.5 |

% |

Tangible Common Equity to Tangible Assets (1) |

9.3 |

|

9.2 |

|

9.4 |

|

9.4 |

|

9.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

Nine Months Ended |

Selected Financial Ratios (2) |

9/30/25 |

6/30/25 |

3/31/25 |

12/31/24 |

9/30/24 |

9/30/25 |

9/30/24 |

| Return on Average Assets |

(1.50) |

% |

1.06 |

% |

0.53 |

% |

0.65 |

% |

0.84 |

% |

0.01 |

% |

0.90 |

% |

| Return on Average Equity |

(15.15) |

|

10.76 |

|

5.24 |

|

6.80 |

|

8.80 |

|

0.15 |

|

9.45 |

|

| Average Interest-Earning Assets to Average Interest-Bearing Liabilities |

134.42 |

|

135.33 |

|

134.70 |

|

133.33 |

|

133.26 |

|

134.82 |

|

135.28 |

|

| Average Equity to Average Assets |

9.93 |

|

9.88 |

|

10.07 |

|

9.63 |

|

9.54 |

|

9.96 |

|

9.54 |

|

| Net Interest Rate Spread |

3.05 |

|

2.91 |

|

2.61 |

|

2.41 |

|

2.36 |

|

2.86 |

|

2.48 |

|

Net Interest Rate Spread (FTE) (1) |

3.08 |

|

2.93 |

|

2.63 |

|

2.42 |

|

2.38 |

|

2.88 |

|

2.50 |

|

| Net Interest Margin |

3.64 |

|

3.54 |

|

3.27 |

|

3.12 |

|

3.11 |

|

3.49 |

|

3.21 |

|

Net Interest Margin (FTE) (1) |

3.67 |

|

3.55 |

|

3.28 |

|

3.13 |

|

3.12 |

|

3.51 |

|

3.22 |

|

Net Charge-Offs (Recoveries) to Average Loans |

(0.03) |

|

(0.01) |

|

0.02 |

|

0.06 |

|

0.03 |

|

(0.01) |

|

0.02 |

|

| Efficiency Ratio |

379.15 |

|

64.94 |

|

81.02 |

|

71.68 |

|

69.11 |

|

99.07 |

|

68.27 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Asset Quality Ratios |

9/30/25 |

6/30/25 |

3/31/25 |

12/31/24 |

9/30/24 |

|

| Allowance for Credit Losses to Total Loans |

0.89 |

% |

0.88 |

% |

0.90 |

% |

0.90 |

% |

0.89 |

% |

|

|

|

|

|

|

|

|

Allowance for Credit Losses to Nonperforming Loans (3) |

464.99 |

|

550.20 |

|

414.48 |

|

548.07 |

|

463.07 |

|

|

Delinquent and Nonaccrual Loans to Total Loans (4) |

0.59 |

|

0.49 |

|

0.54 |

|

0.72 |

|

0.98 |

|

|

Nonperforming Loans to Total Loans (3) |

0.19 |

|

0.16 |

|

0.22 |

|

0.16 |

|

0.19 |

|

|

Nonperforming Assets to Total Assets (5) |

0.15 |

|

0.13 |

|

0.16 |

|

0.12 |

|

0.14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital Ratios (6) |

9/30/25 |

6/30/25 |

3/31/25 |

12/31/24 |

9/30/24 |

|

| Common Equity Tier 1 Capital (to Risk Weighted Assets) |

14.19 |

% |

15.28 |

% |

14.94 |

% |

14.78 |

% |

14.79 |

% |

|

| Tier 1 Capital (to Risk Weighted Assets) |

14.19 |

|

15.28 |

|

14.94 |

|

14.78 |

|

14.79 |

|

|

| Total Capital (to Risk Weighted Assets) |

15.20 |

|

16.29 |

|

15.95 |

|

15.79 |

|

15.76 |

|

|

| Tier 1 Leverage (to Adjusted Total Assets) |

10.06 |

|

10.49 |

|

10.36 |

|

9.98 |

|

9.96 |

|

|

(1) Refer to Explanation of Use of Non-GAAP Financial Measures in this Press Release for the calculation of the measure and reconciliation to the most comparable GAAP measure.

