| Maryland | 001-36008 | 46-2024407 | ||||||||||||

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (IRS Employer Identification No.) | ||||||||||||

| 11620 Wilshire Boulevard, Suite 1000 | ||||||||

| Los Angeles | ||||||||

| California | 90025 | |||||||

| (Address of principal executive offices) | (Zip Code) | |||||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

||||

| Title of each class | Trading symbols | Name of each exchange on which registered | ||||||||||||

| Common Stock, $0.01 par value | REXR | New York Stock Exchange | ||||||||||||

| 5.875% Series B Cumulative Redeemable Preferred Stock | REXR-PB | New York Stock Exchange | ||||||||||||

| 5.625% Series C Cumulative Redeemable Preferred Stock | REXR-PC | New York Stock Exchange | ||||||||||||

| Exhibit Number |

Description | |||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |||||||

| Rexford Industrial Realty, Inc. | |||||

| April 17, 2024 |

/s/ Michael S. Frankel

|

||||

| Michael S. Frankel Co-Chief Executive Officer (Principal Executive Officer) |

|||||

| Rexford Industrial Realty, Inc. | |||||

| April 17, 2024 |

/s/ Howard Schwimmer

|

||||

| Howard Schwimmer Co-Chief Executive Officer (Principal Executive Officer) |

|||||

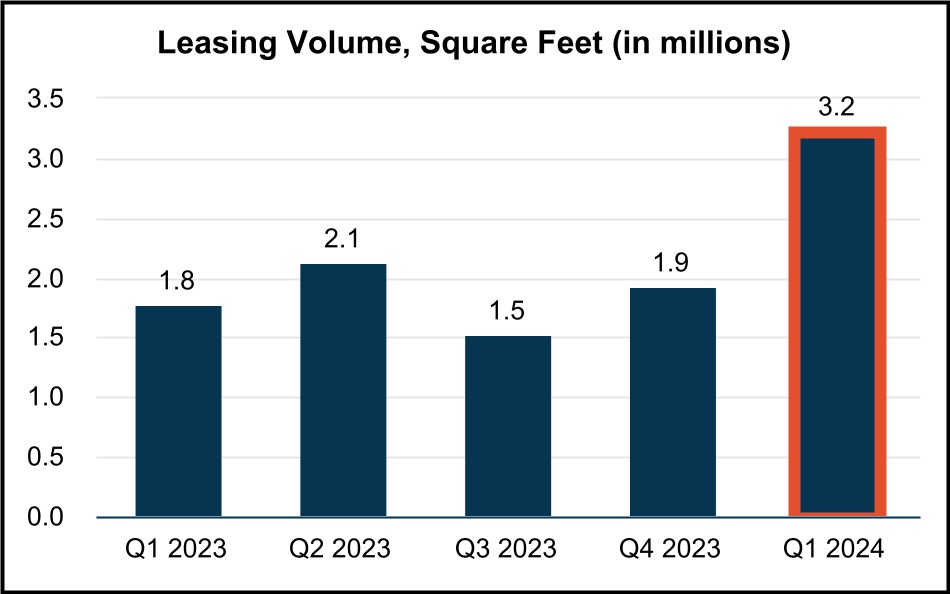

Q1-2024 Leasing Activity |

||||||||||||||||||||||||||||||||||||||

Releasing Spreads |

Releasing Spreads

Excluding Tireco, Inc.

Lease Extension(1)

|

|||||||||||||||||||||||||||||||||||||

# of Leases Executed |

SF of

Leasing

|

GAAP |

Cash |

GAAP |

Cash |

|||||||||||||||||||||||||||||||||

New Leases |

50 | 830,941 | 41.3% | 31.2% | 41.3% | 31.2% | ||||||||||||||||||||||||||||||||

Renewal Leases |

64 | 2,398,076 | 14.8% | 11.3% | 56.8% | 34.4% | ||||||||||||||||||||||||||||||||

Total Leases |

114 | 3,229,017 | 17.3% | 13.2% | 53.0% | 33.6% | ||||||||||||||||||||||||||||||||

2024 Outlook (1) |

Q1 2024 Updated Guidance | Initial Guidance | ||||||||||||

| Net Income Attributable to Common Stockholders per diluted share | $1.17 - $1.20 | $1.11 - $1.14 | ||||||||||||

| Company share of Core FFO per diluted share | $2.31 - $2.34 | $2.27 - $2.30 | ||||||||||||

| Same Property Portfolio NOI Growth - GAAP | 4.25% - 5.25% | 4.0% - 5.0% | ||||||||||||

| Same Property Portfolio NOI Growth - Cash | 7.0% - 8.0% | 7.0% - 8.0% | ||||||||||||

Average Same Property Portfolio Occupancy (Full Year) (2) |

96.5% - 97.0% | 96.5% - 97.0% | ||||||||||||

General and Administrative Expenses (3) |

+/- $83.0M | +/- $83.0M | ||||||||||||

| Net Interest Expense | +/- $99.0M | $60.0M - $61.0M | ||||||||||||

| 2024 Estimate | |||||||||||

| Low | High | ||||||||||

| Net income attributable to common stockholders | $ | 1.17 | $ | 1.20 | |||||||

| Company share of depreciation and amortization | 1.17 | 1.17 | |||||||||

Company share of gains on sale of real estate(1) |

(0.03) | (0.03) | |||||||||

| Company share of Core FFO | $ | 2.31 | $ | 2.34 | |||||||

| March 31, 2024 | December 31, 2023 | ||||||||||

| (unaudited) | |||||||||||

| ASSETS | |||||||||||

| Land | $ | 7,568,720 | $ | 6,815,622 | |||||||

| Buildings and improvements | 4,260,512 | 3,933,379 | |||||||||

| Tenant improvements | 172,707 | 167,251 | |||||||||

| Furniture, fixtures, and equipment | 132 | 132 | |||||||||

| Construction in progress | 258,413 | 240,010 | |||||||||

| Total real estate held for investment | 12,260,484 | 11,156,394 | |||||||||

| Accumulated depreciation | (827,576) | (782,461) | |||||||||

| Investments in real estate, net | 11,432,908 | 10,373,933 | |||||||||

| Cash and cash equivalents | 336,960 | 33,444 | |||||||||

Loan receivable, net |

122,899 | 122,784 | |||||||||

| Rents and other receivables, net | 17,896 | 17,494 | |||||||||

| Deferred rent receivable, net | 130,694 | 123,325 | |||||||||

| Deferred leasing costs, net | 61,017 | 59,351 | |||||||||

| Deferred loan costs, net | 3,069 | 3,426 | |||||||||

| Acquired lease intangible assets, net | 223,698 | 153,670 | |||||||||

| Acquired indefinite-lived intangible | 5,156 | 5,156 | |||||||||

| Interest rate swap asset | 16,737 | 9,896 | |||||||||

| Other assets | 22,114 | 25,225 | |||||||||

| Acquisition related deposits | 7,975 | 2,125 | |||||||||

| Total Assets | $ | 12,381,123 | $ | 10,929,829 | |||||||

| LIABILITIES & EQUITY | |||||||||||

| Liabilities | |||||||||||

| Notes payable | $ | 3,349,120 | $ | 2,225,914 | |||||||

| Accounts payable, accrued expenses and other liabilities | 148,920 | 128,842 | |||||||||

| Dividends and distributions payable | 94,356 | 83,733 | |||||||||

| Acquired lease intangible liabilities, net | 171,687 | 147,561 | |||||||||

| Tenant security deposits | 91,034 | 84,872 | |||||||||

Tenant prepaid rents |

110,727 | 115,002 | |||||||||

| Total Liabilities | 3,965,844 | 2,785,924 | |||||||||

| Equity | |||||||||||

| Rexford Industrial Realty, Inc. stockholders’ equity | |||||||||||

Preferred stock, $0.01 par value per share, 10,050,000 shares authorized: |

|||||||||||

5.875% series B cumulative redeemable preferred stock, 3,000,000 shares outstanding at March 31, 2024 and December 31, 2023 ($75,000 liquidation preference) |

72,443 | 72,443 | |||||||||

5.625% series C cumulative redeemable preferred stock, 3,450,000 shares outstanding at March 31, 2024 and December 31, 2023 ($86,250 liquidation preference) |

83,233 | 83,233 | |||||||||

Common Stock,$ 0.01 par value per share, 489,950,000 authorized and 217,822,056 and 212,346,450 shares outstanding at March 31, 2024 and December 31, 2023, respectively |

2,178 | 2,123 | |||||||||

| Additional paid in capital | 8,233,127 | 7,940,781 | |||||||||

| Cumulative distributions in excess of earnings | (370,720) | (338,835) | |||||||||

| Accumulated other comprehensive loss | 13,922 | 7,172 | |||||||||

| Total stockholders’ equity | 8,034,183 | 7,766,917 | |||||||||

| Noncontrolling interests | 381,096 | 376,988 | |||||||||

| Total Equity | 8,415,279 | 8,143,905 | |||||||||

| Total Liabilities and Equity | $ | 12,381,123 | $ | 10,929,829 | |||||||

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| REVENUES | |||||||||||

| Rental income | $ | 210,990 | $ | 185,164 | |||||||

| Management and leasing services | 132 | 190 | |||||||||

| Interest income | 2,974 | 882 | |||||||||

| TOTAL REVENUES | 214,096 | 186,236 | |||||||||

| OPERATING EXPENSES | |||||||||||

| Property expenses | 47,482 | 42,825 | |||||||||

| General and administrative | 19,980 | 18,197 | |||||||||

| Depreciation and amortization | 66,278 | 59,429 | |||||||||

| TOTAL OPERATING EXPENSES | 133,740 | 120,451 | |||||||||

| OTHER EXPENSES | |||||||||||

| Other expenses | 1,408 | 647 | |||||||||

| Interest expense | 14,671 | 13,701 | |||||||||

| TOTAL EXPENSES | 149,819 | 134,799 | |||||||||

| Gains on sale of real estate | — | 12,133 | |||||||||

| NET INCOME | 64,277 | 63,570 | |||||||||

| Less: net income attributable to noncontrolling interests | (2,906) | (3,064) | |||||||||

| NET INCOME ATTRIBUTABLE TO REXFORD INDUSTRIAL REALTY, INC. | 61,371 | 60,506 | |||||||||

| Less: preferred stock dividends | (2,314) | (2,314) | |||||||||

| Less: earnings attributable to participating securities | (418) | (320) | |||||||||

| NET INCOME ATTRIBUTABLE TO COMMON STOCKHOLDERS | $ | 58,639 | $ | 57,872 | |||||||

Net income attributable to common stockholders per share – basic |

$ | 0.27 | $ | 0.30 | |||||||

Net income attributable to common stockholders per share – diluted |

$ | 0.27 | $ | 0.30 | |||||||

| Weighted-average shares of common stock outstanding – basic | 214,402 | 195,367 | |||||||||

| Weighted-average shares of common stock outstanding – diluted | 214,438 | 195,779 | |||||||||

| Same Property Portfolio Occupancy: | |||||||||||||||||

| March 31, | |||||||||||||||||

| 2024 | 2023 | Change (basis points) | |||||||||||||||

Quarterly Weighted Average Occupancy:(1) |

|||||||||||||||||

| Los Angeles County | 96.9% | 97.5% | (60) bps | ||||||||||||||

| Orange County | 99.6% | 98.8% | 80 bps | ||||||||||||||

| Riverside / San Bernardino County | 94.8% | 93.4% | 140 bps | ||||||||||||||

| San Diego County | 98.4% | 98.9% | (50) bps | ||||||||||||||

| Ventura County | 96.4% | 99.6% | (320) bps | ||||||||||||||

| Same Property Portfolio Weighted Average Occupancy | 96.8% | 97.0% | (20) bps | ||||||||||||||

| Ending Occupancy: | 96.4% | 97.0% | (60) bps | ||||||||||||||

| Same Property Portfolio NOI and Cash NOI: | |||||||||||||||||||||||

| Three Months Ended March 31, | |||||||||||||||||||||||

| 2024 | 2023 | $ Change | % Change | ||||||||||||||||||||

| Rental income | $ | 171,557 | $ | 162,571 | $ | 8,986 | 5.5 | % | |||||||||||||||

| Property expenses | 38,928 | 36,840 | 2,088 | 5.7 | % | ||||||||||||||||||

| Same Property Portfolio NOI | $ | 132,629 | $ | 125,731 | $ | 6,898 | 5.5 | % | |||||||||||||||

| Straight line rental revenue adjustment | (4,753) | (6,924) | 2,171 | (31.4) | % | ||||||||||||||||||

| Above/(below) market lease revenue adjustments | (5,642) | (6,196) | 554 | (8.9) | % | ||||||||||||||||||

| Same Property Portfolio Cash NOI | $ | 122,234 | $ | 112,611 | $ | 9,623 | 8.5 | % | |||||||||||||||

