UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

☐ |

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______________to________________

Commission File No. 001-37704

DARIOHEALTH CORP.

(Exact name of registrant as specified in its charter)

Delaware |

|

45-2973162 |

(State or other jurisdiction of |

|

(I.R.S. Employer |

|

|

|

322 W. 57th St. |

|

10019 |

(Address of principal executive offices) |

|

(Zip Code) |

(972)-4 770-6377

(Registrant’s telephone number, including area code)

Securities Registered pursuant to Section 12(b) of the Act

|

|

|||

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered: |

Common Stock, par value $0.0001 per share |

|

DRIO |

|

The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(b) of the Exchange Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, par value $0.0001 per share; Warrants to purchase Common Stock

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

|

|

|

|

Non-accelerated filer |

☑ |

Smaller reporting company |

☑ |

|

|

|

|

Emerging growth company |

☐ |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the closing price as of the last business day of the registrant’s most recently completed second fiscal quarter is $31,031,352.

As of March 3, 2025, the registrant had outstanding 41,567,016 shares of common stock, $0.0001 par value per share.

Documents Incorporated By Reference: None.

TABLE OF CONTENTS

Item No. |

|

Description |

|

Page |

|

||||

3 |

||||

|

||||

|

||||

|

||||

5 |

||||

60 |

||||

85 |

||||

|

|

85 |

||

86 |

||||

86 |

||||

86 |

||||

|

||||

|

||||

|

||||

87 |

||||

90 |

||||

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

90 |

|||

102 |

||||

102 |

||||

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

102 |

|||

102 |

||||

103 |

||||

|

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

|

103 |

|

|

||||

|

||||

|

||||

104 |

||||

110 |

||||

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

117 |

|||

Certain Relationships and Related Transactions, and Director Independence |

118 |

|||

120 |

||||

|

||||

|

||||

|

|

|||

121 |

||||

125 |

||||

126 |

||||

2

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS AND SUMMARY RISK FACTORS

This Annual Report on Form 10-K, or the Annual Report, contains “forward-looking statements,” which includes information relating to future events, future financial performance, financial projections, strategies, expectations, competitive environment and regulation. Words such as “may,” “should,” “could,” “would,” “predicts,” “potential,” “continue,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates,” and similar expressions, as well as statements in future tense, identify forward-looking statements. Forward-looking statements should not be read as a guarantee of future performance or results and may not be accurate indications of when such performance or results will be achieved. Forward-looking statements are based on information we have when those statements are made or management’s good faith belief as of that time with respect to future events, and are subject to significant risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that could cause such differences include, but are not limited to:

| ● | our current and future capital requirements and our ability to satisfy our capital needs through financing transactions or otherwise; |

| ● | our ability to meet the requirements of our existing debt facility; |

| ● | our product launches and market penetration plans; |

| ● | the execution of agreements with various providers for our solution; |

| ● | our ability to maintain our relationships with key partners; |

| ● | our ability to complete required clinical trials of our product and obtain clearance or approval from the United States Food and Drug Administration (the “FDA”), or other regulatory agencies in different jurisdictions; |

| ● | our ability to maintain or protect the validity of our U.S. and other patents and other intellectual property; |

| ● | our ability to retain key executive members; |

| ● | our ability to internally develop new inventions and intellectual property; |

| ● | general market, political and economic conditions in the countries in which we operate, including those related to recent unrest and actual or potential armed conflict in Israel and other parts of the Middle East, such as the recent attack by Hamas and other terrorist organizations from the Gaza Strip and Israel’s war against them; |

| ● | interpretations of current laws and the passages of future laws; and |

| ● | acceptance of our business model by investors. |

The foregoing does not represent an exhaustive list of matters that may be covered by the forward-looking statements contained herein or risk factors that we are faced with that may cause our actual results to differ from those anticipated in our forward-looking statements. Please see “Risk Factors” for additional risks that could adversely impact our business and financial performance.

Moreover, new risks regularly emerge and it is not possible for our management to predict or articulate all the risks we face, nor can we assess the impact of all risks on our business or the extent to which any risk, or combination of risks, may cause actual results to differ from those contained in any forward-looking statements. All forward-looking statements included in this Annual Report are based on information available to us on the date of this Annual Report. Except to the extent required by applicable laws or rules, we undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained above and throughout this Annual Report.

3

When used in this Annual Report, the terms “Dario,” “DarioHealth,” “the Company,” “we,” “our,” and “us” refer to DarioHealth Corp., a Delaware corporation and our subsidiary LabStyle Innovation Ltd., an Israeli company, PsyInnovations Inc., a Delaware company, Twill, Inc., a Delaware company, Twill ISR Ltd, an Israeli company, and DarioHealth India Services Pvt. Ltd., an Indian company. “Dario” is registered as a trademark in the United States, Israel, China, Canada, Hong Kong, South Africa, Japan, Costa Rica, and Panama. “DarioHealth” is registered as a trademark in the United States and Israel.

Summary of Risk Factors

Our business is subject to a number of risks, including risks that may adversely affect our business, financial condition and results of operations. These risks are discussed more fully below and include, but are not limited to, risks related to:

Risks Related to Our Financial Position and Capital Requirements

| ● | Risks associated with our relatively new business; |

| ● | our future capital needs and their potential impact on our existing stockholders; |

| ● | our history of losses and stockholder’s inability to rely upon our historical operating performance; |

| ● | our revenues are concentrated with a major customer, and our revenues may decrease significantly if we were to lose our major customer; |

Risks Related to Our Business

| ● | the acceptance of our products in the market and our exposure to market trends; |

| ● | our risks of basing our business on the sale of our principal technology; |

| ● | our reliance on manufacturers and distributors; |

| ● | the impact of a failure of our digital marketing efforts; |

| ● | our reliance on the Apple App Store and Google’s Android platform; |

| ● | the risks associated with conducting business internationally; |

| ● | potential errors in our business processes and product offerings; |

| ● | our reliance on the performance of key members of our management team and our need to attract highly skilled personnel; |

| ● | the volatility of capital markets and other macroeconomic factors, including due to inflationary pressures, geopolitical tensions or the outbreak of hostilities or war; |

Risks Related to Product Development and Regulatory Approval

| ● | the expense and time required to obtain regulatory clearance of our products; |

| ● | our limited clinical studies and the susceptibility to varying interpretations of such studies; |

| ● | our ability to complete clinical trials; |

| ● | the failure to comply with the FDA’s Quality System Regulation or any applicable state equivalent; |

| ● | our reliance on third parties to conduct clinical trial work; |

| ● | the impact of legislation and federal, state and foreign laws on our business, including protecting the confidentiality of patient health information; |

| ● | the potential impact of product liability suits; |

Risks Related to Our Intellectual Property

| ● | the risks relating to obtaining or maintaining our intellectual property; |

| ● | potential litigation relating to the protection of our intellectual property; |

| ● | our limited foreign intellectual property rights; |

| ● | Our reliance on confidentiality agreements and the difficulty in enforcing such agreements; |

4

Risks Related to Our Industry

| ● | the intense competition we face in the markets we operate; |

| ● | our need to respond quickly to technological developments; |

| ● | the risks relating to obtaining or maintaining our intellectual property; |

| ● | the risks relating to third-party payors not providing for adequate coverage and reimbursement for our products; |

