Document

|

|

|

|

|

|

|

Exhibit 99.1

Press Release

For Immediate Release

|

INDEPENDENT BANK GROUP, INC. REPORTS THIRD QUARTER FINANCIAL RESULTS AND DECLARES QUARTERLY DIVIDEND

October 23, 2023

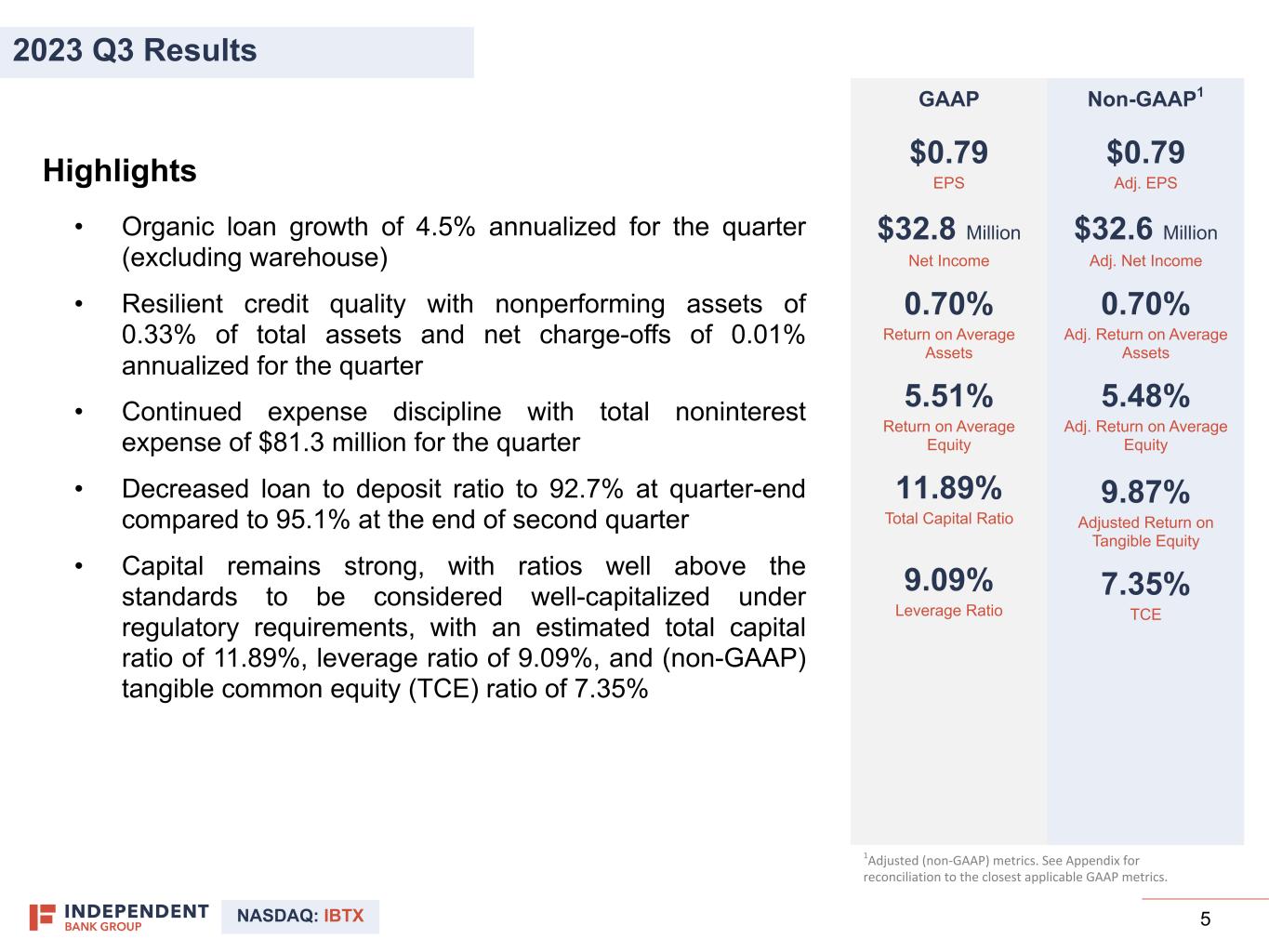

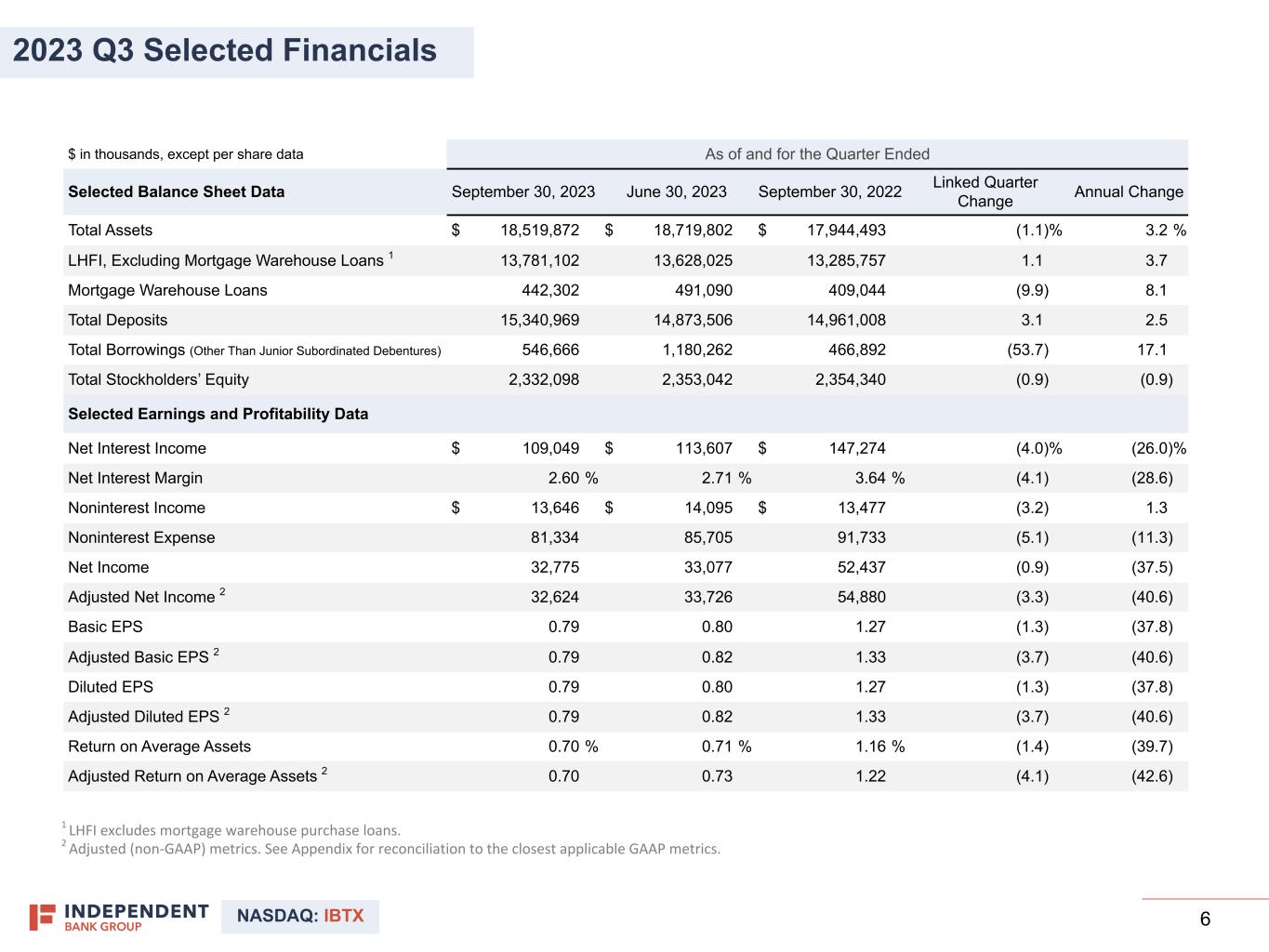

McKINNEY, Texas, October 23, 2023 -- Independent Bank Group, Inc. (NASDAQ: IBTX) today announced net income of $32.8 million, or $0.79 per diluted share, for the quarter ended September 30, 2023, compared to net income of $52.4 million, or $1.27 per diluted share for the quarter ended September 30, 2022 and $33.1 million, or $0.80 per diluted share for the quarter ended June 30, 2023. Adjusted net income for the quarter ended September 30, 2023 was $32.6 million, or $0.79 per diluted share, compared to $54.9 million, or $1.33 per diluted share for the quarter ended September 30, 2022 and $33.7 million, or $0.82 per diluted share for the quarter ended June 30, 2023.

The Company also announced that its Board of Directors declared a quarterly cash dividend of $0.38 per share of common stock. The dividend will be payable on November 16, 2023 to stockholders of record as of the close of business on November 2, 2023.

