UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024

or

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-42113

Seaport Entertainment Group Inc.

(Exact name of registrant as specified in its charter)

Delaware |

99-0947924 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

199 Water Street, 28th Floor |

|

New York, NY |

10038 |

(Address of Principal Executive Offices) |

(Zip Code) |

(212) 732-8257

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

Trading symbol |

Name of exchange on which registered |

Common Stock, par value $0.01 per share |

SEG |

NYSE American LLC |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

|

|

|

|

|

|

|

|

Non-accelerated filer |

☒ |

Smaller reporting company |

☐ |

Emerging growth company |

☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1 (b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The registrant was not a public company as of June 28, 2024, the last business day of its most recently completed fiscal quarter, and therefore cannot calculate the aggregate market value of its voting and non-voting common equity held by non-affiliates as of such date. The registrant’s common stock began trading on the NYSE American LLC on August 1, 2024.

As of March 5, 2025, there were 12,696,599 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement for its 2025 Annual Meeting of Stockholders are incorporated by reference in Part III of this Annual Report on Form 10-K. The registrant intends to file its Proxy Statement with the Securities and Exchange Commission no later than 120 days after the end of its fiscal year ended December 31, 2024.

TABLE OF CONTENTS

|

|

|

|

Page |

|

|

|

5 |

|

|

|

5 |

||

|

|

16 |

||

|

|

47 |

||

|

|

47 |

||

|

|

48 |

||

|

|

48 |

||

|

|

48 |

||

|

|

|

|

|

|

|

|

49 |

|

|

|

49 |

||

|

|

50 |

||

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

50 |

|

|

|

71 |

||

|

|

72 |

||

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

115 |

|

|

|

115 |

||

|

|

115 |

||

|

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

|

116 |

|

|

|

|

|

|

|

|

|

116 |

|

|

|

116 |

||

|

|

116 |

||

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

116 |

|

|

Certain Relationships and Related Transactions, and Director Independence |

|

116 |

|

|

|

116 |

||

|

|

|

|

|

|

|

117 |

||

|

|

117 |

||

|

|

117 |

||

|

117 |

|||

|

122 |

|||

2

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this Annual Report on Form 10-K (“Annual Report”), including, without limitation, those related to our future operations, constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact included in this Annual Report are forward-looking statements and may include words such as “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “intend,” “likely,” “may,” “plan,” “project,” “realize,” “should,” “transform,” “would” or the negative of these terms or other similar expressions and other statements of similar expression. These forward-looking statements involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements or industry results, to differ materially from any predictions of future results, performance or achievements that we express or imply in this Annual Report.

Forward-looking statements include statements related to:

| ● | forecasts of our future economic performance; |

| ● | our ability to operate as a stand-alone public company following our separation (the “separation”) from Howard Hughes Holdings Inc. (“HHH”); |

| ● | our ability to achieve the intended benefits from our separation from HHH; |

| ● | expected capital required for our operations and development opportunities for our properties; |

| ● | the impact of technology on our operations and business; |

| ● | expected performance of our business; |

| ● | expected commencement and completion for property developments; |

| ● | estimates of our future liquidity, development opportunities, development spending and management plans; and |

| ● | descriptions of assumptions underlying or relating to any of the foregoing. |

Some of the risks, uncertainties and other important factors that may affect future results or cause actual results to differ materially from those expressed or implied by forward-looking statements include:

| ● | risks related to our separation from, and relationship with, HHH; |

| ● | macroeconomic conditions, such as volatility in the capital markets, inflation, rising interest rates and a prolonged recession or downturn in the national economy, any of which could impact us, our tenants or consumers; |

| ● | changes in discretionary consumer spending patterns or consumer tastes or preferences; |

| ● | risks associated with our investments in real estate assets and trends in the real estate industry; |

| ● | our ability to obtain operating and development capital on favorable terms, or at all, including our ability to obtain or refinance debt capital, particularly considering our business operations require substantial cash; |

| ● | the availability of debt and equity capital; |

| ● | our ability to renew our leases or re-lease available space; |

3

| ● | our ability to compete effectively; |

| ● | our ability to successfully identify, acquire, develop and manage properties on terms that are favorable to us; |

| ● | the impact of uncertainty around, and disruptions to, our supply chain, including labor shortages and shipping delays; |

| ● | risks related to the concentration of our properties in New York City and the Las Vegas area, including fluctuations in the regional and local economies and local real estate conditions; |

| ● | extreme weather conditions or climate change, including natural disasters, that may cause property damage or interrupt business; |

| ● | the impact of water and electricity shortages on our business; |

| ● | the contamination of our properties by hazardous or toxic substances; |

| ● | catastrophic events or geopolitical conditions, such as the COVID-19 pandemic and other public health crises, that may disrupt our business; |

| ● | actual or threatened terrorist activity and other acts of violence, or the perception of a heightened threat of such events; |

| ● | losses that are not insured or that exceed the applicable insurance limits; |

| ● | risks related to disruption or failure of information technology networks and related systems—both ours and those operated and managed by third parties—including data breaches and other cybersecurity attacks; |

| ● | our ability to attract and retain key personnel; |

| ● | our inability to control certain of our properties due to the joint ownership of such property and our inability to successfully attract desirable strategic partners, including joint venture partners; |

| ● | the significant concentration of ownership of our common stock by Pershing Square (as defined herein) and Pershing Square’s rights pursuant to the investor rights agreement we entered into with it on October 17, 2024 (the “Investor Rights Agreement”) and our amended and restated certificate of incorporation (the “Certificate of Incorporation”) may influence us; and |

| ● | other risks and uncertainties described herein. |

Although we presently believe that the plans, expectations and anticipated results expressed in or suggested by the forward-looking statements contained in this Annual Report are reasonable, all forward-looking statements are inherently subjective, uncertain and subject to change, as they involve substantial risks and uncertainties, including those beyond our control. New factors emerge from time to time, and it is not possible for us to predict the nature, or assess the potential impact, of each new factor on our business. Given these uncertainties, we caution you not to place undue reliance on these forward-looking statements. The forward-looking statements in this Annual Report relate only to events as of the date on which the statements are made. We undertake no obligation to update or revise any of our forward-looking statements for events or circumstances that arise after the statement is made, except as otherwise may be required by law.

4

PART I

ITEM 1. BUSINESS

Overview

Seaport Entertainment Group Inc. (“Seaport Entertainment,” the “Company,” “we,” “our” and “us”) is a Delaware corporation and was incorporated in 2024 in connection with, and anticipation of, Howard Hughes Holdings Inc.’s (“HHH”) spin-off of its entertainment-related assets in New York City and Las Vegas (the “Spin-Off”). The separation of Seaport Entertainment from HHH, which was effected through HHH’s pro rata distribution of 100% of the outstanding shares of common stock of Seaport Entertainment to holders of HHH common stock, was completed on July 31, 2024. Following the completion of the separation, Seaport Entertainment became an independent, publicly traded company. On August 1, 2024, the Company’s common stock began trading on the NYSE American LLC (the “NYSE American”) under the symbol “SEG”.

The information contained in this Annual Report on Form 10-K reflects the historical information of the Seaport Entertainment division of HHH prior to the Spin-Off and the information of Seaport Entertainment Group Inc. following the Spin-Off. See Note 1 in the Notes to the Consolidated and Combined Financial Statements for further information regarding the Spin-Off.

