UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________________

FORM 10-K

______________________

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023

or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 1-32731

______________________

CHIPOTLE MEXICAN GRILL, INC.

(Exact name of registrant as specified in its charter)

______________________

|

|

Delaware |

84-1219301 |

|

(State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

|

|

610 Newport Center Drive, Suite 1100 Newport Beach, CA |

92660 |

(Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (949) 524-4000

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common stock, par value $0.01 per share |

CMG |

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

______________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes No .

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act (check one):

|

|

|

|

|

Large accelerated filer |

Accelerated filer |

Non-accelerated filer |

Smaller reporting company |

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes No

As of June 30, 2023, the aggregate market value of the registrant’s outstanding common equity held by non-affiliates was $46.885 billion, based on the closing price of the registrant’s common stock on June 30, 2023, the last trading day of the registrant’s most recently completed second fiscal quarter. For purposes of this calculation, shares of common stock held by each executive officer and director and by holders of 5% or more of the outstanding common stock have been excluded since those persons may under certain circumstances be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of February 2, 2024, there were 27,421,169 shares of the registrant’s common stock, par value of $0.01 per share outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates certain information by reference from the registrant’s definitive proxy statement for the 2024 annual meeting of shareholders, which will be filed no later than 120 days after the close of the registrant’s fiscal year ended December 31, 2023.

TABLE OF CONTENTS

PART I

Cautionary Note Regarding Forward-Looking Statements

This report includes “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, including projected cash from operations, expected capital expenditures for 2024 and all other statements that are not historical facts. We use words such as “may,” “will,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “think,” “estimate,” “seek,” “expect,” “predict,” “could,” “project,” “potential”, “goal” and other similar terms and phrases, including references to assumptions, to identify forward-looking statements. These forward-looking statements are based on currently available operating, financial and competitive information and are subject to various risks and uncertainties. Our actual future results and trends may differ materially depending on a variety of factors, including, but not limited to, the risks and uncertainties described in this report under the heading “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” so you should not place undue reliance on forward-looking statements. These statements are subject to risks and uncertainties that could cause actual results to differ materially from those described in the statements, including: increasing wage inflation and the competitive labor market, including as a result of regulations such as California AB 1228, which impacts our ability to attract and retain qualified employees and has resulted in occasional staffing shortages; increases in ingredient and other operating costs and the inability of our third-party suppliers and business partners to fulfill their responsibilities and commitments due to inflation, global conflicts, climate change, our Food with Integrity philosophy, tariffs or trade restrictions and supply shortages; increasing supply costs (including beef, tortillas, queso, salsa, beans and rice); risks of food safety incidents and food-borne illnesses; risks associated with our reliance on certain information technology systems operated by us or by third parties and potential failures, outages or interruptions; privacy and cybersecurity risks, including risk of breaches, unauthorized access, theft, modification, destruction or ransom of guest or employee personal or confidential information stored on our network or the network of third-party providers; the impact of competition, including from sources outside the restaurant industry; the competitive labor market and changes in the availability and cost of labor and the impact of any union organizing efforts and our responses to such efforts; the financial impact of increasing our average hourly wage; the impact of federal, state or local government regulations relating to our employees, employment practices, restaurant design and construction, and the sale of food or alcoholic beverages; our ability to achieve our planned growth, such as the costs and availability of suitable new restaurant sites and the equipment needed to fully outfit new restaurants, construction materials and contractors and the expected costs to accelerate our international expansion through franchise restaurants in the Middle East; the uncertainty of our ability to achieve expected levels of comparable restaurant sales due to factors such as changes in guests' perceptions of our brand, including as a result of actual or rumored food safety concerns or other negative publicity, decreased overall consumer spending, including as a result of high inflation, mass layoffs, fears of possible recession and higher energy costs, or the inability to increase menu prices or realize the benefits of menu price increases; risks associated with our digital business, including risks arising from our reliance on third party delivery services; and risks relating to litigation, including possible governmental actions and potential class action litigation related to food safety incidents, cybersecurity incidents, employment or privacy laws, advertising claims or other matters. We are including this Cautionary Note to make applicable and take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 for forward-looking statements. We expressly disclaim any obligation to update or revise any forward-looking statements after the date of this report as a result of new information, future events or other developments, except as required by applicable laws and regulations.

ITEM 1. BUSINESS

General

Chipotle Mexican Grill, Inc., a Delaware corporation, together with its subsidiaries (“Chipotle,” “we,” “us,” or “our”) owns and operates Chipotle Mexican Grill restaurants, which feature a relevant menu of burritos, burrito bowls (a burrito without the tortilla), quesadillas, tacos, and salads. We strive to cultivate a better world by serving responsibly sourced, classically cooked, real food with wholesome ingredients and without artificial colors, flavors or preservatives. We are passionate about providing a great guest experience and making our food more accessible to everyone while continuing to be a brand with a demonstrated purpose. Our first Chipotle restaurant opened in Denver, Colorado in 1993. Over 30 years later, our devotion to seeking out high-quality ingredients, raised with respect for animals, farmers, and the environment, remains at the core of our commitment to Food with Integrity.

As of December 31, 2023, we owned and operated 3,371 Chipotle restaurants throughout the United States (“U.S.”) and 66 international Chipotle restaurants. We manage our operations based on eight regions and aggregate our operations to one reportable segment. Our revenue is derived from sales by our restaurants.

Business Strategy

We are a brand with a demonstrated purpose of Cultivating a Better World. Our mission is to win today while we grow our future by focusing on five key fundamental strategies:

Sustaining world class people leadership by developing and retaining diverse talent at every level;

Running successful restaurants with a people accountable culture that provides great Food with Integrity while delivering exceptional in-restaurant and digital experiences;

Making the brand visible, relevant, and loved to improve overall guest engagement;

Amplifying technology and innovation to drive growth and productivity at our restaurants, support centers and in our supply chain; and

Expanding access and convenience by accelerating new restaurant openings in North America and internationally.

Food with Integrity

Serving high-quality food while still charging reasonable prices is critical to ensuring guests enjoy wholesome food at a great value. In our Chipotle restaurants, we strive to serve only meats that are raised in accordance with criteria we have established in an effort to improve sustainability and promote animal welfare, and without the use of non-therapeutic antibiotics or added growth hormones. We brand these meats as “Responsibly Raised®.” We also seek to use responsibly grown produce, by which we mean produce grown by suppliers whose practices conform to our Food with Integrity standards and our priorities with respect to environmental considerations and employee welfare. For more information about our sustainability and animal welfare initiatives, see our biennial Sustainability Report and interim Update Report on our website www.chipotle.com/sustainability.

Purchasing

Maintaining the high levels of quality and safety we demand in our restaurants depends in part on our ability to acquire high-quality, fresh ingredients and other necessary supplies that meet our specifications from reliable suppliers. Our 26 independently owned and operated regional distribution centers purchase from various suppliers we carefully select based on quality, price, availability, and the suppliers’ understanding of and adherence to our mission and Food with Integrity standards. We have also sought to increase, where practical, the number of suppliers for our ingredients to help mitigate pricing volatility and reduce our reliance on one or several suppliers, which could create supply shortages. In addition, we closely monitor industry news, trade tariffs, weather, exchange rates, foreign demand, crises and other world events that may affect our ingredient prices or available supply. Certain key ingredients (beef, tomatoes, tortillas and adobo) are purchased from a small number of suppliers.