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| Net income | $ | 64,277 | $ | 63,570 | |||||||

| General and administrative | 19,980 | 18,197 | |||||||||

| Depreciation and amortization | 66,278 | 59,429 | |||||||||

| Other expenses | 1,408 | 647 | |||||||||

| Interest expense | 14,671 | 13,701 | |||||||||

| Management and leasing services | (132) | (190) | |||||||||

| Interest income | (2,974) | (882) | |||||||||

| Gains on sale of real estate | — | (12,133) | |||||||||

| Net operating income (NOI) | $ | 163,508 | $ | 142,339 | |||||||

| Straight line rental revenue adjustment | (7,368) | (7,628) | |||||||||

Above/(below) market lease revenue adjustments(1) |

(7,591) | (8,290) | |||||||||

| Cash NOI | $ | 148,549 | $ | 126,421 | |||||||

| NOI | $ | 163,508 | $ | 142,339 | |||||||

| Non-Same Property Portfolio rental income | (39,433) | (22,593) | |||||||||

| Non-Same Property Portfolio property expenses | 8,554 | 5,985 | |||||||||

| Same Property Portfolio NOI | $ | 132,629 | $ | 125,731 | |||||||

| Straight line rental revenue adjustment | (4,753) | (6,924) | |||||||||

| Above/(below) market lease revenue adjustments | (5,642) | (6,196) | |||||||||

| Same Property Portfolio Cash NOI | $ | 122,234 | $ | 112,611 | |||||||

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| Net income | $ | 64,277 | $ | 63,570 | |||||||

| Adjustments: | |||||||||||

| Depreciation and amortization | 66,278 | 59,429 | |||||||||

| Gains on sale of real estate | — | (12,133) | |||||||||

| Funds From Operations (FFO) | $ | 130,555 | $ | 110,866 | |||||||

| Less: preferred stock dividends | (2,314) | (2,314) | |||||||||

Less: FFO attributable to noncontrolling interests(1) |

(5,188) | (4,833) | |||||||||

Less: FFO attributable to participating securities(2) |

(570) | (427) | |||||||||

| Company share of FFO | $ | 122,483 | $ | 103,292 | |||||||

| Company Share of FFO per common share – basic | $ | 0.57 | $ | 0.53 | |||||||

| Company Share of FFO per common share – diluted | $ | 0.57 | $ | 0.53 | |||||||

| FFO | $ | 130,555 | $ | 110,866 | |||||||

| Adjustments: | |||||||||||

| Acquisition expenses | 50 | 73 | |||||||||

| Impairment of right-of-use asset | — | 188 | |||||||||

| Amortization of loss on termination of interest rate swaps | 59 | 59 | |||||||||

| Non-capitalizable demolition costs | 998 | 340 | |||||||||

Write-offs of below-market lease intangibles related to unexercised renewal options(3) |

— | (1,318) | |||||||||

| Core FFO | $ | 131,662 | $ | 110,208 | |||||||

| Less: preferred stock dividends | (2,314) | (2,314) | |||||||||

Less: Core FFO attributable to noncontrolling interest(1) |

(5,226) | (4,809) | |||||||||

Less: Core FFO attributable to participating securities(2) |

(575) | (425) | |||||||||

| Company share of Core FFO | $ | 123,547 | $ | 102,660 | |||||||

| Company share of Core FFO per common share – basic | $ | 0.58 | $ | 0.53 | |||||||

| Company share of Core FFO per common share – diluted | $ | 0.58 | $ | 0.52 | |||||||

| Weighted-average shares of common stock outstanding – basic | 214,402 | 195,367 | |||||||||

| Weighted-average shares of common stock outstanding – diluted | 214,438 | 195,779 | |||||||||

`

`Table of Contents. |

||||||||

| Section | Page | ||||

| Corporate Data: | |||||

| Consolidated Financial Results: | |||||

| Portfolio Data: | |||||

|

First Quarter 2024

Supplemental Financial Reporting Package

|

Page 2

|

|

||||||

Investor Company Summary. |

||||||||

| Executive Management Team | ||||||||

| Howard Schwimmer | Co-Chief Executive Officer, Director | |||||||

| Michael S. Frankel | Co-Chief Executive Officer, Director | |||||||

| Laura Clark | Chief Financial Officer | |||||||

| David Lanzer | General Counsel and Corporate Secretary | |||||||

| Board of Directors | ||||||||

| Richard Ziman | Chairman | |||||||

| Tyler H. Rose | Lead Independent Director | |||||||

| Howard Schwimmer | Co-Chief Executive Officer, Director | |||||||

| Michael S. Frankel | Co-Chief Executive Officer, Director | |||||||

| Robert L. Antin | Director | |||||||

| Diana J. Ingram | Director | |||||||

| Angela L. Kleiman | Director | |||||||

| Debra L. Morris | Director | |||||||

| Investor Relations Information | ||||||||

| investorrelations@rexfordindustrial.com | ||||||||

Equity Research Coverage |

||||||||||||||

| BofA Securities | Camille Bonnel | (646) 855-5042 | ||||||||||||

| Barclays | Brendan Lynch | (212) 526-9428 | ||||||||||||

| BMO Capital Markets | John Kim | (212) 885-4115 | ||||||||||||

| BNP Paribas Exane | Nate Crossett | (646) 342-1588 | ||||||||||||

| Citigroup Investment Research | Craig Mailman | (212) 816-4471 | ||||||||||||

Colliers Securities |

Barry Oxford |

(203) 961-6573 |

||||||||||||

| Green Street Advisors | Vince Tibone | (949) 640-8780 | ||||||||||||

| J.P. Morgan Securities | Michael Mueller | (212) 622-6689 | ||||||||||||

| Jefferies LLC | Jonathan Petersen | (212) 284-1705 | ||||||||||||

| Mizuho Securities USA | Vikram Malhotra | (212) 282-3827 | ||||||||||||

| Robert W. Baird & Co. | Nicholas Thillman | (414) 298-5053 | ||||||||||||

| Scotiabank | Greg McGinniss | (212) 225-6906 | ||||||||||||

Truist Securities |

Anthony Hau |

(212) 303-4176 |

||||||||||||

| Wells Fargo Securities | Blaine Heck | (443) 263-6529 | ||||||||||||

| Wolfe Research | Andrew Rosivach | (646) 582-9250 | ||||||||||||

|

First Quarter 2024

Supplemental Financial Reporting Package

|

Page 3

|

|

||||||

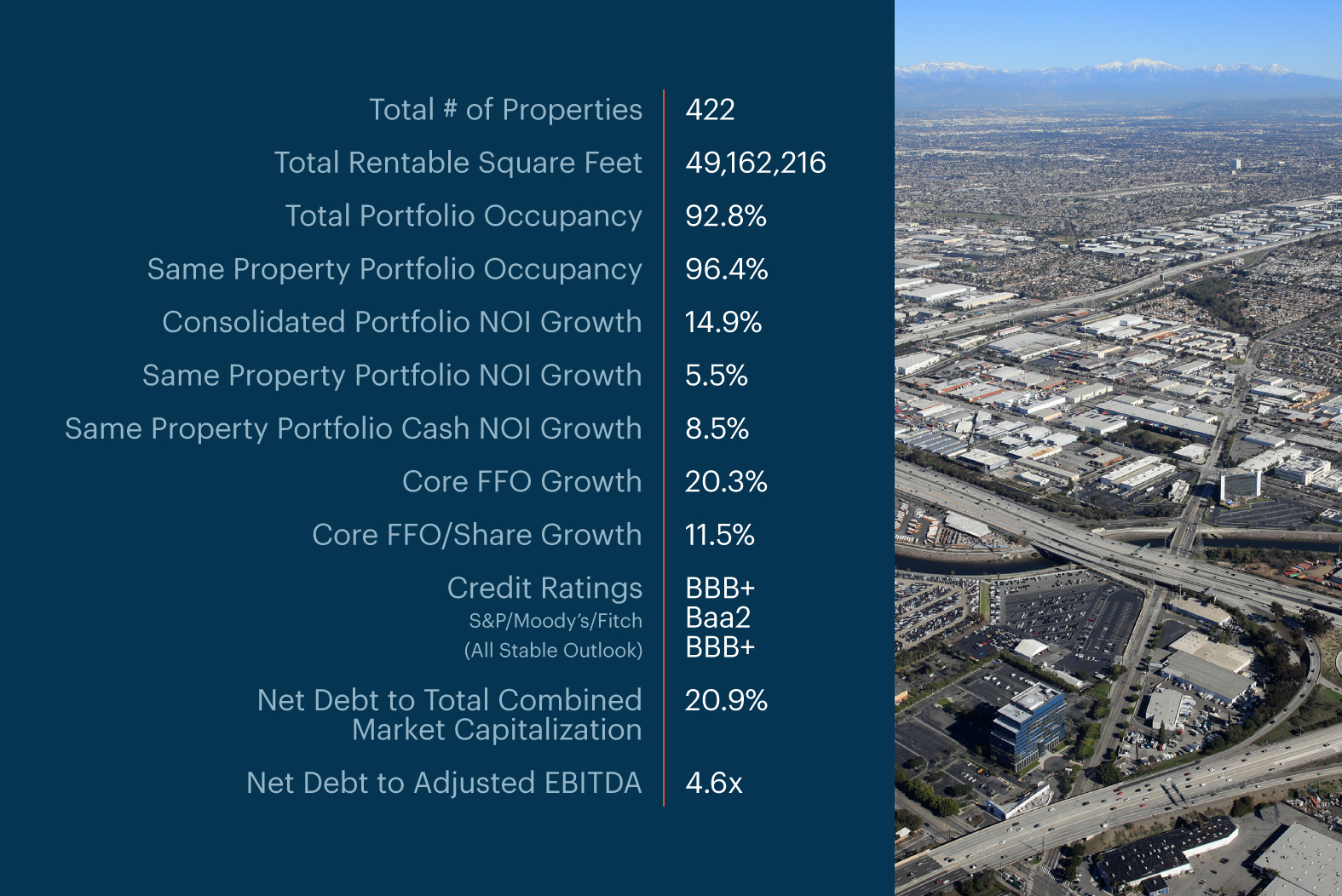

Company Overview. |

||||||||

| For the Quarter Ended March 31, 2024 | ||||||||

|

First Quarter 2024

Supplemental Financial Reporting Package

|

Page 4

|

|

||||||

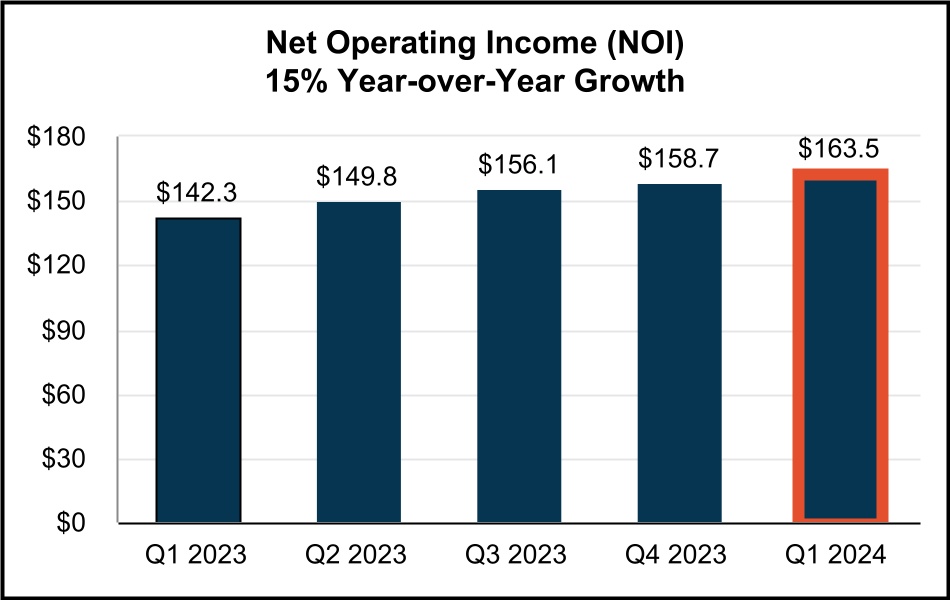

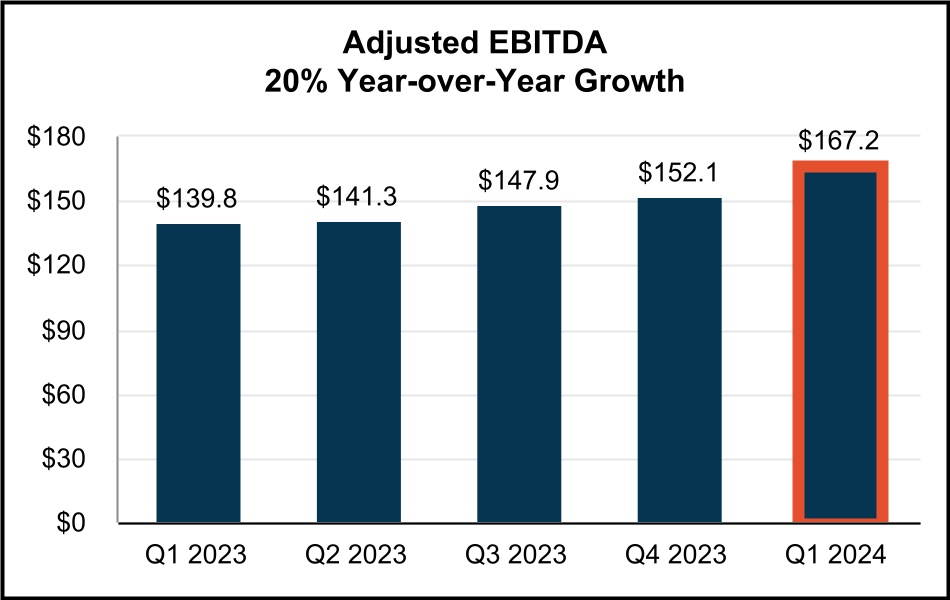

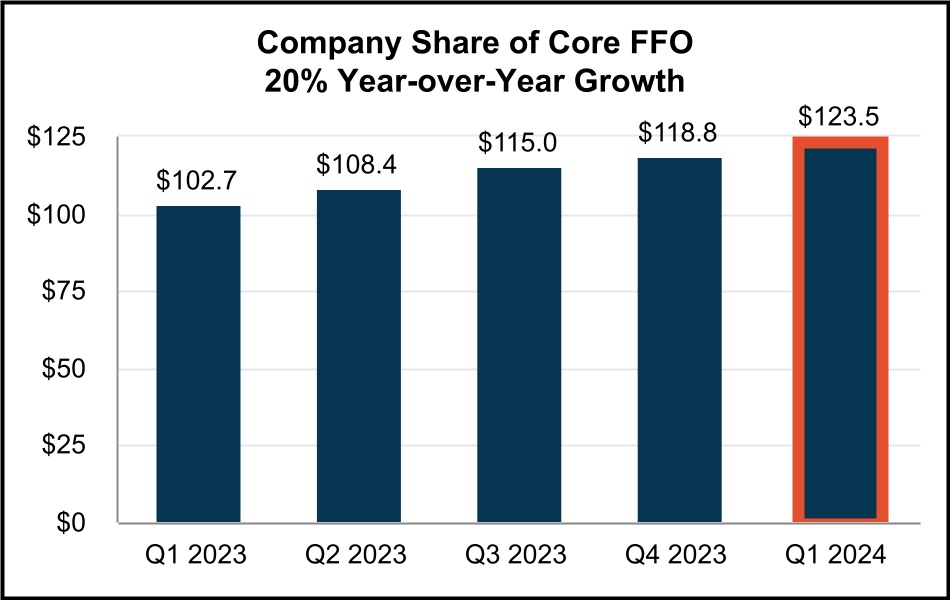

Highlights - Consolidated Financial Results. |

||||||||

| Quarterly Results | (in millions) | |||||||

|

First Quarter 2024

Supplemental Financial Reporting Package

|

Page 5

|

|

||||||

Financial and Portfolio Highlights and Capitalization Data. (1) |

||||||||

| (in thousands except share and per share data and portfolio statistics) | ||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| March 31, 2024 | December 31, 2023 | September 30, 2023 | June 30, 2023 | March 31, 2023 | |||||||||||||||||||||||||

