| Bermuda | 001-36052 | 98-1599372 | ||||||||||||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

||||||||||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class | Trading symbol(s) | Name of each exchange on which registered | ||||||

| Common Shares, $0.10 par value | SPNT | New York Stock Exchange | ||||||

| 8.00% Resettable Fixed Rate Preference Shares, Series B, $0.10 par value, $25.00 liquidation preference per share |

SPNT PB | New York Stock Exchange | ||||||

| Item 2.02 | Results of Operations and Financial Condition. | ||||

| Item 7.01 | Regulation FD Disclosure. | ||||

| Item 9.01 | Financial Statements and Exhibits. | ||||

| Exhibit No. |

Description | |||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

| 99.3 | ||||||||

| 99.4 | ||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). | |||||||

| Date: October 30, 2025 | /s/ Scott Egan |

||||||||||

| Name: | Scott Egan |

||||||||||

| Title: | Chief Executive Officer |

||||||||||

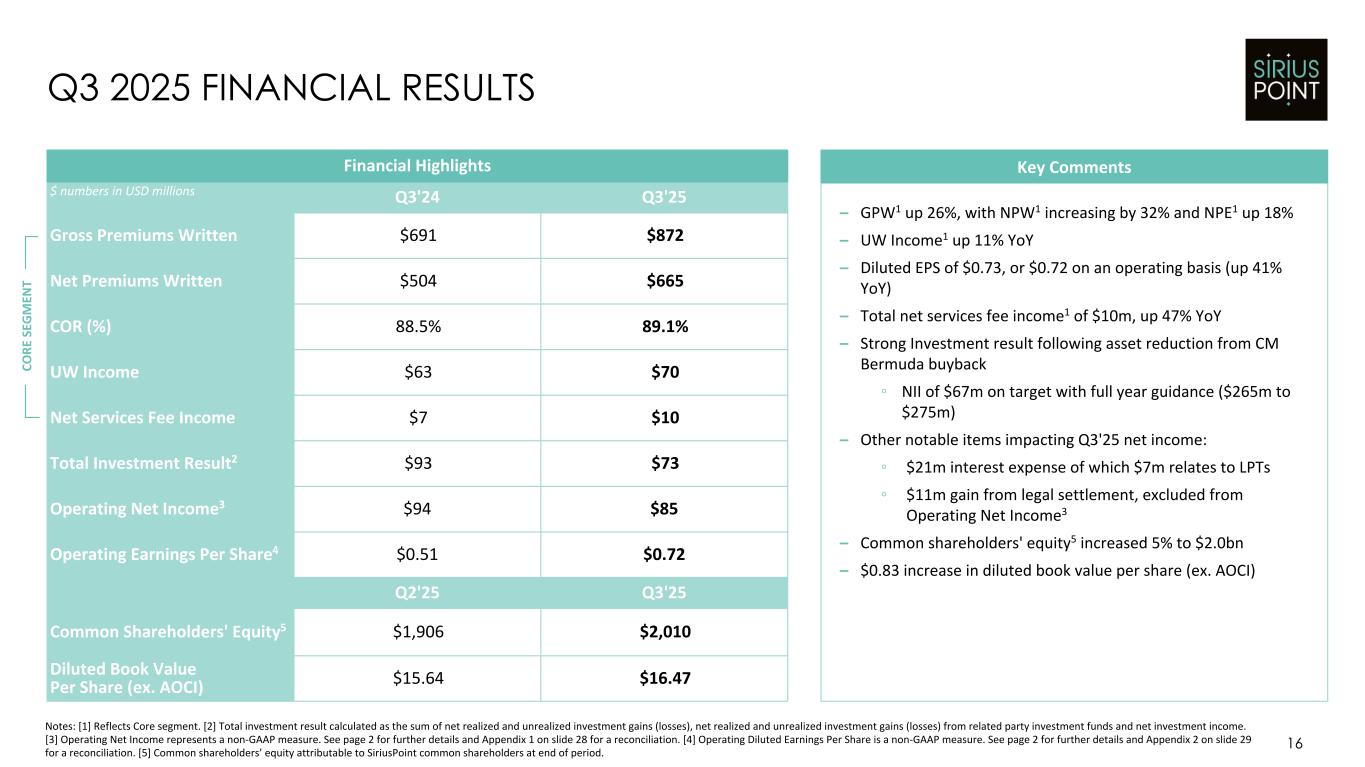

| Three months ended | Nine months ended | ||||||||||||||||||||||

| September 30, 2025 | September 30, 2024 | September 30, 2025 | September 30, 2024 | ||||||||||||||||||||

| ($ in millions, except for ratios) | |||||||||||||||||||||||

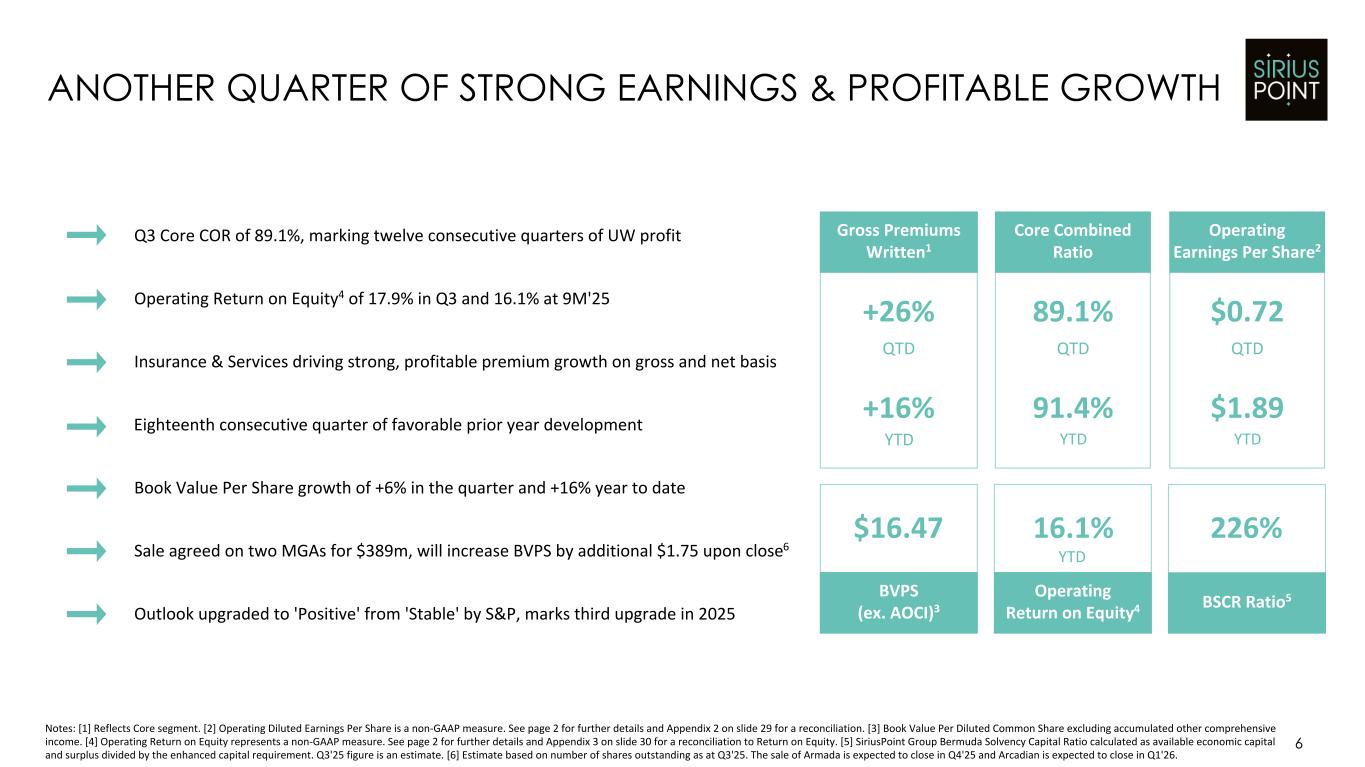

| Combined ratio | 85.9 | % | 84.4 | % | 87.8 | % | 86.1 | % | |||||||||||||||

| Core underwriting income ⁽¹⁾ | $ | 69.6 | $ | 62.5 | $ | 165.7 | $ | 143.7 | |||||||||||||||

| Core net services income ⁽¹⁾ | $ | 10.1 | $ | 7.0 | $ | 37.7 | $ | 34.2 | |||||||||||||||

| Core income ⁽¹⁾ | $ | 79.7 | $ | 69.5 | $ | 203.4 | $ | 177.9 | |||||||||||||||

Core combined ratio ⁽¹⁾ |

89.1 | % | 88.5 | % | 91.4 | % | 91.1 | % | |||||||||||||||

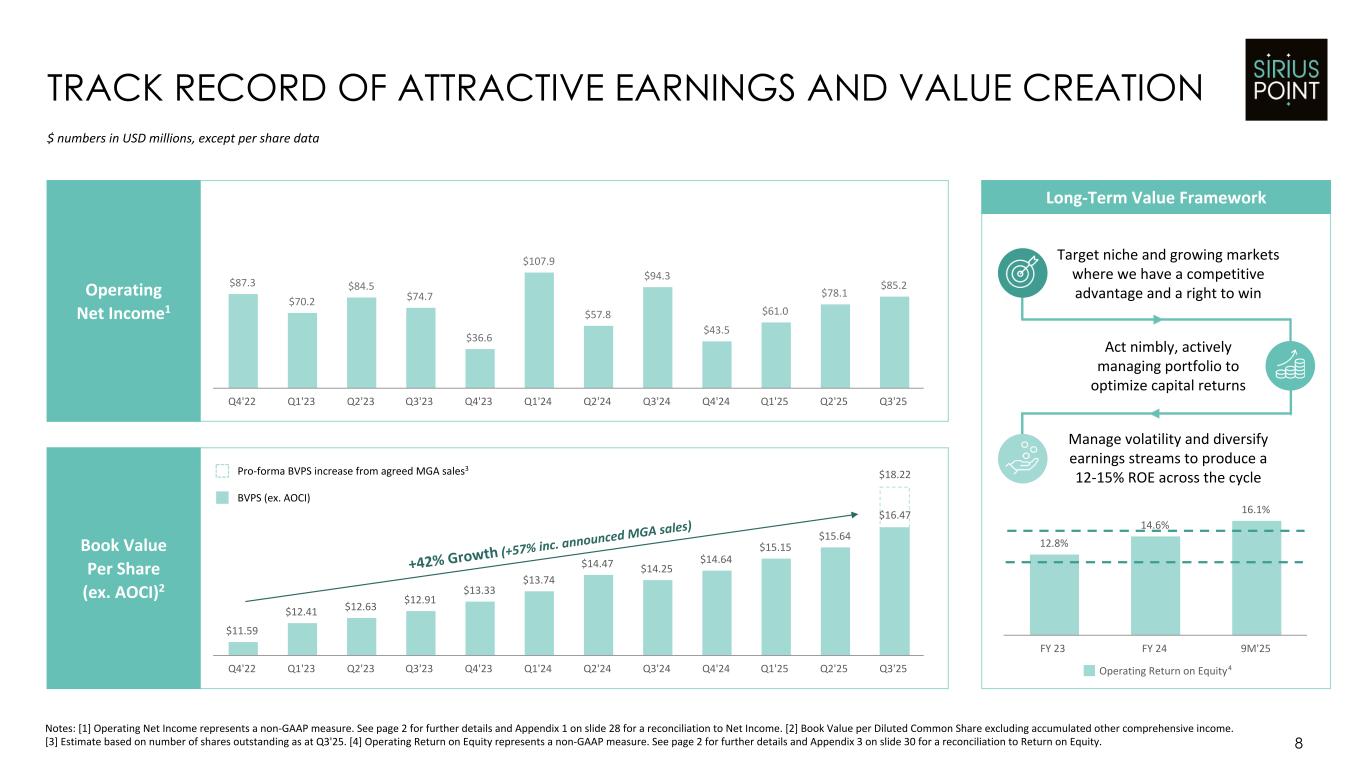

| Operating net income ⁽¹⁾ | $ | 85.2 | $ | 94.3 | $ | 224.3 | $ | 260.1 | |||||||||||||||

Operating diluted earnings per share ⁽¹⁾ |

$ | 0.72 | $ | 0.51 | $ | 1.89 | $ | 1.41 | |||||||||||||||

| Annualized ROE | 17.7 | % | 0.7 | % | 14.5 | % | 11.4 | % | |||||||||||||||

| Annualized Operating ROE ⁽¹⁾ | 17.9 | % | 15.0 | % | 16.1 | % | 14.5 | % | |||||||||||||||

| September 30, 2025 | December 31, 2024 | ||||||||||

| Book value per common share | $ | 17.21 | $ | 14.92 | |||||||

| Book value per diluted common share | $ | 16.91 | $ | 14.60 | |||||||

| Tangible book value per diluted common share ⁽¹⁾ | $ | 15.87 | $ | 13.42 | |||||||

| September 30, 2025 |

December 31, 2024 |

||||||||||

| Assets | |||||||||||

Debt securities, available for sale, at fair value, net of allowance for credit losses of $0.0 (2024 - $1.1) (cost - $5,097.3; 2024 - $5,143.8) |

$ | 5,145.6 | $ | 5,131.0 | |||||||

Debt securities, trading, at fair value (cost - $119.5; 2024 - $187.3) |

98.7 | 162.2 | |||||||||

Short-term investments, at fair value (cost - $24.3; 2024 - $95.3) |

24.6 | 95.8 | |||||||||

Other long-term investments, at fair value (cost - $432.8; 2024 - $438.2) (includes related party investments at fair value of $221.5 (2024 - $217.2)) |

