0001601830FALSE2024FYoneP7DP5DP3Y0M0DP1Y0M0Dhttp://fasb.org/us-gaap/2024#LongTermDebtAndCapitalLeaseObligationsCurrenthttp://fasb.org/us-gaap/2024#LongTermDebtAndCapitalLeaseObligationsCurrenthttp://fasb.org/us-gaap/2024#LongTermDebtAndCapitalLeaseObligationshttp://fasb.org/us-gaap/2024#LongTermDebtAndCapitalLeaseObligations100100100oneoneone476iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:purerxrx:segmentrxrx:inProcessResearchAndDevelopmentAssetutr:sqftrxrx:renewal_optionrxrx:voterxrx:classrxrx:candidaterxrx:performance_obligationrxrx:phenomaprxrx:programrxrx:servicerxrx:area00016018302024-01-012024-12-3100016018302024-06-300001601830us-gaap:CommonClassAMember2025-01-310001601830us-gaap:CommonClassBMember2025-01-3100016018302024-12-3100016018302023-12-310001601830us-gaap:CommonClassAMember2023-12-310001601830us-gaap:CommonClassAMember2024-12-310001601830us-gaap:CommonClassBMember2024-12-310001601830us-gaap:CommonClassBMember2023-12-310001601830rxrx:ExchangeableStockMember2024-12-310001601830rxrx:ExchangeableStockMember2023-12-310001601830us-gaap:LicenseAndServiceMember2024-01-012024-12-310001601830us-gaap:LicenseAndServiceMember2023-01-012023-12-310001601830us-gaap:LicenseAndServiceMember2022-01-012022-12-310001601830us-gaap:GrantMember2024-01-012024-12-310001601830us-gaap:GrantMember2023-01-012023-12-310001601830us-gaap:GrantMember2022-01-012022-12-3100016018302023-01-012023-12-3100016018302022-01-012022-12-310001601830us-gaap:CommonStockMember2021-12-310001601830us-gaap:AdditionalPaidInCapitalMember2021-12-310001601830us-gaap:RetainedEarningsMember2021-12-310001601830us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-3100016018302021-12-310001601830us-gaap:RetainedEarningsMember2022-01-012022-12-310001601830us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001601830us-gaap:CommonStockMember2022-01-012022-12-310001601830us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001601830us-gaap:CommonStockMember2022-12-310001601830us-gaap:AdditionalPaidInCapitalMember2022-12-310001601830us-gaap:RetainedEarningsMember2022-12-310001601830us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-3100016018302022-12-310001601830us-gaap:RetainedEarningsMember2023-01-012023-12-310001601830us-gaap:CommonStockMember2023-01-012023-12-310001601830us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001601830us-gaap:CommonStockMemberrxrx:TempusAgreementMember2023-01-012023-12-310001601830us-gaap:AdditionalPaidInCapitalMemberrxrx:TempusAgreementMember2023-01-012023-12-310001601830rxrx:TempusAgreementMember2023-01-012023-12-310001601830us-gaap:CommonStockMember2023-12-310001601830us-gaap:AdditionalPaidInCapitalMember2023-12-310001601830us-gaap:RetainedEarningsMember2023-12-310001601830us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001601830us-gaap:RetainedEarningsMember2024-01-012024-12-310001601830us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-12-310001601830us-gaap:CommonStockMember2024-01-012024-12-310001601830us-gaap:AdditionalPaidInCapitalMember2024-01-012024-12-310001601830us-gaap:CommonStockMemberrxrx:TempusAgreementMember2024-01-012024-12-310001601830us-gaap:AdditionalPaidInCapitalMemberrxrx:TempusAgreementMember2024-01-012024-12-310001601830rxrx:TempusAgreementMember2024-01-012024-12-310001601830us-gaap:CommonStockMember2024-12-310001601830us-gaap:AdditionalPaidInCapitalMember2024-12-310001601830us-gaap:RetainedEarningsMember2024-12-310001601830us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310001601830rxrx:TempusAgreementMember2022-01-012022-12-310001601830rxrx:ComputerAndOfficeEquipmentMember2024-12-310001601830rxrx:LaboratoryEquipmentMember2024-12-310001601830us-gaap:LeaseholdImprovementsMember2024-12-310001601830rxrx:TempusLabsIncMember2023-11-012023-11-300001601830rxrx:TempusLabsIncMembersrt:MinimumMember2023-11-300001601830rxrx:TempusLabsIncMembersrt:MaximumMember2023-11-300001601830rxrx:LaboratoryEquipmentMember2023-12-310001601830us-gaap:LeaseholdImprovementsMember2023-12-310001601830us-gaap:OfficeEquipmentMember2024-12-310001601830us-gaap:OfficeEquipmentMember2023-12-310001601830us-gaap:AssetUnderConstructionMember2024-12-310001601830us-gaap:AssetUnderConstructionMember2023-12-310001601830rxrx:ExscientiaPlcMember2024-11-202024-11-2000016018302024-11-200001601830rxrx:ExscientiaPlcMember2024-11-200001601830rxrx:ExscientiaPlcMemberus-gaap:TechnologyBasedIntangibleAssetsMember2024-11-200001601830rxrx:ExscientiaPlcMember2024-01-012024-12-310001601830rxrx:ExscientiaPlcMember2023-01-012023-12-310001601830rxrx:ExscientiaPlcMember2024-12-310001601830rxrx:ValenceDiscoveryIncMemberus-gaap:CommonClassAMember2023-05-162023-05-160001601830rxrx:ValenceDiscoveryIncMemberrxrx:ExchangeableStockMember2023-05-162023-05-160001601830us-gaap:EmployeeStockOptionMemberrxrx:ValenceDiscoveryIncMember2023-05-162023-05-160001601830us-gaap:EmployeeStockMemberrxrx:ValenceDiscoveryIncMember2023-05-162023-05-160001601830rxrx:ValenceDiscoveryIncMember2023-05-162023-05-160001601830rxrx:ValenceDiscoveryIncMember2023-05-160001601830rxrx:ValenceDiscoveryIncMemberus-gaap:TechnologyBasedIntangibleAssetsMember2023-05-160001601830rxrx:ValenceDiscoveryIncMember2023-01-012023-12-310001601830rxrx:ValenceDiscoveryIncMember2024-01-012024-12-310001601830rxrx:CyclicaIncMemberus-gaap:CommonClassAMember2023-05-252023-05-250001601830us-gaap:EmployeeStockOptionMemberrxrx:CyclicaIncMember2023-05-252023-05-250001601830rxrx:CyclicaIncMemberus-gaap:CommonClassAMember2024-12-312024-12-310001601830rxrx:CyclicaIncMember2023-05-252023-05-250001601830us-gaap:EmployeeStockMemberrxrx:CyclicaIncMember2023-05-252023-05-250001601830rxrx:CyclicaIncMember2023-05-250001601830rxrx:CyclicaIncMemberus-gaap:TechnologyBasedIntangibleAssetsMember2023-05-250001601830rxrx:CyclicaIncMember2024-01-012024-12-310001601830rxrx:CyclicaIncMember2023-01-012023-12-310001601830rxrx:RecursionValenceAndCyclicaMember2023-01-012023-12-310001601830rxrx:RecursionValenceAndCyclicaMember2022-01-012022-12-310001601830srt:MinimumMember2024-12-310001601830srt:MaximumMember2024-12-310001601830rxrx:MiltonParkLeaseMemberrxrx:ExscientiaPlcMember2024-11-012024-11-300001601830rxrx:MiltonParkLeaseMemberrxrx:ExscientiaPlcMember2024-11-300001601830rxrx:SchrodingerBuildingLeaseMemberrxrx:ExscientiaPlcMember2024-11-012024-11-300001601830rxrx:SchrodingerBuildingLeaseMemberrxrx:ExscientiaPlcMemberrxrx:ComponentOneMember2024-11-300001601830rxrx:SchrodingerBuildingLeaseMemberrxrx:ExscientiaPlcMemberrxrx:ComponentTwoMember2024-11-300001601830rxrx:SchrodingerBuildingLeaseMemberrxrx:ExscientiaPlcMember2024-11-300001601830rxrx:ViennaLeaseMemberrxrx:ExscientiaPlcMember2024-11-012024-11-300001601830rxrx:ViennaLeaseMemberrxrx:ExscientiaPlcMember2024-11-300001601830rxrx:DundeeLeaseMemberrxrx:ExscientiaPlcMember2024-11-012024-11-300001601830rxrx:DundeeLeaseMemberrxrx:ExscientiaPlcMember2024-11-300001601830rxrx:BostonLeaseMemberrxrx:ExscientiaPlcMember2024-11-012024-11-300001601830rxrx:BostonLeaseMemberrxrx:ExscientiaPlcMember2024-11-300001601830rxrx:StrataMiamiLeaseMemberrxrx:ExscientiaPlcMember2024-11-012024-11-300001601830rxrx:StrataMiamiLeaseMemberrxrx:ExscientiaPlcMember2024-11-300001601830rxrx:BiscayneMiamiLeaseMemberrxrx:ExscientiaPlcMember2024-11-012024-11-300001601830rxrx:BiscayneMiamiLeaseMemberrxrx:ExscientiaPlcMember2024-11-300001601830rxrx:NewYorkLeaseMember2024-09-012024-09-300001601830rxrx:NewYorkLeaseMember2024-09-300001601830rxrx:NewYorkLeaseMembersrt:MinimumMember2024-09-300001601830rxrx:NewYorkLeaseMembersrt:MaximumMember2024-09-300001601830rxrx:SupercomputerMember2024-05-310001601830srt:MinimumMemberrxrx:SupercomputerMember2024-05-310001601830srt:MaximumMemberrxrx:SupercomputerMember2024-05-310001601830rxrx:DataCenterLeaseMember2024-02-012024-02-290001601830rxrx:DataCenterLeaseMember2024-04-300001601830rxrx:LondonLeaseMember2024-01-012024-01-310001601830rxrx:LondonLeaseMember2024-01-310001601830us-gaap:TechnologyBasedIntangibleAssetsMember2024-12-310001601830us-gaap:TechnologyBasedIntangibleAssetsMember2023-12-310001601830us-gaap:LicensingAgreementsMember2024-12-310001601830us-gaap:LicensingAgreementsMember2023-12-310001601830us-gaap:LicensingAgreementsMember2024-01-012024-12-310001601830us-gaap:CommonClassAMemberrxrx:PublicOfferingOfCommonStockMember2024-06-012024-06-300001601830us-gaap:CommonClassAMemberrxrx:PublicOfferingOfCommonStockMember2024-06-300001601830us-gaap:CommonClassAMemberrxrx:PublicOfferingOfCommonStockUnderwritingAgreementMember2024-06-012024-06-300001601830rxrx:PublicOfferingOfCommonStockMember2024-06-012024-06-300001601830us-gaap:CommonClassAMemberus-gaap:OverAllotmentOptionMember2024-06-012024-06-300001601830us-gaap:CommonClassAMemberrxrx:AtTheMarketOfferingProgramMember2023-08-012023-08-310001601830us-gaap:CommonClassAMemberrxrx:AtTheMarketOfferingProgramMember2024-12-310001601830us-gaap:CommonClassAMemberrxrx:AtTheMarketOfferingProgramMember2024-01-012024-12-310001601830us-gaap:CommonClassAMemberrxrx:NVDIAPrivatePlacementMember2023-07-012023-07-310001601830us-gaap:CommonClassAMember2023-07-310001601830us-gaap:CommonClassAMember2023-07-012023-07-310001601830rxrx:ValenceDiscoveryIncMemberrxrx:ExchangeableStockMember2023-05-012023-05-310001601830us-gaap:CommonClassAMember2023-05-310001601830rxrx:ExchangeableStockMember2024-01-012024-12-310001601830us-gaap:CommonClassAMemberrxrx:A2022PrivatePlacementMember2022-10-012022-10-310001601830us-gaap:CommonClassAMemberrxrx:A2022PrivatePlacementMember2022-10-310001601830rxrx:NVDIAPrivatePlacementMember2023-08-310001601830rxrx:NVDIAPrivatePlacementMembersrt:MaximumMember2023-08-310001601830rxrx:NVDIAPrivatePlacementMember2024-12-310001601830rxrx:ValenceDiscoveryIncMember2023-05-012023-05-3100016018302022-10-3100016018302021-04-300001601830rxrx:CEOAndAffiliatesMember2024-12-310001601830rxrx:SanofiMemberus-gaap:CollaborativeArrangementMember2022-01-012022-01-310001601830rxrx:SanofiMemberus-gaap:CollaborativeArrangementMember2022-01-310001601830rxrx:ResearchMilestonesMemberrxrx:SanofiMemberus-gaap:CollaborativeArrangementMember2022-01-310001601830rxrx:DevelopmentAndRegulatoryMilestonesMemberrxrx:SanofiMemberus-gaap:CollaborativeArrangementMember2022-01-310001601830rxrx:SanofiMemberus-gaap:CollaborativeArrangementMember2024-11-012024-11-300001601830rxrx:SanofiMemberus-gaap:CollaborativeArrangementMember2024-11-300001601830rxrx:MerckKGaAMerckMemberus-gaap:CollaborativeArrangementMember2023-09-300001601830rxrx:DiscoveryDevelopmentAndSalesMilestonesMemberrxrx:MerckKGaAMerckMemberus-gaap:CollaborativeArrangementMember2022-01-310001601830rxrx:MerckKGaAMerckMemberus-gaap:CollaborativeArrangementMember2024-11-012024-11-300001601830rxrx:MerckKGaAMerckMemberus-gaap:CollaborativeArrangementMember2024-11-300001601830rxrx:RocheAndGenentechMemberus-gaap:CollaborativeArrangementMember2022-01-310001601830rxrx:RocheAndGenentechMemberus-gaap:CollaborativeArrangementMember2024-09-012024-09-300001601830rxrx:PhenomapsCreationMemberrxrx:RocheAndGenentechMemberus-gaap:CollaborativeArrangementMember2022-01-012022-01-310001601830rxrx:PhenomapsRawImagesMemberrxrx:RocheAndGenentechMemberus-gaap:CollaborativeArrangementMember2022-01-012022-01-310001601830rxrx:DevelopedAndCommercializedProgramsMemberrxrx:RocheAndGenentechMemberus-gaap:CollaborativeArrangementMember2022-01-012022-01-310001601830rxrx:RocheAndGenentechMemberus-gaap:CollaborativeArrangementMember2022-01-012022-01-310001601830rxrx:GastrointestinalCancerMemberrxrx:RocheAndGenentechMemberus-gaap:CollaborativeArrangementMember2022-01-012022-01-310001601830rxrx:NeuroscienceMemberrxrx:RocheAndGenentechMemberus-gaap:CollaborativeArrangementMember2022-01-012022-01-310001601830rxrx:BayerAGMemberus-gaap:CollaborativeArrangementMember2020-10-012020-10-310001601830rxrx:BayerAGMemberus-gaap:CollaborativeArrangementMember2020-10-310001601830rxrx:OneCustomerMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-01-012024-12-310001601830rxrx:TwoCustomersMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310001601830rxrx:TwoCustomersMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-12-310001601830rxrx:A2021EquityIncentivePlanMember2024-12-310001601830rxrx:A2024InducementEquityIncentivePlanMember2024-12-310001601830us-gaap:CostOfSalesMember2024-01-012024-12-310001601830us-gaap:CostOfSalesMember2023-01-012023-12-310001601830us-gaap:CostOfSalesMember2022-01-012022-12-310001601830us-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-12-310001601830us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-12-310001601830us-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-12-310001601830us-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-12-310001601830us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-12-310001601830us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-12-310001601830us-gaap:EmployeeStockMember2024-01-012024-12-310001601830us-gaap:EmployeeStockOptionMember2024-01-012024-12-310001601830us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001601830us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001601830us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-12-310001601830us-gaap:RestrictedStockUnitsRSUMember2023-12-310001601830us-gaap:RestrictedStockUnitsRSUMember2024-12-310001601830us-gaap:RestrictedStockUnitsRSUMemberrxrx:ExscientiaLegacyAwardsMember2024-01-012024-12-310001601830us-gaap:RestrictedStockUnitsRSUMemberrxrx:RetentionProgramForEmployeesMember2024-01-012024-12-310001601830us-gaap:DomesticCountryMember2024-12-310001601830us-gaap:DomesticCountryMember2023-12-310001601830us-gaap:StateAndLocalJurisdictionMember2024-12-310001601830us-gaap:StateAndLocalJurisdictionMember2023-12-310001601830us-gaap:ForeignCountryMember2024-12-310001601830us-gaap:ResearchMemberus-gaap:DomesticCountryMember2024-12-310001601830us-gaap:ResearchMemberus-gaap:StateAndLocalJurisdictionMember2024-12-310001601830us-gaap:ResearchMemberus-gaap:ForeignCountryMember2024-12-310001601830us-gaap:ResearchMemberus-gaap:DomesticCountryMember2023-12-310001601830us-gaap:ResearchMemberus-gaap:StateAndLocalJurisdictionMember2023-12-310001601830rxrx:OrphanDrugCreditCarryforwardMember2024-12-310001601830rxrx:OrphanDrugCreditCarryforwardMember2023-12-310001601830us-gaap:EmployeeStockOptionMember2024-01-012024-12-310001601830us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001601830us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001601830rxrx:TempusAgreementMember2024-01-012024-12-310001601830rxrx:TempusAgreementMember2023-01-012023-12-310001601830rxrx:TempusAgreementMember2022-01-012022-12-310001601830us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001601830us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001601830us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001601830us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001601830us-gaap:BankTimeDepositsMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001601830us-gaap:BankTimeDepositsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001601830us-gaap:FairValueMeasurementsRecurringMember2024-12-310001601830us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001601830us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001601830us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001601830us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001601830us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001601830us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001601830us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001601830us-gaap:FairValueMeasurementsRecurringMember2023-12-310001601830us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001601830us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001601830us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001601830us-gaap:PortionAtOtherThanFairValueFairValueDisclosureMemberus-gaap:NotesPayableOtherPayablesMember2024-12-310001601830us-gaap:PortionAtOtherThanFairValueFairValueDisclosureMemberus-gaap:NotesPayableOtherPayablesMember2023-12-310001601830us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:NotesPayableOtherPayablesMember2024-12-310001601830us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:NotesPayableOtherPayablesMember2023-12-310001601830us-gaap:PortionAtOtherThanFairValueFairValueDisclosureMember2024-12-310001601830us-gaap:PortionAtOtherThanFairValueFairValueDisclosureMember2023-12-310001601830us-gaap:EstimateOfFairValueFairValueDisclosureMember2024-12-310001601830us-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001601830rxrx:ReportableSegmentMember2024-01-012024-12-310001601830rxrx:ReportableSegmentMember2023-01-012023-12-310001601830rxrx:ReportableSegmentMember2022-01-012022-12-310001601830country:US2024-12-310001601830country:US2023-12-310001601830country:US2022-12-310001601830country:CA2024-12-310001601830country:CA2023-12-310001601830country:CA2022-12-310001601830country:GB2024-12-310001601830country:GB2023-12-310001601830country:GB2022-12-310001601830rxrx:OtherCountriesMember2024-12-310001601830rxrx:OtherCountriesMember2023-12-310001601830rxrx:OtherCountriesMember2022-12-310001601830us-gaap:CommonClassAMemberus-gaap:SubsequentEventMemberrxrx:AtTheMarketOfferingProgramMember2025-02-012025-02-2800016018302024-10-012024-12-310001601830rxrx:ChristopherGibsonMember2024-01-012024-12-310001601830rxrx:ChristopherGibsonMember2024-10-012024-12-310001601830rxrx:ChristopherGibsonMember2024-12-31