Quality Assurance and Food Safety

We are committed to serving only safe, high-quality food. Our food safety and quality assurance teams work to ensure compliance with our food safety programs and practices, components of which include:

natural inhibitors (to prevent microbial growth in ingredients);

advanced technologies (tools that reduce or eliminate pathogens while maintaining food quality);

enhanced restaurant procedures (protocols for handling ingredients and sanitizing surfaces in our restaurants);

food safety certifications;

internal and third-party restaurant inspections;

small grower support during on-site audits;

supplier interventions (steps to mitigate food safety risks before ingredients reach Chipotle); and

ingredient traceability.

These and other food safety practices underscore our commitment to be a leader in food safety while continuing to serve high-quality food that our guests love. Our food safety and quality assurance teams establish and monitor our quality and food safety programs and work closely with suppliers to ensure our high standards are met throughout the supply chain. We maintain a limited list of approved suppliers, many of whom are among the top suppliers in the industry. In addition, we have a team approach where our training, operations, culinary, legal and restaurant food safety and quality assurance departments develop and implement operating standards for food quality, food preparation, restaurant cleanliness, employee health protocols, and safety in the restaurants. Our food safety programs are also intended to ensure that we not only continue to comply with applicable national, federal, state and local food safety regulations, but also establish Chipotle as an industry leader in food safety. To help achieve this goal, we have a Food Safety Advisory Council comprised of some of the nation’s foremost food safety authorities. The Food Safety Advisory Council is charged with evaluating our programs and advising us on ways to elevate our already high standards for food safety. Our food safety and quality assurance team members hold board seats and participate in technical working groups with several associations. This gives us the opportunity to learn and share our knowledge and expertise with other food safety professionals and regulatory agencies.

Digital Business

Our digital platform continues to be a strategic driver of our growth. In recent years, we have significantly upgraded our capabilities by digitizing our restaurant kitchens, expanding our partnerships with third-party delivery services and building more Chipotlanes, which is our drive through format for customer pick-up of digital orders. Digital sales represent food and beverage revenue generated through the Chipotle website, Chipotle app or third-party delivery aggregators and include revenue deferrals associated with Chipotle Rewards. Digital sales represented 37.4% of food and beverage revenue in 2023, compared to 39.4% of food and beverage revenue in 2022. We have made digital ordering convenient with enhancements to the Chipotle app and website, such as customization, contactless delivery, and group ordering and we have improved the overall guest experience within the app with the inclusion of order readiness messaging, wrong location detection and reminders to scan for points.

Human Capital

At Chipotle, our vision is to cultivate an environment where our employees can thrive, pursue their passion and become lifelong leaders. We believe in investing and supporting our people because they are our most important asset and give us a competitive advantage in our business. As of December 31, 2023, Chipotle employed 116,068 people worldwide and 1,088 contract workers. Of our employees, 114,042 worked in the United States, and 2,026 worked internationally across Canada, France, Germany, and the United Kingdom. Within the U.S., 112,572 employees worked in our restaurants, and 1,470 in our Restaurant Support Centers. There were no union petitions or campaigns in 2023. We continue to bargain with the one restaurant that voted in 2022 to form a union, and we believe that our relationship with our employees is good. We also believe our efforts to manage our workforce have been effective, as evidenced by a strong culture and our employees’ demonstrated commitment to living our purpose and values.

Talent Acquisition

We continue to invest heavily in recruiting top talent and ensuring appropriate staffing levels are maintained, especially during our two peak hiring seasons (spring and fall). We focus on new and innovative ways to attract and engage talent for our restaurants, which includes marketing campaigns that build on our documentary-style television spots, featuring unscripted testimonials from team members about the impact Chipotle has had on their lives. We invest in advertising on social media and highlight growth opportunities and the possible trajectory of achieving six-figure total compensation in approximately three years.

Additionally, we now offer a formal Summer Internship Program to invest in students while creating opportunities for our restaurant employees to further gain exposure to our Restaurant Support Centers.

