UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

OR

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-39130

TELA Bio, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware (State or other jurisdiction of |

|

45-5320061 (I.R.S. Employer |

|

|

|

|

1 Great Valley Parkway, Suite 24 Malvern, Pennsylvania (Address of principal executive offices) |

|

19355 (Zip Code) |

(484) 320-2930

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class: |

|

Trading Symbol |

|

Name of each exchange on which registered: |

Common Stock, $0.001 par value per share |

TELA |

The Nasdaq Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ◻ Yes ⌧ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ◻ Yes ⌧ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ⌧ Yes ◻ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ⌧ Yes ◻ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ◻ |

|

Accelerated filer ◻ |

|

|

Smaller reporting company ⌧ |

Non-accelerated filer ⌧ |

|

Emerging growth company ◻ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ◻

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ◻

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ◻ No ⌧

As of June 28, 2024 (the last business day of the registrant’s most recently completed second fiscal quarter), the aggregate market value of the registrant’s common stock held by non-affiliates was approximately $114.5 million based on the closing price of the common stock as reported on the NASDAQ Global Market on June 28, 2024.

As of March 14, 2025, the registrant had 39,551,098 shares of Common Stock, $0.001 par value per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement to be filed with the U.S. Securities and Exchange Commission (the “SEC”) for TELA Bio’s 2025 annual meeting of stockholders are incorporated by reference into Part III of this Form 10-K.

TABLE OF CONTENTS

Item No. |

|

Page No. |

7 |

||

40 |

||

80 |

||

80 |

||

81 |

||

81 |

||

81 |

||

|

|

|

82 |

||

82 |

||

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

83 |

|

93 |

||

95 |

||

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

95 |

|

95 |

||

96 |

||

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS |

96 |

|

|

|

|

96 |

||

97 |

||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

97 |

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

97 |

|

97 |

||

|

|

|

97 |

||

98 |

||

|

|

|

99 |

||

102 |

||

2

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Annual Report”) and the documents incorporated by reference herein contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. In addition, we may, through our officers and other authorized representatives, make certain forward-looking statements in publicly released materials, both written and oral, including statements contained in filings with the Securities and Exchange Commission, press releases, and our communications with our stockholders.

Forward-looking statements are neither statements of historical facts nor assurances of future performance, but instead discuss the future of our business, operations, future financial performance, future financial condition, plans, anticipated growth strategies, anticipated or perceived trends in our business, the industry in which we operate or the broader economy, and other objectives of management. In some cases, you can identify forward-looking statements by terminology such as “aim,” “anticipate,” “assume,” “believe,” “contemplate,” “continue,” “could,” “design,” “due,” “estimate,” “expect,” “goal,” “intend,” “may,” “objective,” “plan,” “predict,” “positioned,” “potential,” “seek,” “should,” “target,” “will,” “would,” the negative of such terms, and other similar expressions although not all forward-looking statements contain these identifying words.

You should understand that the following important factors could affect our future results and could cause those results or other outcomes to differ materially from those expressed or implied in our forward-looking statements:

| ● | estimates regarding future results of operations, financial position, research and development costs, capital requirements and our needs for additional financing; |

| ● | the commercial success and degree of market acceptance of our products; |

| ● | the introduction of new products or product enhancements by us or others in our industry, including new products which may be perceived to negatively impact the demand for our products now or in the future; |

| ● | our ability to expand, manage and maintain our direct sales and marketing organization and to market and sell our products in the U.S. and Europe; |

| ● | the performance of our exclusive contract manufacturer for our OviTex and OviTex PRS products, Aroa Biosurgery Ltd. (“Aroa”), in connection with the supply of product and in the development of additional products and product configurations within these products; |

| ● | our ability to maintain our supply chain integrity and expand our supply chain to manage increased demand for our products; |

| ● | our ability to compete successfully with larger competitors in our highly competitive industry; |

| ● | our ability to achieve and maintain adequate levels of coverage or reimbursement for our current products and any future products we may seek to commercialize; |

| ● | our ability to enhance our products, expand our indications and develop and commercialize additional products; |

| ● | the development, regulatory approval, efficacy and commercialization of competing products; |

| ● | our business model and strategic plans for our products, technologies and business, including our implementation thereof; |

| ● | the size of the markets for our current and future products; |

| ● | our ability to recruit and retain senior management and other highly qualified personnel; |

| ● | our ability to obtain additional capital to finance our planned operations; |

| ● | our ability to maintain regulatory approval for our products; |

| ● | our ability to commercialize or obtain regulatory approvals for our future products, or the effect of delays in commercializing or obtaining regulatory approvals; |

| ● | decreasing selling prices and pricing pressures; |

| ● | regulatory developments in the U.S. , including regulatory developments due to changes in the U.S. presidential administration and European markets; |

| ● | the potential impact of healthcare reform in the U.S., including the Inflation Reduction Act of 2022, and measures being taken worldwide designed to reduce healthcare costs; |

| ● | any decrease in frequency of surgical procedures using our products, whether through outbreak of illness or disease, cybersecurity events impacting hospital operations, labor and hospital staffing shortages, supply chain disruptions to critical surgical and hospital supplies, and any applicable adverse healthcare economic factors; |

3

| ● | the volatility of capital markets and other adverse macroeconomic factors, including due to inflationary pressures, interest rate and currency rate fluctuations, economic slowdown or recession, banking instability, monetary policy changes, changes in trade policies (including tariffs that have been or may in the future be imposed by the U.S. or other countries), geopolitical tensions or the outbreak of hostilities or war, including from the ongoing Russia-Ukraine conflict, the current conflicts in the Middle East (including any escalation or expansion) and increasing tensions between China and Taiwan; |

| ● | our ability to develop and maintain our corporate infrastructure, including our internal controls; |

| ● | our ability to establish and maintain intellectual property protection for our products, as well as our ability to operate our business without infringing the intellectual property rights of others; |

| ● | our expectations regarding the use of proceeds from recent and any future financings, if any; |

| ● | the occurrence of adverse safety events, restrictions on use with our products or product liability claims; and |

| ● | other risks and uncertainties, including those listed under the caption “Risk Factors.” |

These forward-looking statements are based on management’s current expectations, estimates, forecasts and projections about our business and the industry in which we operate, and management’s beliefs and assumptions are not guarantees of future performance or development and involve known and unknown risks, uncertainties and other factors that are in some cases beyond our control. In light of the significant uncertainties in these forward-looking statements, you should not rely upon forward-looking statements as predictions of future events. Although we believe the expectations reflected in the forward-looking statements are reasonable, the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements may not be achieved or occur at all.

You should refer to the section titled “Risk Factors” in this Annual Report for a discussion of important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. Except as required by law, we undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise.

4

SUMMARY RISK FACTORS

We are providing the following summary of the risk factors contained in our Form 10-K to enhance the readability and accessibility of our risk factor disclosures. Additional discussion of the risks and uncertainties summarized in this risk factor summary, as well as other risks and uncertainties that we face, can be found under “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in this Annual Report. The below summary is qualified in its entirety by those more complete discussions of such risks and uncertainties.

