-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2024 |

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 0-21719

Steel Dynamics, Inc.

(Exact name of registrant as specified in its charter)

Indiana |

|

35-1929476 |

(State or other jurisdiction of incorporation or organization) |

|

(IRS Employer Identification No.) |

|

|

|

7575 West Jefferson Blvd, Fort Wayne, IN |

|

46804 |

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (260) 969-3500

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

Trading Symbol |

Name of each exchange on which registered |

Common Stock voting, $0.0025 par value |

STLD |

NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ⌧ No ◻

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ◻ No ⌧

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ⌧ No ◻

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ⌧ No ◻

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ⌧ |

Accelerated filer ◻ |

||

Non-accelerated filer ◻ |

Smaller reporting company ☐ |

Emerging growth company ☐ |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ◻

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ◻

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ⌧

The aggregate market value of the voting stock held by non-affiliates of the registrant computed by reference to the price at which the common equity was last sold as of June 30, 2024, was approximately $14.8 billion. Registrant has no non-voting shares. For purposes of this calculation, shares of common stock held by directors, officers and 5% stockholders known to the registrant have been deemed to be owned by affiliates, but this should not be construed as an admission that any such person possesses the power, direct or indirect, to direct or cause the direction of the management or policies of the registrant or that such person is controlled by or under common control with the registrant.

As of February 24, 2025, Registrant had outstanding 150,163,986 shares of common stock.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of registrant’s definitive proxy statement for the 2025 Annual Meeting of Shareholders are incorporated by reference into Part III, Items 10 through 14, of this report.

STEEL DYNAMICS, INC.

Table of Contents

|

|

Page |

|

|

|

|

|

|

3 |

||

22 |

||

30 |

||

31 |

||

33 |

||

34 |

||

34 |

||

|

|

|

|

|

|

|

|

|

35 |

||

37 |

||

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

38 |

|

50 |

||

51 |

||

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

82 |

|

82 |

||

82 |

||

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

82 |

|

|

|

|

|

|

|

|

|

|

83 |

||

83 |

||

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

83 |

|

Certain Relationships and Related Transactions, and Director Independence |

84 |

|

84 |

||

|

|

|

|

|

|

|

|

|

85 |

||

85 |

||

|

|

|

86 |

||

|

|

|

89 |

PART I

Special Note Regarding Forward-Looking Statements

Throughout this report, or in other reports or registration statements filed from time to time with the Securities and Exchange Commission under the Securities Exchange Act of 1934, or under the Securities Act of 1933, as well as in documents we incorporate by reference herein or here-from, or in press releases or oral statements made by our officers or Regulation FD authorized representatives, we may make statements that express our opinions, expectations, or projections regarding future events or future results, in contrast with statements that reflect present or historical facts. These predictive statements, which we generally precede or accompany by such typical conditional words as “anticipate,” “intend,” “believe,” “estimate,” “plan,” “seek,” “project” or “expect,” or by the words “may,” “will,” or “should,” are intended to operate as “forward-looking statements” of the kind permitted by the Private Securities Litigation Reform Act of 1995, incorporated in Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements involve both known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. That legislation protects such predictive and cautionary statements by creating a “safe harbor” from liability in the event that a particular prediction does not turn out as anticipated.

While we always intend to express our best judgment when we make statements about what we believe will occur in the future, and although we base these statements on assumptions that we believe to be reasonable when made, these forward-looking statements are not a guarantee of performance, and you should not place undue reliance on such statements. Forward-looking statements are subject to many uncertainties and other variable circumstances, many of which are outside of our control, that could cause our actual results and experience to differ materially from those we thought would occur.

The following listing represents some, but not necessarily all, of the factors that may cause actual results to differ from those we may have anticipated or predicted:

Global and National Risks

| ● | domestic and global economic factors including periods of slower than anticipated economic growth and the risk of a recession; |

| ● | global steelmaking overcapacity and imports of steel into the United States, together with increased scrap prices; |

| ● | pandemics, epidemics, widespread illness or other health issues; |

Industry Risks

| ● | the cyclical nature of the steel industry and some of the industries we serve; |

| ● | volatility and major fluctuations in prices and availability of scrap metal, scrap substitutes and supplies, and our potential inability to pass higher costs on to our customers; |

| ● | cost and availability of electricity, natural gas, oil and other energy resources are subject to volatile market conditions; |

| ● | increased environmental, greenhouse gas emissions and sustainability considerations from our customers and investors or related regulations; |

| ● | compliance with and changes in environmental and remediation requirements; |

1

Operational and Commercial Risks

| ● | significant price and other forms of competition from other steel and aluminum producers, scrap processors and alternative materials; |

| ● | availability of an adequate source of supply of scrap for our metals recycling operations; |

| ● | cybersecurity threats and risks to the security of our sensitive data and information technology; |

| ● | the implementation of our growth strategy; |

| ● | our ability to retain, develop and attract key personnel; |

| ● | litigation and legal compliance; |

| ● | unexpected equipment downtime or shutdowns; |

| ● | governmental agencies may refuse to grant or renew some of our licenses and permits required to operate our businesses; |

| ● | our senior unsecured credit facility contains, and any future financing agreements may contain, restrictive covenants that may limit our flexibility; and |

| ● | the impact of impairment charges. |

We also refer you to and urge you to carefully read the section entitled Risk Factors at Item 1A of this report to better understand some of the principal risks and uncertainties inherent in our businesses or in owning our securities, as well as the section entitled Management’s Discussion and Analysis of Financial Condition and Results of Operations at Item 7. You should also review the notes to consolidated financial statements under headings in Note 1. Use of Estimates and in Note 8. Commitments and Contingencies.

Any forward-looking statements which we make in this report, or in any of the documents that are incorporated by reference herein or here-from, speak only as of the date of such statement, and we undertake no ongoing obligation to update such statements. Comparisons of results between current and any prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should only be viewed as historical data.

2

ITEM 1. BUSINESS

Steel Dynamics, Inc. is one of the largest domestic steel producers and metal recyclers in the United States, based on estimated steelmaking and steel coating capacity of approximately 16 million tons and actual metals recycling volumes as of December 31, 2024, with one of the most diversified product and end market portfolios in the domestic steel industry, combined with meaningful downstream steel fabrication operations. The company is currently investing in its aluminum operations to further diversify its end markets with plans to supply aluminum flat rolled products with high recycled content to the countercyclical sustainable beverage can industry, in addition to the automotive and industrial sectors. Primary sources of revenue are currently from the manufacture and sale of steel products, the processing and sale of recycled ferrous and nonferrous metals, and the fabrication and sale of steel joists and deck products.

We refer to our founding principles as our six core strategic pillars. They bring us together with a common focus, and they provide the foundation upon which we operate and grow. Our unique entrepreneurial culture and business model benefit us operationally, financially, and through the responsible use of our resources in diverse economic environments. Innovation in all forms is essential to our success, and our teams focus on how to do things “smarter” within our current operations, as well as how we continue to grow. This means creating solutions for our teammates, customers, suppliers, and other stakeholders. It also includes finding ways to “do business” with fewer resources and less environmental impact. Our six strategic pillars and the team’s execution of them each day has driven our success and sustainability.

| ● | Health & Safety – Safety is our primary focus and core value. Nothing surpasses the importance of creating and maintaining a safe work environment. Our goal is zero injuries—no accidents. |

| ● | Entrepreneurial Culture – Fosters a team of energetic, positive, driven, innovative and diverse individuals by utilizing open communication and meaningful performance-based compensation aligned to our strategic focus. |

| ● | Customer Commitment – We focus on being a preferred partner of our customers by providing quality products and unique supply chain solutions to meet their current and future needs. |

| ● | Strategic Sustainable Growth – We focus on strategic growth with intentional margin expansion and consistency through-the-cycle. |

| ● | Innovation – Through individual creativity and ingenuity, our teams drive innovation to improve safety, quality, productivity, and resource sustainability. We strive to provide unique, superior products, customer supply chain solutions, and next-generation technologies and processes. |

| ● | Financial Strength – Through our adaptable value-added product diversification, vertically connected businesses model, coupled with our highly variable operating cost structure and performance-based incentive compensation, along with our continued operating innovations and efficiency, we achieve higher utilization and lower costs, which provide strong cash flow generation through both strong and weak market cycles. |

Differentiated Model - Uniquely Steel Dynamics

Competitively advantaged differentiation in everything we do is core to our long-term value creation strategy. We distinguish ourselves in every aspect of our business through an overarching spirit of excellence.

