0

Dear Shareholders, This is my first letter to you as CEO of Instacart — and I couldn’t be more energized about where we’re headed. Over the past six years, I’ve had the privilege of helping build many of the capabilities and partnerships that make Instacart distinct. We’re so much more than a marketplace. Instacart is the leading technology and enablement partner for the grocery industry — helping consumers save time, retailers run their businesses, and brands connect with customers. In a trillion-dollar industry ripe for innovation – we power how groceries get discovered, bought, and delivered — and we’re just getting started. Our foundation is strong, our momentum is growing, and I’m confident we have all the right ingredients to accelerate into our next chapter. In Q3, we delivered another strong quarter: orders grew 14% year-over-year, GTV increased 10%, and both net income and Adjusted EBITDA expanded. Our strategy to accelerate online grocery adoption is working. We’re deepening customer and retailer relationships, expanding our ads ecosystem, and launching innovative AI-powered tools across all aspects of our business — all while driving profitable growth. Winning in grocery means nailing the fundamentals — selection, quality, convenience, and affordability. Fresh food is the hardest part of online grocery, and it’s where Instacart shines. Our deep retailer network, data from over 1.5 billion lifetime orders, and our experienced shopper network ensures we deliver the same freshness and care customers expect from the grocers they’ve trusted for generations. And we deliver fast. 75% of our delivery orders are on demand meaning they are on median delivered in 90 minutes or less, and approximately 25% of typical priority orders are delivered in less than 30 minutes. That combination of selection, quality, speed, and reliability builds trust — and when customers trust us with their perishables, they shop more often, spend more per order, and stay longer. Affordability is key to accelerating online grocery adoption. We’re helping retailers see how offering the same prices online and in-store drives both growth and loyalty. The results are clear: over the past year, retailers offering same-as-in-store pricing have on average grown more than 10 percentage points faster than those that haven’t — and they retain customers better on our platform. In recent months, more retailers are taking action. Pattison Food Group banners – including Buy Low Foods, Nesters Market, and Save-on-Foods – are now live on our marketplace at price parity, along with Best Buy and regional grocers like Choices Market and Jerry’s. Several national and regional grocers have also launched price parity pilots in markets including Chicago, Dallas, Nashville, Tampa, and Tucson. And we’re making these savings easier for customers to find — through improved merchandising and tools like Flyers and Loyalty that help retailers deliver even more value directly to customers. We’re also extending the power of our marketplace to retailers through our enterprise solutions — taking what we’ve built and putting it directly in their hands, at a scale no one else can match. Our enterprise offerings — including Storefront technologies, Fulfillment Services, Carrot Ads, Caper Carts, FoodStorm, Carrot Tags, and more — help retailers compete and grow online and in-store. And because we’re not a retailer ourselves, our success is fully aligned with theirs. When our partners grow, we grow. 1

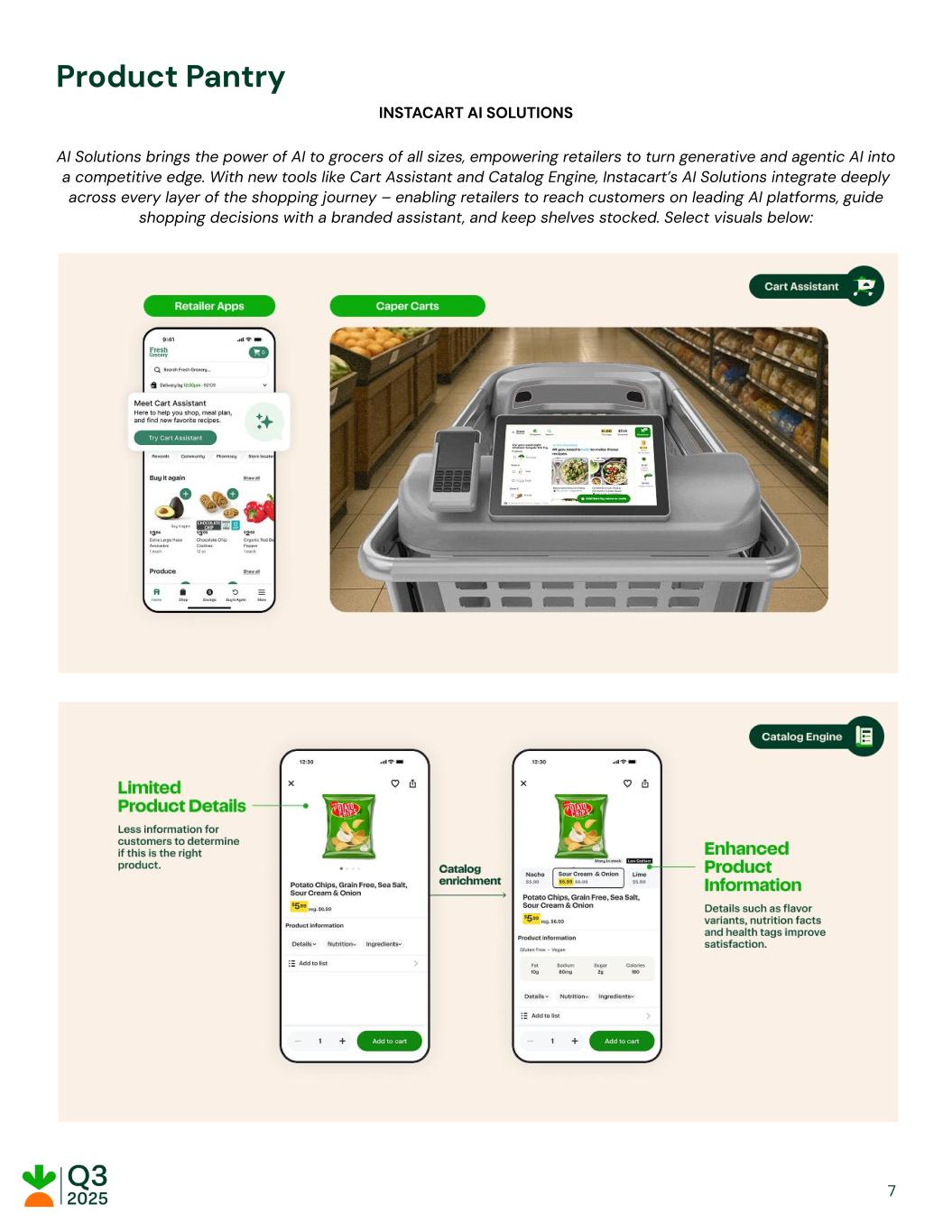

That alignment is paying off. Our Storefront technologies now power more than 350 grocers’ e-commerce sites – and it’s built to scale, as we expand into new categories and regions. We recently launched Storefront Pro with Cub Grocery & Liquor, a leading Midwest grocer, and signed a new partnership with Merchants Distributors, who collectively represents hundreds of local independent grocers. We also rolled out Storefront Pro for Restaurant Depot, one of the biggest wholesalers serving independent restaurants, and introduced Instacart Business features within Storefront and Storefront Pro to help grocers manage complex ordering needs. We also see an exciting international opportunity ahead. Building on our acquisition of Wynshop – which powers storefronts for retailers in Europe and Australia – we’re seeing strong demand and clear product-market fit for our technologies abroad. AI is the newest pillar of our enterprise offerings – and we’re introducing Instacart’s AI solutions at the exact moment retailers need us most. As AI transforms how people shop for groceries and feed their families, our tools bring powerful, practical capabilities to help grocers compete and win — from personalized shopping assistants and smarter catalog insights to real-time shelf intelligence and instant, self-serve analytics. Built for the complexity of grocery and powered by our unique insights, Instacart’s AI Solutions deliver more personalized, connected, and efficient shopping experiences — online and in-stores. We’re partnering with leading retailers like Good Food Holdings, Kroger, McKeever’s, and Sprouts Farmers Market on these solutions and are excited to build on this momentum. Together, the combination of our marketplace scale and enterprise platform make our business stronger and more resilient. Even when retailers participate on other marketplaces, the depth of our integrations and the differentiated value of our enterprise solutions empower us to achieve consistent double-digit annual GTV growth with those retailers on average1. We expect Kroger will be another example of this, especially as they just doubled down on Instacart as their primary delivery fulfillment partner across all Kroger digital properties. Today, more than 80% of our GTV comes from non-exclusive retailers, and among the exclusive GTV that remains, the majority is with retailers who partner with us on at least one enterprise solution. 1 Includes total GTV from both marketplace and enterprise for Instacart's top enterprise retailers that have launched on other marketplace(s) for at least one year. Average line represents the linear regression line of best fit. 2