Risks Related to Achieving or Sustaining Profitability, Financial Position and Capital Requirements

| ● | We have incurred significant operating losses since inception, we expect to incur operating losses in the future, and we may not be able to achieve or sustain profitability. |

| ● | Our indebtedness may limit our flexibility in operating our business and adversely affect our financial health and competitive position. |

| ● | We may require substantial additional capital to finance our planned operations, which may not be available to us on acceptable terms or at all. |

| ● | If we are unable to expand, manage and maintain our direct sales and marketing organizations, we may not be able to generate anticipated revenue. |

| ● | Macroeconomic conditions, including those placing financial strain on hospital systems and their ability to perform the procedures in which our products are used may negatively impact certain aspects of our business, our prospects, results of operations and financial condition. |

| ● | Rising inflation rates could negatively impact our revenues and profitability if increases in the prices of our product or a decrease in consumer spending results in lower volumes of elective surgeries. In addition, if our costs increase and we are not able to pass along these price increases, our profitability would be adversely affected, and the adverse impact may be material. |

Risks Related to the Commercialization of our Products

| ● | To date, the vast majority of our revenue has been generated from sales of our OviTex products, and we therefore are highly dependent on the commercial success of our OviTex products. |

| ● | The commercial success of our products will largely depend upon attaining significant market acceptance. |

| ● | Even if we are able to attain significant market acceptance of our products, the commercial success of our products is not guaranteed. |

| ● | The misuse or off-label use of our products may harm our reputation in the marketplace, result in injuries that lead to product liability suits or result in costly investigations, fines or sanctions by regulatory bodies if we are deemed to have engaged in the promotion of our products for these uses. |

| ● | If we are unable to achieve and maintain adequate levels of coverage or reimbursement for our OviTex and OviTex PRS products we may commercialize in the future, our commercial success may be hindered. |

| ● | Our long-term growth may depend on our ability to enhance our product offerings. |

| ● | In the future our products may become obsolete, which would negatively affect operations and financial condition. |

| ● | To successfully market and sell our products in markets outside of the U.S., we must address many international business risks with which we have limited experience. |

Risks Related to Our Reliance on Third Parties

| ● | We are highly dependent upon Aroa as the exclusive contract manufacturer of our OviTex and OviTex PRS products. |

| ● | We, or our partners, may experience development or manufacturing problems, capacity constraints, or delays in the production of our products that could limit the potential growth of our revenue or increase our losses. |

| ● | Our products contain materials derived from animal sources and may become subject to additional regulation. |

| ● | Our supply of ovine rumen for use in manufacturing our products may be vulnerable to disruption due to natural disaster, disease or other events. |

5

Risks Related to Intellectual Property Matters

| ● | We may need to license intellectual property from third parties, and such licenses may not be available or may not be available on commercially reasonable terms. |

| ● | If we fail to comply with our obligations under any license, collaboration or other agreements, we could lose intellectual property rights that are necessary for developing and protecting our products. |

| ● | If we are unable to adequately protect our intellectual property rights, or if we are accused of infringing on the intellectual property rights of others, our competitive position could be harmed, or we could be required to incur significant expenses to enforce or defend our rights. |

| ● | Litigation or other proceedings or third-party claims of intellectual property infringement could require us to spend significant time and money, enter into license agreements for disputed intellectual property and could prevent us from selling our products. |

| ● | If we are unable to protect the confidentiality of our trade secrets, our business and competitive position could be harmed. |

Risks Related to Government Regulation

| ● | Our products and operations are subject to extensive government regulation and oversight both in the U.S. and internationally. |

| ● | We may not receive, or may be significantly delayed in receiving, the necessary clearances or approvals for our future products and modifications to our current products may require new 510(k) clearances or premarket approval, and may require us to cease marketing or recall the modified products until clearances or approvals are obtained. |

| ● | Although we have obtained regulatory clearance for our products, they will remain subject to extensive regulatory scrutiny. |

| ● | If guidelines for soft-tissue reconstruction surgery change or the standard of care evolves, we may need to redesign and seek new marketing authorization from the U.S. Food and Drug Administration for our OviTex and OviTex PRS products or other products we may commercialize in the future. |

Risks Related to Our Business and Products

| ● | Our financial results may fluctuate significantly and may not fully reflect the underlying performance of our business. |

| ● | We may be unable to renew existing or obtain additional contract positions with major group purchasing organizations and integrated delivery networks for our products, and even if we are able to do so, such contracts may not generate sufficient sales of our products. |

| ● | We have limited data and experience regarding the safety and efficacy of certain of our products. Results of earlier studies may not be predictive of future clinical trial results, or the safety or efficacy profile for such products. |

| ● | Interim or preliminary data from our clinical trials that we announce or publish from time to time may change as more patient data become available and are subject to audit and verification procedures that could result in material changes in the final data. |

Risks Related to Our Securities

| ● | The trading price of the shares of our common stock has been and could in the future be highly volatile. |

| ● | Our directors, officers and principal stockholders have significant voting power and may take actions that may not be in the best interests of our other stockholders. |

| ● | Provisions in our corporate charter documents and under Delaware law could discourage another company from acquiring us and may prevent attempts by our stockholders to replace or remove our current management. |

6

PART I

ITEM 1.BUSINESS

Overview

We are a commercial-stage medical technology company focused on providing innovative soft-tissue reconstruction solutions that optimize clinical outcomes by prioritizing the preservation and restoration of the patient’s own anatomy. Our growing product portfolio is purposefully designed to leverage the patient’s natural healing response while minimizing long-term exposure to permanent synthetic materials. We are committed to delivering our advanced technologies with a strong economic value proposition to assist surgeons and institutions in providing next-generation soft-tissue repair solutions to more patients worldwide.

We are dedicated to building true partnerships with surgeons and healthcare providers to deliver solutions that provide both clinical and economic improvements. We believe that genuine collaboration with surgeons and healthcare providers results in the development of new solutions that empower patient care and addresses unmet needs within the soft tissue reconstruction market.

Our first portfolio of products, the OviTex Reinforced Tissue Matrix (“OviTex”) which we first commercialized in the U.S. in July 2016 and in Europe in February 2019, addresses unmet needs in hernia repair and abdominal wall reconstruction by combining the benefits of biologic matrices and polymer materials while minimizing their shortcomings, at a cost-effective price.

Hernia repair is one of the most common surgeries performed in the U.S., representing approximately 1.2 million procedures annually. Based on the volume weighted average selling price of our OviTex products, we estimate the annual U.S. total addressable market opportunity for our OviTex products to be approximately $1.8 billion.

Our OviTex portfolio consists of multiple product configurations intended to address various surgical procedures within hernia repair and abdominal wall reconstruction, including ventral, inguinal, and hiatal hernia repair. In addition, we have also designed an OviTex product specifically for use in laparoscopic and robotic-assisted hernia repair, which we market as OviTex LPR and began commercializing in November 2018. In February 2023, we launched two larger configurations of OviTex LPR, designed for ventral and incisional hernias. In April 2024, we launched OviTex IHR Reinforced Tissue Matrix, a new OviTex configuration specifically designed to address inguinal hernia procedures performed robotically and laparoscopically.

We have also focused on evaluating and publishing clinical data on the effectiveness and safety of our OviTex products. To date, there have been over forty published or presented works relating to these clinical findings, either by us or a third-party evaluating one or more product configurations in our OviTex portfolio. In October 2022, the 24-month results of our single arm, multicenter post-market clinical study, which we refer to as our BRAVO study, were published in the Annals of Medicine and Surgery. The BRAVO study was designed to evaluate the clinical performance of OviTex for primary or recurrent ventral hernias using open, laparoscopic, or robotic techniques in 92 enrolled patients. The recurrence rate at the 24-month time point was 2.6%, and surgical site occurrences (“SSOs”), were observed in 38% of the study population. Of the enrolled patients, 78% were characterized as high risk for experiencing an SSO based on at least one known risk factor, which included obesity, active smoking, chronic obstructive pulmonary disease (“COPD”), diabetes mellitus, coronary artery disease, or advanced age (≥75 years). The results also indicated that BRAVO patients experienced statistically significant and clinically meaningful improvements in their quality of life and perceived health based on patient responses to the EuroQol-5 Dimension (EQ-5D) health assessment and the validated 12-question Hernia-Related Quality of Life survey (HerQLes). In addition to the BRAVO study, we have also initiated other clinical data collection initiatives evaluating the use of OviTex across a variety of hernia and abdominal wall reconstruction procedures. Among these other initiatives, we continue to enroll patients for our BRAVO II study, a prospective study evaluating the use of OviTex in robot-assisted ventral and inguinal hernia repairs.

