false2023Q20001574197--12-3110010075.037.5http://fasb.org/us-gaap/2023#OtherAssetshttp://fasb.org/us-gaap/2023#OtherAssetshttp://fasb.org/us-gaap/2023#AccountsPayableAndAccruedLiabilitiesCurrentAndNoncurrent http://fasb.org/us-gaap/2023#OtherLiabilitieshttp://fasb.org/us-gaap/2023#AccountsPayableAndAccruedLiabilitiesCurrentAndNoncurrent http://fasb.org/us-gaap/2023#OtherLiabilities00015741972023-01-012023-06-300001574197us-gaap:CommonClassAMember2023-07-14xbrli:shares0001574197us-gaap:CommonClassBMember2023-07-1400015741972023-06-30iso4217:USD00015741972022-12-310001574197us-gaap:RelatedPartyMember2023-06-300001574197us-gaap:RelatedPartyMember2022-12-310001574197us-gaap:NonrelatedPartyMember2023-06-300001574197us-gaap:NonrelatedPartyMember2022-12-310001574197us-gaap:CommonClassAMember2023-06-300001574197us-gaap:CommonClassAMember2022-12-310001574197us-gaap:CommonClassBMember2023-06-300001574197us-gaap:CommonClassBMember2022-12-310001574197us-gaap:NonrelatedPartyMemberus-gaap:LandMember2023-04-012023-06-300001574197us-gaap:NonrelatedPartyMemberus-gaap:LandMember2022-04-012022-06-300001574197us-gaap:NonrelatedPartyMemberus-gaap:LandMember2023-01-012023-06-300001574197us-gaap:NonrelatedPartyMemberus-gaap:LandMember2022-01-012022-06-300001574197us-gaap:RelatedPartyMemberus-gaap:LandMember2023-04-012023-06-300001574197us-gaap:RelatedPartyMemberus-gaap:LandMember2022-04-012022-06-300001574197us-gaap:RelatedPartyMemberus-gaap:LandMember2023-01-012023-06-300001574197us-gaap:RelatedPartyMemberus-gaap:LandMember2022-01-012022-06-300001574197us-gaap:RelatedPartyMemberus-gaap:ManagementServiceMember2023-04-012023-06-300001574197us-gaap:RelatedPartyMemberus-gaap:ManagementServiceMember2022-04-012022-06-300001574197us-gaap:RelatedPartyMemberus-gaap:ManagementServiceMember2023-01-012023-06-300001574197us-gaap:RelatedPartyMemberus-gaap:ManagementServiceMember2022-01-012022-06-300001574197fph:OperatingPropertiesMemberus-gaap:NonrelatedPartyMember2023-04-012023-06-300001574197fph:OperatingPropertiesMemberus-gaap:NonrelatedPartyMember2022-04-012022-06-300001574197fph:OperatingPropertiesMemberus-gaap:NonrelatedPartyMember2023-01-012023-06-300001574197fph:OperatingPropertiesMemberus-gaap:NonrelatedPartyMember2022-01-012022-06-3000015741972023-04-012023-06-3000015741972022-04-012022-06-3000015741972022-01-012022-06-300001574197us-gaap:LandMember2023-04-012023-06-300001574197us-gaap:LandMember2022-04-012022-06-300001574197us-gaap:LandMember2023-01-012023-06-300001574197us-gaap:LandMember2022-01-012022-06-300001574197us-gaap:ManagementServiceMember2023-04-012023-06-300001574197us-gaap:ManagementServiceMember2022-04-012022-06-300001574197us-gaap:ManagementServiceMember2023-01-012023-06-300001574197us-gaap:ManagementServiceMember2022-01-012022-06-300001574197fph:OperatingPropertiesMember2023-04-012023-06-300001574197fph:OperatingPropertiesMember2022-04-012022-06-300001574197fph:OperatingPropertiesMember2023-01-012023-06-300001574197fph:OperatingPropertiesMember2022-01-012022-06-300001574197us-gaap:CommonClassAMember2023-04-012023-06-30iso4217:USDxbrli:shares0001574197us-gaap:CommonClassAMember2022-04-012022-06-300001574197us-gaap:CommonClassAMember2023-01-012023-06-300001574197us-gaap:CommonClassAMember2022-01-012022-06-300001574197us-gaap:CommonClassBMember2023-04-012023-06-300001574197us-gaap:CommonClassBMember2022-04-012022-06-300001574197us-gaap:CommonClassBMember2023-01-012023-06-300001574197us-gaap:CommonClassBMember2022-01-012022-06-300001574197us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-03-310001574197us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-03-310001574197us-gaap:AdditionalPaidInCapitalMember2023-03-310001574197us-gaap:RetainedEarningsMember2023-03-310001574197us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001574197us-gaap:ParentMember2023-03-310001574197us-gaap:NoncontrollingInterestMember2023-03-3100015741972023-03-310001574197us-gaap:RetainedEarningsMember2023-04-012023-06-300001574197us-gaap:ParentMember2023-04-012023-06-300001574197us-gaap:NoncontrollingInterestMember2023-04-012023-06-300001574197us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001574197us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001574197us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-06-300001574197us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-06-300001574197us-gaap:AdditionalPaidInCapitalMember2023-06-300001574197us-gaap:RetainedEarningsMember2023-06-300001574197us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001574197us-gaap:ParentMember2023-06-300001574197us-gaap:NoncontrollingInterestMember2023-06-300001574197us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-03-310001574197us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-03-310001574197us-gaap:AdditionalPaidInCapitalMember2022-03-310001574197us-gaap:RetainedEarningsMember2022-03-310001574197us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-310001574197us-gaap:ParentMember2022-03-310001574197us-gaap:NoncontrollingInterestMember2022-03-3100015741972022-03-310001574197us-gaap:RetainedEarningsMember2022-04-012022-06-300001574197us-gaap:ParentMember2022-04-012022-06-300001574197us-gaap:NoncontrollingInterestMember2022-04-012022-06-300001574197us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-300001574197us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-012022-06-300001574197us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-06-300001574197us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-06-300001574197us-gaap:AdditionalPaidInCapitalMember2022-06-300001574197us-gaap:RetainedEarningsMember2022-06-300001574197us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-300001574197us-gaap:ParentMember2022-06-300001574197us-gaap:NoncontrollingInterestMember2022-06-3000015741972022-06-300001574197us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-12-310001574197us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-12-310001574197us-gaap:AdditionalPaidInCapitalMember2022-12-310001574197us-gaap:RetainedEarningsMember2022-12-310001574197us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001574197us-gaap:ParentMember2022-12-310001574197us-gaap:NoncontrollingInterestMember2022-12-310001574197us-gaap:RetainedEarningsMember2023-01-012023-06-300001574197us-gaap:ParentMember2023-01-012023-06-300001574197us-gaap:NoncontrollingInterestMember2023-01-012023-06-300001574197us-gaap:AdditionalPaidInCapitalMember2023-01-012023-06-300001574197us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-01-012023-06-300001574197us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-06-300001574197us-gaap:CommonClassAMemberus-gaap:CommonStockMember2021-12-310001574197us-gaap:CommonStockMemberus-gaap:CommonClassBMember2021-12-310001574197us-gaap:AdditionalPaidInCapitalMember2021-12-310001574197us-gaap:RetainedEarningsMember2021-12-310001574197us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001574197us-gaap:ParentMember2021-12-310001574197us-gaap:NoncontrollingInterestMember2021-12-3100015741972021-12-310001574197us-gaap:RetainedEarningsMember2022-01-012022-06-300001574197us-gaap:ParentMember2022-01-012022-06-300001574197us-gaap:NoncontrollingInterestMember2022-01-012022-06-300001574197us-gaap:AdditionalPaidInCapitalMember2022-01-012022-06-300001574197us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-01-012022-06-300001574197us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-06-300001574197fph:GreatParkVentureMember2023-01-012023-06-300001574197fph:GreatParkVentureMember2022-01-012022-06-300001574197fph:ValenciaLandbankVentureMember2023-01-012023-06-300001574197fph:ValenciaLandbankVentureMember2022-01-012022-06-30fph:vote0001574197us-gaap:CommonClassBMember2023-01-012023-06-30xbrli:pure0001574197srt:ParentCompanyMemberfph:FivePointOperatingCompanyLLCMembersrt:AffiliatedEntityMemberfph:FivePointOperatingCompanyLLCMember2023-01-012023-06-300001574197srt:ParentCompanyMemberfph:FivePointOperatingCompanyLLCMembersrt:AffiliatedEntityMember2023-01-012023-06-300001574197us-gaap:SubsequentEventMember2023-07-140001574197srt:ParentCompanyMemberfph:FivePointOperatingCompanyLLCMembersrt:AffiliatedEntityMemberus-gaap:SubsequentEventMember2023-07-140001574197fph:FivePointOperatingCompanyLLCMemberfph:TheSanFranciscoVentureMembersrt:AffiliatedEntityMember2023-06-300001574197fph:FivePointOperatingCompanyLLCMemberfph:TheSanFranciscoVentureMembersrt:AffiliatedEntityMember2023-01-012023-06-300001574197fph:FivePointLandLLCMemberus-gaap:SubsidiaryOfCommonParentMember2023-01-012023-06-300001574197us-gaap:EquityMethodInvesteeMemberfph:ContingentPaymentsDuefromRelatedPartiesMemberfph:GreatParkVentureMember2023-06-300001574197fph:ContractAssetsLegacyIncentiveCompensationReceivableMemberus-gaap:EquityMethodInvesteeMemberfph:GreatParkVentureMemberus-gaap:SubsequentEventMember2023-07-140001574197fph:HeritageFieldsLLCMember2023-06-300001574197fph:GreatParkVentureMember2023-06-30fph:member0001574197fph:FPOVHIMemberLLCMemberfph:FivePointOfficeVentureHoldingsILLCAcquisitionMember2023-06-300001574197us-gaap:SubsidiaryOfCommonParentMemberfph:SanFranciscoVentureMember2023-01-012023-06-300001574197fph:FivePointOfficeVentureHoldingsILLCAcquisitionMemberfph:FPOVHIMemberLLCMember2023-06-300001574197us-gaap:LandMemberfph:ValenciaMember2023-04-012023-06-300001574197fph:SanFranciscoMemberus-gaap:LandMember2023-04-012023-06-300001574197us-gaap:LandMemberfph:GreatParkVentureMember2023-04-012023-06-300001574197fph:CommercialLeasingMemberus-gaap:LandMember2023-04-012023-06-300001574197us-gaap:LandMemberfph:ValenciaMember2023-01-012023-06-300001574197fph:SanFranciscoMemberus-gaap:LandMember2023-01-012023-06-300001574197us-gaap:LandMemberfph:GreatParkVentureMember2023-01-012023-06-300001574197fph:CommercialLeasingMemberus-gaap:LandMember2023-01-012023-06-300001574197us-gaap:ManagementServiceMemberfph:ValenciaMember2023-04-012023-06-300001574197us-gaap:ManagementServiceMemberfph:SanFranciscoMember2023-04-012023-06-300001574197us-gaap:ManagementServiceMemberfph:GreatParkVentureMember2023-04-012023-06-300001574197fph:CommercialLeasingMemberus-gaap:ManagementServiceMember2023-04-012023-06-300001574197us-gaap:ManagementServiceMemberfph:ValenciaMember2023-01-012023-06-300001574197us-gaap:ManagementServiceMemberfph:SanFranciscoMember2023-01-012023-06-300001574197us-gaap:ManagementServiceMemberfph:GreatParkVentureMember2023-01-012023-06-300001574197fph:CommercialLeasingMemberus-gaap:ManagementServiceMember2023-01-012023-06-300001574197fph:OperatingPropertiesMemberfph:ValenciaMember2023-04-012023-06-300001574197fph:OperatingPropertiesMemberfph:SanFranciscoMember2023-04-012023-06-300001574197fph:OperatingPropertiesMemberfph:GreatParkVentureMember2023-04-012023-06-300001574197fph:CommercialLeasingMemberfph:OperatingPropertiesMember2023-04-012023-06-300001574197fph:OperatingPropertiesMemberfph:ValenciaMember2023-01-012023-06-300001574197fph:OperatingPropertiesMemberfph:SanFranciscoMember2023-01-012023-06-300001574197fph:OperatingPropertiesMemberfph:GreatParkVentureMember2023-01-012023-06-300001574197fph:CommercialLeasingMemberfph:OperatingPropertiesMember2023-01-012023-06-300001574197fph:ValenciaMember2023-04-012023-06-300001574197fph:SanFranciscoMember2023-04-012023-06-300001574197fph:GreatParkVentureMember2023-04-012023-06-300001574197fph:CommercialLeasingMember2023-04-012023-06-300001574197fph:ValenciaMember2023-01-012023-06-300001574197fph:SanFranciscoMember2023-01-012023-06-300001574197fph:GreatParkVentureMember2023-01-012023-06-300001574197fph:CommercialLeasingMember2023-01-012023-06-300001574197us-gaap:LandMemberfph:ValenciaMember2022-04-012022-06-300001574197fph:SanFranciscoMemberus-gaap:LandMember2022-04-012022-06-300001574197us-gaap:LandMemberfph:GreatParkVentureMember2022-04-012022-06-300001574197fph:CommercialLeasingMemberus-gaap:LandMember2022-04-012022-06-300001574197us-gaap:LandMemberfph:ValenciaMember2022-01-012022-06-300001574197fph:SanFranciscoMemberus-gaap:LandMember2022-01-012022-06-300001574197us-gaap:LandMemberfph:GreatParkVentureMember2022-01-012022-06-300001574197fph:CommercialLeasingMemberus-gaap:LandMember2022-01-012022-06-300001574197us-gaap:ManagementServiceMemberfph:ValenciaMember2022-04-012022-06-300001574197us-gaap:ManagementServiceMemberfph:SanFranciscoMember2022-04-012022-06-300001574197us-gaap:ManagementServiceMemberfph:GreatParkVentureMember2022-04-012022-06-300001574197fph:CommercialLeasingMemberus-gaap:ManagementServiceMember2022-04-012022-06-300001574197us-gaap:ManagementServiceMemberfph:ValenciaMember2022-01-012022-06-300001574197us-gaap:ManagementServiceMemberfph:SanFranciscoMember2022-01-012022-06-300001574197us-gaap:ManagementServiceMemberfph:GreatParkVentureMember2022-01-012022-06-300001574197fph:CommercialLeasingMemberus-gaap:ManagementServiceMember2022-01-012022-06-300001574197fph:OperatingPropertiesMemberfph:ValenciaMember2022-04-012022-06-300001574197fph:OperatingPropertiesMemberfph:SanFranciscoMember2022-04-012022-06-300001574197fph:OperatingPropertiesMemberfph:GreatParkVentureMember2022-04-012022-06-300001574197fph:CommercialLeasingMemberfph:OperatingPropertiesMember2022-04-012022-06-300001574197fph:OperatingPropertiesMemberfph:ValenciaMember2022-01-012022-06-300001574197fph:OperatingPropertiesMemberfph:SanFranciscoMember2022-01-012022-06-300001574197fph:OperatingPropertiesMemberfph:GreatParkVentureMember2022-01-012022-06-300001574197fph:CommercialLeasingMemberfph:OperatingPropertiesMember2022-01-012022-06-300001574197fph:ValenciaMember2022-04-012022-06-300001574197fph:SanFranciscoMember2022-04-012022-06-300001574197fph:GreatParkVentureMember2022-04-012022-06-300001574197fph:CommercialLeasingMember2022-04-012022-06-300001574197fph:ValenciaMember2022-01-012022-06-300001574197fph:SanFranciscoMember2022-01-012022-06-300001574197fph:GreatParkVentureMember2022-01-012022-06-300001574197fph:CommercialLeasingMember2022-01-012022-06-300001574197us-gaap:RelatedPartyMember2021-12-310001574197us-gaap:RelatedPartyMember2022-06-300001574197us-gaap:EquityMethodInvesteeMember2023-01-012023-06-300001574197fph:GreatParkVentureMember2023-01-012023-06-300001574197us-gaap:RelatedPartyMemberus-gaap:LandMemberfph:GreatParkVentureMember2023-01-012023-06-300001574197us-gaap:NonrelatedPartyMemberus-gaap:LandMemberfph:GreatParkVentureMember2023-01-012023-06-300001574197fph:GreatParkVentureMemberfph:HomesitesSoldMember2023-01-012023-06-300001574197us-gaap:RelatedPartyMemberus-gaap:LandMemberfph:GreatParkVentureMember2022-01-012022-06-300001574197us-gaap:NonrelatedPartyMemberus-gaap:LandMemberfph:GreatParkVentureMember2022-01-012022-06-300001574197fph:LandSalesAffiliatedEntityAndThirdPartyMemberfph:GreatParkVentureMember2023-01-012023-06-300001574197fph:LandSalesAffiliatedEntityAndThirdPartyMemberfph:GreatParkVentureMember2022-01-012022-06-300001574197fph:HomeSalesMemberfph:GreatParkVentureMember2023-01-012023-06-300001574197fph:HomeSalesMemberfph:GreatParkVentureMember2022-01-012022-06-300001574197fph:LandSalesMemberfph:GreatParkVentureMember2023-01-012023-06-300001574197fph:LandSalesMemberfph:GreatParkVentureMember2022-01-012022-06-300001574197fph:GreatParkVentureMember2022-01-012022-06-300001574197fph:GreatParkVentureMember2023-06-300001574197fph:GreatParkVentureMember2022-12-310001574197fph:GreatParkVentureMember2022-12-310001574197fph:GatewayCommercialVentureLLCAMemberfph:FivePointOfficeVentureHoldingsILLCAcquisitionMember2023-06-30fph:individualfph:buildingutr:acre0001574197fph:GatewayCommercialVentureLLCAMember2023-06-30utr:sqft0001574197fph:RentalRevenueMemberfph:GatewayCommercialVentureLLCAMember2023-01-012023-06-300001574197fph:RentalRevenueMemberfph:GatewayCommercialVentureLLCAMember2022-01-012022-06-300001574197fph:GatewayCommercialVentureLLCAMember2023-01-012023-06-300001574197fph:GatewayCommercialVentureLLCAMember2022-01-012022-06-300001574197fph:GatewayCommercialVentureLLCAMember2023-01-012023-06-300001574197fph:GatewayCommercialVentureLLCAMember2022-01-012022-06-300001574197fph:GatewayCommercialVentureLLCAMember2022-12-310001574197fph:GatewayCommercialVentureLLCAMember2023-06-300001574197fph:GatewayCommercialVentureLLCAMember2022-12-310001574197fph:ValenciaLandbankVentureMember2023-06-300001574197fph:ValenciaLandbankVentureMember2022-12-310001574197us-gaap:CapitalUnitClassAMembersrt:AffiliatedEntityMemberfph:FivePointOperatingCompanyLLCMember2023-06-300001574197us-gaap:CapitalUnitClassBMembersrt:AffiliatedEntityMemberfph:FivePointOperatingCompanyLLCMember2023-06-300001574197fph:FivePointOperatingCompanyLLCMember2023-06-300001574197fph:ConversionofClassBCommonSharesIntoClassACommonSharesMember2023-01-012023-06-300001574197fph:ManagementPartnerMemberfph:FivePointOperatingCompanyLLCMember2023-04-012023-06-300001574197fph:ManagementPartnerMemberfph:FivePointOperatingCompanyLLCMember2022-04-012022-06-300001574197fph:ManagementPartnerMemberfph:FivePointOperatingCompanyLLCMember2023-01-012023-06-300001574197fph:ManagementPartnerMemberfph:FivePointOperatingCompanyLLCMember2022-01-012022-06-300001574197fph:OtherPartnersMemberfph:FivePointOperatingCompanyLLCMember2023-04-012023-06-300001574197fph:OtherPartnersMemberfph:FivePointOperatingCompanyLLCMember2022-04-012022-06-300001574197fph:OtherPartnersMemberfph:FivePointOperatingCompanyLLCMember2023-01-012023-06-300001574197fph:OtherPartnersMemberfph:FivePointOperatingCompanyLLCMember2022-01-012022-06-300001574197fph:FivePointOperatingCompanyLLCMember2023-04-012023-06-300001574197fph:FivePointOperatingCompanyLLCMember2022-04-012022-06-300001574197fph:FivePointOperatingCompanyLLCMember2023-01-012023-06-300001574197fph:FivePointOperatingCompanyLLCMember2022-01-012022-06-300001574197fph:TheSanFranciscoVentureMember2023-01-012023-06-30fph:class0001574197fph:SanFranciscoVentureMember2019-01-012019-12-310001574197srt:MaximumMemberfph:SanFranciscoVentureMember2019-01-012019-12-310001574197fph:SanFranciscoVentureMember2023-01-012023-06-300001574197fph:SanFranciscoVentureMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-06-300001574197fph:SanFranciscoVentureMemberus-gaap:RelatedPartyMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-06-300001574197fph:SanFranciscoVentureMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-12-310001574197fph:SanFranciscoVentureMemberus-gaap:RelatedPartyMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-12-310001574197fph:FPLPAndFPLMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-06-300001574197us-gaap:RelatedPartyMemberfph:FPLPAndFPLMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-06-300001574197fph:FPLPAndFPLMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-12-310001574197us-gaap:RelatedPartyMemberfph:FPLPAndFPLMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-12-310001574197us-gaap:RelatedPartyMemberfph:ContractAssetsMember2023-06-300001574197us-gaap:RelatedPartyMemberfph:ContractAssetsMember2022-12-310001574197us-gaap:RelatedPartyMemberfph:OperatingLeaseMember2023-06-300001574197us-gaap:RelatedPartyMemberfph:OperatingLeaseMember2022-12-310001574197us-gaap:RelatedPartyMemberfph:OtherMember2023-06-300001574197us-gaap:RelatedPartyMemberfph:OtherMember2022-12-310001574197us-gaap:RelatedPartyMemberfph:ReimbursementObligationMember2023-06-300001574197us-gaap:RelatedPartyMemberfph:ReimbursementObligationMember2022-12-310001574197us-gaap:RelatedPartyMemberfph:PayableToHoldersOfManagementCompanysClassBInterestsMember2023-06-300001574197us-gaap:RelatedPartyMemberfph:PayableToHoldersOfManagementCompanysClassBInterestsMember2022-12-310001574197us-gaap:RelatedPartyMemberfph:AccruedAdvisoryFeesMember2023-06-300001574197us-gaap:RelatedPartyMemberfph:AccruedAdvisoryFeesMember2022-12-310001574197fph:ContractAssetsLegacyIncentiveCompensationReceivableMemberus-gaap:EquityMethodInvesteeMemberfph:GreatParkVentureMember2023-01-012023-06-300001574197fph:ContractAssetsLegacyIncentiveCompensationReceivableMemberus-gaap:EquityMethodInvesteeMember2023-01-012023-06-300001574197us-gaap:EquityMethodInvesteeMemberfph:ContractAssetsNonLegacyIncentiveCompensationReceivableMember2023-01-012023-06-300001574197us-gaap:EquityMethodInvesteeMember2023-06-300001574197fph:ContractAssetsLegacyIncentiveCompensationReceivableMemberus-gaap:RelatedPartyMember2023-06-300001574197fph:ContractAssetsLegacyIncentiveCompensationReceivableMemberus-gaap:RelatedPartyMember2022-12-310001574197us-gaap:RelatedPartyMemberus-gaap:ManagementServiceMemberfph:DevelopmentManagementAgreementMember2023-04-012023-06-300001574197us-gaap:RelatedPartyMemberus-gaap:ManagementServiceMemberfph:DevelopmentManagementAgreementMember2023-01-012023-06-300001574197us-gaap:RelatedPartyMemberus-gaap:ManagementServiceMemberfph:DevelopmentManagementAgreementMember2022-04-012022-06-300001574197us-gaap:RelatedPartyMemberus-gaap:ManagementServiceMemberfph:DevelopmentManagementAgreementMember2022-01-012022-06-300001574197us-gaap:SeniorNotesMemberfph:SeniorNotesDue20257.875Member2023-06-300001574197us-gaap:SeniorNotesMemberfph:SeniorNotesDue20257.875Member2022-12-310001574197us-gaap:RevolvingCreditFacilityMemberus-gaap:UnsecuredDebtMember2023-06-300001574197fph:SecuredOvernightFinancingRateSOFRMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:UnsecuredDebtMember2023-01-012023-06-300