We’re also expanding and strengthening our ads ecosystem — extending our reach across online, off-platform, and in-store channels for more than 7,500 brand partners. Beyond our leading marketplace, which spans more than 1,800 retail banners, we work with over 240 Carrot Ads partners – and that number keeps growing. Nearly all of our new Storefront Pro launches now include Carrot Ads, including recent additions like Cub Grocery & Liquor and Restaurant Depot. We’ve also signed new third-party partners like Bottlecapps and Vroom Delivery, launched Carrot Ads with Hy-Vee RedMedia to power ads on Hy-Vee.com, and deepened our relationships with existing partners such as Uber Eats, where we recently launched Shoppable Display ads on its U.S. grocery and retail marketplace. Together, these integrations showcase the strength of our technology, the depth of advertiser demand, and add more revenue opportunities over time. We’re also bringing our advertiser network into stores. We recently launched Caper Ads with Wakefern, where our AI-powered smart carts will soon be deployed across nearly 20% of Wakefern’s cooperative member stores. And we’re proud to be TikTok’s first end-to-end retail media network partner — opening a new channel for CPGs to use our first-party retail media data to reach highly engaged audiences. Underpinning all of this is AI — which is helping us build smarter products, better tools, and more accurate measurement across our ads ecosystem. In Q3, we enhanced our ad relevance system with large language models — driving stronger engagement and more items added to carts via our Sponsored Product units. We've also scaled our one-click, AI-powered recommendations to approximately 3,000 brands, making it easier for them to optimize bids, budgets, and creativity. And now, our AI-generated landing pages are available to all brands, enabling rapid creation of dynamic, high-performing content for both on-platform and off-platform campaigns. Across our marketplace, enterprise solutions, and ads ecosystem – Instacart is executing from a position of strength. We’re the clear leader in online grocery among digital-first players, one of the top retail media networks in North America, and we operate a profitable, cash-generating model that gives us the flexibility to keep investing in what’s next. Our scale, density, and operational discipline continue to unlock efficiencies that fuel innovation and growth across our platform. And we’re focused on accelerating – bringing more customers online, deepening our partnerships with retailers and brands, and building the technologies that will power the future of grocery. To underscore our confidence in long-term value creation, we authorized a $1.5 billion increase to our share repurchase program and plan to enter into a $250 million accelerated share repurchase program, while continuing to opportunistically repurchase shares. Chris Rogers Chief Executive Officer 3

Business Updates Consumers We’re committed to delivering an exceptional customer experience for the millions of people who use Instacart to feed their families. We’re also finding more ways to make Instacart as easy to use as possible and create even more value for our customers. ● Streamlined the family account invite process to a single click and launched automatic loyalty sharing across family accounts, allowing households to access the same discounts, coupons, and benefits. When customers shop together or place a loyalty-linked order on Instacart, they typically place larger orders – meaning customers get more of what they want and retailers win, too. ● Continued to make Instacart more affordable by adding Pattison Food Group banners – including Buy Low Foods, Nesters Market, and Save-on-Foods – to our marketplace at price parity. Best Buy, along with regional grocers like Choices Market and Jerry’s also moved to same-as-in-store pricing. ● Announced several new partnerships designed to drive more customers and orders to Instacart: ● Partnered with Grubhub to offer groceries powered by Instacart directly within the Grubhub and Seamless platforms, enabling Grubhub customers to shop from Instacart’s network of grocers and retailers nationwide, with fulfillment of orders enabled by Instacart. ● Launched a new partnership with United Airlines to offer new benefits to United MileagePlus members, including $0 delivery fees on orders placed right before, during, or shortly after they take a domestic flight, a first for an airline, and opportunities to earn up to 10,000 miles. ● Launched the first Instacart+ offer in Canada through a new partnership with BMO, one of Canada’s largest financial services providers, to offer BMO credit cardholders new benefits, including an exclusive complimentary six-month Instacart+ membership and annual Instacart credits. ● Renewed our existing partnership with Mastercard to continue offering eligible credit and debit cardholders annual Instacart credits, along with a complimentary three-month Instacart+ membership. This partnership marks the first embedded partnership extended to debit cardholders. ● Our Back-to-School Deal Week campaign and shopping hub drove strong customer engagement by featuring exclusive discounts on supplies and everyday must-haves from top retailers, as well as other perks. Retailers We’re continuing to deepen our integrations with retail partners on Instacart Marketplace and extend our enterprise and omnichannel technology and tools. ● Launched AI Solutions, new enterprise offerings that empower retail partners with AI-powered capabilities. These solutions extend across online storefronts, catalog and analytics, store shelves, and smart carts, helping retailers deliver smarter shopping experiences through AI and driving results for their customers and business. Launch retailers include Good Food Holdings, Kroger, McKeever’s, and Sprouts Farmers Market. ● Expanded our partnership with Kroger, who reaffirmed Instacart as their primary delivery fulfillment provider across all Kroger digital properties, powering fast, accurate delivery from nearly 2,700 stores nationwide. 4

● Continued momentum with our e-commerce solutions, including: ● Restaurant Depot, a wholesale supplier that sells primarily to foodservice professionals, launched on Storefront Pro. We also extended Instacart Business capabilities to all Storefront and Storefront Pro retailers, enabling hundreds of retailers to serve business customers directly through their e-commerce sites with features like bulk ordering, multi-user management, and account oversight. ● Launched Cub Grocery & Liquor and Piggly Wiggly Midwest and signed Dierbergs to Storefront Pro, our premier white-label e-commerce experience, to help each retailer expand their e-commerce presence. ● Partnered with Merchants Distributors, LLC (MDI), a leading wholesale grocery distributor, to bring Instacart’s capabilities to hundreds of independent grocers. MDI members can now join the Instacart marketplace, establish an e-commerce site with Storefront Pro, and access Carrot Ads. ● Retailers are continuing to embrace our other in-store technologies, including: ● Continued momentum with Caper Carts, including: ■ Partnered with UK grocer Morrisons to bring Caper Carts to the UK, marking Instacart’s first retail partnership in the country with one of the UK’s largest supermarket chains. Caper Carts will launch at Morrisons in early 2026, with plans to expand across more stores. ■ Launched new Caper Cart omnichannel savings capabilities, including EBT SNAP item eligibility tracking, on-cart loyalty sign-up, omnichannel savings, and improved product recommendations, making it easier for customers to maximize their benefits. ● Completed the launch of FoodStorm, our catering and prepared foods software, at all five Ahold Delhaize USA banners – our largest FoodStorm deployment to date – along with chain wide rollouts at new partners like Cub Grocery & Liquor, Geissler's Supermarket, Harmons Grocery, Price Chopper Kansas City, and Tops Markets. Brands With our unique data, insights, and partnerships, the Instacart Ads ecosystem is a one-stop advertising platform, connecting brands with high-intent, incremental customers at scale. ● Announced Instacart as the first retail media network partner to provide TikTok with native end-to-end self-service retail media capabilities. Brands advertising on TikTok can now leverage Instacart’s first-party data to enhance their campaigns and make their ads instantly shoppable, driving purchases to Instacart. ● Continued momentum with Carrot Ads – we signed Vroom Delivery, an e-commerce platform with a network of 3,500 convenience stores nationwide, launched Carrot Ads with Hy-Vee RedMedia on Hy-Vee.com, and deepened our relationships with existing partners, including Uber Eats, where we recently launched Shoppable Display ads on its U.S grocery and retail marketplace. ● Launched Caper Ads with Wakefern, where our AI-powered smart carts will soon be deployed at nearly 20% of Wakefern’s cooperative member stores. Now, new and existing shoppable display campaigns can seamlessly extend across the Instacart Marketplace and in-store Caper Cart digital screens. 5

