UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): January 20, 2023

Tesla, Inc.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

Delaware |

|

001-34756 |

|

91-2197729 |

|

(State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|||

1 Tesla Road

Austin, Texas 78725

(Address of Principal Executive Offices, and Zip Code)

(512) 516-8177

Registrant’s Telephone Number, Including Area Code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

☐ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

|

Common stock |

TSLA |

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01Entry Into a Material Definitive Agreement.

Revolving Credit Facility

On January 20, 2023, Tesla, Inc. (“Tesla”) entered into a credit agreement (the “RCF Credit Agreement”) with Citibank, N.A., as administrative agent, Deutsche Bank Securities Inc. and the lenders and other agents party thereto. The RCF Credit Agreement provides for a senior unsecured revolving credit facility of up to $5.0 billion (the “Credit Facility”), which Tesla may draw upon from time to time. Tesla may increase the total commitments under the Credit Facility by up to an additional $2.0 billion, subject to certain conditions, potentially increasing the Credit Facility to $7.0 billion. The Credit Facility provides for the issuance of letters of credit. The proceeds of the loans may be used for general corporate purposes or for any other purpose not otherwise prohibited by the RCF Credit Agreement. The Credit Facility terminates, and all outstanding loans, if any, become due and payable on January 20, 2028. Tesla may request up to two one-year extensions of the facility. No loans were outstanding under the Credit Facility as of January 25, 2023.

Outstanding borrowings under the Credit Facility accrue interest at a variable rate equal to:

|

|

• |

for dollar-denominated loans, at the Company’s election, (a) Term SOFR (the forward-looking secured overnight financing rate) plus 0.10%, or (b) an alternate base rate; |

|

|

• |

for loans denominated in pounds sterling, SONIA (the sterling overnight index average reference rate); or |

|

|

• |

for loans denominated in euros, an adjusted EURIBOR rate; |

in each case, plus an applicable margin. The applicable margin will be based on the rating assigned to Tesla’s senior, unsecured long-term indebtedness from time to time.

Tesla accrues a fee based on the daily unused portion of the Credit Facility. Such fee is also based on the rating assigned to Tesla’s senior, unsecured long-term indebtedness from time to time and is payable quarterly.

The Credit Facility contains covenants that are usual for this type of facility. These covenants include, among others, restrictions on liens and the incurrence of debt by Tesla’s subsidiaries, each subject to exceptions and limitations. The Credit Facility also requires that Tesla maintain $1.0 billion of liquidity (as calculated pursuant to the RCF Credit Agreement). The Credit Facility contains customary events of default. Upon the occurrence of an event of default, the lenders may require the immediate payment of all amounts outstanding.

Item 1.02Termination of a Material Definitive Agreement.

Termination of ABL Credit Agreement

As previously reported, Tesla and its subsidiaries Tesla Motors Netherlands B.V. and Tesla Motors Limited (together with Tesla and Tesla Motors Netherlands B.V., the “Borrowers”) are parties to that certain Amended and Restated ABL Credit Agreement, dated as of March 6, 2019 (as further amended from time to time, the “ABL Credit Agreement”), with Deutsche Bank AG New York Branch, as administrative agent and collateral agent, and the lenders and other agents party thereto. The ABL Credit Agreement was set to mature on July 1, 2023. On January 20, 2023, the ABL Credit Agreement was terminated by the parties. The Borrowers did not have any borrowings outstanding under the ABL Credit Agreement and did not incur any early termination penalties in connection with the termination of the ABL Credit Agreement. Some of the lenders under the ABL Credit Agreement, or their affiliates, are lenders under the RCF Credit Agreement.

Item 2.02Results of Operations and Financial Condition.

On January 25, 2023, Tesla released its financial results for the fiscal quarter and year ended December 31, 2022 by posting its Fourth Quarter and Full Year 2022 Update on its website. The full text of the update is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

This information is intended to be furnished under Item 2.02 of Form 8-K, “Results of Operations and Financial Condition” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth be specific reference in such a filing.

Item 2.03Creation of a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth in Item 1.01 above is incorporated herein by reference.