Our Business

Seaport Entertainment was formed to own, operate and develop a unique collection of assets positioned at the intersection of entertainment and real estate. Our objective is to integrate our one-of-a-kind real estate assets with a variety of restaurant, retail and leisure offerings to form vibrant mixed-use destinations where our customers can work, play and socialize in one cohesive setting. To achieve this objective, we are focused on delivering best-in-class experiences for our surrounding residents, customers and tenants across the three operating segments of our business: (1) Landlord Operations; (2) Hospitality; and (3) Sponsorships, Events, and Entertainment. Our assets, which are primarily concentrated in New York City and Las Vegas, include the Seaport in Lower Manhattan (the “Seaport”), a 25% minority interest in Jean-Georges Restaurants (“JG”) as well as other partnerships, the Las Vegas Aviators Triple-A baseball team (the “Aviators”) and the Las Vegas Ballpark and an interest in and to 80% of the air rights above the Fashion Show mall in Las Vegas (the “Fashion Show Mall Air Rights”). We believe the uniqueness of our assets, the customer-centric focus of our business and the ability to replicate our destinations or business models in other locations collectively present an attractive investment opportunity in thematically similar but differentiated businesses, all of which are positioned to grow over time.

The Seaport is a historic neighborhood in Lower Manhattan on the banks of the East River and within walking distance of the Brooklyn Bridge. With roots dating back to the 1600s and a strategic location in Lower Manhattan, the Seaport attracts millions of visitors every year. The Seaport spans approximately 490,000 square feet, the majority of which is dedicated to entertainment, retail and restaurant uses, and in 2024, the Seaport hosted over 200 public and private events. Among the highlights of the Seaport are: The Rooftop at Pier 17®, a 3,500-person concert venue; the Tin Building, a 54,000-square-foot culinary marketplace leased to an unconsolidated joint venture between us and a subsidiary of JG; the Lawn Club, an immersive indoor/outdoor lawn game entertainment venue and another of our unconsolidated joint ventures; a historic cobblestone retail district; six additional retail and food and beverages concepts; and a 21-unit residential building with approximately 5,500 square feet of ground floor leasable space. In addition, the Company owns 250 Water Street, a one-acre development site directly adjacent to the Seaport, approved for 547,000 zoning square feet of market rate and affordable housing, office, retail and community-oriented gathering space. We are in the process of further transforming the Seaport from a collection of unique assets into a cohesive and vibrant neighborhood that caters to the broad needs of its residents and visitors. By continuing this integration, we believe we can drive further consumer penetration across all our restaurant, retail and event offerings, and make the Seaport our model for potential future mixed-use opportunities.

Jean-Georges Restaurants is a world-renowned hospitality company operated by Michelin-star chef Jean-Georges Vongerichten. JG was formed in 1997 and has grown from 17 locations in 2013 to over 60 high-end restaurant concepts across five continents, 13 countries and 24 markets, including our joint venture tenant, the Tin Building by Jean-Georges, located in the heart of the Seaport.

5

JG’s expertise and versatility allow it to serve the culinary needs of its customers, and with an asset-light platform and highly regarded brand recognition, JG is able to enter new markets and provide customers with a range of culinary options, from high-end restaurants to fast casual concepts to high-quality wholesale products. We believe there is an opportunity for JG’s food and beverage offerings to anchor the destinations we are seeking to create and help differentiate our business from the typical asset mix found in traditional real estate development and landlord operations.

The Las Vegas Aviators are a Minor League Baseball (“MiLB”) team and the current Triple-A affiliate of the Oakland Athletics (the “Athletics”) Major League Baseball (“MLB”) team. As one of the highest-grossing MiLB teams, and a critical component of the Summerlin, Nevada community, we believe the Aviators are a particularly attractive aspect of our portfolio. Seaport Entertainment wholly owns the Aviators, which generate cash flows from ticket sales, concessions, merchandise and sponsorships. In addition to the team, Seaport Entertainment owns the Aviators’ 10,000-person capacity ballpark, which is located in the heart of Downtown Summerlin. Completed in 2019, the ballpark is one of the newest stadiums in the minor league system and was named the “Triple-A Best of the Ballparks” by Ballpark Digest in 2019, 2021 and 2022. This renowned ballpark regularly has upwards of 6,500 fans per game and was chosen to host the Triple-A National Championship Game for the third consecutive year in 2024. In addition to approximately 75 baseball games each year, the ballpark hosts at least 30 other special events, which provide incremental cash flow primarily during the baseball offseason. These events, which include festive holiday attractions, ballpark tours, movie nights, concerts and more, have also integrated the ballpark into the life and culture of Summerlin. As a result, we believe we are uniquely positioned to serve the entertainment needs of this community as it expands in the coming years.

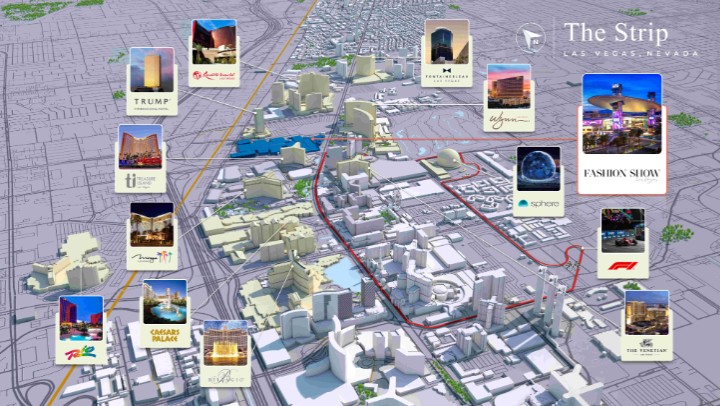

We also have the right to develop, together with an interest in and to 80% of, the air rights above the Fashion Show mall in Las Vegas, representing a unique opportunity to vertically develop a high-quality, well-located real estate asset, which may potentially include a new casino and hotel. The Fashion Show mall, located just northwest of the Sphere and south of the Wynn West project and the Resorts World Las Vegas, and directly across the street from the Wynn Las Vegas hotel, casino and golf course, is the 25th largest mall in the country, with over 250 retailers and over 30 restaurants spread across approximately two million square feet.

Our Strategy

Seaport Entertainment is one of the few publicly traded companies focused on the intersection of entertainment and real estate. Unlike real estate investment trusts, which have limitations on their ability to invest in non-real estate assets or retain taxable income for future growth, Seaport Entertainment has the flexibility to invest in both real estate as well as entertainment-focused operating assets and potentially grow those investments over time. Seaport Entertainment’s business plan is to focus on realizing value for its stockholders primarily through dedicated management of its existing assets, expansion of existing and creation of new partnerships, strategic acquisitions and completion of development projects. The Company’s existing portfolio encompasses a wide range of leisure and recreational activities, including live concerts, fine dining, nightlife, professional sports and high-end and experiential retail. The quality of the portfolio is complimented by the desirability of its locations: primarily Lower Manhattan and Las Vegas, where we believe there are substantial barriers to entry. As a result, we believe Seaport Entertainment is well-positioned to capitalize on trends across the travel, tourism and leisure industries and appeal to today’s consumer who often values experiences over goods.