● Expanded capabilities within our Consumer Insights Portal, enabling companies like Advantage Solutions, Applegate, and Coca-Cola Canada Bottling to access real-time trends and performance data. New features include Promotion Impact, offering first-of-its-kind visibility into how promotions drive trial and habituation, and Innovation Tracking, which monitors the in-market performance of new product launches. ● Deepened our partnership with Advantage Solutions, a leading sales, marketing, and retail execution agency for consumer goods manufacturers and retailers, to deliver new solutions for CPG brands to identify and resolve out-of-stock issues, improve compliance, and boost overall performance. ● Continued to drive strong performance for more than 7,500 brands that advertise on Instacart. On average, our brand partners see a 25% boost in sales — translating into measurable growth and higher revenue.2 ● Launched a new upper-funnel metric, out-of-aisle impressions, in Ads Manager that helps brands measure how their recipe and occasion ads extend visibility beyond their traditional shopping aisles. Brands like Bob’s Red Mill and Barilla are already seeing an increase in consumer engagement and out-of-aisle impressions. ● Released new measurement case studies with Dr. Praeger’s and McCormick, highlighting the power of Instacart Ads to increase brand awareness and drive sales. ● Earned a second accreditation from the Media Rating Council following an independent auditing process, extending our accreditation coverage from Instacart Marketplace to Carrot Ads, our white-label ad technology leveraged by more than 240 e-commerce partner sites. Shoppers We continue to see strong engagement across our experienced community of Instacart shoppers, which plays a critical role in delivering superior customer service. ● Launched an upgraded Carrot Academy, a learning platform now integrated into the Instacart Shopper app that offers over 40 new multimedia lessons, personalized learning paths, and seamless single sign-on access, giving shoppers more intuitive, flexible ways to build skills and deliver shopping excellence. ● Introduced a redesigned replacements experience to simplify substitutions when items are out-of-stock. The app provides recommendations based on customer preferences, guided scanning for replacements, and automatic customer notifications – reducing guesswork and improving communications with customers. 2 Based on the average of internal tests run across all brand partners during the last four quarters ended September 30, 2025 using an updated methodology with a 28-day lookback period. 6

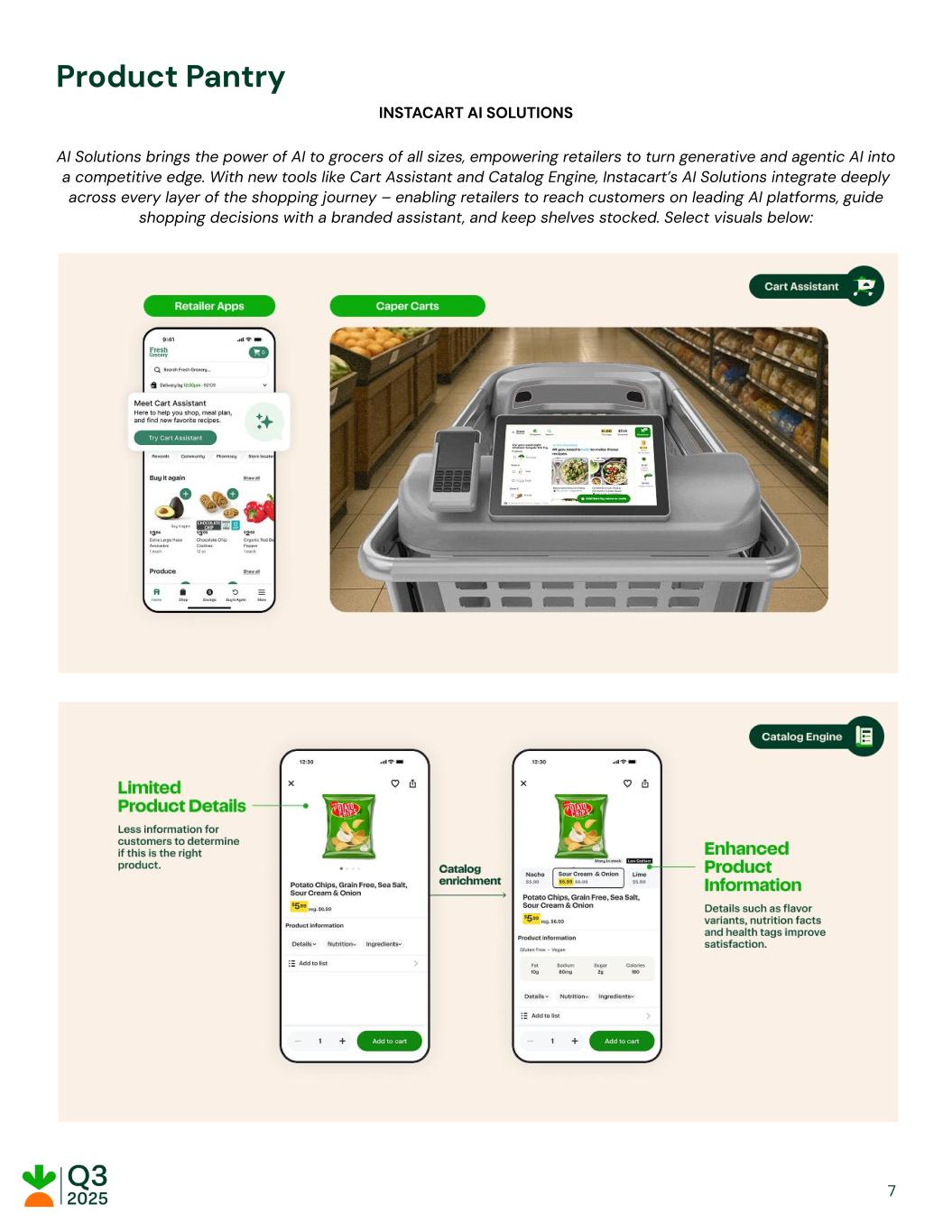

Product Pantry INSTACART AI SOLUTIONS AI Solutions brings the power of AI to grocers of all sizes, empowering retailers to turn generative and agentic AI into a competitive edge. With new tools like Cart Assistant and Catalog Engine, Instacart’s AI Solutions integrate deeply across every layer of the shopping journey – enabling retailers to reach customers on leading AI platforms, guide shopping decisions with a branded assistant, and keep shelves stocked. Select visuals below: 7

Q3’25 Financial Update Q3'25 Financial Highlights ● Orders of 83.4 million, up 14% year-over-year. ● GTV of $9,170 million, up 10% year-over-year. ● Total revenue of $939 million, up 10% year-over-year, representing 10.2% of GTV. ● Transaction revenue of $670 million, up 10% year-over-year, representing 7.3% of GTV. ● Advertising & other revenue of $269 million, up 10% year-over-year, representing 2.9% of GTV. ● GAAP gross profit of $692 million, up 8% year-over-year, representing 7.5% of GTV and 74% of total revenue. ● GAAP net income of $144 million, up 22% year-over-year, representing 1.6% of GTV and 15% of total revenue. ● Adjusted EBITDA of $278 million, up 22% year-over-year, representing 3.0% of GTV and 30% of total revenue. Orders were 83.4 million, up 14% year-over-year, driving GTV of $9,170 million, up 10% year-over-year. As we expected, average order value decreased 4% year-over-year, driven by restaurant orders and lowered basket minimums to $10 for Instacart+ members to get waived delivery fees. Total revenue was $939 million, up 10% year-over-year, primarily driven by GTV growth. 8

