| Delaware | 001-36560 | 51-0483352 | ||||||||||||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

||||||||||||

| 777 Long Ridge Road | |||||||||||

| Stamford, | Connecticut | 06902 | |||||||||

| (Address of principal executive offices) | (Zip Code) | ||||||||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Common stock, par value $0.001 per share | SYF | New York Stock Exchange | ||||||

| Depositary Shares Each Representing a 1/40th Interest in a Share of 5.625% Fixed Rate Non-Cumulative Perpetual Preferred Stock, Series A | SYFPrA | New York Stock Exchange | ||||||

| Depositary Shares Each Representing a 1/40th Interest in a Share of 8.250% Fixed Rate Reset Non-Cumulative Perpetual Preferred Stock, Series B | SYFPrB | New York Stock Exchange | ||||||

| Emerging growth company | ☐ | ||||||||||

| Number | Description | |||||||

| 104 | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL | |||||||

SYNCHRONY FINANCIAL |

||||||||||||||||||||

| Date: October 16, 2024 | By: |

/s/ Jonathan Mothner |

||||||||||||||||||

Name: |

Jonathan Mothner |

|||||||||||||||||||

Title: |

Executive Vice President, Chief Risk and Legal Officer | |||||||||||||||||||

|

For Immediate Release

Synchrony Financial (NYSE: SYF)

October 16, 2024

|

|

|||||||

|

2.6%

Return on

Assets

|

13.1%

CET1

Ratio

|

$399M

Capital

Returned

|

CEO COMMENTARY | |||||||||||||||||||||||||||||

| “Synchrony’s third quarter results reflect our focus on driving value for our many stakeholders through evolving market conditions,” said Brian Doubles, Synchrony’s President and Chief Executive Officer. “During the quarter, we continued to provide responsible access to credit through powerful omnichannel experiences. Customers continued to engage across Synchrony's diversified portfolio, as the broad utility of our flexible financing solutions and compelling value propositions resonated amidst an inflationary environment. “Whether it's through the delivery of scalable, innovative financial solutions that empower our customers, the addition and renewal of programs that span most consumer spend categories, Synchrony is driving access, versatility and value for our customers and partners alike. “As we continue to leverage our core strengths and execute across our key strategic priorities, we are deepening our leadership position as the partner of choice in the consumer finance landscape.” | ||||||||||||||||||||||||||||||||

|

$102.2B

Loan Receivables

| ||||||||||||||||||||||||||||||||

|

Net Earnings of $789 Million or $1.94 per Diluted Share |

|||||||||||||||||||||||||||||||

|

Continued Receivables Growth | |||||||||||||||||||||||||||||||

|

Returned $399 Million of Capital to Shareholders, including $300 Million of Share Repurchases |

|||||||||||||||||||||||||||||||

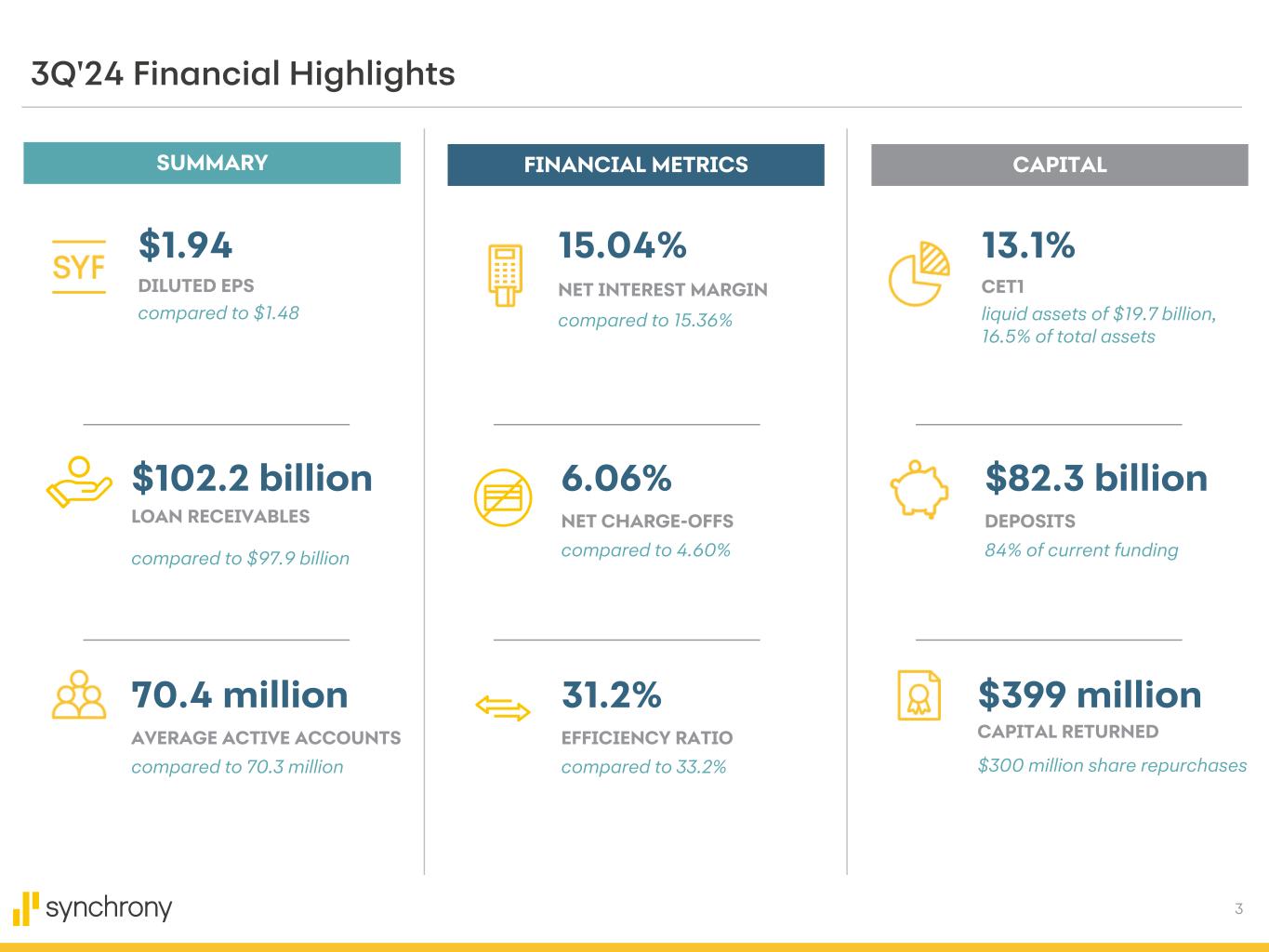

STAMFORD, Conn. – Synchrony Financial (NYSE: SYF) today announced third quarter 2024 net earnings of $789 million, or $1.94 per diluted share, compared to $628 million, or $1.48 per diluted share in the third quarter 2023. | ||||||||||||||||||||||||||||||||