001574197fph:SecuredOvernightFinancingRateSOFRMembersrt:MinimumMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:UnsecuredDebtMember2023-01-012023-06-300001574197srt:MaximumMemberfph:SecuredOvernightFinancingRateSOFRMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:UnsecuredDebtMember2023-01-012023-06-300001574197us-gaap:SuretyBondMember2023-06-300001574197us-gaap:SuretyBondMember2022-12-310001574197fph:TheSanFranciscoVentureMember2023-06-300001574197fph:TheSanFranciscoVentureMember2022-12-310001574197us-gaap:AssetPledgedAsCollateralMember2022-12-310001574197us-gaap:AssetPledgedAsCollateralMember2023-06-300001574197fph:GatewayCommercialVentureLLCAMember2023-06-300001574197us-gaap:OperatingSegmentsMemberfph:ValenciaMember2023-04-012023-06-300001574197us-gaap:OperatingSegmentsMemberfph:ValenciaMember2022-04-012022-06-300001574197us-gaap:OperatingSegmentsMemberfph:ValenciaMember2023-01-012023-06-300001574197us-gaap:OperatingSegmentsMemberfph:ValenciaMember2022-01-012022-06-300001574197fph:SanFranciscoMemberus-gaap:OperatingSegmentsMember2023-04-012023-06-300001574197fph:SanFranciscoMemberus-gaap:OperatingSegmentsMember2022-04-012022-06-300001574197fph:SanFranciscoMemberus-gaap:OperatingSegmentsMember2023-01-012023-06-300001574197fph:SanFranciscoMemberus-gaap:OperatingSegmentsMember2022-01-012022-06-300001574197us-gaap:OperatingSegmentsMemberfph:GreatParkVentureMember2023-04-012023-06-300001574197us-gaap:OperatingSegmentsMemberfph:GreatParkVentureMember2022-04-012022-06-300001574197us-gaap:OperatingSegmentsMemberfph:GreatParkVentureMember2023-01-012023-06-300001574197us-gaap:OperatingSegmentsMemberfph:GreatParkVentureMember2022-01-012022-06-300001574197fph:CommercialLeasingMemberus-gaap:OperatingSegmentsMember2023-04-012023-06-300001574197fph:CommercialLeasingMemberus-gaap:OperatingSegmentsMember2022-04-012022-06-300001574197fph:CommercialLeasingMemberus-gaap:OperatingSegmentsMember2023-01-012023-06-300001574197fph:CommercialLeasingMemberus-gaap:OperatingSegmentsMember2022-01-012022-06-300001574197us-gaap:OperatingSegmentsMember2023-04-012023-06-300001574197us-gaap:OperatingSegmentsMember2022-04-012022-06-300001574197us-gaap:OperatingSegmentsMember2023-01-012023-06-300001574197us-gaap:OperatingSegmentsMember2022-01-012022-06-300001574197fph:GreatParkVentureMemberus-gaap:MaterialReconcilingItemsMember2023-04-012023-06-300001574197fph:GreatParkVentureMemberus-gaap:MaterialReconcilingItemsMember2022-04-012022-06-300001574197fph:GreatParkVentureMemberus-gaap:MaterialReconcilingItemsMember2023-01-012023-06-300001574197fph:GreatParkVentureMemberus-gaap:MaterialReconcilingItemsMember2022-01-012022-06-300001574197fph:GatewayCommercialVentureLLCAMemberus-gaap:MaterialReconcilingItemsMember2023-04-012023-06-300001574197fph:GatewayCommercialVentureLLCAMemberus-gaap:MaterialReconcilingItemsMember2022-04-012022-06-300001574197fph:GatewayCommercialVentureLLCAMemberus-gaap:MaterialReconcilingItemsMember2023-01-012023-06-300001574197fph:GatewayCommercialVentureLLCAMemberus-gaap:MaterialReconcilingItemsMember2022-01-012022-06-300001574197fph:GreatParkVentureMember2023-04-012023-06-300001574197fph:GreatParkVentureMember2022-04-012022-06-300001574197fph:GatewayCommercialVentureLLCAMember2023-04-012023-06-300001574197fph:GatewayCommercialVentureLLCAMember2022-04-012022-06-300001574197us-gaap:CorporateNonSegmentMember2023-04-012023-06-300001574197us-gaap:CorporateNonSegmentMember2022-04-012022-06-300001574197us-gaap:CorporateNonSegmentMember2023-01-012023-06-300001574197us-gaap:CorporateNonSegmentMember2022-01-012022-06-300001574197us-gaap:OperatingSegmentsMemberfph:ValenciaMember2023-06-300001574197us-gaap:OperatingSegmentsMemberfph:ValenciaMember2022-12-310001574197fph:SanFranciscoMemberus-gaap:OperatingSegmentsMember2023-06-300001574197fph:SanFranciscoMemberus-gaap:OperatingSegmentsMember2022-12-310001574197us-gaap:OperatingSegmentsMemberfph:GreatParkVentureMember2023-06-300001574197us-gaap:OperatingSegmentsMemberfph:GreatParkVentureMember2022-12-310001574197fph:CommercialLeasingMemberus-gaap:OperatingSegmentsMember2023-06-300001574197fph:CommercialLeasingMemberus-gaap:OperatingSegmentsMember2022-12-310001574197us-gaap:OperatingSegmentsMember2023-06-300001574197us-gaap:OperatingSegmentsMember2022-12-310001574197fph:GreatParkVentureMemberus-gaap:MaterialReconcilingItemsMember2023-06-300001574197fph:GreatParkVentureMemberus-gaap:MaterialReconcilingItemsMember2022-12-310001574197fph:GatewayCommercialVentureLLCAMemberus-gaap:MaterialReconcilingItemsMember2023-06-300001574197fph:GatewayCommercialVentureLLCAMemberus-gaap:MaterialReconcilingItemsMember2022-12-310001574197us-gaap:IntersegmentEliminationMember2023-06-300001574197us-gaap:IntersegmentEliminationMember2022-12-310001574197us-gaap:CorporateNonSegmentMember2023-06-300001574197us-gaap:CorporateNonSegmentMember2022-12-310001574197us-gaap:CommonClassAMember2023-06-072023-06-070001574197us-gaap:RestrictedStockMember2022-12-310001574197us-gaap:RestrictedStockMember2023-01-012023-06-300001574197us-gaap:RestrictedStockMember2023-06-300001574197us-gaap:RestructuringChargesMember2023-01-012023-06-300001574197us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-01-012023-06-300001574197us-gaap:RestrictedStockMember2023-01-012023-01-310001574197us-gaap:RestrictedStockMember2022-01-012022-01-310001574197us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-06-300001574197us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-06-300001574197us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310001574197us-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310001574197fph:PerformanceRestrictedStockUnitsRSUsMember2023-04-012023-06-300001574197fph:PerformanceRestrictedStockUnitsRSUsMember2022-04-012022-06-300001574197fph:PerformanceRestrictedStockUnitsRSUsMember2023-01-012023-06-300001574197fph:PerformanceRestrictedStockUnitsRSUsMember2022-01-012022-06-300001574197us-gaap:RestrictedStockMember2023-04-012023-06-300001574197us-gaap:RestrictedStockMember2022-04-012022-06-300001574197us-gaap:RestrictedStockMember2023-01-012023-06-300001574197us-gaap:RestrictedStockMember2022-01-012022-06-300001574197fph:PerformanceRestrictedSharesWeightedAverageMember2023-04-012023-06-300001574197fph:PerformanceRestrictedSharesWeightedAverageMember2022-04-012022-06-300001574197fph:PerformanceRestrictedSharesWeightedAverageMember2023-01-012023-06-300001574197fph:PerformanceRestrictedSharesWeightedAverageMember2022-01-012022-06-300001574197us-gaap:CommonClassAMember2023-04-012023-06-300001574197us-gaap:CommonClassAMember2022-04-012022-06-300001574197us-gaap:CommonClassAMember2023-01-012023-06-300001574197us-gaap:CommonClassAMember2022-01-012022-06-300001574197us-gaap:AociAttributableToNoncontrollingInterestMember2023-06-300001574197us-gaap:AociAttributableToNoncontrollingInterestMember2022-12-310001574197us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2023-01-012023-06-300001574197us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2022-01-012022-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 001-38088

