| First Internet Bancorp | ||||||||||||||

| (Exact Name of Registrant as Specified in Its Charter) | ||||||||||||||

| Indiana | ||||||||||||||

| (State or Other Jurisdiction of Incorporation) | ||||||||||||||

| 001-35750 | 20-3489991 | |||||||||||||

| (Commission File Number) | (IRS Employer Identification No.) | |||||||||||||

| 8701 E. 116th Street | 46038 | |||||||||||||

Fishers, Indiana |

||||||||||||||

| (Address of Principal Executive Offices) | (Zip Code) | |||||||||||||

(317) 532-7900 | ||||||||||||||

| (Registrant's Telephone Number, Including Area Code) | ||||||||||||||

| Title of each class | Trading Symbols | Name of each exchange on which registered | ||||||||||||

| Common Stock, without par value | INBK | The Nasdaq Stock Market LLC | ||||||||||||

| 6.0% Fixed to Floating Subordinated Notes due 2029 | INBKZ | The Nasdaq Stock Market LLC | ||||||||||||

| Number | Description | Method of filing | ||||||||||||

| Furnished electronically | ||||||||||||||

| Furnished electronically | ||||||||||||||

| 104 | Cover Page Interactive Data File (embedded in the cover page formatted in inline XBRL) | |||||||||||||

| Dated: | January 25, 2023 | |||||||||||||

| FIRST INTERNET BANCORP | ||||||||||||||

| By: | /s/ Kenneth J. Lovik | |||||||||||||

| Kenneth J. Lovik, Executive Vice President & Chief Financial Officer | ||||||||||||||

| As of December 31, 2022 | ||||||||||||||

| Company | Bank | |||||||||||||

| Total shareholders' equity to assets | 8.03 | % | 9.72 | % | ||||||||||

Tangible common equity to tangible assets 1 |

7.94 | % | 9.62 | % | ||||||||||

Tier 1 leverage ratio 2 |

9.06 | % | 10.84 | % | ||||||||||

Common equity tier 1 capital ratio 2 |

10.93 | % | 13.10 | % | ||||||||||

Tier 1 capital ratio 2 |

10.93 | % | 13.10 | % | ||||||||||

Total risk-based capital ratio 2 |

14.75 | % | 13.99 | % | ||||||||||

1 This information represents a non-GAAP financial measure. For a discussion of non-GAAP financial measures, see the section below entitled "Non-GAAP Financial Measures." | ||||||||||||||

2 Regulatory capital ratios are preliminary pending filing of the Company's and the Bank's regulatory reports. | ||||||||||||||

| Contact Information: | |||||||||||

| Investors/Analysts | Media | ||||||||||

| Paula Deemer | Nicole Lorch | ||||||||||

| Director of Corporate Administration | President & Chief Operating Officer | ||||||||||

| (317) 428-4628 | (317) 532-7906 | ||||||||||

| investors@firstib.com | nlorch@firstib.com | ||||||||||

| First Internet Bancorp | ||||||||||||||||||||||||||||||||

| Summary Financial Information (unaudited) | ||||||||||||||||||||||||||||||||

| Dollar amounts in thousands, except per share data | ||||||||||||||||||||||||||||||||

| Three Months Ended | Twelve Months Ended | |||||||||||||||||||||||||||||||

| December 31, 2022 |

September 30, 2022 |

December 31, 2021 |

December 31, 2022 |

December 31, 2021 |

||||||||||||||||||||||||||||

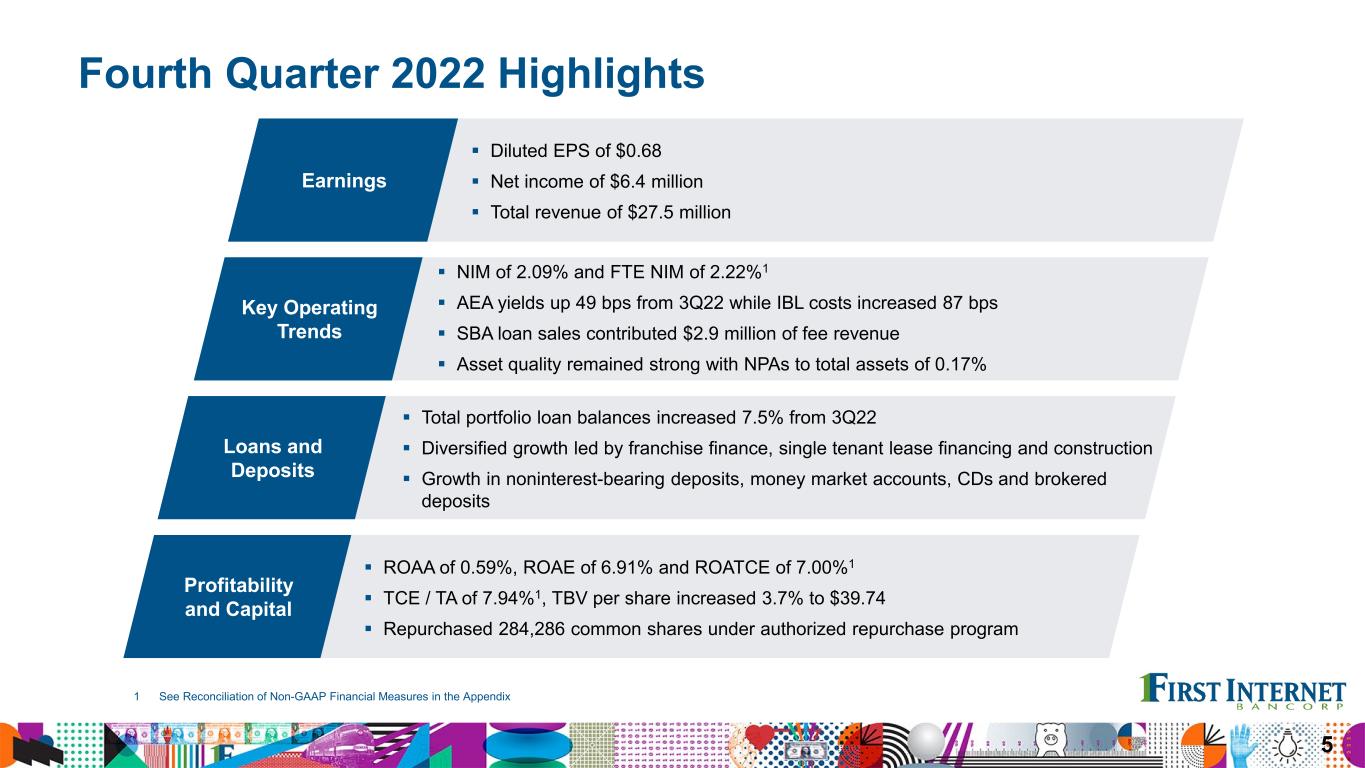

| Net income | $ | 6,351 | $ | 8,436 | $ | 12,478 | $ | 35,541 | $ | 48,114 | ||||||||||||||||||||||

| Per share and share information | ||||||||||||||||||||||||||||||||

| Earnings per share - basic | $ | 0.68 | $ | 0.89 | $ | 1.26 | $ | 3.73 | $ | 4.85 | ||||||||||||||||||||||

| Earnings per share - diluted | 0.68 | 0.89 | 1.25 | 3.70 | 4.82 | |||||||||||||||||||||||||||

| Dividends declared per share | 0.06 | 0.06 | 0.06 | 0.24 | 0.24 | |||||||||||||||||||||||||||

| Book value per common share | 40.26 | 38.84 | 38.99 | 40.26 | 38.99 | |||||||||||||||||||||||||||

Tangible book value per common share 1 |

39.74 | 38.34 | 38.51 | 39.74 | 38.51 | |||||||||||||||||||||||||||

| Common shares outstanding | 9,065,883 | 9,290,885 | 9,754,455 | 9,065,883 | 9,754,455 | |||||||||||||||||||||||||||

| Average common shares outstanding: | ||||||||||||||||||||||||||||||||

| Basic | 9,281,309 | 9,458,259 | 9,903,856 | 9,530,921 | 9,918,083 | |||||||||||||||||||||||||||

| Diluted | 9,343,533 | 9,525,855 | 9,989,951 | 9,595,115 | 9,976,261 | |||||||||||||||||||||||||||

| Performance ratios | ||||||||||||||||||||||||||||||||

| Return on average assets | 0.59 | % | 0.82 | % | 1.19 | % | 0.85 | % | 1.14 | % | ||||||||||||||||||||||

| Return on average shareholders' equity | 6.91 | % | 9.01 | % | 13.14 | % | 9.53 | % | 13.44 | % | ||||||||||||||||||||||

Return on average tangible common equity 1 |

7.00 | % | 9.13 | % | 13.30 | % | 9.65 | % | 13.61 | % | ||||||||||||||||||||||

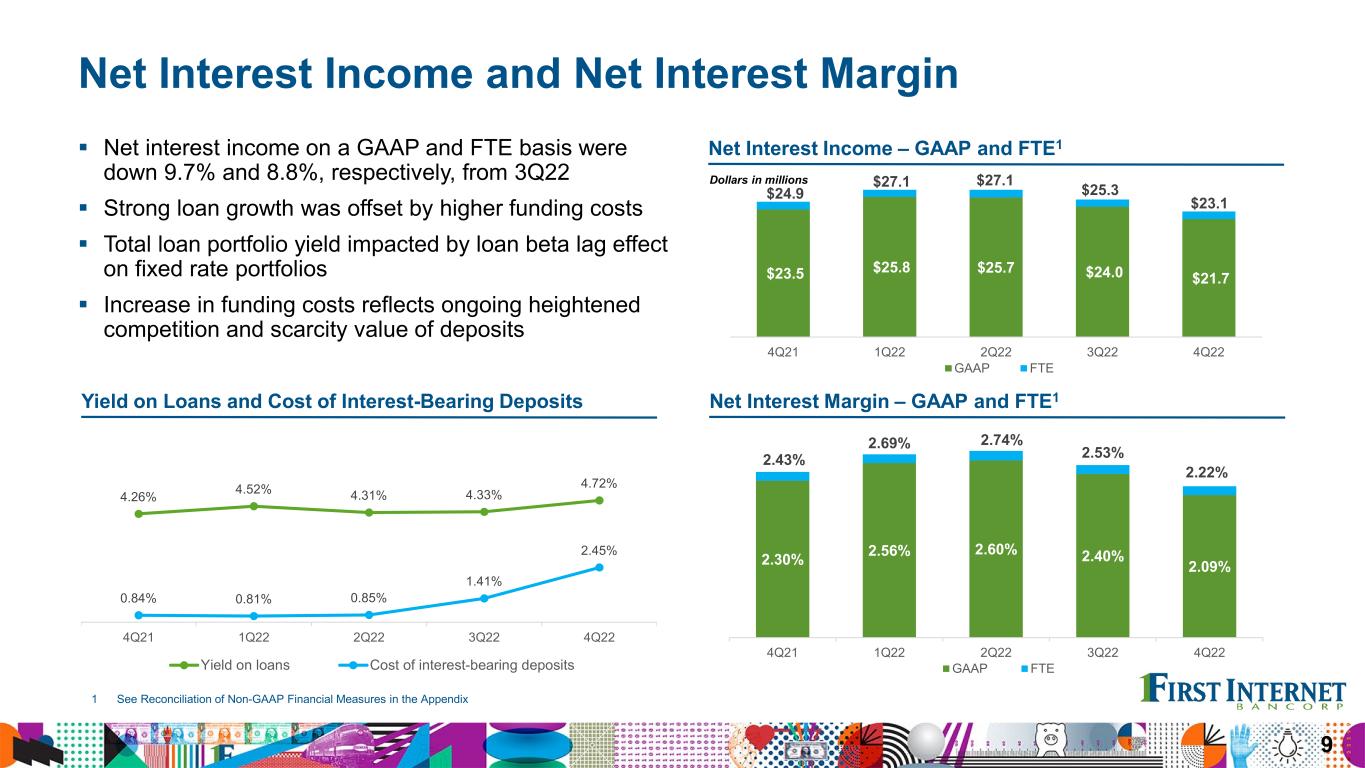

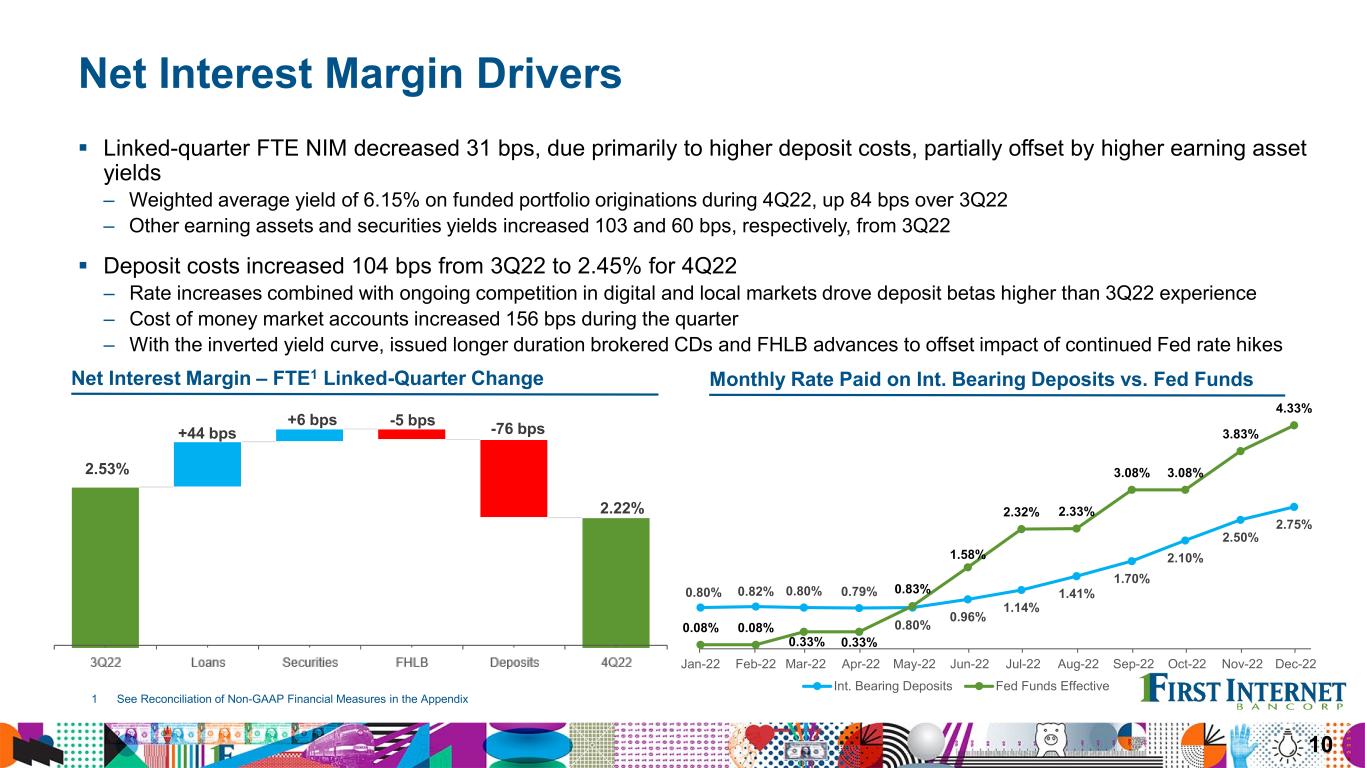

| Net interest margin | 2.09 | % | 2.40 | % | 2.30 | % | 2.41 | % | 2.11 | % | ||||||||||||||||||||||

Net interest margin - FTE 1,2 |

2.22 | % | 2.53 | % | 2.43 | % | 2.54 | % | 2.25 | % | ||||||||||||||||||||||

Capital ratios 3 |

||||||||||||||||||||||||||||||||

| Total shareholders' equity to assets | 8.03 | % | 8.46 | % | 9.03 | % | 8.03 | % | 9.03 | % | ||||||||||||||||||||||

Tangible common equity to tangible assets 1 |

7.94 | % | 8.36 | % | 8.93 | % | 7.94 | % | 8.93 | % | ||||||||||||||||||||||

| Tier 1 leverage ratio | 9.06 | % | 9.49 | % | 9.22 | % | 9.06 | % | 9.22 | % | ||||||||||||||||||||||

| Common equity tier 1 capital ratio | 10.93 | % | 11.72 | % | 12.93 | % | 10.93 | % | 12.93 | % | ||||||||||||||||||||||

| Tier 1 capital ratio | 10.93 | % | 11.72 | % | 12.93 | % | 10.93 | % | 12.93 | % | ||||||||||||||||||||||

| Total risk-based capital ratio | 14.75 | % | 15.73 | % | 17.37 | % | 14.75 | % | 17.37 | % | ||||||||||||||||||||||