Create Unique Entertainment Destinations Within Sought-After Mixed-Use Commercial Hubs. Seaport Entertainment is not limited to a particular type of entertainment asset, and as a result, it seeks to meet the needs of different customers with the flexibility to adapt to changes in consumer trends, which today favor experiences over products. Seaport Entertainment’s portfolio of premier, non-commoditized and destination-focused properties caters to a wide range of consumers. We intend to drive this high-quality product offering by focusing on best-in-class experience-based tenants and partnerships, in addition to integrating sought-after events to drive foot traffic throughout our portfolio. By continuing to offer high quality food and beverage and entertainment options across our portfolio, we seek to create unique, cohesive environments that serve the various needs of our customers and offer more than just a single product or experience. By developing destinations that have multiple touchpoints with our visitors, we believe Seaport Entertainment is well-positioned to grow its revenue base over time by driving increased market penetration.

6

Lease-Up Existing Assets at the Seaport. The portfolio of assets within Landlord Operations at the Seaport was 64% leased and 61% occupied as of December 31, 2024. Subsequent to year-end 2024, the Company entered into a lease with immersive entertainment and experience creator, Meow Wolf, to occupy approximately 74,000 square feet of vacant space in Pier 17. Our dedicated management team is focused on leasing up the Seaport and improving occupancy levels, which we believe will drive foot traffic to the area and improve performance at the Seaport’s food and beverage and entertainment assets. As a further example, we are evaluating the use of some of our vacant space that benefits from panoramic views of the Brooklyn skyline and the Brooklyn Bridge for a variety of hospitality and entertainment offerings.

Improve Efficiencies in our Operating Businesses. We believe there are numerous opportunities to drive efficiencies and increase margins in our operating businesses. Through our dedicated management team, which has significant experience operating entertainment-related assets, we are focused on maximizing our revenues and rightsizing costs. On January 1, 2025, as the Company’s initial step to internalize food and beverage operations at most of its wholly owned and joint venture-owned restaurants at the Seaport, we hired and onboarded employees of our primary food and beverage operator, Creative Culinary Management Company, LLC (“CCMC”), an indirect wholly owned subsidiary of JG, and entered into a shared services agreement with CCMC. We believe internalizing certain of our food and beverage operations will drive efficiency and enhance scalability across our portfolio.

Expand the JG Partnership. Our JG investment has multiple avenues for core growth that could propel this business, including: the opening of new restaurants and luxury marketplaces; introducing a franchise model for certain Jean-Georges concepts; launching fast-casual and quick service restaurant concepts that allow for significant scale; and leveraging the Jean-Georges brand via private label wholesale product distribution. Additionally, we believe we will be able to work with JG to identify additional operating efficiencies in the Seaport Entertainment and JG portfolios.

Leverage Events and Sponsorships to Create a Flywheel Effect at the Seaport. The Seaport’s events, particularly its Rooftop Concert Series, and the Seaport’s year-round programs focused on families, fitness, arts, music, and cinema, drive foot traffic to the entire neighborhood, which in turn creates opportunities for our restaurant and retail tenants as well as our sponsorship business. We are focused on creating a flywheel effect, where visitors who are drawn to the Seaport for an event receive targeted benefits from our sponsors and are engaged by our retail and dining options before and after that event. Our in-house marketing team is also leveraging the success of our Concert Series to advertise all of the offerings at the Seaport to a growing social media following. The Rooftop at Pier 17 gained a significant social media presence, with approximately 168,000 followers on Instagram by the end of 2024, the largest following in its peer group of venues with less than 15,000 seats. The success of the Concert Series has also positioned Seaport Entertainment to potentially benefit from additional opportunities in the near term, including: (1) the possibility of entering into a naming rights deal for The Rooftop venue with a sponsor; (2) better terms on our ticketing services that were recently negotiated with a new ticketing provider; and (3) an enclosed winter structure to increase the number of events we can host in any given year, which we expect to begin in the fourth quarter of 2025.

Improve and Increase Special Event Offerings at the Las Vegas Ballpark. The Las Vegas Ballpark is a key feature of Summerlin, Nevada, a thriving community outside of Las Vegas. By improving and increasing the special events offerings at the ballpark, we plan to further integrate the venue into the daily lives of Summerlin’s residents. The ballpark currently hosts approximately 75 baseball games per year. While preparing the stadium and field for baseball season does require approximately one month, there is significant room for special events through the rest of the year. We are required to host at least 30 “special events” each year pursuant to our naming rights agreement with the LVCVA. We plan to continue to seek opportunities to improve our existing events and identify more impactful revenue generating events that engage and entertain the community.

Opportunistically Acquire Attractive Entertainment-Related Assets and Utilize Strategic Partnerships. Over time, we intend to evaluate and ultimately acquire additional entertainment-related real estate and operating assets. These assets may include but are not limited to stadiums, sports and gaming attractions, concert and entertainment venues, food halls and other restaurant concepts. In addition to acquisitions, we plan to utilize strategic partnerships to accelerate our long-term growth. To execute on this strategy, we intend to leverage our unique experience at the Seaport, where we already successfully work with an array of top-tier partners in the entertainment space.

7

Develop Owned Land Parcels and the Fashion Show Mall Air Rights. Seaport Entertainment currently has two sizeable development opportunities: 250 Water Street and the Fashion Show Mall Air Rights. Each opportunity, if transacted on, could represent a significant driver of long-term growth.

Our Portfolio

We primarily analyze our portfolio of assets through the lens of our three operating segments: (1) Landlord Operations; (2) Hospitality; and (3) Sponsorships, Events, and Entertainment. In each segment, we believe there are multiple opportunities to drive operational efficiencies and value creation over time.

Landlord Operations. Landlord Operations represent our ownership interests in and operation of physical real estate assets. Currently, all Landlord Operations are located in the Seaport. The Seaport encompasses approximately 490,000 square feet of restaurant, retail, office and entertainment properties, as well as 21 residential units. It is one of the few multi-block neighborhoods in New York City largely under private management by a single owner. Over 13 years, HHH, as its previous owner, invested over $1 billion in the area, which we believe helped to revitalize the area and positioned it to become one of the premier food and beverage and entertainment destinations in the city. Currently, we own 11 physical real estate assets in the Seaport that comprise 100% of our current Landlord Operations. These assets, reflected on the map below, include:

| ● | Pier 17 – Pier 17 is an approximately 226,000 square foot mixed-use building containing restaurants, entertainment, office space and an outdoor concert venue. The Rooftop at Pier 17 is a 3,500-person concert venue, which was ranked by Pollstar as the sixth top club worldwide in 2024. In 2024, The Rooftop’s Concert Series sold approximately 180,000 tickets over 60 shows, representing 86% of available ticket inventory. We are also planning to launch year-round concerts and events for The Rooftop at Pier 17 in the fourth quarter of 2025, utilizing a seasonal floor-to-ceiling glass enclosure for the winter months. The total enclosed capacity will be approximately 3,000 guests, and each summer, The Rooftop will pivot back to hosting its open-air summer concerts with 3,500 total standing guest capacity. In addition to the concert venue, the building has five restaurants with renowned chefs including Jean-Georges and Andrew Carmellini, and three floors of unique space that can be utilized for retail, office and entertainment purposes. |

| ● | Tin Building – Across from Pier 17 is the Tin Building, a 54,000-square-foot culinary destination located on the site of the original Fulton Fish Market. The property opened in September 2022 after undergoing an over $200 million, five-year renovation to reconstruct the building in collaboration with Jean-Georges and is leased to our |