Item 9.01Financial Statements and Exhibits.

|

(d) |

Exhibits. |

|

Exhibit No. |

|

Description |

|

|

|

|

|

99.1 104 |

|

Tesla, Inc. Fourth Quarter and Full Year 2022 Update, dated January 25, 2023. Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

TESLA, INC. |

|

|

|

|

|

By: |

|

/s/ Zachary J. Kirkhorn |

|

|

|

Zachary J. Kirkhorn Chief Financial Officer |

Date: January 25, 2023

Q4 and FY 2022 Update 1 Exhibit 99.1

Highlights 03 Financial Summary 04 Operational Summary 07 Vehicle Capacity 09 Core Technology 10 Other Highlights 11 Outlook 12 Photos & Charts 13 Key Metrics 22 Financial Statements 27 Additional Information 34

S U M M A R Y H I G H L I G H T S (1) Excludes SBC (stock-based compensation). (2) Free cash flow = operating cash flow less capex. (3) Includes cash, cash equivalents and investments. (4) ASP= average selling price.

F I N A N C I A L S U M M A R Y (Unaudited) (1)EPS = earnings per share. Prior period results have been retroactively adjusted to reflect the three-for-one stock split effected in the form of a stock dividend in August 2022. 4

F I N A N C I A L S U M M A R Y (Unaudited) (1)EPS = earnings per share. Prior period results have been retroactively adjusted to reflect the three-for-one stock split effected in the form of a stock dividend in August 2022. 5

F I N A N C I A L S U M M A R Y 6 (1) Impact is calculated on a constant currency basis. Actuals are compared against current results converted into USD using average exchange rates from Q4’21. (2) This pertains to wide release of FSD Beta in the US and Canada during the period. Additionally, we expect to recognize nearly $1 billion of deferred revenue that remains for such customers over time as software updates are delivered.

(1)Days of supply is calculated by dividing new car ending inventory by the relevant quarter’s deliveries and using 75 trading days (aligned with Automotive News definition). O P E R A T I O N A L S U M M A R Y (Unaudited) 7

(1)Days of supply is calculated by dividing new car ending inventory by the relevant year’s deliveries and using 300 trading days (aligned with Automotive News definition). (2)In 2021, we began including mobile service vehicles dedicated to tire repair in our mobile service fleet total. Prior period totals have been adjusted to reflect this change. O P E R A T I O N A L S U M M A R Y (Unaudited) 8

V E H I C L E C A P A C I T Y Installed capacity ≠ current production rate and there may be limitations discovered as production rates approach capacity. Production rates depend on a variety of factors, including equipment uptime, component supply, downtime related to factory upgrades, regulatory considerations and other factors. Market share of Tesla vehicles by region (TTM) Source: Tesla estimates based on ACEA; Autonews.com; CAAM – light-duty vehicles only TTM = Trailing twelve months 9

C O R E T E C H N O L O G Y Cumulative miles driven with FSD Beta (millions) 10 Miles driven per accident (millions) Source: https://www.tesla.com/vehiclesafetyreport

