Document

LEASE AGREEMENT

by and between

BRICKELL KEY CENTRE, LLC

(“Landlord”)

and

SUMMIT THERAPEUTICS INC.

(“Tenant”)

dated

, 2024

for

Suite Number 1000 containing approximately 9,425 rentable square feet Brickell Key Centre II

601 Brickell Key Drive, Miami, Florida 33131

TABLE OF CONTENTS

SECTION 1: Terms & Definitions 1

SECTION 2: Premises 3

SECTION 3: Authorized Use 3

SECTION 4: Term 3

SECTION 5: Rental Payment. 4

SECTION 6: Rent 4

SECTION 7: Operating Expenses and Taxes 4

SECTION 8: Letter of Credit 7

SECTION 9: Tenant Improvements 8

SECTION 10: Maintenance and Repair 8

SECTION 11: Services 9

SECTION 12: Electrical Usage 9

SECTION 13: Communication Lines 9

SECTION 14: Prohibited Use 10

SECTION 15: Legal Requirements; Project Rules 10

SECTION 16: Alterations, Additions, and Improvements 10

SECTION 17: Tenant’s Equipment 11

SECTION 18: Taxes and Tenants Property 11

SECTION 19: Access 12

SECTION 20: Tenant’s Insurance 12

SECTION 21: Intentionally Deleted 12

SECTION 22: Waiver of Subrogation; Mutual Waiver of Liability 12

SECTION 23: Casualty 13

SECTION 24: Condemnation 13

SECTION 25: Waiver of Claims 14

SECTION 26: Indemnity 14

SECTION 27: Non-Waiver 14

SECTION 28: Quiet Possession 14

SECTION 29: Notices 14

SECTION 30: Landlord’s Failure to Perform 15

SECTION 31: Tenant’s Failure to Perform 15

SECTION 32: Default 15

SECTION 33: Surrender 16

SECTION 34: Holding Over 16

SECTION 35: Removal of Tenant’s Property 16

SECTION 36: Landlord’s Lien 17

SECTION 37: Intentionally Omitted 17

SECTION 38: Assignment and Subletting 17

SECTION 39: Merger of Estates. 18

SECTION 40: Limitation of Liability 18

SECTION 41: Subordination 18

SECTION 42: Legal Interpretation 19

SECTION 43: Use of Names and Signage 19

SECTION 44: Relocation 19

SECTION 45: Brokerage Fees 19

SECTION 46: Successors and Assigns 20

SECTION 47: Force Majeure 20

SECTION 48: Parking 20

SECTION 49: Rooftop Antenna 20

SECTION 50: Attorneys’ Fees 20

SECTION 51: Tenant Certification 20

SECTION 52: Memorandum of Lease 21

SECTION 53: Financial Statements 21

SECTION 54: Intentionally Omitted 21

SECTION 55: Radon Gas 21

SECTION 56: Governing Law 21

SECTION 57: Entire Agreement 21

SECTION 58: Multiple Counterparts; Electronic Signature 21

SECTION 59: No Liens 21

EXHIBITS:

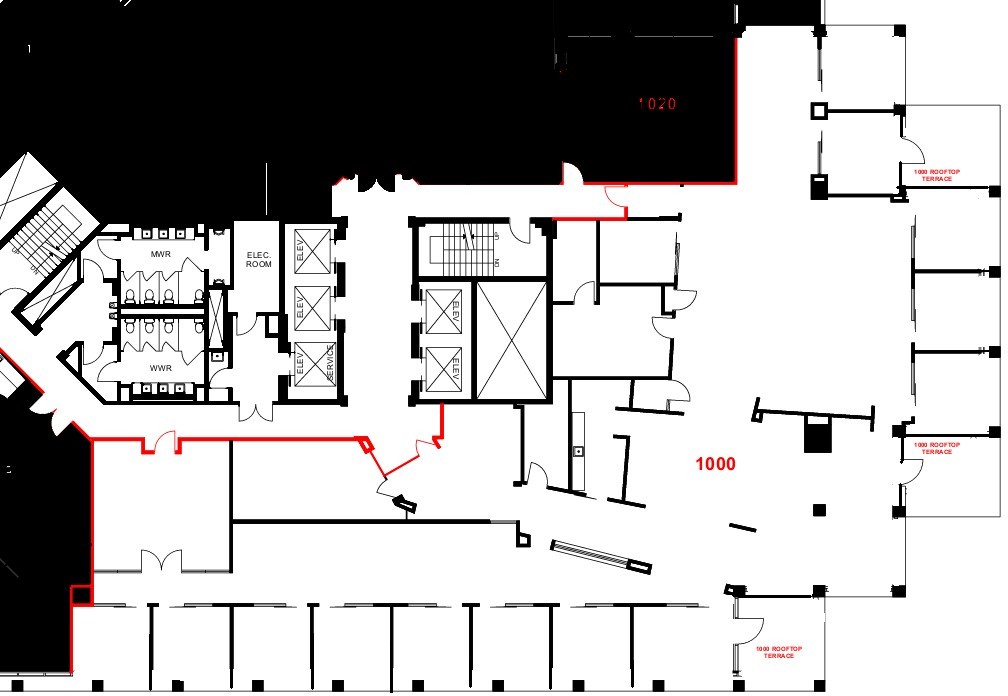

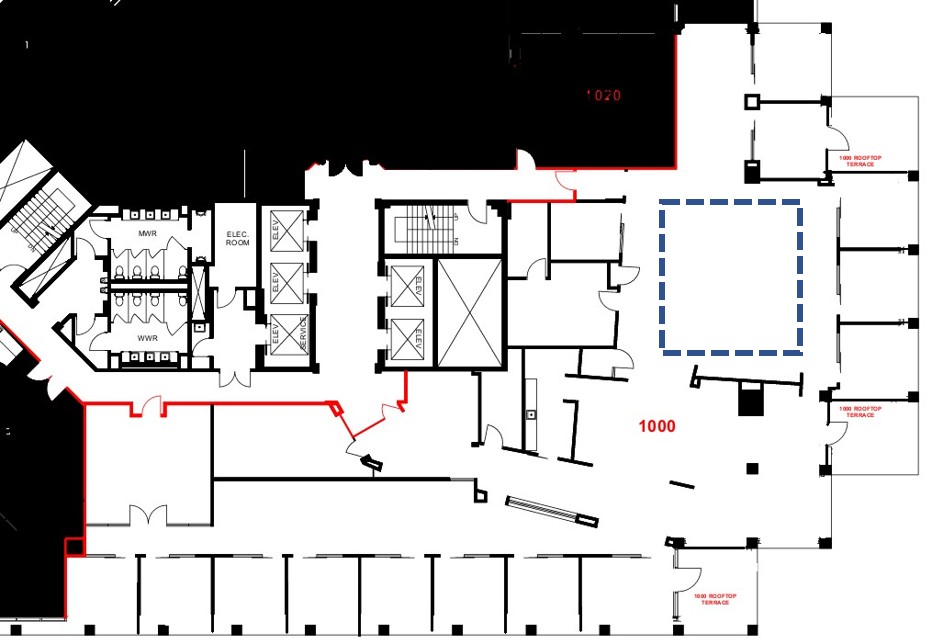

EXHIBIT A: Floor Plan of Premises EXHIBIT B: Cleaning and Janitorial Services

EXHIBIT C: Rules and Regulations of Building EXHIBIT E: Certificate Confirming Lease Dates and Base Rent EXHIBIT F: Supplemental HVAC Equipment

EXHIBIT D: Work Letter

LEASE AGREEMENT

This LEASE AGREEMENT (“Lease”) is entered into as of , 2024 (the “Effective Date”), by and between BRICKELL KEY CENTRE, LLC, a Delaware limited liability company (“Landlord”), and SUMMIT THERAPEUTICS INC., a Delaware corporation (“Tenant”). In consideration of the mutual covenants set forth herein, Landlord and Tenant agree as follows:

1.Terms and Definitions. The following definitions and terms apply to this Lease (other words are defined elsewhere in the text of this Lease):

(a)“Tenant’s Current Address”: 2882 Sand Hill Road, Suite 106, Menlo Park, CA.

(b)“Premises”: Suite 1000 in the Brickell Key Centre II building (the “Building”) located on land with an address of 601 Brickell Key Drive, Miami, Florida 33131 (the “Land”).

(c)“Rentable Area of Premises”: 9,425 rentable square feet (“RSF”).

(d)“Rentable Area of Building”: 225,283 RSF.

(e)“Pro-rata Share”: Tenant’s pro-rata share is 4.18%, which is determined by dividing the Rentable Area of Premises by the Rentable Area of Building.

(f)“Term”: a period of approximately sixty-four (64) months beginning on the Commencement Date and expiring at 6 o’clock PM local time on the Expiration Date.

(g)“Lease Year”: each successive twelve (12) month period throughout the Term; provided that the first Lease Year shall commence on the Commencement Date and expire (i) on the last day of the month preceding the first anniversary of the Commencement Date, if the Commencement Date occurs on the first day of the month; or (ii) on the last day of the month in which the first anniversary of the Commencement Date occurs, if the Commencement Date occurs on a day other than the first day of the month; each subsequent Lease Year shall commence on the day following the expiration of the previous Lease Year; and, the last Lease Year shall expire upon the expiration of the Term.