7

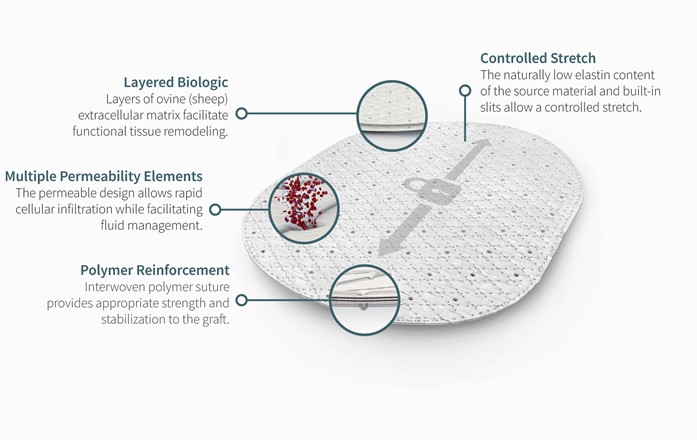

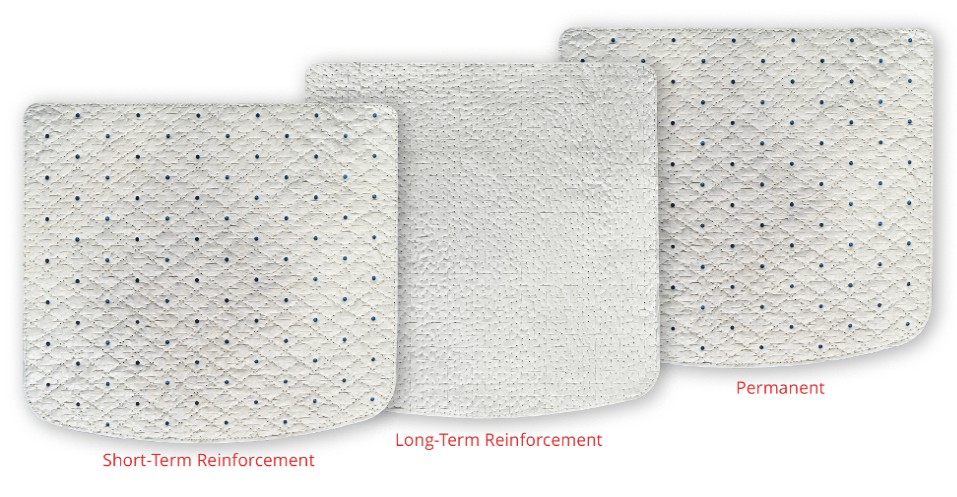

Our second portfolio of products, the OviTex PRS Reinforced Tissue Matrix, (“OviTex PRS”) which we first commercialized in the U.S. in May 2019, addresses unmet needs in plastic and reconstructive surgery. OviTex PRS is indicated for use in implantation to reinforce soft-tissue where weakness exists in patients requiring soft-tissue repair or reinforcement in plastic and reconstructive surgery. Our OviTex PRS portfolio consists of three product configurations with two or three layers of high-quality tissue derived from ovine rumen, which is reinforced with either permanent or resorbable polymer for added strength, stabilization, and controlled stretch. These products are designed to improve outcomes by facilitating functional tissue remodeling while controlling the degree and direction of stretch. OviTex PRS Long-Term Resorbable, our most recent product configuration, launched in August 2023, and was designed to enhance the OviTex PRS portfolio with specific design features including bi-directional stretch and a fully resorbable, long-term polymer for reinforcement.

Our OviTex PRS portfolio is supported by non-human primate data that demonstrated more rapid tissue integration and tissue remodeling compared to the market leading biologic matrix used in this indication. In addition, there have been a growing number of published or presented works evaluating the use of OviTex PRS in plastic and reconstruction applications. We also continue to enroll patients in our OPERA study, a retrospective-prospective trial evaluating the safety profile of OviTex PRS in previous pre-pectoral and sub-pectoral implant-based breast reconstructions. Based on the current sales of biologic matrices in the U.S., we estimate the annual U.S. current addressable market opportunity for our OviTex PRS products to be approximately $800 million.

Our OviTex products have received 510(k) clearances from the U.S. Food and Drug Administration, (“FDA”) which clearances were obtained and are currently held by our exclusive contract manufacturer of these products, Aroa. In April 2019, our first OviTex PRS products received 510(k) clearance from the FDA, which clearance was initially obtained by Aroa and is currently held by us. In March 2023, we received an additional 510(k) clearance for our OviTex PRS Long-Term Resorbable device, which is currently held by us. In May 2024, we received clearance of a Special 510(k) related to minor changes to our OviTex PRS Permanent and Short-Term Resorbable devices. In October 2024, we received approval from the FDA for our investigational device exemption application relating to the study of the safety and effectiveness of our OviTex PRS product in implant-based breast reconstruction. We continue to evaluate and finalize the clinical study protocol and anticipate additional FDA interactions related to such to support a pre-market application to obtain approval for an indication for OviTex PRS for use in breast reconstruction.

Historically, we have sought to expand our service offerings beyond our OviTex and OviTex PRS products through commercial partnerships to distribute complimentary soft tissue preservation and restoration solutions. Some additional product offerings include or have included atraumatic mesh fixation devices or surgical wound management and infection control solutions. In September 2023, we entered into a distribution agreement with Advanced Medical Solutions Limited, a company registered in England, to distribute their LiquiFix Hernia Mesh Fixation Devices (LIQUIFIX FIX8™ and LIQUIFIX Precision™). In March 2024, we announced the full commercial launch of LiquiFix in the U.S. We previously co-developed and commercialized the NIVIS Fibrillar Collagen Pack, (“NIVIS”) an absorbent matrix of Type I and Type III bovine collagen designed to manage moderately to heavily exudating wounds and to control minor bleeding, in partnership with Regenity Biosciences. In March 2024, we sold our distribution rights to MiMedx Group, Inc. in exchange for an initial $5.0 million payment and additional future payments aggregating between a minimum of $3.0 million and a maximum of $7.0 million based on net sales of NIVIS (now marketed as HELIOGEN) during the first two years following its launch by MiMedx Group, Inc. We may assess additional strategic partnerships with medical device companies whereby we may enter into distribution, product development and/or licensing agreements for additional products complimentary to, or related to, existing and future products in our distribution channel, which could result in the payment by us of single digit percentage royalties or other product acquisition costs

We have a broad portfolio of intellectual property protecting our products that we believe, when combined with the proprietary manufacturing processes associated with our products and our know-how, provides significant barriers to entry. Our intellectual property applies to our differentiated product construction and materials. In addition, we believe our exclusive manufacturing and long-term supply and license agreement with Aroa (the “Aroa License”) creates a competitive advantage by allowing us to secure an exclusive supply of ovine rumen at a low cost. Ovine rumen, the forestomach of a sheep, is the source of the biologic material used in both of our OviTex and OviTex PRS products.

8

We use biologic material from ovine rumen because of its plentiful supply, optimal biomechanical profile and open collagen architecture that allows for rapid cellular infiltration. Our OviTex and OviTex PRS products are manufactured by Aroa at their FDA registered and ISO 13485 compliant facility in Auckland, New Zealand. We purchase product from Aroa at a fixed transfer cost as a percentage of Aroa’s cost of goods sold, and subject to a true-up adjustment, resulting in an amount equal to 27% of our net sales of our OviTex and OviTex PRS products, with the exception of OviTex IHR product configurations, for which we pay the greater of the initial fixed transfer cost or 27% of our net sales of OviTex IHR. This revenue sharing arrangement allows us to competitively price our products and pass along cost-savings to our customers.