Highlights

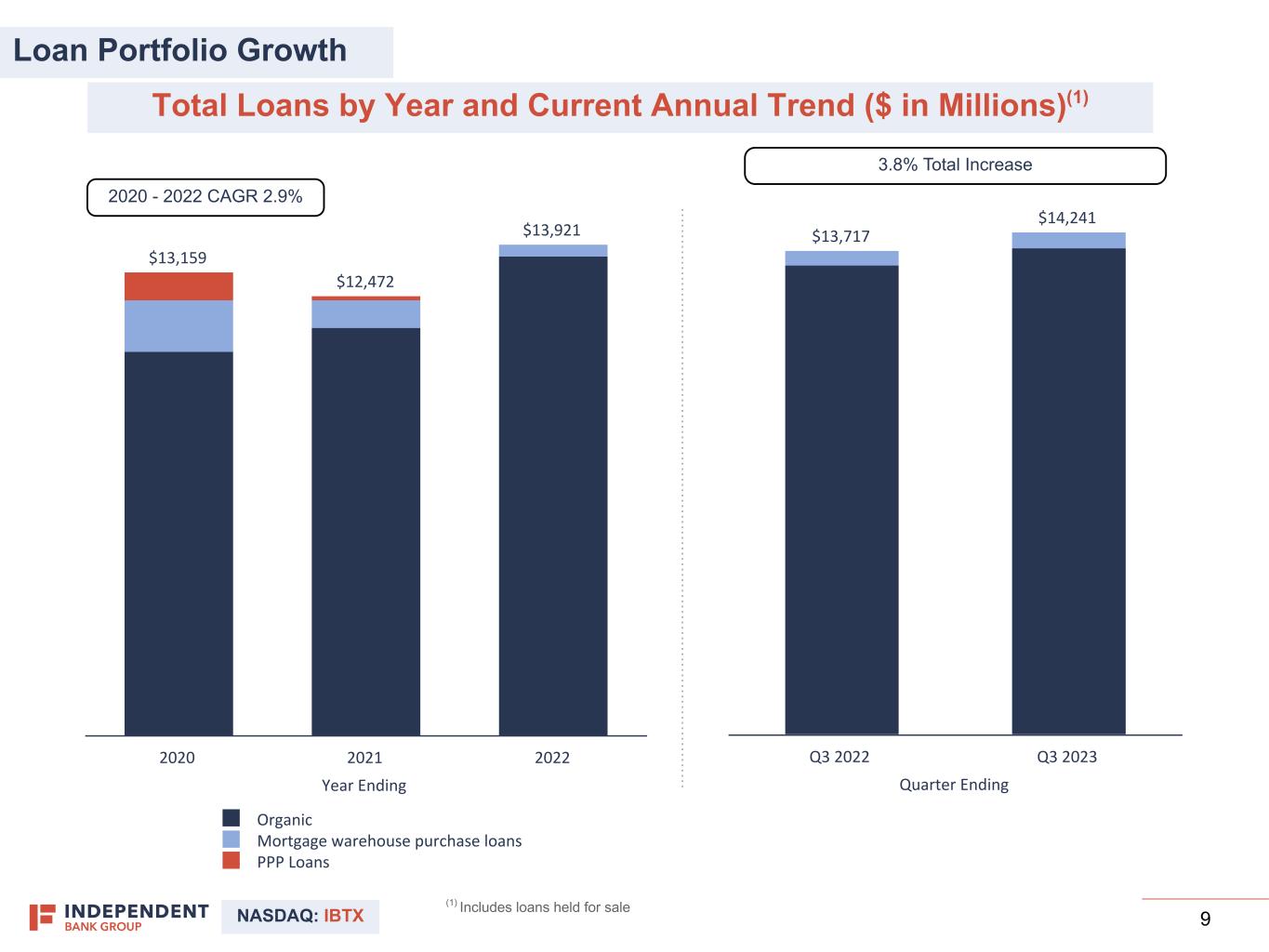

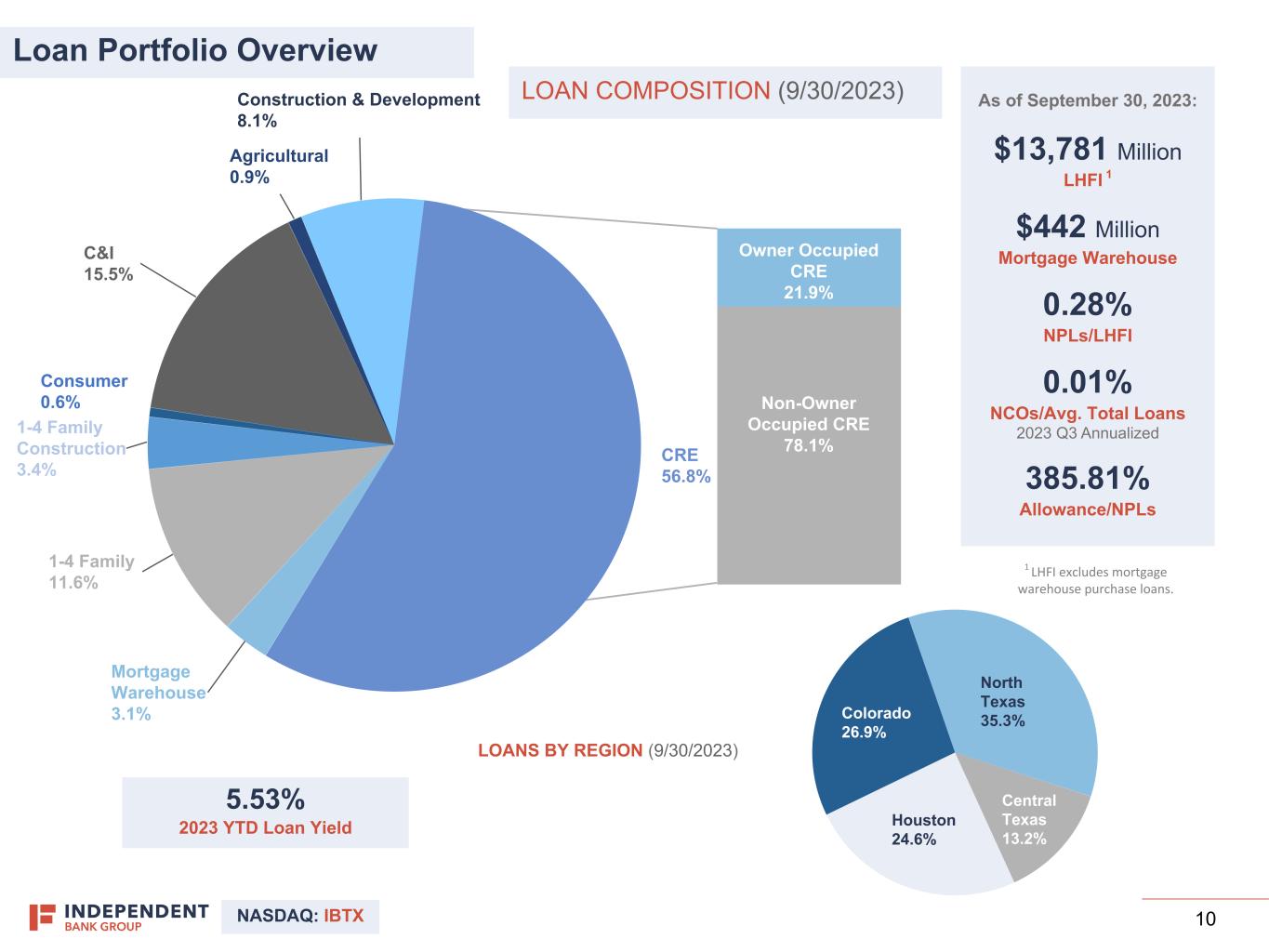

•Organic loan growth of 4.5% annualized for the quarter (excluding warehouse)

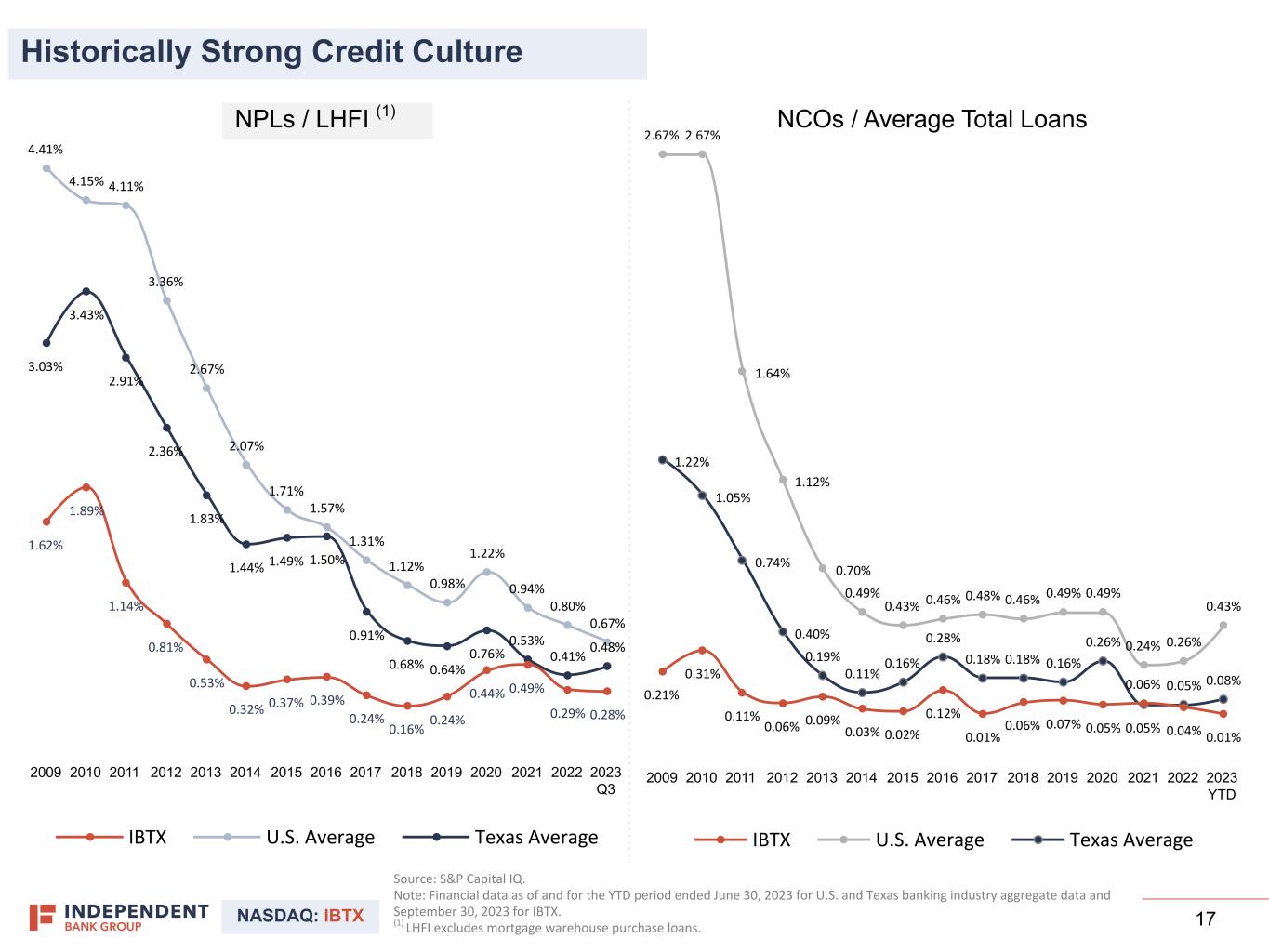

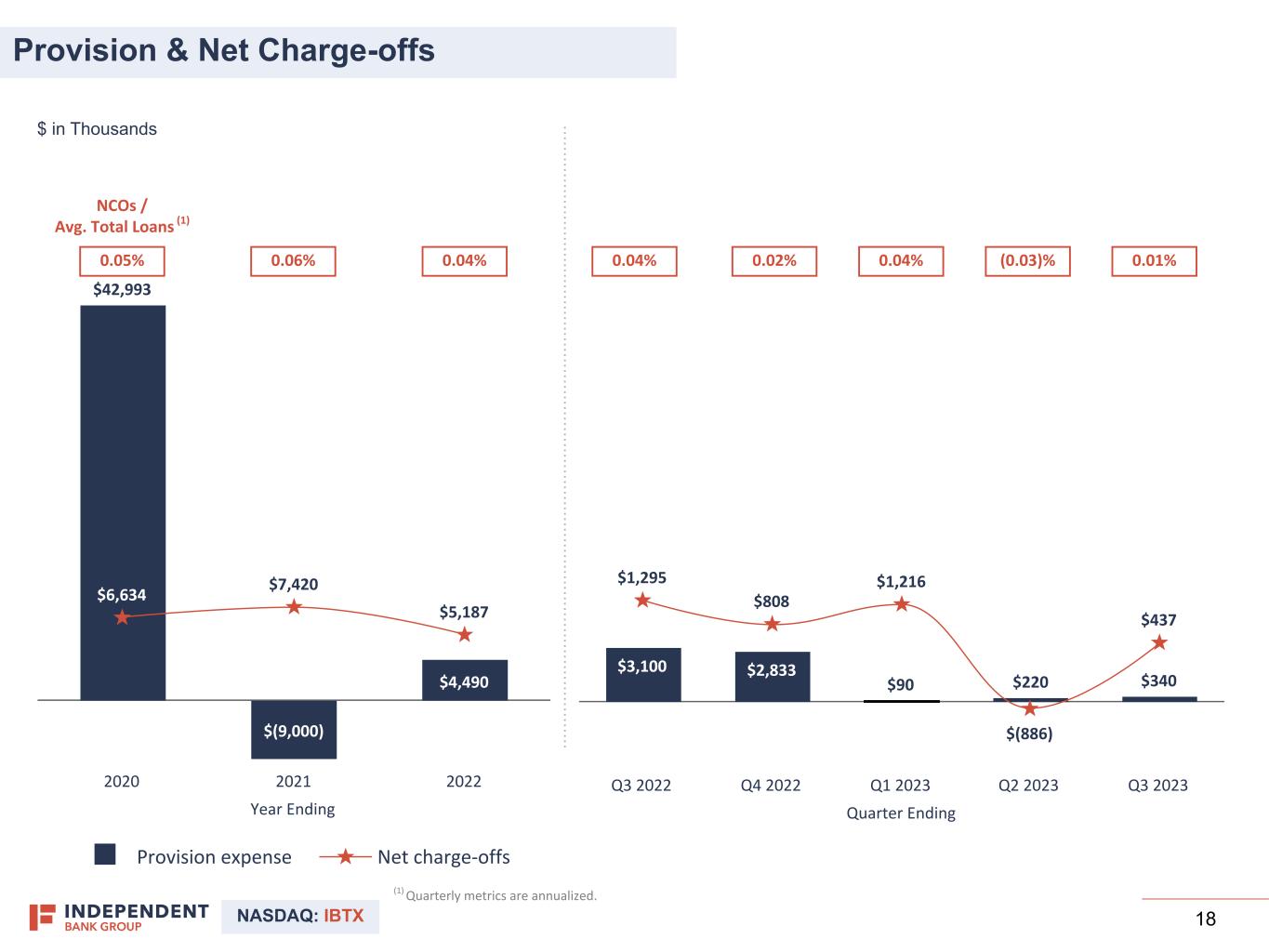

•Resilient credit quality with nonperforming assets of 0.33% of total assets and net charge-offs of 0.01% annualized for the quarter