|

|

|

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-40323

Recursion Pharmaceuticals, Inc.

(Exact name of registrant as specified in its charter)

Delaware___________________________________________________ 46-4099738

(State or other jurisdiction of incorporation or organization)______________________ (I.R.S. Employer Identification No.)

41 S Rio Grande Street

Salt Lake City, UT 84101

(Address of principal executive offices) (Zip code)

(385) 269 - 0203

(Registrant’s telephone number, including area code)

|

|

|

|

|

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class |

Trading symbol(s) |

Name of each exchange on which registered |

| Class A Common Stock, par value $0.00001 |

RXRX |

Nasdaq Global Select Market |

|

|

|

|

Securities registered pursuant to section 12(g) of the Act: None

_____________________________________________________________________________________________________

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes x No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

x |

|

Non-accelerated filer |

☐ |

| Accelerated filer |

☐ |

|

Smaller reporting company |

☐ |

|

|

|

Emerging growth company |

☐ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the 201,103,102 shares of Class A common voting stock held by non-affiliates of the Registrant, computed by reference to the closing price as reported on the Nasdaq Stock Exchange, as of the last business day of the registrant’s most recently completed second fiscal quarter (June 30, 2024) was $1,508.3 million.

As of January 31, 2025, there were 395,072,094 and 6,918,575 shares of the registrant’s Class A and B common stock, respectively, par value $0.00001 per share outstanding, respectively.

|

|

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement for use in connection with the registrant’s 2025 Annual Meeting of Stockholders to be filed hereafter are incorporated by reference into Part III of this report.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A Letter from Our

Co-Founder and CEO

Dear Shareholders,

As we step into 2025, I want to take a moment to reflect on where Recursion stands today and where we are headed. The future of our company—and of the broader pharmaceutical industry—depends on our ability to maintain an unwavering commitment to a bold, audacious vision. This is even more true in challenging times where funding, both for biotech companies and the early research that drives our industry forward, are facing headwinds. At Recursion, we are driven by a singular mission: to decode biology to radically improve lives. We are harnessing the power of cutting-edge technology, vast datasets, and foundation models to transform the way drugs are discovered and developed. And while we’ve adjusted our sails to the winds of our industry, capital markets and more, we’ve never altered our destination. We won’t settle for anything less than achieving this mission, and I’m proud to lead a company where we take that approach, from our employees, to our leadership, and to our Board of Directors. Our boldness in the face of stormy weather is one of the things that makes us the leader in TechBio.

|

|

|

|

|

|

|

|

Largest merger or acquisition

IN THE TECHBIO SPACE TO DATE WITH EXSCIENTIA

|

|

Recursion’s commitment to revolutionizing drug development took a major leap forward last year with the announcement of the largest merger or acquisition in the TechBio space to date—our combination with Exscientia. This was not just a transaction; it was the formation of a first-of-its-kind, fully integrated, technology-first drug discovery platform, and it was a transaction that we’ve known could be transformative for years. By uniting Recursion’s strength in scaling biological insights and clinical translation with Exscientia’s precision chemistry and small-molecule expertise, we have created a seamless, AI-driven approach spanning from early discovery to clinical development.

Through this combination, we have built a unique full-stack platform. Way back in 2013, we started with a point-solution; leveraging computer vision to unlock all of the information in cell morphology. Our pioneering work in phenomics, which is now a part of nearly every large pharmaceutical company’s discovery workstream, was just the beginning. While hundreds of TechBio startups today are optimizing their first point-solution, we’ve continued advancing our tech-enabled philosophy to build, buy and combine point solutions across virtually all major steps in drug discovery from target discovery to clinical development. We’ve continued investing, from scaling new high-dimensional -omics assays, to building BioHive-2, the most advanced supercomputer in the pharmaceutical industry, all because we believe more than ever that a technology-driven approach is what will finally unlock the much needed and anticipated shift in the way drugs are discovered and developed.

And while I’m proud that we have led the burgeoning TechBio space for more than a decade, I’m even happier to see hundreds of companies, big and small, following in our footsteps. For years we preached the potential of combining sophisticated computational techniques with large biological and chemical dataset creation to a skeptical (and sometimes hostile) audience. Today, the naysayers are part of a slimming minority and the progressive visionaries of the industry are all plotting their path to this inevitable future of drug discovery. The era of TechBio is truly here, and we are proud to be such a big part of it.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10 key clinical milestones

EXPECTED OVER THE NEXT 18 MONTHS

|

|

A Look Back at 2024: Delivering on the Promise of AI and Data-Driven Drug Discovery

The strength of our approach is evident in our growing portfolio. We now have 10 clinical and preclinical programs, with approximately 10 key clinical milestones expected over the next 18 months. Beyond that, we have more than 10 advanced discovery programs advancing rapidly toward the clinic alongside some incredibly exciting programs and molecules that are a part of our discovery collaborations.

One compelling example is REC-1245, a potential first-in-class RBM39 degrader for biomarker-enriched solid tumors and lymphoma. This program, one of the first to result from our end-to-end AI-enabled platform, leveraged advanced maps of biology to identify RBM39 as a critical target and our early AI-enabled chemistry platform to advance the molecule to candidate. Through preclinical models, we validated that RBM39 degradation disrupts key DNA damage response (DDR) networks, potentially halting cancer growth. The journey from target identification to IND-enabling studies was completed in just 18 months—less than half of the industry average—leading to our first patient being dosed in the fourth quarter of 2024.