(2) Interim period ratios are calculated on an annualized basis.

(3) Nonperforming loans consist of all nonaccrual loans and accruing loans that are 90 days or more past due.

(4) Delinquent loans consist of accruing loans that are 30 days or more past due.

(5) Nonperforming assets consist of nonperforming loans and other real estate owned.

(6) Capital ratios are for Community Bank only.

Certain items previously reported may have been reclassified to conform with the current reporting period’s format.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| AVERAGE BALANCES AND YIELDS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

| |

September 30, 2025 |

|

June 30, 2025 |

|

March 31, 2025 |

|

December 31, 2024 |

|

September 30, 2024 |

|

Average Balance |

Interest and Dividends |

Yield / Cost (1) |

|

Average Balance |

Interest and Dividends |

Yield / Cost (1) |

|

Average Balance |

Interest and Dividends |

Yield / Cost (1) |

|

Average Balance |

Interest and Dividends |

Yield / Cost (1) |

|

Average Balance |

Interest and Dividends |

Yield / Cost (1) |

| (Dollars in thousands) (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-Earning Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans, Net (2) |

$ |

1,120,036 |

|

$ |

16,034 |

|

5.68 |

% |

|

$ |

1,098,698 |

|

$ |

15,549 |

|

5.68 |

% |

|

$ |

1,075,083 |

|

$ |

14,584 |

|

5.50 |

% |

|

$ |

1,066,304 |

|

$ |

14,975 |

|

5.59 |

% |

|

$ |

1,063,946 |

|

$ |

14,987 |

|

5.60 |

% |

| Debt Securities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Taxable |

259,196 |

|

2,848 |

|

4.40 |

|

|

284,499 |

|

2,860 |

|

4.02 |

|

|

278,362 |

|

2,777 |

|

3.99 |

|

|

284,002 |

|

3,096 |

|

4.36 |

|

|

288,208 |

|

3,289 |

|

4.56 |

|

| Tax-Exempt |

12,461 |

|

185 |

|

5.94 |

|

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

— |

|

| Equity Securities |

1,000 |

|

7 |

|

2.80 |

|

|

1,000 |

|

9 |

|

3.60 |

|

|

2,674 |

|

28 |

|

4.19 |

|

|

2,693 |

|

27 |

|

4.01 |

|

|

2,693 |

|

28 |

|

4.16 |

|

| Interest-Earning Deposits at Banks |

29,682 |

|

293 |

|

3.95 |

|

|

33,564 |

|

331 |

|

3.94 |

|

|

45,056 |

|

459 |

|

4.07 |

|

|

114,245 |

|

1,338 |

|

4.68 |

|

|

111,131 |

|

1,448 |

|

5.21 |

|

| Other Interest-Earning Assets |

3,972 |

|

74 |

|

7.39 |

|

|

3,767 |

|

68 |

|

7.24 |

|

|

3,196 |

|

55 |

|

6.98 |

|

|

3,070 |

|

40 |

|

5.18 |

|

|

3,108 |

|

63 |

|

8.06 |

|

| Total Interest-Earning Assets |

1,426,347 |

|

19,441 |

|

5.41 |

|

|

1,421,528 |

|

18,817 |

|

5.31 |

|

|

1,404,371 |

|

17,903 |

|

5.17 |

|

|

1,470,314 |

|

19,476 |

|

5.27 |

|

|

1,469,086 |

|

19,815 |

|

5.37 |

|

| Noninterest-Earning Assets |

75,480 |

|

|

|

|

67,513 |

|

|

|

|

63,324 |

|

|

|

|

65,786 |

|

|

|

|

57,602 |

|

|

|

| Total Assets |

$ |

1,501,827 |

|

|

|

|

$ |

1,489,041 |

|

|

|

|

$ |

1,467,695 |

|

|

|

|

$ |

1,536,100 |

|

|

|

|

$ |

1,526,688 |

|

|

|

| Liabilities and Stockholders' Equity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-Bearing Liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-Bearing Demand Accounts |

