| First Internet Bancorp | ||||||||||||||

| (Exact Name of Registrant as Specified in Its Charter) | ||||||||||||||

| Indiana | ||||||||||||||

| (State or Other Jurisdiction of Incorporation) | ||||||||||||||

| 001-35750 | 20-3489991 | |||||||||||||

| (Commission File Number) | (IRS Employer Identification No.) | |||||||||||||

| 8701 E. 116th Street | 46038 | |||||||||||||

Fishers, Indiana |

||||||||||||||

| (Address of Principal Executive Offices) | (Zip Code) | |||||||||||||

(317) 532-7900 | ||||||||||||||

| (Registrant's Telephone Number, Including Area Code) | ||||||||||||||

| Title of each class | Trading Symbols | Name of each exchange on which registered | ||||||||||||

| Common Stock, without par value | INBK | The Nasdaq Stock Market LLC | ||||||||||||

| 6.0% Fixed to Floating Subordinated Notes due 2029 | INBKZ | The Nasdaq Stock Market LLC | ||||||||||||

| Number | Description | Method of filing | ||||||||||||

| Furnished electronically | ||||||||||||||

| Furnished electronically | ||||||||||||||

| 104 | Cover Page Interactive Data File (embedded in the cover page formatted in inline XBRL) | |||||||||||||

| Dated: | July 26, 2023 | |||||||||||||

| FIRST INTERNET BANCORP | ||||||||||||||

| By: | /s/ Kenneth J. Lovik | |||||||||||||

| Kenneth J. Lovik, Executive Vice President & Chief Financial Officer | ||||||||||||||

| As of June 30, 2023 | ||||||||||||||

| Company | Bank | |||||||||||||

| Total shareholders’ equity to assets | 7.16% | 8.86% | ||||||||||||

Tangible common equity to tangible assets 1 |

7.07% | 8.77% | ||||||||||||

Tier 1 leverage ratio 2 |

7.63% | 9.35% | ||||||||||||

Common equity tier 1 capital ratio 2 |

10.10% | 12.39% | ||||||||||||

Tier 1 capital ratio 2 |

10.10% | 12.39% | ||||||||||||

Total risk-based capital ratio 2 |

13.87% | 13.37% | ||||||||||||

1 This information represents a non-GAAP financial measure. For a discussion of non-GAAP financial measures, see the section below entitled "Non-GAAP Financial Measures." | ||||||||||||||

2 Regulatory capital ratios are preliminary pending filing of the Company's and the Bank's regulatory reports. | ||||||||||||||

| Contact Information: | |||||||||||

| Investors/Analysts | Media | ||||||||||

| Paula Deemer | Nicole Lorch | ||||||||||

| Director of Corporate Administration | President & Chief Operating Officer | ||||||||||

| (317) 428-4628 | (317) 532-7906 | ||||||||||

| investors@firstib.com | nlorch@firstib.com | ||||||||||

| First Internet Bancorp | ||||||||||||||||||||||||||||||||

| Summary Financial Information (unaudited) | ||||||||||||||||||||||||||||||||

| Dollar amounts in thousands, except per share data | ||||||||||||||||||||||||||||||||

| Three Months Ended | Six Months Ended | |||||||||||||||||||||||||||||||

| June 30, 2023 |

March 31, 2023 | June 30, 2022 |

June 30, 2023 |

June 30, 2022 |

||||||||||||||||||||||||||||

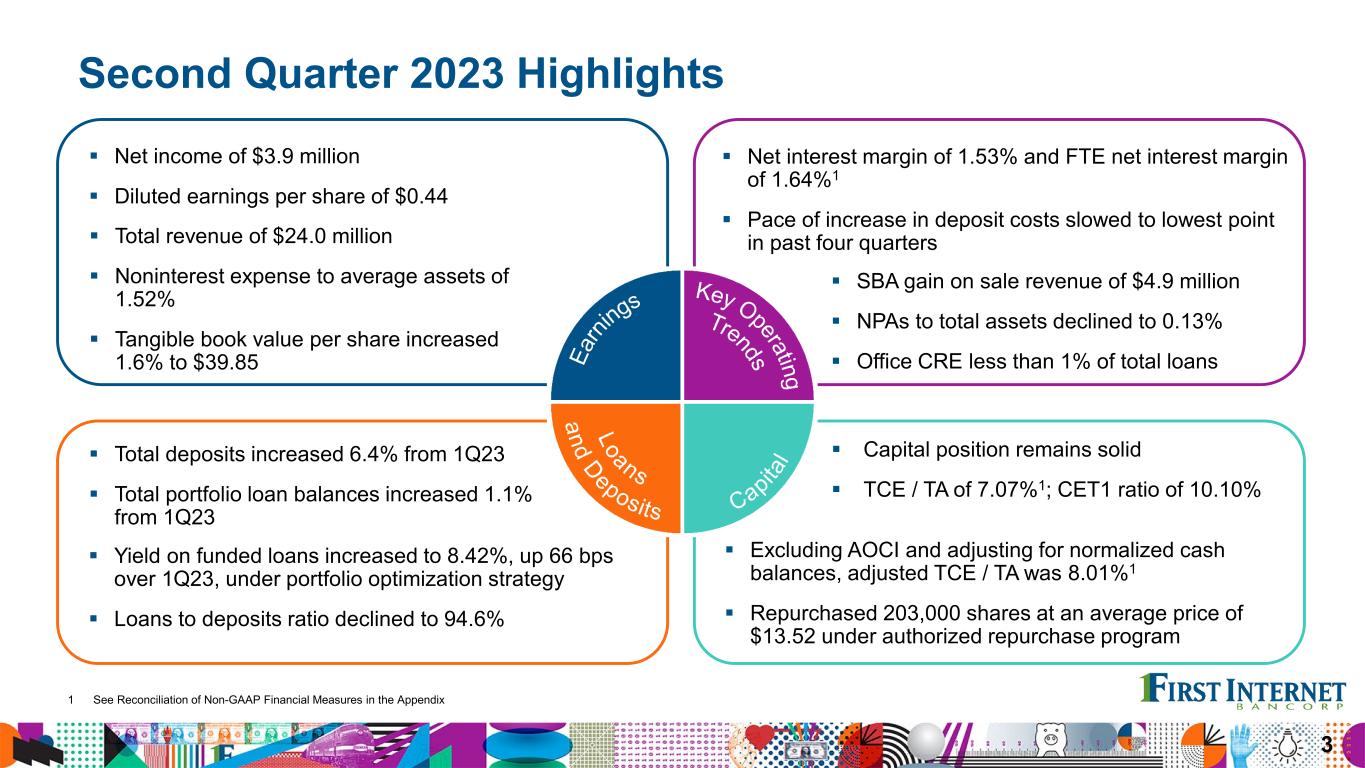

| Net Income (loss) | $ | 3,882 | (3,017) | $ | 9,545 | $ | 865 | $ | 20,754 | |||||||||||||||||||||||

| Per share and share information | ||||||||||||||||||||||||||||||||

| Earnings (loss) per share - basic | $ | 0.44 | $ | (0.33) | $ | 0.99 | $ | 0.10 | $ | 2.14 | ||||||||||||||||||||||

| Earnings(loss) per share - diluted | 0.44 | (0.33) | 0.99 | 0.10 | 2.13 | |||||||||||||||||||||||||||

| Dividends declared per share | 0.06 | 0.06 | 0.06 | 0.12 | 0.12 | |||||||||||||||||||||||||||

| Book value per common share | 40.38 | 39.76 | 38.85 | 40.38 | 38.85 | |||||||||||||||||||||||||||

Tangible book value per common share 1 |

39.85 | 39.23 | 38.35 | 39.85 | 38.35 | |||||||||||||||||||||||||||

| Common shares outstanding | 8,774,507 | 8,943,477 | 9,404,000 | 8,774,507 | 9,404,000 | |||||||||||||||||||||||||||

| Average common shares outstanding: | ||||||||||||||||||||||||||||||||

| Basic | 8,903,213 | 9,024,072 | 9,600,383 | 8,963,308 | 9,694,729 | |||||||||||||||||||||||||||

| Diluted | 8,908,180 | 9,024,072 | 9,658,689 | 8,980,262 | 9,764,232 | |||||||||||||||||||||||||||

| Performance ratios | ||||||||||||||||||||||||||||||||

| Return on average assets | 0.32 | % | (0.26 | %) | 0.93 | % | 0.04 | % | 1.01 | % | ||||||||||||||||||||||

| Return on average shareholders' equity | 4.35 | % | (3.37 | %) | 10.23 | % | 0.48 | % | 11.09 | % | ||||||||||||||||||||||

Return on average tangible common equity 1 |

4.40 | % | (3.41 | %) | 10.36 | % | 0.49 | % | 11.23 | % | ||||||||||||||||||||||

| Net interest margin | 1.53 | % | 1.76 | % | 2.60 | % | 1.64 | % | 2.58 | % | ||||||||||||||||||||||

Net interest margin - FTE 1,2 |

1.64 | % | 1.89 | % | 2.74 | % | 1.76 | % | 2.71 | % | ||||||||||||||||||||||

Capital ratios 3 |

||||||||||||||||||||||||||||||||

| Total shareholders' equity to assets | 7.16 | % | 7.53 | % | 8.91 | % | 7.16 | % | 8.91 | % | ||||||||||||||||||||||

Tangible common equity to tangible assets 1 |

7.07 | % | 7.44 | % | 8.81 | % | 7.07 | % | 8.81 | % | ||||||||||||||||||||||

| Tier 1 leverage ratio | 7.63 | % | 8.10 | % | 9.45 | % | 7.63 | % | 9.45 | % | ||||||||||||||||||||||

| Common equity tier 1 capital ratio | 10.10 | % | 10.30 | % | 12.46 | % | 10.10 | % | 12.46 | % | ||||||||||||||||||||||

| Tier 1 capital ratio | 10.10 | % | 10.30 | % | 12.46 | % | 10.10 | % | 12.46 | % | ||||||||||||||||||||||

| Total risk-based capital ratio | 13.87 | % | 14.13 | % | 16.74 | % | 13.87 | % | 16.74 | % | ||||||||||||||||||||||

| Asset quality | ||||||||||||||||||||||||||||||||

| Nonperforming loans | $ | 6,227 | $ | 9,221 | $ | 4,527 | $ | 6,227 | $ | 4.527 | ||||||||||||||||||||||

| Nonperforming assets | 6,397 | 9,346 | 4,550 | 6,397 | 4,550 | |||||||||||||||||||||||||||

| Nonperforming loans to loans | 0.17 | % | 0.26 | % | 0.15 | % | 0.17 | % | 0.15 | % | ||||||||||||||||||||||

| Nonperforming assets to total assets | 0.13 | % | 0.20 | % | 0.11 | % | 0.13 | % | 0.11 | % | ||||||||||||||||||||||

| Allowance for credit losses - loans to: | ||||||||||||||||||||||||||||||||

| Loans | 0.99 | % | 1.02 | % | 0.95 | % | 0.99 | % | 0.95 | % | ||||||||||||||||||||||

| Nonperforming loans | 579.1 | % | 400.0 | % | 644.0 | % | 579.1 | % | 644.0 | % | ||||||||||||||||||||||

| Net charge-offs to average loans | 0.17 | % | 0.82 | % | 0.04 | % | 0.49 | % | 0.05 | % | ||||||||||||||||||||||

| Average balance sheet information | ||||||||||||||||||||||||||||||||

| Loans | $ | 3,653,839 | $ | 3,573,827 | $ | 2,998,144 | $ | 3,614,054 | $ | 2,973,173 | ||||||||||||||||||||||

| Total securities | 604,182 | 585,270 | 620,396 | 594,777 | 634,485 | |||||||||||||||||||||||||||

| Other earning assets | 511,295 | 331,294 | 322,302 | 421,793 | 388,760 | |||||||||||||||||||||||||||

| Total interest-earning assets | 4,771,623 | 4,499,782 | 3,962,589 | 4,636,453 | 4,021,330 | |||||||||||||||||||||||||||