We primarily market our products through a single direct sales force, predominantly in the U.S., with a small number of sales representatives in the United Kingdom and European Union, and also utilize a smaller number of independent contractors and distributors in the United States and certain European countries. We have invested in our direct sales and marketing infrastructure to expand our presence and to promote awareness and adoption of our products. As of December 31, 2024, we had 75 sales territories in the U.S. and 13 sales territories in Europe. We believe we can enhance the productivity of our sales force by improving customer segmentation and targeting, implementing and further refining our proprietary training programs, leveraging support from our medical education and medical affairs functions to drive physician awareness, education and clinical understanding of our products, and utilizing engagement analytics to support further product development and enhancement opportunities. Additionally, we have contracted with three national group purchasing organizations (“GPOs”) in the United States covering our OviTex and OviTex PRS products and plan to continue to contract with additional GPOs and other integrated delivery networks (“IDNs”) to increase access to and penetration of hospital accounts for all products we commercialize.

We are currently devoting research and development resources to develop additional variations of our OviTex and OviTex PRS products, including larger versions of our current OviTex PRS product configurations, the development of OviTex configurations with longer-acting resorbable polymers and other potential product and packaging enhancements to extend the shelf life of our products. In addition, we also continue to explore the development of lower-cost, higher-margin resorbable polymer-based devices targeting our current indications. We are also exploring additional technologies that may complement our existing products, or expand the number of our products, in each case within the hernia, plastic and reconstruction, and broader soft-tissue reconstruction market. We intend to continue to make investments in research and development efforts to develop improvements and enhancements to our product portfolio.

Our revenue for the years ended December 31, 2024 and 2023 was $69.3 million and $58.5 million, respectively, which represents an increase of $10.8 million, or 19% for the year ended December 31, 2024. Our net loss for the same time periods was $37.8 million and $46.7 million, respectively, which represents a decrease of $8.8 million, or 19% for the year ended December 31, 2024 inclusive of the gain recognized of $7.6 million on the sale of NIVIS to the MiMedx Group, Inc. As of December 31, 2024, we had an accumulated deficit of $358.7 million. The vast majority of our revenue to date has been generated from sales of our OviTex and OviTex PRS products in the U.S., with the remainder generated from sales of our OviTex products in Europe and the sale of other products.

Market Opportunity

OviTex

Hernia repair is one of the most common surgeries performed in the U.S. There are an estimated 1.2 million hernia repairs annually in the U.S. including recurrences, which we categorize as approximately (i) 105,000 complex/moderate ventral hernia repairs and abdominal wall reconstructions, (ii) 395,000 simple ventral hernia repairs and (iii) 645,000 inguinal hernia repairs, and (iv) 42,000 hiatal hernia repairs.

The healthcare burden of hernia disease to patients, insurers and employers is significant. For the patient, a hernia may cause an increasing level of pain when lifting, straining during urination or a bowel movement, or sitting or standing for long periods of time. Increased pain from the hernia is the most common reason that a patient who is deferring surgical hernia repair will ultimately elect repair surgery. Following surgical hernia repair, convalescence has a significant socioeconomic impact.

9

Absence from work during this period can range from approximately five to 14 days according to one study. Pain is the most common cause of delay in returning to work, followed by wound problems. Long-term pain or discomfort at the hernia repair site is one of the most serious complications of hernia surgery and may, in some cases, persist for years.

Given the limitations of and lack of innovation in existing hernia repair products, we believe a significant market opportunity exists for our portfolio of OviTex products. Based on the volume weighted average selling price of our OviTex products, we estimate the annual U.S. total addressable market opportunity for our OviTex products to be approximately $1.8 billion.

|

|

Approximate |

|

|

|

|

|

|

|

Number of |

|

|

|

|

|

|

|

Annual |

|

|

|

|

|

|

|

U.S. Hernia |

|

Estimated |

|

|

|

|

|

Procedures |

|

Annual |

|

|

|

|

|

Using |

|

U.S. Total |

|

|

|

|

|

Tissue |

|

Addressable |

|

Traditional |

|

|

|

Reinforcement |

|

Market |

|

Products |

|

|

|

Material |

|

Opportunity |

|

Utilized |

|

Complex/Moderate Ventral Repair /Abdominal Wall Reconstruction |

|

105,000 |

|

$ |

630 |

million |

Biologic Matrices and Resorbable Synthetic Mesh |

Simple Ventral Hernia Repair |

|

395,000 |

|

$ |

590 |

million |

Permanent Synthetic Mesh |

Inguinal Hernia Repair |

|

645,000 |

|

$ |

540 |

million |

Permanent Synthetic Mesh |

Hiatal Hernia Repair |

|

42,000 |

|

$ |

42 |

million |

Biologic Matrices and Resorbable Synthetic Mesh |

Total |

|

1,187,000 |

|

$ |

1.8 |

billion |

|

OviTex PRS

Modern advances in tissue engineering have transformed the plastic and reconstructive surgeon’s management strategies across a wide variety of applications. Because biologic matrices incorporate into host tissues and enable revascularization and functional tissue remodeling, surgeons have realized multiple applications for their use, with techniques tailored to the specific requirements of the surgery. There is growing clinical literature validating the use of biologic matrices in head and neck surgery and reconstructions of the chest wall, pelvic region, extremities and breast.

In head and neck surgery, biologic matrices are used for both aesthetic and reconstructive purposes that include: surgery of the nose to change its shape or improve its function, referred to as rhinoplasty; lip augmentation; repair of perforations of the cartilage and thin bone separating the nostrils referred to as the nasal septum; complex reconstruction of the oral and oropharynx cavities after oncologic resection; cleft palate repair; upper and lower eyelid reconstruction; scalp defects and defects of the fibrous membrane covering the brain and spinal cord referred to as dura. In chest wall reconstruction, biologic matrices are used to repair defects from oncologic resections. In pelvic reconstruction, biologic matrices are utilized as an adjunct in the reconstruction of acquired pelvic defects caused by resections for colorectal, gynecologic and urologic malignancies. In extremities reconstruction, biologic matrices are used in the upper extremity for repair of the donor site following the harvest of a radial forearm free flap, a procedure used to harvest tissue and replace it in the head and neck after cancer has been resected. In breast reconstruction, biologic matrices are utilized for prosthetic based reconstruction following the removal of cancerous breast tissue.

Based on the current sales of biologic matrices in the U.S., we estimate the annual U.S. current addressable market opportunity for our OviTex PRS products to be approximately $800 million. Given the limitations of and lack of innovation in existing biologic matrices for plastic and reconstructive surgical procedures, we believe a significant market opportunity exists for our OviTex PRS products.

10

Current Materials Used in Hernia Repair and Abdominal Wall Reconstruction and Their Limitations

Hernia Repair and Abdominal Wall Reconstruction

The vast majority of hernias are treated with surgical repair. Surgical hernia repair is performed either through open repair, which uses a single incision to open the abdomen or groin across the hernia, or minimally invasive repair, which involves laparoscopic or robotic-assisted techniques. Laparoscopic surgery is a minimally invasive surgical technique performed in the abdomen or groin through small incisions. Surgical instruments and devices, such as mesh products, are then delivered to the surgical site through a trocar, which is an access port to the patient’s abdomen or groin. Robotic-assisted surgery is also performed using small incisions in the patient’s abdomen or groin and a trocar, but the surgeon sits at a console in the operating room and operates the robotic instruments remotely.

