Document

Hamilton Reports 2025 Third Quarter Results

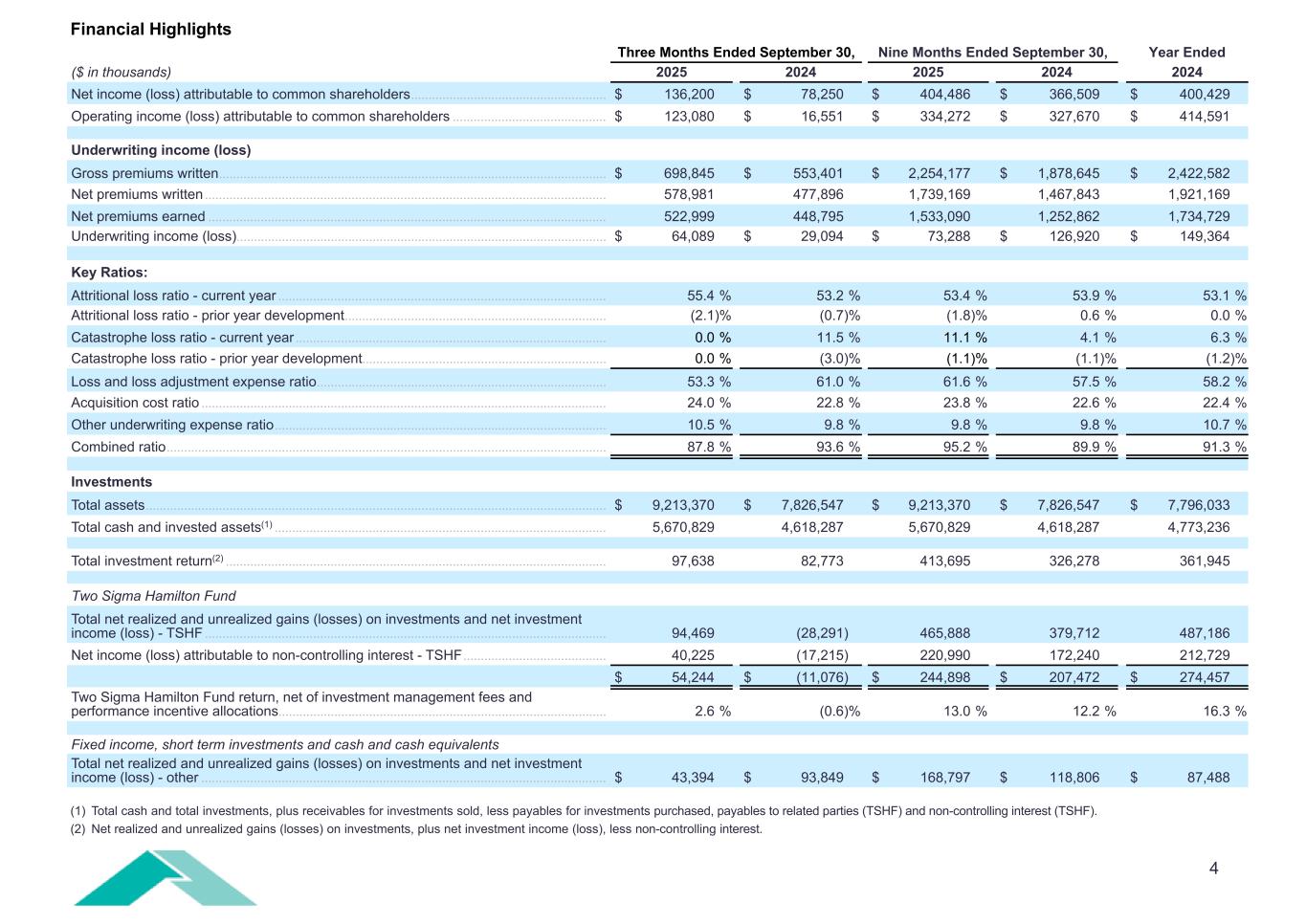

Net Income of $136 million; Annualized Return on Average Equity of 21%

PEMBROKE, Bermuda, November 4, 2025 – Hamilton Insurance Group, Ltd. (NYSE: HG; “Hamilton” or the “Company”) today announced financial results for the third quarter ended September 30, 2025.

Commenting on the results, Pina Albo, CEO of Hamilton, said:

“Hamilton’s strong quarterly performance, highlighted by net income of $136 million and an annualized return on average equity of 21%, resulted in 6% growth in book value per share for the quarter and 18% for the year to date.

Our combined ratio of 87.8%, which resulted in $64 million of underwriting income, is a testament to our talented global team: a group of professionals who know how to navigate a market requiring both discipline and expertise. Our investment results were also impressive, with both our traditional fixed income portfolio and the Two Sigma Hamilton Fund posting solid returns.

I am very pleased with Hamilton’s financial results for the third quarter of 2025, as they demonstrate a strong synergy between underwriting and investment performance.”

Consolidated Highlights – Third Quarter

•Net income of $136.2 million, or $1.32 per diluted share and operating income of $123.1 million, or $1.20 per diluted share;

•Annualized return on average equity of 20.9% and annualized operating return on average equity of 18.9%;

•Gross premiums written of $698.8 million, an increase of 26.3% compared to the third quarter of 2024;

•Net premiums earned of $523.0 million, an increase of 16.5% compared to the third quarter of 2024;

•Combined ratio of 87.8%;

•Underwriting income of $64.1 million;

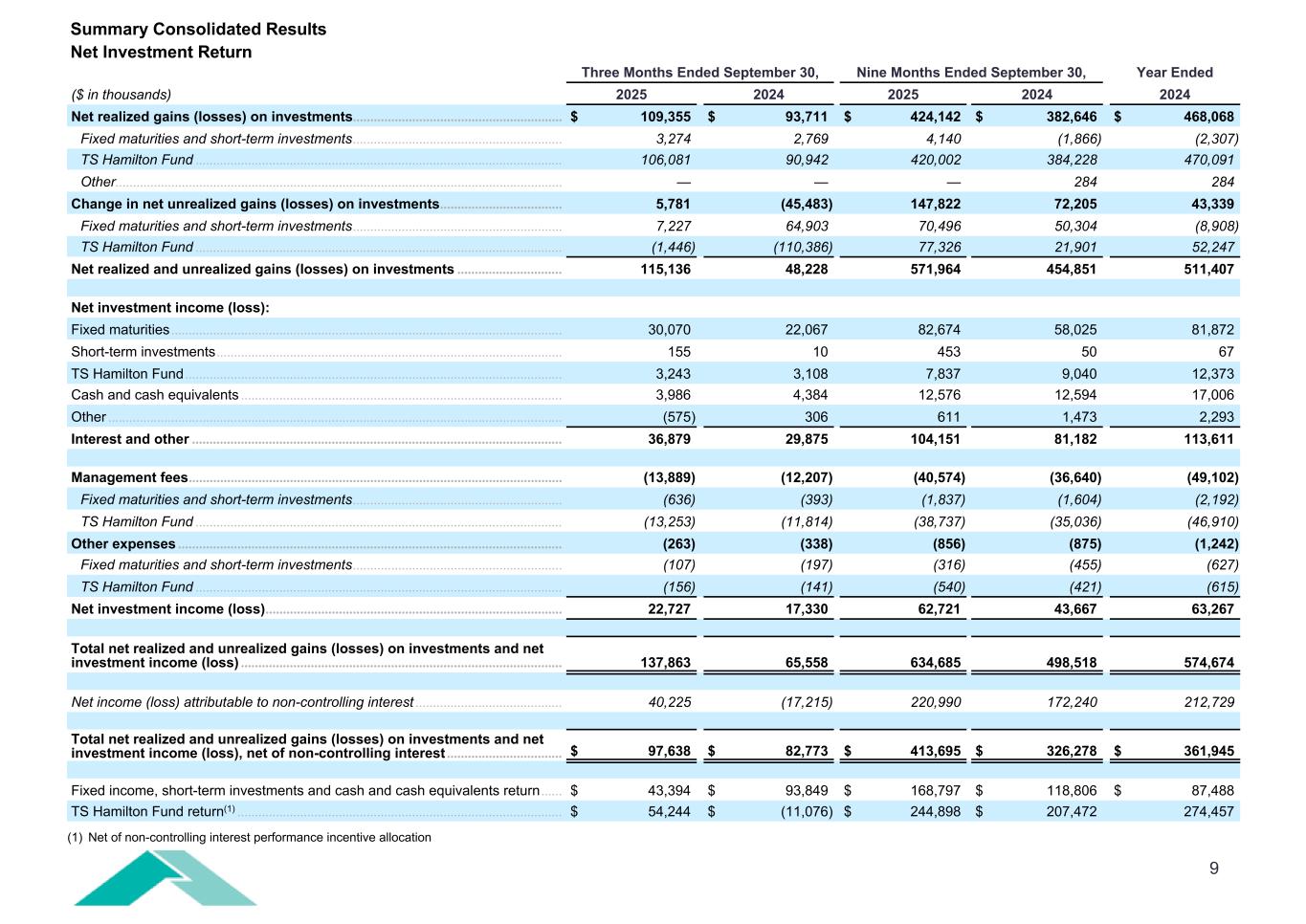

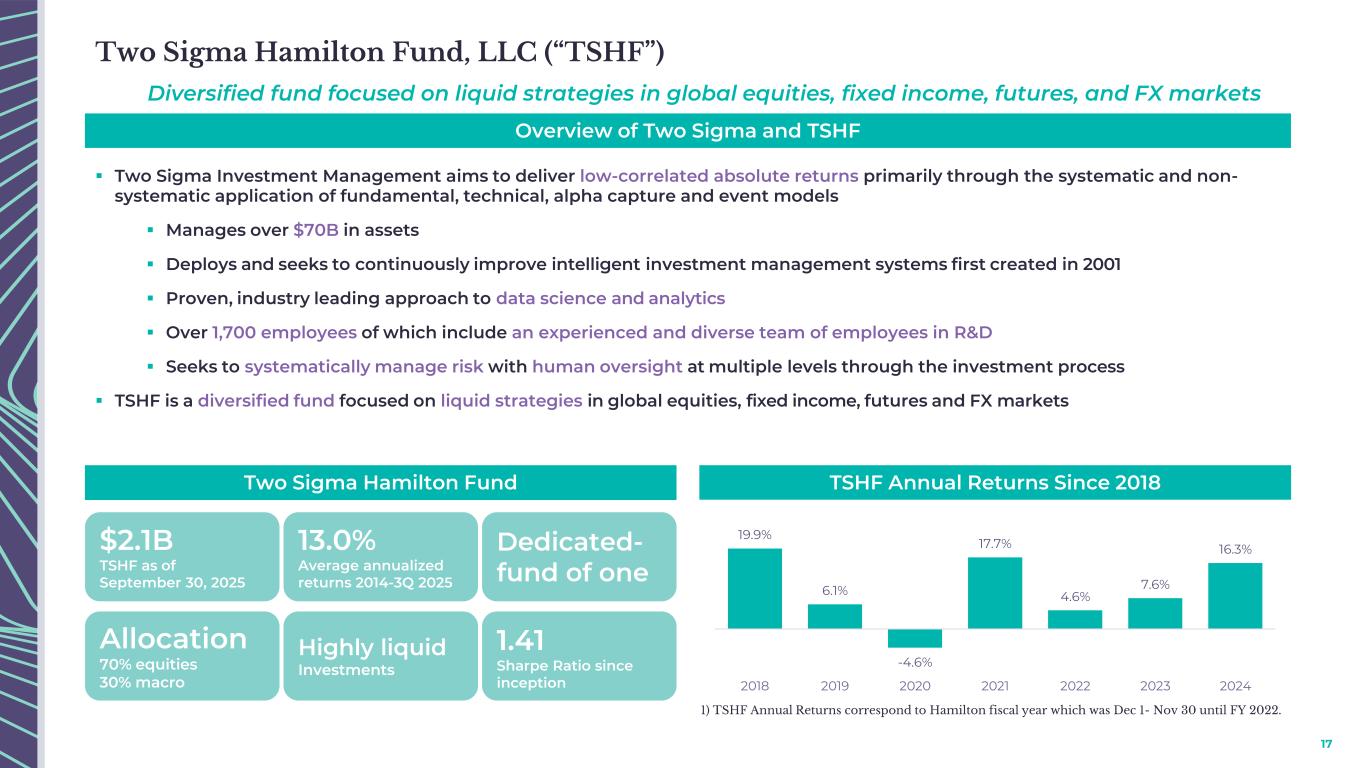

•Net investment income of $97.6 million, comprised of Two Sigma Hamilton Fund returns of $54.2 million, and fixed income, short term and cash and cash equivalents returns of $43.4 million; and

•Repurchased common shares of $40.5 million in the third quarter of 2025.

Consolidated Highlights – Year to Date

•Net income of $404.5 million, or $3.88 per diluted share and operating income of $334.3 million, or $3.20 per diluted share;

•Annualized return on average equity of 21.6% and annualized operating return on average equity of 17.9%;