| Total assets | 4,927,712 | 4,647,156 | 4,097,865 | 4,788,209 | 4,156,068 | |||||||||||||||||||||||||||

| Noninterest-bearing deposits | 117,496 | 134,988 | 108,980 | 126,194 | 110,605 | |||||||||||||||||||||||||||

| Interest-bearing deposits | 3,713,086 | 3,411,969 | 3,018,422 | 3,563,359 | 3,044,775 | |||||||||||||||||||||||||||

| Total deposits | 3,830,582 | 3,546,957 | 3,127,402 | 3,689,553 | 3,155,380 | |||||||||||||||||||||||||||

| Shareholders' equity | 358,312 | 363,273 | 374,274 | 360,779 | 377,504 | |||||||||||||||||||||||||||

| First Internet Bancorp | ||||||||||||||||||||

| Condensed Consolidated Balance Sheets (unaudited) | ||||||||||||||||||||

| Dollar amounts in thousands | ||||||||||||||||||||

| June 30, 2023 |

March 31, 2023 |

June 30, 2022 |

||||||||||||||||||

| Assets | ||||||||||||||||||||

| Cash and due from banks | $ | 9,503 | $ | 27,741 | $ | 6,155 | ||||||||||||||

| Interest-bearing deposits | 456,128 | 276,231 | 201,798 | |||||||||||||||||

| Securities available-for-sale, at fair value | 379,394 | 395,833 | 425,489 | |||||||||||||||||

| Securities held-to-maturity, at amortized cost, net of allowance for credit losses | 230,605 | 210,761 | 185,113 | |||||||||||||||||

| Loans held-for-sale | 32,001 | 18,144 | 31,580 | |||||||||||||||||

| Loans | 3,646,832 | 3,607,242 | 3,082,127 | |||||||||||||||||

| Allowance for credit losses - loans | (36,058) | (36,879) | (29,153) | |||||||||||||||||

| Net loans | 3,610,774 | 3,570,363 | 3,052,974 | |||||||||||||||||

| Accrued interest receivable | 24,101 | 22,322 | 17,466 | |||||||||||||||||

| Federal Home Loan Bank of Indianapolis stock | 28,350 | 28,350 | 25,219 | |||||||||||||||||

| Cash surrender value of bank-owned life insurance | 40,357 | 40,105 | 39,369 | |||||||||||||||||

| Premises and equipment, net | 73,525 | 74,248 | 70,288 | |||||||||||||||||

| Goodwill | 4,687 | 4,687 | 4,687 | |||||||||||||||||

| Servicing asset | 8,252 | 7,312 | 5,345 | |||||||||||||||||

| Other real estate owned | 106 | 106 | — | |||||||||||||||||

| Accrued income and other assets | 49,266 | 45,116 | 34,323 | |||||||||||||||||

| Total assets | $ | 4,947,049 | $ | 4,721,319 | $ | 4,099,806 | ||||||||||||||

| Liabilities | ||||||||||||||||||||

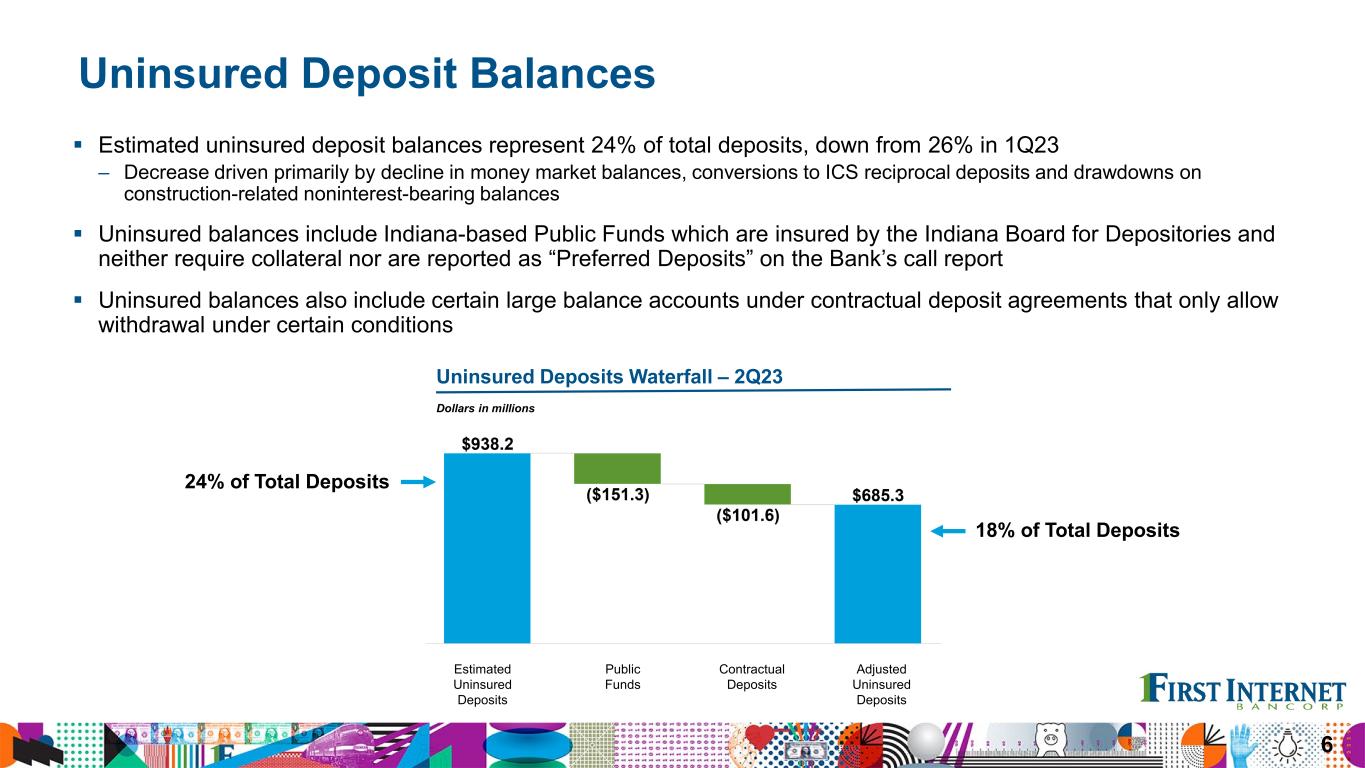

| Noninterest-bearing deposits | $ | 119,291 | $ | 140,449 | $ | 126,153 | ||||||||||||||

| Interest-bearing deposits | 3,735,017 | 3,481,841 | 3,025,948 | |||||||||||||||||

| Total deposits | 3,854,308 | 3,622,290 | 3,152,101 | |||||||||||||||||

| Advances from Federal Home Loan Bank | 614,931 | 614,929 | 464,925 | |||||||||||||||||

| Subordinated debt | 104,684 | 104,608 | 104,381 | |||||||||||||||||

| Accrued interest payable | 3,338 | 2,592 | 2,005 | |||||||||||||||||

| Accrued expenses and other liabilities | 15,456 | 21,328 | 11,062 | |||||||||||||||||

| Total liabilities | 4,592,717 | 4,365,747 | 3,734,474 | |||||||||||||||||

| Shareholders' equity | ||||||||||||||||||||

| Voting common stock | 186,545 | 189,202 | 204,071 | |||||||||||||||||

| Retained earnings | 200,973 | 197,623 | 192,011 | |||||||||||||||||

| Accumulated other comprehensive loss | (33,186) | (31,253) | (30,750) | |||||||||||||||||

| Total shareholders' equity | 354,332 | 355,572 | 365,332 | |||||||||||||||||

| Total liabilities and shareholders' equity | $ | 4,947,049 | $ | 4,721,319 | $ | 4,099,806 | ||||||||||||||

| First Internet Bancorp | |||||||||||||||||||||||||||||

| Condensed Consolidated Statements of Income (unaudited) | |||||||||||||||||||||||||||||

| Dollar amounts in thousands, except per share data | |||||||||||||||||||||||||||||

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||||

| June 30, 2023 |

March 31, 2023 |

June 30, 2022 |

June 30, 2023 |

June 30, 2022 |

|||||||||||||||||||||||||

| Interest income | |||||||||||||||||||||||||||||

| Loans | $ | 46,906 | $ | 43,843 | $ | 32,415 | $ | 90,749 | $ | 65,603 | |||||||||||||||||||

| Securities - taxable | 3,835 | 3,606 | 2,567 | 7,441 | 4,788 | ||||||||||||||||||||||||

| Securities - non-taxable | 860 | 798 | 328 | 1,658 | 577 | ||||||||||||||||||||||||

| Other earning assets | 6,521 | 3,786 | 796 | 10,307 | 1,172 | ||||||||||||||||||||||||

| Total interest income | 58,122 | 52,033 | 36,106 | 110,155 | 72,140 | ||||||||||||||||||||||||

| Interest expense | |||||||||||||||||||||||||||||

| Deposits | 34,676 | 27,270 | 6,408 | 61,946 | 12,505 | ||||||||||||||||||||||||

| Other borrowed funds | 5,301 | 5,189 | 4,018 | 10,490 | 8,205 | ||||||||||||||||||||||||

| Total interest expense | 39,977 | 32,459 | 10,426 | 72,436 | 20,710 | ||||||||||||||||||||||||

| Net interest income | 18,145 | 19,574 | 25,680 | 37,719 | 51,430 | ||||||||||||||||||||||||

| Provision for credit losses | 1,698 | 9,415 | 1,185 | 11,113 | 1,976 | ||||||||||||||||||||||||

| Net interest income after provision for credit losses | 16,447 | 10,159 | 24,495 | 26,606 | 49,454 | ||||||||||||||||||||||||

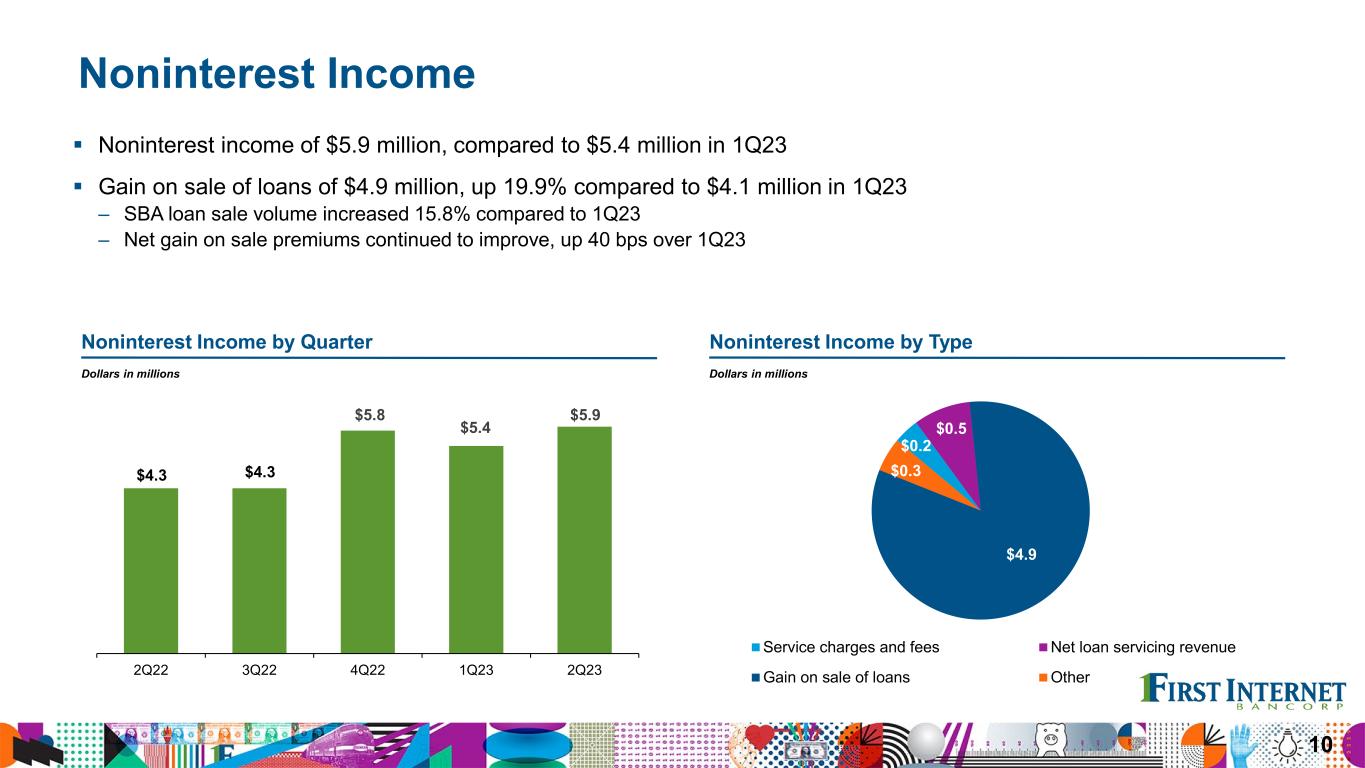

| Noninterest income | |||||||||||||||||||||||||||||

| Service charges and fees | 218 | 209 | 281 | 427 | 597 | ||||||||||||||||||||||||