At the advent of hernia repair, all procedures were performed using an open surgical technique in which an incision is made through the body to access and repair the hernia. Due to the amount of healthy soft-tissue disruption required for an open procedure, there is a high risk of wound-related complications and seroma formation. In the early 1990s, surgeons began using a laparoscopic approach for hernia repair because it provided the benefits of lower wound complication rates, lower patient morbidity and decreased length of stay for patients. Despite these benefits, laparoscopic surgery presents surgeons with challenges, primarily due to restricted instrument dexterity that makes it difficult to achieve primary closure of the hernia defect, in which the connective tissue layer is sutured closed, and leads to a bridged repair. In a bridged repair, the tissue reinforcement material spans a portion of the hernia defect without any connective tissue layer above it to provide additional reinforcement. This leads to increased risk of bulging of the material or hernia recurrence. Robotic-assisted hernia repair addresses this issue while still providing the benefits of a laparoscopic repair. In robotic-assisted repair, the surgeon enjoys greater instrument dexterity and precision, and is able to achieve primary closure of the hernia defect. This has contributed to a significant increase in the number of robotic-assisted hernia repairs over the last several years.

It is estimated that about 90% of hernia repairs today use a form of reconstruction material to provide long-term support at the repair site. Reconstruction materials include synthetic mesh, which can be either permanent or resorbable, and biologic matrices made from tissue material.

In October 2020, we surveyed a group of 71 surgeons to better understand their receptivity to natural repair solutions, their technique preferences across their hernia practice and their views on the risks associated with plastic mesh. Feedback was gathered across inguinal hernia, simple ventral, moderate-to-complex ventral and hiatal hernia repair. Included in the group were 43 general surgeons (61%), 19 plastic reconstructive surgeons (27%) and the remainder were colorectal and trauma surgeons. These surgeons indicated they believe there is a role for natural repair products across all hernia segments and they expect to increase their usage of those products in the next 24 months. Almost 60% of surgeons stated that they are aware of the risks associated with plastic mesh and reported approximately 20% of their hernia patients have voiced concern about the use of plastic mesh within the past 12 months.

In May 2023, we commissioned a consumer survey of 1,152 consumers on consumer awareness, preferences and doctor expectations regarding hernia repair options. The results of this survey indicated a preference for more natural hernia repair options (57%), particularly among those who have previously had a repair using permanent synthetic mesh (77%). The majority of respondents also expressed a reliance on primary care physicians and healthcare professionals for guidance, emphasizing the importance of shared decision-making.

Permanent Synthetic Mesh

Permanent synthetic mesh, the oldest category of hernia repair materials, is made of plastic materials that are also used in industrial and consumer products. These products have gained popularity with surgeons because they are relatively inert, can be readily sterilized, exhibit biomechanical strength and durability and are available at relatively low upfront cost. Limitations of permanent synthetic mesh products may include:

| ● | significant persistent foreign body inflammatory response that can result in encapsulation of the implant by fibrotic tissue or contraction of the mesh; |

11

| ● | chronic post-operative pain; |

| ● | scar tissue formation and lack of regeneration of soft-tissue; |

| ● | permanent susceptibility to mesh infection; |

| ● | significant cost associated with subsequent repairs or failed and infected mesh; |

| ● | compromised abdominal wall anatomy due to damaged and eroded tissue rendering subsequent surgical repairs challenging; and |

| ● | migration of the permanent synthetic mesh which can result in organ erosion or perforation. |

Many of these complications caused by permanent synthetic mesh require additional surgical intervention, including, explantation of the mesh or repair of hernia recurrence or of the abdominal wall. Based on longitudinal data from the Danish Hernia Database, in an analysis of approximately 2,900 patients who received a hernia repair using a permanent synthetic mesh, the observed rate of surgical intervention due to either recurrence or mesh-related complications at five years post operatively was approximately 17%. As a result of these complications and litigation involving these complications, the number of adverse events reported to the FDA for synthetic mesh hernia repairs has climbed from over 2,400 reported events in 2016, to over 21,000 in 2019, while remaining in excess of 8,000 reported events per year in each of 2023 and 2024. Synthetic mesh products have been the subject of a significant number of lawsuits over this time period, with approximately 15,000 cases outstanding in federal and state courts across the U.S. as of November 2024, and not inclusive of more than 40,000 cases that have been settled or dismissed in the prior three-year period.

Biologic Matrices

The complications associated with permanent synthetic mesh prompted the development of biologic matrices as a second category of hernia repair materials. Biologic matrices are derived from human or animal dermis, pericardium or intestinal submucosa, which allows them to become replaced entirely by the patient’s own tissue over time, a process known as remodeling. The goal behind these biologic materials was to lower the foreign body inflammatory response and biomechanical requirements of the repair, while providing a matrix upon which tissue remodeling could occur. Compared to permanent synthetic mesh, biologic matrices are less likely to induce this inflammatory response and become infected; however, they may have the following limitations:

| ● | lack strength or durability as compared to synthetic mesh products; |

| ● | prone to laxity and stretching; |

| ● | difficult to handle, leading to longer operating times as compared to synthetic mesh products; |

| ● | inability to be placed in a patient through a trocar in laparoscopic or robotic-assisted surgery; and |

| ● | considerably more expensive upfront costs than permanent synthetic mesh, typically limiting their use to complex hernia repairs or abdominal wall reconstructions. |

Though hernia recurrence occurs with the use of all types of soft-tissue reconstruction, biologic matrices have the highest rates of recurrence, partly due to common use in complex hernia repairs or abdominal wall reconstructions. The RICH study, a multicenter, prospective study sponsored by LifeCell Corporation (“LifeCell”) that evaluated the performance of Strattice, the industry leader for biological tissue matrices in complex abdominal wall reconstruction, in open ventral incisional hernia repair in contaminated abdominal wall defects, demonstrated post-operative hernia recurrence rates of 19% and 28% at 12-months and 24-months follow-up, respectively.

12

Resorbable Synthetic Mesh

Resorbable synthetic mesh, including biologically-derived synthetic mesh, was introduced as a third category of hernia repair materials and as an alternative to permanent synthetic mesh and biologic matrices. Resorbable synthetic mesh was designed with the intended benefits of full degradation over several months, a moderately lower cost than biologic matrices and gradual transfer of strength from synthetic mesh to native tissue over time. Resorbable synthetic mesh is polymer-based and does not include biologic material to promote tissue remodeling and healing. Despite improvements compared to the use of permanent synthetic mesh or biologic matrices, current limitations of resorbable synthetic mesh may include:

| ● | significant foreign body inflammatory response that can result in encapsulation or contraction of the mesh until resorbed; |

| ● | scar tissue formation and lack of remodeling of soft-tissue; |

| ● | mesh infection until resorbed; |

| ● | migration of the mesh until resorbed which can result in organ erosion or perforation; and |

| ● | lack of mid-term and long-term soft-tissue reinforcement as resorption progresses. |

Many of these complications can require additional surgical intervention including explantation of the resorbable synthetic mesh or repair of hernia recurrence or the abdominal wall. Data from a published, multicenter, prospective study sponsored by C.R. Bard, Inc. (now a subsidiary of Becton, Dickinson and Company) that evaluated the performance of Phasix, the current market-leading resorbable synthetic mesh, in CDC Class I, high risk ventral and incisional hernia repair, showed a post-operative hernia recurrence rate of 9% at 18-months follow-up and 18% at 36-month follow-up.

Current Materials Used in Plastic and Reconstructive Surgery and Their Limitations

Biologic matrices are most commonly used in plastic and reconstructive surgery, including surgery of the nose to change its shape or improve its function, referred to as rhinoplasty, lip augmentation, repair of perforations of cartilage and thin bone separating the nostrils, complex reconstruction of the oral and oropharynx cavities after oncologic resection, cleft palate repair, upper and lower eyelid reconstruction, scalp defects, and defects of the fibrous membrane covering the brain and spinal cord, called the dura, because of their ability to define shape and position, improve tissue quality, reinforce existing soft-tissue and reduce the rate of complications associated with a foreign body inflammatory response, however they are prone to excessive stretching over time and difficult for surgeons to handle. These limitations may lead to undesirable results requiring additional surgical intervention. Additionally, biologic matrices are typically expensive to source.

