Document

PRESS RELEASE

Contact Information:

TXO Partners Brent W. Clum

President, Business Operations & CFO 817.334.7800

ir@txopartners.com

Release Date:

January 15, 2025

TXO PARTNERS ANNOUNCES 3 TCFE OF NATURAL GAS POTENTIAL IN THE MANCOS SHALE OF THE SAN JUAN BASIN

[Fort Worth, TX, January 2025]—TXO Partners, L.P. (NYSE: TXO) is designed as a natural resources production company committed to distributing ongoing cash returns while delivering long-term value to unit holders. This strategy is based on its long-lived, low-risk property base, coupled with strong financial stewardship.

“TXO has built a portfolio of oil and gas rich assets with tremendous potential for development. The confidence we have in the performance of these properties provides the foundation for our premium distribution company,” stated Bob R. Simpson, Chairman and CEO. “With this perspective, our technical team has identified another extraordinary play within TXO’s vast operated production base. The Mancos Shale is an upcoming, giant natural gas field where we hold a 58,500 contiguous- acre position that is held by production.

The target holds nearly 3 Tcfe of natural gas potential. On an oil equivalent basis, we believe this could represent as much as five times our current total reserve base. The catalyst for action in developing this project is commodity price, and we anticipate strong natural gas economics ahead.”