| Loan servicing revenue | 850 | 785 | 620 | 1,635 | 1,205 | ||||||||||||||||||||||||

| Loan servicing asset revaluation | (358) | (55) | (470) | (413) | (767) | ||||||||||||||||||||||||

| Mortgage banking activities | — | 76 | 1,710 | 76 | 3,583 | ||||||||||||||||||||||||

| Gain on sale of loans | 4,868 | 4,061 | 1,952 | 8,929 | 5,797 | ||||||||||||||||||||||||

| Other | 293 | 370 | 221 | 663 | 719 | ||||||||||||||||||||||||

| Total noninterest income | 5,871 | 5,446 | 4,314 | 11,317 | 11,134 | ||||||||||||||||||||||||

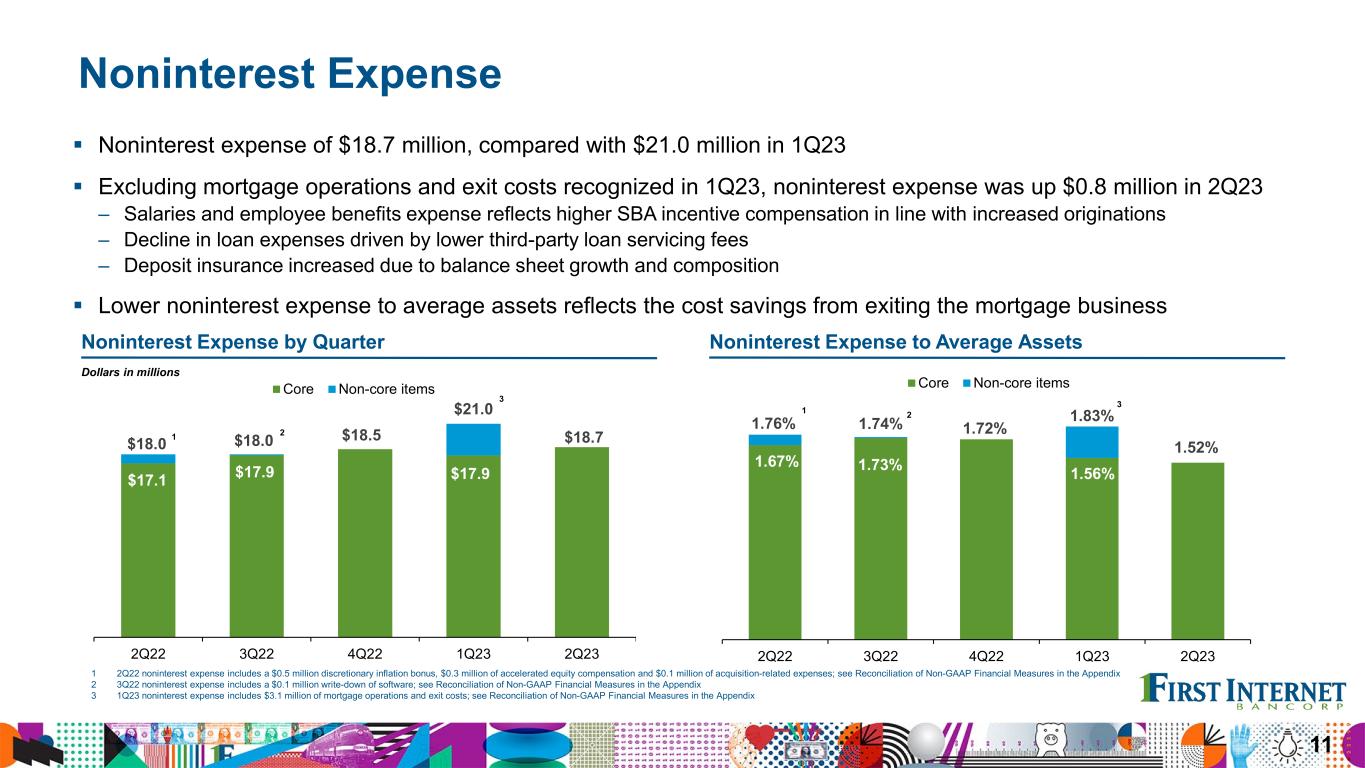

| Noninterest expense | |||||||||||||||||||||||||||||

| Salaries and employee benefits | 10,706 | 11,794 | 10,832 | 22,500 | 20,710 | ||||||||||||||||||||||||

| Marketing, advertising and promotion | 705 | 844 | 920 | 1,549 | 1,676 | ||||||||||||||||||||||||

| Consulting and professional fees | 711 | 926 | 1,197 | 1,637 | 3,122 | ||||||||||||||||||||||||

| Data processing | 520 | 659 | 490 | 1,179 | 939 | ||||||||||||||||||||||||

| Loan expenses | 1,072 | 1,977 | 693 | 3,049 | 2,275 | ||||||||||||||||||||||||

| Premises and equipment | 2,661 | 2,777 | 2,419 | 5,438 | 4,959 | ||||||||||||||||||||||||

| Deposit insurance premium | 936 | 543 | 287 | 1,479 | 568 | ||||||||||||||||||||||||

| Other | 1,359 | 1,434 | 1,147 | 2,793 | 2,516 | ||||||||||||||||||||||||

| Total noninterest expense | 18,670 | 20,954 | 17,985 | 39,624 | 36,765 | ||||||||||||||||||||||||

| Income (loss) before income taxes | 3,648 | (5,349) | 10,824 | (1,701) | 23,823 | ||||||||||||||||||||||||

| Income tax (benefit) provision | (234) | (2,332) | 1,279 | (2,566) | 3,069 | ||||||||||||||||||||||||

| Net income (loss) | $ | 3,882 | $ | (3,017) | $ | 9,545 | $ | 865 | $ | 20,754 | |||||||||||||||||||

| Per common share data | |||||||||||||||||||||||||||||

| Earnings (loss) per share - basic | $ | 0.44 | $ | (0.33) | $ | 0.99 | $ | 0.10 | $ | 2.14 | |||||||||||||||||||

| Earnings (loss) per share - diluted | $ | 0.44 | $ | (0.33) | $ | 0.99 | $ | 0.10 | $ | 2.13 | |||||||||||||||||||

| Dividends declared per share | $ | 0.06 | $ | 0.06 | $ | 0.06 | $ | 0.12 | $ | 0.12 | |||||||||||||||||||

| First Internet Bancorp | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Average Balances and Rates (unaudited) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dollar amounts in thousands | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| June 30, 2023 | March 31, 2023 | June 30, 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Average Balance | Interest / Dividends | Yield / Cost | Average Balance | Interest / Dividends | Yield / Cost | Average Balance | Interest / Dividends | Yield / Cost | |||||||||||||||||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-earning assets | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Loans, including loans held-for-sale 1 |

$ | 3,656,146 | $ | 46,906 | 5.15 | % | $ | 3,583,218 | $ | 43,843 | 4.96 | % | $ | 3,019,891 | $ | 32,415 | 4.31 | % | |||||||||||||||||||||||||||||||||||

| Securities - taxable | 531,040 | 3,835 | 2.90 | % | 511,923 | 3,606 | 2.86 | % | 543,422 | 2,567 | 1.89 | % | |||||||||||||||||||||||||||||||||||||||||

| Securities - non-taxable | 73,142 | 860 | 4.72 | % | 73,347 | 798 | 4.41 | % | 76,974 | 328 | 1.71 | % | |||||||||||||||||||||||||||||||||||||||||

| Other earning assets | 511,295 | 6,521 | 5.12 | % | 331,294 | 3,786 | 4.63 | % | 322,302 | 796 | 0.99 | % | |||||||||||||||||||||||||||||||||||||||||

| Total interest-earning assets | 4,771,623 | 58,122 | 4.89 | % | 4,499,782 | 52,033 | 4.69 | % | 3,962,589 | 36,106 | 3.65 | % | |||||||||||||||||||||||||||||||||||||||||

| Allowance for credit losses - loans | (36,671) | (35,075) | (28,599) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest-earning assets | 192,760 | 182,449 | 163,875 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 4,927,712 | $ | 4,647,156 | $ | 4,097,865 | |||||||||||||||||||||||||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities | |||||||||||||||||||||||||||||||||||||||||||||||||||||

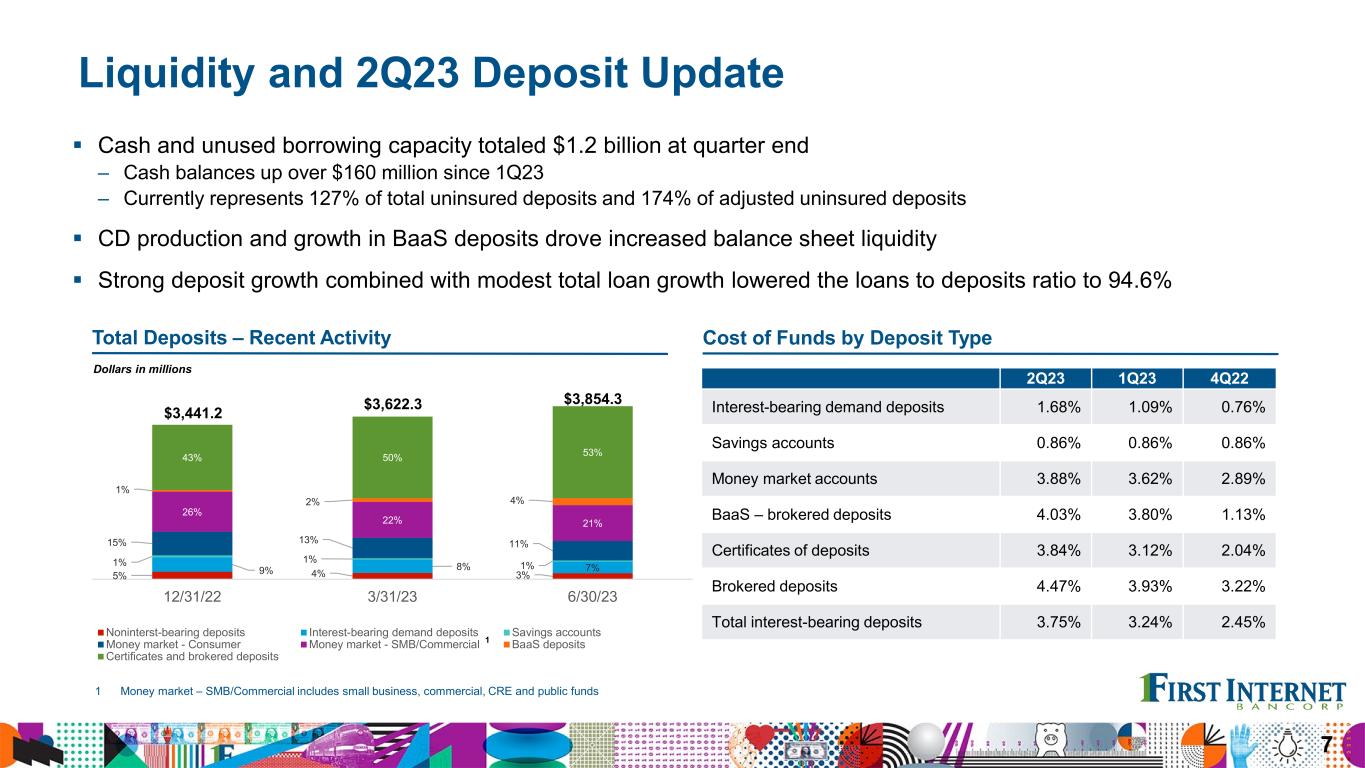

| Interest-bearing demand deposits | $ | 359,969 | $ | 1,509 | 1.68 | % | $ | 333,642 | $ | 900 | 1.09 | % | $ | 348,274 | $ | 466 | 0.54 | % | |||||||||||||||||||||||||||||||||||