Our Solution

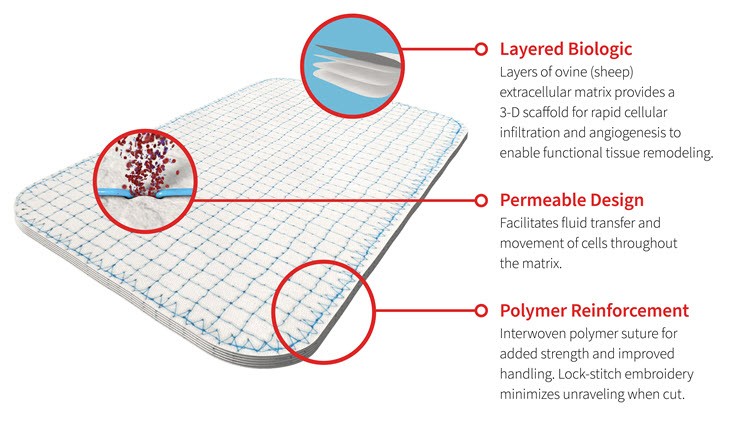

We have created a new category of reinforced tissue matrices that were purposefully designed in close collaboration with more than 100 surgeons to address the unmet clinical needs in soft-tissue reconstruction. Our portfolio of products, generally designed with over approximately 95% biologic material, combines the benefits of both biologic and polymer materials while addressing their limitations by interweaving polymer fibers through layers of a minimally-processed biologic material. These products are priced competitively and designed for use with a range of surgical techniques, allowing the benefits of an advanced biologic repair to be available to more patients for use in accordance with the products’ 510(k) clearances and instructions for use.

The biologic material serves as the natural building block from which we can fabricate devices that meet specific clinical and surgical handling requirements. This material consists of an intact, minimally-processed extracellular matrix derived from ovine rumen, which is the forestomach of a sheep. Polymer fibers are interwoven through the layers of biologic material in unique embroidered patterns and contribute to approximately 5% of the overall device by mass.

13

The interwoven polymer utilized can be either permanent, made from polypropylene, or resorbable, made from polyglycolic acid (“PGA”) or polylactic-co-glycolic acid (“PLGA”). The embroidering pattern varies between our OviTex and OviTex PRS products to impart different biomechanical properties tailored for their respective intended clinical applications. Our OviTex products are designed with a lockstitch embroidery pattern that is sewn in a grid pattern to minimize unraveling (when cut). Our OviTex PRS products are designed with a patented corner-lock stitch pattern designed to resist deformation and to control the degree and direction of stretching of the product.

Our capabilities in polymer science, biologics, textile engineering and analytical testing enable us to quickly design innovative products for development and manufacture. These competencies also allow our technical team to tailor the degree of stretch, direction of stretch, overall strength, handling properties, permeability, thickness, texture, size and shape of each reinforced tissue matrix to suit the needs of particular clinical applications and surgical techniques. This expertise has been utilized in the development of our OviTex and OviTex PRS products, including our OviTex LPR and OviTex IHR configurations and is currently being leveraged in the development of our additional configurations within product pipelines seeking to enhance product features for various applications within our indications.

Our reinforced tissue matrices are designed to improve the outcomes of soft-tissue reconstructions by reinforcing tissue while allowing rapid tissue integration, revascularization and biomechanical control. In addition to overall strength, a key property that we engineer into our products is the degree to which they stretch, which we refer to as compliance. Each of our products is designed to exhibit a degree of compliance appropriate for its intended clinical application.

The graphics below illustrate the key features of our OviTex and OviTex PRS products:

OviTex

14

OviTex PRS

We believe the principal benefits of our reinforced tissue matrices are:

| ● | Reduced foreign body inflammatory response. The biologic material utilized in our reinforced tissue matrices is designed to minimize the body’s inflammatory response to the device. Our unique embroidered patterns create a macroporous grid within the biologic material. In our non-human primate study in which we compared our OviTex products to several commercially available synthetic mesh and biologic matrix products, at 24 weeks, our OviTex products demonstrated a minimal foreign body inflammatory response similar to that of biologic matrices, and less foreign body inflammatory response than all of the synthetic mesh tested. |

| ● | Enhanced remodeling of soft-tissue and rate of healing. Our reinforced tissue matrices are constructed to provide increased surface area and permeability, allowing for rapid absorption of wound fluids and blood during implantation and enabling oxygen supply, cellular infiltration, migration, and repopulation for revascularization and functional tissue remodeling during healing. In our non-human primate comparative study, at 24 weeks the pattern of collagen formation in our OviTex products resembled connective tissue as opposed to the random fibers typical of scar tissue that were seen adjacent to the synthetic mesh. By contrast, the synthetic mesh showed no signs of remodeling of soft-tissue and exhibited a high level of mesh contraction. |

| ● | Highly engineered biomechanical properties supported by clinical evidence. Our reinforced tissue matrices are reinforced with interwoven polymer fibers to provide mid-term and long-term support. The interwoven polymer increases the strength of our OviTex products by approximately 25% compared to the biologic material alone. When tensile forces are applied, this design allows for load sharing between the biologic material and the polymer during the remodeling process. Data from our strength testing demonstrated that our OviTex products meet or exceed that of published data from market-leading permanent and resorbable synthetic mesh. In our BRAVO study, the recurrence rate at the 24-month time point was 2.6%, and SSOs were observed in 38% of the study population. Of the enrolled patients, 78% |

15

| were characterized as high risk for experiencing an SSO based on at least one known risk factor, which included obesity, active smoking, COPD, diabetes mellitus, coronary artery disease, or advanced age (≥75 years). We believe based on a review of available literature that the BRAVO recurrence rate is among the lowest reported rate in any published study, including our biologic or resorbable synthetic mesh competitors evaluating product use in this procedural setting and with a similar cohort of high-risk patients. The addition of polymer to our reinforced tissue matrices allows each product to maintain its physiologic compliance properties, while resisting stretching and elongation. In our non-human primate comparative study, our OviTex devices best preserved their original shape, experiencing less contraction compared to biologic and synthetic mesh. |

| ● | Enhanced surgeon handling and satisfaction. Each of our embroidery patterns was designed specifically to allow the surgeon to trim and shape the product while minimizing the potential for unraveling of the polymer. Based upon our survey of approximately 50 surgeons, our OviTex products conform readily to the contours of surgical sites and are easy to handle, trim, suture and tack in all surgical approaches. In addition, in our BRAVO study, 32 of the 92 enrolled subjects received minimally invasive surgery, of whom 12 received laparoscopic repair and 20 received robotic repair. Of the surgeons who performed minimally invasive surgery, all reported at the time of surgery that the product was easy or very easy to place. The average surgeon satisfaction with the product was 9.7/10 at 30 days for the minimally invasive cohort and remained consistent over 24 months of follow-up. We are also actively enrolling patients in our BRAVO II study, a prospective study evaluating robot-assisted ventral and inguinal hernia repairs with OviTex, including our OviTex LPR, OviTex Core Permanent and OviTex 1S Permanent configurations. |

| ● | Lower upfront cost products. Our reinforced tissue matrices provide our customers with meaningful cost savings over leading competitive products across a range of clinical uses so that more patients can experience the benefits of an advanced biologic repair solution. We price our OviTex products competitively, and on average, our customers realize 20% to 40% cost savings over leading biologic matrices and resorbable synthetic mesh. Our OviTex PRS portfolio is priced below leading biologic matrices. |