3

Unique Entrepreneurial Culture

Our entrepreneurial culture is the foundation of our success and is driven by our extensive, performance-based incentive compensation philosophy for those on the plant floor to our senior leadership team. Over 60% of a production team member’s total potential compensation is “at risk” to both quality production and cost-effectiveness metrics. Over 85% of our senior leadership team’s total potential compensation is “at risk” to companywide financial performance metrics that encourage long-term value creation, including return on equity, growth, cash generation, and return on invested capital measures. We believe diversity within our teams enhances broad-based thinking, innovation, and value creation. Our common goal of consistently achieving excellence in all we do is reflected in the esprit de corps that permeates our team.

Diversified, Value-Added Product Offerings and Supply-Chain Solutions

We have one of the most diversified, high-margin product offerings within the domestic steel industry. We have a track record of profitable growth, driving diversification in both end markets and value-added product offerings to sustain higher volume and profitability through varying market environments. Over 70% of our steel and steel fabrication sales are considered value-added. Throughout our history and today, we seek to provide unique supply-chain alternatives for our customers to increase efficiency, reduce time and costs, and promote decarbonization opportunities. Growing with our customers in this manner has proven to be invaluable in creating long-lasting relationships and product development.

The majority of our steelmaking operations are in locations near sustainable sources of scrap metals and near our customer base, allowing us to realize freight savings for inbound scrap as well as for outbound steel products destined for our customers. This also allows us to provide consistent on-time delivery to our customer base with relatively short lead times, further solidifying our customer relationships.

This diversified portfolio of products enables us to access a broad range of markets, serve a large customer base, and helps mitigate our market exposure to any one product or sector, resulting in increased through-cycle steel mill utilization. In addition, our value-added product offerings help to balance our exposure to commodity grade products supplied by other manufacturers. We will continue to seek additional opportunities, such as entering the recycled aluminum flat rolled products market, and collaborating with our customers to anticipate their future needs by further expanding our range of products and offerings. In 2024, we began operations on our four new value-added flat roll steel coating lines comprised of an additional paint line and galvanizing line located onsite at our Southwest-Sinton Flat Roll Division and a paint line and galvanizing line at our Heartland Flat Roll Division. As with all our growth initiatives, we seek to competitively differentiate ourselves through service, product capability and quality, and supply-chain solutions.

Vertically Connected Businesses and Pull-Through Volume Advantage

Our vertically connected businesses contribute to our higher through-cycle steel production and overall profitability. Our internal manufacturing businesses are a significant competitive advantage supporting higher and more stable through-cycle earnings and cash flow generation. Our steel fabrication operations and downstream processing locations use a significant amount of steel in their operations. During weaker steel demand environments, we can source their steel needs internally, and during strong steel demand environments, we have the option to also purchase their steel needs externally. Ultimately, we optimize our companywide profitability and minimize earnings volatility. In 2024, our own steel consuming businesses purchased 1.7 million tons of steel from our steel mills, representing 14% of our total 2024 steel shipments.

A strategic and synergistic relationship also exists between our electric arc furnace (EAF) steel mills and metals recycling operations. Our metals recycling platform is the largest supplier of recycled ferrous scrap to our steel operations and is expected to be the largest supplier of recycled aluminum scrap to our aluminum operations. This allows us to reduce companywide working capital, as lower scrap inventory volume is required at our steel mills. We are also able to source higher-quality scrap for our steel mills, increasing availability, optimizing costs, and improving quality.

4

Technologically Advanced, Low-Cost, Highly Efficient Operations

We operate some of the most technologically advanced and environmentally responsible steel mills in the world. Our steel mills generate a fraction of the greenhouse gas (GHG) emissions per ton of steel produced as compared to traditional blast furnace steel production and the average global steel industry. Our value-added product diversification, circular manufacturing model, and performance-based incentive compensation programs support our efficient, environmentally responsible, and competitively advantaged footprint. Coupled with our low, highly variable cost structure and our continued operating innovation and efficiency, we are one of the most profitable and lowest-cost domestic steel producers.

Transformational Growth / New Recycled Aluminum Flat Rolled Strategic Investments

We are nearing the completion of our lower-carbon-emitting, recycled aluminum flat rolled products mill. Our investment includes a 650,000-metric ton recycled aluminum flat rolled products mill in Columbus, Mississippi, and two supporting satellite recycled aluminum slab centers. We are bringing our culture and related operating efficiencies to the flat rolled aluminum industry. This investment will allow us to broaden our ability to serve our existing customers as well as new customers by adding high-quality, lower-carbon flat rolled aluminum to our product portfolio. A significant number of our existing carbon flat rolled steel customers also consume, or process aluminum flat rolled products for automotive, appliance, construction, and other applications. We are developing our property to allow customers to locate on-site, with one customer already committed to co-locating and others expected to co-locate at the rolling mill site in Columbus, enhancing cost efficiencies and reducing emissions across the supply chain. The product mix from the flat rolled products mill is expected to be approximately 45% sustainable beverage packaging, 35% automotive, and 20% common alloy and industrial use. The state-of-the-art recycled aluminum flat rolled products mill will utilize a significant amount of aluminum scrap, and as such is also a complementary extension of the company’s metals recycling platform. The product offering will be supported by various value-added finishing lines, including two CASH (continuous annealing solutions heat treating) lines, a coating line, and downstream processing and packaging lines. We plan to begin shipments mid-year 2025. Our unique performance-based operating culture, coupled with our experience in successfully constructing and operating cost-effective, highly profitable flat roll steel mills and coating lines, positions us exceptionally well to execute this significant strategic investment.

Sustainability

Our commitment to all aspects of sustainability is embedded in our founding principles – valuing our people, our partners, our communities, and our environment. These strategic principles drive long-term value creation for all of us. We are committed to operating our business in an environmentally responsible manner and have been since our founding. Our steel mills exclusively use EAF technology, which uses recycled ferrous scrap as the primary raw material, producing lower-carbon emission quality steel products for our customers and driving returns for our shareholders. Our sustainability and decarbonization strategy is an ongoing journey, and we plan to use our entrepreneurial, innovative spirit to continue to be a leader in the industry.

We intentionally developed a circular manufacturing model. Our metals recycling platform collects and processes scrap, which is then sold to end users for reuse, including our EAF steel mills and our aluminum operations. Our products are then sold to consumers that both further process and manufacture end products. We sell a meaningful amount of steel to our own manufacturing businesses that in turn sell finished products to consumers. Scrap, from the industrial manufacturing process, and from when these products ultimately reach the end of their lives, can be collected and used again in our steel and aluminum operations, creating our circular manufacturing model.

While we believe we operate some of the most efficient steel operations in the world, we recognize the need for continuous improvement. In 2023, we began construction of a biocarbon production facility located in Columbus, Mississippi. The facility will use high-temperature pyrolysis to convert sustainably sourced biomass to high-purity biocarbon. We will use this biocarbon as a renewable replacement for anthracite in our steelmaking operations, which could result in as much as a 35% reduction in our steel mills’ Scope 1 GHG absolute emissions. The facility is projected to begin operations in the first half of 2025. This investment represents a significant step toward the decarbonization of our steel mills.

5

Experienced Leadership Team / Fosters an Entrepreneurial Culture

Our senior leadership team is highly experienced and has a proven track record in the steel, metals recycling, and steel fabrication industries, as well as in the construction and start-up of new operations, such as our recycled aluminum flat rolled products mill. Our leadership objectives are closely aligned with our shareholders through meaningful stock ownership positions and performance-based incentive compensation programs that are correlated to the company’s profitability and operational performance in relationship to our steel manufacturing peers. We emphasize decentralized operational decision making and responsibility, while continuing to maintain appropriate corporate governance and risk oversight. We reward teamwork, innovation, and operating efficiency, and focus on maintaining the effectiveness of our performance-driven incentive bonus plans that are designed to maximize overall productivity and align the interests of our leadership and teams with our shareholders.