| Financial Results: | |||||||||||||||||||||||||||||

| Total rental income | $ | 210,990 | $ | 207,909 | $ | 204,212 | $ | 194,098 | $ | 185,164 | |||||||||||||||||||

| Net income | $ | 64,277 | $ | 67,321 | $ | 61,790 | $ | 56,910 | $ | 63,570 | |||||||||||||||||||

| Net Operating Income (NOI) | $ | 163,508 | $ | 158,650 | $ | 156,127 | $ | 149,788 | $ | 142,339 | |||||||||||||||||||

| Company share of Core FFO | $ | 123,547 | $ | 118,781 | $ | 114,969 | $ | 108,419 | $ | 102,660 | |||||||||||||||||||

| Company share of Core FFO per common share - diluted | $ | 0.58 | $ | 0.56 | $ | 0.56 | $ | 0.54 | $ | 0.52 | |||||||||||||||||||

| Adjusted EBITDA | $ | 167,207 | $ | 152,126 | $ | 147,925 | $ | 141,258 | $ | 139,755 | |||||||||||||||||||

| Dividend declared per common share | $ | 0.4175 | $ | 0.380 | $ | 0.380 | $ | 0.380 | $ | 0.380 | |||||||||||||||||||

| Portfolio Statistics: | |||||||||||||||||||||||||||||

| Portfolio rentable square feet (“RSF”) | 49,162,216 | 45,860,368 | 44,998,613 | 44,167,774 | 43,954,272 | ||||||||||||||||||||||||

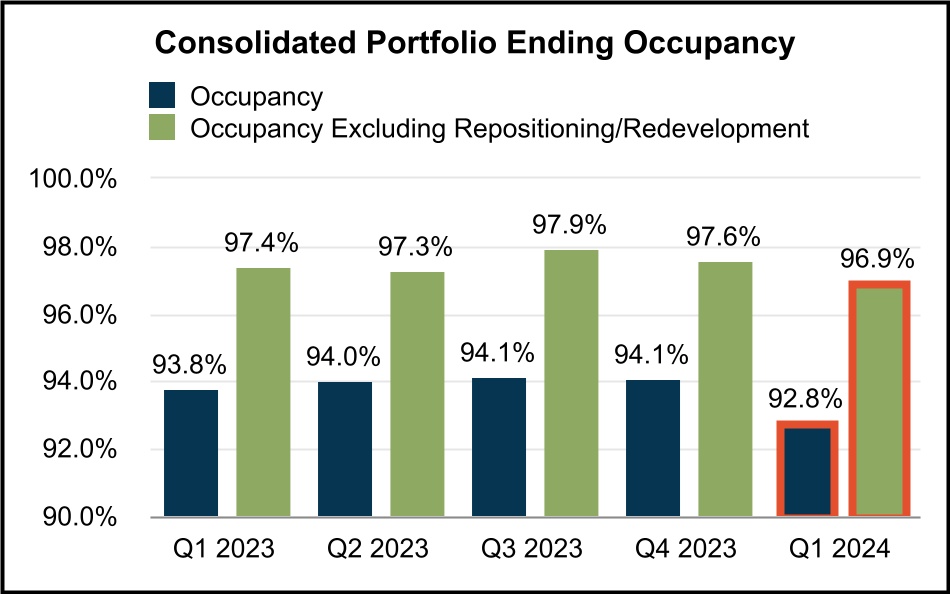

| Ending occupancy | 92.8% | 94.1% | 94.1% | 94.0% | 93.8% | ||||||||||||||||||||||||

Ending occupancy excluding repositioning/redevelopment(2) |

96.9% | 97.6% | 97.9% | 97.3% | 97.4% | ||||||||||||||||||||||||

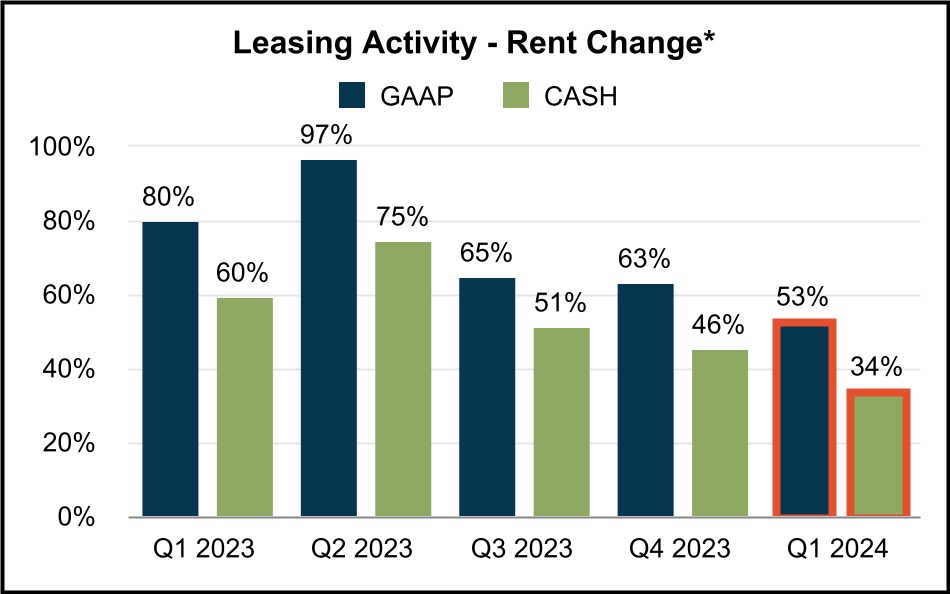

Rent Change - GAAP(3) |

53.0% | 63.1% | 64.8% | 96.8% | 80.2% | ||||||||||||||||||||||||

Rent Change - Cash(3) |

33.6% | 45.6% | 51.4% | 74.8% | 59.7% | ||||||||||||||||||||||||

| Same Property Portfolio Performance: | |||||||||||||||||||||||||||||

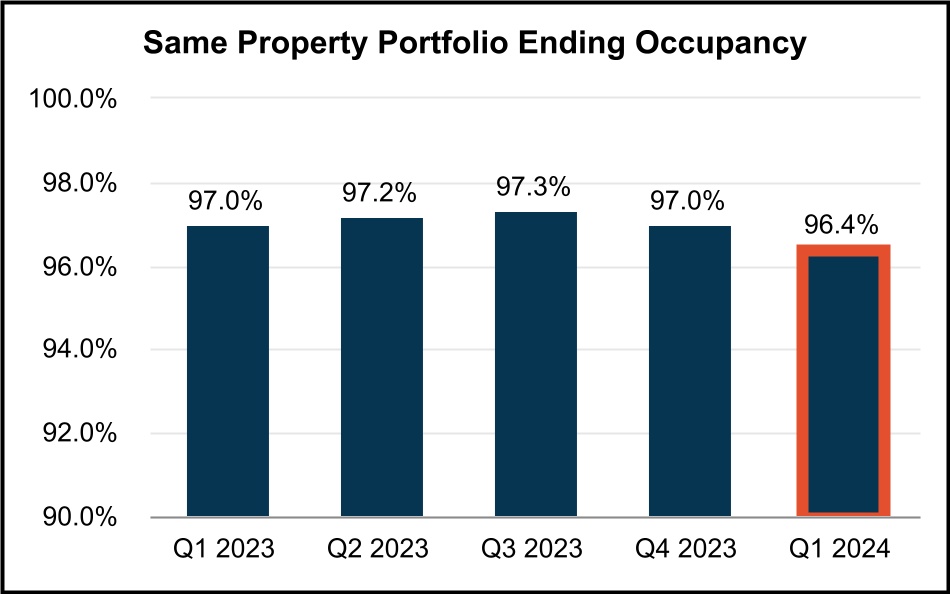

Same Property Portfolio ending occupancy(4) |

96.4% | 97.0% | 97.3% | 97.2% | 97.0% | ||||||||||||||||||||||||

Same Property Portfolio NOI growth(5) |

5.5% | ||||||||||||||||||||||||||||

Same Property Portfolio Cash NOI growth(5) |

8.5% | ||||||||||||||||||||||||||||

| Capitalization: | |||||||||||||||||||||||||||||

Total shares and units issued and outstanding at period end(6) |

224,992,152 | 219,629,857 | 213,435,271 | 208,031,757 | 208,016,268 | ||||||||||||||||||||||||

| Series B and C Preferred Stock and Series 1, 2 and 3 CPOP Units | $ | 241,031 | $ | 241,068 | $ | 241,068 | $ | 241,068 | $ | 241,068 | |||||||||||||||||||

| Total equity market capitalization | $ | 11,558,136 | $ | 12,562,303 | $ | 10,774,099 | $ | 11,104,486 | $ | 12,649,238 | |||||||||||||||||||

| Total consolidated debt | $ | 3,389,088 | $ | 2,243,025 | $ | 2,245,605 | $ | 2,245,972 | $ | 2,250,136 | |||||||||||||||||||

| Total combined market capitalization (net debt plus equity) | $ | 14,610,264 | $ | 14,771,884 | $ | 12,936,436 | $ | 13,214,176 | $ | 14,645,756 | |||||||||||||||||||

| Ratios: | |||||||||||||||||||||||||||||

| Net debt to total combined market capitalization | 20.9% | 15.0% | 16.7% | 16.0% | 13.6% | ||||||||||||||||||||||||

| Net debt to Adjusted EBITDA (quarterly results annualized) | 4.6x | 3.6x | 3.7x | 3.7x | 3.6x | ||||||||||||||||||||||||

|

First Quarter 2024

Supplemental Financial Reporting Package

|

Page 6

|

|

||||||

Guidance. |

||||||||

| As of March 31, 2024 | ||||||||

| METRIC | Q1-2024 UPDATED GUIDANCE |

INITIAL 2024 GUIDANCE |

YTD RESULTS AS OF MARCH 31, 2024 | |||||||||||||||||

Net Income Attributable to Common Stockholders per diluted share (1)(2) |

$1.17 - $1.20 | $1.11 - $1.14 | $0.27 | |||||||||||||||||

Company share of Core FFO per diluted share (1)(2) |

$2.31 - $2.34 | $2.27 - $2.30 | $0.58 | |||||||||||||||||

Same Property Portfolio NOI Growth - GAAP (3) |

4.25% - 5.25% | 4.0% - 5.0% | 5.5% | |||||||||||||||||

Same Property Portfolio NOI Growth - Cash (3) |

7.0% - 8.0% | 7.0% - 8.0% | 8.5% | |||||||||||||||||

Average Same Property Portfolio Occupancy (Full Year) (3) |

96.5% - 97.0% | 96.5% - 97.0% | 96.8% | |||||||||||||||||

General and Administrative Expenses (4) |

+/- $83.0M | +/- $83.0M | $20.0M | |||||||||||||||||

| Net Interest Expense | +/- $99.0M | $60.0M - $61.0M | $14.7M | |||||||||||||||||

|

First Quarter 2024

Supplemental Financial Reporting Package

|

Page 7

|

|

||||||

Guidance (Continued). |

||||||||

| As of March 31, 2024 | ||||||||

| Earnings Components | Range ($ per share) |

Notes | ||||||||||||||||||

2024 Core FFO Per Diluted Share Guidance (Previous) |

$2.27 | $2.30 | Initial 2024 Guidance | |||||||||||||||||

| Same Property Portfolio NOI Growth | — | — | FY 2024 SP NOI Growth (GAAP) Guidance range of 4.25% - 5.25% |

|||||||||||||||||

| 1Q Investments (Includes Closed Subsequent to Quarter End) | 0.23 | 0.23 |

Incremental 2024 NOI related to $1.0B of acquisitions closed since

prior guidance

|

|||||||||||||||||

| Net G&A Expense | — | — | FY 2024 Guidance range of +/- $83.0M |

|||||||||||||||||

| Net Interest Expense | (0.17) | (0.17) | FY 2024 Guidance range of +/- $99.0M |

|||||||||||||||||

| Other | (0.02) | (0.02) | Incremental impact of equity issuance | |||||||||||||||||