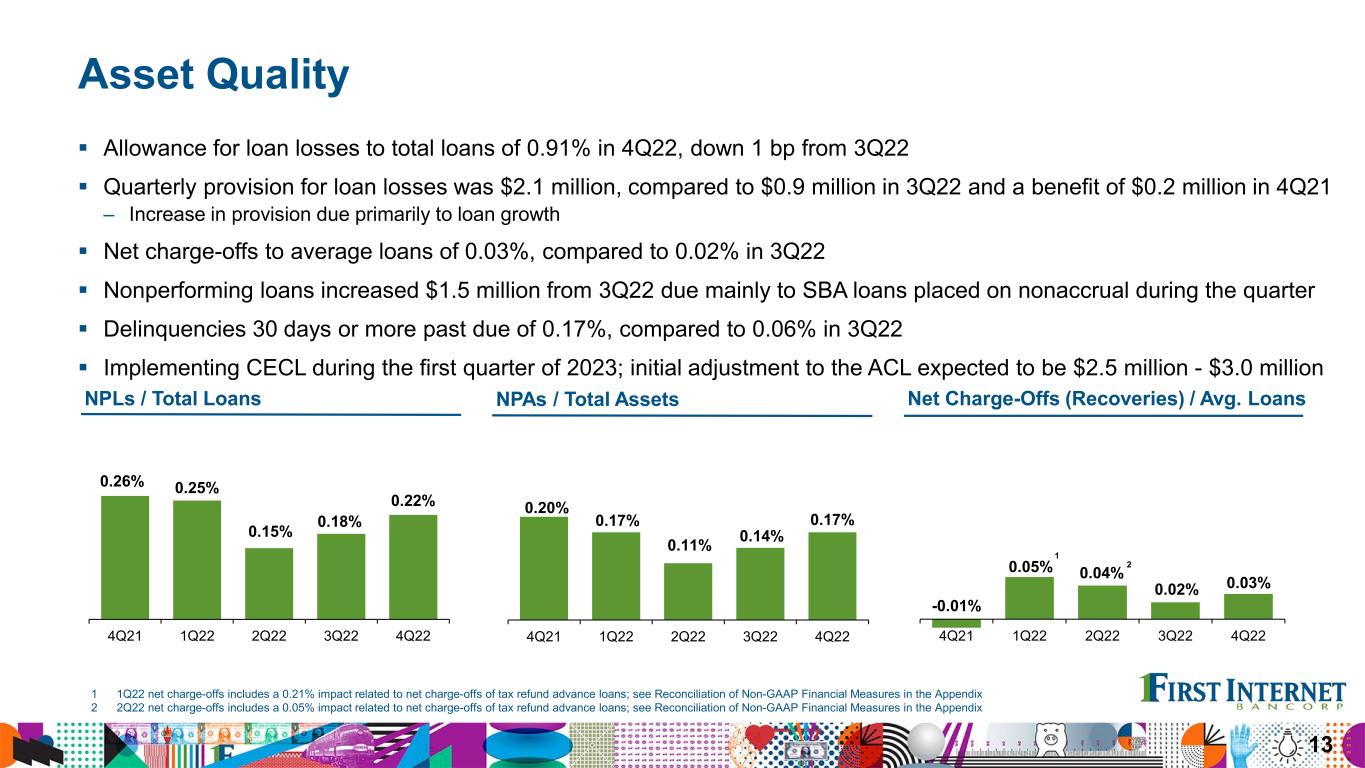

| Asset quality | ||||||||||||||||||||||||||||||||

| Nonperforming loans | $ | 7,529 | $ | 6,006 | $ | 7,401 | $ | 7,529 | $ | 7,401 | ||||||||||||||||||||||

| Nonperforming assets | 7,571 | 6,006 | 8,618 | 7,571 | 8,618 | |||||||||||||||||||||||||||

| Nonperforming loans to loans | 0.22 | % | 0.18 | % | 0.26 | % | 0.22 | % | 0.26 | % | ||||||||||||||||||||||

| Nonperforming assets to total assets | 0.17 | % | 0.14 | % | 0.20 | % | 0.17 | % | 0.20 | % | ||||||||||||||||||||||

| Allowance for loan losses to: | ||||||||||||||||||||||||||||||||

| Loans | 0.91 | % | 0.92 | % | 0.96 | % | 0.91 | % | 0.96 | % | ||||||||||||||||||||||

Loans, excluding PPP loans 1 |

0.91 | % | 0.92 | % | 0.97 | % | 0.91 | % | 0.97 | % | ||||||||||||||||||||||

| Nonperforming loans | 421.5 | % | 497.3 | % | 376.2 | % | 421.5 | % | 376.2 | % | ||||||||||||||||||||||

| Net charge-offs (recoveries) to average loans | 0.03 | % | 0.02 | % | (0.01 | %) | 0.03 | % | 0.09 | % | ||||||||||||||||||||||

| Average balance sheet information | ||||||||||||||||||||||||||||||||

| Loans | $ | 3,382,212 | $ | 3,161,850 | $ | 2,914,858 | $ | 3,123,972 | $ | 2,972,224 | ||||||||||||||||||||||

| Total securities | 578,608 | 606,329 | 677,580 | 613,303 | 629,095 | |||||||||||||||||||||||||||

| Other earning assets | 149,910 | 188,467 | 431,621 | 278,073 | 466,608 | |||||||||||||||||||||||||||

| Total interest-earning assets | 4,119,897 | 3,970,650 | 4,056,254 | 4,033,542 | 4,094,935 | |||||||||||||||||||||||||||

| Total assets | 4,263,246 | 4,105,688 | 4,177,578 | 4,170,526 | 4,205,926 | |||||||||||||||||||||||||||

| Noninterest-bearing deposits | 135,702 | 124,067 | 113,887 | 120,325 | 101,825 | |||||||||||||||||||||||||||

| Interest-bearing deposits | 3,041,022 | 2,961,327 | 3,032,435 | 3,022,794 | 3,098,706 | |||||||||||||||||||||||||||

| Total deposits | 3,176,724 | 3,085,394 | 3,146,322 | 3,143,119 | 3,200,531 | |||||||||||||||||||||||||||

| Shareholders' equity | 364,657 | 371,303 | 376,832 | 372,844 | 358,105 | |||||||||||||||||||||||||||

| First Internet Bancorp | ||||||||||||||||||||

| Condensed Consolidated Balance Sheets (unaudited, except for December 31, 2021) | ||||||||||||||||||||

| Dollar amounts in thousands | ||||||||||||||||||||

| December 31, 2022 |

September 30, 2022 |

December 31, 2021 |

||||||||||||||||||

| Assets | ||||||||||||||||||||

| Cash and due from banks | $ | 17,426 | $ | 14,743 | $ | 7,492 | ||||||||||||||

| Interest-bearing deposits | 239,126 | 206,309 | 435,468 | |||||||||||||||||

| Securities available-for-sale, at fair value | 390,384 | 393,565 | 603,044 | |||||||||||||||||

| Securities held-to-maturity, at amortized cost | 189,168 | 191,057 | 59,565 | |||||||||||||||||

| Loans held-for-sale | 21,511 | 23,103 | 47,745 | |||||||||||||||||

| Loans | 3,499,401 | 3,255,906 | 2,887,662 | |||||||||||||||||

| Allowance for loan losses | (31,737) | (29,866) | (27,841) | |||||||||||||||||

| Net loans | 3,467,664 | 3,226,040 | 2,859,821 | |||||||||||||||||

| Accrued interest receivable | 21,069 | 16,918 | 16,037 | |||||||||||||||||

| Federal Home Loan Bank of Indianapolis stock | 28,350 | 28,350 | 25,650 | |||||||||||||||||

| Cash surrender value of bank-owned life insurance | 39,859 | 39,612 | 38,900 | |||||||||||||||||

| Premises and equipment, net | 72,711 | 70,747 | 59,842 | |||||||||||||||||

| Goodwill | 4,687 | 4,687 | 4,687 | |||||||||||||||||

| Servicing asset | 6,255 | 5,795 | 4,702 | |||||||||||||||||

| Other real estate owned | — | — | 1,188 | |||||||||||||||||

| Accrued income and other assets | 44,894 | 43,498 | 46,853 | |||||||||||||||||

| Total assets | $ | 4,543,104 | $ | 4,264,424 | $ | 4,210,994 | ||||||||||||||

| Liabilities | ||||||||||||||||||||

| Noninterest-bearing deposits | $ | 175,315 | $ | 142,875 | $ | 117,531 | ||||||||||||||

| Interest-bearing deposits | 3,265,930 | 3,049,769 | 3,061,428 | |||||||||||||||||

| Total deposits | 3,441,245 | 3,192,644 | 3,178,959 | |||||||||||||||||

| Advances from Federal Home Loan Bank | 614,928 | 589,926 | 514,922 | |||||||||||||||||

| Subordinated debt | 104,532 | 104,456 | 104,231 | |||||||||||||||||

| Accrued interest payable | 2,913 | 1,887 | 2,018 | |||||||||||||||||

| Accrued expenses and other liabilities | 14,512 | 14,654 | 30,526 | |||||||||||||||||

| Total liabilities | 4,178,130 | 3,903,567 | 3,830,656 | |||||||||||||||||

| Shareholders' equity | ||||||||||||||||||||

| Voting common stock | 192,935 | 200,123 | 218,946 | |||||||||||||||||

| Retained earnings | 205,675 | 199,877 | 172,431 | |||||||||||||||||

| Accumulated other comprehensive loss | (33,636) | (39,143) | (11,039) | |||||||||||||||||

| Total shareholders' equity | 364,974 | 360,857 | 380,338 | |||||||||||||||||

| Total liabilities and shareholders' equity | $ | 4,543,104 | $ | 4,264,424 | $ | 4,210,994 | ||||||||||||||

| First Internet Bancorp | |||||||||||||||||||||||||||||

Condensed Consolidated Statements of Income (unaudited, except for the twelve months ended December 31, 2021) | |||||||||||||||||||||||||||||

| Dollar amounts in thousands, except per share data | |||||||||||||||||||||||||||||

| Three Months Ended | Twelve Months Ended | ||||||||||||||||||||||||||||

| December 31, 2022 |

September 30, 2022 |

December 31, 2021 |

December 31, 2022 |

December 31, 2021 |

|||||||||||||||||||||||||

| Interest income | |||||||||||||||||||||||||||||

| Loans | $ | 40,354 | $ | 34,643 | $ | 31,621 | $ | 140,600 | $ | 123,467 | |||||||||||||||||||

| Securities - taxable | 3,222 | 2,701 | 1,973 | 10,711 | 7,970 | ||||||||||||||||||||||||

| Securities - non-taxable | 699 | 491 | 236 | 1,767 | 1,017 | ||||||||||||||||||||||||

| Other earning assets | 1,394 | 1,264 | 362 | 3,830 | 1,429 | ||||||||||||||||||||||||

| Total interest income | 45,669 | 39,099 | 34,192 | 156,908 | 133,883 | ||||||||||||||||||||||||

| Interest expense | |||||||||||||||||||||||||||||

| Deposits | 18,807 | 10,520 | 6,399 | 41,832 | 29,822 | ||||||||||||||||||||||||

| Other borrowed funds | 5,193 | 4,585 | 4,288 | 17,983 | 17,505 | ||||||||||||||||||||||||

| Total interest expense | 24,000 | 15,105 | 10,687 | 59,815 | 47,327 | ||||||||||||||||||||||||

| Net interest income | 21,669 | 23,994 | 23,505 | 97,093 | 86,556 | ||||||||||||||||||||||||

| Provision (benefit) for loan losses | 2,109 | 892 | (238) | 4,977 | 1,030 | ||||||||||||||||||||||||

| Net interest income after provision (benefit) for loan losses | 19,560 | 23,102 | 23,743 | 92,116 | 85,526 | ||||||||||||||||||||||||

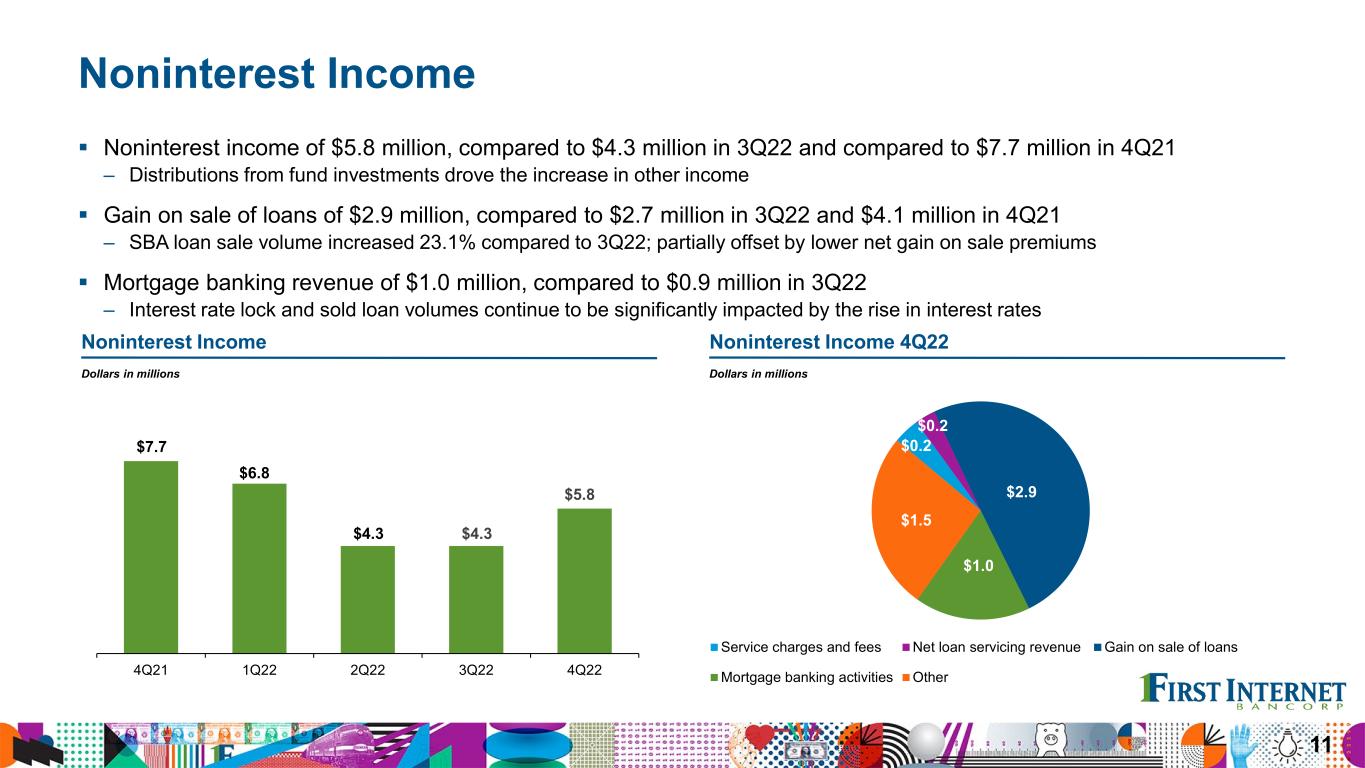

| Noninterest income | |||||||||||||||||||||||||||||

| Service charges and fees | 226 | 248 | 292 | 1,071 | 1,114 | ||||||||||||||||||||||||

| Loan servicing revenue | 715 | 653 | 544 | 2,573 | 1,934 | ||||||||||||||||||||||||

| Loan servicing asset revaluation | (539) | (333) | (400) | (1,639) | (1,069) | ||||||||||||||||||||||||

| Mortgage banking activities | 1,010 | 871 | 2,776 | 5,464 | 15,050 | ||||||||||||||||||||||||

| Gain on sale of loans | 2,862 | 2,713 | 4,137 | 11,372 | 11,598 | ||||||||||||||||||||||||

| Gain on sale of premises and equipment | — | — | — | — | 2,523 | ||||||||||||||||||||||||

| Other | 1,533 | 164 | 345 | 2,416 | 1,694 | ||||||||||||||||||||||||

| Total noninterest income | 5,807 | 4,316 | 7,694 | 21,257 | 32,844 | ||||||||||||||||||||||||