Another breakthrough is REC-617, our precision-designed CDK7 inhibitor, which has shown promising interim results in the Phase 1/2 ELUCIDATE trial. Early data demonstrates robust target engagement, a favorable pharmacokinetic and pharmacodynamic profile, and compelling initial clinical activity. Notably, a confirmed partial response was observed in a heavily pre-treated patient with platinum-resistant ovarian cancer, lasting more than six months, alongside four additional patients achieving stable disease. Designed entirely using our AI-led platform, REC-617 was synthesized from hit to candidate in just under 12 months, requiring only 136 novel molecules—an order of magnitude more efficient than conventional drug discovery.

Beyond our own programs, we continue to collaborate with leading biopharma partners like Roche and Genentech, Sanofi, Bayer, and Merck KGaA, Darmstadt, Germany. These partnerships validate our platform and amplify our impact. For example, our collaboration with Roche and Genentech achieved a groundbreaking milestone: the world’s first genome-scale Neuromap, a comprehensive AI-powered model of neurobiology built from human-induced pluripotent stem cell (hiPSC)-derived neurons. This effort, which required generating over a trillion neurons, led to a first-of-its-kind neuroscience phenomap that Roche-Genentech optioned for $30 million.

Similarly, our work with Sanofi continues to drive value. In 2024, we received $15 million in milestone payments after advancing two discovery programs into lead optimization, each showing strong differentiation and best-in-class potential. To date, we have generated over $450 million in collaboration payments, not only through upfront payments, but by consistently delivering on milestones, a feat achieved by few other biotech companies in history. As we look ahead, we are well on our way toward unlocking up to $20 billion in potential milestone payments before royalties—fueling the next generation of AI-driven drug discovery and development.

|

|

|

|

|

|

|

|

|

|

|

|

>$450 Million

IN COLLABORATION PAYMENTS TO DATE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2025 and Beyond: The Dawn of the Virtual Cell

For the small set of leaders in TechBio—spanning companies, institutes and academics - we are converging around a breakthrough in the coming years that has the potential to create a transformational shift. We are approaching a future where many biological processes can be accurately simulated—a concept we call the "virtual cell." Today, our wet labs primarily generate the data needed to train AI models. But in the near future, these labs will primarily validate AI-driven predictions, fundamentally flipping the paradigm of drug discovery.

|

Four interconnected layers of biology |

|

We believe that achieving this vision will require excellence across four interconnected layers of biology:

1.Population-Scale Patient-Level Data: Thanks to the genomic revolution and the progressive thinking of a small number of governments around the world, we and many others have had access to population-scale -omics data from patients. In the last 18 months, we have dramatically expanded the power of our approach by signing deals with companies like Tempus and Helix to bring tens of petabytes of proprietary data to support our discovery and development.

2.Pathway-Level Data: We are far ahead in systematically mapping gene networks across multiple cellular contexts, using techniques like whole-genome CRISPR knockout and high-dimensional -omics analysis across hundreds of millions of proprietary experiments.

3.Protein-Level Insights: AlphaFold and similar tools have revolutionized protein modeling. By integrating state-of-the-art protein-protein interaction and ligand-binding predictions, we remain at the forefront of this rapidly evolving space.

4.Atomistic-Level Simulations: With Exscientia’s quantum mechanics/molecular dynamics (QM/MD) expertise now part of Recursion, we are uniquely positioned to lead in simulating molecular interactions at atomic precision.

By integrating these layers, Recursion is building one of the most advanced predictive models of human biology ever created. This will allow us to explore the vast landscape of potential drugs and disease mechanisms in silico before ever stepping into the lab—dramatically accelerating drug development timelines and reducing costs.

Transforming Clinical Development with AI and Automation

In 2025, we are also doubling down on transforming clinical development through our ClinTech platform, powered by AI, automation, and real-world evidence. Our partnerships with Tempus, Helix and a growing cohort of other data sources provide us with access to critical patient data, allowing us to:

•Use AI-driven simulations to optimize trial design and enhance our probability of success.

•Automate critical processes like patient recruitment and site activation, dramatically reducing enrollment timelines.

•Leverage real-world evidence to inform regulatory strategies and increase the likelihood of clinical success.

And through partnerships with Faro Health and other industry leaders, we are industrializing clinical workflows, reducing trial costs, and streamlining operations—all while increasing the speed at which we bring new medicines to patients. We are in the early days of this work, but I am so excited at the potential I am already seeing. Coupling these advances with our discovery and translational platform will magnify all of our clintech work and continue to accelerate our lead in the TechBio space.

|

|

|

|

|

|

•Population-Scale Patient-Level Data

•Pathway-Level Data

•Protein-Level Insights

•Atomistic-Level Simulations

|

|

|

|

|

|

| “This is not just about technology for the sake of technology. It is about ensuring that the boldest ideas in biotech are realized and that the future of medicine is shaped by those who are willing to embrace the extraordinary.” |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Future of TechBio: A Call to Boldness

The path we are charting is not an easy one. It is filled with challenges, and it requires taking risks that others shy away from. But if we are to fulfill our promise—to revolutionize drug discovery and improve patient lives at scale—we must push forward with conviction.

This is not just about technology for the sake of technology. It is about ensuring that the boldest ideas in biotech are realized and that the future of medicine is shaped by those who are willing to embrace the extraordinary. As we step into 2025, I am more confident than ever that Recursion is leading the way. With a solid foundation, a world-class team, and a relentless commitment to innovation, we are poised to make this year our most transformative yet.

Thank you for your continued belief in our mission. Together, we are unlocking the future of medicine.

Chris Gibson, Ph.D.

Founder and CEO, Recursion

|

TABLE OF CONTENTS

PART I

Risk Factor Summary

Below is a summary of the principal factors that make an investment in the common stock of Recursion Pharmaceuticals, Inc. (Recursion, the Company, we, us, or our) risky or speculative. This summary does not address all of the risks we face. Additional discussion of the risks summarized below, and other risks that we face, can be found in the section titled “Item 1A. Risk Factors” in this Annual Report on Form 10-K.

Risks Related to Our Limited Operating History, Financial Position, and Need for Additional Capital

◦We are a clinical-stage biotechnology company with a limited operating history and no products approved by regulators for commercial sale, which may make it difficult to evaluate our current and future business prospects

◦We have incurred significant operating losses since our inception and anticipate that we will incur continued losses for the foreseeable future.

◦We will need to raise substantial additional funding. If we are unable to raise capital when needed, we would be forced to delay, reduce, or eliminate at least some of our product development programs, business development plans, strategic investments, and potential commercialization efforts, and to possibly cease operations.

◦Raising additional capital and issuing additional securities may cause dilution to our stockholders, restrict our operations, require us to relinquish rights to our technologies or drug candidates, and divert management’s attention from our core business.

◦We may be required to repurchase for cash all, or to facilitate the purchase by a third party of all, of the shares of Class A common stock that were issued to the Bill & Melinda Gates Foundation, or the Gates Foundation, in exchange for the Exscientia American Depositary Shares (ADSs) that the Gates Foundation purchased from Exscientia in an October 2021 private placement if we default under the global access commitments agreement with Exscientia, which could have an adverse impact on us.

◦We are engaged in strategic collaborations and we intend to seek to establish additional collaborations, including for the clinical development or commercialization of our drug candidates. If we are unable to establish collaborations on commercially reasonable terms or at all, or if current and future collaborations are not successful, we may have to alter our development and commercialization plans.

◦We have no products approved for commercial sale and have not generated any revenue from product sales. We or our current and future collaborators may never successfully develop and commercialize our drug candidates, which would negatively affect our results of operation and our ability to continue our business operations.

◦If we engage in future acquisitions or strategic partnerships, this may increase our capital requirements, dilute our stockholders’ equity, cause us to incur debt or assume contingent liabilities, and subject us to other risks.

Risks Related to the Discovery and Development of Drug Candidates

◦Our approach to drug discovery is unique and may not lead to successful drug products for various reasons, including, but not limited to, challenges identifying mechanisms of action for our candidates.

◦Our drug candidates are in preclinical or clinical development, which are lengthy and expensive processes with uncertain outcomes and the potential for substantial delays.

◦If we experience delays or difficulties in the enrollment of patients in clinical trials, our receipt of necessary regulatory approvals could be delayed or prevented.

◦Our planned clinical trials, or those of our current and potential future collaborators, may not be successful or may reveal significant adverse events not seen in our preclinical or nonclinical studies, which may result in a safety profile that could inhibit regulatory approval or market acceptance of any of our drug candidates.

◦We may develop drug candidates for use in combination with other therapies, which exposes us to additional risks.

◦We conduct clinical trials for our drug candidates outside the United States, and the FDA and similar foreign regulatory authorities may not accept data from such trials.

◦It is difficult to establish with precision the incidence and prevalence for target patient populations of our drug candidates. If the market opportunities for our drug candidates are smaller than we estimate, or if any approval that we obtain is based on a narrower definition of the patient population, our revenue and ability to achieve profitability will be adversely affected, possibly materially.

◦We may never realize a return on our investment of resources and cash in our drug discovery collaborations.

◦We face substantial competition, which may result in others discovering, developing, or commercializing products before, or more successfully than, we do.

◦Because we have multiple programs and drug candidates in our development pipeline and are pursuing a variety of target indications and treatment modalities, we may expend our limited resources to pursue a particular drug candidate and fail to capitalize on development opportunities or drug candidates that may be more profitable or for which there is a greater likelihood of success.

◦Our product candidates may cause significant adverse events, toxicities or other undesirable side effects when used alone or in combination with other approved products or investigational new drugs that may result in a safety profile that could prevent regulatory approval, prevent market acceptance, limit their commercial potential or result in significant negative consequences.

Risks Related to Our Platform and Data

◦We have invested, and expect to continue to invest, in research and development efforts to further enhance our drug discovery platform, which is central to our mission. If the return on these investments is lower or develops more slowly than we expect, our business and operating results may suffer.

◦Our information technology systems and infrastructure may fail or experience security breaches and incidents that could adversely impact our business and operations and subject us to liability.

◦Interruptions in the availability of server systems or communications with internet or cloud-based services, or failure to maintain the security, confidentiality, accessibility, or integrity of data stored on such systems, could harm our business.

◦Our solutions utilize third-party open source software (OSS), which presents risks that could adversely affect our business and subject us to possible litigation.

◦Issues relating to the use of artificial intelligence and machine learning in our offerings could adversely affect our business and operating results.

Risks Related to Our Operations/Commercialization

◦Even if any drug candidates we develop receive marketing approval, they may fail to achieve the degree of market acceptance by physicians, patients, healthcare payors, and others in the medical community necessary for commercial success.

◦If we are unable to establish sales and marketing capabilities or enter into agreements with third parties to sell and market any drug candidates we may develop, we may not be successful in commercializing those drug candidates, if and when they are approved.

◦We are subject to regulatory and operational risks associated with the physical and digital infrastructure at both our internal facilities and those of our external service providers.

◦The manufacture of drugs is complex, and our third-party manufacturers may encounter difficulties in production or supply chain. If any of our third-party manufacturers encounter such difficulties, our ability to provide adequate supply of our product candidates for clinical trials or our products for patients, if approved, could be delayed or prevented.

Risks Related to Our Intellectual Property

◦Our success significantly depends on our ability to obtain and maintain patents of adequate scope covering our proprietary technology and drug candidate products. Obtaining and maintaining patent assets is inherently challenging, and our pending and future patent applications may not issue with the scope we need, if at all.

◦Our current proprietary position for certain drug product candidates depends upon our owned or in-licensed patent filings covering components of such drug product candidates, manufacturing-related methods, formulations, and/or methods of use, which may not adequately prevent a competitor or other third party from using the same drug candidate for the same or a different use.

◦We may not be able to protect our intellectual property and proprietary rights throughout the world.

◦If we do not obtain patent term extension and data exclusivity for any drug product candidates we may develop, our business may be materially harmed.

◦We may need to license certain intellectual property from third parties, and such licenses may not be available or may not be available on commercially reasonable terms.

◦Changes in U.S. patent law could diminish the value of patents in general, thereby impairing our ability to protect our products.

◦Issued patents covering our drug product candidates and proprietary technology that we have developed or may develop in the future could be found invalid or unenforceable if challenged in court or before administrative bodies in the United States or abroad.

Risks Related to Acquisitions

◦The failure to integrate successfully the businesses of Recursion and Exscientia in the expected timeframe would adversely affect Recursion’s future business and financial performance.

◦The anticipated benefits of the business combination with Exscientia may vary from expectations.

◦As a company with substantial operations outside of the United States, we are subject to economic, political, regulatory and other risks associated with international operations.

Risks Related to Government Regulation

◦We may be unable to obtain U.S. or foreign regulatory approval and, as a result, may be unable to commercialize our product candidates.