•Continued expense discipline with total noninterest expense of $81.3 million for the quarter

•Decreased loan to deposit ratio to 92.7% at quarter-end compared to 95.1% at the end of second quarter

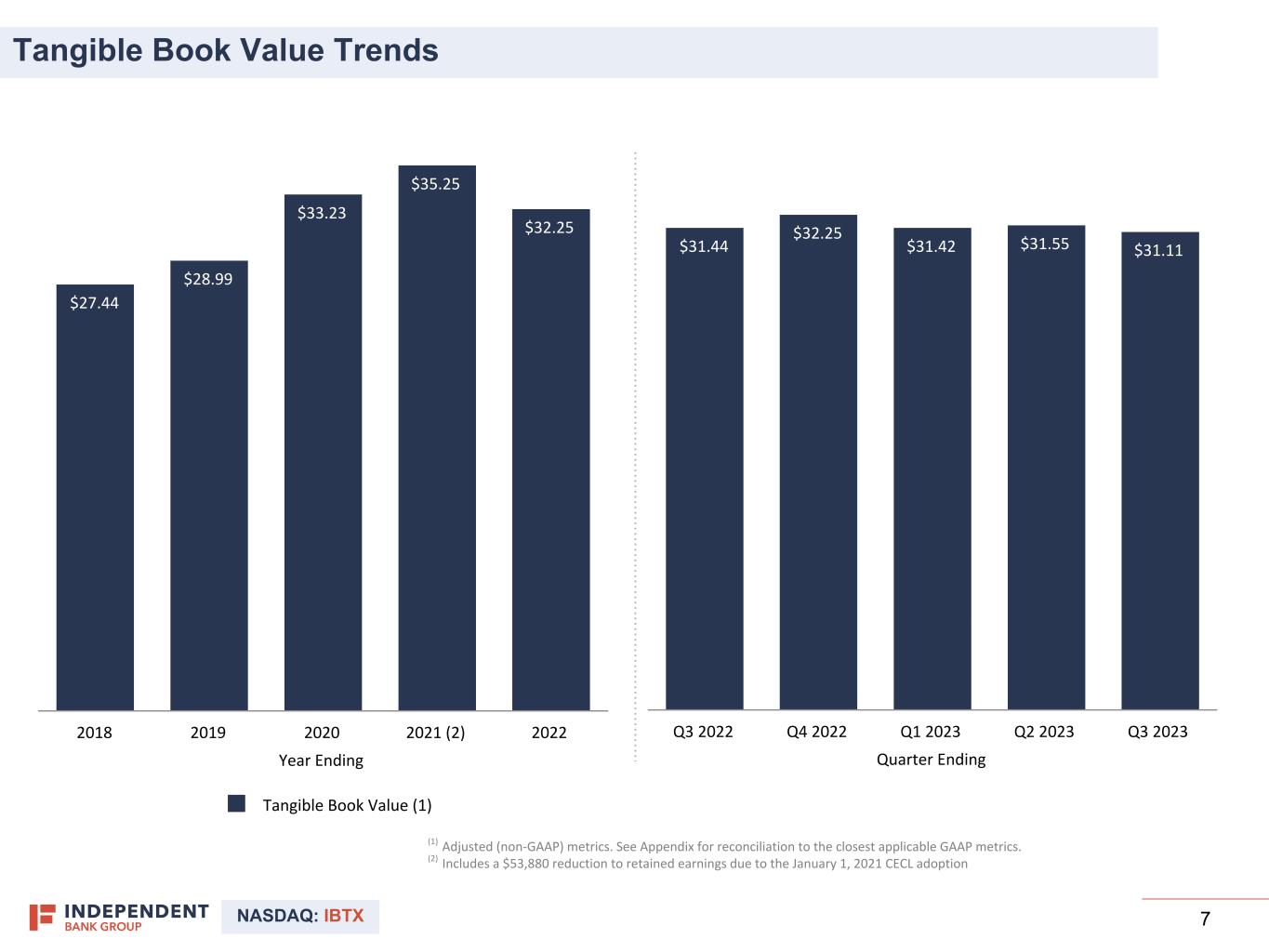

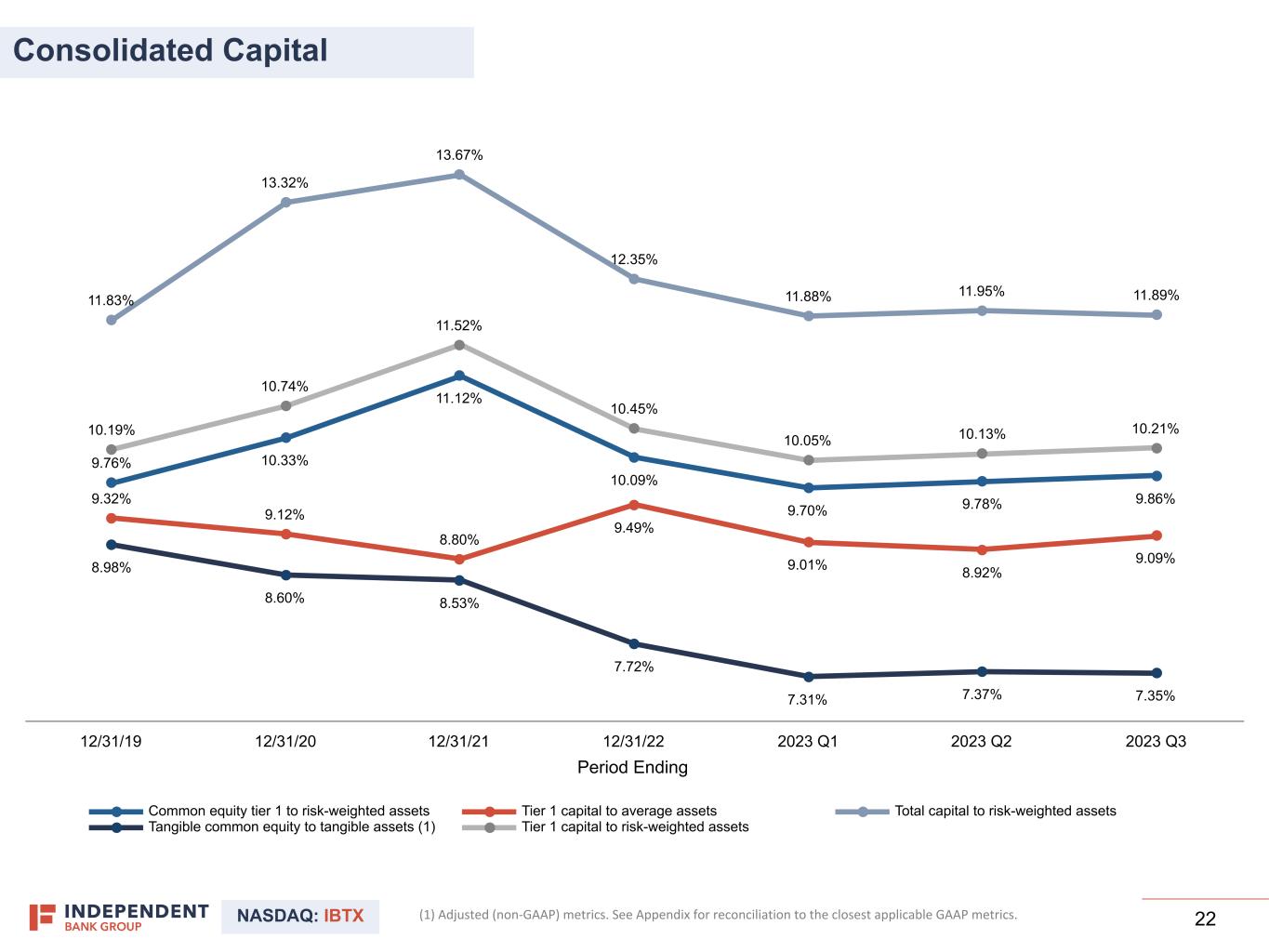

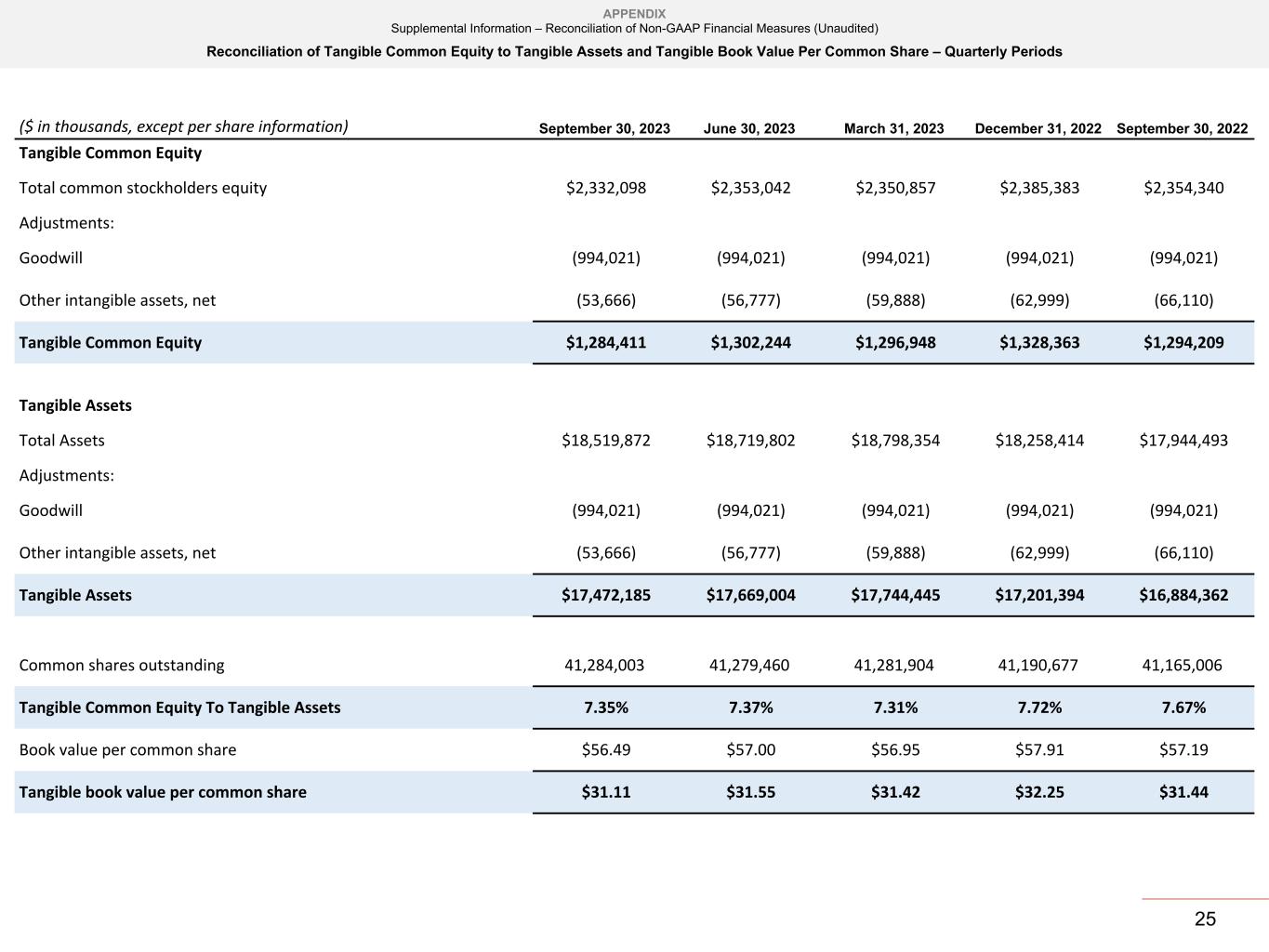

•Capital remains strong, with ratios well above the standards to be considered well-capitalized under regulatory requirements, with an estimated total capital ratio of 11.89%, leverage ratio of 9.09%, and (non-GAAP) tangible common equity (TCE) ratio of 7.35%

