| Delaware | 001-36560 | 51-0483352 | ||||||||||||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

||||||||||||

| 777 Long Ridge Road | |||||||||||

| Stamford, | Connecticut | 06902 | |||||||||

| (Address of principal executive offices) | (Zip Code) | ||||||||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Common stock, par value $0.001 per share | SYF | New York Stock Exchange | ||||||

| Depositary Shares Each Representing a 1/40th Interest in a Share of 5.625% Fixed Rate Non-Cumulative Perpetual Preferred Stock, Series A | SYFPrA | New York Stock Exchange | ||||||

| Depositary Shares Each Representing a 1/40th Interest in a Share of 8.250% Fixed Rate Reset Non-Cumulative Perpetual Preferred Stock, Series B | SYFPrB | New York Stock Exchange | ||||||

| Emerging growth company | ☐ | ||||||||||

| Number | Description | |||||||

| 104 | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL | |||||||

SYNCHRONY FINANCIAL |

||||||||||||||||||||

| Date: April 24, 2024 | By: |

/s/ Jonathan Mothner |

||||||||||||||||||

Name: |

Jonathan Mothner |

|||||||||||||||||||

Title: |

Executive Vice President, Chief Risk and Legal Officer | |||||||||||||||||||

|

For Immediate Release

Synchrony Financial (NYSE: SYF)

April 24, 2024

|

|

|||||||

|

4.4%

Return on

Assets

|

12.6%

CET1

Ratio

|

$402M

Capital

Returned

|

CEO COMMENTARY | |||||||||||||||||||||||||||||

|

“Synchrony’s first quarter performance highlights the resiliency of our business model and focus on delivering sustainable, strong results for each of our stakeholders,” said Brian Doubles, Synchrony’s President and Chief Executive Officer.

“Our differentiated model has empowered consistent performance through evolving environments, while our diversified product suite, compelling value propositions and innovative technology have continued to resonate with consumers and partners alike.

“In the quarter we also successfully completed two previously-announced transactions, which together will broaden our expansive product offerings in the market while delivering compelling risk-adjusted returns.

“We are confident that Synchrony is operating from a position of strength as we navigate the year ahead. We are excited about the opportunities we see to drive considerable long-term value as we continue to partner with hundreds of thousands of small- and mid-size businesses and health providers to help tens of millions of people access their everyday needs and wants.”

| ||||||||||||||||||||||||||||||||

|

$101.7B

Loan Receivables

| ||||||||||||||||||||||||||||||||

|

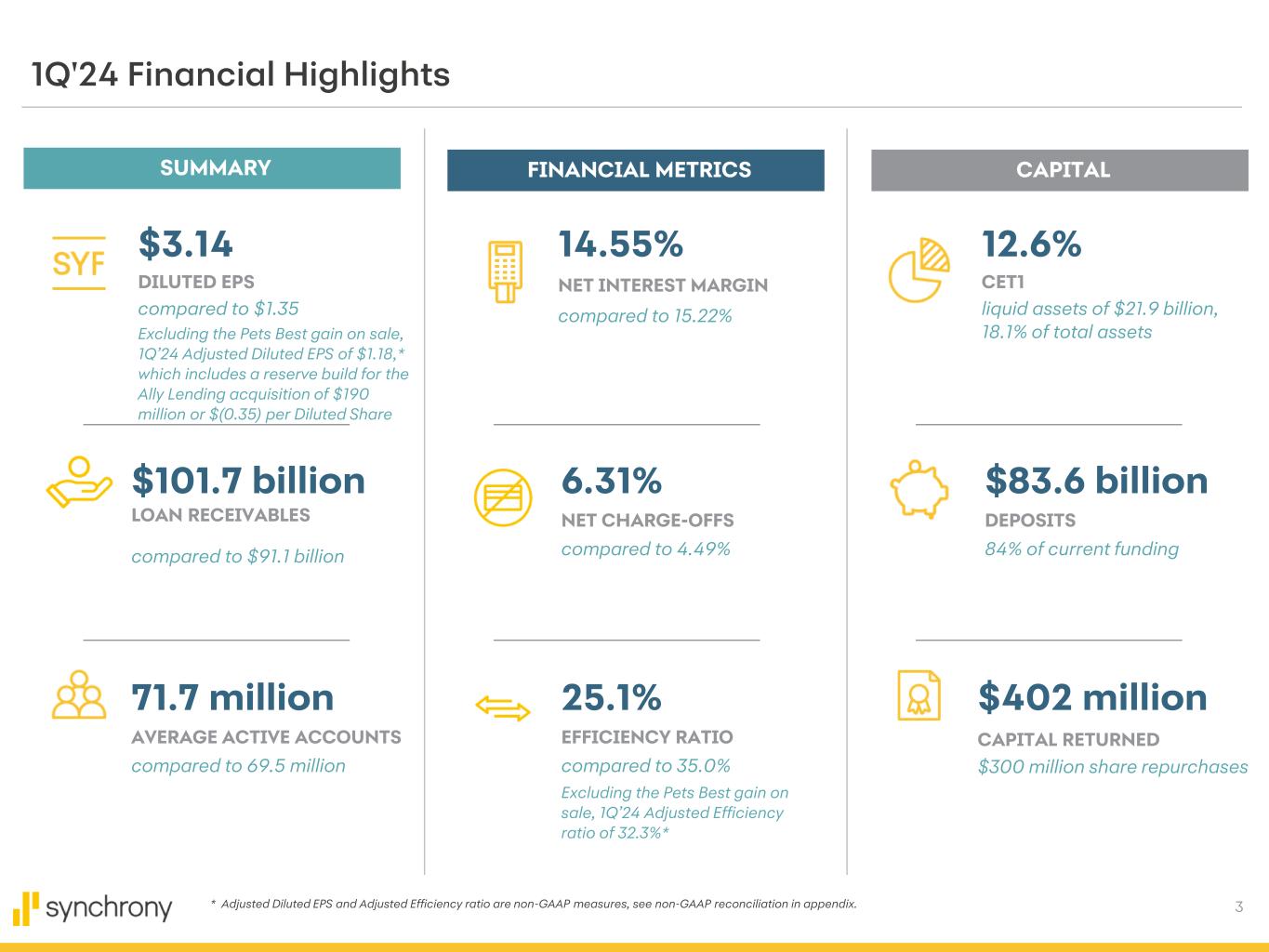

Net Earnings of $1.3 Billion or $3.14 per Diluted Share; excluding the Pets Best gain on sale, Adjusted Net Earnings of $491 million or $1.18 per Diluted Share,* which includes a reserve build for the Ally Lending acquisition of $190 million or $(0.35) per Diluted Share |

|||||||||||||||||||||||||||||||

|

Delivered Record First Quarter Purchase Volume and Strong Receivables Growth | |||||||||||||||||||||||||||||||

|

Returned $402 Million of Capital to Shareholders, including $300 Million of Share Repurchases; Board Approved $1.0 Billion of Incremental Share Repurchase Authorization |

|||||||||||||||||||||||||||||||

STAMFORD, Conn. – Synchrony Financial (NYSE: SYF) today announced first quarter 2024 net earnings of $1.3 billion, or $3.14 per diluted share, compared to $601 million, or $1.35 per diluted share in the first quarter 2023. Excluding the $802 million post-tax impact of the Pets Best gain on sale, first quarter 2024 adjusted net earnings were $491 million, or $1.18 per diluted share,* which includes a reserve build for the Ally Lending acquisition of $190 million or $(0.35) per diluted share. | ||||||||||||||||||||||||||||||||

| KEY OPERATING & FINANCIAL METRICS** | ||||||||||||||||||||||||||||||||

| PERFORMANCE REFLECTS DIFFERENTIATED BUSINESS MODEL AND CONTINUED CONSUMER RESILIENCE | ||||||||||||||||||||||||||||||||

|

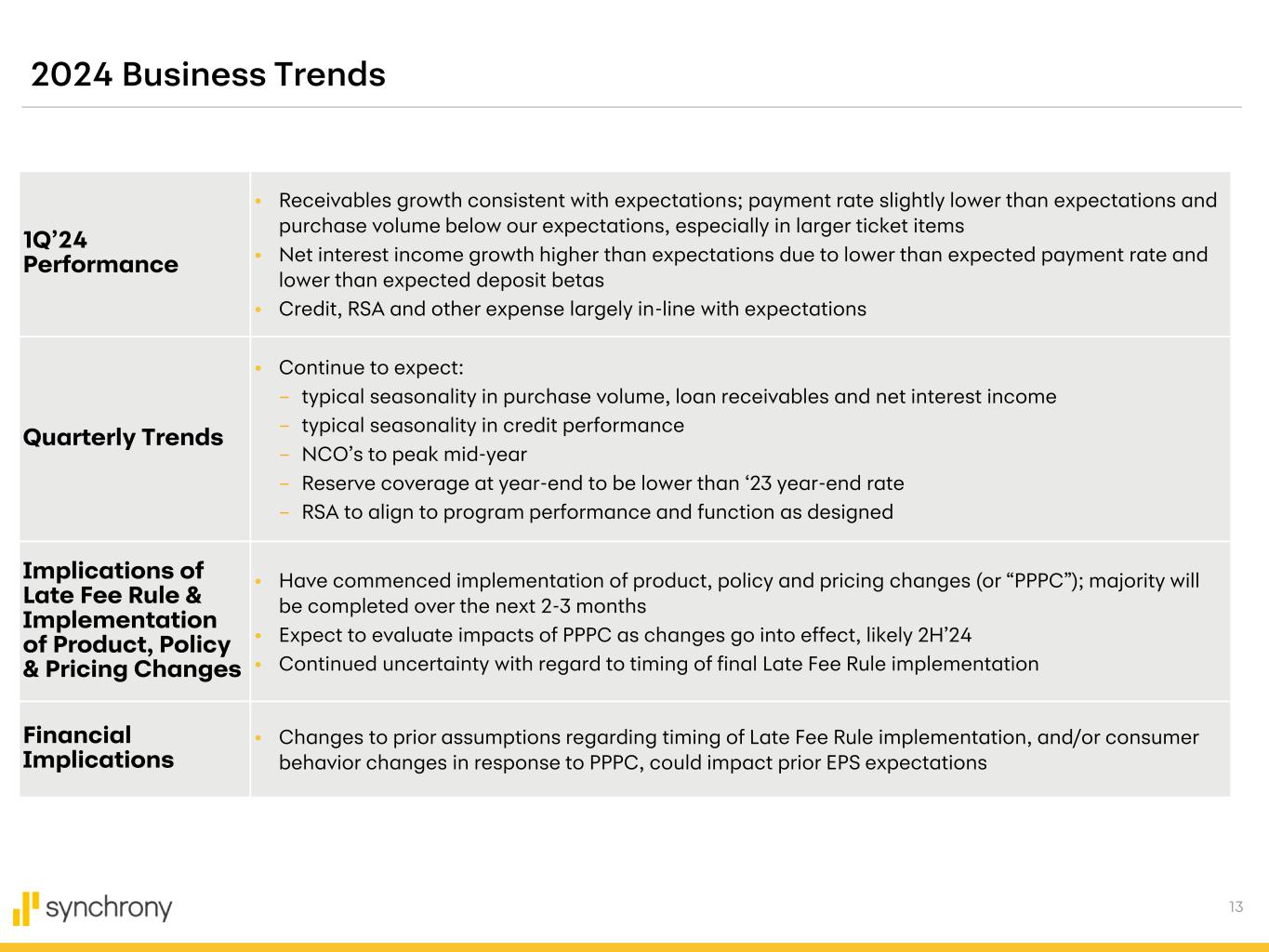

•Purchase volume increased 2% to $42.4 billion

•Loan receivables increased 12% to $101.7 billion

•Average active accounts increased 3% to 71.7 million

•New accounts decreased 8% to 4.8 million

•Net interest margin decreased 67 basis points to 14.55%

•Efficiency ratio decreased 990 basis points to 25.1% or decreased 270 basis points to 32.3% on an adjusted basis*

•Return on assets increased 210 basis points to 4.4% or decreased 60 basis points to 1.7% on an adjusted basis*