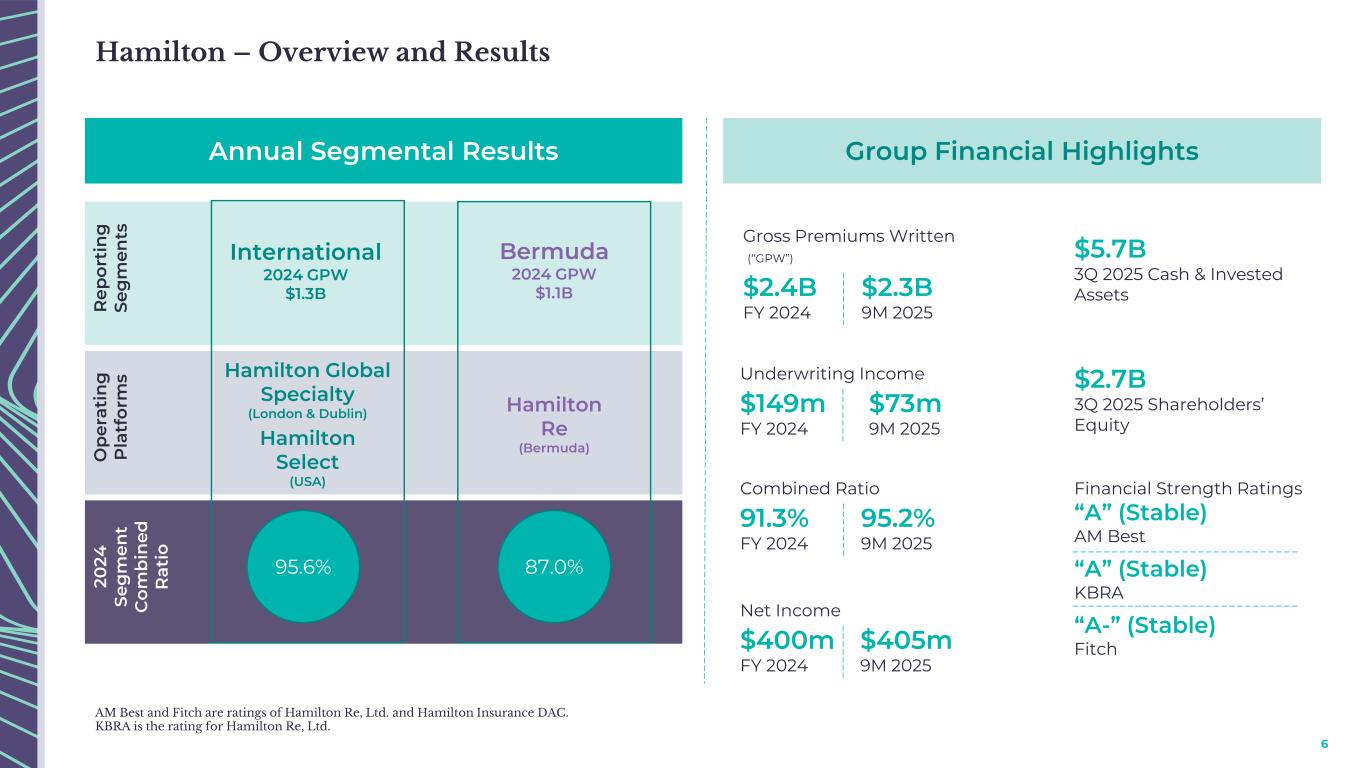

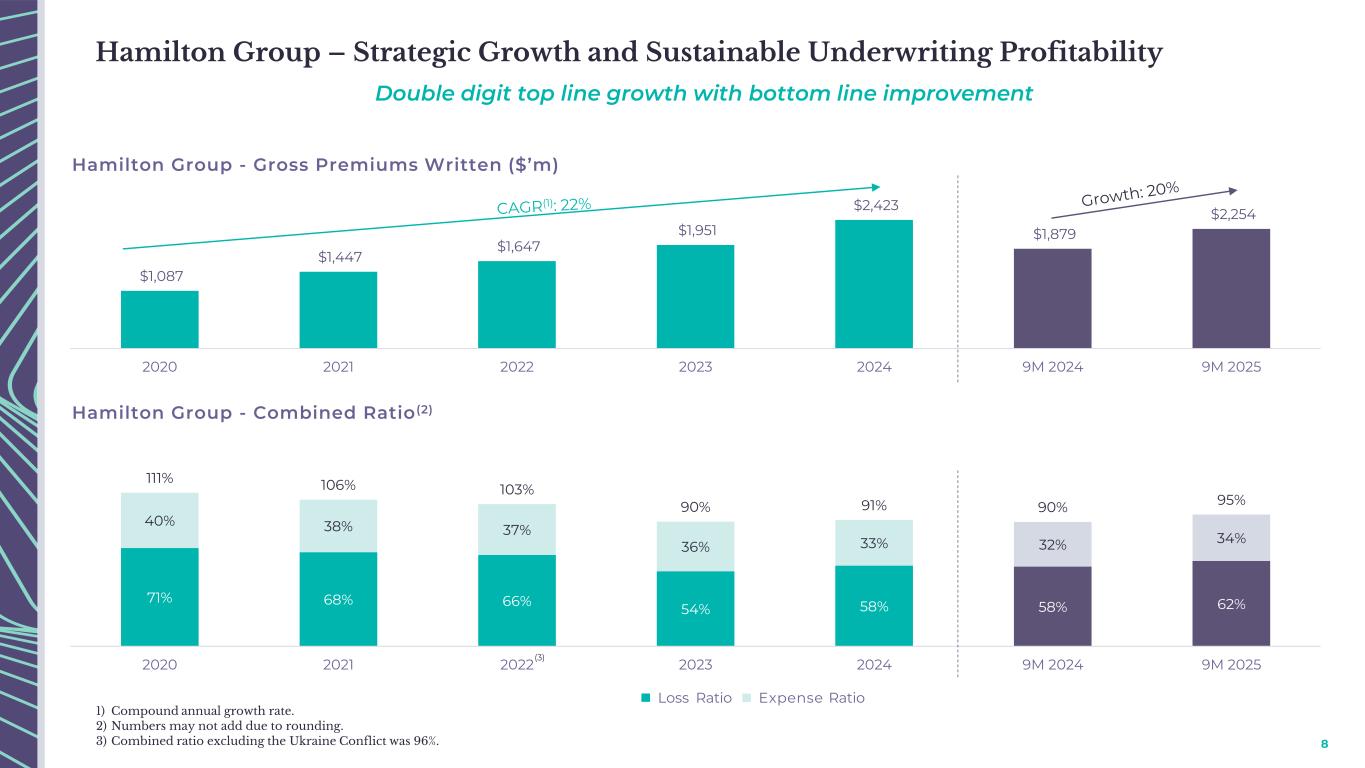

•Gross premiums written of $2.3 billion, an increase of 20.0% compared to the same period in 2024;

•Net premiums earned of $1.5 billion, an increase of 22.4% compared to the same period in 2024;

•Combined ratio of 95.2%;

•Underwriting income of $73.3 million;

•California wildfires losses of $142.8 million, net of reinsurance and $16.9 million of reinstatement premiums;

•Net investment income of $413.7 million, comprised of Two Sigma Hamilton Fund returns of $244.9 million, and fixed income, short term and cash and cash equivalents returns of $168.8 million;

•Book value per share of $27.06, an increase of 17.9% compared to December 31, 2024; and

•Repurchased common shares of $85.8 million in 2025.

Consolidated Results – Third Quarter

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended |

|

|

|

|

|

|

|

| ($ in thousands, except for per share amounts and percentages) |

September 30, 2025 |

|

September 30, 2024 |

|

Change |

|

|

|

|

|

|

|

| Gross premiums written |

$ |

698,845 |

|

$ |

553,401 |

|

$ |

145,444 |

|

|

|

|

|

|

|

| Net premiums written |

578,981 |

|

477,896 |

|

101,085 |

|

|

|

|

|

|

|

| Net premiums earned |

522,999 |

|

448,795 |

|

74,204 |

|

|

|

|

|

|

|

| Underwriting income (loss) |

$ |

64,089 |

|

$ |

29,094 |

|

$ |

34,995 |

|

|

|

|

|

|

|

| Combined ratio |

87.8% |

|

93.6% |

|

(5.8 pts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) attributable to common shareholders |

$ |

136,200 |

|

$ |

78,250 |

|

$ |

57,950 |

|

|

|

|

|

|

|

| Income (loss) per share attributable to common shareholders - diluted |

$ |

1.32 |

|

$ |

0.74 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Book value per common share |

$ |

27.06 |

|

$ |

22.82 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Return on average common equity - annualized |

20.9% |

|

13.8% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended |

|

|

| Key Ratios |

September 30, 2025 |

|

September 30, 2024 |

|

Change |

|

|

| Attritional loss ratio - current year |

55.4 |

% |

|

53.2 |

% |

|

2.2 |

pts |

|

|

| Attritional loss ratio - prior year |

(2.1 |

%) |

|

(0.7 |

%) |

|

(1.4 |

pts) |

|

|

| Catastrophe loss ratio - current year |

0.0 |

% |

|

11.5 |

% |

|

(11.5 |

pts) |

|

|

| Catastrophe loss ratio - prior year |

0.0 |

% |

|

(3.0 |

%) |

|

3.0 |

pts |

|

|

| Loss and loss adjustment expense ratio |

53.3 |

% |

|

61.0 |

% |

|

(7.7 |

pts) |

|

|

| Acquisition cost ratio |

24.0 |

% |

|

22.8 |

% |

|

1.2 |

pts |

|

|

| Other underwriting expense ratio |

10.5 |

% |

|

9.8 |

% |

|

0.7 |

pts |

|

|

| Combined ratio |

87.8 |

% |

|

93.6 |

% |

|

(5.8 |

pts) |

|

|

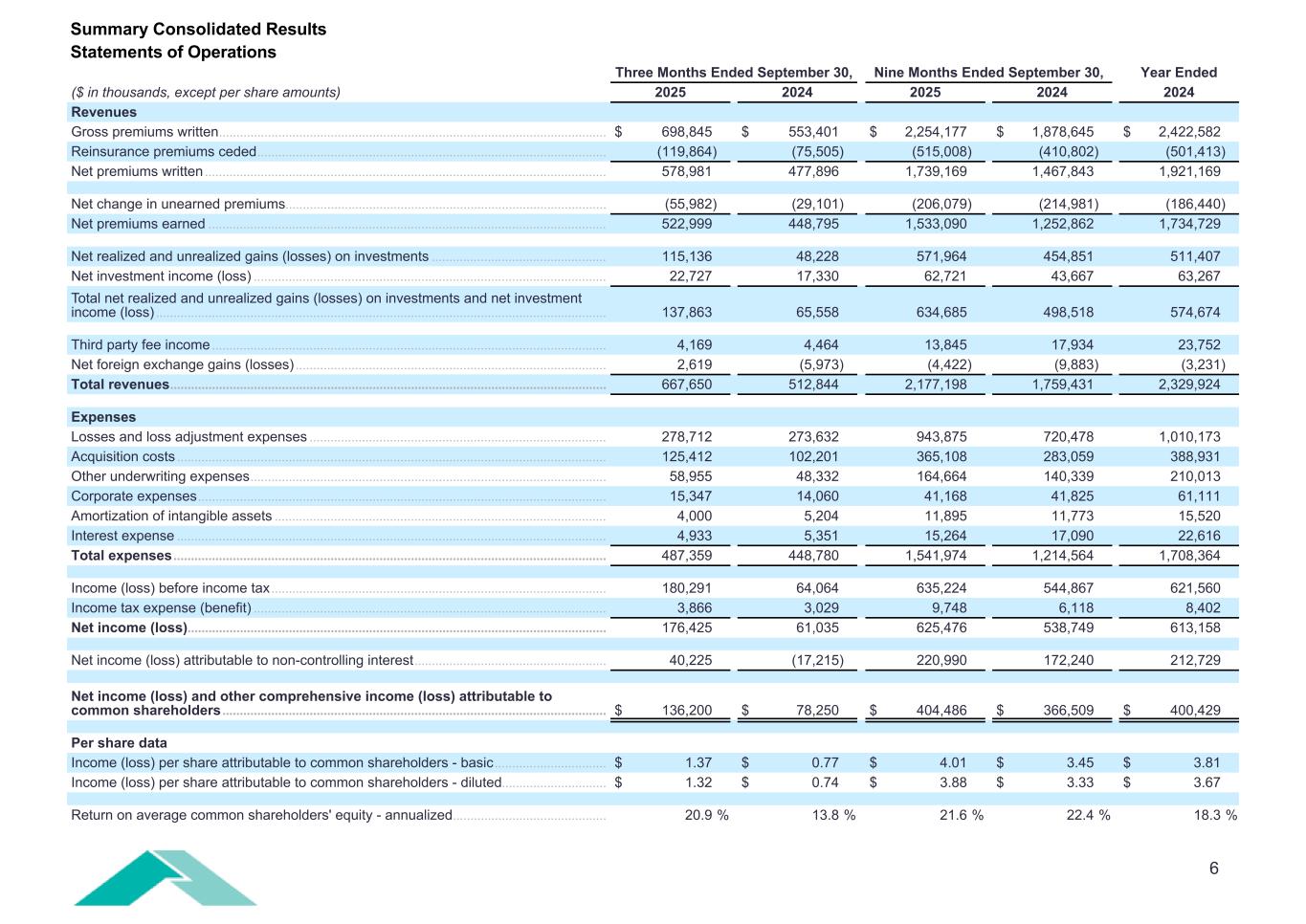

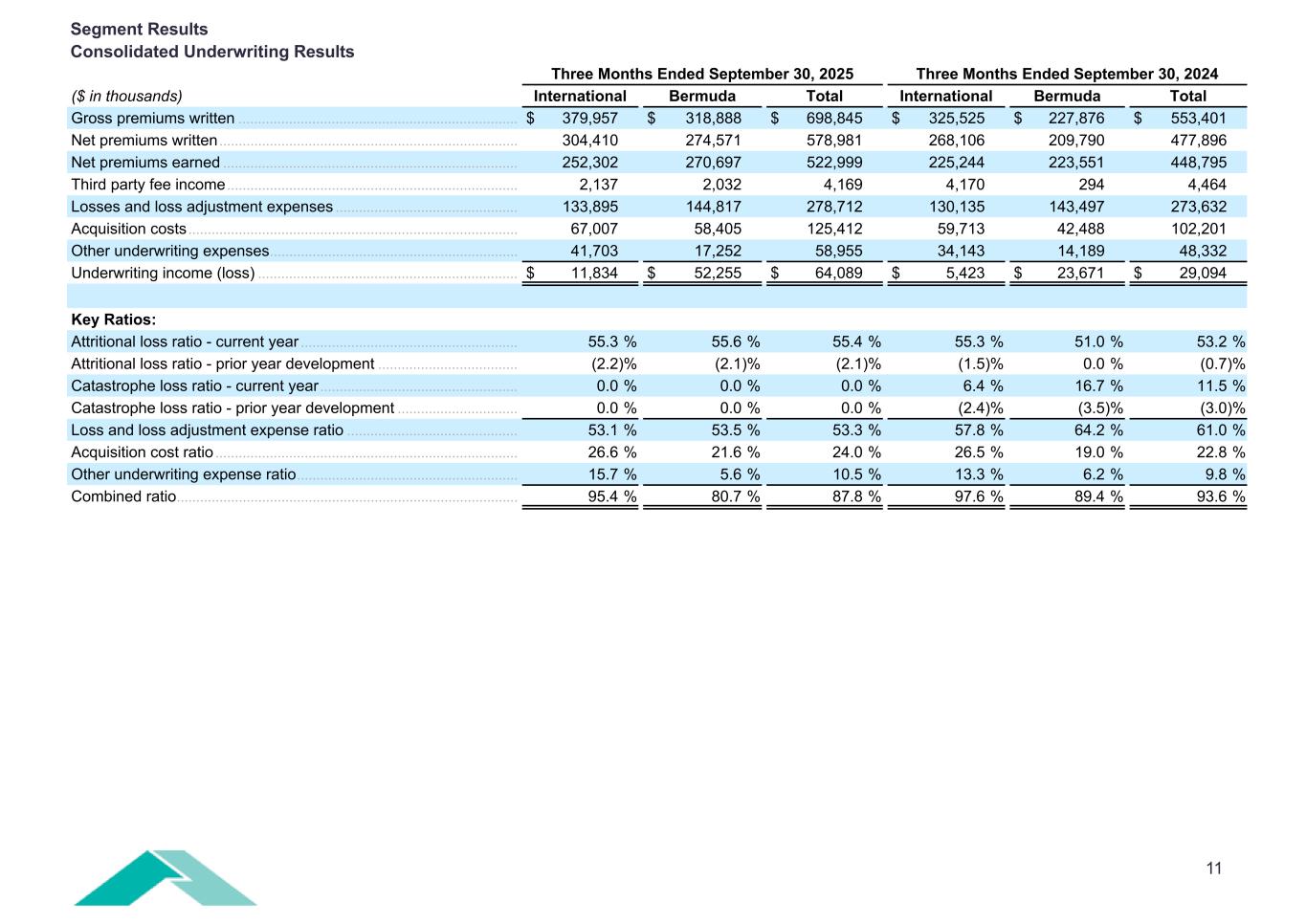

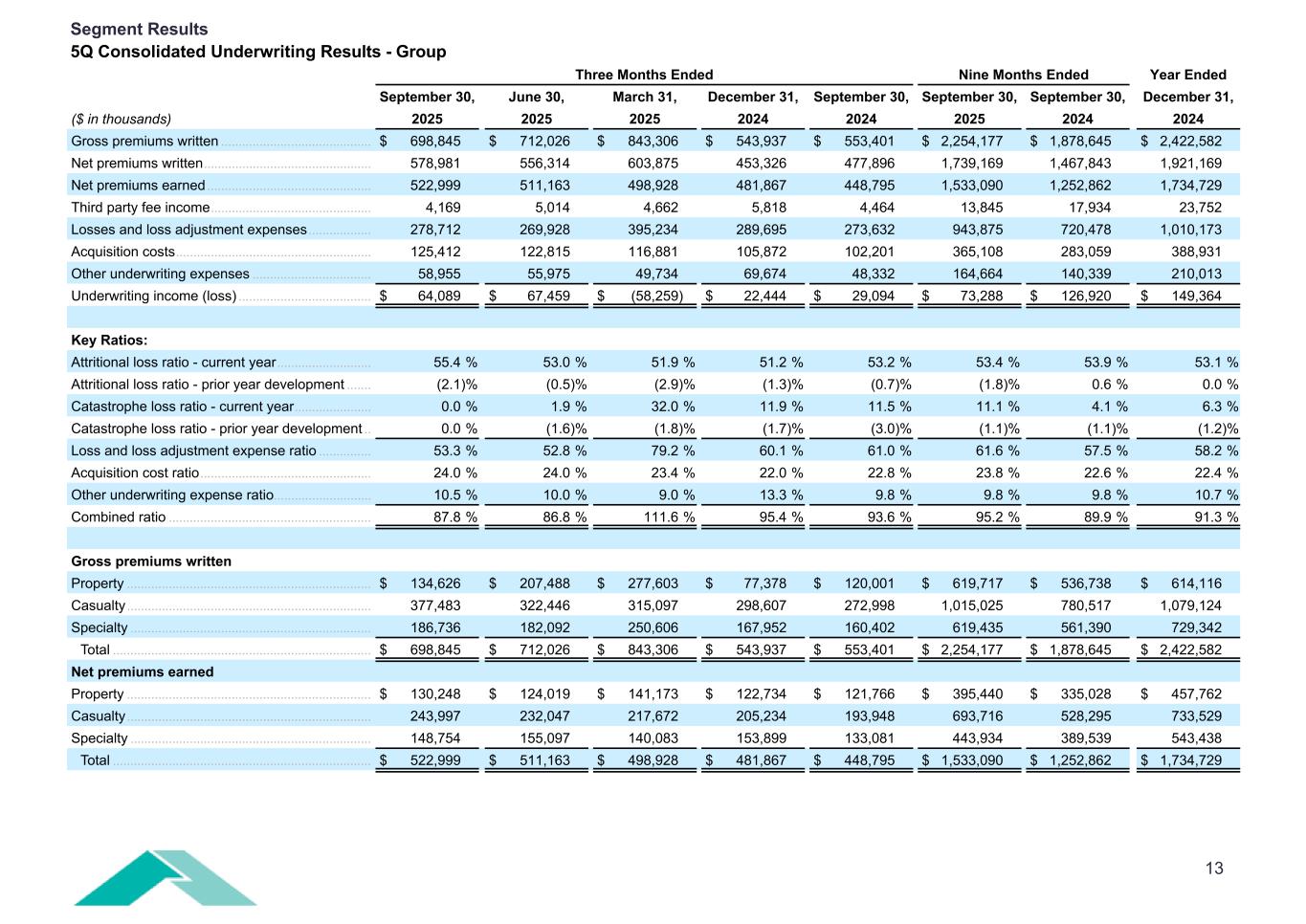

•Gross premiums written increased by $145.4 million, or 26.3%, to $698.8 million with an increase of $91.0 million, or 39.9%, in the Bermuda Segment, and $54.4 million, or 16.7%, in the International Segment.

