Document

shareholder

letter

Q3 2024

our mission is

to develop the

best education

in the world

and make it universally available.

Q3 Highlights

|

|

|

|

|

|

|

|

|

|

|

|

| User Metrics |

Q3 2023 |

|

Q3 2024 |

| Daily Active Users |

24.2M |

|

37.2M |

|

|

|

54% YoY |

| Monthly Active Users |

83.1M |

|

113.1M |

|

|

|

36% YoY |

| Paid Subscribers |

5.8M |

|

8.6M |

| at period end |

|

|

47% YoY |

| Paid Subscriber Penetration |

8.0% |

|

8.5% |

| as % of MAU* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Financial Metrics |

Q3 2023 |

|

Q3 2024 |

| Revenue |

$137.6M |

|

$192.6M |

|

|

|

40% YoY |

| Total Bookings |

$153.6M |

|

$211.5M |

|

|

|

38% YoY |

| Net Income |

$2.8M |

|

$23.4M |

|

|

|

|

| Adjusted EBITDA |

$22.5M |

|

$47.5M |

|

16.3% margin |

|

24.7% margin |

| *LTM MAU |

|

|

|

Dear shareholders,

I’m thrilled to share that Q3 was another great quarter, exceeding our expectations for top line, profitability, and user growth. We showcased several exciting product announcements at Duocon and, because we feel good about our trajectory for the remainder of the year, we’re raising our guidance.

Third quarter highlights

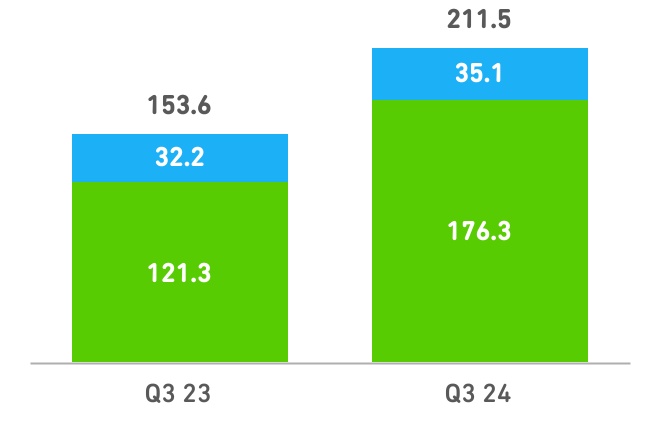

•Total bookings were $211.5 million, an increase of 38% from the prior year quarter;

•Subscription bookings were $176.3 million, an increase of 45% from the prior year quarter;

•Paid subscribers totaled 8.6 million at quarter end, an increase of 47% from the prior year quarter;

•Daily active users (DAUs) were 37.2 million, an increase of 54% from the prior year quarter, and monthly active users (MAUs) were 113.1 million, an increase of 36% from the prior year quarter;

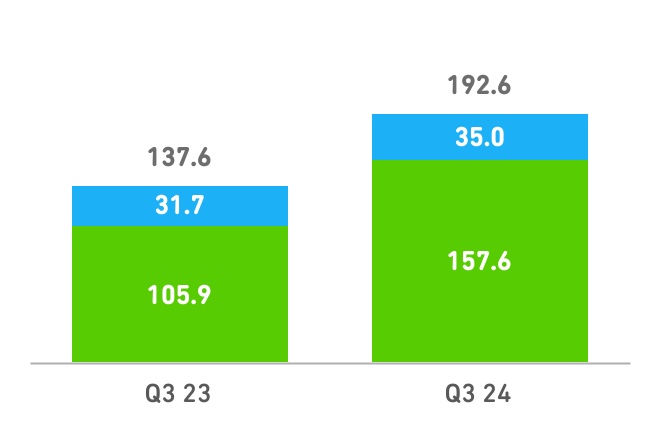

•Total revenues were $192.6 million, an increase of 40% from the prior year quarter;

•Net income was $23.4 million, compared to $2.8 million in the prior year quarter;

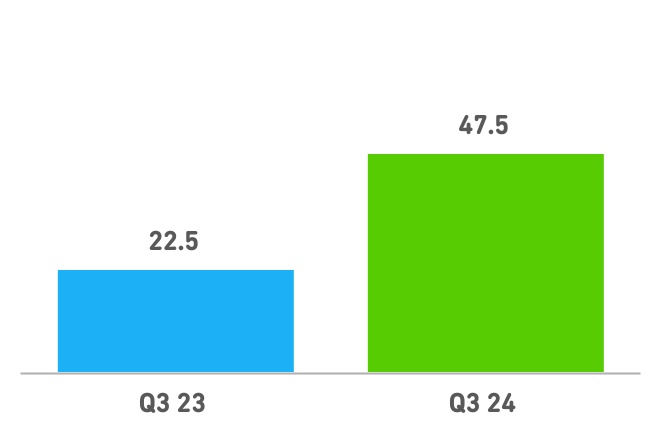

•Adjusted EBITDA was $47.5 million, compared to $22.5 million in the prior year quarter, a 24.7% versus 16.3% Adjusted EBITDA margin, respectively; and