•Return on equity increased 17.4 percentage points to 35.6% or decreased 4.4 percentage points to 13.8% on an adjusted basis*

•Return on tangible common equity*** increased 21.5 percentage points to 43.6% or decreased 5.3 percentage points to 16.8% on an adjusted basis*

| ||||||||||||||||||||||||||||||||

| CFO COMMENTARY |

BUSINESS AND FINANCIAL RESULTS FOR

THE FIRST QUARTER OF 2024**

|

|||||||||||||||||||||||||

|

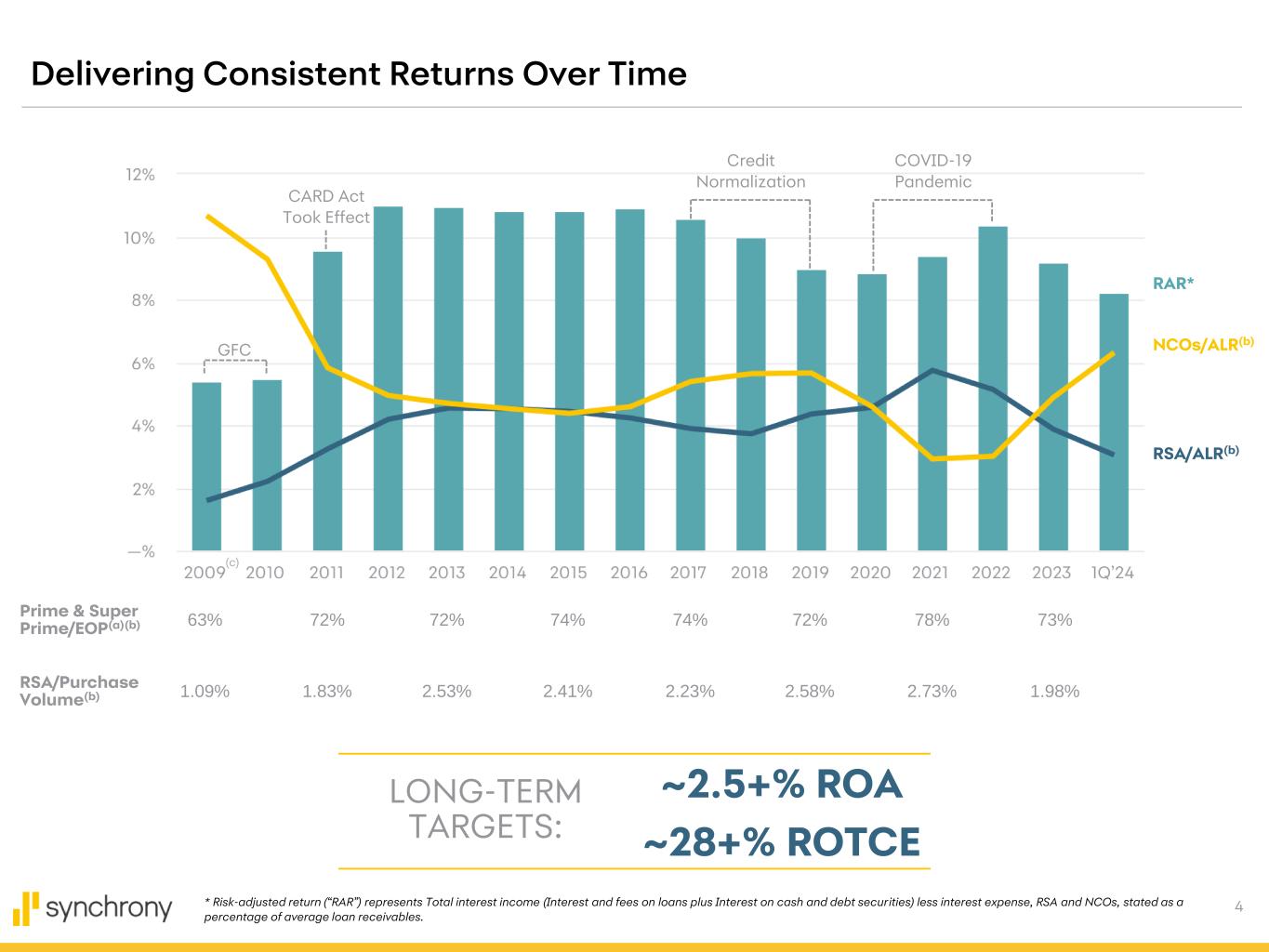

“Synchrony is executing on its business strategy, building on our long history of delivering steady growth at strong risk-adjusted returns through changing market conditions,” said Brian Wenzel, Synchrony’s Executive Vice President and Chief Financial Officer.

"Our differentiated RSA model empowers our financial resilience, while our investments in sophisticated credit management tools empower our agility as we continue to monitor conditions and take actions where necessary to reinforce our positioning for 2024 and beyond.

“In addition, as part of our capital plan, our Board approved an incremental share repurchase authorization of $1 billion and intends to maintain our regular quarterly dividend of $0.25 per share, underscoring their continued confidence in our operating performance and strong balance sheet.

“Taken together, we remain confident that our differentiated model is well positioned to continue to consistently deliver value for each of our stakeholders.”

|

||||||||||||||||||||||||||

| BUSINESS HIGHLIGHTS | ||||||||||||||||||||||||||

| CONTINUED TO EXPAND PORTFOLIO, ENHANCE PRODUCTS AND EXTEND REACH | ||||||||||||||||||||||||||

|

•Completed sale of Pets Best insurance to Independence Pet Holdings, providing the opportunity to build a strategic partnership with one of the leading pet-focused companies in North America.

•Completed acquisition of Ally Lending’s point-of-sale financing business, creating a differentiated solution in the home improvement industry and expanding Synchrony's multi-product strategy within its Home & Auto and Health & Wellness platforms.

•Added or renewed more than 25 programs, including BRP, and new strategic technology partnerships with Adit and ServiceTitan.

| ||||||||||||||||||||||||||

| FINANCIAL HIGHLIGHTS | ||||||||||||||||||||||||||

| EARNINGS DRIVEN BY CORE BUSINESS DRIVERS | ||||||||||||||||||||||||||

|

•Interest and fees on loans increased 15% to $5.3 billion, driven primarily by growth in average loan receivables, lower payment rate, and higher benchmark rates.

•Net interest income increased $354 million, or 9%, to $4.4 billion, driven by higher interest and fees on loans, partially offset by an increase in interest expense from higher benchmark rates and higher funding liabilities.

•Retailer share arrangements decreased $153 million, or 17%, to $764 million, reflecting higher net charge-offs partially offset by higher net interest income.

•Provision for credit losses increased $594 million to $1.9 billion, driven by higher net charge-offs and a $190 million reserve build related to the Ally Lending acquisition.

•Other income increased $1.1 billion to $1.2 billion, driven primarily by the gain on sale of Pets Best of $1.1 billion.

•Other expense increased $87 million, or 8%, to $1.2 billion, driven primarily by growth related items and technology investments.

•Net earnings increased 115% to $1.3 billion, compared to $601 million. Excluding the $802 million after-tax gain on sale of Pets Best, adjusted net earnings declined 18% to $491 million.*

| ||||||||||||||||||||||||||

| CREDIT QUALITY | ||||||||||||||||||||||||||

| CREDIT CONTINUES TO PERFORM IN LINE WITH EXPECTATIONS | ||||||||||||||||||||||||||

|

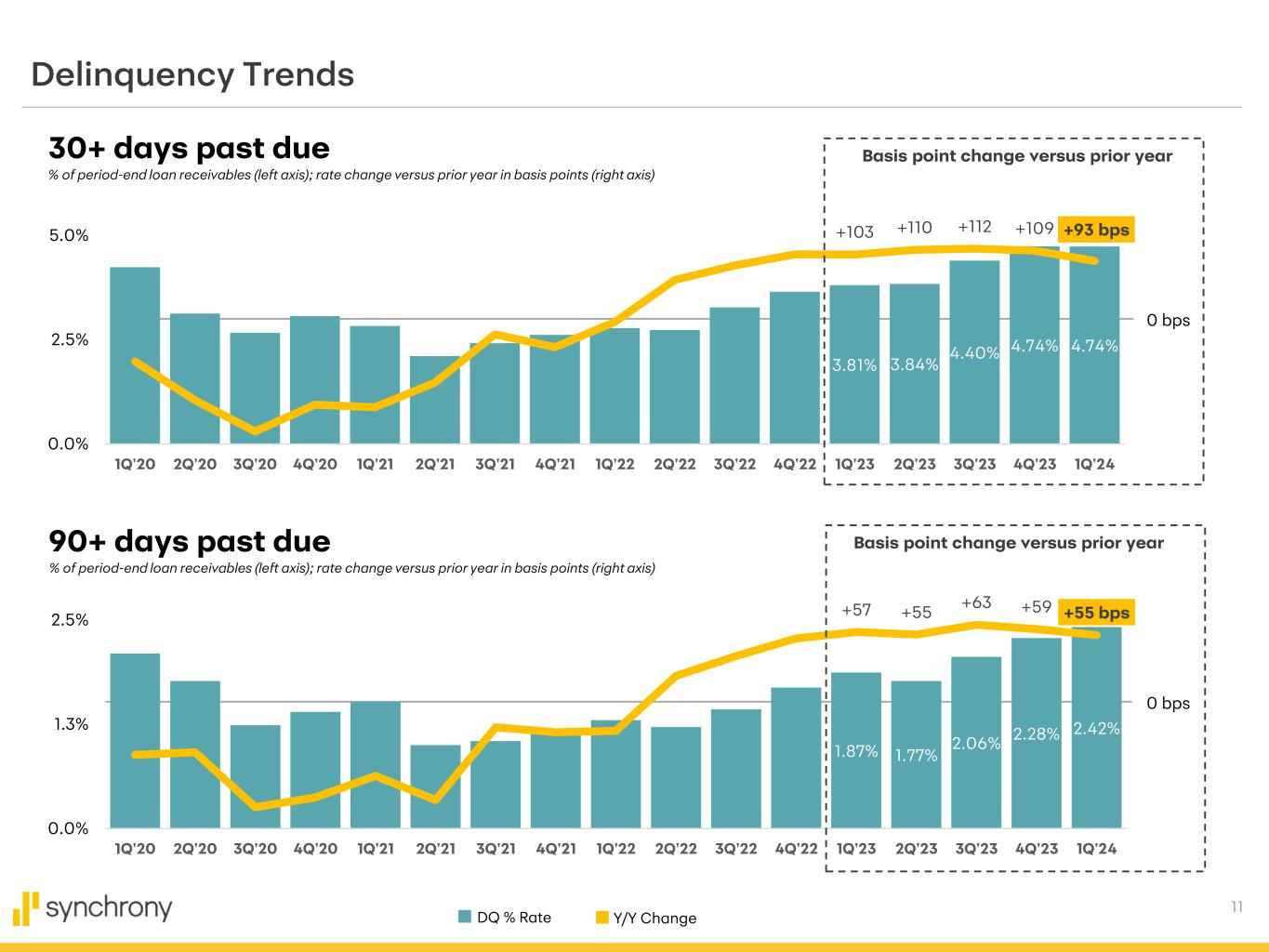

•Loans 30+ days past due as a percentage of total period-end loan receivables were 4.74% compared to 3.81% in the prior year, an increase of 93 basis points and approximately 18 basis points above the average of the first quarters in 2017 through 2019.

•Net charge-offs as a percentage of total average loan receivables were 6.31% compared to 4.49% in the prior year, an increase of 182 basis points, performing within our expectations.