Diversity, Equity & Inclusion

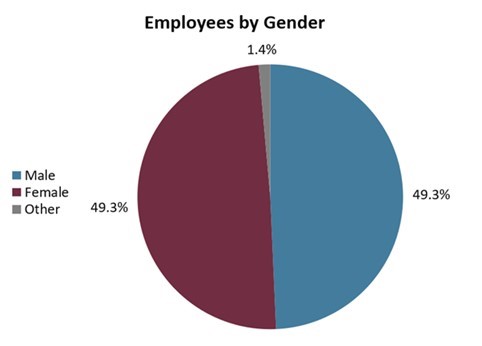

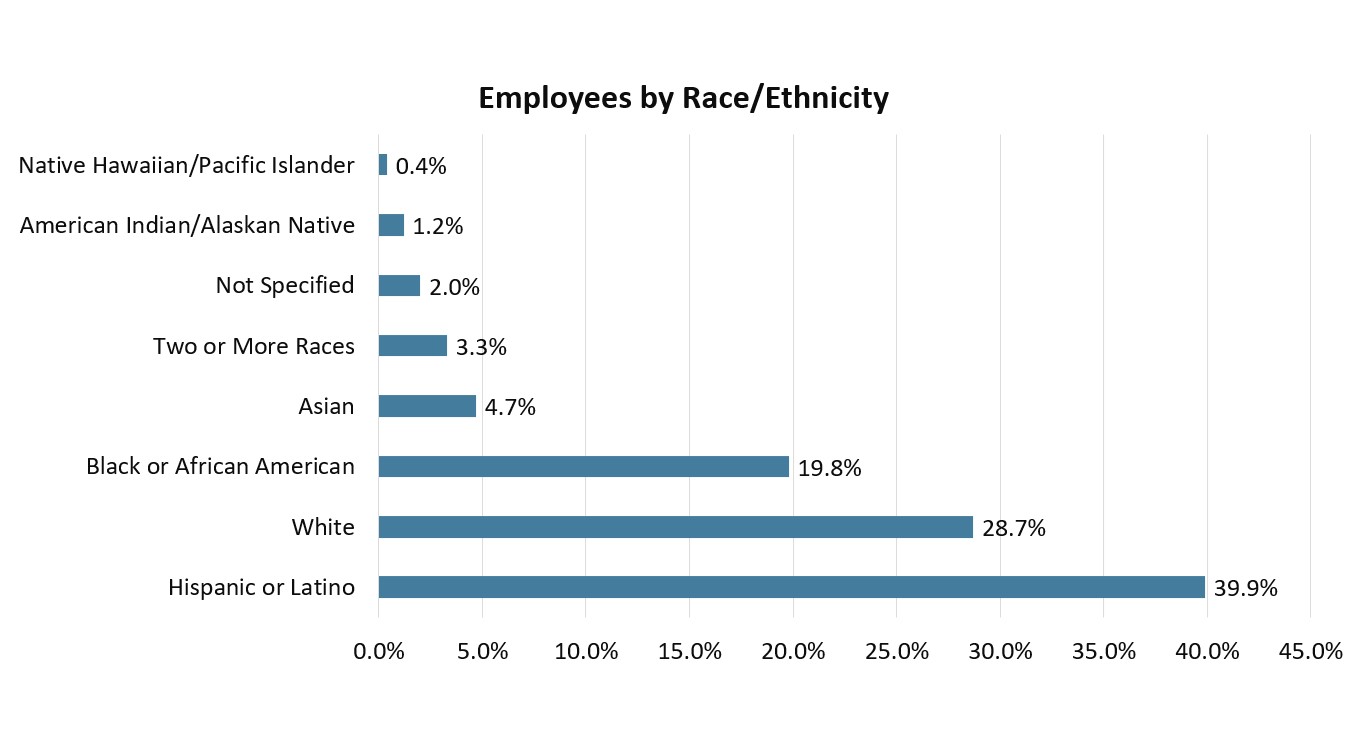

Maintaining a diverse, equitable and inclusive work environment is critical to our success as a business. As of December 31, 2023, U.S.-based employee diversity statistics were as follows:

Our most recent EEO-1 consolidated report is posted on the Investors page of our website at www.ir.chipotle.com under Corporate Governance – Human Capital Information and additional details about the demographics of our employee population is included in our biennial Sustainability Report and interim Update Report on our website www.chipotle.com/sustainability.

Notably, our rate of internal promotions for 2023 was similar within our employee populations, with approximately 50% of promoted employees identifying as female and 39% of promoted employees identifying as Hispanic or Latino.

We have undertaken several actions to promote diverse, equitable and inclusive work environments.

We created a consistent and structured candidate interview process with new interview guides. This ensures quality, speed and equitable hiring practices are followed throughout internal and external candidate interviews. We also launched an internal job board across multiple communication channels to our employees to provide increased visibility and access to internal opportunities.

Since December 2021, we have participated in Management Leadership for Tomorrow’s Black Equity at Work Certification Program, which establishes a comprehensive aggregate measurement system and provides a rigorous, results-oriented approach that accelerates progress toward Black equity internally, amongst our employees, and externally by supporting Black equity within our business partners and in the communities where we operate.

In early 2023, we engaged an independent third-party consultant to conduct a Talent Management Equity Audit to identify places in our talent management cycle where we may need to eliminate bias and/or create more equitable policies, practices, and procedures; identify potential blockers and new opportunities to create and sustain equity in talent management; and identify key strengths and pockets of risk. The consultant concluded that Chipotle has a robust set of processes, practices and policies to enable equitable talent recruiting, development and retention throughout the company and identified opportunities to strengthen Chipotle’s existing practices. See the Investors page of our website at www.ir.chipotle.com under Corporate Governance – Human Capital Information for additional details.

We have a holistic approach to pay equity to ensure consistent and equitable treatment among our employees. We retain an independent third-party compensation consultant each year to conduct a pay equity analysis of our U.S. and Canadian workforce, including factors of pay (e.g., grade level, tenure in role, most recent promotion) and external market conditions (e.g., geographic location), to ensure consistency and equitable treatment among our employees. In 2023, our review included 99% of our U.S. and Canadian employee population, excluding only approximately 50 of our most senior management employees. The analysis identified small, isolated pay gaps for certain segments of the population, and we subsequently made pay adjustments to close those gaps. Since there are not many common roles among our 50 most senior executives, we consider both internal equity by level as well as individualized market data to help ensure we maintain pay equity among this group.

Talent Development

We provide high-quality growth and development opportunities to retain top talent and support internal promotions. In 2023, we had more than 24,000 internal promotions, including 100% of U.S. based Regional Vice Presidents, 87% of Team Directors, and 87% of Field Leaders. To develop our employees, we provide the following programs:

Leadership Evolution and Development: Focuses on preparing a cross-functional cohort of mid-level managers for the future of work and leadership. During the 9-month program, participants learn the critical capabilities of leading oneself, leading others, and leading the business with topics designed to stretch capabilities and improve decision-making skills.

Cultivate University: A four-day immersive leadership experience designed to upskill our new multi-unit restaurant leaders to excel in their role and execute on their Top 5 KPIs. Participants are introduced to a variety of leadership models as well as operational tools to support them in leading effective teams and driving results in their restaurants.

General Manager Upskilling: Trains our restaurant leaders in fundamental soft skills to help bolster their leadership acumen so that they can better lead their teams and create an exceptional guest experience.

Executive Development: Focuses on developing high potential Team Directors in areas such as leadership, marketing, business and finance, data and analytics, ESG and hospitality, so they gain an in-depth understanding of various functions within the company.

Teach & Taste Live seminars: Offers lunch and learn sessions on leadership topics such as effective communication, emotional intelligence, and building a culture of accountability to provide on-going professional development for employees at our Restaurant Support Centers. Each course introduces a new leadership skill and offers best practices and actionable tools to continue developing the top talent that supports our field operations.

Development courses and online programs that focus on creating a culture of belonging.

Online executive coaching for mid- and senior-level leaders throughout the organization.

Succession Planning: We utilize talent calibrations to identify a diverse pipeline of emerging leaders and define appropriate development programs.

Total Rewards

The financial, physical, and mental wellness of our employees remains our top priority and we believe we have compelling compensation packages and incentive programs, and a robust suite of benefit offerings that enable us to engage current team members and attract new team members:

We have made substantial investments in our compensation packages, including competitive wages and industry leading incentive programs, such as our annual and quarterly bonus programs, which allow us to attract and retain the top talent in the industry.

We offer a Debt-Free Degree program that provides Chipotle employees access to nearly 100 degrees at 10 universities, completely tuition debt free.

We support Career Certificates, which further enhances our Tuition Assistance benefits by providing on-demand certificate programs to help Chipotle team members advance their careers in as little as eight weeks.

In 2023, we launched a program that provides our medically enrolled employees and their families with a Health Pro who can help them navigate the complex healthcare environment, helping them understand how their health benefits cover their care, how to save money, as well as get expert, high-quality medical care.

In 2023, we also offered personalized mental health assistance to all Chipotle employees and their family members with support available 24/7 via in-person, phone, or virtual visits with a licensed counselor.

Starting in 2024, we are partnering with SoFi to offer student loan payment matching programs via our 401(k)-retirement program. This, in addition to a credit optimization service, will help bolster our employees’ financial well-being.

Culture and Engagement

Giving employees the opportunity to provide anonymous feedback is a key part of our employee engagement strategy, which positively contributes to our culture. This begins with soliciting feedback regarding onboarding. As of December 31, 2023, 9 in 10 respondents in our restaurants reported a favorable onboarding experience. For our employees in field support organizations and Restaurant Support Centers, nearly 95% of respondents had a favorable view of their onboarding. Results of our surveys are shared with business partners and senior leaders, who continuously work to improve the experience for all employees.