(h)“Commencement Date”: Subject to and upon the terms and conditions set forth herein, the Commencement Date of this Lease shall be the earlier of (i) the date Tenant takes possession of all or any portion of the Premises for the purpose of conducting Tenant’s business therein; (ii) the fifteenth (15th) day following the substantial completion of Landlord’s Work (as such term is hereinafter defined); or (iii) February 1, 2024.

(i)“Expiration Date”: The last day of the sixty-fourth (64th) full calendar month following the Commencement Date.

(j)“Base Rent”: the amounts specified in the chart below, to be paid by Tenant according to the provisions hereof:

Base Rent

Suite 1000

9,425 RSF

|

|

|

|

|

|

|

|

|

Period |

Base Rent per RSF* |

Monthly Base Rent Amount* |

|

Commencement Date –

Month 12

|

$95.00

|

$74,614.58

|

|

|

|

|

|

|

|

|

|

Months 13 – 24 |

$97.85 |

$76,853.02 |

Months 25 – 36 |

$100.79 |

$79,162.15 |

Months 37 – 48 |

$103.81 |

$81,534.10 |

Months 49 – 60 |

$106.92 |

$83,976.75 |

Months 61 – 64 |

$110.13 |

$86,497.94 |

* Plus applicable State sales tax.

Provided that no Default, defined below, exists at the time of the abatement provided below, Tenant’s monthly installments of Base Rent shall be abated for the entire Premises for the four (4) month period commencing upon (i) December 1, 2024 and expiring on December 31, 2024, (ii) December 1, 2025 and expiring on December 31, 2025, (iii) December 1, 2026 and expiring on December 31, 2026, and (iv) December 1, 2027 and expiring on December 31, 2027, as each such installment becomes due, for a total abatement of Base Rent during such period in the amount of $312,163.85 (collectively the “Abated Base Rent”). The principal amount of the Abated Base Rent shall be amortized evenly over the Term. So long as no uncured Default, defined below, occurs under this Lease, then upon Landlord’s receipt of the final monthly installment of Rent, defined below, Tenant shall have no liability to Landlord for the repayment of any portion of the Abated Base Rent. In the event of an uncured Default, then in addition to all of Landlord’s other remedies available under the Lease, Tenant shall also become immediately liable to Landlord for the unamortized portion of the Abated Base Rent existing as of the date of such uncured Default. Provided, however, that if Landlord elects to exercise its rights under Section 32 of this Lease to accelerate the entire amount of all Rent and other charges due from Tenant for the balance of the Term (in accordance with the terms of such Section), and Landlord obtains a judgment for, or is paid by Tenant, the entire amount of such accelerated sum, then such judgment for or payment of such accelerated sum shall preclude a separate recovery by Landlord under the foregoing terms of this Section of such unamortized portion of the Abated Base Rent and any interest thereon.

(k)“Base Year”: Calendar year 2024.

(l)“Tenant Improvements”: the improvements to be made to the Premises by Tenant in accordance with the work letter attached hereto as Exhibit D (the “Work Letter”).

(m)“Letter of Credit Amount”: $300,000.00

(n)“Guarantor”: None.

(o)“Parking Spaces”: Available, parking in the Building’s Parking Facility at a ratio of 2.6 parking spaces per one thousand (1,000) rentable square feet of the Premises (the “Parking Ratio”), on an unreserved basis in common with other tenants of the Building, in locations as determined by Landlord, at the current rate of $160.00 per unreserved space, per month, plus applicable sales tax and surcharges, with such rate subject to increase from time to time as determined by Landlord. As a part of the aforementioned Parking Ratio, Tenant shall have the right to lease up to two (2) reserved parking spaces within the Parking Facility, in locations reasonably determined by Landlord, at the current rate of $280.00 per reserved space, per month, plus applicable sales tax and surcharges, with such rate subject to increase from time to time as determined by Landlord.

(p)“Tenant’s Broker” is: EWM.

(q)“Landlord’s Broker” is: CBRE, Inc.

(r)“Laws” shall mean any and all laws, ordinances, rules, regulations and building and other codes of any governmental or quasi-governmental entity or authority (“Governmental Authority”) applicable to the subject matter hereof, including, without limitation, all Laws relating to disabilities, health, safety or the environment.

(s)“Project”: shall mean the Building, Land, the adjacent land and building commonly known as Brickell Key Centre I located at 501 Brickell Key Drive, Miami, Florida, any areas designated by

Landlord from time to time for the common use of all tenants and occupants of the Building (“Common Areas”), including, but not limited to, the parking facility for the Building designated by Landlord from time to time (the “Parking Facility”), walkways, greenspace, plaza and common areas, and related equipment, fixtures and improvements, as the same may be now located or hereafter erected, located or placed thereon.

(t)“Building Standard”: The quantity and quality of materials, finishes and workmanship from time to time specified by Landlord for use throughout the Building. “Above Standard” means all improvements, fixtures, materials, finishes and workmanship which exceed Building Standard in terms of quantity or quality (or both), including but not limited to Supplemental HVAC Equipment, defined below; water heaters, instant hot faucets, garbage disposals, dishwashers, stoves, microwaves, refrigerators, ice machines, coffee machines, washing machines, dryers or other appliances; and sinks, sink fixtures, sink drain lines, appliance drain lines, water source plumbing, ground fault interrupters, dedicated outlets or other similar plumbing and/or electrical fixtures or items.

(u)“Building Systems”: The mechanical, electrical, plumbing, sanitary, sprinkler, heating, ventilation and air conditioning (“HVAC”), security, life-safety, elevator and other service systems or facilities of the Building up to the point of connection of localized distribution to the Premises.

2.Premises. Subject to and in accordance with the provisions hereof, Landlord leases to Tenant and Tenant leases from Landlord the Premises as designated on Exhibit A. Tenant agrees that, except as expressly stated herein and in the Work Letter, if any, attached to this Lease, no representations or warranties relating to the condition of the Project or the Premises and no promises to alter, repair or improve the Premises have been made by Landlord. Except as otherwise expressly provided in this Lease or any Work Letter attached hereto, Tenant agrees to accept the Premises in their current “AS IS, WHERE IS” condition and acknowledges that LANDLORD MAKES NO WARRANTIES, EXPRESSED OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, IMPLIED WARRANTIES OF MERCHANTABILITY, HABITABILITY AND/OR FITNESS FOR A PARTICULAR PURPOSE, IN CONNECTION WITH THE PREMISES OR THE LANDLORD’S WORK. Upon Tenant’s taking possession for the purposes of conducting business, the Premises, including all Landlord’s Work, shall be deemed accepted by Tenant. Tenant shall also have the non-exclusive right, subject to the terms hereof, to use the Common Areas of the Project. Tenant acknowledges that the Project is or may become an integrated commercial real estate project including the Building, the Land and other buildings, Common Areas and land. Landlord reserves the right, in its sole discretion, at any time and from time to time, to include the Building within a project and/or to expand and/or reduce the amount of Land and/or improvements of which the Building, the Common Areas, or Project consists; to alter, relocate, reconfigure and/or reduce the Common Areas; to temporarily suspend access to portions of the Common Areas, as long as the Premises remain reasonably accessible; and to make all changes, alterations, additions, improvements, repairs or replacements to the Building and Building systems, including changing the arrangement or location of entrances or passageways, doors and doorways, corridors, elevators, stairs, toilets or other Common Areas (collectively, “Restorative Work”), as Landlord reasonably deems necessary, and to take all materials into the Premises required for the performance of such Restorative Work. Landlord shall use commercially reasonable efforts to minimize interference with Tenant's use and occupancy of the Premises during the performance of such Restorative Work. There shall be no Rent abatement or allowance to Tenant for a diminution of rental value, no actual or constructive eviction of Tenant, in whole or in part, no relief from any of Tenant's other obligations under this Lease, and no liability on the part of Landlord by reason of inconvenience, annoyance or injury to business arising from Landlord altering, relocating, reconfiguring, and/or reducing the Common Areas, and/or performing any Restorative Work.

3.Authorized Use. Tenant shall use the Premises solely for general business office purposes, consistent with the uses of office buildings (the “Authorized Use”), and for no other purpose.

4.Term. This Lease shall constitute a legally binding and enforceable agreement between Landlord and Tenant as of the Effective Date. The Term of this Lease is stated in Section 1(f), and the Commencement Date shall be determined as provided in Section 1(h). Landlord and Tenant shall confirm the Commencement Date and Expiration Date in writing within thirty (30) days after the actual Commencement Date pursuant to the form certificate attached as Exhibit E.