•The allowance for credit losses as a percentage of total period-end loan receivables was 10.72%, compared to 10.26% in the fourth quarter 2023 primarily reflecting the impact of seasonal trends.

| ||||||||||||||||||||||||||

| SALES PLATFORM HIGHLIGHTS | |||||||||||||||||||||||

| DIVERSITY ACROSS OUR PLATFORMS CONTINUES TO PROVIDE RESILIENCE | |||||||||||||||||||||||

|

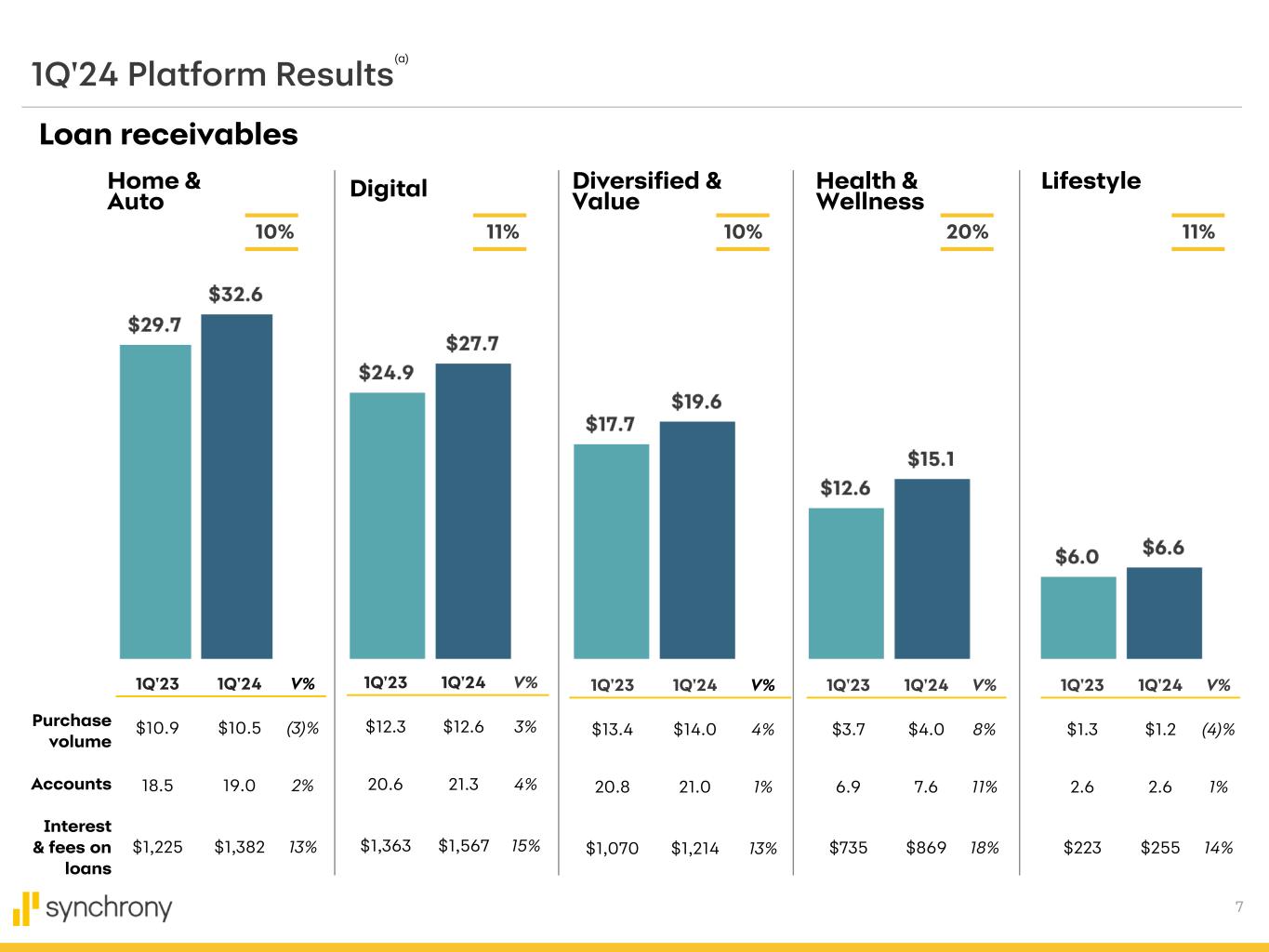

•Home & Auto purchase volume decreased 3%, as the strong growth in Home Specialty, Auto Network, and the impact of the Ally Lending acquisition was offset by a combination of lower consumer traffic, fewer large ticket purchases, and lower gas prices as consumers continued to manage spend across their Home and Auto related needs. Period-end loan receivables increased 10%, reflecting the impacts of the Ally Lending acquisition and lower payment rates. Interest and fees on loans were up 13%, primarily driven by higher average loan receivables and higher benchmark rates. Average active accounts increased 2%.

•Digital purchase volume increased 3%, primarily reflecting continued customer engagement through growth in average active accounts. Period-end loan receivables increased 11%, driven by lower payment rates and continued purchase volume growth. Interest and fees on loans increased 15%, reflecting the impacts of higher average loan receivables, lower payment rate, higher benchmark rates and maturation of newer programs. Average active accounts increased 4%.

•Diversified & Value purchase volume increased 4%, driven by both partner and out-of-partner spend. Period-end loan receivables increased 10%, reflecting purchase volume growth and lower payment rates. Interest and fees on loans increased 13%, driven by the impacts of higher average loan receivables, lower payment rate and higher benchmark rates. Average active accounts increased 1%.

•Health & Wellness purchase volume increased 8%, reflecting broad-based growth in active accounts led by Pet, Dental, and Cosmetic. Period-end loan receivables increased 20%, driven by continued higher purchase volume and lower payment rates, and also reflects the acquisition of Ally Lending. Interest and fees on loans increased 18%, reflecting the impacts of purchase volume growth, higher average loan receivables, and lower payment rate. Average active accounts increased 11%.

•Lifestyle purchase volume decreased 4%, reflecting the impact of lower transaction values. Period-end loan receivables increased 11%, driven by strong prior period purchase volume and lower payment rates. Interest and fees on loans increased 14%, driven primarily by the impacts of higher average loan receivables, lower payment rate and higher benchmark rates. Average active accounts increased 1%.

| |||||||||||||||||||||||

| BALANCE SHEET, LIQUIDITY & CAPITAL | |||||||||||||||||||||||

| FUNDING, CAPITAL & LIQUIDITY REMAIN ROBUST | |||||||||||||||||||||||

|

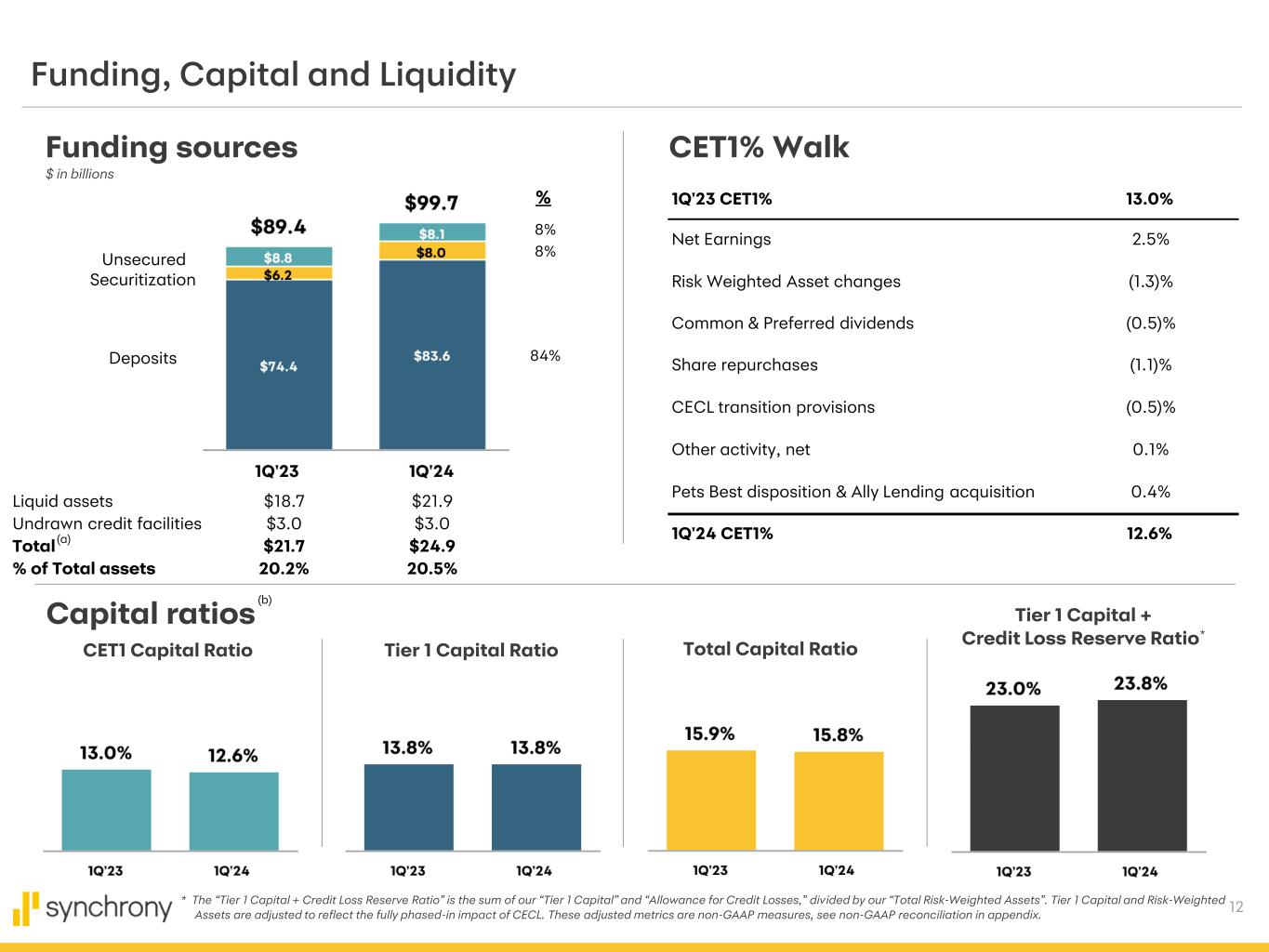

•Loan receivables of $101.7 billion increased 12%; purchase volume increased 2% and average active accounts increased 3%.

•Deposits increased $9.1 billion, or 12%, to $83.6 billion and comprised 84% of funding.

•Total liquid assets and undrawn credit facilities were $24.9 billion, or 20.5% of total assets.

•The company returned $402 million in capital to shareholders, including $300 million of share repurchases and $102 million of common stock dividends.

•As of March 31, 2024 the Company had a total remaining share repurchase authorization of $300 million.

•In April, the Company’s Board approved an incremental share repurchase authorization of $1.0 billion through June 30, 2025, and intends to maintain the quarterly cash dividend at its current amount of $0.25 per share of common stock. Inclusive of the $300 million remaining under its prior share repurchase program as of March 31, 2024, the Company has a total share repurchase authorization of $1.3 billion through June 30, 2025.

•The estimated Common Equity Tier 1 ratio was 12.6% compared to 13.0%, and the estimated Tier 1 Capital ratio was unchanged from the prior year at 13.8%.

| |||||||||||||||||||||||

|

*Financial measures shown on an adjusted basis are non-GAAP measures and exclude the current year amounts related to the Pets Best gain on sale, which was sold in the first quarter of 2024. See non-GAAP reconciliation in the financial tables.