Name |

|

Age |

|

Position |

Mark D. Millett |

|

65 |

|

Co-founder, Chairman, and Chief Executive Officer |

Theresa E. Wagler |

|

54 |

|

Executive Vice President, Chief Financial Officer, and Corporate Secretary |

Barry T. Schneider |

|

56 |

|

President and Chief Operating Officer |

Miguel Alvarez |

|

57 |

|

Senior Vice President, Metals Recycling |

James S. Anderson |

|

64 |

|

Senior Vice President, Long Products Steel Group |

Chris A. Graham |

|

60 |

|

Senior Vice President, Flat Roll Steel Group |

Richard A. Poinsatte |

|

58 |

|

Senior Vice President and Treasurer |

Glenn A. Pushis |

|

59 |

|

Senior Vice President, Special Projects |

Chad Bickford |

|

45 |

|

Vice President, Steel Fabrication |

Mark D. Millett co-founded the Company in 1993. Mr. Millett has been our Board Chair since May 2021 and has been our Chief Executive Officer since January 2012. Prior to that, he has held various positions within the Company, including President and Chief Operating Officer, Executive Vice President of Metals Recycling and Ferrous Resources, and Executive Vice President of Flat Roll Operations. Mr. Millett was responsible for the design, construction, and start-up operation of all of our steel mills, including our Butler, Indiana flat roll, melting, and casting operations. Mr. Millett earned his bachelor’s degree in metallurgy from the University of Surrey, England. Mr. Millett is a Past Chairman of the Steel Manufacturers Association (SMA). In 2019, Mr. Millett was named the recipient of the James F. Collins Achievement in Advocacy Award by the SMA. In 2014 and 2022, Mr. Millet was named Steelmaker of the Year by the Association for Iron & Steel Technology. In 2024, Mr. Millett received the Willy Korf / Ken Iverson Steel Vision Award for his significant contributions to the steel industry while promoting goodwill and integrity.

Theresa E. Wagler has been our Executive Vice President, Chief Financial Officer, and Corporate Secretary since May 2007. Ms. Wagler joined the Steel Dynamics corporate finance team in 1998, and has held various finance and accounting positions, including Chief Accounting Officer and Vice President and Corporate Controller. She is responsible for and oversees accounting and taxation, treasury, risk management, legal, information technology and cybersecurity, human resources, decarbonization strategy, and strategic business development functions, as well as, financial planning and analysis, investor relations, and corporate communications. Ms. Wagler also has various operational responsibilities directly overseeing several joint ventures. Prior to joining Steel Dynamics, Ms. Wagler was a certified public accountant with Ernst & Young LLP. She graduated cum laude from Taylor University with a bachelor’s degree in accounting and systems analysis. In addition, Ms. Wagler serves as a Director, Chair of the Audit Committee, and a member of the environmental sustainability and community committee of CF Industries Holdings, Inc., a public company, and also serves as a trustee for Trine University and a Director for the Metals Service Center Institute.

Barry T. Schneider has been our President and Chief Operating Officer since March 2023. Mr. Schneider is responsible for the company’s steel platform, steel fabrication platform, and metals recycling platform. Before that, Mr. Schneider served as our Senior Vice President, Flat Roll Steel Group, between March 2016 and February 2023, responsible for the company’s entire flat roll steel operations, including the company’s three flat roll steel mills and numerous flat rolled processing, coating, and distribution operations. Before that, Mr. Schneider served in various operational and leadership roles within the company’s steel operations, including our Engineered Bar Products Division and Butler Flat Roll Division.

6

He was also a part of the team that constructed the company’s first steel mill in Butler, Indiana in 1994. Mr. Schneider earned a bachelor's degree in mechanical engineering and a master of science in engineering management from Rose-Hulman Institute of Technology. He also received an executive certificate in Technology, Operations, and Value Chain Management from the MIT Sloan School of Management. In addition, Mr. Schneider served as a Past President for the Association for Iron & Steel Technology.

Miguel Alvarez has been our Senior Vice President, Metals Recycling since March 2022. Mr. Alvarez is responsible for OmniSource’s ferrous and nonferrous metals recycling operations, including marketing, trading and logistics activities. Prior to that, Mr. Alvarez served as Senior Vice President, Southwest United States and Mexico and was responsible for the comprehensive business development and partnerships in the regions, encompassing both steel and recycled metals. Prior to joining Steel Dynamics, Mr. Alvarez served in leadership positions at BlueScope; this included leading BlueScope’s North American metal buildings business with manufacturing facilities in the United States and Mexico, and being responsible for BlueScope’s only North American electric arc furnace flat roll steel mill as President of North Star BlueScope Steel. Mr. Alvarez earned a bachelor’s degree in industrial engineering and an MBA from Tecnológico de Monterrey, México.

James S. Anderson has been our Senior Vice President, Long Products Steel Group since May 2024. Mr. Anderson is responsible for the company’s four long product steel mills, along with a downstream finishing operation and the company’s copper rod manufacturing facility. Prior to that, Mr. Anderson served as our Senior Vice President, Steel Fabrication and was responsible for the company’s steel fabrication operations, comprised of seven steel joist and deck manufacturing facilities located throughout the U.S. and Mexico. Before that, Mr. Anderson held numerous operational and leadership roles including Vice President, Steel Fabrication, Chief Operating Officer of New Millennium Building Systems, and general manager of The Techs three flat roll steel galvanizing lines. Mr. Anderson earned a bachelor's degree in metallurgical engineering from Grove City College and an MBA from the University of Pittsburgh.

Christopher A. Graham has been our Senior Vice President, Flat Roll Steel Group since October 2023. Mr. Graham is responsible for the company’s entire flat roll steel operations, including three flat roll steel mills and numerous flat roll steel processing, coating, and distribution operations. Before that, Mr. Graham served as our Senior Vice President, Long Products Steel Group. In this role, Mr. Graham was responsible for the company’s four long product steel mills, along with a downstream finishing operation and the company’s copper rod manufacturing facility. Prior to that, Mr. Graham served as Senior Vice President, Downstream Manufacturing and President of New Millennium Building Systems, responsible for the company’s steel fabrication and downstream manufacturing operations, and other operational and leadership roles. Mr. Graham was also a part of the team that constructed the company’s first steel mill in Butler, Indiana in 1994. Mr. Graham earned a bachelor's degree in business management from Western Governors University and an MBA from the University of Saint Francis. In addition, Mr. Graham completed the Harvard Advanced Management Program in 2017.

Richard A. Poinsatte has been our Senior Vice President and Treasurer since October 2023. Mr. Poinsatte is responsible for the areas of treasury, legal, business development, and risk. Mr. Poinsatte joined Steel Dynamics in 2000, as the Chief Financial Officer of one of the company’s joint venture businesses, which is now part of the steel fabrication platform. During his time with Steel Dynamics, he has held positions of increasing responsibility, including the operating position of General Manager of the company’s Florida steel fabrication plant. Since 2008, he has served as Vice President and Treasurer and has been responsible for the company’s treasury, risk, and legal applications. Mr. Poinsatte earned a bachelor of business administration with a concentration in accounting from the University of Notre Dame, and he is a certified public accountant. In addition, Mr. Poinsatte serves as the Chairman of the Board of Trustees for the University of Saint Francis.

Glenn A. Pushis has been our Senior Vice President, Special Projects, since February 2019. Mr. Pushis is responsible for the successful design and construction of the company’s new 650,000-metric ton state-of-the-art lower-carbon, recycled aluminum flat rolled products mill in Columbus, Mississippi with two satellite recycled aluminum slab centers in the Southwestern United States and San Luis Potosi, Mexico. From 2019 until 2022, Mr. Pushis was responsible for the successful design and construction of the Company’s new Southwest-Sinton Flat Roll Division, developed to serve the Southwestern United States and Mexico. He has extensive experience in this capacity and has been instrumental in numerous construction projects for Steel Dynamics since its founding.