5.Rental Payment. Commencing on the Commencement Date, Tenant agrees to pay Rent (defined below) in monthly installments on or before the first day of each calendar month during the Term, in lawful money of the United States of America via wire to Landlord’s wire instructions as set forth below or to the following address or to such other address as Landlord may designate from time to time in writing: Brickell Key Centre, LLC, c/o Masaveu & C/O Management Real Estate US LLC, P.O. Box 531828, Atlanta, Georgia 30353-1828:

Landlord's wire instructions are as follows:

Wire Transfers:

Account Name: Brickell Key Centre LLC Account Number: 1029060888

Bank Name: PNC

ACH Routing Number: 043000096 Wire Routing Number: 043000096

Notwithstanding the foregoing, the first full monthly installment of Base Rent due under this Lease shall be paid in advance on the date of Tenant’s execution of this Lease and shall be applied to the first full monthly installment of Base Rent due hereunder. Tenant agrees to timely pay all Base Rent, Additional Rent, defined below, and all other sums of money which become due and payable by Tenant to Landlord hereunder (collectively “Rent”), without abatement, demand, offset, deduction or counterclaim. If Tenant fails to pay part or all of the Rent within seven (7) days after it is due, Tenant shall also pay as a part of the Rent due from Tenant hereunder a late charge equal to five percent (5%) of the unpaid Rent or the maximum then allowed by law, whichever is less; provided, however, that with respect to Tenant’s first late Rent payment during the Term only, Landlord shall provide Tenant with five (5) days prior written notice before it applies the aforementioned late charge. Landlord may assess a reasonable fee to Tenant for any checks made payable to Landlord that are returned unpaid by Tenant’s bank for any reason. If the Term does not begin on the first day of a calendar month, the installment of Rent for that partial month shall be prorated.

6.Rent. Tenant shall pay to Landlord the Base Rent for the Premises in the amounts set forth in Section 1. Base Rent includes a component attributable to Operating Expenses (defined below) for the Base Year as specified in Section 1 (“Base Operating Expenses”), and to Taxes (defined below) for the Base Year (“Base Taxes”). Prior to January 1 of each year in the Term (or as soon thereafter as it is reasonably able to do so), Landlord shall provide Tenant with an estimate of Operating Expenses and Taxes for the next calendar year in the Term (each, an “Operating Period”). If Operating Expenses during any Operating Period, as estimated by Landlord, exceed Base Operating Expenses, Tenant shall pay to Landlord for such Operating Period an amount equal to the product of (a) the difference between Operating Expenses for such Operating Period and the Base Operating Expenses, multiplied by (b) the Pro-rata Share; and if Taxes during any Operating Period, as estimated by Landlord, exceed Base Taxes, Tenant shall pay to Landlord for such Operating Period an amount equal to the product of (i) the difference between Taxes for such Operating Period and the Base Taxes, multiplied by (ii) the Pro-rata Share (the sum of such amounts being collectively referred to herein as “Additional Rent”); such Additional Rent shall be paid in monthly installments of one twelfth (1/12) of the Additional Rent owed from Tenant for such Operating Period, with such installments being due at the same time and in the same manner as Tenant’s monthly payments of Base Rent.

7.Operating Expenses and Taxes. (a) Definitions of Operating Expenses and Taxes. “Operating Expenses,” as used herein, shall mean all expenses, costs and disbursements of every kind and nature relating to or incurred or paid during any Operating Period in connection with the ownership, operation, repair and maintenance of the Project, including, but not limited to, wages and salaries of all employees engaged in the operation, maintenance or security of the Project, whether billed directly or through a common or master association, including taxes,

insurance and benefits relating thereto; the cost of all labor, supplies, equipment, materials and tools used in the operation and maintenance of the Project; management fees; the cost of all legal and accounting expenses incurred in connection with the management and operation of the Project; the cost of all utilities for the Project, including, but not limited to, the cost of HVAC, water, sewer, waste disposal, gas, and electricity; the cost of all maintenance and service agreements for the Project, including but not limited to, security service, window cleaning, elevator maintenance and janitorial service; the cost of all insurance relating to the Project and Landlord’s personal property used in connection therewith, plus the cost of all deductible payments made by Landlord in connection therewith; the cost of all license and permit fees; the cost of repairs, replacements, refurbishing, restoration and general maintenance; a reasonable amortization charge on account of any capital expenditure incurred in an effort (i) to comply with any Laws, or (ii) to reduce the Operating Expenses of the Project; costs billed to the Building, Project or Landlord through a declaration or any cross-easement agreement which encumbers the Project, or any declaration of condominium or other like instrument that encumbers any or all of the improvements on the Project; costs or assessments required to be paid by Landlord in connection with any community improvement district; and, all other items constituting operating and maintenance costs in connection with the Project according to generally accepted accounting principles (“GAAP”); the cost of insurance endorsements in order to repair, replace and re-commission the Building for re- certification after any loss pursuant to the U.S. EPA’s ENERGY STAR® rating and/or Design to Earn ENERGY STAR, the Green Building Initiative’s Green Globes™ for Continual Improvement of Existing Buildings (Green Globes™-CIEB), the U.S. Green Building Council’s Leadership in Energy and Environmental Design (LEED) rating system, or other applicable standard, or to support achieving energy and carbon reduction targets, and all costs of maintaining, managing, reporting, commissioning, and re-commissioning the Building or any part thereof that was designed and/or built to be sustainable and conform with the U.S. EPA’s ENERGY STAR® rating and/or Design to Earn ENERGY STAR, the Green Building Initiative’s Green Globes™ for Continual Improvement of Existing Buildings (Green Globes™-CIEB), the U.S. Green Building Council’s Leadership in Energy and Environmental Design (LEED) rating system, or other applicable standard, provided however, the cost of such application, reporting and commissioning of the Building or any part thereof to seek certification shall be a cost capitalized and thereafter amortized as an Operating Expense under GAAP. Except as specifically provided in the immediately preceding sentence, Operating Expenses shall not include the following: (i) depreciation, (ii) leasing commissions, (iii) repairs and restorations paid for by the proceeds of any insurance policy, (iv) construction of improvements of a capital nature, (v) income and franchise taxes other than that portion, if any, of income and franchise taxes which may hereafter be assessed and paid in lieu of or as a substitute in whole or in part for Taxes, or (vi) costs of utilities directly charged to and reimbursed by Tenant or other tenants. “Taxes,” as used herein, means all ad valorem taxes, personal property taxes, and all other taxes, assessments, and all other similar charges, if any, which are levied, assessed, or imposed upon or become due and payable in connection with, or a lien upon, the Project or any portion thereof or facilities used in connection therewith, and all taxes of whatsoever nature that are imposed in substitution for or in lieu of any of the taxes, assessments, or other charges included in this definition of Taxes, such as taxes paid through a private agreement with respect to the Property as a part of or in connection with an inducement resolution with a development authority and all costs, expenses and fees associated or incurred by Landlord in connection with that inducement resolution and transaction involving a development authority; but excluding, however, taxes and assessments attributable to the personal property of tenants and paid by such tenants as a separate charge. In the event Landlord shall retain any consultant to negotiate the amount of taxes, tax rate, assessed value or other factors influencing the amount of Taxes, then the aggregate of all such reasonable third-party fees (including, without limitation, reasonable attorneys’ and appraisers’ fees) and all disbursements, court costs and other items paid or incurred by Landlord during the applicable tax year with respect to such proceedings shall be included in Taxes. Tenant shall not institute any proceedings with respect to the assessed valuation of the Building, Project, or the Property or any part thereof for the purpose of seeking or securing a tax reduction. If a rental tax, gross receipts tax or sales tax on Rent is imposed on Landlord by any Governmental Authority, Tenant shall, as additional Rent, reimburse Landlord, at the same time as each monthly payment of Rent is due, an amount equal to all such taxes Landlord is required to pay by reason of the Rent paid hereunder. If less than ninety-five percent (95%) of the Rentable Area of the Building is actually occupied during any Operating Period, Operating Expenses shall be the amount that such Operating Expenses would have been for such Operating Period had ninety-five percent (95%) of the Rentable Area of the Building been occupied during all such Operating Period, as determined by Landlord. Notwithstanding any other provision of the Lease to the contrary, Landlord agrees that, for purposes of calculating Operating Expenses, the portion of Operating Expenses for each calendar year after the first full calendar year after the Base Year occurs that consists of Controllable Operating Expenses (as hereinafter defined) shall not increase more than five percent (5%) per year, on a cumulative and compounding basis. As used herein, the term

“Controllable Operating Expenses” shall mean only Operating Expense which are within the reasonable control of Landlord; thus, Controllable Operating Expenses exclude the following (and the following shall not be capped): taxes, insurance, utilities (including, without limitation, water, sewer, waste disposal, gas, electricity and power for heating, lighting, air conditioning and ventilations), security, snow and ice removal and other weather-related costs, costs incurred to comply with governmental requirements or law, third party or contract labor costs (including, without limitation, labor costs for third party or contract janitorial and security personnel), increase in minimum wages and/or union rates, and other costs beyond the reasonable control of Landlord. Any such Operating Expenses that cannot be passed through to Tenant in a given year may be carried forward to and passed through to Tenant, as Additional Rental, in subsequent calendar years, if any, if such increase in Operating Costs does not cause total Operating Expenses to exceed the foregoing limitations. Notwithstanding the foregoing, in all events Landlord shall be entitled to the management fee contribution set forth in Section 3(y) above.