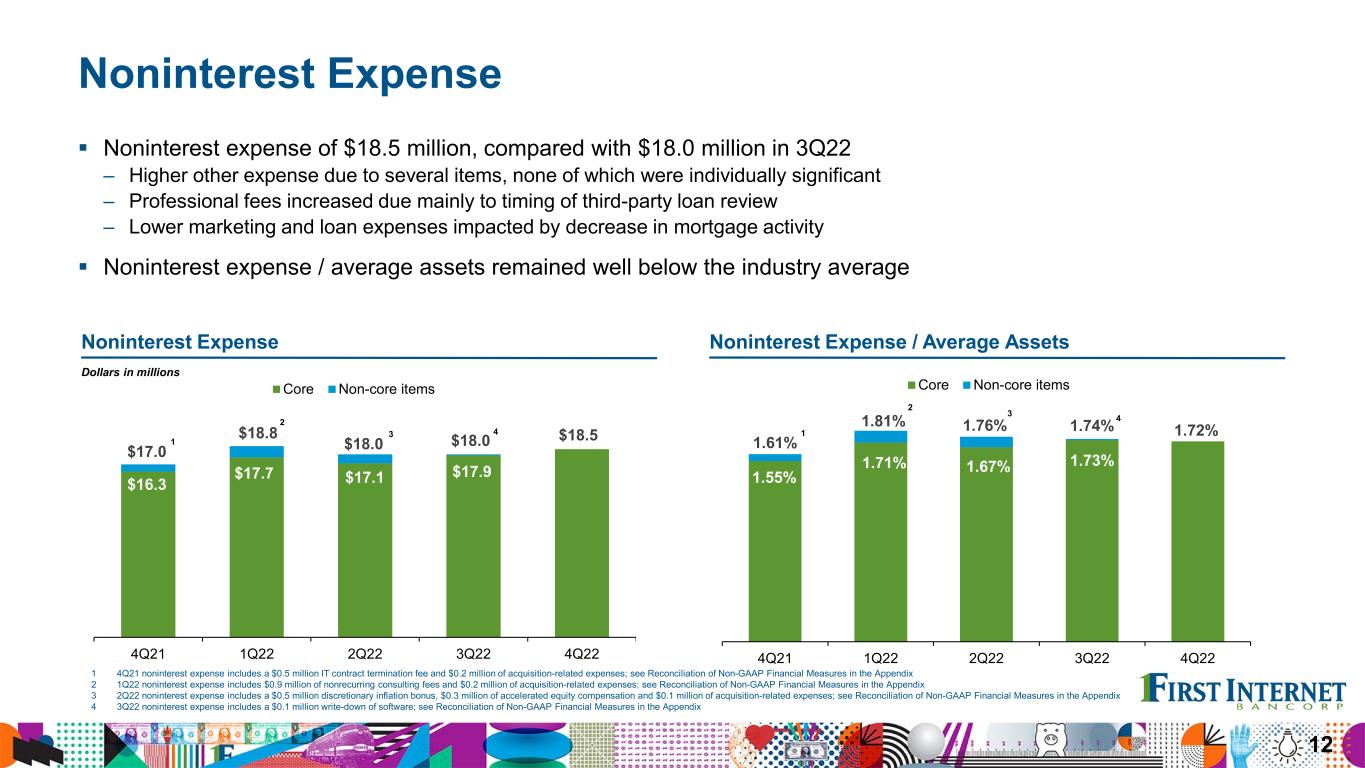

| Noninterest expense | |||||||||||||||||||||||||||||

| Salaries and employee benefits | 10,404 | 10,439 | 10,183 | 41,553 | 38,223 | ||||||||||||||||||||||||

| Marketing, advertising and promotion | 837 | 1,041 | 896 | 3,554 | 3,261 | ||||||||||||||||||||||||

| Consulting and professional fees | 914 | 790 | 1,262 | 4,826 | 4,054 | ||||||||||||||||||||||||

| Data processing | 567 | 483 | 425 | 1,989 | 1,649 | ||||||||||||||||||||||||

| Loan expenses | 1,018 | 1,142 | 654 | 4,435 | 2,112 | ||||||||||||||||||||||||

| Premises and equipment | 2,921 | 2,808 | 2,188 | 10,688 | 7,063 | ||||||||||||||||||||||||

| Deposit insurance premium | 355 | 229 | 283 | 1,152 | 1,213 | ||||||||||||||||||||||||

| Other | 1,497 | 1,063 | 1,064 | 5,076 | 4,223 | ||||||||||||||||||||||||

| Total noninterest expense | 18,513 | 17,995 | 16,955 | 73,273 | 61,798 | ||||||||||||||||||||||||

| Income before income taxes | 6,854 | 9,423 | 14,482 | 40,100 | 56,572 | ||||||||||||||||||||||||

| Income tax provision | 503 | 987 | 2,004 | 4,559 | 8,458 | ||||||||||||||||||||||||

| Net income | $ | 6,351 | $ | 8,436 | $ | 12,478 | $ | 35,541 | $ | 48,114 | |||||||||||||||||||

| Per common share data | |||||||||||||||||||||||||||||

| Earnings per share - basic | $ | 0.68 | $ | 0.89 | $ | 1.26 | $ | 3.73 | $ | 4.85 | |||||||||||||||||||

| Earnings per share - diluted | $ | 0.68 | $ | 0.89 | $ | 1.25 | $ | 3.70 | $ | 4.82 | |||||||||||||||||||

| Dividends declared per share | $ | 0.06 | $ | 0.06 | $ | 0.06 | $ | 0.24 | $ | 0.24 | |||||||||||||||||||

| First Internet Bancorp | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Average Balances and Rates (unaudited) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dollar amounts in thousands | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| December 31, 2022 | September 30, 2022 | December 31, 2021 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Average Balance | Interest / Dividends | Yield / Cost | Average Balance | Interest / Dividends | Yield / Cost | Average Balance | Interest / Dividends | Yield/ Cost | |||||||||||||||||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-earning assets | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Loans, including loans held-for-sale 1 |

$ | 3,391,379 | $ | 40,354 | 4.72 | % | $ | 3,175,854 | $ | 34,643 | 4.33 | % | $ | 2,947,053 | $ | 31,621 | 4.26 | % | |||||||||||||||||||||||||||||||||||

| Securities - taxable | 508,725 | 3,222 | 2.51 | % | 532,470 | 2,701 | 2.01 | % | 595,024 | 1,973 | 1.32 | % | |||||||||||||||||||||||||||||||||||||||||

| Securities - non-taxable | 69,883 | 699 | 3.97 | % | 73,859 | 491 | 2.64 | % | 82,556 | 236 | 1.13 | % | |||||||||||||||||||||||||||||||||||||||||

| Other earning assets | 149,910 | 1,394 | 3.69 | % | 188,467 | 1,264 | 2.66 | % | 431,621 | 362 | 0.33 | % | |||||||||||||||||||||||||||||||||||||||||

| Total interest-earning assets | 4,119,897 | 45,669 | 4.40 | % | 3,970,650 | 39,099 | 3.91 | % | 4,056,254 | 34,192 | 3.34 | % | |||||||||||||||||||||||||||||||||||||||||

| Allowance for loan losses | (30,543) | (29,423) | (27,946) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest-earning assets | 173,892 | 164,461 | 149,270 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 4,263,246 | $ | 4,105,688 | $ | 4,177,578 | |||||||||||||||||||||||||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing demand deposits | $ | 326,102 | $ | 628 | 0.76 | % | $ | 342,116 | $ | 551 | 0.64 | % | $ | 210,283 | $ | 158 | 0.30 | % | |||||||||||||||||||||||||||||||||||

| Savings accounts | 47,799 | 104 | 0.86 | % | 57,700 | 111 | 0.76 | % | 63,575 | 58 | 0.36 | % | |||||||||||||||||||||||||||||||||||||||||

| Money market accounts | 1,441,583 | 10,508 | 2.89 | % | 1,369,783 | 4,581 | 1.33 | % | 1,453,447 | 1,507 | 0.41 | % | |||||||||||||||||||||||||||||||||||||||||

| BaaS - brokered deposits | 4,563 | 13 | 1.13 | % | 153,936 | 859 | 2.21 | % | — | — | 0.00 | % | |||||||||||||||||||||||||||||||||||||||||

| Certificates and brokered deposits | 1,220,975 | 7,554 | 2.45 | % | 1,037,792 | 4,418 | 1.69 | % | 1,305,130 | 4,676 | 1.42 | % | |||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing deposits | 3,041,022 | 18,807 | 2.45 | % | 2,961,327 | 10,520 | 1.41 | % | 3,032,435 | 6,399 | 0.84 | % | |||||||||||||||||||||||||||||||||||||||||

| Other borrowed funds | 712,465 | 5,193 | 2.89 | % | 637,877 | 4,585 | 2.85 | % | 619,115 | 4,288 | 2.75 | % | |||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | 3,753,487 | 24,000 | 2.54 | % | 3,599,204 | 15,105 | 1.67 | % | 3,651,550 | 10,687 | 1.16 | % | |||||||||||||||||||||||||||||||||||||||||

| Noninterest-bearing deposits | 135,702 | 124,067 | 113,887 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Other noninterest-bearing liabilities | 9,400 | 11,114 | 35,309 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities | 3,898,589 | 3,734,385 | 3,800,746 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholders' equity | 364,657 | 371,303 | 376,832 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities and shareholders' equity | $ | 4,263,246 | $ | 4,105,688 | $ | 4,177,578 | |||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 21,669 | $ | 23,994 | $ | 23,505 | |||||||||||||||||||||||||||||||||||||||||||||||

| Interest rate spread | 1.86 | % | 2.24 | % | 2.18 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Net interest margin | 2.09 | % | 2.40 | % | 2.30 | % | |||||||||||||||||||||||||||||||||||||||||||||||

Net interest margin - FTE 2,3 |

2.22 | % | 2.53 | % | 2.43 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| First Internet Bancorp | |||||||||||||||||||||||||||||||||||

| Average Balances and Rates (unaudited) | |||||||||||||||||||||||||||||||||||

| Dollar amounts in thousands | |||||||||||||||||||||||||||||||||||

| Twelve Months Ended | |||||||||||||||||||||||||||||||||||

| December 31, 2022 | December 31, 2021 | ||||||||||||||||||||||||||||||||||

| Average Balance | Interest / Dividends | Yield/Cost | Average Balance | Interest / Dividends | Yield / Cost | ||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||

| Interest-earning assets | |||||||||||||||||||||||||||||||||||

Loans, including loans held-for-sale 1 |

$ | 3,142,166 | $ | 140,600 | 4.47 | % | $ | 2,999,232 | $ | 123,467 | 4.12 | % | |||||||||||||||||||||||

| Securities - taxable | 537,921 | 10,711 | 1.99 | % | 544,613 | 7,970 | 1.46 | % | |||||||||||||||||||||||||||

| Securities - non-taxable | 75,382 | 1,767 | 2.34 | % | 84,482 | 1,017 | 1.20 | % | |||||||||||||||||||||||||||

| Other earning assets | 278,073 | 3,830 | 1.38 | % | 466,608 | 1,429 | 0.31 | % | |||||||||||||||||||||||||||

| Total interest-earning assets | 4,033,542 | 156,908 | 3.89 | % | 4,094,935 | 133,883 | 3.27 | % | |||||||||||||||||||||||||||

| Allowance for loan losses | (29,143) | (29,068) | |||||||||||||||||||||||||||||||||

| Noninterest-earning assets | 166,127 | 140,059 | |||||||||||||||||||||||||||||||||

| Total assets | $ | 4,170,526 | $ | 4,205,926 | |||||||||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities | |||||||||||||||||||||||||||||||||||

| Interest-bearing demand deposits | $ | 333,737 | $ | 2,056 | 0.62 | % | $ | 195,699 | $ | 583 | 0.30 | % | |||||||||||||||||||||||

| Savings accounts | 58,156 | 336 | 0.58 | % | 56,967 | 203 | 0.36 | % | |||||||||||||||||||||||||||

| Money market accounts | 1,423,185 | 18,513 | 1.30 | % | 1,434,829 | 5,892 | 0.41 | % | |||||||||||||||||||||||||||

| BaaS - brokered deposits | 60,699 | 1,033 | 1.70 | % | — | — | 0.00 | % | |||||||||||||||||||||||||||

| Certificates and brokered deposits | 1,147,017 | 19,894 | 1.73 | % | 1,411,211 | 23,144 | 1.64 | % | |||||||||||||||||||||||||||

| Total interest-bearing deposits | 3,022,794 | 41,832 | 1.38 | % | 3,098,706 | 29,822 | 0.96 | % | |||||||||||||||||||||||||||

| Other borrowed funds | 638,526 | 17,983 | 2.82 | % | 600,035 | 17,505 | 2.92 | % | |||||||||||||||||||||||||||

| Total interest-bearing liabilities | 3,661,320 | 59,815 | 1.63 | % | 3,698,741 | 47,327 | 1.28 | % | |||||||||||||||||||||||||||

| Noninterest-bearing deposits | 120,325 | 101,825 | |||||||||||||||||||||||||||||||||

| Other noninterest-bearing liabilities | 16,037 | 47,255 | |||||||||||||||||||||||||||||||||

| Total liabilities | 3,797,682 | 3,847,821 | |||||||||||||||||||||||||||||||||

| Shareholders' equity | 372,844 | 358,105 | |||||||||||||||||||||||||||||||||

| Total liabilities and shareholders' equity | $ | 4,170,526 | $ | 4,205,926 | |||||||||||||||||||||||||||||||

| Net interest income | $ | 97,093 | $ | 86,556 | |||||||||||||||||||||||||||||||

| Interest rate spread | 2.26 | % | 1.99 | % | |||||||||||||||||||||||||||||||

| Net interest margin | 2.41 | % | 2.11 | % | |||||||||||||||||||||||||||||||

Net interest margin - FTE 2,3 |

2.54 | % | 2.25 | % | |||||||||||||||||||||||||||||||

| First Internet Bancorp | ||||||||||||||||||||||||||||||||||||||

| Loans and Deposits (unaudited) | ||||||||||||||||||||||||||||||||||||||

| Dollar amounts in thousands | ||||||||||||||||||||||||||||||||||||||

| December 31, 2022 | September 30, 2022 | December 31, 2021 | ||||||||||||||||||||||||||||||||||||

| Amount | Percent | Amount | Percent | Amount | Percent | |||||||||||||||||||||||||||||||||

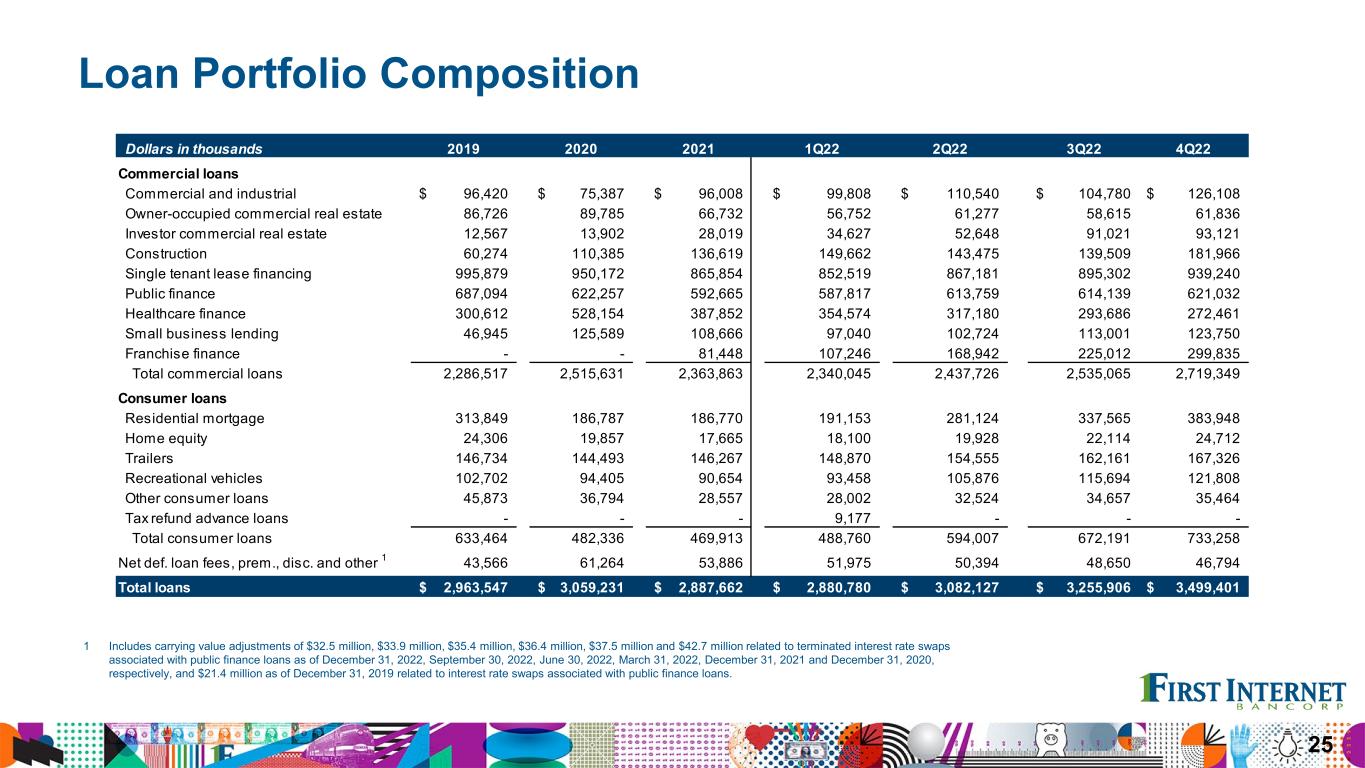

| Commercial loans | ||||||||||||||||||||||||||||||||||||||

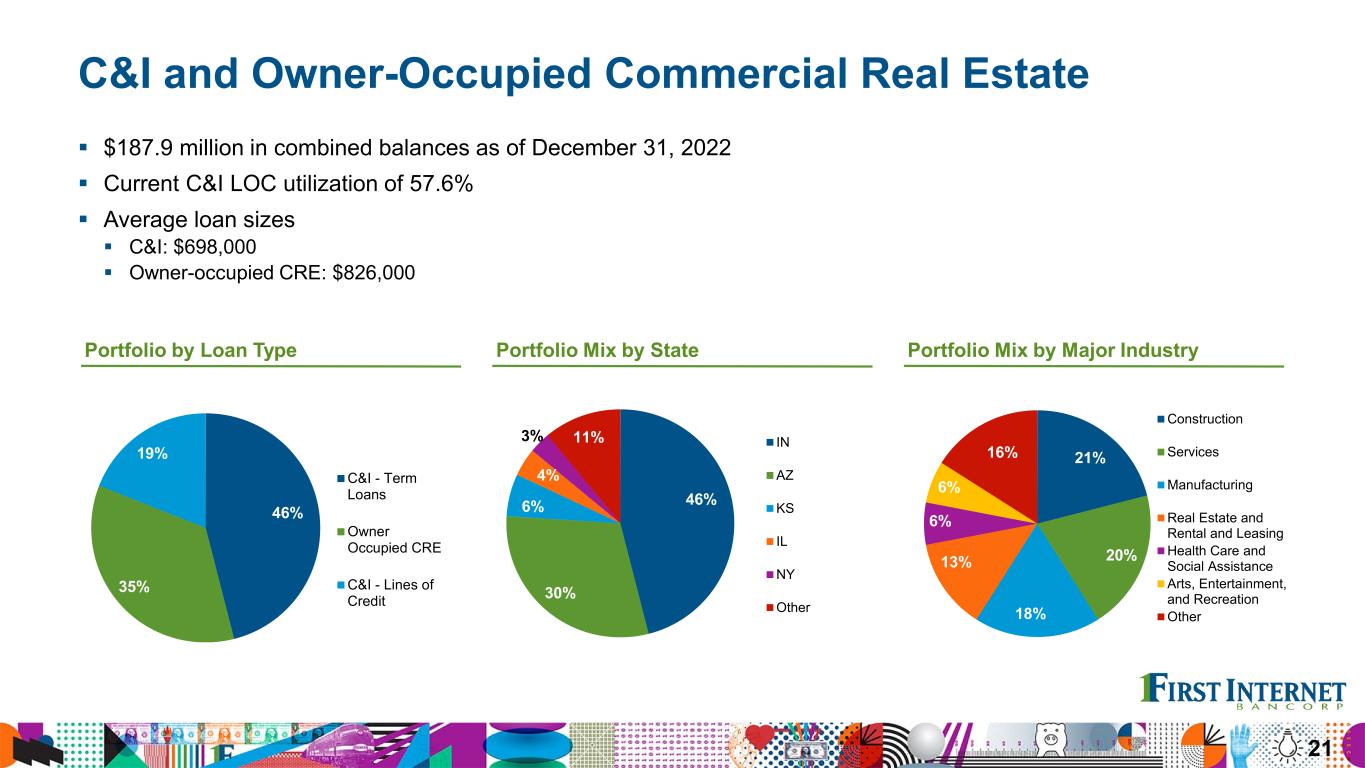

| Commercial and industrial | $ | 126,108 | 3.6 | % | $ | 104,780 | 3.2 | % | $ | 96,008 | 3.3 | % | ||||||||||||||||||||||||||

| Owner-occupied commercial real estate | 61,836 | 1.8 | % | 58,615 | 1.8 | % | 66,732 | 2.3 | % | |||||||||||||||||||||||||||||