7

Prior to that, Mr. Pushis served as Senior Vice President, Long Products Steel Group, responsible for the company’s four long product steel mills. Mr. Pushis has been with Steel Dynamics since 1994, holding various operational and leadership roles, including roles within the Engineered Bar Products Division and the Butler Flat Roll Division. He was also a part of the team that constructed the company’s first steel mill in Butler, Indiana, in 1994. Mr. Pushis earned a bachelor’s degree in mechanical engineering from Purdue University and his MBA from Indiana University. In addition, Mr. Pushis served as a Past President of the Association for Iron & Steel Technology Foundation.

Chad Bickford was appointed Vice President, Steel Fabrication in May 2024. Mr. Bickford is responsible for the company’s steel fabrication operations, New Millennium Building Systems, comprised of seven steel joist and deck manufacturing facilities located throughout the United States and Mexico. Prior to that, Mr. Bickford served as General Manager for the company’s Butler Flat Roll Division. Mr. Bickford has been with Steel Dynamics since 2003, holding various operational and leadership roles with increasing responsibility in both steel and steel fabrication operations, including General Manager for the company’s Engineered Bar Products Division and General Manager of the Virginia steel fabrication facility. Mr. Bickford earned a bachelor’s degree in civil engineering from Ohio University.

Human Capital / Valuing People

We value the dedicated people whose passion, innovation, and spirit of excellence have helped successfully grow our company and serve our customers. We have a culture of trust, fostered through individual empowerment and accountability that drives decision-making throughout our business. We empower our teams with performance goals, align their interests with the company’s long-term strategy, provide them with the right tools and resources, and watch them succeed. Our performance-based incentive compensation programs align with the interests of our strategic long-term growth, our customers, communities, and shareholders. We know our teams will do what is right and that trust comes from effective communication and transparency. The Steel Dynamics team consisted of approximately 13,000 full-time team members at December 31, 2024.

Health and Safety

Valuing people includes providing a healthy and safe work environment, and creating a culture of safety that extends beyond the workplace, into our homes and communities. Safety is, and always will be, our primary focus and core value. We intend for each individual to arrive at the workplace safely and return home safely each day. This is achievable when we all work together. It requires commitment from leadership and team members at every level to take ownership and responsibility for their safety and the safety of others. Under no circumstance does the desire to maximize production or earnings override the value of individual safety.

Safety is our first core strategic pillar — it is the foundation of our decision making. Safety is always at the forefront and is discussed regularly across the company, whether led by a team member from the plant floor, a supervisor, or a manager. Leadership is engaged and continuously evaluates where we can improve. We believe having every individual engaged in safety will lead to zero injuries. We are committed to achieving world-class safety performance throughout our operations. This commitment is foundational and integral to our culture.

8

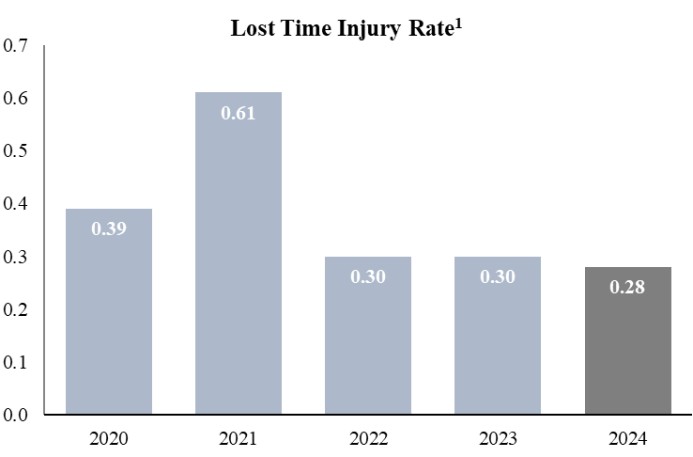

Our total recordable injury rate compared to industry benchmarks and lost time injury rates for 2024 are as follows:

1 Total Recordable Injury Rate is defined as OSHA recordable incidents x 200,000 / hours worked. Lost Time Injury Rate is defined as OSHA days away from work cases x 200,000 / hours worked.

2 Source: 2023 U.S. DOL Bureau of Labor Statistics released in 2024

Compensation Structure

We believe in empowering our teams and rewarding them for their achievements through a four-tiered, performance-based compensation framework. The various components of our compensation programs promote a balance of high-return growth, effective capital investment, low-cost operations, and risk mitigation. By rewarding our teams based on their performance as an individual, as a team, as a company, and based on shareholder interests, we believe we have the ultimate alignment with our external constituents.

9

This is achieved through the following methods:

| ● | Individual performance awards consist of an individual’s base compensation, which is determined by their individual superior performance, responsibilities, and skill level. |

| ● | Team performance awards, such as quality production, return on assets, and conversion bonuses, are based on departmental results, focusing on productivity, cost control, and efficient use of assets. |

| ● | Companywide performance awards unite everyone through our profit-sharing program, which is based on consolidated pretax profitability, and our 401(k) match, which is based on consolidated return on assets. |

| ● | Alignment with our shareholders and the pursuit of long-term value creation is fostered through the issuance of restricted stock units. Each full-time, non-union, United States-based team member receives annual equity awards. These awards generally have a two-year vesting period, supporting retention and companywide strategy alignment. |

Our team-based culture and competitive pay structure support continued high retention. In 2024, our companywide team retention was approximately 79%, with U.S.-based teams retention of 89%. Our compensation framework helps ensure that we remain strong with best-in-class performance and retain top talent even in economic downturns. We all share in the company’s successes, as well as the challenges.

Talent Development and Educational Opportunities

Our people represent the foundation of our six strategic pillars. Their continued education and talent development are paramount to our success. Our educational assistance and development programs encourage personal growth so individuals can remain current in their areas of responsibility, as well as develop new skills for advancement. Senior leadership plays a key role in our development programs, linking our culture to critical, proven leadership concepts. As we continue to grow, building talent, retaining team members with relevant industry and technical experience, and creating opportunities within our teams are some of our most important tasks and are critical to our long-term success.

Workplace Philosophy

Our people are the foundation of our success and are our most important resource. Our culture safeguards all people and requires each person to be treated fairly and with dignity. We have equal employment opportunity, and all job-related considerations are based on merit and ability. We do not tolerate harassment or disrespect of any kind. We respect human rights, which includes providing safe work environments for our people, providing fair compensation based on job responsibilities and performance, and ensuring all team members meet minimum age requirements and eligible working status to qualify for employment. Our leadership receives recurring training on these critical topics.

We recognize the value of having a business that reflects a variety of backgrounds and experiences. We work together as a unified team and respect each other as individuals. Our team-based compensation structure reinforces this philosophy. We strive to create a welcoming and open environment, ensuring the best ideas are heard and valued regardless of the position or the individual. We believe these ideals will continue to drive our success. Our team member population is representative of our industry and the communities where we live and work.

Segments

In the fourth quarter 2024, results from an entity previously reported within the metals recycling operations were moved to the aluminum operations segment, consistent with how the company’s chief operating decision maker currently manages the business. Segment information provided within this Form 10-K has been recast for all prior periods presented, consistent with the current reportable segment presentation. Refer to Notes 1 and 12 in the notes to consolidated financial statements in Part II, Item 8 of this Form 10-K for additional segment information.