•Net premiums written increased by $101.1 million, or 21.2%, to $579.0 million with an increase of $64.8 million, or 30.9%, in the Bermuda Segment, and $36.3 million, or 13.5%, in the International Segment.

•Net premiums earned increased by $74.2 million, or 16.5%, to $523.0 million with an increase of $47.1 million, or 21.1%, in the Bermuda Segment, and $27.1 million, or 12.0%, in the International Segment.

•The attritional loss ratio (current year), net of reinsurance, was 55.4%. The increase of 2.2 points compared to the same period in 2024 was primarily driven by a large loss in our Bermuda specialty and property reinsurance classes and a change in business mix, including increased casualty reinsurance business.

•Net favorable attritional prior year reserve development, net of reinsurance, was $11.2 million, primarily driven by favorable development in property and specialty classes.

•Catastrophe losses (current and prior year), net of reinsurance, were $Nil.

•The acquisition cost ratio increased by 1.2 points compared to the same period in 2024, primarily driven by a change in business mix.

•The other underwriting expense ratio increased modestly by 0.7 points compared to the same period in 2024.

International Segment Underwriting Results – Third Quarter

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| International Segment |

For the Three Months Ended |

|

|

|

|

|

|

| ($ in thousands, except for percentages) |

September 30, 2025 |

|

September 30, 2024 |

|

Change |

|

|

|

|

|

|

| Gross premiums written |

$ |

379,957 |

|

$ |

325,525 |

|

$ |

54,432 |

|

|

|

|

|

|

| Net premiums written |

304,410 |

|

268,106 |

|

36,304 |

|

|

|

|

|

|

| Net premiums earned |

252,302 |

|

225,244 |

|

27,058 |

|

|

|

|

|

|

| Underwriting income (loss) |

$ |

11,834 |

|

$ |

5,423 |

|

$ |

6,411 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Key Ratios |

|

|

|

|

|

|

|

|

|

|

|

| Attritional loss ratio - current year |

55.3 |

% |

|

55.3 |

% |

|

0.0 |

pts |

|

|

|

|

|

|

| Attritional loss ratio - prior year |

(2.2 |

%) |

|

(1.5 |

%) |

|

(0.7 |

pts) |

|

|

|

|

|

|

| Catastrophe loss ratio - current year |

0.0 |

% |

|

6.4 |

% |

|

(6.4 |

pts) |

|

|

|

|

|

|

| Catastrophe loss ratio - prior year |

0.0 |

% |

|

(2.4 |

%) |

|

2.4 |

pts |

|

|

|

|

|

|

| Loss and loss adjustment expense ratio |

53.1 |

% |

|

57.8 |

% |

|

(4.7 |

pts) |

|

|

|

|

|

|

| Acquisition cost ratio |

26.6 |

% |

|

26.5 |

% |

|

0.1 |

pts |

|

|

|

|

|

|

| Other underwriting expense ratio |

15.7 |

% |

|

13.3 |

% |

|

2.4 |

pts |

|

|

|

|

|

|

| Combined ratio |

95.4 |

% |

|

97.6 |

% |

|

(2.2 |

pts) |

|

|

|

|

|

|

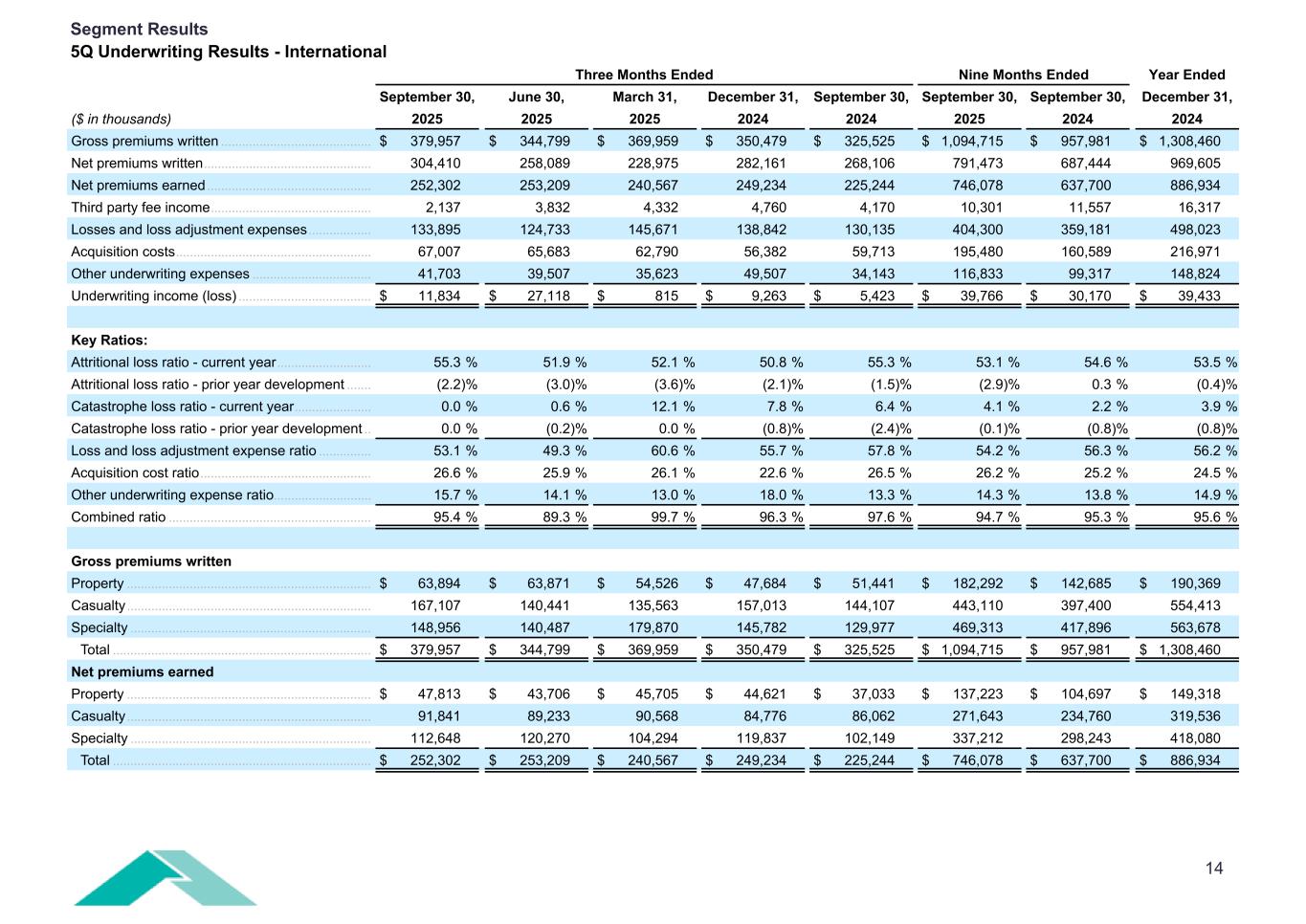

•Gross premiums written increased by $54.4 million, or 16.7%, to $380.0 million, primarily driven by growth in both new and existing business in casualty, specialty and property insurance classes.

•The attritional loss ratio (current year), net of reinsurance, was 55.3%.

•Net favorable attritional prior year reserve development, net of reinsurance, was $5.5 million, primarily driven by favorable development in property classes.

•Catastrophe losses (current and prior year), net of reinsurance, were $Nil.

•The acquisition cost ratio was flat at 26.6%, compared to the same period in 2024.

•The other underwriting expense ratio increased by 2.4 points compared to the same period in 2024, primarily driven by a decrease in third party fee income, partially offset by growth in the premium base.

Bermuda Segment Underwriting Results – Third Quarter

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Bermuda Segment |

For the Three Months Ended |

|

|

|

|

| ($ in thousands, except for percentages) |

September 30, 2025 |

|

September 30, 2024 |

|

Change |

|

|

|

|

| Gross premiums written |

$ |

318,888 |

|

$ |

227,876 |

|

$ |

91,012 |

|

|

|

|

| Net premiums written |

274,571 |

|

209,790 |

|

64,781 |

|

|

|

|

| Net premiums earned |

270,697 |

|

223,551 |

|

47,146 |

|

|

|

|

| Underwriting income (loss) |

$ |

52,255 |

|

$ |

23,671 |

|

$ |

28,584 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Key Ratios |

|

|

|

|

|

|

|

|

|

| Attritional loss ratio - current year |

55.6 |

% |

|

51.0 |

% |

|

4.6 |

pts |

|

|

|

|

| Attritional loss ratio - prior year |

(2.1 |

%) |

|

0.0 |

% |

|

(2.1 |

pts) |

|

|

|

|

| Catastrophe loss ratio - current year |

0.0 |

% |

|

16.7 |

% |

|

(16.7 |

pts) |

|

|

|

|

| Catastrophe loss ratio - prior year |

0.0 |

% |

|

(3.5 |

%) |

|

3.5 |

pts |

|

|

|

|

| Loss and loss adjustment expense ratio |

53.5 |

% |

|

64.2 |

% |

|

(10.7 |

pts) |

|

|

|

|

| Acquisition cost ratio |

21.6 |

% |

|

19.0 |

% |

|

2.6 |

pts |

|

|

|

|

| Other underwriting expense ratio |

5.6 |

% |

|

6.2 |

% |

|

(0.6 |

pts) |

|

|

|

|

| Combined ratio |

80.7 |

% |

|

89.4 |

% |

|

(8.7 |

pts) |

|

|

|

|

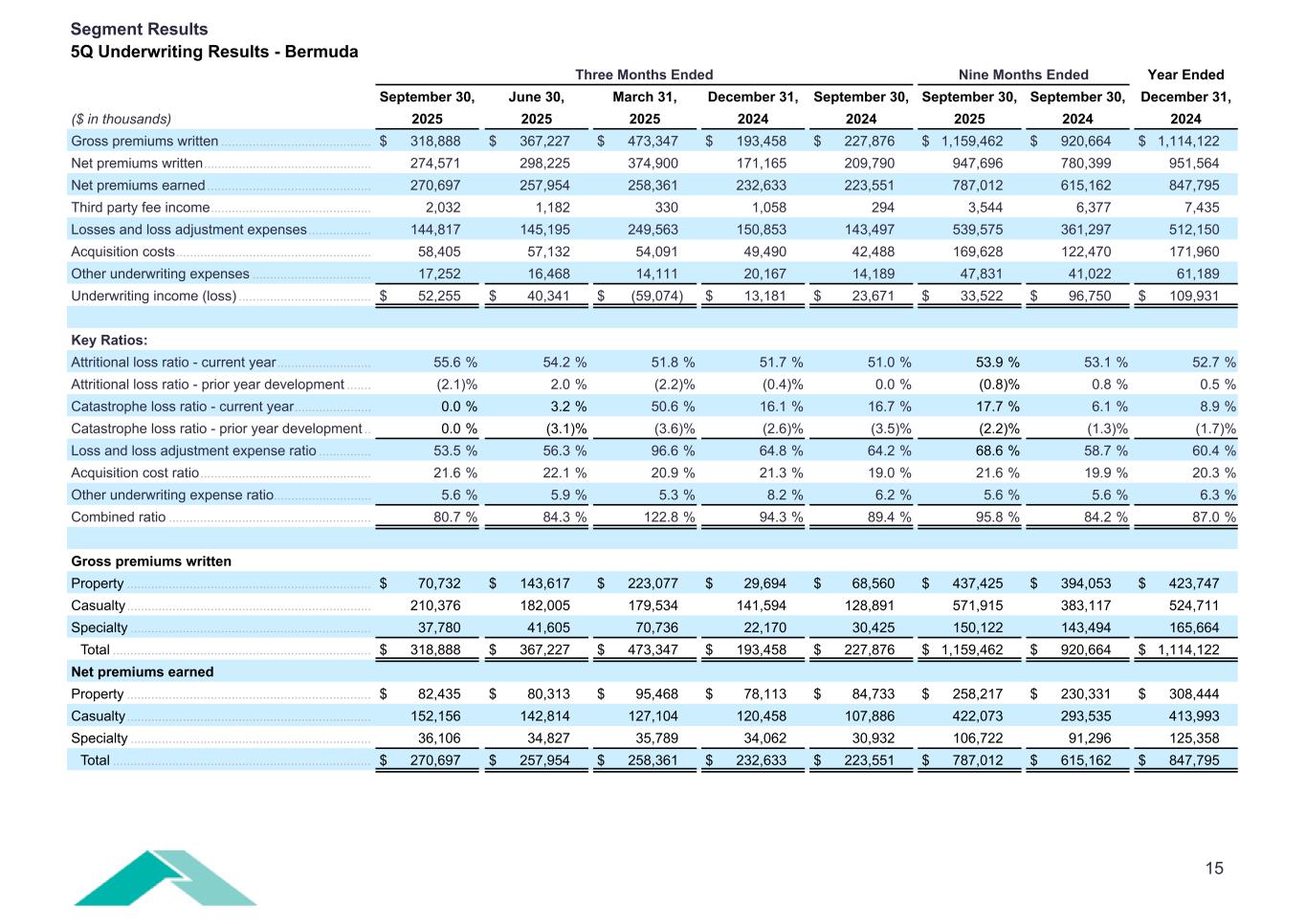

•Gross premiums written increased by $91.0 million, or 39.9%, to $318.9 million, primarily driven by growth in both new and existing business in casualty and specialty reinsurance classes.

•The attritional loss ratio (current year), net of reinsurance, was 55.6%. The increase of 4.6 points compared to the same period in 2024 was primarily driven by a large loss in our specialty and property reinsurance classes and a change in business mix, including increased casualty reinsurance business.

•Net favorable attritional prior year reserve development, net of reinsurance, was $5.7 million, primarily driven by favorable development in specialty and property classes.

•Catastrophe losses (current and prior year), net of reinsurance, were $Nil.

•The acquisition cost ratio increased by 2.6 points compared to the same period in 2024, primarily driven by a change in the business mix.

•The other underwriting expense ratio decreased by 0.6 points compared to the same period in 2024, primarily driven by an increase in net premiums earned and increased third party fee income, which offsets the other underwriting expense ratio.