To encourage a collaborative working culture between our Restaurant Support Centers and restaurant operations, we created an Operations Council comprised of employees from restaurant and field leadership, operations, and our business partners, who work together to share feedback and implement new projects collaboratively.

Additionally, to promote an engaged culture, we respond to employees quickly via our Employee Service Center (“ESC”). The ESC is available seven days a week to resolve employee questions about things like restaurant health and safety, compliance, benefits, payroll, etc. We also maintain a confidential Respectful Workplace Hotline that allows employees to anonymously report concerns like sexual harassment, discrimination, and retaliation.

Government Regulation and Environmental Matters

We are subject to various federal, state and local laws and regulations that govern aspects of our business operations. While costs associated with compliance with laws and regulations have increased as the number and scope of regulation have increased, the total costs incurred have not had, and are not expected to have, a material effect on our capital expenditures, results of operations or competitive position. See “Risk Factors” in Item 1A for discussion of risks relating to federal, state, local and international laws and regulations applicable to our business.

Seasonality

Seasonal factors influencing our business are described under the heading “Quarterly Financial Data/Seasonality” in Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Competition

The fast-casual, quick-service, and casual dining segments of the restaurant industry are highly competitive with respect to, among other things, taste, price, food quality and presentation, service, location, convenience, brand reputation, cleanliness, and ambience of each restaurant. Our competition includes a variety of restaurants in each of these segments, including locally-owned restaurants, as well as national and regional chains. Competition from food delivery services, which offer meals from a wide variety of restaurants, also has increased in recent years and is expected to continue to increase. Many of our competitors also offer dine-in, carry-out, online, catering, and delivery services. Among our main competitors are restaurant formats that claim to serve higher quality ingredients without artificial flavors, colors and preservatives, and that serve food quickly and at a reasonable price.

Our Intellectual Property and Trademarks

“Chipotle,” “Chipotle Mexican Grill,” “Food with Integrity,” “Responsibly Raised,” “Chipotle Rewards,” and a number of other marks and related designs and logos are U.S. registered trademarks of Chipotle. We have filed trademark applications for a number of additional marks in the U.S. as well. In addition to our U.S. registrations, we have registered trademarks for “Chipotle” and a number of other marks in Canada, the European Union, the Middle East and various other countries, and have filed trademark applications for “Chipotle Mexican Grill,” “Chipotle” and a number of other marks in additional countries. We also believe that the design of our restaurants is our proprietary trade dress and have registered elements of our restaurant design for trade dress protection in the U.S. as well.

From time to time, we have taken action against other restaurants that we believe are misappropriating our trademarks, restaurant designs or advertising. Although our policy is to protect and defend vigorously our rights to our intellectual property, we may not be able to adequately protect our intellectual property, which could harm the value of our brand and adversely affect our business.

Available Information

We maintain a website at www.chipotle.com, including an investor relations section at ir.chipotle.com, on which we routinely post important information, such as webcasts of quarterly earnings calls and other investor events in which we participate or host, and any related materials. Our Code of Ethics and our Supplier Code of Conduct also are available in this section of our website. You may access our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports, as well as other reports relating to us that are filed with or furnished to the SEC, free of charge in the investor relations section of our website as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. The SEC also maintains a website that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC at www.sec.gov.

The contents of the websites mentioned above and elsewhere in this report are not incorporated into and should not be considered a part of this report. The references to the URLs for these websites are intended to be inactive textual references only. You should carefully consider the risks described below in addition to the other information set forth in this Annual Report on Form 10-K, including the “Management’s Discussion and Analysis of Financial Conditions and Results of Operations” section and the consolidated financial statements and related notes.

ITEM 1A. RISK FACTORS

If any of the risks and uncertainties described below occur or continue to occur, our business, financial condition and results of operations, and the trading price of our common stock could be materially and adversely affected. The risks and uncertainties described below are those that we have identified as material but are not the only risks and uncertainties we face. Our business is also subject to general risks and uncertainties that affect many other companies, including, but not limited to, overall economic and industry conditions. Additional risks not currently known to us or that we presently deem immaterial may arise or become material and may negatively impact our business, reputation, financial condition, results of operations or the trading price of our common stock.

Risks Related to the Nature of our Business and the Restaurant Industry

Food safety and food-borne illness concerns may have an adverse effect on our business by decreasing sales and increasing costs.

Food safety is our top priority, and we dedicate significant resources to ensuring that our guests enjoy safe, high-quality food products. However, even with strong preventative controls and interventions, food safety risks cannot be completely eliminated in every restaurant. Incidents of food-borne illnesses continue to occur in the restaurant industry and may result from the failure of restaurant employees or suppliers to follow our food safety policies and procedures, or from employees or guests entering our restaurant while ill and contaminating ingredients or surfaces. Although we monitor and audit compliance with our program, we cannot guarantee that each and every food item is safely and properly maintained from the start of the supply chain through guest consumption. Any report, legitimate or rumored, of food-borne illness such as E. coli, hepatitis A, norovirus or salmonella, or other food safety issues, such as food tampering or contamination, at one of our restaurants could adversely affect our reputation and have a negative impact on our sales. In addition, instances of food-borne illness or food safety issues that occur solely at competitors’ restaurants could result in negative publicity about the restaurant industry and adversely impact our sales. Social media has dramatically increased the speed with which negative publicity, including actual or perceived food safety incidents, is disseminated before there is any meaningful opportunity to investigate, respond to and address an issue. The occurrence of food-borne illnesses or food safety issues could also adversely affect the price and availability of affected ingredients, resulting in higher costs and lower margins.

We may be at a higher risk for food safety incidents than some competitors due to our greater use of fresh, unprocessed produce, handling of raw chicken in our restaurants, our reliance on employees cooking with traditional methods and the lack of added preservatives and frozen ingredients in our menu items. The risk of illnesses associated with our food also may increase due to our delivery or catering businesses, in which our food is transported, stored and/or served in conditions that are not under our control. All of these factors could have an adverse impact on our ability to attract and retain guests, which could in turn have a material adverse effect on our growth and profitability.

Our digital business, which accounted for a significant portion of our 2023 total revenue, is subject to risks.

In 2023, 37.4% of our food and beverage revenue was derived from digital orders, which includes third-party delivery and customer pickup in-restaurant and through our Chipotlanes. Approximately 18% of our 2023 food and beverage revenue consisted of delivery orders for which we are reliant on third-party delivery companies. Depending on which ordering platform a guest uses – our platform or the platform of a third-party delivery service – the delivery fee we collect from the guest may be less than the actual delivery cost, which has a negative impact on our profitability. In addition, several jurisdictions (e.g., California, New York City and Seattle) have implemented minimum wages for delivery drivers, and other jurisdictions are considering similar wage regulations, which could increase delivery fees and decrease our digital sales. In 2023, we implemented menu price increases to partially offset the increases in ingredients, labor and other costs; however, our higher menu prices may cause some guests to shift their purchases to other restaurants offered on the platform. If the third-party delivery companies we utilize increase their fees or give greater priority or promotions on their platforms to other restaurants, our delivery business and our sales may be negatively impacted. These delivery companies maintain control over data regarding our guests who use their platform and over the guest experience. We use our mobile app to drive convenience and increase brand engagement with our guests. If a third-party delivery driver fails to make timely deliveries or fails to deliver the complete order, our guests may attribute the bad customer experience to Chipotle and our reputation and sales could be negatively impacted. The ordering and payment platforms used by these third parties, our mobile app or our online ordering site have been and could again be interrupted by technological failures, user errors, cyber-attacks or other factors, which could adversely impact sales through these channels and negatively impact our overall sales and reputation. In addition, the delivery business has been consolidating and may continue to consolidate, which may give third-party delivery companies more leverage in negotiating the terms and pricing of contracts, which in turn could negatively impact our profits from this channel.