Risks Related to Our Operations in Israel

| ● | the risks relating to the political, economic and military instability that may exist in Israel; |

| ● | our principal executive offices and other significant operations are located in Israel, and, therefore, our results may be adversely affected by political, economic and military instability in Israel, including the multi front war Israel is currently facing; |

| ● | the potential for operations to be disrupted as a result of obligations of Israeli citizens to perform military service; |

| ● | the difficulty in enforcing judgements against us or certain of our executive officers and directors; |

Risks Related to the Ownership of Our Common Stock and Warrants

| ● | Nasdaq may delist our securities from trading on its exchange, which could limit investors’ ability to make transactions in our securities and subject us to additional trading restrictions; |

| ● | the ability for our officers, directors and founding stockholders to exert influence over our affairs; |

| ● | the potential lack of liquidity, or volatility, of our common stock and warrants; |

| ● | the impact of analysts not publishing research or reports about us; |

| ● | the expense relating to our requirements as a U.S. public company; |

| ● | the potential failure to maintain effective internal controls over financial reporting; |

| ● | the existence of anti-takeover provisions in our charter documents and Delaware law; and |

| ● | that we do not intend to pay dividends on our common stock. |

PART I

Item 1. Business Overview

We are a leading global digital health company with a mission to power the behavior changes that drive better health. We are committed to transforming healthcare by delivering a comprehensive and highly engaging whole-person health platform, which enables us to create a future where healthy change is effortless and accessible to all.

At the core of our mission and vision is engagement. We believe that most existing digital health solutions in the market fail to deliver improved health outcomes because users are not engaged due to a lack relevance, personalization, consumerization, and longitudinal data and information. We, and our acquired companies, first commercialized our digital behavioral health products in the direct-to-consumer (“D2C”) marketplace, and we continue to use the D2C marketplace as a sandbox and laboratory to innovation. These consumers pay for these digital health products out of their own pockets and are therefore the most value driven among all healthcare consumers. These consumers demanded that we deliver highly engaging user experiences that deliver strong clinical health outcomes for which consumers will pay. The bottom line is that if users are not engaged in digital solutions over a long period of time, they cannot change their behavior and they cannot get healthier – we first deliver engagement followed by sustained behavior change that then leads to measurable health outcomes and improvement. We believe that our D2C marketplace roots and continued focus delivers better user experiences, longer sustained engagement, stronger clinical outcomes, at the most affordable prices, that then delivers the highest return on investment (“ROI”) in the industry.

Our whole-person health model includes the following five elements:

5

| 1. | Physical Health: Focuses on the prevention, and treatment of physical ailments; primarily cardiometabolic and musculoskeletal conditions. |

| 2. | Mental Health: Addresses emotional and psychological well-being, including stress management, as well as clinical anxiety, and depression across all levels of severity. |

| 3. | Social and Environmental Factors: Considers influences like socioeconomic status, community resources, housing, and education. |

| 4. | Individualized Care: Tailored user journey and care plans that respect personal goals, cultural values, and life circumstances. |

| 5. | Integration of Clinical Services: Combines different healthcare providers and systems to deliver seamless care for both physical and mental health needs. |

We have created our whole-person healthcare solution through both organic development and acquisitions of leading companies across several therapeutic areas. As a digital health consolidation leader, we have acquired companies that have spent over a decade and nearly $525 million, in combination with our own investment, to develop and deliver the most engaging whole-person health platform in the market to empower individuals to achieve their optimal health through data-driven, precision artificial intelligence (“AI”) personalized care solutions that integrate the management of physical and mental health needs.

Leveraging advanced analytics, data-driven AI precision and personalization, a deep understanding of consumer behavior, user-centric technology, and a holistic approach, we provide tailored interventions that meet the unique needs of each user to deliver the health industry’s highest levels of user activation and sustained engagement. Our digital self-care solutions ensure optimal levels of clinical outcomes with the highest levels of clinical efficacy by empowering users to overcome the psychological, social, and physical barriers to effective and sustainable behavior change.

With our whole-person digital health platform, we address a broad range of health needs, including chronic condition management (e.g., diabetes, hypertension, obesity, and musculoskeletal issues), behavioral health (e.g., stress, anxiety, and depression), and preventive care. By integrating digital therapeutics and well-being solutions with real-time data monitoring and access to professional care teams, we ensure an AI driven adaptive and continuous care experience that combines digital self-care, with virtual coaching, and virtual clinical care. As of 2024, our eligible user base spans millions of individuals worldwide, supported by partnerships with employers, health plans, pharmaceutical companies, and providers aiming to deliver instant access to the highest quality and most effective self-care and virtual human care that delivers the optimal level of clinical utilization to ensure the best value and outcomes to our users and customers.

Who We Serve

We serve four primary market segments that drive our business model. Our historic roots, as well as those of our largest acquisition, Twill, Inc. (“Twill”), began in the D2C market, which has forced us to create what we consider the industry’s most engaging and effective self-care whole-person digital health solutions; and we continue to operate in the D2C market in the U.S. by providing our chronic condition management and patient engagement solutions across many different health conditions. In addition, we use the D2C market as an innovation laboratory to develop and test new features and benefits to ensure that these innovations meet our high engagement and outcomes standards before deploying them in the business-to-business (“B2B”) market. From our D2C origins, Dario and Twill expanded into similar B2B market segments over the past seven years such that these market segments now represent three-fourths of our current revenues. These B2B market segments include medium-to-large employers, national and regional health plans, and global pharmaceutical companies.

Our medium-to-large employer market segment is focused on employers with over 1,000 employees and currently includes three of the five largest global technology companies and one of the two largest employers in the United States. In total, we had 53 employer customers in 2024. We seek to provide solutions to their employees that address the primary areas of health condition focus on by employers for meaningful costs savings that can deliver high and sustainable returns on investment, which can exceed 5:1. In this market segment, we go to market through a direct sales force, consultants, brokers, and channel partners that sell our solutions to their health plan and employer customers.

6

Our health plan customers include five of the nation’s largest organizations where we provide our solutions to their members both nationally and regionally. We have particularly specialized in providing its behavioral health offering to Medicare and Medicaid members, where we have established itself as the most engaging and effective solutions among these demographics. We are now leveraging this Medicare and Medicaid behavioral health specialty to expand access to its other chronic condition solutions to these populations. We go to market primarily through our own sales force and partners with large national health plans and other channel partners.

In 2018, Twill began to expand its offering to pharmaceutical companies, and in 2022 we entered into our first pharmaceutical company partnership. We now deliver these combined capabilities on our engagement platform to the pharmaceutical industry to provide three value propositions: 1) Top of the Funnel education and awareness to help companies find new patients for their treatments, 2) Mental and physical health support to improve medication adherence, persistence, and compliance, 3) Patient journey data analytics to better understand and target patients to get the right therapy to the right patient at the right time. We have provided our engagement platform services to a dozen global pharmaceutical companies across nearly as many medical conditions. We have a dedicated team with many years of experience selling into the pharmaceutical industry.

How We Generate Revenue

All of our customers have an interest in value-based health outcomes and care and have begun to work with us to align various types of outcomes with innovative revenue models. We differentiate ourselves versus our competitors by being willing to enter into risk-based agreements with performance guarantees that align the financial incentives with the employer, health plan, employee, plan member, and we deliver the best health outcomes at the most affordable price, thereby delivering the highest ROI. Across all market segments, we follow a digital health engagement platform subscription revenue model that is priced upon either a per user population basis (“PMPM”) or a per engaged user basis (“PEMPM”), and in some cases a customer may employee both pricing options together. These revenue models can also include milestone-based payments, as well as performance guarantees. Our digital health platform subscription model applies across our various product and therapeutic areas of focus.