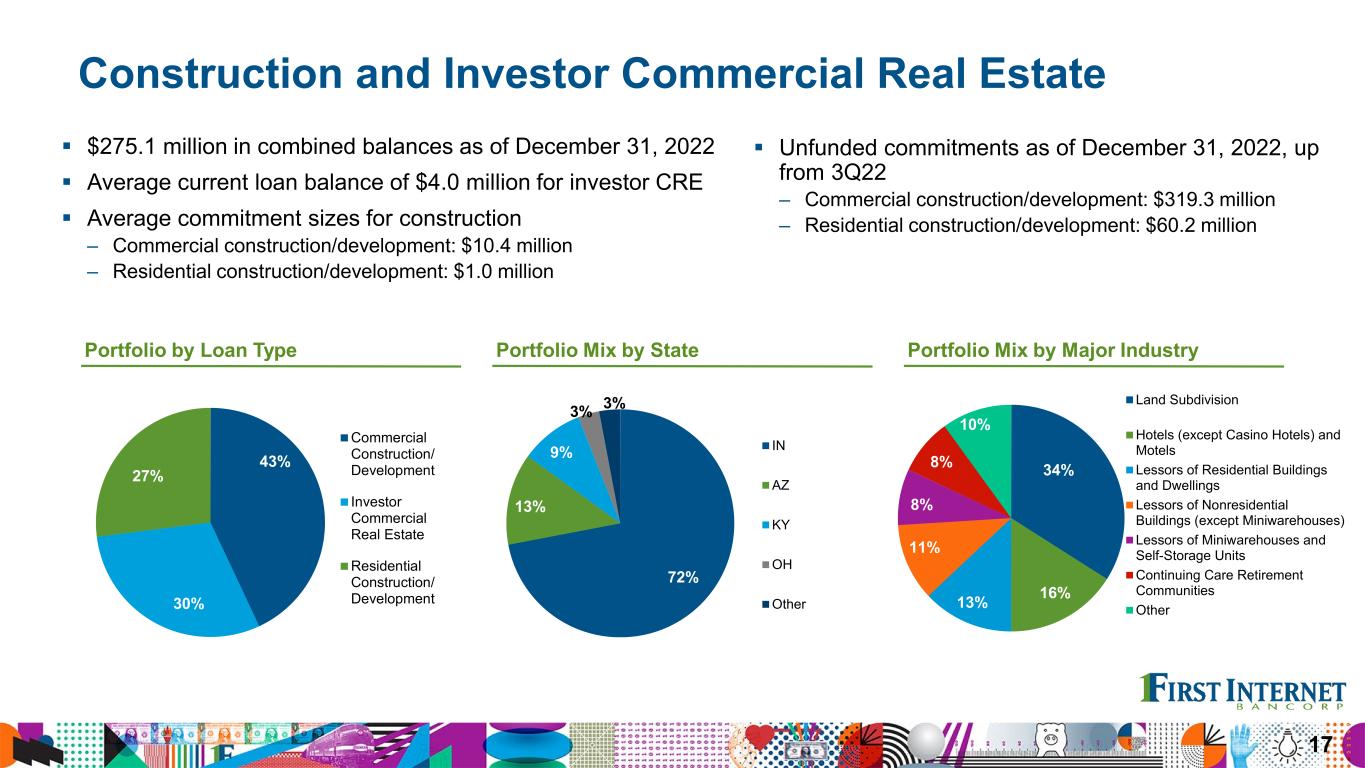

| Investor commercial real estate | 93,121 | 2.7 | % | 91,021 | 2.8 | % | 28,019 | 1.0 | % | |||||||||||||||||||||||||||||

| Construction | 181,966 | 5.2 | % | 139,509 | 4.3 | % | 136,619 | 4.7 | % | |||||||||||||||||||||||||||||

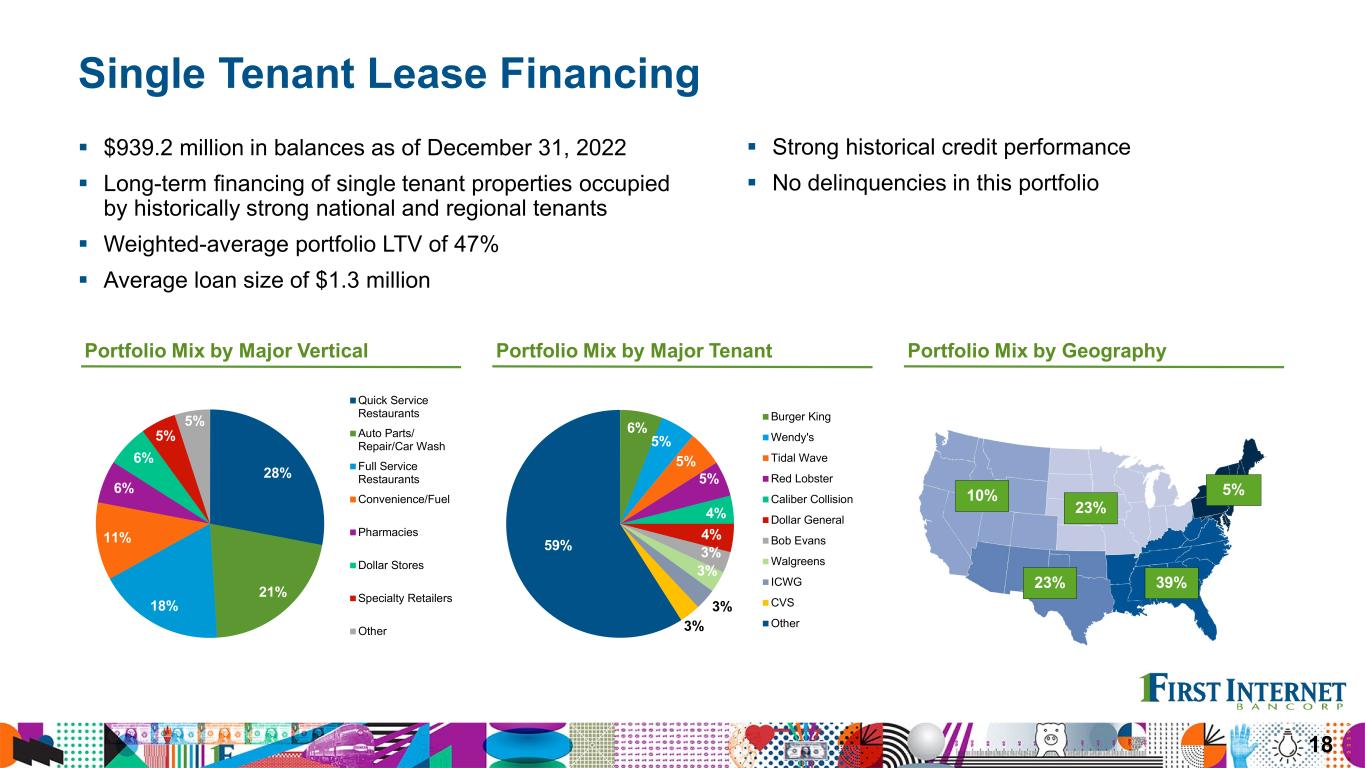

| Single tenant lease financing | 939,240 | 26.8 | % | 895,302 | 27.4 | % | 865,854 | 30.0 | % | |||||||||||||||||||||||||||||

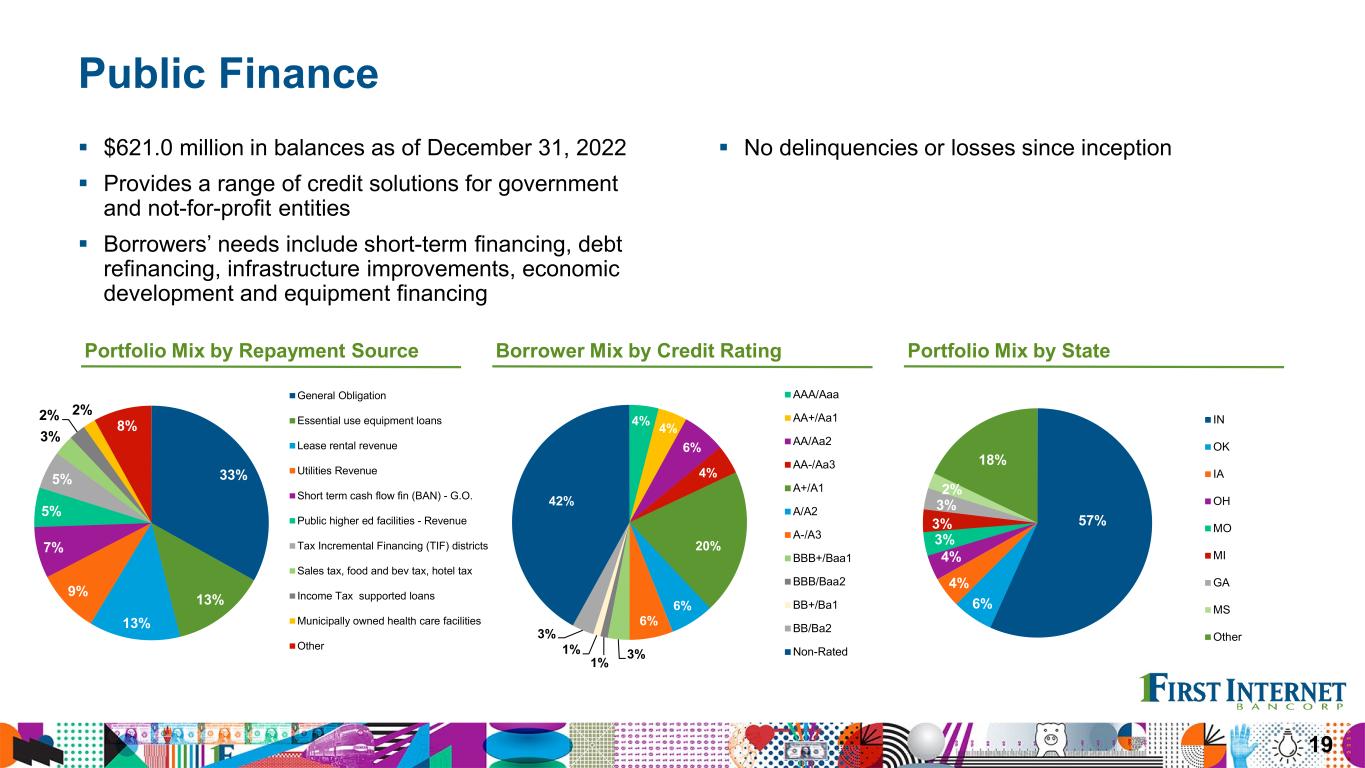

| Public finance | 621,032 | 17.7 | % | 614,139 | 18.9 | % | 592,665 | 20.5 | % | |||||||||||||||||||||||||||||

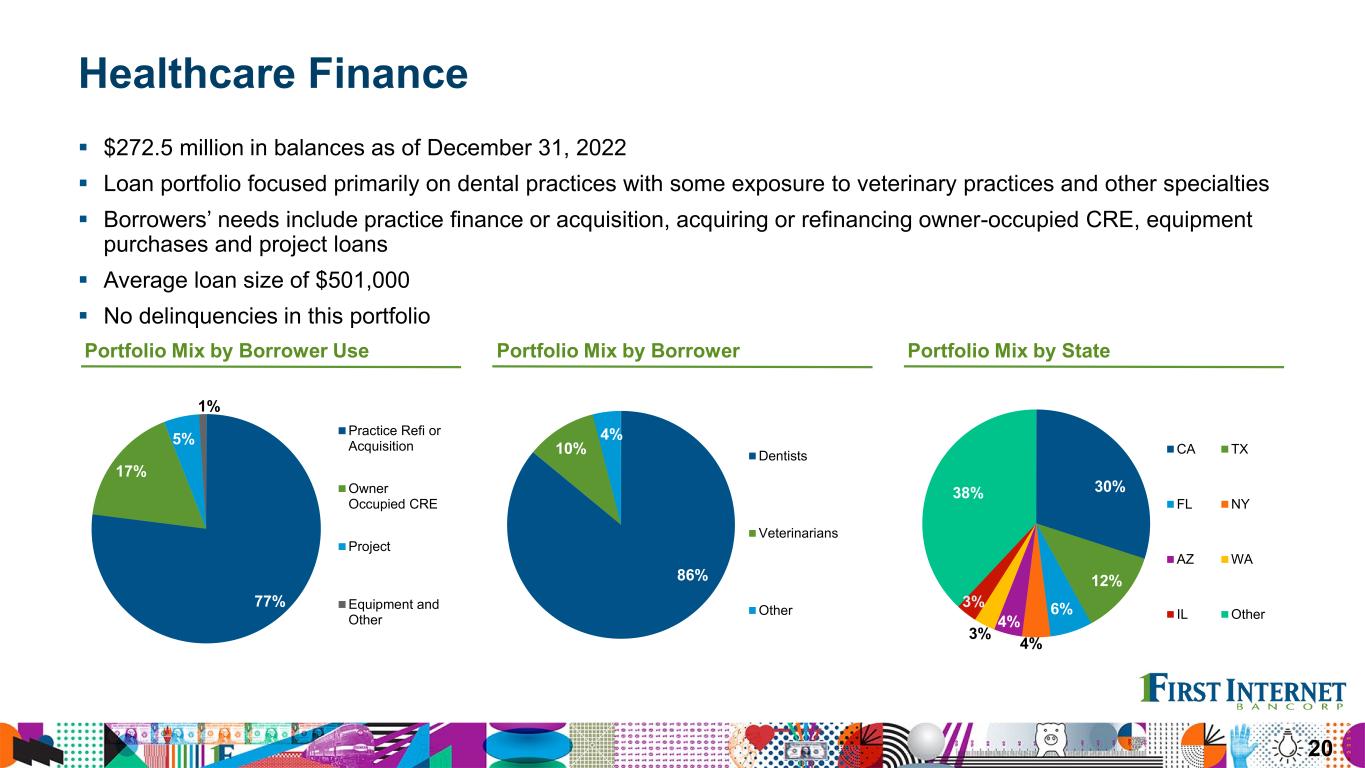

| Healthcare finance | 272,461 | 7.8 | % | 293,686 | 9.0 | % | 387,852 | 13.4 | % | |||||||||||||||||||||||||||||