“Our third quarter results illustrate our through-cycle growth story, strong balance sheet, and consistent performance on credit quality. We were pleased to report healthy core loan growth for the quarter as our teams of bankers capitalized on renewed activity from our longtime customers across the Texas and Colorado markets. In addition, we took tangible steps to further strengthen our balance sheet and reported just one basis point of annualized charge-offs for the quarter,” said Independent Bank Group Chairman & CEO David R. Brooks. “As we finish the year, we continue to be encouraged by the strength of our loan and deposit pipelines, the continued repricing of our fixed-rate assets, and the sustained economic tailwinds across our footprint. We remain disciplined and focused on executing our strategic plan, pursuing healthy growth, and delivering exceptional service to our customers across Texas and Colorado.”

Third Quarter 2023 Balance Sheet Highlights

Loans

•Total loans held for investment, excluding mortgage warehouse purchase loans, were $13.8 billion at September 30, 2023 compared to $13.6 billion at June 30, 2023 and $13.3 billion at September 30, 2022. Loans held for investment, excluding mortgage warehouse loans, increased $154.7 million, or 4.5% on an annualized basis, during third quarter 2023.

•Average mortgage warehouse purchase loans were $425.9 million for the quarter ended September 30, 2023 compared to $413.2 million for the quarter ended June 30, 2023, and $402.2 million for the quarter ended September 30, 2022, an increase of $12.8 million, or 3.1% from the linked quarter and an increase of $23.7 million, or 5.9% year over year.

Asset Quality

•Nonperforming assets totaled $61.0 million, or 0.33% of total assets at September 30, 2023, compared to $60.5 million or 0.32% of total assets at June 30, 2023, and $81.1 million, or 0.45% of total assets at September 30, 2022.

•Nonperforming loans totaled $38.4 million, or 0.28% of total loans held for investment at September 30, 2023, compared to $37.9 million, or 0.28% at June 30, 2023 and $57.0 million, or 0.43% at September 30, 2022.

•The decrease in nonperforming loans and nonperforming assets for the year over year period was primarily due to the sale of a $7.7 million commercial nonaccrual loan and the payoff and partial charge-off of a $10.2 million commercial nonaccrual loan, both occurring in fourth quarter 2022, as well as $2.2 million in writedowns on other real estate properties for the year-over-year period.

•Net charge-offs (recoveries) were 0.01% annualized in the third quarter 2023 compared to (0.03)% annualized in the linked quarter and 0.04% annualized in the prior year quarter.

Deposits, Borrowings and Liquidity

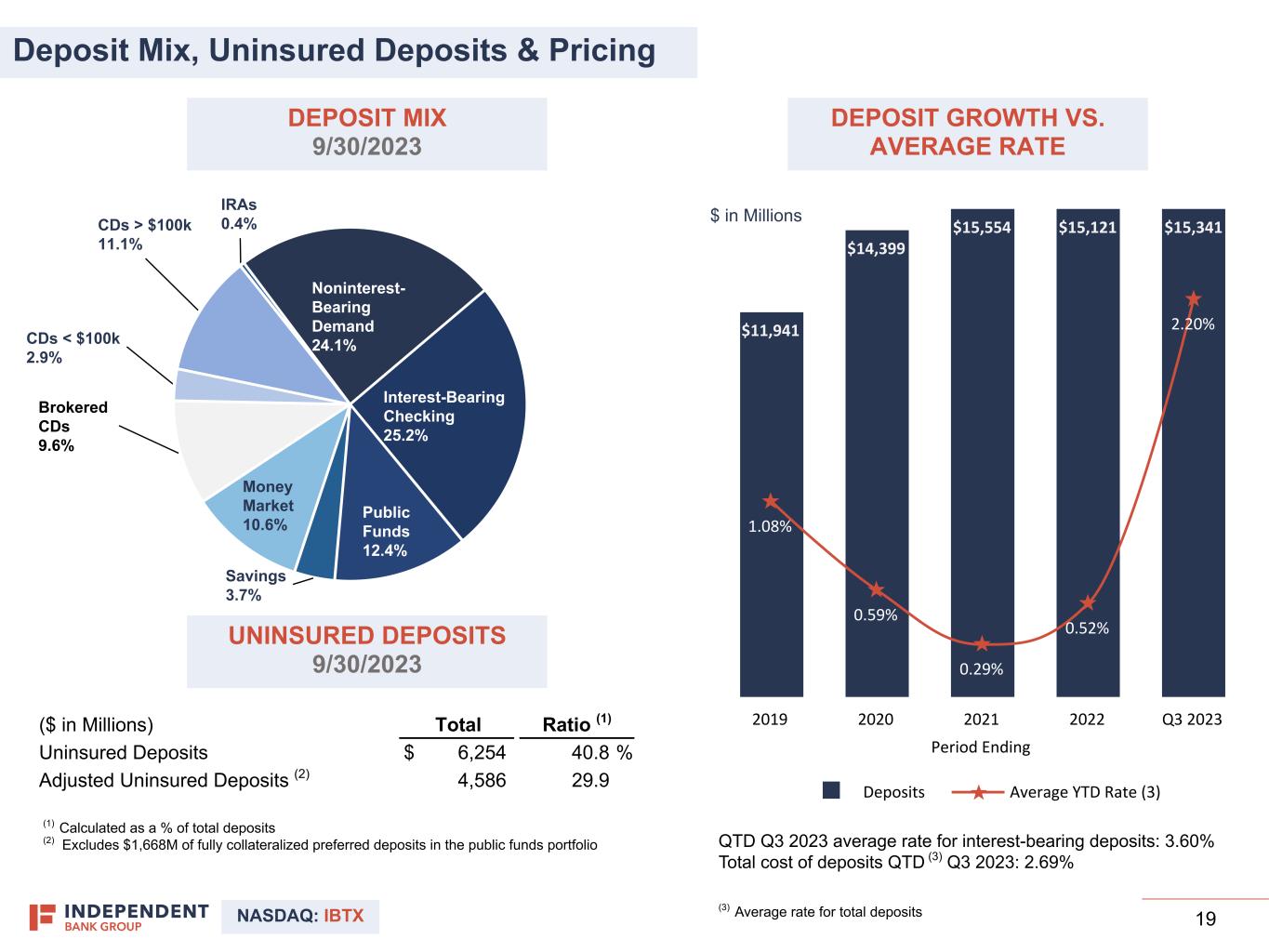

•Total deposits were $15.3 billion at September 30, 2023 compared to $14.9 billion at June 30, 2023 and compared to $15.0 billion at September 30, 2022.

•Estimated uninsured deposits, excluding public funds deposits totaled $4.6 billion, or 29.9% of total deposits as of September 30, 2023 compared to $4.6 billion, or 31.1% as of June 30, 2023.

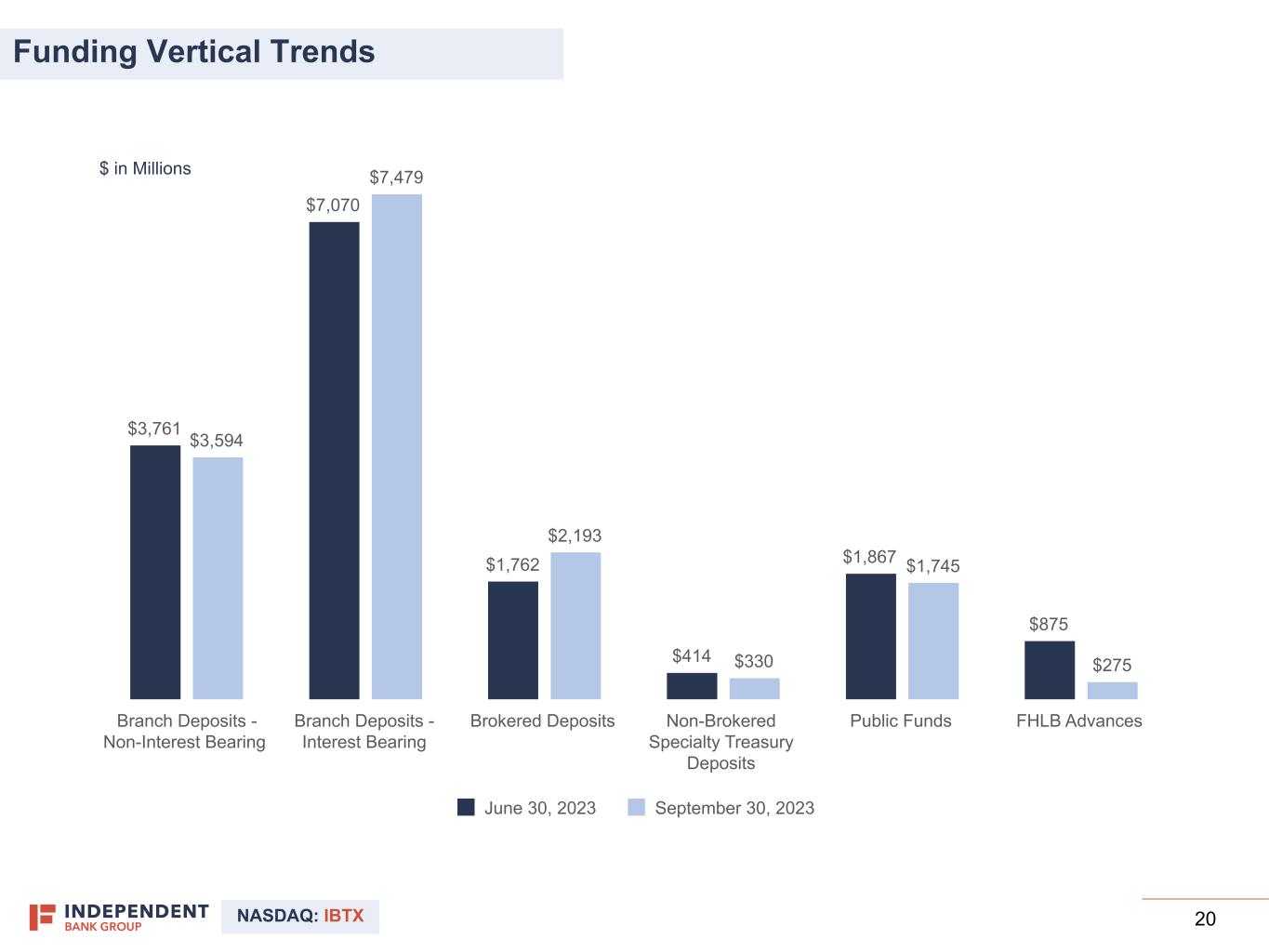

•Total borrowings (other than junior subordinated debentures) were $546.7 million at September 30, 2023, a decrease of $633.6 million from June 30, 2023 and an increase of $79.8 million from September 30, 2022. The year over year change primarily reflects a $75.0 million increase in short-term FHLB advances and $33.8 million outstanding on the Company's unsecured line of credit at quarter-end offset by the redemption of $30.0 million of subordinated debentures in first quarter 2023. The linked quarter change reflects reductions in FHLB advances of $600.0 million as well as a $33.8 million paydown on the Company's line of credit.