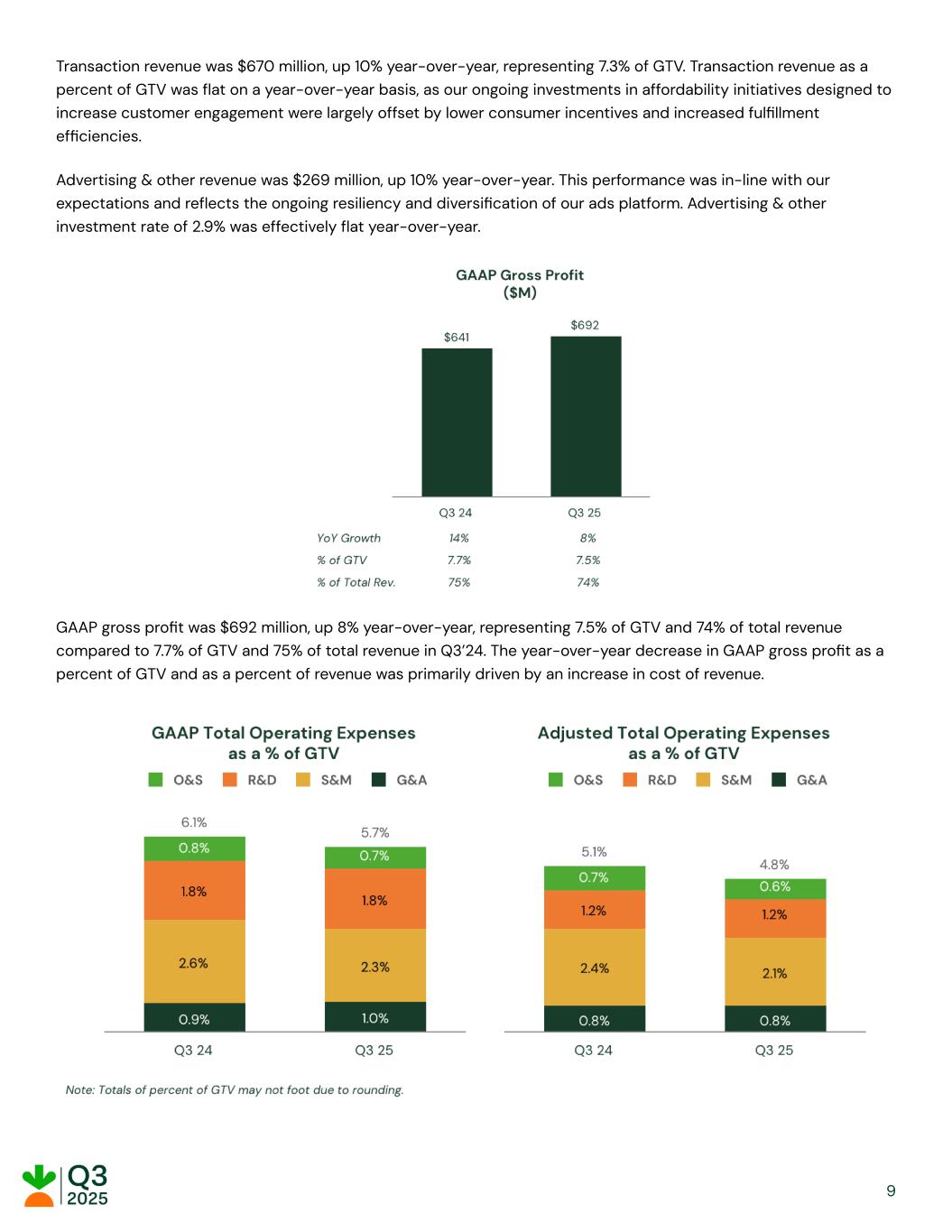

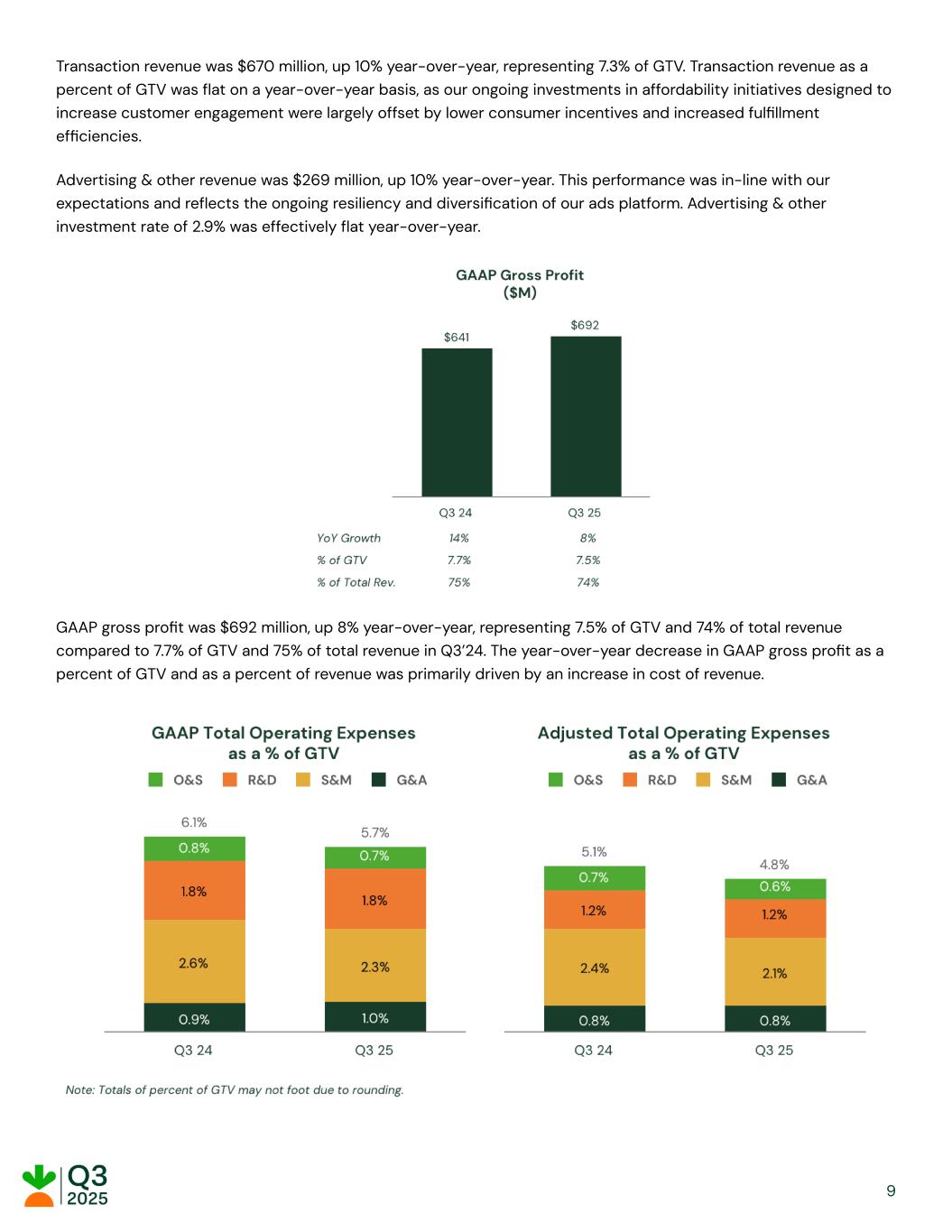

Transaction revenue was $670 million, up 10% year-over-year, representing 7.3% of GTV. Transaction revenue as a percent of GTV was flat on a year-over-year basis, as our ongoing investments in affordability initiatives designed to increase customer engagement were largely offset by lower consumer incentives and increased fulfillment efficiencies. Advertising & other revenue was $269 million, up 10% year-over-year. This performance was in-line with our expectations and reflects the ongoing resiliency and diversification of our ads platform. Advertising & other investment rate of 2.9% was effectively flat year-over-year. GAAP gross profit was $692 million, up 8% year-over-year, representing 7.5% of GTV and 74% of total revenue compared to 7.7% of GTV and 75% of total revenue in Q3’24. The year-over-year decrease in GAAP gross profit as a percent of GTV and as a percent of revenue was primarily driven by an increase in cost of revenue. 9