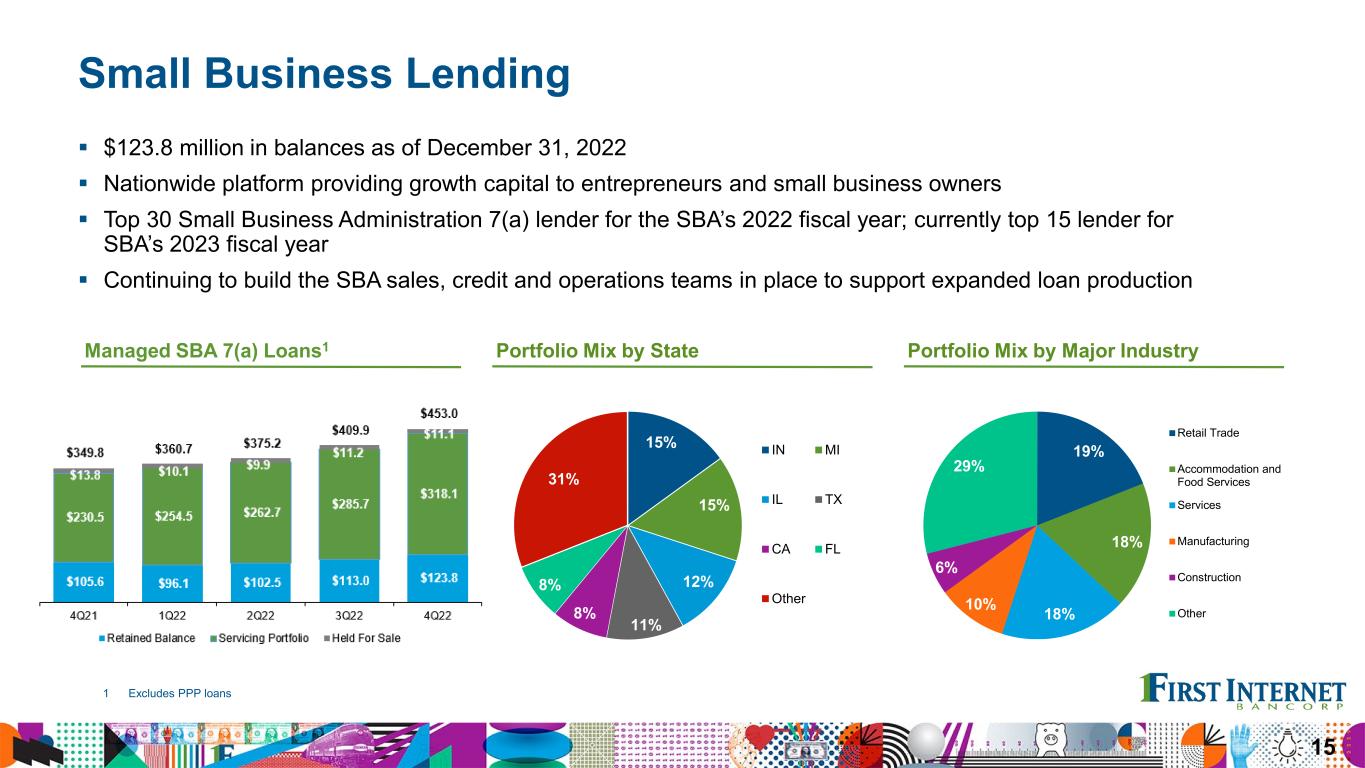

| Small business lending | 123,750 | 3.5 | % | 113,001 | 3.5 | % | 108,666 | 3.8 | % | |||||||||||||||||||||||||||||

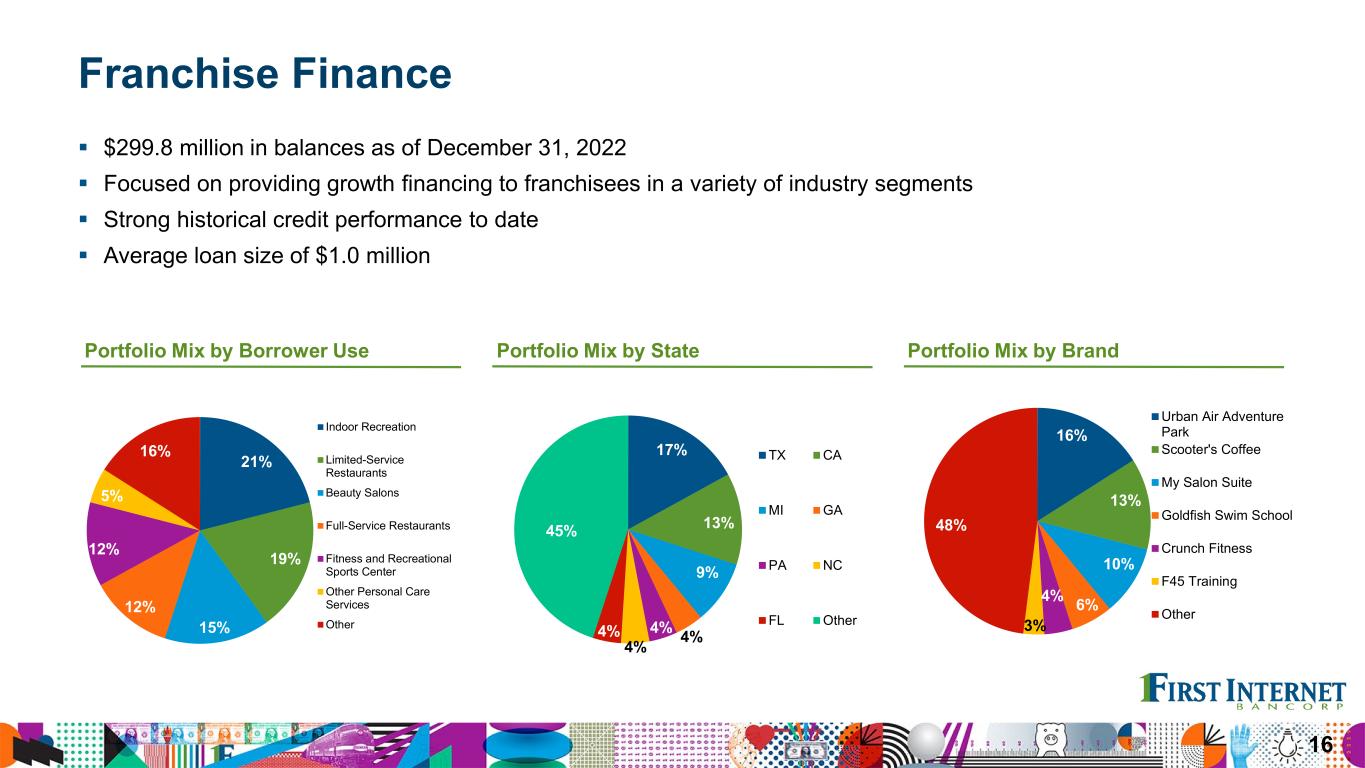

| Franchise finance | 299,835 | 8.6 | % | 225,012 | 6.8 | % | 81,448 | 2.8 | % | |||||||||||||||||||||||||||||

| Total commercial loans | 2,719,349 | 77.7 | % | 2,535,065 | 77.7 | % | 2,363,863 | 81.8 | % | |||||||||||||||||||||||||||||

| Consumer loans | ||||||||||||||||||||||||||||||||||||||

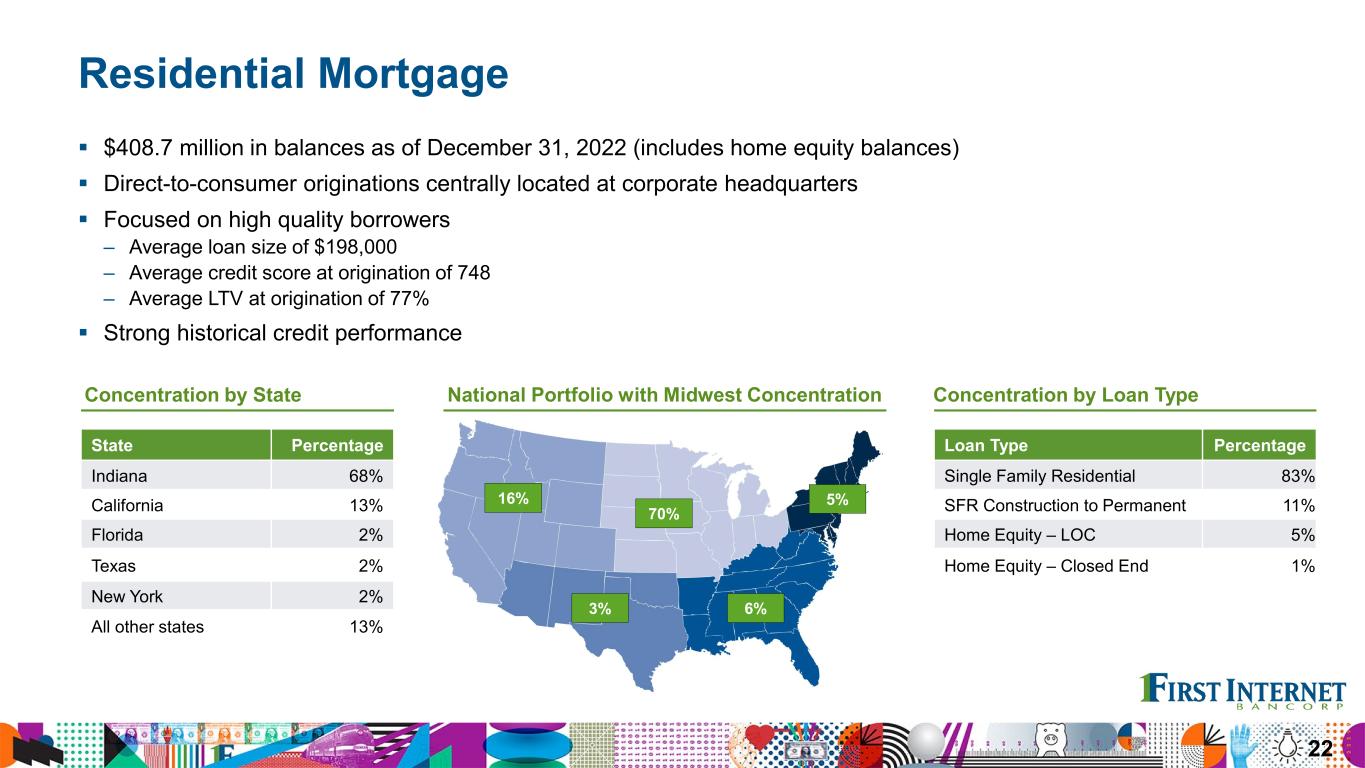

| Residential mortgage | 383,948 | 11.0 | % | 337,565 | 10.4 | % | 186,770 | 6.5 | % | |||||||||||||||||||||||||||||

| Home equity | 24,712 | 0.7 | % | 22,114 | 0.7 | % | 17,665 | 0.6 | % | |||||||||||||||||||||||||||||

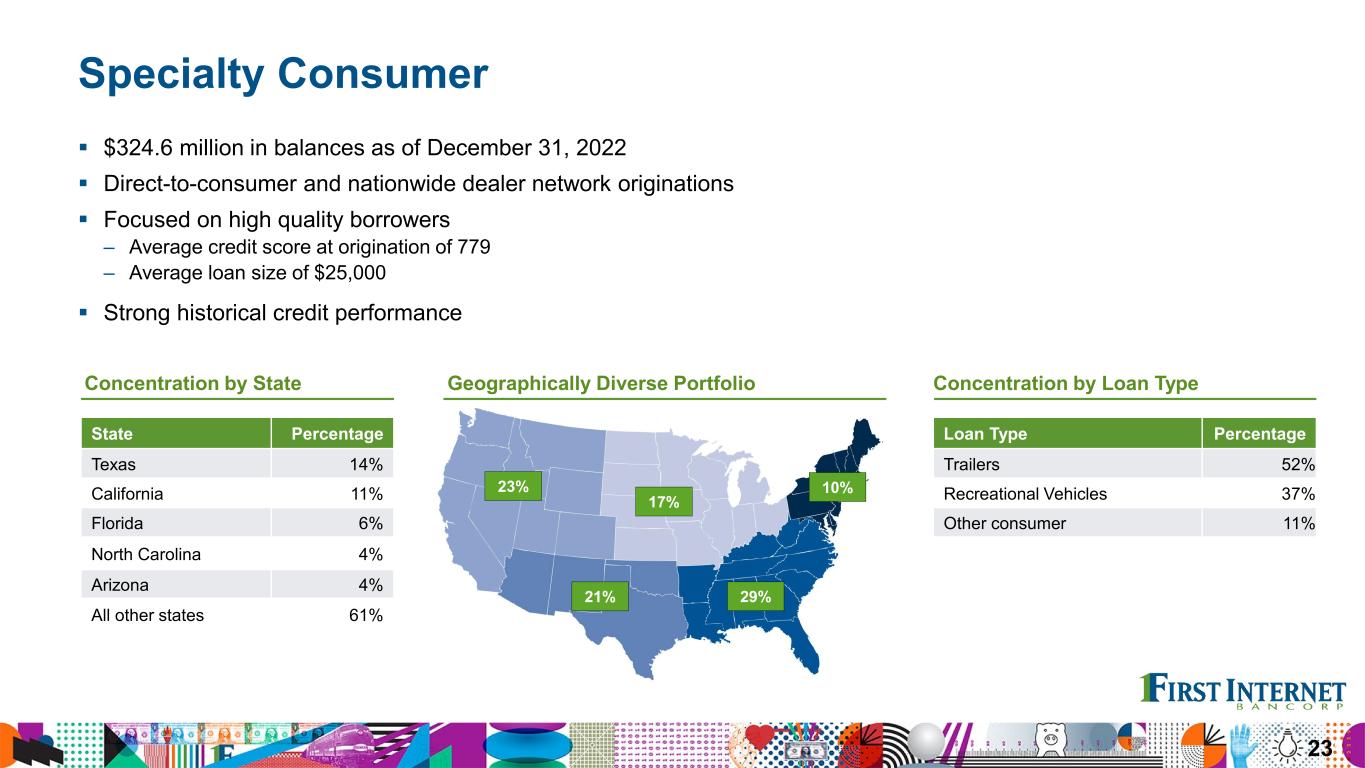

| Trailers | 167,326 | 4.8 | % | 162,161 | 5.0 | % | 146,267 | 5.1 | % | |||||||||||||||||||||||||||||

| Recreational vehicles | 121,808 | 3.5 | % | 115,694 | 3.6 | % | 90,654 | 3.1 | % | |||||||||||||||||||||||||||||

| Other consumer loans | 35,464 | 1.0 | % | 34,657 | 1.1 | % | 28,557 | 1.0 | % | |||||||||||||||||||||||||||||

| Total consumer loans | 733,258 | 21.0 | % | 672,191 | 20.8 | % | 469,913 | 16.3 | % | |||||||||||||||||||||||||||||

Net deferred loan fees, premiums, discounts and other 1 |

46,794 | 1.3 | % | 48,650 | 1.5 | % | 53,886 | 1.9 | % | |||||||||||||||||||||||||||||

| Total loans | $ | 3,499,401 | 100.0 | % | $ | 3,255,906 | 100.0 | % | $ | 2,887,662 | 100.0 | % | ||||||||||||||||||||||||||

| December 31, 2022 | September 30, 2022 | December 31, 2021 | ||||||||||||||||||||||||||||||||||||

| Amount | Percent | Amount | Percent | Amount | Percent | |||||||||||||||||||||||||||||||||

| Deposits | ||||||||||||||||||||||||||||||||||||||

| Noninterest-bearing deposits | $ | 175,315 | 5.1 | % | $ | 142,635 | 4.5 | % | $ | 117,531 | 3.7 | % | ||||||||||||||||||||||||||

| Interest-bearing demand deposits | 335,611 | 9.8 | % | 337,765 | 10.6 | % | 247,967 | 7.8 | % | |||||||||||||||||||||||||||||

| Savings accounts | 44,819 | 1.3 | % | 52,228 | 1.6 | % | 59,998 | 1.9 | % | |||||||||||||||||||||||||||||

| Money market accounts | 1,418,599 | 41.2 | % | 1,378,087 | 43.2 | % | 1,483,936 | 46.7 | % | |||||||||||||||||||||||||||||

| BaaS - brokered deposits | 13,607 | 0.4 | % | 96,287 | 3.0 | % | — | 0.0 | % | |||||||||||||||||||||||||||||

| Certificates of deposits | 874,490 | 25.4 | % | 773,040 | 24.2 | % | 970,107 | 30.5 | % | |||||||||||||||||||||||||||||

| Brokered deposits | 578,804 | 16.8 | % | 412,602 | 12.9 | % | 299,420 | 9.4 | % | |||||||||||||||||||||||||||||

| Total deposits | $ | 3,441,245 | 100.0 | % | $ | 3,192,644 | 100.0 | % | $ | 3,178,959 | 100.0 | % | ||||||||||||||||||||||||||

| First Internet Bancorp | ||||||||||||||||||||||||||||||||

| Reconciliation of Non-GAAP Financial Measures | ||||||||||||||||||||||||||||||||

| Dollar amounts in thousands, except per share data | ||||||||||||||||||||||||||||||||