10

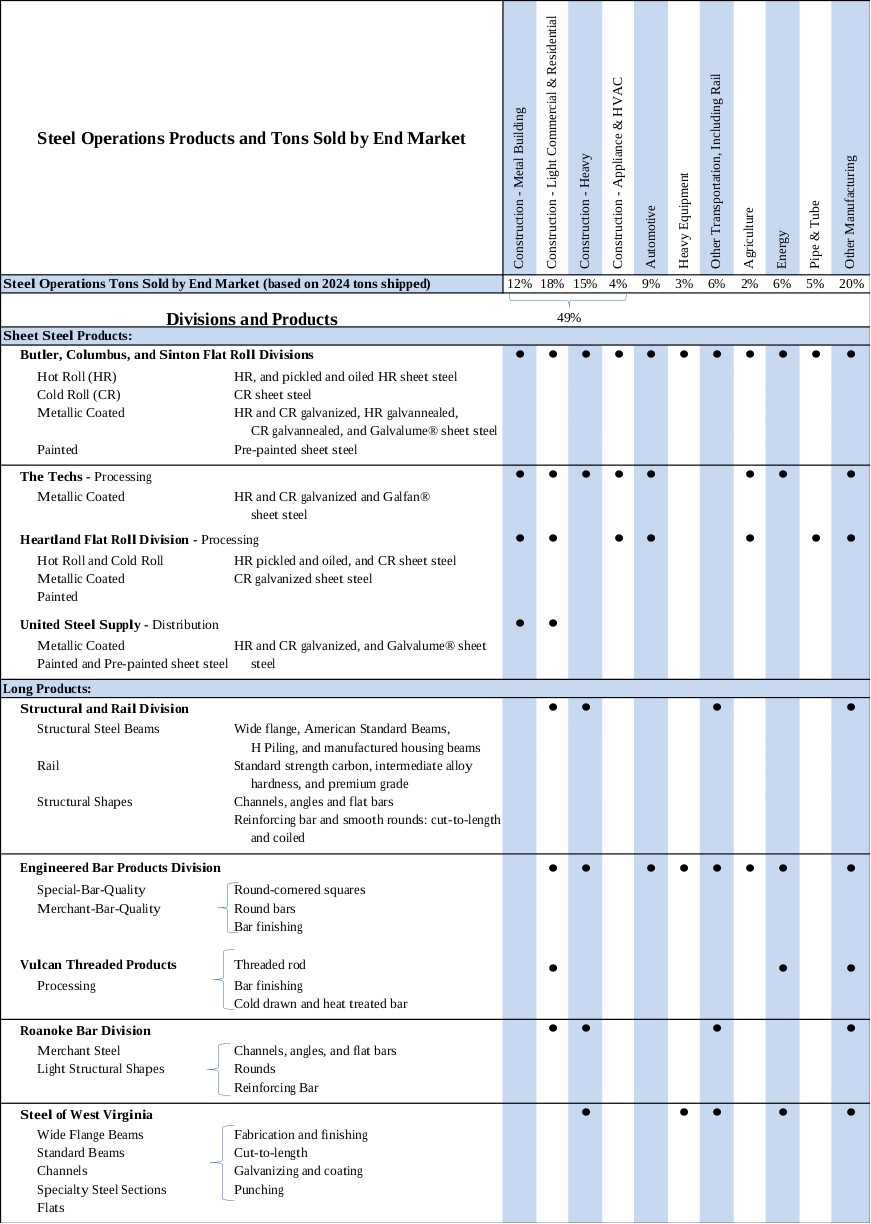

Steel Operations Segment |

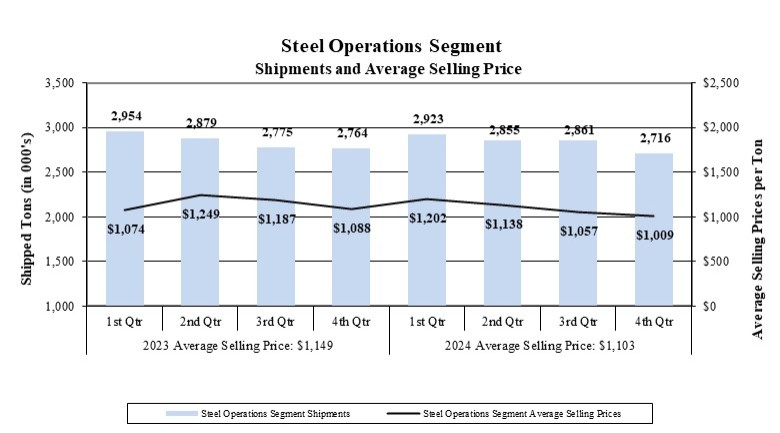

Steel operations consist of our EAF steel mills, producing steel from ferrous scrap and scrap substitutes, utilizing continuous casting and automated rolling mills, and numerous steel coating, processing lines and warehouse operations. Our steel operations sell directly to end-users, steel processors, steel fabricators, and service centers. These products are used in numerous industry sectors, including the construction, automotive, manufacturing, transportation, heavy and agriculture equipment, energy, and pipe and tube (including OCTG) markets. Our steel operations accounted for 69%, 67%, and 65% of our consolidated net sales during 2024, 2023, and 2022, respectively. We are predominantly a domestic steel company. Export sales represented 6%, 8%, and 5% of our steel segment net sales during 2024, 2023, and 2022, respectively.

Our steel operations consist primarily of steelmaking and numerous coating operations. In 2024, we had approximately 9.4 million tons of flat roll steel annual production capacity. We have an additional 2.0 million tons of flat roll steel processing capacity through The Techs and our Heartland Flat Roll Division, as well as distribution of metallic coated and pre-painted products through United Steel Supply (USS). We have annual flat roll galvanizing capability of 5.5 million tons and painting capability of 2.0 million tons. We also have approximately 4.6 million tons of long product steel capacity at our long products divisions.

Capacities represent maximum estimated manufacturing capabilities based on steel mill configuration and related team member support. These capacities do not represent expected volumes in a given year. In addition, estimates of steel mill capacity are highly dependent on the specific product mix manufactured. Each of our steel mills can and do roll many different types and sizes of products; therefore, our capacity estimates assume a typical product mix.

11

The following chart summarizes our steel operations primary products and the estimated percentage of tons sold by end market:

12

SHEET STEEL PRODUCTS

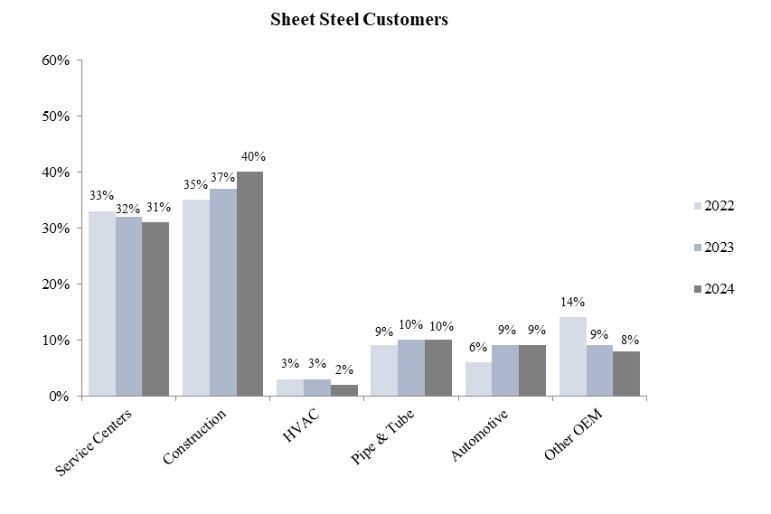

Our sheet steel products, consisting of hot rolled, cold rolled and coated steel products are currently produced by our Butler, Columbus, and Sinton Flat Roll Divisions, and our numerous downstream coating lines, including The Techs, Heartland Flat Roll Division, and USS (Steel Processing divisions). Our sheet steel operations represented 72%, 68%, and 77% of steel operations net sales in 2024, 2023, and 2022, respectively. We produced 9.5 million tons of sheet steel at these facilities in 2024, 9.2 million tons in 2023, and 8.3 million tons in 2022.