2024 Core FFO Per Diluted Share Guidance (Current) |

$2.31 | $2.34 | ||||||||||||||||||

| Core FFO Per Diluted Share Annual Growth | 5% | 7% | ||||||||||||||||||

|

First Quarter 2024

Supplemental Financial Reporting Package

|

Page 8

|

|

||||||

Consolidated Balance Sheets. |

(unaudited and in thousands) | |||||||

| March 31, 2024 | December 31, 2023 | September 30, 2023 | June 30, 2023 | March 31, 2023 | |||||||||||||||||||||||||

| ASSETS | |||||||||||||||||||||||||||||

| Land | $ | 7,568,720 | $ | 6,815,622 | $ | 6,606,022 | $ | 6,400,698 | $ | 6,334,926 | |||||||||||||||||||

| Buildings and improvements | 4,260,512 | 3,933,379 | 3,869,303 | 3,723,837 | 3,671,384 | ||||||||||||||||||||||||

| Tenant improvements | 172,707 | 167,251 | 160,108 | 155,182 | 153,019 | ||||||||||||||||||||||||

| Furniture, fixtures, and equipment | 132 | 132 | 132 | 132 | 132 | ||||||||||||||||||||||||

| Construction in progress | 258,413 | 240,010 | 188,079 | 127,416 | 102,633 | ||||||||||||||||||||||||

| Total real estate held for investment | 12,260,484 | 11,156,394 | 10,823,644 | 10,407,265 | 10,262,094 | ||||||||||||||||||||||||

| Accumulated depreciation | (827,576) | (782,461) | (739,369) | (695,129) | (652,722) | ||||||||||||||||||||||||

| Investments in real estate, net | 11,432,908 | 10,373,933 | 10,084,275 | 9,712,136 | 9,609,372 | ||||||||||||||||||||||||

| Cash and cash equivalents | 336,960 | 33,444 | 83,268 | 136,282 | 253,618 | ||||||||||||||||||||||||

| Restricted cash | — | — | — | — | 16,239 | ||||||||||||||||||||||||

| Loan receivable, net | 122,899 | 122,784 | — | — | — | ||||||||||||||||||||||||

| Rents and other receivables, net | 17,896 | 17,494 | 18,973 | 14,126 | 13,845 | ||||||||||||||||||||||||

| Deferred rent receivable, net | 130,694 | 123,325 | 114,927 | 103,192 | 94,980 | ||||||||||||||||||||||||

| Deferred leasing costs, net | 61,017 | 59,351 | 56,735 | 54,848 | 47,739 | ||||||||||||||||||||||||

| Deferred loan costs, net | 3,069 | 3,426 | 3,783 | 4,139 | 4,474 | ||||||||||||||||||||||||

Acquired lease intangible assets, net(1) |

223,698 | 153,670 | 154,036 | 147,990 | 161,339 | ||||||||||||||||||||||||

| Acquired indefinite-lived intangible | 5,156 | 5,156 | 5,156 | 5,156 | 5,156 | ||||||||||||||||||||||||

| Interest rate swap asset | 16,737 | 9,896 | 24,494 | 19,869 | 6,947 | ||||||||||||||||||||||||

| Other assets | 22,114 | 25,225 | 31,817 | 19,055 | 21,811 | ||||||||||||||||||||||||

| Acquisition related deposits | 7,975 | 2,125 | — | 8,700 | 3,625 | ||||||||||||||||||||||||

| Total Assets | $ | 12,381,123 | $ | 10,929,829 | $ | 10,577,464 | $ | 10,225,493 | $ | 10,239,145 | |||||||||||||||||||

| LIABILITIES & EQUITY | |||||||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||

| Notes payable | $ | 3,349,120 | $ | 2,225,914 | $ | 2,227,637 | $ | 2,227,154 | $ | 2,230,687 | |||||||||||||||||||

| Interest rate swap liability | — | — | — | — | 835 | ||||||||||||||||||||||||

| Accounts payable, accrued expenses and other liabilities | 148,920 | 128,842 | 155,103 | 109,881 | 110,272 | ||||||||||||||||||||||||

| Dividends and distributions payable | 94,356 | 83,733 | 81,423 | 79,370 | 79,370 | ||||||||||||||||||||||||

Acquired lease intangible liabilities, net(2) |

171,687 | 147,561 | 155,582 | 130,511 | 138,339 | ||||||||||||||||||||||||

| Tenant security deposits | 91,034 | 84,872 | 83,643 | 81,163 | 77,029 | ||||||||||||||||||||||||

Tenant prepaid rents(3) |

110,727 | 115,002 | 30,772 | 42,600 | 44,303 | ||||||||||||||||||||||||

| Total Liabilities | 3,965,844 | 2,785,924 | 2,734,160 | 2,670,679 | 2,680,835 | ||||||||||||||||||||||||

| Equity | |||||||||||||||||||||||||||||

| Series B preferred stock, net ($75,000 liquidation preference) | 72,443 | 72,443 | 72,443 | 72,443 | 72,443 | ||||||||||||||||||||||||

| Series C preferred stock, net ($86,250 liquidation preference) | 83,233 | 83,233 | 83,233 | 83,233 | 83,233 | ||||||||||||||||||||||||

| Preferred stock | 155,676 | 155,676 | 155,676 | 155,676 | 155,676 | ||||||||||||||||||||||||

| Common stock | 2,178 | 2,123 | 2,065 | 2,010 | 2,008 | ||||||||||||||||||||||||

| Additional paid in capital | 8,233,127 | 7,940,781 | 7,613,354 | 7,311,458 | 7,299,837 | ||||||||||||||||||||||||

| Cumulative distributions in excess of earnings | (370,720) | (338,835) | (320,180) | (298,367) | (273,849) | ||||||||||||||||||||||||

| Accumulated other comprehensive income (loss) | 13,922 | 7,172 | 21,142 | 16,525 | 3,117 | ||||||||||||||||||||||||

| Total stockholders’ equity | 8,034,183 | 7,766,917 | 7,472,057 | 7,187,302 | 7,186,789 | ||||||||||||||||||||||||

| Noncontrolling interests | 381,096 | 376,988 | 371,247 | 367,512 | 371,521 | ||||||||||||||||||||||||

| Total Equity | 8,415,279 | 8,143,905 | 7,843,304 | 7,554,814 | 7,558,310 | ||||||||||||||||||||||||

| Total Liabilities and Equity | $ | 12,381,123 | $ | 10,929,829 | $ | 10,577,464 | $ | 10,225,493 | $ | 10,239,145 | |||||||||||||||||||

|

First Quarter 2024

Supplemental Financial Reporting Package

|

Page 9

|

|

||||||

Consolidated Statements of Operations. |

||||||||

| Quarterly Results | (unaudited and in thousands, except share and per share data) | |||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| Mar 31, 2024 | Dec 31, 2023 | Sep 30, 2023 | Jun 30, 2023 | Mar 31, 2023 | |||||||||||||||||||||||||

| Revenues | |||||||||||||||||||||||||||||

Rental income(1) |

$ | 210,990 | $ | 207,909 | $ | 204,212 | $ | 194,098 | $ | 185,164 | |||||||||||||||||||

| Management and leasing services | 132 | 163 | 158 | 171 | 190 | ||||||||||||||||||||||||

| Interest income | 2,974 | 2,353 | 1,029 | 1,497 | 882 | ||||||||||||||||||||||||

| Total Revenues | 214,096 | 210,425 | 205,399 | 195,766 | 186,236 | ||||||||||||||||||||||||

| Operating Expenses | |||||||||||||||||||||||||||||

| Property expenses | 47,482 | 49,259 | 48,085 | 44,310 | 42,825 | ||||||||||||||||||||||||

| General and administrative | 19,980 | 19,988 | 18,575 | 18,267 | 18,197 | ||||||||||||||||||||||||

| Depreciation and amortization | 66,278 | 65,839 | 60,449 | 58,793 | 59,429 | ||||||||||||||||||||||||

| Total Operating Expenses | 133,740 | 135,086 | 127,109 | 121,370 | 120,451 | ||||||||||||||||||||||||

| Other Expenses | |||||||||||||||||||||||||||||

| Other expenses | 1,408 | 316 | 551 | 306 | 647 | ||||||||||||||||||||||||

| Interest expense | 14,671 | 14,570 | 15,949 | 17,180 | 13,701 | ||||||||||||||||||||||||

| Total Expenses | 149,819 | 149,972 | 143,609 | 138,856 | 134,799 | ||||||||||||||||||||||||

| Gains on sale of real estate | — | 6,868 | — | — | 12,133 | ||||||||||||||||||||||||

| Net Income | 64,277 | 67,321 | 61,790 | 56,910 | 63,570 | ||||||||||||||||||||||||

| Less: net income attributable to noncontrolling interests | (2,906) | (2,970) | (2,824) | (2,717) | (3,064) | ||||||||||||||||||||||||

| Net income attributable to Rexford Industrial Realty, Inc. | 61,371 | 64,351 | 58,966 | 54,193 | 60,506 | ||||||||||||||||||||||||

| Less: preferred stock dividends | (2,314) | (2,315) | (2,314) | (2,315) | (2,314) | ||||||||||||||||||||||||

| Less: earnings allocated to participating securities | (418) | (357) | (314) | (318) | (320) | ||||||||||||||||||||||||

| Net income attributable to common stockholders | $ | 58,639 | $ | 61,679 | $ | 56,338 | $ | 51,560 | $ | 57,872 | |||||||||||||||||||

| Earnings per Common Share | |||||||||||||||||||||||||||||

| Net income attributable to common stockholders per share - basic | $ | 0.27 | $ | 0.29 | $ | 0.27 | $ | 0.26 | $ | 0.30 | |||||||||||||||||||

| Net income attributable to common stockholders per share - diluted | $ | 0.27 | $ | 0.29 | $ | 0.27 | $ | 0.26 | $ | 0.30 | |||||||||||||||||||

| Weighted average shares outstanding - basic | 214,401,661 | 210,089,164 | 205,279,681 | 200,610,890 | 195,366,969 | ||||||||||||||||||||||||

| Weighted average shares outstanding - diluted | 214,437,913 | 210,362,069 | 205,447,532 | 200,667,250 | 195,779,007 | ||||||||||||||||||||||||

|

First Quarter 2024

Supplemental Financial Reporting Package

|

Page 10

|

|

||||||

Consolidated Statements of Operations. |

||||||||

| Quarterly Results (continued) | (unaudited and in thousands, except share and per share data) | |||||||

| Three Months Ended March 31, | ||||||||||||||

| 2024 | 2023 | |||||||||||||

| Revenues | ||||||||||||||

| Rental income | $ | 210,990 | $ | 185,164 | ||||||||||

| Management and leasing services | 132 | 190 | ||||||||||||

| Interest income | 2,974 | 882 | ||||||||||||

| Total Revenues | 214,096 | 186,236 | ||||||||||||

| Operating Expenses | ||||||||||||||

| Property expenses | 47,482 | 42,825 | ||||||||||||

| General and administrative | 19,980 | 18,197 | ||||||||||||

| Depreciation and amortization | 66,278 | 59,429 | ||||||||||||

| Total Operating Expenses | 133,740 | 120,451 | ||||||||||||

| Other Expenses | ||||||||||||||

| Other expenses | 1,408 | 647 | ||||||||||||

| Interest expense | 14,671 | 13,701 | ||||||||||||

| Total Expenses | 149,819 | 134,799 | ||||||||||||

| Gains on sale of real estate | — | 12,133 | ||||||||||||

| Net Income | 64,277 | 63,570 | ||||||||||||

| Less: net income attributable to noncontrolling interests | (2,906) | (3,064) | ||||||||||||

| Net income attributable to Rexford Industrial Realty, Inc. | 61,371 | 60,506 | ||||||||||||

| Less: preferred stock dividends | (2,314) | (2,314) | ||||||||||||

| Less: earnings allocated to participating securities | (418) | (320) | ||||||||||||

| Net income attributable to common stockholders | $ | 58,639 | $ | 57,872 | ||||||||||

| Net income attributable to common stockholders per share – basic | $ | 0.27 | $ | 0.30 | ||||||||||

| Net income attributable to common stockholders per share – diluted | $ | 0.27 | $ | 0.30 | ||||||||||

| Weighted-average shares of common stock outstanding – basic | 214,401,661 | 195,366,969 | ||||||||||||

| Weighted-average shares of common stock outstanding – diluted | 214,437,913 | 195,779,007 | ||||||||||||

|

First Quarter 2024

Supplemental Financial Reporting Package

|

Page 11

|

|

||||||

Non-GAAP FFO and Core FFO Reconciliations. (1) |

||||||||

| (unaudited and in thousands, except share and per share data) | ||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| March 31, 2024 | December 31, 2023 | September 30, 2023 | June 30, 2023 | March 31, 2023 | |||||||||||||||||||||||||

| Net Income | $ | 64,277 | $ | 67,321 | $ | 61,790 | $ | 56,910 | $ | 63,570 | |||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||||||||

| Depreciation and amortization | 66,278 | 65,839 | 60,449 | 58,793 | 59,429 | ||||||||||||||||||||||||

| Gains on sale of real estate | — | (6,868) | — | — | (12,133) | ||||||||||||||||||||||||

NAREIT Defined Funds From Operations (FFO) |

130,555 | 126,292 | 122,239 | 115,703 | 110,866 | ||||||||||||||||||||||||

| Less: preferred stock dividends | (2,314) | (2,315) | (2,314) | (2,315) | (2,314) | ||||||||||||||||||||||||

Less: FFO attributable to noncontrolling interests(2) |

(5,188) | (4,960) | (4,909) | (4,812) | (4,833) | ||||||||||||||||||||||||

Less: FFO attributable to participating securities(3) |

(570) | (504) | (461) | (451) | (427) | ||||||||||||||||||||||||

| Company share of FFO | $ | 122,483 | $ | 118,513 | $ | 114,555 | $ | 108,125 | $ | 103,292 | |||||||||||||||||||

| Company share of FFO per common share‐basic | $ | 0.57 | $ | 0.56 | $ | 0.56 | $ | 0.54 | $ | 0.53 | |||||||||||||||||||

| Company share of FFO per common share‐diluted | $ | 0.57 | $ | 0.56 | $ | 0.56 | $ | 0.54 | $ | 0.53 | |||||||||||||||||||

| FFO | $ | 130,555 | $ | 126,292 | $ | 122,239 | $ | 115,703 | $ | 110,866 | |||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||||||||

| Acquisition expenses | 50 | 39 | 10 | 247 | 73 | ||||||||||||||||||||||||

Impairment of right-of-use asset(4) |

— | — | — | — | 188 | ||||||||||||||||||||||||

| Amortization of loss on termination of interest rate swaps | 59 | 59 | 59 | 59 | 59 | ||||||||||||||||||||||||

| Non-capitalizable demolition costs | 998 | 180 | 361 | — | 340 | ||||||||||||||||||||||||

Write-offs of below-market lease intangibles related to unexercised renewal options(5) |

— | — | — | — | (1,318) | ||||||||||||||||||||||||

| Core FFO | 131,662 | 126,570 | 122,669 | 116,009 | 110,208 | ||||||||||||||||||||||||

| Less: preferred stock dividends | (2,314) | (2,315) | (2,314) | (2,315) | (2,314) | ||||||||||||||||||||||||