318.3 | 316.5 | |||||||||

| Total investments | 5,587.2 | 5,705.5 | |||||||||

| Cash and cash equivalents | 582.4 | 682.0 | |||||||||

| Restricted cash and cash equivalents | 135.3 | 212.6 | |||||||||

| Due from brokers | 10.0 | 11.2 | |||||||||

| Interest and dividends receivable | 43.9 | 44.0 | |||||||||

| Insurance and reinsurance balances receivable, net | 2,291.4 | 2,054.4 | |||||||||

| Deferred acquisition costs, net | 381.1 | 327.5 | |||||||||

| Unearned premiums ceded | 487.1 | 463.9 | |||||||||

| Loss and loss adjustment expenses recoverable, net | 2,162.9 | 2,315.3 | |||||||||

| Deferred tax asset | 282.2 | 297.0 | |||||||||

| Intangible assets | 123.6 | 140.8 | |||||||||

| Other assets | 330.0 | 270.7 | |||||||||

| Assets held for sale | 43.1 | — | |||||||||

| Total assets | $ | 12,460.2 | $ | 12,524.9 | |||||||

| Liabilities | |||||||||||

| Loss and loss adjustment expense reserves | $ | 5,811.7 | $ | 5,653.9 | |||||||

| Unearned premium reserves | 1,867.9 | 1,639.2 | |||||||||

| Reinsurance balances payable | 1,492.1 | 1,781.6 | |||||||||

| Deferred gain on retroactive reinsurance | — | 8.5 | |||||||||

| Debt | 682.5 | 639.1 | |||||||||

| Due to brokers | 27.5 | 18.0 | |||||||||

| Deferred tax liability | 78.5 | 76.2 | |||||||||

| Share repurchase liability | — | 483.0 | |||||||||

| Other liabilities | 263.2 | 286.6 | |||||||||

| Liabilities held for sale | 25.8 | — | |||||||||

| Total liabilities | 10,249.2 | 10,586.1 | |||||||||

| Commitments and contingent liabilities | |||||||||||

| Shareholders’ equity | |||||||||||

Series B preference shares (par value $0.10; authorized and issued: 8,000,000) |

200.0 | 200.0 | |||||||||

Common shares (issued and outstanding: 116,807,497; 2024 - 116,429,057) |

11.7 | 11.6 | |||||||||

| Additional paid-in capital | 957.4 | 945.0 | |||||||||

| Retained earnings | 988.5 | 784.9 | |||||||||

| Accumulated other comprehensive income (loss), net of tax | 52.3 | (4.1) | |||||||||

| Shareholders’ equity attributable to SiriusPoint shareholders | 2,209.9 | 1,937.4 | |||||||||

| Noncontrolling interests | 1.1 | 1.4 | |||||||||

| Total shareholders’ equity | 2,211.0 | 1,938.8 | |||||||||

| Total liabilities, noncontrolling interests and shareholders’ equity | $ | 12,460.2 | $ | 12,524.9 | |||||||

| Three months ended | Nine months ended | ||||||||||||||||||||||

| September 30, 2025 | September 30, 2024 | September 30, 2025 | September 30, 2024 | ||||||||||||||||||||

| Revenues | |||||||||||||||||||||||

| Net premiums earned | $ | 647.7 | $ | 568.9 | $ | 1,926.4 | $ | 1,753.2 | |||||||||||||||

| Net investment income | 66.5 | 77.7 | 205.9 | 234.7 | |||||||||||||||||||

| Net realized and unrealized investment gains (losses) | 6.2 | 14.8 | 6.6 | (39.1) | |||||||||||||||||||

| Net investment income and net realized and unrealized investment gains (losses) | 72.7 | 92.5 | 212.5 | 195.6 | |||||||||||||||||||

| Other revenues | 35.5 | 18.1 | 92.5 | 164.8 | |||||||||||||||||||

| Loss on settlement and change in fair value of liability-classified capital instruments | — | (117.3) | — | (122.6) | |||||||||||||||||||

| Total revenues | 755.9 | 562.2 | 2,231.4 | 1,991.0 | |||||||||||||||||||

| Expenses | |||||||||||||||||||||||

| Loss and loss adjustment expenses incurred, net | 372.9 | 317.5 | 1,147.3 | 999.4 | |||||||||||||||||||

| Acquisition costs, net | 139.8 | 117.5 | 410.4 | 382.3 | |||||||||||||||||||

| Other underwriting expenses | 43.6 | 44.9 | 133.0 | 127.8 | |||||||||||||||||||

| Net corporate and other expenses | 62.5 | 51.4 | 194.0 | 174.0 | |||||||||||||||||||

| Intangible asset amortization | 2.8 | 3.0 | 8.5 | 8.9 | |||||||||||||||||||

| Interest expense | 21.0 | 13.8 | 60.2 | 50.0 | |||||||||||||||||||

| Foreign exchange losses | 2.4 | 3.0 | 16.9 | 2.9 | |||||||||||||||||||

| Total expenses | 645.0 | 551.1 | 1,970.3 | 1,745.3 | |||||||||||||||||||

| Income before income tax expense | 110.9 | 11.1 | 261.1 | 245.7 | |||||||||||||||||||

| Income tax expense | (20.2) | (2.4) | (45.1) | (26.3) | |||||||||||||||||||

| Net income | 90.7 | 8.7 | 216.0 | 219.4 | |||||||||||||||||||

| Net (income) loss attributable to noncontrolling interests | 0.1 | (0.2) | (0.4) | (2.2) | |||||||||||||||||||

| Net income available to SiriusPoint | 90.8 | 8.5 | 215.6 | 217.2 | |||||||||||||||||||

| Dividends on Series B preference shares | (4.0) | (4.0) | (12.0) | (12.0) | |||||||||||||||||||

| Net income available to SiriusPoint common shareholders | $ | 86.8 | $ | 4.5 | $ | 203.6 | $ | 205.2 | |||||||||||||||

| Earnings per share available to SiriusPoint common shareholders | |||||||||||||||||||||||

| Basic earnings per share available to SiriusPoint common shareholders | $ | 0.74 | $ | 0.03 | $ | 1.75 | $ | 1.15 | |||||||||||||||

| Diluted earnings per share available to SiriusPoint common shareholders | $ | 0.73 | $ | 0.03 | $ | 1.71 | $ | 1.11 | |||||||||||||||

| Weighted average number of common shares used in the determination of earnings per share | |||||||||||||||||||||||

| Basic | 116,726,540 | 165,659,401 | 116,412,996 | 168,275,970 | |||||||||||||||||||

| Diluted | 118,817,903 | 172,803,298 | 118,655,606 | 174,261,326 | |||||||||||||||||||

| Three months ended September 30, 2025 | ||||||||||||||||||||||||||||||||||||||||||||

| Insurance & Services | Reinsurance | Core | Eliminations (2) |

Corporate | Segment Measure Reclass | Total | ||||||||||||||||||||||||||||||||||||||

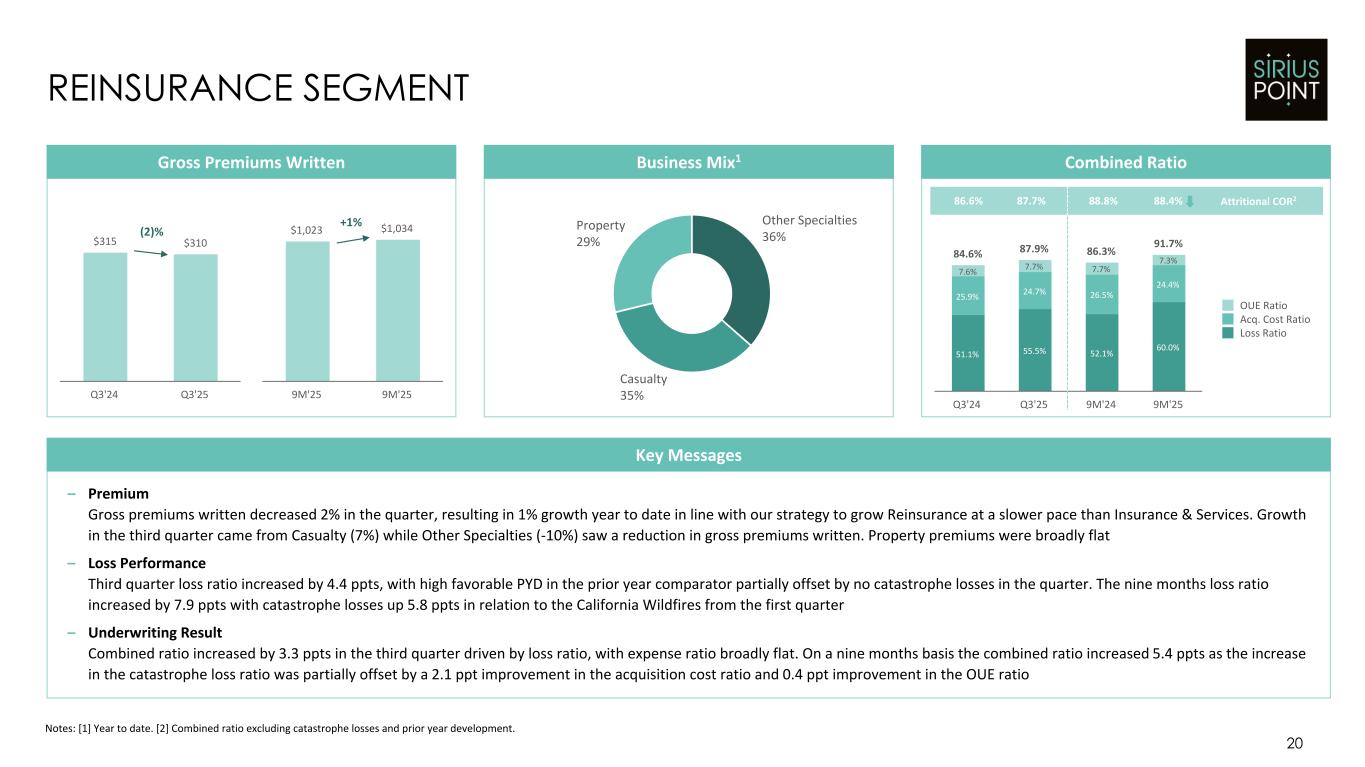

Gross premiums written |

$ | 562.0 | $ | 309.6 | $ | 871.6 | $ | — | $ | 2.8 | $ | — | $ | 874.4 | ||||||||||||||||||||||||||||||

| Net premiums written | 396.8 | 268.1 | 664.9 | — | 5.4 | — | 670.3 | |||||||||||||||||||||||||||||||||||||

| Net premiums earned | 381.2 | 262.3 | 643.5 | — | 4.2 | — | 647.7 | |||||||||||||||||||||||||||||||||||||

| Loss and loss adjustment expenses incurred, net | 225.3 | 145.5 | 370.8 | (1.5) | 3.6 | — | 372.9 | |||||||||||||||||||||||||||||||||||||

| Acquisition costs, net | 98.3 | 64.7 | 163.0 | (26.9) | 3.7 | — | 139.8 | |||||||||||||||||||||||||||||||||||||

| Other underwriting expenses | 19.9 | 20.2 | 40.1 | — | 3.5 | — | 43.6 | |||||||||||||||||||||||||||||||||||||

| Underwriting income (loss) | 37.7 | 31.9 | 69.6 | 28.4 | (6.6) | — | 91.4 | |||||||||||||||||||||||||||||||||||||

| Services revenues | 58.5 | — | 58.5 | (32.7) | — | (25.8) | — | |||||||||||||||||||||||||||||||||||||

| Services expenses | 48.5 | — | 48.5 | — | — | (48.5) | — | |||||||||||||||||||||||||||||||||||||

| Net services fee income | 10.0 | — | 10.0 | (32.7) | — | 22.7 | — | |||||||||||||||||||||||||||||||||||||

| Services noncontrolling loss | 0.1 | — | 0.1 | — | — | (0.1) | — | |||||||||||||||||||||||||||||||||||||

| Net services income | 10.1 | — | 10.1 | (32.7) | — | 22.6 | — | |||||||||||||||||||||||||||||||||||||

| Segment income (loss) | 47.8 | 31.9 | 79.7 | (4.3) | (6.6) | 22.6 | 91.4 | |||||||||||||||||||||||||||||||||||||

| Net investment income | 66.5 | — | 66.5 | |||||||||||||||||||||||||||||||||||||||||

| Net realized and unrealized investment gains | 6.2 | — | 6.2 | |||||||||||||||||||||||||||||||||||||||||

| Other revenues | 9.7 | 25.8 | 35.5 | |||||||||||||||||||||||||||||||||||||||||

| Net corporate and other expenses | (14.0) | (48.5) | (62.5) | |||||||||||||||||||||||||||||||||||||||||

| Intangible asset amortization | (2.8) | — | (2.8) | |||||||||||||||||||||||||||||||||||||||||

| Interest expense | (21.0) | — | (21.0) | |||||||||||||||||||||||||||||||||||||||||

| Foreign exchange losses | (2.4) | — | (2.4) | |||||||||||||||||||||||||||||||||||||||||

| Income (loss) before income tax expense | $ | 47.8 | $ | 31.9 | 79.7 | (4.3) | 35.6 | (0.1) | 110.9 | |||||||||||||||||||||||||||||||||||

| Income tax expense | — | — | (20.2) | — | (20.2) | |||||||||||||||||||||||||||||||||||||||

| Net income | 79.7 | (4.3) | 15.4 | (0.1) | 90.7 | |||||||||||||||||||||||||||||||||||||||

| Net loss attributable to noncontrolling interest | — | — | — | 0.1 | 0.1 | |||||||||||||||||||||||||||||||||||||||

| Net income available to SiriusPoint | $ | 79.7 | $ | (4.3) | $ | 15.4 | $ | — | $ | 90.8 | ||||||||||||||||||||||||||||||||||

| Attritional losses | $ | 234.8 | $ | 145.1 | $ | 379.9 | $ | (1.5) | $ | 3.4 | $ | — | $ | 381.8 | ||||||||||||||||||||||||||||||

| Catastrophe losses | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||

| Prior year loss reserve development | (9.5) | 0.4 | (9.1) | — | 0.2 | — | (8.9) | |||||||||||||||||||||||||||||||||||||

| Loss and loss adjustment expenses incurred, net | $ | 225.3 | $ | 145.5 | $ | 370.8 | $ | (1.5) | $ | 3.6 | $ | — | $ | 372.9 | ||||||||||||||||||||||||||||||

Underwriting Ratios: (1) |

||||||||||||||||||||||||||||||||||||||||||||

| Attritional loss ratio | 61.6 | % | 55.3 | % | 59.0 | % | 59.0 | % | ||||||||||||||||||||||||||||||||||||

| Catastrophe loss ratio | — | % | — | % | — | % | — | % | ||||||||||||||||||||||||||||||||||||

| Prior year loss development ratio | (2.5) | % | 0.2 | % | (1.4) | % | (1.4) | % | ||||||||||||||||||||||||||||||||||||

| Loss ratio | 59.1 | % | 55.5 | % | 57.6 | % | 57.6 | % | ||||||||||||||||||||||||||||||||||||

| Acquisition cost ratio | 25.8 | % | 24.7 | % | 25.3 | % | 21.6 | % | ||||||||||||||||||||||||||||||||||||

| Other underwriting expenses ratio | 5.2 | % | 7.7 | % | 6.2 | % | 6.7 | % | ||||||||||||||||||||||||||||||||||||

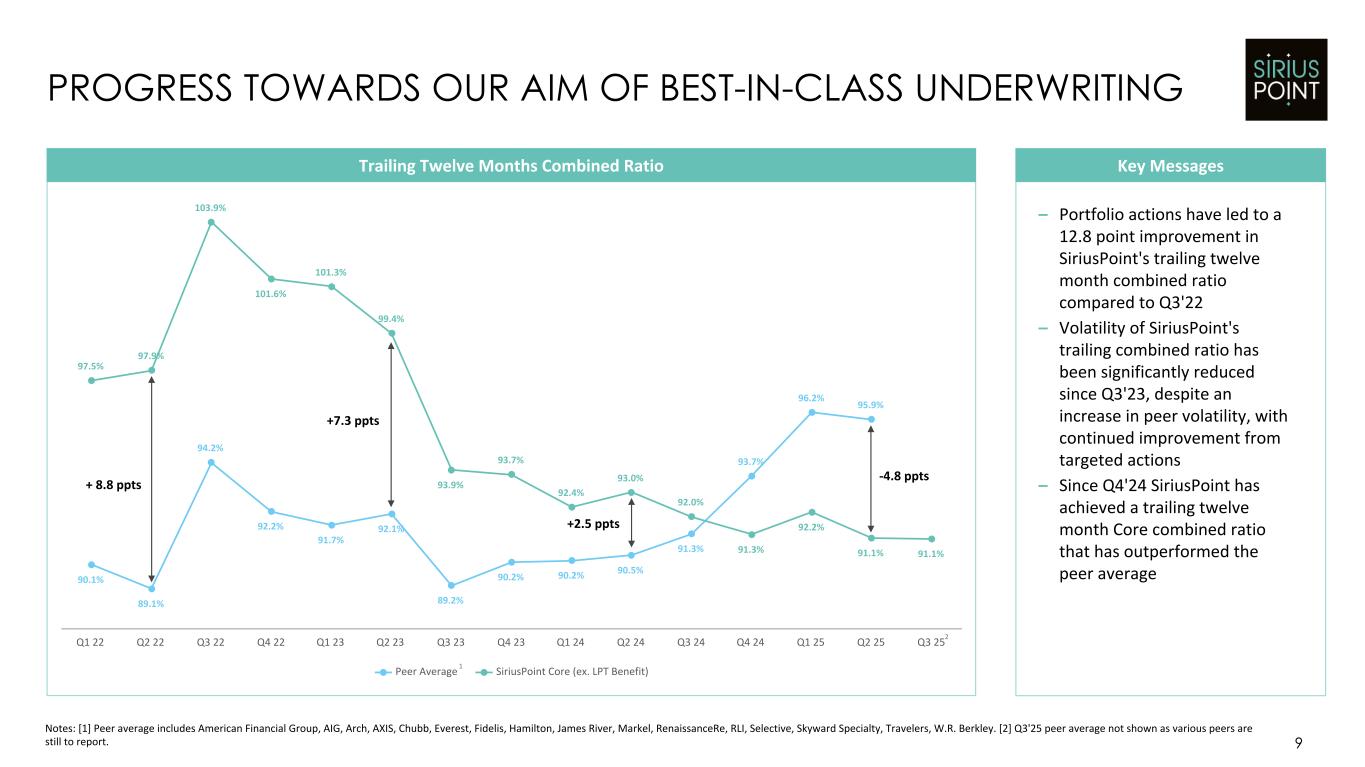

Combined ratio |

90.1 | % | 87.9 | % | 89.1 | % | 85.9 | % | ||||||||||||||||||||||||||||||||||||

| Three months ended September 30, 2024 | ||||||||||||||||||||||||||||||||||||||||||||

| Insurance & Services | Reinsurance | Core | Eliminations (2) |

Corporate | Segment Measure Reclass | Total | ||||||||||||||||||||||||||||||||||||||