8

| joint venture with a subsidiary of Jean-Georges. The building has three levels, offering a variety of culinary experiences, including restaurants, bars, grocery markets, retail and private dining. |

| ● | Fulton Market Building – The Fulton Market Building is a three-story, 115,000-square-foot mixed-use building. It is 100% leased to tenants including IPIC Theaters, which occupies 46,000 square feet and has a lease through 2035. In July 2022, high-end fashion brand Alexander Wang leased the entire third floor for its global fashion headquarters. The Lawn Club, an experiential retail concept focused on “classic lawn games” and superb cocktails, is one of our joint ventures and the most recent tenant, having opened in November 2023. |

| ● | Historic District Retail & Other – Seaport Entertainment is also the landlord for the following Historic District retail and other locations: Museum Block (1st and 2nd Level - Select Spaces), Schermerhorn Row (1st and 2nd Level - Select Spaces), Seaport Translux (1st and 2nd Level - Select Spaces), 117 Beekman Street (1st Level & Basement - Select Spaces), One Seaport Plaza (1st and 2nd Level - Select Spaces) and the John Street Service Building (Select Spaces), which collectively make up approximately 91,000 square feet. |

| ● | 250 Water Street – 250 Water Street is a full block, one-acre development site that is zoned for 547,000 square feet of market rate and affordable housing, office, retail and community-oriented gathering space. We believe 250 Water Street is a unique opportunity at the Seaport to redevelop this site into a vibrant mixed-use asset. Current project plans include an estimated 219,000 square feet of programmable/leasable commercial space and 399 multifamily units. We have received all of the necessary approvals for the plans and permits to build the foundation, which we began building in the second quarter of 2022. Final remediation work on the site is complete, and we can commence construction of the new development at our discretion. |

| ● | 85 South Street – 85 South Street is an eight-story residential building with 21 multifamily units and approximately 5,500 square feet of ancillary leasable space. |

The following table shows information about our Seaport assets as of December 31, 2024:

Asset |

|

Asset Type |

|

Ownership Type |

|

Owned Rentable Square Feet |

|

Rentable Units |

|

% Occupied |

|

% Leased |

|

Pier 17 |

|

Mixed-Use |

|

Owned Improvements |

|

225,615 |

|

— |

|

45 |

% |

52 |

% |

Fulton Market Building |

|

Mixed-Use |

|

Owned Improvements |

|

114,999 |

|

— |

|

100 |

% |

100 |

% |

Tin Building |

|

Retail |

|

Owned Improvements |

|

53,783 |

|

— |

|

100 |

% |

100 |

% |

Schermerhorn Row |

|

Retail |

|

Owned Improvements |

|

28,808 |

|

— |

|

78 |

% |

78 |

% |

One Seaport Plaza |

|

Retail |

|

Owned Improvements |

|

24,518 |

|

— |

|

10 |

% |

10 |

% |

Museum Block |

|

Retail |

|

Owned Improvements |

|

23,381 |

|

— |

|

18 |

% |

18 |

% |

Seaport Translux |

|

Retail |

|

Owned Improvements |

|

9,470 |

|

— |

|

0 |

% |

0 |

% |

117 Beekman Street |

|

Retail |

|

Owned Improvements |

|

3,609 |

|

— |

|

0 |

% |

0 |

% |

John Street Service Building |

|

Retail |

|

Owned Improvements |

|

225 |

|

— |

|

100 |

% |

100 |

% |

85 South Street |

|

Multifamily & Office |

|

Fee Simple |

|

5,522 |

|

21 |

|

100 |

%(2) |

100 |

%(2) |

250 Water Street(1) |

|

Development Site |

|

Fee Simple |

|

— |

|

— |

|

0 |

% |

0 |

% |

Total |

|

|

|

|

|

489,930 |

|

21 |

|

61 |

% |

64 |

% |

(1) |

250 Water Street is zoned for 547,000 square feet of market rate and affordable housing, office, retail and community-oriented gathering space. |

(2) |

Occupancy and leasing figures for multifamily space. Ground floor office space is vacant as of December 31, 2024. |

9

Our Seaport assets primarily sit under a long-term ground lease from the City of New York that provides for an extension option that would extend its expiration from 2071 to 2120. In 2024, we paid $2.6 million in rent and fees under that ground lease and two smaller ground leases on our Seaport assets. The following table shows information about our ground leases as of December 31, 2024:

|

|

|

|

|

|

Annual Rent |

|

|

|

|

|

|

|

|

|

Payments for |

|

|

|

|

|

|

|

|

|

the Year |

|

|

|

|

|

|

|

|

|

Ended |

|

|

|

|

|

|

|

|

|

December 31, |

|

|

|

|

|

|

|

|

|

2024 |

|

|

|

Location |

|

Expiration |

|

Extensions |

|

(thousands) |

|

Rent Escalator |

|

Seaport Neighborhood(1) |

|

December 2071 |

|

December 2120 |

|

$ |

1,905 |

|

3% annually |

Translux Building |

|

December 2071 |

|

December 2120 |

|

$ |

158 |

(2) |

3% annually |

One Seaport Plaza |

|

December 2071 |

|

N/A |

|

$ |

525 |

|

Adjusted every 15 years provided operating profits have been achieved; subject to caps |

Note: Our 85 South Street and 250 Water Street assets are not subject to a ground lease. For the John Street Service Building, there is a separate license agreement with the New York City Department of Parks and Recreation.

(1) |

Ground lease for the following properties: Pier 17, the Tin Building, Schermerhorn Row, Museum Block, 117 Beekman Street and the Fulton Market Building. |

(2) |

Includes partial rent abatement of approximately $137,000 and $141,000 for the years ended December 31, 2023 and December 31, 2024, respectively, which is not expected to continue. |

Hospitality. Hospitality represents our ownership interests in various food and beverage operating businesses. Currently, we own, either wholly or through partnerships with third parties, and operate, including under license and management agreements, six fine dining and casual dining restaurants, cocktail bars, nightlife and entertainment venues (The Fulton, Mister Dips, Carne Mare, Malibu Farm, Gitano and The Lawn Club), as well as our unconsolidated venture, the Tin Building by Jean-Georges, which offers a variety of culinary experiences, including restaurants, bars, grocery markets, retail and private dining. These businesses are all our tenants and are a part of our Landlord Operations.

Jean-Georges Restaurants was founded by renowned Michelin-star chef Jean-Georges Vongerichten and operates over 60 hospitality offerings across the world. In March 2022, the Company acquired a 25% interest in Jean-Georges Restaurants for $45 million. The Tin Building by Jean-Georges was the first project completed by the Company and Jean-Georges since the minority stake acquisition, and it now plays an integral part in the Seaport’s overall performance. CCMC provides management services for certain retail and food and beverage businesses within the Seaport. On January 1, 2025, as the Company’s initial step to internalize food and beverage operations at most of its wholly owned and joint venture-owned restaurants at the Seaport, we hired and onboarded CCMC employees and entered into a shared services agreement with CCMC.