| Savings accounts | 29,915 | 64 | 0.86 | % | 38,482 | 82 | 0.86 | % | 66,657 | 68 | 0.41 | % | |||||||||||||||||||||||||||||||||||||||||

| Money market accounts | 1,274,453 | 12,314 | 3.88 | % | 1,377,600 | 12,300 | 3.62 | % | 1,427,665 | 1,921 | 0.54 | % | |||||||||||||||||||||||||||||||||||||||||

| BaaS - brokered deposits | 22,918 | 230 | 4.03 | % | 14,741 | 138 | 3.80 | % | 71,234 | 154 | 0.87 | % | |||||||||||||||||||||||||||||||||||||||||

| Certificates and brokered deposits | 2,025,831 | 20,559 | 4.07 | % | 1,647,504 | 13,850 | 3.41 | % | 1,104,592 | 3,799 | 1.38 | % | |||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing deposits | 3,713,086 | 34,676 | 3.75 | % | 3,411,969 | 27,270 | 3.24 | % | 3,018,422 | 6,408 | 0.85 | % | |||||||||||||||||||||||||||||||||||||||||

| Other borrowed funds | 719,577 | 5,301 | 2.95 | % | 719,499 | 5,189 | 2.92 | % | 583,553 | 4,018 | 2.76 | % | |||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | 4,432,663 | 39,977 | 3.62 | % | 4,131,468 | 32,459 | 3.19 | % | 3,601,975 | 10,426 | 1.16 | % | |||||||||||||||||||||||||||||||||||||||||

| Noninterest-bearing deposits | 117,496 | 134,988 | 108,980 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Other noninterest-bearing liabilities | 19,241 | 17,427 | 12,636 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities | 4,569,400 | 4,283,883 | 3,723,591 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholders' equity | 358,312 | 363,273 | 374,274 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities and shareholders' equity | $ | 4,927,712 | $ | 4,647,156 | $ | 4,097,865 | |||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 18,145 | $ | 19,574 | $ | 25,680 | |||||||||||||||||||||||||||||||||||||||||||||||

| Interest rate spread | 1.27 | % | 1.50 | % | 2.49 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Net interest margin | 1.53 | % | 1.76 | % | 2.60 | % | |||||||||||||||||||||||||||||||||||||||||||||||

Net interest margin - FTE 2,3 |

1.64 | % | 1.89 | % | 2.74 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| First Internet Bancorp | |||||||||||||||||||||||||||||||||||

| Average Balances and Rates (unaudited) | |||||||||||||||||||||||||||||||||||

| Dollar amounts in thousands | |||||||||||||||||||||||||||||||||||

| Six Months Ended | |||||||||||||||||||||||||||||||||||

| June 30, 2023 | June 30, 2022 | ||||||||||||||||||||||||||||||||||

| Average Balance | Interest / Dividends | Yield / Cost | Average Balance | Interest / Dividends | Yield / Cost | ||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||

| Interest-earning assets | |||||||||||||||||||||||||||||||||||

Loans, including loans held-for-sale 1 |

$ | 3,619,883 | $ | 90,749 | 5.06 | % | $ | 2,998,085 | $ | 65,603 | 4.41 | % | |||||||||||||||||||||||

| Securities - taxable | 521,533 | 7,441 | 2.88 | % | 555,533 | 4,788 | 1.74 | % | |||||||||||||||||||||||||||

| Securities - non-taxable | 73,244 | 1,658 | 4.56 | % | 78,952 | 577 | 1.47 | % | |||||||||||||||||||||||||||

| Other earning assets | 421,793 | 10,307 | 4.93 | % | 388,760 | 1,172 | 0.61 | % | |||||||||||||||||||||||||||

| Total interest-earning assets | 4,636,453 | 110,155 | 4.79 | % | 4,021,330 | 72,140 | 3.62 | % | |||||||||||||||||||||||||||

| Allowance for loan losses | (35,877) | (28,288) | |||||||||||||||||||||||||||||||||

| Noninterest-earning assets | 187,633 | 163,026 | |||||||||||||||||||||||||||||||||

| Total assets | $ | 4,788,209 | $ | 4,156,068 | |||||||||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities | |||||||||||||||||||||||||||||||||||

| Interest-bearing demand deposits | $ | 346,878 | $ | 2,409 | 1.40 | % | $ | 333,361 | $ | 878 | 0.53 | % | |||||||||||||||||||||||

| Savings accounts | 34,175 | 145 | 0.86 | % | 63,653 | 121 | 0.38 | % | |||||||||||||||||||||||||||

| Money market accounts | 1,325,741 | 24,614 | 3.74 | % | 1,440,976 | 3,425 | 0.48 | % | |||||||||||||||||||||||||||

| BaaS - brokered deposits | 18,852 | 368 | 3.94 | % | 41,836 | 160 | 0.77 | % | |||||||||||||||||||||||||||

| Certificates and brokered deposits | 1,837,713 | 34,410 | 3.78 | % | 1,164,949 | 7,921 | 1.37 | % | |||||||||||||||||||||||||||

| Total interest-bearing deposits | 3,563,359 | 61,946 | 3.51 | % | 3,044,775 | 12,505 | 0.83 | % | |||||||||||||||||||||||||||

| Other borrowed funds | 719,538 | 10,490 | 2.94 | % | 601,274 | 8,205 | 2.75 | % | |||||||||||||||||||||||||||

| Total interest-bearing liabilities | 4,282,897 | 72,436 | 3.41 | % | 3,646,049 | 20,710 | 1.15 | % | |||||||||||||||||||||||||||

| Noninterest-bearing deposits | 126,194 | 110,605 | |||||||||||||||||||||||||||||||||

| Other noninterest-bearing liabilities | 18,339 | 21,910 | |||||||||||||||||||||||||||||||||

| Total liabilities | 4,427,430 | 3,778,564 | |||||||||||||||||||||||||||||||||

| Shareholders' equity | 360,779 | 377,504 | |||||||||||||||||||||||||||||||||

| Total liabilities and shareholders' equity | $ | 4,788,209 | $ | 4,156,068 | |||||||||||||||||||||||||||||||

| Net interest income | $ | 37,719 | $ | 51,430 | |||||||||||||||||||||||||||||||

| Interest rate spread | 1.38 | % | 2.47 | % | |||||||||||||||||||||||||||||||

| Net interest margin | 1.64 | % | 2.58 | % | |||||||||||||||||||||||||||||||

Net interest margin - FTE 2,3 |

1.76 | % | 2.71 | % | |||||||||||||||||||||||||||||||

| First Internet Bancorp | ||||||||||||||||||||||||||||||||||||||

| Loans and Deposits (unaudited) | ||||||||||||||||||||||||||||||||||||||

| Dollar amounts in thousands | ||||||||||||||||||||||||||||||||||||||

| June 30, 2023 | March 31, 2023 | June 30, 2022 | ||||||||||||||||||||||||||||||||||||

| Amount | Percent | Amount | Percent | Amount | Percent | |||||||||||||||||||||||||||||||||

| Commercial loans | ||||||||||||||||||||||||||||||||||||||

| Commercial and industrial | $ | 112,423 | 3.1 | % | $ | 113,198 | 3.1 | % | $ | 110,540 | 3.6 | % | ||||||||||||||||||||||||||

| Owner-occupied commercial real estate | 59,564 | 1.6 | % | 59,643 | 1.7 | % | 61,277 | 2.0 | % | |||||||||||||||||||||||||||||

| Investor commercial real estate | 137,504 | 3.8 | % | 142,174 | 3.9 | % | 52,648 | 1.7 | % | |||||||||||||||||||||||||||||

| Construction | 192,453 | 5.3 | % | 158,147 | 4.4 | % | 143,475 | 4.7 | % | |||||||||||||||||||||||||||||

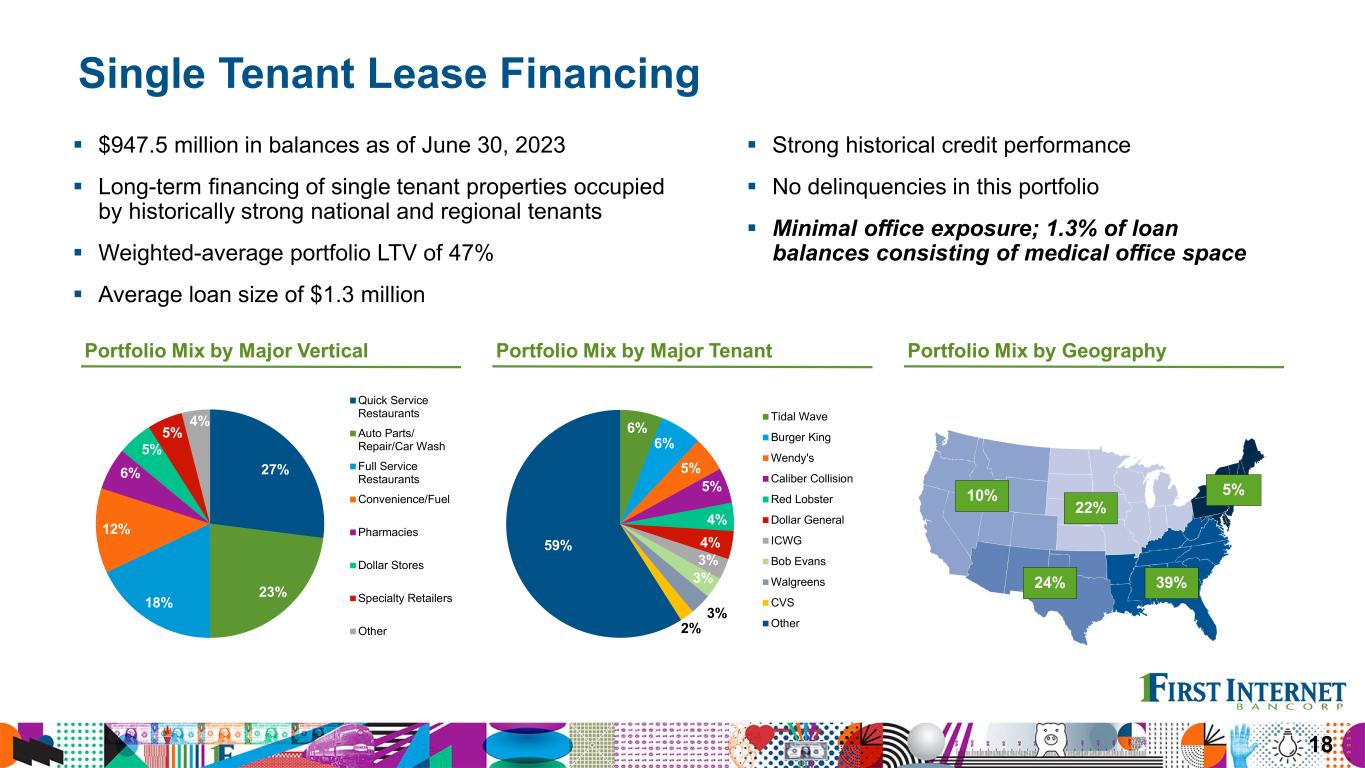

| Single tenant lease financing | 947,466 | 25.9 | % | 952,533 | 26.4 | % | 867,181 | 28.1 | % | |||||||||||||||||||||||||||||

| Public finance | 575,541 | 15.8 | % | 604,898 | 16.8 | % | 613,759 | 19.9 | % | |||||||||||||||||||||||||||||

| Healthcare finance | 245,072 | 6.7 | % | 256,670 | 7.1 | % | 317,180 | 10.3 | % | |||||||||||||||||||||||||||||

| Small business lending | 170,550 | 4.7 | % | 136,382 | 3.8 | % | 102,724 | 3.3 | % | |||||||||||||||||||||||||||||