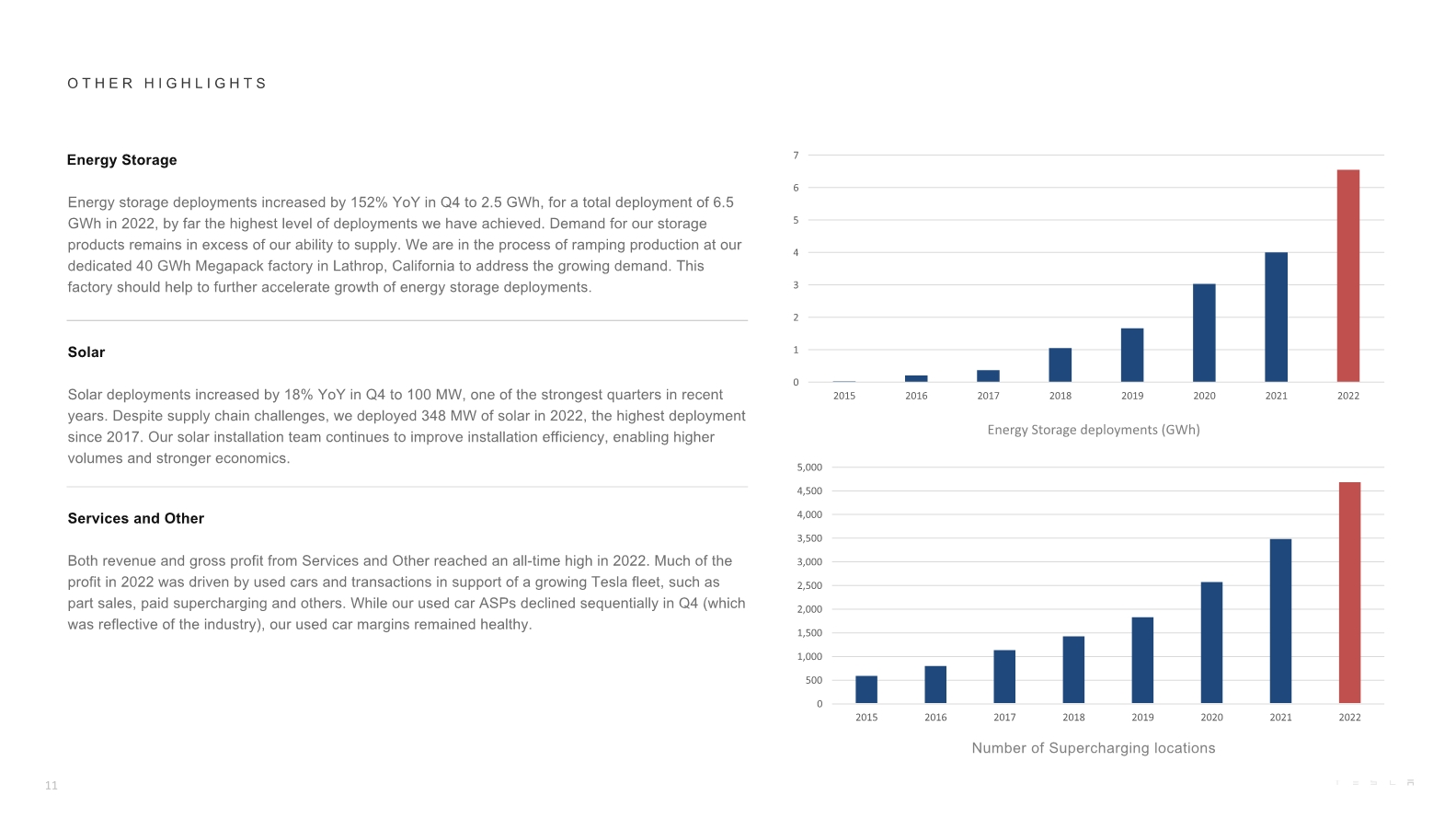

O T H E R H I G H L I G H T S 11 Number of Supercharging locations Energy Storage deployments (GWh)