Capital

•The Company continues to be well capitalized under regulatory guidelines. At September 30, 2023, the estimated common equity Tier 1 to risk-weighted assets, Tier 1 capital to average assets, Tier 1 capital to risk-weighted assets and total capital to risk-weighted asset ratios were 9.86%, 9.09%, 10.21% and 11.89%, respectively, compared to 9.78%, 8.92%, 10.13%, and 11.95%, respectively, at June 30, 2023 and 10.00%, 9.41%, 10.35%, and 12.27%, respectively at September 30, 2022.

Third Quarter 2023 Operating Results

Net Interest Income

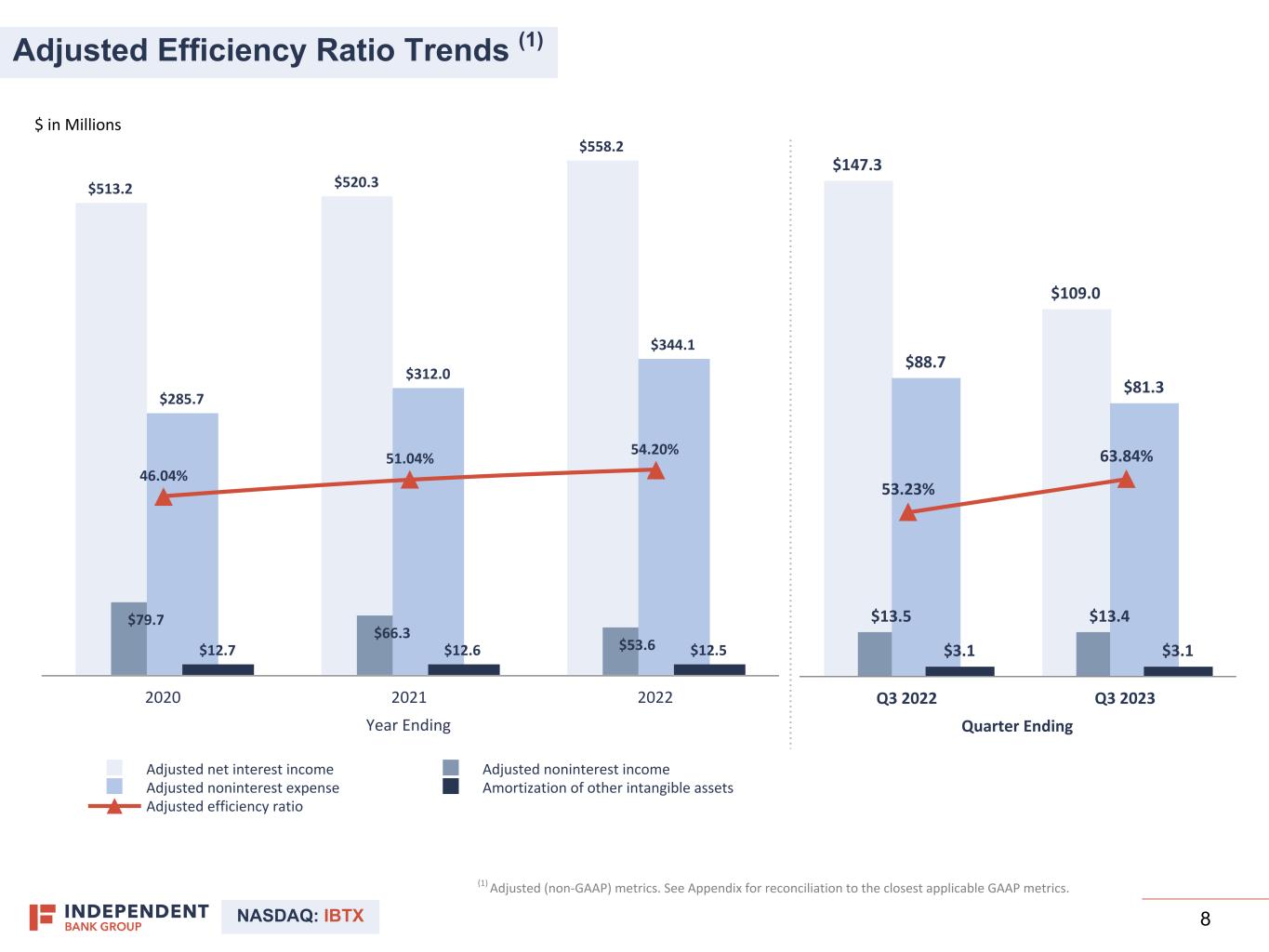

•Net interest income was $109.0 million for third quarter 2023 compared to $147.3 million for third quarter 2022 and $113.6 million for second quarter 2023. The decrease from the prior year was primarily due to the increased funding costs on our deposit products and FHLB advances due to Fed rate increases over the last year offset to a lesser extent by increased earnings on interest earning assets, primarily loans and interest-bearing cash accounts. The prior year decrease also reflects lower acquired loan accretion for the year over year period. The decrease from the linked quarter was primarily due to continued increases in deposit funding costs offset by lower interest expense on FHLB advances due to a $948.7 million reduction in average balances as well as increased earnings on loans due to growth. The third quarter 2023 includes $940 thousand in acquired loan accretion compared to $2.1 million in third quarter 2022 and $870 thousand in second quarter 2023.

•The average balance of total interest-earning assets grew by $616.6 million and totaled $16.7 billion for the quarter ended September 30, 2023 compared to $16.0 billion for the quarter ended September 30, 2022 and decreased $140.5 million from $16.8 billion for the quarter ended June 30, 2023. The increase from the prior year is primarily due to higher average loans of $579.1 million due to organic growth for the year over year period but also due in part to a $258.0 million increase in average interest-bearing cash balances offset by a $192.1 million decrease in average taxable securities balances. The decrease from the linked quarter is primarily due to lower average interest-bearing cash balances offset by an increase in average loan balances.

•The yield on interest-earning assets was 5.31% for third quarter 2023 compared to 4.30% for third quarter 2022 and 5.14% for second quarter 2023. The increase in asset yield compared to the linked quarter and prior year is primarily a result of increases in the Fed Funds rate over the last year. The average loan yield, net of acquired loan accretion and PPP income was 5.67% for the current quarter, compared to 4.62% for prior year quarter and 5.51% for the linked quarter.

•The cost of interest-bearing liabilities, including borrowings, was 3.72% for third quarter 2023 compared to 1.02% for third quarter 2022 and 3.37% for second quarter 2023. The increase from the linked quarter and prior year is reflective of higher funding costs, primarily on deposit products and FHLB advances as a result of Fed Funds rate increases. In addition, deposit funding costs were also higher due to promotional campaigns for certificate of deposit accounts.

•The net interest margin was 2.60% for third quarter 2023 compared to 3.64% for third quarter 2022 and 2.71% for second quarter 2023. The net interest margin excluding acquired loan accretion was 2.58% for third quarter 2023 compared to 3.59% for third quarter 2022 and 2.69% for second quarter 2023. The decrease in net interest margin from the prior year was primarily due to the increased funding costs on deposits and short-term advances resulting from continued Fed rate increases over the year, offset by higher earnings on loans due to organic growth and rate increases and higher earnings on interest-bearing cash balances due to rate increases for the respective periods. The decrease from the linked quarter also reflects the increased funding costs on deposits offset by higher earnings due to loan growth and lower interest expense on FHLB advances.

Noninterest Income

•Total noninterest income increased $169 thousand compared to third quarter 2022 and decreased $449 thousand compared to second quarter 2023.

•The change from the prior year quarter reflects increases of $374 thousand in service charge income and $314 thousand in investment management fees offset by decreases of $405 thousand in mortgage banking revenue and $226 thousand in other noninterest income.

•The change from the linked quarter primarily reflects a decrease of $474 thousand in mortgage banking revenue offset by a $285 thousand increase in other noninterest income. In addition, a $367 thousand gain on the sale of vacant land was recognized in the linked quarter.

Noninterest Expense

•Total noninterest expense decreased $10.4 million compared to third quarter 2022 and $4.4 million compared to second quarter 2023.

•The net decrease in noninterest expense in third quarter 2023 compared to the prior year is due primarily to decreases of $10.5 million in salaries and benefits expense and $2.2 million in professional fees offset by an increase of $1.9 million in FDIC assessment.

•The decrease in noninterest expense in third quarter 2023 compared to the linked quarter is due primarily to decreases of $3.3 million in salaries and benefits expense. In addition, impairment expense of $1.0 million was recorded in second quarter 2023 on an other real estate property.

•The decrease in salaries and benefits from the prior year is due primarily to $5.3 million in lower combined salaries and bonus expenses due to the fourth quarter 2022 reduction-in-force and overall strategic efforts to reduce costs, as well as lower contract labor costs of $1.4 million. Furthermore, third quarter 2022 includes $2.6 million in severance and stock grant amortization related to the separation of an executive officer offset by a $1.0 million economic development incentive grant related to job growth that was recorded in third quarter 2022 as a reduction to salaries expense. Third quarter 2023 was also impacted by lower stock grant amortization of $2.2 million related to performance-based executive compensation. The linked quarter change also reflects $377 thousand lower contract labor costs in addition to the lower stock amortization expense mentioned above.

•The decrease in professional fees compared to the prior year was due primarily to lower legal fees as a result of the settlement of litigation in first quarter 2023 but also due to lower consulting fees compared to the prior year.

•The increase in FDIC assessment compared to prior year was due to increases in the assessment rate charged by the FDIC which took effect in 2023, as well as an increase in the liquidity stress rate.

Provision for Credit Losses

•The Company recorded $340 thousand provision for credit losses for third quarter 2023, compared to $3.1 million provision for third quarter 2022 and $220 thousand provision for the linked quarter. Provision expense during a given period is generally dependent on changes in various factors, including economic conditions, credit quality and past due trends, as well as loan growth and charge-offs or specific credit loss allocations taken during the respective period. The higher provision expense in third quarter 2022 reflects loan growth during that period.

•The allowance for credit losses on loans was $148.2 million, or 1.08% of total loans held for investment, net of mortgage warehouse purchase loans, at September 30, 2023, compared to $146.4 million, or 1.10% at September 30, 2022 and compared to $147.8 million, or 1.08% at June 30, 2023.

•The allowance for credit losses on off-balance sheet exposures was $4.4 million at September 30, 2023 compared to $4.3 million at September 30, 2022 and compared to $4.9 million at June 30, 2023. Changes in the allowance for unfunded commitments are generally driven by the remaining unfunded amount and the expected utilization rate of a given loan segment.

Income Taxes

•Federal income tax expense of $8.2 million was recorded for the third quarter 2023, an effective rate of 20.1% compared to tax expense of $13.5 million and an effective rate of 20.5% for the prior year quarter and income tax expense of $8.7 million and an effective rate of 20.5% for the linked quarter.

Subsequent Events

The Company is required, under generally accepted accounting principles, to evaluate subsequent events through the filing of its consolidated financial statements for the quarter ended September 30, 2023 on Form 10-Q. As a result, the Company will continue to evaluate the impact of any subsequent events on critical accounting assumptions and estimates made as of September 30, 2023 and will adjust amounts preliminarily reported, if necessary.

About Independent Bank Group, Inc.