** All comparisons are for the first quarter of 2024 compared to the first quarter of 2023, unless otherwise noted.

*** Tangible common equity is a non-GAAP financial measure. See non-GAAP reconciliation in the financial tables.

| |||||||||||||||||||||||

| CORRESPONDING FINANCIAL TABLES AND INFORMATION | |||||||||||||||||||||||

No representation is made that the information in this news release is complete. Investors are encouraged to review the foregoing summary and discussion of Synchrony Financial's earnings and financial condition in conjunction with the detailed financial tables and information that follow, the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as filed February 8, 2024, and the Company’s forthcoming Quarterly Report on Form 10-Q for the quarter ended March 31, 2024. The detailed financial tables and other information are also available on the Investor Relations page of the Company’s website at www.investors.synchronyfinancial.com. This information is also furnished in a Current Report on Form 8-K filed with the SEC today. | |||||||||||||||||||||||

|

CONFERENCE CALL AND WEBCAST

| ||||||||||||||

On Wednesday, April 24, 2024, at 8:00 a.m. Eastern Time, Brian Doubles, President and Chief Executive Officer, and Brian Wenzel Sr., Executive Vice President and Chief Financial Officer, will host a conference call to review the financial results and outlook for certain business drivers. The conference call can be accessed via an audio webcast through the Investor Relations page on the Synchrony Financial corporate website, www.investors.synchrony.com, under Events and Presentations. A replay will also be available on the website. | ||||||||||||||

| Investor Relations | Media Relations | ||||

| Kathryn Miller | Lisa Lanspery | ||||

| (203) 585-6291 | (203) 585-6143 | ||||

| SYNCHRONY FINANCIAL | ||||||||||||||||||||||||||||||||||||||

| FINANCIAL SUMMARY | ||||||||||||||||||||||||||||||||||||||

| (unaudited, in millions, except per share statistics) | ||||||||||||||||||||||||||||||||||||||

| Quarter Ended | ||||||||||||||||||||||||||||||||||||||

| Mar 31, 2024 |

Dec 31, 2023 |

Sep 30, 2023 |

Jun 30, 2023 |

Mar 31, 2023 |

1Q'24 vs. 1Q'23 | |||||||||||||||||||||||||||||||||

| EARNINGS | ||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 4,405 | $ | 4,466 | $ | 4,362 | $ | 4,120 | $ | 4,051 | $ | 354 | 8.7 | % | ||||||||||||||||||||||||

| Retailer share arrangements | (764) | (878) | (979) | (887) | (917) | 153 | (16.7) | % | ||||||||||||||||||||||||||||||

| Other income | 1,157 | 71 | 92 | 61 | 65 | 1,092 | NM | |||||||||||||||||||||||||||||||

| Net revenue | 4,798 | 3,659 | 3,475 | 3,294 | 3,199 | 1,599 | 50.0 | % | ||||||||||||||||||||||||||||||

| Provision for credit losses | 1,884 | 1,804 | 1,488 | 1,383 | 1,290 | 594 | 46.0 | % | ||||||||||||||||||||||||||||||

| Other expense | 1,206 | 1,316 | 1,154 | 1,169 | 1,119 | 87 | 7.8 | % | ||||||||||||||||||||||||||||||

| Earnings before provision for income taxes | 1,708 | 539 | 833 | 742 | 790 | 918 | 116.2 | % | ||||||||||||||||||||||||||||||

| Provision for income taxes | 415 | 99 | 205 | 173 | 189 | 226 | 119.6 | % | ||||||||||||||||||||||||||||||

| Net earnings | $ | 1,293 | $ | 440 | $ | 628 | $ | 569 | $ | 601 | $ | 692 | 115.1 | % | ||||||||||||||||||||||||

| Net earnings available to common stockholders | $ | 1,282 | $ | 429 | $ | 618 | $ | 559 | $ | 590 | $ | 692 | 117.3 | % | ||||||||||||||||||||||||

| COMMON SHARE STATISTICS | ||||||||||||||||||||||||||||||||||||||

| Basic EPS | $ | 3.17 | $ | 1.04 | $ | 1.49 | $ | 1.32 | $ | 1.36 | $ | 1.81 | 133.1 | % | ||||||||||||||||||||||||

| Diluted EPS | $ | 3.14 | $ | 1.03 | $ | 1.48 | $ | 1.32 | $ | 1.35 | $ | 1.79 | 132.6 | % | ||||||||||||||||||||||||

| Dividend declared per share | $ | 0.25 | $ | 0.25 | $ | 0.25 | $ | 0.23 | $ | 0.23 | $ | 0.02 | 8.7 | % | ||||||||||||||||||||||||

| Common stock price | $ | 43.12 | $ | 38.19 | $ | 30.57 | $ | 33.92 | $ | 29.08 | $ | 14.04 | 48.3 | % | ||||||||||||||||||||||||

| Book value per share | $ | 35.03 | $ | 32.36 | $ | 31.50 | $ | 30.25 | $ | 29.08 | $ | 5.95 | 20.5 | % | ||||||||||||||||||||||||

Tangible common equity per share(1) |

$ | 30.36 | $ | 27.59 | $ | 27.18 | $ | 25.89 | $ | 24.71 | $ | 5.65 | 22.9 | % | ||||||||||||||||||||||||

| Beginning common shares outstanding | 406.9 | 413.8 | 418.1 | 428.4 | 438.2 | (31.3) | (7.1) | % | ||||||||||||||||||||||||||||||

| Issuance of common shares | — | — | — | — | — | — | NM | |||||||||||||||||||||||||||||||

| Stock-based compensation | 2.0 | 0.4 | 0.2 | 0.2 | 1.5 | 0.5 | 33.3 | % | ||||||||||||||||||||||||||||||

| Shares repurchased | (7.5) | (7.3) | (4.5) | (10.5) | (11.3) | 3.8 | (33.6) | % | ||||||||||||||||||||||||||||||

| Ending common shares outstanding | 401.4 | 406.9 | 413.8 | 418.1 | 428.4 | (27.0) | (6.3) | % | ||||||||||||||||||||||||||||||

| Weighted average common shares outstanding | 404.7 | 411.9 | 416.0 | 422.7 | 434.4 | (29.7) | (6.8) | % | ||||||||||||||||||||||||||||||

| Weighted average common shares outstanding (fully diluted) | 408.2 | 414.6 | 418.4 | 424.2 | 437.2 | (29.0) | (6.6) | % | ||||||||||||||||||||||||||||||

| (1) Tangible Common Equity ("TCE") is a non-GAAP measure. For corresponding reconciliation of TCE to a GAAP financial measure, see Reconciliation of Non-GAAP Measures and Calculations of Regulatory Measures. | ||||||||||||||||||||||||||||||||||||||

| SYNCHRONY FINANCIAL | ||||||||||||||||||||||||||||||||||||||

| SELECTED METRICS | ||||||||||||||||||||||||||||||||||||||

| (unaudited, $ in millions) | ||||||||||||||||||||||||||||||||||||||

| Quarter Ended | ||||||||||||||||||||||||||||||||||||||

| Mar 31, 2024 |

Dec 31, 2023 |

Sep 30, 2023 |

Jun 30, 2023 |

Mar 31, 2023 |

1Q'24 vs. 1Q'23 | |||||||||||||||||||||||||||||||||

| PERFORMANCE METRICS | ||||||||||||||||||||||||||||||||||||||

Return on assets(1) |

4.4 | % | 1.5 | % | 2.3 | % | 2.1 | % | 2.3 | % | 2.1 | % | ||||||||||||||||||||||||||

Return on equity(2) |

35.6 | % | 12.4 | % | 18.1 | % | 17.0 | % | 18.2 | % | 17.4 | % | ||||||||||||||||||||||||||

Return on tangible common equity(3) |

43.6 | % | 14.7 | % | 21.9 | % | 20.6 | % | 22.1 | % | 21.5 | % | ||||||||||||||||||||||||||

| — | % | |||||||||||||||||||||||||||||||||||||

| — | % | |||||||||||||||||||||||||||||||||||||

Net interest margin(4) |

14.55 | % | 15.10 | % | 15.36 | % | 14.94 | % | 15.22 | % | (0.67) | % | ||||||||||||||||||||||||||

| Net revenue as a % of average loan receivables, including held for sale | 19.11 | % | 14.56 | % | 14.33 | % | 14.29 | % | 14.29 | % | 4.82 | % | ||||||||||||||||||||||||||

Efficiency ratio(5) |

25.1 | % | 36.0 | % | 33.2 | % | 35.5 | % | 35.0 | % | (9.9) | % | ||||||||||||||||||||||||||

| Other expense as a % of average loan receivables, including held for sale | 4.80 | % | 5.24 | % | 4.76 | % | 5.07 | % | 5.00 | % | (0.20) | % | ||||||||||||||||||||||||||

| Effective income tax rate | 24.3 | % | 18.4 | % | 24.6 | % | 23.3 | % | 23.9 | % | 0.4 | % | ||||||||||||||||||||||||||

| CREDIT QUALITY METRICS | ||||||||||||||||||||||||||||||||||||||

| Net charge-offs as a % of average loan receivables, including held for sale | 6.31 | % | 5.58 | % | 4.60 | % | 4.75 | % | 4.49 | % | 1.82 | % | ||||||||||||||||||||||||||

30+ days past due as a % of period-end loan receivables(6) |

4.74 | % | 4.74 | % | 4.40 | % | 3.84 | % | 3.81 | % | 0.93 | % | ||||||||||||||||||||||||||

90+ days past due as a % of period-end loan receivables(6) |

2.42 | % | 2.28 | % | 2.06 | % | 1.77 | % | 1.87 | % | 0.55 | % | ||||||||||||||||||||||||||

| Net charge-offs | $ | 1,585 | $ | 1,402 | $ | 1,116 | $ | 1,096 | $ | 1,006 | $ | 579 | 57.6 | % | ||||||||||||||||||||||||

Loan receivables delinquent over 30 days(6) |

$ | 4,820 | $ | 4,885 | $ | 4,304 | $ | 3,641 | $ | 3,474 | $ | 1,346 | 38.7 | % | ||||||||||||||||||||||||

Loan receivables delinquent over 90 days(6) |

$ | 2,459 | $ | 2,353 | $ | 2,020 | $ | 1,677 | $ | 1,705 | $ | 754 | 44.2 | % | ||||||||||||||||||||||||

| Allowance for credit losses (period-end) | $ | 10,905 | $ | 10,571 | $ | 10,176 | $ | 9,804 | $ | 9,517 | $ | 1,388 | 14.6 | % | ||||||||||||||||||||||||

Allowance coverage ratio(7) |

10.72 | % | 10.26 | % | 10.40 | % | 10.34 | % | 10.44 | % | 0.28 | % | ||||||||||||||||||||||||||

| BUSINESS METRICS | ||||||||||||||||||||||||||||||||||||||

Purchase volume(8) |

$ | 42,387 | $ | 49,339 | $ | 47,006 | $ | 47,276 | $ | 41,557 | $ | 830 | 2.0 | % | ||||||||||||||||||||||||

| Period-end loan receivables | $ | 101,733 | $ | 102,988 | $ | 97,873 | $ | 94,801 | $ | 91,129 | $ | 10,604 | 11.6 | % | ||||||||||||||||||||||||

| Credit cards | $ | 93,736 | $ | 97,043 | $ | 92,078 | $ | 89,299 | $ | 86,113 | $ | 7,623 | 8.9 | % | ||||||||||||||||||||||||

| Consumer installment loans | $ | 5,957 | $ | 3,977 | $ | 3,784 | $ | 3,548 | $ | 3,204 | $ | 2,753 | 85.9 | % | ||||||||||||||||||||||||

| Commercial credit products | $ | 1,912 | $ | 1,839 | $ | 1,879 | $ | 1,826 | $ | 1,690 | $ | 222 | 13.1 | % | ||||||||||||||||||||||||

| Other | $ | 128 | $ | 129 | $ | 132 | $ | 128 | $ | 122 | $ | 6 | 4.9 | % | ||||||||||||||||||||||||

| Average loan receivables, including held for sale | $ | 100,957 | $ | 99,683 | $ | 96,230 | $ | 92,489 | $ | 90,815 | $ | 10,142 | 11.2 | % | ||||||||||||||||||||||||

Period-end active accounts (in thousands)(9) |

70,754 | 73,484 | 70,137 | 70,269 | 68,589 | 2,165 | 3.2 | % | ||||||||||||||||||||||||||||||

Average active accounts (in thousands)(9) |

71,667 | 71,526 | 70,308 | 69,517 | 69,494 | 2,173 | 3.1 | % | ||||||||||||||||||||||||||||||

| LIQUIDITY | ||||||||||||||||||||||||||||||||||||||

| Liquid assets | ||||||||||||||||||||||||||||||||||||||

| Cash and equivalents | $ | 20,021 | $ | 14,259 | $ | 15,643 | $ | 12,706 | $ | 15,303 | $ | 4,718 | 30.8 | % | ||||||||||||||||||||||||

| Total liquid assets | $ | 21,929 | $ | 16,808 | $ | 17,598 | $ | 16,448 | $ | 18,778 | $ | 3,151 | 16.8 | % | ||||||||||||||||||||||||

| Undrawn credit facilities | ||||||||||||||||||||||||||||||||||||||

| Undrawn credit facilities | $ | 2,950 | $ | 2,950 | $ | 2,950 | $ | 2,950 | $ | 2,950 | $ | — | — | % | ||||||||||||||||||||||||