O U T L O O K 12

P H O T O S & C H A R T S

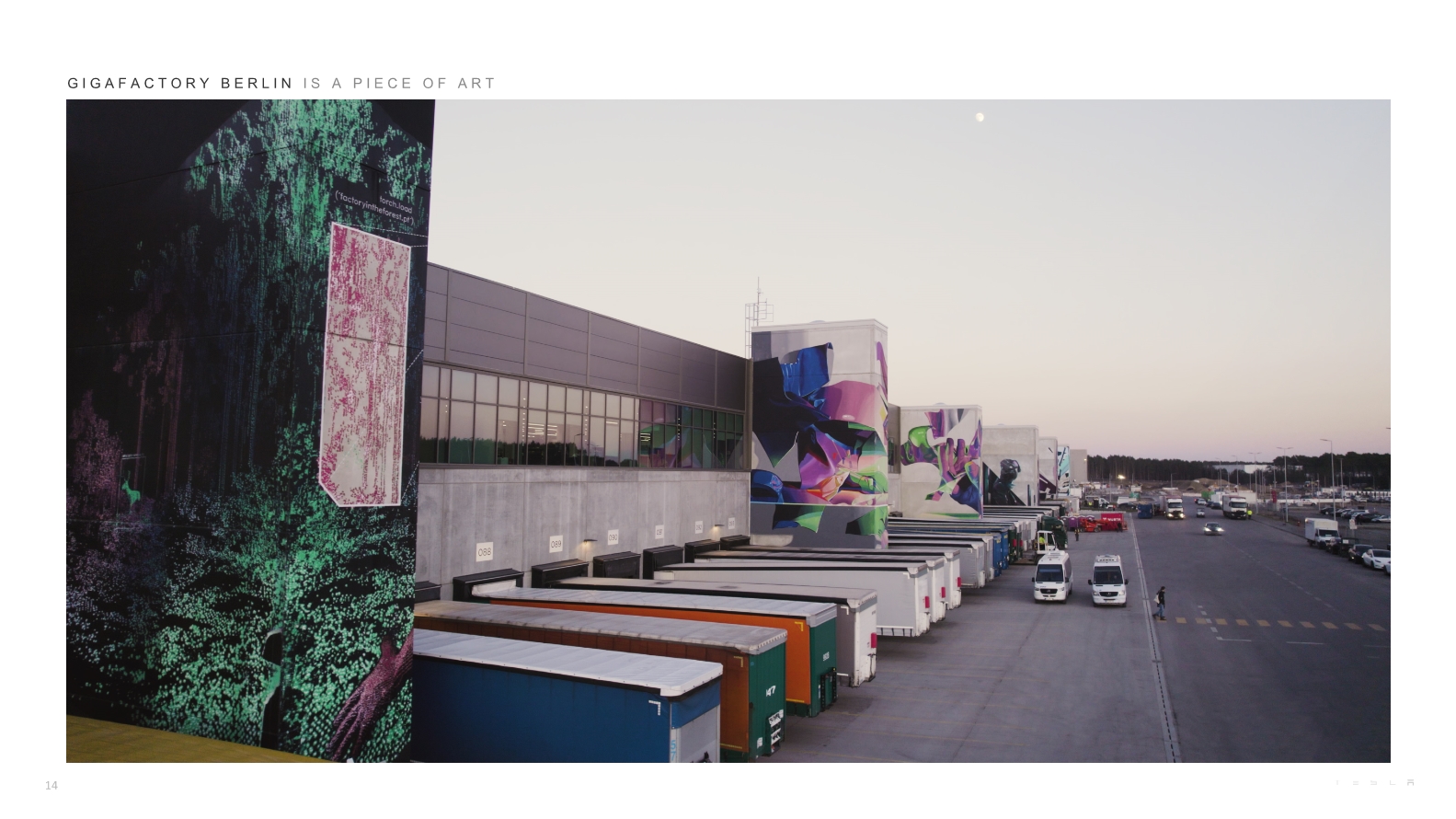

G I G A F A C T O R Y B E R L I N I S A P I E C E O F A R T 14

G I G A F A C T O R Y B E R L I N — M O D E L Y P A I N T S H O P 15

M E G A F A C T O R Y L A T H R O P , C A — M E G A P A C K F I N A L A S S E M B L Y 16

G I G A F A C T O R Y S H A N G H A I — S T A M P I N G P R E S S 17

G I G A F A C T O R Y S H A N G H A I — B O D Y S H O P 18

G I G A F A C T O R Y N E V A D A — E X P A N S I O N P L A N S 19

T E S L A S E M I 20

G I G A F A C T O R Y T E X A S — 4 6 8 0 C E L L P R O D U C T I O N 21

Vehicle Deliveries (millions of units) K E Y M E T R I C S Q U A R T E R L Y (Unaudited) Operating Cash Flow ($B) Free Cash Flow ($B) Net Income ($B) Adjusted EBITDA ($B) 22