Independent Bank Group, Inc. is a bank holding company headquartered in McKinney, Texas. Through its wholly owned subsidiary, Independent Bank, doing business as Independent Financial, Independent Bank Group serves customers across Texas and Colorado with a wide range of relationship-driven banking services tailored to meet the needs of businesses, professionals and individuals. Independent Bank Group, Inc. operates in four market regions located in the Dallas/Fort Worth, Austin and Houston areas in Texas and the Colorado Front Range area, including Denver, Colorado Springs and Fort Collins.

Conference Call

A conference call covering Independent Bank Group’s third quarter earnings announcement will be held on Tuesday, October 24, 2023 at 8:30 am (ET) and can be accessed by the webcast link, https://www.webcast-eqs.com/indepbankgroup10242023_en/en or by calling 1-877-407-0989 and by identifying the meeting number 13741490 or by identifying "Independent Bank Group Third Quarter 2023 Earnings Conference Call." The conference materials will also be available by accessing the Investor Relations page of our website, https://ir.ifinancial.com. If you are unable to participate in the live event, a recording of the conference call will be accessible via the Investor Relations page of our website.

Forward-Looking Statements

From time to time the Company’s comments and releases may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties and are made pursuant to the safe harbor provisions of Section 27A of the Securities Act, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and other related federal security laws. Forward-looking statements include information about the Company’s possible or assumed future results of operations, including its future revenues, income, expenses, provision for taxes, effective tax rate, earnings (loss) per share and cash flows, its future capital expenditures and dividends, its future financial condition and changes therein, including changes in the Company’s loan portfolio and allowance for credit losses, the Company’s future capital structure or changes therein, the plan and objectives of management for future operations, the Company’s future or proposed acquisitions, the future or expected effect of acquisitions on the Company’s operations, results of operations and financial condition, the Company’s future economic performance and the statements of the assumptions underlying any such statement. Such statements are typically, but not exclusively, identified by the use in the statements of words or phrases such as “aim,” “anticipate,” “estimate,” “expect,” “goal,” “guidance,” “intend,” “is anticipated,” “is estimated,” “is expected,” “is intended,” “objective,” “plan,” “projected,” “projection,” “will affect,” “will be,” “will continue,” “will decrease,” “will grow,” “will impact,” “will increase,” “will incur,” “will reduce,” “will remain,” “will result,” “would be,” variations of such words or phrases (including where the word “could,” “may” or “would” is used rather than the word “will” in a phrase) and similar words and phrases indicating that the statement addresses some future result, occurrence, plan or objective. The forward-looking statements that the Company makes are based on its current expectations and assumptions regarding its business, the economy, and other future conditions. Because forward-looking statements relate to future results and occurrences, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict. The Company’s actual results may differ materially from those contemplated by the forward looking statements, which are neither statements of historical fact nor guarantees or assurances of future performance. Many possible events or factors could affect the Company’s future financial results and performance and could cause those results or performance to differ materially from those expressed in the forward-looking statements.

These possible events or factors include, but are not limited to: 1) the effects of infectious disease outbreaks, including the ongoing COVID-19 pandemic and the significant impact that the COVID-19 pandemic and associated efforts to limit its spread have had and may continue to have on economic conditions and the Company's business, employees, customers, asset quality and financial performance; 2) the Company’s ability to sustain its current internal growth rate and total growth rate; 3) changes in geopolitical, business and economic events, occurrences and conditions, including changes in rates of inflation or deflation, nationally, regionally and in the Company’s target markets, particularly in Texas and Colorado; 4) worsening business and economic conditions nationally, regionally and in the Company’s target markets, particularly in Texas and Colorado, and the geographic areas in those states in which the Company operates; 5) the Company’s dependence on its management team and its ability to attract, motivate and retain qualified personnel; 6) the concentration of the Company’s business within its geographic areas of operation in Texas and Colorado; 7) changes in asset quality, including increases in default rates on loans and higher levels of nonperforming loans and loan charge-offs generally; 8) concentration of the loan portfolio of Independent Financial, before and after the completion of acquisitions of financial institutions, in commercial and residential real estate loans and changes in the prices, values and sales volumes of commercial and residential real estate; 9) the ability of Independent Financial to make loans with acceptable net interest margins and levels of risk of repayment and to otherwise invest in assets at acceptable yields and that present acceptable investment risks; 10) inaccuracy of the assumptions and estimates that the managements of the Company and the financial institutions that the Company acquires make in establishing reserves for credit losses and other estimates generally; 11) lack of liquidity, including as a result of a reduction in the amount of sources of liquidity the Company currently has; 12) material increases or decreases in the amount of deposits held by Independent Financial or other financial institutions that the Company acquires and the cost of those deposits; 13) the Company’s access to the debt and equity markets and the overall cost of funding its operations; 14) regulatory requirements to maintain minimum capital levels or maintenance of capital at levels sufficient to support the Company’s anticipated growth; 15) changes in market interest rates that affect the pricing of the loans and deposits of each of Independent Financial and the financial institutions that the Company acquires and that affect the net interest income, other future cash flows, or the market value of the assets of each of Independent Financial and the financial institutions that the Company acquires, including investment securities; 16) fluctuations in the market value and liquidity of the securities the Company holds for sale, including as a result of changes in market interest rates; 17) effects of competition from a wide variety of local, regional, national and other providers of financial, investment and insurance services; 18) changes in economic and market conditions, that affect the amount and value of the assets of Independent Financial and of financial institutions that the Company acquires; 19) the institution and outcome of, and costs associated with, litigation and other legal proceedings against one or more of the Company, Independent Financial and financial institutions that the Company acquired or will acquire or to which any of such entities is subject; 20) the occurrence of market conditions adversely affecting the financial industry generally; 21) the impact of recent and future legislative regulatory changes, including changes in banking, securities, and tax laws and regulations and their application by the Company’s regulators, and changes in federal government policies, as well as regulatory requirements applicable to, and resulting from regulatory supervision of, the Company and Independent Financial as a financial institution with total assets greater than $10 billion; 22) changes in accounting policies, practices, principles and guidelines, as may be adopted by the bank regulatory agencies, the Financial Accounting Standards Board, the SEC and the Public Company Accounting Oversight Board, as the case may be; 23) governmental monetary and fiscal policies; 24) changes in the scope and cost of FDIC insurance and other coverage; 25) the effects of war or other conflicts, including, but not limited to, the conflicts between Russia and the Ukraine and Israel and Hamas, acts of terrorism (including cyberattacks) or other catastrophic events, including natural disasters such as storms, droughts, tornadoes, hurricanes and flooding, that may affect general economic conditions; 26) the Company’s actual cost savings resulting from previous or future acquisitions are less than expected, the Company is unable to realize those cost savings as soon as expected, or the Company incurs additional or unexpected costs; 27) the Company’s revenues after previous or future acquisitions are less than expected; 28) the liquidity of, and changes in the amounts and sources of liquidity available to the Company, before and after the acquisition of any financial institutions that the Company acquires; 29) deposit attrition, operating costs, customer loss and business disruption before and after the Company completed acquisitions, including, without limitation, difficulties in maintaining relationships with employees, may be greater than the Company expected; 30) the effects of the combination of the operations of financial institutions that the Company has acquired in the recent past or may acquire in the future with the Company’s operations and the operations of Independent Financial, the effects of the integration of such operations being unsuccessful, and the effects of such integration being more difficult, time consuming, or costly than expected or not yielding the cost savings the Company expects; 31) the impact of investments that the Company or Independent Financial may have made or may make and the changes in the value of those investments; 32) the quality of the assets of financial institutions and companies that the Company has acquired in the recent past or may acquire in the future being different than it determined or determine in its due diligence investigation in connection with the acquisition of such financial institutions and any inadequacy of credit loss reserves relating to, and exposure to unrecoverable losses on, loans acquired; 33) the Company’s ability to continue to identify acquisition targets and successfully acquire desirable financial institutions to sustain its growth, to expand its presence in the Company’s markets and to enter new markets; 34) changes in general business and economic conditions in the markets in which the Company currently operates and may operate in the future; 35) changes occur in business conditions and inflation generally; 36) an increase in the rate of personal or commercial customers’ bankruptcies generally; 37) technology-related changes are harder to make or are more expensive than expected; 38) attacks on the security of, and breaches of, the Company's and Independent Financial's digital infrastructure or information systems, the costs the Company or Independent Financial incur to provide security against such attacks and any costs and liability the Company or Independent Financial incurs in connection with any breach of those systems; 39) the potential impact of climate change and related government regulation on the Company and its customers; 40) the potential impact of technology and “FinTech” entities on the banking industry generally; 41) other economic, competitive, governmental, regulatory, technological and geopolitical factors affecting the Company's operations, pricing and services; and 42) the other factors that are described or referenced in Part I, Item 1A, of the Company’s Annual Report on Form 10-K filed with the SEC on February 21, 2023, the Company’s Quarterly Reports on Form 10-Q, in each case under the caption “Risk Factors”; and The Company urges you to consider all of these risks, uncertainties and other factors carefully in evaluating all such forward-looking statements made by the Company. As a result of these and other matters, including changes in facts, assumptions not being realized or other factors, the actual results relating to the subject matter of any forward-looking statement may differ materially from the anticipated results expressed or implied in that forward-looking statement. Any forward-looking statement made in this filing or made by the Company in any report, filing, document or information incorporated by reference in this filing, speaks only as of the date on which it is made.

The Company undertakes no obligation to update any such forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law. A forward-looking statement may include a statement of the assumptions or bases underlying the forward-looking statement. The Company believes that these assumptions or bases have been chosen in good faith and that they are reasonable. However, the Company cautions you that assumptions as to future occurrences or results almost always vary from actual future occurrences or results, and the differences between assumptions and actual occurrences and results can be material. Therefore, the Company cautions you not to place undue reliance on the forward-looking statements contained in this filing or incorporated by reference herein.