Descriptions of our joint venture agreements as of December 31, 2024 follows:

| ● | JG Restaurants. In March 2022, we acquired a 25% interest in JG for $45.0 million. JG currently has over 60 hospitality offerings and a pipeline of new concepts. Under the terms of the current operating agreement, all cash distributions and the recognition of income-producing activities are pro rata based on stated ownership interest. We have various, standard protective rights under the operating agreement, including board designation rights tied to our ownership stake in JG, certain consent rights over actions taken with respect to JG and preemptive rights and a right of first refusal to, in certain cases, acquire a greater interest in JG. Concurrent with our acquisition of the 25% interest, we entered into a warrant agreement with Jean-Georges, pursuant to which we paid $10.0 million for the option to acquire up to an additional 20% interest in JG, which expires on March 2, 2026. During the year ended December 31, 2024, the Company recognized an impairment of $10.0 million related to this warrant. See Note 3 – Impairment for additional information. |

10

| ● | Tin Building by Jean-Georges. In 2015, together with VS-Fulton Seafood Market, LLC (the “Fulton Partner”), we formed Fulton Seafood Market, LLC to operate a 53,783 square foot culinary marketplace in the historic Tin Building. The Fulton Partner is a wholly owned subsidiary of JG. Under the terms of the joint venture agreement, we contribute the cash necessary to fund pre-opening, opening and operating costs of the Tin Building. The Fulton Partner is not required to make any capital contributions. The Tin Building by Jean-Georges culinary marketplace began operations in the third quarter of 2022. We have a 65% final profit-sharing interest in Fulton Seafood Market, LLC. Various provisions in the operating agreement regarding distributions of cash flow based on capital account balances, allocations of profits and losses, and preferred returns may result in our economic interest differing from our final profit-sharing interest. Based on capital contribution and distribution provisions, we currently receive substantially all of the economic interest in the venture. However, as of December 31, 2024, we do not have the power to direct the restaurant- related activities that most significantly impact the venture’s economic performance, nor are we the primary beneficiary, and we account for this investment in accordance with the equity method. |

| ● | The Lawn Club. In 2021, we formed HHC Lawn Games, LLC with The Lawn Club NYC, LLC (“Endorphin Ventures”) to construct and operate an immersive indoor and outdoor restaurant that includes an extensive area of indoor grass, a stylish clubhouse bar and a wide variety of lawn games. This concept opened in the fourth quarter of 2023. Under the terms of the initial agreement, the Company funded 80% of the cost to construct the restaurant, and Endorphin Ventures contributed the remaining 20%. In October 2023, we executed an amended LLC agreement, in which we will fund 90% of any remaining capital requirements and Endorphin Ventures will contribute 10%. We have a 50% final profit-sharing interest in HHC Lawn Games, LLC, although various provisions in the operating agreement regarding distributions of cash flow based on capital account balances, allocations of profits and losses, and preferred returns may result in our economic interest differing from our final profit-sharing interest. We also entered into a lease agreement with HHC Lawn Games, LLC pursuant to which we agreed to lease approximately 27,000 square feet of the Fulton Market Building to this venture. |

Sponsorships, Events, and Entertainment. Our Sponsorships, Events, and Entertainment segment includes the Las Vegas Aviators, the Las Vegas Ballpark, the Fashion Show Mall Air Rights, Seaport events and concerts and all of our sponsorship agreements across both the Seaport and the Las Vegas Ballpark.

| ● | The Aviators and Las Vegas Ballpark. The Las Vegas Aviators are an MiLB team and the Triple-A affiliate of the Athletics. The team was acquired by the Summerlin Las Vegas Baseball Club, a subsidiary of HHH at the time, and Play Ball Owners Group in May 2013. In 2017, HHH acquired Play Ball’s 50% ownership stake for $16.4 million. In addition to the team, included in Seaport Entertainment is the Aviators’ 10,000-person capacity ballpark, which is located in the heart of Downtown Summerlin, approximately nine miles west of the Las Vegas Strip. The Aviators have consistently generated ticket sale revenue in the top quintile for MiLB Triple-A clubs. The Las Vegas Ballpark had a gross carrying value before accumulated depreciation of $133.2 million as of December 31, 2024. In addition to hosting baseball games, the ballpark holds various special events throughout the year. In 2024, the Aviators and the ballpark generated approximately $31.4 million in revenue. |

11

The following map shows the location of the Las Vegas Ballpark in relation to certain other Las Vegas landmarks.

| ● | The Rooftop at Pier 17. The Rooftop at Pier 17 has evolved into one of the premier concert venues in New York City. The venue has capacity of 3,500 guests and in 2023 and 2024 hosted 63 and 60 concerts, respectively. Located two blocks south of the Brooklyn Bridge, the unique outdoor venue was voted the #1 outdoor music venue in New York City in 2022 by Red Bull and ranked by Pollstar as the sixth top club worldwide in 2024. The venue provides an unmatched outdoor entertainment opportunity for both emerging and established musicians. In addition, given the venue’s destination-like location, it has proven to be successful at hosting events year round and drives incremental revenue outside of the Summer Concert Series. |

The demand for live music at The Rooftop at Pier 17 is evident based on the success of our Concert Series, which premiered in 2018, hosting 24 shows and selling over 63,000 tickets. In 2024, our Concert Series sold out 30 of 60 shows and sold approximately 180,000 tickets, which represented 86% of all available tickets, generating over $12 million in gross ticket sales. The venue’s success is also demonstrated by its social media following, which is one of the largest for any New York City-area arena or concert venue, despite only having a 3,500-guest capacity. We are planning to launch year-round concerts and events for The Rooftop at Pier 17 in the fourth quarter of 2025, utilizing a seasonal floor-to-ceiling glass enclosure for the winter months. The total enclosed capacity will be approximately 3,000 guests, and each summer, The Rooftop will pivot back to hosting its open-air summer concerts with 3,500 total standing guest capacity.

| ● | The Fashion Show Mall Air Rights. The Fashion Show mall is the 25th largest mall in the country and one of the largest shopping, dining and entertainment destinations on the Las Vegas Strip. It has a prime Las Vegas Strip location, adjacent to the Wynn and Treasure Island. The mall is owned by Brookfield Properties and features more than 250 retailers and over 30 restaurants spread across approximately two million square feet. Seaport Entertainment has an interest in and to 80% of the air rights above the mall, with Brookfield Properties having an interest in and to the remaining 20% stake. The Fashion Show Mall Air Rights are a contractual right to form a joint venture to hold an 80% managing member interest in a to-be-formed entity that would own the air rights above the Fashion Show mall, as well as the exclusive right to develop such air rights. The Fashion Show Mall Air Rights may potentially be used to develop a new casino and hotel on the Las Vegas Strip. For additional information, see “Risk Factors—Risks Related to Our Business and Our Industry—We are exposed to risks associated with the development, redevelopment or construction of our properties, including the planned |

12

| redevelopment at 250 Water Street and intended development in connection with our Fashion Show Mall Air Rights.” |

Seasonality

Significant portions of our business are seasonal in nature, and the periods during which our properties experience higher revenues vary from property to property, depending primarily on their location, the customer base served and potential impacts due to weather and the timing of certain holidays. For example, our Seaport business is significantly impacted by seasonality due to weather conditions, New York City tourism and other factors, with the majority of Seaport’s revenue generated between May and September. In Las Vegas, we are significantly impacted by the baseball season, with a significant portion of our Sponsorship, Events, and Entertainment segment revenue generated between April and September. As a result, our total revenues tend to be higher in the second and third quarters, and our quarterly results for any one quarter or in any given fiscal year may not be indicative of results to be expected for any other quarter or year. Additionally, during periods of extreme temperatures (either hot or cold) or precipitation, we have historically experienced, and will likely continue experiencing, significant reductions in consumer traffic.