Operating Cash Flow ($B) Free Cash Flow ($B) K E Y M E T R I C S T R A I L I N G 1 2 M O N T H S ( T T M ) (Unaudited) Net Income ($B) Adjusted EBITDA ($B) 23 Vehicle Deliveries (millions of units)

K E Y M E T R I C S T R A I L I N G 1 2 M O N T H S ( T T M ) (Unaudited) 24 YoY Revenue Growth Operating Margin Source: OEM financial disclosures, Bloomberg Autos Industry includes: Tesla, BMW, Mercedes-Benz, Ford, GM, Honda, Hyundai, Nissan, Toyota and VW. Stellantis is excluded given limited historical disclosures due to the recent merger between FCA and PSA. Autos Industry operating margin is calculated by dividing the sum of USD equivalent operating profits for the entire industry by the USD equivalent revenues for respective periods.

K E Y M E T R I C S A S P V S . O P E R A T I N G M A R G I N S (Unaudited) 25 Vehicle ASP1 vs. Operating Margin (GAAP) 1 Vehicle ASP is calculated by taking automotive sales (excluding regulatory credits and automotive leasing) and dividing by deliveries (adjusted for operating and sales-type leases) for each respective period.

K E Y M E T R I C S V O L U M E G R O W T H (Unaudited) 26 Vehicle Delivery Growth Rate – Assuming 50% CAGR Since 2020 Note: We expect to achieve 50% average annual growth in vehicle production and deliveries over a multi-year horizon, although not necessarily on a yearly basis.

F I N A N C I A L S T A T E M E N T S

S T A T E M E N T O F O P E R A T I O N S (Unaudited) 28 (1) Prior period results have been retroactively adjusted to reflect the three-for-one stock split effected in the form of a stock dividend in August 2022.

B A L A N C E S H E E T (Unaudited) 29

S T A T E M E N T O F C A S H F L O W S (Unaudited) 30

R e c o n c I l I a t I o n o f G A A P t o N o n – G A A P F I n a n c I a l I n f o r m a t I o n (Unaudited) 31 (1) Prior period results have been retroactively adjusted to reflect the three-for-one stock split effected in the form of a stock dividend in August 2022.

R e c o n c I l I a t I o n o f G A A P t o N o n – G A A P F I n a n c I a l I n f o r m a t I o n (Unaudited) 32 (1) Prior period results have been retroactively adjusted to reflect the three-for-one stock split effected in the form of a stock dividend in August 2022.

R e c o n c I l I a t I o n o f G A A P t o N o n – G A A P F I n a n c I a l I n f o r m a t I o n (Unaudited) TTM = Trailing twelve months 33