| KEY OPERATING & FINANCIAL METRICS* | ||||||||||||||||||||||||||||||||

| PERFORMANCE REFLECTS DIFFERENTIATED BUSINESS MODEL | ||||||||||||||||||||||||||||||||

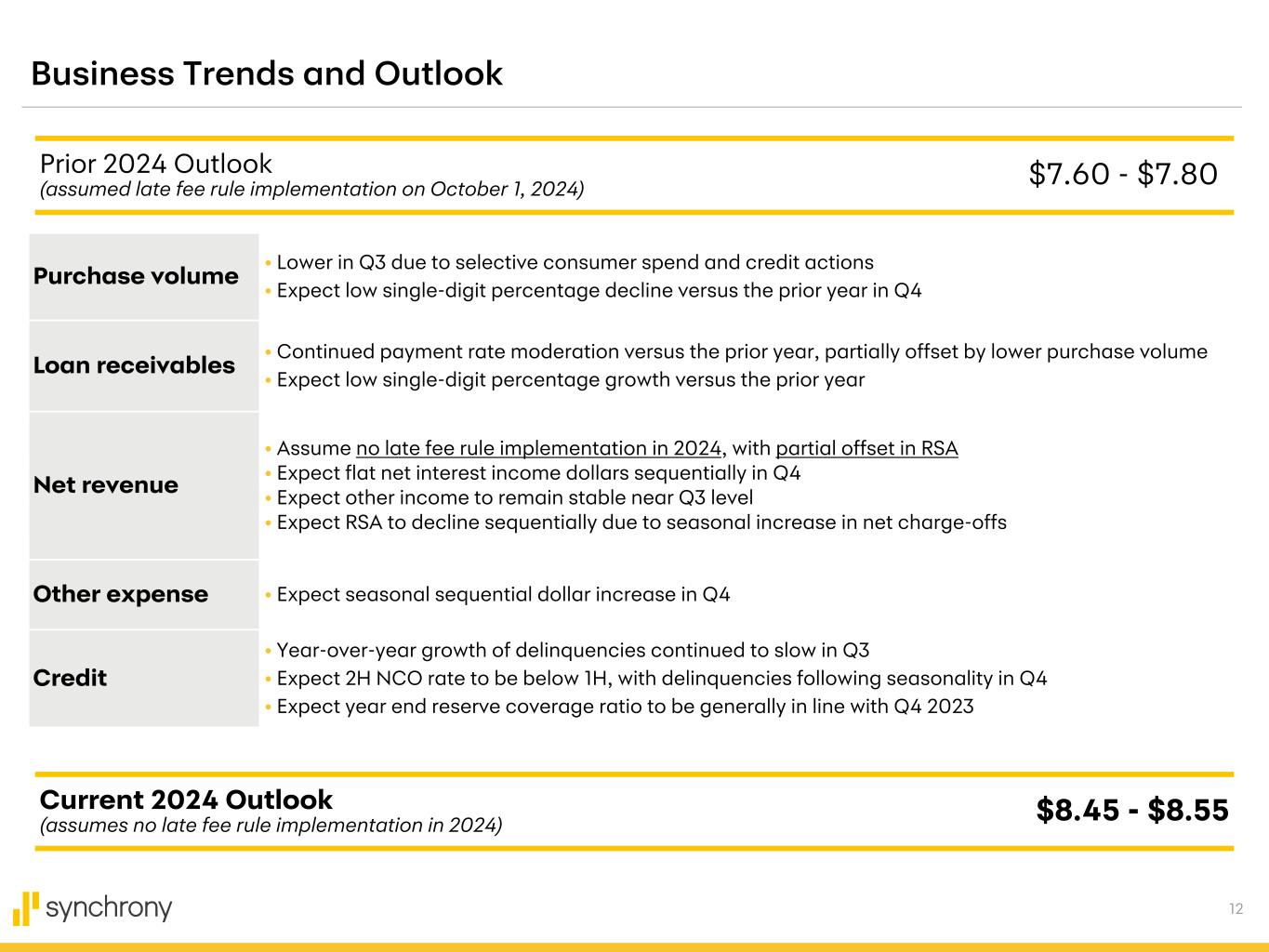

|

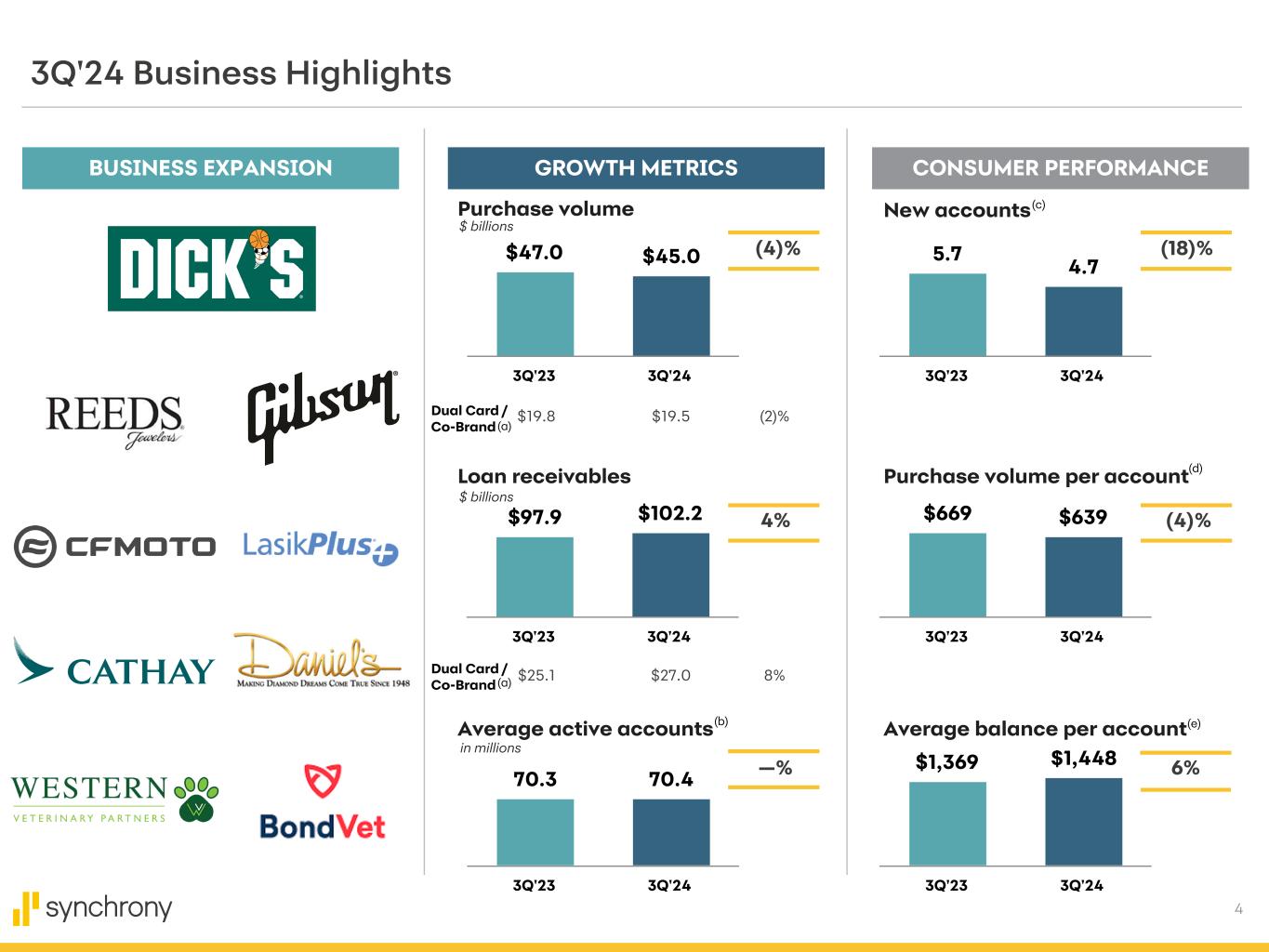

•Purchase volume decreased 4% to $45.0 billion

•Loan receivables increased 4% to $102.2 billion

•Average active accounts remained flat at 70.4 million

•New accounts decreased 18% to 4.7 million

•Net interest margin decreased 32 basis points to 15.04%

•Efficiency ratio decreased 200 basis points to 31.2%

•Return on assets increased 30 basis points to 2.6%

•Return on equity increased 170 basis points to 19.8%

•Return on tangible common equity** increased 240 basis points to 24.3%

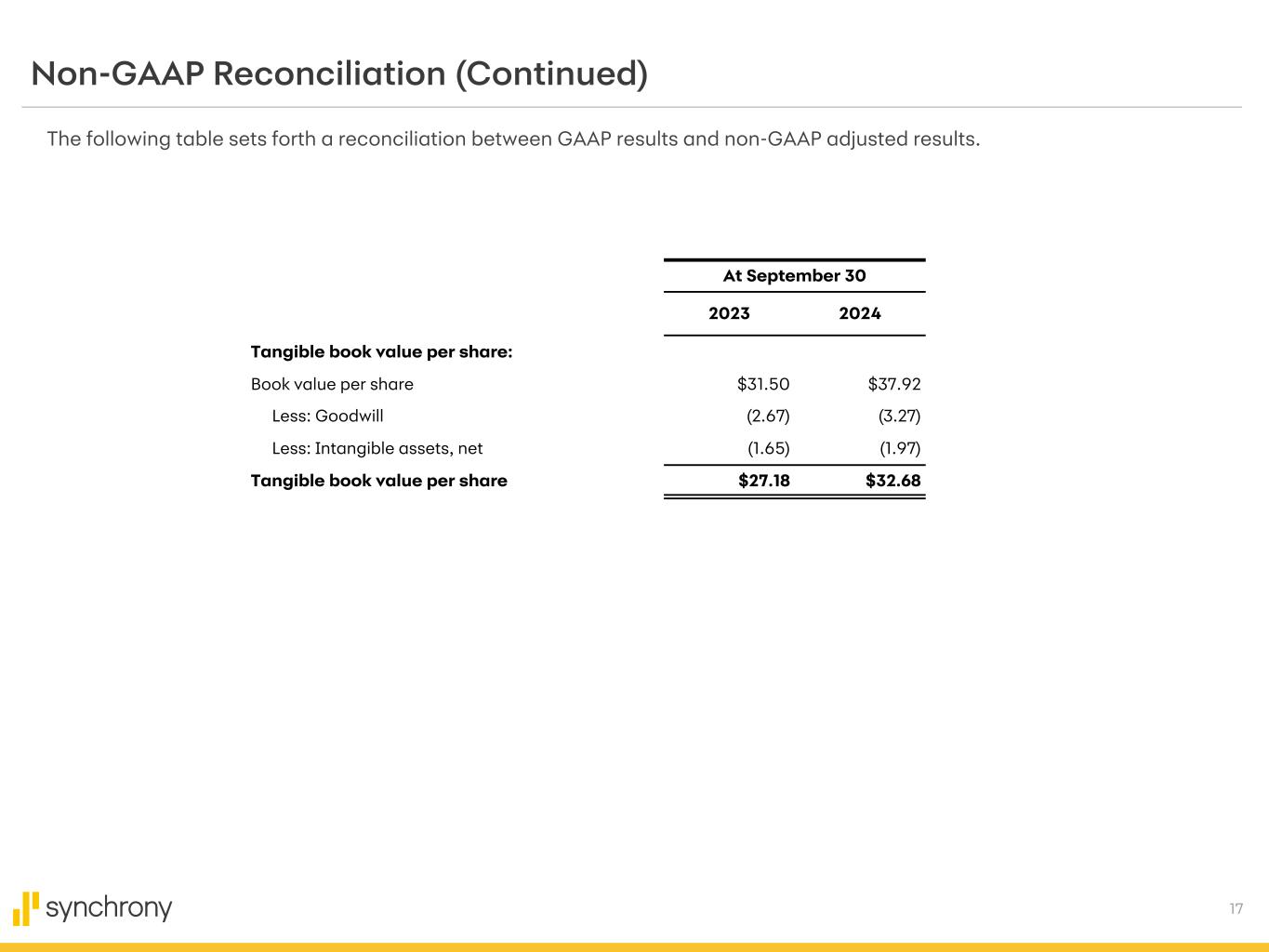

•Book value per share increased 20% to $37.92

•Tangible book value per share** increased 20% to $32.68

| ||||||||||||||||||||||||||||||||

| CFO COMMENTARY |

BUSINESS AND FINANCIAL RESULTS FOR

THE THIRD QUARTER OF 2024*

|

|||||||||||||||||||||||||

|

“Synchrony delivered another strong performance during the third quarter, demonstrating both the resilience of our differentiated business model and our ability to deliver consistently compelling outcomes for our stakeholders,” said Brian Wenzel, Synchrony’s Executive Vice President and Chief Financial Officer.”

“While we continue to monitor consumer behavior and our portfolio performance closely, we are confident that the measures we’ve taken thus far to provide dynamic financial solutions to our customers – while also driving loyalty and sales for our partners – are driving progress toward our shared objectives.

“The unique combination of Synchrony’s industry expertise, proprietary data and analytics, and innovative digital capabilities is powering our trajectory forward, and we believe we are well-positioned to drive sustainable and strong risk-adjusted returns over the long-term.”

|

||||||||||||||||||||||||||

| BUSINESS HIGHLIGHTS | ||||||||||||||||||||||||||

| CONTINUED TO EXPAND PORTFOLIO, ENHANCE PRODUCTS AND EXTEND REACH | ||||||||||||||||||||||||||

|

•Added or renewed more than 15 programs, including Dick’s Sporting Goods, CF Moto, Reeds and Gibson.

•Extended partnership with Dick’s Sporting Goods, building on our more than 20 year long relationship, focused on enhancing athlete services and experiences with the continued ability to earn rewards twice as fast, exclusive member-only offers and digital account management for their ScoreRewards Credit Card and ScoreRewards Mastercard.

•Launched first-of-its-kind, patent-pending payment experience to seamlessly integrate CareCredit and Pets Best products and enable direct insurance claim reimbursement.

| ||||||||||||||||||||||||||

| FINANCIAL HIGHLIGHTS | ||||||||||||||||||||||||||

| EARNINGS DRIVEN BY CORE BUSINESS DRIVERS | ||||||||||||||||||||||||||

|

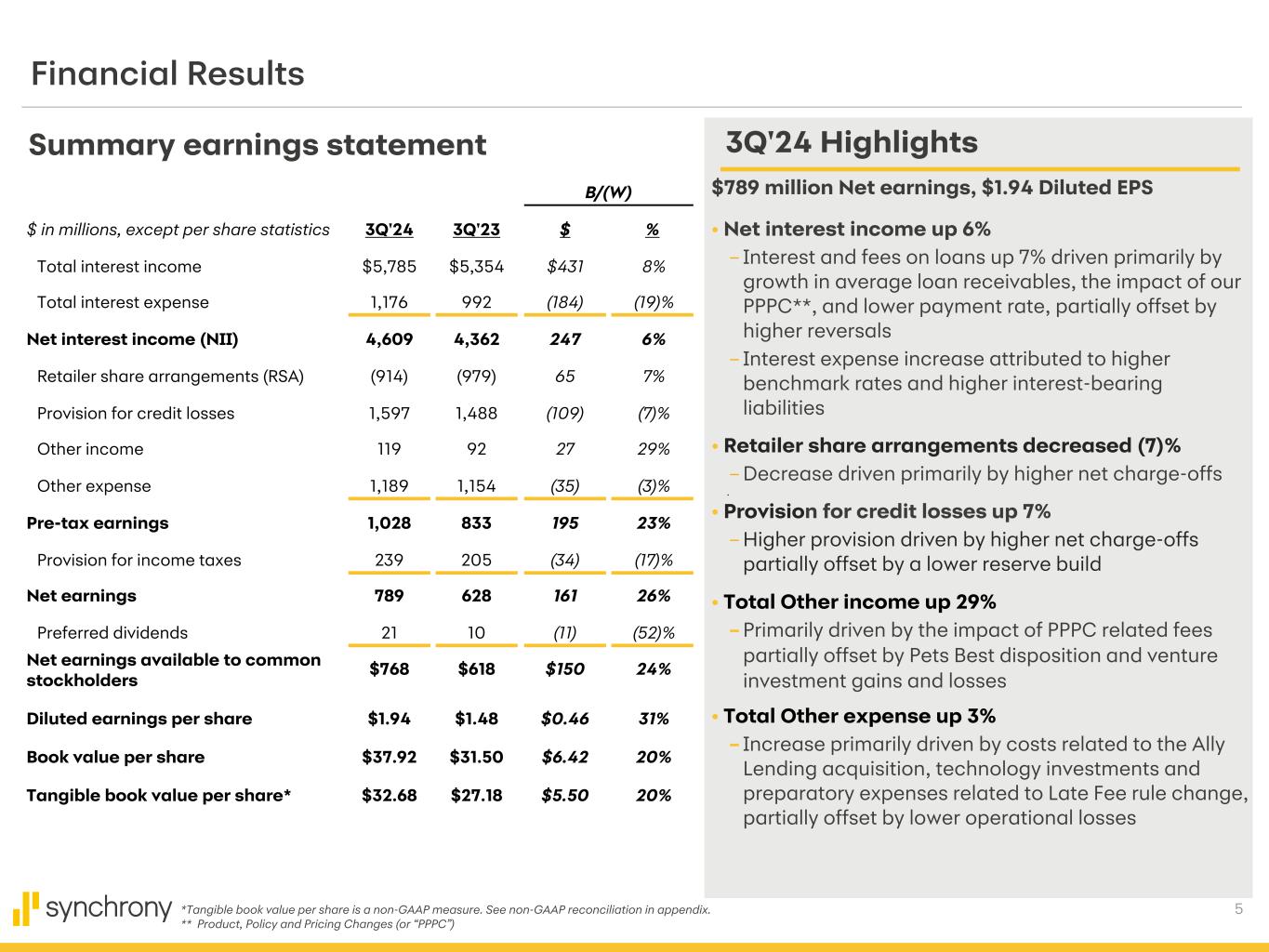

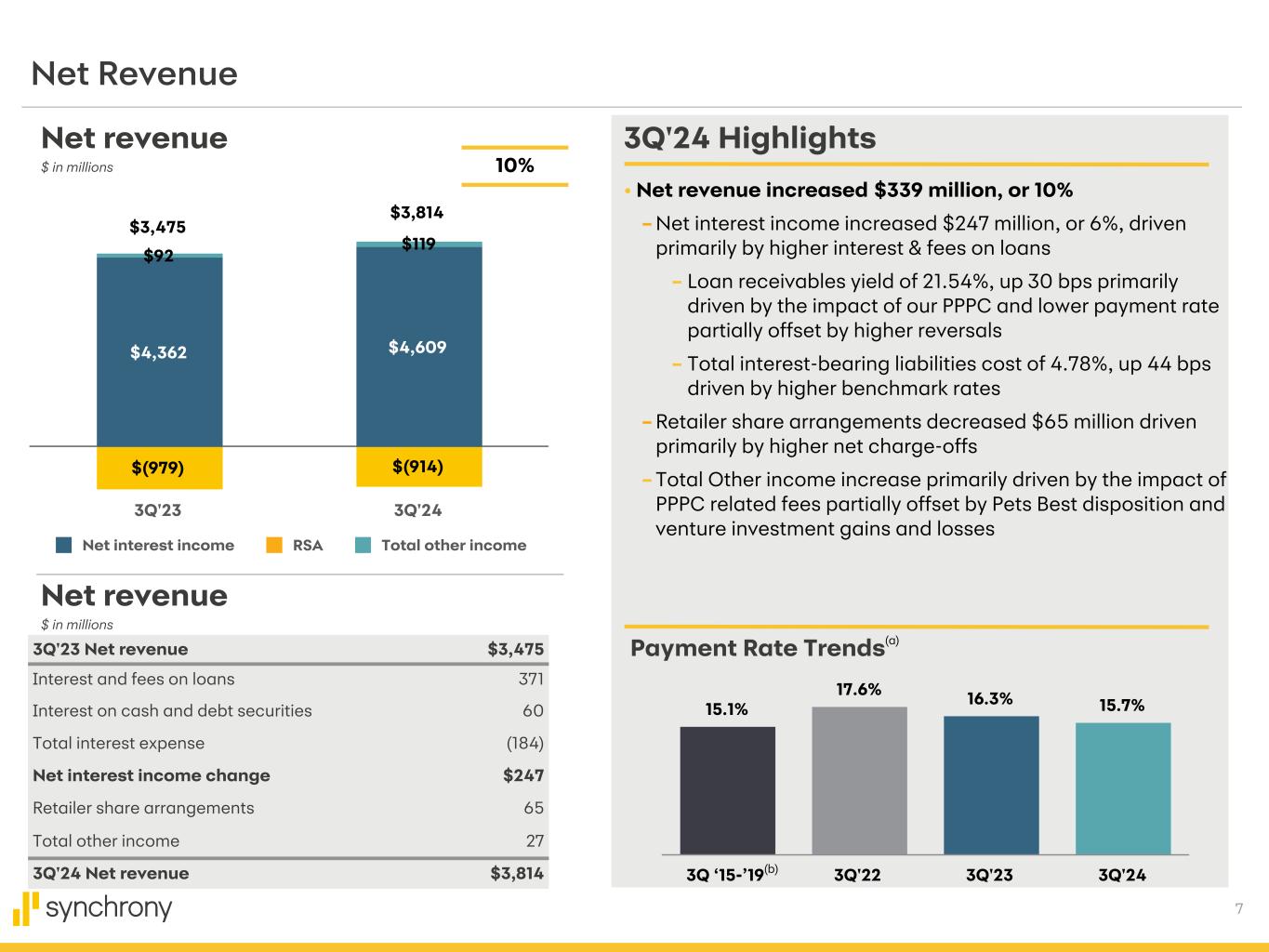

•Interest and fees on loans increased 7% to $5.5 billion, driven primarily by growth in average loan receivables, the impact of product, pricing and policy changes (“PPPC”), and lower payment rate, partially offset by higher reversals.

•Net interest income increased $247 million, or 6%, to $4.6 billion, driven by higher interest and fees on loans, partially offset by an increase in interest expense from higher benchmark rates and higher interest-bearing liabilities.

•Retailer share arrangements decreased $65 million, or 7%, to $914 million, reflecting higher net charge-offs.

•Provision for credit losses increased $109 million to $1.6 billion, driven by higher net charge-offs partially offset by a lower reserve build.

•Other income increased $27 million to $119 million, primarily reflecting the impact of PPPC related fees, partially offset by the impact of the Pets Best disposition and venture investment gains and losses.