$ |

350,232 |

|

$ |

1,835 |

|

2.08 |

% |

|

$ |

334,752 |

|

$ |

1,677 |

|

2.01 |

% |

|

$ |

317,799 |

|

$ |

1,526 |

|

1.95 |

% |

|

$ |

328,129 |

|

$ |

1,838 |

|

2.23 |

% |

|

$ |

316,301 |

|

$ |

1,923 |

|

2.42 |

% |

| Money Market Accounts |

211,660 |

|

1,401 |

|

2.63 |

|

|

238,195 |

|

1,747 |

|

2.94 |

|

|

230,634 |

|

1,726 |

|

3.04 |

|

|

227,606 |

|

1,821 |

|

3.18 |

|

|

217,148 |

|

1,726 |

|

3.16 |

|

| Savings Accounts |

171,188 |

|

43 |

|

0.10 |

|

|

174,055 |

|

42 |

|

0.10 |

|

|

172,322 |

|

41 |

|

0.10 |

|

|

170,612 |

|

45 |

|

0.10 |

|

|

175,753 |

|

46 |

|

0.10 |

|

| Time Deposits |

287,646 |

|

2,531 |

|

3.49 |

|

|

259,506 |

|

2,255 |

|

3.49 |

|

|

285,093 |

|

2,818 |

|

4.01 |

|

|

341,686 |

|

3,788 |

|

4.41 |

|

|

358,498 |

|

4,197 |

|

4.66 |

|

| Total Interest-Bearing Deposits |

1,020,726 |

|

5,810 |

|

2.26 |

|

|

1,006,508 |

|

5,721 |

|

2.28 |

|

|

1,005,848 |

|

6,111 |

|

2.46 |

|

|

1,068,033 |

|

7,492 |

|

2.79 |

|

|

1,067,700 |

|

7,892 |

|

2.94 |

|

| Short-Term Borrowings |

5,655 |

|

68 |

|

4.77 |

|

|

9,143 |

|

108 |

|

4.74 |

|

|

1,985 |

|

23 |

|

4.70 |

|

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

— |

|

| Other Borrowings |

34,743 |

|

364 |

|

4.16 |

|

|

34,733 |

|

391 |

|

4.52 |

|

|

34,723 |

|

402 |

|

4.70 |

|

|

34,713 |

|

407 |

|

4.66 |

|

|

34,702 |

|

407 |

|

4.67 |

|

| Total Interest-Bearing Liabilities |

1,061,124 |

|

6,242 |

|

2.33 |

|

|

1,050,384 |

|

6,220 |

|

2.38 |

|

|

1,042,556 |

|

6,536 |

|

2.54 |

|

|

1,102,746 |

|

7,899 |

|

2.85 |

|

|

1,102,402 |

|

8,299 |

|

2.99 |

|

| Noninterest-Bearing Demand Deposits |

271,462 |

|

|

|

|

270,729 |

|

|

|

|

265,522 |

|

|

|

|

267,598 |

|

|

|

|

263,650 |

|

|

|

Total Funding and Cost of Funds |

1,332,586 |

|

|

1.86 |

|

|

1,321,113 |

|

|

1.89 |

|

|

1,308,078 |

|

|

2.03 |

|

|

1,370,344 |

|

|

2.29 |

|

|

1,366,052 |

|

|

2.42 |

|

| Other Liabilities |

20,120 |

|

|

|

|

20,789 |

|

|

|

|

11,854 |

|

|

|

|

17,883 |

|

|

|

|

15,043 |

|

|

|

| Total Liabilities |

1,352,706 |

|

|

|

|

1,341,902 |

|

|

|

|

1,319,932 |

|

|

|

|

1,388,227 |

|

|

|

|

1,381,095 |

|

|

|

| Stockholders' Equity |

149,121 |

|

|

|

|

147,139 |

|

|

|

|

147,763 |

|

|

|

|

147,873 |

|

|

|

|

145,593 |

|

|

|

| Total Liabilities and Stockholders' Equity |

$ |

1,501,827 |

|

|

|

|

$ |

1,489,041 |

|

|

|

|

$ |

1,467,695 |

|

|

|

|

$ |

1,536,100 |

|

|

|

|

$ |

1,526,688 |

|

|

|

|

Net Interest Income (FTE)

(Non-GAAP) (3)

|

|

$ |

13,199 |

|

|

|

|

$ |

12,597 |

|

|

|

|

$ |

11,367 |

|

|

|

|

$ |

11,577 |

|

|

|

|

$ |

11,516 |

|

|

Net Interest-Earning Assets (4) |