The restaurant industry is highly competitive. If we are not able to compete successfully, our business, financial condition and results of operations would be adversely affected.

The restaurant industry is highly competitive with respect to taste preferences, price, food quality and selection, customer service, brand reputation, digital engagement, advertising and promotional initiatives, and the location, attractiveness and maintenance of restaurants. We also compete with non-traditional market participants, such as “convenience meals” in the form of entrées, side dishes or meal preparation kits from the deli or prepared foods sections of grocery stores, meal kit delivery services, and “ghost” or “dark” kitchens, where meals are prepared at separate takeaway premises rather than a restaurant. Increased competition could have an adverse effect on our sales, profitability and development plans. If guest or dietary preferences change, if our marketing efforts are unsuccessful, or if our restaurants are unable to compete successfully with other restaurant outlets, our business could be adversely affected.

We continue to believe that our commitment to higher-quality and responsibly sourced ingredients resonates with guests and gives us a competitive advantage; however, many of our competitors also make claims related to the quality of their ingredients and lack of artificial flavors, colors and preservatives. The increasing use of these claims by competitors, regardless of the accuracy of such claims, may lessen our differentiation and make it more difficult for us to compete. If we are unable to continue to maintain our distinctiveness and compete effectively, our business, financial condition and results of operations could be adversely affected.

If we do not continue to persuade guests of the benefits of paying higher prices for our higher-quality food, our sales and results of operations could be hurt.

Our success depends in large part on our ability to persuade guests that food made with ingredients that were raised or grown according to our Food with Integrity principles are worth paying a higher price relative to prices of some of our competitors, particularly quick-service restaurants. Under our Food with Integrity principles, for example, animals must be responsibly raised, and the milk in our sour cream, cheese and queso must come from cows that have not been treated with rBGH, practices which typically are more costly than conventional farming. If we are not able to successfully persuade guests that consuming food made in accordance with our Food with Integrity principles is better for them and the environment, or if guests do not agree with the overall value proposition of our menu, our sales could be adversely affected, which would negatively impact our results of operations.

Our inability or failure to recognize, respond to and effectively manage the immediacy of social media could have a material adverse impact on our business.

Social media and internet-based communications, including video-sharing, social networking, and gaming and messaging platforms, give users immediate access to a broad audience. These platforms have dramatically increased the speed and scale of dissemination and accessibility of information, including negative comments about our food quality or safety, negative guest or employee experiences and videos depicting inappropriate behavior of employees and guests. Accurate, inaccurate or misleading information can be widely disseminated before there is any meaningful opportunity to respond or address an issue. It is impossible for us to fully predict or control social media backlash, and the inappropriate use of social media by our guests or employees could harm our business, prospects, financial condition, and results of operations, regardless of the information’s accuracy.

Use of social media is an important element of our marketing efforts. Social media and internet-based communication platforms are evolving rapidly, and we need to continuously innovate and evolve our marketing strategies to maintain our brand relevance and broad appeal to guests. We also continue to invest in other digital marketing initiatives to reach our guests and build their awareness of, engagement with, and loyalty to us, including our “Chipotle Rewards” loyalty program. These initiatives may not be successful, resulting in expenses incurred without the benefit of higher revenues, increased customer engagement or brand recognition. Other risks associated with our use of social media and internet-based communication platforms include association with influencers or online celebrities who become embroiled in controversy, platforms and business partners who experience challenges, improper disclosure of proprietary information, negative comments about us, exposure of personally identifiable information, fraud, hoaxes or malicious dissemination of false information. Use of social media by our employees, guests and associates could lead to litigation or result in negative publicity that could damage our reputation.

Risks Related to Human Capital

If we are not able to hire, develop and retain qualified restaurant employees and/or appropriately plan our workforce, our growth plan and profitability could be adversely affected.

Our aggressive pace of opening new restaurants can make it increasingly difficult to recruit and hire sufficient numbers of qualified employees to manage and work in our restaurants, to maintain an effective system of internal controls for a dispersed workforce and to train employees to deliver a consistently high-quality product and customer experience, which could materially harm our business and results of operations. Maintaining appropriate staffing in our restaurants requires precise workforce planning, which has become more complex due to predictive scheduling laws (also called “fair workweek” or “secure scheduling”) and “just cause” termination legislation in certain geographic areas where we operate. The market for qualified talent continues to be competitive and we must continue to offer competitive wages, benefits and workplace conditions to retain qualified employees. We have experienced and may continue to experience challenges in hiring and retaining restaurant employees and in maintaining full restaurant staffing in various locations, which has resulted in longer wait times for guest orders, temporary closures of the digital make line and decreased employee and guest satisfaction. In one instance, we permanently closed a restaurant due to lack of necessary staff after a prolonged recruiting effort. A shortage of qualified candidates who meet legal work authorization requirements, failure to hire, train and retain new restaurant employees in a timely manner or higher than expected turnover levels could affect our ability to open new restaurants, grow sales at existing restaurants or meet our labor cost objectives. In addition, failure to adequately monitor and proactively respond to employee dissatisfaction could lead to poor guest satisfaction, higher turnover, litigation and unionization efforts, which could negatively impact our ability to meet our growth targets. We have experienced labor union efforts to organize groups of our employees from time to time and, if successful, those organizational efforts may decrease our operational flexibility and disrupt our normal operations, which could adversely affect our business.

If we fail to comply with applicable federal, state and local employment and labor laws and regulations, it could have a material, adverse impact on our business.

Various federal, state and local employment and labor laws and regulations govern our relationships with our employees, and similar laws and regulations apply to our operations outside of the U.S. These laws and regulations relate to matters such as employment discrimination, wage and hour laws, requirements to provide and document meal and rest periods or other benefits, family leave mandates, requirements regarding working conditions and accommodations to certain employees, citizenship or work authorization and related requirements, insurance and workers’ compensation rules, healthcare laws and anti-discrimination and anti-harassment laws. We incur substantial costs to comply with these laws and regulations and non-compliance could expose us to significant liabilities. For example, we have had lawsuits filed against us alleging violations of federal and state laws regarding employee wages and payment of overtime, meal and rest breaks, employee classification, employee record-keeping and related practices with respect to our employees. We incur legal costs to defend these types cases, and we could incur losses from these and similar cases, and the amount of such losses or costs could be material.