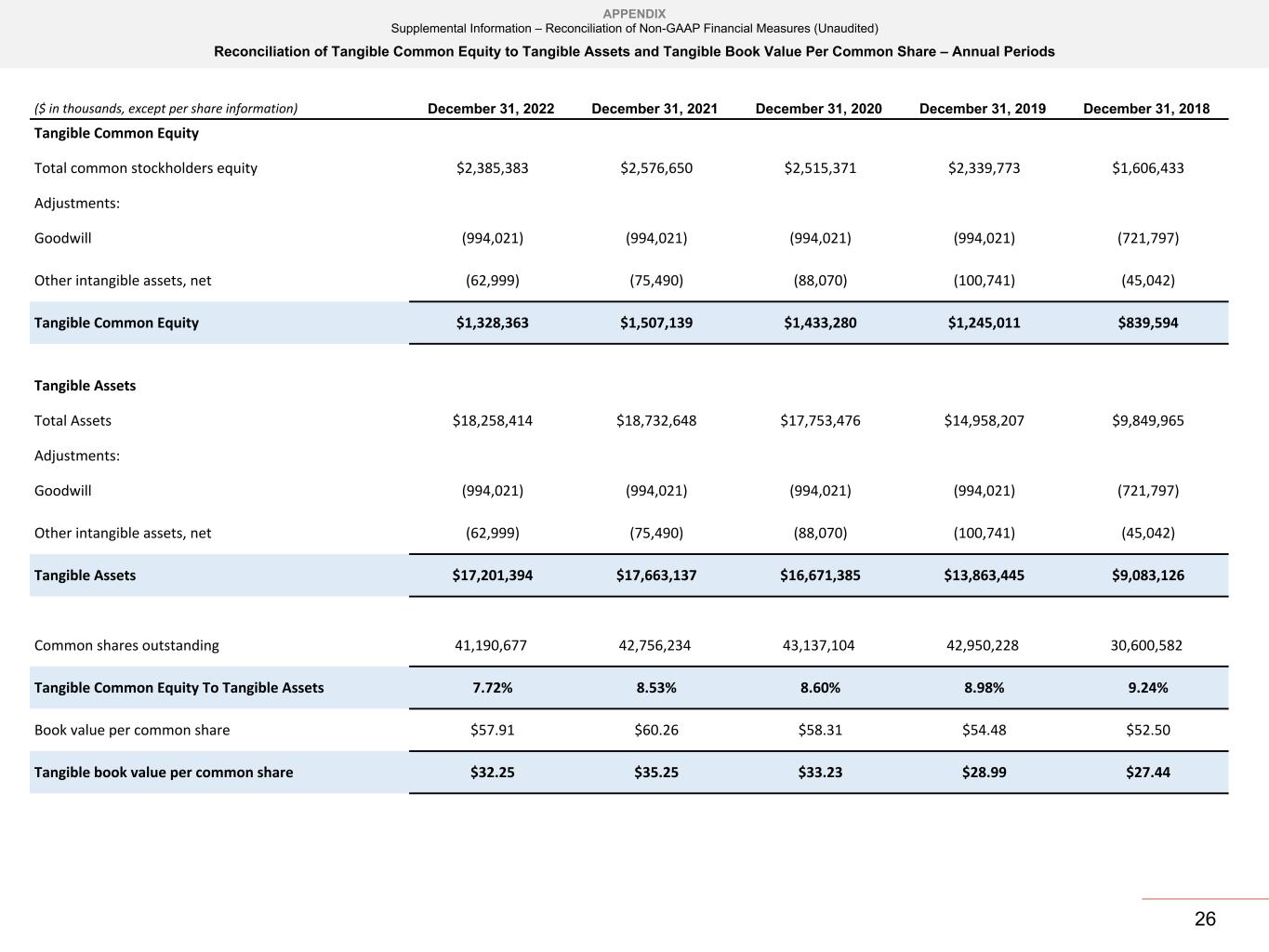

Non-GAAP Financial Measures

In addition to results presented in accordance with GAAP, this press release contains certain non-GAAP financial measures. These measures and ratios include “adjusted net income,” “adjusted earnings,” “tangible book value,” “tangible book value per common share,” “adjusted efficiency ratio,” “tangible common equity to tangible assets,” “adjusted net interest margin,” “return on tangible equity,” “adjusted return on average assets” and “adjusted return on average equity” and are supplemental measures that are not required by, or are not presented in accordance with, accounting principles generally accepted in the United States. We consider the use of select non-GAAP financial measures and ratios to be useful for financial operational decision making and useful in evaluating period-to-period comparisons. We believe that these non-GAAP financial measures provide meaningful supplemental information regarding our performance by excluding certain expenditures or assets that we believe are not indicative of our primary business operating results. We believe that management and investors benefit from referring to these non-GAAP financial measures in assessing our performance and when planning, forecasting, analyzing and comparing past, present and future periods.

We believe that these measures provide useful information to management and investors that is supplementary to our financial condition, results of operations and cash flows computed in accordance with GAAP; however we acknowledge that our financial measures have a number of limitations relative to GAAP financial measures. Certain non-GAAP financial measures exclude items of income, expenditures, expenses, assets, or liabilities, including provisions for credit losses and the effect of goodwill, other intangible assets and income from accretion on acquired loans arising from purchase accounting adjustments, that we believe cause certain aspects of our results of operations or financial condition to be not indicative of our primary operating results. All of these items significantly impact our financial statements. Additionally, the items that we exclude in our adjustments are not necessarily consistent with the items that our peers may exclude from their results of operations and key financial measures and therefore may limit the comparability of similarly named financial measures and ratios. We compensate for these limitations by providing the equivalent GAAP measures whenever we present the non-GAAP financial measures and by including a reconciliation of the impact of the components adjusted for in the non-GAAP financial measure so that both measures and the individual components may be considered when analyzing our performance.

A reconciliation of our non-GAAP financial measures to the comparable GAAP financial measures is included at the end of the financial statements tables.

CONTACTS:

Analysts/Investors:

|

|

|

Paul Langdale

Executive Vice President, Chief Financial Officer

(972) 562-9004

Paul.Langdale@ifinancial.com |

Media:

|

|

|

|

Wendi Costlow

Executive Vice President, Chief Marketing Officer

(972) 562-9004

Wendi.Costlow@ifinancial.com

|

Source: Independent Bank Group, Inc.

Independent Bank Group, Inc. and Subsidiaries

Consolidated Financial Data

Three Months Ended September 30, 2023, June 30, 2023, March 31, 2023, December 31, 2022 and September 30, 2022

(Dollars in thousands, except for share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of and for the Quarter Ended |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2023 |

|

June 30, 2023 |

|

March 31, 2023 |

|

December 31, 2022 |

|

September 30, 2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selected Income Statement Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income |

$ |

222,744 |

|

|

$ |

215,294 |

|

|

$ |

201,176 |

|

|

$ |

189,769 |

|

|

$ |

173,687 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

113,695 |

|

|

101,687 |

|

|

73,254 |

|

|

47,982 |

|

|

26,413 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income |

109,049 |

|

|

113,607 |

|

|

127,922 |

|

|

141,787 |

|

|

147,274 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Provision for credit losses |

340 |

|

|

220 |

|

|

90 |

|

|

2,833 |

|

|

3,100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income after provision for credit losses |

108,709 |

|

|

113,387 |

|

|

127,832 |

|

|

138,954 |

|

|

144,174 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Noninterest income |

13,646 |

|

|

14,095 |

|

|

12,754 |

|

|

11,227 |

|

|

13,477 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Noninterest expense |

81,334 |

|

|

85,705 |

|

|

189,380 |

|

|

98,774 |

|

|

91,733 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax expense (benefit) |

8,246 |

|

|

8,700 |

|

|

(11,284) |

|

|

10,653 |

|

|

13,481 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

32,775 |

|

|

33,077 |

|

|

(37,510) |

|

|

40,754 |

|

|

52,437 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted net income (1) |

32,624 |

|

|

33,726 |

|

|

44,083 |

|

|

49,433 |

|

|

54,880 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Per Share Data (Common Stock) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

$ |

0.79 |

|

|

$ |

0.80 |

|

|

$ |

(0.91) |

|

|

$ |

0.99 |

|

|

$ |

1.27 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

0.79 |

|

|

0.80 |

|

|

(0.91) |

|

|

0.99 |

|

|

1.27 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted earnings: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic (1) |

0.79 |

|

|

0.82 |

|

|

1.07 |

|

|

1.20 |

|

|

1.33 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted (1) |

0.79 |

|

|

0.82 |

|

|

1.07 |

|

|

1.20 |

|

|

1.33 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dividends |

0.38 |

|

|

0.38 |

|

|

0.38 |

|

|

0.38 |

|

|

0.38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Book value |

56.49 |

|

|

57.00 |

|

|

56.95 |

|

|

57.91 |

|

|

57.19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tangible book value (1) |

31.11 |

|

|

31.55 |

|

|

31.42 |

|

|

32.25 |

|

|

31.44 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common shares outstanding |

41,284,003 |

|

|

41,279,460 |

|

|

41,281,904 |

|

|

41,190,677 |

|

|

41,165,006 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average basic shares outstanding (2) |

41,284,964 |

|

|

41,280,312 |

|

|

41,223,376 |

|

|

41,193,716 |

|

|

41,167,258 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average diluted shares outstanding (2) |

41,381,034 |

|

|

41,365,275 |

|

|

41,316,798 |

|

|

41,285,383 |

|

|

41,253,662 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selected Period End Balance Sheet Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

$ |

18,519,872 |

|

|

$ |

18,719,802 |

|

|

$ |

18,798,354 |

|

|

$ |

18,258,414 |

|

|

$ |

17,944,493 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

711,709 |

|

|

902,882 |

|

|

1,048,590 |

|

|

654,322 |

|

|

516,159 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Securities available for sale |

1,545,904 |

|

|

1,637,682 |

|

|

1,675,415 |

|

|

1,691,784 |

|

|

1,730,163 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Securities held to maturity |

205,689 |

|

|

206,146 |

|

|

206,602 |

|

|

207,059 |

|

|

207,516 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans, held for sale |

18,068 |

|

|

18,624 |

|

|

16,576 |

|

|

11,310 |

|

|

21,973 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans, held for investment (3) |

13,781,102 |

|

|

13,628,025 |

|

|

13,606,039 |

|

|

13,597,264 |

|

|

13,285,757 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mortgage warehouse purchase loans |

442,302 |

|

|

491,090 |

|

|

400,547 |

|

|

312,099 |

|

|

409,044 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Allowance for credit losses on loans |

148,249 |

|

|

147,804 |

|

|

146,850 |

|

|

148,787 |

|

|

146,395 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Goodwill and other intangible assets |

1,047,687 |

|

|

1,050,798 |

|

|

1,053,909 |

|

|

1,057,020 |

|

|

1,060,131 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other real estate owned |

22,505 |

|

|

22,505 |

|

|

22,700 |

|

|

23,900 |

|

|

23,900 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Noninterest-bearing deposits |

3,703,784 |

|

|

3,905,492 |

|

|

4,148,360 |

|

|

4,736,830 |

|

|

5,107,001 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing deposits |

11,637,185 |

|

|

10,968,014 |

|

|

9,907,327 |

|

|

10,384,587 |

|

|

9,854,007 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Borrowings (other than junior subordinated debentures) |

546,666 |

|

|

1,180,262 |

|

|

2,137,607 |

|

|

567,066 |

|

|

466,892 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Junior subordinated debentures |

54,568 |

|

|

54,518 |

|

|

54,469 |

|

|

54,419 |

|

|

54,370 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total stockholders' equity |

2,332,098 |

|

|

2,353,042 |

|

|

2,350,857 |

|

|

2,385,383 |

|

|

2,354,340 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Independent Bank Group, Inc. and Subsidiaries

Consolidated Financial Data

Three Months Ended September 30, 2023, June 30, 2023, March 31, 2023, December 31, 2022 and September 30, 2022

(Dollars in thousands, except for share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of and for the Quarter Ended |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2023 |

|

June 30, 2023 |

|

March 31, 2023 |

|

December 31, 2022 |

|

September 30, 2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selected Performance Metrics |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Return on average assets |

0.70 |

% |

|

0.71 |

% |

|

(0.83) |

% |

|

0.90 |

% |

|

1.16 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Return on average equity |

5.51 |

|

|

5.62 |

|

|

(6.39) |

|

|

6.85 |

|

|

8.66 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on tangible equity (4) |

9.92 |

|

|

10.14 |

|

|

(11.48) |

|

|

12.42 |

|

|

15.52 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted return on average assets (1) |

0.70 |

|

|

0.73 |

|

|

0.98 |

|

|

1.09 |

|

|

1.22 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted return on average equity (1) |

5.48 |

|

|

5.73 |

|

|

7.51 |

|

|

8.31 |

|

|

9.07 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted return on tangible equity (1) (4) |

9.87 |

|

|

10.34 |

|

|

13.49 |

|

|

15.07 |

|

|

16.24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest margin |

2.60 |

|

|

2.71 |

|

|

3.17 |

|

|

3.49 |

|

|

3.64 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Efficiency ratio (5) |

63.75 |

|

|

64.68 |

|

|

132.41 |

|

|

62.52 |

|

|

55.13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted efficiency ratio (1) (5) |

63.84 |

|

|

63.93 |

|

|

58.17 |

|

|

55.51 |

|

|

53.23 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Credit Quality Ratios (3) (6) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Nonperforming assets to total assets |

0.33 |

% |

|

0.32 |

% |

|

0.32 |

% |

|

0.35 |

% |

|

0.45 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Nonperforming loans to total loans held for investment |