Consolidated Underwriting Results – Year to Date

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Nine Months Ended |

|

|

|

|

|

| ($ in thousands, except for per share amounts and percentages) |

September 30, 2025 |

|

September 30, 2024 |

|

Change |

|

|

|

|

|

| Gross premiums written |

$ |

2,254,177 |

|

$ |

1,878,645 |

|

$ |

375,532 |

|

|

|

|

|

| Net premiums written |

1,739,169 |

|

1,467,843 |

|

271,326 |

|

|

|

|

|

| Net premiums earned |

1,533,090 |

|

1,252,862 |

|

280,228 |

|

|

|

|

|

| Underwriting income (loss) |

$ |

73,288 |

|

$ |

126,920 |

|

$ |

(53,632) |

|

|

|

|

|

| Combined ratio |

95.2% |

|

89.9% |

|

5.3 pts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) attributable to common shareholders |

$ |

404,486 |

|

$ |

366,509 |

|

$ |

37,977 |

|

|

|

|

|

| Income (loss) per share attributable to common shareholders - diluted |

$ |

3.88 |

|

$ |

3.33 |

|

|

|

|

|

|

|

| Book value per common share |

$ |

27.06 |

|

$ |

22.82 |

|

|

|

|

|

|

|

| Change in book value per share |

17.9% |

|

22.8% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Return on average common equity - annualized |

21.6% |

|

22.4% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Nine Months Ended |

|

|

| Key Ratios |

September 30, 2025 |

|

September 30, 2024 |

|

Change |

|

|

| Attritional loss ratio - current year |

53.4 |

% |

|

53.9 |

% |

|

(0.5 |

pts) |

|

|

| Attritional loss ratio - prior year |

(1.8 |

%) |

|

0.6 |

% |

|

(2.4 |

pts) |

|

|

| Catastrophe loss ratio - current year |

11.1 |

% |

|

4.1 |

% |

|

7.0 |

pts |

|

|

| Catastrophe loss ratio - prior year |

(1.1 |

%) |

|

(1.1 |

%) |

|

0.0 |

pts |

|

|

| Loss and loss adjustment expense ratio |

61.6 |

% |

|

57.5 |

% |

|

4.1 |

pts |

|

|

| Acquisition cost ratio |

23.8 |

% |

|

22.6 |

% |

|

1.2 |

pts |

|

|

| Other underwriting expense ratio |

9.8 |

% |

|

9.8 |

% |

|

0.0 |

pts |

|

|

| Combined ratio |

95.2 |

% |

|

89.9 |

% |

|

5.3 |

pts |

|

|

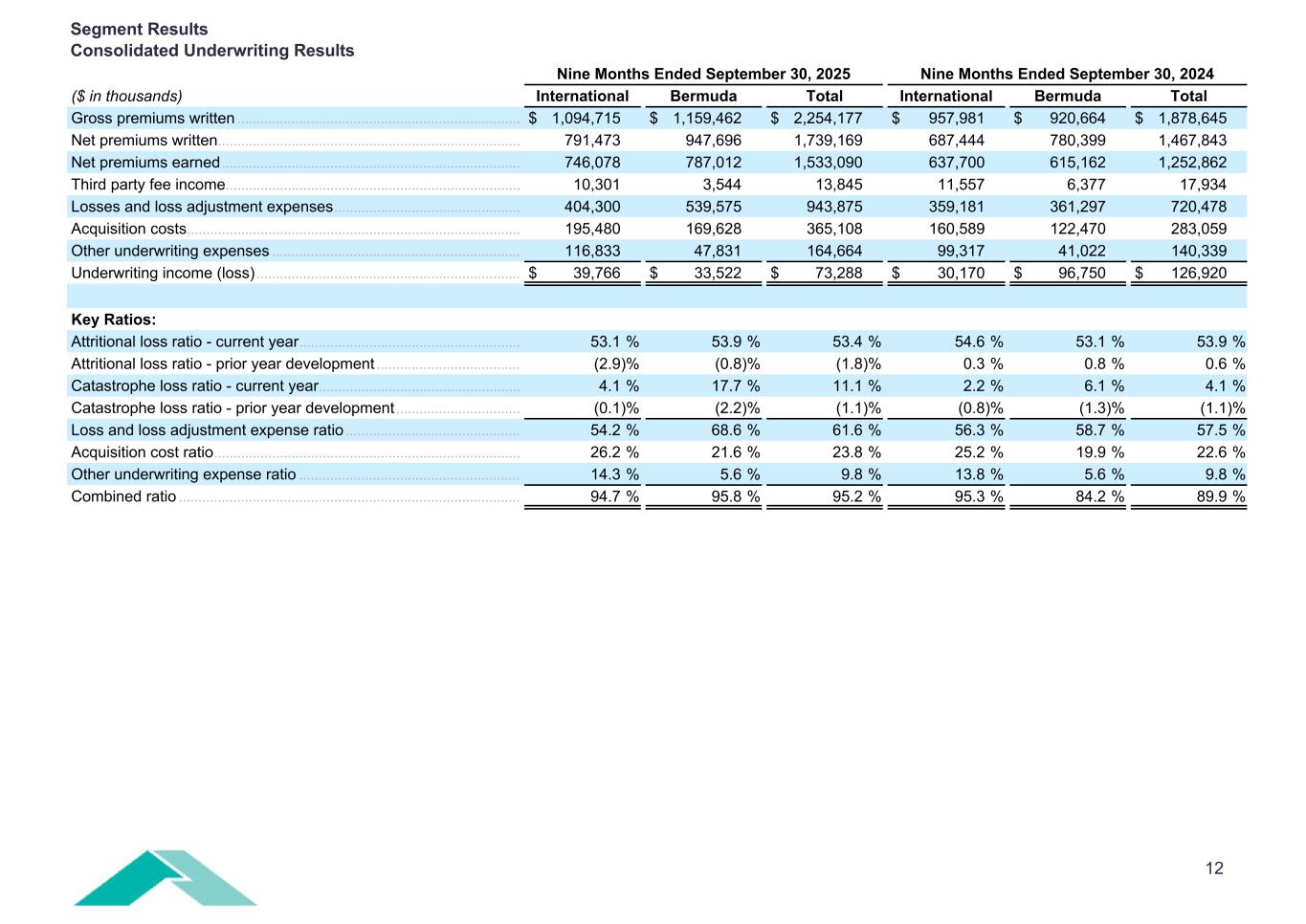

•Gross premiums written increased by $375.5 million, or 20.0%, to $2.3 billion, with an increase of $238.8 million, or 25.9%, in the Bermuda Segment, and $136.7 million, or 14.3%, in the International Segment.

•Net premiums written increased by $271.3 million, or 18.5%, to $1.7 billion, with an increase of $167.3 million, or 21.4%, in the Bermuda Segment, and $104.0 million, or 15.1%, in the International Segment.

•Net premiums earned increased by $280.2 million, or 22.4%, to $1.5 billion, with an increase of $171.9 million, or 27.9%, in the Bermuda Segment, and $108.4 million, or 17.0%, in the International Segment.

•The attritional loss ratio (current year), net of reinsurance, of 53.4% for the nine months ended September 30, 2025 was impacted by two large losses primarily in our Bermuda specialty and property reinsurance classes, in addition to a change in business mix, including an increase in casualty reinsurance business.

•Net favorable attritional prior year reserve development, net of reinsurance, was $28.3 million, primarily driven by favorable development in specialty and property classes, partially offset by unfavorable development in certain casualty classes.

•Catastrophe losses (current and prior year), net of reinsurance, were $152.0 million, driven by the California wildfires ($159.7 million) and severe convective storms ($9.9 million), partially offset by favorable prior year development ($17.6 million).

•The acquisition cost ratio increased by 1.2 points compared to the same period in 2024, primarily due to a change in business mix and higher profit commission costs on certain lines of business.

•The other underwriting expense ratio was flat compared to the same period in 2024.

International Segment Underwriting Results – Year to Date

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| International Segment |

For the Nine Months Ended |

|

|

|

|

|

|

| ($ in thousands, except for percentages) |

September 30, 2025 |

|

September 30, 2024 |

|

Change |

|

|

|

|

|

|

| Gross premiums written |

$ |

1,094,715 |

|

$ |

957,981 |

|

$ |

136,734 |

|

|

|

|

|

|

| Net premiums written |

791,473 |

|

687,444 |

|

104,029 |

|

|

|

|

|

|

| Net premiums earned |

746,078 |

|

637,700 |

|

108,378 |

|

|

|

|

|

|

| Underwriting income (loss) |

$ |

39,766 |

|

$ |

30,170 |

|

$ |

9,596 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Key Ratios |

|

|

|

|

|

|

|

|

|

|

|

| Attritional loss ratio - current year |

53.1 |

% |

|

54.6 |

% |

|

(1.5 |

pts) |

|

|

|

|

|

|

| Attritional loss ratio - prior year |

(2.9 |

%) |

|

0.3 |

% |

|

(3.2 |

pts) |

|

|

|

|

|

|

| Catastrophe loss ratio - current year |

4.1 |

% |

|

2.2 |

% |

|

1.9 |

pts |

|

|

|

|

|

|

| Catastrophe loss ratio - prior year |

(0.1 |

%) |

|

(0.8 |

%) |

|

0.7 |

pts |

|

|

|

|

|

|

| Loss and loss adjustment expense ratio |

54.2 |

% |

|

56.3 |

% |

|

(2.1 |

pts) |

|

|

|

|

|

|

| Acquisition cost ratio |

26.2 |

% |

|

25.2 |

% |

|

1.0 |

pts |

|

|

|

|

|

|

| Other underwriting expense ratio |

14.3 |

% |

|

13.8 |

% |

|

0.5 |

pts |

|

|

|

|

|

|

| Combined ratio |

94.7 |

% |

|

95.3 |

% |

|

(0.6 |

pts) |

|

|

|

|

|

|

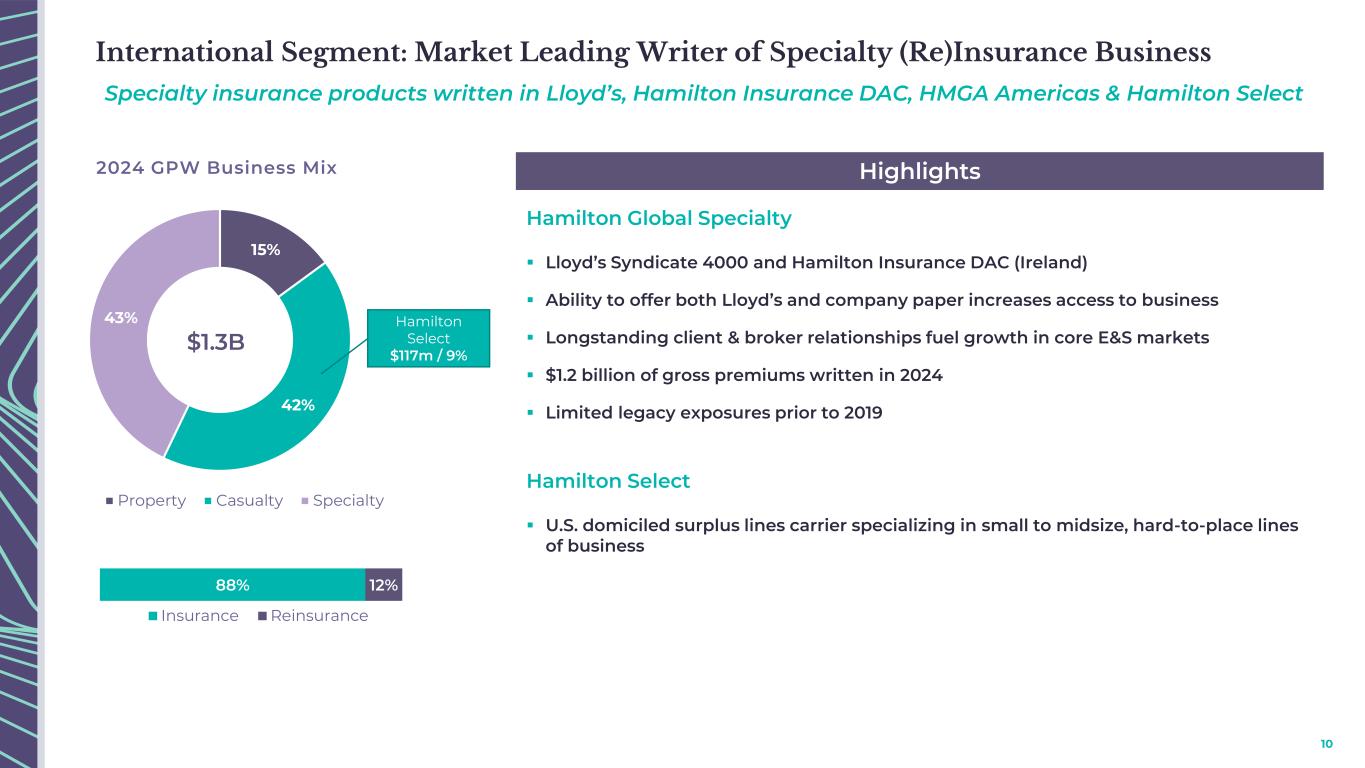

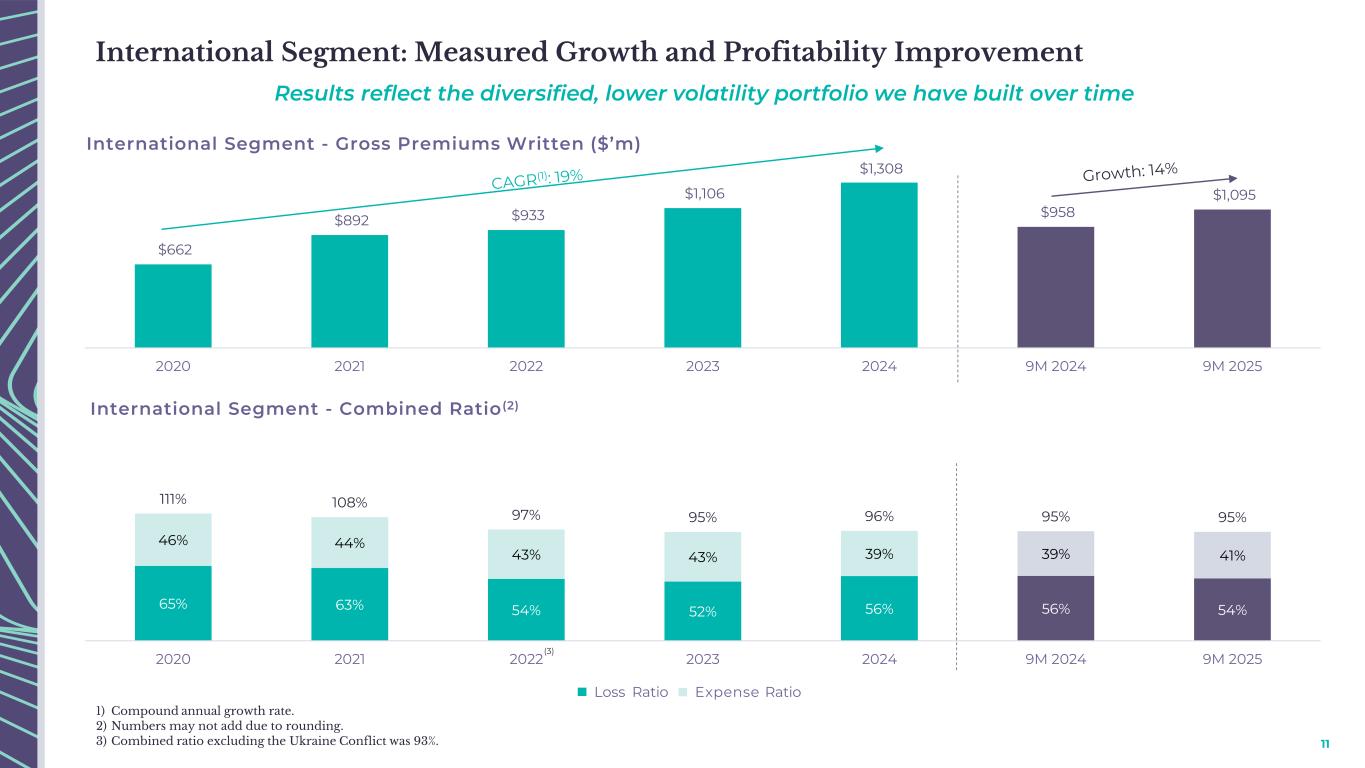

•Gross premiums written increased by $136.7 million, or 14.3%, to $1.1 billion, primarily driven by growth in both new and existing business in casualty, specialty and property insurance classes.

•The attritional loss ratio (current year), net of reinsurance, was 53.1%. The decrease of 1.5 points was primarily driven by the reduced impact of large losses, compared to the same period in 2024, which was impacted by the Baltimore Bridge collapse.

•Net favorable attritional prior year reserve development, net of reinsurance, was $21.9 million, primarily driven by favorable development in property, specialty and casualty classes.

•Catastrophe losses (current and prior year), net of reinsurance, were $30.2 million, driven by the California wildfires and severe convective storms, partially offset by favorable prior year development.

•The acquisition cost ratio increased by 1.0 point compared to the same period in 2024, primarily driven by a change in business mix and higher profit commissions.

•The other underwriting expense ratio increased modestly by 0.5 points compared to the same period in 2024.