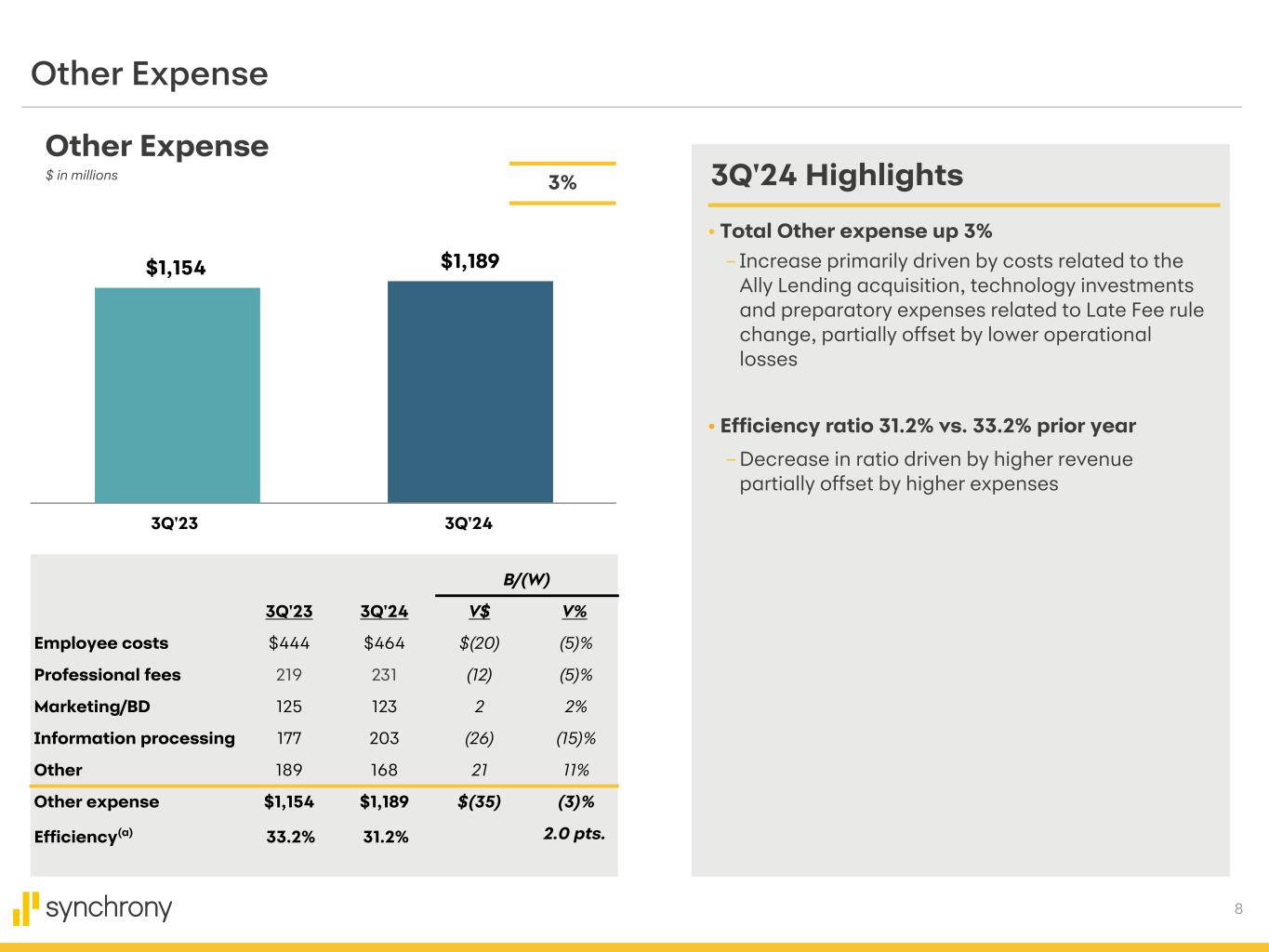

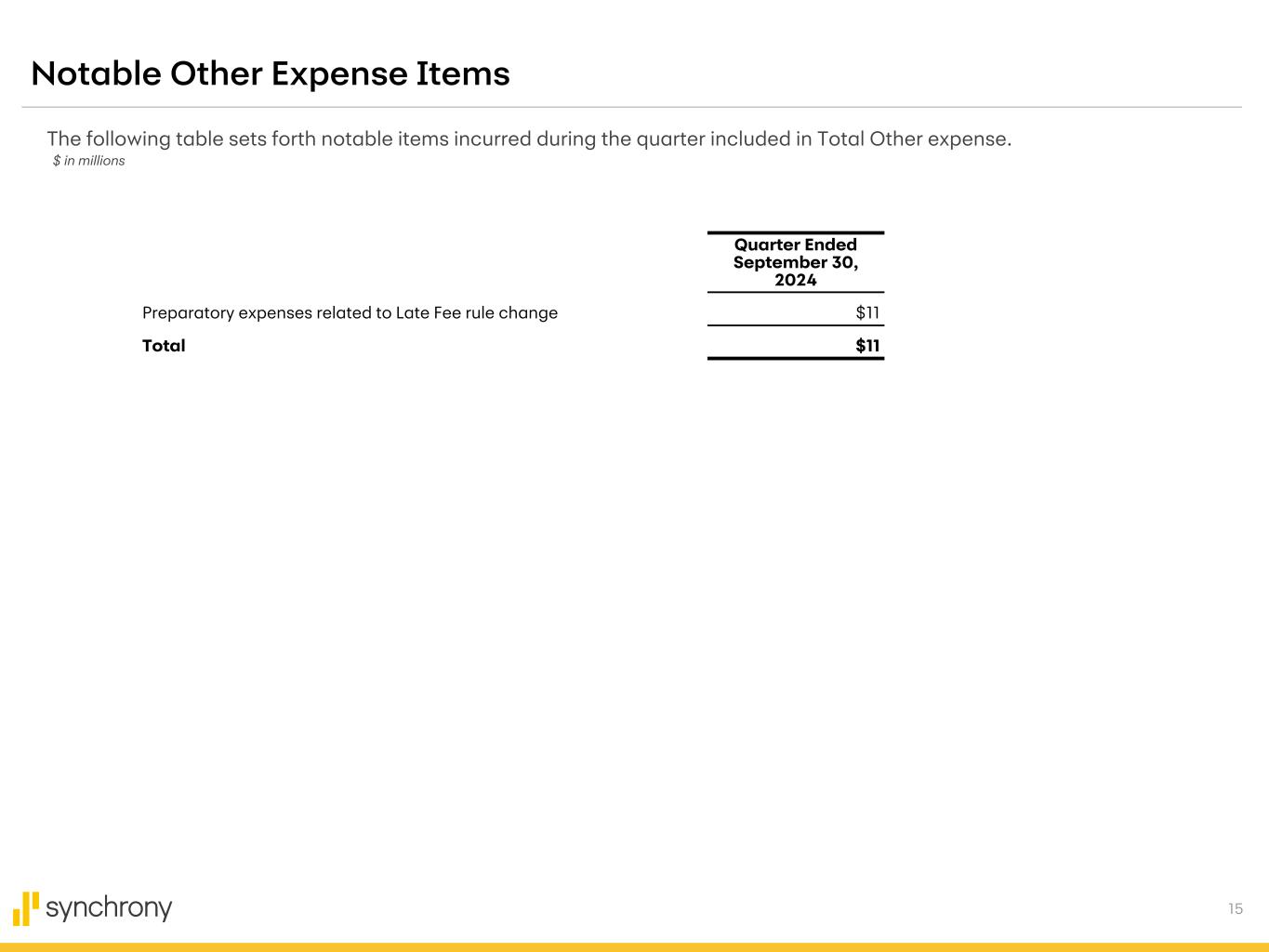

•Other expense increased $35 million, or 3%, to $1.2 billion, primarily driven by costs related to the Ally Lending acquisition, technology investments, and preparatory expenses related to the Late Fee rule change, partially offset by lower operational losses.

•Net earnings increased 26% to $789 million, compared to $628 million.

| ||||||||||||||||||||||||||

| CREDIT QUALITY | ||||||||||||||||||||||||||

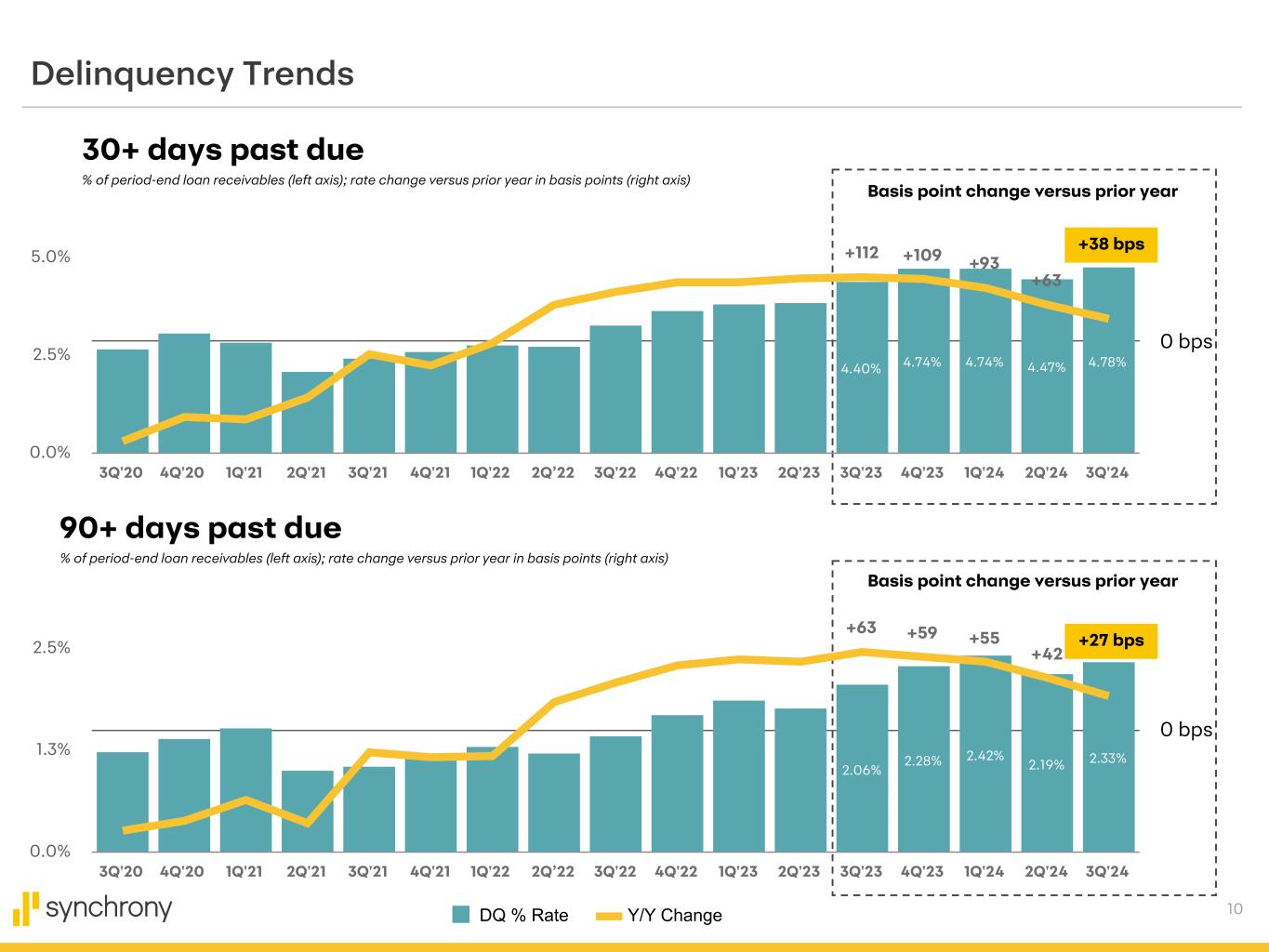

| DELINQUENCY TRENDING IN LINE WITH SEASONALITY | ||||||||||||||||||||||||||

|

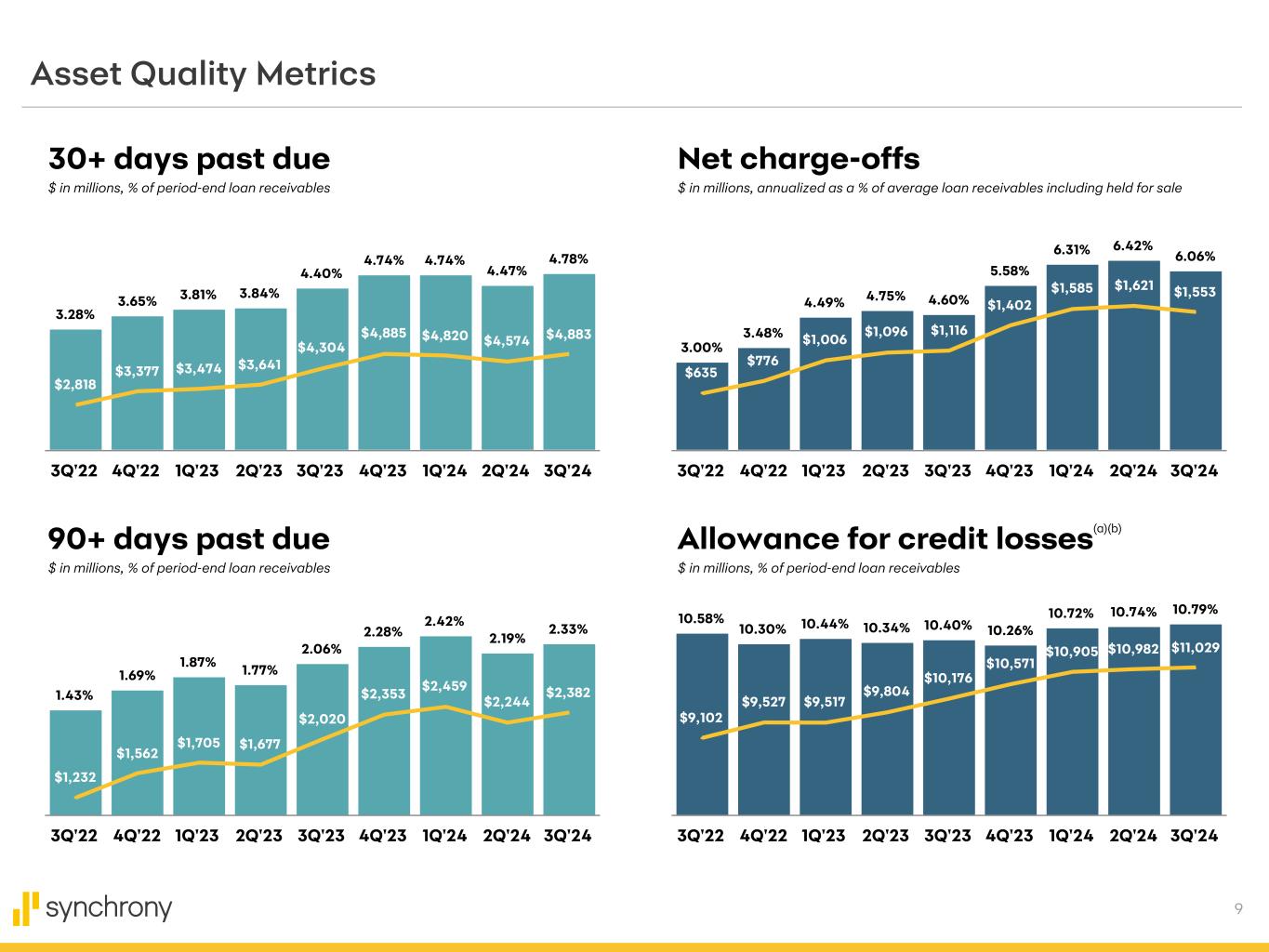

•Loans 30+ days past due as a percentage of total period-end loan receivables were 4.78% compared to 4.40% in the prior year, an increase of 38 basis points and approximately 16 basis points above the average of the third quarters in 2017 through 2019.

•Net charge-offs as a percentage of total average loan receivables were 6.06% compared to 4.60% in the prior year, an increase of 146 basis points, and 97 basis points above the average of the third quarters in 2017 through 2019.