Our Strengths

We are focused on developing and commercializing a new category of reinforced tissue matrix for surgeons and patients that aim to address the shortcomings of existing products. We believe the following strengths will allow us to build our business and potentially increase our market penetration:

| ● | Innovative and broad portfolio of products. Our OviTex and OviTex PRS products are the only FDA-cleared products to incorporate polymer fibers interwoven through layers of biologic material in a lockstitch pattern creating an embroidered construction. The biologic matrix is derived from ovine rumen and utilizes a patented process to create a reinforced tissue matrix that is optimized for soft-tissue reconstruction. Our OviTex and OviTex PRS products are available in resorbable and permanent polymer versions in a variety of configurations and sizes. For example, our OviTex devices are currently available in sizes ranging from 4 × 8 cm to 25 × 40 cm, and our OviTex LPR devices are designed with specific thickness, handling properties and shapes optimized for use in laparoscopic and robotic-assisted surgery. |

| ● | Disruptive technology supported by compelling pre-clinical and clinical evidence. OviTex product technology is supported by extensive pre-clinical research, including bench testing, in-vitro and in-vivo studies. These studies have demonstrated appropriate physiologic strength for the repair, compliance within the physiologic range of the human abdominal wall, retention of extracellular matrix proteins which may aid in tissue remodeling and porosity and permeability to promote fluid transfer. Our in-vivo non-human primate data demonstrated that use of our OviTex products resulted in more rapid tissue integration and revascularization compared to pure biologic matrices, as well as lower inflammatory response and better functional tissue remodeling compared to permanent and resorbable synthetic mesh. This preclinical data is supported by our compelling clinical evidence showing the safety and efficacy of our OviTex products in published data on over 1,200 hernia patients. |

16

| ● | Long-term supply agreement that provides pricing flexibility. Our Aroa License provides for the exclusive supply of ovine rumen and manufacture of our OviTex and OviTex PRS products, which gives us a low and fixed cost of raw materials. We purchase product from Aroa at a fixed transfer cost as a percentage of Aroa’s cost of goods sold, and subject to a true-up adjustment, resulting in an amount equal to 27% of our net sales of our OviTex and OviTex PRS products, with the exception of OviTex IHR product configurations, for which we pay the greater of the initial fixed transfer cost or 27% of our net sales of OviTex IHR. |

| ● | Potential cost savings to healthcare systems and hospitals. Our pricing flexibility allows us to sell our OviTex and OviTex PRS products to hospitals and healthcare systems at prices substantially below competitive products based on national average competitive pricing. Our OviTex products are sold at prices approximately 20% to 40% lower than other biologic matrices and resorbable synthetic mesh. We believe our pricing flexibility will continue to drive greater adoption of our products. Our OviTex PRS products are priced below leading biologic matrices, and as we further commercialize our OviTex PRS portfolio, we anticipate that our customers will realize cost savings over biologic matrices based on national average competitive pricing. We believe that the average selling prices across our products will provide financial benefits to our customers in addition to improving clinical outcomes. |

| ● | Established reimbursement pathway for hernia repair. The implantation of biologic matrices and synthetic mesh for hernia repair is coded using an established fixed procedure payment system known as a MS-DRG that consists of a lump sum payment rate that varies based on the degree of complications and comorbidities of each hernia. In addition, surgeons receive payment for their services depending on the coding associated with the procedure. The MS-DRG-based reimbursement system encourages hospitals to become more efficient in treating patients due to its fixed per-patient reimbursement nature. |

| ● | Broad intellectual property portfolio. Our products are covered by intellectual property that broadly covers changing a biologic matrix’s biomechanical properties by interweaving a polymer thread through the biologic matrix. Specifically, our patents claim the ability to tailor stretch resistance. The ability to predictably control the biomechanical properties of a biologic matrix is the cornerstone of our product portfolio. Our intellectual property also covers the development of extracellular matrix derived from ovine rumen, methods for isolating these scaffolds from ovine rumen, layering multiple sheets of these ovine rumen matrices together, sewing in an anti-adhesive layer into a matrix, and adding unique patterns sewn or embroidered into these matrices using different polymers to impart reinforcing strength. Our portfolio also includes patents covering implants with gripping strands, and implants with multivesicular liposomes that may be used to deliver drugs. Through the Aroa License and our issued or allowed patents and patent applications, we have a broad portfolio of intellectual property that is leveraged in all of our reinforced tissue matrix products. In addition, we believe that the trade secrets developed with Aroa create additional barriers to entry. |

| ● | Highly accomplished executive team with proven track record. Our executive team consists of seasoned medical device professionals with deep industry experience, and a broad network of relationships within the industry and the medical community. Our executive team has led and managed companies through significant growth and introduction and commercialization of multiple new products, including driving surgeon adoption of biologic and biosurgery technologies. Members of our team have held leading positions with medical technology companies such as Orthovita Inc., Stryker Corporation, OraSure Technologies, Inc., LifeCell and Medtronic plc. We believe this team is well-positioned to lead us through the commercial expansion of our products and development and launch of future products. |

17

Our Growth Strategy

Our goal is to become the leading provider of soft-tissue reconstruction products. The key elements of our strategy include:

| ● | Successfully deploy our U.S. commercial organization to support our growth. We primarily sell our products through a single direct sales organization in the U.S. As of December 31, 2024, we had 75 sales territories in the U.S. which are supported by 133 employees in our U.S. based commercial organization. We plan to hire additional territory managers and field-based support employees to support and service new accounts for soft-tissue reconstruction procedures. We believe we can also enhance the productivity of our sales force by improving customer segmentation and targeting, implementing and further refining our proprietary training programs, leveraging support from our medical education and medical affairs functions to drive physician awareness and education on our products, and utilizing engagement analytics to support product development. |

| ● | Promote awareness of our products to drive surgeon use. We educate surgeons regarding the value proposition of our products through presentations and exhibits at industry conferences, medical education symposia, direct training and education, webinars and publishing additional clinical data demonstrating the benefits of our products and establishing online peer-to-peer communities. We plan to continue to drive awareness of our products through in-person and virtual versions of these programs, while expanding their geographic reach and increasing the number of surgeon interactions. We will continue to increase our digital marketing efforts as well to build brand awareness with event marketing engagement, targeted ads and emails, various social media efforts and patient education and outreach efforts. |

| ● | Drive utilization through existing GPO and IDN contracts and secure additional contracts. We are focused on partnering with our existing GPO- and IDN-contracted customers to promote implementation of our contracts, increase our access to surgeon customers, broaden awareness of products and our economic messaging and help drive utilization of our products within associated hospitals and healthcare systems. To date, we have contracted with three national GPOs covering our OviTex and OviTex PRS products. In addition, we continue to pursue contracts with additional GPOs and IDNs. GPO and IDN contracts enable greater access to geographies with high procedural volumes and provide prioritized status within hospital procurement systems. |

| ● | Continue to build upon clinical evidence of the effectiveness and safety of our products. We are committed to evidence-based medicine and investing in clinical data to support the use of our products. In our BRAVO study, the recurrence rate at the 24-month time point was 2.6%, and SSOs were observed in 38% of the study population. 78% of all enrolled patients were characterized as high risk for experiencing an SSO based on at least one known risk factor, which included obesity, active smoking, COPD, diabetes mellitus, coronary artery disease, or advanced age (≥75 years). Our analysis of patients in the BRAVO study reaching 24-month follow-up was published in the Annals of Medicine and Surgery in October 2022. We have begun our next post-market prospective study, BRAVO II, which evaluates OviTex LPR, OviTex Core Permanent and OviTex 1S Permanent in the robotic repair of ventral and inguinal hernias over 24 months. With respect to OviTex PRS, in addition to independent, third-party publications evaluating the use of the product in various soft tissue applications, we also continue to enroll patients in our OPERA study, a retrospective-prospective trial evaluating the safety profile of OviTex PRS in previous pre-pectoral and sub-pectoral implant-based breast reconstructions. Following receipt of our investigational device exemption application in October 2024 relating to the study of the safety and effectiveness of our OviTex PRS product in implant-based breast reconstruction, we continue to evaluate and finalize the clinical study protocol to eventually support a pre-market application to obtain approval for an indication for OviTex PRS for use in breast reconstruction. |

| ● | Advance our portfolio of reinforced tissue matrices with the introduction of new product features and designs. We plan to continue to expand our product offerings and the treatment capabilities of our products to address a broader patient base within soft-tissue reconstruction. As we innovate and develop our |