GAAP total operating expenses were $525 million, representing 5.7% of GTV compared to 6.1% of GTV in Q3'24. The year-over-year decrease in GAAP total operating expenses as a percent of GTV was primarily due to a decrease in paid marketing, which was elevated in the prior year quarter as we leaned into seasonal events. Adjusted total operating expenses, which exclude the impact of stock-based compensation expense and certain other expenses, were $436 million and represented 4.8% of GTV compared to 5.1% of GTV in Q3'24. The year-over-year improvement was primarily driven by a decrease in paid marketing for the reasons described above. GAAP net income was $144 million, up 22% year-over-year, representing 1.6% of GTV and 15% of total revenue. The year-over-year increase was primarily driven by growth in GAAP gross profit as described above. Adjusted EBITDA was $278 million, up 22% year-over-year, representing 3.0% of GTV and 30% of total revenue. The year-over-year increase was driven by a combination of GTV growth and operating leverage. We also generated operating cash flow of $287 million, an increase of $102 million year-over-year, primarily driven by strong operational performance. 10

Q4’25 Financial Outlook GTV $9,450 - $9,600 million Adjusted EBITDA $285 - $295 million This GTV outlook represents year-over-year growth between 9% to 11%, with orders growth expected to outpace GTV growth. It reflects our strong performance in October, continued momentum from landing and expanding our enterprise partnerships, and is partially offset by the expected impact of EBT SNAP funding scenarios on our business. We have not provided the forward-looking GAAP equivalent to our adjusted EBITDA or a GAAP reconciliation as a result of the uncertainty regarding, and the potential variability of, reconciling items such as stock-based compensation and related payroll tax expenses, certain legal and regulatory accruals and settlements, and reserves for sales and other indirect taxes. Accordingly, a reconciliation of this non-GAAP guidance metric to its corresponding GAAP equivalent is not available without unreasonable effort. However, it is important to note that these reconciling items could have a significant effect on future GAAP results. Live Conference Call Instacart management will host a conference call to discuss the company's results at 5:00 a.m. Pacific Time (8:00 a.m. Eastern Time) on Monday, November 10. To access a live webcast of the conference call, please visit our Investor Relations website at https://investors.instacart.com. After the call concludes, a replay will be made available on our Investor Relations website. 11

Forward-Looking Statements This letter and the accompanying oral presentation contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact could be deemed forward-looking, including without limitation statements regarding our financial outlook, including GTV, adjusted EBITDA, transaction revenue, advertising and other revenue, stock-based compensation expense, and orders, trends in our business and industry, impacts from macroeconomic conditions, our plans and expectations regarding growth, products, features, and partnerships, including expansion of our capabilities, services, and solutions, international expansion, the adoption and expected benefits of AI, our strategic priorities, investments, and initiatives, our ability to drive sales and growth for our partners, activity under our share repurchase program, and our planned accelerated share repurchase program. In some cases, you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “toward,” “will,” or “would,” or the negative of these words or other similar terms or expressions. The forward-looking statements contained in this letter and the accompanying oral presentation are subject to known and unknown risks, uncertainties, assumptions, and other factors that may cause actual results or outcomes to be materially different from any future results or outcomes expressed or implied by the forward-looking statements. These risks, uncertainties, assumptions, and other factors include, but are not limited to, those related to anticipated trends, growth rates, and challenges in our business, industry, and the markets in which we operate; our ability to attract and increase engagement of customers and shoppers; our ability to effectively manage the increasing scale, scope, and complexity of our business; our ability to operate our business and effectively manage our growth and margins under evolving and uncertain macroeconomic conditions; our ability to achieve or maintain profitability and profitable growth; our ability to maintain and expand our relationships with retailers and advertisers; competition in our markets; our ability to expand our existing and develop new products, offerings, features, and use cases, bring them to market in a timely manner, and whether retailers, customers, brands, shoppers, or other partners launch or utilize such products, offerings, features, and use cases in the manner and timing that we expect; our ability to continue to grow across our current markets and expand into new markets; our estimated market opportunity; the impact on our business of macroeconomic and industry trends, including tariffs or other trade restrictions, inflation, elevated interest rates, supply chain challenges, cessation of, interruptions to, or changes to government aid programs, heightened recession risk, market volatility, and geopolitical conflicts; legal and governmental proceedings; new or changes to laws and regulations and other regulatory matters and developments, particularly with respect to the classification of shoppers on our platform; the occurrence of any security incidents or disruptions of service on our platform or technology offerings; our reliance on key personnel and our ability to attract, integrate, and retain management and skilled personnel; our ability to identify, complete, and achieve anticipated benefits from acquisitions, strategic investments, collaborations, commercial arrangements, alliances, or partnerships; our ability to successfully integrate other businesses or our partners’ technologies that we acquire and realize the intended benefits of those acquisitions; the impact of weather patterns; and our reliance on third-party devices, operating systems, applications, and services that we do not control; as well as other risks described from time to time in our filings with the Securities and Exchange Commission (SEC), including in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2025 filed with the SEC on August 8, 2025. 12

You should not rely on forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this letter and the accompanying oral presentation primarily on information available to us as of the date of this letter and the accompanying oral presentation and our current expectations and projections about future events and trends that we believe may affect our business, financial condition, and results of operations. While we believe such information provides a reasonable basis for these statements, such information may be limited or incomplete. Our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely on these statements. Moreover, we operate in a very competitive and rapidly changing environment, and new risks may emerge from time to time. It is not possible for us to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results or outcomes to differ materially from those contained in any forward-looking statements we may make. Except as required by law, we undertake no obligation, and do not intend, to update these forward-looking statements. Key Business Metrics We use the following key business metrics to help us evaluate our business, identify trends affecting our performance, formulate business plans, and make strategic decisions. • Gross Transaction Value (GTV): We define GTV as the value of the products sold through Instacart, including applicable taxes, deposits and other local fees, customer tips, which go directly to shoppers, customer fees, which include flat subscription fees related to Instacart+ that are charged monthly or annually, and other fees. GTV consists of orders including those completed through Instacart Marketplace or services that are part of the Instacart Enterprise Platform. We believe that GTV indicates the health of our business, including our ability to drive revenue and profits, and the value we provide to our constituents. • Orders: We define an order as a completed customer transaction to purchase goods for delivery or pickup primarily from a single retailer through Instacart during the period indicated, including those completed through Instacart Marketplace or services that are part of the Instacart Enterprise Platform. We believe that orders are an indicator of the scale and growth of our business as well as the value we bring to our constituents. Non-GAAP Financial Measures We use the following non-GAAP financial measures in conjunction with GAAP measures to assess performance, to inform the preparation of our annual operating budget and quarterly forecasts, to evaluate the effectiveness of our business strategies, and to discuss our business and financial performance with our board of directors. We believe that these non-GAAP financial measures provide useful information to investors about our business and financial performance, enhance their overall understanding of our past performance and future prospects, and allow for greater transparency with respect to metrics used by our management in their financial and operational decision making. We are presenting these non-GAAP financial measures to assist investors in seeing our business and 13