•The allowance for credit losses as a percentage of total period-end loan receivables was 10.79%, compared to 10.74% in the second quarter 2024.

| ||||||||||||||||||||||||||

| SALES PLATFORM HIGHLIGHTS | |||||||||||||||||||||||

| PERFORMANCE CONTINUES TO BE IMPACTED BY CREDIT ACTIONS AND SELECTIVE CONSUMER SPEND DUE TO INFLATIONARY EFFECTS ON AFFORDABILITY | |||||||||||||||||||||||

|

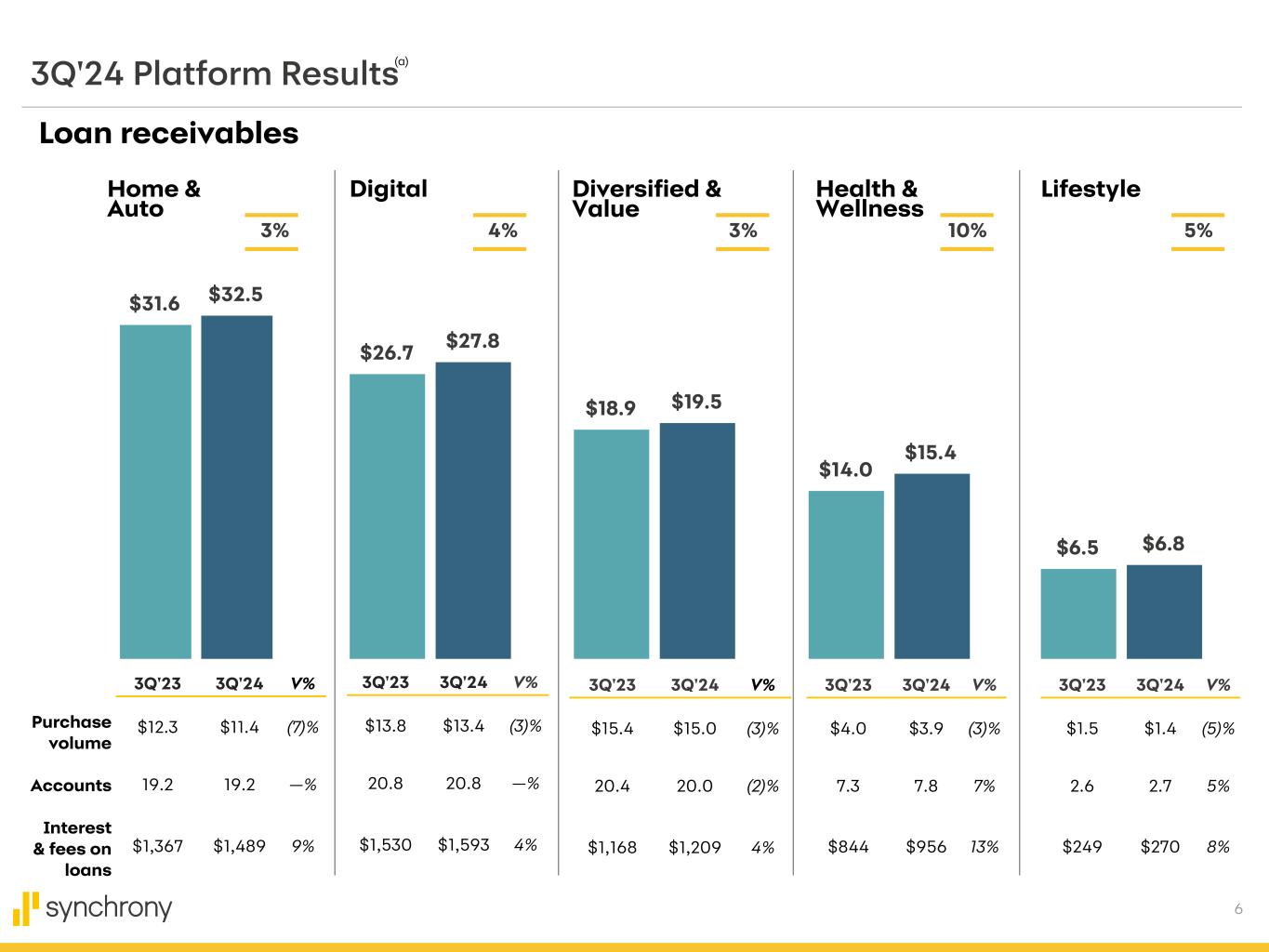

•Home & Auto purchase volume decreased 7%, as the impact of the Ally Lending acquisition was more than offset by a combination of lower consumer traffic, fewer large ticket purchases, and the impact of credit actions. Period-end loan receivables increased 3%, reflecting the impacts of the Ally Lending acquisition and lower payment rates. Interest and fees on loans were up 9%, primarily driven by higher average loan receivables and higher benchmark rates. Average active accounts remained flat.

•Digital purchase volume decreased 3%, driven by lower spend per account and the impact of credit actions. Period-end loan receivables increased 4%, driven primarily by lower payment rates. Interest and fees on loans increased 4%, reflecting the impacts of higher average loan receivables, lower payment rates, and higher benchmark rates. Average active accounts remained flat.

•Diversified & Value purchase volume decreased 3%, driven by lower spend per account and the impact of credit actions. Period-end loan receivables increased 3%, driven primarily by lower payment rates. Interest and fees on loans increased 4%, driven by the impacts of higher average loan receivables, lower payment rates, and higher benchmark rates. Average active accounts decreased 2%.

•Health & Wellness purchase volume decreased 3%, as lower spend in Dental, Cosmetic, and Vision, combined with the impact of credit actions, was partially offset by growth in Pet and Audiology. Period-end loan receivables increased 10%, driven by continued higher purchase volume over the last 12 months and lower payment rates. Interest and fees on loans increased 13%, reflecting the impacts of higher average loan receivables. Average active accounts increased 7%.

•Lifestyle purchase volume decreased 5%, driven by lower transaction values and the impact of credit actions. Period-end loan receivables increased 5%, reflecting payment rate moderation. Interest and fees on loans increased 8%, driven by the impacts of higher average loan receivables and higher benchmark rates. Average active accounts increased 5%.

| |||||||||||||||||||||||

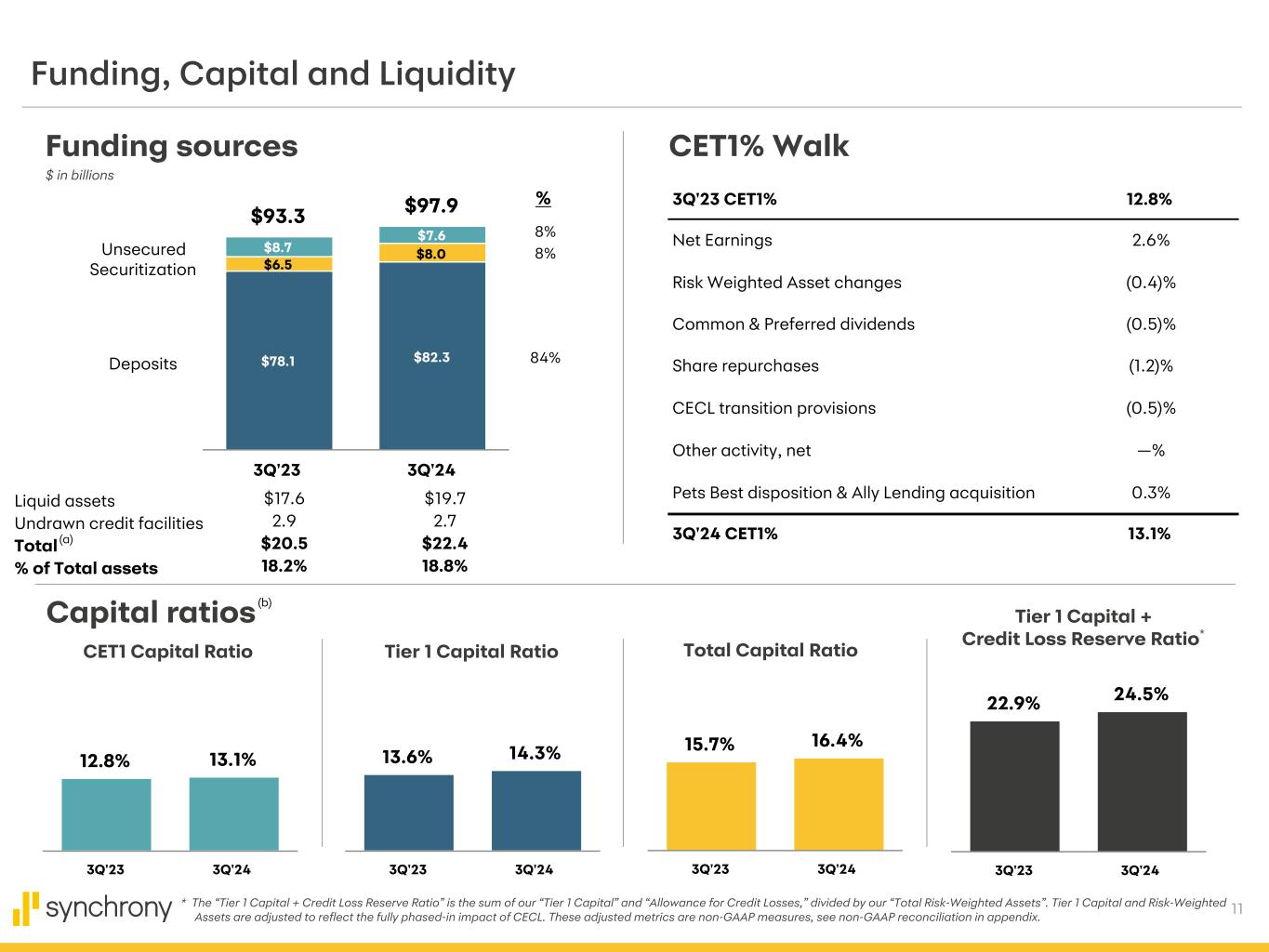

| BALANCE SHEET, LIQUIDITY & CAPITAL | |||||||||||||||||||||||

| FUNDING, CAPITAL & LIQUIDITY REMAIN ROBUST | |||||||||||||||||||||||

|

•Loan receivables of $102.2 billion increased 4%; purchase volume decreased 4% and average active accounts remained flat.

•Deposits increased $4.2 billion, or 5%, to $82.3 billion and comprised 84% of funding.

•Total liquid assets and undrawn credit facilities were $22.4 billion, or 18.8% of total assets.

•The company returned $399 million in capital to shareholders, including $300 million of share repurchases and $99 million of common stock dividends.

•As of September 30, 2024 the Company had a total remaining share repurchase authorization of $700 million.

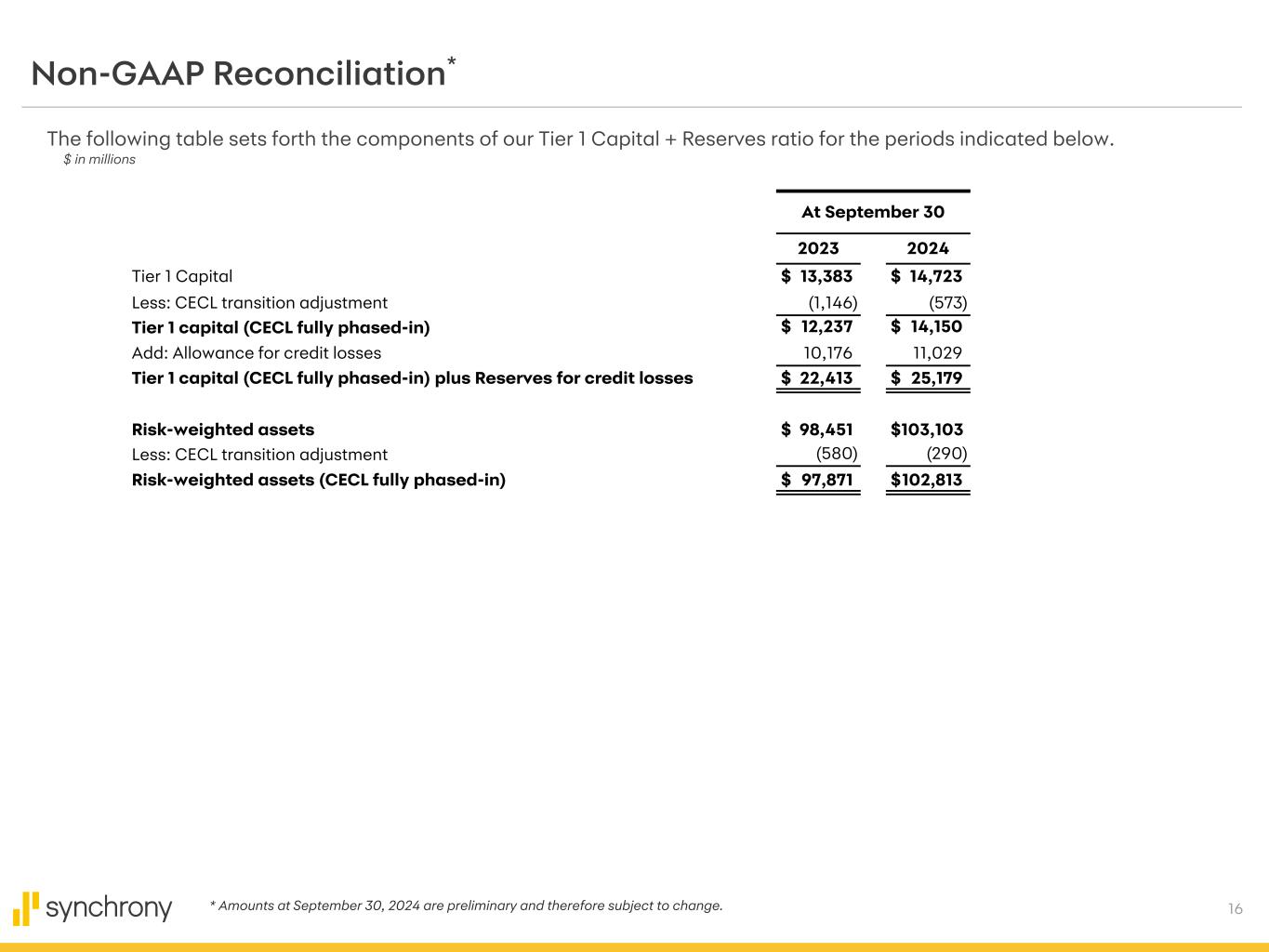

•The estimated Common Equity Tier 1 ratio was 13.1% compared to 12.8%, and the estimated Tier 1 Capital ratio was 14.3% compared to 13.6% in the prior year.

| |||||||||||||||||||||||

|

* All comparisons are for the third quarter of 2024 compared to the third quarter of 2023, unless otherwise noted.