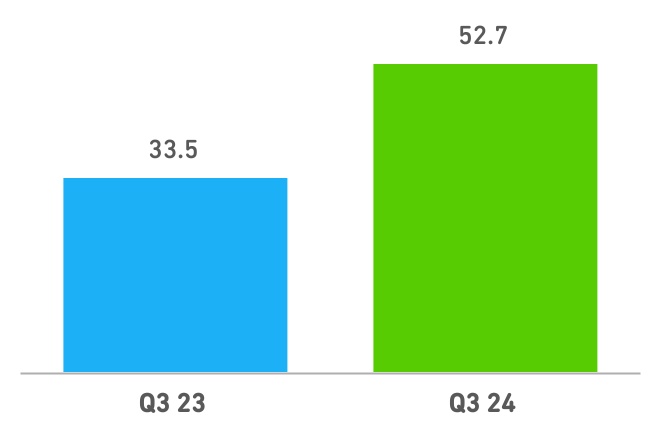

•Net cash provided by operating activities was $56.3 million, compared to $37.7 million in the prior year quarter, and free cash flow was $52.7 million, compared to $33.5 million in the prior year quarter.

Compounding DAU growth

Our 50%+ year over year DAU growth is especially impressive considering that we’re building on 60%+ growth in the third quarter of last year. We have been able to sustain this growth rate because we constantly improve features that were already considered home runs, like launching Friends Streak as an extension of one of our most powerful retention mechanics. What we’ve learned from over a decade of building habit-forming products is that these minor improvements compound over time.

More than half of our top-of-funnel growth in the past year has come from returning users who have been inactive for over a month. This highlights our success in reigniting engagement with our platform, which we believe is due in part to our social-first marketing strategy that keeps us top of mind. We’ve also seen an 80% increase in social media impressions in the past year, thanks to our expanding reach in channels like YouTube Shorts.

The growth in intermediate English learners on our platform presents an additional long-term opportunity. We now have over 2 million DAUs learning intermediate English on our platform. Given the enormous global demand for learning English, we believe our investment in more advanced content can yield meaningful user growth.

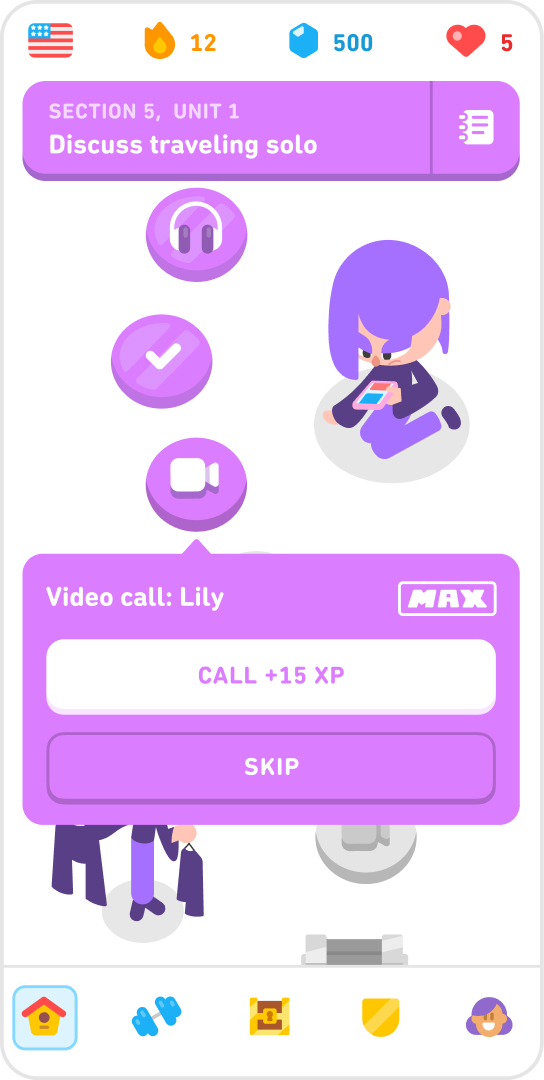

Improving conversation skills with Video Call

In Q3, we announced new GenAI-powered product enhancements that are transforming the learning experience on Duolingo.

The biggest announcement was our new Video Call feature within Duolingo Max, our highest subscription tier. This feature allows users to practice conversation skills through video calls with our purple-haired, teenage character named Lily in a low-pressure environment. Lily also remembers past interactions, like my love for tacos or my recent trip to New York. This makes the experience feel more personal and brings our characters to life.