(b)Additional Rent. Landlord shall, within one hundred twenty (120) days after the end of each Operating Period (or as soon thereafter as it is reasonably able to do so), furnish Tenant with a statement of the Operating Expenses and Taxes during such year and a computation of the Additional Rent owed by Tenant for such Operating Period (“Expense Statement”). Failure of Landlord to provide such statement within such time period shall not be a waiver of Landlord’s right to collect any Additional Rent. If such statement shows that the actual amount Tenant owes for such Operating Period is more than the estimated Additional Rent paid by Tenant for such Operating Period, Tenant shall pay the difference within thirty (30) days after Tenant’s receipt of the Expense Statement. If the Expense Statement shows that Tenant paid more in estimated Additional Rent than the actual amount of Additional Rent owed by Tenant for such Operating Period, Tenant shall receive a credit therefor. The credit shall be applied to future monthly payments attributable to the Additional Rent or the Base Rent (at Tenant’s discretion), or if this Lease has expired, such amount shall be refunded to Tenant. The Operating Expenses, Taxes and Additional Rent set forth in the Expense Statement shall be binding upon Tenant. Provided, however, that in the event that the Term of this Lease expires, or is terminated pursuant to the terms of this Lease, on a date other than December 31, then, at the option of Landlord, Landlord may, either prior to the date on which the Term expires, or within thirty (30) days thereafter, elect to provide Tenant with a revised estimate of the Operating Expenses and Taxes for the Operating Period in which such expiration or termination date occurs and the Additional Rent that will be due from Tenant for such Operating Period, which estimated Additional Rent shall be prorated to reflect the portion of such Operating Period that is contained within the Term of the Lease (the “Final Expense Estimate”). In the event that Landlord elects to deliver a Final Expense Estimate to Tenant, then (i) Tenant shall pay the prorated Additional Rent reflected in such statement within fifteen (15) days after Tenant’s receipt of such estimate; (ii) the estimated amount of the Additional Rent for the final Operating Period shall be binding upon Landlord and Tenant; and (iii) Landlord shall not thereafter seek from Tenant any additional payment of Additional Rent if the actual Operating Expenses and Taxes for such Operating Period are greater than those reflected in the Final Expense Estimate, nor shall Landlord have any obligation to refund to Tenant any excess funds paid by Tenant to Landlord should the actual Operating Expenses and Taxes for such Operating Period be less than those reflected in the Final Expense Estimate. In the event that Landlord elects not to provide Tenant with a Final Expense Estimate, then it shall be presumed that Landlord will provide Tenant with an Expense Statement within one hundred twenty (120) days after the end of the final Operating Period contained in the Term, as provided above, and the Additional Rent shown in such Expense Statement shall be due from Tenant to Landlord within fifteen (15) days after Tenant’s receipt of such statement.

(c)Tenant’s Audit. Tenant shall have the right to have Landlord’s books and records pertaining to Operating Expenses and Taxes for each Operating Period reviewed, copied (provided Landlord is reimbursed for the cost of such copies) and audited (“Tenant’s Audit”), provided that: (a) such right shall not be exercised more than once during any calendar year; (b) if Tenant elects to conduct Tenant’s Audit, Tenant shall provide Landlord with written notice thereof (“Tenant’s Audit Notice”) no later than thirty (30) days following Tenant’s receipt of the Expense Statement for the year to which Tenant’s Audit will apply; (c) Tenant shall have no right to conduct Tenant’s Audit if an uncured Default by Tenant exists either at the time of Landlord’s receipt of Tenant’s Audit Notice or at any time during Tenant’s Audit; (d) no subtenant shall have any right to conduct an audit and no assignee shall conduct an audit for any period during which such assignee was not in possession of the Premises; (e) conducting Tenant’s Audit shall not relieve Tenant from the obligation to timely pay Base Rent or the Additional Rent, pending the outcome of such audit; (f) Tenant’s right to conduct such audit for any calendar year shall expire thirty (30) days following Tenant’s receipt of the Expense Statement for such year, and if Landlord has not received Tenant’s Audit Notice within such thirty (30) day period, Tenant shall have waived its right to conduct Tenant’s

Audit for such calendar year; provided, however, that with respect to any audit of Operating Expenses and Taxes for the Base Year, Tenant’s right to conduct an audit for such year shall expire the earlier of sixty (60) days following Tenant’s receipt of the Expense Statement for the Base Year or sixty (60) days following Tenant’s receipt of the first Expense Statement forwarded by Landlord to Tenant for any Operating Period during the Term; (g) Tenant’s Audit shall be conducted by a Certified Public Accountant whose compensation is not contingent upon the results of Tenant’s Audit or the amount of any refund received by Tenant, and who is not employed by or otherwise affiliated with Tenant; (h) Tenant’s Audit shall be conducted at Landlord’s office where the records of the year in question are maintained by Landlord, during Landlord’s normal business hours; (i) Tenant’s Audit shall be completed within thirty (30) days after the date of Tenant’s Audit Notice, and a complete copy of the results thereof shall be delivered to Landlord within sixty (60) days after the date of Tenant’s Audit Notice; and (j) Tenant’s Audit shall be conducted at Tenant’s sole cost and expense. If Tenant’s Audit is completed and submitted to Landlord in accordance with the requirements of this Section and such audit demonstrates to Landlord’s reasonable satisfaction that Landlord has overstated the Operating Expenses or Taxes for the year audited, then Landlord shall reimburse Tenant for any overpayment.

(d)Confidentiality. Tenant hereby agrees to keep the results of Tenant’s Audit confidential and to require the auditor conducting Tenant’s Audit, including its employees and each of their respective attorneys and advisors, to keep the results of Tenant’s Audit in strictest confidence. In particular, but without limitation, Tenant agrees that: (a) Tenant shall not disclose the results of Tenant’s Audit to any past, current or prospective tenant of the Building; and (b) Tenant shall require that its auditors, attorneys and anyone associated with such parties shall not disclose the results of Tenant’s Audit to any past, current or prospective tenant of the Building; provided, however, that Landlord hereby agrees that nothing in items (a) or (b) of this subparagraph shall preclude Tenant from disclosing the results of Tenant’s Audit in any judicial or quasi-judicial proceeding, or pursuant to court order or discovery request, or to any current or prospective assignee or subtenant of Tenant, or to any agent, representative or employee of Landlord who or which request the same. If Tenant intends to disclose the results of Tenant’s Audit in any judicial or quasi-judicial proceeding, or if Tenant receives notice that it may be required in any such proceeding by either the order of any judicial, regulatory or other governmental entity presiding over such proceeding, or by a discovery request made in such proceeding, to disclose the results of Tenant’s Audit, then Tenant shall (i) provide Landlord with sufficient prior written notice of Tenant’s intent to make such disclosure, or such order or request for such disclosure, in order to permit Landlord to contest such intended disclosure, order or request; and (ii) cooperate with Landlord, at Tenant’s expense, in seeking a protective order or other remedy to limit the disclosure of such results to the extent reasonably required to adjudicate the matters at issue in such proceeding. If required by Landlord, Tenant shall execute and require Tenant’s auditor to execute Landlord’s then-current confidentiality agreement reflecting the terms of this Section as a condition precedent to Tenant’s right to conduct Tenant’s Audit.

8.Letter of Credit. (a) Terms and Conditions. Within thirty (30) days of the Effective Date, Tenant shall deliver to Landlord a clean, irrevocable letter of credit (the “Letter of Credit”) established in Landlord’s (and its successors’ and assigns’) favor in the Letter of Credit Amount set forth in Section 1(m) of this Lease, issued by a federally insured banking or lending institution (i.e., insured by the FDIC) with a retail banking branch located in Miami, Florida, and otherwise reasonably acceptable to Landlord (the “Issuer”), and in other form and substance reasonably acceptable to Landlord. The Letter of Credit shall specifically provide for partial draws, shall be self- renewing annually as an “Evergreen” letter of credit, without amendment, for additional one-year periods, shall have a term that is self-renewing until sixty (60) days after the expiration of the Term of the Lease (which shall include any exercised and unexercised renewal terms, if any) and shall by its terms be transferable by the beneficiary thereunder for a transfer fee not to exceed $250.00 payable by Tenant. If Tenant fails to make any payment of Rent, or other charges due to Landlord under the terms of the Lease, or otherwise commits a Default hereunder, Landlord, at Landlord’s option, may make a demand for payment under the Letter of Credit in an amount equal to the amounts then due and owing to Landlord under the Lease. If Landlord draws upon the Letter of Credit, Tenant shall present to Landlord a replacement Letter of Credit in the full Letter of Credit Amount satisfying all of the terms and conditions of this Section within twenty-one (21) days after receipt of notice from Landlord of such draw. Tenant’s failure to do so within such 21-day period will constitute a Default hereunder (Tenant hereby waiving any additional notice and grace or cure period), and upon such Default by Tenant, Landlord shall be entitled to immediately exercise all rights and remedies available to it hereunder, at law or in equity. If the Letter of Credit is terminated by the Issuer thereof prior to the date that is sixty (60) days after the expiration of the Term of this Lease, as set forth above, and Tenant has not presented to Landlord a replacement Letter of Credit which complies with the terms and conditions of the