365,223 |

|

|

|

|

371,144 |

|

|

|

|

361,815 |

|

|

|

|

367,568 |

|

|

|

|

366,684 |

|

|

|

|

Net Interest Rate Spread (FTE)

(Non-GAAP) (3) (5)

|

|

|

3.08 |

% |

|

|

|

2.93 |

% |

|

|

|

2.63 |

% |

|

|

|

2.42 |

% |

|

|

|

2.38 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Interest Margin (FTE)

(Non-GAAP) (3)(6)

|

|

|

3.67 |

|

|

|

|

3.55 |

|

|

|

|

3.28 |

|

|

|

|

3.13 |

|

|

|

|

3.12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Annualized based on three months ended results.

(2) Net of the allowance for credit losses and includes nonaccrual loans with a zero yield and Loans Held for Sale if applicable.

(3) Refer to Explanation and Use of Non-GAAP Financial Measures in this Press Release for the calculation of the measure and reconciliation to the most comparable GAAP measure.

(4) Net interest-earning assets represent total interest-earning assets less total interest-bearing liabilities.

(5) Net interest rate spread represents the difference between the weighted average yield on interest-earning assets and the weighted average cost of interest-bearing liabilities.

(6) Net interest margin represents annualized net interest income divided by average total interest-earning assets.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| AVERAGE BALANCES AND YIELDS |

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended |

|

September 30, 2025 |

|

September 30, 2024 |

|

Average Balance |

|

Interest and Dividends |

|

Yield /Cost (1) |

|

Average Balance |

|

Interest and Dividends |

|

Yield / Cost (1) |

| (Dollars in thousands) (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

| Assets: |

|

|

|

|

|

|

|

|

|

|

|

| Interest-Earning Assets: |

|

|

|

|

|

|

|

|

|

|

|

Loans, Net (2) |

$ |

1,098,105 |

|

|

$ |

46,167 |

|

|

5.62 |

% |

|

$ |

1,076,052 |

|

|

$ |

44,571 |

|

|

5.53 |

% |

| Debt Securities |

|

|

|

|

|

|

|

|

|

|

|

| Taxable |

273,949 |

|

|

8,485 |

|

|

4.13 |

|

|

263,433 |

|

|

8,437 |

|

|

4.27 |

|

| Exempt From Federal Tax |

4,199 |

|

|

185 |

|

|

5.87 |

|

|

— |

|

|

— |

|

|

— |

|

| Marketable Equity Securities |

1,552 |

|

|

44 |

|

|

3.78 |

|

|

2,693 |

|

|

82 |

|

|

4.06 |

|

| Interest-Earning Deposits at Banks |

36,044 |

|

|

1,083 |

|

|

4.01 |

|

|

90,507 |

|

|

3,493 |

|

|

5.15 |

|

| Other Interest-Earning Assets |

3,648 |

|

|

196 |

|

|

7.18 |

|

|

3,166 |

|

|

234 |

|

|

9.87 |

|

| Total Interest-Earning Assets |

1,417,497 |

|

|

56,160 |

|

|

5.30 |

|

|

1,435,851 |

|

|

56,817 |

|

|

5.29 |

|

| Noninterest-Earning Assets |

69,034 |

|

|

|

|

|

|

55,366 |

|

|

|

|

|

| Total Assets |

$ |

1,486,531 |

|

|

|

|

|

|

$ |

1,491,217 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and Stockholders' Equity: |