Video Call marks a big step towards offering a tutor-like experience, especially for English learners. In fact, early data show that, on average, English learners are using this feature about twice as much as other language learners.

Video Call is available to nearly all Duolingo Max subscribers. As of the end of the third quarter, Duolingo Max was available to about half of our DAUs and we’ll scale it to more users, primarily on Android, by the end of the year.

|

|

|

|

| Video Call is a conversational feature available to Duolingo Max subscribers |

Closing

Thank you to everyone who tuned into Duocon in September. We set a new record for live viewership this year, three times higher than last year.

As we head into the final stretch of the year, we have a lot to look forward to. This includes our Year in Review, a social feature for learners to share their achievements, and our New Year promotion—the one time a year we discount our subscription—which is perfectly timed for learners making fresh resolutions.

Sorry, I’m getting a video call from Lily, gotta run!

|

|

|

|

| Luis von Ahn |

| CEO and Co-Founder |

financial performance and outlook

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Summary of Financial and Key Operating Metrics |

|

|

|

|

|

|

|

|

|

|

| (in millions) |

Q3 2023 |

Q3 2024 |

YoY |

|

|

|

| User Metrics |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Monthly active users (MAUs) |

83.1 |

|

113.1 |

|

36 |

% |

|

|

|

| Daily active users (DAUs) |

24.2 |

|

37.2 |

|

54 |

% |

|

|

|

| Paid subscribers (period end) |

5.8 |

|

8.6 |

|

47 |

% |

|

|

|

| Operating Metrics |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Subscription bookings |

$121.3 |

|

$176.3 |

|

45% |

|

|

|

| Total bookings |

$153.6 |

|

$211.5 |

|

38% |

|

|

|

|

|

|

|

|

|

|

| GAAP Financial Measures |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

$137.6 |

|

$192.6 |

|

40% |

|

|

|

| Gross profit |

$101.4 |

|

$140.4 |

|

39% |

|

|

|

| Gross margin (%) |

73.7 |

% |

72.9 |

% |

~(80) bps |

|

|

|

| Net income |

$2.8 |

|

$23.4 |

|

>100% |

|

|

|

| Net cash from operating activities |

$37.7 |

|

$56.3 |

|

49% |

|

|

|

|

|

|

|

|

|

|

| Non-GAAP Financial Measures (1) |

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

$22.5 |

|

$47.5 |

|

>100% |

|

|

|

| Adjusted EBITDA margin |

16.3 |

% |

24.7 |

% |

~8 pts |

|

|

|

| Free cash flow |

$33.5 |

|

$52.7 |

|

57% |

|

|

|

| Free cash flow margin |

24.3 |

% |

27.3 |

% |

~3 pts |

|

|

|

(1) Please refer to the Appendix at the end of this letter for a reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measure.

Amounts reported in millions are computed based on the amounts in thousands. As a result, the sum of the components reported in millions may not equal the total amount reported in millions due to rounding. In addition, percentages presented are calculated from the underlying numbers in thousands and may not add to their respective totals due to rounding.

|

|

|

|

|

|

|

|

|

|

|

|

| Bookings ($M) |

Revenue ($M) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Subscription |

|

Non-Subscription |

In Q3, total bookings were $211.5 million, growing 38% year over year on a reported basis (39% on a constant currency basis), driven primarily by a 45% increase in subscription bookings on a reported basis (46% on a constant currency basis). Revenues totaled $192.6 million in Q3, representing a 40% increase on a reported basis (41% on a constant currency basis), driven primarily by growth in subscription revenue, which grew 49% year over year on a reported basis (50% on a constant currency basis), and comprised 82% of revenues.

The increase in both subscription bookings and subscription revenue was primarily attributable to an increase in the average number of paid subscribers year over year.

The table below provides revenues by product type:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions) |

Q3 2023 |

Q3 2024 |

Change |

% Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Subscription |

$105.9 |

|

$157.6 |

|

$51.7 |

|

49 |

% |

|

|

|

|

| Other (1) |

$31.7 |

|

$35.0 |

|

$3.2 |

|

10 |

% |

|

|

|

|

| Total revenues |

$137.6 |

|

$192.6 |

|

$55.0 |

|

40 |

% |

|

|

|

|

________________

(1) Other revenue is comprised mainly of Advertising, Duolingo English Test, and In-App Purchases.

