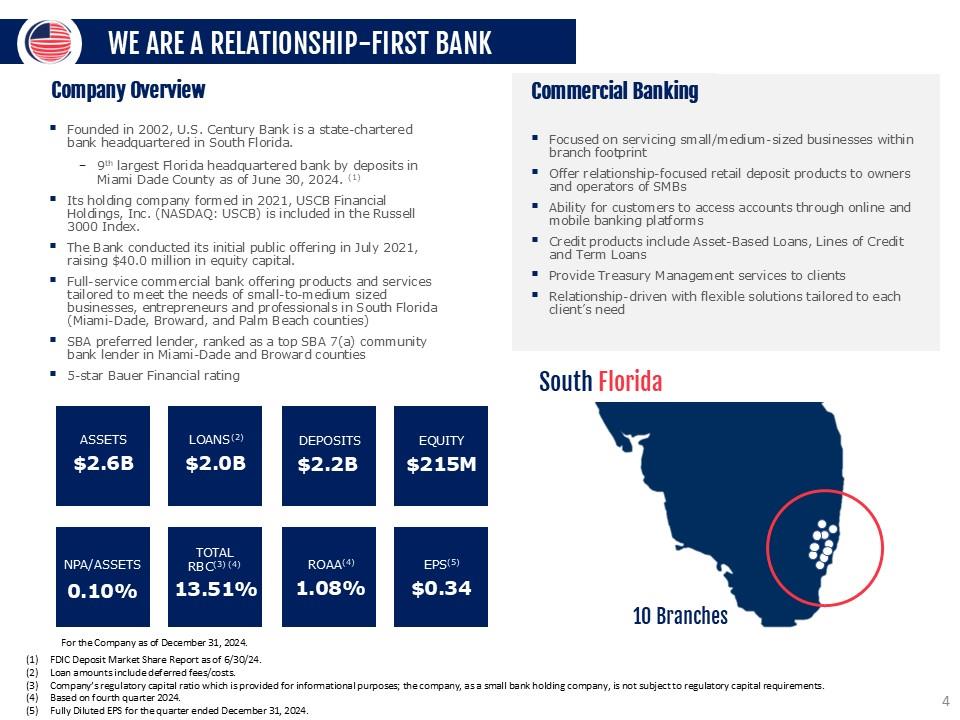

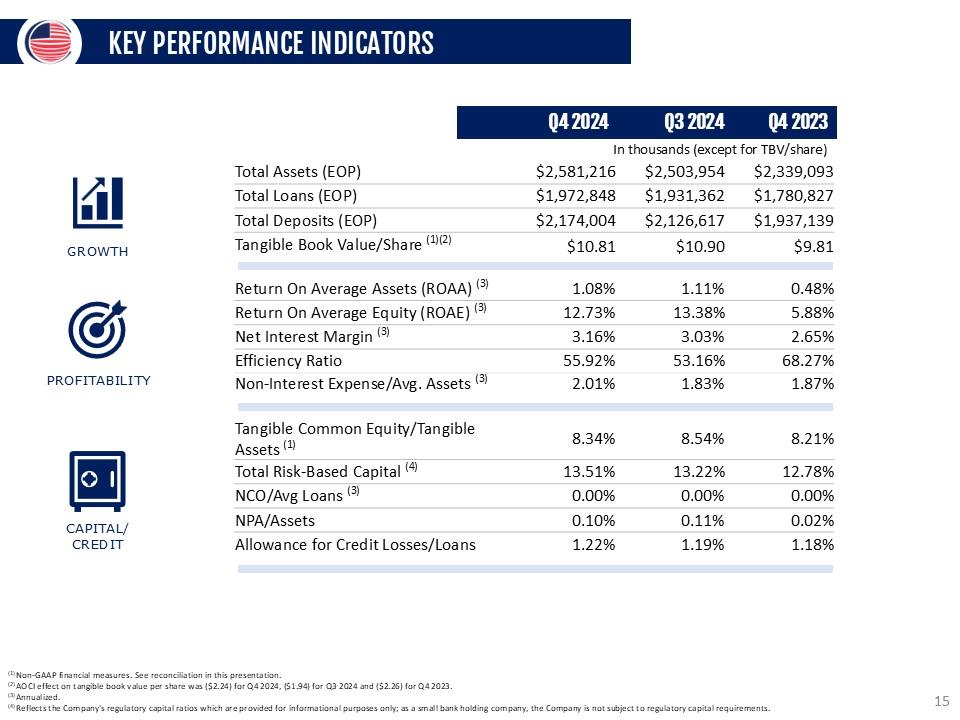

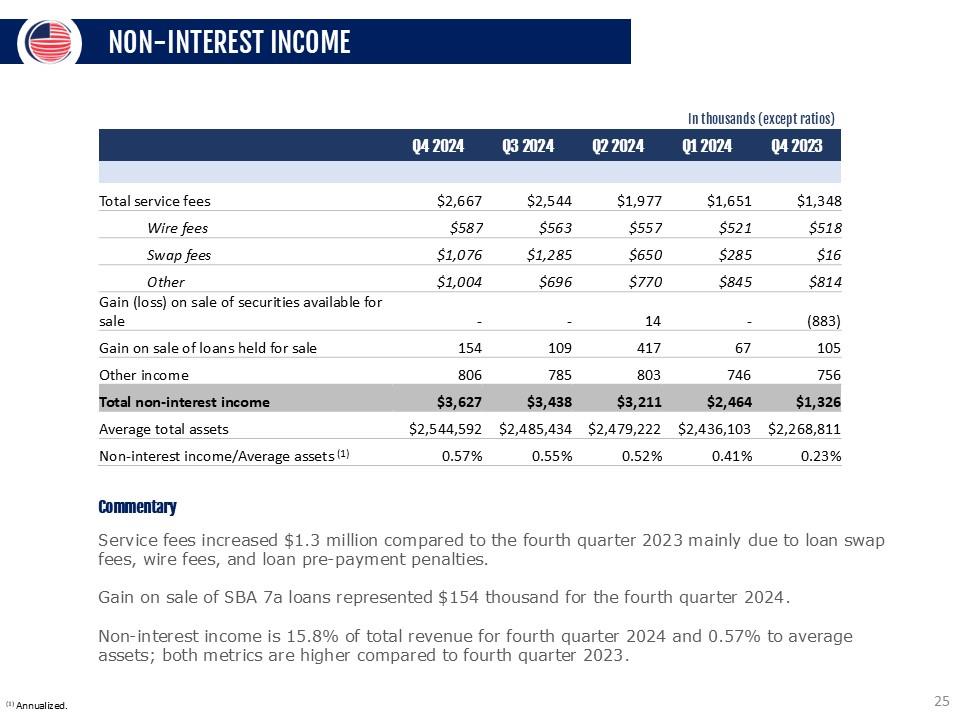

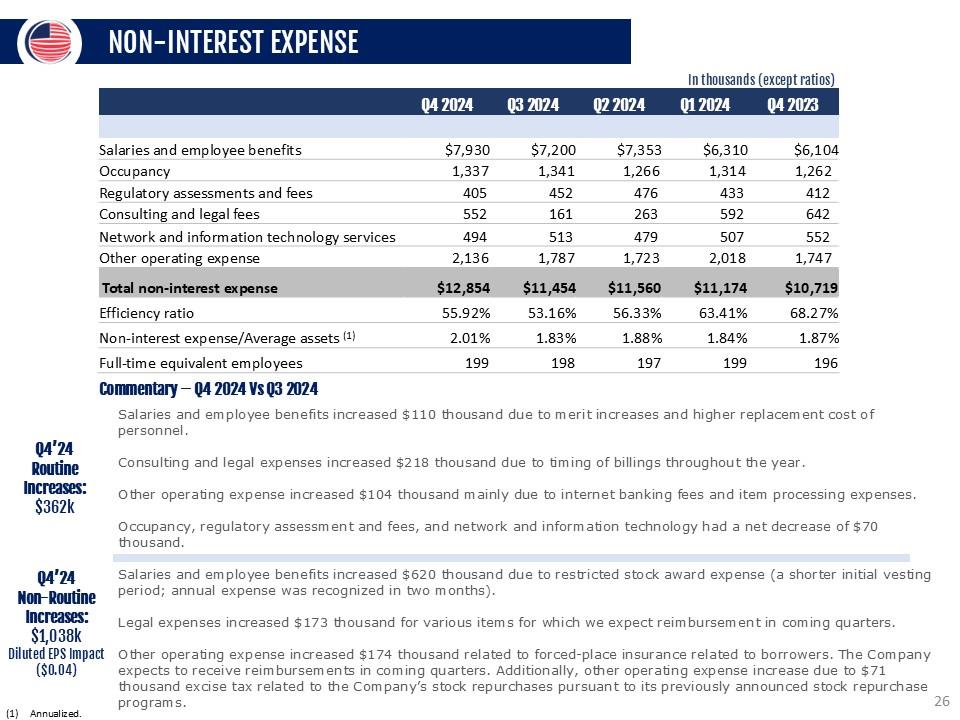

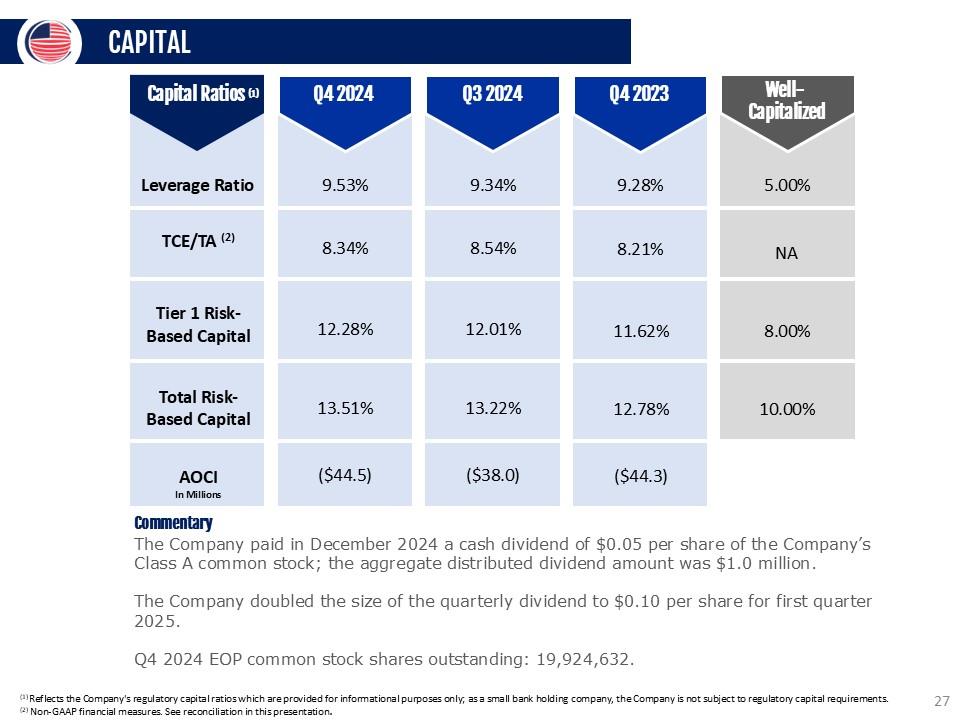

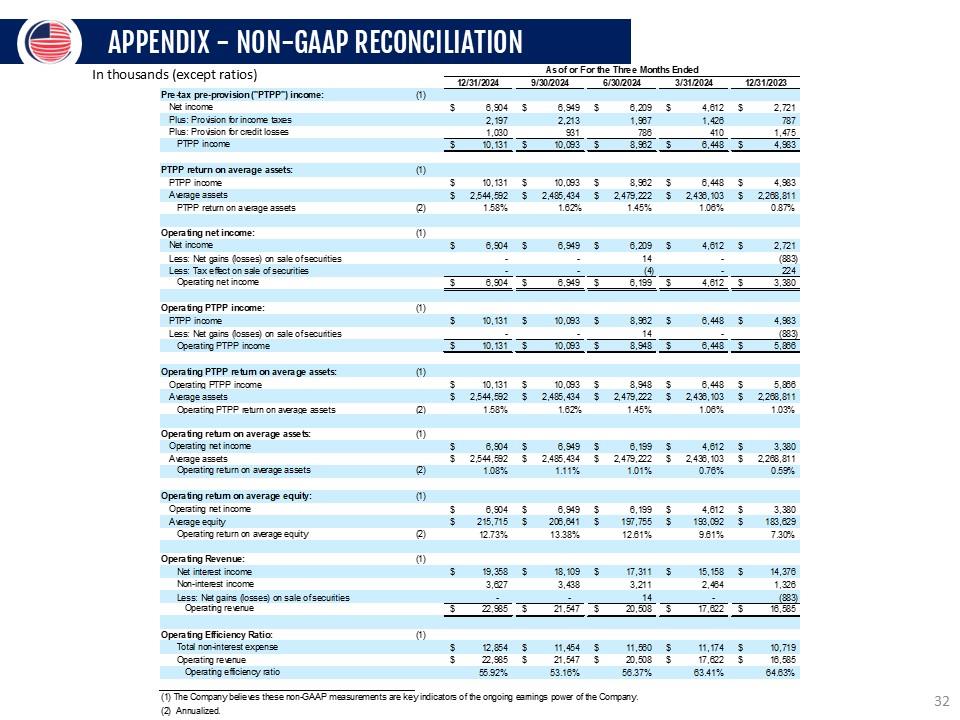

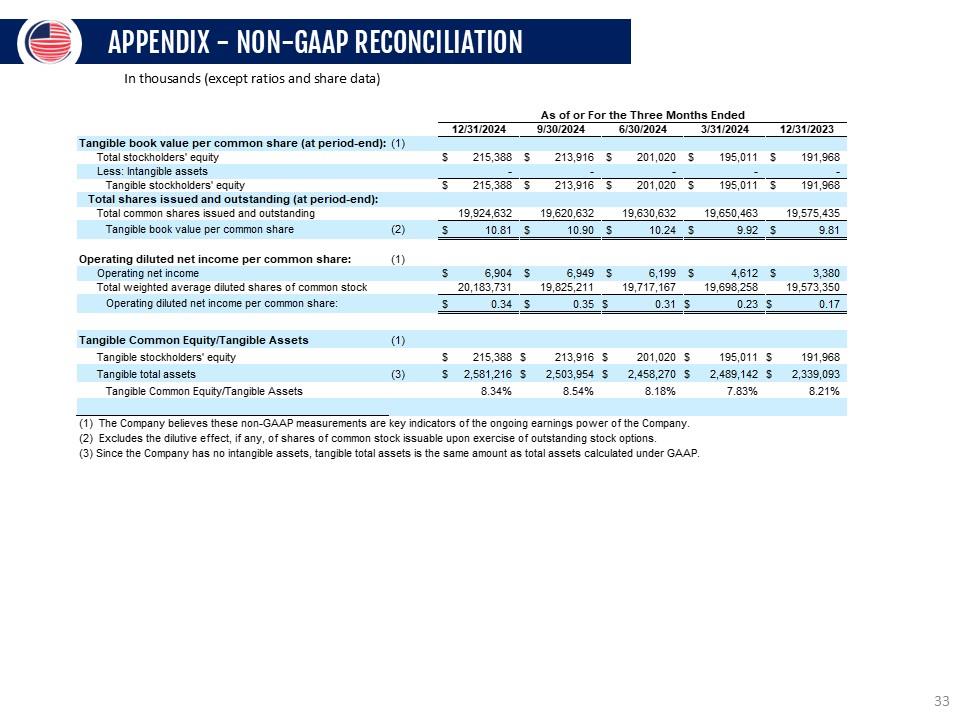

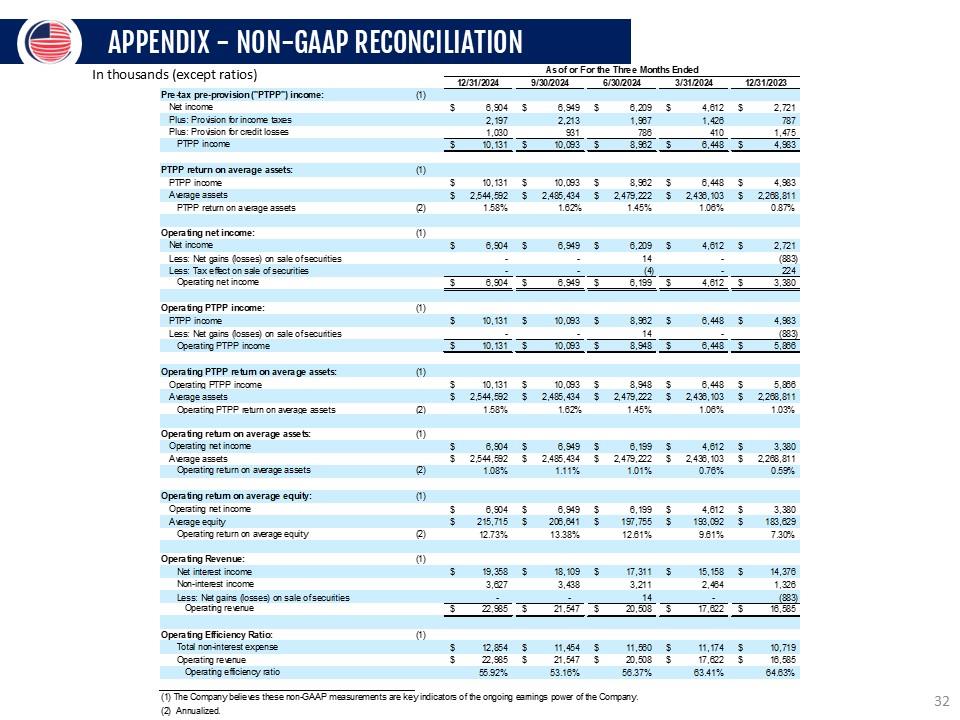

2,464 1,326 Less: Net gains (losses) on sale of securties Operating revenue c 22 08= c 21 E47 c 14 20 Eng c 17623 c (883) 16 coc — Operating Efficiency Ratio: (1) Total non-interest expense s 12,854 s 11,454 s 11,560 s 11,174 s 10,719 Operating revenue Operating efficiency ratio s 22,985 55.92% s 21,547 53.16% s 20,508 56.37% s 17,622 63.41% s 16,585 64.63% (1)The Company believes these non-GAAP measurements are key indicators of the ongoing eamings power of the Company. (2) Annualized. 