|

|

|

|

|

|

|

|

|

|

|

| Interest-Bearing Liabilities: |

|

|

|

|

|

|

|

|

|

|

|

| Interest-Bearing Demand Accounts |

$ |

334,380 |

|

|

$ |

5,039 |

|

|

2.01 |

% |

|

$ |

325,383 |

|

|

$ |

5,576 |

|

|

2.29 |

% |

| Savings Accounts |

172,517 |

|

|

126 |

|

|

0.10 |

|

|

184,017 |

|

|

157 |

|

|

0.11 |

|

| Money Market Accounts |

226,760 |

|

|

4,874 |

|

|

2.87 |

|

|

211,921 |

|

|

4,885 |

|

|

3.08 |

|

| Time Deposits |

277,424 |

|

|

7,604 |

|

|

3.66 |

|

|

305,386 |

|

|

10,330 |

|

|

4.52 |

|

| Total Interest-Bearing Deposits |

1,011,081 |

|

|

17,643 |

|

|

2.33 |

|

|

1,026,707 |

|

|

20,948 |

|

|

2.73 |

|

| Short-Term Borrowings |

5,607 |

|

|

199 |

|

|

4.75 |

|

|

1 |

|

|

— |

|

|

— |

|

| Other Borrowings |

34,733 |

|

|

1,156 |

|

|

4.45 |

|

|

34,692 |

|

|

1,215 |

|

|

4.68 |

|

| Total Interest-Bearing Liabilities |

1,051,421 |

|

|

18,998 |

|

|

2.42 |

|

|

1,061,400 |

|

|

22,163 |

|

|

2.79 |

|

| Noninterest-Bearing Demand Deposits |

269,259 |

|

|

|

|

|

|

271,511 |

|

|

|

|

|

Total Funding and Cost of Funds |

1,320,680 |

|

|

|

|

1.92 |

|

|

1,332,911 |

|

|

|

|

2.22 |

|

| Other Liabilities |

17,812 |

|

|

|

|

|

|

16,045 |

|

|

|

|

|

| Total Liabilities |

1,338,492 |

|

|

|

|

|

|

1,348,956 |

|

|

|

|

|

| Stockholders' Equity |

148,039 |

|

|

|

|

|

|

142,261 |

|

|

|

|

|

| Total Liabilities and Stockholders' Equity |

$ |

1,486,531 |

|

|

|

|

|

|

$ |

1,491,217 |

|

|

|

|

|

Net Interest Income (FTE) (Non-GAAP) (3) |

|

|

37,162 |

|

|

|

|

|

|

34,654 |

|

|

|

Net Interest-Earning Assets (4) |

366,076 |

|

|

|

|

|

|

374,451 |

|

|

|

|

|

Net Interest Rate Spread (FTE) (Non-GAAP) (3)(5) |

|

|

|

|

2.88 |

% |

|

|

|

|

|

2.50 |

% |

Net Interest Margin (FTE) (Non-GAAP) (3)(6) |

|

|

|

|

3.51 |

|

|

|

|

|

|

3.22 |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Annualized based on nine months ended results.

(2) Net of the allowance for credit losses and includes nonaccrual loans with a zero yield and Loans Held for Sale if applicable.

(3) Refer to Explanation and Use of Non-GAAP Financial Measures in this Press Release for the calculation of the measure and reconciliation to the most comparable GAAP measure.

(4) Net interest-earning assets represent total interest-earning assets less total interest-bearing liabilities.

(5) Net interest rate spread represents the difference between the weighted average yield on interest-earning assets and the weighted average cost of interest-bearing liabilities.