18

| products, the new features and improved surgical techniques expand the clinical applications for soft-tissue reinforcement. Areas of focus include enhanced surgical handling, larger product configurations, increased permeability, and longer-acting resorbable polymers. Improving the surgical handling and implementation of our devices benefits both the clinician and patient. We believe that increasing the size of our product configurations will support utilization in new surgical applications or with certain patient populations. Increasing product permeability encourages a more-natural healing response. Longer-acting polymers can provide additional support for patients that need more time to heal. We believe these technology enhancements will continue to bolster our portfolio and expand the successful use of our products. |

| ● | Expand our service offerings and diversify our supplier base to create a broader soft tissue preservation and restoration portfolio. We plan to continue assessing internal development strategies and strategic partnerships with medical device companies whereby we may enter into distribution, product development and/or licensing agreements for new soft tissue preservation and restoration products complimentary to, or related to, existing and future products in our distribution channel. For example, in September 2023, we entered into a distribution agreement with Advanced Medical Solutions Limited, a company registered in England, to be their exclusive distributor of certain hernia mesh fixation devices in the U.S. In March 2024, we announced the full commercial launch of the LiquiFix Hernia Mesh Fixation Devices (LiquiFix FIX8™ and LiquiFix Precision™) in the U.S. Similarly, we continue to evaluate additional product opportunities that address patient health and unmet needs within the indications in which we operate. |

Our Products

Our Technology Platform

Our advanced reinforced tissue matrix technology consists of multiple layers of minimally-processed, decellularized extracellular matrix derived from ovine rumen with interwoven polymer fibers in a unique embroidered pattern. The extracellular matrix is the collagen component of the rumen that is retained following removal of the epithelium, muscle and cellular content, and has an optimal biomechanical profile and open collagen architecture that allows for rapid cellular infiltration. These thin, strong layers of ovine rumen are plentiful in supply and serve as building blocks from which we can construct multilayered devices to customize products to adapt to clinical needs and surgeon preferences. The layers of extracellular matrix provide a high degree of surface area for tissue remodeling. We strengthen these reinforced tissue matrix layers with interwoven polymers, that are either permanent (polypropylene), or resorbable (PGA or PLGA). These polymers were selected because they are well characterized suture materials with a history of significant clinical use and recognized safety profiles. Polypropylene has a high tensile strength and a low inflammatory response in small quantities. PGA is the fastest resorbing polymer and within three months it tends to be fully absorbed into the body, whereas using PLGA in our products provides a slower absorption option of approximately six months.

Our highly specialized and customizable textile engineering capability allows us to tailor the degree and direction of stretch, overall strength, handling properties, permeability, thickness, texture, size and shape of each reinforced tissue matrix to suit the needs of particular clinical applications and surgical techniques. Our textile engineering utilizes a computer-controlled fabrication method that is scalable, reproducible, efficient and customizable. This embroidery process creates hundreds of micro-channels to allow the multi-directional passage of the patients’ native cells and fluids throughout the product. The interwoven polymers are embroidered using a lockstitch pattern, which allows for the device to be trimmed while minimizing unraveling (when cut), and we use a patented corner-lock pattern, which creates a stable polymer fabric within the biologic material. We manipulate the polymer thread patterns to control the degree and stretch of our products. Denser grid patterns increase the amount of reinforcement and less dense patterns of different geometry allow for greater stretch. We are also able to manufacture products with smooth external layers that minimize the amount of exposed polymer such that the product can be placed in contact with the viscera.

OviTex Reinforced Tissue Matrix

Our OviTex Reinforced Tissue Matrix has received 510(k) clearance from the FDA, which clearance was obtained and is currently held by Aroa and is intended for use as a surgical mesh to reinforce and/or repair soft-tissue where weakness exists. Indications for use include the repair of hernias and/or abdominal wall defects that require the use of reinforcing or bridging material to obtain the desired surgical outcome.

19

Our OviTex products can be used in a variety of hernia repairs, including simple and complex ventral, inguinal and hiatal hernias, as well as abdominal wall reconstructions.

Our OviTex products are sterile reinforced tissue matrices derived from ovine rumen with either polypropylene or PGA. The product is provided in a dry, hydratable form and packaged in a double pouched configuration. The product can be stored at room temperature and only needs five minutes of rehydration for use. To be used in surgery our OviTex product is placed in a sterile dish, rehydrated with sterile saline for five minutes, trimmed to fit the site, if needed, and then positioned to achieve maximum contact between the device and the surrounding tissue. The device may be sutured, stapled or tacked into place.

All of our OviTex products were designed to minimize the amount of polymer material implanted in patients. The synthetic material in our OviTex products comprise less than 5% of our final product or approximately 12% in our OviTex LPR devices or approximately 15% in our OviTex IHR devices. Depending on the configuration selected, the amount of polymer is approximately 75% less than the polymer content of the most widely implanted permanent synthetic mesh, thereby reducing the patient’s foreign body inflammatory response to the polymer.

We market a variety of OviTex products in a range of sizes, thicknesses and degrees of reinforcement in order to suit surgeon preference and desired surgical technique. Our OviTex portfolio is designed to allow surgeons to select a device appropriate for any abdominal tissue plane. Generally, surgeons may place the reinforced tissue matrix in direct contact with internal organs, known as intraperitoneal placement, or away from these internal organs in a variety of tissue planes, known as pre-peritoneal placement. When selecting a product for intraperitoneal placement, surgeons require a surface that minimizes the risk of tissue attachment, whereas when selecting a product for pre-peritoneal placement, surgeons are able to use a product with polymer exposure on both sides. Surgeons may select the most appropriate product from our OviTex portfolio based on the size of the defect, necessity or surgeon preference for internal organ contact, use of a minimally invasive or open surgical technique and risk of infection.

OviTex Configurations for Laparoscopic and Robotic Procedures

Our OviTex LPR product was specifically designed for use in laparoscopic and robotic-assisted hernia surgical repairs. OviTex LPR was designed for use with a trocar and requires the same rehydration and fixation as our other OviTex products. This product includes design elements to improve surgical handling, including two extra embroidered lines of blue colored polypropylene fibers (ellipse shapes) to enhance endoscopic orientation and alignment. This product can be introduced into the patient’s body through various sized trocar ports. Based on surgeon feedback, OviTex LPR was designed in an elliptical or circular shape to minimize trimming.

Our OviTex IHR product was specifically designed for use in laparoscopic and robotic-assisted inguinal hernia repair and is available in anatomical and rectangle shapes.

20

OviTex Portfolio

|

|

OviTex |

|

OviTex 1S |

|

OviTex 2S |

|

OviTex LPR |

|

OviTex IHR |

|

|

|

|

|

|

|

|

|

|

|

Size and Shape |

|

4x8 cm to 25x40 cm* (Rectangle or Square) |

|

4x8 cm to 25x40 cm* (Rectangle or Square) |

|

4x8 cm to 25x40 cm* (Rectangle or Square) |

|

12x18 cm to 15x25 cm* (Ellipse); 9cm to 15cm (Round) |

|

10x17 cm (Anatomical); 13x17 cm (Rectangle) |

|

|