Competition

The Company operates in a highly competitive environment across its various business segments. Within our Landlord Operations segment, we compete for primarily retail and office tenants. We compete with other property owners whose properties may be perceived to offer a better location or better amenities or whose pricing may be perceived as a better value given the quality, location and terms that the prospective tenant seeks.

In the Hospitality industry, the Company faces competition from a variety of dining establishments, including both high-end restaurants and casual dining options located within the Seaport neighborhood, throughout Manhattan and in the broader New York City area. Competitors range from established fine dining brands and local, independent restaurateurs to innovative new entrants offering unique dining experiences.

Within our Sponsorships, Events, and Entertainment segment, we compete with other entertainment venues, concert spaces and event venues in the New York City area, including those offering similar music, entertainment and public event programming. These venues may offer different capacities, amenities or event types that could attract similar audiences, including large arenas and smaller intimate venues. The Las Vegas Aviators operate in a competitive sports market, with rival teams competing for fan engagement, sponsorships and media attention. Local sports teams and major league affiliates can influence attendance and community support, as well as impact sponsorship and advertising opportunities.

13

Overall, the Company’s competitive position is influenced by factors such as unique locations, brand strength, customer loyalty, and the ability to offer differentiated and exclusive experiences. The Company is committed to maintaining a strong market presence by adapting to evolving customer preferences, ensuring high-quality service, and investing in unique, memorable experiences across all its business segments.

Human Capital

As of December 31, 2024, we had 90 full-time employees supporting our business, and we consider our current relationship with our employees to be good. As of December 31, 2024, none of our employees were represented by unions or covered by collective bargaining agreements.

We believe that our future success largely depends upon our continued ability to attract and retain highly skilled talent. We provide our employees with competitive salaries and bonuses, opportunities for equity ownership, development programs that enable continued learning and growth and a robust employment package that promotes well-being across all aspects of their lives.

We strive to create and maintain an environment where individuals can excel, regardless of background; we believe this ultimately drives top performance, inclusive culture and leadership development. We invest in processes that help to activate equitable access for employee growth, both personally and professionally, and it is our policy to not make employment decisions on the basis of any legally protected characteristic.

Government Regulation and Compliance

We are subject to numerous federal, state and local government laws and regulations, including those relating to: real property; employment practices; building, health and safety; competition, anti-bribery and anti-corruption; the preparation and sale of food and beverages; building and zoning requirements; cybersecurity and data privacy; and general business license and permit requirements. For example, various federal, state and local statutes, ordinances, rules and regulations concerning building, health and safety, site and building design, environment, zoning, sales and similar matters apply to or affect the real estate industry. Our ability to obtain or renew permits or approvals and the continued effectiveness of permits already granted or approvals already obtained depends on factors beyond our control, such as changes in federal, state and local policies, rules and regulations and their interpretations and application. Additionally, approval to develop real property sometimes requires political support and generally entails an extensive entitlement process involving multiple and overlapping regulatory jurisdictions and often requires discretionary action by local governments. Real estate projects must generally comply with local land development regulations and may need to comply with state and federal regulations. We incur substantial costs to comply with legal and regulatory requirements.

There is also a variety of legislation being enacted, or considered for enactment, at the federal, state and local levels relating to energy and climate change. This legislation relates to items such as carbon dioxide emissions control and building codes that impose energy efficiency standards. New building code requirements that impose stricter energy efficiency standards could significantly increase our cost to construct buildings. As climate change concerns continue to grow, legislation and regulations of this nature are expected to continue and become more costly to comply with. We may be required to apply for additional approvals or modify our existing approvals because of changes in local circumstances or applicable law. Governmental regulation also affects sales activities, mortgage lending activities and other dealings with consumers. Further, government agencies routinely initiate audits, reviews or investigations of our business practices to ensure compliance with applicable laws and regulations, which can cause us to incur costs or create other disruptions in our business that can be significant. We may experience delays and increased expenses as a result of legal challenges, whether brought by governmental authorities or private parties.

Under various federal, state and local laws and regulations, an owner of real estate is liable for the costs of remediation of certain hazardous substances, including petroleum and certain toxic substances (collectively hazardous substances) on such real estate. These laws often impose such liability without regard to whether the owner knew of, or was responsible for, the presence of such hazardous substances. The costs of remediation of such substances may be substantial, and the presence of such substances, or the failure to remediate such substances, may adversely affect the owner’s ability to sell such real estate or to obtain financing using such real estate as collateral.

14

Other federal, state and local laws, ordinances and regulations require abatement or removal of asbestos-containing materials in the event of demolition or certain renovations or remodeling, the cost of which may be substantial for certain redevelopments, and also govern emissions of and exposure to asbestos fibers in the air. Federal and state laws also regulate the operation and removal of underground storage tanks. In connection with our ownership, operation and management of certain properties, we could be held liable for the costs of remedial action with respect to these regulated substances or tanks or related claims.

Intellectual Property

We own several trademarks, copyrights and other intellectual property rights. Although our intellectual property rights are important to our success, we do not consider any single right to be of material significance to our business.

Available Information

Our corporate headquarters is located at 199 Water Street, 28th Floor, New York, New York, 10038, and our telephone number is (212) 732-8257. Our website address is www.seaportentertainment.com. Information contained on, or that can be accessed through, our website does not constitute part of this Annual Report.

Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, are available, without charge, on our investor relations website, ir.seaportentertainment.com, as soon as reasonably practicable after they are electronically filed with, or furnished to, the Securities and Exchange Commission (the “SEC”). The public may read and obtain a copy of any materials the Company files electronically with the SEC at www.sec.gov.

15

ITEM 1A. RISK FACTORS

The risks and uncertainties described below are those that we deem currently to be material, and do not represent all of the risks that we face. You should carefully consider the following risks and uncertainties, in addition to the other information contained in this Annual Report and the other documents we file with the SEC. Additional risks and uncertainties not presently known to us or that we currently do not consider material may in the future become material and impair our business operations. If any of the following risks actually occur, our business could be materially harmed, our financial condition, results of operations and prospects could be materially and adversely affected, and the value of our securities could decline significantly.

Risk Factors Summary

An investment in shares of our common stock is subject to a number of risks, including risks relating to the separation, the successful implementation of our strategy and the ability to grow our business. The following list of risk factors is not exhaustive. See “Risk Factors” for a more thorough description of these and other risks.