Gross premiums written |

$ | 376.0 | $ | 314.5 | $ | 690.5 | $ | — | $ | 23.5 | $ | — | $ | 714.0 | ||||||||||||||||||||||||||||||

| Net premiums written | 235.3 | 268.3 | 503.6 | — | 0.6 | — | 504.2 | |||||||||||||||||||||||||||||||||||||

| Net premiums earned | 276.9 | 269.4 | 546.3 | — | 22.6 | — | 568.9 | |||||||||||||||||||||||||||||||||||||

| Loss and loss adjustment expenses incurred, net | 170.1 | 137.6 | 307.7 | (1.4) | 11.2 | — | 317.5 | |||||||||||||||||||||||||||||||||||||

| Acquisition costs, net | 65.9 | 69.8 | 135.7 | (24.1) | 5.9 | — | 117.5 | |||||||||||||||||||||||||||||||||||||

| Other underwriting expenses | 20.0 | 20.4 | 40.4 | — | 4.5 | — | 44.9 | |||||||||||||||||||||||||||||||||||||

| Underwriting income | 20.9 | 41.6 | 62.5 | 25.5 | 1.0 | — | 89.0 | |||||||||||||||||||||||||||||||||||||

| Services revenues | 48.1 | — | 48.1 | (29.9) | — | (18.2) | — | |||||||||||||||||||||||||||||||||||||

| Services expenses | 41.3 | — | 41.3 | — | — | (41.3) | — | |||||||||||||||||||||||||||||||||||||

| Net services fee income | 6.8 | — | 6.8 | (29.9) | — | 23.1 | — | |||||||||||||||||||||||||||||||||||||

| Services noncontrolling loss | 0.2 | — | 0.2 | — | — | (0.2) | — | |||||||||||||||||||||||||||||||||||||

| Net services income | 7.0 | — | 7.0 | (29.9) | — | 22.9 | — | |||||||||||||||||||||||||||||||||||||

| Segment income | 27.9 | 41.6 | 69.5 | (4.4) | 1.0 | 22.9 | 89.0 | |||||||||||||||||||||||||||||||||||||

| Net investment income | 77.7 | — | 77.7 | |||||||||||||||||||||||||||||||||||||||||

| Net realized and unrealized investment gains | 14.8 | — | 14.8 | |||||||||||||||||||||||||||||||||||||||||

| Other revenues | (0.1) | 18.2 | 18.1 | |||||||||||||||||||||||||||||||||||||||||

| Loss on settlement and change in fair value of liability-classified capital instruments | (117.3) | — | (117.3) | |||||||||||||||||||||||||||||||||||||||||

| Net corporate and other expenses | (10.1) | (41.3) | (51.4) | |||||||||||||||||||||||||||||||||||||||||

| Intangible asset amortization | (3.0) | — | (3.0) | |||||||||||||||||||||||||||||||||||||||||

| Interest expense | (13.8) | — | (13.8) | |||||||||||||||||||||||||||||||||||||||||

| Foreign exchange losses | (3.0) | — | (3.0) | |||||||||||||||||||||||||||||||||||||||||

| Income (loss) before income tax expense | $ | 27.9 | $ | 41.6 | 69.5 | (4.4) | (53.8) | (0.2) | 11.1 | |||||||||||||||||||||||||||||||||||

| Income tax expense | — | — | (2.4) | — | (2.4) | |||||||||||||||||||||||||||||||||||||||

| Net income (loss) | 69.5 | (4.4) | (56.2) | (0.2) | 8.7 | |||||||||||||||||||||||||||||||||||||||

| Net income attributable to noncontrolling interest | — | — | (0.4) | 0.2 | (0.2) | |||||||||||||||||||||||||||||||||||||||

| Net income (loss) available to SiriusPoint | $ | 69.5 | $ | (4.4) | $ | (56.6) | $ | — | $ | 8.5 | ||||||||||||||||||||||||||||||||||

| Attritional losses | $ | 183.9 | $ | 142.9 | $ | 326.8 | $ | (1.4) | $ | 12.1 | $ | — | $ | 337.5 | ||||||||||||||||||||||||||||||

| Catastrophe losses | (0.7) | 11.3 | 10.6 | — | — | — | 10.6 | |||||||||||||||||||||||||||||||||||||

| Prior year loss reserve development | (13.1) | (16.6) | (29.7) | — | (0.9) | — | (30.6) | |||||||||||||||||||||||||||||||||||||

| Loss and loss adjustment expenses incurred, net | $ | 170.1 | $ | 137.6 | $ | 307.7 | $ | (1.4) | $ | 11.2 | $ | — | $ | 317.5 | ||||||||||||||||||||||||||||||

Underwriting Ratios: (1) |

||||||||||||||||||||||||||||||||||||||||||||

| Attritional loss ratio | 66.4 | % | 53.1 | % | 59.8 | % | 59.3 | % | ||||||||||||||||||||||||||||||||||||

| Catastrophe loss ratio | (0.3) | % | 4.2 | % | 1.9 | % | 1.9 | % | ||||||||||||||||||||||||||||||||||||

| Prior year loss development ratio | (4.7) | % | (6.2) | % | (5.4) | % | (5.4) | % | ||||||||||||||||||||||||||||||||||||

| Loss ratio | 61.4 | % | 51.1 | % | 56.3 | % | 55.8 | % | ||||||||||||||||||||||||||||||||||||

| Acquisition cost ratio | 23.8 | % | 25.9 | % | 24.8 | % | 20.7 | % | ||||||||||||||||||||||||||||||||||||

| Other underwriting expenses ratio | 7.2 | % | 7.6 | % | 7.4 | % | 7.9 | % | ||||||||||||||||||||||||||||||||||||

| Combined ratio | 92.4 | % | 84.6 | % | 88.5 | % | 84.4 | % | ||||||||||||||||||||||||||||||||||||

| Nine months ended September 30, 2025 | ||||||||||||||||||||||||||||||||||||||||||||

| Insurance & Services | Reinsurance | Core | Eliminations (2) |

Corporate | Segment Measure Reclass | Total | ||||||||||||||||||||||||||||||||||||||

| Gross premiums written | $ | 1,757.5 | $ | 1,034.1 | $ | 2,791.6 | $ | — | $ | 15.7 | $ | — | $ | 2,807.3 | ||||||||||||||||||||||||||||||

| Net premiums written | 1,273.1 | 843.6 | 2,116.7 | — | 1.0 | — | 2,117.7 | |||||||||||||||||||||||||||||||||||||

| Net premiums earned | 1,086.6 | 828.3 | 1,914.9 | — | 11.5 | — | 1,926.4 | |||||||||||||||||||||||||||||||||||||

| Loss and loss adjustment expenses incurred, net | 644.4 | 497.2 | 1,141.6 | (5.0) | 10.7 | — | 1,147.3 | |||||||||||||||||||||||||||||||||||||

| Acquisition costs, net | 283.5 | 202.3 | 485.8 | (83.1) | 7.7 | — | 410.4 | |||||||||||||||||||||||||||||||||||||

| Other underwriting expenses | 61.4 | 60.4 | 121.8 | — | 11.2 | — | 133.0 | |||||||||||||||||||||||||||||||||||||

| Underwriting income (loss) | 97.3 | 68.4 | 165.7 | 88.1 | (18.1) | — | 235.7 | |||||||||||||||||||||||||||||||||||||

| Services revenues | 178.7 | — | 178.7 | (94.6) | — | (84.1) | — | |||||||||||||||||||||||||||||||||||||

| Services expenses | 141.2 | — | 141.2 | — | — | (141.2) | — | |||||||||||||||||||||||||||||||||||||

| Net services fee income | 37.5 | — | 37.5 | (94.6) | — | 57.1 | — | |||||||||||||||||||||||||||||||||||||

| Services noncontrolling loss | 0.2 | — | 0.2 | — | — | (0.2) | — | |||||||||||||||||||||||||||||||||||||

| Net services income | 37.7 | — | 37.7 | (94.6) | — | 56.9 | — | |||||||||||||||||||||||||||||||||||||

| Segment income (loss) | 135.0 | 68.4 | 203.4 | (6.5) | (18.1) | 56.9 | 235.7 | |||||||||||||||||||||||||||||||||||||

| Net investment income | 205.9 | — | 205.9 | |||||||||||||||||||||||||||||||||||||||||

| Net realized and unrealized investment gains | 6.6 | — | 6.6 | |||||||||||||||||||||||||||||||||||||||||

| Other revenues | 8.4 | 84.1 | 92.5 | |||||||||||||||||||||||||||||||||||||||||

| Net corporate and other expenses | (52.8) | (141.2) | (194.0) | |||||||||||||||||||||||||||||||||||||||||

| Intangible asset amortization | (8.5) | — | (8.5) | |||||||||||||||||||||||||||||||||||||||||

| Interest expense | (60.2) | — | (60.2) | |||||||||||||||||||||||||||||||||||||||||

| Foreign exchange losses | (16.9) | — | (16.9) | |||||||||||||||||||||||||||||||||||||||||

| Income (loss) before income tax expense | $ | 135.0 | $ | 68.4 | 203.4 | (6.5) | 64.4 | (0.2) | 261.1 | |||||||||||||||||||||||||||||||||||

| Income tax expense | — | — | (45.1) | — | (45.1) | |||||||||||||||||||||||||||||||||||||||

| Net income | 203.4 | (6.5) | 19.3 | (0.2) | 216.0 | |||||||||||||||||||||||||||||||||||||||

| Net income attributable to noncontrolling interest | — | — | (0.6) | 0.2 | (0.4) | |||||||||||||||||||||||||||||||||||||||

| Net income available to SiriusPoint | $ | 203.4 | $ | (6.5) | $ | 18.7 | $ | — | $ | 215.6 | ||||||||||||||||||||||||||||||||||

| Attritional losses | $ | 661.3 | $ | 470.1 | $ | 1,131.4 | $ | (5.0) | $ | 5.3 | $ | — | $ | 1,131.7 | ||||||||||||||||||||||||||||||

| Catastrophe losses | 4.8 | 62.6 | 67.4 | — | — | — | 67.4 | |||||||||||||||||||||||||||||||||||||

| Prior year loss reserve development | (21.7) | (35.5) | (57.2) | — | 5.4 | — | (51.8) | |||||||||||||||||||||||||||||||||||||

| Loss and loss adjustment expenses incurred, net | $ | 644.4 | $ | 497.2 | $ | 1,141.6 | $ | (5.0) | $ | 10.7 | $ | — | $ | 1,147.3 | ||||||||||||||||||||||||||||||

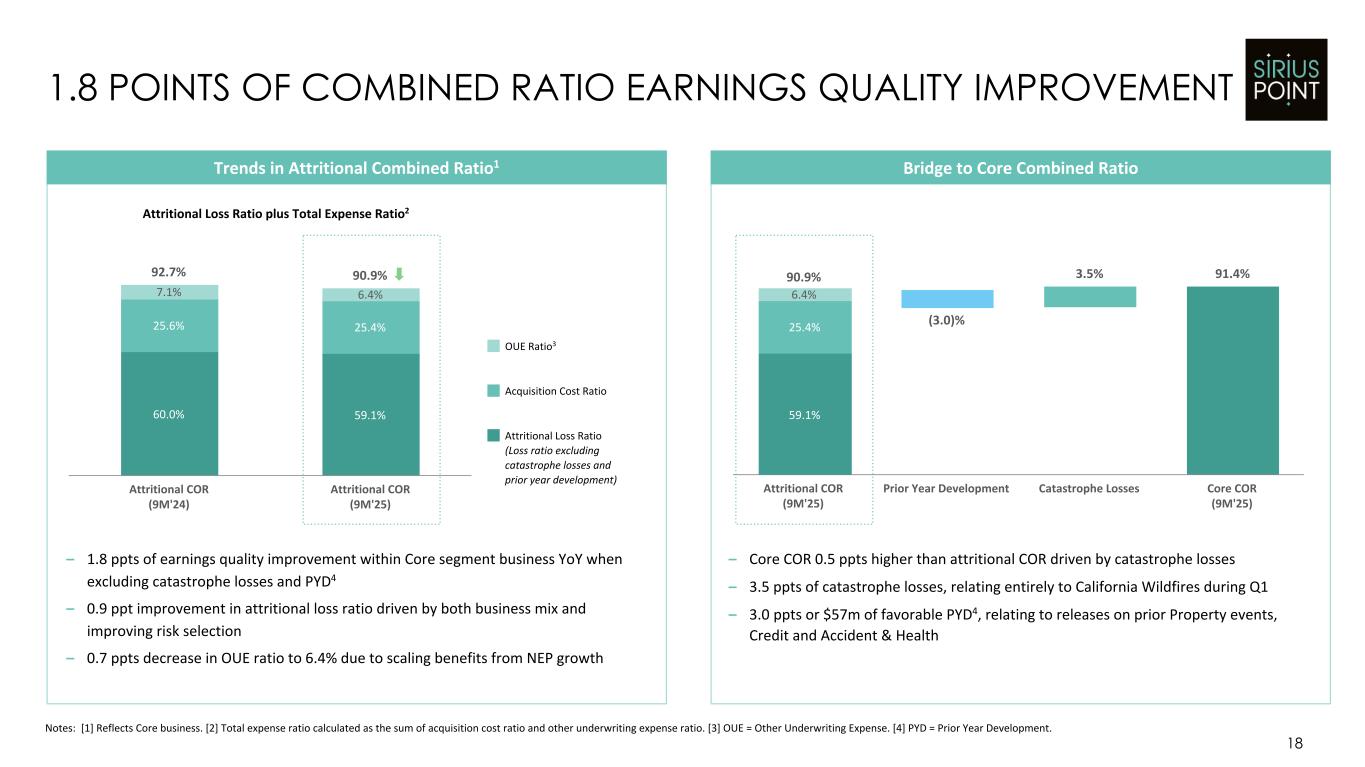

Underwriting Ratios: (1) |

||||||||||||||||||||||||||||||||||||||||||||

| Attritional loss ratio | 60.9 | % | 56.7 | % | 59.1 | % | 58.8 | % | ||||||||||||||||||||||||||||||||||||

| Catastrophe loss ratio | 0.4 | % | 7.6 | % | 3.5 | % | 3.5 | % | ||||||||||||||||||||||||||||||||||||

| Prior year loss development ratio | (2.0) | % | (4.3) | % | (3.0) | % | (2.7) | % | ||||||||||||||||||||||||||||||||||||

| Loss ratio | 59.3 | % | 60.0 | % | 59.6 | % | 59.6 | % | ||||||||||||||||||||||||||||||||||||

| Acquisition cost ratio | 26.1 | % | 24.4 | % | 25.4 | % | 21.3 | % | ||||||||||||||||||||||||||||||||||||

| Other underwriting expenses ratio | 5.7 | % | 7.3 | % | 6.4 | % | 6.9 | % | ||||||||||||||||||||||||||||||||||||

Combined ratio |

91.1 | % | 91.7 | % | 91.4 | % | 87.8 | % | ||||||||||||||||||||||||||||||||||||

| Nine months ended September 30, 2024 | ||||||||||||||||||||||||||||||||||||||||||||

| Insurance & Services | Reinsurance | Core | Eliminations (2) |

Corporate | Segment Measure Reclass | Total | ||||||||||||||||||||||||||||||||||||||