We shipped the following sheet steel products volumes at the following facilities (net tons):

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

2023 |

|

2022 |

|

|

|

Butler, Columbus, and Sinton |

7,702,731 |

|

7,459,023 |

|

6,772,162 |

|

|

|

Flat Roll divisions |

|

|

|

|

|

|

|

|

Steel Processing divisions |

1,779,429 |

|

1,731,911 |

|

1,673,967 |

|

|

|

|

|

|

|

|

|

|

|

The following chart summarizes the types of sheet steel products sold by sales dollars, during the respective years, with cold rolled and coated products representing value-added products:

Customers. Steel processors and service centers typically act as intermediaries between primary sheet steel producers and the many end-user manufacturers that require further processing of hot roll coils. The additional processing performed by the intermediate steel processors and service centers include pickling, galvanizing, cutting to length, slitting to size, leveling, blanking, shape correcting, edge rolling, shearing, and stamping. We believe that our intermediate steel processor and service center customers will remain an integral part of our customer base. The Columbus and Sinton Flat Roll Divisions allow us to capitalize on the industrial markets in the Southern United States and Mexico, as well as further expand our customer base in painted, line pipe, and other pipe products. Galvanized flat rolled products produced by our Butler, Columbus, and Sinton Flat Roll Divisions are similar and are sold to a similar customer base. The Techs and Heartland Flat Roll Division specialize in the galvanizing of specific types of flat roll steels in primarily non-automotive applications, servicing a variety of customers in the heating, ventilation and air conditioning (HVAC), construction, agriculture, and consumer goods markets. USS adds a complementary distribution channel for metallic coated and pre-painted flat roll steel coils to the roll-former market, serving the roofing and siding industry. This connects us to an industry sector with customers that have not historically purchased steel directly from a steel producer. Our sheet steel operations also provide a substantial portion (64% in 2024) of the sheet steel utilized in our steel fabrication operations.

13

The following chart summarizes the types of end customers who purchased our sheet steel products, by sales dollars, during the respective years:

LONG PRODUCTS

Our long steel products consist of a wide array of differentiating products produced by our four mills and Vulcan Threaded Products, Inc. (Vulcan), a downstream finishing operation.

Structural and Rail Division produces a variety of parallel flange beams and channel sections, as well as large unequal leg angles, and reinforcing steel bar including custom cut-to-length, smooth bar, and coiled. We also produce standard strength carbon, intermediate alloy hardness, and premium grade rails in 40 to 320 feet length for the railroad industry. Our state-of-the art heat treating system allows us to produce high quality premium rail, which has been certified by all Class I railroads. In addition, our rail-welding facility has the ability to weld (Continuous Welded Rail) in lengths up to 1,650 feet, which offers substantial savings to the railroads both in terms of initial capital cost and through reduced maintenance. We also utilize our Structural and Rail Division’s excess capacity to supply our Engineered Bar Products Division with pull-through volume of billets to utilize its excess rolling capacity.

Engineered Bar Products Division produces a broad range of engineered special-bar-quality (SBQ), merchant-bar-quality (MBQ), and other engineered round steel bars. We also have a bar finishing facility, which provides various downstream finishing operations for SBQ steel bars, including turning, polishing, straightening, chamfering, precision saw-cutting, and heat-treating capabilities. Vulcan produces threaded rod products, and cold drawn and heat-treated bar, creating strategic pull-through demand of our Engineered Bar Products Division’s special-bar-quality products.

Roanoke Bar Division produces merchant products, including channels, angles, flats, merchant rounds, and reinforcing steel bars. Excess steel billet production is sold to mills without sufficient melting capacities, including our Steel of West Virginia facility. Our steel fabrication operations also purchase angles from our Roanoke Bar Division.

Steel of West Virginia produces a wide array of specialty shapes and light structural steel and frequently performs fabrication and finishing operations on those products, such as cutting to length, additional straightening, hole punching, shot blasting, plasma cutting, welding, galvanizing, and coating. Through this array of products and additional finishing, we create custom finished products that are generally placed directly into our customers’ assembly operations.

14

We shipped the following long products volumes at each of these facilities (net tons):

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

2023 |

|

2022 |

|

|

|

Structural and Rail Division |

1,625,913 |

|

1,851,349 |

|

1,865,405 |

|

|

|

Rail shipments (included above) |

254,203 |

|

319,241 |

|

299,795 |

|

|

|

Engineered Bar Products Division |

714,509 |

|

836,179 |

|

894,374 |

|

|

|

Roanoke Bar Division |

516,258 |

|

564,776 |

|

589,449 |

|

|

|

Steel of West Virginia |

321,647 |

|

378,515 |

|

363,832 |

|

|

Customers. The principal customers for our structural steel products are steel service centers, steel fabricators and various manufacturers. Service centers provide key distribution channels for the mills and value-add services to the end-user. The steel rail marketplace in the United States, Canada, and Mexico is specialized and defined, with seven Class I railroads and a large distribution network.

SBQ products are principally consumed by cold finishers, forgers, intermediate processors, OEM manufacturers, steel service centers, and distributors, as well as pull-through volume to Vulcan. Our MBQ products are sold primarily to steel service centers, as well as reinforcing steel bar distributors, joist producers (such as our New Millennium Building Systems), and OEMs. Some of the excess steel billet production at the Roanoke Bar Division is sold to mills without sufficient melting capacities, including our Steel of West Virginia facility. Our steel fabrication operations also purchase angles from Roanoke Bar Division. Steel of West Virginia’s customers are primarily OEMs producing solar panel structures, truck trailers, industrial lift trucks, merchant products, guardrail posts, manufactured housing, mining, and off-highway construction equipment. Steel of West Virginia’s flexible manufacturing capabilities enable us to meet demand for a variety of custom-ordered and designed products. Many of these products are produced in small quantities for low volume end-uses resulting in a wide variety of customers, the largest of which are in the truck trailer and industrial lift truck industries.

Steel Operations Segment Competition

The markets in which we conduct business are highly competitive with an abundance of competition in the carbon steel industry from North American and foreign integrated and mini-mill steelmaking and processing operations. We compete in numerous industry sections, most significantly tied to the construction, automotive, and other manufacturing sectors. In many applications within these industry sections, steel competes with other materials, such as aluminum, cement, composites, plastics, carbon fiber, glass, and wood. Some of our products are commodities, subject to their own cyclical fluctuations in supply and demand. However, we are focused on providing a broad range of diversified value-added products that de-emphasize commodity steel. The primary competitive influences on products we sell are price, quality, and value-added services.

15

Metals Recycling Operations Segment |

Metals Recycling operations include both ferrous and nonferrous scrap metal processing, transportation, marketing, brokerage, and scrap management services, strategically located in close proximity to our steel mills and other end-user scrap consumers, throughout the United States and Mexico. Our metals recycling operations accounted for 11% of our consolidated net sales during 2024 and 2023 and 9% during 2022. Export sales represented 17%, 19%, and 14% of metals recycling segment net sales during 2024, 2023, and 2022, respectively.

We shipped the following from our metals recycling operations:

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

2023 |

|

2022 |

|

|

|

Ferrous metal total (gross tons) |

5,850,544 |

|

5,792,484 |

|

5,314,318 |

|

|

|

Shipments to our steel mills |

3,656,034 |

|

3,593,328 |

|

3,488,206 |

|

|

|

Percent of total to our steel mills |

62% |

|

62% |

|

66% |

|

|

|

|

|

|

|

|

|

|

|

|

Nonferrous metals (thousands of pounds) |

965,491 |

|

970,445 |

|

923,319 |

|

|

We sell various grades of processed ferrous scrap primarily to steel mills and foundries. Ferrous scrap metal is the primary raw material for EAFs, including our steel mills. In addition, we sell various grades of nonferrous metals including copper, brass, aluminum, and stainless steel, to smelters, refineries, alloy manufacturers, specialty mills and other consumers, including our aluminum operations.

We purchase processed and unprocessed ferrous and nonferrous scrap metals in a variety of forms for our metals recycling facilities.

Ferrous scrap comes from two primary sources:

| ● | Manufacturing industrial facilities, metal fabrication plants, and machine shops, which generate ferrous scrap referred to as prompt or industrial scrap, and |

| ● | Scrap dealers, retail individuals, auto wreckers, demolition firms and others who provide steel and iron scrap, referred to as obsolete scrap. Obsolete scrap includes scrap recycled from end-of-life items, such as automobiles, appliances, and machinery. |

Nonferrous scrap comes from three primary sources:

| ● | Manufacturers and other nonferrous scrap sources, which generate or sell scrap aluminum, copper, stainless steel, and other nonferrous metals, |

| ● | Producers of items such as electric wire, telecommunication service providers, aerospace, defense, and recycling companies that generate nonferrous scrap consisting primarily of copper wire, aluminum beverage cans, and various other metals and alloys, and |

| ● | Retail transactions conducted with the general public who sell material directly to our facilities, collected from a variety of sources. |

We do not purchase a significant amount of scrap metal from a single source or from a limited number of major sources. Market demand and the composition, quality, size, weight, and location of the materials are the primary factors that determine prices.