Total liquid assets and undrawn credit facilities(10) |

$ | 24,879 | $ | 19,758 | $ | 20,548 | $ | 19,398 | $ | 21,728 | $ | 3,151 | 14.5 | % | ||||||||||||||||||||||||

| Liquid assets % of total assets | 18.10 | % | 14.31 | % | 15.58 | % | 15.13 | % | 17.41 | % | 0.69 | % | ||||||||||||||||||||||||||

| Liquid assets including undrawn credit facilities % of total assets | 20.53 | % | 16.82 | % | 18.19 | % | 17.85 | % | 20.15 | % | 0.38 | % | ||||||||||||||||||||||||||

| (1) Return on assets represents net earnings as a percentage of average total assets. | ||||||||||||||||||||||||||||||||||||||

| (2) Return on equity represents net earnings as a percentage of average total equity. | ||||||||||||||||||||||||||||||||||||||

| (3) Return on tangible common equity represents net earnings available to common stockholders as a percentage of average tangible common equity. Tangible common equity ("TCE") is a non-GAAP measure. For corresponding reconciliation of TCE to a GAAP financial measure, see Reconciliation of Non-GAAP Measures and Calculations of Regulatory Measures. | ||||||||||||||||||||||||||||||||||||||

| (4) Net interest margin represents net interest income divided by average interest-earning assets. | ||||||||||||||||||||||||||||||||||||||

| (5) Efficiency ratio represents (i) other expense, divided by (ii) net interest income, plus other income, less retailer share arrangements. | ||||||||||||||||||||||||||||||||||||||

| (6) Based on customer statement-end balances extrapolated to the respective period-end date. | ||||||||||||||||||||||||||||||||||||||

| (7) Allowance coverage ratio represents allowance for credit losses divided by total period-end loan receivables. | ||||||||||||||||||||||||||||||||||||||

| (8) Purchase volume, or net credit sales, represents the aggregate amount of charges incurred on credit cards or other credit product accounts less returns during the period. | ||||||||||||||||||||||||||||||||||||||

| (9) Active accounts represent credit card or installment loan accounts on which there has been a purchase, payment or outstanding balance in the current month. | ||||||||||||||||||||||||||||||||||||||

| (10) Excludes available borrowing capacity related to unencumbered assets. | ||||||||||||||||||||||||||||||||||||||

| SYNCHRONY FINANCIAL | ||||||||||||||||||||||||||||||||||||||

| STATEMENTS OF EARNINGS | ||||||||||||||||||||||||||||||||||||||

| (unaudited, $ in millions) | ||||||||||||||||||||||||||||||||||||||

| Quarter Ended | ||||||||||||||||||||||||||||||||||||||

| Mar 31, 2024 |

Dec 31, 2023 |

Sep 30, 2023 |

Jun 30, 2023 |

Mar 31, 2023 |

1Q'24 vs. 1Q'23 | |||||||||||||||||||||||||||||||||

| Interest income: | ||||||||||||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 5,293 | $ | 5,323 | $ | 5,151 | $ | 4,812 | $ | 4,616 | $ | 677 | 14.7 | % | ||||||||||||||||||||||||

| Interest on cash and debt securities | 275 | 226 | 203 | 209 | 170 | 105 | 61.8 | % | ||||||||||||||||||||||||||||||

| Total interest income | 5,568 | 5,549 | 5,354 | 5,021 | 4,786 | 782 | 16.3 | % | ||||||||||||||||||||||||||||||

| Interest expense: | ||||||||||||||||||||||||||||||||||||||

| Interest on deposits | 954 | 878 | 800 | 717 | 557 | 397 | 71.3 | % | ||||||||||||||||||||||||||||||

| Interest on borrowings of consolidated securitization entities | 105 | 99 | 86 | 78 | 77 | 28 | 36.4 | % | ||||||||||||||||||||||||||||||

| Interest on senior unsecured notes | 104 | 106 | 106 | 106 | 101 | 3 | 3.0 | % | ||||||||||||||||||||||||||||||

| Total interest expense | 1,163 | 1,083 | 992 | 901 | 735 | 428 | 58.2 | % | ||||||||||||||||||||||||||||||

| Net interest income | 4,405 | 4,466 | 4,362 | 4,120 | 4,051 | 354 | 8.7 | % | ||||||||||||||||||||||||||||||

| Retailer share arrangements | (764) | (878) | (979) | (887) | (917) | 153 | (16.7) | % | ||||||||||||||||||||||||||||||

| Provision for credit losses | 1,884 | 1,804 | 1,488 | 1,383 | 1,290 | 594 | 46.0 | % | ||||||||||||||||||||||||||||||

| Net interest income, after retailer share arrangements and provision for credit losses | 1,757 | 1,784 | 1,895 | 1,850 | 1,844 | (87) | (4.7) | % | ||||||||||||||||||||||||||||||

| Other income: | ||||||||||||||||||||||||||||||||||||||

| Interchange revenue | 241 | 270 | 267 | 262 | 232 | 9 | 3.9 | % | ||||||||||||||||||||||||||||||

| Protection product revenue | 141 | 139 | 131 | 125 | 115 | 26 | 22.6 | % | ||||||||||||||||||||||||||||||

| Loyalty programs | (319) | (369) | (358) | (345) | (298) | (21) | 7.0 | % | ||||||||||||||||||||||||||||||

| Other | 1,094 | 31 | 52 | 19 | 16 | 1,078 | NM | |||||||||||||||||||||||||||||||

| Total other income | 1,157 | 71 | 92 | 61 | 65 | 1,092 | NM | |||||||||||||||||||||||||||||||

| Other expense: | ||||||||||||||||||||||||||||||||||||||

| Employee costs | 496 | 538 | 444 | 451 | 451 | 45 | 10.0 | % | ||||||||||||||||||||||||||||||

| Professional fees | 220 | 228 | 219 | 209 | 186 | 34 | 18.3 | % | ||||||||||||||||||||||||||||||

| Marketing and business development | 125 | 138 | 125 | 133 | 131 | (6) | (4.6) | % | ||||||||||||||||||||||||||||||

| Information processing | 186 | 190 | 177 | 179 | 166 | 20 | 12.0 | % | ||||||||||||||||||||||||||||||

| Other | 179 | 222 | 189 | 197 | 185 | (6) | (3.2) | % | ||||||||||||||||||||||||||||||

| Total other expense | 1,206 | 1,316 | 1,154 | 1,169 | 1,119 | 87 | 7.8 | % | ||||||||||||||||||||||||||||||

| Earnings before provision for income taxes | 1,708 | 539 | 833 | 742 | 790 | 918 | 116.2 | % | ||||||||||||||||||||||||||||||

| Provision for income taxes | 415 | 99 | 205 | 173 | 189 | 226 | 119.6 | % | ||||||||||||||||||||||||||||||

| Net earnings | $ | 1,293 | $ | 440 | $ | 628 | $ | 569 | $ | 601 | $ | 692 | 115.1 | % | ||||||||||||||||||||||||

| Net earnings available to common stockholders | $ | 1,282 | $ | 429 | $ | 618 | $ | 559 | $ | 590 | $ | 692 | 117.3 | % | ||||||||||||||||||||||||

| SYNCHRONY FINANCIAL | ||||||||||||||||||||||||||||||||||||||

| STATEMENTS OF FINANCIAL POSITION | ||||||||||||||||||||||||||||||||||||||

| (unaudited, $ in millions) | ||||||||||||||||||||||||||||||||||||||

| Quarter Ended | ||||||||||||||||||||||||||||||||||||||

| Mar 31, 2024 |

Dec 31, 2023 |

Sep 30, 2023 |

Jun 30, 2023 |

Mar 31, 2023 |

Mar 31, 2024 vs. Mar 31, 2023 |

|||||||||||||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||||||||||||||

| Cash and equivalents | $ | 20,021 | $ | 14,259 | $ | 15,643 | $ | 12,706 | $ | 15,303 | $ | 4,718 | 30.8 | % | ||||||||||||||||||||||||

| Debt securities | 3,005 | 3,799 | 2,882 | 4,294 | 4,008 | (1,003) | (25.0) | % | ||||||||||||||||||||||||||||||

| Loan receivables: | ||||||||||||||||||||||||||||||||||||||

| Unsecuritized loans held for investment | 81,642 | 81,554 | 78,470 | 75,532 | 72,079 | 9,563 | 13.3 | % | ||||||||||||||||||||||||||||||

| Restricted loans of consolidated securitization entities | 20,091 | 21,434 | 19,403 | 19,269 | 19,050 | 1,041 | 5.5 | % | ||||||||||||||||||||||||||||||

| Total loan receivables | 101,733 | 102,988 | 97,873 | 94,801 | 91,129 | 10,604 | 11.6 | % | ||||||||||||||||||||||||||||||

| Less: Allowance for credit losses | (10,905) | (10,571) | (10,176) | (9,804) | (9,517) | (1,388) | 14.6 | % | ||||||||||||||||||||||||||||||

| Loan receivables, net | 90,828 | 92,417 | 87,697 | 84,997 | 81,612 | 9,216 | 11.3 | % | ||||||||||||||||||||||||||||||

| Goodwill | 1,073 | 1,018 | 1,105 | 1,105 | 1,105 | (32) | (2.9) | % | ||||||||||||||||||||||||||||||

| Intangible assets, net | 800 | 815 | 680 | 717 | 768 | 32 | 4.2 | % | ||||||||||||||||||||||||||||||

| Other assets | 5,446 | 4,915 | 4,932 | 4,878 | 5,057 | 389 | 7.7 | % | ||||||||||||||||||||||||||||||

| Assets held for sale | — | 256 | — | — | — | — | NM | |||||||||||||||||||||||||||||||

| Total assets | $ | 121,173 | $ | 117,479 | $ | 112,939 | $ | 108,697 | $ | 107,853 | $ | 13,320 | 12.4 | % | ||||||||||||||||||||||||

| Liabilities and Equity | ||||||||||||||||||||||||||||||||||||||

| Deposits: | ||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposit accounts | $ | 83,160 | $ | 80,789 | $ | 77,669 | $ | 75,344 | $ | 74,008 | $ | 9,152 | 12.4 | % | ||||||||||||||||||||||||

| Non-interest-bearing deposit accounts | 394 | 364 | 397 | 421 | 417 | (23) | (5.5) | % | ||||||||||||||||||||||||||||||

| Total deposits | 83,554 | 81,153 | 78,066 | 75,765 | 74,425 | 9,129 | 12.3 | % | ||||||||||||||||||||||||||||||

| Borrowings: | ||||||||||||||||||||||||||||||||||||||

| Borrowings of consolidated securitization entities | 8,016 | 7,267 | 6,519 | 5,522 | 6,228 | 1,788 | 28.7 | % | ||||||||||||||||||||||||||||||

| Senior and Subordinated unsecured notes | 8,117 | 8,715 | 8,712 | 8,709 | 8,706 | (589) | (6.8) | % | ||||||||||||||||||||||||||||||

| Total borrowings | 16,133 | 15,982 | 15,231 | 14,231 | 14,934 | 1,199 | 8.0 | % | ||||||||||||||||||||||||||||||

| Accrued expenses and other liabilities | 6,204 | 6,334 | 5,875 | 5,321 | 5,301 | 903 | 17.0 | % | ||||||||||||||||||||||||||||||

| Liabilities held for sale | — | 107 | — | — | — | — | NM | |||||||||||||||||||||||||||||||

| Total liabilities | 105,891 | 103,576 | 99,172 | 95,317 | 94,660 | 11,231 | 11.9 | % | ||||||||||||||||||||||||||||||

| Equity: | ||||||||||||||||||||||||||||||||||||||

| Preferred stock | 1,222 | 734 | 734 | 734 | 734 | 488 | 66.5 | % | ||||||||||||||||||||||||||||||

| Common stock | 1 | 1 | 1 | 1 | 1 | — | — | % | ||||||||||||||||||||||||||||||

| Additional paid-in capital | 9,768 | 9,775 | 9,750 | 9,727 | 9,705 | 63 | 0.6 | % | ||||||||||||||||||||||||||||||