We have the following product offerings with the engagement platform subscription revenue models:

Dario Connect (Well-being) – Our free D2C user engagement offering activates users, educates them, and encourages them to take the next best action on their patient journey. It is a digital front door to all other Dario products, as well as to our customer’s other digital offerings. For pharmaceutical companies, Dario Connect is used to create engaged communities around specific health conditions to increase awareness and education so that they will seek access to the most effective medication prescriptions. Previous claims-based analysis of script conversion completed by third parties demonstrated a 10:1 ROI for pharmaceutical companies who subscribed to this service. For pharmaceutical companies, their subscription fees are a function of the therapeutic area, the complexity of the patient journey, number of patients targeted, and platform configuration required to meet the needs of these patients. Among employers, this offering is used to increase access to our product benefits among non-employee dependents, and the payment for this service is included in the subscription for the primary product purchased for the various conditions addressed. For health plans, it provides support to patients across a broad array of medical conditions.

Dario Mind (Mental Health) – Our behavioral health offering decreases the symptoms of stress, anxiety, and depression by 25-30% in 8 weeks or less when used as directed. Many users will continue to use the product for many months and even years, with sustained engagement rates of close to 60% at 2 months, 40% at 12 months, and 30% at three years. Most of our customers see mental health condition prevalence among their employees at 20%. This is a digital first offering for empowered digital self-care that is then augmented with virtual coaching, and/or virtual clinical care from therapists and/or prescribers to address the needs of users across all levels of clinical severity. Customers can pay for digital self-care and virtual coaching on either a PMPM or PEMPM basis. When adding clinical care services, these can be paid for on a fee-for-service (“FFS”) basis, PMPM, or PEMPM basis, and is only offered through our B2B sales channel. We find prevalence of mental health conditions to be around 20% among employer and health plan populations, and more than 50% among some pharmaceutical company therapeutic areas of focus.

Dario Health (Diabetes) – Combining our proprietary glucometer as well as our Dario Health digital self-care application and virtual coaching, Dario Health for diabetes delivers the highest level of A1c reduction among the leading digital health companies focused on diabetes, of between 1.4 and 2.3 points, depending on the patients’ initial baseline.

7

This is offered through both our D2C and B2B sales channels. In the B2B sales channel, we see prevalence of this condition between 8-10% for most employers and health plans. Studies completed with a top 20 pharmaceutical company using claims data suggested total medical cost savings for patients using this solution reaching $5,000 per year. Customers can pay for digital self-care and virtual coaching on either a PMPM or PEMPM basis.

Dario Health (Hypertension) – We include our own proprietary blood pressure cuff with our Digital Health self-care application and virtual coaching. Clinical research has demonstrated that more than two-thirds of users with Hypertension stage 1 levels experience a 13mmHg reduction in systolic blood pressure when used as directed. As hypertension is one of the most prevalent conditions among adults in the United States, we find that among health plans and employers this solution is useful to 35% or more of their employees and members. This is offered through both our D2C and B2B sales channels. Customers can pay for digital self-care and virtual coaching on either a PMPM or PEMPM basis.

Dario Health (Weight management and GLP-1) – 30.7% of the U.S. population is overweight with about 42.4% being obese, meaning they have a body-mass index (“BMI”) of 30 or greater, creating the greatest level of prevalence among all of our product offerings. The recent introduction of GLP-1 medication has also increased the interest in this solution. We believe that we have demonstrated that our digital self-care solution, with our proprietary weight scale, Dario Health app and virtual coaching, delivers the industry’s highest level of digital self-care weight loss, at 10%, over 12 months. By educating users and helping them change their diet, exercise, and sleep behaviors, users can keep the weight off. We have modified our core offering to complement GLP-1 onboarding and offboarding, as well as GLP-1 prescription services. We offer this through B2B sales channels. Customers can pay for digital self-care and virtual coaching on either a PMPM or PEMPM basis. In 2024, we provided our GLP-1 offering to 20% of our employer customers, and we expect this to increase due to the strong demand for GLP-1s among patients and employers.

Dario Move (MSK) – Pain is one of the primary reasons for employees missing work and it is one of the key drivers of healthcare costs. Dario Move focuses on improving posture to alleviate pain with its proprietary medical device used with its Dario Move application and virtual coaching. We find that prevalence among employers is nearly 25%. This solution is only sold on a B2B and D2C basis, and is generally combined with our other offerings, and can be paid for on either a PMPM or PEMPM basis.

Bundled Full-suite or Partial-suite – While any one of our solutions can be subscribed to individually, increasingly employers and health plans are seeking vendors who are no longer point solution providers but who can consolidate multiple condition offerings into a single offering with one simple price. To accommodate these market demands, we now increasingly provides subscriptions for its full-suite or partial-suite on a PMPM or PEMPM basis, where additional clinical network services can be added on either a FFS basis or added to the PMPM or PEMPM subscription pricing. As one of the only whole-person digital health companies with a full suite of cardiometabolic, behavioral health, and musculoskeletal solutions, we believe that we have a competitive advantage with our bundled offering.

Why We Have Confidence in Our Digital Offerings

We have developed a comprehensive body of research, encompassing over 90 studies, that have demonstrated the transformative potential of our digital health solutions in advancing clinical care. We believe that these findings emphasize the platform’s ability to deliver long-term sustainable outcomes, including durable results over three years, while showcasing scalability with outcomes for more than 100,000 members.

We have established ourselves as a pioneer in the digital health sector, being the first to analyze multi-condition impacts by exploring relationships such as blood glucose and blood pressure, as well as blood glucose and weight monitoring. This work spans diverse clinical domains, including diabetes, hypertension, weight loss, pain, depression, and anxiety. Among diabetes users, significant improvements were recorded, i.e. those with a baseline HbA1c greater than 9, with a 2.3-point reduction in HbA1c compared to a 1.8-point reduction among non-Dario users.

Additionally, our members achieved substantial cost savings of $5,077 per person annually, driven by reductions in all-cause healthcare resource utilization (“HCRU”) and office visit costs.

8

These outcomes are underpinned by the demonstrated effectiveness of behavioral engagement, which serves as a critical driver of improved clinical results. Collectively, these achievements position us as a leader in digital health, delivering enhanced care and meaningful economic value.

The following provides a summary of many of our clinical research findings that support our claims to improving user clinical, health, and economic outcomes.

| • | 28% reduction in depression and anxiety symptoms |

| • | 2.0 reduction in A1c |

| • | 10% reduction in weight |

| • | 10% reduction in blood pressure |

| • | 10% improvement in medication adherence |

| • | 50% reduction in pain |

| • | $2,323 annual medical cost savings from behavioral interventions |

| • | $5,077 annual medical cost savings from cardiometabolic interventions |

Competitive Strengths

Our competitive advantage has emerged from our founding roots as a D2C company, that required us to develop the most engaging self-care digital behavioral programs and medical devices. Over more than a decade and over $500 million investment in technology, we have completed over 90 studies on the various whole-person health offerings to demonstrate their first-in-class clinical and health outcomes that results for a combination of high levels of sustained user engagement and highly effective clinically validated behavior change. We expanded from our initial diabetes focus to now include hypertension, obesity, weight management, musculoskeletal pain, stress, anxiety, and depression, that are all offered from the same digital health platform and can be bundled together or sold individually. By collecting billions of data points across all these health conditions over a decade, we have developed and commercialized it AI driven personalization that magnifies all of our competitive advantages to deliver more valuable results for users and customers. Claim-based analysis of our users has shown that we generate the highest ROI for its customers, whether they be employers, health plans, or pharmaceutical companies.