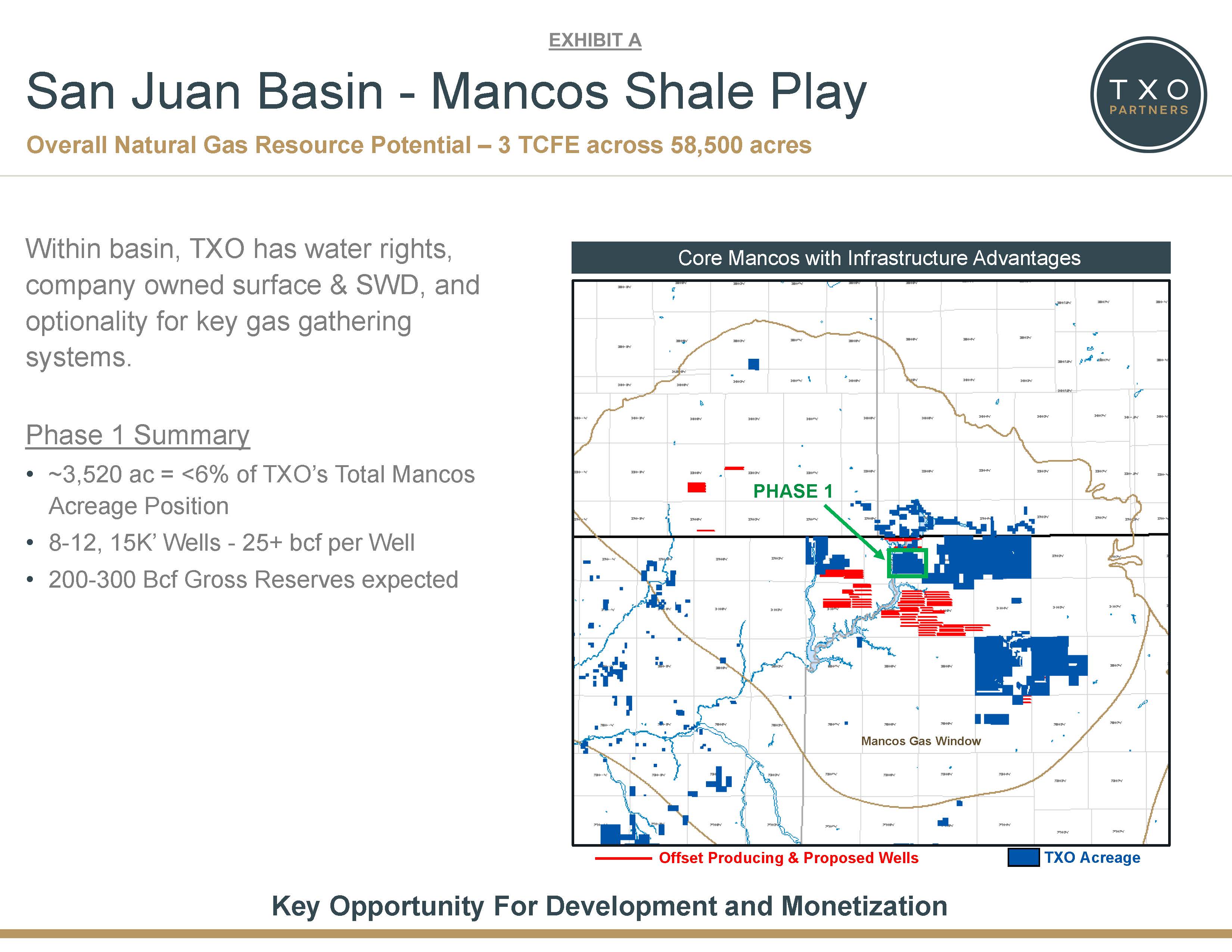

“We believe the Mancos Shale development will be a game-changer for our reserve holdings and production potential” continues Gary D. Simpson, President of Production and Development. “TXO acreage and operations reside in prime position. Offset drilling on adjoining acreage has confirmed well results. Given all the important criteria—reservoir characteristics, acreage location, productivity data, and infrastructure access—we have identified a tactical 3,520-acre block as Phase I for developing and monetizing reserves, representing about 6% of our current Mancos position. Specifically, our internal engineers estimate that this single position holds about 200 to 300 Bcf of natural gas with 25 Bcfe estimated per drill well and has the potential to almost double our existing natural gas reserves. Importantly, the company’s acres for exploitation are held by production with no leasehold expiration dates.

We expect to drill, develop, and monetize at an economically opportune time and pace. We believe this high-impact, shale project will drive extraordinary value for our owners.”

For perspective, Exhibit A reflects the summary of our Mancos Play Phase I project within the scope of the total 3 Tcfe of captured potential, which is in excess of 58,000 contiguous acres. The ongoing cash flow from all activities will be allocated to capital investment decisions, unit distributions, and debt management.

About TXO Partners, L.P.

TXO Partners, L.P. is a master limited partnership focused on the acquisition, development, optimization and exploitation of conventional oil, natural gas, and natural gas liquid reserves in North America. TXO’s current acreage positions are concentrated in the Permian Basin of West Texas and New Mexico, the San Juan Basin of New Mexico and Colorado and the Williston Basin of Montana and North Dakota.

Cautionary Statement Concerning Forward-Looking Statements

Certain statements contained in this press release constitute “forward- looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include the words such as “may,” “assume,” “forecast,” “could,” “should,” “will,” “plan,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” “budget” and similar expressions, although not all forward-looking statements contain such identifying words. These forward-looking statements include the resource potential of our acreage in the Mancos Play of the San Juan Basin, the future production and potential economic value of our Mancos acreage, our ability to realize the anticipated benefits from our Mancos acreage, the impacts of the Mancos acreage on our reserves and production, our expectations of positive natural gas commodity pricing environments ahead, the timing, amount and area of focus of future investments in our assets and the impacts of future commodity price changes. These forward-looking statements are based on management’s current belief, based on currently available information, as to the outcome and timing of future events at the time such statement was made, and it is possible that the results described in this press release will not be achieved.

Our assumptions and future performance are subject to a wide range of business risks, uncertainties and factors, including, without limitation, the following: our ability to meet distribution expectations and projections; the volatility of oil, natural gas and NGL prices; our ability to safely and efficiently operate TXO’s assets; uncertainties about our estimated oil, natural gas and NGL reserves, including the impact of commodity price declines on the economic producibility of such reserves, and in projecting future rates of production; and the risks and other factors disclosed in TXO’s filings with the SEC, including its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

Any forward-looking statement speaks only as of the date on which it is made, and, except as required by law, TXO does not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. New factors emerge from time to time, and it is not possible for TXO to predict all such factors.

Cautionary Note to Investors

The SEC permits oil and gas companies, in their filings with the SEC, to disclose only proved, probable and possible reserves that meet the SEC's definitions for such terms. TXO may use certain broader terms such as “natural gas potential,” “natural gas resource potential,” “gross reserves,” “total reserve base” and “total possible value” in its communications to investors that the SEC's guidelines strictly prohibit TXO from including in filings with the SEC. These types of estimates do not represent, and are not intended to represent, any category of reserves based on SEC definitions, are by their nature more speculative than estimates of proved, probable and possible reserves and do not constitute "reserves" within the meaning of the SEC's rules. These estimates are subject to greater uncertainties, and accordingly, are subject to a substantially greater risk of actually being realized. Investors are urged to consider closely the disclosures and risk factors in the reports TXO files with the SEC.