Total gross margin was 72.9% and 73.7% during the three months ended September 30, 2024 and 2023, respectively. This decline was due to a combination of lower margins in other revenue offset by an increase in subscription revenue as a percentage of total revenue.

|

|

|

|

|

|

|

|

|

|

|

|

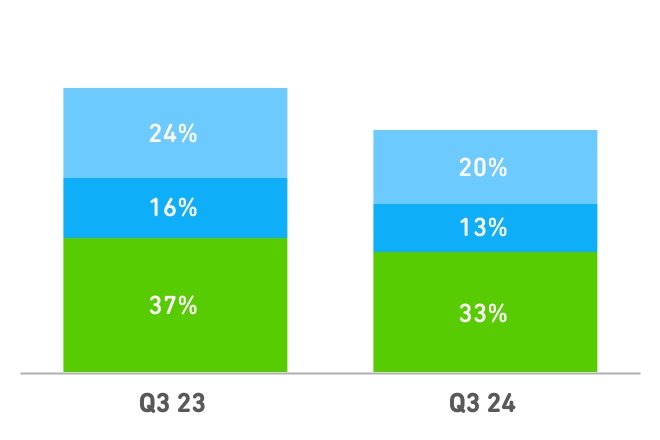

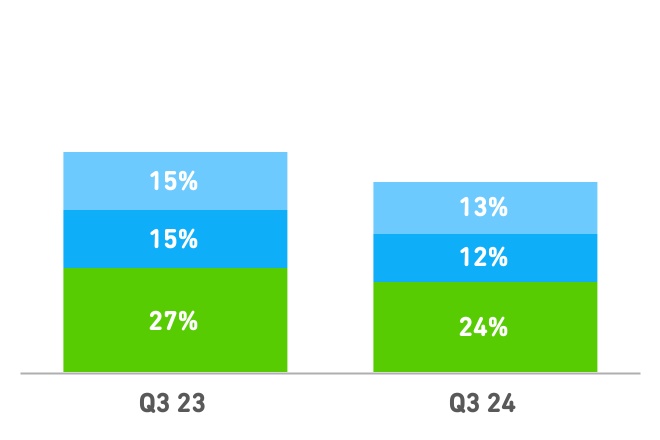

GAAP Operating Expenses

(% of Revenue) |

Non-GAAP Operating Expenses

(% of Revenue) |

We report three categories of operating expenses: Research and development (R&D), Sales and marketing (S&M), and General and administrative (G&A). Non-GAAP operating expenses† represent GAAP expenses adjusted for depreciation, amortization, stock-based compensation expenses related to equity awards, and other expenses. The most significant adjustment in Q3 2024 was for stock-based compensation (SBC) expenses related to equity awards of $30 million. Approximately 15% of our SBC expense in Q3 was related to our pre-IPO founder equity awards, which are intended to serve as our founders’ sole equity award opportunity through 2031.

In Q3, we achieved leverage across total operating expenses and for each category of operating expense, both on a GAAP and non-GAAP basis, because we continued to scale our revenue faster than our operating expenses. GAAP R&D expense decreased from 37% to 33% of revenue year over year. On a non-GAAP basis, R&D expense decreased year over year from 27% to 24%. GAAP S&M expense decreased from 16% to 13% of revenue year over year as we continue to leverage our past learnings to allocate spending strategically, improving user acquisition efficiency. On a non-GAAP basis, S&M expense decreased year over year from 15% to 12%. GAAP G&A expense decreased from 24% to 20% of revenue year over year. On a non-GAAP basis, G&A expense decreased year over year from 15% to 13%.

†Please refer to the Appendix at the end of this letter for a reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measure.

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA ($M) |

Free Cash Flow ($M) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16.3% |

|

24.7% |

Margin |

24.3% |

|

27.3% |

|

In Q3, Adjusted EBITDA† increased by $25.0 million year over year to $47.5 million, a 24.7% Adjusted EBITDA margin†. The increase in margin was driven by growth in revenue and improved leverage across all categories of operating expenses.

During Q3, we generated free cash flow (FCF)† of $52.7 million, a 27.3% FCF margin†, driven primarily by an increase in cash from operations. Cash from operations increased mainly due to generation of higher net income during the current period.

†Please refer to the Appendix at the end of this letter for a reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measure.

Q4 and FY 2024 Guidance

Duolingo is providing the following guidance for the fourth quarter ending December 31, 2024, and is updating its guidance for the full year ending December 31, 2024.

|

|

|

|

|

|

|

|

|

| (in millions) |

Q4 2024 |

FY 2024 |

| Bookings |

$244.5 - $247.5 |

$843.5 - $846.5 |

| YoY Bookings Growth |

28.0% - 29.6% |

35.6% - 36.1% |

| Revenues |

$202.5 - $205.5 |

$741.0 - $744.0 |

| YoY Revenue Growth |

34.1% - 36.1% |

39.5% - 40.1% |

| Adjusted EBITDA |

$48.6 - $50.8 |

$188.3 - $190.4 |

| Adjusted EBITDA margin |

24.0% - 24.7% |

25.4% - 25.6% |

With regards to the non-GAAP Adjusted EBITDA and Adjusted EBITDA margin outlook provided above, a reconciliation to GAAP net income, the most directly comparable financial measure presented in accordance with GAAP, has not been provided as the quantification of certain items included in the calculation of GAAP net income cannot be calculated or predicted at this time without unreasonable efforts. For example, the non-GAAP adjustment for stock-based compensation expenses related to equity awards requires additional inputs such as number of shares granted and market price that are not currently ascertainable, and the non-GAAP adjustment for certain legal, tax and regulatory reserves and expenses depends on the timing and magnitude of these expenses and cannot be accurately forecasted. For the same reasons, we are unable to address the probable significance of the unavailable information, which could have a potentially unpredictable, and potentially significant, impact on our future GAAP financial results.