Products. Our metals recycling operations primarily involve the purchase, processing, and resale of ferrous and nonferrous scrap metals into reusable forms and grades. We process an array of ferrous products through a variety of methods, including sorting, shredding, shearing, cutting, bailing, and breaking. Our major ferrous products include heavy melting steel, busheling, bundled scrap, shredded scrap, and other scrap metal products, such as steel turnings and cast iron.

16

These products vary in properties or attributes related to cleanness, size of individual pieces, and residual alloys. The necessary characteristics of the ferrous products are determined by the specific needs and requirements of the consumer and affect the individual product’s relative value. We process numerous grades of nonferrous products, including aluminum, brass, copper, stainless steel, and other nonferrous metals. Additionally, we provide transportation logistics (truck, rail, and river barge), marketing, brokerage, and scrap management services, providing competitive price and cost advantages to our suppliers and customers. We design, install, and manage customized scrap management programs for industrial manufacturing companies.

Customers. We sell various grades of processed ferrous scrap to end-users, such as EAF steel mills, integrated steelmakers, foundries, secondary smelters, and metal brokers, who aggregate materials for other large users. Ferrous scrap metal is the primary raw material for EAFs, including our steel mills. Most of our ferrous scrap customers purchase processed scrap through negotiated spot sales contracts which establish a quantity purchase for the month. The price we charge for ferrous scrap depends upon market demand, composition, size, weight, and transportation costs, as well as the quality and grade of the scrap. We sell various grades of processed nonferrous scrap to end-users such as aluminum sheet and ingot manufacturers, brass and bronze ingot makers, copper refineries, mills, including our new recycled aluminum flat rolled products mill, smelters, specialty steelmakers, alloy manufacturers, wire and cable producers, and utilities. The price we charge for nonferrous scrap also depends upon market demand and pricing, transportation costs, as well as the quality and grade of the scrap.

Competition. Scrap is a global commodity influenced by conditions in a number of industrialized and emerging markets throughout Asia, Europe, and North America. The markets for scrap metals are highly competitive, both in the purchase of raw or unprocessed scrap, and the sale of processed scrap. With regard to the purchase of unprocessed scrap, we compete with numerous independent recyclers, as well as smaller scrap companies engaged only in collecting obsolete scrap. In many cases, we also purchase unprocessed scrap metal from smaller scrap dealers and other processors. Successful procurement of materials is determined primarily by the price offered by the purchaser for the raw scrap and the proximity of our processing facility to the source of the raw scrap. Both ferrous and nonferrous scrap sell as a commodity in both domestic and international markets, which are affected, sometimes significantly, by relative economic conditions, currency fluctuations, and the availability and cost of transportation. Competition for sales of processed scrap is based primarily on the price, quality, and location of the scrap metals, as well as the level of service provided in terms of reliability and timing of delivery.

We also face potential competition for sales of processed scrap from other producers of steel products, such as EAFs and integrated steel mills, some of which, like us, are also vertically connected in the scrap metals recycling business. In addition, other steel mills may compete with us in attempting to secure scrap supply through direct purchasing from our scrap suppliers. Scrap metal processors also face competition from substitutes for prepared ferrous scrap, such as pig iron, pelletized iron, hot briquetted iron (HBI), direct reduced iron (DRI), and other forms of processed iron.

The industry is highly fragmented with many small, regional, national, and global companies, which have multiple locations in areas in which our metals recycling operations operate. No single scrap metals recycler has a significant market share in the domestic market.

17

Steel Fabrication Operations Segment |

Our steel fabrication operations include seven New Millennium Building Systems plants that primarily serve the non-residential construction industry throughout the United States. We have a national operating footprint that allows us to serve the entire domestic non-residential construction market including large retail chains and e-commerce distribution channels.

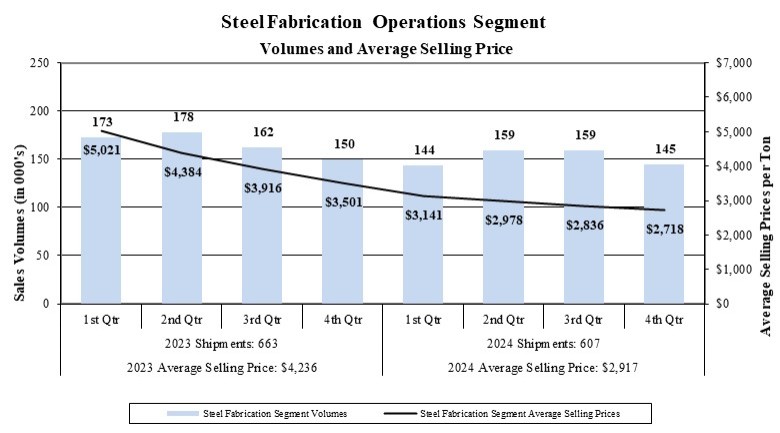

Steel fabrication operations accounted for 10%, 15%, and 19% of our consolidated net sales during 2024, 2023, and 2022, respectively. We sold 607,000, 663,000, and 856,000 tons of joist and deck products during 2024, 2023, and 2022, respectively.

Products. Our steel fabrication operations produce steel non-residential building components, including steel joists, girders, and steel deck. Our joist products include bowstring, arched, scissor, double-pitched, and single-pitched joists. Our deck products include a full range of steel decking: roof, form, cellular, composite floor, specialty architectural, floor systems, and bridge deck.

Customers and Markets. Our primary steel fabrication operations customers are non-residential steel fabricators, metal building companies, general construction contractors, developers, owners, brokers, and governmental entities. Our customers are located throughout the United States, including national accounts. Our steel fabrication operations maintain approximately one-third of the total domestic steel joist and deck market for bookings, of approximately 1.7 million tons, 1.8 million tons, and 2.1 million tons during 2024, 2023, and 2022, respectively.

Competition. We compete with other North American joist and steel deck producers primarily on the basis of price, quality, customer service, and proximity to the customer. Our national footprint allows us to service the entire domestic non-residential construction market, as well as national accounts such as large retail chains, including their distribution warehouse facilities, and certain specialty deck customers.

18

Other Information |

Sources, Availability, and Cost of Steel and Other Operations’ Raw Materials

Scrap Metals. The principal raw material of our EAF steel operations is recycled ferrous scrap derived from, among other sources, "home scrap,” generated internally at our steel mills themselves; industrial scrap, generated as a by-product of manufacturing; obsolete scrap, recycled from end-of-life automobiles, appliances, and machinery; and demolition scrap, recycled from obsolete structures, containers, and machines.

Recycled ferrous scrap typically comprises more than 80% of the metallic melt mix in EAF steelmaking, in contrast to integrated mill steelmaking, where the proportion of scrap has traditionally been approximately 25% to 35%. Depending upon the scrap substitute material that may be available from time to time, and the relative cost of such material, the percentage of scrap used in our steelmaking operations could be increased or reduced in our metallic melt mix.

Many variables can impact ferrous scrap prices, all of which reflect the pushes and pulls of the supply-demand equation. These factors include the level of domestic steel production (high quality, low-residual scrap is a by-product of manufacturing activity), the level of exports of scrap from the United States, and the amount of obsolete scrap recycled. In addition, historical domestic ferrous scrap prices typically have a strong correlation and spread to global pig iron pricing. Generally, as domestic steel production increases, so does scrap demand and resulting scrap prices. The reverse is also normally, but not always, true with scrap prices following steel prices downward when supply exceeds demand. When scrap prices greatly accelerate, this can challenge one of the principal elements of an EAF based steel mill’s traditional lower cost structure—the cost of its metallic raw material.

Iron Units. In addition to scrap, pig iron, DRI, HBI, and internally sourced liquid pig iron are used in our EAF steel mill production. During 2024 and 2023 we consumed 13.0 million tons and during 2022 we consumed 12.0 million tons of metallic materials in our steelmaking furnaces, of which iron units other than scrap represented approximately 15% of the tons in 2024 and 2023, and 13% of the tons in 2022.