| Retained earnings | 19,790 | 18,662 | 18,338 | 17,828 | 17,369 | 2,421 | 13.9 | % | ||||||||||||||||||||||||||||||

| Accumulated other comprehensive income (loss) | (69) | (68) | (96) | (96) | (102) | 33 | (32.4) | % | ||||||||||||||||||||||||||||||

| Treasury stock | (15,430) | (15,201) | (14,960) | (14,814) | (14,514) | (916) | 6.3 | % | ||||||||||||||||||||||||||||||

| Total equity | 15,282 | 13,903 | 13,767 | 13,380 | 13,193 | 2,089 | 15.8 | % | ||||||||||||||||||||||||||||||

| Total liabilities and equity | $ | 121,173 | $ | 117,479 | $ | 112,939 | $ | 108,697 | $ | 107,853 | $ | 13,320 | 12.4 | % | ||||||||||||||||||||||||

| SYNCHRONY FINANCIAL | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AVERAGE BALANCES, NET INTEREST INCOME AND NET INTEREST MARGIN | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (unaudited, $ in millions) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mar 31, 2024 | Dec 31, 2023 | Sep 30, 2023 | Jun 30, 2023 | Mar 31, 2023 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest | Average | Interest | Average | Interest | Average | Interest | Average | Interest | Average | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Average | Income/ | Yield/ | Average | Income/ | Yield/ | Average | Income/ | Yield/ | Average | Income/ | Yield/ | Average | Income/ | Yield/ | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance | Expense | Rate | Balance | Expense | Rate | Balance | Expense | Rate | Balance | Expense | Rate | Balance | Expense | Rate | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-earning assets: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-earning cash and equivalents | $ | 17,405 | $ | 236 | 5.45 | % | $ | 13,762 | $ | 188 | 5.42 | % | $ | 12,753 | $ | 172 | 5.35 | % | $ | 14,198 | $ | 178 | 5.03 | % | $ | 12,365 | $ | 140 | 4.59 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Securities available for sale | 3,432 | 39 | 4.57 | % | 3,895 | 38 | 3.87 | % | 3,706 | 31 | 3.32 | % | 3,948 | 31 | 3.15 | % | 4,772 | 30 | 2.55 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loan receivables, including held for sale: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Credit cards | 94,216 | 5,096 | 21.75 | % | 93,744 | 5,162 | 21.85 | % | 90,587 | 5,003 | 21.91 | % | 87,199 | 4,679 | 21.52 | % | 85,904 | 4,497 | 21.23 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consumer installment loans | 4,734 | 149 | 12.66 | % | 3,875 | 116 | 11.88 | % | 3,656 | 108 | 11.72 | % | 3,359 | 94 | 11.22 | % | 3,103 | 83 | 10.85 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial credit products | 1,878 | 45 | 9.64 | % | 1,934 | 42 | 8.62 | % | 1,861 | 38 | 8.10 | % | 1,808 | 36 | 7.99 | % | 1,697 | 34 | 8.13 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 129 | 3 | 9.35 | % | 130 | 3 | 9.16 | % | 126 | 2 | 6.30 | % | 123 | 3 | 9.78 | % | 111 | 2 | 7.31 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total loan receivables, including held for sale | 100,957 | 5,293 | 21.09 | % | 99,683 | 5,323 | 21.19 | % | 96,230 | 5,151 | 21.24 | % | 92,489 | 4,812 | 20.87 | % | 90,815 | 4,616 | 20.61 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-earning assets | 121,794 | 5,568 | 18.39 | % | 117,340 | 5,549 | 18.76 | % | 112,689 | 5,354 | 18.85 | % | 110,635 | 5,021 | 18.20 | % | 107,952 | 4,786 | 17.98 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Non-interest-earning assets: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash and due from banks | 944 | 886 | 964 | 976 | 1,024 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Allowance for credit losses | (10,677) | (10,243) | (9,847) | (9,540) | (9,262) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other assets | 6,973 | 6,616 | 6,529 | 6,330 | 6,128 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total non-interest-earning assets | (2,760) | (2,741) | (2,354) | (2,234) | (2,110) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 119,034 | $ | 114,599 | $ | 110,335 | $ | 108,401 | $ | 105,842 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposit accounts | $ | 82,598 | $ | 954 | 4.65 | % | $ | 78,892 | $ | 878 | 4.42 | % | $ | 75,952 | $ | 800 | 4.18 | % | $ | 74,812 | $ | 717 | 3.84 | % | $ | 72,216 | $ | 557 | 3.13 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Borrowings of consolidated securitization entities | 7,383 | 105 | 5.72 | % | 6,903 | 99 | 5.69 | % | 6,096 | 86 | 5.60 | % | 5,863 | 78 | 5.34 | % | 6,229 | 77 | 5.01 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Senior and Subordinated unsecured notes | 8,630 | 104 | 4.85 | % | 8,712 | 106 | 4.83 | % | 8,710 | 106 | 4.83 | % | 8,707 | 106 | 4.88 | % | 8,442 | 101 | 4.85 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | 98,611 | 1,163 | 4.74 | % | 94,507 | 1,083 | 4.55 | % | 90,758 | 992 | 4.34 | % | 89,382 | 901 | 4.04 | % | 86,887 | 735 | 3.43 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Non-interest-bearing liabilities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Non-interest-bearing deposit accounts | 390 | 379 | 401 | 420 | 411 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other liabilities | 5,419 | 5,652 | 5,418 | 5,164 | 5,130 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total non-interest-bearing liabilities | 5,809 | 6,031 | 5,819 | 5,584 | 5,541 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities | 104,420 | 100,538 | 96,577 | 94,966 | 92,428 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Equity | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total equity | 14,614 | 14,061 | 13,758 | 13,435 | 13,414 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities and equity | $ | 119,034 | $ | 114,599 | $ | 110,335 | $ | 108,401 | $ | 105,842 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 4,405 | $ | 4,466 | $ | 4,362 | $ | 4,120 | $ | 4,051 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Interest rate spread(1) |

13.64 | % | 14.22 | % | 14.51 | % | 14.16 | % | 14.55 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Net interest margin(2) |

14.55 | % | 15.10 | % | 15.36 | % | 14.94 | % | 15.22 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (1) Interest rate spread represents the difference between the yield on total interest-earning assets and the rate on total interest-bearing liabilities. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (2) Net interest margin represents net interest income divided by average interest-earning assets. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SYNCHRONY FINANCIAL | ||||||||||||||||||||||||||||||||||||||

| BALANCE SHEET STATISTICS | ||||||||||||||||||||||||||||||||||||||

| (unaudited, $ in millions, except per share statistics) | ||||||||||||||||||||||||||||||||||||||

| Quarter Ended | ||||||||||||||||||||||||||||||||||||||

| Mar 31, 2024 |

Dec 31, 2023 |

Sep 30, 2023 |

Jun 30, 2023 |

Mar 31, 2023 |

Mar 31, 2024 vs. Mar 31, 2023 |

|||||||||||||||||||||||||||||||||

| BALANCE SHEET STATISTICS | ||||||||||||||||||||||||||||||||||||||

| Total common equity | $ | 14,060 | $ | 13,169 | $ | 13,033 | $ | 12,646 | $ | 12,459 | $ | 1,601 | 12.9 | % | ||||||||||||||||||||||||

| Total common equity as a % of total assets | 11.60 | % | 11.21 | % | 11.54 | % | 11.63 | % | 11.55 | % | 0.05 | % | ||||||||||||||||||||||||||

| Tangible assets | $ | 119,300 | $ | 115,535 | $ | 111,154 | $ | 106,875 | $ | 105,980 | $ | 13,320 | 12.6 | % | ||||||||||||||||||||||||

Tangible common equity(1) |

$ | 12,187 | $ | 11,225 | $ | 11,248 | $ | 10,824 | $ | 10,586 | $ | 1,601 | 15.1 | % | ||||||||||||||||||||||||

Tangible common equity as a % of tangible assets(1) |

10.22 | % | 9.72 | % | 10.12 | % | 10.13 | % | 9.99 | % | 0.23 | % | ||||||||||||||||||||||||||

Tangible common equity per share(1) |

$ | 30.36 | $ | 27.59 | $ | 27.18 | $ | 25.89 | $ | 24.71 | $ | 5.65 | 22.9 | % | ||||||||||||||||||||||||

REGULATORY CAPITAL RATIOS(2)(3) |

||||||||||||||||||||||||||||||||||||||

| Basel III - CECL Transition | ||||||||||||||||||||||||||||||||||||||

Total risk-based capital ratio(4) |

15.8 | % | 14.9 | % | 15.7 | % | 15.7 | % | 15.9 | % | ||||||||||||||||||||||||||||

Tier 1 risk-based capital ratio(5) |

13.8 | % | 12.9 | % | 13.6 | % | 13.6 | % | 13.8 | % | ||||||||||||||||||||||||||||

Tier 1 leverage ratio(6) |

12.0 | % | 11.7 | % | 12.2 | % | 12.0 | % | 12.1 | % | ||||||||||||||||||||||||||||

| Common equity Tier 1 capital ratio | 12.6 | % | 12.2 | % | 12.8 | % | 12.8 | % | 13.0 | % | ||||||||||||||||||||||||||||

| (1) Tangible common equity ("TCE") is a non-GAAP measure. We believe TCE is a more meaningful measure of the net asset value of the Company to investors. For corresponding reconciliation of TCE to a GAAP financial measure, see Reconciliation of Non-GAAP Measures and Calculations of Regulatory Measures. | ||||||||||||||||||||||||||||||||||||||

| (2) Regulatory capital ratios at March 31, 2024 are preliminary and therefore subject to change. | ||||||||||||||||||||||||||||||||||||||

| (3) Capital ratios reflect the phase-in of an estimate of CECL’s effect on regulatory capital over a three-year transitional period beginning in the first quarter of 2022 through 2024. Capital ratios for 2024 and 2023 reflect 75% and 50%, respectively, of the phase-in of CECL effects. | ||||||||||||||||||||||||||||||||||||||

| (4) Total risk-based capital ratio is the ratio of total risk-based capital divided by risk-weighted assets. | ||||||||||||||||||||||||||||||||||||||

| (5) Tier 1 risk-based capital ratio is the ratio of Tier 1 capital divided by risk-weighted assets. | ||||||||||||||||||||||||||||||||||||||

| (6) Tier 1 leverage ratio is the ratio of Tier 1 capital divided by total average assets, after certain adjustments. | ||||||||||||||||||||||||||||||||||||||

| SYNCHRONY FINANCIAL | ||||||||||||||||||||||||||||||||||||||

| PLATFORM RESULTS | ||||||||||||||||||||||||||||||||||||||

| (unaudited, $ in millions) | ||||||||||||||||||||||||||||||||||||||

| Quarter Ended | ||||||||||||||||||||||||||||||||||||||

| Mar 31, 2024 |

Dec 31, 2023 |

Sep 30, 2023 |

Jun 30, 2023 |

Mar 31, 2023 |

1Q'24 vs. 1Q'23 | |||||||||||||||||||||||||||||||||

| HOME & AUTO | ||||||||||||||||||||||||||||||||||||||

Purchase volume(1) |

$ | 10,512 | $ | 11,421 | $ | 12,273 | $ | 12,853 | $ | 10,863 | $ | (351) | (3.2) | % | ||||||||||||||||||||||||

| Period-end loan receivables | $ | 32,615 | $ | 31,969 | $ | 31,648 | $ | 30,926 | $ | 29,733 | $ | 2,882 | 9.7 | % | ||||||||||||||||||||||||

| Average loan receivables, including held for sale | $ | 31,865 | $ | 31,720 | $ | 31,239 | $ | 30,210 | $ | 29,690 | $ | 2,175 | 7.3 | % | ||||||||||||||||||||||||