Video Webcast

Duolingo will host a video webcast to discuss its third quarter and full year results today, November 6, 2024, at 5:30 p.m. ET. This live webcast and related materials will be publicly available and can be accessed at investors.duolingo.com. A replay will be available on the Investor Relations website two hours following completion of the webcast and will remain available for a period of one year.

About Duolingo

Duolingo is the leading mobile learning platform globally. Its flagship app has organically become the world's most popular way to learn languages and the top-grossing app in the Education category on both Google Play and the Apple App Store. With technology at the core of everything it does, Duolingo has consistently invested to provide learners a fun, engaging, and effective learning experience while remaining committed to its mission to develop the best education in the world and make it universally available.

Definitions

Monthly Active Users (MAUs). MAUs are defined as unique users who engage with our Duolingo App or the learning section of our website each month. MAUs are reported for a measurement period by taking the average of the MAUs for each calendar month in that measurement period. The measurement period for MAUs is the three months ended September 30, 2024 and the same period in the prior year where applicable, and the analysis of results is based on those periods. MAUs are a measure of the size of our global active user community on Duolingo.

Daily Active Users (DAUs). DAUs are defined as unique users who engage with our Duolingo App or the learning section of our website each calendar day. DAUs are reported for a measurement period by taking the average of the DAUs for each day in that measurement period. The measurement period for DAUs is the three months ended September 30, 2024 and the same period in the prior year where applicable, and the analysis of results is based on those periods. DAUs are a measure of the consistent engagement of our global user community on Duolingo.

Paid Subscribers. Paid subscribers are defined as users who pay for access to any Duolingo subscription offering and had an active subscription as of the end of the measurement period. Each unique user account is treated as a single paid subscriber regardless of whether such user purchases multiple subscriptions, and the count of paid subscribers does not include users who are currently on a free trial or who are non-paying members of a family plan.

Subscription Bookings and Total Bookings. Subscription bookings represent the amounts we receive from a purchase of any Duolingo subscription offering. Total bookings include subscription bookings, income from advertising networks for advertisements served to our users, purchases of the Duolingo English Test, and in-app purchases of virtual goods. We believe bookings provide an indication of trends in our operating results, including cash flows, that are not necessarily reflected in our revenues because we recognize subscription revenues ratably over the lifetime of a subscription, which is generally from one to twelve months.

Limitation of Key Operating Metrics and Other Data

We manage our business by tracking several operating metrics, including MAUs, DAUs, paid subscribers, and subscription and total bookings. While these metrics are based on what we believe to be reasonable estimates of our user base for the applicable period of measurement, there are inherent challenges in measuring how our platform is used. These metrics are determined by using internal data gathered on an analytics platform that we developed and operate and have not been validated by an independent third party. This platform tracks user account and session activity. If we fail to maintain an effective analytics platform, our metrics calculations may be inaccurate. We believe that these metrics are reasonable estimates of our user base for the applicable period of measurement, and that the methodologies we employ and update from time-to-time to create these metrics are reasonable bases to identify trends in user behavior. Because we update the methodologies we employ to create metrics, our operating metrics may not be comparable to those in prior periods. Other companies, including companies in our industry, may calculate these metrics differently.

Non-GAAP Financial Measures

We use certain non-GAAP financial measures to supplement our Unaudited Condensed Consolidated Financial Statements, which are presented in accordance with GAAP. Non-GAAP financial measures include Adjusted EBITDA; Adjusted EBITDA margin; non-GAAP R&D expense, non-GAAP S&M expense and non-GAAP G&A expense (collectively, the “non-GAAP operating expenses”); Free cash flow, and Free cash flow margin. Please refer to the definitions and reconciliation at the end of this letter. We use these non-GAAP financial measures for financial and operational decision-making and as a means to evaluate period-to-period comparisons. By excluding certain items that may not be indicative of our recurring core operating results, we believe that these non-GAAP financial measures provide meaningful supplemental information regarding our performance. Accordingly, we believe these non-GAAP financial measures are useful to investors and others because they allow for additional information with respect to financial measures used by management in its financial and operational decision-making and they may be used by our institutional investors and the analyst community to help them analyze the health of our business. However, there are a number of limitations related to the use of non-GAAP financial measures, and these non-GAAP financial measures should be considered in addition to, not as a substitute for or in isolation from, our financial results prepared in accordance with GAAP. Other companies, including companies in our industry, may calculate these non-GAAP financial measures differently or not at all, which reduces their usefulness as comparative measures.