Less: Core FFO attributable to noncontrolling interests(2) |

(5,226) | (4,969) | (4,924) | (4,823) | (4,809) | ||||||||||||||||||||||||

Less: Core FFO attributable to participating securities(3) |

(575) | (505) | (462) | (452) | (425) | ||||||||||||||||||||||||

| Company share of Core FFO | $ | 123,547 | $ | 118,781 | $ | 114,969 | $ | 108,419 | $ | 102,660 | |||||||||||||||||||

| Company share of Core FFO per common share‐basic | $ | 0.58 | $ | 0.57 | $ | 0.56 | $ | 0.54 | $ | 0.53 | |||||||||||||||||||

| Company share of Core FFO per common share‐diluted | $ | 0.58 | $ | 0.56 | $ | 0.56 | $ | 0.54 | $ | 0.52 | |||||||||||||||||||

| Weighted-average shares outstanding-basic | 214,401,661 | 210,089,164 | 205,279,681 | 200,610,890 | 195,366,969 | ||||||||||||||||||||||||

Weighted-average shares outstanding-diluted(6) |

214,437,913 | 210,362,069 | 205,447,532 | 200,667,250 | 195,779,007 | ||||||||||||||||||||||||

|

First Quarter 2024

Supplemental Financial Reporting Package

|

Page 12

|

|

||||||

Non-GAAP FFO and Core FFO Reconciliations. (1) |

||||||||

| (unaudited and in thousands, except share and per share data) | ||||||||

| Three Months Ended March 31, | ||||||||||||||

| 2024 | 2023 | |||||||||||||

| Net Income | $ | 64,277 | $ | 63,570 | ||||||||||

| Adjustments: | ||||||||||||||

| Depreciation and amortization | 66,278 | 59,429 | ||||||||||||

| Gains on sale of real estate | — | (12,133) | ||||||||||||

| Funds From Operations (FFO) | 130,555 | 110,866 | ||||||||||||

| Less: preferred stock dividends | (2,314) | (2,314) | ||||||||||||

| Less: FFO attributable to noncontrolling interests | (5,188) | (4,833) | ||||||||||||

| Less: FFO attributable to participating securities | (570) | (427) | ||||||||||||

| Company share of FFO | $ | 122,483 | $ | 103,292 | ||||||||||

| Company share of FFO per common share‐basic | $ | 0.57 | $ | 0.53 | ||||||||||

| Company share of FFO per common share‐diluted | $ | 0.57 | $ | 0.53 | ||||||||||

| FFO | $ | 130,555 | $ | 110,866 | ||||||||||

| Adjustments: | ||||||||||||||

| Acquisition expenses | 50 | 73 | ||||||||||||

| Impairment of right-of-use asset | — | 188 | ||||||||||||

| Amortization of loss on termination of interest rate swaps | 59 | 59 | ||||||||||||

| Non-capitalizable demolition costs | 998 | 340 | ||||||||||||

Write-offs of below-market lease intangibles related to unexercised renewal options(2) |

— | (1,318) | ||||||||||||

| Core FFO | 131,662 | 110,208 | ||||||||||||

| Less: preferred stock dividends | (2,314) | (2,314) | ||||||||||||

| Less: Core FFO attributable to noncontrolling interests | (5,226) | (4,809) | ||||||||||||

| Less: Core FFO attributable to participating securities | (575) | (425) | ||||||||||||

| Company share of Core FFO | $ | 123,547 | $ | 102,660 | ||||||||||

| Company share of Core FFO per common share‐basic | $ | 0.58 | $ | 0.53 | ||||||||||

| Company share of Core FFO per common share‐diluted | $ | 0.58 | $ | 0.52 | ||||||||||

| Weighted-average shares outstanding-basic | 214,401,661 | 195,366,969 | ||||||||||||

| Weighted-average shares outstanding-diluted | 214,437,913 | 195,779,007 | ||||||||||||

|

First Quarter 2024

Supplemental Financial Reporting Package

|

Page 13

|

|

||||||

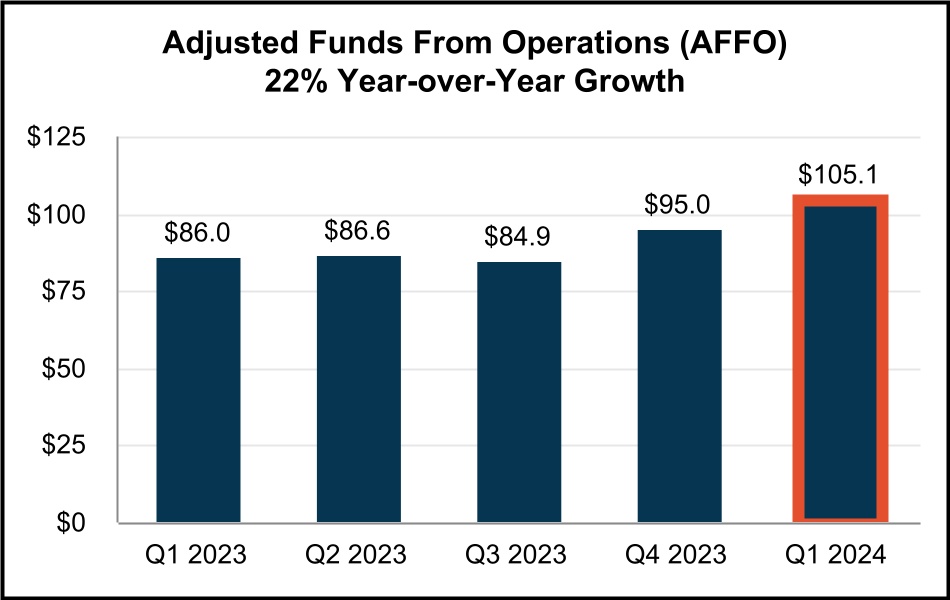

Non-GAAP AFFO Reconciliation. (1) |

||||||||

| (unaudited and in thousands, except share and per share data) | ||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| March 31, 2024 |

December 31, 2023 |

September 30, 2023 |

June 30, 2023 |

March 31, 2023 |

|||||||||||||||||||||||||

Funds From Operations(2) |

$ | 130,555 | $ | 126,292 | $ | 122,239 | $ | 115,703 | $ | 110,866 | |||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||||||||

| Amortization of deferred financing costs | 1,011 | 1,000 | 1,001 | 999 | 856 | ||||||||||||||||||||||||

| Non-cash stock compensation | 9,088 | 9,338 | 8,166 | 7,956 | 8,178 | ||||||||||||||||||||||||

| Impairment of right-of-use asset | — | — | — | — | 188 | ||||||||||||||||||||||||

| Amortization related to termination/settlement of interest rate derivatives | 137 | 137 | 137 | 136 | 129 | ||||||||||||||||||||||||

| Note payable (discount) premium amortization, net | 293 | 214 | 205 | 203 | 66 | ||||||||||||||||||||||||

| Non-capitalizable demolition costs | 998 | 180 | 361 | — | 340 | ||||||||||||||||||||||||

| Deduct: | |||||||||||||||||||||||||||||

| Preferred stock dividends | (2,314) | (2,315) | (2,314) | (2,315) | (2,314) | ||||||||||||||||||||||||

Straight line rental revenue adjustment(3) |

(7,368) | (8,514) | (11,792) | (8,653) | (7,628) | ||||||||||||||||||||||||

Above/(below) market lease revenue adjustments(4) |

(7,591) | (8,119) | (7,241) | (6,232) | (8,290) | ||||||||||||||||||||||||

Capitalized payments(5) |

(13,163) | (12,443) | (10,581) | (8,885) | (8,924) | ||||||||||||||||||||||||

| Accretion of net loan origination fees | (115) | (84) | — | — | — | ||||||||||||||||||||||||

Recurring capital expenditures(6) |

(2,990) | (7,047) | (10,874) | (6,683) | (2,194) | ||||||||||||||||||||||||

2nd generation tenant improvements and leasing commissions(7) |

(3,457) | (3,611) | (4,406) | (5,623) | (5,259) | ||||||||||||||||||||||||

| Adjusted Funds From Operations (AFFO) | $ | 105,084 | $ | 95,028 | $ | 84,901 | $ | 86,606 | $ | 86,014 | |||||||||||||||||||

|

First Quarter 2024

Supplemental Financial Reporting Package

|

Page 14

|

|

||||||

Statement of Operations Reconciliations - NOI, Cash NOI, EBITDAre and Adjusted EBITDA. (1) | ||||||||

| (unaudited and in thousands) | ||||||||

| NOI and Cash NOI | |||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| Mar 31, 2024 | Dec 31, 2023 | Sep 30, 2023 | Jun 30, 2023 | Mar 31, 2023 | |||||||||||||||||||||||||

Rental income(2)(3) |

$ | 210,990 | $ | 207,909 | $ | 204,212 | $ | 194,098 | $ | 185,164 | |||||||||||||||||||

| Less: Property expenses | 47,482 | 49,259 | 48,085 | 44,310 | 42,825 | ||||||||||||||||||||||||

| Net Operating Income (NOI) | $ | 163,508 | $ | 158,650 | $ | 156,127 | $ | 149,788 | $ | 142,339 | |||||||||||||||||||

Above/(below) market lease revenue adjustments |

(7,591) | (8,119) | (7,241) | (6,232) | (8,290) | ||||||||||||||||||||||||

| Straight line rental revenue adjustment | (7,368) | (8,514) | (11,792) | (8,653) | (7,628) | ||||||||||||||||||||||||

| Cash NOI | $ | 148,549 | $ | 142,017 | $ | 137,094 | $ | 134,903 | $ | 126,421 | |||||||||||||||||||

EBITDAre and Adjusted EBITDA |

|||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| Mar 31, 2024 | Dec 31, 2023 | Sep 30, 2023 | Jun 30, 2023 | Mar 31, 2023 | |||||||||||||||||||||||||

| Net income | $ | 64,277 | $ | 67,321 | $ | 61,790 | $ | 56,910 | $ | 63,570 | |||||||||||||||||||

| Interest expense | 14,671 | 14,570 | 15,949 | 17,180 | 13,701 | ||||||||||||||||||||||||

| Depreciation and amortization | 66,278 | 65,839 | 60,449 | 58,793 | 59,429 | ||||||||||||||||||||||||

| Gains on sale of real estate | — | (6,868) | — | — | (12,133) | ||||||||||||||||||||||||

EBITDAre |

$ | 145,226 | $ | 140,862 | $ | 138,188 | $ | 132,883 | $ | 124,567 | |||||||||||||||||||

| Stock-based compensation amortization | 9,088 | 9,338 | 8,166 | 7,956 | 8,178 | ||||||||||||||||||||||||

| Acquisition expenses | 50 | 39 | 10 | 247 | 73 | ||||||||||||||||||||||||

| Impairment of right-of-use asset | — | — | — | — | 188 | ||||||||||||||||||||||||

Pro forma effect of acquisitions and loan issuance(4) |

12,843 | 1,976 | 1,561 | 172 | 6,927 | ||||||||||||||||||||||||

Pro forma effect of dispositions(5) |

— | (89) | — | — | (178) | ||||||||||||||||||||||||

| Adjusted EBITDA | $ | 167,207 | $ | 152,126 | $ | 147,925 | $ | 141,258 | $ | 139,755 | |||||||||||||||||||

|

First Quarter 2024

Supplemental Financial Reporting Package

|

Page 15

|

|

||||||

Same Property Portfolio Performance.(1) |

||||||||

| (unaudited and dollars in thousands) | ||||||||

| Same Property Portfolio: | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Number of properties | 296 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Square Feet | 37,109,867 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Same Property Portfolio NOI and Cash NOI: | ||||||||||||||||||||||||||

| Three Months Ended March 31, | ||||||||||||||||||||||||||

| 2024 | 2023 | $ Change | % Change | |||||||||||||||||||||||

Rental income(2)(3)(4) |

$ | 171,557 | $ | 162,571 | $ | 8,986 | 5.5% | |||||||||||||||||||

| Property expenses | 38,928 | 36,840 | 2,088 | 5.7% | ||||||||||||||||||||||

| Same Property Portfolio NOI | $ | 132,629 | $ | 125,731 | $ | 6,898 | 5.5% | (4) |

||||||||||||||||||

Straight-line rental revenue adjustment |

(4,753) | (6,924) | 2,171 | (31.4)% | ||||||||||||||||||||||

Above/(below) market lease revenue adjustments |

(5,642) | (6,196) | 554 | (8.9)% | ||||||||||||||||||||||

| Same Property Portfolio Cash NOI | $ | 122,234 | $ | 112,611 | $ | 9,623 | 8.5% | (4) |

||||||||||||||||||

| Same Property Portfolio Occupancy: | |||||||||||||||||||||||||||||

| Three Months Ended March 31, | |||||||||||||||||||||||||||||

| 2024 | 2023 | Year-over-Year Change (basis points) |

Three Months Ended December 31, 2023 | Sequential Change (basis points) |

|||||||||||||||||||||||||

Quarterly Weighted Average Occupancy:(5) |

|||||||||||||||||||||||||||||

| Los Angeles County | 96.9% | 97.5% | (60) bps | 97.2% | (30) bps | ||||||||||||||||||||||||

| Orange County | 99.6% | 98.8% | 80 bps | 98.6% | 100 bps | ||||||||||||||||||||||||

| Riverside / San Bernardino County | 94.8% | 93.4% | 140 bps | 95.1% | (30) bps | ||||||||||||||||||||||||

| San Diego County | 98.4% | 98.9% | (50) bps | 98.5% | (10) bps | ||||||||||||||||||||||||

| Ventura County | 96.4% | 99.6% | (320) bps | 97.7% | (130) bps | ||||||||||||||||||||||||

| Quarterly Weighted Average Occupancy | 96.8% | 97.0% | (20) bps | 97.0% | (20) bps | ||||||||||||||||||||||||

| Ending Occupancy: | 96.4% | 97.0% | (60) bps | 97.0% | (60) bps | ||||||||||||||||||||||||

|

First Quarter 2024

Supplemental Financial Reporting Package

|

Page 16

|

|

||||||

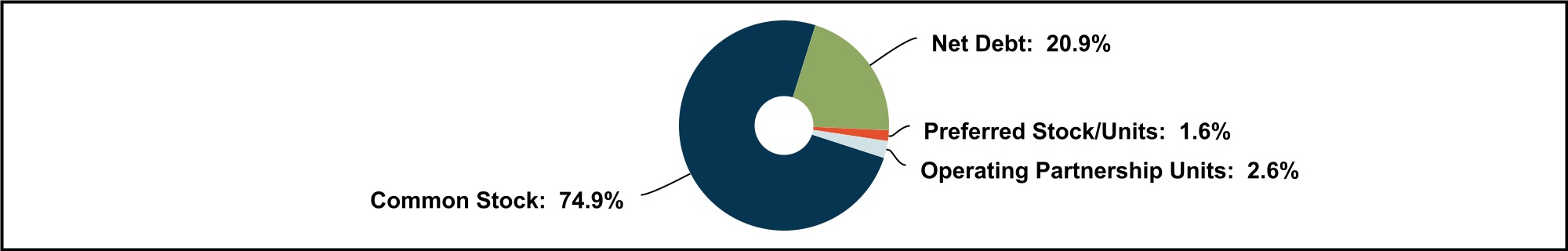

Capitalization Summary. |

||||||||

| (unaudited and in thousands, except share and per share data) | ||||||||

| Capitalization as of March 31, 2024 | ||||||||

| Description | March 31, 2024 | December 31, 2023 | September 30, 2023 | June 30, 2023 | March 31, 2023 | |||||||||||||||||||||||||||