Lease on or before thirty (30) days prior to the expiration date of any such Letter of Credit then held by Landlord, then Tenant shall be deemed to have committed a Default hereunder and Landlord, in addition to all other rights and remedies provided for hereunder, shall have the right to draw upon the Letter of Credit then held by Landlord and any such amount paid to Landlord by the Issuer of the Letter of Credit shall be held in a segregated account by Landlord as security for the performance of Tenant’s obligations hereunder. Any interest earned on such amounts shall be the property of Landlord. Landlord’s election to draw under the Letter of Credit and to hold the proceeds of the drawing under the Letter of Credit in a segregated account shall not be deemed a cure of any default by Tenant hereunder and shall not relieve Tenant from its obligation to present to Landlord a replacement Letter of Credit which complies with the terms and conditions of this Lease. Tenant acknowledges that any proceeds of a draw made under the Letter of Credit and thereafter held in a segregated account by Landlord may be used by Landlord to cure or satisfy any obligation of Tenant hereunder as if such proceeds were instead proceeds of a draw made under a Letter of Credit that remained outstanding and in full force and effect at the time such amounts are applied by Landlord to cure or satisfy any such obligation of Tenant. Tenant hereby affirmatively disclaims any interest Tenant has, may have, claims to have, or may claim to have in any proceeds drawn by Landlord under the Letter of Credit and held in accordance with the terms hereof. Without limiting the generality of the foregoing, Tenant expressly acknowledges and agrees that at the end of the Term of the Lease (whether by expiration or earlier termination hereof), and if Tenant is not then in Default under this Lease, Landlord shall return to the Issuer of the Letter of Credit or its successor (or as such Issuer may direct in writing) any remaining and unapplied proceeds of any prior draws made under the Letter of Credit, and Tenant shall have no rights, residual or otherwise, in or to such proceeds. In addition to the foregoing, Landlord will have the right to require Tenant to have a new Letter of Credit issued in accordance with the above requirements from a different Issuer if either the original Issuer is placed on an FDIC “watch list”, if the FDIC or similar state or federal banking regulatory agency is appointed as receiver or conservator for such Issuer or if Landlord analyzes such Issuer’s capitalization, asset quality, earnings, and/or liquidity and in Landlord’s sole and absolute discretion, disapproves of such Issuer’s financial wherewithal and ability to remain as the Issuer of the Letter of Credit. Such new Letter of Credit must comply with the foregoing requirements and must be issued within thirty (30) days of Landlord’s demand therefor.

(b) Security Deposit. In the event that Tenant does not deliver the Letter of Credit in the Letter of Credit Amount to Landlord on the Effective Date as required by Section 8(a) above, then simultaneously upon Tenant’s execution of this Lease, Tenant shall deposit a security deposit with Landlord in the amount of $300,000.00 (the “Security Deposit”) to secure Tenant’s performance under this Lease. Tenant hereby grants to Landlord a security interest in the Security Deposit as collateral for all Rent and other sums of money becoming due from Tenant to Landlord under this Lease, and for the performance of Tenant’s obligations under this Lease, which security interest shall remain in effect until all such Rent and other sums of money have been paid in full and all such obligations have been fulfilled; the parties hereby acknowledge and agree that this Lease constitutes a security agreement under which such security interest is granted from Tenant to Landlord. In the event of an uncured Default, defined below, then Landlord may, without prejudice to Landlord’s other remedies, apply part or all of the Security Deposit to cure such Default. If Landlord so uses part or all of the Security Deposit, then Tenant shall within ten (10) days after written demand, provide Landlord with a replacement Security Deposit in an amount sufficient to restore the Security Deposit to its original amount. Any part of the Security Deposit not used by the Landlord as permitted by this Lease shall be returned to Tenant after the Expiration Date. If Landlord sells the Building then the Landlord shall transfer the Security Deposit to the new owner and Landlord shall be relieved of any liability for the Security Deposit. Tenant shall not be entitled to any interest on the Security Deposit, and Landlord may commingle the Security Deposit with other monies of Landlord. Notwithstanding anything contained herein to the contrary, in the event Tenant delivers the Letter of Credit in the Letter of Credit Amount to Landlord as required by Section 8(a) above within thirty (30) days following the Effective Date, then Landlord shall return the unapplied portion of the Security Deposit to Tenant within three (3) business days of its receipt of the Letter of Credit.

1.Tenant Improvements. The construction of any Tenant Improvements to the Premises shall be undertaken in accordance with the terms and conditions of this Lease and if applicable, the terms set forth in the Work Letter attached hereto as Exhibit D and incorporated herein by this reference. Unless otherwise stated herein, the parties’ respective obligations for payment of the Tenant Improvements shall be governed by the terms of the Work Letter. Except as expressly stated in this Lease and in the Work Letter, Landlord shall have no obligation to improve or otherwise modify the Premises for Tenant’s occupancy.

2.Maintenance and Repair. Landlord shall make such improvements, repairs or replacements as may be necessary for normal maintenance of the Building Systems serving the Premises, the exterior and the structural portions of the Building and the Common Areas. Subject to the terms of Section 7, the maintenance and repairs to be performed by Landlord hereunder shall be at Landlord’s expense, unless the need for such maintenance or repairs was caused by the negligence or willful misconduct of Tenant, its employees, agents, contractors or invitees, in which event Tenant shall reimburse Landlord for the cost of such maintenance or repairs, plus a construction oversight fee for Landlord in an amount equal to five percent (5%) of the cost and expense of such maintenance or repairs; the construction oversight or management fee, if any, applicable to construction of the Tenant Improvements shall be governed by the terms of the Work Letter and not by the provisions of this Section. Except to the extent that Landlord is obligated to restore and repair the Premises pursuant to Section 23, Tenant, at its sole cost, shall maintain and repair the Premises and otherwise keep the Premises in good order and repair. Any repair or maintenance by Tenant shall be undertaken in accordance with the provisions and requirements of Section 16. Landlord is not responsible for replacing and/or repairing Tenant’s fixtures or any Above Standard improvements, or fixtures. Except as expressly provided in this Lease, Tenant shall accept the Premises including any existing appliances and Above Standard fixtures in their “AS IS, WHERE IS” condition as of the Effective Date. For purposes of this Lease, all Above Standard improvements and fixtures existing in the Premises as of the Effective Date shall be deemed to be Tenant’s property until the expiration or earlier termination of this Lease or Tenant’s right to possession of the Premises under this Lease, at which time such Above Standard improvements and fixtures shall become the property of Landlord and shall be surrendered to Landlord with the Premises.

3.Services. Landlord shall furnish Tenant during Tenant's occupancy of the Premises the following services: (i) Cleaning and Janitorial Services (defined in Exhibit B), (ii) domestic water at those points of supply provided for general office use of tenants in the Building, (iii) electricity for normal, Building Standard office uses subject to Section 12, (iv) elevator service at the times and frequency reasonably required for normal business use of the Premises, and (v) lamp and ballast replacement for Building Standard light fixtures, and (vi) HVAC service between 8:00 o’clock a.m. and 6:00 o’clock p.m. on Monday through Friday (“Building Standard Hours”), except on New Year’s Day, Memorial Day, July 4, Labor Day, Thanksgiving Day, Christmas Day and other holidays observed by a majority of the tenants of the Building (“Holidays”). If any Holiday falls on a weekend, the Building may observe the Holiday on the preceding Friday or the succeeding Monday. In addition to HVAC service provided during Building Standard Hours, Landlord shall, upon Tenant’s request, provide HVAC service to the Premises between the hours of 8:00 o’clock a.m. and noon on Saturday, at no additional charge to Tenant, provided that such request is made no later than 2 o’clock p.m. on the immediately preceding day. Tenant may periodically request, and Landlord shall furnish HVAC service on days and at times other than those referred to above, provided Tenant requests such service in accordance with the Project Rules, defined below, then in effect, and agrees to reimburse Landlord for this service at the then existing rate being charged in the Building (which rate as of the Effective Date is $100.00 per hour, per zone, with a two (2) hour minimum). If Tenant utilizes services provided by Landlord hereunder in either quantity and/or quality exceeding the quantity and/or quality customarily utilized by normal office uses of comparable premises in the Building, then Landlord may separately meter or otherwise monitor Tenant's use of such services, and charge Tenant a reasonable amount for such excess usage; such amount shall constitute additional Rent due hereunder within thirty (30) days of Tenant's receipt of Landlord's statement for such excess. Landlord shall not be liable for any damages directly or indirectly resulting from, nor shall any Rent be abated by reason of, the installation, use or interruption of use of any equipment in connection with furnishing any of the foregoing services, or failure to furnish or delay in furnishing any such service. The failure to furnish any such services shall not be construed as an eviction of Tenant or relieve Tenant from any of its obligations under this Lease. Tenant shall, at Tenant's expense, be responsible for cleaning and maintaining any Above Standard improvements or fixtures, including Above Standard Tenant Work, defined below, and Above Standard Tenant Improvements, in the Premises.