The effect of currency exchange rates on our business is an important factor in understanding period to period comparisons. We use non-GAAP percentage change in constant currency revenues, which exclude the impact of fluctuations in foreign currency exchange rates, for financial and operational decision-making and as a means to evaluate period-to-period comparisons. We believe this information is useful to investors to facilitate comparisons and better identify trends in our business. The impact of changes in foreign currency may vary significantly from period to period, and such changes generally are outside of the control of our management. We calculate constant currency revenues by using current period foreign currency revenues and translating them to constant currency using prior year comparable period exchange rates for the entire period of related bookings. Constant currency revenue percentage change is calculated by dividing the difference between constant currency revenue and the prior year comparable period revenue by the prior year comparable period revenue.

Forward-Looking Statements

This Shareholder Letter contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements other than statements of historical facts contained in this letter, including without limitation, statements regarding our business model and strategic priorities for growth and monetization, including the expected benefits and efficacy of new products and product updates for user growth and retention, the availability of new products, the effectiveness of our marketing efforts, and our financial outlook are forward-looking statements. Without limiting the generality of the foregoing, you can identify forward-looking statements because they contain words such as “may,” “will,” “shall,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential,” “goal,” “objective,” “seeks,” or “continue” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans, or intentions. Such forward-looking statements are neither promises nor guarantees, but involve a number of known and unknown risks, uncertainties and assumptions that may cause our actual results, performance or achievements to differ materially from those expressed or implied in the forward-looking statements due to various factors, including, but not limited to: our ability to retain and grow our users and sustain their engagement with our products; competition in the online language learning industry; our limited operating history; our ability to maintain profitability; our ability to manage our growth and operate at such scale; the success of our investments; our reliance on third-party platforms to store and distribute our products and collect revenue; our reliance on third-party hosting and cloud computing providers; our ability to compete for advertisements; acceptance by educational organizations of technology-based education; our ability to access, collect, and use personal data about our users and payers, and to comply with applicable data privacy laws; regulatory and legislative developments on the use of artificial intelligence and machine learning; potential intellectual property-related litigation and proceedings; our ability adequately obtain, protect and maintain our intellectual property rights; and the other important factors more fully detailed under the caption "Risk Factors" in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as any such factors may be updated from time to time, including without limitation in our Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2024 and in our other filings with the SEC, accessible on the SEC’s website at www.sec.gov and the Investor Relations section of the Company’s website at investors.duolingo.com. All forward-looking statements speak only as of the date of this letter. While we may elect to update such forward-looking statements at some point in the future, unless required by applicable law, we disclaim any obligation to do so, even if subsequent events cause our views to change.

Website Information

We routinely post important information for investors on the Investor Relations section of our website, investors.duolingo.com, and also from time to time may use social media channels, including our X (formerly Twitter) account x.com/duolingo and our LinkedIn account linkedin.com/company/duolingo, as an additional means of disclosing public information to investors, the media, and others interested in us. It is possible that certain information we post on our website and on social media could be deemed to be material information, and we encourage investors, the media, and others interested in us to review the business and financial information we post on our website and on the social media channels identified above, in addition to following our press releases, SEC filings, public conference calls, presentations, and webcasts. The information contained on, or that may be accessed through, our website and our social media channels is not incorporated by reference into, and is not a part of, this document.

|

|

|

|

|

|

|

|

|

|

|

|

DUOLINGO, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS |

|

| (in thousands) |

December 31,

2023 |

|

September 30,

2024 |

|

|

|

|

| ASSETS |

|

|

|

| Cash and cash equivalents |

$747,610 |

|

|

$854,409 |

|

| Short-term investments |

— |

|

|

26,354 |

|

| Accounts receivable |

88,975 |

|

|

94,215 |

|

| Deferred cost of revenues |

53,931 |

|

|

67,329 |

|

| Prepaid expenses and other current assets |

7,282 |

|

|

16,130 |

|

| Noncurrent assets |

56,159 |

|

|

161,112 |

|

| Total assets |

$953,957 |

|

|

$1,219,549 |

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

| Deferred revenues |

249,192 |

|

|

310,603 |

|

| Accounts payable |

2,447 |

|

|

3,649 |

|

| Other current liabilities |

25,723 |

|

|

27,881 |

|

| Long-term obligation under operating leases |

21,094 |

|

|

54,651 |

|

| Deferred tax liabilities, net |

— |

|

|

312 |

|

| Total liabilities |

298,456 |

|

|

397,096 |

|

| Total stockholders’ equity |

655,501 |

|

|

822,453 |

|

| Total liabilities and stockholders' equity |

$953,957 |

|

|

$1,219,549 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DUOLINGO, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE INCOME |