31 APPENDIX - NON-GAAP RECONCILIATION In thousands (except ratios) As of or For the Three Mon ths Ended 12/31/2024 9/30/2024 6/30/2024 3/31/2024 12/31/2023 Pre-tax pre-provision ("PTPP") income: Net income Plus: Provision income taxes Plus: Provision br credit losses PTPP income PTPP return on average assets PTPP income Average assets PIPP return on average assets Operating net income: Net income Less: Net gains (losses) on sale of securities Less: Tax effect on sale of securities Operating net income Operating PTPP income: PTPP income Less: Net gains (losses) on sale of securities Operating PTPP income Operating PTPP return on average assets Operating PTPP income Average assets Operating PTPP return on average assets Operating return on average assets Operating net income Average assets Operating return on average assets > 6,904 3 6,949 > 6,209 3 4,612 3 2,‘21 2,197 2,213 1,967 1,426 787 1,030 931 786 410 1,475 LS_ 10,131 $ 10,093 $ 8,962 $ 6,448 $ 4,983 s 10,131 s 10,093 s 8,962 s 6,448 s 4,983 s 2,544,592 s 2,485,434 s 2,479,222 s 2,436,103 s 2,268,811 1.58% 1.62% 1.45% 1.06% 0.87% s 6,904 s 6,949 s 6,209 s 4,612 s 2,721 - - 14 - (883) - - (4) - 224 s 6,904 S 6,949 S 6,199 S 4,612 S 3,380 S 10,131 S 10,093 S 8,962 S 6,448 S 4,983 c 10131 c 10 003 c 14 8 048 c s 448 c (883) c 2cc • • • • s s 10,131 PcA con s c 10,093 2 JOc 494 s s 8,948 2 170 299 