A D D I T I O N A L I N F O R M A T I O N WEBCAST INFORMATION Tesla will provide a live webcast of its fourth quarter 2022 financial results conference call beginning at 4:30 p.m. CT on January 25, 2023 at ir.tesla.com. This webcast will also be available for replay for approximately one year thereafter. CERTAIN TERMS When used in this update, certain terms have the following meanings. Our vehicle deliveries include only vehicles that have been transferred to end customers with all paperwork correctly completed. Our energy product deployment volume includes both customer units installed and equipment sales; we report installations at time of commissioning for storage projects or inspection for solar projects, and equipment sales at time of delivery. "Adjusted EBITDA" is equal to (i) net income (loss) attributable to common stockholders before (ii)(a) interest expense, (b) provision for income taxes, (c) depreciation, amortization and impairment and (d) stock-based compensation expense, which is the same measurement for this term pursuant to the performance-based stock option award granted to our CEO in 2018. "Free cash flow" is operating cash flow less capital expenditures. Average cost per vehicle is cost of automotive sales divided by new vehicle deliveries (excluding leases). “Days sales outstanding” is equal to (i) average accounts receivable, net for the period divided by (ii) total revenues and multiplied by (iii) the number of days in the period. “Days payable outstanding” is equal to (i) average accounts payable for the period divided by (ii) total cost of revenues and multiplied by (iii) the number of days in the period. “Days of supply” is calculated by dividing new car ending inventory by the relevant quarter’s deliveries and using 75 trading days. Constant currency impacts are calculated by comparing actuals against current results converted into USD using average exchange rates from the prior period. NON-GAAP FINANCIAL INFORMATION Consolidated financial information has been presented in accordance with GAAP as well as on a non-GAAP basis to supplement our consolidated financial results. Our non-GAAP financial measures include non-GAAP automotive gross margin, non-GAAP net income (loss) attributable to common stockholders, non-GAAP net income (loss) attributable to common stockholders on a diluted per share basis (calculated using weighted average shares for GAAP diluted net income (loss) attributable to common stockholders), Adjusted EBITDA, Adjusted EBITDA margin and free cash flow. These non-GAAP financial measures also facilitate management’s internal comparisons to Tesla’s historical performance as well as comparisons to the operating results of other companies. Management believes that it is useful to supplement its GAAP financial statements with this non-GAAP information because management uses such information internally for its operating, budgeting and financial planning purposes. Management also believes that presentation of the non-GAAP financial measures provides useful information to our investors regarding our financial condition and results of operations, so that investors can see through the eyes of Tesla management regarding important financial metrics that Tesla uses to run the business and allowing investors to better understand Tesla’s performance. Non-GAAP information is not prepared under a comprehensive set of accounting rules and therefore, should only be read in conjunction with financial information reported under U.S. GAAP when understanding Tesla’s operating performance. A reconciliation between GAAP and non-GAAP financial information is provided above. FORWARD-LOOKING STATEMENTS Certain statements in this update, including statements in the “Outlook” section; statements relating to the future development, ramp, production capacity and output rates, supply chain, demand and market growth, cost, pricing and profitability, deliveries, deployment, availability and other features and improvements and timing of existing and future Tesla products and technologies such as Model 3, Model Y, Model X, Model S, Cybertruck, Tesla Semi, our next generation vehicle platform, our Autopilot, Full Self-Driving and other vehicle software and our energy storage and solar products; statements regarding operating margin, operating profits, spending and liquidity; and statements regarding expansion, improvements and/or ramp and related timing at the California Factory, Gigafactory Shanghai, Gigafactory Berlin-Brandenburg, Gigafactory Texas and Megapack factory are “forward-looking statements” that are subject to risks and uncertainties. These forward-looking statements are based on management’s current expectations, and as a result of certain risks and uncertainties, actual results may differ materially from those projected. The following important factors, without limitation, could cause actual results to differ materially from those in the forward-looking statements: uncertainties in future macroeconomic and regulatory conditions arising from the current global pandemic; the risk of delays in launching and manufacturing our products and features cost-effectively; our ability to grow our sales, delivery, installation, servicing and charging capabilities and effectively manage this growth; consumers’ demand for electric vehicles generally and our vehicles specifically; the ability of suppliers to deliver components according to schedules, prices, quality and volumes acceptable to us, and our ability to manage such components effectively; any issues with lithium-ion cells or other components manufactured at Gigafactory Nevada and Gigafactory Shanghai; our ability to ramp Gigafactory Shanghai, Gigafactory Berlin-Brandenburg and Gigafactory Texas in accordance with our plans; our ability to procure supply of battery cells, including through our own manufacturing; risks relating to international expansion; any failures by Tesla products to perform as expected or if product recalls occur; the risk of product liability claims; competition in the automotive and energy product markets; our ability to maintain public credibility and confidence in our long-term business prospects; our ability to manage risks relating to our various product financing programs; the status of government and economic incentives for electric vehicles and energy products; our ability to attract, hire and retain key employees and qualified personnel and ramp our installation teams; our ability to maintain the security of our information and production and product systems; our compliance with various regulations and laws applicable to our operations and products, which may evolve from time to time; risks relating to our indebtedness and financing strategies; and adverse foreign exchange movements. More information on potential factors that could affect our financial results is included from time to time in our Securities and Exchange Commission filings and reports, including the risks identified under the section captioned “Risk Factors” in our quarterly report on Form 10-Q filed with the SEC on October 24, 2022. Tesla disclaims any obligation to update information contained in these forward-looking statements whether as a result of new information, future events or otherwise. 34