| Three Months Ended | Twelve Months Ended | |||||||||||||||||||||||||||||||

| December 31, 2022 |

September 30, 2022 |

December 31, 2021 |

December 31, 2022 |

December 31, 2021 |

||||||||||||||||||||||||||||

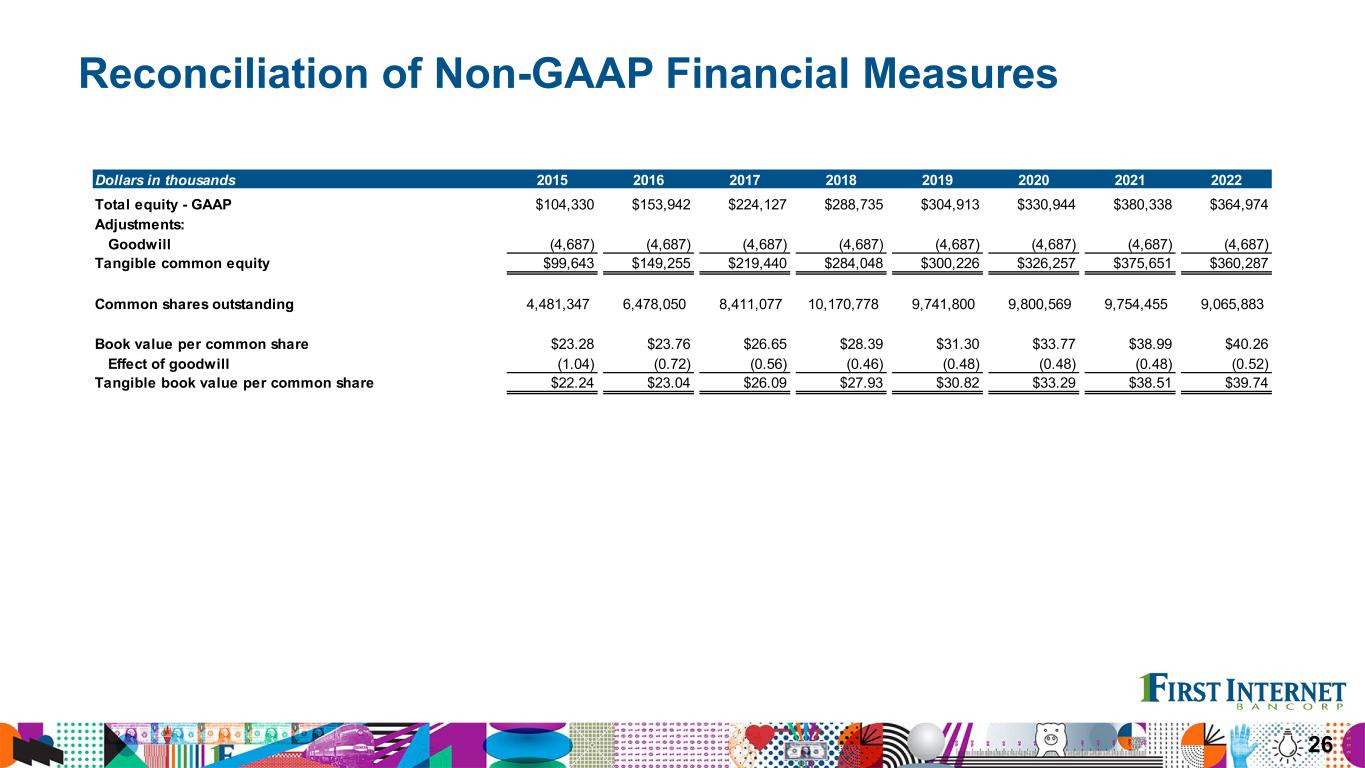

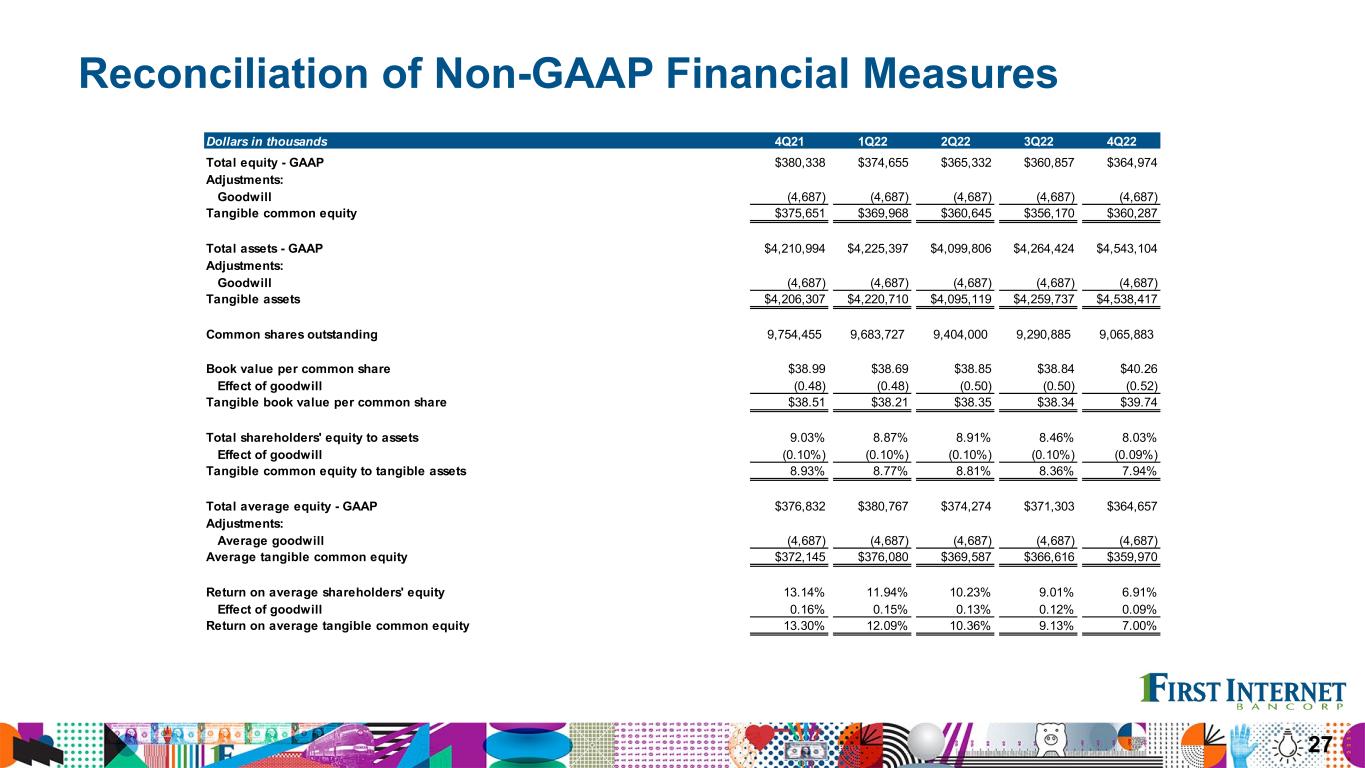

| Total equity - GAAP | $ | 364,974 | $ | 360,857 | $ | 380,338 | $ | 364,974 | $ | 380,338 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Goodwill | (4,687) | (4,687) | (4,687) | (4,687) | (4,687) | |||||||||||||||||||||||||||

| Tangible common equity | $ | 360,287 | $ | 356,170 | $ | 375,651 | $ | 360,287 | $ | 375,651 | ||||||||||||||||||||||

| Total assets - GAAP | $ | 4,543,104 | $ | 4,264,424 | $ | 4,210,994 | $ | 4,543,104 | $ | 4,210,994 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Goodwill | (4,687) | (4,687) | (4,687) | (4,687) | (4,687) | |||||||||||||||||||||||||||

| Tangible assets | $ | 4,538,417 | $ | 4,259,737 | $ | 4,206,307 | $ | 4,538,417 | $ | 4,206,307 | ||||||||||||||||||||||

| Common shares outstanding | 9,065,883 | 9,290,885 | 9,754,455 | 9,065,883 | 9,754,455 | |||||||||||||||||||||||||||

| Book value per common share | $ | 40.26 | $ | 38.84 | $ | 38.99 | $ | 40.26 | $ | 38.99 | ||||||||||||||||||||||

| Effect of goodwill | (0.52) | (0.50) | (0.48) | (0.52) | (0.48) | |||||||||||||||||||||||||||

| Tangible book value per common share | $ | 39.74 | $ | 38.34 | $ | 38.51 | $ | 39.74 | $ | 38.51 | ||||||||||||||||||||||

| Total shareholders' equity to assets | 8.03 | % | 8.46 | % | 9.03 | % | 8.03 | % | 9.03 | % | ||||||||||||||||||||||

| Effect of goodwill | (0.09 | %) | (0.10 | %) | (0.10 | %) | (0.09 | %) | (0.10 | %) | ||||||||||||||||||||||

| Tangible common equity to tangible assets | 7.94 | % | 8.36 | % | 8.93 | % | 7.94 | % | 8.93 | % | ||||||||||||||||||||||

| Total average equity - GAAP | $ | 364,657 | $ | 371,303 | $ | 376,832 | $ | 372,844 | $ | 358,105 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Average goodwill | (4,687) | (4,687) | (4,687) | (4,687) | (4,687) | |||||||||||||||||||||||||||

| Average tangible common equity | $ | 359,970 | $ | 366,616 | $ | 372,145 | $ | 368,157 | $ | 353,418 | ||||||||||||||||||||||

| Return on average shareholders' equity | 6.91 | % | 9.01 | % | 13.14 | % | 9.53 | % | 13.44 | % | ||||||||||||||||||||||

| Effect of goodwill | 0.09 | % | 0.12 | % | 0.16 | % | 0.12 | % | 0.17 | % | ||||||||||||||||||||||

| Return on average tangible common equity | 7.00 | % | 9.13 | % | 13.30 | % | 9.65 | % | 13.61 | % | ||||||||||||||||||||||

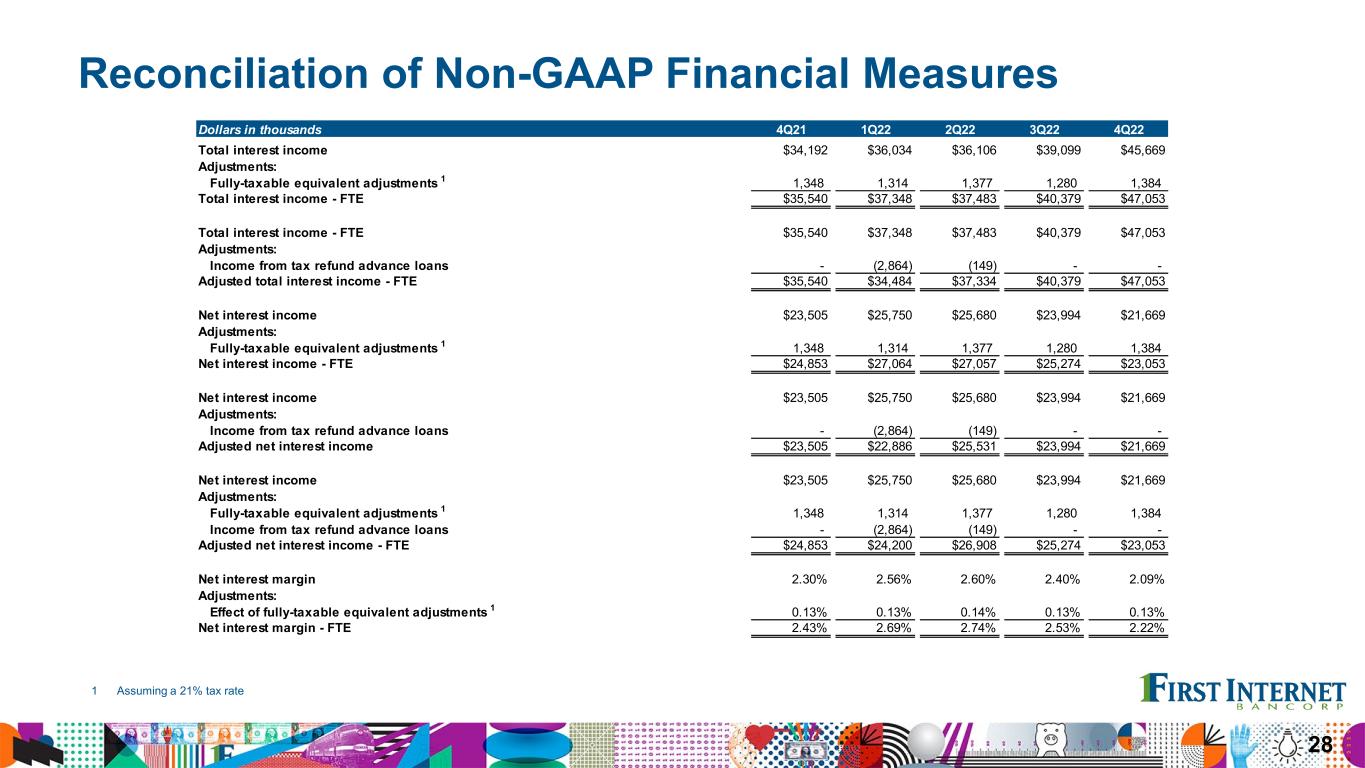

| Total interest income | $ | 45,669 | $ | 39,099 | $ | 34,192 | $ | 156,908 | $ | 133,883 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

Fully-taxable equivalent adjustments 1 |

1,384 | 1,280 | 1,348 | 5,355 | 5,453 | |||||||||||||||||||||||||||

| Total interest income - FTE | $ | 47,053 | $ | 40,379 | $ | 35,540 | $ | 162,263 | $ | 139,336 | ||||||||||||||||||||||

| Total interest income - FTE | $ | 47,053 | $ | 40,379 | $ | 35,540 | $ | 162,263 | $ | 139,336 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Income from tax refund advance loans | — | — | — | (3,013) | — | |||||||||||||||||||||||||||

| Adjusted total interest income - FTE | $ | 47,053 | $ | 40,379 | $ | 35,540 | $ | 159,250 | $ | 139,336 | ||||||||||||||||||||||

| Net interest income | $ | 21,669 | $ | 23,994 | $ | 23,505 | $ | 97,093 | $ | 86,556 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

Fully-taxable equivalent adjustments 1 |

1,384 | 1,280 | 1,348 | 5,355 | 5,453 | |||||||||||||||||||||||||||

| Net interest income - FTE | $ | 23,053 | $ | 25,274 | $ | 24,853 | $ | 102,448 | $ | 92,009 | ||||||||||||||||||||||

| Net interest income | $ | 21,669 | $ | 23,994 | $ | 23,505 | $ | 97,093 | $ | 86,556 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Subordinated debt redemption cost | — | — | — | — | 810 | |||||||||||||||||||||||||||

| Income from tax refund advance loans | — | — | — | (3,013) | — | |||||||||||||||||||||||||||

| Adjusted net interest income | $ | 21,669 | $ | 23,994 | $ | 23,505 | 94,080 | $ | 87,366 | |||||||||||||||||||||||

1 Assuming a 21% tax rate |

||||||||||||||||||||||||||||||||

| First Internet Bancorp | ||||||||||||||||||||||||||||||||

| Reconciliation of Non-GAAP Financial Measures | ||||||||||||||||||||||||||||||||

| Dollar amounts in thousands, except per share data | ||||||||||||||||||||||||||||||||

| Three Months Ended | Twelve Months Ended | |||||||||||||||||||||||||||||||

| December 31, 2022 |

September 30, 2022 |

December 31, 2021 |

December 31, 2022 |

December 31, 2021 |

||||||||||||||||||||||||||||

| Net interest income | $ | 21,669 | $ | 23,994 | $ | 23,505 | $ | 97,093 | $ | 86,556 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

Fully-taxable equivalent adjustments 1 |

1,384 | 1,280 | 1,348 | 5,355 | 5,453 | |||||||||||||||||||||||||||

| Subordinated debt redemption cost | — | — | — | — | 810 | |||||||||||||||||||||||||||

| Income from tax refund advance loans | — | — | — | (3,013) | — | |||||||||||||||||||||||||||

| Adjusted net interest income - FTE | $ | 23,053 | $ | 25,274 | $ | 24,853 | $ | 99,435 | $ | 92,819 | ||||||||||||||||||||||

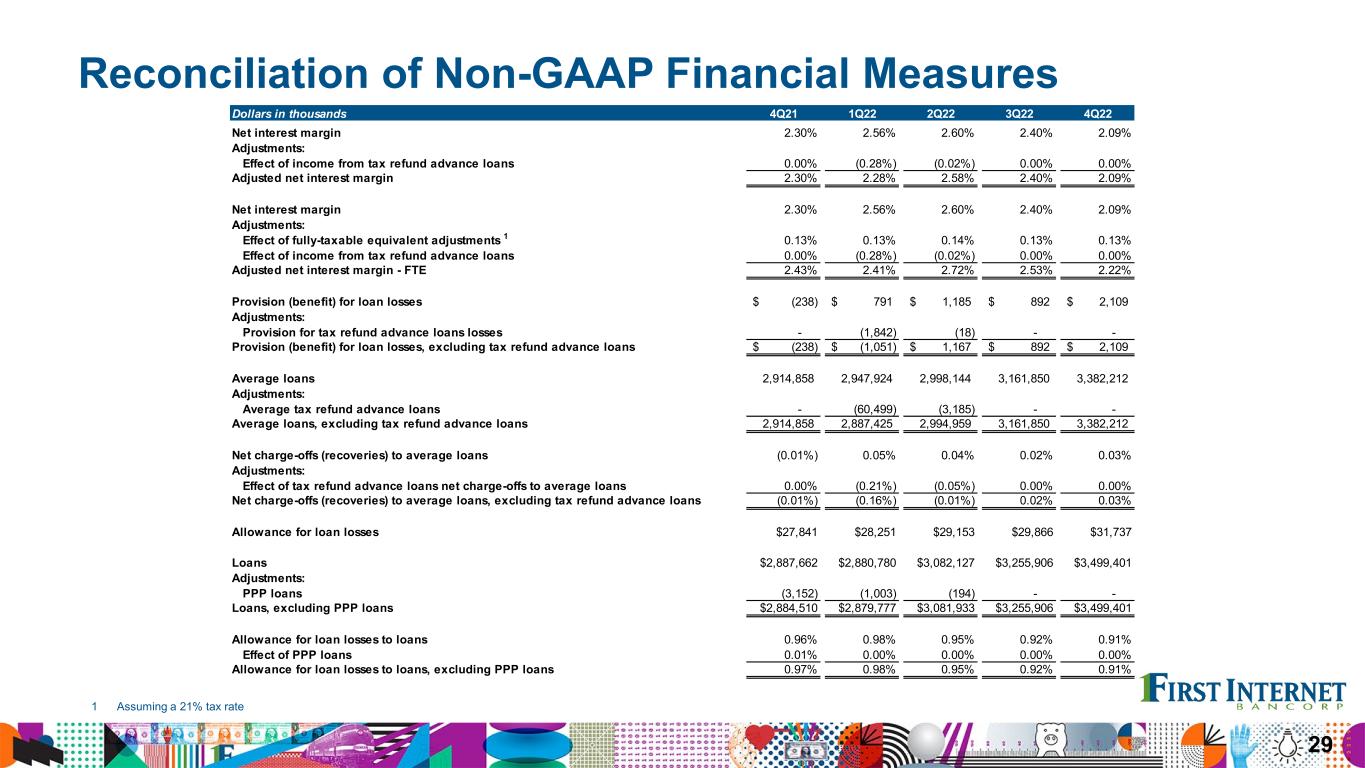

| Net interest margin | 2.09 | % | 2.40 | % | 2.30 | % | 2.41 | % | 2.11 | % | ||||||||||||||||||||||