financial performance through the eyes of management, and because we believe that these non-GAAP financial measures provide an additional tool for investors to use in comparing results of operations of our business over multiple periods with other companies in our industry. Adjusted EBITDA, Adjusted EBITDA as a Percent of GTV, and Adjusted EBITDA Margin. We define adjusted EBITDA as net income, adjusted to exclude (i) provision for income taxes, (ii) interest income, (iii) other (income) expense, net, (iv) depreciation and amortization expense, (v) stock-based compensation expense, (vi) payroll taxes related to stock-based compensation, (vii) certain legal and regulatory accruals and settlements, net, (viii) reserves for sales and other indirect taxes, net, and (ix) acquisition-related expenses. We define adjusted EBITDA margin as adjusted EBITDA as a percent of total revenue. We use adjusted EBITDA, adjusted EBITDA as a percent of GTV, and adjusted EBITDA margin because they are important measures upon which our management assesses our operating performance and the operating leverage in our business. Because adjusted EBITDA, adjusted EBITDA as a percent of GTV, and adjusted EBITDA margin facilitate internal comparisons of our historical operating performance, including as an indication of our total revenue growth and operating efficiencies when compared to GTV and total revenue over time, we use them to evaluate the effectiveness of our strategic initiatives and for business planning purposes. We also believe that adjusted EBITDA, adjusted EBITDA as a percent of GTV, and adjusted EBITDA margin, when taken collectively, may be useful to investors because they provide consistency and comparability with past financial performance, so that investors can evaluate our operating efficiencies by excluding certain items that may not be indicative of our business, results of operations, or outlook. In addition, we believe adjusted EBITDA is widely used by investors, securities analysts, rating agencies, and other parties in evaluating companies in our industry as a measure of operational performance. Adjusted EBITDA, adjusted EBITDA as a percent of GTV, and adjusted EBITDA margin should not be considered as alternatives to net income, net income as a percent of GTV, net income as a percent of total revenue, or any other measure of financial performance calculated and presented in accordance with GAAP. There are a number of limitations related to the use of adjusted EBITDA, adjusted EBITDA as a percent of GTV, and adjusted EBITDA margin rather than net income, net income as a percent of GTV, and net income as a percent of total revenue, which are the most directly comparable GAAP measures. Some of these limitations are that each of adjusted EBITDA, adjusted EBITDA as a percent of GTV, and adjusted EBITDA margin: ● excludes stock-based compensation expense; ● excludes payroll taxes related to stock-based compensation; ● excludes depreciation and amortization expense, and although these are non-cash expenses the assets being depreciated may have to be replaced in the future, increasing our cash requirements; ● excludes acquisition-related expenses; ● does not reflect the positive or adverse adjustments related to the reserve for sales and other indirect taxes or certain legal regulatory accruals and settlements; ● does not reflect interest income which increases cash available to us; ● does not reflect other income or expense that includes unrealized and realized gains and losses on foreign currency exchange; and ● does not reflect provision for or benefit from income taxes that reduces or increases cash available to us. 14

Adjusted Cost of Revenue and Adjusted Cost of Revenue as a Percent of GTV. We define adjusted cost of revenue as cost of revenue excluding depreciation and amortization expense and stock-based compensation expense. Adjusted Operations and Support Expense and Adjusted Operations and Support Expense as a Percent of GTV. We define adjusted operations and support expense as operations and support expense excluding depreciation and amortization expense, stock-based compensation expense, and payroll taxes related to stock-based compensation. Adjusted Research and Development Expense and Adjusted Research and Development Expense as a Percent of GTV. We define adjusted research and development expense as research and development expense excluding depreciation and amortization expense, stock-based compensation expense, and payroll taxes related to stock-based compensation. Adjusted Sales and Marketing Expense and Adjusted Sales and Marketing Expense as a Percent of GTV. We define adjusted sales and marketing expense as sales and marketing expense excluding depreciation and amortization expense, stock-based compensation expense, and payroll taxes related to stock-based compensation. Adjusted General and Administrative Expense and Adjusted General and Administrative Expense as a Percent of GTV. We define adjusted general and administrative expense as general and administrative expense excluding depreciation and amortization expense; stock-based compensation expense; payroll taxes related to stock-based compensation; certain legal and regulatory accruals and settlements, net; reserves for sales and other indirect taxes, net; and acquisition-related expenses. Adjusted Total Operating Expenses and Adjusted Total Operating Expenses as a Percent of GTV. We define adjusted total operating expenses as the sum of adjusted operations and support expense, adjusted research and development expense, adjusted sales and marketing expense, and adjusted general and administrative expense. We exclude depreciation and amortization expense and stock-based compensation expense from our non-GAAP financial measures as these are non-cash in nature. We exclude payroll taxes related to the vesting and settlement of certain equity awards; certain legal and regulatory accruals and settlements, net; reserves for sales and other indirect taxes, net; and acquisition-related expenses as these are not indicative of our operating performance. Non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP financial measures and should be read only in conjunction with our condensed consolidated financial statements prepared in accordance with GAAP. Our presentation of non-GAAP financial measures may not be comparable to similar measures used by other companies, which reduce their usefulness as comparative measures. In addition, other companies may not publish these or similar measures. Further, these measures have certain limitations in that they do not include the impact of certain expenses that are reflected in our consolidated statements of operations. We encourage investors and others to review our business, results of operations, and financial information in their entirety, not to rely on any single financial measure, and carefully consider our results under GAAP, as well as our supplemental non-GAAP information and the reconciliation between these presentations, to more fully understand our business. Please see the tables included at the end of this letter for the reconciliation of GAAP to non-GAAP results. 15