◦The FDA, EMA and other comparable foreign regulatory authorities may not accept data from trials conducted in locations outside of their jurisdiction.

◦Even if we receive FDA or other regulatory approval for any of our drug candidates, we will be subject to ongoing regulatory obligations and other conditions that may result in significant additional expense, as well as the potential recall or market withdrawal of an approved product if unanticipated safety issues are discovered.

◦The FDA and other regulatory agencies actively enforce the laws and regulations prohibiting the promotion of off-label uses.

◦Though we have been granted orphan drug designation for certain of our drug candidates, we may be unsuccessful or unable to maintain the benefits associated with such a designation, including the potential for market exclusivity.

◦We are subject to U.S. and foreign laws regarding privacy, data protection, and data security that could entail substantial compliance costs, while the failure to comply could subject us to significant liability.

◦Regulatory and legislative developments related to the use of AI could adversely affect our use of such technologies in our products, services, and business.

Other Risks

◦Third parties that perform some of our research and preclinical testing or conduct our clinical trials may not perform satisfactorily or their agreements may be terminated.

◦Third parties that manufacture our drug candidates for preclinical development, clinical testing, and future commercialization may not provide sufficient quantities of our drug candidates or products at an acceptable cost, which could delay, impair, or prevent our development or commercialization efforts.

◦We may not realize all of the anticipated outcomes and benefits of our Acquisitions.

◦Our future success depends on our ability to retain key executives and experienced scientists, and to attract, retain, and motivate qualified personnel.

◦We have identified a material weakness in our internal control over financial reporting.

Cautionary Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K contains “forward-looking statements” about us and our industry within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical facts are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “would,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential,” or “continue” or the negative of these terms or other similar expressions. Forward-looking statements contained in this report may include without limitation those regarding:

•our research and development programs;

•the initiation, timing, progress, results, and cost of our current and future preclinical and clinical studies, including statements regarding the design of, and the timing of initiation and completion of, studies and related preparatory work, as well as the period during which the results of the studies will become available and key milestones will be met;

•our ability to use our combined assets from our recent business combination to create a fully integrated, technology-first drug discovery platform;

•the timing and likelihood of our ability to shift our wet-lab from a source of data generation to a model for validating data from AI-generated results;

•the ability and willingness of our collaborators to continue research and development activities relating to our development candidates and investigational medicines;

•future agreements with third parties in connection with the commercialization of our investigational medicines and any other approved product;

•the timing, scope, and likelihood of regulatory filings and approvals, including the timing of Investigational New Drug applications and final approval by the U.S. Food and Drug Administration, or FDA, of our current drug candidates and any other future drug candidates, as well as our ability to maintain any such approvals;

•the timing, scope, or likelihood of foreign regulatory filings and approvals, including our ability to maintain any such approvals;

•the size of the potential market opportunity for TechBio companies, including the expected impact of AI-enabled technologies;

•the size of the potential market opportunity for our drug candidates, including our estimates of the number of patients who suffer from the diseases we are targeting;

•our ability to identify viable new drug candidates for clinical development and the rate at which we expect to identify such candidates, whether through an inferential approach or otherwise;

•our expectation that the assets that will drive the most value for us are those that we will identify in the future using our datasets and tools;

•our ability to develop and advance our current drug candidates and programs into, and successfully complete, clinical studies;

•our ability to reduce the time or cost or increase the likelihood of success of our research and development relative to the traditional drug discovery paradigm, including the use of data sets from our partners to accelerate the development of our AI-enabled technologies;

•our ability to improve, and the rate of improvement in, our infrastructure, datasets, biology, technology tools, and drug discovery platform, and our ability to realize benefits from such improvements;

•our ability to effectively use machine learning and artificial intelligence in our drug development process;

•our ability to leverage our collaborations and partnerships to develop our products and grow our business;

•our expectations related to the performance and benefits of our BioHive-2 supercomputer, Recursion OS, and our digital chemistry platform;

•our ability to realize a return on our investment of resources and cash in our drug discovery collaborations;

•our ability to sell or license assets and re-invest proceeds into funding our long-term strategy;

•our ability to scale like a technology company and to add more programs to our pipeline each year;

•our ability to acquire and generate datasets to train and develop our AI-enabled technologies;

•our ability to successfully compete in a highly competitive market;

•our manufacturing, commercialization, and marketing capabilities and strategies;

•our plans relating to commercializing our drug candidates, if approved, including the geographic areas of focus and sales strategy;

•our expectations regarding the approval and use of our drug candidates in combination with other drugs;

•the rate and degree of market acceptance and clinical utility of our current drug candidates, if approved, and other drug candidates we may develop;

•our competitive position and the success of competing approaches that are or may become available, including with respect to our AI-enabled technologies;

•our estimates of the number of patients that we will enroll in our clinical trials and the timing of their enrollment;

•the beneficial characteristics, safety, efficacy, and therapeutic effects of our drug candidates;

•our plans for further development of our drug candidates, including additional indications we may pursue;

•our ability to adequately protect and enforce our intellectual property and proprietary technology, including the scope of protection we are able to establish and maintain for intellectual property rights covering our current drug candidates and other drug candidates we may develop, receipt of patent protection, the extensions of existing patent terms where available, the validity of intellectual property rights held by third parties, the protection of our trade secrets, and our ability not to infringe, misappropriate or otherwise violate any third-party intellectual property rights;

•the impact of any intellectual property disputes and our ability to defend against claims of infringement, misappropriation, or other violations of intellectual property rights;

•our ability to keep pace with new technological developments, including with respect to AI;

•our ability to utilize third-party open source software and cloud-based infrastructure, on which we are dependent;

•the adequacy of our insurance policies and the scope of their coverage;

•the potential impact of a pandemic, epidemic, or outbreak of an infectious disease, such as COVID-19, or natural disaster, global political instability, or warfare, and the effect of such outbreak or natural disaster, global political instability, or warfare on our business and financial results;

•our ability to achieve net-zero greenhouse gas emissions across our operations;

•our ability to maintain our technical operations infrastructure to avoid errors, delays, or cybersecurity breaches;

•our continued reliance on third parties to conduct additional clinical trials of our drug candidates, and for the manufacture of our drug candidates for preclinical studies and clinical trials;

•our ability to obtain, and negotiate favorable terms of, any collaboration, licensing or other arrangements that may be necessary or desirable to research, develop, manufacture, or commercialize our platform and drug candidates;

•the pricing and reimbursement of our current drug candidates and other drug candidates we may develop, if approved;

•our estimates regarding expenses, future revenue, capital requirements, and need for additional financing;

•our financial performance;

•the period over which we estimate our existing cash and cash equivalents will be sufficient to fund our future operating expenses and capital expenditure requirements;

•our ability to raise substantial additional funding;

•the impact of current and future laws and regulations, and our ability to comply with all regulations that we are, or may become, subject to;

•the need to hire additional personnel and our ability to attract and retain such personnel;

•the impact of any current or future litigation, which may arise during the ordinary course of business and be costly to defend;

•our ability to maintain effective internal control over financial reporting and disclosure controls and procedures, including our ability to remediate the material weakness in internal control over financial reporting;

•our anticipated use of our existing resources and the net proceeds from our public offerings; and

•other risks and uncertainties, including those listed in the section titled “Risk Factors.”

We have based these forward-looking statements largely on our current expectations and projections about our business, the industry in which we operate, and financial trends that we believe may affect our business, financial condition, results of operations, and prospects. These forward-looking statements are not guarantees of future performance or development. These statements speak only as of the date of this report and are subject to a number of risks, uncertainties and assumptions described in the section titled “Risk Factors” and elsewhere in this report. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Except as required by applicable law, we undertake no obligation to update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, or otherwise.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this report. While we believe such information forms a reasonable basis for such statements, the information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and you are cautioned not to unduly rely upon them.

Item 1. Business.

Recursion At-a-Glance

The Problem

Discovering and developing effective new medicines is among the most challenging human pursuits due to the incredible complexity of biology, the vastness of chemical space, and both the ineffectiveness and inefficiencies in clinical development. Today more than 90% of clinical trials fail.

Our Mission and Philosophy

Recursion was founded in 2013 to decode biology to radically improve lives by building the next generation biopharma company from the ground-up, leveraging the latest technology tools to help map and navigate the incredible complexity of biology, vastness of chemical space, and the broken drug development process. We believe that rapid commoditization of artificial intelligence creates a once-in-a-generation market opportunity for companies with the ability to build the right datasets in biology and chemistry to win.

Our Competitive Advantage

That’s why we have invested heavily in creating one of the most sophisticated automated wet-laboratories in the world where robots and sensors help us conduct and digitize millions of real-life experiments each week, spanning cellular systems, chemical systems, tissue systems, and animal models. We also partner with select companies to aggregate and relate data from patients and health systems at scale. In addition, we command industry-leading computational capabilities including BioHive-2 (the fastest supercomputer wholly owned and operated by any biopharma company), and employ hundreds of data scientists, software engineers, and AI researchers who build software to automate our work and foundational AI models that help us see patterns in our data at scale. Together our laboratories, data, software, compute, and team comprise what we believe is one of the most sophisticated operating systems for drug discovery on earth, The Recursion OS.

How we Create Value

We leverage the Recursion OS to deliver value in three ways: 1) our own pipeline of clinical and preclinical potential medicines focused in precision oncology, rare disease, and other niche areas of unmet need; 2) by discovering new medicines with large biopharmaceutical companies in some of the biggest areas of unmet need like neuroscience and inflammation; and 3) by leveraging our tools, technology, and data for the benefit of other partners in targeted and limited ways.

Figure 1. Portfolio poised for value creation from a unified operating system. 1Includes preclinical programs (programs expected to enter the clinic within the next 18 months). 2Program milestones include data readouts, preliminary data updates, regulatory submissions, trial initiation, etc.

2024 Highlights & Progress

In 2024, we accelerated the next wave of AI-driven drug discovery and development, delivering key milestones across multiple clinical programs, advancing our transformative partnerships, unveiling major breakthroughs in foundation models, and by consolidating some of the best tools, technologies, and talent into what we believe is the leading company in the burgeoning field of TechBio.

Advancements in the Pipeline:

•REC-617: A potential best-in-class CDK7 inhibitor optimized using our AI platform, delivered early Phase 1/2 results demonstrating promising safety and preliminary efficacy, including a durable partial response in a late-stage metastatic ovarian cancer patient and stable disease across four other patients with solid tumors (e.g. CRC, NSCLC)

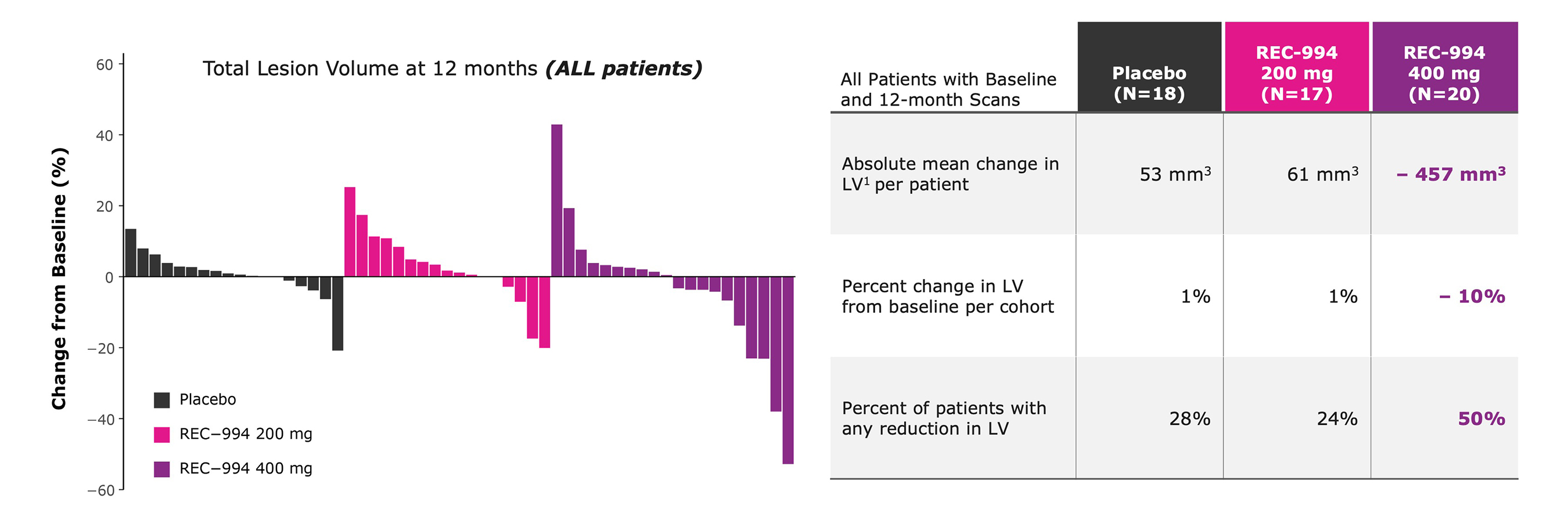

•REC-994: A potential first-in-disease oral superoxide scavenger for symptomatic CCM, confirmed safety and tolerability of chronic dosing in a Phase 2 study, with exploratory analyses suggesting lesion volume reduction on MRI and symptom stabilization as evaluated by change in mRS scores