D2C Roots Ensured Highest Levels of Engagement

Unlike most of our competitors, we have always operated in the D2C market, and we continue to operate in both the D2C market as well as the B2B market, where the former drives rapid innovation cycles that require accelerated deployment of new features that can then be provided to our B2B customers. This ensures that our whole-person health platform continues to be highly intuitive and engaging so that it drives high user satisfaction and sustained engagement, ensuring better adherence to care plans that deliver the highest levels of quality outcomes and the industry’s leading ROI. Across all our offerings, we have had over 5 million users with billions of datapoints that have enabled the company to A/B test thousands of product features and functions and measure which deliver the highest levels of engagement.

Clinical Validation of The Highest Levels of Health Outcomes

Over more than a decade, we have completed over 90 randomized controlled trials (“RCTs”), real-world evidence studies (“RWE”), observational studies, interventional studies, and insurance-claims-based analysis. These have demonstrated our ability to generate best-in-class clinical and economic outcomes. Such studies provide the supporting evidence and confidence for us to provide at-risk offerings, performance guarantees, and value-based care.

9

Integrated Whole-Person Digital Health Platform

During the past five years, employers, health plans, healthcare providers, and pharmaceutical companies have expressed “point solution fatigue,” and have begun to prune the number of point solutions vendors and instead consolidate their digital health offering with vendors that provide a whole-person portfolio that covers all the major health conditions that drive their healthcare spending. Our whole-person digital health platform addresses these primary therapeutic areas of focus among employers, health plans, health systems, and pharmaceutical companies. These include all areas of cardiometabolic health (e.g., diabetes, hypertension, overweight/obesity), behavioral health (e.g., stress, anxiety, and depression), and musculoskeletal pain. In addition, we are partnering with clinical healthcare provides to provide virtual clinical care to its digital health offerings and virtual coaching. By integrating all these onto its whole-person digital health platform, it enables a hyper personalized, seamless, and individualized experience across all relevant health needs that ensure high levels of user engagement to deliver robust clinical outcomes that exceed those of nearly all competitors across all medical conditions.

AI and Data-Driven Personalization

Our proprietary AI and machine learning algorithms deliver highly personalized health insights and interventions, ensuring relevance and efficacy for each user. These were developed initially based upon our D2C experience with millions of users who pay out-of-pocket for our digital self-care solutions. By leveraging billions of data points with our D2C offering, we optimize our user recruitment, activation, and engagement algorithms for first-in-class engagement. Dario applies its AI, developed in the D2C market, to its B2B businesses to optimize the B2B businesses to enable Dario to outperform competitors in each market segment in engaging users and delivering valuable outcomes.

The Industries Highest ROIs

We have done claims-based analysis of our various offerings with its customers to measure the medical and economic outcomes that results from using its whole-person digital health offerings. These studies support our claims for providing the digital health industry’s strongest ROIs by decreasing medical costs, increasing medication adherence, and activating and engagement users in the healthcare system more effectively than alternatives. In addition, our offerings deliver impressive improvements in worker productivity by decreasing absenteeism, presenteeism, and healthy engagement in work. The key to these costs savings is that we collaborate with employers, payers, pharmaceutical companies, and providers to deliver comprehensive care solutions and improve accessibility. Across all these market segments, we power behavior change by providing digital first self-care, complemented with virtual coaching care, and then the optimal level of clinical care delivered through our clinical provider partners to accelerate access to care and improved whole-person health outcomes, at the lowest possible cost.

Our Growth Strategies

We have four core growth strategies that leverage all aspects of our whole-person digital health platform. After the acquisition of Twill in 2024 and integrating its commercial offerings and technological platform with ours, we are now prepared in 2025 to execute our growth strategies to both drive top line growth and to do so with greater operating efficiency that we believe will enable profitable growth.

Dario Health Comprehensive Cardiometabolic Health

Our core offering is our Dario Health cardiometabolic suite that provides FDA cleared devices and a digital behavioral health experience that enables users to decrease the symptoms of hypertension, diabetes, and obesity. Our primary market for this offering are medium-to-large sized employers that are seeking to control their chronic disease healthcare spending. We also work with large regional health plans to provide this offering to their members and self-insured employer customers. We provide virtual coaching to all of these users and provides access to virtual clinical services to these users as well. We find that among employees for most employers, the prevalence of diabetes is about 10%, while hypertension is 35%, and obesity and being overweight is between 35-75%.

10

Dario Connect is offered with Dario Health as a free digital experience that engages users across many different medical conditions. Users of Dario Connect participate in digital communities to learn more about their health condition, treatment options, learn from healthcare experts, including clinicians, and explore ways that they can improve their overall health. Dario Connect acts as a gateway and digital front door to get access to all of our whole-person digital offerings, as well as to get access to our customer products and services. Among employer customers, Dario Connect is how non-employee dependent learn about health care benefits they have access to and can access those benefits. Users can also get access to our virtual clinic partners and services through Dario Connect. Dario Connect is also the product that we configure for pharmaceutical companies to provide Top of Funnel awareness campaigns to help them find new patients.

Dario Mind Comprehensive Behavior Health

We have expanded our Dario Mind offering to include not only the industry leading self-care digital mental health application to decrease the symptoms of stress, anxiety, and depression, but also to provide access to virtual coaching, and virtual clinical services including virtual therapy and virtual clinical consultations, prescribing, and medication management. We are the only provider in the market with a comprehensive whole-person digital health offering supported by RCTs that demonstrate the clinical efficacy of its digital cognitive behavioral therapy (“CBT”) and mindfulness interventions. This offering has been deployed globally in 10 different languages among some of the world’s largest employers and health plans. We find that among most of our employer clients, over 20% will have a meaningful mental health challenge that require some level of treatment and support that Dario Mind can provide. In addition, we have several large pharmaceutical companies that provide Dario Mind to patients to address their comorbid stress, anxiety, and depression associated with their underlying medical condition. By addressing these symptoms, and providing imbedded psychoeducation about their condition, we have seen medication adherence rates increase by 10-20% over 6–12-month periods.

Bundled Full Suite Offering for Body and Mind

We offer the most comprehensive whole-person digital health offering in the market and can offer it as a bundled full-suite offering to employers and health plans where these customers can pay for the full bundle under any one of several revenue models such as PMPM, PEMPM, and milestone value-based. This full suite bundle includes Dario Mind, Dario Health, Dario Connect, and Dario Move. When pricing the full bundle, we price this based upon expected prevalence, engagement, outcomes for each component of the full bundle. By so doing, we believe that we can achieve meaningful economies of scale related cost savings that it can pass on to our customers and thereby deliver industry leading ROIs.