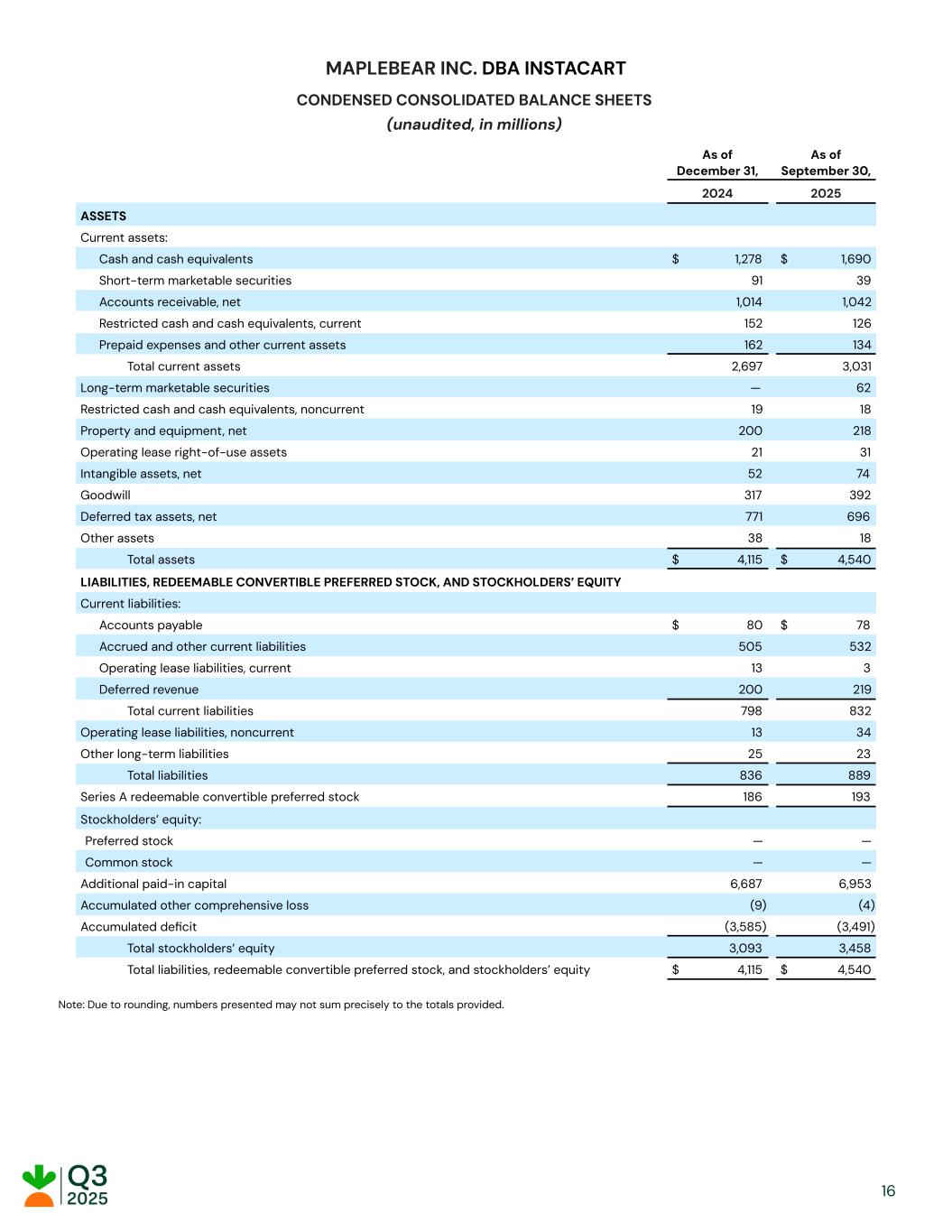

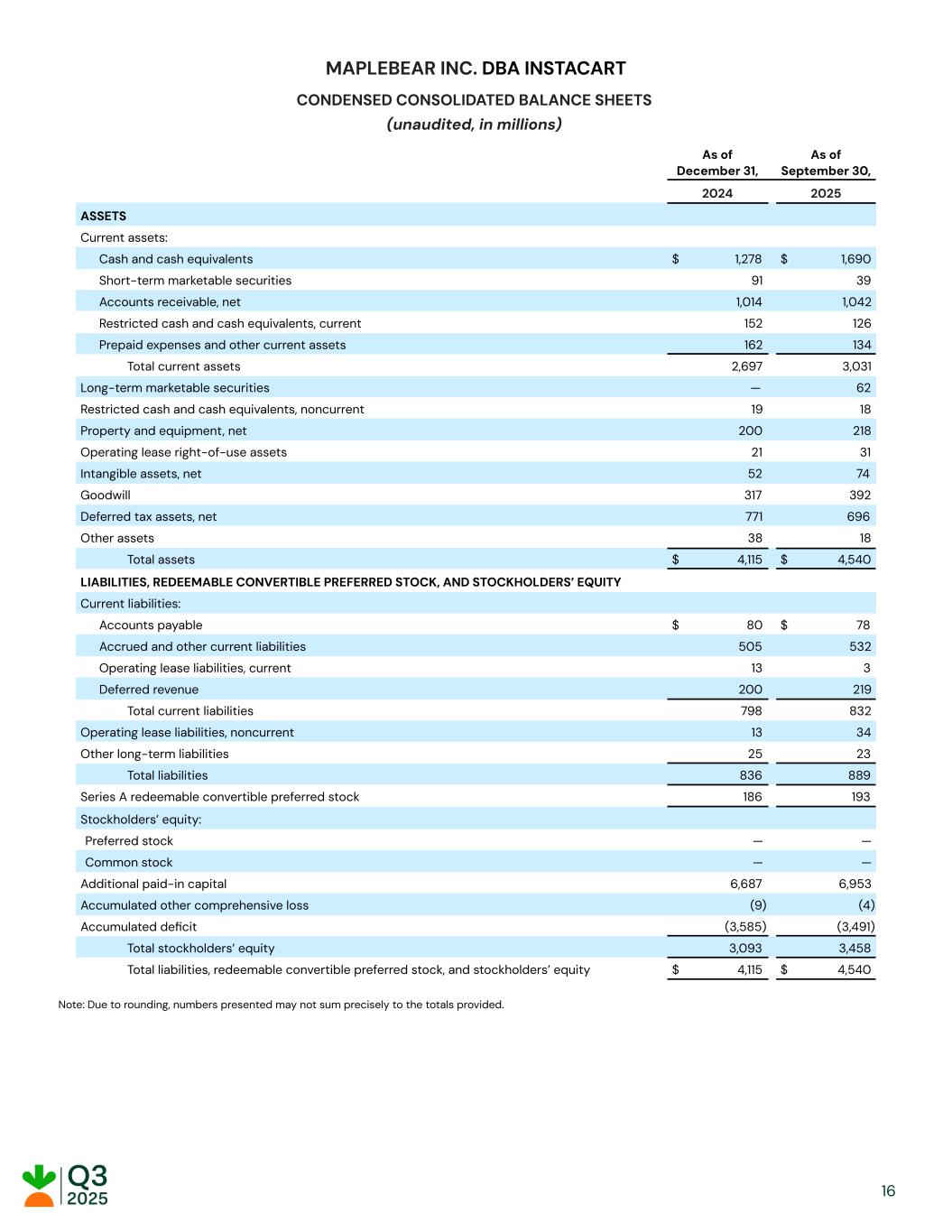

MAPLEBEAR INC. DBA INSTACART CONDENSED CONSOLIDATED BALANCE SHEETS (unaudited, in millions) As of December 31, As of September 30, 2024 2025 ASSETS Current assets: Cash and cash equivalents $ 1,278 $ 1,690 Short-term marketable securities 91 39 Accounts receivable, net 1,014 1,042 Restricted cash and cash equivalents, current 152 126 Prepaid expenses and other current assets 162 134 Total current assets 2,697 3,031 Long-term marketable securities — 62 Restricted cash and cash equivalents, noncurrent 19 18 Property and equipment, net 200 218 Operating lease right-of-use assets 21 31 Intangible assets, net 52 74 Goodwill 317 392 Deferred tax assets, net 771 696 Other assets 38 18 Total assets $ 4,115 $ 4,540 LIABILITIES, REDEEMABLE CONVERTIBLE PREFERRED STOCK, AND STOCKHOLDERS’ EQUITY Current liabilities: Accounts payable $ 80 $ 78 Accrued and other current liabilities 505 532 Operating lease liabilities, current 13 3 Deferred revenue 200 219 Total current liabilities 798 832 Operating lease liabilities, noncurrent 13 34 Other long-term liabilities 25 23 Total liabilities 836 889 Series A redeemable convertible preferred stock 186 193 Stockholders’ equity: Preferred stock — — Common stock — — Additional paid-in capital 6,687 6,953 Accumulated other comprehensive loss (9) (4) Accumulated deficit (3,585) (3,491) Total stockholders’ equity 3,093 3,458 Total liabilities, redeemable convertible preferred stock, and stockholders’ equity $ 4,115 $ 4,540 Note: Due to rounding, numbers presented may not sum precisely to the totals provided. 16

MAPLEBEAR INC. DBA INSTACART CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited, in millions, except share amounts, which are reflected in thousands, and per share amounts) Three Months Ended September 30, Nine Months Ended September 30, 2024 2025 2024 2025 Revenue $ 852 $ 939 $ 2,495 $ 2,750 Cost of revenue 211 247 617 709 Gross profit 641 692 1,878 2,041 Operating expenses: Operations and support 64 62 206 203 Research and development 149 169 449 479 Sales and marketing 213 206 600 640 General and administrative 77 87 289 319 Total operating expenses 503 525 1,544 1,641 Income from operations 138 166 334 401 Other income (expense), net — (1) (2) 1 Interest income 15 16 54 45 Income before provision for income taxes 153 181 386 447 Provision for income taxes 35 37 77 81 Net income $ 118 $ 144 $ 309 $ 366 Accretion related to Series A redeemable convertible preferred stock (2) (2) (7) (7) Net income attributable to common stockholders, basic $ 116 $ 142 $ 302 $ 359 Accretion related to Series A redeemable convertible preferred stock 2 2 — 7 Net income attributable to common stockholders, diluted $ 118 $ 144 $ 302 $ 366 Net income per share attributable to common stockholders: Basic $ 0.45 $ 0.54 $ 1.13 $ 1.37 Diluted $ 0.42 $ 0.51 $ 1.06 $ 1.30 Weighted-average shares used in computing net income per share attributable to common stockholders: Basic 259,660 264,895 266,550 263,314 Diluted 281,003 283,176 285,701 282,479 Note: Due to rounding, numbers presented may not sum precisely to the totals provided. 17