Energy Resources

Electricity. Electricity is a significant input required in our EAF steel operations, representing approximately 4% of steel production costs of goods sold in 2024, 2023, and 2022. We have entered into fixed price electricity contracts for the Butler Flat Roll Division, Columbus Flat Roll Division, Roanoke Bar Division and Steel of West Virginia, while our Engineered Bar Products Division has a combination of fixed pricing and market pricing for the various components of the electrical services (demand charge, energy charge, riders, etc.). Our Sinton Flat Roll Division purchases electricity at current market prices. Our Structural and Rail Division purchases electricity at current market prices and through fixed price forward contracts.

Research and Development

Our research and development activities have consisted of efforts to expand, develop, and improve our products and operating processes, such as our Sinton Flat Roll Division, and our efforts to develop and improve renewable product alternatives, such as our construction of a biocarbon production facility. Most of these research and development efforts have been conducted in-house by our team members.

19

Environmental Matters

Our operations are subject to substantial and evolving environmental, health and safety laws and regulations concerning, among other things, emissions to the air, discharges to surface and ground water and to sewer systems, and the generation, handling, storage, transportation, treatment and disposal of solid and hazardous wastes and secondary materials. Our operations are dependent upon permits regulating discharges into the environment or the use and handling of by-products in order to operate our facilities. We dedicate considerable resources aimed at achieving compliance with applicable laws concerning the environment. While we do not currently believe that our future compliance efforts with such provisions will have a material adverse effect on our results of operations, cash flows, or financial condition, this is subject to change in the ever-evolving regulatory environment in which we operate.

Since the interpretation and enforcement of environmental laws and regulations that may be enacted from time to time can be subject to changing social or political norms, our environmental capital expenditures and costs for environmental compliance may increase in the future. In addition, due to the possibility of unanticipated regulatory or other developments, the amount and timing of future environmental expenditures may vary substantially from those currently anticipated. The cost of current and future environmental compliance may also place our operations at a competitive disadvantage with respect to foreign producers, which may not be required to undertake equivalent costs in their operations.

Pursuant to the Resource Conservation and Recovery Act (RCRA), which governs the handling, recycling and disposal of solid and hazardous wastes and hazardous secondary materials, the United States Environmental Protection Agency (United States EPA) and authorized state or local environmental agencies may conduct inspections to identify alleged violations or areas where there may have been releases of solid or hazardous constituents into the environment and require the facilities to pay penalties and/or take corrective action to address any such releases. RCRA also allows citizens in certain situations to bring claims against regulated facilities for potential damages and cleanup. Many states have statutes and regulatory authorities similar to RCRA that can also apply. Many of our facilities generate wastes and secondary materials subject to these requirements. Some of these materials, for example EAF dust, may be categorized as hazardous waste, requiring special handling for disposal or for the recovery of metallics. While we cannot predict the future actions of the regulators or other interested parties, the potential exists for required corrective action, the costs of which could be substantial.

Under the Comprehensive Environmental Response Compensation and Liability Act, known as CERCLA or Superfund, the United States EPA, state agencies and, in some instances, private parties have the authority to assert joint and several liability for the remediation of contaminated properties upon generators of hazardous substances, current and former site owners and operators, transporters, and other potentially responsible parties, regardless of fault or the legality of the original disposal activity. Many states have statutes and regulatory authorities similar to CERCLA that can also apply. We have a number of material handling agreements with various contractors to properly dispose of or recycle our EAF dust and other by-products of our operations. However, we cannot assure that, even if there has been no fault by us, we may not still be cited as a hazardous substances generator by reason of an environmental cleanup at one of our facilities or a site to which our by-products were transported.

The Clean Water Act and similar state and local laws apply to aspects of our operations and impose regulatory restrictions related to the discharge of wastewater, storm water, and dredged or fill material. The United States EPA, state agencies and, in certain instances, local governments and private parties have the ability to bring claims alleging violations and seeking penalties and injunctive relief. These legal provisions can also require new or expanded water treatment investments to be made and can limit or even prohibit certain current or planned activities at our operations.

The Clean Air Act and analogous state and local laws require many of our facilities to obtain and maintain air permits in order to operate. Air permits can impose new or expanded obligations to limit or prevent current or future emissions and to add costly pollution control equipment. Claims for alleged violations can be brought by the United States EPA, state agencies, and in certain instances local governments and private parties, and can result in penalties and injunctive relief.

20

In addition, there are a number of other environmental, health and safety laws and regulations that apply to our facilities and may affect our operations. By way of example and not of limitation, certain portions of the federal Toxic Substances Control Act, Oil Pollution Act, Safe Drinking Water Act, and Emergency Planning and Community Right-to-Know Act, as well as state and local laws and regulations implemented by the regulatory agencies, apply to aspects of our facilities’ operations. Our operations in Mexico are similarly subject to environmental requirements applicable to those operations. In some instances, we may also be subject to other foreign governments’ regulations and international treaties and laws. Many of these laws allow both the governments and citizens in certain situations to bring claims against regulated facilities for alleged environmental violations. Finally, our operations could in certain situations be subject to toxic tort claims brought by third parties alleging causes of action such as nuisance, negligence, trespass, infliction of emotional distress, or other claims alleging personal injury, property damage, or other harms.

Available Information

Our internet website address is www.steeldynamics.com. We make available on our internet website, under "Investors,” free of charge, as soon as reasonably practicable after such materials are electronically filed with, or furnished to, the Securities and Exchange Commission, our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports, as well as press releases, ownership reports pursuant to Section 16(a) of the Securities Act of 1933, our Code of Ethics for Principal Executive Officers and Senior Financial Officers, our Code of Business Conduct and Ethics, and any amendments thereto or waivers thereof, as well as our Audit, Compensation, and Corporate Governance and Nominating Committee Charters. The contents of our or any other website are not incorporated into this report. These reports are also available publicly on the Securities and Exchange Commission website, www.sec.gov.

21

ITEM 1A. RISK FACTORS

Many factors may have an effect on our business, results of operations, financial condition and cash flows. We are subject to various risks resulting from changing economic, environmental, regulatory, political, industry, business and financial conditions. The factors described below are some of the risks that could materially negatively impact us.

Global and National Risks Related to our Business

Our industry, as well as the industries of many of our customers and suppliers upon whom we are dependent, is affected by domestic and global economic factors including periods of slower than anticipated economic growth and the risk of a recession.

Our financial results are substantially dependent not only upon overall economic conditions in the United States and globally, including North America, Europe and in Asia, but also as they may affect one or more of the industries upon which we depend for the sale of our products. Global or domestic actions or conditions, including political actions, proposed or actual trade policies or restrictions, including tariffs or quotas, proposed or actual changes in tax laws, including the sunset of certain tax laws, proposed or actual regulation, including those related to the environment, interest rates, terrorism, acts of war or hostility, natural disasters, or pandemics, epidemics, widespread illness or other health issues, could result in changing economic conditions in the United States and globally, disruptions to or slowdowns in our business, our supply chain, or our global or domestic industry, or those of our customers or suppliers upon whom we are dependent. Additionally, periods of slower than anticipated economic growth could reduce customer confidence and adversely affect demand for our products and further adversely affect our business, results of operations, financial condition and cash flows. Metals industries have historically been vulnerable to significant declines in consumption and product pricing during periods of economic downturn or continued uncertainty.

Our business is also dependent upon certain industries, such as construction, automotive, manufacturing, transportation, heavy and agriculture equipment, energy and pipe and tube (including OCTG) markets, and these industries are also cyclical in nature and may experience supply chain disruptions. Therefore, these industries may experience their own fluctuations in demand for our products based on such things as economic conditions, interest rates, supply chain disruptions, raw material and energy costs, consumer demand, the rate of inflation and infrastructure funding decisions by governments. Many of these factors are beyond our control. As a result of volatility in our industry or in the industries we serve, we may have difficulty increasing or maintaining our level of sales or profitability. A downturn in our industry or the industries we serve may adversely affect our business, results of operations, financial condition and cash flows.