GLP-1 Opportunities with Employers and Pharmaceutical Companies

According to the Center for Disease Control (the “CDC”), 42.4% of Americans meet the BMI level of 30 for an obesity diagnosis. In the past few years, pharmaceutical companies like Eli Lilly and Novo Nordisk have launched expensive, blockbuster GLP-1 drugs for patient who have been diagnosed as obese that have demonstrated the ability to decrease BMI by 10-20%. Due to the success of these drugs in decreasing BMI, there are now nearly 100 drugs in the pipeline among these two pharmaceutical companies and their competitors that address many of the side effects that these drugs have with regards to tolerability, fatigue, and muscle loss. Research indicates that 26.2% of patients discontinue GLP-1s at 3 months, with an additional 30.8 doing so at 6 mots, and 36.5% at 12 months; with only 25% remaining on the medication after two years. Once a patient discontinues use of the GLP-1, the typical patient regained two-thirds of their weight within one year. For this reason, employers are eager to have their employees engaged in an effective digital behavioral health program while they are on a GLP-1 that will in crease their weight loss while on the medication and keep the weight off after discontinuation by helping the patient develop new, sustainable healthy habits. Presently, 20% of our employer customers now subscribe to its GLP-1 offering, and we see this as an important growth engine in the future. We have also found interest among pharmaceutical companies in providing our GLP-1 solution so support patients on their medication in developing healthy habits to improve outcomes.

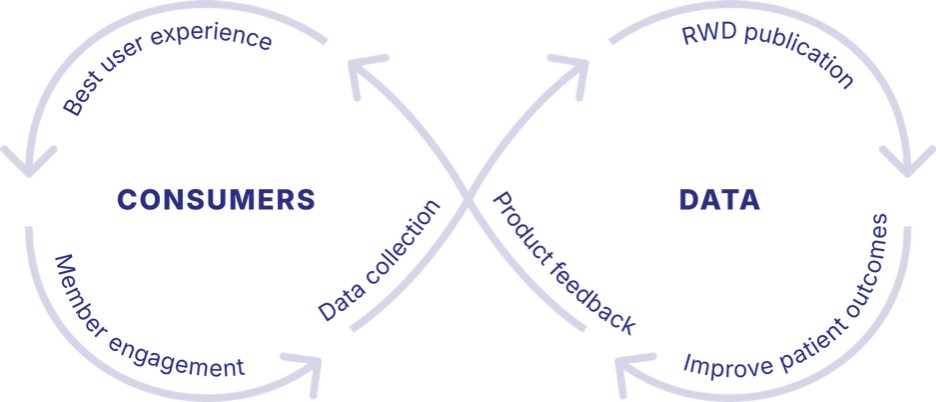

Dario Flywheel Integrates All These Growth Strategies

Our strategy is to integrate all these growth strategies into a united whole through its flywheel as diagramed below, which shows how its B2B and D2C strategies feed one another to create greater value as follows:

More B2B Clients: By getting more B2B customers it increases the number of users on the platform, which increases the data collected and used, increases the value to third-party and inhouse virtual clinical care networks, increases cross condition and cross client monetization, such as from behavior health to cardiometabolic health, which increases the average revenue per user, and then increases the D2C users and value.

11

More Users: User come from both our B2B and D2C market strategies, which drives our data driven innovation, and our value to virtual human care services.

More Value Per User: Data and associated AI, machine learning and analytics is what drives improved personalized user experience, which drives better outcomes, increased trust, more clients, and more users. In addition, our whole-person health model creates more value per user by providing access to different kinds of care and access to virtual clinical care.

Better Health Outcomes: As the users increase, the clients increase, the data increases with greater personalization, and expanded access to virtual human care, users achieve better health outcomes, that increase trust among both customers and users, which then increases the data, cross condition referrals.

Sales and Marketing

We employ a multi-channel sales and marketing approach designed to effectively reach diverse stakeholders.

Employer Sales

We employ a hybrid approach to the employer market due to its size and complexity. This means that it works with brokers and consultants as well as employing a direct sales force. Most medium-to-large employers go through a two-to-three-year request for proposal (“RFP”) cycle where they evaluate digital health vendors to select new ones based upon the value of their offering. Our value proposition with employers is to engage their employees at the highest levels, with effective, evidenced-based behavioral interventions that deliver meaningful clinical outcomes, and show compelling evidence of ROI at twice the industry average. We can contract directly with an employer or enable the employer to leverage their existing health plan benefits to pay for our services.

Health Plan Integration

We partner with payers to integrate our solutions into their benefit plan offerings. We can also provide our services on either a direct basis or through its claims-based billing. Health plans are a channel to employers as well as a channel to Medicare Advantage members. We have our own direct-to-health plan sales force but will also leverage consultants and brokers where appropriate. Marketing is focused on industry conferences, and highly targeted outreach.

12

Pharmaceutical Sales and Marketing

Many pharmaceutical companies work with consultants to identify how they can leverage digital health to complement and provide companion digital health services to support patients on their medications or to find new patients for their medications. We will often work with these consultants to design solutions with its engagement platform for their pharmaceutical clients. In addition, our pharma sales team will reach out to executives at pharmaceutical companies in the targeted areas we have identified to market and sell subscriptions to its engagement platform to these companies. Its primary areas of focus are oncology, rare disease, cardiometabolic health, dermatology, and mental health.

Dario AI Creating a Hyper-personalized Digital Health Future

We are successfully integrating AI to enhance patient care, streamline operations, and drive continuous innovation on its whole-person digital health platform. Our mission has been to empower individuals with personalized, data-driven health solutions while continuously improving clinical outcomes and healthcare efficiency. AI has been instrumental in harnessing the power of data to deliver precise, proactive, and personalized care.

We employ curated generative AI models trained on our decade of user journey data on millions of users and large content library to derive proprietary insights not otherwise attainable from publicly available data to drive significant competitive advantages in engagement, clinical and financial outcomes. We apply these insights to the Dario experience to create a sustainable competitive advantage.

Data and AI as a Strategic Asset

We, along with Twill (formerly a standalone entity before being acquired by us), has built an extensive repository of health data over a cumulative 25 years. This wealth of information serves as a critical asset, fueling AI-driven insights that enhance decision-making, predict health risks, and optimize patient engagement. Our proprietary datasets span multiple health conditions, providing a unique foundation for developing advanced AI models tailored to real-world patient needs.

25 Years of Cumulative Experience, With Billions of Proprietary Data Points

Our AI capabilities are built upon a rich foundation of proprietary data and research, including:

| • | Large available member datasets: Billions of data points from providing its products to over 5 million users over a cumulative 25 years. |

| • | Multi-condition focus: Addressing multiple therapeutic areas Cardiometabolic (diabetes, hypertension, weight management), Behavioral Health (stress, anxiety, depression), and musculoskeletal pain with over 75 million physical and behavioral health measurements collected through our medical devices and tens of billions of data points through its applications. |

| • | Uniquely matched datasets: Enriched with metadata such as biomedical and behavioral, as well as location, nutrition, and other timely and relevant health information for deeper insights. |

| • | Extensive AI research: Over 7 years of AI advancements, including the development of large language models, conversational AI chatbot, and advanced machine learning and deep learning algorithms, delivering over 15 million behavioral health interventions and 25 million digital behavioral health virtual coaching interactions. |

| • | Direct access to claims data: Utilized on an anonymized basis in-house to train proprietary models for optimized care delivery and outcomes. |

| • | Open architecture: Enabling integration with client-provided care modalities, seamlessly connecting them to Dario’s digital care pathways. |