Average active accounts (in thousands)(2) |

18,969 | 19,177 | 19,223 | 18,935 | 18,521 | 448 | 2.4 | % | ||||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 1,382 | $ | 1,403 | $ | 1,367 | $ | 1,275 | $ | 1,225 | $ | 157 | 12.8 | % | ||||||||||||||||||||||||

| Other income | $ | 33 | $ | 26 | $ | 28 | $ | 27 | $ | 25 | $ | 8 | 32.0 | % | ||||||||||||||||||||||||

| DIGITAL | ||||||||||||||||||||||||||||||||||||||

Purchase volume(1) |

$ | 12,628 | $ | 15,510 | $ | 13,808 | $ | 13,472 | $ | 12,261 | $ | 367 | 3.0 | % | ||||||||||||||||||||||||

| Period-end loan receivables | $ | 27,734 | $ | 28,925 | $ | 26,685 | $ | 25,758 | $ | 24,944 | $ | 2,790 | 11.2 | % | ||||||||||||||||||||||||

| Average loan receivables, including held for sale | $ | 28,081 | $ | 27,553 | $ | 26,266 | $ | 25,189 | $ | 24,982 | $ | 3,099 | 12.4 | % | ||||||||||||||||||||||||

Average active accounts (in thousands)(2) |

21,349 | 21,177 | 20,768 | 20,559 | 20,564 | 785 | 3.8 | % | ||||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 1,567 | $ | 1,579 | $ | 1,530 | $ | 1,422 | $ | 1,363 | $ | 204 | 15.0 | % | ||||||||||||||||||||||||

| Other income | $ | 6 | $ | (7) | $ | (6) | $ | (2) | $ | 1 | $ | 5 | NM | |||||||||||||||||||||||||

| DIVERSIFIED & VALUE | ||||||||||||||||||||||||||||||||||||||

Purchase volume(1) |

$ | 14,023 | $ | 16,987 | $ | 15,445 | $ | 15,356 | $ | 13,439 | $ | 584 | 4.3 | % | ||||||||||||||||||||||||

| Period-end loan receivables | $ | 19,559 | $ | 20,666 | $ | 18,865 | $ | 18,329 | $ | 17,702 | $ | 1,857 | 10.5 | % | ||||||||||||||||||||||||

| Average loan receivables, including held for sale | $ | 19,593 | $ | 19,422 | $ | 18,565 | $ | 17,935 | $ | 17,713 | $ | 1,880 | 10.6 | % | ||||||||||||||||||||||||

Average active accounts (in thousands)(2) |

21,032 | 21,038 | 20,410 | 20,346 | 20,807 | 225 | 1.1 | % | ||||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 1,214 | $ | 1,204 | $ | 1,168 | $ | 1,091 | $ | 1,070 | $ | 144 | 13.5 | % | ||||||||||||||||||||||||

| Other income | $ | (17) | $ | (30) | $ | (28) | $ | (21) | $ | (14) | $ | (3) | 21.4 | % | ||||||||||||||||||||||||

| HEALTH & WELLNESS | ||||||||||||||||||||||||||||||||||||||

Purchase volume(1) |

$ | 3,980 | $ | 3,870 | $ | 3,990 | $ | 4,015 | $ | 3,690 | $ | 290 | 7.9 | % | ||||||||||||||||||||||||

| Period-end loan receivables | $ | 15,065 | $ | 14,521 | $ | 14,019 | $ | 13,327 | $ | 12,581 | $ | 2,484 | 19.7 | % | ||||||||||||||||||||||||

| Average loan receivables, including held for sale | $ | 14,697 | $ | 14,251 | $ | 13,600 | $ | 12,859 | $ | 12,309 | $ | 2,388 | 19.4 | % | ||||||||||||||||||||||||

Average active accounts (in thousands)(2) |

7,611 | 7,447 | 7,276 | 7,063 | 6,887 | 724 | 10.5 | % | ||||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 869 | $ | 866 | $ | 844 | $ | 786 | $ | 735 | $ | 134 | 18.2 | % | ||||||||||||||||||||||||

| Other income | $ | 66 | $ | 82 | $ | 74 | $ | 54 | $ | 61 | $ | 5 | 8.2 | % | ||||||||||||||||||||||||

| LIFESTYLE | ||||||||||||||||||||||||||||||||||||||

Purchase volume(1) |

$ | 1,244 | $ | 1,550 | $ | 1,490 | $ | 1,580 | $ | 1,302 | $ | (58) | (4.5) | % | ||||||||||||||||||||||||

| Period-end loan receivables | $ | 6,604 | $ | 6,744 | $ | 6,483 | $ | 6,280 | $ | 5,971 | $ | 633 | 10.6 | % | ||||||||||||||||||||||||

| Average loan receivables, including held for sale | $ | 6,631 | $ | 6,568 | $ | 6,383 | $ | 6,106 | $ | 5,919 | $ | 712 | 12.0 | % | ||||||||||||||||||||||||

Average active accounts (in thousands)(2) |

2,642 | 2,620 | 2,556 | 2,529 | 2,611 | 31 | 1.2 | % | ||||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 255 | $ | 255 | $ | 249 | $ | 232 | $ | 223 | $ | 32 | 14.3 | % | ||||||||||||||||||||||||

| Other income | $ | 8 | $ | 7 | $ | 8 | $ | 7 | $ | 7 | $ | 1 | 14.3 | % | ||||||||||||||||||||||||

| CORP, OTHER | ||||||||||||||||||||||||||||||||||||||

Purchase volume(1) |

$ | — | $ | 1 | $ | — | $ | — | $ | 2 | $ | (2) | (100.0) | % | ||||||||||||||||||||||||

| Period-end loan receivables | $ | 156 | $ | 163 | $ | 173 | $ | 181 | $ | 198 | $ | (42) | (21.2) | % | ||||||||||||||||||||||||

| Average loan receivables, including held for sale | $ | 90 | $ | 169 | $ | 177 | $ | 190 | $ | 202 | $ | (112) | (55.4) | % | ||||||||||||||||||||||||

Average active accounts (in thousands)(2) |

64 | 67 | 75 | 85 | 104 | (40) | (38.5) | % | ||||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 6 | $ | 16 | $ | (7) | $ | 6 | $ | — | $ | 6 | NM | |||||||||||||||||||||||||

| Other income | $ | 1,061 | $ | (7) | $ | 16 | $ | (4) | $ | (15) | $ | 1,076 | NM | |||||||||||||||||||||||||

| TOTAL SYF | ||||||||||||||||||||||||||||||||||||||

Purchase volume(1) |

$ | 42,387 | $ | 49,339 | $ | 47,006 | $ | 47,276 | $ | 41,557 | $ | 830 | 2.0 | % | ||||||||||||||||||||||||

| Period-end loan receivables | $ | 101,733 | $ | 102,988 | $ | 97,873 | $ | 94,801 | $ | 91,129 | $ | 10,604 | 11.6 | % | ||||||||||||||||||||||||

| Average loan receivables, including held for sale | $ | 100,957 | $ | 99,683 | $ | 96,230 | $ | 92,489 | $ | 90,815 | $ | 10,142 | 11.2 | % | ||||||||||||||||||||||||

Average active accounts (in thousands)(2) |

71,667 | 71,526 | 70,308 | 69,517 | 69,494 | 2,173 | 3.1 | % | ||||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 5,293 | $ | 5,323 | $ | 5,151 | $ | 4,812 | $ | 4,616 | $ | 677 | 14.7 | % | ||||||||||||||||||||||||

| Other income | $ | 1,157 | $ | 71 | $ | 92 | $ | 61 | $ | 65 | $ | 1,092 | NM | |||||||||||||||||||||||||

| (1) Purchase volume, or net credit sales, represents the aggregate amount of charges incurred on credit cards or other credit product accounts less returns during the period. | ||||||||||||||||||||||||||||||||||||||

| (2) Active accounts represent credit card or installment loan accounts on which there has been a purchase, payment or outstanding balance in the current month. | ||||||||||||||||||||||||||||||||||||||

| SYNCHRONY FINANCIAL | |||||||||||||||||||||||||||||

RECONCILIATION OF NON-GAAP MEASURES AND CALCULATIONS OF REGULATORY MEASURES(1) |

|||||||||||||||||||||||||||||

| (unaudited, $ in millions, except per share statistics) | |||||||||||||||||||||||||||||

| Quarter Ended | |||||||||||||||||||||||||||||

| Mar 31, 2024 |

Dec 31, 2023 |

Sep 30, 2023 |

Jun 30, 2023 |

Mar 31, 2023 |

|||||||||||||||||||||||||

COMMON EQUITY AND REGULATORY CAPITAL MEASURES(2) |

|||||||||||||||||||||||||||||

| GAAP Total equity | $ | 15,282 | $ | 13,903 | $ | 13,767 | $ | 13,380 | $ | 13,193 | |||||||||||||||||||

| Less: Preferred stock | (1,222) | (734) | (734) | (734) | (734) | ||||||||||||||||||||||||

| Less: Goodwill | (1,073) | (1,105) | (1,105) | (1,105) | (1,105) | ||||||||||||||||||||||||

| Less: Intangible assets, net | (800) | (839) | (680) | (717) | (768) | ||||||||||||||||||||||||

| Tangible common equity | $ | 12,187 | $ | 11,225 | $ | 11,248 | $ | 10,824 | $ | 10,586 | |||||||||||||||||||

| Add: CECL transition amount | 573 | 1,146 | 1,146 | 1,146 | 1,146 | ||||||||||||||||||||||||

| Adjustments for certain deferred tax liabilities and certain items in accumulated comprehensive income (loss) | 225 | 229 | 255 | 255 | 258 | ||||||||||||||||||||||||

| Common equity Tier 1 | $ | 12,985 | $ | 12,600 | $ | 12,649 | $ | 12,225 | $ | 11,990 | |||||||||||||||||||

| Preferred stock | 1,222 | 734 | 734 | 734 | 734 | ||||||||||||||||||||||||

| Tier 1 capital | $ | 14,207 | $ | 13,334 | $ | 13,383 | $ | 12,959 | $ | 12,724 | |||||||||||||||||||

| Add: Subordinated debt | 741 | 741 | 741 | 741 | 740 | ||||||||||||||||||||||||

| Add: Allowance for credit losses includible in risk-based capital | 1,399 | 1,389 | 1,322 | 1,282 | 1,239 | ||||||||||||||||||||||||

| Total Risk-based capital | $ | 16,347 | $ | 15,464 | $ | 15,446 | $ | 14,982 | $ | 14,703 | |||||||||||||||||||

ASSET MEASURES(2) |

|||||||||||||||||||||||||||||

| Total average assets | $ | 119,034 | $ | 114,599 | $ | 110,335 | $ | 108,401 | $ | 105,842 | |||||||||||||||||||

| Adjustments for: | |||||||||||||||||||||||||||||

| Add: CECL transition amount | 573 | 1,146 | 1,146 | 1,146 | 1,146 | ||||||||||||||||||||||||

| Less: Disallowed goodwill and other disallowed intangible assets (net of related deferred tax liabilities) and other |

(1,631) | (1,671) | (1,507) | (1,537) | (1,564) | ||||||||||||||||||||||||

| Total assets for leverage purposes | $ | 117,976 | $ | 114,074 | $ | 109,974 | $ | 108,010 | $ | 105,424 | |||||||||||||||||||

| Risk-weighted assets | $ | 103,242 | $ | 103,460 | $ | 98,451 | $ | 95,546 | $ | 92,379 | |||||||||||||||||||