Risks Related to Our Business and Our Industry

| ● | Our portfolio has experienced, and is expected to continue to experience, significant negative operating cash flow for the foreseeable future, along with net losses. We require substantial cash, and, in the event that our management team is unsuccessful in achieving its business plan quickly enough, we may be forced to change our business plan, dispose of assets and/or take other actions, which could materially adversely affect our financial condition and results of operations. Such actions could also affect the tax treatment of the distribution to HHH and its stockholders, which could result in a material indemnification obligation pursuant to the tax matters agreement. |

| ● | Our business is dependent on discretionary consumer spending patterns and, as a result, could be materially, adversely impacted by an economic downturn, recession, financial instability, inflation or changes in consumer tastes and preferences. |

| ● | Downturn in tenants’ businesses may reduce our revenues and cash flows. |

| ● | We may be unable to renew leases, lease vacant space or re-lease space as leases expire. |

| ● | The operational results of some of our assets may be volatile, especially the Seaport, which could have an adverse effect on our financial condition and results of operations. |

| ● | Significant competition could have an adverse effect on our business. |

| ● | The concentration of our properties in New York City and Las Vegas exposes our revenues and the value of our assets to adverse changes in local economic conditions. |

| ● | Some of our properties are subject to potential natural or other disasters. |

| ● | Climate change, as well as scrutiny of climate change and other environmental or social matters may adversely affect our business. |

| ● | Several of our properties and our tenants depend on frequent deliveries of food, alcohol and other supplies, which subjects us to risks of shortages, interruptions and price fluctuations for those goods. |

| ● | We are exposed to risks associated with the development, redevelopment or construction of our properties, including the potential redevelopment at 250 Water Street and in connection with our Fashion Show Mall Air Rights. |

16

| ● | Our development projects may subject us to certain liabilities. |

| ● | Government housing regulations may limit opportunities at 250 Water Street and any future communities in which we invest, and failure to comply with resident qualification requirements may result in financial penalties or loss of benefits. |

Risks Related to Our Sports Assets

| ● | Our sports assets face intense and wide-ranging competition, which may have a material negative effect on our business and results of operations. |

| ● | Our business is substantially dependent on the continued popularity and/or competitive success of the Aviators, which cannot be assured. |

Financial Risks

| ● | We will be unable to develop, redevelop or expand our properties without sufficient capital or financing. |

| ● | As of December 31, 2024, we had outstanding indebtedness of approximately $101.6 million, and in the future we may incur additional indebtedness. This indebtedness and changing interest rates could adversely affect our business, prospects, financial condition or results of operations and prevent us from fulfilling our financial obligations. |

| ● | Inflation has adversely affected us and may continue to adversely affect us by increasing costs beyond what we can recover through price increases. |

Regulatory, Legal and Environmental Risks

| ● | Development of properties entails a lengthy, uncertain and costly entitlement process. |

| ● | Government regulations and legal challenges may delay the start or completion of the development of our properties, increase our expenses or limit our building or other activities. |

Risks Related to Our Separation From and Relationship with HHH

| ● | Prior to the Spin-Off, we had no history of operating as a separate, publicly traded company, and our historical financial information is not necessarily representative of the results that we would have achieved as a separate, publicly traded company and may not be a reliable indicator of our future results. |

| ● | We may not achieve some or all of the expected benefits of the separation, and the separation may adversely affect our business. |

| ● | If the Spin-Off failed to qualify as a distribution under Section 355 of the U.S. Internal Revenue Code of 1986, as amended (the “Code”), HHH stockholders could incur significant adverse tax consequences, and we could be required to indemnify HHH for certain tax consequences that could be material pursuant to indemnification obligations under the tax matters agreement. |

Risks Related to our Common Stock

| ● | We cannot be certain that an active trading market for our common stock will be sustained, and the price of our common stock may fluctuate significantly. |

17

Risks Related to Our Business and Our Industry

Our portfolio has experienced, and is expected to continue to experience, significant negative operating cash flow for the foreseeable future, along with net losses. We require substantial cash, and, in the event that our management team is unsuccessful in achieving its business plan quickly enough, we may be forced to change our business plan, dispose of assets and/or take other actions, which could materially adversely affect our financial condition and results of operations. Such actions could also affect the tax treatment of the distribution to HHH and its stockholders, which could result in a material indemnification obligation pursuant to the tax matters agreement.

We have a history of incurring net losses, and we currently expect to experience negative operating cash flow for the foreseeable future. For the years ended December 31, 2024, 2023 and 2022, we incurred net losses of $153.3 million, $838.1 million ($128.6 million excluding an impairment charge of $672.5 million for our assets and $37.0 million for unconsolidated ventures) and $111.3 million, respectively. We had negative operating cash flows of $52.6 million, $50.8 million and $29.5 million for the years ended December 31, 2024, 2023 and 2022, respectively. Historically, our portfolio required support in the form of contributions from HHH to fund our operations and meet our obligations, with net transfers from HHH of $169.5 million, $125.3 million and $239.6 million for the years ended December 31, 2024, 2023 and 2022, respectively. Following our Spin-Off from HHH, we no longer receive funding from HHH.

Additionally, our business model is cash intensive. The campus nature of our Seaport portfolio requires a higher level of overhead because expenses like cleaning and security are not directly correlated to the occupancy in one building. Instead, overhead costs are largely correlated to the activation of the entire district for retail, events, sponsorships and food and beverage operations. In addition, our management’s business plan depends significantly on leasing up our existing Seaport assets, which we expect will involve significant capital expenditures. For instance, the portfolio of assets within Landlord Operations at the Seaport was 64% leased and 61% occupied as of December 31, 2024, and we are focused on leasing this space. As of December 31, 2024, approximately 50% of our existing office space was leased and occupied in the Seaport. In January 2025, we entered into a lease agreement with a tenant to occupy approximately 74,000 square feet of space in Pier 17. We are actively seeking to lease the remaining vacant space, which may involve converting space from office to hospitality uses. We are also focused on leasing other available retail space at the Seaport, of which 73% was leased and 68% was occupied as of the same period-end. Such leasing activities will require significant capital expenditures in addition to the substantial capital expenditures necessary or the ongoing operation of our portfolio.

We cannot offer any assurance as to our future financial results, and, as noted above, we currently expect to experience significant negative operating cash flow and net losses for the foreseeable future. While we believe that our existing cash balances and restricted cash balances will provide adequate liquidity to meet all of our current and long-term obligations when due, including our third-party mortgages payable, and adequate liquidity to fund capital expenditures and redevelopment projects, including our working capital and capital expenditure needs for the next twelve months, we cannot provide assurances that we will be able to secure additional funding on terms acceptable to us, or at all, if and when needed. Our inability to achieve positive cash flow from our current operating plans over time or to raise capital to cover anticipated shortfall would have a material adverse effect on our business, financial condition, results of operations and ability to implement our business plan, and could have a material adverse effect on our ability to meet our obligations as they become due, which could force us to change our business plans, dispose of assets and/or take other action in order to continue to operate. In addition, such actions could affect the tax treatment of the distribution to HHH and its stockholders, and if so, we could be required to indemnify HHH for certain tax consequences that could be material pursuant to indemnification obligations under the tax matters agreement. See “—Risks Related to the Separation From and Our Relationship with HHH.”

18

Our business is dependent on discretionary consumer spending patterns and, as a result, could be materially, adversely impacted by an economic downturn, recession, financial instability, inflation or changes in consumer tastes and preferences.