Effect of fully-taxable equivalent adjustments 1 |

0.13 | % | 0.13 | % | 0.13 | % | 0.13 | % | 0.14 | % | ||||||||||||||||||||||

| Net interest margin - FTE | 2.22 | % | 2.53 | % | 2.43 | % | 2.54 | % | 2.25 | % | ||||||||||||||||||||||

| Net interest margin | 2.09 | % | 2.40 | % | 2.30 | % | 2.41 | % | 2.11 | % | ||||||||||||||||||||||

| Effect of subordinated debt redemption cost | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | 0.02 | % | ||||||||||||||||||||||

| Effect of income from tax refund advance loans | 0.00 | % | 0.00 | % | 0.00 | % | (0.07 | %) | 0.00 | % | ||||||||||||||||||||||

| Adjusted net interest margin | 2.09 | % | 2.40 | % | 2.30 | % | 2.34 | % | 2.13 | % | ||||||||||||||||||||||

| Net interest margin | 2.09 | % | 2.40 | % | 2.30 | % | 2.41 | % | 2.11 | % | ||||||||||||||||||||||

Effect of fully-taxable equivalent adjustments 1 |

0.13 | % | 0.13 | % | 0.13 | % | 0.13 | % | 0.14 | % | ||||||||||||||||||||||

| Effect of subordinated debt redemption cost | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | 0.02 | % | ||||||||||||||||||||||

| Effect of income from tax refund advance loans | 0.00 | % | 0.00 | % | 0.00 | % | (0.07 | %) | 0.00 | % | ||||||||||||||||||||||

| Adjusted net interest margin - FTE | 2.22 | % | 2.53 | % | 2.43 | % | 2.47 | % | 2.27 | % | ||||||||||||||||||||||

| Provision (benefit) for loan losses | $ | 2,109 | $ | 892 | $ | (238) | $ | 4,977 | $ | 1,030 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Provision for tax refund advance loans losses | — | — | — | (1,860) | — | |||||||||||||||||||||||||||

| Provision (benefit) for loan losses, excluding tax refund advance loans | $ | 2,109 | $ | 892 | $ | (238) | $ | 3,117 | $ | 1,030 | ||||||||||||||||||||||

| Average loans | $ | 3,382,212 | $ | 3,161,850 | $ | 2,914,858 | $ | 3,123,972 | $ | 2,972,224 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Average tax refund advance loans | — | — | — | (15,712) | — | |||||||||||||||||||||||||||

| Average loans, excluding tax refund advance loans | $ | 3,382,212 | $ | 3,161,850 | $ | 2,914,858 | $ | 3,108,260 | $ | 2,972,224 | ||||||||||||||||||||||

| Net charge-offs (recoveries) to average loans | 0.03 | % | 0.02 | % | (0.01 | %) | 0.03 | % | 0.09 | % | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Effect of tax refund advance lending net charge-offs (recoveries) to average loans | 0.00 | % | 0.00 | % | 0.00 | % | (0.06 | %) | 0.00 | % | ||||||||||||||||||||||

| Net charge-offs (recoveries) to average loans, excluding tax refund advance loans | 0.03 | % | 0.02 | % | (0.01 | %) | (0.03 | %) | 0.09 | % | ||||||||||||||||||||||

| Allowance for loan losses | $ | 31,737 | $ | 29,866 | $ | 27,841 | $ | 31,737 | $ | 27,841 | ||||||||||||||||||||||

| Loans | $ | 3,499,401 | $ | 3,255,906 | $ | 2,887,662 | $ | 3,499,401 | $ | 2,887,662 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| PPP loans | — | — | (3,152) | — | (3,152) | |||||||||||||||||||||||||||

| Loans, excluding PPP loans | $ | 3,499,401 | $ | 3,255,906 | $ | 2,884,510 | $ | 3,499,401 | $ | 2,884,510 | ||||||||||||||||||||||

| Allowance for loan losses to loans | 0.91 | % | 0.92 | % | 0.96 | % | 0.91 | % | 0.96 | % | ||||||||||||||||||||||

| Effect of PPP loans | 0.00 | % | 0.00 | % | 0.01 | % | 0.00 | % | 0.01 | % | ||||||||||||||||||||||

| Allowance for loan losses to loans, excluding PPP loans | 0.91 | % | 0.92 | % | 0.97 | % | 0.91 | % | 0.97 | % | ||||||||||||||||||||||

| First Internet Bancorp | ||||||||||||||||||||||||||||||||

| Reconciliation of Non-GAAP Financial Measures | ||||||||||||||||||||||||||||||||

| Dollar amounts in thousands, except per share data | ||||||||||||||||||||||||||||||||

| Three Months Ended | Twelve Months Ended | |||||||||||||||||||||||||||||||

| December 31, 2022 |

September 30, 2022 |

December 31, 2021 |

December 31, 2022 |

December 31, 2021 |

||||||||||||||||||||||||||||

| Total revenue - GAAP | $ | 27,476 | $ | 28,310 | $ | 31,199 | $ | 118,350 | $ | 119,400 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Gain on sale of premises and equipment | — | — | — | — | (2,523) | |||||||||||||||||||||||||||

| Subordinated debt redemption cost | — | — | — | — | 810 | |||||||||||||||||||||||||||

| Adjusted total revenue | $ | 27,476 | $ | 28,310 | $ | 31,199 | $ | 118,350 | $ | 117,687 | ||||||||||||||||||||||

| Noninterest income - GAAP | $ | 5,807 | $ | 4,316 | $ | 7,694 | $ | 21,257 | $ | 32,844 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Gain on sale of premises and equipment | — | — | — | — | (2,523) | |||||||||||||||||||||||||||

| Adjusted noninterest income | $ | 5,807 | $ | 4,316 | $ | 7,694 | $ | 21,257 | $ | 30,321 | ||||||||||||||||||||||

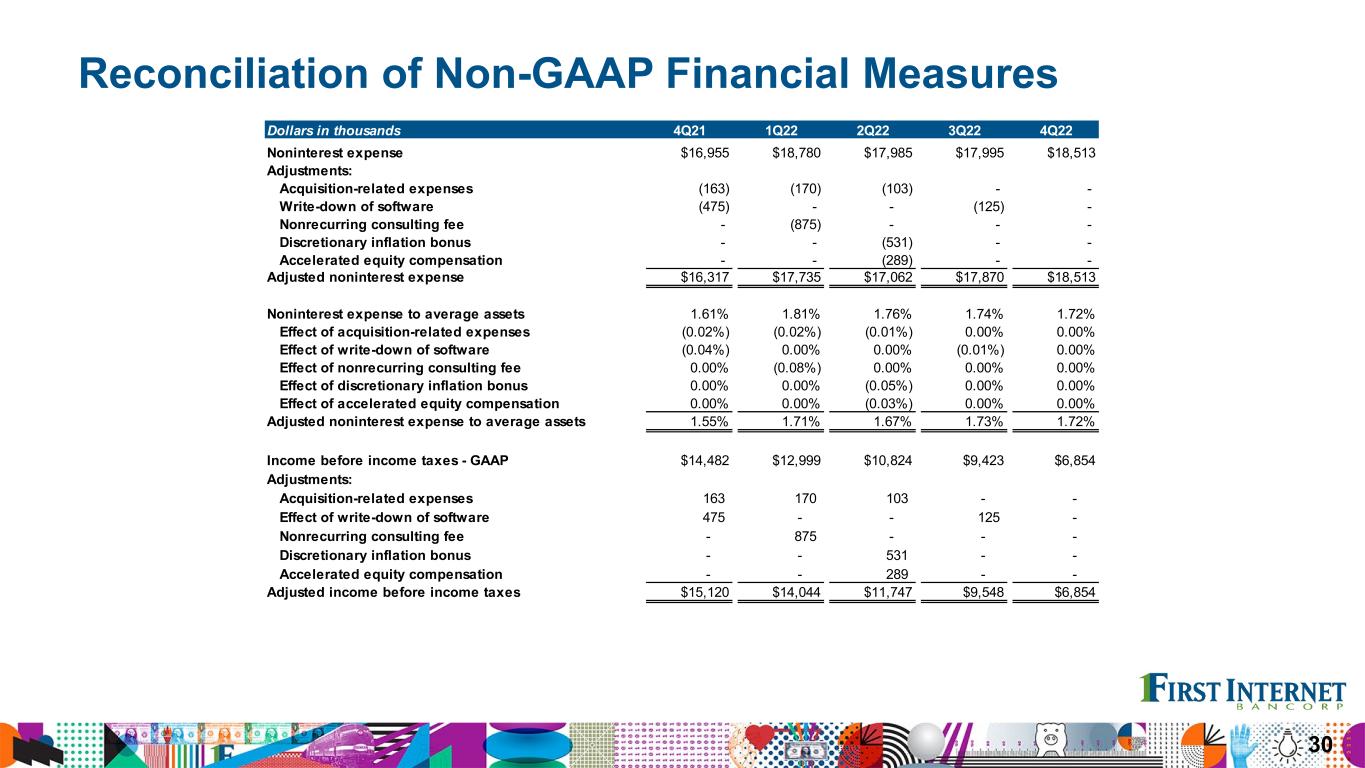

| Noninterest expense - GAAP | $ | 18,513 | $ | 17,995 | $ | 16,955 | $ | 73,273 | $ | 61,798 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Acquisition-related expenses | — | — | (163) | (273) | (163) | |||||||||||||||||||||||||||

| Write-down of software | — | (125) | — | (125) | — | |||||||||||||||||||||||||||

| IT Termination fee | — | — | (475) | — | (475) | |||||||||||||||||||||||||||

| Nonrecurring consulting fee | — | — | — | (875) | — | |||||||||||||||||||||||||||

| Discretionary inflation bonus | — | — | — | (531) | — | |||||||||||||||||||||||||||

| Accelerated equity compensation | — | — | — | (289) | — | |||||||||||||||||||||||||||

| Adjusted noninterest expense | $ | 18,513 | $ | 17,870 | $ | 16,317 | $ | 71,180 | $ | 61,160 | ||||||||||||||||||||||

| Income before income taxes - GAAP | $ | 6,854 | $ | 9,423 | $ | 14,482 | $ | 40,100 | $ | 56,572 | ||||||||||||||||||||||

Adjustments:1 |

||||||||||||||||||||||||||||||||

| Gain on sale of premises and equipment | — | — | — | — | (2,523) | |||||||||||||||||||||||||||

| Acquisition-related expenses | — | — | 163 | 273 | 163 | |||||||||||||||||||||||||||

| Write-down of software | — | 125 | — | 125 | — | |||||||||||||||||||||||||||

| IT Termination fee | — | — | 475 | — | 475 | |||||||||||||||||||||||||||

| Subordinated debt redemption cost | — | — | — | — | 810 | |||||||||||||||||||||||||||

| Nonrecurring consulting fee | — | — | — | 875 | — | |||||||||||||||||||||||||||

| Discretionary inflation bonus | — | — | — | 531 | — | |||||||||||||||||||||||||||

| Accelerated equity compensation | — | — | — | 289 | — | |||||||||||||||||||||||||||

| Adjusted income before income taxes | $ | 6,854 | $ | 9,548 | $ | 15,120 | $ | 42,193 | $ | 55,497 | ||||||||||||||||||||||

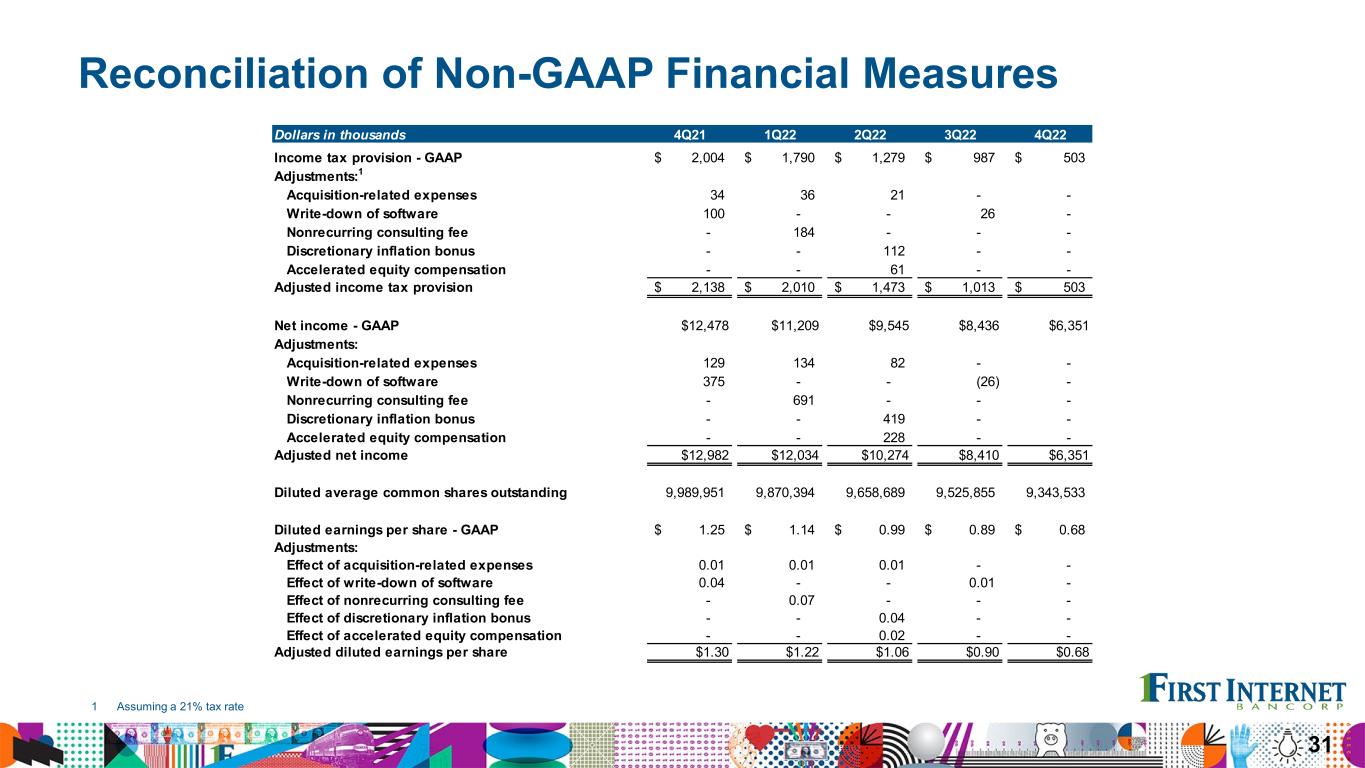

| Income tax provision - GAAP | $ | 503 | $ | 987 | $ | 2,004 | $ | 4,559 | $ | 8,458 | ||||||||||||||||||||||

Adjustments:1 |

||||||||||||||||||||||||||||||||

| Gain on sale of premises and equipment | — | — | — | — | (530) | |||||||||||||||||||||||||||

| Acquisition-related expenses | — | — | 34 | 57 | 34 | |||||||||||||||||||||||||||

| Write-down of software | — | 26 | — | 26 | — | |||||||||||||||||||||||||||

| IT Termination fee | — | — | 100 | — | 100 | |||||||||||||||||||||||||||

| Subordinated debt redemption cost | — | — | — | — | 170 | |||||||||||||||||||||||||||

| Nonrecurring consulting fee | — | — | — | 184 | — | |||||||||||||||||||||||||||

| Discretionary inflation bonus | — | — | — | 112 | — | |||||||||||||||||||||||||||

| Accelerated equity compensation | — | — | — | 61 | — | |||||||||||||||||||||||||||

| Adjusted income tax provision | $ | 503 | $ | 1,013 | $ | 2,138 | $ | 4,999 | $ | 8,232 | ||||||||||||||||||||||