Five Point Holdings, LLC

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Delaware |

|

27-0599397 |

| (State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

2000 FivePoint |

4th Floor |

Irvine |

California |

|

92618 |

(Address of Principal Executive Offices) |

|

(Zip code) |

(949) 349-1000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name, former address, and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Class A common shares |

FPH |

New York Stock Exchange |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Large accelerated filer |

☐ |

|

Accelerated filer |

☒ |

Non-accelerated filer |

☐ |

|

Smaller reporting company |

☐ |

|

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of July 14, 2023, 69,199,938 Class A common shares and 79,233,544 Class B common shares were outstanding.

FIVE POINT HOLDINGS, LLC

TABLE OF CONTENTS

FORM 10-Q

|

|

|

|

|

|

|

|

|

|

|

Page |

|

PART I. FINANCIAL INFORMATION |

|

ITEM 1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ITEM 2. |

|

|

ITEM 3. |

|

|

ITEM 4. |

|

|

|

|

|

|

PART II. OTHER INFORMATION |

|

ITEM 1. |

|

|

ITEM 1A. |

|

|

ITEM 2. |

|

|

ITEM 3. |

|

|

ITEM 4. |

|

|

ITEM 5. |

|

|

ITEM 6. |

|

|

|

|

|

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements that are subject to risks and uncertainties. These statements concern expectations, beliefs, projections, plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. When used, the words “anticipate,” “believe,” “expect,” “intend,” “may,” “might,” “plan,” “estimate,” “project,” “should,” “will,” “would,” “result” and similar expressions that do not relate solely to historical matters are intended to identify forward-looking statements. This report may contain forward-looking statements regarding: our expectations of our future revenues, costs and financial performance; future demographics and market conditions in the areas where our communities are located; the outcome of pending litigation and its effect on our operations; the timing of our development activities; and the timing of future real estate purchases or sales, including anticipated deliveries of homesites and anticipated amenities in our communities.

We caution you that any forward-looking statements presented in this report are based on our current views and information currently available to us. Forward-looking statements are subject to risks, trends, uncertainties and factors that are beyond our control. We believe these risks and uncertainties include, but are not limited to, the following:

•uncertainties and risks related to public health issues such as a major epidemic or pandemic, including COVID-19;

•risks associated with the real estate industry;

•downturns in economic conditions or demographic changes at the national, regional or local levels, particularly in the areas where our properties are located;

•uncertainty and risks related to zoning and land use laws and regulations, including environmental planning and protection laws;

•risks associated with development and construction projects;

•adverse developments in the economic, political, competitive or regulatory climate of California;

•loss of key personnel;

•uncertainties and risks related to adverse weather conditions, natural disasters and climate change;

•fluctuations in interest rates;

•the availability of cash for distribution and debt service and exposure to risk of default under debt obligations;

•exposure to liability relating to environmental and health and safety matters;

•exposure to litigation or other claims;

•insufficient amounts of insurance or exposure to events that are either uninsured or underinsured;

•intense competition in the real estate market and our ability to sell properties at desirable prices;

•fluctuations in real estate values;

•changes in property taxes;

•risks associated with our trademarks, trade names and service marks;

•conflicts of interest with our directors;

•general volatility of the capital and credit markets and the price of our Class A common shares; and

•risks associated with public or private financing or the unavailability thereof.

Please see Part I, Item 1A, “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022, as well as other risks and uncertainties detailed from time to time in our subsequent Quarterly Reports on Form 10-Q and other filings with the Securities and Exchange Commission, for a more detailed discussion of these and other risks.

Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated or projected. We caution you therefore against relying on any of these forward-looking statements.

While forward-looking statements reflect our good faith beliefs, they are not guarantees of future performance. They are based on estimates and assumptions only as of the date of this report. We undertake no obligation to update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, new information, data or methods, future events or other changes, except as required by applicable law.

PART I. FINANCIAL INFORMATION

ITEM 1. Financial Statements

FIVE POINT HOLDINGS, LLC

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except shares)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2023 |

|

December 31, 2022 |

ASSETS |

|

|

|

INVENTORIES |

$ |

2,254,935 |

|

|

$ |

2,239,125 |

|

INVESTMENT IN UNCONSOLIDATED ENTITIES |

302,337 |

|

|

331,594 |

|

PROPERTIES AND EQUIPMENT, NET |

29,668 |

|

|

30,243 |

|

|

|

|

|

INTANGIBLE ASSET, NET—RELATED PARTY |

31,656 |

|

|

40,257 |

|

CASH AND CASH EQUIVALENTS |

193,203 |

|

|

131,771 |

|

RESTRICTED CASH AND CERTIFICATES OF DEPOSIT |

992 |

|

|

992 |

|

RELATED PARTY ASSETS |

89,933 |

|

|

97,126 |

|

OTHER ASSETS |

11,179 |

|

|

14,676 |

|

TOTAL |

$ |

2,913,903 |

|

|

$ |

2,885,784 |

|

|

|

|

|

LIABILITIES AND CAPITAL |

|

|

|

LIABILITIES: |

|

|

|

Notes payable, net |

$ |

621,419 |

|

|

$ |

620,651 |

|

Accounts payable and other liabilities |

90,760 |

|

|

94,426 |

|

|

|

|

|

Related party liabilities |

83,684 |

|

|

93,086 |

|

Deferred income tax liability, net |

11,506 |

|

|

11,506 |

|

Payable pursuant to tax receivable agreement |

173,208 |

|

|

173,068 |

|

Total liabilities |

980,577 |

|

|

992,737 |

|

|

|

|

|

| COMMITMENTS AND CONTINGENT LIABILITIES (Note 11) |

|

|

|

REDEEMABLE NONCONTROLLING INTEREST |

25,000 |

|

|

25,000 |

|

CAPITAL: |

|

|

|

Class A common shares; No par value; Issued and outstanding: June 30, 2023—69,199,938 shares; December 31, 2022—69,068,354 shares |

|

|

|

Class B common shares; No par value; Issued and outstanding: June 30, 2023—79,233,544 shares; December 31, 2022—79,233,544 shares |

|

|

|

Contributed capital |

589,634 |

|

|

587,733 |

|

Retained earnings |

52,421 |

|

|

33,386 |

|

Accumulated other comprehensive loss |

(2,939) |

|

|

(2,988) |

|

Total members’ capital |

639,116 |

|

|

618,131 |

|

Noncontrolling interests |

1,269,210 |

|

|

1,249,916 |

|

Total capital |

1,908,326 |

|

|

1,868,047 |

|

TOTAL |

$ |

2,913,903 |

|

|

$ |

2,885,784 |

|

See accompanying notes to unaudited condensed consolidated financial statements.

FIVE POINT HOLDINGS, LLC

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except share and per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