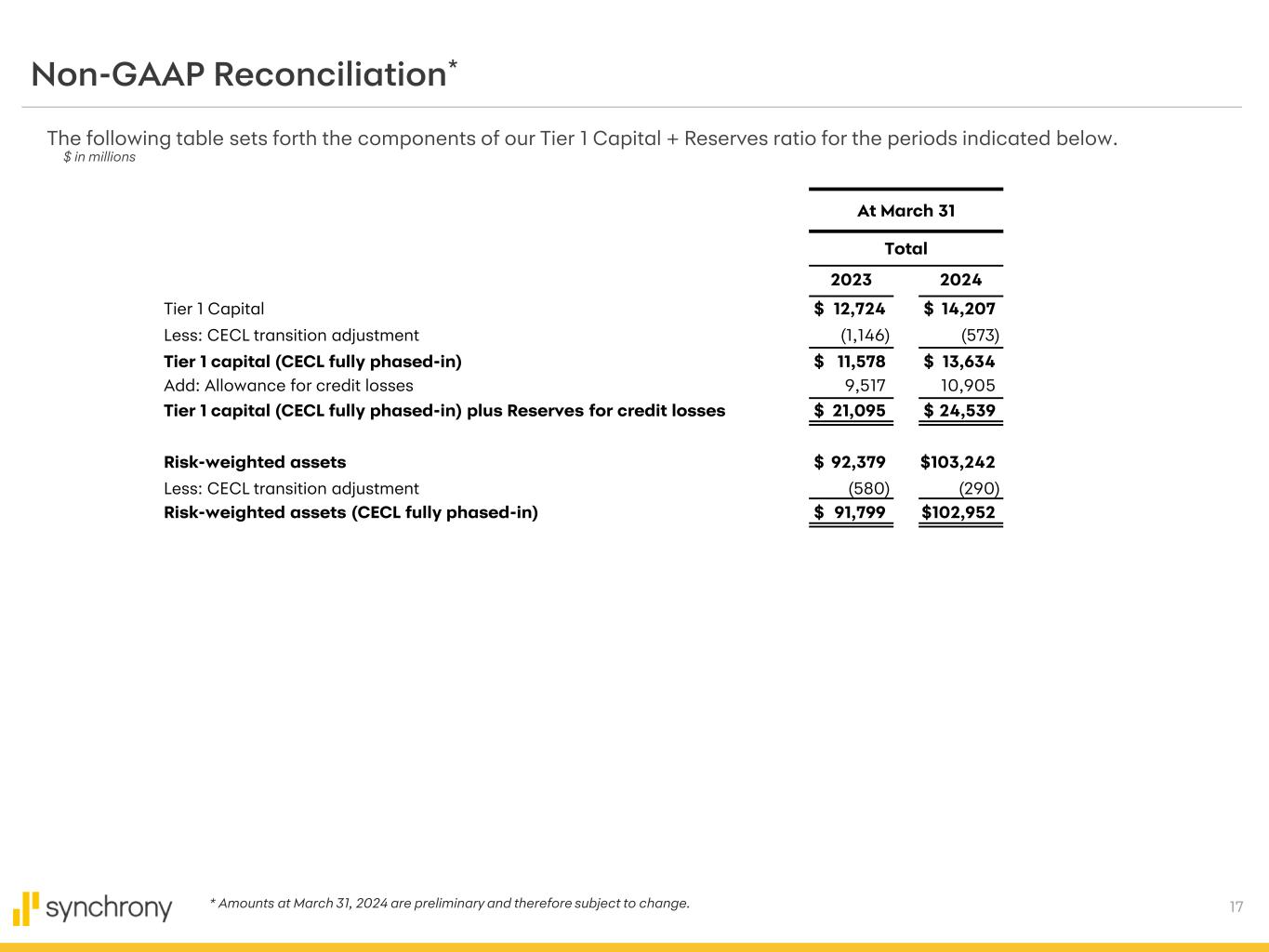

| CECL FULLY PHASED-IN CAPITAL MEASURES | |||||||||||||||||||||||||||||

| Tier 1 capital | $ | 14,207 | $ | 13,334 | $ | 13,383 | $ | 12,959 | $ | 12,724 | |||||||||||||||||||

| Less: CECL transition adjustment | (573) | (1,146) | (1,146) | (1,146) | (1,146) | ||||||||||||||||||||||||

| Tier 1 capital (CECL fully phased-in) | $ | 13,634 | $ | 12,188 | $ | 12,237 | $ | 11,813 | $ | 11,578 | |||||||||||||||||||

| Add: Allowance for credit losses | 10,905 | 10,571 | 10,176 | 9,804 | 9,517 | ||||||||||||||||||||||||

| Tier 1 capital (CECL fully phased-in) + Reserves for credit losses | $ | 24,539 | $ | 22,759 | $ | 22,413 | $ | 21,617 | $ | 21,095 | |||||||||||||||||||

| Risk-weighted assets | $ | 103,242 | $ | 103,460 | $ | 98,451 | $ | 95,546 | $ | 92,379 | |||||||||||||||||||

| Less: CECL transition adjustment | (290) | (580) | (580) | (580) | (580) | ||||||||||||||||||||||||

| Risk-weighted assets (CECL fully phased-in) | $ | 102,952 | $ | 102,880 | $ | 97,871 | $ | 94,966 | $ | 91,799 | |||||||||||||||||||

| TANGIBLE COMMON EQUITY PER SHARE | |||||||||||||||||||||||||||||

| GAAP book value per share | $ | 35.03 | $ | 32.36 | $ | 31.50 | $ | 30.25 | $ | 29.08 | |||||||||||||||||||

| Less: Goodwill | (2.68) | (2.72) | (2.67) | (2.65) | (2.58) | ||||||||||||||||||||||||

| Less: Intangible assets, net | (1.99) | (2.05) | (1.65) | (1.71) | (1.79) | ||||||||||||||||||||||||

| Tangible common equity per share | $ | 30.36 | $ | 27.59 | $ | 27.18 | $ | 25.89 | $ | 24.71 | |||||||||||||||||||

| (1) Regulatory measures at March 31, 2024 are preliminary and therefore subject to change. | |||||||||||||||||||||||||||||

| (2) Capital ratios reflect the phase-in of an estimate of CECL’s effect on regulatory capital over a three-year transitional period beginning in the first quarter of 2022 through 2024. Capital ratios for 2024 and 2023 reflect 75% and 50%, respectively, of the phase-in of CECL effects. | |||||||||||||||||||||||||||||

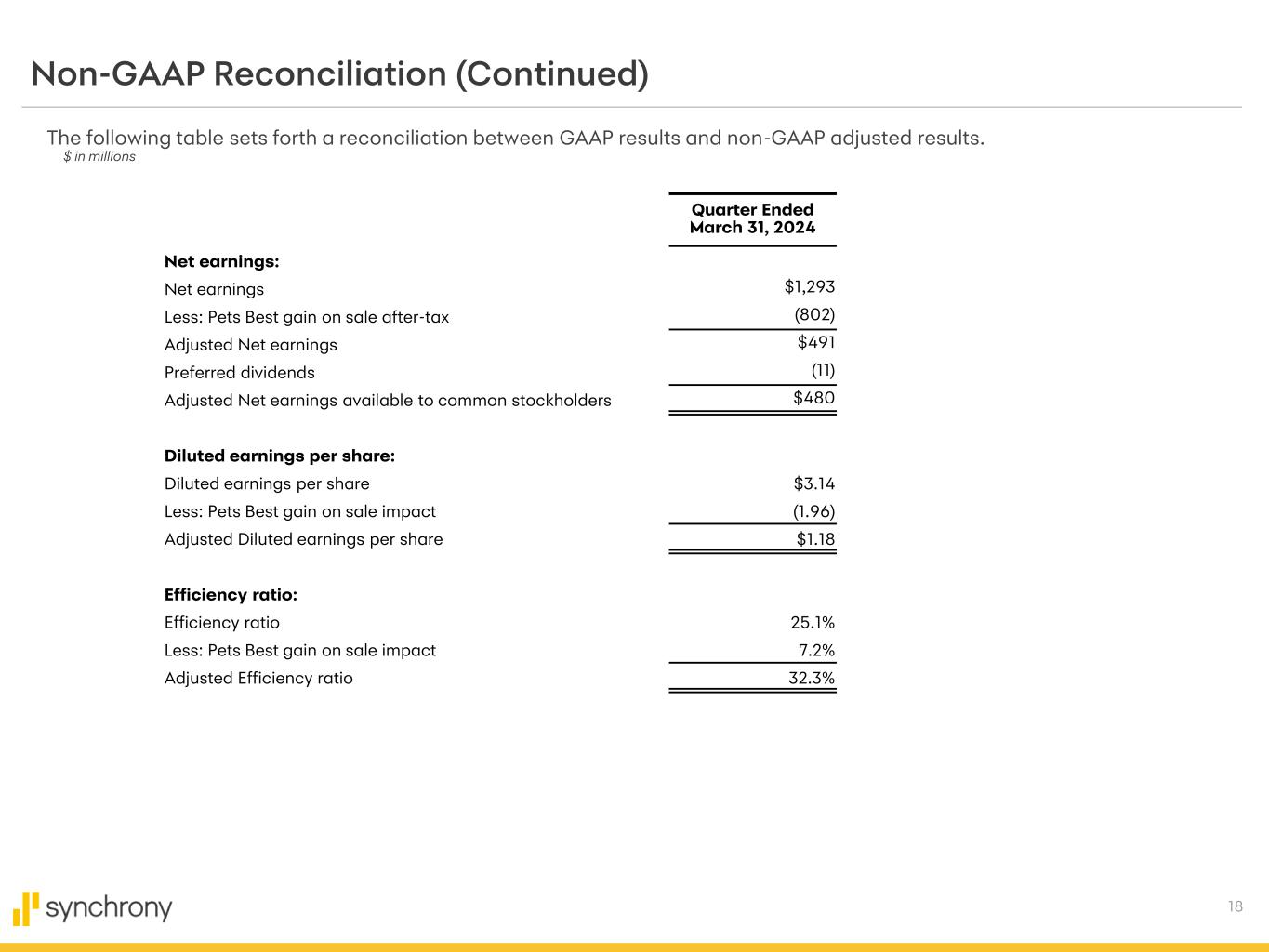

| SYNCHRONY FINANCIAL | ||||||||

| RECONCILIATION OF NON-GAAP MEASURES (Continued) | ||||||||

| (unaudited, $ in millions, except per share statistics) | ||||||||

| ADJUSTED FINANCIAL MEASURES | Quarter Ended | |||||||

| Mar 31, 2024 |

||||||||

| Net revenue: | ||||||||

| Net revenue | $ | 4,798 | ||||||

| Less: Pets Best pre-tax gain on sale included in Other income | (1,069) | |||||||

| Adjusted Net revenue | $ | 3,729 | ||||||

| Net earnings: | ||||||||

| Net earnings | $ | 1,293 | ||||||

| Less: Pets Best gain on sale after-tax | (802) | |||||||

| Adjusted Net earnings | $ | 491 | ||||||

| Preferred dividends | (11) | |||||||

| Adjusted Net earnings available to common stockholders | $ | 480 | ||||||

| Diluted earnings per share: | ||||||||

| Diluted earnings per share | $ | 3.14 | ||||||

| Less: Pets Best gain on sale impact | (1.96) | |||||||

| Adjusted Diluted earnings per share | $ | 1.18 | ||||||

| Return on assets: | ||||||||

Return on assets(1) |

4.4 | % | ||||||

| Less: Pets Best gain on sale impact | (2.7) | % | ||||||

| Adjusted Return on assets | 1.7 | % | ||||||

| Return on equity: | ||||||||

Return on equity(2) |

35.6 | % | ||||||

| Less: Pets Best gain on sale impact | (21.8) | % | ||||||

| Adjusted Return on equity | 13.8 | % | ||||||

| Return on tangible common equity: | ||||||||

Return on tangible common equity(3) |

43.6 | % | ||||||

| Less: Pets Best gain on sale impact | (26.8) | % | ||||||

| Adjusted Return on tangible common equity | 16.8 | % | ||||||

| Efficiency ratio: | ||||||||

Efficiency Ratio(4) |

25.1 | % | ||||||

| Less: Pets Best gain on sale impact | 7.2 | % | ||||||

| Adjusted Efficiency ratio | 32.3 | % | ||||||

| (1) Return on assets represents net earnings as a percentage of average total assets. | ||||||||

| (2) Return on equity represents net earnings as a percentage of average total equity. | ||||||||

| (3) Return on tangible common equity represents net earnings available to common stockholders as a percentage of average tangible common equity. Tangible common equity ("TCE") is a non-GAAP measure. For corresponding reconciliation of TCE to a GAAP financial measure, see Reconciliation of Non-GAAP Measures and Calculations of Regulatory Measures. | ||||||||

| (4) Efficiency ratio represents (i) other expense, divided by (ii) net interest income, plus other income, less retailer share arrangements. | ||||||||