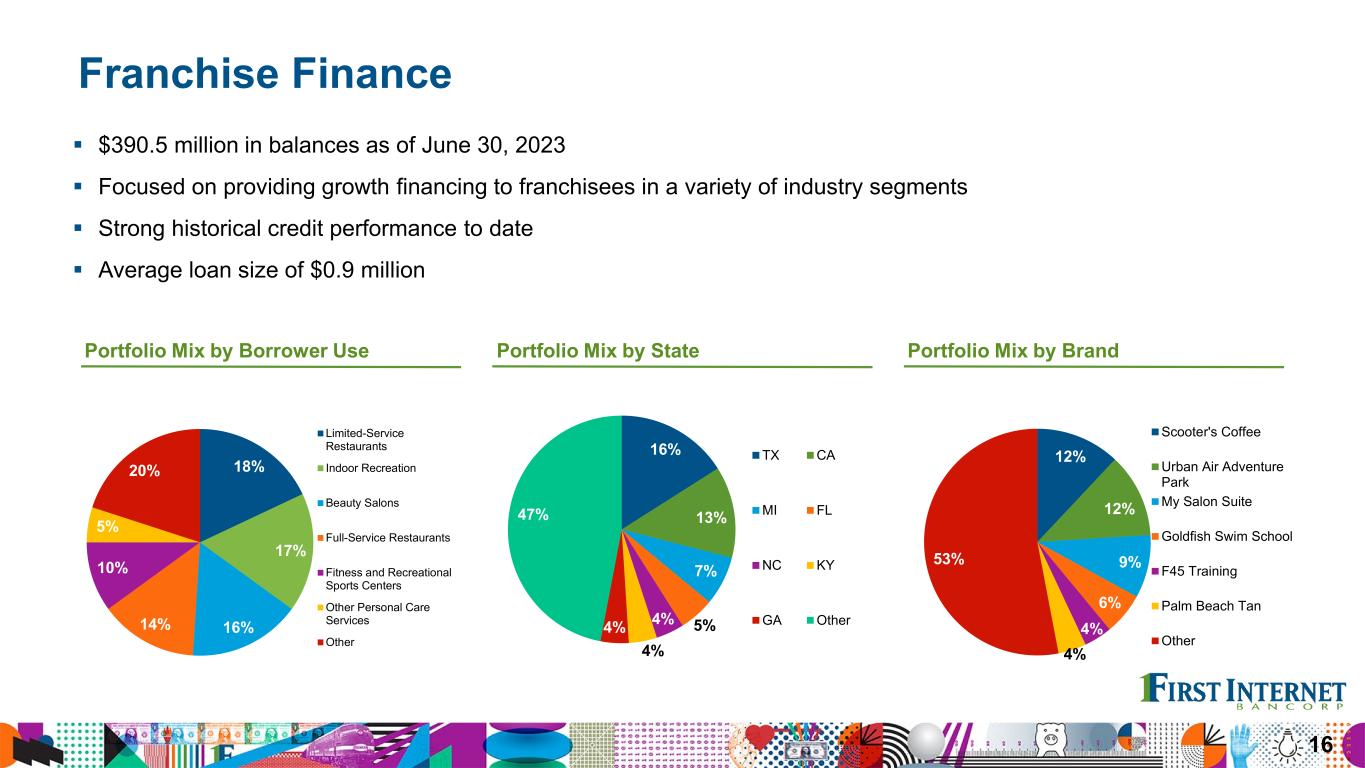

| Franchise finance | 390,479 | 10.6 | % | 382,161 | 10.6 | % | 168,942 | 5.5 | % | |||||||||||||||||||||||||||||

| Total commercial loans | 2,831,052 | 77.5 | % | 2,805,806 | 77.8 | % | 2,437,726 | 79.1 | % | |||||||||||||||||||||||||||||

| Consumer loans | ||||||||||||||||||||||||||||||||||||||

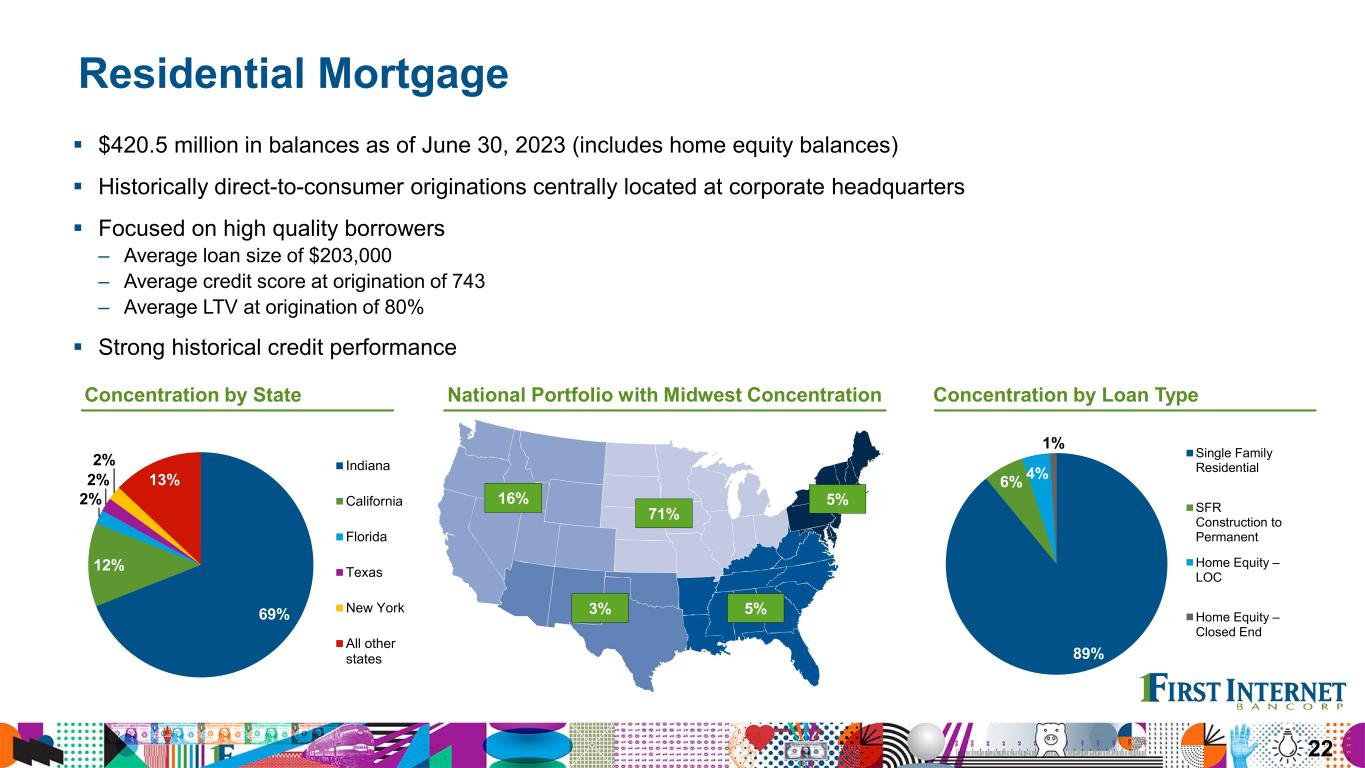

| Residential mortgage | 396,154 | 10.9 | % | 392,062 | 10.9 | % | 281,124 | 9.1 | % | |||||||||||||||||||||||||||||

| Home equity | 24,375 | 0.7 | % | 26,160 | 0.7 | % | 19,928 | 0.6 | % | |||||||||||||||||||||||||||||

| Trailers | 178,035 | 4.9 | % | 172,640 | 4.8 | % | 154,555 | 5.0 | % | |||||||||||||||||||||||||||||

| Recreational vehicles | 133,283 | 3.7 | % | 128,307 | 3.6 | % | 105,876 | 3.4 | % | |||||||||||||||||||||||||||||

| Other consumer loans | 40,806 | 1.1 | % | 37,186 | 1.0 | % | 32,524 | 1.2 | % | |||||||||||||||||||||||||||||

| Total consumer loans | 772,653 | 21.3 | % | 756,355 | 21.0 | % | 594,007 | 19.3 | % | |||||||||||||||||||||||||||||

Net deferred loan fees, premiums, discounts and other 1 |

43,127 | 1.2 | % | 45,081 | 1.2 | % | 50,394 | 1.6 | % | |||||||||||||||||||||||||||||

| Total loans | $ | 3,646,832 | 100.0 | % | $ | 3,607,242 | 100.0 | % | $ | 3,082,127 | 100.0 | % | ||||||||||||||||||||||||||

| June 30, 2023 | March 31, 2023 | June 30, 2022 | ||||||||||||||||||||||||||||||||||||

| Amount | Percent | Amount | Percent | Amount | Percent | |||||||||||||||||||||||||||||||||

| Deposits | ||||||||||||||||||||||||||||||||||||||

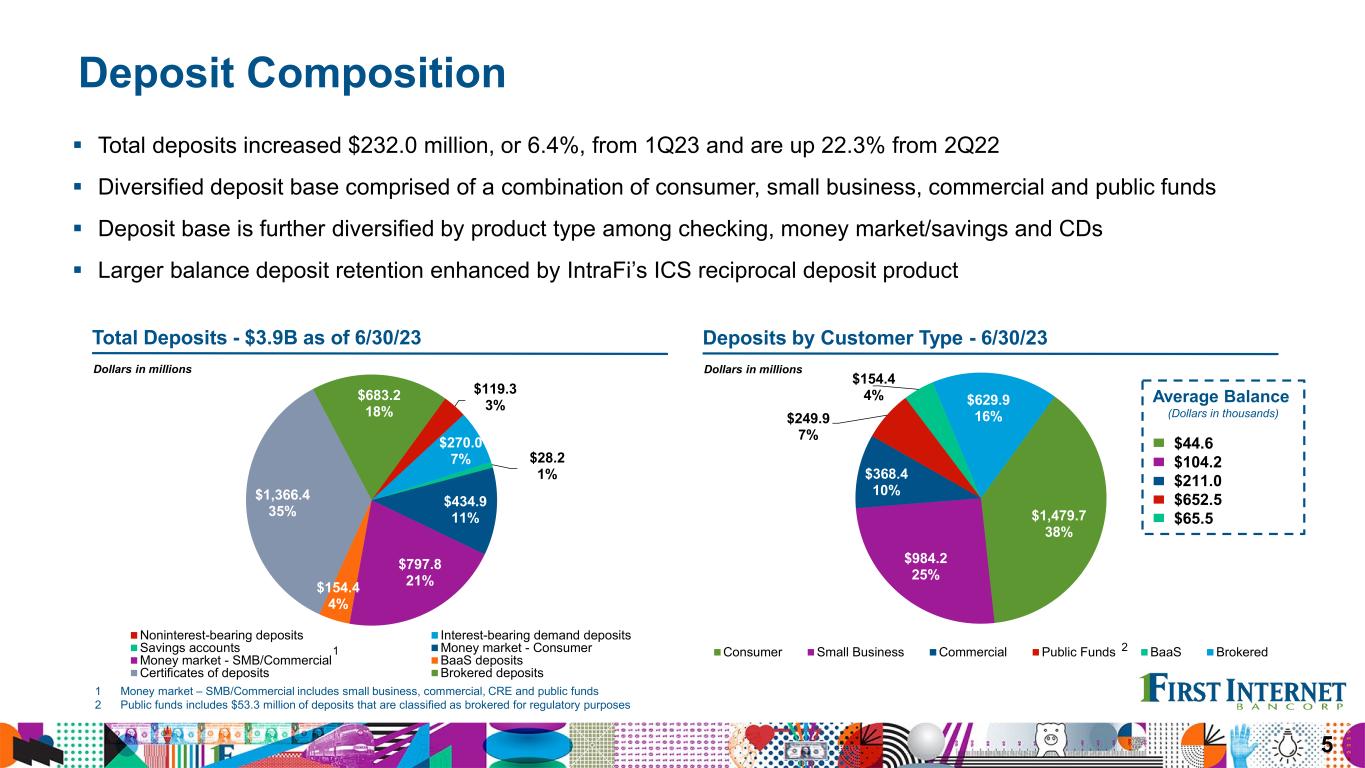

| Noninterest-bearing deposits | $ | 119,291 | 3.1 | % | $ | 140,449 | 3.9 | % | $ | 126,153 | 4.0 | % | ||||||||||||||||||||||||||