REVENUES: |

|

|

|

|

|

|

|

Land sales |

$ |

16 |

|

|

$ |

14 |

|

|

$ |

(9) |

|

|

$ |

571 |

|

Land sales—related party |

(29) |

|

|

1,711 |

|

|

595 |

|

|

1,712 |

|

Management services—related party |

20,774 |

|

|

2,703 |

|

|

25,010 |

|

|

6,250 |

|

Operating properties |

588 |

|

|

965 |

|

|

1,454 |

|

|

1,746 |

|

Total revenues |

21,349 |

|

|

5,393 |

|

|

27,050 |

|

|

10,279 |

|

COSTS AND EXPENSES: |

|

|

|

|

|

|

|

Land sales |

— |

|

|

— |

|

|

— |

|

|

— |

|

Management services |

9,682 |

|

|

2,200 |

|

|

12,048 |

|

|

4,884 |

|

Operating properties |

1,798 |

|

|

2,378 |

|

|

2,970 |

|

|

4,217 |

|

Selling, general, and administrative |

12,710 |

|

|

12,651 |

|

|

26,462 |

|

|

29,442 |

|

| Restructuring |

— |

|

|

— |

|

|

— |

|

|

19,437 |

|

|

|

|

|

|

|

|

|

Total costs and expenses |

24,190 |

|

|

17,229 |

|

|

41,480 |

|

|

57,980 |

|

| OTHER INCOME (EXPENSE): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

1,293 |

|

|

117 |

|

|

2,129 |

|

|

138 |

|

|

|

|

|

|

|

|

|

Miscellaneous |

(20) |

|

|

112 |

|

|

(41) |

|

|

224 |

|

Total other income |

1,273 |

|

|

229 |

|

|

2,088 |

|

|

362 |

|

| EQUITY IN EARNINGS (LOSS) FROM UNCONSOLIDATED ENTITIES |

52,128 |

|

|

643 |

|

|

53,176 |

|

|

(389) |

|

| INCOME (LOSS) BEFORE INCOME TAX PROVISION |

50,560 |

|

|

(10,964) |

|

|

40,834 |

|

|

(47,728) |

|

| INCOME TAX PROVISION |

(5) |

|

|

(8) |

|

|

(13) |

|

|

(13) |

|

| NET INCOME (LOSS) |

50,555 |

|

|

(10,972) |

|

|

40,821 |

|

|

(47,741) |

|

| LESS NET INCOME (LOSS) ATTRIBUTABLE TO NONCONTROLLING INTERESTS |

26,984 |

|

|

(5,861) |

|

|

21,786 |

|

|

(25,500) |

|

| NET INCOME (LOSS) ATTRIBUTABLE TO THE COMPANY |

$ |

23,571 |

|

|

$ |

(5,111) |

|

|

$ |

19,035 |

|

|

$ |

(22,241) |

|

|

|

|

|

|

|

|

|

| NET INCOME (LOSS) ATTRIBUTABLE TO THE COMPANY PER CLASS A SHARE |

|

|

|

|

|

|

|

| Basic |

$ |

0.34 |

|

|

$ |

(0.07) |

|

|

$ |

0.28 |

|

|

$ |

(0.32) |

|

Diluted |

$ |

0.34 |

|

|

$ |

(0.07) |

|

|

$ |

0.27 |

|

|

$ |

(0.33) |

|

WEIGHTED AVERAGE CLASS A SHARES OUTSTANDING |

|

|

|

|

|

|

|

| Basic |

68,811,975 |

|

|

68,495,523 |

|

|

68,758,894 |

|

|

68,332,460 |

|

Diluted |

145,040,689 |

|

|

69,635,563 |

|

|

144,939,450 |

|

|

69,472,500 |

|

| NET INCOME (LOSS) ATTRIBUTABLE TO THE COMPANY PER CLASS B SHARE |

|

|

|

|

|

|

|

Basic and diluted |

$ |

0.00 |

|

|

$ |

(0.00) |

|

|

$ |

0.00 |

|

|

$ |

(0.00) |

|

WEIGHTED AVERAGE CLASS B SHARES OUTSTANDING |

|

|

|

|

|

|

|

| Basic and diluted |

79,233,544 |

|

|

79,233,544 |

|

|

79,233,544 |

|

|

79,233,544 |

|

|

|

|

|

|

|

|

|

See accompanying notes to unaudited condensed consolidated financial statements.

FIVE POINT HOLDINGS, LLC

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| NET INCOME (LOSS) |

$ |

50,555 |

|

|

$ |

(10,972) |

|

|

$ |

40,821 |

|

|

$ |

(47,741) |

|

OTHER COMPREHENSIVE INCOME: |

|

|

|

|

|

|

|

| Reclassification of actuarial loss on defined benefit pension plan included in net income (loss) |

40 |

|

|

13 |

|

|

81 |

|

|

26 |

|

Other comprehensive income before taxes |

40 |

|

|

13 |

|

|

81 |

|

|

26 |

|

INCOME TAX PROVISION RELATED TO OTHER COMPREHENSIVE INCOME |

— |

|

|

— |

|

|

— |

|

|

— |

|

OTHER COMPREHENSIVE INCOME—Net of tax |

40 |

|

|

13 |

|

|

81 |

|

|

26 |

|

| COMPREHENSIVE INCOME (LOSS) |

50,595 |

|

|

(10,959) |

|

|

40,902 |

|

|

(47,715) |

|

| LESS COMPREHENSIVE INCOME (LOSS) ATTRIBUTABLE TO NONCONTROLLING INTERESTS |

26,999 |

|

|

(5,856) |

|

|

21,816 |

|

|

(25,490) |

|

| COMPREHENSIVE INCOME (LOSS) ATTRIBUTABLE TO THE COMPANY |

$ |

23,596 |

|

|

$ |

(5,103) |

|

|

$ |

19,086 |

|

|

$ |

(22,225) |

|

See accompanying notes to unaudited condensed consolidated financial statements.

FIVE POINT HOLDINGS, LLC

CONDENSED CONSOLIDATED STATEMENTS OF CAPITAL

(In thousands, except share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class A Common Shares |

|

Class B Common Shares |

|

Contributed Capital |

|

Retained Earnings |

|

Accumulated Other Comprehensive Loss |

|

Total Members’ Capital |

|

Noncontrolling Interests |

|

Total Capital |

| BALANCE - March 31, 2023 |

69,199,938 |

|

|

79,233,544 |

|

|

$ |

588,704 |

|

|

$ |

28,850 |

|

|

$ |

(2,964) |

|

|

$ |

614,590 |

|

|

$ |

1,242,211 |

|

|

$ |

1,856,801 |

|

| Net income |

— |

|

|

— |

|

|

— |

|

|

23,571 |

|

|

— |

|

|

23,571 |

|

|

26,984 |

|

|

50,555 |

|

Share-based compensation expense |

— |

|

|

— |

|

|

930 |

|

|

— |

|

|

— |

|

|

930 |

|

|

— |

|

|

930 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income—net of tax of $0 |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

25 |

|

|

25 |

|

|

15 |

|

|

40 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| BALANCE - June 30, 2023 |

69,199,938 |

|

|

79,233,544 |

|

|

$ |

589,634 |

|

|

$ |

52,421 |

|

|

$ |

(2,939) |

|

|

$ |

639,116 |

|

|

$ |

1,269,210 |

|

|

$ |

1,908,326 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| BALANCE - March 31, 2022 |

69,068,354 |

|

|

79,233,544 |

|

|

$ |

585,606 |

|

|

$ |

31,659 |

|

|

$ |

(1,933) |

|

|

$ |

615,332 |

|

|

$ |

1,250,280 |

|

|

$ |

1,865,612 |

|

| Net loss |

— |

|

|

— |

|

|

— |

|

|

(5,111) |

|

|

— |

|

|

(5,111) |

|

|

(5,861) |

|

|

(10,972) |

|

Share-based compensation expense |

— |

|

|

— |

|

|

661 |

|

|

— |

|

|

— |

|

|

661 |

|

|

— |

|

|

661 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income—net of tax of $0 |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

8 |

|

|

8 |

|

|

5 |

|

|

13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| BALANCE - June 30, 2022 |

69,068,354 |

|

|

79,233,544 |

|

|

$ |

586,267 |

|

|

$ |

26,548 |

|

|

$ |

(1,925) |

|

|

$ |

610,890 |

|

|

$ |

1,244,424 |

|

|

$ |

1,855,314 |

|

See accompanying notes to unaudited condensed consolidated financial statements.

FIVE POINT HOLDINGS, LLC

CONDENSED CONSOLIDATED STATEMENTS OF CAPITAL

(In thousands, except share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class A

Common

Shares |

|

Class B

Common

Shares |

|

Contributed

Capital |

|

Retained

Earnings |

|

Accumulated

Other

Comprehensive

Loss |

|

Total

Members’

Capital |

|

Noncontrolling

Interests |

|

Total

Capital |

| BALANCE - December 31, 2022 |

69,068,354 |

|

|

79,233,544 |

|

|

$ |

587,733 |

|

|

$ |

33,386 |

|

|

$ |

(2,988) |

|

|

$ |

618,131 |

|

|

$ |

1,249,916 |

|

|

$ |

1,868,047 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

— |

|

|

— |

|

|

— |

|

|

19,035 |

|

|

— |

|

|

19,035 |

|

|

21,786 |

|

|

40,821 |

|

Share-based compensation expense |

— |

|

|

— |

|

|

1,693 |

|

|

— |

|

|

— |

|

|

1,693 |

|

|

— |

|

|

1,693 |

|

Reacquisition of share-based compensation awards for tax-withholding purposes |

(83,660) |

|

|

— |

|

|

(202) |

|

|

— |

|

|

— |

|

|

(202) |

|

|

— |

|

|

(202) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Issuance of share-based compensation awards, net of forfeitures |

215,244 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

Other comprehensive income—net of tax of $0 |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

51 |

|

|

51 |

|

|

30 |

|

|

81 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tax distributions to noncontrolling interests |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(1,974) |

|

|

(1,974) |

|

Adjustment to liability recognized under tax receivable agreement—net of tax of $0 |