Common shares outstanding(1) |

217,382,937 | 211,998,010 | 206,134,730 | 200,680,708 | 200,418,714 | |||||||||||||||||||||||||||

Operating partnership units outstanding(2) |

7,609,215 | 7,631,847 | 7,300,541 | 7,351,049 | 7,597,554 | |||||||||||||||||||||||||||

| Total shares and units outstanding at period end | 224,992,152 | 219,629,857 | 213,435,271 | 208,031,757 | 208,016,268 | |||||||||||||||||||||||||||

| Share price at end of quarter | $ | 50.30 | $ | 56.10 | $ | 49.35 | $ | 52.22 | $ | 59.65 | ||||||||||||||||||||||

| Common Stock and Operating Partnership Units - Capitalization | $ | 11,317,105 | $ | 12,321,235 | $ | 10,533,031 | $ | 10,863,418 | $ | 12,408,170 | ||||||||||||||||||||||

Series B and C Cumulative Redeemable Preferred Stock(3) |

$ | 161,250 | $ | 161,250 | $ | 161,250 | $ | 161,250 | $ | 161,250 | ||||||||||||||||||||||

4.43937% Series 1 Cumulative Redeemable Convertible Preferred Units(4) |

27,031 | 27,031 | 27,031 | 27,031 | 27,031 | |||||||||||||||||||||||||||

4.00% Series 2 Cumulative Redeemable Convertible Preferred Units(4) |

40,750 | 40,787 | 40,787 | 40,787 | 40,787 | |||||||||||||||||||||||||||

3.00% Series 3 Cumulative Redeemable Convertible Preferred Units(4) |

12,000 | 12,000 | 12,000 | 12,000 | 12,000 | |||||||||||||||||||||||||||

| Preferred Equity | $ | 241,031 | $ | 241,068 | $ | 241,068 | $ | 241,068 | $ | 241,068 | ||||||||||||||||||||||

| Total Equity Market Capitalization | $ | 11,558,136 | $ | 12,562,303 | $ | 10,774,099 | $ | 11,104,486 | $ | 12,649,238 | ||||||||||||||||||||||

| Total Debt | $ | 3,389,088 | $ | 2,243,025 | $ | 2,245,605 | $ | 2,245,972 | $ | 2,250,136 | ||||||||||||||||||||||

| Less: Cash and cash equivalents | (336,960) | (33,444) | (83,268) | (136,282) | (253,618) | |||||||||||||||||||||||||||

| Net Debt | $ | 3,052,128 | $ | 2,209,581 | $ | 2,162,337 | $ | 2,109,690 | $ | 1,996,518 | ||||||||||||||||||||||

| Total Combined Market Capitalization (Net Debt plus Equity) | $ | 14,610,264 | $ | 14,771,884 | $ | 12,936,436 | $ | 13,214,176 | $ | 14,645,756 | ||||||||||||||||||||||

| Net debt to total combined market capitalization | 20.9 | % | 15.0 | % | 16.7 | % | 16.0 | % | 13.6 | % | ||||||||||||||||||||||

Net debt to Adjusted EBITDA (quarterly results annualized)(5) |

4.6x | 3.6x | 3.7x | 3.7x | 3.6x | |||||||||||||||||||||||||||

Net debt & preferred equity to Adjusted EBITDA (quarterly results annualized)(5) |

4.9x | 4.0x | 4.1x | 4.2x | 4.0x | |||||||||||||||||||||||||||

|

First Quarter 2024

Supplemental Financial Reporting Package

|

Page 17

|

|

||||||

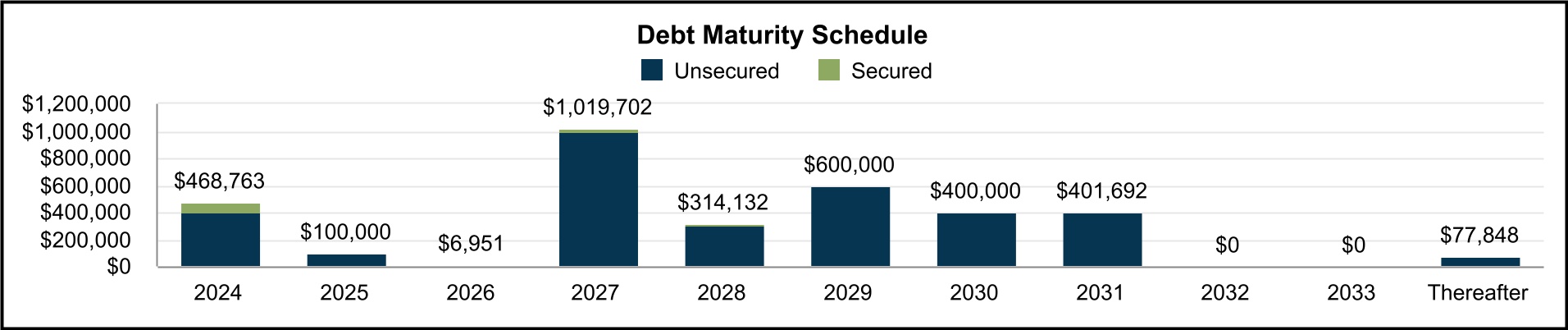

Debt Summary. |

||||||||

| (unaudited and dollars in thousands) | ||||||||

| Debt Detail: | ||||||||||||||||||||||||||

| As of March 31, 2024 | ||||||||||||||||||||||||||

| Debt Description | Maturity Date | Stated Interest Rate |

Effective

Interest Rate(1)

|

Principal

Balance(2)

|

||||||||||||||||||||||

| Unsecured Debt: | ||||||||||||||||||||||||||

$1.0 Billion Revolving Credit Facility(3) |

5/26/2026(4) |

SOFR+0.685%(5) |

6.125% | $ | — | |||||||||||||||||||||

| $400M Term Loan Facility | 7/19/2024(4) |

SOFR+0.76%(5) |

4.832%(6) |

400,000 | ||||||||||||||||||||||

| $100M Senior Notes | 8/6/2025 | 4.290% | 4.290% | 100,000 | ||||||||||||||||||||||

$575M Exchangeable 2027 Senior Notes(7) |

3/15/2027 | 4.375% | 4.375% | 575,000 | ||||||||||||||||||||||

| $300M Term Loan Facility | 5/26/2027 | SOFR+0.76%(5) |

3.677%(8) |

300,000 | ||||||||||||||||||||||

| $125M Senior Notes | 7/13/2027 | 3.930% | 3.930% | 125,000 | ||||||||||||||||||||||

| $300M Senior Notes | 6/15/2028 | 5.000% | 5.000% | 300,000 | ||||||||||||||||||||||

$575M Exchangeable 2029 Senior Notes(7) |

3/15/2029 | 4.125% | 4.125% | 575,000 | ||||||||||||||||||||||

| $25M Series 2019A Senior Notes | 7/16/2029 | 3.880% | 3.880% | 25,000 | ||||||||||||||||||||||

| $400M Senior Notes | 12/1/2030 | 2.125% | 2.125% | 400,000 | ||||||||||||||||||||||

| $400M Senior Notes - Green Bond | 9/1/2031 | 2.150% | 2.150% | 400,000 | ||||||||||||||||||||||

| $75M Series 2019B Senior Notes | 7/16/2034 | 4.030% | 4.030% | 75,000 | ||||||||||||||||||||||

| Secured Debt: | ||||||||||||||||||||||||||

| 11600 Los Nietos Road | 5/1/2024 | 4.190% | 4.190% | 2,246 | ||||||||||||||||||||||

| $60M Term Loan Facility | 10/27/2024(9) |

SOFR+1.250%(9) |

5.060%(10) |

60,000 | ||||||||||||||||||||||

| 5160 Richton Street | 11/15/2024 | 3.790% | 3.790% | 3,997 | ||||||||||||||||||||||

| 22895 Eastpark Drive | 11/15/2024 | 4.330% | 4.330% | 2,520 | ||||||||||||||||||||||

| 701-751 Kingshill Place | 1/5/2026 | 3.900% | 3.900% | 6,951 | ||||||||||||||||||||||

| 13943-13955 Balboa Boulevard | 7/1/2027 | 3.930% | 3.930% | 14,502 | ||||||||||||||||||||||

| 2205 126th Street | 12/1/2027 | 3.910% | 3.910% | 5,200 | ||||||||||||||||||||||

| 2410-2420 Santa Fe Avenue | 1/1/2028 | 3.700% | 3.700% | 10,300 | ||||||||||||||||||||||

| 11832-11954 La Cienega Boulevard | 7/1/2028 | 4.260% | 4.260% | 3,832 | ||||||||||||||||||||||

| 1100-1170 Gilbert Street (Gilbert/La Palma) | 3/1/2031 | 5.125% | 5.125% | 1,692 | ||||||||||||||||||||||

| 7817 Woodley Avenue | 8/1/2039 | 4.140% | 4.140% | 2,848 | ||||||||||||||||||||||

| 3.827% | $ | 3,389,088 | ||||||||||||||||||||||||

Debt Composition(1): |

||||||||||||||||||||||||||||||||

| Category | Weighted Average Term Remaining (yrs)(11) |

Stated Interest Rate | Effective Interest Rate | Balance | % of Total | |||||||||||||||||||||||||||

| Fixed | 4.2 | 3.827% (See Table Above) |

3.827% | $ | 3,389,088 | 100% | ||||||||||||||||||||||||||

| Variable | — | — | —% | $ | — | 0% | ||||||||||||||||||||||||||

| Secured | 2.0 | 4.544% | $ | 114,088 | 3% | |||||||||||||||||||||||||||

| Unsecured | 4.3 | 3.800% | $ | 3,275,000 | 97% | |||||||||||||||||||||||||||

|

First Quarter 2024

Supplemental Financial Reporting Package

|

Page 18

|

|

||||||

Debt Summary (Continued). |

||||||||

| (unaudited and dollars in thousands) | ||||||||

Debt Maturity Schedule(12): |

||||||||||||||||||||||||||||||||

| Year | Secured(13) |

Unsecured | Total | % Total | Effective Interest Rate(1) |

|||||||||||||||||||||||||||

| 2024 | $ | 68,763 | $ | 400,000 | $ | 468,763 | 14 | % | 4.847 | % | ||||||||||||||||||||||

| 2025 | — | 100,000 | 100,000 | 3 | % | 4.290 | % | |||||||||||||||||||||||||

| 2026 | 6,951 | — | 6,951 | — | % | 3.900 | % | |||||||||||||||||||||||||

| 2027 | 19,702 | 1,000,000 | 1,019,702 | 30 | % | 4.106 | % | |||||||||||||||||||||||||

| 2028 | 14,132 | 300,000 | 314,132 | 9 | % | 4.948 | % | |||||||||||||||||||||||||

| 2029 | — | 600,000 | 600,000 | 18 | % | 4.115 | % | |||||||||||||||||||||||||

| 2030 | — | 400,000 | 400,000 | 12 | % | 2.125 | % | |||||||||||||||||||||||||

| 2031 | 1,692 | 400,000 | 401,692 | 12 | % | 2.163 | % | |||||||||||||||||||||||||

| 2032 | — | — | — | — | % | — | % | |||||||||||||||||||||||||

| 2033 | — | — | — | — | % | — | % | |||||||||||||||||||||||||

| Thereafter | 2,848 | 75,000 | 77,848 | 2 | % | 4.034 | % | |||||||||||||||||||||||||

| Total | $ | 114,088 | $ | 3,275,000 | $ | 3,389,088 | 100 | % | 3.827 | % | ||||||||||||||||||||||

|

First Quarter 2024

Supplemental Financial Reporting Package

|

Page 19

|

|

||||||

Operations. |

||||||||

| Quarterly Results | ||||||||

|

First Quarter 2024

Supplemental Financial Reporting Package

|

Page 20

|

|

||||||

Portfolio Overview. |

||||||||

| At March 31, 2024 | (unaudited results) | |||||||

| Consolidated Portfolio: | ||||||||

| Rentable Square Feet | Ending Occupancy % | In-Place ABR(3) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Market | # of Properties |