| Interest-bearing demand deposits | 398,899 | 10.3 | % | 351,641 | 9.7 | % | 350,551 | 11.1 | % | |||||||||||||||||||||||||||||

| Savings accounts | 28,239 | 0.7 | % | 32,762 | 0.9 | % | 65,365 | 2.1 | % | |||||||||||||||||||||||||||||

| Money market accounts | 1,232,719 | 32.0 | % | 1,254,013 | 34.6 | % | 1,363,424 | 43.3 | % | |||||||||||||||||||||||||||||

| BaaS - brokered deposits | 25,549 | 0.7 | % | 25,725 | 0.7 | % | 194,133 | 6.2 | % | |||||||||||||||||||||||||||||

| Certificates of deposits | 1,366,409 | 35.5 | % | 1,170,094 | 32.3 | % | 800,598 | 25.3 | % | |||||||||||||||||||||||||||||

| Brokered deposits | 683,202 | 17.7 | % | 647,606 | 17.9 | % | 251,877 | 8.0 | % | |||||||||||||||||||||||||||||

| Total deposits | $ | 3,854,308 | 100.0 | % | $ | 3,622,290 | 100.0 | % | $ | 3,152,101 | 100.0 | % | ||||||||||||||||||||||||||

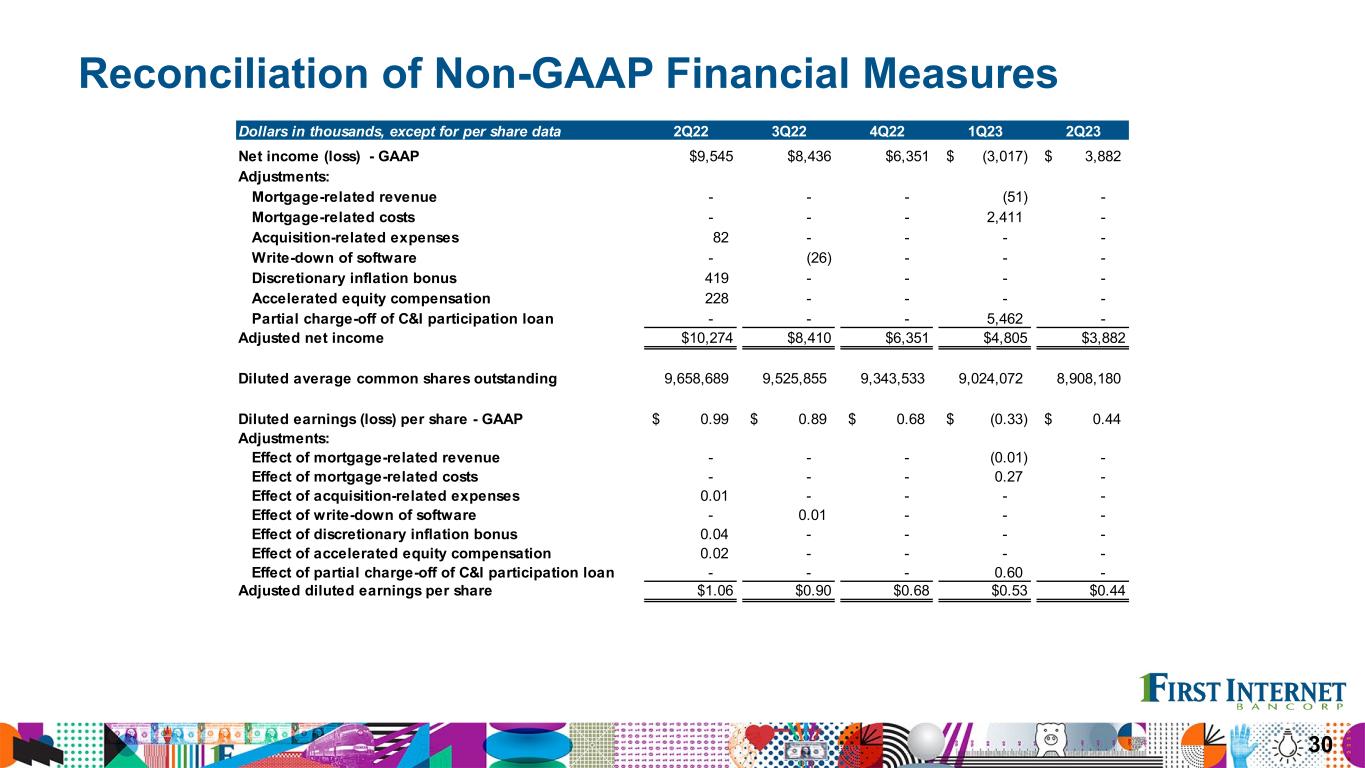

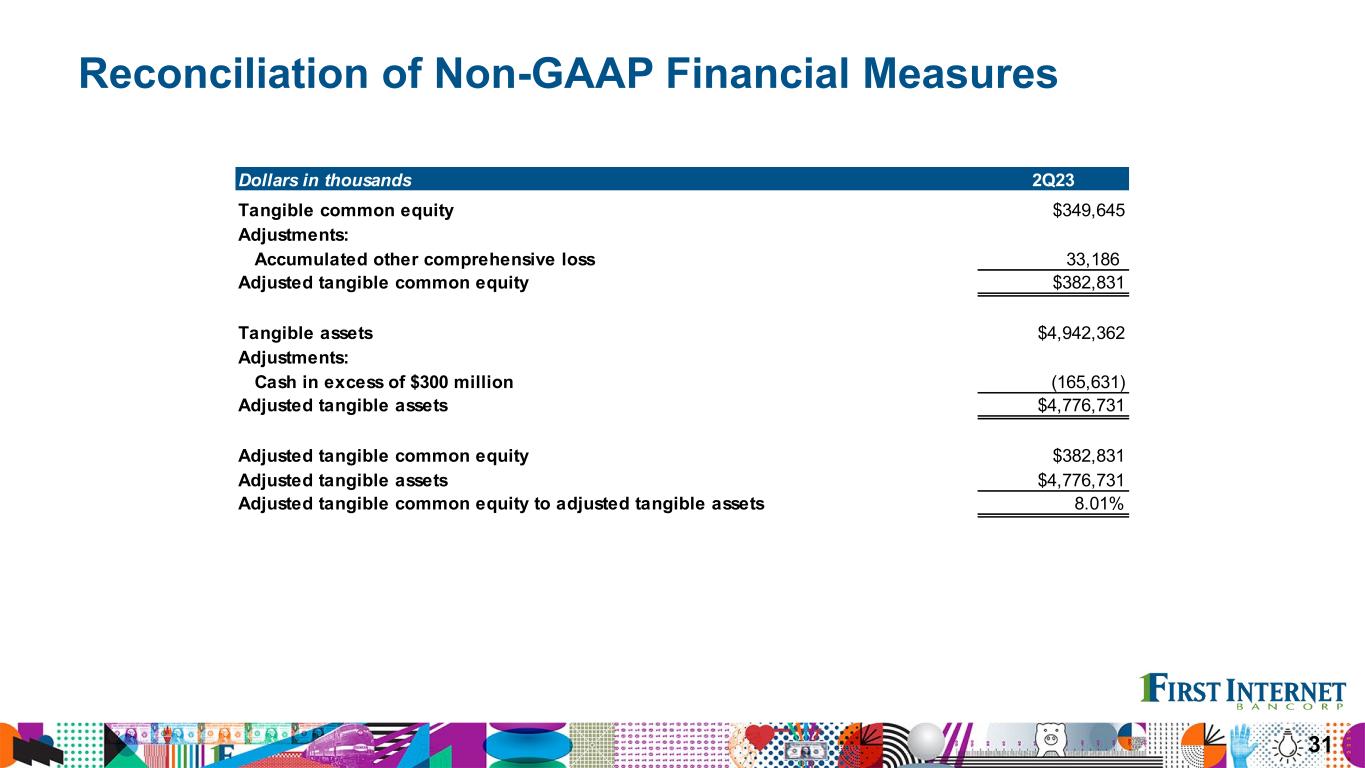

| First Internet Bancorp | ||||||||||||||||||||||||||||||||

| Reconciliation of Non-GAAP Financial Measures | ||||||||||||||||||||||||||||||||

| Dollar amounts in thousands, except per share data | ||||||||||||||||||||||||||||||||

| Three Months Ended | Six Months Ended | |||||||||||||||||||||||||||||||

| June 30, 2023 |

March 31, 2023 |

June 30, 2022 |

June 30, 2023 |

June 30, 2022 |

||||||||||||||||||||||||||||

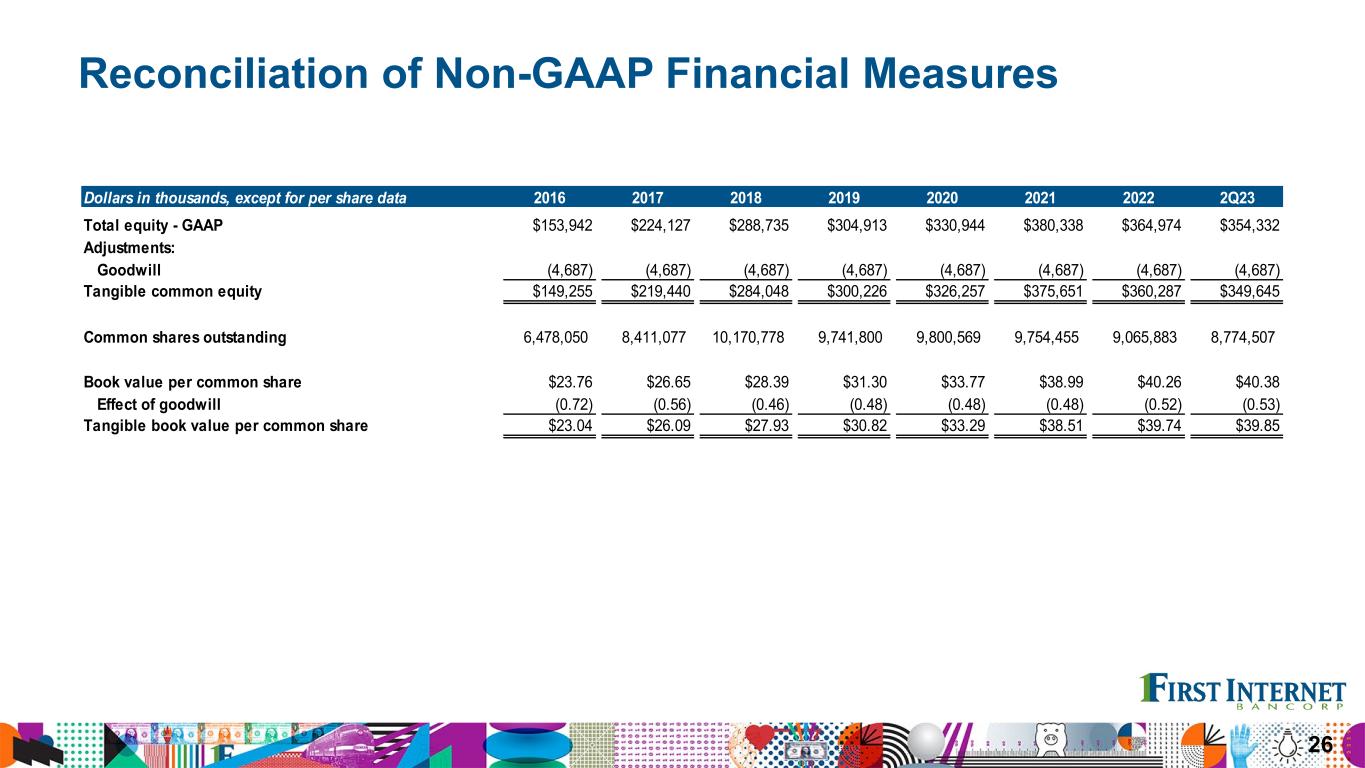

| Total equity - GAAP | $ | 354,332 | $ | 355,572 | $ | 365,332 | $ | 354,332 | $ | 365,332 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Goodwill | (4,687) | (4,687) | (4,687) | (4,687) | (4,687) | |||||||||||||||||||||||||||