4.Electrical Usage. Landlord shall supply sufficient electrical capacity to a panel box located in the core of each floor for lighting and for Tenant’s office equipment to the extent that the total demand load at 100% capacity of such lighting and equipment does not exceed six (6) watts per RSF in the Premises (“Electrical Design Load”). If Tenant utilizes any portion of the Premises on a regular basis beyond Building Standard Hours or in any manner in excess of the Electrical Design Load, Landlord shall have the right to separately meter such space and charge Tenant for all excess usage; additionally, Landlord shall have the right, at Tenant’s expense, to separately meter any Above Standard fixture(s) in the Premises, such as water heaters and vending machines, and to charge

Tenant for the electricity consumed by such fixture(s). If separate metering is not practical, Landlord may reasonably estimate such excess usage and charge Tenant a reasonable hourly rate. Tenant shall pay to Landlord the cost of all electricity consumed in excess of six (6) watts per RSF in the Premises for the number of hours in the Building Standard Hours for the relevant period, plus any actual accounting expenses incurred by Landlord in connection with the metering or calculation thereof. Tenant shall pay the cost of installing, maintaining, repairing and replacing all such meters. In the event that the level of occupancy of the Premises, or any machinery or equipment located in the Premises, creates unusual demands on the HVAC system serving the Premises, then Tenant may install, and Landlord may require that Tenant install, its own supplemental HVAC unit(s) (“Supplemental HVAC Equipment”) in the Premises, and in either event the installation, maintenance and removal of the Supplemental HVAC Equipment shall be governed by the terms of Exhibit F attached hereto and incorporated herein by this reference. In the event that the Premises are separately metered for electricity, and electricity is provided to the Premises directly from the utility provider, then Tenant shall, at reasonable intervals specified by Landlord, submit to Landlord data regarding the consumption of electricity in the Premises in a format that is reasonably acceptable to Landlord.

5.Communication Lines. Subject to Building design limits and its existing, or then existing, capacity, Tenant may install, maintain, replace, remove or use communications or computer wires and cables which service the Premises (“Lines”), provided: (a) Tenant shall obtain Landlord’s prior written consent, and shall use contractors approved in writing by Landlord, (b) all such Lines shall be plenum rated and neatly bundled, labeled and attached to beams and not to suspended ceiling grids, (c) any such installation, maintenance, replacement, removal or use shall comply with all Laws applicable thereto, including, but not limited to the National Electric Code, and shall not interfere with any then existing Lines at the Building, and (d) Tenant shall pay all costs and expenses in connection therewith. Landlord reserves the right to require Tenant to remove any Lines located in or serving the Premises which violate this Lease or represent a dangerous or potentially dangerous condition, within three (3) business days after written notice. Tenant shall remove all Lines installed by or on behalf of Tenant upon termination or expiration of this Lease. Any Lines that Landlord expressly permits to remain at the expiration or termination of this Lease shall become the property of Landlord without payment of any type. Under no circumstances shall any Line problems be deemed an actual or constructive eviction of Tenant, render Landlord liable to Tenant for abatement of Rent, or relieve Tenant from performance of Tenant’s obligations under this Lease.

6.Prohibited Use. Tenant shall not do or permit anything to be done within the Project nor bring, keep or permit anything to be brought or kept therein, which is prohibited by any Laws now in force or hereafter enacted or promulgated, or which is prohibited by any insurance policy or which may increase the existing rate or otherwise affect any insurance which Landlord carries on the Project, or which would violate any then existing exclusive use granted by Landlord to any other tenant or occupant of the Project. Tenant shall not do or permit anything to be done in or about the Premises which will in any way obstruct or interfere with the rights of other tenants, or injure or annoy them or use or allow the Premises to be used for any unlawful or objectionable purpose. Tenant shall not commit or suffer to be committed any waste to, in or about the Premises or Project.

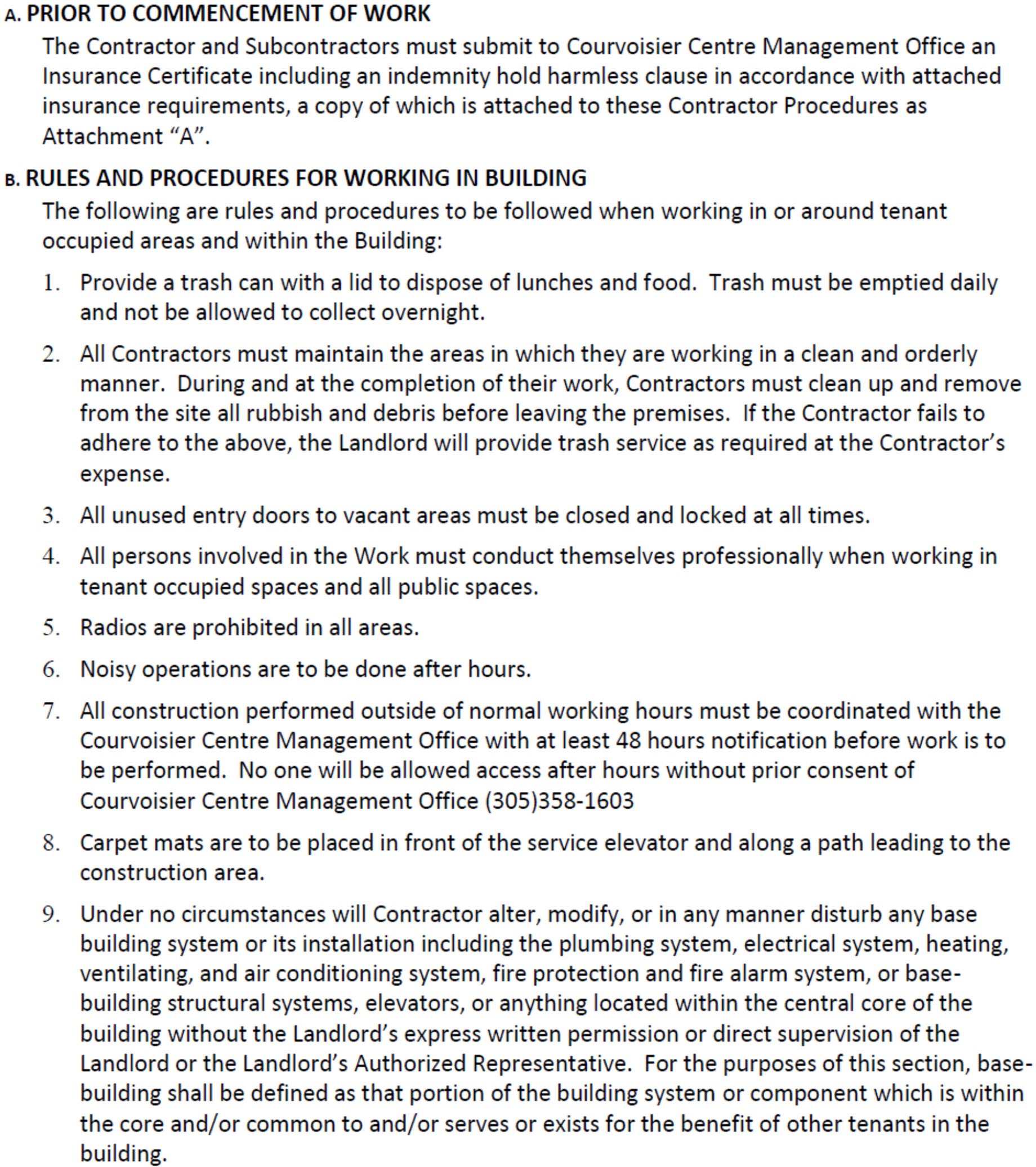

7.Legal Requirements; Project Rules. Tenant shall comply with, and shall indemnify and hold Landlord and its directors, officers, partners, members, shareholders, employees and agents harmless from any and all obligations, claims, administrative proceedings, judgments, damages, fines, penalties, costs, and liabilities, including reasonable attorneys’ fees (collectively, “Costs”) incurred by Landlord as a result of the failure by Tenant, its employees, agents or contractors to comply with all Laws relating to the use, condition or occupancy of the Premises now or hereafter enacted, and the Project Rules, defined below. Tenant shall cause its employees, agents and contractors to comply with, and shall use reasonable efforts to cause its invitees to comply with, all Laws applicable to the Project. Tenant shall not cause or permit the use, generation, storage, release or disposal in or about the Premises or the Project of any substances, materials or wastes subject to regulation under any Laws from time to time including, without limitation, flammable, explosive, hazardous, petroleum, toxic or radioactive materials, unless Tenant shall have received Landlord’s prior written consent, which consent Landlord may withhold or revoke at any time in its sole discretion. Tenant shall comply with, and cause its employees, agents and contractors to comply with, and shall use its reasonable efforts to cause its invitees to comply with, the rules and regulations of the Project adopted by Landlord from time to time for the safety, care and cleanliness of the Premises and the Project (“Project Rules”). In the event of any conflict between this Lease and the Project Rules, the provisions of this Lease shall control. Landlord shall not have any liability to Tenant for any failure of any other tenants to comply with the

Project Rules. The Project Rules in effect as of the Effective Date are attached hereto as Exhibit C. In the event that any Governmental Authority, ordinance or other Law applicable to the Project requires either Landlord or Tenant to establish and implement a transportation management plan designed to reduce the number of single-occupancy vehicles being used by employees and other permitted occupants of the Building for commuting to and from the Building, then Tenant shall cooperate with Landlord in establishing and implementing such plan. In the event that any Governmental Authority with jurisdiction over the Project requires that modifications be made to the Common Areas as a result of Tenant’s particular use or occupancy of the Premises, then such modifications shall be made by Landlord, and Tenant shall reimburse Landlord, as additional Rent due under this Lease, for Landlord’s reasonable cost incurred in making such modifications, with such reimbursement to be made within thirty (30) days after Tenant’s receipt of Landlord’s statement for such cost.