** Return on tangible common equity and tangible book value per share are non-GAAP financial measures. See non-GAAP reconciliation in the financial tables.

| |||||||||||||||||||||||

| CORRESPONDING FINANCIAL TABLES AND INFORMATION | |||||||||||||||||||||||

Investors should review the foregoing summary and discussion of Synchrony Financial's earnings and financial condition in conjunction with the detailed financial tables and information that follow, the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as filed February 8, 2024, and the Company’s forthcoming Quarterly Report on Form 10-Q for the quarter ended September 30, 2024. The detailed financial tables and other information are also available on the Investor Relations page of the Company’s website at www.investors.synchronyfinancial.com. This information is also furnished in a Current Report on Form 8-K filed with the SEC today. | |||||||||||||||||||||||

|

CONFERENCE CALL AND WEBCAST

| ||||||||||||||

On Wednesday, October 16, 2024, at 8:00 a.m. Eastern Time, Brian Doubles, President and Chief Executive Officer, and Brian Wenzel Sr., Executive Vice President and Chief Financial Officer, will host a conference call to review the financial results and outlook for certain business drivers. The conference call can be accessed via an audio webcast through the Investor Relations page on the Synchrony Financial corporate website, www.investors.synchrony.com, under Events and Presentations. A replay will also be available on the website. | ||||||||||||||

| Investor Relations | Media Relations | ||||

| Kathryn Miller | Lisa Lanspery | ||||

| (203) 585-6291 | (203) 585-6143 | ||||

| SYNCHRONY FINANCIAL | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FINANCIAL SUMMARY | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (unaudited, in millions, except per share statistics) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter Ended | Nine Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sep 30, 2024 |

Jun 30, 2024 |

Mar 31, 2024 |

Dec 31, 2023 |

Sep 30, 2023 |

3Q'24 vs. 3Q'23 | Sep 30, 2024 |

Sep 30, 2023 |

YTD'24 vs. YTD'23 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| EARNINGS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 4,609 | $ | 4,405 | $ | 4,405 | $ | 4,466 | $ | 4,362 | $ | 247 | 5.7 | % | $ | 13,419 | $ | 12,533 | $ | 886 | 7.1 | % | |||||||||||||||||||||||||||||||||||||

| Retailer share arrangements | (914) | (810) | (764) | (878) | (979) | 65 | (6.6) | % | (2,488) | (2,783) | 295 | (10.6) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Other income | 119 | 117 | 1,157 | 71 | 92 | 27 | 29.3 | % | 1,393 | 218 | 1,175 | NM | |||||||||||||||||||||||||||||||||||||||||||||||

| Net revenue | 3,814 | 3,712 | 4,798 | 3,659 | 3,475 | 339 | 9.8 | % | 12,324 | 9,968 | 2,356 | 23.6 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Provision for credit losses | 1,597 | 1,691 | 1,884 | 1,804 | 1,488 | 109 | 7.3 | % | 5,172 | 4,161 | 1,011 | 24.3 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Other expense | 1,189 | 1,177 | 1,206 | 1,316 | 1,154 | 35 | 3.0 | % | 3,572 | 3,442 | 130 | 3.8 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Earnings before provision for income taxes | 1,028 | 844 | 1,708 | 539 | 833 | 195 | 23.4 | % | 3,580 | 2,365 | 1,215 | 51.4 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Provision for income taxes | 239 | 201 | 415 | 99 | 205 | 34 | 16.6 | % | 855 | 567 | 288 | 50.8 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Net earnings | $ | 789 | $ | 643 | $ | 1,293 | $ | 440 | $ | 628 | $ | 161 | 25.6 | % | $ | 2,725 | $ | 1,798 | $ | 927 | 51.6 | % | |||||||||||||||||||||||||||||||||||||

| Net earnings available to common stockholders | $ | 768 | $ | 624 | $ | 1,282 | $ | 429 | $ | 618 | $ | 150 | 24.3 | % | $ | 2,674 | $ | 1,767 | $ | 907 | 51.3 | % | |||||||||||||||||||||||||||||||||||||

| COMMON SHARE STATISTICS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Basic EPS | $ | 1.96 | $ | 1.56 | $ | 3.17 | $ | 1.04 | $ | 1.49 | $ | 0.47 | 31.5 | % | $ | 6.71 | $ | 4.16 | $ | 2.55 | 61.3 | % | |||||||||||||||||||||||||||||||||||||

| Diluted EPS | $ | 1.94 | $ | 1.55 | $ | 3.14 | $ | 1.03 | $ | 1.48 | $ | 0.46 | 31.1 | % | $ | 6.65 | $ | 4.14 | $ | 2.51 | 60.6 | % | |||||||||||||||||||||||||||||||||||||

| Dividend declared per share | $ | 0.25 | $ | 0.25 | $ | 0.25 | $ | 0.25 | $ | 0.25 | $ | — | — | % | $ | 0.75 | $ | 0.71 | $ | 0.04 | 5.6 | % | |||||||||||||||||||||||||||||||||||||

| Common stock price | $ | 49.88 | $ | 47.19 | $ | 43.12 | $ | 38.19 | $ | 30.57 | $ | 19.31 | 63.2 | % | $ | 49.88 | $ | 30.57 | $ | 19.31 | 63.2 | % | |||||||||||||||||||||||||||||||||||||

| Book value per share | $ | 37.92 | $ | 36.24 | $ | 35.03 | $ | 32.36 | $ | 31.50 | $ | 6.42 | 20.4 | % | $ | 37.92 | $ | 31.50 | $ | 6.42 | 20.4 | % | |||||||||||||||||||||||||||||||||||||

Tangible book value per share(1) |

$ | 32.68 | $ | 31.05 | $ | 30.36 | $ | 27.59 | $ | 27.18 | $ | 5.50 | 20.2 | % | $ | 32.68 | $ | 27.18 | $ | 5.50 | 20.2 | % | |||||||||||||||||||||||||||||||||||||

| Beginning common shares outstanding | 395.1 | 401.4 | 406.9 | 413.8 | 418.1 | (23.0) | (5.5) | % | 406.9 | 438.2 | (31.3) | (7.1) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Issuance of common shares | — | — | — | — | — | — | NM | — | — | — | NM | ||||||||||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation | 0.7 | 0.6 | 2.0 | 0.4 | 0.2 | 0.5 | 250.0 | % | 3.3 | 1.9 | 1.4 | 73.7 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Shares repurchased | (6.6) | (6.9) | (7.5) | (7.3) | (4.5) | (2.1) | 46.7 | % | (21.0) | (26.3) | 5.3 | (20.2) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Ending common shares outstanding | 389.2 | 395.1 | 401.4 | 406.9 | 413.8 | (24.6) | (5.9) | % | 389.2 | 413.8 | (24.6) | (5.9) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Weighted average common shares outstanding | 392.3 | 399.3 | 404.7 | 411.9 | 416.0 | (23.7) | (5.7) | % | 398.7 | 424.3 | (25.6) | (6.0) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Weighted average common shares outstanding (fully diluted) | 396.5 | 402.6 | 408.2 | 414.6 | 418.4 | (21.9) | (5.2) | % | 402.4 | 426.5 | (24.1) | (5.7) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| (1) Tangible book value per share is a non-GAAP measure, calculated based on Tangible common equity divided by common shares outstanding. For corresponding reconciliation of this measure to a GAAP financial measure, see Reconciliation of Non-GAAP Measures and Calculations of Regulatory Measures. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SYNCHRONY FINANCIAL | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SELECTED METRICS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (unaudited, $ in millions) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter Ended | Nine Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sep 30, 2024 |

Jun 30, 2024 |

Mar 31, 2024 |

Dec 31, 2023 |

Sep 30, 2023 |

3Q'24 vs. 3Q'23 | Sep 30, 2024 |

Sep 30, 2023 |

YTD'24 vs. YTD'23 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| PERFORMANCE METRICS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Return on assets(1) |

2.6 | % | 2.2 | % | 4.4 | % | 1.5 | % | 2.3 | % | 0.3 | % | 3.0 | % | 2.2 | % | 0.8 | % | |||||||||||||||||||||||||||||||||||||||||

Return on equity(2) |

19.8 | % | 16.7 | % | 35.6 | % | 12.4 | % | 18.1 | % | 1.7 | % | 23.8 | % | 17.8 | % | 6.0 | % | |||||||||||||||||||||||||||||||||||||||||

Return on tangible common equity(3) |

24.3 | % | 20.2 | % | 43.6 | % | 14.7 | % | 21.9 | % | 2.4 | % | 29.1 | % | 21.5 | % | 7.6 | % | |||||||||||||||||||||||||||||||||||||||||

Net interest margin(4) |

15.04 | % | 14.46 | % | 14.55 | % | 15.10 | % | 15.36 | % | (0.32) | % | 14.68 | % | 15.17 | % | (0.49) | % | |||||||||||||||||||||||||||||||||||||||||

| Net revenue as a % of average loan receivables, including held for sale | 14.87 | % | 14.71 | % | 19.11 | % | 14.56 | % | 14.33 | % | 0.54 | % | 16.22 | % | 14.30 | % | 1.92 | % | |||||||||||||||||||||||||||||||||||||||||

Efficiency ratio(5) |

31.2 | % | 31.7 | % | 25.1 | % | 36.0 | % | 33.2 | % | (2.0) | % | 29.0 | % | 34.5 | % | (5.5) | % | |||||||||||||||||||||||||||||||||||||||||

| Other expense as a % of average loan receivables, including held for sale | 4.64 | % | 4.66 | % | 4.80 | % | 5.24 | % | 4.76 | % | (0.12) | % | 4.70 | % | 4.94 | % | (0.24) | % | |||||||||||||||||||||||||||||||||||||||||

| Effective income tax rate | 23.2 | % | 23.8 | % | 24.3 | % | 18.4 | % | 24.6 | % | (1.4) | % | 23.9 | % | 24.0 | % | (0.1) | % | |||||||||||||||||||||||||||||||||||||||||

| CREDIT QUALITY METRICS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net charge-offs as a % of average loan receivables, including held for sale | 6.06 | % | 6.42 | % | 6.31 | % | 5.58 | % | 4.60 | % | 1.46 | % | 6.26 | % | 4.62 | % | 1.64 | % | |||||||||||||||||||||||||||||||||||||||||

30+ days past due as a % of period-end loan receivables(6) |

4.78 | % | 4.47 | % | 4.74 | % | 4.74 | % | 4.40 | % | 0.38 | % | 4.78 | % | 4.40 | % | 0.38 | % | |||||||||||||||||||||||||||||||||||||||||

90+ days past due as a % of period-end loan receivables(6) |

2.33 | % | 2.19 | % | 2.42 | % | 2.28 | % | 2.06 | % | 0.27 | % | 2.33 | % | 2.06 | % | 0.27 | % | |||||||||||||||||||||||||||||||||||||||||

| Net charge-offs | $ | 1,553 | $ | 1,621 | $ | 1,585 | $ | 1,402 | $ | 1,116 | $ | 437 | 39.2 | % | $ | 4,759 | $ | 3,218 | $ | 1,541 | 47.9 | % | |||||||||||||||||||||||||||||||||||||

Loan receivables delinquent over 30 days(6) |

$ | 4,883 | $ | 4,574 | $ | 4,820 | $ | 4,885 | $ | 4,304 | $ | 579 | 13.5 | % | $ | 4,883 | $ | 4,304 | $ | 579 | 13.5 | % | |||||||||||||||||||||||||||||||||||||

Loan receivables delinquent over 90 days(6) |

$ | 2,382 | $ | 2,244 | $ | 2,459 | $ | 2,353 | $ | 2,020 | $ | 362 | 17.9 | % | $ | 2,382 | $ | 2,020 | $ | 362 | 17.9 | % | |||||||||||||||||||||||||||||||||||||

| Allowance for credit losses (period-end) | $ | 11,029 | $ | 10,982 | $ | 10,905 | $ | 10,571 | $ | 10,176 | $ | 853 | 8.4 | % | $ | 11,029 | $ | 10,176 | $ | 853 | 8.4 | % | |||||||||||||||||||||||||||||||||||||

Allowance coverage ratio(7) |

10.79 | % | 10.74 | % | 10.72 | % | 10.26 | % | 10.40 | % | 0.39 | % | 10.79 | % | 10.40 | % | 0.39 | % | |||||||||||||||||||||||||||||||||||||||||

| BUSINESS METRICS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Purchase volume(8) |

$ | 44,985 | $ | 46,846 | $ | 42,387 | $ | 49,339 | $ | 47,006 | $ | (2,021) | (4.3) | % | $ | 134,218 | $ | 135,839 | $ | (1,621) | (1.2) | % | |||||||||||||||||||||||||||||||||||||

| Period-end loan receivables | $ | 102,193 | $ | 102,284 | $ | 101,733 | $ | 102,988 | $ | 97,873 | $ | 4,320 | 4.4 | % | $ | 102,193 | $ | 97,873 | $ | 4,320 | 4.4 | % | |||||||||||||||||||||||||||||||||||||

| Credit cards | $ | 94,008 | $ | 94,091 | $ | 93,736 | $ | 97,043 | $ | 92,078 | $ | 1,930 | 2.1 | % | $ | 94,008 | $ | 92,078 | $ | 1,930 | 2.1 | % | |||||||||||||||||||||||||||||||||||||

| Consumer installment loans | $ | 6,125 | $ | 6,072 | $ | 5,957 | $ | 3,977 | $ | 3,784 | $ | 2,341 | 61.9 | % | $ | 6,125 | $ | 3,784 | $ | 2,341 | 61.9 | % | |||||||||||||||||||||||||||||||||||||

| Commercial credit products | $ | 1,936 | $ | 2,003 | $ | 1,912 | $ | 1,839 | $ | 1,879 | $ | 57 | 3.0 | % | $ | 1,936 | $ | 1,879 | $ | 57 | 3.0 | % | |||||||||||||||||||||||||||||||||||||

| Other | $ | 124 | $ | 118 | $ | 128 | $ | 129 | $ | 132 | $ | (8) | (6.1) | % | $ | 124 | $ | 132 | $ | (8) | (6.1) | % | |||||||||||||||||||||||||||||||||||||

| Average loan receivables, including held for sale | $ | 102,009 | $ | 101,478 | $ | 100,957 | $ | 99,683 | $ | 96,230 | $ | 5,779 | 6.0 | % | $ | 101,484 | $ | 93,198 | $ | 8,286 | 8.9 | % | |||||||||||||||||||||||||||||||||||||

Period-end active accounts (in thousands)(9) |

69,965 | 70,991 | 70,754 | 73,484 | 70,137 | (172) | (0.2) | % | 69,965 | 70,137 | (172) | (0.2) | % | ||||||||||||||||||||||||||||||||||||||||||||||

Average active accounts (in thousands)(9) |

70,424 | 70,974 | 71,667 | 71,526 | 70,308 | 116 | 0.2 | % | 71,052 | 69,842 | 1,210 | 1.7 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| LIQUIDITY | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Liquid assets | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash and equivalents | $ | 17,934 | $ | 18,632 | $ | 20,021 | $ | 14,259 | $ | 15,643 | $ | 2,291 | 14.6 | % | $ | 17,934 | $ | 15,643 | $ | 2,291 | 14.6 | % | |||||||||||||||||||||||||||||||||||||

| Total liquid assets | $ | 19,704 | $ | 20,051 | $ | 21,929 | $ | 16,808 | $ | 17,598 | $ | 2,106 | 12.0 | % | $ | 19,704 | $ | 17,598 | $ | 2,106 | 12.0 | % | |||||||||||||||||||||||||||||||||||||

| Undrawn credit facilities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Undrawn credit facilities | $ | 2,700 | $ | 2,950 | $ | 2,950 | $ | 2,950 | $ | 2,950 | $ | (250) | (8.5) | % | $ | 2,700 | $ | 2,950 | $ | (250) | (8.5) | % | |||||||||||||||||||||||||||||||||||||