Gross premiums written |

$ | 1,390.5 | $ | 1,023.4 | $ | 2,413.9 | $ | — | $ | 71.2 | $ | — | $ | 2,485.1 | ||||||||||||||||||||||||||||||

| Net premiums written | 913.5 | 867.2 | 1,780.7 | — | 6.4 | — | 1,787.1 | |||||||||||||||||||||||||||||||||||||

| Net premiums earned | 838.3 | 779.2 | 1,617.5 | — | 135.7 | — | 1,753.2 | |||||||||||||||||||||||||||||||||||||

| Loss and loss adjustment expenses incurred, net | 538.8 | 406.0 | 944.8 | (4.1) | 58.7 | — | 999.4 | |||||||||||||||||||||||||||||||||||||

| Acquisition costs, net | 206.9 | 206.8 | 413.7 | (93.8) | 62.4 | — | 382.3 | |||||||||||||||||||||||||||||||||||||

| Other underwriting expenses | 55.4 | 59.9 | 115.3 | — | 12.5 | — | 127.8 | |||||||||||||||||||||||||||||||||||||

| Underwriting income | 37.2 | 106.5 | 143.7 | 97.9 | 2.1 | — | 243.7 | |||||||||||||||||||||||||||||||||||||

| Services revenues | 171.3 | — | 171.3 | (101.4) | — | (69.9) | — | |||||||||||||||||||||||||||||||||||||

| Services expenses | 135.0 | — | 135.0 | — | — | (135.0) | — | |||||||||||||||||||||||||||||||||||||

| Net services fee income | 36.3 | — | 36.3 | (101.4) | — | 65.1 | — | |||||||||||||||||||||||||||||||||||||

| Services noncontrolling income | (2.1) | — | (2.1) | — | — | 2.1 | — | |||||||||||||||||||||||||||||||||||||

| Net services income | 34.2 | — | 34.2 | (101.4) | — | 67.2 | — | |||||||||||||||||||||||||||||||||||||

| Segment income | 71.4 | 106.5 | 177.9 | (3.5) | 2.1 | 67.2 | 243.7 | |||||||||||||||||||||||||||||||||||||

| Net investment income | 234.7 | — | 234.7 | |||||||||||||||||||||||||||||||||||||||||

| Net realized and unrealized investment losses | (39.1) | — | (39.1) | |||||||||||||||||||||||||||||||||||||||||

| Other revenues | 94.9 | 69.9 | 164.8 | |||||||||||||||||||||||||||||||||||||||||

| Loss on settlement and change in fair value of liability-classified capital instruments | (122.6) | — | (122.6) | |||||||||||||||||||||||||||||||||||||||||

| Net corporate and other expenses | (39.0) | (135.0) | (174.0) | |||||||||||||||||||||||||||||||||||||||||

| Intangible asset amortization | (8.9) | — | (8.9) | |||||||||||||||||||||||||||||||||||||||||

| Interest expense | (50.0) | — | (50.0) | |||||||||||||||||||||||||||||||||||||||||

| Foreign exchange gains | (2.9) | — | (2.9) | |||||||||||||||||||||||||||||||||||||||||

| Income before income tax expense | $ | 71.4 | $ | 106.5 | 177.9 | (3.5) | 69.2 | 2.1 | 245.7 | |||||||||||||||||||||||||||||||||||

| Income tax expense | — | — | (26.3) | — | (26.3) | |||||||||||||||||||||||||||||||||||||||

| Net income | 177.9 | (3.5) | 42.9 | 2.1 | 219.4 | |||||||||||||||||||||||||||||||||||||||

| Net (income) loss attributable to noncontrolling interests | — | — | (0.1) | (2.1) | (2.2) | |||||||||||||||||||||||||||||||||||||||

| Net income available to SiriusPoint | $ | 177.9 | $ | (3.5) | $ | 42.8 | $ | — | $ | 217.2 | ||||||||||||||||||||||||||||||||||

| Attritional losses | $ | 546.3 | $ | 424.9 | $ | 971.2 | $ | (4.1) | $ | 86.7 | $ | — | $ | 1,053.8 | ||||||||||||||||||||||||||||||

| Catastrophe losses | 1.9 | 14.3 | 16.2 | — | — | — | 16.2 | |||||||||||||||||||||||||||||||||||||

| Prior year loss reserve development | (9.4) | (33.2) | (42.6) | — | (28.0) | — | (70.6) | |||||||||||||||||||||||||||||||||||||

| Loss and loss adjustment expenses incurred, net | $ | 538.8 | $ | 406.0 | $ | 944.8 | $ | (4.1) | $ | 58.7 | $ | — | $ | 999.4 | ||||||||||||||||||||||||||||||

Underwriting Ratios: (1) |

||||||||||||||||||||||||||||||||||||||||||||

| Attritional loss ratio | 65.2 | % | 54.6 | % | 60.0 | % | 60.1 | % | ||||||||||||||||||||||||||||||||||||

| Catastrophe loss ratio | 0.2 | % | 1.8 | % | 1.0 | % | 0.9 | % | ||||||||||||||||||||||||||||||||||||

| Prior year loss development ratio | (1.1) | % | (4.3) | % | (2.6) | % | (4.0) | % | ||||||||||||||||||||||||||||||||||||

| Loss ratio | 64.3 | % | 52.1 | % | 58.4 | % | 57.0 | % | ||||||||||||||||||||||||||||||||||||

| Acquisition cost ratio | 24.7 | % | 26.5 | % | 25.6 | % | 21.8 | % | ||||||||||||||||||||||||||||||||||||

| Other underwriting expenses ratio | 6.6 | % | 7.7 | % | 7.1 | % | 7.3 | % | ||||||||||||||||||||||||||||||||||||

| Combined ratio | 95.6 | % | 86.3 | % | 91.1 | % | 86.1 | % | ||||||||||||||||||||||||||||||||||||

| September 30, 2025 |

December 31, 2024 |

||||||||||

| ($ in millions, except share and per share amounts) | |||||||||||

| Common shareholders’ equity attributable to SiriusPoint common shareholders | $ | 2,009.9 | $ | 1,737.4 | |||||||

| Accumulated other comprehensive income (loss), net of tax | 52.3 | (4.1) | |||||||||

| Common shareholders’ equity attributable to SiriusPoint common shareholders ex. AOCI | 1,957.6 | 1,741.5 | |||||||||

| Intangible assets | 123.6 | 140.8 | |||||||||

| Tangible common shareholders' equity attributable to SiriusPoint common shareholders | $ | 1,886.3 | $ | 1,596.6 | |||||||

| Common shares outstanding | 116,807,497 | 116,429,057 | |||||||||

| Effect of dilutive stock options, restricted share units and warrants | 2,034,652 | 2,559,359 | |||||||||

| Book value per diluted common share denominator | 118,842,149 | 118,988,416 | |||||||||

| Book value per common share | $ | 17.21 | $ | 14.92 | |||||||

| Book value per diluted common share | $ | 16.91 | $ | 14.60 | |||||||

| Book value per diluted common share ex. AOCI | $ | 16.47 | $ | 14.64 | |||||||

| Tangible book value per diluted common share | $ | 15.87 | $ | 13.42 | |||||||

| Three months ended | Nine months ended | ||||||||||||||||||||||

| September 30, 2025 | September 30, 2024 | September 30, 2025 | September 30, 2024 | ||||||||||||||||||||

| ($ in millions, except share and per share amounts) | |||||||||||||||||||||||

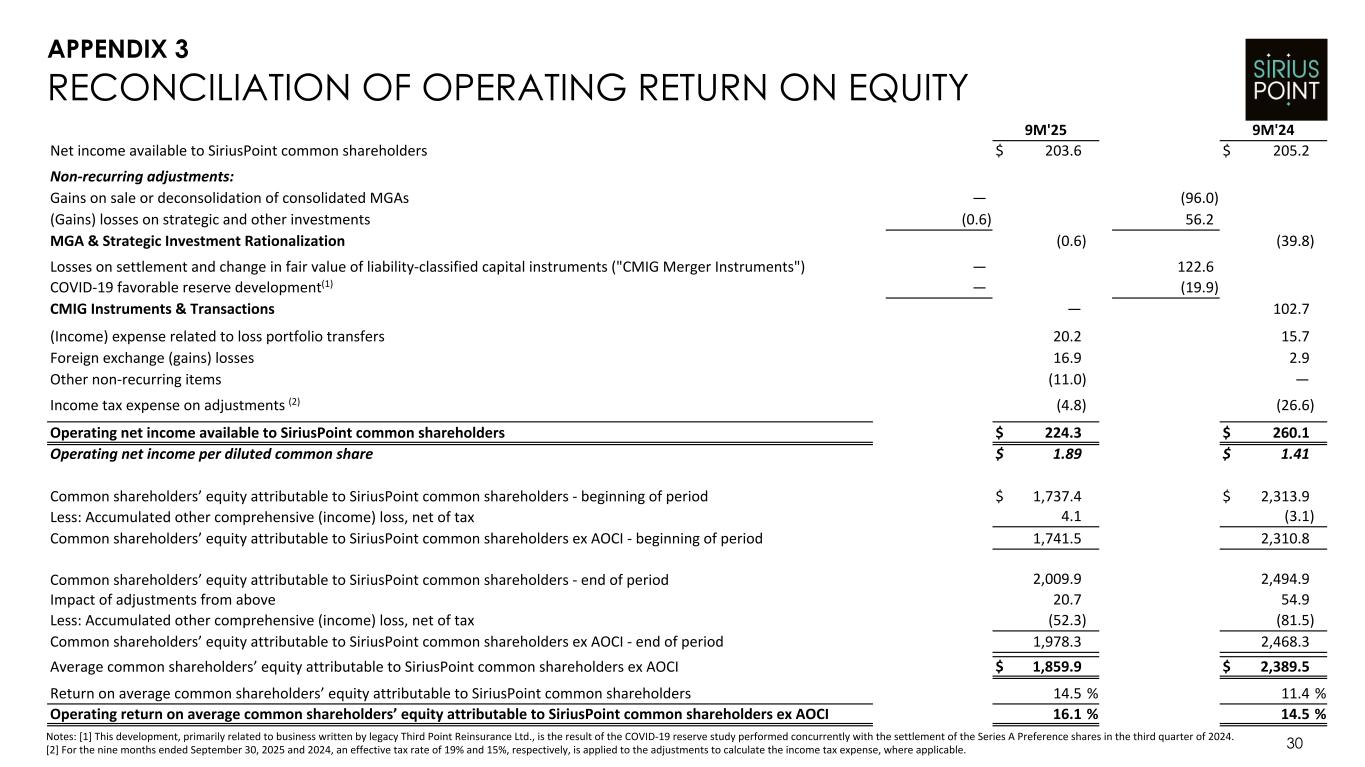

| Net income available to SiriusPoint common shareholders | $ | 86.8 | $ | 4.5 | $ | 203.6 | $ | 205.2 | |||||||||||||||

| Non-recurring adjustments: | |||||||||||||||||||||||

| Gain on sale or deconsolidation of consolidated MGAs | — | — | — | (96.0) | |||||||||||||||||||

| (Gains) losses on strategic and other investments | (1.1) | 3.4 | (0.6) | 56.2 | |||||||||||||||||||

| MGA & Strategic Investment Rationalization | (1.1) | 3.4 | (0.6) | (39.8) | |||||||||||||||||||

| Loss on settlement of liability classified financial instruments and deal costs | — | 90.7 | — | 90.7 | |||||||||||||||||||

| Change in fair value of liability classified financial instruments | — | 26.6 | — | 31.9 | |||||||||||||||||||

| CMIG Instruments & Transactions | — | 117.3 | — | 122.6 | |||||||||||||||||||

| Expense related to loss portfolio transfers | 7.7 | 1.9 | 20.2 | 15.7 | |||||||||||||||||||

| Foreign exchange losses | 2.4 | 3.0 | 16.9 | 2.9 | |||||||||||||||||||

| COVID-19 favorable reserve development | — | (19.9) | — | (19.9) | |||||||||||||||||||

| Other non-recurring items | (11.0) | — | (11.0) | — | |||||||||||||||||||

Income tax expense on adjustments (1) |

0.4 | (15.9) | (4.8) | (26.6) | |||||||||||||||||||

| Operating net income | $ | 85.2 | $ | 94.3 | $ | 224.3 | $ | 260.1 | |||||||||||||||

| Weighted average number of diluted common shares used in the determination of earnings per share | 118,817,903 | 172,803,298 | 118,655,606 | 174,261,326 | |||||||||||||||||||

| Operating diluted earnings per share prior to participating shareholder adjustments | $ | 0.72 | $ | 0.55 | $ | 1.89 | $ | 1.49 | |||||||||||||||

| Effect of above and net income allocated to participating shareholders | — | (0.04) | — | (0.08) | |||||||||||||||||||

| Operating diluted earnings per share | $ | 0.72 | $ | 0.51 | $ | 1.89 | $ | 1.41 | |||||||||||||||

| Three months ended | Nine months ended | ||||||||||||||||||||||

| September 30, 2025 | September 30, 2024 | September 30, 2025 | September 30, 2024 | ||||||||||||||||||||

| ($in millions, except for ratios) | |||||||||||||||||||||||

| Operating net income | $ | 85.2 | $ | 94.3 | $ | 224.3 | $ | 260.1 | |||||||||||||||

| Common shareholders’ equity attributable to SiriusPoint common shareholders - beginning of period | 1,905.7 | 2,504.1 | 1,737.4 | 2,313.9 | |||||||||||||||||||

| Accumulated other comprehensive income (loss), net of tax - beginning of period | 46.5 | (28.0) | (4.1) | 3.1 | |||||||||||||||||||

| Common shareholders’ equity attributable to SiriusPoint common shareholders ex. AOCI - beginning of period | 1,859.2 | 2,532.1 | 1,741.5 | 2,310.8 | |||||||||||||||||||

| Common shareholders’ equity attributable to SiriusPoint common shareholders - end of period | 2,009.9 | 2,494.9 | 2,009.9 | 2,494.9 | |||||||||||||||||||

| Adjustments to Net income to arrive at Operating net income | (1.6) | 89.8 | 20.7 | 54.9 | |||||||||||||||||||

| Accumulated other comprehensive income (loss), net of tax - end of period | 52.3 | 81.5 | 52.3 | 81.5 | |||||||||||||||||||

| Common shareholders’ equity attributable to SiriusPoint common shareholders ex. AOCI - end of period | 1,956.0 | 2,503.2 | 1,978.3 | 2,468.3 | |||||||||||||||||||

| Average common shareholders’ equity attributable to SiriusPoint common shareholders ex. AOCI | $ | 1,907.6 | $ | 2,517.7 | $ | 1,859.9 | $ | 2,389.6 | |||||||||||||||

| Annualized Operating ROE | 17.9 | % | 15.0 | % | 16.1 | % | 14.5 | % | |||||||||||||||

| Three months ended | Nine months ended | ||||||||||||||||||||||

| September 30, 2025 | September 30, 2024 | September 30, 2025 | September 30, 2024 | ||||||||||||||||||||