1 Assuming a 21% tax rate |

||||||||||||||||||||||||||||||||

| First Internet Bancorp | ||||||||||||||||||||||||||||||||

| Reconciliation of Non-GAAP Financial Measures | ||||||||||||||||||||||||||||||||

| Dollar amounts in thousands, except per share data | ||||||||||||||||||||||||||||||||

| Three Months Ended | Twelve Months Ended | |||||||||||||||||||||||||||||||

| December 31, 2022 |

September 30, 2022 |

December 31, 2021 |

December 31, 2022 |

December 31, 2021 |

||||||||||||||||||||||||||||

| Net income - GAAP | $ | 6,351 | $ | 8,436 | $ | 12,478 | $ | 35,541 | $ | 48,114 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Gain on sale of premises and equipment | — | — | — | — | (1,993) | |||||||||||||||||||||||||||

| Acquisition-related expenses | — | — | 129 | 216 | 129 | |||||||||||||||||||||||||||

| Write-down of software | — | 99 | — | 99 | — | |||||||||||||||||||||||||||

| IT Termination fee | — | — | 375 | — | 375 | |||||||||||||||||||||||||||

| Subordinated debt redemption cost | — | — | — | — | 640 | |||||||||||||||||||||||||||

| Nonrecurring consulting fee | — | — | — | 691 | — | |||||||||||||||||||||||||||

| Discretionary inflation bonus | — | — | — | 419 | — | |||||||||||||||||||||||||||

| Accelerated equity compensation | — | — | — | 228 | — | |||||||||||||||||||||||||||

| Adjusted net income | $ | 6,351 | $ | 8,535 | $ | 12,982 | $ | 37,194 | $ | 47,265 | ||||||||||||||||||||||

| Diluted average common shares outstanding | 9,343,533 | 9,525,855 | 9,989,951 | 9,595,115 | 9,976,261 | |||||||||||||||||||||||||||

| Diluted earnings per share - GAAP | $ | 0.68 | $ | 0.89 | $ | 1.25 | $ | 3.70 | $ | 4.82 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Effect of gain on sale of premises and equipment | — | — | — | — | (0.19) | |||||||||||||||||||||||||||

| Effect of acquisition-related expenses | — | — | 0.01 | 0.02 | 0.01 | |||||||||||||||||||||||||||

| Effect of write-down of software | — | 0.01 | — | 0.01 | — | |||||||||||||||||||||||||||

| Effect of IT termination fee | — | — | 0.04 | — | 0.04 | |||||||||||||||||||||||||||

| Effect of nonrecurring consulting fee | — | — | — | 0.07 | — | |||||||||||||||||||||||||||

| Effect of subordinated debt redemption cost | — | — | — | — | 0.06 | |||||||||||||||||||||||||||

| Effect of discretionary inflation bonus | — | — | — | 0.04 | — | |||||||||||||||||||||||||||

| Effect of accelerated equity compensation | — | — | — | 0.02 | — | |||||||||||||||||||||||||||

| Adjusted diluted earnings per share | $ | 0.68 | $ | 0.90 | $ | 1.30 | $ | 3.86 | $ | 4.74 | ||||||||||||||||||||||

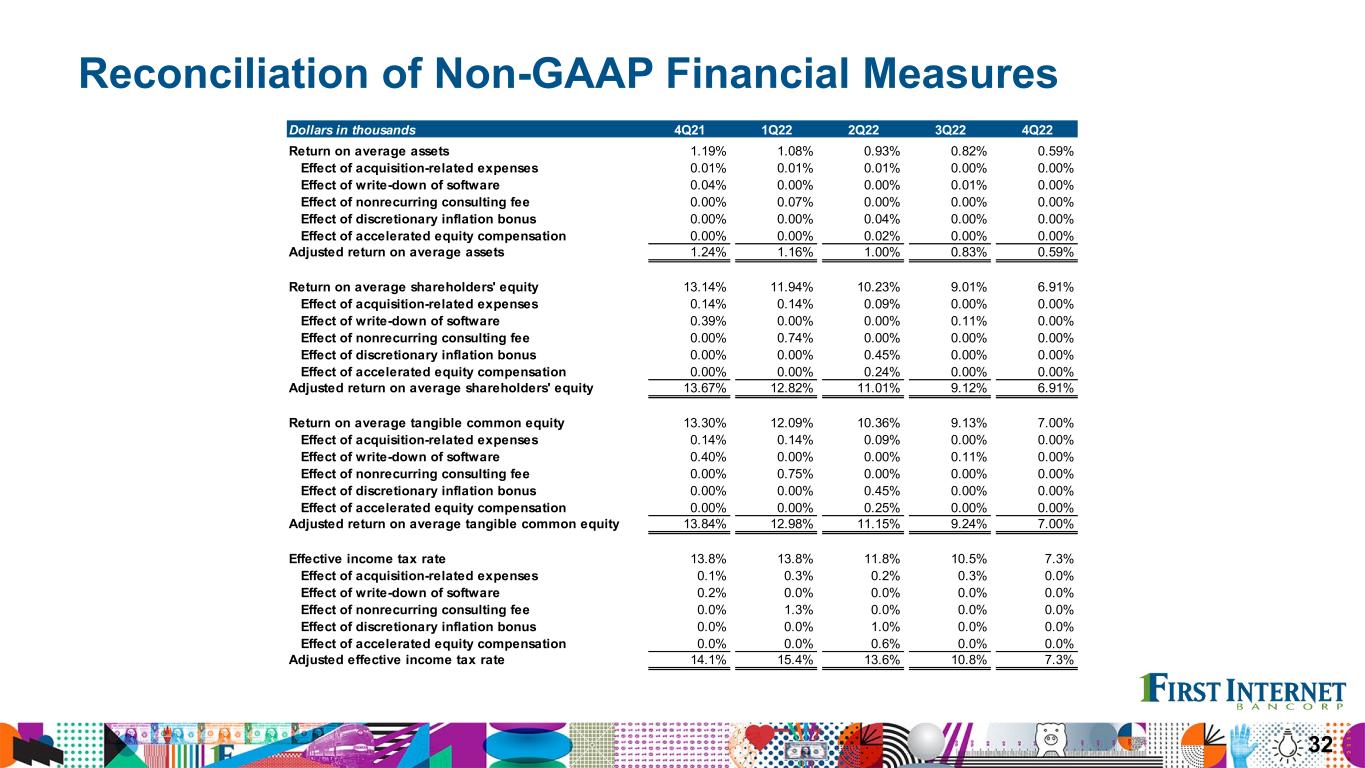

| Return on average assets | 0.59 | % | 0.82 | % | 1.19 | % | 0.85 | % | 1.14 | % | ||||||||||||||||||||||

| Effect of gain on sale of premises and equipment | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | (0.05 | %) | ||||||||||||||||||||||

| Effect of acquisition-related expenses | 0.00 | % | 0.00 | % | 0.01 | % | 0.01 | % | 0.00 | % | ||||||||||||||||||||||

| Effect of write-down of software | 0.00 | % | 0.01 | % | 0.00 | % | 0.00 | % | 0.00 | % | ||||||||||||||||||||||

| Effect of IT termination fee | 0.00 | % | 0.00 | % | 0.04 | % | 0.00 | % | 0.01 | % | ||||||||||||||||||||||

| Effect of nonrecurring consulting fee | 0.00 | % | 0.00 | % | 0.00 | % | 0.02 | % | 0.00 | % | ||||||||||||||||||||||

| Effect of subordinated debt redemption cost | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | 0.02 | % | ||||||||||||||||||||||

| Effect of discretionary inflation bonus | 0.00 | % | 0.00 | % | 0.00 | % | 0.01 | % | 0.00 | % | ||||||||||||||||||||||

| Effect of accelerated equity compensation | 0.00 | % | 0.00 | % | 0.00 | % | 0.01 | % | 0.00 | % | ||||||||||||||||||||||

| Adjusted return on average assets | 0.59 | % | 0.83 | % | 1.24 | % | 0.90 | % | 1.12 | % | ||||||||||||||||||||||

| Return on average shareholders' equity | 6.91 | % | 9.01 | % | 13.14 | % | 9.53 | % | 13.44 | % | ||||||||||||||||||||||

| Effect of gain on sale of premises and equipment | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | (0.56 | %) | ||||||||||||||||||||||

| Effect of acquisition-related expenses | 0.00 | % | 0.00 | % | 0.14 | % | 0.06 | % | 0.04 | % | ||||||||||||||||||||||

| Effect of write-down of software | 0.00 | % | 0.11 | % | 0.00 | % | 0.03 | % | 0.00 | % | ||||||||||||||||||||||

| Effect of IT termination fee | 0.00 | % | 0.00 | % | 0.39 | % | 0.00 | % | 0.10 | % | ||||||||||||||||||||||

| Effect of nonrecurring consulting fee | 0.00 | % | 0.00 | % | 0.00 | % | 0.19 | % | 0.00 | % | ||||||||||||||||||||||

| Effect of subordinated debt redemption cost | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | 0.18 | % | ||||||||||||||||||||||

| Effect of discretionary inflation bonus | 0.00 | % | 0.00 | % | 0.00 | % | 0.11 | % | 0.00 | % | ||||||||||||||||||||||

| Effect of accelerated equity compensation | 0.00 | % | 0.00 | % | 0.00 | % | 0.06 | % | 0.00 | % | ||||||||||||||||||||||

| Adjusted return on average shareholders' equity | 6.91 | % | 9.12 | % | 13.67 | % | 9.98 | % | 13.20 | % | ||||||||||||||||||||||

| First Internet Bancorp | ||||||||||||||||||||||||||||||||

| Reconciliation of Non-GAAP Financial Measures | ||||||||||||||||||||||||||||||||

| Dollar amounts in thousands, except per share data | ||||||||||||||||||||||||||||||||

| Three Months Ended | Twelve Months Ended | |||||||||||||||||||||||||||||||

| December 31, 2022 |

September 30, 2022 |

December 31, 2021 |

December 31, 2022 |

December 31, 2021 |

||||||||||||||||||||||||||||

| Return on average tangible common equity | 7.00 | % | 9.13 | % | 13.30 | % | 9.65 | % | 13.61 | % | ||||||||||||||||||||||

| Effect of gain on sale of premises and equipment | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | (0.56 | %) | ||||||||||||||||||||||

| Effect of acquisition-related expenses | 0.00 | % | 0.00 | % | 0.14 | % | 0.06 | % | 0.04 | % | ||||||||||||||||||||||

| Effect of write-down of software | 0.00 | % | 0.11 | % | 0.00 | % | 0.03 | % | 0.00 | % | ||||||||||||||||||||||

| Effect of IT termination fee | 0.00 | % | 0.00 | % | 0.40 | % | 0.00 | % | 0.10 | % | ||||||||||||||||||||||

| Effect of nonrecurring consulting fee | 0.00 | % | 0.00 | % | 0.00 | % | 0.19 | % | 0.00 | % | ||||||||||||||||||||||

| Effect of subordinated debt redemption cost | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | 0.18 | % | ||||||||||||||||||||||

| Effect of discretionary inflation bonus | 0.00 | % | 0.00 | % | 0.00 | % | 0.11 | % | 0.00 | % | ||||||||||||||||||||||

| Effect of accelerated equity compensation | 0.00 | % | 0.00 | % | 0.00 | % | 0.06 | % | 0.00 | % | ||||||||||||||||||||||

| Adjusted return on average tangible common equity | 7.00 | % | 9.24 | % | 13.84 | % | 10.10 | % | 13.37 | % | ||||||||||||||||||||||

| Effective income tax rate | 7.3 | % | 10.5 | % | 13.8 | % | 11.4 | % | 15.0 | % | ||||||||||||||||||||||

| Effect of gain on sale of premises and equipment | 0.0 | % | 0.0 | % | 0.0 | % | 0.0 | % | (0.4 | %) | ||||||||||||||||||||||

| Effect of acquisition-related expenses | 0.0 | % | 0.0 | % | 0.1 | % | 0.1 | % | 0.0 | % | ||||||||||||||||||||||

| Effect of write-down of software | 0.0 | % | 0.3 | % | 0.0 | % | 0.1 | % | 0.0 | % | ||||||||||||||||||||||

| Effect of IT termination fee | 0.0 | % | 0.0 | % | 0.2 | % | 0.0 | % | 0.1 | % | ||||||||||||||||||||||

| Effect of nonrecurring consulting fee | 0.0 | % | 0.0 | % | 0.0 | % | 0.4 | % | 0.0 | % | ||||||||||||||||||||||

| Effect of subordinated debt redemption cost | 0.0 | % | 0.0 | % | 0.0 | % | 0.0 | % | 0.1 | % | ||||||||||||||||||||||

| Effect of discretionary inflation bonus | 0.0 | % | 0.0 | % | 0.0 | % | 0.3 | % | 0.0 | % | ||||||||||||||||||||||

| Effect of accelerated equity compensation | 0.0 | % | 0.0 | % | 0.0 | % | 0.1 | % | 0.0 | % | ||||||||||||||||||||||

| Adjusted effective income tax rate | 7.3 | % | 10.8 | % | 14.1 | % | 12.4 | % | 14.8 | % | ||||||||||||||||||||||

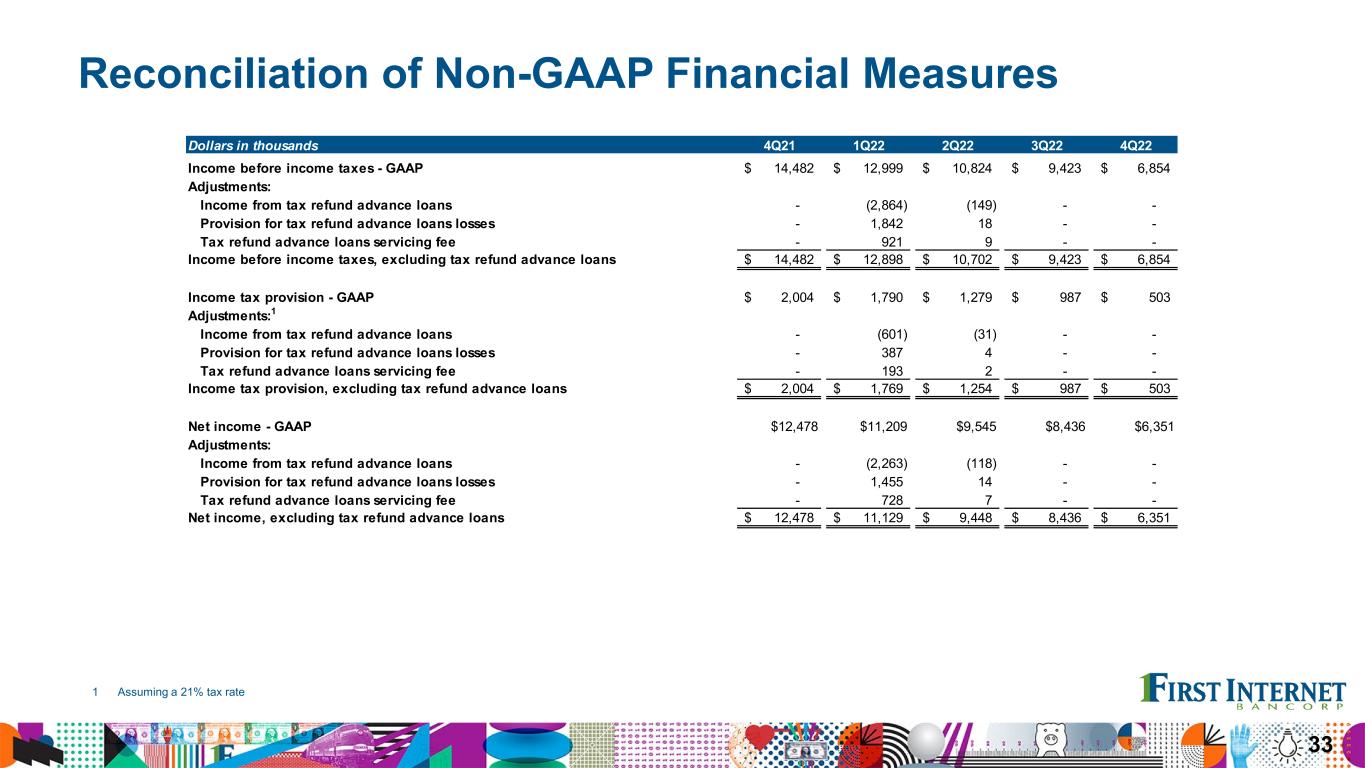

| Income before income taxes - GAAP | $ | 6,854 | $ | 9,423 | $ | 14,482 | $ | 40,100 | $ | 56,572 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Income from tax refund advance lending | — | — | — | (3,013) | — | |||||||||||||||||||||||||||

| Provision for tax refund advance lending losses | — | — | — | 1,860 | — | |||||||||||||||||||||||||||

| Tax refund advance lending servicing fee | — | — | — | 930 | — | |||||||||||||||||||||||||||

| Income before income taxes, excluding tax refund advance loans | $ | 6,854 | $ | 9,423 | $ | 14,482 | $ | 39,877 | $ | 56,572 | ||||||||||||||||||||||

| Income tax provision - GAAP | $ | 503 | $ | 987 | $ | 2,004 | $ | 4,559 | $ | 8,458 | ||||||||||||||||||||||

Adjustments: 1 |

||||||||||||||||||||||||||||||||

| Income from tax refund advance lending | — | — | — | (633) | — | |||||||||||||||||||||||||||

| Provision for tax refund advance lending losses | — | — | — | 391 | — | |||||||||||||||||||||||||||

| Tax refund advance lending servicing fee | — | — | — | 195 | — | |||||||||||||||||||||||||||

| Income tax provision, excluding tax refund advance loans | $ | 503 | $ | 987 | $ | 2,004 | $ | 4,512 | $ | 8,458 | ||||||||||||||||||||||

| Net income - GAAP | $ | 6,351 | $ | 8,436 | $ | 12,478 | $ | 35,541 | $ | 48,114 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Income from tax refund advance lending | — | — | — | (2,380) | — | |||||||||||||||||||||||||||

| Provision for tax refund advance lending losses | — | — | — | 1,469 | — | |||||||||||||||||||||||||||

| Tax refund advance lending servicing fee | — | — | — | 735 | — | |||||||||||||||||||||||||||

| Net income, excluding tax refund advance loans | $ | 6,351 | $ | 8,436 | $ | 12,478 | $ | 35,365 | $ | 48,114 | ||||||||||||||||||||||

1 Assuming a 21% tax rate |

||||||||||||||||||||||||||||||||