In addition, several jurisdictions (e.g. New York City, Philadelphia, Chicago, Seattle, etc.) have implemented fair workweek or “secure scheduling” legislation, which impose complex requirements related to scheduling for certain restaurant and retail employees, and additional jurisdictions are considering similar legislation. Several jurisdictions also have implemented sick pay and paid time off legislation, which requires employers to provide paid time off to employees, and “just cause” termination legislation, which restricts companies’ ability to terminate employees or reduce employees’ hours unless they can prove “just cause” or a “bona fide economic reason” for the termination or reduction in hours. All of these regulations impose additional obligations on us and our failure to comply with any of these regulations could subject us to penalties and other legal liabilities, which could adversely affect our ability to attract and retain employees and our results of operations, and potentially cause us to close or reduce operating hours of some restaurants in these jurisdictions. For example, we previously reported the settlement of a complaint alleging that we violated New York City’s Fair Workweek law and Earned Safe and Sick Time Act, and we also have been and are undergoing several audits of our compliance with employment law requirements, which could result in additional liabilities. Our liability exposure for these employment laws and regulations may be higher than our restaurant peers because we are one of the largest restaurant companies that owns and operates all our restaurants, while most of our restaurant peers franchise some or a significant portion of their operations.

Increases in the cost of labor, including mandated minimum wage increases, could adversely impact our business and profitability.

Our profitability has been and could continue to be adversely impacted by increases in labor costs, including wages and benefits, which are some of our most significant costs, including increases triggered by federal, state and local laws governing matters such as minimum wages, meal and rest breaks and changes to eligibility for overtime pay; regulations regarding scheduling and benefits; increased health care and workers’ compensation insurance costs; and higher wages and benefit costs necessary to attract, hire and retain high-quality employees with the right skill sets in a highly competitive job market. In addition, state and local laws may require wage increases and standards on working hours and other factors that would restrict our flexibility to respond to market conditions and increase our costs without corresponding benefits. Beginning in April 2024, new California legislation requires national restaurant chains, including Chipotle, to pay a minimum $20 per hour wage to restaurant workers in California, which minimum wage may be increased annually by a state-appointed council. Other state, county and city jurisdictions are considering similar regulations. Our ability to offset higher labor costs by increasing menu prices depends on the willingness of our guests to pay the higher prices and the perceived value of our meals relative to competitors. If competitive or inflationary pressures or other factors prevent us from offsetting higher labor costs by increased menu prices, our profitability may decline.

A failure to recruit, develop and retain effective leaders or the loss or shortage of personnel with key capacities and skills could impact our strategic growth plans and jeopardize our ability to meet our business performance expectations and growth targets.

Our ability to continue to grow our business depends substantially on the contributions and abilities of our executive leadership team and other key management personnel. Changes in senior management could expose us to significant changes in strategic direction and initiatives. A failure to maintain appropriate organizational capacity and capability to support our strategic initiatives or to build adequate bench strength with key skillsets required for seamless succession of leadership, could jeopardize our ability to meet our business performance expectations and growth targets. If we are unable to attract, develop, retain and incentivize sufficiently experienced and capable management personnel, our business and financial results may suffer.

Risks Related to Cybersecurity, Data Privacy and IT Systems

Breaches or other unauthorized access, theft, modification or destruction of guest and/or employee personal, confidential or other material information that is stored in our systems or by third parties on our behalf could adversely affect our business.

As our reliance on technology has grown, the scope and severity of risks posed to our systems from cyber threats has increased. Many of our information technology systems (whether cloud-based or hosted in proprietary servers), including those used for our point-of-sale, web and mobile platforms, online and mobile payment systems, delivery services and rewards programs and administrative functions, contain personal, financial or other information that is entrusted to us by our guests, business partners and employees. Many of our information technology systems also contain confidential information about our business, such as business strategies, development initiatives and designs, and confidential information about third parties, such as suppliers. Similar to many other restaurant companies, we have in the past experienced, and we expect to continue to experience, cyber-attacks, including phishing, and other attempts to breach, or gain unauthorized access to, our systems and databases. To date, these attacks have not had a material impact on our operations, but we cannot provide assurance that they will not have an impact in the future.

Our third-party providers’ and business partners’ information technology systems and databases are likewise subject to such risks. The number and frequency of these attempts varies from year to year but could be exacerbated to some extent by an increase in our digital operations. In addition, we provide some guest and employee data, as well as confidential information important to our business, to third parties to conduct our business. Individuals performing work for us and these third parties also may access some of this data, including on personally owned digital devices. To the extent we, a third party or such an individual were to experience a breach of our or their information technology systems that results in the unauthorized access, theft, use, destruction or other compromises of customers’ or employees’ data or confidential information of Chipotle stored in or transmitted through such systems, including through cyber-attacks or other external or internal methods, it could result in a material loss of revenues from the potential adverse impact to our reputation and brand, a decrease in our ability to retain customers or attract new ones, the imposition of potentially significant costs (including loss of data or payment for recovery of data) and liabilities, loss of business, loss of business partners and licensees and the disruption to our supply chain, business and plans. Unauthorized access, theft, use, destruction or other compromises are becoming increasingly sophisticated and may occur through a variety of methods, including attacks using malicious code, vulnerabilities in software, hardware or other infrastructure (including systems used by our supply chain), system misconfigurations, phishing or social engineering. The rapid evolution and increased adoption of artificial intelligence technologies may intensify our cybersecurity risks. Our logging capabilities, or the logging capabilities of third parties, are not always complete or sufficiently granular, affecting our ability to fully understand the scope of security breaches.

Such security breaches also could result in a violation of applicable U.S. and international privacy, cyber and other laws or trigger data breach notification laws, including new disclosure rules promulgated by the SEC, and subject us to private third party or securities litigation and governmental investigations and proceedings, any of which could result in our exposure to material civil or criminal liability.

We may be required to make significant capital investments and other expenditures to investigate security incidents, remedy cybersecurity problems, recuperate lost data, prevent future compromises and adapt systems and practices to react to the changing threat environment. These include costs associated with notifying affected individuals and other agencies, additional security technologies, training and personnel, retention of experts and providing credit monitoring services for individuals whose data has been breached. These costs could be material and could adversely impact our results of operations in the period in which they are incurred, including by causing us to delay the pursuit of other important business strategies and initiatives, and may not meaningfully limit the success of future attempts to breach our information technology systems.

Media or other reports of existing or perceived security vulnerabilities in our systems or those of our third-party business partners or service providers can also adversely impact our brand and reputation and materially impact our business. Additionally, the techniques and sophistication used to conduct cyber-attacks and compromise information technology systems, as well as the sources and targets of these attacks, change frequently and are often not recognized until such attacks are launched or have been in place for a period of time. The rapid evolution and increased adoption of artificial intelligence technologies amplifies these concerns. We continue to make significant investments in technology, third-party services and personnel to develop and implement systems and processes that are designed to anticipate cyber-attacks and to prevent or minimize breaches of our information technology systems or data loss, but these security measures cannot provide assurance that we will be successful in preventing such breaches or data loss.