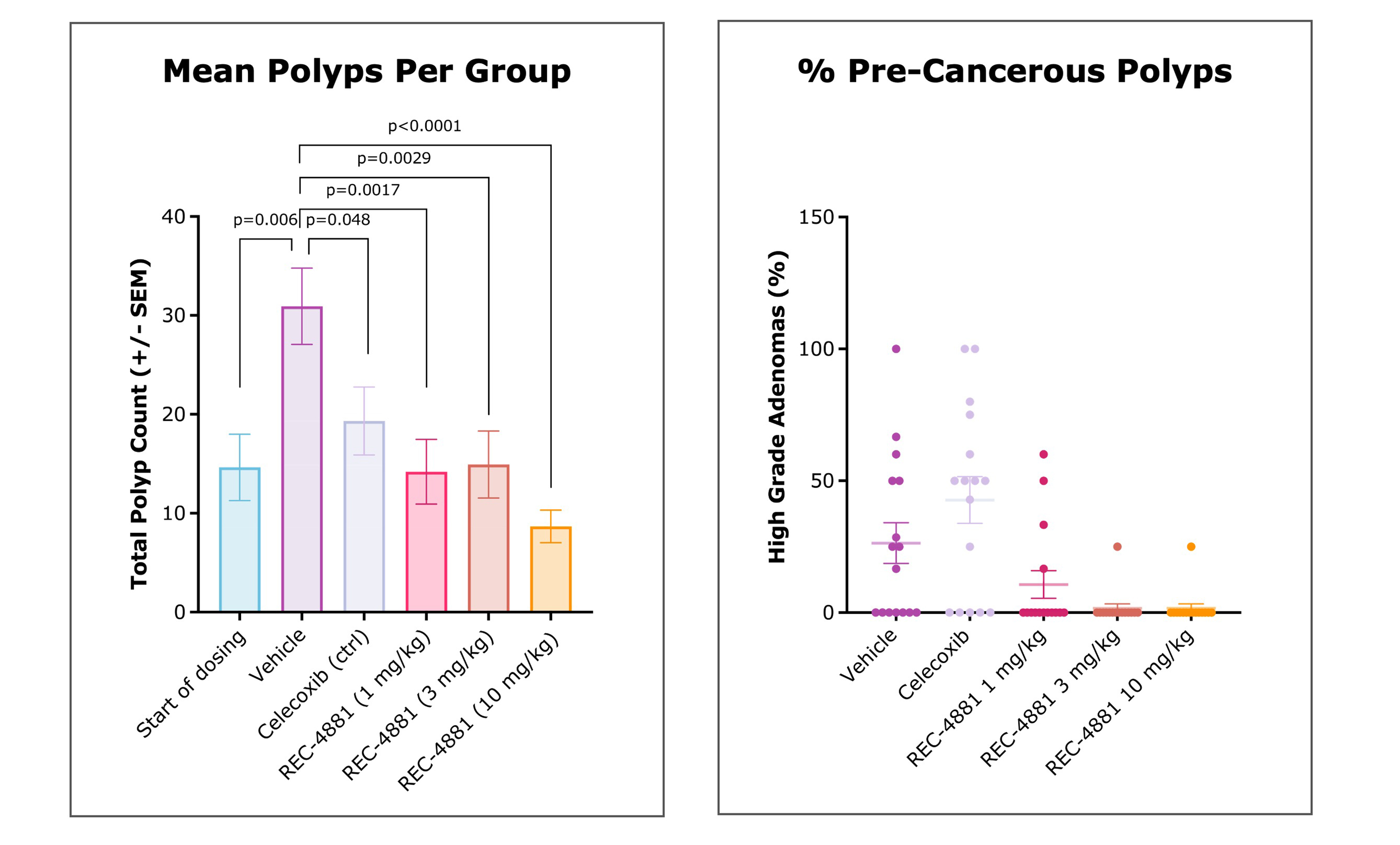

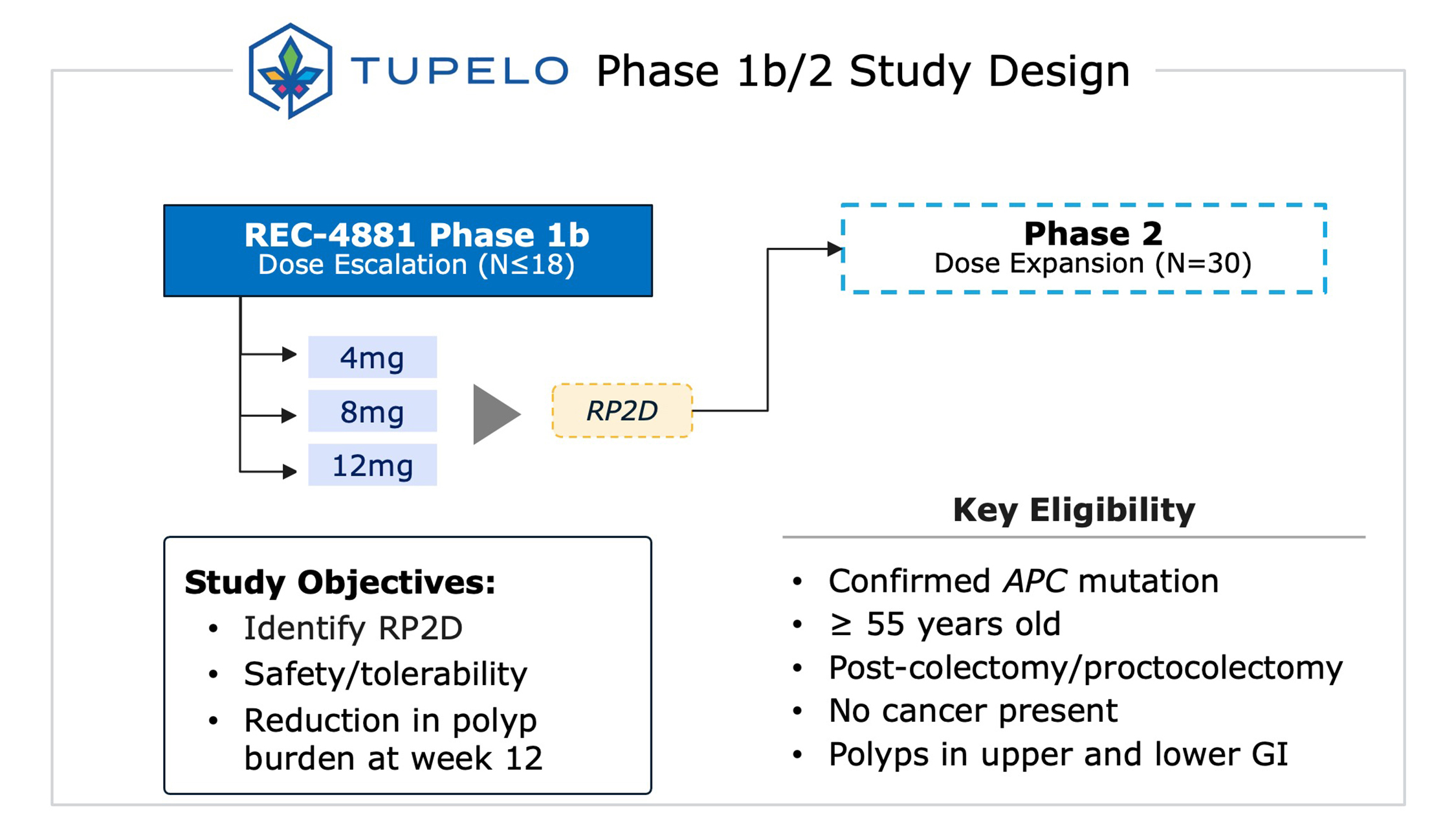

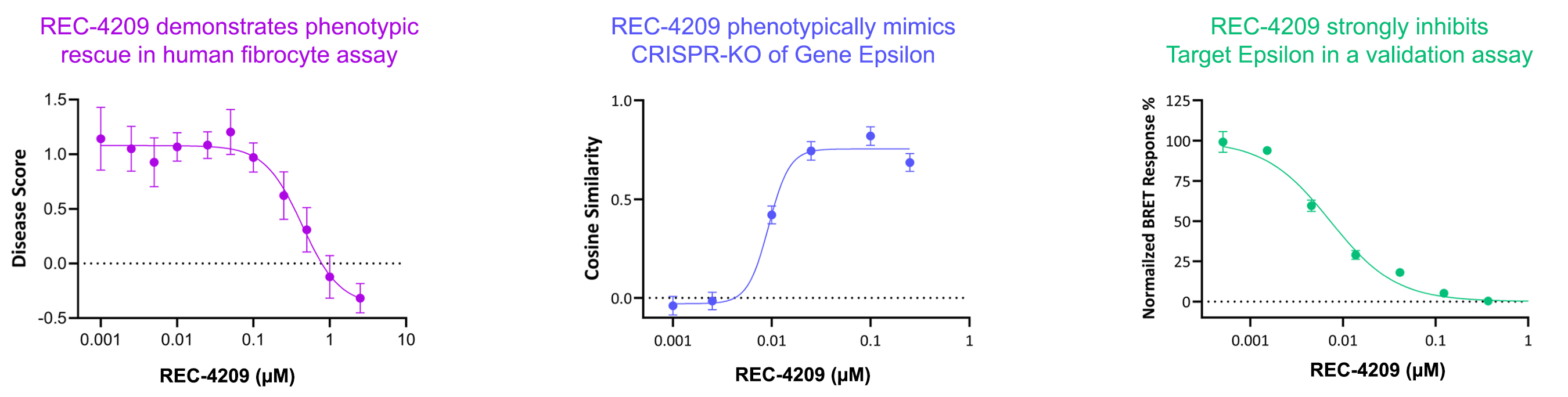

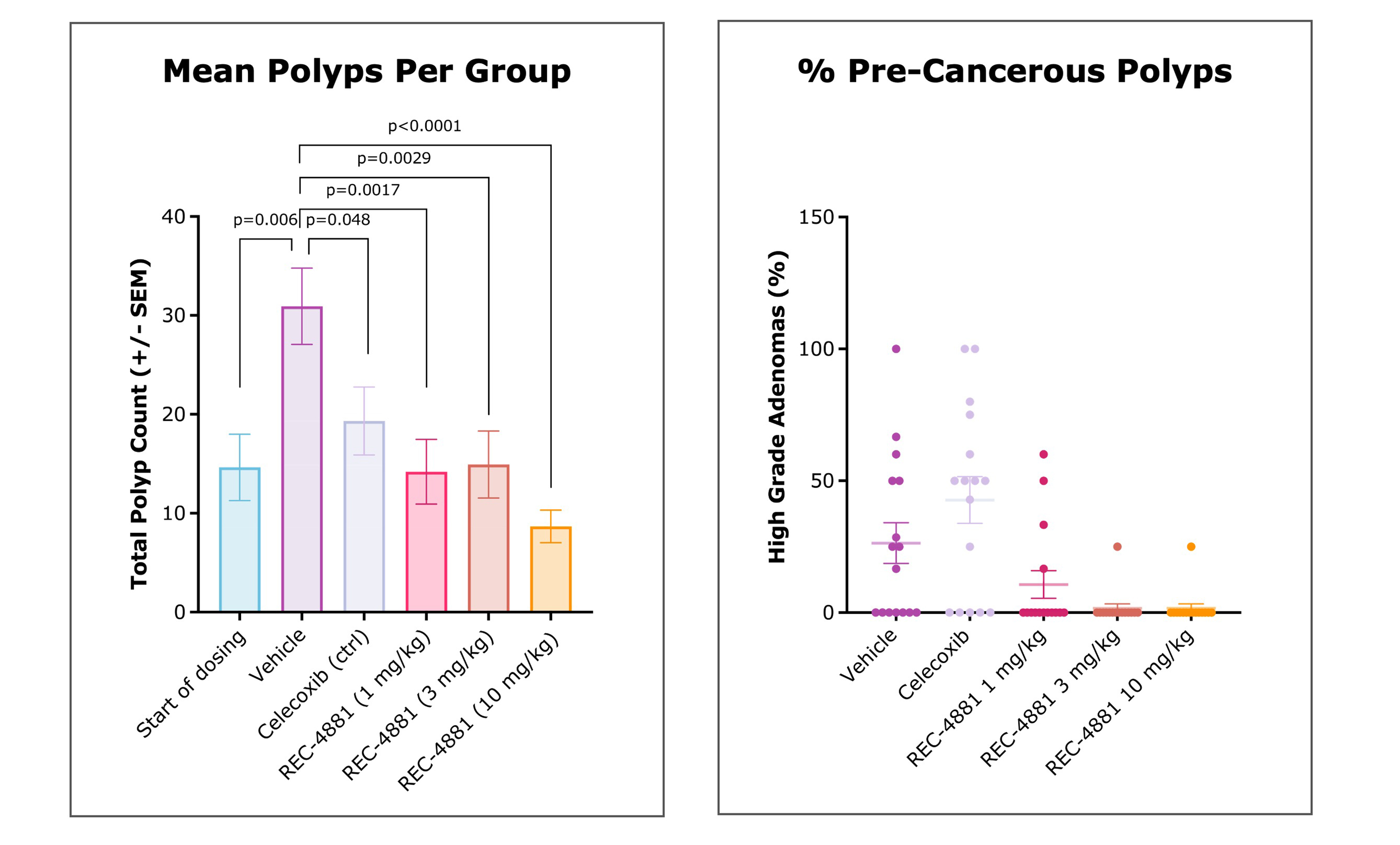

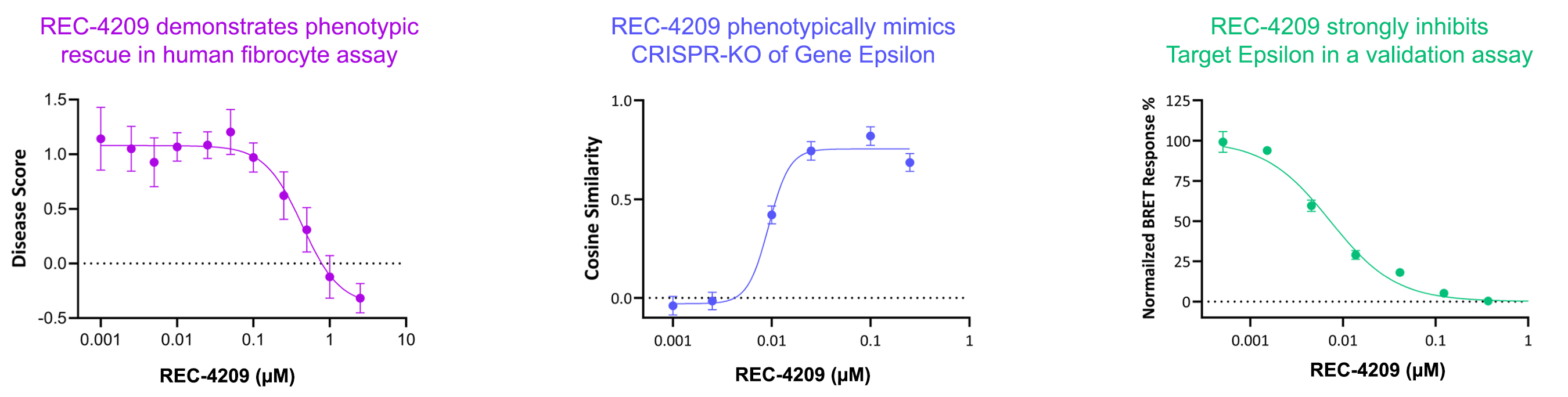

•Clinical Advancements and Regulatory Milestones: Initiated three clinical studies: DAHLIA (Phase 1/2, REC-1245 for solid tumors and lymphoma), TUPELO (Phase 1b/2, REC-4881 for FAP), and ALDER (Phase 2, REC-3964 for recurrent C. difficile infection), received IND clearance for REC-4539 (small cell lung cancer), CTA approval for REC-3565 (b-cell malignancies), and progressed REC-4209 (idiopathic pulmonary fibrosis) to IND-enabling studies

Advancements in Partnerships:

•Roche and Genentech: Generated whole-genome and chemical perturbation maps in a gastrointestinal oncology indication and a whole genome neuroscience phenomap. The neuro phenomap resulted in the exercise of a $30M milestone

•Sanofi: Achieved $15M in milestones, advancing multiple targets in immunology and oncology into lead optimization

•Bayer: Completed 25 multimodal oncology data packages and delivery of LOWE, our LLM-orchestrated workflow software, to enhance research capabilities

•Merck KGaA (Darmstadt, Germany): Advanced alliance to identify first-in-class or best-in-class targets across oncology and immunology

Advancements in Platform:

•Full Stack AI Powered Platform: Our constantly evolving Recursion OS spans target discovery through clinical development, enabling efficient molecule design and testing for both first-in-class and best-in-class opportunities

•Breakthroughs in Foundation Models: We’ve developed both unimodal and multimodal AI models like Phenom, MolPhenix, and MolGPS that accelerate our ability to make high-confidence predictions in our therapeutics programs

•Advancement in Causal AI Models: Through collaborations with Tempus and Helix, we integrate real-world, scaled patient datasets with our proprietary internal data to deepen biological insights and better match our therapeutic candidates with target populations