8.Alterations, Additions and Improvements. After the Commencement Date, Tenant shall not permit, make or allow to be made any construction, alterations, physical additions or improvements in or to the Premises without obtaining the prior written consent of Landlord, which shall not be unreasonably withheld (“Tenant Work”), nor place any signs in the Premises which are visible from outside the Premises, without obtaining the prior written consent of Landlord, which may be withheld in Landlord’s sole discretion. Notwithstanding the foregoing, Landlord will not unreasonably withhold its consent to Tenant Work that: (i) is non-structural and does not adversely affect any Building Systems or improvements, (ii) is not visible from the exterior of the Premises, (iii) does not affect the exterior of the Building or any Common Areas, (iv) does not violate any provision of this Lease, (v) does not violate any Laws, and (vi) will not interfere with the use and occupancy of any other portion of the Project by any other tenant or occupant of the Project. Tenant’s plans and specifications and all contractors, subcontractors, vendors, architects and engineers (collectively, “Outside Contractors”) shall be subject to Landlord’s prior written approval. If requested by Landlord, Tenant shall execute a work letter for any such Tenant Work substantially in the form then used by Landlord for construction performed by tenants of the Building. Tenant shall pay Landlord a construction oversight fee in an amount equal to three percent (3%) of the cost and expense of any Tenant Work whether undertaken by Landlord or Tenant. Landlord may hire outside consultants to review such documents and information furnished to Landlord, and Tenant shall reimburse Landlord for the cost thereof, including reasonable attorneys’ fees, upon demand. Neither review nor approval by Landlord of any plans or specifications shall constitute a representation or warranty by Landlord that such documents either (i) are complete or suitable for their intended purpose, or (ii) comply with applicable Laws, it being expressly agreed by Tenant that Landlord assumes no responsibility or liability whatsoever to Tenant or any other person or entity for such completeness, suitability or compliance. Tenant shall furnish any documents and information reasonably requested by Landlord, including “as-built” drawings (both in paper and in electronic format acceptable to Landlord) after completion of such Tenant Work. Landlord may impose such conditions on Tenant Work as are reasonably appropriate, including without limitation, compliance with any construction rules adopted by Landlord from time to time, requiring Tenant to furnish Landlord with security for the payment of all costs to be incurred in connection with such Tenant Work, insurance covering Landlord against liabilities which may arise out of such work, plans and specifications, and permits for such Tenant Work. All Building Standard Tenant Work shall become the property of Landlord upon completion and shall be surrendered to Landlord upon the expiration or earlier termination of this Lease or Tenant’s right to possession of the Premises under this Lease, unless Landlord shall require removal or restoration of such Tenant Work by Tenant. All Tenant Work that is Above Standard shall be and remain the property of Tenant, and shall be maintained by Tenant in good condition and repair throughout the Term, until the expiration or earlier termination of this Lease or Tenant’s right to possession of the Premises under this Lease, at which time such Tenant Work shall become the property of Landlord and shall be surrendered to Landlord with the Premises, unless Landlord specifies, at the time of the approval of the installation of such Above Standard Tenant Work, that Landlord will require Tenant to remove same upon the expiration or earlier termination of the Lease or Tenant’s right to possession of the Premises under the Lease. Any Tenant Work that Tenant is required to remove from the Premises upon the expiration or earlier termination of this Lease or Tenant’s right to possession of the Premises under this Lease shall be removed at Tenant’s sole expense, and Tenant shall, at Tenant’s expense, promptly repair any damage to the Premises or the Building caused by such removal. Tenant shall not allow any liens to be filed against the Premises or the Project in connection with any Tenant Work. If any liens are filed, Tenant shall cause the same to be released within five (5) days after Tenant’s receipt of written notice of the filing of such lien by bonding or other method acceptable to Landlord. All Outside Contractors shall maintain insurance in amounts and types required by, and in compliance with, Section 20. An ACORD 25 (or its equivalent) certificates of insurance in the most recent edition available evidencing such coverage shall be provided to Landlord prior to

commencement of any Tenant Work. All Outside Contractors shall perform all work in a good and workmanlike manner, in compliance with all Laws and all applicable Project Rules and Building construction rules. No Tenant Work shall be unreasonably disruptive to other tenants. Prior to final completion of any Tenant Work, Landlord shall prepare and submit to Tenant a punch list of items to be completed, and Tenant shall diligently complete all such punch list items.

9.Tenant’s Equipment. Except for personal computers, facsimile machines, copiers and other similar office equipment, Tenant shall not install within the Premises any fixtures, equipment or other improvements until the plans and location thereof have been approved by Landlord. The location, weight and supporting devices for any libraries, central filing areas, safes and other heavy equipment shall in all cases be approved by Landlord prior to initial installation or any relocation. Landlord may prohibit any article, equipment or any other item that may exceed the load capacity of the Building from being brought into the Building.

10.Taxes on Tenant’s Property. Tenant shall pay all ad valorem and similar taxes or assessments levied upon all equipment, fixtures, furniture and other property placed by Tenant in the Premises and all license and other fees or taxes imposed on Tenant’s business. If any improvements installed or placed in the Project by, or at the expense of, Tenant result in Landlord being required to pay higher Taxes with respect to the Project than would have been payable otherwise, Tenant shall pay to Landlord, within thirty (30) days after demand, the amount by which such excess Taxes are reasonably attributable to Tenant.

11.Access. Landlord shall have the right to enter the Premises at all reasonable times in order to inspect the condition, show the Premises, determine if Tenant is performing its obligations hereunder, perform the services or make the repairs that Landlord is obligated or elects to perform hereunder, make repairs to adjoining space, cure any Defaults of Tenant hereunder that Landlord elects to cure, and remove from the Premises any improvements or property placed therein in violation of this Lease. Except in the case of an emergency or to perform routine services hereunder, Landlord shall use reasonable efforts to provide Tenant prior notice of such access.

12.Tenant’s Insurance. Commencing the date Tenant is required to provide Landlord with the certificate of insurance, as provided below, and continuing until the expiration or earlier termination of the Lease Term, Tenant shall carry and maintain at its expense the following insurance coverages with insurance companies reasonably acceptable to Landlord with a rating of A- or better by A.M. Best Company: (i) Commercial General Liability (CGL) Policy (written on an occurrence basis), with limits not less than One Million Dollars ($1,000,000) combined single limit per occurrence, Two Million Dollar ($2,000,000) annual aggregate covering liability arising from premises, operations, independent contractors, products-completed operations, personal injury, advertising injury and liability assumed under a contract; (ii) Property Damage Insurance on a Causes of Loss-Special Form basis covering on a replacement cost value all Above Standard improvements, fixtures, personal property and equipment located within the Premises; (iii) Business Interruption and Extra Expense insurance in such amounts as will reimburse Tenant for direct or indirect loss of earnings attributable to the perils insured against under this section; (iv) Workers’ Compensation insurance policy as required by the applicable state law, and Employers Liability insurance with limits of not less than One Million Dollars ($1,000,000.00); (v) Automobile Liability insurance with single limit coverage of at least $1,000,000 for all owned, leased/hired or non-owned vehicles; (vi) to the extent applicable to Tenant, if Tenant will serve or sell alcohol at the Project, a liquor liability insurance policy with minimum coverage of One Million Dollars ($1,000,000.00); and (vii) Excess/Umbrella liability policy “following form” of not less than Four Million Dollars ($4,000,000), including a “drop down” feature in case the limits of the primary policy are exhausted. Landlord may also require all Outside Contractors (if any) to provide additional types of insurance coverages in amounts and types deemed necessary by Landlord, including, without limitation, construction All-Risk Builder’s risks, Owners and Contractors Protective (OCP) Liability insurance, Professional Errors and Omissions liability insurance, and insurance covering such contractor’s equipment and tools. Each Liability insurance policy required to be maintained hereunder by Tenant shall name the following entities as Additional Insureds: Landlord, any of Landlord’s lenders, and their direct and indirect parent companies and subsidiaries and any of their affiliated entities, successors and assigns, as well as their respective current or future directors, officers, employees, partners, members and agents. Tenant’s insurance shall be considered primary, not excess, and non-contributory with Landlord’s insurance policies. Insurance deductibles or retentions should be reasonable and customary for policy holders in similar businesses and locations. An ACORD 25 certificate of such insurance in the most recent edition available and reasonably satisfactory to Landlord, before the earlier of the Commencement Date or ten (10) days after execution of the Lease, reflecting the limits and endorsements required

herein, and renewal certificates shall be delivered to Landlord at least ten (10) days prior to the expiration date of any policy. Each policy shall be endorsed to provide notice of nonrenewal to Landlord and shall further provide that it may not be materially altered or canceled without thirty (30) days prior notice to Landlord. Landlord agrees to cooperate with Tenant to the extent reasonably requested by Tenant to enable Tenant to obtain such insurance. Landlord shall have the right to require increased limits if, in Landlord’s reasonable judgment, such increase is necessary. Tenant shall pay all premiums and charges for all of said policies, and, if Tenant shall fail to make any such payment when due or carry any such policy, Landlord may, but shall not be obligated to, make such payment or carry such policy, and the amount paid by Landlord shall be repaid to Landlord by Tenant within ten (10) days following demand therefor, and all such amounts so repayable, together with such interest, shall be deemed to constitute additional Rent hereunder. Payment by Landlord of any such premium, or the carrying by Landlord of any such policy, shall not be deemed to waive or release Tenant from any remedy available to Landlord under this Lease.