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

(in thousands) |

2023 |

|

2024 |

|

|

|

|

|

|

|

|

|

|

| Revenues |

$137,624 |

|

|

$192,594 |

|

|

|

|

| Cost of revenues |

36,254 |

|

|

52,180 |

|

|

|

|

| Gross profit |

101,370 |

|

|

140,414 |

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

| Research and development |

50,305 |

|

|

62,878 |

|

|

|

|

| Sales and marketing |

22,335 |

|

|

25,574 |

|

|

|

|

| General and administrative |

33,400 |

|

|

38,388 |

|

|

|

|

| Total operating expenses |

106,040 |

|

|

126,840 |

|

|

|

|

| (Loss) income from operations |

(4,670) |

|

|

13,574 |

|

|

|

|

| Other (expense) income, net |

(1,023) |

|

|

569 |

|

|

|

|

| (Loss) income before interest income and income taxes |

(5,693) |

|

|

14,143 |

|

|

|

|

| Interest income |

8,625 |

|

|

11,246 |

|

|

|

|

| Income before income taxes |

2,932 |

|

|

25,389 |

|

|

|

|

| Provision for income taxes |

125 |

|

|

2,029 |

|

|

|

|

| Net income and comprehensive income |

$2,807 |

|

|

$23,360 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| DUOLINGO, INC. AND SUBSIDIARIES |

| UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

|

|

|

|

|

Nine Months Ended September 30, |

| (in thousands) |

2023 |

|

2024 |

|

|

|

|

| Cash flows from operating activities: |

|

|

|

| Net income |

$3,950 |

|

|

$74,667 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

| Depreciation and amortization |

5,053 |

|

|

7,193 |

|

| Stock-based compensation expense |

70,219 |

|

|

80,690 |

|

| Accretion on marketable securities, net |

— |

|

|

(12) |

|

| Gain on sale of capitalized software |

(100) |

|

|

— |

|

| Loss on disposal of leasehold improvements |

417 |

|

|

— |

|

| Changes in assets and liabilities: |

24,882 |

|

|

39,631 |

|

| Net cash provided by operating activities |

104,421 |

|

|

202,169 |

|

| Net cash used for investing activities |

(9,436) |

|

|

(106,965) |

|

| Net cash (used for) provided by financing activities |

(1,428) |

|

|

11,595 |

|

| Net increase in cash, cash equivalents and restricted cash |

93,557 |

|

|

106,799 |

|

| Cash, cash equivalents and restricted cash - Beginning of period |

608,180 |

|

|

750,345 |

|

| Cash, cash equivalents and restricted cash - End of period |

$701,737 |

|

|

$857,144 |

|

Reconciliation: Adjusted EBITDA and Adjusted EBITDA Margin and GAAP Operating Expenses and Non-GAAP Operating Expenses

Adjusted EBITDA is defined as net income excluding interest income, income taxes, depreciation and amortization, stock-based compensation expenses related to equity awards, transaction costs related to acquisitions, acquisition earn-out costs and loss on disposal of leasehold improvements. Adjusted EBITDA margin is defined as Adjusted EBITDA as a percentage of revenues. GAAP operating expenses consist of research and development, sales and marketing, and general and administrative expenses. Non-GAAP operating expenses are defined as the respective GAAP operating expenses excluding depreciation and amortization, stock-based compensation expenses related to equity awards, and, as applicable, transaction costs related to an acquisition, acquisition earn-out costs and loss on disposal of leasehold improvements. These non-GAAP financial measures are used by management to evaluate the financial performance of our business and we present these non-GAAP financial measures because we believe that they are helpful in highlighting trends in our operating results and that they are frequently used by analysts, investors and other interested parties to evaluate companies in our industry. The following tables present a reconciliation of our net income and GAAP operating expenses, the most directly comparable financial measures presented in accordance with GAAP, to Adjusted EBITDA and Adjusted EBITDA margin and non-GAAP operating expenses, respectively.

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

| (in thousands) |

2023 |

2024 |

|

|

| Net income |

$2,807 |

|

$23,360 |

|

|

|

Add (deduct): |

|

|

|

|

| Interest income |

(8,625) |

|

(11,246) |

|

|

|

| Provision for income taxes |

125 |

|

2,029 |

|

|

|

| Depreciation and amortization |

1,657 |

|

2,876 |

|

|

|

| Stock-based compensation expenses related to equity awards (1) |

26,007 |

|

29,990 |

|

|

|

|

|

|

|

|

| Acquisition transaction costs (2) |

— |

|

399 |

|

|

|

| Acquisition earn-out costs (3) |

113 |

|

100 |

|

|

|

|

|

|

|

|

| Loss on disposal of leasehold improvements |

417 |

|

— |

|

|

|

| Adjusted EBITDA |

$22,501 |

|

$47,508 |

|

|

|

|

|

|

|

|

| Revenues |

$137,624 |

|

$192,594 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA margin |

16.3 |

% |

24.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation: GAAP to Non-GAAP Operating Expense |