Bermuda Segment Underwriting Results – Year to Date

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Bermuda Segment |

For the Nine Months Ended |

|

|

|

|

| ($ in thousands, except for percentages) |

September 30, 2025 |

|

September 30, 2024 |

|

Change |

|

|

|

|

| Gross premiums written |

$ |

1,159,462 |

|

$ |

920,664 |

|

$ |

238,798 |

|

|

|

|

| Net premiums written |

947,696 |

|

780,399 |

|

167,297 |

|

|

|

|

| Net premiums earned |

787,012 |

|

615,162 |

|

171,850 |

|

|

|

|

| Underwriting income (loss) |

$ |

33,522 |

|

$ |

96,750 |

|

$ |

(63,228) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Key Ratios |

|

|

|

|

|

|

|

|

|

| Attritional loss ratio - current year |

53.9 |

% |

|

53.1 |

% |

|

0.8 |

pts |

|

|

|

|

| Attritional loss ratio - prior year |

(0.8 |

%) |

|

0.8 |

% |

|

(1.6 |

pts) |

|

|

|

|

| Catastrophe loss ratio - current year |

17.7 |

% |

|

6.1 |

% |

|

11.6 |

pts |

|

|

|

|

| Catastrophe loss ratio - prior year |

(2.2 |

%) |

|

(1.3 |

%) |

|

(0.9 |

pts) |

|

|

|

|

| Loss and loss adjustment expense ratio |

68.6 |

% |

|

58.7 |

% |

|

9.9 |

pts |

|

|

|

|

| Acquisition cost ratio |

21.6 |

% |

|

19.9 |

% |

|

1.7 |

pts |

|

|

|

|

| Other underwriting expense ratio |

5.6 |

% |

|

5.6 |

% |

|

0.0 |

pts |

|

|

|

|

| Combined ratio |

95.8 |

% |

|

84.2 |

% |

|

11.6 |

pts |

|

|

|

|

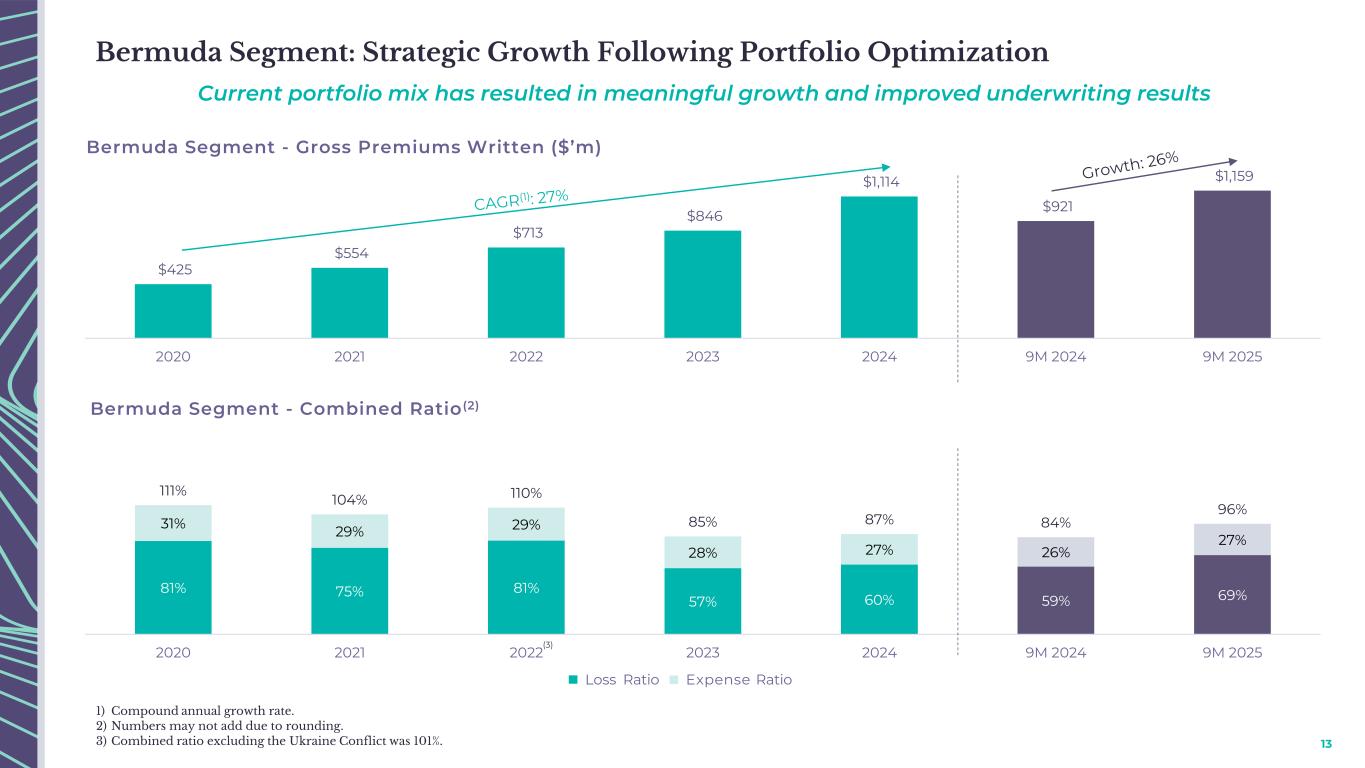

•Gross premiums written increased by $238.8 million, or 25.9%, to $1.2 billion, primarily driven by growth in both new and existing business in casualty and property reinsurance classes.

•The attritional loss ratio (current year), net of reinsurance, of 53.9% for the nine months ended September 30, 2025 was impacted by two large losses in our specialty and property reinsurance classes, in addition to a change in business mix, including an increase in casualty reinsurance business.

•Net favorable attritional prior year reserve development, net of reinsurance, was $6.4 million, primarily driven by favorable development in specialty and property classes, partially offset by unfavorable development in certain casualty classes.

•Catastrophe losses (current and prior year), net of reinsurance, were $121.9 million, primarily driven by the California wildfires and severe convective storms, partially offset by favorable prior year development.

•The acquisition cost ratio increased by 1.7 points compared to the same period in 2024 driven by a change in the business mix.

•The other underwriting expense ratio was flat compared to the same period in 2024.