($ in millions, except for ratios) |

|||||||||||||||||||||||

| Net income available to SiriusPoint common shareholders | $ | 86.8 | $ | 4.5 | $ | 203.6 | $ | 205.2 | |||||||||||||||

| Common shareholders’ equity attributable to SiriusPoint common shareholders - beginning of period | 1,905.7 | 2,504.1 | 1,737.4 | 2,313.9 | |||||||||||||||||||

| Common shareholders’ equity attributable to SiriusPoint common shareholders - end of period | 2,009.9 | 2,494.9 | 2,009.9 | 2,494.9 | |||||||||||||||||||

| Average common shareholders’ equity attributable to SiriusPoint common shareholders | $ | 1,957.8 | $ | 2,499.5 | $ | 1,873.7 | $ | 2,404.4 | |||||||||||||||

| Annualized return on average common shareholders’ equity attributable to SiriusPoint common shareholders | 17.7 | % | 0.7 | % | 14.5 | % | 11.4 | % | |||||||||||||||

| Point Building | Liam Blackledge - Investor Relations and Strategy Manager |

|||||||

| 3 Waterloo Lane | Tel: + 44 203 772 3082 | |||||||

| Pembroke HM 08 | Email: investor.relations@siriuspt.com | |||||||

| Bermuda | Website: www.siriuspt.com | |||||||

| Key Performance Indicators | ||||||||

| Consolidated Financial Statements | ||||||||

| Consolidated Statements of Income | ||||||||

| Consolidated Statements of Income - by Quarter | ||||||||

| Operating Segment Information | ||||||||

| Segment Reporting - Three months ended September 30, 2025 | ||||||||

| Segment Reporting - Three months ended September 30, 2024 | ||||||||

| Segment Reporting - Nine months ended September 30, 2025 | ||||||||

| Segment Reporting - Nine months ended September 30, 2024 | ||||||||

Consolidated Results - by Quarter

|

||||||||

Core Results - by Quarter

|

||||||||

Insurance & Services Segment - by Quarter

|

||||||||

Reinsurance Segment - by Quarter

|

||||||||

| Investments | ||||||||

| Other | ||||||||

| Earnings per Share - by Quarter | ||||||||

| Annualized Return on Average Common Shareholders’ Equity - by Quarter | ||||||||

| Book Value per Share - by Quarter | ||||||||

| Net Corporate and Other Expenses - by Quarter | ||||||||

Operating net income and Operating diluted earnings per share |

||||||||

Annualized Operating ROE computation |

||||||||

| Three months ended | Nine months ended | ||||||||||||||||||||||

| September 30, 2025 | September 30, 2024 | September 30, 2025 | September 30, 2024 | ||||||||||||||||||||

| ($ in millions, except for ratios and per share amounts) | |||||||||||||||||||||||

| Combined ratio | 85.9 | % | 84.4 | % | 87.8 | % | 86.1 | % | |||||||||||||||

Core underwriting income (1) |

$ | 69.6 | $ | 62.5 | $ | 165.7 | $ | 143.7 | |||||||||||||||

Core net services income (1) |

$ | 10.1 | $ | 7.0 | $ | 37.7 | $ | 34.2 | |||||||||||||||

Core income (1) |

$ | 79.7 | $ | 69.5 | $ | 203.4 | $ | 177.9 | |||||||||||||||

Core combined ratio (1) |

89.1 | % | 88.5 | % | 91.4 | % | 91.1 | % | |||||||||||||||

Operating net income (1) |

$ | 85.2 | $ | 94.3 | $ | 224.3 | $ | 260.1 | |||||||||||||||

Operating diluted earnings per share (1) |

$ | 0.72 | $ | 0.51 | $ | 1.89 | $ | 1.41 | |||||||||||||||

| Annualized ROE | 17.7 | % | 0.7 | % | 14.5 | % | 11.4 | % | |||||||||||||||

Annualized Operating ROE (1) |

17.9 | % | 15.0 | % | 16.1 | % | 14.5 | % | |||||||||||||||

| September 30, 2025 | December 31, 2024 | ||||||||||

| Book value per common share | $ | 17.21 | $ | 14.92 | |||||||

Book value per diluted common share (1) |

$ | 16.91 | $ | 14.60 | |||||||

Tangible book value per diluted common share (1) |

$ | 15.87 | $ | 13.42 | |||||||

| September 30, 2025 |

June 30, 2025 |

March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

||||||||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||||||||

| Debt securities, available for sale, at fair value, net of allowance for credit losses | $ | 5,145.6 | $ | 4,735.9 | $ | 4,635.2 | $ | 5,131.0 | $ | 5,411.8 | ||||||||||||||||||||||

| Debt securities, trading, at fair value | 98.7 | 102.9 | 117.6 | 162.2 | 233.1 | |||||||||||||||||||||||||||

| Short-term investments, at fair value | 24.6 | 54.9 | 48.2 | 95.8 | 52.4 | |||||||||||||||||||||||||||

| Other long-term investments, at fair value | 318.3 | 320.1 | 317.7 | 316.5 | 350.6 | |||||||||||||||||||||||||||

| Total investments | 5,587.2 | 5,213.8 | 5,118.7 | 5,705.5 | 6,047.9 | |||||||||||||||||||||||||||

| Cash and cash equivalents | 582.4 | 732.4 | 740.3 | 682.0 | 640.7 | |||||||||||||||||||||||||||

| Restricted cash and cash equivalents | 135.3 | 190.8 | 184.9 | 212.6 | 174.5 | |||||||||||||||||||||||||||

| Due from brokers | 10.0 | 8.2 | 18.8 | 11.2 | 13.9 | |||||||||||||||||||||||||||

| Interest and dividends receivable | 43.9 | 42.5 | 42.1 | 44.0 | 49.4 | |||||||||||||||||||||||||||

| Insurance and reinsurance balances receivable, net | 2,291.4 | 2,290.1 | 2,240.8 | 2,054.4 | 2,069.1 | |||||||||||||||||||||||||||

| Deferred acquisition costs, net | 381.1 | 379.5 | 369.3 | 327.5 | 330.0 | |||||||||||||||||||||||||||

| Unearned premiums ceded | 487.1 | 484.0 | 514.3 | 463.9 | 467.2 | |||||||||||||||||||||||||||

| Loss and loss adjustment expenses recoverable, net | 2,162.9 | 2,263.9 | 2,335.7 | 2,315.3 | 2,198.7 | |||||||||||||||||||||||||||

| Deferred tax asset | 282.2 | 297.1 | 293.3 | 297.0 | 249.2 | |||||||||||||||||||||||||||

| Intangible assets | 123.6 | 135.1 | 137.9 | 140.8 | 143.8 | |||||||||||||||||||||||||||

| Other assets | 330.0 | 318.3 | 284.4 | 270.7 | 298.1 | |||||||||||||||||||||||||||

| Assets held for sale | 43.1 | — | — | — | — | |||||||||||||||||||||||||||

| Total assets | $ | 12,460.2 | $ | 12,355.7 | $ | 12,280.5 | $ | 12,524.9 | $ | 12,682.5 | ||||||||||||||||||||||

| Liabilities | ||||||||||||||||||||||||||||||||

| Loss and loss adjustment expense reserves | $ | 5,811.7 | $ | 5,817.4 | $ | 5,762.6 | $ | 5,653.9 | $ | 5,702.1 | ||||||||||||||||||||||

| Unearned premium reserves | 1,867.9 | 1,854.0 | 1,816.8 | 1,639.2 | 1,684.0 | |||||||||||||||||||||||||||

| Reinsurance balances payable | 1,492.1 | 1,539.9 | 1,707.5 | 1,781.6 | 1,509.6 | |||||||||||||||||||||||||||

| Deferred gain on retroactive reinsurance | — | — | 6.6 | 8.5 | 21.7 | |||||||||||||||||||||||||||

| Debt | 682.5 | 678.4 | 663.5 | 639.1 | 660.5 | |||||||||||||||||||||||||||

| Due to brokers | 27.5 | 9.0 | 6.6 | 18.0 | 23.1 | |||||||||||||||||||||||||||

| Deferred tax liability | 78.5 | 89.6 | 94.2 | 76.2 | 38.9 | |||||||||||||||||||||||||||

| Liability-classified capital instruments | — | — | — | — | 58.4 | |||||||||||||||||||||||||||

| Share repurchase liability | — | — | — | 483.0 | — | |||||||||||||||||||||||||||

| Other liabilities | 263.2 | 260.6 | 196.0 | 286.6 | 287.7 | |||||||||||||||||||||||||||

| Liabilities held for sale | 25.8 | — | — | — | — | |||||||||||||||||||||||||||

| Total liabilities | 10,249.2 | 10,248.9 | 10,253.8 | 10,586.1 | 9,986.0 | |||||||||||||||||||||||||||

| Commitments and contingent liabilities | ||||||||||||||||||||||||||||||||

| Shareholders’ equity | ||||||||||||||||||||||||||||||||

| Series B preference shares | 200.0 | 200.0 | 200.0 | 200.0 | 200.0 | |||||||||||||||||||||||||||

| Common shares | 11.7 | 11.7 | 11.6 | 11.6 | 16.2 | |||||||||||||||||||||||||||

| Additional paid-in capital | 957.4 | 945.8 | 944.7 | 945.0 | 1,591.0 | |||||||||||||||||||||||||||

| Retained earnings | 988.5 | 901.7 | 842.5 | 784.9 | 806.2 | |||||||||||||||||||||||||||

| Accumulated other comprehensive income (loss), net of tax | 52.3 | 46.5 | 26.4 | (4.1) | 81.5 | |||||||||||||||||||||||||||

| Shareholders’ equity attributable to SiriusPoint shareholders | 2,209.9 | 2,105.7 | 2,025.2 | 1,937.4 | 2,694.9 | |||||||||||||||||||||||||||

| Noncontrolling interests | 1.1 | 1.1 | 1.5 | 1.4 | 1.6 | |||||||||||||||||||||||||||

| Total shareholders’ equity | 2,211.0 | 2,106.8 | 2,026.7 | 1,938.8 | 2,696.5 | |||||||||||||||||||||||||||

| Total liabilities, noncontrolling interests and shareholders’ equity | $ | 12,460.2 | $ | 12,355.7 | $ | 12,280.5 | $ | 12,524.9 | $ | 12,682.5 | ||||||||||||||||||||||

| Three months ended | Nine months ended | ||||||||||||||||||||||

| September 30, 2025 | September 30, 2024 | September 30, 2025 | September 30, 2024 | ||||||||||||||||||||

| Revenues | |||||||||||||||||||||||

| Net premiums earned | $ | 647.7 | $ | 568.9 | $ | 1,926.4 | $ | 1,753.2 | |||||||||||||||

| Net investment income | 66.5 | 77.7 | 205.9 | 234.7 | |||||||||||||||||||

| Net realized and unrealized investment gains (losses) | 6.2 | 14.8 | 6.6 | (39.1) | |||||||||||||||||||

| Net investment income and net realized and unrealized investment gains (losses) | 72.7 | 92.5 | 212.5 | 195.6 | |||||||||||||||||||

| Other revenues | 35.5 | 18.1 | 92.5 | 164.8 | |||||||||||||||||||

| Loss on settlement and change in fair value of liability-classified capital instruments | — | (117.3) | — | (122.6) | |||||||||||||||||||

| Total revenues | 755.9 | 562.2 | 2,231.4 | 1,991.0 | |||||||||||||||||||

| Expenses | |||||||||||||||||||||||

| Loss and loss adjustment expenses incurred, net | 372.9 | 317.5 | 1,147.3 | 999.4 | |||||||||||||||||||

| Acquisition costs, net | 139.8 | 117.5 | 410.4 | 382.3 | |||||||||||||||||||

| Other underwriting expenses | 43.6 | 44.9 | 133.0 | 127.8 | |||||||||||||||||||

| Net corporate and other expenses | 62.5 | 51.4 | 194.0 | 174.0 | |||||||||||||||||||

| Intangible asset amortization | 2.8 | 3.0 | 8.5 | 8.9 | |||||||||||||||||||

| Interest expense | 21.0 | 13.8 | 60.2 | 50.0 | |||||||||||||||||||

| Foreign exchange losses | 2.4 | 3.0 | 16.9 | 2.9 | |||||||||||||||||||

| Total expenses | 645.0 | 551.1 | 1,970.3 | 1,745.3 | |||||||||||||||||||

| Income before income tax expense | 110.9 | 11.1 | 261.1 | 245.7 | |||||||||||||||||||

| Income tax expense | (20.2) | (2.4) | (45.1) | (26.3) | |||||||||||||||||||

| Net income | 90.7 | 8.7 | 216.0 | 219.4 | |||||||||||||||||||

| Net (income) loss attributable to noncontrolling interests | 0.1 | (0.2) | (0.4) | (2.2) | |||||||||||||||||||

| Net income available to SiriusPoint | 90.8 | 8.5 | 215.6 | 217.2 | |||||||||||||||||||

| Dividends on Series B preference shares | (4.0) | (4.0) | (12.0) | (12.0) | |||||||||||||||||||

| Net income available to SiriusPoint common shareholders | $ | 86.8 | $ | 4.5 | $ | 203.6 | $ | 205.2 | |||||||||||||||

| Earnings per share available to SiriusPoint common shareholders | |||||||||||||||||||||||

| Basic earnings per share available to SiriusPoint common shareholders ⁽¹⁾ | $ | 0.74 | $ | 0.03 | $ | 1.75 | $ | 1.15 | |||||||||||||||

| Diluted earnings per share available to SiriusPoint common shareholders ⁽¹⁾ | $ | 0.73 | $ | 0.03 | $ | 1.71 | $ | 1.11 | |||||||||||||||

| Weighted average number of common shares used in the determination of earnings per share | |||||||||||||||||||||||

| Basic | 116,726,540 | 165,659,401 | 116,412,996 | 168,275,970 | |||||||||||||||||||

| Diluted | 118,817,903 | 172,803,298 | 118,655,606 | 174,261,326 | |||||||||||||||||||

| September 30, 2025 |

June 30, 2025 |

March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

||||||||||||||||||||||||||||

| Revenues | ||||||||||||||||||||||||||||||||

| Net premiums earned | $ | 647.7 | $ | 652.0 | $ | 626.7 | $ | 590.3 | $ | 568.9 | ||||||||||||||||||||||

| Net investment income | 66.5 | 68.2 | 71.2 | 68.9 | 77.7 | |||||||||||||||||||||||||||

| Net realized and unrealized investment gains (losses) | 6.2 | 0.7 | (0.3) | (39.9) | 14.8 | |||||||||||||||||||||||||||

| Net investment income and net realized and unrealized investment gains (losses) | 72.7 | 68.9 | 70.9 | 29.0 | 92.5 | |||||||||||||||||||||||||||

| Other revenues | 35.5 | 27.3 | 29.7 | 19.4 | 18.1 | |||||||||||||||||||||||||||

| Loss on settlement and change in fair value of liability-classified capital instruments | — | — | — | (25.9) | (117.3) | |||||||||||||||||||||||||||

| Total revenues | 755.9 | 748.2 | 727.3 | 612.8 | 562.2 | |||||||||||||||||||||||||||

| Expenses | ||||||||||||||||||||||||||||||||

| Loss and loss adjustment expenses incurred, net | 372.9 | 372.6 | 401.8 | 369.1 | 317.5 | |||||||||||||||||||||||||||

| Acquisition costs, net | 139.8 | 140.9 | 129.7 | 134.6 | 117.5 | |||||||||||||||||||||||||||

| Other underwriting expenses | 43.6 | 48.3 | 41.1 | 53.9 | 44.9 | |||||||||||||||||||||||||||

| Net corporate and other expenses | 62.5 | 70.9 | 60.6 | 58.1 | 51.4 | |||||||||||||||||||||||||||

| Intangible asset amortization | 2.8 | 2.8 | 2.9 | 3.0 | 3.0 | |||||||||||||||||||||||||||

| Interest expense | 21.0 | 21.1 | 18.1 | 19.6 | 13.8 | |||||||||||||||||||||||||||

| Foreign exchange (gains) losses | 2.4 | 16.7 | (2.2) | (12.9) | 3.0 | |||||||||||||||||||||||||||

| Total expenses | 645.0 | 673.3 | 652.0 | 625.4 | 551.1 | |||||||||||||||||||||||||||

| Income (loss) before income tax expense | 110.9 | 74.9 | 75.3 | (12.6) | 11.1 | |||||||||||||||||||||||||||

| Income tax expense | (20.2) | (11.6) | (13.3) | (4.4) | (2.4) | |||||||||||||||||||||||||||

| Net income (loss) | 90.7 | 63.3 | 62.0 | (17.0) | 8.7 | |||||||||||||||||||||||||||

| Net (income) loss attributable to noncontrolling interests | 0.1 | (0.1) | (0.4) | (0.3) | (0.2) | |||||||||||||||||||||||||||