Total liquid assets and undrawn credit facilities(10) |

$ | 22,404 | $ | 23,001 | $ | 24,879 | $ | 19,758 | $ | 20,548 | $ | 1,856 | 9.0 | % | $ | 22,404 | $ | 20,548 | $ | 1,856 | 9.0 | % | |||||||||||||||||||||||||||||||||||||

| Liquid assets % of total assets | 16.53 | % | 16.64 | % | 18.10 | % | 14.31 | % | 15.58 | % | 0.95 | % | 16.53 | % | 15.58 | % | 0.95 | % | |||||||||||||||||||||||||||||||||||||||||

| Liquid assets including undrawn credit facilities % of total assets | 18.79 | % | 19.09 | % | 20.53 | % | 16.82 | % | 18.19 | % | 0.60 | % | 18.79 | % | 18.19 | % | 0.60 | % | |||||||||||||||||||||||||||||||||||||||||

| (1) Return on assets represents annualized net earnings as a percentage of average total assets. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (2) Return on equity represents annualized net earnings as a percentage of average total equity. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (3) Return on tangible common equity represents annualized net earnings available to common stockholders as a percentage of average tangible common equity. Tangible common equity ("TCE") is a non-GAAP measure. For corresponding reconciliation of TCE to a GAAP financial measure, see Reconciliation of Non-GAAP Measures and Calculations of Regulatory Measures. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (4) Net interest margin represents annualized net interest income divided by average total interest-earning assets. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (5) Efficiency ratio represents (i) other expense, divided by (ii) net interest income, plus other income, less retailer share arrangements. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (6) Based on customer statement-end balances extrapolated to the respective period-end date. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (7) Allowance coverage ratio represents allowance for credit losses divided by total period-end loan receivables. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (8) Purchase volume, or net credit sales, represents the aggregate amount of charges incurred on credit cards or other credit product accounts less returns during the period. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (9) Active accounts represent credit card or installment loan accounts on which there has been a purchase, payment or outstanding balance in the current month. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (10) Excludes uncommitted credit facilities and available borrowing capacity related to unencumbered assets. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SYNCHRONY FINANCIAL | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| STATEMENTS OF EARNINGS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (unaudited, $ in millions) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter Ended | Nine Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sep 30, 2024 |

Jun 30, 2024 |

Mar 31, 2024 |

Dec 31, 2023 |

Sep 30, 2023 |

3Q'24 vs. 3Q'23 | Sep 30, 2024 |

Sep 30, 2023 |

YTD'24 vs. YTD'23 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest income: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 5,522 | $ | 5,301 | $ | 5,293 | $ | 5,323 | $ | 5,151 | $ | 371 | 7.2 | % | $ | 16,116 | $ | 14,579 | $ | 1,537 | 10.5 | % | |||||||||||||||||||||||||||||||||||||

| Interest on cash and debt securities | 263 | 281 | 275 | 226 | 203 | 60 | 29.6 | % | 819 | 582 | 237 | 40.7 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Total interest income | 5,785 | 5,582 | 5,568 | 5,549 | 5,354 | 431 | 8.1 | % | 16,935 | 15,161 | 1,774 | 11.7 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Interest expense: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest on deposits | 968 | 967 | 954 | 878 | 800 | 168 | 21.0 | % | 2,889 | 2,074 | 815 | 39.3 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Interest on borrowings of consolidated securitization entities | 108 | 110 | 105 | 99 | 86 | 22 | 25.6 | % | 323 | 241 | 82 | 34.0 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Interest on senior unsecured notes | 100 | 100 | 104 | 106 | 106 | (6) | (5.7) | % | 304 | 313 | (9) | (2.9) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Total interest expense | 1,176 | 1,177 | 1,163 | 1,083 | 992 | 184 | 18.5 | % | 3,516 | 2,628 | 888 | 33.8 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | 4,609 | 4,405 | 4,405 | 4,466 | 4,362 | 247 | 5.7 | % | 13,419 | 12,533 | 886 | 7.1 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Retailer share arrangements | (914) | (810) | (764) | (878) | (979) | 65 | (6.6) | % | (2,488) | (2,783) | 295 | (10.6) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Provision for credit losses | 1,597 | 1,691 | 1,884 | 1,804 | 1,488 | 109 | 7.3 | % | 5,172 | 4,161 | 1,011 | 24.3 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income, after retailer share arrangements and provision for credit losses | 2,098 | 1,904 | 1,757 | 1,784 | 1,895 | 203 | 10.7 | % | 5,759 | 5,589 | 170 | 3.0 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Other income: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interchange revenue | 256 | 263 | 241 | 270 | 267 | (11) | (4.1) | % | 760 | 761 | (1) | (0.1) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Protection product revenue | 145 | 125 | 141 | 139 | 131 | 14 | 10.7 | % | 411 | 371 | 40 | 10.8 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Loyalty programs | (346) | (346) | (319) | (369) | (358) | 12 | (3.4) | % | (1,011) | (1,001) | (10) | 1.0 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Other | 64 | 75 | 1,094 | 31 | 52 | 12 | 23.1 | % | 1,233 | 87 | 1,146 | NM | |||||||||||||||||||||||||||||||||||||||||||||||

| Total other income | 119 | 117 | 1,157 | 71 | 92 | 27 | 29.3 | % | 1,393 | 218 | 1,175 | NM | |||||||||||||||||||||||||||||||||||||||||||||||

| Other expense: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Employee costs | 464 | 434 | 496 | 538 | 444 | 20 | 4.5 | % | 1,394 | 1,346 | 48 | 3.6 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Professional fees | 231 | 236 | 220 | 228 | 219 | 12 | 5.5 | % | 687 | 614 | 73 | 11.9 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Marketing and business development | 123 | 129 | 125 | 138 | 125 | (2) | (1.6) | % | 377 | 389 | (12) | (3.1) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Information processing | 203 | 207 | 186 | 190 | 177 | 26 | 14.7 | % | 596 | 522 | 74 | 14.2 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Other | 168 | 171 | 179 | 222 | 189 | (21) | (11.1) | % | 518 | 571 | (53) | (9.3) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Total other expense | 1,189 | 1,177 | 1,206 | 1,316 | 1,154 | 35 | 3.0 | % | 3,572 | 3,442 | 130 | 3.8 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Earnings before provision for income taxes | 1,028 | 844 | 1,708 | 539 | 833 | 195 | 23.4 | % | 3,580 | 2,365 | 1,215 | 51.4 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Provision for income taxes | 239 | 201 | 415 | 99 | 205 | 34 | 16.6 | % | 855 | 567 | 288 | 50.8 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Net earnings | $ | 789 | $ | 643 | $ | 1,293 | $ | 440 | $ | 628 | $ | 161 | 25.6 | % | $ | 2,725 | $ | 1,798 | $ | 927 | 51.6 | % | |||||||||||||||||||||||||||||||||||||

| Net earnings available to common stockholders | $ | 768 | $ | 624 | $ | 1,282 | $ | 429 | $ | 618 | $ | 150 | 24.3 | % | $ | 2,674 | $ | 1,767 | $ | 907 | 51.3 | % | |||||||||||||||||||||||||||||||||||||

| SYNCHRONY FINANCIAL | ||||||||||||||||||||||||||||||||||||||

| STATEMENTS OF FINANCIAL POSITION | ||||||||||||||||||||||||||||||||||||||

| (unaudited, $ in millions) | ||||||||||||||||||||||||||||||||||||||

| Quarter Ended | ||||||||||||||||||||||||||||||||||||||

| Sep 30, 2024 |

Jun 30, 2024 |

Mar 31, 2024 |

Dec 31, 2023 |

Sep 30, 2023 |

Sep 30, 2024 vs. Sep 30, 2023 |

|||||||||||||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||||||||||||||

| Cash and equivalents | $ | 17,934 | $ | 18,632 | $ | 20,021 | $ | 14,259 | $ | 15,643 | $ | 2,291 | 14.6 | % | ||||||||||||||||||||||||

| Debt securities | 2,345 | 2,693 | 3,005 | 3,799 | 2,882 | (537) | (18.6) | % | ||||||||||||||||||||||||||||||

| Loan receivables: | ||||||||||||||||||||||||||||||||||||||

| Unsecuritized loans held for investment | 81,005 | 82,144 | 81,642 | 81,554 | 78,470 | 2,535 | 3.2 | % | ||||||||||||||||||||||||||||||

| Restricted loans of consolidated securitization entities | 21,188 | 20,140 | 20,091 | 21,434 | 19,403 | 1,785 | 9.2 | % | ||||||||||||||||||||||||||||||

| Total loan receivables | 102,193 | 102,284 | 101,733 | 102,988 | 97,873 | 4,320 | 4.4 | % | ||||||||||||||||||||||||||||||

| Less: Allowance for credit losses | (11,029) | (10,982) | (10,905) | (10,571) | (10,176) | (853) | 8.4 | % | ||||||||||||||||||||||||||||||

| Loan receivables, net | 91,164 | 91,302 | 90,828 | 92,417 | 87,697 | 3,467 | 4.0 | % | ||||||||||||||||||||||||||||||

| Goodwill | 1,274 | 1,274 | 1,073 | 1,018 | 1,105 | 169 | 15.3 | % | ||||||||||||||||||||||||||||||

| Intangible assets, net | 765 | 776 | 800 | 815 | 680 | 85 | 12.5 | % | ||||||||||||||||||||||||||||||

| Other assets | 5,747 | 5,812 | 5,446 | 4,915 | 4,932 | 815 | 16.5 | % | ||||||||||||||||||||||||||||||

| Assets held for sale | — | — | — | 256 | — | — | NM | |||||||||||||||||||||||||||||||

| Total assets | $ | 119,229 | $ | 120,489 | $ | 121,173 | $ | 117,479 | $ | 112,939 | $ | 6,290 | 5.6 | % | ||||||||||||||||||||||||

| Liabilities and Equity | ||||||||||||||||||||||||||||||||||||||

| Deposits: | ||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposit accounts | $ | 81,901 | $ | 82,708 | $ | 83,160 | $ | 80,789 | $ | 77,669 | $ | 4,232 | 5.4 | % | ||||||||||||||||||||||||

| Non-interest-bearing deposit accounts | 383 | 392 | 394 | 364 | 397 | (14) | (3.5) | % | ||||||||||||||||||||||||||||||

| Total deposits | 82,284 | 83,100 | 83,554 | 81,153 | 78,066 | 4,218 | 5.4 | % | ||||||||||||||||||||||||||||||

| Borrowings: | ||||||||||||||||||||||||||||||||||||||

| Borrowings of consolidated securitization entities | 8,015 | 7,517 | 8,016 | 7,267 | 6,519 | 1,496 | 22.9 | % | ||||||||||||||||||||||||||||||

| Senior and Subordinated unsecured notes | 7,617 | 8,120 | 8,117 | 8,715 | 8,712 | (1,095) | (12.6) | % | ||||||||||||||||||||||||||||||

| Total borrowings | 15,632 | 15,637 | 16,133 | 15,982 | 15,231 | 401 | 2.6 | % | ||||||||||||||||||||||||||||||

| Accrued expenses and other liabilities | 5,333 | 6,212 | 6,204 | 6,334 | 5,875 | (542) | (9.2) | % | ||||||||||||||||||||||||||||||

| Liabilities held for sale | — | — | — | 107 | — | — | NM | |||||||||||||||||||||||||||||||

| Total liabilities | 103,249 | 104,949 | 105,891 | 103,576 | 99,172 | 4,077 | 4.1 | % | ||||||||||||||||||||||||||||||

| Equity: | ||||||||||||||||||||||||||||||||||||||

| Preferred stock | 1,222 | 1,222 | 1,222 | 734 | 734 | 488 | 66.5 | % | ||||||||||||||||||||||||||||||

| Common stock | 1 | 1 | 1 | 1 | 1 | — | — | % | ||||||||||||||||||||||||||||||

| Additional paid-in capital | 9,822 | 9,793 | 9,768 | 9,775 | 9,750 | 72 | 0.7 | % | ||||||||||||||||||||||||||||||

| Retained earnings | 20,975 | 20,310 | 19,790 | 18,662 | 18,338 | 2,637 | 14.4 | % | ||||||||||||||||||||||||||||||

| Accumulated other comprehensive income (loss) | (50) | (73) | (69) | (68) | (96) | 46 | (47.9) | % | ||||||||||||||||||||||||||||||

| Treasury stock | (15,990) | (15,713) | (15,430) | (15,201) | (14,960) | (1,030) | 6.9 | % | ||||||||||||||||||||||||||||||

| Total equity | 15,980 | 15,540 | 15,282 | 13,903 | 13,767 | 2,213 | 16.1 | % | ||||||||||||||||||||||||||||||

| Total liabilities and equity | $ | 119,229 | $ | 120,489 | $ | 121,173 | $ | 117,479 | $ | 112,939 | $ | 6,290 | 5.6 | % | ||||||||||||||||||||||||

| SYNCHRONY FINANCIAL | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AVERAGE BALANCES, NET INTEREST INCOME AND NET INTEREST MARGIN | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (unaudited, $ in millions) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sep 30, 2024 | Jun 30, 2024 | Mar 31, 2024 | Dec 31, 2023 | Sep 30, 2023 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest | Average | Interest | Average | Interest | Average | Interest | Average | Interest | Average | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Average | Income/ | Yield/ | Average | Income/ | Yield/ | Average | Income/ | Yield/ | Average | Income/ | Yield/ | Average | Income/ | Yield/ | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance | Expense | Rate(1) |