•Emerging Focus on ClinTech: We are using AI and machine learning to optimize clinical trial design, accelerate patient enrollment, and enhance evidence generation through data-driven methodologies

What’s Next

In 2025, we plan to accelerate our pipeline with additional clinical readouts, deepen existing partnerships, and further expand our proprietary data suite. We anticipate up to 10 additional clinical program milestones over the next 18 months, exciting milestone achievements in our R&D collaborations, and continued breakthroughs in AI-driven discovery, advancing our mission to decode biology to radically improve lives. Significant milestones from our portfolio of pharma R&D partnerships and a focus on monetizing select assets in our pipeline will help to subsidize continued investment to expand our leading position in the TechBio space, which we view as a generational opportunity for value creation.

Business Overview

Recursion is a leading clinical stage TechBio company with a mission to decode biology to radically improve lives. We aim to achieve our mission by industrializing drug discovery using the Recursion Operating System (OS), a vertical platform of diverse technologies that enables us to map and navigate trillions of biological, chemical, and patient-centric relationships utilizing approximately 65 petabytes of proprietary data.

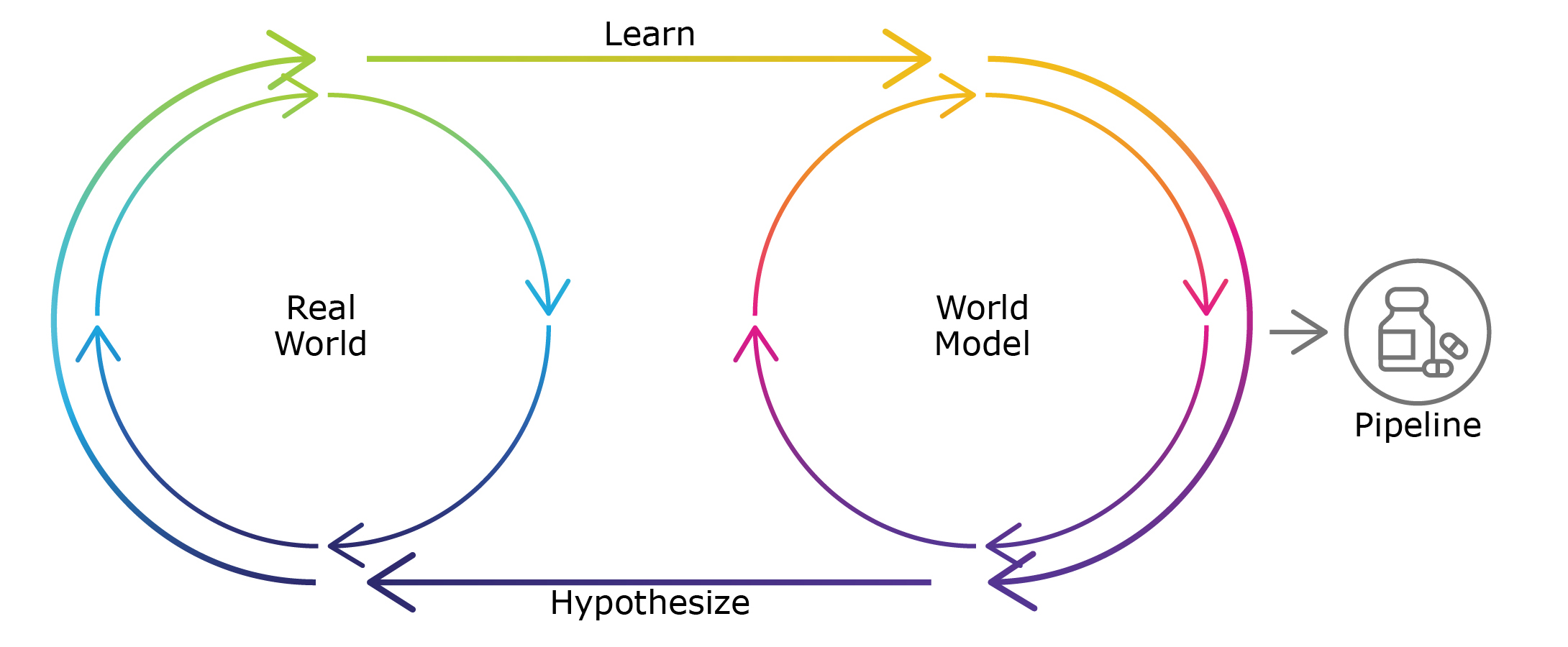

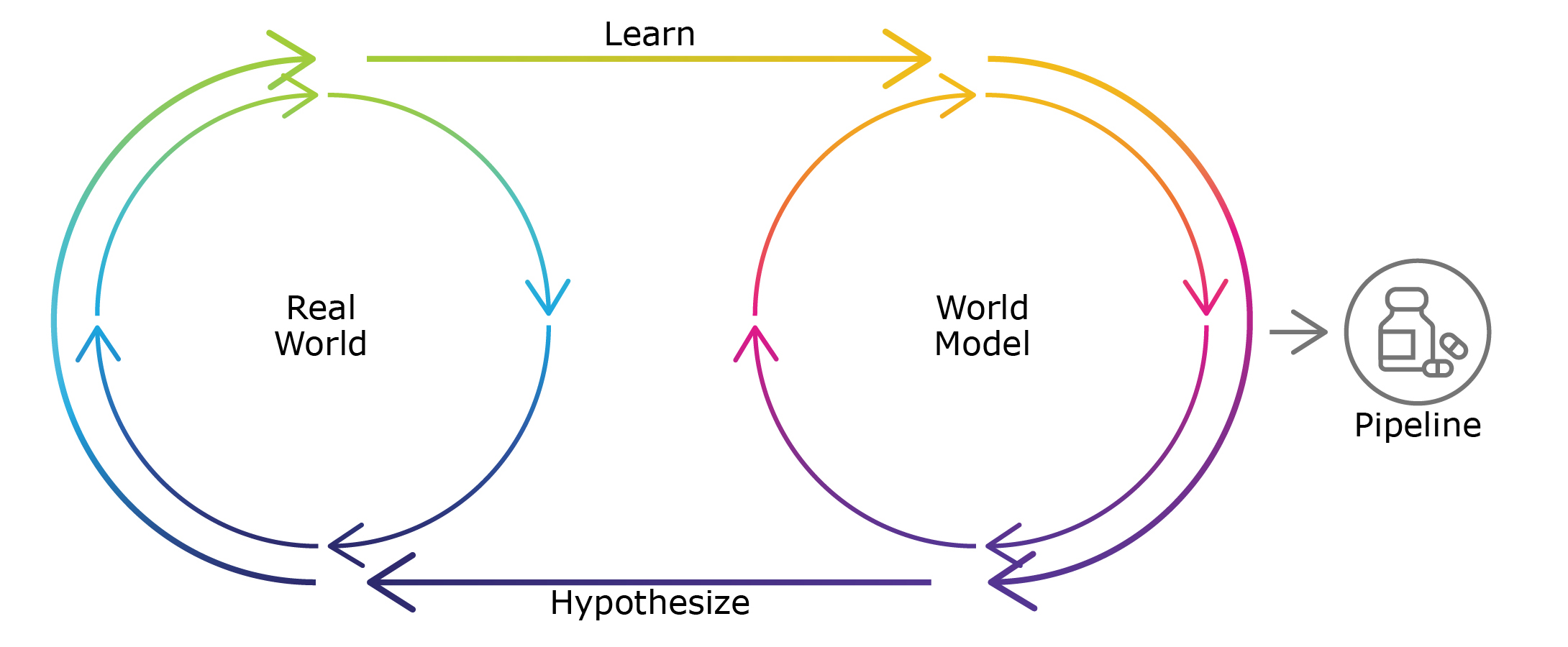

The Recursion OS integrates ‘Real World’ data generated in our own wet-laboratories or by select partners and a ‘World Model’ which is a collection of AI computational models we also build in-house. Today, our scaled ‘wet-lab’ biology, chemistry, and patient-centric experimental data feed our ‘dry-lab’ computational tools to identify, validate, and translate therapeutic insights, which we can then validate in our wet-lab to both advance drug discovery programs and to generate data to further refine our world model.