13

Our AI strategy has three primary pillars:

| 1. | Operational Efficiency and Simplification: Optimizing workflows, reducing administrative burdens, and enhancing operational efficiency to drive better healthcare outcomes. |

| 2. | Whole-Person Patient Care: Expanding our product offerings to provide the most comprehensive and personalized care experience for every individual from digital self-care to virtual clinical care. |

| 3. | Curated generative AI: Leveraging a cumulative 25 years of proprietary data collection and content creation to develop a unique generative AI model tailored to personalized care in a highly regulated healthcare environment. Recent advancements in AI model training, particularly in reducing hardware costs, serve as a significant accelerator for Dario’s curated generative AI. These developments enable us to scale and refine our AI models more efficiently, further enhancing predictive accuracy and real-time personalization. |

| 1. | Operational Efficiency and Simplification |

Our AI has been instrumental in improving operational efficiency across multiple functions, enhancing productivity, automating routine tasks, and optimizing decision-making processes. Specific applications include:

| • | High-Quality Content Creation: AI-driven tools assist in generating engaging, evidence-based health content, improving efficiency and consistency. |

| • | Culturally Adapted Content Translation: Custom trained generative AI models based on our vast content library in more than 10 languages enable automatic translation of new content that maintains a consistent tone of voice and cultural sensitivities across all languages. |

| • | Software Development: AI accelerates software development by optimizing code generation, debugging, and deployment processes. |

| • | Member Services: Deploy AI-powered automation to optimize member engagement, enhance customer support, improve response times and member satisfaction. |

| • | Product Management: Enables data-driven product decisions, enhancing usability and personalization. |

| • | Human Resources (HR): Improve recruitment, employee engagement, and workforce planning, streamlining HR processes. |

| • | Finance: Optimize financial operations, forecasting, and risk management, reducing manual efforts and improving accuracy. |

| • | Internal Knowledge Retrieval: Retrieval-Augmented Generation (“RAG”) used to facilitate seamless access to organizational knowledge, enabling employees to quickly find relevant data, policies, and historical insights for improved decision-making and efficiency. |

Our AI development and adoption is enabling us to reduce operating expenses. Looking ahead, we expect ongoing AI advancements to drive an additional efficiency gains in the next few years, further reducing costs and improving user experience, customer service, innovation, and value.

| 2. | Curated Generative AI |

We are pioneering a proprietary generative AI model today, which delivers highly personalized care solutions in a tightly regulated healthcare environment. Our advancements in AI model training reduce hardware dependency and costs and further accelerate the scalability and performance of curated generative AI. RAG represents a key component of this model that enhances generative AI by integrating real-time, domain-specific proprietary data retrieval, which represents a proprietary advantage.

14

| • | Context-Aware Generative AI – Our RAG engine enhances AI-generated content by incorporating the latest medical insights, ensuring accuracy and relevance. |

| • | Unique and Certified Data - Unlike generic GenAI models relying on publicly available internet data, our generative AI is built upon a unique, healthcare-intelligent, and certified dataset. |

| • | Healthcare-Specific Intelligence – Our generative AI integrates domain-specific knowledge, ensuring high accuracy and contextual relevance for patient care applications. |

| • | Regulatory Compliance – We designed our RAG to adhere to strict healthcare regulations. As such, we supports safe, ethical, and privacy-compliant AI-driven health solutions. |

| • | Commitment to Ethical AI - We prioritize fairness, transparency, and ethical AI development in all our models. |

| • | Regulatory Adherence - Our AI systems comply with healthcare regulations, including Health Insurance Portability and Accountability Act of 1996 (“HIPAA”) and the EU General Data Protection Regulation (“GDPR”), ensuring data security and patient privacy. |

| • | Bias Mitigation - Continuous refinement of AI models help minimize bias, improving accuracy and equitable healthcare delivery. |

| • | Patient Trust - AI systems are built with patient trust in mind, ensuring that AI-driven insights enhance rather than replace clinical decision-making. |

| 3. | Whole-Person Patient Care |

Our AI-powered solutions enhance patient engagement, provide predictive analytics, and deliver personalized treatment plans. AI applications in patient care include:

| • | Personalized Digital Therapeutics: AI-powered algorithms tailor interventions based on individual health data, improving adherence and engagement. |

| • | Predictive Analytics for Chronic Disease Management: Our predictive model for blood glucose levels demonstrates over 90% accuracy, which can support efforts to guide user behaviors to engage in timely interventions and proactive treatment in cases where early warning signs can ameliorate health deterioration. |

| • | Automated Coaching and Behavioral Insights: AI-driven behavioral coaching adapts to users in real-time, enhancing self-management and lifestyle modifications. |

| • | Clinical Decision Support: AI enhances provider decision-making by surfacing actionable insights based upon algorithms that are based upon vast data sources that enhance clinical judgments. |

| • | Recommendation Engine Optimization: AI-driven recommendation systems refine patient treatment strategies, enhance engagement and improve health outcomes. |

On Dario’s AI Roadmap

In 2025, we plan to widen and deepen its utilization of AI in the following four areas:

| • | GLP-1 optimization: Utilize AI-powered models to predict members’ level of adherence to GLP-1 prescription prior to prescribing and their level of success in maintaining outcomes post GLP-1 off-boarding. This capability will allow Dario to intelligently prioritize prescriptions over other weight loss and behavior change programs. |

| • | Advancing RAG-powered Generative AI: Refining AI-driven personalized healthcare by integrating real-time monitoring, improving predictive accuracy, and adapting models to personalized treatment plans. |

15

| Leveraging reinforcement learning enables continuous AI improvements based on patient feedback and outcomes. |

| • | Operational Efficiency and Simplification: We have several productivity initiatives in multiple areas such as Product Management, Member Services, and Human Resources. |

Competition

We operate in a highly competitive digital health market, characterized by rapid innovation and evolving consumer expectations. During the past five years, employers and health plans have expressed “point-solution fatigue” and have begun to decrease the number of their point-solution digital health vendors, and to consolidate their digital health vendors among those that provide multiple, integrated offerings. This has driven substantial industry consolidation and has enabled us to differentiate itself as a consolidation leader among competitors as it provides a whole-person health care solutions covering six different medical conditions.

We see two primary dimensions emerging: economies of scale and economies of scope. The first dimension is an increased focus on ROI driving by economies of scale. Recent surveys of employer’s priorities indicates that they want digital health solutions that have much lower costs that can be broadly deployed among their populations and deliver much higher ROIs than they have accepted in the past. A 2:1 ROI is no longer adequate to meet the needs of employers and health plans. For this reason, we have leveraged our AI investments, superior user engagement, highly effective user behavior change, and access to virtual digital care and services to deliver the highest ROIs in the industry that generally exceed 5:1.

The second dimension is driven by economies of scope that increases simplicity by decreasing the number of digital health vendor that deliver an increasingly broad scope of digital health offerings. This simplifies contracting, reporting, value creation, access to users, and the creation of value for users, employers, and health plans.

With these two emerging value creation dimensions that are driving competitive advantage, we see the following companies as its primary competitors:

Broad-based Digital Health Platforms

Companies such as Teladoc Health, Inc. and MDLive, an Evernorth company, offer a full array of integrated virtual care solutions for primary care, chronic and behavioral health. While these companies have both scale and scope, they have not yet developed an operating model that deliver their services profitably at scale.

Cardiometabolic Health Platforms

There are other more narrowly focused companies such as Omada Health, Inc., Vida Health, Inc., Virta Health Corp, and Welldoc, Inc. that focus on the B2B market. And other D2C oriented companies such as Ro, Inc., Hims & Hers, Inc., Weight Watchers International, Inc., and Noom, Inc., that compete with us in the cardiometabolic and GLP-1 space. Most of these companies lack the whole-personal digital health scope that we offer, and still deliver ROIs that are half of what customers expect and demand.