0.28 |

|

|

0.28 |

|

|

0.27 |

|

|

0.29 |

|

|

0.43 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Nonperforming assets to total loans held for investment and other real estate |

0.44 |

|

|

0.44 |

|

|

0.44 |

|

|

0.47 |

|

|

0.61 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Allowance for credit losses on loans to nonperforming loans |

385.81 |

|

|

389.84 |

|

|

393.69 |

|

|

371.14 |

|

|

256.65 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Allowance for credit losses to total loans held for investment |

1.08 |

|

|

1.08 |

|

|

1.08 |

|

|

1.09 |

|

|

1.10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (recoveries) charge-offs to average loans outstanding (annualized) |

0.01 |

|

|

(0.03) |

|

|

0.04 |

|

|

0.02 |

|

|

0.04 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Capital Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Estimated common equity Tier 1 capital to risk-weighted assets |

9.86 |

% |

|

9.78 |

% |

|

9.70 |

% |

|

10.09 |

% |

|

10.00 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Estimated tier 1 capital to average assets |

9.09 |

|

|

8.92 |

|

|

9.01 |

|

|

9.49 |

|

|

9.41 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Estimated tier 1 capital to risk-weighted assets |

10.21 |

|

|

10.13 |

|

|

10.05 |

|

|

10.45 |

|

|

10.35 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Estimated total capital to risk-weighted assets |

11.89 |

|

|

11.95 |

|

|

11.88 |

|

|

12.35 |

|

|

12.27 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total stockholders' equity to total assets |

12.59 |

|

|

12.57 |

|

|

12.51 |

|

|

13.06 |

|

|

13.12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tangible common equity to tangible assets (1) |

7.35 |

|

|

7.37 |

|

|

7.31 |

|

|

7.72 |

|

|

7.67 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

____________

(1) Non-GAAP financial measure. See reconciliation.

(2) Total number of shares includes participating shares (those with dividend rights).

(3) Loans held for investment excludes mortgage warehouse purchase loans.

(4) Non-GAAP financial measure. Excludes average balance of goodwill and net other intangible assets.

(5) Efficiency ratio excludes amortization of other intangible assets. See reconciliation of Non-GAAP financial measures.

(6) Credit metrics - Nonperforming assets, which consist of nonperforming loans, OREO and other repossessed assets, totaled $61,044, $60,533, $60,115, $64,109 and $81,054, respectively. Nonperforming loans, which consists of nonaccrual loans, loans delinquent 90 days and still accruing interest, and troubled debt restructurings (TDR) totaled $38,425, $37,914, $37,301, $40,089 and $57,040, respectively. With the adoption of ASU 2022-02, effective January 1, 2023, TDR accounting has been eliminated.

Independent Bank Group, Inc. and Subsidiaries

Consolidated Statements of Income

Three and Nine Months Ended September 30, 2023 and 2022

(Dollars in thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| Interest income: |

|

|

|

|

|

|

|

|

| Interest and fees on loans |

|

$ |

202,725 |

|

|

$ |

160,160 |

|

|

$ |

580,631 |

|

|

$ |

427,765 |

|

| Interest on taxable securities |

|

7,674 |

|

|

8,306 |

|

|

23,323 |

|

|

24,908 |

|

| Interest on nontaxable securities |

|

2,558 |

|

|

2,655 |

|

|

7,747 |

|

|

7,729 |

|

| Interest on interest-bearing deposits and other |

|

9,787 |

|

|

2,566 |

|

|

27,513 |

|

|

4,846 |

|

| Total interest income |

|

222,744 |

|

|

173,687 |

|

|

639,214 |

|

|

465,248 |

|

| Interest expense: |

|

|

|

|

|

|

|

|

| Interest on deposits |

|

102,600 |

|

|

21,586 |

|

|

243,005 |

|

|

35,306 |

|

| Interest on FHLB advances |

|

6,054 |

|

|

443 |

|

|

29,903 |

|

|

786 |

|

| Interest on other borrowings |

|

3,808 |

|

|

3,635 |

|

|

12,248 |

|

|

10,986 |

|

| Interest on junior subordinated debentures |

|

1,233 |

|

|

749 |

|

|

3,480 |

|

|

1,749 |

|

| Total interest expense |

|

113,695 |

|

|

26,413 |

|

|

288,636 |

|

|

48,827 |

|

| Net interest income |

|

109,049 |

|

|

147,274 |

|

|

350,578 |

|

|

416,421 |

|

| Provision for credit losses |

|

340 |

|

|

3,100 |

|

|

650 |

|

|

1,657 |

|

| Net interest income after provision for credit losses |

|

108,709 |

|

|

144,174 |

|

|

349,928 |

|

|

414,764 |

|

| Noninterest income: |

|

|

|

|

|

|

|

|

| Service charges on deposit accounts |

|

3,568 |

|

|

3,194 |

|

|

10,436 |

|

|

8,996 |

|

| Investment management fees |

|

2,470 |

|

|

2,156 |

|

|

7,215 |

|

|

6,998 |

|

| Mortgage banking revenue |

|

1,774 |

|

|

2,179 |

|

|

5,646 |

|

|

7,695 |

|

| Mortgage warehouse purchase program fees |

|

555 |

|

|

596 |

|

|

1,414 |

|

|

2,285 |

|

| Loss on sale of loans |

|

(7) |

|

|

— |

|

|

(14) |

|

|

(1,501) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) gain on sale and disposal of premises and equipment |

|

(56) |

|

|

(101) |

|

|

345 |

|

|

(310) |

|

| Increase in cash surrender value of BOLI |

|

1,465 |

|

|

1,350 |

|

|

4,252 |

|

|

3,987 |

|

| Other |

|

3,877 |

|

|

4,103 |

|

|

11,201 |

|

|

12,089 |

|

| Total noninterest income |

|

13,646 |

|

|

13,477 |

|

|

40,495 |

|

|

40,239 |

|

| Noninterest expense: |

|

|

|

|

|

|

|

|

| Salaries and employee benefits |

|

43,618 |

|

|

54,152 |

|

|

136,833 |

|

|

154,837 |

|

| Occupancy |

|

12,408 |

|

|

11,493 |

|

|

35,607 |

|

|

31,526 |

|

| Communications and technology |

|

6,916 |

|

|

6,545 |

|

|

21,202 |

|

|

18,276 |

|

| FDIC assessment |

|

3,653 |

|

|

1,749 |

|

|

10,171 |

|

|

4,831 |

|

| Advertising and public relations |

|

587 |

|

|

424 |

|

|

2,195 |

|

|

1,583 |

|

| Other real estate owned (income) expenses, net |

|

(253) |

|

|

133 |

|

|

(482) |

|

|

199 |

|

| Impairment of other real estate |

|

— |

|

|

— |

|

|

2,200 |

|

|

— |

|

| Amortization of other intangible assets |

|

3,111 |

|

|

3,117 |

|

|

9,333 |

|

|

9,380 |

|

| Litigation settlement |

|

— |

|

|

— |

|

|

102,500 |

|

|

— |

|

| Professional fees |

|

1,262 |

|

|

3,457 |

|

|

6,112 |

|

|

10,990 |

|

|

|

|

|

|

|

|

|

|

| Other |

|

10,032 |

|

|

10,663 |

|

|

30,748 |

|

|

28,493 |

|

| Total noninterest expense |

|

81,334 |

|

|

91,733 |

|

|

356,419 |

|

|

260,115 |

|

| Income before taxes |

|

41,021 |

|

|

65,918 |

|

|

34,004 |

|

|

194,888 |

|

| Income tax expense |

|

8,246 |

|

|

13,481 |

|

|

5,662 |

|

|

39,351 |

|

| Net income |

|

$ |

32,775 |

|

|

$ |

52,437 |

|

|

$ |

28,342 |

|

|

$ |

155,537 |

|

Independent Bank Group, Inc. and Subsidiaries

Consolidated Balance Sheets

As of September 30, 2023 and December 31, 2022

(Dollars in thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

December 31, |

| Assets |

2023 |

|

2022 |

| Cash and due from banks |

$ |

92,921 |

|

|

$ |

134,183 |

|

| Interest-bearing deposits in other banks |

618,788 |

|

|

520,139 |

|

|

|

|

|

| Cash and cash equivalents |

711,709 |

|

|

654,322 |

|

| Certificates of deposit held in other banks |

248 |

|

|

496 |

|

| Securities available for sale, at fair value |

1,545,904 |

|

|

1,691,784 |

|

| Securities held to maturity, net of allowance for credit losses of $0 and $0, respectively |

205,689 |

|

|

207,059 |

|

| Loans held for sale (includes $10,499 and $10,612 carried at fair value, respectively) |

18,068 |

|

|

11,310 |

|

| Loans, net of allowance for credit losses of $148,249 and $148,787, respectively |

14,075,155 |

|

|

13,760,576 |

|

| Premises and equipment, net |

355,533 |

|

|

355,368 |

|

| Other real estate owned |

22,505 |

|

|

23,900 |

|

| Federal Home Loan Bank (FHLB) of Dallas stock and other restricted stock |

25,496 |

|

|

23,436 |

|

| Bank-owned life insurance (BOLI) |

243,980 |

|

|

240,448 |

|

| Deferred tax asset |

106,658 |

|

|

78,669 |

|

| Goodwill |

994,021 |

|

|

994,021 |

|

| Other intangible assets, net |

53,666 |

|

|

62,999 |

|

| Other assets |

161,240 |

|

|

154,026 |

|

| Total assets |

$ |

18,519,872 |

|

|

$ |

18,258,414 |

|

|

|

|

|

| Liabilities and Stockholders’ Equity |

|

|

|

| Deposits: |

|

|

|

| Noninterest-bearing |

$ |

3,703,784 |

|

|

$ |

4,736,830 |

|

| Interest-bearing |

11,637,185 |

|

|

10,384,587 |

|

| Total deposits |

15,340,969 |

|

|

15,121,417 |

|

| FHLB advances |

275,000 |

|

|

300,000 |

|

|

|

|

|

| Other borrowings |

271,666 |

|

|

267,066 |

|

|

|

|

|

| Junior subordinated debentures |

54,568 |

|

|

54,419 |

|

| Other liabilities |

245,571 |

|

|

130,129 |

|

| Total liabilities |

16,187,774 |

|

|

15,873,031 |

|

| Commitments and contingencies |

— |

|

|

— |

|

| Stockholders’ equity: |

|

|

|

| Preferred stock (0 and 0 shares outstanding, respectively) |

— |

|

|

— |

|

| Common stock (41,284,003 and 41,190,677 shares outstanding, respectively) |

413 |

|

|

412 |

|

| Additional paid-in capital |

1,964,764 |

|

|

1,959,193 |

|

| Retained earnings |

617,673 |

|

|

638,354 |

|

|

|

|

|

| Accumulated other comprehensive loss |

(250,752) |

|

|

(212,576) |

|

| Total stockholders’ equity |

2,332,098 |

|

|

2,385,383 |

|

| Total liabilities and stockholders’ equity |

$ |

18,519,872 |

|

|

$ |

18,258,414 |

|

Independent Bank Group, Inc. and Subsidiaries

Consolidated Average Balance Sheet Amounts, Interest Earned and Yield Analysis

Three Months Ended September 30, 2023 and 2022

(Dollars in thousands)

(Unaudited)

The analysis below shows average interest-earning assets and interest-bearing liabilities together with the average yield on the interest-earning assets and the average cost of the interest-bearing liabilities for the periods presented.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

2023 |

|

2022 |

|

|

Average

Outstanding

Balance |

|

Interest |

|

Yield/

Rate (4)

|

|

Average

Outstanding

Balance |

|

Interest |

|

Yield/

Rate (4)

|

| Interest-earning assets: |

|

|

|

|

|

|

|

|