| Tangible common equity | $ | 349,645 | $ | 350,885 | $ | 360,645 | $ | 349,645 | $ | 360,645 | ||||||||||||||||||||||

| Total assets - GAAP | $ | 4,947,049 | $ | 4,721,319 | $ | 4,099,806 | $ | 4,947,049 | $ | 4,099,806 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Goodwill | (4,687) | (4,687) | (4,687) | (4,687) | (4,687) | |||||||||||||||||||||||||||

| Tangible assets | $ | 4,942,362 | $ | 4,716,632 | $ | 4,095,119 | $ | 4,942,362 | $ | 4,095,119 | ||||||||||||||||||||||

| Common shares outstanding | 8,774,507 | 8,943,477 | 9,404,000 | 8,774,507 | 9,404,000 | |||||||||||||||||||||||||||

| Book value per common share | $ | 40.38 | $ | 39.76 | $ | 38.85 | $ | 40.38 | $ | 38.85 | ||||||||||||||||||||||

| Effect of goodwill | (0.53) | (0.53) | (0.50) | (0.53) | (0.50) | |||||||||||||||||||||||||||

| Tangible book value per common share | $ | 39.85 | $ | 39.23 | $ | 38.35 | $ | 39.85 | $ | 38.35 | ||||||||||||||||||||||

| Total shareholders' equity to assets | 7.16 | % | 7.53 | % | 8.91 | % | 7.16 | % | 8.91 | % | ||||||||||||||||||||||

| Effect of goodwill | (0.09 | %) | (0.09 | %) | (0.10 | %) | (0.09 | %) | (0.10 | %) | ||||||||||||||||||||||

| Tangible common equity to tangible assets | 7.07 | % | 7.44 | % | 8.81 | % | 7.07 | % | 8.81 | % | ||||||||||||||||||||||

| Total average equity - GAAP | $ | 358,312 | $ | 363,273 | $ | 374,274 | $ | 360,779 | $ | 377,504 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Average goodwill | (4,687) | (4,687) | (4,687) | (4,687) | (4,687) | |||||||||||||||||||||||||||

| Average tangible common equity | $ | 353,625 | $ | 358,586 | $ | 369,587 | $ | 356,092 | $ | 372,817 | ||||||||||||||||||||||

| Return on average shareholders' equity | 4.35 | % | (3.37 | %) | 10.23 | % | 0.48 | % | 11.09 | % | ||||||||||||||||||||||

| Effect of goodwill | 0.05 | % | (0.04 | %) | 0.13 | % | 0.01 | % | 0.14 | % | ||||||||||||||||||||||

| Return on average tangible common equity | 4.40 | % | (3.41 | %) | 10.36 | % | 0.49 | % | 11.23 | % | ||||||||||||||||||||||

| Total interest income | $ | 58,122 | $ | 52,033 | $ | 36,106 | $ | 110,155 | $ | 72,140 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

Fully-taxable equivalent adjustments 1 |

1,347 | 1,383 | 1,377 | 2,731 | 2,691 | |||||||||||||||||||||||||||

| Total interest income - FTE | $ | 59,469 | $ | 53,416 | $ | 37,483 | $ | 112,886 | $ | 74,831 | ||||||||||||||||||||||

| Net interest income | $ | 18,145 | $ | 19,574 | $ | 25,680 | $ | 37,719 | $ | 51,430 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

Fully-taxable equivalent adjustments 1 |

1,347 | 1,383 | 1,377 | 2,731 | 2,691 | |||||||||||||||||||||||||||

| Net interest income - FTE | $ | 19,492 | $ | 20,957 | $ | 27,057 | $ | 40,450 | $ | 54,121 | ||||||||||||||||||||||

| Net interest margin | 1.53 | % | 1.76 | % | 2.60 | % | 1.64 | % | 2.58 | % | ||||||||||||||||||||||

Effect of fully-taxable equivalent adjustments 1 |

0.11 | % | 0.13 | % | 0.14 | % | 0.12 | % | 0.13 | % | ||||||||||||||||||||||

| Net interest margin - FTE | 1.64 | % | 1.89 | % | 2.74 | % | 1.76 | % | 2.71 | % | ||||||||||||||||||||||

| First Internet Bancorp | ||||||||||||||||||||||||||||||||

| Reconciliation of Non-GAAP Financial Measures | ||||||||||||||||||||||||||||||||

| Dollar amounts in thousands, except per share data | ||||||||||||||||||||||||||||||||

| Three Months Ended | Six Months Ended | |||||||||||||||||||||||||||||||

| June 30, 2023 |

March 31, 2023 |

June 30, 2022 |

June 30, 2023 |

June 30, 2022 |

||||||||||||||||||||||||||||

| Total revenue - GAAP | $ | 24,016 | $ | 25,020 | $ | 29,994 | $ | 49,036 | $ | 62,564 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Mortgage-related revenue | — | (65) | — | — | — | |||||||||||||||||||||||||||

| Adjusted total revenue | $ | 24,016 | $ | 24,955 | $ | 29,994 | $ | 49,036 | $ | 62,564 | ||||||||||||||||||||||

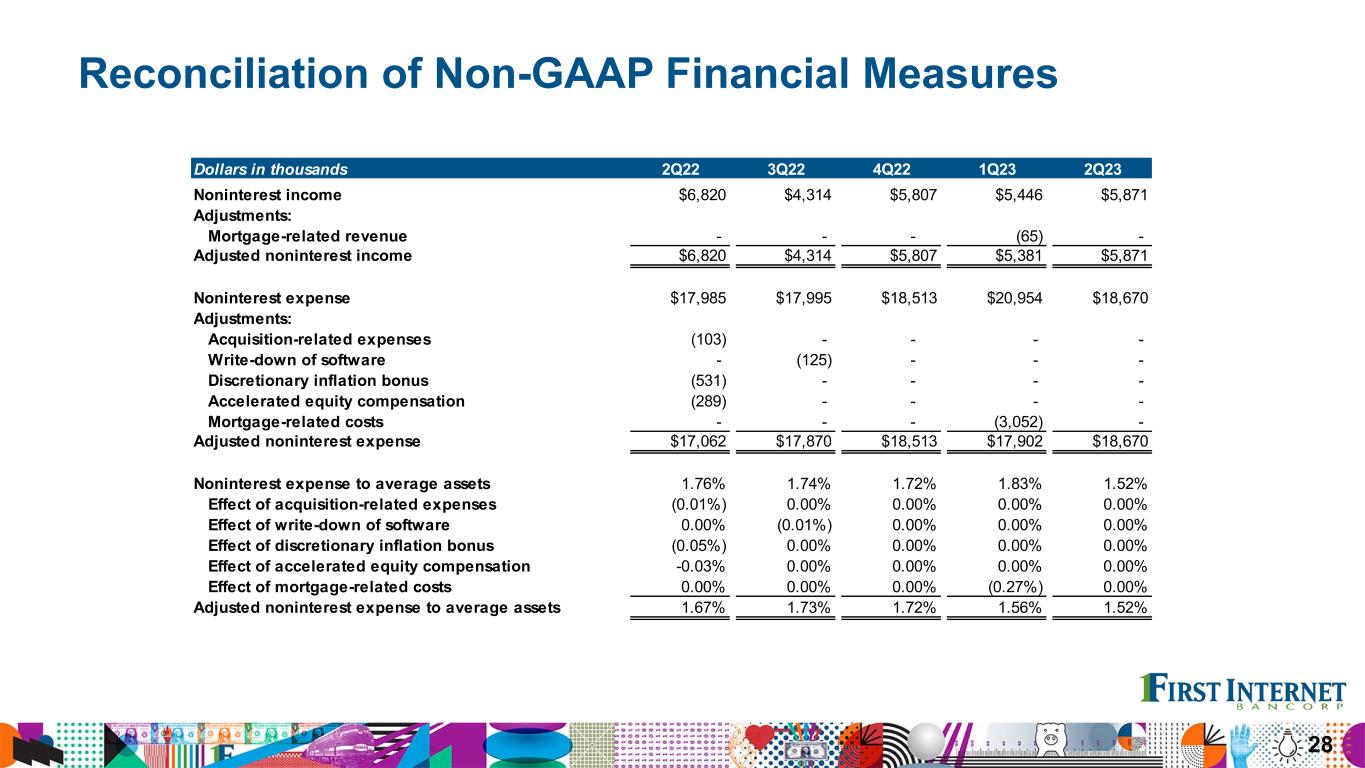

| Noninterest income - GAAP | $ | 5,871 | $ | 5,446 | $ | 4,314 | $ | 11,317 | $ | 11,134 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Mortgage-related revenue | — | (65) | — | (65) | — | |||||||||||||||||||||||||||

| Adjusted noninterest income | $ | 5,871 | $ | 5,381 | $ | 4,314 | $ | 11,252 | $ | 11,134 | ||||||||||||||||||||||

| Noninterest expense - GAAP | $ | 18,670 | $ | 20,954 | $ | 17,985 | $ | 39,624 | $ | 36,765 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Mortgage-related costs | — | (3,052) | — | (3,052) | — | |||||||||||||||||||||||||||

| Acquisition-related expenses | — | — | (103) | — | (273) | |||||||||||||||||||||||||||

| Nonrecurring consulting fee | — | — | — | — | (875) | |||||||||||||||||||||||||||

| Discretionary inflation bonus | — | — | (531) | — | (531) | |||||||||||||||||||||||||||

| Accelerated equity compensation | — | — | (289) | — | (289) | |||||||||||||||||||||||||||

| Adjusted noninterest expense | $ | 18,670 | $ | 17,902 | $ | 17,062 | $ | 36,572 | $ | 34,797 | ||||||||||||||||||||||