(6) Net interest margin represents annualized net interest income divided by average total interest-earning assets.

Explanation of Use of Non-GAAP Financial Measures

In addition to financial measures presented in accordance with generally accepted accounting principles (“GAAP”), we use, and this Press Release contains or references, certain Non-GAAP financial measures. We believe these Non-GAAP financial measures provide useful information in understanding our underlying results of operations or financial position and our business and performance trends as they facilitate comparisons with the performance of other companies in the financial services industry. Non-GAAP adjusted items impacting the Company's financial performance are identified to assist investors in providing a complete understanding of factors and trends affecting the Company’s business and in analyzing the Company’s operating results on the same basis as that applied by management. Although we believe that these Non-GAAP financial measures enhance the understanding of our business and performance, they should not be considered an alternative to GAAP or considered to be more important than financial results determined in accordance with GAAP, nor are they necessarily comparable with similar Non-GAAP measures which may be presented by other companies. Where Non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation to the comparable GAAP financial measure, can be found herein.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9/30/25 |

6/30/25 |

3/31/25 |

12/31/24 |

9/30/24 |

| (Dollars in thousands, except share and per share data) (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

Total Assets (GAAP) |

$ |

1,545,514 |

|

$ |

1,517,984 |

|

$ |

1,483,456 |

|

$ |

1,481,564 |

|

$ |

1,561,741 |

|

| Goodwill and Intangible Assets, Net |

(9,732) |

|

(9,732) |

|

(9,732) |

|

(9,732) |

|

(9,820) |

|

| Tangible Assets (Non-GAAP) (Numerator) |

$ |

1,535,782 |

|

$ |

1,508,252 |

|

$ |

1,473,724 |

|

$ |

1,471,832 |

|

$ |

1,551,921 |

|

| Stockholders' Equity (GAAP) |

$ |

152,465 |

|

$ |

148,362 |

|

$ |

148,289 |

|

$ |

147,378 |

|

$ |

149,140 |

|

| Goodwill and Intangible Assets, Net |

(9,732) |

|

(9,732) |

|

(9,732) |

|

(9,732) |

|

(9,820) |

|

| Tangible Common Equity or Tangible Book Value (Non-GAAP) (Denominator) |

$ |

142,733 |

|

$ |

138,630 |

|

$ |

138,557 |

|

$ |

137,646 |

|

$ |

139,320 |

|

| Stockholders’ Equity to Assets (GAAP) |

9.9 |

% |

9.8 |

% |

10.0 |

% |

9.9 |

% |

9.5 |

% |

| Tangible Common Equity to Tangible Assets (Non-GAAP) |

9.3 |

% |

9.2 |

% |

9.4 |

% |

9.4 |

% |

9.0 |

% |

| Common Shares Outstanding (Denominator) |

4,998,383 |

|

4,972,300 |

|

5,099,069 |

|

5,132,654 |

|

5,129,921 |

|

| Book Value per Common Share (GAAP) |

$ |

30.50 |

|

$ |

29.84 |

|

$ |

29.08 |

|

$ |

28.71 |

|

$ |

29.07 |

|

| Tangible Book Value per Common Share (Non-GAAP) |

$ |

28.56 |

|

$ |

27.88 |

|

$ |

27.17 |

|

$ |

26.82 |

|

$ |

27.16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

Nine Months Ended |

|

9/30/25 |

6/30/25 |

3/31/25 |

12/31/24 |

9/30/24 |

9/30/25 |

9/30/24 |

| (Dollars in thousands) (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (Loss) Income (GAAP) |

$ |

(5,696) |

|

$ |

3,949 |

|

$ |

1,909 |

|

$ |

2,529 |

|

$ |

3,219 |

|

$ |

164 |

|

$ |

10,065 |

|

| Amortization of Intangible Assets, Net |

— |

|

— |

|

— |

|

88 |

|

264 |

|

— |

|

870 |

|

|

|

|

|

|

|

|

|