s s 6,448 2,436,103 1.06% s s 5,866 2,268,811 1.03% —, —44,04 1.58% • —, —0U,04 1.62% ,--4 1.45% S 6,904 S 6,949 S 6,199 S 4,612 S 3,380 s 2,544,592 s 2,485,434 S 2,479,222 s 2,436,103 S 2,268,811 1.08% 1.11% 1.01% 0.76% 0.59% 32 APPENDIX - NON-GAAP RECONCILIATION In thousands (except ratios and share data) As of or For the Three Months Ended 12/31/2024 9/30/2024 6/30/2024 3/31/2024 12/31/2023 Tangible book value per common share (at period-end): (1) Total stockholders’ equity $ 215,388 $ 213,916 $ 201,020 $ 195,011 $ 191,968 Less: Intangible assets - - - - - Tangible stockholders’ equity $ 215,388 $ 213,916 $ 201 .020 $ 195,011 $ 191,968 Total shares issued and outstanding (at period-end): Total common shares issued and outstanding 19,924,632 19,620,632 19,630,632 19,650,463 19,575,435 Tangible book value per common share (2) S 10.81 $ 10.90 $ 10.24 $ 9.92 $ 9.81 Operating diluted net incom e per com mons hare: (1) Operating net income $ 6,904 $ 6,949 $ 6,199 $ 4,612 $ 3,380 Total weighted average diluted shares of common stock 20,183,731 19,825,211 19,717,167 19,698,258 19,573,350 Operating diluted net income per common share: $ 0.34 $ 0.35 $ 0.31 $ 0.23 $ 0.17 Tangible Com m on Equity/Tangible Assets (1) Tangible stockholders’ equity $ 215,388 $ 213,916 $ 201,020 $ 195,011 $ 191,968 Tangible total assets (3) $ 2,581,216 $ 2,503,954 $ 2,458,270 $ 2,489,142 $ 2,339,093 Tangible Common Equity/Tangible Assets 8.34% 8.54% 8.18% 7.83% 8.21% 1.