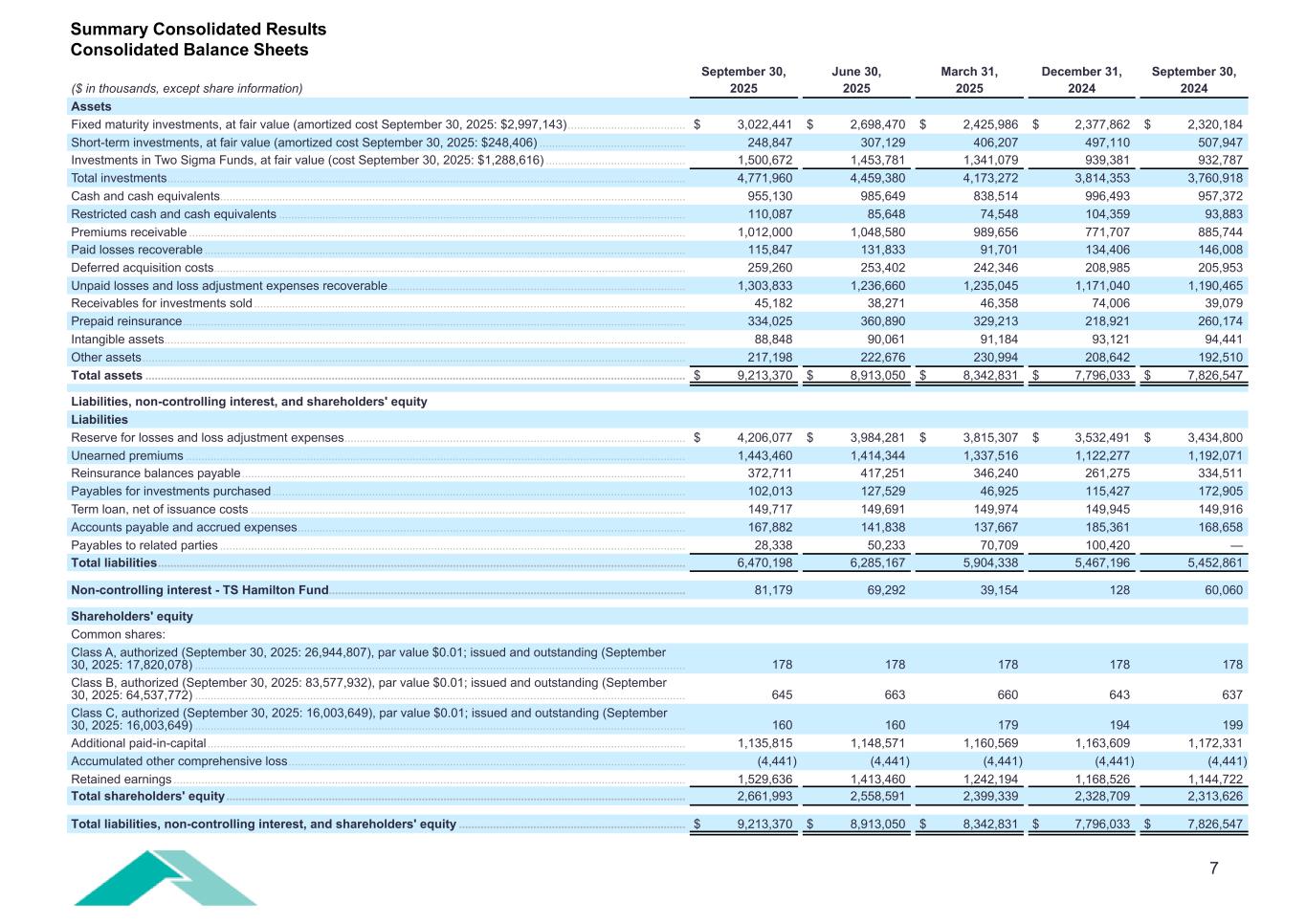

Investments and Shareholders’ Equity as of September 30, 2025

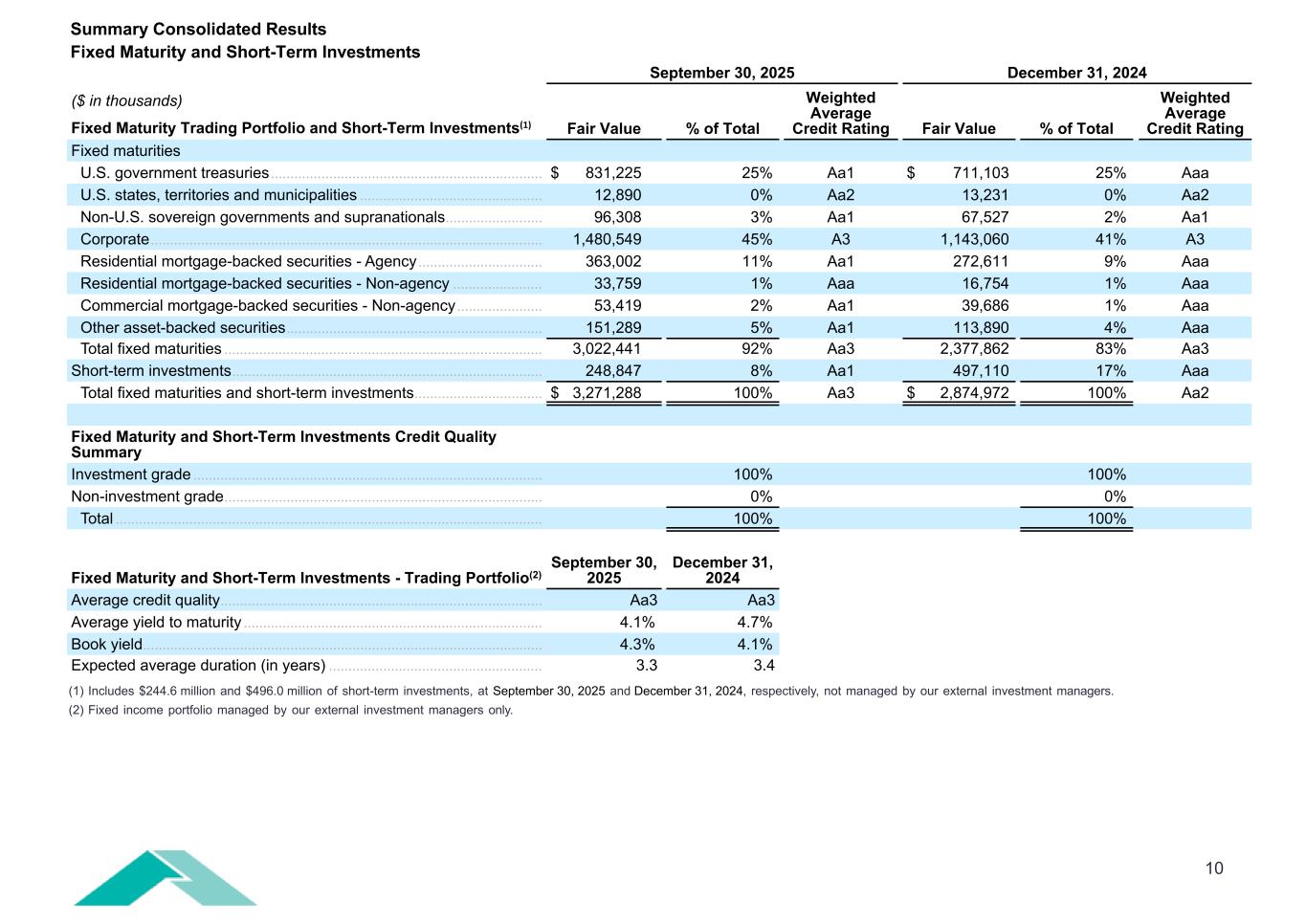

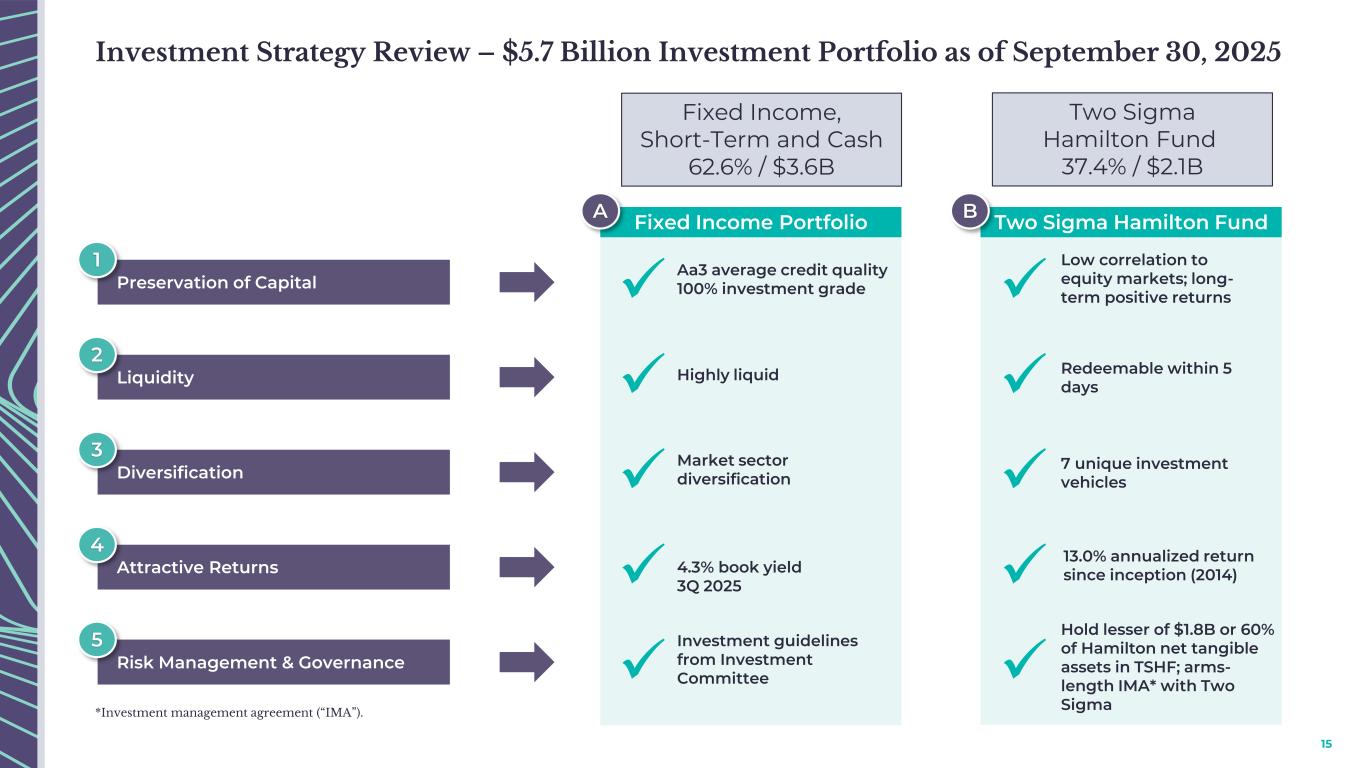

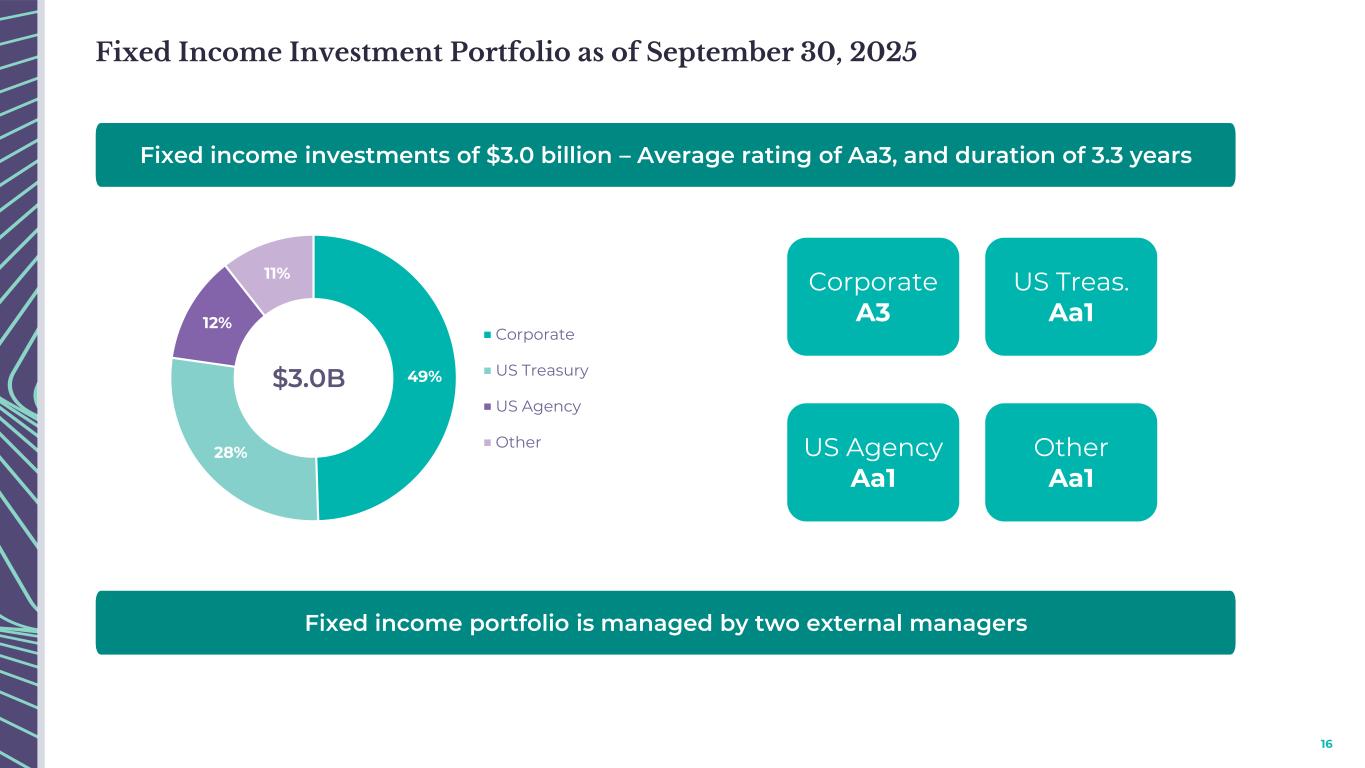

•Total invested assets and cash of $5.7 billion compared to $4.8 billion at December 31, 2024.

•Total shareholders’ equity of $2.7 billion compared to $2.3 billion at December 31, 2024.

•Book value per share of $27.06 compared to $22.95 at December 31, 2024, an increase of 17.9%.

Conference Call Details and Additional Information

Conference Call Information

Hamilton will host a conference call to discuss its financial results on Wednesday, November 5, 2025, at 9:00 a.m. Eastern Time. A live, audio webcast of the conference call can be accessed through the Investors portal of the Company’s website at investors.hamiltongroup.com where a replay of the call will also be available.

For access to the webcast, please log in a few minutes in advance to complete any necessary registration.

Additional Information

In addition to the information provided in the Company's earnings release, we have also made available supplementary financial information and an investor presentation which may be referred to during the conference call and will be available on the Company’s website at investors.hamiltongroup.com.

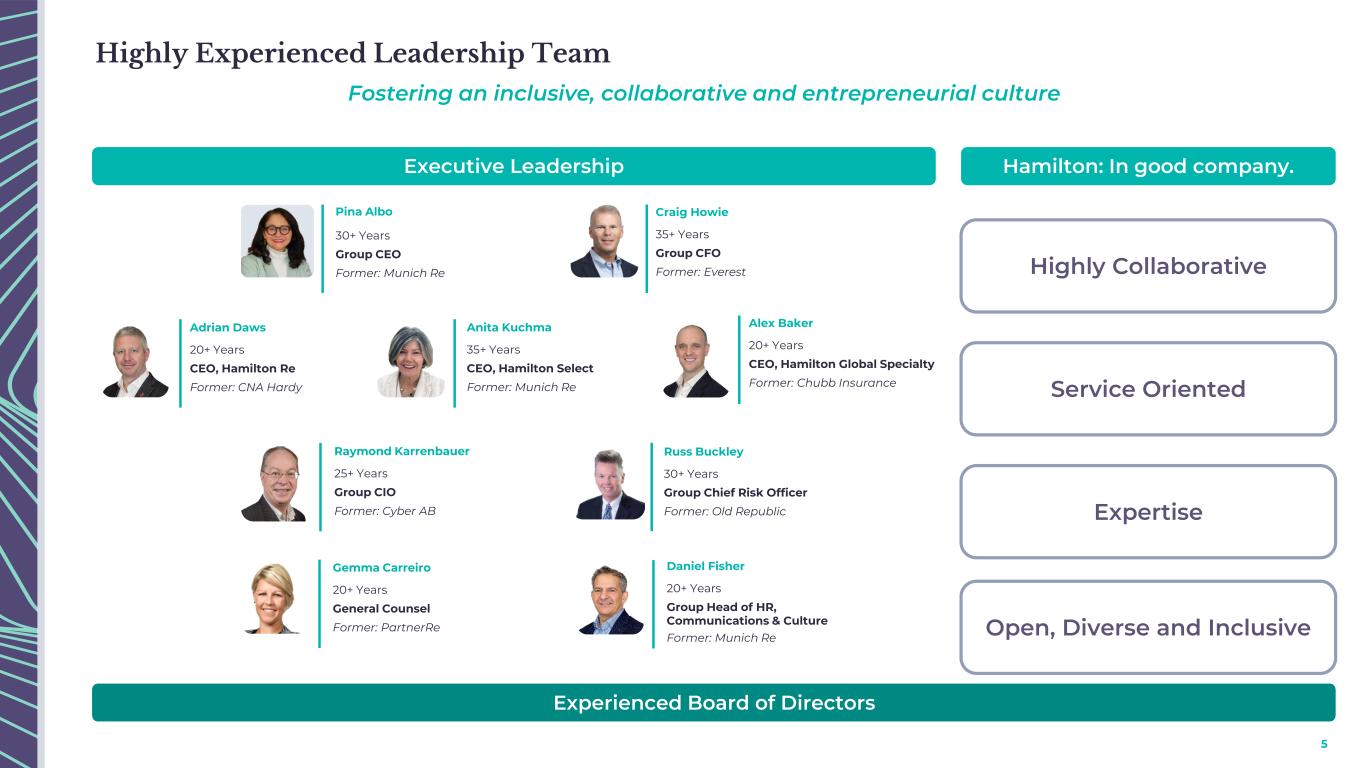

About Hamilton Insurance Group, Ltd.

Hamilton is a Bermuda-headquartered specialty insurance and reinsurance company that underwrites risks on a global basis through its wholly owned subsidiaries. Its three underwriting platforms: Hamilton Global Specialty, Hamilton Select and Hamilton Re, each with dedicated and experienced leadership, provide access to diversified and profitable business around the world.

For more information about Hamilton, visit our website at www.hamiltongroup.com or find us on LinkedIn at Hamilton.

Consolidated Balance Sheet

|

|

|

|

|

|

|

|

|

|

|

|

($ in thousands, except share information) |

September 30,

2025 |

|

December 31,

2024 |

| Assets |

|

|

|

|

Fixed maturity investments, at fair value

(amortized cost 2025: $2,997,143; 2024: $2,422,917)

|

$ |

3,022,441 |

|

|

$ |

2,377,862 |

|

Short-term investments, at fair value (amortized cost 2025: $248,406; 2024: $495,630) |

248,847 |

|

497,110 |

Investments in Two Sigma Funds, at fair value (cost 2025: $1,288,616; 2024: $805,623) |

1,500,672 |

|

939,381 |

Total investments |

4,771,960 |

|

|

3,814,353 |

|

Cash and cash equivalents |

955,130 |

|

|

996,493 |

|

Restricted cash and cash equivalents |

110,087 |

|

|

104,359 |

|

Premiums receivable |

1,012,000 |

|

|

771,707 |

|

Paid losses recoverable |

115,847 |

|

|

134,406 |

|

Deferred acquisition costs |

259,260 |

|

|

208,985 |

|

Unpaid losses and loss adjustment expenses recoverable |

1,303,833 |

|

|

1,171,040 |

|

Receivables for investments sold |

45,182 |

|

|

74,006 |

|

Prepaid reinsurance |

334,025 |

|

|

218,921 |

|

Intangible assets |

88,848 |

|

|

93,121 |

|

Other assets |

217,198 |

|

|

208,642 |

|

| Total assets |

$ |

9,213,370 |

|

|

$ |

7,796,033 |

|

|

|

|

|

| Liabilities, non-controlling interest, and shareholders' equity |

|

|

|

| Liabilities |

|

|

|

Reserve for losses and loss adjustment expenses |

$ |

4,206,077 |

|

|

$ |

3,532,491 |

|

Unearned premiums |

1,443,460 |

|

|

1,122,277 |

|

Reinsurance balances payable |

372,711 |

|

|

261,275 |

|

Payables for investments purchased |

102,013 |

|

|

115,427 |

|

Term loan, net of issuance costs |

149,717 |

|

|

149,945 |

|

Accounts payable and accrued expenses |

167,882 |

|

|

185,361 |

|

Payables to related parties |

28,338 |

|

|

100,420 |

|

| Total liabilities |

6,470,198 |

|

|

5,467,196 |

|

|

|

|

|

Non-controlling interest – TS Hamilton Fund |

81,179 |

|

|

128 |

|

|

|

|

|

Shareholders’ equity |

|

|

|

Common shares: |

|

|

|

| Class A, authorized (2025 and 2024: 26,944,807), par value $0.01; issued and outstanding (2025 and 2024: 17,820,078)

|

178 |

|

|

178 |

|

|

Class B, authorized (2025: 83,577,932 and 2024: 80,205,911), par value $0.01;

issued and outstanding (2025: 64,537,772 and 2024: 64,271,249)

|

645 |

|

|

643 |

|

|

Class C, authorized (2025: 16,003,649 and 2024: 19,375,670), par value $0.01;

issued and outstanding (2025: 16,003,649 and 2024: 19,375,670)

|

160 |

|

|

194 |

|

Additional paid-in capital |

1,135,815 |

|

|

1,163,609 |

|

Accumulated other comprehensive loss |

(4,441) |

|

|

(4,441) |

|

Retained earnings |

1,529,636 |

|

|

1,168,526 |

|

| Total shareholders' equity |

2,661,993 |

|

|

2,328,709 |

|

|

|

|

|

| Total liabilities, non-controlling interest, and shareholders' equity |

$ |

9,213,370 |

|

|

$ |

7,796,033 |

|

Consolidated Statement of Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

September 30, |

|

September 30, |

| ($ in thousands, except for per share amounts) |

2025 |

|

2024 |

|

2025 |

|

2024 |

| Revenues |

|

|

|

|

|

|

|

| Gross premiums written |

$ |

698,845 |

|

|

$ |

553,401 |

|

|

$ |

2,254,177 |

|

|

$ |

1,878,645 |

|

| Reinsurance premiums ceded |

(119,864) |

|

|

(75,505) |

|

|

(515,008) |

|

|

(410,802) |

|

| Net premiums written |

578,981 |

|

|

477,896 |

|

|

1,739,169 |

|

|

1,467,843 |

|

|

|

|

|

|

|

|

|

| Net change in unearned premiums |

(55,982) |

|

|

(29,101) |

|

|

(206,079) |

|

|

(214,981) |

|

| Net premiums earned |

522,999 |

|

|

448,795 |

|

|

1,533,090 |

|

|

1,252,862 |

|

|

|

|

|

|

|

|

|

| Net realized and unrealized gains (losses) on investments |

115,136 |

|

|

48,228 |

|

|

571,964 |

|

|

454,851 |

|

| Net investment income (loss) |

22,727 |

|

|

17,330 |

|

|

62,721 |

|

|

43,667 |

|

| Total net realized and unrealized gains (losses) on investments and net investment income (loss) |

137,863 |

|

|

65,558 |

|

|

634,685 |

|

|

498,518 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income (loss) |

4,169 |

|

|

4,464 |

|

|

13,845 |

|

|

17,934 |

|

| Net foreign exchange gains (losses) |

2,619 |

|

|

(5,973) |

|

|

(4,422) |

|

|

(9,883) |

|

| Total revenues |

667,650 |

|

|

512,844 |

|

|

2,177,198 |

|

|

1,759,431 |

|

|

|

|

|

|

|

|

|

| Expenses |

|

|

|

|

|

|

|

| Losses and loss adjustment expenses |

278,712 |

|

|

273,632 |

|

|

943,875 |

|

|

720,478 |

|

| Acquisition costs |

125,412 |

|

|

102,201 |

|

|

365,108 |

|

|

283,059 |

|

| General and administrative expenses |

74,302 |

|

|

62,392 |

|

|

205,832 |

|

|

182,164 |

|

|

|

|

|

|

|

|

|

| Amortization of intangible assets |

4,000 |

|

|

5,204 |

|

|

11,895 |

|

|

11,773 |

|

| Interest expense |

4,933 |

|

|

5,351 |

|

|

15,264 |

|

|

17,090 |

|

| Total expenses |

487,359 |

|

|

448,780 |

|

|

1,541,974 |

|

|

1,214,564 |

|

|

|

|

|

|

|

|

|

| Income (loss) before income tax |

180,291 |

|

|

64,064 |

|

|

635,224 |

|

|

544,867 |

|

| Income tax expense (benefit) |

3,866 |

|

|

3,029 |

|

|

9,748 |

|

|

6,118 |

|

| Net income (loss) |

176,425 |

|

|

61,035 |

|

|

625,476 |

|

|

538,749 |

|

|

|

|

|

|

|

|

|

| Net income (loss) attributable to non-controlling interest |

40,225 |

|

|

(17,215) |

|

|

220,990 |

|

|

172,240 |

|

|

|

|

|

|

|

|

|

| Net income (loss) and other comprehensive income (loss) attributable to common shareholders |