| Net income (loss) available to SiriusPoint | 90.8 | 63.2 | 61.6 | (17.3) | 8.5 | |||||||||||||||||||||||||||

| Dividends on Series B preference shares | (4.0) | (4.0) | (4.0) | (4.0) | (4.0) | |||||||||||||||||||||||||||

| Net income (loss) available to SiriusPoint common shareholders | $ | 86.8 | $ | 59.2 | $ | 57.6 | $ | (21.3) | $ | 4.5 | ||||||||||||||||||||||

| Earnings (loss) per share available to SiriusPoint common shareholders | ||||||||||||||||||||||||||||||||

| Basic earnings (loss) per share available to SiriusPoint common shareholders ⁽¹⁾ | $ | 0.74 | $ | 0.51 | $ | 0.50 | $ | (0.13) | $ | 0.03 | ||||||||||||||||||||||

| Diluted earnings (loss) per share available to SiriusPoint common shareholders ⁽¹⁾ | $ | 0.73 | $ | 0.50 | $ | 0.49 | $ | (0.13) | $ | 0.03 | ||||||||||||||||||||||

| Weighted average number of common shares used in the determination of earnings (loss) per share | ||||||||||||||||||||||||||||||||

| Basic | 116,726,540 | 116,523,435 | 115,975,961 | 161,378,360 | 165,659,401 | |||||||||||||||||||||||||||

| Diluted | 118,817,903 | 118,669,471 | 118,555,166 | 161,378,360 | 172,803,298 | |||||||||||||||||||||||||||

| September 30, 2025 |

June 30, 2025 |

March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

||||||||||||||||||||||||||||

| Comprehensive income (loss) | ||||||||||||||||||||||||||||||||

| Net income (loss) | $ | 90.7 | $ | 63.3 | $ | 62.0 | $ | (17.0) | $ | 8.7 | ||||||||||||||||||||||

| Other comprehensive income (loss), net of tax | ||||||||||||||||||||||||||||||||

| Change in foreign currency translation adjustment | (3.3) | 3.4 | (0.2) | 2.6 | 0.4 | |||||||||||||||||||||||||||

| Unrealized gains (losses) from debt securities held as available for sale investments | 2.2 | 19.1 | 32.7 | (89.1) | 112.2 | |||||||||||||||||||||||||||

| Reclassifications from accumulated other comprehensive income (loss) | 6.9 | (2.4) | (2.0) | 0.9 | (3.1) | |||||||||||||||||||||||||||

| Total other comprehensive income (loss) | 5.8 | 20.1 | 30.5 | (85.6) | 109.5 | |||||||||||||||||||||||||||

| Comprehensive income (loss) | 96.5 | 83.4 | 92.5 | (102.6) | 118.2 | |||||||||||||||||||||||||||

| Net (income) loss attributable to noncontrolling interests | 0.1 | (0.1) | (0.4) | (0.3) | (0.2) | |||||||||||||||||||||||||||

| Comprehensive income (loss) available to SiriusPoint | $ | 96.6 | $ | 83.3 | $ | 92.1 | $ | (102.9) | $ | 118.0 | ||||||||||||||||||||||

| Insurance & Services | Reinsurance | Core | Eliminations (2) |

Corporate | Segment Measure Reclass | Total | |||||||||||||||||||||||||||||||||||

Gross premiums written |

$ | 562.0 | $ | 309.6 | $ | 871.6 | $ | — | $ | 2.8 | $ | — | $ | 874.4 | |||||||||||||||||||||||||||

| Net premiums written | 396.8 | 268.1 | 664.9 | — | 5.4 | — | 670.3 | ||||||||||||||||||||||||||||||||||

| Net premiums earned | 381.2 | 262.3 | 643.5 | — | 4.2 | — | 647.7 | ||||||||||||||||||||||||||||||||||

| Loss and loss adjustment expenses incurred, net | 225.3 | 145.5 | 370.8 | (1.5) | 3.6 | — | 372.9 | ||||||||||||||||||||||||||||||||||

| Acquisition costs, net | 98.3 | 64.7 | 163.0 | (26.9) | 3.7 | — | 139.8 | ||||||||||||||||||||||||||||||||||

| Other underwriting expenses | 19.9 | 20.2 | 40.1 | — | 3.5 | — | 43.6 | ||||||||||||||||||||||||||||||||||

| Underwriting income (loss) | 37.7 | 31.9 | 69.6 | 28.4 | (6.6) | — | 91.4 | ||||||||||||||||||||||||||||||||||

| Services revenues | 58.5 | — | 58.5 | (32.7) | — | (25.8) | — | ||||||||||||||||||||||||||||||||||

| Services expenses | 48.5 | — | 48.5 | — | — | (48.5) | — | ||||||||||||||||||||||||||||||||||

| Net services fee income | 10.0 | — | 10.0 | (32.7) | — | 22.7 | — | ||||||||||||||||||||||||||||||||||

| Services noncontrolling loss | 0.1 | — | 0.1 | — | — | (0.1) | — | ||||||||||||||||||||||||||||||||||

| Net services income | 10.1 | — | 10.1 | (32.7) | — | 22.6 | — | ||||||||||||||||||||||||||||||||||

| Segment income (loss) | 47.8 | 31.9 | 79.7 | (4.3) | (6.6) | 22.6 | 91.4 | ||||||||||||||||||||||||||||||||||

| Net investment income | 66.5 | — | 66.5 | ||||||||||||||||||||||||||||||||||||||

| Net realized and unrealized investment gains | 6.2 | — | 6.2 | ||||||||||||||||||||||||||||||||||||||

| Other revenues | 9.7 | 25.8 | 35.5 | ||||||||||||||||||||||||||||||||||||||

| Net corporate and other expenses | (14.0) | (48.5) | (62.5) | ||||||||||||||||||||||||||||||||||||||

| Intangible asset amortization | (2.8) | — | (2.8) | ||||||||||||||||||||||||||||||||||||||

| Interest expense | (21.0) | — | (21.0) | ||||||||||||||||||||||||||||||||||||||

| Foreign exchange losses | (2.4) | — | (2.4) | ||||||||||||||||||||||||||||||||||||||

| Income (loss) before income tax expense | $ | 47.8 | $ | 31.9 | 79.7 | (4.3) | 35.6 | (0.1) | 110.9 | ||||||||||||||||||||||||||||||||

| Income tax expense | — | — | (20.2) | — | (20.2) | ||||||||||||||||||||||||||||||||||||

| Net income | 79.7 | (4.3) | 15.4 | (0.1) | 90.7 | ||||||||||||||||||||||||||||||||||||

| Net (income) loss attributable to noncontrolling interest | — | — | — | 0.1 | 0.1 | ||||||||||||||||||||||||||||||||||||

| Net income available to SiriusPoint | $ | 79.7 | $ | (4.3) | $ | 15.4 | $ | — | $ | 90.8 | |||||||||||||||||||||||||||||||

| Attritional losses | $ | 234.8 | $ | 145.1 | $ | 379.9 | $ | (1.5) | $ | 3.4 | $ | — | $ | 381.8 | |||||||||||||||||||||||||||

| Catastrophe losses | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Prior year loss reserve development | (9.5) | 0.4 | (9.1) | — | 0.2 | — | (8.9) | ||||||||||||||||||||||||||||||||||

| Loss and loss adjustment expenses incurred, net | $ | 225.3 | $ | 145.5 | $ | 370.8 | $ | (1.5) | $ | 3.6 | $ | — | $ | 372.9 | |||||||||||||||||||||||||||

Underwriting Ratios: (1) |

|||||||||||||||||||||||||||||||||||||||||

| Attritional loss ratio | 61.6 | % | 55.3 | % | 59.0 | % | 59.0 | % | |||||||||||||||||||||||||||||||||

| Catastrophe loss ratio | — | % | — | % | — | % | — | % | |||||||||||||||||||||||||||||||||

| Prior year loss development ratio | (2.5) | % | 0.2 | % | (1.4) | % | (1.4) | % | |||||||||||||||||||||||||||||||||

| Loss ratio | 59.1 | % | 55.5 | % | 57.6 | % | 57.6 | % | |||||||||||||||||||||||||||||||||

| Acquisition cost ratio | 25.8 | % | 24.7 | % | 25.3 | % | 21.6 | % | |||||||||||||||||||||||||||||||||

| Other underwriting expenses ratio | 5.2 | % | 7.7 | % | 6.2 | % | 6.7 | % | |||||||||||||||||||||||||||||||||

Combined ratio |

90.1 | % | 87.9 | % | 89.1 | % | 85.9 | % | |||||||||||||||||||||||||||||||||

| Insurance & Services | Reinsurance | Core | Eliminations (2) |

Corporate | Segment Measure Reclass | Total | |||||||||||||||||||||||||||||||||||

Gross premiums written |

$ | 376.0 | $ | 314.5 | $ | 690.5 | $ | — | $ | 23.5 | $ | — | $ | 714.0 | |||||||||||||||||||||||||||

| Net premiums written | 235.3 | 268.3 | 503.6 | — | 0.6 | — | 504.2 | ||||||||||||||||||||||||||||||||||

| Net premiums earned | 276.9 | 269.4 | 546.3 | — | 22.6 | — | 568.9 | ||||||||||||||||||||||||||||||||||

| Loss and loss adjustment expenses incurred, net | 170.1 | 137.6 | 307.7 | (1.4) | 11.2 | — | 317.5 | ||||||||||||||||||||||||||||||||||

| Acquisition costs, net | 65.9 | 69.8 | 135.7 | (24.1) | 5.9 | — | 117.5 | ||||||||||||||||||||||||||||||||||

| Other underwriting expenses | 20.0 | 20.4 | 40.4 | — | 4.5 | — | 44.9 | ||||||||||||||||||||||||||||||||||

| Underwriting income | 20.9 | 41.6 | 62.5 | 25.5 | 1.0 | — | 89.0 | ||||||||||||||||||||||||||||||||||

| Services revenues | 48.1 | — | 48.1 | (29.9) | — | (18.2) | — | ||||||||||||||||||||||||||||||||||

| Services expenses | 41.3 | — | 41.3 | — | — | (41.3) | — | ||||||||||||||||||||||||||||||||||

| Net services fee income | 6.8 | — | 6.8 | (29.9) | — | 23.1 | — | ||||||||||||||||||||||||||||||||||

| Services noncontrolling loss | 0.2 | — | 0.2 | — | — | (0.2) | — | ||||||||||||||||||||||||||||||||||

| Net services income | 7.0 | — | 7.0 | (29.9) | — | 22.9 | — | ||||||||||||||||||||||||||||||||||

| Segment income | 27.9 | 41.6 | 69.5 | (4.4) | 1.0 | 22.9 | 89.0 | ||||||||||||||||||||||||||||||||||

| Net investment income | 77.7 | — | 77.7 | ||||||||||||||||||||||||||||||||||||||

| Net realized and unrealized investment gains | 14.8 | — | 14.8 | ||||||||||||||||||||||||||||||||||||||

| Other revenues | (0.1) | 18.2 | 18.1 | ||||||||||||||||||||||||||||||||||||||

| Loss on settlement and change in fair value of liability-classified capital instruments | (117.3) | — | (117.3) | ||||||||||||||||||||||||||||||||||||||

| Net corporate and other expenses | (10.1) | (41.3) | (51.4) | ||||||||||||||||||||||||||||||||||||||

| Intangible asset amortization | (3.0) | — | (3.0) | ||||||||||||||||||||||||||||||||||||||

| Interest expense | (13.8) | — | (13.8) | ||||||||||||||||||||||||||||||||||||||

| Foreign exchange losses | (3.0) | — | (3.0) | ||||||||||||||||||||||||||||||||||||||

| Income (loss) before income tax benefit | $ | 27.9 | $ | 41.6 | 69.5 | (4.4) | (53.8) | (0.2) | 11.1 | ||||||||||||||||||||||||||||||||

| Income tax expense | — | — | (2.4) | — | (2.4) | ||||||||||||||||||||||||||||||||||||

| Net income (loss) | 69.5 | (4.4) | (56.2) | (0.2) | 8.7 | ||||||||||||||||||||||||||||||||||||

| Net income attributable to noncontrolling interest | — | — | (0.4) | 0.2 | (0.2) | ||||||||||||||||||||||||||||||||||||

| Net income (loss) available to SiriusPoint | $ | 69.5 | $ | (4.4) | $ | (56.6) | $ | — | $ | 8.5 | |||||||||||||||||||||||||||||||

| Attritional losses | $ | 183.9 | $ | 142.9 | $ | 326.8 | $ | (1.4) | $ | 12.1 | $ | — | $ | 337.5 | |||||||||||||||||||||||||||

| Catastrophe losses | (0.7) | 11.3 | 10.6 | — | — | — | 10.6 | ||||||||||||||||||||||||||||||||||

| Prior year loss reserve development | (13.1) | (16.6) | (29.7) | — | (0.9) | — | (30.6) | ||||||||||||||||||||||||||||||||||

| Loss and loss adjustment expenses incurred, net | $ | 170.1 | $ | 137.6 | $ | 307.7 | $ | (1.4) | $ | 11.2 | $ | — | $ | 317.5 | |||||||||||||||||||||||||||

Underwriting Ratios: (1) |

|||||||||||||||||||||||||||||||||||||||||

| Attritional loss ratio | 66.4 | % | 53.1 | % | 59.8 | % | 59.3 | % | |||||||||||||||||||||||||||||||||

| Catastrophe loss ratio | (0.3) | % | 4.2 | % | 1.9 | % | 1.9 | % | |||||||||||||||||||||||||||||||||

| Prior year loss development ratio | (4.7) | % | (6.2) | % | (5.4) | % | (5.4) | % | |||||||||||||||||||||||||||||||||

| Loss ratio | 61.4 | % | 51.1 | % | 56.3 | % | 55.8 | % | |||||||||||||||||||||||||||||||||

| Acquisition cost ratio | 23.8 | % | 25.9 | % | 24.8 | % | 20.7 | % | |||||||||||||||||||||||||||||||||

| Other underwriting expenses ratio | 7.2 | % | 7.6 | % | 7.4 | % | 7.9 | % | |||||||||||||||||||||||||||||||||

| Combined ratio | 92.4 | % | 84.6 | % | 88.5 | % | 84.4 | % | |||||||||||||||||||||||||||||||||

| Insurance & Services | Reinsurance | Core | Eliminations (2) |

Corporate | Segment Measure Reclass | Total | |||||||||||||||||||||||||||||||||||