Our business depends in part on consumers spending discretionary dollars at our assets. Consumer spending has in the past declined, and may in the future decline at any time, for reasons beyond our control, including as a result of economic downturns or recessions, unemployment and consumer income levels, financial market volatility, credit conditions and availability, inflation, rising interest rates, tariffs, increases in theft or other crime, pandemics or other public health concerns and changes in consumer preferences. The risks associated with our businesses and described herein may become more acute in periods of a slowing economy or recession. In addition, instability and weakness in the U.S. and global economies, including due to the effects caused by disruptions to financial markets, high inflation, high interest rates, tariffs, recession, high unemployment, geopolitical events and the negative effects on consumer confidence and consumers’ discretionary spending, have in the past negatively affected, and may in the future materially negatively affect, our business and operations. For example, the restaurant and hospitality industries are highly dependent on consumer confidence and discretionary spending. Economic, political or social conditions or events that adversely impact consumers’ ability or willingness to dine out could, in turn, adversely impact our revenues related to JG and the Seaport. If such conditions or events were to persist for an extended period of time or worsen, our overall business and results of operations may be adversely affected.

Downturn in tenants’ businesses may reduce our revenues and cash flows.

A tenant may experience a downturn in its business, due to a variety of factors including rising inflation or interest rates or supply chain issues, including those potentially caused from global trade uncertainty or tariffs, which may weaken its financial condition and result in its failure to make timely rental payments or result in defaults under our leases. The rate of defaults may increase from historical levels due to tenants’ businesses being negatively impacted by higher interest rates. In the event of default by a tenant, we may experience delays in enforcing our rights as the landlord and may incur substantial costs in protecting our investment.

We may be unable to renew leases, lease vacant space or re-lease space as leases expire.

We cannot provide any assurance that existing leases will be renewed, that we will be able to lease vacant space or re-lease space as leases expire or that our rental rates will be equal to or above the current rental rates previously negotiated by HHH. Subsequent to year-end 2024, we entered into a lease with a new tenant to occupy approximately 74,000 square feet of space in Pier 17, comprised of existing vacant space as well as space currently occupied by one tenant whose lease is set to expire in December 2025 and who represented approximately 11% of our total 2024 revenues. The assets within Landlord Operations at the Seaport were 64% leased as of December 31, 2024, and we are focused on improving occupancy levels at these assets; however, no assurance can be given that we will be successful in leasing this space. If the average rental rates for our properties decrease, existing tenants do not renew their leases, vacant space is not leased or available space is not re-leased as leases expire, our financial condition, results of operations, cash flows, the quoted trading price of our securities and our ability to satisfy our debt service obligations at the affected properties could be adversely affected.

The operational results of some of our assets may be volatile, especially the Seaport, which could have an adverse effect on our financial condition and results of operations.

The Seaport’s operational results have been and may in the future be volatile. The volatility is largely the result of: (i) seasonality; (ii) potential sponsorship revenue; (iii) potential event revenue; (iv) demand for rentable space; and (v) business operating risks from various start-up businesses. We own, either wholly or through joint ventures, and in some instances operate, several start-up businesses in the Seaport. As a result, the revenues and expenses of these businesses directly impact the net operating income of the Seaport, which could have an adverse effect on our financial condition and results of operations.

19

For example, seasonality has a significant impact on our Seaport business due to weather conditions, New York City tourism and other factors, with the majority of Seaport’s revenue generated between May and October. Similarly, in Las Vegas, we are significantly impacted by the baseball season, with a significant portion of our Sponsorship, Events, and Entertainment segment revenue generated between April and September. As a result, our total revenues tend to be higher in the second and third quarters, and our quarterly results for any one quarter or in any given fiscal year may not be indicative of results to be expected for any other quarter or year. Additionally, during periods of extreme temperatures (either hot or cold) or precipitation, we may experience significant reductions in consumer traffic, which could adversely affect our assets and our business as a whole.

Additionally, our investment in JG and the related development of the Tin Building are both relatively new, and uncertainty around those investments could also contribute to volatile results.

Significant competition could have an adverse effect on our business.

The nature and extent of the competition we face depend on the type of property. Because our existing portfolio consists of entertainment-related assets, these properties compete for consumers and their discretionary dollars with other forms of entertainment, leisure and recreational activities. This competition is particularly intense in Manhattan and in the Las Vegas area, where all of our assets are located. The success of our business depends in part on our ability to anticipate and respond quickly to changing consumer tastes, preferences and purchasing habits. Many of the entities operating competing businesses are larger and have greater financial resources, have been in business longer, or have greater name recognition, and as a result may be able to invest greater resources than we can in attracting consumers to our properties. Certain of our assets will depend on our ability to attract concerts and other events to our venues, and in turn the ability of performers to attract strong attendance.

JG, in which we own a 25% stake, competes in the restaurant industry with national, regional and locally-owned or operated restaurants, an industry characterized by the continual introduction of new concepts and subject to rapidly changing consumer preferences, tastes, trends and eating and purchasing habits. A substantial number of restaurants compete with JG for customers, consumer dollars, restaurant locations and qualified management and other restaurant staff.

Numerous residential and commercial developers, some with greater financial and other resources, compete with us in seeking resources for development and prospective purchasers and tenants. Competition from other real estate developers may adversely affect our ability to attract and retain experienced real estate development personnel or obtain construction materials and labor. These competitive conditions can adversely affect our results of operations and financial condition.

Additionally, there are numerous shopping facilities that compete with our operating retail properties in attracting retailers to lease space. In addition, retailers at these properties face continued competition from other retailers, including internet retailers. Competition of this type could adversely affect our results of operations and financial condition. In addition, we compete with other major real estate investors and developers, many of whom have lower costs of, and superior access, to capital for attractive investment and development opportunities.

The concentration of our properties in New York City and Las Vegas exposes our revenues and the value of our assets to adverse changes in local economic conditions.

The properties we own are located in the same or a limited number of geographic regions, largely Manhattan and the Las Vegas area. Our current and future operations at the properties in these areas are generally subject to significant fluctuations caused by various factors that are beyond our control such as the regional and local economies, which may be negatively impacted by material relocation by residents, industry slowdowns, increased unemployment, lack of availability of consumer credit, levels of consumer debt, adverse weather conditions, natural disasters, climate change and other factors, as well as the local real estate conditions, such as an oversupply of, or a reduction in demand for, retail space or retail goods and the availability and creditworthiness of current and prospective tenants.

20

In addition, some of our properties are subject to various other factors specific to those geographic areas. For example, tourism is a major component of the local economies in lower Manhattan and in the Las Vegas area, so our properties in those areas are susceptible to factors that affect travel and tourism related to these areas, including cost and availability of air services and the impact of any events that disrupt air travel to and from these regions. Moreover, these properties may be affected by risks such as acts of terrorism and natural disasters, including major wildfires, floods, droughts and heat waves, as well as severe or inclement weather, which could also decrease tourism activity.

Given that the majority of our revenue comes from the Seaport in New York City, we are also particularly vulnerable to adverse events (including acts of terrorism, threats to public safety, natural disasters, epidemics, pandemics, weather conditions, labor market disruptions and government actions) and economic conditions in New York City and the surrounding areas. For example, the Seaport’s operations and operating results were materially impacted by the COVID-19 pandemic and New York state and city laws and regulations regarding lockdowns and capacity restrictions. Declines or disruptions in certain industries—for example, the financial services or media sectors—may also have a significant adverse effect on the New York City economy or real estate market, which could disproportionately impact on our business.