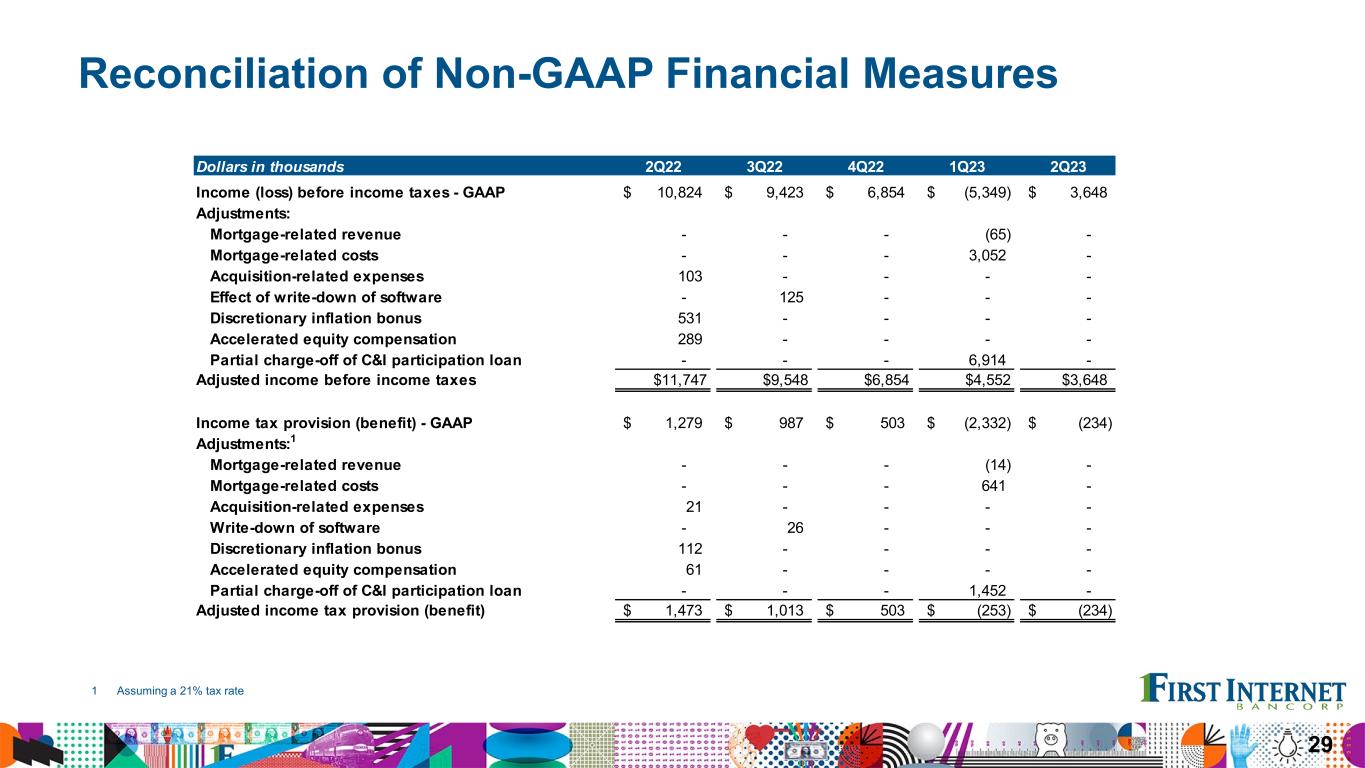

| Income (loss) before income taxes - GAAP | $ | 3,648 | $ | (5,349) | $ | 10,824 | $ | (1,701) | $ | 23,823 | ||||||||||||||||||||||

Adjustments:1 |

||||||||||||||||||||||||||||||||

| Mortgage-related revenue | — | (65) | — | (65) | — | |||||||||||||||||||||||||||

| Mortgage-related costs | — | 3,052 | — | 3,052 | — | |||||||||||||||||||||||||||

| Acquisition-related expenses | — | — | 103 | — | 273 | |||||||||||||||||||||||||||

| Partial charge-off of C&I participation loan | — | 6,914 | — | 6,914 | — | |||||||||||||||||||||||||||

| Nonrecurring consulting fee | — | — | — | — | 875 | |||||||||||||||||||||||||||

| Discretionary inflation bonus | — | — | 531 | — | 531 | |||||||||||||||||||||||||||

| Accelerated equity compensation | — | — | 289 | — | 289 | |||||||||||||||||||||||||||

| Adjusted income (loss) before income taxes | $ | 3,648 | $ | 4,552 | $ | 11,747 | $ | 8,200 | $ | 25,791 | ||||||||||||||||||||||

| Income tax (benefit) provision - GAAP | $ | (234) | $ | (2,332) | $ | 1,279 | $ | (2,566) | $ | 3,069 | ||||||||||||||||||||||

Adjustments:1 |

||||||||||||||||||||||||||||||||

| Mortgage-related revenue | — | (14) | — | (14) | — | |||||||||||||||||||||||||||

| Mortgage-related costs | — | 641 | — | 641 | — | |||||||||||||||||||||||||||

| Acquisition-related expenses | — | — | 21 | — | 57 | |||||||||||||||||||||||||||

| Partial charge-off of C&I participation loan | — | 1,452 | — | 1,452 | — | |||||||||||||||||||||||||||

| Nonrecurring consulting fee | — | — | — | — | 184 | |||||||||||||||||||||||||||

| Discretionary inflation bonus | — | — | 112 | — | 112 | |||||||||||||||||||||||||||

| Accelerated equity compensation | — | — | 61 | — | 61 | |||||||||||||||||||||||||||

| Adjusted income tax (benefit) provision | $ | (234) | $ | (253) | $ | 1,473 | $ | (487) | $ | 3,483 | ||||||||||||||||||||||

| Net income (loss) - GAAP | $ | 3,882 | $ | (3,017) | $ | 9,545 | $ | 865 | $ | 20,754 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Mortgage-related revenue | — | (51) | — | (51) | — | |||||||||||||||||||||||||||

| Mortgage-related costs | — | 2,411 | — | 2,411 | — | |||||||||||||||||||||||||||

| Acquisition-related expenses | — | — | 82 | — | 216 | |||||||||||||||||||||||||||

| Partial charge-off of C&I participation loan | — | 5,462 | — | 5,462 | — | |||||||||||||||||||||||||||

| Nonrecurring consulting fee | — | — | — | — | 691 | |||||||||||||||||||||||||||

| Discretionary inflation bonus | — | — | 419 | — | 419 | |||||||||||||||||||||||||||

| Accelerated equity compensation | — | — | 228 | — | 228 | |||||||||||||||||||||||||||

| Adjusted net income | $ | 3,882 | $ | 4,805 | $ | 10,274 | $ | 8,687 | $ | 22,308 | ||||||||||||||||||||||

1Assuming a 21% tax rate |

||||||||||||||||||||||||||||||||

| First Internet Bancorp | ||||||||||||||||||||||||||||||||

| Reconciliation of Non-GAAP Financial Measures | ||||||||||||||||||||||||||||||||

| Dollar amounts in thousands, except per share data | ||||||||||||||||||||||||||||||||

| Three Months Ended | Six Months Ended | |||||||||||||||||||||||||||||||

| June 30, 2023 |

March 31, 2023 |

June 30, 2022 |

June 30, 2023 |

June 30, 2022 |

||||||||||||||||||||||||||||

| Diluted average common shares outstanding | 8,908,180 | 9,024,072 | 9,658,689 | 8,980,262 | 9,764,232 | |||||||||||||||||||||||||||

| Diluted (loss) earnings per share - GAAP | $ | 0.44 | $ | (0.33) | $ | 0.99 | $ | 0.10 | $ | 2.13 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Effect of mortgage-related revenue | — | (0.01) | — | (0.01) | — | |||||||||||||||||||||||||||

| Effect of mortgage-related costs | — | 0.27 | — | 0.27 | — | |||||||||||||||||||||||||||

| Effect of partial charge-off of C&I participation loan | — | 0.60 | — | 0.61 | — | |||||||||||||||||||||||||||

| Effect of acquisition-related expenses | — | — | 0.01 | — | 0.02 | |||||||||||||||||||||||||||

| Effect of nonrecurring consulting fee | — | — | — | — | 0.07 | |||||||||||||||||||||||||||

| Effect of discretionary inflation bonus | — | — | 0.04 | — | 0.04 | |||||||||||||||||||||||||||

| Effect of accelerated equity compensation | — | — | 0.02 | — | 0.02 | |||||||||||||||||||||||||||

| Adjusted diluted (loss) earnings per share | $ | 0.44 | $ | 0.53 | $ | 1.06 | $ | 0.97 | $ | 2.28 | ||||||||||||||||||||||

| Return on average assets | 0.32 | % | (0.26 | %) | 0.93 | % | 0.04 | % | 1.01 | % | ||||||||||||||||||||||

| Effect of mortgage-related revenue | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | ||||||||||||||||||||||

| Effect of mortgage-related costs | 0.00 | % | 0.21 | % | 0.00 | % | 0.10 | % | 0.00 | % | ||||||||||||||||||||||

| Effect of partial charge-off of C&I participation loan | 0.00 | % | 0.48 | % | 0.00 | % | 0.23 | % | 0.00 | % | ||||||||||||||||||||||

| Effect of acquisition-related expenses | 0.00 | % | 0.00 | % | 0.01 | % | 0.00 | % | 0.01 | % | ||||||||||||||||||||||

| Effect of nonrecurring consulting fee | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | 0.03 | % | ||||||||||||||||||||||

| Effect of discretionary inflation bonus | 0.00 | % | 0.00 | % | 0.04 | % | 0.00 | % | 0.02 | % | ||||||||||||||||||||||

| Effect of accelerated equity compensation | 0.00 | % | 0.00 | % | 0.02 | % | 0.00 | % | 0.01 | % | ||||||||||||||||||||||

| Adjusted return on average assets | 0.32 | % | 0.43 | % | 1.00 | % | 0.37 | % | 1.08 | % | ||||||||||||||||||||||

| Return on average shareholders' equity | 4.35 | % | (3.37 | %) | 10.23 | % | 0.48 | % | 11.09 | % | ||||||||||||||||||||||

| Effect of mortgage-related revenue | 0.00 | % | (0.06 | %) | 0.00 | % | (0.03 | %) | 0.00 | % | ||||||||||||||||||||||

| Effect of mortgage-related costs | 0.00 | % | 2.69 | % | 0.00 | % | 1.35 | % | 0.00 | % | ||||||||||||||||||||||

| Effect of partial charge-off of C&I participation loan | 0.00 | % | 6.10 | % | 0.00 | % | 3.05 | % | 0.00 | % | ||||||||||||||||||||||

| Effect of acquisition-related expenses | 0.00 | % | 0.00 | % | 0.09 | % | 0.00 | % | 0.12 | % | ||||||||||||||||||||||

| Effect of nonrecurring consulting fee | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | 0.37 | % | ||||||||||||||||||||||

| Effect of discretionary inflation bonus | 0.00 | % | 0.00 | % | 0.45 | % | 0.00 | % | 0.22 | % | ||||||||||||||||||||||

| Effect of accelerated equity compensation | 0.00 | % | 0.00 | % | 0.24 | % | 0.00 | % | 0.12 | % | ||||||||||||||||||||||

| Adjusted return on average shareholders' equity | 4.35 | % | 5.36 | % | 11.01 | % | 4.85 | % | 11.92 | % | ||||||||||||||||||||||

| Return on average tangible common equity | 4.40 | % | (3.41 | %) | 10.36 | % | 0.49 | % | 11.23 | % | ||||||||||||||||||||||

| Effect of mortgage-related revenue | 0.00 | % | (0.06 | %) | 0.00 | % | (0.03 | %) | 0.00 | % | ||||||||||||||||||||||

| Effect of mortgage-related costs | 0.00 | % | 2.73 | % | 0.00 | % | 1.37 | % | 0.00 | % | ||||||||||||||||||||||

| Effect of partial charge-off of C&I participation loan | 0.00 | % | 6.18 | % | 0.00 | % | 3.09 | % | 0.00 | % | ||||||||||||||||||||||

| Effect of acquisition-related expenses | 0.00 | % | 0.00 | % | 0.09 | % | 0.00 | % | 0.12 | % | ||||||||||||||||||||||

| Effect of nonrecurring consulting fee | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | 0.37 | % | ||||||||||||||||||||||

| Effect of discretionary inflation bonus | 0.00 | % | 0.00 | % | 0.45 | % | 0.00 | % | 0.23 | % | ||||||||||||||||||||||

| Effect of accelerated equity compensation | 0.00 | % | 0.00 | % | 0.25 | % | 0.00 | % | 0.12 | % | ||||||||||||||||||||||

| Adjusted return on average tangible common equity | 4.40 | % | 5.44 | % | 11.15 | % | 4.92 | % | 12.07 | % | ||||||||||||||||||||||