$ |

136,200 |

|

|

$ |

78,250 |

|

|

$ |

404,486 |

|

|

$ |

366,509 |

|

|

|

|

|

|

|

|

|

| Per share data |

|

|

|

|

|

|

|

| Basic income (loss) per share attributable to common shareholders |

$ |

1.37 |

|

|

$ |

0.77 |

|

|

$ |

4.01 |

|

|

$ |

3.45 |

|

| Diluted income (loss) per share attributable to common shareholders |

$ |

1.32 |

|

|

$ |

0.74 |

|

|

$ |

3.88 |

|

|

$ |

3.33 |

|

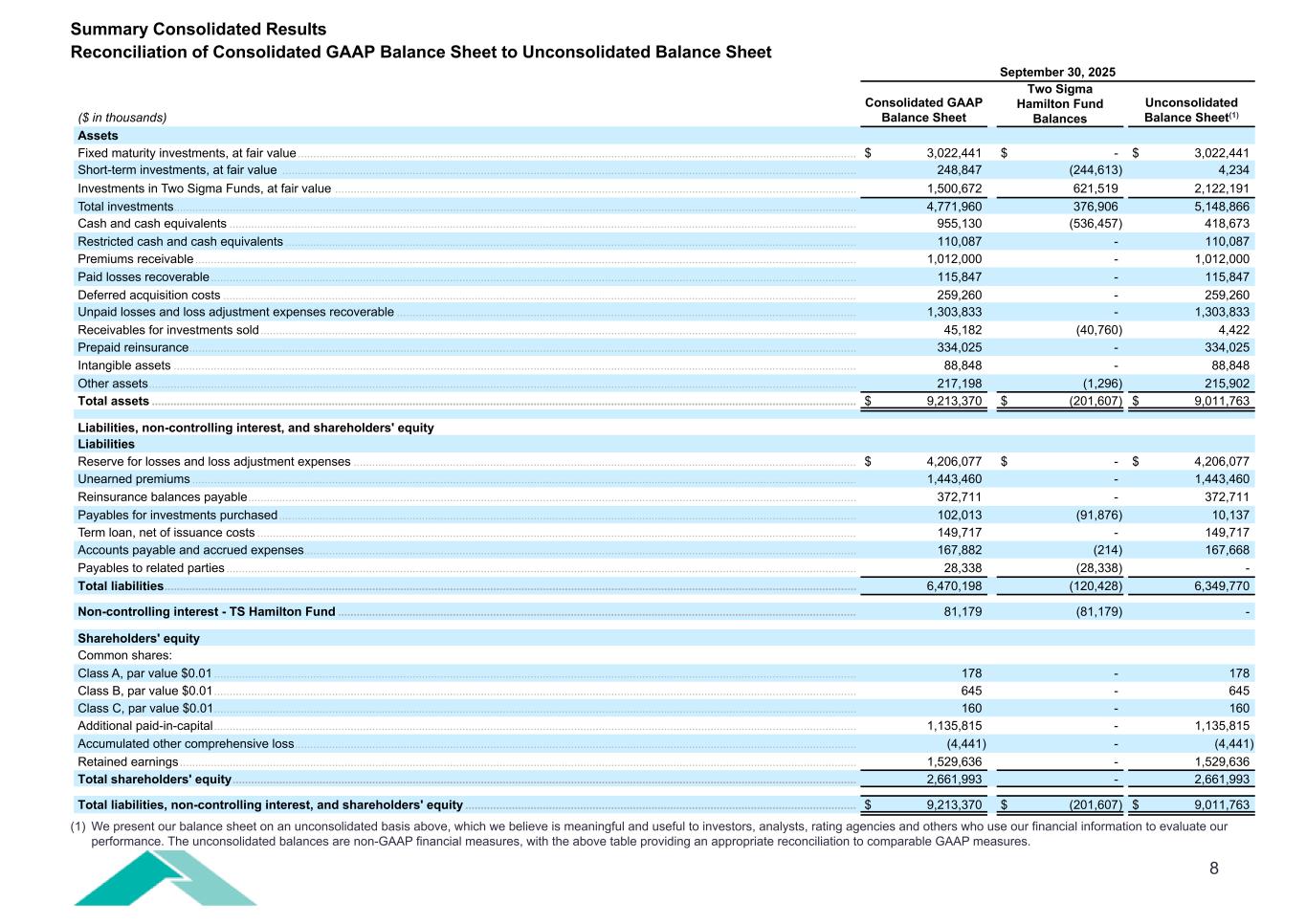

Non-GAAP Financial Measures Reconciliation

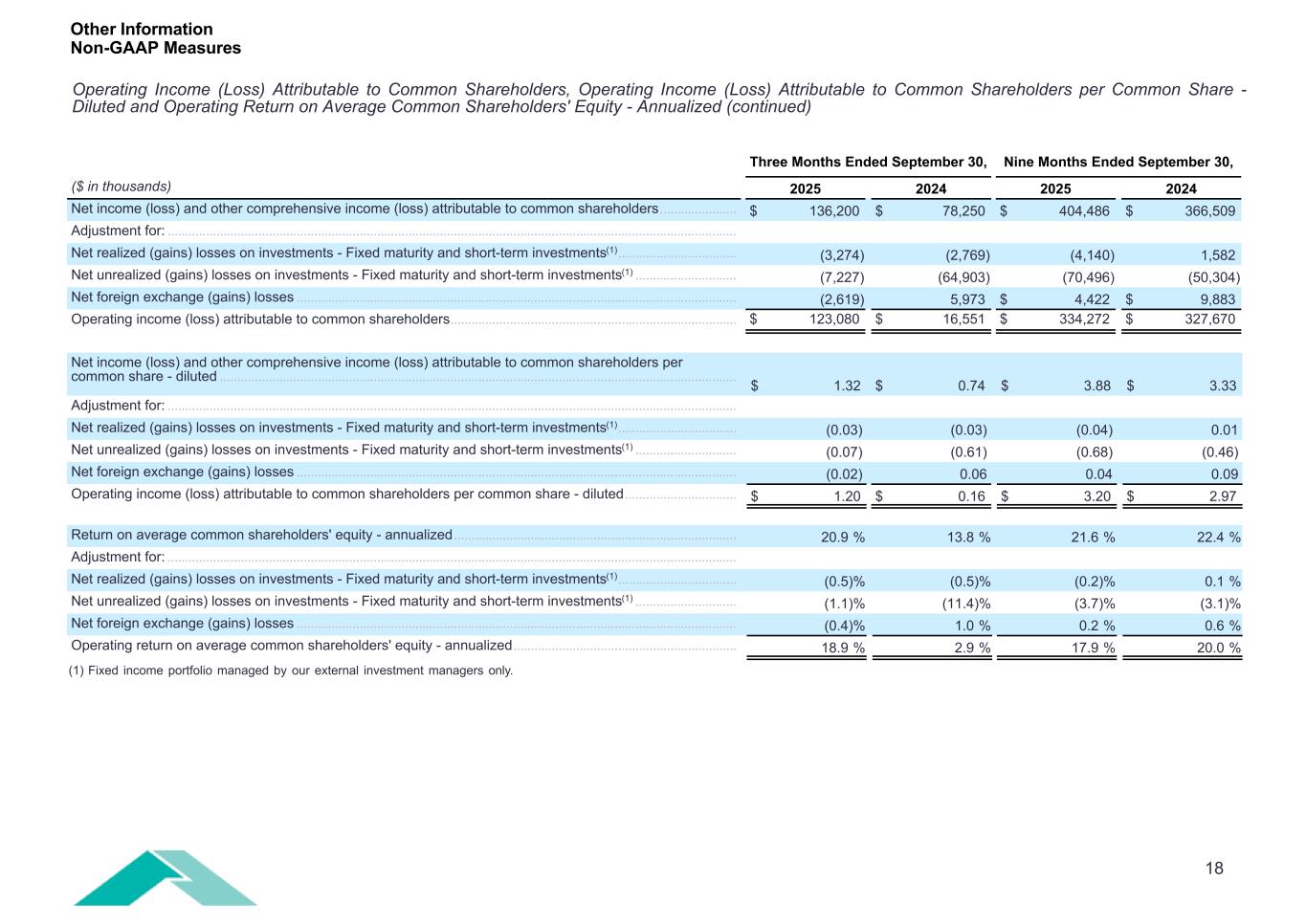

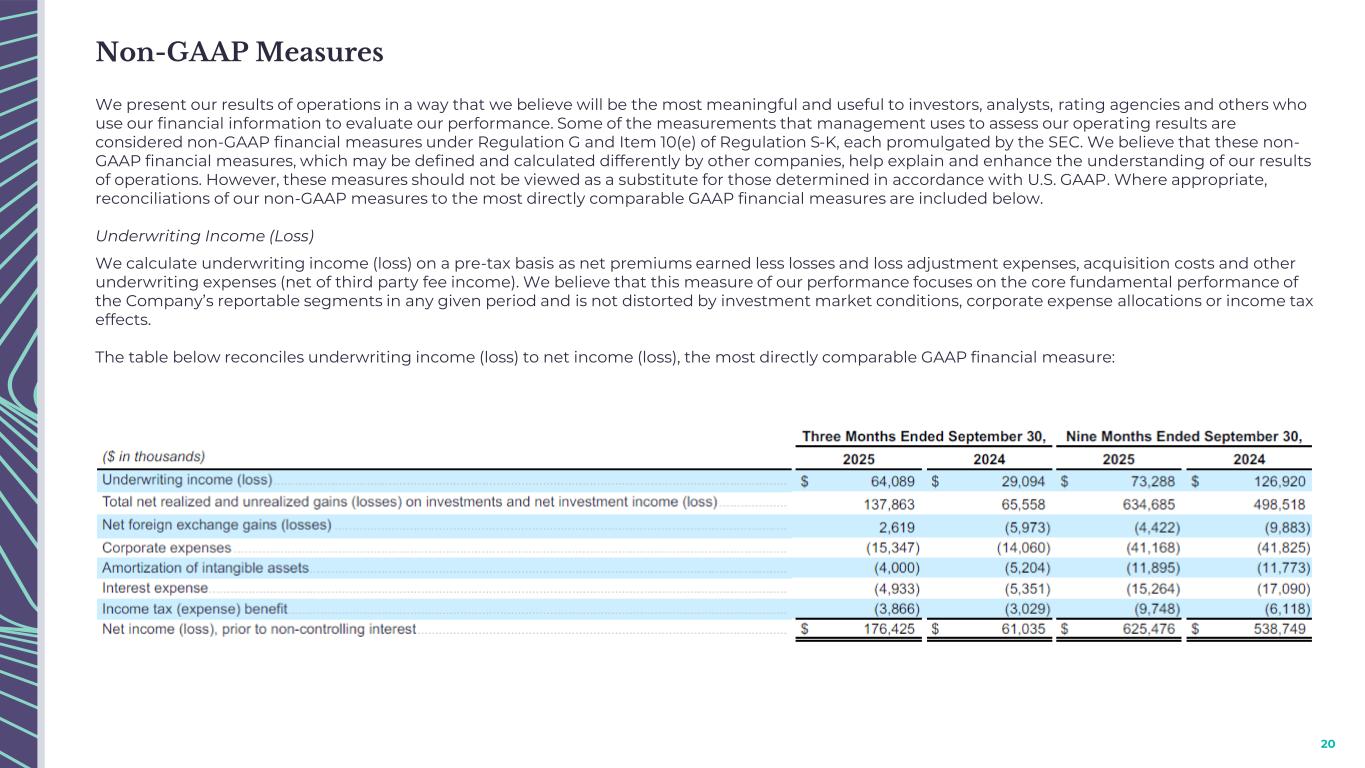

We present our results of operations in a way that we believe will be the most meaningful and useful to investors, analysts, rating agencies and others who use our financial information to evaluate our performance. Some of the measurements that management uses to assess our operating results are considered non-GAAP financial measures under Regulation G and Item 10(e) of Regulation S-K, each promulgated by the SEC. We believe that these non-GAAP financial measures, which may be defined and calculated differently by other companies, help explain and enhance the understanding of our results of operations. However, these measures should not be viewed as a substitute for those determined in accordance with U.S. GAAP. Where appropriate, reconciliations of our non-GAAP measures to the most directly comparable GAAP financial measures are included below.

Operating Income (Loss) Attributable to Common Shareholders, Operating Income (Loss) Attributable to Common Shareholders per Common Share - Diluted and Operating Return on Average Common Shareholders' Equity - Annualized

Operating income (loss) attributable to common shareholders, as used herein, differs from net income (loss) and other comprehensive income (loss) attributable to common shareholders, which we believe is the most directly comparable GAAP measure, by the exclusion of net realized and unrealized gains and losses on fixed maturity and short term investments, and net foreign exchange gains and losses. We also use operating income (loss) attributable to common shareholders to calculate operating income (loss) attributable to common shareholders per common share - diluted and operating return on average common shareholders' equity - annualized.

We believe that operating income (loss) attributable to common shareholders, operating income (loss) attributable to common shareholders per common share - diluted and operating return on average common shareholders' equity - annualized are meaningful and useful to investors, analysts, rating agencies and others who use our financial information to evaluate our performance.

The following tables are a reconciliation of: net income (loss) and other comprehensive income (loss) attributable to common shareholders to operating income (loss) attributable to common shareholders; net income (loss) and other comprehensive income (loss) attributable to common shareholders per common share - diluted to operating income (loss) attributable to common shareholders per common share - diluted; and return on average common shareholders' equity - annualized to operating return on average common shareholders' equity - annualized. Comparative information for the prior periods presented have been updated to conform to the current methodology and presentation.

Operating Income (Loss) Attributable to Common Shareholders, Operating Income (Loss) Attributable to Common Shareholders per Common Share - Diluted and Operating Return on Average Common Shareholders' Equity - Annualized (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

September 30, |

|

September 30, |

| ($ in thousands, except for per share amounts) |

2025 |

|

2024 |

|

2025 |

|

2024 |

| Net income (loss) and other comprehensive income (loss) attributable to common shareholders |

$ |

136,200 |

|

|

$ |

78,250 |

|

|

$ |

404,486 |

|

|

$ |

366,509 |

|

| Adjustment for: |

|

|

|

|

|

|

|

Net realized (gains) losses on investments - Fixed maturity and short-term investments(1) |

(3,274) |

|

|

(2,769) |

|

|

(4,140) |

|

|

1,582 |

|

Net unrealized (gains) losses on investments - Fixed maturity and short-term investments(1) |

(7,227) |

|

|

(64,903) |

|

|

(70,496) |

|

|

(50,304) |

|

| Net foreign exchange (gains) losses |

(2,619) |

|

|

5,973 |

|

|

4,422 |

|

|

9,883 |

|

| Operating income (loss) attributable to common shareholders |

$ |

123,080 |

|

|

$ |

16,551 |

|

|

$ |

334,272 |

|

|

$ |

327,670 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) and other comprehensive income (loss) attributable to common shareholders per common share - diluted |

$ |

1.32 |

|

|

$ |

0.74 |

|

|

$ |

3.88 |

|

|

$ |

3.33 |

|

| Adjustment for: |

|

|

|

|

|

|

|

Net realized (gains) losses on investments - Fixed maturity and short-term investments(1) |

(0.03) |

|

|

(0.03) |

|

|

(0.04) |

|

|

0.01 |

|

Net unrealized (gains) losses on investments - Fixed maturity and short-term investments(1) |

(0.07) |

|

|

(0.61) |

|

|

(0.68) |

|

|

(0.46) |

|

| Net foreign exchange (gains) losses |

(0.02) |

|

|

0.06 |

|

|

0.04 |

|

|

0.09 |

|

| Operating income (loss) attributable to common shareholders per common share - diluted |

$ |

1.20 |

|

|

$ |

0.16 |

|

|

$ |

3.20 |

|

|

$ |

2.97 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Return on average common shareholders' equity - annualized |

20.9 |

% |

|

13.8 |

% |

|

21.6 |

% |

|

22.4 |

% |

| Adjustment for: |

|

|

|

|

|

|

|

Net realized (gains) losses on investments - Fixed maturity and short-term investments(1) |

(0.5) |

% |

|

(0.5) |

% |

|

(0.2) |

% |

|

0.1 |

% |

Net unrealized (gains) losses on investments - Fixed maturity and short-term investments(1) |

(1.1) |

% |

|

(11.4) |

% |

|

(3.7) |

% |

|

(3.1) |

% |

| Net foreign exchange (gains) losses |

(0.4) |

% |

|

1.0 |

% |

|

0.2 |

% |

|

0.6 |

% |

| Operating return on average common shareholders' equity - annualized |

18.9 |

% |

|

2.9 |

% |

|

17.9 |

% |

|

20.0 |

% |

(1) Fixed income portfolio managed by our external investment managers only.