Behavioral Health Providers

Specialized mental health platforms like Spring Care, Inc., Lyra Health, Inc., Headspace, Inc., BetterHelp, Inc. (a division of Teladoc), Calm.com, Inc., and Talkspace, Inc., compete in the B2B behavioral health marketplace. All these companies focus narrowly on behavioral health with no plans to expand their scope to include additional chronic disease conditions.

Wearable Technology Firm

While we integrate with many wearable technology firm’s devices from companies such as Fitbit, Garmin, and Apple, these companies also provide some D2C offerings that could be considered as competitors to our D2C products. However, these companies do not truly compete in the B2B employer, health plan, and pharmaceutical marketplace with competitive comprehensive behavioral and cardiometabolic offerings.

16

As such, we do not see these companies are true competitors.

Traditional Healthcare Systems and Health Plans

While many health systems may have their own home-grown solutions for many of the conditions that we address, few really provide a commercially competitive offering beyond their own network. The same is generally true for most health plans, which primarily focus on vendors like us to provide chronic and behavioral health solutions to their members.

Given this competitive landscape, we differentiate ourself through our integrated whole-person health approach, AI and data-driven personalization, and commitment to user-centric design to deliver industry leading levels of sustained user engagement. Our focus on measurable outcomes and strong partnerships positions us as a leader in the digital health market that can deliver the economies of scale and scope that delivers the highest ROI and easiest delivery of its individual or bundled solutions.

Recent Developments

Aetna

In the first quarter of 2024, we launched the Aetna behavioral platform with approximately a dozen customers, whereby we began to generate revenue from that collaboration, and we expect Aetna to continue to add employers to the platform. A separate self-help program contracted with Aetna last year launched on the platform at the end of the first quarter and is also expected to grow throughout 2024.

Employer Contracts

In April 2024, we announced four new contracts to provide integrated chronic condition management solutions for two employers beginning in the second quarter of 2024.

In November 2024, we announced the signing of four contracts with self-insured employers that are expected to go live in the first quarter of 2025. The contracts span across the full suite of our platform, with no one opting for a single condition, showing evidence of the value of a multi-condition offering.

Presentation of New Studies

In March 2024, we announced two new clinical studies presented at the International Conference on Advanced Technologies and Treatments for Diabetes (ATTD) 2024, demonstrating a 6.38% reduction in weight for members with a baseline BMI of 30 and above and an overall reduction in blood glucose levels, with average blood glucose levels remaining below 140 mg/dL for one year.

In April 2024, we announced two new studies published in the leading peer-reviewed journal for digital health and medicine, Journal of Internet Medicine (JMIR), including a Randomized Controlled Trial (RCT) demonstrating the impact of a digital stress reduction program for teens.

In April 2024, we announced new research published in the leading peer-reviewed journal for digital health and medicine, JMIR, demonstrating a clinically significant reduction in blood glucose levels for members using Dario to manage weight alongside diabetes.

GLP-1 Updates

In June 2024, we announced a new contract with a national employer to provide its cardiometabolic solution with integrated support for GLP-1s to employees beginning in the third quarter of 2024.

In June 2024, we presented two studies presented at the 84th Annual American Diabetes Association (ADA) Scientific Sessions in Orlando. The first study provides an analysis of member data for those tracking a GLP-1 medication in Dario's cardiometabolic solution.

17

A retrospective analysis was conducted using data from members using Dario to manage Type 2 diabetes or prediabetes and taking either Metformin, a standard medication prescribed for diabetes, or a GLP-1. Both member groups were tracked for 12 months as they engaged with our digital chronic condition solution to measure blood glucose levels and track lifestyle activities such as diet and exercise. Members also utilized our Medication Cabinet feature to log Metformin or GLP-1 dataset reminders and report adherence. The data showed significant improvement in adopting healthy behaviors over a 12-month period across both groups as shown by increased tracking of healthy lifestyle behaviors as shown by logged meals and physical activity beginning in the first three months and sustained through the 12-month period.

Additional research presented by us at the ADA conference examined Dario's ability to help members realize the goal of diabetes remission for people living with Type 2 diabetes. The ADA considers remission to be achieve when an individual with Type 2 diabetes sustains normal blood glucose levels of less than 6.5% HbA1c for three months without the aid of a diabetic medication.1 This retrospective study analyzed the data of 7,240 individuals with Type 2 diabetes using our platform to help manage their condition without the help of insulin for at least six months. The results demonstrated a significant impact:

| ● | 31% of our members experienced blood glucose levels reflecting the goal of diabetes remission with average blood glucose readings of less than 140 mg/dL (A1c 6.5%) during a three-month period; |

| ● | 70% of our members achieved a blood glucose level of less than 140 mg/dL in their last month of usage maintained it for three-month period, indicating behavior change and improved long-term glycemic control; and |

| ● | Lifestyle activities as shown by logged meals and physical activity moderated the reduction in average blood glucose levels and high readings ratio. |

New Research Reveals How Physical Activity Mediates the Impact of Depression on Blood Glucose Levels in Individuals with Diabetes or Prediabetes

In September 2024, we announced the publication of a new study in the peer-reviewed journal Frontiers in Endocrinology. The study demonstrates the effectiveness of our cardiometabolic solution for members living with diabetes or prediabetes and depression.

Integration of Twill Behavioral Health Capabilities into Cardiometabolic Health Solution

In September 2024, we announced the integration of condition-specific communities and peer groups with personalized navigation capabilities into our cardiometabolic solution to improve outcomes-based engagement, marking a significant milestone in the integration of the Dario-Twill product offering.

Twill by Dario to Offer a Benefit for AARP Members

In October 2024, we announced a new AARP member benefit that provides members with proven digital behavioral health and well-being solutions from Twill by Dario. The new benefit is expected to launch in January of 2025 for AARP members.

Integration of Twill Capabilities Across Full Multi-Condition Platform

In October 2024, we announced the full integration of Twill's advanced behavioral health and navigation capabilities into our platform. The integration completed our effort to create one of the most comprehensive and effective end-to-end digital health solutions in the market. By unifying data across mental and physical health, we offer a more personalized and effective approach to care.

New Regional Health Plan, Expanding Reach in Medicaid Population

In October 2024, we announced a new contract with a regional health plan in the Medicaid space, which has launched with the full suite of cardiometabolic solutions. Starting with an initial pilot program, we will work closely with the health plan to bring its proven solutions to the plan's population, which includes nearly 10,000 Medicaid members.

18

Pharma Collaborations with Global Pharma Leader to Enhance User Engagement

In November 2024, we announced a new collaboration with a pharma company that will utilize Dario Connect (formerly Twill Care) among their patient populations to further their direct-to-consumer efforts using our refined engagement and navigation technologies. In an effort to strengthen and expand connections across patient populations that are candidates for a new drug to treat psoriasis, a top pharmaceutical company chose us to pilot a cutting-edge initiative aimed to help onboard patients that will engage with the drug via the platform. This collaboration is designed to collect critical insights on patient outcomes and drug effectiveness, with Dario Connect's innovative community-building capabilities playing a key role in enhancing patient engagement.

GLP-1 Solution with Prescribing Capabilities through Collaboration with MediOrbis LLC, Targeting Employers and Direct-to-Consumer Markets

In January 2025, we announced a collaboration with MediOrbis, a multi-specialty digital health provider, to add prescribing capabilities to our GLP-1 behavior change solution for a comprehensive medical weight loss program. This strategic addition creates a fully integrated solution for employers covering weight-loss medications and supports direct-to-consumer offerings, expanding our addressable market in one of the fastest-growing segments of digital health.