We may incur increased costs to comply with privacy and data protection laws and, if we fail to comply, we could be subject to government enforcement actions, private litigation and adverse publicity.

Complex local, state, federal and international laws and regulations apply to the collection, use, retention, protection, disclosure, transfer and other processing of personal data. These privacy and data protection laws and regulations are quickly evolving, with new or modified laws and regulations proposed and implemented frequently and existing laws and regulations subject to new or different interpretations and enforcement. For example, the European Union’s General Data Protection Regulation (“GDPR”) requires companies to meet certain requirements regarding the handling of personal data, including its use, protection and transfer and the ability of persons whose data is stored to correct or delete such data about themselves, and failure to meet the GDPR requirements could result in penalties of up to 4% of annual worldwide revenue. Additionally, the California Consumer Privacy Act of 2018 (“CCPA”) provides a private right of action for data breaches and requires companies that process the personal information of California residents to make new disclosures to consumers about their data collection, use and sharing practices, allow consumers to opt out of certain data sharing with third parties and to request deletion of personal information (subject to certain exceptions). Other states passed similar privacy legislation that took effect in 2023, and other states and countries passed or are considering expanding or passing comprehensive privacy laws. If we fail, or are perceived to have failed, to properly respond to security breaches of our or a third party’s information technology systems or fail to properly respond to or honor consumer requests under any of the foregoing privacy laws, we could experience reputational damage, adverse publicity, loss of consumer confidence, reduced sales and profits, complications in executing our growth initiatives and regulatory and legal risk, including regulatory fines and penalties, and in some cases civil liabilities where individuals have been provided with a private right of action.

Compliance with the current and future privacy and data protection laws can be costly and time-consuming and there is no assurance that our compliance efforts will be successful in preventing breaches or data loss. Our failure to comply with applicable laws and regulations or other obligations to which we may be subject relating to personal information, or to protect personal information from unauthorized access, use or other processing, could result in enforcement actions and regulatory investigations against us, claims for damages by customers and other affected individuals, fines or damage to our brand reputation, any of which could have a material adverse effect on our operations, financial performance and business.

The regulatory environment related to privacy and data security is changing at an ever-increasing pace, with new, increasingly rigorous, and often unclear requirements applicable to our business. In addition, the issues regulated by privacy laws (such as advertising and marketing, children, biometric, employee, surveillance, artificial intelligence, and health related information) have expanded, as have the number of city, state, federal and international governmental bodies and agencies that have recently passed or are currently considering privacy legislation or regulatory rulemaking. Where not limited by preemption and where there are perceived shortcomings in federal laws, many states have passed or are considering adopting stricter versions of federal privacy laws (e.g., state level statutes similar to the Telephone Consumer Protection Act of 1991, the Health Insurance Portability and Accountability Act, and the Children’s Online Privacy Protection Act of 1998). Private service providers also have implemented mandatory privacy requirements impacting businesses, like Chipotle, that wish to utilize services available on their platforms.

In addition, a number of recent lawsuits have pled creative claims under privacy legislation such as the Video Privacy Protection Act, Electronic Communications Privacy Act (including the WireTap Act and Stored Communications Act), Computer Fraud and Abuse Act, and similar state laws alleging wiretapping, eavesdropping, tape recording and invasion of privacy through the use of marketing pixels, analytics software, session replay technology, voice recording, and live chat functionality. Defending against such claims can be costly and strain internal resources.

Taken together, Chipotle faces rapidly increasing compliance costs in order to modify its operations and business practices to comply with applicable laws, regulations and other requirements.

We rely heavily on information technology systems and failures or interruptions in our IT systems could harm our ability to effectively operate our business and/or result in the loss of guests or employees.

We rely heavily on information technology systems, including the point-of-sale and payment processing system in our restaurants, technologies supporting our digital and delivery business, technologies that trace ingredients back to suppliers and growers and manage our supply chain, our rewards program, technologies that facilitate marketing initiatives, employee engagement and payroll processing, and various other processes and transactions. Our ability to effectively manage our business and coordinate the procurement, production, distribution, safety and sale of our products depends significantly on the availability, reliability and security of these systems. Many of these critical systems are provided and managed by third parties, and we are reliant on these third-party providers to implement protective measures that ensure the security and availability of their systems. Although we have operational safeguards in place, these safeguards may not be effective in preventing the failure of these third-party systems or platforms to operate effectively and be available. Failures may be caused by various factors, including power outages, catastrophic events, physical theft, computer and network failures, inadequate or ineffective redundancy, problems with transitioning to upgraded or replacement systems or platforms, flaws in third-party software or services, errors or improper use by our employees or the third-party service providers. If any of our critical IT systems were to become unreliable, unavailable, compromised or otherwise fail, and we were unable to recover in a timely manner, we could experience an interruption in our operations that could have a material adverse impact on our profitability.

Risks Related to Supply Chain

Increases in the costs of ingredients and other materials, including increases caused by inflation, global conflicts and climate risks, or the failure to procure sufficient ingredients could adversely affect our results of operations.

Supply chain risk could increase our costs and result in a shortage of ingredients and supplies that are critical to our restaurant operations. The markets for some of our ingredients, such as beef, avocado and other produce, are particularly volatile due to factors beyond our control such as limited sources, seasonal shifts, climate conditions, inclement weather, natural disasters, recent inflationary trends, military and geopolitical conflicts and industry demand, including as a result of animal disease outbreaks, international commodity markets, food safety concerns, product recalls and government regulation. In addition, for certain of our ingredients and other materials, we have a limited number of suppliers and distributors. We remain in regular contact with our key suppliers and to date we have not experienced significant prolonged disruptions in our supply chain; however, inflationary pressures for certain supplies and ingredients could continue as inflation increases continue across the global supply chain. Our efforts to mitigate future price risk through forward contracts, strong partnerships with key suppliers, directly managing key raw material procurement, diversifying our supply base and other activities may not fully insulate us from increases in commodity costs, which could have an adverse impact on our profitability.

We also could be adversely impacted by price increases specific to meats raised in accordance with our Responsibly Raised animal welfare criteria, and ingredients grown in accordance with our Food with Integrity specifications, the markets for which are generally smaller and more concentrated than the markets for conventionally raised or grown ingredients. Any increase in the prices of the ingredients most critical to our menu, such as chicken, beef, dairy (for cheese, sour cream and queso), avocados, tomatoes and pork, would have a particularly adverse effect on our operating results. If the cost of one or more ingredients significantly increases, we may choose to temporarily suspend serving menu items that use those ingredients, such as guacamole or one of our proteins, rather than pay the increased cost. Any such changes to our available menu may negatively impact our restaurant traffic and could adversely impact our sales and brand.

Shortages or interruptions in the supply of ingredients could adversely affect our operating results.