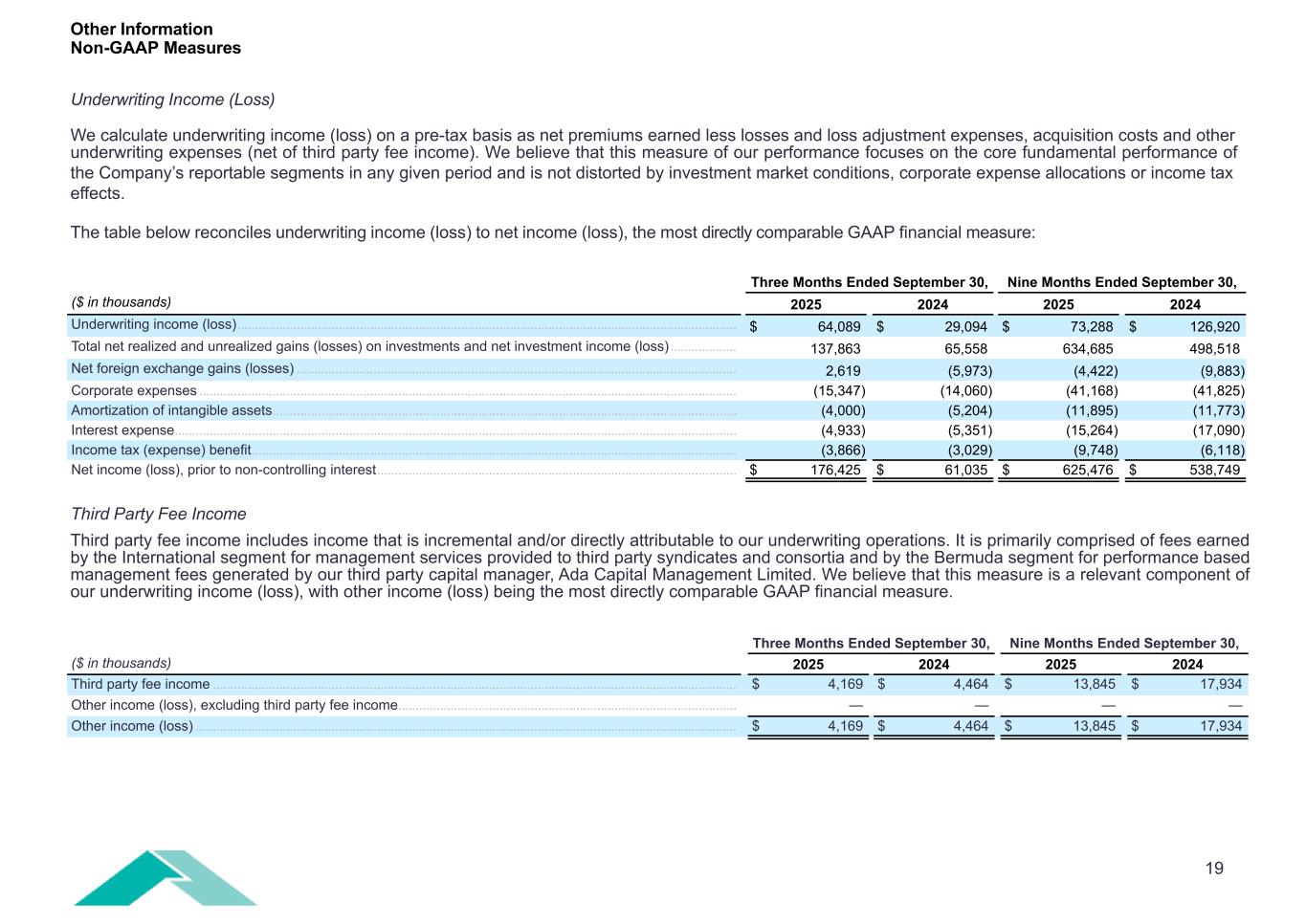

Underwriting Income (Loss)

We calculate underwriting income (loss) on a pre-tax basis as net premiums earned less losses and loss adjustment expenses, acquisition costs and other underwriting expenses (net of third party fee income). We believe that this measure of our performance focuses on the core fundamental performance of the Company’s reportable segments in any given period and is not distorted by investment market conditions, corporate expense allocations or income tax effects.

The following table reconciles underwriting income (loss) to net income (loss), the most directly comparable GAAP financial measure:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

September 30, |

|

September 30, |

| ($ in thousands) |

2025 |

|

2024 |

|

2025 |

|

2024 |

| Underwriting income (loss) |

$ |

64,089 |

|

|

$ |

29,094 |

|

|

$ |

73,288 |

|

|

$ |

126,920 |

|

| Total net realized and unrealized gains (losses) on investments and net investment income (loss) |

137,863 |

|

|

65,558 |

|

|

634,685 |

|

|

498,518 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net foreign exchange gains (losses) |

2,619 |

|

|

(5,973) |

|

|

(4,422) |

|

|

(9,883) |

|

| Corporate expenses |

(15,347) |

|

|

(14,060) |

|

|

(41,168) |

|

|

(41,825) |

|

|

|

|

|

|

|

|

|

| Amortization of intangible assets |

(4,000) |

|

|

(5,204) |

|

|

(11,895) |

|

|

(11,773) |

|

| Interest expense |

(4,933) |

|

|

(5,351) |

|

|

(15,264) |

|

|

(17,090) |

|

| Income tax (expense) benefit |

(3,866) |

|

|

(3,029) |

|

|

(9,748) |

|

|

(6,118) |

|

| Net income (loss), prior to non-controlling interest |

$ |

176,425 |

|

|

$ |

61,035 |

|

|

$ |

625,476 |

|

|

$ |

538,749 |

|

Third Party Fee Income

Third party fee income includes income that is incremental and/or directly attributable to our underwriting operations. It is primarily comprised of fees earned by the International Segment for management services provided to third party syndicates and consortia and by the Bermuda Segment for performance based management fees generated by our third party capital manager, Ada Capital Management Limited. We believe that this measure is a relevant component of our underwriting income (loss).

The following table reconciles third party fee income to other income, the most directly comparable GAAP financial measure:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

September 30, |

|

September 30, |

| ($ in thousands) |

2025 |

|

2024 |

|

2025 |

|

2024 |

| Third party fee income |

$ |

4,169 |

|

|

$ |

4,464 |

|

|

$ |

13,845 |

|

|

$ |

17,934 |

|

|

|

|

|

|

|

|

|

| Other income (loss) |

$ |

4,169 |

|

|

$ |

4,464 |

|

|

$ |

13,845 |

|

|

$ |

17,934 |

|

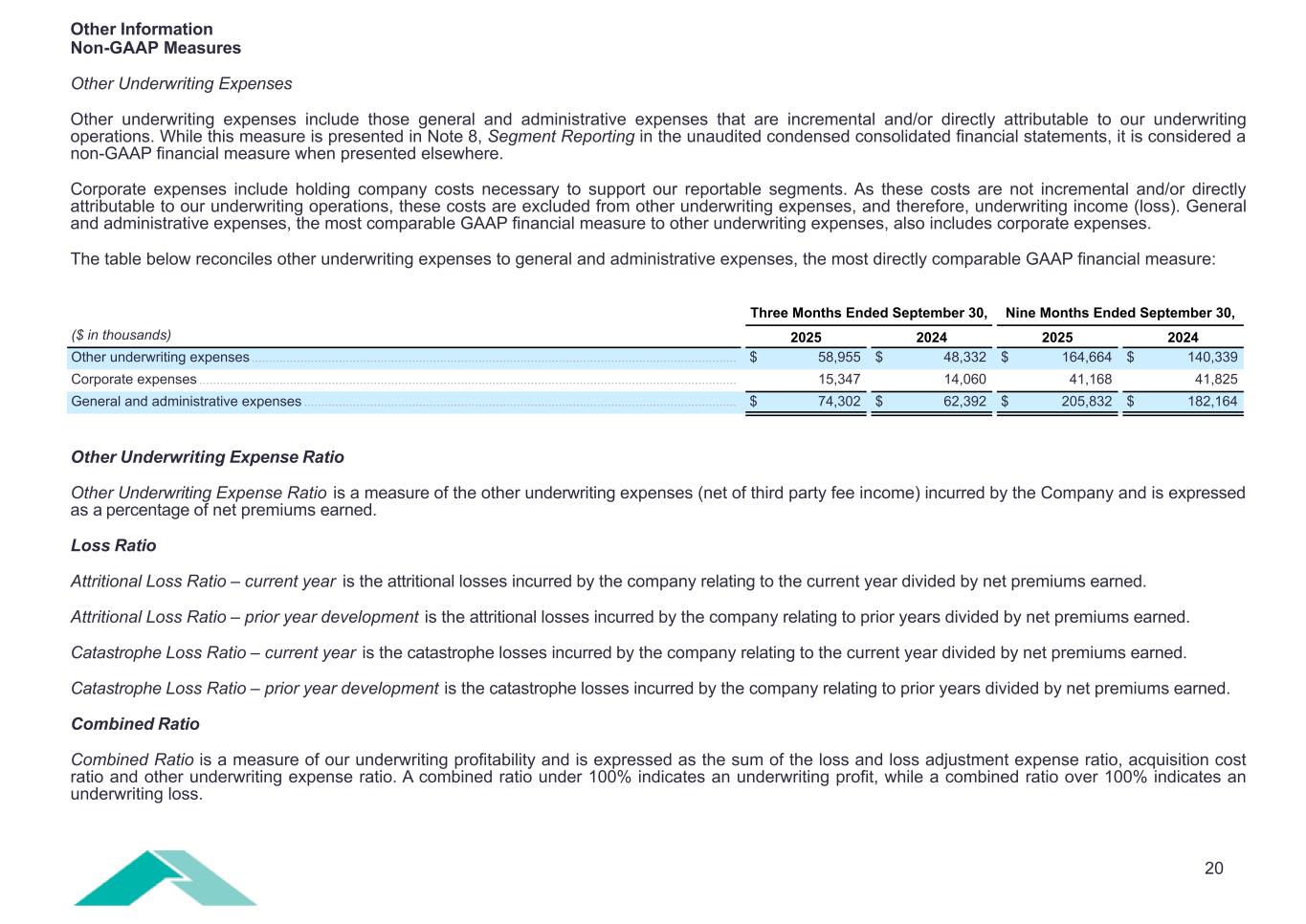

Other Underwriting Expenses

Other underwriting expenses include those general and administrative expenses that are incremental and/or directly attributable to our underwriting operations. While this measure is presented in Note 8, Segment Reporting in the unaudited condensed consolidated financial statements, it is considered a non-GAAP financial measure when presented elsewhere.

Corporate expenses include holding company costs necessary to support our reportable segments. As these costs are not incremental and/or directly attributable to our underwriting operations, these costs are excluded from other underwriting expenses, and therefore, underwriting income (loss). General and administrative expenses, the most comparable GAAP financial measure to other underwriting expenses, also includes corporate expenses.

The following table reconciles other underwriting expenses to general and administrative expenses, the most directly comparable GAAP financial measure:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

September 30, |

|

September 30, |

| ($ in thousands) |

2025 |

|

2024 |

|

2025 |

|

2024 |

| Other underwriting expenses |

$ |

58,955 |

|

|

$ |

48,332 |

|

|

$ |

164,664 |

|

|

$ |

140,339 |

|

| Corporate expenses |

15,347 |

|

|

14,060 |

|

|

41,168 |

|

|

41,825 |

|

| General and administrative expenses |

$ |

74,302 |

|

|

$ |

62,392 |

|

|

$ |

205,832 |

|

|

$ |

182,164 |

|

Other Underwriting Expense Ratio

Other Underwriting Expense Ratio is a measure of the other underwriting expenses (net of third party fee income) incurred by the Company and is expressed as a percentage of net premiums earned.

Loss Ratio

Attritional Loss Ratio – current year is the attritional losses incurred by the company relating to the current year divided by net premiums earned.

Attritional Loss Ratio – prior year development is the attritional losses incurred by the company relating to prior years divided by net premiums earned.

Catastrophe Loss Ratio – current year is the catastrophe losses incurred by the company relating to the current year divided by net premiums earned.

Catastrophe Loss Ratio – prior year development is the catastrophe losses incurred by the company relating to prior years divided by net premiums earned.

Combined Ratio

Combined Ratio is a measure of our underwriting profitability and is expressed as the sum of the loss and loss adjustment expense ratio, acquisition cost ratio and other underwriting expense ratio. A combined ratio under 100% indicates an underwriting profit, while a combined ratio over 100% indicates an underwriting loss.

Special Note Regarding Forward-Looking Statements

This information includes “forward looking statements” pursuant to the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by the use of terms such as “believes,” “expects,” “may,” “will,” “target,” “should,” “could,” “would,” “seeks,” “intends,” “plans,” “contemplates,” “estimates,” or “anticipates,” or similar expressions which concern our strategy, plans, projections or intentions. These forward-looking statements appear in a number of places throughout and relate to matters such as our industry, growth strategy, goals and expectations concerning our market position, future operations, margins, profitability, capital expenditures, liquidity and capital resources and other financial and operating information. By their nature, forward-looking statements: speak only as of the date they are made; are not statements of historical fact or guarantees of future performance; and are subject to risks, uncertainties, assumptions, or changes in circumstances that are difficult to predict or quantify. Our expectations, beliefs, and projections are expressed in good faith and we believe there is a reasonable basis for them. However, there can be no assurance that management’s expectations, beliefs and projections will be achieved and actual results may vary materially from what is expressed in or indicated by the forward-looking statements.

There are a number of risks, uncertainties, and other important factors that could cause our actual results to differ materially from the forward-looking statements contained herein. Such risks, uncertainties, and other important factors include, among others, the risks, uncertainties and factors set forth in “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024 (the “Form 10-K”) and other subsequent periodic reports filed with the Securities and Exchange Commission and the following:

•challenges from competitors, including those arising from industry consolidation and technological advancements;

•unpredictable catastrophic events, global climate change and/or emerging claim and coverage issues;

•our ability, or those of the third parties on which we rely, to ensure reserves are adequate to cover actual losses and to accurately evaluate underwriting risk, models, assessments and/or pricing of risks;

•our ability to defend our intellectual property rights, including our proprietary technology platforms, to comply with our obligations under our license and technology agreements or to license rights to technology or data on reasonable terms;

•the impact of risks associated with human error, fraud, model uncertainties, cybersecurity threats such as cyber-attacks and security breaches and our reliance on third-party information technology systems that can fail or need replacement;

•our ability to secure necessary credit facilities, or additional types of credit, on favorable terms or at all;

•our limited financial and operating flexibility due to the covenants in our existing credit facilities;

•our exposure to the credit risk of the intermediaries on which we rely;

•our failure to pay claims in a timely manner or the need to sell investments under unfavorable conditions to meet liquidity requirements;

•downgrades, potential downgrades or other negative actions by rating agencies;

•our ability to manage risks associated with macroeconomic conditions resulting from geopolitical and global economic events, including current or anticipated military conflicts, public health crises, terrorism, sanctions, rising energy prices, inflation and interest rates and other global events, including the instability from recent international trade policies;

•the cyclical nature of the insurance and reinsurance business, which may cause the pricing and terms for our products to decline;

•our results of operations potentially fluctuating significantly from period to period and not being indicative of our long-term prospects;

•our ability to execute our strategy and to modify our business and strategic plan without shareholder approval;

•our dependence on key executives, including the potential loss of Bermudian personnel, and our ability to attract qualified personnel, particularly in very competitive hiring conditions;

•foreign operational risk such as foreign currency risk and political risk;

•our ability to identify and execute opportunities for growth, to complete transactions as planned or realize the anticipated benefits of any acquisitions or other investments;

•our management of alternative reinsurance platforms on behalf of investors in entities managed by Hamilton Strategic Partnerships;

•our inability to control the allocations to, and/or the performance of, the Two Sigma Hamilton Fund, LLC (“TS Hamilton Fund” or “Two Sigma Hamilton Fund”) investment portfolio and our limited ability to withdraw our capital accounts;

•the impact of risks from conflicts of interest among Two Sigma Principals, LLC, Two Sigma Investments, LP (“Two Sigma”) and their respective affiliates affecting our business;

•the historical performance of Two Sigma not being indicative of the future results of the TS Hamilton Fund’s investment portfolio and/or of our future results;

•the impacts of risks associated with our investment strategy, including that such risks are greater than those faced by our competitors;

•our potentially becoming subject to U.S. federal income taxation, Bermuda taxation or other taxes as a result of a change of tax laws or otherwise;

•the potential characterization of us and/or any of our subsidiaries as a passive foreign investment company, or PFIC;

•our potentially becoming subject to U.S. withholding and information reporting requirements under the U.S. Foreign Account Tax Compliance Act, or FATCA, provisions;

•our ability to compete effectively in a heavily regulated industry in light of new domestic or international laws and regulations, including accounting practices, and the impact of new interpretations of current laws and regulations;

•the suspension or revocation of our subsidiaries’ insurance licenses;

•significant legal, governmental or regulatory proceedings;

•our insurance and reinsurance subsidiaries’ ability to pay dividends and other distributions to us being restricted by law;

•challenges related to compliance with the applicable laws, rules and regulations related to being a public company, which is expensive and time consuming;

•the limited ability of investors to influence corporate matters due to our multiple class common share structure and the voting provisions of our Bye-laws;

•the risk that anti-takeover provisions in our Bye-laws could discourage, delay, or prevent a change in control, even if the change in control would be beneficial to our shareholders;

•the difficulties investors may face in protecting their interests and serving process or enforcing judgments against us in the United States; and

•our current strategy does not include paying cash dividends on our Class B common shares in the near term.

There may be other factors that could cause our actual results to differ materially from the forward-looking statements, including factors disclosed under the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Form 10-K. You should evaluate all forward-looking statements made herein in the context of these risks and uncertainties.

You should read this information completely and with the understanding that actual future results may be materially different from expectations. We caution you that the risks, uncertainties, and other factors referenced above may not contain all of the risks, uncertainties and other factors that are important to you. In addition, we cannot assure you that we will realize the results, benefits, or developments that we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our business in the way expected. All forward-looking statements contained herein apply only as of the date hereof and are expressly qualified in their entirety by these cautionary statements. We undertake no obligation to publicly update or revise any forward-looking statements to reflect subsequent events or circumstances.

Investor contact:

Darian Niforatos

Investor.Relations@hamiltongroup.com

Media contact:

Kelly Corday Ferris

kelly.ferris@hamiltongroup.com