— |

|

|

— |

|

|

(140) |

|

|

— |

|

|

— |

|

|

(140) |

|

|

— |

|

|

(140) |

|

Adjustment of noncontrolling interest in the Operating Company |

— |

|

|

— |

|

|

550 |

|

|

— |

|

|

(2) |

|

|

548 |

|

|

(548) |

|

|

— |

|

| BALANCE - June 30, 2023 |

69,199,938 |

|

|

79,233,544 |

|

|

$ |

589,634 |

|

|

$ |

52,421 |

|

|

$ |

(2,939) |

|

|

$ |

639,116 |

|

|

$ |

1,269,210 |

|

|

$ |

1,908,326 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| BALANCE - December 31, 2021 |

70,107,552 |

|

|

79,233,544 |

|

|

$ |

587,587 |

|

|

$ |

48,789 |

|

|

$ |

(1,952) |

|

|

$ |

634,424 |

|

|

$ |

1,265,954 |

|

|

$ |

1,900,378 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

— |

|

|

— |

|

|

— |

|

|

(22,241) |

|

|

— |

|

|

(22,241) |

|

|

(25,500) |

|

|

(47,741) |

|

Share-based compensation expense |

— |

|

|

— |

|

|

4,764 |

|

|

— |

|

|

— |

|

|

4,764 |

|

|

— |

|

|

4,764 |

|

Reacquisition of share-based compensation awards for tax-withholding purposes |

(417,716) |

|

|

— |

|

|

(2,736) |

|

|

— |

|

|

— |

|

|

(2,736) |

|

|

— |

|

|

(2,736) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Forfeitures of share-based compensation awards, net of issuances |

(621,482) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

Other comprehensive income—net of tax of $0 |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

16 |

|

|

16 |

|

|

10 |

|

|

26 |

|

| Tax distributions to noncontrolling interests |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(435) |

|

|

(435) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustment to liability recognized under tax receivable agreement—net of tax of $0 |

— |

|

|

— |

|

|

1,058 |

|

|

— |

|

|

— |

|

|

1,058 |

|

|

— |

|

|

1,058 |

|

Adjustment of noncontrolling interest in the Operating Company |

— |

|

|

— |

|

|

(4,406) |

|

|

— |

|

|

11 |

|

|

(4,395) |

|

|

4,395 |

|

|

— |

|

| BALANCE - June 30, 2022 |

69,068,354 |

|

|

79,233,544 |

|

|

$ |

586,267 |

|

|

$ |

26,548 |

|

|

$ |

(1,925) |

|

|

$ |

610,890 |

|

|

$ |

1,244,424 |

|

|

$ |

1,855,314 |

|

See accompanying notes to unaudited condensed consolidated financial statements.

FIVE POINT HOLDINGS, LLC

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30, |

|

2023 |

|

2022 |

| CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

| Net income (loss) |

$ |

40,821 |

|

|

$ |

(47,741) |

|

| Adjustments to reconcile net income (loss) to net cash used in operating activities: |

|

|

|

| Equity in (earnings) loss from unconsolidated entities |

(53,176) |

|

|

389 |

|

| Return on investment from Great Park Venture |

52,736 |

|

|

— |

|

|

|

|

|

| Depreciation and amortization |

11,204 |

|

|

3,034 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Share-based compensation |

1,693 |

|

|

4,764 |

|

| Changes in operating assets and liabilities: |

|

|

|

| Inventories |

(14,867) |

|

|

(89,880) |

|

| Related party assets |

6,013 |

|

|

2,029 |

|

| Other assets |

2,430 |

|

|

(602) |

|

| Accounts payable and other liabilities |

(3,520) |

|

|

(14,521) |

|

| Related party liabilities |

(5,409) |

|

|

8,997 |

|

| Net cash provided by (used in) operating activities |

37,925 |

|

|

(133,531) |

|

| CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

| Return of investment from Great Park Venture |

29,028 |

|

|

— |

|

| Return of investment from Valencia Landbank Venture |

648 |

|

|

1,544 |

|

|

|

|

|

| Contribution to Valencia Landbank Venture |

— |

|

|

(95) |

|

|

|

|

|

|

|

|

|

| Purchase of properties and equipment |

— |

|

|

(62) |

|

| Net cash provided by investing activities |

29,676 |

|

|

1,387 |

|

| CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Related party reimbursement obligation |

(3,993) |

|

|

(2,327) |

|

|

|

|

|

|

|

|

|

| Reacquisition of share-based compensation awards for tax-withholding purposes |

(202) |

|

|

(2,736) |

|

|

|

|

|

| Tax distributions to noncontrolling interests |

(1,974) |

|

|

(435) |

|

|

|

|

|

| Net cash used in financing activities |

(6,169) |

|

|

(5,498) |

|

| NET INCREASE (DECREASE) IN CASH, CASH EQUIVALENTS, AND RESTRICTED CASH |

61,432 |

|

|

(137,642) |

|

| CASH, CASH EQUIVALENTS, AND RESTRICTED CASH—Beginning of period |

132,763 |

|

|

266,792 |

|

| CASH, CASH EQUIVALENTS, AND RESTRICTED CASH—End of period |

$ |

194,195 |

|

|

$ |

129,150 |

|

SUPPLEMENTAL CASH FLOW INFORMATION (Note 12)

See accompanying notes to unaudited condensed consolidated financial statements.

FIVE POINT HOLDINGS, LLC

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. BUSINESS AND ORGANIZATION

Five Point Holdings, LLC, a Delaware limited liability company (the “Holding Company” and, together with its consolidated subsidiaries, the “Company”), is an owner and developer of mixed-use planned communities in California. The Holding Company owns all of its assets and conducts all of its operations through Five Point Operating Company, LP, a Delaware limited partnership (the “Operating Company”), and its subsidiaries.

The Company has two classes of shares outstanding: Class A common shares and Class B common shares. Holders of Class A common shares and holders of Class B common shares are entitled to one vote for each share held of record on all matters submitted to a vote of shareholders, and are both entitled to receive distributions at the same time. However, the distributions paid to holders of Class B common shares are in an amount per share equal to 0.0003 multiplied by the amount paid per Class A common share.

The Company presents noncontrolling interests on the Company’s condensed consolidated balance sheet and classifies such interests within capital but separate from the Company’s Class A and Class B members’ capital. Noncontrolling interests represent equity interests in the Company’s consolidated subsidiaries held by partners in the Operating Company, excluding the Holding Company, and members in The Shipyard Communities, LLC (the “San Francisco Venture”), excluding the Operating Company (see Note 5).