Gross premiums written |

$ | 1,757.5 | $ | 1,034.1 | $ | 2,791.6 | $ | — | $ | 15.7 | $ | — | $ | 2,807.3 | |||||||||||||||||||||||||||

| Net premiums written | 1,273.1 | 843.6 | 2,116.7 | — | 1.0 | — | 2,117.7 | ||||||||||||||||||||||||||||||||||

| Net premiums earned | 1,086.6 | 828.3 | 1,914.9 | — | 11.5 | — | 1,926.4 | ||||||||||||||||||||||||||||||||||

| Loss and loss adjustment expenses incurred, net | 644.4 | 497.2 | 1,141.6 | (5.0) | 10.7 | — | 1,147.3 | ||||||||||||||||||||||||||||||||||

| Acquisition costs, net | 283.5 | 202.3 | 485.8 | (83.1) | 7.7 | — | 410.4 | ||||||||||||||||||||||||||||||||||

| Other underwriting expenses | 61.4 | 60.4 | 121.8 | — | 11.2 | — | 133.0 | ||||||||||||||||||||||||||||||||||

| Underwriting income (loss) | 97.3 | 68.4 | 165.7 | 88.1 | (18.1) | — | 235.7 | ||||||||||||||||||||||||||||||||||

| Services revenues | 178.7 | — | 178.7 | (94.6) | — | (84.1) | — | ||||||||||||||||||||||||||||||||||

| Services expenses | 141.2 | — | 141.2 | — | — | (141.2) | — | ||||||||||||||||||||||||||||||||||

| Net services fee income | 37.5 | — | 37.5 | (94.6) | — | 57.1 | — | ||||||||||||||||||||||||||||||||||

| Services noncontrolling loss | 0.2 | — | 0.2 | — | — | (0.2) | — | ||||||||||||||||||||||||||||||||||

| Net services income | 37.7 | — | 37.7 | (94.6) | — | 56.9 | — | ||||||||||||||||||||||||||||||||||

| Segment income (loss) | 135.0 | 68.4 | 203.4 | (6.5) | (18.1) | 56.9 | 235.7 | ||||||||||||||||||||||||||||||||||

| Net investment income | 205.9 | — | 205.9 | ||||||||||||||||||||||||||||||||||||||

| Net realized and unrealized investment gains | 6.6 | — | 6.6 | ||||||||||||||||||||||||||||||||||||||

| Other revenues | 8.4 | 84.1 | 92.5 | ||||||||||||||||||||||||||||||||||||||

| Net corporate and other expenses | (52.8) | (141.2) | (194.0) | ||||||||||||||||||||||||||||||||||||||

| Intangible asset amortization | (8.5) | — | (8.5) | ||||||||||||||||||||||||||||||||||||||

| Interest expense | (60.2) | — | (60.2) | ||||||||||||||||||||||||||||||||||||||

| Foreign exchange losses | (16.9) | — | (16.9) | ||||||||||||||||||||||||||||||||||||||

| Income (loss) before income tax expense | $ | 135.0 | $ | 68.4 | 203.4 | (6.5) | 64.4 | (0.2) | 261.1 | ||||||||||||||||||||||||||||||||

| Income tax expense | — | — | (45.1) | — | (45.1) | ||||||||||||||||||||||||||||||||||||

| Net income | 203.4 | (6.5) | 19.3 | (0.2) | 216.0 | ||||||||||||||||||||||||||||||||||||

| Net income attributable to noncontrolling interests | — | — | (0.6) | 0.2 | (0.4) | ||||||||||||||||||||||||||||||||||||

| Net income available to SiriusPoint | $ | 203.4 | $ | (6.5) | $ | 18.7 | $ | — | $ | 215.6 | |||||||||||||||||||||||||||||||

| Attritional losses | $ | 661.3 | $ | 470.1 | $ | 1,131.4 | $ | (5.0) | $ | 5.3 | $ | — | $ | 1,131.7 | |||||||||||||||||||||||||||

| Catastrophe losses | 4.8 | 62.6 | 67.4 | — | — | — | 67.4 | ||||||||||||||||||||||||||||||||||

| Prior year loss reserve development | (21.7) | (35.5) | (57.2) | — | 5.4 | — | (51.8) | ||||||||||||||||||||||||||||||||||

| Loss and loss adjustment expenses incurred, net | $ | 644.4 | $ | 497.2 | $ | 1,141.6 | $ | (5.0) | $ | 10.7 | $ | — | $ | 1,147.3 | |||||||||||||||||||||||||||

Underwriting Ratios: (1) |

|||||||||||||||||||||||||||||||||||||||||

| Attritional loss ratio | 60.9 | % | 56.7 | % | 59.1 | % | 58.8 | % | |||||||||||||||||||||||||||||||||

| Catastrophe loss ratio | 0.4 | % | 7.6 | % | 3.5 | % | 3.5 | % | |||||||||||||||||||||||||||||||||

| Prior year loss development ratio | (2.0) | % | (4.3) | % | (3.0) | % | (2.7) | % | |||||||||||||||||||||||||||||||||

| Loss ratio | 59.3 | % | 60.0 | % | 59.6 | % | 59.6 | % | |||||||||||||||||||||||||||||||||

| Acquisition cost ratio | 26.1 | % | 24.4 | % | 25.4 | % | 21.3 | % | |||||||||||||||||||||||||||||||||

| Other underwriting expenses ratio | 5.7 | % | 7.3 | % | 6.4 | % | 6.9 | % | |||||||||||||||||||||||||||||||||

Combined ratio |

91.1 | % | 91.7 | % | 91.4 | % | 87.8 | % | |||||||||||||||||||||||||||||||||

| Insurance & Services | Reinsurance | Core | Eliminations (2) |

Corporate | Segment Measure Reclass | Total | |||||||||||||||||||||||||||||||||||

Gross premiums written |

$ | 1,390.5 | $ | 1,023.4 | $ | 2,413.9 | $ | — | $ | 71.2 | $ | — | $ | 2,485.1 | |||||||||||||||||||||||||||

| Net premiums written | 913.5 | 867.2 | 1,780.7 | — | 6.4 | — | 1,787.1 | ||||||||||||||||||||||||||||||||||

| Net premiums earned | 838.3 | 779.2 | 1,617.5 | — | 135.7 | — | 1,753.2 | ||||||||||||||||||||||||||||||||||

| Loss and loss adjustment expenses incurred, net | 538.8 | 406.0 | 944.8 | (4.1) | 58.7 | — | 999.4 | ||||||||||||||||||||||||||||||||||

| Acquisition costs, net | 206.9 | 206.8 | 413.7 | (93.8) | 62.4 | — | 382.3 | ||||||||||||||||||||||||||||||||||

| Other underwriting expenses | 55.4 | 59.9 | 115.3 | — | 12.5 | — | 127.8 | ||||||||||||||||||||||||||||||||||

| Underwriting income | 37.2 | 106.5 | 143.7 | 97.9 | 2.1 | — | 243.7 | ||||||||||||||||||||||||||||||||||

| Services revenues | 171.3 | — | 171.3 | (101.4) | — | (69.9) | — | ||||||||||||||||||||||||||||||||||

| Services expenses | 135.0 | — | 135.0 | — | — | (135.0) | — | ||||||||||||||||||||||||||||||||||

| Net services fee income | 36.3 | — | 36.3 | (101.4) | — | 65.1 | — | ||||||||||||||||||||||||||||||||||

| Services noncontrolling income | (2.1) | — | (2.1) | — | — | 2.1 | — | ||||||||||||||||||||||||||||||||||

| Net services income | 34.2 | — | 34.2 | (101.4) | — | 67.2 | — | ||||||||||||||||||||||||||||||||||

| Segment income | 71.4 | 106.5 | 177.9 | (3.5) | 2.1 | 67.2 | 243.7 | ||||||||||||||||||||||||||||||||||

| Net investment income | 234.7 | — | 234.7 | ||||||||||||||||||||||||||||||||||||||

| Net realized and unrealized investment losses | (39.1) | — | (39.1) | ||||||||||||||||||||||||||||||||||||||

| Other revenues | 94.9 | 69.9 | 164.8 | ||||||||||||||||||||||||||||||||||||||

| Loss on settlement and change in fair value of liability-classified capital instruments | (122.6) | — | (122.6) | ||||||||||||||||||||||||||||||||||||||

| Net corporate and other expenses | (39.0) | (135.0) | (174.0) | ||||||||||||||||||||||||||||||||||||||

| Intangible asset amortization | (8.9) | — | (8.9) | ||||||||||||||||||||||||||||||||||||||

| Interest expense | (50.0) | — | (50.0) | ||||||||||||||||||||||||||||||||||||||

| Foreign exchange losses | (2.9) | — | (2.9) | ||||||||||||||||||||||||||||||||||||||

| Income before income tax expense | $ | 71.4 | $ | 106.5 | 177.9 | (3.5) | 69.2 | 2.1 | 245.7 | ||||||||||||||||||||||||||||||||

| Income tax expense | — | — | (26.3) | — | (26.3) | ||||||||||||||||||||||||||||||||||||

| Net income | 177.9 | (3.5) | 42.9 | 2.1 | 219.4 | ||||||||||||||||||||||||||||||||||||

| Net income attributable to noncontrolling interests | — | — | (0.1) | (2.1) | (2.2) | ||||||||||||||||||||||||||||||||||||

| Net income available to SiriusPoint | $ | 177.9 | $ | (3.5) | $ | 42.8 | $ | — | $ | 217.2 | |||||||||||||||||||||||||||||||

| Attritional losses | $ | 546.3 | $ | 424.9 | $ | 971.2 | $ | (4.1) | $ | 86.7 | $ | — | $ | 1,053.8 | |||||||||||||||||||||||||||

| Catastrophe losses | 1.9 | 14.3 | 16.2 | — | — | — | 16.2 | ||||||||||||||||||||||||||||||||||

| Prior year loss reserve development | (9.4) | (33.2) | (42.6) | — | (28.0) | — | (70.6) | ||||||||||||||||||||||||||||||||||

| Loss and loss adjustment expenses incurred, net | $ | 538.8 | $ | 406.0 | $ | 944.8 | $ | (4.1) | $ | 58.7 | $ | — | $ | 999.4 | |||||||||||||||||||||||||||

Underwriting Ratios: (1) |

|||||||||||||||||||||||||||||||||||||||||

| Attritional loss ratio | 65.2 | % | 54.6 | % | 60.0 | % | 60.1 | % | |||||||||||||||||||||||||||||||||

| Catastrophe loss ratio | 0.2 | % | 1.8 | % | 1.0 | % | 0.9 | % | |||||||||||||||||||||||||||||||||

| Prior year loss development ratio | (1.1) | % | (4.3) | % | (2.6) | % | (4.0) | % | |||||||||||||||||||||||||||||||||

| Loss ratio | 64.3 | % | 52.1 | % | 58.4 | % | 57.0 | % | |||||||||||||||||||||||||||||||||

| Acquisition cost ratio | 24.7 | % | 26.5 | % | 25.6 | % | 21.8 | % | |||||||||||||||||||||||||||||||||

| Other underwriting expenses ratio | 6.6 | % | 7.7 | % | 7.1 | % | 7.3 | % | |||||||||||||||||||||||||||||||||

| Combined ratio | 95.6 | % | 86.3 | % | 91.1 | % | 86.1 | % | |||||||||||||||||||||||||||||||||

| September 30, 2025 |

June 30, 2025 |

March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

||||||||||||||||||||||||||||

| Revenues | ||||||||||||||||||||||||||||||||

| Gross premiums written | $ | 874.4 | $ | 948.2 | $ | 984.7 | $ | 759.5 | $ | 714.0 | ||||||||||||||||||||||

| Net premiums written | 670.3 | 704.4 | 743.0 | 565.0 | 504.2 | |||||||||||||||||||||||||||

| Net premiums earned | 647.7 | 652.0 | 626.7 | 590.3 | 568.9 | |||||||||||||||||||||||||||

| Expenses | ||||||||||||||||||||||||||||||||

| Loss and loss adjustment expenses incurred, net | 372.9 | 372.6 | 401.8 | 369.1 | 317.5 | |||||||||||||||||||||||||||

| Acquisition costs, net | 139.8 | 140.9 | 129.7 | 134.6 | 117.5 | |||||||||||||||||||||||||||

| Other underwriting expenses | 43.6 | 48.3 | 41.1 | 53.9 | 44.9 | |||||||||||||||||||||||||||

| Underwriting income | $ | 91.4 | $ | 90.2 | $ | 54.1 | $ | 32.7 | $ | 89.0 | ||||||||||||||||||||||

| Attritional losses | $ | 381.8 | $ | 381.8 | $ | 368.1 | $ | 367.8 | $ | 337.5 | ||||||||||||||||||||||

Catastrophe losses, net of reinsurance and reinstatement premiums |

— | (0.5) | 67.9 | 38.6 | 10.6 | |||||||||||||||||||||||||||

Favorable prior year loss reserve development |

$ | (8.9) | $ | (8.7) | $ | (34.2) | $ | (37.3) | $ | (30.6) | ||||||||||||||||||||||

Underwriting Ratios (1): |

||||||||||||||||||||||||||||||||

| Loss ratio | 57.6 | % | 57.1 | % | 64.1 | % | 62.5 | % | 55.8 | % | ||||||||||||||||||||||

| Acquisition cost ratio | 21.6 | % | 21.6 | % | 20.7 | % | 22.8 | % | 20.7 | % | ||||||||||||||||||||||

| Other underwriting expenses ratio | 6.7 | % | 7.4 | % | 6.6 | % | 9.1 | % | 7.9 | % | ||||||||||||||||||||||

| Combined ratio | 85.9 | % | 86.1 | % | 91.4 | % | 94.4 | % | 84.4 | % | ||||||||||||||||||||||

| September 30, 2025 |

June 30, 2025 |

March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

||||||||||||||||||||||||||||

| Revenues | ||||||||||||||||||||||||||||||||

| Gross premiums written | $ | 871.6 | $ | 930.1 | $ | 989.9 | $ | 762.5 | $ | 690.5 | ||||||||||||||||||||||

| Net premiums written | 664.9 | 699.8 | 752.0 | 560.2 | 503.6 | |||||||||||||||||||||||||||

| Net premiums earned | 643.5 | 645.6 | 625.8 | 581.6 | 546.3 | |||||||||||||||||||||||||||

| Expenses | ||||||||||||||||||||||||||||||||

| Loss and loss adjustment expenses incurred, net | 370.8 | 365.6 | 405.2 | 323.6 | 307.7 | |||||||||||||||||||||||||||

| Acquisition costs, net | 163.0 | 168.4 | 154.4 | 150.9 | 135.7 | |||||||||||||||||||||||||||

| Other underwriting expenses | 40.1 | 44.0 | 37.7 | 50.8 | 40.4 | |||||||||||||||||||||||||||

| Underwriting income | 69.6 | 67.6 | 28.5 | 56.3 | 62.5 | |||||||||||||||||||||||||||

| Services revenues | 58.5 | 58.1 | 62.1 | 51.6 | 48.1 | |||||||||||||||||||||||||||

| Services expenses | 48.5 | 49.6 | 43.1 | 41.2 | 41.3 | |||||||||||||||||||||||||||

| Net services fee income | 10.0 | 8.5 | 19.0 | 10.4 | 6.8 | |||||||||||||||||||||||||||

| Services noncontrolling (income) loss | 0.1 | 0.2 | (0.1) | — | 0.2 | |||||||||||||||||||||||||||

| Net services income | 10.1 | 8.7 | 18.9 | 10.4 | 7.0 | |||||||||||||||||||||||||||

| Segment income | $ | 79.7 | $ | 76.3 | $ | 47.4 | $ | 66.7 | $ | 69.5 | ||||||||||||||||||||||

| Attritional losses | $ | 379.9 | $ | 379.9 | $ | 371.6 | $ | 343.1 | $ | 326.8 | ||||||||||||||||||||||

Catastrophe losses, net of reinsurance and reinstatement premiums |

— | (0.5) | 67.9 | 38.6 | 10.6 | |||||||||||||||||||||||||||

Favorable prior year loss reserve development |

$ | (9.1) | $ | (13.8) | $ | (34.3) | $ | (58.1) | $ | (29.7) | ||||||||||||||||||||||