Our business is dependent on frequent and consistent deliveries of ingredients that comply with our Food with Integrity specifications, such as dairy (for cheese, sour cream and queso). We may experience shortages, delays or interruptions in the supply of ingredients and other supplies to our restaurants due to inclement weather, natural disasters, labor issues or other operational disruptions at our suppliers, distributors or transportation providers, or other conditions beyond our control. Ongoing global conflicts have disrupted and could continue to disrupt some shipping routes, which could result in shortages or delays of certain ingredients. In addition, we have a single or a limited number of suppliers for some of our ingredients, including certain oils, tomatoes, tortillas and adobo. Although we believe we have potential alternative suppliers and sufficient reserves of ingredients, shortages or interruptions in our supply of ingredients could adversely affect our financial results.

Legal and Regulatory Risks

We could be party to litigation or other legal proceedings that could adversely affect our business, results of operations and reputation.

We have been and likely will continue to be subject to litigation and other legal proceedings that may adversely affect our business. These legal proceedings may involve claims brought by employees, guests, government agencies, suppliers, shareholders or others through private actions, administrative proceedings, regulatory actions or other litigation, including litigation on a class or collective basis on behalf of what can be a large group of potential claimants. These legal proceedings have involved, and in the future may involve, allegations of illegal, unfair or inconsistent employment practices, including those governing wage and hour, employment of minors, discrimination, harassment, wrongful termination, and vacation and family leave laws; food safety issues including food-borne illness, food contamination and adverse health effects from consumption of our food products; data security or privacy breaches; guest discrimination; personal injury in our restaurants; marketing and advertising claims, including claims that our Food with Integrity or other sustainability claims are misleading or inaccurate; infringement of patent, copyright or other intellectual property rights; violation of the federal securities laws; workers’ compensation; or other concerns. We are party to a number of pending lawsuits and governmental audits alleging violations of federal and state employment laws, including wage and hour claims, and we could be involved in similar or even more significant litigation and legal proceedings in the future. Even if the allegations against us in current or future legal matters are unfounded or we ultimately are held not liable, the costs to defend ourselves may be significant and the litigation may subject us to substantial settlements, fines, penalties or judgments against us and may divert management's attention away from operating our business, all of which could negatively impact our financial condition and results of operations. Litigation also may generate negative publicity, regardless of whether the allegations are valid, or we ultimately are not liable, which could damage our reputation, and adversely impact our sales as well as our relationships with our employees and guests.

We are subject to extensive laws, government regulation, and other legal requirements and our failure to comply with existing or new laws and regulations could adversely affect our operational efficiencies, ability to attract and retain talent and results of operations.

Our business is subject to extensive federal, state, local and international laws and regulations, including those relating to:

preparation, sale and labeling of food, including regulations of the Food and Drug Administration, which oversees the safety of the entire food system, including inspections and mandatory food recalls, menu labeling and nutritional content;

employment practices and working conditions, including minimum wage rates, wage and hour practices, meal and rest breaks, fair workweek/secure scheduling and “just cause” legislation, employment of minors, discrimination, harassment, classification of employees, paid and family leave, workplace safety, immigration and overtime among others;

privacy and data security (including regulations governing the protection of personal information, advertising and marketing, access by children, biometrics, surveillance, artificial intelligence, health-related information and financial information), such as California Privacy Rights Act and CCPA in California and privacy-related legislation in a growing number of other states, and international laws such as GDPR in the European Union and Personal Information Protection and Electronic Documents Act in Canada;

health, sanitation, safety and fire standards and the sale of alcoholic beverages;

building and zoning requirements, including state and local licensing and regulation governing the design and operation of facilities and land use;

public accommodations and safety conditions, including the Americans with Disabilities Act and similar state laws that give civil rights protections to individuals with disabilities in the context of employment, public accommodations, online resources and other areas;

environmental matters, such as emissions and air quality; water consumption; the discharge, storage, handling, release and disposal of hazardous or toxic substances; local ordinances restricting the types of packaging we can use in our restaurants; and claims we make about our sustainability practices and achievements; and

public company compliance, disclosure and governance matters, including accounting and tax regulations, SEC and NYSE disclosure requirements.

Compliance with these laws and regulations, and future new laws or changes in these laws or regulations that impose additional requirements, can be costly. Any failure or perceived failure to comply with these laws or regulations could result in, among other things, revocation of required licenses, administrative enforcement actions, fines and civil and criminal liability.

Risks Related to Our Growth and Business Strategy

If we are unable to meet our projections for new restaurant openings, or efficiently maintain the attractiveness of our existing restaurants, our profitability could suffer.

Our growth depends on our ability to open new restaurants at an aggressive rate and operate them profitably as soon as possible. In the past year, the cost of opening new restaurants has increased, due to construction labor inflation and increased costs of materials and equipment. Our timeline for completing construction also has gotten longer, due to landlord reluctance to commit to building in light of high interest rates, tight money supply and general economic conditions, and due to backlogs and long wait times for us to obtain required permits and utility hookups. In addition, we incur substantial startup expenses each time we open a new restaurant, and it can take up to 36 months to ramp up the sales and profitability of a new restaurant, during which time costs may be higher as we train new employees and build up a customer base. If we are unable to build the customer base that we expect or fail to overcome the higher startup expenses associated with new restaurants, our new restaurants may not be as profitable as our existing restaurants. Our ability to open and profitably operate new restaurants also is subject to various risks, such as the identification and availability of desirable locations; the negotiation of acceptable lease terms; the need to obtain all required governmental permits (including zoning approvals and liquor licenses) and comply with other regulatory requirements; the availability of capable contractors and subcontractors; increases in the cost and decreases in the availability of labor and building material; changes in weather, natural disasters, pandemics or other acts of God that could delay construction and adversely affect guest traffic; our ability to hire and train qualified management and restaurant employees; and general economic and business conditions. At each potential location, we compete with other restaurants and retail businesses for desirable development sites, construction contractors, management personnel, hourly employees and other resources. If we are unable to successfully manage these risks, we could face increased costs and lower than anticipated sales and earnings in future periods.

In addition, we continue to improve our existing restaurants through remodels, upgrades and regular upkeep. If the costs associated with remodels, upgrades or regular upkeep are higher than anticipated, restaurants are closed for remodeling for longer periods than planned or remodeled restaurants do not perform as expected, we may not realize our projected desired return on investment, which could have a negative effect on our operating results.

Our failure to effectively manage and support our growth could have a negative adverse effect on our business and financial results.

As of December 31, 2023, we owned and operated over 3,400 Chipotle restaurants and we plan to open a significant number of new restaurants in the next several years. Our existing restaurant management systems, back-office technology systems and processes, financial and management controls, information systems and personnel may not be adequate to support our continued growth. To effectively manage a larger number of restaurants, we may need to upgrade and expand our infrastructure and information systems, automate more processes that currently are manual or require manual intervention and hire, train and retrain restaurant employees and corporate support staff, all of which may result in increased costs and at least temporary inefficiencies. We also place a lot of importance on our culture, which we believe has been an important contributor to our success, and as we continue to grow it may be increasingly difficult to maintain our culture. Our failure to sufficiently invest in our infrastructure and information systems and maintain our strong staffing and culture could harm our brand and operating results.

If we partner with or acquire new businesses and third-party providers that do not align with our core values or that do not fulfill their contractual responsibilities and commitments, our brand reputation and international growth plans could suffer.