Balance | Expense | Rate(1) |

Balance | Expense | Rate(1) |

Balance | Expense | Rate(1) |

Balance | Expense | Rate(1) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-earning assets: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-earning cash and equivalents | $ | 17,316 | $ | 235 | 5.40 | % | $ | 18,337 | $ | 249 | 5.46 | % | $ | 17,405 | $ | 236 | 5.45 | % | $ | 13,762 | $ | 188 | 5.42 | % | $ | 12,753 | $ | 172 | 5.35 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Securities available for sale | 2,587 | 28 | 4.31 | % | 2,731 | 32 | 4.71 | % | 3,432 | 39 | 4.57 | % | 3,895 | 38 | 3.87 | % | 3,706 | 31 | 3.32 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loan receivables, including held for sale: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Credit cards | 93,785 | 5,236 | 22.21 | % | 93,267 | 5,013 | 21.62 | % | 94,216 | 5,096 | 21.75 | % | 93,744 | 5,162 | 21.85 | % | 90,587 | 5,003 | 21.91 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consumer installment loans | 6,107 | 238 | 15.50 | % | 6,085 | 243 | 16.06 | % | 4,734 | 149 | 12.66 | % | 3,875 | 116 | 11.88 | % | 3,656 | 108 | 11.72 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial credit products | 1,992 | 46 | 9.19 | % | 2,001 | 43 | 8.64 | % | 1,878 | 45 | 9.64 | % | 1,934 | 42 | 8.62 | % | 1,861 | 38 | 8.10 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 125 | 2 | 6.37 | % | 125 | 2 | 6.44 | % | 129 | 3 | 9.35 | % | 130 | 3 | 9.16 | % | 126 | 2 | 6.30 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total loan receivables, including held for sale | 102,009 | 5,522 | 21.54 | % | 101,478 | 5,301 | 21.01 | % | 100,957 | 5,293 | 21.09 | % | 99,683 | 5,323 | 21.19 | % | 96,230 | 5,151 | 21.24 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-earning assets | 121,912 | 5,785 | 18.88 | % | 122,546 | 5,582 | 18.32 | % | 121,794 | 5,568 | 18.39 | % | 117,340 | 5,549 | 18.76 | % | 112,689 | 5,354 | 18.85 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Non-interest-earning assets: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash and due from banks | 847 | 887 | 944 | 886 | 964 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Allowance for credit losses | (10,994) | (10,878) | (10,677) | (10,243) | (9,847) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other assets | 7,624 | 7,309 | 6,973 | 6,616 | 6,529 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total non-interest-earning assets | (2,523) | (2,682) | (2,760) | (2,741) | (2,354) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 119,389 | $ | 119,864 | $ | 119,034 | $ | 114,599 | $ | 110,335 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposit accounts | $ | 82,100 | $ | 968 | 4.69 | % | $ | 82,749 | $ | 967 | 4.70 | % | $ | 82,598 | $ | 954 | 4.65 | % | $ | 78,892 | $ | 878 | 4.42 | % | $ | 75,952 | $ | 800 | 4.18 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Borrowings of consolidated securitization entities | 7,817 | 108 | 5.50 | % | 7,858 | 110 | 5.63 | % | 7,383 | 105 | 5.72 | % | 6,903 | 99 | 5.69 | % | 6,096 | 86 | 5.60 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Senior and Subordinated unsecured notes | 7,968 | 100 | 4.99 | % | 8,118 | 100 | 4.95 | % | 8,630 | 104 | 4.85 | % | 8,712 | 106 | 4.83 | % | 8,710 | 106 | 4.83 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | 97,885 | 1,176 | 4.78 | % | 98,725 | 1,177 | 4.80 | % | 98,611 | 1,163 | 4.74 | % | 94,507 | 1,083 | 4.55 | % | 90,758 | 992 | 4.34 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Non-interest-bearing liabilities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Non-interest-bearing deposit accounts | 387 | 396 | 390 | 379 | 401 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other liabilities | 5,302 | 5,221 | 5,419 | 5,652 | 5,418 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total non-interest-bearing liabilities | 5,689 | 5,617 | 5,809 | 6,031 | 5,819 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities | 103,574 | 104,342 | 104,420 | 100,538 | 96,577 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Equity | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total equity | 15,815 | 15,522 | 14,614 | 14,061 | 13,758 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities and equity | $ | 119,389 | $ | 119,864 | $ | 119,034 | $ | 114,599 | $ | 110,335 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 4,609 | $ | 4,405 | $ | 4,405 | $ | 4,466 | $ | 4,362 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Interest rate spread(2) |

14.10 | % | 13.53 | % | 13.64 | % | 14.22 | % | 14.51 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Net interest margin(3) |

15.04 | % | 14.46 | % | 14.55 | % | 15.10 | % | 15.36 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (1) Average yields/rates are based on annualized total interest income/expense divided by average balances. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (2) Interest rate spread represents the difference between the yield on total interest-earning assets and the rate on total interest-bearing liabilities. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (3) Net interest margin represents annualized net interest income divided by average total interest-earning assets. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SYNCHRONY FINANCIAL | |||||||||||||||||||||||||||||||||||

| AVERAGE BALANCES, NET INTEREST INCOME AND NET INTEREST MARGIN | |||||||||||||||||||||||||||||||||||

| (unaudited, $ in millions) | |||||||||||||||||||||||||||||||||||

| Nine Months Ended Sep 30, 2024 |

Nine Months Ended Sep 30, 2023 |

||||||||||||||||||||||||||||||||||

| Interest | Average | Interest | Average | ||||||||||||||||||||||||||||||||

| Average | Income/ | Yield/ | Average | Income/ | Yield/ | ||||||||||||||||||||||||||||||

| Balance | Expense | Rate(1) |

Balance | Expense | Rate(1) |

||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||

| Interest-earning assets: | |||||||||||||||||||||||||||||||||||

| Interest-earning cash and equivalents | $ | 17,685 | $ | 720 | 5.44 | % | $ | 13,107 | $ | 490 | 5.00 | % | |||||||||||||||||||||||

| Securities available for sale | 2,915 | 99 | 4.54 | % | 4,138 | 92 | 2.97 | % | |||||||||||||||||||||||||||

| Loan receivables, including held for sale: | |||||||||||||||||||||||||||||||||||

| Credit cards | 93,757 | 15,345 | 21.86 | % | 87,914 | 14,179 | 21.56 | % | |||||||||||||||||||||||||||

| Consumer installment loans | 5,644 | 630 | 14.91 | % | 3,375 | 285 | 11.29 | % | |||||||||||||||||||||||||||

| Commercial credit products | 1,957 | 134 | 9.15 | % | 1,789 | 108 | 8.07 | % | |||||||||||||||||||||||||||

| Other | 126 | 7 | 7.42 | % | 120 | 7 | 7.80 | % | |||||||||||||||||||||||||||

| Total loan receivables, including held for sale | 101,484 | 16,116 | 21.21 | % | 93,198 | 14,579 | 20.91 | % | |||||||||||||||||||||||||||

| Total interest-earning assets | 122,084 | 16,935 | 18.53 | % | 110,443 | 15,161 | 18.35 | % | |||||||||||||||||||||||||||

| Non-interest-earning assets: | |||||||||||||||||||||||||||||||||||

| Cash and due from banks | 892 | 987 | |||||||||||||||||||||||||||||||||

| Allowance for credit losses | (10,850) | (9,552) | |||||||||||||||||||||||||||||||||

| Other assets | 7,303 | 6,331 | |||||||||||||||||||||||||||||||||

| Total non-interest-earning assets | (2,655) | (2,234) | |||||||||||||||||||||||||||||||||

| Total assets | $ | 119,429 | $ | 108,209 | |||||||||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities: | |||||||||||||||||||||||||||||||||||

| Interest-bearing deposit accounts | $ | 82,481 | $ | 2,889 | 4.68 | % | $ | 74,340 | $ | 2,074 | 3.73 | % | |||||||||||||||||||||||

| Borrowings of consolidated securitization entities | 7,686 | 323 | 5.61 | % | 6,062 | 241 | 5.32 | % | |||||||||||||||||||||||||||

| Senior and subordinated unsecured notes | 8,238 | 304 | 4.93 | % | 8,621 | 313 | 4.85 | % | |||||||||||||||||||||||||||

| Total interest-bearing liabilities | 98,405 | 3,516 | 4.77 | % | 89,023 | 2,628 | 3.95 | % | |||||||||||||||||||||||||||

| Non-interest-bearing liabilities | |||||||||||||||||||||||||||||||||||

| Non-interest-bearing deposit accounts | 391 | 410 | |||||||||||||||||||||||||||||||||

| Other liabilities | 5,315 | 5,239 | |||||||||||||||||||||||||||||||||

| Total non-interest-bearing liabilities | 5,706 | 5,649 | |||||||||||||||||||||||||||||||||

| Total liabilities | 104,111 | 94,672 | |||||||||||||||||||||||||||||||||

| Equity | |||||||||||||||||||||||||||||||||||

| Total equity | 15,318 | 13,537 | |||||||||||||||||||||||||||||||||

| Total liabilities and equity | $ | 119,429 | $ | 108,209 | |||||||||||||||||||||||||||||||

| Net interest income | $ | 13,419 | $ | 12,533 | |||||||||||||||||||||||||||||||

Interest rate spread(2) |

13.76 | % | 14.41 | % | |||||||||||||||||||||||||||||||

Net interest margin(3) |

14.68 | % | 15.17 | % | |||||||||||||||||||||||||||||||

| (1) Average yields/rates are based on annualized total interest income/expense divided by average balances. | |||||||||||||||||||||||||||||||||||

| (2) Interest rate spread represents the difference between the yield on total interest-earning assets and the rate on total interest-bearing liabilities. | |||||||||||||||||||||||||||||||||||

| (3) Net interest margin represents annualized net interest income divided by average total interest-earning assets. | |||||||||||||||||||||||||||||||||||

| SYNCHRONY FINANCIAL | ||||||||||||||||||||||||||||||||||||||

| BALANCE SHEET STATISTICS | ||||||||||||||||||||||||||||||||||||||

| (unaudited, $ in millions, except per share statistics) | ||||||||||||||||||||||||||||||||||||||

| Quarter Ended | ||||||||||||||||||||||||||||||||||||||

| Sep 30, 2024 |

Jun 30, 2024 |

Mar 31, 2024 |

Dec 31, 2023 |

Sep 30, 2023 |

Sep 30, 2024 vs. Sep 30, 2023 |

|||||||||||||||||||||||||||||||||

| BALANCE SHEET STATISTICS | ||||||||||||||||||||||||||||||||||||||

| Total common equity | $ | 14,758 | $ | 14,318 | $ | 14,060 | $ | 13,169 | $ | 13,033 | $ | 1,725 | 13.2 | % | ||||||||||||||||||||||||

| Total common equity as a % of total assets | 12.38 | % | 11.88 | % | 11.60 | % | 11.21 | % | 11.54 | % | 0.84 | % | ||||||||||||||||||||||||||

| Tangible assets | $ | 117,190 | $ | 118,439 | $ | 119,300 | $ | 115,535 | $ | 111,154 | $ | 6,036 | 5.4 | % | ||||||||||||||||||||||||

Tangible common equity(1) |

$ | 12,719 | $ | 12,268 | $ | 12,187 | $ | 11,225 | $ | 11,248 | $ | 1,471 | 13.1 | % | ||||||||||||||||||||||||

Tangible common equity as a % of tangible assets(1) |

10.85 | % | 10.36 | % | 10.22 | % | 9.72 | % | 10.12 | % | 0.73 | % | ||||||||||||||||||||||||||

Tangible book value per share(2) |

$ | 32.68 | $ | 31.05 | $ | 30.36 | $ | 27.59 | $ | 27.18 | $ | 5.50 | 20.2 | % | ||||||||||||||||||||||||

REGULATORY CAPITAL RATIOS(3)(4) |

||||||||||||||||||||||||||||||||||||||

| Basel III - CECL Transition | ||||||||||||||||||||||||||||||||||||||

Total risk-based capital ratio(5) |

16.4 | % | 15.8 | % | 15.8 | % | 14.9 | % | 15.7 | % | ||||||||||||||||||||||||||||

Tier 1 risk-based capital ratio(6) |

14.3 | % | 13.8 | % | 13.8 | % | 12.9 | % | 13.6 | % | ||||||||||||||||||||||||||||

Tier 1 leverage ratio(7) |

12.5 | % | 12.0 | % | 12.0 | % | 11.7 | % | 12.2 | % | ||||||||||||||||||||||||||||

| Common equity Tier 1 capital ratio | 13.1 | % | 12.6 | % | 12.6 | % | 12.2 | % | 12.8 | % | ||||||||||||||||||||||||||||

| (1) Tangible common equity ("TCE") is a non-GAAP measure. We believe TCE is a more meaningful measure of the net asset value of the Company to investors. For corresponding reconciliation of TCE to a GAAP financial measure, see Reconciliation of Non-GAAP Measures and Calculations of Regulatory Measures. | ||||||||||||||||||||||||||||||||||||||

| (2) Tangible book value per share is a non-GAAP measure, calculated based on Tangible common equity divided by common shares outstanding. For corresponding reconciliation of this measure to a GAAP financial measure, see Reconciliation of Non-GAAP Measures and Calculations of Regulatory Measures. | ||||||||||||||||||||||||||||||||||||||

| (3) Regulatory capital ratios at September 30, 2024 are preliminary and therefore subject to change. | ||||||||||||||||||||||||||||||||||||||

| (4) Capital ratios reflect the phase-in of an estimate of CECL’s effect on regulatory capital over a three-year transitional period beginning in the first quarter of 2022 through 2024. Capital ratios for 2024 and 2023 reflect 75% and 50%, respectively, of the phase-in of CECL effects. | ||||||||||||||||||||||||||||||||||||||

| (5) Total risk-based capital ratio is the ratio of total risk-based capital divided by risk-weighted assets. | ||||||||||||||||||||||||||||||||||||||

| (6) Tier 1 risk-based capital ratio is the ratio of Tier 1 capital divided by risk-weighted assets. | ||||||||||||||||||||||||||||||||||||||

| (7) Tier 1 leverage ratio is the ratio of Tier 1 capital divided by total average assets, after certain adjustments. | ||||||||||||||||||||||||||||||||||||||

| SYNCHRONY FINANCIAL | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PLATFORM RESULTS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (unaudited, $ in millions) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter Ended | Nine Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sep 30, 2024 |

Jun 30, 2024 |

Mar 31, 2024 |

Dec 31, 2023 |

Sep 30, 2023 |

3Q'24 vs. 3Q'23 | Sep 30, 2024 |

Sep 30, 2023 |

YTD'24 vs. YTD'23 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| HOME & AUTO | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Purchase volume(1) |

$ | 11,361 | $ | 12,496 | $ | 10,512 | $ | 11,421 | $ | 12,273 | $ | (912) | (7.4) | % | $ | 34,369 | $ | 35,989 | $ | (1,620) | (4.5) | % | |||||||||||||||||||||||||||||||||||||

| Period-end loan receivables | $ | 32,542 | $ | 32,822 | $ | 32,615 | $ | 31,969 | $ | 31,648 | $ | 894 | 2.8 | % | $ | 32,542 | $ | 31,648 | $ | 894 | 2.8 | % | |||||||||||||||||||||||||||||||||||||

| Average loan receivables, including held for sale | $ | 32,613 | $ | 32,592 | $ | 31,865 | $ | 31,720 | $ | 31,239 | $ | 1,374 | 4.4 | % | $ | 32,358 | $ | 30,386 | $ | 1,972 | 6.5 | % | |||||||||||||||||||||||||||||||||||||

Average active accounts (in thousands)(2) |

19,157 | 19,335 | 18,969 | 19,177 | 19,223 | (66) | (0.3) | % | 19,136 | 18,894 | 242 | 1.3 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 1,489 | $ | 1,419 | $ | 1,382 | $ | 1,403 | $ | 1,367 | $ | 122 | 8.9 | % | $ | 4,290 | $ | 3,867 | $ | 423 | 10.9 | % | |||||||||||||||||||||||||||||||||||||

| Other income | $ | 56 | $ | 38 | $ | 33 | $ | 26 | $ | 28 | $ | 28 | 100.0 | % | $ | 127 | $ | 80 | $ | 47 | 58.8 | % | |||||||||||||||||||||||||||||||||||||

| DIGITAL | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Purchase volume(1) |

$ | 13,352 | $ | 13,403 | $ | 12,628 | $ | 15,510 | $ | 13,808 | $ | (456) | (3.3) | % | $ | 39,383 | $ | 39,541 | $ | (158) | (0.4) | % | |||||||||||||||||||||||||||||||||||||

| Period-end loan receivables | $ | 27,771 | $ | 27,704 | $ | 27,734 | $ | 28,925 | $ | 26,685 | $ | 1,086 | 4.1 | % | $ | 27,771 | $ | 26,685 | $ | 1,086 | 4.1 | % | |||||||||||||||||||||||||||||||||||||

| Average loan receivables, including held for sale | $ | 27,704 | $ | 27,542 | $ | 28,081 | $ | 27,553 | $ | 26,266 | $ | 1,438 | 5.5 | % | $ | 27,776 | $ | 25,484 | $ | 2,292 | 9.0 | % | |||||||||||||||||||||||||||||||||||||