Underwriting Ratios (2): |

||||||||||||||||||||||||||||||||

| Loss ratio | 57.6 | % | 56.6 | % | 64.7 | % | 55.6 | % | 56.3 | % | ||||||||||||||||||||||

| Acquisition cost ratio | 25.3 | % | 26.1 | % | 24.7 | % | 25.9 | % | 24.8 | % | ||||||||||||||||||||||

| Other underwriting expenses ratio | 6.2 | % | 6.8 | % | 6.0 | % | 8.7 | % | 7.4 | % | ||||||||||||||||||||||

| Combined ratio | 89.1 | % | 89.5 | % | 95.4 | % | 90.2 | % | 88.5 | % | ||||||||||||||||||||||

| Accident year loss ratio | 59.0 | % | 58.8 | % | 70.2 | % | 65.6 | % | 61.8 | % | ||||||||||||||||||||||

| Accident year combined ratio | 90.6 | % | 91.7 | % | 100.9 | % | 100.3 | % | 94.0 | % | ||||||||||||||||||||||

| Attritional loss ratio | 59.0 | % | 58.8 | % | 59.3 | % | 59.0 | % | 59.8 | % | ||||||||||||||||||||||

| Attritional combined ratio | 90.5 | % | 91.7 | % | 90.0 | % | 93.6 | % | 92.0 | % | ||||||||||||||||||||||

| September 30, 2025 |

June 30, 2025 |

March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

||||||||||||||||||||||||||||

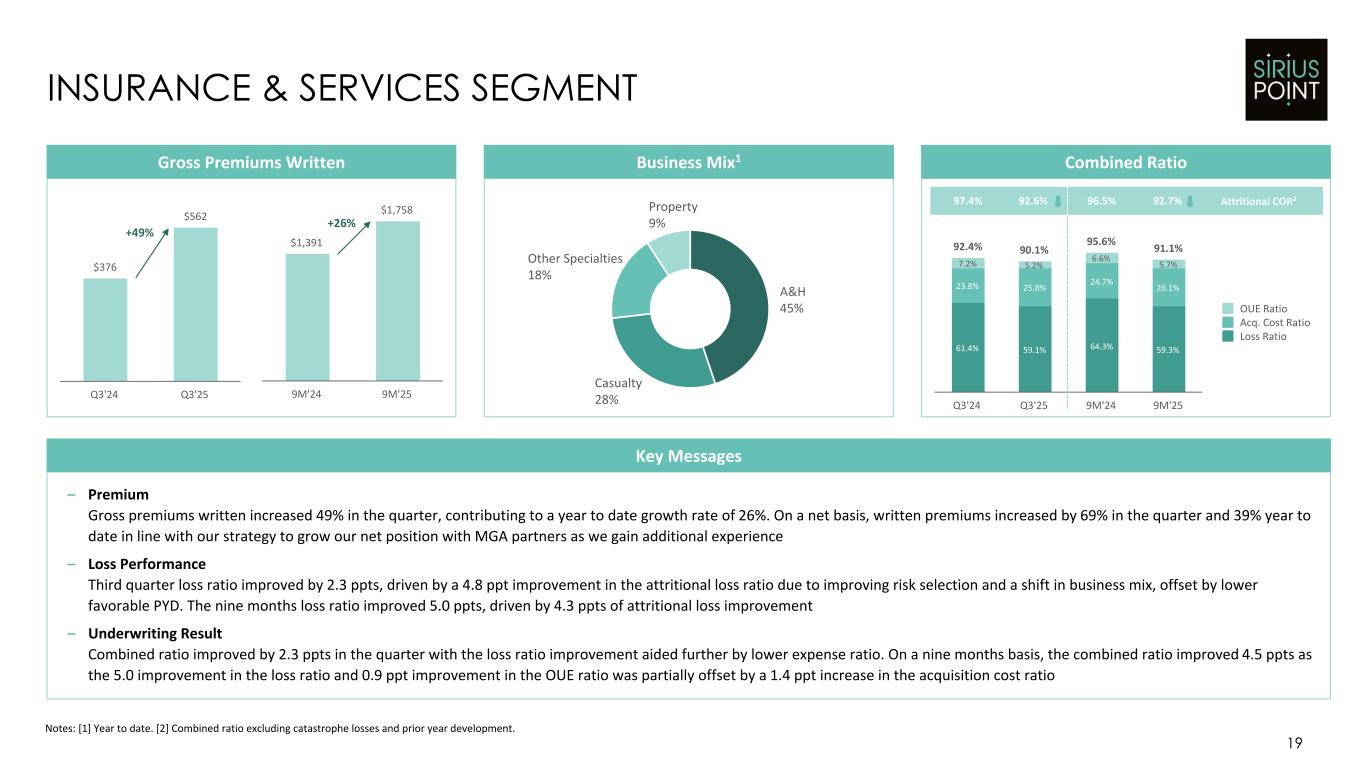

| Revenues | ||||||||||||||||||||||||||||||||

| Gross premiums written | $ | 562.0 | $ | 560.4 | $ | 635.1 | $ | 450.3 | $ | 376.0 | ||||||||||||||||||||||

| Net premiums written | 396.8 | 392.8 | 483.5 | 322.7 | 235.3 | |||||||||||||||||||||||||||

| Net premiums earned | 381.2 | 369.2 | 336.2 | 315.7 | 276.9 | |||||||||||||||||||||||||||

| Expenses | ||||||||||||||||||||||||||||||||

| Loss and loss adjustment expenses incurred, net | 225.3 | 209.2 | 209.9 | 175.3 | 170.1 | |||||||||||||||||||||||||||

| Acquisition costs, net | 98.3 | 97.9 | 87.3 | 77.8 | 65.9 | |||||||||||||||||||||||||||

| Other underwriting expenses | 19.9 | 22.6 | 18.9 | 24.6 | 20.0 | |||||||||||||||||||||||||||

| Underwriting income | 37.7 | 39.5 | 20.1 | 38.0 | 20.9 | |||||||||||||||||||||||||||

| Services revenues | 58.5 | 58.1 | 62.1 | 51.6 | 48.1 | |||||||||||||||||||||||||||

| Services expenses | 48.5 | 49.6 | 43.1 | 41.2 | 41.3 | |||||||||||||||||||||||||||

| Net services fee income | 10.0 | 8.5 | 19.0 | 10.4 | 6.8 | |||||||||||||||||||||||||||

| Services noncontrolling (income) loss | 0.1 | 0.2 | (0.1) | — | 0.2 | |||||||||||||||||||||||||||

| Net services income | 10.1 | 8.7 | 18.9 | 10.4 | 7.0 | |||||||||||||||||||||||||||

| Segment income | $ | 47.8 | $ | 48.2 | $ | 39.0 | $ | 48.4 | $ | 27.9 | ||||||||||||||||||||||

| Attritional losses | $ | 234.8 | $ | 218.9 | $ | 207.6 | $ | 188.2 | $ | 183.9 | ||||||||||||||||||||||

Catastrophe losses, net of reinsurance and reinstatement premiums |

— | — | 4.8 | 3.4 | (0.7) | |||||||||||||||||||||||||||

(Favorable) adverse prior year loss reserve development |

$ | (9.5) | $ | (9.7) | $ | (2.5) | $ | (16.3) | $ | (13.1) | ||||||||||||||||||||||

Underwriting Ratios (1): |

||||||||||||||||||||||||||||||||

| Loss ratio | 59.1 | % | 56.7 | % | 62.4 | % | 55.5 | % | 61.4 | % | ||||||||||||||||||||||

| Acquisition cost ratio | 25.8 | % | 26.5 | % | 26.0 | % | 24.6 | % | 23.8 | % | ||||||||||||||||||||||

| Other underwriting expenses ratio | 5.2 | % | 6.1 | % | 5.6 | % | 7.8 | % | 7.2 | % | ||||||||||||||||||||||

| Combined ratio | 90.1 | % | 89.3 | % | 94.0 | % | 87.9 | % | 92.4 | % | ||||||||||||||||||||||

| Accident year loss ratio | 61.6 | % | 59.3 | % | 63.2 | % | 60.7 | % | 66.2 | % | ||||||||||||||||||||||

| Accident year combined ratio | 92.6 | % | 91.9 | % | 94.8 | % | 93.1 | % | 97.2 | % | ||||||||||||||||||||||

| Attritional loss ratio | 61.6 | % | 59.3 | % | 61.7 | % | 59.6 | % | 66.4 | % | ||||||||||||||||||||||

| Attritional combined ratio | 92.6 | % | 91.9 | % | 93.3 | % | 92.0 | % | 97.4 | % | ||||||||||||||||||||||

| September 30, 2025 |

June 30, 2025 |

March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

||||||||||||||||||||||||||||

| Revenues | ||||||||||||||||||||||||||||||||

| Gross premiums written | $ | 309.6 | $ | 369.7 | $ | 354.8 | $ | 312.2 | $ | 314.5 | ||||||||||||||||||||||

| Net premiums written | 268.1 | 307.0 | 268.5 | 237.5 | 268.3 | |||||||||||||||||||||||||||

| Net premiums earned | 262.3 | 276.4 | 289.6 | 265.9 | 269.4 | |||||||||||||||||||||||||||

| Expenses | ||||||||||||||||||||||||||||||||

| Loss and loss adjustment expenses incurred, net | 145.5 | 156.4 | 195.3 | 148.3 | 137.6 | |||||||||||||||||||||||||||

| Acquisition costs, net | 64.7 | 70.5 | 67.1 | 73.1 | 69.8 | |||||||||||||||||||||||||||

| Other underwriting expenses | 20.2 | 21.4 | 18.8 | 26.2 | 20.4 | |||||||||||||||||||||||||||

| Underwriting income | $ | 31.9 | $ | 28.1 | $ | 8.4 | $ | 18.3 | $ | 41.6 | ||||||||||||||||||||||

| Attritional losses | $ | 145.1 | $ | 161.0 | $ | 164.0 | $ | 154.9 | $ | 142.9 | ||||||||||||||||||||||

Catastrophe losses, net of reinsurance and reinstatement premiums |

— | (0.5) | 63.1 | 35.2 | 11.3 | |||||||||||||||||||||||||||

Favorable prior year loss reserve development |

$ | 0.4 | $ | (4.1) | $ | (31.8) | $ | (41.8) | $ | (16.6) | ||||||||||||||||||||||

Underwriting Ratios (1): |

||||||||||||||||||||||||||||||||

| Loss ratio | 55.5 | % | 56.6 | % | 67.4 | % | 55.8 | % | 51.1 | % | ||||||||||||||||||||||

| Acquisition cost ratio | 24.7 | % | 25.5 | % | 23.2 | % | 27.5 | % | 25.9 | % | ||||||||||||||||||||||

| Other underwriting expenses ratio | 7.7 | % | 7.7 | % | 6.5 | % | 9.9 | % | 7.6 | % | ||||||||||||||||||||||

| Combined ratio | 87.9 | % | 89.8 | % | 97.1 | % | 93.2 | % | 84.6 | % | ||||||||||||||||||||||

| Accident year loss ratio | 55.3 | % | 58.1 | % | 78.4 | % | 71.5 | % | 57.2 | % | ||||||||||||||||||||||

| Accident year combined ratio | 87.7 | % | 91.3 | % | 108.1 | % | 108.8 | % | 90.7 | % | ||||||||||||||||||||||

| Attritional loss ratio | 55.3 | % | 58.3 | % | 56.6 | % | 58.3 | % | 53.0 | % | ||||||||||||||||||||||

| Attritional combined ratio | 87.7 | % | 91.5 | % | 86.3 | % | 95.7 | % | 86.5 | % | ||||||||||||||||||||||

| September 30, 2025 |

June 30, 2025 |

March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

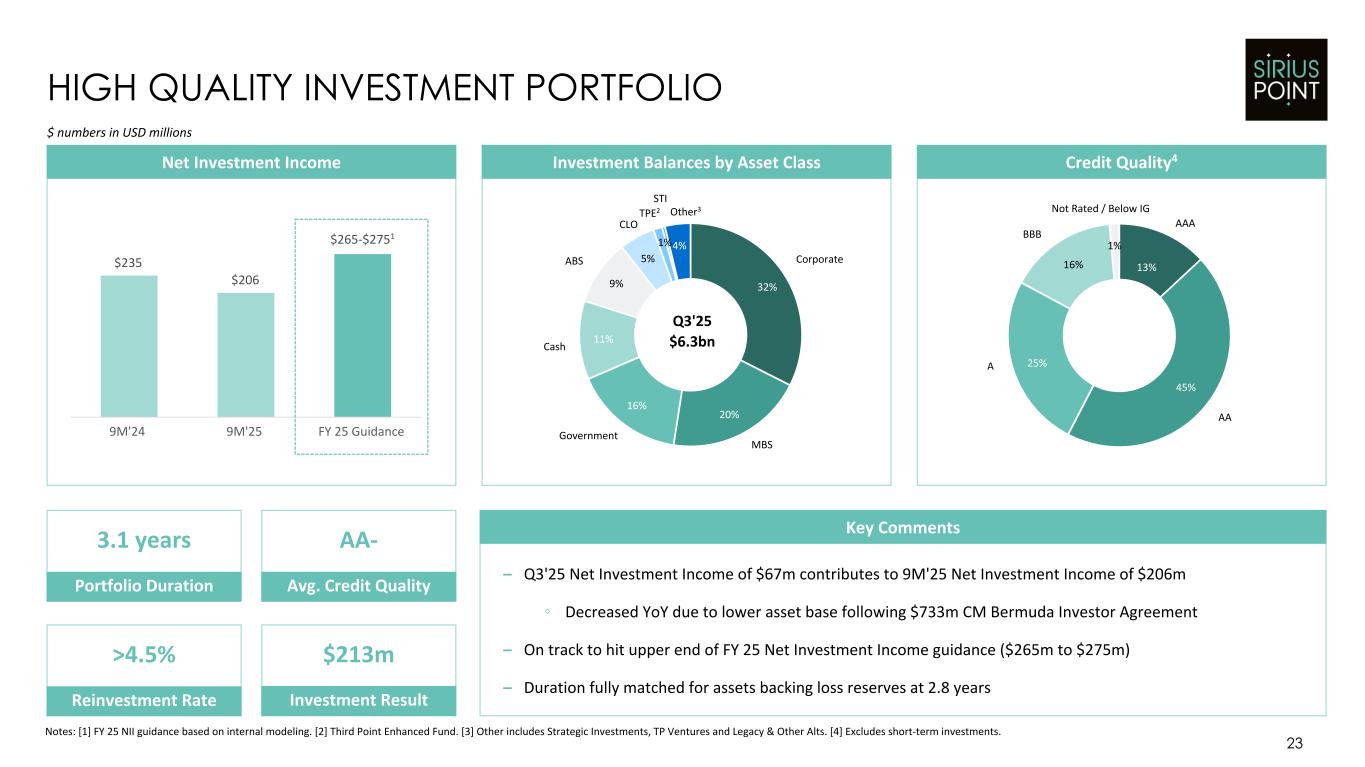

| Fair Value | % | Fair Value | % | Fair Value | % | Fair Value | % | Fair Value | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Asset-backed securities | $ | 914.4 | 16.4 | % | $ | 984.4 | 18.9 | % | $ | 1,007.8 | 19.8 | % | $ | 1,149.7 | 20.1 | % | $ | 1,164.7 | 19.3 | % | |||||||||||||||||||||||||||||||||||||||

| Residential mortgage-backed securities | 974.4 | 17.5 | % | 916.9 | 17.6 | % | 931.0 | 18.2 | % | 973.8 | 17.1 | % | 1,054.2 | 17.4 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Commercial mortgage-backed securities | 204.4 | 3.7 | % | 177.6 | 3.4 | % | 174.0 | 3.4 | % | 224.5 | 3.9 | % | 251.6 | 4.2 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Corporate debt securities | 2,043.0 | 36.7 | % | 1,701.3 | 32.6 | % | 1,618.3 | 31.6 | % | 1,899.9 | 33.3 | % | 1,892.2 | 31.2 | % | ||||||||||||||||||||||||||||||||||||||||||||

| U.S. government and government agency | 990.1 | 17.7 | % | 936.2 | 18.0 | % | 881.4 | 17.2 | % | 859.0 | 15.1 | % | 1,024.4 | 16.9 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Non-U.S. government and government agency | 19.3 | 0.2 | % | 19.5 | 0.3 | % | 22.7 | 0.4 | % | 24.1 | 0.4 | % | 24.7 | 0.4 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Total debt securities, available for sale | 5,145.6 | 92.2 | % | 4,735.9 | 90.8 | % | 4,635.2 | 90.6 | % | 5,131.0 | 89.9 | % | 5,411.8 | 89.4 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Asset-backed securities | 8.6 | 0.2 | % | 9.7 | 0.2 | % | 19.1 | 0.4 | % | 53.1 | 0.9 | % | 102.9 | 1.6 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Residential mortgage-backed securities | 46.1 | 0.8 | % | 47.0 | 0.9 | % | 47.9 | 0.9 | % | 48.7 | 0.9 | % | 53.1 | 0.9 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Commercial mortgage-backed securities | 36.1 | 0.6 | % | 38.6 | 0.7 | % | 42.7 | 0.8 | % | 51.8 | 0.9 | % | 59.1 | 1.0 | % | ||||||||||||||||||||||||||||||||||||||||||||