Same Property Portfolio |

Non-Same Property Portfolio |

Total Portfolio |

Same Property Portfolio |

Non-Same Property Portfolio |

Total

Portfolio(1)

|

Total Portfolio

Excluding

Repositioning/

Redevelopment(2)

|

Total (in 000’s) |

Per Square Foot |

||||||||||||||||||||||||||||||||||||||||||||||||||||

| Central LA | 22 | 2,803,151 | 383,278 | 3,186,429 | 93.3 | % | 54.7 | % | 88.6 | % | 95.1 | % | $ | 34,338 | $12.16 | |||||||||||||||||||||||||||||||||||||||||||||||

| Greater San Fernando Valley | 74 | 5,638,426 | 1,343,701 | 6,982,127 | 97.7 | % | 82.8 | % | 94.8 | % | 98.8 | % | 98,302 | $14.85 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Mid-Counties | 38 | 2,266,738 | 2,037,041 | 4,303,779 | 97.5 | % | 95.0 | % | 96.4 | % | 98.7 | % | 65,613 | $15.82 | ||||||||||||||||||||||||||||||||||||||||||||||||

| San Gabriel Valley | 46 | 3,908,505 | 1,995,562 | 5,904,067 | 97.3 | % | 95.5 | % | 96.7 | % | 98.0 | % | 71,486 | $12.52 | ||||||||||||||||||||||||||||||||||||||||||||||||

| South Bay | 82 | 6,260,782 | 1,241,069 | 7,501,851 | 95.8 | % | 68.3 | % | 91.3 | % | 97.5 | % | 145,391 | $21.23 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Los Angeles County | 262 | 20,877,602 | 7,000,651 | 27,878,253 | 96.5 | % | 85.9 | % | 93.8 | % | 97.8 | % | 415,130 | $15.88 | ||||||||||||||||||||||||||||||||||||||||||||||||

| North Orange County | 24 | 1,404,332 | 886,436 | 2,290,768 | 100.0 | % | 76.7 | % | 91.0 | % | 100.0 | % | 33,295 | $15.98 | ||||||||||||||||||||||||||||||||||||||||||||||||

| OC Airport | 10 | 1,018,385 | 188,204 | 1,206,589 | 99.7 | % | 100.0 | % | 99.7 | % | 99.7 | % | 22,178 | $18.43 | ||||||||||||||||||||||||||||||||||||||||||||||||

| South Orange County | 10 | 448,762 | 183,098 | 631,860 | 100.0 | % | 87.3 | % | 96.3 | % | 96.3 | % | 9,793 | $16.09 | ||||||||||||||||||||||||||||||||||||||||||||||||

| West Orange County | 10 | 610,876 | 688,436 | 1,299,312 | 100.0 | % | 50.4 | % | 73.7 | % | 87.7 | % | 14,705 | $15.36 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Orange County | 54 | 3,482,355 | 1,946,174 | 5,428,529 | 99.9 | % | 70.6 | % | 89.4 | % | 96.8 | % | 79,971 | $16.48 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Inland Empire East | 1 | 33,258 | — | 33,258 | 100.0 | % | — | % | 100.0 | % | 100.0 | % | 635 | $19.09 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Inland Empire West | 51 | 7,472,746 | 1,702,582 | 9,175,328 | 94.6 | % | 74.4 | % | 90.9 | % | 95.5 | % | 118,029 | $14.16 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Riverside / San Bernardino County | 52 | 7,506,004 | 1,702,582 | 9,208,586 | 94.6 | % | 74.4 | % | 90.9 | % | 95.5 | % | 118,664 | $14.18 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Central San Diego | 21 | 1,160,347 | 850,062 | 2,010,409 | 99.1 | % | 88.2 | % | 94.5 | % | 95.1 | % | 35,333 | $18.60 | ||||||||||||||||||||||||||||||||||||||||||||||||

| North County San Diego | 14 | 1,336,344 | 143,663 | 1,480,007 | 97.4 | % | 79.1 | % | 95.6 | % | 99.2 | % | 20,509 | $14.50 | ||||||||||||||||||||||||||||||||||||||||||||||||

| San Diego County | 35 | 2,496,691 | 993,725 | 3,490,416 | 98.1 | % | 86.9 | % | 94.9 | % | 96.9 | % | 55,842 | $16.85 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Ventura | 19 | 2,747,215 | 409,217 | 3,156,432 | 94.6 | % | 78.8 | % | 92.6 | % | 92.8 | % | 37,042 | $12.68 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Ventura County | 19 | 2,747,215 | 409,217 | 3,156,432 | 94.6 | % | 78.8 | % | 92.6 | % | 92.8 | % | 37,042 | $12.68 | ||||||||||||||||||||||||||||||||||||||||||||||||

| CONSOLIDATED TOTAL / WTD AVG | 422 | 37,109,867 | 12,052,349 | 49,162,216 | 96.4 | % | 81.6 | % | 92.8 | % | 96.9 | % | $ | 706,649 | $15.49 | |||||||||||||||||||||||||||||||||||||||||||||||

|

First Quarter 2024

Supplemental Financial Reporting Package

|

Page 21

|

|

||||||

Leasing Statistics and Trends. |

||||||||

| (unaudited results) | ||||||||

| Leasing Activity and Weighted Average New / Renewal Leasing Spreads: | ||||||||

| Three Months Ended | ||||||||||||||||||||||||||||||||

| Mar 31, 2024 | Dec 31, 2023 | Sep 30, 2023 | Jun 30, 2023 | Mar 31, 2023(1) |

||||||||||||||||||||||||||||

| Leasing Spreads: | ||||||||||||||||||||||||||||||||

GAAP Rent Change(2) |

53.0 | % | 63.1 | % | 64.8 | % | 96.8 | % | 80.2 | % | ||||||||||||||||||||||

Cash Rent Change(2) |

33.6 | % | 45.6 | % | 51.4 | % | 74.8 | % | 59.7 | % | ||||||||||||||||||||||

Leasing Activity (SF):(3) |

||||||||||||||||||||||||||||||||

| New leases | 830,941 | 727,886 | 862,420 | 961,235 | 522,288 | |||||||||||||||||||||||||||

| Renewal leases | 2,398,076 | 1,196,023 | 667,179 | 1,165,452 | 1,254,005 | |||||||||||||||||||||||||||

| Total leasing activity | 3,229,017 | 1,923,909 | 1,529,599 | 2,126,687 | 1,776,293 | |||||||||||||||||||||||||||

| Total expiring leases | (3,819,253) | (2,193,335) | (1,653,111) | (2,065,869) | (2,461,943) | |||||||||||||||||||||||||||

| Expiring leases - placed into repositioning/redevelopment | 732,083 | 473,701 | 557,387 | 395,180 | 720,119 | |||||||||||||||||||||||||||

Net absorption(4) |

141,847 | 204,275 | 433,875 | 455,998 | 34,469 | |||||||||||||||||||||||||||

Retention rate(5) |

82 | % | 77 | % | 62 | % | 71 | % | 83 | % | ||||||||||||||||||||||

Retention + Backfill rate(6) |

87 | % | 84 | % | 80 | % | 79 | % | 90 | % | ||||||||||||||||||||||

Leasing Activity and Change in Annual Rental Rates and Turnover Costs for Current Quarter Leases:(7) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GAAP Rent | Cash Rent | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| First Quarter 2024: | # Leases Signed |

SF of Leasing |

Wtd. Avg. Lease Term (Years) |

Current Lease |

Prior Lease |

Rent Change - GAAP |

Current Lease |

Prior Lease |

Rent Change - Cash |

Wtd. Avg. Abatement (Months) |

Turnover

Costs

per SF(8)

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New | 50 | 830,941 | 4.2 | $18.02 | $12.75 | 41.3% | $17.83 | $13.59 | 31.2% | 2.1 | $7.01 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Renewal | 64 | 2,398,076 | 3.1 | $17.61 | $15.34 | 14.8% | $17.71 | $15.91 | 11.3% | 1.7 | $1.53 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total / Wtd. Average | 114 | 3,229,017 | 3.4 | $17.65 | $15.05 | 17.3% | $17.72 | $15.65 | 13.2% | 1.7 | $2.14 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Excluding Tireco, Inc. Lease Extension:(2) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Renewal |

63 | 1,296,236 | 4.1 | $19.64 | $12.53 | 56.8% | $18.08 | $13.46 | 34.4% | 1.2 | $3.94 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total / Wtd. Average | 113 | 2,127,177 | 4.1 | $19.25 | $12.58 | 53.0% | $18.02 | $13.49 | 33.6% | 1.4 | $4.69 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

First Quarter 2024

Supplemental Financial Reporting Package

|

Page 22

|

|

||||||

Leasing Statistics (Continued). |

||||||||

| (unaudited results) | ||||||||

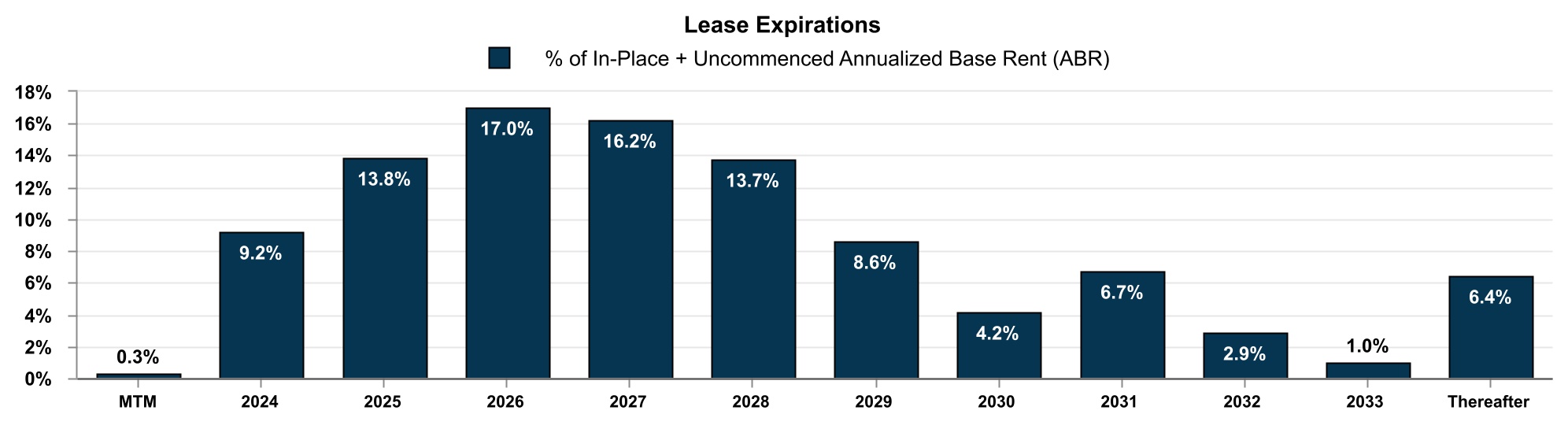

| Lease Expiration Schedule as of March 31, 2024: | ||||||||

| Year of Lease Expiration | # of Leases Expiring |

Total Rentable Square Feet |

In-Place + Uncommenced ABR (in thousands) |

In-Place + Uncommenced ABR per SF |

||||||||||||||||||||||

| Available | — | 1,590,141 | $ | — | $— | |||||||||||||||||||||

Repositioning/Redevelopment(1) |

— | 1,351,820 | — | $— | ||||||||||||||||||||||

| MTM Tenants | 6 | 159,555 | 2,035 | $12.75 | ||||||||||||||||||||||

| 2024 | 305 | 4,765,435 | 66,444 | $13.94 | ||||||||||||||||||||||

| 2025 | 412 | 7,115,085 | 99,793 | $14.03 | ||||||||||||||||||||||

| 2026 | 378 | 8,741,930 | 123,134 | $14.09 | ||||||||||||||||||||||

| 2027 | 225 | 7,390,942 | 117,537 | $15.90 | ||||||||||||||||||||||

| 2028 | 150 | 5,375,271 | 99,505 | $18.51 | ||||||||||||||||||||||

| 2029 | 85 | 3,670,173 | 62,547 | $17.04 | ||||||||||||||||||||||

| 2030 | 28 | 1,978,712 | 30,438 | $15.38 | ||||||||||||||||||||||

| 2031 | 26 | 3,328,558 | 48,662 | $14.62 | ||||||||||||||||||||||

| 2032 | 16 | 973,530 | 20,782 | $21.35 | ||||||||||||||||||||||

| 2033 | 10 | 386,007 | 7,182 | $18.61 | ||||||||||||||||||||||

| Thereafter | 39 | 2,335,057 | 46,522 | $19.92 | ||||||||||||||||||||||

| Total Portfolio | 1,680 | 49,162,216 | $ | 724,581 | $15.68 | |||||||||||||||||||||

|

First Quarter 2024

Supplemental Financial Reporting Package

|

Page 23

|

|

||||||

Top Tenants and Lease Segmentation. |

||||||||

| (unaudited results) | ||||||||

Top 20 Tenants as of March 31, 2024 |

||||||||

| Tenant | Submarket | Leased Rentable SF |

In-Place + Uncommenced

ABR (in 000’s)(1)

|

% of In-Place +

Uncommenced ABR(1)

|

In-Place + Uncommenced

ABR per SF(1)

|

Lease Expiration |

||||||||||||||||||||||||||||||||

Tireco, Inc.(2) |

Inland Empire West | 1,101,840 | $19,251 | 2.7% | $17.47 | 1/31/2027 | ||||||||||||||||||||||||||||||||

| L3 Technologies, Inc. | Multiple Submarkets(3) |

595,267 | $12,555 | 1.7% | $21.09 | 9/30/2031 | ||||||||||||||||||||||||||||||||

| Zenith Energy West Coast Terminals LLC | South Bay | —(4) |

$11,446 | 1.6% | $3.28(4) |

9/29/2041 | ||||||||||||||||||||||||||||||||

| Cubic Corporation | Central San Diego | 515,382 | $10,786 | 1.5% | $20.93 | 3/31/2038(5) |

||||||||||||||||||||||||||||||||

| Federal Express Corporation | Multiple Submarkets(6) |

527,861 | $10,238 | 1.4% | $19.40 | 11/30/2032(6) |

||||||||||||||||||||||||||||||||

GXO Logistics Supply Chain, Inc. |

Mid-Counties |

411,034 | $8,385 | 1.2% | $20.40 | 11/30/2028 | ||||||||||||||||||||||||||||||||

| Best Buy Stores, L.P. | Inland Empire West | 501,649 | $8,201 | 1.1% | $16.35 | 6/30/2029 | ||||||||||||||||||||||||||||||||

| The Hertz Corporation | South Bay | 38,680(7) |

$7,932 | 1.1% | $9.90(7) |

3/31/2026 | ||||||||||||||||||||||||||||||||

| IBY, LLC | San Gabriel Valley | 993,142 | $7,059 | 1.0% | $7.11 | 4/5/2031 | ||||||||||||||||||||||||||||||||

| Michael Kors (USA) | Mid-Counties | 565,619 | $6,098 | 0.8% | $10.78 | 11/30/2026 | ||||||||||||||||||||||||||||||||

| Top 10 Tenants | 5,250,474 | $101,951 | 14.1% | |||||||||||||||||||||||||||||||||||

| Top 11 - 20 Tenants | 2,776,006 | $44,736 | 6.2% | |||||||||||||||||||||||||||||||||||

| Total Top 20 Tenants | 8,026,480 | $146,687 | 20.3% | |||||||||||||||||||||||||||||||||||

| Lease Segmentation by Size: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Square Feet | Number of Leases |