Average active accounts (in thousands)(2) |

20,787 | 20,920 | 21,349 | 21,177 | 20,768 | 19 | 0.1 | % | 21,033 | 20,641 | 392 | 1.9 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 1,593 | $ | 1,544 | $ | 1,567 | $ | 1,579 | $ | 1,530 | $ | 63 | 4.1 | % | $ | 4,704 | $ | 4,315 | $ | 389 | 9.0 | % | |||||||||||||||||||||||||||||||||||||

| Other income | $ | 4 | $ | — | $ | 6 | $ | (7) | $ | (6) | $ | 10 | (166.7) | % | $ | 10 | $ | (7) | $ | 17 | (242.9) | % | |||||||||||||||||||||||||||||||||||||

| DIVERSIFIED & VALUE | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Purchase volume(1) |

$ | 14,992 | $ | 15,333 | $ | 14,023 | $ | 16,987 | $ | 15,445 | $ | (453) | (2.9) | % | $ | 44,348 | $ | 44,240 | $ | 108 | 0.2 | % | |||||||||||||||||||||||||||||||||||||

| Period-end loan receivables | $ | 19,466 | $ | 19,516 | $ | 19,559 | $ | 20,666 | $ | 18,865 | $ | 601 | 3.2 | % | $ | 19,466 | $ | 18,865 | $ | 601 | 3.2 | % | |||||||||||||||||||||||||||||||||||||

| Average loan receivables, including held for sale | $ | 19,413 | $ | 19,360 | $ | 19,593 | $ | 19,422 | $ | 18,565 | $ | 848 | 4.6 | % | $ | 19,455 | $ | 18,074 | $ | 1,381 | 7.6 | % | |||||||||||||||||||||||||||||||||||||

Average active accounts (in thousands)(2) |

19,960 | 20,253 | 21,032 | 21,038 | 20,410 | (450) | (2.2) | % | 20,448 | 20,571 | (123) | (0.6) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 1,209 | $ | 1,165 | $ | 1,214 | $ | 1,204 | $ | 1,168 | $ | 41 | 3.5 | % | $ | 3,588 | $ | 3,329 | $ | 259 | 7.8 | % | |||||||||||||||||||||||||||||||||||||

| Other income | $ | (11) | $ | (22) | $ | (17) | $ | (30) | $ | (28) | $ | 17 | (60.7) | % | $ | (50) | $ | (63) | $ | 13 | (20.6) | % | |||||||||||||||||||||||||||||||||||||

| HEALTH & WELLNESS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Purchase volume(1) |

$ | 3,867 | $ | 4,089 | $ | 3,980 | $ | 3,870 | $ | 3,990 | $ | (123) | (3.1) | % | $ | 11,936 | $ | 11,695 | $ | 241 | 2.1 | % | |||||||||||||||||||||||||||||||||||||

| Period-end loan receivables | $ | 15,439 | $ | 15,280 | $ | 15,065 | $ | 14,521 | $ | 14,019 | $ | 1,420 | 10.1 | % | $ | 15,439 | $ | 14,019 | $ | 1,420 | 10.1 | % | |||||||||||||||||||||||||||||||||||||

| Average loan receivables, including held for sale | $ | 15,311 | $ | 15,111 | $ | 14,697 | $ | 14,251 | $ | 13,600 | $ | 1,711 | 12.6 | % | $ | 15,041 | $ | 12,927 | $ | 2,114 | 16.4 | % | |||||||||||||||||||||||||||||||||||||

Average active accounts (in thousands)(2) |

7,801 | 7,752 | 7,611 | 7,447 | 7,276 | 525 | 7.2 | % | 7,713 | 7,076 | 637 | 9.0 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 956 | $ | 911 | $ | 869 | $ | 866 | $ | 844 | $ | 112 | 13.3 | % | $ | 2,736 | $ | 2,365 | $ | 371 | 15.7 | % | |||||||||||||||||||||||||||||||||||||

| Other income | $ | 68 | $ | 48 | $ | 66 | $ | 82 | $ | 74 | $ | (6) | (8.1) | % | $ | 182 | $ | 189 | $ | (7) | (3.7) | % | |||||||||||||||||||||||||||||||||||||

| LIFESTYLE | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Purchase volume(1) |

$ | 1,411 | $ | 1,525 | $ | 1,244 | $ | 1,550 | $ | 1,490 | $ | (79) | (5.3) | % | $ | 4,180 | $ | 4,372 | $ | (192) | (4.4) | % | |||||||||||||||||||||||||||||||||||||

| Period-end loan receivables | $ | 6,831 | $ | 6,822 | $ | 6,604 | $ | 6,744 | $ | 6,483 | $ | 348 | 5.4 | % | $ | 6,831 | $ | 6,483 | $ | 348 | 5.4 | % | |||||||||||||||||||||||||||||||||||||

| Average loan receivables, including held for sale | $ | 6,823 | $ | 6,723 | $ | 6,631 | $ | 6,568 | $ | 6,383 | $ | 440 | 6.9 | % | $ | 6,726 | $ | 6,137 | $ | 589 | 9.6 | % | |||||||||||||||||||||||||||||||||||||

Average active accounts (in thousands)(2) |

2,677 | 2,662 | 2,642 | 2,620 | 2,556 | 121 | 4.7 | % | 2,668 | 2,572 | 96 | 3.7 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 270 | $ | 258 | $ | 255 | $ | 255 | $ | 249 | $ | 21 | 8.4 | % | $ | 783 | $ | 704 | $ | 79 | 11.2 | % | |||||||||||||||||||||||||||||||||||||

| Other income | $ | 9 | $ | 6 | $ | 8 | $ | 7 | $ | 8 | $ | 1 | 12.5 | % | $ | 23 | $ | 22 | $ | 1 | 4.5 | % | |||||||||||||||||||||||||||||||||||||

| CORP, OTHER | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Purchase volume(1) |

$ | 2 | $ | — | $ | — | $ | 1 | $ | — | $ | 2 | NM | $ | 2 | $ | 2 | $ | — | — | % | ||||||||||||||||||||||||||||||||||||||

| Period-end loan receivables | $ | 144 | $ | 140 | $ | 156 | $ | 163 | $ | 173 | $ | (29) | (16.8) | % | $ | 144 | $ | 173 | $ | (29) | (16.8) | % | |||||||||||||||||||||||||||||||||||||

| Average loan receivables, including held for sale | $ | 145 | $ | 150 | $ | 90 | $ | 169 | $ | 177 | $ | (32) | (18.1) | % | $ | 128 | $ | 190 | $ | (62) | (32.6) | % | |||||||||||||||||||||||||||||||||||||

Average active accounts (in thousands)(2) |

42 | 52 | 64 | 67 | 75 | (33) | (44.0) | % | 54 | 88 | (34) | (38.6) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 5 | $ | 4 | $ | 6 | $ | 16 | $ | (7) | $ | 12 | (171.4) | % | $ | 15 | $ | (1) | $ | 16 | NM | ||||||||||||||||||||||||||||||||||||||

| Other income | $ | (7) | $ | 47 | $ | 1,061 | $ | (7) | $ | 16 | $ | (23) | (143.8) | % | $ | 1,101 | $ | (3) | $ | 1,104 | NM | ||||||||||||||||||||||||||||||||||||||

| TOTAL SYF | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Purchase volume(1) |

$ | 44,985 | $ | 46,846 | $ | 42,387 | $ | 49,339 | $ | 47,006 | $ | (2,021) | (4.3) | % | $ | 134,218 | $ | 135,839 | $ | (1,621) | (1.2) | % | |||||||||||||||||||||||||||||||||||||

| Period-end loan receivables | $ | 102,193 | $ | 102,284 | $ | 101,733 | $ | 102,988 | $ | 97,873 | $ | 4,320 | 4.4 | % | $ | 102,193 | $ | 97,873 | $ | 4,320 | 4.4 | % | |||||||||||||||||||||||||||||||||||||

| Average loan receivables, including held for sale | $ | 102,009 | $ | 101,478 | $ | 100,957 | $ | 99,683 | $ | 96,230 | $ | 5,779 | 6.0 | % | $ | 101,484 | $ | 93,198 | $ | 8,286 | 8.9 | % | |||||||||||||||||||||||||||||||||||||

Average active accounts (in thousands)(2) |

70,424 | 70,974 | 71,667 | 71,526 | 70,308 | 116 | 0.2 | % | 71,052 | 69,842 | 1,210 | 1.7 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 5,522 | $ | 5,301 | $ | 5,293 | $ | 5,323 | $ | 5,151 | $ | 371 | 7.2 | % | $ | 16,116 | $ | 14,579 | $ | 1,537 | 10.5 | % | |||||||||||||||||||||||||||||||||||||

| Other income | $ | 119 | $ | 117 | $ | 1,157 | $ | 71 | $ | 92 | $ | 27 | 29.3 | % | $ | 1,393 | $ | 218 | $ | 1,175 | NM | ||||||||||||||||||||||||||||||||||||||

| (1) Purchase volume, or net credit sales, represents the aggregate amount of charges incurred on credit cards or other credit product accounts less returns during the period. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (2) Active accounts represent credit card or installment loan accounts on which there has been a purchase, payment or outstanding balance in the current month. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SYNCHRONY FINANCIAL | |||||||||||||||||||||||||||||

RECONCILIATION OF NON-GAAP MEASURES AND CALCULATIONS OF REGULATORY MEASURES(1) |

|||||||||||||||||||||||||||||

| (unaudited, $ in millions, except per share statistics) | |||||||||||||||||||||||||||||

| Quarter Ended | |||||||||||||||||||||||||||||

| Sep 30, 2024 |

Jun 30, 2024 |

Mar 31, 2024 |

Dec 31, 2023 |

Sep 30, 2023 |

|||||||||||||||||||||||||

COMMON EQUITY AND REGULATORY CAPITAL MEASURES(2) |

|||||||||||||||||||||||||||||

| GAAP Total equity | $ | 15,980 | $ | 15,540 | $ | 15,282 | $ | 13,903 | $ | 13,767 | |||||||||||||||||||

| Less: Preferred stock | (1,222) | (1,222) | (1,222) | (734) | (734) | ||||||||||||||||||||||||

| Less: Goodwill | (1,274) | (1,274) | (1,073) | (1,105) | (1,105) | ||||||||||||||||||||||||

| Less: Intangible assets, net | (765) | (776) | (800) | (839) | (680) | ||||||||||||||||||||||||

| Tangible common equity | $ | 12,719 | $ | 12,268 | $ | 12,187 | $ | 11,225 | $ | 11,248 | |||||||||||||||||||

| Add: CECL transition amount | 573 | 573 | 573 | 1,146 | 1,146 | ||||||||||||||||||||||||

| Adjustments for certain deferred tax liabilities and certain items in accumulated comprehensive income (loss) | 209 | 227 | 225 | 229 | 255 | ||||||||||||||||||||||||

| Common equity Tier 1 | $ | 13,501 | $ | 13,068 | $ | 12,985 | $ | 12,600 | $ | 12,649 | |||||||||||||||||||

| Preferred stock | 1,222 | 1,222 | 1,222 | 734 | 734 | ||||||||||||||||||||||||

| Tier 1 capital | $ | 14,723 | $ | 14,290 | $ | 14,207 | $ | 13,334 | $ | 13,383 | |||||||||||||||||||

| Add: Subordinated debt | 741 | 741 | 741 | 741 | 741 | ||||||||||||||||||||||||

| Add: Allowance for credit losses includible in risk-based capital | 1,400 | 1,407 | 1,399 | 1,389 | 1,322 | ||||||||||||||||||||||||

| Total Risk-based capital | $ | 16,864 | $ | 16,438 | $ | 16,347 | $ | 15,464 | $ | 15,446 | |||||||||||||||||||

ASSET MEASURES(2) |

|||||||||||||||||||||||||||||

| Total average assets | $ | 119,389 | $ | 119,864 | $ | 119,034 | $ | 114,599 | $ | 110,335 | |||||||||||||||||||

| Adjustments for: | |||||||||||||||||||||||||||||

| Add: CECL transition amount | 573 | 573 | 573 | 1,146 | 1,146 | ||||||||||||||||||||||||

| Less: Disallowed goodwill and other disallowed intangible assets (net of related deferred tax liabilities) and other |

(1,808) | (1,805) | (1,631) | (1,671) | (1,507) | ||||||||||||||||||||||||

| Total assets for leverage purposes | $ | 118,154 | $ | 118,632 | $ | 117,976 | $ | 114,074 | $ | 109,974 | |||||||||||||||||||

| Risk-weighted assets | $ | 103,103 | $ | 103,718 | $ | 103,242 | $ | 103,460 | $ | 98,451 | |||||||||||||||||||

| CECL FULLY PHASED-IN CAPITAL MEASURES | |||||||||||||||||||||||||||||

| Tier 1 capital | $ | 14,723 | $ | 14,290 | $ | 14,207 | $ | 13,334 | $ | 13,383 | |||||||||||||||||||

| Less: CECL transition adjustment | (573) | (573) | (573) | (1,146) | (1,146) | ||||||||||||||||||||||||

| Tier 1 capital (CECL fully phased-in) | $ | 14,150 | $ | 13,717 | $ | 13,634 | $ | 12,188 | $ | 12,237 | |||||||||||||||||||

| Add: Allowance for credit losses | 11,029 | 10,982 | 10,905 | 10,571 | 10,176 | ||||||||||||||||||||||||

| Tier 1 capital (CECL fully phased-in) + Reserves for credit losses | $ | 25,179 | $ | 24,699 | $ | 24,539 | $ | 22,759 | $ | 22,413 | |||||||||||||||||||

| Risk-weighted assets | $ | 103,103 | $ | 103,718 | $ | 103,242 | $ | 103,460 | $ | 98,451 | |||||||||||||||||||

| Less: CECL transition adjustment | (290) | (290) | (290) | (580) | (580) | ||||||||||||||||||||||||

| Risk-weighted assets (CECL fully phased-in) | $ | 102,813 | $ | 103,428 | $ | 102,952 | $ | 102,880 | $ | 97,871 | |||||||||||||||||||

| TANGIBLE BOOK VALUE PER SHARE | |||||||||||||||||||||||||||||

| Book value per share | $ | 37.92 | $ | 36.24 | $ | 35.03 | $ | 32.36 | $ | 31.50 | |||||||||||||||||||

| Less: Goodwill | (3.27) | (3.23) | (2.68) | (2.72) | (2.67) | ||||||||||||||||||||||||

| Less: Intangible assets, net | (1.97) | (1.96) | (1.99) | (2.05) | (1.65) | ||||||||||||||||||||||||

| Tangible book value per share | $ | 32.68 | $ | 31.05 | $ | 30.36 | $ | 27.59 | $ | 27.18 | |||||||||||||||||||

| (1) Regulatory measures at September 30, 2024 are preliminary and therefore subject to change. | |||||||||||||||||||||||||||||

| (2) Capital ratios reflect the phase-in of an estimate of CECL’s effect on regulatory capital over a three-year transitional period beginning in the first quarter of 2022 through 2024. Capital ratios for 2024 and 2023 reflect 75% and 50%, respectively, of the phase-in of CECL effects. | |||||||||||||||||||||||||||||