MAPLEBEAR INC. DBA INSTACART CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (unaudited, in millions) Three Months Ended September 30, Nine Months Ended September 30, 2024 2025 2024 2025 OPERATING ACTIVITIES Net income $ 118 $ 144 $ 309 $ 366 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization expense 15 25 39 65 Stock-based compensation expense 69 82 214 253 Impairments of long-lived assets and other assets — 10 — 21 Provision for bad debts 4 3 16 12 Amortization of operating lease right-of-use assets 3 2 9 7 Deferred income taxes 28 67 55 66 Other — 1 2 (4) Changes in operating assets and liabilities, net of effects of business acquisitions: Accounts receivable (63) (4) (112) (35) Prepaid expenses and other assets 15 — (7) 46 Accounts payable 13 9 (3) (3) Accrued and other current liabilities (2) (49) 18 (17) Deferred revenue (5) — 13 18 Operating lease liabilities (5) (1) (12) (7) Other long-term liabilities (5) (2) (7) (2) Net cash provided by operating activities 185 287 534 788 INVESTING ACTIVITIES Purchases of marketable securities (20) (86) (25) (230) Maturities of marketable securities 10 94 54 221 Purchases of property and equipment, including capitalized internal-use software (14) (15) (52) (49) Acquisitions of businesses, net of cash acquired — — — (105) Other investing activities (2) — (3) (1) Net cash used in investing activities (26) (7) (26) (163) FINANCING ACTIVITIES Taxes paid related to net share settlement of equity awards (3) (7) (92) (21) Proceeds from exercise of stock options 2 1 76 8 Changes in advances from payment card issuer 57 (2) 57 41 Repurchases of common stock (357) (62) (1,397) (272) Net cash used in financing activities (301) (70) (1,356) (245) Effect of foreign exchange on cash, cash equivalents, and restricted cash and cash equivalents 2 (2) (4) 4 Net increase (decrease) in cash, cash equivalents, and restricted cash and cash equivalents (140) 208 (852) 384 Cash, cash equivalents, and restricted cash and cash equivalents - beginning of period 1,581 1,625 2,293 1,449 Cash, cash equivalents, and restricted cash and cash equivalents - end of period $ 1,441 $ 1,833 $ 1,441 $ 1,833 Note: Due to rounding, numbers presented may not sum precisely to the totals provided. 18

MAPLEBEAR INC. DBA INSTACART KEY BUSINESS METRICS AND RECONCILIATION OF GAAP TO NON-GAAP RESULTS (unaudited, in millions) Three Months Ended September 30, 2024 2025 Gross transaction value (“GTV”) $ 8,303 $ 9,170 Orders 72.9 83.4 Net income $ 118 $ 144 Provision for income taxes 35 37 Interest income (15) (16) Other (income) expense, net — 1 Depreciation and amortization expense 15 25 Stock-based compensation expense 69 82 Payroll taxes related to stock-based compensation (1) 3 4 Certain legal and regulatory accruals and settlements, net (2) 2 2 Reserves for sales and other indirect taxes, net (3) (1) (1) Acquisition-related expenses 1 — Adjusted EBITDA $ 227 $ 278 Net income as a percent of GTV 1.4 % 1.6 % Adjusted EBITDA as a percent of GTV 2.7 % 3.0 % Total revenue $ 852 $ 939 Net income as a percent of total revenue 14 % 15 % Adjusted EBITDA margin 27 % 30 % (1) Represents employer payroll taxes related to the vesting and settlement of certain equity awards. (2) Represents certain legal, regulatory, and policy expenses including those related to worker classification matters. (3) Represents sales and other indirect tax reserves, net of abatements, for periods in which we were unable to collect such taxes from customers. We believe this adjustment is useful for investors in understanding our underlying operating performance because in these cases, the taxes were not intended to be a cost to us but rather are to be borne by the customers. Note: Due to rounding, numbers presented may not sum precisely to the totals provided. 19

MAPLEBEAR INC. DBA INSTACART RECONCILIATION OF GAAP TO NON-GAAP RESULTS (unaudited, in millions) Three Months Ended Sep. 30, Dec. 31, Mar. 31, Jun. 30, Sept. 30, 2024 2024 2025 2025 2025 Cost of revenue $ 211 $ 219 $ 226 $ 236 $ 247 Depreciation and amortization expense (10) (12) (14) (15) (20) Stock-based compensation expense (2) (2) (2) (2) (3) Adjusted cost of revenue $ 199 $ 205 $ 210 $ 218 $ 225 Cost of revenue as a percent of GTV 2.5 % 2.5 % 2.5 % 2.6 % 2.7 % Adjusted cost of revenue as a percent of GTV 2.4 % 2.4 % 2.3 % 2.4 % 2.5 % Operations and support expense $ 64 $ 72 $ 75 $ 66 $ 62 Depreciation and amortization expense — (1) — — — Stock-based compensation expense (4) (4) (3) (4) (3) Payroll taxes related to stock-based compensation (1) — — (1) — — Adjusted operations and support expense $ 60 $ 67 $ 71 $ 61 $ 58 Operations and support expense as a percent of GTV 0.8 % 0.8 % 0.8 % 0.7 % 0.7 % Adjusted operations and support expense as a percent of GTV 0.7 % 0.8 % 0.8 % 0.7 % 0.6 % Research and development expense $ 149 $ 155 $ 144 $ 166 $ 169 Depreciation and amortization expense (2) (1) (2) (2) (2) Stock-based compensation expense (45) (45) (34) (58) (56) Payroll taxes related to stock-based compensation (1) (2) (2) (6) (2) (2) Adjusted research and development expense $ 100 $ 107 $ 102 $ 103 $ 109 Research and development expense as a percent of GTV 1.8 % 1.8 % 1.6 % 1.8 % 1.8 % Adjusted research and development expense as a percent of GTV 1.2 % 1.2 % 1.1 % 1.1 % 1.2 % Sales and marketing expense $ 213 $ 208 $ 216 $ 217 $ 206 Depreciation and amortization expense (2) (2) (2) (2) (3) Stock-based compensation expense (14) (16) (13) (18) (13) Payroll taxes related to stock-based compensation (1) (1) — (1) (1) (1) Adjusted sales and marketing expense $ 196 $ 190 $ 200 $ 197 $ 191 Sales and marketing expense as a percent of GTV 2.6 % 2.4 % 2.4 % 2.4 % 2.3 % Adjusted sales and marketing expense as a percent of GTV 2.4 % 2.2 % 2.2 % 2.2 % 2.1 % 20

MAPLEBEAR INC. DBA INSTACART RECONCILIATION OF GAAP TO NON-GAAP RESULTS (CONTINUED) (unaudited, in millions) Three Months Ended Sep. 30, Dec. 31, Mar. 31, Jun. 30, Sept. 30, 2024 2024 2025 2025 2025 General and administrative expense $ 77 $ 74 $ 126 $ 106 $ 87 Depreciation and amortization expense (1) (1) (1) (1) (1) Stock-based compensation expense (4) (19) (14) (23) (7) Payroll taxes related to stock-based compensation (1) — — (2) (1) (1) Certain legal and regulatory accruals and settlements, net (2) (2) (1) (40) (6) (2) Reserves for sales and other indirect taxes, net (3) 1 10 1 — 1 Acquisition-related expenses (1) (1) — — — Adjusted general and administrative expense $ 70 $ 62 $ 70 $ 74 $ 78 General and administrative expense as a percent of GTV 0.9 % 0.9 % 1.4 % 1.2 % 1.0 % Adjusted general and administrative expense as a percent of GTV 0.8 % 0.7 % 0.8 % 0.8 % 0.8 % Total operating expenses $ 503 $ 509 $ 561 $ 554 $ 525 Depreciation and amortization expense (5) (5) (5) (6) (6) Stock-based compensation expense (67) (84) (64) (103) (79) Payroll taxes related to stock-based compensation (1) (3) (2) (10) (5) (3) Certain legal and regulatory accruals and settlements, net (2) (2) (1) (40) (6) (2) Reserves for sales and other indirect taxes, net (3) 1 10 1 — 1 Acquisition-related expenses (1) (1) — — — Adjusted total operating expenses $ 426 $ 426 $ 443 $ 434 $ 436 Total operating expenses as a percent of GTV 6.1 % 5.9 % 6.1 % 6.1 % 5.7 % Adjusted total operating expenses as a percent of GTV 5.1 % 4.9 % 4.9 % 4.8 % 4.8 % (1) Represents employer payroll taxes related to the vesting and settlement of certain equity awards. (2) Represents certain legal, regulatory, and policy expenses including those related to worker classification matters. (3) Represents sales and other indirect tax reserves, net of abatements, for periods in which we were unable to collect such taxes from customers. We believe this adjustment is useful for investors in understanding our underlying operating performance because in these cases, the taxes were not intended to be a cost to us but rather are to be borne by the customers. Note: Due to rounding, numbers presented may not sum precisely to the totals provided. 21