Figure 2. The Recursion OS. Recursion generates massive quantities of rich, high-dimensional real world –omics data (e.g., phenomics, transcriptomics and proteomics) and chemical data. We build and train ML and AI models that take the data and learning from the real world to understand and identify patterns and insights, using the fastest supercomputer wholly owned and operated by any pharmaceutical company globally (based on available data). This creates a virtuous cycle of learning and iteration based on real-world data and models that learn to simulate that real world. This virtuous cycle, i.e., the Recursion OS, generates value through our pipeline, in addition to building pipelines for our partners.

We have demonstrated that the Recursion OS already accelerates the timelines and scale of drug discovery, and we hope to prove in the coming years that we not only meet the industry average probability of success in clinical development but exceed it. If successful in achieving our mission, we may be able to build one of the most valuable businesses in our industry while also improving the lives of patients and pushing down the cost of healthcare.

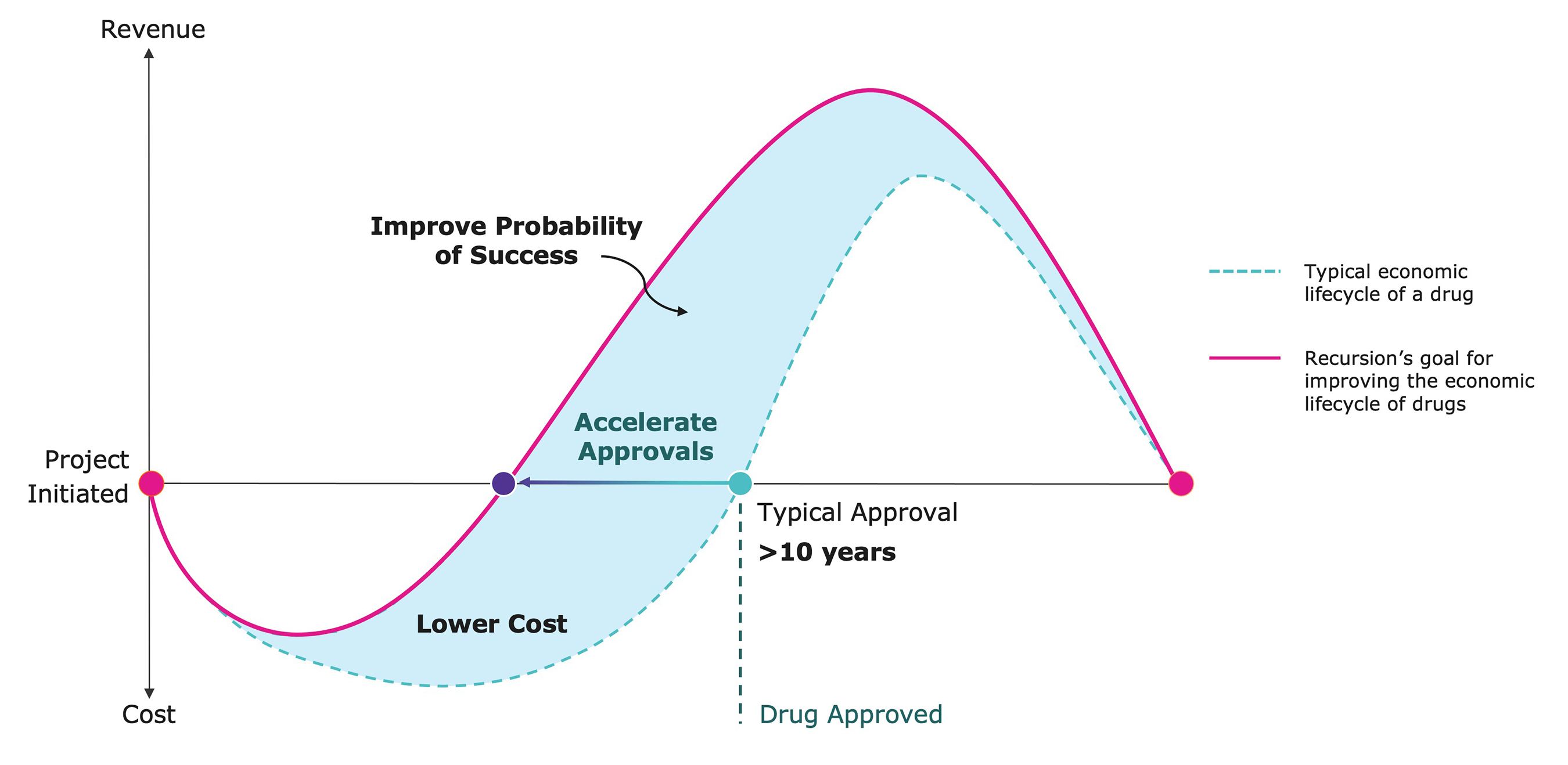

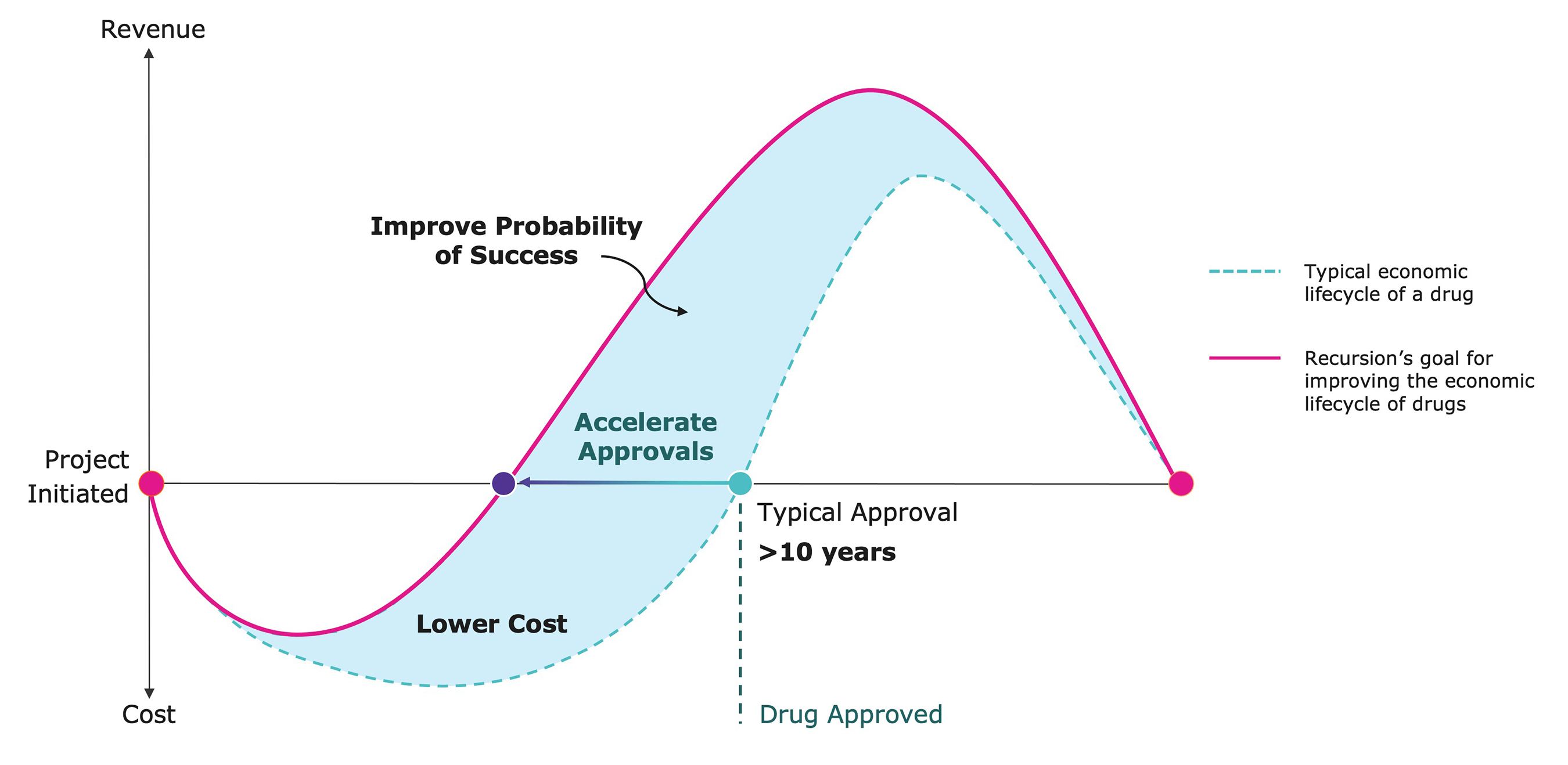

Figure 3. Over time, we believe our transformational way of designing and developing drugs can change the industry's underlying pharmacoeconomic model, what we call 'shifting the curve'. We aim to demonstrate that it is simultaneously possible to improve probability of success through designing better quality drugs while also reducing investment requirements through improved technologies and process. Recursion was created to take advantage of the discontinuity between these fields and harness the power of accelerating technological innovations to improve the efficiency of drug discovery and development.

The Recursion OS – A Platform that Powers a Portfolio

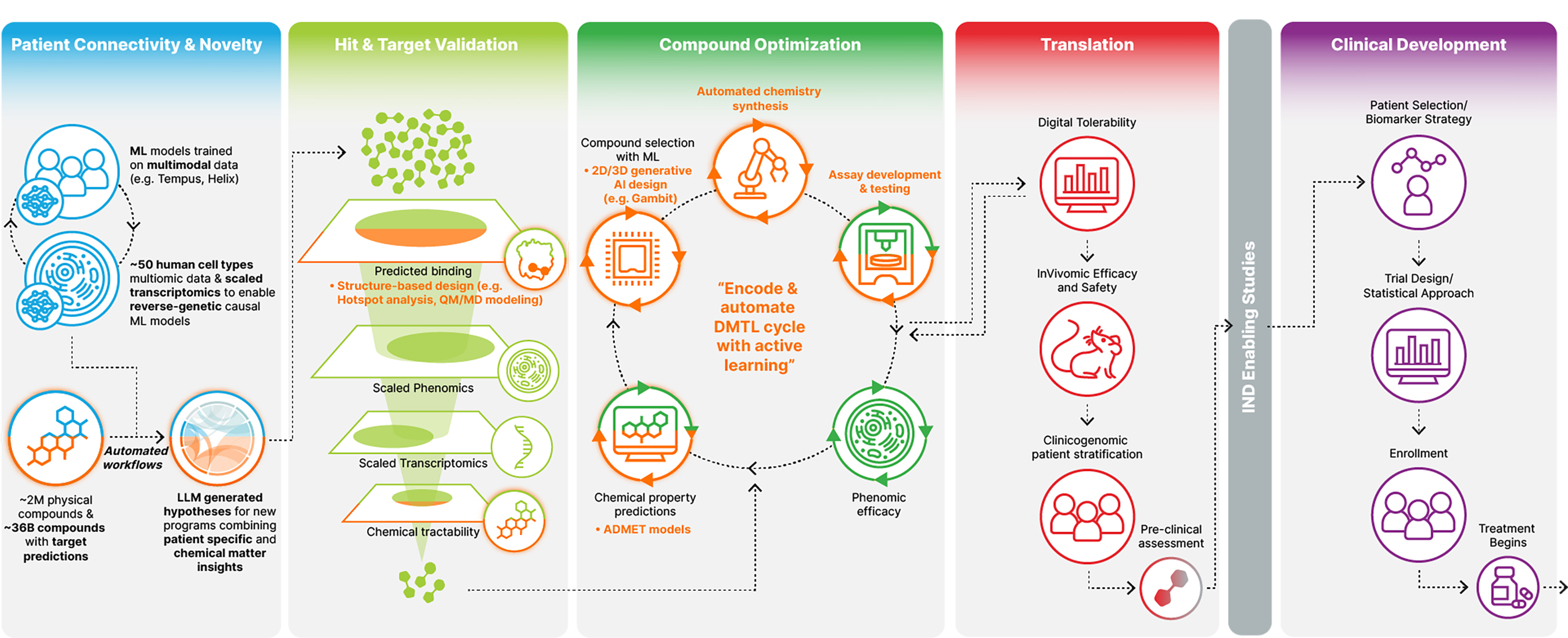

The Recursion OS is a full-stack solution delivering technology-enabled first-in-class and best-in-class molecules with speed, efficiency, and scale from target discovery through early clinical development. We generate and aggregate enormous quantities of high-quality, high-dimensional data spanning hundreds of millions of cellular perturbations across biology and chemistry, translational experiments, ADMET experiments, in vivo experiments, patient data, and from scaled automated chemical synthesis. In parallel, we have built foundation models that leverage those data to learn and understand the underlying biological and chemical interactions with broad predictive capabilities.