Leased Building Rentable SF |

Building Rentable SF |

Building Leased % |

Building Leased % Excl. Repo/Redev |

In-Place +

Uncommenced ABR

(in 000’s)(1)

|

% of In-Place +

Uncommenced

ABR(1)

|

In-Place +

Uncommenced

ABR per SF(1)

|

|||||||||||||||||||||||||||||||||||||||||||||

| <4,999 | 638 | 1,548,763 | 1,711,164 | 90.5% | 92.7% | $ | 28,626 | 4.0% | $18.48 | ||||||||||||||||||||||||||||||||||||||||||||

| 5,000 - 9,999 | 233 | 1,673,774 | 1,849,154 | 90.5% | 93.5% | 30,598 | 4.2% | $18.28 | |||||||||||||||||||||||||||||||||||||||||||||

| 10,000 - 24,999 | 326 | 5,302,471 | 5,850,392 | 90.6% | 94.0% | 92,355 | 12.7% | $17.42 | |||||||||||||||||||||||||||||||||||||||||||||

| 25,000 - 49,999 | 181 | 6,589,755 | 7,293,592 | 90.3% | 96.5% | 102,871 | 14.2% | $15.61 | |||||||||||||||||||||||||||||||||||||||||||||

| 50,000 - 99,999 | 120 | 8,732,381 | 9,447,034 | 92.4% | 97.5% | 134,059 | 18.5% | $15.35 | |||||||||||||||||||||||||||||||||||||||||||||

| >100,000 | 121 | 22,179,809 | 22,762,340 | 97.4% | 100.0% | 294,514 | 40.7% | $13.28 | |||||||||||||||||||||||||||||||||||||||||||||

| Building Subtotal / Wtd. Avg. | 1,619 | 46,026,953 | (2) |

48,913,676 | (2) |

94.1% | (2) |

97.8% | $ | 683,023 | 94.3% | $14.84 | |||||||||||||||||||||||||||||||||||||||||

Land/IOS(3) |

24 | 8,146,906 | (4) |

39,447 | 5.4% | $4.84 | (4) |

||||||||||||||||||||||||||||||||||||||||||||||

Other(3) |

37 | 2,110 | 0.3% | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total | 1,680 | $ | 724,580 | 100.0% | |||||||||||||||||||||||||||||||||||||||||||||||||

|

First Quarter 2024

Supplemental Financial Reporting Package

|

Page 24

|

|

||||||

Capital Expenditure Summary. |

||||||||

| (unaudited results, in thousands, except square feet and per square foot data) | ||||||||

| Three months ended March 31, 2024 | ||||||||

| Year to Date | ||||||||||||||||||||

| Total | SF(1) |

PSF | ||||||||||||||||||

| Tenant Improvements: | ||||||||||||||||||||

| New Leases – 1st Generation | $ | 378 | 224,102 | $ | 1.69 | |||||||||||||||

| New Leases – 2nd Generation | — | — | $ | 0.00 | ||||||||||||||||

| Renewals | 226 | 238,579 | $ | 0.95 | ||||||||||||||||

| Total Tenant Improvements | $ | 604 | ||||||||||||||||||

| Leasing Commissions & Lease Costs: | ||||||||||||||||||||

| New Leases – 1st Generation | $ | 2,189 | 585,122 | $ | 3.74 | |||||||||||||||

| New Leases – 2nd Generation | 985 | 276,719 | $ | 3.56 | ||||||||||||||||

| Renewals | 2,246 | 665,746 | $ | 3.37 | ||||||||||||||||

| Total Leasing Commissions & Lease Costs | $ | 5,420 | ||||||||||||||||||

| Total Recurring Capex | $ | 2,990 | 46,208,746 | $ | 0.06 | |||||||||||||||

| Recurring Capex % of NOI | 1.8 | % | ||||||||||||||||||

| Recurring Capex % of Rental Income | 1.4 | % | ||||||||||||||||||

| Nonrecurring Capex: | ||||||||||||||||||||

Repositioning and Redevelopment in Process(2) |

$ | 55,817 | ||||||||||||||||||

Unit Renovation(3) |

1,843 | |||||||||||||||||||

Other(4) |

4,377 | |||||||||||||||||||

| Total Nonrecurring Capex | $ | 62,037 | 26,409,973 | $ | 2.35 | |||||||||||||||

Other Capitalized Costs(5) |

$ | 13,535 | ||||||||||||||||||

|

First Quarter 2024

Supplemental Financial Reporting Package

|

Page 25

|

|

||||||

Properties and Space Under Repositioning/Redevelopment.(1) | ||||||||

| As of March 31, 2024 | (unaudited results, $ in millions) | |||||||

| Repositioning | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Total

Property

RSF(2)

|

Repo/

Lease-Up

RSF(2)

|

Total Property Leased % 3/31/2024 |

Est. Constr.

Period(1)

|

Est.

Stabilization

Period(1)(3)

|

Purch.

Price(1)

|

Proj.

Repo

Costs(1)

|

Proj.

Total

Invest.(1)

|

Cumulative

Investment

to Date(1)

|

Actual

Cash NOI

1Q-2024(1)

|

Est.

Annual

Stabilized

Cash NOI(1)

|

Est.

Unlevered

Stabilized

Yield(1)

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Property (Submarket) | Start | Target Complet. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CURRENT REPOSITIONING: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2880 Ana Street (South Bay) | LAND | LAND | —% | 3Q-23 | 2Q-24 | 4Q-24 | $ | 34.9 | $ | 5.4 | $ | 40.3 | $ | 36.5 | $ | 0.0 | $ | 1.8 | 4.5% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 14434-14527 San Pedro Street (South Bay) | 58,094 | 58,094 | —% | 3Q-23 | 2Q-25 | 4Q-25 | 49.8 | 14.6 | 64.4 | 51.5 | 0.0 | 3.6 | 5.5% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 29120 Commerce Center Drive (SF Valley) | 135,258 | 135,258 | 100%(4) |

3Q-23 | 4Q-25 | 3Q-26 | 27.1 | 4.1 | 31.2 | 31.2 | 0.3 | 2.5 | 7.9% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 263-321 Gardena Blvd (South Bay) | 55,238 | 55,238 | —% | 4Q-23 | 3Q-24 | 1Q-25 | 16.2 | 2.9 | 19.1 | 17.5 | 0.0 | 2.1 | 11.1% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 17311 Nichols Lane (OC West) | 104,182 | 104,182 | 100%(5) |

1Q-24 | 2Q-24 | 3Q-24 | 17.1 | 4.6 | 21.7 | 17.8 | 0.0 | 1.7 | 8.0% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

East 27th Street (Central LA)(6) |

300,389 | 126,563 | 58% | 1Q-24 | 4Q-24 | 2Q-25 | 26.9 | 6.4 | 33.3 | 28.0 | (0.1) | 1.8 | 5.4% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 122-125 N. Vinedo Avenue (SF Valley) | 48,381 | 48,381 | —% | 1Q-24 | 4Q-24 | 3Q-25 | 5.3 | 3.2 | 8.5 | 5.8 | 0.0 | 1.2 | 13.5% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1020 Bixby Drive (SG Valley) | 56,915 | 56,915 | —% | 1Q-24 | 4Q-24 | 3Q-25 | 16.5 | 3.4 | 19.9 | 17.2 | 0.2 | 0.9 | 4.5% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 12907 Imperial Highway (Mid-Counties) | 101,080 | 101,080 | —% | 1Q-24 | 4Q-24 | 3Q-25 | 12.3 | 3.5 | 15.8 | 12.6 | 0.1 | 2.0 | 12.4% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

17000 Kingsview Avenue (South Bay) |

100,121 | 100,121 | 77%(7) |

1Q-24 | 1Q-25 | 4Q-25 | 14.0 | 4.4 | 18.4 | 14.5 | 0.2 | 1.6 | 8.5% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 29125 Avenue Paine (SF Valley) | 175,897 | 175,897 | 100%(8) |

1Q-24 | 3Q-25 | 1Q-26 | 45.3 | 5.9 | 51.2 | 47.0 | 0.3 | 3.1 | 6.1% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total/Weighted Average | 1,135,555 | 961,729 | $ | 265.4 | $ | 58.4 | $ | 323.8 | $ | 279.6 | $ | 1.0 | $ | 22.3 | 6.8% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| LEASE-UP REPOSITIONING: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 20851 Currier Road (SG Valley) | 59,412 | 59,412 | 100%(9) |

1Q-23 | 2Q-23 | 2Q-24 | $ | 22.0 | $ | 2.1 | $ | 24.1 | $ | 23.6 | $ | 0.0 | $ | 1.0 | 4.4% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 444 Quay Avenue (South Bay) | 26,700 | 26,700 | 100%(10) |

1Q-23 | 1Q-24 | 2Q-24 | 25.8 | 10.0 | 35.8 | 34.5 | 0.0 | 3.2 | 8.9% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 500 Dupont Avenue (Inland Empire West) | 274,898 | 274,898 | —% | 1Q-23 | 1Q-24 | 3Q-24 | 58.8 | 10.5 | 69.3 | 67.4 | 0.0 | 4.0 | 5.7% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

11308-11350 Penrose Street (SF Valley)(11) |

151,011 | 71,547 | 53% | 1Q-23 | 1Q-24 | 3Q-24 | 12.1 | 5.2 | 17.3 | 16.7 | 0.0 | 1.4 | 7.8% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4039 Calle Platino (North County SD) | 143,663 | 73,807 | 79% | 2Q-23 | 1Q-24 | 3Q-24 | 20.5 | 4.2 | 24.7 | 24.5 | 0.2 | 2.0 | 8.2% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total/Weighted Average | 655,684 | 506,364 | $ | 139.2 | $ | 32.0 | $ | 171.2 | $ | 166.7 | $ | 0.2 | $ | 11.6 | 6.8% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| STABILIZED REPOSITIONING: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

8210-8240 Haskell Avenue (SF Valley)(12) |

52,934 | 52,934 | 50% | 1Q-22 | 1Q-23 | 1Q-24 | $ | 12.5 | $ | 2.2 | $ | 14.7 | $ | 14.4 | $ | 0.0 | $ | 0.9 | 6.2% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 9755 Distribution Avenue (Central SD) | 48,011 | 24,071 | 100% | 2Q-23 | 4Q-23 | 1Q-24 | 5.5 | 1.6 | 7.1 | 7.1 | 0.1 | 0.9 | 13.4% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8902-8940 Activity Road (Central SD) | 112,876 | 13,950 | 98% | 3Q-23 | 1Q-24 | 1Q-24 | 3.3 | 1.7 | 5.0 | 5.0 | 0.0 | 0.4 | 7.0% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total/Weighted Average | 213,821 | 90,955 | $ | 21.3 | $ | 5.5 | $ | 26.8 | $ | 26.5 | $ | 0.1 | $ | 2.2 | 8.3% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FUTURE REPOSITIONING: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 19301 Santa Fe Avenue (South Bay) | LAND | LAND | —% | 2Q-24 | 1Q-25 | 3Q-25 | $ | 14.7 | $ | 5.8 | $ | 20.5 | $ | 15.0 | $ | 0.1 | $ | 1.0 | 5.0% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

East 46th Street (Central LA) |

190,663 | 78,928 | 75% | 2Q-24 | 2Q-25 | 1Q-26 | 14.7 | 5.0 | 19.7 | 14.8 | 0.3 | 2.0 | 10.0% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

3131 Harcourt Street (South Bay) |

34,000 | 34,000 | 56% | 3Q-24 | 3Q-25 | 2Q-26 | 54.4 | 9.9 | 64.3 | 54.9 | 0.2 | 2.6 | 4.1% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

14400 Figueroa Street (South Bay) |

56,700 | 56,700 | —% | 3Q-24 | 4Q-25 | 3Q-26 | 61.4 | 13.1 | 74.5 | 62.1 | 0.0 | 3.0 | 4.0% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

8985 Crestmar Point (Central SD) |

53,395 | 53,395 | 87% | 4Q-24 | 3Q-25 | 2Q-26 | 8.1 | 6.4 | 14.5 | 8.2 | 0.1 | 0.8 | 5.4% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total/Weighted Average | 334,758 | 223,023 | $ | 153.3 | $ | 40.2 | $ | 193.5 | $ | 155.0 | $ | 0.7 | $ | 9.4 | 4.9% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Repositioning (Excluding Other) | 2,339,818 | 1,782,071 | $ | 579.2 | $ | 136.1 | $ | 715.3 | $ | 627.8 | $ | 2.0 | $ | 45.5 | 6.3% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

First Quarter 2024

Supplemental Financial Reporting Package

|

Page 26

|

|

||||||

Properties and Space Under Repositioning/Redevelopment (Continued).(1) | ||||||||

| As of March 31, 2024 | (unaudited results, $ in millions) | |||||||

| Redevelopment | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Projected

RSF(13)

|

Total

Property

Leased %

3/31/2024

|

Est. Constr. Period(1) |

Est.

Stabilization

Period(1)(3)

|

Purch.

Price(1)

|

Proj.

Redev

Costs(1)

|

Proj.

Total

Invest.(1)

|

Cumulative

Investment

to Date(1)

|

Actual

Cash NOI

1Q-2024(1)

|

Est.

Annual

Stabilized

Cash NOI(1)

|