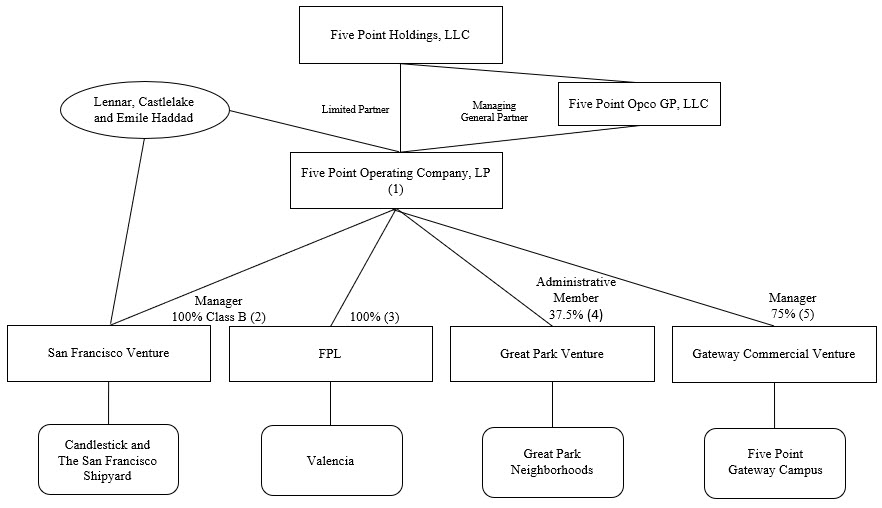

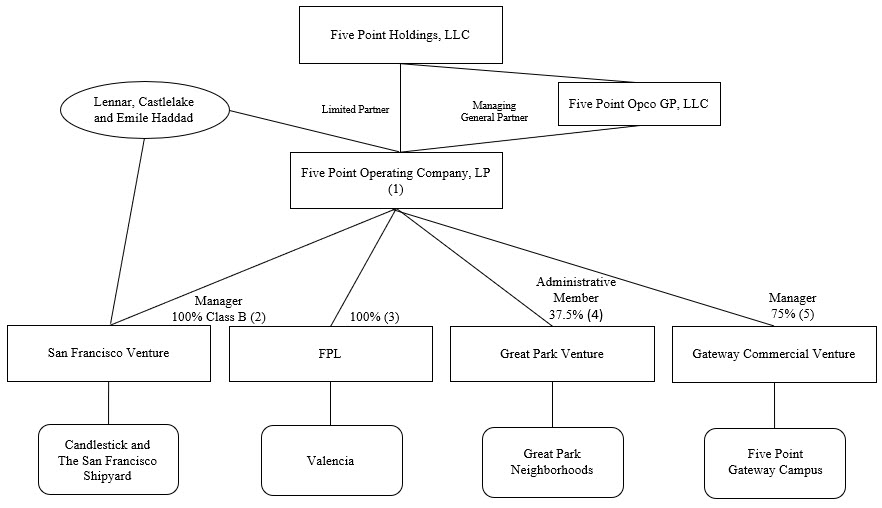

The Company has an entity structure in which the Company’s two largest equity owners, Lennar Corporation (“Lennar”) and Castlelake, LP (“Castlelake”), and the Company’s founder and Chairman Emeritus, Emile Haddad, separately hold, in addition to interests in the Company’s common shares, equity interests in either or both the Operating Company or the San Francisco Venture that can be exchanged for, at the Company’s option, either the Company’s Class A common shares or cash. The diagram below presents a simplified depiction of the Company’s organizational structure as of June 30, 2023:

(1) A wholly owned subsidiary of the Holding Company serves as the sole managing general partner of the Operating Company. As of June 30, 2023, the Company owned approximately 62.6% of the outstanding Class A Common Units of the Operating Company. After a one year holding period, a holder of Class A Common Units of the Operating Company can exchange the units for, at the Company’s option, either Class A common shares of the Holding Company, on a one-for-one basis, or cash equal to the fair market value of such shares. Until Class A Common Units of the Operating Company are exchanged or redeemed, the capital associated with Class A Common Units of the Operating Company not held by the Holding Company is presented within "noncontrolling interests" on the Company’s condensed consolidated balance sheet. Assuming the exchange of all outstanding Class A Common Units of the Operating Company and all outstanding Class A units of the San Francisco Venture (see (2)

below), that are not held by the Company, based on the closing price of the Company’s Class A common shares on July 14, 2023 ($3.00), the equity market capitalization of the Company was approximately $445.4 million.

(2) The Operating Company owns all of the outstanding Class B units of the San Francisco Venture, the entity developing the Candlestick and The San Francisco Shipyard communities. The Class A units of the San Francisco Venture, which the Operating Company does not own, are intended to be economically equivalent to Class A Common Units of the Operating Company. As the holder of all outstanding Class B units of the San Francisco Venture, the Operating Company is entitled to receive 99% of available cash from the San Francisco Venture after the holders of Class A units in the San Francisco Venture have received distributions equivalent to the distributions, if any, paid on Class A Common Units of the Operating Company. Class A units of the San Francisco Venture can be exchanged, on a one-for-one basis, for Class A Common Units of the Operating Company (See Note 5). Until exchanged or redeemed through the Operating Company, the capital associated with Class A units of the San Francisco Venture is presented within "noncontrolling interests" on the Company’s condensed consolidated balance sheet.

(3) Together, the Operating Company, Five Point Communities, LP, a Delaware limited partnership (“FP LP”), and Five Point Communities Management, Inc., a Delaware corporation (“FP Inc.” and together with FP LP, the “Management Company”) own 100% of Five Point Land, LLC, a Delaware limited liability company (“FPL”), the entity developing Valencia, a mixed-use planned community located in northern Los Angeles County, California. The Operating Company has a controlling interest in the Management Company.

(4) Interests in Heritage Fields LLC, a Delaware limited liability company (the “Great Park Venture”), are either “Percentage Interests” or “Legacy Interests.” Holders of the Legacy Interests were entitled to receive priority distributions up to an aggregate amount of $565.0 million, of which $524.3 million had been distributed as of July 14, 2023 (See Note 4). The Company owns a 37.5% Percentage Interest in the Great Park Venture and serves as its administrative member. However, management of the Great Park Venture is vested in the four voting members, who have a total of five votes. Major decisions generally require the approval of at least 75% of the votes of the voting members. The Company has two votes, and the other three voting members each have one vote, so the Company is unable to approve any major decision without the consent or approval of at least two of the other voting members. The Company does not include the Great Park Venture as a consolidated subsidiary, but rather as an equity method investee, in its condensed consolidated financial statements.

(5) The Company owns a 75% interest in Five Point Office Venture Holdings I, LLC, a Delaware limited liability company (the “Gateway Commercial Venture”). The Company manages the Gateway Commercial Venture, however, the manager’s authority is limited. Major decisions by the Gateway Commercial Venture generally require unanimous approval by an executive committee composed of two people designated by the Company and two people designated by another investor. Some decisions require approval by all of the members of the Gateway Commercial Venture. The Company does not include the Gateway Commercial Venture as a consolidated subsidiary, but rather as an equity method investee, in its condensed consolidated financial statements.

2. BASIS OF PRESENTATION

Principles of consolidation—The accompanying condensed consolidated financial statements include the accounts of the Holding Company and the accounts of all subsidiaries in which the Holding Company has a controlling interest and the consolidated accounts of variable interest entities (“VIEs”) in which the Holding Company is deemed to be the primary beneficiary. All intercompany transactions and balances have been eliminated in consolidation.

Unaudited interim financial information—The accompanying condensed consolidated financial statements are unaudited and have been prepared in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”) for interim financial information, the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information and notes required by U.S. GAAP for complete financial statements. These condensed consolidated financial statements should be read in conjunction with the Company’s Annual Report on Form 10-K for the year ended December 31, 2022. In the opinion of management, all adjustments (including normal recurring adjustments) considered necessary for a fair presentation have been included. Operating results and cash flows for the three and six months ended June 30, 2023 are not necessarily indicative of the operating results and cash flows that may be expected for the full year.

Use of estimates—The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting periods. Management evaluates its estimates on an ongoing basis and makes revisions to these estimates and related disclosures as experience develops or new information becomes known. Actual results could differ from those estimates.

Miscellaneous other (loss) income—Miscellaneous other (loss) income consisted of the following (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| Net periodic pension (cost) benefit |

$ |

(20) |

|

|

$ |

112 |

|

|

$ |

(41) |

|

|

$ |

224 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total miscellaneous other (loss) income |

$ |

(20) |

|

|

$ |

112 |

|

|

$ |

(41) |

|

|

$ |

224 |

|

Recently adopted accounting pronouncements—There are no recent accounting pronouncements that have had or are expected to have a material impact on the Company’s condensed consolidated financial statements or disclosures.

3. REVENUES

The following tables present the Company’s consolidated revenues disaggregated by revenue source and reporting segment (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, 2023 |

|

Six Months Ended June 30, 2023 |

|

Valencia |

|

San Francisco |

|

Great Park(1) |

|

Commercial(1) |

|

Total |

|

Valencia |

|

San Francisco |

|

Great Park(1) |

|

Commercial(1) |

|

Total |

Land sales and land sales—related party |

$ |

(13) |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

(13) |

|

|

$ |

586 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

586 |

|

Management services—related party |

— |

|

|

— |

|

|

20,670 |

|

|

104 |

|

|

20,774 |

|

|

— |

|

|

— |

|

|

24,799 |

|

|

211 |

|

|

25,010 |

|

| Operating properties |

141 |

|

|

— |

|

|

— |

|

|

— |

|

|

141 |

|

|

499 |

|

|

— |

|

|

— |

|

|

— |

|

|

499 |

|

|

128 |

|

|

— |

|

|

20,670 |

|

|

104 |

|

|

20,902 |

|

|

1,085 |

|

|

— |

|

|

24,799 |

|

|

211 |

|

|

26,095 |

|

| Operating properties leasing revenues |

285 |

|

|

162 |

|

|

— |

|

|

— |

|

|

447 |

|

|

631 |

|

|

324 |

|

|

— |

|

|

— |

|

|

955 |

|

|

$ |

413 |

|

|

$ |

162 |

|

|

$ |

20,670 |

|

|

$ |

104 |

|

|

$ |

21,349 |

|

|

$ |

1,716 |

|

|

$ |

324 |

|

|

$ |

24,799 |

|

|

$ |

211 |

|

|

$ |

27,050 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|