Figure 4. Recursion’s World Model approach (1) Profile biological and chemical systems using automation to scale a small number of data-rich assays, including phenomics, transcriptomics, InVivomics, and ADME to generate massive, high quality empirical data; (2) aggregate and analyze the resultant data using a variety of machine learning models, in a process coordinated with in-house software systems and tools; and (3) map and navigate leveraging proprietary software tools to infer properties and relationships in biology and chemistry. These inferred properties and relationships serve as the basis of our ability to predict how to navigate between biological states using chemical or biological perturbations, which we can then validate in our automated laboratories, completing a virtuous cycle of learning and iteration.

Our competitive advantage compared to the hundreds of companies both large and small that seek to follow our path is the intense focus and early success in verticalizing this approach. The company began by pioneering a point solution to scaled target discovery and hit ID based on phenomics, the use of cell morphology and computer vision. Today, we are generating, aggregating, or simulating data from patients to cells, cells to pathways, pathways to proteins, proteins to atomistic interactions, cells to organoids, organoids to animals, and animals to people in the clinic. We're systematically capturing complex, high-dimensional datasets, training specialized machine learning and AI models, and building foundation models that synthesize insights across diverse data layers. As we combine and coalesce these foundation models, spanning target discovery through clinical development, we are increasingly building a ‘world model’ that contains within it a virtual representation of how biology and chemistry are working. Today, our world model is enabling us to make many high-confidence predictions about the result of previously untried or untested questions.

In the coming years we believe that our world model will attain a level of understanding of biology and chemistry of sufficient quality that our wet lab will move from data generation for model improvement as its primary use to ‘scaled validation of simulated solutions.’ In essence, our world model will become a ‘virtual cell’ where we can simulate an inexhaustible quantity of ‘experiments,’ identify those targets and chemistries that have the highest probability of success in modulating disease and achieving a desired (and automatically generated) Target Product Profile, and then our wet lab can validate those predictions at scale.

Figure 5. Over time, models can become broadly applicable and performant enough to be the first rather than last step in the process, that is “move to the left” in the diagram, with Real World Models serving to validate individual insights “on the right.”

Building a Pipeline

Building on a first-in-class and best-in-class OS platform after the business combination with Exscientia, Recursion’s pipeline now encompasses 10 clinical and preclinical programs and over 10 advanced discovery programs across oncology, rare diseases, and other areas of high unmet need. This broad and rapidly evolving portfolio reflects our commitment to advancing discovery and clinical development through unbiased, scaled scientific insights and AI-driven discovery. Programs in our internal pipeline are built on unique biological and chemical insights surfaced through the Recursion OS where:

•The etiology of the disease is well defined, but the subsequent impacts of the disease are generally obscure and/or the primary targets are typically considered undruggable,

•There is a high unmet medical need, no approved therapies, or significant limitations to existing treatments.

Figure 6. The power of our Recursion OS exemplified by our expansive therapeutic pipeline. 1Includes non-small cell lung cancer (NSCLC), colorectal cancer, breast cancer, pancreatic cancer, ovarian cancer, head and neck cancer. 2Joint venture with Rallybio.

Advancing our Pipeline

We are accelerating critical clinical milestones while delivering measurable progress against diseases with high unmet medical needs. At the same time, we continue to validate various components of the Recursion OS, which has played a role in advancing every program in our portfolio, reinforcing its potential to accelerate drug discovery and development.

We have already demonstrated promising safety and preliminary efficacy data for two of our programs. REC-994, a superoxide scavenger in development as a potential first-in-disease therapy for symptomatic CCM, was featured in a late-breaking oral presentation at the 2025 International Stroke Conference. Phase 2 data highlighted MRI-based lesion volume reduction and symptom stabilization trends. Next steps in this program will be informed by regulatory discussions and long-term extension data expected in 2025. REC-617, a potential best-in-class CDK7 inhibitor has demonstrated early clinical activity in advanced solid tumors, including a durable partial response in metastatic ovarian cancer and stable disease across patients with multiple tumor types. These findings support further clinical development as we continue to explore its potential in combination regimens.

In parallel, Recursion has recently initiated three other clinical studies: DAHLIA (Phase 1/2, REC-1245 for solid tumors and lymphoma), TUPELO (Phase 1b/2, REC-4881 for FAP), and ALDER (Phase 2, REC-3964 for prevention of recurrent C. difficile infection). Additionally, REC-3565 (B-cell malignancies) and REC-4539 (SCLC) are expected to enter dose escalation studies. REC-4209 (idiopathic pulmonary fibrosis) has progressed to IND-enabling studies and REV102 (HPP) IND-enabling studies have been initiated, further expanding our pipeline across oncology, rare diseases, and other areas of high unmet need.

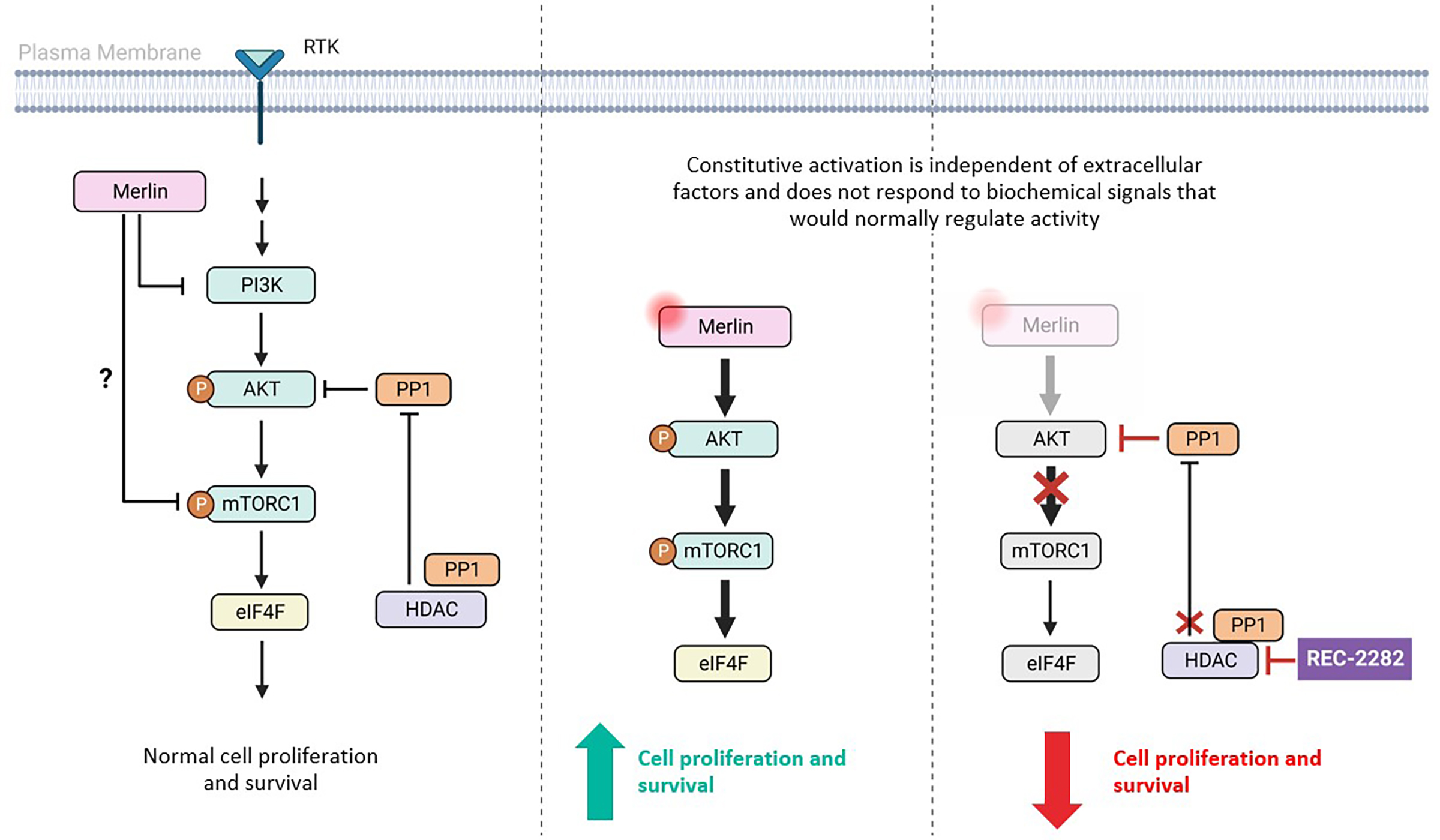

Anticipated Near-term Catalysts. Recursion is poised for a catalyst-rich period, with multiple programs reaching critical milestones over the next 18 months. REC-3565 (MALT-1i) will enter Phase 1 for B-cell malignancies, with the first patient expected to be dosed in the first half of 2025. REC-617 (CDK7i) will initiate combination studies in advanced solid tumors in the first half of 2025. REC-4881 (MEK1/2i) will report Phase 1b/2 safety and early efficacy data for FAP during the same period. REC-2282 (HDACi) for NF2-related meningioma will undergo PFS6 futility analysis and REC-4539 (LSD-1i) will begin Phase 1 dose escalation in SCLC during the same period. Additional Phase 1 data from the ELUCIDATE trial for REC-617 (CDK7i) in advanced solid tumors is expected in the second half of 2025. Furthermore, we continue to rapidly advance development programs such as a PI3Kα H1047Ri and an ENPP1i towards the clinic.

Impact Through Partnerships

Through our business combination with Exscientia, we have doubled our partnership footprint with leading pharmaceutical companies including Roche and Genentech, Sanofi, Bayer and Merck KGaA (Darmstadt, Germany), securing $450M million in upfront milestone payments to date with the potential for over $20 billion in additional milestones before royalties. These global collaborations not only provide near-term cash flows but also combine our scaled biology, precision chemistry, and automated synthesis capabilities to pave the way for transformative therapies in oncology, neuroscience, immunology, and other therapeutic areas with high unmet need. By partnering with some of the best biopharmaceutical companies on earth in their respective areas, our platform and team have an opportunity to learn from some of the most experienced teams in the industry. By uniting our AI-driven platforms, vast proprietary data, and deep scientific expertise, we continue to unlock powerful innovations and expand patient impact. Below are some of the latest developments illustrating this momentum:

Roche and Genentech

•Gastrointestinal-Oncology Advancements: In partnership with Roche and Genentech, we generated multiple whole-genome phenomaps with chemical perturbations across various disease-relevant cell types, enabling deeper insights into how different cellular contexts respond to gene knockouts and chemicals.

•Neuro-specific CRISPR KO Phenomap: In partnership with Roche and Genentech, we have developed the first whole-genome CRISPR knockout map in neural iPSC cells, providing valuable data to identify potential new targets in neuroscience, an area with limited new discoveries.

•Milestones and Collaboration: The neuroscience phenomap work led to a $30M option from Roche and Genentech in August 2024, and we’re moving forward with target validation projects.

Sanofi

•Immunology & Oncology Achievements: We reached milestones in three programs, generating $15M in aggregate payments from Sanofi for two of these programs in 2024.

Bayer

•Oncology Achievements: Completed 25 multimodal oncology data packages utilizing the Recursion OS platform. Multiple programs rapidly progressing to Lead Series nomination.

•LOWE: Additionally, Bayer was the first beta-user of our LOWE LLM-orchestrated workflow software to enhance their research capabilities.

Merck KGaA (Darmstadt, Germany)

•Our ongoing alliance with Merck KGaA, Darmstadt, Germany is focused on leveraging Recursion’s discovery engine to identify first-in-class and best-in-class targets across oncology and immunology, driving innovation in these key therapeutic areas.

Leading indications of success in our business combination with Exscientia