Sanofi

On November 26, 2024, we were notified of the termination of the Amended and Restated Exclusive Preferred Partner, Co-Promotion, Development and License Agreement with Sanofi U.S. Services Inc. (“Sanofi”), dated July 10, 2023, which was originally executed on February 28, 2022. On December 4, 2024, we transitioned our relationship with Sanofi and entered into a services agreement. Pursuant to the services agreement, we will configure our Twill Care platform for Sanofi and transition the relationship to a recuring revenue model.

Rula Health

In March 2025, we announced a strategic collaboration with Path CCM, Inc. d/b/a Rula Health ("Rula”), a leading provider of high-quality behavioral health services, to expand access to mental health support for employers and their workforce nationwide. Through this strategic collaboration, we will have exposure to Rula’s extensive network of over 15,000 providers. By leveraging Rula’s high-quality provider network with extensive coverage, we will offer an “easy button” solution for employers looking to implement behavioral health support seamlessly within their existing benefits structure.

19

Clinical Studies

Main Highlights

Our studies below demonstrate the clinical value of our legacy digital therapeutic devices and the ability of our solutions to deliver sustainable outcomes over time.

At the ADA 2018 session, Dario presented three real-world-data analysis studies, as detailed below.

Type 2 Diabetes Users of Dario Digital Diabetes Management System Experience a Shift from Greater than 180 mg/dL to Normal Glucose Levels with Sustainable Results

| ● | Reduction of 19.3% in high glucose readings within 12 months |

| ● | Increase of 11.3% in in-range readings within 12 months |

Methods: A retrospective data evaluation study was performed on the DarioTM cloud database. A population of all active Type 2 Diabetic (T2D) users that took measurements with DarioTM Blood Glucose Monitoring System (“BGMS”) on average of 20 measurements per month during 2017. The study assessed the ratio of all high blood glucose readings (180-400 mg/dL) and the ratio of all normal blood glucose readings (80-120 mg/dL) in their first month of use to their last month of use during 2017 as recorded in the database.

Results: For 17,156 T2D users activated during 2017 the average ratio of high events (180-400 mg/dL) was reduced by 19.3% (from 28.4% to 22.9% of the entire measurements). While at the same time, the ratio of normal range readings (80-120 mg/dL) was increased by 11.3% (from 25.6% to 28.5% of the entire measurements).

Updated Analysis combining 2017 and 2018 data totals 38,838 Type 2 Diabetes active users and 3,318,014 measurements show 14.3% decrease in high readings (180-400 mg/dL) and 9.2 % increase in In-range (80-120 mg/dL) readings.

A decrease in High Readings and Severe Hyperglycemic Events for People with T2D over the Full Year of 2017 in Users Monitoring with Dario Digital Diabetes Management System

| ● | Reduction of 20% of High events (180-400 mg/dL) in T2D sustained within 12 months |

| ● | Reduction of 58% of Hyper events (>400mg/dL) in T2D within 12 months |

Methods: A retrospective data evaluation study was performed on the DarioTM cloud database. A population of active T2D users that continuously measured their blood glucose using DarioTM BGMS during the full year of 2017 was evaluated. The study assessed the ratio of high (180-400 mg/dL) and hyperglycemic (>400mg/dL) blood glucose readings during full year of 2017 as recorded in the database. The average of high and hyperglycemic glucose readings were calculated in periods of 30-60, 60-90, 90-120, 120-150, 150-180, 180-210, 210-240, 240-270, 270-300, 300-330, 330-360 days and compared to first 30 days as a starting point of analysis.

Results: For 225 T2D active users the ratio of high events (180-400 mg/dL) was reduced gradually in 19.6% (from 23.4% to 18.8% of the entire measurements) from baseline compared to the 12th month of the year. Moreover, the ratio of severe hyperglycemia events (>400 mg/dL) was decreased in 57.8% (from 0.90% to 0.38% of the entire measurements) at the same period.

Continuous Reduction of Blood Glucose Average during One Year of Glucose Monitoring Using Dario Digital Monitoring System in a High-Risk Population

| ● | The study presented a reduction of 14% Blood Glucose average was observed in T2D within 12 months |

| ● | 76% of the population showed 24% improvement in Blood glucose average within 12 months |

20

Methods: An exploratory data analysis study reviewed a population of high-risk active type 2 Diabetic users with initial 30 days glucose average above 180 mg/dL during a full calendar year. The study assessed the average blood glucose readings along a year of usage. The average glucose readings was calculated per user in periods of 30 days intervals from 30-60 to 330-360 days and compared to the first 30 days as the starting point baseline of analysis.

Results: Overall of 238 highly engaged T2D users (more than one daily measurement in average) whose average blood glucose level was above 180mg/dL in the first 30 days of measurements (225±45 mg/dL) showed continuous reduction in glucose level average vs. baseline. Reduction in blood glucose average level was demonstrated gradually, in the succeeding 3, 6 and 12 months showing average decrease of 7%, 11% and 14% vs. baseline, respectively. Furthermore, 76% of the entire population (180 out of 238 users) improved their average blood glucose level over a year. Those 180 users (average blood glucose 228±46) showed an average decrease of 10%, 16% and 24% in their glucose average following 3, 6 and 12 months, respectively.

At the American Association of Diabetes Educators (AADE) 2018 Dario presented a study titled “Decrease in Estimated A1C for people in High-risk over a full year of users monitoring with a digital Diabetes management system.”

A reduction of 1.4% in estimated HbA1C in Type 2 Diabetes high risk users from baseline after one year of the Dario system use.

Methods: A retrospective data evaluation study was performed on the DarioTM cloud database. A population of high-risk (with baseline A1C > 7.5 percent), active users that continuously measured their blood glucose using DarioTM BGMS during a full year was evaluated. The study assessed estimated A1C values based on blood glucose readings during a full year as recorded in the database. The estimated A1C values were calculated in periods of 3, 6, 9 and 12 months and compared to first 30 days as a starting point of analysis.

Results: A group of 363 high-risk Dario BGMS users (A1C>7.5) with greater than two blood glucose measurements taken per day in the first 30 days and in the 12th month of the year was selected. Estimated A1C was improved by -0.7, -0.8 and -1 percent from baseline to 3, 6 and 9 months respectively, and remained -1 percent lower following 12 months of usage (8.65±0.96 vs.7.65±1.0). Moreover, subgroup analyses by diabetes type revealed substantial estimated A1C improvement among people with T2D showing improvement of -1 percent from baseline to 3, 6 months and 1.4 percent following 12 months (8.5 ± 0.91% vs. 7.14% ± 0.98%).

An additional study evaluated the potential improvement in glycemic variability in Type 2 diabetes over six months in patients monitoring with Dario Digital Diabetes Management System. Dario presented the study results at the Advance Technologies and Treatment for Diabetes (ATTD) conference in February 2019 in Berlin. We presented two additional studies outcomes at ADA 2019 conference.

Decrease in Glycemic Variability for T2D over Six Months in Patients Monitoring with Dario Digital Diabetes Management System

| ● | The study demonstrated a reduction of 14%-18% in measurements variability was observed in T2D within 6 months |

| ● | Hypo events (<70 mg/dL) remained <1 event on average |