13.Intentionally Deleted.

14.Waiver of Subrogation; Mutual Waiver of Liability. All policies of insurance required to be carried by either party hereunder shall include a waiver of subrogation endorsement, containing a waiver by the insurer of all right of subrogation against the other party in connection with any loss, injury or damage thereby insured against. The waiver of subrogation shall apply regardless of any deductible (or self-insured retention) or self-insurance carried by either party. Any additional premium for such waiver shall be paid by the primary insured. To the full extent permitted by law, Landlord and Tenant each waive all rights of recovery against the other (and any officers, directors, partners, employees, agents and representatives of the other), and agree to release the other from liability, for loss or damage to the extent such loss or damage is covered by valid and collectible insurance in effect covering the party seeking recovery at the time of such loss or damage or would be covered by the insurance required to be maintained under this Lease by the party seeking recovery. If the release of either party, as set forth above, should contravene any law with respect to exculpatory agreements, the liability of the party in question shall be deemed not released but shall be secondary to the liability of the other’s insurer.

15.Casualty. If the Premises or the Project is damaged or destroyed, in whole or in part, by fire or other casualty at any time during the Term and if, after such damage or destruction, Tenant is not able to use the portion of the Premises not damaged or destroyed to substantially the same extent and for the Authorized Use for which the Premises were leased to Tenant hereunder, and within sixty (60) days after Landlord’s receipt of written notice from Tenant describing such damage or destruction Landlord provides notice to Tenant that the Premises, as improved to the extent of the Building Standard improvements existing immediately prior to such destruction or casualty, cannot be repaired or rebuilt to the condition which existed immediately prior to such destruction or casualty within three hundred sixty-five (365) days following the date of such destruction or casualty, then either Landlord or Tenant may by written notice to the other within thirty (30) days following such notice by Landlord terminate this Lease. Unless such damage or destruction is the result of the negligence or willful misconduct of Tenant or its employees, agents, contractors or invitees, the Rent shall be abated for the period and proportionately to the extent that after such damage or destruction Tenant is not able to use the portion of the Premises damaged or destroyed for the Authorized Use and to substantially the same extent as Tenant used the Premises prior thereto. If this Lease is not terminated pursuant to the foregoing, then upon receiving the available insurance proceeds, Landlord shall restore or replace the damaged or destroyed portions of the Premises, as improved to the extent of the Building Standard improvements existing immediately prior to such destruction or casualty, or Project; Tenant shall restore or replace the improvements to the Premises required to be insured by Tenant hereunder; and this Lease shall continue in full force and effect in accordance with the terms hereof except for the abatement of Rent referred to above, if applicable, and except that the Term shall be extended by a length of time equal to the period beginning on the date of such damage or destruction and ending upon completion of such restoration or replacement. Landlord shall restore or replace the damaged or destroyed portions of the Premises or Project that Landlord is required to restore or replace hereunder within a reasonable time, subject to Force Majeure Events and the availability of insurance proceeds. If either party elects to terminate this Lease as provided in this Section, this Lease shall terminate on the date which is thirty (30) days following the date of the notice of termination as if the Term hereof had been scheduled to expire on such date, and, except for obligations which are expressly stated herein to survive the expiration or earlier termination of this Lease, neither party shall have any liability to the other party as a result of such termination. Landlord shall not be obligated to repair any damage to Above Standard improvements or fixtures, Tenant’s inventory, trade fixtures or other personal property. If the Premises or any portion of the Project

are damaged or destroyed by fire or other casualty caused by the recklessness or willful misconduct of Tenant, its employees, agents, contractors, or invitees, then any repair or restoration of the Premises by Landlord pursuant to the terms of this Section shall be at Tenant’s sole cost and expense. Notwithstanding anything in this Section to the contrary, Landlord shall have no obligation to repair or restore the Premises or the Project on account of damage resulting from any casualty which occurs during the last twelve (12) months of the Term, or if the estimated cost of such repair or restoration would exceed fifty percent (50%) of the reasonable value of the Building prior to the casualty. The abatement of Rent, if applicable hereunder, and termination of this Lease by Tenant, if applicable hereunder, are the sole remedies available to Tenant in the event the Premises or the Project is damaged or destroyed, in whole or in part, by fire or other casualty.

16.Condemnation. If more than fifty percent (50%) of the Premises or if a substantial portion of the Building is taken by the power of eminent domain, then either Landlord or Tenant shall have the right to terminate this Lease by written notice to the other within thirty (30) days after the date of taking; provided, however, that a condition to the exercise by Tenant of such right to terminate shall be that the portion of the Premises or Building taken shall be of such extent and nature as to substantially impair Tenant’s use of the Premises or the balance of the Premises remaining and Landlord is unwilling or unable to provide reasonable replacement space within the Project. In the event of any taking, Landlord shall be entitled to any and all compensation and awards with respect thereto, except for an award, if any, specified by the condemning authority for any claim made by Tenant for property that Tenant has the right to remove upon termination of this Lease. Tenant shall have no claim against Landlord for the value of any unexpired portion of the Term. In the event of a partial taking of the Premises which does not result in a termination of this Lease, the Rent shall be equitably reduced as to the square footage so taken.

17.Waiver of Claims. Except for the willful misconduct or gross negligence of Landlord, its employees, agents or contractors, Landlord shall not be liable to Tenant for damage to person or property caused by defects in the HVAC, electrical, plumbing, elevator or other apparatus or systems, or by water discharged from sprinkler systems, if any, in the Building, nor shall Landlord be liable to Tenant for the theft or loss of or damage to any property of Tenant whether from the Premises or any part of the Building or Project, including the loss of trade secrets or other confidential information. Landlord agrees to make commercially reasonable efforts to protect Tenant from interference or disturbance by third persons, including other tenants; however, Landlord shall not be liable for any such interference, disturbance or breach, whether caused by another tenant or tenants or by Landlord or any other person, nor shall Tenant be relieved from any obligation under this Lease because of such interference, disturbance or breach. Landlord may comply with voluntary controls or guidelines promulgated by any governmental entity relating to the use or conservation of energy, water, gas, light or electricity or the reduction of automobile or other emissions without creating any liability of Landlord to Tenant under this Lease, provided that the Premises are not thereby rendered untenantable. In no event shall Landlord, Masaveu & C/O Management Real Estate US LLC, or their directors, officers, shareholders, partners, members, employees, or agents be liable in any manner for incidental, consequential or punitive damages, loss of profits, or business interruption. The waivers in this Section shall survive the expiration or earlier termination of this Lease.

18.Indemnity. Except for claims, rights of recovery and causes of action covered by the waiver of subrogation, Tenant shall indemnify and hold harmless Landlord and its agents, directors, officers, shareholders, partners, members, employees and invitees, from all claims, losses, costs, damages, or expenses (including reasonable attorneys’ fees) in connection with any injury to, including death of, any person or damage to any property arising, wholly or in part, out of any prohibited use of the Premises or other action, omission, or neglect of Tenant or its Outside Contractors, directors, officers, shareholders, members, partners, employees, agents, invitees, subtenants or guests, or any parties contracting with such party relating to the Project. If Landlord shall without fault on its part, be made a party to any action commenced by or against Tenant, for which Tenant is obligated to indemnify Landlord hereunder, then Tenant shall protect and hold Landlord harmless from, and shall pay all costs, expenses, including reasonable attorneys’ fees, of Landlord in connection therewith.

Tenant’s obligations under this Section shall not be limited by the amount or types of insurance maintained or required to be maintained under this Lease. The obligations under this Section shall survive the expiration or earlier termination of this Lease.

19.Non-Waiver. No consent or waiver, express or implied, by Landlord to any breach by Tenant of any of its obligations under this Lease shall be construed as or constitute a consent or waiver to any other breach by Tenant. Neither the acceptance by Landlord of any Rent or other payment, whether or not any Default by Tenant is then known to Landlord, nor any custom or practice followed in connection with this Lease shall constitute a waiver of any of Tenant’s obligations under this Lease. Failure by Landlord to complain of any act or omission by Tenant or to declare that a Default has occurred, irrespective of how long such failure may continue, shall not be deemed to be a waiver by Landlord of any of its rights hereunder. Time is of the essence with respect to the performance of every obligation of Tenant in which time of performance is a factor. No payment by Tenant or receipt by Landlord of an amount less than the Rent due shall be deemed to be other than a partial payment of the Rent, nor shall any endorsement or statement of any check or any letter accompanying any check or payment as Rent be deemed an accord and satisfaction. Landlord may accept such check or payment without prejudice to its right to recover the balance of such Rent or pursue any other right or remedy. Except for the execution and delivery of a written agreement expressly accepting surrender of the Premises, no act taken or failed to be taken by Landlord shall be deemed an acceptance of surrender of the Premises.

20.Quiet Possession. Provided Tenant has performed all its obligations, Tenant shall peaceably and quietly hold and enjoy the Premises for the Term, subject to the provisions of this Lease.