|

|

|

Three Months Ended September 30, |

|

| (in thousands) |

2023 |

2024 |

|

|

|

|

|

|

|

| Total GAAP Operating Expense |

$106,040 |

|

$126,840 |

|

|

|

| Less: Depreciation and amortization |

(1,255) |

|

(1,479) |

|

|

|

| Less: Stock-based compensation expenses related to equity awards (1) |

(25,992) |

|

(29,970) |

|

|

|

| Less: Other adjustments (2) (3) |

(113) |

|

(499) |

|

|

|

| Non-GAAP Operating Expense |

$78,680 |

|

$94,892 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation: GAAP to Non-GAAP R&D Expense |

|

|

|

|

Three Months Ended September 30, |

|

| (in thousands) |

2023 |

2024 |

|

|

|

|

|

|

|

| Total GAAP R&D Expense |

$50,305 |

|

$62,878 |

|

|

|

| Less: Depreciation and amortization |

(415) |

|

(648) |

|

|

|

| Less: Stock-based compensation expenses related to equity awards (1) |

(12,610) |

|

(16,807) |

|

|

|

|

|

|

|

|

| Non-GAAP R&D Expense |

$37,280 |

|

$45,423 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation: GAAP to Non-GAAP S&M Expense |

|

|

|

|

Three Months Ended September 30, |

|

| (in thousands) |

2023 |

2024 |

|

|

|

|

|

|

|

| Total GAAP S&M Expense |

$22,335 |

|

$25,574 |

|

|

|

| Less: Depreciation and amortization |

(270) |

|

(218) |

|

|

|

| Less: Stock-based compensation expenses related to equity awards (1) |

(1,171) |

|

(1,336) |

|

|

|

|

|

|

|

|

| Non-GAAP S&M Expense |

$20,894 |

|

$24,020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation: GAAP to Non-GAAP G&A Expense |

|

|

|

|

|

Three Months Ended September 30, |

|

| (in thousands) |

2023 |

2024 |

|

|

|

|

|

|

|

| Total GAAP G&A Expense |

$33,400 |

|

$38,388 |

|

|

|

| Less: Depreciation and amortization |

(570) |

|

(613) |

|

|

|

| Less: Stock-based compensation expenses related to equity awards (1) |

(12,211) |

|

(11,827) |

|

|

|

| Less: Other adjustments (2) (3) |

(113) |

|

(499) |

|

|

|

| Non-GAAP G&A Expense |

$20,506 |

|

$25,449 |

|

|

|

Reconciliation: Free Cash Flow and Free Cash Flow Margin

Free cash flow represents net cash provided by operating activities, reduced by capitalized software development costs and purchases of property and equipment and increased by taxes paid related to stock-based compensation equity awards and transaction costs related to acquisitions as we believe such items are not indicative of future liquidity. Free cash flow margin is defined as Free cash flow as a percentage of revenues. We believe that free cash flow is a measure of liquidity that provides useful information to our management, investors and others in understanding and evaluating the strength of our liquidity and future ability to generate cash that can be used for strategic opportunities or investing in our business. Free cash flow has certain limitations in that it does not represent our residual cash flow for discretionary expenditures and our non-discretionary commitments. The following table presents a reconciliation of net cash provided by operating activities, the most directly comparable financial measure calculated in accordance with GAAP, to free cash flow.

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

| (in thousands) |

2023 |

2024 |

|

|

|

|

|

|

|

| Net cash provided by operating activities |

$37,650 |

|

$56,267 |

|

|

|

| Less: Capitalized software development costs and purchases of intangible assets |

(3,994) |

|

(1,845) |

|

|

|

| Less: Purchases of property and equipment |

(759) |

|

(3,178) |

|

|

|

| Plus: Taxes paid related to stock-based compensation equity awards |

575 |

|

1,031 |

|

|

|

|

|

|

|

|

| Plus: Acquisition transaction costs (2) |

— |

|

399 |

|

|

|

|

|

|

|

|

| Free cash flow |

$33,472 |

|

$52,674 |

|

|

|

|

|

|

|

|

| Revenues |

$137,624 |

|

$192,594 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Free cash flow margin |

24.3 |

% |

27.3 |

% |

|

|

(1) In addition to stock-based compensation expense of $29.0 million and $25.4 million for the three months ended September 30, 2024 and 2023, respectively, this includes costs incurred related to taxes paid on equity transactions.

(2) Represents costs incurred related to acquisitions, including integration costs.

(3) Represents costs incurred related to the earn-out payments on acquisitions.

Contacts

Investor Relations:

Deborah Belevan, VP of Investor Relations

ir@duolingo.com

Press:

Sam Dalsimer, Global Head of Communications

press@duolingo.com